Investor Presentation November 2016

Forward‐Looking Statements 2 This presentation contains forward-looking statements within the meaning of federal securities laws regarding Marathon Petroleum Corporation ("MPC") and MPLX LP ("MPLX"). These forward-looking statements relate to, among other things, expectations, estimates and projections concerning the business and operations of MPC and MPLX, including proposed strategic initiatives. You can identify forward-looking statements by words such as "anticipate," "believe," "design," "estimate," "expect," "forecast," "goal," "guidance," "imply," "intend," "objective," "opportunity," "outlook," "plan," "position," "pursue," "prospective," "predict," "project," "potential," "seek," "strategy," "target," "could," "may," "should," "would," "will" or other similar expressions that convey the uncertainty of future events or outcomes. Such forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond the companies' control and are difficult to predict. Factors that could cause MPC's actual results to differ materially from those implied in the forward-looking statements include: the time, costs and ability to obtain regulatory or other approvals and consents and otherwise consummate the strategic initiatives discussed herein; the satisfaction or waiver of conditions in the agreements governing the strategic initiatives discussed herein; our ability to achieve the strategic and other objectives related to the strategic initiatives discussed herein; adverse changes in laws including with respect to tax and regulatory matters; inability to agree with the MPLX conflicts committee with respect to the timing of and value attributed to assets identified for dropdown; risks described below relating to MPLX and the MPLX/MarkWest Energy Partners, L.P. ("MarkWest") merger; changes to the expected construction costs and timing of projects; continued/further volatility in and/or degradation of market and industry conditions; the availability and pricing of crude oil and other feedstocks; slower growth in domestic and Canadian crude supply; the effects of the lifting of the U.S. crude oil export ban; completion of pipeline capacity to areas outside the U.S. Midwest; consumer demand for refined products; transportation logistics; the reliability of processing units and other equipment; MPC's ability to successfully implement growth opportunities; modifications to MPLX earnings and distribution growth objectives; compliance with federal and state environmental, economic, health and safety, energy and other policies and regulations, including the cost of compliance with the Renewable Fuel Standard, and/or enforcement actions initiated thereunder; changes to MPC's capital budget; other risk factors inherent to MPC's industry; and the factors set forth under the heading "Risk Factors" in MPC's Annual Report on Form 10-K for the year ended Dec. 31, 2015, filed with Securities and Exchange Commission (SEC). Factors that could cause MPLX's actual results to differ materially from those implied in the forward-looking statements include: negative capital market conditions, including a persistence or increase of the current yield on common units, which is higher than historical yields, adversely affecting MPLX's ability to meet its distribution growth guidance; risk that the synergies from the acquisition of MarkWest by MPLX may not be fully realized or may take longer to realize than expected; disruption from the MPLX/MarkWest merger making it more difficult to maintain relationships with customers, employees or suppliers; risks relating to any unforeseen liabilities of MarkWest; the time, costs and ability to obtain regulatory or other approvals and consents and otherwise consummate the strategic initiatives discussed herein and other proposed transactions; the satisfaction or waiver of conditions in the agreements governing the strategic initiatives discussed herein and other proposed transactions; our ability to achieve the strategic and other objectives related to the strategic initiatives discussed herein and other proposed transactions; adverse changes in laws including with respect to tax and regulatory matters; inability to agree with respect to the timing of and value attributed to assets identified for dropdown; the adequacy of MPLX's capital resources and liquidity, including, but not limited to, availability of sufficient cash flow to pay distributions, and the ability to successfully execute its business plans and growth strategy; the timing and extent of changes in commodity prices and demand for crude oil, refined products, feedstocks or other hydrocarbon-based products; continued/further volatility in and/or degradation of market and industry conditions; changes to the expected construction costs and timing of projects; completion of midstream infrastructure by competitors; disruptions due to equipment interruption or failure, including electrical shortages and power grid failures; the suspension, reduction or termination of MPC's obligations under MPLX's commercial agreements; modifications to earnings and distribution growth objectives; the level of support from MPC, including dropdowns, alternative financing arrangements, taking equity units, and other methods of sponsor support, as a result of the capital allocation needs of the enterprise as a whole and its ability to provide support on commercially reasonable terms; compliance with federal and state environmental, economic, health and safety, energy and other policies and regulations and/or enforcement actions initiated thereunder; changes to MPLX's capital budget; other risk factors inherent to MPLX's industry; and the factors set forth under the heading "Risk Factors" in MPLX's Annual Report on Form 10-K for the year ended Dec. 31, 2015, and Quarterly Report on Form 10-Q for the quarter ended March 31, 2016, filed with the SEC. In addition, the forward-looking statements included herein could be affected by general domestic and international economic and political conditions. Unpredictable or unknown factors not discussed here, in MPC's Form 10-K or in MPLX's Form 10-K or Form 10-Q could also have material adverse effects on forward-looking statements. Copies of MPC's Form 10-K are available on the SEC website, MPC's website at http://ir.marathonpetroleum.com or by contacting MPC's Investor Relations office. Copies of MPLX's Form 10-K and Form 10-Q are available on the SEC website, MPLX's website at http://ir.mplx.com or by contacting MPLX's Investor Relations office. Non-GAAP Financial Measures EBITDA, Adjusted EBITDA and distributable cash flow are non-GAAP financial measures provided in this presentation. EBITDA, Adjusted EBITDA and distributable cash-flow reconciliations to the nearest GAAP financial measure are included in the Appendix to this presentation. EBITDA, Adjusted EBITDA and distributable cash flow are not defined by GAAP and should not be considered in isolation or as an alternative to net income attributable to MPC or MPLX, net cash provided by operating activities or other financial measures prepared in accordance with GAAP. The EBITDA forecasts related to certain projects were determined on an EBITDA-only basis. Accordingly, information related to the elements of net income, including tax and interest, are not available and, therefore, reconciliations of these non-GAAP financial measures to the nearest GAAP financial measures have not been provided.

Important Additional Information MPC, its directors and certain of its executive officers may be deemed to be participants in the solicitation of proxies from MPC shareholders in connection with the matters to be considered at MPC’s 2017 Annual Meeting. MPC intends to file a proxy statement with the SEC in connection with any such solicitation of proxies from MPC shareholders. MPC shareholders are encouraged to read any such proxy statement and accompanying white proxy card when they become available as they will contain important information. Information regarding the ownership of MPC’s directors and executive officers in MPC shares, restricted shares and options is included in their SEC filings on Forms 3, 4 and 5. More detailed information regarding the identity of potential participants, and their direct or indirect interests, by security holdings or otherwise, will be set forth in the proxy statement and other materials to be filed with the SEC in connection with MPC’s 2017 Annual Meeting. Information can also be found in MPC’s Annual Report on Form 10-K for the year ended Dec. 31, 2015, filed with the SEC, and Current Report on Form 8-K filed with the SEC on Oct. 5, 2016. Shareholders will be able to obtain any proxy statement, any amendments or supplements to the proxy statement and other documents filed by MPC with the SEC for no charge on the SEC website, MPC’s website at http://ir.marathonpetroleum.com or by contacting MPC’s Investor Relations office. 3

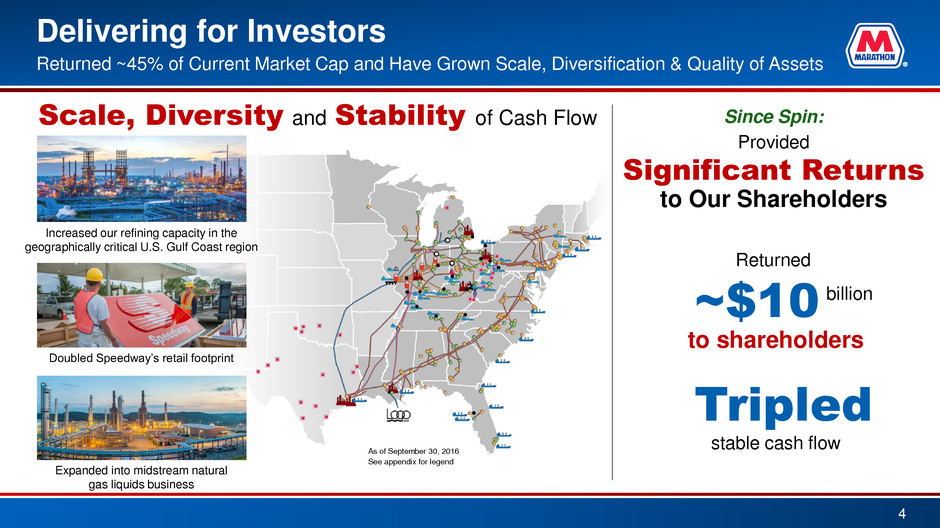

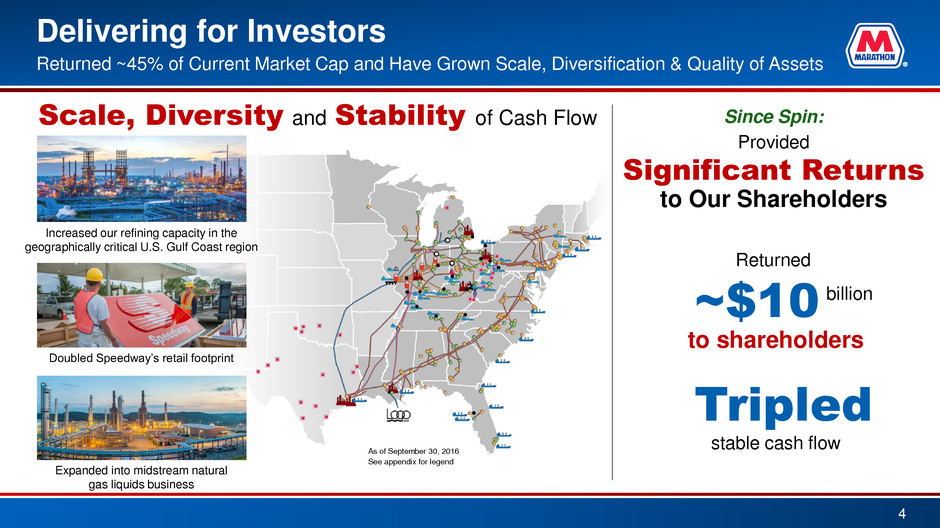

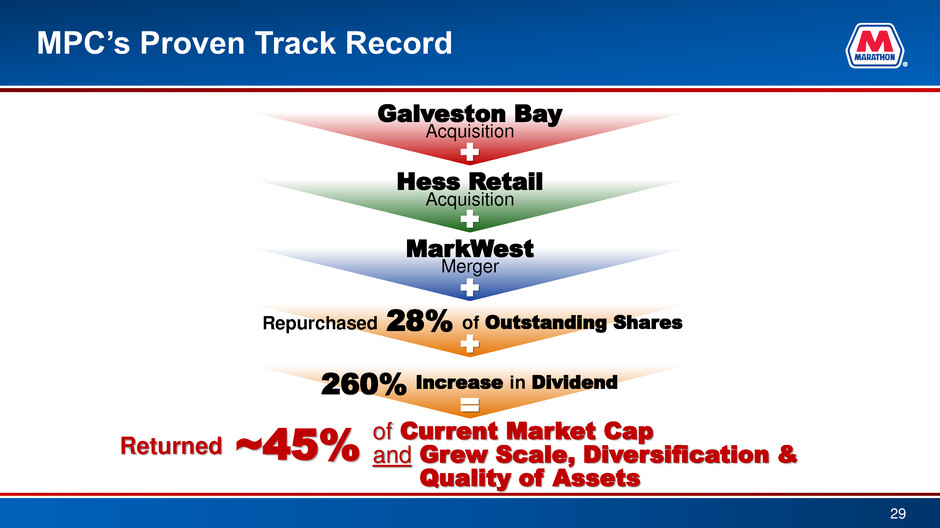

Delivering for Investors 4 Returned ~45% of Current Market Cap and Have Grown Scale, Diversification & Quality of Assets Scale, Diversity and Stability of Cash Flow Increased our refining capacity in the geographically critical U.S. Gulf Coast region Doubled Speedway’s retail footprint Expanded into midstream natural gas liquids business stable cash flow Tripled Provided Significant Returns to Our Shareholders Returned ~$10 to shareholders As of September 30, 2016 See appendix for legend Since Spin: billion

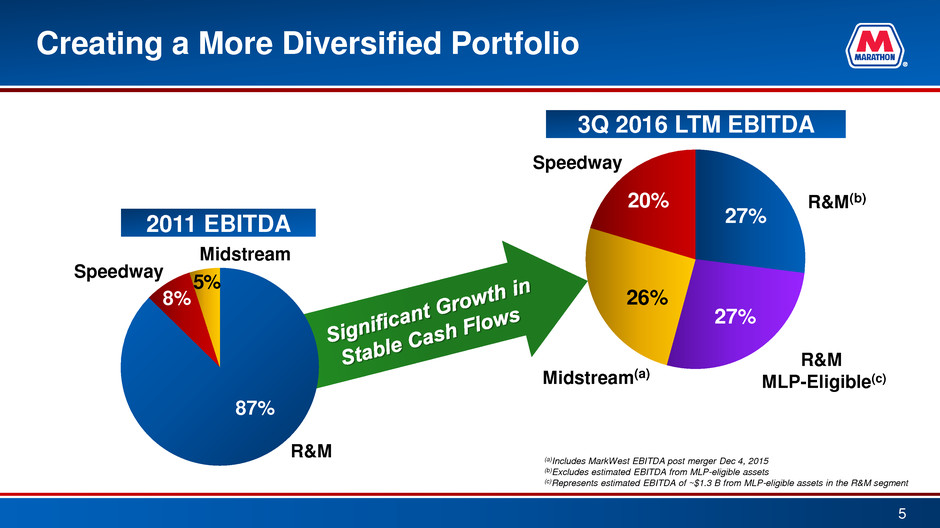

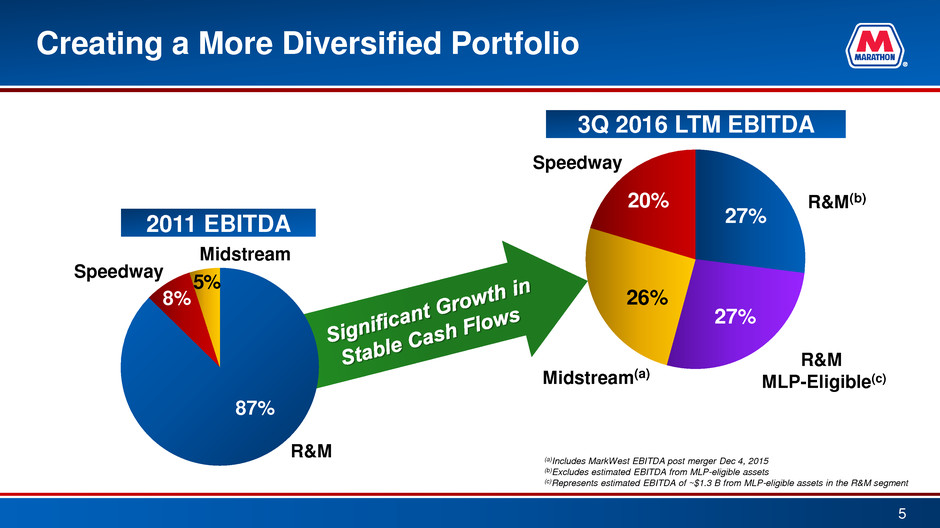

27% 27% 26% 20% 87% 8% 5% Creating a More Diversified Portfolio 5 2011 EBITDA Speedway R&M Speedway Midstream(a) R&M(b) 3Q 2016 LTM EBITDA Midstream R&M MLP-Eligible(c) (a)Includes MarkWest EBITDA post merger Dec 4, 2015 (b)Excludes estimated EBITDA from MLP-eligible assets (c)Represents estimated EBITDA of ~$1.3 B from MLP-eligible assets in the R&M segment

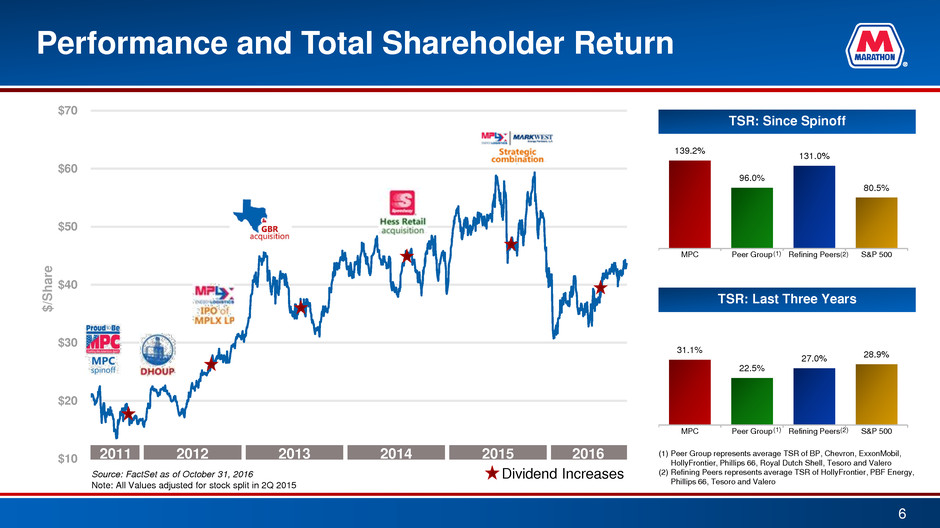

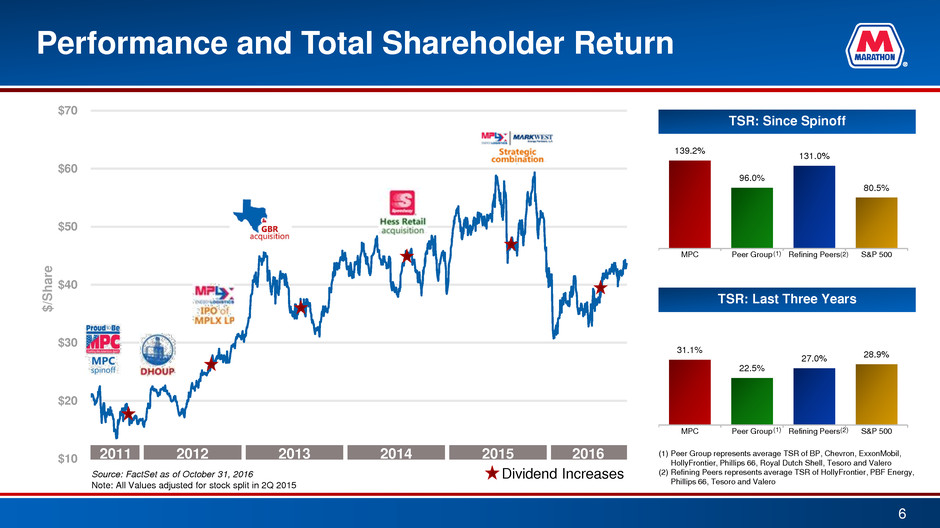

$10 $20 $30 $40 $50 $60 $70 $/ Sh ar e Performance and Total Shareholder Return 6 2011 2012 2013 2014 2015 2016 TSR: Since Spinoff TSR: Last Three Years Dividend Increases Source: FactSet as of October 31, 2016 Note: All Values adjusted for stock split in 2Q 2015 (1) Peer Group represents average TSR of BP, Chevron, ExxonMobil, HollyFrontier, Phillips 66, Royal Dutch Shell, Tesoro and Valero (2) Refining Peers represents average TSR of HollyFrontier, PBF Energy, Phillips 66, Tesoro and Valero 31.1% 22.5% 27.0% 28.9% MPC Peer Group Refining Peers S&P 500 139.2% 96.0% 131.0% 80.5% MPC Peer Group Refining Peers S&P 500 (1) (2) (1) (2)

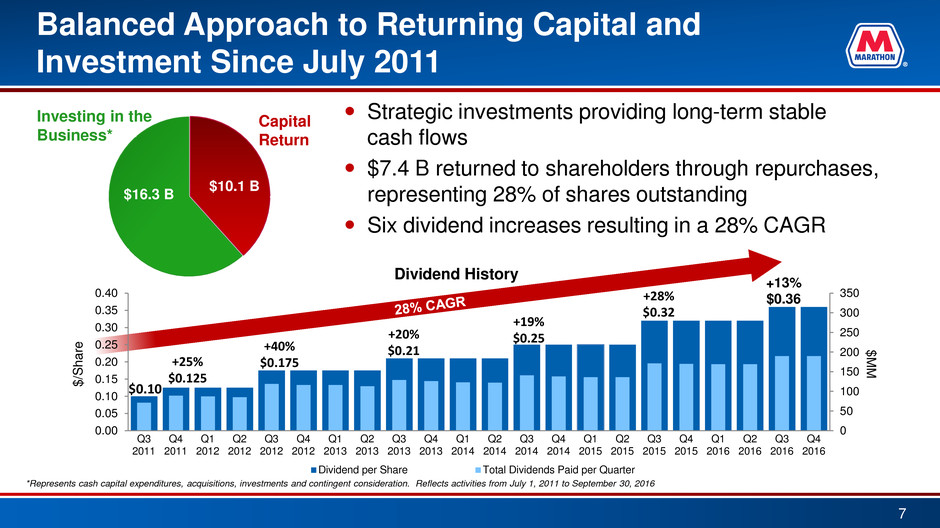

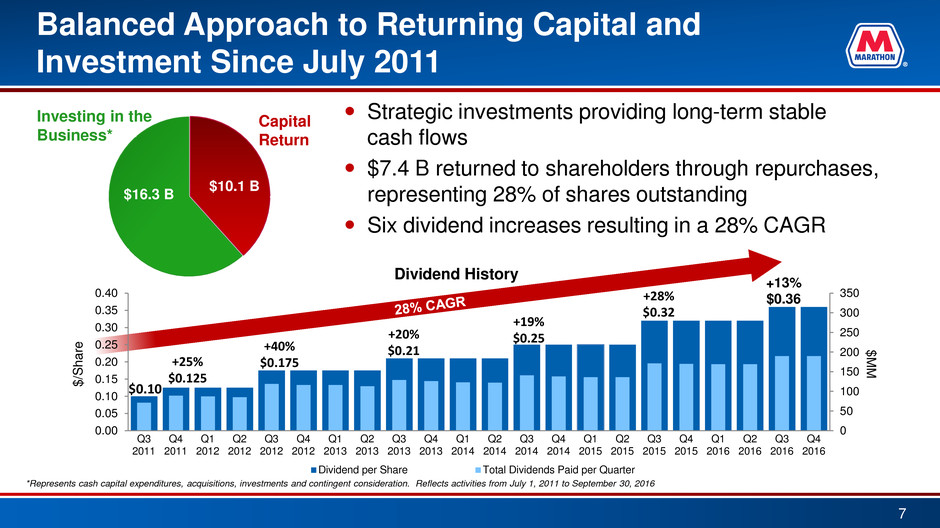

0 50 100 150 200 250 300 350 0.00 0.05 0.10 0.15 0.20 0.25 0.30 0.35 0.40 Q3 2011 Q4 2011 Q1 2012 Q2 2012 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 $ M M $/ S h a re Dividend History Dividend per Share Total Dividends Paid per Quarter +25% $0.125 $0.10 +40% $0.175 +20% $0.21 +19% $0.25 +28% $0.32 7 Balanced Approach to Returning Capital and Investment Since July 2011 *Represents cash capital expenditures, acquisitions, investments and contingent consideration. Reflects activities from July 1, 2011 to September 30, 2016 Strategic investments providing long-term stable cash flows $7.4 B returned to shareholders through repurchases, representing 28% of shares outstanding Six dividend increases resulting in a 28% CAGR Capital Return Investing in the Business* $10.1 B $16.3 B +13% $0.36

Strategic Plan to Enhance Shareholder Value Aggressive dropdown strategy* – MPC plans to offer assets with ~$350 MM of annual EBITDA to MPLX by the end of 2017, including ~$235 MM by the end of Q1 2017 – Following these initial dropdowns and as soon as practicable, MPC expects to offer its remaining MLP-eligible annual EBITDA of ~ $1B to MPLX by the end of 2019 Evaluate strategic opportunities to highlight and capture the value of MPC’s general partner interest in MPLX and optimize the partnership’s cost of capital Review of segment reporting – Largely focused on the assets and earnings associated with our future dropdown strategy that are currently reported in the refining and marketing segment 8 *Subject to market and other conditions and pending requisite approvals

Market Outlook Distillate demand expected to be strong – Normal winter weather expected to support distillate demand and lead to a reduction in inventory – As gasoline demand is impacted by CAFE standards, global distillate demand is expected to be greater than gasoline – International bunker specifications are expected to increase demand for distillate Continued strong U.S. refined product exports – U.S. refineries have cost advantages and are more complex Heavy and sour crude oil differentials remain favorable Crude differentials expected to improve as commodity prices strengthen Frac spread and NGL prices expected to strengthen – Increased LPG export capacity supports propane and butane prices – Increased ethane demand as ethane cracker projects come on line from 2017-2021 9

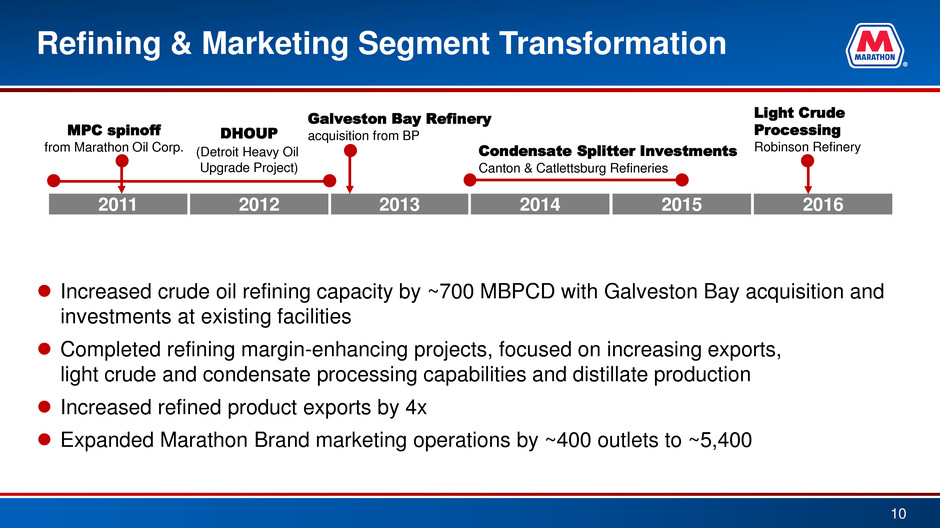

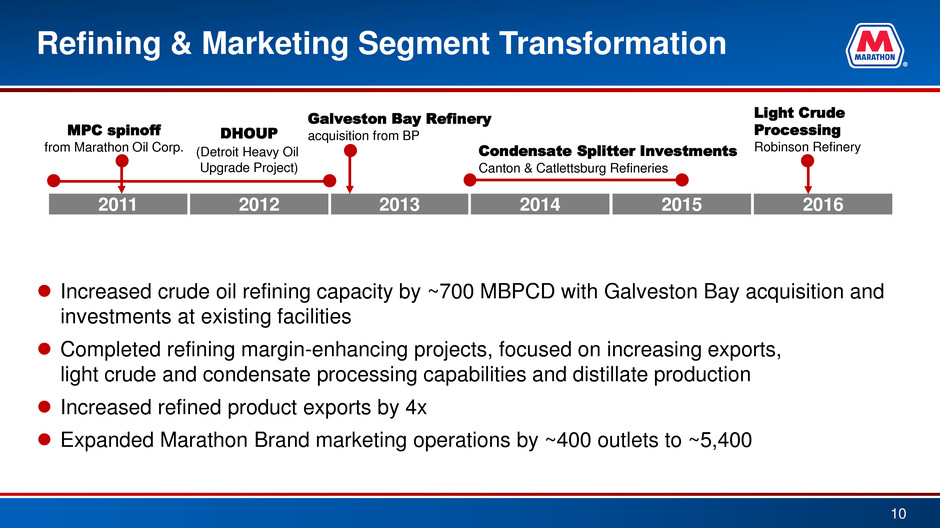

Refining & Marketing Segment Transformation Increased crude oil refining capacity by ~700 MBPCD with Galveston Bay acquisition and investments at existing facilities Completed refining margin-enhancing projects, focused on increasing exports, light crude and condensate processing capabilities and distillate production Increased refined product exports by 4x Expanded Marathon Brand marketing operations by ~400 outlets to ~5,400 10 2013 2014 2015 2012 2011 2016 DHOUP (Detroit Heavy Oil Upgrade Project) Galveston Bay Refinery acquisition from BP Condensate Splitter Investments Canton & Catlettsburg Refineries Light Crude Processing Robinson Refinery MPC spinoff from Marathon Oil Corp.

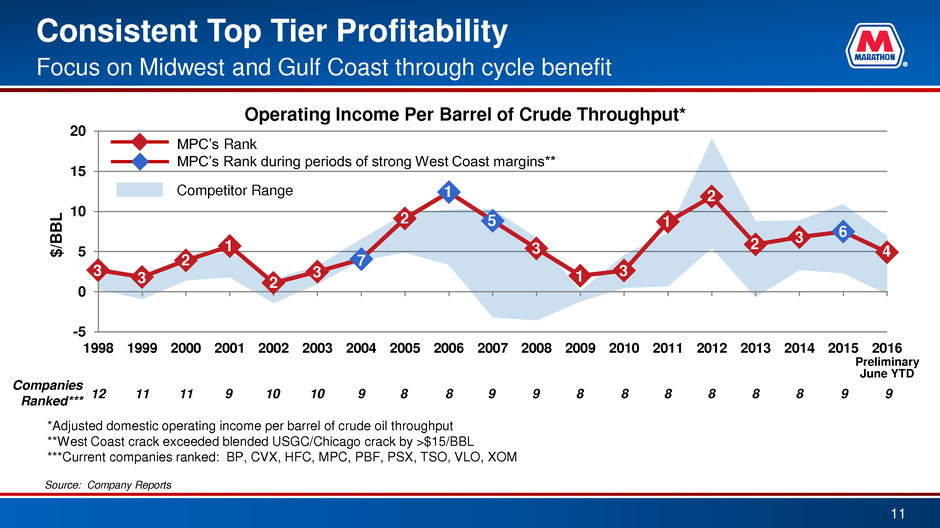

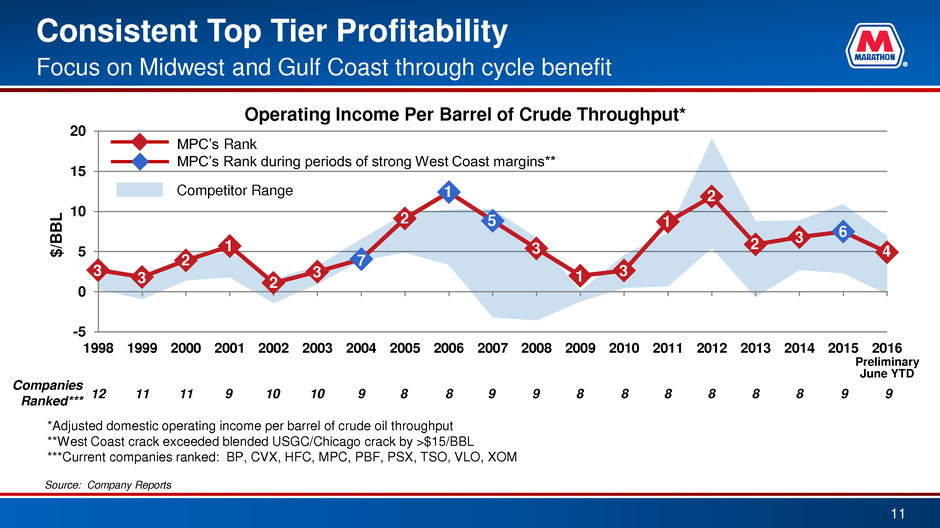

Source: Company Reports -5 0 5 10 15 20 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 $ /BB L MPC’s Rank MPC’s Rank during periods of strong West Coast margins** Companies Ranked*** *Adjusted domestic operating income per barrel of crude oil throughput **West Coast crack exceeded blended USGC/Chicago crack by >$15/BBL ***Current companies ranked: BP, CVX, HFC, MPC, PBF, PSX, TSO, VLO, XOM Consistent Top Tier Profitability 11 Focus on Midwest and Gulf Coast through cycle benefit 11 12 11 9 10 9 8 9 9 8 10 8 8 8 8 8 8 9 Preliminary June YTD 9 Operating Income Per Barrel of Crude Throughput* 6 4 3 3 2 1 2 3 7 2 1 5 3 1 3 1 2 2 3 Competitor Range

Strong Operational Performance and Responsible Corporate Leadership 12

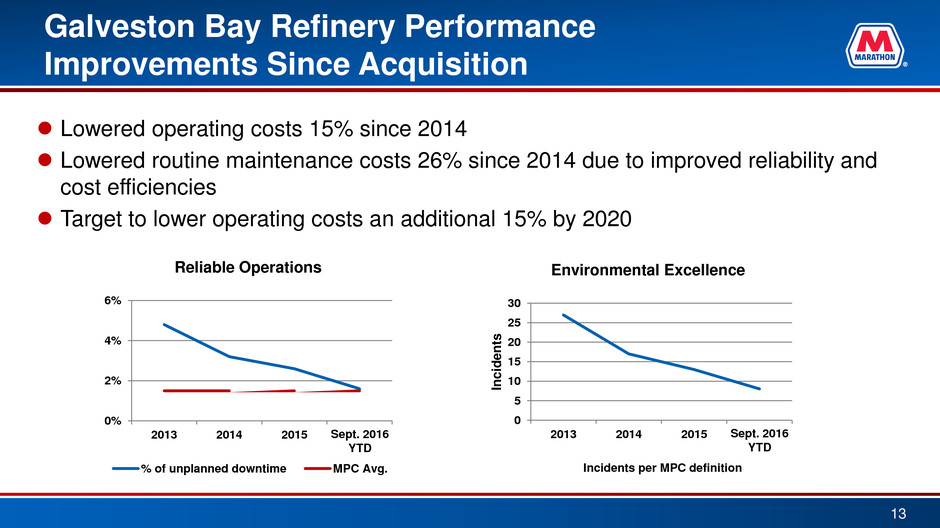

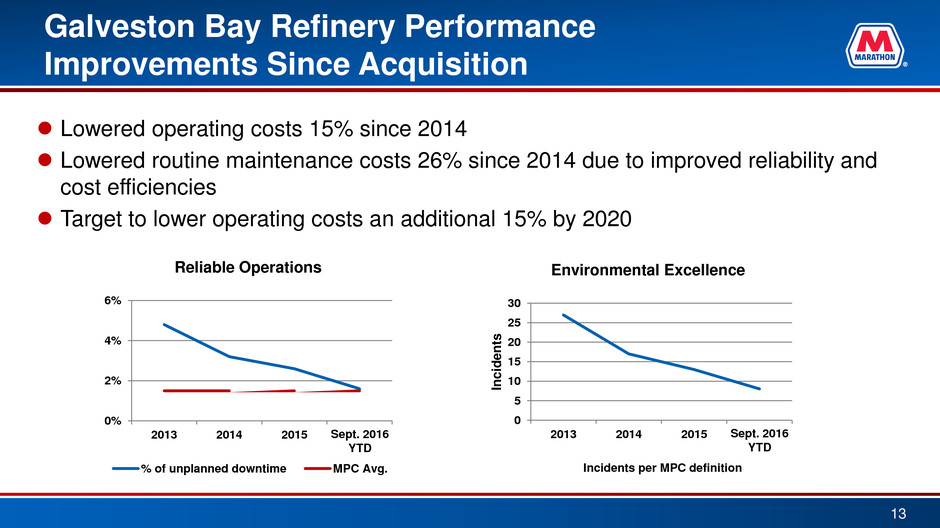

Galveston Bay Refinery Performance Improvements Since Acquisition Lowered operating costs 15% since 2014 Lowered routine maintenance costs 26% since 2014 due to improved reliability and cost efficiencies Target to lower operating costs an additional 15% by 2020 13 0 5 10 15 20 25 30 2013 2014 2015 Jul 2016 YTD Inci d en ts Environmental Excellence Incidents per MPC definition 0% 2% 4% 6% 2013 2014 2015 Jul 2016 YTD Reliable Operations % of unplanned downtime MPC Avg. Sept. 2016 Sept. 2016

Optimization of South Texas Asset Repositioning (STAR) Program Potential reduction of total planned investment from $2 B to $1.5 B Project scope and investment return profile substantially preserved Project scope: – Increase residual oil (resid) processing – Revamp crude unit – Increase ULSD production – Complete integration of Galveston Bay and Texas City refineries 14

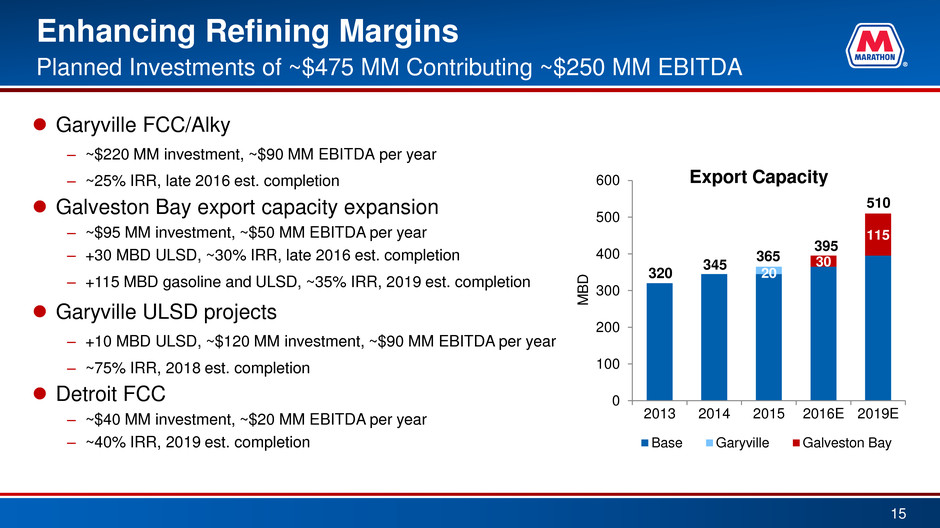

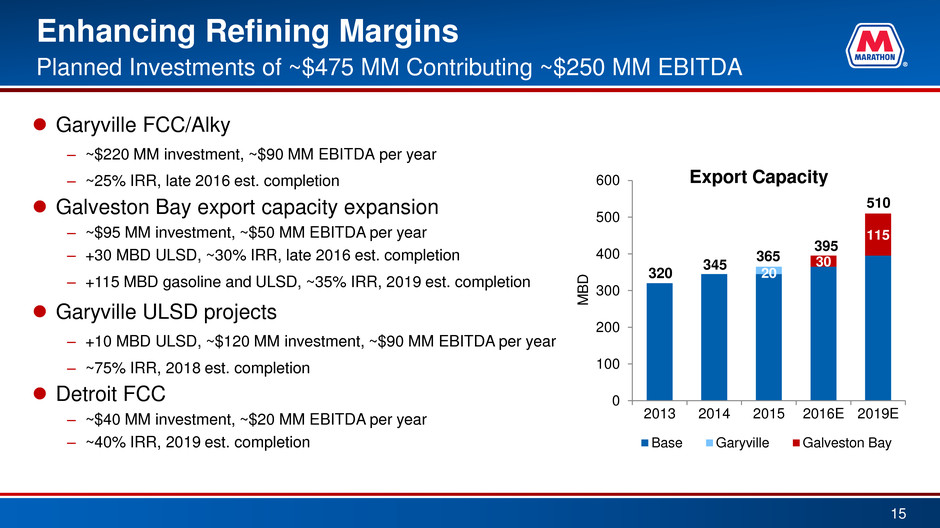

Enhancing Refining Margins 15 Planned Investments of ~$475 MM Contributing ~$250 MM EBITDA Garyville FCC/Alky – ~$220 MM investment, ~$90 MM EBITDA per year – ~25% IRR, late 2016 est. completion Galveston Bay export capacity expansion – ~$95 MM investment, ~$50 MM EBITDA per year – +30 MBD ULSD, ~30% IRR, late 2016 est. completion – +115 MBD gasoline and ULSD, ~35% IRR, 2019 est. completion Garyville ULSD projects – +10 MBD ULSD, ~$120 MM investment, ~$90 MM EBITDA per year – ~75% IRR, 2018 est. completion Detroit FCC – ~$40 MM investment, ~$20 MM EBITDA per year – ~40% IRR, 2019 est. completion 320 345 395 510 365 20 30 115 0 100 200 300 400 500 600 2013 2014 2015 2016E 2019E M B D Base Garyville Galveston Bay Export Capacity

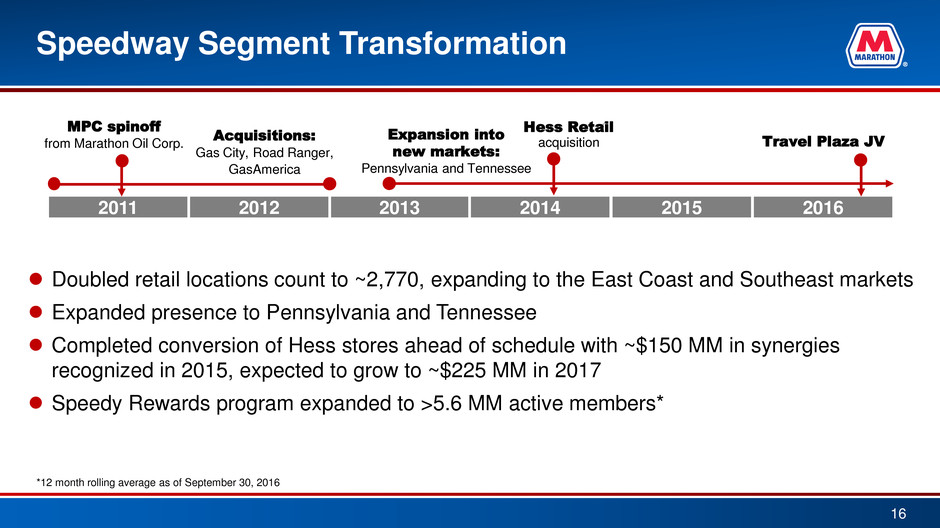

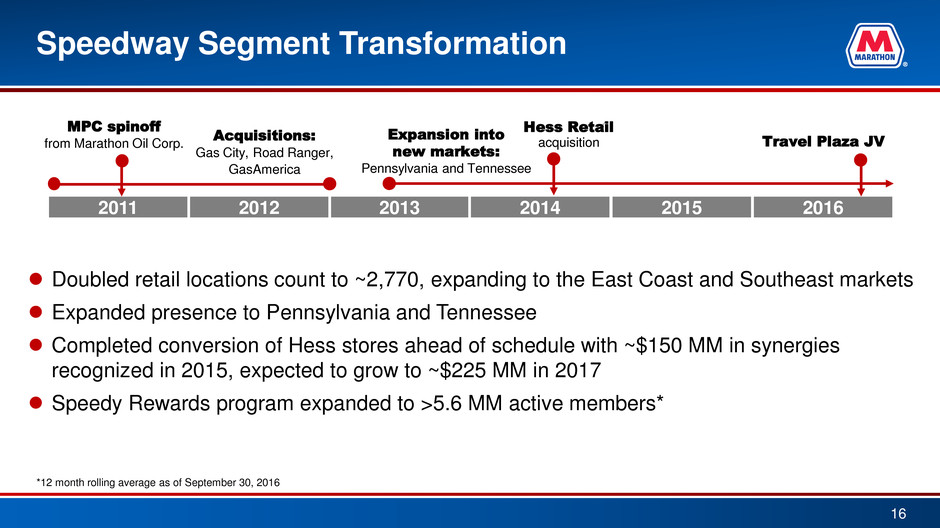

2013 2014 2015 2012 2011 2016 Speedway Segment Transformation Doubled retail locations count to ~2,770, expanding to the East Coast and Southeast markets Expanded presence to Pennsylvania and Tennessee Completed conversion of Hess stores ahead of schedule with ~$150 MM in synergies recognized in 2015, expected to grow to ~$225 MM in 2017 Speedy Rewards program expanded to >5.6 MM active members* 16 *12 month rolling average as of September 30, 2016 Acquisitions: Gas City, Road Ranger, GasAmerica Travel Plaza JV Expansion into new markets: Pennsylvania and Tennessee MPC spinoff from Marathon Oil Corp. Hess Retail acquisition

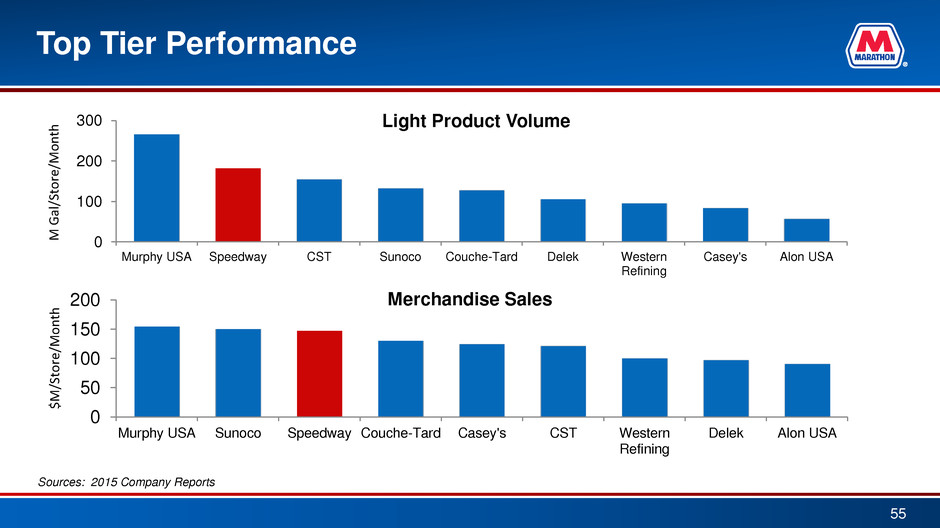

Speedway - Top tier Performer in Convenience Store Industry 17 0 10 20 30 40 Speedway Sunoco Casey's CST Couche-Tard Murphy USA Delek Alon USA Western Refining $ M /S tore/M o nt h EBITDA 0 25 50 75 100 Sunoco Speedway CST Casey's Couche-Tard Murphy USA Western Refining Delek Alon USA $ M /Sto re /M o nt h Total Margin Light Product Merchandise Speedway Light Product Speedway Merchandise Source: 2015 Company Reports Generates predictable, stable cash flows #1 in EBITDA/store/month vs. public peers

Speedway Exceeding Expected Acquisition-Related Synergies Continuing to focus on marketing enhancements opportunities Completed 39 remodels in 3Q 2016, 493 to date at acquired locations Reduced overall light product breakeven by ~25% in 3Q 2016 compared to 3Q 2015* 18 20 75 120 155 190 225 0 50 100 150 200 250 2014E 2014 2015E 2015 2016E 2016E 2017E 2017E $ M M Synergies and Marketing Enhancements Guidance** Speedway Synergies R&M Synergies 47 149 *Light Product Breakeven = (Total Expense – Merchandise Margin) / Light Product Volume **Based on original announcement guidance in May 2014

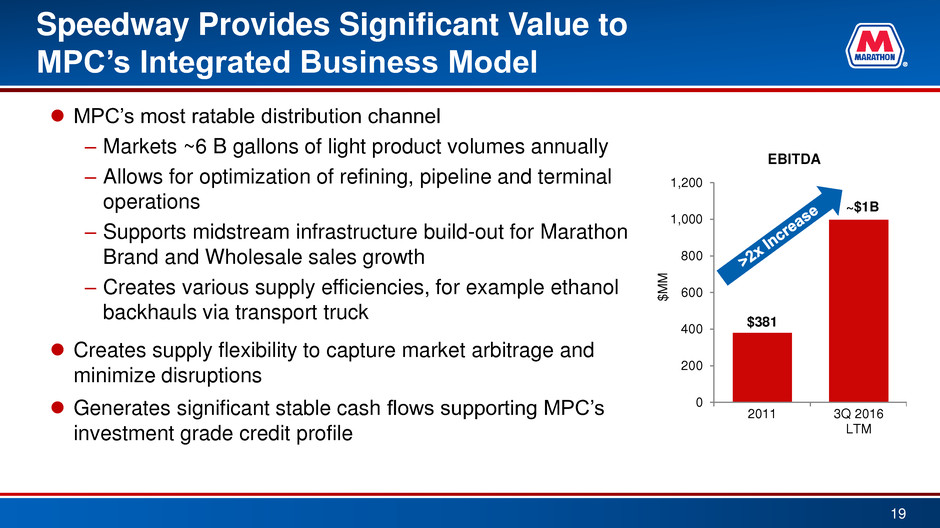

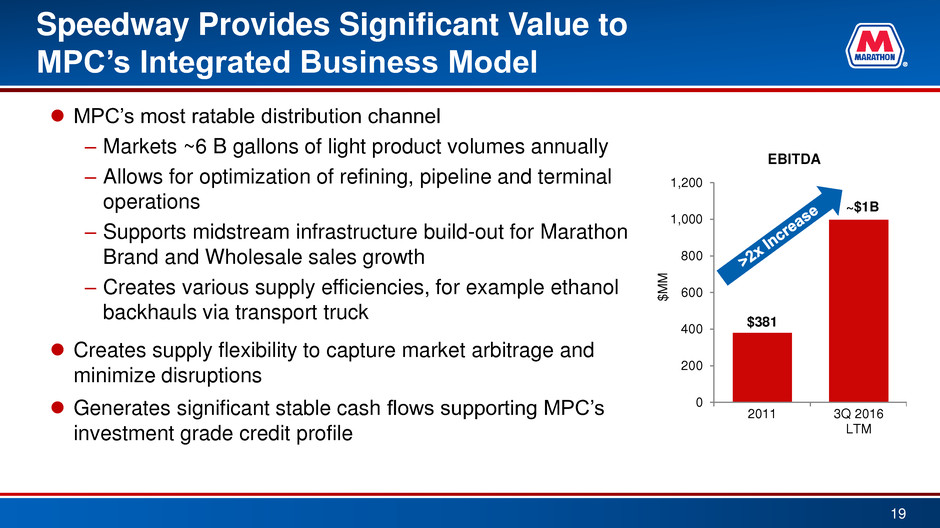

Speedway Provides Significant Value to MPC’s Integrated Business Model MPC’s most ratable distribution channel – Markets ~6 B gallons of light product volumes annually – Allows for optimization of refining, pipeline and terminal operations – Supports midstream infrastructure build-out for Marathon Brand and Wholesale sales growth – Creates various supply efficiencies, for example ethanol backhauls via transport truck Creates supply flexibility to capture market arbitrage and minimize disruptions Generates significant stable cash flows supporting MPC’s investment grade credit profile 19 $381 ~$1B 0 200 400 600 800 1,000 1,200 2011 3Q 2016 LTM $ M M EBITDA

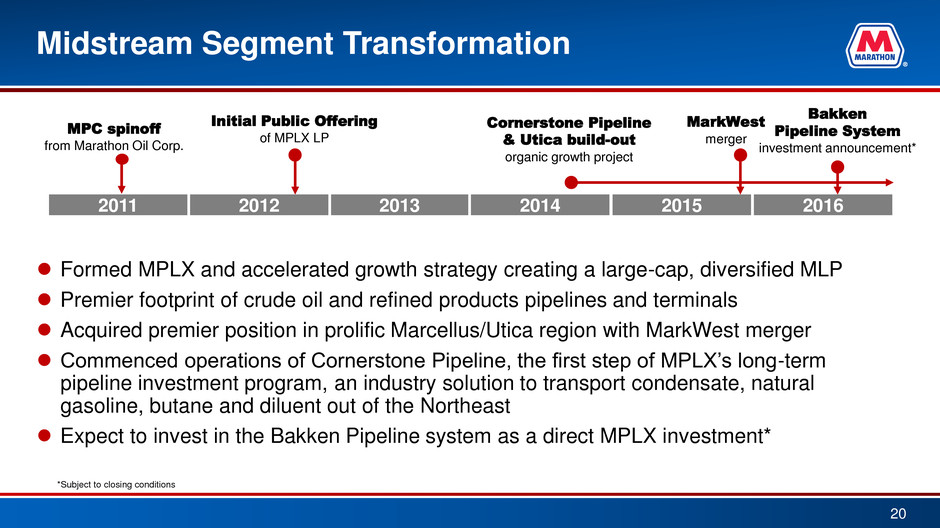

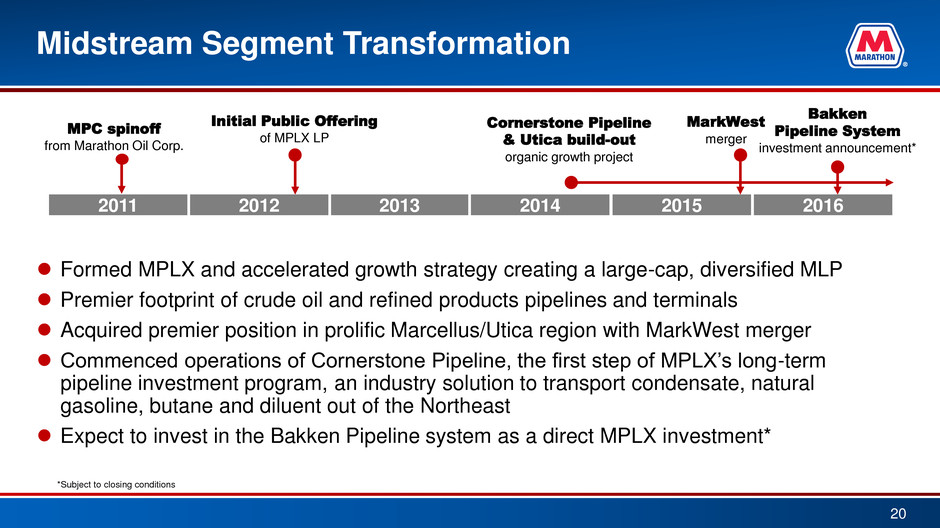

2013 2014 2015 2012 2011 2016 Midstream Segment Transformation Formed MPLX and accelerated growth strategy creating a large-cap, diversified MLP Premier footprint of crude oil and refined products pipelines and terminals Acquired premier position in prolific Marcellus/Utica region with MarkWest merger Commenced operations of Cornerstone Pipeline, the first step of MPLX’s long-term pipeline investment program, an industry solution to transport condensate, natural gasoline, butane and diluent out of the Northeast Expect to invest in the Bakken Pipeline system as a direct MPLX investment* 20 Initial Public Offering of MPLX LP MarkWest merger Cornerstone Pipeline & Utica build-out organic growth project Bakken Pipeline System investment announcement* MPC spinoff from Marathon Oil Corp. *Subject to closing conditions

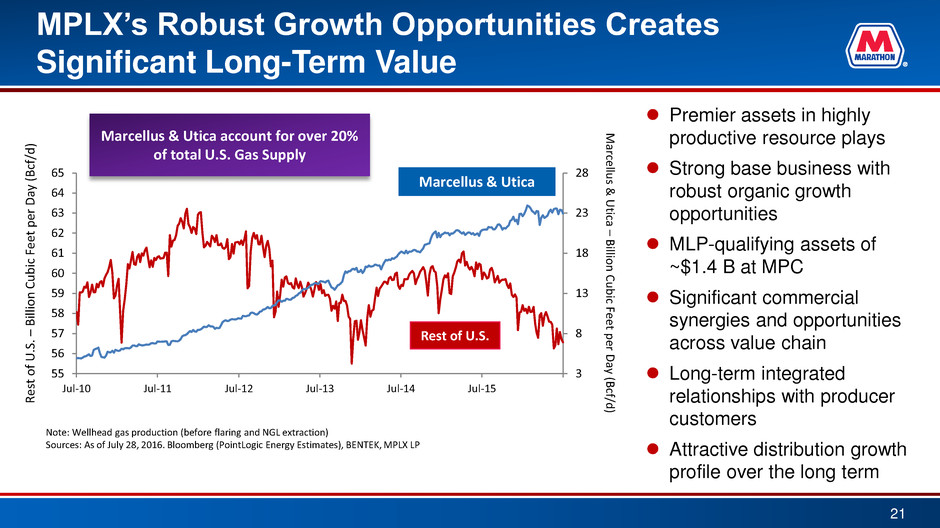

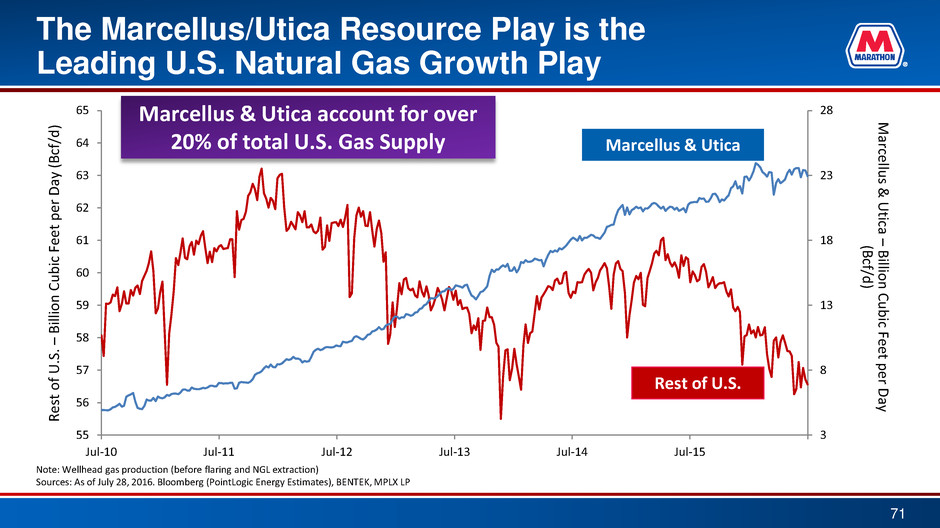

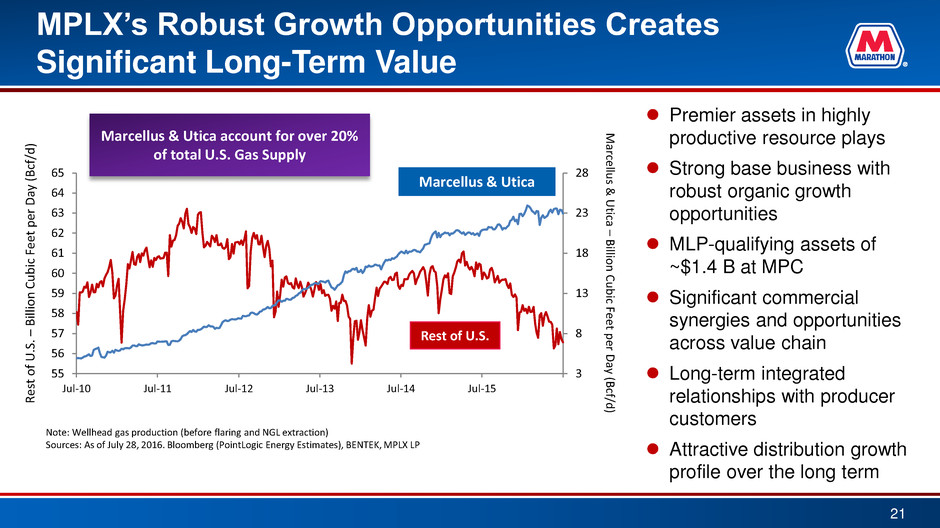

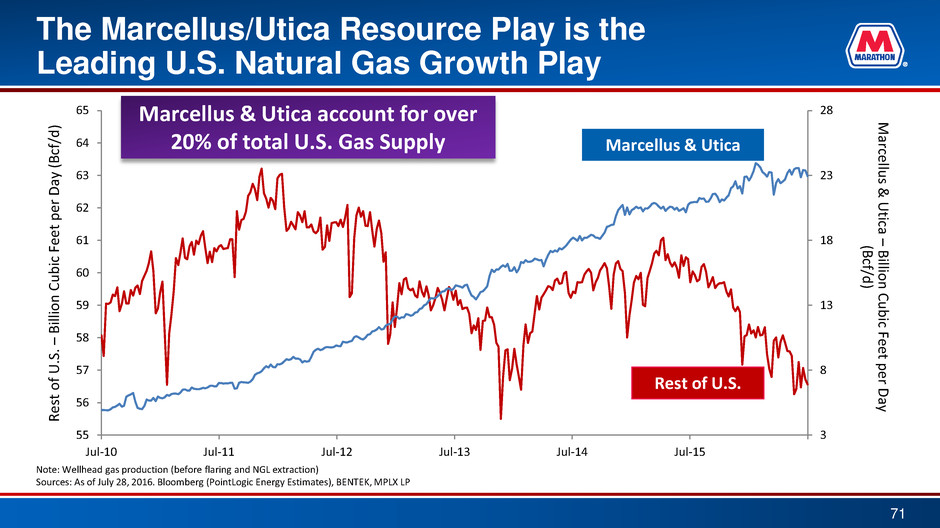

3 8 13 18 23 28 55 56 57 58 59 60 61 62 63 64 65 Jul-10 Jul-11 Jul-12 Jul-13 Jul-14 Jul-15 MPLX’s Robust Growth Opportunities Creates Significant Long-Term Value Premier assets in highly productive resource plays Strong base business with robust organic growth opportunities MLP-qualifying assets of ~$1.4 B at MPC Significant commercial synergies and opportunities across value chain Long-term integrated relationships with producer customers Attractive distribution growth profile over the long term R e st o f U .S . – Bi lli o n Cu b ic F ee t pe r D ay ( Bcf/d ) Note: Wellhead gas production (before flaring and NGL extraction) Sources: As of July 28, 2016. Bloomberg (PointLogic Energy Estimates), BENTEK, MPLX LP M arc ellus & Utica – Bi llio n Cu b ic F eet p er Da y (B cf/d ) Marcellus & Utica account for over 20% of total U.S. Gas Supply Marcellus & Utica Rest of U.S. 21

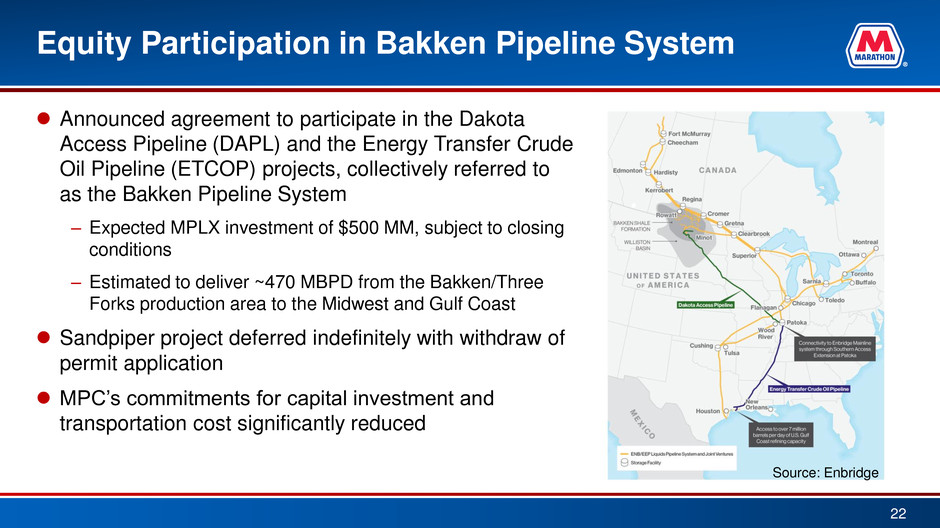

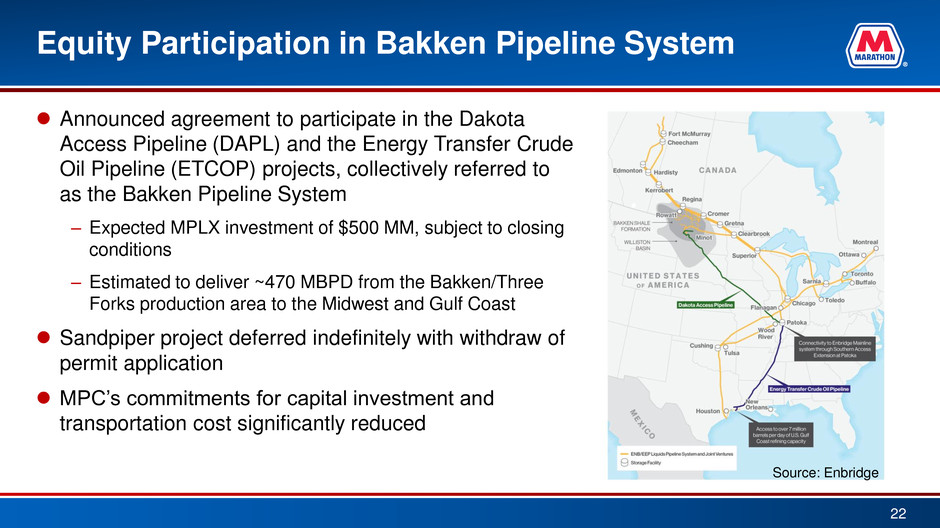

Equity Participation in Bakken Pipeline System 22 Announced agreement to participate in the Dakota Access Pipeline (DAPL) and the Energy Transfer Crude Oil Pipeline (ETCOP) projects, collectively referred to as the Bakken Pipeline System – Expected MPLX investment of $500 MM, subject to closing conditions – Estimated to deliver ~470 MBPD from the Bakken/Three Forks production area to the Midwest and Gulf Coast Sandpiper project deferred indefinitely with withdraw of permit application MPC’s commitments for capital investment and transportation cost significantly reduced Source: Enbridge

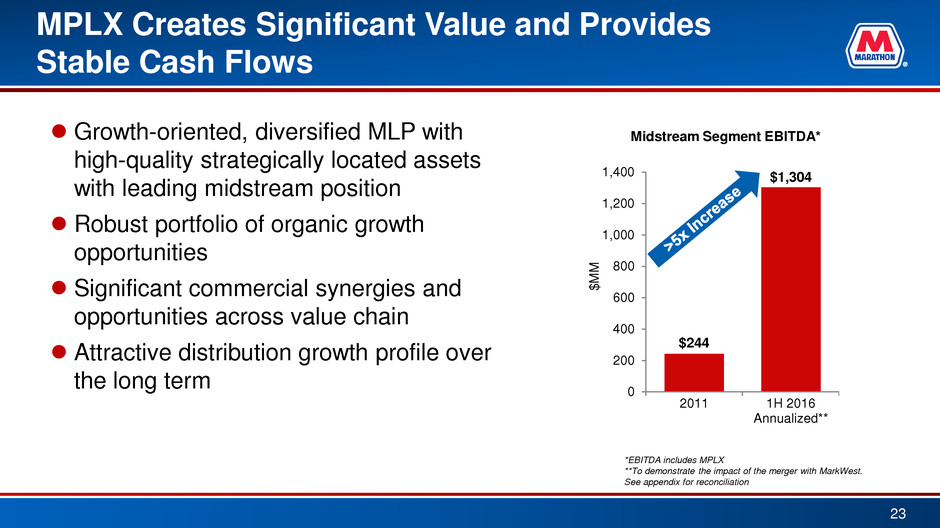

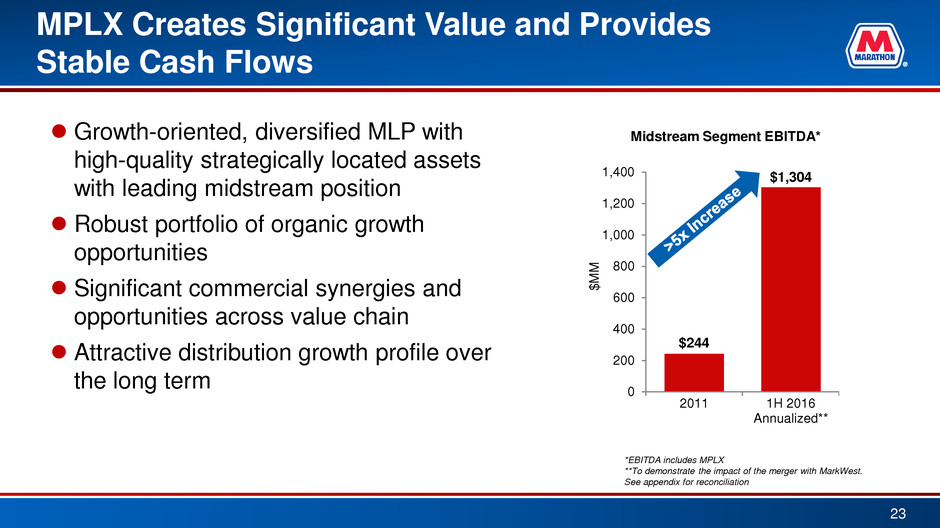

MPLX Creates Significant Value and Provides Stable Cash Flows Growth-oriented, diversified MLP with high-quality strategically located assets with leading midstream position Robust portfolio of organic growth opportunities Significant commercial synergies and opportunities across value chain Attractive distribution growth profile over the long term 23 $244 $1,304 0 200 400 600 800 1,000 1,200 1,400 2011 1H 2016 Annualized** $ M M Midstream Segment EBITDA* *EBITDA includes MPLX **To demonstrate the impact of the merger with MarkWest. See appendix for reconciliation

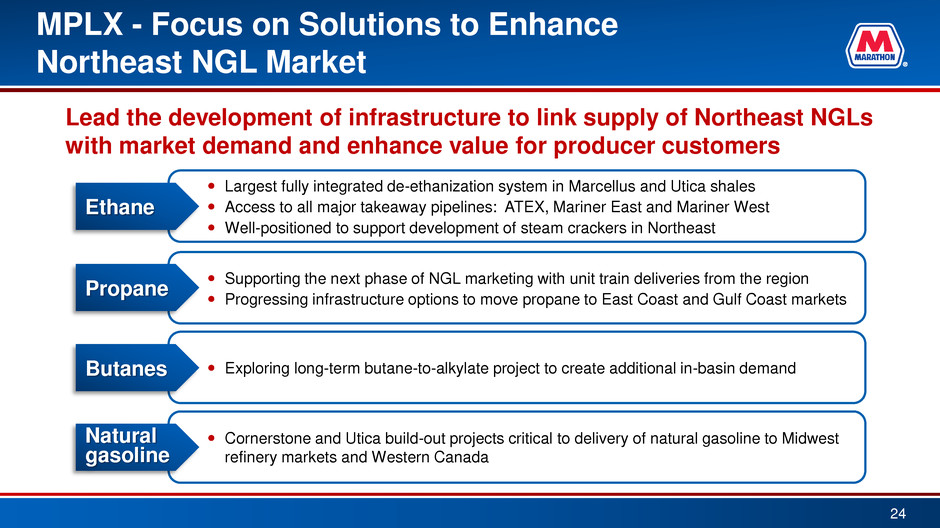

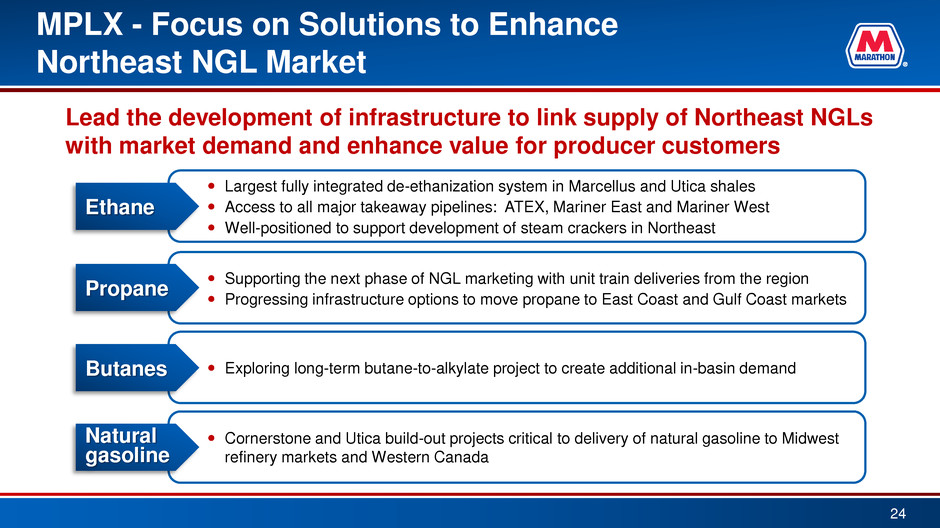

MPLX - Focus on Solutions to Enhance Northeast NGL Market Lead the development of infrastructure to link supply of Northeast NGLs with market demand and enhance value for producer customers 24 Ethane Largest fully integrated de-ethanization system in Marcellus and Utica shales Access to all major takeaway pipelines: ATEX, Mariner East and Mariner West Well-positioned to support development of steam crackers in Northeast Propane Supporting the next phase of NGL marketing with unit train deliveries from the region Progressing infrastructure options to move propane to East Coast and Gulf Coast markets Butanes Exploring long-term butane-to-alkylate project to create additional in-basin demand Natural gasoline Cornerstone and Utica build-out projects critical to delivery of natural gasoline to Midwest refinery markets and Western Canada

MPC’s Substantial MLP-Qualifying Asset Portfolio 25 ~ $1.4 B of estimated annual EBITDA expected to be dropped by the end of 2019 ● 59 MMBBL storage (tanks and caverns) ● 25 rail loading racks and 26 truck loading racks; 7 owned and 11 non-owned docks ● 2 condensate splitter investments ● 21 owned and 2,189 leased ● 793 general service; 1,102 high pressure; 315 open-top hoppers ● ~5,400 miles of additional pipelines (owns, leases or has an ownership interest) ● 61 light product; ~20 MMBBL storage; 187 loading lanes ● 18 asphalt; ~4 MMBBL storage; 68 loading lanes ● Utica investments (crude & condensate trucking and truck/barge terminals) ● Equity in 50/50 blue water JV with Crowley ● 20 B gallons of fuels distribution volume at MPC/Speedway Railcars Pipelines Terminals Refineries Fuels Distribution Marine

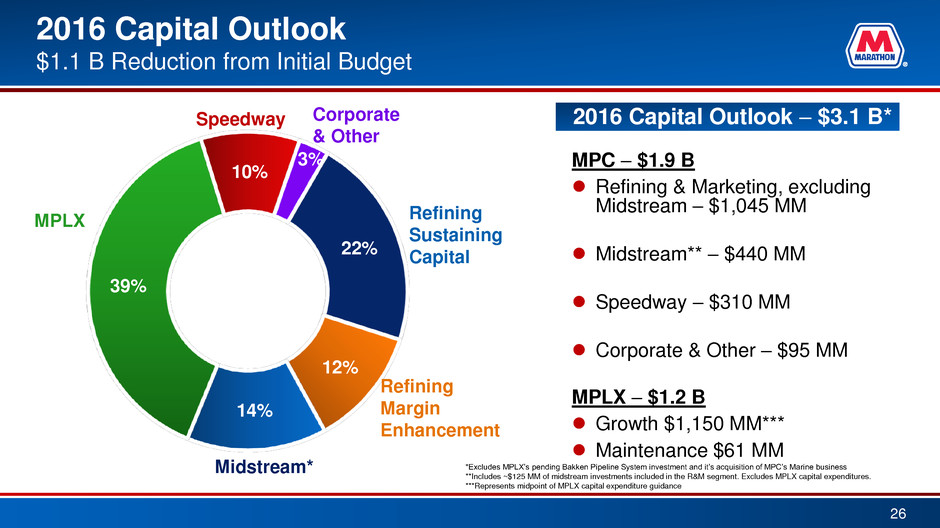

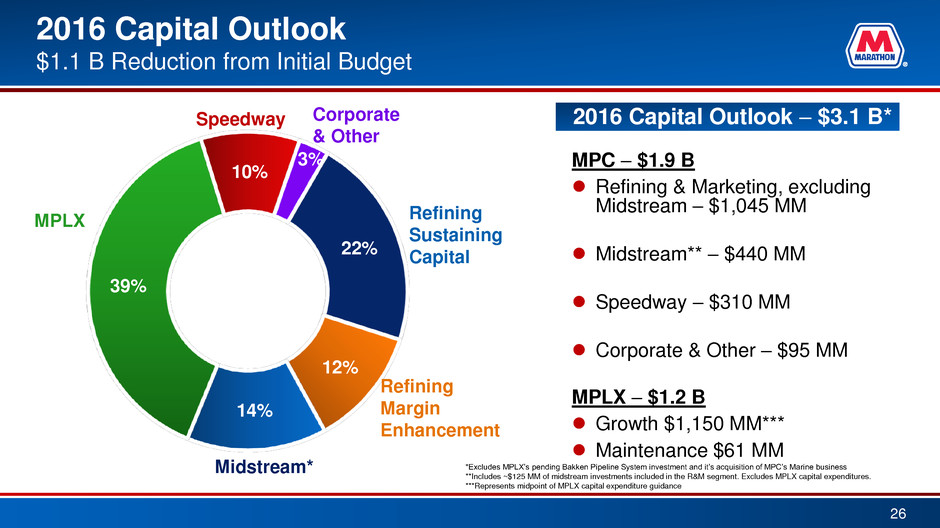

2016 Capital Outlook – $3.1 B* MPC – $1.9 B Refining & Marketing, excluding Midstream – $1,045 MM Midstream** – $440 MM Speedway – $310 MM Corporate & Other – $95 MM MPLX – $1.2 B Growth $1,150 MM*** Maintenance $61 MM 22% 12% 14% 39% 10% 3% Speedway Midstream* MPLX Refining Margin Enhancement Corporate & Other Refining Sustaining Capital *Excludes MPLX’s pending Bakken Pipeline System investment and it’s acquisition of MPC’s Marine business **Includes ~$125 MM of midstream investments included in the R&M segment. Excludes MPLX capital expenditures. ***Represents midpoint of MPLX capital expenditure guidance 2016 Capital Outlook $1.1 B Reduction from Initial Budget 26

Our Priorities for Value Creation 27 Maintain Top Tier Safety and Environmental Performance Grow Higher Valued and Stable Cash-flow Businesses Balance Capital Returns with Value-enhancing Investments Enhance Margins for Our Refinery Operations

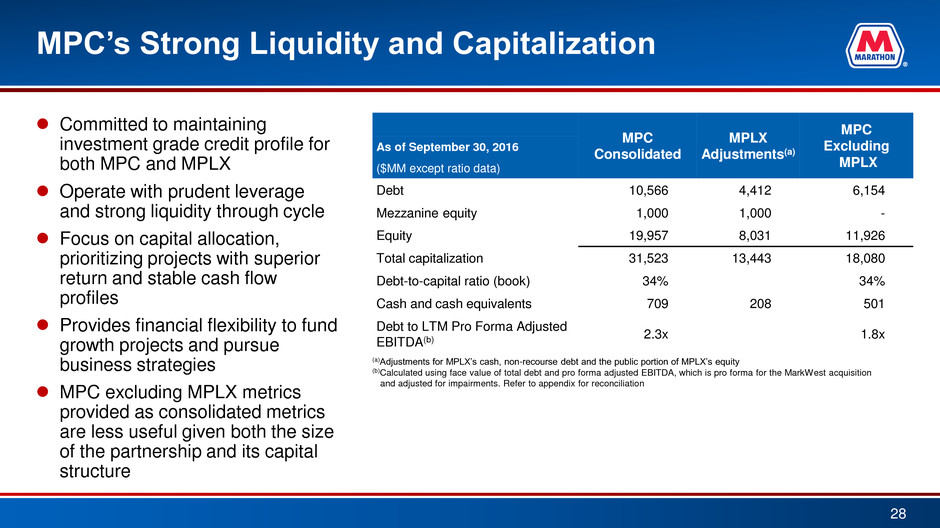

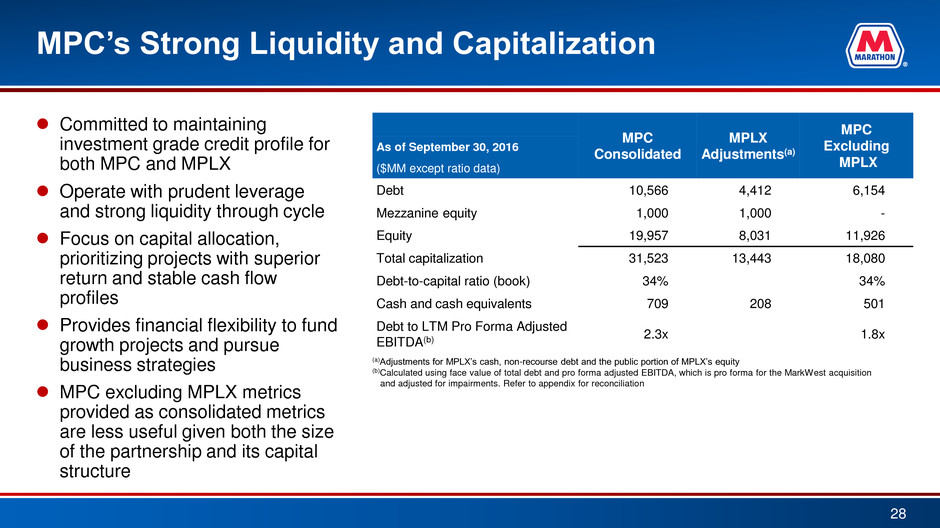

MPC’s Strong Liquidity and Capitalization Committed to maintaining investment grade credit profile for both MPC and MPLX Operate with prudent leverage and strong liquidity through cycle Focus on capital allocation, prioritizing projects with superior return and stable cash flow profiles Provides financial flexibility to fund growth projects and pursue business strategies MPC excluding MPLX metrics provided as consolidated metrics are less useful given both the size of the partnership and its capital structure 28 MPC Consolidated MPLX Adjustments(a) MPC Excluding MPLX As of September 30, 2016 ($MM except ratio data) Debt 10,566 4,412 6,154 Mezzanine equity 1,000 1,000 - Equity 19,957 8,031 11,926 Total capitalization 31,523 13,443 18,080 Debt-to-capital ratio (book) 34% 34% Cash and cash equivalents 709 208 501 Debt to LTM Pro Forma Adjusted EBITDA(b) 2.3x 1.8x (a)Adjustments for MPLX’s cash, non-recourse debt and the public portion of MPLX’s equity (b)Calculated using face value of total debt and pro forma adjusted EBITDA, which is pro forma for the MarkWest acquisition and adjusted for impairments. Refer to appendix for reconciliation

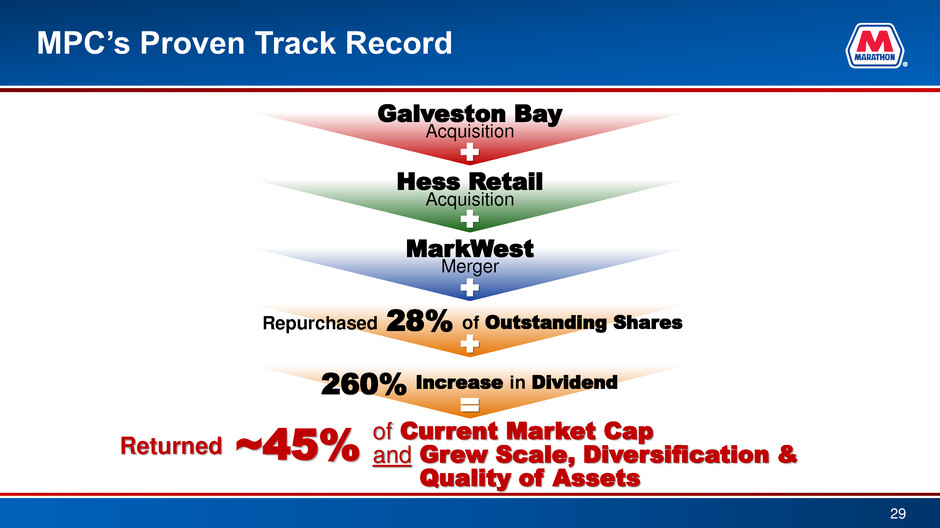

MPC’s Proven Track Record 29 + + + + = Galveston Bay Acquisition Hess Retail Acquisition MarkWest Merger 28% Repurchased of Outstanding Shares 260% Increase in Dividend of Current Market Cap and Grew Scale, Diversification & Quality of Assets Returned ~45%

Appendix

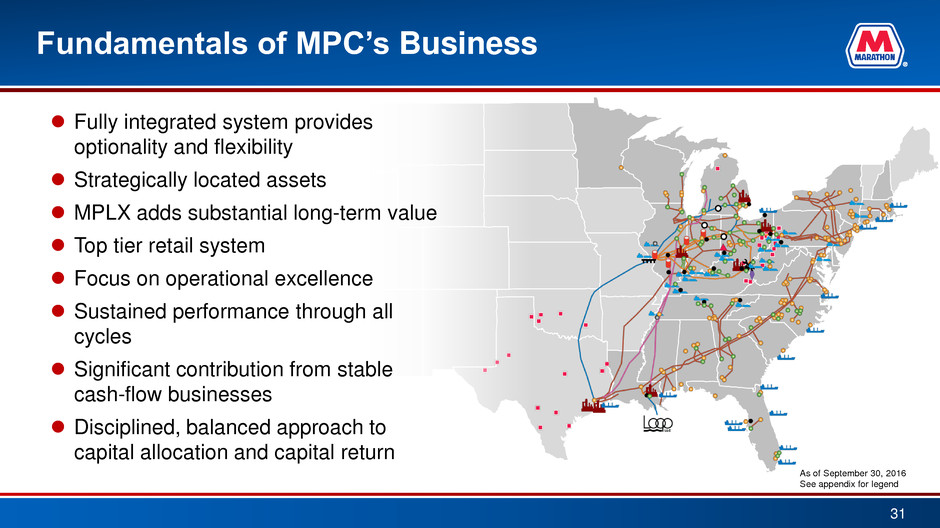

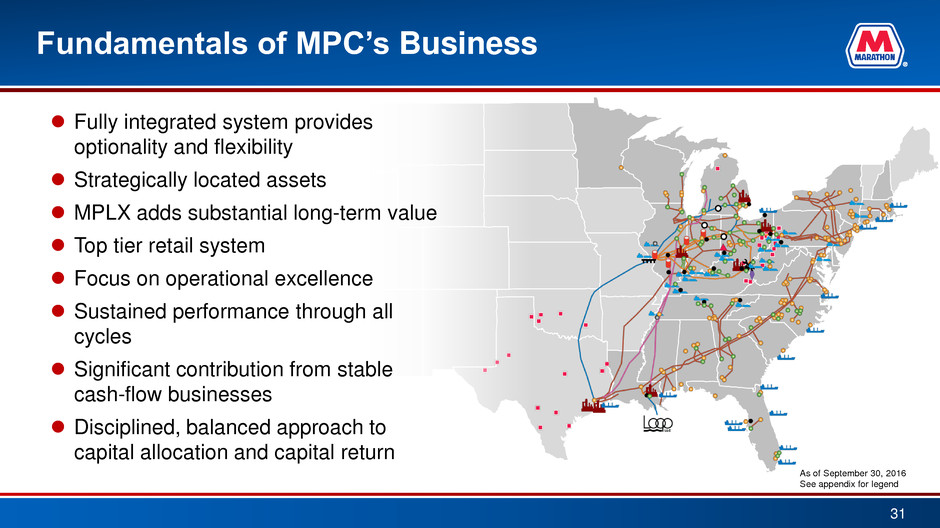

Fundamentals of MPC’s Business As of September 30, 2016 See appendix for legend Fully integrated system provides optionality and flexibility Strategically located assets MPLX adds substantial long-term value Top tier retail system Focus on operational excellence Sustained performance through all cycles Significant contribution from stable cash-flow businesses Disciplined, balanced approach to capital allocation and capital return 31

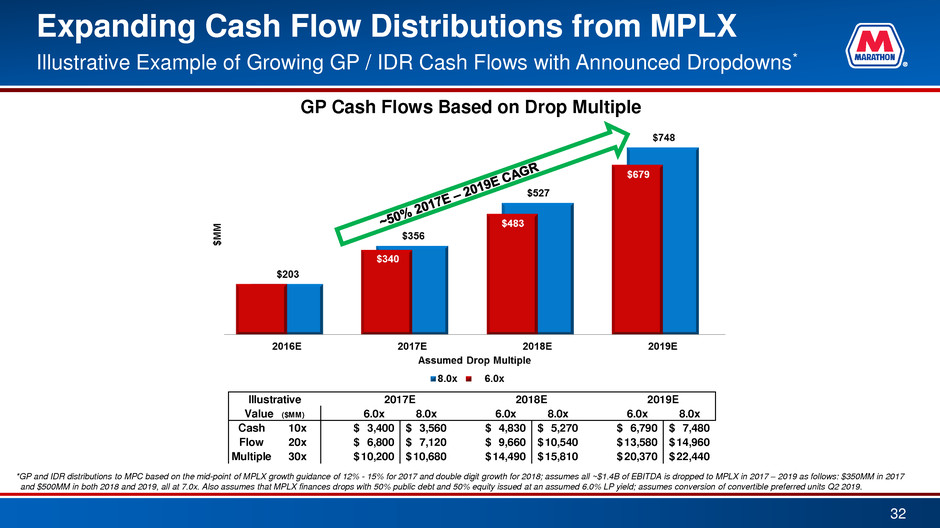

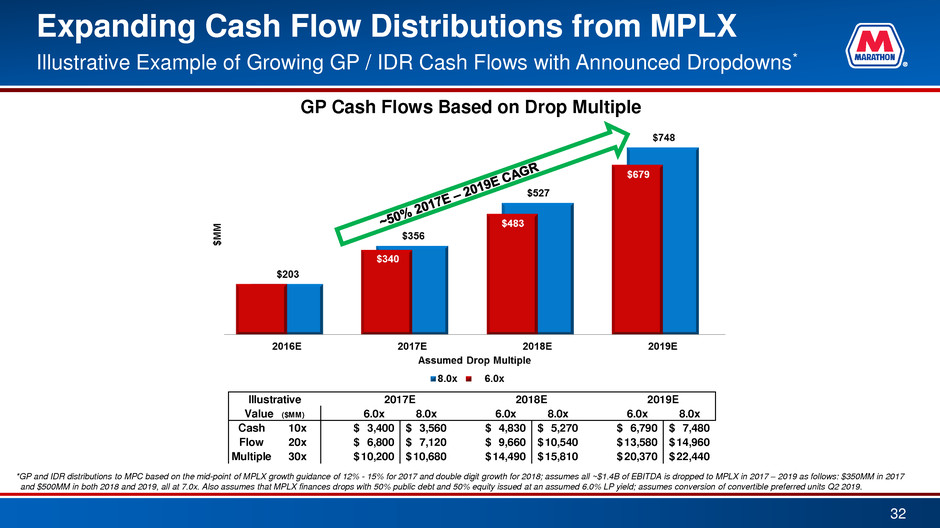

Expanding Cash Flow Distributions from MPLX Illustrative Example of Growing GP / IDR Cash Flows with Announced Dropdowns* *GP and IDR distributions to MPC based on the mid-point of MPLX growth guidance of 12% - 15% for 2017 and double digit growth for 2018; assumes all ~$1.4B of EBITDA is dropped to MPLX in 2017 – 2019 as follows: $350MM in 2017 and $500MM in both 2018 and 2019, all at 7.0x. Also assumes that MPLX finances drops with 50% public debt and 50% equity issued at an assumed 6.0% LP yield; assumes conversion of convertible preferred units Q2 2019. GP Cash Flows Based on Drop Multiple 32 6.0x 8.0x 6.0x 8.0x 6.0x 8.0x 10x 3,400$ 3,560$ 4,830$ 5,270$ 6,790$ 7,480$ 20x 6,800$ 7,120$ 9,660$ 10,540$ 13,580$ 14,960$ 30x 10,200$ 10,680$ 14,490$ 15,810$ 20,370$ 22,440$ 2017E 2018E 2019EIllustrative Value ($MM) Cash Flow Multiple

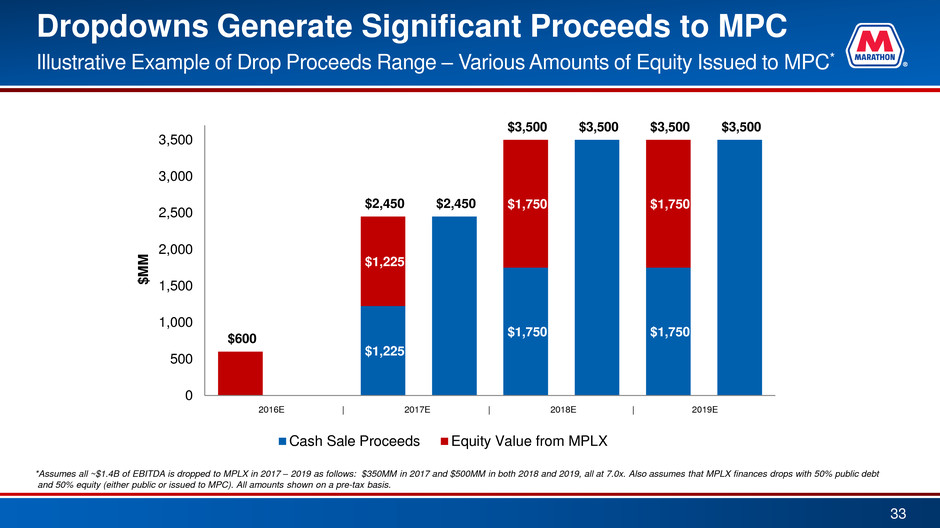

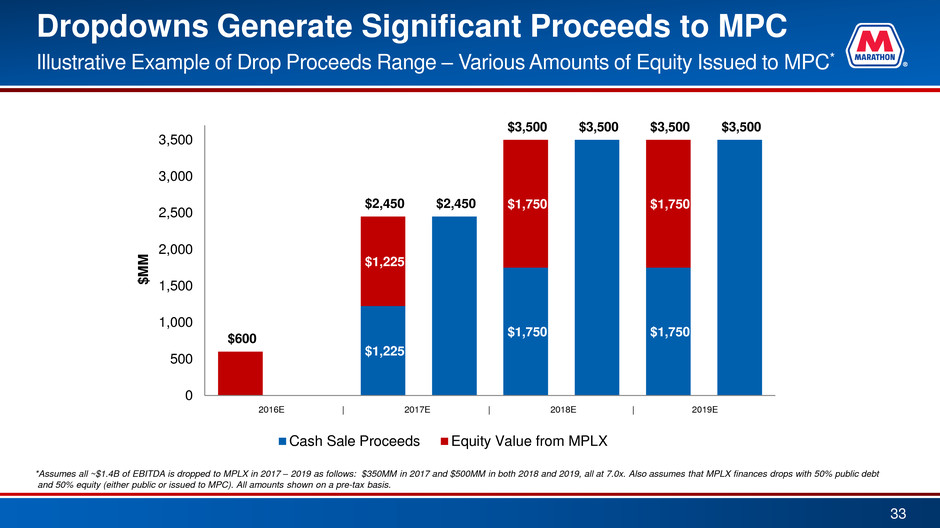

$1,225 $1,750 $1,750 $1,225 $1,750 $1,750 $600 $2,450 $2,450 $3,500 $3,500 $3,500 $3,500 0 500 1,000 1,500 2,000 2,500 3,000 3,500 2016E 2017E 2018E 2019E $ M M Cash Sale Proceeds Equity Value from MPLX *Assumes all ~$1.4B of EBITDA is dropped to MPLX in 2017 – 2019 as follows: $350MM in 2017 and $500MM in both 2018 and 2019, all at 7.0x. Also assumes that MPLX finances drops with 50% public debt and 50% equity (either public or issued to MPC). All amounts shown on a pre-tax basis. Dropdowns Generate Significant Proceeds to MPC Illustrative Example of Drop Proceeds Range – Various Amounts of Equity Issued to MPC* 2016E | 2017E | 2018E | 2019E 33

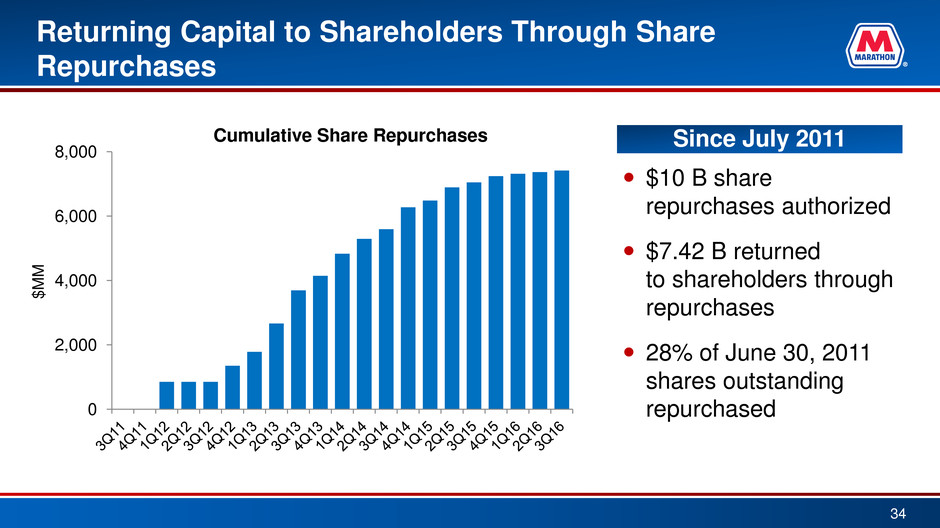

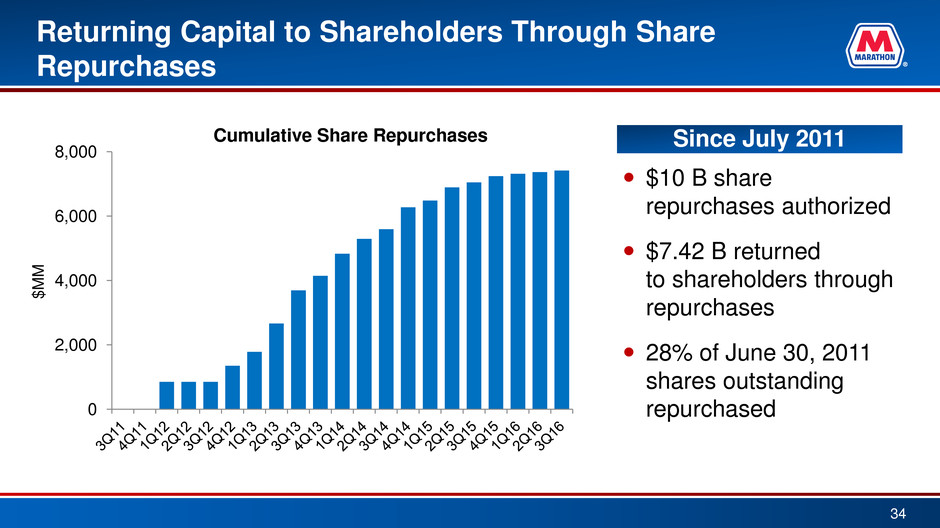

Returning Capital to Shareholders Through Share Repurchases 34 0 2,000 4,000 6,000 8,000 $ M M Cumulative Share Repurchases $10 B share repurchases authorized $7.42 B returned to shareholders through repurchases 28% of June 30, 2011 shares outstanding repurchased Since July 2011

Refining Increasing EBITDA Through Continuous Process Improvements Low or no investment projects Focus on technical excellence Improvements in process unit performance EBITDA improvement of approximately $800 MM between 2012 and 2015 35 0 200 400 600 800 1,000 2013 2014 2015 M a rg in I m p ro v e m e n t $ M M Refining Process Improvements* Galveston Bay All Other *Galveston Bay synergies included

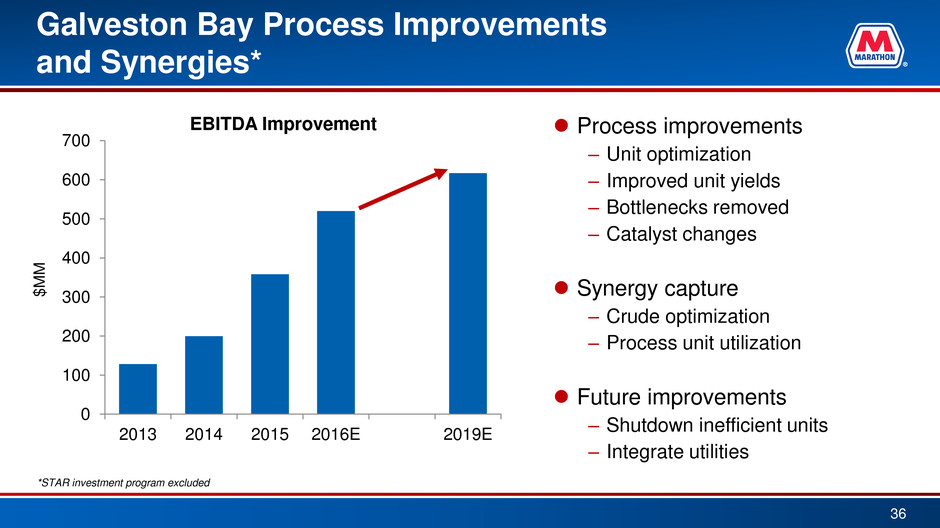

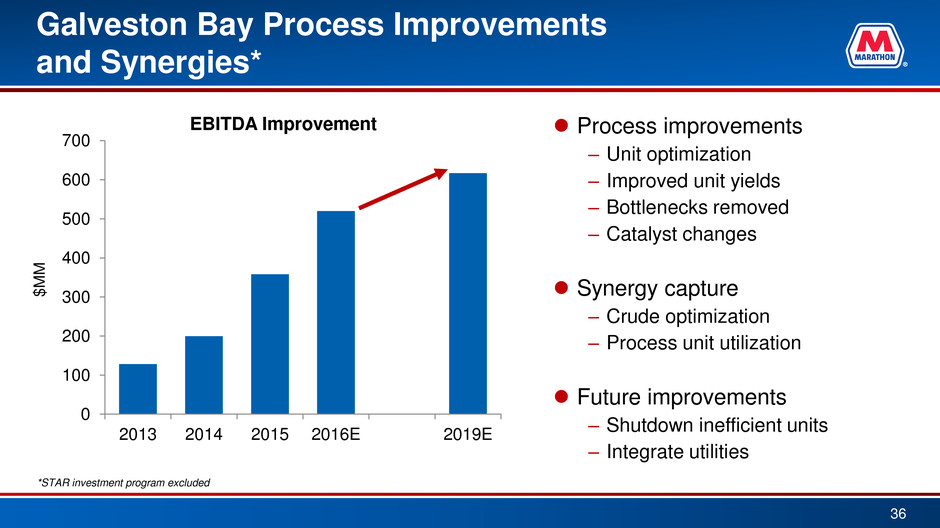

0 100 200 300 400 500 600 700 2013 2014 2015 2016E 2019E $ M M EBITDA Improvement Galveston Bay Process Improvements and Synergies* Process improvements – Unit optimization – Improved unit yields – Bottlenecks removed – Catalyst changes Synergy capture – Crude optimization – Process unit utilization Future improvements – Shutdown inefficient units – Integrate utilities 36 *STAR investment program excluded

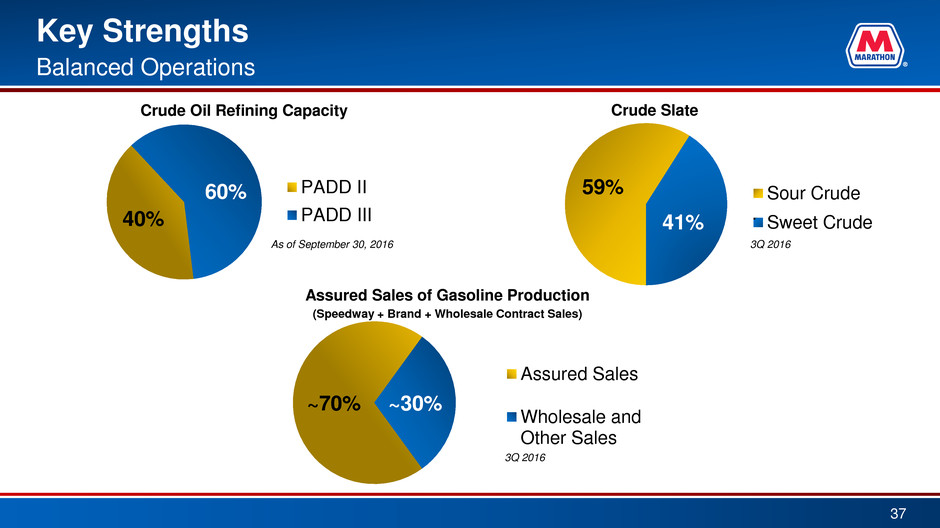

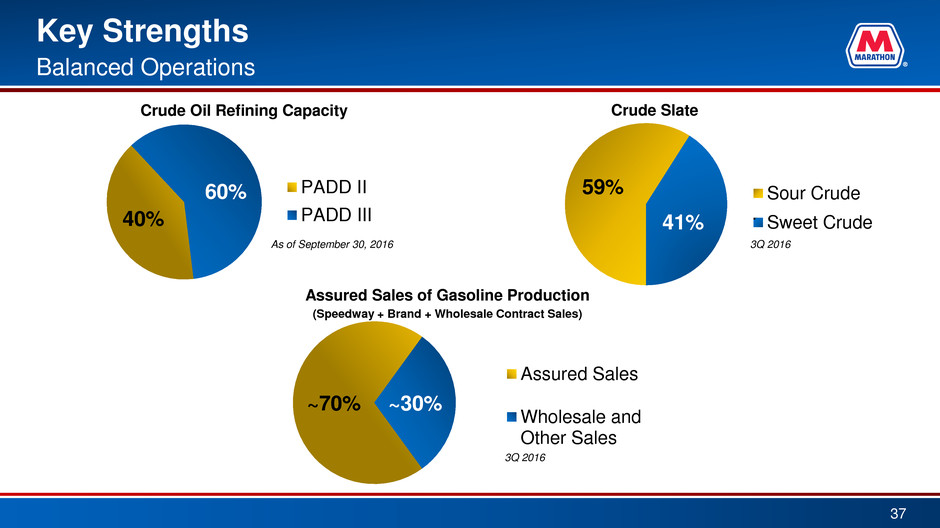

Key Strengths 37 Balanced Operations 40% 60% Crude Oil Refining Capacity PADD II PADD III 59% 41% Crude Slate Sour Crude Sweet Crude ~70% ~30% Assured Sales Wholesale and Other Sales Assured Sales of Gasoline Production (Speedway + Brand + Wholesale Contract Sales) As of September 30, 2016 3Q 2016 3Q 2016

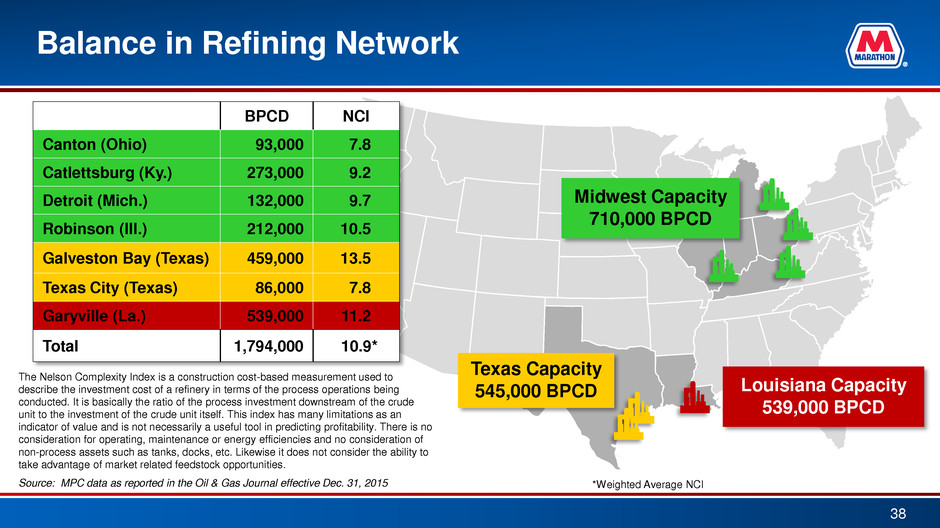

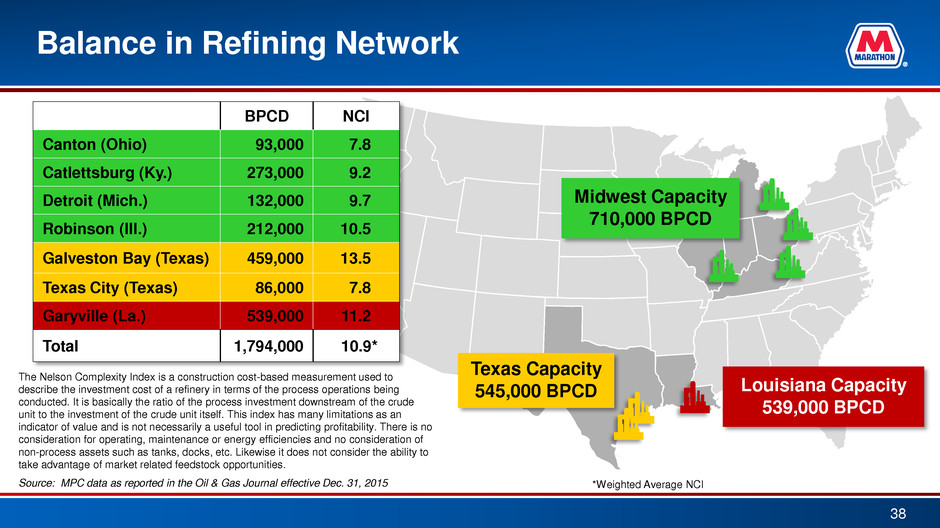

Balance in Refining Network Midwest Capacity 710,000 BPCD Louisiana Capacity 539,000 BPCD Texas Capacity 545,000 BPCD 38 *Weighted Average NCI The Nelson Complexity Index is a construction cost-based measurement used to describe the investment cost of a refinery in terms of the process operations being conducted. It is basically the ratio of the process investment downstream of the crude unit to the investment of the crude unit itself. This index has many limitations as an indicator of value and is not necessarily a useful tool in predicting profitability. There is no consideration for operating, maintenance or energy efficiencies and no consideration of non-process assets such as tanks, docks, etc. Likewise it does not consider the ability to take advantage of market related feedstock opportunities. Source: MPC data as reported in the Oil & Gas Journal effective Dec. 31, 2015 BPCD NCI Canton (Ohio) 93,000 7.8 Catlettsburg (Ky.) 273,000 9.2 Detroit (Mich.) 132,000 9.7 Robinson (Ill.) 212,000 10.5 Galveston Bay (Texas) 459,000 13.5 Texas City (Texas) 86,000 7.8 Garyville (La.) 539,000 11.2 Total 1,794,000 10.9*

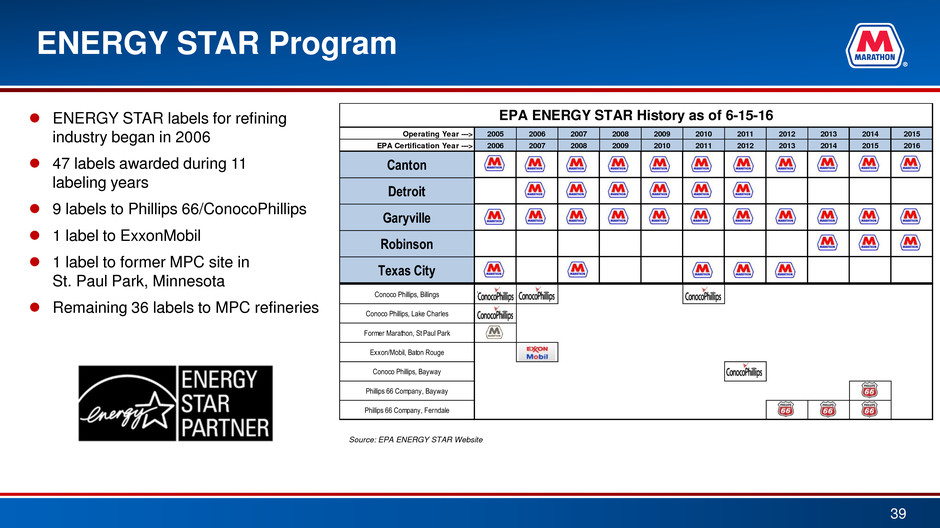

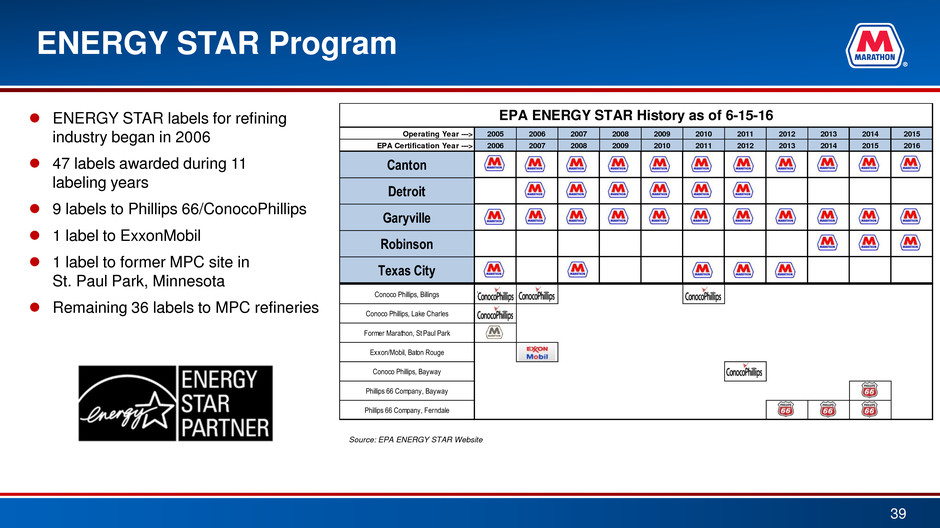

ENERGY STAR Program ENERGY STAR labels for refining industry began in 2006 47 labels awarded during 11 labeling years 9 labels to Phillips 66/ConocoPhillips 1 label to ExxonMobil 1 label to former MPC site in St. Paul Park, Minnesota Remaining 36 labels to MPC refineries 39 39 Operating Year ---> 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 EPA Certification Year ---> 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 Canton 1 1 1 1 1 1 1 1 1 1 1 Detroit 1 1 1 1 1 1 Garyville 1 1 1 1 1 1 1 1 1 1 1 Robinson 1 1 1 Texas City 1 1 1 1 1 Conoco Phillips, Billings 1 1 1 Conoco Phillips, Lake Charles 1 Former Marathon, St Paul Park 1 Exxon/Mobil, Baton Rouge 1 Conoco Phillips, Bayway 1 Phillips 66 Company, Bayway 1 Phillips 66 Company, Ferndale 1 1 1 EPA ENERGY STAR History as of 6-15-16 Source: EPA ENERGY STAR Website

0 20 40 60 80 100 120 M M B D Distillate Leading World Liquids Demand Average product demand growth of 1.6 MMBD in 2016-2017 Distillate remains the growth leader through 2025 Heavy fuel oil continues its structural decline 40 Sources: BP Statistical Review of World Energy (Actual), MPC Economics (Forecast) Middle Distillate Gasoline Resid Other Average Annual Volumetric Growth (MBD) 2015 vs. 2025 +445 -19 +623 +157 Forecast Actual

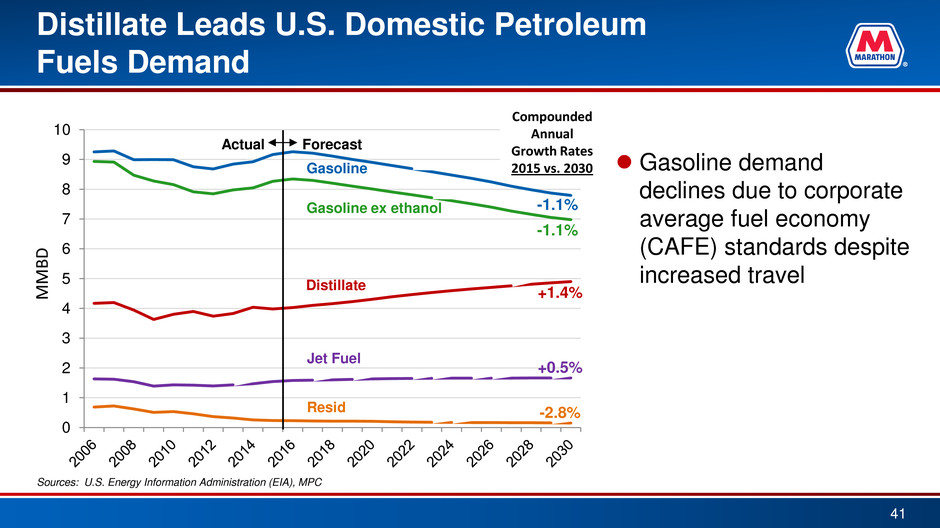

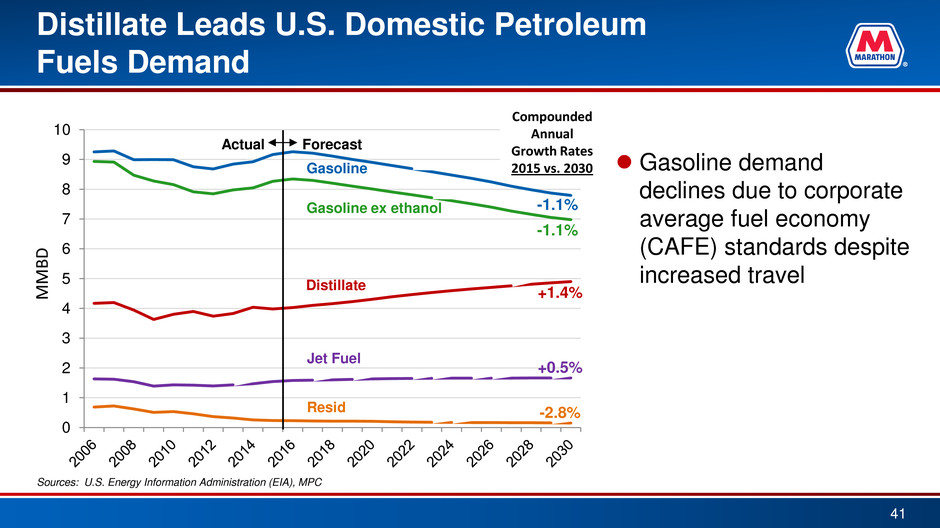

Distillate Leads U.S. Domestic Petroleum Fuels Demand 41 0 1 2 3 4 5 6 7 8 9 10 MMB D Compounded Annual Growth Rates 2015 vs. 2030 Sources: U.S. Energy Information Administration (EIA), MPC Gasoline Gasoline ex ethanol Distillate Jet Fuel Resid -1.1% -1.1% +1.4% +0.5% -2.8% Forecast Actual Gasoline demand declines due to corporate average fuel economy (CAFE) standards despite increased travel

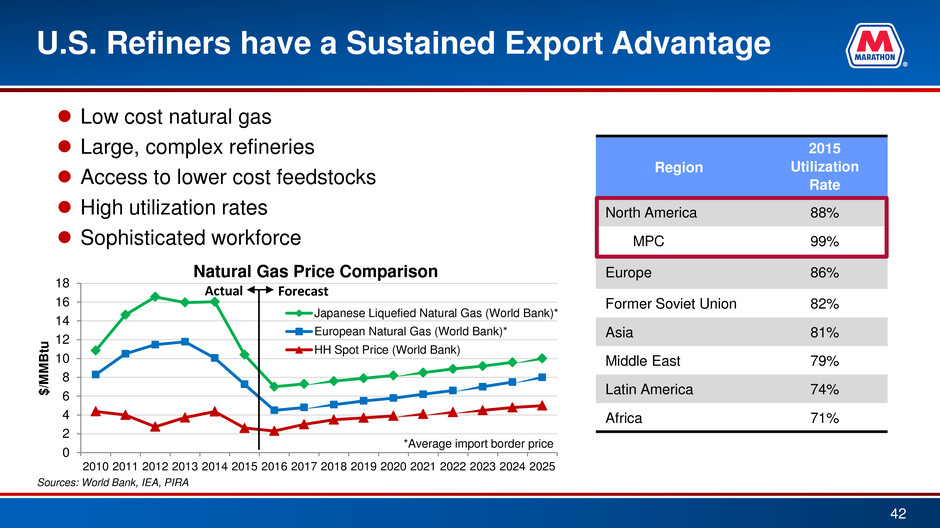

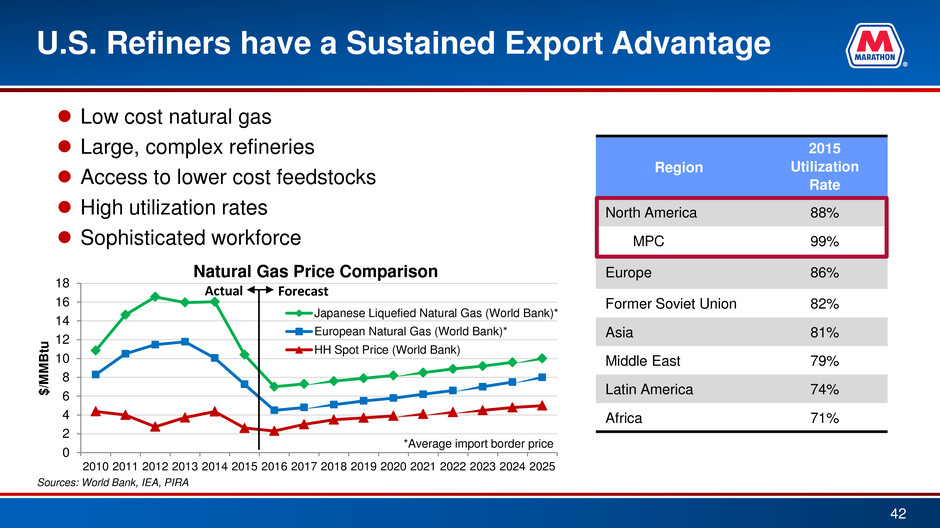

Region 2015 Utilization Rate North America 88% MPC 99% Europe 86% Former Soviet Union 82% Asia 81% Middle East 79% Latin America 74% Africa 71% 0 2 4 6 8 10 12 14 16 18 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 $/ M M B tu Natural Gas Price Comparison Japanese Liquefied Natural Gas (World Bank)* European Natural Gas (World Bank)* HH Spot Price (World Bank) Forecast Actual U.S. Refiners have a Sustained Export Advantage 42 Low cost natural gas Large, complex refineries Access to lower cost feedstocks High utilization rates Sophisticated workforce Sources: World Bank, IEA, PIRA *Average import border price

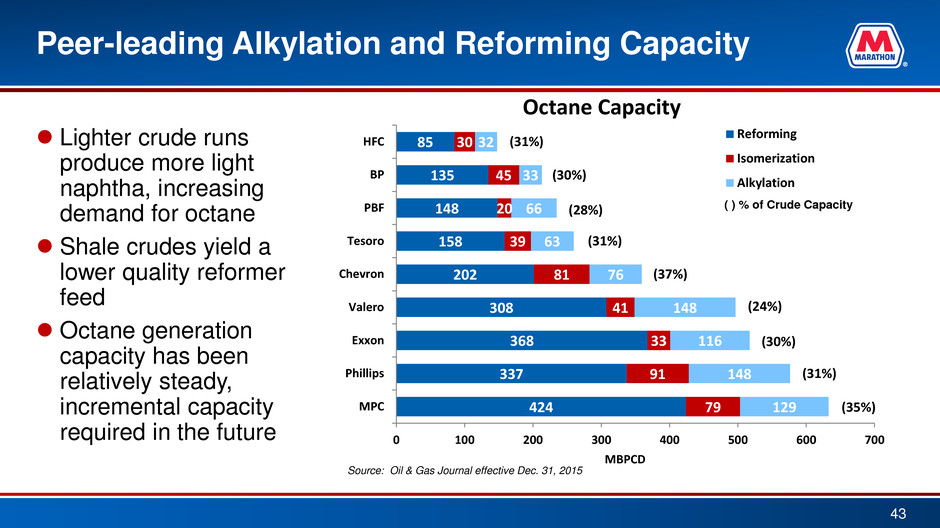

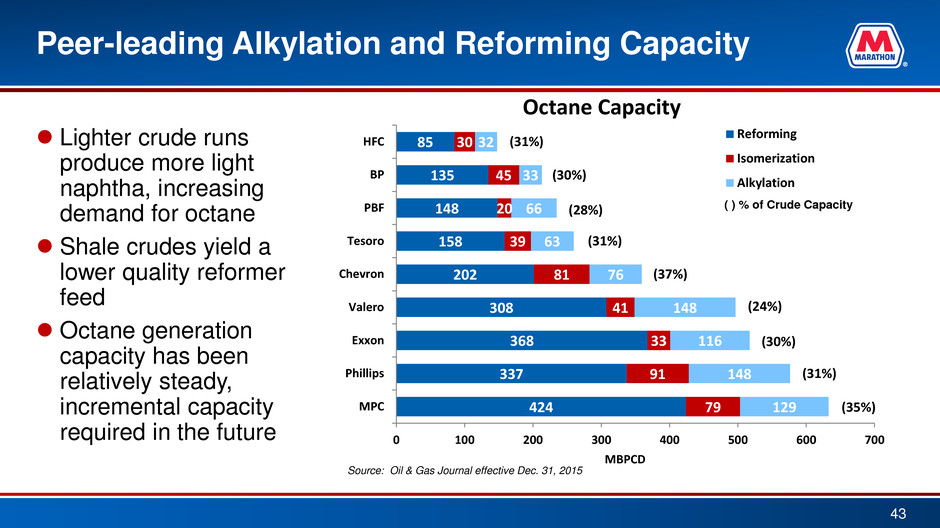

Peer-leading Alkylation and Reforming Capacity Lighter crude runs produce more light naphtha, increasing demand for octane Shale crudes yield a lower quality reformer feed Octane generation capacity has been relatively steady, incremental capacity required in the future 43 424 337 368 308 202 158 148 135 85 79 91 33 41 81 39 20 45 30 129 148 116 148 76 63 66 33 32 0 100 200 300 400 500 600 700 MPC Phillips Exxon Valero Chevron Tesoro PBF BP HFC MBPCD Octane Capacity Reforming Isomerization Alkylation (31%) (30%) (24%) (37%) (31%) (28%) (30%) (31%) (35%) ( ) % of Crude Capacity Source: Oil & Gas Journal effective Dec. 31, 2015

0 2 4 6 8 10 12 14 16 2010 2012 2014 2016 2018 2020 M M B D North American Crude Production Shale production challenged in current price environment Drilling improvements and efficiency gains have lessened near-term declines Long-term production growth is still expected 44 Canada U.S. Shale Forecast Actual U.S. Non-Shale Sources: MPC, CAPP

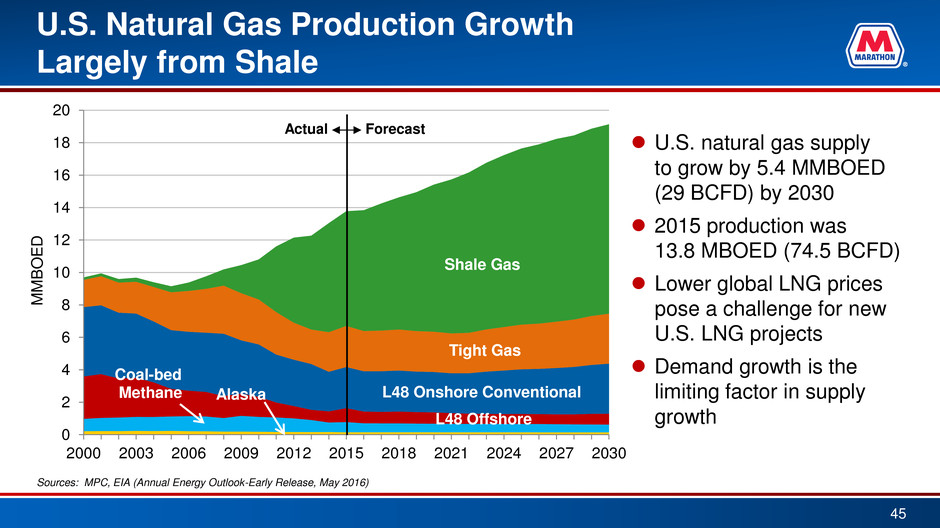

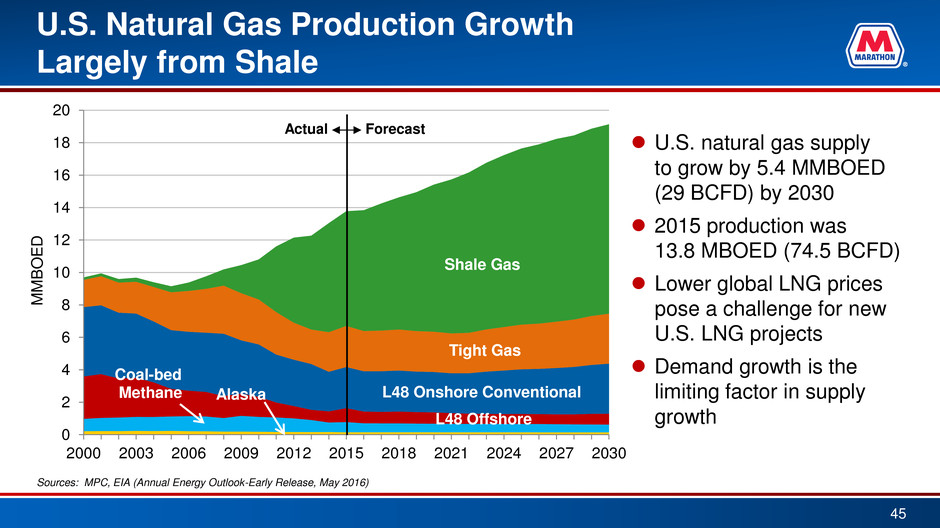

Alaska Coal-bed Methane Tight Gas Shale Gas 0 2 4 6 8 10 12 14 16 18 20 2000 2003 2006 2009 2012 2015 2018 2021 2024 2027 2030 M M B O E D L48 Onshore Conventional L48 Offshore U.S. Natural Gas Production Growth Largely from Shale U.S. natural gas supply to grow by 5.4 MMBOED (29 BCFD) by 2030 2015 production was 13.8 MBOED (74.5 BCFD) Lower global LNG prices pose a challenge for new U.S. LNG projects Demand growth is the limiting factor in supply growth 45 Sources: MPC, EIA (Annual Energy Outlook-Early Release, May 2016) Forecast Actual

Nat. Gasoline Butanes Propane Purity Ethane 0 1 2 3 4 5 6 7 2005 2010 2015 2020 2025 2030 M M B D U.S. NGL Volume Growth Creates a Need for Incremental Infrastructure 46 Forecast Actual Source: MPC 2016 LT Forecast Gulf Coast ethylene crackers are being built, adding 700 MBD to demand for ethane by 2021 Realized ethane production increases from 2016-2020 as rejection tapers off due to increased demand and exports Supply growth of other NGLs slows through 2017 with lower prices and lower natural gas production growth

Key North American Crude Oil Pipelines Sources: Publicly available information 47 *Capacity has not been announced Planned Pipelines MBPD In-Service Date Dakota Access 570 2017 ETCO 570 2017 Bayou Bridge (Lake Charles to St. James) TBD* 2017 Diamond 200 2017 Midland to Sealy 300 2018 Trans Mountain Expansion 590 2019 Energy East 1,100 2020

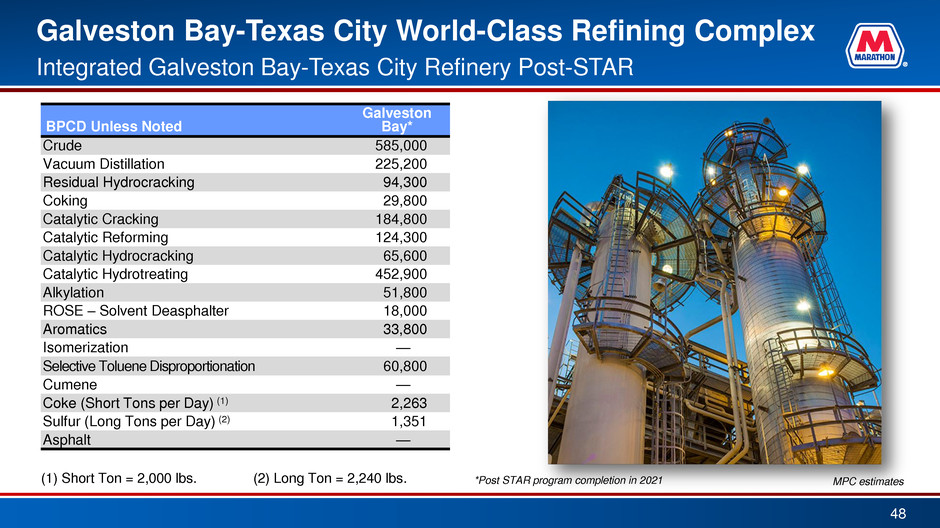

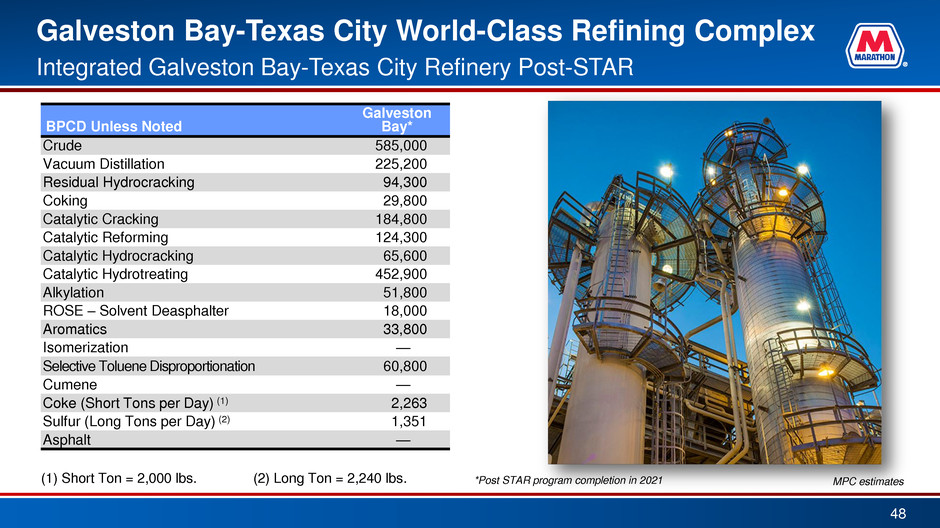

Galveston Bay-Texas City World-Class Refining Complex 48 Integrated Galveston Bay-Texas City Refinery Post-STAR BPCD Unless Noted Galveston Bay* Crude 585,000 Vacuum Distillation 225,200 Residual Hydrocracking 94,300 Coking 29,800 Catalytic Cracking 184,800 Catalytic Reforming 124,300 Catalytic Hydrocracking 65,600 Catalytic Hydrotreating 452,900 Alkylation 51,800 ROSE – Solvent Deasphalter 18,000 Aromatics 33,800 Isomerization — Selective Toluene Disproportionation 60,800 Cumene — Coke (Short Tons per Day) (1) 2,263 Sulfur (Long Tons per Day) (2) 1,351 Asphalt — (1) Short Ton = 2,000 lbs. (2) Long Ton = 2,240 lbs. MPC estimates *Post STAR program completion in 2021

0 50 100 150 200 250 300 350 2010 2011 2012 2013 2014 2015 M B D MPC Finished Product Exports 0 200 400 600 800 1,000 1,200 1,400 1,600 1,800 2010 2011 2012 2013 2014 2015 M B D Gross U.S. Finished Product Exports Other U.S. MPC Capitalizing on Growing U.S. Finished Product Exports 49 Sources: MPC, EIA

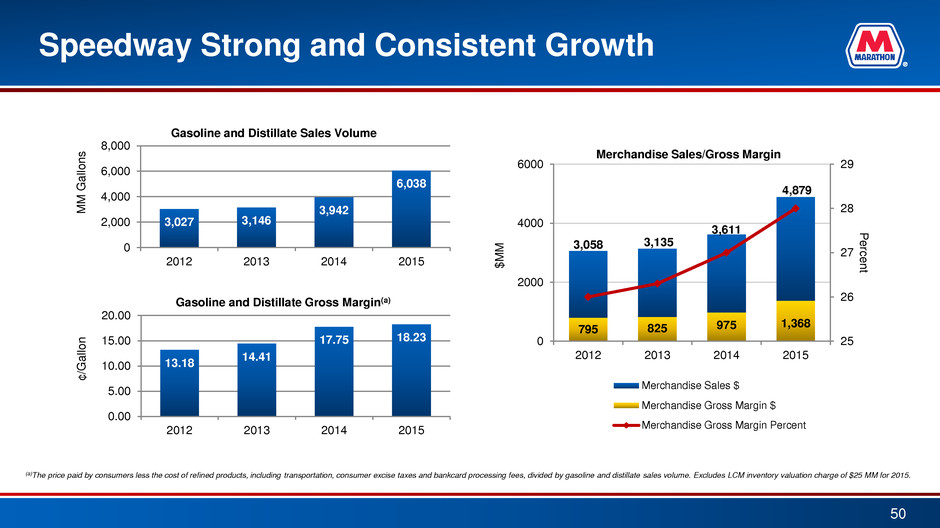

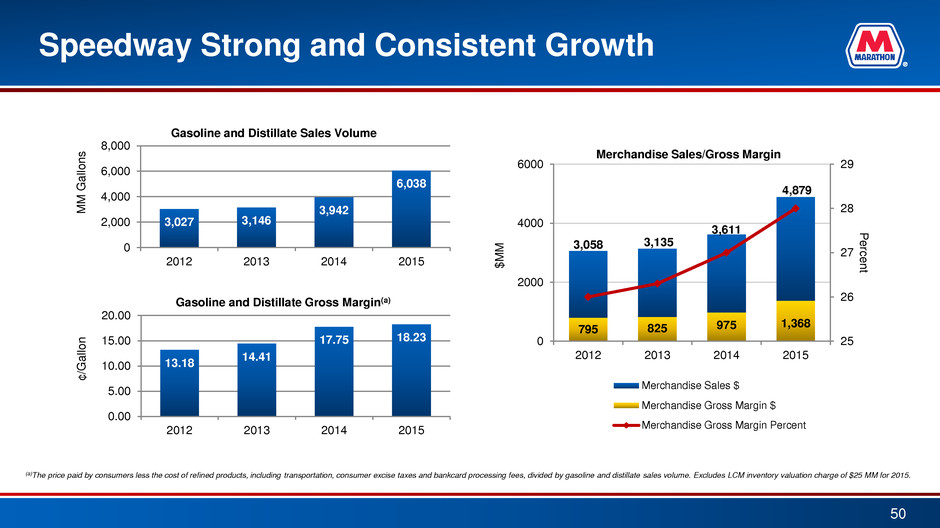

Speedway Strong and Consistent Growth 50 3,027 3,146 3,942 6,038 0 2,000 4,000 6,000 8,000 2012 2013 2014 2015 M M Ga llo n s Gasoline and Distillate Sales Volume 13.18 14.41 17.75 18.23 0.00 5.00 10.00 15.00 20.00 2012 2013 2014 2015 ¢ /Ga llo n Gasoline and Distillate Gross Margin(a) 795 825 975 1,368 3,058 3,135 3,611 4,879 25 26 27 28 29 0 2000 4000 6000 2012 2013 2014 2015 P e rc e n t $ M M Merchandise Sales/Gross Margin Merchandise Sales $ Merchandise Gross Margin $ Merchandise Gross Margin Percent (a)The price paid by consumers less the cost of refined products, including transportation, consumer excise taxes and bankcard processing fees, divided by gasoline and distillate sales volume. Excludes LCM inventory valuation charge of $25 MM for 2015.

Speedway: Pursuing Attractive and Accretive Acquisitions Leverage MPC’s supply and logistical network – Increase assured sales – Optimize terminal utilization Fill market voids in Speedway footprint – High quality assets – Continue focus in Pennsylvania and Tennessee – Growth opportunities in Georgia, South Carolina and Florida panhandle Capitalize on opportunistic acquisition environment 51 As of September 30, 2016 See appendix for legend Speedway Marketing Area Speedway Location

Following Through on Goals for Acquired Locations Invest ~$570 MM in conversions, remodels and maintenance Converted stores to Speedway brand and technology platforms Remodel approximately 700 locations to drive marketing enhancements Generate $365 MM of annual EBITDA in 2017 Achieve $190 MM in annual synergies in 2017 52 20 30 35 10 20 40 45 45 45 25 70 0 50 100 150 200 2014E** 2015E 2016E 2017E $ M M Synergies and Marketing Enhancements (Original Guidance) WilcoHess Synergies Operating and G&A Expense Synergies Light Product Supply and Logistics Marketing Enhancements 175 365 35 40 45 70 0 100 200 300 400 2013 Pro Forma Hess EBITDA* Form 10 WilcoHess Synergies Operating and G&A Expense Synergies Light Product Supply and Logistics Marketing Enhancements 2017E Hess EBITDA $ M M Earnings Opportunities (Original Guidance) **Based on Oct. 1, 2014 closing Sources: Company reports, MPC internal estimates *Sept. 30, 2013 Form 10 Pro Forma annualized 190 20 75 120

Focus on Improving Light Product Breakeven Measure of operating efficiency and merchandise contribution to total expense Potential to drive substantial value in the business over time 7.13 -1 1 3 5 7 9 11 13 2005 2013 Lig h t P ro d u ct B re ak ev en ( cp g) 2.56 12.39 Each 1.00 cent per gallon improvement = ~$30 MM annual pretax earnings Speedway Hess Sept. 30, 2013 Form 10 Estimate LPBE = Total Expenses – Merchandise Margin Light Product Volume 53

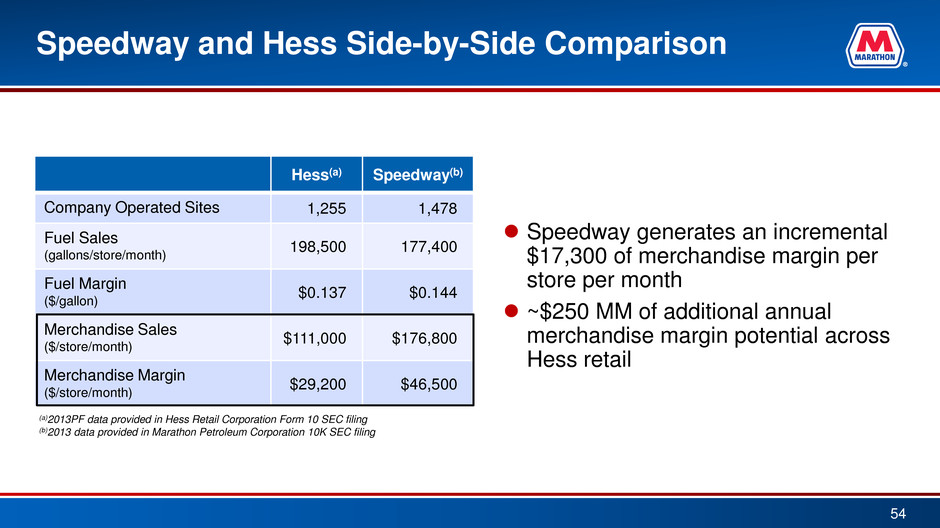

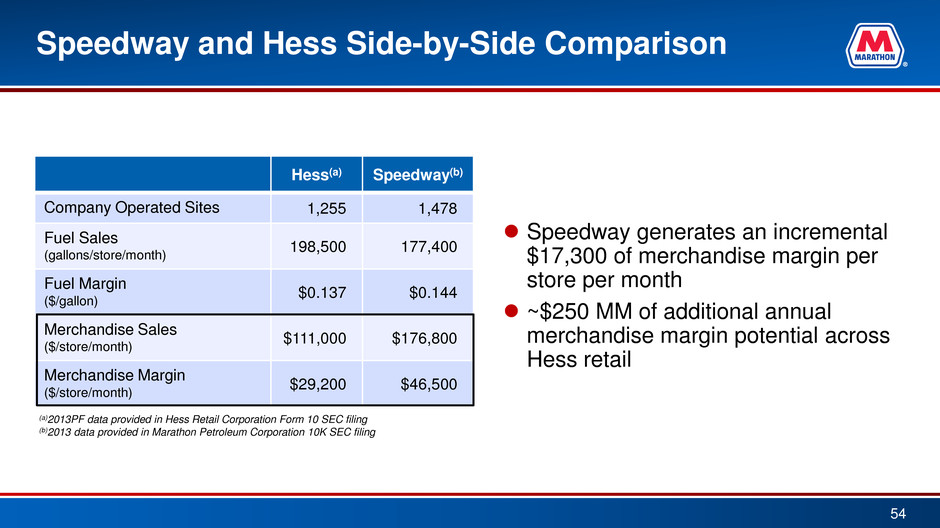

Speedway and Hess Side-by-Side Comparison Speedway generates an incremental $17,300 of merchandise margin per store per month ~$250 MM of additional annual merchandise margin potential across Hess retail Hess(a) Speedway(b) Company Operated Sites 1,255 1,478 Fuel Sales (gallons/store/month) 198,500 177,400 Fuel Margin ($/gallon) $0.137 $0.144 Merchandise Sales ($/store/month) $111,000 $176,800 Merchandise Margin ($/store/month) $29,200 $46,500 (a)2013PF data provided in Hess Retail Corporation Form 10 SEC filing (b)2013 data provided in Marathon Petroleum Corporation 10K SEC filing 54

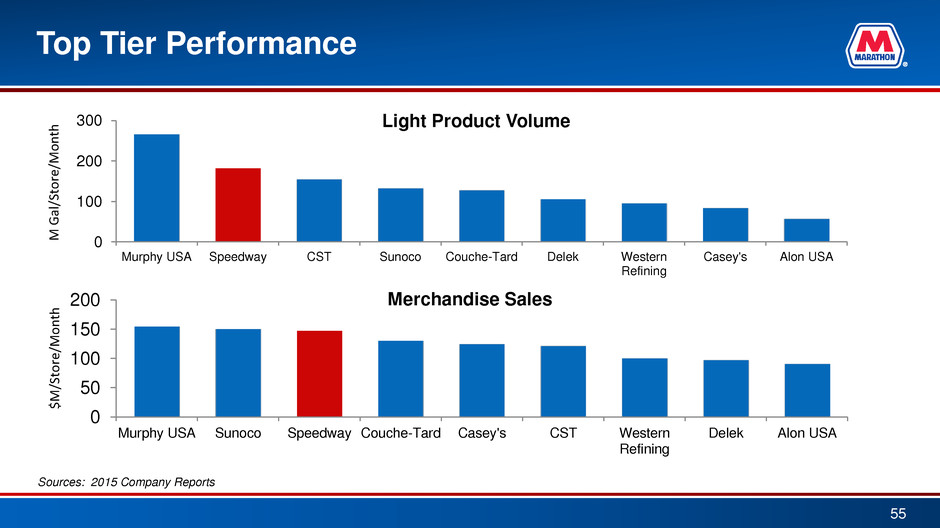

0 100 200 300 Murphy USA Speedway CST Sunoco Couche-Tard Delek Western Refining Casey's Alon USA M Ga l/ St o re /M o n th Light Product Volume 0 50 100 150 200 Murphy USA Sunoco Speedway Couche-Tard Casey's CST Western Refining Delek Alon USA $ M /St o re /M o nt h Merchandise Sales Top Tier Performance Sources: 2015 Company Reports 55

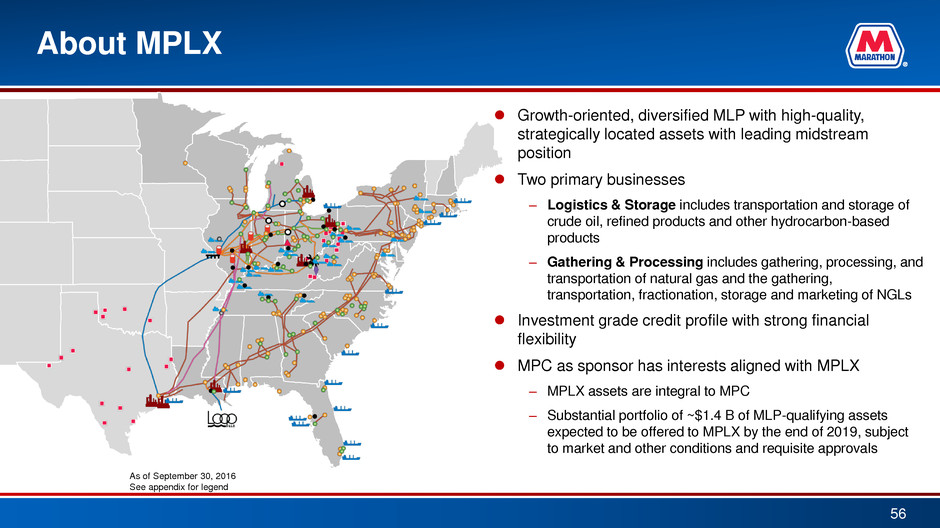

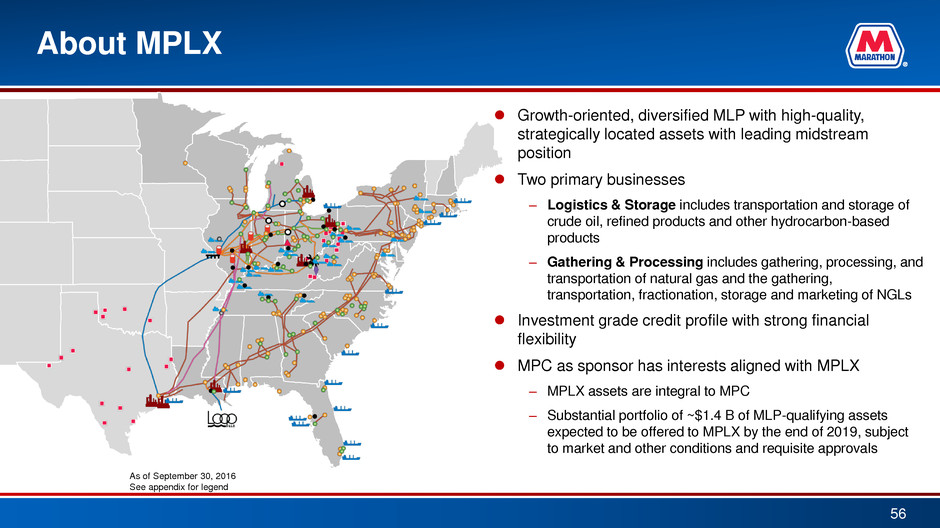

About MPLX Growth-oriented, diversified MLP with high-quality, strategically located assets with leading midstream position Two primary businesses – Logistics & Storage includes transportation and storage of crude oil, refined products and other hydrocarbon-based products – Gathering & Processing includes gathering, processing, and transportation of natural gas and the gathering, transportation, fractionation, storage and marketing of NGLs Investment grade credit profile with strong financial flexibility MPC as sponsor has interests aligned with MPLX – MPLX assets are integral to MPC – Substantial portfolio of ~$1.4 B of MLP-qualifying assets expected to be offered to MPLX by the end of 2019, subject to market and other conditions and requisite approvals 56 As of September 30, 2016 See appendix for legend

MPLX Key Investment Highlights High standard for safety and environmental stewardship Premier assets in highly productive resource plays Long-term integrated relationships with our producer customers Strategic relationship with MPC Strong base business with robust growth opportunities – Leading development of Marcellus and Utica shale play infrastructure and new worldwide NGL hub – Connecting across hydrocarbon value chain with combination of midstream and downstream business – Expanding presence in the Southwest and USGC Attractive distribution growth profile over the long term – Expect 12-15% distribution growth in 2016; forecast 2017 distribution growth rate of 12-15% and double-digit growth in 2018 57

2% GP interest MPLX and MPC are Aligned MPC views MPLX as integral to its operations and is aligned with its success and incentivized to grow MPLX MPC owns 22% LP interest and 100% of MPLX’s GP interest and IDRs 100% interest r 100% interest Public Preferred Common Class B 76% LP interest 100% interest MPLX GP LLC (our General Partner) 22% LP interest MPLX LP* (NYSE: MPLX) (the “Partnership”) Marathon Petroleum Corporation and Affiliates (NYSE: MPC) MPLX Organizational Structure 58 As of Sept 2, 2016 *Preferred convertible securities are included with the public ownership percentage and depicted on an as-converted basis. All Class B units are owned by M&R MWE Liberty, LLC and included with the public ownership percentage and depicted on an as-converted basis. MPLX Terminal and Storage LLC MarkWest Energy Partners, L.P. 100% interest MarkWest Hydrocarbon, L.L.C. MarkWest Operating Subsidiaries MPLX Operations LLC Hardin Street Marine LLC MPLX Pipe Line Holdings LLC

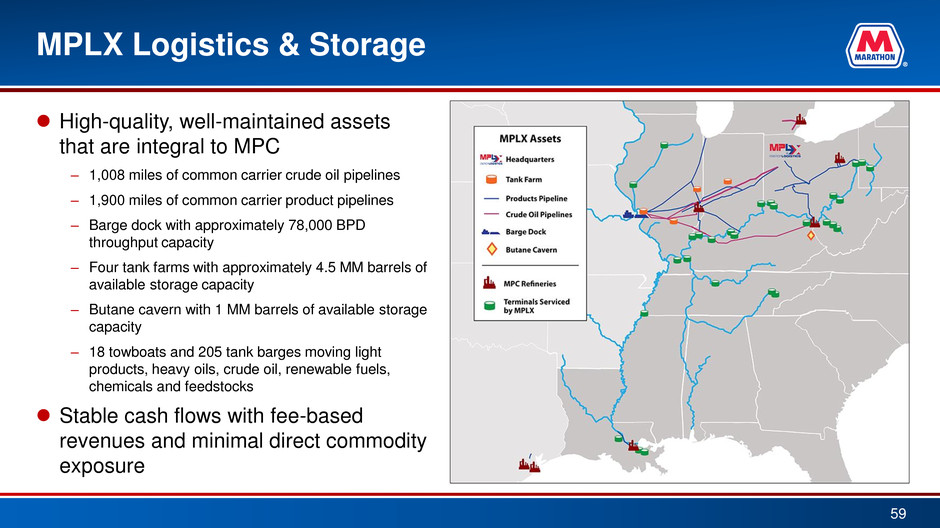

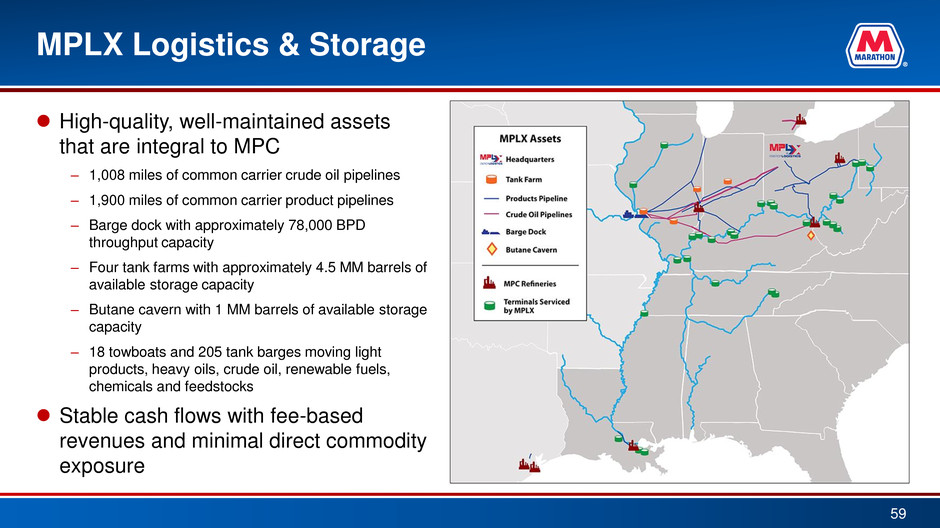

MPLX Logistics & Storage 59 High-quality, well-maintained assets that are integral to MPC – 1,008 miles of common carrier crude oil pipelines – 1,900 miles of common carrier product pipelines – Barge dock with approximately 78,000 BPD throughput capacity – Four tank farms with approximately 4.5 MM barrels of available storage capacity – Butane cavern with 1 MM barrels of available storage capacity – 18 towboats and 205 tank barges moving light products, heavy oils, crude oil, renewable fuels, chemicals and feedstocks Stable cash flows with fee-based revenues and minimal direct commodity exposure

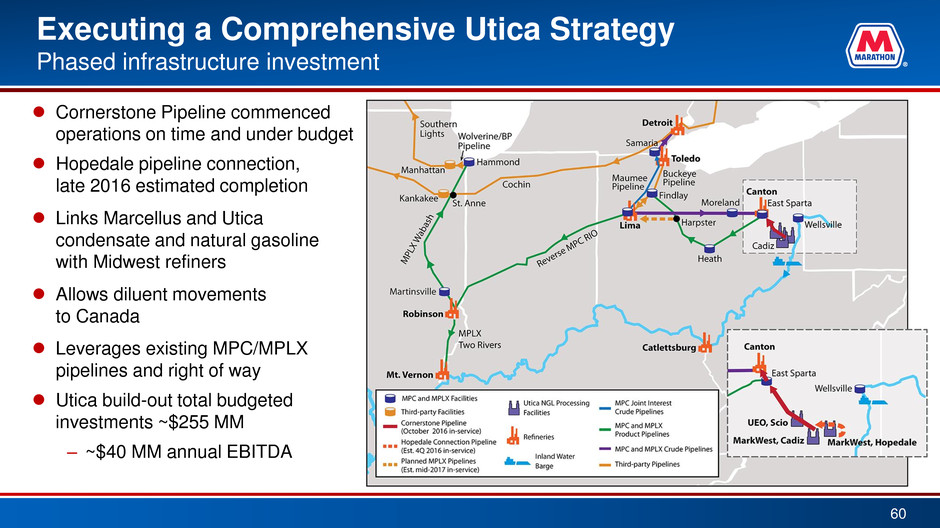

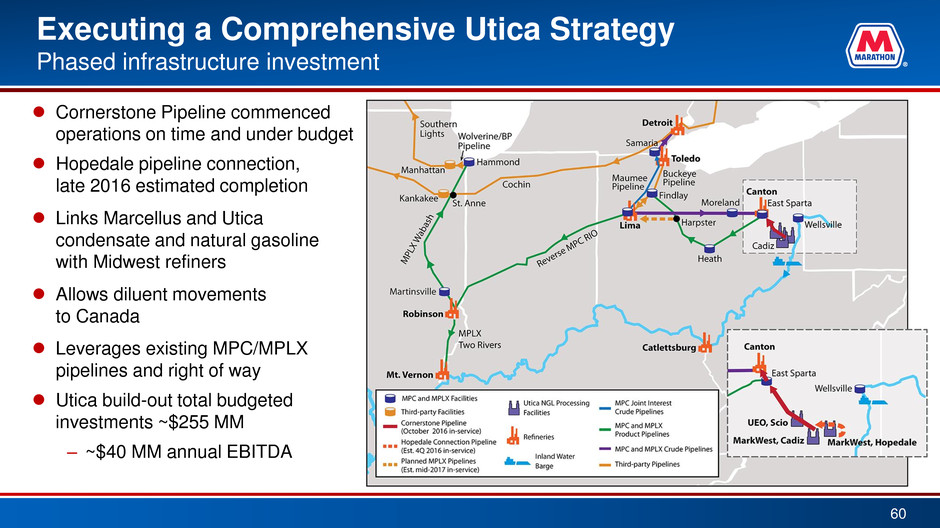

Executing a Comprehensive Utica Strategy Phased infrastructure investment 60 Cornerstone Pipeline commenced operations on time and under budget Hopedale pipeline connection, late 2016 estimated completion Links Marcellus and Utica condensate and natural gasoline with Midwest refiners Allows diluent movements to Canada Leverages existing MPC/MPLX pipelines and right of way Utica build-out total budgeted investments ~$255 MM – ~$40 MM annual EBITDA

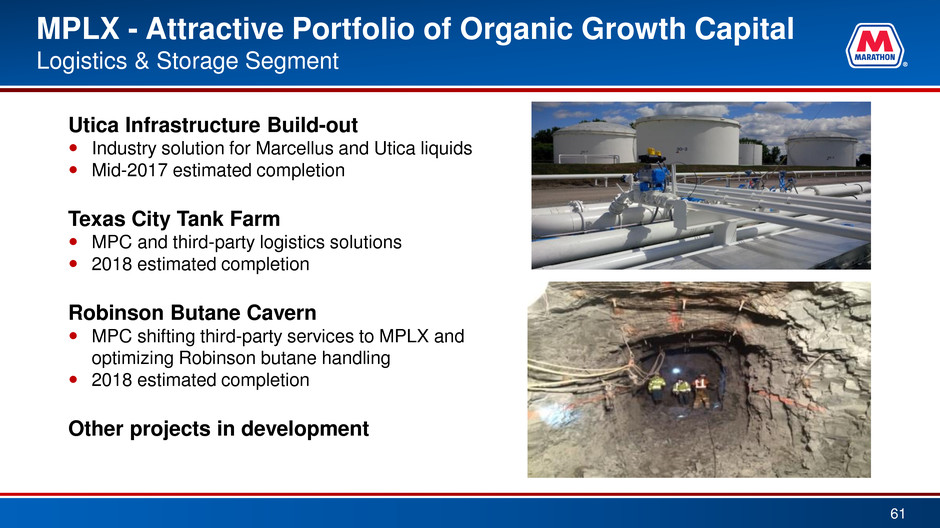

MPLX - Attractive Portfolio of Organic Growth Capital Logistics & Storage Segment Utica Infrastructure Build-out Industry solution for Marcellus and Utica liquids Mid-2017 estimated completion Texas City Tank Farm MPC and third-party logistics solutions 2018 estimated completion Robinson Butane Cavern MPC shifting third-party services to MPLX and optimizing Robinson butane handling 2018 estimated completion Other projects in development 61

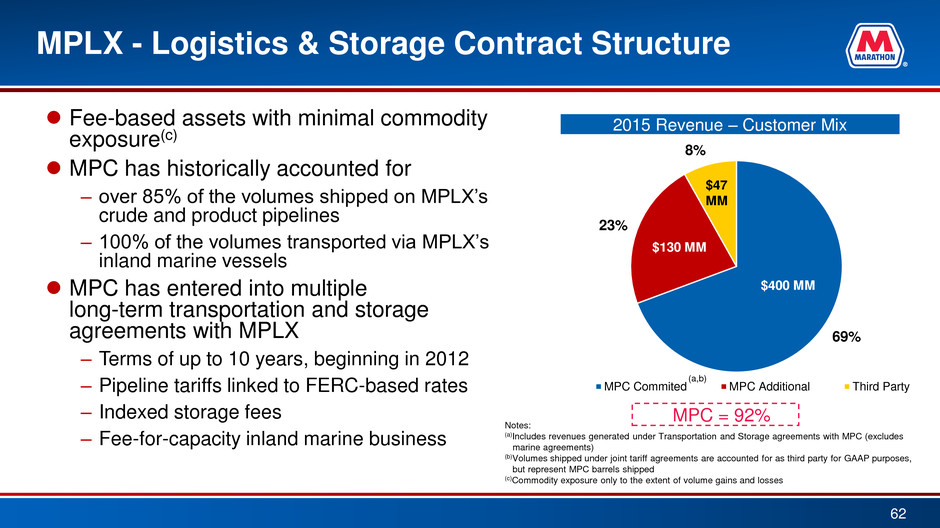

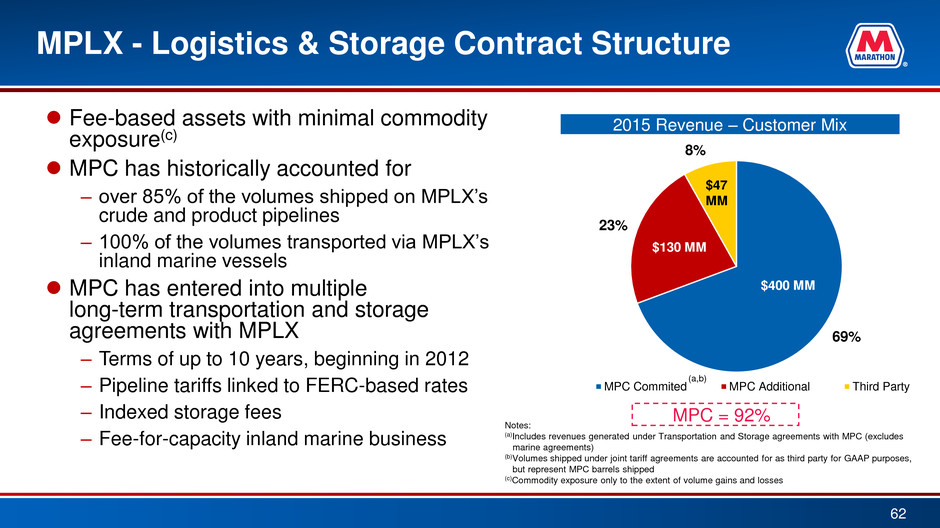

69% 23% 8% MPC Commited MPC Additional Third Party MPLX - Logistics & Storage Contract Structure Fee-based assets with minimal commodity exposure(c) MPC has historically accounted for – over 85% of the volumes shipped on MPLX’s crude and product pipelines – 100% of the volumes transported via MPLX’s inland marine vessels MPC has entered into multiple long-term transportation and storage agreements with MPLX – Terms of up to 10 years, beginning in 2012 – Pipeline tariffs linked to FERC-based rates – Indexed storage fees – Fee-for-capacity inland marine business 62 2015 Revenue – Customer Mix MPC = 92% $400 MM $130 MM $47 MM (a,b) Notes: (a)Includes revenues generated under Transportation and Storage agreements with MPC (excludes marine agreements) (b)Volumes shipped under joint tariff agreements are accounted for as third party for GAAP purposes, but represent MPC barrels shipped (c)Commodity exposure only to the extent of volume gains and losses

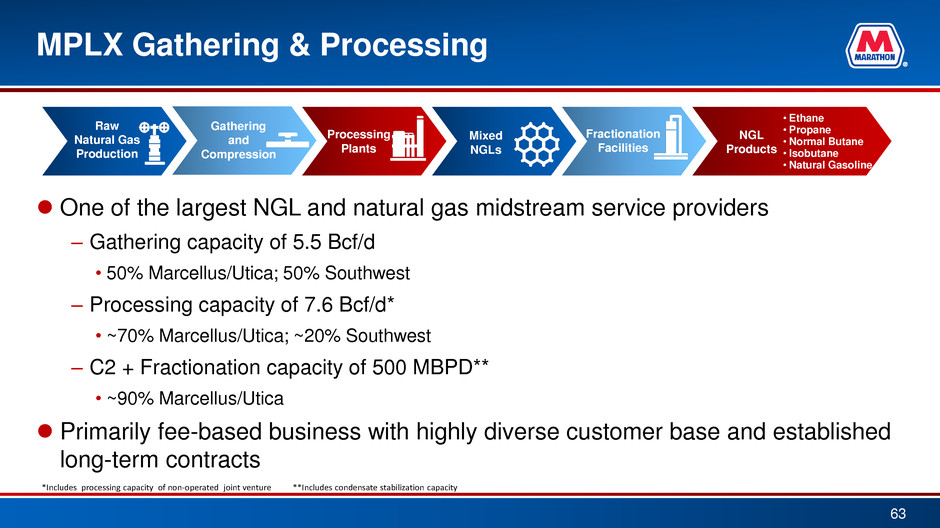

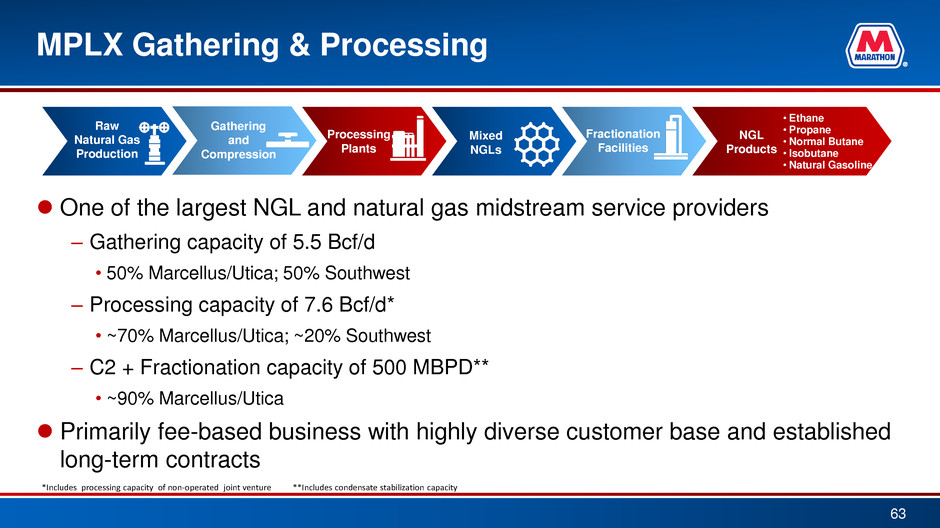

MPLX Gathering & Processing 63 One of the largest NGL and natural gas midstream service providers – Gathering capacity of 5.5 Bcf/d • 50% Marcellus/Utica; 50% Southwest – Processing capacity of 7.6 Bcf/d* • ~70% Marcellus/Utica; ~20% Southwest – C2 + Fractionation capacity of 500 MBPD** • ~90% Marcellus/Utica Primarily fee-based business with highly diverse customer base and established long-term contracts Raw Natural Gas Production Processing Plants Mixed NGLs Fractionation Facilities NGL Products • Ethane • Propane • Normal Butane • Isobutane • Natural Gasoline Gathering and Compression *Includes processing capacity of non-operated joint venture **Includes condensate stabilization capacity

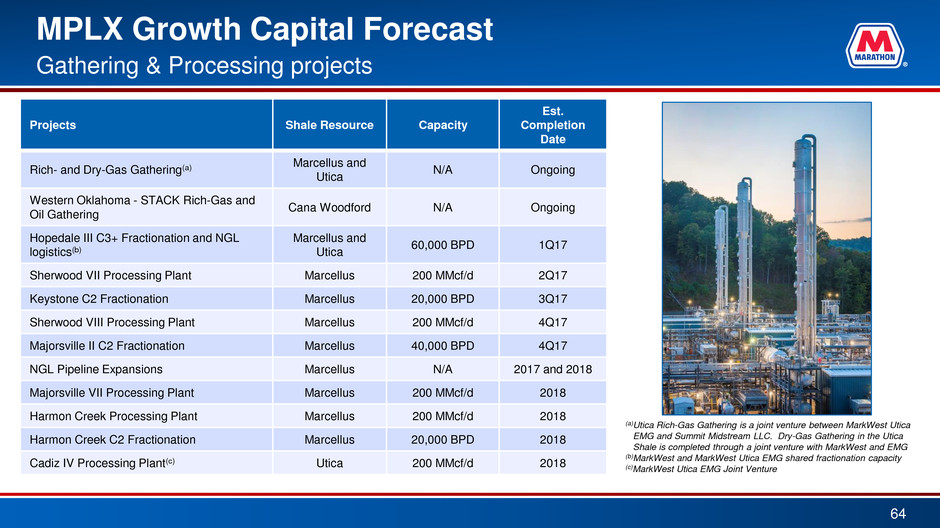

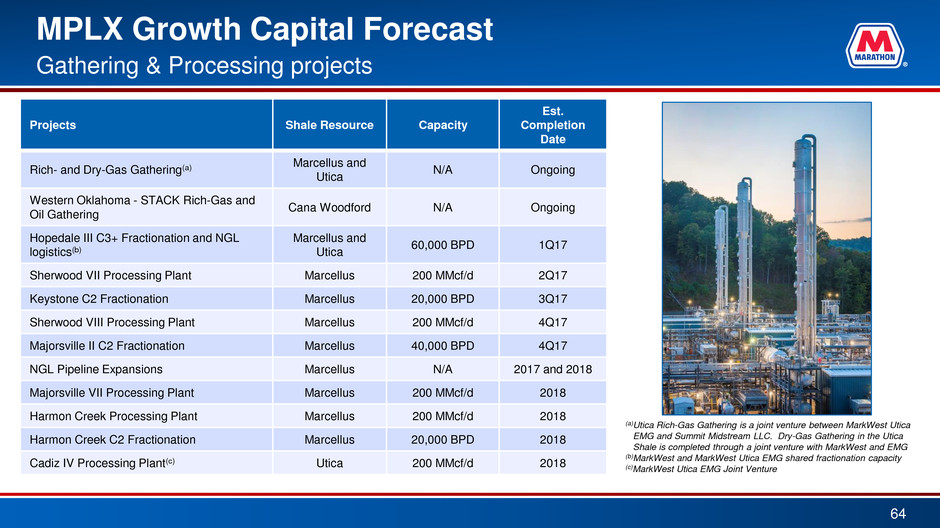

MPLX Growth Capital Forecast 64 Gathering & Processing projects (a)Utica Rich-Gas Gathering is a joint venture between MarkWest Utica EMG and Summit Midstream LLC. Dry-Gas Gathering in the Utica Shale is completed through a joint venture with MarkWest and EMG (b)MarkWest and MarkWest Utica EMG shared fractionation capacity (c)MarkWest Utica EMG Joint Venture Projects Shale Resource Capacity Est. Completion Date Rich- and Dry-Gas Gathering(a) Marcellus and Utica N/A Ongoing Western Oklahoma - STACK Rich-Gas and Oil Gathering Cana Woodford N/A Ongoing Hopedale III C3+ Fractionation and NGL logistics(b) Marcellus and Utica 60,000 BPD 1Q17 Sherwood VII Processing Plant Marcellus 200 MMcf/d 2Q17 Keystone C2 Fractionation Marcellus 20,000 BPD 3Q17 Sherwood VIII Processing Plant Marcellus 200 MMcf/d 4Q17 Majorsville II C2 Fractionation Marcellus 40,000 BPD 4Q17 NGL Pipeline Expansions Marcellus N/A 2017 and 2018 Majorsville VII Processing Plant Marcellus 200 MMcf/d 2018 Harmon Creek Processing Plant Marcellus 200 MMcf/d 2018 Harmon Creek C2 Fractionation Marcellus 20,000 BPD 2018 Cadiz IV Processing Plant(c) Utica 200 MMcf/d 2018

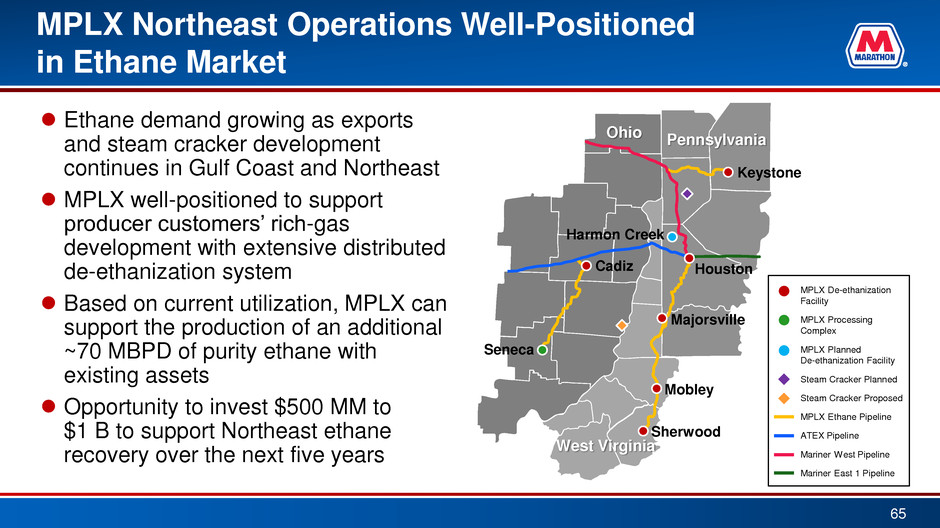

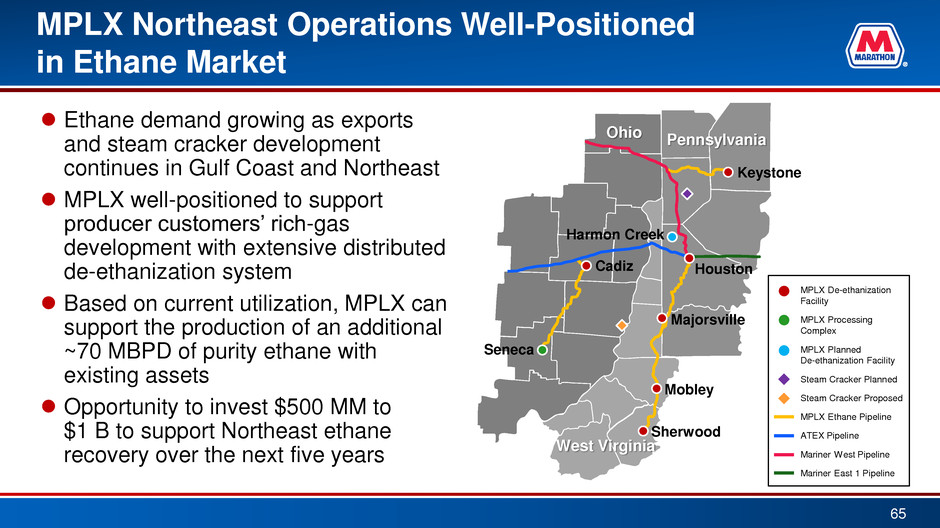

MPLX Northeast Operations Well-Positioned in Ethane Market Ethane demand growing as exports and steam cracker development continues in Gulf Coast and Northeast MPLX well-positioned to support producer customers’ rich-gas development with extensive distributed de-ethanization system Based on current utilization, MPLX can support the production of an additional ~70 MBPD of purity ethane with existing assets Opportunity to invest $500 MM to $1 B to support Northeast ethane recovery over the next five years 65 West Virginia Pennsylvania Ohio Sherwood Mobley Majorsville Cadiz Houston Keystone Harmon Creek Seneca MPLX De-ethanization Facility MPLX Processing Complex MPLX Planned De-ethanization Facility Steam Cracker Planned Steam Cracker Proposed MPLX Ethane Pipeline ATEX Pipeline Mariner West Pipeline Mariner East 1 Pipeline

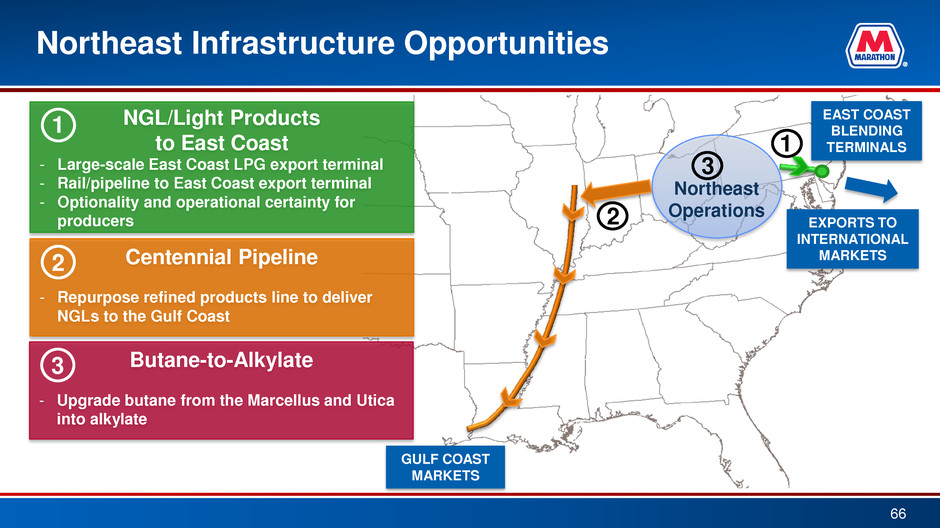

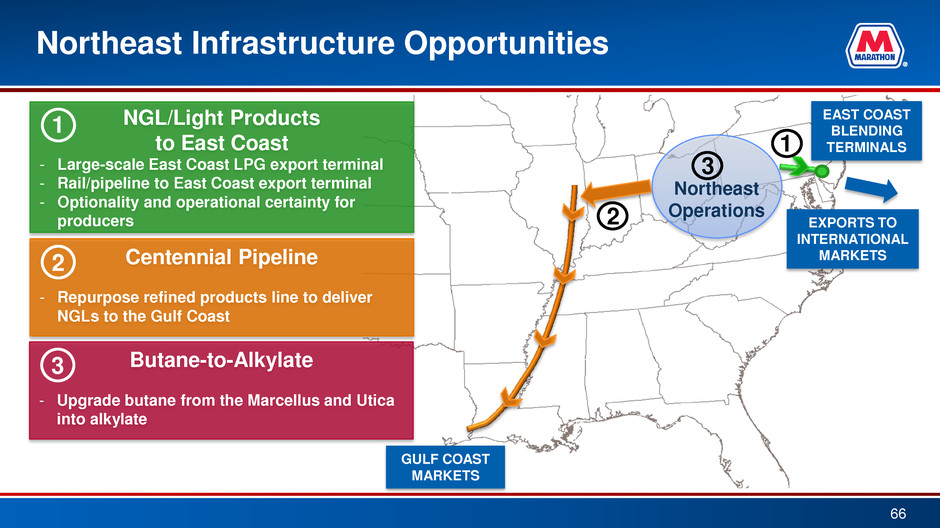

Northeast Infrastructure Opportunities NGL/Light Products to East Coast - Large-scale East Coast LPG export terminal - Rail/pipeline to East Coast export terminal - Optionality and operational certainty for producers Centennial Pipeline - Repurpose refined products line to deliver NGLs to the Gulf Coast 66 1 2 EXPORTS TO INTERNATIONAL MARKETS EAST COAST BLENDING TERMINALS Northeast Operations 1 2 GULF COAST MARKETS Butane-to-Alkylate - Upgrade butane from the Marcellus and Utica into alkylate 3 3

MPLX - Gathering & Processing Contract Structure 67 Durable long-term partnerships across leading basins Marcellus Utica Southwest Resource Play Marcellus, Upper Devonian Utica Haynesville, Cotton Valley, Woodford, Anadarko Basin, Granite Wash, Cana-Woodford, Permian, Eagle Ford Producers 14 – including Range, Antero, EQT, CNX, Noble, Southwestern, Rex and others 10 – including Antero, Gulfport, Ascent, Rice, Rex, PDC and others 140 – including Anadarko, Newfield, Devon, BP, Chevron, PetroQuest and others Contract Structure Long-term agreements initially 10-15 years, which contain renewal provisions Long-term agreements initially 10-15 years, which contain renewal provisions Long-term agreements initially 10-15 years, which contain renewal provisions Volume Protection (MVCs) 65% of 2016 capacity contains minimum volume commitments 25% of 2016 capacity contains minimum volume commitments 15% of 2016 capacity contains minimum volume commitments Area Dedications 4 MM acres 3.9 MM acres 1.4 MM acres Inflation Protection Yes Yes Yes

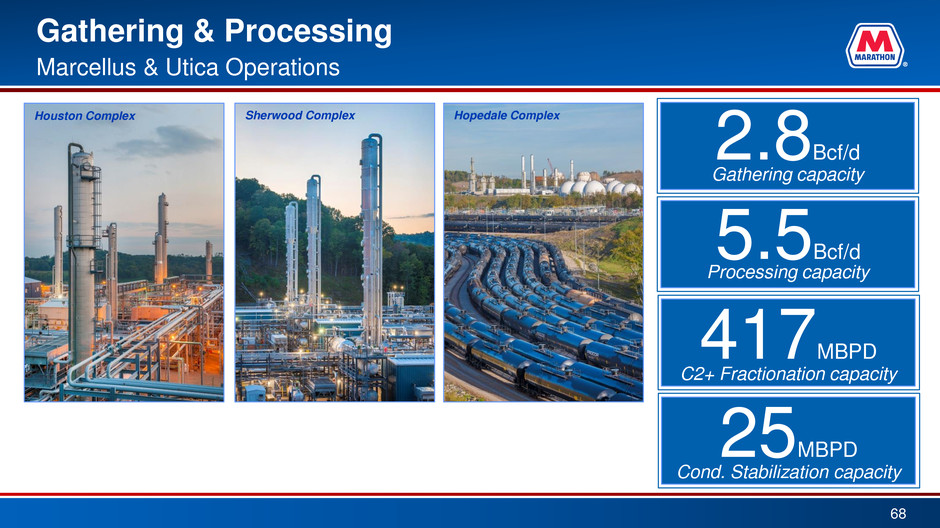

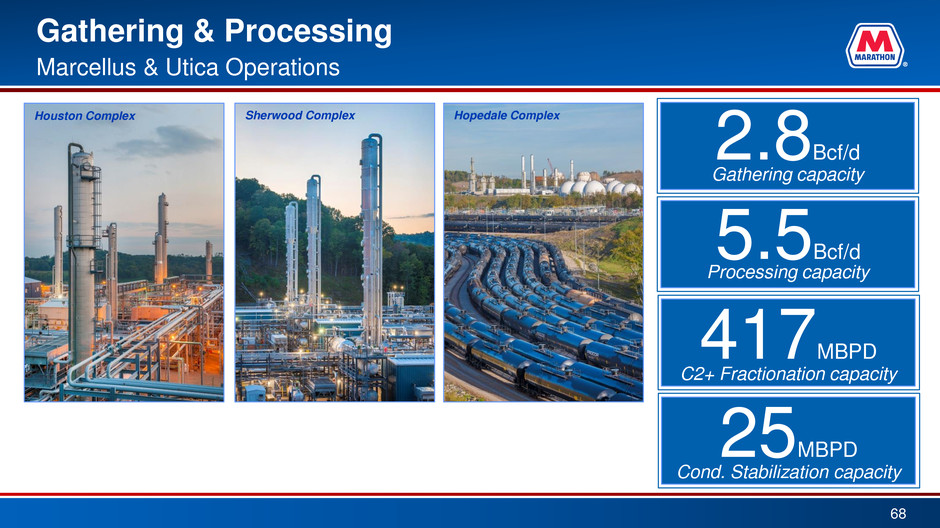

Gathering & Processing 68 Marcellus & Utica Operations 0 2.8Bcf/d Gathering capacity 5.5Bcf/d Processing capacity 417MBPD C2+ Fractionation capacity 25MBPD Cond. Stabilization capacity Houston Complex Sherwood Complex Hopedale Complex

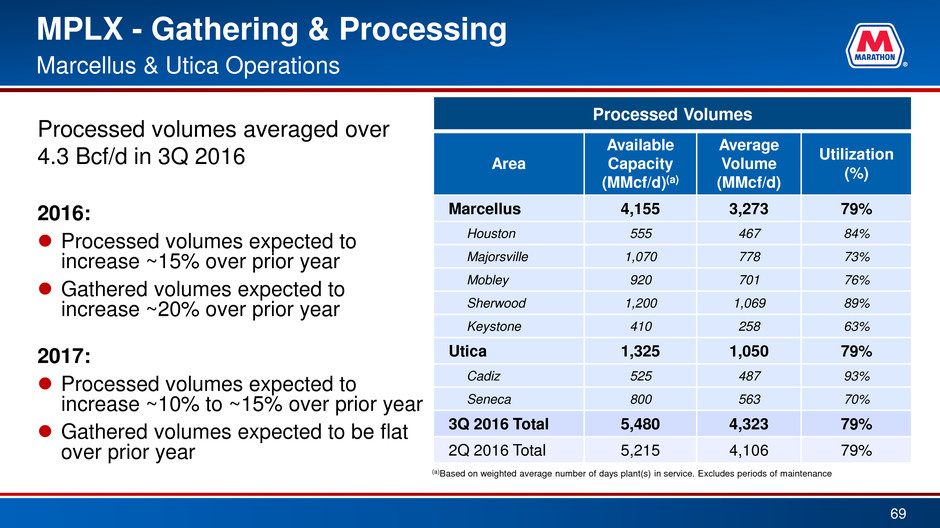

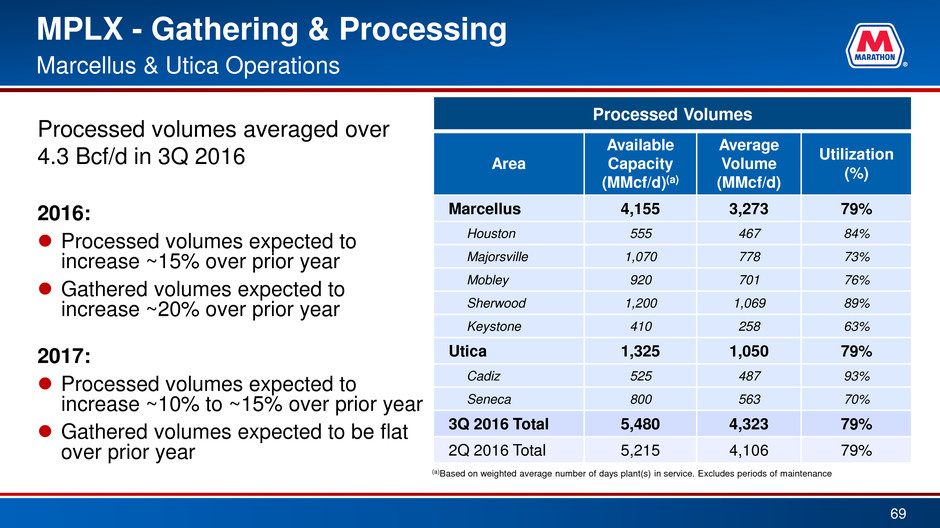

MPLX - Gathering & Processing 69 Marcellus & Utica Operations Processed volumes averaged over 4.3 Bcf/d in 3Q 2016 2016: Processed volumes expected to increase ~15% over prior year Gathered volumes expected to increase ~20% over prior year 2017: Processed volumes expected to increase ~10% to ~15% over prior year Gathered volumes expected to be flat over prior year Processed Volumes Area Available Capacity (MMcf/d)(a) Average Volume (MMcf/d) Utilization (%) Marcellus 4,155 3,273 79% Houston 555 467 84% Majorsville 1,070 778 73% Mobley 920 701 76% Sherwood 1,200 1,069 89% Keystone 410 258 63% Utica 1,325 1,050 79% Cadiz 525 487 93% Seneca 800 563 70% 3Q 2016 Total 5,480 4,323 79% 2Q 2016 Total 5,215 4,106 79% (a)Based on weighted average number of days plant(s) in service. Excludes periods of maintenance

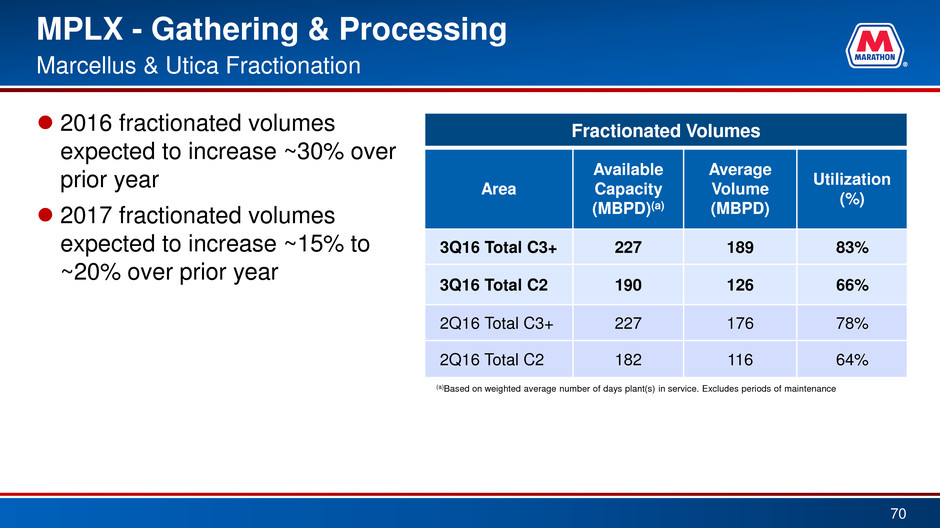

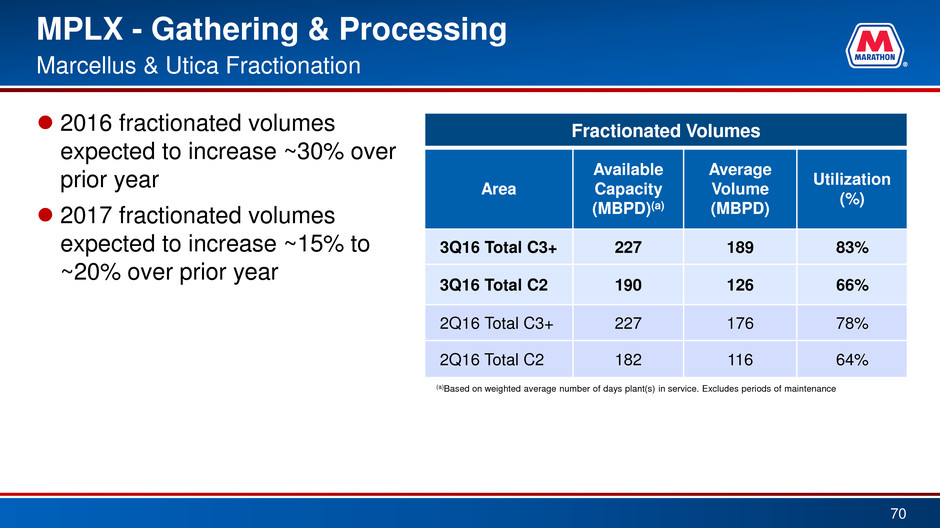

MPLX - Gathering & Processing 70 Marcellus & Utica Fractionation 2016 fractionated volumes expected to increase ~30% over prior year 2017 fractionated volumes expected to increase ~15% to ~20% over prior year Fractionated Volumes Area Available Capacity (MBPD)(a) Average Volume (MBPD) Utilization (%) 3Q16 Total C3+ 227 189 83% 3Q16 Total C2 190 126 66% 2Q16 Total C3+ 227 176 78% 2Q16 Total C2 182 116 64% (a)Based on weighted average number of days plant(s) in service. Excludes periods of maintenance

3 8 13 18 23 28 55 56 57 58 59 60 61 62 63 64 65 Jul-10 Jul-11 Jul-12 Jul-13 Jul-14 Jul-15 The Marcellus/Utica Resource Play is the Leading U.S. Natural Gas Growth Play 71 Rest o f U .S. – B illi o n Cu b ic F ee t p er D ay ( B cf /d ) Note: Wellhead gas production (before flaring and NGL extraction) Sources: As of July 28, 2016. Bloomberg (PointLogic Energy Estimates), BENTEK, MPLX LP M arcell u s & Utica – B illi o n Cu b ic Feet p er D ay (B cf/d ) Marcellus & Utica account for over 20% of total U.S. Gas Supply Marcellus & Utica Rest of U.S.

2000 2020 U.S. Natural Gas and NGL Trade Flows Changing Paradigm shift from U.S. Northeast being a significant importer to a significant exporter Driven by Marcellus and Utica production growth Infrastructure continuing to build out to reflect changes in trade flows 72

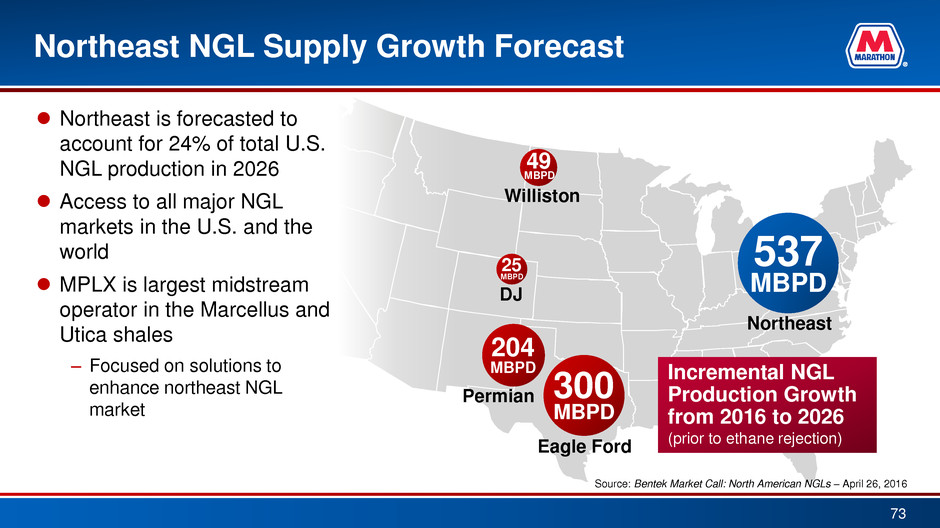

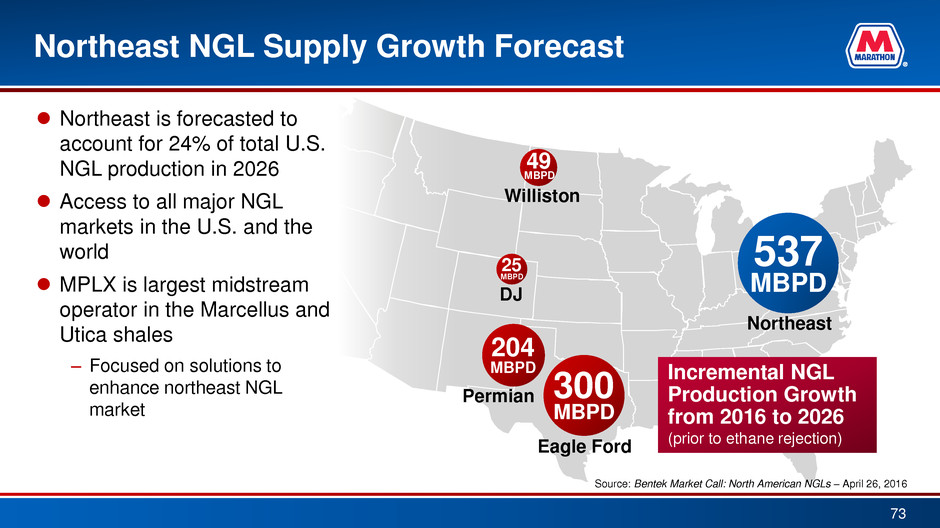

Northeast NGL Supply Growth Forecast 73 Incremental NGL Production Growth from 2016 to 2026 (prior to ethane rejection) Williston Permian Eagle Ford DJ Source: Bentek Market Call: North American NGLs – April 26, 2016 49 MBPD 25 MBPD 204 MBPD 300 MBPD 537 MBPD Northeast Northeast is forecasted to account for 24% of total U.S. NGL production in 2026 Access to all major NGL markets in the U.S. and the world MPLX is largest midstream operator in the Marcellus and Utica shales – Focused on solutions to enhance northeast NGL market

Edmonton Markets Gulf Coast Markets Northeast Operations Well-Positioned to Access all Major NGL Markets* 74 Distribution by Pipeline Distribution by Rail Distribution by Truck 60% - 65% 30% - 35% 5% - 10% MPLX 2016 NGL Marketing by Transport Access to all major NGL markets in the U.S. and the world Key takeaway solutions underway such as Utica infrastructure build-out, Mariner East 2 and additional projects Northeast exports are geographically and structurally advantaged to Europe and parts of South America MPLX developing a comprehensive export solution for producers Northeast Markets Midwest Markets Mid-Atlantic Markets Ontario Markets Mid-Con Markets Chesapeake Terminal Northeast Operations * Excludes ethane

Ontario Markets Northeast Operations Well-Positioned in Ethane Market 75 Operate 190 MBPD of de-ethanization capacity in the Marcellus and Utica shales Produced 126 MBPD of purity ethane in third-quarter 2016, a 78% increase from prior year quarter Supply ethane to multiple locations including Canadian, Gulf Coast and international markets Satisfy demand from new large-scale ethane crackers Gulf Coast Markets Distribution by Pipeline Northeast Operations Mariner West Mariner East Exports

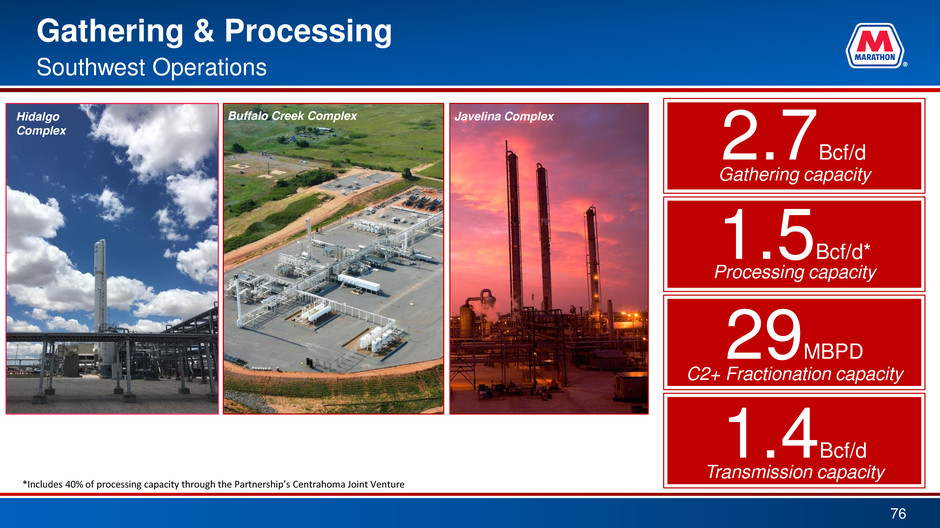

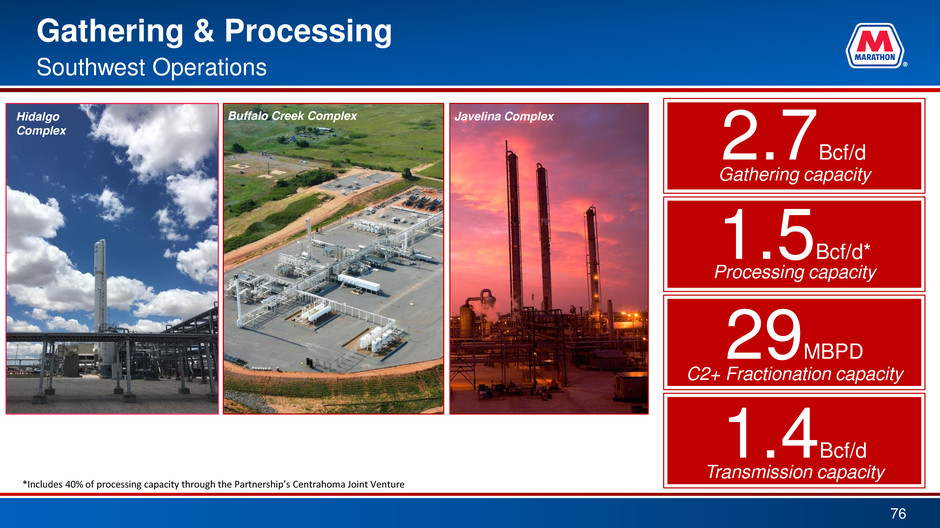

Gathering & Processing 76 Southwest Operations 0 Gathering capacity 1.5Bcf/d* Processing capacity 29MBPD C2+ Fractionation capacity 2.7Bcf/d Javelina Complex Carthage Complex Buffalo Creek Complex Transmission capacity 1.4Bcf/d *Includes 40% of processing capacity through the Partnership’s Centrahoma Joint Venture Hidalgo Complex

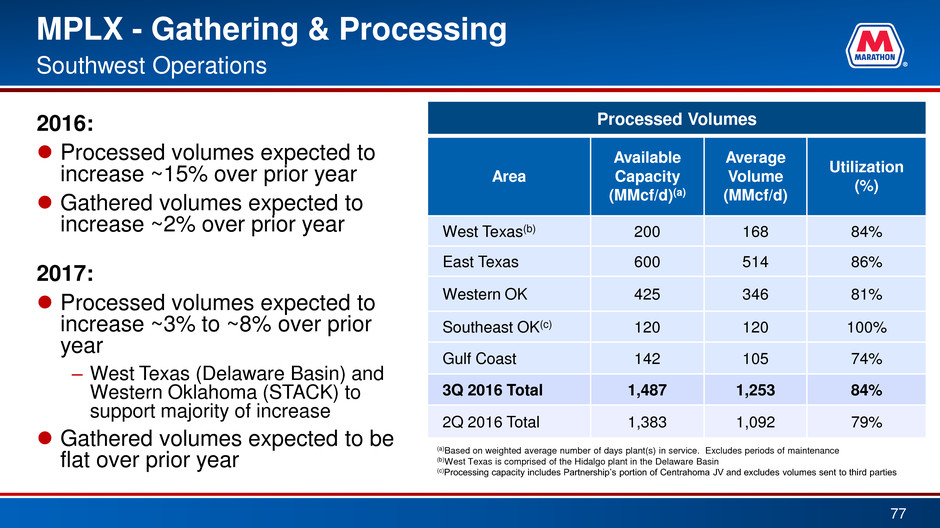

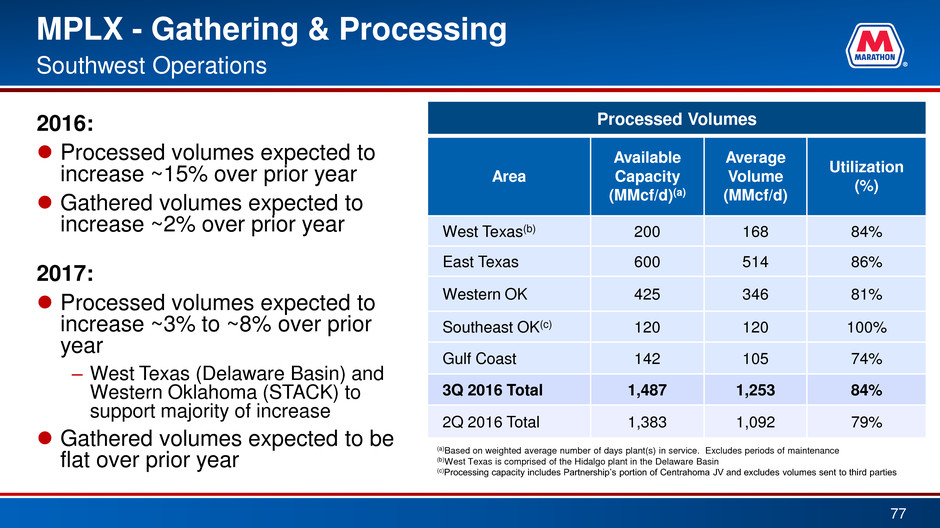

MPLX - Gathering & Processing 77 Southwest Operations 2016: Processed volumes expected to increase ~15% over prior year Gathered volumes expected to increase ~2% over prior year 2017: Processed volumes expected to increase ~3% to ~8% over prior year – West Texas (Delaware Basin) and Western Oklahoma (STACK) to support majority of increase Gathered volumes expected to be flat over prior year Processed Volumes Area Available Capacity (MMcf/d)(a) Average Volume (MMcf/d) Utilization (%) West Texas(b) 200 168 84% East Texas 600 514 86% Western OK 425 346 81% Southeast OK(c) 120 120 100% Gulf Coast 142 105 74% 3Q 2016 Total 1,487 1,253 84% 2Q 2016 Total 1,383 1,092 79% (a)Based on weighted average number of days plant(s) in service. Excludes periods of maintenance (b)West Texas is comprised of the Hidalgo plant in the Delaware Basin (c)Processing capacity includes Partnership’s portion of Centrahoma JV and excludes volumes sent to third parties

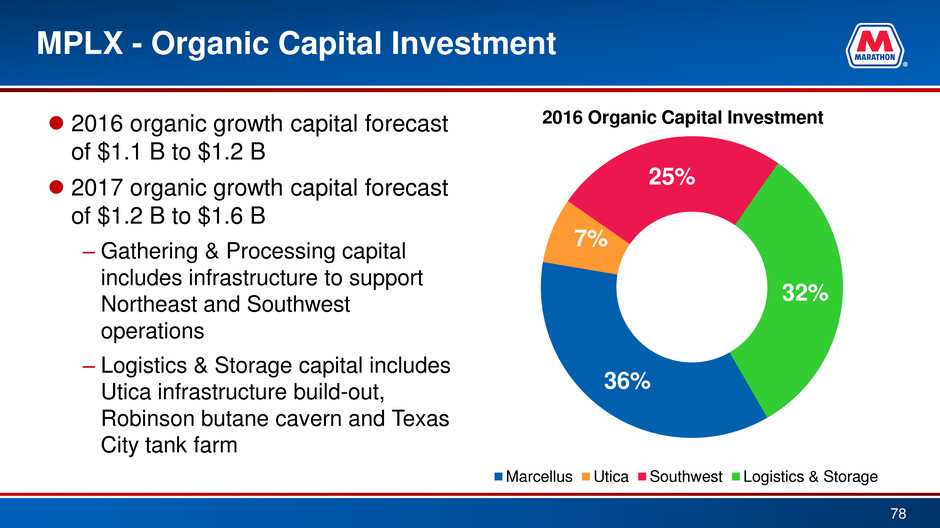

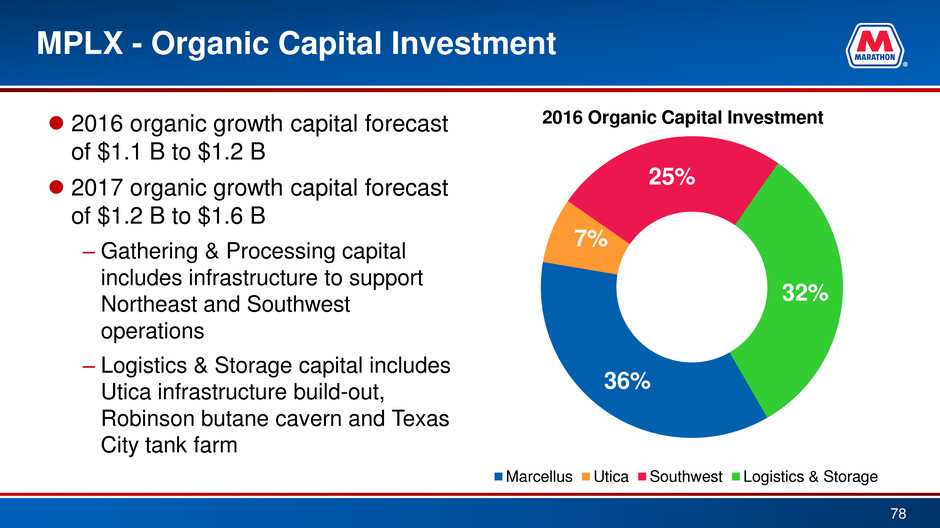

MPLX - Organic Capital Investment 78 2016 organic growth capital forecast of $1.1 B to $1.2 B 2017 organic growth capital forecast of $1.2 B to $1.6 B – Gathering & Processing capital includes infrastructure to support Northeast and Southwest operations – Logistics & Storage capital includes Utica infrastructure build-out, Robinson butane cavern and Texas City tank farm 36% 7% 25% 32% Marcellus Utica Southwest Logistics & Storage 2016 Organic Capital Investment

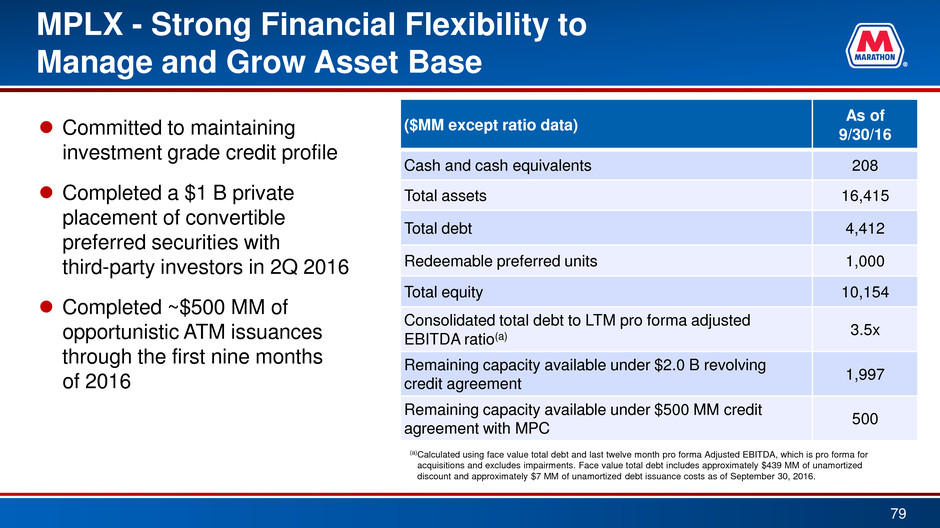

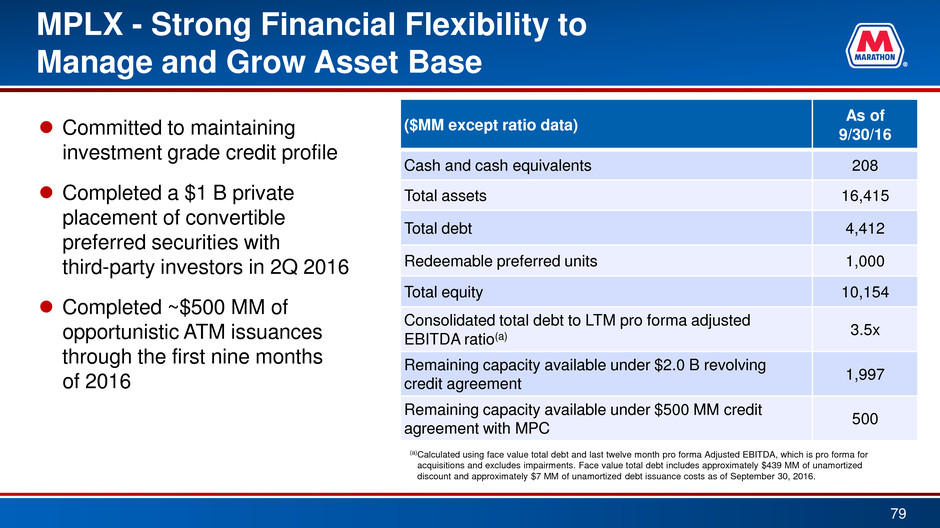

MPLX - Strong Financial Flexibility to Manage and Grow Asset Base 79 Committed to maintaining investment grade credit profile Completed a $1 B private placement of convertible preferred securities with third-party investors in 2Q 2016 Completed ~$500 MM of opportunistic ATM issuances through the first nine months of 2016 ($MM except ratio data) As of 9/30/16 Cash and cash equivalents 208 Total assets 16,415 Total debt 4,412 Redeemable preferred units 1,000 Total equity 10,154 Consolidated total debt to LTM pro forma adjusted EBITDA ratio(a) 3.5x Remaining capacity available under $2.0 B revolving credit agreement 1,997 Remaining capacity available under $500 MM credit agreement with MPC 500 (a)Calculated using face value total debt and last twelve month pro forma Adjusted EBITDA, which is pro forma for acquisitions and excludes impairments. Face value total debt includes approximately $439 MM of unamortized discount and approximately $7 MM of unamortized debt issuance costs as of September 30, 2016.

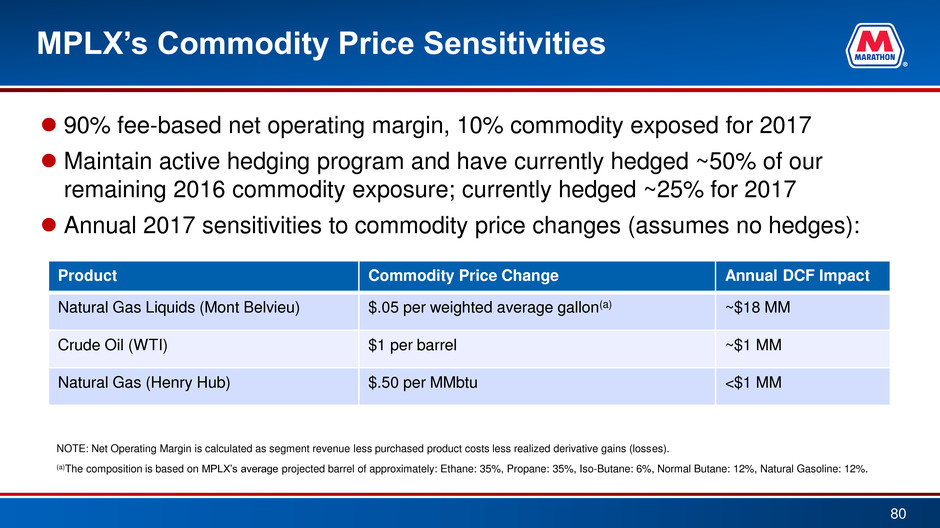

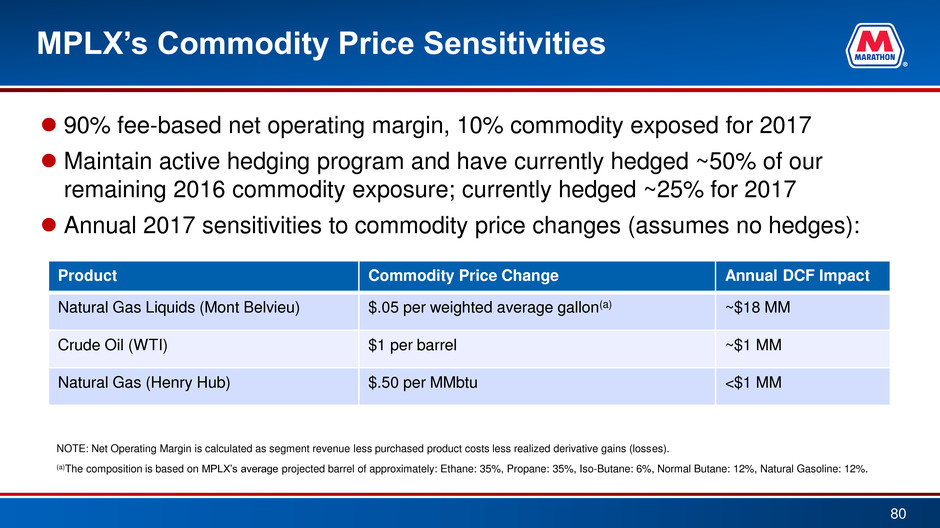

MPLX’s Commodity Price Sensitivities 80 NOTE: Net Operating Margin is calculated as segment revenue less purchased product costs less realized derivative gains (losses). (a)The composition is based on MPLX’s average projected barrel of approximately: Ethane: 35%, Propane: 35%, Iso-Butane: 6%, Normal Butane: 12%, Natural Gasoline: 12%. Product Commodity Price Change Annual DCF Impact Natural Gas Liquids (Mont Belvieu) $.05 per weighted average gallon(a) ~$18 MM Crude Oil (WTI) $1 per barrel ~$1 MM Natural Gas (Henry Hub) $.50 per MMbtu <$1 MM 90% fee-based net operating margin, 10% commodity exposed for 2017 Maintain active hedging program and have currently hedged ~50% of our remaining 2016 commodity exposure; currently hedged ~25% for 2017 Annual 2017 sensitivities to commodity price changes (assumes no hedges):

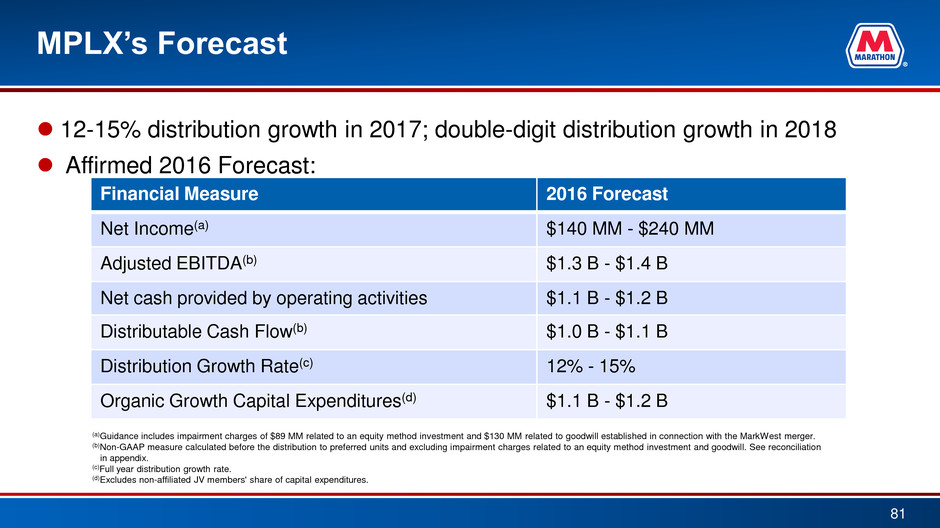

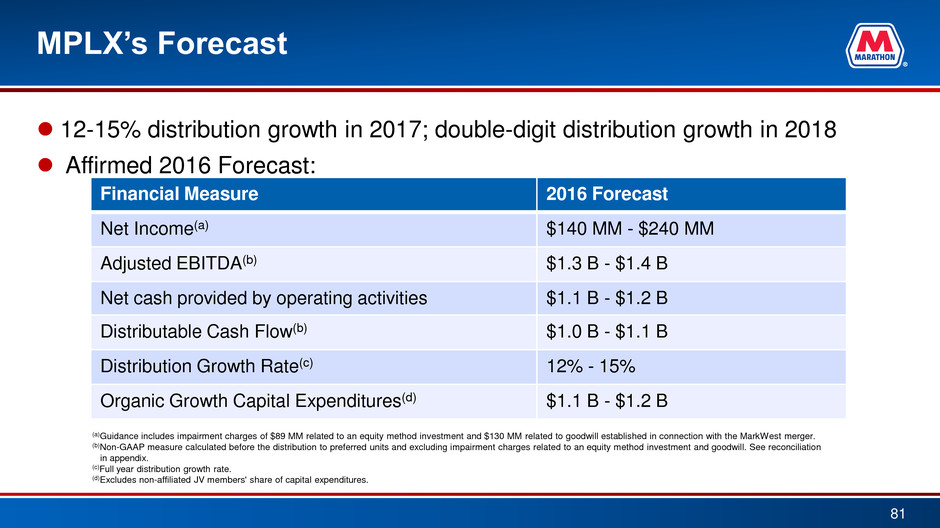

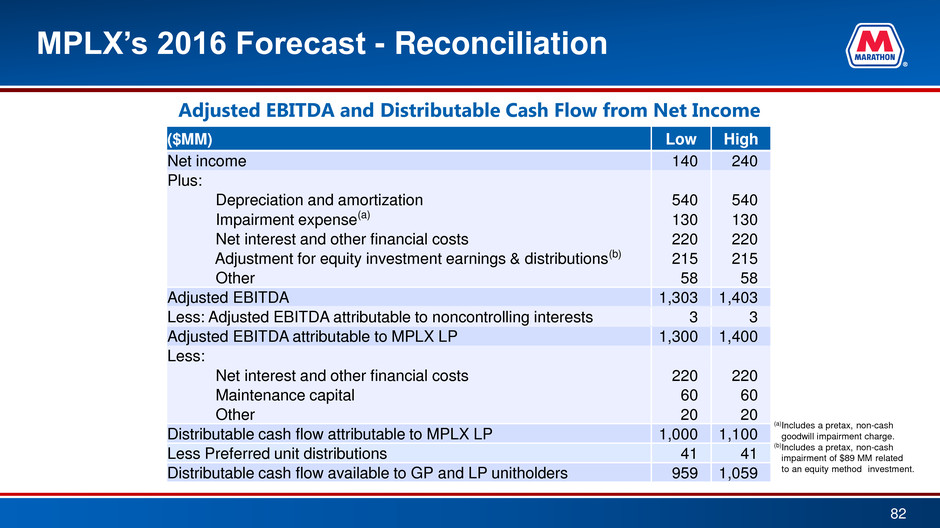

MPLX’s Forecast 12-15% distribution growth in 2017; double-digit distribution growth in 2018 Affirmed 2016 Forecast: 81 Financial Measure 2016 Forecast Net Income(a) $140 MM - $240 MM Adjusted EBITDA(b) $1.3 B - $1.4 B Net cash provided by operating activities $1.1 B - $1.2 B Distributable Cash Flow(b) $1.0 B - $1.1 B Distribution Growth Rate(c) 12% - 15% Organic Growth Capital Expenditures(d) $1.1 B - $1.2 B (a)Guidance includes impairment charges of $89 MM related to an equity method investment and $130 MM related to goodwill established in connection with the MarkWest merger. (b)Non-GAAP measure calculated before the distribution to preferred units and excluding impairment charges related to an equity method investment and goodwill. See reconciliation in appendix. (c)Full year distribution growth rate. (d)Excludes non-affiliated JV members' share of capital expenditures.

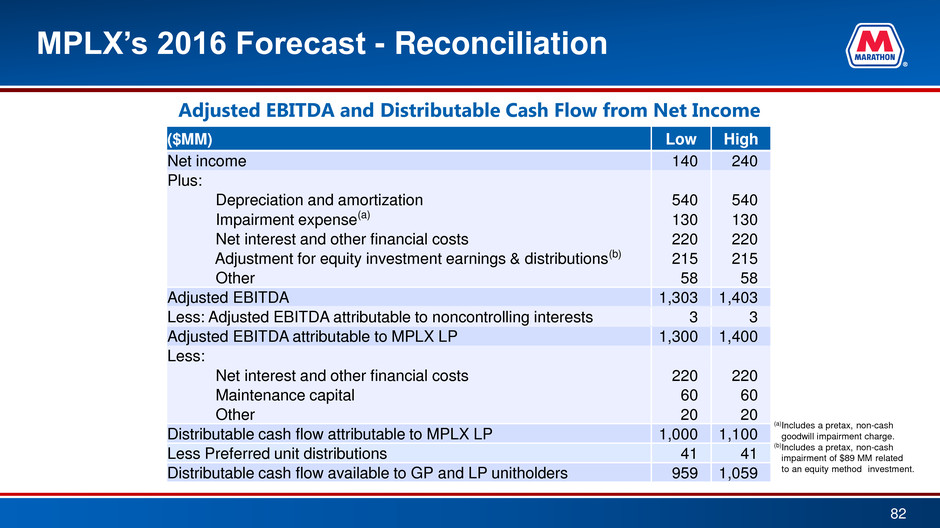

MPLX’s 2016 Forecast - Reconciliation 82 (a)Includes a pretax, non-cash goodwill impairment charge. (b)Includes a pretax, non-cash impairment of $89 MM related to an equity method investment. Adjusted EBITDA and Distributable Cash Flow from Net Income ($MM) Low High Net income 140 240 Plus: Depreciation and amortization 540 540 Impairment expense(a) 130 130 Net interest and other financial costs 220 220 Adjustment for equity investment earnings & distributions(b) 215 215 Other 58 58 Adjusted EBITDA 1,303 1,403 Less: Adjusted EBITDA attributable to noncontrolling interests 3 3 Adjusted EBITDA attributable to MPLX LP 1,300 1,400 Less: Net interest and other financial costs 220 220 Maintenance capital 60 60 Other 20 20 Distributable cash flow attributable to MPLX LP 1,000 1,100 Less Preferred unit distributions 41 41 Distributable cash flow available to GP and LP unitholders 959 1,059

Reconciliations 83 ($MM) 2011 4Q 2015 2015 1Q 2016 2Q 2016 3Q 2016 3Q 2016 LTM Speedway Segment Income from Operations 271 135 673 167 193 209 704 Plus: Depreciations and Amortization 110 66 254 63 69 71 269 Plus: Lower of Cost or Market Inventory Valuation Charge (Benefit) - 25 25 - (25) - - Speedway Segment Adjusted EBITDA 381 226 952 230 237 280 973 Speedway Segment Adjusted EBITDA to Segment Income from Operations *Based on Hess Sept. 30, 2013 Form 10 data annualized **Based on original announcement guidance in May 2014 EBITDA to Net Income for Acquired Locations ($MM) 2013* 2017E** Income from Operations 47 138 Less: Net interest and other financial income (costs) (12) - Plus: Provision for income taxes 22 78 Plus: Depreciation and Amortization 94 149 Acquired Locations EBITDA 175 365

Reconciliation 84 Midstream Segment EBITDA to Segment Income from Operations ($MM) 2011 2Q 2016 YTD 1H 2016 Annualized Midstream Segment Income from Operations 199 368 736 Plus: Depreciation and Amortization 45 284 568 Midstream Segment EBITDA 244 652 1,304

Reconciliation 85 Pro Forma Adjusted EBITDA to Pro Forma Net Income Attributable to MPC ($MM) 2015 2016 LTM 4Q 1Q 2Q 3Q Pro Forma Net Income attributable to MPC(a) 225 1 801 145 1,172 Less: Net interest and other financial income (costs) (139) (142) (137) (141) (559) Add: Net income (loss) attributable to inco noncontrolling interests (33) (79) (18) 74 (56) Provision for income taxes 104 11 395 75 585 Depreciation and amortization 502 490 500 507 1,999 Impairment expense - 129 90 267 486 Inventory market valuation adjustment 370 15 (385) - - Pro Forma Adjusted EBITDA 1,307 709 1,520 1,209 4,745 Less: Pro Forma Adjusted EBITDA related to MPLX 1,254 Pro Forma adjusted EBITDA excluding MPLX 3,491 (a)4Q 2015 pro forma for MarkWest acquisition

Reconciliation 86 Pro Forma Adjusted EBITDA related to MPLX to Pro Forma MPLX Net Income ($MM) 2015 2016 LTM 4Q 1Q 2Q 3Q Pro Forma MPLX Net Income(a) 104 (37) 20 143 230 Less: Net interest and other financial income (costs) (67) (68) (64) (64) (263) Add: Provision for income taxes - (4) (8) - (12) Depreciation and amortization 147 132 137 138 554 Impairment expense - 129 90 - 219 Pro Forma Adjusted EBITDA related to MPLX 318 288 303 345 1,254 (a)4Q 2015 pro forma for MarkWest acquisition

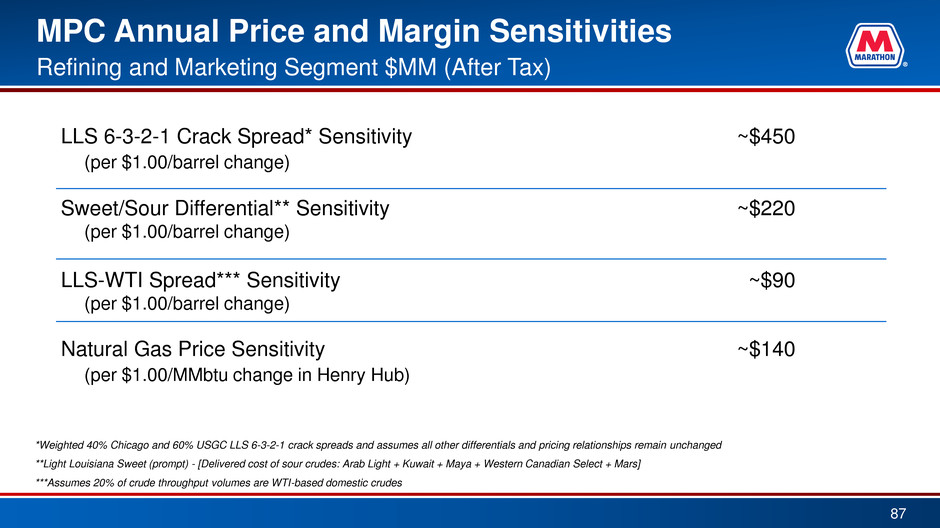

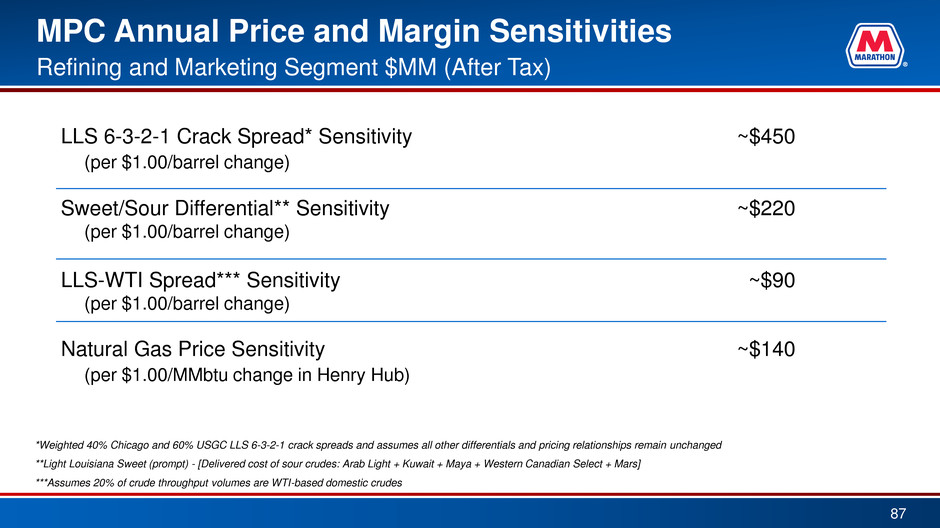

MPC Annual Price and Margin Sensitivities Refining and Marketing Segment $MM (After Tax) LLS 6-3-2-1 Crack Spread* Sensitivity ~$450 (per $1.00/barrel change) Sweet/Sour Differential** Sensitivity ~$220 (per $1.00/barrel change) LLS-WTI Spread*** Sensitivity ~$90 (per $1.00/barrel change) Natural Gas Price Sensitivity ~$140 (per $1.00/MMbtu change in Henry Hub) *Weighted 40% Chicago and 60% USGC LLS 6-3-2-1 crack spreads and assumes all other differentials and pricing relationships remain unchanged **Light Louisiana Sweet (prompt) - [Delivered cost of sour crudes: Arab Light + Kuwait + Maya + Western Canadian Select + Mars] ***Assumes 20% of crude throughput volumes are WTI-based domestic crudes 87

MPC’s Fully Integrated Downstream System Refining and Marketing Seven-plant refining system with ~1.8 MMBPCD capacity One biodiesel facility and interest in three ethanol facilities One of the largest wholesale suppliers in our market area One of the largest producers of asphalt in the U.S. ~5,400 Marathon Brand retail outlets across 19 states Owns/operates 61 light product terminals and 18 asphalt terminals, while utilizing third-party terminals at 120 light product and two asphalt locations 2,210 owned/leased railcars, 173 owned transport trucks Speedway ~2,770 locations in 22 states Second largest U.S. owned/operated c-store chain Midstream Owns, leases or has interest in ~8,400 miles of crude and refined product pipelines 18 owned inland waterway towboats with ~205 owned barges and 14 leased barges Owns/operates over 5,500 miles of gas gathering and NGL pipelines Owns/operates 54 gas processing plants, 13 NGL fractionation facilities and two condensate stabilization facilities MPC Refineries Light Product Terminals MPC owned and Part-owned Third Party Asphalt/Heavy Oil Terminals MPC Owned Third Party Water Supplied Terminals Coastal Inland Pipelines MPC Owned and Operated MPC Interest: Operated by MPC MPC Interest: Operated by Others Pipelines Used by MPC Marketing Area MarkWest Facility Tank Farms Butane Cavern Pipelines Barge Dock Ethanol Facility Biodiesel Facility Renewable Fuels 88 As of September 30, 2016