QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. 2)

| | |

| Filed by the Registrantý |

Filed by a Party other than the Registrant o |

Check the appropriate box: |

ý |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

o |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12 |

| | | | |

| Performance Sports Group Ltd. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

PRELIMINARY COPY — SUBJECT TO COMPLETION

September • , 2015

Fellow Shareholders:

You are cordially invited to attend the 2015 Annual and Special Meeting of Shareholders of Performance Sports Group Ltd. at 9:00 a.m. (Eastern Time) on October 14, 2015, at the W Hotel New York — Downtown, 8 Albany Street, New York, New York 10006. The Board of Directors and management hope that you will be able to attend the Meeting.

The attached Notice of Annual and Special Meeting of Shareholders and Proxy Statement describe the business to be conducted at the Meeting. Following the Meeting, we will also review the Company's Fiscal 2015 performance and discuss our plans to continue delivering value to you, our shareholders.

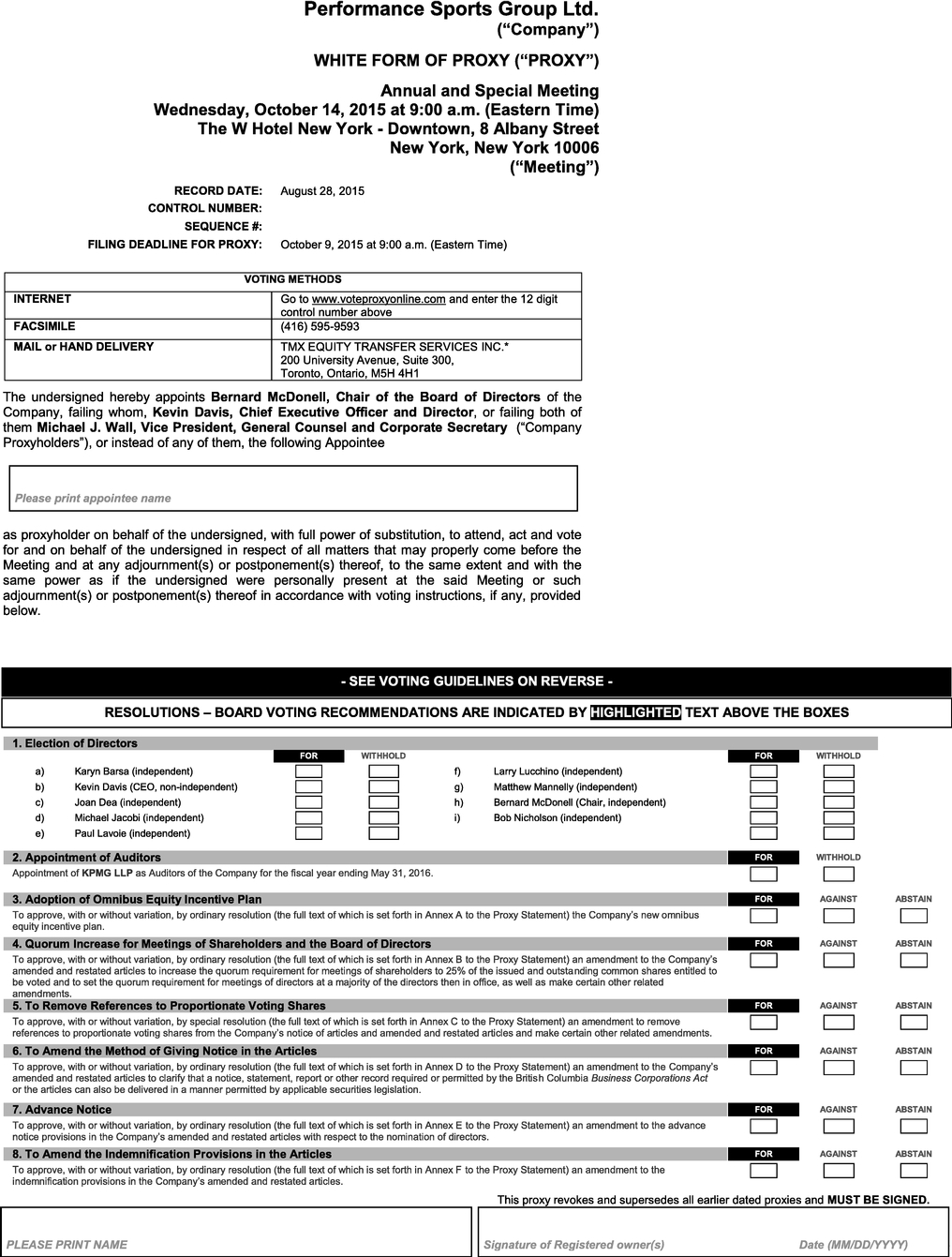

As a shareholder, you will be asked to vote on a number of important matters, which are listed and detailed in the accompanying Notice of Annual and Special Meeting of Shareholders and Proxy Statement, including: the election of nine directors of the Company who will serve until the next annual shareholders meeting or until their successors are elected or appointed, the approval of the appointment of KPMG LLP as our auditor for the fiscal year ending May 31, 2016, the approval of our new omnibus equity incentive plan, the approval of certain amendments to our amended and restated articles, each as described in more detail in the Proxy Statement, and such other business as may properly be brought before the Meeting or any adjournment or postponement thereof.

Finally, we encourage you to vote — regardless of the size of your share holdings. Please take the time to carefully read each of the proposals described in the Proxy Statement and cast your vote by following the instructions in the Proxy Statement sent to you.

Your vote will be especially important at the Meeting. The Walter Graeme Roustan Trust (the "Roustan Trust") has notified the Company that the Roustan Trust intends to nominate W. Graeme Roustan ("Roustan") for election to your Board of Directors at the Meeting in opposition to the nominees recommended by our Board of Directors. You may receive a proxy statement and a proxy card from the Roustan Trust or Roustan. The Company is not responsible for the accuracy of any information provided by or relating to the Roustan Trust or Roustan contained in solicitation materials filed or disseminated by or on behalf of the Roustan Trust or Roustan or any other statements that the Roustan Trust or Roustan or their representatives may make.

The Board of Directors does NOT endorse Roustan and unanimously recommends that you vote FOR the election of each of the nominees proposed by the Board of Directors. The Board of Directors strongly urges you to disregard any proxy or information that you receive from the Roustan Trust or Roustan. Only vote the WHITE Company proxy.

I look forward to greeting those of you who are able to attend the Meeting.

Thank you for your continued support of Performance Sports Group Ltd.

| | |

| | Sincerely, |

|

|

|

| | Kevin Davis

Chief Executive Officer |

Performance Sports Group Ltd.

100 Domain Drive

Exeter, New Hampshire 03833

NOTICE OF ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN that the 2015 Annual and Special Meeting (the "Meeting") of the holders (the "Shareholders") of common shares (the "Shares") of Performance Sports Group Ltd. (the "Company") will be held at 9:00 a.m. (Eastern Time) on October 14, 2015, at the W Hotel New York — Downtown, 8 Albany Street, New York, New York 10006, for the following purposes:

- 1.

- To receive the audited consolidated financial statements of the Company for the fiscal year ended May 31, 2015, together with the auditor's report thereon;

- 2.

- To elect nine directors of the Company who will serve until the next annual meeting of Shareholders or until their successors are elected or appointed;

- 3.

- To consider and, if thought advisable, approve, with or without variation, the appointment of an independent registered public accounting firm, KPMG LLP, as the Company's auditor for the fiscal year ending May 31, 2016;

- 4.

- To consider and, if thought advisable, to approve, with or without variation, by ordinary resolution (the full text of which is set forth in Annex A to the Proxy Statement) the Company's new omnibus equity incentive plan;

- 5.

- To consider and, if thought advisable, to approve, with or without variation, by ordinary resolution (the full text of which is set forth in Annex B to the Proxy Statement) an amendment to the Company's amended and restated articles (as amended, the "Articles") to increase the quorum requirement for meetings of Shareholders to 25% of the issued and outstanding Shares entitled to be voted and to set the quorum requirement for meetings of directors at a majority of the directors then in office, as well as make certain other related amendments;

- 6.

- To consider and, if thought advisable, to approve, with or without variation, by special resolution (the full text of which is set forth in Annex C to the Proxy Statement) an amendment to remove references to proportionate voting shares from the Notice of Articles and the Articles and make certain other related amendments;

- 7.

- To consider and, if thought advisable, to approve, with or without variation, by ordinary resolution (the full text of which is set forth in Annex D to the Proxy Statement) an amendment to the Articles to clarify that a notice, statement, report or other record required or permitted by the British ColumbiaBusiness Corporations Act or the Articles can also be delivered in a manner permitted by applicable securities legislation;

- 8.

- To consider and, if thought advisable, to approve, with or without variation, by ordinary resolution (the full text of which is set forth in Annex E to the Proxy Statement) an amendment to the advance notice provisions in the Articles with respect to the nomination of directors;

- 9.

- To consider and, if thought advisable, to approve, with or without variation, by ordinary resolution (the full text of which is set forth in Annex F to the Proxy Statement) an amendment to the indemnification provisions in the Articles; and

- 10.

- To transact such other business as may properly be brought before the Meeting or any adjournment or postponement thereof.

The Board of Directors recommends a voteFOR each of the proposals listed in this Notice of Annual and Special Meeting of Shareholders. The accompanying Proxy Statement provides detailed information relating to each of the proposals to be considered at the Meeting and forms part of this Notice of Annual and Special Meeting of Shareholders.

i

Please note that the Walter Graeme Roustan Trust (the "Roustan Trust") has notified the Company that it intends to nominate W. Graeme Roustan ("Roustan") for election to your Board of Directors at the Meeting. You may receive solicitation materials from the Roustan Trust or Roustan or their representatives seeking your proxy to vote for Roustan.THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE "FOR" THE ELECTION OF EACH OF THE BOARD OF DIRECTORS' NOMINEES ON THE ENCLOSED WHITE PROXY CARD AND URGES YOU NOT TO SIGN OR RETURN OR VOTE ANY PROXY CARD SENT TO YOU BY THE ROUSTAN TRUST OR ROUSTAN.

You are a "Registered Shareholder" if your name appears on your Share certificate or if you are registered as the holder of the Shares in book-entry form. Registered Shareholders are requested to complete, date, sign and return (in the prepaid envelope provided for that purpose) the form of proxy for their Shares.You may also vote your Shares by proxy by appointing another person to attend the Meeting and vote your Shares for you. To be valid, the form of proxy must be signed and received by the proxy department of the Company's transfer agent, Equity Financial Trust Company, by mail at 200 University Avenue, Suite 300, Toronto, Ontario M5H 4H1, on the internet atwww.voteproxyonline.com or by facsimile at416-595-9593 not later than 9:00 a.m. (Eastern Time) on October 9, 2015, or if the Meeting is adjourned or postponed, not less than two business days before the time of any such adjourned or postponed Meeting. Failure to properly complete or deposit a proxy may result in its invalidation.

You are a "Non-Registered Shareholder" if your broker or other financial intermediary holds your Shares for you. The Company is not sending its proxy-related materials directly to Non-Registered Shareholders. The Company will pay for the cost of intermediaries to deliver its proxy-related materials and the voting instruction form to Non-Registered Shareholders (both objecting beneficial owners and non-objecting beneficial owners). The Company will not reimburse Shareholders, nominees or agents for the cost incurred in obtaining authorization to execute forms of proxy from their principals or beneficial owners.

The Board of Directors has fixed the close of business on August 28, 2015 as the record date for determining Shareholders entitled to receive notice of, and to vote at, the Meeting or any adjournment or postponement thereof. Whether or not you expect to attend the Meeting, please exercise your right to vote. Shareholders who have voted by proxy may still attend the Meeting.

If you have any questions, please contact D.F. King, our proxy solicitor assisting us in connection with the Meeting. Shareholders may call toll free at 1-866-521-4425 or by email at inquiries@dfking.com. Banks and brokers may call collect at 201-806-7301.

We appreciate your continued support of Performance Sports Group Ltd.

| | |

| | By Order of the Board of Directors |

| |

Bernard McDonell

Chair of the Board of Directors |

Exeter, New Hampshire

September • , 2015

ii

YOUR VOTE IS EXTREMELY IMPORTANT THIS YEAR IN LIGHT OF THE POTENTIAL

PROXY CONTEST BEING CONDUCTED BY THE WALTER GRAEME ROUSTAN TRUST

You may receive solicitation materials from a dissident Shareholder, the Walter Graeme Roustan Trust (the "Roustan Trust"), seeking your proxy to vote for W. Graeme Roustan ("Roustan") to become a member of our Board of Directors.THE BOARD OF DIRECTORS DOES NOT ENDORSE ROUSTAN AND URGES YOU NOT TO SIGN OR RETURN ANY PROXY CARD SENT TO YOU BY THE ROUSTAN TRUST OR ROUSTAN. THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE ELECTION OF THE BOARD OF DIRECTORS' NOMINEES LISTED ON THE ENCLOSED WHITE PROXY CARD.

WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING IN PERSON, IT IS IMPORTANT THAT YOUR SHARES BE REPRESENTED. WE URGE YOU TO SUBMIT YOUR PROXY AS PROMPTLY AS POSSIBLE (1) VIA THE INTERNET, (2) BY FACSIMILE OR (3) BY SIGNING, DATING AND MARKING THE ENCLOSED PROXY FORM AND RETURNING IT IN THE PREPAID ENVELOPE PROVIDED. ANY REGISTERED SHAREHOLDER WHO IS PRESENT AT THE MEETING MAY VOTE IN PERSON INSTEAD OF BY PROXY, THEREBY CANCELING ANY PREVIOUS PROXY. YOU MAY REVOKE YOUR PROXY AT ANY TIME BEFORE THE MEETING.

IF YOUR SHARES ARE HELD IN THE NAME OF A BROKER OR OTHER FINANCIAL INTERMEDIARY, PLEASE FOLLOW THE INSTRUCTIONS ON THE VOTING INSTRUCTION FORM FURNISHED TO YOU BY SUCH BROKER OR OTHER FINANCIAL INTERMEDIARY. FOR MORE INFORMATION ON HOW TO VOTE YOUR SHARES, SEE "VOTING PROCEDURES" IN THE PROXY STATEMENT.

We urge you to read the accompanying Proxy Statement carefully and in its entirety. If you have any questions concerning the accompanying Proxy Statement, would like additional copies of the accompanying Proxy Statement or need help voting your shares, please contact:

D.F. King

320 Bay Street

Toronto, ON M5H 4A6

North American Toll-free: 1-866-521-4425

Banks and brokers: 201-806-7301

Email:inquiries@dfking.com

Or

Performance Sports Group Ltd.

100 Domain Drive

Exeter, NH 03833-4801

Attention: Investor Relations

Telephone: (603) 610-5802

Email:investor@performancesportsgroup.com

NO SECURITIES REGULATORY AUTHORITY HAS PASSED UPON THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED IN THIS PROXY STATEMENT. ANY REPRESENTATION TO THE CONTRARY IS AN OFFENSE.

REPORTING CURRENCY

The Company presents its consolidated financial statements in United States dollars. In this Proxy Statement, references to "$", "US$", "dollars" or "U.S. dollars" are to United States dollars and references to "Cdn$" and "Canadian dollars" are to Canadian dollars. Amounts are stated in U.S. dollars unless otherwise indicated.

On May 29, 2015, the last trading day of the fiscal year ended May 31, 2015 ("Fiscal 2015"), the noon rate of exchange posted by the Bank of Canada for conversion of U.S. dollars into Canadian dollars was US$1.00 equals Cdn$1.2465.

iii

TABLE OF CONTENTS

| | |

| | Page |

|---|

VOTING PROCEDURES | | 1 |

Why did I receive this Proxy Statement? | | 1 |

Who will bear the expenses of this proxy solicitation? | | 1 |

When and where is the Meeting? | | 2 |

Who is entitled to vote? | | 2 |

What constitutes a quorum at the Meeting? | | 2 |

What proposals will be voted on at the Meeting? | | 2 |

How does the Board of Directors recommend that I vote? | | 3 |

How do I know if I am a Registered Shareholder? | | 3 |

How do I know if I am a Non-Registered Shareholder? | | 4 |

Does my broker or other financial intermediary have discretion to vote the Shares in my brokerage account (for U.S. Shareholders only) ? | | 5 |

What if additional proposals are presented at the Meeting? | | 5 |

How are votes counted? | | 5 |

BACKGROUND OF THE SOLICITATION | | 7 |

FINANCIAL STATEMENTS | | 9 |

PROPOSAL NO. 1 ELECTION OF DIRECTORS | | 10 |

Advance Notice Provisions | | 10 |

Majority Voting Policy | | 11 |

Board of Directors and Corporate Governance | | 13 |

Director Independence and Qualifications | | 13 |

Corporate Governance Guidelines | | 19 |

Board Meetings and Attendance | | 19 |

Director Attendance at the Annual Meeting | | 21 |

Director Compensation | | 21 |

Board Committees | | 22 |

Orientation and Continuing Education | | 25 |

Code of Business Conduct and Ethics | | 25 |

Anti-Corruption Policy | | 26 |

Considerations in Evaluating Director Nominees | | 26 |

Diversity Policy | | 27 |

Board Renewal | | 28 |

Board of Directors and Committee Evaluation | | 28 |

Shareholder Recommendations for Nominations to the Board of Directors | | 29 |

Communications with the Board of Directors | | 29 |

Cease Trade Orders or Bankruptcies | | 30 |

Penalties or Sanctions | | 30 |

PROPOSAL NO. 2 APPROVAL OF APPOINTMENT OF AUDITOR | | 31 |

iv

| | |

| | Page |

|---|

Policy and Audit Committee Pre-Approval of Audit and Permitted Non-Audit Services | | 32 |

Audit and Related Fees | | 32 |

Auditor Independence | | 33 |

Report of the Audit Committee | | 33 |

Reliance on Certain Exemptions | | 33 |

PROPOSAL NO. 3 ADOPTION OF OMNIBUS EQUITY INCENTIVE PLAN | | 34 |

Omnibus Equity Incentive Plan | | 36 |

U.S. Federal Income Tax Consequences | | 42 |

Canadian Federal Income Tax Consequences | | 43 |

PROPOSAL NO. 4 APPROVAL OF AN AMENDMENT TO THE ARTICLES TO INCREASE THE QUORUM REQUIREMENT FOR MEETINGS OF EACH OF SHAREHOLDERS AND THE BOARD OF DIRECTORS | | 44 |

PROPOSAL NO. 5 APPROVAL OF AN AMENDMENT TO THE NOTICE OF ARTICLES AND THE ARTICLES TO REMOVE REFERENCES TO PROPORTIONATE VOTING SHARES | | 45 |

PROPOSAL NO. 6 APPROVAL OF AN AMENDMENT TO THE METHOD OF GIVING NOTICE IN THE ARTICLES | | 47 |

PROPOSAL NO. 7 APPROVAL OF AN AMENDMENT TO THE ADVANCE NOTICE PROVISIONS IN THE ARTICLES WITH RESPECT TO THE NOMINATION OF DIRECTORS | | 48 |

PROPOSAL NO. 8 APPROVAL OF AN AMENDMENT TO THE INDEMNIFICATION PROVISIONS IN THE ARTICLES | | 50 |

EXECUTIVE OFFICERS | | 51 |

Family Relationships | | 53 |

EXECUTIVE COMPENSATION | | 54 |

Introduction | | 54 |

Summary Compensation Table | | 54 |

Narrative Disclosure to Summary Compensation Table | | 54 |

Outstanding Share-Based Awards and Option-Based Awards | | 60 |

Securities Authorized for Issuance Under Equity Compensation Plans | | 61 |

Retirement Benefits | | 61 |

Employment Agreements, Termination Benefits, Change of Control and Other Benefits | | 61 |

Indemnification and Insurance | | 62 |

Interest of Certain Persons or Companies in Matters to be Acted Upon | | 63 |

Share Ownership Guidelines | | 63 |

Insider Trading Policy | | 63 |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | | 64 |

CERTAIN RELATIONSHIPS AND RELATED-PARTY TRANSACTIONS | | 66 |

Registration Rights Agreement | | 66 |

Indemnification of Directors and Officers | | 66 |

Statement of Policy Regarding Transactions with Related Persons | | 66 |

OTHER MATTERS | | 67 |

Indebtedness of Directors and Executive Officers | | 67 |

v

| | |

| | Page |

|---|

Interest of Informed Persons in Material Transactions | | 67 |

Section 16(a) Beneficial Ownership Reporting Compliance | | 67 |

Shareholders Sharing the Same Address; Householding | | 67 |

Shareholder Proposals | | 67 |

Fiscal Year 2015 Annual Report, SEC Filings and Additional Information | | 68 |

Other Business | | 68 |

Questions | | 68 |

Availability of Quarterly Financial Information | | 68 |

Approval by Directors | | 69 |

APPENDIX A ADDITIONAL INFORMATION REGARDING PARTICIPANTS IN THE SOLICITATION | | |

ANNEX A ORDINARY RESOLUTION APPROVING THE OMNIBUS EQUITY INCENTIVE PLAN | | A-1 |

ANNEX B ORDINARY RESOLUTION APPROVING AN AMENDMENT TO THE ARTICLES TO INCREASE THE QUORUM FOR MEETINGS OF EACH OF SHAREHOLDERS AND THE BOARD OF DIRECTORS | | B-1 |

ANNEX C SPECIAL RESOLUTION APPROVING AN AMENDMENT TO THE NOTICE OF ARTICLES AND THE ARTICLES TO REMOVE REFERENCES TO PROPORTIONATE VOTING SHARES | | C-1 |

ANNEX D ORDINARY RESOLUTION APPROVING AN AMENDMENT TO THE METHOD OF GIVING NOTICE IN THE ARTICLES | | D-1 |

ANNEX E ORDINARY RESOLUTION APPROVING AN AMENDMENT TO THE ADVANCE NOTICE PROVISIONS IN THE ARTICLES WITH RESPECT TO NOMINATION OF DIRECTORS | | E-1 |

ANNEX F ORDINARY RESOLUTION APPROVING AN AMENDMENT TO THE INDEMNIFICATION PROVISIONS IN THE ARTICLES | | F-1 |

ANNEX G OMNIBUS EQUITY INCENTIVE PLAN | | G-1 |

ANNEX H SECOND AMENDED AND RESTATED ARTICLES | | H-1 |

ANNEX I CORPORATE GOVERNANCE GUIDELINES | | I-1 |

ANNEX J AUDIT COMMITTEE CHARTER | | J-1 |

vi

PRELIMINARY COPY — SUBJECT TO COMPLETION

PROXY STATEMENT

VOTING PROCEDURES

This Proxy Statement is being furnished to the holders (the "Shareholders") of common shares (the "Shares") of Performance Sports Group Ltd. (the "Company," "we," "us" or "our") in connection with the solicitation of proxies by the Board of Directors (the "Board of Directors") and management of the Company, for use at the 2015 Annual and Special Meeting of Shareholders (the "Meeting") to be held at 9:00 a.m. (Eastern Time) on October 14, 2015, at the W Hotel New York — Downtown, 8 Albany Street, New York, New York 10006, or any adjournment or postponement thereof, for the purpose of considering and acting upon the matters set forth in the accompanying Notice of Annual and Special Meeting of Shareholders.

Your vote is important. Whether or not you plan to attend the Meeting in person, it is important that your Shares be represented. This Proxy Statement and accompanying form of proxy or voting instruction form, as applicable, along with the Company's 2015 Annual Report on Form 10-K (the "Annual Report"), are being mailed on or about September 21, 2015, to Shareholders as of the Record Date (as defined below). If you are a Registered Shareholder, please submit your proxy as promptly as possible (1) via the Internet, (2) by facsimile or (3) by signing, dating and marking the enclosed proxy form and returning it in the prepaid envelope provided. In lieu of sending proxy-related materials directly to Non-Registered Shareholders, the Company will pay for the cost incurred by intermediaries to deliver the proxy-related materials and the voting instruction form to Non-Registered Shareholders (both objecting beneficial owners and non-objecting beneficial owners). If you are a Non-Registered Shareholder and your Shares are held in the name of a broker or other financial intermediary, please follow the voting instruction form furnished to you by such broker or other financial intermediary.

Why did I receive this Proxy Statement?

The information contained in this Proxy Statement is furnished in connection with the solicitation of proxies by and on behalf of the Board of Directors and management of the Company to be used at the Meeting and for the purposes set forth in the Notice of Annual and Special Meeting of Shareholders. The information included in this Proxy Statement relates to the proposals to be considered and voted on at the Meeting, the voting procedures, the compensation of directors and the Company's three most highly paid executive officers, and other required information.

Who will bear the expenses of this proxy solicitation?

The costs of the Company's solicitation will be borne by the Company. In addition to mail and e-mail, proxies may be solicited personally, via the Internet or by telephone or facsimile, by certain of our regular employees without additional compensation. The Company intends to reimburse brokers or other financial intermediaries for their reasonable out-of-pocket expenses incurred in connection with the Company's solicitation of proxies for the Meeting. As a result of the potential proxy solicitation by the Walter Graeme Roustan Trust (the "Roustan Trust"), we may incur additional costs in connection with our solicitation of proxies. We have hired D.F. King ("D.F. King"), to assist us in the solicitation of proxies for a fee of up to $150,000 plus out-of-pocket expenses. D.F. King expects that approximately 22 of its employees will assist in the solicitation. Our expenses related to the solicitation of proxies from Shareholders this year will significantly exceed those normally spent for an annual meeting. Such additional costs are expected to aggregate to approximately $950,000. These additional solicitation costs are expected to include the fee payable to our proxy solicitor; fees of outside counsel and other advisors to advise the Company in connection with a contested solicitation of proxies; and increased mailing costs, such as the costs of additional mailings of solicitation material to Shareholders, including printing costs, mailing costs and the reimbursement of reasonable expenses

1

of banks, brokerage houses and other agents incurred in forwarding solicitation materials to beneficial owners of our Shares, as described above. To date, we have incurred approximately $175,000 of these solicitation costs.

When and where is the Meeting?

The Meeting is scheduled to be held at 9:00 a.m. (Eastern Time) on October 14, 2015, at the W Hotel New York — Downtown, 8 Albany Street, New York, New York 10006, for the purposes set forth in the accompanying Notice of Annual and Special Meeting of Shareholders. The Company reserves the right to adjourn or postpone the Meeting if considered appropriate by the Board of Directors.

Who is entitled to vote?

The Board of Directors has established the Record Date for the Meeting as the close of business on August 28, 2015 (the "Record Date"). Only Shareholders of record at the close of business on the Record Date will be entitled to receive notice of, and to vote at the Meeting or any adjournment or postponement thereof. No Shareholders becoming Shareholders of record after that time will be entitled to vote at the Meeting or any adjournment or postponement thereof.

What constitutes a quorum at the Meeting?

The transaction of business at the Meeting may occur only if a quorum is present. Under the Company's amended and restated articles (as amended, the "Articles"), two persons who are, or who represent by proxy, Shareholders who, in the aggregate, hold at least five percent of the Shares constitute a quorum.

What proposals will be voted on at the Meeting?

The following matters are scheduled to be voted on at the Meeting:

- •

- Proposal No. 1 (the election of each of the nine nominees as directors);

- •

- Proposal No. 2 (the approval of the appointment of an independent registered public accounting firm, KPMG LLP ("KPMG"), as the Company's auditor for the fiscal year ending May 31, 2016 ("Fiscal 2016"));

- •

- Proposal No. 3 (the approval of the Company's new omnibus equity incentive plan (the "Omnibus Equity Incentive Plan"));

- •

- Proposal No. 4 (the approval of an amendment to the Articles to increase the quorum for meetings of each of Shareholders and the Board of Directors);

- •

- Proposal No. 5 (the approval of an amendment to the Notice of Articles and the Articles to remove references to proportionate voting shares ("Proportionate Voting Shares"));

- •

- Proposal No. 6 (the approval of an amendment to the method of giving notice in the Articles);

- •

- Proposal No. 7 (the approval of an amendment to the Advance Notice Provisions (as defined below) in the Articles); and

- •

- Proposal No. 8 (the approval of an amendment to the indemnification provisions in the Articles).

In addition, such other business as may properly come before the Meeting or any adjournment or postponement thereof may be voted on.

The Roustan Trust, a Shareholder of the Company, has notified the Company that the Roustan Trust intends to nominate W. Graeme Roustan ("Roustan") for election to your Board of Directors at the Meeting in opposition to the nominees recommended by your Board of Directors. Roustan has NOT been endorsed by your Board of Directors, and your Board of Directors unanimously recommends a vote FOR each of your Board of Directors' nominees for director on the enclosedWHITE proxy card accompanying this proxy statement.Your Board of Directors unanimously recommends that you disregard and do not return any proxy card you receive from the Roustan Trust or Roustan. Voting to "withhold" with respect to Roustan on a proxy card sent to you by the Roustan Trust or Roustan is NOT the same as voting for your Board of Directors' nominees because a vote to "withhold" with respect to Roustan on the proxy card will revoke any proxy you previously submitted.

2

How does the Board of Directors recommend that I vote?

The Board of Directors recommends a vote:

- •

- FOR Proposal No. 1 (the election of each of the nine nominees as directors);

- •

- FOR Proposal No. 2 (the approval of the appointment of an independent registered public accounting firm, KPMG, as the Company's auditor for Fiscal 2016);

- •

- FOR Proposal No. 3 (the approval of the Omnibus Equity Incentive Plan);

- •

- FOR Proposal No. 4 (the approval of an amendment to the Articles to increase the quorum for meetings of each of Shareholders and the Board of Directors);

- •

- FOR Proposal No. 5 (the approval of an amendment to the Notice of Articles and the Articles to remove references to Proportionate Voting Shares);

- •

- FOR Proposal No. 6 (the approval of an amendment to the method of giving notice in the Articles);

- •

- FOR Proposal No. 7 (the approval of an amendment to the Advance Notice Provisions in the Articles); and

- •

- FOR Proposal No. 8 (the approval of an amendment to the indemnification provisions in the Articles).

As described above, the Roustan Trust has notified the Company that the Roustan Trust intends to nominate Roustan for election to your Board of Directors at the Meeting in opposition to the nominees recommended by your Board of Directors. Roustan has NOT been endorsed by your Board of Directors, and your Board of Directors unanimously recommends that you vote FOR each of your Board of Directors' nominees for director on the enclosedWHITE proxy card accompanying this proxy statement.

How do I know if I am a Registered Shareholder?

You are a Registered Shareholder if your name appears on your Share certificate or if you are registered as the holder of Shares in book-entry form. If you are a Registered Shareholder of Shares, the proxy form is included in the proxy-related materials mailed to you.

If you are a Registered Shareholder, you can vote in person at the Meeting or by proxy. Voting by proxy means that you are giving the person or people named on your proxy form (your proxyholders) the authority to vote your Shares for you at the Meeting or any adjournment or postponement thereof.

How do Registered Shareholders vote in person?

If you are a Registered Shareholder and intend to be present and vote in person at the Meeting, you do not need to complete or return your proxy form. At the Meeting, you should see a representative of Equity Financial Trust Company, the Company's transfer agent. Voting in person at the Meeting can revoke any proxy you completed earlier upon your request.

How do Registered Shareholders vote by proxy?

Complete and return the form of proxy in the prepaid envelope provided. The proxy must be executed by the Registered Shareholder or the attorney of such Registered Shareholder, duly authorized in writing.

If you vote by proxy, the Company proxyholders named on the proxy form will vote your Shares for you, unless you appoint someone else to be your proxyholder.You may also vote your Shares by proxy by appointing another person to attend the Meeting and vote your Shares for you. This person does not have to be a Shareholder but must be present at the Meeting to vote your Shares. Write the name of the person you are appointing in the space provided. Complete your voting instructions and date and sign the form. Make sure that the person you appoint is aware that he or she has been appointed and attends the Meeting. At the Meeting, he or she should see a representative of Equity Financial Trust Company.

If you are voting your Shares by proxy, the Company's transfer agent, Equity Financial Trust Company, must receive your signed proxy:

- 1.

- by mail, using a proxy form, at 200 University Avenue, Suite 300, Toronto, Ontario M5H 4H1;

3

- 2.

- on the internet atwww.voteproxyonline.com; or

- 3.

- by facsimile at416-595-9593;

not later than 9:00 a.m. (Eastern Time) on October 9, 2015, or, if the Meeting is adjourned or postponed, not less than two business days before the time of any such adjourned or postponed Meeting. Failure to properly complete or deposit a proxy may result in its invalidation. The proxy voting deadline may be waived or extended by the Board of Directors in their discretion.

The Shares represented by any proxies received will be voted for, against, withheld or abstained from voting, as the case may be, by the persons named in the Company's form of proxy in accordance with the direction of the Shareholder appointing them.In the absence of any direction to the contrary, the Company proxyholders named in the Company's form of proxy intend to vote the Shares represented by such proxies "FOR": Proposal No. 1 (the election of each of the nine nominees as directors); Proposal No. 2 (the approval of the appointment of an independent registered public accounting firm, KPMG, as the Company's auditor for the Fiscal 2016); Proposal No. 3 (the approval of the Omnibus Equity Incentive Plan); Proposal No. 4 (the approval of an amendment to the Articles to increase the quorum for meetings of each of Shareholders and the Board of Directors); Proposal No. 5 (the approval of an amendment to the Notice of Articles and the Articles to remove references to Proportionate Voting Shares); Proposal No. 6 (the approval of an amendment to the method of giving notice in the Articles); Proposal No. 7 (the approval of an amendment to the Advance Notice Provisions in the Articles); and Proposal No. 8 (the approval of an amendment to the indemnification provisions in the Articles.

Can Registered Shareholders revoke or change their vote?

A Registered Shareholder completing and submitting the form of proxy may revoke it at any time before it has been exercised by:

- •

- completing a proxy form that is dated later than the proxy form you are revoking and mailing it to Equity Financial Trust Company so that it is received before 9:00 a.m. (Eastern Time) on October 9, 2015;

- •

- sending a revocation notice in writing to the Corporate Secretary of the Company at its registered office, which is located at 666 Burrard Street, Suite 1700, Vancouver, British Columbia, V6C 2X8, so that it is received at any time up to and including the last business day before the date of the Meeting. The notice can be from the Shareholder or the attorney of such Shareholder, duly authorized in writing; or

- •

- attending the Meeting and providing a revocation notice to the chair of the Meeting before any vote in respect of which the proxy has been given.

How do I know if I am a Non-Registered Shareholder?

You are a Non-Registered Shareholder if your broker or other financial intermediary holds your Shares for you. In that case, you will not receive a proxy form from the Company. In most cases, you will receive a voting instruction form from your financial intermediary that allows you to provide your voting instructions by telephone, on the internet or by mail.

If you are not sure whether you are a Registered Shareholder or a Non-Registered Shareholder, please contact the Company's transfer agent, Equity Financial Trust Company, at 200 University Avenue, Suite 300, Toronto, Ontario M5H 4H1 or by e-mail atTMXEinvestorservices@tmx.com.

How Do Non-Registered Shareholders vote?

Applicable regulatory rules requires brokers and other financial intermediaries to seek voting instructions from Non-Registered Shareholders in advance of shareholders' meetings. Every broker or other financial intermediary has its own mailing procedures and provides its own return instructions, which should be carefully followed by Non-Registered Shareholders in order to ensure that their Shares are voted at the Meeting. Often, the voting instruction form supplied to a Non-Registered Shareholder by its broker or other financial intermediary appears identical to the form of proxy provided to Registered Shareholders. However, its purpose is limited to instructing your broker or other financial intermediary, as the Registered Shareholder, how to vote on your behalf.

4

Non-Registered Shareholders who receive a voting instruction form in the proxy-related materials should carefully follow the instructions provided to ensure their vote is counted.

How do Non-Registered Shareholders vote in person?

Although Non-Registered Shareholders may not be recognized directly at the Meeting for the purposes of voting Shares registered in the name of CDS Clearing and Depository Services Inc., The Depositary Trust Company or their broker or other intermediary, a Non-Registered Shareholder may attend the Meeting as proxy holder for the Registered Shareholder and vote their Shares in that capacity. A Non-Registered Shareholder who wishes to attend the Meeting and indirectly vote their Shares as proxyholder for the Registered Shareholder, should enter their own name in the blank space on the voting instruction form provided and return the same to their broker or other intermediary in accordance with the instructions provided by such broker or other intermediary. At the Meeting, any such proxyholder should see a representative of Equity Financial Trust Company.

Can Non-Registered Shareholders change their vote?

A Non-Registered Shareholder may change or revoke a voting instruction by following the instructions on the voting instruction form in sufficient time prior to the Meeting.

Does my broker or other financial intermediary have discretion to vote the Shares in my brokerage account (for U.S. Shareholders only)?

If you hold your Shares through a broker or other financial intermediary, your broker or other financial intermediary will not be permitted to vote on your behalf on most of the matters presented at the Meeting, including the election of directors, unless you provide specific instructions by completing and returning the voting instruction form or following the instructions provided to you to vote your Shares.

Generally, Canadian securities laws and New York Stock Exchange ("NYSE") rules prohibit brokers from voting on any of the proposals without receiving voting instructions from the Non-Registered Shareholders, except that U.S. brokers will have discretionary authority to vote uninstructed Shares only with respect to the appointment of KPMG, in accordance with NYSE rules.As brokers and other financial intermediaries generally may not vote your Shares in the absence of your specific instructions as to how to vote (except in the limited circumstances described below), we encourage you to provide voting instructions to your broker or other financial intermediary before the date of the Meeting. See "— How are votes counted?" below.

If you have any questions about this rule or the proxy voting procedures in general, please contact the broker or other financial intermediary where you hold your Shares. The Securities and Exchange Commission (the "SEC") also has a website (www.sec.gov/spotlight/proxymatters.shtml) with more information about your rights as a Shareholder.

What if additional proposals are presented at the Meeting?

The form of proxy and any voting instructions submitted confer discretionary authority upon the persons named therein with respect to matters not specifically mentioned in the Notice of Annual and Special Meeting of Shareholders but which may properly come before the Meeting or any adjournment(s) or postponement(s) thereof, and with respect to amendments to or variations of matters identified in the Notice of Annual and Special Meeting of Shareholders. As at the date hereof, management knows of no such amendments, variations or other matters to come before the Meeting other than the matters referred to in the Notice of Annual and Special Meeting of Shareholders and routine matters incidental to the conduct of the Meeting. If any further or other business is properly brought before the Meeting, it is intended that the persons appointed as proxy will vote on such other business in such manner as such persons then consider to be proper.

How are votes counted?

Other than Proposal No. 1 (the election of each of the nine nominees as directors) and Proposal No. 5 (the approval of an amendment to the Notice of Articles and the Articles to remove references to Proportionate Voting Shares), all other proposals that are scheduled to be voted upon at the Meeting are ordinary resolutions.

5

Ordinary resolutions are passed by a simple majority of votes cast in person or by proxy at the Meeting. If more than half of the votes cast are cast in favor, the ordinary resolution passes. Special resolutions are passed by not less than two-thirds of the votes cast in person or by proxy at the Meeting. If two-thirds of the votes cast are in favor, the special resolution passes. Under the British ColumbiaBusiness Corporations Act ("BCBCA"), director elections are based on the plurality system, where Shareholders vote for or withhold their votes for a director. Votes withheld are not counted, with the result that, technically, a director could be elected to the Board of Directors with just one vote in favor; however, pursuant to the Company's Majority Voting Policy, if a nominee in an uncontested election does not receive at least the majority of the votes cast (including votes "for" and votes "withheld"), such director is required to promptly tender his or her resignation from the Board of Directors. However, under our Majority Voting Policy, because we have received notice from the Roustan Trust that the Roustan Trust intends to nominate Roustan for election to our Board of Directors in opposition to the nominees recommended by our Board of Directors, the provisions of our Majority Voting Policy relating to majority voting for directors will not be applicable to the Meeting and, pursuant to our Majority Voting Policy, plurality voting will apply. Accordingly, the nine nominees for director who receive the most votes of all votes cast for directors will be elected. As described above, broker non-votes do not constitute a vote "for" or "withheld" with respect to a director. In the event the Roustan Trust were to withdraw Roustan as a nominee, such that there would no longer be a contested election, the majority voting provisions of our Majority Voting Policy would apply. The Company's Majority Voting Policy is described in more detail under the heading "Proposal No.1 Election of Directors — Majority Voting Policy" below.

For U.S Shareholders only, a broker "non-vote" occurs when a nominee holding Shares for a Non-Registered Shareholder does not vote on a particular proposal because the nominee does not have discretionary voting power on that item (pertaining to a "non-routine" matter) and has not received instructions from the Non-Registered Shareholder. Each of the proposals, other than Proposal No. 2 (the approval of the appointment of an independent registered public accounting firm, KPMG, as the Company's auditor for Fiscal 2016), is a "non-routine" matter and could result in broker "non-votes." Broker "non-votes" and the Shares with respect to which a Shareholder abstains to vote are included in determining whether a quorum is present, but are not deemed as "votes cast." As a result, abstentions and broker "non-votes" are not included in the tabulation of the voting results on the election of directors or issues requiring approval by ordinary or special resolutions (other than Proposal No. 2) and, therefore, do not act as a yes or no vote on the matters to be considered at the Meeting.

It will NOT help to elect all nominees recommended by your Board of Directors if you sign and return a proxy card sent by the Roustan Trust or Roustan, even if you withhold with respect to Roustan using such proxy card. Doing so will cancel any previous vote you may have cast on our WHITE proxy card. The only way to support all of your Board of Directors' nominees is to vote FOR the Board of Directors' nominees on our WHITE proxy card and to disregard, and not return, any proxy card that you receive that is not a WHITE proxy card, including any proxy card that you receive from the Roustan Trust or Roustan.

Voting Shares

The Company's authorized share capital consists of an unlimited number of Shares and an unlimited number of Proportionate Voting Shares. As of the Record Date, the Company had 45,552,180 issued and outstanding Shares. No Proportionate Voting Shares are currently issued and outstanding.

Voting Rights

The Shares carry one vote per Share for all matters coming before Shareholders. The holders of Shares are entitled to receive notice of any meeting of Shareholders of the Company, and to attend and vote at those meetings, except those meetings at which holders of a specific class of shares are entitled to vote separately as a class under the BCBCA.

Ownership of Shares of the Company

As of the record date, to the Company's knowledge, no person or company owned beneficially, directly or indirectly, or controlled or directed more than 10% of the Shares. See "Security Ownership of Certain Beneficial Owners and Management."

If you have any questions or need assistance voting, please contact D.F. King, our proxy solicitor assisting us in connection with the Meeting. Shareholders may call toll free at 1-866-521-4425 or by email at inquiries@dfking.com. Banks and brokers may call collect at 201-806-7301.

6

BACKGROUND OF THE SOLICITATION

On April 17, 2008, an investor group led by Kohlberg & Company ("Kohlberg"), a leading private equity firm, purchased Bauer Hockey from Nike, Inc.

Kohlberg funded the acquisition of Bauer Hockey, along with the participation of members of management, including Mr. Davis. W. Graeme Roustan, who was named as Chairman of Bauer Hockey in April 2008, did not make any financial investment. Instead, Mr. Roustan entered into a consulting agreement with the Company and received grants of stock options (the "Roustan Options"). Mr. Roustan subsequently transferred the Roustan Options to the Roustan Trust.

Under new ownership and led by new management, including Kevin Davis as President and Chief Executive Officer and Amir Rosenthal as Chief Financial Officer and later President, PSG Brands, the Company leveraged its hockey business management expertise and developed a platform upon which it commenced the Company's transformation from a single-sport hockey company to a multi-sport high-performance equipment manufacturer.

In March 2011, the Company, then named Bauer Performance Sports Ltd., completed its initial public offering in Canada, listing its Shares on the Toronto Stock Exchange (the "TSX"). The Canadian initial public offering price was Cdn$7.50 per Share, which implied a market capitalization of approximately Cdn$236.5 million at such time. As a public company, management accelerated its pace of strategic accretive acquisitions. In June 2014, the Company completed its initial public offering in the United States, listing its Shares on the NYSE. The U.S. initial public offering price was $15.50 per Share, which implied a market capitalization of approximately $681 million at such time.

In March 2011, at the time of the Company's initial public offering in Canada, Mr. Roustan's consulting arrangement was terminated, but he continued to serve as non-independent Chairman.

On September 18, 2012, Mr. Roustan resigned as non-independent Chairman and withdrew his name for re-election as a director of the Company at the October 2012 annual and special meeting of Shareholders.

On January 9, 2013, following Mr. Roustan's departure from the Board of Directors, the Company, Mr. Roustan and the Roustan Trust entered into an option-extension agreement pursuant to which the Company agreed to extend the expiration date of all of the Roustan Options held by the Roustan Trust. In consideration for such extension, Mr. Roustan agreed to certain restrictive covenants. He subsequently exercised the Roustan Options for Shares on a net exercise basis, without cash payment.

On January 6, 2015, Mr. Roustan sent a letter to Mr. Bernard McDonell, Chairman of the Board of Directors, asking to be appointed to the Board of Directors effective as soon as possible. On January 15, 2015, Mr. McDonell responded to Mr. Roustan's letter, stating that his request had been referred to the Corporate Governance and Nominating Committee for consideration. Mr. McDonell subsequently informed Mr. Roustan that his request would be considered at the meeting of the Board of Directors that was scheduled to be held on April 8, 2015.

On April 10, 2015, Mr. McDonell informed Mr. Roustan that the Board of Directors had considered his request and, based on the recommendation of the Corporate Governance and Nominating Committee, unanimously determined that it was not in the Company's best interest to recommend that Mr. Roustan be nominated to the Board of Directors.

On May 11, 2015, Mr. Roustan delivered a letter to the Company questioning the propriety of the Company's imminent opening of its first "Own the Moment" Bauer Hockey retail store.

On May 12, 2015, a Bauer Hockey customer informed the Company that a third-party consulting firm (the "Survey Consultant") was contacting the Company's customers and conducting a survey pertaining to the Company's "Own the Moment" Bauer Hockey retail store strategy, on behalf of a shareholder of the Company. Mr. Roustan subsequently acknowledged that he had retained the Survey Consultant. The Company was not involved in any way with the survey and was concerned that the actions of the Survey Consultant would adversely affect certain of its customer relationships.

The Company's external counsel delivered letters to each of the Survey Consultant and Mr. Roustan's counsel expressing concern that the survey conducted by the Survey Consultant could cause harm to the

7

Company and that it was interfering with the Company's relationships with its customers. The Survey Consultant subsequently stopped conducting the survey.

On June 5, 2015, representatives of the Company, including Mr. McDonell, Ms. Barsa, Mr. Nicholson, Mr. Davis and Mr. Wall, together with external counsel, met with Mr. Roustan and his representatives. At the meeting, the Company and its representatives confirmed to Mr. Roustan that the Board of Directors had no reason to reconsider Mr. Roustan's appointment to the Board of Directors, as it had received no new information subsequent to when Mr. Roustan's candidacy was previously considered at the April 8, 2015 meeting of the Board of Directors.

On July 9, 2015, Mr. Roustan's counsel delivered a letter to the Company's external counsel requesting that the Roustan Options that Mr. Roustan had previously exercised be reinstated, and that Mr. Roustan be given two seats on the Board of Directors for himself and an unnamed second person.

On August 7, 2015, the Company's external counsel delivered a letter to Mr. Roustan's counsel in response to the July 9, 2015 letter. The letter reiterated that the Roustan Options previously exercised no longer existed and could not be reinstated, because Mr. Roustan had already received the underlying Shares. The letter also stated that the Board of Directors had considered Mr. Roustan's request for two seats on the Board of Directors and determined there was no rationale to grant the request.

In mid-August, one of Mr. Roustan's representatives approached outside counsel to the Company and suggested that Mr. Roustan would agree not to commence a proxy contest if the Company reimbursed Mr. Roustan for certain of his expenses. The Company considered the proposal, but was of the view that the amount requested by Mr. Roustan for expense reimbursement was too high. A counter-proposal was made to Mr. Roustan's representative, but it was rejected.

On September 11, 2015, the Company received a notice from the Roustan Trust, dated as of August 31, 2015, indicating that the Roustan Trust intended to nominate Mr. Roustan to stand for election as a director at the Meeting and stating that the Roustan Trust would solicit proxies in support of such election.

We are not responsible for the accuracy of any information provided by or relating to Roustan or the Roustan Trust contained in any proxy solicitation materials filed or disseminated by, or on behalf of, Roustan or the Roustan Trust or any other statements that Roustan or the Roustan Trust may otherwise make. The Roustan Trust and Roustan choose which of our Shareholders will receive their proxy solicitation materials.

8

FINANCIAL STATEMENTS

The audited consolidated financial statements of the Company for the fiscal year ended May 31, 2015 ("Fiscal 2015"), together with the auditor's report thereon, will be submitted at the Meeting, but no vote thereon is required. These audited consolidated financial statements, together with the management's discussion and analysis thereon, may also be obtained on the Company's corporate website atwww.performancesportsgroup.com, on the EDGAR website maintained by the SEC atwww.sec.gov and on the SEDAR website maintained by the Canadian Securities Administrators ("CSA") atwww.sedar.com. The Company's corporate website does not form part of this Proxy Statement.

9

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Nine directors are to be elected at the Meeting, each of whom is to hold office until the end of the next annual meeting of Shareholders or until their successors are elected or appointed.

All of the Board of Directors' nominees have established their eligibility and willingness to serve as directors. As of the date hereof, management of the Company does not expect that any of the Board of Directors' nominees will be unable to serve as a director. However, if, for any reason, at the time of the Meeting any of the Board of Directors' nominees are unable to serve and unless otherwise specified, it is intended that the persons designated in the Company's form of proxy will vote at their discretion for a substitute nominee or nominees.

The Articles state that the Board of Directors must have a minimum of three and a maximum of ten directors. The Board of Directors has currently fixed the size of the Board of Directors at nine directors. At the Meeting, each of the persons identified in the section "Board of Directors and Corporate Governance" will be nominated for election as a director; all such nominees are presently directors of the Company. The directors are elected annually and, unless re-elected, retire from office at the end of the next annual meeting of Shareholders.

The Board of Directors unanimously recommends that Shareholders use the enclosed WHITE proxy card to vote FOR each of the Board of Directors' nine nominees for director. The Roustan Trust, a Shareholder, has notified the Company that the Roustan Trust intends to nominate Roustan for election to your Board of Directors at the Meeting in opposition to the nominees recommended by your Board of Directors. As a result, the election of directors is considered a contested election, and the nine nominees receiving the largest pluralities of the votes cast will be elected, as described in more detail below.

The Board of Directors unanimously recommends that you disregard any proxy card that may be sent to you by the Roustan Trust or Roustan. It will NOT help elect all nominees recommended by your Board of Directors if you sign and return a proxy card sent by the Roustan Trust or Roustan, even if you withhold with respect to Roustan using the Roustan Trust's proxy card. Doing so will cancel any previous vote you may have cast on our WHITE proxy card. The only way to support all of your Board of Directors' nominees is to vote FOR the Board of Directors' nominees on our WHITE proxy card and to disregard, and not return, any proxy card that you receive that is not a WHITE proxy card, including any proxy card that you receive from the Roustan Trust or Roustan.

Advance Notice Provisions

On October 16, 2013, Shareholders approved an amendment to the Articles to include advance notice provisions (the "Advance Notice Provisions") in the Articles for the purpose of providing Shareholders, directors and management of the Company with a clear framework for nominating directors of the Company in connection with any annual or special meeting of Shareholders.

The purpose of the Advance Notice Provisions is to (i) ensure that all Shareholders receive adequate notice of director nominations and sufficient time and information with respect to all nominees for appropriate deliberations and register an informed vote; and (ii) facilitate an orderly and efficient process for annual or special meetings of Shareholders of the Company. The Advance Notice Provisions fix the deadlines by which holders of record of Shares must submit director nominations to the Corporate Secretary of the Company prior to any annual or special meeting of Shareholders for an effective nomination to occur. No person will be eligible for election as a director of the Company unless nominated in accordance with the Advance Notice Provisions.

In the case of an annual meeting of Shareholders, such as the Meeting, notice must be received by the Corporate Secretary of the Company at the principal executive office of the Company not later than 5:00 p.m. (Eastern Time) on the 30th day and not earlier than 9:00 a.m. (Eastern Time) on the 65th day before the date of the annual meeting;provided,however, that in the event that the annual meeting is to be held on a date that is less than 50 days after the date on which the first public announcement of the date of the annual meeting was made, notice may be made not later than the close of business on the 10th day following such public announcement. In the case of a special meeting of Shareholders (which is not also an annual meeting), notice to the Company must be made not later than the close of business on the 15th day following the day on which the

10

first public announcement of the date of the special meeting was made. These provisions may preclude Shareholders from making nominations for directors at an annual or special meeting of Shareholders. The Board of Directors may, in its sole discretion, waive any requirement of the Advance Notice Provisions. For the purposes of the Advance Notice Provisions, "public announcement" means disclosure in a press release reported by a national news service in Canada, or in a document filed by the Company for public access under its profile on the SEDAR website maintained by the CSA atwww.sedar.com.

At the Meeting, the Company will be seeking approval from Shareholders to amend the Advance Notice Provisions to better reflect evolving corporate governance practices and to conform to current industry standards; however, such proposed amendments will not be effective unless and until Shareholder approval has been obtained in respect thereof and, therefore, such proposed amendments are not applicable in respect of this Meeting. See "Proposal No. 7 — Approval of an Amendment to the Advance Notice Provisions in the Articles with respect to the Nomination of Directors."

The foregoing description of the Advance Notice Provisions is intended as a summary only and does not purport to be complete and is subject to, and is qualified in its entirety by reference to, all of the provisions of the Articles, which contain the full text of the Advance Notice Provisions, and which are available on EDGAR atwww.sec.gov and SEDAR atwww.sedar.com.

Majority Voting Policy

In accordance with the TSX Company Manual, the Company has adopted a majority voting policy, as amended (the "Majority Voting Policy"), which requires that in an uncontested election of directors, if any nominee receives a greater number of votes "withheld" than votes "for," the nominee will tender a resignation to the Chair of the Board of Directors immediately following the meeting. As set out in the Majority Voting Policy, an "uncontested election" means an election where the number of nominees for director shall be equal to the number of directors to be elected, as determined by the Board of Directors. The Corporate Governance and Nominating Committee will consider the offer of resignation in a timely manner and shall make a recommendation to the Board of Directors. The Board of Directors will make a final decision on the resignation no later than within 90 days of the meeting, having considered the factors reviewed by the Corporate Governance and Nominating Committee, and is expected to accept the resignation except in situations where exceptional circumstances would warrant the director continuing to serve on the Board of Directors. A director who tenders his or her resignation will not participate in the Corporate Governance and Nominating Committee's or the Board of Directors' consideration of whether to accept the tendered resignation. The Board of Directors will promptly disclose its decision in a press release, and should, the Board of Directors decline to accept the resignation, the press release will fully state the reasons for its decision.

The Majority Voting Policy does not apply where the number of nominees for election as a director exceeds the number of directors to be elected and/or an election involving a proxy battle, i.e., where proxy material is circulated and/or a solicitation of proxies is carried out in support of one or more nominees who are not director nominees supported by the Board of Directors or public communications are disseminated against one or more nominees who are supported by the Board of Directors. Because we have received notice from the Roustan Trust that the Roustan Trust intends to nominate Roustan for election to our Board of Directors at the Meeting in opposition to the nominees recommended by our Board of Directors, the provisions of our Majority Voting Policy relating to majority voting for directors will not be applicable to the Meeting and plurality voting will apply. Accordingly, the nine nominees for director who receive the most votes of all votes cast for directors will be elected. Broker non-votes do not constitute a vote "for" or "withheld" with respect to a director. In the event the Roustan Trust were to withdraw Roustan as a nominee, such that there would no longer be a contested election, the majority voting provisions of our Majority Voting Policy would apply.

The foregoing description of the Majority Voting Policy is intended as a summary only and does not purport to be complete and is subject to, and is qualified in its entirety by reference to, all of the provisions of the Majority Voting Policy, a copy of which is available on the Company's corporate website athttp://www.performancesportsgroup.com/site/downloads/2015-PSG-Majority-Voting-Policy.pdf.

11

Vote Required for Approval

A plurality of the votes duly cast in person or by proxy by the Shareholders at the Meeting with respect to each director is required for the election of each director.

The Board of Directors unanimously recommends that Shareholders use the enclosed WHITE proxy card to vote FOR each of the Board of Directors' nine nominees for director, and unanimously recommends that you disregard any proxy card that may be sent to you by the Roustan Trust or Roustan. It will NOT help elect all nominees recommended by your Board of Directors if you sign and return a proxy card sent by the Roustan Trust or Roustan, even if you withhold with respect to Roustan using the Roustan Trust's proxy card. Doing so will cancel any previous vote you may have cast on our WHITE proxy card. The only way to support all of your Board of Directors' nominees is to vote FOR the Board of Directors' nominees on our WHITE proxy card and to disregard, and not return, any proxy card that you receive that is not a WHITE proxy card, including any proxy card that you receive from the Roustan Trust or Roustan.

Unless a proxy specifies that the Shares it represents should be withheld from voting in respect of the election of directors or otherwise voted in accordance with the specification in the proxy, the Company proxyholders named in the Company's form of proxy intend to vote FOR the election of each of the Board of Directors' nominees listed in this Proxy Statement.

12

Board of Directors and Corporate Governance

Director Independence and Qualifications

Each of the Board of Directors' nominees is currently a director of the Company. The Board of Directors has determined that eight of the nine current and incumbent directors (or 89% of the Board of Directors) have no material relationship with the Company either directly or indirectly and are "independent" within the meaning of the listing requirements of the NYSE and, where applicable, National Instrument 58-101 — Disclosure of Corporate Governance Practices ("NI 58-101") (such directors, the "Independent Directors"). Specifically, the Board of Directors has identified each of the directors, with the exception of Mr. Davis, who is not independent as he is the Company's Chief Executive Officer, as independent for the purposes of NI 58-101 and as an Independent Director as such term is defined by each of the NYSE Listed Company Manual and Rule 10A-3 of the Securities Exchange Act of 1934, as amended (the "Exchange Act").

| | | | | | |

Name | | Independent | | Non-Independent | | Reasons for

Non-Independence |

|---|

Karyn Barsa | | ü | | | | |

Kevin Davis | | | | ü | | Chief Executive Officer |

Joan Dea | | ü | | | | |

C. Michael Jacobi | | ü | | | | |

Paul Lavoie | | ü | | | | |

Larry Lucchino | | ü | | | | |

Matthew Mannelly | | ü | | | | |

Bernard McDonell (Chair) | | ü | | | | |

Bob Nicholson | | ü | | | | |

The Chair of the Board of Directors, Bernard McDonell, is an Independent Director. The Independent Directors are entitled to hold in-camera sessions without management present at meetings of the Board of Directors, if considered necessary, and did so periodically throughout Fiscal 2015. At the committee level, all members on the Audit Committee, the Corporate Governance and Nominating Committee, the Compensation Committee and the recently established Risk Committee, are Independent Directors. Each of the charters of the committees of the Board of Directors generally provides that the committee will be granted unrestricted access to all information regarding the Company that is necessary or desirable to fulfill its duties and all directors, officers and employees of the Company will be directed to cooperate as requested by the members of the committee. In addition, each committee has the authority to retain, at the Company's expense, independent legal, financial and other advisors, consultants and experts, to assist the committee in fulfilling its duties and responsibilities, including authority to retain and to approve any such firm's fees and other retention terms.

Set forth below is certain information concerning the Board of Directors' nominees for election as directors of the Company, including information regarding each person's service as a director, business experience, director positions held currently or at any time during the last five years, equity ownership in the Company, and the experience, qualifications, attributes or skills on the basis of which the Corporate Governance and Nominating Committee and the Board of Directors determined that the person should serve as a director of the Company.

13

|

| |

Karyn Barsa, 54

Utah, USA

Director Since: 2014

Independent |

Karyn Barsa has been a member of the Company's Board of Directors since May 2014. Ms. Barsa has led numerous global premium brands and has been a member of the board of directors of Deckers Outdoor Corporation since 2008. Ms. Barsa served as the CEO at Coyuchi, Inc. from 2009 to 2013 and has also served as the CEO of Investors' Circle and Smith & Hawken, Ltd. In addition to her Chief Executive roles, Ms. Barsa served as Chief Operating Officer and CFO at Patagonia, Inc. and was the founder of HeadStart Custom Helmets. Ms. Barsa has also held financial positions with Kerr Glass Manufacturing Company, Wells Fargo Bank, Tacoma Boatbuilding Corporation and Midland Capital. Ms. Barsa has over 20 years of experience in leading businesses with an emphasis on finance and operations, in both retail and wholesale. |

Ms. Barsa received a Bachelor of Arts degree in Economics from Connecticut College and an MBA from the University of Southern California. |

Ms. Barsa was selected to the serve on the Board of Directors because of her experience in the consumer goods, retail and financial sectors. Ms. Barsa's experience in the retail sector provides the Company with valuable expertise, especially in relation to the Company's hockey retail initiative. |

| | | | | | |

| |

Equity Ownership

| | Public Board Membership

|

|---|

| |

| Shares | | DSUs | | Options | | Deckers Outdoor Corporation (NYSE: DECK) |

| | | |

| Nil | | 4,194 | | Nil | | |

| | | | |

| |

Committee Membership

| | Areas of Expertise

| |

|

|---|

| |

| Compensation Committee (Chair) | | Retail/Customer Experience | | Compensation |

| Risk Committee | | Governance and Regulatory | | Strategy |

| | | Management/Leadership | | |

| |

|

| |

Kevin Davis, 48

New Hampshire, USA

Director Since: 2008

Non-Independent |

Kevin Davis is currently the CEO of the Company, and from 2008 to June 1, 2015, he acted as President and CEO. Mr. Davis joined the Company in 2002 and has held positions of increasing responsibility over that time, including as the Chief Operating Officer from 2006 to 2008 and CFO from 2004 to 2006. Prior to joining the Company, Mr. Davis held senior finance positions in the medical device industry for Pathway Medical Technologies and Boston Scientific Corporation and in consumer products with The Gillette Company. |

Mr. Davis received a Bachelor of Science degree from the University of Massachusetts and earned Certified Public Accountant (CPA) and Certified Management Accountant (CMA) designations while employed at Ernst & Young LLP. |

As CEO, Mr. Davis' participation on the Board of Directors is critical. He has extensive knowledge of the Company's operations, brands and finances and leads the Company's strategic planning. |

| | | | | | |

| |

Equity Ownership

| | Public Board Membership

|

|---|

| |

| Shares | | DSUs | | Options | | None |

| | | |

| 38,274(1) | | N/A | | 711,300(1) | | |

| | | | |

| |

Committee Membership

| | Areas of Expertise

| |

|

|---|

| |

| None | | Retail/Customer Experience | | Management/Leadership |

| | | Brand Product Marketing | | Accounting/Financial |

| | | Strategy | | International Markets |

| |

- (1)

- These amounts include 4,102 Shares indirectly held by a family trust and options to purchase 711,300 Shares also indirectly held by such trust.

14

|

| |

Joan Dea, 52

California, USA

Director Since: 2015

Independent |

Joan Dea is a director of Cineplex Inc. and Charles Schwab Bank and an investor. She also served as a director of Torstar Corporation from 2009 to 2015. Ms. Dea brings audit, compliance, compensation, nominating and governance committee experience and has more than 25 years of experience in the consumer retail and financial services sectors. She retired as Executive Vice President, Head of Strategic Management and Corporate Marketing from BMO Financial Group in 2008 where she was also a member of the Executive Committee. Prior to joining BMO, Ms. Dea held multiple positions with The Boston Consulting Group, where she advised Fortune 500 companies on issues of global competitiveness, leadership and performance in North America, Asia and Europe. She became a partner and director at Boston Consulting Group in 1994, was a leader in the Consumer Goods and Retail Practice, and founded the firm's Canadian Financial Services practice. |

Ms. Dea received a Bachelor of Arts degree from Yale University and a Master of Science (with Distinction) from the London School of Economics. |

Ms. Dea was selected to serve on the Board of Directors due to her vast experience in consumer retail, brand marketing and financial services, as well as her board experience with publicly traded companies in both Canada and the United States. In addition, Ms. Dea's extensive global expertise is also important as the Company seeks to continue its global growth. |

| | | | | | |

| |

Equity Ownership

| | Public Board Membership

|

|---|

| |

| Shares | | DSUs | | Options | | Cineplex Inc. (TSX: CGX) |

| | | |

| Nil | | 1,504 | | Nil | | Charles Schwab Bank (NYSE: SCHW) |

| | | | |

| |

Committee Membership

| | Areas of Expertise

| |

|

|---|

| |

| Audit Committee | | Retail/Customer Experience | | Financial/Accounting |

| Risk Committee | | Management/Leadership | | Strategy |

| | | Governance | | Brand Marketing |

| |

|

| |

C. Michael Jacobi, 73

Connecticut, USA

Director Since: 2012

Independent |

C. Michael Jacobi is the president of Stable House 1, LLC, a private company engaged in real estate development. He has extensive executive and director experience with major international companies, including previously serving as President and CEO of Timex Corporation, a leading worldwide manufacturer of watches. He also serves as Chair of the board of directors of Sturm, Ruger & Co., Inc., a company engaged in the manufacture and distribution of firearms. Mr. Jacobi previously was President and CEO at Katy Industries, Inc. and also currently serves on the board of directors of Webster Financial Corporation, KCAP Financial, Inc., and Corrections Corporation of America. |

Mr. Jacobi received a Bachelor of Science degree from the University of Connecticut. He is a Certified Public Accountant. |

Mr. Jacobi was selected to serve on the Board of Directors due to his extensive business, investment management and board governance experience, as well as financial expertise. His experience with large international companies is increasingly important as the Company continues to expand its global reach. |

| | | | | | |

| |

Equity Ownership

| | Public Board Membership

|

|---|

| |

| Shares | | DSUs | | Options | | Corrections Corp of America (NYSE: CXW) |

| | | |

| Nil | | 18,257 | | Nil | | KCAP Financial Inc. (NASDAQ: KCAP) |

| | | | | | | Sturm, Ruger & Company (NYSE: RGR) |

| | | | | | | Webster Financial Corporation (NYSE: WBS) |

| | | | |

| |

Committee Membership

| | Areas of Expertise

| |

|

|---|

| |

| Audit Committee | | Retail/Customer Experience | | Management/Leadership |

| Corporate Governance and Nominating Committee (Chair) | | Merchandising | | Financial and Accounting |

| | | Governance | | International Markets |

| |

15

|

| |

Paul Lavoie, 59

Toronto, Ontario

Director Since: 2013

Independent |

Paul Lavoie is the Chair of TAXI, a Montreal-based marketing and communications company which he co-founded in 1992. Mr. Lavoie has extensive experience in international marketing, integrated brand communications, and digital, print and broadcast production. Prior to co-founding TAXI, he held the positions of Creative Director for Cossette and Art Director for J. Walter Thompson. Mr. Lavoie currently serves on two not-for-profit boards as a member of the HEC's International Advisory Board and the Virginia Commonwealth University's Brand Center. |

Mr. Lavoie attended Dawson College in Westmount, Quebec. |

Mr. Lavoie was selected to serve on the Board of Directors due to his in-depth experience in branding and marketing, which is valuable given the Company's emphasis on brand marketing. In addition to providing marketing expertise, Mr. Lavoie brings a wealth of experience in the Quebec market, one of the key geographical areas for Bauer Hockey. |

| | | | | | |

| |

Equity Ownership

| | Public Board Membership

|

|---|

| |

| Shares | | DSUs | | Options | | None |

| | | |

| Nil | | 12,485 | | Nil | | |

| | | | |

| |

Committee Membership

| | Areas of Expertise

| |

|

|---|

| |

| Compensation Committee | | Retail/Customer Experience | | Strategy |

| | | Management/Leadership | | |

| |

|

| |

Larry Lucchino, 69

Massachusetts, USA

Director Since: 2014

Independent |