KEY OPERATING METRICS AND

NON-GAAP FINANCIAL MEASURES

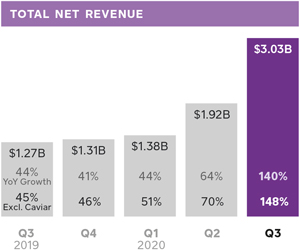

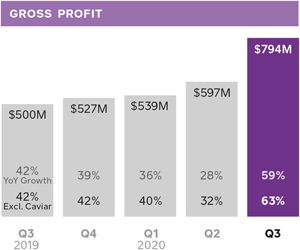

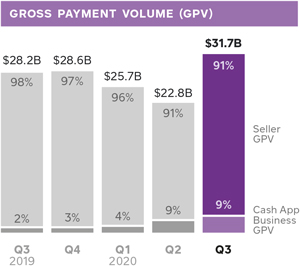

To supplement our financial information presented in accordance with generally accepted accounting principles in the United States (GAAP), we consider certain operating and financial measures that are not prepared in accordance with GAAP, including Gross Payment Volume (GPV), Adjusted EBITDA, Adjusted EBITDA margin, Adjusted Net Income, Diluted Adjusted Net Income Per Share (Adjusted EPS), and non-GAAP operating expenses as well as other measures defined in the shareholder letter such as measures excluding Caviar, which we sold in October 2019, and measures excluding bitcoin. We believe these metrics and measures are useful to facilitate period-to-period comparisons of our business and to facilitate comparisons of our performance to that of other payments solution providers.

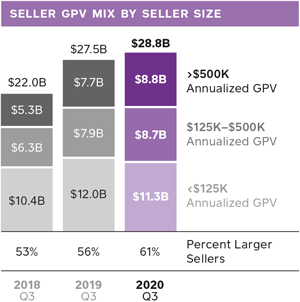

We define GPV as the total dollar amount of all card payments processed by sellers using Square, net of refunds. Additionally, GPV includes Cash App activity related to Cash for Business and to peer-to-peer payments sent from a credit card.

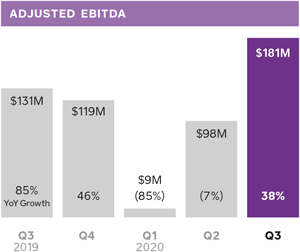

Adjusted EBITDA, Adjusted EBITDA margin, Adjusted Net Income, and Diluted Adjusted Net Income Per Share (Adjusted EPS) are non-GAAP financial measures that represent our net loss and net loss per share, adjusted to eliminate the effect of share-based compensation expenses; amortization of intangible assets; amortization of debt discount and issuance costs in connection with our offering of convertible senior notes in the first quarter of 2017, the second quarter of 2018, and the first quarter of 2020; gain or loss on revaluation of equity investment; gain or loss on debt extinguishment related to the conversion of senior notes; the gain or loss on the disposal of property and equipment; and impairment of intangible assets, as applicable. We also exclude certain costs associated with acquisitions and other activities that are not normal recurring operating expenses, including amounts paid to redeem acquirees’ unvested stock-based compensation awards, and legal, accounting, and due diligence costs, and we add back the impact of the acquired deferred revenue and deferred cost adjustment, which was written down to fair value in purchase accounting. Additionally, for purposes of calculating diluted Adjusted EPS, we add back cash interest expense on convertible senior notes, as if converted at the beginning of the period, if the impact is dilutive, since we intend to settle future conversions of our convertible senior notes entirely in shares. In addition to the items above, Adjusted EBITDA is a non-GAAP financial measure that also excludes depreciation, other interest income and expense, other income and expense, and provision or benefit from income taxes, as applicable. To calculate the diluted Adjusted EPS, we adjust the weighted-average number of shares of common stock outstanding for the dilutive effect of all potential shares of common stock. In periods when we recorded an Adjusted Net Loss, the diluted Adjusted EPS is the same as basic Adjusted EPS because the effects of potentially dilutive items were anti-dilutive given the Adjusted Net Loss position.

Non-GAAP operating expenses is a non-GAAP financial measure that represents operating expenses adjusted to remove the impact of share-based compensation, depreciation and amortization, loss on disposal of property and equipment, and acquisition-related costs. Adjusted EBITDA margin is calculated as Adjusted EBITDA divided by gross profit. This calculation of Adjusted EBITDA margin will not be comparable to the calculation used in quarters prior to the fourth quarter of 2019, which was previously based on a non-GAAP revenue metric.

We have included Adjusted EBITDA, Adjusted EPS, and non-GAAP operating expenses because they are key measures used by our management to evaluate our operating performance, generate future operating plans, and make strategic decisions, including those relating to operating expenses and the allocation of internal resources. Accordingly, we believe that Adjusted EBITDA, Adjusted EPS, and non-GAAP operating expenses provide useful information to investors and others in understanding and evaluating our operating results in the same manner as our management and board of directors. In addition, they provide useful measures for period-to-period comparisons of our business, as they remove the effect of certain non-cash items and certain variable charges. We have included measures excluding Caviar because we believe these measures are useful in understanding the ongoing results of our operations. We have included measures excluding bitcoin revenue because our role is to facilitate customers’ access to bitcoin. When customers buy bitcoin through Cash App, we only apply a small margin to the market cost of bitcoin, which tends to be volatile and outside our control. Therefore, we believe deducting bitcoin revenue better reflects the economic benefits as well as our performance from these transactions.

Adjusted EBITDA, Adjusted EPS, and non-GAAP operating expenses, as well as other measures defined in the shareholder letter, such as measures excluding Caviar, which we sold in October 2019, and measures excluding bitcoin have limitations as financial measures, and should be considered as supplemental in nature, and are not meant as substitutes for the related financial information prepared in accordance with GAAP.

We believe that the aforementioned metrics provide useful information about our operating results, enhance the overall understanding of our past performance and future prospects, and provide useful measures for period-to-period comparisons of our business, as they remove the effect of certain variable amounts. Our management uses these measures to evaluate our operating performance, generate future operating plans, and make strategic decisions, including those relating to operating expenses and the allocation of internal resources.

These non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. These non-GAAP financial measures are not based on any standardized methodology prescribed by GAAP and are not necessarily comparable to similarly titled measures presented by other companies.