As filed with the U.S. Securities and Exchange Commission on July 14, 2016

1933 Act File No. 333-211616

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 [X]

Pre-Effective Amendment No. 1 Post-Effective Amendment No. ___ [ ]

MANAGED PORTFOLIO SERIES

(Exact Name of Registrant as Specified in Charter)

615 East Michigan Street

Milwaukee, Wisconsin 53202

(Address of Principal Executive Offices, Zip Code)

(414) 287-3700

(Registrant’s Telephone Number)

James R. Arnold, President and Principal Executive Officer

615 East Michigan Street

Milwaukee, Wisconsin 53202

(Name and Address of Agent for Service)

Copy to:

| Thomas G. Sheehan, Esq. |

| Bernstein, Shur, Sawyer & Nelson P.A. |

| 100 Middle Street |

| P.O. Box 9729 |

| Portland, ME 04104-5029 |

Title of Securities being Registered: Shares of the IS class of the Jackson Square Select 20 Growth Fund, Shares of the IS class of the Jackson Square SMID-Cap Growth Fund and Shares of the IS class of the Jackson Square Large-Cap Growth Fund.

Approximate Date of Proposed Public Offering: As soon as practicable after the Registration Statement becomes effective under the Securities Act of 1933, as amended.

No filing fee is required under the Securities Act of 1933, as amended, because an indefinite number of shares of beneficial interest have previously been registered pursuant to Section 24(f) of the Investment Company Act of 1940, as amended.

It is proposed that this filing will become effective on July 15, 2016.

DELAWARE POOLED® TRUST

2005 MARKET STREET

PHILADELPHIA, PENNSYLVANIA 19103

(800) 231-8002

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS OF

THE LARGE-CAP GROWTH EQUITY PORTFOLIO

THE FOCUS SMID-CAP GROWTH EQUITY PORTFOLIO

THE SELECT 20 PORTFOLIO

TO BE HELD ON SEPTEMBER 12, 2016

A special meeting (the “Meeting”) of the shareholders of The Large-Cap Growth Equity Portfolio, The Focus Smid-Cap Growth Equity Portfolio and The Select 20 Portfolio (each, a “Target Fund,” and collectively, the “Target Funds”), each a series of Delaware Pooled® Trust (the “Target Trust”) will be held on September 12, 2016 at 10:00 a.m. at the offices of Stradley Ronon Stevens & Young, LLP, 2005 Market Street, 26th Floor, Philadelphia, Pennsylvania 19103 to vote on the following proposal (the “Proposal”), and any other matters that may properly come before the Meeting or any adjournment or postponement thereof:

PROPOSAL: TO APPROVE AN AGREEMENT AND PLAN OF REORGANIZATION BETWEEN THE TARGET TRUST ON BEHALF OF THE TARGET FUNDS AND MANAGED PORTFOLIO SERIES (THE “ACQUIRING TRUST”), ON BEHALF OF THE JACKSON SQUARE LARGE-CAP GROWTH FUND, THE JACKSON SQUARE SMID-CAP GROWTH FUND AND THE JACKSON SQUARE SELECT 20 GROWTH FUND (THE “ACQUIRING FUNDS”), PROVIDING FOR: (A) THE ACQUISITION OF ALL OF THE ASSETS AND ASSUMPTION OF ALL OF THE LIABILITIES OF EACH TARGET FUND BY ITS CORRESPONDING ACQUIRING FUND IN EXCHANGE FOR IS CLASS SHARES OF THE ACQUIRING FUND; (B) THE DISTRIBUTION OF SUCH SHARES TO THE SHAREHOLDERS OF SUCH TARGET FUND; AND (C) THE LIQUIDATION AND TERMINATION OF EACH TARGET FUND (THE “REORGANIZATION”).

Target Fund shareholders of record as of the close of business on June 20, 2016 are entitled to notice of, and to vote at, the Meeting or any adjournment of the Meeting. The shareholders of each Target Fund will vote separately on the Proposal. The Proposal will be effected with respect to an individual Target Fund only if the Target Fund’s shareholders approve the Proposal.

The Board of Trustees of the Target Trust (the “Target Funds Board”) requests that you vote your shares by completing the enclosed proxy card and returning it in the enclosed postage paid return envelope or by voting by telephone or via the internet using the instructions on the proxy card. The Target Funds Board recommends that you cast your vote “for” the proposal as described in the accompanying proxy statement/prospectus. If you are voting by mail, please sign and promptly return the proxy card in the postage paid return envelope regardless of the number of shares owned. Proxy card instructions may be revoked at any time before they are exercised by submitting a written notice of revocation or a subsequently executed proxy card or by attending the Meeting and voting in person.

By order of the Board of Trustees,

/s/ Shawn K. Lytle

Shawn K. Lytle

President, Chief Executive Officer and Trustee

July 26, 2016

THE SELECT 20 PORTFOLIO THE FOCUS SMID-CAP GROWTH EQUITY PORTFOLIO THE LARGE-CAP GROWTH EQUITY PORTFOLIO EACH A SERIES OF DELAWARE POOLED® TRUST 2005 MARKET STREET PHILADELPHIA, PENNSYLVANIA 19103 (800) 231-8002 | | JACKSON SQUARE SELECT 20 GROWTH FUND JACKSON SQUARE SMID-CAP GROWTH FUND JACKSON SQUARE LARGE-CAP GROWTH FUND EACH A SERIES OF MANAGED PORTFOLIO SERIES 615 EAST MICHIGAN STREET MILWAUKEE, WISCONSIN 53202 (414) 287-3700 |

PROXY STATEMENT/PROSPECTUS

July 15, 2016

INTRODUCTION

This Proxy Statement/Prospectus contains information that shareholders of The Large-Cap Growth Equity Portfolio, The Focus Smid-Cap Growth Equity Portfolio and The Select 20 Portfolio (each, a “Target Fund,” and collectively, the “Target Funds”), each a series of Delaware Pooled® Trust (the “Target Trust”), should know before voting on the proposed reorganization that is described herein, and should be retained for future reference. This document is both the proxy statement of each Target Fund and also a prospectus for the Jackson Square Large-Cap Growth Fund, the Jackson Square SMID-Cap Growth Fund and the Jackson Square Select 20 Growth Fund (each, an “Acquiring Fund,” and collectively, the “Acquiring Funds,” and, together with the Target Funds, the “Funds”), each a series of Managed Portfolio Series (the “Acquiring Trust”). The Target Funds and the Acquiring Funds are each a series of separate registered open-end management investment companies. The following lists the Target Funds with the corresponding Acquiring Funds:

Target Fund | Corresponding Acquiring Fund (Share Class) |

| The Large-Cap Growth Equity Portfolio | Jackson Square Large-Cap Growth Fund (IS Class) |

| The Focus Smid-Cap Growth Equity Portfolio | Jackson Square SMID-Cap Growth Fund (IS Class) |

| The Select 20 Portfolio | Jackson Square Select 20 Growth Fund (IS Class) |

A special meeting of the shareholders of the Target Funds (the “Meeting”) will be held at the offices of Stradley Ronon Stevens & Young, LLP, 2005 Market Street, 26th Floor, Philadelphia, Pennsylvania 19103 on September 12, 2016 at 10:00 a.m. At the Meeting, shareholders of the Target Funds will be asked to consider the following proposal (the “Proposal”), and any other matters that may properly come before the Meeting or any adjournment or postponement thereof:

PROPOSAL: TO APPROVE AN AGREEMENT AND PLAN OF REORGANIZATION (THE “AGREEMENT”) BETWEEN THE TARGET TRUST AND THE ACQUIRING TRUST, PROVIDING FOR: (a) THE ACQUISITION OF ALL OF THE ASSETS AND ASSUMPTION OF ALL OF THE LIABILITIES OF EACH TARGET FUND BY ITS CORRESPONDING ACQUIRING FUND IN EXCHANGE FOR IS CLASS SHARES OF THE ACQUIRING FUND; (b) THE DISTRIBUTION OF SUCH SHARES TO THE SHAREHOLDERS OF SUCH TARGET FUND; AND (c) THE LIQUIDATION AND TERMINATION OF EACH TARGET FUND (EACH, A “REORGANIZATION”).

The total dollar value of the Acquiring Fund shares that shareholders will receive in the Reorganization will be the same as the total dollar value of the shares of a Target Fund that shareholders hold immediately prior to the Reorganization. Each Reorganization is anticipated to be a tax-free transaction, meaning that, in general, shareholders are not expected to be required to pay any U.S. federal income tax in connection with the Reorganization. For more detailed information about the U.S. federal income tax consequences of the Reorganization, please refer to the section titled “U.S. Federal Income Tax Considerations” below.

The Board of Trustees of the Target Funds (the “Target Funds Board”) has fixed the close of business on June 20, 2016 as the record date (“Record Date”) for the determination of Target Fund shareholders entitled to notice of and to vote at the Meeting and at any adjournment thereof. Shareholders of a Target Fund on the Record Date will be entitled to one vote for each share of the Target Fund held (and a proportionate fractional vote for each fractional share). The shareholders of each individual Target Fund will vote separately on the Proposal. The Proposal will be effected with respect to an individual Target Fund only if the Target Fund’s shareholders approve the Proposal. Failure of a Target Fund’s shareholders to approve the Proposal will not prevent the Proposal from passing with respect to the other Target Funds. This Proxy Statement/Prospectus, the enclosed Notice of Special Meeting of Shareholders, and the enclosed proxy card will be mailed on or about July 26, 2016, to all shareholders eligible to vote on the Proposal.

The Target Funds Board has approved the Agreement and has determined that the Reorganization is in the best interests of each Target Fund and will not dilute the interests of the existing shareholders of each Target Fund. Accordingly, the Target Funds Board recommends that shareholders of the Target Funds vote “FOR” the Proposal. Because the shareholders of each Target Fund will vote separately on the Proposal, the Proposal will pass for a Target Fund if it is approved by that Target Fund’s shareholders, even if the Proposal is not approved by shareholders of the other Target Funds. If shareholders of a Target Fund do not approve the Proposal, the Target Funds Board will consider what further action is appropriate for the Target Fund.

Additional information about the Funds is available in the following materials:

| · | Prospectus dated February 26, 2016 for the Target Funds (“Target Funds Prospectus”); |

| · | Supplements dated May 27, 2016 and May 20, 2016 to the Target Funds Prospectus; |

| · | Statement of Additional Information dated February 26, 2016 for the Target Funds (“Target Funds SAI”); |

| · | Supplements dated March 28, 2016 and June 7, 2016 to the Target Funds SAI; |

| · | Prospectus dated March 29, 2016, as revised July 5, 2016, for the Acquiring Funds (“Acquiring Funds Prospectus”); |

| · | Supplements dated April 15, 2016, May 2, 2016 and May 5, 2016 to the Acquiring Funds Prospectus; |

| · | Statement of Additional Information dated March 29, 2016 for the Acquiring Funds (“Acquiring Funds SAI”); and |

| · | The audited financial statements and related report of the independent public accounting firm included in the Target Funds’ Annual Report to Shareholders for the fiscal year ended October 31, 2015 (“Target Funds Annual Report”) (File No. 811-06322). The financial highlights for the Target Funds contained in the Target Funds Annual Report are included in this Proxy Statement/Prospectus as Exhibit C. |

| · | The Target Funds’ unaudited financial statements included in the Target Funds Semi-Annual Report to Shareholders for the fiscal period ended April 30, 2016 (the “Target Funds Semi-Annual Report”) (File No. 811-06322). The financial highlights for the Target Funds contained in the Target Funds Semi-Annual Report are included in this Proxy Statement/Prospectus as Exhibit C. |

The documents listed above are on file with the U.S. Securities and Exchange Commission (the “SEC”). The Target Funds Prospectus is incorporated herein by reference and is legally deemed to be part of this Proxy Statement/Prospectus. A copy of the Acquiring Funds Prospectus accompanies this Proxy Statement/Prospectus and is incorporated herein by reference and is legally deemed to be part of this Proxy Statement/Prospectus. The Statement of Additional Information to this Proxy Statement/Prospectus (“Proxy Statement SAI”) also is incorporated herein by reference and is legally deemed to be part of this Proxy Statement/Prospectus. The Target Funds Prospectus, Target Funds SAI and Target Funds Annual Report are available on the Target Funds’ website at delawareinvestments.com/institutional/literature. Copies of these documents are also available at no cost by calling 800-231-8002 or by sending an e-mail request to CSSUPPORTTEAM@DELINVEST.COM. Copies of the Acquiring Funds SAI are available at no charge by calling the Acquiring Funds (toll-free) at 844-577-3863, by visiting the Acquiring Funds’ website at www.JSPFunds.com or by writing to the Acquiring Funds, c/o U.S. Bancorp Fund Services, LLC, P.O. Box 701, Milwaukee, Wisconsin 53201-0701.

You also may view or obtain these documents from the SEC’s Public Reference Room, which is located at 100 F Street, N.E., Washington, D.C. 20549-1520, or from the SEC’s website at www.sec.gov. Information on the operation of the SEC’s Public Reference Room may be obtained by calling the SEC at (202) 551-8090. You can also request copies of these materials, upon payment at the prescribed rates of the duplicating fee, by electronic request to the SEC’s e-mail address (publicinfo@sec.gov) or by writing the Public Reference Branch, Office of Consumer Affairs and Information Services, SEC, Washington, D.C. 20549-1520.

THESE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION NOR HAS THE U.S. SECURITIES AND EXCHANGE COMMISSION PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROXY STATEMENT/PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE. AN INVESTMENT IN THE FUNDS IS NOT A DEPOSIT WITH A BANK AND IS NOT INSURED OR GUARANTEED BY THE FEDERAL DEPOSIT INSURANCE CORPORATION (“FDIC”) OR ANY OTHER GOVERNMENT AGENCY. YOU MAY LOSE MONEY BY INVESTING IN THE FUNDS.

| | PAGE |

| | |

| 6 |

| 6 |

| 6 |

| 6 |

| 7 |

| 7 |

| 7 |

| 9 |

| 12 |

| 15 |

| 16 |

| 16 |

| 17 |

| 17 |

| 17 |

| 17 |

| 17 |

| 18 |

| 18 |

| 18 |

| 18 |

| 18 |

| 18 |

| 24 |

| 29 |

| 33 |

| 35 |

| 35 |

| 36 |

| 38 |

| 40 |

| 40 |

| 41 |

| 41 |

| 41 |

| 42 |

| 42 |

| 43 |

| 43 |

| 43 |

| 44 |

| 45 |

| 45 |

EXHIBITS | |

| A-1 |

| B-1 |

| C-1 |

NO DEALER, SALESPERSON OR ANY OTHER PERSON HAS BEEN AUTHORIZED TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATIONS REGARDING THE REORGANIZATION OTHER THAN THOSE CONTAINED IN THIS PROXY STATEMENT/PROSPECTUS OR RELATED SOLICITATION MATERIALS ON FILE WITH THE U.S. SECURITIES AND EXCHANGE COMMISSION, AND YOU SHOULD NOT RELY ON SUCH OTHER INFORMATION OR REPRESENTATIONS.

SUMMARY OF KEY INFORMATION

The following is a summary of certain information contained elsewhere in this Proxy Statement/Prospectus, in the Agreement, and/or in the prospectuses and SAIs of the Funds. Shareholders should read the entire Proxy Statement/Prospectus, the Acquiring Funds Prospectus (which accompanies this Proxy Statement/Prospectus), the Target Funds Prospectus, the Acquiring Funds SAI, and the Target Funds SAI carefully for more complete information.

WHY ARE YOU SENDING ME THE PROXY STATEMENT/PROSPECTUS?

You are receiving this Proxy Statement/Prospectus because you own shares in one or more of the Target Funds as of the Record Date and have the right to vote on the very important proposal described herein concerning the Target Funds. This Proxy Statement/Prospectus contains information that shareholders of the Target Funds should know before voting on the Proposal. This document is both a proxy statement of the Target Funds and also a prospectus for the Acquiring Funds.

ON WHAT AM I BEING ASKED TO VOTE?

You are being asked to approve transitioning the Target Funds to a new fund family. Specifically, as a Target Fund shareholder, you are being asked to vote on the approval of the Agreement providing for the Reorganization of the Target Funds. The Agreement provides for the: (i) acquisition by the Acquiring Trust, on behalf of each Acquiring Fund, of all of the property, assets and goodwill of the corresponding Target Fund, in exchange solely for IS Class shares of the Acquiring Fund; (ii) the assumption by the Acquiring Trust, on behalf of each Acquiring Fund, of all of the liabilities of the corresponding Target Fund; (iii) the distribution of IS Class shares of each Acquiring Fund to the shareholders of the corresponding Target Fund according to their respective interests in complete liquidation of each Target Fund; and (iv) the dissolution of each Target Fund as soon as practicable after the Reorganization. As a result of the Reorganization (if approved by shareholders), a Target Fund shareholder will become an IS Class shareholder of the corresponding Acquiring Fund and shareholders of each Target Fund will receive IS Class shares in the corresponding Acquiring Fund having a total dollar value equal to the total dollar value of the shares such shareholder held in the Target Fund immediately prior to the Reorganization.

WHAT ARE THE

REASONS FOR THE PROPOSED REORGANIZATION?

The proposed Reorganization will enable Jackson Square Partners, LLC (“JSP”), the investment sub-adviser of the Target Funds and the investment adviser of the Acquiring Funds, to serve as the sole investment adviser with respect to the assets that you have invested in one or more of the Target Funds, by transferring such assets to the corresponding Acquiring Funds. The proposed Reorganization would, in turn, provide JSP with the opportunity to create future economies of scale that could benefit shareholders if certain fixed costs can be spread across a larger asset base.

In considering the Reorganization and the Agreement, the Target Funds Board considered these and other factors in concluding that the Reorganization would be in the best interest of each Target Fund and its shareholders. The Target Funds Board’s considerations are described in more detail in the “THE PROPOSED REORGANIZATION -- Board Considerations in Approving the Reorganization” section below.

HAS MY FUND’S BOARD OF TRUSTEES APPROVED THE REORGANIZATION?

Yes. The Target Funds Board has carefully reviewed the Proposal and unanimously approved the Agreement and the Reorganization. THE BOARD RECOMMENDS THAT SHAREHOLDERS OF THE TARGET FUNDS VOTE “FOR” THE PROPOSAL.

WHAT EFFECT WILL THE REORGANIZATION HAVE ON ME AS A SHAREHOLDER?

Immediately after the Reorganization, you will hold shares of the Acquiring Fund(s) having a total dollar value equal to the dollar value of the shares of the corresponding Target Fund(s) that you held immediately prior to the closing of the Reorganization. The principal differences between each Target Fund and the corresponding Acquiring Fund are described in this Proxy Statement/Prospectus. The Acquiring Funds Prospectus that accompanies this Proxy Statement/Prospectus contains additional information about the Acquiring Funds.

HOW DO THE FUNDS’ INVESTMENT OBJECTIVES, PRINCIPAL INVESTMENT STRATEGIES AND PRINCIPAL RISKS COMPARE?

Each Acquiring Fund and the corresponding Target Fund have identical investment objectives, as described below. Each Fund’s investment objective is classified as non-fundamental, which means that the Target Funds’ investment objectives can be changed by the Target Funds’ Board without shareholder approval, and the Acquiring Funds’ investment objectives can be changed by the Board of Trustees of the Acquiring Funds (the “Acquiring Funds Board”) without shareholder approval.

In addition, because of their substantially similar investment strategies, most of the principal investment risks of each Acquiring Fund are generally the same as the principal investment risks of owning shares of the corresponding Target Fund, as described below. However, two of the Acquiring Funds, Jackson Square Large-Cap Growth Fund and Jackson Square SMID-Cap Growth Fund, are each subject to “Non-Diversified Fund Risk,” while the corresponding Target Funds are not, and all of the Acquiring Funds are subject to “New Fund Risk”, while none of the Target Funds are subject to such risk.

The Large-Cap Growth Equity Portfolio and Jackson Square Large-Cap Growth Fund

Both The Large-Cap Growth Equity Portfolio and the Jackson Square Large-Cap Growth Fund seek capital appreciation as an investment objective. The principal investment strategies of each Fund are substantially similar. Both The Large-Cap Growth Equity Portfolio and the Jackson Square Large-Cap Growth Fund invest primarily in common stocks of growth-oriented U.S. large capitalization companies. However, the Jackson Square Large Cap Growth Fund, as a non-diversified fund, is permitted to invest a greater percentage of its assets in the securities of a single issuer, while The Large-Cap Growth Equity Portfolio, as a diversified fund, is more limited with respect to the percentage of its assets that may be committed to a single issuer.

Because of the substantially similar investment strategies of The Large-Cap Growth Equity Fund and the Jackson Square Large-Cap Growth Fund, most of their principal investment risks are generally the same. However, Jackson Square Large-Cap Growth Fund is subject to “Non-Diversified Fund Risk,” while The Large-Cap Growth Equity Portfolio is not. As a non-diversified fund, Jackson Square Large-Cap Growth Fund is permitted to invest a greater percentage of its assets in the securities of a single issuer and may have fewer holdings than other mutual funds. As a result, a decline in the value of a single issuer could cause the Jackson Square Large-Cap Growth Fund’s overall value to decline to a greater degree than if the fund held a more diversified portfolio. As a diversified fund, The Large-Cap Growth Equity Portfolio is not subject to “Non-Diversified Fund Risk.” However, JSP, the investment adviser to Jackson Square Large-Cap Growth Fund and the sub-adviser to The Large-Cap Growth Equity Portfolio, does not anticipate significant differences in the portfolio of the Jackson Square Large-Cap Growth Fund compared to the portfolio of The Large-Cap Growth Equity Portfolio as a result of the non-diversified status. In addition, the Jackson Square Large-Cap Growth Fund is subject to “New Fund Risk,” while The Large-Cap Growth Equity Portfolio is not. New Fund Risk is the risk associated with the fact that Jackson Square Large-Cap Growth Fund is new with no operating history and with no assurance that the Fund will grow to or maintain an economically viable size. In such circumstances, the Board of Trustees may determine to liquidate the Fund if it determines it is in the best interest of shareholders to do so, with no requirement of shareholder approval. The timing of any Fund liquidation may not be favorable to certain individual shareholders.

The Focus Smid-Cap Growth Equity Portfolio and the Jackson Square SMID-Cap Growth Fund

Both The Focus Smid-Cap Growth Equity Portfolio and the Jackson Square SMID-Cap Growth Fund seek long-term capital appreciation as an investment objective. The principal investment strategies of each Fund are substantially similar. The Focus Smid-Cap Growth Equity Portfolio and the Jackson Square SMID-Cap Growth Fund both focus their investments in the common stocks of growth-oriented small- and mid-capitalization companies. The Focus Smid-Cap Growth Equity Portfolio is classified as a diversified fund, which means it is more limited in the percentage of its assets that may be invested in a single issuer than the Jackson Square SMID-Cap Growth Fund, a non-diversified fund.

Because of the substantially similar investment strategies of The Focus Smid-Cap Growth Equity Portfolio and the Jackson Square SMID-Cap Growth Fund, most of their principal investment risks are generally the same. However, Jackson Square SMID-Cap Growth Fund is subject to “Non-Diversified Fund Risk,” while The Focus Smid-Cap Growth Equity Portfolio is not. As a non-diversified fund, Jackson Square SMID-Cap Growth Fund is permitted to invest a greater percentage of its assets in the securities of a single issuer and may have fewer holdings than other mutual funds. As a result, a decline in the value of a single issuer could cause the Jackson Square SMID-Cap Growth Fund’s overall value to decline to a greater degree than if the fund held a more diversified portfolio. As a diversified fund, The Focus Smid-Cap Growth Equity Portfolio is not subject to “Non-Diversified Fund Risk.” However, JSP, the investment adviser to the Jackson Square SMID-Cap Growth Fund and the sub-adviser to The Focus Smid-Cap Growth Equity Portfolio, does not anticipate significant differences in the portfolio of the Jackson Square SMID-Cap Growth Fund compared to the portfolio of The Focus Smid-Cap Growth Equity Portfolio as a result of the non-diversified status. In addition, the Jackson Square SMID-Cap Growth Fund is subject to “New Fund Risk”, while The Focus Smid-Cap Growth Equity Portfolio is not. New Fund Risk is the risk associated with the fact that Jackson Square SMID-Cap Growth Fund is new with no operating history and with no assurance that the Fund will grow to or maintain an economically viable size. In such circumstances, the Board of Trustees may determine to liquidate the Fund if it determines it is in the best interest of shareholders to do so, with no requirement of shareholder approval. The timing of any Fund liquidation may not be favorable to certain individual shareholders.

The Select 20 Portfolio and the Jackson Square Select 20 Growth Fund

Both The Select 20 Portfolio and the Jackson Square Select 20 Growth Fund seek long-term capital appreciation as an investment objective. The principal investment strategies of each Fund are substantially similar. The Select 20 Portfolio and its corresponding Acquiring Fund, Jackson Square Select 20 Growth Fund, are each non-diversified funds that invest in approximately 20 common stocks of growth-oriented companies that can be of any capitalization size.

Because of the substantially similar investment strategies of The Select 20 Portfolio and the Jackson Square Select 20 Growth Fund, most of their principal investment risks are generally the same. However, the Jackson Square Select 20 Growth Fund is subject to “New Fund Risk”, while The Large-Cap Growth-Fund is not. New Fund Risk is the risk associated with the fact that Jackson Square Select 20 Growth Fund is new with no operating history and with no assurance that the Fund will grow to or maintain an economically viable size. In such circumstances the Board of Trustees may determine to liquidate the Fund if it determines it is in the best interest of shareholders to do so, with no requirement of shareholder approval. The timing of any Fund liquidation may not be favorable to certain individual shareholders.

HOW DO THE FUNDS’

EXPENSES COMPARE?

The following tables compare the annual operating expenses, expressed as a percentage of net assets (“expense ratios”), of the Target Funds with the PRO FORMA expense ratios of the Acquiring Funds. The expense ratios of the Acquiring Funds are expected to be the same as or lower than the expense ratios of the corresponding Target Funds, after taking into account the Acquiring Funds’ contractual expense limitations (as described below). The PRO FORMA expense ratios show projected estimated expenses, but actual expenses may be higher or lower than those shown.

| Target Fund: The Large-Cap Growth Equity Portfolio |

| Acquiring Fund: Jackson Square Large-Cap Growth Fund (IS Class) |

Shareholder Fees (fees paid directly from your investment) | The Large Cap- Growth Equity Portfolio | Jackson Square Large- Cap Growth Fund IS Class (PRO FORMA) |

| | None | None |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | The Large Cap- Growth Equity Portfolio | Jackson Square Large- Cap Growth Fund IS Class (PRO FORMA) |

| Management Fees | 0.55% | 0.55% |

| Shareholder Servicing Plan Fee | 0.00% | 0.00% |

| Distribution and Service (Rule 12b-1) Fees | 0.00% | 0.00% |

| Other Expenses | 0.09 %(1) | 0.14% (2) |

| Total Annual Fund Operating Expenses | 0.64% | 0.69% |

| Less: Fee Waiver | 0.00 % | (0.05)%(3) |

Total Annual Fund Operating Expenses After Fee Waiver | 0.64% | 0.64%(3) |

| (1) | The Large-Cap Growth Equity Portfolio’s other expenses reflect expenses for the fiscal year ended October 31, 2015. |

| (2) | Because the Jackson Square Large-Cap Growth Fund is new, these expenses are based on estimated amounts for the Jackson Square Large-Cap Growth Fund’s current fiscal year ending October 31, 2016. |

| (3) | JSP has contractually agreed to reduce its management fees and reimburse the Jackson Square Large-Cap Growth Fund for its operating expenses in order to ensure that Total Annual Fund Operating Expenses (excluding Rule 12b-1 fees, Shareholder Servicing Plan fees, acquired fund fees and expenses, leverage/borrowing interest, other interest expense, taxes, brokerage commissions and extraordinary expenses) do not exceed 0.64% of the average daily net assets of the Fund. Fees reduced and expenses reimbursed by JSP may be recouped by JSP for a period of three fiscal years following the fiscal year during which such reduction and reimbursement was made, if such recoupment can be achieved without exceeding the expense limit in effect at the time the fee reduction and expense reimbursement occurred and at the time fee/expenses are being recouped. The Operating Expenses Limitation Agreement shall remain in effect for at least two years from the effective date of the Jackson Square Large-Cap Growth Fund’s Prospectus dated March 29, 2016. |

| Target Fund: The Focus Smid-Cap Growth Equity Portfolio |

| Acquiring Fund: Jackson Square SMID-Cap Growth Fund (IS Class) |

Shareholder Fees (fees paid directly from your investment) | The Focus Smid-Cap Growth Equity Portfolio | Jackson Square SMID- Cap Growth Fund IS Class (PRO FORMA) |

| | None | None |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | The Focus Smid-Cap Growth Equity Portfolio | Jackson Square SMID- Cap Growth Fund IS Class (PRO FORMA) |

| Management Fees | 0.75% | 0.75% |

| Shareholder Servicing Plan Fee | 0.00% | 0.00% |

| Distribution and Service (Rule 12b-1) Fees | 0.00% | 0.00% |

| Other Expenses | 0.17 %(1) | 0.17% (2) |

| Total Annual Fund Operating Expenses | 0.92% | 0.92% |

| Less: Fee Waiver | (0.00 %) | (0.05)%(3) |

Total Annual Fund Operating Expenses After Fee Waiver | 0.92% | 0.87%(3) |

| (1) | The Focus Smid-Cap Growth Equity Portfolio’s other expenses reflect expenses for the fiscal year ended October 31, 2015. |

| (2) | Because the Jackson Square SMID-Cap Growth Fund is new, these expenses are based on estimated amounts for the Jackson Square SMID-Cap Growth Fund’s current fiscal year ending October 31, 2016. |

| (3) | JSP has contractually agreed to reduce its management fees and reimburse the Jackson Square SMID-Cap Growth Fund for its operating expenses in order to ensure that Total Annual Fund Operating Expenses (excluding Rule 12b-1 fees, Shareholder Servicing Plan fees, acquired fund fees and expenses, leverage/borrowing interest, other interest expense, taxes, brokerage commissions and extraordinary expenses) do not exceed 0.87% of the average daily net assets of the Fund. Fees reduced and expenses reimbursed by JSP may be recouped by JSP for a period of three fiscal years following the fiscal year during which such reduction and reimbursement was made, if such recoupment can be achieved without exceeding the expense limit in effect at the time the fee reduction and expense reimbursement occurred and at the time fee/expenses are being recouped. The Operating Expenses Limitation Agreement shall remain in effect for two years from the effective date of the Jackson Square SMID-Cap Growth Fund’s Prospectus dated March 29, 2016. |

| Target Fund: The Select 20 Portfolio |

| Acquiring Fund: Jackson Square Select 20 Growth Fund (IS Class) |

Shareholder Fees (fees paid directly from your investment) | The Select 20 Portfolio | Jackson Square Select 20 Growth Fund IS Class (PRO FORMA) |

| | None | None |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | The Select 20 Portfolio | Jackson Square Select 20 Growth Fund IS Class (PRO FORMA) |

| Management Fees | 0.75% | 0.65% |

| Shareholder Servicing Plan Fee | 0.00% | 0.00% |

| Distribution and Service (Rule 12b-1) Fees | 0.00% | 0.00% |

| Other Expenses | 0.14 %(1) | 0.25% (2) |

| Total Annual Fund Operating Expenses | 0.89% | 0.90% |

| Less: Fee Waiver | (0.00 %) | (0.03)%(3) |

Total Annual Fund Operating Expenses After Fee Waiver | 0.89% | 0.87%(3) |

| (1) | The Select 20 Portfolio’s other expenses reflect expenses for the fiscal year ended October 31, 2015. |

| (2) | Because the Jackson Square Select 20 Growth Fund is new, these expenses are based on estimated amounts for the Jackson Square Select 20 Growth Fund’s current fiscal year ending October 31, 2016. |

| (3) | JSP has contractually agreed to reduce its management fees and reimburse the Jackson Square Select 20 Growth Fund for its operating expenses in order to ensure that Total Annual Fund Operating Expenses (excluding Rule 12b-1 fees, Shareholder Servicing Plan fees, acquired fund fees and expenses, leverage/borrowing interest, other interest expense, taxes, brokerage commissions and extraordinary expenses) do not exceed 0.87% of the average daily net assets of the Fund. Fees reduced and expenses reimbursed by JSP may be recouped by JSP for a period of three fiscal years following the fiscal year during which such reduction and reimbursement was made, if such recoupment can be achieved without exceeding the expense limit in effect at the time the fee reduction and expense reimbursement occurred and at the time fee/expenses are being recouped. The Operating Expenses Limitation Agreement shall remain in effect for two years from the effective date of the Jackson Square Select 20 Growth Fund’s Prospectus dated March 29, 2016. |

EXAMPLE

The Example is intended to help you compare the costs of investing in a Target Fund and the corresponding Acquiring Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 for the time periods indicated and then either redeem or do not redeem your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the operating expenses (including capped expenses for the Funds for the periods described in the footnotes to the fee tables) remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| | One Year | Three Years | Five Years | Ten Years |

| The Large-Cap Growth Equity Portfolio | $65 | $205 | $357 | $798 |

Jackson Square Large-Cap Growth Fund (PRO FORMA) | $65 | $210 | $374 | $849 |

| | One Year | Three Years | Five Years | Ten Years |

| The Focus Smid-Cap Growth Equity Portfolio | $94 | $293 | $509 | $1,131 |

Jackson Square SMID-Cap Growth Fund (PRO FORMA) | $89 | $283 | $499 | $1,122 |

| | One Year | Three Years | Five Years | Ten Years |

| The Select 20 Portfolio | $91 | $284 | $493 | $1,096 |

Jackson Square Select 20 Growth Fund (PRO FORMA) | $89 | $281 | $492 | $1,102 |

For further discussion regarding the Target Funds Board’s consideration of the fees and expenses of the Funds in approving the Reorganization, see the section entitled “THE PROPOSED REORGANIZATION - Board Considerations in Approving the Reorganization” in this Proxy Statement/Prospectus.

PORTFOLIO TURNOVER

Each Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the expense examples shown above, affect each Fund’s performance.

During the fiscal year ended October 31, 2015, the Target Funds’ portfolio turnover rates were: 49% of the average value of the portfolio of The Large-Cap Growth Equity Portfolio, 21% of the average value of the portfolio of The Focus Smid-Cap Growth Equity Portfolio, and 31% of the average value of the portfolio of The Select 20 Portfolio. No portfolio turnover information is included here for the Acquiring Funds, because the Jackson Square SMID-Cap Growth Fund has not completed a full fiscal period, and the Jackson Square Large-Cap Growth Fund and Jackson Square Select 20 Growth Fund have not yet commenced operations.

HOW DO THE

PERFORMANCE RECORDS OF THE FUNDS COMPARE?

If the Reorganization is approved, each Acquiring Fund will assume the performance history of the corresponding Target Fund. The Acquiring Funds do not have performance history shown herein because the Jackson Square SMID-Cap Growth Fund has not completed a calendar year of operations, and the Jackson Square Large-Cap Growth Fund and Jackson Square Select 20 Growth Fund have not yet commenced operations.

The bar charts and tables below provide some indication of the risks of investing in the Target Funds by showing changes in the Target Funds’ performance from year to year and by showing how the Target Funds’ average annual total returns for the 1-, 5-, and 10-year periods compare with those of a broad measure of market performance. A Target Fund’s past performance (before and after taxes) is not necessarily an indication of how it will perform in the future. The returns reflect any expense caps in effect during these periods. The returns would be lower without the expense caps. You may obtain the Target Funds’ most recently available month-end performance by calling 800-231-8002 or by visiting the Target Funds’ website at delawareinvestments.com/institutional.

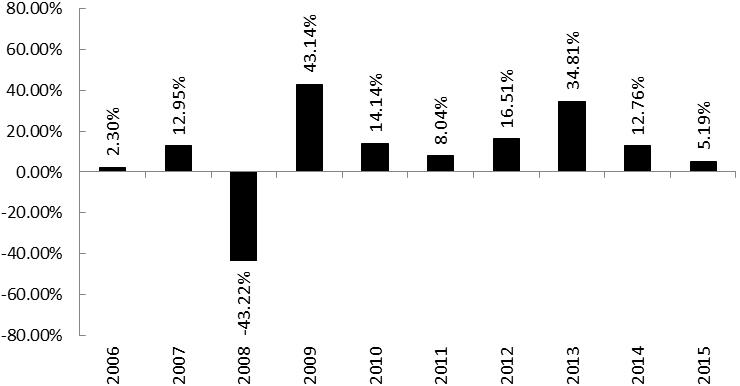

Year-by-year total return (The Large-Cap Growth Equity Portfolio)

During the periods illustrated in this bar chart, The Large-Cap Growth Equity Portfolio’s highest quarterly return was 16.08% for the quarter ended March 31, 2012 and its lowest quarterly return was ‑22.25% for the quarter ended December 31, 2008. Year to date performance (before taxes) as of 6/30/2016: -7.63%.

Average Annual Total Returns for Periods Ended December 31, 2015

Actual after-tax returns depend on the investor’s individual tax situation and may differ from the returns shown. After-tax returns are not relevant for shares held in tax-advantaged investment vehicles such as employer-sponsored 401(k) plans and individual retirement accounts (IRAs). The after-tax returns shown are calculated using the highest individual federal marginal income tax rates in effect during the Target Funds’ lifetime and do not reflect the impact of state and local taxes.

Average Annual Total Returns for the periods ended December 31, 2015 | | | |

| The Large-Cap Growth Equity Portfolio | One Year | Five Years | Ten Years |

| Return Before Taxes | 5.19% | 15.02% | 7.99% |

| Return After Taxes on Distributions | 1.55% | 13.68% | 7.33% |

| Return After Taxes on Distributions and Sale of Portfolio Shares | 5.91% | 12.09% | 6.51% |

Russell 1000® Growth Index (reflects no deduction for fees, expenses or taxes) | 5.67% | 13.53% | 8.53% |

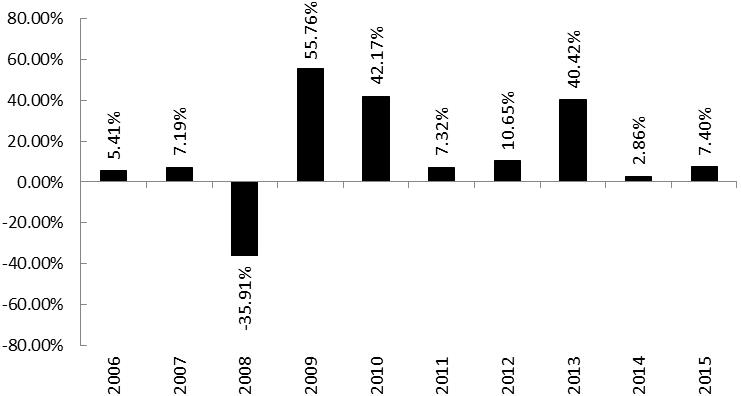

Year-by-year total return (The Focus Smid-Cap Growth Equity Portfolio)

During the periods illustrated in this bar chart, The Focus Smid-Cap Growth Equity Portfolio’s highest quarterly return was 27.04% for the quarter ended June 30, 2009 and its lowest quarterly return was -24.94% for the quarter ended December 31, 2008. Year to date performance (before taxes) as of 6/30/2016: 1.57%.

Average Annual Total Returns for Periods Ended December 31, 2015

Actual after-tax returns depend on the investor’s individual tax situation and may differ from the returns shown. After-tax returns are not relevant for shares held in tax-advantaged investment vehicles such as employer-sponsored 401(k) plans and individual retirement accounts (IRAs). The after-tax returns shown are calculated using the highest individual federal marginal income tax rates in effect during the Target Funds’ lifetime and do not reflect the impact of state and local taxes.

Average Annual Total Returns for the periods ended December 31, 2015 | | | |

| The Focus Smid-Cap Growth Equity Portfolio | One Year | Five Years | Ten Years |

| Return Before Taxes | 7.40% | 12.99% | 11.48% |

| Return After Taxes on Distributions | 5.89% | 11.16% | 10.24% |

| Return After Taxes on Distributions and Sale of Portfolio Shares | 5.41% | 10.09% | 9.24% |

Russell 2500™ Growth Index (reflects no deduction for fees, expenses or taxes) | (0.19%) | 11.43% | 8.49% |

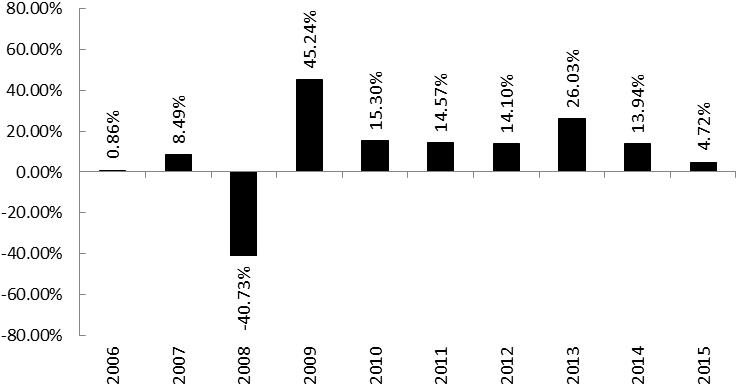

Year-by-year total return (The Select 20 Portfolio)

On Feb. 28, 2008, the Portfolio changed its investment strategy to limit its investments to no less than 15 securities and no more than 25 securities. The performance prior to Feb. 28, 2008 is that of the Portfolio’s predecessor, The All-Cap Growth Equity Portfolio.

During the periods illustrated in this bar chart, The Select 20 Portfolio’s highest quarterly return was 18.57% for the quarter ended June 30, 2009 and its lowest quarterly return was -21.91% for the quarter ended December 31, 2008. Year to date performance (before taxes) as of 6/30/2016: -9.86%.

Average Annual Total Returns for Periods Ended December 31, 2015

Actual after-tax returns depend on the investor’s individual tax situation and may differ from the returns shown. After-tax returns are not relevant for shares held in tax-advantaged investment vehicles such as employer-sponsored 401(k) plans and individual retirement accounts (IRAs). The after-tax returns shown are calculated using the highest individual federal marginal income tax rates in effect during the Target Funds’ lifetime and do not reflect the impact of state and local taxes.

Average Annual Total Returns for the periods ended December 31, 2015 | | | |

| The Select 20 Portfolio | One Year | Five Years | Ten Years |

| Return Before Taxes | 4.72% | 14.48% | 7.88% |

| Return After Taxes on Distributions | 0.15% | 11.77% | 6.59% |

| Return After Taxes on Distributions and Sale of Portfolio Shares | 6.35% | 11.52% | 6.36% |

Russell 3000® Growth Index (reflects no deduction for fees, expenses or taxes) | 5.09% | 13.30% | 8.49% |

HOW DO THE INVESTMENT

ADVISERS AND DISTRIBUTORS OF THE FUNDS COMPARE?

INVESTMENT ADVISERS. Delaware Management Company (“DMC”) serves as the investment adviser, and JSP serves as the investment sub-adviser, of the Target Funds. JSP serves as the investment adviser of the Acquiring Funds.

DMC, located at 2005 Market Street, Philadelphia, PA, 19103, is a series of Delaware Management Business Trust, which is a subsidiary of Delaware Management Holdings, Inc. (“DMHI”). DMHI is a wholly owned subsidiary of Macquarie Group Ltd. Collectively, DMHI and its subsidiaries are known as “Delaware Investments.” As of March 31, 2016 Delaware Investments managed more than $169.3 billion in assets, including mutual funds, separate accounts, and other investment vehicles.

JSP, a limited liability company organized under the laws of Delaware in 2014, is located at 101 California Street, Suite 3750, San Francisco, California 94111. JSP was formed through a joint venture with Delaware Investments. JSP is majority owned and controlled by key employees of JSP through California Street Partners LP, established in 2014. Delaware Investments has a non-voting minority ownership interest in JSP. As of March 31, 2016, JSP had approximately $26.9 billion in assets under management.

ADVISORY FEES. The contractual advisory fee for both Jackson Square Large-Cap Growth Fund and The Large-Cap Growth Equity Portfolio is 0.55% of the Fund’s average daily net assets. The contractual advisory fee for both Jackson Square SMID-Cap Growth Fund and The Focus Smid-Cap Growth Equity Portfolio is 0.75% of the Fund’s average daily net assets. The contractual advisory fee for Jackson Square Select 20 Growth Fund is 0.65% of the Fund’s average daily net assets, which is less than the contractual advisory fee for The Select 20 Portfolio, which is equal to 0.75% of the Fund’s average daily net assets.

DISTRIBUTORS. Delaware Distributors, L.P., an affiliate of DMC, acts as the distributor of shares of the Target Funds. The address of Delaware Distributors, L.P. is 2005 Market Street, Philadelphia, PA 19103. Quasar Distributors, LLC acts as the distributor of shares of the Acquiring Funds. The address of Quasar Distributors, LLC is 615 East Michigan Street, Milwaukee, Wisconsin 53202.

HOW DO THE FUNDS’

OTHER SERVICE PROVIDERS COMPARE?

The following table identifies the other principal service providers of the Target Funds and the Acquiring Funds:

| SERVICE PROVIDER | TARGET FUNDS | ACQUIRING FUNDS |

| Accounting Services/Administrator | Bank of New York Mellon | U.S. Bancorp Fund Services, LLC |

| Transfer Agent | Delaware Investments Fund Services Company | U.S. Bancorp Fund Services, LLC |

| Custodian | Bank of New York Mellon | U.S. Bank, National Association |

| Auditor | PricewaterhouseCoopers LLP | Cohen Fund Audit Services, Ltd. |

HOW DO THE FUNDS’

PURCHASE AND REDEMPTION PROCEDURES AND EXCHANGE POLICIES COMPARE?

You may purchase or redeem shares of the Funds on any day that the New York Stock Exchange (“NYSE”) is open for business. The minimum initial investment for a shareholder of any Target Fund is $1 million in the aggregate across all series of the Target Trust. There are no minimums for subsequent contributions in a Target Fund where the aggregate minimum initial investment for the Target Trust has been satisfied. Certain types of shareholders may invest in the Target Funds without meeting the minimum initial investment of $1 million. To purchase shares of the IS Class of any Acquiring Fund for the first time, you must invest at least $10 million, and there is no minimum for subsequent investments in the same Acquiring Fund. JSP may waive or reduce the minimum investment amount for IS Class shares for each Acquiring Fund at its discretion.

Target Fund shares may be exchanged for shares of the other series of the Target Trust, or, if certain eligibility requirements are satisfied, institutional class shares of other Delaware Investments® Funds. Acquiring Fund shares may be exchanged for shares of the other series of the Acquiring Trust that JSP manages.

For more information on the purchase and redemption procedures and exchange policies of the Funds, see the Funds’ respective prospectuses.

HOW DO THE FUNDS’

SALES CHARGES AND DISTRIBUTION ARRANGEMENTS COMPARE?

The Target Funds and the IS Class shares of the Acquiring Fund do not impose sales charges and are not subject to a distribution and/or shareholder servicing plan.

WILL THE ACQUIRING FUNDS HAVE

DIFFERENT PORTFOLIO MANAGERS THAN THE TARGET FUNDS?

No. The portfolio management teams of the Target Funds are the same as the portfolio management teams of the Acquiring Funds. The Acquiring Funds Prospectus that accompanies this Proxy Statement/Prospectus provides biographical information about the key individuals that comprise the portfolio management teams.

WILL THERE BE ANY

TAX CONSEQUENCES RESULTING FROM THE REORGANIZATION?

Each Reorganization is expected to qualify as a tax-free reorganization for U.S. federal income tax purposes. This means that, in general, the shareholders of each Target Fund will recognize no gain or loss for U.S. federal income tax purposes upon the exchange of all of their shares in the applicable Target Fund for shares in the corresponding Acquiring Fund. Each Target Fund anticipates receiving a legal opinion as to this and other expected U.S. federal income tax consequences of the Reorganization. It is possible that the Internal Revenue Service (“IRS”) or a court could disagree with Ropes & Gray LLP’s opinion, which therefore cannot be free from doubt.

JSP does not anticipate the need for any significant portfolio realignment of the Acquiring Fund after the Reorganization as the Funds are currently managed pursuant to substantially similar investment strategies and policies.

This Proxy Statement/Prospectus relates only to the U.S. federal income tax consequences of the Reorganization. Shareholders should consult their tax adviser about state, local and foreign tax consequences of the Reorganization, if any.

For more detailed information about the U.S. federal income tax consequences of the Reorganization, please refer to the section titled “THE PROPOSED REORGANIZATION – U.S. Federal Income Tax Considerations” below.

WILL MY DIVIDENDS BE

AFFECTED BY THE REORGANIZATION?

No. Each Fund generally distributes its net investment income, and makes distributions of its net realized capital gains, if any, annually.

WHEN IS THE

REORGANIZATION EXPECTED TO OCCUR?

If shareholders of the Target Fund approve the Reorganization, it is anticipated that the Reorganization will occur on or around September 19, 2016.

The Reorganization may not close unless certain conditions are met. If such conditions are not met, the Reorganization will not be consummated, even if Target Fund shareholders approve the Reorganization, and the Target Funds will not be combined with the Acquiring Funds.

HOW DO I VOTE ON THE REORGANIZATION?

There are several ways you can vote your shares, including in person at the Meeting, by mail, by telephone, or via the Internet. The proxy card that accompanies this Proxy Statement/Prospectus provides detailed instructions on how you may vote your shares. If you properly fill in and sign your proxy card and send it to us in time to vote at the Meeting, your “proxy” (the individuals named on your proxy card) will vote your shares as you have directed. If you sign your proxy card but do not make specific choices, your proxy will vote your shares “FOR” the Proposal, as recommended by the Target Funds Board, and in their best judgment on other matters.

WHAT WILL HAPPEN IF SHAREHOLDERS OF A TARGET FUND DO NOT APPROVE THE REORGANIZATION?

Because the shareholders of each Target Fund will vote separately on the Proposal, it is possible that the Proposal may be approved for one or more Target Funds, but not for others. If the shareholders of a Target Fund do not approve the Reorganization, the Target Funds Board will consider other possible courses of action for that Target Fund.

WHAT IF I DO NOT WISH TO PARTICIPATE IN THE REORGANIZATION?

If you do not wish to have your shares of the Target Funds exchanged for shares of the Acquiring Funds as part of the Reorganization, you may redeem your shares prior to the consummation of the Reorganization. If you redeem your shares, and if you hold shares in a taxable account, you will recognize a taxable gain or loss based on the difference between your tax basis in the shares and the amount you receive for them.

WHERE CAN I FIND MORE INFORMATION ABOUT THE FUNDS AND THE REORGANIZATION?

Additional information about the Funds can be found in their respective prospectuses and SAIs. The remainder of this Proxy Statement/Prospectus contains additional information about the Funds and the Reorganization. You are encouraged to read the entire document. If you need any assistance, or have any questions regarding the Reorganization or how to vote, please call the Target Funds at 800-231-8002.

ADDITIONAL INFORMATION ABOUT THE FUNDS

COMPARISON OF PRINCIPAL INVESTMENT STRATEGIES

The following section describes the principal investment strategies of the Target Funds and the principal investment strategies of the corresponding Acquiring Funds, which are substantially the same, except as described below. JSP does not anticipate the need for any significant portfolio realignment of the acquiring Jackson Square SMID-Cap Growth Fund after the Reorganization as each of the Acquiring Fund and Target Fund are currently managed pursuant to substantially similar investment strategies and policies.

In addition to the principal investment strategies described below, each Fund is also subject to certain additional investment policies and limitations, which are described in each Fund’s prospectus and SAI. The cover page of this Proxy Statement/Prospectus describes how you can obtain copies of these documents. A comparison of the principal risks associated with the Funds’ investment strategies is described below under “Comparison of Principal Risks of Investing in the Funds.”

Target Fund: The Large-Cap Growth Equity Portfolio Acquiring Fund: Jackson Square Large-Cap Growth Fund | |

| Investment Strategy | Description of Key Differences |

Investments in Common Stocks: The Target Fund and Acquiring Fund each invest primarily in common stocks of growth-oriented companies that JSP believes have long-term capital appreciation potential and expect to grow faster than the U.S. economy. For purposes of the Target Fund and Acquiring Fund, JSP will generally consider large-capitalization companies to be those that, at the time of purchase, have total market capitalizations within the range of market capitalizations of companies in the Russell 1000® Growth Index. The Fund will normally invest in common stocks of companies with market capitalizations of at least $3 billion at the time of purchase. The market capitalization range for the Russell 1000 Growth Index will change on a periodic basis. As of February 29, 2016, the capitalization range of the Russell 1000® Growth Index was between approximately $581 million and $536 billion. A company’s market capitalization is determined based on its current market capitalization. Russell Investment Group is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. Russell is a trademark of the Russell Investment Group. | None. |

1940 Act Diversification: The Target Fund is a “diversified” fund within the meaning of the 1940 Act. A “diversified company” means that as to 75% of a Fund’s total assets: (1) no more than 5% may be invested in the securities of a single issuer, and (2) a Fund may not hold more than 10% of the outstanding voting securities of a single issuer. The Acquiring Fund is a “non-diversified” fund. A non-diversified fund is a fund that does not satisfy the definition of a “diversified company” set forth in the 1940 Act. | The Acquiring Fund is subject to a less strict standard for portfolio diversification than the Target Fund, and is subject to the risks related to investing a greater amount of its assets in fewer issuers. JSP believes the non-diversified status of the Acquiring Fund will permit the flexibility the portfolio managers need in future portfolio management decisions. |

80% Policies: Under normal circumstances, the Target Fund will invest at least 80% of its net assets (plus any borrowings for investment purposes) in equity securities of large-capitalization companies. Under normal circumstances, the Acquiring Fund invests at least 80% of its net assets (plus any borrowings for investment purposes) in securities issued by large-capitalization companies. For both the Target Fund and the Acquiring Fund JSP defines large-capitalization companies as companies having a market capitalization, at the time of purchase, within the range of the market capitalization of companies constituting the Russell 1000® Growth Index. Each Fund’s 80% Policy may be changed without shareholder approval. However, shareholders will be given notice at least 60 days prior to any such change. | The 80% Policies are substantially the same because the Target Fund and Acquiring Fund each consider large-capitalization companies to be those companies having market capitalizations at the time of purchase within the range of the market capitalization of companies constituting the Russell 1000® Growth Index. |

Number of Holdings: The Target Fund tends to hold a relatively focused Fund of between 25 and 40 stocks, although it maintains a diversified Fund representing a number of different industries in order to minimize the impact that any one security or industry could have on the Target Fund if it were to experience a period of slow or declining earnings growth. The Acquiring Fund tends to hold a relatively focused portfolio of between 25 and 35 companies, although from time to time the Acquiring Fund may hold fewer or more companies depending on JSP’s assessment of the investment opportunities available. | The Acquiring Fund may have a less diversified portfolio than the Target Fund, and as a result, may be subject to the risks of investing its assets in a fewer number of issuers. |

Bottom-up Investment Approach: Using a bottom-up approach, the Target Fund’s managers seek to select securities of companies that have large market opportunities. Companies that have large market opportunities are those that, in our opinion, may have a large demand or market for their goods or services. The Target Fund managers also consider a company’s operational efficiencies, management’s plans for capital allocation, and the company’s shareholder orientation. All of these factors give the portfolio managers insight into the outlook for a company, helping the portfolio managers identify companies poised for sustainable free cash-flow growth. The Target Fund managers believe that sustainable free cash-flow growth, if it occurs, may result in price appreciation for the company’s stock. Using a bottom-up approach in selecting securities for the Acquiring Fund, JSP seeks to select securities of companies that it believes have strong competitive positions, strong and consistent cash flows, and the opportunity to generate consistent growth of intrinsic business value. JSP typically considers a company’s operational efficiency and management’s plans for capital allocation. Through JSP’s investment research process, it seeks to identify the companies that it believes will exceed the market’s expectations for: 1) key financial metrics and 2) sustainable competitive advantage. JSP purchases these securities for the Acquiring Fund when it believes the market has not already reflected these expectations in the current stock price. Additionally, JSP typically invests for a 3-5 year time horizon, allowing it to take advantage of discrepancies between short-term price movements and long-term fundamental prospects. | Although the bottom-up approach to security selection is described using different terminology in the principal investment strategies of the Target Fund and Acquiring Fund, there are no significant differences to the investment selection process applied by JSP in managing the Funds. |

Investments in Other Securities and Instruments: In addition to common stocks, the Target Fund may also invest in other securities, including preferred stock, real estate investment trusts (“REITs” are corporations or trusts that invest primarily in fee or leasehold ownership of real estate, mortgages or shares issued by other REITs, and that receive favorable tax treatment provided they meet certain conditions, including the requirement that they distribute at least 90% of their taxable income), warrants, equity and debt securities that are convertible into stocks, debt securities of government and corporate issuers and investment company securities, futures, and options. To the extent the Target Fund invests in convertible debt securities, those securities will be purchased on the basis of their equity characteristics, and ratings of those securities, if any, will not be an important factor in their selection. The Target Fund may engage in options and futures transactions. The Acquiring Fund may invest in REITs as a principal investment strategy. With respect to the other securities and instruments listed above for the Target Fund, the Acquiring Fund may also invest in these types of securities and instruments, but intends to only do so as non-principal investment strategies. | None. While the Target Fund and Acquiring Fund categorize certain investment types differently as principal or non-principal, JSP does not expect the Acquiring Fund’s use of these securities and instruments to differ significantly from the Target Fund. |

Foreign Securities: The Target Fund and Acquiring Fund each may invest up to 20% of its assets in foreign securities, which may include global depositary receipts (GDRs) and, without limitation, in sponsored and unsponsored American depositary receipts (ADRs) that are actively traded in the United States, including issuers located or operating in emerging markets and frontier markets. To the extent the Target Fund or Acquiring Fund invests in securities denominated in a particular currency, it may invest in forward foreign currency exchange contracts to hedge currency risks associated with the investment. | None. |

Target Fund: The Focus Smid-Cap Growth Equity Portfolio Acquiring Fund: Jackson Square SMID-Cap Growth Fund | |

| Investment Strategy | Description of Key Differences |

Investments in Common Stocks: The Target Fund invests primarily in common stocks of growth-oriented companies that its portfolio managers believe have long-term capital appreciation potential and expect to grow faster than the U.S. economy. For purposes of the Target Fund, small-market capitalization companies are those companies whose market capitalization is similar to the market capitalization of companies in the Russell 2000® Growth Index, and mid-market capitalization companies are those companies whose market capitalization is similar to the market capitalization of companies in the Russell Midcap® Growth Index. The two indices listed above are for purposes of determining range and not for targeting Fund management. As of Dec. 31, 2015, the Russell 2000 Growth Index had a market capitalization range between $18.66 million and $6.5 billion, and the Russell Midcap Growth Index had a market capitalization range between $717.6 million and $30.5 billion. The market capitalization ranges for the Russell 2000 Growth Index and Russell Midcap Growth Index will change on a periodic basis. A company’s market capitalization is determined based on its current market capitalization. Russell Investment Group is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. Russell is a trademark of the Russell Investment Group. The Acquiring Fund also invests primarily in common stocks of growth-oriented companies that JSP believes have long-term capital appreciation potential and may grow faster than the U.S. economy. With respect to the Acquiring Fund, JSP defines small-and mid-capitalization companies as companies, at the time of purchase, within the range of the capitalization of companies constituting the Russell 2500® Growth Index. As of February 29, 2016, the capitalization range of the Russell 2500® Growth Index was between approximately $13.3 million and $23 billion. | None. Although the Target Fund and the Acquiring Fund use different indices to determine market capitalization range, the different indices result in substantially similar market capitalization ranges. |

1940 Act Diversification: The Target Fund is a “diversified” fund within the meaning of the 1940 Act. A “diversified company” means that as to 75% of a Fund’s total assets: (1) no more than 5% may be invested in the securities of a single issuer, and (2) a Fund may not hold more than 10% of the outstanding voting securities of a single issuer. The Acquiring Fund is a “non-diversified” fund. A non-diversified fund is a fund that does not satisfy the definition of a “diversified company” set forth in the 1940 Act. | The Acquiring Fund is subject to a less strict standard for portfolio diversification than the Target Fund, and is subject the risks related to investing a greater amount of its assets in fewer issuers. JSP believes the non-diversified status of the Acquiring Fund will permit the flexibility the portfolio managers need in future portfolio management decisions. |

80% Policies: Under normal circumstances, the Target Fund and the Acquiring Fund each invests at least 80% of its net assets, plus any borrowings for investment purposes, in securities of small- and mid-capitalization companies. Each Fund’s 80% policy may be changed without shareholder approval. However, shareholders will be given notice at least 60 days prior to any such change. | None. |

Number of Holdings: The Target Fund generally holds 25 to 30 stocks, although from time to time the Target Fund may hold fewer or more names depending on our assessment of the investment opportunities available. The Acquiring Fund tends to hold a relatively focused portfolio of between 25 and 35 companies, although from time to time the Acquiring Fund may hold fewer or more stocks depending on JSP’s assessment of the investment opportunities available. | None. |

Bottom-up Investment Approach: Using a bottom-up approach, the Target Fund managers seek to select securities of companies that have large market opportunities. Companies that have large market opportunities are those that, in the portfolio managers’ opinion, may have a large demand or market for their goods or services. The portfolio managers also consider a company’s operational efficiencies, management’s plans for capital allocation, and the company’s shareholder orientation. All of these factors give the portfolio managers insight into the outlook for a company, helping the portfolio managers identify companies poised for sustainable free cash-flow growth. The portfolio managers believe that sustainable free cash-flow growth, if it occurs, may result in price appreciation for the company’s stock. Using a bottom-up approach in selecting securities for the Acquiring Fund, JSP seeks to select securities of companies that it believes have strong competitive positions, strong and consistent cash flows, and the opportunity to generate consistent, long-term growth of intrinsic business value. JSP typically considers a company’s operational efficiency and management’s plans for capital allocation. Through JSP’s investment research process, it seeks to identify the companies that it believes will exceed the market’s expectations for: 1) key financial metrics and 2) sustainable competitive advantage. JSP purchases these securities for the Acquiring Fund when it believes the market has not already reflected these expectations in the current stock price. Additionally, JSP typically invests for a 3-5 year time horizon, allowing it to take advantage of discrepancies between short-term price movements and long-term fundamental prospects. Holdings are typically sold to make room in the portfolio for more attractive stocks, or where the holding reaches JSP’s estimate for its intrinsic value, or in response to an unexpected, negative fundamental change, including a change in management’s strategic direction. | Although the bottom-up approach to security selection is described using different terminology in the principal investment strategies of the Target Fund and Acquiring Fund, there are no significant differences to the investment selection process applied by JSP in managing the Funds. |

Investments in Other Securities and Instruments: The Target Fund and Acquiring Fund may each invest in REITs. In unusual market conditions, in order to meet redemption requests, for temporary defensive purposes and pending investment, the Target Fund and Acquiring Fund may each hold a substantial portion of its assets in cash or short-term, debt obligations. The Target Fund may engage in options and futures transactions as a principal investment strategy. The Acquiring Fund may engage in options and futures transactions as a non-principal investment strategy. | None. While the Target Fund and Acquiring Fund categorize its ability to invest in options and futures transactions differently as principal and non-principal, JSP does not expect the Acquiring Fund’s use of these securities and instruments to differ significantly from the Target Fund. |

Investments in Foreign Securities: The Target Fund and the Acquiring Fund may each invest up to 20% of its assets in foreign securities, which may include GDRs and, without limitation, in sponsored and unsponsored ADRs that are actively traded in the United States. The Target Fund may invest up to 10% of its net assets in emerging market securities. The Acquiring Fund may invest up to 20% of its net assets in emerging market securities. | None. |

Target Fund: The Select 20 Portfolio Acquiring Fund: Jackson Square Select 20 Growth Fund | |

| Investment Strategy | Description of Key Differences |

Investments in Common Stocks/Number of Holdings: The Target Fund and the Acquiring Fund each seeks to achieve its objective by investing in a portfolio of 20 securities. The Target Fund will invest in no fewer than 15 and no more than 25 equity securities. JSP currently expects that the Acquiring Fund will invest in no fewer than 15 and no more than 25 companies. Each Fund invests primarily in common stocks of companies of any size or market capitalization that the portfolio managers believe have long-term capital appreciation potential and expected to grow faster than the U.S. economy. | None. |

1940 Act Diversification: The Target Fund and Acquiring Fund are each considered “non-diversified” as defined in the 1940 Act, which means that it may invest in a smaller number of issuers than a diversified mutual fund. | None. |

Investment Selection Process: With respect to the Target Fund, using a bottom-up approach, the portfolio managers seek to select securities of companies that have large market opportunities. Companies that have large market opportunities are those that, in the portfolio managers’ opinion, may have a large demand or market for their goods or services. The portfolio managers also consider a company’s operational efficiencies, management plans for capital allocation, and the company’s shareholder orientation. The portfolio managers research individual companies and analyze economic and market conditions, seeking to identify the securities or market sectors that they think are the best investments for the Target Fund. Specifically, the portfolio managers look for structural changes in the economy, industry, or product cycle changes, or changes in management, targeting those companies that can best capitalize on such changes. The following is a description of how the portfolio managers pursue the Target Fund’s investment goals. The portfolio managers strive to identify companies that offer the potential for long-term price appreciation because they are likely to experience sustainable free cash-flow growth. Using a bottom-up approach, the portfolio managers look for companies that they believe: ● have attractive end-market potential or dominance of a profitable niche market, dominant business models, and strong cash-flow generation; ● demonstrate operational and scale efficiencies; ● have demonstrated expertise for capital allocation; or ● have clear shareholder-oriented governance and compensation policies. All of these factors give the portfolio managers insight into the outlook for a company, helping the portfolio managers to identify companies poised for sustainable free cash-flow growth. The portfolio managers believe that sustainable free cash-flow growth, if it occurs, may result in price appreciation for the company’s stock. The portfolio managers maintain a diversified portfolio, typically holding a mix of different stocks, representing a wide array of industries and a mix of small-, medium-, and large-size companies. | Although the approach to security selection is described using different terminology in the principal investment strategies of the Target Fund and Acquiring Fund, there are no significant differences to the investment selection process applied by JSP in managing the Funds. |

| | Using a bottom-up approach in selecting securities for the Acquiring Fund, JSP seeks to select securities of companies that it believes have strong competitive positions, strong and consistent cash flows, and the opportunity to generate consistent, long-term growth of intrinsic business value. JSP typically considers a company’s operational efficiency and management’s plans for capital allocation. Through JSP’s investment research process, it seeks to identify the companies that it believes will exceed the market’s expectations for: 1) key financial metrics and 2) sustainable competitive advantage. JSP purchases these securities for the Fund when it believes the market has not already reflected these expectations in the current stock price. Additionally, JSP typically invests for a 3-5 year time horizon, allowing it to take advantage of discrepancies between short-term price movements and long-term fundamental prospects. | |

Investments in Other Securities and Instruments: The Target Fund and the Acquiring Fund may each invest in REITs. | None. |

Investments in Foreign Securities: The Target Fund and the Acquiring Fund may each invest up to 20% of the Fund’s net assets in securities of foreign issuers, which may include GDRs and, without limitation, sponsored and unsponsored ADRs that are actively traded in the United States, including issuers located or operating in emerging markets and frontier markets including issuers located in emerging markets. To the extent the Fund invests in securities denominated in a particular currency, it may invest in forward foreign currency exchange contracts to hedge currency risks associated with the investment. | None. |

COMPARISON OF PRINCIPAL RISKS OF INVESTING IN THE FUNDS

The principal risks of investing in the Acquiring Funds are discussed below. Although the Funds present their risks differently, the principal risks of the Target Funds and the Acquiring Funds are substantially similar, because the principal investment strategies of the Funds are substantially the same, with the exception of the diversification of The Large-Cap Growth Equity Portfolio and The Focus Smid-Cap Growth Equity Portfolio compared to the Jackson Square Large-Cap Growth Fund and the Jackson Square SMID-Cap Growth Fund, as described below.

The Large-Cap Growth Equity Portfolio and The Focus Smid-Cap Growth Equity Portfolio are “diversified” funds within the meaning of the 1940 Act. A “diversified company” means that as to 75% of a Fund’s total assets: (1) no more than 5% may be invested in the securities of a single issuer, and (2) a Fund may not hold more than 10% of the outstanding voting securities of a single issuer. The Jackson Square Large-Cap Growth Fund and the Jackson Square SMID-Cap Growth Fund, the corresponding Acquiring Funds to The Large-Cap Growth Equity Portfolio and The Focus Smid-Cap Growth Equity Portfolio, respectively, are each “non-diversified” funds. A non-diversified fund is a fund that does not satisfy the definition of a “diversified company” set forth in the 1940 Act. JSP believes the non-diversified status of the Acquiring Funds will permit the flexibility the portfolio managers need in future portfolio management decisions. However, JSP does not expect significant differences to the investment portfolios of the Acquiring Funds compared to the Target Funds as a result of the non-diversified status. The Select 20 Portfolio and its corresponding Acquiring Fund are each non-diversified funds, and as such, there is no difference in these Funds’ investment strategies with respect to diversification of their investment portfolios. The risks related to a fund’s status as “non-diversified” are described below as “Non-Diversified Fund Risk”.

General Market Risk (all Funds). The net asset value and investment return of each Fund will fluctuate based upon changes in the value of the Fund’s portfolio securities. The market value of a security may move up or down, sometimes rapidly and unpredictably. These fluctuations may cause a security to be worth less than the price originally paid for it, or less than it was worth at an earlier time. Market risk may affect a single issuer, industry, sector of the economy or the market as a whole. U.S. and international markets have experienced, and may continue to experience, volatility, which may increase risks associated with an investment in the Funds. The market value of securities in which the Funds invest is based upon the market’s perception of value and is not necessarily an objective measure of the securities’ value. In some cases, for example, the stock prices of individual companies have been negatively affected even though there may be little or no apparent degradation in the financial condition or prospects of the issuers. Similarly, the debt markets have experienced substantially lower valuations, reduced liquidity, price volatility, credit downgrades, increased likelihood of default, and valuation difficulties. As a result of this significant volatility, many of the following risks associated with an investment in the Funds may be increased. Continuing market volatility may have adverse effects on the Funds.

Management Risk (all Funds). The ability of a Fund to meet its investment objective is directly related to the investment adviser’s investment strategies for the Fund. The value of your investment in a Fund may vary with the effectiveness of the investment adviser’s research, analysis, asset allocation and portfolio management among portfolio securities. If the investment adviser’s investment strategies do not produce the expected results, the value of your investment could be diminished or even lost entirely and a Fund could underperform other mutual funds with similar investment strategies.