Letter from Consortium to ISS, dated September 14, 2012

Exhibit 99.1

PRC Bank Financing

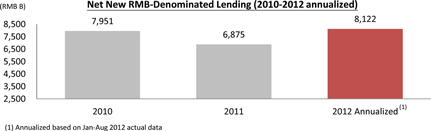

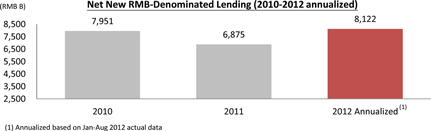

| 1. | Despite claims from Senior Management regarding lending restrictions in China, the data below clearly illustrates that recent bank lending in China still amounted to approximately RMB 7.95 trillion during 2010, RMB 6.88 trillion during 2011, and has showed significant improvements during January-August 2012 with RMB 6.1 trillion of lending (or about RMB 8.12 trillion on an annualized basis). |

Source: The People’s Bank of China

| 2. | Hydropower is a highly favored and a priority sector in China and local banks have been encouraged to provide lending to the hydropower sector. |

| | • | | In China’s 12th Five Year Plan adopted by the Chinese government in March 2011, hydropower plays one of the most important roles in China’s attempt to develop clean energy and to meet emission reduction targets. |

| | • | | China Development Bank (“CDB”), thelargest lender to the hydropower sector in China, is committed toproviding mid-to-long term loans and offering priority approvals to hydropower companies. As of the end of 2011, the bank has lent out more than RMB350B (~US$56B) of loans to the sector. |

| | • | | Agricultural Development Bank of China (“Agricultural Bank”) is not only another major force in providing liquidity to the hydropower sector, it also supports small hydropower plants. |

| | • | | Shanghai Pudong Development Bank (“SPDB”) through its “Green Credit Solutions” [translated from Chinese] offers financing to “green” industries including hydropower. |

| 3. | We do not believe the existing Board can support the Company to obtain additional bank lending in China. |

| | • | | Members of the Shareholder Group introduced both local and international banks as well as development finance institutes to Senior Management based in U.S., and CHC did not close on any of these financings. |

| | • | | We do not believe the existing Board to be removed has any contacts in Asia with local banks or capability to help manage the liquidity situation. |

| | • | | The new Board nominees are based in Asia and have contacts at these local banks in China, including significant experience in lending from Chinese banks. For instance, Mr. Jui Kian Lim, one of the director nominees, has more than 10 years of experience in China in successfully obtaining financings for various infrastructure projects. |

| | • | | The Shareholder Group continues to believe that CHC has good assets and can work with financial institutions to re-align its debt and debt profile back to a healthy and sustainable condition. |

1

G&A Expense

| 1. | As shown in the calculations below based on CHC’s SEC filings,Cash G&A Expenses continued to increase from 1H2011 to 1H2012, despite concerns repeatedly raised by members of the Shareholder Group. It is unclear how the Company arrived at its weighted average MW calculation for expenses based on public filings. |

| | • | | It is unclear how the Company derived its Cash G&A Expenses calculations as we have based our calculations from publicly available financial information. High G&A Expenses have been an issue raised multiple times in various forums, including during the Company’s 3Q2011 earnings call which John Kuhns refused to properly address. |

| | | | | | | | |

(US$M) | | 1H2011(1) | | | 1H2012(1) | |

G&A Expenses | | | 10.1 | | | | 8.7 | |

Deduct: ESOP expense | | | 1.9 | | | | 0.2 | |

| | | | | | | | |

“Cash” G&A Expenses | | | 8.2 | | | | 8.6 | |

| | | | | | | | |

| | (1) | For continuing operations |

| 2. | We DO NOT believe the Company will achieve its forecasted US$13.8M of Cash G&A Expenses. |

| | • | | In 2010 and 2011, Cash G&A Expenses have always been higher in the second half of the year as bonuses and other costs are decided in the second half of the year. |

| | • | | Given the Company has already disclosed it has already incurred US$8.6M in the first half of 2012, we believe the forecasted 2012 Cash G&A Expenses of US$13.8M is unachievable. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | FY2010 | | | FY2011 | |

(US$M) | | 1Q2010 | | | 2Q2010 | | | 3Q2010 | | | 4Q2010 | | | 1Q2011 | | | 2Q2011 | | | 3Q2011 | | | 4Q2011(1) | |

G&A Expenses | | | 4.3 | | | | 4.9 | | | | 4.6 | | | | 5.6 | | | | 5.1 | | | | 5.1 | | | | 4.5 | | | | 14.4 | |

Deduct: ESOP expense | | | 0.6 | | | | 1.0 | | | | 1.0 | | | | 1.0 | | | | 0.9 | | | | 1.0 | | | | 0.9 | | | | 7.6 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

“Cash” G&A Expenses | | | 3.7 | | | | 3.9 | | | | 3.6 | | | | 4.6 | | | | 4.2 | | | | 4.1 | | | | 3.6 | | | | 6.7 | |

% of total of the year | | | 23 | % | | | 25 | % | | | 23 | % | | | 29 | % | | | 23 | % | | | 22 | % | | | 19 | % | | | 36 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | For continuing operations |

| 3. | The Board is currently spending additional unnecessary expenses |

| | • | | The Board is spending a lot of money hiring multiple legal counsels, an investment bank and other professionals to distract shareholders on non-existent issues from making a simple vote at the EGM. |

| | • | | This not only clearly demonstrates that the Board and the Senior Management are insensitive to the Cash G&A Expenses issues on hand, but they are exacerbating the Company’s liquidity problems. |

Other Financings

| 1. | CPI Ballpark (NewQuest) does NOT have any plans to enter into a dilutive financing that would increase CPI Ballpark’s percentage ownership relative to other significant shareholders. |

| 2. | Senior Management and the Board are trying to mislead and frighten the shareholders with their false and disingenuous statements that member of the Shareholder Group would engage in dilutive financing. |

| | • | | In fact, the Senior Management retained investment bankers in Q3 2011 to advise equity financings that would dilute existing shareholders. In August 2011, the Company actually did dilute shareholders by restructuring warrants to Vicis, which did not raise sufficient amounts to resolve the Company’s liquidity issues. Moreover, the Company does not dispute that conflicts of interest existed between Vicis and the Company in favoring Vicis over other shareholders in this dilutive financing. |

2

| | • | | Instead, CPI Ballpark (NewQuest), who holds the largest shareholding of the Shareholder Group, has expressed concerns and requested the Company to evaluate all other options before it resorted to equity financing that would dilute all existing shareholders given that the Company was considering dilutive equity financing at that time. |

| | • | | Moreover, CPI Ballpark only wished to provide financing as a last resort, and was even willing to pay a premium to the then-market prices so that it would not get diluted by the Company. At that time, CPI Ballpark also insisted that the Company should first give an opportunity to ALL existing shareholders to participate in any equity financing, which the Company rejected. |

| | • | | Please refer to the November 2011 letter, which CPI Ballpark sent to the Company to clear up the false and misleading statements made by Senior Management on this issue. |

| 3. | The Company falsely asserts that “[s]ome time ago CPI (NewQuest) did put forward financing proposals that your Board rejected”. |

| | • | | Again, the Company misrepresents the facts as the Company put forward the initial financing proposals and CPI Ballpark merely responded to the Company’s proposed financing term sheet as reflected in the November 2011 letter from CPI Ballpark to the Company. (November 2011 letter attached asExhibit A hereto) |

NYSE Notice

| 1. | Notification to NYSE regarding the record date hasno legal bearing on the Shareholder Group’s right to call an EGM under Cayman law or Company’s M&A. |

Senior Management and the Board provide NO strategy or plan

| 1. | Despite accusing the Shareholder Group, the Senior Management and the Board have failed to provide any strategy or plan in its presentation to ISS, except for the engagement of Morgan Stanley which the Company only engaged after the Shareholder Group filed its August 21 joint letter to the Board. |

John Kuhns does not deny conflicts of interests created by his multiple business dealings

| 1. | John Kuhns mentions that his interest in Kuhns Brothers is inactive and has “effectively mothballed”, yet, Kuhns Brothers Securities Corporation and Kuhns Brothers Capital Management still maintain active filings with the Financial Industry Regulatory Authority (FINRA) as a brokerage firm and investment advisor firm, respectively. Moreover, the Kuhns Brothers web site (www.kuhnsbrothers.com) still appears to be active. |

| 2. | Mr. Kuhns also mentions that he “has commuted to China two weeks each month since the, for 6 years”, but fails to mention that he is also the CEO, Chairman, and/or Legal Representative of at least 6 other businesses in China, two of which were listed in the U.S. or are SEC reporting companies. In addition, he fails to mention that he is also involved with the China Hand Fund, which shares an office with the Company. |

3

(Exhibit A to ISS Letter, dated September 14, 2012)

| | | | | | |

| | | | | | CPI Ballpark Investments Ltd. c/o DTOS Ltd, 10th Floor Raffles Tower, 19 Cybercity Ebene, Mauritius |

Sent via post, facsimile & electronic mail

The Board of Directors of

China Hydroelectric Corporation

420 Lexington Avenue

Suite 860

New York, NY 10170

Fax: +1 646 467-9820

November 10, 2011

Re: China Hydroelectric Corporation (the “Company”)

Dear Members of the Board of Directors,

Given the challenging year with over a 75% drop in share price and the resulting delay in the Company’s expansion strategy, we write to members of the Board of Directors to address concerns regarding the Company’s performance, and to formally reiterate our continued strong support and commitment to assist the Company in resolving recent difficulties, including improving the Company’s operations and participating as the sole or primary investor in a new financing round to mitigate the Company’s current liquidity situation.

As the Board may already know, we have been working with the management to assess cutting unwarranted costs that could add significant value to all stakeholders. We believe considerable cost savings can be achieved which is a typical way for utility companies globally to create significant value. We are aware that the management is working on certain cost cutting measures, and we will continue our dialogue with the management on this front.

Moreover, in order to better assist the Company through some of these operational issues and given our significant shareholding, we have requested for representation on the Board of the Directors. In fact, we have had numerous discussions with Chairman Kuhns since April 2011 and a few discussions with Director Stastney regarding such appointment, and both have indicated initial support, including support from the Board. However, despite confirmation of such support and our submission of requested Board appointment materials, our representative has yet to be appointed to the Company’s Board. We believe that we could provide much value added assistance to the Company and its Board of Directors, and we would welcome the opportunity to work with the Company’s Board in improving operating performance.

In addition, as the Board would have been informed, we have also been working with the Company since June 2011 to address the current liquidity situation by:

| | (i) | assessing capital raising options with investment banks in Asia which includes various convertible instruments; and |

4

| | (ii) | proposing our own direct investment into the Company’s contemplated preferred securities offering, which would have the advantage of price, speed and certainty. |

Indeed, on September 5, 2011, we submitted our comments to the terms initially proposed by the Company for a new round of preferred share financing. As is typical in such financing, we had repeatedly communicated to management that we are willing to discuss and negotiate our proposal in order to reach mutually acceptable terms. In addition, we stated that we are open to working with other parties in such a financing round, as our main objective is to prevent additional dilution to our current shareholding. Despite multiple requests and several assurances from management for a substantive discussion (in particular with the Pricing Committee of the Board), we have yet to be invited to participate in a forum through which we could meaningfully engage with the Company. Instead, we understand the Company has primarily been engaging with third parties, which could ultimately result in a highly dilutive financing round without our (or other existing shareholder) participation.

While we understand that the Board may consider various options to address the Company’s liquidity issue, we remain highly concerned as the share price continues to decline and has plummeted around 40% since we submitted our comments over two months ago on the terms proposed by the Company.

Given the current market environment, we urge the Board to protect the interest of all existing shareholders, and consider either divesting select non-core assets or offering current shareholders the opportunity to provide the liquidity to the Company and not be diluted at such depressed share prices. In particular, we believe it is incumbent on the Board of Directors in exercising their fiduciary duties to show that they have thoughtfully explored divestment opportunities and engage in meaningful discussions with shareholders such as ourselves who have expressed a willingness to subscribe for and participate in a new financing round before consummating any other transaction that would dilute existing shareholders.

To that end, we will also like to re-affirm our interest in funding partially (or completely with a co-investor) the liquidity needs of the Company at a premium to market, or in case of a bona fide third party investor, at a premium to the price at which the other investor is willing to pay. In addition to the price advantage, the other advantages to the Company would be speed and certainty; as an existing investor, we would be able to close a financing transaction with the Company much more quickly than could a new investor. We are happy to work with the management and the Board or any Committee of the Board towards mutually acceptable terms, or consider market terms or terms that the Company has received from other bona fide third party investors. We believe participation of existing shareholders in any new round of financing will be in the best interest of all stakeholders, and would be the fastest and cheapest method for the Company to mitigate its liquidity needs.

Accordingly, in order to further our commitment to this Company and in the best interest of all stakeholders, we respectfully request that the Board:

| | (i) | approve the appointment of one representative of CPI Ballpark Investments Ltd. on the Board of Directors of the Company tasked with assisting the Company through some operational issues, among other Board tasks; |

| | (ii) | diligently explore possible divestment opportunities of select non-core assets; and |

5

| | (iii) | hold meaningful discussions with CPI Ballpark Investments Ltd. and other existing shareholders on participation in any round of new financing, whereby we are prepared to discuss pricing (including paying a potential premium to market, or in case of a bona fide third party investor, a potential premium to the price at which the other investor is willing to pay) and similar terms the Company has received from other bona fide third party investors. |

We believe our requests are reasonable in light of the current market environment, and would like to thank you in advance for your time and support. We assure you that we will continue to devote significant resources to work with the management and achieve what the Company has originally set out to do. Given the lack of meaningful response on our initial financial proposal and the declining stock price, we respectfully request your written response to our requests by no later than close of business, Eastern Standard Time, November 15, 2011.

Please copy your written response to: ryutaro.aida@nqcap.com.

|

| Sincerely, |

|

|

| Ryutaro Aida |

| Director |

| CPI Ballpark Investments Ltd. |

Cc: John Kuhns, Chairman and CEO

6