- LIND Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

CORRESP Filing

Lindblad Expeditions (LIND) CORRESPCorrespondence with SEC

Filed: 27 May 15, 12:00am

Graubard Miller The Chrysler Building 405 Lexington Avenue New York, N.Y. 10174-1101 (212) 818-8800 | ||||

| facsimile | direct dial number | |||

| (212) 818-8881 | (212) 818-8638 | |||

| email address | ||||

| jgallant@graubard.com |

May 26, 2015

VIA EDGAR

Ms. Anne Nguyen Parker

Assistant Director

Securities and Exchange Commission

100 F Street, N.E.

Washington, D.C. 20549

| Re: | Capitol Acquisition Corp. II | |

| Revised Preliminary Proxy Statement on Schedule 14A | ||

| Filed May 11, 2015 | ||

| File No. 001-35898 |

Dear Ms. Parker:

On behalf of Capitol Acquisition Corp. II (the “Company”), we respond as follows to the Staff’s comment letter, dated May 19, 2015, relating to the above-captioned Preliminary Proxy Statement on Schedule 14A (“Proxy Statement”). Captions and page references herein correspond to those set forth in Amendment No. 3 to the Proxy Statement, a copy of which has been marked with the changes from Amendment No. 2 to the Proxy Statement. We are also delivering three (3) courtesy copies of such marked copy to Tonya K. Aldave.

Please note that for the Staff’s convenience, we have recited each of the Staff’s comments and provided the Company’s response to each comment immediately thereafter.

General

| 1. | Please update your financial statements in accordance with Rule 3-12 of Regulation S-X. |

We have updated the financial statements in accordance with Rule 3-12 of Regulation S-X as requested.

Securities and Exchange Commission

May 26, 2015

Page 2

Satisfaction of 80% Test, page 58

| 2. | We note your disclosure added in response to prior comment 4 where you describe the valuation analysis performed to support the $407 million fair market value of Lindblad. Please provide us with a copy of your valuation analysis and/or report. |

A copy of the valuation analysis performed by the Company is attached hereto as Exhibit A.

Equity Method Investment, page FS-15

| 3. | Please confirm our understanding that the owners of CFMF, Cruise/Ferry Finance Partners Private Foundation (as stated in your response to our previous comment 10) also controlled CFMF. Additionally, please tell us the names of the owners/shareholders of CFMF. It appears that if the owners of CFMF also controlled CFMF, and CFMF had control of Lindblad as you previously stated, they also controlled Lindblad. Please support your assertion that CFMF and Lindblad were not under common control, or revise your financial statements to account for this transaction as a transfer of assets among entities under common control in accordance with FASB ASC 805-50-25, 805- 50-30-5, and 805-50-45. Finally, please tell us the business purpose for the purchase of CFMF. In this regard, tell us why the company acquired CFMF versus repaying the outstanding debt with CFMF. |

Business Purpose for the Purchase of CFMF

We respectfully advise the Staff that the purpose of the December 11, 2014 transactions was to recapture and terminate the outstanding, unexercised warrant (the “Warrant”) held by CFMF That Warrant, giving its holder the right to acquire 60% of the shares of Lindblad stock for nominal consideration, came out of a package of concessions granted by Lindblad in connection with a restructuring of its debt in 2009. At that time, as a result of the financial crisis, Lindblad was under extraordinary financial and business pressures that had exhausted its cash reserves. CFMF, already a lender to Lindblad, offered to restructure its existing junior loan to defer certain obligations and to provide additional credit. CFMF also agreed to forebear from enforcing certain of its rights under its loan to Lindblad. In exchange, CFMF wanted substantial equity in Lindblad and representation on Lindblad’s Board. Ultimately, Lindblad agreed – with the consent and approval of Sven-Olof Lindblad as majority shareholder – to grant the extraordinary rights that the agreement represented including granting CFMF the power to designate two members of the Lindblad Board and declaring that CFMF had control of Lindblad. CFMF’s power to designate two of the three Board members and its corresponding control was memorialized in a Voting Agreement dated April 15, 2009 by and among Lindblad, Sven-Olof Lindblad, and DVB Bank America N.V. (“DVB”) as agent and security trustee for CFMF.

By 2014, Lindblad had regained its footing and was no longer under the same financial and business pressures that it was under in 2009. At this time, it wanted to explore possible strategic options. However, it could not make any commitments so long as the Warrant was outstanding because by its terms, the Warrant was freely transferable, had no expiration and was not redeemable by Lindblad. Nor would eventual repayment of the junior loan to CFMF be of any help in this regard, as repayment would have had no effect on the Warrant itself.

Securities and Exchange Commission

May 26, 2015

Page 3

Seeking to relieve Lindblad of the uncertainty to its future caused by the Warrant, Lindblad’s President and majority shareholder, Sven-Olof Lindblad, initiated negotiations with CFMF with the goal of repurchasing the Warrant. Although there was a willingness on the part of CFMF to relinquish the Warrant in exchange for fair value, it would not agree to any transaction involving a direct sale of the Warrant. For non-US tax reasons beneficial to the holders of interests in or to CFMF, it was CFMF’s firm requirement that any such transaction be structured instead as a sale of the various interests in CFMF. Inasmuch as the end result would allow Lindblad, through acquisition of ownership and control of CFMF, to recapture and extinguish the Warrant, Lindblad agreed to such a transaction structure as the only means of recovering the Warrant.

This led to entry into the several agreements as of December 11, 2014 that provided for the purchase by Lindblad of (i) the Profit Participation Loan (“PPL”) held by DVB, (ii) the Profit Participation Rights (“PPR”) held by Buss 1 and Buss 2, and (iii) the outstanding stock of CFMF held by Cruise/Ferry Finance Partners Private Foundation (the “Finance Foundation”). For reasons of Lindblad’s cash flow, and to permit it to obtain the financing it needed to fund payment of the amounts due the selling parties, each of the three agreements allowed for deferred closing: the PPL purchase agreement gave Lindblad until June 30, 2015 to pay the balance due DVB after the initial payment of $25 Million made by Lindblad on December 11, 2014; the PPR purchase agreement and the stock purchase agreement each gave Lindblad until December 31, 2016 to make the required payments. The stock purchase agreement contained an additional provision that made its closing contingent upon the prior closing of the PPL and PPR purchases.

Following completion of the transactions on May 8, 2015, the Warrant was cancelled and the Voting Agreement that had given CFMF a right to designate members of Lindblad’s Board and provided CFMF with control was terminated. Upon Lindblad owning and controlling CFMF, the Junior loan owing to CFMF was repaid. CFMF then having no remaining assets or liabilities, Lindblad initiated proceedings for the liquidation of CFMF on May 21, 2014, and liquidation will be final as of May 29, 2015. Lindblad’s acquisition of CFMF was thus only a means to the desired end of recapturing and terminating the Warrant.

Ownership and Control of CFMF

The Staff asked that we confirm their understanding that the Finance Foundation, as owners of CFMF, also controlled CFMF. We respectfully advise the Staff that its understanding in that respect is not correct. Although the Finance Foundation owned 100% of the common stock of CFMF (as of the time of Lindblad’s entry into the various agreements that would result in Lindblad’s acquisition of CFMF), the Finance Foundation did not control CFMF.

Securities and Exchange Commission

May 26, 2015

Page 4

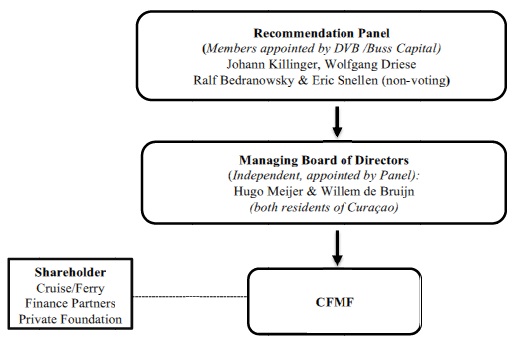

Corporate governance of CFMF, as established by the CFMF Amended Deed of Incorporation (the “Deed”), was by a Managing Board of Directors. Although the initial Director was appointed by the Deed itself, the Deed gave the power of appointment to the Managing Board of Directors not to the shareholder of CFMF but to a Recommendation Panel (the “Panel”). Such a governance structure was and is permitted by Curacao law for the N.V. form of entity that was chosen when CFMF was established. The Deed also specified that the sole authority to appoint representatives to the Panel was to be held by DVB and Buss Capital GmbH & Co. KG (“Buss Capital”). The Finance Foundation was not granted any right to appoint members to the Panel or to the Board. The members of the Managing Board of Directors of CFMF were at all relevant times independent.

Prior to its acquisition by Lindblad, the ownership and control structure of CFMF was thus as follows:

Securities and Exchange Commission

May 26, 2015

Page 5

Finance Foundation, the sole shareholder of CFMF, was itself organized as a private foundation under Curacao law. This type of entity may engage in business but not make any profit (i.e., any gain it does derive from business activities or investments must be donated to charitable purposes to offset what otherwise would be recognized as profit). Accordingly, private foundations such as Finance Foundation do not have any shareholders or owners. Nor, despite its name, were there any “partners” in Finance Foundation. The management and control of the Finance Foundation was vested in a single Managing Director who functioned under the direction and supervision of a single member Supervisory Board. Neither the sole managing director (Jan Koning) nor the sole Supervisory Board member (Willem de Bruijn) had any legal or beneficial ownership in Finance Foundation, and both were independent.

Finance Foundation Did Not Control CFMF

We respectfully disagree with the Staff’s statement that “if the owners of CFMF also controlled CFMF, and CFMF had control of Lindblad as you previously stated, they also controlled Lindblad.” As described above, Finance Foundation, though it was the owner of CFMF, did not control CFMF. Control of CFMF in many but not all respects was in the hands of the Managing Board of Directors, and above that by the Recommendation Panel that had the power of appointment to the Board, and ultimately by DVB and Buss Capital that had the power of appointment to the Panel. But fundamental company actions (merger, etc.) involving CFMF would require consent of its shareholder(s), and so in some respects Finance Foundation would have had shared control over CFMF. But none of the respects in which Finance Foundation might have shared control over CFMF would have resulted in it having any control over Lindblad.

Prior to the acquisition of CFMF by Lindblad, CFMF had the power to designate two of the three members of Lindblad’s board pursuant to the Voting Agreement entered into in connection with the 2009 restructuring of Lindblad’s debt. Any decisions regarding those designations would have been made by CFMF’s own Board, over which Finance Partners had no influence. As a result, CFMF had effective control over Lindblad’s Board.

Upon the completion of Lindblad’s acquisition of CFMF on May 8, 2015, the Voting Agreement was terminated and CFMF ceased to have any power of appointment whatsoever to the Lindblad Board. Following that acquisition, the Warrant was cancelled without it ever having been exercised.

Lindblad’s Acquisition of CFMF (the “Transaction”)

We respectfully request that the Staff note, as discussed above inBusiness Purpose for the Purchase of CFMF, that Lindblad’s intention in the CFMF transactions was to remove the uncertainty to its future that the Warrant represented. That goal was achieved through the series of related transactions carried out pursuant to the agreements entered into on December 11, 2014 and concluded on May 8, 2015. Since control of CFMF and Lindblad changed as a result of these transactions, from some combination of DVB, Buss Capital and Finance Foundation, to the shareholders of Lindblad, we consider that accounting for the transactions in accordance with the common control guidance inFASB ASC 805-50-25, 805-50-30-5, and 805-50-45 is not applicable.

Securities and Exchange Commission

May 26, 2015

Page 6

All facts and circumstances related to a transaction must be considered in determining whether common control exists. Typically entities are under common control if they (1) were consolidated by the same parent both before and after the transaction or (2) would have been consolidated if the parent (or controlling party) were required to prepare consolidated financial statements.” Neither of these is the case with CFMF and Lindblad. Following the Transaction, there was a change in control. After the acquisition of CFMF by Lindblad, CFMF was liquidated. CFMF has no continuity.

The $25 million payment made by Lindblad to CFMF in December 2014 was the initial payment on the transactions (presented in our financial statements as an equity investment) that ultimately led to recapture and termination of the Warrant. Following completion of the transactions, Lindblad gained sole control of CFMF, and with that control took action to eliminate the authority of the Recommendation Panel), cancel the Warrant, and terminate CFMF's right to designate members of the Lindblad Board. None of the entities that formerly had any control or influence over CFMF prior to completion of Lindblad’s acquisition of CFMF retained any control or influence over either Lindblad or CFMF after the acquisition.

CFMF and Lindblad were Not Under Common Control subsequent to completion of the Transaction

In accordance with FASB Accounting Standards Codification (“ASC”) 805-50-25, 805-50-30-3, and 805-50-45, an acquisition between entities under common control is not under the scope of standard business combination accounting (under ASC 805-10 through 805-30). The ASC sections references provide that when there is an acquisition between entities with a common parent, the “pooling of interests” method would apply and all assets and liabilities transferred would be measured at book value. Furthermore, the financial statements shall be retrospectively adjusted to furnish comparative information of the entity acquired. ASC 805-50-30-5 provides that “when accounting for a transfer of assets or exchange of shares between entities under common control, the entity that receives the net assets or the equity interests should initially measure the recognized assets and liabilities transferred at their carrying amounts in the accounts of the transferring entity at the date of transfer.”

Securities and Exchange Commission

May 26, 2015

Page 7

ASC 805 does not, however, provide a definition of what common control is. ASC 805-50-15-6 provides some example of common control transactions. We have provided an analysis for the Staff on whether these examples are analogous to the acquisition of CFMF by Lindblad, below:

| Examples of Common Control from ASC 805-50-15-6 | Applicability to the acquisition of CFMF by Lindblad | |

| a. An entity charters a newly formed entity and then transfers some or all of its net assets to that newly chartered entity. | This does not apply to this transaction. No newly chartered entity was formed. | |

b. A parent transfers the net assets of a wholly owned subsidiary into the parent and liquidates the subsidiary. That transaction is a change in legal organization but not a change in the reporting entity. | This does not apply to this transaction. No assets were transferred from a subsidiary to a parent. | |

c. A parent transfers its controlling interest in several partially owned subsidiaries to a new wholly owned subsidiary. That also is a change in legal organization but not in the reporting entity. | This does not apply to this transaction. No new subsidiary was formed. | |

d. A parent exchanges its ownership interests or the net assets of a wholly owned subsidiary for additional shares issued by the parent’s less-than-wholly-owned subsidiary, thereby increasing the parent’s percentage of ownership in the less-than-wholly-owned subsidiary but leaving all of the existing noncontrolling interest outstanding. | This does not apply to this transaction. No ownership interests were transferred from one subsidiary to another. | |

e. A parent’s less-than-wholly-owned subsidiary issues its shares in exchange for shares of another subsidiary previously owned by the same parent, and the noncontrolling shareholders are not party to the exchange. That is not a business combination from the perspective of the parent. | This does not apply to this transaction. No shares were exchanged between subsidiaries. | |

f. A limited liability company is formed by combining entities under common control. | This does not apply to this transaction. No LLC was formed by combining entities. | |

g. Two or more not-for-profit entities (NFPs) that are effectively controlled by the same board members transfer their net assets to a new entity, dissolve the former entities, and appoint the same board members to the newly combined entity. | This does not apply to this transaction. Neither CFMF nor Lindblad is a NFP entity. |

Securities and Exchange Commission

May 26, 2015

Page 8

All facts and circumstances related to a transaction must be considered in determining whether common control exists. Typically entities are under common control if they (1) were consolidated by the same parent both before and after the transaction or (2) would have been consolidated if the parent (or controlling party) were required to prepare consolidated financial statements.” Neither of these is the case with CFMF and Lindblad. Following the acquisition of CFMF by Lindblad, there was a change in control. After the acquisition of CFMF by Lindblad, liquidation proceedings were initiated. As a result, CFMF has no continuity.

Note 7 – Long Term Debt

Junior Credit Facility, page FS-22

| 4. | Your response to our prior comment 11 indicates an additional borrowing under the Junior Credit Facility occurred on January 19, 2010 of $15 million, for a total amount outstanding of $40 million. It does not appear this additional borrowing is disclosed in this footnote. As such, please revise your disclosure here to include a discussion of this additional borrowing, including all material terms. |

We have revised the disclosure on page FS-40 of the Proxy Statement to include a discussion of the additional borrowing of $15 million, including all material terms, as requested.

| 5. | Further, we note your statement that the Second Amendment to the Junior Credit Facility increased availability to $40 million. Your response to our prior comment 11 appears to indicate availability was already $40 million. Please clarify this disclosure. |

We have clarified the disclosure on page FS-40 of the Proxy Statement relating to the increased availability of the Junior Credit Facility to $40 million as requested.

| 6. | As a related matter, please tell us whether this revision is related to the shareholder loans issued on the same date, as discussed in Note 14 on page FS-31. |

We respectfully advise the Staff that the shareholders loans that were issued on the same day, and discussed in Note 14, are not related to the Junior Credit Facility Second Amendment

| 7. | It appears from your response to our prior comment 12 that the Second Amendment to the Junior Credit Facility does not contain a prepayment penalty; instead, it requires prepayment of $10 million on or before December 31, 2012. If our understanding is correct, please revise your disclosure to include language indicating the $10 million payment was mandatory by December 31, 2012, and that the credit facility did not contain penalties for prepayment. The disclosure as currently presented appears to indicate the remaining $30 million is subject to prepayment penalty. |

Securities and Exchange Commission

May 26, 2015

Page 9

We have revised the disclosure on page FS-40 of the Proxy Statement to include language indicating the $10 million payment was mandatory by December 31, 2012, and that the credit facility did not contain penalties for prepayment as requested.

Note 9 – Commitments and Contingencies, page FS-26

| 8. | Refer to our prior comment 13. Please further revise the disclosure related to the extended NG agreement to include how you intend to record this transaction in your financial statements. In this regard, we note you have included an adjustment in your pro forma financial statements to record the value of the option as a capital contribution in accordance with SAB Topic 5.T. |

We have revised the disclosure on page FS-43 of the Proxy Statement to include how Lindblad intends to record this transaction in its financial statements as requested.

*************

If you have any questions, please do not hesitate to contact me at the above telephone and facsimile numbers.

| Sincerely, | |

| /s/ Jeffrey M. Gallant | |

| Jeffrey M. Gallant |

| cc: | Mr. Mark Ein |

Securities and Exchange Commission

May 26, 2015

Page 10

EXHIBIT A

STRICTLY PRIVATE & CONFIDENTIAL

Lindblad Valuation at Offer and Satisfaction of the 80 Percent Test

| $ in millions | ||||

| Capitol Acquisition Corp. II | ||||

| Cash in Trust | $ | 200 | ||

| Less: Deferred Underwriting Discount | (8 | ) | ||

| Cash in Trust Net of Deferred Underwriting Discount | $ | 192 | ||

| Threshold for 80% Test (= 80% of Cash in Trust Net of Deferred Underwriting Discount) | $ | 154 | ||

| Lindblad Expeditions, Inc. | ||||

| Equity Value at Offer (1) | $ | 330 | ||

| Less: Cash, unrestricted (12/31/14) | (40 | ) | ||

| Less: Cash, restricted (12/31/14) | (8 | ) | ||

| Less: CFMF Cash (2) | (4 | ) | ||

| Plus: Debt (12/31/14) | 57 | |||

| Plus: Remaining CFMF Purchase Price (3) | 73 | |||

| Enterprise Value at Offer | $ | 407 | ||

| EV / 2015 Adjusted EBITDA ($45 million) | 9.1 | x | ||

| Median EV / 2015E Adjusted EBITDA (4) | 12.1 | x | ||

Lindblad Fair Market Value = Lindblad Enterprise Value at Offer | $ | 407 | ||

80 Percent Test | ||||

| Lindblad Fair Market Value | $ | 407 | ||

| Threshold for 80% Test | 154 | |||

| Lindblad Fair Market Value in Excess of Threshold for 80% Test | $ | 253 | ||

80 Percent Test Met? | YES |

(1) Merger consideration to Lindblad shareholders, negotiated at arms-length.

(2) Cash at CFMF acquired with the purchase of CFMF.

(3) Per CFMF purchase agreements.

(4) Median of valuation multiples of publicly-traded comparable companies (Carnival Corporation & plc, Royal Caribbean Cruises Ltd., and Norwegian Cruise Line Holdings Ltd.) based on Wall Street research, Bloomberg and FactSet.