Exhibit 99.1

October 18, 2024

This presentation contains forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 , which involve risks and uncertainties. All statements contained in this presentation other than statements of historical facts, including, without limitation, state men ts regarding our future financial and business performance, our business and strategy, expected growth, planned investments and capital expenditure, capacity expansion plans, anticipated fu tur e financing transactions and expected financial results, are forward - looking statements. The words “anticipate,” “believe,” “continue,” “estimate,” “expect,” “guide,” “intend,” “likely,” “m ay,” “will” and similar expressions and their negatives are intended to identify forward - looking statements. These forward - looking statements are subject to risks, uncertainties and assumptions, some of which are beyond our control. Actu al results may differ materially from the results predicted or implied by such statements, and our reported results should not be considered as an indication of future performance. The pot ent ial risks and uncertainties that could cause actual results to differ from the results predicted or implied by such statements include, among others: competitive pressures, technological d eve lopments, our ability to secure and retain clients, and our need to expend capital to accommodate the growth of the business, as well as those risks and uncertainties related to our continui ng businesses included under the captions “Risk Factors” and “Operating and Financial Review and Prospects” in our Annual Report on Form 20 - F for the year ended December 31, 2023, filed wit h the Securities and Exchange Commission (“SEC”) on April 26, 2024, and “Risk Factors” in the Shareholder Circular filed as Exhibit 99.1 to our Current Report on Form 6 - K dated Feb ruary 8, 2024, which are available on our investor relations website at https://group.nebius.com/sec - filings and on the SEC website at https://www.sec.gov/ . All information and numbers in this presentation is as of October 18, 2024 (unless stated otherwise). The forward - looking statem ents made in this presentation relate only to events or information as of the date on which the statements are made in this presentation. Except as required by law, we undertake no obl igation to update or revise publicly any forward - looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are ma de or to reflect the occurrence of unanticipated events. In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. Th ese statements are based upon information available to us as of the date of this presentation, and while we believe such information forms a reasonable basis for such statements, such informati on may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant infor mat ion. These statements are inherently uncertain, and investors are cautioned not to unduly rely upon these statements. Forward - looking statements Disclaimer

Table of contents 4 Introducing Nebius Group 1 3 Nebius : our core AI infrastructure business 1 4 Business overview 2 6 Competitive advantages 2 9 Clients 3 5 Growth plans 3 8 Financials 42 Toloka 5 7 TripleTen 7 1 Avride 8 6 Nebius Group Financials and Outlook 9 0 Appendices

Introducing Nebius Group Nebius Group

Technology for Technologists Strongly positioned to build one of the largest specialist AI infrastructure players

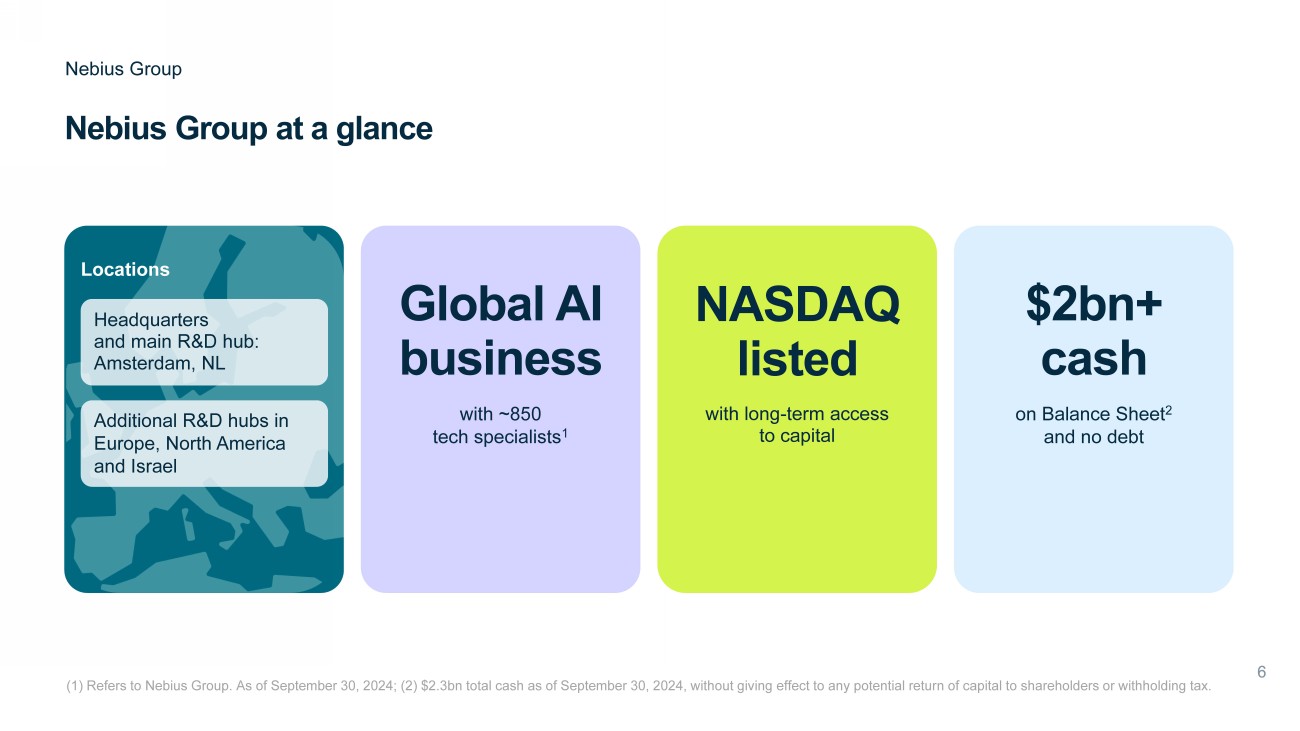

Nebius Group at a glance Nebius Group (1) Refers to Nebius Group. As of September 30, 2024; (2) $2.3bn total cash as of September 30, 2024, without giving effect to any potential retur n of capital to shareholders or withholding tax. $2bn+ cash on Balance Sheet 2 and no debt NASDAQ listed with long - term access to capital Global AI business with ~850 tech specialists 1 Locations Headquarters and main R&D hub: Amsterdam, NL Additional R&D hubs in Europe, North America and Israel

Building a global AI business which integrates essential components for successful AI development: infrastructure, data, and expertise Nebius Group (1) Approximately 28% stake on a fully diluted basis, upon exercise of penny warrants to acquire Common Stock and Series A and B sto ck; latest publicly available valuation of ClickHouse was $2 billion following its Series B financing in October 2021; (2) Refers to Nebius Group. As of September 30, 2024. Our businesses and infrastructure Data partner for all stages of AI development from training to evaluation Leading edtech player, re - skilling people for successful careers in tech Autonomous driving technology for self - driving cars and delivery robots Approximately 28% 1 stake in ClickHouse , с reator of a popular open - source column - oriented DBMS Nebius : our core business AI - centric cloud platform built for intensive AI & ML workloads featuring both owned and collocation data center capacity, with ongoing expansion Our data and expertise ~850 Top - tier AI / ML / LLM, cloud engineers and other tech specialists 2 As our R&D backbone with a track record of developing world - class tech and AI infrastructure

Illustrative value building blocks for Nebius Group Nebius Group value building blocks State - of - the - art owned Finnish data center with ~ 14 ,000 GPUs paid and deployed 1 Building specialized AI cloud Full stack & efficient infrastructure platform 2025 ARR $500 - 1,000m 2 Our core business: Nebius (1) The number of deployed GPUs is expected to exceed 20 thousand by the year end; (2) Depending on the amount of capital available to cover the company’s investment program; (3) $2.3bn total cash as of September 30, 2024, without giving effect to any potential return of capital to shareholders or withholding tax ; (4) Approximately 28% stake on a fully diluted basis, upon exercise of penny warrants to acquire Common Stock and Series A and B stock; latest publicly available valuation of ClickHouse was $2 billion following its Series B financing in October 2021. Cash and access to financing Other group businesses Minority stakes Additional building blocks $2bn+ in cash on balance sheet 3 Access to capital markets TripleTen Toloka Avride Approximately 28% s take in ClickHouse 4

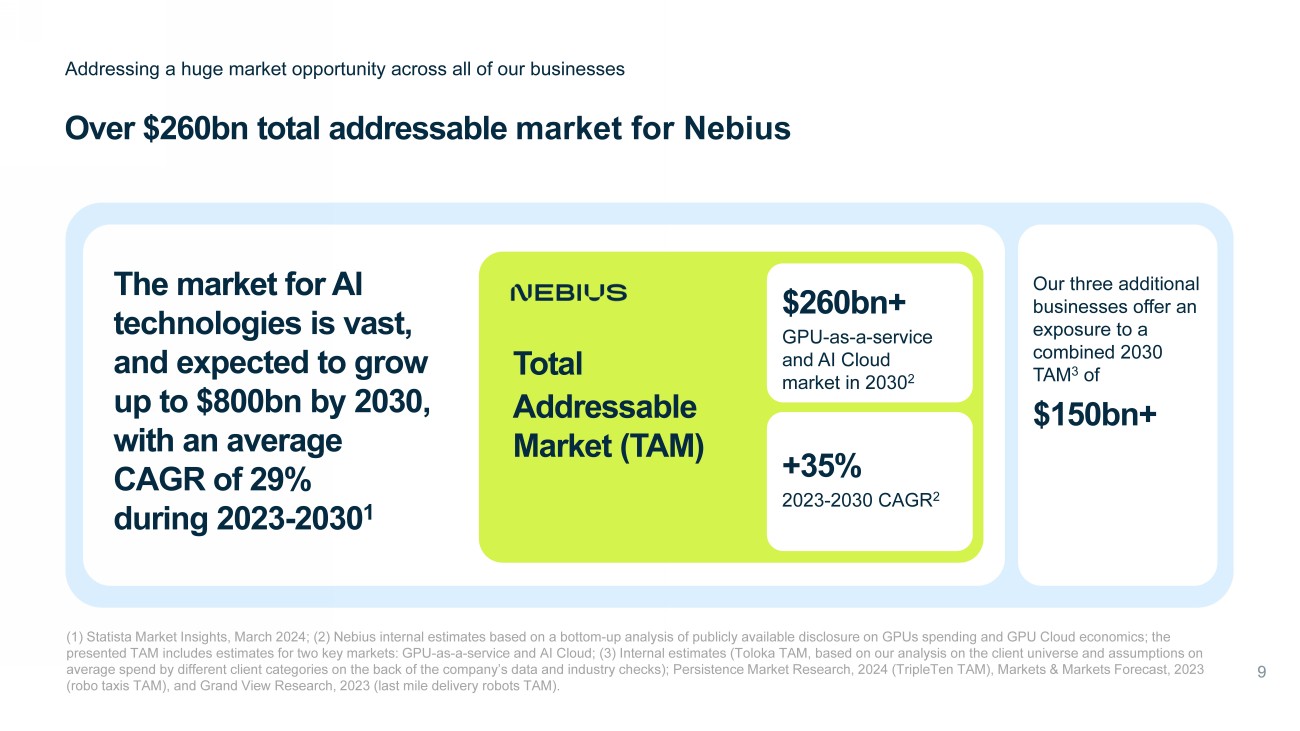

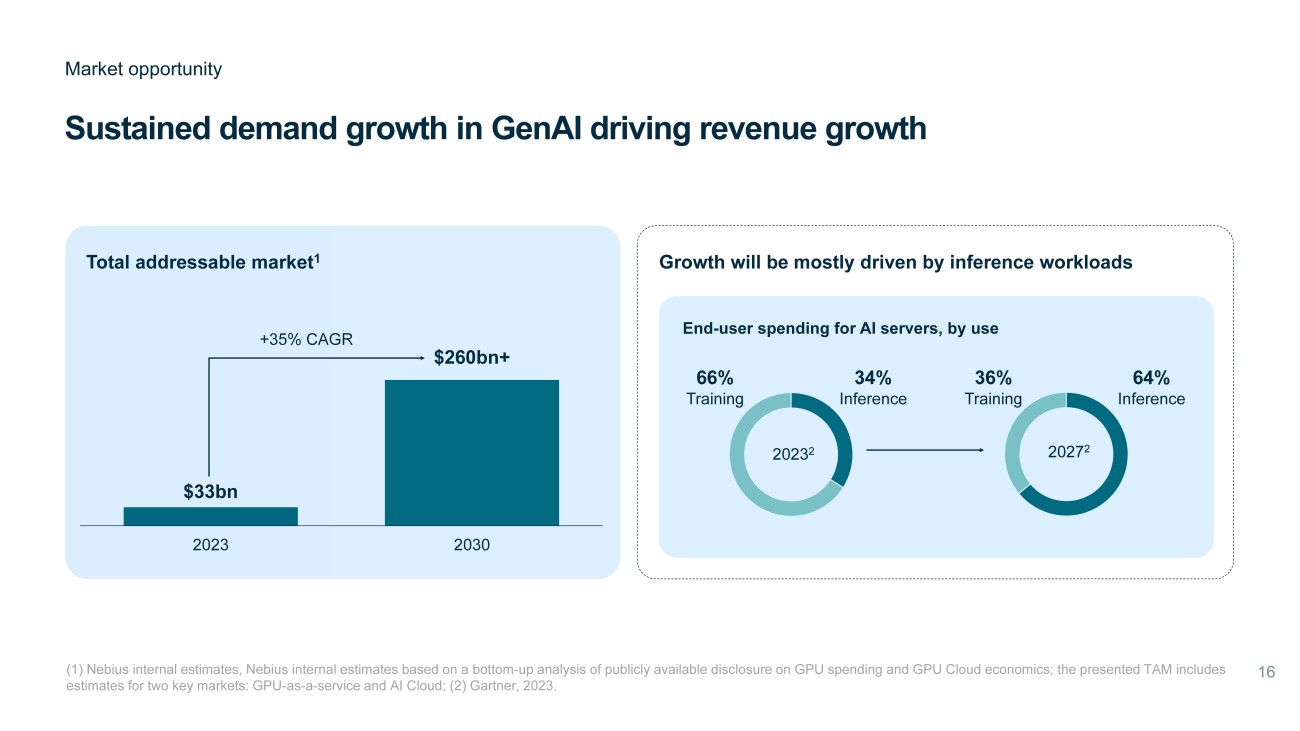

Over $ 26 0 bn total addressable market for Nebius Addressing a huge market opportunity across all of our businesses (1) Statista Market Insights, March 2024 ; (2) Nebius internal estimates based on a bottom - up analysis of publicly available disclosure on GPUs spending and GPU Cloud economics ; the presented TAM includes estimates for two key markets: GPU - as - a - service and AI Cloud; (3) Internal estimates (Toloka TAM, based on our analysis on the client universe and assumptions on average spend by different client categories on the back of the company’s data and industry checks); Persistence Market Research, 2024 (TripleTen TAM), Markets & Markets Forecast, 2023 ( robo taxis TAM), and Grand View Research, 2023 (last mile delivery robots TAM). $260bn+ GPU - as - a - service and AI Cloud market in 2030 2 +35% 2023 - 2030 CAGR 2 Total Addressable Market ( TAM ) Our three additional businesses offer an exposure to a combined 2030 TAM 3 of $150bn+ The market for AI technologies is vast, and expected to grow up to $800bn by 2030 , with an average CAGR of 29% during 2023 - 2030 1

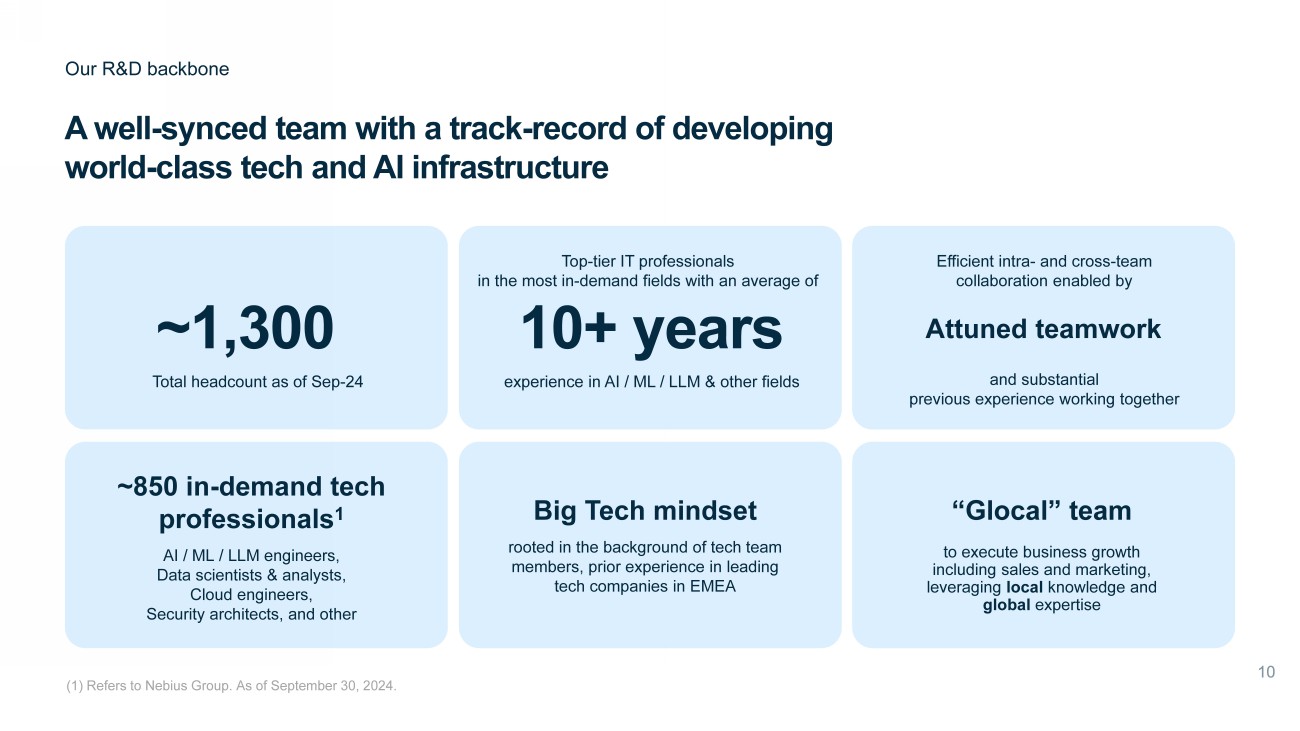

A well - synced team with a track - record of developing world - class tech and AI infrastructure Our R&D backbone ~850 in - demand tech professionals 1 AI / ML / LLM engineers, Data scientists & analysts , Cloud engineers, Security architects, and other ~ 1 , 3 00 Total headcount as of Sep - 24 Big Tech mindset rooted in the background of tech team members, prior experience in leading tech companies in EMEA experience in AI / ML / LLM & other fields Top - tier IT professionals in the most in - demand fields with an average of 10+ years Efficient intra - and cross - team collaboration enabled by Attuned teamwork “ Glocal ” team to execute business growth including sales and marketing, leveraging local knowledge and global expertise and substantial previous experience working together (1) Refers to Nebius Group. As of September 30, 2024.

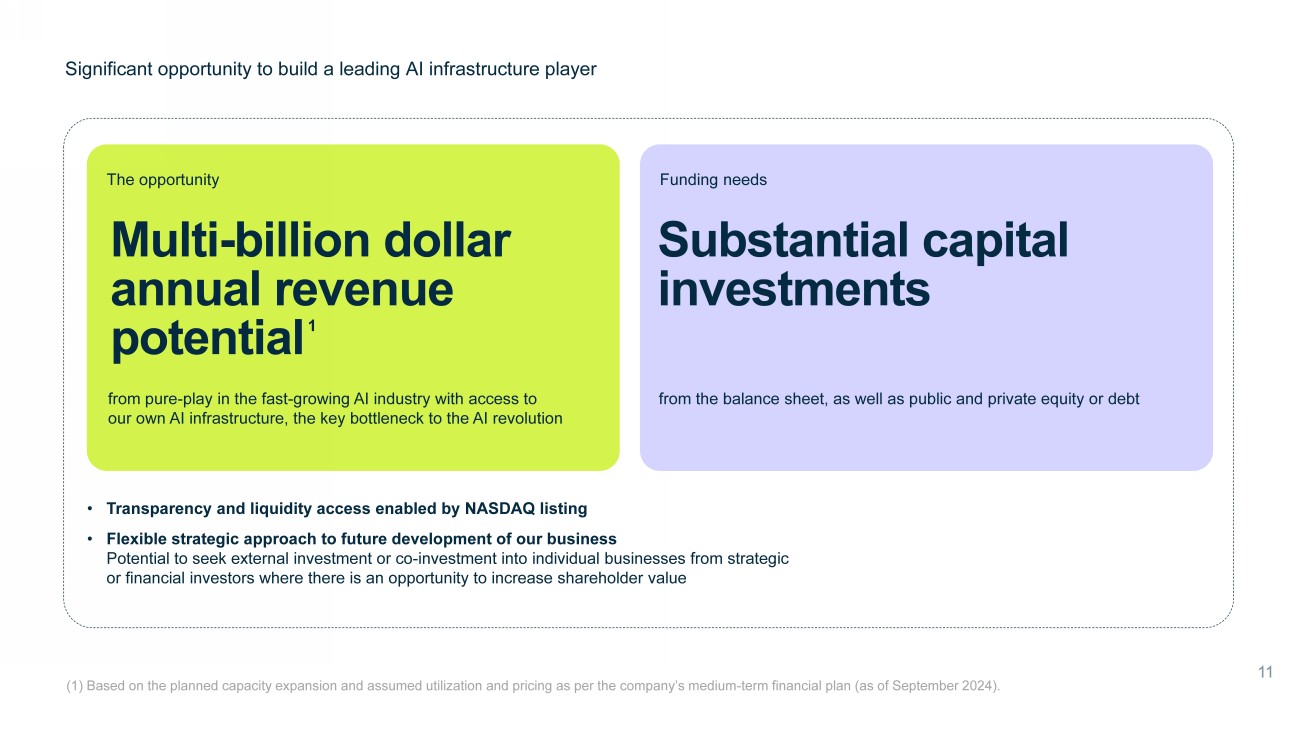

Significant opportunity to build a leading AI infrastructure player Funding needs Substantial capital investments from the balance sheet, as well as public and private equity or debt The opportunity Multi - billion dollar annual revenue potential from pure - play in the fast - growing AI industry with access to our own AI infrastructure, the key bottleneck to the AI revolution • Transparency and liquidity access enabled by NASDAQ listing • Flexible strategic approach to future development of our business Potential to seek external investment or co - investment into individual businesses from strategic or financial investors where there is an opportunity to increase shareholder value (1) Based on the planned capacity expansion and assumed utilization and pricing as per the company’s medium - term financial plan (as of September 2024). 1

Why do we think we can be successful? Expertise We have a strong team with extensive technical experience, having built 200MW+ of cutting - edge infrastructure and cloud business from the ground up Track record We built one of the largest tech companies 1 in Europe with a $30bn market cap and established a strong and trusted relationship with the capital markets Resources We have over $2bn in cash 2 , a big tech mindset, and the expertise to build the largest specialist AI infrastructure company, positioned to support the explosive growth of the AI industry (1) Yandex N.V. reached ~$30bn market cap in Q4 2021; (2) $2.3bn total cash as of September 30, 2024, without giving effect t o a ny potential return of capital to shareholders or withholding tax.

Nebius : our core AI infrastructure business Visit website

A leading AI - centric cloud platform built for intensive AI workloads Nebius

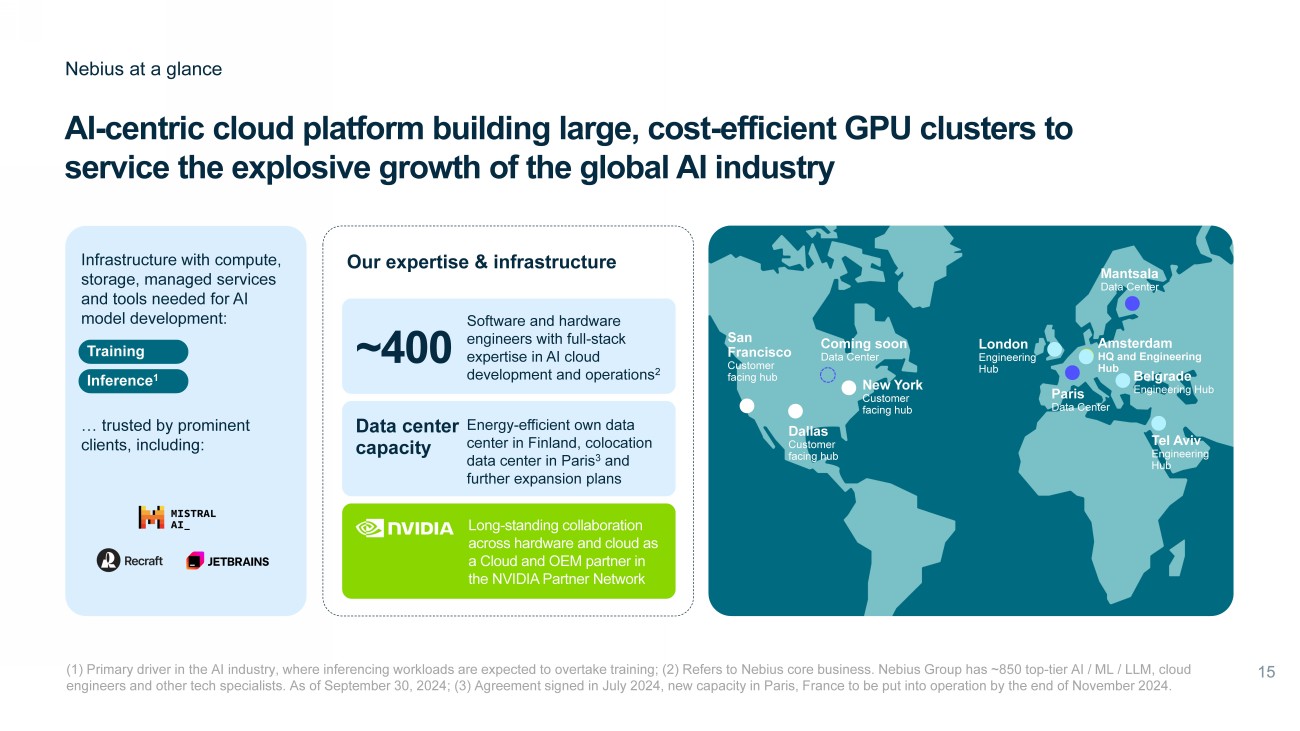

AI - centric cloud platform building large, cost - efficient GPU clusters to service the explosive growth of the global AI industry Nebius at a glance (1) Primary driver in the AI industry, where inferencing workloads are expected to overtake training; (2) Refers to Nebius core business. Nebius Group has ~850 top - tier AI / ML / LLM, cloud engineers and other tech specialists. As of September 30, 2024 ; (3) Agreement signed in July 2024, new capacity in Paris, France to be put into operation by the end of November 2024. Our expertise & infrastructure ~400 Software and hardware engineers with full - stack expertise in AI cloud development and operations 2 Data center capacity Energy - efficient own data center in Finland , colocation data center in Paris 3 and further expansion plans Infrastructure with compute, storage, managed services and tools needed for AI model development: … trusted by prominent clients, including: Training Inference 1 Long - standing collaboration across hardware and cloud as a Cloud and OEM partner in the NVIDIA Partner Network Mantsala Data Center Paris Data Center London Engineering Hub Amsterdam HQ and Engineering Hub Belgrade Engineering Hub Tel Aviv Engineering Hub New York Customer facing hub Dallas Customer facing hub Coming soon Data Center San Francisco Customer facing hub

$33bn $260bn + 2023 2030 Sustained demand growth in GenAI driving revenue growth Market opportunity (1) Nebius internal estimates, Nebius internal estimates based on a bottom - up analysis of publicly available disclosure on GPU spending and GPU Cloud economics; the presented TAM includes estimates for two key markets: GPU - as - a - service and AI Cloud; (2) Gartner, 2023. Total addressable market 1 Growth will be mostly driven by inference workloads 2027 2 End - user spending for AI servers , by use +35% CAGR 2023 2 66% Training 34% Inference 36% Training 64% Inference

4. AI expertise Dogfooding by in - house LLM team helps to adjust hardware and platform to the real needs of ML/AI practitioners 3. Cloud platform A proprietary cloud platform is essential for creating large GPU clusters optimized for extensive AI training and inferencing without performance bottlenecks 2. Hardware In - house hardware R&D further improves business unit economics by providing resilient servers and reducing power consumption 5. Experienced team 500+ employees, including ~400 engineers 1 experienced in building cloud businesses from the ground up, with expertise spanning code development, data center operations and business development Our core pillars provide full - stack infrastructure for AI developers, allowing us to maintain control over the whole value creation chain Nebius business model: key pillars 1. Data centers Improves unit economics through increased energy efficiency and lower data center cost, while enabling scalability (1) Refers to Nebius core business. Nebius Group has ~850 top - tier AI / ML / LLM, cloud engineers and other tech specialists. As of September 30, 2024 .

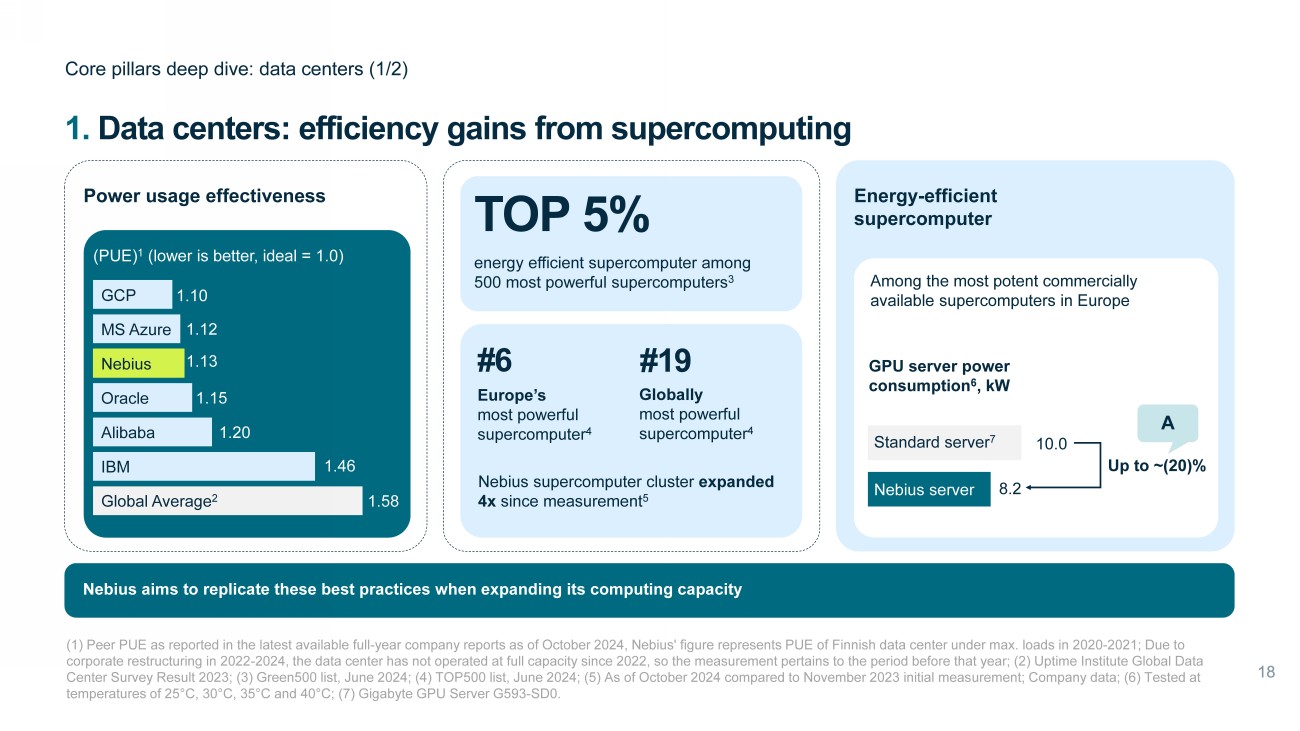

Power usage effectiveness 1. Data centers: efficiency gains from supercomputing Core pillars deep dive: data centers (1/2) (1) Peer PUE as reported in the latest available full - year company reports as of October 2024, Nebius' figure represents PUE of Finnish data center under max. loads in 2020 - 2021; Due to corporate restructuring in 2022 - 2024, the data center has not operated at full capacity since 2022, so the measurement pertains to the period before that year ; (2) Uptime Institute Global Data Center Survey Result 2023; (3) Green500 list, June 2024; (4) TOP500 list, June 2024; (5) As of October 2024 compared to November 2023 initial meas ure ment; Company data; (6) Tested at temperatures of 25 ° C, 30 ° C, 35 ° C and 40 ° C; (7) Gigabyte GPU Server G593 - SD0. Energy - efficient supercomputer Among the most potent commercially available supercomputers in Europe GPU server power consumption 6 , kW 10.0 8.2 Up to ~(20)% Standard server 7 Nebius server (PUE) 1 (lower is better, ideal = 1.0) 1.10 1.12 1.13 1.15 1.20 1.46 1.58 GCP MS Azure Nebius Alibaba Oracle IBM TOP 5% energy efficient supercomputer among 500 most powerful supercomputers 3 #6 Europe’s most powerful supercomputer 4 #19 Globally most powerful supercomputer 4 Nebius supercomputer cluster expanded 4x since measurement 5 Global Average 2 Nebius aims to replicate these best practices when expanding its computing capacity A

Optimized cooling 1. Data centers : pioneers in optimized cooling and heat recovery Core pillars deep dive: data centers (2/2) (1) Leveraging external ambient air to reduce air temperature in the data rooms; (2) As per ASHRAE standards for inlet air te mpe ratures; (3) Assuming that a household consists of three persons living in a standalone house; according to the data provided by a Finland - based energy producer, such a household may consume up to 8 MWh of electricity per year for heating ; (4) Based on the latest pre - pandemic measurement. Annual heat sales to the municipality in 2020 - 2023 remained at and above the pre - pandemic l evels; (5) Based on the 2019 (pre - pandemic) measurement. Figures are deemed representative for the following years, in line with the trends in heating sales and utility prices. Heat recovery • ~10 ° C higher than the upper limit typically set by off - the - shelf hardware • Eliminates the need of inlet air subcooling • Allows slower (less - energy intensive) airflows compared to similar DC designs ~40 ƒ C Operational t ƒ max Wholly owned Finland data center employs free cooling 1 instead of traditional chillers , eliminating the need for water and refrigerants, which enhances cost - effectiveness and environmental friendliness One of the first in the region to introduce heat recovery tech to warm local homes Nebius aims to replicate these best practices when expanding its data center capacity while typical data centers worldwide would aim not to exceed the limit of 27 ° C due to server architecture constraints 2 18 – 40 ƒ C Fully functional under 100% workload at as data center’s operating environment does not require subcooling Additional energy saved 80k+ MWh of server heat was reused for municipal heating in 2020 – 2023. This is equivalent to energy consumed by ~2,500 Finnish households 3 for heating their homes within the four - year period 50%+ of the annual heating needs of the town were historically 4 covered by the server heat from our data center Up to 12% of household annual heating costs (~30% of the data center electricity costs) were saved in recent years 5

2 . Hardware: why do we design, develop and produce our own servers? Core pillars deep dive: hardware (1/2) Lower total cost of ownership via power efficient cooling and full control over the supply chain Faster time - to - market with on demand development, quick prototyping and production, deployment and shipment In - house engineering for full stack validation and quick feature implementation Open - source infrastructure ensuring security, transparency & flexibility

System architects Electronic engineers Embedded developers Mechanical engineers Thermal engineers 2 . Hardware: in - house expertise in R&D … (1) Compares electricity consumption of Nebius ’ custom - designed servers to off - the - shelf alternatives, showing ~20% lower usage. This allows Nebius to deploy about 20% more s ervers per 1MW of data center power capacity. Core pillars deep dive: hardware (2/2) … and a team covering the whole development chain Key differentiating factors: More capacity within the same data center limits 1 20% Up to ~20% Lower electricity consumption decreasing power and data center costs 1 B allows for easy installation and replacement of broken components Tool - less design due to direct purchases of components and optimized design Lower cost of servers allows for easy installation and replacement of broken components Direct relationship with key suppliers B

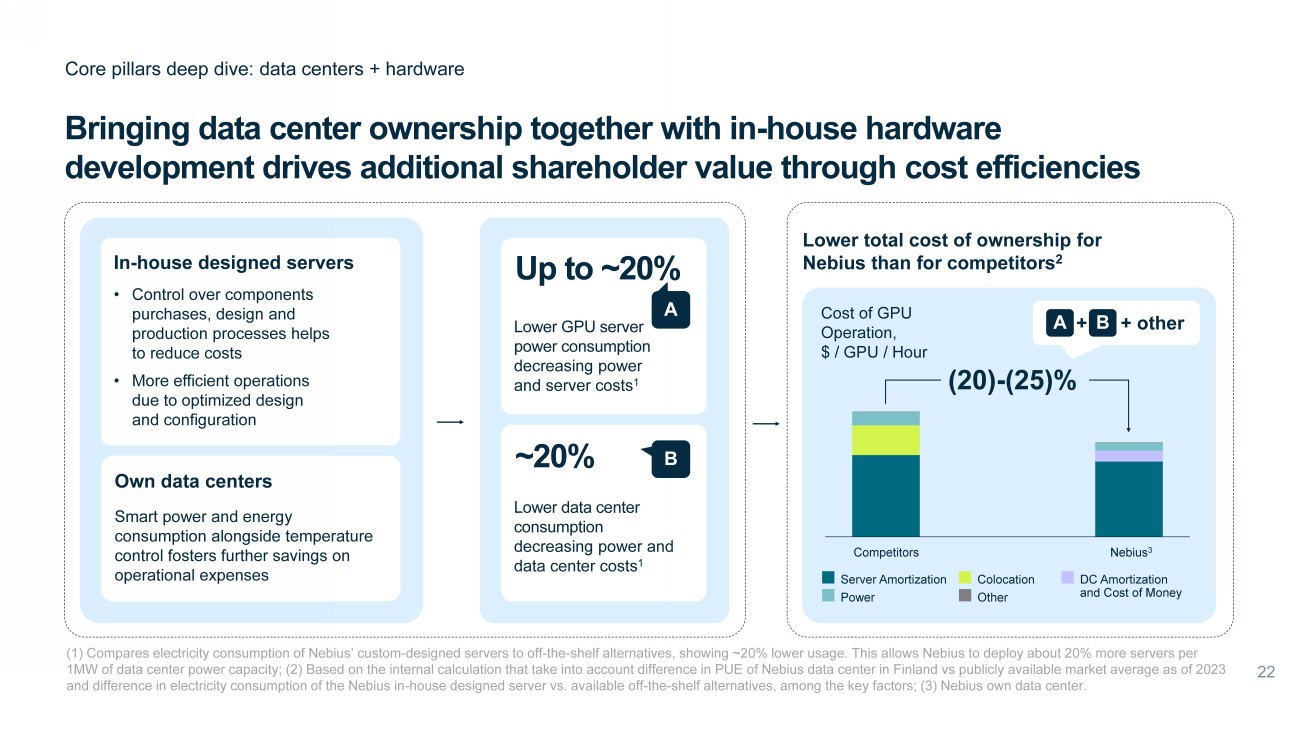

In - house designed servers • Control over components purchases, design and production processes helps to reduce costs • More efficient operations due to optimized design and configuration Bringing data center ownership together with in - house hardware development drives additional shareholder value through cost efficiencies Competitors Nebius 3 Server Amortization Colocation DC Amortization and Cost of Money Power Other Cost of GPU Operation, $ / GPU / Hour C ore pillars deep dive: data centers + hardware (1) Compares electricity consumption of Nebius ’ custom - designed servers to off - the - shelf alternatives, showing ~20% lower usage. This allows Nebius to deploy about 20% more s ervers per 1MW of data center power capacity ; (2) Based on the internal calculation that take into account difference in PUE of Nebius data center in Finland vs publicly available market average as of 2023 and difference in electricity consumption of the Nebius in - house designed server vs. available off - the - shelf alternatives, among the key factors; (3) Nebius own data center . Own data centers Smart power and energy consumption alongside temperature control fosters further savings on operational expenses Up to ~20% Lower GPU server power consumption decreasing power and server costs 1 A ~20% B Lower total cost of ownership for Nebius than for competitors 2 (20) - (25)% A B + + other Lower data center consumption decreasing power and data center costs 1

3. Nebius Platform: more than 'bare metal', more flexible and wider product portfolio than GPU Cloud (1) Open - source object - rationale database system; (2) Open - source platform for managing the end - to - end machine learning lifecycle; (3) O pen - source data tools for batch processing, querying, streaming and machine learning; (4) Kubernetes: portable, extensible, open - source platform for managing containerised workloads and services. Supported by the most popular MLOps solutions on top, available as managed services or through our Applications Ready for intensive ML workloads, our GPU cloud layer offers scalable clusters with robust networking, storage, and orchestration AI Platform and Applications (PaaS) Managed PostgreSQL 1 Managed MLflow 2 Managed Spark 3 Kubeflow vLLM JupyterHub Applications Applications Applications Ray Airflow Triton Inference Service AI Cloud (IaaS) Managed K8s 4 GPU clusters Slurm - based clusters : system for managing and scheduling Linux clusters Network (VPC) Virtual platform cloud: isolated private cloud hosted within a public cloud Block storage Compute Shared file storage Object storage Applications Applications Applications C ore pillars deep dive: software (1/2) Integrated monitoring Comprehensive documentation API enabled Friendly user interface

Nebius Studio is a new product from Nebius designed to help foundation model users and app builders simplify the process of creating applications using these models with our first release, Inference Service, providing endpoints for the most popular large lan gua ge models 3. Nebius Studio: API SaaS for opensource models Core pillars deep dive: software (2/2) (1) Measured by Nebius in August 2024 on a group of selected competitors. (2) Company data; (3) The company’s price on input toke ns is 3x lower than the company’s price on output tokens. Real - time inference Benchmark - backed performance and cost efficiency Up to 4 .5x faster time to first token in Europe than competitors 1 $2.5 per million tokens for Meta - Llama - 405B 2 Key benefits 3 x saving on input tokens 3 Ability to choose speed or economy Achievement of ultra - low latency No MLOps experience required Verified model quality Access to expert support Services Batch inference Coming soon Fine - tuning Coming soon Evaluation Coming soon RAG Coming soon

4 – 5. The most in - demand engineers are already on board Core pillars deep dive: people and expertise (1) Refers to Nebius core business. As of September 30, 2024. Software Development LLM team Hardware R&D Data center operations Product development Sales and marketing Other Team of 500+ professionals to focus on software, hardware and data center with the back - up of support departments 1 A team of software and hardware engineers with full - stack expertise in AI cloud development and operations, covering everything from server design to running cutting - edge large language models (LLMs) Key strengths In - house LLM team facilitate adjusting Nebius hardware and platform to the real needs of ML/AI practitioners The right number of people with the necessary expertise in place to support scaling and future growth

Nebius competitive advantages Nebius

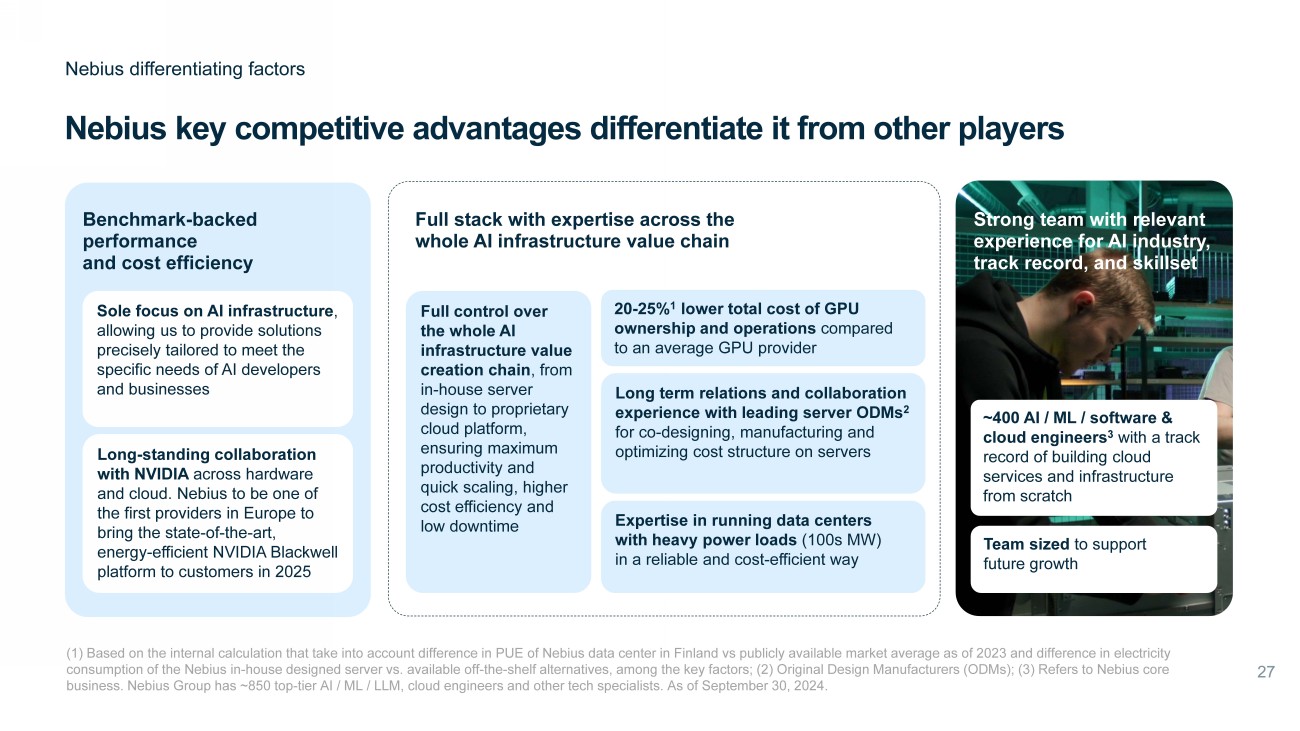

Nebius key competitive advantages differentiate it from other players Nebius differentiating factors Sole focus on AI infrastructure , allowing us to provide solutions precisely tailored to meet the specific needs of AI developers and businesses Benchmark - backed performance and cost efficiency Long - standing collaboration with NVIDIA across hardware and cloud. Nebius to be one of the first providers in Europe to bring the state - of - the - art, energy - efficient NVIDIA Blackwell platform to customers in 2025 (1) Based on the internal calculation that take into account difference in PUE of Nebius data center in Finland vs publicly available market average as of 2023 and difference in electricity consumption of the Nebius in - house designed server vs. available off - the - shelf alternatives, among the key factors; (2) Original Design Manufacturers (ODMs); (3) Refers to Nebius core business. Nebius Group has ~850 top - tier AI / ML / LLM, cloud engineers and other tech specialists. As of September 30, 2024 . Full stack with expertise across the whole AI infrastructure value chain Strong team with relevant experience for AI industry, track record, and skillset Full control over the whole AI infrastructure value creation chain , from in - house server design to proprietary cloud platform, ensuring maximum productivity and quick scaling, higher cost efficiency and low downtime 20 - 25% 1 lower total cost of GPU ownership and operations compared to an average GPU provider ~400 AI / ML / software & cloud engineers 3 with a track record of building cloud services and infrastructure from scratch T eam sized to support future growth Long term relations and collaboration experience with leading server ODMs 2 for co - designing, manufacturing and optimizing cost structure on servers Expertise in running data centers with heavy power loads (100s MW) in a reliable and cost - efficient way

Nebius proposition is differentiated vs. other players, allowing us to serve the broadest set of customer demands The Nebius proposition Our customer proposition that differentiates Nebius ... (1) Original Design Manufacturers (ODMs); (2) Part of DigitalOcean . Solutions tailored to meet the needs of AI developers and businesses Full control over the AI infrastructure value chain Leading team of AI / ML & cloud engineers GPU ownership and operations cost advantage Longstanding partnerships with NVIDIA & collaboration with leading server ODMs 1 Experienced team of cloud solution architects to onboard and support clients Expertise in running data centers with heavy power loads in a reliable and cost - efficient way … with key advantages over each group of competitors Nebius is more than just bare metal: provides additional resources and services for AI workloads Bare metal Nebius offers more flexibility than GPU clouds in regard to GPU consumption and has a broader service offering fuelled by a larger development team GPU Clouds Nebius provides tailored approach for AI developers and businesses (including small and medium size customers) Hyperscalers

Our clients Nebius

Nebius is able to serve a large list of clients including model builders and Generative AI app builders Clients snapshot How we reach them? Client category Primary product Segments 2. Non AI - centric SaaS IaaS + PaaS Research and experiments in progress Community hackathons and events / Digital & SEO / PR 1. Inference engine IaaS Blue w h ales 20 - 30 companies $100 m + annual cheque W h ales 300+ companies $20 - 50 m annual cheque SMBs 5k+ companies $5 - 10 m annual cheque Account based marketing Product - led growth (self - service) 3. Generative AI a pp builders Model builders / tuners

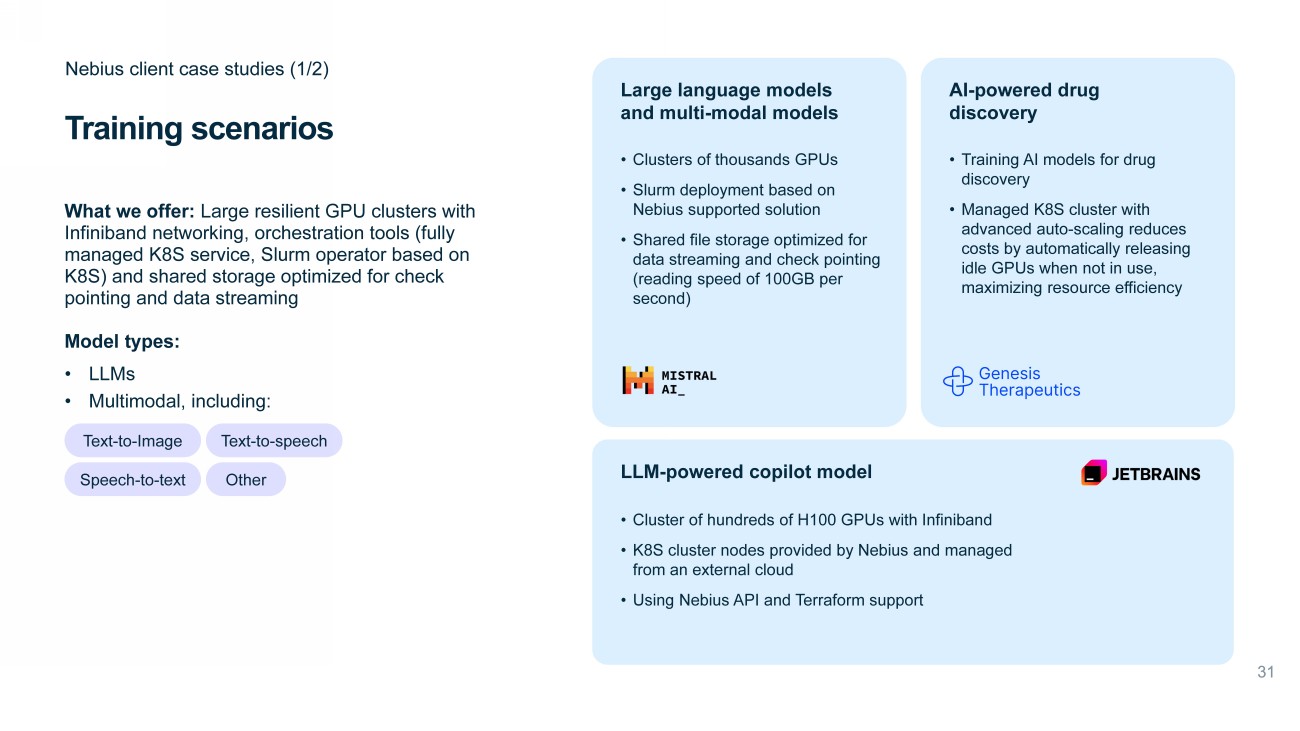

Training scenarios Nebius client case studies (1/2) What we offer: Large resilient GPU clusters with Infiniband networking, orchestration tools (fully managed K8S service, Slurm operator based on K8S) and shared storage optimized for check pointing and data streaming Model types: • LLMs • Multimodal, including: Large language models and multi - modal models • Clusters of thousands GPUs • Slurm deployment based on N ebius supported solution • Shared file storage optimized for data streaming and check pointing (reading speed of 100GB per second) AI - powered drug discovery • Training AI models for drug discovery • Managed K8S cluster with advanced auto - scaling reduces costs by automatically releasing idle GPUs when not in use, maximizing resource efficiency LLM - powered copilot model • Cluster of hundreds of H100 GPUs with Infiniband • K8S cluster nodes provided by Nebius and managed from an external cloud • Using Nebius API and Terraform support Text - to - Image Text - to - speech Speech - to - text Other

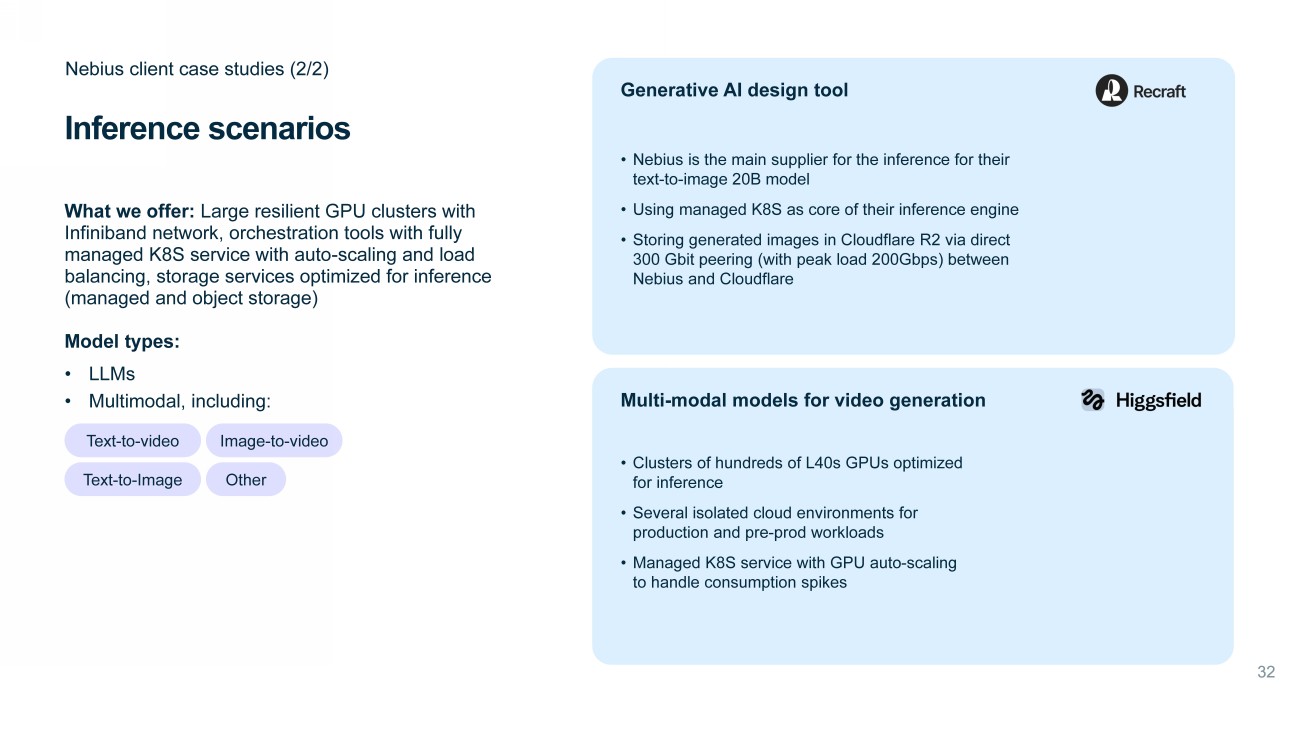

Nebius client case studies (2/2) Inference scenarios What we offer: Large resilient GPU clusters with Infiniband network, orchestration tools with fully managed K8S service with auto - scaling and load balancing, storage services optimized for inference (managed and object storage) Model types: • LLMs • Multimodal, including: Generative AI design tool • Nebius is th e main supplier for the inference for their text - to - image 20B model • Using managed K8S as core of their inference engine • Storing generated images in Cloudflare R2 via direct 300 Gbit peering (with peak load 200Gbps) between Nebius and Cloudflare Multi - modal models for video generation • Clusters of hundreds of L40s GPUs optimized for inference • Several isolated cloud environments for production and pre - prod workloads • Managed K8S service with GPU auto - scaling to handle consumption spikes Text - to - video Image - to - video Text - to - Image Other

What our customers say: testimonials and recognition Customer reviews “ Nebius is one of the best cloud platforms , providing excellent customer support and flexible offerings . Most other cloud providers don't provide a flexible offering of H100, which becomes a hurdle for early - stage startups. For Higgsfield , we faced the same issue, and we are grateful for Nebius for their on - demand H100 offering <…>. The consumer - targeted model was built with Nebius , and now hundreds of thousands of users are generating personalized videos in Diffuse app, which is pioneering AI - powered social media content creation on mobile.” “In Recraft we are serving image generation models to more than 1 million users. We have our own model trained from scratch and run training and data processing all the time. Recraft has been using Nebius for those purposes for about a year. Nebius stands out when compared to other clouds , especially if you're looking for flexibility and quick support. With Nebius , you get your own managed Kubernetes cluster, which means you have full admin control to deploy whatever you need without restrictions. Plus, their support is top - notch — super fast, and you get to talk directly with cloud architects, which is a huge plus. On the scalability front, they always have GPUs available , so no frustrating delays waiting for quotas. The storage speed on Nebius is also higher in comparison to some other clouds. Overall, Nebius offers more control, better support, and reliable scalability compared to some other clouds. Apart from that, we are the first company to test experimental setups in Nebius . Most problems in those have been fixed in days. This shows the pace of development of new features and infra improvements in the company.” “ Nebius compute and network infrastructure proved to be in the top tiers of what we tried in terms of stability and allowed us to train our models efficiently.” “We are grateful to be working with Nebius for our GPU infrastructure needs. Nebius ' team is responsive, they clearly communicate capacity / availability, and technical set up has been straightforward. We consider them a strategic partner who can accelerate our state - of - the - art AI research at Genesis Therapeutics.”

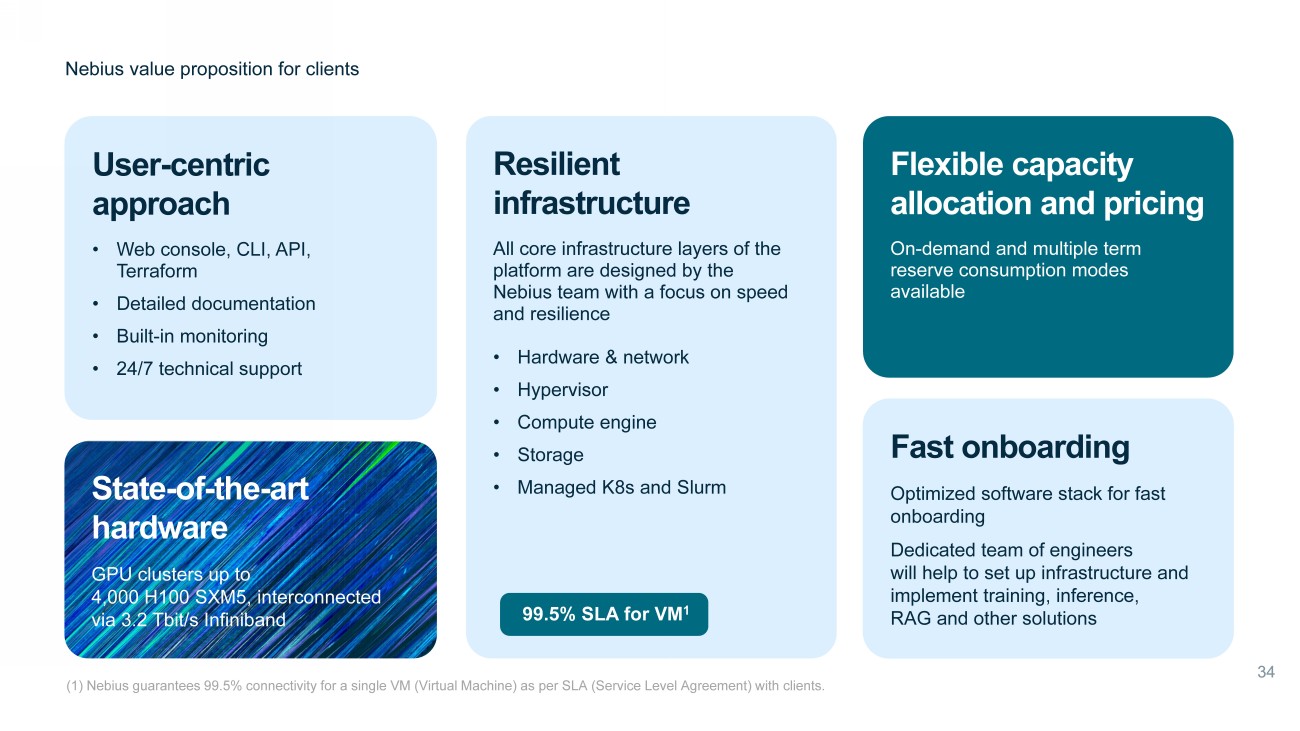

State - of - the - art hardware GPU clusters up to 4,000 H100 SXM5, interconnected via 3.2 Tb it/ s Infiniband Flexible capacity allocation and pricing On - demand and multiple term reserve consumption modes available User - centric approach • Web console, CLI, API, Terraform • Detailed documentation • Built - in monitoring • 24/7 technical support Fast onboarding Optimized software stack for fast onboarding Dedicated team of engineers will help to set up infrastructure and implement training, inference, RAG and other solutions Resilient infrastructure All core infrastructure layers of the platform are designed by the Nebius team with a focus on speed and resilience • Hardware & network • Hypervisor • Compute engine • Storage • Managed K8s and Slurm 99.5% SLA for VM 1 Nebius value proposition for clients (1) Nebius guarantees 99.5% connectivity for a single VM (Virtual Machine) as per SLA (Service Level Agreement) with clients.

Growth plans Nebius

Nebius has ambitious medium - term plans on capacity expansion of both data center and GPU capacity Capturing increasing market demand (1) In Nvidia H100 equivalent; (2) Finnish data center expansion Phase I commenced in Q2’24; (3) To be put into operation by the end of November 2024; (4) Depending on the amount of capital available to cover the company’s investment program during the respective periods. Scaling is backed by robust infrastructure Expansion of GPU capacity • Finnish data center expansion : expected to triple power capacity to 75MW by the end of 2025 or early 2026 2 • Co - location data centers : signed first agreement in July 2024 with a facility in Paris, France 3 . More locations to be added (including in US) • Greenfield data centers MW (adjusted for PUE) Additional tens of thousands of GPUs capacity to be added in the next 12 months GPU capacity 1 , thousand 2024 2025 4 Medium term 4 240+ ~60 ~100 ~ 3 0 2024 2025 4 Medium term 4 240+ 60+ ~35 ~20

External This is just the beginning: huge potential for growth across multiple levers … Roadmap of future growth (1) Nebius internal estimates based on a bottom - up analysis of publicly available disclosure on GPUs spending and GPU Cloud economic; the presented TAM includes estimates for two key markets: GPU - as - a - service and AI Cloud. Internal … enabled through significant data center and GPU capacity expansion • Secure long - term contracts with existing customers, acquire additional GenAI labs and expand into new customer segments • Continue supporting existing customers and providing additional volume as they evolve, starting small and continuously scaling ; complemented by a unique team of cloud solution architects to onboard and support new clients Client base Continue expanding product range offered to customers leveraging the existing expertise, data and infrastructure (i.e., Launching AI Studio: API SaaS for open - source models with per token pricing) Value - add services Leverage GPUaaS and AI Cloud markets growth – expected to be 8x over the next 7 years Nebius to continue expanding market share in a growing market Total addressable market 1 Tremendous market growth +35% CAGR $33bn $260bn + 2023 2030

Financials Nebius

Historical and current trading Nebius historical financials (1) Annualized run - rate revenue by the end of the period (revenue for last month of the period multiplied by twelve); ARR for 3Q’24 is based on preliminary r eve nue for September 2024 as per management accounts. ARR 1 $m 21 4Q’23 32 1Q’24 45 2Q’24 12 1 3Q’24 1 7 0 - 190 4Q’24F 100% ~8 - 9x YoY growth Key drivers Expansion of our client base from 10 clients at the end of 2023 to 40+ managed clients as of now and we expect further growth by the year - end Driven by capacity expansion from ~2k in 4Q’23 to 20k+ GPUs expected by the end of 2024 Growing consumption by existing clients

Nebius expects the revenue to increase at least 5x and become Adj EBITDA positive in 2025 Nebius financial outlook (1) Annualized run - rate revenue by the end of the period (December revenue multiplied by twelve); ARR for 3Q’24 is based on prel iminary revenue for September 2024 as per management accounts; (2) Adjusted EBITDA/(loss) for business segments is segment revenue minus all cash operating expenses, including ce rta in cash Stock Based Compensation (SBC) costs before one - off restructuring and other expenses; (3) Preliminary Q3 2024 financial results based on the management accounts. 2024 Q3’2024 3 С urrent trading and 2024 guidance $170 – 190m $ 1 2 1m ARR 1 $ 70 – 80 m $ 2 7m Revenue ($60 – 7 0m) ( $ 7 m ) Adj. EBITDA 2 Cash Opex of $15 - 17m / month expected to be fully covered by revenue by the end of 2024 or early 2025 $0.9 – 1.0b n $ 164 m Capex 2025 Outlook Depending on the amount of capital available in 2025 to cover the company’s investment program we intend to : • spend between $600m and $1.5bn on CAPEX (most of it will be invested in NVIDIA GB200 GPUs, as well as expansion of our DC capacity) • g enerate $500 - 1,000m ARR by the end of 2025 and corresponding $400 - 600mn revenue for the full year based on assumed capacity expansion • become Adj EBITDA positive for the full year 2025

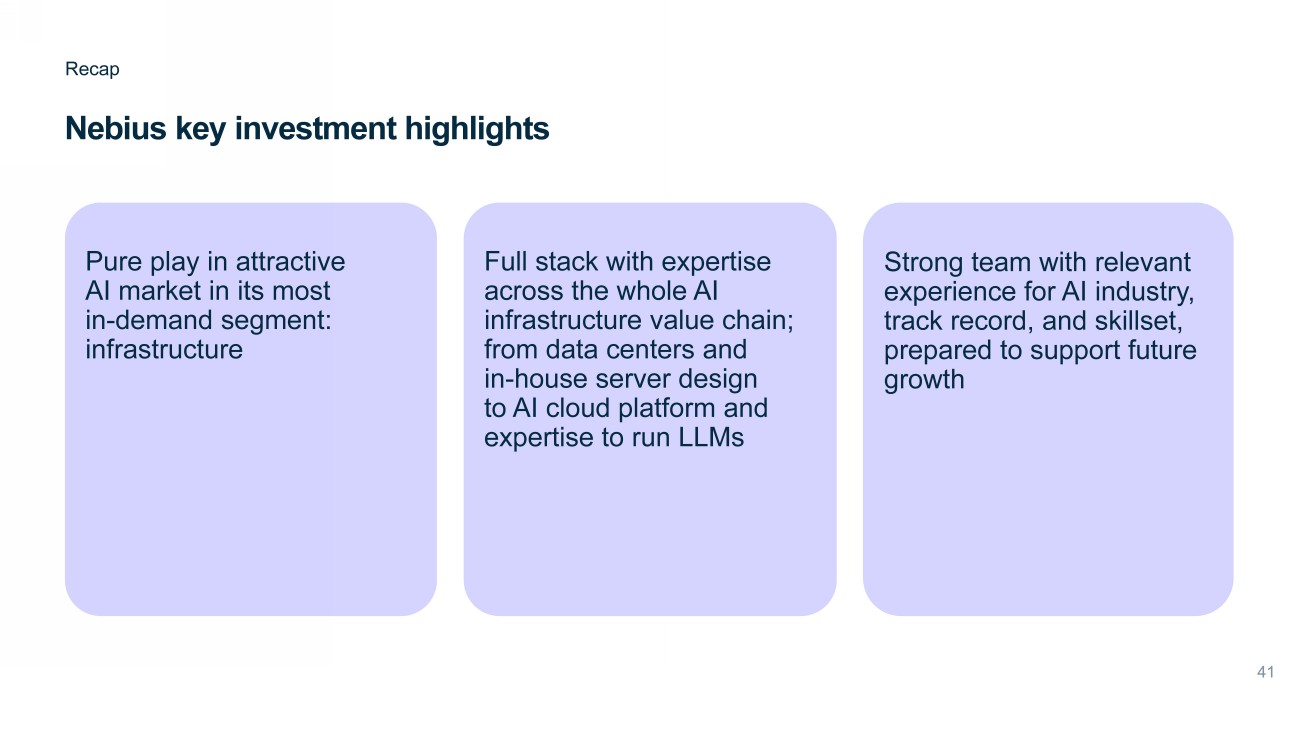

Nebius key investment highlights Recap Pure play in attractive AI market i n its most in - demand segment: infrastructure Full stack with expertise across the whole AI infrastructure value chain; from data centers and in - house server design to AI cloud platform and expertise to run LLMs Strong team with relevant experience for AI industry, track record, and skillset, prepared to support future growth

Toloka Visit website

A data partner for all stages of AI development from training to evaluation Toloka

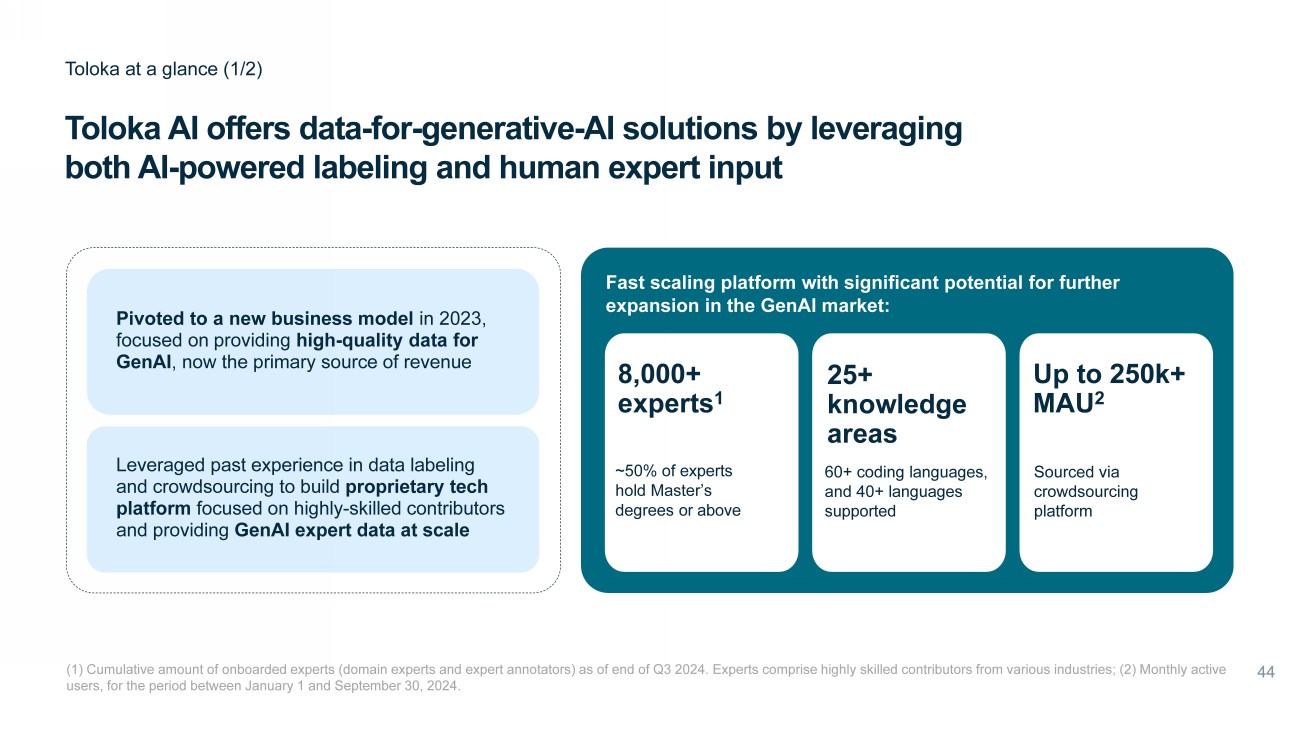

(1 ) Cumulative amount of onboarded experts (domain experts and expert annotators) as of end of Q3 2024. Experts comprise highly skilled contributors from various industries ; (2 ) Monthly active users, for the period between January 1 and September 30, 2024 . Fast scaling platform with significant potential for further expansion in the GenAI market : 8 ,000+ experts 1 ~ 50% of experts hold Master’s degrees or above 6 0+ coding languages, and 40+ languages supported 25+ knowledge areas Sourced via crowdsourcing platform Up to 250 k+ MAU 2 Toloka AI offers data - for - generative - AI solutions by leveraging both AI - powered labeling and human expert input Toloka at a glance (1/2) Pivoted to a new business model in 2023, focused on providing high - quality data for GenAI , now the primary source of revenue Leveraged past experience in data labeling and crowdsourcing to build proprietary tech platform focused on highly - skilled contributors and providing GenAI expert data at scale

(1) Supervised Fine - Tuning; (2) Reinforcement Learning from Human Feedback; (3) Direct Preference Optimisation. Toloka powers AI production with human intelligence Toloka at a glance (2/2) Data stage s RLHF 2 , DPO 3 , Preference collection SFT 1 Prompts generation Completions (responses) generation Context collection (generation) Comparison, side - by side, ranking, fine - grained RLHF 2 Prompt generation Comparison, side - by side, ranking, fine - grained RLHF 2 Prompt generation Toloka main focus is on stages 2 → 4 of the LLM development, where large volumes of data are required on a recurring basis Initial dataset collection Cleaning initial dataset 2. Fine - tuning 3. Alignment 4. Evaluation 1. Pre - training Toloka services for GenAI

(1 ) Toloka’s internal estimates based on our analysis on the client universe and assumptions on average spend by different categories on t he back of the company’s data and industry checks. Growth of Gen AI raises the demand for large volumes of data The market opportunity Gen AI Data User Profiles Increased spend per company Increased # of companies Eval. R LH F S FT Spending for data Specialization Cluster ~ 20 in the world Spending 10s - 100s MM Top foundational models producers ~ 100 in the world Spending 1s - 10s MM Smaller - scale, specialised, national models producers ~ 100s in the world Spending 1s MM Hea vy f inetuners ~ 1 , 000s in the world Lower spend E nterprise e nd users of GenAI Expert data for generative AI market size 1 Growth of AI raises the demand for large volumes of accurate, diverse, legally compliant, human - annotated data providing a vast opportunity for TAM expansion ~$1 7 bn 202 4 2030 $2bn 40 % + CAGR 1 2 3 Companies tend to diversify sourcing from multiple providers 4

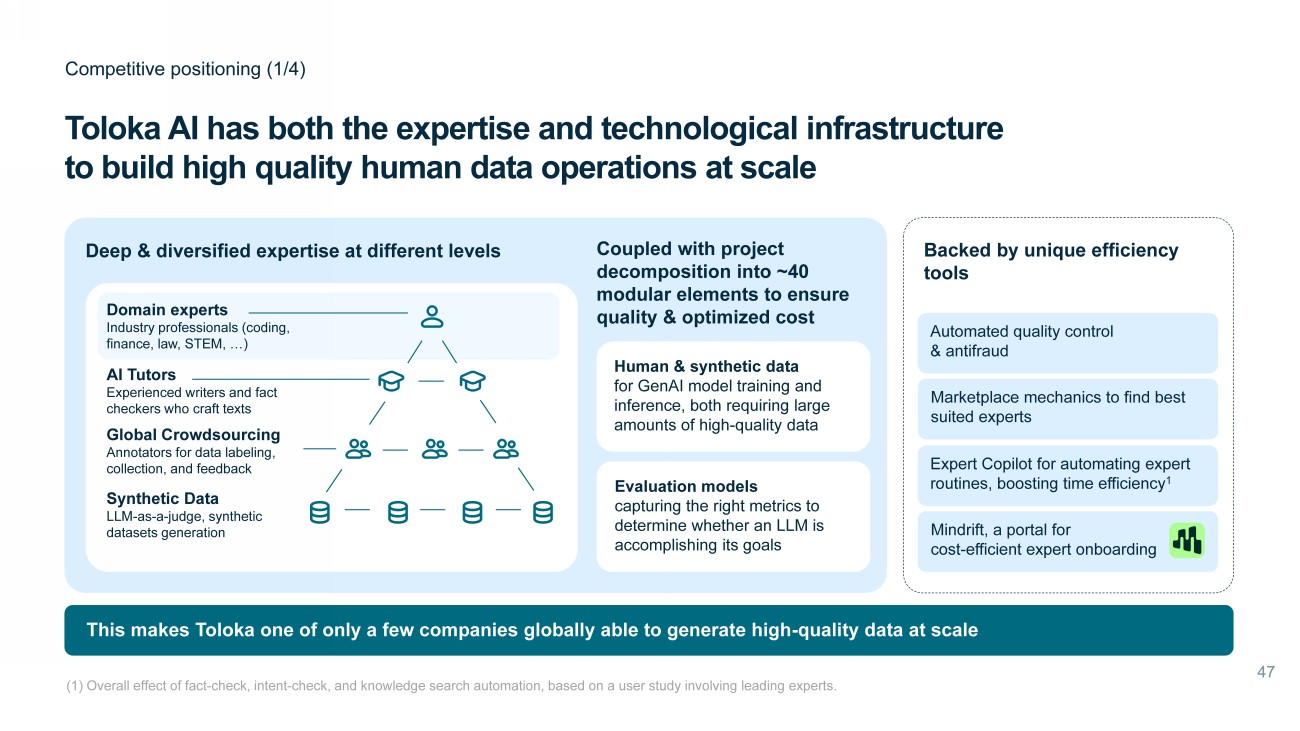

Toloka AI has both the expertise and technological infrastructure to build high quality human data operations at scale Competitive positioning (1/4) This makes Toloka one of only a few companies globally able to generate high - quality data at scale Deep & diversified expertise at different levels Domain experts Industry professionals (coding, finance, law, STEM, …) AI Tutors Experienced writers and fact checkers who craft texts Global Crowdsourcing Annotators for data labeling , collection, and feedback Coupled with project decomposition into ~40 modular elements to ensure quality & optimized cost Human & synthetic data for GenAI model training and inference, both requiring large amounts of high - quality data Evaluation models capturing the right metrics to determine whether an LLM is accomplishing its goals Synthetic Data LLM - as - a - judge, synthetic datasets generation Backed by unique efficiency tools Expert Copilot for automating expert routines, boosting time efficiency 1 Mindrift , a portal for cost - efficient expert onboarding Automated quality control & antifraud Marketplace mechanics to find best suited experts (1) Overall effect of fact - check, intent - check, and knowledge search automation, based on a user study involving leading experts .

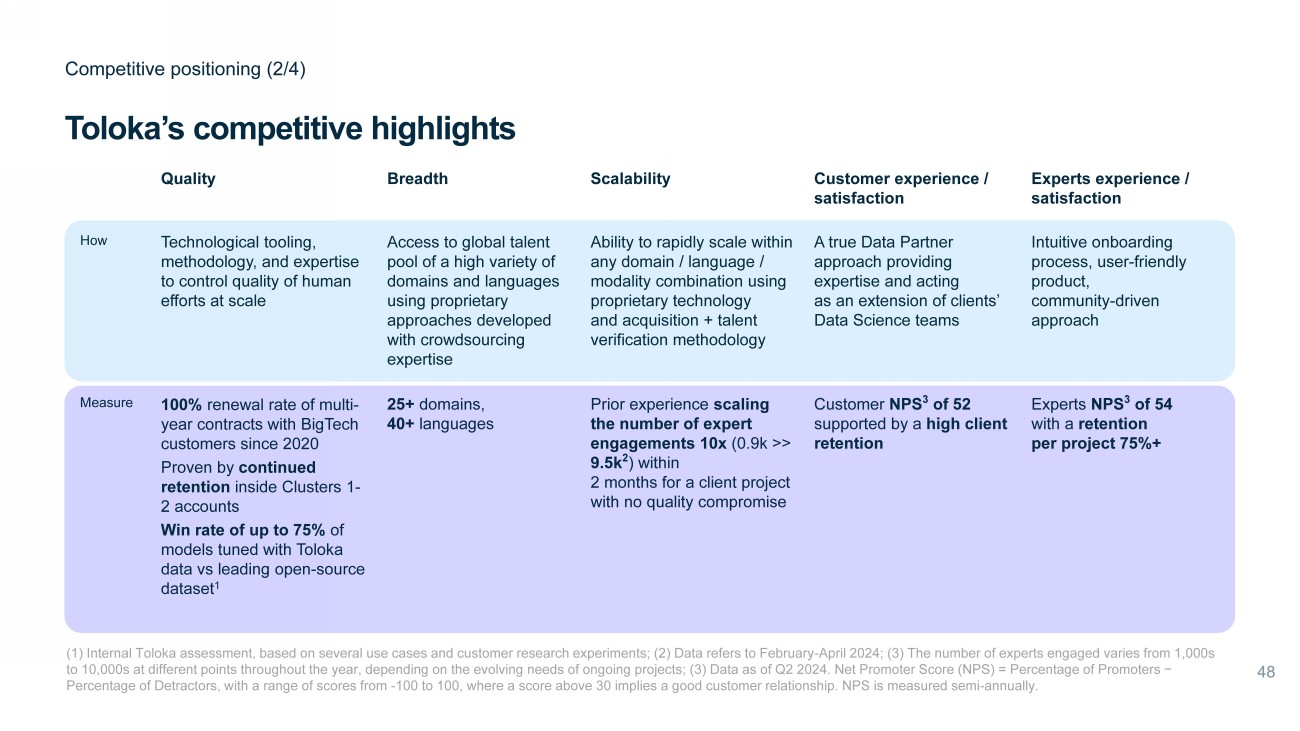

Experts experience / satisfaction Customer experience / satisfaction Scalability Breadth Quality Intuitive onboarding process, user - friendly product, community - driven approach A true Data Partner approach providing expertise and acting as an extension of clients’ Data Science teams Ability to rapidly scale within any domain / language / modality combination using proprietary technology and acquisition + talent verification methodology Access to global talent pool of a high variety of domains and languages using proprietary approaches developed with crowdsourcing expertise Technological tooling, methodology, and expertise to control quality of human efforts at scale How Experts NPS 3 of 54 with a retention per project 75%+ Customer NPS 3 of 52 supported by a high client retention Prior experience scaling the number of expert engagements 10x (0.9k >> 9.5k 2 ) within 2 months for a client project with no quality compromise 25+ domains, 40+ languages 100% renewal rate of multi - year contracts with BigTech customers since 2020 Proven by continued retention inside Clusters 1 - 2 accounts Win rate of up to 75% of models tuned with Toloka data vs leading open - source dataset 1 Measure Toloka’s competitive highlights Competitive positioning (2/4) (1) Internal Toloka assessment, based on several use cases and customer research experiments; (2) Data refers to February - April 2024; (3) T he number of experts engaged varies from 1,000s to 10,000s at different points throughout the year, depending on the evolving needs of ongoing projects; (3) Data as of Q2 2024. Net Promoter Score (NPS) = Percentage of Promoters − Percentage of Detractors, with a range of scores from - 100 to 100, where a score above 30 implies a good customer relationship. NPS is measured semi - annually.

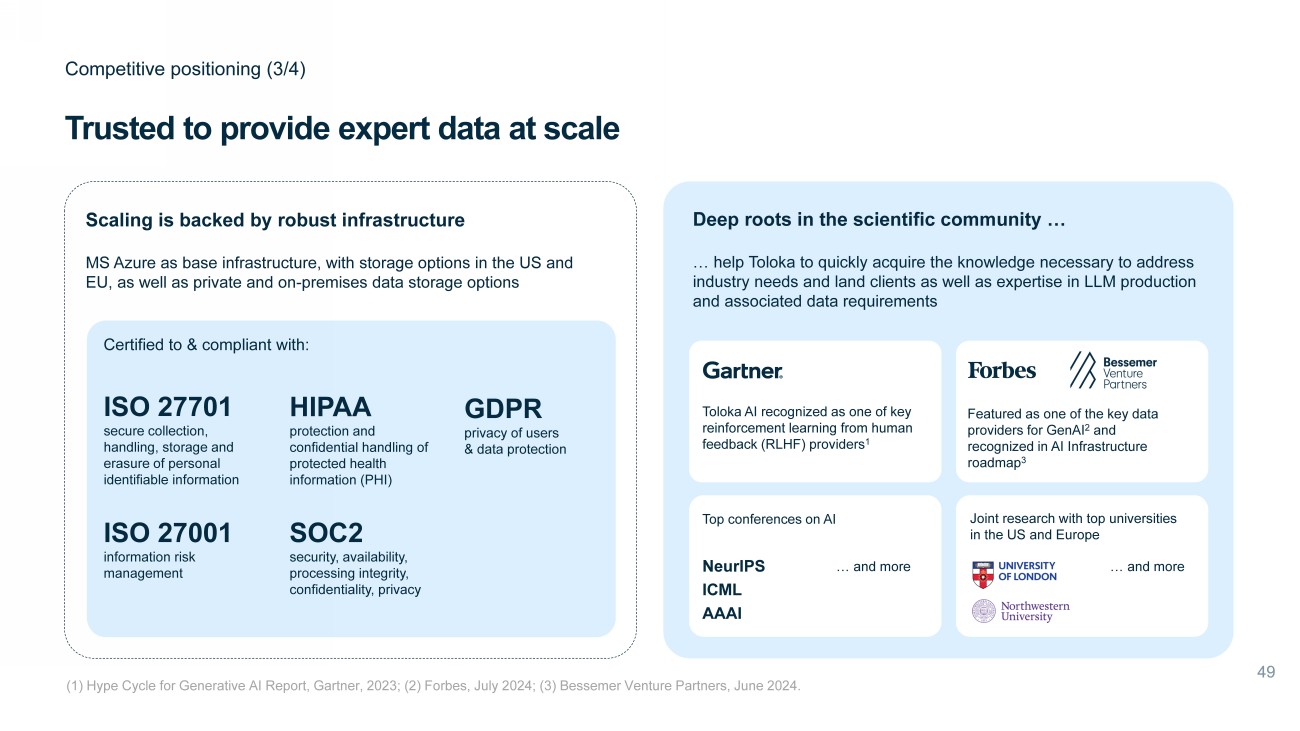

Trusted to provide expert data at scale Competitive positioning (3/4) Scaling is backed by robust infrastructure MS Azure as base infrastructure, with storage options in the US and EU, as well as private and on - premises data storage options Deep roots in the scientific community … … help Toloka to quickly acquire the knowledge necessary to address industry needs and land clients as well as expertise in LLM production and associated data requirements Toloka AI recognized as one of key reinforcement learning from human feedback (RLHF) providers 1 Featured as one of the key data providers for GenAI 2 and recognized in AI Infrastructure roadmap 3 Top conferences on AI Joint research with top universities in the US and Europe NeurIPS ICML AAAI … and more … and more Certified to & compliant with: ISO 27001 information risk management ISO 27701 secure collection, handling, storage and erasure of personal identifiable information HIPAA protection and confidential handling of protected health information (PHI) GDPR privacy of users & data protection SOC2 security, availability, processing integrity, confidentiality, privacy (1) Hype Cycle for Generative AI Report, Gartner, 2023; (2) Forbes, July 2024; (3) Bessemer Venture Partners, June 2024.

Toloka AI is trusted by Big Tech, Fortune - 500 companies, and A - class startups given strong ML experience of the team and research partnerships Competitive positioning (4/4) “Thanks a lot to the Toloka team. Wonderful collaboration in the past two years.” Select customer feedback “Our collaboration in both business and research areas has always been extremely fruitful and pleasant. Toloka has established itself as a highly professional and knowledgeable team with a strong focus on responsible AI.” “We were excited with Toloka’s speed – 14 categories of personal sensitive information were annotated from 12,000 code files within just 4 days.” “Communication and iteration towards QA goals are fantastic. Team members are always available to answer questions and bring forward questions of their own that improve the results of the project.” MIT: using human effort to improve AI - generated content detection technology Select research collaborations Positive feedback and research experience leading to industry recognition Gartner: Recognized in Hype Cycle for Generative AI Bessemer Venture Partners: Recognized in AI Infrastructure roadmap Cohere: Aligning LLMs to Low - Resource Languages, tutorial at AAAI Hugging Face: Reinforcement Learning from Human Feedback: A Tutorial at ICML SIGIR: Best Prompts for Text - to - Image Models and How to Find Them Cohere for AI: evaluation benchmark for assessing end - to - end real - world code generation task Meta / Microsoft / UCL: large - scale machine translation evaluation for African Languages

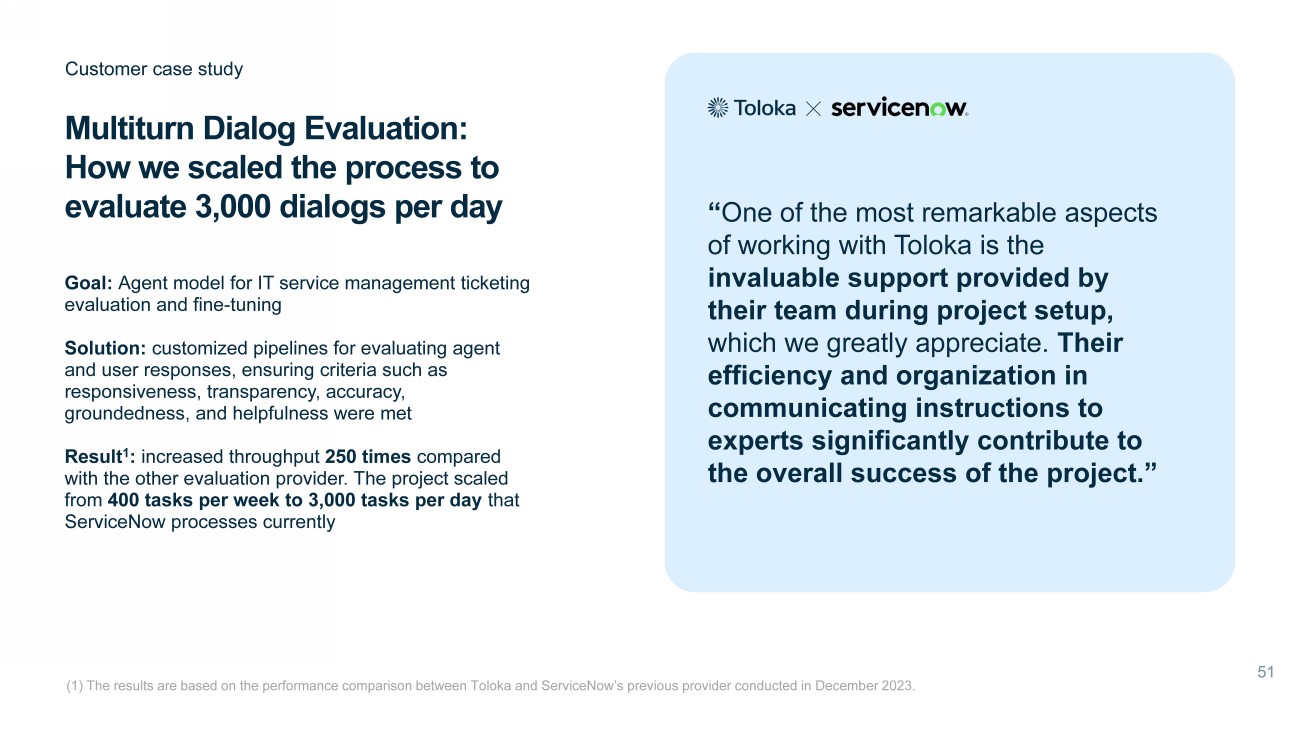

Goal: Agent model for IT service management ticketing evaluation and fine - tuning Solution: customized pipelines for evaluating agent and user responses, ensuring criteria such as responsiveness, transparency, accuracy, groundedness , and helpfulness were met Result 1 : i ncreased throughput 250 times compared with the other evaluation provider. The project scaled from 400 tasks per week to 3,000 tasks per day that ServiceNow processes currently Multiturn Dialog Evaluation: How we scaled the process to evaluate 3,000 dialogs per day C ustomer case study “ One of the most remarkable aspects of working with Toloka is the invaluable support provided by their team during project setup, which we greatly appreciate. Their efficiency and organization in communicating instructions to experts significantly contribute to the overall success of the project.” (1) The results are based on the performance comparison between Toloka and ServiceNow’s previous provider conducted in Decemb er 2023.

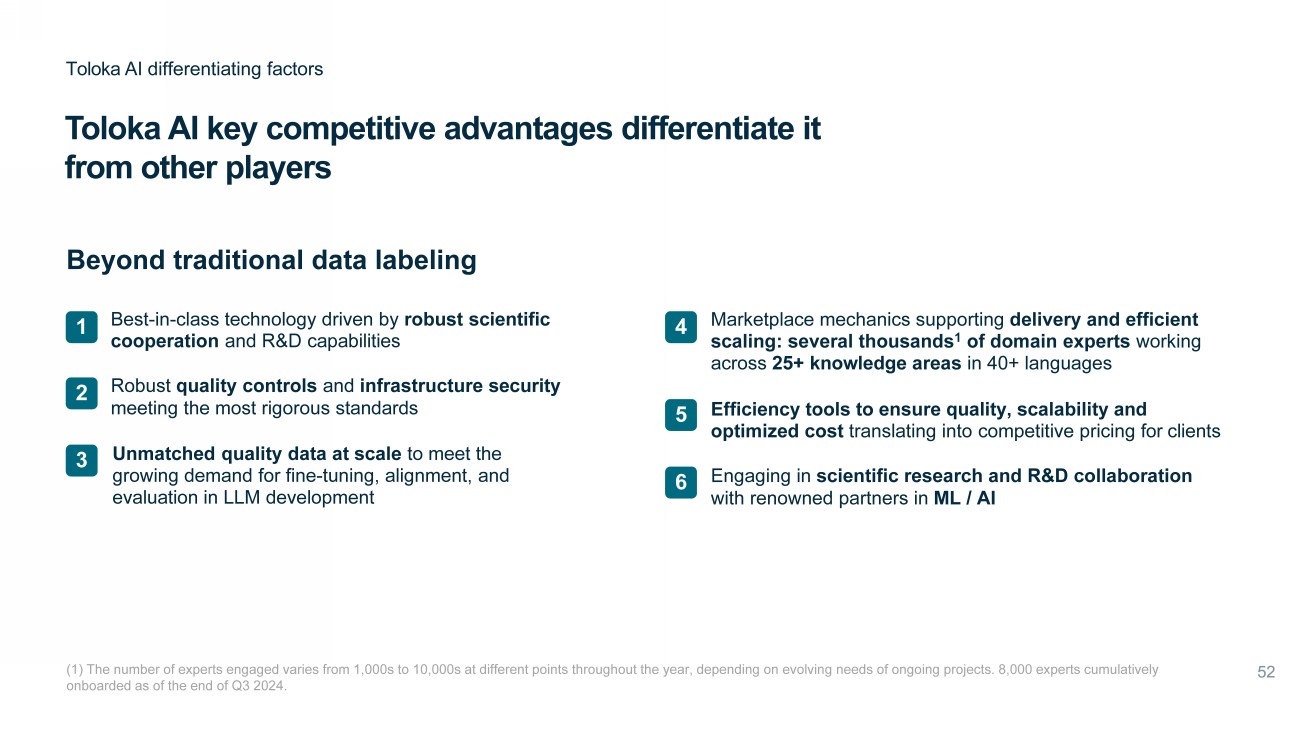

Toloka AI key competitive advantages differentiate it from other players Toloka AI differentiating factors (1) The number of experts engaged varies from 1,000s to 10,000s at different points throughout the year, depending on evolvin g n eeds of ongoing projects. 8,000 experts cumulatively onboarded as of the end of Q3 2024. Best - in - class technology driven by robust scientific cooperation and R&D capabilities Robust quality controls and infrastructure security meeting the most rigorous standards Unmatched quality data at scale to meet the growing demand for fine - tuning, alignment, and evaluation in LLM development 1 2 3 Beyond traditional d ata labeling Marketplace mechanics supporting delivery and efficient scaling: several thousands 1 of domain experts working across 25+ knowledge areas in 40+ languages Efficiency tools to ensure quality, scalability and optimized cost translating into competitive pricing for clients Engaging in scientific research and R&D collaboration with renowned partners in ML / AI 3 4 5 6

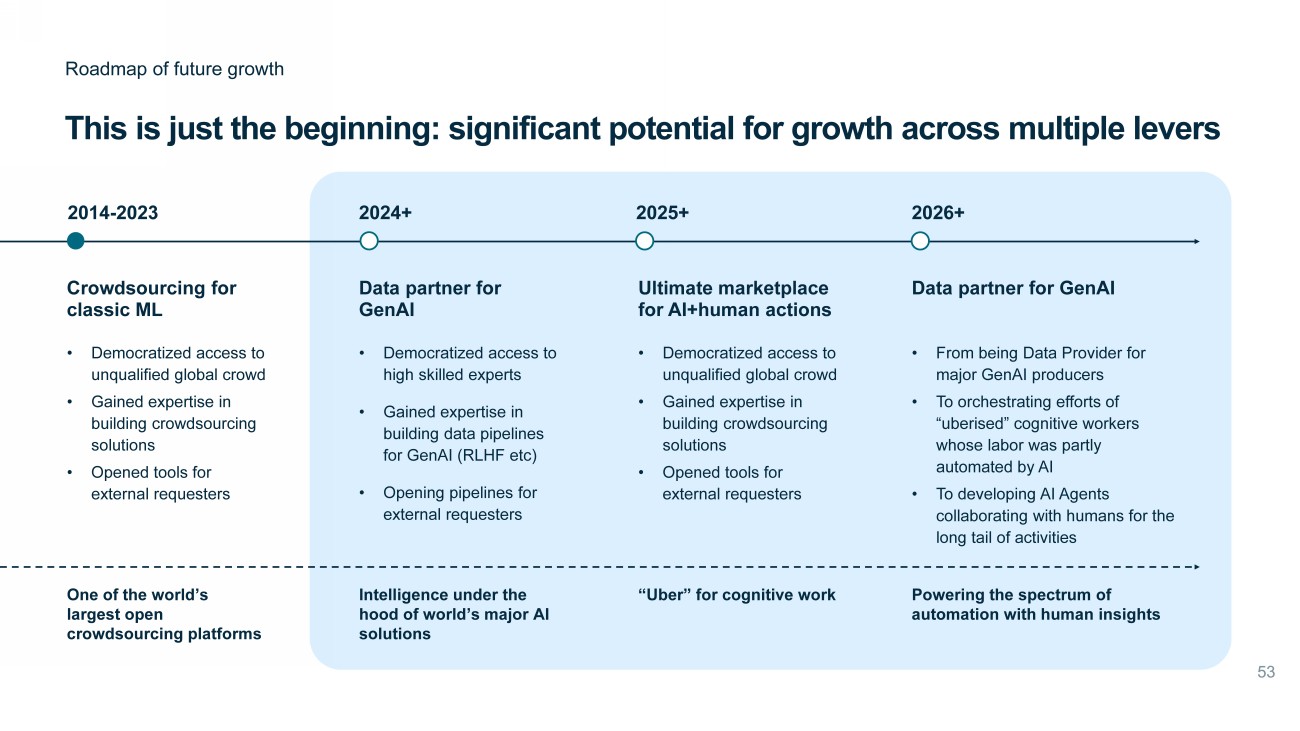

This is just the beginning: significant potential for growth across multiple levers Roadmap of future growth One of the world’s largest open crowdsourcing platforms 2024+ Data partner for GenAI • Democratized access to high skilled experts • Gained expertise in building data pipelines for GenAI (RLHF etc) • Opening pipelines for external requesters Crowdsourcing for classic ML • Democratized access to unqualified global crowd • Gained expertise in building crowdsourcing solutions • Opened tools for external requesters 2014 - 2023 2025+ Ultimate marketplace for AI+human actions • Democratized access to unqualified global crowd • Gained expertise in building crowdsourcing solutions • Opened tools for external requesters 2026+ Data partner for GenAI • From being Data Provider for major GenAI producers • To orchestrating efforts of “uberised” cognitive workers whose labor was partly automated by AI • To developing AI Agents collaborating with humans for the long tail of activities Intelligence under the hood of world’s major AI solutions “Uber” for cognitive work Powering the spectrum of automation with human insights

Financial Highlights

Overview of key revenue drivers Toloka AI revenue Non - core non - Gen AI services Self - serve platform Evolved GenAI Classic GenAI Solutions Revenue categories Hybrid solutions , including ML use cases not effectively covered by GenAI or other state - of - the - art models at reasonable costs Launch of Toloka self - service solution in 2025 Appealing solution to lower - cluster companies or those seeking direct access to experts and annotators Growing demand for security and evaluation solutions from both Cluster 1 and Cluster 2 - 3 ML teams Re - launch of the Toloka platform will enhance ability to deliver responsible AI solutions Securing new Cluster 1 and Cluster 2 customers (at least 1 - 2 new Cluster 1 customers and 3 - 4 new Cluster 2 customers by the end of 2024) Expand wallet share with existing clients by consistently delivering uncompromised quality to meet increasing data needs across more domains, modalities, and specializations Core growth drive 80%+ of Toloka’s revenue in 2024 1 <20% of Toloka’s revenue in 2024 1 (1) Based on the expected full year 2024 revenue, as per September 2024.

Toloka AI key investment highlights Recap Delivering unmatched quality data at scale to satisfy broad needs of LLM development Large team of domain experts, operating a marketplace model to enable rapid and efficient scaling Premium technology backed by scientific research collaborations and extensive previous R&D High - quality client base providing strong positive feedback

TripleTen Visit website

A leading edtech platform specializing in reskilling individuals for successful careers in tech TripleTen

TripleTen at a glance Addressing the widening skills gap created by rapid digitalization Expertise and results in STEM Long - standing collaboration across hardware and cloud as a Cloud and OEM partner Top - rated edtech 5 immersive B2C study tracks: Software engineering Quality assurance BI analytics Data science Cybersecurity B2B offering AI tech courses for beginners and professionals already working with AI 10+ years of experience in edtech for Triple Ten management team 1,000+ people enrolling monthly, and the number is growing 87% employment rate within six months of graduation 1 (1) In the US market. See 2023 Outcomes Report; (2) Fortune Magazine's ranking, 2024. US and LATAM are focus markets where demand for skilled tech talent is high and growing HQ United States Best overall provider 2 of software engineering bootcamps

Market opportunity $ 95 bn+ Global digital education market 1 202 4 2030 $ 19 bn + 26 % CAGR Capitalizing on growing demand for IT reskilling (1) Persistence Market Research, 2024 ; ( 2 ) BCG, 2023. Demand for tech talent is high and growing, including across TripleTen’s primary markets — US and LATAM Growing B2B market as companies respond to tech disruption by seeking to close IT skills gaps, embrace Al and retain talent by upskilling staff in high - demand areas; allocating as much as up to 1.5% of total budget to reskilling 2

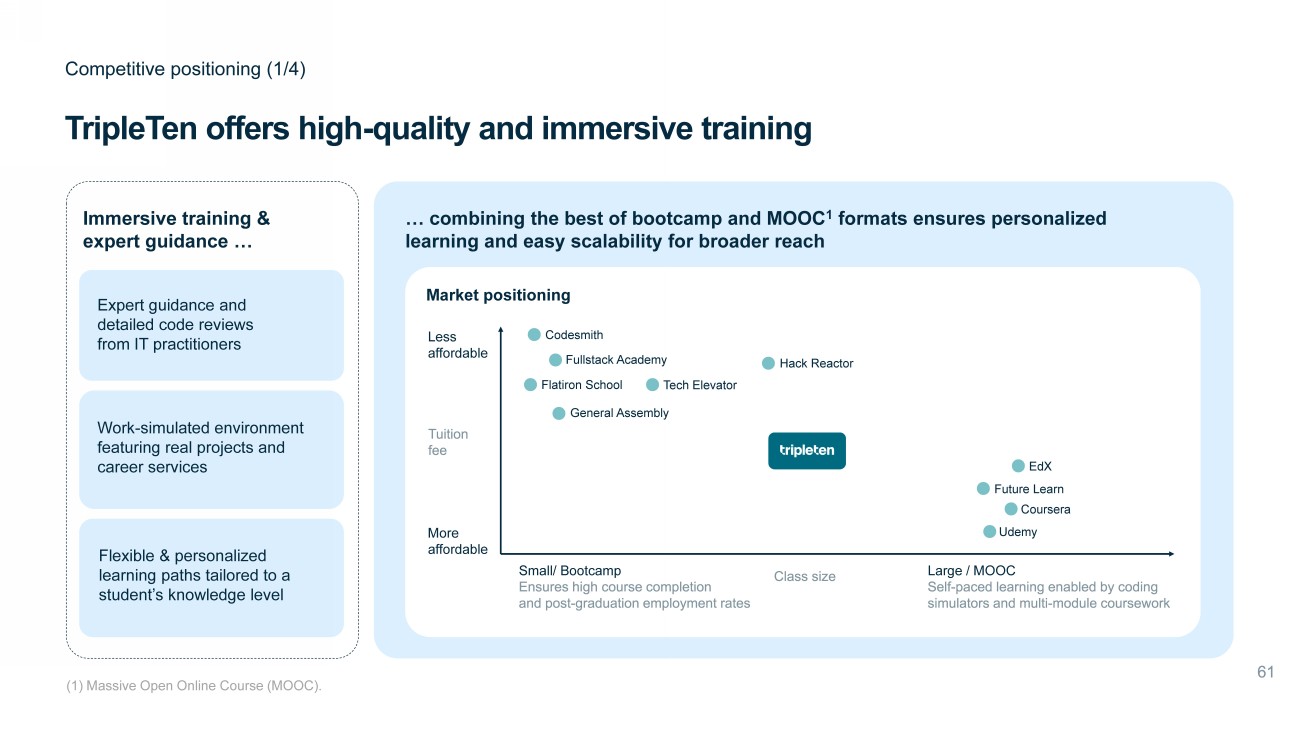

TripleTen offers high - quality and immersive training Immersive training & expert guidance … Flexible & personalized learning paths tailored to a student’s knowledge level Work - simulated environment featuring real projects and career services Expert guidance and detailed code reviews from IT practitioners Market positioning Small/ Bootcamp Competitive positioning (1/4) (1) Massive Open Online Course (MOOC). … combining the best of bootcamp and MOOC 1 formats ensures personalized learning and easy scalability for broader reach Codesmith Fullstack Academy Hack Reactor Flatiron School Tech Elevator General Assembly EdX Future Learn Coursera Udemy Less affordable Large / MOOC More affordable

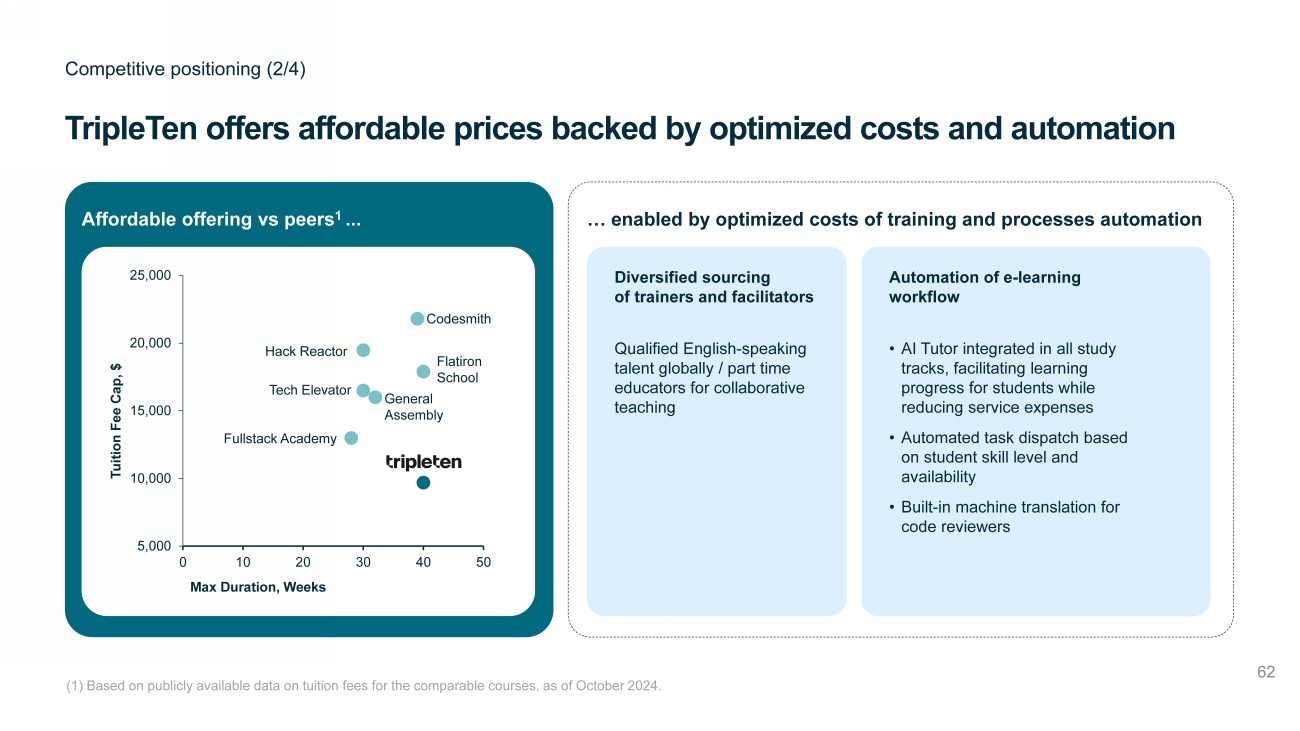

TripleTen offers affordable prices backed by optimized costs and automation Competitive positioning (2/4) (1) Based on publicly available data on tuition fees for the comparable courses, as of October 2024. … enabled by optimized costs of training and processes automation Affordable offering vs peers 1 ... 5,000 10,000 15,000 20,000 25,000 0 10 20 30 40 50 Tuition Fee Cap, $ Max Duration, Weeks Codesmith Fullstack Academy Hack Reactor Flatiron School Tech Elevator General Assembly Diversified sourcing of trainers and facilitators Qualified English - speaking talent globally / part time educators for collaborative teaching Automation of e - learning workflow • AI Tutor integrated in all study tracks, facilitating learning progress for students while reducing service expenses • Automated task dispatch based on student skill level and availability • Built - in machine translation for code reviewers

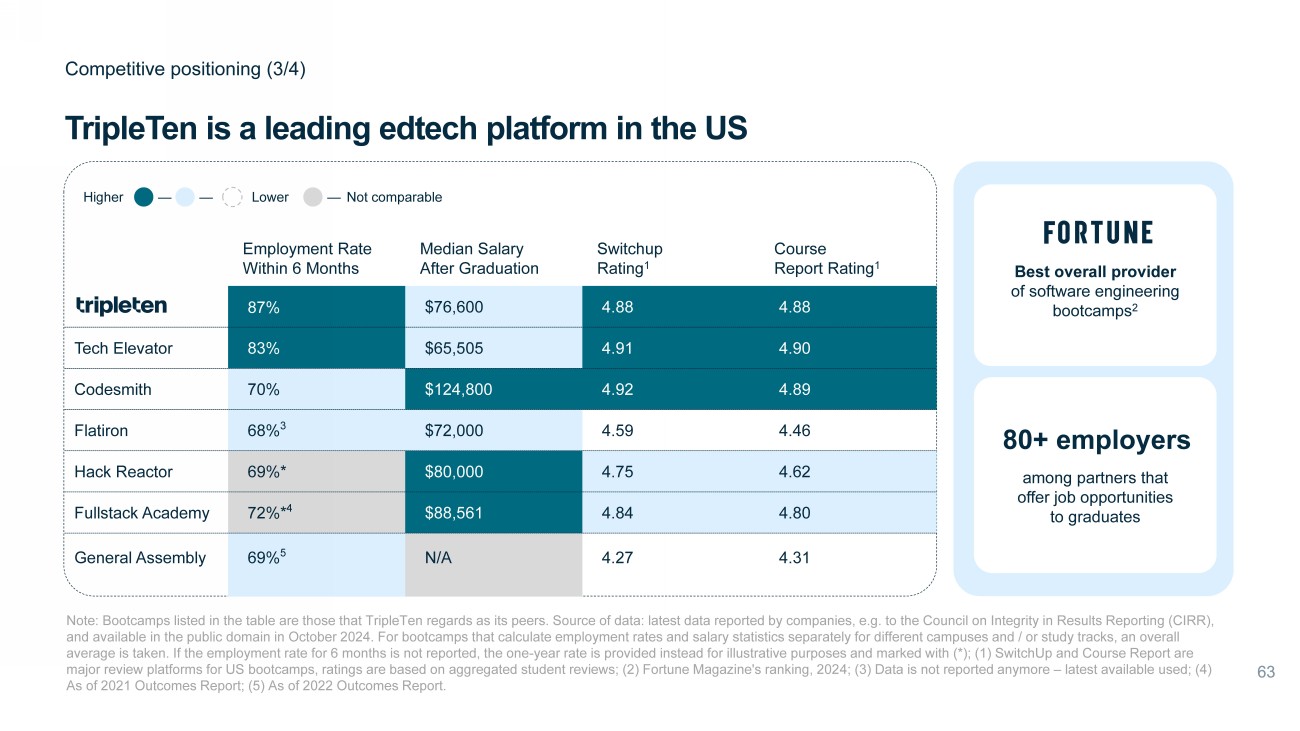

Best overall provider of software engineering bootcamps 2 80+ employers among partners that offer job opportunities to graduates Note: Bootcamps listed in the table are those that TripleTen regards as its peers. Source of data: latest data reported by companies, e.g. to the Council on Integrity in Results Reportin g (CIRR), and available in the public domain in October 2024. For bootcamps that calculate employment rates and salary statistics separ ate ly for different campuses and / or study tracks, an overall average is taken. If the employment rate for 6 months is not reported, the one - year rate is provided instead for illustrative pu rposes and marked with (*); (1) SwitchUp and Course Report are major review platforms for US bootcamps, ratings are based on aggregated student reviews; (2) Fortune Magazine's ranking, 202 4; (3) Data is not reported anymore – latest available used; (4) As of 2021 Outcomes Report; (5) As of 2022 Outcomes Report. TripleTen is a leading edtech platform in the US Competitive positioning (3/4) Course Report Rating 1 Switchup Rating 1 Median Salary After Graduation Employment Rate Within 6 Months 4.88 4.88 $7 6 , 600 87% 4.90 4.91 $65,505 83% Tech Elevator 4.89 4.92 $124,800 70% Codesmith 4.46 4.59 $72,000 68% 3 Flatiron 4.62 4.75 $80,000 69%* Hack Reactor 4.80 4.84 $88,561 72%* 4 Fullstack Academy 4.31 4.27 N/A 69% 5 General Assembly Higher — Lower — Not comparable —

What our customers say: testimonials and recognition Competitive positioning (4/4) Across 800+ reviews on Career Karma, SwitchUp , and Course Report 1 4.9 “We hire TripleTen students because of their ability to work well, own the project, care about it and solve new and complex problems. Any software engineer, even a junior, should demonstrate these qualities on their level” “AC’s strong data skills and positive mindset have made him a standout at OMD USA. Completion of a TripleTen bootcamp and ability to optimize processes have positioned him as a valuable contributor in driving business decisions and leveraging media data.” Student reviews “Because of TripleTen’s sprint based project schedule, I was able to study and build on my own time, but still practice the pace of delivery that I use in my new career.” “They prepare you for a real career. They give you a taste of what your professional tasks will look like.” Best overall 2 : TripleTen “ TripleTen’s software engineering bootcamp aims to teach total beginners the languages and tools needed to become a full - stack developer.” Why we picked it “The bootcamp strikes the best balance of costs, curriculum, brand prestige, and student experience. The program also merges theoretical study with hands - on, practical application through multiple 2 - 3 week sprints, while teachers provide line - by - line code reviews, portfolio - building opportunities, daily office hours, and access to experienced mentors.” (1) As of October 2024; (2) Fortune Magazine's ranking, 2024 .

Affordable pricing enabled by optimization of training costs through diversified sourcing of trainers, automation of e - learning workflows, and AI - enabled student support and guidance Top - rated edtech in the US by employment rate and student feedback with a solid median salary after graduation. 87% of graduates find a job within six months of graduation, ahead of the 60 - 82% reported by most key peers 1 TripleTen differentiating factors (1) Based on the Outcome Reports analysis in October 2024 . Proprietary tech stack and automated platform that enable seamless launching, scaling and localization of courses at minimal additional cost Extensive assistance and guidance provided by tutors and experts as well as flexible e - learning environment allow customers to tailor the study journey to personal needs and knowledge level and to receive significant value - add from solving complex problems provided by real companies 2 3 4 TripleTen key competitive advantages differentiate it from other players 1

This is just the beginning: significant potential for TripleTen growth across multiple levers Roadmap of future growth Continue to expand B2C offering Launch new programs : • Cyber Analyst (recently launched) • UI/UX designer (near future launch) • Continue to expand in the US & gain share from competitors • Growth in the number of alumni to help enrol new students and optimize CAC Grow market share in existing markets Geo expansion to LATAM • Deep localization to better address market needs • Fast scaling of solutions that have already been tested • Expansion of courses available in LATAM, increasing penetration across existing LATAM markets B2B product expansion • Launch B2B product for upskilling • Corporate bootcamps in English and Spanish • Role assessment for data and development specialists • Potential and motivation assessment service AI - enabled proprietary platform Further development and integration of AI across the platform to fuel further efficiency and enable further scaling First AI - related courses for B2B clients on practical aspects of implementation of AI tools and apps for managers and technical staff AI Co - pilot to assists B2B clients in assessing hard skills during interviews with skilled specialists AI - driven identification of students struggling during the course to provide help and guidance in advance

Financial highlights

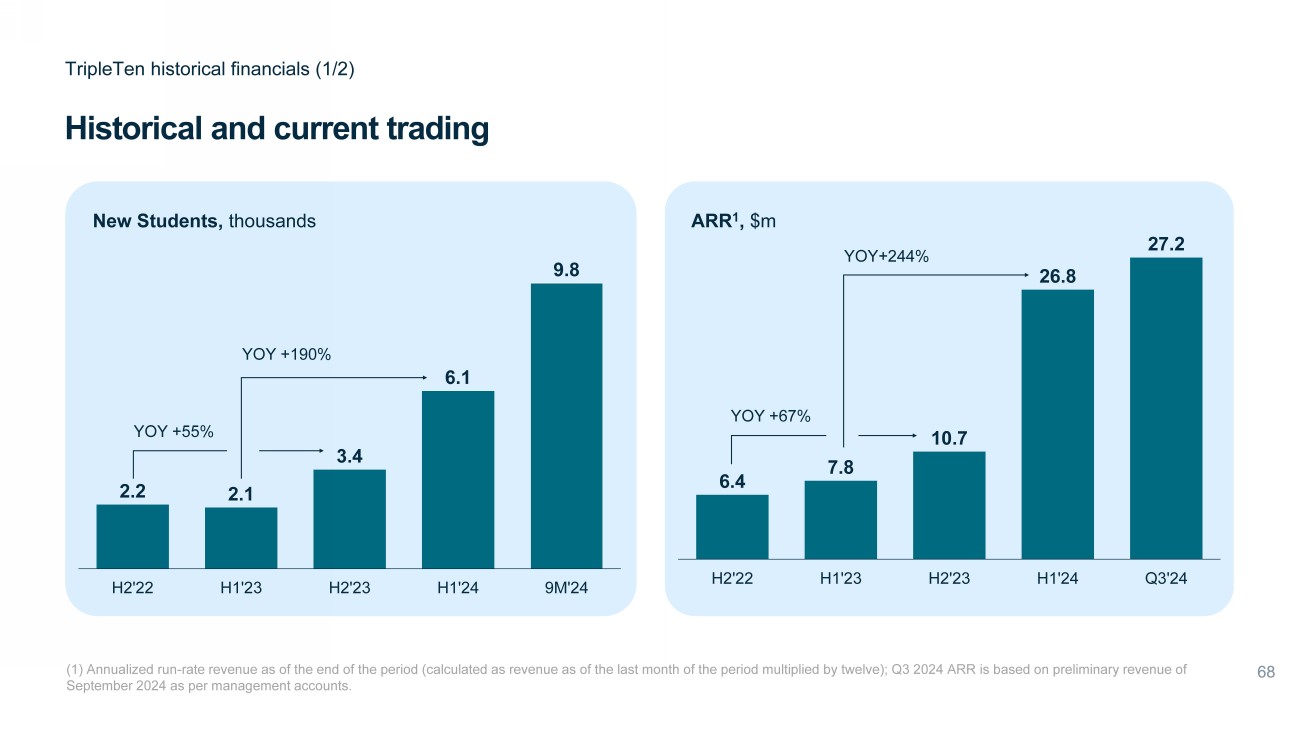

2.2 2.1 3.4 6.1 9.8 H2'22 H1'23 H2'23 H1'24 9M'24 ARR 1 , $m Historical and current trading TripleTen historical financials (1 /2) New Students, thousands (1) Annualized run - rate revenue as of the end of the period (calculated as revenue as of the last month of the period multiplied by twelve); Q3 2024 ARR is b ase d on preliminary revenue of September 2024 as per management accounts. 6.4 7.8 10.7 26.8 27.2 H2'22 H1'23 H2'23 H1'24 Q3'24 YOY +55% YOY +190% YOY+244% YOY + 67 %

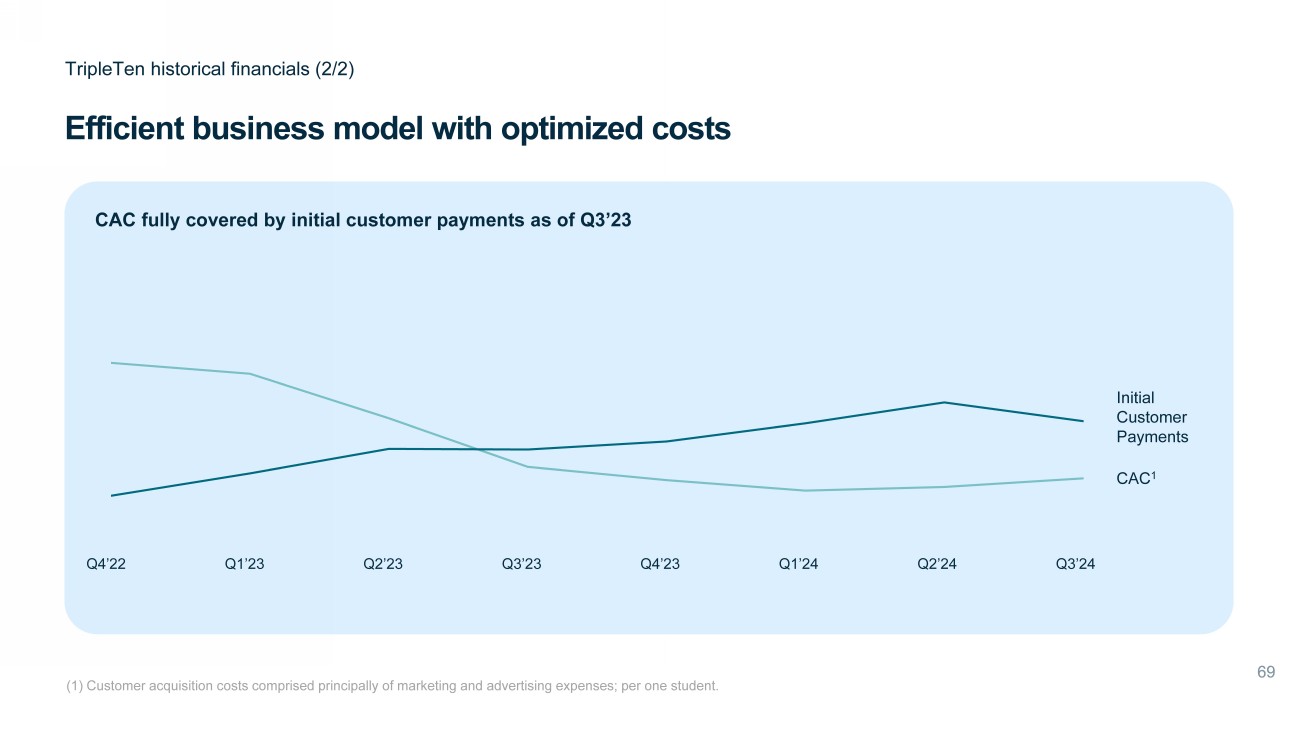

Efficient business model with optimized costs TripleTen historical financials (2/2) Initial Customer Payments CAC 1 CAC fully covered by initial customer payments as of Q3’23 (1) Customer acquisition costs comprised principally of marketing and advertising expenses; per one student. Q4’22 Q2’23 Q4’23 Q2’24 Q 3 ’24 Q 1 ’24 Q 3 ’2 3 Q 1 ’2 3

TripleTen’s key investment highlights Recap Top - rated US bootcamp characterized by high employment rate, salaries and student feedback Automated flexible e - learning platform simplifies launching and scaling on new markets and enables affordable pricing for customers and cost savings for the business Growing presence in both B2B and B2C opening massive growth opportunities across key focus markets (US and LATAM)

Avride Visit website

Developer of autonomous driving technology for self - driving cars and delivery robots

Who we are? Avride at a glance 200+ self - driving tech engineers & software developers 1 7+ years experience of the team in developing autonomous solutions Offices and R&D hubs Headquarters Austin, TX US - based executive team with additional offices in Tel Aviv, Belgrade, Seoul USA & South Korea USA, Israel, Serbia and South Korea HQ Austin, US Testing and operation R&D hubs and offices Tel - Aviv, Israel Belgrade, Serbia Seoul, South Korea Strategic partnership with Uber on autonomous delivery and mobility (1) As of September 30, 2024.

Return of capital to shareholders via share repurchase Avride is uniquely positioned in the industry by simultaneously developing autonomous driving technology for cars and delivery robots Avride at a glance (1) The number of passenger rides, driven kilometers and delivered orders is cumulative for the period since the launch of th e s ervice until September 30, 2024, including previous operations as Yandex Self - Driving Group in 2017 - 2021; (2) Non - commercial rides. 1. Autonomous Vehicles Leveraging shared and mutually enhancing technologies Testing in EMEA, USA & South Korea Robotaxi launch within two years of testing 47,000+ passenger rides given 2 Driven 22m+ autonomous km Previous Experience Snapshot 1 2. Delivery Robots Commercial deployment in the USA, UAE, South Korea Delivered ~200k client orders Previous Experience Snapshot 1 Use cases Use cases Restaurant deliveries Small - scale logistics Grocery deliveries Ride - hailing Food and grocery delivery Logistics E - commerce

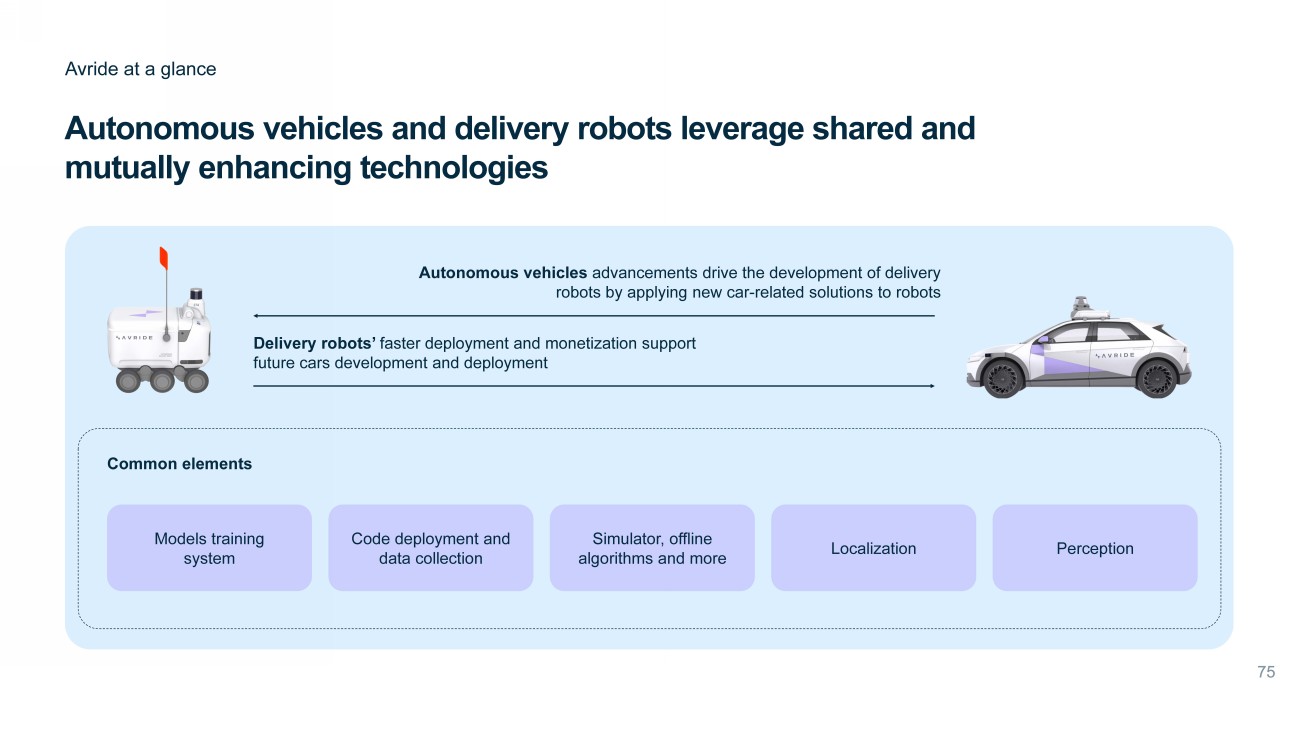

Autonomous vehicles and delivery robots leverage shared and mutually enhancing technologies Avride at a glance Common elements Code deployment and data collection Simulator, offline algorithms and more Localization Perception Models training system Delivery robots’ faster deployment and monetization support future cars development and deployment Autonomous vehicles advancements drive the development of delivery robots by applying new car - related solutions to robots

Scalable business model focused on large and attractive end markets Market opportunity $46bn TAM in 2030 1 $6bn TAM in 2030 2 (1) Markets&Markets Forecast, 2023; (2) Grand View Research, 2023; (3) Management calculations based on third party data; calculated as an averag e of forecasts ranging from $4bn to $23bn+; Precedence Research, 2023; Allied Market Research, 2023. Core segments under development ~$14bn TAM in 2030 3 Potential future upsides Robo taxis (B2B) • Focus on fleet management software, tech maintenance and local operations • Cooperation with e - hailing partners (i.e. Uber, Lyft, etc.) Intra - city delivery (vans/ robo taxis) • Delivery from hub to small warehouses • Delivery of medium - size packages to end customers (doorstep) Last mile delivery robots • Restaurant deliveries • Groceries • (Small) e - commerce deliveries • Subscription services (e.g., logistics companies, hotels, etc.) Inter - city delivery Highway and non - urban transportation

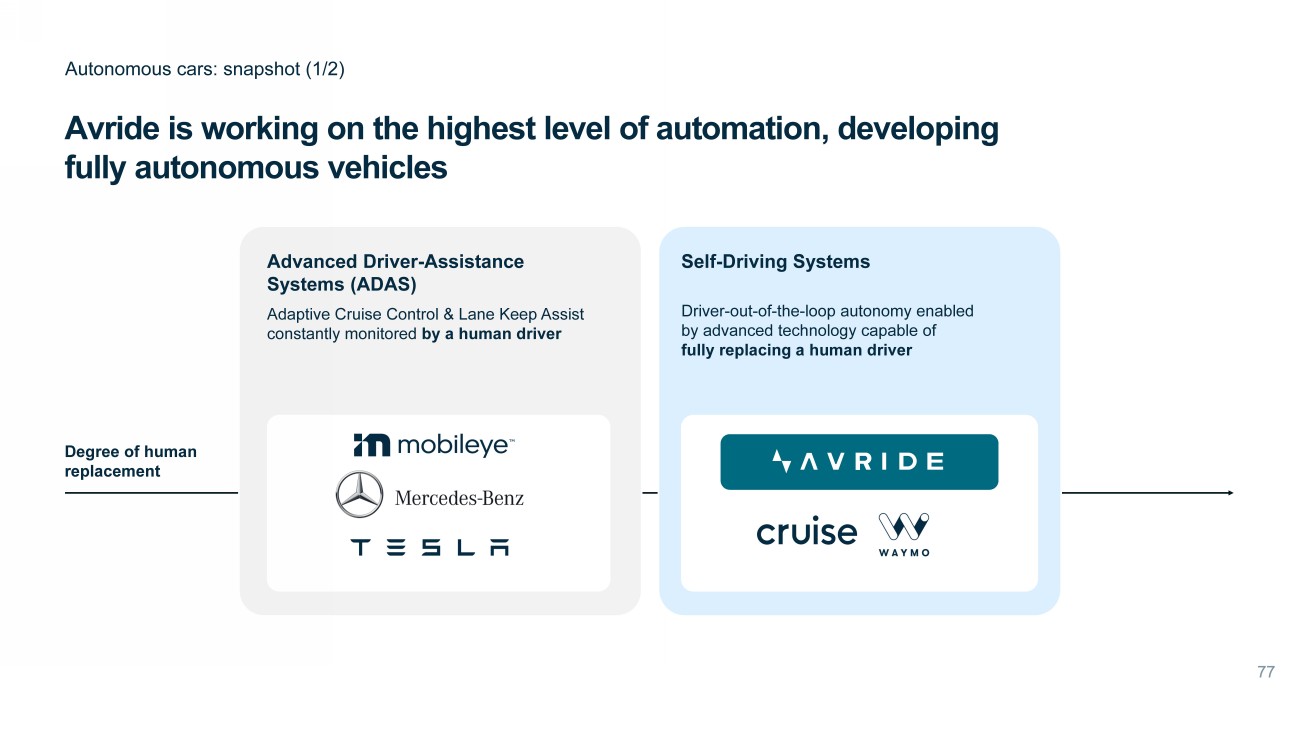

Avride is working on the highest level of automation, developing fully autonomous vehicles Autonomous cars: snapshot (1/2) Advanced Driver - Assistance Systems (ADAS) Adaptive Cruise Control & Lane Keep Assist constantly monitored by a human driver Self - Driving Systems Driver - out - of - the - loop autonomy enabled by advanced technology capable of fully replacing a human driver Degree of human replacement

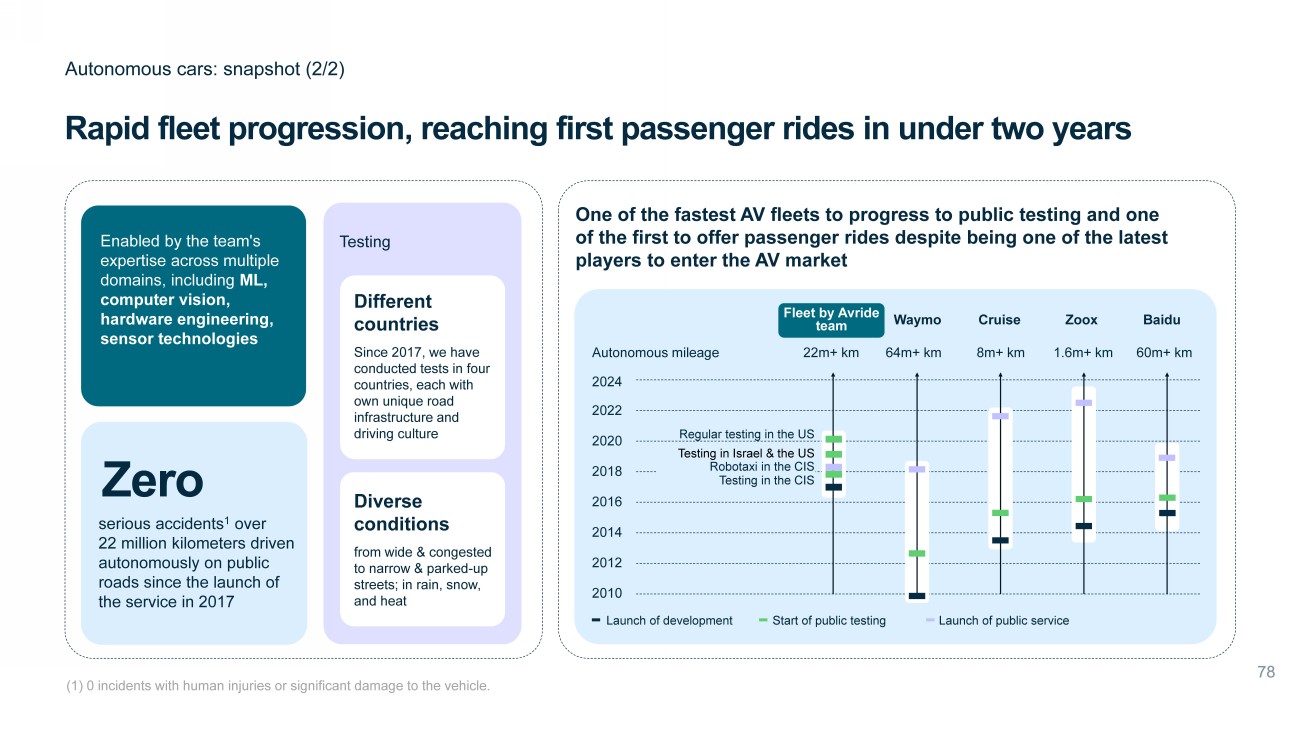

Rapid fleet progression, reaching first passenger rides in under two years Autonomous cars: snapshot (2/2) (1) 0 incidents with human injuries or significant damage to the vehicle. Enabled by the team's expertise across multiple domains, including ML, computer vision, hardware engineering, sensor technologies Zero serious accidents 1 over 22 million kilometers driven autonomously on public roads since the launch of the service in 2017 Different countries Since 2017, we have conducted tests in four countries, e ach with own unique road infrastructure and driving culture Testing Diverse conditions from wide & congested to narrow & parked - up streets; in rain, snow, and heat One of the fastest AV fleets to progress to public testing and one of the first to offer passenger rides despite being one of the latest players to enter the AV market Launch of development Start of public testing Launch of public service Robotaxi in the CIS Testing in the CIS 2020 2018 2016 2014 2012 2024 2022 2010 Regular testing in the US Testing in Israel & the US Fleet by Avride team Waymo Cruise Zoox Baidu Autonomous mileage 22m+ km 64m+ km 8m+ km 1.6m+ km 60m+ km

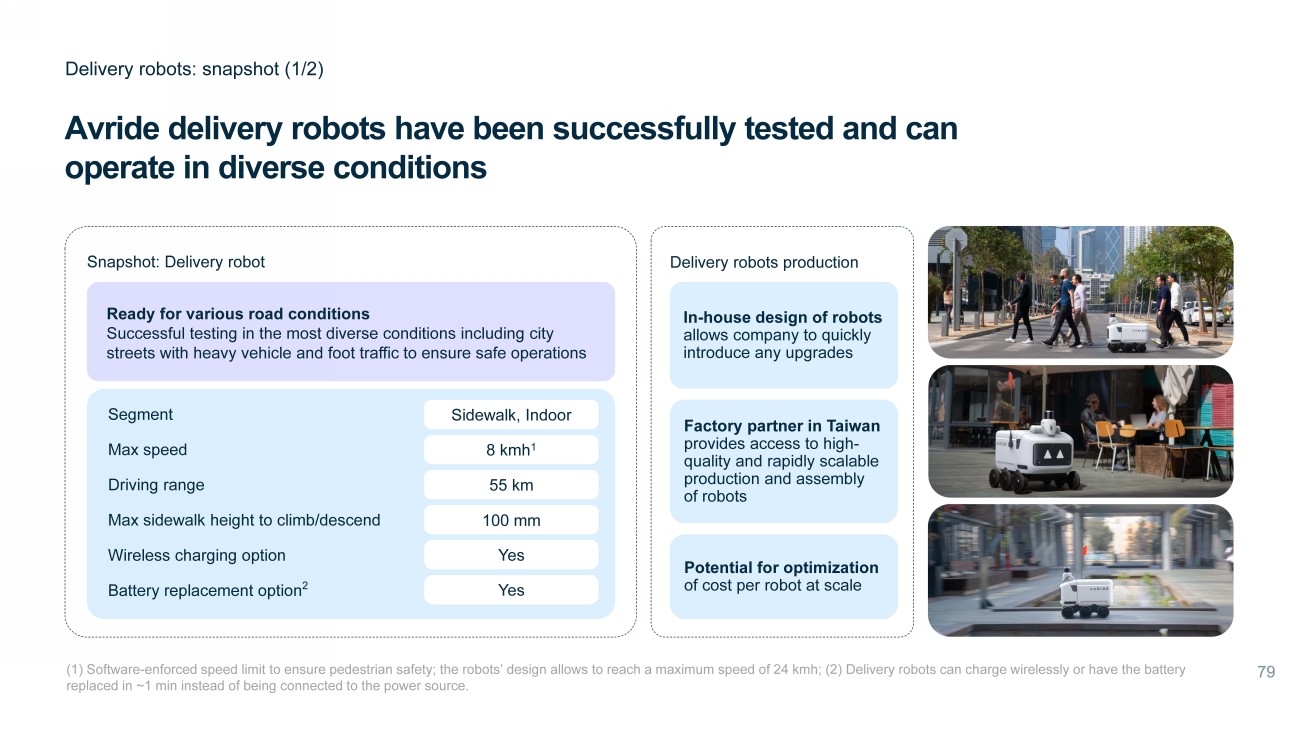

Avride delivery robots have been successfully tested and can operate in diverse conditions Delivery robots: snapshot (1/2) (1) Software - enforced speed limit to ensure pedestrian safety; the robots’ design allows to reach a maximum speed of 24 kmh; (2) Delivery robots can charge wirelessly or have the battery replaced in ~1 min instead of being connected to the power source. Ready for various road conditions Successful testing in the most diverse conditions including city streets with heavy vehicle and foot traffic to ensure safe operations Snapshot: Delivery robot Segment Sidewalk, Indoor Max speed 8 kmh 1 Driving range 55 km Max sidewalk height to climb/descend 100 mm Wireless charging option Yes Battery replacement option 2 Yes Delivery robots production In - house design of robots allows company to quickly introduce any upgrades Factory partner in Taiwan provides access to high - quality and rapidly scalable production and assembly of robots Potential for optimization of cost per robot at scale

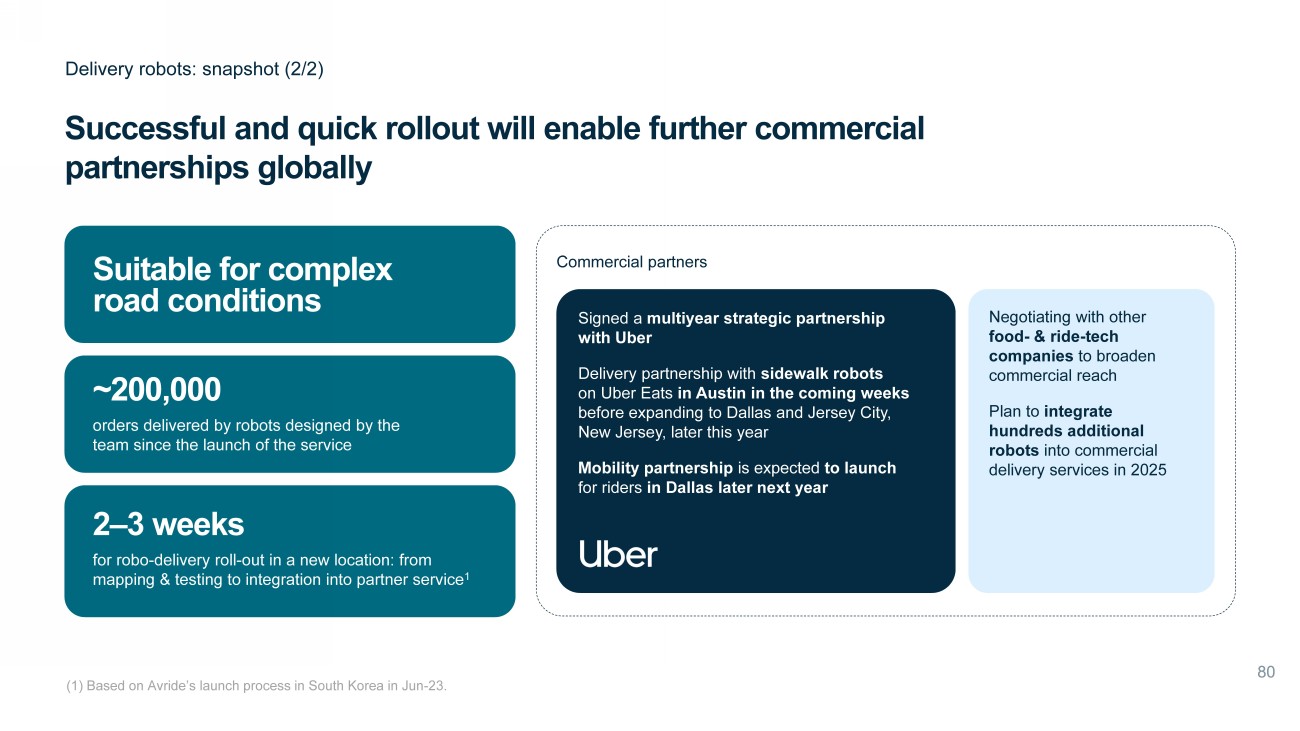

Successful and quick rollout will enable further commercial partnerships globally Delivery robots: snapshot (2/2) ~200,000 orders delivered by robots designed by the team since the launch of the service 2 – 3 weeks for robo - delivery roll - out in a new location: from mapping & testing to integration into partner service 1 Suitable for complex road conditions Commercial partners Signed a multiyear strategic partnership with Uber Delivery partnership with sidewalk robots on Uber Eats in Austin in the coming weeks before expanding to Dallas and Jersey City, New Jersey, later this year Mobility partnership is expected to launch for riders in Dallas later next year Negotiating with other food - & ride - tech companies to broaden commercial reach Plan to integrate hundreds additional robots into commercial delivery services in 2025 (1) Based on Avride’s launch process in South Korea in Jun - 23.

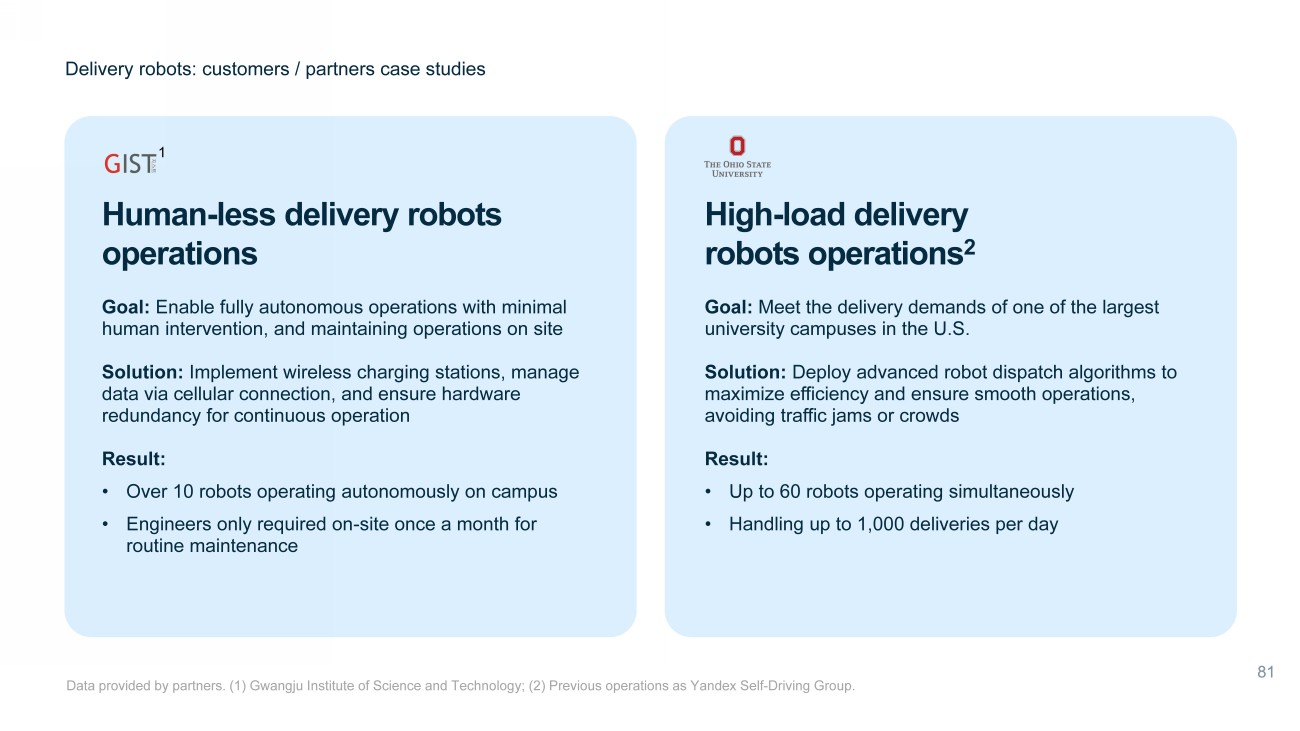

Human - less delivery robots operations 1 High - load delivery robots operations 2 Goal: Meet the delivery demands of one of the largest university campuses in the U.S. Solution: Deploy advanced robot dispatch algorithms to maximize efficiency and ensure smooth operations, avoiding traffic jams or crowds Result: • Up to 60 robots operating simultaneously • Handling up to 1,000 deliveries per day Delivery robots: customers / partners case studies Goal: Enable fully autonomous operations with minimal human intervention, and maintaining operations on site Solution: Implement wireless charging stations, manage data via cellular connection, and ensure hardware redundancy for continuous operation Result: • Over 10 robots operating autonomously on campus • Engineers only required on - site once a month for routine maintenance Data provided by partners. (1) Gwangju Institute of Science and Technology; (2) P revious operations as Yandex Self - Driving Group.

Key efficiencies achieved Avride’s autonomous vehicle offering has been highly efficient since launch Efficiency levers Launch From the outset in 2017, we leveraged cutting - edge technologies and solutions to address early - stage challenges more swiftly and effectively than competitors Autonomous cars and delivery robots: efficiency and key value drivers ~$ 3 10m of invested capital in 2017 - 9M’24, much less than competitors spent over years 1 , to reach the below milestones 47k+ passenger rides since launching as 1 st European robo - taxi company in 2018 ~ 2 00k commercial deliveries conducted with delivery robots since launch (incl. Grubhub and Talabat ) Vehicle Platform Close collaborations with automotive manufacturers and Tier 1 suppliers enable us to integrate self - driving technology into production vehicles more rapidly & effectively Fleet Efficient use of fleet; logging more kilometers per vehicle than many competitors 1 Testing We strategically selected test locations to maximize the benefits of our testing, ensuring optimal data collection and insights Team Efficient team with relevant experience in working with wide range of breakthrough technologies and high - load projects (1) Compared to Waymo, Cruise and Zoox .

Financial Highlights

Unsupervised public launch in multiple cities Supervised public launch for closed list of users Rollout of vehicles for R&D deployments Deployment Vehicles 200+ vehicles 100+ vehicles (R&D and production) 10 - 20 vehicles (R&D) Fleet size ~3,000 robots 1 ,000 + robots 100+ robots Deployment Delivery robots Generate double - digit million USD revenue Break - even on contribution profit 2 by the end of 2025 Expect the first revenue to come by the end of the year Monetization We expect to be flexible in our strategic approach to the future development of Avride, including by seeking external investment or co - investment up to $150m combined in 2024E - 2025E Avride combined funding need 1 2024 202 6+ 202 5 Avride mid - term outlook (1) In addition to ~$49 m invested in the 9M ’24; (2) Calculated as Revenue minus robots direct per - unit costs, including costs like Remote assist and Mechanics (on the ground personnel) . Avride mid - term growth strategy and required investments

Avride key investment highlights Recap One of the most experienced teams in the autonomous vehicles industry Fast track to commercial deployment at a fraction of costs Partners hips with leading automakers and delivery platforms Technology tested in diverse road conditions with outstanding safety record

Nebius Group Financials and Outlook Nebius Group

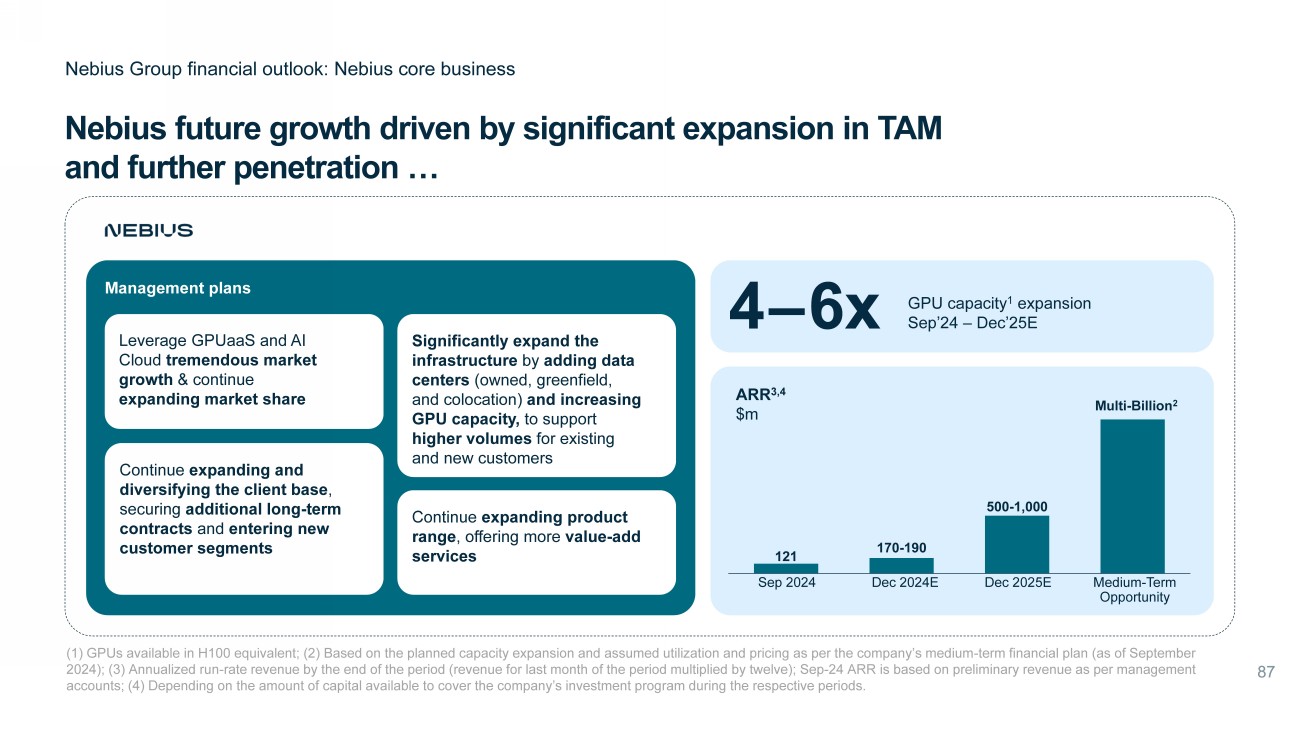

Nebius future growth driven by significant expansion in TAM and further penetration … Nebius Group financial outlook: Nebius core business (1) GPUs available in H100 equivalent; (2) Based on the planned capacity expansion and assumed utilization and pricing as per the company’s medium - term financial plan (as of September 2024); (3) Annualized run - rate revenue by the end of the period (revenue for last month of the period multiplied by twelve) ; Sep - 24 ARR is based on preliminary revenue as per management accounts ; (4) Depending on the amount of capital available to cover the company’s investment program during the respective periods. Long - standing collaboration across hardware and cloud as a Cloud and OEM partner 4 – 6x Leverage GPUaaS and AI Cloud tremendous market growth & continue expanding market share Continue expanding and diversifying the client base , securing additional long - term contracts and entering new customer segments Significantly expand the infrastructure by adding data centers (owned, greenfield, and colocation) and increasing GPU capacity, to support higher volumes for existing and new customers Continue expanding product range , offering more value - add services 121 170 - 190 500 - 1,000 Sep 2024 Dec 2024E Dec 2025E Medium - Term Opportunity Multi - Billion 2 ARR 3,4 $m GPU capacity 1 expansion Sep’24 – Dec’25E Management plans

… supported by growth across our other businesses Nebius Group financial outlook: additional businesses Expand revenue across all Toloka revenue categories and continue estab - lishing presence in the growing market Secure new customers and expand wallet share with existing clients for Classic GenAI Solutions Capitalise growing demand across Evolved GenAI , Self - serve platform, and non - core non - Gen AI services offering Grow market share in existing markets , expanding in the US, gaining share from competitors Continue to grow B2C offering and expand B2B product Expand offering and increase penetration in LATAM Continue developing and expanding commercial reach to scale operations globally Expand vehicle and robot operating fleet size Continue being a leader in efficiency in commercial deployment 2025E revenue expected to be $50 - 70m Capital expenditures for Toloka are immaterial 2025E revenue expected to be $40 - 60 m Capital expenditures for TripleTen are immaterial U p to $150m combined funding need expected in 2024E - 2025E ; in itial revenue expected from partnership with Uber and other sources

Nebius Group financial outlook Nebius Group expects to deliver $500 - 700m revenue in 2025 and push towards Adj EBITDA breakeven (1) Adjusted EBITDA/(loss) means net income/(loss) from continuing operations plus depreciation and amortization, certain SBC ex pense, interest expense, income tax expense, one - off restructuring and other expenses, less interest income, other income/(loss), net, and income/(loss) from equity method invest men ts. Please refer to the Appendix for reconciliation of Q3 2024 Adjusted EBITDA figures; (2) Adjusted EBITDA for the group also includes corporate overheads; (3) Preliminary Q3 2024 financi al results based on the management accounts. 2024E Q3’2024 3 С urrent trading and 2024 guidance $120 - 130m $43m Revenue ($250 - 300m) ($52m) Adj. EBITDA 2 ~$1 - 1.1bn $167m Capex 2025 Outlook Depending on the amount of capital available in 2025 to cover the company’s investment program we intend to : • s pend between $600m and $1.5bn on CAPEX, primarily on the core Nebius business (GPUs) ; capex for Toloka, TripleTen and Avride is immaterial compared to Nebius • grow revenue by 3 - 4x to $ 5 00 - 700m based on assumed capacity expansion, primarily driven by Nebius core business, as well as over 2x revenue growth in both Toloka and TripleTen • move into a positive territory on Adj EBITDA during 2025 (for the full year we will likely maintain below break - even Adj EBITDA)

Appendices 91 Historical trading 9 2 Management overview 9 3 BoD overview 9 4 Employee snapshot 9 5 Shareholder structure 96 Sustainability overview 97 Reconciliation of Adjusted EBITDA to US GAAP Net income / (loss)

Historical and current trading 1 Nebius Group historical financials Revenue $m Adjusted EBITDA 2 $m Capex $m (1) Q3 2024 results are based on preliminary management accounts; (2) Adjusted EBITDA/(loss) means U.S. GAAP net income/(loss) from continuing operations plus depreciation and amortization, certain SBC expense, interest expense, income tax expense, one - off restructuring and other expenses, less interest income, other income/(loss), net, and income/(loss) from equity method investments . Please refer to the end of Appendix for reconciliation of Q3 2024 Adjusted EBITDA figure. 5 5 7 11 25 43 11 35 31 (68) (52) 162 167 11.4 (69) (68) 59 (71) ~ 8 .7x YoY growth (81) 2Q’23 3Q’23 4Q’23 1Q’24 2Q’24 3Q’24 2Q’23 3Q’23 4Q’23 1Q’24 2Q’24 3Q’24 2Q’23 3Q’23 4Q’23 1Q’24 2Q’24 3Q’24

Nebius Group Nebius Group management team Business units Arkady Volozh CEO and Founder Visionary founder; previously co - founded successful Tech companies including Yandex and CompTek International C - Suite Andrey Korolenko Chief Product & Infrastructure Officer 20 years supervising IT infrastructure development and expertise in deploying supercomputers ranking among TOP - 20 most powerful ones globally Ron Jacobs CFO Finance expert with hands - on experience leading M&A and transformation programs in Europe’s biggest telco companies 10+ years of experience in AI & Data Labeling Toloka Olga Megorskaya CEO 6+ years driving edtech ventures e xpertise in startup consulting and go - to - market strategies TripleTen Ilya Zalessky CEO 7+ years heading self - driving tech, 13 years of experience leading mobile services Avride Dmitry Polishchuk CEO Roman Chernin Chief Business Officer 12 years heading the development and deployment of digital B2B and B2C services (including Search and Maps) and an experienced startup mentor Ophir Nave COO Proven leader and legal and corporate finance expert, having previously led Corporate M&A at Arnon , Tadmor - Levy Tom Blackwell Chief Comms. Officer Strategic communications expert, chairman, founder and previously CEO of EM, an emerging markets focused PR/IR advisory firm — based in

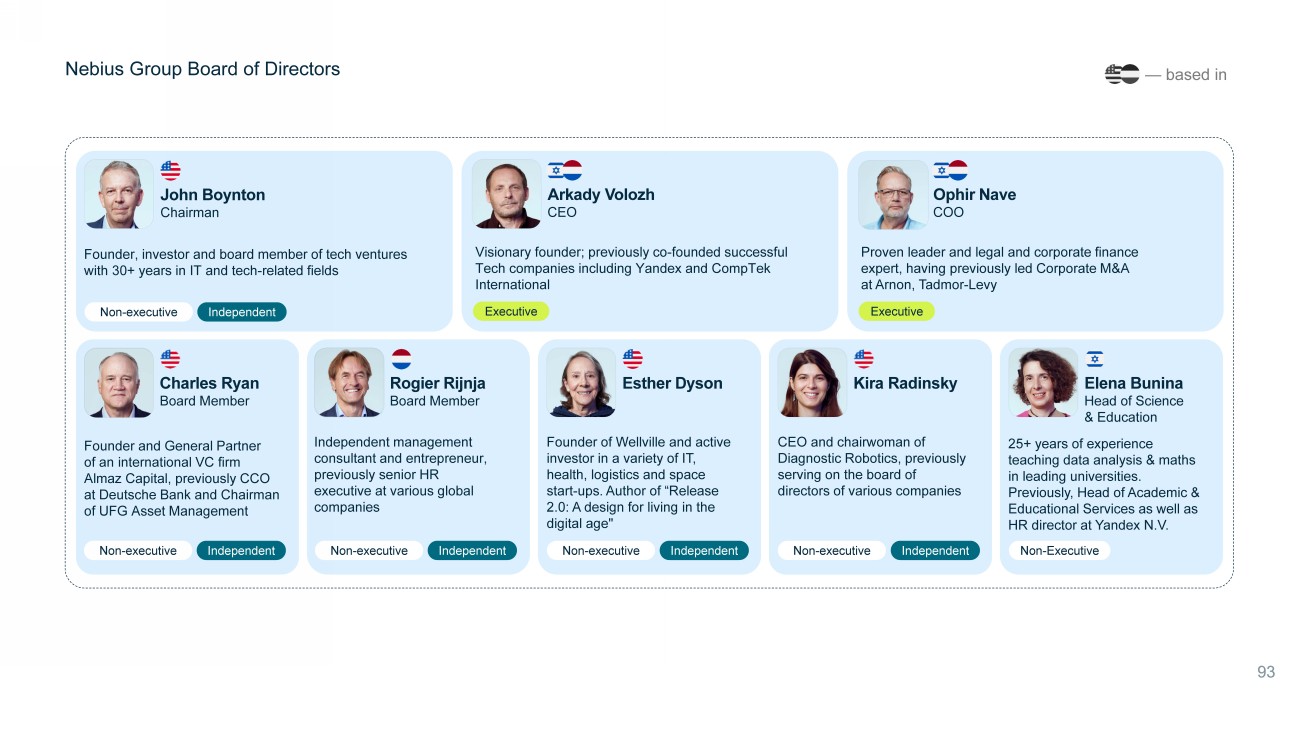

Nebius Group Board of Directors — based in John Boynton Chairman Founder, investor and board member of tech ventures with 30+ years in IT and tech - related fields Non - executive Independent Ophir Nave COO Proven leader and legal and corporate finance expert, having previously led Corporate M&A at Arnon , Tadmor - Levy Executive Arkady Volozh CEO Visionary founder; previously co - founded successful Tech companies including Yandex and CompTek International Executive Rogier Rijnja Board Member Independent management consultant and entrepreneur, previously senior HR executive at various global companies Elena Bunina Head of Science & Education 25+ years of experience teaching data analysis & maths in leading universities. Previously, Head of Academic & Educational Services as well as HR director at Yandex N.V. Esther Dyson Founder of Wellville and active investor in a variety of IT, health, logistics and space start - ups. Author of “Release 2.0: A design for living in the digital age" Kira Radinsky CEO and chairwoman of Diagnostic Robotics, previously serving on the board of directors of various companies Non - Executive Non - executive Independent Non - executive Independent Charles Ryan Board Member Foun der and General Partner of an intern ational VC firm Almaz Сapital , previously CCO at Deutsche Bank and Chairman of UFG Asset Management Non - executive Independent Non - executive Independent

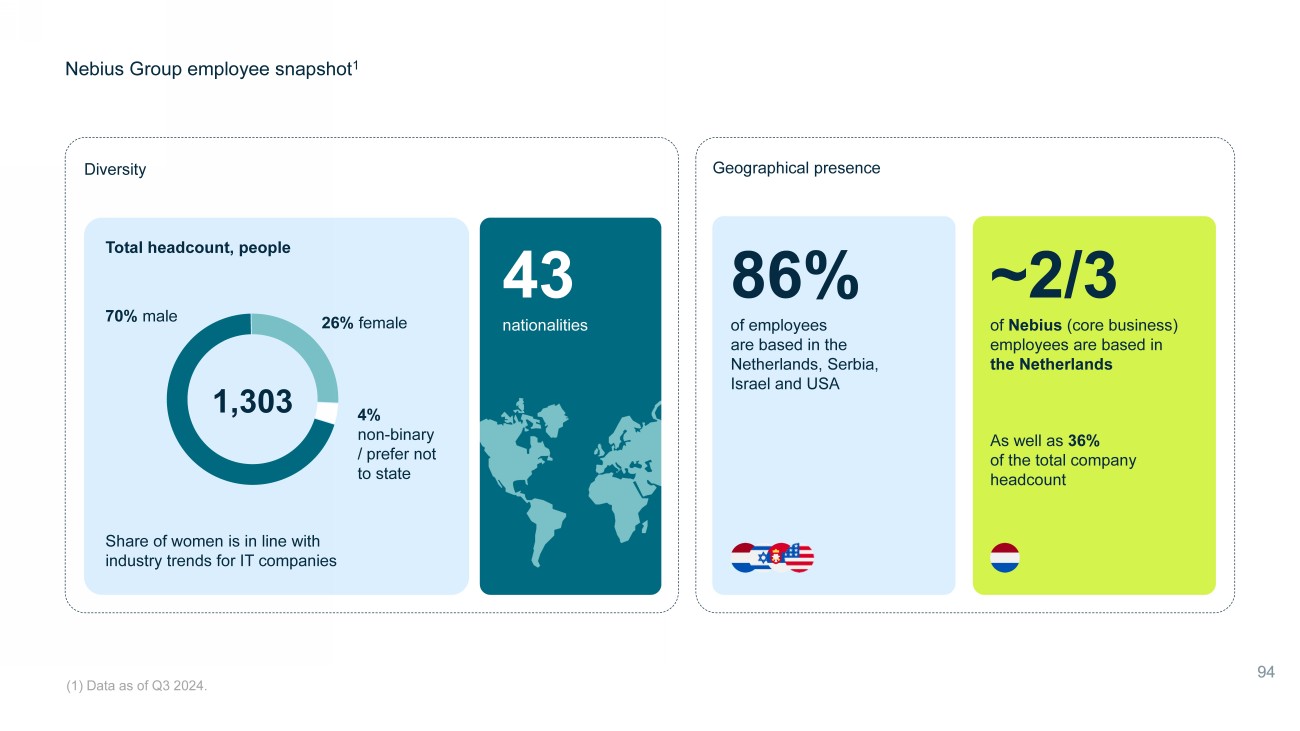

Nebius Group employee snapshot 1 (1) Data as of Q3 2024. Total headcount, people Share of women is in line with industry trends for IT companies Diversity Geographical presence 70% m ale 26% female 4% non - binary / prefer not to state 1,303 43 nationalities 86% of employees are based in the Netherlands, Serbia, Israel and USA ~2/3 of Nebius (core business) employees are based in the Netherlands As well as 36% of the total company headcount

Nebius Group ownership structure (1) Family trust established by Mr . Volozh in December 2019. Total shares issued & outstanding Economic ownership Class A 163, 641 , 444 Class B 35,698,674 Excluding 16 2 , 700 , 826 Class A shares held in treasury pending use under our equity incentive plans and for further financing purposes As of September 30, 2024 Voting power 59.1% 11.0% 29.9% 15.4% 6.5% 78.1% — LASTAR Trust 1 — Other directors, officers & employees, pre - IPO shareholders — Free float