Exhibit 99.1

WEBSTER THEATER WEBSTER CITY, IA Q2 2017 Shareholder Letter SQUARE.COM/INVESTORS

Highlights

| • | | We continue to delivertop-line growth and margin expansion, which reflect our continued ability to attract larger sellers and increase product usage. |

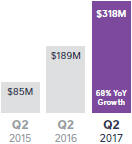

| • | | We grew Square Capital loan volume 68% year over year and further diversified our investor base. |

| • | | Square Cash Card provides more ways for people to spend, and adoption is growing fast: In just the first month, we shipped as many units as we did in the first eight months of the original Square Reader. |

| • | | With 90 million customer profiles, our customer-centric Point of Sale enables powerful CRM tools for our sellers. |

Second Quarter 2017 Key Results

| | | | |

| GROSS PAYMENT VOLUME (GPV) | | TOTAL NET REVENUE | | NET INCOME (LOSS) |

| | |

| |

| |

|

| | |

| GPV MIX BY SELLER SIZE | | ADJUSTED REVENUE | | ADJUSTED EBITDA |

| | |

| |

| |

|

A reconciliation ofnon-GAAP metrics used in this letter to their nearest GAAP equivalents is provided at the end of this letter.

Adjusted Revenue is defined as total net revenue less transaction-based revenue from Starbucks and transaction-based costs.

Adjusted EBITDA margin is calculated as Adjusted EBITDA divided by Adjusted Revenue.

2

| | |

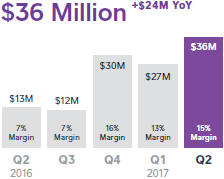

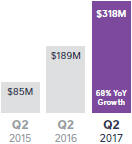

To Our Shareholders: In the second quarter, ourtop-line results reflect our continued ability to attract larger sellers and increase product usage through cross-selling. Total GPV grew 32% year over year, and GPV from larger sellers grew 45% year over year. Transaction-based revenue increased 32% year over year—the same rate as GPV, which is a result of our ability to maintain transaction revenue margin. Subscription and services-based revenue nearly doubled year over year. Strongtop-line growth, lower risk loss rates, and ongoing operating expense leverage drove another quarter of significant EBITDA and margin improvement. We grew Square Capital loan volume 68% year over year and further diversified our investor base. In the second quarter, Square Capital facilitated over 49,000 business loans totaling $318 million, an increase of 68% year over year. We are further expanding access to financing by adding tools to the Square Capital product suite that help our sellers grow their businesses. In June, we launched a pilot of Square Installments, an integration with Square Invoices that allows a seller’s customers to finance large purchases over the course of several months. Typically, only larger businesses have the ability to offer purchase financing—Square Installments provides smaller businesses access to this growth tool as well. We continue to focus on building a strong and diversified investor base for Square Capital. We added Canada Pension Plan Investment Board (CPPIB), a global investment manager with over CA$300 billion in assets under management and a focus on sustained, long-term returns, as a new loan purchaser. Additionally, several of our existing investors have entered into financing facilities provided by global banks to fund their ongoing purchases of Square Capital loans—a demonstration of confidence in our program. Square Capital remains a trusted partner to small businesses: In a recent survey we conducted, 84% of respondents said that Square Capital helped them grow their business. Additionally, we see that sellers who accept Square Capital often use other services in our ecosystem. For | | AUGUST 2, 2017 SQUARE CAPITAL VOLUME

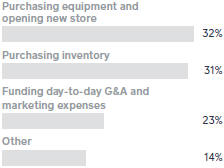

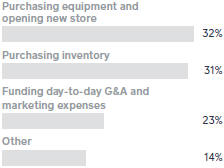

HOW OUR SELLERS USE SQUARE CAPITAL Based on a January 2017 survey of 7,000 sellers who accepted a loan through Square Capital.

ON THE COVER: Webster Theateris a recently restored movie theater that is helping revitalize the town of Webster City, Iowa. For Every Dream |

Purchasing equipment and opening new store

Purchasing inventory

Funding day-to-day G&A and marketing expenses

Other

3

| | |

example, Lucia Rollow is the owner of Bushwick Community Darkroom in Brooklyn, New York. She began creating photography and art and renting her basement to other photographers who needed a darkroom, using Square to manage payments. The bookings increased quickly: Lucia has moved her darkroom twice to accommodate the growth, and Square Capital helped her expand the space by 50%. Today, Bushwick Community Darkroom is in a3,000-square-foot warehouse that not only rents darkroom space but also develops film and prints for other photographers, and offers beginner photography classes to the public. Lucia recently hired her first full-time staff member and now uses Square Payroll. Square Cash Card provides more ways for people to spend, and adoption is growing fast: In just the first month, we shipped as many units as we did in the first eight months of the original Square Reader. Individuals can sign up for Square Cash in minutes and use the app to store money, send and track P2P(peer-to-peer) payments, and deposit money to their bank account. Businesses can use Square Cash to accept payments from their customers (Square Cash for Business). Square Cash has maintained strong organic growth, ranking regularly in the top five finance apps in both Google Play and the iOS App Store in the second quarter. Importantly, in the second quarter, Square Cash has also consistently ranked in the top 100 free apps in the iOS App Store, underscoring its broad-based utility. We have extended Square Cash beyond P2P payments by adding new services that provide individuals with more options to spend their cash balance. Since the rollout of our virtual Cash Card in September 2016, people are using it for everyday purchases, such as Netflix, Spotify, Amazon, and Lyft. We introduced a physical Cash Card in June that allows people to spend their balance anywhere in the U.S. that Visa is accepted. During the second quarter, more than a third of active Square Cash customers conducted afee-based transaction, which includes Cash Card, credit card, Instant Deposit, and Square Cash for Business. In the same way that we’ve empowered businesses with fast, simple, and cohesive tools, we see an opportunity with Square Cash to build a similar ecosystem of services for individuals. | | SELLER HIGHLIGHT

“ Getting a loan through Square Capital was the simplest, best thing in the world. They were very transparent: It was this much money, at this rate, and an easy way to pay it back. I already trusted Square from the other services I used, and that relationship made it easy for me to trust the loan offer.” LUCIA ROLLOW Bushwick Community Darkroom

Cash Card |

4

| | |

With 90 million customer profiles, our customer-centric Point of Sale enables powerful CRM tools for our sellers. The unique integration of our software and payment processing allows us to capture rich commerce data for our sellers. From the moment a seller joins Square, our Point of Sale automatically creates or updates customer records in the seller’s Customer Directory for every interaction between the seller and the customer. These interactions include payment transactions, feedback, loyalty stars, coupon redemptions, and appointment bookings. As a result, Square has 90 million unique customer profiles with an associated email address or phone number. We leverage this deep understanding of the customer to build CRM tools that enable sellers to immediately respond to feedback from customers, and run marketing, loyalty, and gifting programs that are easy to use, measurable, and effective. Sellers can use Square to build their own marketing campaigns, or run Square’s automated campaigns, to reach a targeted subset of their customers with relevant offers and announcements. Our loyalty programs are tracked and managed by Square Point of Sale, and we can recommend programs optimized for the seller’s particular business. For example, a hair salon has a higher transaction size but lower visit frequency than an ice cream shop, so each should have different characteristics for a loyalty program. Importantly, our technology creates and runs these programs, tying the result to individual customers and their transactions—thus “closing the loop” and allowing sellers to easily and accurately measure effectiveness. On average, Square Marketing programs generate more than $10 in sales by our sellers for every $1 in spend, and Square Loyalty programs result in a 70% increase in buyer visit frequency. Keva Juice is a Square seller that makes smoothie and juice blends and uses Square’s CRM tools in 22 retail locations across the U.S. For Keva, it all starts with the customer: The business uses Square’s digital receipts to communicate with customers, allowing Keva to immediately address feedback and “make every customer visit an opportunity to shine.” Keva uses Square Point of Sale to manage digital loyalty cards for its 35,000 enrolled customers, helping it avoid the kinds of fraud associated with physical punch cards. Keva switched to Square Gift Cards for the | |

Square Point of Sale manages digital loyalty rewards and integrates with seller customer and sales data. This enables sellers to track key metrics and the impact to their business.

Square Point of Sale also manages the loyalty program for the customer, and loyalty rewards motivate customers to come back again and again. |

5

| | |

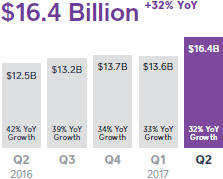

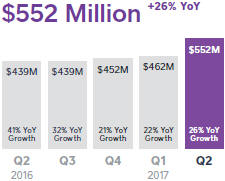

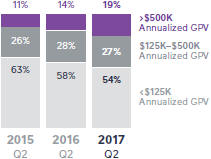

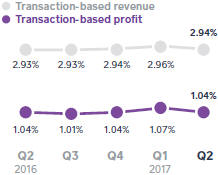

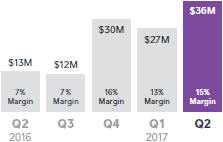

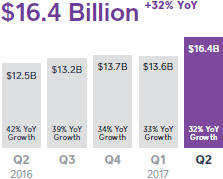

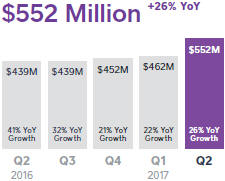

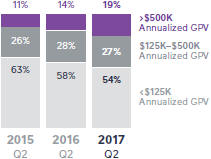

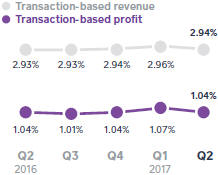

integration with Square Point of Sale, saving the time and labor required to manually track and reconcile its previous gift cards on its old system. Keva also uses Square’s automated marketing campaigns to regularly send birthday promotions, encourage reviews, and offer special discounts to its customers. These campaigns have driven significant growth for Keva and fuel a virtuous cycle of growth between Keva and Square. Financial Discussion Gross Payment Volume (GPV) We processed $16.4 billion of GPV in the second quarter of 2017, up 32% year over year. This is comparable to 33% year-over-year growth in the first quarter of 2017. GPV from larger sellers, which we define as all sellers that generate more than $125,000 in annualized GPV, grew 45% year over year and accounted for 46% of total GPV, up from 42% in the second quarter of 2016. Of note, midmarket sellers, which we define as larger sellers that generate more than $500,000 in annualized GPV, grew 61% year over year, accounting for 19% of GPV, a sizable increase from 14% in the second quarter of 2016. Revenue Total net revenue was $552 million in the second quarter of 2017, up 26% year over year. This compares to 22% year-over-year growth in the first quarter of 2017. We did not generate any revenue from Starbucks in the quarter, as it transitioned off our infrastructure during the fourth quarter of 2016. Excluding Starbucks revenue, total net revenue grew 36% year over year. Adjusted Revenue was $240 million, up 41% year over year. This compares to 39% year-over-year growth in the first quarter of 2017. Transaction-based revenue was $482 million in the second quarter of 2017, up 32% year over year. Transaction-based revenue as a percentage of GPV was 2.94%, up from 2.93% in the prior year period. Transaction-based profit as a percentage of GPV was 1.04% in the second quarter of 2017, flat from the prior year period. Transaction-based revenue and | | SELLER HIGHLIGHT “ Keva Juice will grow by more than 30% this year. Part of this success comes from our ability to engage customers and ensure that operational costs remain low. Square is the only platform we have seen that completes the entire package. As a small business, we’ve been able to access technology that’s typically only available to big businesses.” GARY THOMAS Keva Juice TOTAL NET REVENUE

ADJUSTED REVENUE

Adjusted Revenue is defined as total net revenue less transaction-based revenue from Starbucks and transaction-based costs. |

6

| | |

transaction-based profit as percentages of GPV benefited from strong growth in Invoices, Virtual Terminal, ande-commerce API payments, which all have higher rates than our card-present transactions. Subscription and services-based revenue was $59 million in the second quarter of 2017, up 99% year over year. The increase was driven primarily by continued growth of Instant Deposit, Caviar, and Square Capital. Instant Deposit benefited from increased usage by our sellers as well as individuals using the Square Cash app. Caviar grew order volume as a result of more diners using the platform and more restaurants offering both delivery and pickup. Square Capital facilitated 49,000 business loans totaling $318 million, up 68% year over year. Hardware revenue was $10 million in the second quarter of 2017, down 7% year over year and up 14% on a sequential basis. The year-over-year decline was driven by higher-than-normal sales in the first half of 2016 associated withpre-orders for our contactless and chip reader. We recently sold our one millionth contactless and chip reader. Operating Expenses/Earnings Operating expenses were $220 million in the second quarter of 2017, up 25% year over year.Non-GAAP operating expenses of $173 million were up 28% year over year, representing 72% of Adjusted Revenue. • Product development expenses were $78 million on a GAAP basis and $50 million on anon-GAAP basis, up 14% and 20%, respectively, year over year. Similar to previous quarters, the increase was driven by personnel costs related to engineering, product, and design. • Sales and marketing expenses were $60 million on a GAAP basis and $55 million on anon-GAAP basis, up 53% and 55%, respectively, year over year. The increase was driven primarily by costs related to increased marketing spend, growth in our sales andgo-to-market teams, and costs related to the growth of Square Cash and international expansion. • General and administrative expenses were $63 million on a GAAP basis and $49 million on anon-GAAP basis, up 24% and 23%, respectively, year over year. The increase was due primarily to increased personnel | | AS A PERCENTAGE OF GPV:

In the second quarter of 2016, we provided sellers with promotional processing credits forpre-orders of our contactless and chip reader. Excluding these credits, transaction-based revenue as a percentage of GPV would have been 2.94% in the second quarter of 2016; transaction-based profit would have been 1.05%. |

7

| | |

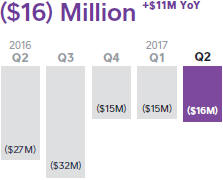

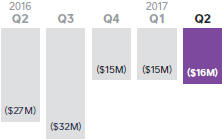

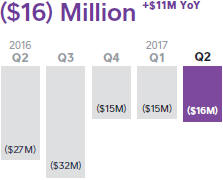

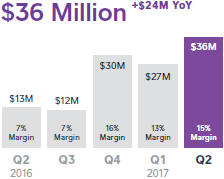

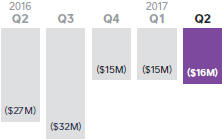

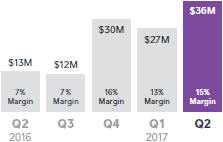

costs in legal, finance, business systems, and business operations for Square Capital. • Transaction, loan, and advance losses were $18 million. Transaction losses as a percentage of GPV continued to trend below our 0.1% historical average. Net loss was $16 million in the second quarter of 2017, compared to a net loss of $27 million in the second quarter of 2016. Net loss per share, basic and diluted, was $0.04, compared to a net loss per share of $0.08 in the second quarter of 2016. We had 376 million weighted-average basic shares in the second quarter of 2017. Adjusted EBITDA was $36.5 million in the second quarter of 2017, compared to $12.6 million in the second quarter of 2016, an improvement of $23.9 million year over year. Second-quarter Adjusted EBITDA margin of 15% is an improvement of 8 percentage points year over year. Our Adjusted EBITDA improvement reflects strongtop-line growth, lower risk loss rates, and ongoing operating expense leverage. Adjusted Net Income Per Share (Adjusted EPS) was $0.07 based on 418 million weighted-average diluted shares for the second quarter of 2017. This represents an improvement of $0.05 from the second quarter of 2016. Balance Sheet/Cash Flow We ended the second quarter of 2017 with $1.1 billion in cash, cash equivalents, restricted cash, and investments in marketable securities, up from $990 million at the end of the first quarter of 2017. Positive Adjusted EBITDA and proceeds from employee stock option exercises contributed to the increase in the balance at the end of the quarter. | | NET INCOME (LOSS)

ADJUSTED EBITDA

A reconciliation ofnon-GAAP metrics used in this letter to their nearest GAAP equivalents is provided at the end of this letter. Adjusted EBITDA margin is calculated as Adjusted EBITDA divided by Adjusted Revenue. Adjusted EPS is computed by dividing net loss, excluding transaction-based revenue and transaction-based costs related to Starbucks, share-based compensation expense, amortization of intangible assets, amortization of debt discount and issuance costs, loss on sale of property and equipment, and certain litigation settlement expenses, by the weighted-average number of shares of common stock during the period, including the dilutive effect of all potential shares. |

8

Guidance

Given our strong results for the second quarter, we are increasing our guidance for the full year.

| | | | | | | | | | |

| | | Q3 | | | Current 2017 | | | Previous 2017 |

| | | |

Total net revenue | | | $562M to $568M | | | | $2.14B to $2.16B | | | $2.12B to $2.16B |

| | | |

Adjusted Revenue | | | $238M to $241M | | | | $925M to $935M | | | $890M to $910M |

| | | |

Adj. Revenue YoY growth (midpoint) | | | 35% | | | | 35% | | | 31% |

| | | | | | | |

| | | |

Adjusted EBITDA | | | $27M to $30M | | | | $120M to $128M | | | $110M to $120M |

| | | |

Adj. EBITDA margin (midpoint) | | | 12% | | | | 13% | | | 13% |

| | | | | | | |

| | | |

Net income (loss) per share | | | $(0.07) to $(0.06) | | | | $(0.21) to $(0.19) | | | $(0.24) to $(0.20) |

| | | |

Adjusted EPS (diluted) | | | $0.04 to $0.05 | | | | $0.21 to $0.23 | | | $0.16 to $0.20 |

We have not reconciled Adjusted EBITDA, Adjusted EBITDA margin, and Adjusted EPS guidance to their GAAP equivalents as a result of the uncertainty regarding, and the potential variability of, reconciling items such as share-based compensation expense and weighted-average fully diluted shares outstanding. Accordingly, a reconciliation of thesenon-GAAP guidance metrics to their corresponding GAAP equivalents is not available without unreasonable effort. However, we have provided a reconciliation of GAAP tonon-GAAP metrics in tables at the end of this letter. It is important to note that the actual amount of such reconciling items would have a significant impact if they were included in our Adjusted EBITDA, Adjusted EBITDA margin, and Adjusted EPS.

9

| | |

Earnings Webcast Square (NYSE:SQ) will host a conference call and earnings webcast at 2:00 p.m. Pacific time/5:00 p.m. Eastern time today, August 2, 2017, to discuss these financial results. The domesticdial-in for the call is (866)548-4713. The Conference ID is 1868989. To listen to a live audio webcast, please visit Square’s Investor Relations website atsquare.com/investors. A replay will be available on the same website following the call. We will release financial results for the third quarter of 2017 on November 8, 2017, after the market closes, and will also host a conference call and earnings webcast at 2:00 p.m. Pacific time/5:00 p.m. Eastern time on the same day to discuss those financial results. | | MEDIA CONTACT press@squareup.com INVESTOR RELATIONS CONTACT ir@squareup.com |

| | |

| |  |

| Jack Dorsey | | Sarah Friar |

| CEO | | CFO |

10

| | |

| | “Since joining Square, we’ve noticed a significant increase in customer adoption of Apple Pay. It has improved line efficiency, and we love the enhanced level of security for both us and our customers. “Square has been a win for us: it’s reliable, we get our money in 24 hours, and our overall revenue has gone up. Everything just works.” Jeremiah Gard Director of Finance & Business Development Red River Zoo |

Mike Ahumada

General Curator

SAFE HARBOR STATEMENT

This letter contains forward-looking statements within the meaning of the Safe Harbor provisions of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact could be deemed forward-looking, including, but not limited to, statements regarding the future performance of Square, Inc. and its consolidated subsidiaries (the Company); the Company’s expected financial results for future periods; future growth in the Company’s businesses; the cessation of transaction-based revenue from Starbucks; the Company’s expectations regarding scale, profitability, and the demand for or benefits from its products, product features, and services in the U.S. and in international markets; and management’s statements related to business strategy, plans, and objectives for future operations. In some cases, forward-looking statements can be identified by terms such as “may,” “will,” “appears,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential,” or “continue,” or the negative of these words or other similar terms or expressions that concern our expectations, strategy, plans, or intentions. Such statements are subject to a number of risks, uncertainties, and assumptions, and investors are cautioned not to place undue reliance on these statements. Actual results could differ materially from those expressed or implied, and reported results should not be considered as an indication of future performance.

Risks that contribute to the uncertain nature of the forward-looking statements include, among others, the Company’s ability to deal with the substantial and increasingly intense competition in its industry; changes to the rules and practices of payment card networks and acquiring processors; the effect of evolving regulations and oversight related to the Company’s provision of payments services and other financial services; the effect of management changes and business initiatives; and changes in political, business, and economic conditions; as well as other risks listed or described from time to time in the Company’s filings with the Securities and Exchange Commission (the SEC), including the Company’s Quarterly Report on Form10-Q for the fiscal quarter ended March 31, 2017, which is on file with the SEC and available on the investor relations page of the Company’s website. Except as required by law, the Company assumes no obligation to update any of the statements in this letter.

KEY OPERATING METRICS ANDNON-GAAP FINANCIAL MEASURES

To supplement our financial information presented in accordance with generally accepted accounting principles in the United States (GAAP), we consider certain operating and financial measures that are not prepared in accordance with GAAP, including Gross Payment Volume, Adjusted Revenue, Adjusted EBITDA, Adjusted EBITDA margin, Adjusted Net Income (Loss), and Adjusted EPS. We believe these metrics and measures are useful to facilitateperiod-to-period comparisons of our business and to facilitate comparisons of our performance to that of other payments solution providers. Each of these metrics and measures excludes the effect of our processing agreement with Starbucks, which transitioned to another payments solution provider in the fourth quarter of 2016. As a result, we believe it is useful to exclude Starbucks activity to clearly show the impact Starbucks has had on our financial results historically. Our agreements with other sellers generally provide both those sellers and us the unilateral right to terminate such agreements at any time, without fine or penalty. Furthermore, we generally do not enter into long-term contractual agreements with sellers.

We define Gross Payment Volume (GPV) as the total dollar amount of all card payments processed by sellers using Square, net of refunds. Additionally, GPV includes Square Cash activity related topeer-to-peer payments sent from a credit card, and Square Cash for Business. GPV excludes card payments processed for Starbucks.

Adjusted Revenue is anon-GAAP financial measure that we define as our total net revenue less transaction-based costs, adjusted to eliminate the effect of activity with Starbucks. As described above, Starbucks completed its previously announced transition to another payments solutions provider and has ceased using our payments solutions altogether, and we believe that providing Adjusted Revenue metrics that exclude the impact of our agreement with Starbucks is useful to investors. We believe it is useful to exclude transaction-based costs from Adjusted Revenue as this is a primary metric used by management to measure our business performance, and it affords greater comparability to other payments solution providers. Adjusted Revenue has limitations as a financial measure, should be considered as supplemental in nature, and is not meant as a substitute for the related financial information prepared in accordance with GAAP.

Adjusted EBITDA, Adjusted Net Income (Loss), and Adjusted EPS arenon-GAAP financial measures that represent our net loss and net loss per share, adjusted to eliminate the effect of Starbucks transaction-based revenue, Starbucks transaction-based costs, share-based compensation expenses, amortization of intangible assets, amortization of debt discount and issuance costs in connection with our offering of convertible senior notes in the first quarter of 2017, the litigation settlement with Robert E. Morley, the gain or loss on the sale of property and equipment, and impairment of intangible assets. In addition to the items above, Adjusted EBITDA as anon-GAAP financial measure also excludes depreciation, other cash interest income and expense, other income and expense, and provision or benefit from income taxes. Basic Adjusted Net Income (Loss) Per Share is computed by dividing the Adjusted Net Income (Loss) by the weighted-average number of shares of common stock outstanding during the period. Diluted Adjusted Net Income Per Share is computed by dividing Adjusted Net Income by the weighted-average number of shares of common stock outstanding, adjusted for the dilutive effect of all potential shares. In periods when we recorded an Adjusted Net Loss, the Diluted Adjusted Net Loss Per Share is the same as Basic Adjusted Net Loss Per Share because the effects of potentially dilutive items were anti-dilutive given the Adjusted Net Loss position.

We have included Adjusted EBITDA and Adjusted EPS because they are key measures used by our management to evaluate our operating performance, generate future operating plans, and make strategic decisions, including those relating to operating expenses and the allocation of internal resources. Accordingly, we believe that Adjusted EBITDA and Adjusted EPS provide useful information to investors and others in understanding and evaluating our operating results in the same manner as our management and board of directors. In addition, they provide useful measures forperiod-to-period comparisons

12

of our business, as they remove the effect of certainnon-cash items and certain variable charges. Adjusted EBITDA and Adjusted EPS have limitations as financial measures, should be considered as supplemental in nature, and are not meant as substitutes for the related financial information prepared in accordance with GAAP.

Thesenon-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. Thesenon-GAAP financial measures are not based on any standardized methodology prescribed by GAAP and are not necessarily comparable to similarly titled measures presented by other companies.

13

| | |

| Condensed Consolidated Statements of Operations | | UNAUDITED |

| | In thousands, except per share data |

| | | | | | | | | | | | | | | | |

| | | THREE MONTHS ENDED | | | SIX MONTHS ENDED | |

| | | Jun 30, 2017 | | | Jun 30, 2016 | | | Jun 30, 2017 | | | Jun 30, 2016 | |

Revenue: | | | | | | | | | | | | | | | | |

Transaction-based revenue | | $ | 482,065 | | | $ | 364,864 | | | $ | 885,543 | | | $ | 665,317 | |

Starbucks transaction-based revenue | | | — | | | | 32,867 | | | | — | | | | 71,705 | |

Subscription and services-based revenue | | | 59,151 | | | | 29,717 | | | | 108,211 | | | | 53,513 | |

Hardware revenue | | | 10,289 | | | | 11,085 | | | | 19,305 | | | | 27,267 | |

| | | | | | | | | | | | | |

Total net revenue | | | 551,505 | | | | 438,533 | | | | 1,013,059 | | | | 817,802 | |

| | | | | | | | | | | | | |

Cost of revenue: | | | | | | | | | | | | | | | | |

Transaction-based costs | | | 311,092 | | | | 234,857 | | | | 568,870 | | | | 429,133 | |

Starbucks transaction-based costs | | | — | | | | 28,672 | | | | — | | | | 65,282 | |

Subscription and services-based costs | | | 17,116 | | | | 10,144 | | | | 32,992 | | | | 19,177 | |

Hardware costs | | | 14,173 | | | | 14,015 | | | | 26,835 | | | | 40,755 | |

Amortization of acquired technology | | | 1,695 | | | | 1,886 | | | | 3,502 | | | | 4,256 | |

| | | | | | | | | | | | | |

Total cost of revenue | | | 344,076 | | | | 289,574 | | | | 632,199 | | | | 558,603 | |

| | | | | | | | | | | | | |

Gross profit | | | 207,429 | | | | 148,959 | | | | 380,860 | | | | 259,199 | |

| | | | | | | | | | | | | |

Operating expenses: | | | | | | | | | | | | | | | | |

Product development | | | 78,126 | | | | 68,638 | | | | 146,708 | | | | 133,230 | |

Sales and marketing | | | 59,916 | | | | 39,220 | | | | 109,816 | | | | 77,716 | |

General and administrative | | | 62,988 | | | | 50,784 | | | | 119,923 | | | | 146,891 | |

Transaction, loan and advance losses | | | 18,401 | | | | 17,455 | | | | 30,292 | | | | 25,316 | |

Amortization of acquired customer assets | | | 222 | | | | 222 | | | | 427 | | | | 539 | |

| | | | | | | | | | | | | |

Total operating expenses | | | 219,653 | | | | 176,319 | | | | 407,166 | | | | 383,692 | |

| | | | | | | | | | | | | |

Operating loss | | | (12,224) | | | | (27,360) | | | | (26,306) | | | | (124,493) | |

| | | | | | | | | | | | | |

Interest and other (income) expense, net | | | 3,266 | | | | (327) | | | | 3,765 | | | | (1,044) | |

| | | | | | | | | | | | | |

Loss before income tax | | | (15,490) | | | | (27,033) | | | | (30,071) | | | | (123,449) | |

| | | | | | | | | | | | | |

Provision for income taxes | | | 472 | | | | 312 | | | | 981 | | | | 651 | |

| | | | | | | | | | | | | |

Net loss | | $ | (15,962) | | | $ | (27,345) | | | $ | (31,052) | | | $ | (124,100) | |

| | | | | | | | | | | | | |

Net loss per share: | | | | | | | | | | | | | | | | |

Basic | | $ | (0.04) | | | $ | (0.08) | | | $ | (0.08) | | | $ | (0.37) | |

| | | | | | | | | | | | | |

Diluted | | $ | (0.04) | | | $ | (0.08) | | | $ | (0.08) | | | $ | (0.37) | |

| | | | | | | | | | | | | |

Weighted-average shares used to compute net loss per share: | | | | | | | | | | | | | | | | |

Basic | | | 376,357 | | | | 334,488 | | | | 371,573 | | | | 332,906 | |

| | | | | | | | | | | | | |

Diluted | | | 376,357 | | | | 334,488 | | | | 371,573 | | | | 332,906 | |

| | | | | | | | | | | | | |

14

| | |

| Condensed Consolidated Balance Sheets | | UNAUDITED |

| | In thousands, except share and per share data |

| | | | | | | | | | |

| Assets | | | | Jun 30, 2017 | | | Dec 31, 2016 | |

| Current assets: | | | | | | | | | | |

Cash and cash equivalents | | | | $ | 716,989 | | | $ | 452,030 | |

Short-term investments | | | | | 203,287 | | | | 59,901 | |

Restricted cash | | | | | 22,147 | | | | 22,131 | |

Settlements receivable | | | | | 309,021 | | | | 321,102 | |

Customer funds | | | | | 73,596 | | | | 43,574 | |

Loans held for sale | | | | | 50,079 | | | | 42,144 | |

Other current assets | | | | | 62,798 | | | | 60,543 | |

| | | | | |

| Total current assets | | | | | 1,437,917 | | | | 1,001,425 | |

| | | | | |

| Property and equipment, net | | | | | 87,442 | | | | 88,328 | |

| Goodwill | | | | | 57,961 | | | | 57,173 | |

| Acquired intangible assets, net | | | | | 16,452 | | | | 19,292 | |

| Long-term investments | | | | | 124,099 | | | | 27,366 | |

| Restricted cash | | | | | 14,565 | | | | 14,584 | |

| Other assets | | | | | 3,278 | | | | 3,194 | |

| | | | | |

| Total assets | | | | $ | 1,741,714 | | | $ | 1,211,362 | |

| | | | | |

| | | |

| Liabilities and Stockholders’ Equity | | | | | | | | | | |

| Current liabilities: | | | | | | | | | | |

Accounts payable | | | | $ | 11,375 | | | $ | 12,602 | |

Customers payable | | | | | 465,926 | | | | 431,632 | |

Settlements payable | | | | | 41,834 | | | | 51,151 | |

Accrued transaction losses | | | | | 22,455 | | | | 20,064 | |

Accrued expenses | | | | | 56,699 | | | | 39,543 | |

Other current liabilities | | | | | 26,639 | | | | 22,472 | |

| | | | | |

| Total current liabilities | | | | | 624,928 | | | | 577,464 | |

| | | | | |

| Long-term debt | | | | | 349,960 | | | | — | |

| | | | | |

| Other liabilities | | | | | 63,082 | | | | 57,745 | |

| | | | | |

| Total liabilities | | | | | 1,037,970 | | | | 635,209 | |

| Stockholders’ equity: | | | | | | | | | | |

Preferred stock, $0.0000001 par value: 100,000,000 shares authorized at June 30, 2017, and December 31, 2016. None issued and outstanding at June 30, 2017, and December 31, 2016. | | | | | — | | | | — | |

Class A common stock, $0.0000001 par value: 1,000,000,000 shares authorized at June 30, 2017, and December 31, 2016; 250,974,736 and 198,746,620 issued and outstanding at June 30, 2017, and December 31, 2016, respectively. | | | | | — | | | | — | |

Class B common stock, $0.0000001 par value: 500,000,000 shares authorized at June 30, 2017, and December 31, 2016; 131,645,329 and 165,800,756 issued and outstanding at June 30, 2017, and December 31, 2016, respectively. | | | | | — | | | | — | |

Additionalpaid-in capital | | | | | 1,515,237 | | | | 1,357,381 | |

Accumulated deficit | | | | | (810,974 | ) | | | (779,239 | ) |

Accumulated other comprehensive loss | | | | | (519 | ) | | | (1,989 | ) |

| | | | | |

| Total stockholders’ equity | | | | | 703,744 | | | | 576,153 | |

| | | | | |

| Total liabilities and stockholders’ equity | | | | $ | 1,741,714 | | | $ | 1,211,362 | |

| | | | | |

15

| | | | | | | | | | | | |

| Condensed Consolidated Statements of Cash Flows | | | | | | UNAUDITED | |

| | | | | | | | | In thousands | |

| | | | | | | SIX MONTHS ENDED | |

| Cash Flows from Operating Activities | | | | | Jun 30, 2017 | | | Jun 30, 2016 | |

| Net loss | | | | | | $ | (31,052) | | | $ | (124,100) | |

| Adjustments to reconcile net loss to net cash provided by (used in) operating activities: | | | | | | | | | |

Depreciation and amortization | | | | | | | 18,562 | | | | 18,136 | |

Non-cash interest and other expense | | | | | | | 5,680 | | | | 131 | |

Share-based compensation | | | | | | | 71,263 | | | | 68,120 | |

Transaction, loan and advance losses | | | | | | | 30,292 | | | | 25,316 | |

Deferred provision for income taxes | | | | | | | 99 | | | | 63 | |

Changes in operating assets and liabilities: | | | | | | | | | | | | |

Settlements receivable | | | | | | | 8,934 | | | | (64,186) | |

Customer funds | | | | | | | (30,022) | | | | 3,233 | |

Purchase of loans held for sale | | | | | | | (570,819) | | | | (212,727) | |

Sales and principal payments of loans held for sale | | | | | | | 560,209 | | | | 183,748 | |

Other current assets | | | | | | | (2,201) | | | | 7,985 | |

Other assets | | | | | | | (110) | | | | (377) | |

Accounts payable | | | | | | | 143 | | | | 2,538 | |

Customers payable | | | | | | | 34,149 | | | | 84,826 | |

Settlements payable | | | | | | | (9,317) | | | | (10,579) | |

Charge-offs to accrued transaction losses | | | | | | | (22,243) | | | | (24,475) | |

Accrued expenses | | | | | | | 17,000 | | | | (13,784) | |

Other current liabilities | | | | | | | 4,327 | | | | 24,025 | |

Other noncurrent liabilities | | | | 5,696 | | | | (431) | |

| | | | | |

Net cash provided by (used in) operating activities | | | | | | | 90,590 | | | | (32,538) | |

| | | | | |

| | | |

| Cash Flows from Investing Activities | | | | | | | | | | | | |

Purchase of marketable securities | | | | | | | (314,055) | | | | (102,245) | |

Proceeds from maturities of marketable securities | | | | | | | 52,064 | | | | 16,768 | |

Proceeds from sale of marketable securities | | | | | | | 21,730 | | | | 4,964 | |

Purchase of property and equipment | | | | | | | (13,883) | | | | (15,840) | |

Payment for acquisition of intangible assets | | | | | | | — | | | | (400) | |

Business acquisitions | | | | | | | (1,600) | | | | — | |

| | | | | |

Net cash used in investing activities: | | | | | | | (255,744) | | | | (96,753) | |

| | | | | |

16

| | |

| Condensed Consolidated Statements of Cash Flows (continued) | | UNAUDITED In thousands |

| | | | | | | | | | |

| | | | | SIX MONTHS ENDED | |

| Cash Flows from Financing Activities | | | | Jun 30, 2017 | | | Jun 30, 2016 | |

Proceeds from issuance of convertible senior notes, net | | | | | 428,250 | | | | — | |

Purchase of convertible senior note hedges | | | | | (92,136) | | | | — | |

Proceeds from issuance of warrants | | | | | 57,244 | | | | — | |

Payment for termination of Starbucks warrant | | | | | (54,808) | | | | — | |

Principal payments on capital lease obligation | | | | | (634) | | | | — | |

Payments of offering costs related to initial public offering | | | | | — | | | | (5,530) | |

Proceeds from the exercise of stock options and purchases under the employee stock purchase plan, net | | | | | 89,863 | | | | 15,496 | |

| | | | | |

Net cash provided by financing activities | | | | | 427,779 | | | | 9,966 | |

| | | | | |

Effect of foreign exchange rate changes on cash and cash equivalents | | | | | 2,331 | | | | 2,672 | |

| | | | | |

Net increase (decrease) in cash, cash equivalents and restricted cash | | | | | 264,956 | | | | (116,653) | |

| Cash, cash equivalents and restricted cash, beginning of period | | | | | 488,745 | | | | 489,552 | |

| | | | | |

| Cash, cash equivalents and restricted cash, end of period | | | | $ | 753,701 | | | $ | 372,899 | |

| | | | | |

17

| | |

| Key Operating Metrics andNon-GAAP Financial Measures | | UNAUDITED |

| | In thousands, except GPV and per share data |

| | | | | | | | | | | | | | | | |

| | | THREE MONTHS ENDED | | | SIX MONTHS ENDED | |

| | | Jun 30, 2017 | | | Jun 30, 2016 | | | Jun 30, 2017 | | | Jun 30, 2016 | |

| | | | |

| Gross Payment Volume (GPV) (in millions) | | $ | 16,421 | | | $ | 12,451 | | | $ | 30,068 | | | $ | 22,741 | |

| Adjusted Revenue | | $ | 240,413 | | | $ | 170,809 | | | $ | 444,189 | | | $ | 316,964 | |

| Adjusted EBITDA | | $ | 36,496 | | | $ | 12,554 | | | $ | 63,521 | | | $ | 3,471 | |

| Adjusted Net Income (Loss) Per Share: | | | | | | | | | | | | | | | | |

| Basic | | $ | 0.08 | | | $ | 0.02 | | | $ | 0.13 | | | $ | (0.03) | |

| Diluted | | $ | 0.07 | | | $ | 0.02 | | | $ | 0.12 | | | $ | (0.03) | |

Adjusted Revenue Reconciliation | | | | | | | | | | | | | | | UNAUDITED | |

| | | | | | | | | | | | In thousands | |

| | |

| | | THREE MONTHS ENDED | | | SIX MONTHS ENDED | |

| | | Jun 30, 2017 | | | Jun 30, 2016 | | | Jun 30, 2017 | | | Jun 30, 2016 | |

| Total net revenue | | $ | 551,505 | | | $ | 438,533 | | | $ | 1,013,059 | | | $ | 817,802 | |

| Less: Starbucks transaction-based revenue | | | — | | | | 32,867 | | | | — | | | | 71,705 | |

| Less: transaction-based costs | | | 311,092 | | | | 234,857 | | | | 568,870 | | | | 429,133 | |

| | | | | | | | | | | | | |

Adjusted Revenue | | $ | 240,413 | | | $ | 170,809 | | | $ | 444,189 | | | $ | 316,964 | |

| | | | | | | | | | | | | |

Adjusted EBITDA Reconciliation | | | | | | | | | | | | | | | UNAUDITED | |

| | | | | | | | | | | | | | | In thousands | |

| | | THREE MONTHS ENDED | | | SIX MONTHS ENDED | |

| | | Jun 30, 2017 | | | Jun 30, 2016 | | | Jun 30, 2017 | | | Jun 30, 2016 | |

| Net loss | | $ | (15,962) | | | $ | (27,345) | | | $ | (31,052) | | | $ | (124,100) | |

| Starbucks transaction-based revenue | | | — | | | | (32,867) | | | | — | | | | (71,705) | |

| Starbucks transaction-based costs | | | — | | | | 28,672 | | | | — | | | | 65,282 | |

| Share-based compensation expense | | | 39,593 | | | | 36,922 | | | | 71,263 | | | | 68,120 | |

| Depreciation and amortization | | | 9,125 | | | | 9,018 | | | | 18,562 | | | | 18,136 | |

| Litigation settlement expense | | | — | | | | (2,000) | | | | — | | | | 48,000 | |

| Interest and other (income) expense, net | | | 3,266 | | | | (327) | | | | 3,765 | | | | (1,044) | |

| Provision for income taxes | | | 472 | | | | 312 | | | | 981 | | | | 651 | |

| Loss on sale of property and equipment | | | 2 | | | | 169 | | | | 2 | | | | 131 | |

| | | | | | | | | | | | | |

Adjusted EBITDA | | $ | 36,496 | | | $ | 12,554 | | | $ | 63,521 | | | $ | 3,471 | |

| | | | | | | | | | | | | |

18

| | |

| Adjusted Net Income (Loss) Reconciliation | | UNAUDITED |

| | In thousands, except per share data |

| | | | | | | | | | | | | | | | |

| | | THREE MONTHS ENDED | | | SIX MONTHS ENDED | |

| | | Jun 30, 2017 | | | Jun 30, 2016 | | | Jun 30, 2017 | | | Jun 30, 2016 | |

| | | | | | | | | | | | | |

| Net loss | | $ | (15,962) | | | $ | (27,345) | | | $ | (31,052) | | | $ | (124,100) | |

| Starbucks transaction-based revenue | | | — | | | | (32,867) | | | | — | | | | (71,705) | |

| Starbucks transaction-based costs | | | — | | | | 28,672 | | | | — | | | | 65,282 | |

| Share-based compensation expense | | | 39,593 | | | | 36,922 | | | | 71,263 | | | | 68,120 | |

| Amortization of intangible assets | | | 1,943 | | | | 2,134 | | | | 4,064 | | | | 4,847 | |

| Litigation settlement expense | | | — | | | | (2,000) | | | | — | | | | 48,000 | |

| Amortization of debt discount and issuance costs | | | 4,221 | | | | — | | | | 5,611 | | | | — | |

| Loss on sale of property and equipment | | | 2 | | | | 169 | | | | 2 | | | | 131 | |

| | | | | | | | | | | | | |

Adjusted Net Income (Loss) | | $ | 29,797 | | | $ | 5,685 | | | $ | 49,888 | | | $ | (9,425) | |

| | | | | | | | | | | | | |

Adjusted Net Income (Loss) Per Share: | | | | | | | | | | | | | | | | |

Basic | | $ | 0.08 | | | $ | 0.02 | | | $ | 0.13 | | | $ | (0.03) | |

Diluted | | $ | 0.07 | | | $ | 0.02 | | | $ | 0.12 | | | $ | (0.03) | |

Weighted-average shares used to compute Adjusted Net Income (Loss) | | | | | | | | | | | | | | | | |

Per Share: | | | | | | | | | | | | | | | | |

Basic | | | 376,357 | | | | 334,488 | | | | 371,573 | | | | 332,906 | |

Diluted | | | 418,468 | | | | 365,731 | | | | 411,420 | | | | 332,906 | |

| | |

| Adjusted Revenue Guidance Reconciliation | | UNAUDITED |

| | In thousands |

| | | | | | | | |

| | | THREE MONTHS ENDED | | | YEAR ENDED | |

| | | Sep 30, 2017 | | | Dec 31, 2017 | |

| | | | | | | | |

| Total net revenue | | $ | 562,000 - 568,000 | | | $ | 2,140,000 - 2,160,000 | |

| Less: Transaction-based costs | | | 324,000 - 327,000 | | | | 1,215,000 - 1,225,000 | |

| | | | | |

Adjusted Revenue | | $ | 238,000 - 241,000 | | | $ | 925,000- 935,000 | |

| | | | | |

19

| | | | | | | | | | | | | | | | |

| Non-GAAP Operating Expenses | | | | | | | | | | | | | | | UNAUDITED | |

| | | | | | | | | | | | | | | In thousands | |

| | | THREE MONTHS ENDED | | | SIX MONTHS ENDED | |

| | | Jun 30, 2017 | | | Jun 30, 2016 | | | Jun 30, 2017 | | | Jun 30, 2016 | |

| | | | |

| Operating expenses | | $ | (219,653) | | | $ | (176,319) | | | $ | (407,166) | | | $ | (383,692) | |

| Share-based compensation | | | 39,575 | | | | 36,922 | | | | 71,245 | | | | 68,120 | |

| Depreciation and amortization | | | 7,400 | | | | 6,573 | | | | 14,931 | | | | 12,762 | |

| Litigation settlement expense | | | — | | | | (2,000) | | | | — | | | | 48,000 | |

| Loss (gain) on sale of fixed assets | | | 2 | | | | 169 | | | | 2 | | | | 131 | |

| | | | | | | | | | | | | |

Non-GAAP operating expenses | | $ | (172,676) | | | $ | (134,655) | | | $ | (320,988) | | | $ | (254,679) | |

| | | | | | | | | | | | | |

| | | | |

| Product development | | $ | (78,126) | | | $ | (68,638) | | | $ | (146,708) | | | $ | (133,230) | |

| Share-based compensation | | | 25,136 | | | | 24,168 | | | | 44,492 | | | | 46,115 | |

| Depreciation and amortization | | | 3,436 | | | | 3,128 | | | | 7,148 | | | | 6,269 | |

| | | | | | | | | | | | | |

Non-GAAP product development | | $ | (49,554) | | | $ | (41,173) | | | $ | (95,068) | | | $ | (80,677) | |

| | | | | | | | | | | | | |

| | | | |

| Sales and marketing | | $ | (59,916) | | | $ | (39,220) | | | $ | (109,816) | | | $ | (77,716) | |

| Share-based compensation | | | 4,355 | | | | 3,363 | | | | 8,290 | | | | 6,266 | |

| Depreciation and amortization | | | 98 | | | | 6 | | | | 175 | | | | 8 | |

| Loss (gain) on sale of fixed assets | | | 2 | | | | — | | | | 60 | | | | 18 | |

| | | | | | | | | | | | | |

Non-GAAP sales and marketing | | $ | (55,461) | | | $ | (35,851) | | | $ | (101,291) | | | $ | (71,424) | |

| | | | | | | | | | | | | |

| | | | |

| General and administrative | | $ | (62,988) | | | $ | (50,784) | | | $ | (119,923) | | | $ | (146,891) | |

| Share-based compensation | | | 10,084 | | | | 9,391 | | | | 18,463 | | | | 15,739 | |

| Depreciation and amortization | | | 3,866 | | | | 3,439 | | | | 7,608 | | | | 6,485 | |

| Litigation settlement expense | | | — | | | | (2,000) | | | | — | | | | 48,000 | |

| Loss (gain) on sale of fixed assets | | | — | | | | — | | | | (58) | | | | (56) | |

| | | | | | | | | | | | | |

Non-GAAP general and administrative | | $ | (49,038) | | | $ | (39,954) | | | $ | (93,910) | | | $ | (76,723) | |

| | | | | | | | | | | | | |

| | | | |

| Depreciation and Amortization by Function | | | | | | | | | | | | | | | UNAUDITED | |

| | | | | | | | | | | | | | | In thousands | |

| | | THREE MONTHS ENDED | | | SIX MONTHS ENDED | |

| | | Jun 30, 2017 | | | Jun 30, 2016 | | | Jun 30, 2017 | | | Jun 30, 2016 | |

| | | | |

| Cost of revenue | | $ | 1,725 | | | $ | 2,445 | | | $ | 3,631 | | | $ | 5,374 | |

| Product development | | | 3,436 | | | | 3,128 | | | | 7,148 | | | | 6,269 | |

| Sales and marketing | | | 98 | | | | 6 | | | | 175 | | | | 8 | |

| General and administrative | | | 3,866 | | | | 3,439 | | | | 7,608 | | | | 6,485 | |

| | | | | | | | | | | | | |

Total depreciation and amortization | | $ | 9,125 | | | $ | 9,018 | | | $ | 18,562 | | | $ | 18,136 | |

| | | | | | | | | | | | | |

20