KEY OPERATING METRICS AND

NON-GAAP FINANCIAL MEASURES

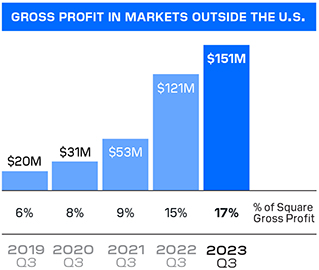

Constant currency growth is calculated by assuming international results in a given period and the comparative prior period are translated from local currencies to the U.S. dollar at rates consistent with the monthly average rates in the comparative prior period. We discuss growth on a constant currency basis because a portion of our business operates in markets outside the U.S. and is subject to changes in foreign exchange rates.

Adjusted Free Cash Flow is a non-GAAP financial measure that represents our net cash provided by operating activities adjusted to include cash flows associated with consumer receivables generated through our BNPL platform, and payments for the purchase of property and equipment as we consider such cash flows to be core part of our normal operations, but are presented as investing activities under GAAP. Adjusted Free Cash Flow however excludes the effects of changes in customers payable, settlements receivables and settlements payable as these amounts, which represent customer transactions, may result in significant fluctuations in Adjusted Free Cash Flow depending on the timing of the end of the reporting period and whether such date is a bank holiday or a weekend. We believe that Adjusted Free Cash Flow provides helpful information in understanding the cash generated by our business, after investments in property and equipment, that can possibly be used for investing in our business, making strategic investments, and strengthening our balance sheet.

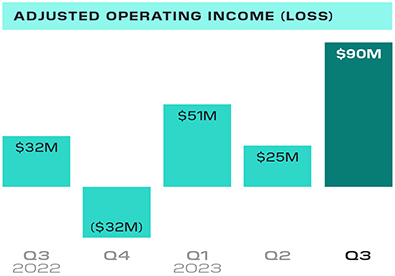

Non-GAAP operating expenses is a non-GAAP financial measure that represents operating expenses adjusted to remove the impact of share-based compensation, depreciation and amortization, bitcoin impairment losses, loss on disposal of property and equipment, and acquisition-related integration and other costs.

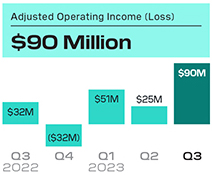

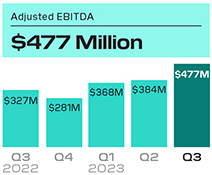

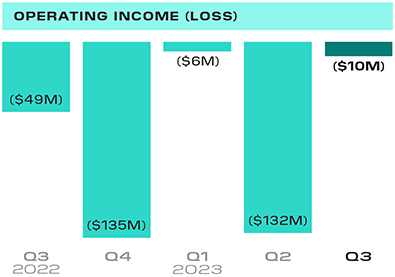

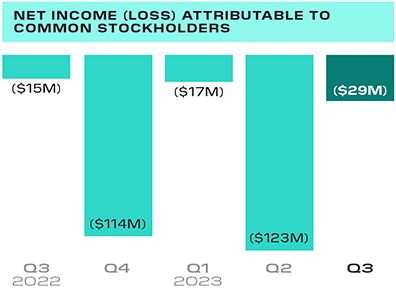

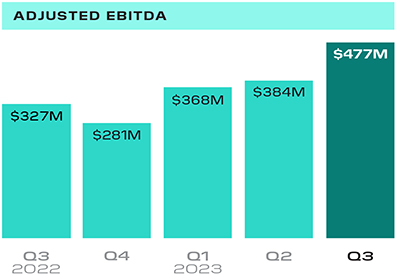

We have included Adjusted EBITDA, Adjusted Operating Income (Loss), Adjusted Operating Income (Loss) margin, Adjusted Net Income, Adjusted EPS, Adjusted Free Cash Flow, and non-GAAP operating expenses because they are key measures used by our management to evaluate our operating performance, generate future operating plans, and make strategic decisions, including those relating to operating expenses and the allocation of internal resources. Accordingly, we believe that Adjusted EBITDA, Adjusted Operating Income (Loss), Adjusted Operating Income (Loss) margin, Adjusted Net Income, Adjusted EPS, Adjusted Free Cash Flow, and non-GAAP operating expenses provide useful information to investors and others in understanding and evaluating our operating results in the same manner as our management and board of directors. In addition, they provide useful measures for period-to-period comparisons of our business, as certain of these measures remove the effect of certain non-cash items and certain variable charges that do not vary with our operations. We have included measures excluding our BNPL platform because we believe these measures are useful in understanding the ongoing results of our operations. We have included measures excluding bitcoin revenue because our role is to facilitate customers’ access to bitcoin. When customers buy bitcoin through Cash App, we only apply a small margin to the market cost of bitcoin, which tends to be volatile and outside our control. Therefore, we believe deducting bitcoin revenue or gross profit better reflects the economic benefits as well as our performance from these transactions. We have included measures excluding PPP loan forgiveness gross profit because we believe these measures are useful in order to facilitate comparisons of our business without PPP loan forgiveness.

Adjusted EBITDA, Adjusted Net Income, Adjusted Operating Income (Loss), Adjusted Operating Income (Loss) margin, Adjusted EPS, Adjusted Free Cash Flow, and non-GAAP operating expenses, as well as other measures defined in the shareholder letter, such as measures excluding our BNPL platform, bitcoin revenue, and PPP loan forgiveness gross profit, have limitations as financial measures, should be considered as supplemental in nature, and are not meant as substitutes for the related financial information prepared in accordance with GAAP.

We believe that the aforementioned metrics and measures provide useful information about our operating results, enhance the overall understanding of our past performance and future prospects, and provide useful measures for period-to-period comparisons of our business, as they remove the effect of certain variable amounts, or they remove amounts that were not repeated across periods and therefore make comparisons more difficult. Our management uses these measures to evaluate our operating performance, generate future operating plans, and make strategic decisions, including those relating to operating expenses and the allocation of internal resources.

These non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. These non-GAAP financial measures are not based on any standardized methodology prescribed by GAAP. Other companies, including companies in our industry, may calculate these non-GAAP financial measures differently or not at all, which reduces their usefulness as comparative measures.