- MPC Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

PRE 14A Filing

Marathon Petroleum (MPC) PRE 14APreliminary proxy

Filed: 7 Mar 25, 4:11pm

| ||||||||

| MARATHON PETROLEUM CORPORATION | ||||||||

| 2025 | ||||||||

| NOTICE OF ANNUAL MEETING AND PROXY STATEMENT | ||||||||

| WEDNESDAY | ||||||||

| APRIL 30, 2025 | ||||||||

| 10 AM EDT | ||||||||

PRELIMINARY COPY - SUBJECT TO COMPLETION Marathon Petroleum Corporation intends to release definitive copies of the Proxy Statement to shareholders on or about March 17, 2025. | ||||||||

| NOTICE OF 2025 ANNUAL MEETING OF SHAREHOLDERS | |||||||

| Dear Shareholder, | ||

| You are invited to attend Marathon Petroleum Corporation’s 2025 Annual Meeting of Shareholders at which shareholders will be asked to vote on the following matters: | ||

| DATE AND TIME | AGENDA | ||||||||||||||||||||||

Wednesday, April 30, 2025 10 a.m. Eastern Daylight Time | 1. Elect the four director nominees for Class II named in the Proxy Statement 2. Ratify the appointment of our independent auditor for 2025 3. Approve, on an advisory basis, our named executive officer compensation | ||||||||||||||||||||||

| VIRTUAL LOCATION | 4. Approve an amendment to the Certificate of Incorporation to declassify the Board of Directors 5. Approve an amendment to the Certificate of Incorporation to eliminate supermajority provisions 6. One shareholder proposal, if properly presented at the meeting 7. Transact any other business that may properly come before the meeting or any adjournment or postponement thereof | ||||||||||||||||||||||

The meeting will be held virtually at: www.virtualshareholder meeting.com/MPC2025 | |||||||||||||||||||||||

| þ | Your vote is important. Even if you plan to attend the virtual Annual Meeting, please vote as soon as possible using one of the following options: | ||||||||||||||||||||||

|  |  | |||||||||||||||||||||

| Via the Internet: | Call Toll-Free: | Mail Signed Proxy Card: | |||||||||||||||||||||

| Follow the instructions in the Notice, proxy card or voting instruction form. | Call the toll-free number on your proxy card or voting instruction form. | Follow the instructions on your proxy card or voting instruction form. | |||||||||||||||||||||

Shareholders of record at the close of business on Monday, March 3, 2025, are entitled to vote at the Annual Meeting. See “FAQs About Voting and the Annual Meeting” beginning on page 77 for more information. | ||

We provide our proxy materials, including our Proxy Statement and Annual Report, over the internet. This expedites your receipt of proxy materials, conserves natural resources and lowers the cost of the meeting. On or about March 17, 2025, we are posting our proxy materials at www.proxyvote.com and mailing to shareholders a Notice Regarding the Availability of Proxy Materials (the “Notice”), explaining how to access the proxy materials over the internet. We are also mailing a printed set of the proxy materials to shareholders who have elected to receive paper copies. Shareholders may request a printed set of the proxy materials by following the instructions provided in the Notice. | ||

| We thank you for your continued support and look forward to your attendance at our virtual Annual Meeting. | ||

| By order of the Board of Directors, | |||||

| |||||

Molly R. Benson Chief Legal Officer and Corporate Secretary | |||||

| IMPORTANT NOTICE REGARDING THE INTERNET AVAILABILITY OF PROXY MATERIALS: | |||||

The Proxy Statement and Marathon Petroleum Corporation’s 2024 Annual Report are available at www.proxyvote.com. | |||||

| TABLE OF CONTENTS | ||

| FREQUENTLY REQUESTED INFORMATION | ||||||||||||||||||||

| Auditor fees | Independent Lead Director | |||||||||||||||||||

| Board, committee and individual director evaluations | Key areas of Board oversight | |||||||||||||||||||

| Board leadership structure | Business strategy and risk management | |||||||||||||||||||

| Board meeting director attendance | Cybersecurity | |||||||||||||||||||

| Board skills, expertise and demographics matrix | Human capital management and succession planning | |||||||||||||||||||

| CEO pay ratio | Political engagement and public policy | |||||||||||||||||||

| Clawback policy | Sustainability and climate risk | |||||||||||||||||||

| Codes of conduct and ethics | Pay versus performance | |||||||||||||||||||

| Committees of the Board | Prohibition on hedging and pledging | |||||||||||||||||||

| Communicating with the Board | Proxy access | |||||||||||||||||||

| Compensation reference group | Related party transactions | |||||||||||||||||||

| Director biographies | Say-on-pay proposal | |||||||||||||||||||

| Director board commitments | Shareholder engagement program | |||||||||||||||||||

| Director compensation table | Shareholder proposals and nominees for the 2026 annual meeting | |||||||||||||||||||

| Director independence | ||||||||||||||||||||

| Executive compensation mix | ||||||||||||||||||||

| TERMS AND ACRONYMS | ||||||||||||||||||||

| ACB | Annual Cash Bonus program | GAAP | Generally Accepted Accounting Principles in the United States | |||||||||||||||||

| Annual Meeting | Marathon Petroleum Corporation’s 2025 annual meeting of shareholders | |||||||||||||||||||

| GHG | Greenhouse gas | |||||||||||||||||||

| Board | Board of Directors, Marathon Petroleum Corporation | LTI | Long-term incentive | |||||||||||||||||

| Marathon | Marathon Petroleum Corporation | |||||||||||||||||||

| Bylaws | Amended and Restated Bylaws of Marathon Petroleum Corporation | |||||||||||||||||||

| MPC | Marathon Petroleum Corporation | |||||||||||||||||||

| MPLX | MPLX LP | |||||||||||||||||||

| CD&A | Compensation discussion and analysis | |||||||||||||||||||

| NEO | Named Executive Officer | |||||||||||||||||||

| CEO | Chief Executive Officer | |||||||||||||||||||

| NYSE | New York Stock Exchange | |||||||||||||||||||

| CFO | Chief Financial Officer | |||||||||||||||||||

| OSHA | U.S. Occupational Safety and Health Administration | |||||||||||||||||||

| Company | Marathon Petroleum Corporation | |||||||||||||||||||

| DCF | Distributable cash flow at MPLX LP | |||||||||||||||||||

| PSUs | Performance share units | |||||||||||||||||||

| DGCL | Delaware General Corporation Law | |||||||||||||||||||

| PwC | PricewaterhouseCoopers LLP | |||||||||||||||||||

| EPA | U.S. Environmental Protection Agency | |||||||||||||||||||

| RSUs | Restricted stock units | |||||||||||||||||||

| ERM | Enterprise risk management | |||||||||||||||||||

| SEC | U.S. Securities and Exchange Commission | |||||||||||||||||||

| Exchange Act | Securities Exchange Act of 1934, as amended | |||||||||||||||||||

| TSR | Total shareholder return | |||||||||||||||||||

| PROXY STATEMENT SUMMARY | ||

| This summary highlights information contained in this Proxy Statement, which is first being sent or made available to shareholders on or about March 17, 2025. This summary does not contain all of the information you should consider before voting. Please read the entire Proxy Statement before voting. For more complete information regarding 2024 operational and financial performance and definitions of industry terms, please review MPC’s Annual Report on Form 10-K for the year ended December 31, 2024, which accompanies this Proxy Statement. | ||

| Annual Meeting and Voting Information | ||

| DATE AND TIME | VIRTUAL LOCATION | RECORD DATE | VOTING | |||||||||||||||||

| Wednesday, April 30, 2025 | The Annual Meeting will be held virtually at: www.virtualshareholder meeting.com/MPC2025 | Monday, March 3, 2025 | Only holders of record of MPC’s common stock as of the record date will be entitled to Notice and to vote | |||||||||||||||||

| 10 a.m. EDT | Shares outstanding and entitled to vote: | |||||||||||||||||||

| 311,531,359 | ||||||||||||||||||||

MPC’s 2025 Annual Meeting will be held exclusively online. See “FAQs About Voting and the Annual Meeting” beginning on page 77 for additional information about how to attend and vote at the virtual Annual Meeting. | ||

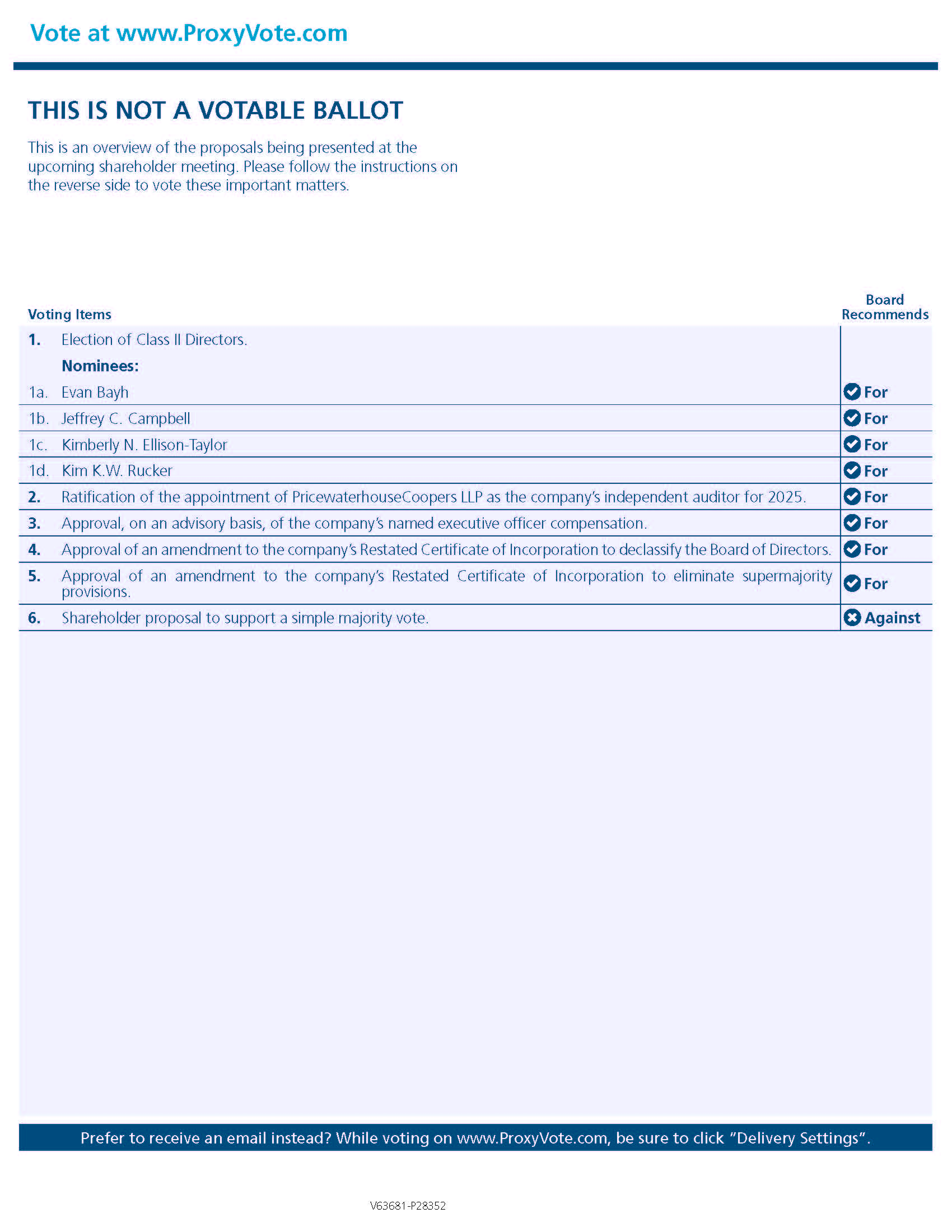

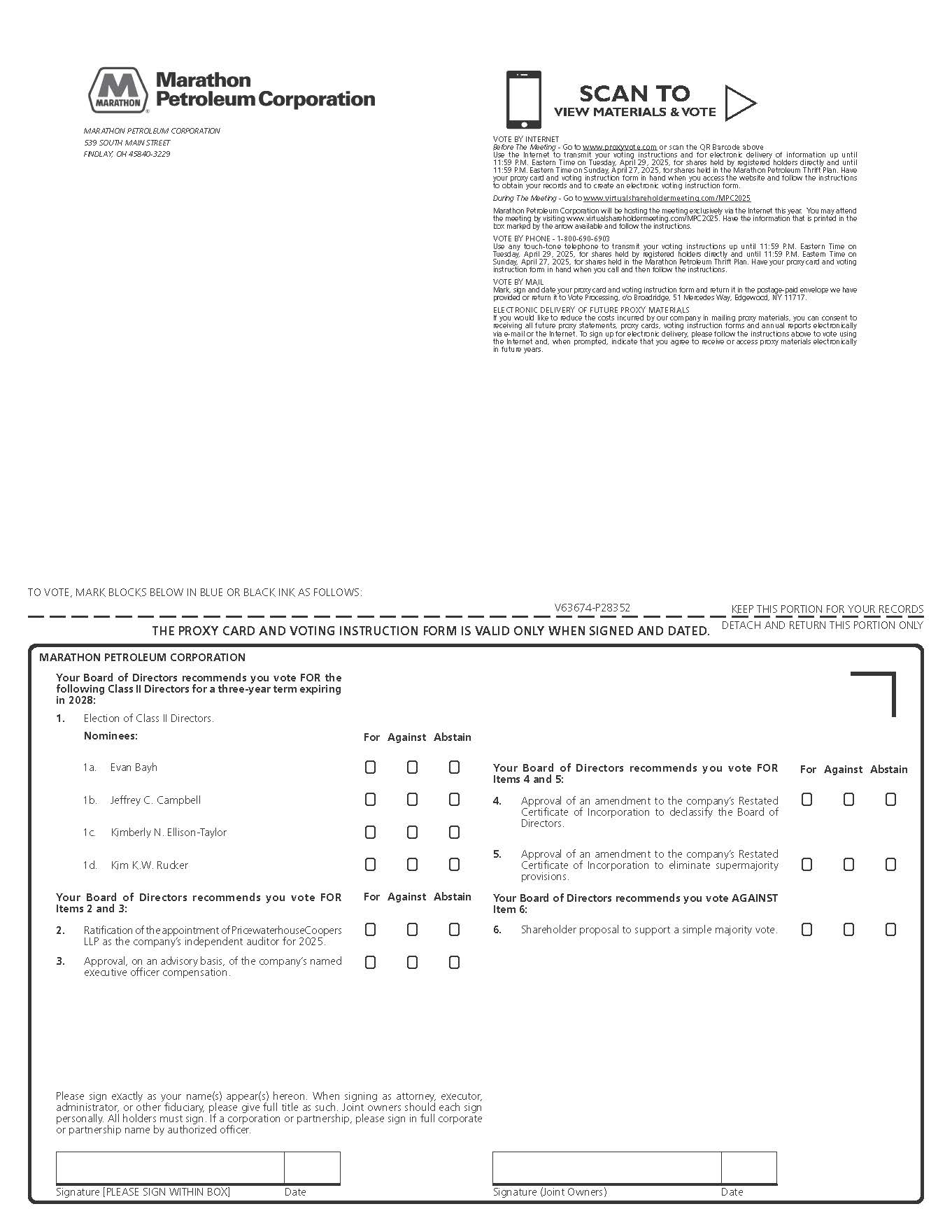

| Voting Items | ||

Your vote is important. Please vote your proxy promptly so that your shares can be represented, even if you plan to attend the virtual Annual Meeting. You can vote via the internet or telephone by following the voting procedures described in the Notice, proxy card or voting instruction form, or by returning your completed and signed proxy card or voting instruction form in the provided envelope. | ||

| Proposal | Page Reference | Board Recommendation | |||||||||

Proposal 1. Elect four director nominees to Class II | FOR each nominee | ||||||||||

Proposal 2. Ratify the appointment of our independent auditor for 2025 | FOR | ||||||||||

Proposal 3. Approve, on an advisory basis, our named executive officer compensation | FOR | ||||||||||

Proposal 4. Approve an amendment to the Certificate of Incorporation to declassify the Board of Directors | FOR | ||||||||||

Proposal 5. Approve an amendment to the Certificate of Incorporation to eliminate supermajority provisions | FOR | ||||||||||

Proposal 6. Vote on one shareholder proposal, if properly presented | AGAINST | ||||||||||

| Additional Information | ||

Our principal executive offices are located at 539 South Main Street, Findlay, OH 45840, and our telephone number is (419) 422-2121. Our website address is www.marathonpetroleum.com. References to our website or other publications are provided for convenience only. The information contained on our website or other publications is not a part of this Proxy Statement or any of our other filings with the SEC. | ||

| References throughout this Proxy Statement to “Company,” “MPC,” “Marathon,” “we” or “our” refer to Marathon Petroleum Corporation. References to “MPLX” refer to MPLX LP, a publicly traded master limited partnership we control through our ownership of its general partner, MPLX GP LLC (“MPLX GP”), and approximately 64% (as of December 31, 2024) of its outstanding common units. | ||

| 2025 Proxy Statement | 1 | |||||||

| About Marathon Petroleum Corporation | ||

| With more than 135 years in the energy industry, Marathon Petroleum Corporation (NYSE: MPC) is a leading, integrated, downstream energy company headquartered in Findlay, Ohio. We operate one of the nation’s largest refining systems with approximately 3.0 million barrels per day of crude oil refining capacity and a growing renewable fuels portfolio that includes the second largest renewable diesel facility in the United States. We distribute our refined products through one of the largest terminal operations in the United States and one of the largest private domestic fleets of inland petroleum product barges. Our integrated midstream energy asset network links producers of natural gas and natural gas liquids from some of the largest supply basins in the United States to domestic and international markets. Additionally, our marketing system includes two strong brands, Marathon® and ARCO®, with locations across the United States and in Mexico. We and our employees are focused on doing our part to meet the world’s need for reliable, affordable and responsibly produced fuels, challenging ourselves to lead in sustainable energy by investing in an energy-diverse future and strengthening the resiliency of our business. | ||

| 2024 Company Performance Highlights | ||

| FINANCIAL PERFORMANCE | OPERATIONAL EXCELLENCE | |||||||||||||||||||||||||

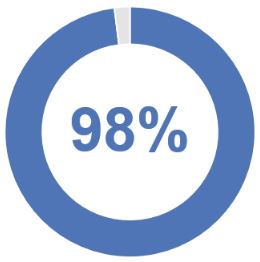

$3.4 billion | $11.3 billion | $8.7 billion | 92% | 99% | ||||||||||||||||||||||

| net income attributable to MPC | adjusted EBITDA* | net cash from operations | refining utilization | capture | ||||||||||||||||||||||

| PEER-LEADING CAPITAL RETURN TO SHAREHOLDERS | ||||||||||||||

| ~10% | $10.2 billion | $10.0 billion | ||||||||||||

| increase in our quarterly dividend (from $0.825 to $0.910 per share) | total 2024 capital return through share repurchases and dividends, resulting in a 23% capital return yield for our shareholders | additional repurchase authorization in 2024 ($5.0 billion announced in April, with an additional $5.0 billion announced in November) | ||||||||||||

| RECOGNITION | ||

•EPA ENERGY STAR® Partner of the Year – Sustained Excellence five years in a row •Five MPC refineries earned ENERGY STAR® certifications in 2024. Since refineries first became eligible for Energy Star certification in 2006, MPC has earned more certifications than all other refining companies combined •MPLX Bluestone natural gas plant became the first facility in the natural gas processing sector to achieve the EPA’s ENERGY STAR® Challenge for Industry | ||

| * | Adjusted EBITDA is not a measure of financial performance under GAAP and may not be comparable to similarly titled measures reported by other companies. See Appendix I for the reconciliation of this non-GAAP financial measure to its most directly comparable GAAP financial measure. | ||||

| 2024 Leadership Transition | ||

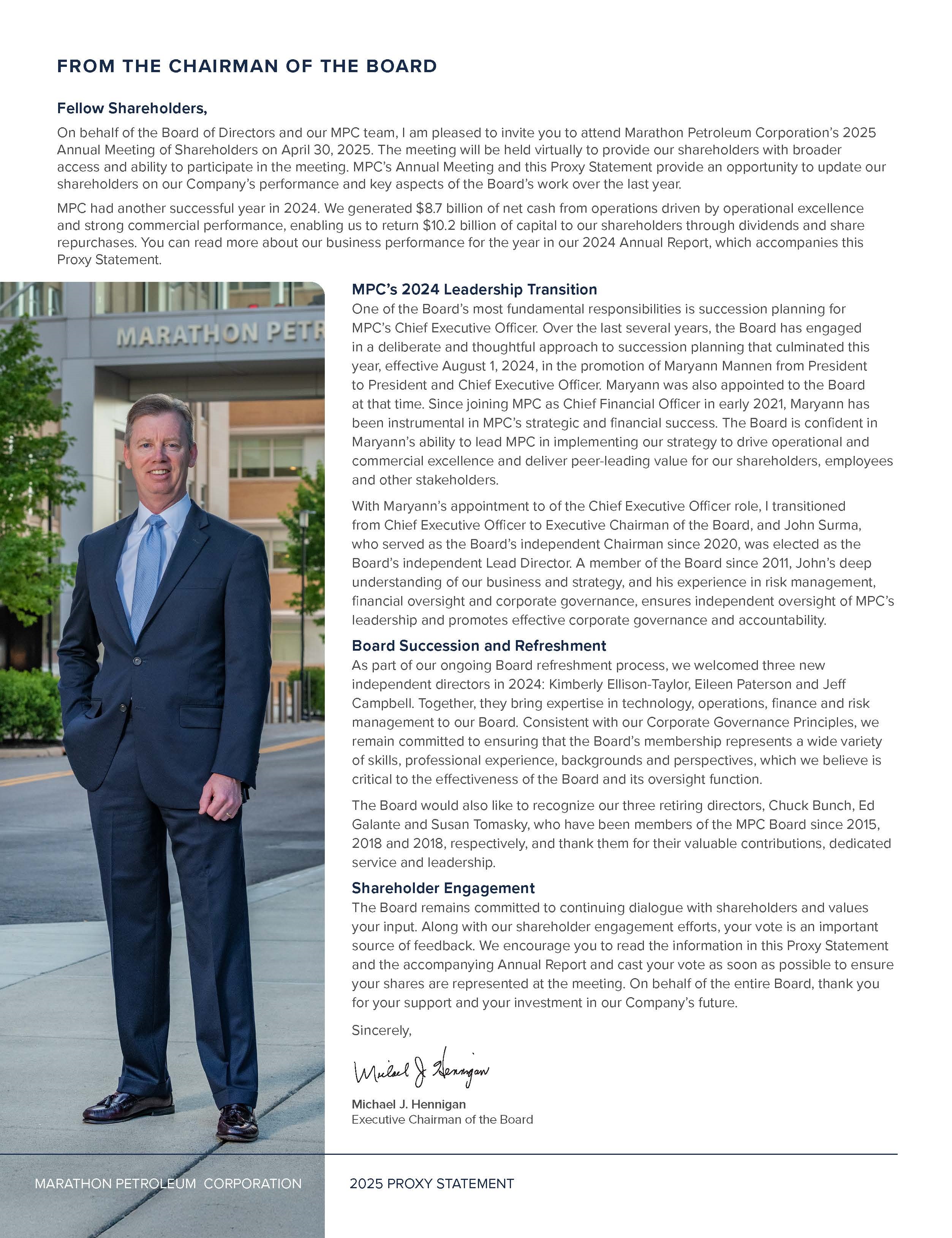

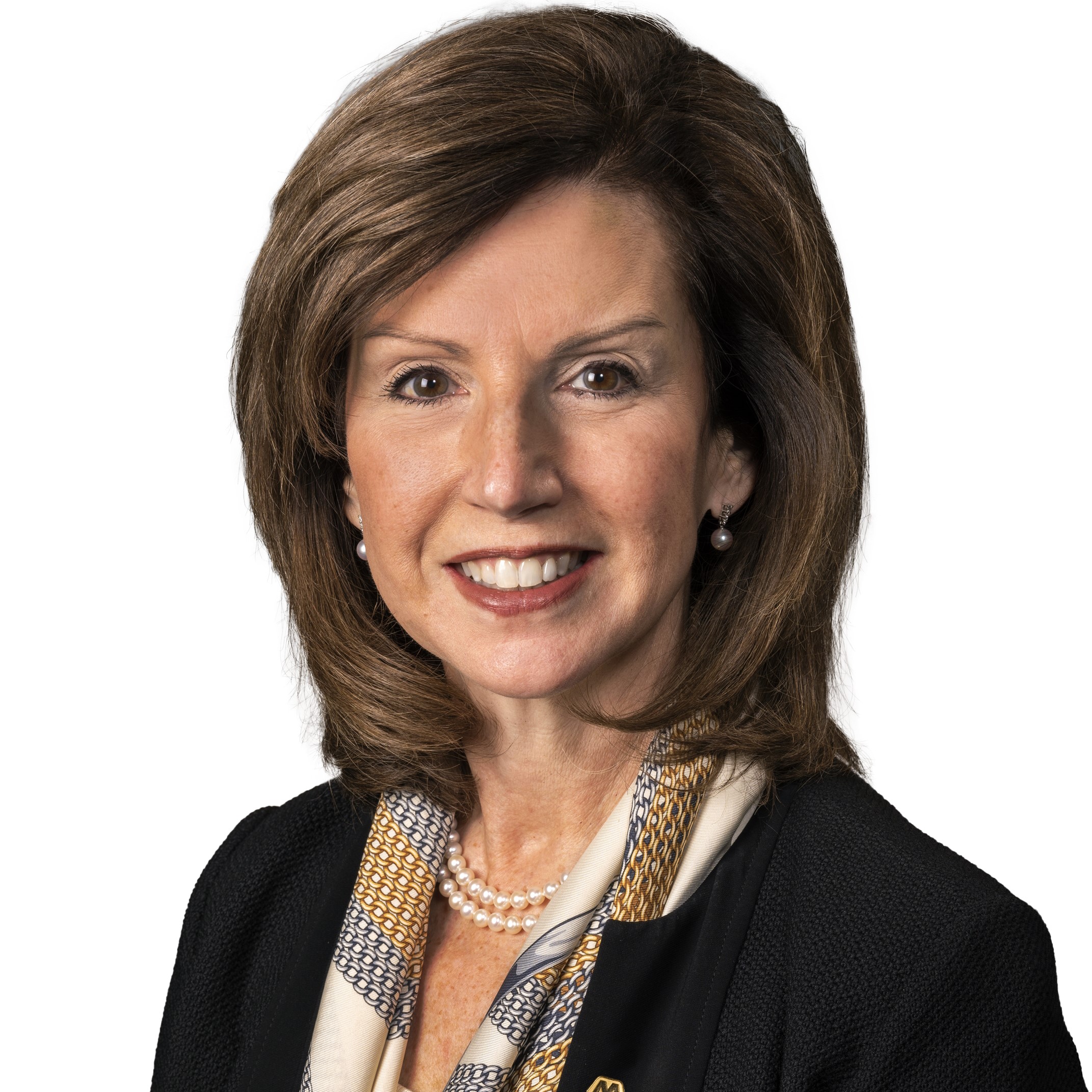

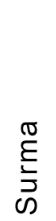

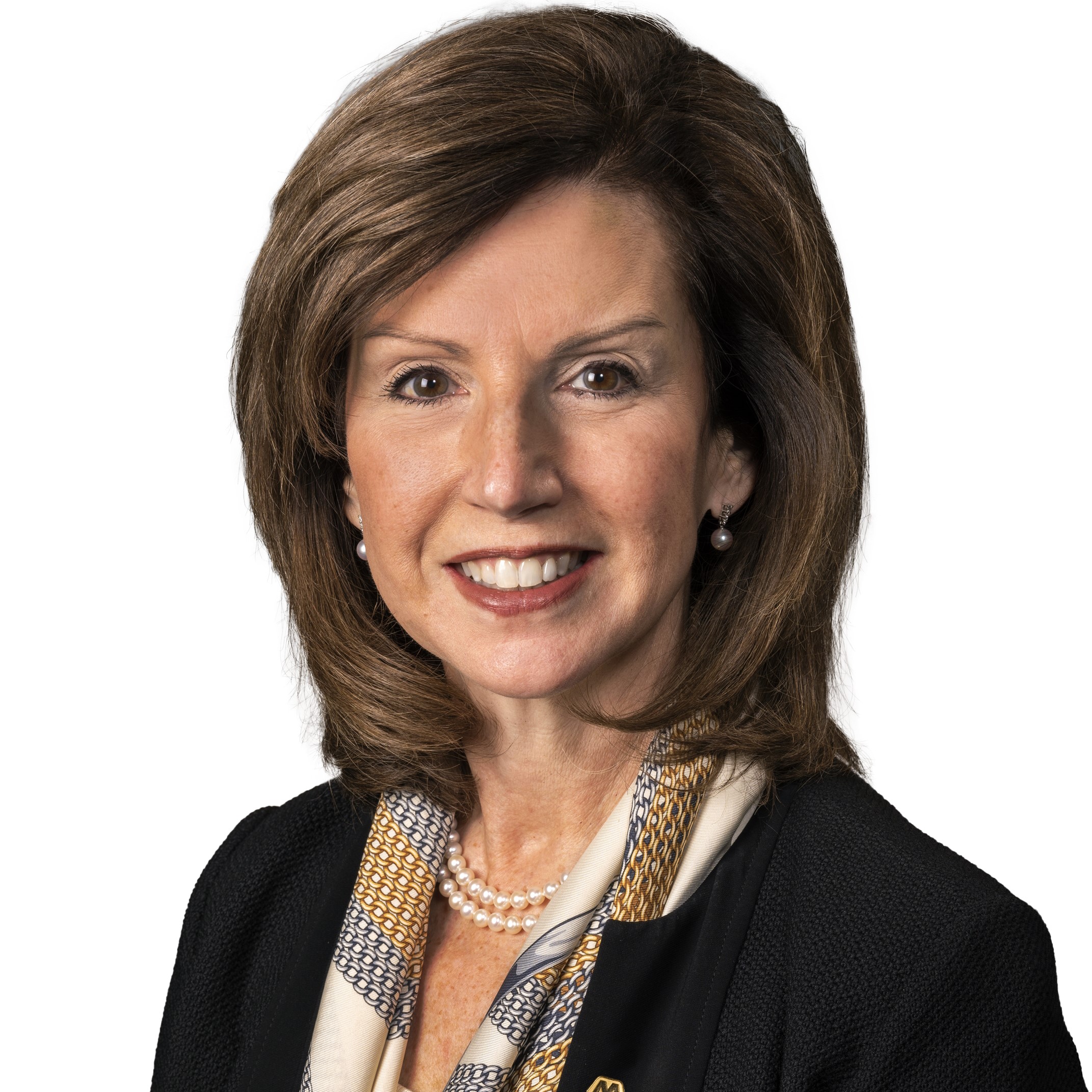

Following several years of a disciplined succession planning process, our Board announced a “Leadership Transition,” effective August 1, 2024. Maryann T. Mannen, previously MPC’s President, was promoted to President and CEO, succeeding Michael J. Hennigan as CEO. Ms. Mannen was also elected as a member of the Board. Mr. Hennigan was elected Executive Chairman of the Board. John P. Surma, previously the Board’s independent Chairman, was elected as the Board’s independent Lead Director. See “Board Leadership Structure” beginning on page 18 for additional information on the respective roles of Messrs. Hennigan and Surma. | ||

| Maryann T. Mannen |  | Michael J. Hennigan |  | John P. Surma | ||||||||||||||||||

| President and CEO | Executive Chairman | Independent Lead Director | |||||||||||||||||||||

| 2 | Marathon Petroleum Corporation | |||||||

| Overview of Our Board of Directors | ||

Following is an overview of our Board of Directors after the Annual Meeting, assuming all nominees are elected. More detailed information about each director’s background, key skills and expertise can be found beginning on page 8, as well as in the individual director profiles beginning on page 9. Three current members of our Board, Charles A. Bunch, Edward G. Galante and Susan Tomasky, will retire from the Board following the Annual Meeting. | ||

Age (as of April 30, 2025) | Director Since | Committee Memberships | Other Current Public Company Boards | |||||||||||||||||||||||||||||||||||||||||

| Name and Principal Occupation | Independent | A | C | G | S | |||||||||||||||||||||||||||||||||||||||

| Abdulaziz F. Alkhayyal Former Senior Vice President, Industrial Relations, Saudi Aramco | 71 | 2016 | ü | ¡ | ¡ | 2 | |||||||||||||||||||||||||||||||||||||

| Evan Bayh Senior Advisor, Apollo Global Management | 69 | 2011 | ü | ¡ | µ | 3 | |||||||||||||||||||||||||||||||||||||

| Jeffrey C. Campbell Former Vice Chairman and CFO, American Express Company | 64 | 2024 | ü | µ | * | ¡ | 2 | ||||||||||||||||||||||||||||||||||||

| Jonathan Z. Cohen Founder, CEO and President, Hepco Capital Management, LLC | 54 | 2019 | ü | ¡ | ¡ | 1 | |||||||||||||||||||||||||||||||||||||

| Kimberly N. Ellison-Taylor Former Executive Director, Finance Thought Leadership, Oracle Corporation | 55 | 2024 | ü | ¡ | ¡ | 1 | |||||||||||||||||||||||||||||||||||||

| Michael J. Hennigan Executive Chairman, Marathon Petroleum Corporation | 65 | 2020 | Executive Chairman | 2 | ** | ||||||||||||||||||||||||||||||||||||||

| Maryann T. Mannen President and CEO, Marathon Petroleum Corporation | 62 | 2024 | CEO | ¡ | 2 | ** | |||||||||||||||||||||||||||||||||||||

| Eileen P. Paterson Former CEO and President, Aerojet Rocketdyne Holdings, Inc. | 59 | 2024 | ü | ¡ | ¡ | 2 | |||||||||||||||||||||||||||||||||||||

| Kim K.W. Rucker Former Executive Vice President, General Counsel and Secretary, Andeavor | 58 | 2018 | ü | ¡ | µ | * | 3 | ||||||||||||||||||||||||||||||||||||

| Frank M. Semple Former Chairman, President and CEO, MarkWest Energy Partners, L.P. | 73 | 2021 | ü | ¡ | ¡ | 1 | ** | ||||||||||||||||||||||||||||||||||||

| J. Michael Stice Professor, The University of Oklahoma | 66 | 2017 | ü | µ | * | ¡ | 2 | ** | |||||||||||||||||||||||||||||||||||

| John P. Surma Lead Director, Marathon Petroleum Corporation | 70 | 2011 | ü | ¡ | ¡ | 3 | ** | ||||||||||||||||||||||||||||||||||||

| A | Audit Committee | * | Elected to serve as Chair, replacing the retiring committee Chair, immediately following the Annual Meeting. | ||||||||||||||

| C | Compensation and Organization Development Committee | ||||||||||||||||

| G | Corporate Governance and Nominating Committee | ** | Includes service on the board of directors of MPLX GP LLC, a wholly owned subsidiary of MPC. Our Corporate Governance Principles count concurrent service on the boards of MPC and MPLX GP LLC as one public company board for purposes of assessing the level of public company board commitments. | ||||||||||||||

| S | Sustainability and Public Policy Committee | ||||||||||||||||

| µ | Chair | ||||||||||||||||

| ¡ | Member | ||||||||||||||||

| 2025 Proxy Statement | 3 | |||||||

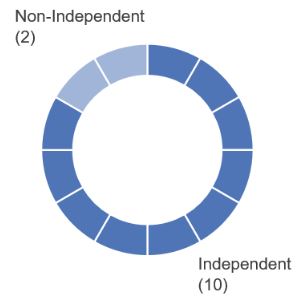

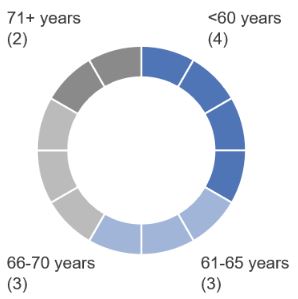

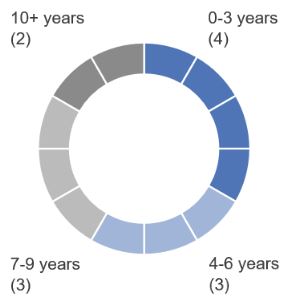

| Composition of Our Board | ||

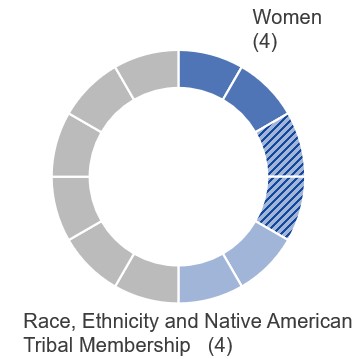

The members of our Board represent a wide range of backgrounds, critical skills, perspectives and expertise, as well as a mix of tenure of service on the Board. The following graphs show the composition of our Board after the Annual Meeting, assuming all nominees are elected. More detailed information about considerations for director candidate selection and evaluation can be found under “Board Composition and Director Selection,” beginning on page 16. | ||

| INDEPENDENCE | AGE | TENURE | DEMOGRAPHICS | ||||||||||||||||||||||||||

10 of 12 directors | 63.8 years average | 5.7 years average | 50% demographic diversity | ||||||||||||||||||||||||||

|  |  |  | ||||||||||||||||||||||||||

| Shareholder Engagement and Responsiveness | ||

| We believe regular dialogue with, and accountability to, our shareholders is critical to our success. Our leadership team participates in numerous investor engagements throughout the year to discuss our business and strategic priorities. Shareholder feedback provides our Board and leadership with valuable insights on our business strategy and performance, corporate responsibility, executive compensation, sustainability initiatives and many other topics. Our core shareholder engagement team includes senior members of our investor relations, corporate governance, human resources and sustainability teams, supplemented by our CEO, CFO, Executive Chairman, Lead Director or other directors, as appropriate. | ||

| FALL ENGAGEMENT | PROGRAM ENHANCEMENT | 2024 Engagement Program | ||||||||||||||||||

| Our shareholder engagement team solicits and receives feedback from shareholders on governance practices and trends, Board composition, executive compensation, sustainability, human capital management and other shareholder priorities. | ð | The Board uses shareholder feedback to enhance disclosures, including in our proxy statement and sustainability reporting, and revise governance practices, the executive compensation program, sustainability practices or other programs and policies, as appropriate. | ||||||||||||||||||

| Outreach to: | ||||||||||||||||||||

Shareholders representing 71% of our outstanding shares | ||||||||||||||||||||

| Investor engagements with: | ||||||||||||||||||||

Shareholders representing 42% of our outstanding shares | ||||||||||||||||||||

| ñ | ò | |||||||||||||||||||

| ANNUAL MEETING | SPRING ENGAGEMENT | |||||||||||||||||||

| We receive and publish voting results from our annual meeting, which help shape our ongoing improvements and developments in governance practices, executive compensation, sustainability and other shareholder interest areas. | ï | Our shareholder engagement team conducts additional outreach with shareholders to provide updates on changes made in response to shareholder feedback and to address Board and shareholder proposals, as well as other topics of interest, prior to the annual meeting. | Additional ways we engaged: | |||||||||||||||||

•Quarterly earnings calls •Industry presentations and conferences •Email updates such as topical news releases and reports | ||||||||||||||||||||

| At our 2024 Annual Meeting, and proposed again for the 2025 Annual Meeting, is a shareholder proposal requesting that any voting requirements in our charter or bylaws that are greater than a simple majority be replaced by a majority of votes cast standard. At the 2024 Annual Meeting, this proposal received support from 38% of shares present and entitled to vote at the meeting. In our engagement sessions with investors, to the degree investors have supported this proposal, such support has been expressed in terms of reducing the supermajority voting standard applicable to certain articles within our Restated Certificate of Incorporation, down from an 80% of shares outstanding standard to a simple majority standard, and not in terms of further reducing the voting standard in our Bylaws, which was reduced to a simple majority of shares outstanding in 2018. Accordingly, we believe that inclusion | ||

| 4 | Marathon Petroleum Corporation | |||||||

| in this Proxy Statement of Board Proposal 5, seeking to eliminate the supermajority provisions in our Restated Certificate of Incorporation, sufficiently addresses our shareholders’ interests on this matter. | ||

| Governance Highlights | ||

| Key Corporate Governance Practices | ||

The Board of Directors believes our commitment to strong corporate governance benefits all our stakeholders, including our shareholders, employees, business partners, customers, communities, governments and others who have a stake in how we operate. Our key corporate governance practices include: | ||

| BOARD INDEPENDENCE AND LEADERSHIP | DIRECTOR ELECTIONS | BOARD PRACTICES | SHAREHOLDER RIGHTS AND ENGAGEMENT | SUSTAINABILITY ACCOUNTABILITY | ||||||||||||||||||||||

10 of 12 directors are independent Strong independent Lead Director role reinforces effective independent leadership on the Board Three fully independent standing Board committees | Majority voting standard for uncontested director elections Demonstrated commitment to Board refreshment Directors not elected by a majority of votes cast are subject to the Board’s resignation policy | Risk oversight by the full Board and its committees Independent directors meet regularly in executive session Annual Board and committee self-evaluations, and individual evaluations of nominees for reelection | Shareholder right to call a special meeting of shareholders Shareholder “proxy access” right to submit director nominations for inclusion in our proxy statement Robust year-round shareholder engagement program | Strong oversight by the full Board and its committees Industry-leading disclosures on environmental targets and performance Extensive human capital management disclosures, including EEO-1 data | ||||||||||||||||||||||

| Recent Governance Enhancements | ||

| We believe good governance is critical to achieving long-term shareholder value. We approach governance in a strategic and thoughtful manner, taking into consideration multiple perspectives, including those of our Board, our Corporate Governance and Nominating Committee, our shareholders, experts and other stakeholders, to align on what makes the most sense for our Company. We continuously look for ways to enhance our corporate governance and increase value to our shareholders. Recent governance enhancements and actions include: | ||

| 2021- 2025 | Every year beginning in 2021, we have submitted to our shareholders, for consideration at the annual meeting, amendments to our Certificate of Incorporation providing for annual elections for all directors and elimination of supermajority provisions | |||||||||||||

| 2024 | ||||||||||||||

| ▶ | Following approval from our shareholders, amended our Certificate of Incorporation to provide for officer exculpation, as permitted under Delaware law | |||||||||||||

| ▶ | Elected an independent Lead Director of the Board | |||||||||||||

| 2023 | ||||||||||||||

| ▶ | Following approval from our shareholders, amended our Certificate of Incorporation to increase the maximum size of the Board of Directors | |||||||||||||

| ▶ | Revised our Corporate Governance Principles to affirmatively state the Board’s policy on director commitments | |||||||||||||

| 2021 | ||||||||||||||

| ▶ | Following a thorough review of Board committee oversight responsibilities, amended our committee charters to adjust and clarify committee responsibilities, including for sustainability oversight and stakeholder engagement | |||||||||||||

| 2019 | ||||||||||||||

| ▶ | Amended our Corporate Governance Principles to require individual director evaluations for directors whose terms expire at the next annual meeting and are eligible for reelection | |||||||||||||

| 2018 | ||||||||||||||

| ▶ | Amended our Bylaws to provide shareholders the right to call a special meeting of shareholders | |||||||||||||

| ▶ | Amended our Bylaws to eliminate the 80% supermajority requirement for Bylaw amendments | |||||||||||||

| 2016 | ||||||||||||||

| ▶ | Amended our Bylaws to provide proxy access for shareholders | |||||||||||||

| 2025 Proxy Statement | 5 | |||||||

| Sustainability Highlights | ||

| Our commitment to sustainability means striving to create shared value with our stakeholders – empowering people to achieve more, contributing to progress in our communities and protecting the environment we all share. Under the guidance of the Board and its Sustainability and Public Policy Committee, we aspire to be an ever-better company as we contribute to an evolving energy industry. This objective drives us to strengthen the resiliency of our business, innovate for the future and embed sustainability in all we do. | ||

| STRENGTHEN RESILIENCY | ||||||||

| Strengthening our business for today while building resilience for the future | ||||||||

| Robust Suite of Targets and Accomplishments | Recognized by U.S. EPA as ENERGY STAR® Partner of the Year – Sustained Excellence for fifth consecutive year | |||||||||||||

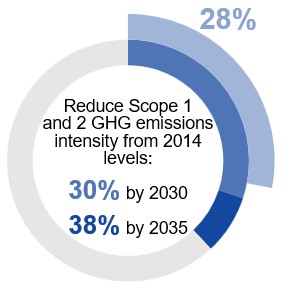

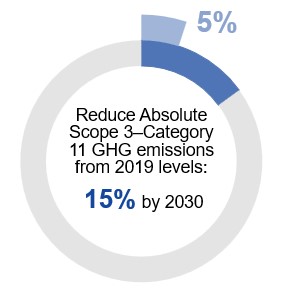

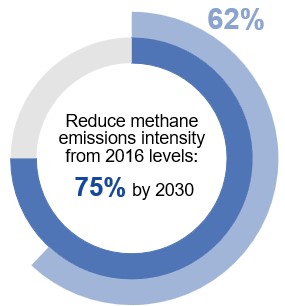

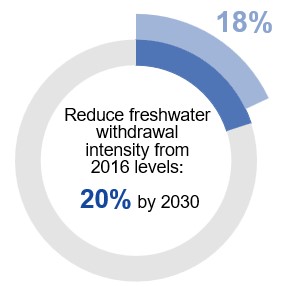

•Reduced our Scope 1 and 2 GHG emissions intensity for the tenth consecutive year* and, given our significant progress toward our 2030 target, added a new 2035 reduction target •Progressed toward our 2030 methane emissions intensity reduction target •Advanced progress on our 2030 freshwater withdrawal intensity reduction target •Progressed on our pipeline right-of-way biodiversity target | ||||||||||||||

•Our refineries have earned more ENERGY STAR® certifications for energy efficiency than all other refineries in the U.S. combined •MPLX Bluestone natural gas plant became the first facility in the natural gas processing sector to achieve the EPA’s ENERGY STAR® Challenge for Industry | ||||||||||||||

| Diversified Portfolio | ||||||||||||||

•Largest natural gas processor in the U.S., facilitating over 270 million tonnes of CO2e reductions per year from coal-to-gas switching within the power sector* | ||||||||||||||

* See our 2024 Perspectives on Climate-Related Scenarios report on our website for additional information on how we calculate GHG intensity and CO2e reductions | ||||||||||||||

| INNOVATE FOR THE FUTURE | ||||||||

| Investing in renewables and other lower-carbon technologies | ||||||||

| Renewable Fuels | Martinez, California Renewable Fuels Facility | Dickinson, North Dakota Renewable Diesel Facility | LF Bioenergy | |||||||||||||||||||||||||||||

| Producing a renewable diesel with ∼50% lower carbon intensity | Investing in LF Bioenergy to produce renewable natural gas (RNG) from dairy operations | ||||||||||||||||||||||||||||||

730 million gallons/year capacity Among the largest renewable diesel facilities in the world | 184 million gallons/year capacity Processing diversified feedstock slate | |||||||||||||||||||||||||||||||

| EMBED SUSTAINABILITY | ||||||||

| Integrating sustainability in our decision-making and in our engagement with employees and our many stakeholders | ||||||||

| Promoting a Culture of Safety | Engaging Our Stakeholders and Communities | ||||||||||

•Safety is a core value and our number-one priority •Strong safety management systems and compliance programs •Four MPC refineries recognized by American Fuel & Petrochemical Manufacturers (AFPM) Safety Awards for top safety performance and innovation •Garyville refinery achieved 30 years as an OSHA Voluntary Protection Program (VPP) Star site - the longest duration for any petroleum refinery | •Comprehensive approach to stakeholder engagement across the Company focused on building relationships and engaging in open dialogue •Robust engagement with tribal stakeholders in our operational footprint •Company matching gifts program supports employee giving and volunteering in communities •Regular dialogue with investor stewardship teams; reporting and disclosures informed by TCFD, SASB, CDP and GRI standards •JUST 100 Recognized as one of America’s most just companies by JUST Capital | ||||||||||

| Building an Engaged and Energized Workforce | |||||||||||

•Committed to our core values •We offer competitive compensation and benefits and extensive professional development opportunities | |||||||||||

| 6 | Marathon Petroleum Corporation | |||||||

| Executive Compensation Highlights | |||||||||||

| Leading Executive Compensation Practices | |||||||||||

| Our executive compensation program demonstrates our commitment to sound compensation and governance practices, promotes the objectives in our guiding principles and serves our shareholders’ long-term interests. | |||||||||||

| ü | Majority of total target compensation is performance-based | ü | Annual compensation risk assessment overseen by Compensation and Organization Development Committee | ||||||||

| ü | Performance measures align with shareholder interests | ||||||||||

| ü | Significant stock ownership requirements | ü | No guaranteed minimum bonuses | ||||||||

| ü | Performance metrics achievement capped at 200% of target | ü | No excise tax gross-ups | ||||||||

| ü | Clawback provisions for both long-term and short-term incentive awards | ü | No tax gross-ups on perquisites (other than for relocation reimbursements in limited circumstances) | ||||||||

| ü | “Double trigger” LTI vesting in a change of control | ü | No dividend equivalents paid on unvested awards | ||||||||

| ü | Executive and employee compensation tied to financial and non-financial performance | ü | Policy prohibiting executives from hedging or pledging our securities | ||||||||

| ü | Limited perquisites and personal benefits | ü | Discontinued grants of stock options | ||||||||

| Our Compensation Program Supports Our Business Strategy and Culture | ||

| Executive Compensation Guiding Principles | ||

| We believe our executive compensation program plays a critical role in maximizing long-term value for our shareholders, employees and other stakeholders. Our executive compensation guiding principles are embodied in our executive compensation program and policies, which are designed to: | ||

| v | Attract, retain, motivate and reward the highest-quality executive team by providing market-competitive compensation. | ||||

| v | Be simple and transparent so they can be clearly communicated both internally and externally. | ||||

| v | Create direct alignment between executive pay and the creation of shareholder value over time. | ||||

| v | Reward for execution of our business strategy and desired culture. | ||||

| v | Differentiate pay on the basis of performance, experience and skill set. | ||||

| 2024 Target Compensation Mix | ||

| The Compensation and Organization Development Committee believes using a mix of cash and equity compensation encourages and motivates our NEOs to achieve both our short-term and long-term business objectives. Consistent with our guiding principles that executive compensation should reward performance and be directly aligned with creating long-term value for our shareholders, a substantial majority of our NEOs’ compensation is at-risk and based on performance measures tied to our business strategy and culture. | ||

CEO Mannen* | Base Salary | ACB | MPC PSUs | MPC RSUs | MPLX Phantom Units | ||||||||||||

| 9% | 15% | 46% | 15% | 15% | |||||||||||||

| 61% Performance-Based | 30% Time-Based | ||||||||||||||||

| 91% At-Risk | |||||||||||||||||

OTHER NEOs Average** | Base Salary | ACB | MPC PSUs | MPC RSUs | MPLX Phantom Units | ||||||||||||

| 19% | 18% | 38% | 12.5% | 12.5% | |||||||||||||

| 56% Performance-Based | 25% Time-Based | ||||||||||||||||

| 81% At-Risk | |||||||||||||||||

| * | Ms. Mannen’s compensation has been annualized to reflect her total target compensation had she served as President and CEO for the entire year. | |||||||

| ** | Excludes Mr. Hennigan because his compensation as Executive Chairman differs materially from compensation for the other NEOs. | |||||||

| 2025 Proxy Statement | 7 | |||||||

| CORPORATE GOVERNANCE | ||

| Proposal 1. Election of Directors | ||

| ü | The Board of Directors recommends you vote FOR each of the following Class II director nominees: | |||||||||||||

| Evan Bayh | Jeffrey C. Campbell | Kimberly N. Ellison-Taylor | Kim K.W. Rucker | |||||||||||

The Board of Directors is divided into three classes of directors, with one class elected each year for a three-year term. The current members of Class II, which is due to stand for election at the 2025 Annual Meeting, are Messrs. Bayh, Bunch and Galante and Mses. Ellison-Taylor and Rucker. Messrs. Bunch and Galante are not standing for reelection as they have reached our mandatory retirement age for directors. Mr. Campbell, who was elected to the Board as a member of Class I in November 2024, has been nominated for election at the Annual Meeting as a Class II director to maintain the classes as equal in size as practicable. Assuming all director nominees are elected at the Annual Meeting, the Board expects to set the current number of directors at 12, with four directors in each class. | ||

As informed by our individual director evaluation process discussed further on page 22, our Board recommends that shareholders vote FOR the election to the Board of each Class II director nominee. We expect each nominee will be able to serve if elected. Any director vacancy may be filled by a majority vote of the remaining directors. Any director elected in this manner would hold office until expiration of the term of the class to which he or she has been elected. | ||

| BOARD SKILLS, EXPERTISE AND DEMOGRAPHICS* |  |  |  |  |  |  |  |  |  |  |  |  | ||||||||||||||||||||||||||||||||||||||||||||

MPC Board Tenure (years at April 30, 2025) | 9 | 5 | 5 | 4 | 14 | <1 | 1 | 7 | 1 | 1 | 8 | 14 | 5.7 Years Average Tenure | |||||||||||||||||||||||||||||||||||||||||||

| Director Independence | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü | 83% Independent | |||||||||||||||||||||||||||||||||||||||||||||

| Key Skills and Expertise | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Senior Leadership | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü | 12/12 | |||||||||||||||||||||||||||||||||||||||||||

| Public Company CEO | ü | ü | ü | ü | ü | ü | ü | 7/12 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Risk Management | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü | 12/12 | |||||||||||||||||||||||||||||||||||||||||||

| Corporate Governance | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü | 12/12 | |||||||||||||||||||||||||||||||||||||||||||

| Finance & Accounting | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü | 12/12 | |||||||||||||||||||||||||||||||||||||||||||

| Energy Industry | ü | ü | ü | ü | ü | ü | ü | ü | 8/12 | |||||||||||||||||||||||||||||||||||||||||||||||

| International Business | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü | 10/12 | |||||||||||||||||||||||||||||||||||||||||||||

| Sustainability | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü | 12/12 | |||||||||||||||||||||||||||||||||||||||||||

| Environment | ü | ü | ü | ü | 4/12 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Government, Legal & Regulatory | ü | ü | ü | ü | ü | 5/12 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Technology & Cybersecurity | ü | ü | ü | ü | ü | ü | 6/12 | |||||||||||||||||||||||||||||||||||||||||||||||||

Age (at April 30, 2025) | 71 | 54 | 65 | 73 | 69 | 64 | 55 | 58 | 62 | 59 | 66 | 70 | 63.8 Years Average Age | |||||||||||||||||||||||||||||||||||||||||||

| Gender | Male | ¡ | ¡ | ¡ | ¡ | ¡ | ¡ | ¡ | ¡ | 67% | ||||||||||||||||||||||||||||||||||||||||||||||

| Female | ¡ | ¡ | ¡ | ¡ | 33% | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Race, Ethnicity and Native American Tribal Membership | ¡ | ¡ | ¡ | ¡ | 33% | |||||||||||||||||||||||||||||||||||||||||||||||||||

| CLASS I | CLASS II | CLASS III | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| * | Reflects expected composition of the Board following the Annual Meeting, assuming all Class II director nominees are elected. See “Director Skills, Experience and Expertise” on page 17 for more information on each key skill and how it supports our company strategy. | |||||||

| 8 | Marathon Petroleum Corporation | |||||||

| Evan Bayh | CLASS II DIRECTOR NOMINEE | ||||||||||||||||||||||

| Senior Advisor, Apollo Global Management | Term expires 2025 | ||||||||||||||||||||||

| Key Skills and Expertise | ||||||||||||||||||||||

| ü | Senior leadership | ü | Finance & accounting | ü | Government, legal & regulatory | ||||||||||||||||||

| ü | Risk management | ü | International business | ü | Technology & cybersecurity | ||||||||||||||||||

| ü | Corporate governance | ü | Sustainability | ||||||||||||||||||||

| Career Highlights: | |||||||||||||||||||||||

| v | Senior Advisor, Apollo Global Management, a private equity firm (since 2011) | ||||||||||||||||||||||

Independent Director Age: 69 Director since: 2011 MPC Board Committees: Corporate Governance and Nominating Sustainability and Public Policy, Chair | v | U.S. Senator (1999-2011); served on Senate committees including Banking, Housing and Urban Affairs; Armed Services; Energy and Natural Resources; Select Committee on Intelligence; Small Business and Entrepreneurship; Special Committee on Aging; chaired the International Trade and Finance Subcommittee | |||||||||||||||||||||

| v | Governor of the State of Indiana (1989-1997); Secretary of State (1986-1989) | ||||||||||||||||||||||

| v | Senior Advisor and Of Counsel, Cozen O’Connor Public Strategies, a law firm (2018-2019) | ||||||||||||||||||||||

| v | Partner, McGuireWoods LLP, a global diversified law firm (2011-2018) | ||||||||||||||||||||||

Other Public Company Directorships (current): Berry Global Group, Inc. (since 2011); Fifth Third Bancorp (since 2011); RLJ Lodging Trust (since 2011) | |||||||||||||||||||||||

Education: B.S., Business Economics, Indiana University; J.D., University of Virginia School of Law | |||||||||||||||||||||||

Other Professional Experience and Community Involvement: | |||||||||||||||||||||||

| Treasurer, Evan and Susan Bayh Foundation | |||||||||||||||||||||||

| Jeffrey C. Campbell | CLASS II DIRECTOR NOMINEE | ||||||||||||||||||||||

| Former Vice Chairman and CFO, American Express Company | Term expires 2025 | ||||||||||||||||||||||

| Key Skills and Expertise | ||||||||||||||||||||||

| ü | Senior leadership | ü | Finance & accounting | ü | Environment | ||||||||||||||||||

| ü | Risk management | ü | International business | ü | Technology & cybersecurity | ||||||||||||||||||

| ü | Corporate governance | ü | Sustainability | ||||||||||||||||||||

| Career Highlights: | |||||||||||||||||||||||

| v | Vice Chairman (2023-2024), Vice Chairman and CFO (2021-2023), Executive Vice President and CFO (2013-2021), and Executive Vice President, Finance (2013) of American Express Company, a financial services company | ||||||||||||||||||||||

Independent Director Age: 64 Director since: 2024 MPC Board Committees: Audit, Chair(1) Compensation and Organization Development | |||||||||||||||||||||||

| v | Executive Vice President and CFO, McKesson Corporation (2003-2013) | ||||||||||||||||||||||

| v | Senior Vice President, Finance and CFO (2002-2003), Vice President, Europe (2000-2002), and Vice President, Corporate Development and Treasurer (1998-2000) of AMR Corporation, and in various positions of increasing responsibility at AMR Corporation since 1990 | ||||||||||||||||||||||

Other Public Company Directorships (current): Aon plc (since 2018); Hexcel Corporation (since 2003), Lead Director (since 2018) | |||||||||||||||||||||||

Education: A.B., Economics, Stanford University; M.B.A., Harvard University | |||||||||||||||||||||||

(1) Elected to serve as Chair, replacing the retiring Chair, immediately following the Annual Meeting. | |||||||||||||||||||||||

Other Professional Experience and Community Involvement: | |||||||||||||||||||||||

| Member, Board of Directors, The Julliard School | |||||||||||||||||||||||

| 2025 Proxy Statement | 9 | |||||||

| Kimberly N. Ellison-Taylor | CLASS II DIRECTOR NOMINEE | ||||||||||||||||||||||

| Former Executive Director, Finance Thought Leadership, Oracle Corporation | Term expires 2025 | ||||||||||||||||||||||

| Key Skills and Expertise | ||||||||||||||||||||||

| ü | Senior leadership | ü | Finance & accounting | ü | Technology & cybersecurity | ||||||||||||||||||

| ü | Risk management | ü | International business | ||||||||||||||||||||

| ü | Corporate governance | ü | Sustainability | ||||||||||||||||||||

| Career Highlights: | |||||||||||||||||||||||

| v | Founder and CEO of KET Solutions, LLC, a consulting firm (since 2021) | ||||||||||||||||||||||

Independent Director Age: 55 Director since: 2024 MPC Board Committees: Audit Corporate Governance and Nominating | v | Executive Director, Finance Thought Leadership (2019), Global Strategy Leader, Cloud Business Group (2018-2019), Global Strategy Director, Financial Services Industry Group (2015-2018), and Executive Director and Global Leader for Health, Human Services and Labor Solutions Group (2004-2015) of Oracle Corporation | |||||||||||||||||||||

| v | Chief Information & Technology Officer, Prince George’s County, Maryland (2001-2004) | ||||||||||||||||||||||

Other Public Company Directorships (current): U.S. Bancorp (since 2021) | |||||||||||||||||||||||

Other Public Company Directorships (within past five years): EverCommerce Inc. (2021-2024) | |||||||||||||||||||||||

Education: B.A., Information Systems Management, University of Maryland; M.B.A., Business Administration and Decision Science, Loyola University Maryland; M.S., Information Technology Management, Carnegie Mellon University | |||||||||||||||||||||||

Other Professional Experience and Community Involvement: | |||||||||||||||||||||||

| Member, Board of Directors, Mutual of Omaha Insurance Corporation (since 2020) | |||||||||||||||||||||||

| Adjunct Professor, Heinz College of Information Systems and Public Policy, Carnegie Mellon University | |||||||||||||||||||||||

| Former Chairman, American Institute of CPAs (AICPA) | |||||||||||||||||||||||

| Certified public accountant; certified internal auditor; certified information systems auditor | |||||||||||||||||||||||

| Kim K.W. Rucker | CLASS II DIRECTOR NOMINEE | ||||||||||||||||||||||

| Former Executive Vice President, General Counsel and Secretary, Andeavor | Term expires 2025 | ||||||||||||||||||||||

| Key Skills and Expertise | ||||||||||||||||||||||

| ü | Senior leadership | ü | Finance & accounting | ü | Sustainability | ||||||||||||||||||

| ü | Risk management | ü | Energy industry | ü | Government, legal & regulatory | ||||||||||||||||||

| ü | Corporate governance | ü | International business | ü | Technology & cybersecurity | ||||||||||||||||||

| Career Highlights: | |||||||||||||||||||||||

| v | Executive Vice President, General Counsel and Secretary of Andeavor (2016-2018); Executive Vice President and General Counsel of Tesoro Logistics GP, LLC (2016-2018) | ||||||||||||||||||||||

Independent Director Age: 58 Director since: 2018 MPC Board Committees: Audit Compensation and Organization Development, Chair(1) Sustainability and Public Policy(2) | |||||||||||||||||||||||

| v | Executive Vice President, Corporate & Legal Affairs, General Counsel and Corporate Secretary of Kraft Foods Group, Inc., a grocery manufacturing and processing company (2012-2015) | ||||||||||||||||||||||

| v | Senior Vice President, General Counsel and Chief Compliance Officer (2008-2012) and Corporate Secretary (2009-2012) of Avon Products, Inc. | ||||||||||||||||||||||

| v | Former Partner in the Corporate & Securities group at Sidley Austin LLP, a law firm | ||||||||||||||||||||||

Other Public Company Directorships (current): Celanese Corporation (since 2018); HP Inc. (since 2021); GE Vernova (since 2024) | |||||||||||||||||||||||

Other Public Company Directorships (within past five years): Lennox International Inc. (2015-2024) | |||||||||||||||||||||||

Education: B.B.A., Economics, University of Iowa; J.D., Harvard Law School; M.P.P., John F. Kennedy School of Government at Harvard University | |||||||||||||||||||||||

(1) Elected to serve as Chair, replacing the retiring Chair, immediately following the Annual Meeting. (2) Will cease service on this committee effective April 30, 2025. | |||||||||||||||||||||||

Other Professional Experience and Community Involvement: | |||||||||||||||||||||||

| Member, Board of Trustees, Johns Hopkins Medicine | |||||||||||||||||||||||

| Member, Board of Directors, Haven for Hope | |||||||||||||||||||||||

| 10 | Marathon Petroleum Corporation | |||||||

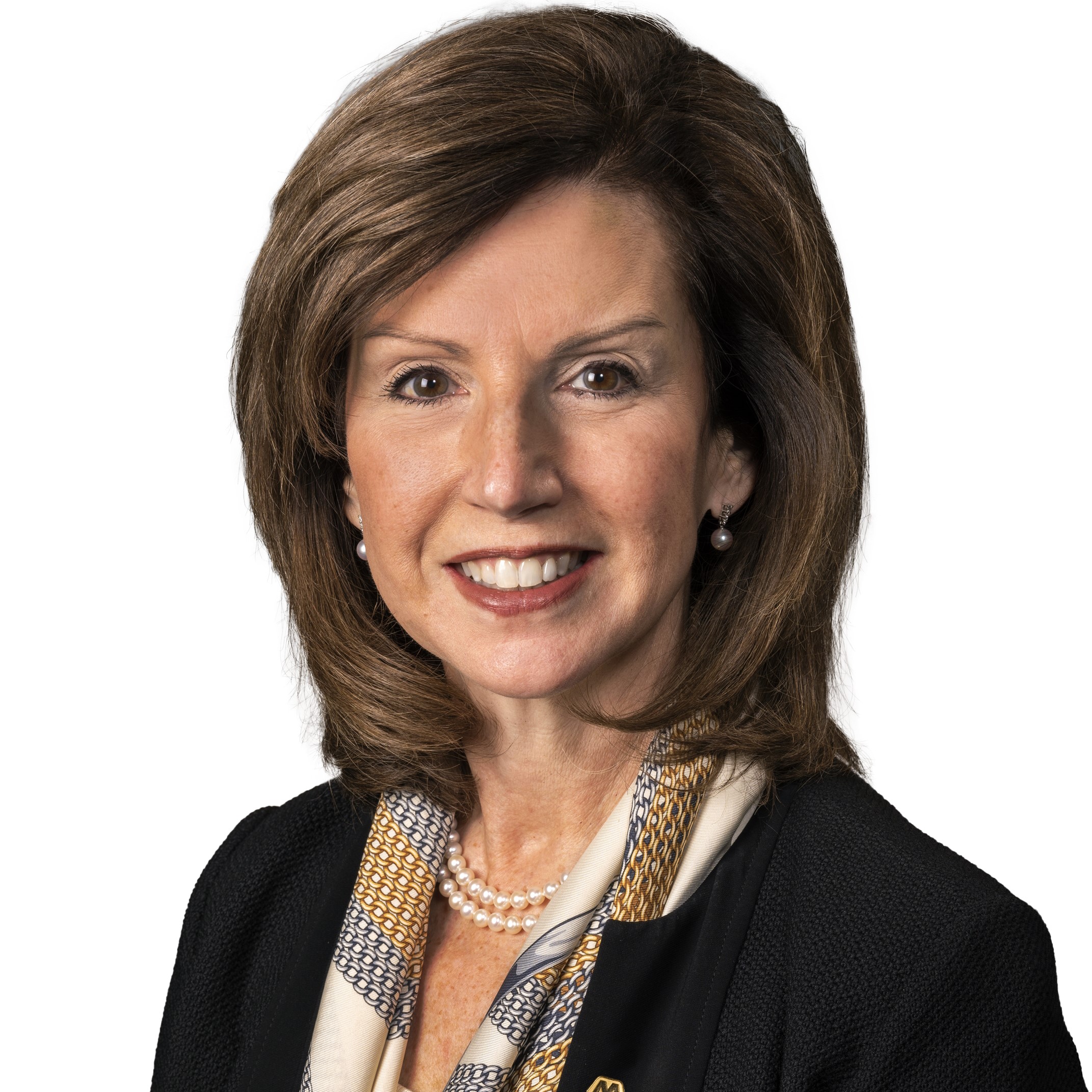

| Maryann T. Mannen | CLASS III DIRECTOR | ||||||||||||||||||||||

| President and CEO, Marathon Petroleum Corporation | Term expires 2026 | ||||||||||||||||||||||

| Key Skills and Expertise | ||||||||||||||||||||||

| ü | Senior leadership | ü | Corporate governance | ü | International business | ||||||||||||||||||

| ü | Public company CEO | ü | Finance & accounting | ü | Sustainability | ||||||||||||||||||

| ü | Risk management | ü | Energy industry | ||||||||||||||||||||

| Career Highlights: | |||||||||||||||||||||||

| v | President, CEO and a director (since August 2024), President (January-July 2024) and Executive Vice President and Chief Financial Officer of MPC (2021-2023); President and CEO (since August 2024) and director (since 2021) of MPLX | ||||||||||||||||||||||

Executive Director Age: 62 Director since: 2024 MPC Board Committees: Sustainability and Public Policy | |||||||||||||||||||||||

| v | Executive Vice President and CFO (2017-2020) of TechnipFMC (a successor to FMC Technologies, Inc.), an engineering services and energy technology company; Executive Vice President and CFO (2014-2017) and Senior Vice President and CFO (2011-2017), and in various positions of increasing responsibility at FMC Technologies since 1986 | ||||||||||||||||||||||

Other Public Company Directorships (current): MPLX GP LLC* (since 2021); Owens Corning (since 2014) | |||||||||||||||||||||||

Education: B.S.B.A., Accounting, Rider University; M.B.A., Rider University | |||||||||||||||||||||||

Other Professional Experience and Community Involvement: | |||||||||||||||||||||||

| Executive Committee member, American Petroleum Institute (API) | |||||||||||||||||||||||

| Executive Committee member, American Fuel and Petrochemical Manufacturers (AFPM) | |||||||||||||||||||||||

| Executive Committee member, Ohio Business Roundtable; member, The Business Council | |||||||||||||||||||||||

| Secretary, Executive Committee and Finance Committee member, Cynthia Woods Mitchell Pavilion Board of Directors | |||||||||||||||||||||||

| Eileen P. Paterson | CLASS III DIRECTOR | ||||||||||||||||||||||

| Former CEO and President, Aerojet Rocketdyne Holdings, Inc. | Term expires 2026 | ||||||||||||||||||||||

| Key Skills and Expertise | ||||||||||||||||||||||

| ü | Senior leadership | ü | Corporate governance | ü | Sustainability | ||||||||||||||||||

| ü | Public company CEO | ü | Finance & accounting | ü | Government, legal & regulatory | ||||||||||||||||||

| ü | Risk management | ü | International business | ||||||||||||||||||||

| Career Highlights: | |||||||||||||||||||||||

| v | CEO and President (2015-2023) and Chief Operating Officer (2015) of Aerojet Rocketdyne Holdings, Inc., an aerospace company | ||||||||||||||||||||||

Independent Director Age: 59 Director since: 2024 MPC Board Committees: Compensation and Organization Development Sustainability and Public Policy | |||||||||||||||||||||||

| v | Various roles in senior management at United Technologies Corporation (2003-2015), including as Division President, Pratt & Whitney AeroPower (2013-2015); Vice President, Operations (2009-2013); and Vice President, Operations & Quality, Environmental, Health & Safety and Achieving Competitive Excellence, Carrier Corp. (2006-2009) | ||||||||||||||||||||||

| v | Seven years active duty in the U.S. Army, including as Aviator and Airfield Commander of Davison Army Airfield, Fort Belvoir, Virginia | ||||||||||||||||||||||

Other Public Company Directorships (current): Constellation Energy Corporation (since 2024); Woodward, Inc. (since 2017) | |||||||||||||||||||||||

Other Public Company Directorships (within past five years): Aerojet Rocketdyne Holdings, Inc. (2015-2023) | |||||||||||||||||||||||

Education: B.A., International Politics, College of New Rochelle; M.B.A., Butler University | |||||||||||||||||||||||

Other Professional Experience and Community Involvement: | |||||||||||||||||||||||

| Former member: National Board of Directors, Girl Scouts of the USA; Board of Governors, Aerospace Industries Association; National Space Council Users’ Advisory Group | |||||||||||||||||||||||

| * | Under our Corporate Governance Principles, due to their affiliate nature, concurrent service on the boards of MPC and MPLX GP LLC is counted as one public company board for purposes of assessing the level of public company board commitments. | ||||

| 2025 Proxy Statement | 11 | |||||||

| J. Michael Stice | CLASS III DIRECTOR | ||||||||||||||||||||||

| Professor, The University of Oklahoma | Term expires 2026 | ||||||||||||||||||||||

| Key Skills and Expertise | ||||||||||||||||||||||

| ü | Senior leadership | ü | Corporate governance | ü | International business | ||||||||||||||||||

| ü | Public company CEO | ü | Finance & accounting | ü | Sustainability | ||||||||||||||||||

| ü | Risk management | ü | Energy industry | ü | Environment | ||||||||||||||||||

| Career Highlights: | |||||||||||||||||||||||

| v | Dean, Mewbourne College of Earth & Energy at The University of Oklahoma (2015-2022) | ||||||||||||||||||||||

Independent Director Age: 66 Director since: 2017 MPC Board Committees: Audit(1) Corporate Governance and Nominating, Chair(2) Sustainability and Public Policy | v | CEO (2009-2014) and member of the board of directors (2012-2015) of Access Midstream Partners L.P., a publicly traded gathering and processing master limited partnership | |||||||||||||||||||||

| v | Nearly 30 years of service in positions of increasing responsibility at ConocoPhillips and its predecessor companies, including as President of ConocoPhillips Qatar (2003-2008) | ||||||||||||||||||||||

Other Public Company Directorships (current): Kosmos Energy Ltd. (since 2023); MPLX GP LLC* (since 2018) | |||||||||||||||||||||||

Other Public Company Directorships (within past five years): Spartan Acquisition Corp. II (2020-2021); Spartan Acquisition Corp. III (2021-2022); Spartan Energy Acquisition Corp. (2018-2020); U.S. Silica Holdings, Inc. (2013-2021) | |||||||||||||||||||||||

(1) Will cease service on this committee effective April 30, 2025. (2) Elected to serve as Chair, replacing the retiring Chair, immediately following the Annual Meeting. | Education: B.S., Chemical Engineering, The University of Oklahoma; M.S., Business, Stanford University; Ed.D, Organizational Leadership, The George Washington University | ||||||||||||||||||||||

Other Professional Experience and Community Involvement: | |||||||||||||||||||||||

| Member, Board of Advisors, Energy Institute, The University of Oklahoma | |||||||||||||||||||||||

| Co-leader, Oklahoma Solve Climate by 2030, Center for Environmental Policy at Bard College | |||||||||||||||||||||||

| John P. Surma | CLASS III DIRECTOR | ||||||||||||||||||||||

| Former Chairman and CEO, United States Steel Corporation | Term expires 2026 | ||||||||||||||||||||||

| Key Skills and Expertise | ||||||||||||||||||||||

| ü | Senior leadership | ü | Finance & accounting | ü | Sustainability | ||||||||||||||||||

| ü | Public company CEO | ü | Energy industry | ü | Environment | ||||||||||||||||||

| ü | Risk management | ü | International business | ü | Government, legal & regulatory | ||||||||||||||||||

| ü | Corporate governance | ||||||||||||||||||||||

| Career Highlights: | |||||||||||||||||||||||

Independent Lead Director Age: 70 Director since: 2011 MPC Board Committees: Audit(1) Corporate Governance and Nominating(1) | v | CEO (2004-2013) and Chairman (2006-2013), President and Chief Operating Officer (2003-2004), and Vice Chairman and CFO (2002-2003) of United States Steel Corporation | |||||||||||||||||||||

| v | Executive roles at Marathon Oil Corporation (1997-2001), including President, Speedway SuperAmerica LLC, and President, Marathon Ashland Petroleum | ||||||||||||||||||||||

| v | Price Waterhouse LLP (1976-1997), admitted to the partnership in 1987 | ||||||||||||||||||||||

Other Public Company Directorships (current): MPLX GP LLC* (since 2012); Public Service Enterprise Group Inc. (since 2019); Trane Technologies plc (since 2013) | |||||||||||||||||||||||

Other Public Company Directorships (within past five years): Concho Resources Inc. (2014-2020) | |||||||||||||||||||||||

Education: B.S., Accounting, Pennsylvania State University | |||||||||||||||||||||||

Other Professional Experience and Community Involvement: | |||||||||||||||||||||||

(1) Will join this committee effective April 30, 2025. | Chairperson, board of the University of Pittsburgh Medical Center | ||||||||||||||||||||||

| Former Chair, board of the Federal Reserve Bank of Cleveland | |||||||||||||||||||||||

| Former Vice Chairman, President’s Advisory Committee for Trade Policy and Negotiations | |||||||||||||||||||||||

| Former Chairman, board of the National Safety Council | |||||||||||||||||||||||

| * | Under our Corporate Governance Principles, due to their affiliate nature, concurrent service on the boards of MPC and MPLX GP LLC is counted as one public company board for purposes of assessing the level of public company board commitments. | ||||

| 12 | Marathon Petroleum Corporation | |||||||

| Abdulaziz F. Alkhayyal | CLASS I DIRECTOR | ||||||||||||||||||||||

| Former Senior Vice President, Industrial Relations, Saudi Aramco | Term expires 2027 | ||||||||||||||||||||||

| Key Skills and Expertise | ||||||||||||||||||||||

| ü | Senior leadership | ü | Finance & accounting | ü | Sustainability | ||||||||||||||||||

| ü | Risk management | ü | Energy industry | ||||||||||||||||||||

| ü | Corporate governance | ü | International business | ||||||||||||||||||||

| Career Highlights: | |||||||||||||||||||||||

| v | Senior Vice President of Industrial Relations (2007-2014), Senior Vice President of Refining, Marketing and International (2001-2007), Senior Vice President, International Operations (2000-2001) of Saudi Arabian Oil Company (Saudi Aramco) | ||||||||||||||||||||||

Independent Director Age: 71 Director since: 2016 MPC Board Committees: Audit(1) Compensation and Organization Development Sustainability and Public Policy | |||||||||||||||||||||||

| v | Thirty-three year career at Saudi Aramco, beginning in various field positions and progressing through management roles of increasing responsibility | ||||||||||||||||||||||

Other Public Company Directorships (current): Halliburton Company (since 2014); National Gas & Industrialization Company (since 2019) | |||||||||||||||||||||||

Education: B.S., Mechanical Engineering, University of California, Irvine; M.B.A., University of California, Irvine; Advanced Management Program, University of Pennsylvania | |||||||||||||||||||||||

Other Professional Experience and Community Involvement: | |||||||||||||||||||||||

| Director, Saudi Electricity Company (2018-2020) | |||||||||||||||||||||||

(1) Will cease service on this committee effective April 30, 2025. | Member, Board of Directors for the International Youth Foundation | ||||||||||||||||||||||

| Jonathan Z. Cohen | CLASS I DIRECTOR | ||||||||||||||||||||||

| Founder, CEO and President, Hepco Capital Management, LLC | Term expires 2027 | ||||||||||||||||||||||

| Key Skills and Expertise | ||||||||||||||||||||||

| ü | Senior leadership | ü | Corporate governance | ü | Sustainability | ||||||||||||||||||

| ü | Public company CEO | ü | Finance & accounting | ü | Government, legal & regulatory | ||||||||||||||||||

| ü | Risk management | ü | Energy industry | ü | Technology & cybersecurity | ||||||||||||||||||

| Career Highlights: | |||||||||||||||||||||||

| v | Founder, CEO and President of Hepco Capital Management, LLC, a private investment firm (since 2016) | ||||||||||||||||||||||

Independent Director Age: 54 Director since: 2019 MPC Board Committees: Audit Corporate Governance and Nominating | |||||||||||||||||||||||

| v | Co-Chairman (2019-2021) and CEO (2018-2019), Osprey Technology Acquisition Corp., the predecessor of BlackSky Technology, Inc., a provider of real-time geospatial intelligence | ||||||||||||||||||||||

| v | Chairman of the Board (2018-2020) and CEO (2018), Falcon Minerals Corporation, a mineral rights acquisition and management company; Co-founder and CEO of its predecessor, Osprey Energy Acquisition Corp. (2017-2018) | ||||||||||||||||||||||

| v | President and CEO (2004-2016), Resource America, Inc., an asset management company | ||||||||||||||||||||||

| v | Co-founder and various executive roles at Atlas Pipeline Partners, LP and Atlas Energy, Inc. | ||||||||||||||||||||||

Other Public Company Directorships (current): Crane Harbor Acquisition Corp. (since 2025) | |||||||||||||||||||||||

Other Public Company Directorships (within past five years): Falcon Minerals Corporation (2017-2020); Osprey Technology Acquisition Corp. (2019-2021) | |||||||||||||||||||||||

Education: B.A., University of Pennsylvania; J.D., American University Washington College of Law | |||||||||||||||||||||||

Other Professional Experience and Community Involvement: | |||||||||||||||||||||||

| Co-founder, Castine Capital Management, LLC (2003-2020) | |||||||||||||||||||||||

| Vice Chairman, Lincoln Center Theater | |||||||||||||||||||||||

| Trustee: East Harlem School; Arete Foundation; American School of Classical Studies in Athens, Greece | |||||||||||||||||||||||

| Member, Board of Advisors, College of Arts and Sciences, University of Pennsylvania | |||||||||||||||||||||||

| 2025 Proxy Statement | 13 | |||||||

| Michael J. Hennigan | CLASS I DIRECTOR | ||||||||||||||||||||||

| Executive Chairman, Marathon Petroleum Corporation | Term expires 2027 | ||||||||||||||||||||||

| Key Skills and Expertise | ||||||||||||||||||||||

| ü | Senior leadership | ü | Finance & accounting | ü | Sustainability | ||||||||||||||||||

| ü | Public company CEO | ü | Energy industry | ü | Environment | ||||||||||||||||||

| ü | Risk management | ü | International business | ü | Technology & cybersecurity | ||||||||||||||||||

| ü | Corporate governance | ||||||||||||||||||||||

| Career Highlights: | |||||||||||||||||||||||

Executive Chairman Age: 65 Director since: 2020 | v | Executive Chairman (since August 2024), CEO (2020-July 2024), President (2020-2023) and director (since 2020) of MPC; Chairman (since 2020), director (since 2017), CEO (2019-July 2024) and President (2019-2023) of MPLX | |||||||||||||||||||||

| v | President, Crude, NGL and Refined Products (2017), of the general partner of Energy Transfer Partners L.P., a natural gas and propane pipeline transport company | ||||||||||||||||||||||

| v | President and CEO (2012-2017), President and Chief Operating Officer (2010-2012) and Vice President, Business Development (2009-2010), of Sunoco Logistics Partners L.P., an energy service provider | ||||||||||||||||||||||

Other Public Company Directorships (current): MPLX GP LLC* (since 2017); Nutrien Ltd. (since 2022) | |||||||||||||||||||||||

Education: B.S., Chemical Engineering, Drexel University | |||||||||||||||||||||||

Other Professional Experience and Community Involvement: | |||||||||||||||||||||||

| Chair, Executive Committee, American Fuel & Petrochemical Manufacturers (AFPM) | |||||||||||||||||||||||

| Frank M. Semple | CLASS I DIRECTOR | ||||||||||||||||||||||

| Former Chairman, President and CEO, MarkWest Energy Partners, L.P. | Term expires 2027 | ||||||||||||||||||||||

| Key Skills and Expertise | ||||||||||||||||||||||

| ü | Senior leadership | ü | Corporate governance | ü | Sustainability | ||||||||||||||||||

| ü | Public company CEO | ü | Finance & accounting | ||||||||||||||||||||

| ü | Risk management | ü | Energy industry | ||||||||||||||||||||

| Career Highlights: | |||||||||||||||||||||||

| v | Vice Chairman (2015-2016) and director (since 2015) of MPLX following MPLX’s acquisition of MarkWest Energy Partners, L.P. (“MarkWest”) | ||||||||||||||||||||||

Independent Director Age: 73 Director since: 2021 (previous MPC Board member 2015-2018) MPC Board Committees: Audit Compensation and Organization Development | |||||||||||||||||||||||

| v | President and CEO (2003-2015) and Chairman (2008-2015) of MarkWest | ||||||||||||||||||||||

| v | Twenty-two years of service with The Williams Companies, Inc. and WilTel Communications, progressing through management roles of increasing responsibility | ||||||||||||||||||||||

Other Public Company Directorships (current): MPLX GP LLC* (since 2015) | |||||||||||||||||||||||

Other Public Company Directorships (within past five years): Tortoise Acquisition Corp. (2019-2020) | |||||||||||||||||||||||

Education: B.S., Mechanical Engineering, United States Naval Academy; Program for Management Development, Harvard Business School | |||||||||||||||||||||||

Other Professional Experience and Community Involvement: | |||||||||||||||||||||||

| Service in the United States Navy | |||||||||||||||||||||||

| Member, Board of Directors, Choctaw Global, LLC, an affiliate of the Choctaw Nation of Oklahoma | |||||||||||||||||||||||

| Member, Board of Directors, National Cowboy & Western Heritage Museum | |||||||||||||||||||||||

| Member, Board of Directors, Semple Family Museum of Native American Art, Southeastern Oklahoma State University | |||||||||||||||||||||||

| * | Under our Corporate Governance Principles, due to their affiliate nature, concurrent service on the boards of MPC and MPLX GP LLC is counted as one public company board for purposes of assessing the level of public company board commitments. | ||||

| 14 | Marathon Petroleum Corporation | |||||||

| Our Corporate Governance Framework | ||

| Core Governance Documents | ||

| Our Bylaws, Corporate Governance Principles and the charters of our Board committees together implement the governance philosophy we believe is best for MPC and our shareholders. They address, among other things, the primary roles, responsibilities and oversight functions of the Board and its standing committees; director independence; the process for director selection; director qualifications; outside commitments; Board, committee and individual director evaluations; director indemnification and shareholder rights; director compensation; and director retirement and resignation. | ||

| Codes of Business Conduct and Ethics | ||

| Our Code of Business Conduct, which applies to all of our directors, officers and employees, defines our expectations for ethical decision-making, accountability and responsibility. Our Code of Ethics for Senior Financial Officers, which is specifically applicable to our CEO, CFO, controller, treasurer and other leaders performing similar functions, affirms the principle that the honesty, integrity and sound judgment of our senior officers with responsibility for preparation and certification of our financial statements are essential to the proper functioning and success of our Company. These codes are available on our website as noted below, and printed copies are available upon request to our Chief Legal Officer and Corporate Secretary. We would post on our website any amendments to, or waivers from, either of these codes requiring disclosure under applicable rules within four business days following any such amendment or waiver. | ||

| Additional Governance Policies | ||

| Our Whistleblowing as to Accounting Matters Policy establishes procedures for the receipt, retention and treatment of any complaints we receive regarding accounting, internal accounting controls or auditing matters, and provides for the confidential, anonymous submission of concerns by our employees or others regarding questionable accounting or auditing matters. | ||

| Our Conflicts of Interest Policy provides guidance on recognizing and resolving real or apparent conflicts of interest. This policy acknowledges that business decisions on behalf of the Company must be made through the exercise of independent judgment in the Company’s best interests and not influenced by personal interests. | ||

| 8 | FIND MORE AT WWW.MARATHONPETROLEUM.COM | ||||||||||||||||

| The following are available under the “Investors” tab of our website, by selecting “Corporate Governance”: | |||||||||||||||||

| Ø | Bylaws | Ø | Code of Ethics for Senior Financial Officers | ||||||||||||||

| Ø | Corporate Governance Principles | Ø | Whistleblowing as to Accounting Matters Policy | ||||||||||||||

| Ø | Code of Business Conduct | Ø | Conflicts of Interest Policy | ||||||||||||||

| Our Board committee charters, and other information about our Board, are available under the “About” tab of our website by selecting “Board of Directors.” | |||||||||||||||||

| 2025 Proxy Statement | 15 | |||||||

| Board Composition and Director Selection | ||

| Our Corporate Governance Principles set forth the processes for director selection and the establishment of director qualifications. The Board has delegated the director recruitment process to the Corporate Governance and Nominating Committee with input from our Chairman and our Lead Director. | ||

| The Board believes that it, as a whole, should possess the combination of skills, professional experience, and range of backgrounds and viewpoints necessary to oversee our business and ensure an effective mix of perspectives. Accordingly, the Board and the Corporate Governance and Nominating Committee consider the qualifications of directors and director candidates individually and in the broader context of the Board’s overall composition and our current and future needs. In developing long-term plans for Board composition, the Corporate Governance and Nominating Committee takes into consideration the current strengths, skills and experience of members of the Board, their outside commitments, our director retirement policy and our strategic direction. | ||

| Director Nomination Process | ||

| The Corporate Governance and Nominating Committee assesses candidates for membership on the Board. The Committee may work with a third-party professional search firm to assist with identifying and evaluating director candidates and their credentials. The Committee has the authority to retain and terminate any such firm, including the authority to approve the firm’s fees and other retention terms. The Committee retained Spencer Stuart to assist in identifying and evaluating potential director candidates for its most recent director searches, which culminated in the appointments to the Board of Mses. Ellison-Taylor and Paterson, effective March 1, 2024, and Mr. Campbell, effective November 11, 2024. | ||

The Corporate Governance and Nominating Committee may also consider candidates recommended by shareholders. Shareholder candidates will be evaluated using the same criteria for director selection described above. See “Proxy Access” on page 18 for more information on the proxy access provision of our Bylaws and “When must shareholder proposals and director nominations be submitted for the 2026 annual meeting?” on page 80 for information on how to submit director nominations for our 2026 annual meeting in accordance with our Bylaws. | ||

| Board Refreshment and Director Tenure | ||

The Board is committed to striking a balance between retaining directors with deep knowledge of the Company and seeking fresh perspectives in its recruiting efforts. Our robust Board and individual director evaluation process, discussed on page 22, supports this objective. Further, our Corporate Governance Principles provide that directors may not stand for reelection once they reach age 73. The average tenure of our directors (following the Annual Meeting, assuming all director nominees are elected) is 5.7 years. | ||

| Director Independence | ||

| A director is considered independent if the Board affirmatively determines that he or she meets the independence standards in our Corporate Governance Principles, has no material relationship with us other than as a director and satisfies the independence requirements of the NYSE and applicable SEC rules. The Board determines director independence at least annually, considering all relevant facts and circumstances including, without limitation: | ||

•Transactions between MPC and the director, immediate family members of the director or organizations with which the director is affiliated; •Any service by the director on the board of a company with which we conduct business; •The frequency and dollar amounts associated with any such transactions; and •Whether any such transactions are at arm’s length in the ordinary course of business and on terms and conditions similar to those with unrelated parties. | ||

| In evaluating the above criteria, the Board specifically considered the Company’s ordinary course business transactions with the following companies at which certain of our directors also serve as director: Clean Harbors, Inc. (with respect to Mr. Galante), Constellation Energy Corporation (with respect to Ms. Paterson), GE Vernova (with respect to Ms. Rucker) and HP Inc. (with respect to Ms. Rucker). The Board concluded that these transactions did not affect any director’s independence. | ||

| 16 | Marathon Petroleum Corporation | |||||||

| Based on these criteria and considerations, the Board has determined that each of the following directors is independent: Mr. Alkhayyal; Mr. Bayh; Mr. Bunch; Mr. Campbell; Mr. Cohen; Ms. Ellison-Taylor; Mr. Galante; Ms. Paterson; Ms. Rucker; Mr. Semple; Mr. Stice; Mr. Surma and Ms. Tomasky. Neither Ms. Mannen, in her role as President and CEO, nor Mr. Hennigan, in his role as Executive Chairman, is independent. | ||

| Director Skills, Experience and Expertise | ||

| In evaluating director candidates and recommending incumbent directors for renomination, the Corporate Governance and Nominating Committee considers a wide range of backgrounds, critical skills, perspectives and expertise that it believes contribute to sound governance and effective oversight of our operations, risks and long-term strategy. All directors must possess integrity, good judgment, a strong work ethic, collaborative approach to engagement, record of public service and the ability to devote sufficient time to our affairs. In addition, the Committee has identified the following key skills and areas of expertise that should be represented on the Board.* | ||

| Senior Leadership | Experience in significant leadership positions provides the necessary skills to develop and oversee our strategy, drive long-term value, and motivate and retain individual leaders. | 12 |  | ||||||||||||||

| Directors | |||||||||||||||||

| Public Company CEO | Leadership experience as a chief executive officer of a large, public company provides a unique perspective and the ability to effectively advise and oversee the performance of our CEO. | 7 |  | ||||||||||||||

| Directors | |||||||||||||||||

| Risk Management | Experience in identifying, prioritizing and managing a broad spectrum of risks, including with respect to environmental, social and cybersecurity matters, provides skills critical to the Board’s oversight of our risk assessment and risk management programs. | 12 |  | ||||||||||||||

| Directors | |||||||||||||||||

| |||||||||||||||||

| Corporate Governance | Service on other public company boards and committees provides knowledge critical to the governance of our organization and insight into board management and oversight functions. | 12 | |||||||||||||||

| Directors | |||||||||||||||||

| Finance & Accounting | An understanding of finance, accounting and financial reporting processes provides the financial acumen necessary to understand and evaluate our capital structure and oversee our financial performance and long-term strategic planning. | 12 |  | ||||||||||||||

| Directors | |||||||||||||||||

| Energy Industry | Leadership experience in the energy industry, particularly in refining and logistics operations, provides practical understanding of our business and effective oversight in implementing our strategy. | 8 |  | ||||||||||||||

| Directors | |||||||||||||||||

| International Business | Experience with international trade, conducting operations outside the U.S. or leading a global business provides valuable business knowledge and perspective on our international operations and global commodity trade. | 10 |  | ||||||||||||||

| Directors | |||||||||||||||||

| Sustainability | Experience overseeing, operating or advising on matters of sustainable energy, corporate social responsibility or human capital management supports effective oversight over these matters and reinforces our commitment to creating shared value with our stakeholders. | 12 |  | ||||||||||||||

| Directors | |||||||||||||||||

| Environment | Expertise in environmental policy and emerging technologies strengthens oversight and helps ensure that our business strategies are aligned with the evolving energy landscape as we strive to meet the energy needs of today while investing in an energy-diverse future. | 4 |  | ||||||||||||||

| Directors | |||||||||||||||||

| Government, Legal & Regulatory | As we operate in a heavily regulated industry, expertise in government, legal or regulatory functions provides insight and perspective helpful to navigating these complex issues. | 5 |  | ||||||||||||||

| Directors | |||||||||||||||||

| Technology & Cybersecurity | Experience in leading innovative technological strategies and/or cybersecurity oversight provides knowledge critical to support digital transformation and management of cyber risks. | 6 |  | ||||||||||||||

| Directors | |||||||||||||||||

| * | Reflects expected composition of the Board following the Annual Meeting, assuming all Class II director nominees are elected. | ||||

Specific information about the key qualifications and experience of each director and director nominee can be found beginning on page 8 under “Proposal 1. Election of Directors.” | ||

| 2025 Proxy Statement | 17 | |||||||

| Majority Voting for Directors | ||

| Our Bylaws include a majority vote standard for uncontested director elections, which requires that a nominee for director in an uncontested election receive a majority of votes cast at a shareholder meeting in order to be elected to the Board. Any director nominee who does not receive a majority of the votes cast is required to submit an irrevocable resignation to the Corporate Governance and Nominating Committee, which will make a recommendation to the Board as to whether to accept or reject the resignation or take other action. The Board will, within 90 days following certification of the election results, publicly disclose its decision regarding the resignation and, if such resignation is rejected, the rationale behind the decision. | ||

| Proxy Access | ||