- BSQKZ Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Block (BSQKZ) DEF 14ADefinitive proxy

Filed: 26 Apr 24, 4:00pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

|

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

|

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under § 240.14a-12

BLOCK, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee paid previously with preliminary materials

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

BLOCK, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held at 12:00 p.m. (U.S. Pacific Time) on Tuesday, June 18, 2024

Dear Stockholders of Block, Inc.:

We cordially invite you to attend the 2024 annual meeting of stockholders (the “Annual Meeting”) of Block, Inc., a Delaware corporation, which will be held virtually on Tuesday, June 18, 2024, at 12:00 p.m. (U.S. Pacific Time). You can attend the Annual Meeting by visiting www.virtualshareholdermeeting.com/SQ2024, where you will be able to listen to the meeting live, submit questions and vote your shares online during the meeting, just as you could at an in-person meeting.

We are holding the Annual Meeting for the following purposes, as more fully described in the accompanying proxy statement:

Our board of directors has fixed the close of business on April 22, 2024 (U.S. Eastern Time) as the record date for the Annual Meeting. Only stockholders of record at the close of business on April 22, 2024 (U.S. Eastern Time) are entitled to notice of, and to vote at, the Annual Meeting. A list of stockholders entitled to vote at the Annual Meeting will be available for examination by any stockholder for any purpose germane to the Annual Meeting for a period of ten days ending the date prior to the date of the Annual Meeting at 1955 Broadway, Suite 600, Oakland, CA 94612. Further information regarding voting rights, the matters to be voted upon and instructions to attend the Annual Meeting is presented in the accompanying proxy statement.

The Notice of Internet Availability of Proxy Materials containing instructions on how to access the proxy statement and our annual report is first being mailed on or about April 26, 2024 to all stockholders entitled to vote at the Annual Meeting. The accompanying proxy statement and our annual report can be accessed by visiting www.proxyvote.com. You will be asked to enter the 16-digit control number located on your Notice of Internet Availability of Proxy Materials, your proxy card or the instructions that accompanied your proxy materials to attend the Annual Meeting.

Holders of record of Chess Depositary Interests (“CDIs”) as of the close of business on April 22, 2024 (U.S. Eastern Time) may vote the shares of our Class A common stock underlying their CDIs through our CDI Depositary, CHESS Depositary Nominees Pty Ltd (“CDN”). Each CDI holder may instruct CDN to vote on behalf of such CDI holder at the Annual Meeting by either voting online at www.investorvote.com.au or contacting Computershare Australia using the details on the Notice of Access Letter to request a hard copy of the CDI voting form to be sent in the mail to their registered address. The CDI Notice of Access Letter is being mailed or emailed from Australia to CDI holders on or about April 29, 2024 (Australia time).

YOUR VOTE IS IMPORTANT. Whether or not you plan to attend the Annual Meeting, we urge you to submit your vote via the Internet, telephone or mail as soon as possible to ensure your shares are represented. For additional instructions on attending the Annual Meeting or voting your shares (or directing CDN to vote if you hold your shares in the form of CDIs), please refer to the section entitled “Questions and Answers About Our Proxy Materials and the Annual Meeting” in this proxy statement. Returning the proxy does not deprive you of your right to attend the Annual Meeting or to vote your shares at the Annual Meeting.

We appreciate your continued support of Block.

| By order of the Board of Directors, |

|

|

|

|

|

|

| Jack Dorsey |

| Block Head, Square Head and Chairperson of the Board of Directors |

|

|

| Approximate Date of Mailing of Notice of Internet Availability of Proxy Materials: April 26, 2024 |

TABLE OF CONTENTS |

EXECUTIVE SUMMARY |

This summary highlights information regarding the 2024 annual meeting of stockholders of Block, Inc., a Delaware corporation (referred to herein as the “Company,” “Block,” “we,” “us” or “our”) contained elsewhere in this proxy statement. This summary does not contain all of the information you should consider, and you should read the entire proxy statement carefully before voting. Throughout this proxy statement, we refer to our 2024 annual meeting of stockholders (and any postponements, adjournments, or continuations thereof) as the “Annual Meeting.”

Information about our 2024 Annual Meeting of Stockholders

Date and Time: Tuesday, June 18, 2024, at 12:00 p.m. (U.S. Pacific Time).

Location: The Annual Meeting will be a completely virtual meeting. You can attend the Annual Meeting by visiting www.virtualshareholdermeeting.com/SQ2024, where you will be able to listen to the meeting live, submit questions, and vote your shares online during the meeting.

Record Date: April 22, 2024 (U.S. Eastern Time).

Voting Matters

|

|

| Proposals |

|

| Board |

| | Page Number for |

| |

| 1 |

|

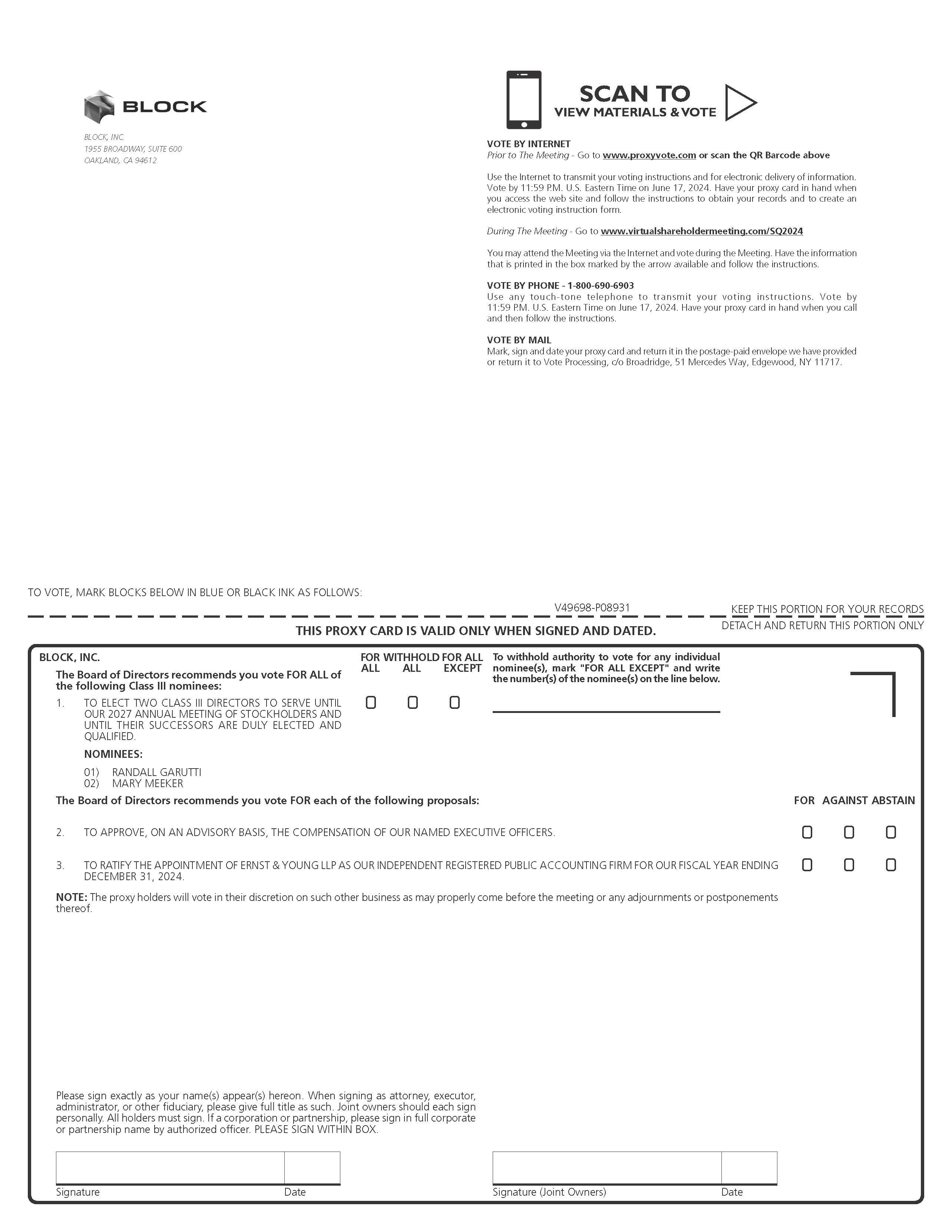

| To elect Randall Garutti and Mary Meeker to serve as our Class III directors until our 2027 annual meeting of stockholders and until their successors are duly elected and qualified. |

|

| FOR |

| | 17 |

|

| 2 |

|

| To approve, on an advisory basis, the compensation of our named executive officers. |

|

| FOR |

| | 18 |

|

| 3 |

|

| To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2024. |

|

| FOR |

| | 19 |

|

We will also transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof. As of the date of this proxy statement, we have not received notice of any such business.

Information contained on or accessible through our website is not incorporated by reference in this proxy statement, and references to our website address in this proxy statement are inactive textual references only.

| BLOCK 2024 Proxy Statement | i |

Corporate Governance Highlights

We are committed to having sound corporate governance principles that we believe promote long-term value and serve the best interest of all our stockholders, sellers, customers and other stakeholders. Some highlights of our corporate governance practices are listed below:

• Proactive approach to board of directors pipeline management • 7 out of 10 current directors are independent • 4 out of 10 current directors are women; 2 out of 10 current directors identify as underrepresented minorities • 2 out of 4 current executive officers are women • Separate Lead Independent Director and Chairperson • Strong risk oversight by full board of directors and committees |

| • Annual board of directors, committee and individual director evaluations • Significant stock ownership requirements for directors and executive officers • Insider Trading Policy prohibits hedging and pledging transactions • All board committees are 100% independent • Comprehensive clawback policies for our executive officers |

Our 2024 Director Nominees

Both of our Class III director nominees currently serve on our board of directors and demonstrate a mix of experiences and perspectives.

| Name |

|

| Director |

|

| Experience |

| | Independent | | | Board and Committee | | | Other Current | |

| Randall Garutti |

|

| 2017 |

|

| Chief Executive Officer, Shake Shack, Inc. |

| | X | | | Chair, Nominating and Corporate Governance Committee; Compensation Committee | | | Shake Shack, Inc. | |

| Mary Meeker |

|

| 2011 |

|

| General Partner, Bond Capital |

| | X | | | Chair, Compensation Committee | | | Next Door Holdings, Inc. | |

| BLOCK 2024 Proxy Statement | ii |

Executive Compensation Philosophy and Highlights

Our Compensation Philosophy

At Block, we are building an ecosystem of ecosystems, each focused on distinct customer audiences. We define an ecosystem as a set of tools and services that work together cohesively, often positively reinforcing one another. This helps create resilient relationships with customers as they use our tools and services to satisfy multiple needs. Our ecosystems are united by our shared purpose of economic empowerment, with each ecosystem serving different people — sellers, consumers, artists, fans, and developers. As we scale, we are focused on investing in developing connections between our ecosystems and by creating more connections to increase the resilience of our overall company.

Our compensation programs are designed to attract, retain, and grow the best teams that are aligned with this purpose and embody the essential values of our company culture, centered around the following core principles:

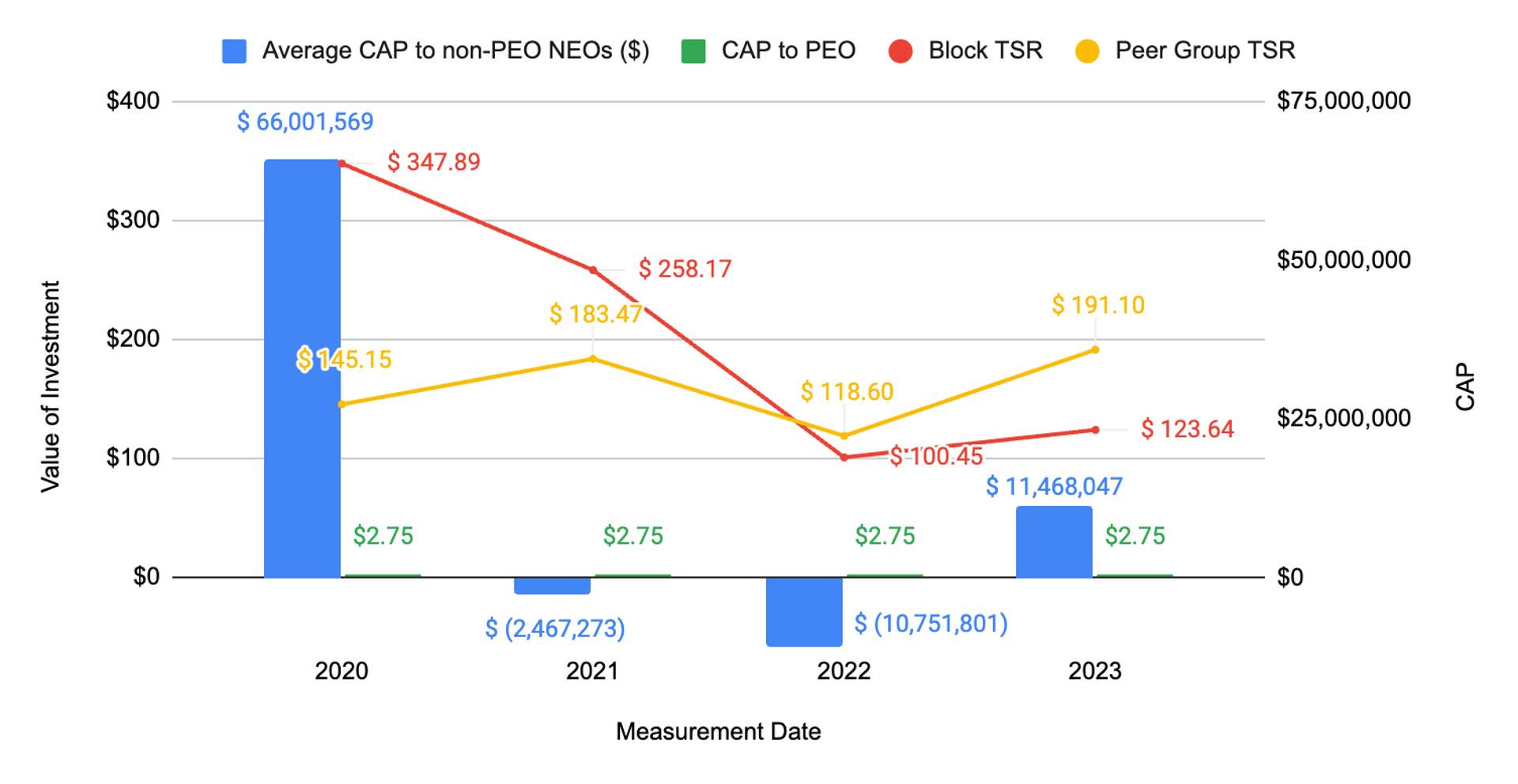

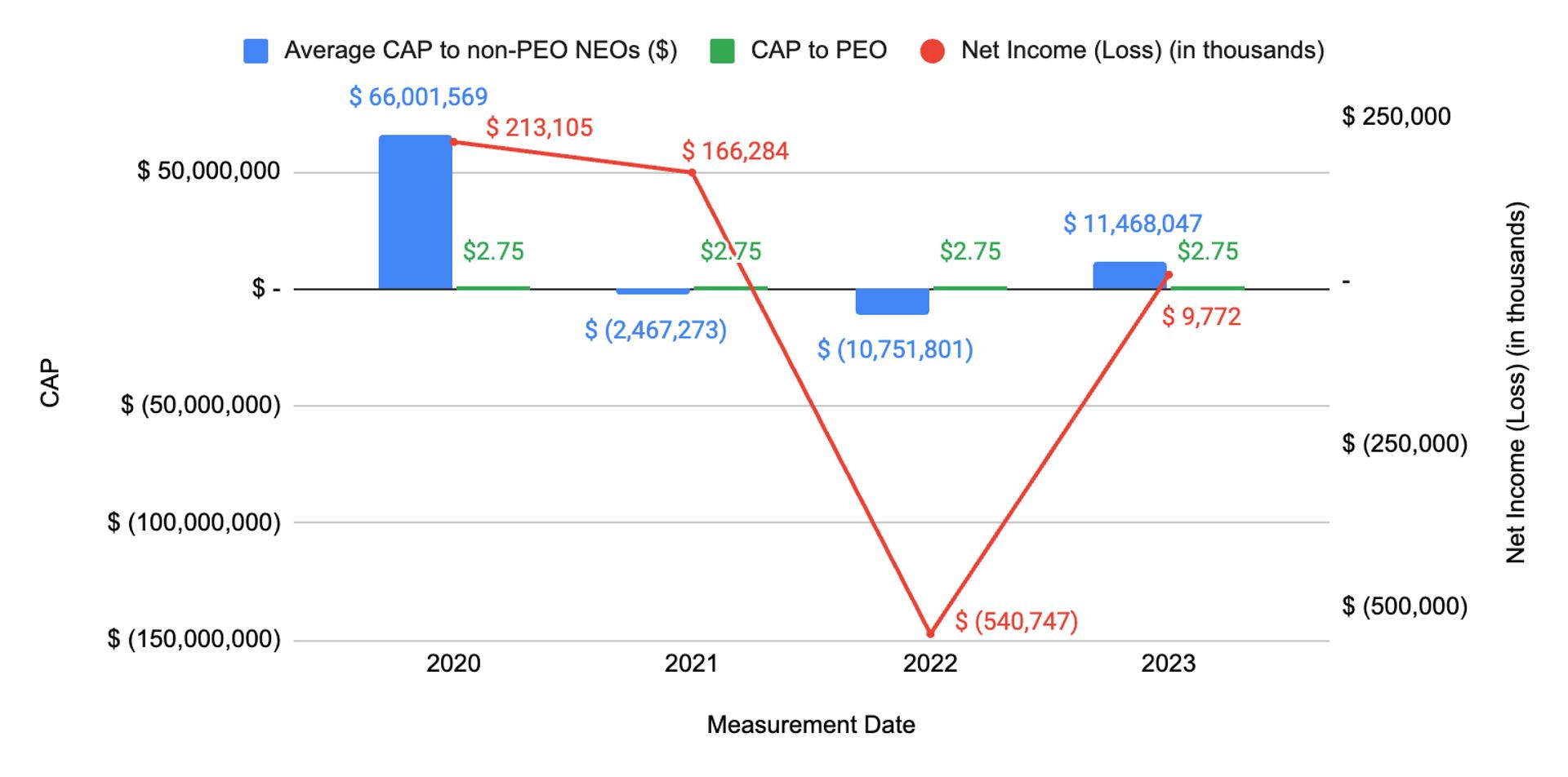

Executive Compensation Highlights

• Block Head (our version of Chief Executive Officer) Compensation. At his request, Jack Dorsey receives no cash or equity compensation except for an annual salary of $2.75. • Annual “Say-on-Pay” Vote. We conduct an annual advisory vote on the compensation of our named executive officers. At our 2023 annual meeting of stockholders, approximately 98% of the votes cast on the “say-on-pay” proposal were voted in favor of the named executive officers’ compensation. • Robust Clawback Policies. In addition to the financial restatement clawback policy mandated by the U.S. Securities and Exchange Commission (the “SEC”) and the listing standards of the New York Stock Exchange (the “NYSE”) for Section 16 officers, all covered employees who receive severance via a change of control and severance agreement, including our executive officers, are subject to a severance clawback policy, which permits us to recover certain severance compensation if an employee engages in certain misconduct. |

| • Independent Compensation Consultant. Our compensation committee engages its own independent compensation consultant to advise on executive and outside director compensation matters. • Alignment of Compensation with Company Success. A substantial percentage of our executive officers’ compensation aligns with the long-term success of the company through grants of stock options and stock-based awards. • Risk Oversight. Strong oversight by our compensation committee mitigates risk and exposures. • Stock Ownership Guidelines. Our stock ownership guidelines require significant stock ownership levels and are designed to align the long-term interests of our executives and outside directors with those of our stockholders. |

| BLOCK 2024 Proxy Statement | iii |

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE |

We are committed to having sound corporate governance principles. Our business affairs are managed under the direction of our board of directors, which is currently composed of 10 members. All of our current directors, other than Messrs. Carter, Dorsey and McKelvey, are independent within the meaning of the listing standards of the NYSE. Our board of directors is divided into three staggered classes of directors. At each annual meeting of stockholders, a class of directors will be elected for a three-year term to succeed the class whose term is then expiring.

The following table sets forth the names, ages as of April 26, 2024, and certain other information for each of the members of our board of directors with terms expiring at the Annual Meeting, who are also nominees for election as a director at the Annual Meeting, and for each of the other current members of our board of directors. As previously announced, Ms. Rothstein, who currently serves as a Class III director, will not stand for reelection at the Annual Meeting. Ms. Rothstein’s term will expire at the Annual Meeting.

Name |

| Class |

| Age |

| Position |

| Director |

| Current |

| Expiration of Term |

|

|

|

|

|

|

|

|

|

|

|

|

|

Directors with Terms Expiring at the Annual Meeting/Nominees | ||||||||||||

Randall Garutti(1)(2) |

| III |

| 49 |

| Director |

| 2017 |

| 2024 |

| 2027 |

Mary Meeker(2) |

| III |

| 64 |

| Director |

| 2011 |

| 2024 |

| 2027 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Continuing Directors | ||||||||||||

Jack Dorsey |

| I |

| 47 |

| Block Head, Square Head and Chairperson |

| 2009 |

| 2025 |

| — |

Paul Deighton(2)(3) |

| I |

| 68 |

| Director |

| 2016 |

| 2025 |

| — |

Neha Narula(1)(3) |

| I |

| 42 |

| Director |

| 2023 |

| 2025 |

| — |

Roelof Botha(2)(3) |

| II |

| 50 |

| Lead Independent Director |

| 2011 |

| 2026 |

| — |

Amy Brooks(1) |

| II |

| 49 |

| Director |

| 2019 |

| 2026 |

| — |

Shawn Carter |

| II |

| 54 |

| Director |

| 2021 |

| 2026 |

| — |

James McKelvey |

| II |

| 58 |

| Director |

| 2009 |

| 2026 |

| — |

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-Continuing Director | ||||||||||||

Sharon Rothstein(2) |

| III |

| 66 |

| Director |

| 2022 |

| 2024 |

| — |

|

| BLOCK 2024 Proxy Statement | 1 |

Director Nominees

Randall Garutti has served as a member of our board of directors since July 2017. Since April 2012, Mr. Garutti has served as Chief Executive Officer and on the board of directors of Shake Shack, Inc. (“Shake Shack”). Mr. Garutti has announced that he expects to step down from both roles effective May 2024 and transition to an advisor role through year end. Prior to becoming Chief Executive Officer of Shake Shack, Mr. Garutti served as its Chief Operating Officer since January 2010. Before Shake Shack, Mr. Garutti was the Director of Operations for Union Square Hospitality Group, LLC, overseeing the operations for all its restaurants. Additionally, Mr. Garutti serves on the board of directors of the Columbus Avenue Business Improvement District, a not-for-profit organization. He previously served on the board of directors of USHG Acquisition Corp. from February 2021 to December 2022. Mr. Garutti holds a B.S. in Hotel Administration from Cornell University’s School of Hotel Administration.

Mr. Garutti was selected to serve on our board of directors because of his business expertise and leadership of a global brand.

Mary Meeker has served as a member of our board of directors since June 2011. Since January 2019, Ms. Meeker has served as a General Partner of Bond Capital. From December 2010 to December 2018, Ms. Meeker served as a General Partner of Kleiner Perkins Caufield & Byers. From 1991 to 2010, Ms. Meeker served as Managing Director and Research Analyst with Morgan Stanley. Ms. Meeker previously served on the boards of directors of LendingClub Corporation, from June 2012 to June 2019, and DocuSign, Inc., from July 2012 to June 2019, and currently serves on the board of directors of Nextdoor Holdings, Inc. and a number of privately held companies as well as the Defense Innovation Board. Ms. Meeker holds a B.A. in Psychology from DePauw University and an M.B.A. from Cornell University.

Ms. Meeker was selected to serve on our board of directors because of her extensive experience advising and analyzing technology companies.

Continuing Directors

Jack Dorsey is our co-founder and has served as our principal executive officer and as a member of our board of directors since July 2009, having previously served as our Chief Executive Officer and President from July 2009 until his title changed to Block Head as of April 2022. Mr. Dorsey has also served as our Square Head since October 2023 and as Chairperson of our board of directors since October 2010. From May 2007 to October 2008, Mr. Dorsey served as President and Chief Executive Officer of Twitter, Inc. (“Twitter”). Mr. Dorsey returned to serve as Chief Executive Officer of Twitter from July 2015 until November 2021. He served on the board of directors of Twitter from May 2007 to May 2022.

Mr. Dorsey was selected to serve on our board of directors because of the perspective and experience he provides as one of our founders and our Block Head, as well as his extensive experience with technology companies and innovation.

Paul Deighton has served as a member of our board of directors since May 2016. In April 2024, it was announced that Mr. Deighton will serve as Chairman of Goldman Sachs International and Goldman Sachs International Bank. Mr. Deighton has served as the non-executive Chairperson of The Economist Group since July 2018 and the non-executive Chairman of Heathrow Airport Holdings Limited, the owner of Heathrow Airport in the United Kingdom since June 2016. From December 2012 to May 2015, Mr. Deighton served as Commercial Secretary to the Treasury and as a member of the House of Lords in the United Kingdom. Mr. Deighton previously served as the Chief Executive Officer of the London Organising Committee of the Olympic and Paralympic Games and held various roles at Goldman Sachs. Mr. Deighton serves as the non-executive Chairperson of Hakluyt Company Limited, an advisory firm. Mr. Deighton holds a B.A. in Economics from Trinity College, Cambridge University.

Mr. Deighton was selected to serve on our board of directors because of his financial and business expertise, as well as his international perspective and his government and regulatory experience.

Neha Narula has served as a member of our board of directors since July 2023. Dr. Narula has served as a Director of the Digital Currency Initiative at the Massachusetts Institute of Technology (“MIT”) Media Lab, an interdisciplinary research lab focusing on cryptocurrencies and blockchain technology, since January 2017, and she previously was the Director of Research in digital currency at MIT Media Lab from May to December 2016. Prior to joining MIT, Dr. Narula was a Senior Software Engineer at Google. Dr. Narula currently serves on the Financial Industry Regulatory Authority’s FinTech Industry Committee and

| BLOCK 2024 Proxy Statement | 2 |

the Federal Reserve Bank of New York’s Innovations Advisory Council. She also previously served on PayPal’s Blockchain, Crypto, and Digital Currencies Advisory Council and the World Economic Forum’s Global Futures Council on Blockchain. Dr. Narula holds a B.A. in Mathematics and Computer Science from Dartmouth College and a Master’s degree and a Ph.D. in Computer Science from MIT.

Dr. Narula was selected to serve on our board of directors because of her experience with distributed systems, cryptography, cryptocurrencies and programmable money.

Roelof Botha has served as a member of our board of directors since January 2011 and as our Lead Independent Director since June 2022. Since January 2003, Mr. Botha has served in various positions at Sequoia Capital, a venture capital firm, including as a Senior Steward and as a Managing Member of Sequoia Capital Operations, LLC. From 2000 to 2003, Mr. Botha served in various positions at PayPal Holdings, Inc., including as Chief Financial Officer. Mr. Botha serves as the Chairman of the board for Unity Software Inc. and on the boards of directors of 23andMe Holding Co., Natera, Inc., MongoDB, Inc. and a number of privately held companies. Mr. Botha previously served on the boards of directors of Bird Global, Inc., from June 2018 to December 2022, and Eventbrite, Inc., from October 2009 to June 2022. Mr. Botha holds a B.S. in Actuarial Science, Economics and Statistics from the University of Cape Town and an M.B.A. from the Stanford Graduate School of Business.

Mr. Botha was selected to serve on our board of directors because of his financial and managerial experience.

Amy Brooks has served as a member of our board of directors since October 2019. Since January 2024, Ms. Brooks has served as President, New Business Ventures at the National Basketball Association, after serving as President, Team Marketing & Business Operations and Chief Innovation Officer from November 2017 to December 2023, the Executive Vice President from May 2014 to November 2017 and Senior Vice President from January 2010 to May 2014. Ms. Brooks also serves on the boards of directors of a number of privately held companies and charitable organizations. Ms. Brooks holds a B.A. in Political Science and Communication from Stanford University and an M.B.A. from the Stanford Graduate School of Business.

Ms. Brooks was selected to serve on our board of directors because of her sales and marketing experience as well as her expertise in growing a global brand.

Shawn Carter has served as a member of our board of directors since May 2021. Known professionally as Jay-Z, Mr. Carter is a musician, songwriter, record executive, producer and entrepreneur. He has served as the co-founder and majority owner of Roc Nation LLC and founder of Marcy Media LLC, a full-service agency and entertainment company, since 2008 and co-founder and Manager of Marcy Venture Partners, L.P., a venture capital and private equity firm, since March 2019. Mr. Carter founded TIDAL, which is now majority owned by Block, in March 2015, and remains a shareholder and artist of the music streaming service. Since 2014, Mr. Carter has served as the co-founder, Manager and board member of Ace of Spades Holdings, LLC, a luxury champagne company, and serves on the boards of directors of a number of privately held companies. Since 2003, Mr. Carter has served as the founder of the Shawn Carter Scholarship Foundation, a charitable organization focused on education. He also serves on the board of directors of REFORM, a philanthropic organization advocating for criminal justice reform. Mr. Carter previously served as the Chief Visionary Officer of TPCO Holding Corp. (“TPCO Holding”) from November 2020 to 2023, and as the Chief Brand Strategist of CMG Partners, Inc., or Caliva, from July 2019 until its acquisition by TPCO Holding in November 2020.

Mr. Carter was selected to serve on our board of directors because of his entrepreneurial experience and expertise in the music industry, which is valuable for our TIDAL business.

James McKelvey is our co-founder and has served as a member of our board of directors since July 2009. Since March 2012, Mr. McKelvey has served in various positions at Mira Smart Conferencing, Inc., a digital conferencing company. Mr. McKelvey currently serves on the board of directors of Emerson Electric Co. and previously served as Chair of the St. Louis Federal Reserve. He also serves on the boards of directors of a number of privately held companies. Mr. McKelvey holds a B.S. in Computer Science and a B.A. in Economics from Washington University in St. Louis.

Mr. McKelvey was selected to serve on our board of directors because of the perspective and experience he brings as one of our founders.

| BLOCK 2024 Proxy Statement | 3 |

Non-Continuing Directors

Sharon Rothstein has served as a member of our board of directors since January 2022. Since October 2018, Ms. Rothstein has served as an Operating Partner at Stripes, LLC (“Stripes”), a growth equity firm. Prior to joining Stripes, Ms. Rothstein served as Executive Vice President, Global Chief Marketing Officer, and subsequently, as Executive Vice President, Global Chief Product Officer of Starbucks Corporation (“Starbucks”) from April 2013 to February 2018. Prior to joining Starbucks, Ms. Rothstein held senior marketing and brand management positions with Sephora, Godiva, Starwood Hotels and Resorts, Nabisco Biscuit Company and Procter & Gamble. Ms. Rothstein serves on the boards of directors of Yelp Inc., InterContinental Hotels Group PLC and a number of privately held companies. She previously served on the board of directors of Afterpay Limited (“Afterpay”) from June 2020 until its acquisition by Block in 2022. Ms. Rothstein holds a Bachelor of Commerce from the University of British Columbia and an M.B.A. from the University of California, Los Angeles.

Ms. Rothstein was appointed to our board of directors in connection with Block’s acquisition of Afterpay. She was selected to serve on our board of directors because of her marketing expertise and global operations experience.

Director Independence

Our Class A common stock is listed on the NYSE. Under NYSE listing standards, independent directors must comprise a majority of a listed company’s board of directors. In addition, NYSE listing standards require that, subject to specified exceptions, each member of a listed company’s audit, compensation and nominating and corporate governance committees be independent. Under NYSE listing standards, a director will only qualify as an “independent director” if, in the opinion of that listed company’s board of directors, that director does not have a material relationship with the company (either directly or as a partner, shareholder or officer of an organization that has a relationship with the company). As noted in the commentary to the listing standards, the concern is independence from management.

Audit and risk committee members must also satisfy the additional independence criteria set forth in Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and NYSE listing standards. Compensation committee members must also satisfy the additional independence criteria set forth in Rule 10C-1 under the Exchange Act and NYSE listing standards.

Our board of directors has undertaken a review of the independence of each of our directors. Based on information provided by each director concerning their background, employment and affiliations, our board of directors has determined that none of Mses. Brooks, Meeker, and Rothstein; Dr. Narula; or Messrs. Botha, Deighton, and Garutti has a material relationship with the Company and that each of these current directors is “independent” as that term is defined under NYSE listing standards. Former director Dr. Lawrence Summers (who resigned from our board of directors on February 9, 2024) was also determined to be independent within the meaning of the NYSE listing standards during the period in which he served on our board of directors. In making the determination of the independence of our directors, the board of directors considered relevant transactions between Block and entities associated with our directors or members of their immediate families, including transactions involving Block and payments made to or from companies and entities in the ordinary course of business where our directors or members of their immediate families serve as partners, directors or as a member of the executive management of the other party to the transaction, and determined that none of these relationships constitute material relationships that would impair the independence of our directors. In addition, each member of our audit and risk committee and our compensation committee meets the enhanced independence standards required for such committee members under the applicable rules and regulations of the SEC and the NYSE listing standards.

Board of Directors Leadership Structure and Role of Our Lead Independent Director

Our board of directors does not have a policy as to whether the roles of the Chairperson of our board of directors and our Block Head should be separate or combined. Our board of directors believes that it should have the flexibility to make this determination as circumstances require and in a manner that it believes is best to provide appropriate leadership for our company. Currently, Mr. Dorsey serves as both the Chairperson of our board of directors and our principal executive officer. As our co-founder and Block Head, Mr. Dorsey is best positioned to identify and drive strategic priorities, oversee product development, identify key areas of risk for the company, lead critical discussions and execute our business plans.

| BLOCK 2024 Proxy Statement | 4 |

Our board of directors has adopted Corporate Governance Guidelines that provide that one of our independent directors should serve as our Lead Independent Director at any time when the Chairperson of our board of directors is not independent. Because Mr. Dorsey is our Chairperson and is not an “independent” director as defined in NYSE listing standards, our board of directors has appointed Roelof Botha as our Lead Independent Director. Mr. Botha, a director since 2011, has served as our Lead Independent Director since June 2022. As a seasoned director with extensive experience in the financial technology industry, Mr. Botha has played an essential role in advising our senior management in key strategic areas and has provided independent oversight in his roles as a member of both our audit and risk committee and our compensation committee, and our board of directors believes that he is a strong, independent and effective Lead Independent Director.

As our Lead Independent Director, Mr. Botha is responsible for, among other matters:

We believe that our leadership structure of Mr. Dorsey serving as both Chairperson of our board of directors and Block Head, with a separate Lead Independent Director, is appropriate because it provides a balance between Mr. Dorsey’s company-specific experience, leadership and insight and our independent directors’ experience, leadership, oversight and expertise from outside of our company. This structure also enables strong leadership, creates clear accountability and enhances our ability to communicate our strategy clearly and consistently to stockholders while ensuring robust, independent oversight by our board of directors and our independent directors, led by our Lead Independent Director.

Board of Directors Meetings, Attendance and Committees

During our fiscal year ended December 31, 2023, our board of directors held four meetings, and each director attended at least 75% of the aggregate of (i) the total number of meetings of our board of directors held during the period for which such director has served as a director and (ii) the total number of meetings held by all committees of our board of directors on which such director has served during the periods that such director has served as a committee member, except Roelof Botha, who attended 72% of the aggregate of (i) and (ii). Mr. Botha attended all meetings of our board of directors during the fiscal year ended December 31, 2023. Mr. Botha’s absences from committee meetings were largely due to late adjustments to existing meeting schedules. Mr. Botha was briefed on matters covered at committee meetings, which included receipt of presentation materials provided. In addition, Mr. Botha made himself available to management between meetings to consult on specific matters.

| BLOCK 2024 Proxy Statement | 5 |

Although we do not have a formal policy regarding attendance by members of our board of directors at our annual meeting of stockholders, we encourage, but do not require, our directors to attend. All but one of our directors who were serving as directors at the time attended our 2023 annual meeting of stockholders.

Our board of directors has established an audit and risk committee, a compensation committee and a nominating and corporate governance committee. The composition and responsibilities of each of the committees of our board of directors is described below. Members serve on these committees until their resignation or until otherwise determined by our board of directors.

Audit and Risk Committee

Our audit and risk committee currently consists of Messrs. Botha and Deighton and Dr. Narula, with Mr. Deighton serving as Chair. Dr. Summers served on our audit and risk committee throughout 2023 until his departure from our board of directors in February 2024.

Each of our current audit and risk committee members meets (and during his tenure, Dr. Summers met) the requirements for independence for audit committee members under NYSE listing standards and SEC rules and regulations. Each member of our audit and risk committee also meets the financial literacy and sophistication requirements of NYSE listing standards. In addition, our board of directors has determined that each of Messrs. Botha and Deighton is an audit committee financial expert within the meaning of Item 407(d) of Regulation S-K under the Securities Act of 1933, as amended (“Regulation S-K”). Our audit and risk committee is, among other matters, responsible for the following:

Our audit and risk committee charter provides that, consistent with NYSE listing standards, no member of our audit and risk committee should simultaneously serve on the audit committees of more than two additional public companies unless our board of directors determines that such simultaneous service would not impair the ability of such member to effectively serve on our audit and risk committee and we disclose such determination. Our board of directors has considered Mr. Botha’s simultaneous service on the audit committees of three additional public companies and has determined that such simultaneous service does not impair his ability to effectively serve as a member of our audit and risk committee. We believe that Mr. Botha’s financial and managerial experience continue to provide valuable insight.

| BLOCK 2024 Proxy Statement | 6 |

Our audit and risk committee operates under a written charter that satisfies the applicable rules and regulations of the SEC and NYSE listing standards. A copy of the charter of our audit and risk committee is available on our investor relations website at https://investors.block.xyz. Information on or accessible through our website is not incorporated by reference in this proxy statement. During 2023, our audit and risk committee held eight meetings.

Compensation Committee

Our compensation committee consists of Mses. Meeker and Rothstein and Messrs. Botha, Deighton and Garutti, with Ms. Meeker serving as Chair. Mr. Garutti was appointed to our compensation committee in April 2024. Each of our compensation committee members, as well as Ms. Rothstein, who will serve on the compensation committee until the expiration of her term as a member of our board of directors at the Annual Meeting, meets the requirements for independence for compensation committee members under NYSE listing standards and SEC rules and regulations, including Rule 10C-1 under the Exchange Act. Each of Mses. Meeker and Rothstein and Messrs. Botha and Deighton is also a “non-employee director” as defined pursuant to Rule 16b-3 promulgated under the Exchange Act. Our compensation committee is, among other matters, responsible for the following:

Our compensation committee operates under a written charter that satisfies the applicable rules and regulations of the SEC and NYSE listing standards. A copy of the charter of our compensation committee is available on our investor relations website at https://investors.block.xyz. During 2023, our compensation committee held six meetings.

Our compensation committee may delegate its authority and duties to subcommittees or individuals as it deems appropriate and in accordance with applicable laws and regulations. Our compensation committee has delegated authority to our management equity committee, which during 2023 consisted of our Block Head and People Lead, to make equity grants within predetermined guidelines to employees and consultants who are not our Section 16 officers or members of our management equity committee. In addition, our compensation committee may establish, and has in the past established, a subcommittee comprised of members of our compensation committee, which has the nonexclusive authority to grant equity and other awards under our compensation plans, including, if applicable, awards that comply with Section 16 of the Exchange Act, including Rule 16b-3 thereunder.

Nominating and Corporate Governance Committee

Our nominating and corporate governance committee currently consists of Ms. Brooks, Dr. Narula and Mr. Garutti, with Mr. Garutti serving as Chair. Each of our nominating and corporate governance committee members meets the requirements for independence under NYSE listing standards and SEC rules and regulations. Our nominating and corporate governance committee is, among other matters, responsible for the following:

| BLOCK 2024 Proxy Statement | 7 |

Our nominating and corporate governance committee operates under a written charter that satisfies the applicable NYSE listing standards. A copy of the charter of our nominating and corporate governance committee is available on our investor relations website at https://investors.block.xyz. During 2023, our nominating and corporate governance committee held four meetings.

Compensation Committee Interlocks and Insider Participation

None of the current members of our compensation committee, or any member that served during the past fiscal year, is or has been an officer or employee of our company, or had any relationship requiring disclosure under Item 404 of Regulation S-K. None of our executive officers currently serves, or in the past fiscal year has served, as a member of the board of directors or compensation committee (or other board committee performing equivalent functions) of any entity that has one or more of its executive officers serving on our compensation committee. None of our executive officers currently serves, or in the past fiscal year has served, as a member of the compensation committee (or other board committee performing equivalent functions) of any entity that has one or more of its executive officers serving on our board of directors.

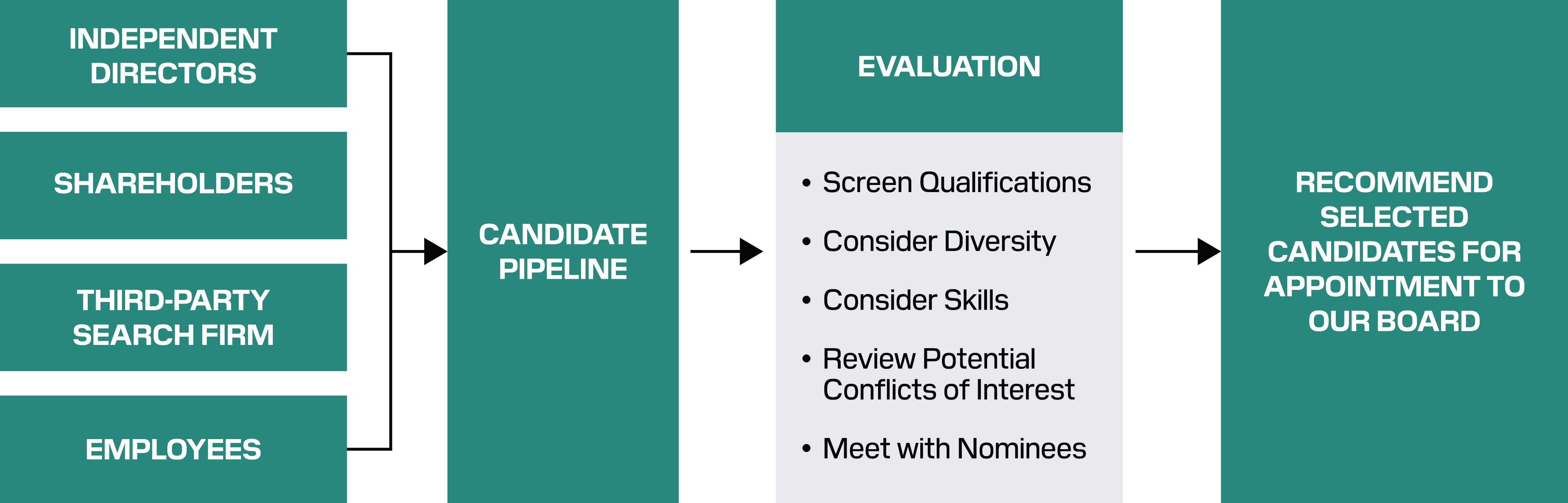

Considerations in Evaluating Director Nominees

Our nominating and corporate governance committee uses a variety of methods for identifying and evaluating director nominees, which may include reviewing candidates whom our stockholders have properly submitted for recommendation or retaining a third-party executive search firm to identify and review candidates. We maintain policies and procedures for director candidates, which require our nominating and corporate governance committee to evaluate director candidates in light of the current size and composition, organization and governance of our board of directors and the needs of our board of directors and its committees. There is no difference in the evaluation process of a director candidate recommended by a stockholder as compared to the evaluation process of a candidate identified by any other means. Some of the qualifications that our nominating and corporate governance committee considers include, without limitation:

| BLOCK 2024 Proxy Statement | 8 |

After completing its review and evaluation of director candidates, our nominating and corporate governance committee recommends to our full board of directors the director nominees for selection. While factors relating to diversity were considered for our current directors, no single factor was determinative with respect to any of our current directors.

Stockholder Recommendations and Nominations to our Board of Directors

Our nominating and corporate governance committee will consider director candidates recommended by stockholders holding the lesser of: (i) $2,000 in market value or (ii) one percent (1%) on a fully diluted basis of the Company’s securities continuously for at least twelve (12) months prior to the date of the submission of the recommendation, so long as such recommendations comply with our amended and restated certificate of incorporation, our amended and restated bylaws and any applicable laws, rules and regulations, including those promulgated by the SEC. Our nominating and corporate governance committee will evaluate such recommendations in accordance with its charter, our amended and restated bylaws and our policies and procedures for director candidates, as well as the director nominee criteria described above that is applicable to all director candidates. This process is designed to ensure that our board of directors includes members with diverse backgrounds, skills and experience, including appropriate financial and other expertise relevant to our business. Eligible stockholders may recommend a candidate for nomination by submitting the recommendation in writing to our Chief Legal Officer and Corporate Secretary or legal department at Block, Inc., 1955 Broadway, Suite 600, Oakland, CA 94612. Such recommendation must include information about the candidate, a statement of support by the recommending stockholder, evidence of the recommending stockholder’s ownership of our capital stock and a signed letter from the candidate confirming willingness to serve on our board of directors. Our nominating and corporate governance committee has discretion to decide which individuals to recommend for nomination as directors.

Under our amended and restated bylaws, stockholders may also directly nominate persons for our board of directors. Any nomination must comply with the requirements set forth in our amended and restated bylaws and should be sent in writing to our Corporate Secretary at Block, Inc., 1955 Broadway, Suite 600, Oakland, CA 94612. To be timely for our 2025 annual meeting of stockholders, our Corporate Secretary must receive the nomination no earlier than the close of business on February 18, 2025 and no later than the close of business on March 20, 2025, or in the event that we hold our 2025 annual meeting of stockholders more than 30 days before or more than 60 days after the one-year anniversary of the Annual Meeting, no earlier than the close of business on the 120th day before our 2025 annual meeting of stockholders and no later than the close of business on the later of either (i) the 90th day prior to our 2025 annual meeting of stockholders or (ii) the 10th day following the day on which public announcement of the date of our 2025 annual meeting of stockholders is first made if such first public announcement is less than 100 days prior to the date of our 2025 annual meeting of stockholders. Any notice of director nomination submitted must include the information required by Rule 14a-19(b) under the Exchange Act.

| BLOCK 2024 Proxy Statement | 9 |

Communications with Non-Management Members of Our Board of Directors

Interested parties wishing to communicate with our non-management members of our board of directors may do so by writing to the particular non-management member or members of our board of directors, and mailing the correspondence via registered or overnight mail to our Chief Legal Officer and Corporate Secretary at Block, Inc., 1955 Broadway, Suite 600, Oakland, CA 94612. Each communication should set forth (i) the name and address of the interested party (as it appears on our books, if applicable) and if the shares of our common stock are held by a nominee, the name and address of the beneficial owner of such shares, and (ii) the class and number of shares of our common stock that are owned of record by the record holder and beneficially by the beneficial owner.

Our Chief Legal Officer and Corporate Secretary, or legal department, in consultation with appropriate members of our board of directors as necessary, will review all incoming communications and, if appropriate, forward such communications to the appropriate non-management member or members of our board of directors, or if none is specified, to the Chairperson of our board of directors or the Lead Independent Director if the Chairperson of our board of directors is not independent.

Corporate Governance Guidelines and Code of Business Conduct and Ethics

Our board of directors has adopted Corporate Governance Guidelines that address items such as the qualifications and responsibilities of our directors and director candidates and the responsibilities of members of committees of our board of directors. In addition, our board of directors has adopted a Code of Business Conduct and Ethics that applies to all of our employees, officers and directors, including our Block Head, Chief Financial Officer and other executive and senior financial officers. The full texts of our Corporate Governance Guidelines and our Code of Business Conduct and Ethics are posted on our investor relations website at https://investors.block.xyz. We will post amendments to our Corporate Governance Guidelines and our Code of Business Conduct and Ethics and any waivers of our Code of Business Conduct and Ethics for directors and executive officers on the same website.

Risk Management

Our board of directors recognizes the oversight of risk management as one of its primary responsibilities and central to maintaining an effective, risk-aware and accountable organization. The oversight responsibility of our board of directors and its committees is supported by management reporting processes that are designed to provide visibility to our board of directors regarding the identification, assessment and management of risks and management’s strategic approach to risk mitigation. The Chair of our audit and risk committee meets with our Internal Audit Lead, Chief Financial Officer, Chief Compliance Officer and Chief Legal Officer on a regular cadence to identify and discuss risks and exposures, and escalate potential issues to our audit and risk committee or board of directors, as appropriate.

As part of our overall risk management process, we conduct an annual Enterprise Risk Assessment (“ERA”), which is shared and discussed with our board of directors. Oversight of the ERA is supported and enabled by our audit and risk committee. Our board of directors’ oversight of the ERA framework includes a routine evaluation, with discussions with key management and outside advisors, as appropriate, of the processes used to identify, assess, monitor and report on risks across the organization and the setting and communication of the organization’s implementation and measurement of risk tolerances, limits and mitigation. Our board of directors, management and functional leaders of our ERA define our primary risk focus areas for review. These areas include strategic, operational, people, financial and compliance. We address risks such as cybersecurity, financial reporting and competition within each of these areas.

While our board of directors maintains ultimate responsibility for the oversight of risk, it has implemented a multi-layered approach that delegates certain responsibilities to the appropriate board committees to ensure that these primary areas of focus are discussed in appropriate detail and that a full understanding of the applicable risk is obtained. Our board of directors and its committees oversee risks associated with their respective areas of responsibility, as summarized below. Each board committee meets in executive session with key management personnel and representatives of outside advisors as required or requested. Our board of directors may delegate additional risk areas to its committees in the future.

| BLOCK 2024 Proxy Statement | 10 |

Board of Directors / | | Primary Areas of Risk Oversight |

| ||

Full Board of Directors | | Strategic, financial and execution risks and exposures associated with our business strategy, policy matters, succession planning, data privacy, data security, and cybersecurity, significant litigation and regulatory exposures and other current matters that may present material risk to our financial performance, operations, infrastructure, plans, prospects or reputation, acquisitions and divestitures and our operational infrastructure. |

| ||

Audit and Risk Committee | | Risks and exposures associated with financial matters, particularly financial reporting, tax, accounting, disclosure controls and procedures, internal control over financial reporting, investment guidelines and credit and liquidity matters, our programs and policies relating to legal and regulatory compliance, and operational security and reliability. In addition, our audit and risk committee assists our board of directors with oversight of certain matters related to privacy, data security and cybersecurity. |

| ||

Nominating and Corporate Governance Committee | | Risks and exposures associated with director and executive succession planning; director and corporate officer conflicts of interest, other than transactions with related persons reviewed by our audit and risk committee; environmental, social, corporate governance, inclusion and diversity, and corporate responsibility matters; and overall board and committee effectiveness and composition. |

| ||

Compensation Committee | | Risks and exposures associated with leadership assessment, retention and succession, executive compensation programs and arrangements and our compensation philosophy and practices. |

Board’s Role in Data Privacy and Cybersecurity Oversight

While our board of directors maintains ultimate responsibility for the oversight of our data privacy and cybersecurity program and risks, it has delegated certain responsibilities to our audit and risk committee. Our board of directors and audit and risk committee’s principal role is one of oversight, recognizing that management is responsible for the design, implementation, and maintenance of an effective program for protecting against and mitigating data privacy and cybersecurity risks. The audit and risk committee assists our board of directors in enhancing its understanding of data privacy and cybersecurity issues by overseeing our data privacy and information security programs, strategy, policies, standards, architecture, processes, and significant risks, as well as overseeing responses to security and data incidents, as appropriate.

Our full board of directors undergoes annual information security and privacy training by our Chief Information Security Officer (“CISO”) and our Chief Privacy Officer (“CPO”), which covers, among other matters, our privacy and cybersecurity programs and risks. Our audit and risk committee receives updates, at least quarterly, from our CISO and CPO on significant data privacy and security risks, including any significant incidents, relevant industry developments, threat vectors and significant risks identified in periodic penetration tests or vulnerability scans. These updates also include significant legal and legislative developments concerning data privacy and security, our approach to complying with applicable law, and significant engagement with regulators concerning data privacy and cybersecurity. Our audit committee provides regular updates to the board of directors on such reports. For additional information regarding our cybersecurity governance, please refer to our Annual Report on Form 10-K for the fiscal year ended December 31, 2023.

| BLOCK 2024 Proxy Statement | 11 |

ESG and Corporate Responsibility

Our nominating and corporate governance committee oversees our corporate responsibility initiatives. We maintain our steadfast focus on driving economic empowerment through our broad spectrum of products and services. In alignment with this product-driven focus on financial inclusion, we believe that operating in a responsible and sustainable manner helps support long-term shareholder value, builds a more resilient and efficient company, and helps us mitigate against potential environmental risk factors. Our strong commitment to social responsibility is designed to amplify the reach and depth of the positive impact we strive to deliver through our ecosystem of ecosystems. This holds true for both our internal and external stakeholders including customers, artists, sellers, employees, key suppliers, and our investor community. During 2023 and early 2024, we met with several investors to review our ongoing ESG initiatives. We discussed key updates on our climate action program as well as inclusion and diversity metrics. We also discussed data security and privacy, as well as our governance structure and composition.

We take an integrated approach to managing ESG performance and disclosure:

Key areas of focus for our ESG strategy are:

| BLOCK 2024 Proxy Statement | 12 |

Director Compensation

Pursuant to our Outside Director Compensation Policy, our outside directors receive compensation in the form of equity granted under the terms of our 2015 Equity Incentive Plan, as amended and restated (the “2015 Plan”), and cash, as described below. Our 2015 Plan contains maximum limits on the size of the equity awards that can be granted to each of our outside directors in any fiscal year, but those maximum limits do not reflect the intended size of any potential grants or a commitment to make any equity award grants to our outside directors in the future. The only commitment to make equity award grants to our outside directors is under our Outside Director Compensation Policy, as it may be amended from time to time. The maximum limits under our 2015 Plan provide that no outside director may be granted, in any fiscal year, equity awards having a grant date fair value (determined in accordance with generally accepted accounting principles (“GAAP”)) of more than $1 million, provided that the limit is $2 million in connection with the director’s initial service as an outside director. Equity awards granted to an individual while they were an employee or a consultant, but not an outside director, do not count for purposes of these limits.

Our compensation committee periodically reviews our Outside Director Compensation Policy, including review of competitive practices provided by Compensia, Inc., an independent compensation consulting firm engaged by our compensation committee (“Compensia”). In 2023, based on data provided by Compensia, our average total direct compensation per director (including annual cash retainer and equity awards) approximated the 10th percentile amongst our compensation peer group identified below in the section entitled “Executive Compensation—Compensation-Setting Process—Competitive Positioning.”

Equity Compensation.

Initial Award. Subject to any limits in our 2015 Plan, each person who first becomes an outside director will receive an initial grant of restricted stock units (“RSUs”) on the date of their appointment having a grant date fair value (determined in accordance with GAAP) equal to $250,000 multiplied by a fraction: (i) the numerator of which is (x) 12 minus (y) the number of months between the date of the last annual meeting of stockholders and the date the outside director becomes a member of our board of directors and (ii) the denominator of which is 12. However, if a person first becomes an outside director on the day of an annual meeting of stockholders, they will only receive an annual award (described below) on such date, but will not receive an initial award. The shares of our Class A common stock underlying the RSUs vest in full upon the earlier of (i) the first anniversary of the grant date or (ii) the date of the next annual meeting of stockholders, in each case subject to continued service through the vesting date. If the appointment date is the same as the date of annual meeting, then such outside director will only be granted an annual award.

| BLOCK 2024 Proxy Statement | 13 |

Annual Award. On the date of each annual meeting of stockholders, and subject to any limits in our 2015 Plan, each of our outside directors is granted RSUs having a grant date fair value (determined in accordance with GAAP) equal to $250,000. The shares of our Class A common stock underlying the RSUs vest in full upon the earlier of (i) the first anniversary of the grant date or (ii) on the date of the next annual meeting of stockholders, in each case subject to continued service through the vesting date.

Our Lead Independent Director receives an annual grant of RSUs, in addition to the annual grant provided to all outside directors, on the date of each annual meeting of stockholders having a grant date fair value (determined in accordance with GAAP) of $70,000, subject to any limits in our 2015 Plan. The shares of our Class A common stock underlying the RSUs vest in full upon the earlier of (i) the first anniversary of the grant date or (ii) the date of the next annual meeting of stockholders, in each case subject to continued service through the vesting date.

The awards granted to an outside director under our Outside Director Compensation Policy will become fully vested upon a “change in control” as defined in our 2015 Plan.

Cash Compensation. Each of our outside directors receives an annual cash retainer of $40,000 for serving on our board of directors. In addition, each year, outside directors are eligible to receive the following cash fees for service on the committees of our board of directors.

Board Committee |

| Chair Fee ($) |

|

| Member Fee ($) |

| ||

Audit and Risk Committee |

|

| 20,000 |

|

|

| 10,000 |

|

Compensation Committee |

|

| 15,000 |

|

|

| 5,000 |

|

Nominating and Corporate Governance Committee |

|

| 10,000 |

|

|

| 2,500 |

|

Subject to any limits under our 2015 Plan, each outside director may elect to convert any cash compensation that they would otherwise be entitled to receive under our Outside Director Compensation Policy into an award of RSUs under our 2015 Plan. If the outside director makes this election in accordance with the policy, each such award of RSUs will be granted on the first business day following the last day of the fiscal quarter for which the cash compensation otherwise would be paid under the policy, will be fully vested on the grant date, and will cover a number of shares equal to (A) the aggregate amount of cash compensation otherwise payable to the outside director on that date divided by (B) the closing price per share as of the last day of the fiscal quarter for which the grant relates.

2023 Compensation

The following table provides information regarding the total compensation that was earned by each of our outside directors in 2023. Mr. Walker and Dr. Summers served as directors until August 1, 2023 and February 9, 2024, respectively. Dr. Narula began her service as a director on July 27, 2023.

The amounts under the “Stock Awards” column represent the aggregate of initial or annual equity compensation provided under the Outside Director Compensation Policy, and equity grants made in lieu of cash compensation, each as detailed in footnotes 2 and 3, respectively. The aggregate number of stock awards outstanding for each director at December 31, 2023 are included in footnote 2 below.

Director |

| Fees Earned or |

|

| Stock Awards |

|

| All Other |

|

| Total ($) |

| ||||

Roelof Botha |

|

| — |

|

|

| 374,618 |

|

|

| — |

|

|

| 374,618 |

|

Amy Brooks |

|

| — |

|

|

| 292,220 |

|

|

| — |

|

|

| 292,220 |

|

Shawn Carter |

|

| — |

|

|

| 289,720 |

|

|

| — |

|

|

| 289,720 |

|

Paul Deighton |

|

| 65,000 |

|

|

| 249,959 |

|

|

| — |

|

|

| 314,959 |

|

Randall Garutti |

|

| 50,000 |

|

|

| 249,959 |

|

|

| — |

|

|

| 299,959 |

|

James McKelvey |

|

| — |

|

|

| 289,720 |

|

|

| — |

|

|

| 289,720 |

|

Mary Meeker |

|

| — |

|

|

| 304,642 |

|

|

| — |

|

|

| 304,642 |

|

Neha Narula |

|

| — |

|

|

| 236,125 |

|

|

| — |

|

|

| 236,125 |

|

Sharon Rothstein |

|

| 45,000 |

|

|

| 249,959 |

|

|

| — |

|

|

| 294,959 |

|

Lawrence Summers |

|

| 50,000 |

|

|

| 249,959 |

|

|

| — |

|

|

| 299,959 |

|

Darren Walker |

|

| — |

|

|

| 290,243 |

|

|

| — |

|

|

| 290,243 |

|

|

| BLOCK 2024 Proxy Statement | 14 |

Name |

| Grant Date |

| Number of RSUs |

|

| Grant Date Fair |

|

| Total Cash Retainer Forgone ($) |

| |||

Roelof Botha |

| January 3, 2023 |

|

| 218 |

|

|

| 14,092 |

|

|

| 13,750 |

|

|

| April 3, 2023 |

|

| 200 |

|

|

| 13,566 |

|

|

| 13,750 |

|

|

| July 3, 2023 |

|

| 206 |

|

|

| 13,637 |

|

|

| 13,750 |

|

|

| October 2, 2023 |

|

| 310 |

|

|

| 13,389 |

|

|

| 13,750 |

|

|

|

|

|

|

|

|

|

|

|

|

| |||

Amy Brooks |

| January 3, 2023 |

|

| 169 |

|

|

| 10,924 |

|

|

| 10,625 |

|

|

| April 3, 2023 |

|

| 154 |

|

|

| 10,446 |

|

|

| 10,625 |

|

|

| July 3, 2023 |

|

| 159 |

|

|

| 10,526 |

|

|

| 10,625 |

|

|

| October 2, 2023 |

|

| 240 |

|

|

| 10,366 |

|

|

| 10,625 |

|

|

|

|

|

|

|

|

|

|

|

|

| |||

Shawn Carter |

| January 3, 2023 |

|

| 159 |

|

|

| 10,278 |

|

|

| 10,000 |

|

|

| April 3, 2023 |

|

| 145 |

|

|

| 9,835 |

|

|

| 10,000 |

|

|

| July 3, 2023 |

|

| 150 |

|

|

| 9,930 |

|

|

| 10,000 |

|

|

| October 2, 2023 |

|

| 225 |

|

|

| 9,718 |

|

|

| 10,000 |

|

|

|

|

|

|

|

|

|

|

|

|

| |||

Jim McKelvey |

| January 3, 2023 |

| 159 |

|

|

| 10,278 |

|

|

| 10,000 |

| |

|

| April 3, 2023 |

| 145 |

|

|

| 9,835 |

|

|

| 10,000 |

| |

|

| July 3, 2023 |

| 150 |

|

|

| 9,930 |

|

|

| 10,000 |

| |

|

| October 2, 2023 |

| 225 |

|

|

| 9,718 |

|

|

| 10,000 |

| |

|

|

|

|

|

|

|

|

|

|

|

| |||

Mary Meeker |

| January 3, 2023 |

|

| 218 |

|

|

| 14,092 |

|

|

| 13,750 |

|

|

| April 3, 2023 |

|

| 200 |

|

|

| 13,566 |

|

|

| 13,750 |

|

|

| July 3, 2023 |

|

| 206 |

|

|

| 13,637 |

|

|

| 13,750 |

|

|

| October 2, 2023 |

|

| 310 |

|

|

| 13,389 |

|

|

| 13,750 |

|

|

|

|

|

|

|

|

|

|

|

|

| |||

Neha Narula |

| October 2, 2023 |

| 162 |

|

|

| 6,997 |

|

|

| 7,174 |

| |

|

|

|

|

|

|

|

|

|

|

|

| |||

Darren Walker |

| January 3, 2023 |

|

| 169 |

|

|

| 10,924 |

|

|

| 10,625 |

|

|

| April 3, 2023 |

|

| 175 |

|

|

| 11,870 |

|

|

| 12,042 |

|

|

| July 3, 2023 |

|

| 197 |

|

|

| 13,041 |

|

|

| 13,125 |

|

|

| October 2, 2023 |

|

| 103 |

|

|

| 4,449 |

|

|

| 4,565 |

|

Directors may be reimbursed for their reasonable expenses for attending board and committee meetings. Directors who are also our employees receive no additional compensation for their service as directors. During 2023, only Mr. Dorsey was an employee. For additional information regarding Mr. Dorsey’s compensation, refer to the section entitled “Executive Compensation.”

| BLOCK 2024 Proxy Statement | 15 |

Stock Ownership Guidelines

Our board of directors has adopted stock ownership guidelines to ensure ongoing alignment of the interests of our directors and executive officers with the long-term interests of our stockholders. Our guidelines require that (i) each non-employee director own a number of shares of our common stock with a value equal to at least five times their annual cash retainer, (ii) each executive officer (other than the Block Head) own a number of shares of our common stock with a value equal to at least three times their annual base salary and (iii) the Block Head own a number of shares of our common stock with a value equal to at least the greater of (x) five times their annual base salary and (y) $2 million. Each non-employee director and executive officer is required to comply with our stock ownership guidelines within five years from their promotion or hiring as an executive officer or election to our board of directors. Until a non-employee director or executive officer has satisfied their applicable level of ownership, they are required to retain an amount equal to fifty percent (50%) of the net shares received from any new equity award granted after the adoption of the guidelines. As of December 31, 2023, all of our non-employee directors and executive officers had met or were on track to comply with these stock ownership guidelines within the applicable time periods.

| BLOCK 2024 Proxy Statement | 16 |

| PROPOSAL NO. 1 |

In accordance with our amended and restated certificate of incorporation, our board of directors is divided into three staggered classes of directors. Two of our Class III directors, Mr. Garutti and Ms. Meeker, are standing for election at the Annual Meeting for a three-year term.

Each director’s term continues until the election and qualification of their successor, or such director’s earlier death, resignation or removal. Any increase or decrease in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of our directors.

Nominees

Our nominating and corporate governance committee has recommended, and our board of directors has approved, Mr. Randall Garutti and Ms. Mary Meeker as nominees for election as Class III directors at the Annual Meeting. If elected, both Mr. Garutti and Ms. Meeker will serve as Class III directors until our 2027 annual meeting of stockholders and until their successors are duly elected and qualified. Both of the nominees are currently a director of our company. For additional information regarding our nominees for the board of directors, refer to the section entitled “Board of Directors and Corporate Governance.”

If you are a stockholder of record and you sign your proxy card or vote by telephone or over the Internet, but do not give instructions with respect to the voting of directors, your shares will be voted “FOR” the election of Mr. Garutti and Ms. Meeker. Mr. Garutti and Ms. Meeker have both agreed to serve as a director if elected; however, in the event that a director nominee is unable or declines to serve as a director at the time of the Annual Meeting, the proxies will be voted for any nominee designated by our board of directors to fill such vacancy. If you are a street name stockholder and you do not give voting instructions to your broker or nominee, your broker will leave your shares unvoted on this matter.

Vote Required

The election of directors requires a plurality of the voting power of the shares of our common stock present virtually or by proxy at the Annual Meeting and entitled to vote thereon to be approved. Broker non-votes will have no effect on this proposal.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” EACH OF THE NOMINEES NAMED ABOVE. |

| BLOCK 2024 Proxy Statement | 17 |

PROPOSAL NO. 2 |

The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”) enables our stockholders to approve, on an advisory or non-binding basis, the compensation of our named executive officers as disclosed pursuant to Section 14A of the Exchange Act. This proposal, commonly known as a “Say-on-Pay” proposal, gives our stockholders the opportunity to express their views on our named executive officers’ compensation. This vote is not intended to address any specific item of compensation or any specific named executive officer, but rather the overall compensation of all of our named executive officers and the philosophy, policies and practices described in this proxy statement. We currently hold our Say-on-Pay vote every year.

The Say-on-Pay vote is advisory, and therefore is not binding on us, our compensation committee or our board of directors. The Say-on-Pay vote will, however, provide information to us regarding investor sentiment about our executive compensation philosophy, policies and practices, which our compensation committee will consider when determining executive compensation for the remainder of the current fiscal year and beyond. Our board of directors and our compensation committee value the opinions of our stockholders. To the extent there is any significant vote against the compensation of our named executive officers as disclosed in this proxy statement, we will endeavor to communicate with stockholders to better understand the concerns that influenced the vote and consider our stockholders’ concerns, and our compensation committee will evaluate whether any actions are necessary to address those concerns.

We believe that the information provided in the section entitled “Executive Compensation,” and in particular the information discussed in the section entitled “Executive Compensation—Compensation Philosophy,” demonstrates that our executive compensation program was designed appropriately and is working to ensure management’s interests are aligned with our stockholders’ interests to support long-term value creation. Accordingly, we ask our stockholders to vote “FOR” the following resolution at the Annual Meeting:

“RESOLVED, that the stockholders approve, on an advisory basis, the compensation paid to our named executive officers, as disclosed in the proxy statement for the Annual Meeting pursuant to the compensation disclosure rules of the SEC, including the compensation discussion and analysis, compensation tables and narrative discussion and other related disclosure.”

Vote Required

The approval, on an advisory basis, of the compensation of our named executive officers requires the affirmative vote of a majority of the voting power of the shares of our common stock present virtually or by proxy at the Annual Meeting and entitled to vote thereon. Abstentions will have the effect of a vote against this proposal, and broker non-votes will have no effect.

As an advisory vote, the result of this proposal is non-binding. Although the vote is non-binding, our board of directors and our compensation committee value the opinions of our stockholders and will consider the outcome of the vote when making future compensation decisions for our named executive officers.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE APPROVAL, ON AN ADVISORY BASIS, OF THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS. |

| BLOCK 2024 Proxy Statement | 18 |

PROPOSAL NO. 3 RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

Our audit and risk committee has appointed Ernst & Young LLP (“EY”) as our independent registered public accounting firm to audit our consolidated financial statements for our fiscal year ending December 31, 2024. During our fiscal year ended December 31, 2023, EY served as our independent registered public accounting firm.

Notwithstanding the appointment of EY, and even if our stockholders ratify the appointment, our audit and risk committee, in its discretion, may appoint another independent registered public accounting firm at any time during our fiscal year if our audit and risk committee believes that such a change would be in the best interests of our company and our stockholders. At the Annual Meeting, our stockholders are being asked to ratify the appointment of EY as our independent registered public accounting firm for our fiscal year ending December 31, 2024. Although not required by applicable law or listing rules, our audit and risk committee is submitting the appointment of EY to our stockholders because we value our stockholders’ views on our independent registered public accounting firm and as a matter of good corporate governance. Representatives of EY will be present at the Annual Meeting, and they will have an opportunity to make a statement and will be available to respond to appropriate questions from our stockholders.

If our stockholders do not ratify the appointment of EY, our audit and risk committee may reconsider the appointment.

Fees Paid to the Independent Registered Public Accounting Firm

The following table presents fees for professional audit services and other services rendered to our company by EY for our fiscal years ended December 31, 2022, and December 31, 2023, respectively.

|

| 2022 |

|

| 2023 |

| ||

|

| (in thousands) |

| |||||

Audit Fees(1) |

| $ | 11,797 |

|

| $ | 13,533 |

|

Audit-Related Fees(2) |

|

| — |

|

|

| — |

|

Tax Fees(3) |

|

| 725 |

|

|

| 902 |

|

All Other Fees(4) |

|

| 8 |

|

|

| 3 |

|

Total Fees |

| $ | 12,530 |

|

| $ | 14,438 |

|

|

Auditor Independence

In our fiscal year ended December 31, 2023, there were no other professional services provided by EY, other than those listed above, that would have required our audit and risk committee to consider their compatibility with maintaining the independence of EY.

Audit and Risk Committee Policy on Pre-Approval of Audit and Permissible Non-Audit Services of Independent Registered Public Accounting Firm

Our audit and risk committee has established a policy governing our use of the services of our independent registered public accounting firm. Under this policy, our audit and risk committee is required

| BLOCK 2024 Proxy Statement | 19 |

to pre-approve all audit, internal control-related services and permissible non-audit services performed by our independent registered public accounting firm in order to ensure that the provision of such services does not impair the public accountants’ independence. All services provided by EY for our fiscal year ended December 31, 2023, were pre-approved by our audit and risk committee pursuant to this policy.

Vote Required

The ratification of the appointment of EY as our independent registered public accounting firm for our fiscal year ending December 31, 2024, requires the affirmative vote of a majority of the voting power of the shares of our common stock present virtually or by proxy at the Annual Meeting and entitled to vote thereon. Abstentions will have the effect of a vote against this proposal. Because this is a routine proposal, we do not expect broker non-votes on this proposal.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM. |

| BLOCK 2024 Proxy Statement | 20 |

REPORT OF THE AUDIT AND RISK COMMITTEE |