HLSS Servicer Advance Receivables Trust Investor Presentation

|

|

Disclaimer FORWARD-LOOKING STATEMENTS: THIS PRESENTATION CONTAINS FORWARD-LOOKING STATEMENTS THAT INVOLVE RISKS AND UNCERTAINTIES. ALL STATEMENTS IN THIS PRESENTATION OTHER THAN STATEMENTS OF HISTORICAL FACTS ARE FORWARD-LOOKING STATEMENTS. THESE FORWARD-LOOKING STATEMENTS ARE SUBJECT TO INHERENT RISKS AND UNCERTAINTIES IN PREDICTING FUTURE RESULTS AND CONDITIONS THAT COULD CAUSE THE COMPANY’S ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE PROJECTED IN THESE FORWARD-LOOKING STATEMENTS. WE HAVE INCLUDED IMPORTANT FACTORS IN THE CAUTIONARY STATEMENTS MADE IN OUR ANNUAL REPORT ON FORM 10-K, PARTICULARLY UNDER THE HEADINGS “RISK FACTORS” AND “MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS,” THAT WE BELIEVE COULD CAUSE OUR ACTUAL RESULTS OR EVENTS TO DIFFER MATERIALLY FROM THOSE EXPRESSED OR IMPLIED BY THE FORWARD LOOKING STATEMENTS THAT WE MAKE IN THIS PRESENTATION. IN LIGHT OF THE SIGNIFICANT UNCERTAINTIES IN THESE FORWARD-LOOKING STATEMENTS, YOU SHOULD NOT REGARD THESE STATEMENTS AS A REPRESENTATION OR WARRANTY BY US OR ANY OTHER PERSON THAT WE WILL ACHIEVE OUR OBJECTIVES AND PLANS IN ANY SPECIFIED TIME FRAME, OR AT ALL. UNLESS REQUIRED BY LAW, WE UNDERTAKE NO OBLIGATION TO PUBLICLY UPDATE OR REVISE ANY FORWARD-LOOKING STATEMENTS TO REFLECT NEW INFORMATION OR FUTURE EVENTS OR OTHERWISE. NON-GAAP MEASURES: OUR PRESENTATION CONTAINS REFERENCES TO SERVICING REVENUE AND SERVICING EXPENSE, WHICH ARE NON-GAAP PERFORMANCE MEASURES. WE BELIEVE THESE NON-GAAP PERFORMANCE MEASURES MAY PROVIDE ADDITIONAL MEANINGFUL COMPARISONS BETWEEN CURRENT RESULTS AND RESULTS IN PRIOR PERIODS. NON-GAAP PERFORMANCE MEASURES SHOULD BE VIEWED IN ADDITION TO, AND NOT AS AN ALTERNATIVE FOR, THE COMPANY’S REPORTED RESULTS UNDER ACCOUNTING PRINCIPLES GENERALLY ACCEPTED IN THE UNITED STATES.

Table of Contents 1. HLSS Overview 2. Ocwen Overview 3. HSART Master Trust Overview 4. Appendices

HLSS Overview

|

|

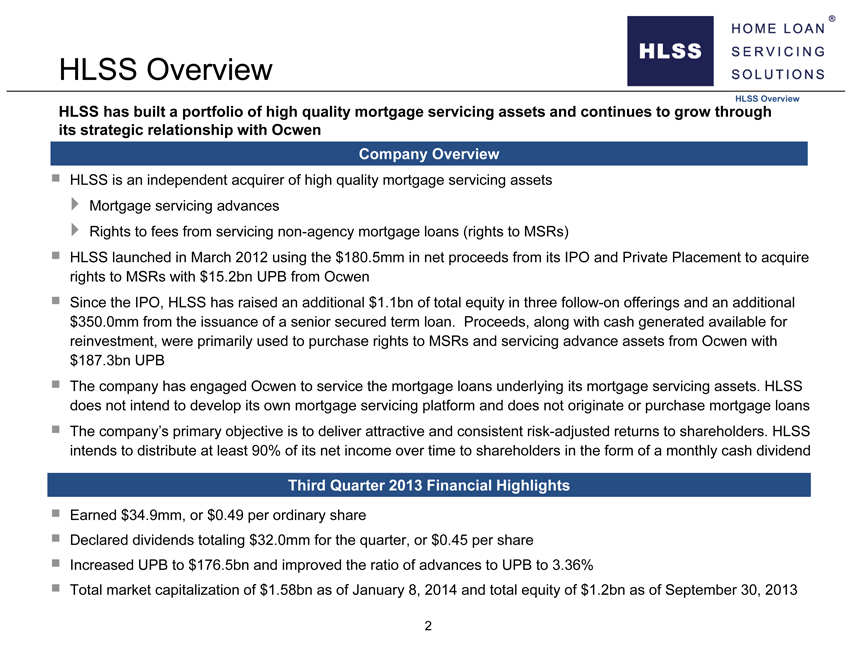

HLSS Overview HLSS Overview HLSS has built a portfolio of high quality mortgage servicing assets and continues to grow through its strategic relationship with Ocwen Company Overview ? HLSS is an independent acquirer of high quality mortgage servicing assets? Mortgage servicing advances? Rights to fees from servicing non-agency mortgage loans (rights to MSRs) ? HLSS launched in March 2012 using the $180.5mm in net proceeds from its IPO and Private Placement to acquire rights to MSRs with $15.2bn UPB from Ocwen? Since the IPO, HLSS has raised an additional $1.1bn of total equity in three follow-on offerings and an additional $350.0mm from the issuance of a senior secured term loan. Proceeds, along with cash generated available for reinvestment, were primarily used to purchase rights to MSRs and servicing advance assets from Ocwen with $187.3bn UPB ? The company has engaged Ocwen to service the mortgage loans underlying its mortgage servicing assets. HLSS does not intend to develop its own mortgage servicing platform and does not originate or purchase mortgage loans? The company’s primary objective is to deliver attractive and consistent risk-adjusted returns to shareholders. HLSS intends to distribute at least 90% of its net income over time to shareholders in the form of a monthly cash dividend Third Quarter 2013 Financial Highlights ? Earned $34.9mm, or $0.49 per ordinary share ? Declared dividends totaling $32.0mm for the quarter, or $0.45 per share ? Increased UPB to $176.5bn and improved the ratio of advances to UPB to 3.36% ? Total market capitalization of $1.58bn as of January 8, 2014 and total equity of $1.2bn as of September 30, 2013 2

|

|

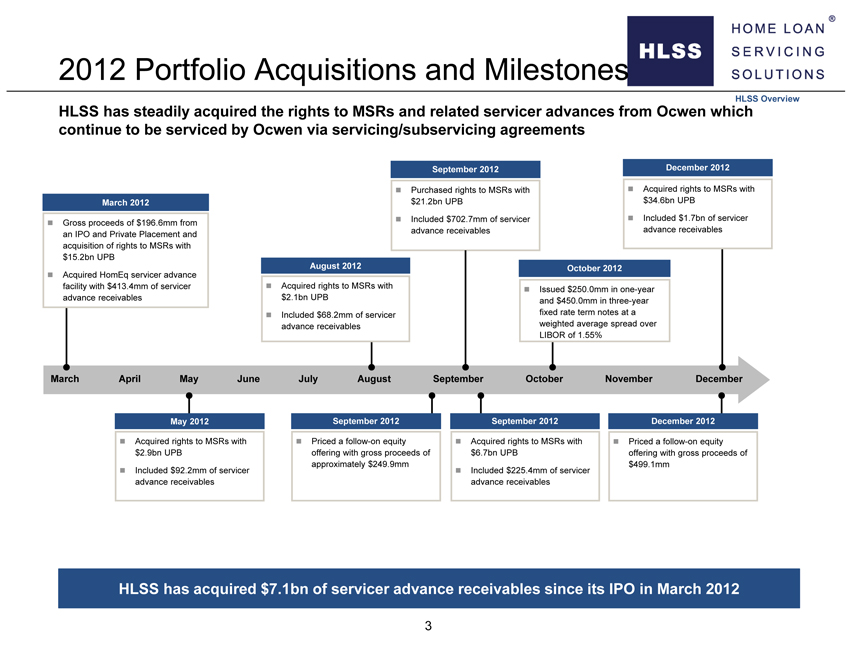

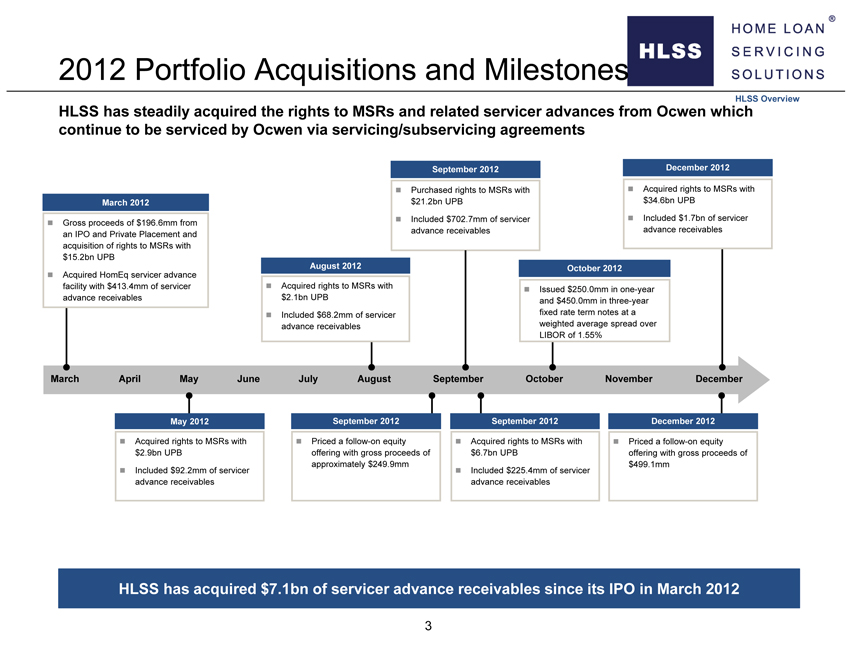

2012 Portfolio Acquisitions and Milestones HLSS Overview HLSS has steadily acquired the rights to MSRs and related servicer advances from Ocwen which continue to be serviced by Ocwen via servicing/subservicing agreements 12n Purchased rights to MSRs withn Acquired rights to MSRs with March 2012 $21.2bn UPB $34.6bn UPBn Included $702.7mm of servicern Included $1.7bn of servicern Gross proceeds of $196.6mm from advance receivables advance receivables an IPO and Private Placement and acquisition of rights to MSRs with $15.2bn UPB August 2012 October 2012n Acquired HomEq servicer advance facility with $413.4mm of servicern Acquired rights to MSRs withn Issued $250.0mm in one-year advance receivables $2.1bn UPB and $450.0mm in three-yearn Included $68.2mm of servicer fixed rate term notes at a advance receivables weighted average spread over LIBOR of 1.55% March April May June July August September October November December May 2012 September 2012 September 2012 December 2012n Acquired rights to MSRs withn Priced a follow-on equityn Acquired rights to MSRs withn Priced a follow-on equity $2.9bn UPB offering with gross proceeds of $6.7bn UPB offering with gross proceeds of approximately $249.9mm $499.1mmn Included $92.2mm of servicern Included $225.4mm of servicer advance receivables advance receivables HLSS has acquired $7.1bn of servicer advance receivables since its IPO in March 2012 3

|

|

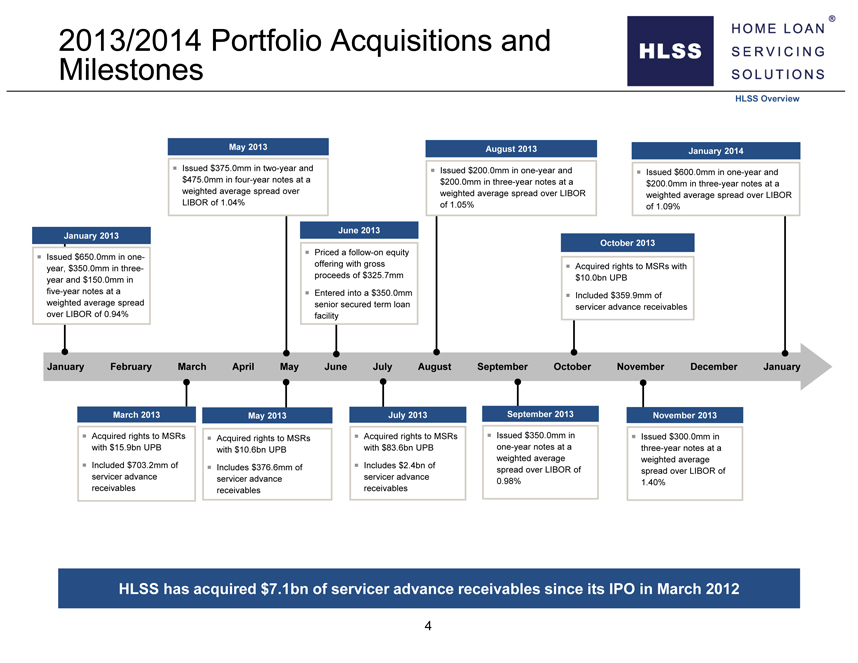

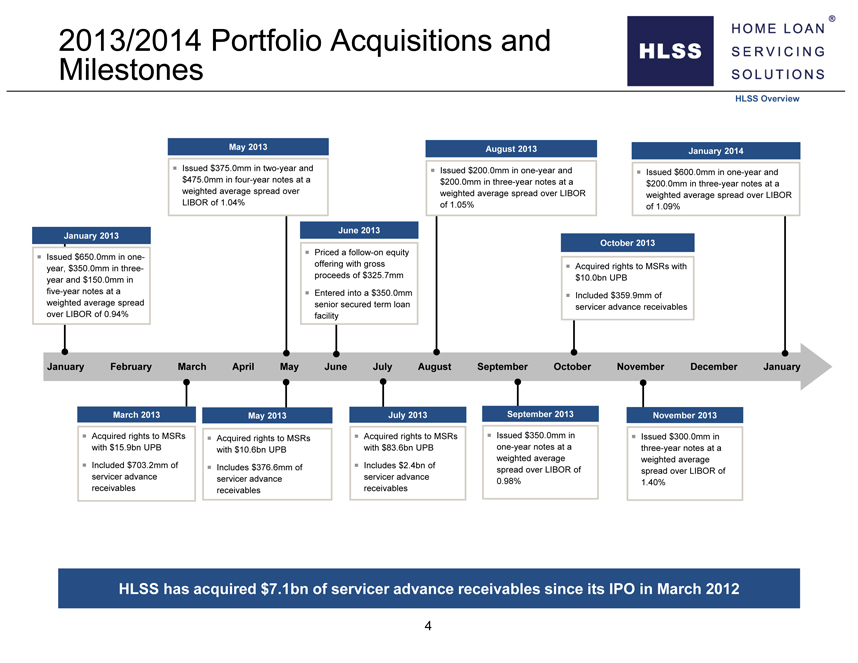

2013/2014 Portfolio Acquisitions and Milestones HLSS Overview May 2013 August 2013 January 2014 ? Issued $375.0mm in two-year and ? Issued $200.0mm in one-year and $475.0mm in four-year notes at a ? Issued $600.0mm in one-year and $200.0mm in three-year notes at a $200.0mm in three-year notes at a weighted average spread over weighted average spread over LIBOR LIBOR of 1.04% weighted average spread over LIBOR of 1.05% of 1.09% June 2013 January 2013 October 2013 ? Priced a follow-on equity ? Issued $650.0mm in one-offering with gross ? Acquired rights to MSRs with year, $350.0mm in three-proceeds of $325.7mm $10.0bn UPB year and $150.0mm in five-year notes at a ? Entered into a $350.0mm ? Included $359.9mm of weighted average spread senior secured term loan servicer advance receivables over LIBOR of 0.94% facility January February March April May June July August September October November December January March 2013 May 2013 July 2013 September 2013 November 2013 ? Acquired rights to MSRs ? Acquired rights to MSRs ? Acquired rights to MSRs ? Issued $350.0mm in ? Issued $300.0mm in with $15.9bn UPB with $10.6bn UPB with $83.6bn UPB one-year notes at a three-year notes at a weighted average weighted average ? Included $703.2mm of ? Includes $376.6mm of ? Includes $2.4bn of spread over LIBOR of spread over LIBOR of servicer advance servicer advance servicer advance 0.98% 1.40% receivables receivables receivables HLSS has acquired $7.1bn of servicer advance receivables since its IPO in March 2012 4

|

|

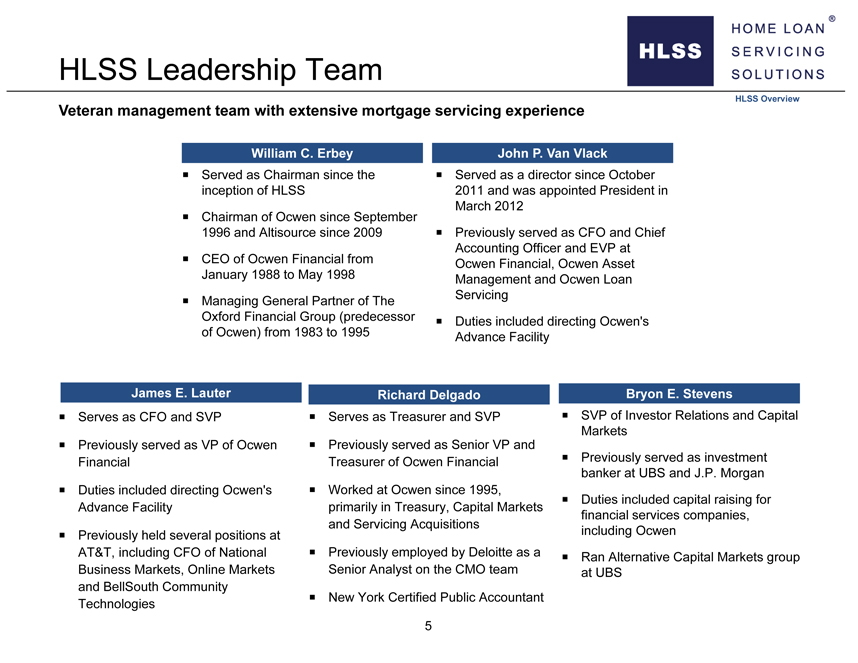

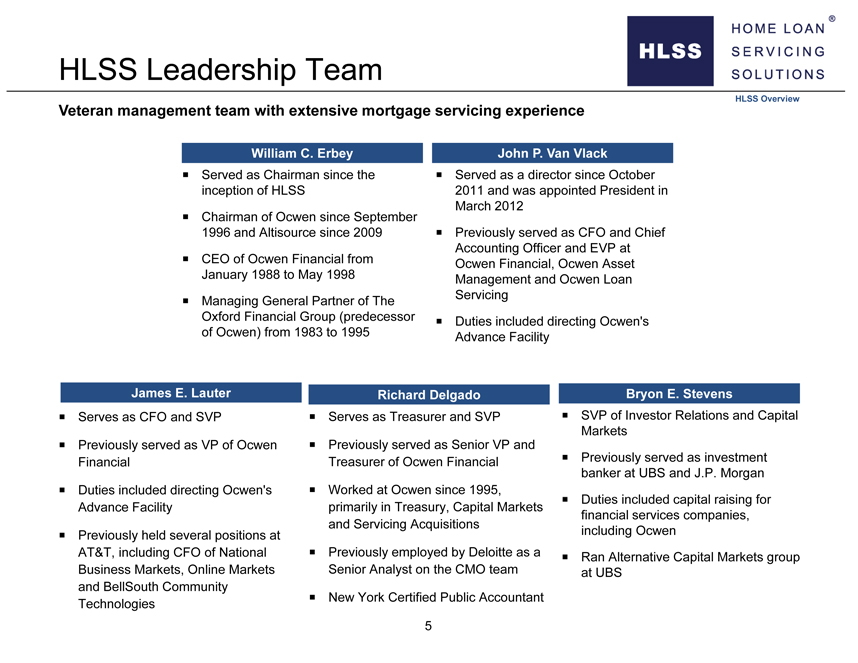

HLSS Leadership Team Veteran management team with extensive mortgage servicing experience HLSS Overview William C. Erbey John P. Van Vlack ? Served as Chairman since the ? Served as a director since October inception of HLSS 2011 and was appointed President in ? March 2012 Chairman of Ocwen since September 1996 and Altisource since 2009? Previously served as CFO and Chief Accounting Officer and EVP at ? CEO of Ocwen Financial from Ocwen Financial, Ocwen Asset January 1988 to May 1998 Management and Ocwen Loan Servicing? Managing General Partner of The Oxford Financial Group (predecessor ? Duties included directing Ocwen’s of Ocwen) from 1983 to 1995 Advance Facility James E. Lauter Richard Delgado Bryon E. Stevens ? Serves as CFO and SVP? Serves as Treasurer and SVP? SVP of Investor Relations and Capital Markets? Previously served as VP of Ocwen ? Previously served as Senior VP and Financial Treasurer of Ocwen Financial? Previously served as investment banker at UBS and J.P. Morgan? Duties included directing Ocwen’s ? Worked at Ocwen since 1995, ? Duties included capital raising for Advance Facility primarily in Treasury, Capital Markets financial services companies, and Servicing Acquisitions? Previously held several positions at including Ocwen AT&T, including CFO of National ? Previously employed by Deloitte as a ? Ran Alternative Capital Markets group Business Markets, Online Markets Senior Analyst on the CMO team at UBS and BellSouth Community ? New York Certified Public Accountant Technologies 5

|

|

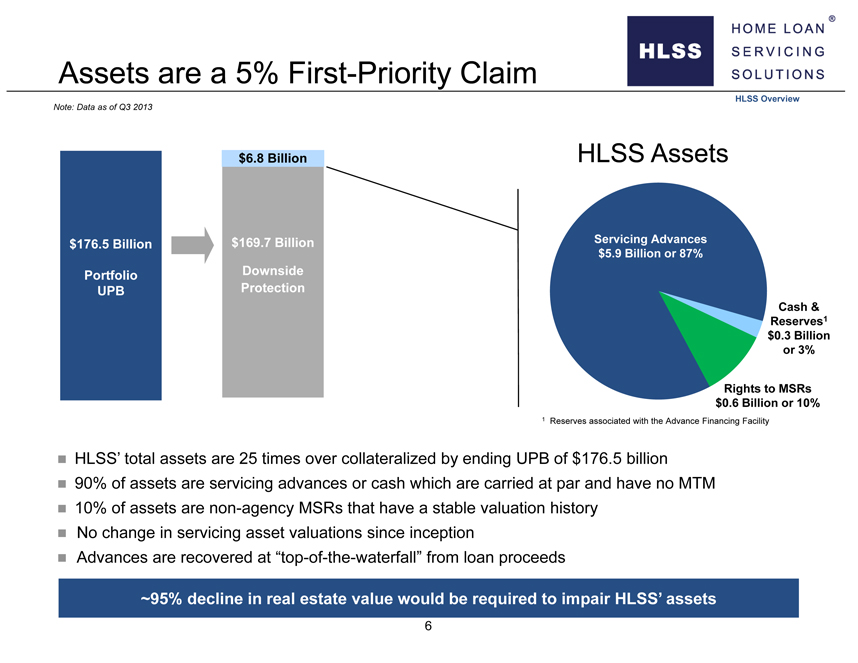

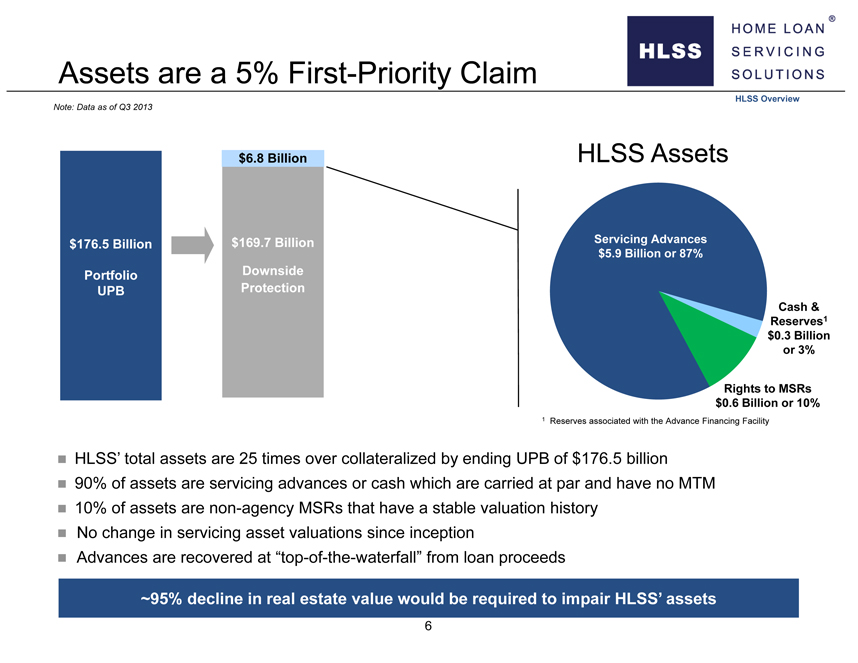

Assets are a 5% First-Priority Claim Note: Data as of Q3 2013 HLSS Overview $6.8 Billion HLSS Assets $176.5 Billion $169.7 Billion Servicing Advances $5.9 Billion or 87% Portfolio Downside UPB Protection Cash & Reserves1 $0.3 Billion or 3% Rights to MSRs $0.6 Billion or 10% 1 Reserves associated with the Advance Financing Facilityn HLSS’ total assets are 25 times over collateralized by ending UPB of $176.5 billionn 90% of assets are servicing advances or cash which are carried at par and have no MTMn 10% of assets are non-agency MSRs that have a stable valuation historyn No change in servicing asset valuations since inceptionn Advances are recovered at “top-of-the-waterfall” from loan proceeds ~95% decline in real estate value would be required to impair HLSS’ assets 6

|

|

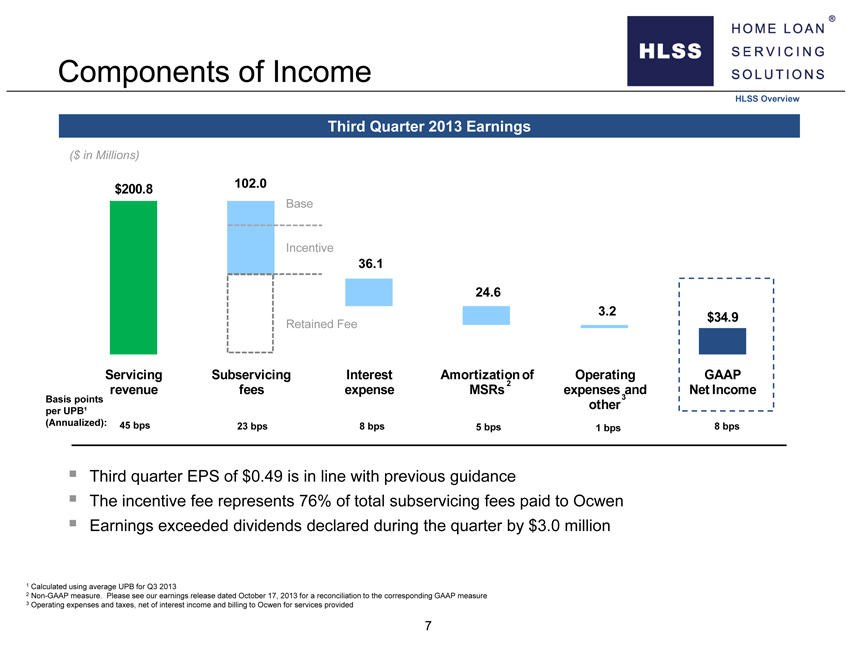

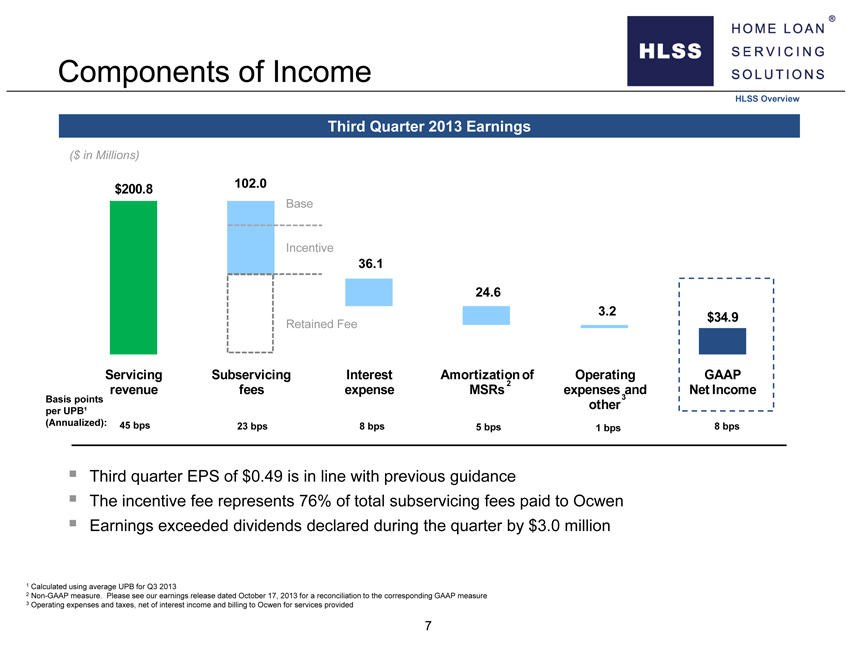

Components of Income HLSS Overview Third Quarter 2013 Earnings ($ in Millions) $200.8 102.0 Base Incentive 36.1 24.6 3.2 $34.9 Retained Fee Servicing Subservicing Interest Amortization 2 of Operating GAAP revenue fees expense MSRs expenses and Net Income Basis points 3 Other per UPB¹ (Annualized): 45 bps 23 bps 8 bps 8 bps 5 bps 1 bpsn Third quarter EPS of $0.49 is in line with previous guidancen The incentive fee represents 76% of total subservicing fees paid to Ocwenn Earnings exceeded dividends declared during the quarter by $3.0 million 1 Calculated using average UPB for Q3 2013 2 Non-GAAP measure. Please see our earnings release dated October 17, 2013 for a reconciliation to the corresponding GAAP measure 3 Operating expenses and taxes, net of interest income and billing to Ocwen for services provided 7

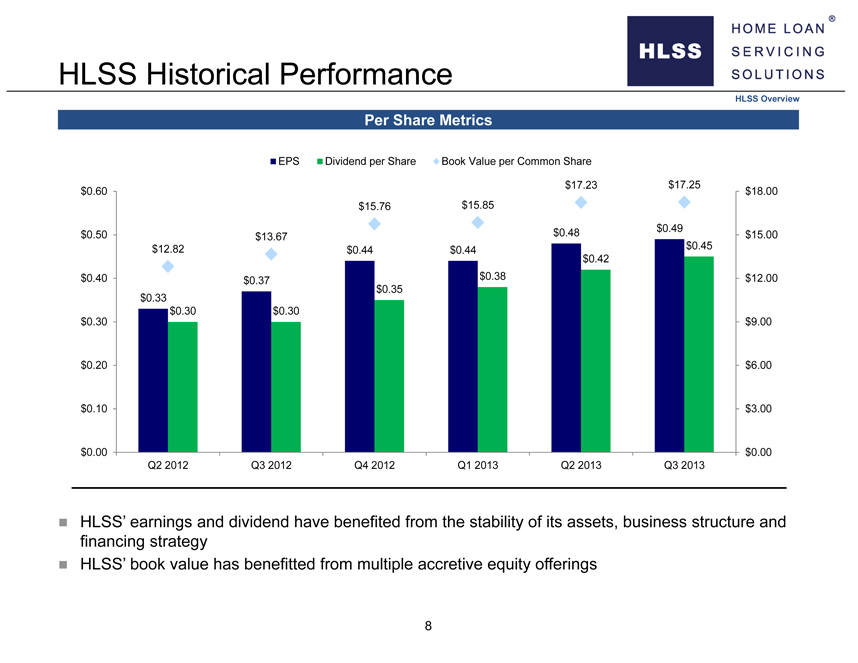

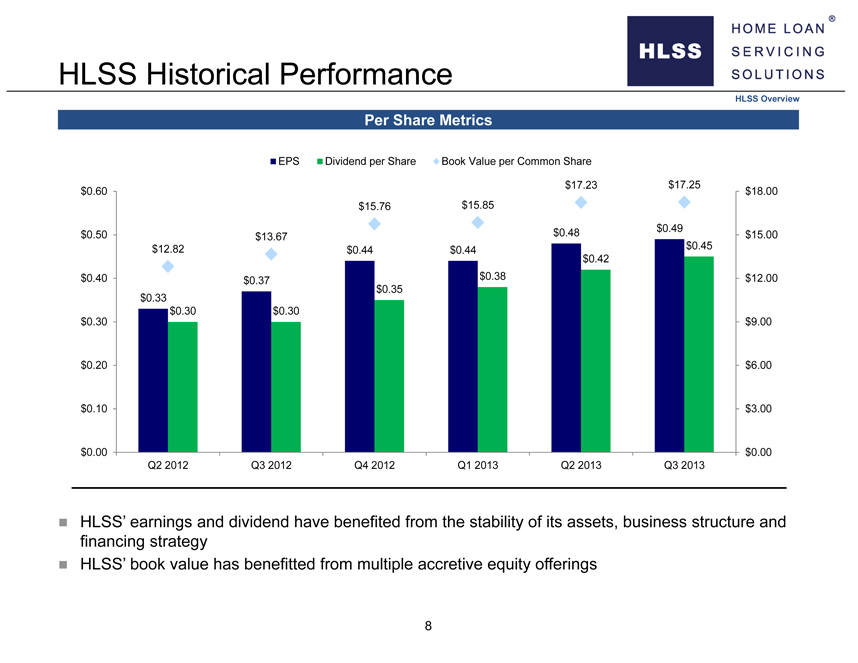

HLSS Historical Performance HLSS Overview Per Share Metrics EPS Dividend per Share Book Value per Common Share $17.23 $17.25 $0.60 $18.00 $15.76 $15.85 $0.48 $0.49 $0.50 $13.67 $15.00 $12.82 $0.44 $0.44 $0.45 $0.42 $0.40 $0.37 $0.38 $12.00 $0.35 $0.33 $0.30 $0.30 $0.30 $9.00 $0.20 $6.00 $0.10 $3.00 $0.00 $0.00 Q2 2012 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Q3 2013n HLSS’ earnings and dividend have benefited from the stability of its assets, business structure and financing strategyn HLSS’ book value has benefitted from multiple accretive equity offerings 8

|

|

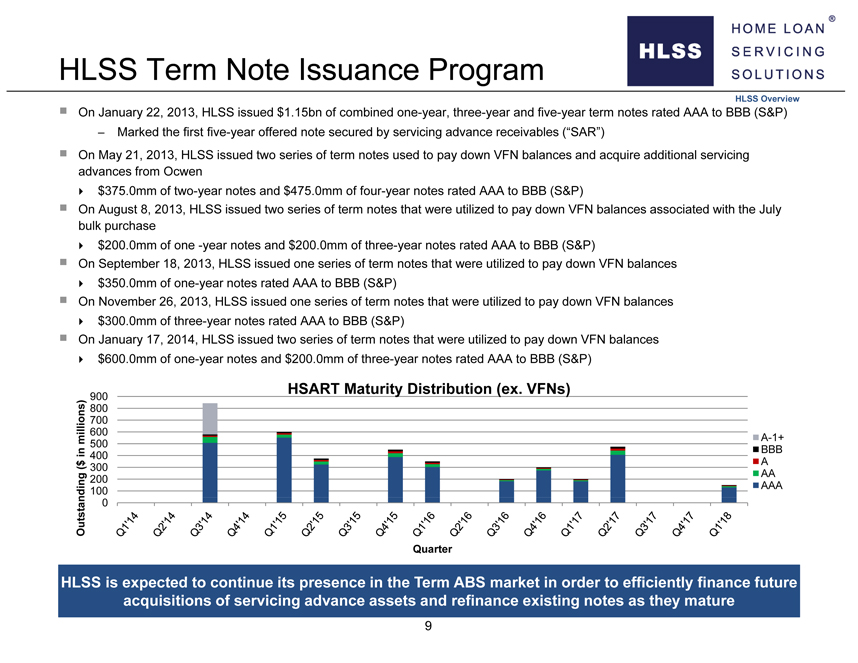

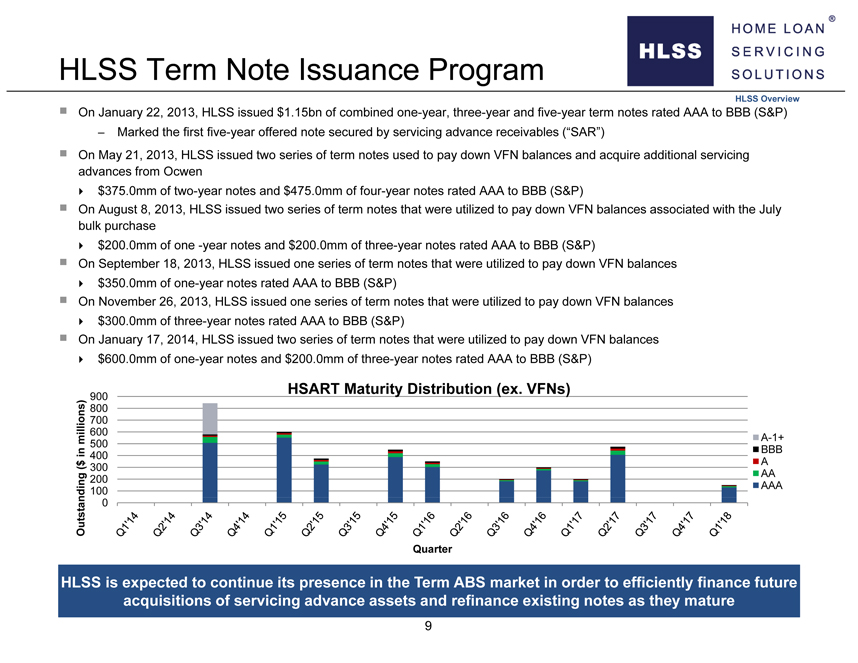

HLSS Term Note Issuance Program HLSS Overview ? On January 22, 2013, HLSS issued $1.15bn of combined one-year, three-year and five-year term notes rated AAA to BBB (S&P) – Marked the first five-year offered note secured by servicing advance receivables (“SAR”) ? On May 21, 2013, HLSS issued two series of term notes used to pay down VFN balances and acquire additional servicing advances from Ocwen? $375.0mm of two-year notes and $475.0mm of four-year notes rated AAA to BBB (S&P)? On August 8, 2013, HLSS issued two series of term notes that were utilized to pay down VFN balances associated with the July bulk purchase? $200.0mm of one -year notes and $200.0mm of three-year notes rated AAA to BBB (S&P)? On September 18, 2013, HLSS issued one series of term notes that were utilized to pay down VFN balances? $350.0mm of one-year notes rated AAA to BBB (S&P)? On November 26, 2013, HLSS issued one series of term notes that were utilized to pay down VFN balances? $300.0mm of three-year notes rated AAA to BBB (S&P)? On January 17, 2014, HLSS issued two series of term notes that were utilized to pay down VFN balances? $600.0mm of one-year notes and $200.0mm of three-year notes rated AAA to BBB (S&P) HSART Maturity Distribution (ex. VFNs) 900 ns) 800 700 600 millio A-1+ 500 in BBB 400 $ A ( 300 AA 200 AAA ding 100 Outstan 0 Quarter HLSS is expected to continue its presence in the Term ABS market in order to efficiently finance future acquisitions of servicing advance assets and refinance existing notes as they mature 9

|

|

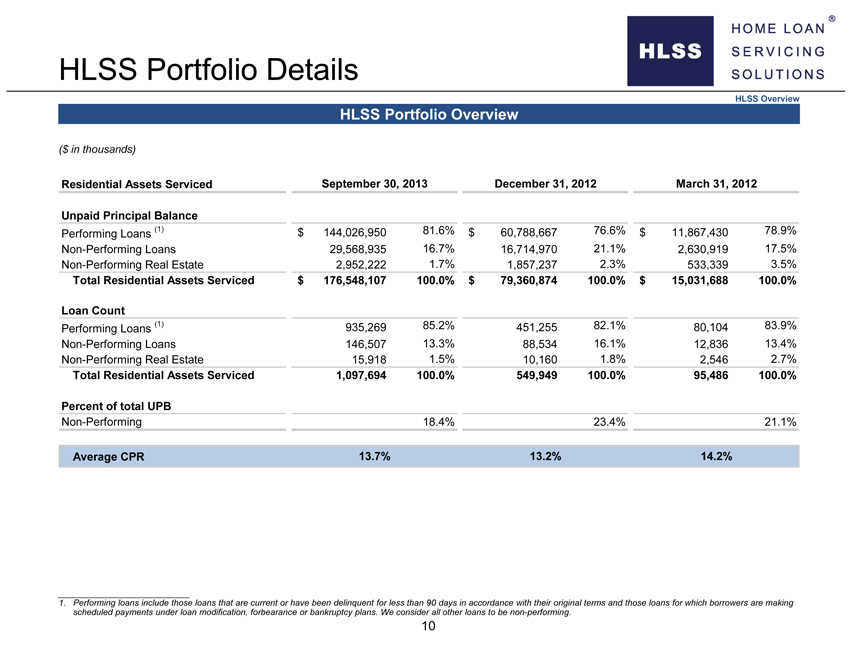

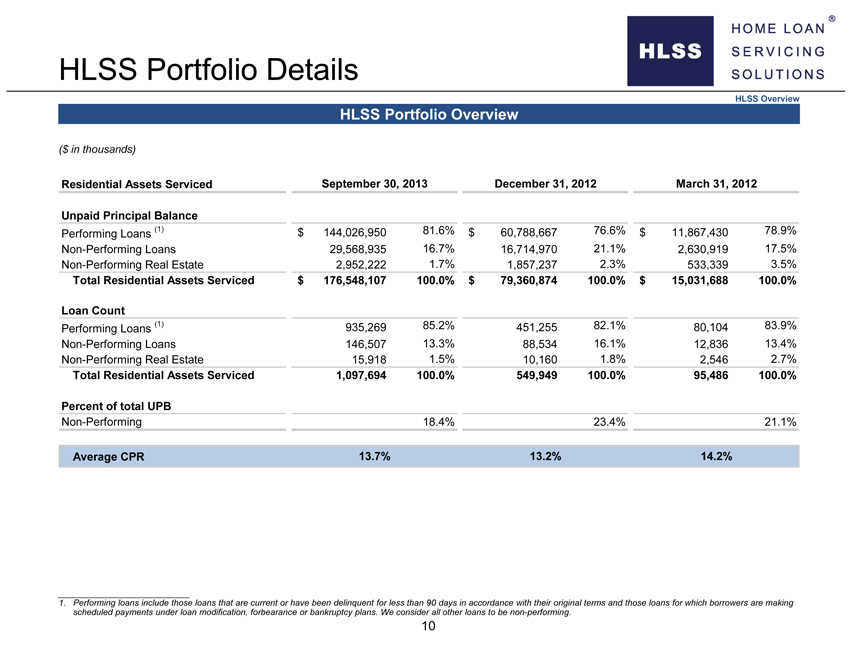

HLSS Portfolio Details HLSS Overview HLSS Portfolio Overview ($ in thousands) Residential Assets Serviced September 30, 2013 December 31, 2012 March 31, 2012 Unpaid Principal Balance Performing Loans (1) $ 144,026,950 81.6% $ 60,788,667 76.6% $ 11,867,430 78.9% Non-Performing Loans 29,568,935 16.7% 16,714,970 21.1% 2,630,919 17.5% Non-Performing Real Estate 2,952,222 1.7% 1,857,237 2.3% 533,339 3.5% Total Residential Assets Serviced $ 176,548,107 100.0% $ 79,360,874 100.0% $ 15,031,688 100.0% Loan Count Performing Loans (1) 935,269 85.2% 451,255 82.1% 80,104 83.9% Non-Performing Loans 146,507 13.3% 88,534 16.1% 12,836 13.4% Non-Performing Real Estate 15,918 1.5% 10,160 1.8% 2,546 2.7% Total Residential Assets Serviced 1,097,694 100.0% 549,949 100.0% 95,486 100.0% Percent of total UPB Non-Performing 18.4% 23.4% 21.1% Average CPR 13.7% 13.2% 14.2% 1. Performing loans include those loans that are current or have been delinquent for less than 90 days in accordance with their original terms and those loans for which borrowers are making scheduled payments under loan modification, forbearance or bankruptcy plans. We consider all other loans to be non-performing. 10

|

|

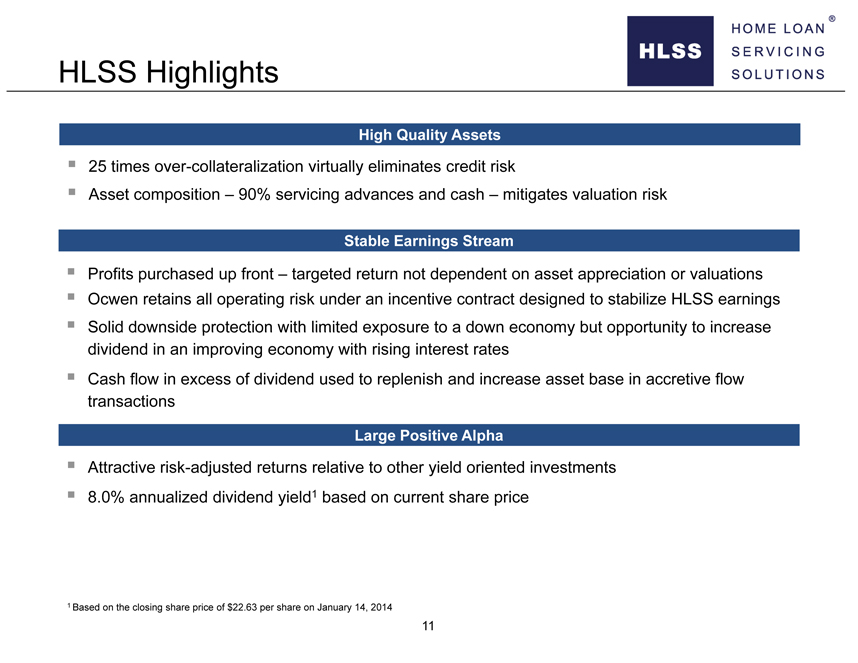

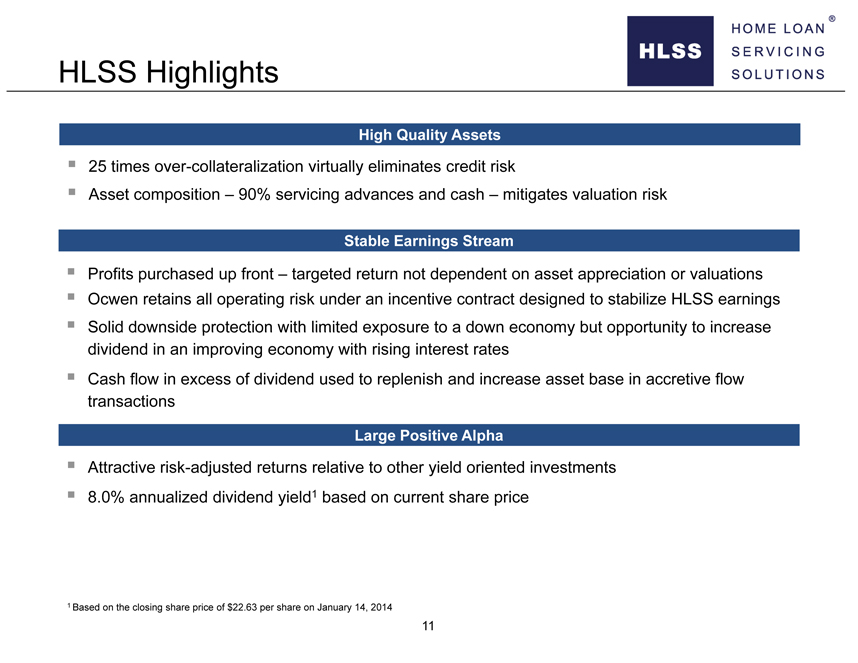

HLSS Highlights High Quality Assetsn 25 times over-collateralization virtually eliminates credit riskn Asset composition – 90% servicing advances and cash – mitigates valuation risk Stable Earnings Streamn Profits purchased up front – targeted return not dependent on asset appreciation or valuationsn Ocwen retains all operating risk under an incentive contract designed to stabilize HLSS earningsn Solid downside protection with limited exposure to a down economy but opportunity to increase dividend in an improving economy with rising interest ratesn Cash flow in excess of dividend used to replenish and increase asset base in accretive flow transactions Large Positive Alphan Attractive risk-adjusted returns relative to other yield oriented investmentsn 8.0% annualized dividend yield1 based on current share price 1 Based on the closing share price of $22.63 per share on January 14, 2014 11

Ocwen Overview

|

|

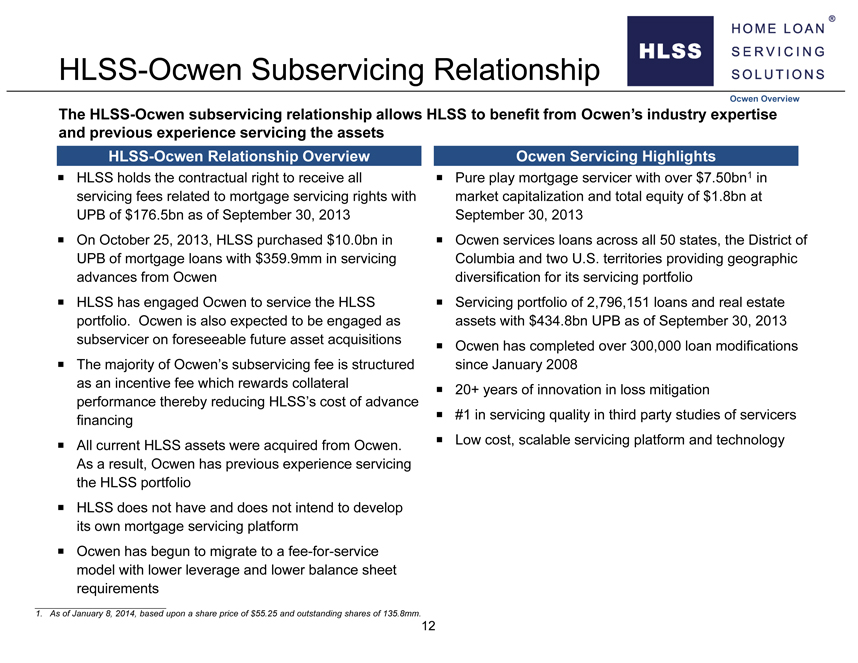

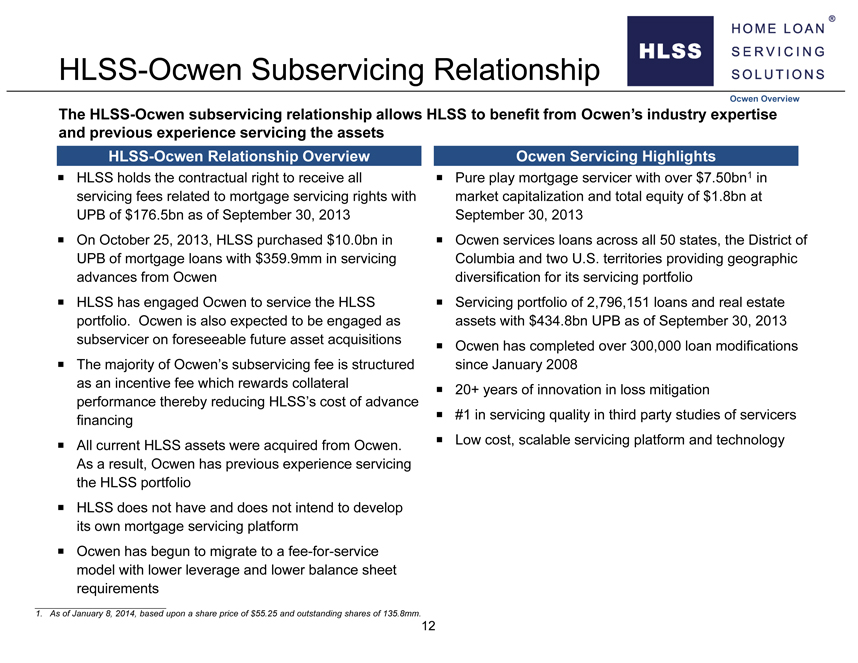

HLSS-Ocwen Subservicing Relationship Ocwen Overview The HLSS-Ocwen subservicing relationship allows HLSS to benefit from Ocwen’s industry expertise and previous experience servicing the assets HLSS-Ocwen Relationship Overview Ocwen Servicing Highlights ? HLSS holds the contractual right to receive all ? Pure play mortgage servicer with over $7.50bn1 in servicing fees related to mortgage servicing rights with market capitalization and total equity of $1.8bn at UPB of $176.5bn as of September 30, 2013 September 30, 2013? On October 25, 2013, HLSS purchased $10.0bn in ? Ocwen services loans across all 50 states, the District of UPB of mortgage loans with $359.9mm in servicing Columbia and two U.S. territories providing geographic advances from Ocwen diversification for its servicing portfolio? HLSS has engaged Ocwen to service the HLSS ? Servicing portfolio of 2,796,151 loans and real estate portfolio. Ocwen is also expected to be engaged as assets with $434.8bn UPB as of September 30, 2013 subservicer on foreseeable future asset acquisitions? Ocwen has completed over 300,000 loan modifications ? The majority of Ocwen’s subservicing fee is structured since January 2008 as an incentive fee which rewards collateral ? 20+ years of innovation in loss mitigation performance thereby reducing HLSS’s cost of advance financing? #1 in servicing quality in third party studies of servicers? All current HLSS assets were acquired from Ocwen. ? Low cost, scalable servicing platform and technology As a result, Ocwen has previous experience servicing the HLSS portfolio? HLSS does not have and does not intend to develop its own mortgage servicing platform? Ocwen has begun to migrate to a fee-for-service model with lower leverage and lower balance sheet requirements 1. As of January 8, 2014, based upon a share price of $55.25 and outstanding shares of 135.8mm. 12

|

|

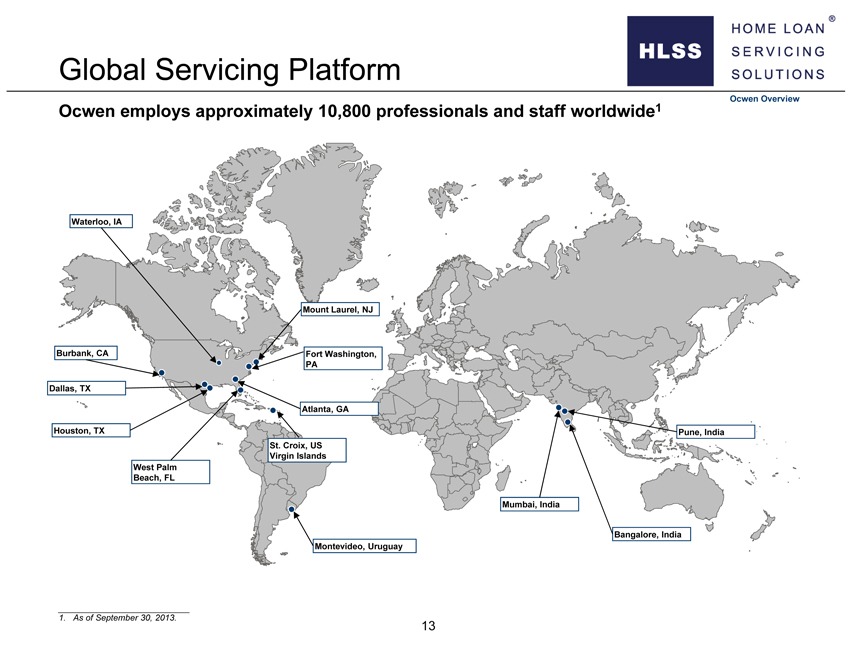

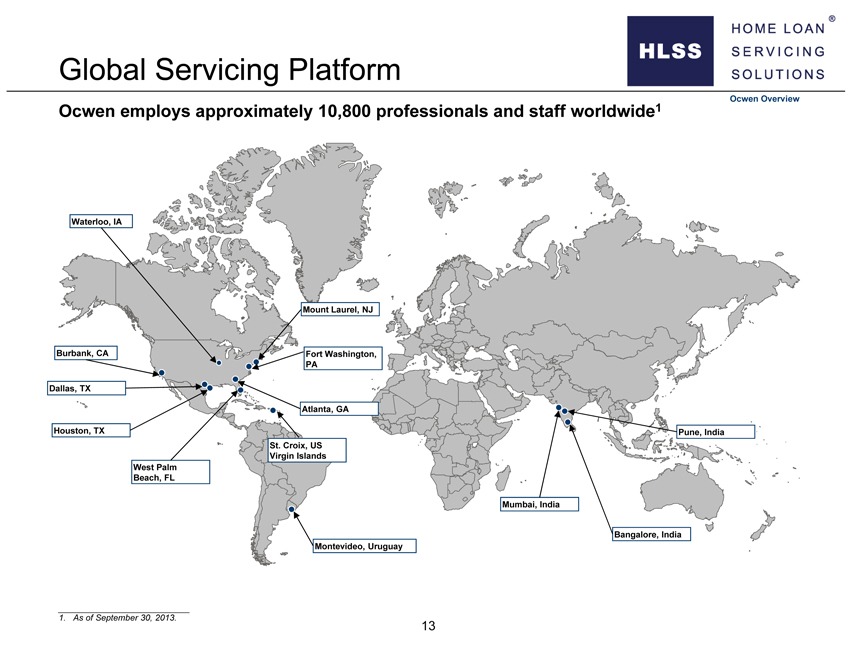

Global Servicing Platform Ocwen employs approximately 10,800 professionals and staff worldwide1 Ocwen Overview Waterloo, IA Mount Laurel, NJ Burbank, CA Fort Washington, PA Dallas, TX Atlanta, GA Houston, TX Pune, India St. Croix, US Virgin Islands West Palm Beach, FL Mumbai, India Bangalore, India Montevideo, Uruguay 1. As of September 30, 2013. 13

|

|

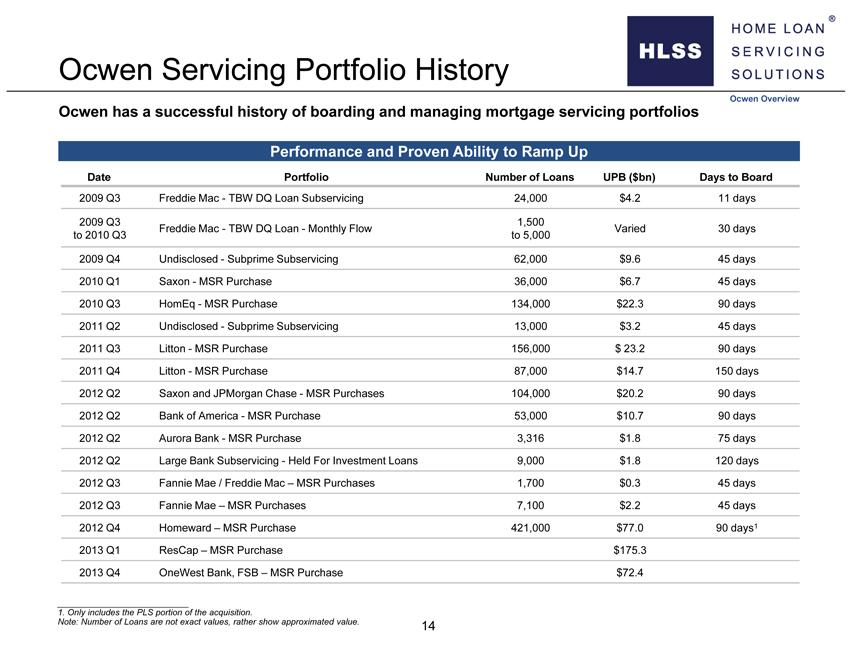

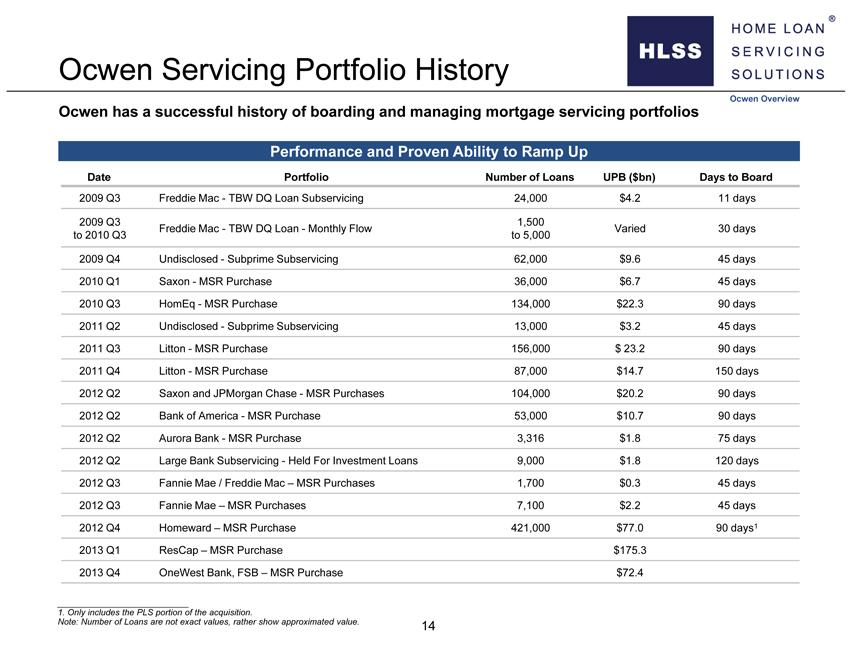

Ocwen Servicing Portfolio History Ocwen Overview Ocwen has a successful history of boarding and managing mortgage servicing portfolios Performance and Proven Ability to Ramp Up Date Portfolio Number of Loans UPB ($bn) Days to Board 2009 Q3 Freddie Mac—TBW DQ Loan Subservicing 24,000 $4.2 11 days 2009 Q3 1,500 Freddie Mac—TBW DQ Loan—Monthly Flow Varied 30 days to 2010 Q3 to 5,000 2009 Q4 Undisclosed—Subprime Subservicing 62,000 $9.6 45 days 2010 Q1 Saxon—MSR Purchase 36,000 $6.7 45 days 2010 Q3 HomEq—MSR Purchase 134,000 $22.3 90 days 2011 Q2 Undisclosed—Subprime Subservicing 13,000 $3.2 45 days 2011 Q3 Litton—MSR Purchase 156,000 $ 23.2 90 days 2011 Q4 Litton—MSR Purchase 87,000 $14.7 150 days 2012 Q2 Saxon and JPMorgan Chase—MSR Purchases 104,000 $20.2 90 days 2012 Q2 Bank of America—MSR Purchase 53,000 $10.7 90 days 2012 Q2 Aurora Bank—MSR Purchase 3,316 $1.8 75 days 2012 Q2 Large Bank Subservicing—Held For Investment Loans 9,000 $1.8 120 days 2012 Q3 Fannie Mae / Freddie Mac – MSR Purchases 1,700 $0.3 45 days 2012 Q3 Fannie Mae – MSR Purchases 7,100 $2.2 45 days 2012 Q4 Homeward – MSR Purchase 421,000 $77.0 90 days1 2013 Q1 ResCap – MSR Purchase $175.3 2013 Q4 OneWest Bank, FSB – MSR Purchase $72.4 1. Only includes the PLS portion of the acquisition. Note: Number of Loans are not exact values, rather show approximated value. 14

|

|

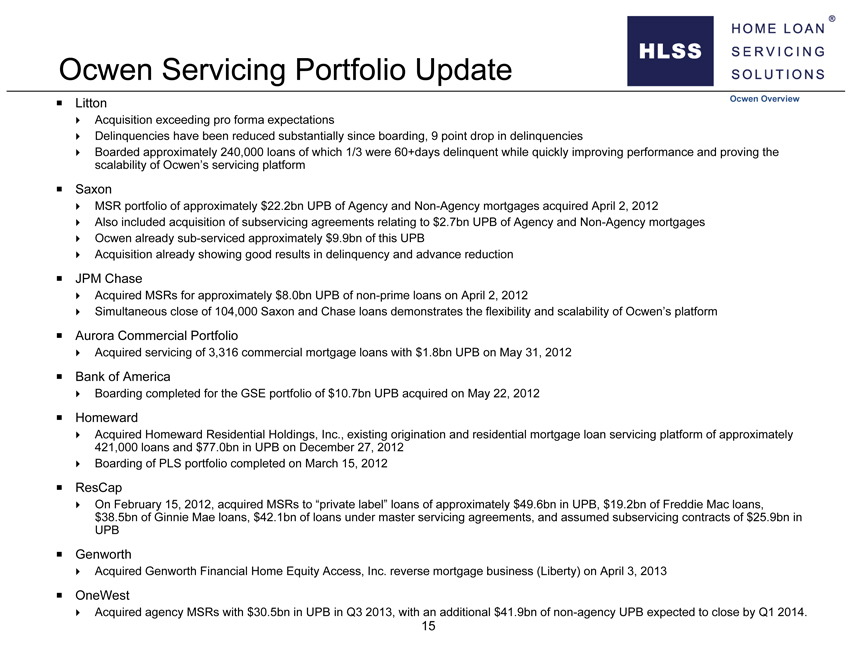

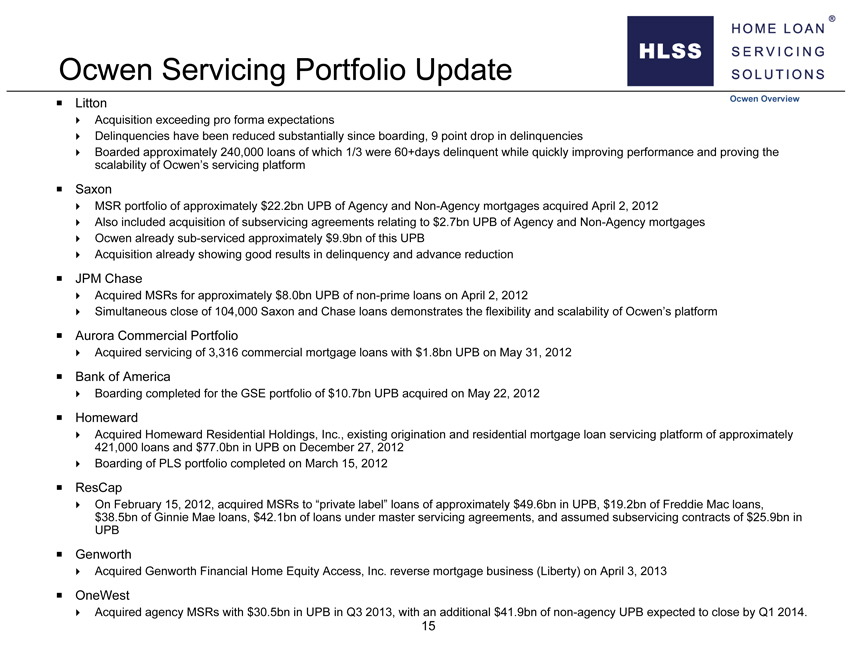

Ocwen Servicing Portfolio Update ? Litton Ocwen Overview ? Acquisition exceeding pro forma expectations ? Delinquencies have been reduced substantially since boarding, 9 point drop in delinquencies ? Boarded approximately 240,000 loans of which 1/3 were 60+days delinquent while quickly improving performance and proving the scalability of Ocwen’s servicing platform ? Saxon ? MSR portfolio of approximately $22.2bn UPB of Agency and Non-Agency mortgages acquired April 2, 2012 ? Also included acquisition of subservicing agreements relating to $2.7bn UPB of Agency and Non-Agency mortgages? Ocwen already sub-serviced approximately $9.9bn of this UPB ? Acquisition already showing good results in delinquency and advance reduction ? JPM Chase ? Acquired MSRs for approximately $8.0bn UPB of non-prime loans on April 2, 2012 ? Simultaneous close of 104,000 Saxon and Chase loans demonstrates the flexibility and scalability of Ocwen’s platform ? Aurora Commercial Portfolio ? Acquired servicing of 3,316 commercial mortgage loans with $1.8bn UPB on May 31, 2012 ? Bank of America ? Boarding completed for the GSE portfolio of $10.7bn UPB acquired on May 22, 2012 ? Homeward ? Acquired Homeward Residential Holdings, Inc., existing origination and residential mortgage loan servicing platform of approximately 421,000 loans and $77.0bn in UPB on December 27, 2012? Boarding of PLS portfolio completed on March 15, 2012 ? ResCap ? On February 15, 2012, acquired MSRs to “private label” loans of approximately $49.6bn in UPB, $19.2bn of Freddie Mac loans, $38.5bn of Ginnie Mae loans, $42.1bn of loans under master servicing agreements, and assumed subservicing contracts of $25.9bn in UPB ? Genworth ? Acquired Genworth Financial Home Equity Access, Inc. reverse mortgage business (Liberty) on April 3, 2013 ? OneWest ? Acquired agency MSRs with $30.5bn in UPB in Q3 2013, with an additional $41.9bn of non-agency UPB expected to close by Q1 2014. 15

|

|

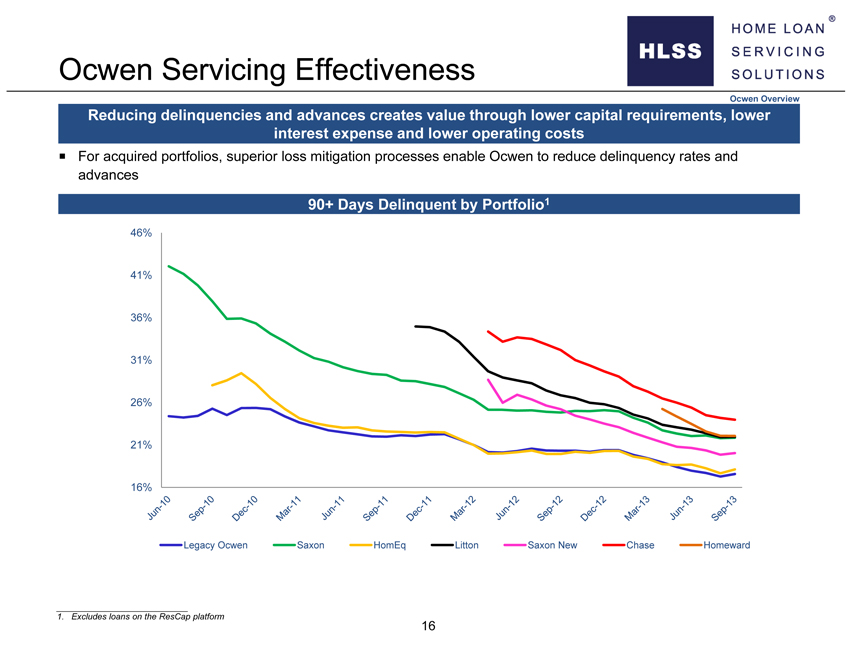

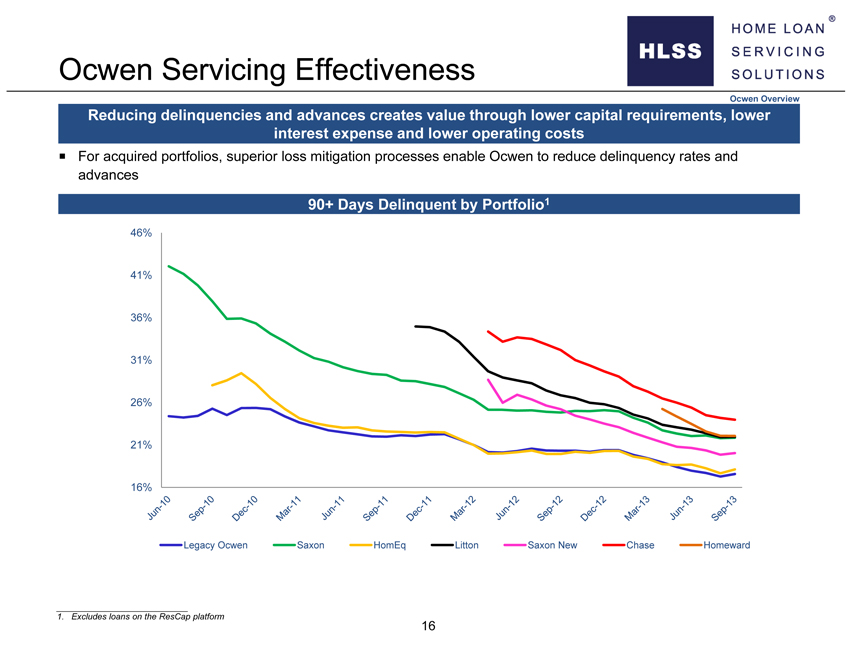

Ocwen Servicing Effectiveness Ocwen Overview Reducing delinquencies and advances creates value through lower capital requirements, lower interest expense and lower operating costs ? For acquired portfolios, superior loss mitigation processes enable Ocwen to reduce delinquency rates and advances 90+ Days Delinquent by Portfolio1 46% 41% 36% 31% 26% 21% 16% Legacy Ocwen Saxon HomEq Litton Saxon New Chase Homeward 1. Excludes loans on the ResCap platform 16

|

|

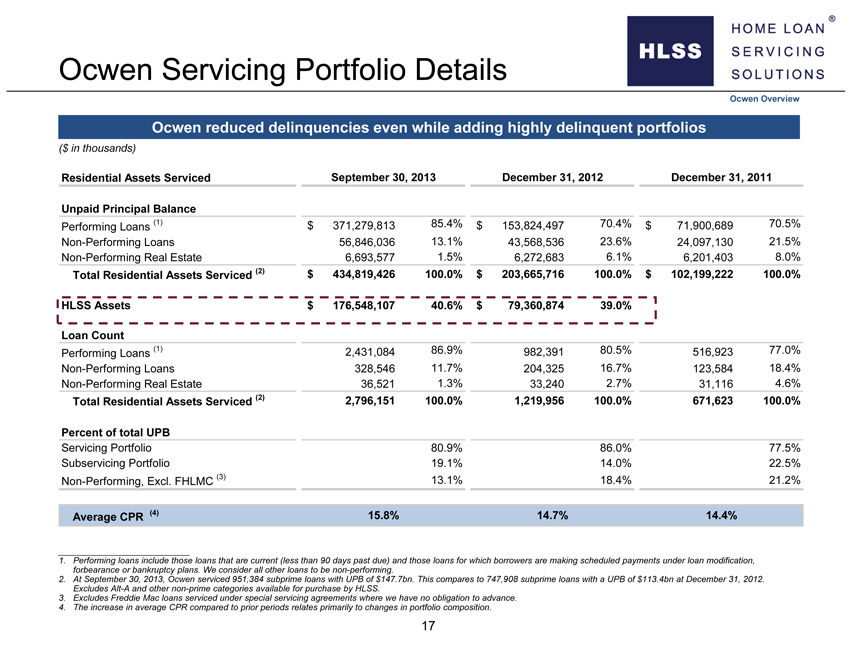

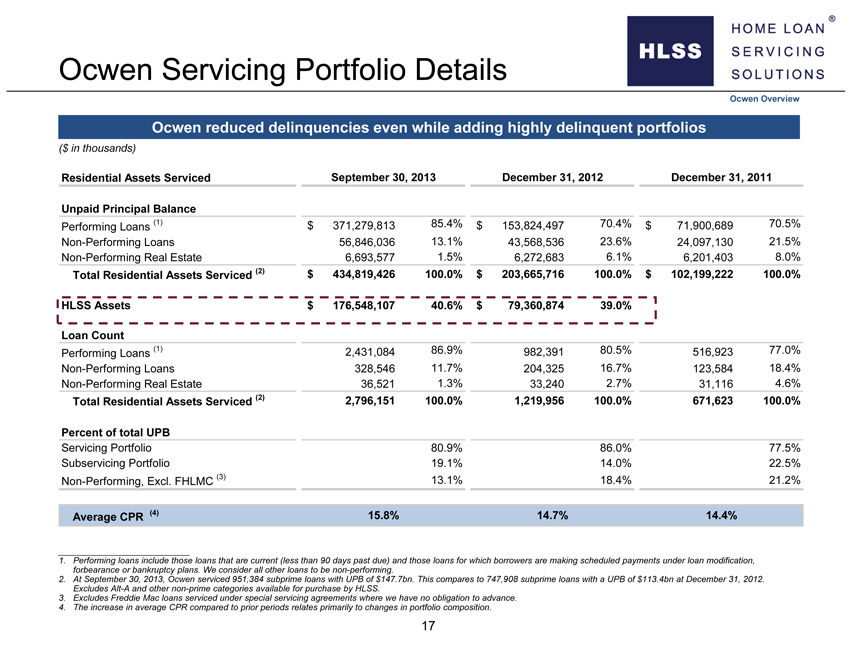

Ocwen Servicing Portfolio Details Ocwen Overview Ocwen reduced delinquencies even while adding highly delinquent portfolios ($ in thousands) Residential Assets Serviced September 30, 2013 December 31, 2012 December 31, 2011 Unpaid Principal Balance Performing Loans (1) $ 371,279,813 85.4% $ 153,824,497 70.4% $ 71,900,689 70.5% Non-Performing Loans 56,846,036 13.1% 43,568,536 23.6% 24,097,130 21.5% Non-Performing Real Estate 6,693,577 1.5% 6,272,683 6.1% 6,201,403 8.0% Total Residential Assets Serviced (2) $ 434,819,426 100.0% $ 203,665,716 100.0% $ 102,199,222 100.0% HLSS Assets $ 176,548,107 40.6% $ 79,360,874 39.0% Loan Count Performing Loans (1) 2,431,084 86.9% 982,391 80.5% 516,923 77.0% Non-Performing Loans 328,546 11.7% 204,325 16.7% 123,584 18.4% Non-Performing Real Estate 36,521 1.3% 33,240 2.7% 31,116 4.6% Total Residential Assets Serviced (2) 2,796,151 100.0% 1,219,956 100.0% 671,623 100.0% Percent of total UPB Servicing Portfolio 80.9% 86.0% 77.5% Subservicing Portfolio 19.1% 14.0% 22.5% Non-Performing, Excl. FHLMC (3) 13.1% 18.4% 21.2% Average CPR (4) 15.8% 14.7% 14.4% 1. Performing loans include those loans that are current (less than 90 days past due) and those loans for which borrowers are making scheduled payments under loan modification, forbearance or bankruptcy plans. We consider all other loans to be non-performing. 2. At September 30, 2013, Ocwen serviced 951,384 subprime loans with UPB of $147.7bn. This compares to 747,908 subprime loans with a UPB of $113.4bn at December 31, 2012. Excludes Alt-A and other non-prime categories available for purchase by HLSS. 3. Excludes Freddie Mac loans serviced under special servicing agreements where we have no obligation to advance. 4. The increase in average CPR compared to prior periods relates primarily to changes in portfolio composition. 17

|

|

HSART Master Trust Overview

|

|

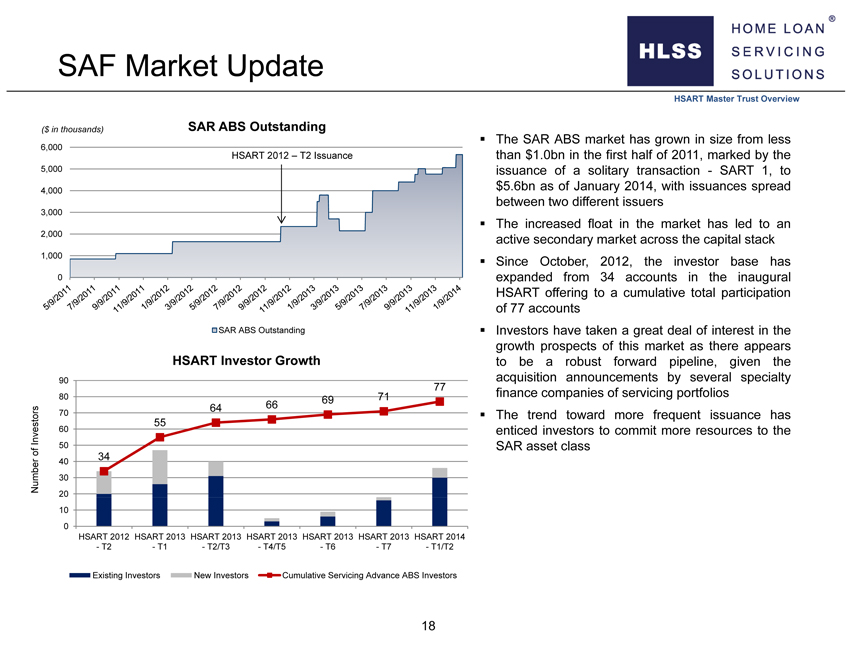

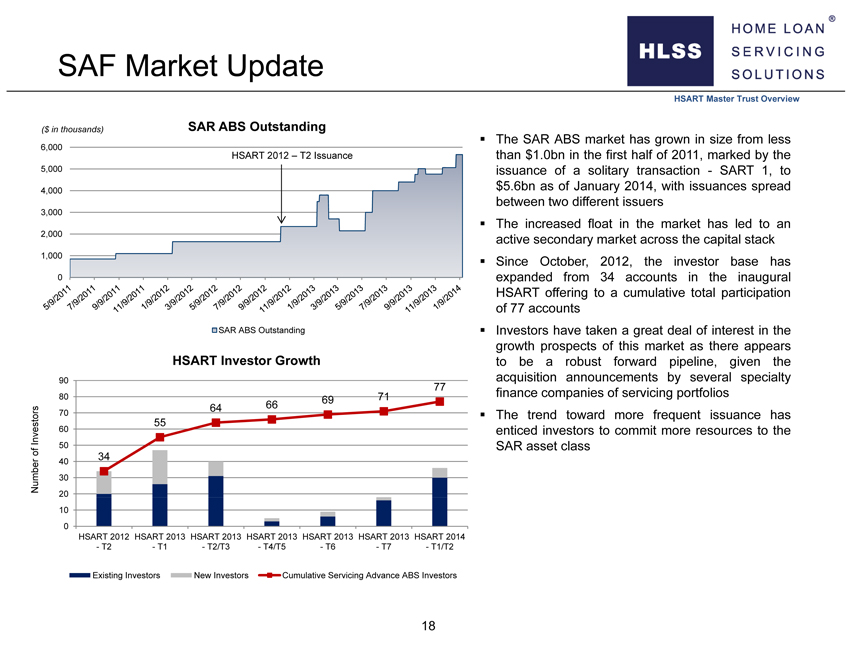

SAF Market Update HSART Master Trust Overview ($ in thousands) SAR ABS Outstandingn The SAR ABS market has grown in size from less 6,000 HSART 2012 – T2 Issuance than $1.0bn in the first half of 2011, marked by the 5,000 issuance of asolitary transaction—SART 1, to 4,000 $5.6bn as of January 2014, with issuances spread between two different issuers 3,000n The increased float in the market has led to an 2,000 active secondary market across the capital stack 1,000n Since October, 2012, the investor base has 0 expanded from 34 accounts in the inaugural HSART offering to a cumulative total participation of 77 accounts SAR ABS Outstandingn Investors have taken a great deal of interest in the growth prospects of this market as there appears HSART Investor Growth to be a robust forward pipeline, given the 90 acquisition announcements by several specialty 77 finance companies of servicing portfolios 80 69 71 64 66 rs 70n The trend toward more frequent issuance has 55 Investo 60 enticed investors to commit more resources to the of 50 SAR asset class 40 34 Number 30 20 10 0 HSART 2012 HSART 2013 HSART 2013 HSART 2013 HSART 2013 HSART 2013 HSART 2014—T2—T1—T2/T3—T4/T5—T6—T7—T1/T2 Existing Investors New Investors Cumulative Servicing Advance ABS Investors 18

|

|

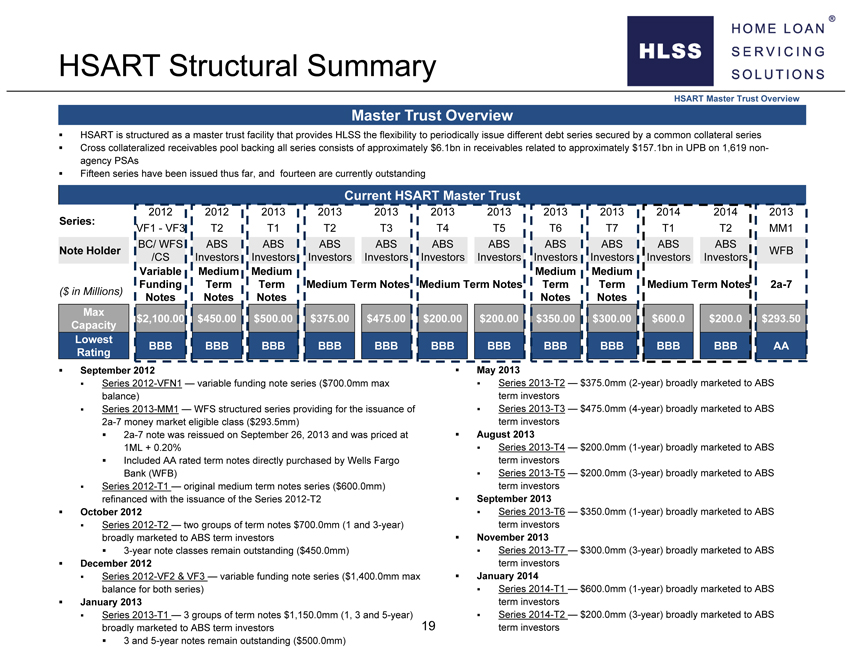

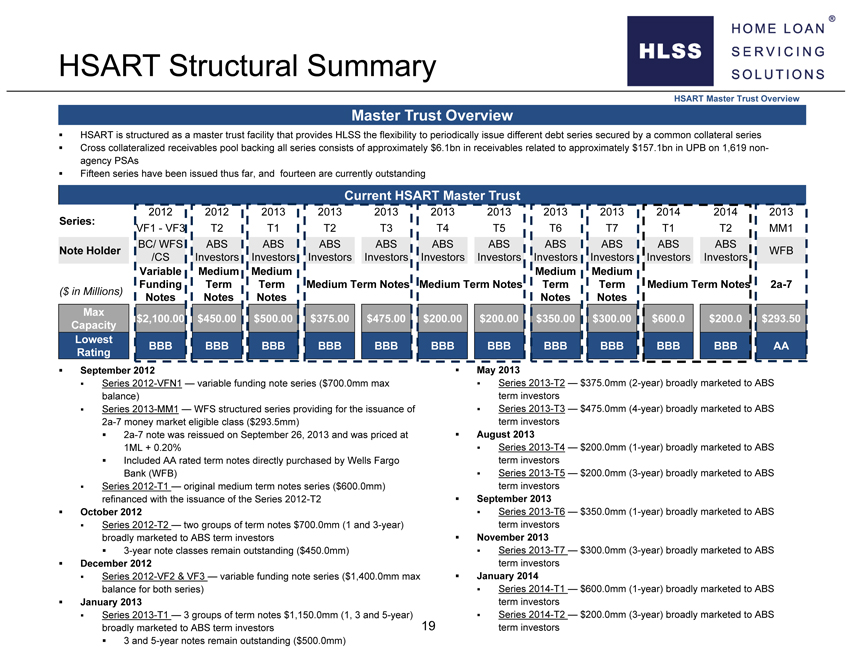

HSART Structural Summary HSART Master Trust Overview Master Trust Overviewn HSART is structured as a master trust facility that provides HLSS the flexibility to periodically issue different debt series secured by a common collateral seriesn Cross collateralized receivables pool backing all series consists of approximately $6.1bn in receivables related to approximately $157.1bn in UPB on 1,619 nonagency PSAsn Fifteen series have been issued thus far, and fourteen are currently outstanding Current HSART Master Trust 2012 2012 2013 2013 2013 2013 2013 2013 2013 2014 2014 2013 Series: VF1—VF3 T2 T1 T2 T3 T4 T5 T6 T7 T1 T2 MM1 BC/ WFS ABS ABS ABS ABS ABS ABS ABS ABS ABS ABS Note Holder WFB /CS Investors Investors Investors Investors Investors Investors Investors Investors Investors Investors Variable Medium Medium Medium Medium Funding Term Term Medium Term Notes Medium Term Notes Term Term Medium Term Notes 2a-7 ($ in Millions) Notes Notes Notes Notes Notes Max $2,100.00 $450.00 $500.00 $375.00 $475.00 $200.00 $200.00 $350.00 $300.00 $600.0 $200.0 $293.50 Capacity Lowest BBB BBB BBB BBB BBB BBB BBB BBB BBB BBB BBB AA Ratingn September 2012n May 2013n Series 2012-VFN1 — variable funding note series ($700.0mm maxn Series 2013-T2 — $375.0mm (2-year) broadly marketed to ABS balance) term investorsn Series 2013-MM1 — WFS structured series providing for the issuance ofn Series 2013-T3 — $475.0mm (4-year) broadly marketed to ABS 2a-7 money market eligible class ($293.5mm) term investorsn 2a-7 note was reissued on September 26, 2013 and was priced atn August 2013 1ML + 0.20%n Series 2013-T4 — $200.0mm (1-year) broadly marketed to ABSn Included AA rated term notes directly purchased by Wells Fargo term investors Bank (WFB)n Series 2013-T5 — $200.0mm (3-year) broadly marketed to ABSn Series 2012-T1 — original medium term notes series ($600.0mm) term investors refinanced with the issuance of the Series 2012-T2n September 2013n October 2012n Series 2013-T6 — $350.0mm (1-year) broadly marketed to ABSn Series 2012-T2 — two groups of term notes $700.0mm (1 and 3-year) term investors broadly marketed to ABS term investorsn November 2013n 3-year note classes remain outstanding ($450.0mm)n Series 2013-T7 — $300.0mm (3-year) broadly marketed to ABSn December 2012 term investorsn Series 2012-VF2 & VF3 — variable funding note series ($1,400.0mm maxn January 2014 balance for both series)n Series 2014-T1 — $600.0mm (1-year) broadly marketed to ABSn January 2013 term investorsn Series 2013-T1 — 3 groups of term notes $1,150.0mm (1, 3 and 5-year)n Series 2014-T2 — $200.0mm (3-year) broadly marketed to ABS broadly marketed to ABS term investors 19 term investorsn 3 and 5-year notes remain outstanding ($500.0mm)

|

|

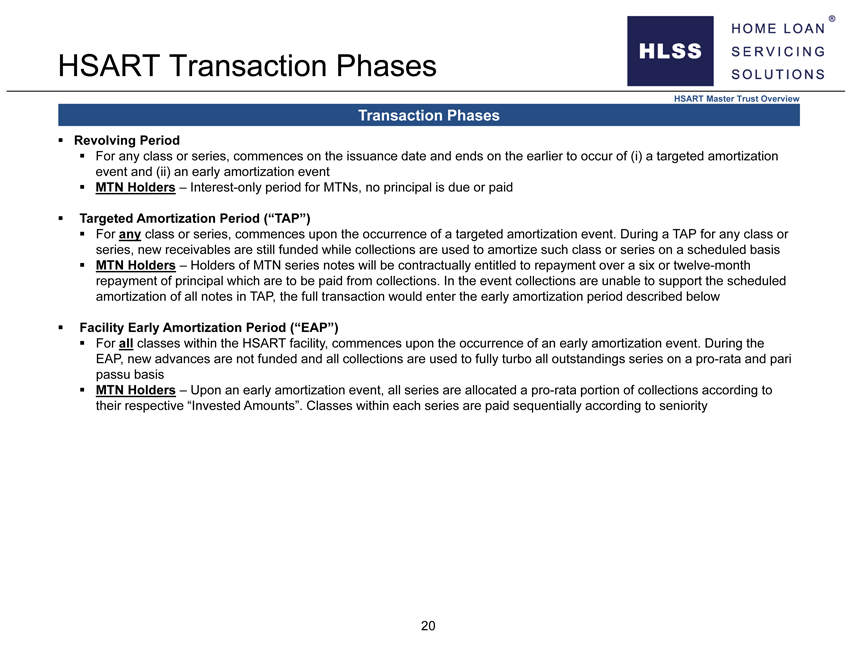

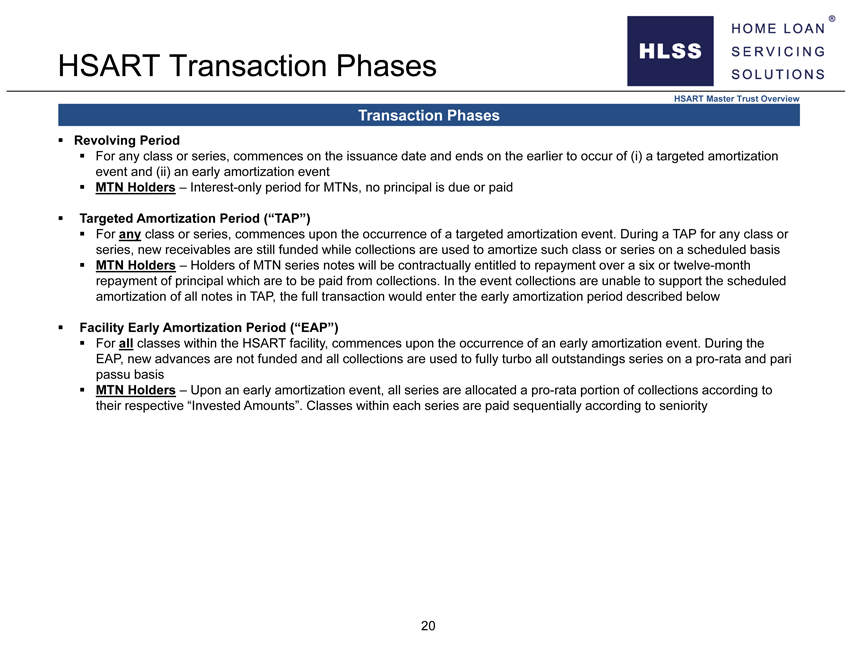

HSART Transaction Phases HSART Master Trust Overview Transaction Phasesn Revolving Periodn For any class or series, commences on the issuance date and ends on the earlier to occur of (i) a targeted amortization event and (ii) an early amortization eventn MTN Holders – Interest-only period for MTNs, no principal is due or paidn Targeted Amortization Period (“TAP”)n For any class or series, commences upon the occurrence of a targeted amortization event. During a TAP for any class or series, new receivables are still funded while collections are used to amortize such class or series on a scheduled basisn MTN Holders – Holders of MTN series notes will be contractually entitled to repayment over a six or twelve-month repayment of principal which are to be paid from collections. In the event collections are unable to support the scheduled amortization of all notes in TAP, the full transaction would enter the early amortization period described belown Facility Early Amortization Period (“EAP”)n For all classes within the HSART facility, commences upon the occurrence of an early amortization event. During the EAP, new advances are not funded and all collections are used to fully turbo all outstandings series on a pro-rata and pari passu basisn MTN Holders – Upon an early amortization event, all series are allocated a pro-rata portion of collections according to their respective “Invested Amounts”. Classes within each series are paid sequentially according to seniority

|

|

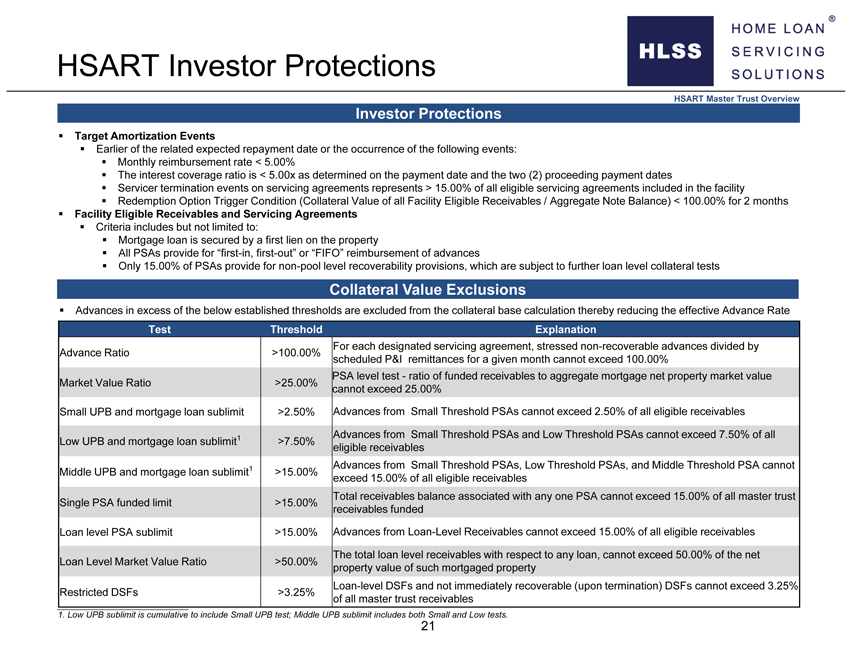

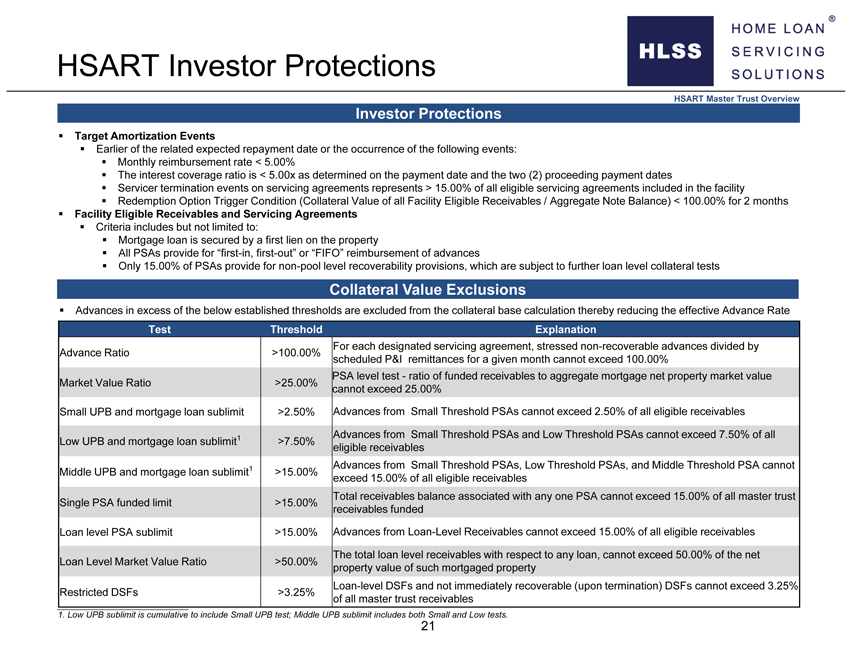

HSART Investor Protections HSART Master Trust Overview Investor Protectionsn Target Amortization Eventsn Earlier of the related expected repayment date or the occurrence of the following events:n Monthly reimbursement rate < 5.00%n The interest coverage ratio is < 5.00x as determined on the payment date and the two (2) proceeding payment datesn Servicer termination events on servicing agreements represents > 15.00% of all eligible servicing agreements included in the facilityn Redemption Option Trigger Condition (Collateral Value of all Facility Eligible Receivables / Aggregate Note Balance) < 100.00% for 2 monthsn Facility Eligible Receivables and Servicing Agreementsn Criteria includes but not limited to:n Mortgage loan is secured by a first lien on the propertyn All PSAs provide for “first-in, first-out” or “FIFO” reimbursement of advancesn Only 15.00% of PSAs provide for non-pool level recoverability provisions, which are subject to further loan level collateral tests Collateral Value Exclusionsn Advances in excess of the below established thresholds are excluded from the collateral base calculation thereby reducing the effective Advance Rate Test Threshold Explanation For each designated servicing agreement, stressed non-recoverable advances divided by Advance Ratio >100.00% scheduled P&I remittances for a given month cannot exceed 100.00% PSA level test—ratio of funded receivables to aggregate mortgage net property market value Market Value Ratio >25.00% cannot exceed 25.00% Small UPB and mortgage loan sublimit >2.50% Advances from Small Threshold PSAs cannot exceed 2.50% of all eligible receivables 1 Advances from Small Threshold PSAs and Low Threshold PSAs cannot exceed 7.50% of all Low UPB and mortgage loan sublimit >7.50% eligible receivables 1 Advances from Small Threshold PSAs, Low Threshold PSAs, and Middle Threshold PSA cannot Middle UPB and mortgage loan sublimit >15.00% exceed 15.00% of all eligible receivables Total receivables balance associated with any one PSA cannot exceed 15.00% of all master trust Single PSA funded limit >15.00% receivables funded Loan level PSA sublimit >15.00% Advances from Loan-Level Receivables cannot exceed 15.00% of all eligible receivables The total loan level receivables with respect to any loan, cannot exceed 50.00% of the net Loan Level Market Value Ratio >50.00% property value of such mortgaged property Loan-level DSFs and not immediately recoverable (upon termination) DSFs cannot exceed 3.25% Restricted DSFs >3.25% of all master trust receivables 1. Low UPB sublimit is cumulative to include Small UPB test; Middle UPB sublimit includes both Small and Low tests. 21

|

|

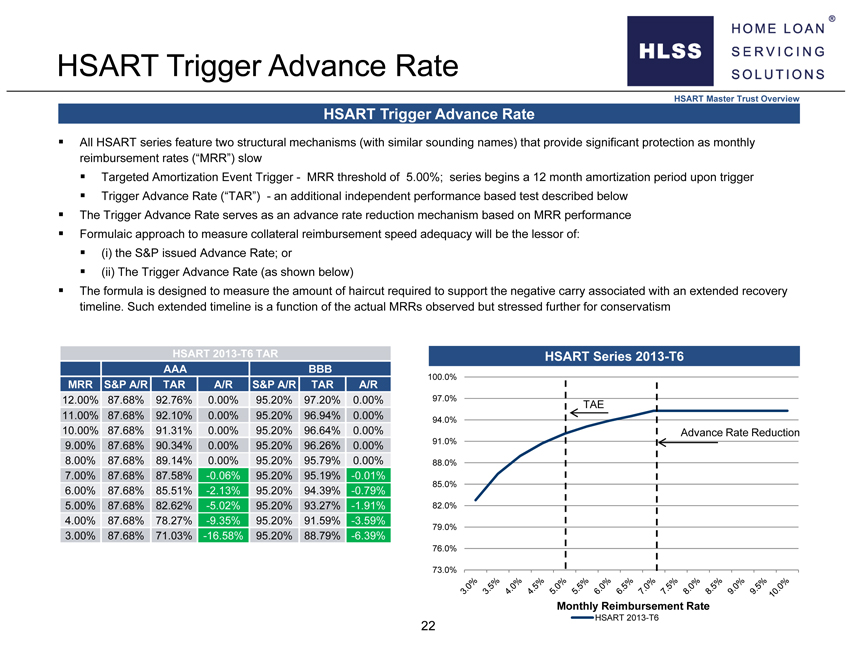

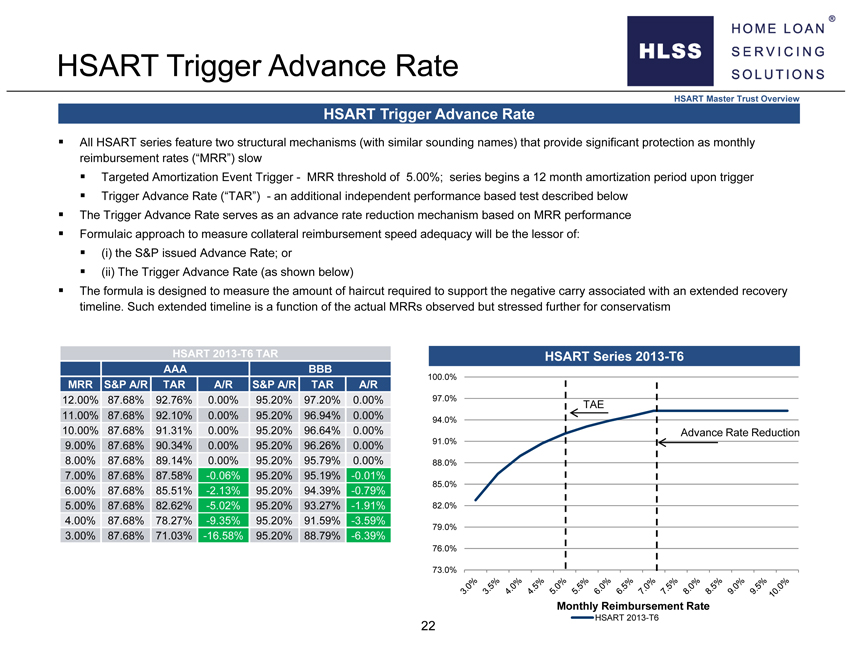

HSART Trigger Advance Rate HSART Master Trust Overview HSART Trigger Advance Raten All HSART series feature two structural mechanisms (with similar sounding names) that provide significant protection as monthly reimbursement rates (“MRR”) slown Targeted Amortization Event Trigger—MRR threshold of 5.00%; series begins a 12 month amortization period upon triggern Trigger Advance Rate (“TAR”)—an additional independent performance based test described belown The Trigger Advance Rate serves as an advance rate reduction mechanism based on MRR performancen Formulaic approach to measure collateral reimbursement speed adequacy will be the lessor of:n (i) the S&P issued Advance Rate; orn (ii) The Trigger Advance Rate (as shown below)n The formula is designed to measure the amount of haircut required to support the negative carry associated with an extended recovery timeline. Such extended timeline is a function of the actual MRRs observed but stressed further for conservatism HSART 2013-T6 TAR HSART Series 2013-T6 AAA BBB 100.0% MRR S&P A/R TAR A/R S&P A/R TAR A/R 12.00% 87.68% 92.76% 0.00% 95.20% 97.20% 0.00% 97.0% TAE 11.00% 87.68% 92.10% 000% . 95.20% 96.94% 000% . 94.0% 10.00% 87.68% 91.31% 0.00% 95.20% 96.64% 0.00% Advance Rate Reduction 9.00% 87.68% 90.34% 0.00% 95.20% 96.26% 0.00% 91.0% 8.00% 87.68% 89.14% 0.00% 95.20% 95.79% 0.00% 88.0% 7.00% 87.68% 87.58% -0.06% 95.20% 95.19% -0.01% 85.0% 6.00% 87.68% 85.51% -2.13% 95.20% 94.39% -0.79% 5.00% 87.68% 82.62% -5.02% 95.20% 93.27% -1.91% 82.0% 4.00% 87.68% 78.27% -9.35% 95.20% 91.59% -3.59% 3.00% 87.68% 71.03% -16.58% 95.20% 88.79% -6.39% 79.0% 76.0% 73.0% Monthly Reimbursement Rate HSART 2013-T6 22

|

|

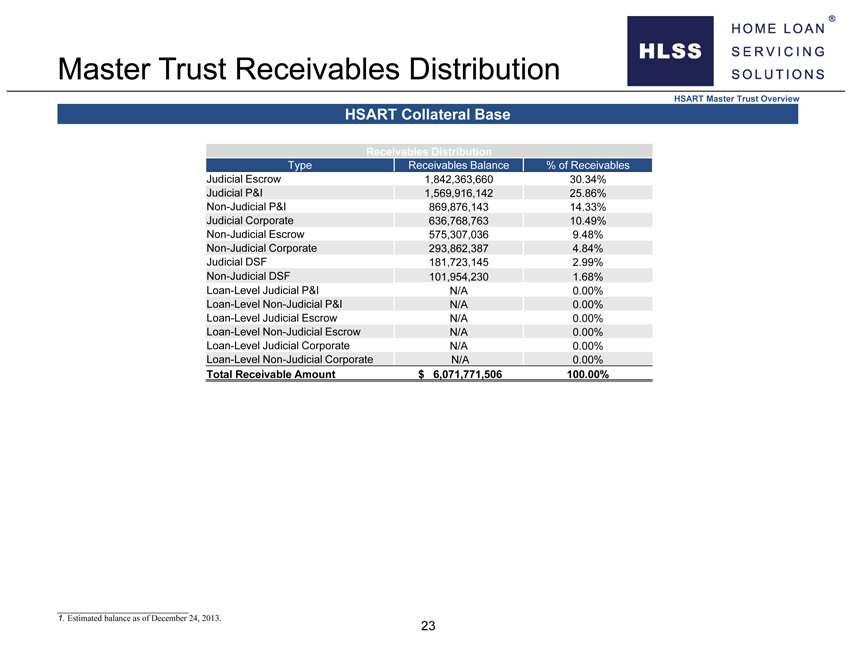

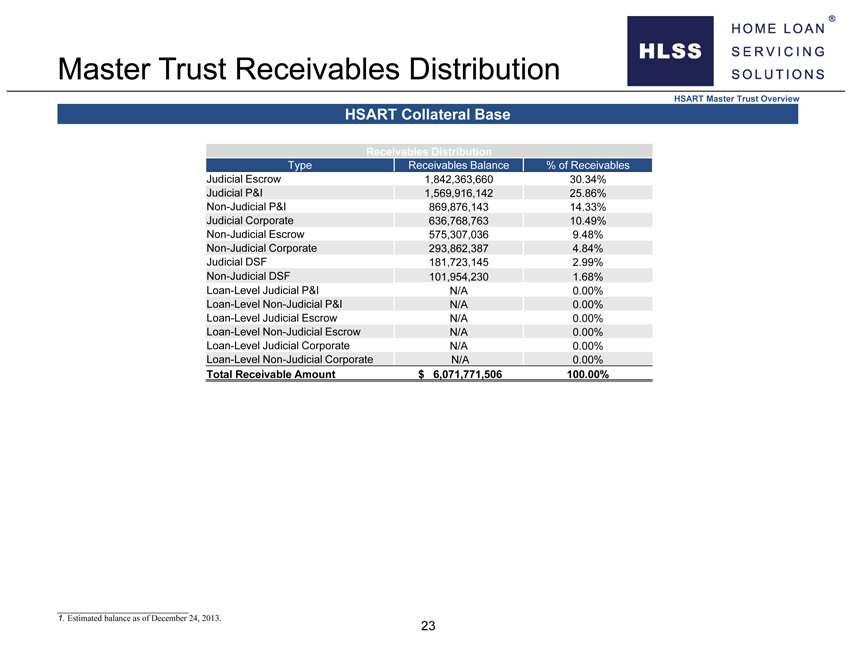

Master Trust Receivables Distribution HSART Master Trust Overview HSART Collateral Base Receivables Distribution Type Receivables Balance % of Receivables Judicial Escrow 1,842,363,660 30.34% Judicial P&I 1,569,916,142 25.86% Non-Judicial P&I 869,876,143 14.33% Judicial Corporate 636,768,763 10.49% Non-Judicial Escrow 575,307,036 9.48% Non-Judicial Corporate 293,862,387 4.84% Judicial DSF 181,723,145 2.99% Non-Judicial DSF 101,954,230 1.68% Loan-Level Judicial P&I N/A 0.00% Loan-Level Non-Judicial P&I N/A 0.00% Loan-Level Judicial Escrow N/A 0.00% Loan-Level Non-Judicial Escrow N/A 0.00% Loan-Level Judicial Corporate N/A 0.00% Loan-Level Non-Judicial Corporate N/A 0.00% Total Receivable Amount $ 6,071,771,506 100.00% 1. Estimated balance as of December 24, 2013. 23

Appendices

Appendix: Past Transactions

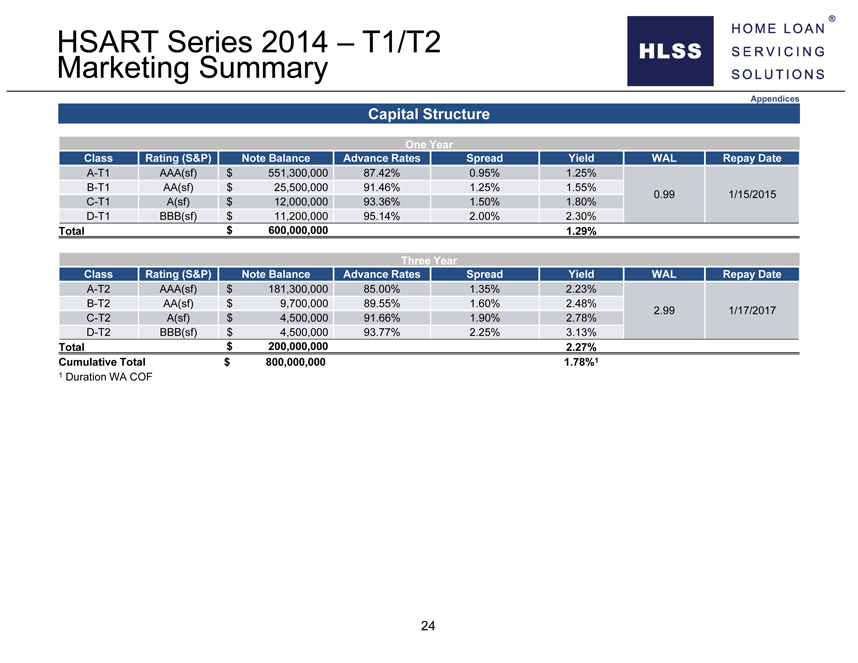

HSART Series 2014 – T1/T2 Marketing Summary Appendices Capital Structure One Year Class Rating (S&P) Note Balance Advance Rates Spread Yield WAL Repay Date A-T1 AAA(sf) $ 551,300,000 87.42% 0.95% 1.25% B-T1 AA(sf) $ 25,500,000 91.46% 1.25% 1.55% 0.99 1/15/2015 C-T1 A(sf) $ 12,000,000 93.36% 1.50% 1.80% D-T1 BBB(sf) $ 11,200,000 95.14% 2.00% 2.30% Total $ 600,000,000 1.29% Three Year Class Rating (S&P) Note Balance Advance Rates Spread Yield WAL Repay Date A-T2 AAA(sf) $ 181,300,000 85.00% 1.35% 2.23% B-T2 AA(sf) $ 9,700,000 89.55% 1.60% 2.48% 2.99 1/17/2017 C-T2 A(sf) $ 4,500,000 91.66% 1.90% 2.78% D-T2 BBB(sf) $ 4,500,000 93.77% 2.25% 3.13% Total $ 200,000,000 2.27% Cumulative Total $ 800,000,000 1.78%1 1 Duration WA COF

|

|

HSART Series 2013 – T7 Marketing Summary Appendices Capital Structure Three Year Class Rating (S&P) Note Balance Advance Rates Spread Yield WAL Repay Date A-T7 AAA(sf) $ 273,150,000 85.25% 135 1.99% B-T7 AA(sf) $ 13,950,000 89.60% 160 2.24% 2.97 11/15/2016 C-T7 A(sf) $ 6,750,000 91.71% 190 2.54% D-T7 BBB(sf) $ 6,150,000 93.63% 240 3.04% Total $ 300,000,000 140 2.04% 25

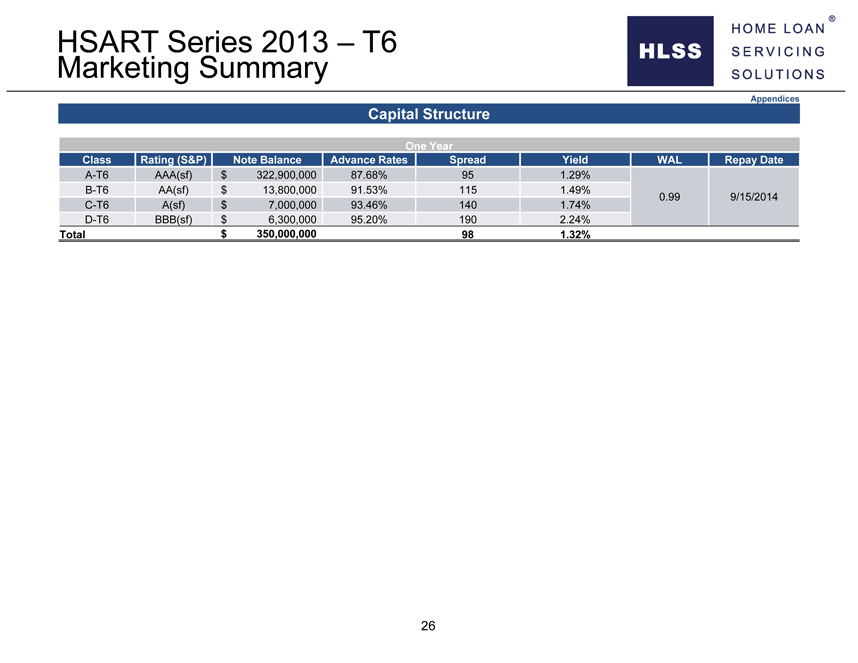

HSART Series 2013 – T6 Marketing Summary Appendices Capital Structure One Year Class Rating (S&P) Note Balance Advance Rates Spread Yield WAL Repay Date A-T6 AAA(sf) $ 322,900,000 87.68% 95 1.29% B-T6 AA(sf) $ 13,800,000 91.53% 115 1.49% 0.99 9/15/2014 C-T6 A(sf) $ 7,000,000 93.46% 140 1.74% D-T6 BBB(sf) $ 6,300,000 95.20% 190 2.24% Total $ 350,000,000 98 1.32% 26

|

|

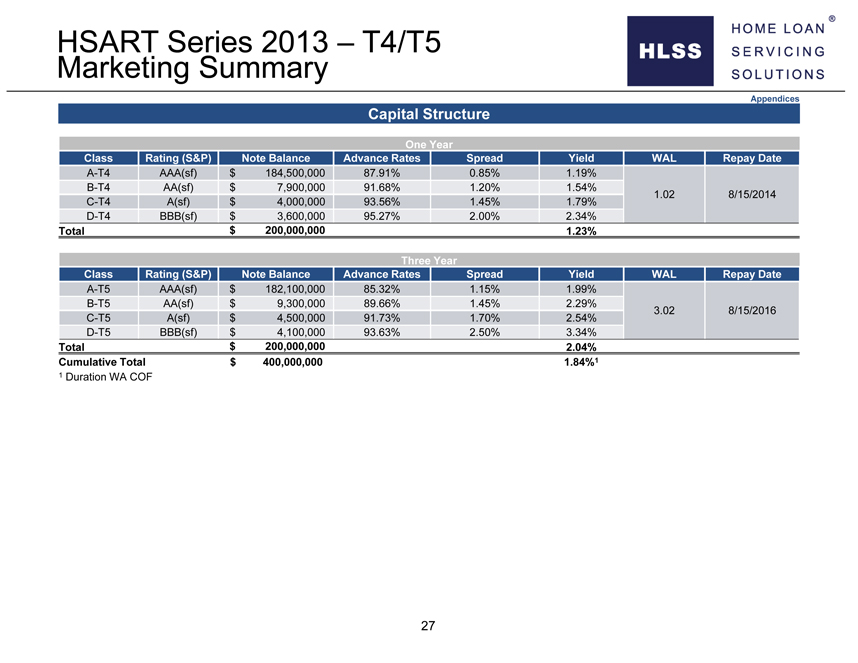

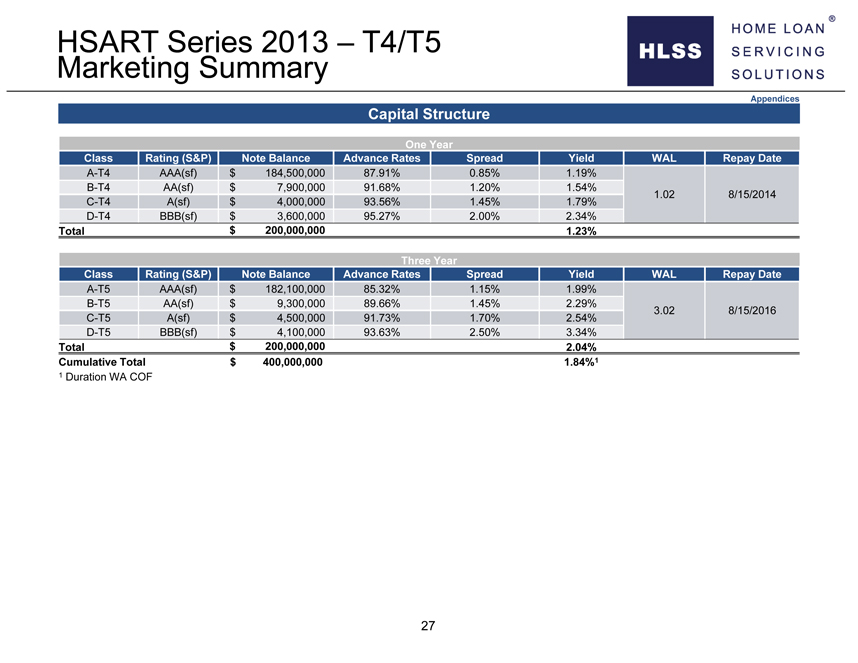

HSART Series 2013 – T4/T5 Marketing Summary Appendices Capital Structure One Year Class Rating (S&P) Note Balance Advance Rates Spread Yield WAL Repay Date A-T4 AAA(sf) $ 184,500,000 87.91% 0.85% 1.19% B-T4 AA(sf) $ 7,900,000 91.68% 1.20% 1.54% 1.02 8/15/2014 C-T4 A(sf) $ 4,000,000 93.56% 1.45% 1.79% D-T4 BBB(sf) $ 3,600,000 95.27% 2.00% 2.34% Total $ 200,000,000 1.23% Three Year Class Rating (S&P) Note Balance Advance Rates Spread Yield WAL Repay Date A-T5 AAA(sf) $ 182,100,000 85.32% 1.15% 1.99% B-T5 AA(sf) $ 9,300,000 89.66% 1.45% 2.29% 3.02 8/15/2016 C-T5 A(sf) $ 4,500,000 91.73% 1.70% 2.54% D-T5 BBB(sf) $ 4,100,000 93.63% 2.50% 3.34% Total $ 200,000,000 2.04% Cumulative Total $ 400,000,000 1.84%1 1 Duration WA COF 27

|

|

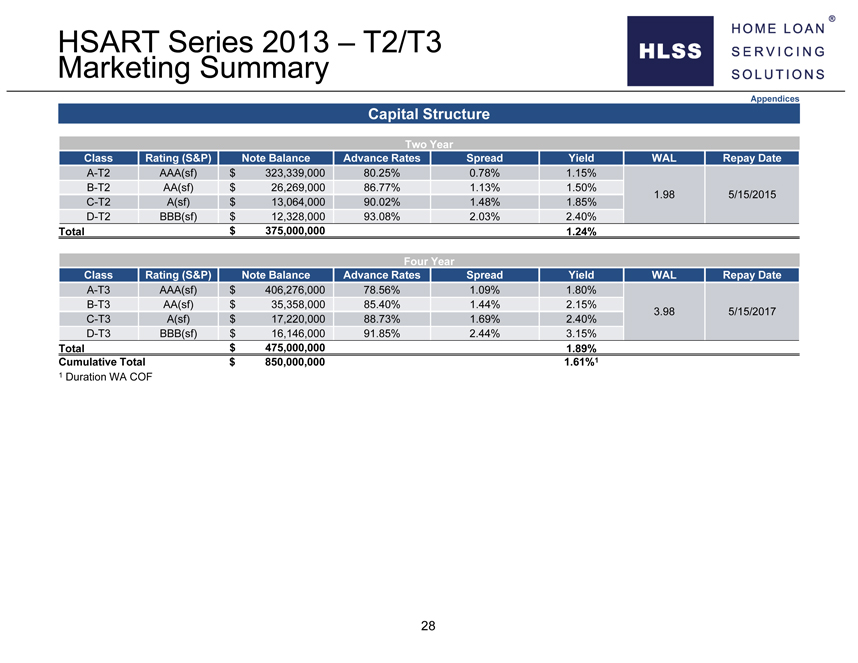

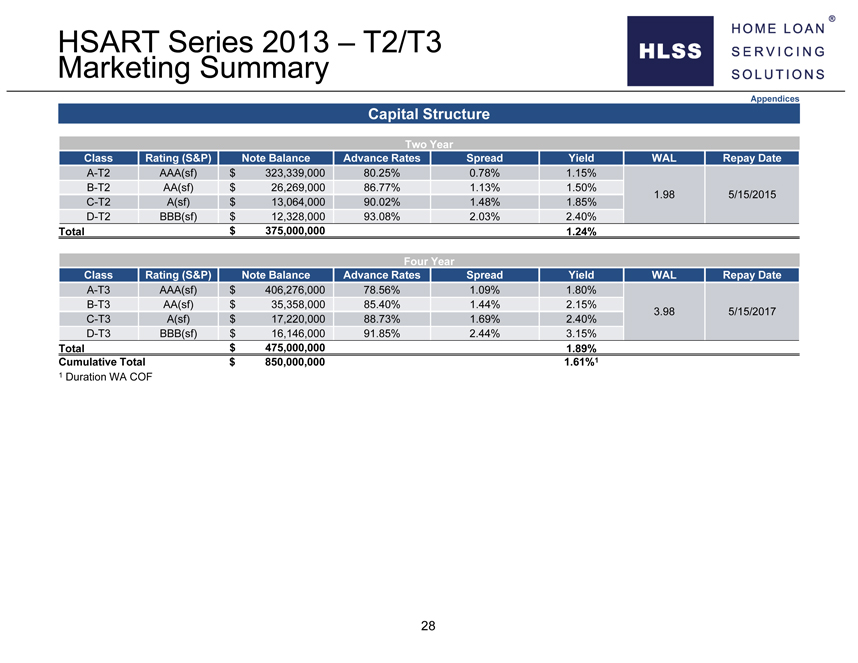

HSART Series 2013 – T2/T3 Marketing Summary Appendices Capital Structure Two Year Class Rating (S&P) Note Balance Advance Rates Spread Yield WAL Repay Date A-T2 AAA(sf) $ 323,339,000 80.25% 0.78% 1.15% B-T2 AA(sf) $ 26,269,000 86.77% 1.13% 1.50% 1.98 5/15/2015 C-T2 A(sf) $ 13,064,000 90.02% 1.48% 1.85% D-T2 BBB(sf) $ 12,328,000 93.08% 2.03% 2.40% Total $ 375,000,000 1.24% Four Year Class Rating (S&P) Note Balance Advance Rates Spread Yield WAL Repay Date A-T3 AAA(sf) $ 406,276,000 78.56% 1.09% 1.80% B-T3 AA(sf) $ 35,358,000 85.40% 1.44% 2.15% 3.98 5/15/2017 C-T3 A(sf) $ 17,220,000 88.73% 1.69% 2.40% D-T3 BBB(sf) $ 16,146,000 91.85% 2.44% 3.15% Total $ 475,000,000 1.89% Cumulative Total $ 850,000,000 1.61%1 1 Duration WA COF

|

|

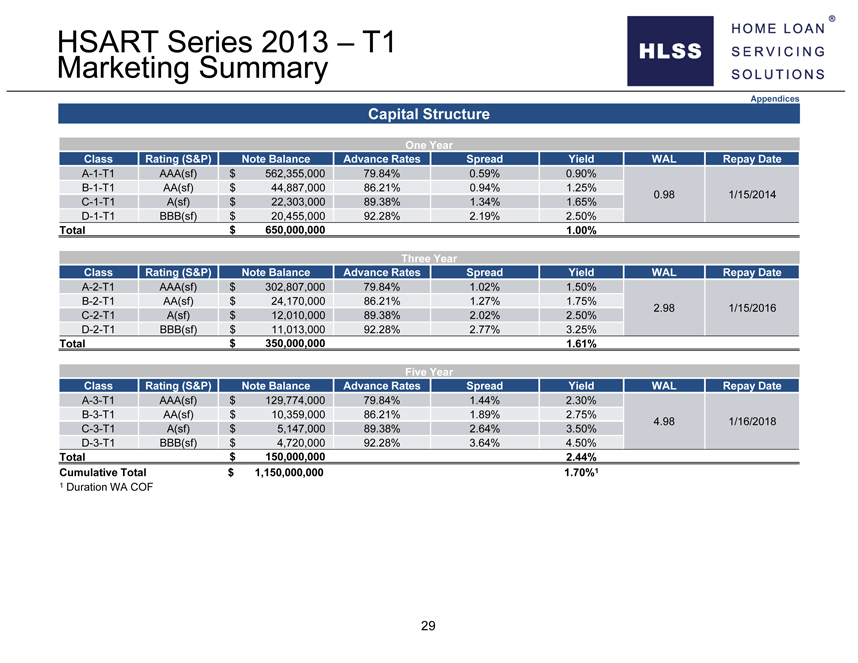

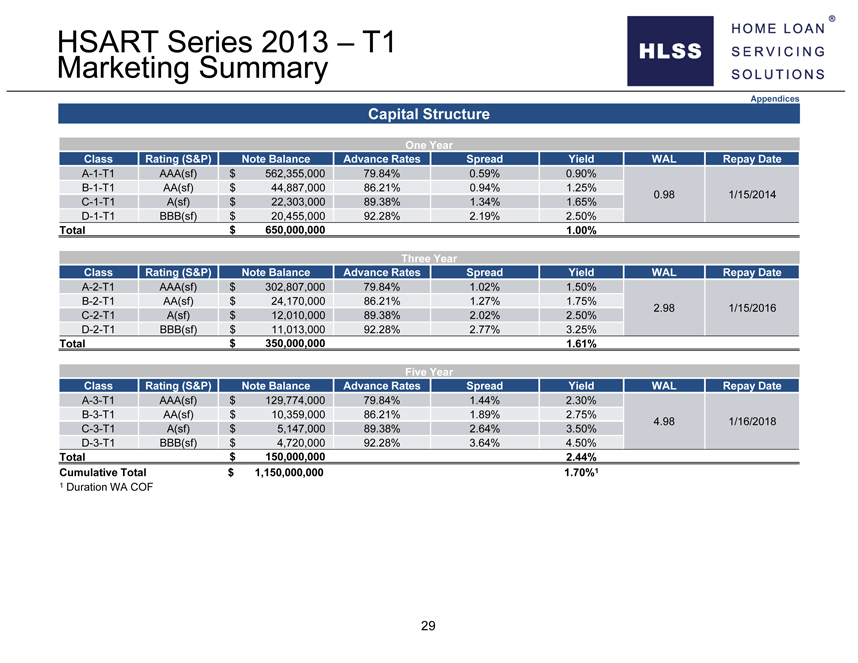

HSART Series 2013 – T1 Marketing Summary Appendices Capital Structure One Year Class Rating (S&P) Note Balance Advance Rates Spread Yield WAL Repay Date A-1-T1 AAA(sf) $ 562,355,000 79.84% 0.59% 0.90% B-1-T1 AA(sf) $ 44,887,000 86.21% 0.94% 1.25% 0.98 1/15/2014 C-1-T1 A(sf) $ 22,303,000 89.38% 1.34% 1.65% D-1-T1 BBB(sf) $ 20,455,000 92.28% 2.19% 2.50% Total $ 650,000,000 1.00% Three Year Class Rating (S&P) Note Balance Advance Rates Spread Yield WAL Repay Date A-2-T1 AAA(sf) $ 302,807,000 79.84% 1.02% 1.50% B-2-T1 AA(sf) $ 24,170,000 86.21% 1.27% 1.75% 2.98 1/15/2016 C-2-T1 A(sf) $ 12,010,000 89.38% 2.02% 2.50% D-2-T1 BBB(sf) $ 11,013,000 92.28% 2.77% 3.25% Total $ 350,000,000 1.61% Five Year Class Rating (S&P) Note Balance Advance Rates Spread Yield WAL Repay Date A-3-T1 AAA(sf) $ 129,774,000 79.84% 1.44% 2.30% B-3-T1 AA(sf) $ 10,359,000 86.21% 1.89% 2.75% 4.98 1/16/2018 C-3-T1 A(sf) $ 5,147,000 89.38% 2.64% 3.50% D-3-T1 BBB(sf) $ 4,720,000 92.28% 3.64% 4.50% Total $ 150,000,000 2.44% Cumulative Total $ 1,150,000,000 1.70%1 1 Duration WA COF 29

|

|

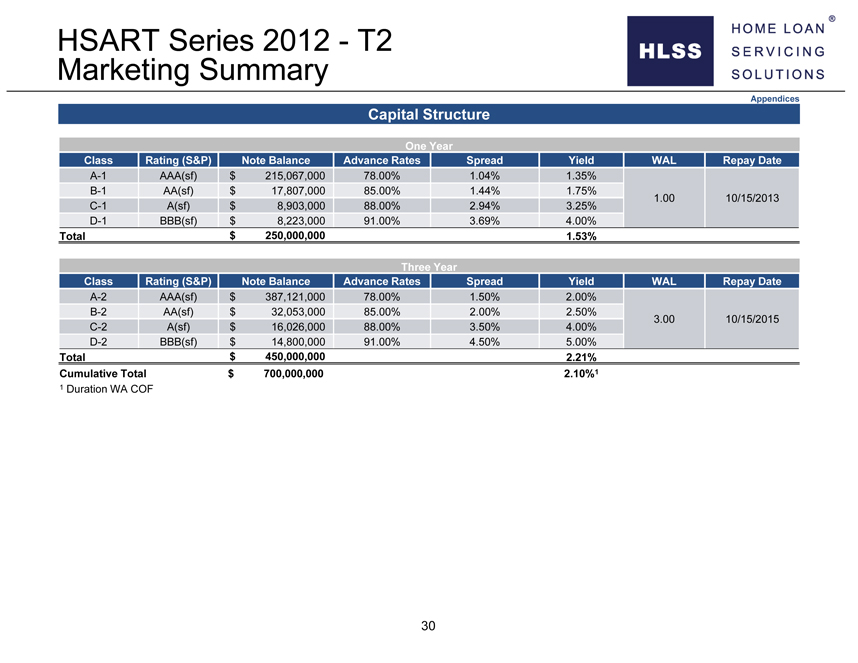

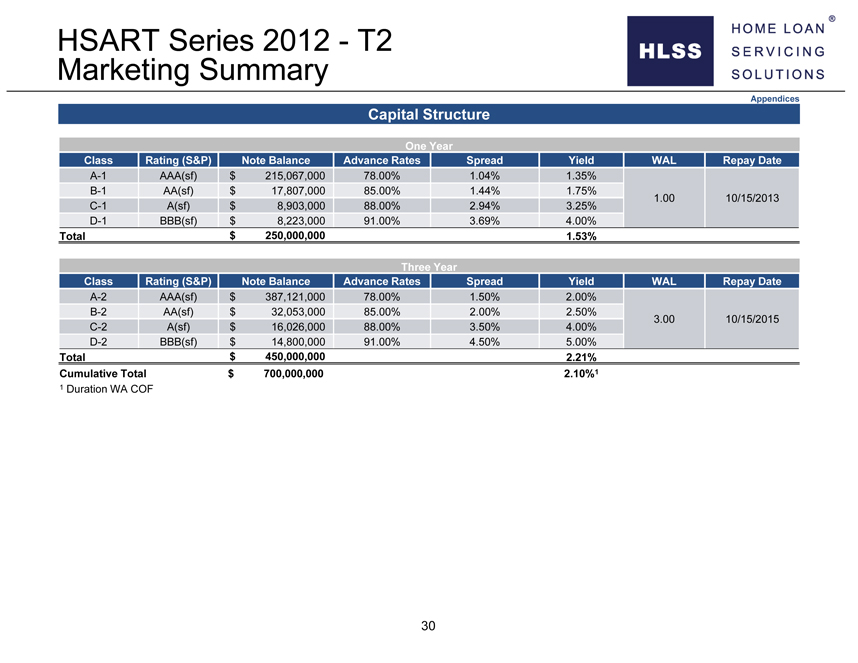

HSART Series 2012—T2 Marketing Summary Appendices Capital Structure One Year Class Rating (S&P) Note Balance Advance Rates Spread Yield WAL Repay Date A-1 AAA(sf) $ 215,067,000 78.00% 1.04% 1.35% B-1 AA(sf) $ 17,807,000 85.00% 1.44% 1.75% 1.00 10/15/2013 C-1 A(sf) $ 8,903,000 88.00% 2.94% 3.25% D-1 BBB(sf) $ 8,223,000 91.00% 3.69% 4.00% Total $ 250,000,000 1.53% Three Year Class Rating (S&P) Note Balance Advance Rates Spread Yield WAL Repay Date A-2 AAA(sf) $ 387,121,000 78.00% 1.50% 2.00% B-2 AA(sf) $ 32,053,000 85.00% 2.00% 2.50% 3.00 10/15/2015 C-2 A(sf) $ 16,026,000 88.00% 3.50% 4.00% D-2 BBB(sf) $ 14,800,000 91.00% 4.50% 5.00% Total $ 450,000,000 2.21% Cumulative Total $ 700,000,000 2.10%1 1 Duration WA COF 30

Appendix: Performance

|

|

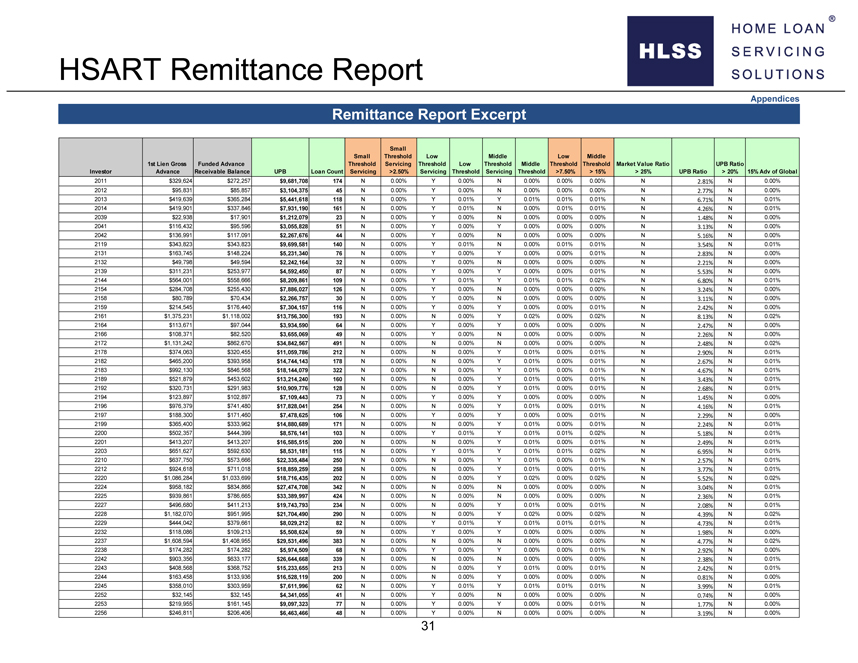

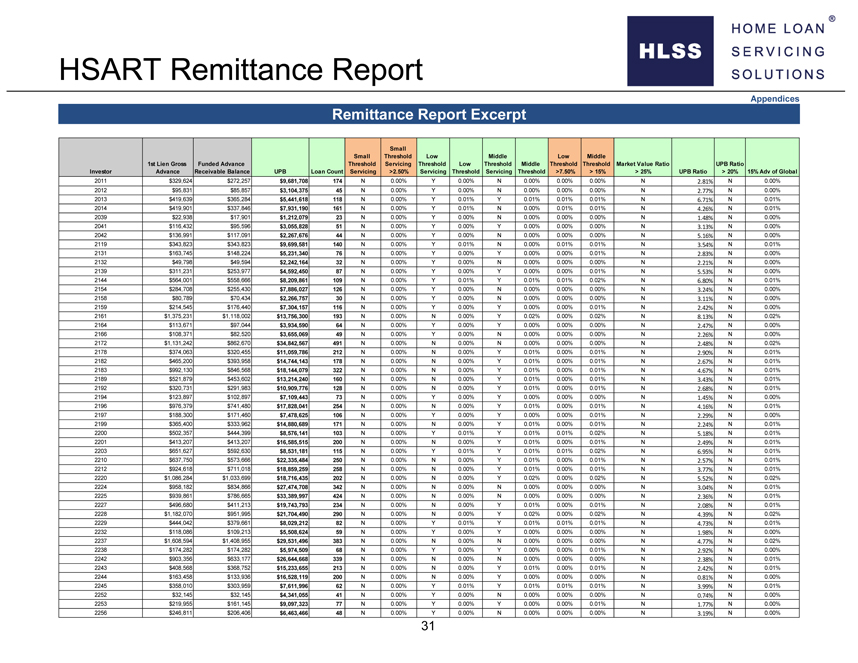

HSART Remittance Report Appendices Remittance Report Excerpt Small Small Threshold Low Middle Low Middle 1st Lien Gross Funded Advance Threshold Servicing Threshold Low Threshold Middle Threshold Threshold Market Value Ratio UPB Ratio Investor Advance Receivable Balance UPB Loan Count Servicing >2.50% Servicing Threshold Servicing Threshold >7.50% > 15% > 25% UPB Ratio > 20% 15% Adv of Global 2011 $329,624 $272,257 $9,681,708 174 N 0.00% Y 0.00% N 0.00% 0.00% 0.00% N 2.81% N0.00% 2012 $95,831 $85,857 $3,104,375 45 N 0.00% Y 0.00% N 0.00% 0.00% 0.00% N 2.77% N0.00% 2013 $419,639 $365,284 $5,441,618 118 N 0.00% Y 0.01% Y 0.01% 0.01% 0.01% N 6.71% N0.01% 2014 $419,901 $337,846 $7,931,190 161 N 0.00% Y 0.01% N 0.00% 0.01% 0.01% N 4.26% N0.01% 2039 $22,938 $17,901 $1,212,079 23 N 0.00% Y 0.00% N 0.00% 0.00% 0.00% N 1.48% N0.00% 2041 $116,432 $95,596 $3,055,828 51 N 0.00% Y 0.00% Y 0.00% 0.00% 0.00% N 3.13% N0.00% 2042 $136,991 $117,091 $2,267,676 44 N 0.00% Y 0.00% N 0.00% 0.00% 0.00% N 5.16% N0.00% 2119 $343,823 $343,823 $9,699,581 140 N 0.00% Y 0.01% N 0.00% 0.01% 0.01% N 3.54% N0.01% 2131 $163,745 $148,224 $5,231,340 76 N 0.00% Y 0.00% Y 0.00% 0.00% 0.01% N 2.83% N0.00% 2132 $49,798 $49,594 $2,242,164 32 N 0.00% Y 0.00% N 0.00% 0.00% 0.00% N 2.21% N0.00% 2139 $311,231 $253,977 $4,592,450 87 N 0.00% Y 0.00% Y 0.00% 0.00% 0.01% N 5.53% N0.00% 2144 $564,001 $558,666 $8,209,861 109 N 0.00% Y 0.01% Y 0.01% 0.01% 0.02% N 6.80% N0.01% 2154 $284,708 $255,430 $7,886,027 126 N 0.00% Y 0.00% N 0.00% 0.00% 0.00% N 3.24% N0.00% 2158 $80,789 $70,434 $2,266,757 30 N 0.00% Y 0.00% N 0.00% 0.00% 0.00% N 3.11% N0.00% 2159 $214,545 $176,440 $7,304,157 116 N 0.00% Y 0.00% Y 0.00% 0.00% 0.01% N 2.42% N0.00% 2161 $1,375,231 $1,118,002 $13,756,300 193 N 0.00% N 0.00% Y 0.02% 0.00% 0.02% N 8.13% N0.02% 2164 $113,671 $97,044 $3,934,590 64 N 0.00% Y 0.00% Y 0.00% 0.00% 0.00% N 2.47% N0.00% 2166 $108,371 $82,520 $3,655,069 49 N 0.00% Y 0.00% N 0.00% 0.00% 0.00% N 2.26% N0.00% 2172 $1,131,242 $862,670 $34,842,567 491 N 0.00% N 0.00% N 0.00% 0.00% 0.00% N 2.48% N0.02% 2178 $374,063 $320,455 $11,059,786 212 N 0.00% N 0.00% Y 0.01% 0.00% 0.01% N 2.90% N0.01% 2182 $465,200 $393,958 $14,744,143 178 N 0.00% N 0.00% Y 0.01% 0.00% 0.01% N 2.67% N0.01% 2183 $992,130 $846,568 $18,144,079 322 N 0.00% N 0.00% Y 0.01% 0.00% 0.01% N 4.67% N0.01% 2189 $521,879 $453,602 $13,214,240 160 N 0.00% N 0.00% Y 0.01% 0.00% 0.01% N 3.43% N0.01% 2192 $320,731 $291,983 $10,909,776 128 N 0.00% N 0.00% Y 0.01% 0.00% 0.01% N 2.68% N0.01% 2194 $123,897 $102,897 $7,109,443 73 N 0.00% Y 0.00% Y 0.00% 0.00% 0.00% N 1.45% N0.00% 2196 $976,379 $741,480 $17,828,041 254 N 0.00% N 0.00% Y 0.01% 0.00% 0.01% N 4.16% N0.01% 2197 $188,300 $171,460 $7,478,625 106 N 0.00% Y 0.00% Y 0.00% 000.00% % 000.01% N 2.29% N 000.00% % 2199 $365,400 $333,962 $14,880,689 171 N 0.00% N 0.00% Y 0.01% 0.00% 0.01% N 2.24% N0.01% 2200 $502,357 $444,399 $8,576,141 103 N 0.00% Y 0.01% Y 0.01% 0.01% 0.02% N 5.18% N0.01% 2201 $413,207 $413,207 $16,585,515 200 N 0.00% N 0.00% Y 0.01% 0.00% 0.01% N 2.49% N0.01% 2203 $651,627 $592,630 $8,531,181 115 N 0.00% Y 0.01% Y 0.01% 0.01% 0.02% N 6.95% N0.01% 2210 $637,750 $573,666 $22,335,484 250 N 0.00% N 0.00% Y 0.01% 0.00% 0.01% N 2.57% N0.01% 2212 $924,618 $711,018 $18,859,259 258 N 0.00% N 0.00% Y 0.01% 0.00% 0.01% N 3.77% N0.01% 2220 $1,086,284 $1,033,699 $18,716,435 202 N 0.00% N 0.00% Y 0.02% 0.00% 0.02% N 5.52% N0.02% 2224 $958,182 $834,866 $27,474,708 342 N 0.00% N 0.00% N 0.00% 0.00% 0.00% N 3.04% N0.01% 2225 $939,861 $786,665 $33,389,997 424 N 0.00% N 0.00% N 0.00% 0.00% 0.00% N 2.36% N 0.01% 2227 $496,680 $411,213 $19,743,793 234 N 0.00% N 0.00% Y 0.01% 0.00% 0.01% N 2.08% N0.01% 2228 $1,182,070 $951,995 $21,704,490 290 N 0.00% N 0.00% Y 0.02% 0.00% 0.02% N 4.39% N0.02% 2229 $444,042 $379,661 $8,029,212 82 N 0.00% Y 0.01% Y 0.01% 0.01% 0.01% N 4.73% N0.01% 2232 $118,086 $109,213 $5,508,624 59 N 0.00% Y 0.00% Y 0.00% 0.00% 0.00% N 1.98% N0.00% 2237 $1,608,594 $1,408,955 $29,531,496 383 N 0.00% N 0.00% N 0.00% 0.00% 0.00% N 4.77% N0.02% 2238 $174,282 $174,282 $5,974,509 68 N 0.00% Y 0.00% Y 0.00% 0.00% 0.01% N 2.92%

N0.00% 2242 $903,356 $633,177 $26,644,668 339 N 0.00% N 0.00% N 0.00% 0.00% 0.00% N 2.38% N0.01% 2243 $408,568 $368,752 $15,233,655 213 N 0.00% N 0.00% Y 0.01% 0.00% 0.01% N 2.42% N0.01% 2244 $163,458 $133,936 $16,528,119 200 N 0.00% N 0.00% Y 0.00% 0.00% 0.00% N 0.81% N0.00% 2245 $358,010 $303,959 $7,611,996 62 N 0.00% Y 0.01% Y 0.01% 0.01% 0.01% N 3.99% N0.01% 2252 $32,145 $32,145 $4,341,055 41 N 0.00% Y 0.00% N 0.00% 0.00% 0.00% N 0.74% N0.00% 2253 $219,955 $161,145 $9,097,323 77 N 0.00% Y 0.00% Y 0.00% 0.00% 0.01% N 1.77% N0.00% 2256 $246,811 $206,406 $6,463,466 48 N 0.00% Y 0.00% N 0.00% 0.00% 0.00% N 3.19% N0.00% 31

|

|

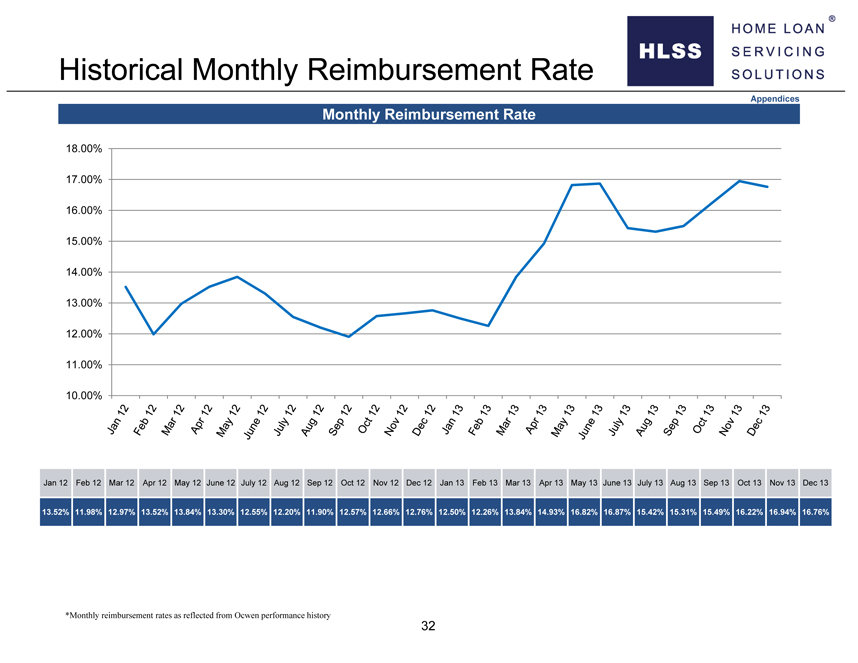

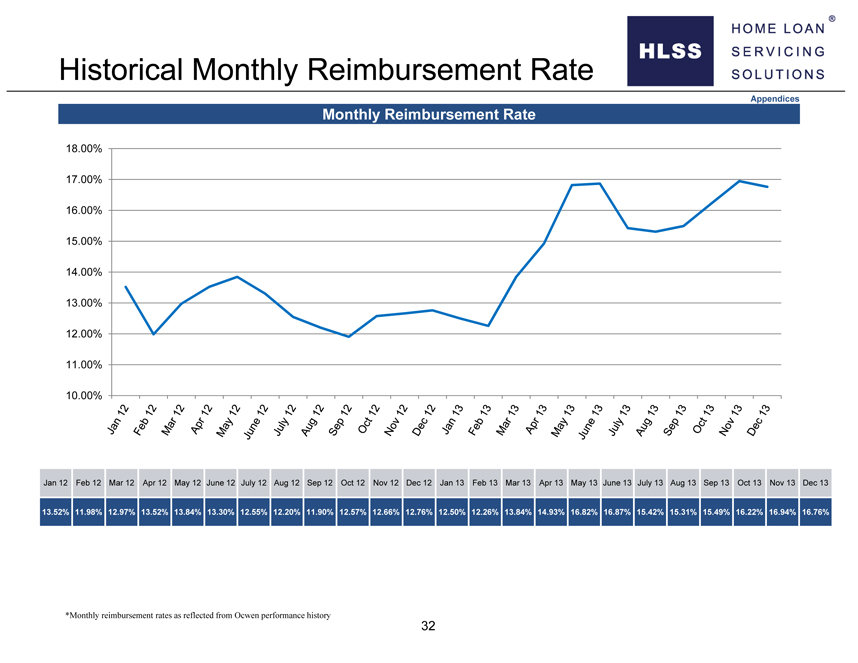

Historical Monthly Reimbursement Rate Appendices Monthly Reimbursement Rate 18.00% 17.00% 16.00% 15.00% 14.00% 13.00% 12.00% 11.00% 10.00% Jan 12 Feb 12 Mar 12 Apr 12 May 12 June 12 July 12 Aug 12 Sep 12 Oct 12 Nov 12 Dec 12 Jan 13 Feb 13 Mar 13 Apr 13 May 13 June 13 July 13 Aug 13 Sep 13 Oct 13 Nov 13 Dec 13 13.52% 11.98% 12.97% 13.52% 13.84% 13.30% 12.55% 12.20% 11.90% 12.57% 12.66% 12.76% 12.50% 12.26% 13.84% 14.93% 16.82% 16.87% 15.42% 15.31% 15.49% 16.22% 16.94% 16.76% *Monthly reimbursement rates as reflected from Ocwen performance history 32

|

|

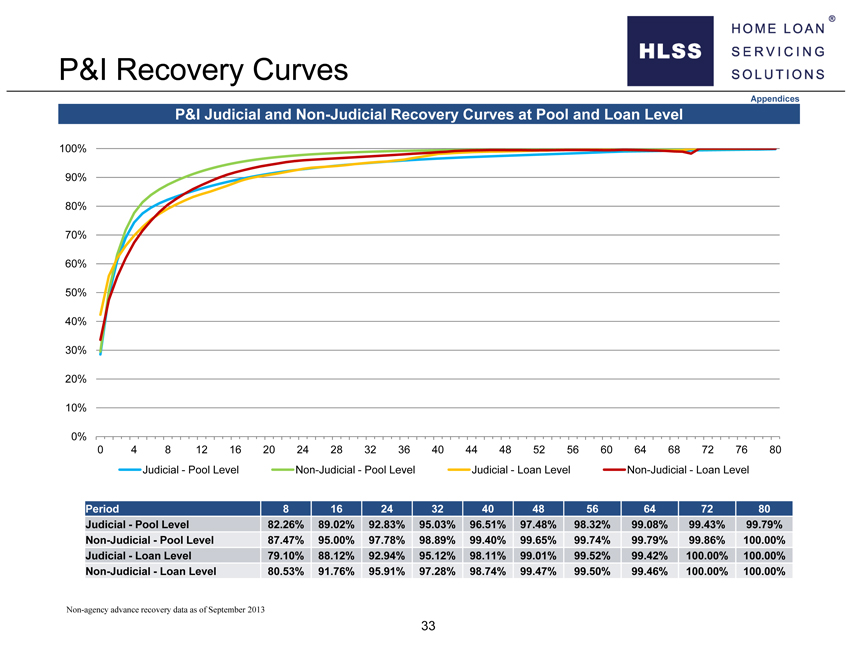

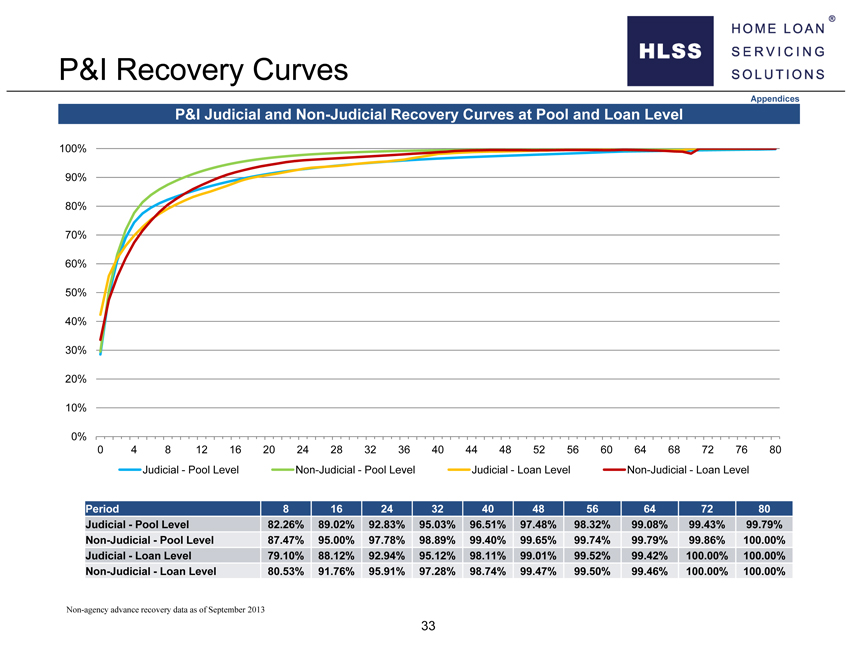

P&I Recovery Curves Appendices P&I Judicial and Non-Judicial Recovery Curves at Pool and Loan Level 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% 0 4 8 121620 242832 36404448 525660 64687276 80 Judicial—Pool Level Non-Judicial—Pool Level Judicial—Loan Level Non-Judicial—Loan Level Period 8 1624324048 56 64 72 80 Judicial—Pool Level 82.26% 89.02% 92.83% 95.03% 96.51% 97.48% 98.32% 99.08% 99.43% 99.79% Non-Judicial—Pool Level 87.47% 95.00% 97.78% 98.89% 99.40% 99.65% 99.74% 99.79% 99.86% 100.00% Judicial—Loan Level 79.10% 88.12% 92.94% 95.12% 98.11% 99.01% 99.52% 99.42% 100.00% 100.00% Non-Judicial—Loan Level 80.53% 91.76% 95.91% 97.28% 98.74% 99.47% 99.50% 99.46% 100.00% 100.00% Non-agency advance recovery data as of September 2013 33

|

|

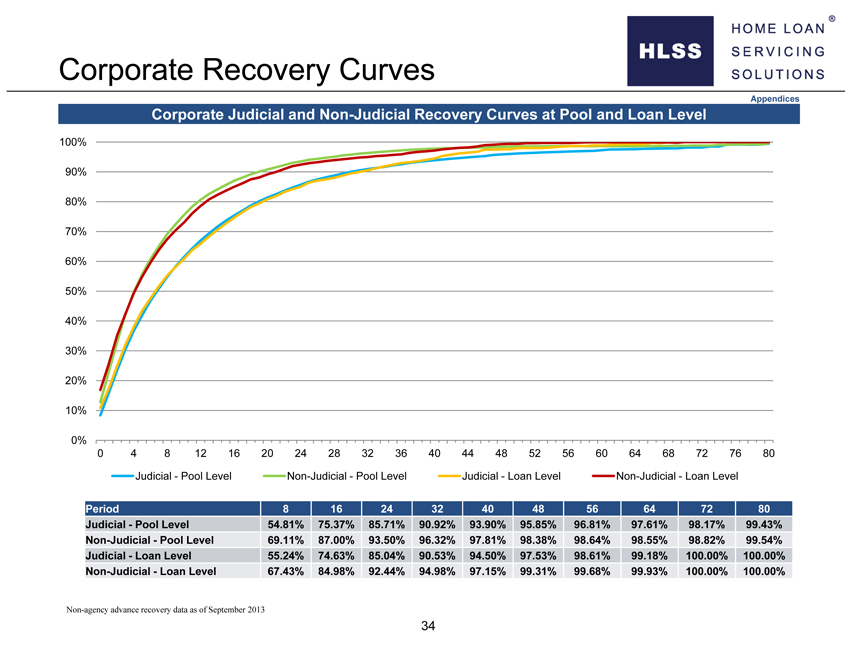

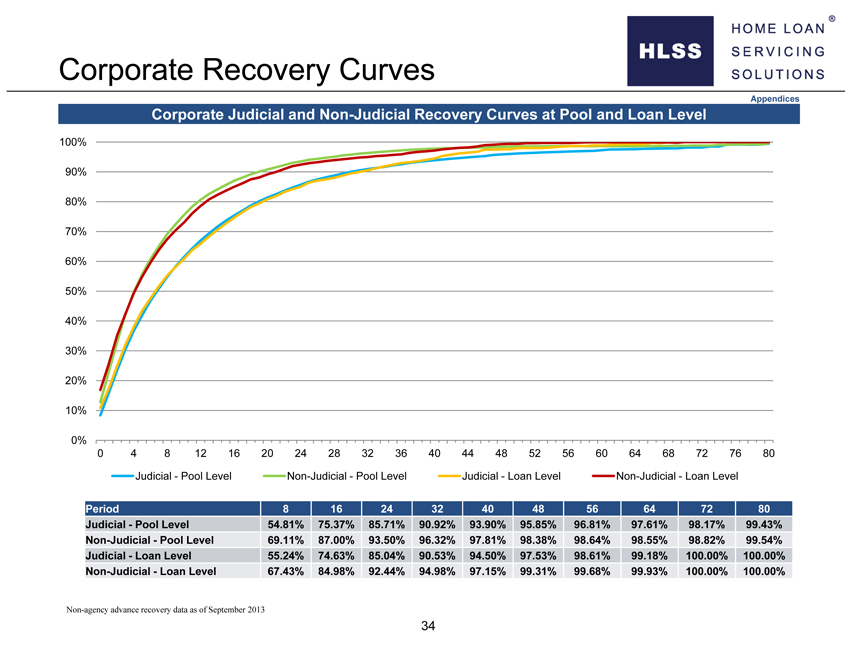

Corporate Recovery Curves Appendices Corporate Judicial and Non-Judicial Recovery Curves at Pool and Loan Level 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% 0 4 8 121620 242832 364044 485256 606468 727680 Judicial—Pool Level Non-Judicial—Pool Level Judicial—Loan Level Non-Judicial—Loan Level Period 8 1624324048 56 64 72 80 Judicial—Pool Level 54.81% 75.37% 85.71% 90.92% 93.90% 95.85% 96.81% 97.61% 98.17% 99.43% Non-Judicial—Pool Level 69.11% 87.00% 93.50% 96.32% 97.81% 98.38% 98.64% 98.55% 98.82% 99.54% Judicial—Loan Level 55.24% 74.63% 85.04% 90.53% 94.50% 97.53% 98.61% 99.18% 100.00% 100.00% Non-Judicial—Loan Level 67.43% 84.98% 92.44% 94.98% 97.15% 99.31% 99.68% 99.93% 100.00% 100.00% Non-agency advance recovery data as of September 2013 34

|

|

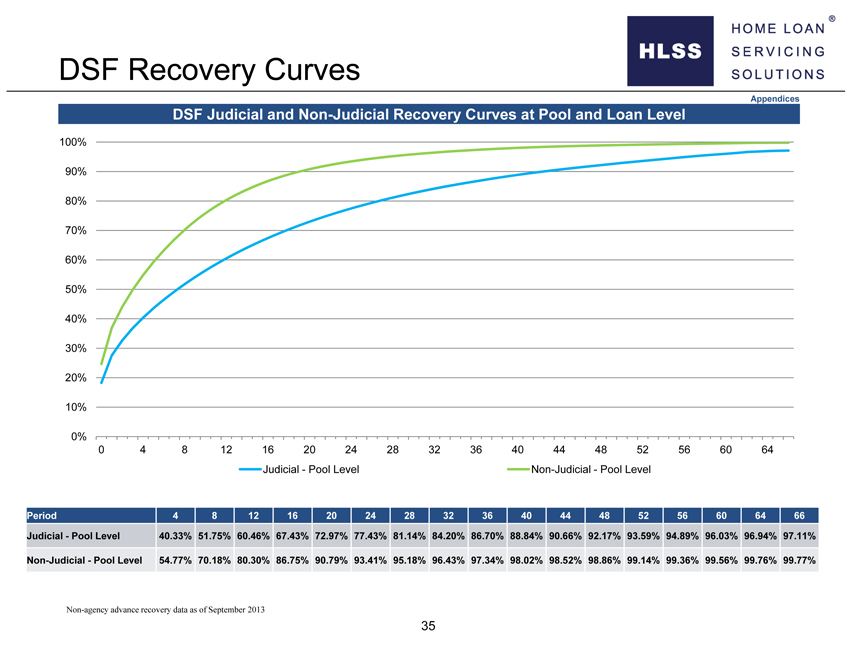

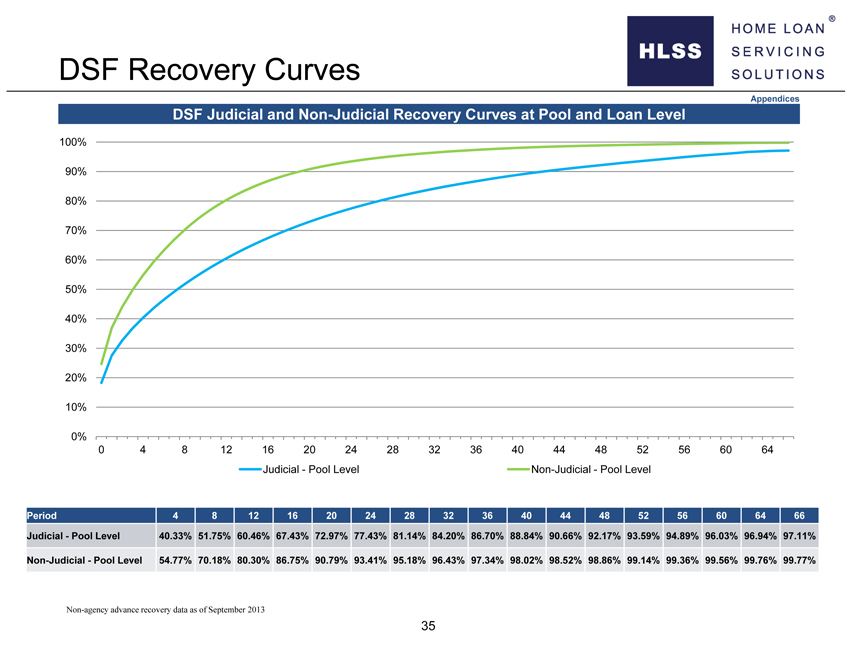

DSF Recovery Curves Appendices DSF Judicial and Non-Judicial Recovery Curves at Pool and Loan Level 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% 0 4 8 12 16 20 24 28 32 36 40 44 48 52 56 60 64 Judicial—Pool Level Non-Judicial—Pool Level Period 4 8 12 16 20 24 28 32 36 40 44 48 52 56 60 64 66 Judicial—Pool Level 40.33% 51.75% 60.46% 67.43% 72.97% 77.43% 81.14% 84.20% 86.70% 88.84% 90.66% 92.17% 93.59% 94.89% 96.03% 96.94% 97.11% Non-Judicial—Pool Level 54.77% 70.18% 80.30% 86.75% 90.79% 93.41% 95.18% 96.43% 97.34% 98.02% 98.52% 98.86% 99.14% 99.36% 99.56% 99.76% 99.77% Non-agency advance recovery data as of September 2013 35

|

|

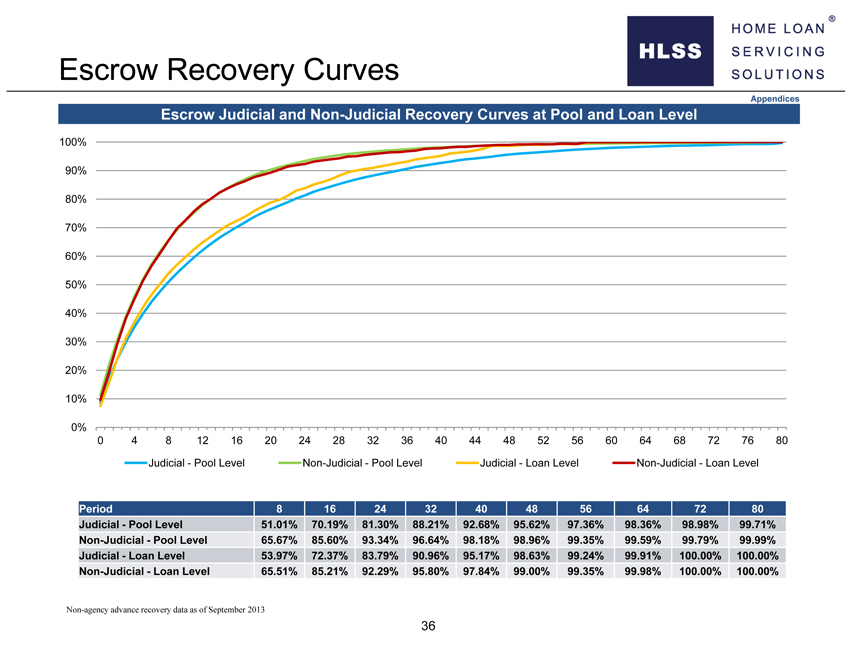

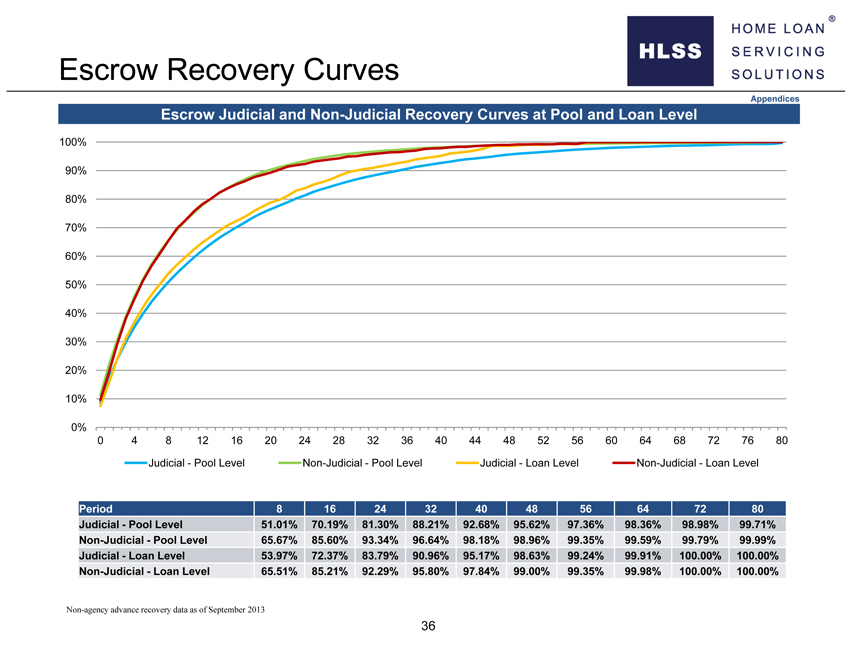

Escrow Recovery Curves Appendices Escrow Judicial and Non-Judicial Recovery Curves at Pool and Loan Level 100% 90% 80% 70% 60% 50% 40% 30% 20% 10%0% 0 4 8 12 16 20 24 28 32 36 40 44 48 52 56 60 64 68 72 76 80 Judicial—Pool Level Non-Judicial—Pool Level Judicial—Loan Level Non-Judicial—Loan Level Period 8 1624324048 56 64 72 80 Judicial—Pool Level 51.01% 70.19% 81.30% 88.21% 92.68% 95.62% 97.36% 98.36% 98.98% 99.71% Non-Judicial—Pool Level 65.67% 85.60% 93.34% 96.64% 98.18% 98.96% 99.35% 99.59% 99.79% 99.99% Judicial—Loan Level 53.97% 72.37% 83.79% 90.96% 95.17% 98.63% 99.24% 99.91% 100.00% 100.00% Non-Judicial—Loan Level 65.51% 85.21% 92.29% 95.80% 97.84% 99.00% 99.35% 99.98% 100.00% 100.00% Non-agency advance recovery data as of September 2013 36

HLSS Servicer Advance Receivables Trust