UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10

GENERAL FORM FOR REGISTRATION OF SECURITIES

Pursuant to Section 12(b) or 12(g) of the Securities Exchange Act of 1934

ASIA LEECHDOM HOLDING CORPORATION

(Exact name of small business issuer as specified in its charter)

| Nevada | 26-3552219 |

| (State or other jurisdiction of | (I.R.S. Employer Identification No.) |

| incorporation or organization) | |

No.55 Miyun Road

Nankai District, Tianjin City, 300111

People’s Republic of China

(Address of Principal Executive Offices; Zip Code)

| Registrant’s Telephone Number, Including Area Code:+86 22 27640191 |

| | |

| Securities to be registered under Section 12(b) of the Act: |

| | |

| Title of each class | Name of each exchange on which |

| to be so registered | each class is to be registered |

| None | None |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value $0.001

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definition for “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large Accelerated Filer [ ] | Accelerated Filer [ ] |

| Non-Accelerated Filer [X] | Smaller Reporting Company [ ] |

Table of Contents

| | Page |

| SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS | 1 |

| OUR BUSINESS | 2 |

| RISK FACTORS | 17 |

| SELECTED FINANCIAL DATA | 30 |

| MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 31 |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 44 |

| DIRECTORS AND EXECUTIVE OFFICERS | 45 |

| EXECUTIVE COMPENSATION | 49 |

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE | 50 |

| LEGAL PROCEEDINGS | 52 |

| MARKET PRICE OF AND DIVIDENDS ON THE REGISTRANT'S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS | 53 |

| RECENT SALES OF UNREGISTERED SECURITIES | 53 |

| DESCRIPTION OF REGISTRANT'S SECURITIES TO BE REGISTERED | 54 |

| INDEMNIFICATION OF DIRECTORS AND OFFICERS | 56 |

| FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | 57 |

| CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | 57 |

i

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

This report contains forward-looking statements. The forward-looking statements are contained principally in the sections entitled “Our Business,” “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” These statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. These risks and uncertainties include, but are not limited to, the factors described in the section captioned “Risk Factors” above. In some cases, you can identify forward-looking statements by terms such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “would” and similar expressions intended to identify forward-looking statements. Forward-looking statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements. These forward-looking statements include, among other things, statements relating to:

our ability to overcome competition in our market;

the impact that a downturn or negative changes in nutraceutical prices could have on our business and profitability;

our ability to simultaneously fund the implementation of our business plan and invest in new projects;

economic, political, regulatory, legal and foreign exchange risks associated with international expansion; or

the loss of key members of our senior management.

Also, forward-looking statements represent our estimates and assumptions only as of the date of this registration statement. You should read this registration statement and the documents that we reference and filed as exhibits to the registration statement completely and with the understanding that our actual future results may be materially different from what we expect. Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future.

Use of Certain Defined Terms

Except as otherwise indicated by the context, references in this report to:

"ALH" are to Asia Leechdom Holding Corporation, a New Jersey corporation;

"Company," "we," "us," or "our," are references to the combined business of Asia Leechdom Holding Corporation, a Nevada corporation, together with its wholly-owned subsidiary, ALH, and ALH’s wholly-owned subsidiary, BOAI Pharm, and BOAI Pharm’s wholly-owned subsidiary, BOAI Leechdom, and majority-owned subsidiary, BOAI Bio-Pharm;

“China,��� the “state” and “PRC” are references to the People’s Republic of China;

the “Exchange Act” are to the Securities Exchange Act of 1934, as amended;

“BOAI Bio-Pharm” are references to Tianjin BOAI Bio-Pharmaceutical Co., Ltd., a PRC limited company;

“BOAI Pharm” are references to Tianjin BOAI Pharmaceutical Co., Ltd., a PRC limited company;

“BOAI Leechdom” are references to Tianjin BOAI Leechdom Technique Co., Ltd., a PRC limited company;

“RMB” are to Renminbi, the legal currency of China; and “U.S. dollar,” “USD” or “$,” are to the legal currency of the United States of America (RMB 6.8129 = $1.00 for its December 31, 2010 audited balance sheet, with the exception of the equity accounts, and RMB 6.8449 = $1.00 for its December 31, 2009 audited balance sheets, with the exception of the equity accounts; the equity accounts were stated at their historical rate; the average exchange rates applied to the income statement and statement of cash flows for the years ended December 31, 2010 and 2009 were RMB 6.8280 and RMB 6.8482, respectively); and

the “Securities Act” are to Securities Act of 1933, as amended.

- 1 -

In this registration statement we are relying on and we refer to information and statistics regarding the pharmaceutical industry that we have obtained from cited sources throughout. This information is publicly available for free and has not been specifically prepared for us for use or incorporation in this Registration Statement or otherwise.

OUR BUSINESS

Overview

We are a producer and distributor of pharmaceutical products including a variety of medical supplies, prescription and over-the-counter, or OTC, drugs in China and abroad. Through our wholly-owned PRC subsidiary, BOAI Pharm and BOAI Pharm’s wholly-owned subsidiary, BOAI Leechdom, we currently produce and sell 42 medicines and distribute over 7,000 medicines and medical devices for third-party producers and manufacturers. We market our products through a sales network covering 23 provinces and municipalities in China, including Beijing, Shanghai, Shandong, and Guangdong. We also export our products through agents to customers in North America, Europe and East Asia.

We produce our products at our 3,428.4 square meter production facility located in Tianjin, China. We currently operate 9 production lines, each serving the following product formats: (1) ointment, (2) pill, (3) tablet, (4) syrup, (5) granule, (6) capsule, (7) orally taken liquid, (8) plaster and (9) extract; and further separated into liquid preparations (such as ointment and syrup) and solid preparations (such as tablets, pills and granules). We recently obtained land use rights for another 85,938.92 square meters of property for construction of an additional production facility in Tianjin. We expect to complete the initial phase of construction for this new facility by August 2011.

We generate revenues from the sale and distribution of our products and other third party products in China and abroad. For the fiscal years ended June 30, 2010, 2009 and 2008, total revenue was $68,166,997, $49,489,066 and $32,381,120, respectively, and our net income for the same periods was $21,750,626, $15,460,736 and $11,125,217, respectively.

Our Corporate History and Background

We were organized under the laws of the State of Arizona, in 2004, as VT French Services, Inc., a wholly owned subsidiary of Visitalk Capital Corporation, (“VCC”), which in turn was a wholly owned subsidiary of Visitalk.com (“Visitalk”). As part of Visitalk’s Chapter 11 reorganization plan, we were established as a shell company with no assets or operations and VCC was authorized by the Visitalk plan to be the reorganized debtor. Effective September 11, 2008, our name was changed from VT French Services, Inc. to Bay Peak 6 Acquisition Corp., in connection with our redomestication to Nevada. On July 28, 2010, we changed our name to Asia Leechdom Holding Corp., in connection with our reverse acquisition of Asia Leechdom Holding Corp. (“ALH”), a New Jersey corporation, discussed in more detail below. As a result of the reverse acquisition, we are now engaged in the production and distribution of pharmaceutical products including a variety of medical supplies, prescription and over-the-counter, or OTC, drugs. We currently produce and sell 42 medicines and distribute over 7,000 medicines and medical devices for third-party producers and manufacturers.

Reverse Acquisition and Warrant Financing

Reverse Acquisition

Prior to May 28, 2010, we were a shell company and had no operations. On May 28, 2010, we completed a reverse acquisition through a share exchange with ALH, whereby we issued the sole shareholder of ALH, 32,310,758 shares of our common stock, par value $0.001, for 100% of the issued and outstanding capital stock of ALH. ALH thereby became our wholly-owned subsidiary and its subsidiary, BOAI Pharm, became the Company’s indirect subsidiary. In accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 805, “Business Combinations,” the Company recorded this merger using the recapitalization method which consolidated the Company, ALH and BOAI Pharm and treated the Company as a shell at the time of the merger. According to ASC 805-10-55-13, “the acquirer usually is the combining entity whose relative size (measured in, for example, assets, revenues, or earnings), is significantly larger than that of the other.” Since the Company was a shell at the time of the merger while ALH had operations through its acquisition of BOAI Pharm and was significantly larger than the Company was, under ASC 805, ALH was considered the acquirer.

- 2 -

Upon the closing of the reverse acquisition on May 28, 2010, Mr. Cory Roberts, our Director and former President and Chief Financial Officer resigned from his offices as President and Chief Financial Officer, effective immediately, and Mr. Lanny R. Lang, our former Secretary and Director, resigned from all positions held by him, effective immediately, and our Board of Directors appointed Ms. Xuecheng Xia to serve as our Chief Executive Officer and Chief Financial Officer in Mr. Roberts’ stead, effective immediately. Also upon the closing of the reverse acquisition, our Board of Directors increased its size to 3 members and, in addition to Mr. Roberts, who remains a director, the board appointed Ms. Xia and Ms. Haiwei He to fill the vacancies created by such increase, effective immediately.

As a condition to the closing of the reverse acquisition, we filed a certificate of amendment to our articles of incorporation with the Nevada Secretary of State on July 28, 2010, to change our name from Bay Peak 6 Acquisition Corp. to Asia Leechdom Holding Corporation.

Warrant Financing

As part of the implementation of Visitalk’s Chapter 11 reorganization plan, Visitalk issued six series of warrants, designated as Series A through F, together the Plan Warrants, to certain Visitalk creditors. Each Plan Warrant entitled its holder to purchase, subject to the terms and conditions set forth in a Plan Warrant Agreement, effective as of June 22, 2004, one fully paid and non-assessable share of our common stock at a purchase price equal to the designated exercise price of such Plan Warrant. The Plan Warrants were exercisable as follows:

| Warrant | Exercise Price |

| Series A | $2.00 |

| Series B | $2.00 |

| Series C | $3.00 |

| Series D | $3.00 |

| Series E | $4.00 |

| Series F | $4.00 |

The Plan Warrants were exercisable as of September 17, 2004 and were to expire on November 30, 2008, unless such date was extended by us. From November 2008 through June 30, 2010, our Board of Directors approved extensions of the expiration or termination date of the outstanding Plan Warrants through June 30, 2010 when the Plan Warrants expired. In addition, our Board of Directors approved a reduction of the exercise price for the Series C through F Plan Warrants to $2.51 per share of common stock. We extended the exercise date and adjusted the exercise price in accordance with the terms and conditions of the Plan Warrant Agreement and the Plan. In March, May and June 2010, certain holders of the Plan Warrants, each a Warrant Investor, exercised their right to purchase an aggregate of 110,000 shares of common stock at $2.00 per share and an aggregate of 4,177,381 shares of common stock at $2.51 per share, for aggregate proceeds of approximately $10.7 million.

Pursuant to Side Letter Agreements, dated May 28, 2010 and June 30, 2010, among the Company, the controlling shareholder and each of the Warrant Investors, we agreed to issue to each of the Warrant Investors, on a pro rata basis, new five-year warrants, the New Warrants, to purchase an aggregate of 835,476 shares of common stock at $2.51 per share. The controlling shareholder also agreed to (1) surrender an amount of shares equal to 10% of our issued and outstanding shares as at the closing of the reverse acquisition and the warrant financing, if the Company failed to reach certain income thresholds for the years ending June 30, 2009, 2010 and 2011; and (2) surrender an amount of shares equal to 2% of our issued and outstanding shares, if the Company was not a “reporting company” within the meaning of Rule 144 under the Securities Act of 1933, as amended, within 180 days following the closing of such financing, and had not filed a registration statement on Form 10 with respect to its Common Stock with the U.S. Securities and Exchange Commission, or the SEC, before December 31, 2010. We have met the 2009 and 2010 income thresholds but we did not meet our obligation to become a reporting company by the required date. As a result, our controlling shareholders were obligated to either deliver approximately 796,812 shares of Company’s common stock owned by them to the investors. On February, 11, 2011, the Company, the controlling stockholders and the investors entered into an amendment and waiver agreement, pursuant to which: the investors agreed to extend the Company’s requirement to become a reporting company to February 15, 2011; we agreed to list our Common Stock on the Nasdaq Stock Market, the NYSE Amex or the New York Stock Exchange, on or before October 31, 2011; and the controlling stockholders agreed to surrender an amount of shares equal to 2% of our issued and outstanding fully diluted common stock, if the Company’s actual 2011 net income is not equal to or greater than $27,500,000. We also agreed to appoint a bilingual (English and Mandarin) Chief Financial Officer with prior experience with U.S. public companies and United States generally accepted accounting principles, or U.S. GAAP, within 90 days of the closing of the financing. On October 14, 2010, Ms. Xia resigned from her position as Chief Financial Officer and our Board of Directors appointed Mr. Shuyuan Chang to serve as Chief Financial Officer in her stead.

- 3 -

As consideration for its services as financial advisor in connection with the May 2010 and June 2010 financing, at the closing of such financing we also paid Bay Peak, LLC, the company’s financial advisor, $935,000 in cash and issued them 675,317 shares of our Common Stock valued at $2.51 per share. Bay Peak is beneficially owned and controlled by our Director, Cory Roberts.

China BOI Hunter Settlement

ALH was obligated to repay $1,500,000 due to China BOI Hunter, LLC, or BOI Hunter, under a certain Secured Convertible Promissory Note, due December 20, 2008, issued pursuant to a certain Credit and Security Agreement, dated as of June 20, 2008, among BOI Hunter, ALH and the other ALH affiliates signatory thereto. The note was convertible into warrants to purchase up an amount of shares of ALH common stock equal to $750,000. The note remained outstanding and unconverted until the parties agreed to a settlement agreement, dated May 25, 2010, among the Company, ALH, BOAI Pharm and BOI Hunter, pursuant to which the controlling stockholder agreed to allocate to BOI Hunter as settlement of the Obligations, 239,044 shares of our common stock to be issued to him in exchange for his equity interests in ALH. We also agreed to issue BOI Hunter, a three-year warrant to purchase 298,805 shares of common stock at an exercise price of $2.51 per share.

Acquisition of BOAI Pharm

ALH was incorporated on June 20, 2007 in New Jersey. On July 5, 2007, ALH entered into an equity transfer agreements with the original shareholders of BOAI Pharm, pursuant to which ALH acquired 100% of the outstanding equity interest of BOAI Pharm. The transaction was approved on August 17, 2007, by the Tianjin Commission of Economy and Trade, subject to the PRCRegulations on Merger with and Acquisition of Domestic Enterprises by Foreign Investors, or the Merger Regulations, which require the equity interest transfer price to be paid in full by a date certain, or in the absence of such express date, within three months commencing from the issuance of the new business license. On November 22, 2007, a renewed business license was issued by the Tianjin Administration for Industry and Commerce, or AIC, and BOAI Pharm was converted into a wholly foreign owned enterprise. BOAI Pharm’s new business license is valid through August 5, 2021 and is subject to renewal 180 days prior to such expiration date. We expect that such renewal will be granted within 30 days of applying so long as we continue operating within the scope of the business license.

BOAI Pharm was incorporated on August 6, 2001, and engages in the production and sale of 42 medicines. BOAI Pharm products are sold under its registered trademarks, referred to as Branded Products, and under third party trademarks pursuant to Original Design Manufacture, or ODM arrangements. BOAI Pharm acquired BOAI Leechdom on August 10, 2007, when the original shareholders of BOAI Leechdom transferred their respective equity in BOAI Leechdom to BOAI Pharm, pursuant to equity transfer agreements, dated August 10, 2007, among BOAI Pharm and each of them. After the acquisition, BOAI Pharm became the sole shareholder of BOAI Leechdom. BOAI Leechdom was incorporated on March 17, 1999, and engages in the wholesale and distribution of BOAI Pharm’s Branded Products, ODM products and the pharmaceutical products and medical devices manufactured by third party companies.

Acquisition of Qi Shi Leather

On November 20, 2010, we consummated a property purchase agreement, dated on May 8, 2010, between the Company and Tianjin Qi Shi Leather Co., Ltd., or Qi Shi Leather, pursuant to which we acquired 100% of the equity interest in Qi Shi Leather, for an aggregate purchase price of RMB 80,000,000 Chinese Renminbi (approximately $11.7 million) in cash. Ninety-three percent of the equity interest in Qi Shi Leather was transferred to BOAI Pharm and the remaining 7% was transferred to BOAI Leechdom. Qi Shi Leather was incorporated on July 22, 2003 and at the closing date did not have any business operations, assets or liabilities, other than its land use rights for 85,938.92 square meters of property and 22,138.22 square meters of building space in Jinghai District, Tianjin. Our purpose for acquiring Qi Shi Leather was to acquire such land use rights and property. The acquisition of the Qi Shi Leather equity interest was in lieu of an asset acquisition which would have required us to engage in a more time-consuming process for the transfer of Qi Shi Leather's properties. We intend to use the property acquired with Qi Shi Leather to enhance our current production facilities and increase our production capacity. The additional production facilities are under construction and are expected to be completed by August, 2011. In connection with the closing of the acquisition, we have changed Qi Shi Leather's name to Tianjin BOAI Bio-Pharmaceutical Co., Ltd., or BOAI Bio-Pharm.

- 4 -

Call Option Exercises

On February 27, 2010, Chenghai Du, our former controlling stockholder, entered into a series of call option agreements with each of Ma Dan, Xia Xuecheng, Wang Yan, Wang Yansheng, He Haiwei and Tian Mengchun, the original shareholders and managers of BOAI Pharm, pursuant to which Mr. Du granted each of them an option to acquire an amount of shares equal to 90% of the shares of our common stock issued to Mr. Du in the reverse acquisition, at an exercise price of $0.0001 per share, and on January 10, 2011, Mr. Du entered into an additional call option with Ms. Jianping Lu, pursuant to which Mr. Du granted her an option to acquire an amount of shares equal to the remaining 10% of the shares of our common stock issued to Mr. Du in the reverse acquisition, on the same terms and conditions as the other option holders. Each of the option holders had the right to exercise their option during the period commencing on the date of the option agreement and ending on the fifth anniversary of the date thereof.

On January 11, 2011, the option holders transferred and assigned their options to purchase an aggregate of 9,454,183 shares of our Common Stock to Dragon Core Limited, a British Virgin Islands company, or Dragon Core, and an aggregate of 22,059,762 shares of our Common Stock to Neo Profit Limited, a British Virgin Islands company, or Neo Profit. On the same date each of Dragon Core and Neo Profit exercised their options to purchase their respective shares from Mr. Du. As a result of the exercises, Dragon Core and Neo Profit hold an aggregate of 31,513,945, or 79.1%, of our issued and outstanding common stock and Mr. Du is no longer affiliated with, and no longer holds any equity interest in the Company or its subsidiaries. Dragon Core Limited is 67% beneficially owned and controlled by our Chief Executive Officer and Director, Ms. Xuecheng Xia, and 33% beneficially owned and controlled by Ms. Jianping Lu, an executive employee of BOAI Pharm and Neo Profit Limited is wholly-owned and controlled by Ms. Xia.

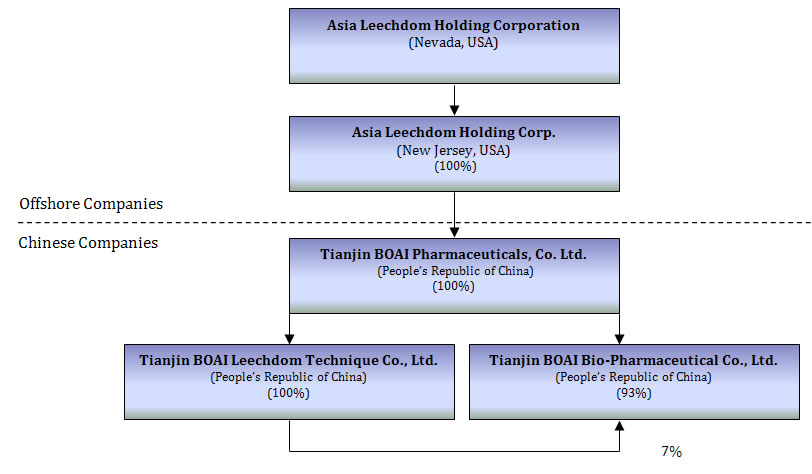

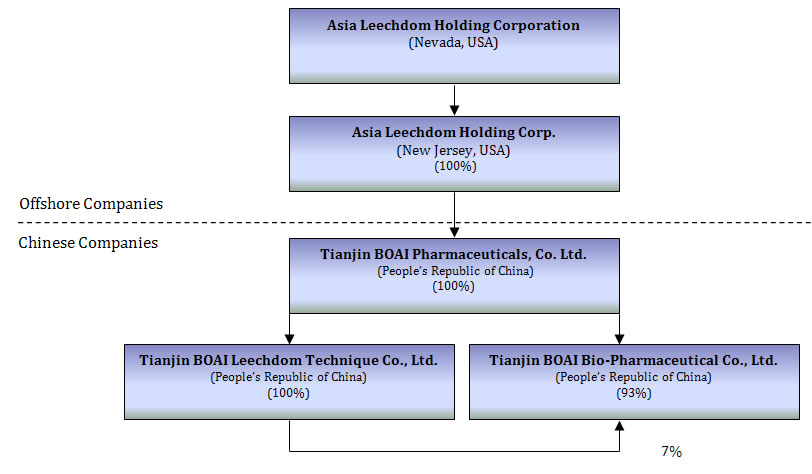

Our Corporate Structure

The following chart reflects our organizational structure as of the date of this registration statement.

- 5 -

Our corporate headquarters are located at No.55 Miyun Road, Nankai District, Tianjin City, 300111, China. Our telephone number is (+86) 22 27640191. We maintain a website at www.tjboai-pharma.com that contains information about our Company, but that information is not incorporated into, or otherwise considered a part of, this registration statement.

Our Industry and Market Trends

Through our wholly-owned PRC subsidiary, BOAI Pharm and BOAI Pharm’s wholly-owned subsidiary, BOAI Leechdom, we are a producer and distributor of pharmaceutical products including a variety of medical supplies, prescription and over-the-counter, or OTC, drugs in China and abroad. We currently produce and sell 42 medicines and distribute over 7,000 medicines and medical devices. As a result pharmaceutical industry trends in China and the availability of domestic insurance coverage can affect our business and operations.

China’s Pharmaceutical Industry

According to the 2009 Blue Book on China’s Pharmaceutical Market, the value of China’s pharmaceutical market has increased from RMB 7.9 billion in 1978 to RMB 66.79 billion in 2007, with an average growth of 16.8% per year, as compared to an average growth of 8%-10% in the global pharmaceutical industry. In 2008, the value of the Chinese pharmaceutical market reached RMB 86.7 billion, an annual growth rate of 25.74%. The 30-year domestic pharmaceutical industry growth rate from 1978 to 2008 outpaced the record growth rate of China’s gross domestic product, or GDP, which was 9.85%. Despite the global financial crisis, in 2009 the gross industrial output value for China’s pharmaceutical market was over RMB 1,000 billion for the first time, with a growth rate of 21.18%, compared to the 2008 growth rate. Furthermore, over the last 8 years, the domestic pharmaceutical market has experienced a compound annual growth rate of 20.45%, as compared to the 8.45% growth rate of the global pharmaceutical market.

Insurance Coverage in China

In China, eligible participants in the national medical insurance program, mainly consisting of urban residents, are entitled to buy medicines when presenting their medical insurance cards in an authorized pharmacy, provided that the medicines they purchase are included in the national or provincial medical insurance catalogs. The pharmacy in turn obtains reimbursement from the relevant government social security bureaus. The provincial and municipal authorities responsible for administering social medical insurance funds to cover such reimbursements have gradually increased funding in recent years.

According to statistics from China’s Ministry of Human Resources and Social Security, in 2009, 182.1 million people were already covered by medical insurance in rural and urban areas nationwide. We expect that, in light of the expanded availability of medical insurance, coverage should increase to over 90% both in rural and urban areas by 2014.

Our Growth Strategy

Our goal is to become one of the leading companies in the field of research and development, production, sale and distribution of pharmaceutical products in China. We intend to pursue the following strategies to achieve our goal:

Research and Development and Branding: We plan to develop our brand reputation through continual improvement in the quality and technology of our products through continued investment in research and development. We will also continue to implement Good Manufacturing Practices, or GMP, to ensure the standardization of production of our pharmaceutical products.

New Products and Expansion of Production Capacity: We intend to increase our production capacity through the construction of a new manufacturing facility. We also plan to develop new products through effective cooperation with local universities and institutes to increase our competitiveness and profit margins.

- 6 -

- Increase of Market Share: We plan to expand our share of the domestic and international pharmaceutical market through the establishment of broader distribution networks and the expansion of sales channels. We also plan to identify new and unique product portfolios that suit market demands, and provide after-sale services to our customers.

Our Products

Through our subsidiaries, BOAI Pharm and BOAI Leechdom, we are engaged in the production and sale of 42 medicines, some of which are sold under our registered trademarks, referred to as Branded Products, and others which are sold under third party trademarks pursuant to ODM arrangements. We are also engaged in the distribution of more than 7,000 medicines and medical devices produced and manufactured by third-party companies.

Branded Products

Our subsidiary, BOAI Pharm, is primarily engaged in the production and sale of 30 Branded Products, including 27 traditional Chinese medicinal, or TCM, products, and 3 western medicines. According to the PRC Academy of Chinese Medical Sciences, TCMs are characterized by the extraction of active ingredients from Chinese herbs and plants, and from animals and minerals to a lesser extent. TCM are widely used in China and are recognized for their remarkable effectiveness and minimal side effects, as compared to western medicines.

Among BOAI Pharm’s Branded Products, 13 require a physician’s prescription and the remaining 17 are OTCs. All Branded Products have received approval from the PRC State Food and Drug Administration, or SFDA, and are sold in 10 provinces and municipalities across China, 15 of them are included in the PRC Insurance Catalogue of the National Medical Insurance Program, and 3 of them are included in the PRC National Essential Drugs List.

For the fiscal year ended June 30, 2009 and 2010, the revenue from the sale of our Branded Products was $16.3 million and $22.8 million, respectively, accounting for 33.05% and 33.48% of our total revenue. Our top five Branded Products for the fiscal year ended June 30, 2010 are discussed in the following table:

Product Name

| Description

| Prescription

Needed

| Covered by

Medical

Insurance | 2010

Sales

| 2010

Sales Ratio

|

FuFangYiMuCao

Gel | For regulating

menstruation | X

| X

| $5.5 million

| 8.08%

|

YiQiRunChang

Gel

| For relieving stomach

discomfort, dry mouth,

and poor digestion

associated with

constipation and to relax

the bowels for relief

from constipation. | X

| X

| $3.6 million

| 5.33%

|

YangYinQingFei

Gel

| For resolving phlegm,

cough and relieving sore

throat | X

| X

| $3.3 million

| 4.89%

|

PuDiLanXiaoYan

Tablet | For reducing fever and

Tonsillitis | X

| X

| $2.0 million

| 2.95%

|

LianQiaoBaiDu

Tablet | For dispelling toxins

and for detoxification | X | X | $1.6 million | 2.38% |

- 7 -

ODM Products

BOAI Pharm manufactures 12 ODM Products for both domestic and international pharmaceutical companies. Its ODM Products include products sold under the “American Ginseng Tea” brands by the Prince of Peace Company in the United States through the Northern International Group Tianjin Pharmaceutical Import and Export Co., Ltd, and products sold under the “Chitin Capsule” and “Cordyceps.sinensis” and “Job's Tears Powder” brands, for the Tianjin Tiens Group Co., Ltd., which are sold nationwide across China. Other ODM Products are sold to customers in Canada, Europe and Asia. Revenue from ODM products accounted for about 8.33% and 7.81% of total revenue for the fiscal year ended June 30, 2009 and 2010, respectively.

Marketing and Distribution Efforts

Sales Strategy

We have adopted a sales strategy that utilizes internal and external sales agents. We expect to expand our sales network by:

advertising, organizing or participating in professional lectures and exhibitions to publicize and promote our products as well as broaden our brand recognition;

coordinating with more qualified new sales agents nationwide benefiting from their efficient management and existing network;

establishing online sales network system; and

extending the reach of our distribution network by setting up agents for clinical sales and services in hospital pharmacies.

Through these methods, we expect to build a distribution network nationwide, and achieve an increased market share. Our objective is to become the leading brand in the Chinese pharmaceutical industry.

Distribution

Our subsidiary, BOAI Leechdom, sells BOAI Pharm’s Branded and ODM Products, and distributes more than 7,000 medicines produced by third party companies, for 70 of which BOAI Leechdom has exclusive distribution rights. The range of products includes not only prescription and OTC medicines, but also healthcare products and devices such as massage machines and blood pressure monitors. We sell these products to hospitals, clinics, pharmacies and other wholesalers across China.

For the fiscal years ended June 30, 2009 and 2010, the revenue from BOAI Leechdom’s distribution of pharmaceutical products was 59.77% and 59.01% of total revenue, respectively. For the fiscal year ended June 30, 2010, the top two products distributed by BOAI Leechdom were as follows:

Product Name

| Description

| Prescription

Needed

| Covered by

Medical

Insurance | 2010 Sales

| Sales Ratio 2010

|

| | | | | | |

| Snakegourd Peel | | X | X | $2.3 million | 3.33% |

| | | | | | |

| Ciluostazot Tablets | | X | X | $1.2 million | 1.83% |

| | | | | | |

- 8 -

Production

We currently own a 3,428.4 square meter production facility located in Tianjin. We operate 9 production lines, each serving the following specific product formats: (1) concentrated decoctions, (2) pills, (3) tablets, (4) syrups, (5) granules, (6) capsules, (7) oral solutions, (8) plasters and (9) extracts, and further separated into liquid preparations (such as ointment and syrup) and solid preparations (such as tablets, pills and granules). We have received GMP certification for the above (1) to (7) production lines.

We intend to use the 85,938.92 square meters of property acquired with Qi Shi Leather to enhance our current production facilities and increase our production capacity. The additional production facilities are under construction and are expected to be completed by August, 2011.

Quality Control Measures

Our production facility is a contamination-free zone, controlled by a centrally controlled closed-circuit air conditioning system, which not only controls temperature and humidity but also continually purifies and disinfects the circulating air.

According to the new 2011 GMP standard, a workshop for the production of liquid and solid preparations must reach class 100,000 cleanliness. This means that the maximum permissible dust must be 3.5million micrometer per cubic meter (μm/m3), and the maximum permissible microorganisms must be not more than 500 μm /m3 of planktonic bacteria (bacteria that are suspended or growing in a fluid environment as opposed to those attached to a surface) and not more than 10/utensil for depositing bacteria (bacteria that deposit in a variety of environments). We are in compliance with the above standard and have GMP certificates for all of our production lines.

Raw Materials and Suppliers

We use 49 different herbs and 12 ancillary materials as the primary raw material for our products. Our raw materials usually account for over half of our production costs. We select eligible raw material suppliers near our production facilities in order reduce the cost of transportation and control product quality. None of our suppliers were responsible for more than 20% of our raw material expenses for the year ended June 30, 2010.

Competition

The pharmaceutical industry is characterized by rapid product development and technology change. We face direct competition from other producers of our pharmaceutical products and indirect competition from producers of other products having similar medical efficacy as our products. Our pharmaceuticals could be rendered obsolete or made uneconomical due to the development of new pharmaceuticals to treat the same conditions, technological advances affecting the cost of production, or marketing or pricing actions by one or more of our competitors. Our business, results of operations and financial condition could be materially adversely affected by any one or more of these developments. Our competitors may also be able to obtain regulatory approval for new products more quickly than we are and, therefore, may begin to market their products in advance of our products. We believe that competition among pharmaceuticals in China will continue to be based on, among other things, brand name recognition, product efficacy, safety, reliability, availability, promotional activities and price.

Many of our existing and potential competitors have substantially greater financial, technical, manufacturing or other resources than we do. Our competitors’ greater size in some cases provides them with a competitive advantage with respect to manufacturing costs because of their economies of scale and their ability to purchase raw materials at lower prices. Many of our competitors may also have greater brand name recognition, more established distribution networks, larger customer base, or have more extensive knowledge of our customer groups. As a result, they may be able to devote greater resources on research, development, promotion and sale of their products and respond more quickly to evolving industry standards and changes in market conditions than we can. In addition, certain of our competitors may adopt low-margin sales strategies and compete against us based on lower prices. Furthermore, as a result of China’s admission to the WTO in 2001 and subsequent changes in PRC government laws and regulations, we may also face increasing competition from foreign manufacturers in addition to domestic manufacturers.

- 9 -

Subsequent to the reduction of import tariffs pursuant to China’s WTO obligations, the selling prices in China of imported pharmaceuticals have become more competitive. Also, some foreign pharmaceutical producers have set up domestic production bases in China leading to increasing direct competition.

Our generic pharmaceuticals are not protected by patents and are subject to competition from other generic pharmaceuticals. However, the SFDA may at its discretion, subject to certain limitations, grant first-to-market generic pharmaceuticals the protection of a multiple-year monitoring period, or a protection period under the prior regulation, during which other pharmaceutical companies cannot apply for the registration of pharmaceuticals with the same chemical structure, dosage form and indication. Once the transitional protection period elapses, other manufacturers will be able to produce pharmaceuticals with the same chemical structure, dosage form and indication, and may be able to sell such products at a lower price. As a result, hospitals, clinics, pharmacies and other retail outlets may choose the lower priced products over our pharmaceuticals, resulting in a commensurate loss in sales of our products. Most of our products are branded generics, which can be manufactured and sold by other pharmaceutical producers in China once the relevant protection or monitoring periods elapse.

We believe that the combination of our manufacturing capabilities, ODM client base and regional distribution network gives us leverage to capture a substantial portion of the value chain. This value chain allows us to negotiate procurement pricing with other producers on a periodic basis, thus providing us with favorable discounts.

Research and Development

Research and development, or R&D, efforts are critical to the future of our business so we have focused our efforts on R&D partnerships with Tsinghua University, Tianjin University, the Tianjin University of Technology and the Tianjin Nankai Science and Technology Park. Our joint research and development efforts have resulted in our development of the following products:

Paclitaxel –We produce Paclitaxel, or “Taxol,” an anti-cancer raw material originally derived from the bark of the Pacific Yew tree and currently under production in small quantities. Paclitaxel is used to treat patients with lung, ovarian, breast cancer, head and neck cancer and advanced forms of Kaposi’s sarcoma. Paclitaxel binds to microtubules and inhibits their molecular disassembly into tubulin, which blocks a cell’s ability to break down into mitotic spindle during mitosis. This stops the cell from dividing and combats cancerous cells from spreading.

We process Paclitaxel through a new technique developed during our cooperation with Tsinghua University. We own this new technology pursuant to a Technology Transfer Agreement, dated September 30, 2008, whereby Tsinghua University agreed to transfer the proprietary technology to us. The proprietary technology involves a “solid to liquid” cell cultivation method that increases the success ratio and consistency of the product.

According to the Chinese Ministry of Health, the cancer mortality rate of urban Chinese residents is 140.47 per 100,000, or 21.82%, of all urban deaths and the cancer mortality rate of rural Chinese residents was 111.57 per 100,000, or 16.50%, of all rural deaths. The anti-cancer drug market in China has been growing at a 22.24% annual growth rate as of 2007, and the total market for anti-cancer drugs was RMB 25.45 billion, or $3.63 billion USD, based on research from Nan Fang Institute, a direct subsidiary of the Chinese SFDA. We are currently capable of “pilot” scale production of Paclitaxel, but we intend to significantly ramp up our scale of production to 100 kg once our additional production facility is completed in August 2011, and 200-300 kg within the next 3 years.

- SuBing Oral Suspension –SuBing is an OTC cardiovascular drug to relieve the symptoms of cardio- cerebral-vascular diseases. SuBing was co developed with Tianjin University and is currently in the final stage of SFDA approval. According to a Development Agreement, dated June 20, 2007, between BOAI Pharm and The Pharmaceutical College of Tianjin University, we will be the sole owner of all the proprietary technologies related to SuBing, including a 20-year patent currently owned by Tianjin University covering the “oral suspension” form with an added benefit of extending the shelf life from 18 months to 36 months after the SFDA’s approval is granted. The delivery method of the most popular SuBing drug on the market, the Fu Fang Danshen Pill, is also available in an oral suspension form but takes upwards of 3 to 5 minutes to dissolve, while our patent covers the effective delivery in a pill which dissolves in 30 seconds. Compared to the sales performance of other similar products in the market, we believe that the potential annual sales of SuBing within our current sales channel will reach $21 million in its first year of release and $150 million within 3 years.

- 10 -

- Bing WuSuanNa Syrup –Bing WuSuanNa, or sodium valproate, our solely developed SFDA approved product, is designed to treat epilepsy symptoms such as partial seizures, nmyoclonic epilepsy and tonic- clonic seizures. Our formula is in a syrup form and is designed to be easier to administer to children.

The following table outlines our research and development work in progress:

Products Currently in

Development * | Cure/Use

| Status of Product

Development | SFDA Stage **

|

| SuBing Oral Suspension | Used to relieve the symptoms of cardio- cerebral-vascular diseases | Completed | In the last stage of SFDA approval |

| Paclitaxel | Raw materials for cancer treatment | Completed | No SFDA approval required |

| Bing WuSuanNa Syrup | Used to treat epilepsy symptoms | Completed | SFDA approval granted |

____________

* Under PRC law, each variation in the packaging, dosage and concentration of medical products requires registration and approval by the SFDA. During this process the altered product is not commercially available for sale.

** These stages refer to the stages in the regulatory approval process for our products disclosed under the heading “Regulation” in this report.

For the fiscal years ended June 30, 2010 and 2009, total research and development expenses amounted to approximately $1.6 million and $0.5 million, respectively, representing approximately 2.3% and 1.0%, respectively, of our revenues.

Intellectual Property

We hold 2 registered trademarks for our DongFang and BOAI labels. We also currently hold 2 proprietary technologies and 2 external design patents.

Patents

| Description Appearance Design | Patent No | Issue Date | Expiration Date |

| | | | |

Appearance Design: Package:

Fufang Yimucao Gao | ZL 02 3 30403.8

| December 4, 2002

| June 24, 2012

|

Appearance Design: Package:

Yangyin Qingfei Gao | ZL 02 3 30429.4

| December 11, 2002

| July 24, 2012

|

Trademarks

| Description Trade Mark | Trade Mark No | Term of the Trade Mark |

| | | |

| Trade Mark Bo Ai | 1974880 | December 7, 2002 to December 6, 2012 |

| Trade Mark Dong Fang | 1014753 | May 28, 2007 to May 27, 2017 |

- 11 -

There can be no assurance that third parties will not assert infringement or other claims against us with respect to any of our existing or future products or processes. There can be no assurance that licenses would be available if any of our technology was successfully challenged by a third party, or if it became desirable to use any third-party technology to enhance our products. Litigation to protect our proprietary information or to determine the validity of any third-party claims could result in a significant expense and divert the efforts of our technical and management personnel, whether or not such litigation is determined in our favor.

While we have no knowledge that we are infringing upon the proprietary rights of any third party, there can be no assurance that such claims will not be asserted in the future with respect to existing or future products or processes. Any such assertion by a third party could require us to pay royalties, to participate in costly litigation and defend licensees in any such suit pursuant to indemnification agreements, or to refrain from selling an alleged infringing product.

Employees

As of June 30, 2010, we had 344 employees. The payment of salaries conforms to the local minimum salary standard. We are not subject to any collective bargaining agreements and we believe our relationship with our employees is excellent. We have not experienced any significant problems or disruption to our operations due to labor disputes, nor have we experienced any difficulties in recruitment and retention of experienced staff.

Our ability to achieve our operational and financial objectives depends in part upon our ability to retain key technical, marketing and operational personnel, and to attract new employees as required to support growth. Working capital constraints may impair our ability to retain and attract the staff needed to maintain current operations and meet the needs of anticipated growth.

As required by applicable Chinese laws, we have entered into employment contracts with all of our officers, managers and employees.

Our employees in China participate in a state pension scheme organized by Chinese municipal and provincial governments. In addition, we are required by Chinese laws to cover employees in China with various types of social insurance. We have purchased social insurances for all of our employees.

Regulations

Regulation of Pharmaceuticals

The testing, approval, manufacturing, labeling, advertising and marketing, post-approval safety reporting, of our products or product candidates are extensively regulated by governmental authorities in the PRC. Our main sales market is presently in China. We are subject to the Drug Administration Law of China, which governs the licensing, production, marketing and distribution of pharmaceutical products in China and sets penalties for violations of the law. Additionally, we are subject to various regulations and permit systems by the Chinese government. These regulations and their impact on the business of us are set forth in more detail below.

Drug Administration Law of the PRC

The PRC Drug Administration Law was promulgated by the Standing Committee of National People’s Congress on February 28, 2001 and was effective as of December 1, 2001, and its implemental rules were promulgated by the State Council on August 4, 2004 and were effective as of September 15, 2002. According to the Drug Administration Law and its implemental rules, a pharmaceutical producer is required to obtain a Pharmaceutical Manufacturing Permit and a Drug Approval Number for each manufactured medicine from its SFDA provincial branch. Such permit and approval number are valid for five years and are renewable upon application before expiration. We have obtained such permits and approvals for each of our medicines and we renew them prior to expiration.

- 12 -

Administration Regulations for Drug Registration

The Administration Regulations for Drug Registration was promulgated by the SFDA on July 10, 2007, and was effective as of October 1, 2007. The regulations specify the requirements and procedures of obtaining a Drug Approval Number for new drugs, including the requirements for the clinical trial of new drugs, procedures for registering imported medicines and reporting and approval procedures for generic medicines.A Drug Approval Number is valid for five years and can be re-registered upon expiration. We have obtained a Drug Approval Number for each of our drugs and have applied for re-registration prior to their expiration.

GMP for Pharmaceutical Products and Authentication Regulations for Drug GMP

As revised in 1998,GMP for Pharmaceutical Products was promulgated by the SFDA on June 18, 1999 and became effective as of August 1, 1999, and the Authentication Regulations for Drug GMP was promulgated by the SFDA on September 7, 2005 and became effective on of October 1, 2005.A pharmaceutical producer must meet the GMP standards and obtain a GMP Certificate with a five-year validity period from the SFDA. Before GMP Certification expires, the pharmaceutical producer must apply for recertification and complete the relevant procedures in order to maintain its pharmaceutical production permit. The recertification process can take up to 120 business days to complete. Our GMP Certification will expire on January 13, 2015.

Administration Regulations for Drug Recall

The regulations on Drug Recall were promulgated by the SFDA on December 10, 2007 and were immediately effective. According to the regulations, pharmaceutical producers must establish drug recall procedures and collect information regarding the safety of their pharmaceutical products. If a producer learns that any of its drugs pose unreasonable danger to public health and safety, it must immediately stop the manufacturing and sale of such drug, notify its distributors and report its findings to the applicable SFDA branch. The regulations also establish standards for the required drug recall procedures and the standards by which pharmaceutical producers may evaluate whether its drug poses a danger to the public. None of our products has been recalled to date.

Administration Regulations for Drug Instructions and Labels

The regulations for Drug Instructions and Labels were promulgated by the SFDA on March 15, 2006 and were effective as of June 1, 2006. According to the regulations, the SFDA must approve the content of all drug labels and instructions, and that even the smallest packing unit of drug must include such instructions. We have received approval and we maintain labeling for our products in conformity with such regulations.

Regulations for Drug Advertisement Censoring and Publication

The regulations for Drug Advertisement Censoring and Publication were promulgated by the SFDA and by the State Administration for Industry and Commerce, or SAIC, on March 3, 2007, and were effective as of May 1, 2007. According to the regulations, a pharmaceutical producer must obtain a Drug Advertisement Approval Number from its relevant provincial branch of the SFDA if a drug advertisement will describes the functions or benefits of a drug. This approval number is valid for a one-year period and is not required if (1) such publication involves an OTC drug advertisement in any media, or a prescription drug advertisement in a professional medical magazine or (2) such publication only refers to the name of the drug, including the generic name and commercial name, without any additional promotional information. We are currently in compliance with all regulations relating to the advertisement of our products.

The PRC Drug Approval Process

The SFDA and China Traditional Medicine Administration Bureau regulate the new drug approval and licensing in China. The process can involve many layers of authority, lacks transparency, and presents one of the greatest obstacles to the introduction of new drugs into the market. A pharmaceutical producer must take the steps below to obtain approval for its newly developed drugs. The new drug approval process usually lasts between three and four years.

- 13 -

| Stage | Description | Approximate Time/Duration |

| 1. | A new drug applicant prepares documentation of a pharmacological study, toxicity study and pharmacokinetics and drug metabolism study for the proposed drug and submit such documentation along with samples of the drug to its provincial branch of the SFDA, or the Local SFDA | Timing depends on the category and class of the new drug and the applicant’s internal processes. Our process usually takes 18 – 24 months |

| 2. | The Local SFDA sends its officials to the applicant to inspect the applicant’s research and development facilities and arranges to convene a local new drug examination committee meeting, consisting of government officials, for approval deliberations. If approved by the committee, the local SFDA will submit the approved documentation and samples to the SFDA | 3 months |

| 3. | The SFDA examines the documentation, tests the drug samples and arranges to convene a state new drug examination committee meeting for approval deliberations. If the application is approved by the committee, the SFDA will issue a clinical trial license to the applicant for clinical trials | 1 year |

| 4. | The applicant conducts and completes clinical trial and prepares documentation and files for submission to the SFDA for new drug approval. | 1 – 2 years (depending on the category and class of the new drug) |

| 5. | The SFDA examines the documentation, gives final approval for the new drug and issues a new drug license to the applicant. | 8 months |

A preliminary aspect of the foregoing application process involves a review of the PRC market’s need for a particular drug. If the SFDA determines that the market for a particular drug is saturated, the drug will not receive further consideration and the licensing application will be denied.

Compliance with Environmental Law

Our operation and facilities are subject to environmental laws and regulations stipulated by the national and the local environment protection bureaus in China, including the PRC Environmental Protection Law. Relevant laws and regulations include provisions governing air emissions, water discharges and the management and disposal of hazardous substances and wastes. The PRC regulatory authorities require pharmaceutical companies to carry out environmental impact studies before engaging in new construction projects to ensure that their production processes meet the required environmental standards.

We maintain controls at our production facilities to facilitate compliance with such environmental rules and regulations. In addition to such compliance, we actively ensure the environmental sustainability of our operations. The Company is not aware of any investigations, prosecutions, disputes, claims or other proceedings in respect of environmental protection, nor has it been subject to any action made by any environmental administration authorities of the PRC. To management’s knowledge, the Company’s operation meets or exceeds the existing requirements of the PRC.

Regulation of Foreign Currency Exchange

The principal regulations governing foreign currency exchange in China are the Foreign Exchange Administration Regulations (1996), as amended, and the Administration Rules of the Settlement, Sale and Payment of Foreign Exchange (1996). Under these regulations, the Renminbi is freely convertible for current account items, including the distribution of dividends, interest payments, trade and service-related foreign exchange transactions, but not for most capital account items, such as direct investment, loan, repatriation of investment and investment in securities outside China, unless the prior approval of SAFE or its local counterparts is obtained. In addition, any loans to an operating subsidiary in China that is a foreign invested enterprise, cannot, in the aggregate, exceed the difference between its respective approved total investment amount and its respective approved registered capital amount.

- 14 -

Furthermore, any foreign loan must be registered with SAFE or its local counterparts for the loan to be effective. Any increase in the amount of the total investment and registered capital must be approved by the PRC Ministry of Commerce or its local counterpart. We may not be able to obtain these government approvals or registrations on a timely basis, if at all, which could result in a delay in the process of making these loans.

Dividends paid by the PRC subsidiary to its foreign shareholder are deemed shareholder income and are taxable in China. Pursuant to the Administration Rules of the Settlement, Sale and Payment of Foreign Exchange (1996), foreign-invested enterprises in China may purchase or remit foreign exchange, subject to a cap approved by SAFE, for settlement of current account transactions without the approval of SAFE. Foreign exchange transactions under the capital account are still subject to limitations and require approvals from, or registration with, SAFE and other relevant PRC governmental authorities.

Regulation of Dividend Distribution

The principal regulations governing the distribution of dividends by foreign holding companies include the Foreign Investment Enterprise Law (1986), as amended, and the Administrative Rules under the Foreign Investment Enterprise Law (2001).

Under these regulations, foreign investment enterprises in China may pay dividends only out of their retained profits, if any, determined in accordance with PRC accounting standards and regulations. In addition, foreign investment enterprises in China are required to allocate at least 10% of their respective retained profits each year, if any, to fund certain reserve funds unless these reserves have reached 50% of the registered capital of the enterprises. These reserves are not distributable as cash dividends.

Taxation

PRC enterprise income tax is calculated based on taxable income determined under PRC accounting principles. According to the Foreign-invested Enterprises and Foreign Enterprises Income Tax Law (the “FIE Income Tax Law”) and the related implementing rules, both of which issued in 1991, foreign-invested enterprises established in China are generally subject to an income tax rate of 33% (consisting of 30% enterprise income tax and 3% local income tax). The FIE Income Tax Law and the related implementing rules provide certain favorable tax treatments to qualified foreign invested enterprises.

Under the EIT Law, a unified enterprise income tax rate of 25% and unified tax deduction standards will be applied equally to both domestic-invested enterprises and foreign-invested enterprises. Enterprises established prior to March 16, 2007 eligible for preferential tax treatment in accordance with the currently prevailing tax laws and administrative regulations shall, under the regulations of the State Council, gradually become subject to the EIT Law rate over a five-year transition period starting from the date of effectiveness of the EIT Law. The details of the transitional arrangement for the five-year period from January 1, 2008 to December 31, 2012 applicable to enterprises approved for establishment prior to March 16, 2007, such as our company, were adopted in January 2008.

Furthermore, under the EIT Law, an enterprise established outside of the PRC with “de facto management bodies” within the PRC is considered a resident enterprise and will normally be subject to the enterprise income tax at the rate of 25% on its global income. If the PRC tax authorities subsequently determine that we or any of our non-PRC subsidiaries should be classified as a PRC resident enterprise, then such entity’s global income will be subject to PRC income tax at a tax rate of 25%. In addition, under the EIT Law, payments from BDL to us may be subject to a withholding tax. The EIT Law currently provides for a withholding tax rate of 20%. We are actively monitoring the proposed withholding tax and are evaluating appropriate organizational changes to minimize the corresponding tax impact.

- 15 -

Value Added Tax

Pursuant to the Provisional Regulation of China on Value Added Tax and its implementing rules, issued in December 1993, all entities and individuals that are engaged in the businesses of sales of goods, provision of repair and placement services and importation of goods into China are generally subject to a 17% VAT (with the exception of certain goods which are subject to a rate of 13%) of the gross sales proceeds received, less any VAT already paid or borne by the taxpayer on the goods or services purchased by it and utilized in the production of goods or provisions of services that have generated the gross sales proceeds.

Business Tax

Companies in China are generally subject to business tax and related surcharges by various local tax authorities at rates ranging from 3% to 20% of revenue generated from providing services and revenue generated from the transfer of intangibles.

Labor Contract Law

The new Labor Contract Law took effect January 1, 2008, and governs standard terms and conditions for employment, including termination and lay-off rights, contract requirements, compensation levels and consultation with labor unions, among other topics. In addition, the law limits non-competition agreements with senior management and other employees with knowledge of trade secrets to two years and imposes restrictions or geographical limits.

Our Properties and Facilities

There is no private ownership of land in China and all land ownership is held by the government of the PRC, its agencies and collectives. Land use rights can be obtained from the government for a period of up to 50 years, and are typically renewable. Land use rights can be transferred upon approval by the land administrative authorities of the PRC (State Land Administration Bureau) upon payment of the required land transfer fee.

The table below provides a summary of our land use rights to: Xi Qing Dan Guo Yong (2003) No.132 located in Yonghong Industry, Nanhe Town, Xiqing District, Tianjin, China; Fang Di Zheng Jin Zi No. 104030753702 and Jing Dan Guo Yong (2006) No. 46, located at Ke Ji Street in the Tianyu Tranquility Science and Technology Parks, Jinghai District, Tianjin, China (respectively, “Land 1”, “Land 2”, and “Land 3”):

| Land | Usage | Area (m2) | Type of Land Use Right | Term of Use |

| Land 1 | Industrial | 3,438.4 | Granted | Expiration on October 27, 2053 |

| Land 2 | Industrial | 2,524.3 | Granted | Expiration on September 3, 2057 |

| Land 3 | Industrial | 85,938.9 | Granted | Expiration on June 24, 2054 |

We also own the property titles to six buildings located at Tianjin City, China. “Tianjin Property Ownership Certificate No. 110029331” includes 2 buildings with a total area of 1325.8 square meters, “Fang Di Zheng Jin Zi No. 104030753702” includes 1 building with a total area of, 2,856.8 square meters. The properties are used for industrial and office purposes.We also own “Fang Quan Zheng Jin Fang Zi No.000011279" for property in the Jinghai District that includes 3 buildings with a total area of 22,138.2 square meters.

- 16 -

RISK FACTORS

RISKS RELATED TO OUR BUSINESS

Our products and product candidates may not achieve or maintain widespread market acceptance.

Success of our products is highly dependent on the needs and preferences of healthcare practitioners and patients and market acceptance, and we may not achieve or maintain widespread market acceptance of our products or product candidates among healthcare practitioners and patients. We believe that market acceptance of our products will depend on many factors, including:

the perceived advantages of our products over competing products and the availability and success of competing products;

the effectiveness of our sales and marketing efforts;

the safety and efficacy of our products and the prevalence and severity of adverse side effects, if any;

our product pricing and cost effectiveness;

publicity concerning our products, product candidates or competing products;

whether or not patients routinely use our products, refill prescriptions and purchase additional products;

our ability to respond to changes in healthcare practitioner and patient preferences; and

the continued inclusion of our products in the Medical Insurance Catalogs.

If our products fail to achieve or maintain market acceptance, or if new products are introduced by others that are more favorably received than our products, which are more cost effective or otherwise render our products obsolete, we may experience a decline in the demand for our products. If we were unable to market and sell our products successfully, our business, financial condition, results of operation and future growth would be adversely affected.

Most of our products are branded generics that can be manufactured and sold by other pharmaceutical producers in China once the relevant protection or monitoring periods, if any, elapse.

Most of our products are branded generic pharmaceuticals and are not protected by patents. As a result, if other pharmaceutical companies sell equivalent products at a lower cost, this might adversely affect sales of our branded generic products. Certain of our generic products are subject to a protection or monitoring period. The maximum monitoring period currently granted by the SFDA is five years. During such period, the SFDA, will not accept applications for new medicine certificates for the same product by other pharmaceutical companies or approve the production or import of the same product by other pharmaceutical companies. However, once such protection or monitoring periods expire, other manufacturers may obtain relevant production approvals and will be entitled to sell generic pharmaceutical products with similar formulae or production methods in China.

Delays in production due to regulatory restrictions or other factors could have a material adverse impact on our business.

We manufacture a large number of our products in our own manufacturing facilities. The manufacture of pharmaceutical products requires precise and reliable controls and regulatory authorities in China have imposed significant compliance obligations to regulate the manufacturing of pharmaceutical products. As a result, we may face delays in production due to regulatory restrictions or other factors. Failure by our own manufacturing facility or any third party product supplier to comply with regulatory requirements could adversely affect our ability to provide products. All facilities and manufacturing techniques used for the manufacture of pharmaceutical products must be operated in conformity with GMPs. In complying with GMP requirements, we and our product suppliers must continually spend time, money and effort in production, record-keeping and quality assurance and control to ensure that the product meets applicable specifications and other requirements for product safety, efficacy and quality. Manufacturing facilities are subject to periodic unannounced inspections by the SFDA and other regulatory authorities. In addition, adverse experiences with the use of products must be reported to the SFDA and could result in the imposition of market restrictions through labeling changes or in product removal.

- 17 -

Suppliers of certain active and inactive pharmaceutical ingredients and certain packaging materials used in our products are required to obtain SFDA approval before they may supply us with such materials. The development and regulatory approval of our products are dependent upon our ability to procure these ingredients, packaging materials and finished products from SFDA-approved sources. SFDA approval of a new supplier would be required if, for example, an existing supplier breached its obligations to us, active ingredients, packaging materials or finished products were no longer available from the initially approved supplier or if a supplier had its approval from the SFDA withdrawn. The qualification of a new product supplier could potentially delay the manufacture of the product involved. Furthermore, we may not be able to obtain active ingredients, packaging materials or finished products from a new supplier on terms that are at least as favorable to us as those agreed with the initially approved supplier or at reasonable prices.

A delay in supplying, or failure to supply, products by any product supplier could result in our inability to meet the demand for our products and adversely affect our revenues, financial condition, results of operations and cash flows.

Counterfeit pharmaceuticals in China could negatively impact our revenues, brand reputation, business and results of operations.

Our products are also subject to competition from counterfeit pharmaceuticals, which are pharmaceuticals manufactured without proper licenses or approvals and are fraudulently mislabeled with respect to their content and/or manufacturer. Counterfeiters may illegally manufacture and market pharmaceuticals under our brand name or that of our competitors. Counterfeit pharmaceuticals are generally sold at lower prices than the authentic products due to their low production costs, and in some cases are very similar in appearance to the authentic products. Counterfeit pharmaceuticals may or may not have the same chemical content as their authentic counterparts. If counterfeit pharmaceuticals illegally sold under our brand name results in adverse side effects to consumers, we may be associated with any negative publicity resulting from such incidents. In addition, consumers may buy counterfeit pharmaceuticals that are in direct competition with our pharmaceuticals, which could have an adverse impact on our revenues, business and results of operations. Although the PRC government has recently been increasingly active in policing counterfeit pharmaceuticals, there is not yet an effective counterfeit pharmaceutical regulation control and enforcement system in China. The proliferation of counterfeit pharmaceuticals has grown in recent years and may continue to grow in the future. Any such increase in the sales and production of counterfeit pharmaceuticals in China, or the technological capabilities of the counterfeiters, could negatively impact our revenues, brand reputation, business and results of operations.

We may be subject to damages resulting from claims that we or our employees have wrongfully used or disclosed alleged trade secrets of their former employers.

Certain of our employees and consultants were previously employed at other biotechnology or pharmaceutical companies, including our competitors or potential competitors, or at universities or other research institutions. Although no claims against us are currently pending, we may be subject to claims that these employees, consultants or we have inadvertently or otherwise used or disclosed trade secrets or other proprietary information of their former employers. Litigation may be necessary to defend against these claims. Even if we are successful in defending against these claims, litigation could result in substantial costs and be a distraction to our management. If we fail in defending such claims, in addition to paying monetary damages, we may lose valuable intellectual property rights or personnel. A loss of key research personnel or their work product could delay or prevent us from commercializing one or more of our product candidates.

- 18 -

Our future research and development projects may not be successful.

The successful development of pharmaceutical products can be affected by many factors. Products that appear to be promising at their early phases of research and development may fail to be commercialized for various reasons, including the failure to obtain the necessary regulatory approvals. In addition, the research and development cycle for new products for which we may obtain an approval certificate is long. The process of conducting basic research and various stages of tests and trials of a new product before obtaining an approval certificate and commercializing the product may require ten years or longer. Many of our product candidates are in the early stages of pre-clinical studies or clinical trials and we must conduct significant additional clinical trials before we can seek the necessary regulatory approvals to begin commercial production and sales of these products. There is no assurance that our future research and development projects will be successful or completed within the anticipated time frame or budget or that we will receive the necessary approvals from relevant authorities for the production of these newly developed products, or that these newly developed products will achieve commercial success. Even if such products can be successfully commercialized, we may not achieve the level of market acceptance that we expect.

In addition, the pharmaceutical industry is characterized by rapid changes in technology, constant enhancement of industrial know-how and frequent emergence of new products. Future technological improvements and continual product developments in the pharmaceutical market may render our existing products obsolete or affect their viability and competitiveness. Therefore, our future success will largely depend on our research and development capability, including our ability to improve our existing products, diversify our product range and develop new and competitively priced products that can meet the requirements of the changing market. Should we fail to respond to these frequent technological advances by improving our existing products or developing new products in a timely manner or these products do not achieve a desirable level of market acceptance, our business and profitability will be materially and adversely affected.

We may not be successful in competing with other manufacturers of pharmaceuticals in the tender processes for the purchase of medicines by state-owned and state-controlled hospitals.

A substantial portion of the products we sell to our distributor customers are sold to hospitals owned and controlled by counties or higher-level government authorities in China. These hospitals must implement collective tender processes for the purchase of medicines listed in the Medical Insurance Catalogs and medicines that are consumed in large volumes and commonly prescribed for clinical uses. During a collective tender process, the hospitals will establish a committee consisting of recognized pharmaceutical experts. The committee will assess the bids submitted by the pharmaceutical producers, taking into consideration, among other things, the quality and price of the medicine and the service and reputation of the manufacturers. For the same type of pharmaceutical, the committee usually selects from among two to three different brands. Only pharmaceuticals that have won in the collective tender processes may be purchased by these hospitals. The collective tender process for pharmaceuticals with the same chemical composition must be conducted at least annually, and pharmaceuticals that have won in the collective tender processes previously must participate and win in the collective tender processes in the following period before new purchase orders can be issued. If we are unable to win purchase contracts through the collective tender processes in which we decide to participate, we will lose market share to our competitors, and our revenue and profitability will be adversely affected.

Key employees are essential to growing our business.

Ms. Xuecheng Xia, our Board Chair and Chief Executive Officer, Mr. Yansheng Wang, the General Manager of our PRC subsidiaries, and Mr. Shuyuan Chang, Chief Financial Officer are essential to our ability to continue to grow our business. Mrs. Xia and Wang have established relationships within the industries in which we operate. If either of them were to leave us, our growth strategy might be hindered, which could limit our ability to increase revenue. In addition, we face competition for attracting skilled personnel. If we fail to attract and retain qualified personnel to meet current and future needs, this could slow our ability to grow our business, which could result in a decrease in market share.

- 19 -

Our marketing activities are critical to the success of our products, and if we fail to grow our marketing capabilities or maintain adequate spending on marketing activities, the market share of our products and our brand name and product reputation would be materially adversely affected.