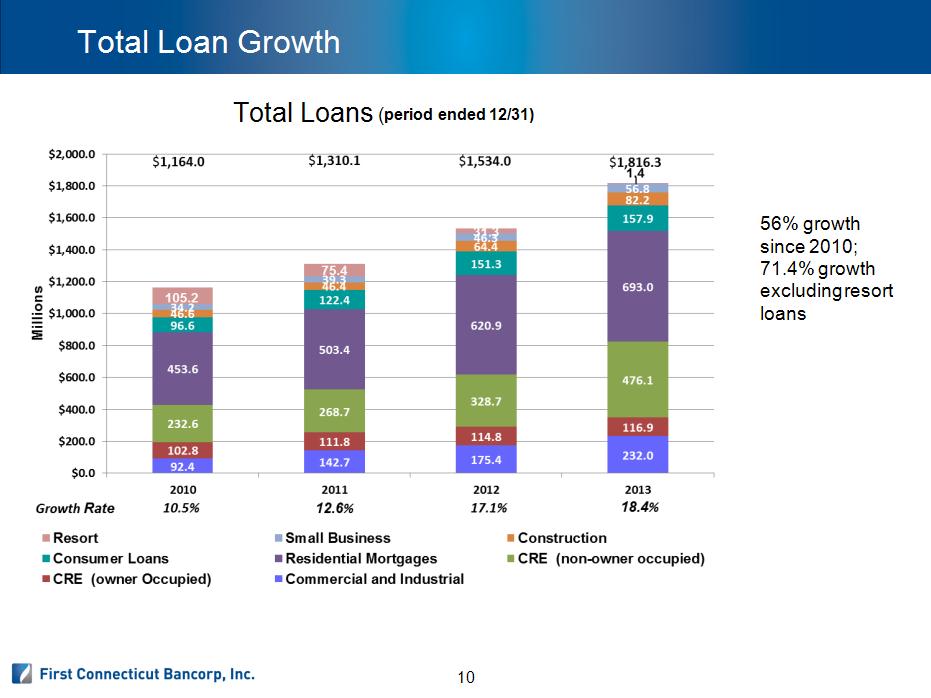

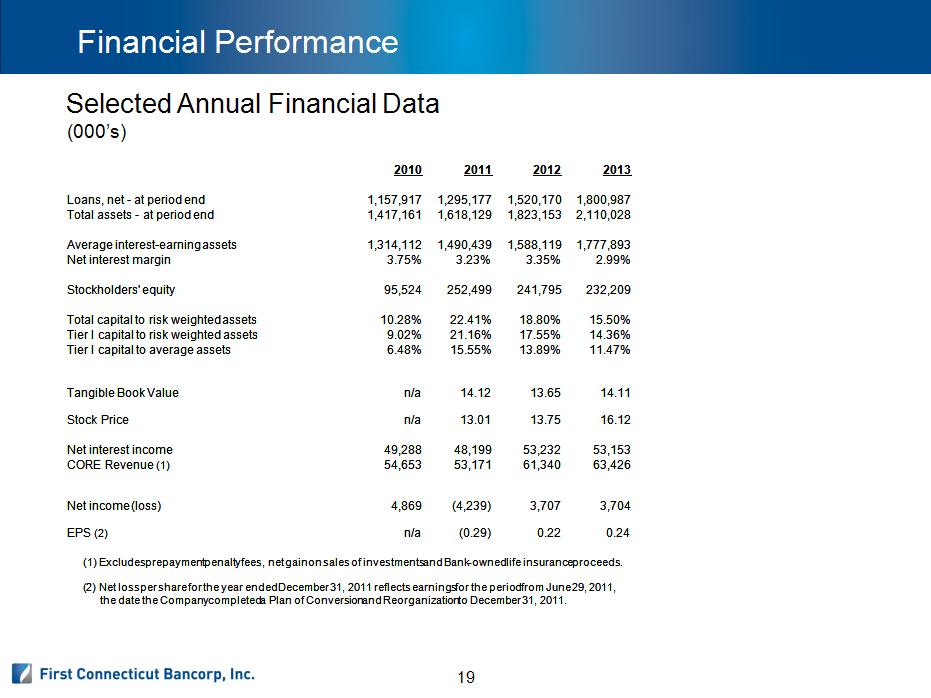

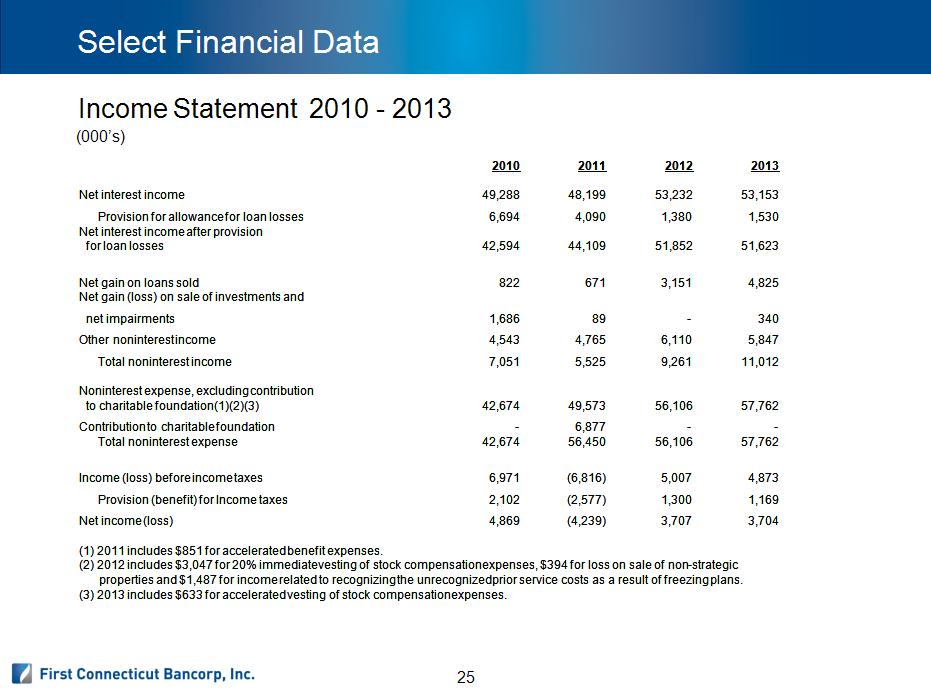

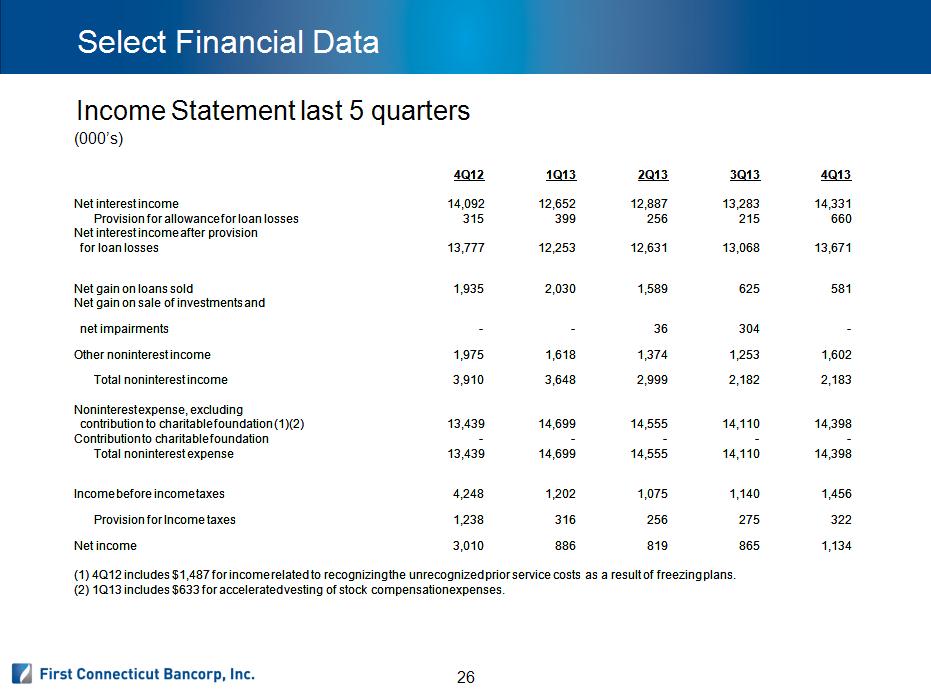

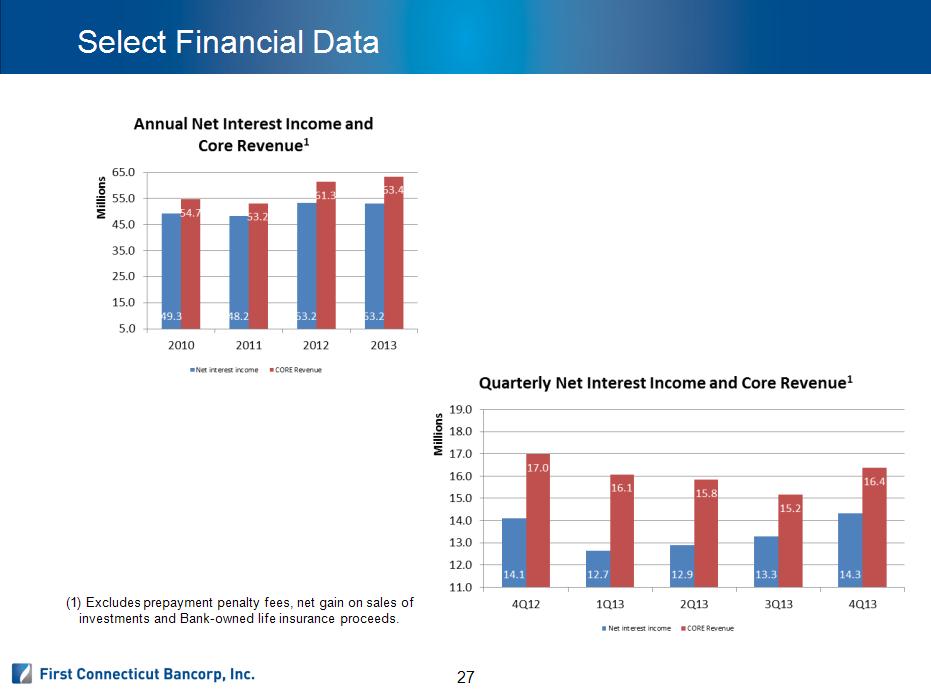

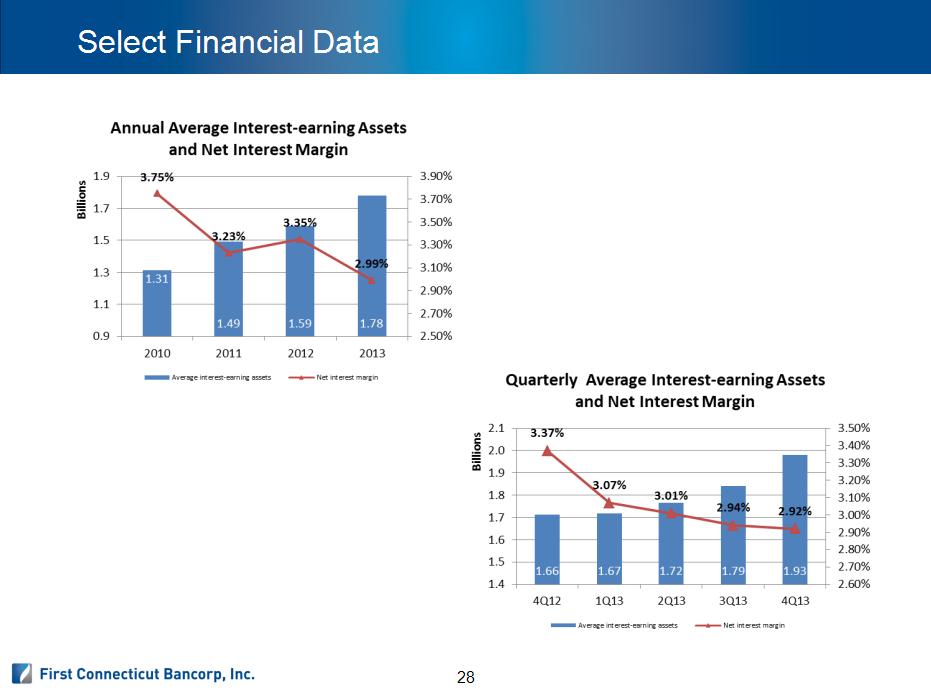

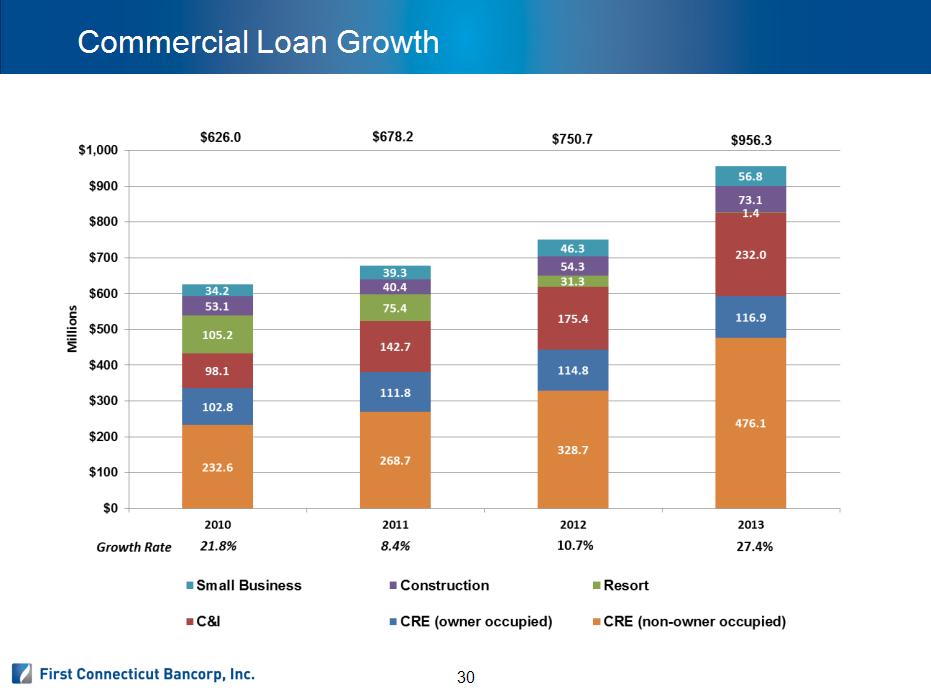

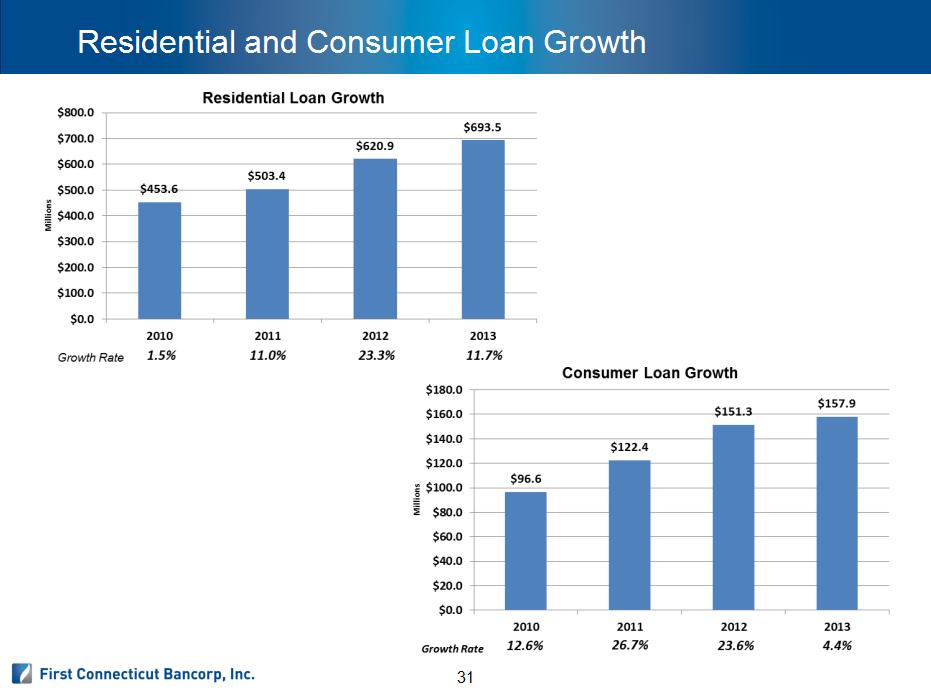

Financial Performance * Selected Annual Financial Data (000’s) 2010 2011 2012 2013 Loans, net - at period end Loans, net - at period end Loans, net - at period end 1,157,917 1,295,177 1,520,170 1,800,987 Total assets - at period end Total assets - at period end Total assets - at period end 1,417,161 1,618,129 1,823,153 2,110,028 Average interest-earning assets Average interest-earning assets Average interest-earning assets Average interest-earning assets 1,314,112 1,490,439 1,588,119 1,777,893 Net interest margin Net interest margin Net interest margin 3.75% 3.23% 3.35% 2.99% Stockholders' equity Stockholders' equity Stockholders' equity 95,524 252,499 241,795 232,209 Total capital to risk weighted assets Total capital to risk weighted assets Total capital to risk weighted assets Total capital to risk weighted assets 10.28% 22.41% 18.80% 15.50% Tier I capital to risk weighted assets Tier I capital to risk weighted assets Tier I capital to risk weighted assets Tier I capital to risk weighted assets 9.02% 21.16% 17.55% 14.36% Tier I capital to average assets Tier I capital to average assets Tier I capital to average assets Tier I capital to average assets 6.48% 15.55% 13.89% 11.47% Tangible Book Value Tangible Book Value Tangible Book Value n/a 14.12 13.65 14.11 Stock Price Stock Price n/a 13.01 13.75 16.12 Net interest income Net interest income Net interest income 49,288 48,199 53,232 53,153 CORE Revenue (1) CORE Revenue (1) CORE Revenue (1) 54,653 53,171 61,340 63,426 Net income (loss) Net income (loss) Net income (loss) 4,869 (4,239) 3,707 3,704 EPS (2) EPS (2) n/a (0.29) 0.22 0.24 (1) Excludes prepayment penalty fees, net gain on sales of investments and Bank-owned life insurance proceeds. (1) Excludes prepayment penalty fees, net gain on sales of investments and Bank-owned life insurance proceeds. (1) Excludes prepayment penalty fees, net gain on sales of investments and Bank-owned life insurance proceeds. (1) Excludes prepayment penalty fees, net gain on sales of investments and Bank-owned life insurance proceeds. (1) Excludes prepayment penalty fees, net gain on sales of investments and Bank-owned life insurance proceeds. (1) Excludes prepayment penalty fees, net gain on sales of investments and Bank-owned life insurance proceeds. (1) Excludes prepayment penalty fees, net gain on sales of investments and Bank-owned life insurance proceeds. (1) Excludes prepayment penalty fees, net gain on sales of investments and Bank-owned life insurance proceeds. (2) Net loss per share for the year ended December 31, 2011 reflects earnings for the period from June 29, 2011, (2) Net loss per share for the year ended December 31, 2011 reflects earnings for the period from June 29, 2011, (2) Net loss per share for the year ended December 31, 2011 reflects earnings for the period from June 29, 2011, (2) Net loss per share for the year ended December 31, 2011 reflects earnings for the period from June 29, 2011, (2) Net loss per share for the year ended December 31, 2011 reflects earnings for the period from June 29, 2011, (2) Net loss per share for the year ended December 31, 2011 reflects earnings for the period from June 29, 2011, (2) Net loss per share for the year ended December 31, 2011 reflects earnings for the period from June 29, 2011, (2) Net loss per share for the year ended December 31, 2011 reflects earnings for the period from June 29, 2011, the date the Company completed a Plan of Conversion and Reorganization to December 31, 2011. the date the Company completed a Plan of Conversion and Reorganization to December 31, 2011. the date the Company completed a Plan of Conversion and Reorganization to December 31, 2011. the date the Company completed a Plan of Conversion and Reorganization to December 31, 2011. the date the Company completed a Plan of Conversion and Reorganization to December 31, 2011. the date the Company completed a Plan of Conversion and Reorganization to December 31, 2011. the date the Company completed a Plan of Conversion and Reorganization to December 31, 2011. the date the Company completed a Plan of Conversion and Reorganization to December 31, 2011.