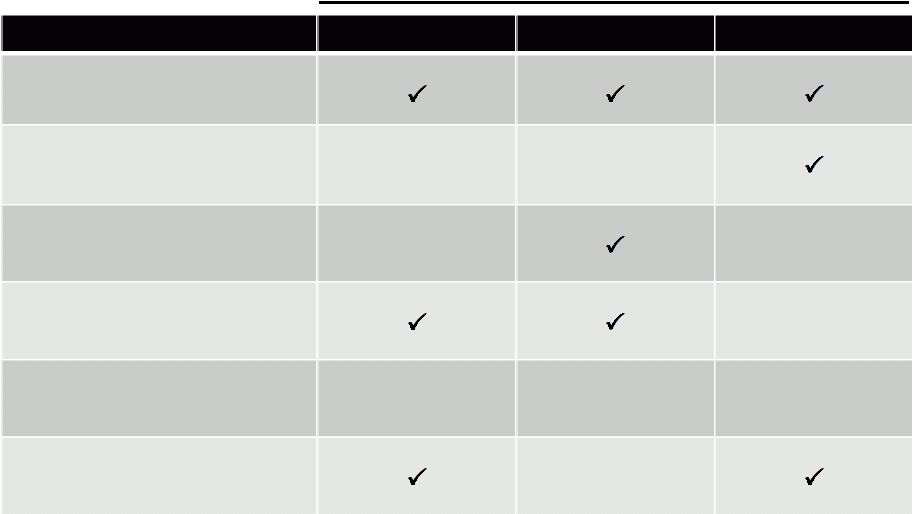

Company Background Issues/Concerns Catalyst Energy (1984 – 1987) Kuhns founded Catalyst Energy and took it public in 1984. ¹ Share price tanked from peak of US$29 to $3.75 in 1987. New York Times mentioned that he “alienated key investors and sent Catalyst’s stock into a tailspin.” 1 It was alleged that Kuhns received US$1.3M in salary, bonuses and benefits 2 during his three years as CEO, and sold Catalyst Energy shares for more than US$3M. ¹ New World Power (1989 – 1996) Kuhns founded New World Power and took it public in 1992. In total, the company raised ~US$63M in equity. ³ The company reported net loss of $41.3M in 1995 and went through debt restructuring, asset sale and reorganization in 1996; Kuhns stepped down as CEO (pressured by creditors) and was not re-nominated to serve as Chairman in 1996. 2&5 The company’s auditor raise[d] substantial doubt about the company's ability to continue as a going concern. 5 It was alleged that Kuhns received ~US$1.5M in salary and benefits from 1993-1995; As part of severance benefit, the company’s headquarter in Lime Rock, Connecticut was transferred to him (building and leasehold improvement worth at least US$1.5M). 2&4 SEC issued cease and desist orders under securities law following his failures to file reports reflecting his sales of over US$3M of NWP stock while the stock was falling. 2&6 The company paid US$1.3M to Kuhns’ wholly-owned construction company from 1993-1995 for development of the headquarters, which he received as severance. 4 Questionable Track Record of Senior Management 30 1 30 March 1988, The New York Times, Article “A Highflier’s One Final Gamble” by Alison Leigh Cowan 2 Schedule 14A (Information Required in Proxy Statement) Dominion Bridge 3 26 October 1992, Dow Jones News Service, Article “New World Power Corp Ini 1M shares prices at $7”. 4 Distributed Power (Previously known as New World Power) 10-K filed in July 1996 5 Distributed Power (Previously known as New World Power) 10-K filed in May 1997 6 Distributed Power (Previously known as New World Power) SC 13-D in January 1996 7 Master Silicon Carbide Industries, 10-K filed in April 2012 8 Master Silicon Carbide Industries, 10-Q filed in May 2012 9 Master Silicon Carbide Industries, 15-12G filed in June 2012 10 China New Energy Group, 10-K filed in April 2010 11 China New Energy Group, 10-Q filed in November 2010 12 China New Energy Group, 8-K filed in January 2011 13 China New Energy Group, 15-12B filed in September 2012 14 Capital IQ and Thompson One Master Silicon Carbide Industries (2008 – current) Kuhns has been Chairman of the Board, President and CEO since 2008. 7 The company had negative EPS since 2008 and delisted in 2012. 7&9 According to the March 2012 10-Q, the company's financial position “raises substantial doubt about the Company’s ability to continue as a going concern.” 8 The company raised US$10M in 2008 (China Hand Fund I, LLC) and another US$10M in 2009 (Vicis Capital Master Fund). 8 Salaries: Kuhns – US$175K p.a., Fellows – US$100K p.a. 7 Kuhns Brothers – US$150K p.a. management fees 8 Rental fee of US$90K paid to Kuhns Brothers to lease NY Office Space 8 Company notified of delisting in June 2012 9 China New Energy Group (2008 – current) Kuhns became a Director in 2008, and along with Stastney and Fellows, serve on the Compensation Committee. He also serves on the Audit Committee. 10 China Hand invested US$29M from 2008-2010, and sold substantially to Vicis and related entities in the same periods 10&11 Bought assets with initial payment of US$17.6M in January 2011 12 The company traded at ~US$1 per share in 2009 and is now trading at ~US$0.03 on the OTC markets. 14 Kuhns, Fellows, Stastney receive US$20K each p.a. 10 Kuhns Brothers was paid an advisory fees of 10% of proceeds raised i.e. US$1.4M and warrants to purchase 10.4M shares as placement agents for the private placement of US$14.4M from China Hand Fund I, LLC. The fund is managed by John Kuhns. 10&14 The company has not filed recent annual reports and was recently notified of listing termination. 13 ” “ |