Exhibit 4.8

Notice of 2011 Annual General Meeting of Shareholders

and Management Information Circular

Our annual general meeting of shareholders will be held at 11:00 a.m. (Eastern time) on Thursday, January 27, 2011

at the Hilton Montreal Bonaventure, 900 de La Gauchetière West, Montreal, Québec, in the Westmount Room.

As a shareholder of Tembec Inc., you have the right to vote your shares, either by proxy or in person at the meeting.

YOUR VOTE IS IMPORTANT

This document tells you who can vote, what you will be voting on and how to exercise

your right to vote your shares. Please read it carefully.

MANAGEMENT INFORMATION CIRCULAR

Table of Contents

| | | | |

SECTION 1 – VOTING INFORMATION | | | 1 | |

| |

Solicitation of Proxies | | | 1 | |

Appointment and Revocation of Proxy | | | 1 | |

Non-Registered Holders of Shares | | | 1 | |

Additional Information for Non-Registered Holders of Shares | | | 2 | |

Exercise of Discretion by Agents | | | 2 | |

Voting Shares and Principal Holders Thereof | | | 3 | |

| |

SECTION 2 – BUSINESS OF THE MEETING | | | 3 | |

| |

Election of Directors | | | 3 | |

Information Concerning Nominee Directors | | | 4 | |

Appointment and Remuneration of Auditors | | | 12 | |

| |

SECTION 3 – STATEMENT OF EXECUTIVE COMPENSATION | | | 13 | |

| |

Compensation Discussion and Analysis | | | 13 | |

Executive Compensation Components | | | 18 | |

Pension, Benefits and Perquisites | | | 27 | |

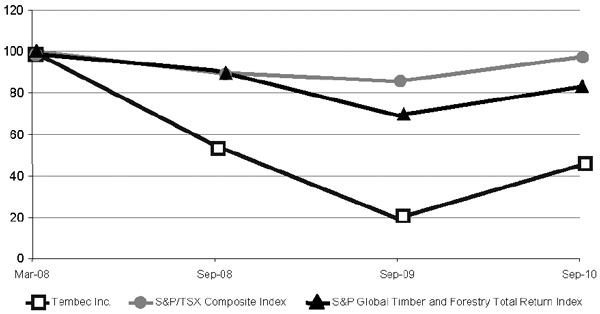

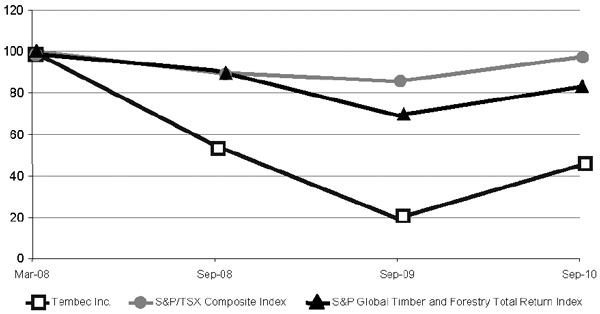

Performance Graph | | | 29 | |

Summary Compensation Table | | | 30 | |

Incentive Plan Awards | | | 31 | |

Defined Benefit Pension Plans Table | | | 34 | |

Defined Contribution Pension Plans Table | | | 35 | |

Termination and Change of Control Benefits | | | 35 | |

| |

SECTION 4 – DIRECTORS COMPENSATION | | | 37 | |

| |

Compensation of Directors | | | 37 | |

Directors Compensation Table | | | 38 | |

Former Long-Term Incentive Plan | | | 39 | |

Deferred Share Unit Plans | | | 40 | |

Directors Outstanding Option-Based Awards and Share-Based Awards | | | 40 | |

| |

SECTION 5 – INDEBTEDNESS | | | 42 | |

| |

SECTION 6 – OTHER INFORMATION | | | 44 | |

| |

Corporate Governance | | | 44 | |

Independence | | | 44 | |

Audit Committee Information | | | 44 | |

Liability Protection for Directors and Officers | | | 44 | |

Other Business | | | 44 | |

Approval of the Board of Directors | | | 45 | |

| | | | |

Management Information Circular | | (i) | | Tembec Inc. |

TEMBEC INC.

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN that the Annual General Meeting of Shareholders (the “Meeting”) of Tembec Inc. (the “Corporation”) will be held in the Westmount Room, at the Hilton Montreal Bonaventure, 900 de La Gauchetière West in Montreal, Québec, on Thursday, January 27, 2011, at 11:00 a.m., local time, for the following purposes:

| | 1. | to receive the consolidated financial statements of the Corporation for the fiscal year ended September 25, 2010 together with the auditors’ report thereon; |

| | 2. | to elect the directors of the Corporation for the ensuing year; |

| | 3. | to appoint the auditors and authorize the board of directors to fix their remuneration; and |

| | 4. | to transact such other business as may properly come before the Meeting. |

A copy of the management information circular accompanies this Notice.

Since it is desirable that as many shares as possible be represented and voted at the Meeting, you are requested, if unable to attend the Meeting in person, to complete, date, sign and return the enclosed form of proxy in the envelope provided for that purpose to Tembec Inc., c/o Computershare Trust Company of Canada, no later than 5:00 p.m. on January 25, 2011.

Montreal, this 15th day of December 2010.

By order of the Board of Directors,

|

/s/ Patrick LeBel |

|

PATRICK LEBEL |

|

Vice President, General Counsel and Corporate Secretary |

TEMBEC INC.

MANAGEMENT INFORMATION CIRCULAR

SECTION 1 - VOTING INFORMATION

This Management Information Circular (the “Circular”) is furnished in connection with the solicitation by the management of Tembec Inc. (“Tembec” or the “Corporation”) of proxies to be used at the annual general meeting of shareholders of the Corporation (the “Meeting”) to be held at the time and place and for the purposes set forth in the foregoing Notice of Annual General Meeting of Shareholders. All information provided in this Circular is given as of November 30, 2010, unless specified otherwise.

Solicitation of Proxies

The management of the Corporation (“Management”) is soliciting proxies for use at the Meeting. The solicitation will be primarily by mail. However, the directors, executive officers, officers and employees of the Corporation (the “Directors”, the “Executive Officers” and the “Officers”, as applicable) may also solicit proxies by telephone, e-mail, facsimile or in person. The Corporation will pay for the cost of proxy solicitation.

Appointment and Revocation of Proxy

The persons named in the enclosed proxy form are Officers and/or proposed nominees to the Board of Directors (the “nominee Directors”) of the Corporation.A SHAREHOLDER WISHING TO APPOINT SOME OTHER PERSON TO REPRESENT HIM OR HER AT THE MEETING MAY DO SO by striking out the names of the persons designated and by inserting such other person’s name in the blank space provided in the proxy form and, delivering the completed proxy form to Tembec Inc., c/o Computershare Trust Company of Canada, 9th Floor, 100 University Avenue, Toronto, Ontario, M5J 2Y1 not later than 5:00 p.m. on January 25, 2011.

Shareholders executing the proxy form may revoke it at any time, as long as it has not been exercised, by instrument in writing executed by the shareholder or his attorney authorized in writing and deposited either at the head office of the Corporation at 800 René-Lévesque Blvd. West, Suite 1050, Montreal, Québec, H3B 1X9 at any time up to and including the last business day preceding the date of the Meeting, or any adjournment thereof, or with the chairman of the Meeting on the day of the Meeting or adjournment thereof.

Non-Registered Holders of Shares

The information set out in this section is of importance to shareholders who do not hold shares in their own name. Persons who hold shares through their brokers, intermediaries, trustees or other persons, or who otherwise do not hold such securities in their own name (the “Non-Registered Holders”) should note that only proxies deposited by persons whose names appear on the records of the Corporation may be recognized and acted upon at the meeting. If shares are listed in an account statement provided to a Non-Registered Holder by a broker, then in almost all cases, those shares will not be registered in the Non-Registered Holder’s name on the records of the Corporation. Such shares will more

| | | | |

Management Information Circular | | 1 | | Tembec Inc. |

likely be registered under the names of the broker or an agent of that broker. In Canada, the vast majority of shares are registered under the name of CDS & Co., which acts as nominee for many Canadian brokerage firms. Shares held by brokers, agents or nominees can only be voted upon the instructions of the Non-Registered Holder. Without specific instructions, brokers, agents and nominees are prohibited from voting securities for the brokers’ clients.Non-Registered Holders should ensure that instructions respecting the voting of their shares are communicated to the appropriate person at the appropriate time.

Intermediaries/brokers are required to seek voting instructions from Non-Registered Holders in advance of shareholders’ meetings. Each intermediary/broker has its own mailing procedures and provides its own return instructions to clients, which should be carefully followed by Non-Registered Holders to ensure that their shares are voted at the Meeting. The purpose of the form of proxy or voting instruction form supplied to a Non-Registered Holder by its broker, agent or nominee is limited to instructing the broker or agent of the broker how to vote on behalf of the Non-Registered Holder. The majority of brokers now delegate this responsibility to Broadridge Financial Solutions, Inc. (“Broadridge”). Broadridge typically supplies a voting instruction form, mails those forms to Non-Registered Holders and asks them to return the forms to Broadridge or follow specified telephone voting procedures. Broadridge then tabulates the results of all instructions received and provides appropriate instructions respecting the voting of shares to be represented at the meeting.A Non-Registered Holder receiving a voting instruction form from Broadridge cannot use that form to vote shares directly at the Meeting — the voting instruction forms must be registered by mail, via the internet or by telephone well in advance of the Meeting in order to have such shares voted. Non-Registered Holders that wish to vote in person at the Meeting must insert their name in the space provided on the voting instruction form, and adhere to the signing and return instructions provided by Broadridge. By doing so, Non-Registered Holders are instructing their intermediary/broker to appoint them as proxy holder.

Additional Information for Non-Registered Holders of Shares

These securityholder materials are being sent to both registered and non-registered owners of the securities. If you are a non-registered owner, and the issuer or its agent has sent these materials directly to you, your name and address and information about your holdings of securities, have been obtained in accordance with applicable securities regulatory requirements from the intermediary holding on your behalf.

By choosing to send these materials to you directly, the issuer (and not the intermediary holding on your behalf) has assumed responsibility for (i) delivering these materials to you, and (ii) executing your proper voting instructions. Please return your voting instructions as specified in the request for voting instructions.

Exercise of Discretion by Agents

The shares represented by the enclosed proxy form will be voted or withheld from voting in accordance with the instructions of the shareholder executing it and, where a choice is specified, the shares will be voted accordingly.WHERE NO CHOICE IS SPECIFIED, THE SHARES SO REPRESENTED WILL BE VOTED IN FAVOUR OF THE ELECTION OF EACH OF THE PROPOSED NOMINEES TO THE BOARD OF DIRECTORS AND IN FAVOUR OF THE APPOINTMENT OF THE PROPOSED NOMINEE AS AUDITORS. The enclosed proxy form confers discretionary authority upon the persons named therein with respect to amendments or new matters submitted to the meeting. At the time of printing of this Circular, the Executive Officers of the Corporation know of no such amendments or new matters.

| | | | |

Management Information Circular | | 2 | | Tembec Inc. |

Voting Shares and Principal Holders Thereof

As at November 30, 2010, 100,000,000 common shares of the Corporation were issued and outstanding, each carrying the right to one vote. Only shareholders of record at the close of business on December 10, 2010 will be entitled to vote at the meeting.

On February 29, 2008, a shareholder rights plan (the “Rights Plan”) was implemented to ensure, to the extent practicable, that all shareholders of the Corporation will be treated equally and fairly in connection with any take-over bid for the Corporation. For the purposes of the Rights Plan, the permitted bid mechanism will endeavour to ensure that any person seeking to acquire beneficial ownership of 20% or more of the common shares of the Corporation gives shareholders and the Directors sufficient time to evaluate the transaction, negotiate with the acquirer and encourage the making of competing bids, all with a view to maximizing shareholder value. The term of the Rights Plan expires on the date of the Corporation’s 2013 annual shareholders’ meeting. On June 10, 2008, the Corporation waived the application of the permitted bid mechanism in the Rights Plan to permit Wayzata Investment Partners LLC or funds managed by Wayzata Investment Partners LLC and/or its affiliates (“Wayzata”) to purchase up to a maximum of 30% of the Corporation’s outstanding common shares subject to certain conditions, as more fully described in a material change report filed with securities regulatory authorities on June 10, 2008.

On February 29, 2008, in the context of the recapitalization implemented on that date, the Corporation issued an aggregate of 11,095,839, subsequently reduced to 11,093,943, “cashless” warrants convertible into common shares of the Corporation which shall expire on February 29, 2012, if not previously converted (the “Warrants”). The Warrants shall be automatically converted into an aggregate of up to 11,093,943 common shares of the Corporation when the 20-day volume-weighted average trading price of a single common share reaches or exceeds $ 12.00; or immediately prior to any transaction that would constitute a change of control of the Corporation at a price per common share equal to at least $12.00.

As at November 30, 2010, to the knowledge of the Directors and Management, no person or company beneficially owns, directly or indirectly, or controls or directs ten per cent (10%) or more of the voting rights attached to all common shares of the Corporation, with the exception of Wayzata, which owns 20,934,224 common shares representing approximately 20.93% of the Corporation’s outstanding common shares; Trilogy Capital, LLC, which owns or controls 15,515,387 common shares representing approximately 15.52% of the Corporation’s outstanding common shares; and Värde Management, L.P., which owns or controls 10,353,123 common shares representing approximately 10.35% of the Corporation’s outstanding common shares. The information relating to the number of securities owned, controlled or directed by each person mentioned hereinabove is based upon public filings made by each person or company and has not been independently verified by Tembec nor its Directors and Management.

SECTION 2 – BUSINESS OF THE MEETING

Election of Directors

There will be eleven (11) nominees proposed to be elected at the meeting as Directors of the Corporation. If elected, they will hold office until the next annual meeting of shareholders or until their successors are elected or appointed in accordance with the by-laws of the Corporation.

| | | | |

Management Information Circular | | 3 | | Tembec Inc. |

All of the proposed nominees for election to the Board of Directors are currently members of the Board and each was elected at our annual general meeting of shareholders held on January 28, 2010, by at least a majority of the votes cast, with the exception of Michel Dumas, Jacques Leduc and Pierre Lortie who are new nominees.

Unless authority to vote on the election of Directors is withheld, it is the intention of the persons named in the enclosed form of proxy to vote the shares represented thereby in favour of each of the eleven (11) nominees listed below or, in the event of any vacancies among such nominees (an event that the Management has no reason to believe will occur) in favour of the remaining nominees and of any substitute nominees.

Information Concerning Nominee Directors

Set forth below is information pertaining to the nominee Directors. The following information is based on data furnished by the nominee Directors. The information with respect to ownership of common shares includes those shares for which such persons have voting power or investment power. Voting power and investment power are not shared with others, unless specifically stated. All holdings information presented below, except for holdings of common shares which are presented as of November 30, 2010, is given as of September 25, 2010.

| | | | |

| NORMAN M. BETTS, New Brunswick, Canada |

| |

| | DIRECTORSINCEJANUARY 2005 Independent Mr. Betts is an Associate Professor at the Faculty of Business Administration, University of New Brunswick. He is also the former Finance Minister and Minister of Business with the Province of New Brunswick. Mr. Betts chairs the Board of Starfield Resources Inc. and chairs the audit committees of Tanzanian Royalty Exploration Corp., Adex Mining Inc. and Sheltered Oak Resources Corp. He also serves as Director of the New Brunswick Power Corporation and Export Development Canada. Mr. Betts is a co-chair of the Board of Trustees of the Pension Plan for Academic Employees of the University of New Brunswick and is a director of the Nature Conservancy of Canada for the Atlantic region. Mr. Betts is a Fellow Chartered Accountant and received a Doctor of Philosophy degree in management, with a concentration in accounting and finance from Queen’s University in 1991. |

| |

HOLDINGS 146 common shares 326 Warrants 258 stock options 43,905 deferred share units 5,230 deferred share units(1) | | POSITIONONCOMMITTEESOFTHE BOARDOF DIRECTORS Chairman of the Audit Committee |

| | | | |

Management Information Circular | | 4 | | Tembec Inc. |

| | |

| JAMES E. BRUMM, New York, United States of America |

| |

| | DIRECTORSINCEAPRIL 1999 Independent Currently, Mr. Brumm is President of Glastonbury Commons, Ltd., a consulting firm. He is also an Executive Advisor to Mitsubishi International Corporation, the North American subsidiary of Mitsubishi Corporation. At Mitsubishi International Corporation, Mr. Brumm also serves as a Director and previously served as Executive Vice President, General Counsel. Mr. Brumm is a member of the Boards of Visitors of Columbia University Law School and California State University, Fresno and is a board member of Forest Trends, a public/private non-profit coalition that promotes market-based approaches to forest conservation. Mr. Brumm also chairs the American Bird Conservancy and is a board member of The International Crane Foundation. Mr. Brumm is President of the Mitsubishi Corporation Foundation for the Americas. Mr. Brumm graduated with a bachelor’s degree in political science from California State University, Fresno in 1965 and received an L.L.B. from Columbia University School of Law in 1968. |

| |

HOLDINGS 2,263 common shares 5,029 Warrants 4,070 stock options 42,385 deferred share units 1,853 deferred share units(1) | | POSITIONONCOMMITTEESOFTHE BOARDOF DIRECTORS Member of the Corporate Governance and Human Resources Committee |

| | |

| | |

| JAMES N. CHAPMAN, Connecticut, United States of America |

| |

| | DIRECTORSINCEFEBRUARY 2008 Independent Mr. Chapman is non-executive Vice Chairman of SkyWorks Leasing, LLC, an aircraft management services company, which he joined in December 2004. Prior to SkyWorks, he was associated with Regiment Capital Advisors, LP, an investment advisor based in Boston specializing in high yield investments, which he joined in January 2003. Mr. Chapman serves as a member of the board of directors of the public companies AerCap Holdings NV, Scottish Re Group Limited and Tower International, Inc. In addition, he is also a board member of several private companies including American Media, Inc., Hayes-Lemmerz International, Inc., MXenergy Corporation and Neenah Enterprises Inc. Mr. Chapman was a director of Anchor Glass Container Corporation from August 2002 to March 2006 and Chrysler LLC from September 2007 to April 2009. In addition, Mr. Chapman serves on the Finance Committee of the Whitby School in Greenwich. Mr. Chapman received a Bachelor’s of Arts degree, with distinction, and a Master of Business Administration degree, with distinction,magna cum laude, from Dartmouth College in 1984 and 1985, respectively. |

| |

HOLDINGS 41,551 deferred share units | | POSITIONONCOMMITTEESOFTHE BOARDOF DIRECTORS Member of the Corporate Governance and Human Resources Committee Member of the Special Committee for Strategic Purposes |

| | | | |

Management Information Circular | | 5 | | Tembec Inc. |

| | |

| JAMES V. CONTINENZA, Minnesota, United States of America |

| |

| | DIRECTORSINCE FEBRUARY 2008 Independent Mr. Continenza has been President of STi Prepaid, LLC, a facilities-based provider of prepaid long-distance wireline and wireless communications services from October 2007 to October 2010. In 2010, Mr. Continenza became chairman of Hawkeye Renewables, LLC, an ethanol producer operating in Iowa, and of Neff Holdings, LLC, a construction equipment rental company. In May 2006, he joined the board of directors of Anchor Glass Container Corp., a provider of rigid packaging services in the United States, and also served as its interim chief executive officer from October to December 2006. Mr. Continenza is also a director of Portola Packaging, Inc., a manufacturer of plastic closures and bottles, and of RathGibson LLC, a pipe and tubing company, the boards of which he joined in 2008 and 2010, respectively. In the past, Mr. Continenza also sat on the boards of Maxim Crane Works Inc., Rural Cellular Corp, Inc., U.S.A. Mobility Inc. and Microcell Telecommunications Inc. |

| |

HOLDINGS 116,343 deferred share units | | POSITIONONCOMMITTEESOFTHE BOARDOF DIRECTORS Chairman of the Board of Directors Member of the Corporate Governance and Human Resources Committee Member of the Special Committee for Strategic Purposes |

| | |

| MICHEL DUMAS, Ontario, Canada |

| |

| | Non independent Mr. Dumas was named Executive Vice President, Finance and Chief Financial Officer of the Corporation in 1997. Mr. Dumas joined the Corporation in 1985 as Controller for the high-yield pulp mill in Temiscaming, Quebec. In 1991, he became Vice President, Finance and Chief Financial Officer of Spruce Falls Inc., an affiliate of the Corporation. Mr. Dumas has also acted as a Director of various subsidiaries of the Corporation. He obtained an honors bachelor’s of commerce degree from the University of Ottawa in 1980. |

| |

HOLDINGS 14,406 common shares 32,016 Warrants 16,719 stock options 180,000 PCRSUs | | POSITIONONCOMMITTEESOFTHE BOARDOF DIRECTORS N/A |

| | | | |

Management Information Circular | | 6 | | Tembec Inc. |

| | |

| JACQUES LEDUC, Québec, Canada |

| |

| | Independent Mr. Leduc is a Director of TerreStar Corporation since April 2006. He is a co-founder and managing partner of Trio Capital Inc., a private equity and venture capital firm that he started in January 2006, which invests primarily in telecommunications and new media. He is also Chief Financial Officer and Treasurer of Terrestar Solutions Inc. and Terrestar Networks (Canada) Inc. since November 2009. He served as Chief Financial Officer of Microcell Telecommunications Inc., a nationwide wireless operator in Canada from February 2001 through November 2004, and as Vice President Finance and Director Corporate Planning from January 1995 to February 2001. Mr. Leduc has also served as a member of the board of directors of Rural Cellular Corporation, Inc., a wireless communications service provider, from May 2005 to August 2009. Mr. Leduc is a Chartered Accountant and holds a Master of Business Administration degree from HEC Montreal and a bachelor’s degree in Business Administration from the Université du Québec à Montreal and was admitted by the Canadian Institute of Chartered Accountants in 1986. |

| |

HOLDINGS — | | POSITIONONCOMMITTEESOFTHE BOARDOF DIRECTORS N/A |

| | |

| JAMES LOPEZ, Ontario, Canada |

| |

| | DIRECTORSINCEJANUARY 2006 Non independent Mr. Lopez was appointed President and Chief Executive Officer in January 2006 and has been a Director of the Corporation since January 2006. Prior to being named President and Chief Executive Officer, Mr. Lopez served as Executive Vice President and President of the Corporation’s Forest Products Group from August 2003 to January 2006. From 1999 to August 2003, Mr. Lopez was Executive Vice President, Forest Resource Management Group of Tembec. Mr. Lopez also holds a seat on, and is chairman of, the board of directors of the Forest Products Association of Canada (FPAC) and is a co-chairman of the Bi-National Softwood Lumber Council between Canada and the United States. He is a member of the board of directors of FP Innovations and he sits on the President’s Board of Advisors for California University of Pennsylvania. Mr. Lopez graduated from California University of Pennsylvania with a bachelor’s degree in economics in 1981. |

| |

HOLDINGS 8,176 common shares 18,171 Warrants 17,519 stock options 270,000 PCRSUs | | POSITIONONCOMMITTEESOFTHE BOARDOF DIRECTORS Member of the Environment, Health and Safety Committee |

| | | | |

Management Information Circular | | 7 | | Tembec Inc. |

| | |

| PIERRE LORTIE, Québec, Canada |

| |

| | Independent Mr. Lortie is Senior Business Advisor at the law firm Fraser Milner Casgrain LLP. He is also a director of Consolidated Thompson Iron Mines Ltd., Canam Group Inc. and Altair Nanotechnologies, Inc. Mr. Lortie also served as President of the Transition Committee of the Agglomeration of Montreal from its inception in June 2004 to the end of its mandate in December 2005. Mr. Lortie served as President and Chief Operating Officer of Bombardier Transportation, Bombardier Capital, Bombardier International, and as President of Bombardier Aerospace, Regional Aircraft. He has also served as Chairman of Canada’s Royal Commission on Electoral Reform and Party Financing. He has been Chairman of the Board, President and Chief Executive Officer of Provigo Inc., President and Chief Executive Officer of the Montreal Stock Exchange and a Senior Partner of Secor Inc. Mr. Lortie received a Master of Business Administration degree with honors from the University of Chicago, a license in applied economics from the Université catholique de Louvain, Belgium, and a Bachelor’s degree in applied sciences (engineering physics) from Université Laval, Canada. He received his certification from the Canadian Institute of Corporate Directors (ICD.D). Mr. Lortie is a member of the Order of Canada. |

| |

HOLDINGS 15,000 common shares | | POSITIONONCOMMITTEESOFTHE BOARDOF DIRECTORS N/A |

| | |

| FRANCIS M. SCRICCO, Massachusetts, United States of America |

| |

| | DIRECTORSINCEFEBRUARY 2008 Independent Mr. Scricco retired in November 2008 from Avaya Inc., a global provider of communications systems and software for enterprises where, since February 2007, he was the Senior Vice President, Manufacturing Logistics and Procurement. Prior to that, he was President of Avaya Global Services. Additionally, Mr. Scricco formerly was President and Chief Executive Officer of Arrow Electronics Inc. one of the world’s largest distributors of electronic components and computer products, as well as Inglis Ltd., Whirlpool Corporation’s Canadian subsidiary. Mr. Scricco has served on the board of directors of Magnatrax Corporation and Arrow Electronics, Inc. He is currently a director of Sirva, Inc., Sleep Innovations Inc. and Masonite Inc. Mr. Scricco began his career at The Boston Consulting Group and was also previously a General Manager at General Electric. In 1971, Mr. Scricco received a bachelor of science degree from Worcester Polytechnic Institute and, in 1973, a Master of Business Administration degree from Columbia University Business School. |

| |

HOLDINGS 100,000 common shares 41,551 deferred share units | | POSITIONONCOMMITTEESOFTHE BOARDOF DIRECTORS Chairman of the Corporate Governance and Human Resources Committee Member of the Special Committee for Strategic Purposes |

| | | | |

Management Information Circular | | 8 | | Tembec Inc. |

| | |

| DAVID J. STEUART, Ontario, Canada |

| |

| | DIRECTORSINCEFEBRUARY 2008 Independent Mr. Steuart worked 37 years in the pulp and paper industry in senior executive positions, most recently from August 1998 to December 2006 with Bowater Incorporated as President, Pulp Division and as Senior Vice President. Mr. Steuart was Chairman of the Ontario Forest Industries Association in 1997 and 1998. From September 1993 to July 1998, Mr. Steuart was President of the Pulp Division at Avenor Inc. Mr. Steuart holds a Bachelor of Commerce degree from the University of Saskatchewan, which he received in 1970. |

| |

HOLDINGS 41,551 deferred share units | | POSITIONONCOMMITTEESOFTHE BOARDOF DIRECTORS Chairman of the Environment, Health and Safety Committee Member of the Audit Committee Member of the Special Committee for Strategic Purposes |

| | |

| LORIE WAISBERG, Ontario, Canada |

| |

| | DIRECTORSINCEFEBRUARY 2008 Independent Mr. Waisberg is a corporate director. Between August 2000 and October 2002, Mr. Waisberg served as Executive Vice President, Finance and Administration for Co-Steel Inc., a steel manufacturing company. From 1974 to August 2000, he was a partner at the Toronto office Goodmans LLP, a Canadian law firm. Mr. Waisberg is Chairman and a trustee of Chemtrade Logistics Income Fund and a director of Metalex Ventures Limited, Noront Resources Ltd. and Primary Energy Recycling Corporation, all publicly traded companies in Canada. |

| |

HOLDINGS 4,000 common shares 41,551 deferred share units | | POSITIONONCOMMITTEESOFTHE BOARDOF DIRECTORS Member of the Audit Committee |

| (1) | DSUs payable at a price determinable based upon the market value of the Warrants as of the entitlement date. |

The average age of the nominee Directors is 58.

Cease Trade Orders, Bankruptcies, Penalties and Sanctions

To the knowledge of the Corporation and based on the information furnished by the nominee Directors, except as disclosed below, no such nominee Director:

| | (a) | is, as at the date of this Circular, or has been within the 10 years before the date of this Circular, a director or executive officer of any corporation that: |

| | (i) | while the nominee Director was acting in that capacity was subject to a cease trade or similar order or an order that denied the relevant corporation access to any exemption under securities legislation, for a period of more than 30 consecutive days; or |

| | (ii) | was subject to a cease trade or similar order or an order that denied the relevant corporation access to any exemption under securities legislation, for a period of more than 30 consecutive days, that was issued after the nominee Director ceased to be a director or executive officer and which resulted from an event that occurred while that person acted as director or executive officer; or |

| | | | |

Management Information Circular | | 9 | | Tembec Inc. |

| | (iii) | while the nominee Director was acting as director or executive officer or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets; |

| | (b) | has, within the 10 years before the date of this Circular, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold his assets; |

| | (i) | any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement after December 30, 2000 with a securities regulatory authority; or |

| | (ii) | any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable securityholder in deciding whether to vote for the proposed Director. |

All of the nominee Directors, except for James V. Continenza, Francis M. Scricco, James N. Chapman, Lorie Waisberg, David J. Steuart, Michel Dumas, Jacques Leduc and Pierre Lortie were directors of Tembec Inc. (“Former Tembec”) and/or Tembec Industries Inc. for varying periods of time immediately prior to the completion of the recapitalization transaction that was completed on February 29, 2008, and approved at a meeting of the noteholders of Tembec Industries Inc. and at a special meeting of the shareholders of Former Tembec on February 22, 2008 (the “Recapitalization”). The Recapitalization was also approved and sanctioned by a final order of the Ontario Superior Court of Justice on February 27, 2008 (the “Final Order”). All of the transactions completed as part of the Recapitalization were consummated pursuant to a plan of arrangement (the “Plan of Arrangement”) under section 192 of the Canada Business Corporations Act (the “CBCA”), as sanctioned by the Final Order. On October 31, 2008, Tembec Industries Inc. obtained a final order by an American court recognizing the Plan of Arrangement as a foreign proceeding under Chapter 15 of the U.S. Bankruptcy Code thereby giving full effect to the Final Order in the U.S.A.

At the request of Tembec, Mr. James Lopez was a director of Marathon Pulp Inc. from January 26, 2006 to February 27, 2009. On March 17, 2009, Marathon Pulp Inc. was declared bankrupt after failing to file a proposal within 30 days of filing a notice of intention to file a proposal under theBankruptcy and Insolvency Act (Canada).

At the request of Tembec, Mr. Michel Dumas was a director of Gestion Papiers Gaspésia Inc. and its subsidiary, Papiers Gaspésia Inc., from March 2004 until October 2004. On January 30, 2004, Papiers Gaspésia Inc. and Papiers Gaspésia Limited Partnership filed for protection under the Companies’ Creditors Arrangement Act. On July 4, 2005, the plan of arrangement submitted by Papiers Gaspésia Inc. and Papiers Gaspésia Limited Partnership to their creditors was homologated by the Court and has been fully implemented.

| | | | |

Management Information Circular | | 10 | | Tembec Inc. |

At the request of Tembec, Mr. Michel Dumas was a director of Marathon Pulp Inc. from February 2, 2000 to February 27, 2009. On March 17, 2009, Marathon Pulp Inc. was declared bankrupt after failing to file a proposal within 30 days of filing a notice of intention to file a proposal under theBankruptcy and Insolvency Act (Canada).

At the request of Tembec, Mr. Michel Dumas was a director of Jager Building Systems Inc. from August 23, 2001 to September 11, 2008. On September 15, 2008, Jager Building Systems Inc. filed a voluntary assignment in bankruptcy under theBankruptcy and Insolvency Act (Canada). At the request of Tembec, Mr. Michel Dumas was a director of Temlam Inc. from July 31, 2001 to September 11, 2008. On September 15, 2008, Temlam Inc. filed a voluntary assignment in bankruptcy under the BIA.

Mr. James N. Chapman was a director of Anchor Glass Container Corporation from August 2002 to March 2006. Such corporation filed for bankruptcy on August 8, 2005 due to high natural gas prices and excess leverage. The equity has since been transferred to bondholders and an investment banking group is now the controlling shareholder.

Mr. James N. Chapman was a director of Chrysler LLC from September 2007 to April 2009. Chrysler LLC filed for protection from its creditors under Chapter 11 of the United States Bankruptcy Code on April 30, 2009.

Mr. James N. Chapman is a director of American Media Inc. since March 12, 2009. On November 17, 2010, American Media Inc. filed for voluntary petitions for relief under Chapter 11 of the United States Bankruptcy code.

Mr. Jacques Leduc was an executive officer of Microcell Telecommunications Inc. from February 2001 to November 2004. Such corporation filed for and received protection under theCompanies’ Creditors Arrangement Act (Canada) (CCAA) on January 3, 2003.

Mr. Jacques Leduc is a director of Terrestar Corporation since April 2006 and is Chief Financial Officer and Treasurer of Terrestar Solutions Inc. and Terrestar Networks (Canada) Inc. since November 2009. Terrestar Corporation, Terrestar Networks (Canada) Inc. and Terrestar Networks Holdings (Canada) Inc. filed for and received protection under Chapter 11 of the United States Bankruptcy Code on October 19, 2010.

Mr. Lorie Waisberg was a director of McWatters Mining Inc. (“MWA”) from September 1997 to August 2004. MWA initiated insolvency proceedings in 2001 and in 2004. Canadian securities regulators issued cease trade orders by reason of MWA’s failure to file required financial statements. The cease trade orders are no longer in effect and MWA has emerged from bankruptcy.

Mr. Lorie Waisberg was a director of FMF Capital Group Ltd. (“FMF”) from March 2005 to May 18, 2007. On May 18, 2007, a subsidiary of FMF, of which Mr. Waisberg was not a director, conveyed its assets to a trustee to facilitate the orderly wind-up of its business.

Attendance Record of Directors to Board and Committee Meetings

The Board has established the following three standing committees, each with its own written charter: the Corporate Governance and Human Resources Committee, the Audit Committee and the Environment, Health and Safety Committee. During Fiscal 2009, the Board created an ad hoc committee called the Special Committee for Strategic Purposes. The Committee’s mandate involves considering and advising the Board on matters of strategic importance to the Corporation.

| | | | |

Management Information Circular | | 11 | | Tembec Inc. |

The following table summarizes, for each of the current Directors, the number of meetings of the board of directors of the Corporation (the “Board”) and its committees they have attended during Fiscal 2010.

| | | | | | | | | | |

Directors | | Board of Directors | | Audit

Committee | | Corporate

Governance and

Human

Resources

Committee | | Environment,

Health and

Safety

Committee | | Special

Committee

for Strategic

Purposes |

Norman M. Betts | | 8 of 8 | | 4 of 4 | | n/a | | n/a | | n/a |

James E. Brumm | | 8 of 8 | | n/a | | 10 of 10 | | n/a | | n/a |

James N. Chapman | | 8 of 8 | | n/a | | 10 of 10 | | n/a | | 10 of 10 |

James V. Continenza | | 8 of 8 | | n/a | | 10 of 10 | | n/a | | 8 of 10 |

James Lopez | | 8 of 8 | | n/a | | n/a | | 4 of 4 | | n/a |

Luc Rossignol | | 8 of 8 | | n/a | | n/a | | 4 of 4 | | n/a |

Francis M. Scricco | | 8 of 8 | | n/a | | 10 of 10 | | n/a | | n/a |

David J. Steuart | | 8 of 8 | | 4 of 4 | | n/a | | 4 of 4 | | 10 of 10 |

Lorie Waisberg | | 8 of 8 | | 4 of 4 | | n/a | | n/a | | n/a |

Overall Attendance Record | | 100% | | 100% | | 100% | | 100% | | 93.33% |

The table below summarizes the number of Board and committee meetings held during Fiscal 2010:

| | | | |

Meeting Type | | Totals | |

Board of Directors | | | 8 | (1) |

Audit Committee | | | 4 | |

Corporate Governance and Human Resources Committee | | | 10 | |

Environment, Health and Safety Committee | | | 4 | |

Special Committee for Strategic Purposes | | | 10 | |

| | | | |

Total number of meetings held | | | 36 | |

| | | | |

| (1) | Over the course of Fiscal 2010, two special meetings of the Board of Directors were held to discuss strategic issues, namely the sale of certain assets of a subsidiary of the Corporation in France and Tembec Industries Inc.’s issue of Senior Secured Notes due 2018. |

Appointment and Remuneration of Auditors

KPMG LLP, chartered accountants, are currently the auditors of the Corporation. The Board on the recommendation of its Audit Committee, proposes that KPMG LLP be re-appointed as auditors of the Corporation.

It is the intention of the persons named in the enclosed form of proxy to vote the shares represented thereby for the appointment of KPMG LLP as auditors of the Corporation, at a remuneration to be fixed by the Board.Except where the authority to vote in favour of the appointment of the auditors is withheld, the persons whose names are printed on the form of proxy or voting instructions card intend to vote FOR the appointment of KPMG LLP as auditors of the Corporation and authorizing the Board of Directors to determine their remuneration.

| | | | |

Management Information Circular | | 12 | | Tembec Inc. |

The following table shows fees paid to KPMG LLP in Canadian dollars in the past two fiscal years for various services provided to Tembec:

| | | | | | | | |

| | | Year Ended

September 26, 2009 | | | Year Ended

September 25, 2010 | |

Audit Fees | | $ | 1,090,000 | | | $ | 1,275,000 | |

Audit-Related Fees | | $ | 95,000 | | | $ | 175,000 | |

Tax Fees | | $ | 520,000 | | | $ | 119,000 | |

Other Fees | | | — | | | | — | |

| | | | | | | | |

Total | | $ | 1,705,000 | | | $ | 1,569,000 | |

| | | | | | | | |

Audit Fees

These fees include professional services rendered by the external auditors for statutory audits of the annual financial statements and for other audits.

Audit-Related Fees

These fees include professional services that reasonably relate to the performance of the audit or review of Tembec’s financial statements. These services include accounting consultations related to accounting, financial reporting or disclosure matters not classified as “Audit Services”; assistance with understanding and implementing new accounting and financial reporting guidance from rulemaking authorities; financial audits of employee benefit plans; agreed upon or expanded procedures related to accounting records required to respond to or comply with financial, accounting or regulatory reporting matters.

Tax Fees

These fees include professional services for tax compliance, tax advice and tax planning. These services include review of tax returns, assistance with tax audits, capital structure, corporate transactions and other special purpose mandates approved by the Audit Committee.

Other Fees

The fees include the total fees paid to the auditors for all services other than those presented in the categories of audit fees, audit related fees and tax fees, including the consultation services for the due diligence audit of business acquisitions, consultation to expatriates fees and certain filings.

SECTION 3 – STATEMENT OF EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

The disclosure under this section communicates the compensation provided to the President and Chief Executive Officer (“CEO”), Mr. James Lopez, the Executive Vice-President Finance and Chief Financial Officer (“CFO”), Mr. Michel Dumas and the three most highly compensated senior management executives of the Corporation for the most recently completed financial year ended September 25, 2010; namely Mr. John Valley, Executive Vice-President Business Development and

| | | | |

Management Information Circular | | 13 | | Tembec Inc. |

Corporate Affairs, Mr. Yvon Pelletier, Executive Vice-President and President Pulp Group and Mr. Dennis Rounsville, Executive Vice-President and President, Forest Products Group (all of whom are collectively referred to as the “Named Executive Officers” or “NEOs” of the Corporation; or individually as a “NEO” in this Circular.

In the context of the Recapitalization completed on February 29, 2008, the Corporate Governance and Human Resources Committee (in this Statement of Executive Compensation section referred to as the “Committee”) proceeded to a complete review of the Corporation’s compensation philosophy. At the time, the Committee’s objectives were to gain an understanding of the existing total compensation of each Executive Officer and to articulate a new total compensation strategy. Accordingly, during Fiscal 2008 and 2009, the Committee undertook to realign executive compensation in consideration of the goals of the Corporation and the challenges facing the forest products industry. This resulted in a number of significant decisions affecting compensation, and the establishment of the compensation philosophy fully described below. Salaries for executives were frozen in 2010. All remaining Named Executives Officers in the Defined Benefit Supplementary Pension Plan (Mr. Lopez, Mr. Dumas and Mr. Pelletier) were transferred to the Supplementary Defined Contribution Plan for future service, effective January 1, 2010, and all remaining management employees on Defined Benefit Pension Plans were transferred to the Tembec Supplementary Defined Contribution Plan for future service, effective July 1, 2010. The changes were made to better align executive compensation with Tembec’s performance and allow the Corporation to effectively compete in the forest products industry.

The following has been prepared to ensure the transparency of the Corporation’s executive compensation strategy. It provides explanations regarding the Corporation’s compensation philosophy and the objectives and implementation of the Corporation’s executive compensation programs.

Introduction

The Committee is mandated by the Board to supervise and approve or recommend to the Board, depending on the level of seniority of the executive involved the human resources practices and policies of the Corporation that support its strategy and objectives. The Corporation’s strategy and objectives are rooted in the following principles and guidelines that provide a reference point in accomplishing the Corporation’s mission:

| | • | | Create a safe and competitive working environment in which every employee can contribute; |

| | • | | Manage the Corporation efficiently and effectively to achieve consistently superior financial performance in the forest industry; |

| | • | | Remain a global leader in resource stewardship; |

| | • | | Attain and maintain an operational regime focused on energy efficiency, minimum reliance on all forms of purchased energy and feasible reduction of greenhouse gas emissions; |

| | • | | Be a world-class manufacturing entity that consistently supplies high-quality products through its commitment to innovation and continuous improvement; |

| | • | | Consider customers as long-term partners, anticipating and meeting their needs, including environmentally-friendly solutions, and provide them with superior service; and |

| | • | | Establish partnerships with suppliers that consistently meet the Corporation’s quality, service and price requirements. |

| | | | |

Management Information Circular | | 14 | | Tembec Inc. |

Compensation Philosophy

The executive compensation philosophy of the Corporation is designed to ensure both external and internal equity. External equity is ensured by linking the compensation policy to market compensation practices, as typically expressed in terms of market positioning. Internal equity is ensured by the consistent application of the policy to all covered executive positions, thereby ensuring that all incumbents are treated in a fair and equitable manner for performance at all levels. Such compensation philosophy is based on the following principles and guidelines and, as a consequence, the Corporation’s total compensation for its Executive Officers is sensitive to the achievement of operational objectives that contribute to increasing shareholder value:

| | • | | Support the maximization of shareholder value by emphasizing incentive compensation over fixed compensation; |

| | • | | Favor dependable and sustainable performance by ensuring that the CEO’s compensation is primarily comprised of long-term incentives; |

| | • | | Maintain a significant percentage of at-risk compensation for each senior Executive Officer, |

| | • | | Identify a proper reference market and establish the desirable position for Tembec within such reference market both by compensation component and for total compensation; |

| | • | | Assess on a regular basis the aggregate compensation of each Executive Officer and the incentives to which they are subject in light of the Corporation’s compensation philosophy and make the appropriate adjustment(s) if and when necessary; and |

Central to such compensation philosophy is the effective design and implementation of a long-term incentive program with the objectives to:

| | • | | Offer a significant incentive opportunity to the Executive Officers to create shareholder value over cycles ranging from 3 to 5 years; |

| | • | | Promote retention of key contributors; |

| | • | | Offer superior rewards for superior results; and |

| | • | | Maintain tax and cost effectiveness. |

The Committee has the authority to retain any independent consultant of its choice to advise its members on total executive compensation policy matters and to determine the fees and the terms and conditions of the engagement of such consultants.

During Fiscal 2008, the Committee asked Towers Perrin (now Towers Watson & Co.) (“Towers”) to conduct a comprehensive review of the total compensation of each Executive Officer of the Corporation, and assist the Committee in formulating the executive compensation philosophy described above. Towers was also given the mandate to design a new long-term incentive program and further provided their assessment with respect to the trends and practices on executive compensation to the Committee. Towers reported directly to the Committee for these matters.

The Committee did not require the services of Towers or any other firm for consulting services related to executive compensation during Fiscal 2010. However, Towers provided the Corporation with pension-related consulting services during Fiscal 2010 and data to determine appropriate fees for Directors who are members of the Special Committee for Strategic Purposes.

| | | | |

Management Information Circular | | 15 | | Tembec Inc. |

The Committee is satisfied that it has appropriately fulfilled its mandate during Fiscal 2010.

Reference Market

The comparator group used for the NEOs of the Corporation is provided in the table below:

| | |

Industry | | Corporation |

Paper and Forest Products | | AbitibiBowater Inc. |

| | Canfor Corporation |

| | Cascades Inc. |

| | Catalyst Paper Corporation |

| | Domtar Corporation |

| | Fraser Papers Inc. |

| | International Forest Products Corporation |

| | Norbord Inc. |

| | West Fraser Timber Co. Ltd |

| |

Industrial Manufacturing | | Algoma Steel Inc. (now Essar Algoma Steel Inc.) |

| | Dofasco Inc. (now Arcelormittal Dofasco Inc.) |

| | Gerdau Ameristeel Corporation |

| | ShawCor Ltd. |

The 13 Canadian companies have been selected on the basis of meeting most or all of the following characteristics that are common to the Corporation:

| | • | | Companies in the pulp, paper, forest products, basic materials, and/or other capital intensive industry; and |

| | • | | Companies that have either lost executives to or attracted executives from the pulp, paper and forest products industry. |

The Corporation reviews the composition of the comparator group approximately every three years. The latest review occurred in Fiscal 2008.

| | | | |

Management Information Circular | | 16 | | Tembec Inc. |

Target Market Position

Each component of the compensation package (base salary, short-term incentives, long-term incentives, pension, benefits and perquisites) are separately considered in the benchmarking. The Committee approves the formula and target amount for each component of compensation separately based on the Corporation’s financial goals. Each component by itself could be slightly below or above the median. However, the total target value of the compensation package comprised of all the components is positioned at the median of the benchmark results. The following table shows the components of total compensation:

| | | | | | | | | | |

Component | | Type | | Form | | Performance Period | | Payouts Based On | | Market Positioning |

Base Salary | | Fixed | | Cash | | One year | | Adjustments based on individual performance and market trends | | Target = 95% of median |

| | | | | |

Short-Term Incentives | | Variable | | Cash | | One year | | Operational performance | | Target = median |

| | | | | |

Long-Term Incentives | | Variable | | Performance-Conditioned Restricted Share Units | | Three years | | Mix of operational and stock market performance | | Target = amount required to position target total compensation at median assuming that salary is at 95% of median |

| | | | | |

Pension | | Fixed | | Employer-provided value | | One year (linked to applicable pensionable earnings) | | Accrued entitlement | | Competitive in local market |

| | | | | |

Benefits | | Fixed | | Indirect compensation | | One year (linked to salary) | | Coverage based on a mix of fixed and salary-based components | | Target = market median |

| | | | | |

Perquisites | | Fixed | | Indirect compensation | | Not performance-driven | | Actual usage cost with a maximum | | Below market, minimal |

| | | | | |

Total Compensation | | | | | | | | Emphasis on at-risk performance-driven pay | | Target = median |

Pay Mix

The following table sets forth the percentage of each component of the total compensation package for the NEOs in accordance with the above stated compensation policy and the effect of the assumed achievement of target performance on the compensation programs for the financial year ended September 25, 2010.

The target weightings of each component intend to put more emphasis on the at-risk compensation of each senior executive to ensure his alignment with shareholders’ interest. The relative weighting of each component of direct compensation is aligned with each senior executive’s ability to influence the short and long-term performance of the Corporation.

| | | | |

Management Information Circular | | 17 | | Tembec Inc. |

| | | | | | | | | | | | | | |

Name | | Base

Salary

(%) | | Short-term

Incentive

(%) | | Long-term

Incentive

(%) | | Pension and

Benefits (%) | �� | Perquisite

(%) | | Total Target

Compensation

(%) | | Total at-risk

Compensation

(%) |

James Lopez | | 30 | | 18 | | 46 | | 6 | | 0 | | 100 | | 64 |

Michel Dumas | | 37 | | 15 | | 40 | | 7 | | 1 | | 100 | | 55 |

John Valley | | 37 | | 15 | | 40 | | 7 | | 1 | | 100 | | 55 |

Yvon Pelletier | | 37 | | 15 | | 40 | | 7 | | 1 | | 100 | | 55 |

Dennis Rounsville | | 37 | | 15 | | 40 | | 7 | | 1 | | 100 | | 55 |

Pay Leverage

The Corporation’s emphasis on variable at-risk pay results in a highly leveraged total compensation opportunity for its executives. Total compensation will be below the market median when performance objectives are not met and, conversely, will exceed the median when achieved performance is above objectives.

Executive Compensation Components

This section provides additional details regarding each executive compensation component and their underlying rationale.

Base Salary

For its executive positions, since the Corporation has decided to put more emphasis on variable compensation, it uses a salary structure based on scales with a midpoint set at 95% of the comparator group median for equivalent positions. The midpoint defines the target salary level for the position. Base salaries within each scale range from 80% to 120% of the midpoint. The actual base salary paid to an executive officer takes into consideration his responsibilities, current and sustained performance in the position, skills and potential to ensure that the base salary reflects his actual contribution.

The following table summarizes the actual salaries of NEOs as compared to the revised target salary midpoints:

| | | | | | | | | | | | | | |

Name | | Current Salary | | | Market Median | | | Midpoint(1) | | | Actual vs. Midpoint

(%) |

James Lopez | | $ | 880,000 | | | $ | 804,000 | | | $ | 760,000 | | | 116 |

Michel Dumas | | $ | 400,000 | | | $ | 398,000 | | | $ | 380,000 | | | 105 |

John Valley | | $ | 360,200 | | | $ | 334,000 | | | $ | 310,000 | | | 116 |

Yvon Pelletier | | $ | 330,000 | | | $ | 404,000 | | | $ | 380,000 | | | 87 |

Dennis Rounsville | | $ | 320,000 | | | $ | 392,000 | | | $ | 380,000 | | | 84 |

| (1) | Some salary midpoints were rounded and amalgamated together in a single band for internal consistency despite slight differences in position market values. |

James Lopez’s salary in Fiscal 2010 was $880,000, unchanged from the prior Fiscal year. The salary midpoint for Mr. Lopez is $760,000. As a result, Mr. Lopez’s salary as a percentage of the target salary midpoint is 116%.

Michel Dumas’ salary in Fiscal was $400,000, unchanged from the prior Fiscal year. The target salary midpoint for Mr. Dumas is $380,000. As a result, Mr. Dumas’ salary as a percentage of the target salary midpoint is 105%.

| | | | |

Management Information Circular | | 18 | | Tembec Inc. |

John Valley’s salary in Fiscal 2010 was $360,200, unchanged from the prior Fiscal year. The target salary midpoint for Mr. Valley is $310,000. As a result, Mr. Valley’s salary as a percentage of the target salary midpoint is 116%.

Yvon Pelletier’s salary in Fiscal 2010 was $330,000, unchanged from the prior Fiscal year. The target salary midpoint for Mr. Pelletier is $380,000. As a result, Mr. Pelletier’s salary as a percentage of the target salary midpoint is 87%.

Dennis Rounsville’s salary in Fiscal 2010 was $320,000, unchanged from the prior Fiscal year. The target salary midpoint for Mr. Rounsville is $380,000. As a result, Mr. Rounsville’s salary as a percentage of the target salary midpoint is 84%.

The CEO’s salary is determined at the sole discretion of the Board. Salaries of other NEOs are also determined by the Board following a recommendation by the CEO to the Committee.

Short-Term Incentives

The purpose of the Corporation’s short-term incentive plan (“STIP”) is to support the achievement of short-term objectives that contribute to the execution of the Corporation’s strategy in order to maximize shareholder return. This is accomplished by aligning executives’ pay with the achievement of predetermined performance objectives measured with key and objective financial performance indicators. The STIP does not include any discretionary component or objectives unrelated to corporate performance. The Committee approved the financial performance indicators and objectives of the STIP for the financial year ended September 25, 2010 at the beginning of such fiscal year. The financial performance indicators and objectives are based on the Corporation’s operating plans for the year as approved by the Board. Members of the Board participate in the Corporation’s annual budget and strategic planning meeting where an annual operating budget is approved and which partially forms the basis from which the Committee formulates corporate performance indicators and related performance objectives to be used under the STIP. The plan design specifies the target and maximum annual incentive award as a percentage of base salary. These percentages vary based on the level of the position held. If the performance objectives are not met, the payout could potentially be nil. If the targets are exceeded, the payout potential can reach twice the target amount.

The STIP payout opportunities for NEOs are as follows (as percentages of actual base salary):

| | | | | | |

Name | | Minimum (%) | | Target (%) | | Maximum (%) |

James Lopez | | 0 | | 60 | | 120 |

Michel Dumas | | 0 | | 40 | | 80 |

John Valley | | 0 | | 40 | | 80 |

Yvon Pelletier | | 0 | | 40 | | 80 |

Dennis Rounsville | | 0 | | 40 | | 80 |

The following table summarizes the Fiscal 2010 performance indicators applicable to Messrs. Lopez, Dumas and Valley:

| | | | | | | | | | | | | | | | | | | | | | |

| | | Performance Indicator | | Weight

(%) | | Threshold | | | Target | | | Maximum | | | Actual | | | Award (%) |

Corporate | | Corporate EBITDA | | 50 | | $ | 65 million | | | $ | 75 million | | | $ | 229 million | | | $ | 132 million | | | 137.01 |

| | Cash Flow from Operations | | 50 | | $ | 28 million | | | $ | 38 million | | | $ | 145 million | | | $ | 86 million | | | 136.92 |

| | | | | | | | | | | | | | | | | | | | | | |

| | Total Corporate | | 100 | | | | | | | | | | | | | | | | | | 136.97 |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | |

Management Information Circular | | 19 | | Tembec Inc. |

Mr. Lopez received a STIP award of $723,202 for Fiscal 2010, which represented 136.97% of a target STIP Award of $528,000. In the prior Fiscal year, Mr. Lopez did not receive any STIP award as compared to the same STIP Target of $528,000.

Mr. Dumas received a STIP award of $219,152 for Fiscal 2010, which represented 136.97% of a target STIP award of $160,000. In addition, a discretionary award of $30,848 was granted to Mr. Dumas. In the prior Fiscal year, Mr. Dumas did not receive any STIP award as compared to the same STIP target of $160,000.

Mr. Valley received a STIP award of $197,346 for Fiscal 2010 which represented 136.97% of a target STIP award of $144,080. In the prior Fiscal year, Mr. Valley did not receive any STIP award as compared to the same STIP target of $144,080.

The following table summarizes the Fiscal 2010 performance indicators applicable to Mr. Pelletier. In addition to the previously noted corporate indicators, Mr. Pelletier had several performance indicators related to the results of the Pulp Group.

| | | | | | | | | | | | | | | | | | | | | | |

| | | Performance Indicator | | Weight

(%) | | Threshold | | | Target | | | Maximum | | | Actual | | | Award

(%) |

Corporate | | Corporate EBITDA | | 25 | | $ | 65 million | | | $ | 75 million | | | $ | 229 million | | | $ | 132 million | | | 34.25 |

| | Cash Flow from Operations | | 25 | | $ | 28 million | | | $ | 38 million | | | $ | 145 million | | | $ | 86 million | | | 34.23 |

| | | | | | | | | | | | | | | | | | | | | | |

| | Total Corporate | | 50 | | | | | | | | | | | | | | | | | | 68.48 |

| | | | | | | | | | | | | | | | | | | | | | |

Pulp Group | | Pulp Group EBITDA | | 12.5 | | $ | 104.3 million | | | $ | 110.3 million | | | $ | 202.2 million | | | $ | 157.5 million | | | 18.93 |

| | Pulp Group Working Capital | | 12.5 | | | 147.2 million | | | $ | 132.9 million | | | $ | 117.5 million | | | $ | 122 million | | | 21.61 |

| | | | |

| | Pulp Group Cost/Unit | | 12.5 | |

| Quantitative information is not provided as it contains sensitive

information that is not in Tembec’s best interest to disclose.

|

| | 18.82 |

| | Pulp Group Competitive EBITDA Margin Benchmarking (Rank) | | 12.5 | | | 8th | | | | 6th | | | | 4th | | | | 7th | | | 6.25 |

| | Total – Pulp Group | | 50 | | | | | | | | | | | | | | | | | | 65.61 |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | 100 | | | | | | | | | | | | | | | | | | 134.09 |

| | | | | | | | | | | | | | | | | | | | | | |

Mr. Pelletier received a STIP award of $176,992 which represented 134.09% of a target STIP award of $132,000. In addition, a discretionary award of $23,008 was granted to Mr. Pelletier. In the prior Fiscal year, Mr. Pelletier had received a STIP award of $37,310, which represented 28.26% of a target STIP award of $ 132,000.

The following table summarizes the Fiscal 2010 performance indicators applicable to Dennis Rounsville. In addition to the corporate indicators described above, Mr. Rounsville had several performance indicators related to the results of the Forest Products Group.

| | | | | | | | | | | | | | | | | | | | | | |

| | | Performance Indicator | | Weight

(%) | | Threshold | | | Target | | | Maximum | | | Actual | | | Award

(%) |

Corporate | | Corporate EBITDA | | 25 | | $ | 65 million | | | $ | 75 million | | | $ | 229 million | | | $ | 132million | | | 34.25 |

| | Cash Flow from Operations | | 25 | | $ | 28 million | | | $ | 38 million | | | $ | 145 million | | | $ | 86 million | | | 34.23 |

| | | | | | | | | | | | | | | | | | | | | | |

| | Total Corporate | | 50 | | | | | | | | | | | | | | | | | | 68.48 |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | |

Management Information Circular | | 20 | | Tembec Inc. |

| | | | | | | | | | | | | | | | | | | | | | |

| | | Performance Indicator | | Weight

(%) | | Threshold | | | Target | | | Maximum | | | Actual | | | Award

(%) |

Forest Product Group | | Forest Product Group EBITDA | | 12.5 | | - $ | 23 million | | | $ | 0 million | | | $ | 12 million | | | - $ | 10 million | | | 9.56 |

| | Forest Product Group Working Capital | | 12.5 | |

| Various group/divisions objectives related to

inventory receivables and payables

|

| | 18.00 |

| | Forest Product Group Cost/Unit | | 12.5 | |

| Quantitative information is not provided as it

contains sensitive information that is not in

Tembec’s best interest to disclose.

|

| | 23.20 |

| | Forest Product Group Competitive EBITDA Margin Benchmarking (Rank) | | 12.5 | |

| 70th

percentile |

| |

| 40th

percentile |

| |

| 10th

percentile |

| |

| 70th

percentile |

| | 0.00 |

| | Total – Forest Product Group | | 50 | | | | | | | | | | | | | | | | | | 50.75 |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | 100 | | | | | | | | | | | | | | | | | | 119.24 |

| | | | | | | | | | | | | | | | | | | | | | |

Mr. Rounsville received a STIP award of $152,621, which represented 119.24% of a target STIP award of $128,000. In the prior Fiscal year, Mr. Rounsville had received a STIP award of $32,960, which represented 25.75% of a target STIP award of $128,000.

In the tables above, all performance indicators are GAAP financial measures, except for the following:

| | |

Non-GAAP Financial Measure | | Formula |

EBITDA | | Sales less cost of sales and selling, general and administrative expenses meaning it represents operating earnings before depreciation, amortization and other specific or non-recurring items. |

| |

Cash Flow from Operations | | EBITDA less capital expenditures adjusted for changes to working capital and the borrowing base available pursuant to the various operating lines of credits. |

| |

Working Capital | | At a given date, the sum of accounts receivable, inventory and prepaid expenses less accounts payables and accruals. |

| |

Cost/Unit | | For a given period, the sum of variable and fixed input costs (fibre, energy, chemicals, labour, etc.) divided by the saleable production for the same period. |

| |

Competitive Pulp Group EBITDA Benchmarking | | Relative ranking of the Pulp Group’s EBITDA for a given period compared to the EBITDA of other pulp groups for corresponding period. |

| |

Competitive Forest Products Group EBITDA Benchmarking | | Relative ranking of the Forest Products Group’s EBITDA for a given period compared to the EBITDA of other North American forest products groups for the corresponding period. |

| | | | |

Management Information Circular | | 21 | | Tembec Inc. |

Long-Term Incentives

The objective of the Corporation’s long-term incentive program is to link executive pay with the long-term corporate operational and financial market performance, to retain key executives, and to contribute to providing them with a competitive total compensation opportunity.

The Corporation is currently granting long-term incentive awards under the Performance-Conditioned Restricted Share Unit Plan (the “PCRSU Plan”). However, NEOs have received long-term incentive awards that are still outstanding under “legacy” plans. Due to the relatively low potential value of these “legacy” plans, the Committee did not consider them when granting awards under the PCRSU Plan.

Former Long-Term Incentive Plan

The former Long-Term Incentive Plan (“Former LTIP”) was designed to:

| | (i) | align the interests of key employees with those of shareholders by participation in a stock purchase program and through the granting of options in order to ensure that key employees own at least 50% of their base salary in shares on an ongoing basis; |

| | (ii) | reward key employees if the Corporation’s relative performance is superior to its competitors; and |

| | (iii) | retain key employees. |

Under the stock purchase section of the Former LTIP, participants in the Former LTIP were granted an annual entitlement to purchase shares, without any financial assistance from the Corporation, determined by multiplying the individual’s base salary by a factor applicable to the position. The factor ranged from 0.50 for the CEO, down to 0.10 depending on the level of the position. The factor for the other NEOs was set at 0.25. On the date of the grant of the entitlement, a key employee was awarded options to purchase that number of shares which is equal to the entitlement divided by the weighted average closing price of the Former Tembec’s common shares during the five trading days preceding the date of grant, multiplied by two. An option granted under the Former LTIP expires no later than ten years after the date on which the option was granted. An option becomes vested and may be exercised after 24 months following the date of grant for up to 40% of the number of shares to which the participant is entitled, after 36 months following the date of grant, up to another 20% of the number of shares to which the participant is entitled, after 48 months following the date of grant, up to another 20% of the number of shares to which the participant is entitled and, after 60 months following the date of grant, up to the last 20% of the number of shares to which the participant is entitled. If an option holder retires at the normal retirement age, the holder’s options vest immediately and may be exercised within five years. If an option holder retires earlier than normal retirement age, all of the holder’s vested options may be exercised within five years and all of the holder’s unvested options, at the discretion of the Committee, vest immediately and may be exercised within five years. In case of a change of control of the Corporation leading to termination of an option holder’s employment, such holder’s options will vest immediately and may be exercised within five years.

Options are exercisable at a price per share equal to the weighted average closing price of the Corporation’s common shares on the TSX during the five trading days preceding the date of the option grant. As result of the Recapitalization that was completed on February 29, 2008, the exercise price of the then issued and outstanding options were increased 17.1 times and the number of options was reduced by the same factor. As a result, it is likely that most of these options will expire “out of the money” and not provide any compensation to their holders.

| | | | |

Management Information Circular | | 22 | | Tembec Inc. |

Any options granted under the Former LTIP will terminate: (i) on the date of expiration specified in the notice of grant, such date being no later than ten years after the date the option is granted; (ii) immediately upon the termination of the optionee’s employment when the employment is terminated for cause; (iii) 90 days after the date of the termination of the optionee’s employment due to his or her resignation; and (iv) 180 days after the date of the optionee’s death, during which period the options may be exercised only by the optionee’s legal personal representatives and only to the extent the optionee would have been entitled to exercise the options at the time of his or her death.

Certain employees who committed to purchase shares under an annual entitlement received a participating award and a participating monetary award and remain eligible to receive a long-term monetary award based on the Corporation’s performance compared with a sample of the return on capital invested of companies in the Canadian forest products industry at the end of a measurement period and based on the amount such participant has paid for shares committed in the subscription. Based on the Corporation’s financial performance, it is also unlikely that any compensation will be earned pursuant to this component of the Former LTIP.

The rights of a participant pursuant to the provisions of the Former LTIP are non-assignable. The Board may, subject to approval of the TSX, amend or terminate the Former LTIP at any time but, in such event, the rights of employees will be preserved and maintained. The terms of the Former LTIP do not require that shareholder approval be obtained in order for the Former LTIP to be amended.

Securities Authorized for Issuance under Equity Compensation Plans

The following table sets out certain details with respect to the compensation plans under which equity securities of the Corporation are authorized for issuance as at the end of the Corporation’s most recently completed financial year:

| | | | | | |

| | | Number of securities

to

be issued upon

exercise

of outstanding

options, warrants

and rights(1) | | Weighted-average

exercise price of

outstanding options,

warrants and rights(1) | | Number of securities

remaining available for

future issuance under

equity compensation

plans (excluding

securities reflected in

column (a)) |

Plan Category | | (a) | | (b) | | (c) |

Equity compensation plans approved by securityholders | | 161,123 | | $89.01 | | 301,342 |

Equity compensation plans not approved by securityholders | | N/A | | N/A | | N/A |

| | | | | | |

Total | | 161,123 | | $89.01 | | 301,342 |

| | | | | | |

| (1) | As of September 25, 2010 |

As of November 30, 2010, the total number of common shares of the Corporation reserved for issuance under the Former LTIP was 301,342 or approximately 0.3% of the issued and outstanding common shares of the Corporation. 160,652 options to purchase 160,652 common shares representing 0.2% of the issued and outstanding common shares of the Corporation were outstanding under all former stock option plans as of November 30, 2010.

| | | | |

Management Information Circular | | 23 | | Tembec Inc. |

Former Performance Share Unit Plan

On January 26, 2006, the Board of Directors of Former Tembec adopted a Performance Share Unit Plan (the “Former PSU Plan”) to replace the Former LTIP with a view to retaining key employees, encouraging the achievement of the Corporation’s objectives by key employees and promoting a greater alignment of interests between such employees and the shareholders of the Corporation. 25% of the awarded performance share units (“PSUs”) vest following three years after the effective date of the award provided that the participant is still an employee of the Corporation. Vesting of the remaining 75% is subject to satisfaction of performance criteria in addition to time vesting.

In the event of death, disability or retirement between the effective date of an award of PSUs and the end of the performance period, the participant or, as the case may be, the participant’s beneficiaries, shall be entitled to the vested PSUs following the completion of the performance period that will terminate in the calendar year of death, disability or retirement, had the participant been in active employment as of the end of the performance period. PSUs related to a performance period ending after the end of the calendar year of death, disability or retirement shall be forfeited.

Vested PSUs are settled in the form of a cash payment only. This payment is equal to the product of the number of vested PSUs and the average closing market price of the Corporation’s shares and, if applicable, warrants over the last 5 trading days prior to the date of valuation. As of 2009, the Former PSU Plan does not require participants to use a portion of the amounts received in settlement of PSUs to purchase common shares of the Corporation.

The Former PSU Plan has effectively been replaced by the PCRSU Plan described below.

Performance-Conditioned Restricted Share Unit Plan

On August 1, 2008, the Board decided to replace the Former PSU Plan with the PCRSU Plan. Executive Officers, including NEOs, and other key employees (“Participants”) are eligible to participate in the PCRSU Plan. Under the PCRSU Plan, Participants are granted a specified number of performance-conditioned restricted share units (“PCRSUs”) that vest over a three-year period if certain corporate performance objectives established by the Committee are met. The purpose of the PCRSU Plan is to enhance the Corporation’s ability to attract and retain executives and key employees of the Corporation and its subsidiaries and to promote a greater alignment of interests between such individuals and the shareholders of the Corporation and to provide a performance incentive for the attainment of pre-established performance objectives.

The target annual long-term incentive opportunities for NEOs are as follows (as a percentage of actual base salary):

| | |

Name | | Target (%) |

James Lopez | | 150 |

Michel Dumas | | 110 |

John Valley | | 110 |

Yvon Pelletier | | 110 |

Dennis Rounsville | | 110 |

| | | | |

Management Information Circular | | 24 | | Tembec Inc. |