UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22525

Managed Portfolio Series

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

Brian Wiedmeyer, President

Managed Portfolio Series

c/o U.S. Bank Global Fund Services

777 East Wisconsin Ave., 6th Floor

Milwaukee, WI 53202

(Name and address of agent for service)

(414) 516-1712

Registrant’s telephone number, including area code

Date of fiscal year end: 11/30/2024

Date of reporting period: 05/31/2024

Item 1. Reports to Stockholders.

| | |

| Tortoise Energy Infrastructure Total Return Fund | |

| Class A | TORTX |

| Semi-Annual Shareholder Report | May 31, 2024 |

This semi-annual shareholder report contains important information about the Tortoise Energy Infrastructure Total Return Fund for the period of December 1, 2023, to May 31, 2024. You can find additional information about the Fund at https://etp.tortoiseadvisors.com/resource-center/fund-documents/. You can also request this information by contacting us at

1-913-981-1020 or info@tortoiseadvisors.com.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class A | $63 | 1.18% |

KEY FUND STATISTICS (as of May 31, 2024)

| |

Net Assets | $2,499,678,888 |

Number of Holdings | 29 |

Portfolio Turnover | 10% |

Visit https://etp.tortoiseadvisors.com/resource-center/fund-documents/ for more recent performance information.

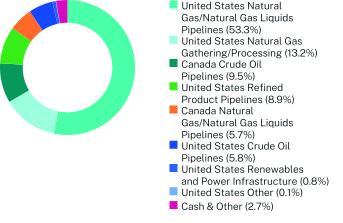

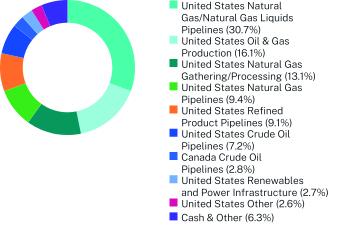

WHAT DID THE FUND INVEST IN? (as of May 31, 2024)

| |

Top 10 Issuers | (%)* |

Targa Resources Corp. | 11.1% |

Cheniere Energy, Inc. | 8.5% |

The Williams Companies, Inc. | 7.8% |

ONEOK, Inc. | 7.6% |

MPLX LP | 7.6% |

Energy Transfer LP | 7.2% |

Kinder Morgan, Inc. | 4.8% |

Plains GP Holdings L.P. | 4.9% |

Pembina Pipeline Corporation | 4.8% |

Enbridge, Inc. | 4.7% |

| * | Percentages are listed as a % of net assets. |

| Tortoise Energy Infrastructure Total Return Fund | PAGE 1 | TSR_SAR_56166Y305 |

Managed Distributions

The Fund may distribute more than its income and net realized capital gains; therefore, a portion of distributions may be a return of capital. A return of capital may occur, for example, when some or all of the money a shareholder has invested in the Fund is paid back to the shareholder. A return of capital distribution does not necessarily reflect the Fund’s investment performance and should not be confused with “yield” or “income.”

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://etp.tortoiseadvisors.com/resource-center/fund-documents/

The Tortoise Energy Infrastructure Total Return Fund is distributed by Quasar Distributors, LLC.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Tortoise Capital Advisors, LLC documents not be householded, please contact Tortoise Capital Advisors, LLC at 1-913-981-1020, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Tortoise Capital Advisors, LLC or your financial intermediary.

| Tortoise Energy Infrastructure Total Return Fund | PAGE 2 | TSR_SAR_56166Y305 |

53.313.29.58.95.75.80.80.12.7

| | |

| Tortoise Energy Infrastructure Total Return Fund | |

| Class C | TORCX |

| Semi-Annual Shareholder Report | May 31, 2024 |

This semi-annual shareholder report contains important information about the Tortoise Energy Infrastructure Total Return Fund for the period of December 1, 2023, to May 31, 2024. You can find additional information about the Fund at https://etp.tortoiseadvisors.com/resource-center/fund-documents/. You can also request this information by contacting us at

1-913-981-1020 or info@tortoiseadvisors.com.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class C | $102 | 1.92% |

KEY FUND STATISTICS (as of May 31, 2024)

| |

Net Assets | $2,499,678,888 |

Number of Holdings | 29 |

Portfolio Turnover | 10% |

Visit https://etp.tortoiseadvisors.com/resource-center/fund-documents/ for more recent performance information.

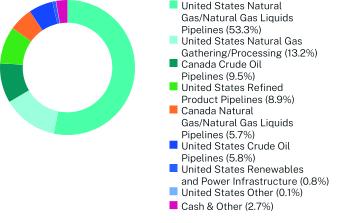

WHAT DID THE FUND INVEST IN? (as of May 31, 2024)

| |

Top 10 Issuers | (%)* |

Targa Resources Corp. | 11.1% |

Cheniere Energy, Inc. | 8.5% |

The Williams Companies, Inc. | 7.8% |

ONEOK, Inc. | 7.6% |

MPLX LP | 7.6% |

Energy Transfer LP | 7.2% |

Kinder Morgan, Inc. | 4.8% |

Plains GP Holdings L.P. | 4.9% |

Pembina Pipeline Corporation | 4.8% |

Enbridge, Inc. | 4.7% |

| * | Percentages are listed as a % of net assets. |

| Tortoise Energy Infrastructure Total Return Fund | PAGE 1 | TSR_SAR_56166Y826 |

Managed Distributions

The Fund may distribute more than its income and net realized capital gains; therefore, a portion of distributions may be a return of capital. A return of capital may occur, for example, when some or all of the money a shareholder has invested in the Fund is paid back to the shareholder. A return of capital distribution does not necessarily reflect the Fund’s investment performance and should not be confused with “yield” or “income.”

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://etp.tortoiseadvisors.com/resource-center/fund-documents/

The Tortoise Energy Infrastructure Total Return Fund is distributed by Quasar Distributors, LLC.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Tortoise Capital Advisors, LLC documents not be householded, please contact Tortoise Capital Advisors, LLC at 1-913-981-1020, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Tortoise Capital Advisors, LLC or your financial intermediary.

| Tortoise Energy Infrastructure Total Return Fund | PAGE 2 | TSR_SAR_56166Y826 |

53.313.29.58.95.75.80.80.12.7

| | |

| Tortoise Energy Infrastructure Total Return Fund | |

| Institutional Class | TORIX |

| Semi-Annual Shareholder Report | May 31, 2024 |

This semi-annual shareholder report contains important information about the Tortoise Energy Infrastructure Total Return Fund for the period of December 1, 2023, to May 31, 2024. You can find additional information about the Fund at https://etp.tortoiseadvisors.com/resource-center/fund-documents/. You can also request this information by contacting us at

1-913-981-1020 or info@tortoiseadvisors.com.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Institutional Class | $50 | 0.93% |

KEY FUND STATISTICS (as of May 31, 2024)

| |

Net Assets | $2,499,678,888 |

Number of Holdings | 29 |

Portfolio Turnover | 10% |

Visit https://etp.tortoiseadvisors.com/resource-center/fund-documents/ for more recent performance information.

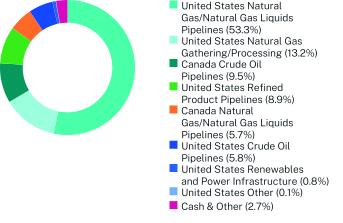

WHAT DID THE FUND INVEST IN? (as of May 31, 2024)

| |

Top 10 Issuers | (%)* |

Targa Resources Corp. | 11.1% |

Cheniere Energy, Inc. | 8.5% |

The Williams Companies, Inc. | 7.8% |

ONEOK, Inc. | 7.6% |

MPLX LP | 7.6% |

Energy Transfer LP | 7.2% |

Kinder Morgan, Inc. | 4.8% |

Plains GP Holdings L.P. | 4.9% |

Pembina Pipeline Corporation | 4.8% |

Enbridge, Inc. | 4.7% |

| * | Percentages are listed as a % of net assets. |

| Tortoise Energy Infrastructure Total Return Fund | PAGE 1 | TSR_SAR_56166Y404 |

Managed Distributions

The Fund may distribute more than its income and net realized capital gains; therefore, a portion of distributions may be a return of capital. A return of capital may occur, for example, when some or all of the money a shareholder has invested in the Fund is paid back to the shareholder. A return of capital distribution does not necessarily reflect the Fund’s investment performance and should not be confused with “yield” or “income.”

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://etp.tortoiseadvisors.com/resource-center/fund-documents/

The Tortoise Energy Infrastructure Total Return Fund is distributed by Quasar Distributors, LLC.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Tortoise Capital Advisors, LLC documents not be householded, please contact Tortoise Capital Advisors, LLC at 1-913-981-1020, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Tortoise Capital Advisors, LLC or your financial intermediary.

| Tortoise Energy Infrastructure Total Return Fund | PAGE 2 | TSR_SAR_56166Y404 |

53.313.29.58.95.75.80.80.12.7

| | |

| Tortoise Energy Infrastructure and Income Fund | |

| Class A | INFRX |

| Semi-Annual Shareholder Report | May 31, 2024 |

This semi-annual shareholder report contains important information about the Tortoise Energy Infrastructure and Income Fund for the period of December 1, 2023, to May 31, 2024. You can find additional information about the Fund at https://etp.tortoiseadvisors.com/resource-center/fund-documents/. You can also request this information by contacting us at

1-913-981-1020 or info@tortoiseadvisors.com.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class A | $72 | 1.37% |

KEY FUND STATISTICS (as of May 31, 2024)

| |

Net Assets | $524,659,321 |

Number of Holdings | 43 |

Portfolio Turnover | 11% |

Visit https://etp.tortoiseadvisors.com/resource-center/fund-documents/ for more recent performance information.

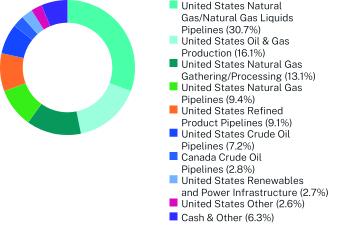

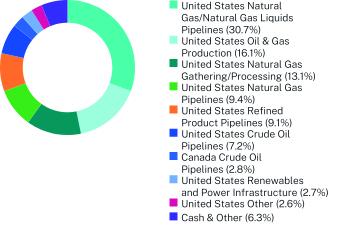

WHAT DID THE FUND INVEST IN? (as of May 31, 2024)

| |

Top 10 Issuers | (%)* |

MPLX LP | 7.2% |

Cheniere Energy, Inc. | 7.1% |

Targa Resources Corp. | 5.0% |

Energy Transfer LP | 4.9% |

ONEOK, Inc. | 4.9% |

Plains GP Holdings L.P. | 4.7% |

The Williams Companies, Inc. | 4.7% |

Enterprise Products Partners LP | 4.5% |

EQT Corporation | 3.7% |

ConocoPhillips | 3.6% |

| * | Percentages are listed as a % of net assets. |

| Tortoise Energy Infrastructure and Income Fund | PAGE 1 | TSR_SAR_56167N530 |

Managed Distributions

The Fund may distribute more than its income and net realized capital gains; therefore, a portion of distributions may be a return of capital. A return of capital may occur, for example, when some or all of the money a shareholder has invested in the Fund is paid back to the shareholder. A return of capital distribution does not necessarily reflect the Fund’s investment performance and should not be confused with “yield” or “income.”

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://etp.tortoiseadvisors.com/resource-center/fund-documents/

The Tortoise Energy Infrastructure and Income Fund is distributed by Quasar Distributors, LLC.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Tortoise Capital Advisors, LLC documents not be householded, please contact Tortoise Capital Advisors, LLC at 1-913-981-1020, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Tortoise Capital Advisors, LLC or your financial intermediary.

| Tortoise Energy Infrastructure and Income Fund | PAGE 2 | TSR_SAR_56167N530 |

30.716.113.19.49.17.22.82.72.66.3

| | |

| Tortoise Energy Infrastructure and Income Fund | |

| Class C | INFFX |

| Semi-Annual Shareholder Report | May 31, 2024 |

This semi-annual shareholder report contains important information about the Tortoise Energy Infrastructure and Income Fund for the period of December 1, 2023, to May 31, 2024. You can find additional information about the Fund at https://etp.tortoiseadvisors.com/resource-center/fund-documents/. You can also request this information by contacting us at

1-913-981-1020 or info@tortoiseadvisors.com.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class C | $111 | 2.12% |

KEY FUND STATISTICS (as of May 31, 2024)

| |

Net Assets | $524,659,321 |

Number of Holdings | 43 |

Portfolio Turnover | 11% |

Visit https://etp.tortoiseadvisors.com/resource-center/fund-documents/ for more recent performance information.

WHAT DID THE FUND INVEST IN? (as of May 31, 2024)

| |

Top 10 Issuers | (%)* |

MPLX LP | 7.2% |

Cheniere Energy, Inc. | 7.1% |

Targa Resources Corp. | 5.0% |

Energy Transfer LP | 4.9% |

ONEOK, Inc. | 4.9% |

Plains GP Holdings L.P. | 4.7% |

The Williams Companies, Inc. | 4.7% |

Enterprise Products Partners LP | 4.5% |

EQT Corporation | 3.7% |

ConocoPhillips | 3.6% |

| * | Percentages are listed as a % of net assets. |

| Tortoise Energy Infrastructure and Income Fund | PAGE 1 | TSR_SAR_56167N514 |

Managed Distributions

The Fund may distribute more than its income and net realized capital gains; therefore, a portion of distributions may be a return of capital. A return of capital may occur, for example, when some or all of the money a shareholder has invested in the Fund is paid back to the shareholder. A return of capital distribution does not necessarily reflect the Fund’s investment performance and should not be confused with “yield” or “income.”

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://etp.tortoiseadvisors.com/resource-center/fund-documents/

The Tortoise Energy Infrastructure and Income Fund is distributed by Quasar Distributors, LLC.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Tortoise Capital Advisors, LLC documents not be householded, please contact Tortoise Capital Advisors, LLC at 1-913-981-1020, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Tortoise Capital Advisors, LLC or your financial intermediary.

| Tortoise Energy Infrastructure and Income Fund | PAGE 2 | TSR_SAR_56167N514 |

30.716.113.19.49.17.22.82.72.66.3

| | |

| Tortoise Energy Infrastructure and Income Fund | |

| Institutional Class | INFIX |

| Semi-Annual Shareholder Report | May 31, 2024 |

This semi-annual shareholder report contains important information about the Tortoise Energy Infrastructure and Income Fund for the period of December 1, 2023, to May 31, 2024. You can find additional information about the Fund at https://etp.tortoiseadvisors.com/resource-center/fund-documents/. You can also request this information by contacting us at

1-913-981-1020 or info@tortoiseadvisors.com.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Institutional Class | $59 | 1.12% |

KEY FUND STATISTICS (as of May 31, 2024)

| |

Net Assets | $524,659,321 |

Number of Holdings | 43 |

Portfolio Turnover | 11% |

Visit https://etp.tortoiseadvisors.com/resource-center/fund-documents/ for more recent performance information.

WHAT DID THE FUND INVEST IN? (as of May 31, 2024)

| |

Top 10 Issuers | (%)* |

MPLX LP | 7.2% |

Cheniere Energy, Inc. | 7.1% |

Targa Resources Corp. | 5.0% |

Energy Transfer LP | 4.9% |

ONEOK, Inc. | 4.9% |

Plains GP Holdings L.P. | 4.7% |

The Williams Companies, Inc. | 4.7% |

Enterprise Products Partners LP | 4.5% |

EQT Corporation | 3.7% |

ConocoPhillips | 3.6% |

| * | Percentages are listed as a % of net assets. |

| Tortoise Energy Infrastructure and Income Fund | PAGE 1 | TSR_SAR_56167N522 |

Managed Distributions

The Fund may distribute more than its income and net realized capital gains; therefore, a portion of distributions may be a return of capital. A return of capital may occur, for example, when some or all of the money a shareholder has invested in the Fund is paid back to the shareholder. A return of capital distribution does not necessarily reflect the Fund’s investment performance and should not be confused with “yield” or “income.”

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://etp.tortoiseadvisors.com/resource-center/fund-documents/

The Tortoise Energy Infrastructure and Income Fund is distributed by Quasar Distributors, LLC.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Tortoise Capital Advisors, LLC documents not be householded, please contact Tortoise Capital Advisors, LLC at 1-913-981-1020, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Tortoise Capital Advisors, LLC or your financial intermediary.

| Tortoise Energy Infrastructure and Income Fund | PAGE 2 | TSR_SAR_56167N522 |

30.716.113.19.49.17.22.82.72.66.3

| | |

| Ecofin Global Renewables Infrastructure Fund | |

| Class A | ECOAX |

| Semi-Annual Shareholder Report | May 31, 2024 |

This semi-annual shareholder report contains important information about the Ecofin Global Renewables Infrastructure Fund for the period of December 1, 2023, to May 31, 2024. You can find additional information about the Fund at https://etp.tortoiseadvisors.com/resource-center/fund-documents/. You can also request this information by contacting us at

1-913-981-1020 or info@tortoiseadvisors.com.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class A | $63 | 1.18% |

KEY FUND STATISTICS (as of May 31, 2024)

| |

Net Assets | $272,591,946 |

Number of Holdings | 32 |

Portfolio Turnover | 25% |

Visit https://etp.tortoiseadvisors.com/resource-center/fund-documents/ for more recent performance information.

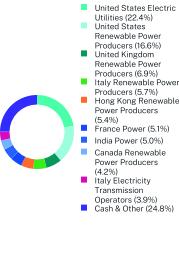

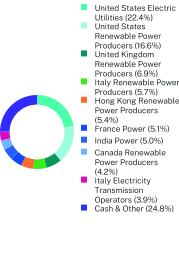

WHAT DID THE FUND INVEST IN? (as of May 31, 2024)

Geographic Breakdown (%)*

| |

Top 10 Issuers | (%)* |

Clearway Energy, Inc. | 5.9% |

ERG SpA | 5.7% |

NextEra Energy Partners LP | 5.4% |

Dominion Energy, Inc. | 5.3% |

NextEra Energy, Inc. | 5.2% |

Neoen SA | 5.1% |

ReNew Energy Global PLC | 5.0% |

Exelon Corp. | 5.0% |

Edison International | 4.9% |

Avista Corp. | 4.4% |

| * | Percentages are listed as a % of net assets. |

| Ecofin Global Renewables Infrastructure Fund | PAGE 1 | TSR_SAR_56167N480 |

Managed Distributions

The Fund may distribute more than its income and net realized capital gains; therefore, a portion of distributions may be a return of capital. A return of capital may occur, for example, when some or all of the money a shareholder has invested in the Fund is paid back to the shareholder. A return of capital distribution does not necessarily reflect the Fund’s investment performance and should not be confused with “yield” or “income.”

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://etp.tortoiseadvisors.com/resource-center/fund-documents/

The Ecofin Global Renewables Infrastructure Fund is distributed by Quasar Distributors, LLC.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Tortoise Capital Advisors, LLC documents not be householded, please contact Tortoise Capital Advisors, LLC at 1-913-981-1020, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Tortoise Capital Advisors, LLC or your financial intermediary.

| Ecofin Global Renewables Infrastructure Fund | PAGE 2 | TSR_SAR_56167N480 |

22.416.66.95.75.45.15.04.23.924.839.412.86.95.45.45.15.04.23.312.5

| | |

| Ecofin Global Renewables Infrastructure Fund | |

| Institutional Class | ECOIX |

| Semi-Annual Shareholder Report | May 31, 2024 |

This semi-annual shareholder report contains important information about the Ecofin Global Renewables Infrastructure Fund for the period of December 1, 2023, to May 31, 2024. You can find additional information about the Fund at https://etp.tortoiseadvisors.com/resource-center/fund-documents/. You can also request this information by contacting us at

1-913-981-1020 or info@tortoiseadvisors.com.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Institutional Class | $50 | 0.93% |

KEY FUND STATISTICS (as of May 31, 2024)

| |

Net Assets | $272,591,946 |

Number of Holdings | 32 |

Portfolio Turnover | 25% |

Visit https://etp.tortoiseadvisors.com/resource-center/fund-documents/ for more recent performance information.

WHAT DID THE FUND INVEST IN? (as of May 31, 2024)

Geographic Breakdown (%)*

| |

Top 10 Issuers | (%)* |

Clearway Energy, Inc. | 5.9% |

ERG SpA | 5.7% |

NextEra Energy Partners LP | 5.4% |

Dominion Energy, Inc. | 5.3% |

NextEra Energy, Inc. | 5.2% |

Neoen SA | 5.1% |

ReNew Energy Global PLC | 5.0% |

Exelon Corp. | 5.0% |

Edison International | 4.9% |

Avista Corp. | 4.4% |

| * | Percentages are listed as a % of net assets. |

| Ecofin Global Renewables Infrastructure Fund | PAGE 1 | TSR_SAR_56167N472 |

Managed Distributions

The Fund may distribute more than its income and net realized capital gains; therefore, a portion of distributions may be a return of capital. A return of capital may occur, for example, when some or all of the money a shareholder has invested in the Fund is paid back to the shareholder. A return of capital distribution does not necessarily reflect the Fund’s investment performance and should not be confused with “yield” or “income.”

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://etp.tortoiseadvisors.com/resource-center/fund-documents/

The Ecofin Global Renewables Infrastructure Fund is distributed by Quasar Distributors, LLC.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Tortoise Capital Advisors, LLC documents not be householded, please contact Tortoise Capital Advisors, LLC at 1-913-981-1020, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Tortoise Capital Advisors, LLC or your financial intermediary.

| Ecofin Global Renewables Infrastructure Fund | PAGE 2 | TSR_SAR_56167N472 |

22.416.66.95.75.45.15.04.23.924.839.412.86.95.45.45.15.04.23.312.5

Item 2. Code of Ethics.

Not applicable for semi-annual reports.

Item 3. Audit Committee Financial Expert.

Not applicable for semi-annual reports.

Item 4. Principal Accountant Fees and Services.

Not applicable for semi-annual reports.

Item 5. Audit Committee of Listed Registrants.

Not applicable

Item 6. Investments.

| (a) | Schedule of Investments is included within the financial statements filed under Item 7 of this form. |

Item 7. Financial Statements and Financial Highlights for Open-End Investment Companies.

MANAGED PORTFOLIO SERIES

TORTOISE OPEN END FUNDS

Core Financial Statements

May 31, 2024

Back to Table of Contents

Tortoise Energy Infrastructure Total Return Fund

Schedule of Investments

as of May 31, 2024 (Unaudited)

| | | | | | | | |

COMMON STOCKS - 74.1%

| |

Canada Crude Oil Pipelines - 9.5%

| | | | |

Enbridge, Inc. | | | 3,219,085 | | | $117,754,129 | |

Pembina Pipeline Corporation | | | 3,236,279 | | | 120,219,235 | |

| | | | | | 237,973,364 | |

Canada Natural Gas/Natural Gas Liquids Pipelines - 5.7%

| | | | |

Keyera Corp. | | | 2,873,032 | | | 76,075,956 | |

TC Energy Corporation | | | 1,739,291 | | | 67,067,061 | |

| | | | | | 143,143,017 | |

United States Crude Oil Pipelines - 4.9%

| |

Plains GP Holdings L.P. | | | 6,704,273 | | | 120,743,957 | |

United States Natural Gas Gathering/Processing - 10.0%

| |

Antero Midstream Corporation | | | 2,610,185 | | | 38,239,210 | |

EnLink Midstream, LLC | | | 4,318,100 | | | 54,796,689 | |

Equitrans Midstream Corp. | | | 5,485,143 | | | 78,327,842 | |

Hess Midstream LP | | | 1,771,401 | | | 61,556,185 | |

Kinetik Holdings, Inc. | | | 210,428 | | | 8,625,443 | |

Kodiak Gas Services, Inc. | | | 270,976 | | | 7,465,389 | |

| | | | | | 249,010,758 | |

United States Natural Gas/Natural Gas Liquids

Pipelines - 41.9%

| |

Cheniere Energy, Inc. | | | 1,340,507 | | | 211,518,600 | |

DT Midstream, Inc. | | | 487,496 | | | 32,701,232 | |

Excelerate Energy, Inc. | | | 373,516 | | | 6,652,320 | |

Kinder Morgan, Inc. | | | 6,215,530 | | | 121,140,680 | |

NextDecade Corp.(a) | | | 1,909,915 | | | 13,674,991 | |

ONEOK, Inc. | | | 2,341,148 | | | 189,632,988 | |

Targa Resources Corp. | | | 2,343,850 | | | 277,113,385 | |

The Williams Companies, Inc. | | | 4,694,194 | | | 194,855,993 | |

| | | | | | 1,047,290,189 | |

United States Refined Product Pipelines - 1.3%

| |

Sunoco LP | | | 632,304 | | | 32,247,504 | |

United States Renewables and Power Infrastructure - 0.8%

| |

Clearway Energy, Inc. | | | 343,302 | | | 9,612,456 | |

Sempra Energy | | | 143,558 | | | 11,058,273 | |

| | | | | | 20,670,729 | |

TOTAL COMMON STOCKS

(Cost $1,146,222,658) | | | | | | 1,851,079,518 | |

| | | | | | | | |

| | | | | | | |

MASTER LIMITED PARTNERSHIPS - 23.2%

|

United States Crude Oil Pipelines - 0.9%

|

Plains All American Pipeline LP | | | 1,308,099 | | | $22,250,764 |

United States Natural Gas Gathering/Processing - 3.3%

|

Western Midstream Partners LP | | | 2,172,529 | | | 81,078,782 |

United States Natural Gas/Natural Gas Liquids

Pipelines - 11.4%

|

Energy Transfer LP | | | 11,512,483 | | | 180,400,609 |

Enterprise Products Partners LP | | | 3,695,576 | | | 105,323,916 |

| | | | | | 285,724,525 |

United States Other - 0.1%

| | | | | | |

Westlake Chemical Partners LP | | | 127,871 | | | 2,988,345 |

United States Refined Product Pipelines - 7.6%

|

MPLX LP | | | 4,649,802 | | | 189,153,946 |

TOTAL MASTER LIMITED PARTNERSHIPS

(Cost $363,231,004) | | | | | | 581,196,362 |

| | | Shares | | | |

SHORT-TERM INVESTMENTS - 2.5%

|

Money Market Funds - 2.5%

| |

First American Government Obligations Fund - Class X, 5.24%(b) | | | 61,459,325 | | | 61,459,325 |

TOTAL SHORT-TERM INVESTMENTS

(Cost $61,459,325) | | | | | | 61,459,325 |

TOTAL

INVESTMENTS - 99.8%

(Cost $1,570,912,987) | | | | | | $2,493,735,205 |

Other Assets in Excess of

Liabilities - 0.2% | | | | | | 5,943,683 |

TOTAL NET ASSETS - 100.0% | | | | | | $2,499,678,888 |

| | | | | | | |

Percentages are stated as a percent of net assets.

(a)

| Non-income producing security. |

(b)

| The rate shown represents the 7-day effective yield as of May 31, 2024. |

The accompanying notes are an integral part of these financial statements.

Back to Table of Contents

Tortoise Energy Infrastructure and Income Fund

Schedule of Investments

as of May 31, 2024 (Unaudited)

| | | | | | | |

COMMON STOCKS - 57.4%

| |

Canada Crude Oil Pipelines - 2.1%

| | | | |

Enbridge, Inc. | | | 304,484 | | | $11,138,025 |

Canada Oil & Gas Production - 1.9%

|

Ovintiv, Inc. | | | 187,315 | | | 9,678,566 |

United States Crude Oil Pipelines - 4.7%

|

Plains GP Holdings L.P. | | | 1,370,563 | | | 24,683,840 |

United States Natural Gas Gathering/Processing - 4.7%

|

Equitrans Midstream Corp. | | | 661,408 | | | 9,444,906 |

Hess Midstream LP - Class A | | | 276,274 | | | 9,600,522 |

Kinetik Holdings, Inc. | | | 40,684 | | | 1,667,637 |

Kodiak Gas Services, Inc. | | | 145,707 | | | 4,014,228 |

| | | | | | 24,727,293 |

United States Natural Gas/Natural Gas

Liquids Pipelines - 24.2%

|

Cheniere Energy, Inc. | | | 235,544 | | | 37,166,488 |

Kinder Morgan, Inc. | | | 670,842 | | | 13,074,711 |

ONEOK, Inc. | | | 315,901 | | | 25,587,981 |

Targa Resources Corp. | | | 222,480 | | | 26,303,810 |

The Williams Companies, Inc. | | | 589,845 | | | 24,484,466 |

| | | | | | 126,617,456 |

United States Oil & Gas Production - 15.2%

|

ConocoPhillips | | | 162,747 | | | 18,956,771 |

Coterra Energy, Inc. | | | 432,396 | | | 12,331,934 |

Devon Energy Corporation | | | 170,926 | | | 8,389,048 |

Diamondback Energy, Inc. | | | 64,482 | | | 12,848,683 |

EQT Corporation | | | 472,972 | | | 19,434,419 |

Exxon Mobil Corp. | | | 67,539 | | | 7,919,623 |

| | | | | | 79,880,478 |

United States Refined Product Pipelines - 1.9%

|

Phillips 66 | | | 71,185 | | | 10,116,100 |

United States Renewables and Power Infrastructure - 2.7%

|

Clearway Energy, Inc. - Class C | | | 154,878 | | | 4,336,584 |

Vistra Corp. | | | 97,935 | | | 9,703,400 |

| | | | | | 14,039,984 |

TOTAL COMMON STOCKS (Cost $193,805,875) | | | | | | 300,881,742 |

| | | | | | | |

| | | | | | | |

MASTER LIMITED PARTNERSHIPS - 22.2%

|

United States Crude Oil Pipelines - 2.5%

|

Plains All American Pipeline LP | | | 781,293 | | | 13,289,794 |

United States Natural Gas Gathering/Processing - 3.1%

|

Western Midstream Partners LP | | | 432,087 | | | 16,125,487 |

United States Natural Gas Pipelines - 9.4%

|

Energy Transfer LP | | | 1,639,077 | | | 25,684,337 |

Enterprise Products Partners LP | | | 825,395 | | | 23,523,757 |

| | | | | | 49,208,094 |

| | | | | | | |

| | | | | | | |

United States Refined Product Pipelines - 7.2%

|

MPLX LP | | | 936,118 | | | $38,081,280 |

TOTAL MASTER LIMITED PARTNERSHIPS

(Cost $60,752,936) | | | | | | 116,704,655 |

| | | | | | | |

| | | | | | | |

CORPORATE BONDS - 18.4%

|

Canada Crude Oil Pipelines - 0.7%

|

Enbridge, Inc., 5.50% to 07/15/2027 then 3 mo. Term SOFR +

3.68%, 07/15/2077 | | | 4,000,000 | | | 3,768,644 |

United States Natural Gas Gathering/Processing - 5.3%

|

Antero Midstream Partners LP / Antero Midstream Finance Corp., 5.75%, 03/01/2027(a) | | | 6,370,000 | | | 6,287,426 |

Blue Racer Midstream LLC / Blue Racer Finance Corp.,

6.63%, 07/15/2026(a) | | | 3,800,000 | | | 3,799,225 |

EnLink Midstream, LLC,

5.38%, 06/01/2029 | | | 4,455,000 | | | 4,337,321 |

Hess Midstream Operations LP, 5.63%, 02/15/2026(a) | | | 8,125,000 | | | 8,080,489 |

Kodiak Gas Services LLC,

7.25%, 02/15/2029(a) | | | 5,000,000 | | | 5,081,343 |

| | | | | | 27,585,804 |

United States Natural Gas/Natural Gas

Liquids Pipelines - 6.5%

|

DT Midstream, Inc.,

4.38%, 06/15/2031(a) | | | 6,100,000 | | | 5,482,525 |

EQM Midstream Partners LP,

5.50%, 07/15/2028 | | | 4,250,000 | | | 4,157,212 |

NGPL PipeCo LLC,

7.77%, 12/15/2037(a) | | | 9,125,000 | | | 10,422,429 |

Tallgrass Energy Partners LP / Tallgrass Energy Finance Corp., 5.50%, 01/15/2028(a) | | | 7,925,000 | | | 7,564,640 |

Venture Global LNG, Inc.,

9.88%, 02/01/2032 (a) | | | 6,000,000 | | | 6,437,338 |

| | | | | | 34,064,144 |

United States Oil & Gas Production - 0.9%

|

Comstock Resources, Inc.,

6.75%, 03/01/2029(a) | | | 5,000,000 | | | 4,835,945 |

United States Oil Field Services - 1.2%

|

Archrock Partners LP / Archrock Partners Finance Corp.,

6.88%, 04/01/2027(a) | | | 6,575,000 | | | 6,597,342 |

United States Other - 2.6%

|

New Fortress Energy, Inc.

|

6.75%, 09/15/2025(a) | | | 5,708,000 | | | 5,645,218 |

6.50%, 09/30/2026(a) | | | 8,400,000 | | | 7,910,646 |

| | | | | | 13,555,864 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

Back to Table of Contents

Tortoise Energy Infrastructure and Income Fund

Schedule of Investments

as of May 31, 2024 (Unaudited) (Continued)

| | | | | | | |

CORPORATE BONDS - (Continued)

|

United States Refining - 1.2%

|

PBF Holding Co. LLC / PBF Finance Corp.,

7.88%, 09/15/2030(a) | | | 6,000,000 | | | $ 6,171,546 |

TOTAL CORPORATE BONDS (Cost $96,572,160) | | | | | | 96,579,289 |

| | | | | | | |

| | | | | | | |

SHORT-TERM INVESTMENTS - 1.2%

|

Money Market Funds - 1.2%

|

First American Government Obligations Fund - Class X, 5.24%(b) | | | 6,462,322 | | | 6,462,322 |

TOTAL SHORT-TERM INVESTMENTS

(Cost $6,462,322) | | | | | | 6,462,322 |

TOTAL INVESTMENTS - 99.2% (Cost $357,593,293) | | | | | | $520,628,008 |

Other Assets in Excess of

Liabilities - 0.8% | | | | | | 4,031,313 |

TOTAL NET ASSETS - 100.0% | | | | | | $524,659,321 |

| | | | | | | |

Percentages are stated as a percent of net assets.

SOFR - Secured Overnight Financing Rate

(a)

| Security is exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended. These securities may only be resold in transactions exempt from registration to qualified institutional investors. As of May 31, 2024, the value of these securities total $84,316,112 or 16.1% of the Fund’s net assets. |

(b)

| The rate shown represents the 7-day effective yield as of May 31, 2024. |

The accompanying notes are an integral part of these financial statements.

Back to Table of Contents

Ecofin Global Renewables Infrastructure Fund

Schedule of Investments

as of May 31, 2024 (Unaudited)

| | | | | | | |

COMMON STOCKS - 95.3%

|

Belgium Electricity Transmission Operators - 1.3%

|

Elia Group SA/NV | | | 34,498 | | | $ 3,513,732 |

Canada Renewable Power Producers - 4.2%

|

Innergex Renewable Energy, Inc. | | | 1,588,895 | | | 11,377,978 |

Denmark Infrastructure, Utilities and Renewables - 3.3%

|

Orsted AS(a) | | | 144,630 | | | 8,871,138 |

France Power - 5.1%

|

Neoen SA | | | 335,648 | | | 13,844,305 |

Hong Kong Renewable Power Producers - 5.4%

|

China Longyuan Power Group Corp. Ltd. | | | 8,135,898 | | | 7,434,102 |

China Suntien Green Energy Corp. Ltd. | | | 11,889,782 | | | 5,596,257 |

Xinyi Energy Holdings Ltd. | | | 12,103,729 | | | 1,722,112 |

| | | | | | 14,752,471 |

India Power - 5.0%

|

ReNew Energy Global PLC - Class A(a) | | | 2,279,867 | | | 13,656,403 |

Italy Electricity Transmission Operators - 3.9%

|

Terna - Rete Elettrica Nazionale SpA | | | 1,271,294 | | | 10,699,797 |

Italy Power - 3.2%

|

Enel SpA | | | 1,205,983 | | | 8,756,266 |

Italy Renewable Power Producers - 5.7%

|

ERG SpA | | | 558,853 | | | 15,659,484 |

Japan Renewable Power Producers - 1.6%

|

RENOVA, Inc.(a) | | | 677,792 | | | 4,420,810 |

Portugal Electric Utilities - 3.7%

|

EDP - Energias de Portugal, S.A. | | | 2,488,275 | | | 10,124,843 |

Portugal Renewables Power Producer - 1.7%

|

Greenvolt-Energias Renovaveis, S.A.(a) | | | 519,343 | | | 4,679,959 |

Spain Integrated Utilities - 2.2%

|

EDP Renovaveis SA | | | 379,947 | | | 6,105,887 |

Switzerland Integrated Utilities - 2.2%

|

BKW Energie AG | | | 38,075 | | | 5,999,943 |

Thailand Renewable Power Producers - 0.9%

|

Super Energy Corporation PLC(a) | | | 301,831,784 | | | 2,379,212 |

| | | | | | | |

| | | | | | | |

United Kingdom Renewable Power Producers - 6.9%

|

Atlantica Sustainable Infrastructure PLC | | | 472,850 | | | $10,393,243 |

Greencoat UK Wind PLC/Funds | | | 2,439,888 | | | 4,380,594 |

National Grid PLC | | | 365,579 | | | 4,110,539 |

| | | | | | 18,884,376 |

United States Electric Utilities - 22.4%

|

Avista Corp. | | | 324,134 | | | 11,986,475 |

Constellation Energy Corp. | | | 11,303 | | | 2,455,577 |

Edison International | | | 176,174 | | | 13,538,972 |

Exelon Corp. | | | 362,666 | | | 13,618,108 |

NextEra Energy, Inc. | | | 176,346 | | | 14,111,207 |

Public Service Enterprise Group Incorporated | | | 71,566 | | | 5,421,840 |

| | | | | | 61,132,179 |

United States Renewable Power Producers - 16.6%

|

Clearway Energy, Inc. | | | 578,010 | | | 16,184,280 |

Dominion Energy, Inc. | | | 267,392 | | | 14,417,776 |

NextEra Energy

Partners LP | | | 431,715 | | | 14,553,113 |

| | | | | | 45,155,169 |

TOTAL COMMON STOCKS

(Cost $268,306,069) | | | | | | 260,013,952 |

SHORT-TERM INVESTMENTS - 0.3%

| | | |

Money Market Funds - 0.3%

|

First American Government Obligations Fund - Class X, 5.24%(b) | | | 709,026 | | | 709,026 |

TOTAL SHORT-TERM

INVESTMENTS

(Cost $709,026) | | | | | | 709,026 |

TOTAL INVESTMENTS - 95.6%

(Cost $269,015,095) | | | | | | $ 260,722,978 |

Other Assets in Excess of Liabilities - 4.4% | | | | | | 11,868,968 |

TOTAL NET

ASSETS - 100.0% | | | | | | $272,591,946 |

| | | | | | | |

Percentages are stated as a percent of net assets.

AG - Aktiengesellschaft

NV - Naamloze Vennootschap

PLC - Public Limited Company

SA - Sociedad Anónima

SA/NV - Societe Anonime/Naamloze Vennootschap

(a)

| Non-income producing security. |

(b)

| The rate shown represents the 7-day effective yield as of May 31, 2024. |

The accompanying notes are an integral part of these financial statements.

Back to Table of Contents

Ecofin Global Renewables Infrastructure Fund

Schedule of Total Return Swap Contracts

as of May 31, 2024 (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | |

Drax Group LLC | | | Morgan Stanley | | | Long | | | 08/15/2024 | | | 0.21% | | | Month | | | $9,193,659 | | | $3,239,113 | | | $216,585 |

| | | | | | | | | $3,239,113 | | | $216,585 |

| | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

Back to Table of Contents

Statement of Assets & Liabilities

May 31, 2024 (Unaudited)

| | | | | | | | | | |

Assets:

|

Investments, at fair value (cost $1,570,912,987, $357,593,293,and $269,015,095, respectively) | | | $ 2,493,735,205 | | | $520,628,008 | | | $ 260,722,978 |

Foreign Cash (cost $0, $0, and $77,659, respectively) | | | — | | | — | | | 77,725 |

Cash held as collateral | | | — | | | — | | | 10,009,146 |

Dividends & interest receivable | | | 1,917,095 | | | 2,825,772 | | | 1,232,927 |

Receivable for investment securities sold | | | 3,726,613 | | | 11,442,237 | | | 3,944,726 |

Receivable for swap contracts | | | — | | | — | | | 216,585 |

Receivable for capital shares sold | | | 3,379,921 | | | 89,835 | | | 1,224,537 |

Prepaid expenses and other assets | | | 68,078 | | | 35,360 | | | 20,136 |

Total assets | | | 2,502,826,912 | | | 535,021,212 | | | 277,526,424 |

Liabilities:

|

Payable for investment securities purchased | | | — | | | 9,679,464 | | | 4,112,759 |

Payable for capital shares redeemed | | | 700,345 | | | 87,031 | | | 525,626 |

Payable to Adviser | | | 1,777,042 | | | 444,665 | | | 169,297 |

Payable for fund administration & accounting fees | | | 76,251 | | | 23,254 | | | 9,206 |

Payable for compliance fees | | | 641 | | | 640 | | | 542 |

Payable for custody fees | | | 19,278 | | | 2,930 | | | 7,642 |

Payable for audit & tax | | | 26,898 | | | 15,915 | | | 15,635 |

Payable for transfer agent fees & expenses | | | 59,579 | | | 13,505 | | | 13,876 |

Accrued expenses | | | 133,860 | | | 29,251 | | | — |

Accrued distribution fees | | | 354,130 | | | 65,236 | | | 2,231 |

Total liabilities | | | 3,148,024 | | | 10,361,891 | | | 4,934,478 |

Net Assets | | | $ 2,499,678,888 | | | $524,659,321 | | | $ 272,591,946 |

Net Assets Consist of:

|

Capital Stock | | | $ 2,670,246,860 | | | $782,537,864 | | | $ 316,201,662 |

Total accumulated loss | | | (170,567,972) | | | (257,878,543) | | | (43,609,716) |

Net assets | | | $ 2,499,678,888 | | | $524,659,321 | | | $ 272,591,946 |

Institutional Class

|

Net assets | | | $ 2,257,483,132 | | | $454,557,442 | | | $ 271,382,976 |

Shares issued and outstanding(1) | | | 142,187,921 | | | 55,201,739 | | | 27,825,033 |

Net asset value, redemption price and minimum offering price per share | | | $15.88 | | | $8.23 | | | $9.75 |

A Class

|

Net assets | | | $223,208,298 | | | $51,852,696 | | | $1,208,970 |

Shares issued and outstanding(1) | | | 14,291,889 | | | 6,153,180 | | | 124,191 |

Net asset value, redemption price and minimum offering price per share | | | $15.62 | | | $8.43 | | | $9.73 |

Maximum offering price per share(2) | | | $16.53 | | | $8.92 | | | $10.30 |

| | | | | | | | | | |

See accompanying Notes to Financial Statements.

Back to Table of Contents

Statement of Assets & Liabilities

May 31, 2024 (Unaudited) (Continued)

| | | | | | | | | | |

C Class

|

Net assets | | | $ 18,987,458 | | | $ 18,249,183 | | | $ — |

Shares issued and outstanding(1) | | | 1,249,270 | | | 2,188,573 | | | — |

Net asset value, redemption price and minimum offering

price per share | | | $15.20 | | | $8.34 | | | $— |

| | | | | | | | | | |

(1)

| Unlimited shares authorized. |

(2)

| The offering price is calculated by dividing the net asset value by 1 minus the maximum sales charge of 5.50%. |

See accompanying Notes to Financial Statements.

Back to Table of Contents

Statements of Operations

For the Six Months Ended May 31, 2024 (Unaudited)

| | | | | | | | | | |

Investment Income:

| | | | | | | | | |

Dividends income | | | $32,274,786 | | | $4,954,396 | | | $2,945,051 |

Less: foreign taxes withheld | | | (1,892,536) | | | (6,1410) | | | (412,464) |

Interest income | | | 1,161,496 | | | 3,241,352 | | | 374,040 |

Total investment income | | | 31,543,746 | | | 8,134,338 | | | 2,906,627 |

Expenses:

| | | | | | | | | |

Advisory fees (See Note 6) | | | 9,657,159 | | | 2,529,251 | | | 942,563 |

Fund administration & accounting fees (See Note 6) | | | 438,261 | | | 153,824 | | | 94,486 |

Transfer agent fees & expenses (See Note 6) | | | 137,693 | | | 55,032 | | | 36,714 |

Shareholder communication fees | | | 103,950 | | | 21,384 | | | 9,849 |

Custody fees (See Note 6) | | | 58,058 | | | 9,907 | | | 19,628 |

Registration fees | | | 39,250 | | | 28,328 | | | 20,017 |

Audit & tax fees | | | 26,901 | | | 15,911 | | | 15,639 |

Trustee fees | | | 11,341 | | | 10,515 | | | 10,428 |

Other | | | 12,538 | | | 4,886 | | | 3,480 |

Legal fees | | | 9,053 | | | 6,321 | | | 6,385 |

Insurance fees | | | 8,222 | | | 2,301 | | | 1,652 |

Compliance fees (See Note 6) | | | 5,227 | | | 5,225 | | | 5,225 |

Distribution fees (See Note 7):

| | | | | | | | | |

A Class | | | 258,112 | | | 61,953 | | | 1,828 |

C Class | | | 93,030 | | | 90,492 | | | — |

Total expenses before interest expense | | | 10,858,795 | | | 2,995,330 | | | 1,167,894 |

Interest expense on line of credit (See Note 11) | | | 7,932 | | | 132 | | | 7,792 |

Total expenses | | | 10,866,727 | | | 2,995,462 | | | 1,175,686 |

Net Investment Income | | | 20,677,019 | | | 5,138,876 | | | 1,730,941 |

Realized and Unrealized Gain (Loss) on Investments and Translations of Foreign Currency

| | | | | | | | | |

Net realized gain (loss) on:

| | | | | | | | | |

Unaffiliated Investments, including foreign currency gain (loss) | | | 72,887,191 | | | 9,787,708 | | | (7,883,574) |

Swap contracts | | | — | | | — | | | 1,785,198 |

Net change in unrealized appreciation (depreciation) of:

| | | | | | | | | |

Unaffiliated investments and translations of foreign currency | | | 193,049,018 | | | 36,231,918 | | | 36,054,109 |

Swap contracts | | | — | | | — | | | 5,292 |

Net realized and unrealized gain on investments and translations of foreign currency | | | 265,936,209 | | | 46,019,626 | | | 29,961,025 |

Net increase in net assets resulting from operations | | | $286,613,228 | | | $51,158,502 | | | $31,691,966 |

| | | | | | | | | | |

See accompanying Notes to Financial Statements.

Back to Table of Contents

Statements of Changes in Net Assets

| | | | | | | |

Operations

| | | | | | | | | | | | |

Net investment income | | | $20,677,019 | | | $39,541,790 | | | $5,138,876 | | | $10,445,969 |

Net realized gain on unaffiliated investments and foreign currency | | | 72,887,191 | | | 273,202,779 | | | 9,787,708 | | | 36,995,944 |

Net change in unrealized appreciation (depreciation) of unaffiliated investments and translations of foreign currency | | | 193,049,018 | | | (140,489,303) | | | 36,231,918 | | | (19,344,072) |

Net increase in net assets resulting from operations | | | 286,613,228 | | | 172,255,266 | | | 51,158,502 | | | 28,097,841 |

|

Capital Share Transactions

| | | | | | | | | | | | |

Institutional Class:

| | | | | | | | | | | | |

Proceeds from shares sold | | | 286,204,321 | | | 390,902,199 | | | 22,345,920 | | | 61,090,754 |

Proceeds from reinvestment of distributions | | | 54,706,268 | | | 67,615,673 | | | 7,186,059 | | | 14,174,851 |

Payments for shares redeemed | | | (254,794,517) | | | (767,963,098) | | | (37,309,246) | | | (99,940,873) |

Increase (decrease) in net assets from Institutional Class transactions | | | 86,116,072 | | | (309,445,226) | | | (7,777,267) | | | (24,675,268) |

A Class:

| | | | | | | | | | | | |

Proceeds from shares sold(1) | | | 7,321,809 | | | 15,773,373 | | | 4,651,628 | | | 10,535,192 |

Proceeds from reinvestment of distributions | | | 7,426,435 | | | 7,537,237 | | | 426,540 | | | 764,939 |

Payments for shares redeemed | | | (8,045,866) | | | (22,963,720) | | | (5,309,383) | | | (8,409,091) |

Increase (decrease) in net assets from A Class transactions | | | 6,702,378 | | | 346,890 | | | (231,215) | | | 2,891,040 |

C Class:

| | | | | | | | | | | | |

Proceeds from shares sold | | | 415,803 | | | 1,234,184 | | | 597,061 | | | 1,342,526 |

Proceeds from reinvestment of distributions | | | 575,871 | | | 712,895 | | | 224,827 | | | 539,456 |

Payments for shares

redeemed(1) | | | (3,068,469) | | | (5,286,444) | | | (2,923,976) | | | (6,664,453) |

Decrease in net assets from C Class transactions | | | (2,076,795) | | | (3,339,365) | | | (2,102,088) | | | (4,782,471) |

Net increase (decrease) in net assets resulting from capital share transactions | | | 90,741,655 | | | (312,437,701) | | | (10,110,570) | | | (26,566,699) |

| | | | | | | | | | | | | |

See accompanying Notes to Financial Statements.

Back to Table of Contents

Statements of Changes in Net Assets (Continued)

| | | | | | | |

Distributions to Shareholders

| | | | | | | | | | | | |

From distributable earnings

| | | | | | | | | | | | |

Institutional Class | | | (21,830,037) | | | (56,646,159) | | | (555,812) | | | (10,850,004) |

A Class | | | (2,167,549) | | | (4,969,028) | | | (51,112) | | | (1,120,812) |

C Class | | | (197,664) | | | (545,949) | | | (7,484) | | | (474,534) |

From tax return of capital

| | | | | | | | | | | | |

Institutional Class | | | (54,578,191) | | | (32,455,237) | | | (12,921,374) | | | (16,282,380) |

A Class | | | (5,567,101) | | | (2,885,841) | | | (1,424,493) | | | (1,681,978) |

C Class | | | (499,333) | | | (313,735) | | | (494,560) | | | (712,126) |

Total distributions to shareholders | | | (84,839,875) | | | (97,815,949) | | | (15,454,835) | | | (31,121,834) |

Total Increase (Decrease) in Net Assets | | | 292,515,008 | | | (237,998,384) | | | 25,593,097 | | | (29,590,692) |

Net Assets

| | | | | | | | | | | | |

Beginning of period | | | 2,207,163,880 | | | 2,445,162,264 | | | 499,066,224 | | | 528,656,916 |

End of period | | | $2,499,678,888 | | | $2,207,163,880 | | | $ 524,659,321 | | | $ 499,066,224 |

Transactions in Shares:

| | | | | | | | | | | | |

Institutional Class:

| | | | | | | | | | | | |

Shares sold | | | 18,862,212 | | | 29,251,670 | | | 2,837,855 | | | 8,342,522 |

Shares issued to holders in reinvestment of dividends | | | 3,681,211 | | | 5,084,727 | | | 907,572 | | | 1,946,926 |

Shares redeemed | | | (17,187,982) | | | (57,258,977) | | | (4,735,495) | | | (13,667,360) |

Increase (Decrease) in Institutional Class shares outstanding | | | 5,355,441 | | | (22,922,580) | | | (990,068) | | | (3,377,912) |

A Class:

| | | | | | | | | | | | |

Shares sold(1) | | | 502,940 | | | 1,180,887 | | | 577,967 | | | 1,402,538 |

Shares issued to holders in reinvestment of dividends | | | 507,820 | | | 572,589 | | | 52,554 | | | 102,478 |

Shares redeemed | | | (553,204) | | | (1,792,412) | | | (664,014) | | | (1,121,693) |

Increase (Decrease) in A Class shares outstanding | | | 457,556 | | | (38,936) | | | (33,493) | | | 383,323 |

C Class:

| | | | | | | | | | | | |

Shares sold | | | 27,932 | | | 96,653 | | | 74,856 | | | 179,078 |

Shares issued to holders in reinvestment of dividends | | | 40,392 | | | 55,315 | | | 27,954 | | | 72,782 |

Shares redeemed(1) | | | (215,589) | | | (402,800) | | | (370,285) | | | (890,571) |

Decrease in C Class shares outstanding | | | (147,265) | | | (250,832) | | | (267,475) | | | (638,711) |

Net Increase (Decrease) in shares outstanding | | | 5,665,732 | | | (23,212,348) | | | (1,291,036) | | | (3,633,300) |

| | | | | | | | | | | | | |

(1)

| Includes exchanges between share classes of the fund. |

See accompanying Notes to Financial Statements.

Back to Table of Contents

Statements of Changes in Net Assets (Continued)

| | | | |

Operations

| | | | | | |

Net investment income | | | $1,730,941 | | | $5,849,574 |

Net realized gain (loss) on investments, swaps contracts and foreign currency | | | (6,098,376) | | | (28,153,809) |

Net change in unrealized depreciation of investments, swap contracts and translations of foreign currency | | | 36,059,401 | | | (38,913,093) |

Net Increase (Decrease) in net assets resulting from operations | | | 31,691,966 | | | (61,217,328) |

|

Capital Share Transactions

| | | | | | |

Institutional Class:

| | | | | | |

Proceeds from shares sold | | | 66,194,208 | | | 132,111,089 |

Proceeds from reinvestment of distributions | | | 4,445,795 | | | 7,277,724 |

Payments for shares redeemed | | | (54,677,851) | | | (191,448,918) |

Increase (Decrease) in net assets from Institutional Class

transactions | | | 15,962,152 | | | (52,060,105) |

A Class:

| | | | | | |

Proceeds from shares sold | | | 82,079 | | | 624,487 |

Proceeds from reinvestment of distributions | | | 34,599 | | | 64,558 |

Payments for shares redeemed | | | (870,047) | | | (662,108) |

Increase (Decrease) in net assets from A Class transactions | | | (753,369) | | | 26,937 |

Net Increase (Decrease) in net assets resulting from capital share transactions | | | 15,208,783 | | | (52,033,168) |

|

Distributions to Shareholders

| | | | | | |

From distributable earnings

| | | | | | |

Institutional Class | | | (2,163,672) | | | (1,792,623) |

A Class | | | (15,497) | | | (11,439) |

From tax return of capital

| | | | | | |

Institutional Class | | | (3,982,424) | | | (8,054,111) |

A Class | | | (19,163) | | | (53,174) |

Total distributions to shareholders | | | (6,180,756) | | | (9,911,347) |

Total Increase (Decrease) in Net Assets | | | 40,719,993 | | | (123,161,843) |

|

Net Assets

| | | | | | |

Beginning of period | | | 231,871,953 | | | 355,033,796 |

End of period | | | $272,591,946 | | | 231,871,953 |

|

Transactions in Shares:

| | | | | | |

Institutional Class:

| | | | | | |

Shares sold | | | 7,431,949 | | | 13,550,530 |

Shares issued to holders in reinvestment of dividends | | | 472,689 | | | 745,840 |

Shares redeemed | | | (6,156,198) | | | (19,329,343) |

Increase (Decrease) in Institutional Class shares outstanding | | | 1,748,440 | | | (5,032,973) |

| | | | | | | |

See accompanying Notes to Financial Statements.

Back to Table of Contents

Statements of Changes in Net Assets (Continued)

| | | | |

A Class:

| | | | | | |

Shares sold | | | $9,227 | | | $62,638 |

Shares issued to holders in reinvestment of dividends | | | 3,679 | | | 6,694 |

Shares redeemed | | | (96,172) | | | (65,349) |

Increase (Decrease) in A Class shares outstanding | | | (83,266) | | | 3,983 |

Net Increase (Decrease) in shares outstanding | | | 1,665,174 | | | (5,028,990) |

| | | | | | | |

See accompanying Notes to Financial Statements.

Back to Table of Contents

Tortoise Energy Infrastructure Total Return Fund

Financial Highlights

Institutional Class

| | | | | | | |

Per Common Share Data(1)

| | | | | | | | | | | | | | | |

Net asset value, beginning of period | | | $14.54 | | | $13.97 | | | $11.20 | | | $8.33 | | | $11.61 | | | $12.29 |

|

Investment operations:

| | | | | | | | | | | | | | | |

Net investment income(2) | | | 0.15 | | | 0.19 | | | 0.02 | | | 0.06 | | | 0.12 | | | 0.14 |

Net realized and unrealized gain (loss) on investments and translations of foreign

currency(2) | | | 1.74 | | | 0.97 | | | 3.31 | | | 3.27 | | | (2.96) | | | (0.26) |

Total from investment operations | | | 1.89 | | | 1.16 | | | 3.33 | | | 3.33 | | | (2.84) | | | (0.12) |

|

Less distributions from:

| | | | | | | | | | | | | | | |

Net investment income | | | (0.15) | | | (0.37) | | | (0.10) | | | (0.16) | | | (0.14) | | | (0.20) |

Net realized gains | | | — | | | — | | | — | | | — | | | — | | | — |

Return of capital | | | (0.40) | | | (0.22) | | | (0.46) | | | (0.30) | | | (0.30) | | | (0.36) |

Total distributions | | | (0.55) | | | (0.59) | | | (0.56) | | | (0.46) | | | (0.44) | | | (0.56) |

Net asset value, end of period | | | $15.88 | | | $14.54 | | | $13.97 | | | $11.20 | | | $8.33 | | | $11.61 |

Total Return(3) | | | 13.35% | | | 8.73% | | | 31.52% | | | 40.51% | | | (24.70)% | | | (1.09)% |

|

Supplemental Data and Ratios

| | | | | | | | | | | | | | | |

Net assets, end of period (in 000’s) | | | $ 2,257,483 | | | $ 1,989,434 | | | $ 2,231,400 | | | $ 1,680,834 | | | $ 1,493,621 | | | $ 3,226,450 |

Ratio of expenses to average net assets(4) | | | 0.92% | | | 0.93% | | | 0.93% | | | 0.94% | | | 0.94% | | | 0.93% |

Ratio of expenses excluding interest expense to average net assets(4) | | | 0.92% | | | 0.93% | | | 0.93% | | | 0.93% | | | 0.94% | | | 0.93% |

Ratio of net investment income to average net assets(4) | | | 1.85% | | | 1.78% | | | 1.10% | | | 0.92% | | | 1.64% | | | 1.01% |

Portfolio turnover rate(3) | | | 10% | | | 7% | | | 20% | | | 32% | | | 39% | | | 19% |

| | | | | | | | | | | | | | | | | | | |

(1)

| For an Institutional Class Share outstanding for the entire period. |

(2)

| The per common share data for the years ended November 30, 2023, 2022, 2021, 2020, and 2019 do not reflect the change in estimate of investment income and return of capital. See Note 2 to the financial statements for further disclosure.

|

(3)

| Not annualized for periods less than one year.

|

(4)

| Annualized for periods less than one year. |

See accompanying Notes to Financial Statements.

Back to Table of Contents

Tortoise Energy Infrastructure Total Return Fund

Financial Highlights (Continued)

A Class

| | | | | | | |

Per Common Share Data(1)

|

Net asset value, beginning of period | | | $14.33 | | | $13.80 | | | $11.07 | | | $8.25 | | | $11.50 | | | $12.18 |

Investment operations:

|

Net investment income (loss)(2) | | | 0.13 | | | 0.21 | | | (0.03) | | | 0.08 | | | 0.16 | | | 0.11 |

Net realized and unrealized gain (loss) on investments and translations of foreign currency(2) | | | 1.71 | | | 0.90 | | | 3.30 | | | 3.19 | | | (3.01) | | | (0.26) |

Total from investment operations | | | 1.84 | | | 1.11 | | | 3.27 | | | 3.27 | | | (2.85) | | | (0.15) |

Less distributions from:

|

Net investment income | | | (0.15) | | | (0.37) | | | (0.10) | | | (0.16) | | | (0.11) | | | (0.18) |

Net realized gains | | | — | | | — | | | — | | | — | | | — | | | — |

Return of capital | | | (0.40) | | | (0.21) | | | (0.44) | | | (0.29) | | | (0.29) | | | (0.35) |

Total distributions | | | (0.55) | | | (0.58) | | | (0.54) | | | (0.45) | | | (0.40) | | | (0.53) |

Net asset value, end of period | | | $15.62 | | | $14.33 | | | $13.80 | | | $11.07 | | | $8.25 | | | $11.50 |

Total Return(3)(4) | | | 13.17% | | | 8.48% | | | 31.26% | | | 40.12% | | | (24.94)% | | | (1.38)% |

Supplemental Data and Ratios

| | | | | | | | | | | | | | | |

Net assets, end of period

(in 000’s) | | | $ 223,208 | | | $ 198,181 | | | $ 191,407 | | | $ 168,259 | | | $ 132,882 | | | $ 469,882 |

Ratio of expenses to average net assets(5) | | | 1.17% | | | 1.18% | | | 1.18% | | | 1.19% | | | 1.19% | | | 1.18% |

Ratio of expenses excluding interest expense to average net assets(5) | | | 1.17% | | | 1.18% | | | 1.18% | | | 1.18% | | | 1.18% | | | 1.18% |

Ratio of net investment income to average net assets(5) | | | 1.60% | | | 1.53% | | | 0.85% | | | 0.67% | | | 1.40% | | | 0.76% |

Portfolio turnover rate(4) | | | 10% | | | 7% | | | 20% | | | 32% | | | 39% | | | 19% |

| | | | | | | | | | | | | | | | | | | |

(1)

| For an A Class Share outstanding for the entire period. Prior to March 30, 2019, A Class Shares were known as Investor Class Shares. |

(2)

| The per common share data for the years ended November 30, 2023, 2022, 2021, 2020, and 2019 do not reflect the change in estimate of investment income and return of capital. See Note 2 to the financial statements for further disclosure. |

(3)

| Total return does not reflect sales charges. |

(4)

| Not annualized for periods less than one year. |

(5)

| Annualized for periods less than one year. |

See accompanying Notes to Financial Statements.

Back to Table of Contents

Tortoise Energy Infrastructure Total Return Fund

Financial Highlights (Continued)

C Class

| | | | | | | |

Per Common Share Data(1)

| | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | | $14.00 | | | $13.57 | | | $10.92 | | | $8.18 | | | $11.39 | | | $12.05 |

Investment operations:

| | | | | | | | | | | | | | | | | | |

Net investment income (loss)(2) | | | — | | | 0.01 | | | (0.15) | | | (0.07) | | | 0.05 | | | (0.01) |

Net realized and unrealized gain (loss) on investments and translations of foreign currency(2) | | | 1.74 | | | 0.98 | | | 3.28 | | | 3.23 | | | (2.94) | | | (0.23) |

Total from investment operations | | | 1.74 | | | 0.99 | | | 3.13 | | | 3.16 | | | (2.89) | | | (0.24) |

Less distributions from:

| | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.14) | | | (0.35) | | | (0.08) | | | (0.16) | | | (0.11) | | | (0.15) |

Net realized gains | | | — | | | — | | | — | | | — | | | — | | | — |

Return of capital | | | (0.40) | | | (0.21) | | | (0.40) | | | (0.26) | | | (0.21) | | | (0.27) |

Total distributions | | | (0.54) | | | (0.56) | | | (0.48) | | | (0.42) | | | (0.32) | | | (0.42) |

Net asset value, end of period | | | $15.20 | | | $14.00 | | | $13.57 | | | $10.92 | | | $8.18 | | | $11.39 |

Total Return(3)(4) | | | 12.76% | | | 7.68% | | | 30.22% | | | 39.00% | | | (25.41)% | | | (2.13)% |

Supplemental Data and Ratios

| | | | | | | | | | | | | | | |

Net assets, end of period (in 000’s) | | | $ 18,987 | | | $ 19,548 | | | $ 22,356 | | | $ 20,625 | | | $ 19,530 | | | $ 37,888 |

Ratio of expenses to average net

assets(5) | | | 1.92% | | | 1.93% | | | 1.93% | | | 1.94% | | | 1.94% | | | 1.93% |

Ratio of expenses excluding interest expense to average net assets(5) | | | 1.92% | | | 1.93% | | | 1.93% | | | 1.93% | | | 1.94% | | | 1.93% |

Ratio of net investment income (loss) to average net assets(5) | | | 0.85% | | | 0.78% | | | 0.11% | | | (0.08)% | | | 0.64% | | | 0.01% |

Portfolio turnover rate(4) | | | 10% | | | 7% | | | 20% | | | 32% | | | 39% | | | 19% |

| | | | | | | | | | | | | | | | | | | |

(1)

| For a C Class Share outstanding for the entire period. |

(2)

| The per common share data for the years ended November 30, 2023, 2022, 2021, 2020, and 2019 do not reflect the change in estimate of investment income and return of capital. See Note 2 to the financial statements for further disclosure. |

(3)

| Total return does not reflect sales charges. |

(4)

| Not annualized for periods less than one year. |

(5)

| Annualized for periods less than one year. |

See accompanying Notes to Financial Statements.

Back to Table of Contents

Tortoise Energy Infrastructure and Income Fund

Financial Highlights (Continued)

Institutional Class

| | | | | | | |

Per Common Share Data(1)

|

Net asset value, beginning of period | | | $7.68 | | | $7.70 | | | $6.45 | | | $5.44 | | | $6.74 | | | $7.43 |

Investment operations:

|

Net investment income | | | 0.07 | | | 0.16(2) | | | 0.22 | | | 0.10 | | | 0.11(2) | | | 0.81 |

Net realized and unrealized gain (loss) on investments and translations of foreign currency | | | 0.72 | | | 0.29 | | | 1.50 | | | 1.38 | | | (0.91) | | | (0.82) |

Total from investment operations | | | 0.79 | | | 0.45 | | | 1.72 | | | 1.48 | | | (0.80) | | | (0.01) |

Less distributions from:

|

Net investment income | | | (0.03) | | | (0.19) | | | (0.14) | | | (0.07) | | | (0.08) | | | (0.01) |

Net realized gains | | | — | | | — | | | — | | | — | | | — | | | — |

Return of capital | | | (0.21) | | | (0.28) | | | (0.33) | | | (0.40) | | | (0.42) | | | (0.67) |

Total distributions | | | (0.24) | | | (0.47) | | | (0.47) | | | (0.47) | | | (0.50) | | | (0.68) |

Redemption fee proceeds | | | — | | | — | | | — | | | — | | | — | | | —(3) |

Net asset value, end of period | | | $8.23 | | | $7.68 | | | $7.70 | | | $6.45 | | | $5.44 | | | $6.74 |

Total Return(4) | | | 10.50% | | | 6.32% | | | 27.03% | | | 27.63% | | | (11.83)% | | | (0.29)% |

Supplemental Data and Ratios

| | | | | | | | | | | | | | | |

Net assets, end of period (in 000’s) | | | $ 454,557 | | | $ 431,332 | | | $ 458,578 | | | $ 353,595 | | | $ 291,420 | | | $ 628,295 |

Ratio of expenses to average net assets(5) | | | 1.12% | | | 1.13% | | | 1.13% | | | 1.16% | | | 1.14% | | | 1.17% |

Ratio of expenses excluding interest expense to average net assets(5) | | | 1.12% | | | 1.13% | | | 1.13% | | | 1.16% | | | 1.13% | | | 1.17% |

Ratio of net investment income to average net assets(5) | | | 2.09% | | | 2.17% | | | 1.83% | | | 1.00% | | | 2.02% | | | 1.68% |

Portfolio turnover rate(4) | | | 11% | | | 6% | | | 10% | | | 22% | | | 43% | | | 48% |

| | | | | | | | | | | | | | | | | | | |

(1)

| For an Institutional Class Share outstanding for the entire period.

|

(2)

| Per share amounts calculated using average shares method.

|

(3)

| Amount per share is less than $0.01.

|

(4)

| Not annualized for periods less than one year.

|

(5)

| Annualized for periods less than one year. |

See accompanying Notes to Financial Statements.

Back to Table of Contents

Tortoise Energy Infrastructure and Income Fund

Financial Highlights (Continued)

A Class

| | | | | | | |

Per Common Share Data(1)

|

Net asset value, beginning of period | | | $7.86 | | | $7.88 | | | $6.60 | | | $5.56 | | | $6.87 | | | $7.56 |

Investment operations:

|

Net investment income | | | 0.07 | | | 0.14(2) | | | 0.13 | | | 0.05 | | | 0.10(2) | | | 0.79 |

Net realized and unrealized gain (loss) on investments and translations of foreign currency | | | 0.74 | | | 0.30 | | | 1.61 | | | 1.44 | | | (0.93) | | | (0.80) |

Total from investment operations | | | 0.81 | | | 0.44 | | | 1.74 | | | 1.49 | | | (0.83) | | | (0.01) |

Less distributions from:

|

Net investment income | | | (0.03) | | | (0.18) | | | (0.14) | | | (0.06) | | | (0.07) | | | (0.01) |

Net realized gains | | | — | | | — | | | — | | | — | | | — | | | — |

Return of capital | | | (0.21) | | | (0.28) | | | (0.32) | | | (0.39) | | | (0.41) | | | (0.67) |

Total distributions | | | (0.24) | | | (0.46) | | | (0.46) | | | (0.45) | | | (0.48) | | | (0.68) |

Redemption fee proceeds | | | — | | | — | | | — | | | — | | | — | | | —(3) |

Net asset value, end of period | | | $8.43 | | | $7.86 | | | $7.88 | | | $6.60 | | | $5.56 | | | $6.87 |

Total Return(4)(5) | | | 10.45% | | | 6.10% | | | 26.67% | | | 27.19% | | | (11.96)% | | | (0.41)% |

Supplemental Data and Ratios

|

Net assets, end of period (in 000’s) | | | $51,853 | | | $48,599 | | | $45,741 | | | $38,146 | | | $32,256 | | | $45,492 |

Ratio of expenses to average net assets(6) | | | 1.37% | | | 1.38% | | | 1.38% | | | 1.41% | | | 1.39% | | | 1.42% |

Ratio of expenses excluding interest expense to average net assets(6) | | | 1.37% | | | 1.38% | | | 1.38% | | | 1.41% | | | 1.38% | | | 1.42% |

Ratio of net investment income to average net assets(6) | | | 1.84% | | | 1.92% | | | 1.58% | | | 0.75% | | | 1.76% | | | 1.43% |

Portfolio turnover rate(5) | | | 11% | | | 6% | | | 10% | | | 22% | | | 43% | | | 48% |

| | | | | | | | | | | | | | | | | | | |

(1)

| For an A Class Share outstanding for the entire period. |

(2)

| Per share amounts calculated using average shares method. |

(3)

| Amount per share is less than $0.01. |

(4)

| Total return does not reflect sales charges. |

(5)

| Not annualized for periods less than one year. |

(6)

| Annualized for periods less than one year. |

See accompanying Notes to Financial Statements.

Back to Table of Contents

Tortoise Energy Infrastructure and Income Fund

Financial Highlights (Continued)

C Class

| | | | | | | |

Per Common Share Data(1)

| | | | | | | | | | | | | | | | | | |

Net asset value, beginning of

period | | | $7.79 | | | $7.86 | | | $6.60 | | | $5.57 | | | $6.89 | | | $7.59 |

|

Investment operations:

| | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | (0.14) | | | 0.09(3) | | | (0.11) | | | (0.18) | | | 0.06(3) | | | 0.67 |

Net realized and unrealized gain (loss) on investments and translations of foreign currency | | | 0.92 | | | 0.29 | | | 1.79 | | | 1.63 | | | (0.94) | | | (0.75) |

Total from investment operations | | | 0.78 | | | 0.38 | | | 1.68 | | | 1.45 | | | (0.88) | | | (0.08) |

|

Less distributions from:

| | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.02) | | | (0.18) | | | (0.12) | | | (0.06) | | | (0.07) | | | (0.01) |

Net realized gains | | | — | | | — | | | — | | | — | | | — | | | — |

Return of capital | | | (0.21) | | | (0.27) | | | (0.30) | | | (0.36) | | | (0.37) | | | (0.61) |

Total distributions | | | (0.23) | | | (0.45) | | | 0.42 | | | 0.42 | | | (0.44) | | | (0.62) |

Redemption fee proceeds | | | — | | | — | | | — | | | — | | | — | | | —(2) |

Net asset value, end of period | | | $8.34 | | | $7.79 | | | $7.86 | | | $6.60 | | | $5.57 | | | $6.89 |

Total Return(4)(5) | | | 10.10% | | | 5.27% | | | 25.76% | | | 26.35% | | | (12.72)% | | | (1.30)% |

Supplemental Data and Ratios

| | | | | | | | | | | | | | | |

Net assets, end of period

(in 000’s) | | | $ 18,249 | | | $ 19,135 | | | $ 24,339 | | | $ 23,303 | | | $ 23,650 | | | $ 46,979 |

Ratio of expenses to average net assets(6) | | | 2.12% | | | 2.13% | | | 2.13% | | | 2.16% | | | 2.14% | | | 2.17% |

Ratio of expenses excluding interest expense to average net assets(6) | | | 2.12% | | | 2.13% | | | 2.13% | | | 2.16% | | | 2.13% | | | 2.17% |

Ratio of net investment income to average net assets(6) | | | 1.09% | | | 1.17% | | | 0.83% | | | (0.00)% | | | 1.02% | | | 0.68% |

Portfolio turnover rate(5) | | | 11% | | | 6% | | | 10% | | | 22% | | | 43% | | | 48% |

| | | | | | | | | | | | | | | | | | | |

(1)

| For a C Class Share outstanding for the entire period.

|

(2)

| Amount per share is less than $0.01. |

(3)

| Per share amounts calculated using the average shares method. |

(4)

| Total return does not reflect sales charges. |

(5)

| Not annualized for periods less than one year. |

(6)

| Annualized for periods less than one year. |

See accompanying Notes to Financial Statements

Back to Table of Contents

Ecofin Global Renewables Infrastructure Fund

Financial Highlights (Continued)

Institutional Class

| | | | | | | | | | |

Per Common Share Data(2)

| | | | | | | | | | | | | | | |

Net asset value, beginning of period | | | $8.82 | | | $11.34 | | | $12.64 | | | $11.42 | | | $10.00 |

Investment operations:

| | | | | | | | | | | | | | | |

Net investment income | | | 0.07 | | | 0.19 | | | 0.11 | | | 0.15(3) | | | 0.04 |

Net realized and unrealized gain (loss) on investments and translations of foreign currency | | | 1.09 | | | (2.37) | | | (0.84) | | | 1.43 | | | 1.40 |

Total from investment operations | | | 1.16 | | | (2.18) | | | (0.73) | | | 1.58 | | | 1.44 |

Less distributions from:

| | | | | | | | | | | | | | | |

Net investment income | | | (0.09) | | | (0.12) | | | (0.24) | | | (0.31) | | | (0.02) |

Net realized gains | | | — | | | — | | | (0.21) | | | (0.05) | | | — |

Return of capital | | | (0.14) | | | (0.22) | | | (0.12) | | | — | | | — |

Total distributions | | | (0.23) | | | (0.34) | | | (0.57) | | | (0.36) | | | (0.02) |

Net asset value, end of period | | | $9.75 | | | $8.82 | | | $11.34 | | | $12.64 | | | $11.42 |

Total Return(4) | | | 13.22% | | | (19.47)% | | | (5.97)% | | | 14.02% | | | 14.43% |

Supplemental Data and Ratios

| | | | | | | | | | | | |

Net assets, end of period (in 000’s) | | | $271,383 | | | $230,043 | | | $352,726 | | | $368,864 | | | $108,048 |

Ratio of expenses to average net assets:

|

Before expense waiver/recoupment(5) | | | 0.93% | | | 0.93% | | | 0.90% | | | 0.96% | | | 1.46% |

After expense waiver/recoupment(5) | | | 0.93% | | | 0.93% | | | 0.91% | | | 1.00% | | | 1.00% |

Ratio of expenses excluding interest

expenses to average net assets:

|

Before expense waiver/recoupment(5) | | | 0.93% | | | 0.92% | | | 0.90% | | | 0.96% | | | 1.46% |

After expense waiver/recoupment(5) | | | 0.93% | | | 0.92% | | | 0.91% | | | 1.00% | | | 1.00% |

Ratio of net investment income to

average net assets:

|

Before expense waiver/recoupment(5) | | | 1.37% | | | 1.95% | | | 0.88% | | | 1.30% | | | 1.05% |

After expense waiver/recoupment(5) | | | 1.37% | | | 1.95% | | | 0.87% | | | 1.26% | | | 1.51% |

Portfolio turnover rate(4) | | | 25% | | | 61% | | | 40% | | | 41% | | | 20% |

| | | | | | | | | | | | | | | | |

(2)

| For an Institutional Class Share outstanding for the entire period. |

(3)

| Per share amounts calculated using average shares method. |

(4)

| Not annualized for periods less than one year. |

(5)

| Annualized for period less than one year. |

See accompanying Notes to Financial Statements.

Back to Table of Contents

Ecofin Global Renewables Infrastructure Fund

Financial Highlights (Continued)

A Class

| | | | | | | | | | | |

Per Common Share Data(2)

| |

Net asset value, beginning of period | | | $8.81 | | | $11.34 | | | $ 12.65 | | | $11.44 | | | $9.72 | |

Investment operations:

| |

Net investment income | | | 0.21 | | | 0.17 | | | 0.16 | | | 0.13(3) | | | 0.03 | |

Net realized and unrealized gain (loss) on investments and translations of foreign currency | | | 0.93 | | | (2.37) | | | (0.92) | | | 1.44 | | | 1.70 | |

Total from investment operations | | | 1.14 | | | (2.20) | | | (0.76) | | | 1.57 | | | 1.73 | |

Less distributions from:

| |

Net investment income | | | (0.08) | | | (0.12) | | | (0.23) | | | (0.31) | | | (0.01) | |

Net realized gains | | | — | | | — | | | (0.21) | | | (0.05) | | | — | |

Return of capital | | | (0.14) | | | (0.21) | | | (0.11) | | | — | | | — | |

Total distributions | | | (0.22) | | | (0.33) | | | (0.55) | | | (0.36) | | | (0.01) | |

Net asset value, end of period | | | $9.73 | | | $8.81 | | | $11.34 | | | $ 12.65 | | | $11.44 | |

Total Return(4)(5) | | | 13.10% | | | (19.66)% | | | (6.21)% | | | 13.66% | | | 17.82% | |

Supplemental Data and Ratios

| | | | | | | | | | | | | | | | |

Net assets, end of period (in 000’s) | | | $ 1,209 | | | $1,829 | | | $ 2,308 | | | $ 4,983 | | | $ 1,338 | |

Ratio of expenses to average net assets:

| |