The instructions accompanying this Letter of Transmittal and Election Form (the “Letter of Transmittal”) should be read carefully before this Letter of Transmittal is completed. Computershare Investor Services Inc. (the “Depositary”), your broker, investment dealer or other intermediary can assist you in completing this Letter of Transmittal. Persons whose Tahoe Shares are registered in the name of a broker, dealer, bank, trust company or other nominee should immediately contact such registered holder for assistance.

THIS LETTER OF TRANSMITTAL IS FOR USE ONLY IN CONJUNCTION WITH THE PLAN OF ARRANGEMENT INVOLVING TAHOE RESOURCES INC., ITS SECURITYHOLDERS, PAN AMERICAN SILVER CORP. AND 0799714 B.C. LTD.

THIS LETTER OF TRANSMITTAL MUST BE VALIDLY COMPLETED, DULY EXECUTED AND RETURNED TO THE DEPOSITARY. IT IS IMPORTANT THAT YOU VALIDLY COMPLETE, DULY EXECUTE AND RETURN THIS LETTER OF TRANSMITTAL ON A TIMELY BASIS IN ACCORDANCE WITH THE INSTRUCTIONS CONTAINED HEREIN. IN PARTICULAR, IF THIS LETTER OF TRANSMITTAL IS NOT RECEIVED BY THE DEPOSITARY BY 4:30 P.M. (VANCOUVER TIME) ON THE ELECTION DEADLINE (AS DEFINED BELOW), YOU WILL BE DEEMED TO HAVE ELECTED TO RECEIVE THE SHARE CONSIDERATION (AS DEFINED BELOW).

LETTER OF TRANSMITTAL AND ELECTION FORM

FOR COMMON SHARES OF TAHOE RESOURCES INC.

This Letter of Transmittal, or an originally signed facsimile, is for use by registered shareholders (“Tahoe Shareholders”) of common shares (“Tahoe Shares”) of Tahoe Resources Inc. (“Tahoe”) in connection with the proposed plan of arrangement (the “Arrangement”) involving the acquisition of all of the outstanding Tahoe Shares by Pan American Silver Corp. (“Pan American”) pursuant to an arrangement agreement among Tahoe, Pan American and 0799714 B.C. Ltd. dated November 14, 2018, that is being submitted for approval at the meeting of Tahoe Shareholders to be held onJanuary 8, 2019 (the “Tahoe Meeting”). Tahoe Shareholders are referred to the Notice of Special Meeting and management information circular dated December 4, 2018(the “Circular”) prepared in connection with the Tahoe Meeting that accompanies this Letter of Transmittal. The terms and conditions of the Plan of Arrangement, which is attached as Appendix “B” to the Circular, are incorporated by reference in this Letter of Transmittal. Capitalized terms used but not defined in this Letter of Transmittal have the meanings set out in the Circular. You are encouraged to read the Circular in its entirety.

The Plan of Arrangement contemplates that Tahoe Shareholders (other than Pan American or any Dissenting Shareholders) will be entitled to receive, in consideration for each Tahoe Share held consideration (the “Consideration”) consisting of, (a) one contingent value right of Pan American (“CVR”) entitling a Tahoe Shareholder to receive, without any further consideration and action on the part of the holder thereof, 0.0497 of a Pan American Share provided that the Payment Condition is satisfied prior to the Termination Date; and (b) at the Tahoe Shareholder’s election (and subject to proration), either:

| | (i) | US$3.40 in cash (the “Cash Consideration”); or |

| | | |

| | (ii) | 0.2403 of a Pan American Share (the “Share Consideration”). |

In each case where no Consideration election is made prior to the Election Deadline, a Tahoe Shareholder will be deemed to have elected to receive the Share Consideration. The Cash Consideration and the Share Consideration are each subject to proration provisions under which a Tahoe Shareholder may receive both cash and Pan American Shares in exchange for Tahoe Shares regardless of the Tahoe Shareholder’s election to receive the Cash Consideration or Share Consideration. Tahoe Shareholders who are Eligible Holders and who receive Pan American Shares pursuant to the Arrangement may elect pursuant to section 85 of theIncome Tax Act(the “Tax Act”) (and any corresponding provisions of any applicable provincial tax legislation) to defer some or all of the capital gain they would otherwise realize on the exchange of Tahoe Shares. Please refer to the Circular for details and Box E of this Letter of Transmittal.

The election available to you in respect of the Consideration you may receive under the Arrangement is an investment decision which carries tax consequences.You should consult your investment and tax advisors prior to making your election.

No fractional Pan American Shares will be issued to Tahoe Shareholders in connection with the Arrangement. A Tahoe Shareholder who would otherwise receive a fraction of a Pan American Share pursuant to the Arrangement will receive an equivalent cash payment in lieu of such fractional share calculated by ascribing to each whole Pan American Share the Pan American Share Value of US$14.1490. All calculations of Pan American Share consideration to be received under the Arrangement will be rounded up or down to four decimal places. In any case where the aggregate amount of cash payable to a particular Tahoe Shareholder under the Arrangement would, but for this provision, include a fraction of a cent, the consideration payable shall be rounded up to the nearest whole cent.

1

In order to receive the appropriate number of whole Pan American Shares and/or cash that a Tahoe Shareholder is entitled to receive under the Arrangement, Tahoe Shareholders are required to deposit:

| | (i) | the certificate(s) or DRS Statement representing Tahoe Shares held by them, if any, with the Depositary; |

| | | |

| | (ii) | this Letter of Transmittal, properly completed and duly executed; and |

| | | |

| | (iii) | all other required documents. |

For your election to be effective, this Letter of Transmittal, properly completed and duly executed, and accompanied by the certificate(s) or DRS Statement representing your Tahoe Shares, if any, together with all other documents required by the Depositary, must be received by the Depositary no later than 4:30 p.m. (Vancouver time) on January 3, 2019 or the third business day immediately prior to the date of any adjournment or postponement of the Tahoe Meeting (the “Election Deadline”) at one of the addresses specified on the back page of this Letter of Transmittal. If the Depositary does not receive the required documentation or you otherwise fail to make a proper election by the Election Deadline (or any extension thereof), you will be treated as a non-electing Tahoe Shareholder as described above and you will be deemed to have elected to receive the Share Consideration in respect of each Tahoe Share held. Tahoe Shareholders who do not deliver their Tahoe Share certificate(s) or DRS Statement, if any, and all other required documents to the Depositary on or before the date which is six years after the Effective Date shall lose their right to receive the Consideration for their Tahoe Shares.

Pursuant to the Arrangement, you will cease to be a Tahoe Shareholder as of the Effective Date and will only be entitled to receive the Rights Certificate representing the CVRs, the share certificates representing Pan American Shares and/or cash to which you are entitled under the Arrangement.

The Arrangement is subject to a number of conditions, some of which are beyond the control of Tahoe and Pan American. Accordingly, the exact timing of the implementation of the Arrangement is not currently known. Pan American and Tahoe currently expect the Arrangement to become effective on or about February 26, 2019.

This Letter of Transmittal is for use by registered Tahoe Shareholders only. Tahoe PSA Holders and Tahoe DSA Holders will not have certificate(s) or a DRS Statement representing the Tahoe Shares to be issued in respect of their Tahoe PSAs and Tahoe DSAs, as applicable, pursuant to the Plan of Arrangement and, accordingly, are not required to deliver any such certificate(s), DRS Statement or this form of Letter of Transmittal. Rather, for Tahoe PSA Holders and Tahoe DSA Holders to make a valid election as to the Consideration that a holder is entitled to receive under the Arrangement (subject to proration), Tahoe PSA Holders and Tahoe DSA Holders must sign and make a proper election in a separate Letter of Transmittal and Election Form applicable to Tahoe PSA Holders and Tahoe DSA Holders.

2

| TO: | COMPUTERSHARE INVESTOR SERVICES INC., at the office set out herein |

| | |

| AND TO: | TAHOE RESOURCES INC. |

| | |

| AND TO: | PAN AMERICAN SILVER CORP. |

Please read the Circular and the instructions set out below carefully before completing this Letter of Transmittal. Delivery of this Letter of Transmittal to an address other than as set forth herein will not constitute a valid delivery. If Tahoe Shares are registered in different names, a separate Letter of Transmittal must be submitted for each different registered owner. See Instruction 2.

The Depositary, or your broker or other financial advisor, can assist you in completing this Letter of Transmittal (see the back page of this document for addresses and telephone numbers). Persons whose Tahoe Shares are registered in the name of a broker, dealer, bank, trust company or other nominee should immediately contact such registered holder for assistance.

FOR TAHOE SHAREHOLDERS WHOSE TAHOE SHARES ARE REPRESENTED BY SHARECERTIFICATE(S):

In order for Tahoe Shareholders whose Tahoe Shares are represented by share certificate(s) or DRS Statement to receive the elected Consideration, such Tahoe Shareholders are required to deposit the certificate(s) or DRS Statement representing the Tahoe Shares held by them with the Depositary. This Letter of Transmittal, properly completed and duly executed, together with all other required documents, must accompany all certificate(s) or DRS Statement for Tahoe Shares deposited for payment pursuant to the Arrangement.

In connection with the Arrangement, the undersigned hereby deposits with the Depository for transfer upon the Arrangement becoming effective, the enclosed certificate(s) and DRS Statement representing Tahoe Shares (the “Deposited Shares”), details of which are as follows:

Share

Certificate

Number(s) or

DRS Statement

Number | Name(s) and Addresses in which Tahoe Shares are Registered | Number of Tahoe Shares

Represented by Share

Certificate(s) or DRS

Statement |

| | | |

| | | |

| | | |

| | | |

| | TOTAL: | |

Notes:

| 1. | If space is insufficient, please attach a list to this Letter of Transmittal in the above form. |

| | |

| 2. | The total of the numbers filled in above must equal the total number of Tahoe Shares represented by the share certificate(s) or DRS Statement enclosed with this Letter of Transmittal. |

3

Election of Consideration

For each Tahoe Share you hold, you may elect to receive either the Cash Consideration or Share Consideration, subject to proration. Please indicate the number of your Tahoe Shares for which you elect to receive Cash Consideration and the number of your Tahoe Shares for which you elect to receive Share Consideration, under the Arrangement:

| Number of Tahoe Shares for which Cash Consideration is elected | | |

| | | |

| Number of Tahoe Shares for which Share Consideration is elected | | |

| | | |

| Total | | |

Notes:

| 1. | The aggregate amount of cash payable under the Arrangement to Tahoe Shareholders will equal the Aggregate Cash Consideration (US$275,000,000). |

| | |

| 2. | If the aggregate amount of Cash Consideration that would otherwise be payable in respect of all of the Tahoe Shares for which Cash Elections are made (the “Cash Election Shares”) exceeds the Aggregate Cash Consideration, then the consideration payable for each Cash Election Share will consist of: (a) a cash payment in an amount equal to the Aggregate Cash Consideration divided by the aggregate number of Cash Election Shares; and (b) a fraction of a Pan American Share having a value (calculated by ascribing to each whole Pan American Share the Pan American Share Value of US$14.1490) equal to the amount by which US$3.40 exceeds the cash payment described in (a). |

| | |

| 3. | If the aggregate amount of Cash Consideration that would otherwise be payable in respect of the Cash Election Shares is less than the Aggregate Cash Consideration, then the consideration payable for each Tahoe Share for which a Share Election is made (a “Share Election Share”) will consist of: (a) a cash payment in an amount equal to the amount by which the Aggregate Cash Consideration exceeds the aggregate cash payable in respect of the Cash Election Shares, divided by the aggregate number of Share Election Shares; and (b) a fraction of a Pan American Share having a value (calculated by ascribing to each whole Pan American Share the Pan American Share Value of US$14.1490) equal to the amount by which US$3.40 exceeds the cash payment described in (a). |

| | |

| 4. | A Tahoe Shareholder who would otherwise receive a fraction of a Pan American Share pursuant to the Arrangement will receive an equivalent cash payment in lieu of such fractional share calculated by ascribing to each whole Pan American Share the Pan American Share Value. All calculations of Pan American Share consideration to be received under the Arrangement will be rounded up or down to four decimal places. In any case where the aggregate amount of cash payable to a particular Tahoe Shareholder under the Arrangement would, but for this provision, include a fraction of a cent, the consideration payable shall be rounded up to the nearest whole cent. As a result of such payments in lieu and rounding, it is possible that the actual amount of cash paid in consideration for the Tahoe Shares, in the aggregate, may exceed the Aggregate Cash Consideration. Tahoe Shareholders should refer to the full text of the Plan of Arrangement which is attached as Appendix B to the Circular. |

| | |

| 5. | The total number of Tahoe Shares for which you make a Cash Consideration election above plus the total number of Tahoe Shares for which you make a Share Consideration election above (collectively your“Total Elected Shares”) must equal your Deposited Shares. If your Total Elected Shares is less than your Deposited Shares, you will be deemed to have elected to receive the Share Consideration for the Tahoe Shares for which an election is not made. If your Total Elected Shares is more than your Deposited Shares, the number of Tahoe Shares for which you have elected to receive the Cash Consideration will be reduced accordingly. |

4

| 6. | If you do not make an election as to the applicable Consideration you wish to receive under the Arrangement, you will be deemed to have elected to receive the Share Consideration for all Tahoe Shares held. |

| | |

| 7. | You should consult your investment and tax advisors prior to making an election as to the Consideration you wish to receive under the Arrangement. |

It is understood that, upon receipt of this Letter of Transmittal properly completed and duly executed together with the certificate(s) and DRS Statement, if any, representing the Deposited Shares and following the Effective Time of the Arrangement, the Depositary will deliver to the undersigned the Consideration that the undersigned elected to receive and is entitled to receive under the Arrangement, or hold such Consideration for pick-up in accordance with the instructions set out below, and any certificate(s) or DRS Statement representing the Deposited Shares shall forthwith be cancelled. It is understood that all payments (including delivery of Pan American Shares) will be net of any amounts required to be withheld by law including in respect of applicable taxes, payroll deductions or similar amounts. Pursuant to and as required by applicable laws, Pan American, Tahoe and the Depositary, as applicable, shall withhold any amounts whatsoever from the amounts otherwise payable or otherwise deliverable to a Tahoe Shareholder and remit such amounts to the applicable government authorities.

The undersigned registered holder(s) of the above listed Deposited Shares hereby:

| | 1. | Represents and warrants in favour of Tahoe and Pan American that: (i) the undersigned is the registered holder of the Deposited Shares; (ii) such Deposited Shares are owned by the undersigned free and clear of all mortgages, liens, charges, encumbrances, security interests and adverse claims; (iii) the undersigned has full power and authority to execute and deliver this Letter of Transmittal and to deposit, sell, assign, transfer and deliver the Deposited Shares and that, when the Consideration is paid, none of Tahoe and Pan American, or any successor thereto will be subject to any adverse claim in respect of such Deposited Shares; (iv) the Deposited Shares have not been sold, assigned or transferred, nor has any agreement been entered into to sell, assign or transfer any such Deposited Shares, to any other person; (v) the surrender of the Deposited Shares complies with applicable laws; (vi) all information inserted by the undersigned into this Letter of Transmittal is accurate; (vii) unless the undersigned has revoked this Letter of Transmittal by notice in writing given to the Depositary prior to the Effective Date, the undersigned will not, prior to such time, transfer or permit to be transferred any of such Deposited Shares; and (viii) the delivery of the appropriate number of CVRs, Pan American Shares and appropriate Cash Consideration to the undersigned will completely discharge any and all obligations of Tahoe, Pan American and the Depositary with respect to the matters contemplated by this Letter of Transmittal. These representations and warranties shall survive the completion of the Arrangement. |

| | | |

| | 2. | Agrees that all questions as to validity, form, eligibility (including timely receipts) and acceptance of any Tahoe Shares surrendered in connection with the Arrangement shall be determined by Pan American in its sole discretion and that such determination shall be final and binding and acknowledges that there is no duty or obligation upon Tahoe, Pan American, the Depositary or any other person to give notice of any defect or irregularity in any such surrender of Tahoe Shares and no liability will be incurred by any of them for failure to give any such notice. |

| | | |

| | 3. | Acknowledges receipt of the Circular and: (i) understands that whether or not the undersigned delivers the required documentation to the Depositary, as of the Effective Date, the undersigned will cease to be a Tahoe Shareholder and, subject to the ultimate expiry identified below, will only be entitled to receive the Consideration to which the undersigned is entitled under the Arrangement; and (ii)acknowledges and agrees that failure to surrender any certificate(s) or DRS Statement which, prior to the Effective Date, represented issued and outstanding Tahoe Shares with all other instruments required by this Letter of Transmittal, on or prior to the sixth anniversary of the Effective Date will result in such shares ceasing to represent any claim or interest of any kind or nature against Tahoe, Pan American or the Depositary. |

| | | |

| | 4. | Except for any proxy deposited with respect to the vote on the Arrangement Resolution in connection with the Tahoe Meeting, revokes any and all authority, other than as granted in this Letter of Transmittal, whether as agent, attorney-in-fact, proxy or otherwise, previously conferred or agreed to be conferred by the undersigned at any time with respect to the Deposited Shares and no subsequent authority, whether as agent, attorney-in-fact, proxy or otherwise, will be granted with respect to the Deposited Shares. The undersigned irrevocably constitutes and appoints the Depositary and any officer of Tahoe, and each of them and any other persons designated by Tahoe or Pan American in writing, the true and lawful agent, attorney-in-fact and proxy of the undersigned with respect to the Deposited Shares, with full power of substitution, in the name of and on behalf of the undersigned (such power of attorney being deemed to be an irrevocable power coupled with an interest) to: (i) register or record the transfer of such Deposited Shares on the registers of Tahoe; and (ii) execute and deliver, as and when requested by Pan American, any instruments of proxy, authorization or consent in form and on terms satisfactory to Pan American in respect of such Deposited Shares, revoke any such instrument, authorization or consent or designate in such instrument, authorization or consent any person or persons as the proxy of such holder in respect of the Deposited Shares for all purposes, other than in connection with the Tahoe Meeting. The undersigned revokes any and all other authority, whether as agent, attorney-in-fact, proxy or otherwise, previously conferred or agreed to be conferred by the undersigned at any time with respect to the Deposited Shares other than as granted in a form of proxy for use at the Tahoe Meeting. |

5

| | 5. | Acknowledges that the delivery of the Deposited Shares shall be effected and the risk of loss to such Deposited Shares shall pass only upon proper receipt thereof by the Depositary. The undersigned will, upon request, execute any signature guarantees or additional documents deemed by the Depositary to be reasonably necessary or desirable to complete the transfer of the Deposited Shares. |

Each authority conferred or agreed to be conferred by the undersigned in this Letter of Transmittal shall survive the death or incapacity of the undersigned and any obligation of the undersigned hereunder shall be binding upon the heirs, personal representatives, successors and assigns of the undersigned.

The undersigned instructs Pan American and the Depositary to mail the Rights Certificate representing the CVRs, any certificate(s) or DRS Statement representing the Pan American Shares that the undersigned is entitled to receive under the Arrangement and/or the cheque representing the Cash Consideration or cash payment in lieu of any fractional Pan American Shares that the undersigned may be entitled to receive, if any, for the Deposited Shares promptly after the Effective Time, by first-class insured mail, postage prepaid, to the undersigned, or to hold such Rights Certificate, certificate(s) or DRS Statement and/or cheque for pick-up, in accordance with the instructions given below. If no address is specified, the undersigned acknowledges that the Depositary will forward the Rights Certificate, certificate(s) or DRS Statement and/or cheque to the last address of the undersigned as shown on the securities register of Tahoe.

Notwithstanding the foregoing, the undersigned instructs Pan American and the Depositary to deliver the Cash Consideration and cash payment in lieu of any fractional Pan American Shares that the undersigned may be entitled to receive, if any, by wire in accordance with the instructions in Box D if wire instructions are so provided.

If the Arrangement is not completed or proceeded with, the enclosed certificate(s) or DRS Statement and all other ancillary documents will be returned forthwith to the undersigned at the address set out below in Box A or Box B or, failing such address being specified, to the undersigned at the last address of the undersigned as it appears on the securities register maintained by or on behalf of Tahoe.

All cash payments to former Tahoe Shareholders will be in US dollars.

It is understood that under no circumstances will interest accrue or be paid on the Consideration payable in respect of the Deposited Shares in connection with the Arrangement.

By reason of the use by the undersigned of an English language Letter of Transmittal, the undersigned and each of the Depositary, Tahoe and Pan American shall be deemed to have required that any contract in connection with the delivery of the Deposited Shares pursuant to the Arrangement through this Letter of Transmittal, as well as all documents related thereto, be drawn exclusively in the English language.En raison de l’utilisation d’une lettre d’envoi en langue anglaise par le soussigné, le soussigné et les destinataires sont présumés avoir requis que tout contrat attesté par ceci et son acceptation au moyen de la présente lettre d’envoi, de même que tous les documents qui s’y rapportent, soient rédigés exclusivement en langue anglaise.

6

PLEASE COMPLETE ALL BOXES, AS APPROPRIATE

| BOX A | | BOX B |

| | | | | | | |

| ENTITLEMENT DELIVERY | | ISSUE CONSIDERATION IN THE NAME OF*: |

| | | | | | | |

All CVRs, Cash Consideration and Share Consideration will be issued and mailed to your existing registration address unless otherwise stated. If you would like your CVRs, Cash Consideration or Share Consideration issued to a different name or address, please complete BOX B and refer to INSTRUCTION 2 & 3 | | |

| ❑ CHECK BOX IF SAME AS EXISTING REGISTRATION(DEFAULT) |

| | |

| | | |

| | | (NAME) |

❑ MAIL CVRS, SHARE CONSIDERATION AND CASH CONSIDERATION TO ADDRESS ON RECORD(DEFAULT) | | |

| | |

| | | | | | | (STREET NUMBER & NAME) |

❑ MAIL CVRS, SHARE CONSIDERATION AND CASH CONSIDERATION TO A DIFFERENT ADDRESS (MUST COMPLETE BOX B) | | |

| | |

| | (CITY AND PROVINCE/STATE) |

| | | | | | | |

❑ HOLD CVRS, SHARE CONSIDERATION AND CASH CONSIDERATION FOR PICKUP AT THE DEPOSITARY’S OFFICE (CHECK LOCATION) | | |

| | (COUNTRY AND POSTAL/ZIP CODE) |

| | |

| | | | | | | |

| ❍ TORONTO ❍MONTREAL ❍VANCOUVER❍ CALGARY | | |

| | | | | | | (TELEPHONE NUMBER (BUISNESS HOURS) |

| SEE INSTRUCTION SECTION 10 FOR OFFICE ADDRESSES | | |

| | | | | | | |

| ❑ DELIVER FUNDS VIA WIRE* (COMPLETE BOX D) | | (SOCIAL INSURANCE/SECURITY NUMBER) |

| | | | | | | |

| | | *IF THIS NAME OR ADDRESS IS DIFFERENT FROM YOUR REGISTRATION, PLEASEPROVIDE SUPPORTING TRANSFER REQUIREMENTS (SEE INSTRUCTION SECTION 2 & 3) |

| BOX C |

| RESIDENCY DECLARATION |

| ALLTAHOE SHAREHOLDERS ARE REQUIRED TO COMPLETE A RESIDENCY DECLARATION. FAILURE TO COMPLETE A RESIDENCY DECLARATION MAY RESULT IN A DELAY IN YOUR PAYMENT. |

| |

| The undersigned represents that: |

| |

| ❑ The beneficial owner of the Tahoe Shares deposited herewithisa U.S. Shareholder. |

| |

| ❑ The beneficial owner of the Tahoe Shares deposited herewithis nota U.S. Shareholder. |

| |

A “U.S. Shareholder” is any Tahoe shareholder who is either (i) providing an address in Box “B” that is located within the United States or any territory or possession thereof, or (ii) a “U.S. person” for the United States federal income tax purposes as defined in Instruction 8 below. If you are a U.S person or acting on behalf of a U.S. person, you must provide a completed IRS Form W-9 (enclosed) below or otherwise provide certification that you are exempt from backup withholding, as provided in the instructions (see Part VIII). If you are not a U.S. person as defined in (ii) above, but you provide an address that is located within the United States, you must complete an appropriate Form W-8, a copy of which is available from the Depositary upon request If a completed IRS Form W-9 or Form W-8 is not provided, your payment potentially may be subject to backup withholding of U.S. federal income tax by the Depositary. |

| |

7

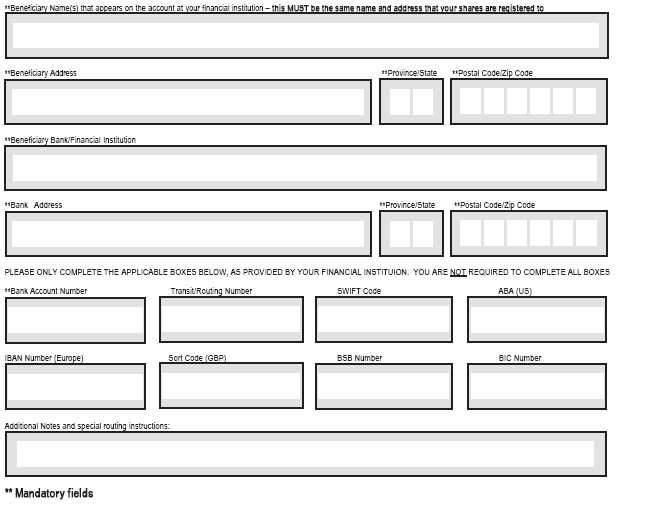

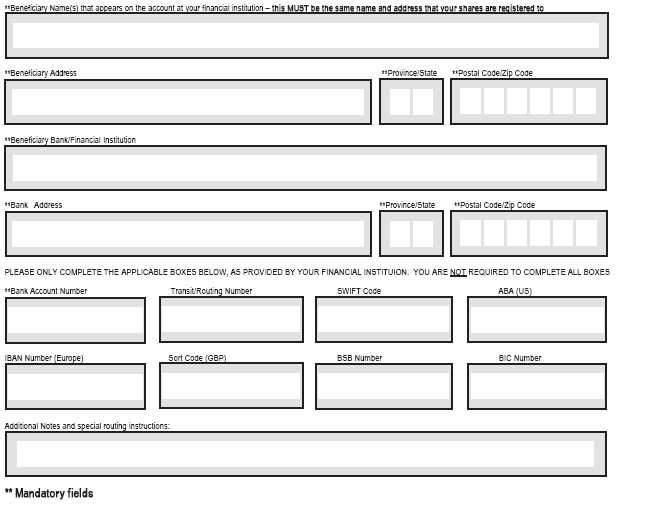

BOX D

WIRE PAYMENT*

*PLEASE NOTE THAT THERE IS A $100 BANKING FEE ON WIRE PAYMENTS. ALTERNATIVELY, CHEQUE PAYMENTS ARE ISSUED AT NO ADDITIONAL COST

*IF WIRE DETAILS ARE INCORRECT OR INCOMPLETE, THE DEPOSITARY WILL ATTEMPT TO CONTACT YOU AND CORRECT THE ISSUE. HOWEVER, IF WE CANNOT CORRECT THE ISSUE PROMPTLY, A CHEQUE WILL BE AUTOMATICALLY ISSUED AND MAILED TO THE ADDRESS ON RECORD. NO FEES WILL BE CHARGED

Please provide email address and telephone number in the event that we need to contact you for corrective measures:

EMAIL ADDRESS: ____________________________________________________TELEPHONE NUMBER: _____-__________-__________

8

BOX E

TAX DEFERRAL ELECTION FOR ELIGIBLE HOLDERS

A beneficial owner of the Tahoe Shares represented by the shares listed in this Letter of Transmittal who is an Eligible Holder (as defined below) and receives Pan American Shares pursuant to the Arrangement may be entitled to make a joint tax election under section 85 of the Tax Act or corresponding provisions of any applicable provincial tax legislation (each one a “Section 85 Election”) with Pan American as described in the Circular, “CertainCanadian Federal Income Tax Considerations – Holders Resident in Canada – Exchange of Tahoe Shares - With Section 85 Election” if (a) the box below is checked, (b) an email address is provided in the space below, and (c) this Letter of Transmittal, properly completed and duly executed, is submitted to the Depositary no later than 4:30 p.m. (Vancouver time) on the Election Deadline. Any such Eligible Holder will promptly receive a tax instruction letter providing instructions on how to make the Section 85 Election with Pan American by email to the email address provided below.

[ ] Check this box if the beneficial owner of the Tahoe Shares represented by the shares listed in this Letter of Transmittal (a) is an “Eligible Holder” (as defined below) entitled to make a Section 85 Election with Pan American, and (b) may wish to make the Section 85 Election with Pan American for the Eligible Holder’s Tahoe Shares disposed of under the Arrangement in the event that the Eligible Holder receives Pan American Shares as partial consideration for such Tahoe Shares pursuant to a Share Consideration election (see under the heading “Election of Consideration” in this Letter of Transmittal) or pursuant to the proration provisions.

Email address: ______________________________________________________________________________________________________________

Neither Tahoe, Pan American nor any successor corporation shall be responsible for the proper completion and filing of any Section 85 Election forms and, except for the obligation to sign and return any duly completed Section 85 Election forms which are received within 60 days of the Effective Date, for any taxes, interest or penalties arising as a result of the failure of an Eligible Holder to properly or timely complete and file such Section 85 Election forms in the form and manner prescribed by the Tax Act (or any applicable provincial legislation). Eligible Holders are cautioned that Pan American will have no obligation, and does not intend, to make a Section 85 Election with any Eligible Holder who does not comply strictly with the procedures and timelines set out in this Letter of Transmittal and the tax instruction letter.

An “Eligible Holder” means a beneficial owner of Tahoe Shares immediately prior to the Effective Time (other than a Dissenting Shareholder) who is (a) a resident of Canada for purposes of the Tax Act (other than a Tax Exempt Person), (b) a partnership any member of which is a resident of Canada for the purposes of the Tax Act (other than a Tax Exempt Person), or (c) a beneficial owner of Tahoe Shares immediately prior to the Effective Time who is not, and is not deemed to be, a resident of Canada for the purposes of the Tax Act and whose Tahoe Shares are “taxable Canadian property” and not “treaty-protected property”, in each case as defined in the Tax Act. An Eligible Holder can only make a Section 85 Election for a Tahoe Share for which a Pan American Share (or part thereof) is received as partial consideration pursuant to a Share Consideration election (see above under the heading “Election of Consideration” in this Letter of Transmittal) or pursuant to the proration provisions. No Section 85 Election can be made for a Tahoe Share in any other circumstances.

Each Eligible Holder should consult the holder’s own tax advisor as to whether the holder should make a Section 85 Election and the procedures for doing so.It is the Eligible Holder’s responsibility to take the steps required to make a valid Section 85 Election.

9

| BOX F – SIGNATURE GUARANTEE | | BOX G - SIGNATURE |

| | | |

| (if required under Instruction 3) | | |

| Signature guaranteed by: | | Dated: _______________________________________________ |

| | | |

| Authorized Signature | | |

| | | Signature of Tahoe Shareholder or Authorized Representative |

| | | |

| Name of Guarantor(please print or type) | | |

| | | |

| | | |

| Address(please print or type) | | Signature of any Joint Holder |

| | | |

| | | |

| Area Code and Telephone Number | | Name of Shareholder |

| | | |

| | | |

| | | Name of Authorized Representative |

| | | |

| | | |

| | | Area Code and Daytime Telephone Number |

| | | |

| | | |

| | | Email Address |

| | | |

| | | |

10

INSTRUCTIONS

| 1. | Use of Letter of Transmittal |

| | (a) | Tahoe Shareholders should read the accompanying Circular prior to completing this Letter of Transmittal. |

| | | |

| | (b) | In order to make an election with respect to the Consideration to be received under the Arrangement, this Letter of Transmittal properly completed and duly executed (or an originally signed facsimile copy thereof) together with accompanying certificate(s) or DRS Statement representing the Tahoe Shares and all other required documents must be sent or delivered to the Depositary at the addresses set out on the back of this Letter of Transmittal and must be received by the Depositary no later than 4:30 p.m. (Vancouver time) on the Election Deadline. |

| | | |

| | (c) | The method used to deliver this Letter of Transmittal and any accompanying certificate(s) or DRS Statement representing Tahoe Shares and all other required documents is at the option and risk of the Tahoe Shareholder, and delivery will be deemed effective only when such documents are actually received. Tahoe recommends that the necessary documentation be hand delivered to the Depositary at the addresses set out on the back of this Letter of Transmittal, and a receipt obtained; otherwise the use of registered mail with return receipt requested, properly insured, is recommended.Tahoe Shareholders whose Tahoe Shares are registered in the name of a broker, investment dealer, bank, trust company or other nominee should contact that nominee for assistance in depositing those Tahoe Shares.Delivery to an office other than to the specified office does not constitute delivery for this purpose. |

| | | |

| | (d) | Pan American reserves the right, if it so elects in its absolute discretion, to instruct the Depositary to waive any defect or irregularity contained in any Letter of Transmittal and/or any accompanying documents received by it. |

| | | |

| | (e) | If the Consideration is to be issued in the name of a person other than the person(s) signing this Letter of Transmittal or if the Consideration or any certificate(s) or DRS Statement representing Tahoe Shares not surrendered are to be mailed to someone other than the person(s) signing this Letter of Transmittal or to the person(s) signing this Letter of Transmittal at an address other than that shown in Box B, the appropriate boxes on this Letter of Transmittal should be completed (Box A and Box B). |

This Letter of Transmittal must be completed and signed by the holder of Tahoe Shares or by such holder’s duly authorized representative (in accordance with Instruction 4 below).

| | (a) | If this Letter of Transmittal is signed by the registered owner(s) of the Deposited Shares, such signature(s) on this Letter of Transmittal must correspond with the name(s) as registered or, where applicable, as written on the face of accompanying share certificate(s) or DRS Statement, without any change whatsoever, and any such certificate(s) or DRS Statement need not be endorsed. If the Deposited Shares are owned of record by two or more joint owners, all such owners must sign this Letter of Transmittal. |

| | | |

| | (b) | If this Letter of Transmittal is completed in respect of Tahoe Shares deposited for the account of an Eligible Institution (defined below), the signature is not required to be guaranteed. |

| | | |

| | (c) | If this Letter of Transmittal is signed by a person other than the registered owner(s) of the Deposited Shares, or if the Rights Certificate representing CVRs, certificate(s) or DRS Statement representing Pan American Shares or the cheque representing Cash Consideration, are to be issued to a person other than the registered owner(s): |

| | (i) | any deposited certificate(s) or DRS Statement for the Deposited Shares must be endorsed or be accompanied by an appropriate share transfer power of attorney duly and properly completed by the registered owner(s); and |

| | | |

| | (ii) | the signature(s) on such endorsement or share transfer power of attorney must correspond exactly to the name(s) of the registered owner(s) as registered or as appearing on the certificate(s) and must be guaranteed as noted in Instruction 3 below. |

11

| 3. | Guarantee of Signatures |

If this Letter of Transmittal is signed by a person other than the registered owner(s) of the Deposited Shares or if the Consideration is to be issued in a name other than the registered owner(s), such signature must be guaranteed by an Eligible Institution (see below), or in some other manner satisfactory to the Depositary (except that no guarantee is required if the signature is that of an Eligible Institution).

An “Eligible Institution” means a Canadian Schedule I chartered bank, a major trust company in Canada, a commercial bank or trust company in the United States, a member of the Securities Transfer Association Medallion Program (STAMP), a member of the Stock Exchange Medallion Program (SEMP) or a member of the New York Stock Exchange, Inc. Medallion Signature Program (MSP). Members of these programs are usually members of a recognized stock exchange in Canada or the United States, members of the Investment Industry Regulatory Organization of Canada, members of the Financial Industry Regulatory Authority or banks and trust companies in the United States.

| 4. | Fiduciaries, Representatives and Authorizations |

Where this Letter of Transmittal is executed by a person as an executor, administrator, trustee or guardian, or on behalf of a corporation, partnership or association or is executed by any other person acting in a representative capacity, this Letter of Transmittal must be accompanied by satisfactory evidence of the authority to act. Pan American or the Depositary, at their discretion, may require additional evidence of authority or additional documentation.

All Rights Certificate(s), certificate(s) or DRS Statement(s) and/or cheque(s) to be issued in exchange for the Deposited Shares will be issued in the name of the person indicated in Box B and delivered to the address indicated in Box B (unless Box A has been checked). If any Rights Certificate(s), certificate(s) or DRS Statement(s) and/or cheque(s) are to be held for pick-up at the offices of the Depositary, complete this section of Box A. If neither Box A nor Box B is completed, any new Rights Certificate(s), certificate(s) or DRS Statement and/or cheque(s) issued in exchange for the Deposited Shares will be issued in the name of the registered holder of the Deposited Shares and will be mailed to the address of the registered holder of the Deposited Shares as it appears on the register of Tahoe. Any Rights Certificate(s), certificate(s) or DRS Statement and/or cheque(s) mailed in accordance with this Letter of Transmittal will be deemed to be delivered at the time of mailing.

All payments in lieu of the receipt of fractional Pan American Shares will be made in US dollars and by cheque in accordance with the instructions indicated by completing Box A or Box B (above).

Notwithstanding the foregoing, the Cash Consideration and cash payment in lieu of any fractional Pan American Shares that a Tahoe Shareholder may be entitled to receive, if any, will be delivered by wire in accordance with the instructions in Box D if wire instructions are so provided.

| 6. | Lost, Stolen or Destroyed Certificates |

In the event any certificate(s) or DRS Statement which immediately prior to the Effective Time represented one or more outstanding Tahoe Shares that are ultimately entitled to Consideration shall have been lost, stolen or destroyed, upon the making of an affidavit or statutory declaration of that fact by the person claiming such certificate(s) or DRS Statement to be lost, stolen or destroyed and who was listed immediately prior to the Effective Time as the registered holder thereof on the securities registers maintained by or on behalf of Tahoe, the Depositary will deliver in exchange for such lost, stolen or destroyed certificate(s) or DRS Statement, certificate(s) or DRS Statement representing the Consideration that such holder is entitled to receive in exchange for such lost, stolen or destroyed certificate(s) or DRS Statement, provided the holder to whom the Consideration is to be delivered shall, as a condition precedent to the delivery, give a bond satisfactory to Pan American and the Depositary (acting reasonably) in such sum as Pan American and the Depositary may direct or otherwise indemnify Pan American and the Depositary in a manner satisfactory to Pan American and the Depositary, acting reasonably, against any claim that may be made against Pan American or the Depositary with respect to the certificate(s) or DRS Statement alleged to have been lost, stolen or destroyed.

If the Arrangement does not proceed for any reason, any certificate(s) or DRS Statement representing Tahoe Shares received by the Depositary will be returned to you forthwith in accordance with your delivery instructions in Box A or Box B, or failing such address being specified, to the undersigned at the last address of the undersigned as it appears on the securities register maintained by or on behalf of Tahoe.

12

| 8. | Form W-9 – U.S. Shareholders |

If you are a U.S. person (as defined below), you must provide a completed IRS Form W-9. If a completed IRS Form W-9 is not provided, or if the correct TIN is not provided on such form, or if any other information is not correctly provided, payments made with respect to the Tahoe Shares potentially may be subject to backup withholding of 24% by the Depositary. For the purposes of this Letter of Transmittal, a “U.S. person” means: a beneficial owner of Tahoe Shares that, for United States federal income tax purposes, is (a) a citizen or resident of the United States, (b) a corporation, or other entity classified as a corporation for United States federal income tax purposes, that is created or organized in or under the laws of the United States or any state in the United States, including the District of Columbia, (c) an estate if the income of such estate is subject to United States federal income tax regardless of the source of such income, (d) a trust if (i) such trust has validly elected to be treated as a U.S. person for United States federal income tax purposes or (ii) a United States court is able to exercise primary supervision over the administration of such trust and one or more U.S. persons have the authority to control all substantial decisions of such trust, or (e) a partnership, limited liability company or other entity classified as a partnership for United States tax purposes that is created or organized in or under the laws of the United States or any state in the United States, including the District of Columbia.

Backup withholding is not an additional United States income tax. Rather, the United States income tax liability of persons subject to backup withholding will be reduced by the amount of tax withheld. If backup withholding results in an overpayment of taxes, a refund may be obtained provided that the required information is furnished to the IRS.

Certain persons (including, among others, corporations, certain “not-for-profit” organizations, and certain non-U.S. persons) are not subject to backup withholding. A Tahoe Shareholder that is a U.S. person should consult his or her tax advisor as to the shareholder’s qualification for an exemption from backup withholding and the procedure for obtaining such exemption.

The TIN for an individual United States citizen or resident is the individual’s social security number or individual taxpayer identification number.

If a Tahoe Shareholder has not been issued a TIN and has applied for a TIN or intends to apply for a TIN in the near future, then such Tahoe Shareholder should write “Applied For” in Part I of the IRS Form W-9. A Tahoe Shareholder that is a U.S. person waiting for a TIN to be issued or has not specified a TIN in the completed IRS Form W-9 must provide a TIN within 60 days, otherwise payments made with respect to the Tahoe Shares potentially may be subject to backup withholding of 24% by the Depositary.

Failure to furnish TIN — If you fail to furnish your correct TIN, you may be subject to a penalty of U.S.$50 for each such failure unless your failure is due to reasonable cause and not to willful neglect.

Non-U.S. persons receiving payments in the U.S. should return a completed Form W-8ECI, W-8IMY, W-8BEN or W-8BEN-E, as appropriate, a copy of which is available from the Depositary upon request.

The Depositary is committed to protecting personal information. In the course of providing services, the Depositary receives non-public personal information about shareholders from transactions the Depositary performs, forms a shareholder may send to the Depositary or other communications the Depositary may have with a shareholder and its representatives. This information could include a shareholder’s name, address, social insurance number, securities holdings and other financial information. The Depositary uses this to administer a shareholder’s account, to better serve client needs and for other lawful purposes relating to its services. The Depositary has prepared a Privacy Code to tell shareholders more about its information practices and how their privacy is protected. It is available at the Depositary’s website, at www.computershare.com, or by writing to the Depositary at, 100 University Avenue, 8th Floor, Toronto, Ontario M5J 2Y1. The Depositary will use any information a Tahoe Shareholder provides with this Letter of Transmittal in order to process a Tahoe Shareholder’s request and will consider a Tahoe Shareholder’s submission of this Letter of Transmittal as its consent to the above.

13

| 10. | Payment Entitlement Pickup Locations |

Entitlements may be picked up at applicable Depositary office locations with counter services. Pick-up instructions must be selected in Box A. Below are the applicable Depositary office locations:

| Montreal | | Toronto | | Calgary | | Vancouver |

| | | | | | | |

1500 Boulevard Robert- Bourassa, 7thFloor Montréal, QC H3A 3S8 | | 100 University Ave 8thFloor, North Tower Toronto ON M5J 2Y1 | | 530 8 Ave SW, 6thFloor Calgary, AB T2P 3S8 | | 510 Burrard Street, 3rdFloor, Vancouver, BC V6C 3A8 |

| | (a) | If the space on this Letter of Transmittal is insufficient to list all separate registrations of Deposited Shares held by the same registered owner(s), the details of additional Deposited Shares may be included on a separate signed list affixed to this Letter of Transmittal. |

| | | |

| | (b) | If Tahoe Shares are registered in different forms (e.g., “John Doe and “J. Doe”) a separate Letter of Transmittal should be signed for each different registration. |

| | | |

| | (c) | No alternative, conditional or contingent deposits of Tahoe Shares will be accepted. All depositing holders of Tahoe Shares by execution of this Letter of Transmittal or a facsimile of an originally signed facsimile copy hereof waive any right to receive any notice of the acceptance of deposited Tahoe Shares, except as required by applicable law. |

| | | |

| | (d) | Additional copies of the Letter of Transmittal may be obtained from the Depositary at the address set out on the back of this Letter of Transmittal. |

| | | |

| | (e) | All questions as to the validity, form, eligibility (including timely receipt) and acceptance of any Tahoe Shares deposited will be determined by Pan American in its sole discretion. Depositing Tahoe Shareholders agree that such determination shall be final and binding. Pan American reserves the absolute right to reject any and all deposits which it determines not to be in proper form or which may be unlawful to accept under the laws of any jurisdiction. Pan American reserves the absolute right to waive any defects or irregularities in the deposit of any Tahoe Shares. No deposit of Tahoe Shares will be deemed to be properly made until all defects and irregularities have been cured or waived. There shall be no duty or obligation on Tahoe, Pan American or the Depositary or any other person to give notice of any defects or irregularities in any deposit and no liability shall be incurred by any of them for failure to give such notice. Pan American’s interpretation of the terms and conditions of the Plan of Arrangement, the Circular and this Letter of Transmittal will be final and binding. |

| | | |

| | (f) | Under no circumstances will any amount be paid by Pan American or the Depositary by reason of any delay in exchanging any Tahoe Shares or in making payments in lieu of fractional Pan American Shares to any person on account of Tahoe Shares accepted in exchange for the Consideration pursuant to the Plan of Arrangement. |

| | | |

| | (g) | Any questions should be directed to the Depositary at 1-800-564-6253 or by e-mail tocorporateactions@computershare.com. |

| | | |

| | (h) | The representations made by the Tahoe Shareholder in this Letter of Transmittal will survive the Effective Time. |

| | | |

| | (i) | This Letter of Transmittal shall be governed by, and construed in accordance with the laws of the Province of British Columbia and the federal laws of Canada applicable therein. |

14

[Page intentionally left blank]

15

The Depositary for the Arrangement is:

| By Mail | By Registered Mail, by Hand or by Courier |

| | |

| Computershare Investor Services Inc. | Computershare Investor Services Inc. |

| P.O. Box 7021 | 100 University Ave. |

| 31 Adelaide St. E | 8thFloor |

| Toronto, ON, M5C 3H2 | Toronto, ON, M5J 2Y1 |

| Attention: Corporate Actions | |

| North American Toll Free Phone: |

| |

| 1-800-564-6253 |

| |

| Email:corporateactions@computershare.com |

Delivery of this Letter of Transmittal to an address other than as set forth above does not constitute a valid delivery.

16