Table of Contents

As filed with the Securities and Exchange Commission on April 17, 2012

Registration No. 333-173037

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

POST-EFFECTIVE

AMENDMENT NO. 1

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

McJUNKIN RED MAN CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware | 5084 | 55-0229830 | ||

(State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

SEE TABLE OF ADDITIONAL REGISTRANT GUARANTORS

2 Houston Center

909 Fannin, Suite 3100

Houston, Texas 77010

(877) 294-7574

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Daniel J. Churay

2 Houston Center

909 Fannin, Suite 3100

Houston, Texas 77010

(877) 294-7574

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Michael A. Levitt, Esq.

Fried, Frank, Harris, Shriver & Jacobson LLP

One New York Plaza

New York, New York 10004

(212) 859-8000

Approximate date of commencement of proposed sale to the public:As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act Registration Statement of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer x | Smaller reporting company | ¨ | ||||

| (Do not check if a smaller reporting company) | ||||||||

CALCULATION OF REGISTRATION FEE

| ||||||||

Title of Each Class of Securities to be Registered | Amount to be Registered | Proposed Maximum Offering Price Per Note(1) | Proposed Maximum Aggregate Offering Price | Amount of Registration Fee | ||||

9.50% Senior Secured Notes due December 15, 2016 | (1) | (1) | (1) | (1) | ||||

Guarantees of 9.50% Senior Secured Notes due December 15, 2016 | (2) | (2) | (2) | (2) | ||||

| ||||||||

| (1) | An indeterminate amount of securities are being registered hereby to be offered solely for market-making purposes by specified affiliates of the registrants. Pursuant to Rule 457(q) under the Securities Act of 1933, as amended, no filing fee is required. |

| (2) | No separate filing fee is required pursuant to Rule 457(n) under the Securities Act. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

TABLE OF ADDITIONAL REGISTRANT GUARANTORS

Exact Name of Registrant Guarantor as Specified in its Charter(1) | State or Other Jurisdiction of Incorporation or Organization | Primary Standard Industrial Classification Code Number | I.R.S. Employer Identification Number | |||||||

GREENBRIER PETROLEUM CORPORATION | West Virginia | 5084 | 55-0566559 | |||||||

MCJUNKIN RED MAN DEVELOPMENT CORPORATION | Delaware | 5084 | 55-0825430 | |||||||

MIDWAY-TRISTATE CORPORATION | New York | 5084 | 13-3503059 | |||||||

MILTON OIL & GAS COMPANY | West Virginia | 5084 | 55-0547779 | |||||||

MRC GLOBAL INC. | Delaware | 5084 | 20-5956993 | |||||||

MRC MANAGEMENT COMPANY | Delaware | 5084 | 26-1570465 | |||||||

RUFFNER REALTY COMPANY | West Virginia | 5084 | 55-0547777 | |||||||

THE SOUTH TEXAS SUPPLY COMPANY, INC. | Texas | 5084 | 74-2804317 | |||||||

| (1) | The address for each of the additional registrant guarantors is c/o McJunkin Red Man Corporation, 2 Houston Center, 909 Fannin, Suite 3100, Houston, Texas 77010. |

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, Dated April 17, 2012

Prospectus

McJunkin Red Man Corporation

$1,050,000,000

9.50% Senior Secured Notes due December 15, 2016

The 9.50% senior secured notes due December 15, 2016 offered hereby, which we refer to as “the notes”, relate to an aggregate of $1,050,000,000 of 9.50% senior secured notes due December 15, 2016 that we originally issued on December 21, 2009 and February 11, 2010.

We pay interest on the notes on June 15 and December 15 of each year. We may also redeem the notes, in whole or in part, at any time on or after December 15, 2012 at the redemption prices set forth in this prospectus. In addition, at any time prior to December 15, 2012, we may redeem some or all of the notes at a price equal to 100% of the principal amount of the notes plus a make-whole premium and accrued and unpaid interest to the redemption date. We may also, at any time prior to December 15, 2012, redeem up to 35% of the aggregate principal amount of the notes issued under the indenture governing the notes with the net proceeds of certain equity offerings at the redemption price set forth in this prospectus.

The notes are unconditionally guaranteed, jointly and severally, by all of our wholly owned domestic subsidiaries (together with any other restricted subsidiaries that may guarantee the notes from time to time, the “Subsidiary Guarantors”) and by MRC Global Inc., our parent company. The notes and the guarantees by the Subsidiary Guarantors are secured on a senior basis (subject to permitted prior liens), together with any other Priority Lien Obligations (as such term is defined in “Description of Notes—Certain Definitions”), equally and ratably by security interests granted to the collateral trustee in all Notes Priority Collateral (as such term is defined in “Description of Notes—Certain Definitions”) from time to time owned by the Issuer or the Subsidiary Guarantors. The guarantee of MRC Global Inc. is not secured. The notes and the guarantees by the Subsidiary Guarantors are also secured on a junior basis (subject to the lien to secure our revolving credit facility and other permitted prior liens) by security interests granted to the collateral trustee in all ABL Priority Collateral (as such term is defined in “Description of Notes—Certain Definitions”) from time to time owned by the Issuer or the Subsidiary Guarantors.

There is no existing public market for the notes offered hereby. We do not intend to list the notes on any securities exchange or seek approval for quotation through any automated trading system.

You should consider carefully the “Risk Factors” beginning on page 22 of this prospectus.

Neither the Securities and Exchange Commission, or the SEC, nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

This prospectus has been prepared for and will be used by Goldman, Sachs & Co. in connection with offers and sales of the notes in market-making transactions. These transactions may occur in the open market or may be privately negotiated at prices related to prevailing market prices at the time of sales or at negotiated prices. Goldman, Sachs & Co. may act as principal or agent in these transactions. We will not receive any proceeds of such sales.

Goldman, Sachs & Co.

The date of this prospectus is , 2012.

Table of Contents

You should rely only on the information contained in this prospectus. We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. This prospectus does not constitute an offer to sell, or solicitation of an offer to buy, to any person in any jurisdiction in which such an offer to sell or solicitation would be unlawful. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus.

| Page | ||||

| 1 | ||||

| 22 | ||||

| 51 | ||||

| 53 | ||||

| 54 | ||||

| 55 | ||||

| 57 | ||||

| 64 | ||||

Management’s Discussion and Analysis of Financial Condition and Results of Operations | 68 | |||

| 103 | ||||

| 133 | ||||

| 169 | ||||

| 174 | ||||

| 175 | ||||

| 183 | ||||

| 284 | ||||

| 292 | ||||

| 293 | ||||

| 293 | ||||

| 294 | ||||

| F-1 | ||||

McJunkin Red Man Corporation is a Delaware corporation. We are a wholly owned subsidiary of MRC Global Inc., a Delaware corporation. Our principal executive offices are located in 2 Houston Center, 909 Fannin, Suite 3100, Houston, Texas 77010. Our telephone number is (877) 294-7574.

This prospectus contains registered and unregistered trademarks and service marks of McJunkin Red Man Corporation and its affiliates, as well as trademarks and service marks of third parties. All brand names, trademarks and service marks appearing in this prospectus are the property of their respective holders.

Table of Contents

The following summary contains a summary of basic information contained elsewhere in this prospectus. It does not contain all the information that may be important to you. For a more complete understanding, we encourage you to read this entire prospectus carefully, including the “Risk Factors” section and the financial statements and related notes. Unless otherwise indicated or the context otherwise requires, all references to “the Company”, “MRC”, “we”, “us”, and “our” refer to MRC Global Inc. and its consolidated subsidiaries, and all references to the “Issuer” are to McJunkin Red Man Corporation, exclusive of its subsidiaries.

Our Company

We are the largest global industrial distributor of pipe, valves and fittings (“PVF”) and related products and services to the energy industry based on sales and hold the leading position in our industry across each of the upstream, midstream and downstream sectors. We offer more than 150,000 stock keeping units (“SKUs”), including an extensive array of PVF, oilfield supply, automation, instrumentation and other general and specialty industry supply products from over 12,000 suppliers. Through our North American and International segments, we serve more than 12,000 customers through over 400 service locations throughout North America, Europe, Asia and Australasia.

Our PVF and oilfield supplies are used in mission critical process applications that require us to provide a high degree of product knowledge, technical expertise and value added services to our customers. We seek to provide best-in-class service and a one-stop shop for our customers by satisfying the most complex, multi-site needs of many of the largest companies in the energy and industrial sectors as their primary PVF supplier. We provide services such as product testing, manufacturer assessments, multiple daily deliveries, volume purchasing, inventory and zone store management and warehousing, technical support, just-in-time delivery, truck stocking, order consolidation, product tagging and system interfaces customized to customer and supplier specifications for tracking and replenishing inventory, which we believe result in deeply integrated customer relationships. We believe the critical role we play in our customers’ supply chain, together with our extensive product offering, broad global presence, customer-linked scalable information systems and efficient distribution capabilities, serve to solidify our long-standing customer relationships and drive our growth. As a result, we have an average relationship of over 20 years with our largest 25 customers.

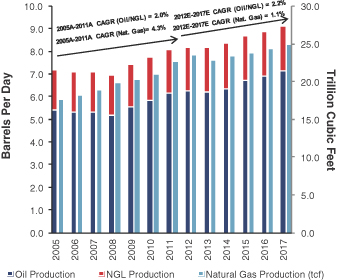

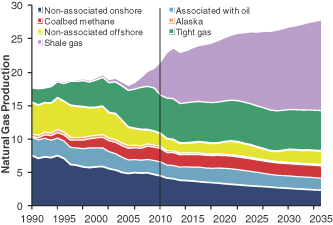

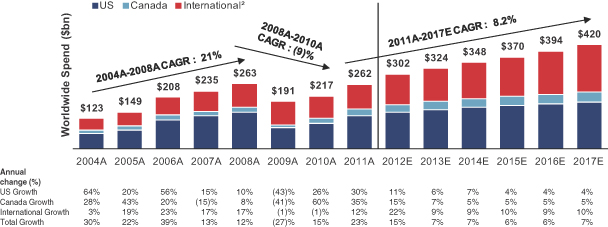

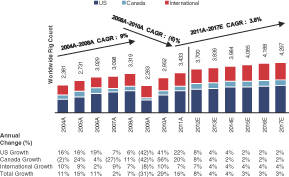

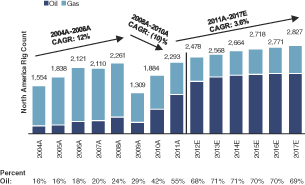

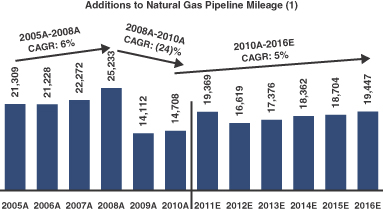

We believe that growth in PVF and industrial supply spending within the energy industry is likely to continue. Several factors have driven the long-term growth in spending, including underinvestment in North American energy infrastructure, production and capacity constraints, and market expectations of future improvements in the oil, natural gas, refined products, petrochemical and other industrial sectors. In addition, the products we distribute are often used in extreme operating environments, leading to the need for a regular replacement cycle. Approximately two-thirds of our sales are attributable to multi-year maintenance, repair and operations (“MRO”) arrangements. Our average annual retention rate for these contracts since 2000 is 95%. We consider MRO arrangements to be normal, generally repetitive business that primarily addresses the recurring maintenance, repair or operational work to existing energy infrastructure. Project activities, including facility expansions, exploration or new construction projects, are more commonly associated with a customer’s capital expenditures budget. Such projects can be more sensitive to global oil and natural gas prices and general economic conditions.

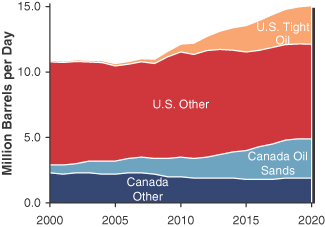

We distribute products globally, including in PVF intensive, rapidly expanding oil and natural gas exploration and production (“E&P”) areas such as the Bakken, Barnett, Eagle Ford, Fayetteville,

1

Table of Contents

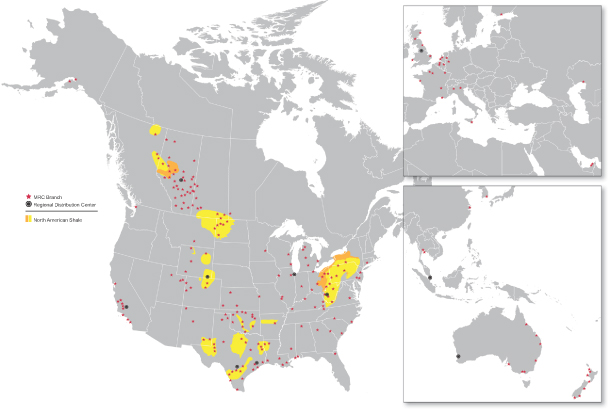

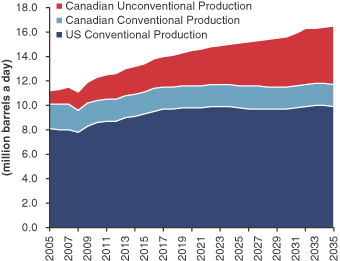

Haynesville, Marcellus, Niobrara and Utica shales in North America. Furthermore, our Canadian subsidiary Midfield Supply ULC (“MRC Midfield”), one of the two largest Canadian PVF distributors based on sales, provides PVF products to oil and natural gas companies operating primarily in Western Canada, including the Western Canadian Sedimentary Basin, Alberta Oil Sands and heavy oil regions. These regions are still in the early stages of infrastructure investment with numerous companies seeking to facilitate the long-term harvesting of difficult to extract and process crude oil. Beyond North America, our acquisitions of Transmark Fcx Group BV (together with its subsidiaries, “MRC Transmark”) and Stainless Pipe and Fittings Australia Pty Ltd. (“MRC SPF”) have provided us with a well-established and integrated platform for international growth and further positioned us to be the leading global PVF distributor to the energy industry. The following map illustrates our global presence:

MRC Locations – 18 Countries

Australia | Kazakhstan | |

Belgium | Netherlands | |

Canada | New Zealand | |

China | Singapore | |

Finland | South Korea | |

France | Thailand | |

Germany | United Arab Emirates | |

Indonesia | United Kingdom | |

Italy | United States |

2

Table of Contents

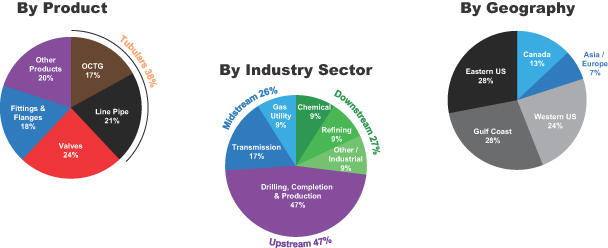

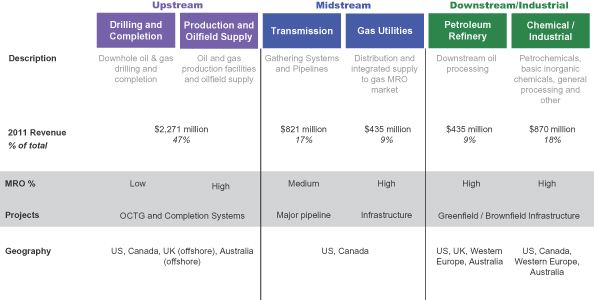

Our business is characterized by diversity in the industry sectors and regions we serve and in the products we supply. The following charts summarize our revenue by sector, geography and product, across both our North American and International segments, for the year ended December 31, 2011:

Due to the demanding operating conditions in the energy industry, high costs and safety risks associated with equipment failure, customers prefer highly reliable products and vendors with established qualifications, reputation and experience. As our PVF products typically are mission critical yet represent a fraction of the total cost of the project, our customers often place a premium on service and high reliability given the high cost to them of maintenance or project delays. Our products are typically used in high-volume, high-stress and abrasive applications or in high-pressure, extreme temperature and high-corrosion applications.

With over 400 global service locations servicing the energy and industrial sectors, we are an important link between our more than 12,000 customers and our more than 12,000 suppliers. We add value to our customers and suppliers in a number of ways:

| Ÿ | Broad Product Offering and High Customer Service Levels: The breadth and depth of our product offering enables us to provide a high level of service to our energy and industrial customers. Given our global inventory coverage and branch network, we are able to fulfill orders more quickly, including orders for less common and specialty items, and provide our customers with a greater array of value added services than if we operated on a smaller scale or only at a local or regional level. These value added services include multiple daily deliveries, volume purchasing, product testing, manufacturer assessments, inventory management and warehousing, technical support, just-in-time delivery, order consolidation, product tagging and tracking and system interfaces customized to customer and supplier specifications. |

| Ÿ | Approved Manufacturer List (“AML”) Services: Our customers rely on us to provide a high level of quality control for their PVF products. We do this by regularly auditing many of our suppliers for quality assurance through our Supplier Registration Process (“SRP”). We use our resulting Approved Supplier List (the “MRC ASL”) to supply products across many of the industries we support, particularly for downstream and midstream customers. Increasingly, many of our customers rely on the MRC ASL and our AML services to help devise and maintain their own approved manufacturer listings. |

3

Table of Contents

| Ÿ | Customized and Integrated Service Offering: We offer our customers integrated supply services, including product procurement, quality assurance, physical warehousing and inventory management and analysis, using our proprietary information technology (“IT”) platform. This is part of an overall strategy to provide a “one stop” solution for PVF purchases across the upstream-midstream-downstream spectrum through integrated supply agreements and MRO contracts. This enables our customers to focus on their core operations, generate cost savings and increase the overall efficiency of their businesses. |

History

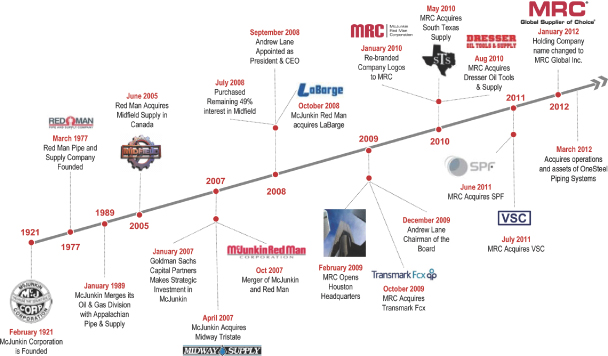

McJunkin Corporation (“McJunkin”) was founded in 1921 in Charleston, West Virginia and initially served the local oil and natural gas industry, focusing primarily on the downstream end market. In 1989, McJunkin broadened its upstream end market presence by merging its oil and natural gas division with Appalachian Pipe & Supply Co. to form McJunkin Appalachian Oilfield Supply Company (“McJunkin Appalachian”, which was a subsidiary of McJunkin Corporation, but has since been merged with and into McJunkin Red Man Corporation), which focused primarily on upstream oil and natural gas customers.

In April 2007, we acquired Midway-Tristate Corporation (“Midway”), a regional PVF oilfield distributor, primarily serving the upstream Appalachia and Rockies regions. This extended our leadership position in Appalachia/Marcellus shale region, while adding additional branches in the Rockies.

Red Man Pipe & Supply Co. (“Red Man”) was founded in 1976 in Tulsa, Oklahoma and began as a distributor to the upstream end market and subsequently expanded into the midstream and downstream end markets. In 2005, Red Man acquired an approximate 51% voting interest in MRC Midfield, giving Red Man a significant presence in the Western Canadian Sedimentary Basin.

In October 2007, McJunkin and Red Man completed a business combination transaction to form the combined company, McJunkin Red Man Corporation. This transformational merger combined leadership positions in the upstream, midstream and downstream end markets, while creating a “one stop” PVF leader across all end markets with full geographic coverage across North America. Red Man has since been merged with and into McJunkin Red Man Corporation.

On July 31, 2008, we acquired the remaining voting and equity interest in Midfield. Also, in October 2008, we acquired LaBarge Pipe & Steel Company (“LaBarge”). LaBarge is engaged in the sale and distribution of carbon steel pipe (predominately large diameter pipe) for use primarily in the North American midstream energy infrastructure market. The acquisition of LaBarge expanded our midstream end market leadership, while adding a new product line in large outside diameter pipe.

On October 30, 2009, we acquired MRC Transmark. MRC Transmark is a leading distributor of valves and flow control products in Europe, Southeast Asia and Australasia. MRC Transmark was formed from a series of acquisitions, the most significant being the acquisition of FCX European and Australasian distribution business in July 2005. The acquisition of MRC Transmark provided geographic expansion internationally, additional downstream diversification and enhanced valve market leadership.

During 2010, we acquired The South Texas Supply Company, Inc. (“South Texas Supply”) and also certain operations and assets from Dresser Oil Tools & Supply. With these two acquisitions, we expanded our footprint in the Eagle Ford and Bakken shale regions, expanding our local presence in two of the emerging active shale basins in North America.

4

Table of Contents

In June 2011, we acquired MRC SPF. Headquartered in Perth, Western Australia, MRC SPF is a distributor of stainless steel piping products through its seven locations across Australia as well as Korea, the United Kingdom and the United Arab Emirates.

In July 2011, we acquired Curtiss-Wright Flow Control Corporation (“VSC”). VSC specializes in valve automation for upstream projects and maintenance, repairs and operation in the downstream sector.

In December 2011, we signed an agreement to acquire the operations and assets of OneSteel Piping Systems (“OPS”). This acquisition was completed in March 2012. OPS is a leading PVF product and service specialist with proven capabilities supplying the oil and gas, mining and mineral processing industries in Australia.

On January 10, 2012, MRC Global Inc. amended its amended and restated certificate of incorporation and amended and restated bylaws to reflect a change in its name from “McJunkin Red Man Holding Corporation” to “MRC Global Inc.”

MRC Global Inc. was incorporated in Delaware on November 20, 2006 and McJunkin Red Man Corporation was incorporated in West Virginia on March 21, 1922 and was reincorporated in Delaware on June 14, 2010. Our principal executive office is located at 2 Houston Center, 909 Fannin, Suite 3100, Houston, Texas 77010. Our telephone number is (877) 294-7574. Our website address iswww.mrcpvf.com. Information contained on our website or on other external websites mentioned throughout this prospectus is expressly not incorporated by reference into this prospectus.

Recent Developments

Preliminary First Quarter 2012 Results

We expect to report the following results for each of sales, net income, Adjusted EBITDA and total indebtedness for the three months ending March 31, 2012 and as of March 31, 2012, as applicable:

| Ÿ | Sales. We expect to report sales of between approximately $1.30 billion and $1.34 billion for the three months ending March 31, 2012, as compared to sales of $991.8 million for the three months ended March 31, 2011. |

| Ÿ | Net income. We expect to report net income of between approximately $30 million and $36 million for the three months ending March 31, 2012, as compared to a net loss of $(1.1) million for the three months ended March 31, 2011. |

| Ÿ | Adjusted EBITDA. We expect to report Adjusted EBITDA of between approximately $101 million and $111 million for the three months ending March 31, 2012, as compared to Adjusted EBITDA of $60 million for the three months ended March 31, 2011. |

| Ÿ | Total indebtedness. We expect that our total indebtedness outstanding at March 31, 2012 will be approximately $1.6 billion to $1.7 billion, as compared to $1.53 billion of total indebtedness as of December 31, 2011. |

Expected results for the three months ending March 31, 2012 primarily reflect continued strength in each of the upstream, midstream and downstream sectors of our business, including strong drilling activity in North America, particularly in the shale and conventional oil regions. The results estimated

5

Table of Contents

above include an approximately $1.7 million write-off of deferred financing costs, which we expect to record in the three months ending March 31, 2012 in connection with the refinancing of our ABL Credit Facility. The expected increase in total indebtedness at March 31, 2012 primarily reflects the acquisition of OneSteel Piping Systems and working capital growth.

Management has prepared the estimates presented above in good faith based upon our internal reporting and expectations as of and for the three months ending March 31, 2012. These estimated ranges are preliminary, unaudited, subject to completion, reflect our current good faith estimates and may be revised as a result of results posted during the remainder of the quarter and management’s further review of our results. We and our auditors have not completed our normal quarterly review procedures as of and for the three months ending March 31, 2012, and there can be no assurance that our final results for this quarterly period will not differ from these estimates. Any such changes could be material. During the course of the preparation of our consolidated financial statements and related notes as of and for the three months ending March 31, 2012, we may identify items that would require us to make material adjustments to the preliminary financial information. These estimates should not be viewed as a substitute for full interim financial statements prepared in accordance with GAAP. In addition, these preliminary estimates as of and for the three months ending March 31, 2012 are not necessarily indicative of the results to be achieved for the remainder of 2012 or any future period. Our consolidated financial statements and related notes as of and for three months ending March 31, 2012 are not expected to be filed with the SEC until after this offering is completed.

Adjusted EBITDA is a non-GAAP measure within the rules of the SEC. The most closely comparable GAAP measure is net income. The following table reconciles Adjusted EBITDA to net income for the ranges presented above for the three months ending March 31, 2012 (estimated) and for the three months ended March 31, 2011 (actual). For more information about our use of Adjusted EBITDA, see footnote 2 to “—Summary Consolidated Financial Information” included elsewhere in this prospectus.

| Three Months Ended March 31, | ||||||||||||

| 2012 (Estimated Low) | 2012 (Estimated High) | 2011 (Actual) | ||||||||||

| ($ in millions) | ||||||||||||

Net income (loss) | $ | 30.0 | $ | 36.1 | $ | (1.1 | ) | |||||

Income tax (benefit) expense | 16.9 | 20.3 | (0.7 | ) | ||||||||

Interest expense | 33.5 | 33.9 | 33.5 | |||||||||

Depreciation and amortization | 4.1 | 4.2 | 4.0 | |||||||||

Amortization of intangibles | 12.1 | 12.2 | 12.4 | |||||||||

Change in fair value of derivative instruments | (2.1 | ) | (1.9 | ) | (1.9 | ) | ||||||

Share based compensation expense | 1.8 | 1.9 | 1.5 | |||||||||

Legal and consulting expenses | (1.1 | ) | (0.9 | ) | 1.2 | |||||||

Increase in LIFO Reserve | 5.0 | 5.2 | 10.1 | |||||||||

Other noncash expenses (1) | (0.9 | ) | (1.3 | ) | 1.0 | |||||||

Deferred financing costs | 1.7 | 1.7 | — | |||||||||

|

|

|

|

|

| |||||||

Adjusted EBITDA | $ | 101.0 | $ | 111.4 | $ | 60.0 | ||||||

|

|

|

|

|

| |||||||

| (1) | For the three months ended March 31, 2012, estimated to include foreign exchange gains and losses. For the three months ended March 31, 2011, included transaction-related expenses, pre-acquisition EBITDA of MRC SPF and other items added back to net income pursuant to our then existing ABL credit facility. |

6

Table of Contents

Global ABL Facility

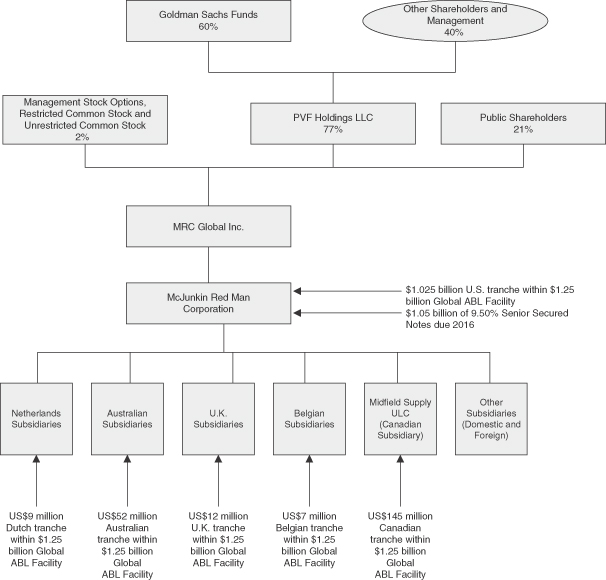

On March 27, 2012, we entered into a new multi-currency Global ABL Facility (the “Global ABL Facility”) which replaced our existing North American ABL Credit Facility, our European Transmark term loan and revolving credit facility and our UK overdraft facility. The administrative agent and collateral agent for the Global ABL Facility is Bank of America, N.A., and the co-syndication agents of the Global ABL Facility are Barclays Bank PLC and Wells Fargo Capital Finance LLC. The five-year Global ABL Facility contains up to US$1.25 billion of total revolving credit facilities, including US$1.025 billion in the United States, US$145 million in Canada, US$12 million in the United Kingdom, US$52 million in Australia, US$9 million in the Netherlands and US$7 million in Belgium. The facility also contains an accordion feature that allows us to increase the principal amount of the facility by up to US$300 million.

The Global ABL Facility is primarily secured by all of our receivables, inventory and related assets in the relevant countries. Our ability to borrow in each jurisdiction under the facility is limited by a borrowing base in that jurisdiction equal to 85% of eligible receivables, plus the lesser of 70% of eligible inventory and 85% of appraised net orderly liquidation value of the inventory. The facility initially bears interest at LIBOR plus an initial margin of 1.75%, though from and after September 1, 2012 the margin will vary between 1.50% and 2.00% based on our fixed charge coverage ratio. For additional information about the Global ABL Facility, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Description of Our Indebtedness—Global ABL Facility.”

Initial Public Offering

On April 17, 2012, MRC Global Inc. closed its initial public offering of 22,727,273 shares of its common stock. MRC Global Inc. sold 17,045,455 shares and PVF Holdings LLC (“PVF Holdings”), a selling stockholder and an affiliate of Goldman, Sachs & Co., sold 5,681,818 shares. The initial public offering price of the common stock was $21.00 per share. The selling stockholder in the offering granted the underwriters a 30-day option to purchase up to 3,409,091 additional shares at the initial public offering price less the underwriting discount. The Company used the proceeds of the offering to repay indebtedness. The Company will not receive any proceeds from the sale of stock by the selling stockholder in the offering. The shares are listed on the New York Stock Exchange under the ticker symbol “MRC”.

The Goldman Sachs Funds

Certain affiliates of The Goldman Sachs Group, Inc., including GS Capital Partners V Fund, L.P., GS Capital Partners VI Fund, L.P. and related entities, or the Goldman Sachs Funds, are the majority owners of PVF Holdings, our largest shareholder.

Since 1986, the Goldman Sachs Merchant Banking Division (“GS MBD”), which manages The Goldman Sachs Funds, has raised 16 private equity and principal debt investment funds aggregating over $78 billion of capital and invested in over 500 companies globally. GS Capital Partners VI is the current private equity vehicle through which Goldman Sachs conducts its large, privately negotiated, corporate equity investment activities. With six offices in five countries around the world, GS MBD is one of the largest managers of private capital globally.

Since 1998, GS MBD has invested over $8 billion in over 20 companies in the energy and industrial distribution sectors. Investments include, but are not limited to, Bill Barrett Corporation (natural gas exploration and production in the Rocky Mountain region of the U.S.), CCS Corporation

7

Table of Contents

(provider of integrated energy and environmental waste management services), Cobalt International Energy (deepwater Gulf of Mexico and West Africa oil exploration), CVR Energy (U.S. mid-continent based oil refinery), EF Energy Holdings, LLC (start-up upstream oil and gas company), Expro International (market leader in deepwater well testing and commissioning services), Horizon Wind Energy (one of the largest developers of wind power projects in North America), Kenan Advantage Group (largest provider of “last mile” fuel delivery services on a dedicated basis in the U.S.), Nalco Corporation (global provider of integrated water treatment and process improvement services), OIG Offshore Installation Group (provider of offshore mooring and subsea installation, module handling and logistics services), Associated Asphalt (largest asphalt terminalling operation in the U.S.) and Ahlsell Sverige (industrial distributor in the Nordic region).

8

Table of Contents

Summary of the Notes

The summary below describes the principal terms of the notes. Some of the terms and conditions described below are subject to important limitations and exceptions. See “Description of Notes” for a more detailed description of the terms and conditions of the notes.

Issuer | McJunkin Red Man Corporation. |

Securities Offered | Up to $1,050,000,000 aggregate principal amount of 9.50% senior secured notes due 2016. |

Maturity Date | The notes will mature on December 15, 2016. |

Interest Payment Dates | Interest on the notes will be payable in cash on June 15 and December 15 of each year. |

Guarantees | The notes are unconditionally guaranteed, jointly and severally, by all of our wholly owned domestic subsidiaries (together with any other restricted subsidiaries that may guarantee the notes from time to time, the “Subsidiary Guarantors”) and by MRC Global Inc. MRC Global Inc. does not have any material assets other than its ownership of 100% of the Issuer’s capital stock. |

| Under the indenture relating to the notes, any wholly owned domestic subsidiary (other than immaterial subsidiaries) formed or acquired on or after the date of the indenture and any restricted subsidiary that provides a guarantee with respect to our asset-based revolving credit facility (the “Global ABL Facility”) or any other indebtedness of the Issuer or any Subsidiary Guarantor will also be required to guarantee the notes. See “Description of Notes—Certain Covenants—Guarantees”. |

Collateral | The notes and the guarantees by the Subsidiary Guarantors are secured on a senior basis (subject to permitted prior liens), together with any other Priority Lien Obligations (as such term is defined in “Description of Notes—Certain Definitions”), equally and ratably by security interests granted to the collateral trustee in all Notes Priority Collateral (as such term is defined in “Description of Notes—Certain Definitions”) from time to time owned by the Issuer or the Subsidiary Guarantors. The guarantee of MRC Global Inc. is not secured. |

| The Notes Priority Collateral generally comprises substantially all of the Issuer’s and the Subsidiary Guarantors’ tangible and intangible assets, other than specified excluded assets. The collateral trustee holds the senior liens on the Notes Priority Collateral in trust for the benefit of the holders of the notes and the holders of any other Priority Lien Obligations. See “Description of Notes—Security—Collateral”. |

9

Table of Contents

| The notes and the guarantees by the Subsidiary Guarantors are also secured on a junior basis (subject to the lien which secures the Global ABL Facility and other permitted prior liens) by security interests granted to the collateral trustee in all ABL Priority Collateral (as such term is defined in “Description of Notes—Certain Definitions”) from time to time owned by the Issuer or the Subsidiary Guarantors. |

| The ABL Priority Collateral generally comprises substantially all of the Issuer’s and the Subsidiary Guarantors’ accounts receivable, inventory, general intangibles and other assets relating to the foregoing, deposit and securities accounts (other than the “Net Available Cash Account”, as such term is defined in the intercreditor agreement), and proceeds and products of the foregoing, other than specified excluded assets. See “Description of Notes—Security—Collateral”. The collateral trustee holds the junior liens on the ABL Priority Collateral in trust for the benefit of the holders of the notes and the holders of any other Priority Lien Obligations. |

| Assets owned by our non-guarantor subsidiaries and by MRC Global Inc. are not part of the collateral securing the notes. See “Description of Notes—Security” and “Risk Factors—Risks Related to the Collateral and the Guarantees”. |

Ranking | The notes and the related guarantees are the Issuer’s and the Subsidiary Guarantors’ senior secured obligations and MRC Global Inc.’s senior unsecured obligation. The indebtedness evidenced by the notes and subsidiary guarantees ranks: |

| Ÿ | senior to any debt of the Issuer and the Subsidiary Guarantors to the extent of the collateral which secures the notes and guarantees on a senior basis; |

| Ÿ | equal with all of the Issuer’s and the Subsidiary Guarantors’ existing and future senior indebtedness (before giving effect to security interests); |

| Ÿ | senior to all of the Issuer’s and the Subsidiary Guarantors’ existing and future subordinated indebtedness; |

| Ÿ | junior in priority to the Global ABL Facility (to the extent of the collateral that secures the Global ABL Facility) and to any other debt incurred after the issue date that has a priority security interest relative to the notes in the collateral that secures the Global ABL Facility; |

| Ÿ | equal in priority to any other indebtedness incurred before or after the issue date which is secured on an equal basis with the notes and guarantees; and |

| Ÿ | junior in priority to the existing and future claims of creditors and holders of preferred stock of our subsidiaries that do not guarantee the notes, including |

10

Table of Contents

foreign subsidiaries that have guaranteed and secured debt of foreign subsidiaries under the Global ABL Facility. |

| As of December 31, 2011, after giving effect to our entry into the Global ABL Facility and assuming the use of proceeds of the initial public offering to repay debt: |

| Ÿ | we and the Subsidiary Guarantors would have had $149.3 million outstanding under the Global ABL Facility and outstanding letters of credit of approximately $16.7 million (with approximately $695.3 million of estimated available borrowings under the Global ABL Facility), all of which would rank senior to the notes to the extent of the collateral securing the Global ABL Facility on a senior basis; |

| Ÿ | our non-guarantor subsidiaries would have had indebtedness of $19.0 million and estimated borrowing availability of an additional approximately $144.9 million, all of which would rank senior to the notes; |

| Ÿ | we and the guarantors would have had $1.05 billion of notes outstanding plus certain outstanding interest rate swap agreements, all of which would rank pari passu with the notes; |

| Ÿ | we and the guarantors would have had no subordinated indebtedness; and |

| Ÿ | our parent guarantor would have had no indebtedness other than its guarantee of the notes. |

| See “Description of Notes—Brief Description of the Notes and the Note Guarantees”. |

Intercreditor Agreement | The collateral trustee has entered into an intercreditor agreement with the Issuer, the Subsidiary Guarantors and Bank of America, N.A., as collateral agent under the Global ABL Facility, which governs the relationship of noteholders and the lenders under the Global ABL Facility with respect to collateral and certain other matters. See “Description of Notes—The Intercreditor Agreement”. |

Collateral Trust Agreement | The Issuer and the Subsidiary Guarantors have entered into a collateral trust agreement with the collateral trustee and the trustee under the indenture governing the notes. The collateral trust agreement sets forth the terms on which the collateral trustee will receive, hold, administer, maintain, enforce and distribute the proceeds of all liens upon the collateral which it holds in trust. See “Description of Notes—The Collateral Trust Agreement”. |

Sharing of Liens and Collateral | The Issuer and the Subsidiary Guarantors may issue additional senior secured indebtedness under the indenture governing the |

11

Table of Contents

notes. The liens securing the notes may also secure, together on an equal and ratable basis with the notes, other Priority Lien Debt (as such term is defined in “Description of Notes—Certain Definitions”) permitted to be incurred by the Issuer under the indenture governing the notes, including additional notes of the same class under the indenture governing the notes. The Issuer and the Subsidiary Guarantors may also grant additional liens on the collateral securing the notes on a junior basis to secure Subordinated Lien Debt (as such term is defined in “Description of Notes—Certain Definitions”) permitted to be incurred under the indenture governing the notes. |

Optional Redemption | We may redeem the notes, in whole or in part, at any time on or after December 15, 2012 at the redemption prices set forth in this prospectus. In addition, at any time prior to December 15, 2012, we may redeem some or all of the notes at a price equal to 100% of the principal amount of the notes plus a make-whole premium and accrued and unpaid interest to the redemption date, in each case, as described in this prospectus under “Description of Notes—Optional Redemption”. |

| We may also, at any time prior to December 15, 2012, redeem up to 35% of the aggregate principal amount of the notes issued under the indenture governing the notes with the net proceeds of certain equity offerings at the redemption price set forth in this prospectus. See “Description of Notes—Optional Redemption”. |

Offers to Purchase | If we sell certain assets without applying the proceeds in a specified manner, or experience certain change of control events, each holder of notes may require us to purchase all or a portion of its notes at the purchase prices set forth in this prospectus, plus accrued and unpaid interest and special interest, if any, to the purchase date. See “Description of Notes—Repurchase at the Option of Holders”. The Global ABL Facility or other agreements may restrict us from repurchasing any of the notes, including any purchase we may be required to make as a result of a change of control or certain asset sales. See “Risk Factors—Risks Related to the Notes—We may not have the ability to raise the funds necessary to finance the change of control offer or the asset sale offer required by the indenture governing the notes”. |

Covenants | The indenture governing the notes contains covenants that impose significant restrictions on our business. The restrictions that these covenants place on us and our restricted subsidiaries include limitations on our ability and the ability of our restricted subsidiaries to, among other things: |

| Ÿ | incur additional indebtedness; |

| Ÿ | issue certain preferred stock or disqualified capital stock; |

| Ÿ | create liens; |

12

Table of Contents

| Ÿ | pay dividends or make other restricted payments; |

| Ÿ | make certain payments on debt that is subordinated or secured on a basis junior to the notes; |

| Ÿ | make investments; |

| Ÿ | sell assets; |

| Ÿ | create restrictions on the payment of dividends or other amounts to us from restricted subsidiaries; |

| Ÿ | consolidate, merge, sell or otherwise dispose of all or substantially all of our assets; |

| Ÿ | enter into transactions with our affiliates; and |

| Ÿ | designate our subsidiaries as unrestricted subsidiaries. |

| These covenants are subject to a number of important exceptions and qualifications, which are described under “Description of Notes”. |

Original Issue Discount | The notes were issued with original issue discount for United States federal income tax purposes. For United States federal income tax purposes, U.S. Holders will be required to include the original issue discount in gross income (as ordinary income) as it accrues on a constant yield basis in advance of the receipt of the cash payment to which such income is attributable (regardless of whether such U.S. Holders use the cash or accrual method of tax accounting). See “Material United States Federal Tax Considerations—Stated Interest and Original Issue Discount”. |

No Assurance of Active Trading Market | The notes are not listed on any securities exchange or on any automated dealer quotation system. We cannot assure you that an active or liquid trading market for the notes will exist or be maintained. If an active or liquid trading market for the notes is not maintained, the market price and liquidity of the notes may be adversely affected. See “Risk Factors—Risks Related to the Notes—An active or liquid trading market for the notes may not be maintained”. |

Risk Factors

Investing in our notes involves substantial risk, and our business faces various risks. For example, decreased capital and operating expenditures in the energy industry could lead to decreased demand for our products and services and could therefore have a material adverse effect on our business, results of operations and financial condition. We face other risks including, among others, fluctuations in steel prices, particularly for our tubular product category, volatility of oil and natural gas prices, economic downturns, our lack of long-term contracts with many of our customers and suppliers and the absence of minimum purchase obligations under the long-term customer contracts that we do have. Additionally, we have significant indebtedness. As of December 31, 2011, we had total debt outstanding of $1,526.7 million, borrowing availability of $583.7 million under our credit facilities and

13

Table of Contents

total liquidity (borrowing capacity plus cash on hand) of $629.8 million, representing leverage of 4.1x as of December 31, 2011 under the terms of our then existing asset-based revolving credit facility (the “ABL Credit Facility”). Our significant indebtedness could limit our ability to obtain additional financing, our ability to use operating cash flow in other areas of our business, and our ability to compete with other companies that are less leveraged, and could have other negative consequences. See “Risk Factors” for a more detailed discussion of these risks and other risks associated with the notes and with our business.

The data included in this prospectus regarding the industrial and oilfield PVF distribution industry, including trends in the market and our position and the position of our competitors within this industry, are based on our estimates which have been derived from management’s knowledge and experience in the areas in which our business operates, and information obtained from customers, suppliers, trade and business organizations, internal research, publicly available information, industry publications and surveys and other contacts in the areas in which our business operates. We have also cited information compiled by industry publications, governmental agencies and publicly available sources.

In this prospectus, unless otherwise indicated, foreign currency amounts are converted into U.S. dollar amounts at the exchange rate in effect on December 31, 2011, the last day of our fiscal year. Income statement figures are converted on a monthly basis, using each month’s average conversion rate.

14

Table of Contents

Summary Consolidated Financial Information

On January 31, 2007, MRC Global Inc. (formerly known as McJunkin Red Man Holding Corporation), an affiliate of The Goldman Sachs Group, Inc., acquired a majority of the equity of the entity now known as McJunkin Red Man Corporation (then known as McJunkin Corporation) (the “GS Acquisition”). In this prospectus, the term “Predecessor” refers to McJunkin Corporation and its subsidiaries prior to January 31, 2007 and the term “Successor” refers to the entity now known as MRC Global Inc. and its subsidiaries on and after January 31, 2007. As a result of the change in McJunkin Corporation’s basis of accounting in connection with the GS Acquisition, Predecessor’s financial statement data for the one month ended January 30, 2007 and earlier periods are not comparable to Successor’s financial data for the eleven months ended December 31, 2007 and subsequent periods.

McJunkin Corporation completed a business combination transaction with Red Man (the “Red Man Transaction”) on October 31, 2007. At that time, McJunkin Corporation was renamed McJunkin Red Man Corporation. Operating results for the eleven-month period ended December 31, 2007 include the results of MRC Global Inc. for the full period and the results of Red Man for the two months after the business combination on October 31, 2007. Accordingly, our historical results for the years ended December 31, 2011, 2010, 2009 and 2008 and the 11 months ended December 31, 2007 are not comparable to McJunkin Corporation’s historical results for the one month ended January 30, 2007.

The summary consolidated financial information presented below under the captions Statement of Operations Data and Other Financial Data for the years ended December 31, 2011, 2010, 2009 and 2008, and the summary consolidated financial information presented below under the caption Balance Sheet Data as of December 31, 2011 and December 31, 2010, have been derived from the consolidated financial statements of MRC Global Inc. included elsewhere in this prospectus that Ernst & Young LLP, our independent registered public accounting firm, has audited. The summary consolidated financial information presented below under the captions Statement of Operations Data and Other Financial Data for the one month ended January 30, 2007 and the eleven months ended December 31, 2007, and the summary consolidated financial information presented below under the caption Balance Sheet Data as of December 31, 2009, December 31, 2008 and December 31, 2007, have been derived from the consolidated financial statements of MRC Global Inc. not included in this prospectus that Ernst & Young LLP has audited.

All information in this prospectus gives effect to the two-for-one reverse split of MRC Global Inc.’s common stock which occurred on February 29, 2012.

15

Table of Contents

The historical data presented below has been derived from financial statements that have been prepared using United States generally accepted accounting principles (“GAAP”). This data should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and related notes included elsewhere in this prospectus.

| Successor | Predecessor | |||||||||||||||||||||||||

| Year Ended December 31, | Eleven Months Ended December 31, | One Month Ended January 30, | ||||||||||||||||||||||||

| 2011 | 2010 | 2009 | 2008 | 2007 | 2007 | |||||||||||||||||||||

| (In millions) | ||||||||||||||||||||||||||

Statement of Operations Data: | ||||||||||||||||||||||||||

Sales | $ | 4,832.4 | $ | 3,845.5 | $ | 3,661.9 | $ | 5,255.2 | $ | 2,124.9 | $ | 142.5 | ||||||||||||||

Cost of sales | 4,124.2 | 3,327.0 | 3,067.4 | 4,273.1 | 1,761.9 | 114.9 | ||||||||||||||||||||

Inventory write-down | — | 0.4 | 46.5 | — | — | — | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Gross margin | 708.2 | 518.1 | 548.0 | 982.1 | 363.0 | 27.6 | ||||||||||||||||||||

Selling, general and administrative expenses | 513.6 | 451.7 | 411.6 | 482.1 | 218.5 | 15.9 | ||||||||||||||||||||

Goodwill and intangibles impairment charge | — | — | 386.1 | — | — | — | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Operating income (loss) | 194.6 | 66.4 | (249.7 | ) | 500.0 | 144.5 | 11.7 | |||||||||||||||||||

Other (expense) income | ||||||||||||||||||||||||||

Interest expense | (136.8 | ) | (139.6 | ) | (116.5 | ) | (84.5 | ) | (61.7 | ) | (0.1 | ) | ||||||||||||||

Write off of debt issuance costs | (9.5 | ) | — | — | — | — | — | |||||||||||||||||||

Change in fair value of derivative instruments | 7.0 | (4.9 | ) | 8.9 | (6.2 | ) | — | — | ||||||||||||||||||

Other, net | 0.5 | 2.9 | 2.5 | (2.6 | ) | (0.8 | ) | (0.4 | ) | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Total other (expense) income | (138.8 | ) | (141.6 | ) | (105.1 | ) | (93.3 | ) | (62.5 | ) | (0.5 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Income (loss) before income taxes | 55.8 | (75.2 | ) | (354.8 | ) | 406.7 | 82.0 | 11.2 | ||||||||||||||||||

Income taxes | 26.8 | (23.4 | ) | (15.0 | ) | 153.2 | 32.1 | 4.6 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Net income (loss) | $ | 29.0 | $ | (51.8 | ) | $ | (339.8 | ) | $ | 253.5 | $ | 49.9 | $ | 6.6 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Other Financial Data: | ||||||||||||||||||||||||||

Net cash provided by (used in) operations | $ | (102.9 | ) | $ | 112.7 | $ | 505.5 | $ | (137.4 | ) | $ | 110.2 | $ | 6.6 | ||||||||||||

Net cash provided by (used in) investing activities | (48.0 | ) | (16.2 | ) | (66.9 | ) | (314.2 | ) | (1,788.9 | ) | (0.2 | ) | ||||||||||||||

Net cash provided by (used in) financing activities | 140.6 | (98.2 | ) | (393.9 | ) | 452.0 | 1,687.2 | (8.3 | ) | |||||||||||||||||

Adjusted Gross Margin(1) | 849.6 | 663.2 | 493.5 | 1,164.0 | 400.6 | 27.9 | ||||||||||||||||||||

Adjusted EBITDA(2) | 360.5 | 224.2 | 218.5 | 744.4 | 344.9 | 26.0 | ||||||||||||||||||||

Adjusted EBITDA RONA(3) | 24.1 | % | 19.6 | % | 18.6 | % | ||||||||||||||||||||

16

Table of Contents

| Successor | ||||||||||||||||||||

| As of December 31, | ||||||||||||||||||||

| 2011 | 2010 | 2009 | 2008 | 2007 | ||||||||||||||||

Balance Sheet Data: | ||||||||||||||||||||

Cash and cash equivalents | $ | 46.1 | $ | 56.2 | $ | 56.2 | $ | 12.1 | $ | 10.1 | ||||||||||

Working capital(4) | 1,074.7 | 842.6 | 930.2 | 1,208.0 | 674.1 | |||||||||||||||

Total assets | 3,227.7 | 2,991.2 | 3,083.2 | 3,919.7 | 3,083.8 | |||||||||||||||

Total debt(5) | 1,526.7 | 1,360.2 | 1,452.6 | 1,748.6 | 868.4 | |||||||||||||||

Stockholders’ equity | 720.9 | 689.8 | 743.9 | 987.2 | 1,262.7 | |||||||||||||||

| (1) | We define Adjusted Gross Margin as sales, less cost of sales, plus depreciation and amortization, plus amortization of intangibles, and plus or minus the impact of our last in, first out (“LIFO”) inventory costing methodology. We present Adjusted Gross Margin because we believe it is a useful indicator of our operating performance and facilitates a meaningful comparison to our peers. We believe this for the following reasons: |

| Ÿ | Our management uses Adjusted Gross Margin for planning purposes, including the preparation of our annual operating budget and financial projections. This measure is also used to assess the performance of our business. |

| Ÿ | Investors use Adjusted Gross Margin to measure a company’s operating performance without regard to items, such as depreciation and amortization, and amortization of intangibles, that can vary substantially from company to company depending upon the nature and extent of transactions they have been involved in. Similarly, the impact of the LIFO inventory costing method can cause results to vary substantially from company to company depending upon whether those companies elect to utilize the LIFO method and depending upon which LIFO method they may elect. |

| Ÿ | Securities analysts can use Adjusted Gross Margin as a supplemental measure to evaluate overall operating performance of companies. |

In particular, we believe that Adjusted Gross Margin is a useful indicator of our operating performance because Adjusted Gross Margin measures our Company’s operating performance without regard to acquisition transaction-related amortization expenses.

However, Adjusted Gross Margin does not represent and should not be considered an alternative to gross margin or any other measure of financial performance calculated and presented in accordance with GAAP. Our Adjusted Gross Margin may not be comparable to similar measures that other companies report because other companies may not calculate Adjusted Gross Margin in the same manner as we do. Although we use Adjusted Gross Margin as a measure to assess the operating performance of our business, Adjusted Gross Margin has significant limitations as an analytical tool because it excludes certain material costs. For example, it does not include depreciation and amortization expense. Because we use capital assets, depreciation expense is a significant element of our costs and impacts our ability to generate revenue. In addition, the omission of amortization expense associated with our intangible assets further limits the usefulness of this measure. Furthermore, Adjusted Gross Margin does not account for our LIFO inventory costing methodology and, therefore, to the extent that recently purchased inventory accounts for a relatively large portion of our sales, Adjusted Gross Margin may overstate our operating performance. Because Adjusted Gross Margin does not account for certain expenses, its utility as a measure of our operating performance has material limitations. Because of these limitations, management does not view Adjusted Gross Margin in isolation or as a primary performance measure and also uses other measures, such as net income and sales, to measure operating performance.

17

Table of Contents

The following table reconciles Adjusted Gross Margin to gross margin (in millions):

| Successor | Predecessor | |||||||||||||||||||||||||

| Year Ended December 31, 2011 | Year Ended December 31, 2010 | Year Ended December 31, 2009 | Year Ended December 31, 2008 | Eleven Months Ended December 31, 2007 | One Month Ended January 31, 2007 | |||||||||||||||||||||

Gross margin | $ | 708.2 | $ | 518.1 | $ | 548.0 | $ | 982.1 | $ | 363.0 | $ | 27.6 | ||||||||||||||

Depreciation and amortization | 17.0 | 16.6 | 14.5 | 11.3 | 5.4 | 0.3 | ||||||||||||||||||||

Amortization of intangibles | 50.7 | 53.9 | 46.6 | 44.4 | 21.9 | — | ||||||||||||||||||||

Increase (decrease) in LIFO reserve | 73.7 | 74.6 | (115.6 | ) | 126.2 | 10.3 | — | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Adjusted Gross Margin | $ | 849.6 | $ | 663.2 | $ | 493.5 | $ | 1,164.0 | $ | 400.6 | $ | 27.9 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

| (2) | We define Adjusted EBITDA as net income plus interest, income taxes, depreciation and amortization, amortization of intangibles, other non-recurring and non-cash charges (such as gains/losses on the early extinguishment of debt, changes in the fair value of derivative instruments and goodwill impairment) and plus or minus the impact of our LIFO inventory costing methodology. We present Adjusted EBITDA because it is an important measure used to determine the interest rate and commitment fee we pay under our Global ABL Facility. In addition, we believe it is a useful indicator of our operating performance. We believe this for the following reasons: |

| Ÿ | Our management uses Adjusted EBITDA for planning purposes, including the preparation of our annual operating budget and financial projections, as well as for determining a significant portion of the compensation of our executive officers. |

| Ÿ | Adjusted EBITDA is widely used by investors to measure a company’s operating performance without regard to items, such as interest expense, income tax expense and depreciation and amortization, that can vary substantially from company to company depending upon their financing and accounting methods, the book value of their assets, their capital structures and the method by which their assets were acquired. |

| Ÿ | Securities analysts use Adjusted EBITDA as a supplemental measure to evaluate the overall operating performance of companies. |

In particular, we believe that Adjusted EBITDA is a useful indicator of our operating performance because Adjusted EBITDA measures our Company’s operating performance without regard to certain non-recurring, non-cash or transaction-related expenses.

Adjusted EBITDA, however, does not represent and should not be considered as an alternative to net income, cash flow from operations or any other measure of financial performance calculated and presented in accordance with GAAP. Our Adjusted EBITDA may not be comparable to similar measures that other companies report because other companies may not calculate Adjusted EBITDA in the same manner as we do. Although we use Adjusted EBITDA as a measure to assess the operating performance of our business, Adjusted EBITDA has significant limitations as an analytical tool because it excludes certain material costs. For example, it does not include interest expense, which has been a significant element of our costs. Because we use capital assets, depreciation expense is a significant element of our costs and impacts our ability to generate revenue. In addition, the omission of the amortization expense associated with our intangible assets further limits the usefulness of this measure. Adjusted EBITDA also does not include the payment of certain taxes, which is also a significant element of our operations. Furthermore, Adjusted EBITDA does not account for our LIFO inventory costing methodology, and therefore, to the extent that recently purchased inventory accounts for a relatively large portion of our sales, Adjusted EBITDA may overstate our operating performance. Because Adjusted EBITDA

18

Table of Contents

does not account for certain expenses, its utility as a measure of our operating performance has material limitations. Because of these limitations, management does not view Adjusted EBITDA in isolation or as a primary performance measure and also uses other measures, such as net income and sales, to measure operating performance.

The calculation of Adjusted EBITDA is consistent with the computation of Consolidated Cash Flow (as such term is defined in “Description of Notes—Certain Definitions”) except for the change in the LIFO reserve, which would not be an adjustment in determining Consolidated Cash Flow.

The following table reconciles Adjusted EBITDA with our net income (loss), as derived from our financial statements (in millions):

| Successor | Predecessor | |||||||||||||||||||||||||

| Year Ended December 31, 2011 | Year Ended December 31, 2010 | Year Ended December 31, 2009 | Year Ended December 31, 2008 | Eleven Months Ended December 31, 2007 | One Month Ended January 31, 2007 | |||||||||||||||||||||

Net income (loss) | $ | 29.0 | $ | (51.8 | ) | $ | (339.8 | ) | $ | 253.5 | $ | 49.9 | $ | 6.6 | ||||||||||||

Income tax expense (benefit) | 26.8 | (23.4 | ) | (15.0 | ) | 153.2 | 32.1 | 4.6 | ||||||||||||||||||

Interest expense | 136.8 | 139.6 | 116.5 | 84.5 | 61.7 | 0.1 | ||||||||||||||||||||

Write off of debt issuance costs | 9.5 | — | — | — | — | — | ||||||||||||||||||||

Depreciation and amortization | 17.0 | 16.6 | 14.5 | 11.3 | 5.4 | 0.3 | ||||||||||||||||||||

Amortization of intangibles | 50.7 | 53.9 | 46.6 | 44.4 | 21.9 | — | ||||||||||||||||||||

Amortization of Purchase Price Accounting | — | — | 15.7 | 2.4 | — | — | ||||||||||||||||||||

Change in fair value of derivative instruments | (7.0 | ) | 4.9 | (8.9 | ) | 6.2 | — | — | ||||||||||||||||||

Closed locations | — | (0.7 | ) | 1.4 | 4.4 | — | — | |||||||||||||||||||

Share based compensation expense | 8.4 | 3.7 | 7.8 | 10.2 | 3.0 | — | ||||||||||||||||||||

Franchise taxes | 0.4 | 0.7 | 1.4 | 1.5 | — | — | ||||||||||||||||||||

Gain on early extinguishment of debt | — | — | (1.3 | ) | — | — | — | |||||||||||||||||||

Goodwill and intangibles impairment charge | — | — | 386.1 | — | — | — | ||||||||||||||||||||

Inventory write-down | — | 0.4 | 46.5 | — | — | — | ||||||||||||||||||||

IT system conversion costs | — | — | 2.4 | 1.4 | — | — | ||||||||||||||||||||

M&A transaction & integration expenses | 0.5 | 1.4 | 17.5 | 30.4 | 12.7 | — | ||||||||||||||||||||

Midway pre-acquisition contribution | — | — | — | — | 2.8 | 1.0 | ||||||||||||||||||||

Legal and consulting expenses | 9.9 | 4.2 | 1.9 | 0.4 | — | — | ||||||||||||||||||||

Joint venture termination | 1.7 | — | — | — | — | — | ||||||||||||||||||||

Provision for uncollectible accounts | 0.4 | (2.0 | ) | 1.0 | 7.7 | 0.4 | — | |||||||||||||||||||

Red Man pre-acquisition contribution | — | — | — | — | 142.2 | 13.1 | ||||||||||||||||||||

Severance and related costs | 1.1 | 3.2 | 4.4 | — | — | — | ||||||||||||||||||||

MRC Transmark pre-acquisition contribution | — | — | 38.5 | — | — | — | ||||||||||||||||||||

LIFO | 73.7 | 74.6 | (115.6 | ) | 126.2 | 10.3 | — | |||||||||||||||||||

Other non-cash expenses | 1.6 | (1.1 | ) | (3.1 | ) | 6.7 | 2.5 | 0.3 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Adjusted EBITDA | $ | 360.5 | $ | 224.2 | $ | 218.5 | $ | 744.4 | $ | 344.9 | $ | 26.0 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

19

Table of Contents

| (3) | We define Adjusted EBITDA Return on Net Assets (“Adjusted EBITDA RONA”) as (a) Adjusted EBITDA divided by (b) accounts receivable, plus inventory, plus the LIFO reserve, plus property, plant & equipment, net, less accounts payable. The calculation of Adjusted EBITDA RONA is set forth below (dollars in thousands): |

| Year Ended December 31, | ||||||||||||

| 2011 | 2010 | 2009 | ||||||||||

Adjusted EBITDA | $ | 360,465 | $ | 224,124 | $ | 218,496 | ||||||

|

|

|

|

|

| |||||||

Accounts receivable | $ | 791,280 | $ | 596,404 | $ | 506,194 | ||||||

Inventory at LIFO | 899,064 | 765,367 | 871,653 | |||||||||

LIFO Reserve | 175,122 | 101,419 | 26,862 | |||||||||

Property, plant & equipment, net | 107,430 | 104,725 | 111,480 | |||||||||

Accounts payable | (479,584 | ) | (426,632 | ) | (338,512 | ) | ||||||

|

|

|

|

|

| |||||||

Total adjusted net assets | $ | 1,493,312 | $ | 1,141,283 | $ | 1,177,677 | ||||||

|

|

|

|

|

| |||||||

Adjusted EBITDA RONA | 24.1 | % | 19.6 | % | 18.6 | % | ||||||

We present Adjusted EBITDA RONA because we believe it is a useful indicator of our operating performance. Management believes that Adjusted EBITDA RONA provides meaningful supplemental information regarding our performance by excluding certain income and expense items and assets and liabilities that may not be indicative of the core business operating results and may help in comparing current period results with those of prior periods as well as with our peers. Our management uses Adjusted EBITDA RONA for determining a significant portion of the compensation of our executive officers. In addition, Adjusted EBITDA RONA is a useful indicator of our operating performance because it measures our performance without regard to acquisition transaction-related assets such as intangibles and goodwill.

However, Adjusted EBITDA RONA does not represent and should not be considered an alternative to other GAAP measures of performance such as net income. Also, our definition of Adjusted EBITDA RONA may not be comparable to similar measures that other companies report. Further, Adjusted EBITDA RONA has certain limitations, such as excluding our LIFO inventory costing methodology. In addition, the omission of our substantial intangible assets and goodwill further limits the usefulness of this measure. As a result, management does not view Adjusted EBITDA RONA in isolation or as a primary performance measure and uses other measures such as net income and sales to measure operating performance.

Management believes that the GAAP-based measure which is most comparable to Adjusted EBITDA RONA is a percentage with net income in the numerator and stockholders’ equity in the denominator. We believe Adjusted EBITDA is a useful measure of performance as compared to net income for the reasons stated above in note 2. We believe that for our Company total adjusted net assets (as calculated above) is a more useful measure than stockholders’ equity for purposes of a RONA calculation because, among other things, our calculation omits intangible assets and goodwill arising from acquisitions. Given the Company’s history of making numerous acquisitions in recent years, the Company believes that the measure it uses is more comparable to similar measures used by other companies if the effects of acquisitions are eliminated.

20

Table of Contents

For a reconciliation of Adjusted EBITDA (the numerator in our calculation of Adjusted EBITDA RONA) to net income, see footnote 2 above. For a reconciliation of total adjusted net assets (the denominator in our calculation of Adjusted EBITDA RONA) to stockholders’ equity, see the following table:

| Year Ended December 31, | ||||||||||||

| 2011 | 2010 | 2009 | ||||||||||

| (dollars in thousands) | ||||||||||||

Stockholders’ equity | $ | 720,862 | $ | 689,758 | $ | 743,898 | ||||||

Long term debt | 1,526,740 | 1,360,241 | 1,452,610 | |||||||||

Deferred taxes, net | 357,195 | 373,719 | 377,948 | |||||||||

Other liabilities | 143,306 | 140,844 | 170,188 | |||||||||

Intangible assets | (1,333,137 | ) | (1,366,549 | ) | (1,425,721 | ) | ||||||

LIFO Reserve | 175,122 | 101,419 | 26,862 | |||||||||

Other assets | (50,649 | ) | (101,947 | ) | (111,864 | ) | ||||||

Cash | (46,127 | ) | (56,202 | ) | (56,244 | ) | ||||||

|

|

|

|

|

| |||||||

Total adjusted net assets | $ | 1,493,312 | $ | 1,141,283 | $ | 1,177,677 | ||||||

|

|

|

|

|

| |||||||

The following table summarizes (1) the numerator and denominator in our calculation of Adjusted EBITDA RONA and (2) the numerator (net income) and denominator (stockholders’ equity) in the most comparable GAAP-based measure.

| Year Ended December 31, | ||||||||||||

| 2011 | 2010 | 2009 | ||||||||||

| (dollars in thousands) | ||||||||||||

Adjusted EBITDA | $ | 360,465 | $ | 224,124 | $ | 218,496 | ||||||

Total adjusted net assets | $ | 1,493,312 | $ | 1,141,283 | $ | 1,177,677 | ||||||

Adjusted EBITDA RONA | 24.1 | % | 19.6 | % | 18.6 | % | ||||||

Net income (loss) | $ | 28,984 | $ | (51,824 | ) | $ | (339,771 | ) | ||||

Stockholders’ equity | $ | 720,862 | $ | 689,758 | $ | 743,898 | ||||||

Net income / stockholders’ equity | 4.02 | % | (7.5 | )% | (45.7 | )% | ||||||

| (4) | Working capital is defined as current assets less current liabilities. |

| (5) | Includes current portion. |

21

Table of Contents

Before investing in the securities offered through this prospectus, you should carefully consider the following risk factors as well as the other information that this prospectus provides. If one or more of these risks or uncertainties actually occurs, they could materially and adversely affect our business, financial condition and operating results. In this prospectus, unless the context expressly requires a different reading, when we state that a factor could “adversely affect us”, have a “material adverse effect”, “adversely affect our business” and similar expressions, we mean that the factor could materially and adversely affect our business, financial condition and operating results.

Risks Related to the Notes

Our substantial level of indebtedness could adversely affect our business, financial condition or results of operations and prevent us from fulfilling our obligations under the notes.

We have now and will likely continue to have a significant amount of indebtedness. As of December 31, 2011, we had total debt outstanding of $1,526.7 million, borrowing availability of $583.7 million under our credit facilities and total liquidity (borrowing capacity plus cash on hand) of $629.8 million, representing leverage of 4.1x under the terms of our then existing ABL Credit Facility. In addition, as of December 31, 2011 on an adjusted basis, after giving effect to our use of proceeds of the initial public offering and our entry into the Global ABL Facility; we would have had total indebtedness outstanding of $1,200.1 million, representing leverage of 3.2x under the terms of the Global ABL Facility. In addition, we may incur significant additional indebtedness in the future. If new indebtedness is added to our current indebtedness, the risks described below could increase.

Our significant level of indebtedness could have important consequences to you, including the following:

| Ÿ | it may be more difficult for us to satisfy our obligations with respect to the notes; |

| Ÿ | our ability to obtain additional financing for working capital, debt service requirements, general corporate purposes or other purposes may be impaired; |

| Ÿ | we must use a substantial portion of our cash flow to pay interest and principal on the notes and our other indebtedness, which will reduce the funds available to us for other purposes; |

| Ÿ | we may be subject to restrictive financial and operating covenants in the agreements governing our and our subsidiaries’ long term indebtedness; |

| Ÿ | we may be exposed to potential events of default (if not cured or waived) under financial and operating covenants contained in our or our subsidiaries’ debt instruments that could have a material adverse effect on our business, results of operations and financial condition; |

| Ÿ | we may be vulnerable to economic downturns and adverse industry conditions, including a downturn in pricing of the products we distribute; |

| Ÿ | our ability to capitalize on business opportunities and to react to pressures and changing market conditions in our industry and in our customers’ industries as compared to our competitors may be compromised due to our high level of indebtedness; |

| Ÿ | our ability to compete with other companies who are not as highly leveraged may be limited; and |

| Ÿ | our ability to refinance our indebtedness, including the notes, may be limited. |

22

Table of Contents

We may be unable to service our indebtedness, including the notes.

Our ability to make scheduled debt payments, to refinance our obligations with respect to our indebtedness and to fund capital and non-capital expenditures necessary to maintain the condition of our operating assets, properties and systems software, as well as to provide capacity for the growth of our business, depends on our financial and operating performance, which, in turn, is subject to prevailing economic conditions and financial, business, competitive, legal and other factors. Our business may not generate sufficient cash flow from operations, and future borrowings may not be available to us under our credit facilities in an amount sufficient to enable us to pay our indebtedness or to fund our other liquidity needs. We may seek to sell assets to fund our liquidity needs but may not be able to do so.

In addition, we can give no assurance that we will be able to refinance any of our debt, including the Global ABL Facility, on commercially reasonable terms or at all. If we were unable to make payments or refinance our debt or obtain new financing under these circumstances, we would have to consider other options, such as sales of assets, sales of equity and/or negotiations with our lenders to restructure the applicable debt. The Global ABL Facility and the indenture governing the notes may restrict, or market or business conditions may limit, our ability to avail ourselves of some or all of these options.

The borrowings under certain of our credit facilities bear interest at variable rates and other debt we incur could likewise be variable-rate debt. If market interest rates increase, variable-rate debt will create higher debt service requirements, which could adversely affect our cash flow. While we may enter into agreements limiting our exposure to higher interest rates, any such agreements may not offer complete protection from this risk.

Despite our current indebtedness level, we and our subsidiaries may still be able to incur substantially more debt, which could exacerbate the risks associated with our substantial indebtedness.