IR call on acquisition of Principia Biopharma Inc. Full ownership of BTKi ‘168 and further strengthening core R&D areas August 17, 2020 Exhibit 99.2

Forward looking statements This presentation contains forward-looking statements. Forward-looking statements are statements that are not historical facts and may include projections and estimates and their underlying assumptions, statements regarding plans, objectives, intentions and expectations with respect to future financial results, events, operations, services, product development and potential, and statements regarding future performance. Forward-looking statements are generally identified by the words “expects”, “anticipates”, “believes”, “intends”, “estimates”, “plans”, “will be” and similar expressions. Although Sanofi’s and Principia Biopharma Inc.’s management each believes that the expectations reflected in such forward-looking statements are reasonable, investors are cautioned that forward-looking information and statements are subject to various risks and uncertainties, many of which are difficult to predict and generally beyond the control of Sanofi and Principia Biopharma Inc., that could cause actual results and developments to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. These risks and uncertainties include among other things, risks related to Sanofi’s and Principia Biopharma Inc.’s ability to complete the acquisition on the proposed terms or on the proposed timeline, including the receipt of required regulatory approvals, the possibility that competing offers will be made, other risks associated with executing business combination transactions, such as the risk that the businesses will not be integrated successfully, that such integration may be more difficult, time-consuming or costly than expected or that the expected benefits of the acquisition will not be realized, risks related to future opportunities and plans for the combined company, including uncertainty of the expected financial performance and results of the combined company following completion of the proposed acquisition, disruption from the proposed acquisition making it more difficult to conduct business as usual or to maintain relationships with customers, employees, manufacturers, suppliers or patient groups, and the possibility that, if the combined company does not achieve the perceived benefits of the proposed acquisition as rapidly or to the extent anticipated by financial analysts or investors, the market price of Sanofi’s shares could decline, as well as other risks related Sanofi’s and Principia Biopharma Inc.’s respective businesses, including the ability to grow sales and revenues from existing products and to develop, commercialize or market new products, competition, including potential generic competition, the uncertainties inherent in research and development, including future clinical data and analysis, regulatory obligations and oversight by regulatory authorities, such as the FDA or the EMA, including decisions of such authorities regarding whether and when to approve any drug, device or biological application that may be filed for any product candidates as well as decisions regarding labelling and other matters that could affect the availability or commercial potential of any product candidates, the absence of a guarantee that any product candidates, if approved, will be commercially successful, the future approval and commercial success of therapeutic alternatives, Sanofi’s ability to benefit from external growth opportunities, to complete related transactions and/or obtain regulatory clearances, risks associated with intellectual property and any related pending or future litigation and the ultimate outcome of such litigation, trends in exchange rates and prevailing interest rates, volatile economic and market conditions, cost containment initiatives and subsequent changes thereto, and the impact that COVID-19 will have on us, our customers, suppliers, vendors, and other business partners, and the financial condition of any one of them, as well as on our employees and on the global economy as a whole. Any material effect of COVID-19 on any of the foregoing could also adversely impact us. This situation is changing rapidly and additional impacts may arise of which we are not currently aware and may exacerbate other previously identified risks. While the list of factors presented here is representative, no list should be considered a statement of all potential risks, uncertainties or assumptions that could have a material adverse effect on companies’ consolidated financial condition or results of operations. The foregoing factors should be read in conjunction with the risks and cautionary statements discussed or identified in the public filings with the U.S. Securities and Exchange Commission (the “SEC”) and the AMF made by Sanofi, including those listed under “Risk Factors” and “Cautionary Statement Regarding Forward-Looking Statements” in Sanofi’s annual report on Form 20-F for the year ended December 31, 2019, and the current reports on Form 8-K, quarterly reports on Form 10-Q and annual reports on Form 10-K filed by Principia Biopharma Inc. with the SEC. The forward-looking statements speak only as of the date hereof and, other than as required by applicable law, Sanofi and Principia Biopharma Inc. do not undertake any obligation to update or revise any forward-looking information or statements.

Additional information for U.S. shareholders The tender offer for the outstanding shares of Principia Biopharma Inc. common stock referenced in this press release has not yet commenced. This press release is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell securities, nor is it a substitute for the tender offer materials that Sanofi and its acquisition subsidiary will file with the SEC, upon the commencement of the tender offer. At the time the tender offer is commenced, Sanofi and its acquisition subsidiary will file a tender offer statement on Schedule TO and thereafter Principia Biopharma Inc. will file a Solicitation/Recommendation Statement on Schedule 14D-9 with the SEC with respect to the tender offer. THE TENDER OFFER MATERIALS (INCLUDING AN OFFER TO PURCHASE, A RELATED LETTER OF TRANSMITTAL AND CERTAIN OTHER TENDER OFFER DOCUMENTS) AND THE SOLICITATION/RECOMMENDATION STATEMENT ON SCHEDULE 14D-9 WILL CONTAIN IMPORTANT INFORMATION. PRINCIPIA BIOPHARMA INC. STOCKHOLDERS ARE URGED TO READ THESE DOCUMENTS CAREFULLY WHEN THEY BECOME AVAILABLE (AS EACH MAY BE AMENDED OR SUPPLEMENTED FROM TIME TO TIME) BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION THAT HOLDERS OF PRINCIPIA BIOPHARMA INC. SECURITIES SHOULD CONSIDER BEFORE MAKING ANY DECISION REGARDING TENDERING THEIR SECURITIES. The Offer to Purchase, the related Letter of Transmittal and certain other tender offer documents, as well as the Solicitation/Recommendation Statement, will be made available to all holders of Principia Biopharma Inc. stock at no expense to them. The tender offer materials and the Solicitation/Recommendation Statement will be made available for free at the SEC’s website at www.sec.gov. Additional copies may be obtained for free by contacting Sanofi or Principia Biopharma Inc. Copies of the documents filed with the SEC by Principia Biopharma will be available free of charge on Principia Biopharma Inc.’s internet website at principiabio.com or by contacting Principia Biopharma Inc.’s Investor Relations Department at ir@principiabio.com. Copies of the documents filed with the SEC by Sanofi will be available free of charge on Sanofi’s internet website at https://en.sanofi.com/investors or by contacting Sanofi’s Investor Relations Department at ir@sanofi.com. In addition to the Offer to Purchase, the related Letter of Transmittal and certain other tender offer documents, as well as the Solicitation/Recommendation Statement, Sanofi files annual and special reports and other information with the SEC and Principia Biopharma Inc. files annual, quarterly and special reports and other information with the SEC. You may read and copy any reports or other information filed by Sanofi and Principia Biopharma Inc. at the SEC public reference room at 100 F. Street, N.E., Washington D.C. 20549. Please call the Commission at 1-800-SEC-0330 for further information on the public reference room. Sanofi’s and Principia Biopharma Inc.’s filings with the SEC are also available to the public from commercial document-retrieval services and at the website maintained by the SEC at www.sec.gov

Agenda Strategic fit with ‘Play to Win’ Bill Sibold EVP, Specialty Care Lead with innovation John Reed EVP, Global Head of R&D Financials Jean-Baptiste de Chatillon EVP, Chief Financial Officer Q&A session (also joining) Paul Hudson Chief Executive Officer Martin Babler President and CEO, Principia Biopharma Inc.

Bill Sibold Strategic fit with ‘Play to Win’ EVP, Specialty Care

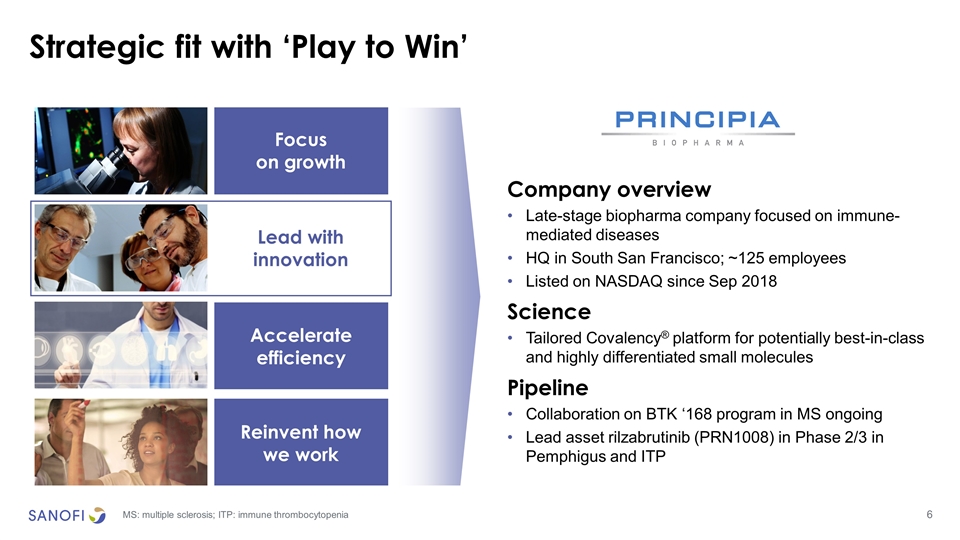

Strategic fit with ‘Play to Win’ Focus on growth Lead with innovation Lead with innovation Accelerate efficiency Reinvent how we work Company overview Late-stage biopharma company focused on immune-mediated diseases HQ in South San Francisco; ~125 employees Listed on NASDAQ since Sep 2018 Science Tailored Covalency® platform for potentially best-in-class and highly differentiated small molecules Pipeline Collaboration on BTK ‘168 program in MS ongoing Lead asset rilzabrutinib (PRN1008) in Phase 2/3 in Pemphigus and ITP MS: multiple sclerosis; ITP: immune thrombocytopenia

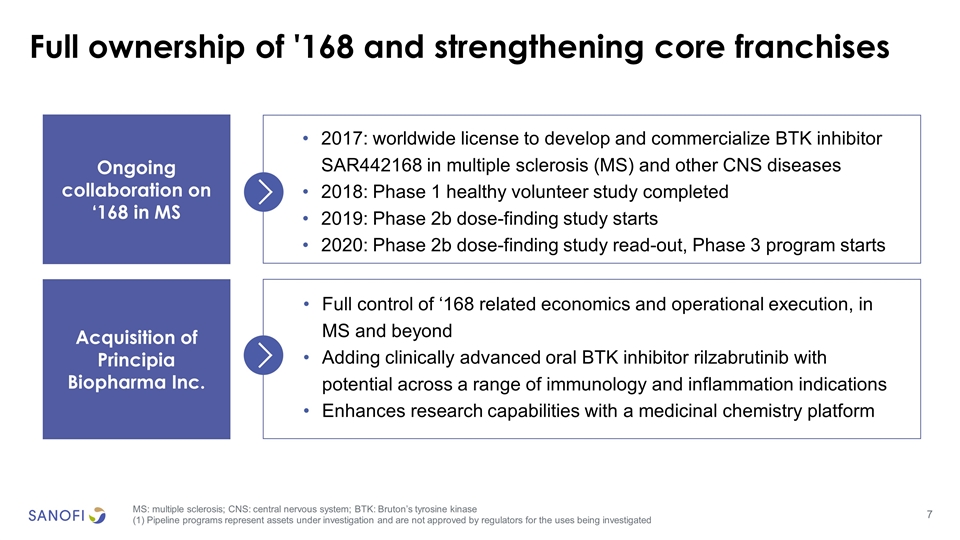

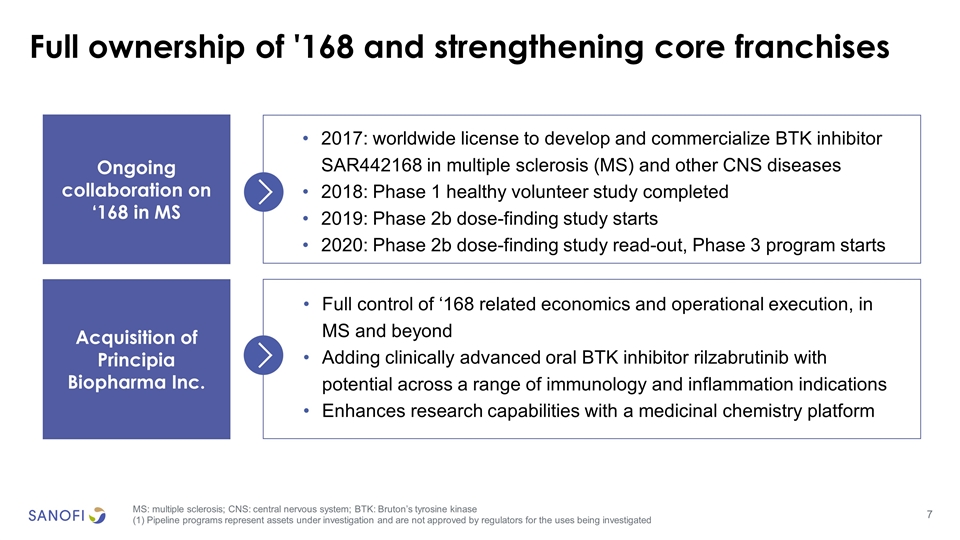

Full ownership of '168 and strengthening core franchises MS: multiple sclerosis; CNS: central nervous system; BTK: Bruton’s tyrosine kinase (1) Pipeline programs represent assets under investigation and are not approved by regulators for the uses being investigated 2017: worldwide license to develop and commercialize BTK inhibitor SAR442168 in multiple sclerosis (MS) and other CNS diseases 2018: Phase 1 healthy volunteer study completed 2019: Phase 2b dose-finding study starts 2020: Phase 2b dose-finding study read-out, Phase 3 program starts Ongoing collaboration on ‘168 in MS Acquisition of Principia Biopharma Inc. Full control of ‘168 related economics and operational execution, in MS and beyond Adding clinically advanced oral BTK inhibitor rilzabrutinib with potential across a range of immunology and inflammation indications Enhances research capabilities with a medicinal chemistry platform

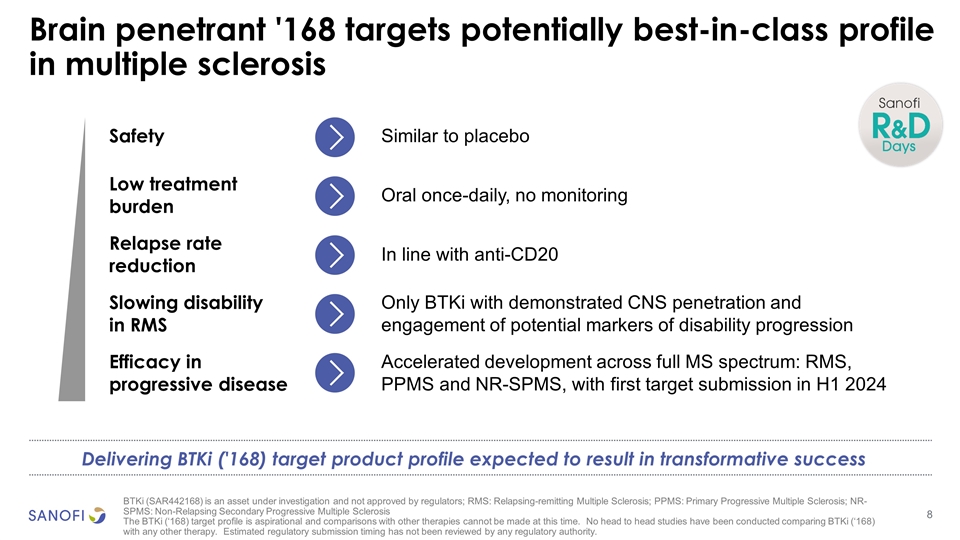

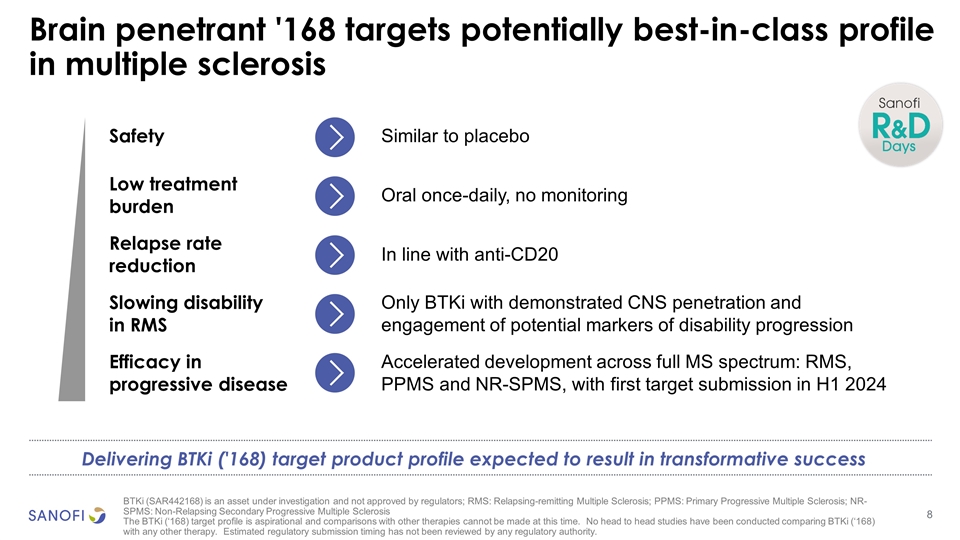

Brain penetrant '168 targets potentially best-in-class profile in multiple sclerosis Safety Similar to placebo Low treatment burden Oral once-daily, no monitoring Relapse rate reduction In line with anti-CD20 Slowing disability in RMS Only BTKi with demonstrated CNS penetration and engagement of potential markers of disability progression Efficacy in progressive disease Accelerated development across full MS spectrum: RMS, PPMS and NR-SPMS, with first target submission in H1 2024 Delivering BTKi ('168) target product profile expected to result in transformative success BTKi (SAR442168) is an asset under investigation and not approved by regulators; RMS: Relapsing-remitting Multiple Sclerosis; PPMS: Primary Progressive Multiple Sclerosis; NR-SPMS: Non-Relapsing Secondary Progressive Multiple Sclerosis The BTKi (‘168) target profile is aspirational and comparisons with other therapies cannot be made at this time. No head to head studies have been conducted comparing BTKi (‘168) with any other therapy. Estimated regulatory submission timing has not been reviewed by any regulatory authority.

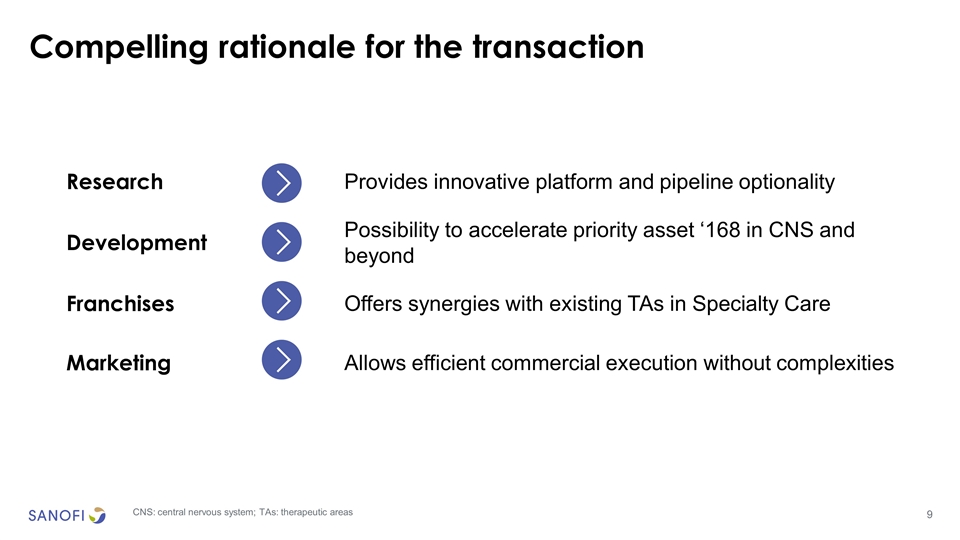

Compelling rationale for the transaction Research Provides innovative platform and pipeline optionality Development Possibility to accelerate priority asset ‘168 in CNS and beyond Franchises Offers synergies with existing TAs in Specialty Care Marketing Allows efficient commercial execution without complexities CNS: central nervous system; TAs: therapeutic areas

Lead with innovation John Reed EVP, Global Head of R&D

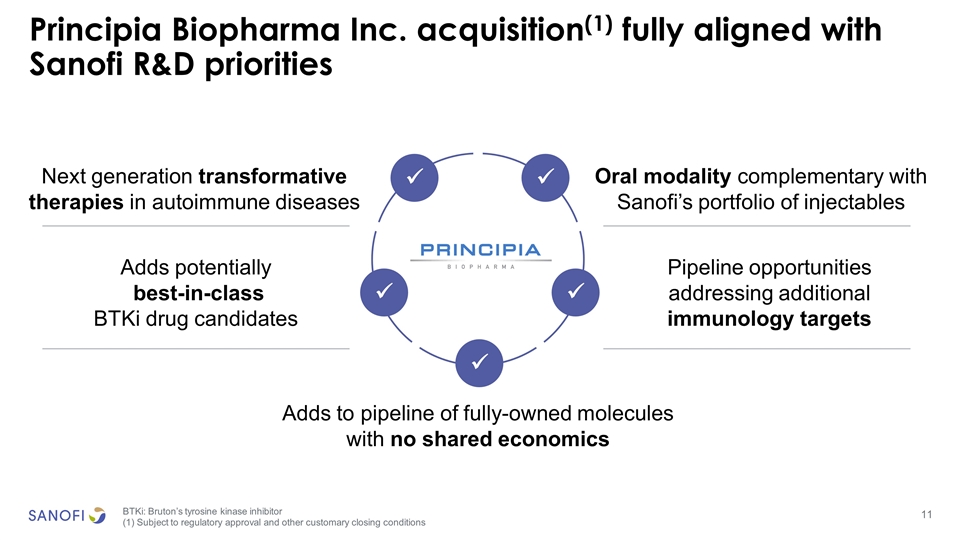

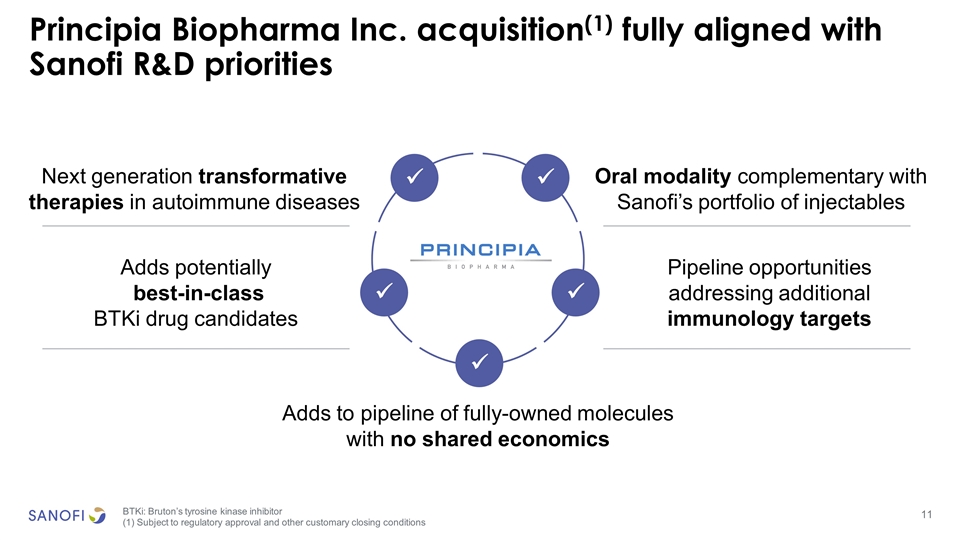

Principia Biopharma Inc. acquisition(1) fully aligned with Sanofi R&D priorities Next generation transformative therapies in autoimmune diseases Pipeline opportunities addressing additional immunology targets Oral modality complementary with Sanofi’s portfolio of injectables Adds potentially best-in-class BTKi drug candidates Adds to pipeline of fully-owned molecules with no shared economics ü ü ü ü ü BTKi: Bruton’s tyrosine kinase inhibitor (1) Subject to regulatory approval and other customary closing conditions

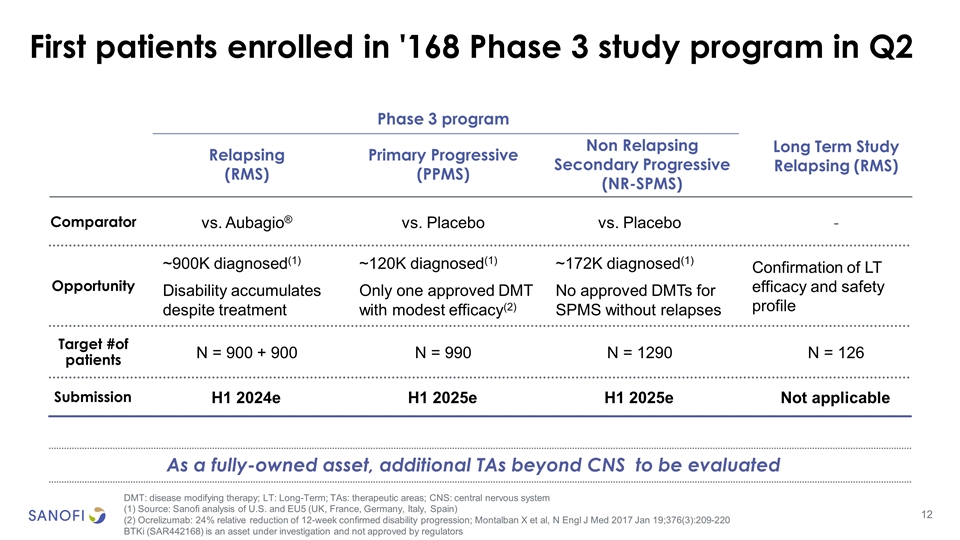

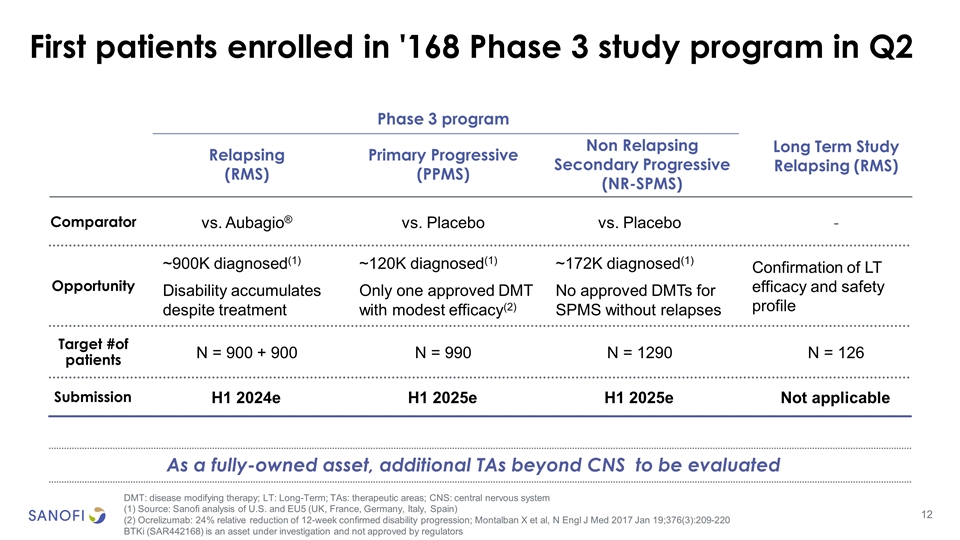

First patients enrolled in '168 Phase 3 study program in Q2 DMT: disease modifying therapy; LT: Long-Term; TAs: therapeutic areas; CNS: central nervous system (1) Source: Sanofi analysis of U.S. and EU5 (UK, France, Germany, Italy, Spain) (2) Ocrelizumab: 24% relative reduction of 12-week confirmed disability progression; Montalban X et al, N Engl J Med 2017 Jan 19;376(3):209-220 BTKi (SAR442168) is an asset under investigation and not approved by regulators Comparator Target #of patients Opportunity N = 900 + 900 ~900K diagnosed(1) Disability accumulates despite treatment Relapsing (RMS) vs. Aubagio® N = 990 ~120K diagnosed(1) Only one approved DMT with modest efficacy(2) Primary Progressive (PPMS) vs. Placebo N = 1290 ~172K diagnosed(1) No approved DMTs for SPMS without relapses Non Relapsing Secondary Progressive (NR-SPMS) vs. Placebo N = 126 Confirmation of LT efficacy and safety profile Long Term Study Relapsing (RMS) - Phase 3 program Submission H1 2024e H1 2025e H1 2025e Not applicable As a fully-owned asset, additional TAs beyond CNS to be evaluated

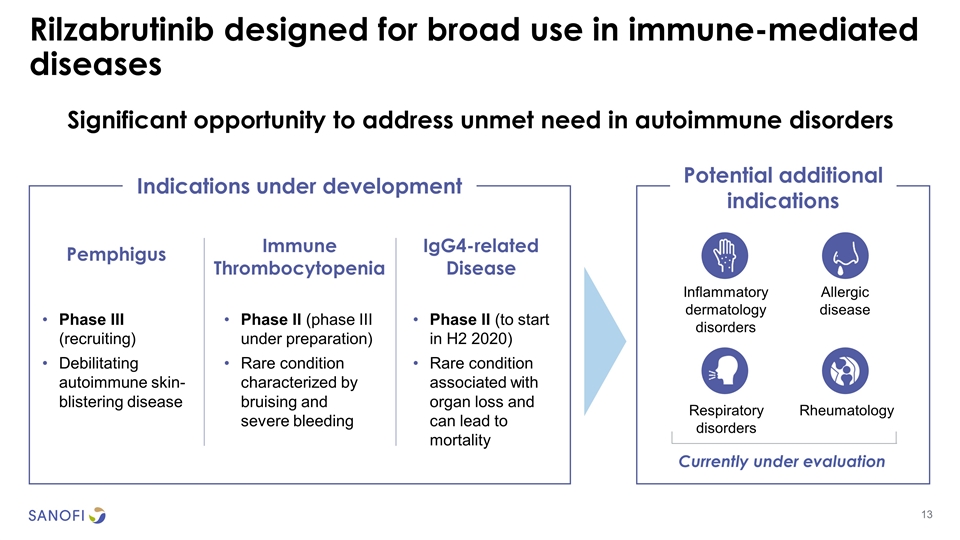

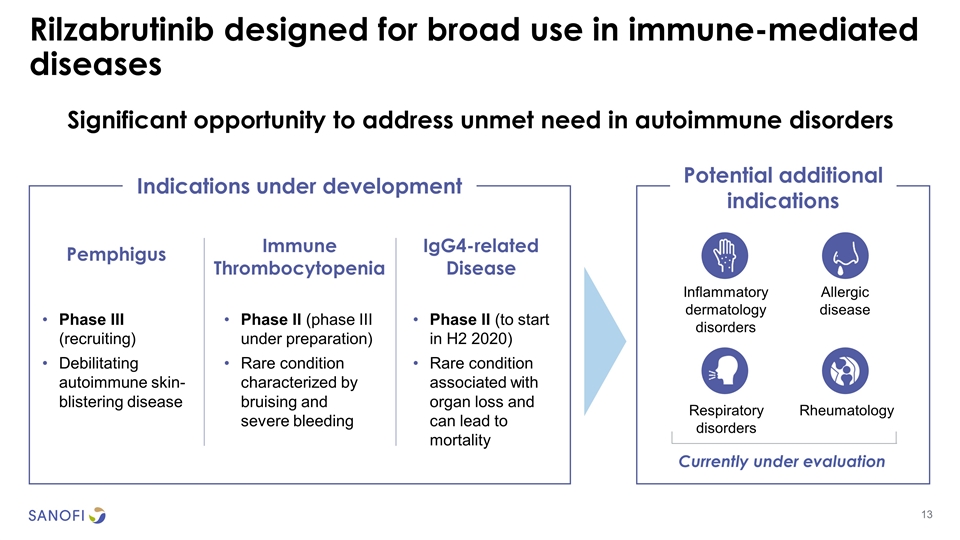

Significant opportunity to address unmet need in autoimmune disorders Rilzabrutinib designed for broad use in immune-mediated diseases Pemphigus Immune Thrombocytopenia IgG4-related Disease Inflammatory dermatology disorders Indications under development Potential additional indications Respiratory disorders Allergic disease Rheumatology Currently under evaluation Phase III (recruiting) Debilitating autoimmune skin-blistering disease Phase II (phase III under preparation) Rare condition characterized by bruising and severe bleeding Phase II (to start in H2 2020) Rare condition associated with organ loss and can lead to mortality

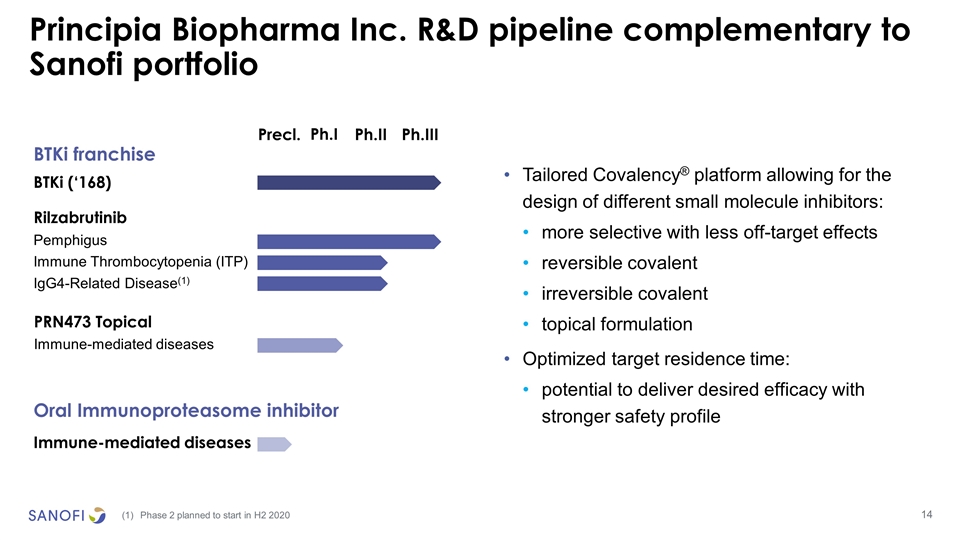

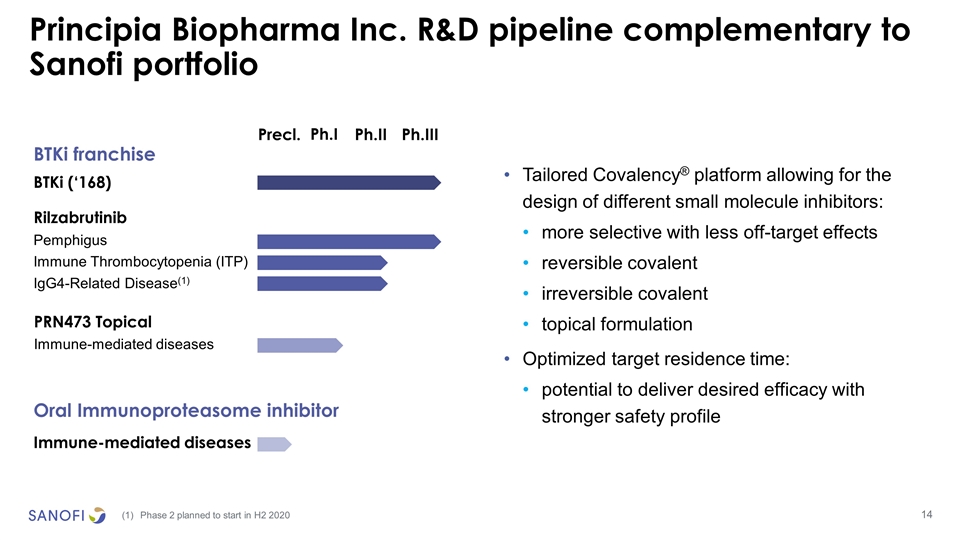

Principia Biopharma Inc. R&D pipeline complementary to Sanofi portfolio Precl. Ph.II Ph.III Ph.I Immune-mediated diseases BTKi franchise Rilzabrutinib Pemphigus Immune Thrombocytopenia (ITP) IgG4-Related Disease(1) Oral Immunoproteasome inhibitor PRN473 Topical Immune-mediated diseases BTKi (‘168) Tailored Covalency® platform allowing for the design of different small molecule inhibitors: more selective with less off-target effects reversible covalent irreversible covalent topical formulation Optimized target residence time: potential to deliver desired efficacy with stronger safety profile Phase 2 planned to start in H2 2020

Jean-Baptiste de Chatillon Financials EVP, Chief Financial Officer

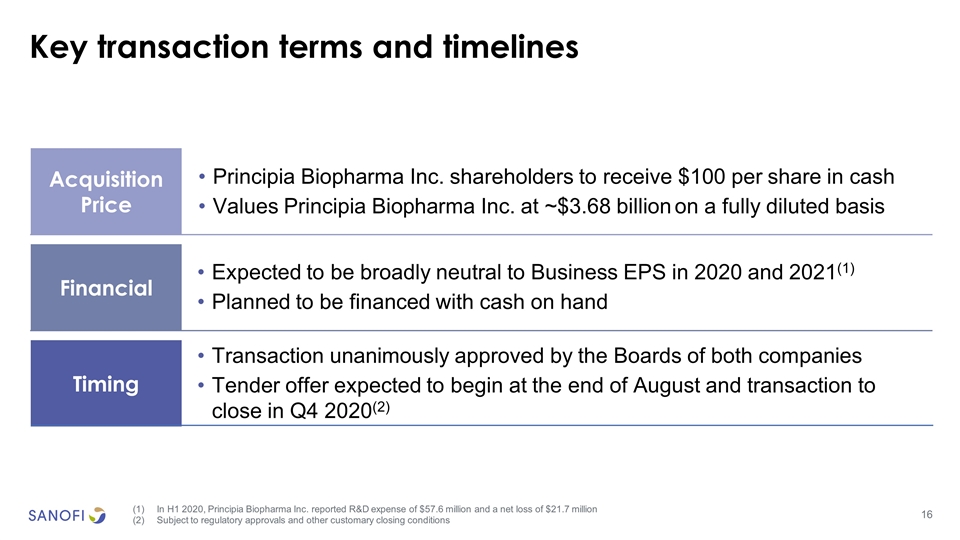

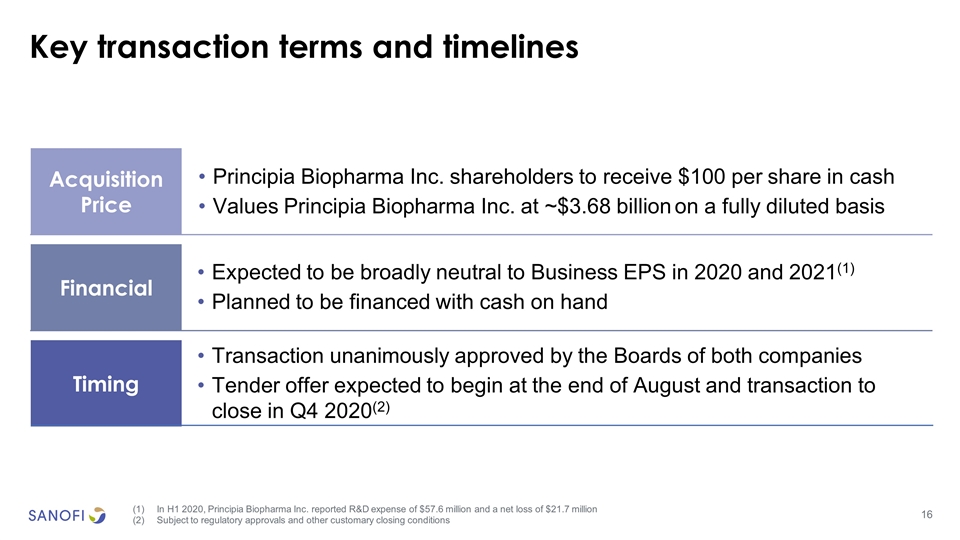

Key transaction terms and timelines In H1 2020, Principia Biopharma Inc. reported R&D expense of $57.6 million and a net loss of $21.7 million Subject to regulatory approvals and other customary closing conditions Acquisition Price Financial Timing Principia Biopharma Inc. shareholders to receive $100 per share in cash Values Principia Biopharma Inc. at ~$3.68 billion on a fully diluted basis Expected to be broadly neutral to Business EPS in 2020 and 2021(1) Planned to be financed with cash on hand Transaction unanimously approved by the Boards of both companies Tender offer expected to begin at the end of August and transaction to close in Q4 2020(2)

Q&A session John Reed EVP, Global Head of R&D Jean-Baptiste de Chatillon EVP, Chief Financial Officer Bill Sibold EVP, Specialty Care Martin Babler President and CEO, Principia Biopharma Inc. Paul Hudson Chief Executive Officer