On August 8, 2016, our Company, AHFL and Mr. Chwan Hau Li entered into an Amendment 3 to the GHFL Acquisition Agreement (the “Third Amendment to GHFL Acquisition Agreement”), pursuant to which, the Second Amendment to GHFL Acquisition Agreement was terminated.

In July of 2018, the Company acquired Joint Broker Co., Limited (“JIB”), a Taiwan Insurance brokerage company, previously known as Kao Te Insurance Broker (“KT Broker”), through GIC. On July 1, 2018, GIC entered into an acquisition agreement (“KT Broker Acquisition Agreement”) with the selling shareholder of KT Broker, Ms. Ma. Pursuant to the KT Broker Acquisition Agreement, GIC agreed to pay $29,545 (NT$ 900,000) in exchange for the insurance brokerage licenses issued to KT Broker by the Taiwanese government, along with right to the KT Broker’s company name and $13,131 (NT$ 400,000) of legal deposits, which were required by the Taiwanese insurance regulations. The Company has no intention of operating the KT Broker existing brokerage business nor retaining any of its sales personnel, therefore the Company recognized for accounting purposes only the acquisition of assets as part of this transaction. The Taiwanese laws do not allow a legal entity to transfer its brokerage license. In order to obtain the desired licenses that KT Broker had, we acquired KT Broker and renamed KT Broker as Joint Insurance Broker Co., Limited to serve as a holding entity for the brokerage licenses. The change of control due to KT Broker Acquisition Agreement and name change did not affect the effectiveness of the insurance brokerage license owned by JIB in Taiwan.

| ● | Recent Development- Uniwill Insurance Broker Co., Ltd. |

On November 15, 2019, the Company, through AIlife International Investment Co., Ltd. (“AIlife”), one of the Company’s wholly-owned subsidiaries, entered into a joint venture agreement (the “Joint Venture Agreement”) with Cyun-Jhan Enterprise Co., Ltd. (“Cyun-Jhan”) and Jian-Zao International Industrial Co., Ltd. to contribute funds, human resources, and technology into Uniwill Insurance Broker Co., Ltd. (“Uniwill”), a wholly owned subsidiary of the Company incorporated in Taiwan, according to the Joint Venture Agreement. Under the terms of the Joint Venture Agreement, a total of $13.3 million (NTD 400 million) will be injected to Uniwill if and when all of the conditions are met as set forth in the Joint Venture Agreement no later than December 31, 2021.

On March 3, 2021, the parties thereto entered into an amendment to the Joint Venture Agreement (the “Amendment to the Joint Venture Agreement”), pursuant to which AIlife shall fulfill the paid-up capital obligation in the aggregate amount of NT$400 million (the “Total Cash Contribution”) during a period of eight (8) years (the “Period”) from November 15, 2019, provided that the number of the registered sales agents of Uniwill exceeds 1,000 and the cumulative revenue of the JV reaches NT$8.7 billion (the “Revenue Threshold”) within the Period. Subject to the terms of the Amendment to the Joint Venture Agreement and Joint Venture Agreement, in the event that Uniwill fails to reach the Revenue Threshold within the Period, AIlife shall only be obligated to make cash contributions through the Period to the Joint Venture in the aggregate amount (the “Total Adjusted Cash Contribution”) calculated as follows:

The Total Adjusted Cash Contribution= (the actual cumulated revenue of Uniwill during the Period/ NT$8.7 billion)* NT$400 million.

For more information, please see the current reports on Form 8-K filed on November 21, 2019 and March 3, 2021.

PRC Segment- Anhou

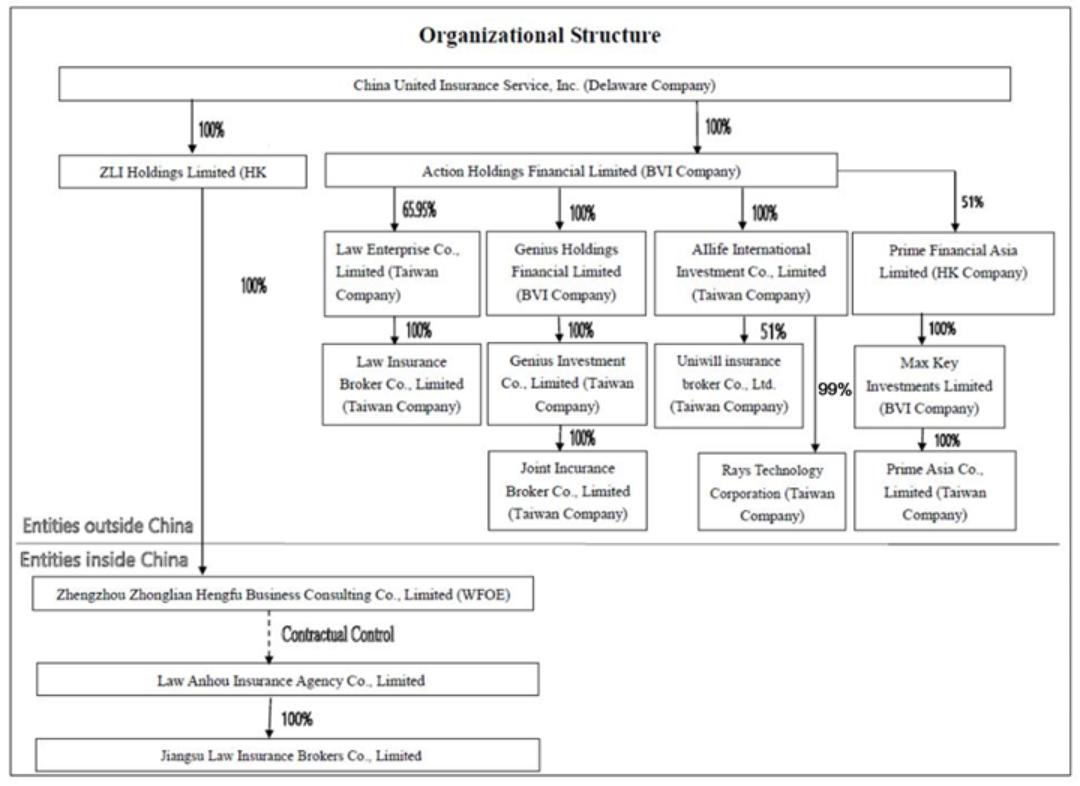

On July 12, 2010, ZLI Holdings Limited (“CU Hong Kong”), a wholly owned subsidiary of our Company, was established under the laws of Hong Kong. On October 20, 2010, Zhengzhou Zhonglian Hengfu Consulting Co., Ltd., a wholly foreign owned enterprise (“CU WFOE”), a wholly owned subsidiary of CU Hong Kong, was established in Henan province of the PRC. On January 16, 2011, our Company issued 20,000,000 shares of common stock to several non-U.S. persons for their investment of $300,000 in CU WFOE. The issuance was made pursuant to an exemption from registration contained in Regulation S under the Securities Act of 1933, as amended.

Zhengzhou Anhou Insurance Agency Co., Ltd., the predecessor entity of Anhou, was founded in Henan province of the PRC on October 9, 2003. Due to PRC legal restrictions on foreign ownership and investment in an insurance agency businesses in China, Able Capital Holding Co., Ltd., a company established with limited liability in Hong Kong, delegated four PRC individuals, namely Yanyan Wang, Zhaohui Chen, Weizhe Hou and Yong Zhang, to invest in Anhou on its behalf.