- MPC Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

PRE 14A Filing

Marathon Petroleum (MPC) PRE 14APreliminary proxy

Filed: 3 Mar 22, 3:51pm

| Marathon Petroleum Corporation | ||||||||||||||||

| 2022 | |||||||||||||||||

NOTICE OF ANNUAL MEETING AND PROXY STATEMENT | |||||||||||||||||

WEDNESDAY APRIL 27, 2022 10 AM (EDT) | |||||||||||||||||

| Marathon Petroleum Corporation intends to release definitive copies of the Proxy Statement to shareholders on or about March 14, 2022. | ||

| NOTICE OF 2022 ANNUAL MEETING OF SHAREHOLDERS | ||||||||||||||||||||||||||||

| Record Date: | Meeting Date: | Meeting Time: | Meeting Location: | ||||||||||||||||||||||||||

| March 2, 2022 | April 27, 2022 | 10 a.m. EDT | www.virtualshareholdermeeting.com/MPC2022 | ||||||||||||||||||||||||||

Additional Meeting Information: See “FAQs About Voting and the Annual Meeting” beginning on page 82. | |||||||||||||||||||||||||||||

| DEAR SHAREHOLDER, | ||

You are invited to attend Marathon Petroleum Corporation’s 2022 Annual Meeting of Shareholders on Wednesday, April 27, 2022, at 10 a.m. EDT, to be held online at www.virtualshareholdermeeting.com/MPC2022. At the meeting, shareholders will be asked to vote on the following matters: | ||

| Ø | Proposal 1: To elect the four director nominees for Class II named in the Proxy Statement. | |||||||

| Ø | Proposal 2: To ratify the appointment of our independent auditor for 2022. | |||||||

| Ø | Proposal 3: To approve, on an advisory basis, our named executive officer compensation. | |||||||

| Ø | Proposal 4: To amend our Certificate of Incorporation to declassify the Board of Directors. | |||||||

| Ø | Proposal 5: To amend our Certificate of Incorporation to eliminate the supermajority provisions. | |||||||

| Ø | Proposal 6: To amend our Certificate of Incorporation to amend the exclusive forum provision. | |||||||

| Ø | Proposals 7-9: If properly presented at the meeting, three shareholder proposals. | |||||||

| We will also transact any other business that may properly come before the meeting or any adjournment or postponement thereof. | ||

| Shareholders of record at the close of business on Wednesday, March 2, 2022, are entitled to vote at the Annual Meeting. See “FAQs About Voting and the Annual Meeting” for more information. | ||

We provide our proxy materials, including our Proxy Statement and Annual Report, over the internet. This expedites your receipt of proxy materials, conserves natural resources and lowers the cost of the meeting. On or about March 14, 2022, we are posting our proxy materials at www.proxyvote.com and mailing to shareholders a Notice Regarding the Availability of Proxy Materials, explaining how to access the proxy materials over the internet. We are also mailing a printed set of the proxy materials to shareholders who have elected to receive paper copies. Shareholders may request a printed set of the proxy materials by following the instructions provided in the Notice. | ||

| We thank you for your continued support and look forward to your attendance at our virtual Annual Meeting. | ||

| By order of the Board of Directors, | |||||||||||||||||||||||

| |||||||||||||||||||||||

Molly R. Benson Vice President, Chief Securities, Governance & Compliance Officer and Corporate Secretary | |||||||||||||||||||||||

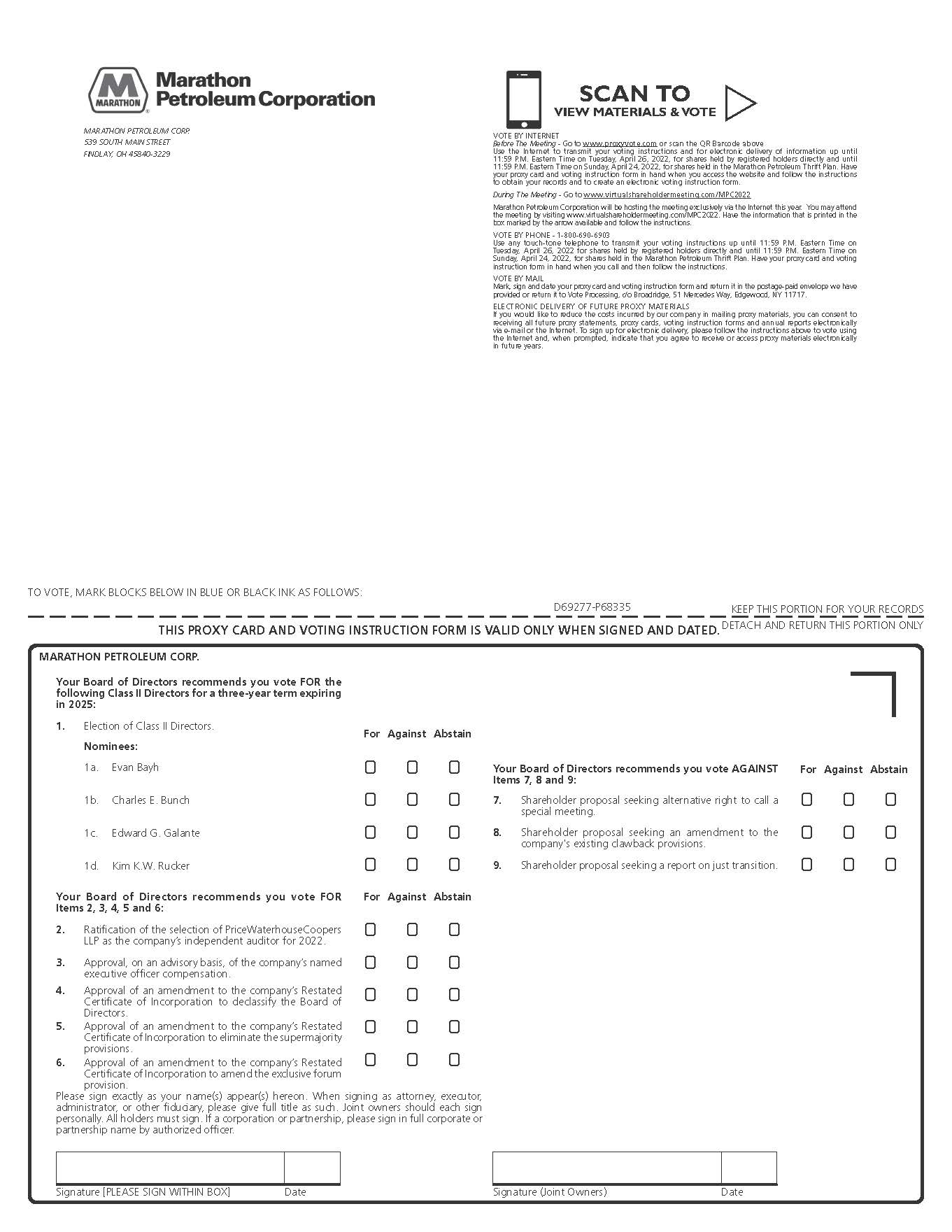

| þ | Your vote is important. Whether or not you plan to participate in the virtual Annual Meeting, please vote as soon as possible using one of the following options: | ||||||||||||||||||||||

| |||||||||||||||||||||||

| Via the Internet: | Call Toll-Free: | Mail Signed Proxy Card: | |||||||||||||||||||||

| Follow the instructions in the Notice, proxy card or voting instruction form. | Call the toll-free number on your proxy card or voting instruction form. | Follow the instructions on your proxy card or voting instruction form. | |||||||||||||||||||||

| IMPORTANT NOTICE REGARDING THE INTERNET AVAILABILITY OF PROXY MATERIALS: | |||||||||||||||||||||||

The Proxy Statement and Marathon Petroleum Corporation’s 2021 Annual Report are available at www.proxyvote.com. | |||||||||||||||||||||||

| TABLE OF CONTENTS | ||

| ü | ||||||||

| Independent Chairman of the Board | ||||||||

| Oversight of Risk Management | ||||||||

| Oversight of Political Engagement and Public Policy | ||||||||

| ü | ||||||||

| PROXY SUMMARY | ||||||||||||||||||||||||||||||||

| This summary highlights information contained in this Proxy Statement, which is first being sent or made available to shareholders on or about March 14, 2022. This summary does not contain all of the information you should consider before voting. Please read the entire Proxy Statement before voting. For more complete information regarding MPC’s 2021 operational and financial performance and definitions of industry terms, please review MPC’s Annual Report on Form 10-K for the year ended December 31, 2021, which accompanies this Proxy Statement. | ||||||||||||||||||||||||||||||||

| Annual Meeting and Voting Information | ||||||||||||||||||||||||||||||||

|  |  |  | |||||||||||||||||||||||||||||

| DATE AND TIME | LOCATION | RECORD DATE | VOTING | |||||||||||||||||||||||||||||

| Wednesday, April 27, 2022 | The Annual Meeting will be held virtually at: www.virtualshareholder meeting.com/MPC2022 | Wednesday, March 2, 2022 | Only holders of record of MPC’s common stock as of the record date will be entitled to notice and to vote | |||||||||||||||||||||||||||||

| 10 a.m. EDT | Shares outstanding: | |||||||||||||||||||||||||||||||

| 558,574,459 | ||||||||||||||||||||||||||||||||

As part of our precautions regarding the coronavirus and to support the health and well-being of our shareholders and employees, MPC’s 2022 Annual Meeting (the “Annual Meeting”) will be held exclusively online. See “FAQs About Voting and the Annual Meeting” beginning on page 82 for additional information about how to attend and vote at the virtual Annual Meeting. | ||||||||||||||||||||||||||||||||

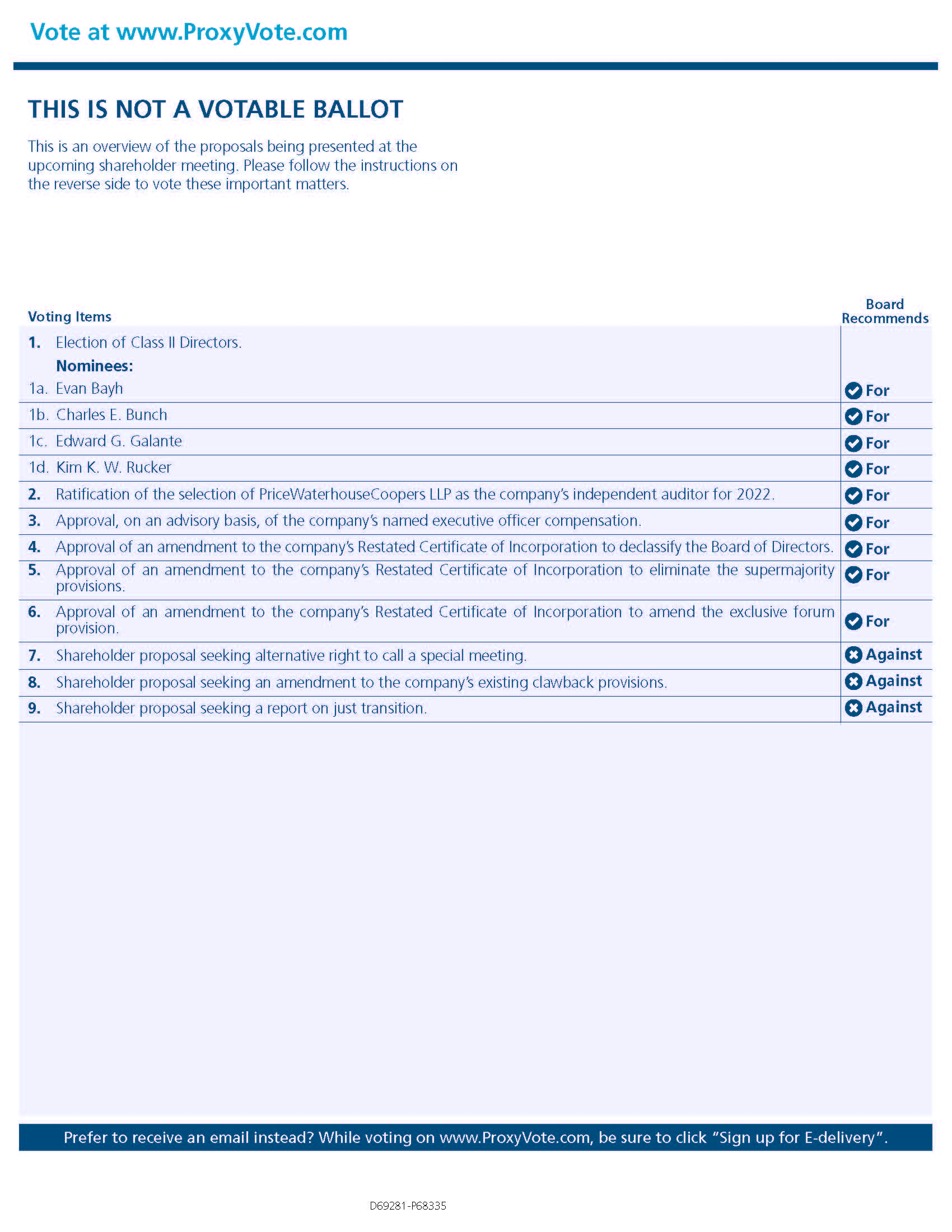

| Voting Items | ||||||||||||||||||||||||||||||||

Your vote is important. Please vote your proxy promptly so that your shares can be represented, even if you plan to attend the virtual Annual Meeting. You can vote via the internet or telephone by following the voting procedures described in the Notice, proxy card or voting instruction form, or by returning your completed and signed proxy card or voting instruction form in the provided envelope. | ||||||||||||||||||||||||||||||||

| Proposal | Page Reference | Board Recommendation | ||||||||||||||||||||||||||||||

Proposal 1. Elect four director nominees to Class II | FOR each nominee | |||||||||||||||||||||||||||||||

Proposal 2. Ratify the independent auditor for 2022 | FOR | |||||||||||||||||||||||||||||||

Proposal 3. Approve, on an advisory basis, our named executive officer compensation | FOR | |||||||||||||||||||||||||||||||

Proposal 4. Amend the Certificate of Incorporation to declassify the Board of Directors | FOR | |||||||||||||||||||||||||||||||

Proposal 5. Amend the Certificate of Incorporation to eliminate the supermajority provisions | FOR | |||||||||||||||||||||||||||||||

Proposal 6. Amend the Certificate of Incorporation to amend the exclusive forum provision | FOR | |||||||||||||||||||||||||||||||

Proposals 7-9. Shareholder proposals | AGAINST | |||||||||||||||||||||||||||||||

| Company Information | ||||||||||||||||||||||||||||||||

| Our principal executive offices are located at 539 South Main Street, Findlay, OH 45840, and our telephone number is (419) 422-2121. Our website address is www.marathonpetroleum.com. The information on our website is not a part of this Proxy Statement. | ||||||||||||||||||||||||||||||||

| References throughout this Proxy Statement to “the Company,” “MPC,” “Marathon,” “we” or “our” refer to Marathon Petroleum Corporation. References to “MPLX” refer to MPLX LP, a publicly traded master limited partnership we control through our ownership of its general partner, MPLX GP LLC (“MPLX GP”), and approximately 63.8% (as of December 31, 2021) of its outstanding common units. References to “Speedway” generally refer to our company-owned and operated retail transportation fuel and convenience store business, which we sold to 7-Eleven, Inc. on May 14, 2021. | ||||||||||||||||||||||||||||||||

| 2022 Proxy Statement | 1 | |||||||

| Overview of Our Board of Directors | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The following table provides summary information about each current member of the Board of Directors and each director nominee. More detailed information about each director nominee’s background, skill set and areas of expertise can be found beginning on page 7 of this Proxy Statement. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Director Since | Committee Memberships | Other Current Public Company Boards | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Name | Age* | Independent | Occupation | A | C | G | S | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Abdulaziz F. Alkhayyal | 68 | 2016 | ü | Retired Senior Vice President, Industrial Relations, Saudi Aramco | ¡ | ¡ | ¤ | 1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Evan Bayh | 66 | 2011 | ü | Senior Advisor, Apollo Global Management | ¡ | µ | 3 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Charles E. Bunch | 72 | 2015 | ü | Retired Chairman and CEO, PPG Industries | ¡ | µ | 3 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Jonathan Z. Cohen | 51 | 2019 | ü | CEO and President, Hepco Capital Management, LLC | ¤ | ¡ | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Steven A. Davis | 63 | 2013 | ü | Former Chairman and CEO, Bob Evans Farms, Inc. | ¤ | ¡ | 3 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Edward G. Galante | 71 | 2018 | ü | Retired Senior Vice President and Management Committee Member, ExxonMobil Corporation | µ | ¡ | 3 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Michael J. Hennigan | 62 | 2020 | CEO | President and CEO, Marathon Petroleum Corporation | ¡ | 1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Kim K.W. Rucker | 55 | 2018 | ü | Former Executive Vice President, General Counsel and Secretary, Andeavor | ¡ | 3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Frank M. Semple | 70 | 2021 | ü | Retired Chairman, President and CEO, MarkWest Energy Partners, L.P. | ¡ | ¡ | 1** | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| J. Michael Stice | 63 | 2017 | ü | Dean, Mewbourne College of Earth & Energy, The University of Oklahoma | ¡ | ¤ | ¡ | 2** | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| John P. Surma | 67 | 2011 | ü | Chairman of the Board, Marathon Petroleum Corporation | INDEPENDENT CHAIRMAN | 3** | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Susan Tomasky | 69 | 2018 | ü | Retired President, AEP Transmission | µ | ¡ | 2 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| * As of April 27, 2022. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ** Includes service on the board of directors of MPLX GP LLC, a wholly owned subsidiary of MPC, which the Corporate Governance and Nominating Committee views as an extension of service on MPC’s Board of Directors for purposes of assessing the level of outside public board commitments. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| A | Audit Committee | C | Compensation and Organization Development Committee | G | Corporate Governance and Nominating Committee | S | Sustainability and Public Policy Committee | µ | Chair | ¤ | Vice Chair | ¡ | Member | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

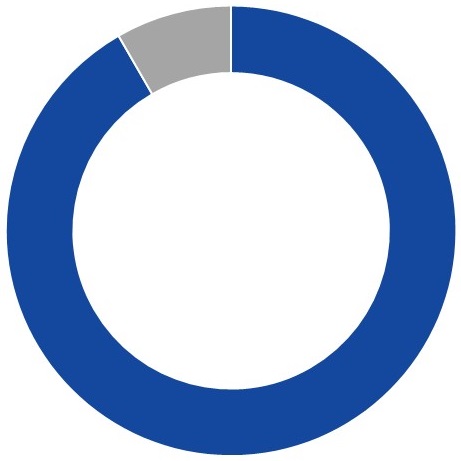

INDEPENDENT CHAIRMAN OF THE BOARD | 2 / 12 | 42% DIVERSE |  | 100% MEETING ATTENDANCE IN 2021 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Women | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4 / 12 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Diversity: Race, Ethnicity and Native American Tribal Membership | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

5.6 YEARS AVERAGE TENURE | 92% OF DIRECTORS ARE INDEPENDENT | 4 STANDING COMMITTEES | Audit | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Compensation and | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Organization Development | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Corporate Governance and Nominating | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 0-4 Yrs | 5-8 Yrs | 9+ Yrs | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Sustainability and Public Policy | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2 | Marathon Petroleum Corporation | |||||||

| Governance Highlights | |||||||||||||||||||||||||||||||||||

| Key Corporate Governance Practices | |||||||||||||||||||||||||||||||||||

The Board of Directors believes that our commitment to strong corporate governance benefits all our stakeholders, including our shareholders, employees, business partners, customers, communities, governments and others who have a stake in how we operate. Our key corporate governance practices include: | |||||||||||||||||||||||||||||||||||

| Page No. | Page No. | ||||||||||||||||||||||||||||||||||

| ü | Shareholder right to call a special meeting of shareholders | ü | Annual Board and committee self-evaluations, and individual evaluations of nominees for reelection | ||||||||||||||||||||||||||||||||

| ü | All non-employee directors are independent | ü | Risk oversight by the full Board and its committees | ||||||||||||||||||||||||||||||||

| ü | Proxy access shareholder right to submit director nominations for inclusion in our proxy statement | ü | Extensive voluntary disclosures in the areas of environmental targets and performance | ||||||||||||||||||||||||||||||||

| ü | Majority voting standard for uncontested director elections | ü | Extensive voluntary disclosures on our human capital management initiatives, including EEO-1 data | ||||||||||||||||||||||||||||||||

| ü | Strong independent Chairman role reinforces effective independent leadership on the Board | ü | Robust shareholder engagement program | ||||||||||||||||||||||||||||||||

| ü | Meaningful stock ownership guidelines for executive officers | ||||||||||||||||||||||||||||||||||

| ü | Three fully independent standing Board committees | ||||||||||||||||||||||||||||||||||

| ü | Independent directors meet regularly in executive session | ü | Prohibition on hedging and pledging of our stock | ||||||||||||||||||||||||||||||||

| ü | Recoupment/clawback policy | ||||||||||||||||||||||||||||||||||

| Recent Governance Enhancements | |||||||||||||||||||||||||||||||||||

| We believe good governance is critical to achieving long-term shareholder value. We approach governance in a strategic and thoughtful manner, taking into consideration multiple perspectives, including those of our Board, our Corporate Governance and Nominating Committee, our shareholders, experts and other stakeholders, to align on what makes the most sense for our Company. We continuously look for ways to enhance our corporate governance and increase value to our shareholders. Recent governance enhancements and actions include: | |||||||||||||||||||||||||||||||||||

| 2022 | |||||||||||||||||||||||||||||||||||

| ▶ | Submitting to our shareholders, for consideration at the 2022 Annual Meeting, amendments to our Certificate of Incorporation providing for annual elections for all directors and elimination of the supermajority provisions | ||||||||||||||||||||||||||||||||||

| 2021 | |||||||||||||||||||||||||||||||||||

| ▶ | Submitted to our shareholders, for consideration at the 2021 Annual Meeting, amendments to our Certificate of Incorporation providing for annual elections for all directors and elimination of the supermajority provisions | ||||||||||||||||||||||||||||||||||

| ▶ | Following a thorough review of Board committee oversight responsibilities, amended our committee charters to adjust and clarify committee responsibilities, including for ESG oversight and stakeholder engagement | ||||||||||||||||||||||||||||||||||

| 2020 | |||||||||||||||||||||||||||||||||||

| ▶ | Elected an independent Chairman of the Board | ||||||||||||||||||||||||||||||||||

| ▶ | Submitted to our shareholders, for consideration at the 2020 Annual Meeting, an amendment to our Certificate of Incorporation providing for annual elections for all directors | ||||||||||||||||||||||||||||||||||

| 2019 | |||||||||||||||||||||||||||||||||||

| ▶ | Amended our Corporate Governance Principles to require individual director evaluations for directors whose terms expire at the next annual meeting and are eligible for reelection | ||||||||||||||||||||||||||||||||||

| 2018 | |||||||||||||||||||||||||||||||||||

| ▶ | Amended our Bylaws to give shareholders owning at least 25% of our common stock the right to call a special meeting of shareholders | ||||||||||||||||||||||||||||||||||

| ▶ | Amended our Corporate Governance Principles to expressly affirm the Board’s commitment to actively seek diverse candidates for Board service | ||||||||||||||||||||||||||||||||||

| ▶ | Amended our Bylaws to eliminate the 80% supermajority requirement for Bylaw amendments, so that the approval threshold for Bylaw amendments is now a majority of outstanding shares | ||||||||||||||||||||||||||||||||||

| 2016 | |||||||||||||||||||||||||||||||||||

| ▶ | Amended our Bylaws to provide proxy access for shareholders | ||||||||||||||||||||||||||||||||||

| 2022 Proxy Statement | 3 | |||||||

| Sustainability Highlights | |||||||||||||||||||||||||||||||||||||||||||||||

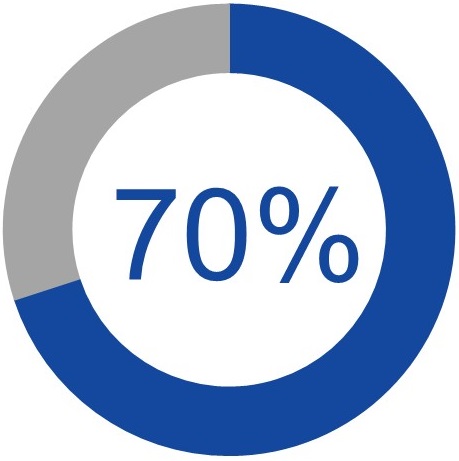

| At MPC, our commitment to sustainability means taking actions that create shared value with our stakeholders – empowering people to achieve more, contributing to progress in our communities and protecting the environment we all share. Under the guidance of the Board and its Sustainability and Public Policy Committee, and following extensive engagement with stakeholders and shareholders holding over 70% of our outstanding shares, we are pleased to share two key developments: | |||||||||||||||||||||||||||||||||||||||||||||||

•In February 2022, we announced the establishment of an absolute target to reduce Scope 3–Category 11 greenhouse gas (“GHG”) emissions from our products to 15% below 2019 levels by the year 2030. | |||||||||||||||||||||||||||||||||||||||||||||||

•We recently published our report on Creating Shared Value Through A Just and Responsible Transition (“Just Transition Report”) to address the potential social impacts of our business as the energy transition progresses. | |||||||||||||||||||||||||||||||||||||||||||||||

See www.marathonpetroleum.com/Sustainability/ for more information on our sustainability targets and to view our annual Sustainability Report and recently-published Just Transition Report. | |||||||||||||||||||||||||||||||||||||||||||||||

| STRENGTHEN RESILIENCY | Strengthening our business for today, while building durability for tomorrow and beyond | ||||||||||||||||||||||||||||||||||||||||||||||

| •Absolute Scope 3–Category 11 GHG emissions reduction target announced February 2022 •Targets to reduce Scope 1 & 2 GHG emissions intensity, methane emissions intensity and freshwater withdrawal intensity | First-ever petroleum refiner to have five refineries earn U.S. EPA’s ENERGY STAR® certifications in one year |  | ||||||||||||||||||||||||||||||||||||||||||||

Diversified Portfolio: Largest natural gas processor in the U.S. facilitating approximately 250 million tonnes of CO2e reductions per year from coal to gas switching within the power sector |  | •Formal Biodiversity Commitment •One of the first U.S. downstream energy companies to launch a program to track and reduce freshwater intensity across all of our operations |  | ||||||||||||||||||||||||||||||||||||||||||||

| INNOVATE FOR THE FUTURE | Investing in the energy evolution to lower carbon intensity and capture value | ||||||||||||||||||||||||||||||||||||||||||||||

| of 2022 planned growth capital spend on renewables | Dickinson, ND, Renewable Diesel Facility | Martinez, CA, Renewable Fuels Facility | ||||||||||||||||||||||||||||||||||||||||||||

184 million gallons/yr capacity | Second largest in the U.S. Producing a >50% lower carbon intensity renewable diesel | 730 million gallons/yr capacity | 60% reduction in GHG emissions compared to previous refinery operations | ||||||||||||||||||||||||||||||||||||||||||||

|  | ||||||||||||||||||||||||||||||||||||||||||||||

Creating alternatives to petroleum-based products through our wholly-owned subsidiary, Virent | Exploring sustainable aviation fuel opportunities with Southwest Airlines and other potential partners | ||||||||||||||||||||||||||||||||||||||||||||||

|  | ||||||||||||||||||||||||||||||||||||||||||||||

Partnering with Fulcrum BioEnergy to process biocrude from municipal solid waste | Evaluating strategic Renewable Natural Gas opportunities for key assets | ||||||||||||||||||||||||||||||||||||||||||||||

| EMBED SUSTAINABILITY | Embracing sustainability in decision-making, in how we engage our people and in how we create value with stakeholders | ||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||

| 20% of Annual Cash Bonus Program Linked to ESG Metric GHG intensity reduction, Diversity, Equity and Inclusion, and environmental and safety metrics | •Comprehensive approach to stakeholder engagement across the company •Just Transition Report focused on potential social impacts of energy transition | |||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||

Strong Safety Performance 40% reduction in Tier 1 and Tier 2 refining process safety events since 2016 |  | No. 1 on S&P Global ESG Rating for U.S. Oil and Gas Refining and Marketing sector | |||||||||||||||||||||||||||||||||||||||||||||

| 4 | Marathon Petroleum Corporation | |||||||

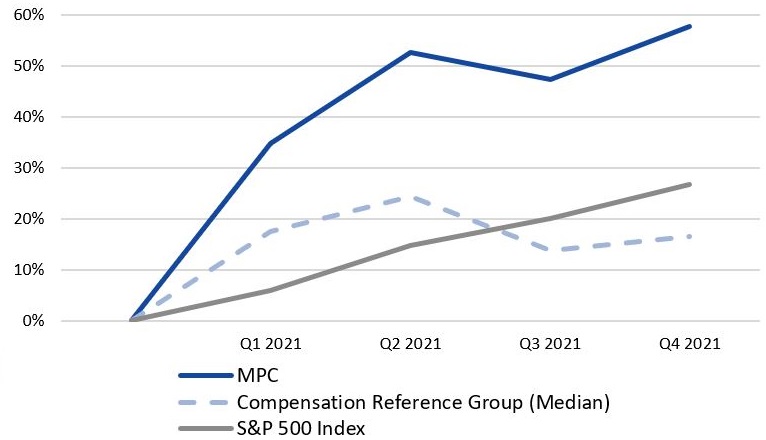

| Executive Compensation Highlights | |||||||||||||||||||||||||||||||||||||||||

| 2021 Say-on-Pay Vote, Shareholder Engagement and Board Responsiveness | |||||||||||||||||||||||||||||||||||||||||

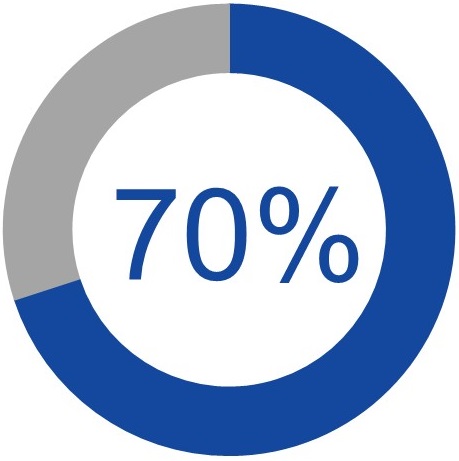

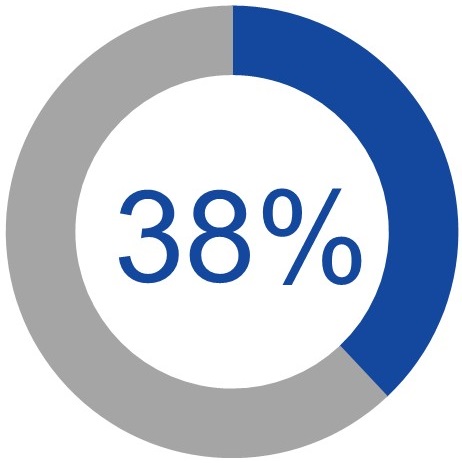

| We regularly engage with our shareholders on a wide range of topics, including our executive compensation program. The Compensation and Organization Development Committee values the feedback from these discussions and uses it, along with the outcome of our annual say-on-pay vote, to inform executive compensation decisions as appropriate. We have historically received strong shareholder support for our executive compensation program, averaging 92% in the five years prior to 2021. However, at our 2021 Annual Meeting, we received approximately 30% shareholder support for our 2020 executive compensation program. Our Board and management were disappointed with the results of the 2021 say-on-pay vote and undertook extensive efforts to obtain our shareholders’ views on our executive compensation program and other key governance and disclosure matters. | |||||||||||||||||||||||||||||||||||||||||

| 2021 SHAREHOLDER ENGAGEMENT | |||||||||||||||||||||||||||||||||||||||||

| Our shareholder engagement team, comprised of: | Proactively reached out to shareholders representing: | Met with shareholders representing: | Matters discussed during these meetings included: | ||||||||||||||||||||||||||||||||||||||

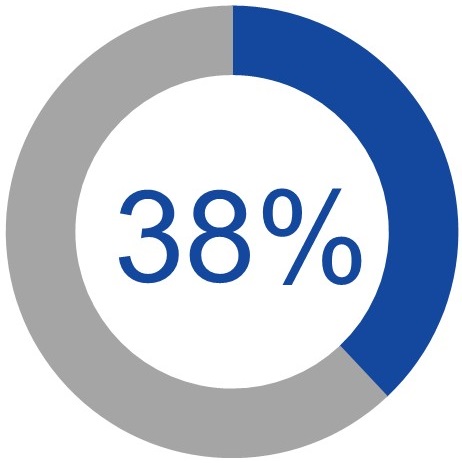

Senior members of executive management from our Finance, Human Resources, Corporate Secretary, Investor Relations, HES&S and ESG groups As requested or as otherwise deemed appropriate, members of our Board, Compensation and Organization Development and Sustainability and Public Policy Committees |  |  | Our business strategy, corporate governance, 2021 executive compensation program, human capital management, sustainability, climate change and public policy | ||||||||||||||||||||||||||||||||||||||

| of our outstanding shares, including 74 institutional investors | of our outstanding shares, including 22 institutional investors | ||||||||||||||||||||||||||||||||||||||||

Shareholder feedback during these meetings was overwhelmingly positive regarding the changes made for our 2021 executive compensation program. See “2021 Say-on-Pay Vote, Shareholder Engagement and Board Responsiveness” beginning on page 31 for additional information about our most recent say-on pay vote, our shareholder engagement process, and the changes the Compensation and Organization Development Committee made for our 2021 executive compensation programs. | |||||||||||||||||||||||||||||||||||||||||

| Leading Practices in Executive Compensation | |||||||||||||||||||||||||||||||||||||||||

| Our executive compensation program and policies demonstrate our commitment to sound compensation and governance practices, promote our pay-for-performance objectives and mitigate risk to our shareholders. | |||||||||||||||||||||||||||||||||||||||||

| ü | Majority of total target compensation is performance-based | ü | Anti-hedging and anti-pledging policy | ||||||||||||||||||||||||||||||||||||||

| ü | Performance measures align with shareholder interests | ü | No repricing of stock options | ||||||||||||||||||||||||||||||||||||||

| ü | No guaranteed minimum bonus | ü | Limited perquisites and personal benefits | ||||||||||||||||||||||||||||||||||||||

| ü | Performance metric achievement capped at 200% | ü | No excise tax gross-ups | ||||||||||||||||||||||||||||||||||||||

| ü | Recoupment/clawback provisions for both long-term incentive and short-term incentive awards | ü | No tax gross-ups on perquisites (other than for relocation reimbursements in limited circumstances) | ||||||||||||||||||||||||||||||||||||||

| ü | Significant stock ownership guidelines | ü | Dividend equivalents paid only when award vests | ||||||||||||||||||||||||||||||||||||||

| ü | “Double trigger” vesting for all long-term incentive awards | ü | Compensation and Organization Development Committee oversight of annual compensation risk assessment | ||||||||||||||||||||||||||||||||||||||

| ü | ESG metrics tied to executive and employee compensation | ||||||||||||||||||||||||||||||||||||||||

| 2022 Proxy Statement | 5 | |||||||

| CORPORATE GOVERNANCE | ||

| Our Governance Framework | ||

| Our Corporate Governance Principles, our Amended and Restated Bylaws (“Bylaws”) and the charters of our Board committees together implement the governance philosophy we believe is best for our shareholders. These governance documents address, among other things, the primary roles, responsibilities and oversight functions of the Board and its committees; director independence; committee composition; the process for director selection; director qualifications; outside commitments; Board, committee and individual director evaluations; director indemnification and shareholder rights; director compensation; and director retirement and resignation. | ||

| Our Code of Business Conduct, which applies to all of our directors, officers and employees, defines our expectations for ethical decision-making, accountability and responsibility. Our Code of Ethics for Senior Financial Officers, which is specifically applicable to our Chief Executive Officer (“CEO”), Chief Financial Officer (“CFO”), Controller, Treasurer and other leaders performing similar roles, affirms the principle that the honesty, integrity and sound judgment of our senior executives with responsibility for preparation and certification of our financial statements are essential to the proper functioning and success of our Company. These documents are available on our website as noted below, and printed copies are available upon request to our Corporate Secretary. We would post on our website any amendments to, or waivers from, either of these codes requiring disclosure under applicable rules within four business days following any such amendment or waiver. | ||

| Our Whistleblowing as to Accounting Matters Policy establishes procedures for the receipt, retention and treatment of any complaints we receive regarding accounting, internal accounting controls or auditing matters, and provides for the confidential, anonymous submission of concerns by our employees or others regarding questionable accounting or auditing matters. | ||

| Our Conflicts of Interest Policy provides guidance on recognizing and resolving real or apparent conflicts of interest. This policy acknowledges that business decisions on behalf of the Company must be made through the exercise of independent judgment in the Company’s best interest and not influenced by the personal interests of decision-makers. | ||

| 8 | |||||||||||||||||||||||

| FIND MORE AT WWW.MARATHONPETROLEUM.COM | |||||||||||||||||||||||

| The following are available under the “Investors” tab of our website, by selecting “Corporate Governance”: | |||||||||||||||||||||||

| ▶ | Bylaws | ▶ | Code of Ethics for Senior Financial Officers | ||||||||||||||||||||

| ▶ | Corporate Governance Principles | ▶ | Whistleblowing as to Accounting Matters Policy | ||||||||||||||||||||

| ▶ | Code of Business Conduct | ▶ | Conflicts of Interest Policy | ||||||||||||||||||||

| Our Board committee charters, and other information about our Board, are available under the “About” tab of our website, by selecting “Board of Directors.” | |||||||||||||||||||||||

| 6 | Marathon Petroleum Corporation | |||||||

| Proposal 1. Election of Directors | ||

| ü | The Board of Directors recommends you vote FOR each of the following Class II director nominees: | |||||||||||||

| Evan Bayh | Charles E. Bunch | Edward G. Galante | Kim K.W. Rucker | |||||||||||

| The Board of Directors, which oversees the management of our business and affairs, currently is divided into three classes of directors, with one class being elected each year for a three-year term. The Board has set the current number of directors at 12, with four directors in each class. Our shareholders elect one class each year for a three-year term. The members of Class II—Messrs. Bayh, Bunch and Galante and Ms. Rucker—are due to stand for election at the 2022 Annual Meeting. | ||

As informed by our individual director evaluation process discussed further on page 19, our Board recommends that shareholders vote FOR the election to the Board of each Class II director nominee. We expect each nominee will be able to serve if elected. Any director vacancy may be filled by a majority vote of the remaining directors. Any director elected in this manner would hold office until expiration of the term of office of the class to which he or she has been elected. | ||

| DIRECTOR SKILLS, EXPERIENCE AND DEMOGRAPHIC MATRIX* | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|  |  |  |  |  |  |  |  |  |  |  | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

MPC Board Tenure (years) | 5 | 2 | 2 | 4 | 11 | 6 | 3 | 3 | 9 | 5 | 11 | 3 | 5.6 Years Average Tenure | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Key Skills and Experience | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Senior Leadership | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü | 12/12 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Finance & Accounting | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü | 11/12 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Industry Expertise | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü | 11/12 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Risk Management | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü | 12/12 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Operations Experience | ü | ü | ü | ü | ü | ü | ü | ü | 8/12 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Government, Legal & Regulatory | ü | ü | ü | ü | ü | 5/12 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ESG/Sustainability Experience | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü | 12/12 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Public Company Governance | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü | 12/12 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Age (at April 27, 2022) | 68 | 51 | 62 | 70 | 66 | 72 | 71 | 55 | 63 | 63 | 67 | 69 | 65 Years Average Age | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gender | Male | ¡ | ¡ | ¡ | ¡ | ¡ | ¡ | ¡ | ¡ | ¡ | ¡ | 83% | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Female | ¡ | ¡ | 17% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Diversity: Race, Ethnicity and Native American Tribal Membership | ¡ | ¡ | ¡ | ¡ | 33% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Diversity | ¡ | ¡ | ¡ | ¡ | ¡ | 42% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CLASS I | CLASS II | CLASS III | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| * Reflects expected composition of the Board following the Annual Meeting, assuming all Class II director nominees are elected. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2022 Proxy Statement | 7 | |||||||

| PROPOSAL 1. ELECTION OF DIRECTORS | ||

| Evan Bayh | CLASS II DIRECTOR NOMINEE | ||||||||||||||||

| Senior Advisor, Apollo Global Management | Term expires 2022 | ||||||||||||||||

| Key Qualifications and Experience | ||||||||||||||||

| ü | Senior leadership experience in government | ü | Government, legal and regulatory | ||||||||||||||

| ü | Finance and accounting | ü | ESG/Sustainability experience | ||||||||||||||

| ü | Risk management | ü | Public company governance | ||||||||||||||

| Career Highlights: | |||||||||||||||||

| ▶ | Senior Advisor, Apollo Global Management, a private equity firm (since 2011) | ||||||||||||||||

| ▶ | U.S. Senator (1999-2011); served on a number of committees, including Banking, Housing and Urban Affairs; Armed Services; Energy and Natural Resources; Select Committee on Intelligence; Small Business and Entrepreneurship; Special Committee on Aging; chaired the International Trade and Finance Subcommittee | ||||||||||||||||

Independent Director Age: 66 Director since: 2011 MPC Board Committees: Corporate Governance and Nominating Sustainability and Public Policy, Chair | |||||||||||||||||

| ▶ | Governor of the State of Indiana (1989-1997); Secretary of State (1986-1989) | ||||||||||||||||

| ▶ | Senior Advisor and Of Counsel, Cozen O’Connor Public Strategies, a law firm (2018-2019) | ||||||||||||||||

| ▶ | Partner, McGuireWoods LLP, a global diversified law firm (2011-2018) | ||||||||||||||||

Current Public Company Directorships: Berry Global Group, Inc. (since 2011); Fifth Third Bancorp (since 2011); RLJ Lodging Trust (since 2011) | |||||||||||||||||

Other Directorships within Past Five Years: None | |||||||||||||||||

Education: B.S., Business Economics, Indiana University; J.D., University of Virginia | |||||||||||||||||

| Charles E. Bunch | CLASS II DIRECTOR NOMINEE | ||||||||||||||||

| Retired Chairman and CEO, PPG Industries, Inc. | Term expires 2022 | ||||||||||||||||

| Key Qualifications and Experience | ||||||||||||||||

| ü | Senior leadership experience as former CEO | ü | Operations experience | ||||||||||||||

| ü | Finance and accounting | ü | ESG/Sustainability experience | ||||||||||||||

| ü | Industry expertise | ü | Public company governance | ||||||||||||||

| ü | Risk management | ||||||||||||||||

| Career Highlights: | |||||||||||||||||

| ▶ | Chairman and CEO (2005-2015) and Executive Chairman (2015-2016) of PPG Industries, Inc. a global supplier of paints and coatings | ||||||||||||||||

Independent Director Age: 72 Director since: 2015 MPC Board Committees: Compensation and Organization Development Corporate Governance and Nominating, Chair | |||||||||||||||||

| ▶ | President, Chief Operating Officer and board member of PPG Industries (2002-2005) | ||||||||||||||||

| ▶ | Thirty-six year career at PPG Industries, serving in various roles in finance and planning, marketing and general management in the United States and Europe, including as Senior Vice President of Strategic Planning and Corporate Services and Executive Vice President, Coatings | ||||||||||||||||

Current Public Company Directorships: ConocoPhillips (since 2014); Mondelez International, Inc. (since 2016); The PNC Financial Services Group, Inc. (since 2007) | |||||||||||||||||

Other Directorships within Past Five Years: None | |||||||||||||||||

Education: B.S., International Affairs, Georgetown University; M.B.A., Harvard University Graduate School of Business Administration | |||||||||||||||||

| Other Professional Experience and Community Involvement: | |||||||||||||||||

| Former Chairman, board of the Federal Reserve Bank of Cleveland | |||||||||||||||||

| 8 | Marathon Petroleum Corporation | |||||||

| PROPOSAL 1. ELECTION OF DIRECTORS | ||

| Edward G. Galante | CLASS II DIRECTOR NOMINEE | ||||||||||||||||

Retired Senior Vice President and Management Committee Member, ExxonMobil Corporation Term expires 2022 | |||||||||||||||||

| Key Qualifications and Experience | ||||||||||||||||

| ü | Senior leadership experience | ü | Operations experience | ||||||||||||||

| ü | Industry expertise | ü | ESG/Sustainability experience | ||||||||||||||

| ü | Risk management | ü | Public company governance | ||||||||||||||

| Career Highlights: | |||||||||||||||||

| ▶ | Senior Vice President and Management Committee member of ExxonMobil Corporation (2001-2006) | ||||||||||||||||

Independent Director Age: 71 Director since: 2018 MPC Board Committees: Compensation and Organization Development, Chair Sustainability and Public Policy | ▶ | More than 30 years at ExxonMobil Corporation in roles of increasing responsibility, including Executive Vice President of ExxonMobil Chemical Company (1999-2001) | |||||||||||||||

Current Public Company Directorships: Celanese Corporation (since 2013), Lead Director (2016-2021); Clean Harbors, Inc. (since 2010); Linde PLC (since 2018) | |||||||||||||||||

Other Directorships within Past Five Years: Andeavor (2016-2018); Praxair, Inc. (2007-2018) | |||||||||||||||||

Education: B.S., Civil Engineering, Northeastern University | |||||||||||||||||

Other Professional Experience and Community Involvement: | |||||||||||||||||

| Member, Board of Directors, United Way Foundation of Metropolitan Dallas | |||||||||||||||||

| Vice Chairman, Board of Trustees, Northeastern University | |||||||||||||||||

| Member, Board of Directors, Artis-Naples | |||||||||||||||||

| Kim K.W. Rucker | CLASS II DIRECTOR NOMINEE | ||||||||||||||||

| Former Executive Vice President, General Counsel and Secretary, Andeavor | Term expires 2022 | ||||||||||||||||

| Key Qualifications and Experience | ||||||||||||||||

| ü | Senior leadership experience | ü | Government, legal and regulatory | ||||||||||||||

| ü | Finance and accounting | ü | ESG/Sustainability experience | ||||||||||||||

| ü | Industry expertise | ü | Public company governance | ||||||||||||||

| ü | Risk management | ||||||||||||||||

| Career Highlights: | |||||||||||||||||

| ▶ | Executive Vice President, General Counsel and Secretary of Andeavor (2016-2018); Executive Vice President and General Counsel of Tesoro Logistics GP, LLC (2016-2018) | ||||||||||||||||

Independent Director Age: 55 Director since: 2018 MPC Board Committees: Sustainability and Public Policy | |||||||||||||||||

| ▶ | Executive Vice President, Corporate & Legal Affairs, General Counsel and Corporate Secretary of Kraft Foods Group, Inc., a grocery manufacturing and processing company (2012-2015) | ||||||||||||||||

| ▶ | Senior Vice President, General Counsel and Chief Compliance Officer (2008-2012) and Corporate Secretary (2009-2012) of Avon Products, Inc. | ||||||||||||||||

| ▶ | Senior Vice President, Corporate Secretary and Chief Governance Officer of Energy Future Holdings Corp. (formerly TXU Corp.) (2004-2008) | ||||||||||||||||

| ▶ | Former Partner in the Corporate & Securities group at Sidley Austin LLP, a law firm | ||||||||||||||||

Current Public Company Directorships: Celanese Corporation (since 2018); HP Inc. (since 2021), Lennox International Inc. (since 2015) | |||||||||||||||||

Other Directorships within Past Five Years: None | |||||||||||||||||

Education: B.B.A., Economics, University of Iowa; J.D., Harvard Law School; M.P.P., John F. Kennedy School of Government at Harvard University | |||||||||||||||||

Other Professional Experience and Community Involvement: | |||||||||||||||||

| Member, Board of Trustees, Johns Hopkins Medicine | |||||||||||||||||

| Member, Board of Directors, Haven for Hope | |||||||||||||||||

| 2022 Proxy Statement | 9 | |||||||

| PROPOSAL 1. ELECTION OF DIRECTORS | ||

| Steven A. Davis | CLASS III DIRECTOR | ||||||||||||||||

| Former Chairman and CEO, Bob Evans Farms, Inc. | Term expires 2023 | ||||||||||||||||

| Key Qualifications and Experience | ||||||||||||||||

| ü | Senior leadership experience as former CEO | ü | Operations experience | ||||||||||||||

| ü | Finance and accounting | ü | ESG/Sustainability experience | ||||||||||||||

| ü | Industry expertise | ü | Public company governance | ||||||||||||||

| ü | Risk management | ||||||||||||||||

| Career Highlights: | |||||||||||||||||

| ▶ | Chairman and CEO and member of the board of directors of Bob Evans Farms, Inc., a foodservice and consumer products company (2006-2014) | ||||||||||||||||

Independent Director Age: 63 Director since: 2013 MPC Board Committees: Compensation and Organization Development, Vice Chair Corporate Governance and Nominating | |||||||||||||||||

| ▶ | President of Long John Silver’s and A&W All-American Food Restaurants (2002-2006) | ||||||||||||||||

| ▶ | Held senior executive and operational positions at Yum! Brands’ Pizza Hut division and Kraft General Foods | ||||||||||||||||

Current Public Company Directorships: Albertsons Companies, Inc. (since 2015); American Eagle Outfitters, Inc. (since 2020); PPG Industries, Inc. (since 2019) | |||||||||||||||||

Other Directorships within Past Five Years: Legacy Acquisition Corp. (2017-2020); Sonic Corp. (2016-2018) | |||||||||||||||||

Education: B.S., Business Administration, University of Wisconsin at Milwaukee; M.B.A., University of Chicago; Hon. D.B.A., University of Wisconsin at Milwaukee | |||||||||||||||||

Other Professional Experience and Community Involvement: | |||||||||||||||||

| Member, International Board of Directors for the Juvenile Diabetes Research Foundation | |||||||||||||||||

| Member, The Council of Chief Executives | |||||||||||||||||

| J. Michael Stice | CLASS III DIRECTOR | ||||||||||||||||

| Dean, Mewbourne College of Earth & Energy, The University of Oklahoma | Term expires 2023 | ||||||||||||||||

| Key Qualifications and Experience | ||||||||||||||||

| ü | Senior leadership experience as former CEO | ü | Operations experience | ||||||||||||||

| ü | Finance and accounting | ü | ESG/Sustainability experience | ||||||||||||||

| ü | Industry expertise | ü | Public company governance | ||||||||||||||

| ü | Risk management | ||||||||||||||||

| Career Highlights: | |||||||||||||||||

| ▶ | Dean, Mewbourne College of Earth & Energy at The University of Oklahoma (since 2015) | ||||||||||||||||

Independent Director Age: 63 Director since: 2017 MPC Board Committees: Audit Corporate Governance and Nominating, Vice Chair Sustainability and Public Policy | |||||||||||||||||

| ▶ | CEO (2009-2014) and member of the board of directors (2012-2015) of Access Midstream Partners L.P., a gathering and processing master limited partnership | ||||||||||||||||

| ▶ | Nearly 30 years’ service in positions of increasing responsibility at ConocoPhillips and its predecessor companies, including as President of ConocoPhillips Qatar (2003-2008) | ||||||||||||||||

Current Public Company Directorships: MPLX GP LLC* (since 2018); Spartan Acquisition Corp. III (since 2021) | |||||||||||||||||

Other Directorships within Past Five Years: Spartan Acquisition Corp. II (2020-2021); Spartan Energy Acquisition Corp. (2018-2020); U.S. Silica Holdings, Inc. (2013-2021) | |||||||||||||||||

Education: B.S., Chemical Engineering, The University of Oklahoma; M.S., Business, Stanford University; Ed.D, Organizational Leadership, The George Washington University | |||||||||||||||||

| *As MPLX GP LLC is a wholly owned subsidiary of MPC, the Corporate Governance and Nominating Committee views service on its board as an extension of service on our Board for purposes of assessing the level of outside public board commitments. | |||||||||||||||||

| 10 | Marathon Petroleum Corporation | |||||||

| PROPOSAL 1. ELECTION OF DIRECTORS | ||

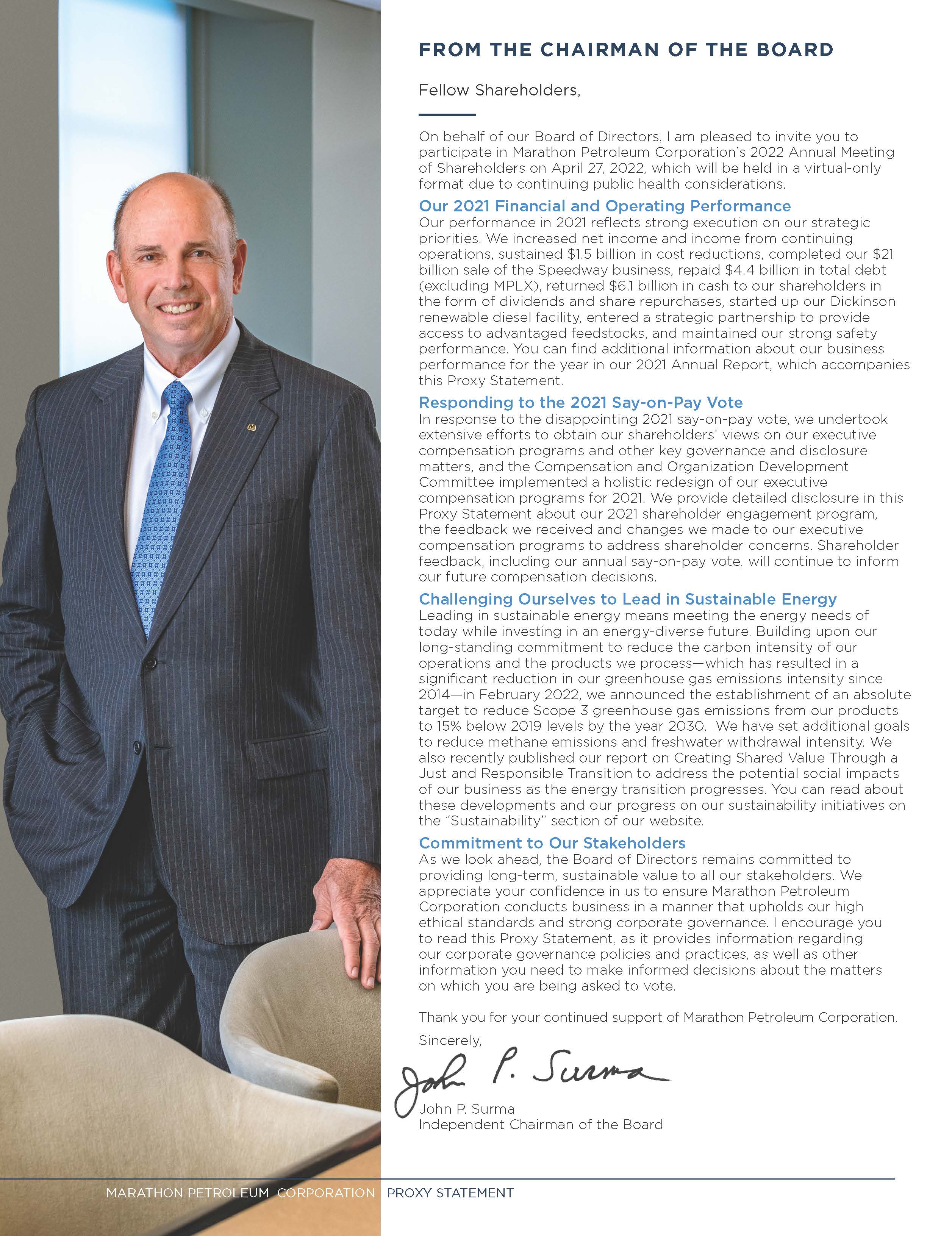

| John P. Surma | CLASS III DIRECTOR | ||||||||||||||||

| Chairman of the Board, Marathon Petroleum Corporation | Term expires 2023 | ||||||||||||||||

| Key Qualifications and Experience | ||||||||||||||||

| ü | Senior leadership experience as former CEO | ü | Operations experience | ||||||||||||||

| ü | Finance and accounting | ü | Government, legal and regulatory | ||||||||||||||

| ü | Industry expertise | ü | ESG/Sustainability experience | ||||||||||||||

| ü | Risk management | ü | Public company governance | ||||||||||||||

| Career Highlights: | |||||||||||||||||

| ▶ | CEO (2004-2013) and Executive Chairman (2006-2013) of United States Steel Corporation; President and Chief Operating Officer (2003-2004); Vice Chairman and CFO (2002-2003) | ||||||||||||||||

| Independent Chairman Age: 67 Director since: 2011 | |||||||||||||||||

| ▶ | Executive roles at Marathon Oil Corporation (1997-2001), including President, Speedway SuperAmerica LLC and President, Marathon Ashland Petroleum | ||||||||||||||||

| ▶ | Price Waterhouse LLP (1976-1997), admitted to the partnership in 1987 | ||||||||||||||||

Current Public Company Directorships: MPLX GP LLC* (since 2012); Public Service Enterprise Group Inc. (since 2019); Trane Technologies plc (formerly Ingersoll-Rand plc) (since 2013) | |||||||||||||||||

Other Directorships within Past Five Years: Concho Resources Inc. (2014-2020) | |||||||||||||||||

Education: B.S., Accounting, Pennsylvania State University | |||||||||||||||||

Other Professional Experience and Community Involvement: | |||||||||||||||||

| *As MPLX GP LLC is a wholly owned subsidiary of MPC, the Corporate Governance and Nominating Committee views service on its board as an extension of service on our Board for purposes of assessing the level of outside public board commitments. | Appointed by President Barack Obama to the President’s Advisory Committee for Trade Policy and Negotiations (2010-2014), served as Vice Chairman | ||||||||||||||||

| Former Chair, board of the Federal Reserve Bank of Cleveland | |||||||||||||||||

| Executive Staff Assistant to the Federal Reserve Board’s Vice Chairman, as part of the President’s Executive Exchange Program in Washington, D.C. (1983) | |||||||||||||||||

| Member, board of the University of Pittsburgh Medical Center; former Chairman, board of the National Safety Council | |||||||||||||||||

| Susan Tomasky | CLASS III DIRECTOR | ||||||||||||||||

Retired President, AEP Transmission, a business division of American Electric Power Co. Term expires 2023 | |||||||||||||||||

| Key Qualifications and Experience | ||||||||||||||||

| ü | Senior leadership experience | ü | Government, legal and regulatory | ||||||||||||||

| ü | Finance and accounting | ü | ESG/Sustainability experience | ||||||||||||||

| ü | Industry expertise | ü | Public company governance | ||||||||||||||

| ü | Risk management | ||||||||||||||||

| Career Highlights: | |||||||||||||||||

| ▶ | President of AEP Transmission, a division of American Electric Power Co., Inc. (2008-2011) | ||||||||||||||||

Independent Director Age: 69 Director since: 2018 MPC Board Committees: Audit, Chair Sustainability and Public Policy | ▶ | Various executive officer positions at American Electric Power Co., including Executive Vice President and General Counsel (1998-2001), Executive Vice President of Finance and CFO (2001-2006), and Executive Vice President of Shared Services (2006-2008) | |||||||||||||||

| ▶ | Former Partner in the Energy Group at Hogan & Hartson (now Hogan Lovells), a law firm | ||||||||||||||||

| ▶ | General Counsel, Federal Energy Regulatory Commission (1993-1997) | ||||||||||||||||

Current Public Company Directorships: Fidelity Equity and High Income Mutual Funds (since 2020); Public Service Enterprise Group Inc. (since 2012) | |||||||||||||||||

Other Directorships within Past Five Years: Andeavor (2011-2018), including service as Lead Director (2015-2018); Summit Midstream Partners GP, LLC (2012-2018) | |||||||||||||||||

Education: B.L.A., University of Kentucky; J.D., The George Washington University Law School | |||||||||||||||||

Other Professional Experience and Community Involvement: | |||||||||||||||||

| Former Director, board of the Federal Reserve Bank of Cleveland | |||||||||||||||||

| Member, Board of Trustees, Kenyon College | |||||||||||||||||

| 2022 Proxy Statement | 11 | |||||||

| PROPOSAL 1. ELECTION OF DIRECTORS | ||

| Abdulaziz F. Alkhayyal | CLASS I DIRECTOR | ||||||||||||||||

| Retired Senior Vice President, Industrial Relations, Saudi Aramco | Term expires 2024 | ||||||||||||||||

| Key Qualifications and Experience | ||||||||||||||||

| ü | Senior leadership experience | ü | Operations experience | ||||||||||||||

| ü | Finance and accounting | ü | ESG/Sustainability experience | ||||||||||||||

| ü | Industry expertise | ü | Public company governance | ||||||||||||||

| ü | Risk management | ||||||||||||||||

| Career Highlights: | |||||||||||||||||

| ▶ | Senior Vice President of Industrial Relations (2007-2014), Senior Vice President of Refining, Marketing and International (2001-2007), Senior Vice President, International Operations (2000-2001) of Saudi Arabian Oil Company (Saudi Aramco) | ||||||||||||||||

Independent Director Age: 68 Director since: 2016 MPC Board Committees: Audit Compensation and Organization Development Sustainability and Public Policy, Vice Chair | |||||||||||||||||

| ▶ | Thirty-three year career at Saudi Aramco beginning in various field positions and progressing through management roles of increasing responsibility | ||||||||||||||||

Current Public Company Directorships: Halliburton Company (since 2014) | |||||||||||||||||

Other Directorships within Past Five Years: None | |||||||||||||||||

Education: B.S., Mechanical Engineering, University of California, Irvine; M.B.A., University of California, Irvine; Advanced Management Program, University of Pennsylvania | |||||||||||||||||

Other Professional Experience and Community Involvement: | |||||||||||||||||

| Director, Saudi Electricity Company (2018-2020) | |||||||||||||||||

| Director, National Gas & Industrialization Company (since 2019) | |||||||||||||||||

| Member, Board of Directors for the International Youth Foundation | |||||||||||||||||

| Jonathan Z. Cohen | CLASS I DIRECTOR | ||||||||||||||||

| CEO and President, Hepco Capital Management, LLC | Term expires 2024 | ||||||||||||||||

| Key Qualifications and Experience | ||||||||||||||||

| ü | Senior leadership experience as former CEO | ü | ESG/Sustainability experience | ||||||||||||||

| ü | Finance and accounting | ü | Government, legal and regulatory | ||||||||||||||

| ü | Industry expertise | ü | Public company governance | ||||||||||||||

| ü | Risk management | ||||||||||||||||

| Career Highlights: | |||||||||||||||||

| ▶ | CEO and President of Hepco Capital Management, a private investment firm (since 2016) | ||||||||||||||||

Independent Director Age: 51 Director since: 2019 MPC Board Committees: Audit, Vice Chair Corporate Governance and Nominating | ▶ | Chairman of the Board (2018-2020) and CEO (2017-2018), Falcon Minerals Corporation, a mineral rights acquisition and management company; Founder and CEO of its predecessor, Osprey Energy Acquisition Corp. (2016-2018); Co-Chairman of Osprey Technology Acquisition Corp. (since 2019) | |||||||||||||||

| ▶ | President (2003-2016) and CEO (2004-2016), Resource America, Inc., an asset management company | ||||||||||||||||

| ▶ | Co-founder and various executive roles at Atlas Pipeline Partners, LP and Atlas Energy, Inc. | ||||||||||||||||

Current Public Company Directorships: None | |||||||||||||||||

Other Directorships within Past Five Years: Atlas Energy Group, LLC (2012-2019*); Energen Corporation (2018); Falcon Minerals Corporation (2017-2020); Osprey Technology Acquisition Corp. (2019-2021); Titan Energy, LLC (2016-2019*) | |||||||||||||||||

Education: B.A., University of Pennsylvania; J.D., American University School of Law | |||||||||||||||||

Other Professional Experience and Community Involvement: | |||||||||||||||||

| Co-founder, Castine Capital Management, LLC | |||||||||||||||||

*Ceased reporting under Exchange Act Section 15(d) in 2019. | Chairman, Executive Committee, Lincoln Center Theater; Trustee, East Harlem School; Trustee, Arete Foundation; Trustee, American School of Classical Studies in Athens, Greece | ||||||||||||||||

| Member, Board of Overseers, College of Arts and Sciences, University of Pennsylvania | |||||||||||||||||

| 12 | Marathon Petroleum Corporation | |||||||

| PROPOSAL 1. ELECTION OF DIRECTORS | ||

| Michael J. Hennigan | CLASS I DIRECTOR | ||||||||||||||||

| President and CEO, Marathon Petroleum Corporation | Term expires 2024 | ||||||||||||||||

| Key Qualifications and Experience | ||||||||||||||||

| ü | Senior leadership experience as CEO | ü | Operations experience | ||||||||||||||

| ü | Finance and accounting | ü | ESG/Sustainability experience | ||||||||||||||

| ü | Industry expertise | ü | Public company governance | ||||||||||||||

| ü | Risk management | ||||||||||||||||

| Career Highlights: | |||||||||||||||||

| ▶ | President and CEO (since March 2020) and director (since April 2020) of MPC; Chairman (since April 2020), CEO (since 2019) and President (since 2017) of MPLX | ||||||||||||||||

Management Director Age: 62 Director since: 2020 MPC Board Committees: Sustainability and Public Policy | |||||||||||||||||

| ▶ | President, Crude, NGL and Refined Products (2017), of the general partner of Energy Transfer Partners L.P., a natural gas and propane pipeline transport company | ||||||||||||||||

| ▶ | President and CEO (2012-2017), President and Chief Operating Officer (2010-2012) and Vice President, Business Development (2009-2010), of Sunoco Logistics Partners L.P., an energy service provider | ||||||||||||||||

Current Public Company Directorships: MPLX GP LLC (since 2017) | |||||||||||||||||

Other Directorships within Past Five Years: Sunoco Partners LLC (2010-2017); Tesoro Logistics GP, LLC (2018-2019) | |||||||||||||||||

Education: B.S., Chemical Engineering, Drexel University | |||||||||||||||||

| Frank M. Semple | CLASS I DIRECTOR | ||||||||||||||||

| Retired Chairman, President and CEO, MarkWest Energy Partners, L.P. | Term expires 2024 | ||||||||||||||||

| Key Qualifications and Experience | ||||||||||||||||

| ü | Senior leadership experience as former CEO | ü | Operations experience | ||||||||||||||

| ü | Finance and accounting | ü | ESG/Sustainability experience | ||||||||||||||

| ü | Industry expertise | ü | Public company governance | ||||||||||||||

| ü | Risk management | ||||||||||||||||

| Career Highlights: | |||||||||||||||||

| ▶ | Vice Chairman (2015-2016) and director (since 2015) of MPLX following MPLX’s acquisition of MarkWest Energy Partners, L.P. | ||||||||||||||||

Independent Director Age: 70 Director since: 2021 (previous MPC Board member 2015-2018) MPC Board Committees: Audit Compensation and Organization Development | |||||||||||||||||

| ▶ | President and CEO (2003-2015) and Chairman (2008-2015) of MarkWest Energy Partners, L.P. | ||||||||||||||||

| ▶ | Twenty-two years of service with The Williams Companies, Inc. and WilTel Communications, progressing through management roles of increasing responsibility | ||||||||||||||||

Current Public Company Directorships: MPLX GP LLC* (since 2015) | |||||||||||||||||

Other Directorships within Past Five Years: MPC (2015-2018); Tesoro Logistics GP, LLC (2018-2019); Tortoise Acquisition Corp. (2019-2020) | |||||||||||||||||

Education: B.S., Mechanical Engineering, United States Naval Academy; Program for Management Development, Harvard Business School | |||||||||||||||||

Other Professional Experience and Community Involvement: | |||||||||||||||||

| Service in the United States Navy | |||||||||||||||||

| Member, Board of Directors, Choctaw Global, LLC | |||||||||||||||||

| *As MPLX GP LLC is a wholly owned subsidiary of MPC, the Corporate Governance and Nominating Committee views service on its board as an extension of service on our Board for purposes of assessing the level of outside public board commitments. | |||||||||||||||||

| 2022 Proxy Statement | 13 | |||||||

| CORPORATE GOVERNANCE | ||

| Board Composition and Director Selection | ||

| Our Corporate Governance Principles set forth the processes for director selection and the establishment of director qualifications. The Board has delegated the director recruitment process to the Corporate Governance and Nominating Committee with input from our Chairman. | ||

| The Board believes that it, as a whole, should possess the combination of skills, professional experience, and diversity of backgrounds and viewpoints necessary to oversee our business and ensure an effective mix of perspectives. Accordingly, the Board and the Corporate Governance and Nominating Committee consider the qualifications of directors and director candidates individually and in the broader context of the Board’s overall composition and our current and future needs. In developing long-term plans for Board composition, the Corporate Governance and Nominating Committee takes into consideration the current strengths, skills and experience of members of the Board, their outside commitments, our director retirement policy and our strategic direction. | ||

| Director Candidates | ||

| The Corporate Governance and Nominating Committee assesses candidates for membership on the Board. The Committee may work with a third-party professional search firm to assist with identifying and evaluating director candidates and their credentials. The Committee has the authority to retain and terminate any such firm, including the authority to approve the firm’s fees and other retention terms. | ||

| The Corporate Governance and Nominating Committee may also consider candidates recommended by shareholders. Shareholder candidates will be evaluated using the same criteria for director selection described below. See “Proxy Access” below for more information on the proxy access provision of our Bylaws and “FAQs About Voting and the Annual Meeting” for instructions on how shareholders may submit director nominations for our 2023 annual meeting in accordance with our Bylaws. | ||

| Proxy Access | ||

| Proxy access refers to the right of shareholders meeting certain ownership criteria to nominate director candidates for inclusion in the Company’s proxy materials for its annual meeting. Our Board amended our Bylaws in February 2016 to provide proxy access to our shareholders. This decision followed a careful evaluation of shareholder views, evolving practices, relevant academic research, the potential impact on the Company and proxy access frameworks adopted by other companies. Following are the key terms of our proxy access Bylaw provision: | ||

| v | v | v | ||||||||||||

| Any shareholder, or group of up to | May nominate and include in our proxy | Provided that the shareholder(s) and | ||||||||||||

20 shareholders, maintaining | materials director nominees constituting | nominee(s) satisfy the requirements | ||||||||||||

continuous ownership of at least 3% | up to the greater of 2 nominees or | specified in our Bylaws | ||||||||||||

| of our outstanding common stock | 20% (rounded down) of the number of | |||||||||||||

for at least 3 years | directors serving on the Board | |||||||||||||

| Director Independence | ||

| No director is deemed to be independent unless the Board affirmatively determines that the director meets the independence standards in our Corporate Governance Principles, has no material relationship with us other than as a director and satisfies the independence requirements of the New York Stock Exchange (“NYSE”) and applicable Securities and Exchange Commission (“SEC”) rules. The Board determines director independence at least annually, considering all relevant facts and circumstances including, without limitation: | ||

| ● | Transactions between the Company and the director, immediate family members of the director or organizations with which the director is affiliated, including those further discussed under “Related Party Transactions” below; | ||||

| ● | Any service by the director on the board of a company with which we conduct business; | ||||

| ● | The frequency and dollar amounts associated with any such transactions; and | ||||

| ● | Whether any such transactions are at arm’s length in the ordinary course of business and on terms and conditions similar to those with unrelated parties. | ||||

| 14 | Marathon Petroleum Corporation | |||||||

| CORPORATE GOVERNANCE | ||

| The Board affirmatively determined that the following directors are independent: |  | |||||||||||||||||||||||||||||||||||||

| Abdulaziz F. Alkhayyal | Steven A. Davis | Frank M. Semple | ||||||||||||||||||||||||||||||||||||

| Evan Bayh | Edward G. Galante | J. Michael Stice | ||||||||||||||||||||||||||||||||||||

| Charles E. Bunch | James E. Rohr* | John P. Surma | ||||||||||||||||||||||||||||||||||||

| Jonathan Z. Cohen | Kim K.W. Rucker | Susan Tomasky | ||||||||||||||||||||||||||||||||||||

92% OF CURRENT DIRECTORS ARE INDEPENDENT | ||||||||||||||||||||||||||||||||||||||

| As our current President and CEO, Mr. Hennigan is not considered to be independent. | ||||||||||||||||||||||||||||||||||||||

| * Mr. Rohr retired from the Board effective April 28, 2021. | ||||||||||||||||||||||||||||||||||||||

| Director Skills and Experience | ||

| In evaluating director candidates and recommending incumbent directors for renomination, the Corporate Governance and Nominating Committee considers a wide range of attributes, critical skills, experience and perspectives that it believes contribute to sound governance and effective oversight of our operations, risks and long-term strategy. All directors must possess integrity, good judgment, a strong work ethic, a collaborative approach to engagement, a record of public service and the ability to devote sufficient time to our affairs. In addition, the Corporate Governance and Nominating Committee has identified a number of key skills and areas of expertise it believes should be represented on the Board for the reasons shown below*: | ||

| Senior Leadership | Directors with experience in significant leadership positions bring the qualifications and skills to develop and oversee our strategy, to drive long-term value, and to motivate and retain individual leaders. | 12 | of 12 Directors possess this skill | |||||||||||||||||

| Finance and Accounting | Financial and audit expertise, particularly knowledge of finance and financial reporting processes, is critical to understanding and evaluating our capital structure and overseeing the preparation of our financial statements and internal controls over financial reporting. | 11 | of 12 Directors possess this skill | |||||||||||||||||

| Industry Expertise | Directors with leadership and operational experience in the energy industry, particularly in the areas of petroleum refining, logistics operations and retail sales, bring practical understanding of our business and effective oversight in implementing our strategy. | 11 | of 12 Directors possess this skill | |||||||||||||||||

| Risk Management | Directors with experience managing risk bring skills critical to the Board’s oversight of our risk assessment and risk management programs. | 12 | of 12 Directors possess this skill | |||||||||||||||||

| Operations Experience | Directors with operations experience bring a practical understanding of developing, implementing and addressing our business strategy and development plan. | 8 | of 12 Directors possess this skill | |||||||||||||||||

| Government, Legal and Regulatory | As we operate in a heavily regulated industry, directors with experience in governmental service or in leading governmental affairs functions bring knowledge helpful to navigating these complex issues. | 5 | of 12 Directors possess this skill | |||||||||||||||||

| ESG/Sustainability Experience | Directors with experience in overseeing, operating or advising on matters of the environment, sustainable energy, corporate and social responsibility, health and safety provide effective oversight over these matters and support our commitment to sustainability and creating shared value with our stakeholders. | 12 | of 12 Directors possess this skill | |||||||||||||||||

| Public Company Governance | Directors who have served on other public company boards have experience overseeing and providing insight and guidance to management and bring knowledge critical to the governance of our organization. | 12 | of 12 Directors possess this skill | |||||||||||||||||

Specific information about the key qualifications and experience of each director and director nominee can be found beginning on page 7 under “Proposal 1. Election of Directors.” | ||

| * Reflects expected composition of the Board following the Annual Meeting, assuming all Class II director nominees are elected. | ||

| 2022 Proxy Statement | 15 | |||||||

| CORPORATE GOVERNANCE | ||

| Board Diversity |  | |||||||

| The Board is committed to diversity, as it believes that having a variety of perspectives contributes to more effective oversight and decision-making. Our Corporate Governance Principles emphasize the importance of diversity of director backgrounds and experiences. The Board amended our Corporate Governance Principles in January 2018 to expressly affirm its commitment to actively seek in its director selection efforts women candidates and candidates of diverse ethnic and racial backgrounds who possess the experience, skills and characteristics identified therein. | ||||||||

| Board Refreshment | ||

| The Board is committed to striking a balance between retaining directors with deep knowledge of the Company and seeking fresh perspectives in its recruiting efforts. Our Board and individual director evaluation process supports this objective. Our Corporate Governance Principles also implement a mandatory retirement age for directors. Directors may not stand for reelection once they reach age 73. | ||

| The Board has welcomed five of our 12 current directors since 2018. These new directors were deliberately selected for their highly relevant skill sets and their ability to guide our strategy, provide effective oversight and effectively represent our shareholders’ interests. The average tenure of our current directors is 5.6 years. | ||

| Director Commitments | ||

| Directors are encouraged to serve on the boards of directors of other companies, as the Board believes such service broadens and deepens our directors’ knowledge and experience. Our Corporate Governance Principles provide that each director’s outside directorships must be limited to a number that does not interfere with his or her ability to meet the responsibilities and expectations of service on our Board. The Corporate Governance and Nominating Committee reviews director commitment levels at least annually and has determined that all directors currently comply with these expectations. Messrs. Semple, Stice and Surma currently serve on the board of MPLX GP, the general partner of MPLX. As MPLX GP is our wholly owned subsidiary, the Committee views such service as an extension of service on our Board for purposes of assessing the level of outside public board commitments. | ||

| Majority Voting for Directors | ||

| Our Bylaws include a majority vote standard for uncontested director elections, which requires that a nominee for director in an uncontested election receive a majority of votes cast at a shareholder meeting in order to be elected to the Board. Any director nominee who does not receive a majority of the votes cast is required to submit an irrevocable resignation to the Corporate Governance and Nominating Committee, which will make a recommendation to the Board as to whether to accept or reject the resignation or take other action. The Board will, within 90 days following certification of the election results, publicly disclose its decision regarding the resignation and, if such resignation is rejected, the rationale behind the decision. | ||

| Board Leadership and Function | ||

| Independent Chairman of the Board | ||

| Our Corporate Governance Principles provide the Board with the flexibility to exercise its business judgment on behalf of shareholders and choose the optimal leadership for the Board depending upon the Company’s particular needs and circumstances at a given time. The independent members of the Board elect the Chairman and, as part of this election, review whether to combine or separate the positions of Chairman and CEO. | ||

| The Board has elected Mr. Surma to lead the Board as its independent Chairman. The Board believes that this leadership structure, which separates the Chairman and CEO roles, is appropriate at this time in light of MPC’s business and operating environment. Mr. Surma, a long-standing member of the Board, has in-depth knowledge of the issues, challenges and opportunities facing MPC. As such, the Board believes that he is best positioned at this time to ensure that the Board’s time and attention are focused on the most critical matters. His role ensures decisive independent leadership and clear accountability. | ||

| 16 | Marathon Petroleum Corporation | |||||||

| CORPORATE GOVERNANCE | ||

| Board Meetings and Attendance | ||

The Board met seven times in 2021. Each of our directors attended 100% of the meetings of the Board and committees on which he or she served in 2021. Our Corporate Governance Principles provide that the non-employee directors will hold regular executive sessions presided over by the Chairman. The non-employee directors held seven such executive sessions in 2021. As an employee of MPC, Mr. Hennigan does not attend these sessions. | ||

| All directors are expected to attend our annual meeting. All members of the Board attended the virtual annual meeting of shareholders held on April 28, 2021. | ||

| Board Committees | ||

| The Board has four standing committees, to which it has delegated certain functions and oversight responsibilities. In 2021, the Board undertook a thorough review of its standing committees and their oversight responsibilities, amending all four committee charters to adjust and clarify committee responsibilities, including for ESG oversight and stakeholder engagement. | ||

| AUDIT COMMITTEE | |||||||||||

Members: Susan Tomasky, Chair1 Jonathan Z. Cohen, Vice Chair1 Abdulaziz F. Alkhayyal1 James E. Rohr2 Frank M. Semple2 J. Michael Stice1 Meetings in 2021: 5 | Primary Responsibilities: | ||||||||||

| Ø | Appoints, compensates and oversees the performance of the independent auditor, including approval of all services to be performed by the auditor. | ||||||||||

| Ø | Reviews with management, the independent auditor and our internal auditors the integrity of our disclosure controls and procedures, annual and quarterly financial statements and internal controls over financial reporting. | ||||||||||

| Ø | Oversees the internal audit function, including its structure and budget, and the performance and compensation of the chief audit executive. | ||||||||||

| Ø | Reviews with management significant corporate risk exposures and risk mitigation efforts. | ||||||||||

| Ø | Reviews and assesses the effectiveness of our information technology controls relating to business continuity, data privacy and cybersecurity. | ||||||||||

1 Audit Committee Financial Expert 2 Effective April 28, 2021, Mr. Semple joined the Committee, and Mr. Rohr retired from the Board. | Ø | Monitors compliance with legal and regulatory requirements, our Codes of Business Conduct and Ethics for Senior Financial Officers and Whistleblowing as to Accounting Matters Policy. | |||||||||

| Ø | Reviews legislative and regulatory issues affecting ESG and climate risk disclosures within the financial reporting framework and monitors developments in integrated reporting for alignment with financial reporting. | ||||||||||

| Ø | Has authority to investigate any matter brought to its attention with full access to all books, records, facilities and personnel of the Company, and to retain independent legal, accounting, or other advisors or consultants. | ||||||||||

| COMPENSATION AND ORGANIZATION DEVELOPMENT COMMITTEE | ||||||||||||||

Members: Edward G. Galante, Chair Steven A. Davis, Vice Chair Abdulaziz F. Alkhayyal Charles E. Bunch James E. Rohr3 Frank M. Semple3 Meetings in 2021: 7 | Primary Responsibilities: | |||||||||||||

| Ø | Sets compensation for the CEO, incorporating relevant goals and objectives, and evaluates the CEO’s performance. | |||||||||||||

| Ø | Sets compensation for our other designated positions and reviews the succession plan for senior management. | |||||||||||||

| Ø | Oversees our executive compensation and benefit policies, plans, programs and practices. | |||||||||||||

| Ø | Oversees our human capital management strategies and policies, including our diversity, equity and inclusion initiatives, pay equity, talent and performance management practices. | |||||||||||||

3 Effective April 28, 2021, Mr. Semple joined the Committee, and Mr. Rohr retired from the Board. | Ø | Oversees our engagement with stakeholders on compensation and human capital management matters. | ||||||||||||

| Ø | Oversees our incentive compensation plans and certifies achievement of performance levels thereunder. | |||||||||||||

Please see “Executive Compensation” beginning on page 31 for additional information about the Compensation and Organization Development Committee and its responsibilities. | ||||||||||||||

| 2022 Proxy Statement | 17 | |||||||

| CORPORATE GOVERNANCE | ||

| CORPORATE GOVERNANCE AND NOMINATING COMMITTEE | ||||||||||||||

Members: Charles E. Bunch, Chair J. Michael Stice, Vice Chair Evan Bayh Jonathan Z. Cohen Steven A. Davis Meetings in 2021: 6 | Primary Responsibilities: | |||||||||||||

| Ø | Selects and recommends director candidates to the Board to be submitted for election at annual meetings and to fill any vacancies on the Board. | |||||||||||||

| Ø | Recommends committee assignments to the Board. | |||||||||||||

| Ø | Monitors our corporate governance practices and recommends to the Board appropriate corporate governance policies and procedures. | |||||||||||||

| Ø | Reviews and recommends to the Board compensation for our non-employee directors. | |||||||||||||

| Ø | Oversees the evaluation of the Board, its committees and individual directors. | |||||||||||||