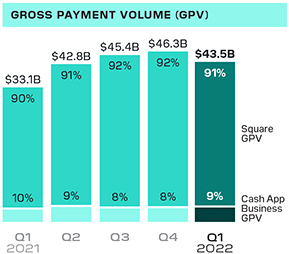

April Trends and Forward-Looking Commentary BUSINESS TRENDS We wanted to provide an update on the trends in our business during the month of April. For the second quarter of 2022, we believe three-year compound annual growth rates from 2019 through 2022 will help reflect underlying trends in each ecosystem, given the variability in year-over-year comparisons due to COVID-19. Square ecosystem • For the month of April, in aggregate, Square GPV is expected to be up 29% year over year. On a three-year CAGR basis, GPV growth is expected to be 24% in April, compared to 22% growth in the first quarter. Cash App ecosystem • In April, we expect Cash App gross profit, excluding Afterpay, to grow on a year-over-year and three year CAGR basis, driven by growth in monthly transacting actives, engagement across our ecosystem, and inflows into Cash App. OPERATING EXPENSES We believe our Cash App and Square ecosystems are well positioned to help our customers adapt and grow based on trends we have observed during recent quarters. We intend to prioritize investments in our Cash App and Square ecosystems that we believe will drive long-term profitable growth given our historical cohort economics, including attractive paybacks and returns on investment. For the second quarter of 2022, we expect non-GAAP operating expenses across product development, sales and marketing, general and administrative expenses, and transaction, loan and consumer receivables losses, in aggregate, to increase by approximately $245 million compared to the first quarter of 2022. Excluding contributions from Afterpay, we expect to increase overall non-GAAP operating expenses by approximately $180 million compared to the first quarter. On a GAAP basis, we expect to incur approximately $50 million of quarterly expenses related to amortization of intangible assets due to the Afterpay transaction through the remainder of 2022 and over the next few years. We expect to recognize approximately $12 million of this expense in cost of sales and the remainder in sales and marketing. Share-based compensation: We are continuing to invest in building out our teams, including attracting, hiring, and retaining talented employees. In the second quarter of 2022, we expect our share-based compensation expense to decrease modestly quarter over quarter on a dollar basis, given a one-time expense in the first quarter related to the Afterpay transaction. These share-based compensation expenses are not included in non-GAAP operating expenses. We have not provided the forward-looking GAAP equivalents for certain forward-looking non-GAAP operating expenses or a GAAP reconciliation as a result of the uncertainty regarding, and the potential variability of, reconciling items such as share-based compensation expense. Accordingly, a reconciliation of these non-GAAP guidance metrics to their corresponding GAAP equivalents is not available without unreasonable effort. However, it is important to note that material changes to reconciling items could have a significant effect on future GAAP results. We have provided a reconciliation of other GAAP to non-GAAP metrics in tables at the end of this letter. |