Exhibit 99.1

Q1 2018 Shareholder Letter

SQUARE.COM/INVESTORS

FEATURED SELLER SisterHearts In Arabi, LA

HIGHLIGHTS:

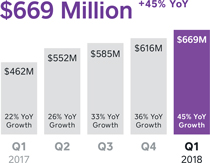

| • | We continue to accelerate growth at scale: In the first quarter of 2018, total net revenue grew 45% year over year and Adjusted Revenue grew 51% year over year, compared to 36% and 47%, respectively, in the fourth quarter of 2017. |

| • | Together with Weebly, we will provide sellers with one cohesive solution to start or grow an omnichannel business. |

| • | Larger sellers come to Square for our ecosystem: More than half of larger sellers use multiple Square products. |

| • | In the UK, we recently launched Instant Deposit and Cash App—two of our fastest-growing services. |

FIRST QUARTER 2018 KEY RESULTS:

| GROSS PAYMENT VOLUME (GPV) | TOTAL NET REVENUE | NET INCOME (LOSS) | ||

|  |  | ||

| GPV MIX BY SELLER SIZE | ADJUSTED REVENUE | ADJUSTED EBITDA | ||

|  |  | ||

Total net revenue in the first quarter of 2018 includes $34 million of bitcoin revenue (see page 7 for further detail).

A reconciliation of non-GAAP metrics used in this letter to their nearest GAAP equivalents is provided at the end of this letter.

Adjusted Revenue is defined as total net revenue less transaction-based costs and bitcoin costs.

Adjusted EBITDA margin is calculated as Adjusted EBITDA divided by Adjusted Revenue.

2

TO OUR SHAREHOLDERS:

|

MAY 2, 2018 | |

We continue to accelerate growth at scale, expanding our ecosystem for sellers and

Together with Weebly, we will provide sellers with one cohesive solution to

Omnichannel commerce—enabling sellers to engage with buyers wherever they

In April, we entered into an agreement to acquire Weebly, a San Francisco-based |

Weebly online store

ON THE COVER: Maryam Henderson-Uloho is the founder of |

3

Weebly will expand Square’s customer base globally and add a new recurring revenue stream. Weebly has millions of customers and more than 625,000 paid subscribers. Square will provide Weebly customers with access to the company’s ecosystem of managed payments, hardware, and software, which complement Weebly’s services, including free website hosting, premium (paid) website hosting, online store, and marketing tools. Nearly 40% of Weebly’s paid subscribers are outside the U.S., which will help accelerate Square’s global expansion.

We will continue to provide an open platform to offer sellers the flexibility to select and integrate the third-party solutions that are best for their business. In the first quarter, the number of sellers that are integrated with a third-party solution increased nearly 80% year over year. Today, we offer more than 100 third-party partner integrations across a diverse range of third-party apps: website builders such as GoDaddy, Wix, and WooCommerce; points of sale such as SuiteRetail and Vend; and back-office systems like SAP Business One, Intuit, and Xero.

Larger sellers come to Square for our ecosystem: More than half of larger sellers use multiple Square products.

Larger sellers often have business needs that extend beyond payments, such as managing multiple employees and locations and tracking inventory. Square provides integrated solutions to meet these diverse needs—saving sellers the time and burden of stitching together individual products from different vendors.

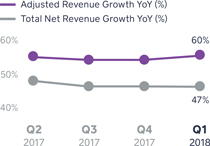

Larger businesses, like other Square sellers, choose Square because they value our cohesive ecosystem: More than half of larger sellers used two or more Square products during 2017. As these sellers use more products, we deepen our relationship with them, and they drive meaningful growth for Square: In the first quarter, total net revenue from larger sellers grew 47% year over year, and Adjusted Revenue from larger sellers grew 60% year over year.

We continue to build remarkable products that meet the needs of sellers of every size. In the fourth quarter of 2017, we launched Square Register, our first product that combines hardware, point-of-sale software, and | A larger seller generates more than $125,000 in annualized GPV.

TOTAL NET REVENUE AND ADJUSTED REVENUE GROWTH OF LARGER SELLERS

Excludes subscription revenue from partners and hardware revenue. |

4

payments technology into a powerful, all-in-one offering. Square Register does not require a third-party mobile device, and the customer display creates an opportunity to establish a seller-buyer connection. The average annualized GPV of a Square Register seller is more than $300,000, demonstrating that this product is resonating with larger sellers. And Square Register is gaining traction with our existing sellers and attracting new sellers: Nearly a third of Square Register units ordered in the first quarter were from sellers new to Square.

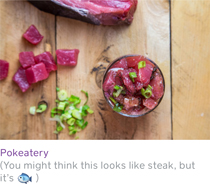

Pokeatery is a quick-serve restaurant that specializes in poké, a raw fish–based dish found in Hawaiian cuisine. The business switched from its merchant services account to Square for our cohesive ecosystem and simple, transparent pricing. Pokeatery uses Square Register in its four locations in Northern California and Austin, Texas. The point-of-sale software has been easy for employees to use, the hardware is an ideal fit for the fast-casual environment, and customers love the look. Owner Derek Chung likes the ability to connect with his customers via Customer Directory, and two locations also use Square Loyalty and Square Marketing. For the catering business, Pokeatery uses Square Invoices—it makes billing and payment simple, and customers value the security. Additionally, Pokeatery Austin uses Square Payroll to easily manage its more than 15 employees. Pokeatery continues to grow and will open a fifth location later this year.

In the UK, we recently launched Instant Deposit and Cash App—two of our fastest-growing services.

We know that all sellers value speed—particularly when it comes to their money. The launch of Instant Deposit helps to solve two of the biggest challenges UK businesses face: managing cash flow and gaining fast access to funds. Settlement of funds in the UK typically takes three days with other payment processors.2 With Instant Deposit, sellers in the UK can now receive their money in minutes at the tap of a button, even outside business hours.

In the first quarter, Cash App remained the #1 Finance App in the App Store, and we are excited to bring the product to the UK. The app is available to download from the App Store, Google Play, and on the web at | TOP INDUSTRIES USING SQUARE REGISTER

Based on number of active sellers.

|

5

cash.me/uk. Cash App features free peer-to-peer money transfer—making it an easy way to send and receive money between UK bank accounts—and customers receive the funds into their bank in minutes. Similar to the U.S., we see an opportunity in the UK to expand the suite of financial services we offer individuals.

As we’ve seen in other markets, Square is growing in communities outside urban centers: More than three-quarters of active Square sellers in the UK are outside London. As more than half of UK bank branches have closed since 1989,3 people are underserved by the financial system, particularly in areas like Holywell, Wales. Philip Jones owns a computer store in Holywell and stopped accepting cards in 2014 because of the fixed monthly fees he incurred (even if he did not process card payments during the month). However, with only one bank branch remaining in the town, he was no longer able to effectively run his business as cash only. With Square’s affordable hardware and transparent pricing, Philip was able to accept cards again. We will continue to provide access to tools to empower people to participate and thrive in the economy.

FINANCIAL DISCUSSION:

Gross Payment Volume (GPV)

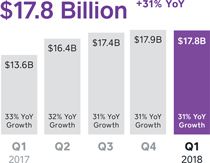

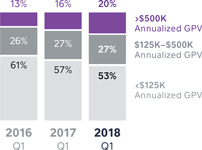

In the first quarter of 2018, we processed $17.8 billion in GPV, up 31% year over year. This was consistent with 31% year-over-year growth in the fourth quarter of 2017, highlighting continued growth at scale. We continue to see strength from larger sellers. In the first quarter of 2018, GPV from larger sellers grew 44% year over year and accounted for 47% of total GPV, up from 43% of total GPV in the first quarter of 2017.

Revenue

Total net revenue was $669 million in the first quarter of 2018, up 45% year over year. This includes $34 million of bitcoin revenue as we fully launched the ability to buy and sell bitcoin in the Cash App in January. Excluding bitcoin revenue, total net revenue was $635 million, up 37% year over year. |

UK Cash App

Active sellersare those who have processed 5+ payments in the last 12 months.

Holywell, Wales |

6

All bitcoin revenue and costs are related to Cash App activity and are recorded based on the following:

| • | Bitcoin revenue is the total sale amount of bitcoin to customers. |

| • | Bitcoin costs are the total amount of bitcoin that we purchase. We purchase bitcoin to facilitate the buying of bitcoin conducted by Cash App customers. |

| • | Adjusted Revenue from bitcoin is our bitcoin revenue less our bitcoin costs. |

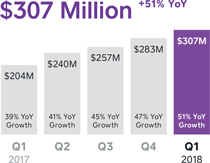

Adjusted Revenue was $307 million in the first quarter of 2018, up 51% year over year. Adjusted Revenue in the first quarter of 2018 includes $0.2 million related to bitcoin.

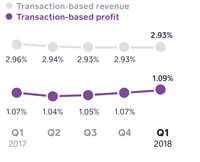

Transaction-based revenue was $523 million in the first quarter of 2018, up 30% year over year. Transaction-based revenue as a percentage of GPV was 2.93% in the first quarter of 2018, down from 2.96% in the first quarter of 2017. Transaction-based profit as a percentage of GPV was 1.09% in the first quarter of 2018, up from 1.07% in the first quarter of 2017. Excluding unused promotional processing credits associated with the contactless and chip reader in the first quarter of 2017, transaction-based revenue as a percentage of GPV was consistent year over year. Transaction-based profit continued to benefit from growth in higher-margin products and improvements in our transaction cost profile. GPV from higher-margin products—Invoices, Virtual Terminal, and eCommerce API payments—doubled year over year.

Subscription and services-based revenue was $97 million in the first quarter of 2018, up 98% year over year. Growth was driven primarily by Instant Deposit, Caviar, and Square Capital. Instant Deposit benefited from volume growth in both our seller base and the Cash App. Cash Card is also becoming a more meaningful contributor to subscription and services-based revenue growth. In the first quarter of 2018, Square Capital facilitated over 50,000 business loans totaling $339 million, up 35% year over year.

Hardware revenue in the first quarter of 2018 was $14 million, up 60% year over year, driven by the launch of Square Register, which began shipping

TOTAL NET REVENUE

Under U.S. GAAP, the current determination is that bitcoin sales are accounted for as gross revenue under ASC 606,Revenue from Contracts with Customers, given Square currently controls the bitcoin prior to sale.

| FINANCIAL IMPACT FROM BITCOIN | ||||

Bitcoin revenue | $34.1M | |||

Bitcoin costs

|

| – $33.9M

|

| |

Adjusted Revenue from bitcoin |

|

$0.2M |

| |

ADJUSTED REVENUE

Adjusted Revenueis defined as total net revenue less transaction-based costs and bitcoin costs.

7

in December 2017, and continued growth in Square Stand and third-party peripherals.

Operating Expenses/Earnings

Operating expenses were $276 million in the first quarter of 2018, up 47% year over year and up 9% from the fourth quarter of 2017, representing 41% of total net revenue. Non-GAAP operating expenses were up 49% year over year, representing 72% of Adjusted Revenue.

• Product development expenses were $105 million on a GAAP basis and $69 million on a non-GAAP basis in the first quarter of 2018, up 53% and 52%, respectively, year over year. This primarily reflects increases in engineering, product, data science, and design personnel costs. • Sales and marketing expenses were $77 million on a GAAP basis and $72 million on a non-GAAP basis in the first quarter of 2018, up 55% and 56%, respectively, year over year. This increase was driven primarily by costs related to our Cash App peer-to-peer transfer service, growth in advertising expenditures, and sales and marketing personnel costs. • General and administrative expenses were $76 million on a GAAP basis and $62 million on a non-GAAP basis in the first quarter of 2018, up 33% and 38%, respectively, year over year. The year-over-year increase was due primarily to increased finance, legal, and support personnel costs. • Transaction, loan, and advance losses were $18 million in the first quarter of 2018. Transaction losses as a percentage of GPV continue to trend below our 0.1% historical average, underscoring ongoing improvements in risk management.

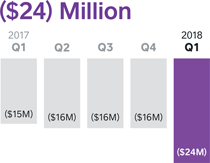

Net loss in the first quarter was $24 million, compared to a net loss of $15 million in the first quarter of 2017. Net loss per share, basic and diluted, was $0.06 for the first quarter of 2018, compared to a net loss per share of $0.04 in the first quarter of 2017. We had 396 million weighted-average shares as of the first quarter of 2018.

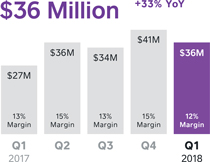

Adjusted EBITDA was $36 million in the first quarter of 2018, compared to $27 million in the first quarter of 2017, up 33% year over year. We achieved an Adjusted EBITDA margin of 12% as we continue to reinvest in the business to drive long-term growth. | AS A PERCENTAGE OF GPV:

Transaction-based revenue as a percentage of GPV in the first quarter of 2017 would have been 2.94% when excluding unused promotional processing credits associated with the contactless and chip reader. We provided sellers with promotional processing credits for pre-orders of our contactless and chip reader at launch. |

8

Adjusted Net Income Per Share (Adjusted EPS) was $0.06 based on 462 million weighted-average diluted shares for the first quarter of 2018, representing a $0.01 improvement year over year.

Balance Sheet/Cash Flow

We ended the first quarter of 2018 with $1.2 billion in cash, cash equivalents, restricted cash, and investments in marketable securities, up from $1.1 billion at the end of the fourth quarter of 2017. Positive Adjusted EBITDA and proceeds from employee stock option exercises contributed to the increase in the balance at the end of the quarter. | NET INCOME (LOSS)

ADJUSTED EBITDA

A reconciliation of non-GAAP metrics used in this letter to their nearest GAAP equivalents is provided at the end of this letter. Adjusted EBITDA margin is calculated as Adjusted EBITDA divided by Adjusted Revenue.

Adjusted EPS is calculated by dividing net loss, excluding share-based compensation expense, amortization of intangible assets, amortization of debt discount and issuance costs, and gain or loss on sale of property and equipment, by the weighted-average number of shares of common stock during the period, including the dilutive effect of all potential shares. |

9

GUIDANCE:

Q2

| Current 2018

| Previous 2018

| ||||||||

Total net revenue | $740M to $760M | $3.00B to $3.06B | $2.82B to $2.88B | |||||||

Adjusted Revenue | $355M to $360M | $1.40B to $1.43B | $1.30B to $1.33B | |||||||

Year-over-year growth (midpoint) | 49%

| 44%

| 34%

| |||||||

Adjusted EBITDA

| $60M to $64M

| $240M to $250M

| $240M to $250M

| |||||||

Net income (loss) per share | $(0.04) to $(0.02) | $(0.04) to $0.00 | $(0.08) to $(0.04) | |||||||

Adjusted EPS (diluted) | $0.09 to $0.11 | $0.44 to $0.48 | $0.43 to $0.47 | |||||||

Based on our results in the first quarter, we are raising our full-year guidance for total net revenue and Adjusted Revenue to reflect the ongoing momentum of our business and the acquisition of Zesty, which closed on April 19. Given the significant market opportunity ahead of us, we will continue to reinvest in our business to drive future growth and are therefore maintaining ourfull-year Adjusted EBITDA guidance.

Full-year 2018 guidance does not include the impact from the Weebly acquisition. We will update guidance after the completion of the transaction, which is subject to customary closing conditions including regulatory approvals and is expected to close during the second quarter of 2018.

We have not reconciled Adjusted EBITDA and Adjusted EPS guidance to their GAAP equivalents as a result of the uncertainty regarding, and the potential variability of, reconciling items such as share-based compensation expense and weighted-average fully diluted shares outstanding. Accordingly, a reconciliation of these non-GAAP guidance metrics to their corresponding GAAP equivalents is not available without unreasonable effort. However, we have provided a reconciliation of GAAP to non-GAAP metrics in tables at the end of this letter. It is important to note that the actual amount of such reconciling items would have a significant impact if they were included in our Adjusted EBITDA and Adjusted EPS.

10

Earnings Webcast

Square (NYSE:SQ) will host a conference call and earnings webcast at 2:00 p.m.

We will release financial results for the second quarter of 2018 on August 1, 2018, | MEDIA CONTACT press@squareup.com

INVESTOR RELATIONS CONTACT ir@squareup.com |

|  | |||

| Jack Dorsey | Sarah Friar | |||

| CEO | CFO | |||

1 How to Survive in an Omnichannel World: Best Practices for Omnichannel Retailing, Euromonitor International

2 Merchant Machine

3 Tackling financial exclusion: A country that works for everyone?

11

| “Square is so unique compared to other payment providers—the platform is clean and easy to use. I’ve used Square Capital to grow my business, and the payback is simple.

“And Square Appointments has made it easy for both me and my customers, reducing cancellations and missed appointments.”

Pedro Dungo Owner Fitted by Pedro |

SAFE HARBOR STATEMENT

This letter contains forward-looking statements within the meaning of the Safe Harbor provisions of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact could be deemed forward-looking, including, but not limited to, statements regarding the strategies, areas of focus, and future performance of Square, Inc. and its consolidated subsidiaries (the Company); the Company’s expected financial results for future periods; future growth in the Company’s businesses and products; the expected closing and impact of the Company’s recent proposed acquisitions, including our expectations regarding our ability to integrate such acquisitions and their impact on our growth and financial results; the Company’s expectations regarding scale, profitability, and the demand for or benefits from its products, product features, and services in the U.S. and in international markets; and management’s statements related to business strategy, plans, and objectives for future operations. In some cases, forward-looking statements can be identified by terms such as “may,” “will,” “appears,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential,” or “continue,” or the negative of these words or other similar terms or expressions that concern our expectations, strategy, plans, or intentions. Such statements are subject to a number of known and unknown risks, uncertainties, assumptions, and other factors that may cause the Company’s actual results, performance, or achievements to differ materially from results expressed or implied in this letter. Investors are cautioned not to place undue reliance on these statements. Actual results could differ materially from those expressed or implied, and reported results should not be considered as an indication of future performance.

Risks that contribute to the uncertain nature of the forward-looking statements include, among others, the Company’s ability to deal with the substantial and increasingly intense competition in its industry; changes to the rules and practices of payment card networks and acquiring processors; the Company’s ability to consummate, and the impact of, any potential acquisitions or divestitures, strategic investments, or entries into new businesses; the effect of evolving regulations and oversight related to the Company’s provision of payments services and other financial services; the effect of management changes and business initiatives; and changes in political, business, and economic conditions; as well as other risks listed or described from time to time in the Company’s filings with the Securities and Exchange Commission (the SEC), including the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2017, which is on file with the SEC and available on the investor relations page of the Company’s website. Additional information will also be set forth in the Company’s Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2018. All forward-looking statements are based on information and estimates available to the Company at the time of this letter and are not guarantees of future performance. Except as required by law, the Company assumes no obligation to update any of the statements in this letter.

KEY OPERATING METRICS AND NON-GAAP FINANCIAL MEASURES

To supplement our financial information presented in accordance with generally accepted accounting principles in the United States (GAAP), we consider certain operating and financial measures that are not prepared in accordance with GAAP, including Gross Payment Volume, Adjusted Revenue, Adjusted EBITDA, Adjusted EBITDA margin, Adjusted Net Income (Loss), Adjusted EPS, and non-GAAP operating expenses. We believe these metrics and measures are useful to facilitate period-to-period comparisons of our business and to facilitate comparisons of our performance to that of other payments solution providers.

We define Gross Payment Volume (GPV) as the total dollar amount of all card payments processed by sellers using Square, net of refunds. Additionally, GPV includes Cash App activity related to peer-to-peer payments sent from a credit card, and Cash for Business.

Adjusted Revenue is a non-GAAP financial measure that we define as our total net revenue less transaction-based costs and bitcoin costs. We believe it is useful to subtract transaction-based costs and bitcoin costs from total net revenue to derive Adjusted Revenue as this is a primary metric used by management to measure our business performance, and it affords greater comparability to other payments solution providers. Substantially all of the transaction-based costs are interchange and assessment fees, processing fees, and bank settlement fees paid to third-party payment processors and financial institutions. While some payments solution providers present their revenue in a similar fashion to us, others present their revenue net of transaction-based costs because, unlike us, they pass through these costs directly to their sellers and are not deemed the principal in these arrangements. Under our standard pricing model, we do not pass through these costs directly to our sellers. We also deduct bitcoin costs because we consider our role in the bitcoin transactions to be facilitating customer access to bitcoin. Since we only apply a small margin to the market cost of bitcoin when we sell bitcoin to customers, and we have no control over the cost of bitcoin in the market, which tends to be volatile, we believe deducting bitcoin costs is a better reflection of the economic benefits as well as the Company’s performance from the bitcoin transactions. Adjusted Revenue has limitations as a financial measure, should be considered as supplemental in nature, and is not meant as a substitute for the related financial information prepared in accordance with GAAP.

Adjusted EBITDA, Adjusted Net Income (Loss), Adjusted EPS, and non-GAAP operating expenses are non-GAAP financial measures that represent our net loss and net loss per share, adjusted to eliminate the effect of share-based compensation expenses, amortization of intangible assets, amortization of debt discount and issuance costs in connection with our offering of convertible senior notes in the first quarter of 2017, the gain or loss on the sale of property and equipment, and impairment of intangible assets, as applicable. In addition to the items above, Adjusted EBITDA and non-GAAP operating expenses are non-GAAP financial measures that also exclude depreciation, other cash interest income and expense, other income and expense, and provision or benefit from income taxes, as applicable. Basic Adjusted Net Income (Loss) Per Share is computed by dividing the Adjusted Net Income (Loss) by the weighted-average number of shares of common stock outstanding during the period. Diluted Adjusted Net Income Per Share is computed by dividing Adjusted Net Income by the weighted-average number of shares of common stock outstanding, adjusted for the dilutive effect of all potential shares of common stock.

13

We have included Adjusted EBITDA and Adjusted EPS because they are key measures used by our management to evaluate our operating performance, generate future operating plans, and make strategic decisions, including those relating to operating expenses and the allocation of internal resources. Accordingly, we believe that Adjusted EBITDA and Adjusted EPS provide useful information to investors and others in understanding and evaluating our operating results in the same manner as our management and board of directors. In addition, they provide useful measures for period-to-period comparisons of our business, as they remove the effect of certain non-cash items and certain variable charges. Adjusted EBITDA and Adjusted EPS have limitations as financial measures, should be considered as supplemental in nature, and are not meant as substitutes for the related financial information prepared in accordance with GAAP.

These non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. These non-GAAP financial measures are not based on any standardized methodology prescribed by GAAP and are not necessarily comparable to similarly titled measures presented by other companies.

14

| Consolidated Statements of Operations | UNAUDITED | |

| In thousands, except per share data |

| THREE MONTHS ENDED | ||||||||

| Mar 31, 2018 | Mar 31, 2017 | |||||||

Revenue: | ||||||||

Transaction-based revenue | $ | 523,037 | $ | 403,478 | ||||

Subscription and services-based revenue | 97,054 | 49,060 | ||||||

Hardware revenue | 14,417 | 9,016 | ||||||

Bitcoin revenue | 34,095 | — | ||||||

|

|

| ||||||

Total net revenue | 668,603 | 461,554 | ||||||

|

|

| ||||||

Cost of revenue: | ||||||||

Transaction-based costs | 327,911 | 257,778 | ||||||

Subscription and services-based costs | 30,368 | 15,876 | ||||||

Hardware costs | 19,702 | 12,662 | ||||||

Bitcoin costs | 33,872 | — | ||||||

Amortization of acquired technology | 1,580 | 1,807 | ||||||

|

|

| ||||||

Total cost of revenue | 413,433 | 288,123 | ||||||

|

|

| ||||||

Gross profit | 255,170 | 173,431 | ||||||

|

|

| ||||||

Operating expenses: | ||||||||

Product development | 105,095 | 68,582 | ||||||

Sales and marketing | 77,266 | 49,900 | ||||||

General and administrative | 75,501 | 56,935 | ||||||

Transaction, loan and advance losses | 18,031 | 11,891 | ||||||

Amortization of acquired customer assets | 269 | 205 | ||||||

|

|

| ||||||

Total operating expenses | 276,162 | 187,513 | ||||||

|

|

| ||||||

Operating loss | (20,992) | (14,082) | ||||||

|

|

| ||||||

Interest and other expense, net | 2,819 | 499 | ||||||

|

|

| ||||||

Loss before income tax | (23,811) | (14,581) | ||||||

|

|

| ||||||

Provision for income taxes | 175 | 509 | ||||||

|

|

| ||||||

Net loss | $ | (23,986) | (15,090) | |||||

|

|

| ||||||

Net loss per share: | ||||||||

Basic | $ | (0.06) | $ | (0.04) | ||||

|

|

| ||||||

Diluted | $ | (0.06) | $ | (0.04) | ||||

|

|

| ||||||

Weighted-average shares used to compute net loss per share | ||||||||

Basic | 395,948 | 366,737 | ||||||

|

|

| ||||||

Diluted | 395,948 | 366,737 | ||||||

|

|

| ||||||

15

| Consolidated Balance Sheets | UNAUDITED In thousands, except share and per share data |

| Assets | Mar 31, 2018 | Dec 31, 2017 | ||||||||

| Current assets: | ||||||||||

Cash and cash equivalents | $ | 738,586 | $ | 696,474 | ||||||

Short-term investments | 200,048 | 169,576 | ||||||||

Restricted cash | 27,688 | 28,805 | ||||||||

Settlements receivable | 700,646 | 620,523 | ||||||||

Customer funds | 152,661 | 103,042 | ||||||||

Loans held for sale | 78,821 | 73,420 | ||||||||

Other current assets | 91,933 | 86,454 | ||||||||

|

|

| ||||||||

| Total current assets | 1,990,383 | 1,778,294 | ||||||||

|

|

| ||||||||

| Property and equipment, net | 98,170 | 91,496 | ||||||||

| Goodwill | 58,327 | 58,327 | ||||||||

| Acquired intangible assets, net | 14,138 | 14,334 | ||||||||

| Long-term investments | 176,672 | 203,667 | ||||||||

| Restricted cash | 9,802 | 9,802 | ||||||||

| Other non-current assets | 32,120 | 31,350 | ||||||||

|

|

| ||||||||

| Total assets | $ | 2,379,612 | $ | 2,187,270 | ||||||

|

|

| ||||||||

| Liabilities and Stockholders’ Equity | ||||||||||

| Current liabilities: | ||||||||||

Accounts payable | $ | 19,556 | $ | 16,763 | ||||||

Customers payable | 881,754 | 733,736 | ||||||||

Settlements payable | 116,902 | 114,788 | ||||||||

Accrued transaction losses | 28,309 | 26,893 | ||||||||

Accrued expenses | 57,997 | 52,280 | ||||||||

Other current liabilities | 27,214 | 28,367 | ||||||||

|

|

| ||||||||

| Total current liabilities | 1,131,732 | 972,827 | ||||||||

|

|

| ||||||||

| Long-term debt | 362,965 | 358,572 | ||||||||

|

|

| ||||||||

| Other non-current liabilities | 74,935 | 69,538 | ||||||||

|

|

| ||||||||

| Total liabilities | 1,569,632 | 1,400,937 | ||||||||

|

|

| ||||||||

| Commitments and contingencies | ||||||||||

| Stockholders’ equity: | ||||||||||

Preferred stock, $0.0000001 par value: 100,000,000 shares authorized at March 31, 2018 and December 31, 2017. None issued and outstanding at March 31, 2018 and December 31, 2017. | — | — | ||||||||

Class A common stock, $0.0000001 par value: 1,000,000,000 shares authorized at March 31, 2018 and December 31, 2017; 287,921,742 and 280,400,813 issued and outstanding at March 31, 2018 and December 31, 2017, respectively. | — | — | ||||||||

Class B common stock, $0.0000001 par value: 500,000,000 shares authorized at March 31, 2018 and December 31, 2017; 112,462,337 and 114,793,262 issued and outstanding at March 31, 2018 and December 31, 2017, respectively. | — | — | ||||||||

Additional paid-in capital | 1,682,581 | 1,630,386 | ||||||||

Accumulated deficit | (871,307) | (842,735) | ||||||||

Accumulated other comprehensive loss | (1,294) | (1,318) | ||||||||

|

|

| ||||||||

| Total stockholders’ equity | 809,980 | 786,333 | ||||||||

|

|

| ||||||||

| Total liabilities and stockholders’ equity | $ | 2,379,612 | $ | 2,187,270 | ||||||

|

|

| ||||||||

16

| Consolidated Statements of Cash Flows | UNAUDITED In thousands |

| THREE MONTHS ENDED | ||||||||||

| Cash Flows from Operating Activities | Mar 31, 2018 | Mar 31, 2017 | ||||||||

| Net loss | $ | (23,986) | $ | (15,090) | ||||||

| Adjustments to reconcile net loss to net cash provided by operating activities: | ||||||||||

Depreciation and amortization | 10,160 | 9,437 | ||||||||

Non-cash interest and other expense | 4,847 | 1,534 | ||||||||

Share-based compensation | 46,824 | 31,670 | ||||||||

Transaction, loan and advance losses | 18,031 | 11,891 | ||||||||

Deferred provision (benefit) for income taxes | (654) | 99 | ||||||||

Changes in operating assets and liabilities: | ||||||||||

Settlements receivable | (81,452) | 54,586 | ||||||||

Customer funds | (49,619) | (13,953) | ||||||||

Purchase of loans held for sale | (344,976) | (252,170) | ||||||||

Sales and principal payments of loans held for sale | 337,092 | 242,431 | ||||||||

Other current assets | (13,444) | 6,105 | ||||||||

Other non-current assets | (1,256) | 141 | ||||||||

Accounts payable | 1,990 | (1,459) | ||||||||

Customers payable | 147,977 | (11,132) | ||||||||

Settlements payable | 2,114 | (15,378) | ||||||||

Charge-offs to accrued transaction losses | (12,842) | (11,178) | ||||||||

Accrued expenses | 2,703 | 3,930 | ||||||||

Other current liabilities | 3,165 | (368) | ||||||||

Other non-current liabilities | 5,379 | 2,902 | ||||||||

|

|

| ||||||||

Net cash provided by operating activities | 52,053 | 43,998 | ||||||||

|

|

| ||||||||

| Cash Flows from Investing Activities | ||||||||||

Purchase of marketable securities | (50,221) | (181,851) | ||||||||

Proceeds from maturities of marketable securities | 45,450 | 15,569 | ||||||||

Proceeds from sale of marketable securities | — | 3,996 | ||||||||

Purchase of property and equipment | (8,083) | (6,508) | ||||||||

Payment for investment in privately held entity | — | — | ||||||||

Purchase of intangible assets | (1,584) | — | ||||||||

Business acquisitions | (1,055) | (1,600) | ||||||||

|

|

| ||||||||

Net cash used in investing activities: | (15,493) | (170,394) | ||||||||

|

|

| ||||||||

17

| Consolidated Statements of Cash Flows (continued) | UNAUDITED In thousands |

| THREE MONTHS ENDED | ||||||||||||||

| Cash Flows from Financing Activities | Mar 31, 2018 | Mar 31, 2017 | ||||||||||||

Proceeds from issuance of convertible senior notes, net | — | 428,250 | ||||||||||||

Purchase of convertible senior note hedges | — | (92,136) | ||||||||||||

Proceeds from issuance of warrants | — | 57,244 | ||||||||||||

Payment for termination of Starbucks warrant | — | (54,808) | ||||||||||||

Principal payments on capital lease obligation | (665) | (247) | ||||||||||||

Proceeds from the exercise of stock options, net | 31,354 | 39,280 | ||||||||||||

Payments for tax withholding related to vesting of restricted stock units | (27,651) | — | ||||||||||||

Net cash provided by financing activities | 3,038 | 377,583 | ||||||||||||

Effect of foreign exchange rate on cash and cash equivalents | 1,397 | 1,058 | ||||||||||||

Net increase in cash, cash equivalents and restricted cash | 40,995 | 252,245 | ||||||||||||

| Cash, cash equivalents and restricted cash, beginning of period | 735,081 | 488,745 | ||||||||||||

| Cash, cash equivalents and restricted cash, end of period | $ 776,076 | $ 740,990 | ||||||||||||

18

| Key Operating Metrics and Non-GAAP Financial Measures | UNAUDITED | |

| In thousands, except GPV and per share data |

| THREE MONTHS ENDED | ||||||||

| Mar 31, 2018 | Mar 31, 2017 | |||||||

| Gross Payment Volume (GPV) (in millions) | $ | 17,827 | $ | 13,647 | ||||

| Adjusted Revenue | $ | 306,820 | $ | 203,776 | ||||

| Adjusted EBITDA | $ | 35,894 | $ | 27,025 | ||||

| Adjusted Net Income Per Share: | ||||||||

Basic | $ | 0.07 | $ | 0.05 | ||||

Diluted | $ | 0.06 | $ | 0.05 | ||||

Adjusted Revenue Reconciliation | UNAUDITED | |||||||

| In thousands | ||||||||

| THREE MONTHS ENDED | ||||||||

| Mar 31, 2018 | Mar 31, 2017 | |||||||

| Total net revenue | $ | 668,603 | $ | 461,554 | ||||

| Less: transaction-based costs | 327,911 | 257,778 | ||||||

| Less: bitcoin costs | 33,872 | — | ||||||

|

|

| ||||||

Adjusted Revenue | $ | 306,820 | $ | 203,776 | ||||

|

|

| ||||||

Adjusted EBITDA Reconciliation | UNAUDITED | |||||||

| In thousands | ||||||||

| THREE MONTHS ENDED | ||||||||

| Mar 31, 2018 | Mar 31, 2017 | |||||||

| Net loss | $ | (23,986) | $ | (15,090) | ||||

| Share-based compensation expense | 46,824 | 31,670 | ||||||

| Depreciation and amortization | 10,160 | 9,437 | ||||||

| Interest and other expense, net | 2,819 | 499 | ||||||

| Provision for income taxes | 175 | 509 | ||||||

| Gain on sale of property and equipment | (98) | — | ||||||

|

|

| ||||||

Adjusted EBITDA | $ | 35,894 | $ | 27,025 | ||||

|

|

| ||||||

19

| Adjusted Net Income (Loss) Reconciliation | UNAUDITED | |

| In thousands, except per share data |

| THREE MONTHS ENDED | ||||||

| Mar 31, 2018 | Mar 31, 2017 | |||||

| Net loss | $ | (23,986) | $ (15,090) | |||

| Share-based compensation expense | 46,824 | 31,670 | ||||

| Amortization of intangible assets | 1,851 | 2,121 | ||||

| Amortization of debt discount and issuance costs | 4,393 | 1,390 | ||||

| Gain on sale of property and equipment | (98) | — | ||||

|

| |||||

Adjusted Net Income | $ | 28,984 | $ 20,091 | |||

|

| |||||

Adjusted Net Income Per Share: | ||||||

Basic | $ | 0.07 | $ 0.05 | |||

|

| |||||

Diluted | $ | 0.06 | $ 0.05 | |||

|

| |||||

Weighted-average shares used to compute Adjusted Net Income Per Share: | ||||||

Basic | 395,948 | 366,737 | ||||

|

| |||||

Diluted | 461,761 | 404,319 | ||||

|

| |||||

| Adjusted Revenue Guidance Reconciliation | UNAUDITED | |

| In thousands |

| THREE MONTHS ENDED | YEAR ENDED | |||||

| Jun 30, 2018 | Dec 31, 2018 | |||||

| Total net revenue | $ | 740,000 - 760,000 | $ 3,000,000 - 3,060,000 | |||

| Less: Transaction-based & bitcoin costs | 385,000 - 400,000 | 1,605,000 - 1,635,000 | ||||

|

| |||||

Adjusted Revenue | $ | 355,000 - 360,000 | $ 1,395,000 - 1,425,000 | |||

|

| |||||

20

| Non-GAAP Operating Expenses | | UNAUDITED In thousands |

|

| THREE MONTHS ENDED | ||||||

| Mar 31, 2018 | Mar 31, 2017 | |||||

| Operating expenses | $ | (276,162) | $ (187,513) | |||

| Share-based compensation | 46,793 | 31,670 | ||||

| Depreciation and amortization | 8,580 | 7,531 | ||||

| Litigation settlement expense | — | — | ||||

| Gain on sale of property and equipment | (98) | — | ||||

|

| |||||

Non-GAAP operating expenses | $ | (220,887) | $ (148,312) | |||

|

| |||||

| Product development | $ | (105,095) | $ (68,582) | |||

| Share-based compensation | 30,482 | 19,356 | ||||

| Depreciation and amortization | 5,473 | 3,712 | ||||

|

| |||||

Non-GAAP product development | $ | (69,140) | $ (45,514) | |||

|

| |||||

| Sales and marketing | $ | (77,266) | $ (49,900) | |||

| Share-based compensation | 4,961 | 3,935 | ||||

| Depreciation and amortization | 609 | 77 | ||||

| Gain on sale of property equipment | 4 | 58 | ||||

|

| |||||

Non-GAAP sales and marketing | $ | (71,692) | $ (45,830) | |||

|

| |||||

| General and administrative | $ | (75,501) | $ (56,935) | |||

| Share-based compensation | 11,350 | 8,379 | ||||

| Depreciation and amortization | 2,229 | 3,537 | ||||

| Gain on sale of property and equipment | (102) | (58) | ||||

|

| |||||

Non-GAAP general and administrative | $ | (62,024) | $ (45,077) | |||

|

| |||||

| Depreciation and Amortization by Function | | UNAUDITED In thousands |

|

| THREE MONTHS ENDED | ||||||

| Mar 31, 2018 | Mar 31, 2017 | |||||

| Cost of revenue | $ | 1,580 | $ 1,906 | |||

| Product Development | 5,473 | 3,712 | ||||

| Sales and Marketing | 609 | 77 | ||||

| General and Administrative | 2,229 | 3,537 | ||||

| Amortization of acquired customer assets | 269 | 205 | ||||

|

| |||||

Total depreciation and amortization | $ | 10,160 | $ 9,437 | |||

|

| |||||

21