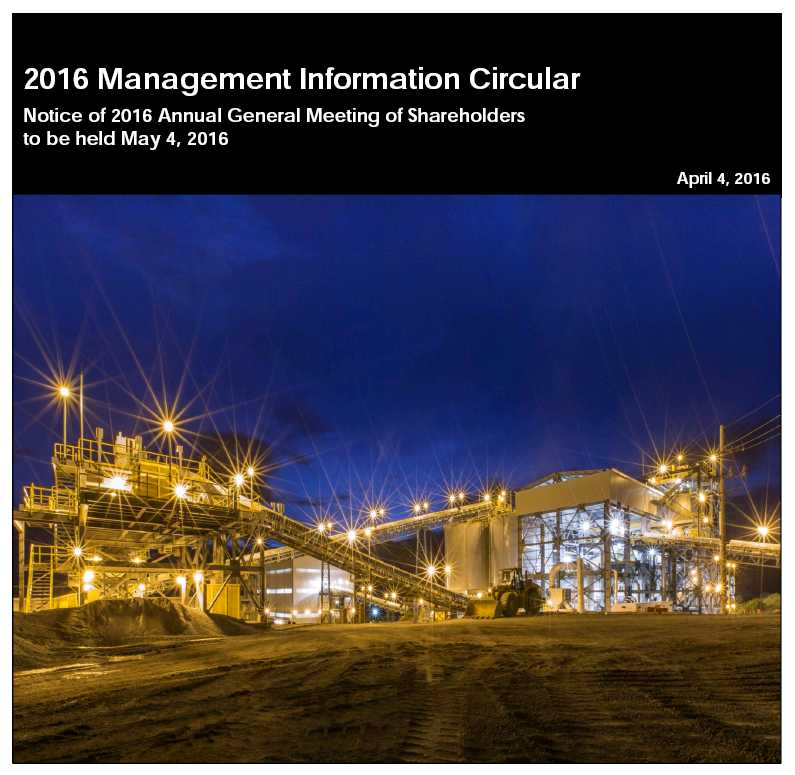

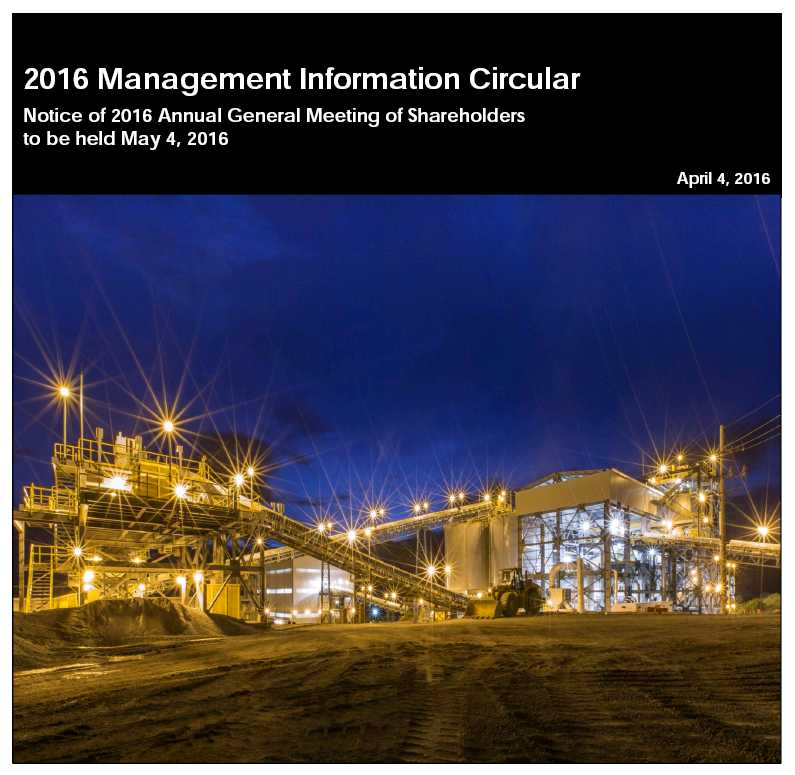

The mill facility at Tahoe’s Escobal mine located in San Rafael las Flores, Santa Rosa, Guatemala.

Best Sustainability, Ethics and Environmental Governance Program

|  |

The Canadian Society of Corporate Secretaries ("CSCS") handed out its third annual Excellence in Governance Awards at the opening gala of the CSCS' 17th Annual Corporate Governance Conference held at the Queen Elizabeth Hotel in Montréal, Québec, on August 16, 2015. Tahoe Resources was the Mid-cap winner of the award for best sustainability, ethics and environmental governance program. Canadian TopGun Company Designation On March 3, 2016, Brendan Wood International (BWI), an independent performance advisor, awarded Tahoe Resources the TopGun Company designation in the precious metals and mining sector. Less than ten percent of candidates were awarded TopGun Company status. “Exceptional Corporate Strategy and Leadership at the Board, CEO, Senior Management and Shareholder Reporting & Disclosure levels are essential components of a TopGun Company,” said Jordan Novak, Managing Director, BWI. |

Canadian TopGun Board of Directors Designation

BWI announced 2015/2016 TopGun Board of Directors of Canada on February 23, 2016, based on votes from equity investors, research analysts and sell-side professionals. BWI awarded Tahoe Resources’ Board of Directors TopGun status in the precious metals and mining sector. Of the 323 potential nominees in Canada, less than ten percent of potential candidates, a total of 27 Boards, were awarded the TopGun designation.

Canadian TopGun CEO Designation

On February 29, 2016, BWI awarded Tahoe Resources’ CEO, Kevin McArthur, TopGun status in the precious metals and mining sector. According to BWI, the TopGun CEO designation is an expression of the highest level of confidence in a CEO by major institutional investors who own or have the ability to own the stock in sizable stakes. Of the 323 potential nominees, less than ten percent of potential candidates, a total of 28 executives, were awarded TopGun status.

Most Transparent Guatemalan Extractives Company

Tahoe’s Guatemalan subsidiary, Minera San Rafael, was named Most Transparent Guatemalan Extractives Company by Accion Ciudadana, the Guatemalan Extractive Industries Transparency Initiative (EITI) chapter. EITI is an international benchmarking initiative which promotes the responsible management of resource revenues. Guatemala joined EITI in March 2014.

| 2016 Management Information Circular | i |

| NOTICE OF THE |

| 2016 ANNUAL GENERAL MEETING OF SHAREHOLDERS |

| Date | | Business of the 2016 Annual General Meeting of Shareholders |

| May 4, 2016 | | |

| | At the 2016 Annual General Meeting of Shareholders (the “Meeting”), the Shareholders will be asked to: |

| | | | |

| Time | | 1. | Receive the report of the Directors of Tahoe and Tahoe’s 2015 audited annual consolidated financial statements together with the report of the auditors on those audited annual consolidated financial statements; |

| 9:00 a.m. (Eastern Daylight Time) |

| |

| Location |

| Four Seasons Hotel Toronto | | | |

| 60 Yorkville Avenue | | 2. | Elect Directors for the ensuing year; |

| Toronto, Ontario | | | |

| M4W 0A4 | | 3. | Appoint the external auditors for the ensuing year; |

| Canada | | | |

| | | 4. | Advisory Vote on Say on Pay; |

| | | | |

| | 5. | Consider any permitted amendment to or variation of any matter identified in this Notice of Meeting; and |

| | | | |

| | 6. | Transact such other business as may properly come before the Meeting or any adjournment thereof. |

| | | | |

| How to Vote | | | |

Please act as soon as possible to vote your shares, even if you plan to attend the annual meeting in person.

Your broker will NOT be able to vote your shares with respect to the election of Directors and most of the other matters presented at the meeting unless you have given your broker specific instructions to do so. We strongly encourage you to vote.

Regardless of whether or not you plan to attend the Meeting in person, please complete, date and sign the enclosed form of proxy and deliver it by hand, mail or facsimile in accordance with the instructions set out in the form of proxy and in the Information Circular.

See "Voting Information" on page 8 for more information.

An Information Circular accompanies this Notice of Meeting and contains details of the matters to be considered at the Meeting.

By Order of the Board

/s/ C. Kevin McArthur

Executive Chair

April 4, 2016

| |

Your vote is important! |

|

Our 2016 Annual General Meeting of Shareholders will be held at 9:00 a.m. (Eastern Daylight Time)on Wednesday, May 4, 2016 at the Four Seasons Hotel Toronto, 60 Yorkville Ave, Toronto, Ontario, Canada. |

|

Whether or not you plan to attend the meeting, we encourage you to vote. Your participation as a Shareholderis very important to us. |

| |

| 2016 Management Information Circular | iii |

April 4, 2016

Dear Shareholder,

On behalf of Tahoe Resources Inc.’s Board of Directors, management and employees, we invite you to attend our 2016 Annual General Meeting of Shareholders, to be held at the Four Seasons Hotel Toronto, 60 Yorkville Avenue, Toronto, Ontario, Canada, on May 4, 2016 at 9:00 a.m. (Eastern Daylight Time).

The items of business to be considered at this meeting are described in the Notice of Annual General Meeting of Shareholders of Tahoe Resources Inc. and accompanying 2016 Management Information Circular (“Information Circular”). The contents and the sending of this Information Circular have been approved by the Board of Directors.

Your participation at this meeting is very important to us. We encourage you to vote, which is easily done by following the instructions enclosed with this Information Circular. Following the formal portion of the meeting, management will review the Company’s operational and financial performance during 2015 and provide an overview of our priorities in 2016 and beyond. You will also have an opportunity to ask questions and to meet your Directors and Executive team.

Many of our public documents, including our audited annual consolidated financial statements, are available in the Investor Relations section on our website located atwww.tahoeresources.com/investors. We encourage you to visit the same Investor Relations section for information about our Company, including news releases and investor presentations. To ensure you receive all the latest news on the Company, subscribe to our news feed via the contact tab in the same Investor Relations section of the Company’s website. Additional information relating to the Company is available on SEDAR atwww.sedar.com.

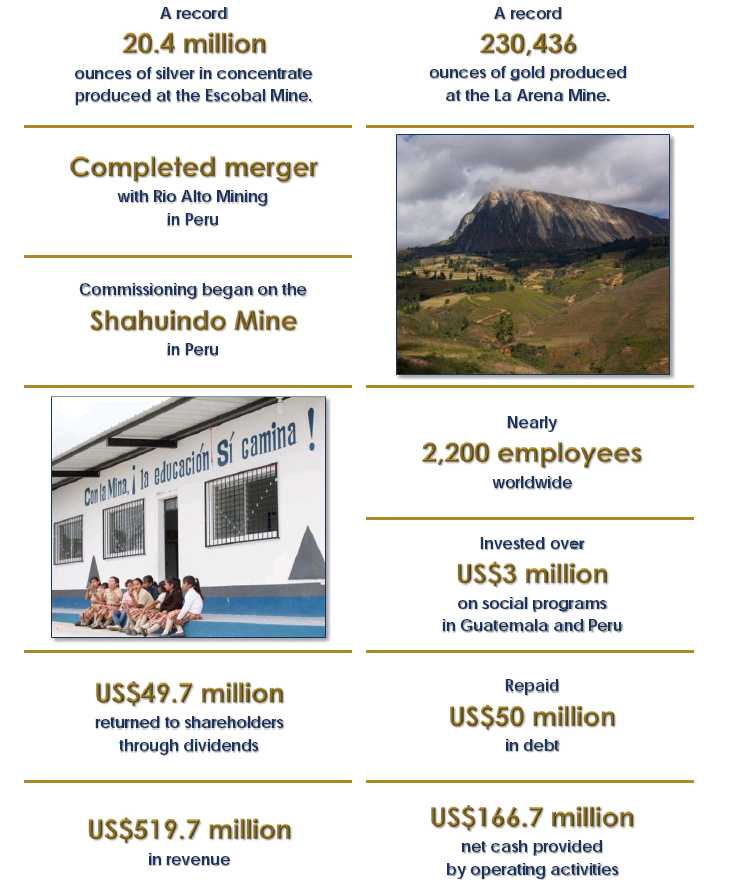

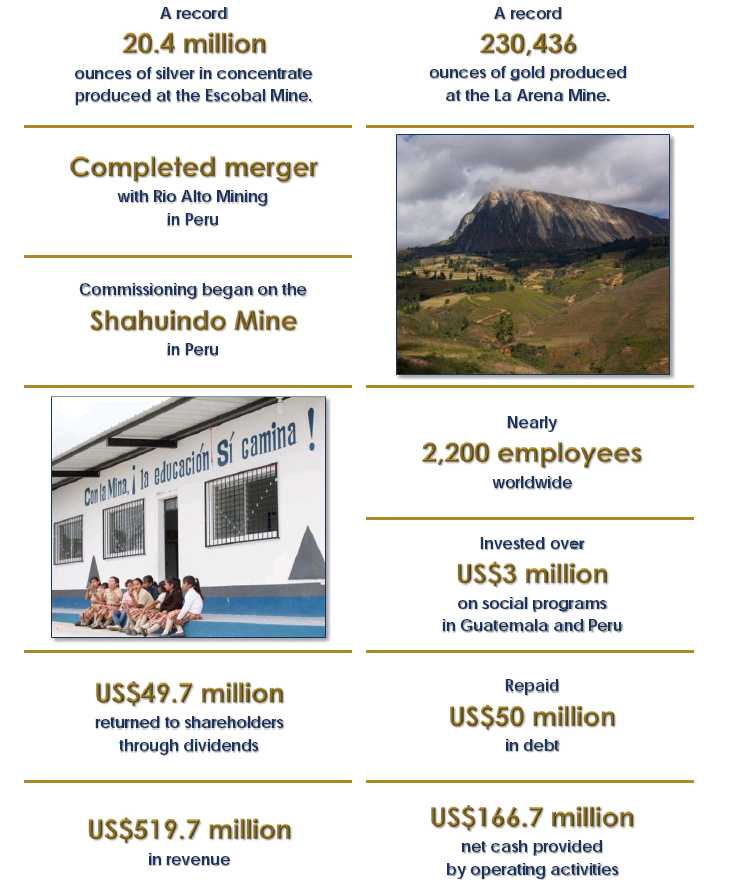

2015 was our second year of commercial production at our Escobal mine in Guatemala, and we had another record production year at 20.4 million silver ounces. We also concluded the merger with Rio Alto in April 2015, and the La Arena mine in Peru finished the year with its own production record of a little over 230,000 ounces of gold in 2015. We completed the Shahuindo construction and commenced commissioning of this new mine for start-up operations in mid-2016.

In Peru, we are working hard to develop a long-term vision for sustained production, including the intriguing sulfide project adjacent to the current oxide heap leach mine at La Arena and further exploration potential on a very large property package. With our technical and financial firepower, we expect to produce some exciting results in the near future.

We recently completed the merger with Lake Shore Gold Corp. and are excited about the addition of our Canadian operations.

As for me, I am overseeing strategic functions such as financing, business development and governance, and leading the Company to ensure it follows best practices in all facets of our business wherever possible. Ron Clayton, our President and Chief Operating Officer, leads our operations, financial reporting and project development. Along with a very experienced senior management team and a proven Board of Directors, we hold significant numbers of Tahoe shares and are aligned with you, the shareholders. Nobody is happy about the state of the precious metals market. Nor are we pleased with our share price performance in 2015. However, we have seen this before—we are convinced this is a cycle and that a truly healthy company like Tahoe will soon realize opportunities to grow the business and be the “go to” company of the future.

We will be working hard on our central pillar—responsibly delivering long-term shareholder value. We look forward to seeing you at the meeting.

Yours sincerely,

/s/ C. Kevin McArthur

Executive Chair

Tahoe Resources Inc.

| 2016 Management Information Circular | v |

How do we connect with shareholders? Here’s how.

| |

| 2016 MANAGEMENT INFORMATION CIRCULAR |

| |

You have received this Information Circular because you owned Tahoe Resources Inc. common shares (“Common Shares”) on April 4, 2016. Management is soliciting your proxy for our Meeting to be held on May 4, 2016 at the time and place and for the purposes set forth in the accompanying Notice of the Meeting.

As a Shareholder, you have the right to attend the Meeting on May 4, 2016 and to vote your shares in person or by proxy.

If any matters which are not now known should properly come before the Meeting, the accompanying form of proxy will be voted on such matters in accordance with the best judgment of the person voting it.

Additional information relating to Tahoe, including the audited annual consolidated financial statements of Tahoe for the financial year ended December 31, 2015, together with the report of the auditors thereon and management’s discussion and analysis of Tahoe’s financial condition and results of operations for the financial year ended December 31, 2015, which provide financial information concerning Tahoe, can be found on the Canadian Securities Administrators’ System for Electronic Document Analysis and Retrieval (“SEDAR”) atwww.sedar.com. Copies of those documents, as well as any additional copies of this Information Circular, are available upon written request to the Vice President of Corporate Affairs, General Counsel and Corporate Secretary, upon payment of a reasonable charge where applicable.

The Board of Directors (the “Board”) has approved the contents of this document and has authorized us to send it to you. We have also sent a copy to each of our Directors and to our external auditors.

In this document, “you” and “your” refer to the Shareholder. References to “the Company”, “Tahoe”, “we” and “our” refer to Tahoe Resources Inc. “Common Shares” means common shares without par value in the capital of the Company, “Beneficial Shareholders” means Shareholders who do not hold Common Shares in their own name and “Intermediaries” refers to brokers, investment firms, clearing houses and similar entities that own securities on behalf of Beneficial Shareholders. Unless otherwise indicated, all references to “$” or “dollars” in this Information Circular mean United States dollars. References to “CAD$” or “Canadian dollars” mean Canadian dollars. Your vote is important. This Information Circular describes what the Meeting will cover and how to vote. Please read it carefully and vote, either by completing the form included with this package or by attending the meeting in person. |

| 2016 Management Information Circular | 1 |

There are three matters of formal business anticipated to be put to Shareholders for voting at the Meeting.

We recommend that you elect the following nominees as Directors of the Company:

Name |

Age |

Year

Appointed | Committees |

Other Public Companies |

Securities

Held |

Audit

| Compensation

| Governance

| HSE&C

|

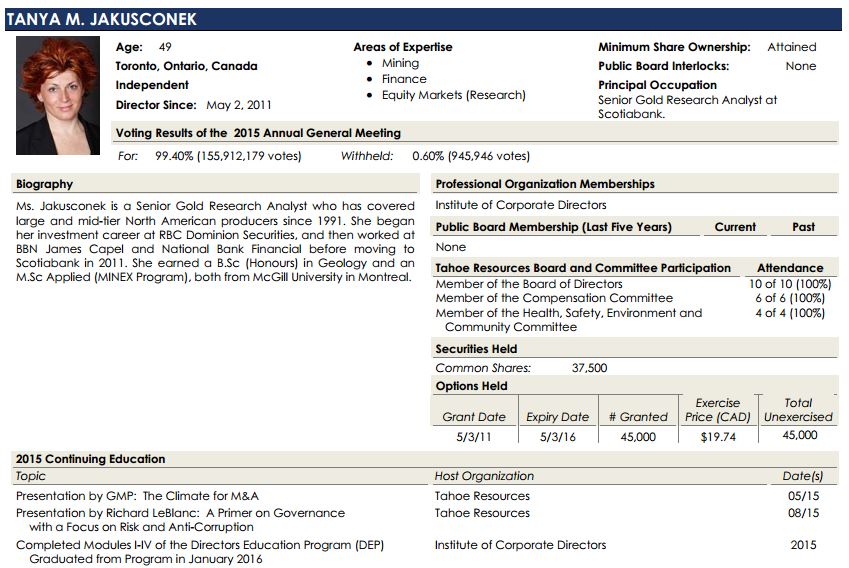

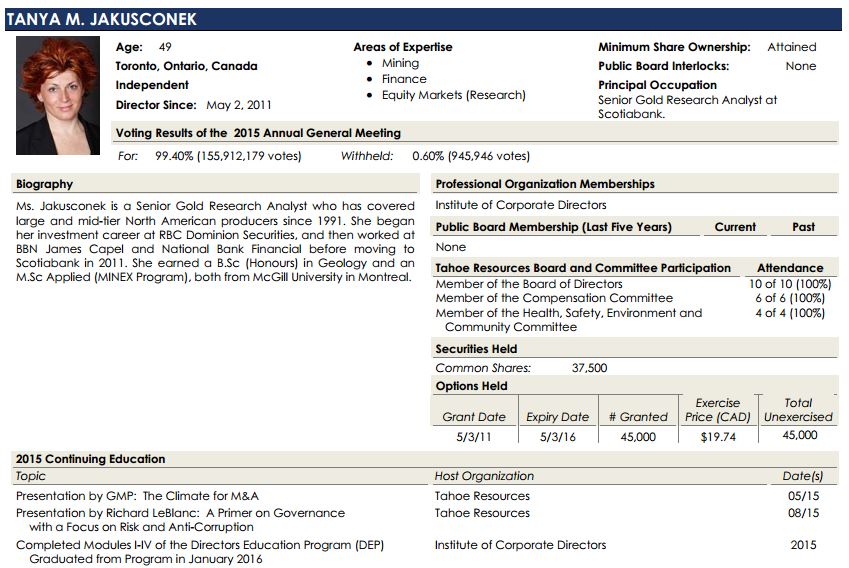

| Tanya M. Jakusconek | 49 | 2011 | | ✔ | | ✔ | | 37,500 |

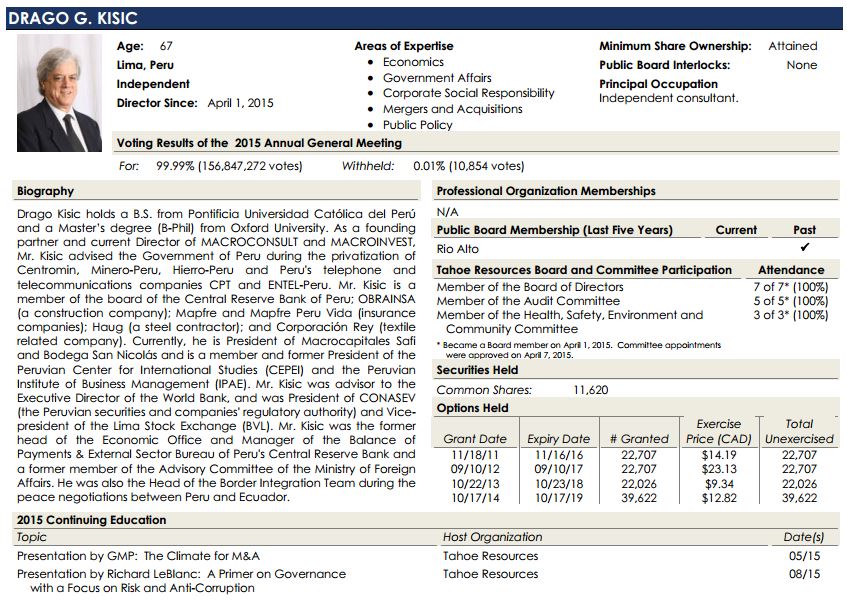

| Drago G. Kisic | 67 | 2015 | ✔ | | | ✔ | | 11,620 |

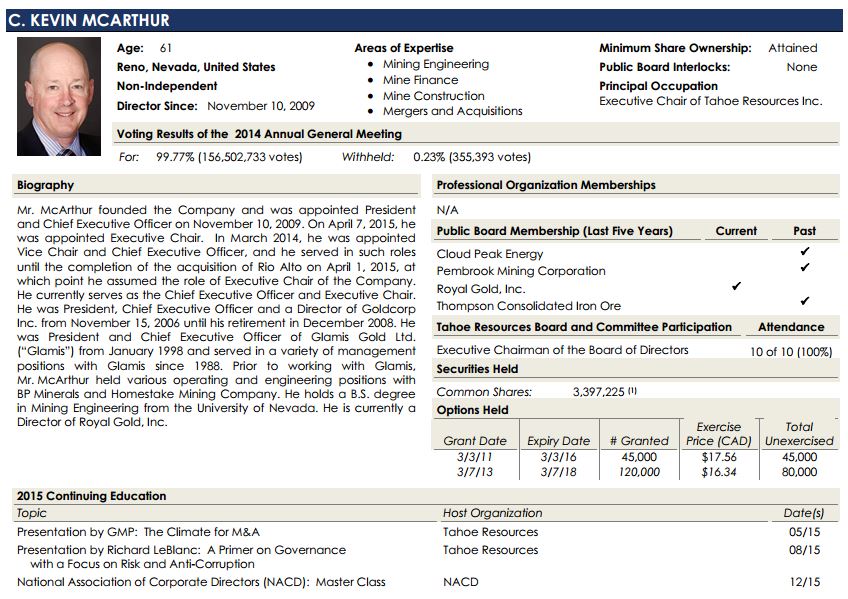

| C. Kevin McArthur | 61 | 2009 | | | | | Royal Gold Inc. | 3,397,225 |

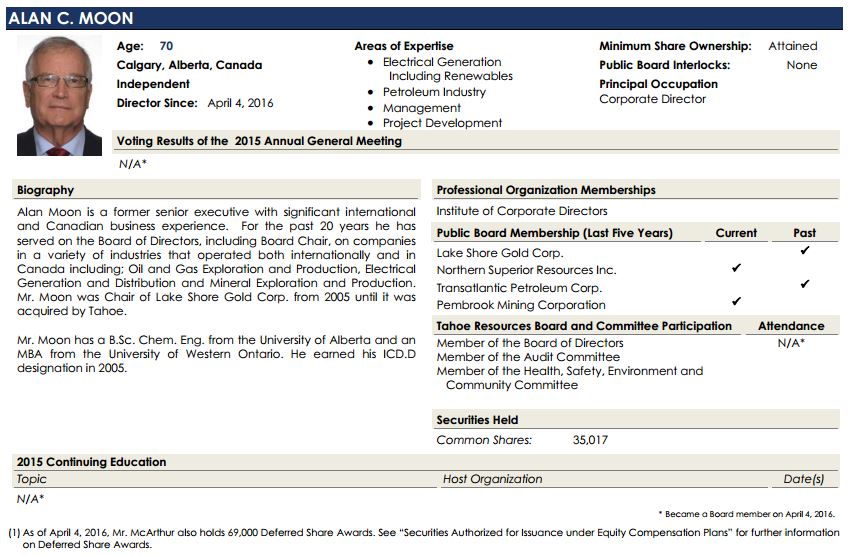

Alan C. Moon

| 70

| 2016

| ✔ |

|

| ✔

| Northern Superior Resources Inc.

Pembrook Mining Corporation | 35,017

|

| A. Dan Rovig | 77 | 2010 | | | ✔ | | | 127,500 |

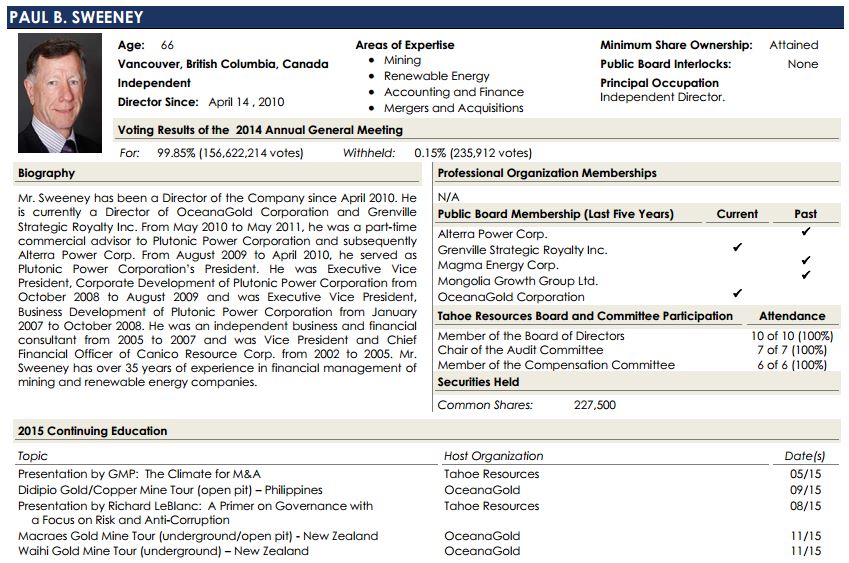

Paul B. Sweeney

| 66

| 2010

| ✔ | ✔ | |

| OceanaGold

Grenville Strategic Royalty Inc. | 227,500

|

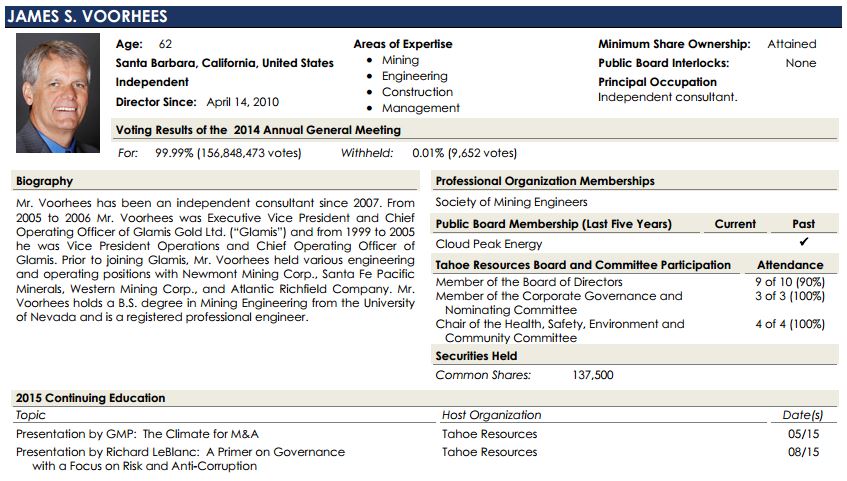

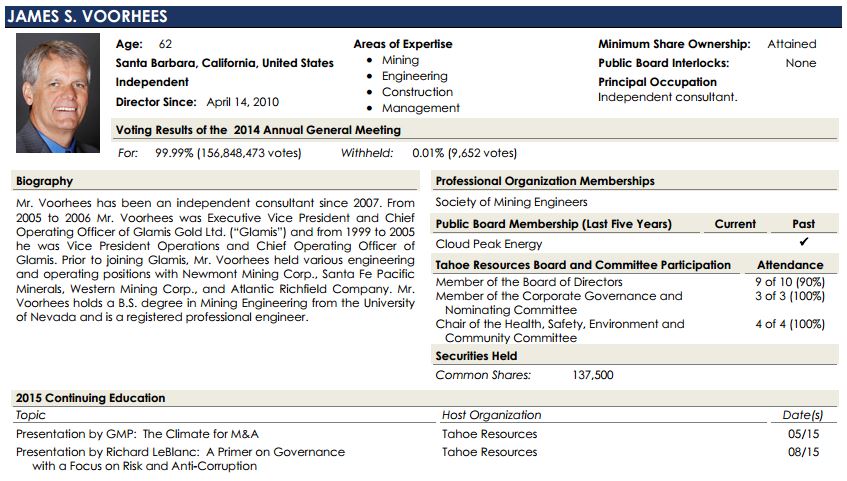

| James S. Voorhees | 62 | 2010 | | | ✔ | ✔ | | 137,500 |

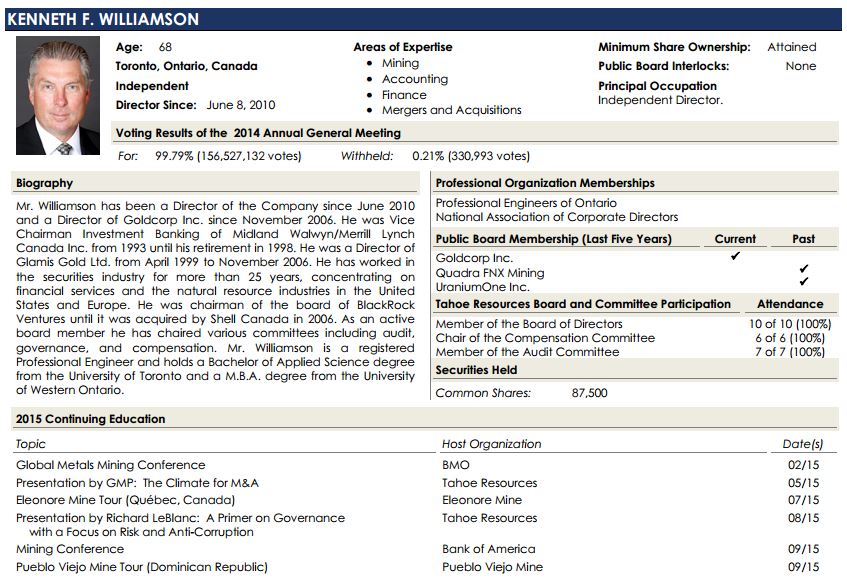

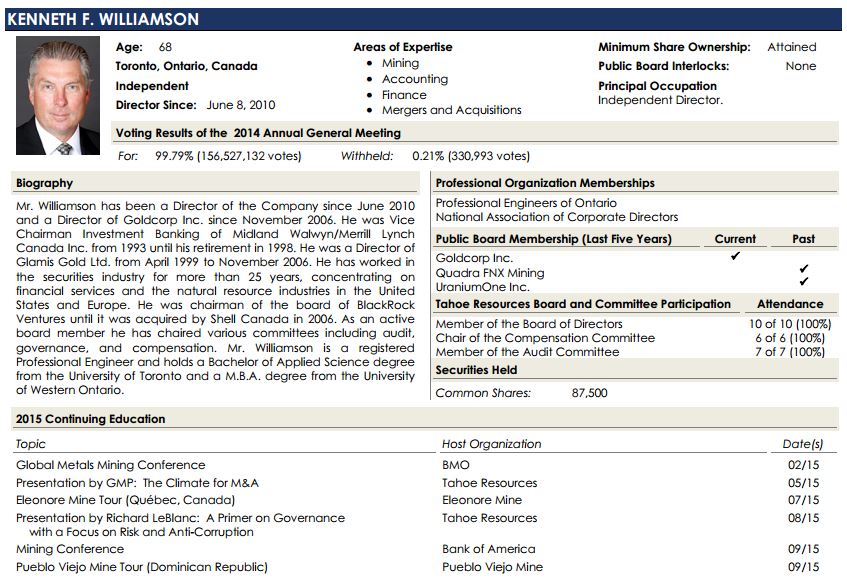

| Kenneth F. Williamson | 68 | 2010 | ✔ | ✔ | | | Goldcorp Inc. | 87,500 |

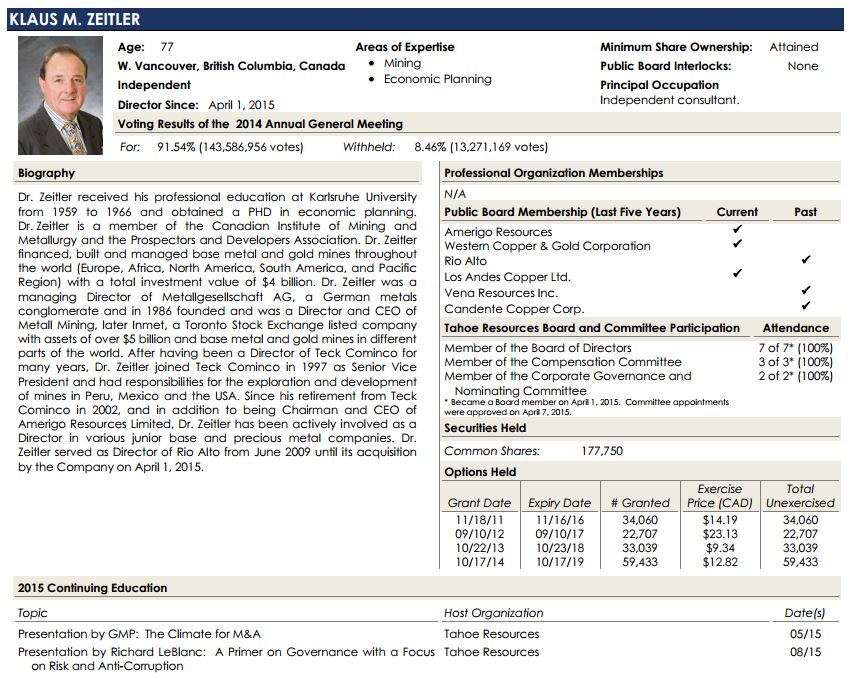

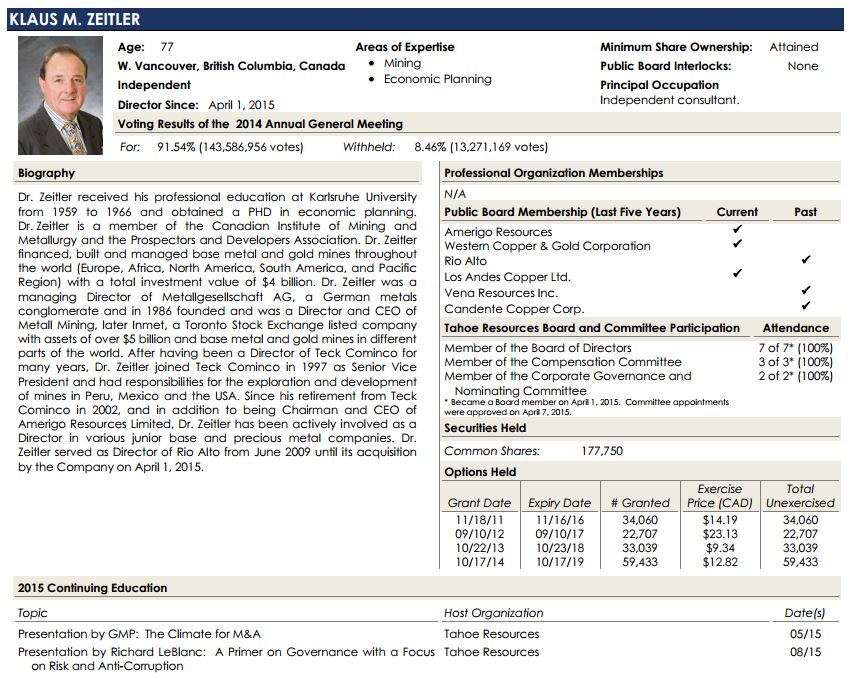

Klaus M. Zeitler

| 77

| 2015

|

| ✔

| ✔

|

| Amerigo Resources Ltd.

Los Andes Copper Ltd.

Western Copper & Gold Corp. | 177,750

|

Further information can be found under the heading “Business of the Meeting”, subheading “Election of Directors” commencing on page 12 of this Circular.

| 2. APPOINTMENT OF AUDITORS |

We recommend that you appoint Deloitte LLP as the auditors of the Company. Deloitte LLP was first appointed as Tahoe’s auditors on August 27, 2012.

| 3. ADVISORY VOTE ON EXECUTIVE COMPENSATION |

We recommend that, on an advisory basis and not to diminish the role and responsibilities of the Board of Directors, you accept the Company’s approach to executive compensation.

Further information can be found under the heading “Business of the Meeting”, subheading “Advisory Vote on Executive Compensation” commencing on page 13 of this Circular.

| REPORT OF 2015 ANNUAL GENERAL MEETING VOTING RESULTS |

The following matters were voted on at our 2015 Annual General Meeting of Shareholders held on May 8, 2015 in Vancouver, Canada. Each matter voted on is described in greater detail in Tahoe’s 2015 Management Information Circular.

| | 1. | Election of Directors |

| | | |

| | | By Resolution passed by ballot vote, the following nine nominees proposed by management were elected Directors of the Company to hold office until the close of the next annual meeting or until their successors are elected or appointed: |

| | | Votes For | Votes Withheld |

| | Director Name | | Number | | Percent | | Number | | Percent |

| | Alex Black | | 156,848,691 | | 99.99 | | 9,434 | | 0.01 |

| | Tanya M. Jakusconek | | 155,912,179 | | 99.40 | | 945,946 | | 0.60 |

| | Drago Kisic | | 156,847,272 | | 99.99 | | 10,854 | | 0.01 |

| | C. Kevin McArthur | | 156,502,733 | | 99.77 | | 355,393 | | 0.23 |

| | A. Dan Rovig | | 156,818,101 | | 99.97 | | 40,024 | | 0.03 |

| | Paul B. Sweeney | | 156,622,214 | | 99.85 | | 235,912 | | 0.15 |

| | James S. Voorhees | | 156,848,473 | | 99.99 | | 9,652 | | 0.01 |

| | Kenneth F. Williamson | | 156,527,132 | | 99.79 | | 330,993 | | 0.21 |

| | Dr. Klaus Zeitler | | 143,586,956 | | 91.54 | | 13,271,169 | | 8.46 |

| 2. | Appointment of Auditors |

| | |

| By Resolution passed by ballot vote, Deloitte LLP was elected to serve as auditors for Tahoe until the close of the next annual meeting or until their successors are elected or appointed. |

| | | Votes For | Votes Withheld |

| | | Number | | Percent | | Number | | Percent |

| | | 165,422,088 | | 99.96 | | 66,076 | | 0.04 |

| 2016 Management Information Circular | 3 |

Tahoe’s management is using this Information Circular to solicit proxies from Shareholders for use at the Meeting.

This Information Circular is dated April 4, 2016 and is furnished in connection with the solicitation of proxies, by or on behalf of management, to be used at the Meeting on May 4, 2016 at the time and place and for the purposes set forth in the accompanying Notice of Meeting.

The record date to determine which Shareholders are entitled to receive notice of and vote at the Meeting is April 4, 2016. |  |

The solicitation of proxies will be primarily by mail, but Tahoe’s Directors, Officers and regular employees may also solicit proxies personally or by telephone. Tahoe will bear all costs of the solicitation. Tahoe has arranged for Intermediaries holding shares on behalf of Beneficial Shareholders of record to forward the Meeting materials to the Beneficial Shareholders. Tahoe may reimburse the Intermediaries for their reasonable fees and disbursements in that regard.

| APPOINTMENT OF PROXYHOLDERS |

The individuals named in the accompanying proxy are Directors or Officers of Tahoe.If you are a Shareholder entitled to vote at the Meeting, you have the right to appoint an individual or company other than either of the individuals designated in the Proxy, who need not be a Shareholder, to attend and act for you and on your behalf at the Meeting. You may do so either by striking out the name of the persons named in the Proxy and inserting the name desired of that other individual or company in the blank space provided in the Proxy or by completing and delivering another suitable form of proxy.

The only methods by which you may appoint a person as proxy are submitting a proxy by mail, hand delivery or fax.

If a Shareholder specifies a choice for a matter in the Proxy, and if the Proxy is duly completed and delivered and has not been revoked, the individuals named in the Proxy will vote the Common Shares of Tahoe (defined as Common Shares) represented thereby in accordance with the choice specified by the Shareholder on any ballot that may be called for. The Proxy confers discretionary authority on the individuals named therein with respect to:

| | > | each matter or group of matters identified therein for which a choice is not specified; |

| | | |

| | > | any amendment to or variation of any matter identified therein; and |

| | | |

| | > | any other matter that properly comes before the Meeting. |

In respect of a matter for which a choice is not specified in the Proxy, the individuals named in the Proxy will vote Common Shares represented by the Proxy for the approval of such matter. However, under New York Stock Exchange (“NYSE”) rules, a broker who has not received specific voting instructions from the Beneficial Shareholder may not vote the shares in its discretion on behalf of such Beneficial Shareholder on “non-routine” proposals. Thus, while such shares will be included in determining the presence of a quorum at the Meeting and will be votes “cast” for purposes of other proposals, they will not be considered votes “cast” for purposes of voting on the election of Directors. “Routine” proposals typically include the ratification of the appointment of the Company’s auditors. The election of Directors, on the other hand, is considered a “non-routine” proposal.

If you are a Registered Shareholder, you may wish to vote by proxy whether or not you attend the Meeting in person. If you wish to submit a Proxy, you must

| | a) | complete, date and sign the Proxy, and then return it to Tahoe’s transfer agent, Computershare Investor Services Inc. (“Computershare”), by fax at 1-866-249-7775 (toll free in North America) or 416-263-9524, or by mail (via postage paid return envelope) to Computershare Investor Services Inc., 9th Floor, 100 University Avenue, Toronto, Ontario, M5J 2Y1 or by hand delivery at 2nd Floor, 510 Burrard Street, Vancouver, BC, V6C 3B9, |

| | | |

| | b) | use a touch-tone phone to transmit voting choices to a toll free number. Registered Shareholders must follow instructions of the voice response system and refer to the enclosed proxy form for the toll free number, the holder’s account number and the proxy access number, or |

| | | |

| | c) | use the internet through the website of the Company’s transfer agent atwww.investorvote.com. Registered Shareholders must follow the instructions that appear on the screen and refer to the enclosed proxy form for the Shareholder’s account number and the proxy access number, |

before 9:00 a.m. (Eastern Daylight Time) on Monday, May 2, 2016, or, if the Meeting is adjourned, the day that is two business days before any reconvening thereof at which the Proxy is to be used, or to the Chair of the Meeting on the day of the Meeting or any reconvening thereof, or in any other manner provided by law. The Chair of the Meeting may waive the proxy cut-off without notice.

The following information is of significant importance to Beneficial Shareholders who do not hold Common Shares, in their own name. Beneficial Shareholders should note that the only proxies that can be recognized and acted upon at the Meeting are those deposited by Registered Shareholders.

If Common Shares are listed in an account statement provided to a Shareholder by a broker, then in almost all cases those Common Shares will not be registered in the Shareholder’s name on the records of Tahoe. Such Common Shares will more likely be registered under the names of the Shareholder’s broker or an agent of that broker. In the United States (“U.S.”), the vast majority of such Common Shares are registered under the name of Cede & Co., as nominee for the Depository Trust Company (which acts as depositary for many U.S. brokerage firms and custodian banks), and in Canada, under the name of CDS & Co. (the registration name for CDS Clearing and Depository Services Inc., which acts as nominee for many Canadian brokerage firms).

Intermediaries are required to seek voting instructions from Beneficial Shareholders in advance of Shareholders’ meetings. Every Intermediary has its own mailing procedures and provides its own return instructions to clients.

There are two kinds of Beneficial Shareholders — those who object to their names being made known to the issuers of securities which they own (called OBOs for Objecting Beneficial Owners), and those who do not so object (called NOBOs for Non-Objecting Beneficial Owners).

Tahoe is taking advantage of National Instrument 54-101 —Communications with Beneficial Owners of Securities of a Reporting Issuer, which permits it to deliver proxy-related materials directly to its NOBOs.As a result, NOBOs should receive a scannable VIF from Computershare. NOBOs should complete and return their VIFs to Computershare as set out in the instructions provided on the VIF. Computershare will tabulate the results of the VIFs received from NOBOs and will provide appropriate instructions at the Meeting with respect to the Common Shares represented by the VIFs it receives.

The Information Circular is being sent to both Registered Shareholders and Beneficial Shareholders. If you are a Beneficial Shareholder, and Tahoe or its agent has sent these materials directly to you, your name and address and information about your Common Shares have been obtained in accordance with applicable securities regulatory requirements from the Intermediary who holds your Common Shares on your behalf.

By choosing to send these materials to you directly, Tahoe (and not your Intermediary) has assumed responsibility for delivering these materials to you and executing your proper voting instructions. Please return your Proxy as specified in the request for voting instructions that you receive.

Beneficial Shareholders who are OBOs should follow the instructions of their Intermediary carefully to ensure that their Common Shares are voted at the Meeting. Management of the Company does not intend to pay for Intermediaries to forward Meeting materials to OBOs, and as a result an OBO will not receive the Meeting materials unless the OBO’s Intermediary assumes the cost of delivery.

| 2016 Management Information Circular | 5 |

The form of proxy supplied to you by your broker will be similar to the Proxy provided to Registered Shareholders by Tahoe. However, its purpose is limited to instructing the Intermediary on how to vote your Common Shares on your behalf. Most brokers now delegate responsibility for obtaining instructions from clients to Broadridge Financial Solution, Inc. (“Broadridge”) in the U.S. and in Canada. Broadridge mails a VIF to you in lieu of the Proxy provided by Tahoe. The VIF will name the same individuals as Tahoe’s Proxy to represent your Common Shares at the Meeting. You have the right to appoint a person (who need not be a Beneficial Shareholder of Tahoe) other than the individuals designated in the VIF, to represent your Common Shares at the Meeting, and that person may be you. To exercise this right, you should insert the name of your desired representative (which may be yourself) in the blank space provided in the VIF. The completed VIF must then be returned to Broadridge by mail or facsimile or given to Broadridge by phone or over the internet, in accordance with Broadridge’s instructions. Broadridge then tabulates the results of all instructions received and provides appropriate instructions respecting the voting of Common Shares to be represented at the Meeting and the appointment of any Shareholder’s representative.If you receive a VIF from Broadridge, the VIF must be completed and returned to Broadridge in accordance with its instructions well in advance of the Meeting in order to have your Common Shares voted or to have an alternate representative duly appointed to attend and to vote your Common Shares at the Meeting.

Notice to Shareholders in the United States

The solicitation of proxies involves securities of an issuer located in Canada and is being effected in accordance with the corporate laws of the Province of British Columbia, Canada and securities laws of the provinces of Canada. The proxy solicitation rules under the United States Securities Exchange Act of 1934, as amended, are not applicable to Tahoe or this solicitation, and this solicitation has been prepared in accordance with the disclosure requirements of the securities laws of the provinces of Canada. Shareholders should be aware that disclosure requirements under the securities laws of the provinces of Canada differ from the disclosure requirements under U.S. federal securities laws.

The enforcement by Shareholders of civil liabilities under U.S. federal securities laws may be affected adversely by the fact that Tahoe is incorporated under the Business Corporations Act (British Columbia), as amended, certain of its Directors and its Executive Officers are residents of Canada and a substantial portion of its assets and the assets of such persons are located outside the U.S. Shareholders may not be able to sue a foreign company or its Officers or Directors in a foreign court for violations of U.S. federal securities laws. It may be difficult to compel a foreign company and its Directors and Officers to subject themselves to a judgment by a U.S. court.

In addition to revocation in any other manner permitted by law, a Registered Shareholder who has given a Proxy may revoke it (a) by executing a proxy bearing a later date, (b) by executing a valid notice of revocation (where a new proxy is not also filed), or (c) by personally attending the Meeting and voting the Registered Shareholder’s Common Shares.

A later dated Proxy or notice of revocation must be executed by the Registered Shareholder or the Registered Shareholder’s authorized attorney in writing, or, if the Registered Shareholder is a corporation, under its corporate seal by an Officer or attorney duly authorized, and delivered to Computershare, by fax at 1-866-249-7775 (toll free in North America) or 416-263-9524, or by mail (via postage paid return envelope) to Computershare Investor Services Inc., 9th Floor, 100 University Avenue, Toronto, Ontario, M5J 2Y1 or by hand delivery at 2nd Floor, 510 Burrard Street, Vancouver, BC, V6C 3B9, or to the address of the registered office of Tahoe at 1500 Royal Centre, 1055 West Georgia Street, P. O. Box 11117, Vancouver, British Columbia, V6E 4N7. |  |

A later dated proxy must be received before 9:00 a.m. (Eastern Daylight Time) on Monday, May 2, 2016, or, if the Meeting is adjourned, the day that is two business days before any reconvening thereof at which the Proxy is to be used, or to the chair of the Meeting on the day of the Meeting or any reconvening thereof, or in any other manner provided by law.

A notice of revocation must be received before 9:00 a.m. (Eastern Daylight Time) on Monday, May 2, 2016, or, if the Meeting is adjourned, the last business day before any reconvening thereof at which the Proxy is to be used, or to the Chair of the Meeting on the day of the Meeting or any reconvening thereof, or in any other manner provided by law.

Only Registered Shareholders have the right to revoke a Proxy. Beneficial Shareholders who wish to change their vote must, in sufficient time in advance of the Meeting, arrange for their Intermediaries to change the vote and, if necessary, revoke their Proxy.

| VOTING SECURITIES AND PRINCIPAL HOLDERS OF VOTING SECURITIES |

Record Date and Outstanding Shares

The Record Date for determining persons entitled to receive notice of and vote at the Meeting is April 4, 2016. Only persons who were Shareholders as of the close of business on April 4, 2016 are entitled to vote at the Meeting, or any adjournment or postponement thereof, in the manner and subject to the procedures described in this Information Circular. A quorum for the Meeting is at least one person being present in person or being represented by proxy, holding not less than 5% of the issued Common Shares entitled to be voted at the Meeting.

A notice of revocation must be received before 9:00 a.m. (Eastern Daylight Time) on Monday, May 2, 2016. At the close of business on April 4, 2016, 296,900,457 Common Shares were issued and outstanding. Each Registered Shareholder is entitled to one vote per Common Share held on all matters to come before the Meeting. Common Shares are the only securities of Tahoe which will have voting rights at the Meeting.

Principal Holders of Common Shares

To the knowledge of the Directors and Officers of the Company, no person or company beneficially owns, controls or directs, directly or indirectly, Common Shares carrying more than 10% of the voting rights attached to all issued and outstanding Common Shares of Tahoe as at April 4, 2016, except as shown in the table below.

Name | Number of Common Shares Beneficially

Owned, Controlled or Directed | Percentage of Outstanding

Common Shares |

BlackRock Inc. (for and on behalf of its

investment advisory subsidiaries) | 39,144,400(1)(2)

| 13.2%

|

| ___________________ |

| (1) | The Company has relied on a Schedule 13G/A filed with the U.S. Securities and Exchange Commission on January 8, 2016. |

| | |

| (2) | The Company has relied on the Bloomberg Report generated on March 4, 2016 which indicated that BlackRock Inc. held 3,701,977 Lake Shore Gold Corp. Shares. This figure assumes that the 3,701,977 Lake Shore Gold Corp. Shares which were reported to be held by BlackRock Inc. were exchanged for 543,080 Common Shares of the Company in connection with the completion of the acquisition of Lake Shore Gold Corp. on April 1, 2016. |

| 2016 Management Information Circular | 7 |

Our Meeting gives you the opportunity to vote on items of Tahoe Resources Inc. business, receive an update on the Company, meet face to face with management and interact with our Board.

The audited annual consolidated financial statements for the year ended December 31, 2015 (the “consolidated financial statements”) and the report of the auditors thereon are available on our website under the Investor Relations section atwww.tahoeresources.com/investors. They are included in our 2015 annual financial review, which was mailed to you if you requested a copy.

You will elect nine (9) Directors to the Board. The term of office of each Director is from the date of the meeting at which he or she is elected or appointed until the next Annual General Meeting of Shareholders or until a successor is elected or appointed. The section entitled “Director Nominees” provides information about the nominated Directors, their background and experience, and any board committees on which they currently sit. All of the Directors are elected for a term of one year.

Unless authority to do so is withheld, the persons named in the accompanying form of proxy intend to vote for the election of the nominees whose names appear in the section entitled “Director Nominees”. Management does not expect that any of the nominees will be unable to serve as a Director but, if that should occur for any reason prior to the Meeting, the persons named in the accompanying form of proxy reserve the right to vote for another nominee at their discretion unless the proxy specifies the Common Shares are to be withheld from voting in the election of Directors.

Cease Trade Orders, Bankruptcies, Penalties or Sanctions

No proposed Director of the Company is, or within ten years prior to the date hereof has been, a Director, Chief Executive Officer or Chief Financial Officer of any company (including the Company) that, (i) was subject to a cease trade order, an order similar to a cease trade order or an order that denied the relevant company access to any exemption under securities legislation, that was in effect for a period of more than 30 consecutive days, that was issued while the proposed Director was acting in the capacity as Director, Chief Executive Officer or Chief Financial Officer; or (ii) was subject to a cease trade order, an order similar to a cease trade order or an order that denied the relevant company access to any exemption under securities legislation, that was in effect for a period of more than 30 consecutive days, that was issued after the proposed Director ceased to be a Director, Chief Executive Officer or Chief Financial Officer and which resulted from an event that occurred while that person was acting in the capacity as Director, Chief Executive Officer or Chief Financial Officer.

No proposed Director of the Company is, or within ten years prior to the date hereof has been, a Director or executive Officer of any company (including the Company) that, while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets.

No proposed Director of the Company has been subject to (i) any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority; or (ii) any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable investor in deciding whether to vote for a proposed Director.

Majority Vote Policy

The Board has adopted a majority voting policy relating to the election of Directors. See “Corporate Governance – Majority Vote Policy”.

Deloitte LLP, Chartered Accountants, of 1055 Dunsmuir Street, Suite 2800, Vancouver, BC V7X 1P4, Canada will be nominated at the Meeting for appointment as external auditor of Tahoe. Deloitte LLP has been the external auditor of Tahoe since August 27, 2012.

| ADVISORY VOTE ON EXECUTIVE COMPENSATION |

In November 2015, the Board recommended that Tahoe include a Shareholder advisory vote on its approach to executive compensation. The Board requests the input of the Shareholders by holding an advisory vote on the approach to executive compensation. The Board believes that an annual "Say on Pay" Shareholder advisory vote on its approach to compensation is an important part of an ongoing integrated engagement process between Shareholders and the Board. The Board believes the Company's approach to compensation reinforces the links between compensation and its strategic objectives and risk management processes using financial and non-financial measures of the achievement of the company's goals over a number of years.

The Canadian Coalition for Good Governance (“CCGG”) recommends that boards voluntarily add to each annual meeting agenda a shareholder advisory vote on the board's and company's reports on executive compensation contained in its annual proxy circular. The Board confirms that its current practices achieve substantially the same results as the CCGG’s Model Policy of the Board of Directors on Engagement with Shareholders on Governance Matters and “Say on Pay” Policy for Boards of Directors.

The Board recommends that Shareholders vote FOR the following resolution and, unless otherwise instructed, the persons designated in the form of proxy or request for voting instructions intend to vote FOR the following resolution:

RESOLVEDon an advisory basis and not to diminish the role and responsibilities of the Board of Directors, that the Shareholders accept the approach to executive compensation disclosed in the Company’s information circular delivered in advance of the 2016 Annual General Meeting of Shareholders of the Company to be held on May 4, 2016. |

If other items of business are properly brought before the Meeting or after the Meeting is adjourned, you (or your proxyholder, if you are voting by proxy) can vote as you see fit. We did not receive any Shareholder proposals for this meeting, and are not aware of any other items of business to be considered at the Meeting.

| 2016 Management Information Circular | 9 |

The size of the Board is fixed at nine. The term of office of each of the current Directors will end immediately before the election of Directors at the Meeting. Unless the Director’s office is earlier vacated in accordance with the provisions of the Business Corporations Act (British Columbia), each Director elected will hold office until immediately before the election of new Directors at the next Annual General Meeting of Shareholders of the Company or, if no Director is then elected, until a successor is elected or appointed. Directors will be elected on an individual basis.

As of April 4, 2016, the Directors of the Company, as a group, beneficially owned, controlled or directed, directly or indirectly, an aggregate of Common Shares, representing 0.28% of the issued and outstanding Common Shares.

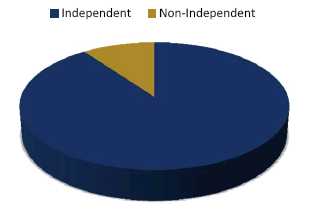

| HIGHLIGHTS OF THE BOARD OF DIRECTORS |

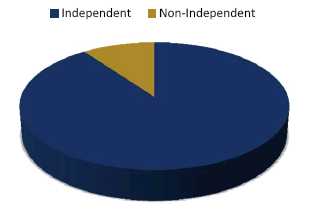

100% of the regularly scheduled Board meetings include an in-camera session during whichonly independent Directors are permitted to attend.

Our Directors have had a 100% attendance rate at all regularly scheduled Board andCommittee meetings and we expect a 100% attendance rate in 2016.

A majority of our Directors have expertise in finance, accounting and/or auditing, mining,mining processing, geology and mineral sciences.

All of our Directors have met our share ownership guidelines.

We have a formal nomination process and maintain a list of suitable Director Candidates.

We spend significant time on executive succession planning, and believe that we are well-positioned to meet any future challenges.

In 2015, the Board moved to an environmentally friendly, paperless process using a secureBoard portal and electronic documents for meetings.

The following pages set out the names of management’s nominees for election as Directors, all major offices and positions with the Company and any of its significant affiliates each nominee now holds, each nominee’s principal occupation, business or employment, the period of time during which each has been a Director of the Company and the number of Common Shares beneficially owned, controlled or directed by each, directly or indirectly, as at April 4, 2016. The number of Common Shares beneficially owned, controlled or directed, directly or indirectly, by the nominees for Directors is based, in part, on information furnished by the nominees themselves and information gathered by the Company, and the insider reports available atwww.sedi.ca.

| 2016 Management Information Circular | 11 |

| 2016 Management Information Circular | 13 |

| 2016 Management Information Circular | 15 |

Approach to Risk

The Board is keenly aware of the fact that compensation practices can have unintended risk consequences. The Compensation Committee continually reviews the Company’s compensation policies to identify any practice that might encourage an employee to expose the Company to unacceptable risk. At the present time, the Compensation Committee is satisfied that the current executive compensation program does not encourage the executives to expose the business to inappropriate risk. The Board takes a conservative approach to executive compensation rewarding individuals for the success of the Company once that success has been demonstrated and incentivizing them to continue to succeed through the grant of long-term incentive awards.

For a detailed explanation of the risks applicable to the Company and its businesses, see the “Risk Factors” section in the Annual Information Form dated March 9, 2016, filed atwww.sedar.comand also available on our website atwww.tahoeresources.com.

Hedging Policy

Insiders of the Company are required to meet specified equity ownership targets to further align their interests with those of Shareholders. The Company believes that transactions that hedge, limit or otherwise change an insider’s economic interest in and exposure to the full rewards and risks of ownership of the Company’s securities would be contrary to this objective.

For that reason, all insiders of the Company are prohibited from engaging in the following transactions with respect to securities of the Company:

| | a) | short sales; |

| | | |

| | b) | monetization of equity awards (stock options, Deferred Share Awards, Restricted Share Awards) before vesting; |

| | | |

| | c) | transactions in derivatives in respect of Company securities, such as put and call options; or |

| | | |

| | d) | any other hedging or equity monetization transactions where the insider’s economic interest and risk exposure in Company securities are changed, such as collars or forward sale contracts. |

Mid-Year Compensation Adjustments

Following the acquisition of Rio Alto, the Company undertook a comprehensive review of overhead expenses with a goal of reducing at least $4 million in annual G&A costs by 2016 in a down precious metals market. Actions taken by the Company included, among other things, a 20 percent salary reduction for the Executive Chair, a 10 percent reduction in annual retainer fees for the Board of Directors, a five percent salary cut for senior executives of the Company and a hiring freeze at the corporate level. In March 2016, the Board voted to freeze executive salaries at 2015 post-cut levels.

Compensation Committee

Information about the Company's Compensation Committee and the skills and experience of its members in making decisions with respect to compensation policies and practices of the Company can be found in the "Corporate Governance - Board Committees - Compensation Committee" section of this Information Circular.

The Company's Directors' compensation is designed to attract and retain high caliber Board members. In 2015, comparative Director compensation data for the following companies were evaluated after being accumulated from a number of external sources: Alamos Gold, Aurico Gold, B2 Gold, Centerra Gold, Detour Gold, Eldorado Gold, Iamgold, Newgold, Pan American Silver, Silver Wheaton and Yamana Gold (together, the “2015 Peer Group”).

The Board meets annually to review the adequacy and form of Directors’ compensation, and to ensure the Company’s approach to Board compensation is:

| | a) | competitive at the median of the Company’s Peer Group; |

| | | |

| | b) | reflects best practice; and |

| | | |

| | c) | takes into account governance trends. |

The Compensation Committee regularly reviews and assesses the appropriateness of the Peer Group and makes changes as needed. It was unanimously resolved that the Company’s Peer Group for purposes of compensation analysis in 2016/2017 shall consist of: Alamos Gold, B2 Gold, Centerra Gold, Detour Gold, Eldorado Gold, Iamgold, Newgold, Pan American Silver, Silver Wheaton and Yamana Gold (together, the “2016 Peer Group”). See “Compensation – Executive Compensation - Benchmarking” for details on the selection criteria for the 2016 Peer Group.

Prior to May 2015, each Board member was entitled to receive annually 5,000 Restricted Share Awards that vested immediately at the time of grant and annual Board fees of $92,230 (C$100,000), except that the Chair of the Board was entitled to receive $156,791 (C$170,000) and each Committee Chair would be entitled to receive an additional $18,446 (C$20,000), with the Audit Committee Chair receiving an additional $36,892 (C$40,000) on an annual basis.

In May 2015, in reviewing total Directors’ compensation, Tahoe made a decision to convert compensation from Canadian to U.S. currency with respect to annual fees. At that time, the Compensation Committee determined that each Board member would be entitled to receive annually 7,500 Restricted Share Awards that vested immediately at the time of grant and annual Board fees of $100,000, except that the Chair of the Board was entitled to receive $170,000, the Audit Committee Chair was entitled to receive an additional $40,000 and each Committee Chair, other than Audit, would be entitled to receive an additional $20,000 on an annual basis.

Director compensation information below is presented with respect to the Board as it was constituted at the end of the 2015 financial year. Effective October 1, 2015, the Board agreed to a 10% reduction in their annual retainer fee in response to cost-cutting measures recommended by management. Upon completion of the acquisition of Rio Alto on April 1, 2015, Messrs. Anderson and Bell ceased being Directors of the Company, and Messrs. Black, Kisic and Zeitler were appointed as independent Directors, and effective August 4, 2015, Mr. Black ceased to be a Director of the Company.

| TABLE 1 |

Name |

Year | Fees

Earned(1)(2)(3)

($) | Share-Based

Awards

($) | Option-Based

Awards

($) | Incentive Plan

Compensation

($) | All Other

Compensation

($) |

Total

($) |

| Tanya M. Jakusconek | 2015 | 89,519 | 104,177.75 | Nil | Nil | Nil | 193,697 |

| Drago G. Kisic | 2015 | 64,465 | 104,177.75 | Nil | Nil | Nil | 173,643 |

| A. Dan Rovig, Lead | 2015 | 166,606 | 104,177.75 | Nil | Nil | Nil | 270,784 |

| Paul B. Sweeney | 2015 | 126,388 | 104,1778 | Nil | Nil | Nil | 230,566 |

| James S. Voorhees | 2015 | 107,953 | 104,1778 | Nil | Nil | Nil | 212,131 |

| Kenneth F. Williamson | 2015 | 107,953 | 104,1778 | Nil | Nil | Nil | 212,131 |

| Klaus M. Zeitler | 2015 | 64,465 | 104,178 | Nil | Nil | Nil | 173,643 |

| ______________________ |

| (1) | For purposes of this disclosure, fees that were paid in Canadian dollars were converted at an average exchange rate of 0.8021. The cash retainer for the first half of the year was paid quarterly in Canadian dollars. In May of 2015, at the recommendation of management, the Compensation Committee approved an action to pay Director annual fees in U.S. currency. Directors are also reimbursed for their Board- related expenses incurred on our behalf. |

| (2) | The fair value of the restricted share awards to Directors in 2015 was based on C$16.79 and the exchange rate on the grant date of C$0.8273. The grant date fair value of share-based awards as presented will differ from the compensation expense included for these grants in the Company’s financial statements. In accordance with IFRS accounting requirements, the compensation expense reflects only the fair value amortized in the period based on each grant’s vesting terms. |

| (3) | During 2015 Messrs. Anderson and Bell earned fees in the amount of $29,999 and $20,054, respectively. |

The Executive Chair does not collect Board fees. No additional fees, including meeting fees, were paid to Directors in 2015. Director compensation is subject to review and possible change on an annual basis. Further share option grants for existing Board members are not anticipated in the near future.

| 2016 Management Information Circular | 17 |

Incentive Plan Awards

The following table provides information for the Directors of the Company regarding the awards outstanding as at December 31, 2015.

| TABLE 2 |

Name | Option-based Awards | Share-based Awards |

Number of

Securities

Underlying

Unexercised

Options |

Option

Exercise

Price

(C$) |

Option Expiration

Date |

Value of Un-

Exercised

In-The-Money

Options(1)

($) |

Number of

Shares or Units

of Shares That

Have Not

Vested | Market or

Payout Value

of Share-

Based Awards

That Have Not

Vested

($) | Market Payout

Value of Vested

Share-Based

Awards Not

Paid Out or

Distributed

($) |

| Tanya M. Jakusconek | 45,000 | 19.74 | 05/03/16 | Nil | Nil | Nil | Nil |

| Drago G. Kisic | 22,707 | 23.13 | 09/10/17 | Nil | Nil | Nil | Nil |

| Drago G. Kisic | 39,622 | 12.82 | 10/17/19 | Nil | Nil | Nil | Nil |

| Drago G. Kisic | 22,707 | 14.19 | 11/16/16 | Nil | Nil | Nil | Nil |

| Drago G. Kisic | 22,026 | 9.34 | 10/23/18 | 41,853 | Nil | Nil | Nil |

| Klaus M. Zeitler | 22,707 | 23.13 | 09/10/17 | Nil | Nil | Nil | Nil |

| Klaus M. Zeitler | 59,433 | 12.82 | 10/17/19 | Nil | Nil | Nil | Nil |

| Klaus M. Zeitler | 34,060 | 14.19 | 11/16/16 | Nil | Nil | Nil | Nil |

| Klaus M. Zeitler | 33,039 | 9.34 | 10/23/18 | 62,780 | Nil | Nil | Nil |

| __________________ |

| (1) | Value calculated based on the difference between the closing price of the Common Shares on December 31, 2015 (C$11.97) and the option exercise price converted to US dollars at the December 31, 2015 exchange rate of C$1.00 – $0.7225. |

The following table provides information regarding the unexercised awards granted to the non-executive Directors of the Company that have vested or have been earned by those Directors during the period from January 1, 2015 to December 31, 2015.

| TABLE 3 |

Name | Option-Based Awards –

Value Vested During the

Period(1)

($) |

Share-Based Awards – Value

Vested During the Period(2)

($) | Non-Equity Incentive Plan

Compensation – Value

Earned During the Period

($) |

| Tanya M. Jakusconek | Nil | $104,178 | Nil |

| Drago G. Kisic | Nil | $104,178 | Nil |

| A. Dan Rovig, Lead | Nil | $104,178 | Nil |

| Paul B. Sweeney | Nil | $104,178 | Nil |

| James S. Voorhees | Nil | $104,178 | Nil |

| Kenneth F. Williamson | Nil | $104,178 | Nil |

| Klaus M. Zeitler | Nil | $104,178 | Nil |

| _____________________ |

| (1) | As at December 31, 2015 all option-based awards had vested. Messrs. Zeitler and Kisic became Directors on April 1, 2015 and had no options vest during the period. |

| (2) | For share-based awards, the fair value was based on the C$16.79 market price of the Common Shares and the exchange rate of C$0.8273. |

As used below, Named Executive Officer (“NEO”) means the Company’s Executive Chair, Chief Executive Officer (“CEO”), President and Chief Financial Officer (“CFO”) and each of the three most highly-compensated Executive Officers, other than the CEO and CFO, whose total annual salary and bonus exceeds C$150,000. For the purposes of the following disclosure, the NEOs are as follows: C. Kevin McArthur, Executive Chair and Chief Executive Officer; Ron Clayton, President and Chief Operating Officer; Mark Sadler, Vice President and Chief Financial Officer; Brian Brodsky, Vice President Exploration; and Edie Hofmeister, Vice President Corporate Affairs, General Counsel and Corporate Secretary.

Mr. Alex Black served as the Company’s CEO from April 1, 2015 until his resignation on August 4, 2015. Information relating to Mr. Black’s compensation is provided in the footnotes of the relevant executive compensation tables.

Executive Compensation Discussion and Analysis

Our approach to executive compensation is to provide suitable compensation for executives that is equitable and competitive and reflects individual achievement. Our compensation arrangements are designed to attract and retain highly qualified individuals who are able to carry out our business objectives.

One of the Company’s primary objectives is to create long-term shareholder value through consistent outperformance relative to its peers. The compensation program is closely tied to this goal as it is designed to: align the performance objectives of executives with maximizing long-term shareholder value; link the operating and market performance of the Company to executive compensation; and provide market competitive pay in order to attract new employees of the highest caliber and retain high-performing executives.

Total compensation for NEOs is set with reference to the Peer Group of companies for similar job descriptions in similar locations. The total compensation target for NEOs is approximately at the 50th percentile of the Peer Group. The four basic components of executive compensation since the Company completed its initial public offering (“IPO”) in June 2010 have been the following: |  |

| | |

| > | base salary; |

| | |

| > | short-term incentive plan (“STIP”); |

| | |

| > | long-term incentive plan (“LTIP”); and |

| | |

| > | extended and group benefits. |

| | |

| | |

Benchmarking

Comparative data for the Peer Group was evaluated after being accumulated from a number of external sources. The Peer Group was updated in 2015 based on the following selection criteria:

| > | similar industry – intermediate precious metals producer; |

| | |

| > | similar market – capitalization range between 0.25x and 4x; and |

| | |

| > | similar revenues – revenues range between 0.25x and 4x. |

Elements of Compensation (Base Salary, STIP, LTIP, Extended and Group Benefits)

Base Salary

Base salary forms an essential element of the Company’s compensation mix, as it is the base measure to compare and remain competitive relative to the Peer Group. Base salaries for NEOs were recommended to the Compensation Committee by the CEO. The CEO did not make a recommendation with respect to his own salary. The Compensation Committee and the Board approved the salary ranges for the Executive Officers based on market competition, compensation levels amongst the Peer Group, particular skill sets, and the experience and proven track records of particular individuals. Annual base salary levels are fixed, and they are generally targeted at or below the 50th percentile of the Peer Group. Annual base salary levels are used as the basis to determine other elements of compensation. In September of 2015, the Company moved to cut costs in reaction to a severe downturn in the conditions of the precious metals industry. Among a number of initiatives taken by the Company, the CEO took a 20% cut in base salary compensation and the remainder of the NEO group took a 5% cut in salary.

Short Term Incentive Plan (“STIP”)

The STIP provides executives and management employees an incentive to achieve annual goals consistent with operating, financial and corporate responsibility measurements that can generally be improved over time. Amounts payable under the STIP are cash based and are linked to safety, project permitting, construction completion, first concentrate shipments and commercial production timelines, underground development goals, silver ounces produced in concentrate, gold ounces produced in doré, overall corporate performance and individual achievement.

STIP criteria include three general categories:

| > | corporate safety and performance; |

| | |

| > | qualitative criteria; and |

| | |

| > | achievement of executive goals. |

| 2016 Management Information Circular | 19 |

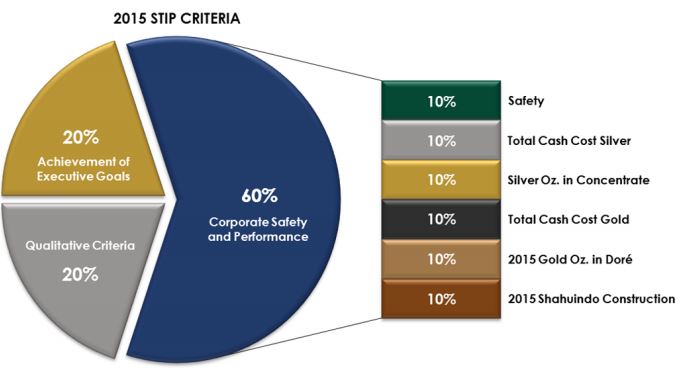

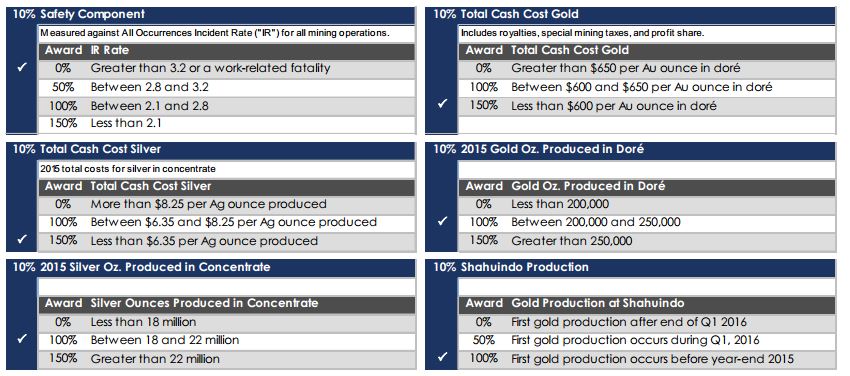

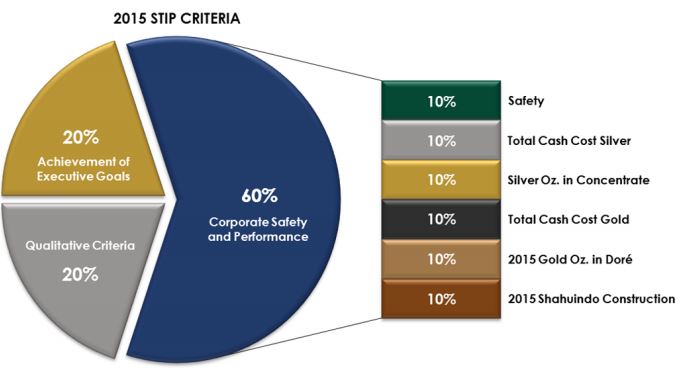

2015 STIP CRITERIA

The Compensation Committee approved STIP measurement criteria for determining the 2015 STIP bonus payments which were paid in the first quarter of 2016. Sixty percent of STIP was measured by corporate performance measures, 20% was measured by performance to individual executive goals and 20% of the STIP was determined by the Compensation Committee using qualitative criteria.

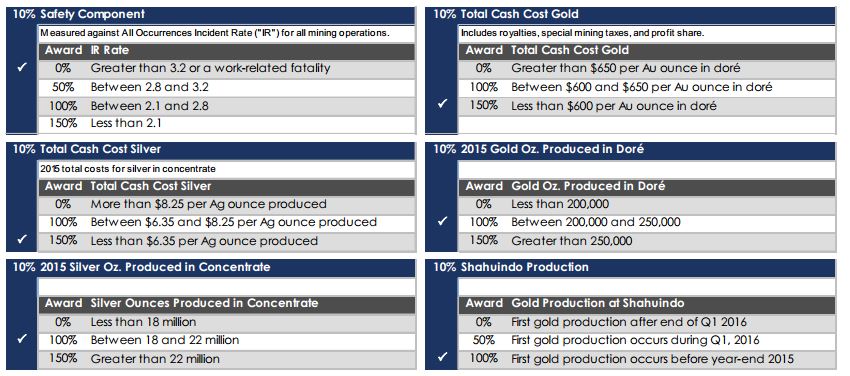

STIP Criteria Category: Corporate Safety and Performance – 2015

A total of 60% of STIP is payable based on the following corporate safety and performance criteria that can range between zero and 150% payout, depending on performance:

STIP Criteria Category: Qualitative Criteria – 2015

A total of 20% of 2015 STIP is based on qualitative factors relating to NEO performance at the sole discretion of the Compensation Committee. Other than CEO STIP, NEO qualitative factors are decided in consultation with the CEO and the Executive Chair.

STIP Criteria Category: Achievement of Executive Goals – 2015

The remaining 20% of 2015 STIP is based on individual performance measured against personal objectives and other criteria at the sole discretion of the Compensation Committee. Individual performance factors for the NEOs are as follows:

| > | The CEO’s performance factors include leading the organization to meet or exceed expectations and accomplishing strategic goals and objectives for the year; advancing the strategic planning process for the Company; effectively representing the Company in relations with relevant stakeholders including employees, investors, the financial community, government and media; and assuring growth in skills and performance in the Company’s management team. |

| | | |

| > | The COO’s performance factors include enhancing the depth and accuracy of the Company’s budgeting and planning process; integrating operations results and financial reporting; timely completion of resource calculations and feasibility studies for new projects; meeting or exceeding forecasts for mine production and operating costs; assisting with investor relations meetings and conferences; recruiting, retaining and developing the Company’s operating and finance management teams; and continuously monitoring and improving safety, community relations and environmental performance at operations. |

| | | |

| > | The CFO’s performance factors include maintaining the Company’s strong financial position, liquidity and safe investment of cash resources; continuous improvement to the financial team’s performance; accurate tax and royalty accounting and timely payments; managing a growing finance and accounting function commensurate with the Company’s growth; accurate and timely reporting of financial results; appropriate risk management and successful implementation of controls such as those defined under Sarbanes-Oxley; and management of metals marketing, administration and negotiation of contracts, timely shipping of concentrates to customers and timely receipt of revenues. |

| | | |

| > | The Vice President of Exploration’s performance factors include leading the exploration department and meeting or exceeding drilling goals; maintaining concession titles, moving new targets into exploration concession status and staking new concessions where appropriate; growing and increasing confidence in mine resources; recruiting, retaining and developing the exploration team; identifying and analyzing potential new business opportunities; and continuously monitoring and improving safety, community relations and environmental performance at exploration operations. |

| | | |

| > | The Vice President Corporate Affairs, General Counsel and Corporate Secretary’s performance factors include leading the legal department and meeting all filing deadlines and disclosure requirements in conjunction with the CFO’s office; providing oversight of human resources; maintaining regulatory compliance in multiple jurisdictions; aiding with the maintenance of concession titles; maintaining accurate and timely shareholder records; monitoring, enhancing and reporting on corporate governance; managing the government affairs program in North America; maintenance of corporate books and records; and overseeing all legal and corporate social responsibility affairs of the Company. |

STIP Bonus Payment Awards

The following table reflects the STIP bonus payment awards in 2013, 2014 and 2015.

TABLE 4

|

NEO Name and

Principal Position |

Year |

Base Salary ($) |

Target as % Salary |

STIP Bonus ($) |

C. Kevin McArthur,

Executive Chair and CEO

| 2015 | 400,000 | N/A(1) | 600,000 |

| 2014 | 450,000 | 150% | 675,000 |

| 2013 | 350,000 | 150% | 525,000 |

Ron Clayton,

President and COO

| 2015 | 570,000 | 80% | 456,000 |

| 2014 | 400,000 | 100% | 360,000 |

| 2013 | 320,000 | 100% | 320,000 |

Mark Sadler, VP and CFO

| 2015 | 332,500 | 60% | 199,500 |

| 2014 | 250,000 | 80% | 200,000 |

| 2013 | 220,000 | 80% | 180,000 |

Brian Brodsky,

VP Exploration

| 2015 | 332,500 | 60% | 199,500 |

| 2014 | 250,000 | 80% | 200,000 |

| 2013 | 220,000 | 80% | 180,000 |

Edie Hofmeister, VP Corporate

Affairs, General Counsel and

Corporate Secretary | 2015 | 332,500 | 60% | 199,500 |

| 2014 | 250,000 | 80% | 200,000 |

| 2013 | 200,000 | 80% | 180,000 |

| ________________ |

| (1) | Starting in 2015, Mr. McArthur no longer had an executive employment agreement with the Company identifying his Target as a Percent of Salary, among other terms. His annual bonus is determined at the discretion of the Compensation Committee. |

| 2016 Management Information Circular | 21 |

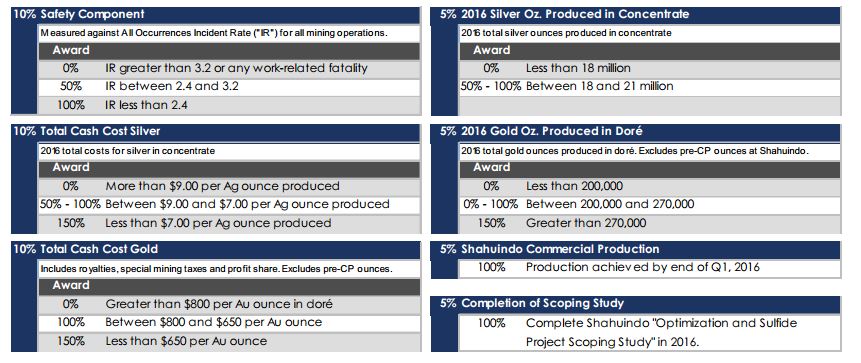

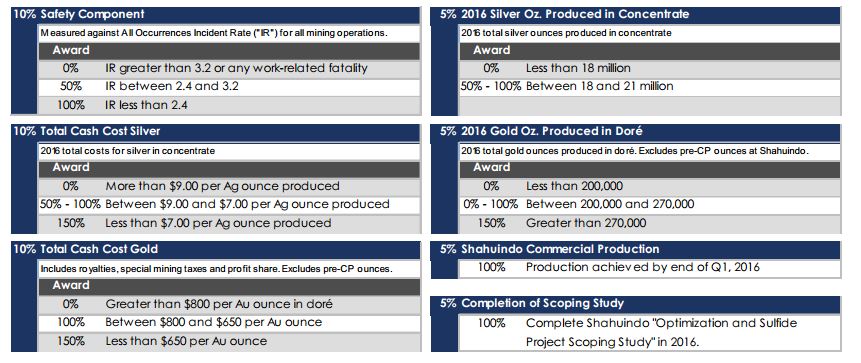

2016 STIP CRITERIA

The Compensation Committee has approved STIP measurement criteria for determining 2016 STIP bonus payments scheduled for the first quarter of 2017.

STIP Criteria Category: Corporate Safety and Performance – 2016

A total of 50% of STIP is payable based on the following corporate safety and performance criteria that can range between zero and 150% payout, depending on performance:

STIP Criteria Category: Qualitative Criteria – 2016

A total of 30% of 2016 STIP is based on qualitative factors relating to overall corporate performance, including such factors as stock price performance relative to peers, maintenance of the social license to operate, exploration and corporate development factors.

STIP Criteria Category: Achievement of Executive Goals – 2016

The remaining 20% of 2016 STIP is based on individual performance measured against personal objectives and other criteria at the sole discretion of the Compensation Committee.

Long Term Incentive Plan (“LTIP”)

The Company’s compensation arrangement includes LTIP share options and share awards. Share option and share award compensation is designed to align the interests of Executive Officers with the longer-term interests of the Shareholders. LTIP awards to NEOs were recommended to the Compensation Committee by the CEO. The CEO did not make a recommendation with respect to his own LTIP award. The Compensation Committee and the Board approved the LTIP awards for the Executive Officers based on market competition, compensation levels amongst the Peer Group, particular skill sets, and the experience and proven track records of particular individuals. LTIP targets are generally set to bring total compensation to approximately the 50thpercentile of the Peer Group. See “Securities Authorized for Issuance under Equity Compensation Plans” for additional information on our Share Option and Incentive Share Plan, and the process used to grant share options and share awards.

The following table lists the number of share-based awards issued in the form of Deferred Share Awards and the value of such awards at the time of grant.

| TABLE 5 |

NEO Name and Principal Position |

Year | Number of Deferred

Share Awards(1)(2) | Value

($) |

C. Kevin McArthur, Executive Chair and CEO

| 2015 | 30,000 | 376,132 |

| 2014 | 45,000 | 953,741 |

| 2013 | Nil | Nil |

Ron Clayton, President and COO

| 2015 | 30,000 | 376,132 |

| 2014 | 30,000 | 635,828 |

| 2013 | Nil | Nil |

Mark Sadler, VP and CFO(3)

| 2015 | 21,000 | 263,292 |

| 2014 | 21,000 | 445,079 |

| 2013 | 15,000 | 237,919 |

Brian Brodsky, VP Exploration

| 2015 | 21,000 | 263,292 |

| 2014 | 21,000 | 445,079 |

| 2013 | Nil | Nil |

Edie Hofmeister, VP Corporate Affairs,

General Counsel and Corporate Secretary

| 2015 | 21,000 | 263,292 |

| 2014 | 21,000 | 445,079 |

| 2013 | Nil | Nil |

| _____________________ |

| (1) | The value for 2015, 2014, and 2013 Deferred Share Award grants was calculated using a grant share price of C$15.68 per share and exchange rate of C$1.00 – $.7996, grant share price of C$23.37 per share and exchange rate of C$1.00 – $.9069, and grant share price of C$16.34 per share and exchange rate of C$1.00 – $.9707, respectively. |

| (2) | Deferred Share Awards were granted on April 1, 2014 and April 7, 2015 and vest one-third on the first, second and third anniversary dates of the applicable grant date for each award. |

| (3) | The Compensation Committee and Board approved a one-time grant of DSAs to Mr. Sadler in March 2013 at the time he was appointed CFO. The award vests in three tranches: one-third at the time of grant; one-third on the first anniversary; and one-third on the second anniversary of the grant date. |

| (4) | Refer to Table 7, footnote 6 for details relating to Deferred Share Awards awarded to Mr. Black in 2015. |

The executive team was granted share-based option awards on March 7, 2013 and April 7, 2015. Such awards were designed to retain high quality executives and to align their interests with those of the Shareholders. The value of these share-based awards and option-based awards are reflected in the compensation tables below. Depending on the future development of the Company and other factors that may be considered relevant, the Compensation Committee and the Board from time to time may decide to emphasize increased base salaries and rely less on share options or other incentives. There were no options granted in 2014.

| 2016 Management Information Circular | 23 |

| TABLE 6 |

NEO Name and Principal Position |

Year | Number of

Options(1)(2)(3) | Value(1)(3)

($) |

C. Kevin McArthur, Executive Chair and CEO

| 2015 | Nil | Nil |

| 2014 | Nil | Nil |

| 2013 | 120,000 | 711,717 |

Ron Clayton, President and COO

| 2015 | 120,000 | 439,342 |

| 2014 | Nil | Nil |

| 2013 | 90,000 | 533,788 |

Mark Sadler, VP and CFO

| 2015 | 90,000 | 329,507 |

| 2014 | Nil | Nil |

| 2013 | 60,000 | 355,859 |

Brian Brodsky, VP Exploration

| 2015 | 90,000 | 329,507 |

| 2014 | Nil | Nil |

| 2013 | 60,000 | 355,859 |

Edie Hofmeister, VP Corporate Affairs, General

Counsel and Corporate Secretary

| 2015 | 90,000 | 329,507 |

| 2014 | Nil | Nil |

| 2013 | 30,000 | 177,929 |

| _________________ |

| (1) | Options granted on April 7, 2015 are valued at US$3.66 using the Black Scholes model, with the exercise price of C$15.68 per share, an expected term of five years, and volatility of 49%. The options vest over three years in three equal tranches beginning on the first year anniversary of the grant date. |

| (2) | No options were granted in 2014. |

| (3) | Options granted on March 7, 2013 are valued at C$6.11 using the Black Scholes model, with the exercise price of C$16.34 per share, an expected term of four years, volatility of 49% and an exchange rate of C$1.00 – $0.9707. The options vest over three years in three equal tranches beginning on the first year anniversary of the grant date. |

| (4) | Refer to Table 7, footnote 6 for details relating to options awarded to Mr. Black in 2015. |

Extended and Group Benefits

The Company offers health benefits, life insurance, disability insurance and a 401(k) program for U.S. employees. Such benefits are designed to be competitive with equivalent positions in comparable Canadian and U.S. organizations. The Company does not provide pensions.

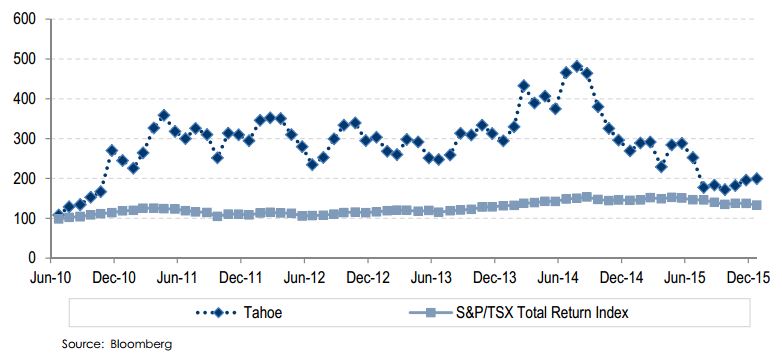

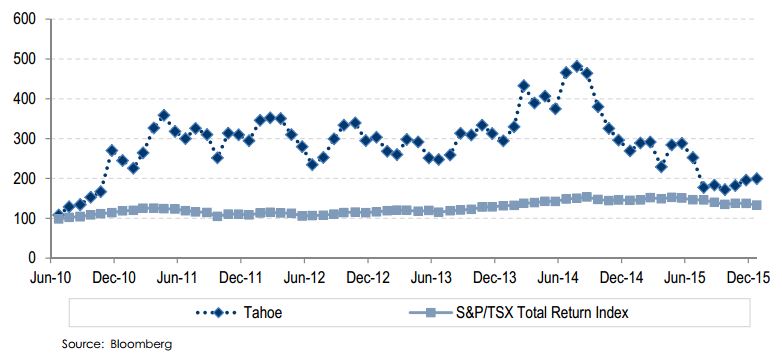

Performance Graph

The following graph compares the monthly percentage change in the Company’s cumulative total shareholder return on its Common Shares against the cumulative total shareholder return of the S&P/TSX Composite Total Return Index from the completion of the Company’s Initial Public Offering (“IPO”) on June 8, 2010 to December 31, 2015.

Since the IPO on June 8, 2010, the Company provided significant shareholder value with a 169% increase in share price. Notably, the Company’s market capitalization increased during that time to approximately C$2.4 billion, representing more than a C$2.0 billion increase over the approximately 5-year period.

The Company’s approach to compensation is closely tied to its goal of creating long-term shareholder value through consistent outperformance relative to its peers. The Company believes that its executive compensation policy is effective and appropriately supports a strong relationship between the compensation earned by NEOs and the investment return of Shareholders. The Company completed its IPO and its common shares commenced trading on the TSX in June 2010. The Company's management team, including the NEOs, are compensated on the basis of metrics that the Company considers to be fundamental, namely the operation of the Company’s mines, instead of on factors tied to the performance of the Company’s shares in the market.

Executive Management Succession Plan

The Company has a succession plan for its executive team. The CEO worked with the Compensation Committee to update the succession plan in 2015 and to review it with the entire Board in executive session. The Plan includes a succession strategy for each of the CEO’s direct reports as well as other key positions in the Company.

The Board is responsible for:

| | > | ensuring there is an orderly succession plan for the position of CEO; |

| | > | reviewing and approving the succession planning for each of the CEO’s direct reports; |

| > | ensuring the succession plan includes a process that would respond to an emergency situation which required an immediate replacement of the CEO or any of his direct reports; and |

| > | ensuring that the CEO has a succession planning process in place for other members of senior management in key positions. |

The Board took steps in each year from 2010 to 2015 to meet with the executive team and employees who have been identified as potential executives. These steps included participation in informal gatherings surrounding regularly scheduled Board meetings, formal and informal presentations during Board meetings and project tours in 2010, 2012, 2013 and 2014 that included the management teams from Tahoe and Minera San Rafael.

Summary Compensation Table

The following table provides information regarding compensation for the years ended December 31, 2015, 2014, and 2013, paid to or earned by the individuals who served as NEOs of the Company during such period.

| TABLE 7 |

NEO Name and

Principal

Position(6) |

Year |

Salary(1)

($) |

Share-

Based

Awards(2)

($) |

Option-

Based

Awards(3)

($) | Non-Equity Incentive Plan

Compensation |

All Other

Compensation(4)

($) |

Total

Compensation

($) |

Annual

Incentive

Plans

($) | Long-term

Incentive

Plans

($) |

C. Kevin

McArthur,

Executive Chair

and CEO | 2015 | 400,000 | 451,358 | Nil | 600,000 | Nil | Nil | 1,451,358 |

| 2014 | 425,000 | 953,741 | Nil | 675,000 | Nil | Nil | 2,053,741 |

| 2013 | 345,187 | Nil | 711,717 | 525,000 | Nil | Nil | 1,581,904 |

Ron Clayton,

President and

COO | 2015 | 570,000 | 376,132 | 439,342 | 387,600 | Nil | 30,741 | 1,803,815 |

| 2014 | 380,000 | 635,828 | Nil | 360,000 | Nil | 33,873 | 1,409,701 |

| 2013 | 312,450 | Nil | 533,788 | 320,000 | Nil | 33,144 | 1,199,382 |

Mark Sadler,

VP and CFO(5)

| 2015 | 332,500 | 263,292 | 329,507 | 171,570 | Nil | 37,595 | 1,127,464 |

| 2014 | 242,500 | 445,079 | Nil | 200,000 | Nil | 41,241 | 928,820 |

| 2013 | 208,736 | 237,919 | 355,859 | 180,000 | Nil | 42,858 | 1,025,371 |

Brian Brodsky,

VP Exploration

| 2015 | 332,500 | 263,292 | 329,507 | 175,560 | Nil | 40,237 | 1,134,096 |

| 2014 | 242,500 | 445,079 | Nil | 200,000 | Nil | 38,671 | 926,250 |

| 2013 | 214,612 | Nil | 355,859 | 180,000 | Nil | 37,936 | 788,406 |

Edie Hofmeister,

VP Corporate

Affairs, General

Counsel and

Corporate

Secretary | 2015 | 332,500 | 263,292 | 329,507 | 175,560 | Nil | 19,929 | 1,113,788 |

| 2014 | 237,500 | 445,079 | Nil | 200,000 | Nil | 20,525 | 903,104 |

| 2013 | 187,291 | Nil | 177,929 | 180,000 | Nil | 22,281 | 567,501 |

| 2016 Management Information Circular | 25 |

| _________________ |

| (1) | During 2013 annual salaries for Messrs. McArthur, Sadler, Clayton, Brodsky and Ms. Hofmeister were $350,000, $220,000, $320,000, $220,000 and $200,000, respectively. With the exceptions of Ms. Hofmeister whose adjusted compensation was effective May 1, 2013 and Mr. Sadler whose adjusted compensation was effective March 8, 2013, amounts disclosed for 2013 reflect a compensation adjustment effective April 1, 2013, the date the Board of Directors set when it approved executive salaries for 2013. During 2014 annual salaries for Messrs. McArthur, Sadler, Clayton, Brodsky and Ms. Hofmeister were $450,000, $250,000, $400,000, $250,000 and $250,000, respectively. Amounts disclosed for 2014 reflect a compensation adjustment effective April 1, 2014, the date the Board of Directors set when it approved executive salaries for 2014. During 2015 annual salaries for Messrs. McArthur, Sadler, Clayton, Brodsky and Ms. Hofmeister were $500,000, $350,000, $600,000, $350,000 and $350,000, respectively. These amounts reflect a compensation adjustment effective April 1, 2015, the date the Board of Directors set when it approved executive salaries for 2015. Amounts disclosed for 2015 reflect a compensation adjustment effective September 1, 2015, at which time Mr. McArthur volunteered to take a 20% salary reduction and all other NEOs agreed to take a 5% salary reduction. |

| (2) | For share-based awards, the fair value was based on the market price of the Common Shares and the exchange rate on the grant date. The grant date fair value of share-based awards as presented will differ from the compensation expense included for these grants in the Company’s financial statements, as in accordance with IFRS accounting requirements the compensation expense reflects only the fair value amortized in the period based on each grant’s vesting terms. |

| (3) | Represents the grant date fair value for option-based awards. Both the grant date fair value and accounting fair value for option-based awards are calculated using the Black-Scholes model using the assumptions described in the table under “Share Option Values and Assumptions” below. (Option-based awards were converted from Canadian dollars to US dollars at the prevailing rate on the date on which the awards were granted.) The grant date fair value of option-based awards as presented will differ from the compensation expense included for these grants in the Company’s financial statements, as in accordance with IFRS accounting requirements the compensation expense reflects only the fair value amortized in the period based on each grant’s vesting terms. See Table 8 for option values and assumptions. |

| (4) | “All other compensation” includes health benefits, life insurance, disability insurance and a 401(k) program for participating employees. |

| (5) | Mr. Sadler was appointed VP and CFO of the Company on March 8, 2013. Prior to such appointment, Mr. Sadler served as the Vice President of Metal Sales and Concentrate Marketing since February 27, 2012. |

| (6) | Mr. Black served as the Company’s CEO from April 1, 2015 until his resignation on August 4, 2015. Under the terms of his executive employment agreement, Mr. Black’s annual base salary was $800,000 with a bonus potential of up to 80%. Following commencement of employment on April 1, 2015, Mr. Black was granted 180,000 options with an exercise price of CAD$15.68, a Black Scholes value of $3.66 per share, and an expiration date of April 7, 2020; and 45,000 DSAs valued at CAD$15.68 on the date of grant (April 7, 2015). During his tenure at the Company, Mr. Black earned $255,677.93 in salary compensation. After resigning on August 4, 2015, Mr. Black received severance compensation in compliance with US, Peruvian, and Canadian regulations and in consideration of his contributions as founder, President, and Chief Executive Officer of Rio Alto Mining, including the development of the La Arena mine and Shahuindo Project. Mr. Black’s severance arrangements were comprised of: 1) US$2.8 million ($800,000 to be paid upon resignation and $2 million to be paid six months thereafter on Feb. 4, 2016); 2) accelerated vesting of 45,000 DSAs which were granted on April 7, 2015; 3) continuation of medical, vision and dental benefits through April 17, 2016; and 4) payment of $61,883.33 for accrued but unused vacation time. The options that were awarded to Mr. Black on April 7, 2016 remained unvested and were cancelled in accordance with the Company’s Option and Incentive Share Plan. |

Share Option Values and Assumptions

The following table describes the assumptions and calculations used in the Black-Scholes models for the grant date fair value and the accounting fair value of option-based awards in U.S. dollars.

| TABLE 8 |

Share Options | Grant Dates |

| Mar-15 | Mar-14 | Mar-13 |

| Share price at grant date | $12.54 | Nil | $15.98 |

| Exercise price | $12.54 | Nil | $15.86 |