Credit Suisse Energy Summit Gary Heminger, President and CEO February 23, 2016

Forward‐Looking Statements This presentation contains forward-looking statements within the meaning of federal securities laws regarding Marathon Petroleum Corporation (“MPC”), MPLX LP (“MPLX”), and MarkWest Energy Partners, L.P. ("MarkWest").These forward-looking statements relate to, among other things, expectations, estimates and projections concerning the business and operations of MPC, MPLX, and MarkWest. You can identify forward- looking statements by words such as “anticipate,” “believe,” “design,” “estimate,” "objective," “expect,” “forecast,” “goal,” "guidance," “imply,” “intend,” “objective,” “opportunity,” “outlook,” "plan,“ “position,” “pursue,” “prospective,” “predict,” “project,” "potential," “seek,” “target,” “could,” “may,” “should,” “would,” “will” or other similar expressions that convey the uncertainty of future events or outcomes. Such forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond the companies’ control and are difficult to predict. Factors that could cause MPC’s actual results to differ materially from those implied in the forward-looking statements include: risks described below relating to MPLX, MarkWest and the MPLX/MarkWest merger transaction; changes to the expected construction costs and timing of pipeline projects; continued/further volatility in and/or degradation of market and industry conditions; the availability and pricing of crude oil and other feedstocks; slower growth in domestic and Canadian crude supply; the effects of the lifting of the U.S. crude oil export ban; completion of pipeline capacity to areas outside the U.S. Midwest; consumer demand for refined products; transportation logistics; the reliability of processing units and other equipment; MPC’s ability to successfully implement growth opportunities; modifications to MPLX earnings and distribution growth objectives; federal and state environmental, economic, health and safety, energy and other policies and regulations, including the cost of compliance with the Renewable Fuel Standard; MPC’s ability to successfully integrate the acquired Hess retail operations and achieve the strategic and other expected objectives relating to the acquisition; changes to MPC’s capital budget; other risk factors inherent to MPC’s industry; and the factors set forth under the heading "Risk Factors" in MPC's Annual Report on Form 10-K for the year ended Dec. 31, 2014, filed with Securities and Exchange Commission (SEC). Factors that could cause MPLX's actual results to differ materially from those implied in the forward-looking statements include: negative capital market conditions, including a persistence or increase of the current yield on common units, which is higher than historical yields, adversely affecting MPLX’s ability to meet its distribution growth guidance; risk that the synergies from the MPLX/MarkWest merger transaction may not be fully realized or may take longer to realize than expected; disruption from the MPLX/MarkWest merger transaction making it more difficult to maintain relationships with customers, employees or suppliers; risks relating to any unforeseen liabilities of MarkWest; the adequacy of MPLX's respective capital resources and liquidity, including, but not limited to, availability of sufficient cash flow to pay MPLX’s distributions, and the ability to successfully execute their business plans and growth strategies; the timing and extent of changes in commodity prices and demand for crude oil, refined products, feedstocks or other hydrocarbon-based products; volatility in and/or degradation of market and industry conditions; completion of midstream infrastructure by competitors; disruptions due to equipment interruption or failure, including electrical shortages and power grid failures; the suspension, reduction or termination of MPC's obligations under MPLX's commercial agreements; modifications to earnings and distribution growth objectives; the level of support from MPC, including dropdowns, alternative financing arrangements, taking equity units, and other methods of sponsor support, as a result of the capital allocation needs of the enterprise as a whole and its ability to provide support on commercially reasonable terms; federal and state environmental, economic, health and safety, energy and other policies and regulations; changes to MPLX's capital budget; other risk factors inherent to MPLX or MarkWest's industry; and the factors set forth under the heading "Risk Factors" in MPLX's Annual Report on Form 10-K for the year ended Dec. 31, 2014, filed with the SEC; and the factors set forth under the heading "Risk Factors" in MarkWest's Annual Report on Form 10- K for the year ended Dec. 31, 2014, and Quarterly Report on Form 10-Q for the quarter ended Sept. 30, 2015, filed with the SEC (former ticker symbol: MWE). These risks, as well as other risks associated with MPLX, MarkWest and the merger transaction, are also more fully discussed in the joint proxy statement and prospectus included in the registration statement on Form S-4 filed by MPLX and declared effective by the SEC on Oct. 29, 2015, as supplemented. In addition, the forward-looking statements included herein could be affected by general domestic and international economic and political conditions. Unpredictable or unknown factors not discussed here, in MPC's Form 10-K, in MPLX's Form 10-K, or in MarkWest's Form 10-K and Form 10-Qs could also have material adverse effects on forward-looking statements. Copies of MPC's Form 10-K are available on the SEC website, MPC's website at http://ir.marathonpetroleum.com or by contacting MPC's Investor Relations office. Copies of MPLX's Form 10-K are available on the SEC website, MPLX's website at http://ir.mplx.com or by contacting MPLX's Investor Relations office. Copies of MarkWest's Form 10-K and Form 10-Qs are available on the SEC website (former ticker symbol: MWE), MarkWest's website at http://investor.markwest.com or by contacting MPLX’s Investor Relations office. Non-GAAP Financial Measures EBITDA is a non-GAAP financial measure provided in this presentation. EBITDA reconciliations to the nearest GAAP financial measures are included in the Appendix to this presentation. EBITDA is not defined by GAAP and should not be considered in isolation or as an alternative to net income attributable to MPC, net cash provided by (used in) operating, investing and financing activities or other financial measures prepared in accordance with GAAP. The EBITDA forecast related to MPC’s marine assets was determined on an EBITDA-only basis. Accordingly, information related to the elements of net income, including tax, and interest, are not available and, therefore, a reconciliation of this non-GAAP financial measure to the nearest GAAP financial measure has not been provided. 2

Our Priorities for Value Creation 3 How We Get There Balance capital returns with value-enhancing investments Enhance margins for our refinery operations Return free cash flow to shareholders through strong and growing base dividend and share repurchases Disciplined approach to capital investment Optimize Galveston Bay and Texas City operations Increase distillate production Increase export capacity Increase margins through process improvements Grow MPLX distributions Grow Speedway EBITDA beyond $1.0 B Maintain top tier safety and environmental performance Continued focus on safety and environmental stewardship – license to operate Strategic Objective Grow higher valued and stable cash-flow businesses

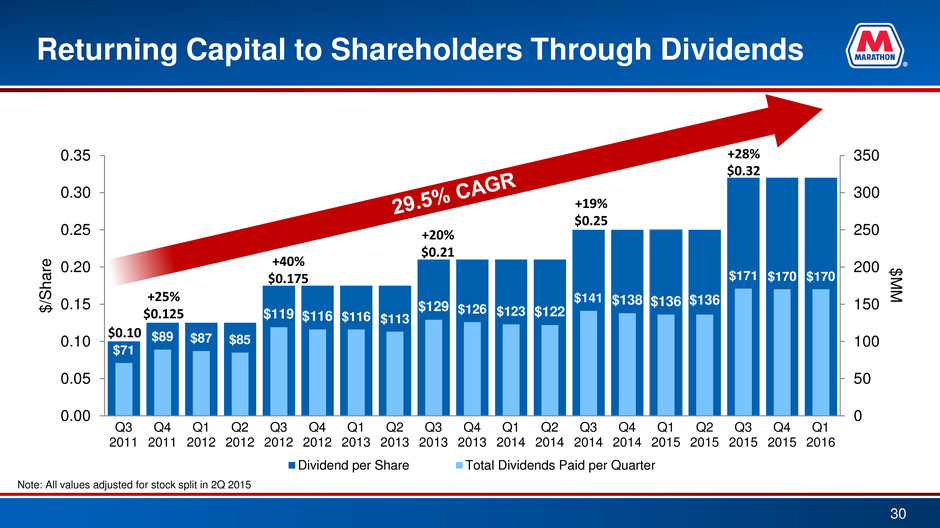

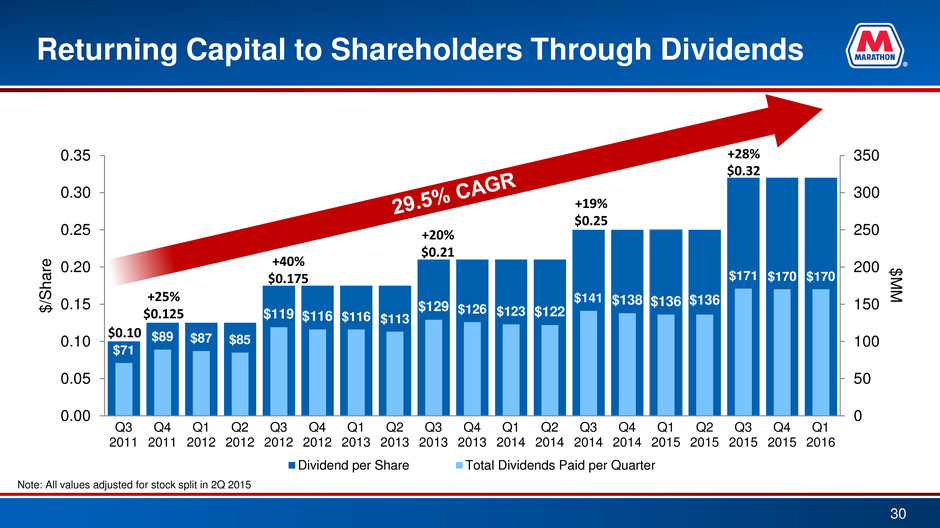

Balanced Approach to Returning Capital and Investment 4 $7.2 B $2.2 B $13.8 B $7.2 B returned to shareholders through repurchases, representing 28% of shares outstanding Five dividend increases resulting in a 29.5% CAGR Strategic investments providing long-term stable cash flows Since July 2011 Share Repurchases Dividends Investing in the Business* *Represents cash capital expenditures, acquisitions, investments and contingent consideration

Fundamentals of MPC’s Business MPC’s fully integrated system provides optionality and flexibility – Perform well in volatile markets MPC has strategically located assets Gasoline demand continues to be strong, supported by low prices Supply dynamics support resilient crack spreads U.S. refiners have a sustained export advantage Heavy and sour crude differentials remain favorable 5 As of Dec. 31, 2015 See appendix for legend

Refining Increasing EBITDA and Driving Value Increasing EBITDA through process improvements Optimizing Galveston Bay and Texas City operations Investing in Galveston Bay Increasing distillate yield and conversion capacity Growing refined product export capacity 6

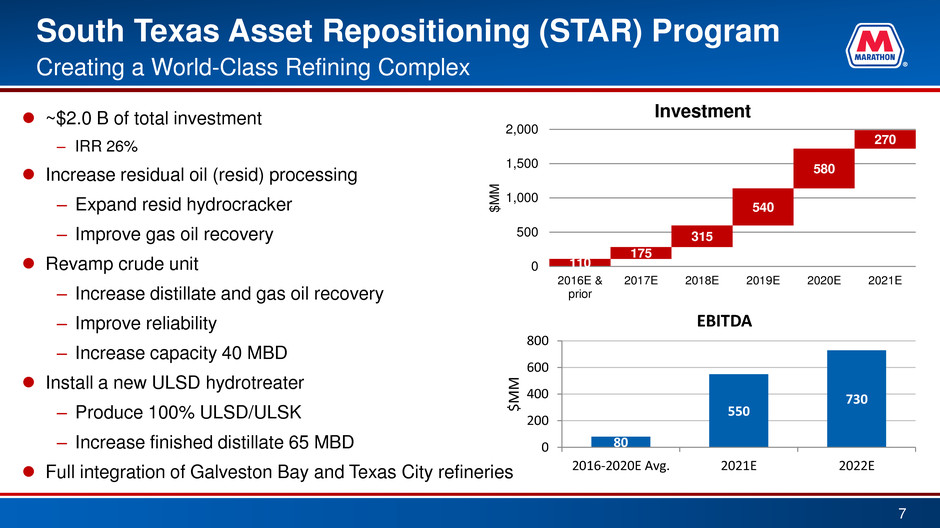

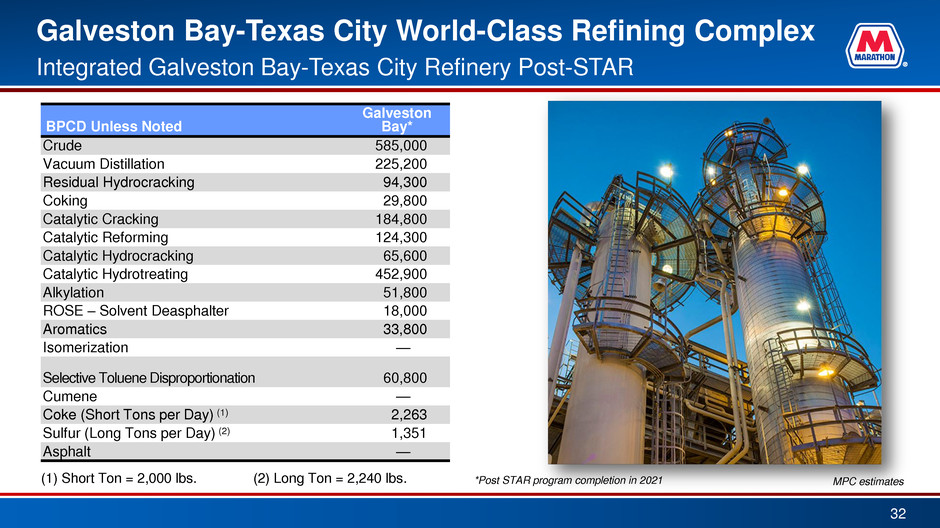

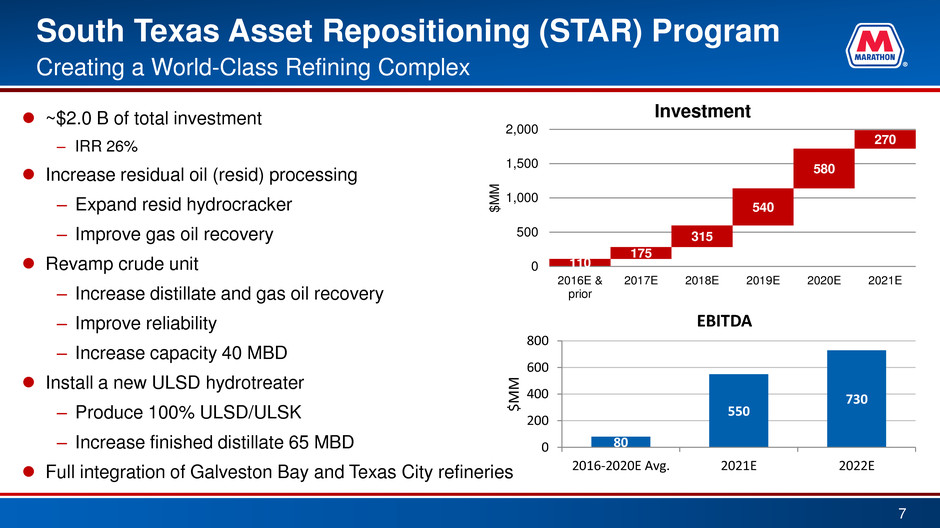

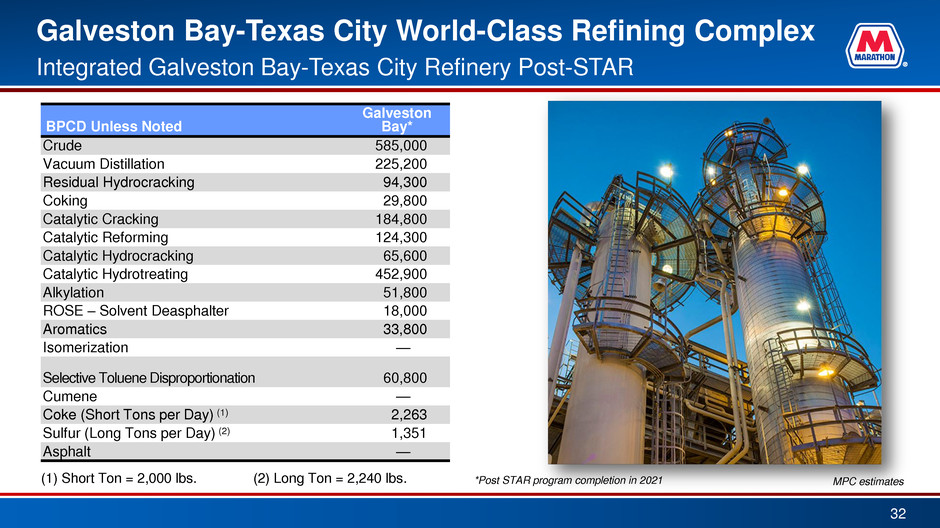

South Texas Asset Repositioning (STAR) Program 7 Creating a World-Class Refining Complex 110 175 315 540 580 270 0 500 1,000 1,500 2,000 2016E & prior 2017E 2018E 2019E 2020E 2021E $ M M Investment 80 550 730 0 200 400 600 800 2016-2020E Avg. 2021E 2022E $ M M EBITDA ~$2.0 B of total investment – IRR 26% Increase residual oil (resid) processing – Expand resid hydrocracker – Improve gas oil recovery Revamp crude unit – Increase distillate and gas oil recovery – Improve reliability – Increase capacity 40 MBD Install a new ULSD hydrotreater – Produce 100% ULSD/ULSK – Increase finished distillate 65 MBD Full integration of Galveston Bay and Texas City refineries

Galveston Bay Process Improvements and Synergies* 8 • Process improvements − Unit optimization − Improved unit yields − Bottlenecks removed − Catalyst changes • Synergy capture − Crude optimization − Process unit utilization • Future improvements − Shutdown inefficient units − Integrate utilities *STAR investment program excluded 0 100 200 300 400 500 600 700 2013 2014 2015 2016E 2019E $ M M EBITDA Improvement

320 345 395 510 365 20 30 115 0 100 200 300 400 500 600 2013 2014 2015 2016E 2019E M B D Base Garyville Galveston Bay Export Capacity Reaching Higher-Value Markets 9 Increasing Finished Product Export Capacity

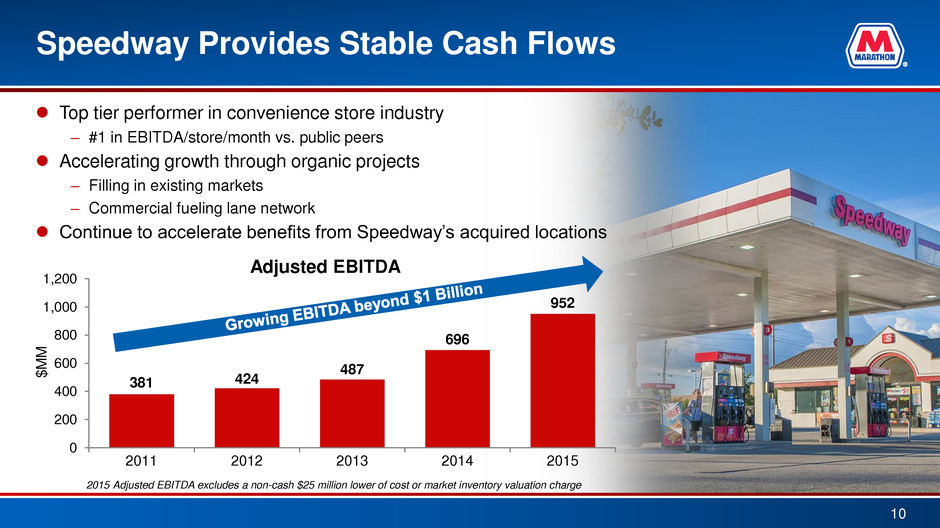

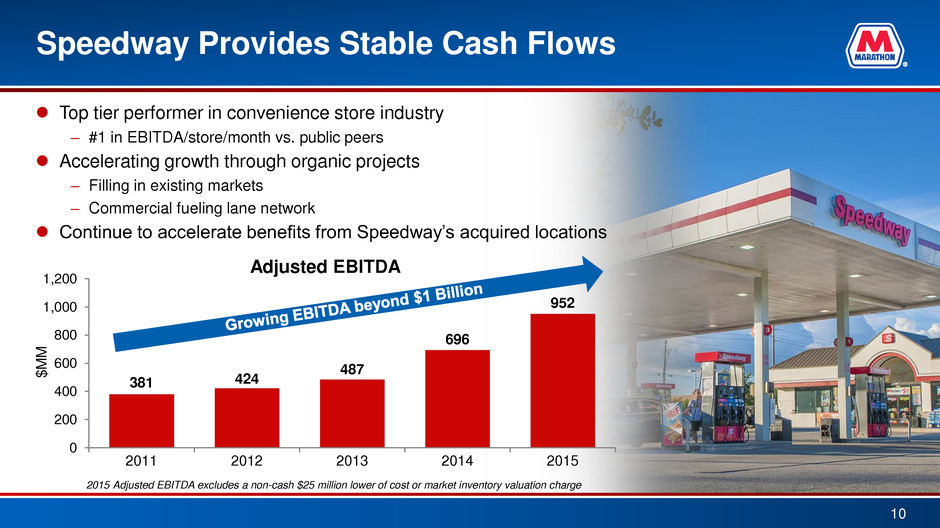

Speedway Provides Stable Cash Flows Top tier performer in convenience store industry – #1 in EBITDA/store/month vs. public peers Accelerating growth through organic projects – Filling in existing markets – Commercial fueling lane network Continue to accelerate benefits from Speedway’s acquired locations 10 381 424 487 696 952 0 200 400 600 800 1,000 1,200 2011 2012 2013 2014 2015 $ M M Adjusted EBITDA 2015 Adjusted EBITDA excludes a non-cash $25 million lower of cost or market inventory valuation charge

Maintain Financial Flexibility Through Cycle Maintain an investment grade credit profile Optimize capital spend – Disciplined entity-wide capital allocation process – 2016 capital expenditure forecast reduced by $1.2 billion – Continual evaluation of capital spend 11

MPC Consolidated 2016 Revised Capital Outlook 0 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 4,500 2016 Capital Budget Refining & Marketing* MPLX** Midstream*** Speedway Corporate and Other 2016 Revised Capital Outlook $ M M 12 (~$100) (~$650) (~$400) (~$50) (~$20) $3.0 B $4.2 B *Excludes Midstream. Includes 6-9 month deferral on spending for STAR program **Represents midpoint of MPLX capital expenditure guidance ***Includes R&M Midstream

MPLX 2016 Revised Capital Outlook 0 500 1,000 1,500 2,000 2016 Capital Budget 2016 Revised Capital Outlook* $ M M 13 *Represents midpoint of MPLX capital expenditure guidance $1.1 B $1.7 B 2016 revised capital outlook Growth $800 MM - $1.2 B Maintenance $61 MM Reduced 2016 midpoint by ~$650 MM Continue to optimize growth capital investments and complete projects on a just-in- time basis

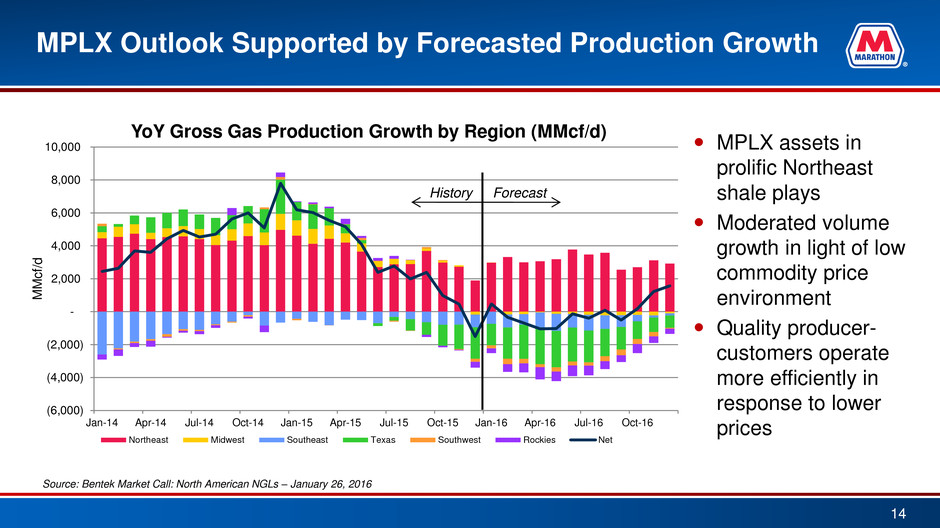

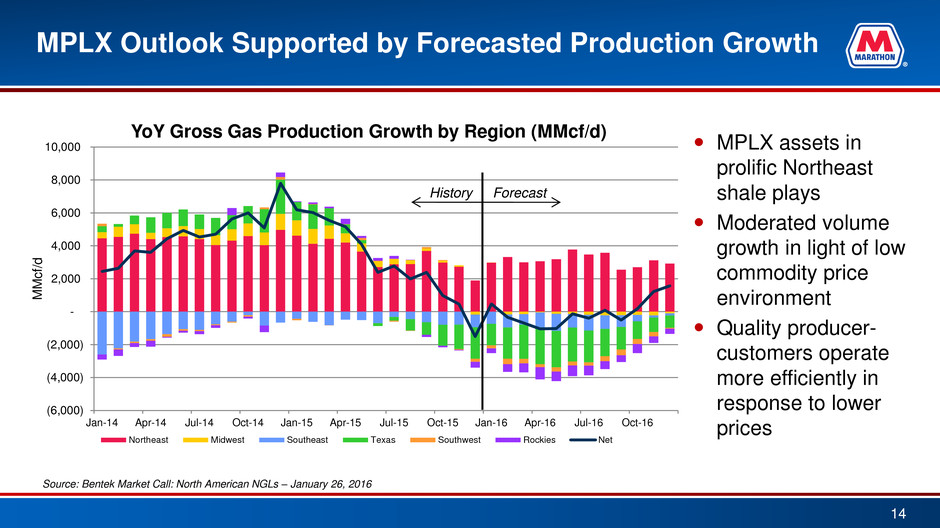

MPLX Outlook Supported by Forecasted Production Growth (6,000) (4,000) (2,000) - 2,000 4,000 6,000 8,000 10,000 Jan-14 Apr-14 Jul-14 Oct-14 Jan-15 Apr-15 Jul-15 Oct-15 Jan-16 Apr-16 Jul-16 Oct-16 M M c f/ d YoY Gross Gas Production Growth by Region (MMcf/d) Northeast Midwest Southeast Texas Southwest Rockies Net Source: Bentek Market Call: North American NGLs – January 26, 2016 Forecast History 14 MPLX assets in prolific Northeast shale plays Moderated volume growth in light of low commodity price environment Quality producer- customers operate more efficiently in response to lower prices

Supporting MPLX’s Distribution Growth Targeting a 12-15% growth rate in 2016, double digit distribution growth for 2017 Sale of marine business to MPLX in 2Q 2016 (~$120 MM of annual EBITDA) – Supportive valuation of not greater than 6x EBITDA and will be accretive to MPLX – Securities issued to MPC in exchange for assets – Fee-for-capacity contracts with MPC Potential for private placement of up to $1 B of securities from MPC – Direct funding or a combination of sponsor support tools eliminates need to access public markets in 2016 15

MPLX Enhances MPC’s Value MarkWest Energy merger – Adds scale and diversity to MPC – Adds high quality natural gas and NGL assets in prolific shale regions – Significant commercial synergies and opportunities across value chain Near term support provides long term value uplift – Cash distributions to MPC via LP units, IDR’s and drop-down proceeds – Substantial inherent value 16

Driving Top Tier Financial Performance Through Sustainable Competitive Advantages 17 Fully integrated system provides optionality and flexibility Strategically located assets Value of MPLX Consistent and reliable operator Sustained performance through all cycles Disciplined, balanced approach to capital allocation and capital return Top tier retail system As of Dec. 31, 2015 See appendix for legend

Appendix 18

Fully Integrated Downstream System Refining and Marketing Seven-plant refining system with ~1.8 MMBPCD capacity One biodiesel facility and interest in three ethanol facilities One of the largest wholesale suppliers in our market area One of the largest producers of asphalt in the U.S. ~5,600 Marathon Brand retail outlets across 19 states ~300 retail outlet contract assignments primarily in the Southeast and select Northeast states Owns/operates 61 light product terminals and 18 asphalt terminals, while utilizing third-party terminals at 120 light product and two asphalt locations 18 owned and one leased inland waterway towboats with 205 owned barges and 14 leased barges, 2,210 owned/leased railcars, 173 owned transport trucks Speedway ~2,770 locations in 22 states Second largest U.S. owned/operated c-store chain Pipeline Transportation/MPLX Owns, leases or has interest in ~8,400 miles of crude and refined product pipelines Owns/operates over 5,000 miles of gas gathering and NGL pipelines Owns/operates >50 gas processing plants, >10 NGL fractionation facilities and one condensate stabilization facility 19 MPC Refineries Light Product Terminals MPC owned and Part-owned Third Party Asphalt/Heavy Oil Terminals MPC Owned Third Party Water Supplied Terminals Coastal Inland Pipelines MPC Owned and Operated MPC Interest: Operated by MPC MPC Interest: Operated by Others Pipelines Used by MPC Marketing Area MarkWest Facility Tank Farms Butane Cavern Pipelines Barge Dock Ethanol Facility Biodiesel Facility Renewable Fuels As of Dec. 31, 2015

0 5 10 15 20 $ /M M B tu Natural Gas Price Comparison Japanese Liquefied Natural Gas (World Bank)* European Natural Gas (World Bank)* HH Spot Price (World Bank) U.S. Refiners have a Sustained Export Advantage 20 Access to lower cost feedstocks Low cost natural gas Large, complex refineries High utilization rates Sophisticated workforce Region 2014 Utilization Rate North America 88% MPC 95% Former Soviet Union 80% Europe 78% Asia 77% Latin America 75% Middle East 71% Africa 66% Sources: World Bank, IEA, PIRA *Average import border price

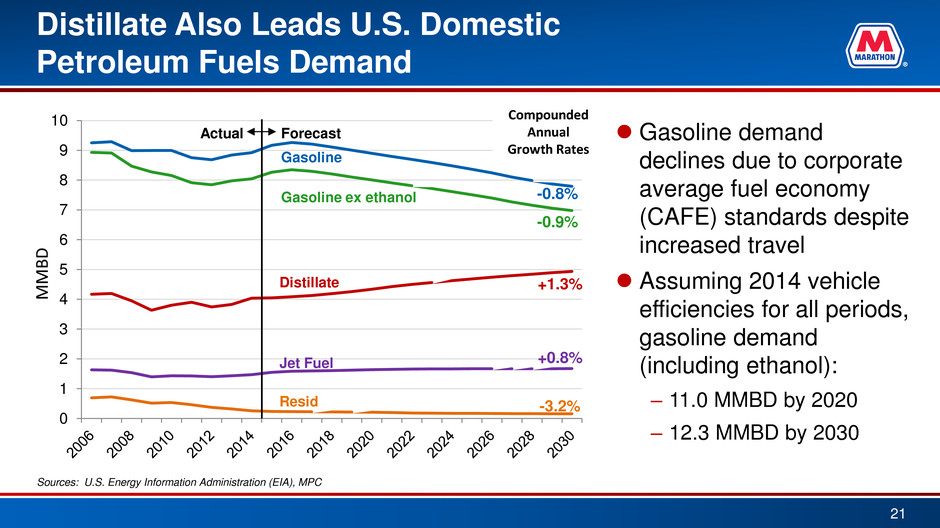

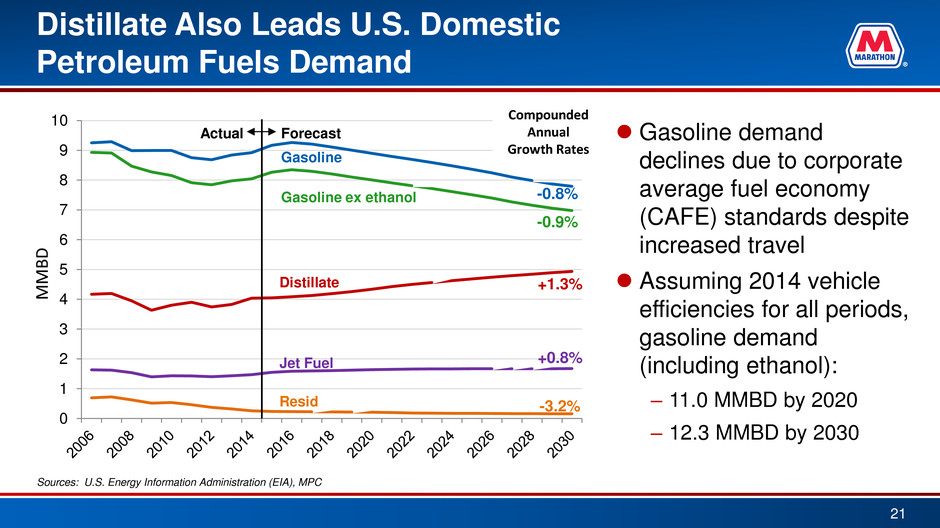

Distillate Also Leads U.S. Domestic Petroleum Fuels Demand 21 0 1 2 3 4 5 6 7 8 9 10 MMB D Compounded Annual Growth Rates Sources: U.S. Energy Information Administration (EIA), MPC Gasoline Gasoline ex ethanol Distillate Jet Fuel Resid -0.8% -0.9% +1.3% +0.8% -3.2% Forecast Actual Gasoline demand declines due to corporate average fuel economy (CAFE) standards despite increased travel Assuming 2014 vehicle efficiencies for all periods, gasoline demand (including ethanol): – 11.0 MMBD by 2020 – 12.3 MMBD by 2030

0 20 40 60 80 100 120 M M B D Distillate Leading World Liquids Demand 22 Sources: BP Statistical Review of World Energy (Actual), MPC Economics (Forecast) Middle Distillate Gasoline Resid Other Annual Average Volumetric Growth (MBD) 2014 vs. 2025 +446 -91 +495 +233 Forecast Actual Average product demand growth of 1.1 MMBD in 2016-2017 Distillate remains the growth leader through 2025 Heavy fuel oil continues its structural decline

Shale Crudes Strengthen Octane Market U.S. summer octane values were strong Lighter crude runs produce more light naphtha, increasing demand for octane Shale crudes yield a lower quality reformer feed Octane generation capacity has been relatively steady, incremental capacity required in the future 23 Sources: U.S. Energy Information Administration (EIA), MPC

0 2 4 6 8 10 12 14 16 2010 2012 2014 2016 2018 2020 M M B D North American Production is Resilient Shale production growth has slowed Continued drilling with improved efficiency has offset steep initial shale declines Long-term growth is still expected 24 Canada U.S. Shale Forecast Actual U.S. Non-Shale Sources: MPC, CAPP

Shale Producers Improving Efficiency Shale producers becoming more efficient in low price environment Producers are benefiting from: −Reduced services costs (20-30%) −High grading acreage − Improved drilling and completion efficiency − Improved production per well − Improved logistics to market 25 Sources: ITG IR, PIRA 0 100 200 300 400 500 600 700 2008 2009 2010 2011 2012 2013 2014 2015 B O E D Peak Production Added Per Rig

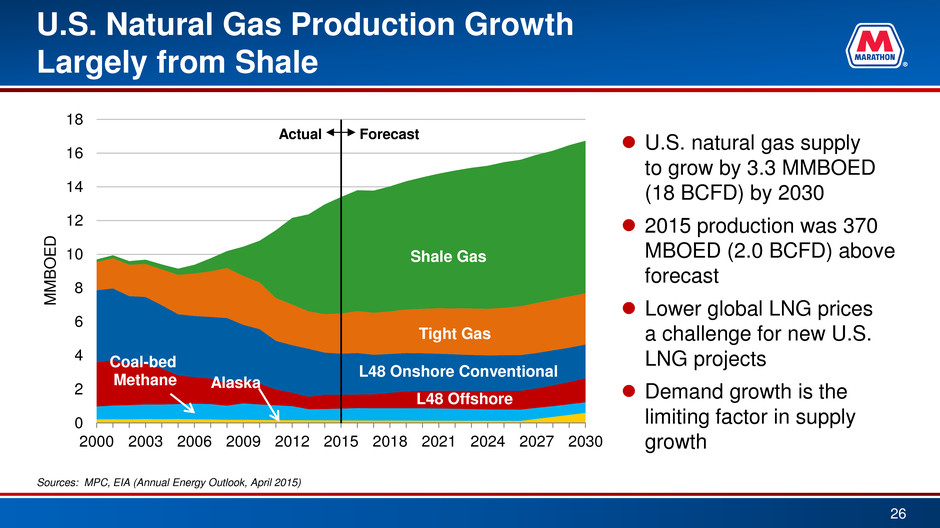

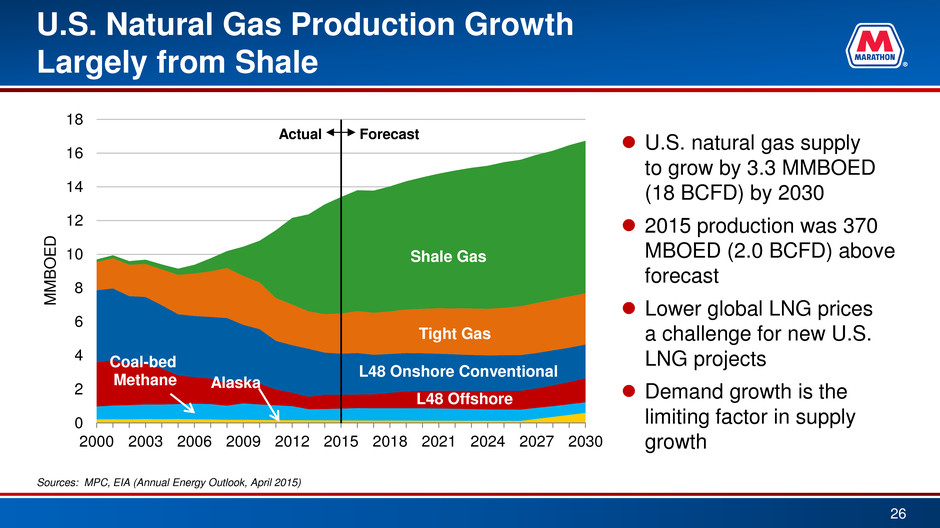

Alaska Coal-bed Methane Tight Gas Shale Gas 0 2 4 6 8 10 12 14 16 18 2000 2003 2006 2009 2012 2015 2018 2021 2024 2027 2030 M M B O E D L48 Onshore Conventional L48 Offshore U.S. Natural Gas Production Growth Largely from Shale U.S. natural gas supply to grow by 3.3 MMBOED (18 BCFD) by 2030 2015 production was 370 MBOED (2.0 BCFD) above forecast Lower global LNG prices a challenge for new U.S. LNG projects Demand growth is the limiting factor in supply growth 26 Sources: MPC, EIA (Annual Energy Outlook, April 2015) Forecast Actual

U.S. NGL Volume Growth Creates a Need for Incremental Infrastructure 27 Nat. Gasoline Butanes Propane Purity Ethane Rejected Ethane 0 1 2 3 4 5 6 7 2005 2010 2015 2020 2025 2030 M M B D Forecast Actual Source: MPC 2015 LT Forecast 2015 NGL production was up 250 MBD from March 2015’s forecast Supply growth will be slowed but not derailed by lower prices Ethane is rejected (retained in natural gas) when the ethane price nears the natural gas price Ethane’s share of NGL production has fallen as more was rejected in 2015

U.S. Natural Gas and NGL Trade Flows Changing Paradigm shift from U.S. Northeast being a significant importer to a significant exporter Driven by Marcellus and Utica production growth Infrastructure continuing to build out to reflect changes in trade flows 28

Returning Capital to Shareholders Through Share Repurchases 29 0 2,000 4,000 6,000 8,000 $ M M Cumulative Share Repurchases $10 B share repurchases authorized $7.24 B returned to shareholders through repurchases 28% of June 30, 2011 shares outstanding repurchased Since July 2011

$71 $89 $87 $85 $119 $116 $116 $113 $129 $126 $123 $122 $141 $138 $136 $136 $171 $170 $170 0 50 100 150 200 250 300 350 0.00 0.05 0.10 0.15 0.20 0.25 0.30 0.35 Q3 2011 Q4 2011 Q1 2012 Q2 2012 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 $ M M $ /S h a re Dividend per Share Total Dividends Paid per Quarter +25% $0.125 $0.10 +40% $0.175 +20% $0.21 +19% $0.25 +28% $0.32 Returning Capital to Shareholders Through Dividends 30 Note: All values adjusted for stock split in 2Q 2015

Growing More Stable Cash-Flow Business Segments 31 2016 Capital Outlook – $3.0 B MPC – $1.9 B Refining & Marketing, excluding Midstream – $1,045 MM Midstream* – $440 MM Speedway – $310 MM Corporate & Other – $95 MM MPLX – $1.1 B Growth $1,000 MM** Maintenance $61 MM 23% 13% 15% 36% 10% 3% Speedway Midstream* MPLX Refining Margin Enhancement Corporate & Other Refining Sustaining Capital * Includes ~$250 MM of midstream investments included in the R&M segment. Excludes MPLX. **Represents midpoint of MPLX capital expenditure guidance

Galveston Bay-Texas City World-Class Refining Complex 32 Integrated Galveston Bay-Texas City Refinery Post-STAR BPCD Unless Noted Galveston Bay* Crude 585,000 Vacuum Distillation 225,200 Residual Hydrocracking 94,300 Coking 29,800 Catalytic Cracking 184,800 Catalytic Reforming 124,300 Catalytic Hydrocracking 65,600 Catalytic Hydrotreating 452,900 Alkylation 51,800 ROSE – Solvent Deasphalter 18,000 Aromatics 33,800 Isomerization — Selective Toluene Disproportionation 60,800 Cumene — Coke (Short Tons per Day) (1) 2,263 Sulfur (Long Tons per Day) (2) 1,351 Asphalt — (1) Short Ton = 2,000 lbs. (2) Long Ton = 2,240 lbs. MPC estimates *Post STAR program completion in 2021

Refining Increasing EBITDA Through Continuous Process Improvements Low or no investment projects Focus on technical excellence Improvements in process unit performance EBITDA improvement of approximately $0.8 B since 2012 33 0 200 400 600 800 1,000 2013 2014 2015 M a rg in I m p ro v e m e n t $ M M Refining Process Improvements* Galveston Bay All Other *Galveston Bay synergies included

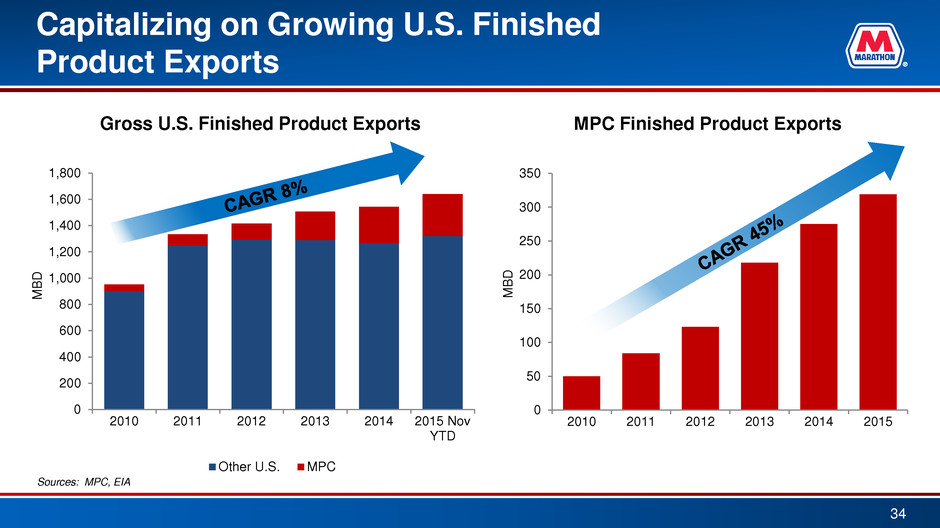

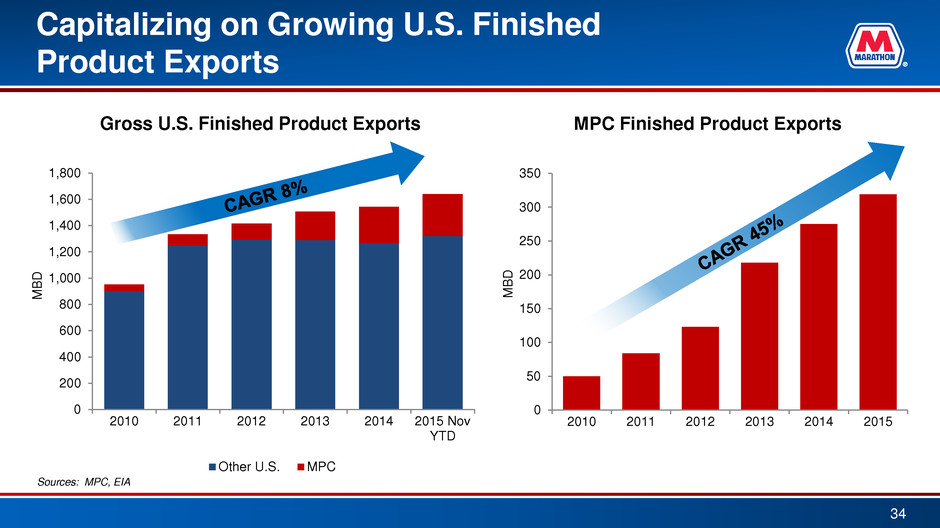

0 50 100 150 200 250 300 350 2010 2011 2012 2013 2014 2015 M B D MPC Finished Product Exports 0 200 400 600 800 1,000 1,200 1,400 1,600 1,800 2010 2011 2012 2013 2014 2015 Nov YTD M B D Gross U.S. Finished Product Exports Other U.S. MPC Capitalizing on Growing U.S. Finished Product Exports 34 Sources: MPC, EIA

Producing Higher-Value Products 35 Investments of ~$360 MM contribute ~$130 MM EBITDA Fluid Catalytic Cracking (FCC) projects Increase alkylate and light products Garyville FCC/Alky – 2016 Investment: ~$220 MM IRR 27% Detroit FCC – 2018 Investment: ~$140 MM IRR 26%

Enhancing Refining Margins Robinson light crude processing project – +30 MBD light crude – $140 MM investment – ~30% ROI, 2016 est. completion Galveston Bay export capacity expansion – +30 MBD ULSD • ~40% ROI, 2016 est. completion – +115 MBD gasoline • ~35% ROI, 2016-2018 est. completion Garyville ULSD project – +35 MBD ULSD – $232 MM investment – ~45% ROI, 2014-2016 est. completion 36

Balance in Refining Network Midwest Capacity 710,000 BPCD Louisiana Capacity 539,000 BPCD Texas Capacity 545,000 BPCD BPCD NCI Canton (Ohio) 93,000 7.8 Catlettsburg (Ky.) 273,000 9.2 Detroit (Mich.) 132,000 9.7 Robinson (Ill.) 212,000 10.5 Galveston Bay (Texas) 459,000 13.5 Texas City (Texas) 86,000 7.8 Garyville (La.) 539,000 11.2 Total 1,794,000 10.9* 37 *Weighted Average NCI The Nelson Complexity Index is a construction cost-based measurement used to describe the investment cost of a refinery in terms of the process operations being conducted. It is basically the ratio of the process investment downstream of the crude unit to the investment of the crude unit itself. This index has many limitations as an indicator of value and is not necessarily a useful tool in predicting profitability. There is no consideration for operating, maintenance or energy efficiencies and no consideration of non-process assets such as tanks, docks, etc. Likewise it does not consider the ability to take advantage of market related feedstock opportunities. Source: MPC data as reported in the Oil & Gas Journal effective Dec. 31, 2015

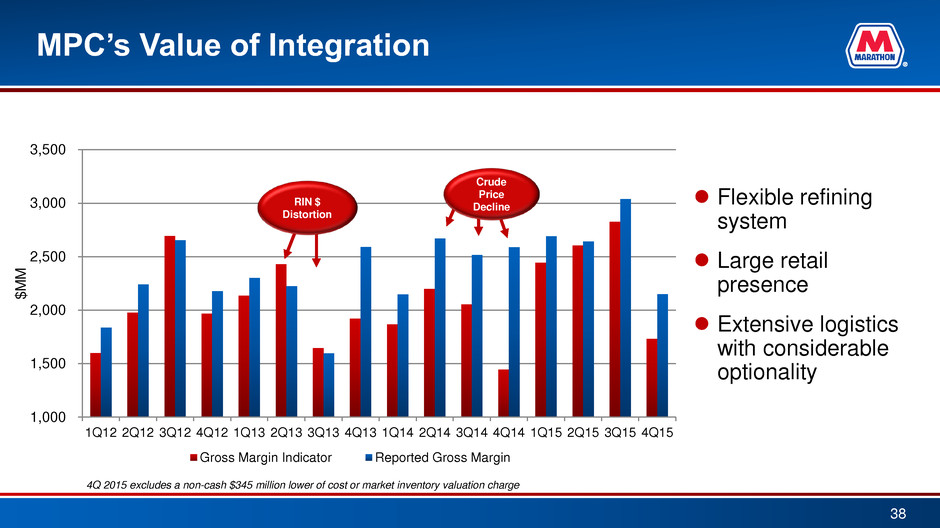

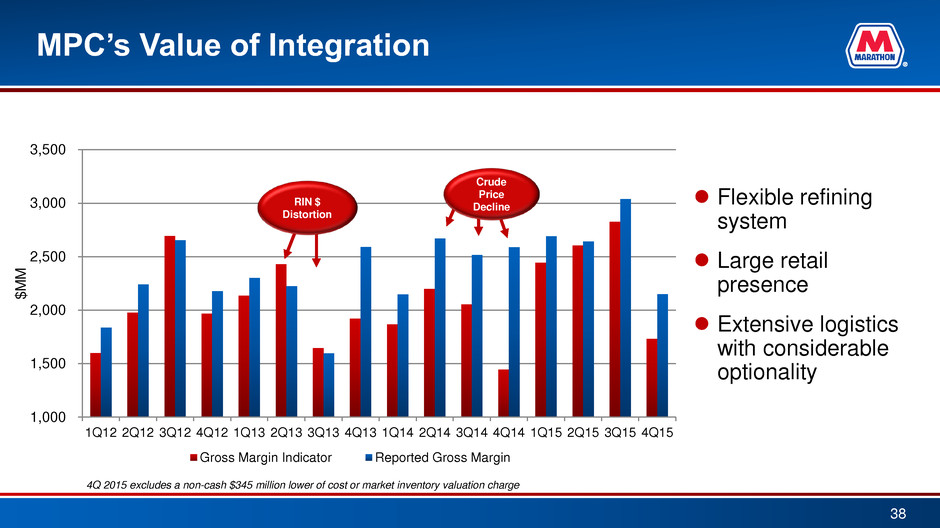

MPC’s Value of Integration Flexible refining system Large retail presence Extensive logistics with considerable optionality 1,000 1,500 2,000 2,500 3,000 3,500 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 $ M M Gross Margin Indicator Reported Gross Margin Crude Price Decline RIN $ Distortion 38 4Q 2015 excludes a non-cash $345 million lower of cost or market inventory valuation charge

Key Strengths 39 Balanced Operations 40% 60% Crude Oil Refining Capacity PADD II PADD III 55% 45% Crude Slate Sour Crude Sweet Crude ~70% ~30% Assured Sales Wholesale and Other Sales Assured Sales of Gasoline Production (Speedway + Brand + Wholesale Contract Sales) As of Dec. 31, 2015 4Q 2015 4Q 2015

Speedway: Pursuing Attractive and Accretive Acquisitions Leverage MPC’s supply and logistical network • Increase assured sales • Optimize terminal utilization Fill market voids in Speedway footprint • High quality assets • Continue focus in Pennsylvania and Tennessee • Growth opportunities in Georgia, South Caroline and Florida panhandle Capitalize on opportunistic acquisition environment 40 As of Dec. 31, 2015 See appendix for legend Speedway Marketing Area Speedway Location

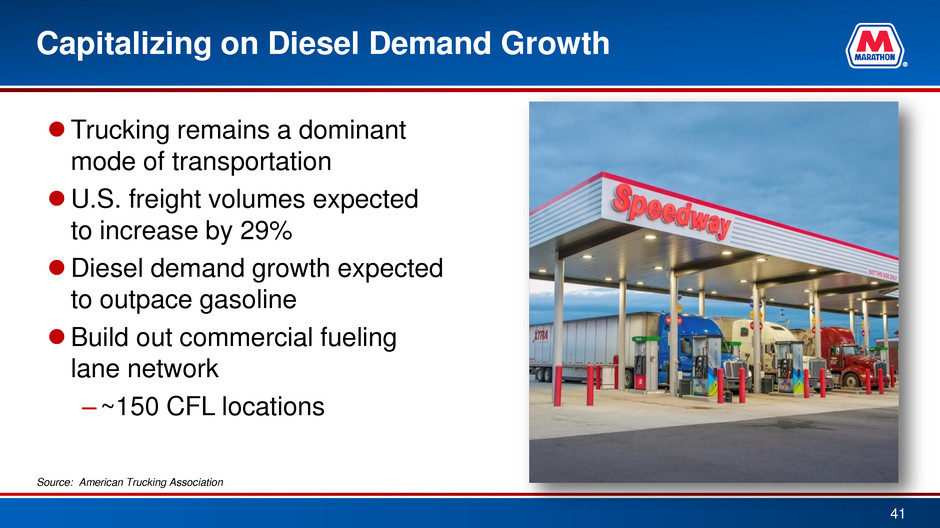

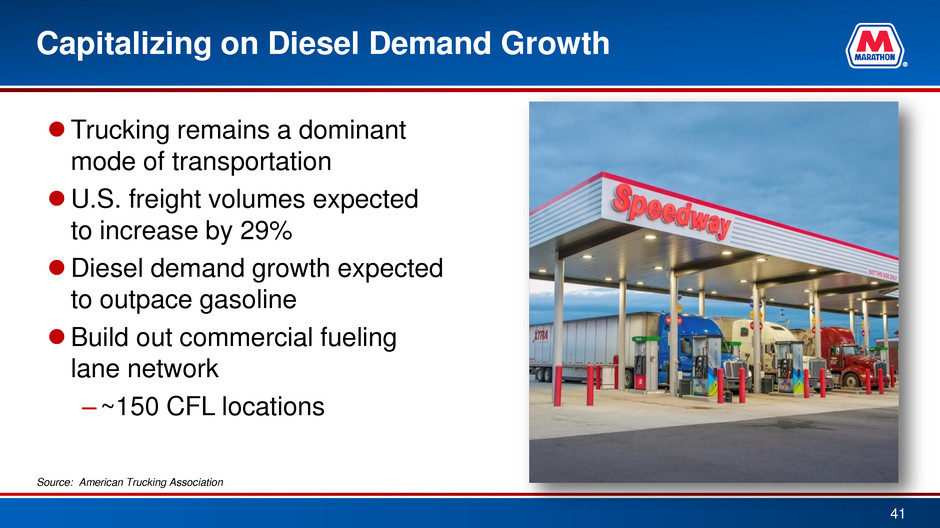

Capitalizing on Diesel Demand Growth Trucking remains a dominant mode of transportation U.S. freight volumes expected to increase by 29% Diesel demand growth expected to outpace gasoline Build out commercial fueling lane network –~150 CFL locations 41 Source: American Trucking Association

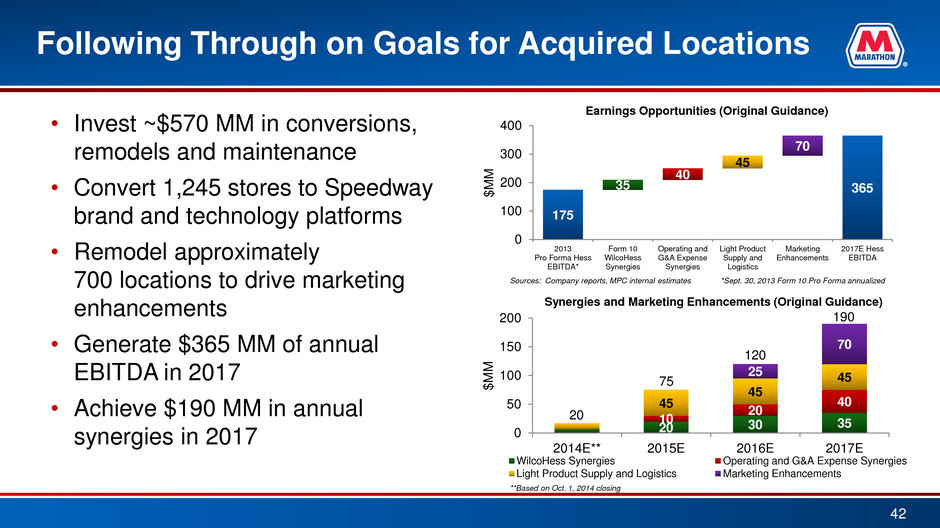

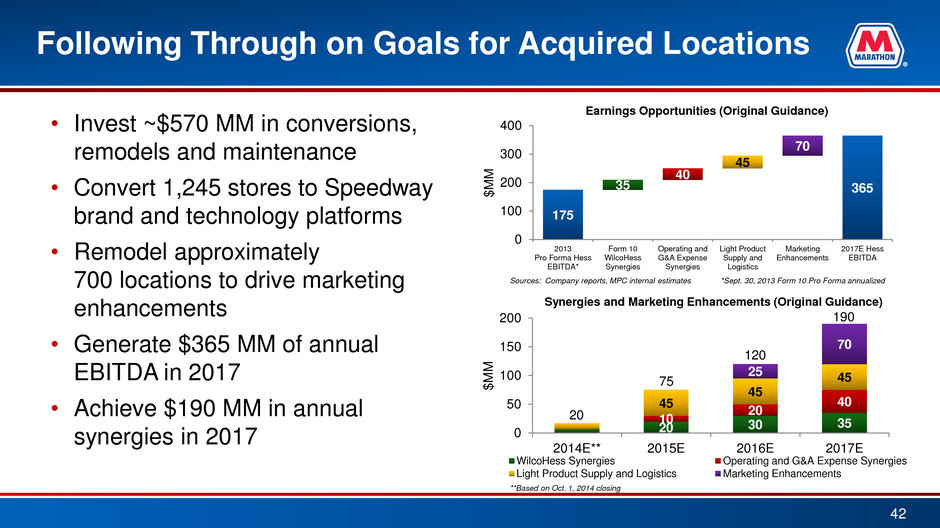

Following Through on Goals for Acquired Locations • Invest ~$570 MM in conversions, remodels and maintenance • Convert 1,245 stores to Speedway brand and technology platforms • Remodel approximately 700 locations to drive marketing enhancements • Generate $365 MM of annual EBITDA in 2017 • Achieve $190 MM in annual synergies in 2017 42 20 30 35 10 20 40 45 45 45 25 70 0 50 100 150 200 2014E** 2015E 2016E 2017E $ M M Synergies and Marketing Enhancements (Original Guidance) WilcoHess Synergies Operating and G&A Expense Synergies Light Product Supply and Logistics Marketing Enhancements 175 365 35 40 45 70 0 100 200 300 400 2013 Pro Forma Hess EBITDA* Form 10 WilcoHess Synergies Operating and G&A Expense Synergies Light Product Supply and Logistics Marketing Enhancements 2017E Hess EBITDA $ M M Earnings Opportunities (Original Guidance) **Based on Oct. 1, 2014 closing Sources: Company reports, MPC internal estimates *Sept. 30, 2013 Form 10 Pro Forma annualized 190 20 75 120

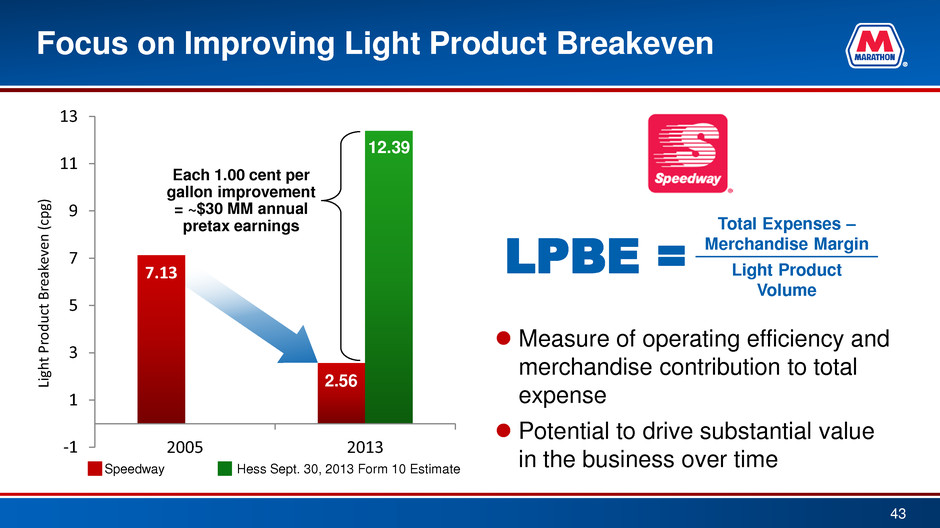

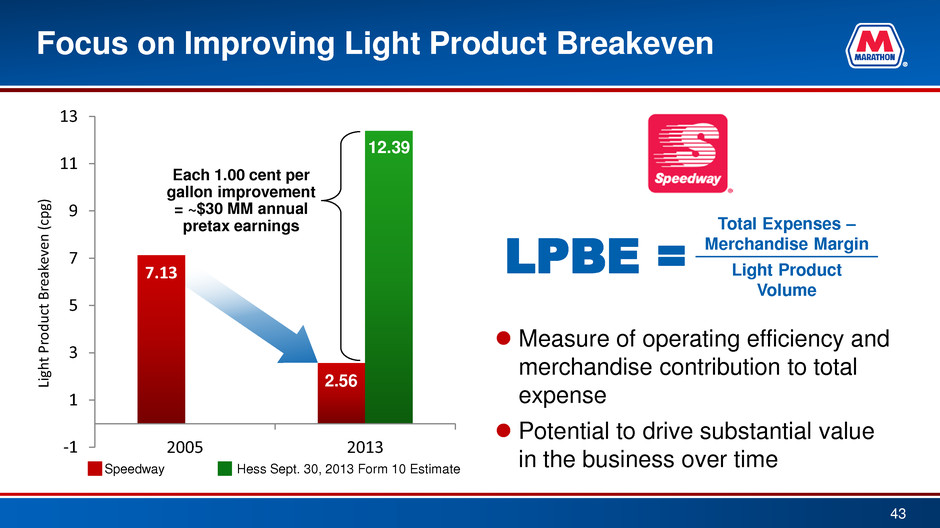

Focus on Improving Light Product Breakeven Measure of operating efficiency and merchandise contribution to total expense Potential to drive substantial value in the business over time 7.13 -1 1 3 5 7 9 11 13 2005 2013 Lig h t P ro d u ct B re ak ev en ( cp g) 2.56 12.39 Each 1.00 cent per gallon improvement = ~$30 MM annual pretax earnings Speedway Hess Sept. 30, 2013 Form 10 Estimate LPBE = Total Expenses – Merchandise Margin Light Product Volume 43

Exceeding Expected Synergies 20 75 120 155 190 225 0 50 100 150 200 250 2014E 2014 2015E 2015E 2016E 2016E 2017E 2017E $ M M Synergies and Marketing Enhancements Guidance* Speedway Synergies R&M Synergies 47 149 44 *Based on original announcement guidance in May 2014

2% GP interest 100% interest MPLX and MPC are Aligned MPC views MPLX as integral to its operations and is aligned with its success and incentivized to grow MPLX MPLX owns crude oil, refined product and natural gas pipelines, gas processing plants, fractionation facilities, a condensate facility and a butane cavern MPC owns 18% LP interest and 100% of MPLX’s GP interest and IDRs 100% interest r 100% interest Public Common Class B 80% LP interest Marathon Pipe Line LLC 100% interest Ohio River Pipe Line LLC MPLX GP LLC (our General Partner) 18% LP interest MPLX LP* (NYSE: MPLX) (the “Partnership”) Marathon Petroleum Corporation and Affiliates (NYSE: MPC) MPLX Organizational Structure 45 As of Dec. 31, 2015 *All Class A units of MPLX are owned by MarkWest Hydrocarbon, Inc. and eliminated in consolidation. All Class B units are owned by M&R MWE Liberty, LLC and included with the public ownership percentage. MPLX Pipe Line Holdings LLC MPLX Terminal and Storage LLC MarkWest Energy Partners, L.P. 100% interest MarkWest Hydrocarbon, Inc. MarkWest Operating Subsidiaries MPLX Operations LLC

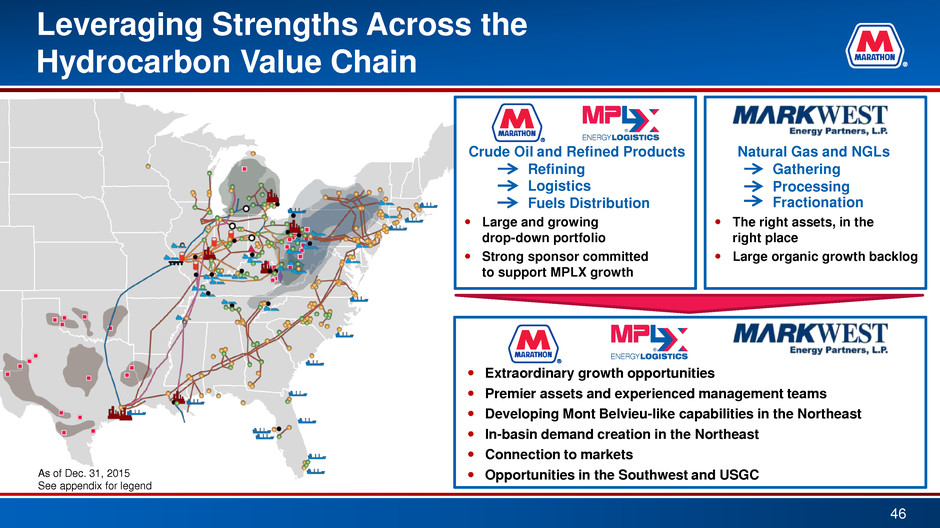

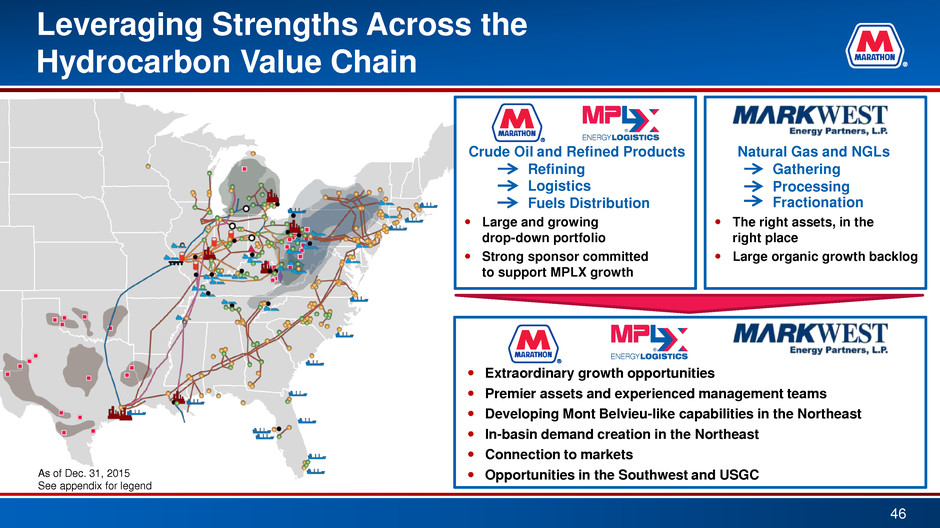

Leveraging Strengths Across the Hydrocarbon Value Chain 46 As of Dec. 31, 2015 See appendix for legend Extraordinary growth opportunities Premier assets and experienced management teams Developing Mont Belvieu-like capabilities in the Northeast In-basin demand creation in the Northeast Connection to markets Opportunities in the Southwest and USGC Crude Oil and Refined Products Logistics Fuels Distribution Refining Large and growing drop-down portfolio Strong sponsor committed to support MPLX growth Natural Gas and NGLs Processing Fractionation Gathering The right assets, in the right place Large organic growth backlog

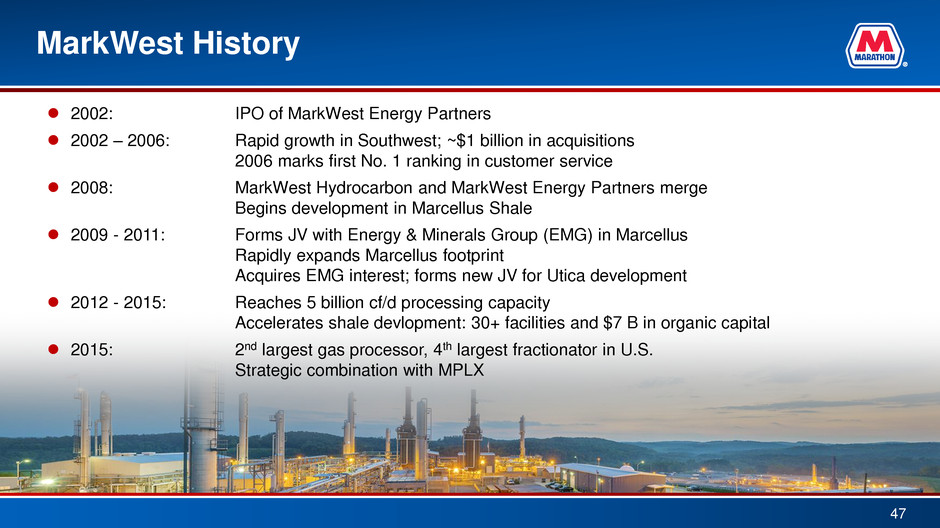

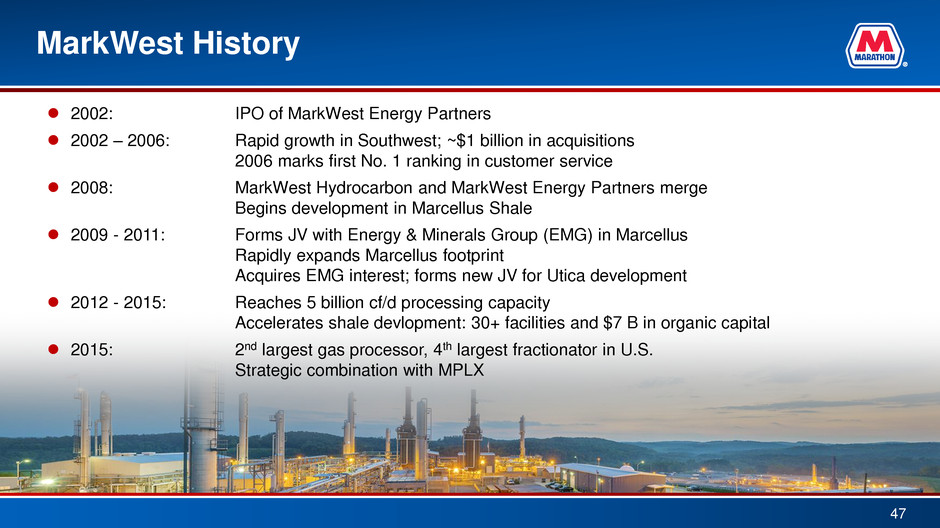

MarkWest History 47 2002: IPO of MarkWest Energy Partners 2002 – 2006: Rapid growth in Southwest; ~$1 billion in acquisitions 2006 marks first No. 1 ranking in customer service 2008: MarkWest Hydrocarbon and MarkWest Energy Partners merge Begins development in Marcellus Shale 2009 - 2011: Forms JV with Energy & Minerals Group (EMG) in Marcellus Rapidly expands Marcellus footprint Acquires EMG interest; forms new JV for Utica development 2012 - 2015: Reaches 5 billion cf/d processing capacity Accelerates shale devlopment: 30+ facilities and $7 B in organic capital 2015: 2nd largest gas processor, 4th largest fractionator in U.S. Strategic combination with MPLX

MarkWest is One of the Largest NGL and Natural Gas Midstream Service Providers Processing ~75% of Total Rich-Gas Production from the Marcellus and Utica Raw Natural Gas Production Processing Plants Mixed NGLs Fractionation Facilities NGL Products • Ethane • Propane • Normal Butane • Isobutane • Natural Gasoline Gathering and Compression Commercial Strategy – Develop a deep understanding of our customer’s business – Create unique solutions and competitive advantages – Build trust and long-term relationships at all levels – Combine world-class assets with an intense focus on service and execution Project Execution Strategy – Standardized plants – Just-in-time completion – Highly reliable operations – Significant scale drives efficiencies 48 Volumes represent 4Q 2015 average 1.4 BCF/D transmission capacity 3.1 BCF/D gathering volumes 5.3 BCF/D total processed volumes 348 MBD total NGL volumes 265 MBD total fractionated volumes

Doddridge Marshall Wetzel Harrison Noble Butler Washington WEST VIRGINIA PENNSYLVANIA OHIO Washington Gathering & Processing 49 Growth Projects Utica Complex ATEX Express Pipeline Purity Ethane Pipeline NGL Pipeline NGL/Purity Ethane Pipeline Sunoco Mariner Pipeline Marcellus Complex Gathering System TEPPCO Product Pipeline Belmont Monroe Jefferson Carroll Tuscarawas Beaver Allegheny Brooke Hancock Ohio Greene KEYSTONE COMPLEX Bluestone I – III & Sarsen I – 410 MMcf/d – Operational Bluestone IV – 200 MMcf/d – TBD C2+ Fractionation – 67,000 Bbl/d – Operational De-ethanization – 34,000 Bbl/d – 4Q16 HARMON CREEK COMPLEX Harmon Creek I – 200 MMcf/d – 2017 De-ethanization – 20,000 Bbl/d – 2017 HOUSTON COMPLEX Houston I – IV – 555 MMcf/d – Operational C2+ Fractionation – 100,000 Bbl/d – Operational MAJORSVILLE COMPLEX Majorsville I – VI – 1,070 MMcf/d – Operational Majorsville VII – 200 MMcf/d – 2017 De-ethanization – 40,000 Bbl/d – Operational MOBLEY COMPLEX Mobley I – IV – 720 MMcf/d – Operational Mobley V – 200 MMcf/d – 1Q16 De-ethanization – 10,000 Bbl/d – 1Q16 SHERWOOD COMPLEX Sherwood I – VI – 1,200 MMcf/d – Operational De-ethanization – 40,000 Bbl/d – Operational Sherwood VII – 200 MMcf/d – 2017 HOPEDALE FRACTIONATION COMPLEX (MarkWest & MarkWest Utica EMG shared fractionation capacity) C3+ Fractionation I & II – 120,000 Bbl/d – Operational C3+ Fractionation III – 60,000 Bbl/d – 2Q17 CADIZ COMPLEX Cadiz I – III – 525 MMcf/d – Operational Cadiz IV – 200 MMcf/d – 2017 De-ethanization – 40,000 Bbl/d – Operational SENECA COMPLEX Seneca I – IV – 800 MMcf/d – Operational OHIO GATHERING & OHIO CONDENSATE MarkWest Utica EMG’s Joint Venture with Summit Midstream, LLC Stabilization Facility – 23,000 Bbl/d – Operational HIDALGO COMPLEX 200 MMcf/d – 2Q16 Texas New Mexico Delaware Basin Note: Forecasted completion dates of projects are shown in green.

3 8 13 18 23 28 55 56 57 58 59 60 61 62 63 64 65 Jan-10 Jan-11 Jan-12 Jan-13 Jan-14 Jan-15 Jan-16 The Marcellus/Utica Resource Play is the Leading U.S. Natural Gas Growth Play Rest o f U .S. – B illi o n Cu b ic F ee t p er D ay ( B CF/ D ) Note: Wellhead gas production (before flaring and NGL extraction) Sources: As of Feb. 10, 2016. Bloomberg (LCI Energy Insight Estimates), BENTEK, MarkWest Energy Partners, L.P. M arcell u s & Utica – B illi o n Cu b ic Feet p er D ay (B C F/D ) Marcellus & Utica account for over 20% of total U.S. Gas Supply Marcellus & Utica Rest of U.S. 50

Overall Midstream Growth Investments of over $9 B Contributing Approximately $1.3 B EBITDA(1) 51 24 to 36 months MarkWest Growth Investments - Cash Flow Return Profile $7.5 B of forecasted growth capital to be invested from 2016-2020 ~7.0x Cash Flow Multiple ~$1 B of Mid-2022 Incremental Run-Rate Cash Flow MPC/Legacy MPLX Major Midstream Growth Investments Summary ($MM) Estimated Investment Estimated EBITDA MPC MPLX Total Sandpiper $1,000 $1,000 $150 Blue Water investment 544(2) 544(2) 55 Cornerstone and Utica Build-out $510 510 80 MPC Feedstock Cost of Supply Improvements 55 170 225 35 Pipeline and Tank Farm Expansions 7 133 140 25 Subtotals $1,606(2) $813 $2,419(2) $345 (1) Does not include MPC/MPLX/MarkWest synergistic opportunities (2) Includes both MPC capital investment and assumption of debt

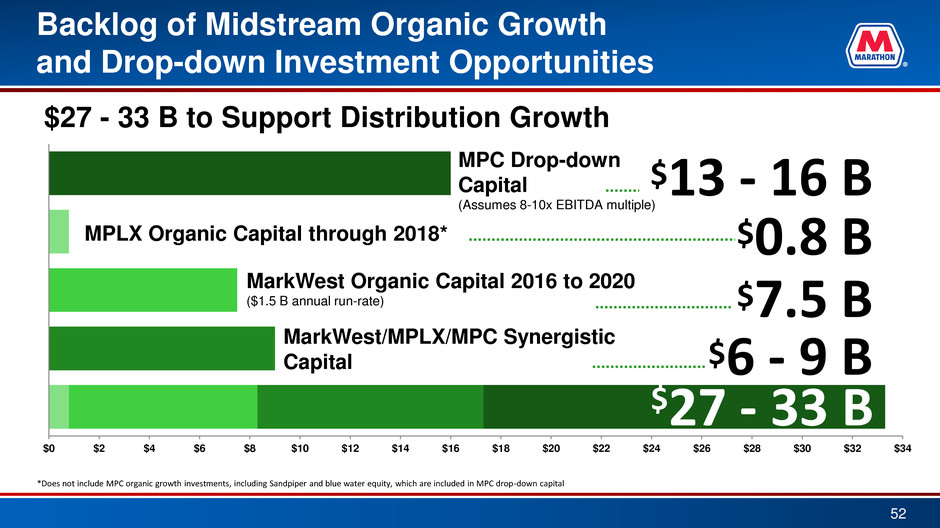

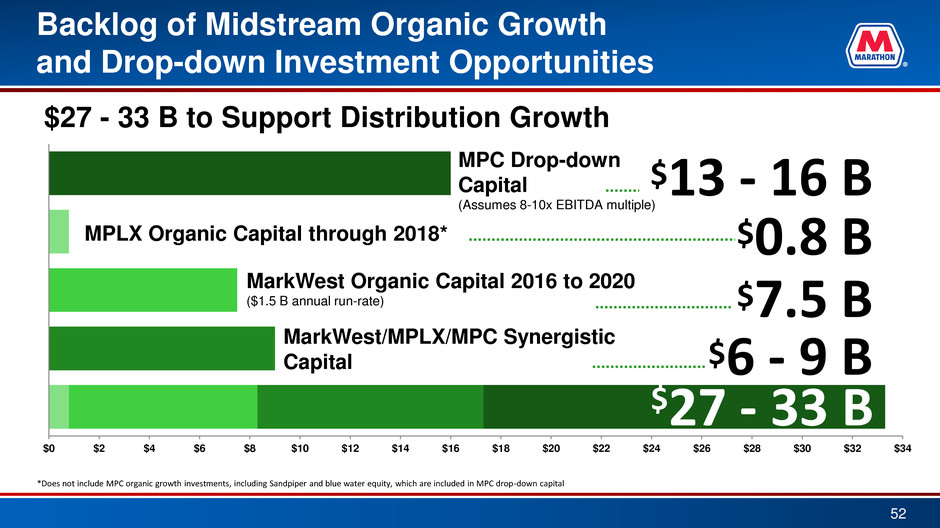

$0 $2 $4 $6 $8 $10 $12 $14 $16 $18 $20 $22 $24 $26 $28 $30 $32 $34 Backlog of Midstream Organic Growth and Drop-down Investment Opportunities 52 $0.8 B $7.5 B $6 - 9 B $13 - 16 B $27 - 33 B MPLX Organic Capital through 2018* MarkWest Organic Capital 2016 to 2020 ($1.5 B annual run-rate) MarkWest/MPLX/MPC Synergistic Capital MPC Drop-down Capital (Assumes 8-10x EBITDA multiple) *Does not include MPC organic growth investments, including Sandpiper and blue water equity, which are included in MPC drop-down capital $27 - 33 B to Support Distribution Growth

$0 $2 $4 $6 $8 $10 $12 $14 $16 $18 $20 $22 $24 $26 $28 $30 $32 $34 Legacy MPLX has Attractive Organic Growth Backlog Estimated to Generate ~$125 MM of EBITDA $0.8 B MPLX Organic Capital through 2018(1) Cornerstone and Utica Build-out Industry solution for Utica liquids 53 Pipeline and Tank Farm Expansions MPC and third-party logistics solutions Robinson Butane Cavern MPC shifting third-party services to MPLX and optimizing Robinson butane handling Other projects in development(2) (1) Estimate does not include MPC organic growth investments, including Sandpiper and blue water equity, which are included in MPC drop-down capital (2) Estimated $0.8 B investment and associated EBITDA does not include other projects in development

$0 $2 $4 $6 $8 $10 $12 $14 $16 $18 $20 $22 $24 $26 $28 $30 $32 $34 $7.5 B MarkWest has Robust Portfolio of Growth Projects Expected to Deliver ~$1 B of EBITDA MarkWest Organic Capital 2016 to 2020 ($1.5 B annual run-rate) Organic Growth Opportunities in the Northeast: Expansion of gas gathering systems Development of additional processing and fractionation infrastructure Expansion of additional NGL transportation logistics Organic Growth Opportunities in the Southwest: Expansion of gathering and processing infrastructure to support continued development of the Cana-Woodford and Haynesville Greenfield development of midstream system in the Delaware Basin of the Permian Northeast Southwest 54

$0 $2 $4 $6 $8 $10 $12 $14 $16 $18 $20 $22 $24 $26 $28 $30 $32 $34 Leveraging Premier Positions Across the Value Chain with Substantial Incremental Combined Opportunities 55 $6 - 9 B MarkWest/MPLX/MPC Synergistic Capital Opportunity Investment 1 Northeast (N.E.) alkylation facility $1.5 - 2.0 B 2 N.E. gasoline blending/storage/dehydrogenation $1.0 - 2.0 B 3 N.E. and long-haul NGL pipeline/infrastructure $1.0 - 1.5 B 4 Rogersville shale infrastructure $1.0 B 5 Northeast dry gas gathering (Ohio, Pa., WVa.) $0.5 - 1.0 B 6 Ethane cracker infrastructure $0.5 - 1.0 B 7 Midstream infrastructure to support refineries $0.5 - 1.0 B 8 NGL logistics infrastructure in the USGC and SW $0.5 - 1.0 B 9 N.E. condensate stabilization expansion $0.1 B 1 2 3 4 5 6 7 8 9

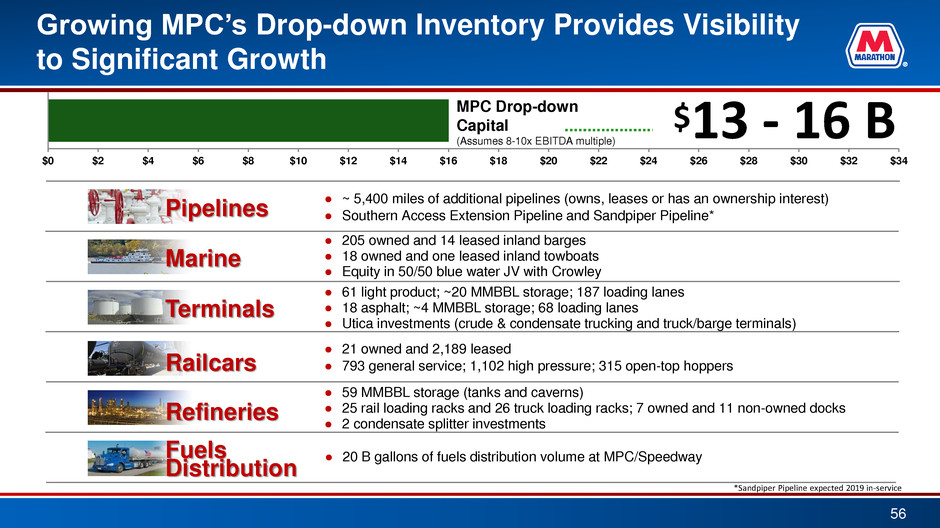

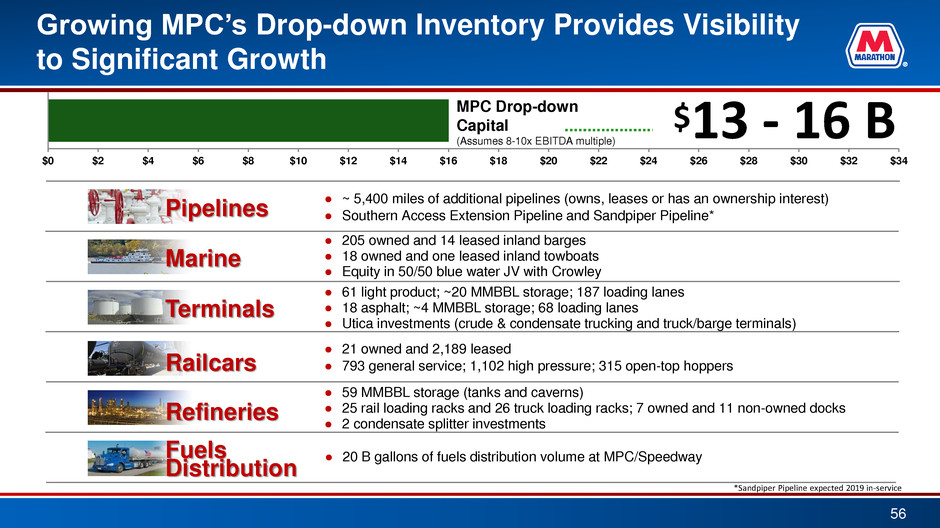

$0 $2 $4 $6 $8 $10 $12 $14 $16 $18 $20 $22 $24 $26 $28 $30 $32 $34 Growing MPC’s Drop-down Inventory Provides Visibility to Significant Growth *Sandpiper Pipeline expected 2019 in-service ● 59 MMBBL storage (tanks and caverns) ● 25 rail loading racks and 26 truck loading racks; 7 owned and 11 non-owned docks ● 2 condensate splitter investments ● 21 owned and 2,189 leased ● 793 general service; 1,102 high pressure; 315 open-top hoppers ● ~ 5,400 miles of additional pipelines (owns, leases or has an ownership interest) ● Southern Access Extension Pipeline and Sandpiper Pipeline* ● 61 light product; ~20 MMBBL storage; 187 loading lanes ● 18 asphalt; ~4 MMBBL storage; 68 loading lanes ● Utica investments (crude & condensate trucking and truck/barge terminals) ● 205 owned and 14 leased inland barges ● 18 owned and one leased inland towboats ● Equity in 50/50 blue water JV with Crowley ● 20 B gallons of fuels distribution volume at MPC/Speedway 56 $13 - 16 B MPC Drop-down Capital (Assumes 8-10x EBITDA multiple) Railcars Pipelines Terminals Marine Refineries Fuels Distribution

Butane to Alkylate (BTA) – Developing Mt. Belvieu Capabilities in the Northeast: $1.5 - 2 B of Opportunity 57 Combines MarkWest’s leading Northeast NGL position with MPC’s premier downstream expertise to transform refinery blendstock supply in the Northeast and Midwest Enhancing the gasoline blendstock value chain Alkylate is an ideal gasoline blending component that will become increasingly valuable with pending fuel regulations (Tier 3, NAAQS, CAFÉ) The U.S. still imports over 500 MBD of gasoline blendstock components into the Northeast; opportunity to displace imports Upgrade butane from the Marcellus and Utica into alkylate, leveraging MarkWest and MPC’s position Provides additional local demand for Marcellus and Utica NGL production, and a new supply source of refinery blendstock Cost: $1.5 - 2.0 B IRR: ~15% EBITDA: $400 - 500 MM Estimated in-service: 2nd half 2020

UMTP - Operated by Kinder Morgan - Batched purity and y-grade to Gulf Coast - Conversion of Tennessee Gas Pipeline Northeast and Long-Haul NGL Pipeline and Related Infrastructure Development 58 NGL/Light Products to East Coast - Large-scale East Coast LPG export terminal - Rail/pipeline to East Coast export terminal - Optionality and operational certainty for producers Centennial Pipeline - Repurpose refined products line to deliver NGLs to the Gulf Coast 2 1 $1 – 1.5 B in Opportunities 3

Develop Infrastructure to Support the Emerging Rogersville Shale and Other Unconventional Northeast Reservoirs Highly prospective play in West Virginia and Kentucky MarkWest strategically positioned to support development Largest processor and fractionator in the southern portion of the Appalachian Basin – 620 MMcf/d of processing capacity – Fully integrated fractionation and NGL marketing logistics Proximity to MPC’s Catlettsburg refinery presents opportunities 59 Up to $1 B of Opportunities

Expanding Dry Gas Gathering in Ohio, Pa., and W.Va. with $500 MM - 1.0 B of Opportunity 60 The Utica Shale is potentially the most economically viable dry gas play in the U.S. Existing Ohio gathering system is critical for development of the highly productive and economic dry gas Utica acreage New, large-scale dry gas gathering system being constructed in eastern Ohio counties – Underpinned by a long-term, fee-based contract with Ascent Resources with initial operation by end of 2015 – Capacity over 2.0 BCF/D, with more than 250 miles of pipeline Well positioned to capture additional dry gas opportunities in the region Source: Producer investor presentations

U.S./Canada Key Existing and Planned Pipelines MBPD Pipeline In Service Date 200 Diamond 2017 450 Dakota Access 2017 450 ETCO (Trunkline Conversion) 2017 225/375 Sandpiper 2019 300 +590 Trans Mountain Trans Mountain Expansion Current 2019 525 Northern Gateway 2019 1,100 Energy East 2020 Sources: Publicly available Information 61

Opportunity Set for Investment is Expanded 62 Multiple Funding Options - Extensive Financial Flexibility • Capacity to incubate MPLX growth projects at MPC • Ability to take back MPLX units as payment for drop-downs • Intercompany funding • Other options MPC Sponsor Support for MPLX Earnings MLP Distribution MLP Proceeds Capital Markets Capital Sources Sustaining Growth Refining Major Projects Midstream Pipeline Projects Terminal Projects Marine Projects Retail Sustaining Growth Cornerstone MPLX Pipeline Butane Cavern MarkWest Investments MPC Drop-downs Capital Sources Earnings Equity (Units) Debt MPC Support Interest Taxes Maintenance Dividends Capital Return Distributions Coverage Maintenance Interest Equity Incubate Projects Growth Management

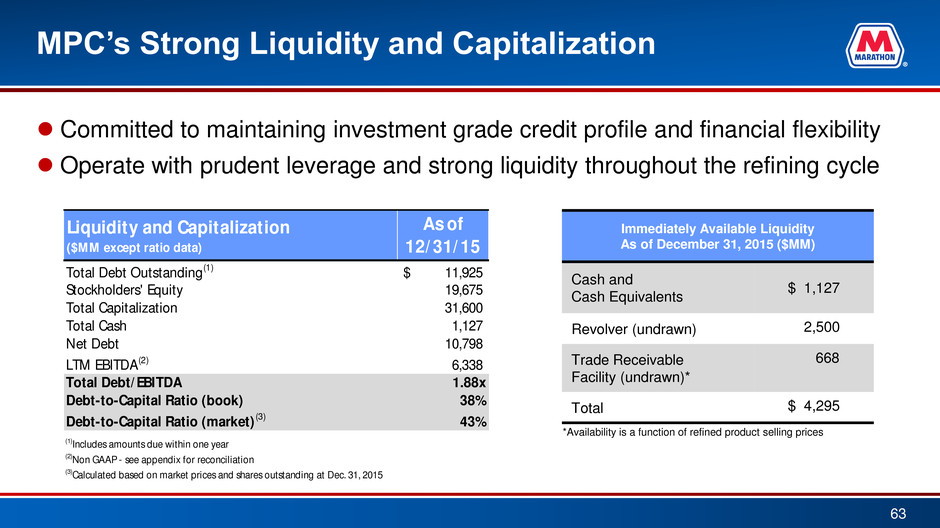

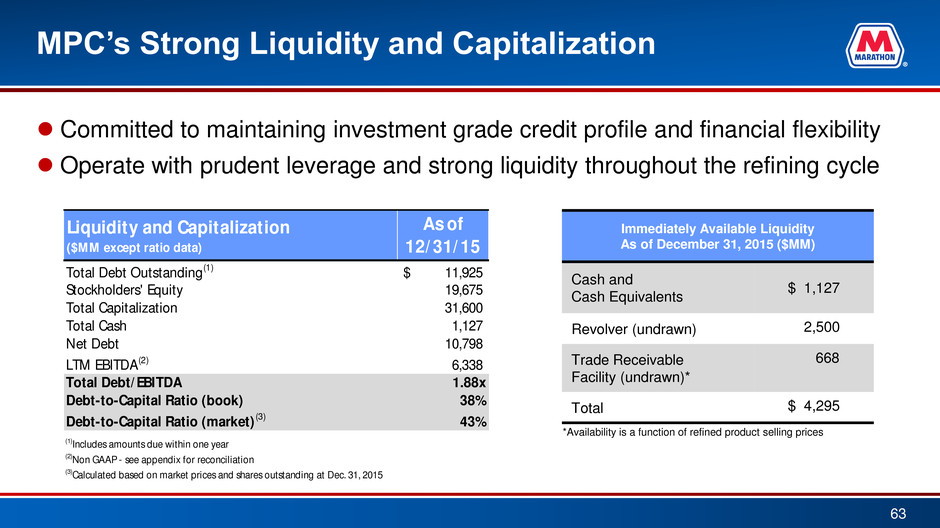

MPC’s Strong Liquidity and Capitalization Committed to maintaining investment grade credit profile and financial flexibility Operate with prudent leverage and strong liquidity throughout the refining cycle 63 Immediately Available Liquidity As of December 31, 2015 ($MM) Cash and Cash Equivalents $ 1,127 Revolver (undrawn) 2,500 Trade Receivable Facility (undrawn)* 668 Total $ 4,295 *Availability is a function of refined product selling prices Liquidity and Capitalization ($MM except ratio data) As of 12/ 31/ 15 Total Debt Outstanding(1) 11,925$ Stockholders' Equity 19,675 Total Capitalization 31,600 Total Cash 1,127 Net Debt 10,798 LTM EBITDA(2) 6,338 Total Debt/ EBITDA 1.88x Debt-to-C pital Ratio (book) 38% Debt-to-Capi al Ratio (market) (3) 43% (1)Includes am ts due within one year (2)Non GAAP - see appendix for reconciliation (3)Calculated based on market prices and shares outstanding at Dec. 31, 2015

4,300 600 800 2,500 400 750-1,750 Requirements Downside Operating Cash Flow Revolver Trade Receivables Facility Implied Cash 0 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 Sustaining Core Liquidity Under All Environments $30/BBL crude price environment Operating Requirements (Non-Discretionary Capex, Interest, Taxes, Dividends) Unexpected Liquidity Needs (Letters of Credit, Operating Upset, Working Capital) Crude Price - Core Liquidity Sensitivity (Primarily a function of working capital exposure and credit availability) (a) $1.0 B facility - forecasted 2016 availability is approximately $400 MM. Availability is a function of refined product selling prices. Target Cash 200 – 600 (a) $ M M

MPLX’s Financial Flexibility to Manage and Grow Asset Base Committed to maintaining investment grade credit profile Completed bond exchange in December 2015 Increased revolving credit facility to $2 billion Entered into a $500 million credit facility with MPC 65 ($MM except ratio data) As of 12/31/15 Cash and cash equivalents 43 Total assets 15,677 Long-term debt(a) 5,255 Total equity 9,254 Consolidated total debt to consolidated EBITDA ratio (covenant basis)(b)(c) 4.7x Outstanding balance of $2.0 B revolving credit agreement 877 Outstanding balance of $500 MM credit agreement with MPC 8 (a) Includes all long-term debt and amounts drawn on revolving credit facilities (b) Maximum covenant ratio <= 5.0 or 5.5 during the six month period following certain acquisitions (c) Consolidated EBITDA is subject to adjustments for certain acquisitions completed and capital projects undertaken during the relevant period

Generating Significant Cash Flow Through All Cycles 66 Pro Forma EBITDA Adjusted for Current Configuration Pro Forma EBITDA *MarkWest mid-cycle EBITDA based on 2015 results 0 2,000 4,000 6,000 8,000 10,000 2008 2009 2010 2011 2012 2013 2014 2015 2008 thru 2015 Mid- CycleRefining and Marketing Speedway Pipeline Transportation Depr. & Amort. less corporate expense GME DHOUP Galveston Bay Hess Retail MarkWest* $ M M

Source: Company Reports MPC vs. Peer Companies’ Operating Income per Barrel 67 -5 0 5 10 15 20 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 $/BB L MPC’s Rank Competitor Range Companies Ranked* Operating Income Per Barrel of Crude Throughput** *Current companies ranked: BP, CVX, HFC, MPC, PSX, TSO, VLO, XOM, PBF **Adjusted domestic operating income per barrel of crude oil throughput 11 12 11 9 10 9 8 9 9 8 10 8 8 8 8 8 8 9 September YTD Preliminary 3 3 2 1 2 3 7 2 1 5 3 1 3 1 2 2 3 6

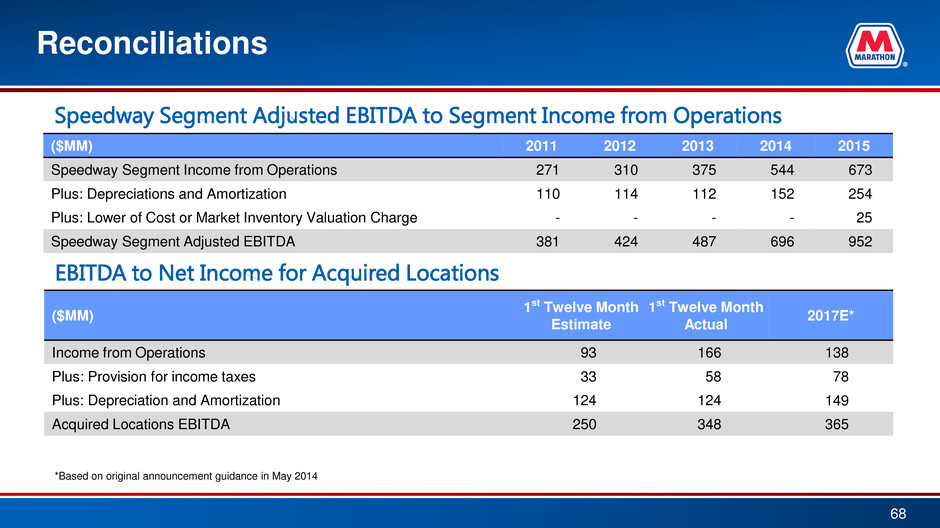

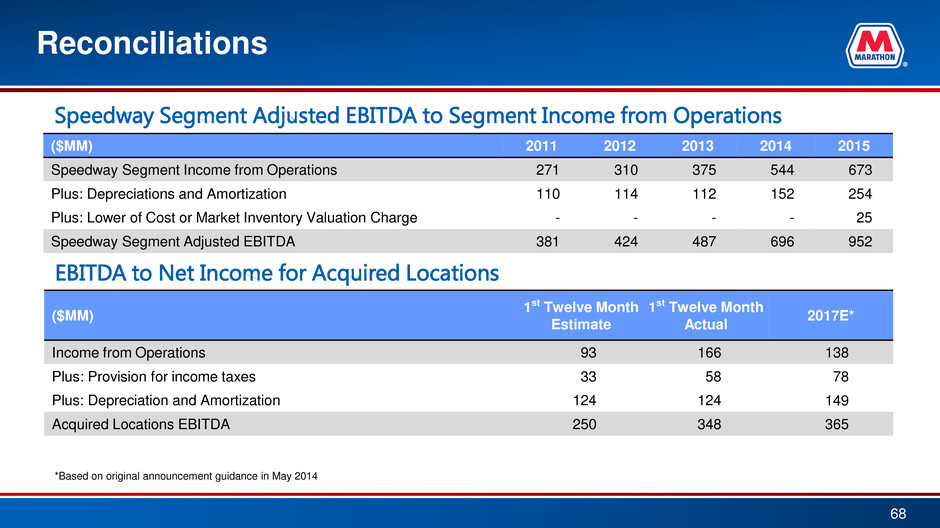

Reconciliations 68 ($MM) 2011 2012 2013 2014 2015 Speedway Segment Income from Operations 271 310 375 544 673 Plus: Depreciations and Amortization 110 114 112 152 254 Plus: Lower of Cost or Market Inventory Valuation Charge - - - - 25 Speedway Segment Adjusted EBITDA 381 424 487 696 952 Speedway Segment Adjusted EBITDA to Segment Income from Operations EBITDA to Net Income for Acquired Locations ($MM) 1st Twelve Month Estimate 1st Twelve Month Actual 2017E* Income from Operations 93 166 138 Plus: Provision for income taxes 33 58 78 Plus: Depreciation and Amortization 124 124 149 Acquired Locations EBITDA 250 348 365 *Based on original announcement guidance in May 2014

Segment EBITDA Reconciliation to Net Income Attributable to MPC 69 ($MM) 2008 2009 2010 2011 2012 2013 2014 2015 1Q 2Q 3Q 4Q Net income attributable to MPC 1,215 449 623 2,389 3,389 2,112 2,524 891 826 948 187 Less: Net interest and other financial income (costs) 30 31 12 (26) (109) (179) (216) (81) (64) (70) (103) Add: Net income (loss) attributable to noncontrolling interests - - - - 4 21 31 12 13 10 (19) Add: Provision for income taxes 670 236 400 1,330 1,845 1,113 1,280 486 432 521 67 Add: Total segment depreciation and amortization 604 670 912 873 972 1,197 1,274 350 349 352 399 Add: Items not allocated to segments (11) 182 265 316 277 366 382 81 77 223 75 Total Segment EBITDA 2,448 1,506 2,188 4,934 6,596 4,988 5,707 1,901 1,761 2,124 812 By Segment Refining & Marketing Segment EBITDA 1,819 950 1,539 4,309 5,902 4,217 4,654 1,583 1,474 1,726 482 Speedway Segment EBITDA 408 343 404 381 424 487 696 231 189 306 201 Pipeline Transportation Segment EBITDA 221 213 245 244 270 284 357 87 98 92 129 Total Segment EBITDA 2,448 1,506 2,188 4,934 6,596 4,988 5,707 1,901 1,761 2,124 812 Last Twelve Months Segment EBITDA 6,598

EBITDA Reconciliation to Net Income Attributable to MPC 70 ($MM) 2014 2015 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q Net income attributable to MPC 199 855 672 798 891 826 948 187 Less: Net interest and other financial income (costs) (46) (48) (50) (72) (81) (64) (70) (103) Add: Net income (loss) attributable to noncontrolling interests 8 9 7 7 12 13 10 (19) Add: Provision for income taxes 108 457 333 382 486 432 521 67 Add: Total depreciation and amortization 320 325 322 359 363 362 508 413 Total EBITDA 681 1,694 1,384 1,618 1,833 1,697 2,057 751 Last Twelve Months EBITDA 6,338

EBITDA Reconciliation to Net Income for Hess 71 ($MM) 2013* 2017E Net Income 47 138 Less: Net interest and other financial income (costs) (12) - Add: Provision for income taxes 22 78 Add: Total depreciation and amortization 94 149 EBITDA 175 365 *Based on Hess Sept. 30, 2013 Form 10 data annualized

Annual Price and Margin Sensitivities $MM (After Tax) LLS 6-3-2-1 Crack Spread* Sensitivity ~$450 (per $1.00/barrel change) Sweet/Sour Differential** Sensitivity ~$220 (per $1.00/barrel change) LLS-WTI Spread*** Sensitivity ~$90 (per $1.00/barrel change) Natural Gas Price Sensitivity ~$140 (per $1.00/MMbtu change in Henry Hub) *Weighted 40% Chicago and 60% USGC LLS 6-3-2-1 crack spreads and assumes all other differentials and pricing relationships remain unchanged **Light Louisiana Sweet (prompt) - [Delivered cost of sour crudes: Arab Light + Kuwait + Maya + Western Canadian Select + Mars] ***Assumes 20% of crude throughput volumes are WTI-based domestic crudes 72

1Q 2016 Outlook 73 *Region throughput data includes inter-refinery transfers, but MPC totals exclude transfers **Includes utilities, labor, routine maintenance and other operating costs ***Includes $1 MM of pension settlement expense in 1Q 2015 ****$/barrel throughput Crude Throughput* Other Charge/ Feedstocks Throughput* Total Throughput* Percent of WTI-priced Crude Turnaround and Major Maintenance Depreciation and Amortization Other Manufacturing Cost** Total Direct Operating Costs Corporate and Other Unallocated Items*** in MBD Refinery Direct Operating Costs**** P ro je c te d 1 Q 2 0 1 6 Gulf Coast Region 975 200 1,175 4% $3.15 $1.20 $4.50 $8.85 Midwest Region 575 50 625 42% $2.00 $2.10 $4.75 $8.85 MPC Total 1,550 150 1,700 18% $2.90 $1.55 $4.90 $9.35 $85 MM 1 Q 2 0 1 5 Gulf Coast Region 1,031 179 1,210 5% $0.80 $1.14 $3.99 $5.93 Midwest Region 641 36 677 43% $0.73 $1.85 $4.51 $7.09 MPC Total 1,672 180 1,852 20% $0.79 $1.42 $4.26 $6.47 $81 MM

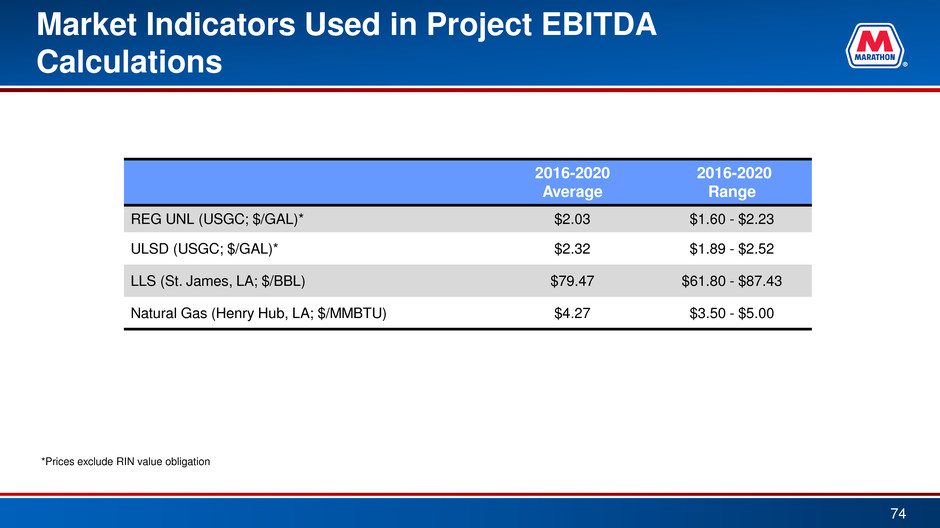

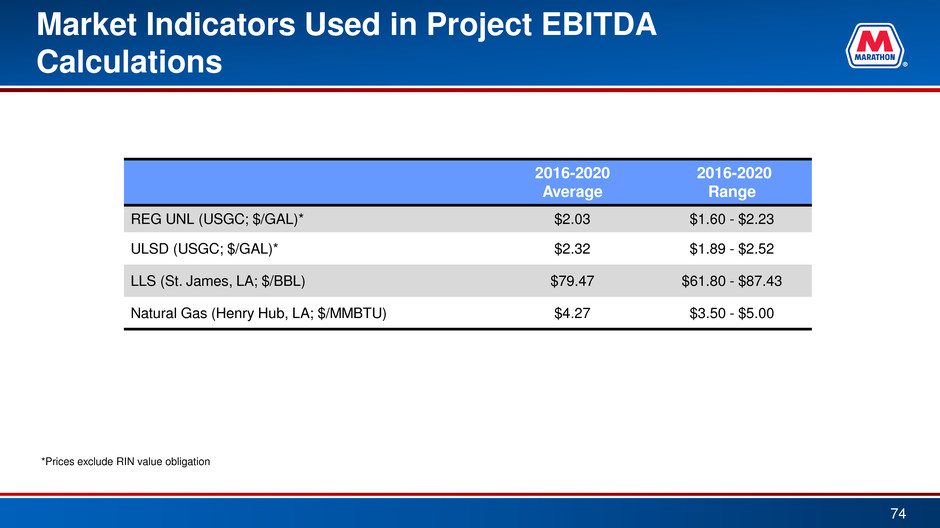

Market Indicators Used in Project EBITDA Calculations 74 2016-2020 Average 2016-2020 Range REG UNL (USGC; $/GAL)* $2.03 $1.60 - $2.23 ULSD (USGC; $/GAL)* $2.32 $1.89 - $2.52 LLS (St. James, LA; $/BBL) $79.47 $61.80 - $87.43 Natural Gas (Henry Hub, LA; $/MMBTU) $4.27 $3.50 - $5.00 *Prices exclude RIN value obligation