| LA ARENA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

DATE AND SIGNATURES PAGE

The effective date of this Technical Report is January 1, 2018. The issue date of this report is February 20, 2018. See Appendix A, Feasibility Study Contributors and Professional Qualifications, for certificates of qualified persons. These certificates are considered the date and signature of this report and the effective date of this report in accordance with Form 43-101F1.

| i |

| LA ARENA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

| LA ARENA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

| |

| TABLE OF CONTENTS |

| SECTION | | | PAGE |

| | | | |

| DATE AND SIGNATURES PAGE | I |

| | |

| TABLE OF CONTENTS | II |

| | | |

| LIST OF FIGURES AND ILLUSTRATIONS | IX |

| | |

| LIST OF TABLES | XII |

| | | | |

| 1 | EXECUTIVE SUMMARY | 1 |

| | | |

| | 1.1 | INTRODUCTION | 1 |

| | | | | |

| | 1.2 | LA ARENA PROPERTY | 1 |

| | | | |

| | | 1.2.1 | Property Description and Location | 1 |

| | | | | |

| | 1.3 | LA ARENA MINE | 1 |

| | | | |

| | | 1.3.1 | Geology and Mineralization | 2 |

| | | 1.3.2 | Mineral Resource and Mineral Reserve Estimates | 2 |

| | | 1.3.3 | Mining Methods | 3 |

| | | 1.3.4 | Recovery Methods | 3 |

| | | 1.3.5 | Project Infrastructure | 3 |

| | | 1.3.6 | Capital and Operating Costs | 4 |

| | | 1.3.7 | Interpretation, Conclusions, and Recommendations | 5 |

| | | | | |

| | 1.4 | LA ARENA II PROJECT | 5 |

| | | | |

| | | 1.4.1 | Geology and Mineralization | 6 |

| | | 1.4.2 | Mineral Resource and Mineral Reserve Estimates | 6 |

| | | 1.4.3 | Mining Methods | 7 |

| | | 1.4.4 | Recovery Methods | 8 |

| | | 1.4.5 | Project Infrastructure | 8 |

| | | 1.4.6 | Capital and Operating Costs | 9 |

| | | 1.4.7 | Financial Analysis | 10 |

| | | 1.4.8 | Interpretation, Conclusions, and Recommendations | 11 |

| | | | | |

| 2 | INTRODUCTION | 13 |

| | | |

| | 2.1 | SOURCES OF INFORMATION | 13 |

| | | | |

| | 2.2 | QUALIFIED PERSONS AND SITE VISITS | 14 |

| | | | |

| | 2.3 | TERMS AND DEFINITIONS | 14 |

| | | | |

| 3 | RELIANCE ON OTHER EXPERTS | 17 |

| | | |

| 4 | PROPERTY DESCRIPTION AND LOCATION | 18 |

| | | |

| | 4.1 | PROPERTY LOCATION | 18 |

| | | | |

| | 4.2 | MINERAL TENURE AND TITLE | 18 |

| | | | |

| | 4.3 | STATE ROYALTIES, TAXES AND FEES | 20 |

| ii |

| LA ARENA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

| | | 4.3.1 | Mineral Concession Maintenance Fees | 20 |

| | | 4.3.2 | Modified Mining Royalty | 20 |

| | | 4.3.3 | Minimum Production Obligation | 20 |

| | | 4.3.4 | OSINERGMIN Contribution | 20 |

| | | 4.3.5 | OEFA Contribution | 20 |

| | | 4.3.6 | Taxation and Foreign Exchange Controls | 21 |

| | | | | |

| | 4.4 | WORKER PARTICIPATION | 21 |

| | | | |

| | 4.5 | ENVIRONMENTAL LIABILITIES | 21 |

| | | | |

| | 4.6 | PERMITS | 21 |

| | | | |

| | | 4.6.1 | Environmental Impact Assessment (EIA) | 21 |

| | | 4.6.2 | Mining Plan | 22 |

| | | 4.6.3 | Beneficiation Concession | 22 |

| | | 4.6.4 | Certificate for the Inexistence of Archaeological Remains (CIRA) | 22 |

| | | 4.6.5 | Mine Closure Plan | 22 |

| | | 4.6.6 | Water Usage License | 22 |

| | | 4.6.7 | Permanent Power Concession | 22 |

| | | 4.6.8 | Other Operation Permits | 22 |

| | | | | |

| | 4.7 | RISKS THAT MAY AFFECT ACCESS, TITLE, OR THE RIGHT OR ABILITY TO PERFORM WORK | 23 |

| | | | |

| 5 | ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE AND PHYSIOGRAPHY | 24 |

| | | |

| | 5.1 | ACCESSIBILITY | 24 |

| | | | |

| | 5.2 | PHYSIOGRAPHY AND CLIMATE | 24 |

| | | | |

| | 5.3 | LOCAL RESOURCES AND INFRASTRUCTURE | 24 |

| | | | |

| 6 | HISTORY | 26 |

| | | |

| | 6.1 | SUMMARY | 26 |

| | | | |

| | 6.2 | EXPLORATION HISTORY | 26 |

| | | | |

| | 6.3 | HISTORICAL MINERAL RESOURCE AND MINERAL RESERVE ESTIMATES | 27 |

| | | | |

| | 6.4 | PRODUCTION HISTORY | 35 |

| | | | |

| 7 | GEOLOGICAL SETTING AND MINERALIZATION | 37 |

| | | |

| | 7.1 | REGIONAL GEOLOGY | 37 |

| | | | |

| | 7.2 | PROJECT GEOLOGY | 40 |

| | | | |

| | 7.3 | STRUCTURAL GEOLOGY | 43 |

| | | | |

| | 7.4 | MINERALIZATION | 44 |

| | | | |

| | | 7.4.1 | High-Sulfidation Epithermal Gold Mineralization | 44 |

| | | 7.4.2 | Porphyry-hosted Copper-Gold Mineralization | 44 |

| | | | | |

| | 7.5 | ALTERATION | 45 |

| | | | |

| 8 | DEPOSIT TYPES | 46 |

| | | |

| 9 | EXPLORATION | 47 |

| | | |

| 10 | DRILLING | 49 |

| iii |

| LA ARENA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

| | 10.1 | SUMMARY | 49 |

| | | | |

| | 10.2 | DRILL CAMPAIGNS | 49 |

| | | | |

| | 10.3 | DATA COLLECTION | 50 |

| | | | |

| | | 10.3.1 | Sample Collection and Handling | 51 |

| | | 10.3.2 | Drill Collar Surveys | 51 |

| | | 10.3.3 | Downhole Surveys | 51 |

| | | 10.3.4 | Geologic Logging | 51 |

| | | 10.3.5 | Geotechnical Logging | 52 |

| | | | | |

| | 10.4 | DRILLING SUMMARY, RESULTS AND CONCLUSIONS | 52 |

| | | | |

| 11 | SAMPLE PREPARATION, ANALYSES AND SECURITY | 53 |

| | | |

| | 11.1 | SAMPLING METHOD | 53 |

| | | | |

| | 11.2 | SAMPLE SECURITY | 53 |

| | | | |

| | 11.3 | LABORATORY SAMPLE PREPARATION AND ANALYSES | 53 |

| | | | |

| | 11.4 | QUALITY ASSURANCE / QUALITY CONTROL | 54 |

| | | | |

| | | 11.4.1 | 2004 to 2007 QA/QC Procedures | 54 |

| | | 11.4.2 | 2010 to 2014 QA/QC Procedures | 54 |

| | | 11.4.3 | Current QA/QC Procedures | 54 |

| | | | | |

| | 11.5 | CONCLUSIONS | 60 |

| | | | |

| 12 | DATA VERIFICATION | 61 |

| | | |

| | 12.1 | PRIOR DATA VERIFICATION PROGRAMS | 61 |

| | | | |

| | 12.2 | 2017 DATA VERIFICATION | 62 |

| | | | |

| 13 | MINERAL PROCESSING AND METALLURGICAL TESTING | 63 |

| | | |

| | 13.1 | LA ARENA MINE METALLURGICAL EVALUATION OF OXIDE GOLD DEPOSIT | 63 |

| | | | |

| | | 13.1.1 | 2014 Column Leach Tests | 63 |

| | | 13.1.2 | Late 2014 Oxide Intrusive Program | 64 |

| | | 13.1.3 | Reagent Consumption | 65 |

| | | | | |

| | 13.2 | LA ARENA II METALLURGICAL EVALUATION | 66 |

| | | | |

| | | 13.2.1 | Sampling | 66 |

| | | 13.2.2 | Head Assays | 68 |

| | | | | |

| | 13.3 | LA ARENA II COMMINUTION TEST WORK | 69 |

| | | | |

| | 13.4 | LA ARENA II FLOTATION TEST WORK | 71 |

| | | | |

| | | 13.4.1 | Slurry Density Effect in Flotation | 71 |

| | | 13.4.2 | Effect pH in Rougher flotation | 71 |

| | | 13.4.3 | Primary Collector Evaluation | 72 |

| | | 13.4.4 | Grind Size Sensitivity Evaluation | 74 |

| | | 13.4.5 | Comparison of Test Program Flow Sheets | 75 |

| | | 13.4.6 | Cleaner Tests | 76 |

| | | 13.4.7 | Variability Tests | 79 |

| | | 13.4.8 | Locked Cycle Tests and Recovery Models | 80 |

| iv |

| LA ARENA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

| | | 13.4.9 | Diagnostic Leach on Flotation Tailings | 83 |

| | | 13.4.10 | Gravity Concentration Test | 85 |

| | | | | |

| | 13.5 | LA ARENA II SUPPLEMENTARY TESTS | 86 |

| | | | |

| | | 13.5.1 | Flocculant Screening Tests | 86 |

| | | 13.5.2 | Dynamic Thickening Test | 86 |

| | | 13.5.3 | Other Factors Tested | 87 |

| | | | | |

| | 13.6 | FUTURE METALLURGICAL INVESTIGATION | 88 |

| | | | |

| 14 | MINERAL RESOURCE ESTIMATES | 89 |

| | | |

| | 14.1 | MINERAL RESOURCE CLASSIFICATION DEFINITIONS | 89 |

| | | | |

| | 14.2 | DATA USED FOR MINERAL RESOURCE ESTIMATION | 90 |

| | | | |

| | 14.3 | LA ARENA MINE MINERAL RESOURCES | 90 |

| | | | |

| | | 14.3.1 | Geological Modeling | 90 |

| | | 14.3.2 | Gold Domain Model | 91 |

| | | 14.3.3 | Samples and Composites | 91 |

| | | 14.3.4 | Density | 92 |

| | | 14.3.5 | Resource Model and Estimation | 93 |

| | | 14.3.6 | Resource Classification | 94 |

| | | | | |

| | 14.4 | LA ARENA II MINERAL RESOURCES | 94 |

| | | | |

| | | 14.4.1 | Geological Modeling | 95 |

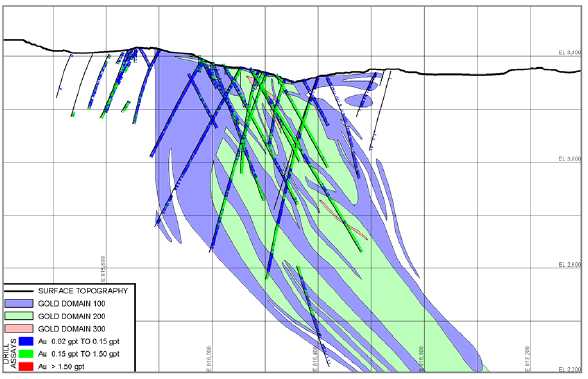

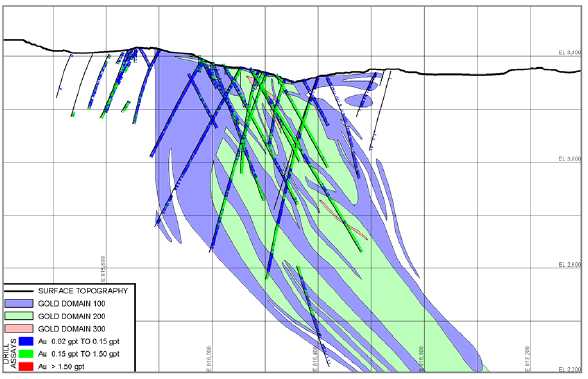

| | | 14.4.2 | Copper and Gold Domain Models | 97 |

| | | 14.4.3 | Samples and Composites | 99 |

| | | 14.4.4 | Density | 100 |

| | | 14.4.5 | Resource Model and Estimation | 100 |

| | | 14.4.6 | Resource Classification | 103 |

| | | | | |

| 15 | MINERAL RESERVE ESTIMATES | 104 |

| | | |

| | 15.1 | MINERAL RESERVE CLASSIFICATION | 104 |

| | | | |

| | | 15.1.1 | Mineral Reserve Definition | 104 |

| | | | | |

| | 15.2 | LA ARENA MINE MINERAL RESERVES | 104 |

| | | | |

| | | 15.2.1 | Cut-off Grade | 105 |

| | | 15.2.2 | Assumptions and Parameters | 105 |

| | | | | |

| | 15.3 | LA ARENA II MINERAL RESERVES | 106 |

| | | | |

| 16 | MINING METHODS | 107 |

| | | |

| | 16.1 | LA ARENA MINE – CURRENT OXIDE OPERATIONS | 107 |

| | | | |

| | | 16.1.1 | Pit Optimization | 107 |

| | | 16.1.2 | Mine | 109 |

| | | 16.1.3 | Waste Rock Storage | 111 |

| | | 16.1.4 | Production Schedule | 111 |

| | | | | |

| | 16.2 | LA ARENA II | 111 |

| | | | |

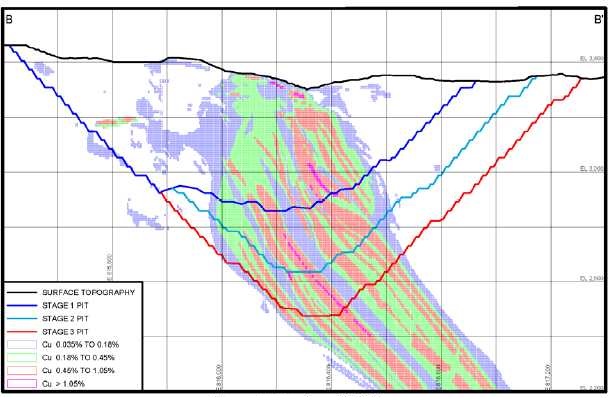

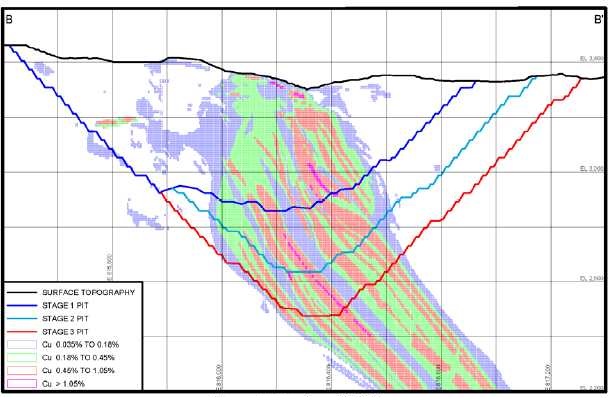

| | | 16.2.1 | Pit Optimization | 114 |

| | | 16.2.2 | Mine Design | 117 |

| v |

| LA ARENA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

| | | 16.2.3 | Waste Rock Storage | 120 |

| | | 16.2.4 | Production Schedule | 120 |

| | | 16.2.5 | Mining Equipment | 123 |

| | | | | |

| 17 | RECOVERY METHODS | 125 |

| | | |

| | 17.1 | LA ARENA MINE EXISTING FACILITY | 125 |

| | | | |

| | 17.2 | LA ARENA II PROCESS | 127 |

| | | | |

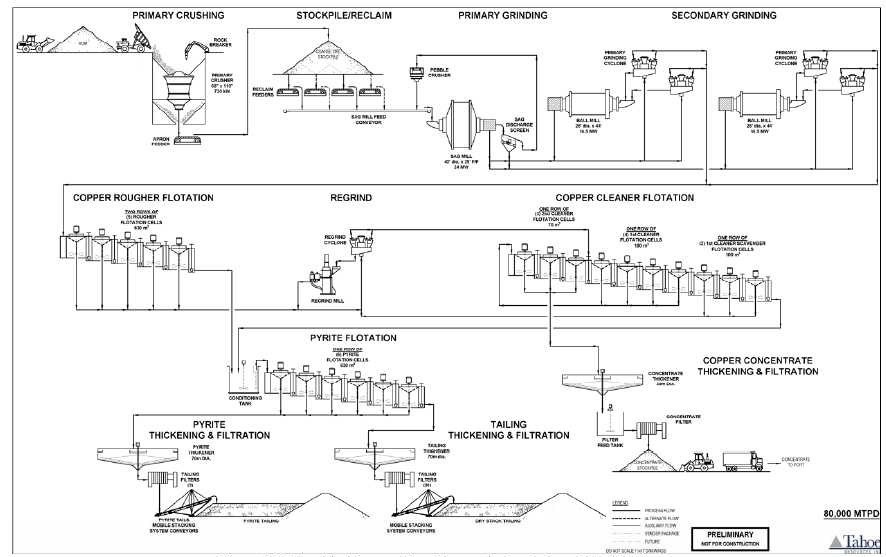

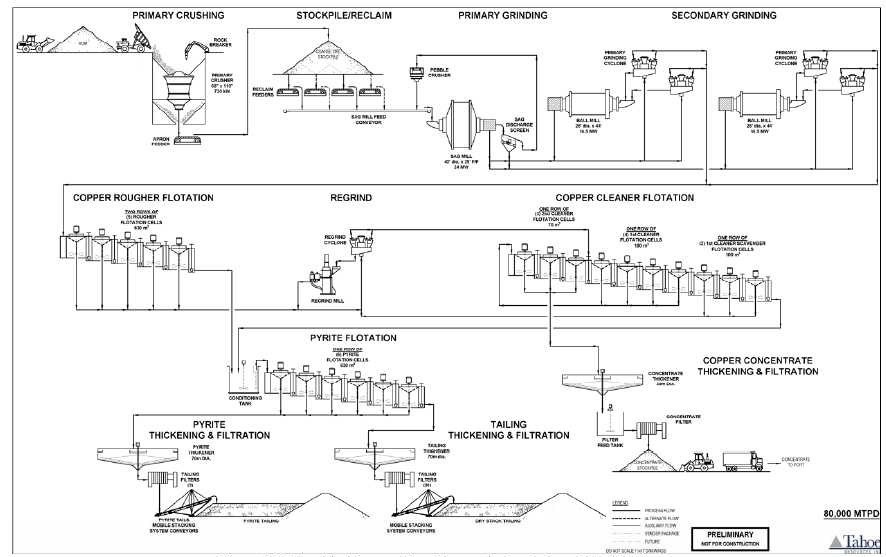

| | | 17.2.1 | La Arena II Process Description | 127 |

| | | 17.2.2 | La Arena II Process Design Criteria | 127 |

| | | 17.2.3 | Crushing and Crushed Material Stockpile | 129 |

| | | 17.2.4 | Grinding | 130 |

| | | 17.2.5 | Flotation | 130 |

| | | 17.2.6 | Copper Concentrate Thickening, Filtration and Storage | 131 |

| | | 17.2.7 | Pyrite Flotation, Thickening and Filtration | 131 |

| | | 17.2.8 | Tailing Filtration and Storage | 131 |

| | | 17.2.9 | Reagents and Consumables | 132 |

| | | 17.2.10 | Water Balance | 132 |

| | | 17.2.11 | Plant Services | 132 |

| | | 17.2.12 | Production Estimate | 133 |

| | | | | |

| 18 | PROJECT INFRASTRUCTURE | 135 |

| | | |

| | 18.1 | LA ARENA MINE | 135 |

| | | | |

| | | 18.1.1 | Roads | 135 |

| | | 18.1.2 | Power Supply | 136 |

| | | 18.1.3 | Water Supply | 136 |

| | | 18.1.4 | Leach Pad | 136 |

| | | 18.1.5 | Waste Rock Storage | 136 |

| | | 18.1.6 | Surface Water Management | 136 |

| | | 18.1.7 | Ancillaries | 136 |

| | | | | |

| | 18.2 | LA ARENA II | 137 |

| | | | |

| | | 18.2.1 | Roads | 139 |

| | | 18.2.2 | Power Supply | 139 |

| | | 18.2.3 | Water Supply | 140 |

| | | 18.2.4 | Tailings, Heap Leach Pad and Waste Rock Dumps | 140 |

| | | 18.2.5 | Surface Water Management | 141 |

| | | 18.2.6 | Ancillaries | 143 |

| | | | | |

| 19 | MARKET STUDIES AND CONTRACTS | 144 |

| | | |

| | 19.1 | LA ARENA MINE | 144 |

| | | | |

| | 19.2 | LA ARENA II | 144 |

| | | | |

| 20 | ENVIRONMENTAL STUDIES, PERMITTING AND SOCIAL OR COMMUNITY IMPACT | 146 |

| | | |

| | 20.1 | ENVIRONMENTAL | 146 |

| | | | |

| | | 20.1.1 | Environmental Impact Assessments | 146 |

| | | 20.1.2 | Site Monitoring and Environmental Mitigation Measures | 147 |

| | | 20.1.3 | Environmental Risks | 148 |

| vi |

| LA ARENA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

| | 20.2 | PERMITTING | 148 |

| | | | |

| | 20.3 | SOCIAL IMPACT | 148 |

| | | | |

| | 20.4 | MINE CLOSURE | 150 |

| | | | |

| 21 | CAPITAL AND OPERATING COSTS | 152 |

| | | |

| | 21.1 | INTRODUCTION | 152 |

| | | | |

| | 21.2 | LA ARENA MINE | 152 |

| | | | |

| | | 21.2.1 | Initial Capital Costs | 152 |

| | | 21.2.2 | Sustaining Capital | 152 |

| | | 21.2.3 | Operating Expenditures | 152 |

| | | | | |

| | 21.3 | LA ARENA II PROJECT | 153 |

| | | | |

| | | 21.3.1 | Initial Capital Costs | 153 |

| | | 21.3.2 | Sustaining Capital Costs | 156 |

| | | 21.3.3 | Operating Costs | 157 |

| | | | | |

| 22 | ECONOMIC ANALYSIS | 162 |

| | | |

| | 22.1 | INTRODUCTION | 162 |

| | | | |

| | 22.2 | MINE PRODUCTION STATISTICS | 162 |

| | | | |

| | 22.3 | PLANT PRODUCTION STATISTICS | 162 |

| | | | |

| | | 22.3.1 | Smelter Return Factors | 163 |

| | | | | |

| | 22.4 | CAPITAL EXPENDITURE | 163 |

| | | | |

| | | 22.4.1 | Initial and Sustaining Capital | 163 |

| | | 22.4.2 | Working Capital | 164 |

| | | 22.4.3 | Salvage Value | 164 |

| | | | | |

| | 22.5 | REVENUE | 164 |

| | | | |

| | 22.6 | OPERATING COST | 165 |

| | | | |

| | �� | 22.6.1 | Total Production Cost | 165 |

| | | | | |

| | 22.7 | TAXATION | 165 |

| | | | |

| | 22.8 | NET INCOME AFTER TAX | 165 |

| | | | |

| | 22.9 | NPV AND IRR | 166 |

| | | | |

| | 22.10 | FINANCIAL MODEL | 166 |

| | | | |

| 23 | ADJACENT PROPERTIES | 169 |

| | | |

| 24 | OTHER RELEVANT DATA AND INFORMATION | 171 |

| | | |

| 25 | INTERPRETATION AND CONCLUSIONS | 172 |

| | | |

| | 25.1 | LA ARENA MINE | 172 |

| | | | |

| | 25.2 | LA ARENA II | 173 |

| | | | |

| 26 | RECOMMENDATIONS | 175 |

| | | |

| | 26.1 | LA ARENA MINE | 175 |

| vii |

| LA ARENA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

| | 26.2 | LA ARENA II | 175 |

| | | | |

| | | 26.2.1 | Resource Definition | 175 |

| | | 26.2.2 | Metallurgical Testing | 175 |

| | | 26.2.3 | Waste and Tails Storage Facilities | 176 |

| | | 26.2.4 | Hydrology and Hydrogeology | 176 |

| | | 26.2.5 | Geochemistry | 177 |

| | | 26.2.6 | Pit Design | 177 |

| | | 26.2.7 | Power Supply | 177 |

| | | 26.2.8 | Permitting | 177 |

| | | 26.2.9 | Community Engagement | 178 |

| | | 26.2.10 | Land Acquisition | 178 |

| | | 26.2.11 | Additional Studies | 178 |

| | | | | |

| 27 | REFERENCES | 179 |

| | | |

| APPENDIX A: FEASIBILITY STUDY CONTRIBUTORS AND PROFESSIONAL QUALIFICATIONS | 181 |

| viii |

| LA ARENA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

LIST OF FIGURES AND ILLUSTRATIONS

| FIGURE | DESCRIPTION | PAGE |

| | | |

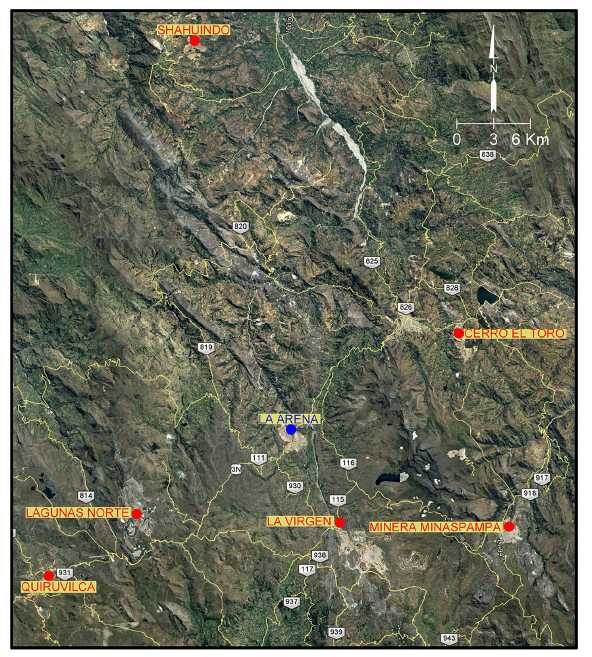

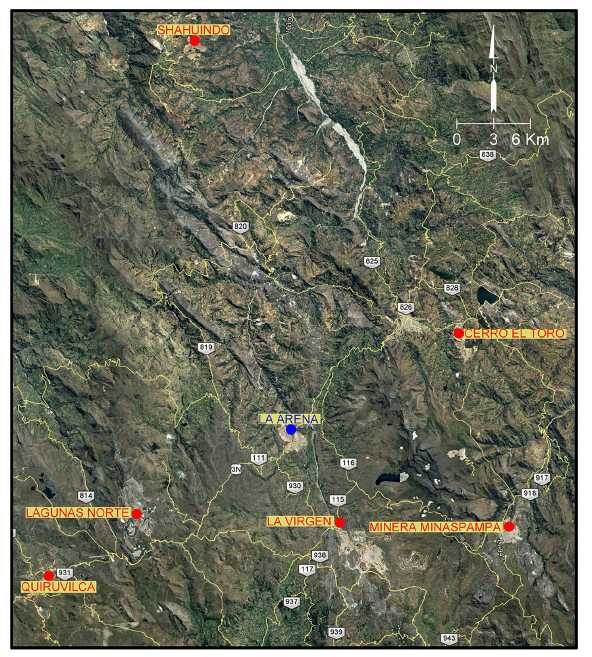

| Figure 4-1: | La Arena Property Location | 18 |

| | | |

| Figure 4-2: | La Arena Concessions | 19 |

| | | |

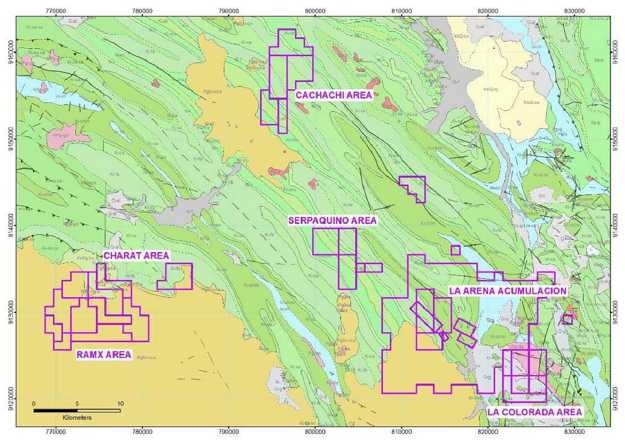

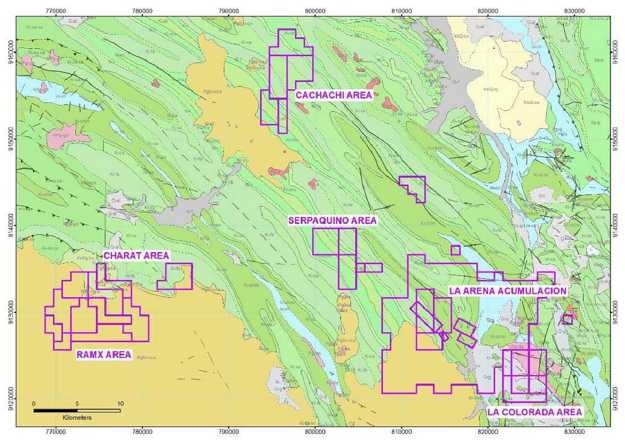

| Figure 7-1: | Regional Geology | 39 |

| | | |

| Figure 7-2: | Regional Geologic Cross Section | 40 |

| | | |

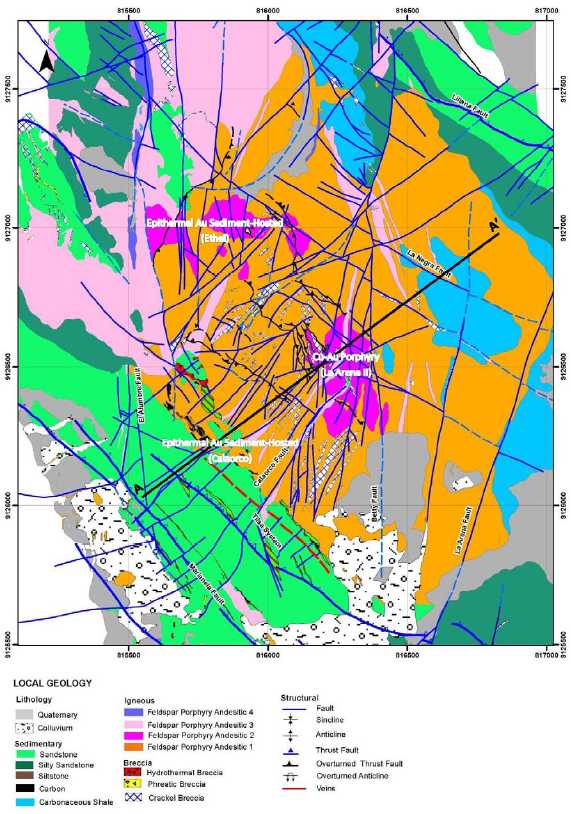

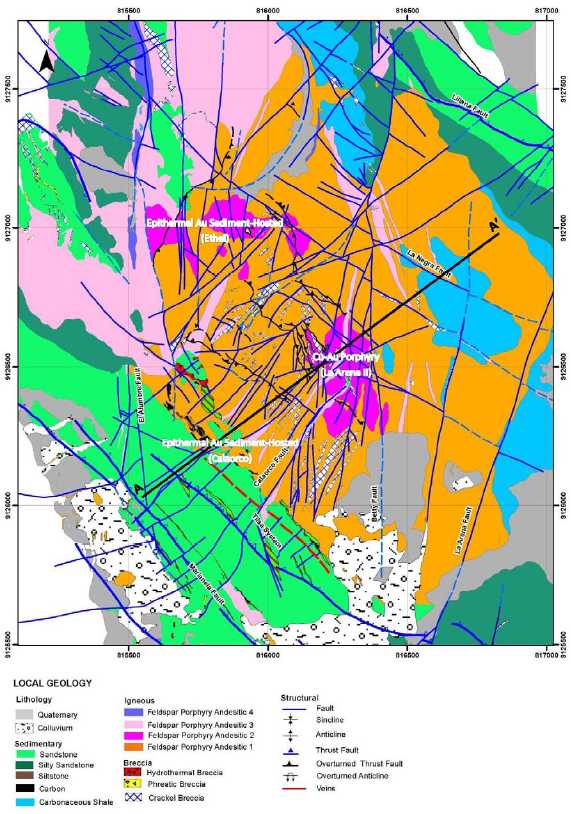

| Figure 7-3: | La Arena Geology | 41 |

| | | |

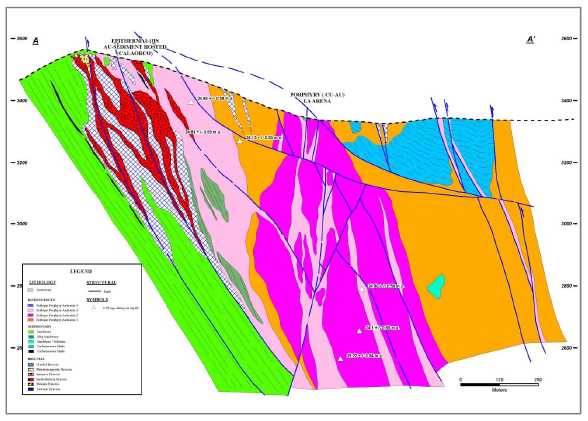

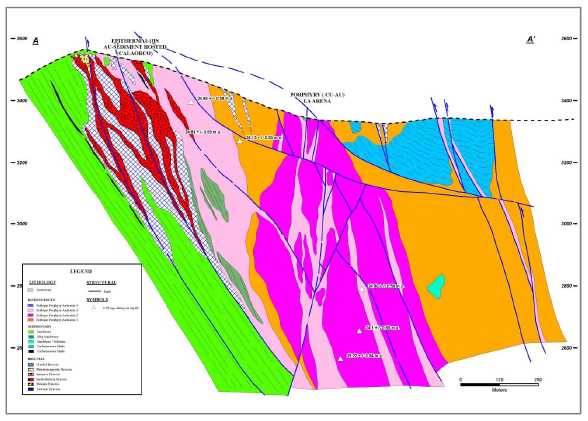

| Figure 7-4: | La Arena Geologic Cross Section | 42 |

| | | |

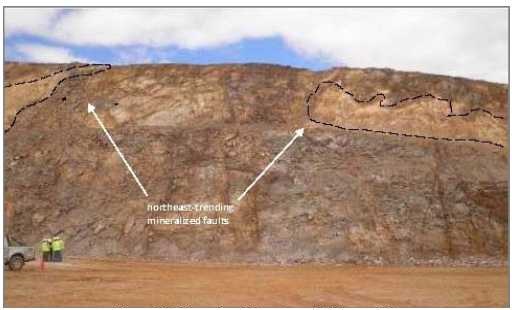

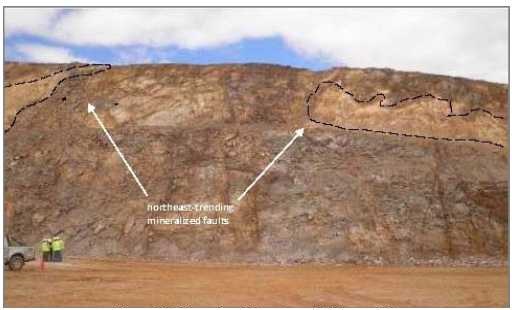

| Figure 7-5: | Mineralized Structures in Calaorco Pit | 43 |

| | | |

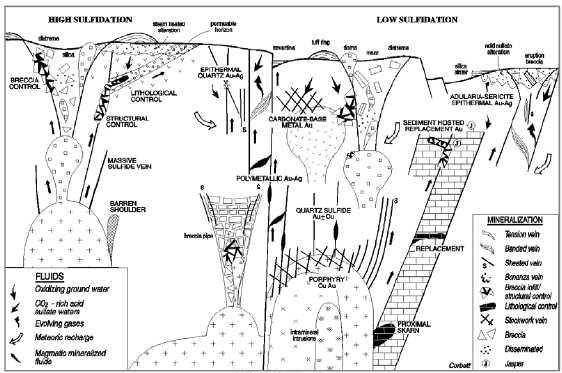

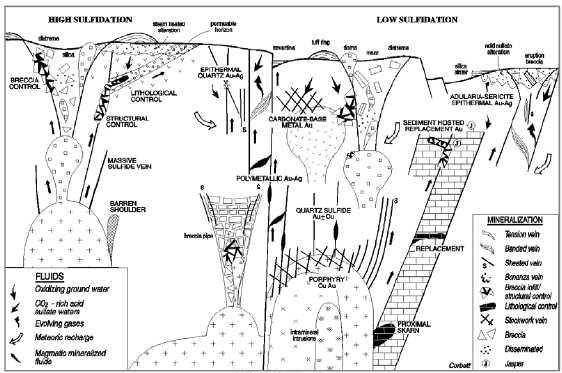

| Figure 8-1: | Spatial Relationship of Epithermal and Porphyry Deposits | 46 |

| | | |

| Figure 9-1: | Regional Exploration Targets | 47 |

| | | |

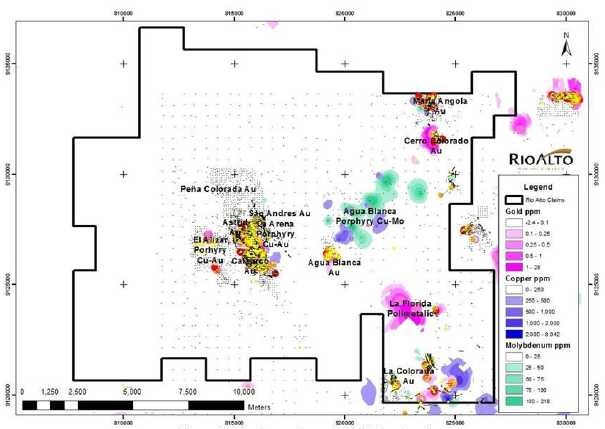

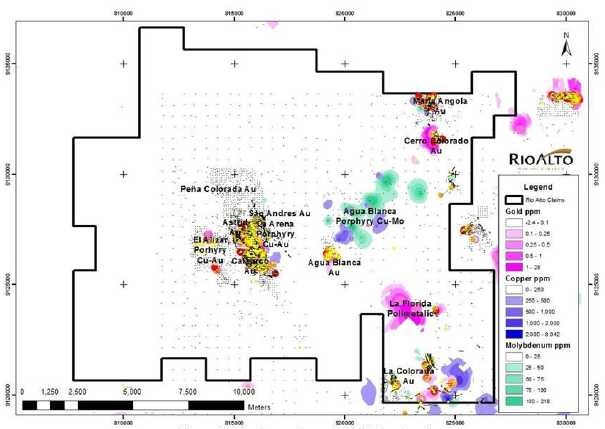

| Figure 9-2: | La Arena Property Soil Geochemistry | 48 |

| | | |

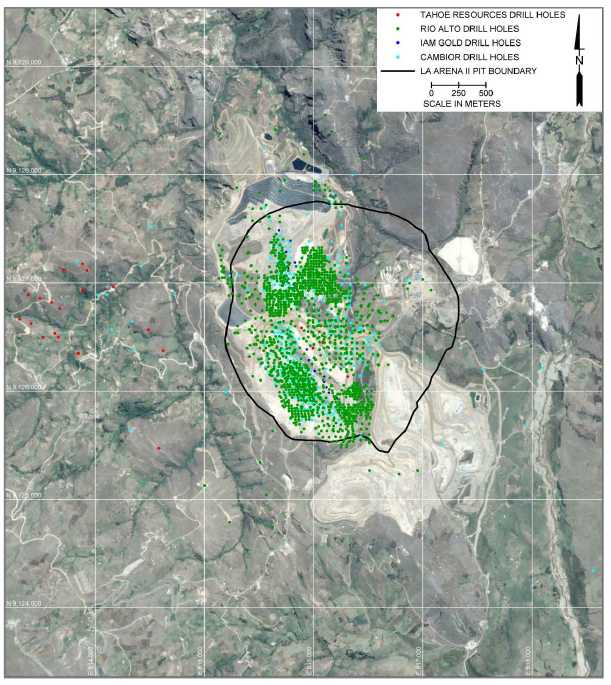

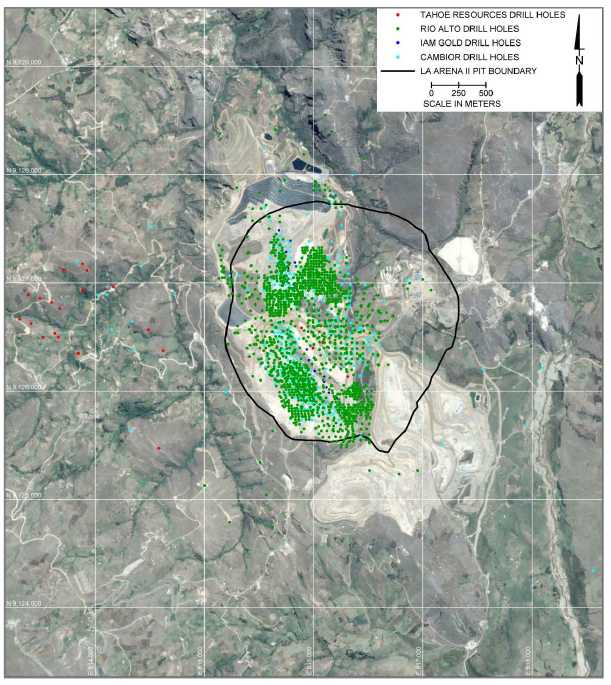

| Figure 10-1: | La Arena Property Drill Hole Location Map | 50 |

| | | |

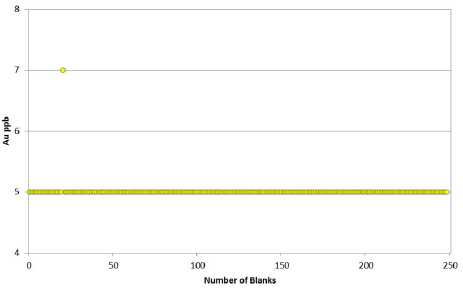

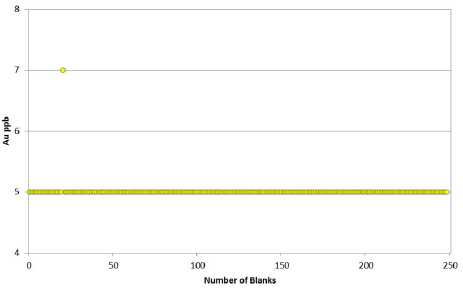

| Figure 11-1: | La Arena Mine Gold Assay Blanks | 55 |

| | | |

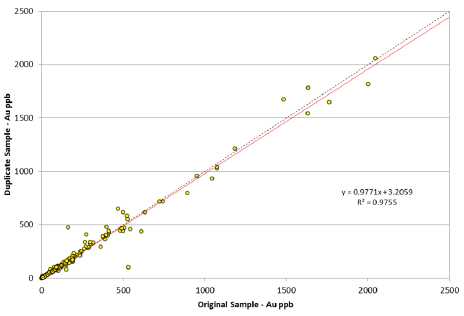

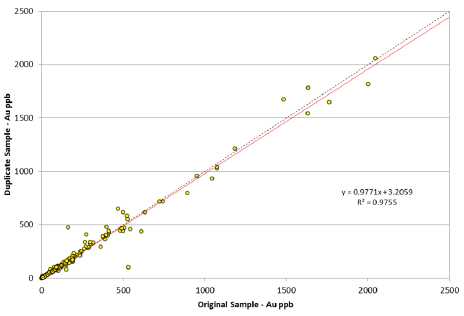

| Figure 11-2: | La Arena Mine Duplicate Sample Results – Gold | 56 |

| | | |

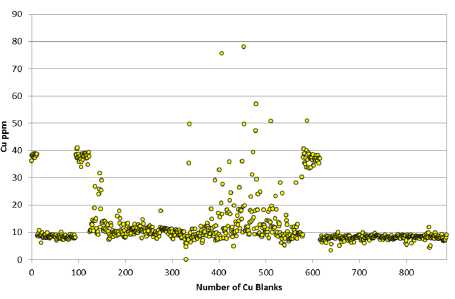

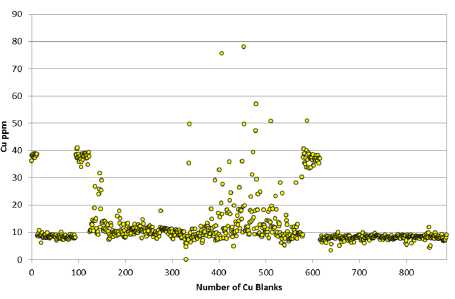

| Figure 11-3: | La Arena II Copper Assay Blanks | 57 |

| | | |

| Figure 11-4: | La Arena II Gold Assay Blanks | 58 |

| | | |

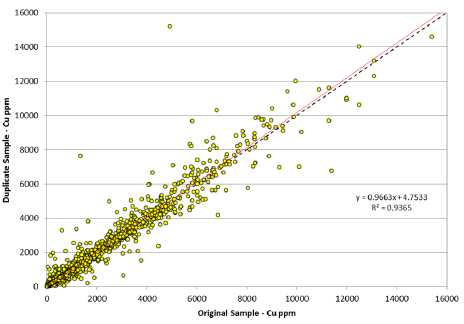

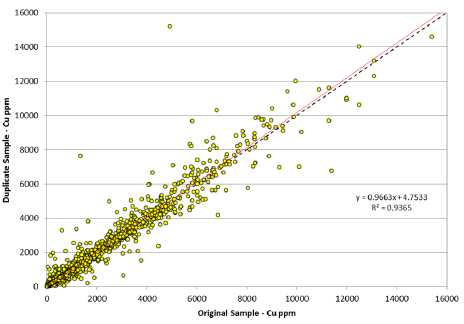

| Figure 11-5: | La Arena II Duplicate Sample Results - Copper | 59 |

| | | |

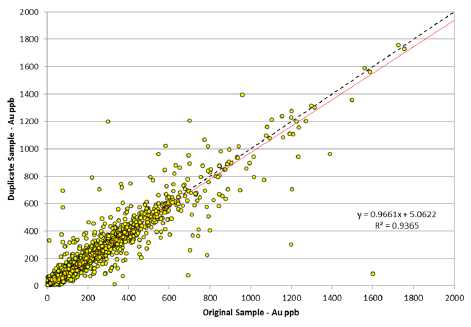

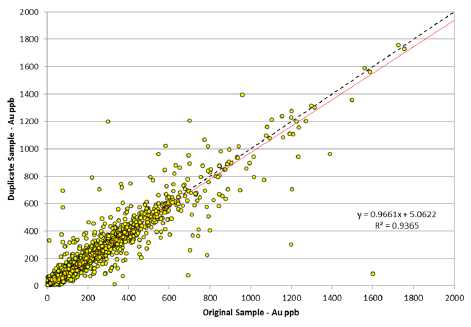

| Figure 11-6: | La Arena II Duplicate Sample Results – Gold | 60 |

| | | |

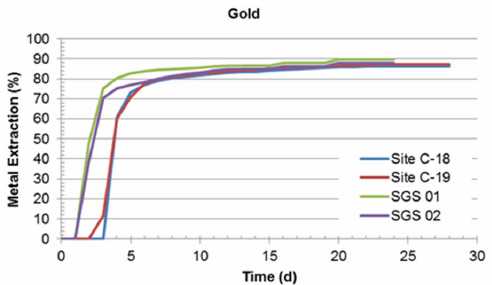

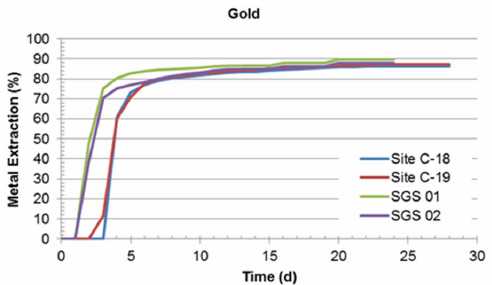

| Figure 13-1: | Gold Extraction Curve kinetics for Column Tests | 64 |

| | | |

| Figure 13-2: | Copper Extraction Curve Kinetics for Column Tests | 64 |

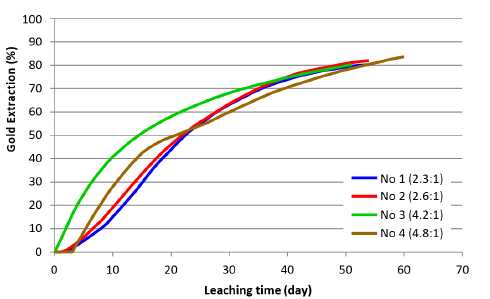

| | | |

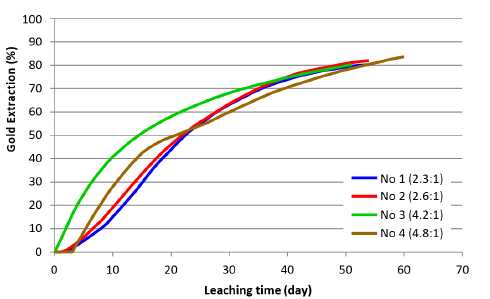

| Figure 13-3: | Kinetic Curve for Gold Extraction in Pilot Dump Leach Test | 65 |

| | | |

| Figure 13-4: | Metallurgical drill hole location superimposed on the mine pit shell | 67 |

| | | |

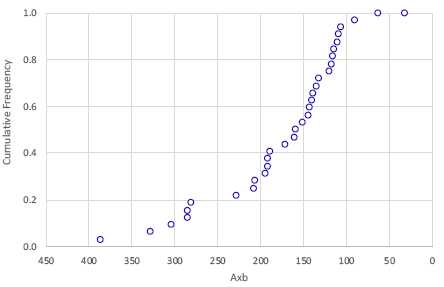

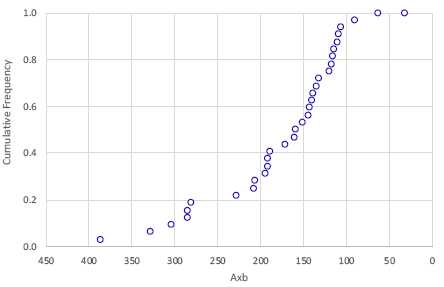

| Figure 13-5: | Cumulative Frequency Distribution of Axb parameters | 70 |

| | | |

| Figure 13-6: | Cumulative Frequency Distribution of Bond Ball Mill Work Indices | 71 |

| | | |

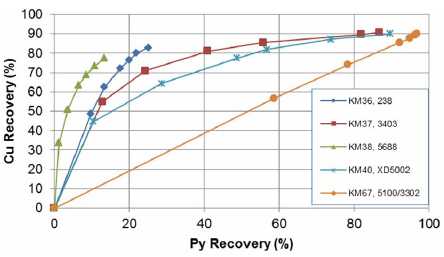

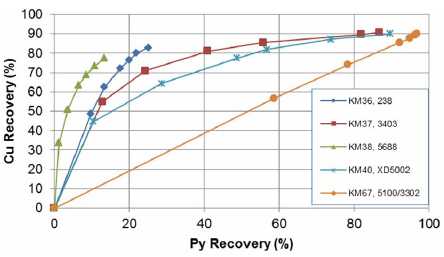

| Figure 13-7: | Selectivity curve for copper against pyrite for ARC samples | 74 |

| | | |

| Figure 13-8: | Selectivity curve for copper minerals against non-sulfide gangue | 74 |

| | | |

| Figure 13-9: | Copper Recovery Versus Grind Size | 75 |

| | | |

| Figure 13-10: | Gold Recovery Versus Grind Size | 75 |

| | | |

| Figure 13-11: | KM3991 Cleaner Flotation Flow Sheet | 77 |

| | | |

| Figure 13-12: | Copper grade-recovery relationship between two and three cleaner stages | 78 |

| | | |

| Figure 13-13: | Gold Grade-Recovery Relationship Between Two and Three Cleaner Stages | 79 |

| | | |

| Figure 13-14: | Comparative copper recovery results in variability composites | 80 |

| ix |

| LA ARENA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

| Figure 13-15: | Gold recovery results vs. Gold head grade for all variability composites | 80 |

| | | |

| Figure 13-16: | Locked Cycle Tests – Flowsheet A | 81 |

| | | |

| Figure 13-17: | Locked Cycle Tests - Flowsheet B | 81 |

| | | |

| Figure 13-18: | Locked Cycle Test Cu Head Grade vs. Cu Recovery | 82 |

| | | |

| Figure 13-19: | Locked Cycle Test Au Head Grade vs. Au Recovery | 82 |

| | | |

| Figure 13-20: | Variability Test Au Head Grade vs. Au Recovery | 83 |

| | | |

| Figure 13-21: | Diagnostic leach tests carried out on locked cycle flotation tailings for ARC sample | 84 |

| | | |

| Figure 13-22: | Diagnostic leach carried out on locked cycle flotation tailings for PHC sample | 84 |

| | | |

| Figure 13-23: | Diagnostic leach carried out on locked cycle flotation tailings for KC sample | 85 |

| | | |

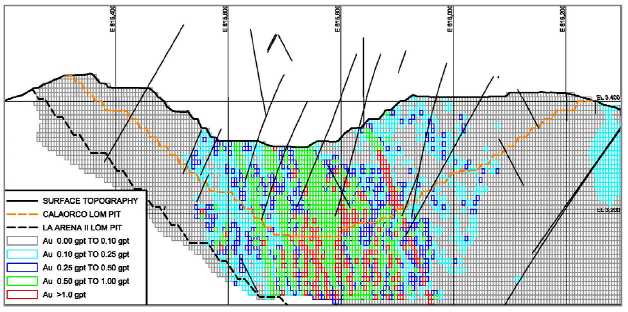

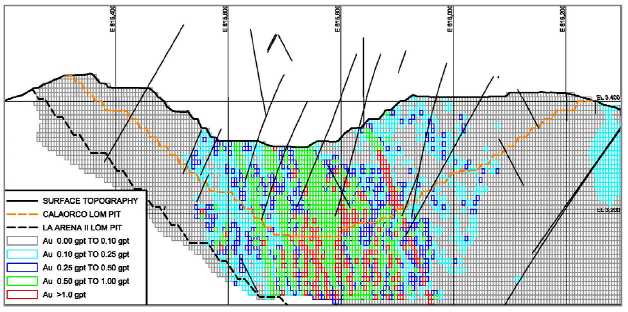

| Figure 14-1: | La Arena Mine Gold Mineral Domains | 91 |

| | | |

| Figure 14-2: | La Arena Mine Mineral Resource Block Model | 94 |

| | | |

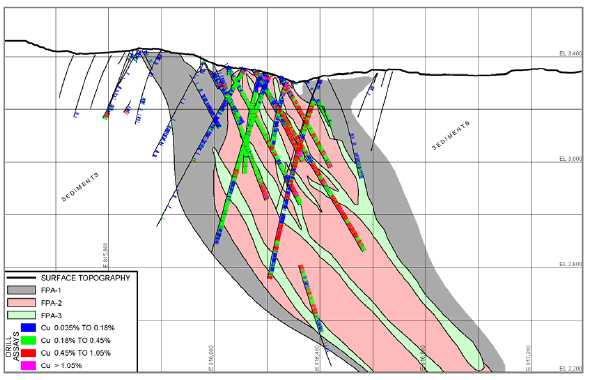

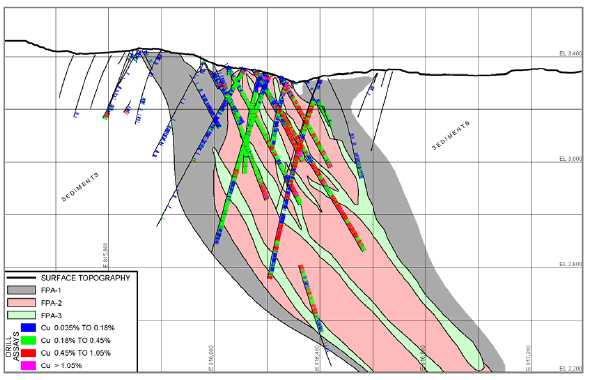

| Figure 14-3: | La Arena II Porphyry Model with Copper Assays | 96 |

| | | |

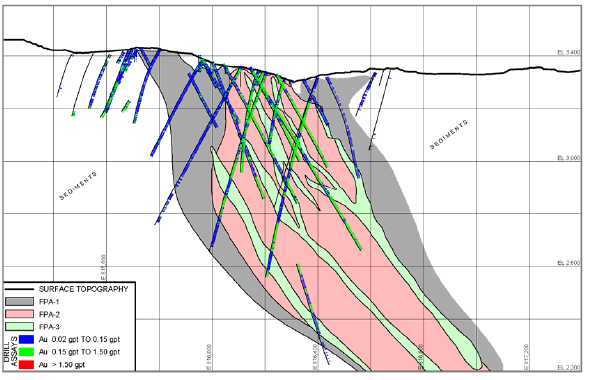

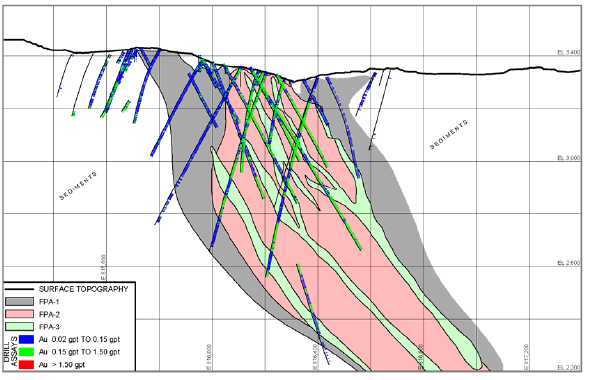

| Figure 14-4: | La Arena II Porphyry Model with Gold Assays | 96 |

| | | |

| Figure 14-5: | La Arena II Copper Domains | 98 |

| | | |

| Figure 14-6: | La Arena II Gold Domains | 98 |

| | | |

| Figure 14-7: | La Arena II Copper Mineral Resources | 102 |

| | | |

| Figure 14-8: | La Arena II Gold Mineral Resources | 102 |

| | | |

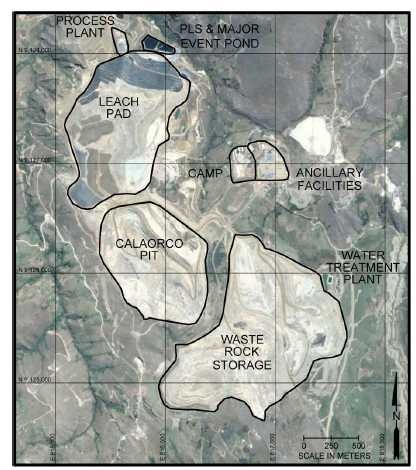

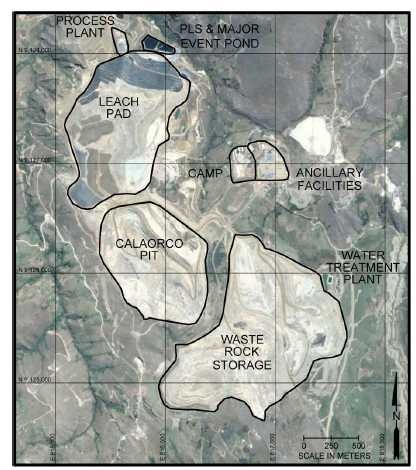

| Figure 16-1: | La Arena Mine Site Layout | 107 |

| | | |

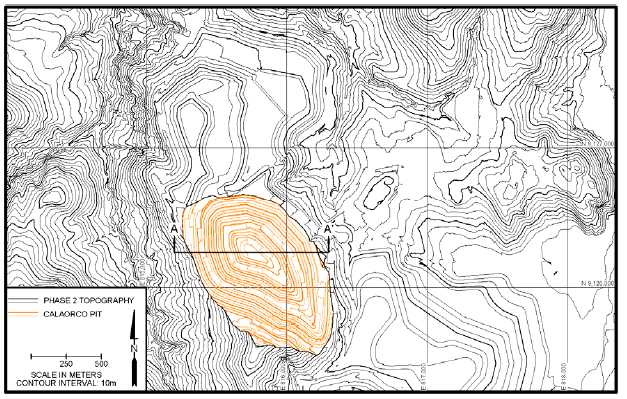

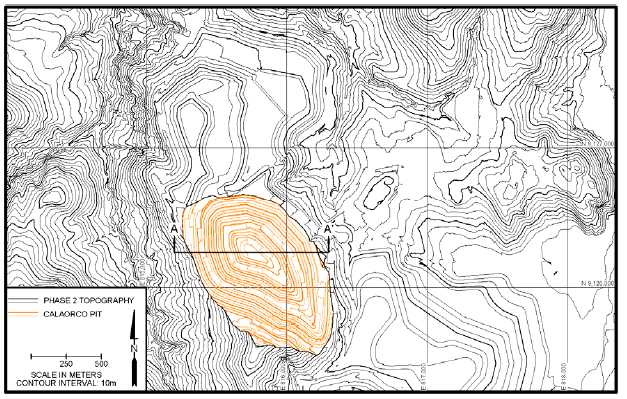

| Figure 16-2: | Calaorco Final Pit | 110 |

| | | |

| Figure 16-3: | Calaorco LOM Pit | 110 |

| | | |

| Figure 16-4: | La Arena II Proposed General Arrangement | 113 |

| | | |

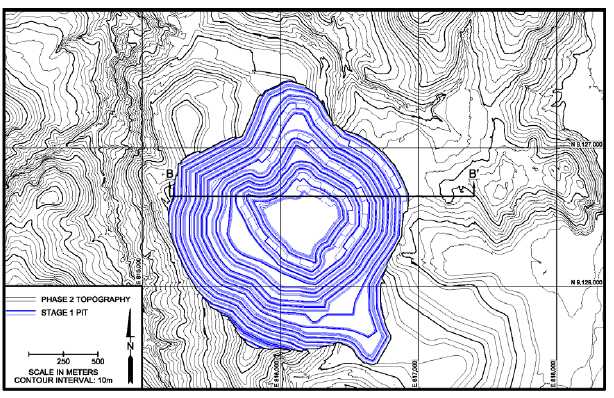

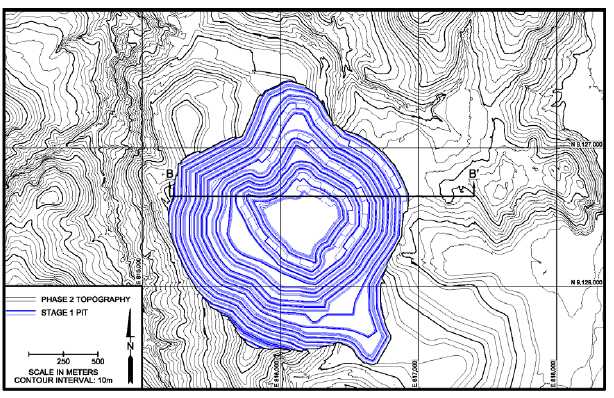

| Figure 16-5: | La Arena II Stage 1 Pit | 118 |

| | | |

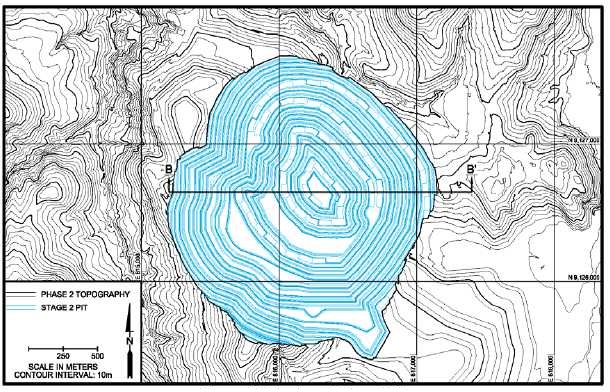

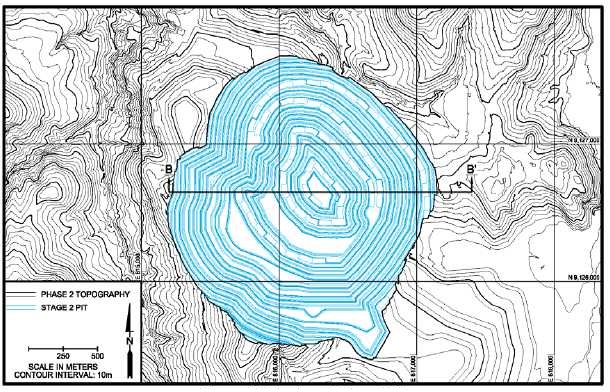

| Figure 16-6: | La Arena II Stage 2 Pit | 118 |

| | | |

| Figure 16-7: | La Arena II Stage 3 Final Pit | 119 |

| | | |

| Figure 16-8: | La Arena II Pit Stages | 119 |

| | | |

| Figure 16-9: | La Arena II Material Movement by Year | 122 |

| | | |

| Figure 16-10: | La Arena II Leach and Mill Movement by Year | 122 |

| | | |

| Figure 16-11: | La Arena II Leach and Mill Process by Year | 123 |

| | | |

| Figure 17-1: | Simplified Process Flow Diagram for the La Arena Mine Gold Dump Leach Operation | 126 |

| | | |

| Figure 17-2: | Simplified Process Flow Diagram for the La Arena II Sulfide Plant | 128 |

| | | |

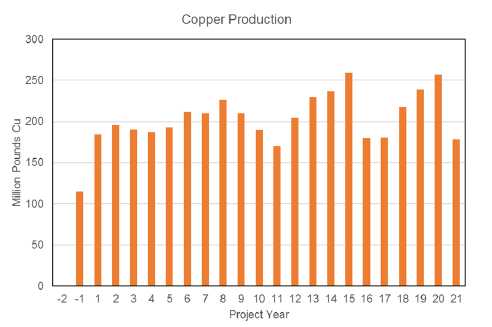

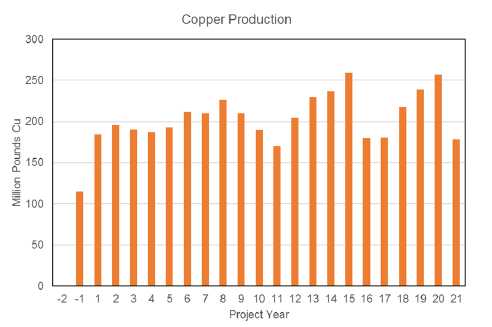

| Figure 17-3: | Copper Production by Year | 134 |

| | | |

| Figure 17-4: | Gold Production by Source and Year | 134 |

| | | |

| Figure 18-1: | Existing La Arena Mine Facilities | 135 |

| | | |

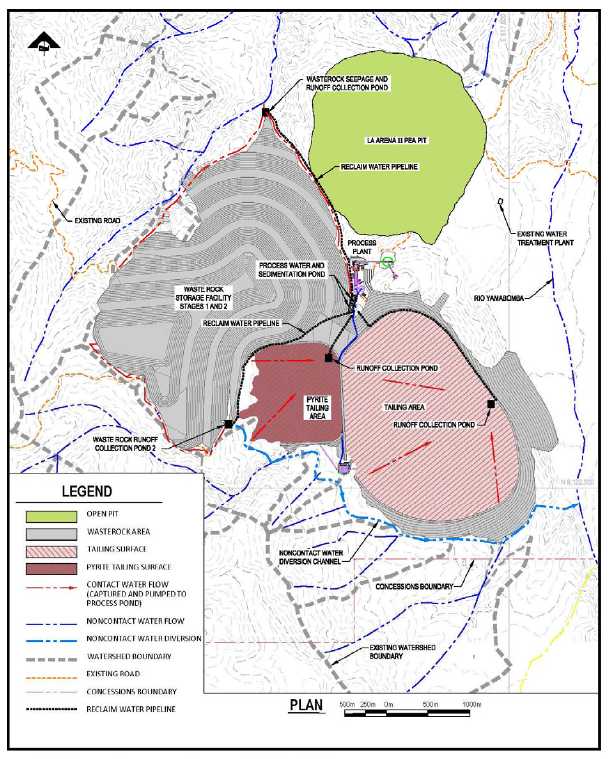

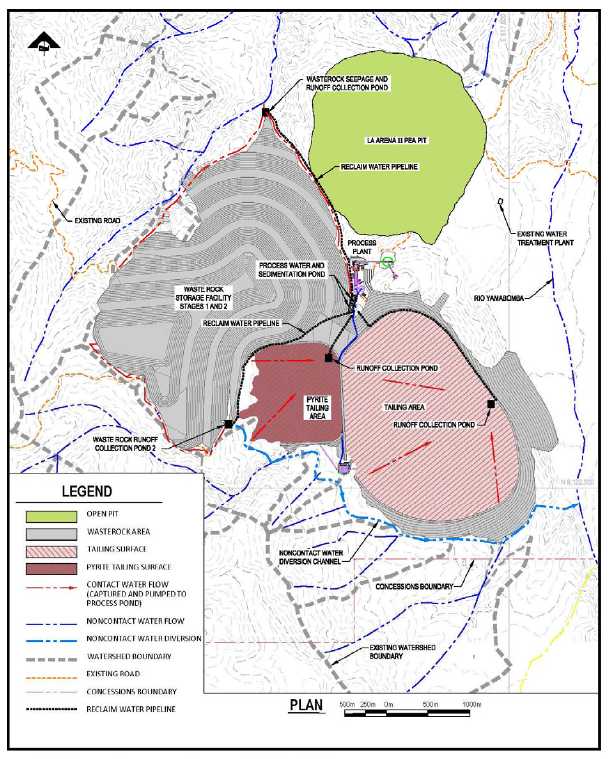

| Figure 18-2: | Overview of La Arena II Conceptual Site Infrastructure | 138 |

| x |

| LA ARENA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

| Figure 18-3: | La Arena II Process Plant Conceptual Infrastructure | 139 |

| | | |

| Figure 18-4: | General Surface Contact Water Control | 142 |

| | | |

| Figure 23-1: | Adjacent Properties | 169 |

| xi |

| LA ARENA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

LIST OF TABLES

| TABLE | DESCRIPTION | PAGE |

| | | |

| Table 1-1: | La Arena Mine Mineral Resources | 2 |

| | | |

| Table 1-2: | La Arena Mine Mineral Reserves | 2 |

| | | |

| Table 1-3: | La Arena Mine Mining Schedule | 3 |

| | | |

| Table 1-4: | La Arena Mine Sustaining Capital Expenditures Remaining LOM | 4 |

| | | |

| Table 1-5: | La Arena Mine Operating Costs Remaining LOM | 4 |

| | | |

| Table 1-6: | La Arena Mine Operating Cost per Tonne | 5 |

| | | |

| Table 1-7: | La Arena II Mineral Resources | 6 |

| | | |

| Table 1-8: | La Arena II Project Mineral Resources in Mine Plan | 7 |

| | | |

| Table 1-9: | Metallurgical Recovery Assumptions | 8 |

| | | |

| Table 1-10: | La Arena II Project Initial Capital Summary | 9 |

| | | |

| Table 1-11: | La Arena II Project Sustaining Capital Summary | 9 |

| | | |

| Table 1-12: | La Arena II Average Annual Operating Costs | 10 |

| | | |

| Table 1-13: | Sensitivity Analysis after Taxes | 11 |

| | | |

| Table 2-1: | Areas of Responsibility and Site Visit Dates | 14 |

| | | |

| Table 2-2: | Terms and Abbreviations | 15 |

| | | |

| Table 6-1: | La Arena Au-Cu Project Mineral Resource (March 31, 2008) | 27 |

| | | |

| Table 6-2: | La Arena Project Probable Mineral Reserve | 28 |

| | | |

| Table 6-3: | La Arena Au-Cu Project Mineral Resource (July 31, 2010) | 28 |

| | | |

| Table 6-4: | La Arena Project – Rio Alto Mineral Reserve (31 July 2010) | 29 |

| | | |

| Table 6-5: | Mineral Resource - Oxide Total (In Situ as at September 30, 2011) | 29 |

| | | |

| Table 6-6: | Mineral Resource – Sulfide Total (In-Situ as at September 30, 2011) | 29 |

| | | |

| Table 6-7: | Mineral Resource – Oxide Total (In Situ as at January 1, 2013) | 30 |

| | | |

| Table 6-8: | Mineral Resource – Sulfide Total (In Situ as at January 1, 2013) | 30 |

| | | |

| Table 6-9: | Mineral Reserve – Oxide and Sulfide (In Situ as at January 1, 2013) | 31 |

| | | |

| Table 6-10: | Mineral Resource – Oxide Total (In Situ as at December 31, 2013) | 31 |

| | | |

| Table 6-11: | La Arena – Oxide Mineral Reserve (In Situ as at December 31, 2013) | 32 |

| | | |

| Table 6-12: | La Arena – Oxide Gold Mineral Resources (In Situ as at December 31, 2014) | 33 |

| | | |

| Table 6-13: | Mineral Resource – Sulfide Total (In Situ as at December 31, 2014) | 33 |

| | | |

| Table 6-14: | La Arena – Oxide Mineral Reserve (In Situ as at December 31, 2013) | 34 |

| | | |

| Table 6-15: | La Arena Mineral Reserve Statement for Sulfide | 35 |

| | | |

| Table 6-16: | La Arena Mine Annual Mine Production | 35 |

| xii |

| LA ARENA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

| Table 6-17: | La Arena Mine Annual Processing Production | 35 |

| | | |

| Table 10-1: | La Arena Property Drilling History | 49 |

| | | |

| Table 11-1: | La Arena Mine Gold Assay Standard Results | 55 |

| | | |

| Table 11-2: | La Arena Mine Duplicate Sample Statistics - Gold | 56 |

| | | |

| Table 11-3: | La Arena II Project Copper Assay Standard Results | 56 |

| | | |

| Table 11-4: | La Arena II Project Gold Assay Standard Results | 57 |

| | | |

| Table 11-5: | La Arena II Duplicate Sample Statistics – Copper | 58 |

| | | |

| Table 11-6: | La Arena II Duplicate Sample Statistics – Gold | 59 |

| | | |

| Table 13-1: | CERTIMIN and SGS Column Tests Results | 63 |

| | | |

| Table 13-2: | Late 2014 Pilot Dump Leach Results | 65 |

| | | |

| Table 13-3: | Reagents Consumption Calculated for Each Rock Type | 65 |

| | | |

| Table 13-4: | Testwork Composites for KM3262, KM3526 and KM3866 | 67 |

| | | |

| Table 13-5: | Test Work Composites for KM3991 | 68 |

| | | |

| Table 13-6: | Main elements for domain and variability composites head assays | 68 |

| | | |

| Table 13-7: | Comminution Data | 69 |

| | | |

| Table 13-8: | Summary of Comminution Design Parameters | 70 |

| | | |

| Table 13-9: | Effect of pH on Rougher Flotation | 72 |

| | | |

| Table 13-10: | Summary of Primary Collector Tests Results for ARC samples | 72 |

| | | |

| Table 13-11: | Results of Rougher Flotation Tests using KM3526, KM3866 and KM3991 Procedures | 76 |

| | | |

| Table 13-12: | Effect of Aerophine 3418A and rougher feed dilution on cleaner tests | 77 |

| | | |

| Table 13-13: | Effect of Slurry Density on Cleaner Tests and Regrind of 2nd Cleaner Feed (Tests 129 and 133) | 78 |

| | | |

| Table 13-14: | Cleaner flotation tests results on variability composites | 79 |

| | | |

| Table 13-15: | Copper Concentrate Chemical Assay – main pay and penalty elements | 83 |

| | | |

| Table 13-16: | Knelson Gravity Test Results | 85 |

| | | |

| Table 13-17: | Optimum Flocculant Concentration for all Composite Samples | 87 |

| | | |

| Table 13-18: | Optimum Solids Loading for all Composite Samples | 87 |

| | | |

| Table 14-1: | La Arena Mine Mineral Resources | 90 |

| | | |

| Table 14-2: | La Arena Mine Gold Mineral Domain Assay Statistics | 92 |

| | | |

| Table 14-3: | La Arena Mine Gold Mineral Domain Composite Statistics | 92 |

| | | |

| Table 14-4: | Densities Used in La Arena Mine Mineral Resource Model | 93 |

| | | |

| Table 14-5: | La Arena Mine Resource Estimation Parameters | 93 |

| | | |

| Table 14-6: | La Arena II Mineral Resources | 95 |

| | | |

| Table 14-7: | La Arena II Mineral Domains | 97 |

| | | |

| Table 14-8: | La Arena II Copper Mineral Domain Assay Statistics | 99 |

| xiii |

| LA ARENA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

| Table 14-9: | La Arena II Gold Mineral Domain Assay Statistics | 99 |

| | | |

| Table 14-10: | La Arena II Sample Capping | 99 |

| | | |

| Table 14-11: | La Arena II Copper Mineral Domain Composite Statistics | 100 |

| | | |

| Table 14-12: | La Arena II Gold Mineral Domain Composite Statistics | 100 |

| | | |

| Table 14-13: | Densities Used in La Arena Mine Mineral Resource Model | 100 |

| | | |

| Table 14-14: | La Arena II Resource Estimation Parameters | 101 |

| | | |

| Table 14-15: | La Arena II Resource Estimation Search Restrictions | 101 |

| | | |

| Table 15-1: | La Arena Mine Mineral Reserves | 105 |

| | | |

| Table 15-2: | La Arena Mine Pit Optimization Parameters | 106 |

| | | |

| Table 16-1: | La Arena Mine Leach Recovery | 108 |

| | | |

| Table 16-2: | La Arena Mine Metal Price Assumptions | 108 |

| | | |

| Table 16-3: | La Arena Mine Operating Cost Assumptions | 108 |

| | | |

| Table 16-4: | La Arena Mine Wall Slope Criteria used in Designs | 109 |

| | | |

| Table 16-5: | La Arena Mine Typical Mining Fleet | 109 |

| | | |

| Table 16-6: | La Arena Mine Mining Schedule | 111 |

| | | |

| Table 16-7: | La Arena II Mineral Resources in Mine Plan | 112 |

| | | |

| Table 16-8: | La Arena II Metallurgical Assumptions | 114 |

| | | |

| Table 16-9: | La Arena II Concentrate Inputs | 115 |

| | | |

| Table 16-10: | La Arena II Operating Cost Assumptions | 115 |

| | | |

| Table 16-11: | La Arena II Wall Slope Assumptions used in Designs | 116 |

| | | |

| Table 16-12: | La Arena II Whittle Pit Shell Summary Positive Margin | 117 |

| | | |

| Table 16-13: | La Arena II Mine Production | 120 |

| | | |

| Table 16-14: | La Arena II Mine Production Schedule | 121 |

| | | |

| Table 16-15: | La Arena II Major Equipment Initial Purchase | 124 |

| | | |

| Table 16-16: | La Arena II Major Equipment Sustaining Purchase | 124 |

| | | |

| Table 17-1: | Process Design Criteria | 129 |

| | | |

| Table 17-2: | Metallurgical Recovery Assumptions | 129 |

| | | |

| Table 17-3: | Flotation Cells | 131 |

| | | |

| Table 17-4: | Process Reagents and Consumption Rates | 132 |

| | | |

| Table 17-5: | La Arena II Mobile Equipment List | 132 |

| | | |

| Table 17-6: | Metal Production | 133 |

| | | |

| Table 19-1: | La Arena II PEA Concentrate Specifications | 145 |

| | | |

| Table 21-1: | La Arena Mine Sustaining Capital Expenditures Remaining LOM | 152 |

| | | |

| Table 21-2: | La Arena Mine Operating Cost Remaining LOM | 153 |

| xiv |

| LA ARENA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

| Table 21-3: | La Arena Mine Operating Cost Remaining LOM | 153 |

| | | |

| Table 21-4: | La Arena Mine Operating Cost per Tonne | 153 |

| | | |

| Table 21-5: | La Arena II Capital Cost Summary | 154 |

| | | |

| Table 21-6: | La Arena II Process Plant and Infrastructure Capital Costs | 154 |

| | | |

| Table 21-7: | La Arena II Initial Mine Equipment Summary | 155 |

| | | |

| Table 21-8: | La Arena II Other Mining Initial Capital Costs | 156 |

| | | |

| Table 21-9: | La Arena II Replacement Operating Hours | 156 |

| | | |

| Table 21-10: | La Arena II Sustaining Mining Capital | 157 |

| | | |

| Table 21-11: | La Arena II Process Sustaining Capital | 157 |

| | | |

| Table 21-12: | La Arena II Mine Operating Costs | 158 |

| | | |

| Table 21-13: | La Arena II Process Plant Operating Cost Summary | 158 |

| | | |

| Table 21-14: | La Arena II Process Plant Operating Cost Summary by Area | 159 |

| | | |

| Table 21-15: | La Arena II Process Plant Labor & Fringes | 160 |

| | | |

| Table 21-16: | La Arena II Power Cost Summary | 160 |

| | | |

| Table 21-17: | La Arena II Reagents Consumption Summary | 161 |

| | | |

| Table 21-18: | La Arena II Grinding Media and Wear Items | 161 |

| | | |

| Table 22-1: | Life of Mine Tonnages, Metal Grades and Contained Metal | 162 |

| | | |

| Table 22-2: | Metal Recovery Factors | 162 |

| | | |

| Table 22-3: | Life of Mine Metal Production Summary | 163 |

| | | |

| Table 22-4: | La Arena II Smelter Return Factors | 163 |

| | | |

| Table 22-5: | Initial and Sustaining Capital Summary | 164 |

| | | |

| Table 22-6: | La Arena II Average Annual Operating Costs | 165 |

| | | |

| Table 22-7: | Sensitivity Analysis after Taxes | 166 |

| | | |

| Table 22-8: | La Arena Project Financial Model – 80,000 tpd – Assumes Metal Recovered in Same Year as Mined . | 167 |

| xv |

| LA ARENA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

LIST OF APPENDICES

| APPENDIX | | DESCRIPTION |

| | | | |

| A | | Feasibility Study Contributors and Professional Qualifications |

| | | |

| | | • | Certificate of Qualified Person (“QP”) |

| xvi |

| LA ARENA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

| 1 | EXECUTIVE SUMMARY |

| | |

| 1.1 | INTRODUCTION |

Tahoe Resources Inc. (Tahoe or the Company), through its wholly-owned subsidiary, La Arena S.A., owns the La Arena Project in north-central Peru. Tahoe assumed ownership of the La Arena property upon their acquisition of Rio Alto Mining Limited in April 2015. The La Arena Project consists of the currently operating La Arena Mine and the La Arena II Project. This Technical Report provides an update to the La Arena Mine and presents a Preliminary Economic Assessment (PEA) for the La Arena II Project.

Both the La Arena Mine and the La Arena II Project are situated within the overall La Arena property owned by the Company, but they are stand-alone projects and independent of each other. The La Arena II Project would not be an expansion of the current operation; rather it would be a separate operation constructed at the end of the La Arena Mine life.

| 1.2 | LA ARENA PROPERTY |

| | |

| 1.2.1 | Property Description and Location |

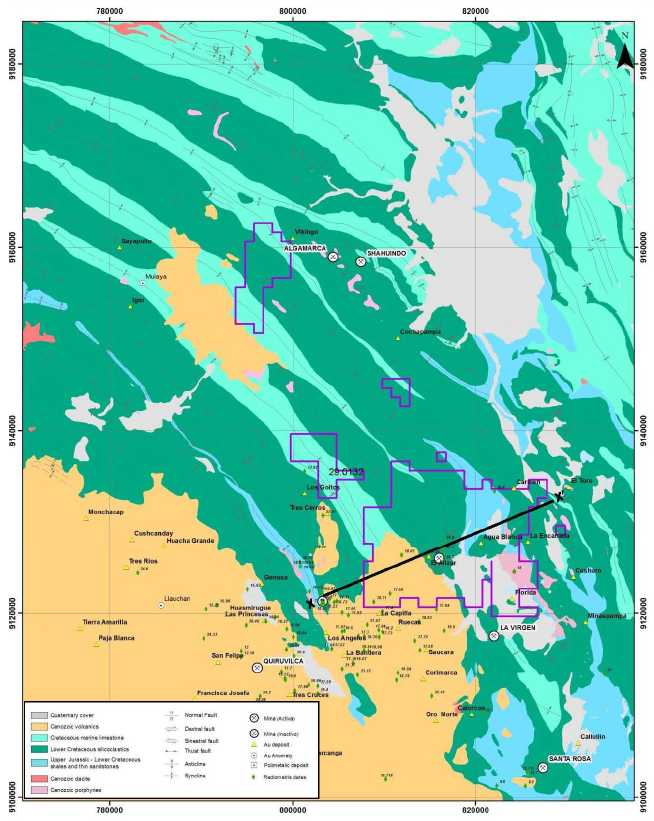

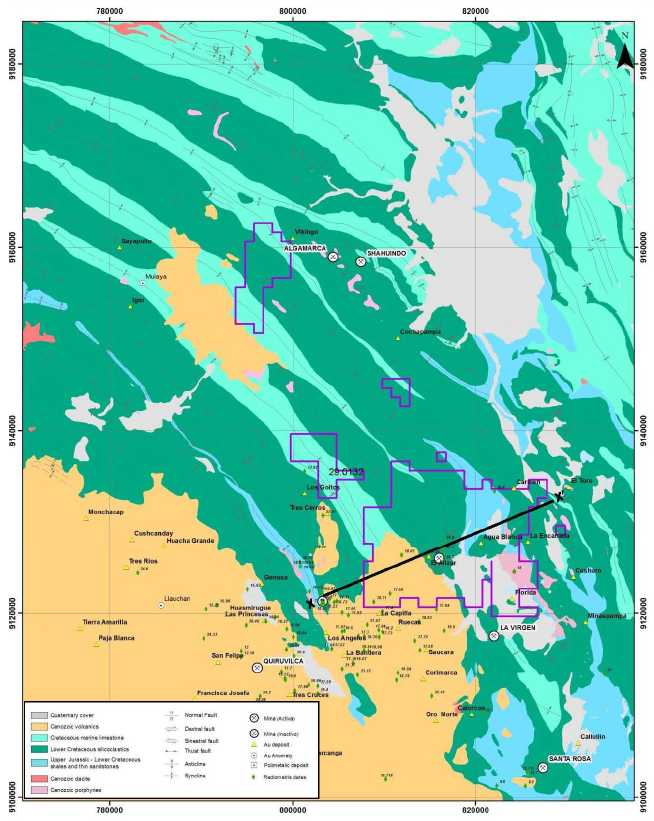

The La Arena property is located in the Huamachuco District, Sánchez Carrion province, Department of La Libertad along the eastern slope of the Western Cordillera of northern Peru, approximately 480 kilometers north-northwest of the city of Lima. Primary access to the property is via a 165 kilometer national highway from the coastal city of Trujillo. The closest population center is the town of Huamachuco, located about 21 kilometers from the property, with a population of about 35,000 residents.

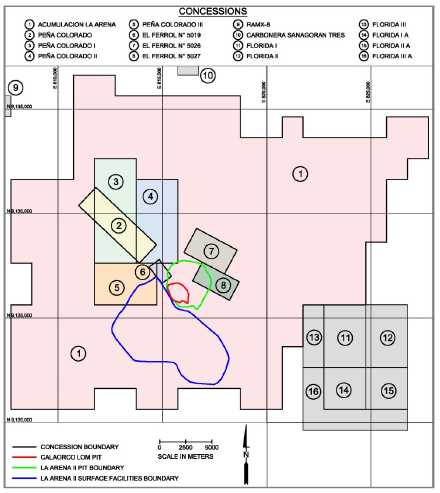

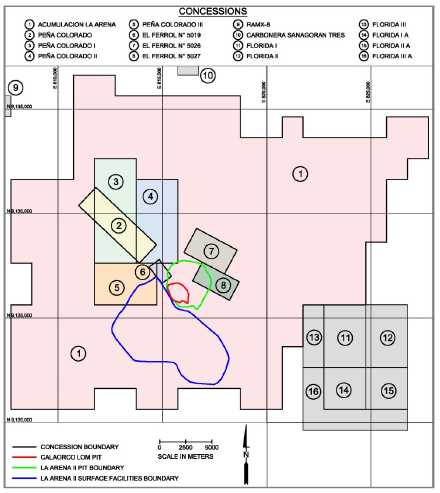

Through its wholly-owned subsidiary, La Arena S.A., the Company holds 27 mineral concessions in the area of La Arena totaling approximately 33,140 hectares. Of this total, approximately 25,440 hectares form the contiguous concession block which comprises the La Arena property; the remaining concessions are located to the north and west of the La Arena property. The mineral concessions are 100% owned by and registered in the name of La Arena S.A. The mineral concessions are all in good standing, with no litigation or other legal issues pending.

All Mineral Resources identified at the La Arena Mine are contained within mining concessions which are free of underlying agreements and/or royalties. The majority of Mineral Resources identified at the La Arena II Project are also free of underlying agreements and/or royalties except for a small portion which has a two percent net smelter return royalty obligation.

The Company currently has surface ownership of approximately 1,948 hectares and has co-ownership of an additional 349 hectares which covers the current La Arena Mine operations; minor surface land additions are required to accommodate the La Arena Mine life of mine plan. Approximately 1,200 hectares of surface ownership or surface rights would need to be acquired to accommodate the La Arena II life of mine plan as envisioned in the PEA of the project.

The La Arena Mine is a gold oxide open pit, run of mine heap leach operation which has been in production since the latter half of 2011. Through the end of 2017, the La Arena Mine has produced a total of 1.32 million ounces of gold in doré. The current mine life runs through 2021, though potential exists to develop additional resources below the currently designed pit and extend the mine life, which the Company is currently drill testing.

| 1 |

| LA ARENA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

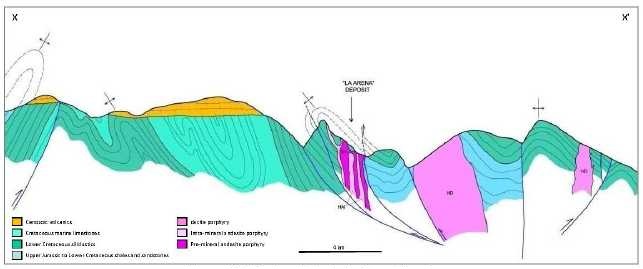

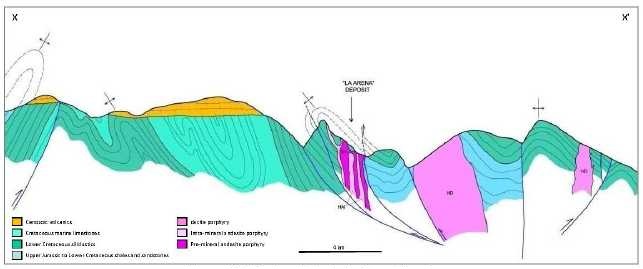

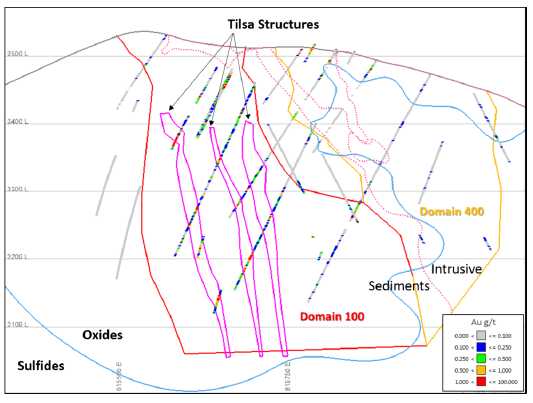

| 1.3.1 | Geology and Mineralization |

High-sulfidation gold mineralization at the La Arena Mine is hosted in the Lower Cretaceous Chimu Formation and is both lithologically and structurally controlled, occurring primarily in silicified fractured sandstones and, locally, in hydrothermal breccias. Structural control is mainly associated to the principle northwest-southeast Andean orientation and secondary to tensional fracturing, as well as to bedding planes. Tensional fracturing has acted as a principal fluid channel way, containing oxidized high sulfidation epithermal gold mineralization. Fine grained native gold is free in small proportions as is electrum.

Higher-grade zones of gold mineralization are directly controlled by the intersection of southwest-northeast faults which transverse the mineralized trend oriented to the northwest-southeast. The northwest-trending ‘feeder’ structures, locally termedTilsa structures, have a strike length of approximately 300 meters and thicknesses ranging from a few centimeters to several meters, with grades of 80 to 100 g/t of gold not uncommon. Lower grade gold mineralization occurs as thin stockwork and disseminations within the Chimu sandstone.

| 1.3.2 | Mineral Resource and Mineral Reserve Estimates |

Measured and Indicated Mineral Resources for the La Arena Mine total 49.9 million tonnes with an average gold grade of 0.40 g/t containing 643.5 thousand ounces of gold; Inferred Mineral Resources total 0.4 million tonnes with an average gold grade of 0.32 g/t containing 4.3 thousand ounces of gold. Mineral Resources for the La Arena Mine, reported at gold cut-off grade of 0.10 g/t within a $1,400 per ounce gold pit shell, are summarized in Table 1-1.

Table 1-1: La Arena Mine Mineral Resources

| Material Type | Classification | Tonnes

(M) | Gold

(g/t) | Gold

(koz) |

|

| Oxide | Measured | 0.3 | 0.38 | 3.3 |

| | Indicated | 49.6 | 0.40 | 640.2 |

| | Measured + Indicated | 49.9 | 0.40 | 643.5 |

| | Inferred | 0.4 | 0.32 | 4.3 |

Totals may not sum due to rounding

Drilling and sampling practices at the La Arena Mine are appropriate for the style and distribution of the oxide gold mineralization and provide for a reliable representation of the deposit. Multiple data verification programs of the project database, analytical data and quality assurance/quality control programs are sufficient to ensure the dataset used for the Mineral Resource estimate is valid.

Proven and Probable Mineral Reserves for the La Arena Mine total 44.0 million tonnes with an average gold grade of 0.40 g/t containing 568.4 thousand ounces of gold. The Mineral Reserve estimate for the La Arena Mine, reported at a gold cut-off grade of 0.10 g/t within a designed pit based on an optimized pit shell using $1200 per ounce gold, is summarized in Table 1-2.

Table 1-2: La Arena Mine Mineral Reserves

| Classification | Ore

Type | Tonnes

(M) | Gold Grade

(g/t) | Gold Ounces

(k) |

| Proven | Sediment | - | - | - |

| Intrusive | 0.3 | 0.38 | 3.3 |

| Probable | Sediment | 38.7 | 0.42 | 519.8 |

| Intrusive | 5.0 | 0.28 | 45.3 |

| Proven & Probable | All | 44.0 | 0.40 | 568.4 |

| 2 |

| LA ARENA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

The Mineral Resource and Mineral Reserve estimates were prepared in accordance with NI 43-101, and classifications adopted by the CIM Council. The effective date of the La Arena Mine Mineral Resource and Mineral Reserve estimates is January 1, 2018.

The current operation has been mining the oxide deposit at the La Arena Mine since 2011. The operation is a conventional drill, blast, shovel and truck open pit run-of-mine (ROM) operation. Mining is carried out on two 12-hour shifts, operating 7 days per week under an alliance style contract with Peruvian contractors. The oxide ore is hauled directly from the pit to the leach facility or to stockpiles.

The mining fleet consists of 90 tonne class rock trucks and 10 m3 hydraulic shovels. Blasthole drilling is performed by diesel powered rotary single pass track drills. Ancillary support equipment includes motor graders, track dozers and water trucks. Mining at the La Arena Mine is in the final stage of the Calaorco pit. The current mine schedule shows mining will be completed in 2021. The production schedule for the remaining Calaorco pit is shown in Table 1-3.

Table 1-3: La Arena Mine Mining Schedule

| Mine Schedule | 2018 | 2019 | 2020 | 2021 |

| Leach Ore Mined | kt | 14,344 | 12,520 | 9,608 | 6,385 |

| Au grade | g/t | 0.42 | 0.42 | 0.39 | 0.42 |

| Au ounces | koz | 192.5 | 167.6 | 121.1 | 86.7 |

| Waste Mined | kt | 26,463 | 33,105 | 21,602 | 1,086 |

| Total Mined | kt | 40,807 | 45,625 | 31,211 | 7,472 |

| Strip Ratio | | 1.8 | 2.6 | 2.2 | 0.2 |

Ore from the La Arena Mine is truck-dumped onto leach pads with no crushing or agglomeration required prior to leaching. The operation has a capacity of 40,000 tonnes per day. Cyanide leach solution is applied by drip emitters at a rate of 0.175 kg per tonne of ore. Pregnant solution is collected in a 73,000 m3 pregnant solution pond, from which it is pumped to the ADR plant for gold recovery.

The ADR plant comprises 35 carbon adsorption columns, two scavenger carbon columns, two pressure strip vessels and 8 units of electrowinning cells with a total volume of 12 m3. The target gold loading on carbon is 4,000 to 6,000 grams per tonne. Once this target is reached, the loaded carbon is pumped from the carbon adsorption tank to one of the strip vessels carbon is stripped using the standard pressure Zadra procedure. Gold metal collected in the electrolytic cathodes is smelted and molded into bullions. The average life of mine gold recovery at the La Arena Mine is approximately 86%.

| 1.3.5 | Project Infrastructure |

The La Arena Mine includes an open pit, a waste rock storage facility, fully lined leach pads, a lined pregnant solution pond, a lined major events pond (storm water catchment), an ADR processing plant, water treatment plant and sundry facilities including a 600-person camp and associated facilities.

Power for the La Arena Mine is supplied from the 220 kV national grid to the La Ramada substation built by La Arena S.A. in 2014. Power is distributed by an internal power distribution network supplying 22.9 kV to all facilities.

| 3 |

| LA ARENA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

The La Arena Mine is authorized to pump ground water from three water wells. Water is pumped to a holding tank and distributed to the workshop, offices, camp, and kitchen via a potable water filtration system. Water can also be delivered to the oxide processing plant for makeup water. The water quality is good and the pH is neutral.

The design of the existing La Arena Mine leach pads is based on conventional pad technology modified to accommodate the mountainous terrain as is common in Peru. The leach pad is contained and all solutions drain into a pregnant solution pond.

All waste material is hauled to the waste rock storage facility located south of the Calaorco pit. Non-Acid Generating (NAG) waste is used to encapsulate the Potentially Acid Generating (PAG) waste.

| 1.3.6 | Capital and Operating Costs |

As the La Arena Mine is a mature operation, capital and operating costs are well understood.

There are no project capital expenditures remaining, as all major components of the operation have been constructed. Only sustaining capital expenditures will be required to maintain production. The estimated sustaining capital requirement for the remaining life of the La Arena Mine gold oxide operation is estimated to be $64.9 million. This includes expansion of the waste rock storage and leach pads, pit dewatering system, land purchases and water treatment facilities. Major sustaining capital items are shown in Table 1-4.

Table 1-4: La Arena Mine Sustaining Capital Expenditures Remaining LOM

| Sustaining Mine Capital | Total LOM

($M) |

|

| Process Expansions | $20.1 |

| Waste Rock Storage | $10.4 |

| Water Treatment | $15.3 |

| Pit Dewatering System | $5.7 |

| Land Purchase | $7.7 |

| Capitalized Mining | $5.0 |

| Other | $0.7 |

| Total | $64.9 |

Table 1-5 shows the total operating costs over the remainder of the operation and Table 1-6 shows operating costs on a per tonne basis.

Table 1-5: La Arena Mine Operating Costs Remaining LOM

| Operating Costs | Total LOM

($) |

|

| G&A Costs | $87.1 |

| Process Costs | $51.9 |

| Mining Costs | $213.0 |

| Total Operating Costs | $352.0 |

| 4 |

| LA ARENA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

Table 1-6: La Arena Mine Operating Cost per Tonne

| Operating Costs | | |

| G&A Costs | $/t processed | $2.06 |

| Process Costs | $/t processed | $1.26 |

| Mining Costs | $/t processed | $4.71 |

| |

| Mining Costs | $/t mined | $1.78 |

| 1.3.7 | Interpretation, Conclusions, and Recommendations |

The La Arena Mine is a mature operation. There is good understanding of the geology and geologic controls on mineralization, mining practices, process methodology and gold recovery, and operating and sustaining capital costs.

All permits required for the current operation of the La Arena Mine are current. A modified Environmental Impact Study (EIAd) will likely be required to accommodate the life of mine waste dump and leach pads.

Increasingly positive production reconciliations are likely the result of the final stage of the open pit nearing the limits of the tightly-spaced definition drilling. Geologic mapping has revealed an increase in the density and extent of higher-grade Tilsa and associated structures that were not evident with the current drill density in the lower portions of the resource. Drilling to identify additional resources below the current pit design with potential to extend the mine life was initiated in late 2017 and is continuing in 2018.

Assuming the La Arena mine operates within its permit requirements, the authors do not reasonably foresee any risks on the project’s continued economic viability.

The La Arena II Project is a porphyry-hosted copper-gold deposit adjacent to the La Arena Mine. There has been no production from the La Arena II Project.

The La Arena II PEA supersedes the NI 43-101 Technical Report issued by Rio Alto in 2015 which considered a small capital-constrained project with restrictive financial hurdles. The resulting Mineral Resource and Mineral Reserve estimates presented in the prior study represented only a small portion of the total Mineral Resources. This PEA re-evaluates the La Arena copper-gold porphyry project in the context of a long-term copper-gold project without regard to the constraints previously applied.

The 2015 study included Probable Mineral Reserves. There are no Mineral Reserves reported in this 2018 PEA as the scope of the project has changed significantly with new exploration results, a refined geologic model, an updated Mineral Resource estimate, increased mining and processing rates, with updated capital and operating cost parameters, modified processing scheme, and the use of alternative tailings disposal facilities. While a portion of the data generated for the 2015 study provides support for some of the assumptions incorporated into the 2018 PEA of the project, most of the mining, processing, geotechnical, hydrological, social, and capital and operating cost parameters used in the 2015 study are no longer applicable to the project as envisioned in the 2018 PEA.

The La Arena II PEA is preliminary in nature and includes Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as Mineral Reserves, and there is no certainty that the preliminary economic assessment will be realized.

| 5 |

| LA ARENA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

| 1.4.1 | Geology and Mineralization |

Multiple intrusions of dacitic and andesitic feldspar porphyries have intruded the Cretaceous sedimentary sequence at the La Arena property. Four intrusive events have been identified – the earliest intrusive phase (FPA-1) is generally barren of mineralization; the second intrusive phase (FPA-2) intruded FPA-1 and is the primary host of the copper-gold mineralization at the La Arena II Project; the third intrusive stage (FPA-3) cross-cuts both FPA-1 and FPA-2 and generally contains nil to lower-grade copper-gold mineralization; and the fourth final intrusive phase (FPA-4) consists of narrow barren andesitic dikes. The La Arena Mine open pit is situated at the eastern margin of the FPA-3 intrusion, which occurs as a laccolith-like structure.

Porphyry-hosted copper-gold mineralization is associated with phyllic and potassic alteration, which is dominated principally by pyrite and chalcopyrite with lesser amounts of bornite, covellite, chalcocite and molybdenite. Mineral zoning from surface downwards below the oxidized cap is typically about 40 to 50 meters for the zone of secondary enrichment (chalcocite + covellite ± copper oxides) and ten to 40 meters for the mixed oxide-sulfide transitional zone (chalcocite + chalcopyrite ± covellite). The top of the primary sulfide mineralized zone (chalcopyrite ± bornite) which predominates at La Arena is typically located at depths in excess of 100 meters from the surface.

The copper-gold porphyry at La Arena II comprises an elongated mineralized body approximately 1,400 meters in length (oriented northwest-southeast) and 200 to 400 meters wide. Mineralization occurs as disseminations along hairline fractures as well as within larger veins. Mineralization has been identified by drilling to depths of 1,000 meters below the surface which shows the porphyry to be narrowing, but with no decrease in copper and gold grades.

| 1.4.2 | Mineral Resource and Mineral Reserve Estimates |

Measured and Indicated Mineral Resources for the La Arena II Project total 742.4 million tonnes with average gold and copper grades of 0.24 g/t and 0.35%, respectively, containing 5.6 million ounces of gold and 5.8 billion pounds of copper. Inferred Mineral Resources total 91.6 million tonnes with average gold and copper grades of 0.23 g/t and 0.17%, respectively, containing 683 thousand ounces of gold and 349 million pounds of copper. The La Arena Mine Mineral Resource estimate is summarized in Table 1-7.

Table 1-7: La Arena II Mineral Resources

| Material Type | Classification | Tonnes

(M) | Gold

(g/t) | Copper

(%) | Gold

(koz) | Copper

(mlbs) |

| Oxide | Measured | 5.9 | 0.27 | - | 51 | - |

| | Indicated | 43.2 | 0.28 | - | 388 | - |

| | Measured + Indicated | 49.1 | 0.28 | - | 440 | - |

| | Inferred | 41.3 | 0.26 | - | 349 | - |

| Sulfide1 | Measured | 149.7 | 0.25 | 0.39 | 1,214 | 1,279 |

| | Indicated | 543.5 | 0.23 | 0.38 | 3,984 | 4,511 |

| | Measured + Indicated | 693.2 | 0.23 | 0.38 | 5,197 | 5,790 |

| | Inferred | 50.4 | 0 21 | 0.31 | 344 | 349 |

| Total | Measured | 155.7 | 0.25 | 0.37 | 1,265 | 1,279 |

| | Indicated | 586.7 | 0.23 | 0.35 | 4,372 | 4,511 |

| | Measured + Indicated | 742.4 | 0.24 | 0.35 | 5,637 | 5,790 |

| | Inferred | 91.6 | 0.23 | 0.17 | 683 | 349 |

| 1includes supergene, transitional oxide-sulfide and sulfide Mineral Resources | Totals may not sum due to rounding |

| 6 |

| LA ARENA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

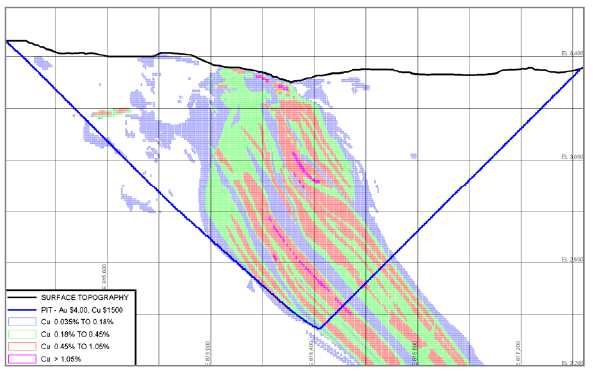

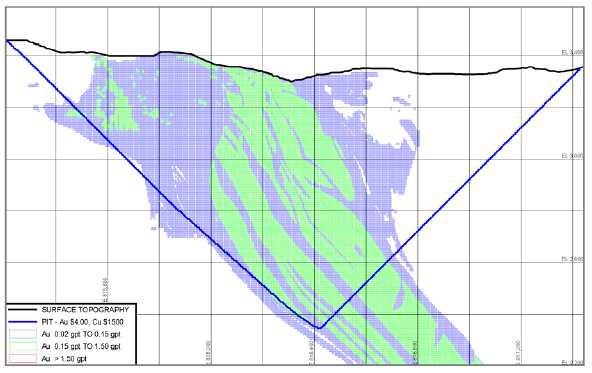

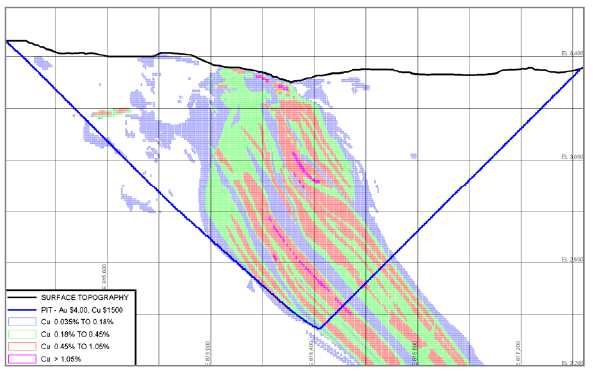

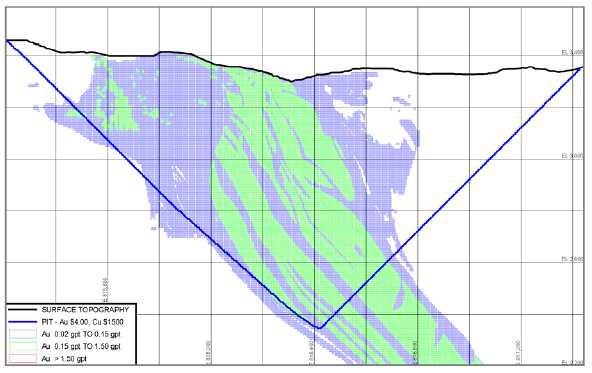

The La Arena II Mineral Resources are reported within an optimized undiscounted cash flow pit shell using metal prices of $4.00 per pound copper and $1,500 per ounce gold and operating cost parameters developed for the La Arena II PEA. Oxide Mineral Resources are reported using a 0.10 g/t gold cut-off grade; sulfide Mineral Resources are reported using a 0.18% copper-equivalent (CuEq) cut-off grade calculated using $4.00 per pound copper and $1500 per ounce gold. The La Arena II Mineral Resource estimate is reported below the post-La Arena Mine topographic surface and below the pit shell used to report the La Arena Mine Mineral Resources.

Drilling and sampling practices at the La Arena II Project are appropriate for the style and distribution of the porphyry-hosted copper-gold mineralization and provide for a reliable representation of the deposit. Multiple data verification programs of the project database, analytical data and quality assurance/quality control programs are sufficient to ensure the dataset used for the Mineral Resource estimate is valid.

The Mineral Resource estimate for the La Arena II Project was prepared in accordance with NI 43-101, and classifications adopted by the CIM Council. The effective date of the La Arena Mineral Resource estimate is January 1, 2018. There are no Mineral Reserves reported for the La Arena II Project.

The PEA considers the La Arena II project as a conventional drill, blast, truck and shovel operation. The study contemplates that the Owner will own and operate all equipment.

Two processing streams are envisioned for the La Arena II Project. Oxide leach material will be hauled to a ROM leach facility. Sulfide material will be hauled to a differential flotation processing facility where a copper-gold concentrate and a pyrite concentrate will be produced. Waste rock will be hauled from the pit to the dry stack tailings facility for use as embankment material or to the waste rock storage facility.

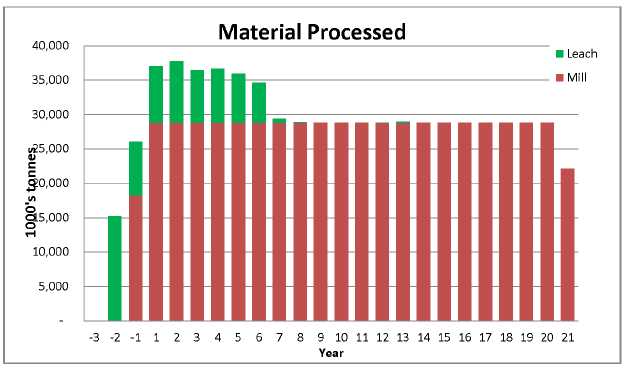

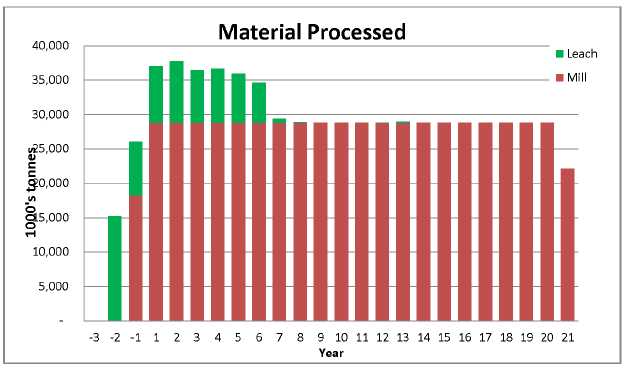

The mine plan was developed to deliver 80,000 tonnes per day of sulfide resources to the flotation process plant. Oxide resources extracted would be hauled directly to the new oxide leach pad. Over the 21 year mine life (excluding pre-production), the mine will deliver 587.4 million tonnes of sulfide resources containing 4.98 billion pounds of copper and 4.54 million ounces of gold to the flotation plant, with an additional 46.6 million tonnes of oxide resources containing 501 thousand ounces delivered to the leach pad. The average mining rate, including waste, is about 110 million tonnes per year over the 21 year mine life.

Total Mineral Resources processed in the mine plan are shown in Table 1-8.

Table 1-8: La Arena II Project Mineral Resources in Mine Plan

| Resources | Units | Total |

| Oxide Leach Tonnes | M | 69.5 |

| Au grade | g/t | 0.30 |

| Cu grade | % | - |

| Au contained ozs | k | 669.4 |

| Cu contained lbs | M | - |

| | | |

| Sulfide Milled Tonnes | M | 616.4 |

| Au grade | g/t | 0.24 |

| Cu grade | % | 0.38 |

| Au contained ozs | k | 4,753.7 |

| Cu contained lbs | M | 5,215 |

| 7 |

| LA ARENA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

The process plant for the La Arena II Project has been designed with a nameplate capacity of 80,000 tpd. The annual ore tonnage milled is nominally 28.8 million tonnes with a life of mine average feed grade of 0.38% Cu and 0.24 g/t Au. The metallurgical recoveries used in this study are summarized in Table 1-9.

Table 1-9: Metallurgical Recovery Assumptions

| Heap Leach Recovery |

| | Sediments | Porphyry |

| Copper Recovery | 0.0% | 0.0% |

| Gold Recovery | 86.0% | 83.0% |

| Mill Recovery |

| | Sulfide | Supergene | Mixed | Oxide |

| Copper Recovery | 87.6% | 87.6% | 43.8% | 0.0% |

| Gold Recovery | 60.1% | 60.1% | 30.5% | 0.0% |

Copper concentrate is produced by conventional flotation with one rougher stage followed by two stages of cleaning. A pyrite flotation circuit is included to reduce the acid generating potential of the mill tailing. Mill tailing and the pyrite tailing will be filtered separately and deposited in separate storage facilities.

| 1.4.5 | Project Infrastructure |

The proposed La Arena II Project includes an open pit, differential flotation processing plant, heap leach pad, dry stack tailing storage facility, lined pyrite tailing storage facility and waste rock storage facility. With the exceptions of the existing ADR plant to process pregnant solution from the new La Arena II heap leach pad and the assay laboratory (which would be relocated), none of the current La Arena Mine facilities will be used for the La Arena II Project.

A 28.5 km road diversion south of the mine site will be needed early during construction to prevent the public from passing through the mining area and to open up options for waste dumps and other future mine infrastructure.

Power to the La Arena Mine is presently supplied from the 220 kV national grid to the La Ramada substation, adjacent to the mine. The existing transmission lines feeding the La Ramada substation have a theoretical capacity of 240 MVA. The La Arena II Project’s new electrical load is envisioned to be 120 MVA.

Processing facilities with filtered tailings require approximately 0.3 m3 of make-up water per each tonne of ore processed. The make-up water for La Arena II is estimated to be 280 L/s. An estimated 180 L/s can be supplied by the pit dewatering program. In the dry season, the remaining estimated water needs of 100 L/s will need to be supplied from groundwater sources. During the rainy season, captured surface water runoff from the tailings and waste rock will provide the required make up water.

There will be two filtered tailings facilities: one for non-acid generating tailings; and one for acid generating tailings (pyrite tailings), which will be lined. The filter pressed tails will be deposited in layers by mobile stacking conveyors. Embankments of non-acid generating waste rock will be constructed around the perimeter of the tailings facilities to provide further stability and containment. The heap leach pad will be within the footprint of the overall tailings facility, will be operated for only the first nine years of mine life, and ultimately will be fully surrounded and covered by non-acid generating tailings after rinsing of the heap has been completed.

| 8 |

| LA ARENA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

Non-acid generating materials will be utilized to encapsulate the potentially acid generating material in the surface waste rock storage facility. Detailed test work of waste material geochemistry, including ABA, humidity cell test, meteoric water mobility tests are required to determine waste rock classification. Runoff water from these areas will flow through sediment ponds, discharging into the process water pond for reuse, or discharged offsite with treatment, as necessary.

The outer slopes of the dry stack tailings facility and waste rock dump will be concurrently reclaimed and vegetated as the tailings and waste rock advances, allowing for surface water runoff directly to native streams. At closure, the top surface of the tailings will be graded, covered if necessary, and vegetated. The closed facilities will thus become a stable geomorphic feature of the landscape.

| 1.4.6 | Capital and Operating Costs |

The capital cost for initial developed for the La Arena II Project totals $1,363.9 million, including pre-production credits as summarized in Table 1-10. LOM sustaining capital is estimate at $1,092.7 million, as summarized in Table 1-11.

Table 1-10: La Arena II Project Initial Capital Summary

| Cost Item | Total ($M) |

| Process Plant and Infrastructure | |

| Project Directs | $598.7 |

| Project Indirects | $169.3 |

| Contingency | $192.0 |

| Subtotal | $960.0 |

| Mine Equipment | $260.2 |

| Owner's Costs | $145.4 |

| Pre-Production Credit | ($1.7) |

| Total | $1,363.9 |

Table 1-11: La Arena II Project Sustaining Capital Summary

| Cost Item | Total ($M) |

| Mine Equipment | $406.9 |

| Capitalized Mining | $593.7 |

| Dewatering Wells | $13.2 |

| Process | $78.9 |

| Total | $1,092.7 |

Operating costs for the La Arena II Project were determined using engineering first principles and management experience at similar size operations. The anticipated average annual operating costs are shown in Table 1-12.

| 9 |

| LA ARENA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

Table 1-12: La Arena II Average Annual Operating Costs

| Total ($M) | $/tonne

processed | $/tonne

mined |

|

| Mining | $120.5 | $3.93 | $1.33 |

| Processing1 | $162.9 | $5.29 | - |

| General & Administrative | $27.9 | $0.91 | - |

| Refining & Treatment | $84.0 | $2.74 | - |

| Total | $395.3 | $12.87 | - |

(1) Processing costs is weighted average of leaching $1.15 per leach tonne and mill $5.61per mill tonne

The average LOM production cost is $12.87 per tonne of ore processed over the 21 year mine life (excluding preproduction revenue and cost), which equates to co-product costs of $1.55 per pound of saleable copper and $600 per ounce of saleable gold.

This study envisions that La Arena II would produce an average of 200 million pounds of payable copper and 142 thousand ounces of payable gold per year, in concentrate and doré, over the 21 year mine life plus an additional 111 million pounds of payable copper and 221 thousand ounces of payable gold in the pre-production period. The total metal recovered to concentrate and doré is 4.5 billion pounds of copper and 3.4 million ounces of gold. The total payable metal produced to concentrate and doré is 4.3 billion pounds of copper and 3.2 million ounces of gold.

The base case economic analysis of the La Arena II project indicates that the project has an NPV at 8% discount rate (NPV8) of $823.8 million and IRR of 14.7% .

La Arena II would generate an average of $273 million in after-tax cash flow over the 21 year mine life, excluding preproduction cash flow and post-mining reclamation costs. The complete financial model for the La Arena II Project is included in Section 22 – Economic Analysis.

Sensitivity analyses were conducted using changes in metal prices, operating cost, initial capital, and sustaining capital. The results are shown in Table 1-13.

| 10 |

| LA ARENA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

Table 1-13: Sensitivity Analysis after Taxes

| Metal Prices | NPV @ 0% | NPV @ 5% | NPV @ 8% | NPV @ 10% | IRR% | Payback |

| Base Case | $4,250 | $1,594 | $824 | $485 | 14.7% | 4.6 |

| 20% | $6,636 | $2,835 | $1,712 | $1,209 | 21.0% | 3.1 |

| 10% | $5,449 | $2,220 | $1,272 | $851 | 18.0% | 3.7 |

| 0% | $4,250 | $1,594 | $824 | $485 | 14.7% | 4.6 |

| -10% | $3,050 | $968 | $375 | $118 | 11.2% | 5.8 |

| -20% | $1,838 | $335 | ($78) | ($252) | 7.3% | 8.4 |

| | | | | | | |

| Operating Cost | NPV @ 0% | NPV @ 5% | NPV @ 8% | NPV @ 10% | IRR% | Payback |

| Base Case | $4,250 | $1,594 | $824 | $485 | 14.7% | 4.6 |

| 20% | $3,311 | $1,071 | $434 | $159 | 11.5% | 5.7 |

| 10% | $3,781 | $1,332 | $629 | $322 | 13.1% | 5.1 |

| 0% | $4,250 | $1,594 | $824 | $485 | 14.7% | 4.6 |

| -10% | $4,719 | $1,855 | $1,018 | $648 | 16.3% | 4.1 |

| -20% | $5,182 | $2,112 | $1,209 | $807 | 17.9% | 3.7 |

| | | | | | | |

| Initial Capital | NPV @ 0% | NPV @ 5% | NPV @ 8% | NPV @ 10% | IRR% | Payback |

| Base Case | $4,250 | $1,594 | $824 | $485 | 14.7% | 4.6 |

| 20% | $4,067 | $1,404 | $637 | $301 | 12.6% | 5.3 |

| 10% | $4,159 | $1,499 | $730 | $393 | 13.6% | 4.9 |

| 0% | $4,250 | $1,594 | $824 | $485 | 14.7% | 4.6 |

| -10% | $4,341 | $1,689 | $917 | $577 | 16.0% | 4.2 |

| -20% | $4,432 | $1,783 | $1,011 | $669 | 17.6% | 3.8 |

| | | | | | | |

| Sustaining Capital | NPV @ 0% | NPV @ 5% | NPV @ 8% | NPV @ 10% | IRR% | Payback |

| Base Case | $4,250 | $1,594 | $824 | $485 | 14.7% | 4.6 |

| 20% | $4,100 | $1,518 | $772 | $445 | 14.4% | 4.6 |

| 10% | $4,175 | $1,556 | $798 | $465 | 14.5% | 4.6 |

| 0% | $4,250 | $1,594 | $824 | $485 | 14.7% | 4.6 |

| -10% | $4,324 | $1,631 | $849 | $505 | 14.9% | 4.6 |

| -20% | $4,399 | $1,669 | $875 | $525 | 15.0% | 4.5 |

| | | | | | | |

| Total Capital | NPV @ 0% | NPV @ 5% | NPV @ 8% | NPV @ 10% | IRR% | Payback |

| Base Case | $4,250 | $1,594 | $824 | $485 | 14.7% | 4.6 |

| 20% | $3,918 | $1,328 | $585 | $261 | 12.3% | 5.3 |

| 10% | $4,084 | $1,461 | $705 | $373 | 13.4% | 5.0 |

| 0% | $4,250 | $1,594 | $824 | $485 | 14.7% | 4.6 |

| -10% | $4,415 | $1,726 | $943 | $597 | 16.2% | 4.2 |

| -20% | $4,581 | $1,859 | $1,062 | $709 | 17.9% | 3.8 |

| 1.4.8 | Interpretation, Conclusions, and Recommendations |

The preliminary economic assessment for the La Arena II Project indicates the potential economic viability of the porphyry-hosted copper-gold deposit worthy of further study. The PEA of the project shows a life of mine after-tax net income of $4.6 billion, with an NPV8 of $824 million, an IRR of 14.7% and payback of 4.6 years. Average annual after-tax cash flow is estimated to be $273 million over the 21 year mine life.

The 2018 La Arena II PEA incorporated a portion of the information and data from prior studies to provide support for some of the assumptions incorporated into the PEA, though much of the mining, processing, geotechnical, hydrological, social, and capital and operating cost parameters used in the prior study are no longer applicable to the project as envisioned in this Technical Report.

| 11 |

| LA ARENA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

The following list is not exhaustive, but highlights some of items that are recommended for the next stage of project evaluation:

| | • | Resource definition; |

| | • | Further metallurgical testing; |

| | • | Geotechnical evaluation of the waste rock and tailings facilities foundations; |

| | • | Geochemical evaluation of the waste and tailings material; |

| | • | Detailed geotechnical assessments of the pit wall slope designs; and |

| | • | Detailed hydrogeology studies to quantify dewatering needs and support pit lake modeling. |

While the authors have confidence in the level of study completed and the results of the La Arena II PEA, it is with the understanding that the La Arena II PEA is preliminary in nature and includes Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as Mineral Reserves, and there is no certainty that the preliminary economic assessment will be realized.

The Mineral Resource estimate for the La Arena II Project is contained within a pit shell, but the mineralized porphyry deposit continues at depth as demonstrated by drill intercepts below the resource pit limits. While the porphyry appears to be narrowing somewhat at depth, the deepest drill holes in the deposit do not show signs of decreasing copper and gold grades with depth. While not a specific recommendation necessary to advance the La Arena II Project as envisioned in this report, Tahoe should consider scoping-level studies to evaluate the potential for underground bulk mining, such as block cave or sublevel cave mining methods that could extend the mine life beyond the life of the open pit.

| 12 |

| LA ARENA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

This Technical Report is authored by M3 Engineering and Technology Corporation, of Tucson, Arizona, USA (M3) and Tahoe Resources Inc., of Reno, Nevada, USA (Tahoe or the Company) on behalf of Tahoe Resources Inc.

Tahoe is the sole proprietor of the La Arena Project, through its subsidiary, La Arena S.A. The La Arena Project consists of the currently operating gold oxide heap leach La Arena Mine and the La Arena II porphyry copper-gold deposit, each of which are the subjects of this Technical Report. The purpose of this Technical report is to provide an update to the currently operating La Arena Mine and present the Preliminary Economic Assessment (PEA) of the La Arena II copper-gold project. While both the La Arena Mine and the La Arena II Project occur within the overall La Arena property, each is a stand-alone project and independent of the other. Should the La Arena II Project be advanced, it would not be as an extension or expansion of the La Arena Mine operation.

The La Arena II PEA supersedes the NI 43-101 Technical Report issued in 2015 and referenced below. The prior study considered a small capital-constrained project with restrictive financial hurdles. The resulting Mineral Resource and Mineral Reserve estimates presented in the prior study represented only a small portion of the total Mineral Resources. This PEA re-evaluates the La Arena copper-gold porphyry project in the context of a long-term copper-gold project without regard to the constraints previously applied.

The 2015 study included Probable Mineral Reserves. There are no Mineral Reserves reported in this 2018 PEA as the scope of the project has changed significantly with new exploration results, a refined geologic model, an updated Mineral Resource estimate, increased mining and processing rates, with updated capital and operating cost parameters, modified processing scheme, and the use of alternative tailings disposal facilities. While a portion of the data generated for the 2015 study provides support for some of the assumptions incorporated into the 2018 PEA of the project, most of the mining, processing, geotechnical, hydrological, social, and capital and operating cost parameters used in the 2015 study are no longer applicable to the project as envisioned in the 2018 PEA.

The La Arena II PEA is preliminary in nature and includes Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as Mineral Reserves, and there is no certainty that the preliminary economic assessment will be realized.

The Technical Report has been prepared in accordance with Canadian National Instrument 43-101,Standards of Disclosure for Mineral Projects, which came into force on June 30, 2011. The effective date of this report is January 1, 2018.

| 2.1 | SOURCES OF INFORMATION |

There have been six Technical Reports previously filed on the La Arena Project on behalf of the prior owner of the La Arena Project:

| • | La Arena Project, Peru Technical Report, dated June 13, 2008 with an effective date of March 31, 2008, prepared by Coffey Mining Pty Ltd on behalf of Rio Alto Mining Limited. |

| | | |

| • | La Arena Project, Peru Technical Report, dated October 28, 2010 with an effective date of July 31, 2010, prepared by Coffey Mining Pty Ltd on behalf of Rio Alto Mining Limited. |

| | | |

| • | La Arena Project, Peru Technical Report (NI 43-101), dated February 17, 2012 with an effective date of September 30, 2011, prepared by Kirk Mining Consultants Pty Ltd on behalf of Rio Alto Mining Limited. |

| | | |

| • | La Arena Project, Peru Technical Report (NI 43-101), dated May 31, 2013 with an effective date of January 1, 2013, prepared by Kirk Mining Consultants Pty Ltd on behalf of Rio Alto Mining Limited. |

| 13 |

| LA ARENA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

| • | La Arena Project, Peru Technical Report (NI 43-101), dated March 28, 2014 with an effective date of December 31, 2013, prepared by Mining Plus Peru S.A.C. on behalf of Rio Alto Mining Limited. |

| | | |

| • | La Arena Project, Peru, Rio Alto Mining Limited, Technical Report (NI 43-101), dated February 27, 2015 with an effective date of December 31, 2014, prepared by Mining Plus Peru S.A.C. on behalf of Rio Alto Mining Limited. |

Additional information was obtained by M3 or provided by Tahoe, and is contained and referenced herein.

| 2.2 | QUALIFIED PERSONS AND SITE VISITS |

The Qualified Persons for this Technical Report are as follows:

| • | Daniel Roth, of M3 Engineering – Project Infrastructure, Process Capital & Operating Costs, and Economic Analysis |

| | • | Art Ibrado, of M3 Engineering – Metallurgy and Recovery Methods |

| | • | Terry Munson, of Tahoe Resources – Mining, Infrastructure and Capital and Operating Mining Costs |

| • | Charlie Muerhoff, of Tahoe Resources – Site Location and Property Description, History, Geology, Exploration, Data Verification, Mineral Resource and Mineral Reserve Estimates, Market Studies and Environmental, Permitting and Social Impacts |

Table 2-1: Areas of Responsibility and Site Visit Dates

| QP Name | Certification | Site Visit Date | Area of Responsibility |

| Daniel Roth | P.Eng. | April 26, 2017 | Sections 2, 18.2, 21.1, 21.3 (process & infrastructure), 22, 24, 27, and corresponding sections of 1, 25 and 26. |

| Art Ibrado, PhD | PE | April 26, 2017 | Sections 13, 17, and corresponding sections of 1, 25 and 26. |

| Terry Munson | SME-RM | April 26, 2017 | Sections 16, 18.1, 21.2, 21.3 (mining) and corresponding sections of 1, 25 and 26. |

| Charlie Muerhoff | SME-RM | Numerous site visits

from 2015 through 2018 | Section 3 thru 12, 14, 15, 19, 20, 23, and corresponding sections of 1, 25 and 26. |

Throughout this report, the La Arena Mine refers to the oxide gold heap leach mining and processing facilities currently in operation by the Company, and the Mineral Resources and Mineral Reserves relative to that operation. The La Arena II Project refers to the porphyry-hosted copper-gold deposit, and the Mineral Resources and Mineral Reserves that are the subject of the PEA for the project. There has been no production from the La Arena II Project.

The report considers US Dollars ($) unless otherwise noted. Most units are metric, however, as noted and as standard for projects of this nature, certain statistics and scientific units are reported as avoirdupois or English units such salable precious metals which are described in terms of troy ounces and salable base metals which are described in terms of English pounds.

Table 2-2 shows the abbreviations that may be used in this report.

| 14 |

| LA ARENA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

Table 2-2: Terms and Abbreviations

| Abbreviation | Unit or Term | | Abbreviation | Unit or Term |

| $ | United States Dollars | | GPS | Global Positioning System |

| % (grade) | Percent by weight (grade) | | ha | hectare |

| 2-D | Two-Dimensional | | HC | Humidity Cell |

| 3-D | Three-Dimensional | | HP / hp | Horsepower |

| 4WD | Four-Wheel Drive | | ICP | Inductively-Coupled Plasma |

| AA | Atomic Adsorption | | ICP | induced-coupled polarization |

| AAS | Atomic Absorption Spectrometry | | ID2 | Inverse Distance Squared |

| ABA | Acid Base Accounting | | ID3 | Inverse Distance Cubed |

| AG | Autogenous Grinding | | IRR | Internal Rate of Return |

| Ag | Silver | | Ja | joint alteration |

| AuEq | Gold Equivalent | | Jn | joint number |

| AGP | Acid Generation Potential | | Jr | joint roughness |

| ANP | Acid Neutralization Potential | | Jw | joint water reduction factor |

| ARD | Acid Rock Drainage | | k | thousands |

| AT | Assay Ton | | kg | kilograms |

| Au | Gold | | kg/t | kilograms per metric tonne |

| cfm | Cubic feet per minute | | km | kilometre |

| Chemex | ALS Chemex | | km2 | square kilometre |

| CO3 | Carbonate | | kPa | kilopascal |

| COG | Cut-off grade | | kV | kilovolt |

| Company | Tahoe Resources Inc. | | kW | kilowatt |

| Cu | Copper | | kW-h | Kilowatt-hour |

| CuEq | Copper Equivalent | | L | Liters |

| CV | Coefficient of Variation (standard eviation/mean) | | lb | pound |

| | LOM | Life of Mine |

| DDH | Diamond Drill Hole | | m | metre |

| dmt | Dry metric tonne | | M | millions |

| dmt/h | Dry metric tonnes per hour | | m3 | cubic metre |

| dmtpd | Dry metric tonnes per day | | M m3 | millions of cubic metres |

| dmtpy | Dry metric tonnes per year | | m3/h | cubic metres per hour |

| EIA | Environmental Impact Assessment | | Ma | Million years old |

| FA | Fire Assay | | masl | metres above sea level |

| Fe | Iron | | Mn | Manganese |

| ft | feet | | Mt | Megatonnes, or one thousand metric tonnes |

| g | gram | |

| g/cm3 | grams per cubic centimetre | | MTPD | Metric Tonnes per Day |

| g/t | grams per metric tonne | | MW | megawatt |

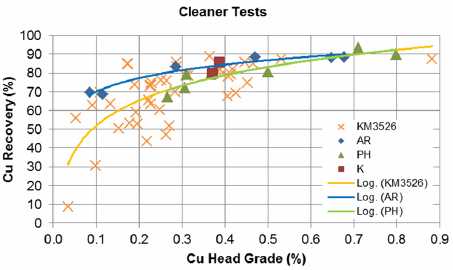

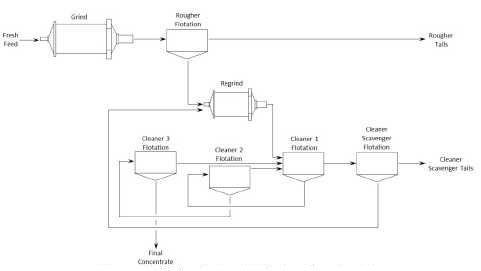

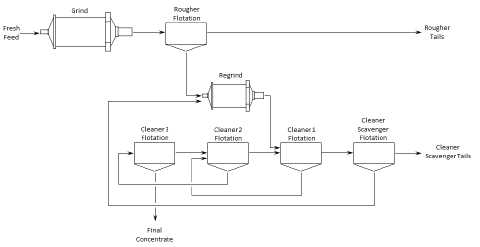

| 15 |

| LA ARENA PROJECT |

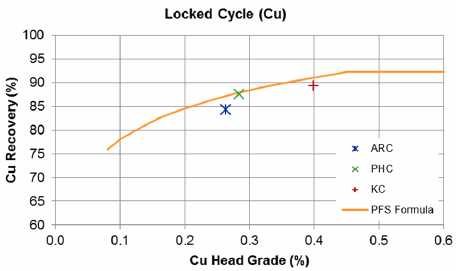

| FORM 43-101F1 TECHNICAL REPORT |

| Abbreviation | Unit or Term | | Abbreviation | Unit or Term |

| MWMP | Meteoric Water Mobility Procedure | | RQD | rock quality designation |

| MY | Million years old | | S | Sulphur |

| MWSF | Mine Waste Storage Facility | | S/R | Strip Ratio |

| NGO | non-governmental organizations | | Sb | Antimony |

| NNP | Net Neutralization Potential | | SCP | Silica Clay Pyrite |

| NPV | Net Present Value | | SRF | stress reduction factor |

| NSR | Net Smelter Return | | t/d | metric tonnes per day |

| opt | Troy ounces per English ton | | t/h | metric tonnes per hour |

| oz/t | troy ounce per short ton | | t/m3 | Tonne per cubic meter |

| PA | Preliminary Assessment or Preliminary Economic Assessment | | t/h/m2 | Tonnes per hour per square meter |

| | tonne | metric tonne |

| PAX | Potassium Amyl Xanthate | | tonnes | dry metric tonnes (where one tonne = 1.1023 short tons) |

| Pb | Lead | |

| EA | Preliminary Economic Assessment | | tpa | Tonnes per annum |

| ppb | part per billion | | tpy | Tonnes per year |

| ppm | Part per million | | UTM | Universal Transverse Mercator coordinate system |

| PROP | Propylitic | |

| PSD | Particle Size Distribution | | VFD | Variable Frequency Drive |

| QA/QC | Quality Assurance/Quality Control | | wmt | Wet Metric Tonne |

| QFP | Quartz Feldspar Porphyry | | XRD | X-Ray Diffraction |

| RC | Reverse Circulation | | XRF | X-Ray Fluorescence |

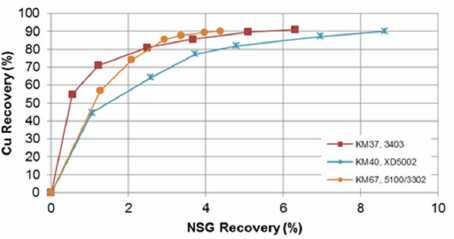

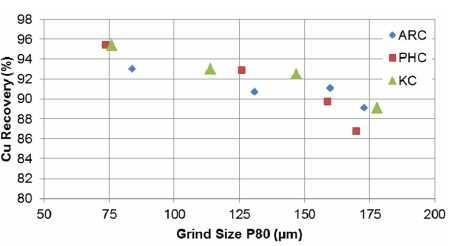

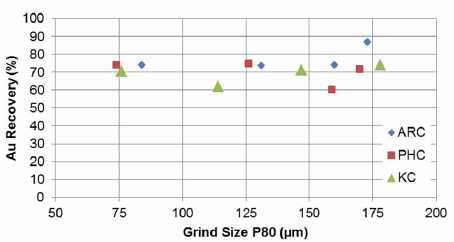

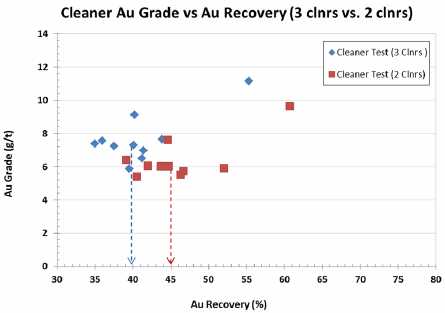

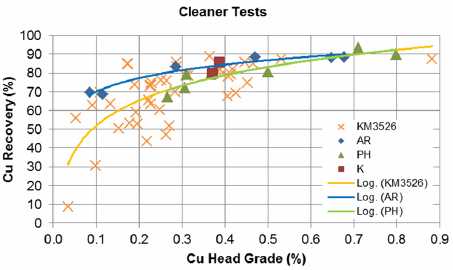

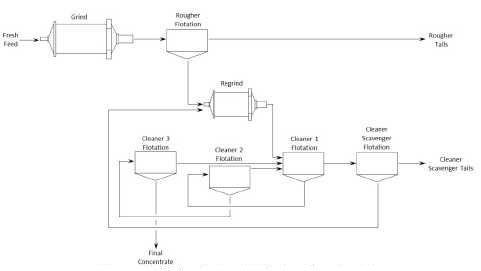

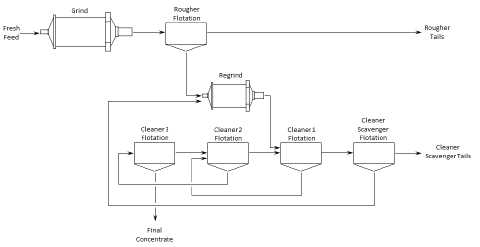

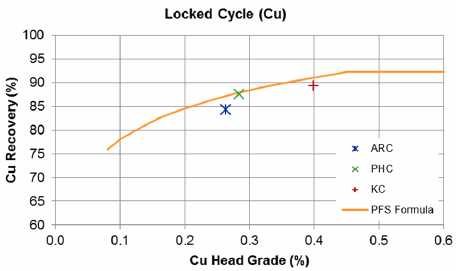

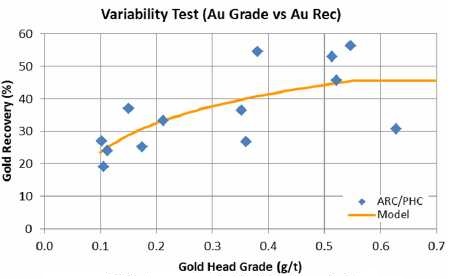

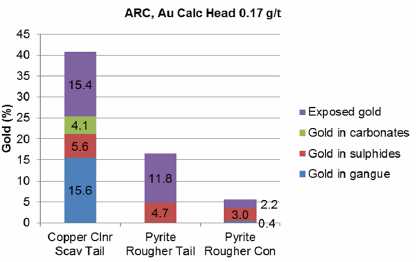

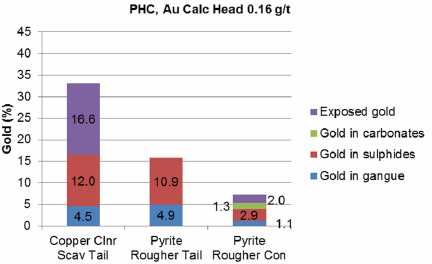

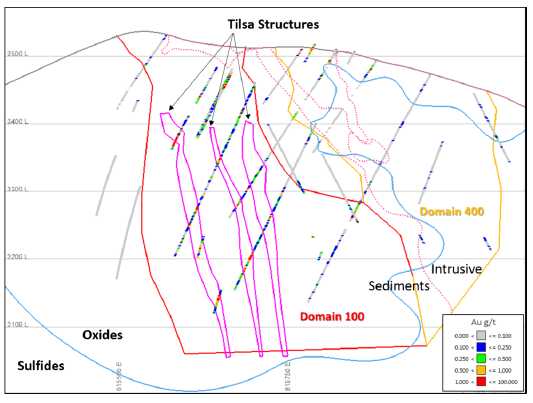

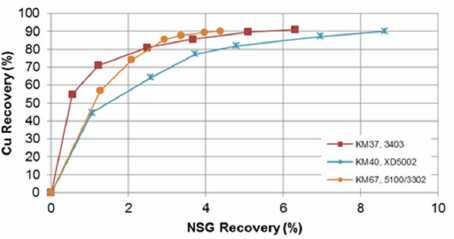

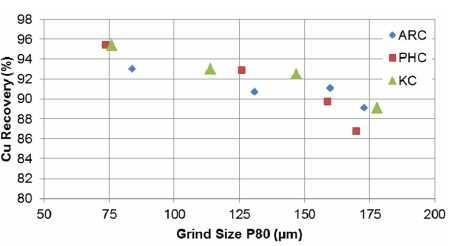

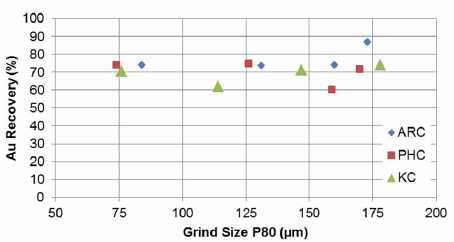

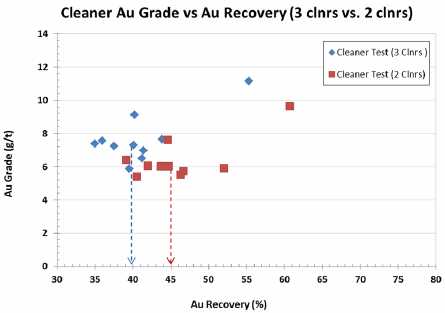

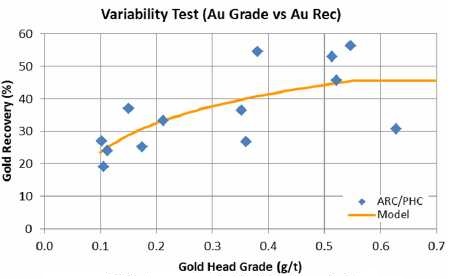

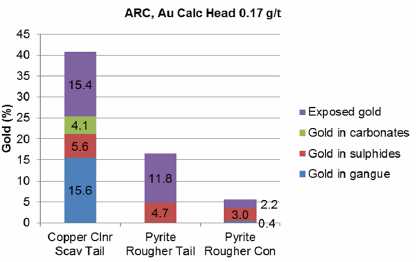

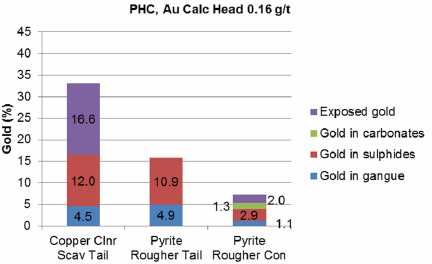

| RMR | rock mass rating | | Zn | Zinc |