1 AG Mortgage Investment Trust, Inc. Q3 2024 Earnings Presentation September 30, 2024

2NYSE: MITT Forward Looking Statements & Non-GAAP Financial Information Forward Looking Statements: This presentation includes "forward-looking statements" within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995 related to dividends, book value, adjusted book value, our investments, our business and investment strategy, investment returns, return on equity, liquidity, financing, taxes, our assets, our interest rate sensitivity, and our views on certain macroeconomic trends and conditions, among others. Forward-looking statements are based on estimates, projections, beliefs and assumptions of management of our company at the time of such statements and are not guarantees of future performance. Forward-looking statements involve risks and uncertainties in predicting future results and conditions. Actual results could differ materially from those projected in these forward- looking statements due to a variety of factors, including, without limitation, our ability to generate attractive risk adjusted returns over the long term as a programmatic aggregator and issuer of Non-Agency residential loan securitizations; our ability to drive earnings power and to make our company a more scaled and profitable pure-play residential mortgage REIT; our ability to create long-term value for our stockholders; failure to realize the anticipated benefits and synergies of the Western Asset Mortgage Capital Corporation (WMC) acquisition, including whether we will achieve the savings and accretion expected within the anticipated timeframe or at all; our ability to continue to opportunistically rotate capital through sales of legacy WMC or other non-core assets; our ability to continue to grow our residential investment portfolio; our acquisition pipeline; our ability to invest in higher yielding assets through Arc Home, other origination partners or otherwise; our levels of liquidity, including whether our liquidity will sufficiently enable us to continue to deploy capital within the residential whole loan space as anticipated or at all; the impact of market, regulatory and structural changes on the market opportunities we expect to have, and whether we will be able to capitalize on such opportunities in the manner we anticipate, including our ability to participate in, and benefit from, the home equity loan market; the impact of market volatility on our business and ability to execute our strategy; our trading volume and liquidity; our portfolio mix, including levels of Non-Agency and Agency mortgage loans; our ability to manage warehouse exposure as anticipated or at all; our levels of leverage, including our levels of recourse and non-recourse financing; our ability to repay or refinance corporate leverage; our ability to execute securitizations, including at the pace anticipated or at all; our ability to achieve our forecasted returns on equity on warehoused assets and post- securitization, including whether such returns will support earnings growth; changes in our business and investment strategy; our ability to grow our book value; our ability to predict and control costs; changes in inflation, interest rates and the fair value of our assets, including negative changes resulting in margin calls relating to the financing of our assets; the impact of credit spread movements on our business; the impact of interest rate changes on our asset yields and net interest margin; changes in the yield curve; the timing and amount of stock issuances pursuant to our ATM program or otherwise; the timing and amount of stock repurchases, if any; our capitalization, including the timing and amount of preferred stock repurchases or exchanges, if any; expense levels, including levels of management fees; changes in prepayment rates on the loans we own or that underlie our investment securities; our distribution policy; Arc Home’s performance, including its ability to increase market share or benefit from improved gain on sale margins; Arc Home’s origination volumes; the composition of Arc Home’s portfolio, including levels of MSR exposure; our percentage allocation of loans originated by Arc Home; increased rates of default or delinquencies and/or decreased recovery rates on our assets; the availability of and competition for our target investments; our ability to obtain and maintain financing arrangements on terms favorable to us or at all; changes in general economic or market conditions in our industry and in the finance and real estate markets, including the impact on the value of our assets; conditions in the market for Residential Investments and Agency RMBS; our levels of Earnings Available for Distribution (“EAD”); market conditions impacting commercial real estate; legislative and regulatory actions by the U.S. Department of the Treasury, the Federal Reserve and other agencies and instrumentalities; regional bank failures; our ability to make distributions to our stockholders in the future; our ability to maintain our qualification as a REIT for federal tax purposes; and our ability to qualify for an exemption from registration under the Investment Company Act of 1940, as amended. Additional information concerning these and other risk factors are contained in our filings with the Securities and Exchange Commission ("SEC"), including those described in Part I – Item 1A. “Risk Factors” of our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, as such factors may be updated from time to time in our filings with the SEC. Copies are available free of charge on the SEC's website, http://www.sec.gov/. All forward looking statements in this presentation speak only as of the date of this presentation. We undertake no duty to update any forward-looking statements to reflect any change in our expectations or any change in events, conditions or circumstances on which any such statement is based. All financial information in this presentation is as of September 30, 2024, unless otherwise indicated. Non-GAAP Financial Information: In addition to the results presented in accordance with GAAP, this presentation includes certain non-GAAP financial results and financial metrics derived therefrom, including EAD, investment portfolio, financing arrangements, and economic leverage ratio, which are calculated by including or excluding unconsolidated investments in affiliates, as described in the footnotes to this presentation. Our management team believes that this non-GAAP financial information, when considered with our GAAP financial statements, provides supplemental information useful for investors to help evaluate our financial performance. However, our management team also believes that our definition of EAD has important limitations as it does not include certain earnings or losses our management team considers in evaluating our financial performance. Our presentation of non-GAAP financial information may not be comparable to similarly-titled measures of other companies, who may use different calculations. This non-GAAP financial information should not be considered a substitute for, or superior to, the financial measures calculated in accordance with GAAP. Our GAAP financial results and the reconciliations of the non-GAAP financial measures included in this presentation to the most directly comparable financial measures prepared in accordance with GAAP should be carefully evaluated. This presentation may contain statistics and other data that has been obtained or compiled from information made available by third-party service providers. We have not independently verified such statistics or data.

3NYSE: MITT Q3 2024 MITT Earnings Call Presenters T.J. Durkin Nicholas Smith Anthony Rossiello Chief Executive Officer & President Chief Investment Officer Chief Financial Officer

4NYSE: MITT MITT: A Pure Play Residential Mortgage REIT Committed to generating attractive risk adjusted returns over the long-term as a programmatic aggregator and issuer of Non-Agency residential loan securitizations Liquidity to Support Continued Portfolio Growth Access to Investment Opportunities High Quality Portfolio through a Credit-first Mindset Disciplined Approach to Securitization and Leverage

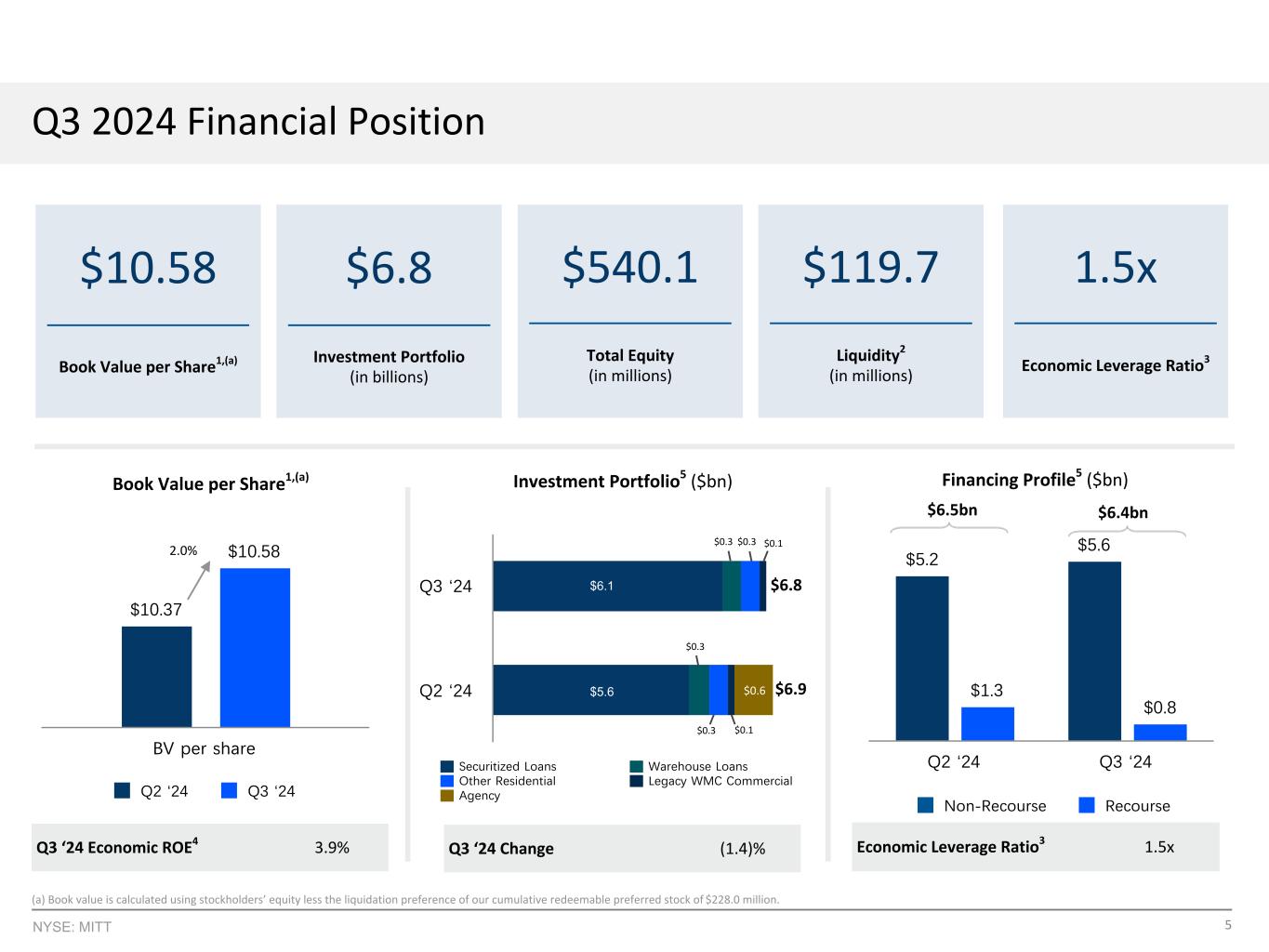

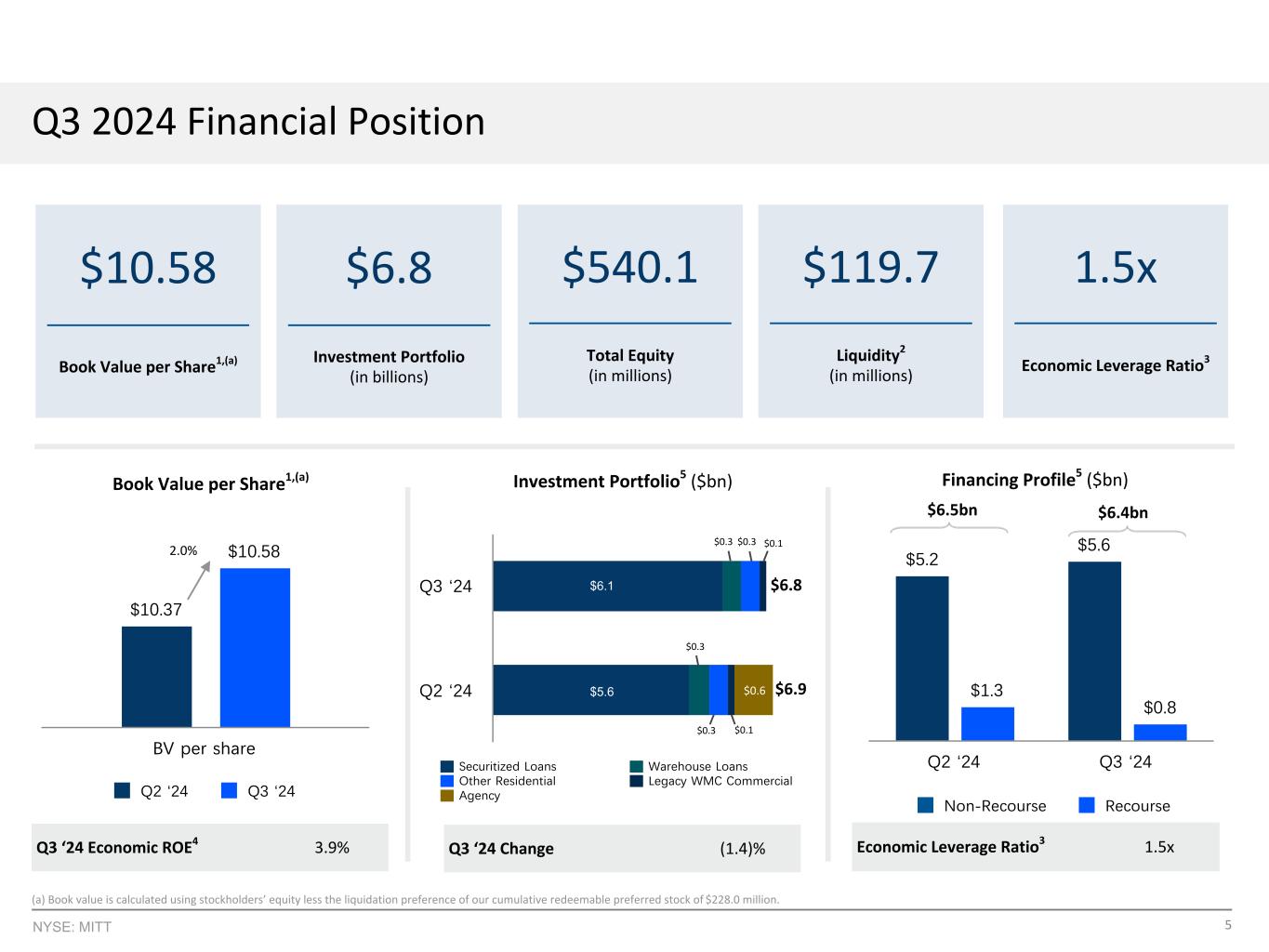

5NYSE: MITT $0.6 Securitized Loans Warehouse Loans Other Residential Legacy WMC Commercial Agency Q3 ‘24 Q2 ‘24 $10.37 $10.58 Q2 ‘24 Q3 ‘24 BV per share Q3 2024 Financial Position Economic Leverage Ratio3 1.5x $5.2 $5.6 $1.3 $0.8 Non-Recourse Recourse Q2 ‘24 Q3 ‘24 $6.9 $6.8 $6.4bn$6.5bn $6.8 Investment Portfolio (in billions) $10.58 Book Value per Share1,(a) $540.1 Total Equity (in millions) $119.7 Liquidity2 (in millions) 1.5x Economic Leverage Ratio3 Investment Portfolio5 ($bn) Financing Profile5 ($bn)Book Value per Share1,(a) Q3 ‘24 Economic ROE4 3.9% —% 2.0% Q3 ‘24 Change (1.4)% $0.3 $0.3$0.3 $0.3 $0.1 $0.1 (a) Book value is calculated using stockholders’ equity less the liquidation preference of our cumulative redeemable preferred stock of $228.0 million. $6.1 $5.6

6NYSE: MITT Q3 2024 Performance $15.8mm Q3 Net Interest Income $0.40 Q3 Earnings per Share6 $0.17 Q3 EAD per Share6,7 $0.19 Dividend per Share Declared in Q3 $524.9mm Q3 Loan Purchases (FMV) $329.7mm Current Pipeline(a) (UPB) $751.5mm Q3 Loans Securitized(b) (UPB) (a) Current Pipeline includes purchases made in October 2024. (b) Includes $360.7 million of Agency-Eligible Loans from a co-sponsored securitization. $681.6mm Q3 Arc Home Originations8 Strong asset appreciation in our investment portfolio drives book value growth • GAAP earnings driven by unrealized gains on our Residential Mortgage Loans and Non-Agency RMBS from declining rates and credit spread tightening • Quarter over quarter decline in EAD driven by lower projected yields on our Residential Mortgage Loans from faster assumed prepayment speeds • Arc Home’s contribution to EAD improved during the quarter as volumes and margins increased Remained active in our securitization strategy and expanded product set into Home Equity Loans • Purchased $136.2 million of Home Equity Loans with pipeline of approximately $200 million(a) • Executed a securitization of $390.8 million UPB of Agency- Eligible Loans • Co-sponsored a securitization of Agency-Eligible Loans, retaining $51.0 million of Non-Agency RMBS • Sold $543.2 million of Agency RMBS and paid off the $79.1 million outstanding Legacy WMC Convertible Notes

7NYSE: MITT Economic Interest Retained Securitized Loans Co-Sponsor Securitized Loans Warehouse Loans Q2 ‘ 21 Q3 ‘ 21 Q4 ‘ 21 Q1 ‘ 22 Q2 ‘ 22 Q3 ‘ 22 Q4 ‘ 22 Q1 ‘ 23 Q2 ‘ 23 Q3 ‘ 23 Q4 ’ 23 Q1 ‘ 24 Q2 ‘ 24 Q3 ‘ 24 $0 $2,000 $4,000 $6,000 Securitization Activity Programmatic issuer of Non-Agency securitizations generating attractive equity returns on our investment portfolio Reinvest Securitization Proceeds Investing and Funding Lifecycle Acquire and Aggregate Loans Securitize Loans Retain Portions of Securitization Targeting returns on equity of 14% to 18% while reducing warehouse risk through issuance of term, non-MTM financing Retaining approximately 5% to 10% of securitization; borrowing against retained bonds Current production yields ranging from 7% to 8.5% targeting returns of 15% to 20% while on warehouse Securitized Loan Portfolio Growth ($mm) Economic Interest Retained Co-Sponsor Deals Retained Securitized Loans Warehouse Loans Q2 ‘ 21 Q3 ‘ 21 Q4 ‘ 21 Q1 ‘ 22 Q2 ‘ 22 Q3 ‘ 22 Q4 ‘ 22 Q1 ‘ 23 Q2 ‘ 23 Q3 ‘ 23 Q4 ’ 23 Q1 ‘ 24 Q2 ‘ 24 $0 $250 $500 $750 $1,000 $1,250 $1,500 $0 $1,200 $2,400 $3,600 $4,800 $6,000 Retained Bonds Allocation 97.7% 2.3% MITT securitizations Co-Sponsored securitizations (b) (c) (a) (d) (a) Increase in economic interest retained and securitized loans in Q4 2023 is attributable to assets acquired in the WMC acquisition of $134.5 million and $971.8 million, respectively. (b) Economic interest retained represents the fair market value of retained tranches from securitizations which are consolidated in the “Securitized residential mortgage loans, at fair value” line item on the Company’s consolidated balance sheets. The economic interest retained from co-sponsored deals which are not consolidated is included in the "Real estate securities, at fair value" line item on the consolidated balance sheets. (c) Securitized Loans represent Securitized Non-Agency and Re/Non-Performing Loans included in the “Securitized residential mortgage loans, at fair value” line item on the Company’s consolidated balance sheets. (d) During Q2 and Q3 2024, MITT participated in securitizations where it acted as a co-sponsor and retained bonds from the deals in order to meet risk retention requirements. Co-Sponsor Securitized Loans represents the total unpaid principal balance of the loans securitized through these deals. These loans are not consolidated on the Company’s consolidated balance sheets and the economic interest retained from this securitization is included in the “Real estate securities, at fair value” line item on the Company’s consolidated balance sheets.

8NYSE: MITT Non-Agency Loan Portfolio Snapshot Note: Data is based on the latest available information. (a) Securitized UPB includes securitized non-agency loans and Warehouse UPB includes non-agency and agency-eligible loans financed via warehouse financing. (b) Metrics including coupon, FICO, and current LTV represent weighted average calculations based off UPB. Weighted average current FICO excludes borrowers where FICO scores were not available. (c) Current LTV reflects loan amortization and estimated home price appreciation or depreciation since acquisition. Zillow Home Value Index (ZHVI) is utilized to estimate updated LTVs. (d) Metrics shown calculated as a percentage of total UPB. $6.2bn Securitized UPB(a) $123.2mm Warehouse UPB(a) Portfolio of Non-Agency loans with strong borrower performance and low LTVs benefiting from accumulated HPA and loan amortization 762 FICO(b) 59% Current LTV(b),(c) 1.0% 90+ Days DQ %(d) 90% Fixed Rate %(d) % 9 0+ D ay s D el in q ue nt Percentage of Loans 90+ Days Delinquent 0.8% 1.0% 1.3% 1.1% 1.0% Q3 ‘ 23 Q4 ‘ 23 Q1 ‘ 24 Q2 ‘ 24 Q3 ‘ 24 Geography California Florida New York Texas New Jersey Other 5.6% Securitized Coupon(b) 7.6% Warehouse Coupon(b) FICO Score U P B o f L oa ns FICO ($ in mm) <621 621-640 640-660 661-680 681-700 701-720 721-740 741-760 761-780 781-800 >800 — 200 400 600 800 1,000 LT V % Current LTV 61% 62% 59% 59% 59% Q3 ‘ 23 Q4 ‘ 23 Q1 ‘ 24 Q2 ‘ 24 Q3 ‘ 24 % 9 0+ D ay s D el in q ue nt Percentage of Loans 90+ Days Delinquent 0.4% 0.6% 0.8% 1.0% 1.2% Q1 ‘ 23 Q2 ‘ 23 Q3 ‘ 23 Q4 ‘ 23 Q1 ‘ 24 (b),(c) 10% 60% XX FICO(b) XX HELOC UPB(a) XX Coupon(b) XX Current LTV(b),(c)

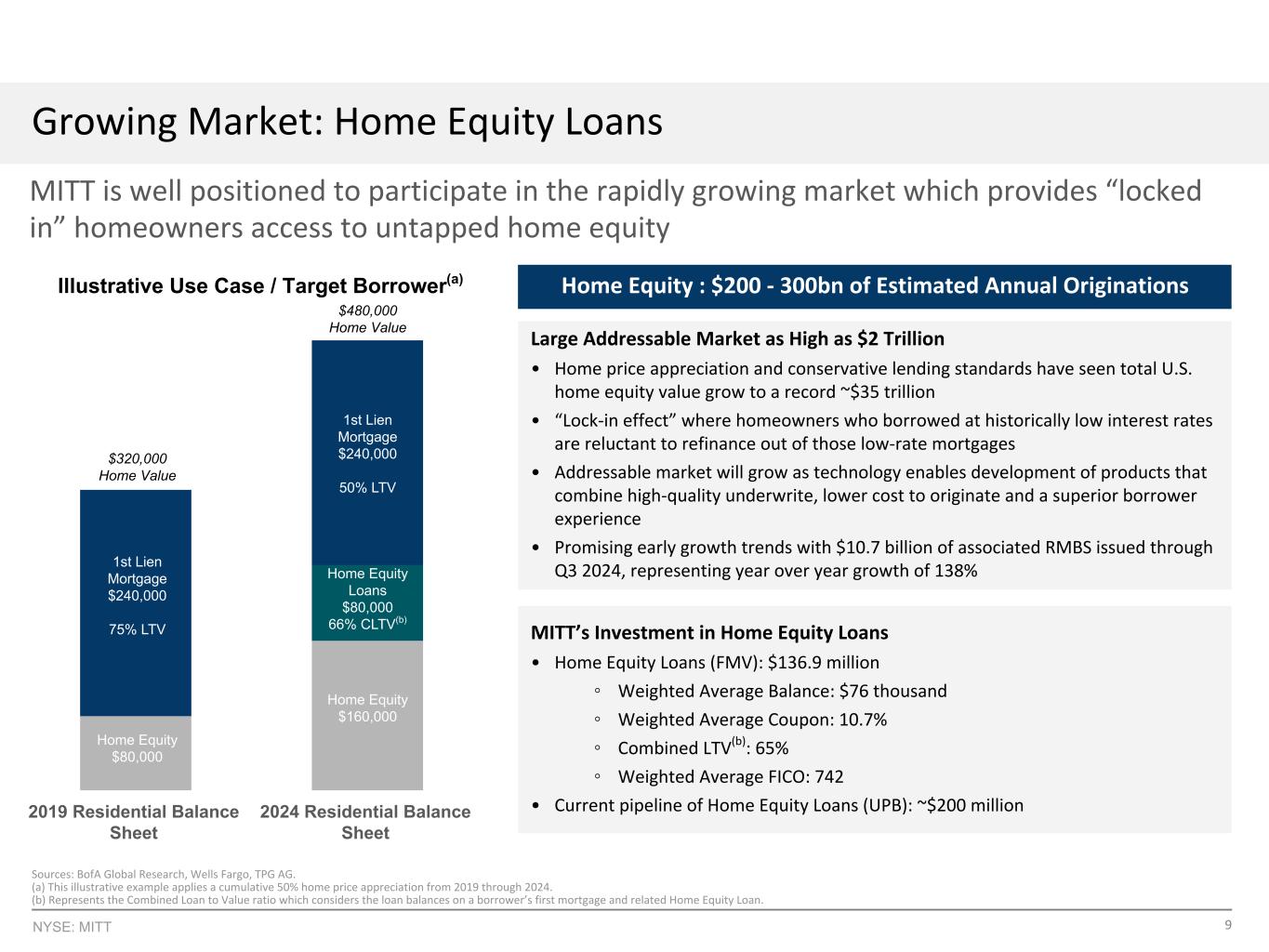

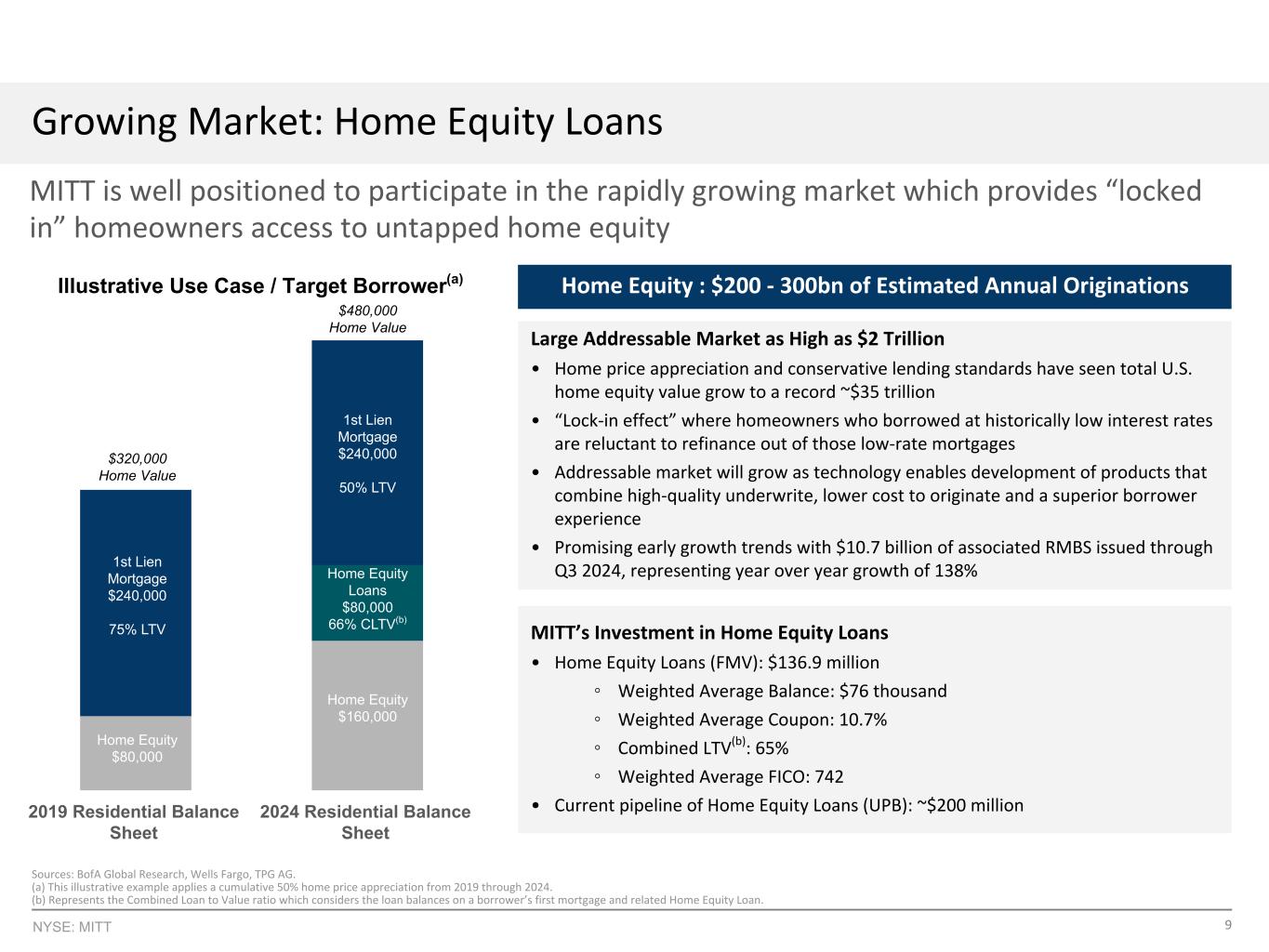

9NYSE: MITT Growing Market: Home Equity Loans MITT is well positioned to participate in the rapidly growing market which provides “locked in” homeowners access to untapped home equity Sources: BofA Global Research, Wells Fargo, TPG AG. (a) This illustrative example applies a cumulative 50% home price appreciation from 2019 through 2024. (b) Represents the Combined Loan to Value ratio which considers the loan balances on a borrower’s first mortgage and related Home Equity Loan. Home Equity : $200 - 300bn of Estimated Annual Originations Large Addressable Market as High as $2 Trillion • Home price appreciation and conservative lending standards have seen total U.S. home equity value grow to a record ~$35 trillion • “Lock-in effect” where homeowners who borrowed at historically low interest rates are reluctant to refinance out of those low-rate mortgages • Addressable market will grow as technology enables development of products that combine high-quality underwrite, lower cost to originate and a superior borrower experience • Promising early growth trends with $10.7 billion of associated RMBS issued through Q3 2024, representing year over year growth of 138% MITT’s Investment in Home Equity Loans • Home Equity Loans (FMV): $136.9 million ◦ Weighted Average Balance: $76 thousand ◦ Weighted Average Coupon: 10.7% ◦ Combined LTV(b): 65% ◦ Weighted Average FICO: 742 • Current pipeline of Home Equity Loans (UPB): ~$200 million2019 Residential Balance Sheet 2024 Residential Balance Sheet Home Equity $80,000 1st Lien Mortgage $240,000 75% LTV 1st Lien Mortgage $240,000 50% LTV Home Equity Loans $80,000 66% CLTV(b) Home Equity $160,000 Illustrative Use Case / Target Borrower(a) $480,000 Home Value $320,000 Home Value

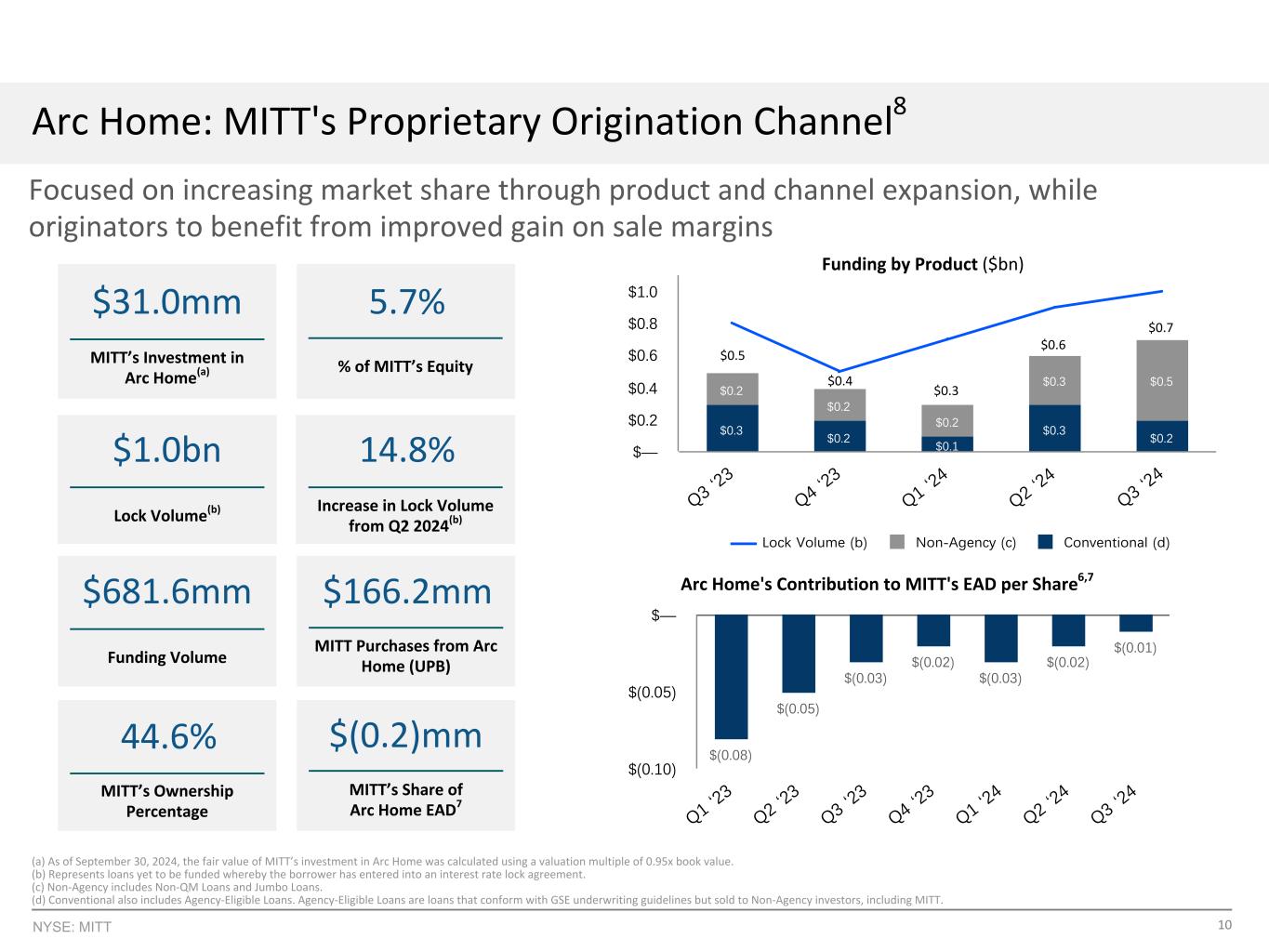

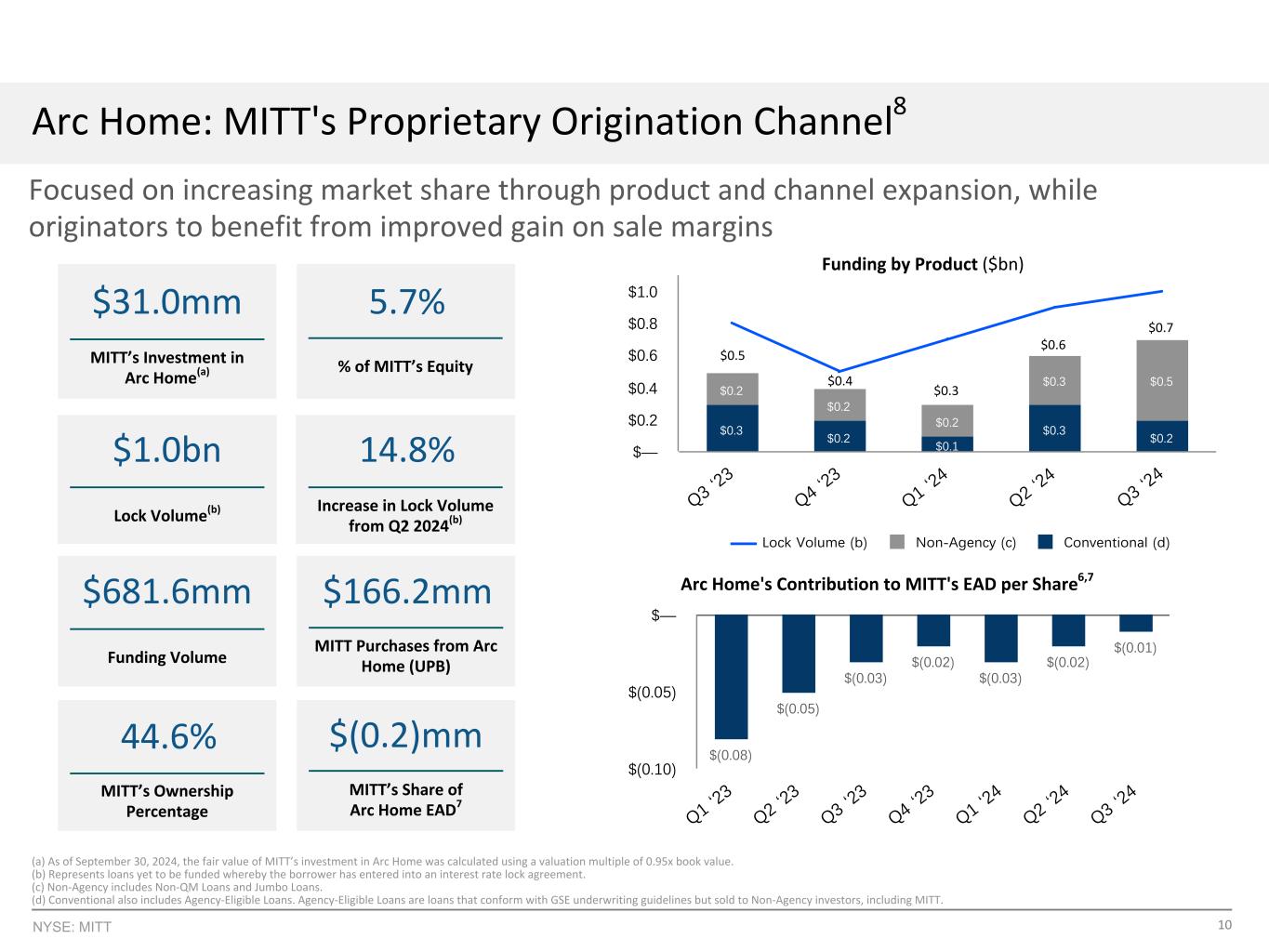

10NYSE: MITT Arc Home: MITT's Proprietary Origination Channel8 Focused on increasing market share through product and channel expansion, while originators to benefit from improved gain on sale margins 44.6% MITT’s Ownership Percentage $(0.2)mm MITT’s Share of Arc Home EAD7 Geography California Florida New York Texas New Jersey Other $31.0mm MITT’s Investment in Arc Home(a) $0.3 $0.2 $0.1 $0.3 $0.2 $0.2 $0.2 $0.2 $0.3 $0.5 Lock Volume (b) Non-Agency (c) Conventional (d) Q3 ‘ 23 Q4 ‘ 23 Q1 ‘ 24 Q2 ‘ 24 Q3 ‘ 24 $— $0.2 $0.4 $0.6 $0.8 $1.0 Funding by Product ($bn) $166.2mm MITT Purchases from Arc Home (UPB) $0.3 $0.5 $0.4 $0.6 19.5% 64.9% 15.6% Cash Servicing Origination $0.7 $(0.08) $(0.05) $(0.03) $(0.02) $(0.03) $(0.02) $(0.01) Q1 ‘ 23 Q2 ‘ 23 Q3 ‘ 23 Q4 ‘ 23 Q1 ‘ 24 Q2 ‘ 24 Q3 ‘ 24 $(0.10) $(0.05) $— $80.1mm of Equity at Arc Home Arc Home's Contribution to MITT's EAD per Share6,7 [MITT’s Investment in Arc Home] • MITT’s investment in Arc Home(a): $31.0mm • MITT’s share of Arc Home Net Income: ($0.2)mm ◦ [breakout of P&L] • Arc Home’s % of MITT’s Equity(b): 4.9% (a) As of September 30, 2024, the fair value of MITT’s investment in Arc Home was calculated using a valuation multiple of 0.95x book value. (b) Represents loans yet to be funded whereby the borrower has entered into an interest rate lock agreement. (c) Non-Agency includes Non-QM Loans and Jumbo Loans. (d) Conventional also includes Agency-Eligible Loans. Agency-Eligible Loans are loans that conform with GSE underwriting guidelines but sold to Non-Agency investors, including MITT. Arc Home Busines Update • [Q3 P&L of XX driven by...] • Growth in lock volume of 12.8% quarter over quarter • Arc Home has expanded their product set into HELOC • MITT purchases from Arc Home (UPB): $166.2mm 5.7% % of MITT’s Equity $681.6mm Funding Volume $1.0bn Lock Volume(b) 14.8% Increase in Lock Volume from Q2 2024(b)

11NYSE: MITT Commercial Investments • Legacy Commercial Real Estate Loans and CMBS acquired in WMC merger represents 1.8% of our Investment Portfolio and 9.6% of total equity (a) As of September 30, 2024, there are Legacy WMC CMBS with an unpaid principal balance of $23.5 million and a fair value of $6.3 million which are on non-accrual or cost recovery status. Legacy WMC Commercial Investments Expect to hold commercial investments as they organically mature or prudently exit through opportunistic sales $119.6mm of Fair Value (by Collateral Type) 50.6% 40.4% 0.5% 1.6% 5.7% 1.2% Hotel Retail Industrial Multifamily Office Other $52.0mm of Equity Invested (by Investment Type) 13.0% 25.3% 23.9% 37.8% CMBS - Conduit Fixed Rate CMBS - SASB Floating Rate CMBS - SASB Fixed Rate Commercial Loans Commercial Real Estate Loans Summary: Two first mortgage participations collateralized by institutionally owned CRE Assets. Freehand Portfolio: Cross-collateralized portfolio of three loans backed by four Freehand hotels located in NYC, Miami, Chicago and LA. Pool is 74% LTV based on recent appraisals. Maturity date of May 6th, 2025 Sono Collection: A Class A trophy mall located in affluent Norwalk, CT and anchored by Bloomingdale’s and Nordstrom. Loan is 43% LTV based on recent appraisals. Maturity date of August 6th, 2025 Par Recovery CMBS: 82% of market value is collateralized by single asset bonds, allowing for detailed underwriting. The two largest positions are loans on The Atlantis in the Bahamas and LA Landmark, Ovation Hollywood. Credit IO: Small positions where returns are a function of income v. principal recovery Loan extensions could provide upside to the positions The Single Asset Single Borrower CMBS market has been receptive to Retail and Hospitality transactions as underlying fundamentals have remained resilient post-Covid. Commercial Loans Summary • Remaining two investments are first mortgage loans • Borrowers on both investments are current • Weighted average LTV at acquisition of 63.7% • Investments collateralized by hotel and retail properties • Geography consists of: CT, NY, CA, IL, and FL • Maturity profile on investments are May 2025 and August 2025 • Weighted average unlevered yield of 9.6% CMBS Summary • Weighted average price of 52%, allowing for book value upside as markets improve • Weighted average unlevered yield of 16.9%(a) • Weighted average life of 2.1 years

12NYSE: MITT Q3 2024 Investment Portfolio5 Description ($ in mm’s) Asset Cost Asset FMV Yield9,(a) Financing Cost(b) Carrying Value of Financing(b) Cost of Funds10,(c) Equity Economic Leverage(d) ROE(e) Securitized Non-Agency Loans $6,235.9 $6,052.1 5.6% $5,875.8 $5,756.1 5.2% $296.0 1.0x 14.7% Securitized RPL/NPL Loans 188.1 174.5 6.1% 155.4 148.8 4.3% 25.7 1.6x 18.4% Agency-Eligble Loans 111.7 112.8 6.8% 103.7 103.7 6.6% 9.1 11.4x 8.0% Home Equity Loans 135.3 136.9 9.6% 114.5 114.5 5.9% 22.4 5.1x 27.8% Non-Agency Loans and Other 14.6 15.4 10.8% 7.7 7.7 5.0% 7.7 1.3x 15.5% Non-Agency RMBS(f) 140.7 143.7 8.9% 90.2 90.2 5.7% 53.5 1.7x 13.8% Agency RMBS 21.1 20.2 8.0% 2.1 2.1 5.6% 18.1 0.1x 8.6% Legacy WMC Commercial Loans 66.5 66.9 9.6% 47.2 47.2 8.1% 19.7 2.4x 13.0% CMBS and Other Securities 59.0 53.7 16.9% 20.3 20.3 6.9% 33.4 0.6x 25.6% Total Investment Portfolio $6,972.9 $6,776.2 5.9% $6,416.9 $6,290.6 5.3% $485.6 1.5x 15.7% Cash and Cash Equivalents 102.5 4.8% 102.5 Interest Rate Swaps(g) 8.0 1.7% 8.0 Arc Home 31.0 31.0 Senior Unsecured Notes(h) — 95.5 10.6% (95.5) Non-Interest Earnings Assets, Net 8.5 8.5 Total $6,926.2 $6,386.1 $540.1 1.5x Interest Only, 12% Loan Balance, 59% Low FICO, 29% Agency Pool Characteristics(c) 2% 28% 23% 18% 10% 19% < 3% 3% - 4 % 4% - 5 % 5% - 6 % 6% - 7 % 7%+ —% 10% 20% 30% Loan Interest Rate Distribution Investment Portfolio (FMV) 93.2% 2.6% 2.1% 0.3% 1.8% Non-Agency Loans RPL/NPL Non-Agency RMBS Agency Legacy WMC Commercial Investment Portfolio (Equity) 68.7% 5.7%11.0% 3.7% 10.9% Non-Agency Loans RPL/NPL Non-Agency RMBS Agency Legacy WMC Commercial Equity Allocation 54.8% 17.1% 11.1% 7.3% 4.9% 4.8% Residential Cash Agency Commercial Arc Home Other Note: Data is as of September 30, 2024. (a) Represents the weighted average yield calculated based on the amortized cost of the underlying assets. (b) Financing is inclusive of securitized debt recorded at fair value and financing arrangements recorded at cost. Financing arrangements on Securitized Non-Agency Loans and Securitized RPL/NPL Loans was $364.6 million and $42.7 million, respectively. (c) Represents the weighted average cost of funds on securitized debt and financing arrangements calculated based on the amortized cost of the underlying financing, inclusive of the benefit of 0.1% from the net interest component of interest rate swaps. Total Cost of Funds related to the financing on the Company’s investment portfolio and the senior unsecured notes was 5.3%. (d) Economic Leverage is calculated by dividing recourse financing by the equity invested in the related investment type inclusive of any cash collateral posted on financing arrangements. Non-recourse financing arrangements include securitized debt and other non-recourse financing arrangements. (e) Return on Equity is calculated by dividing the net interest income, inclusive of any cost or benefit on interest rate swaps, by the equity invested in the related investment type. Net interest income is calculated using Asset Cost multiplied by the Yield less Financing Cost multiplied by the Cost of Funds. (f) Includes $20.1 million and $3.5 million of asset FMV and financing arrangements recorded in the “Investments in debt and equity of affiliates” line item on the Company's consolidated balance sheets. (g) Asset FMV of interest rate swaps represents the sum of the net fair value of interest rate swaps and the margin posted on interest rate swaps. The Yield on interest rate swaps represents the net receive / (pay) rate as of period end. The interest rate swap portfolio had a notional amount of $304.5 million with a weighted average pay-fixed rate of 3.3%, a weighted average receive-variable rate of 5.0%, and a weighted average years to maturity of 5.2 years. The impact of the net interest component of interest rate swaps on cost of funds and return on equity is included within the respective investment portfolio asset line items. (h) Includes $95.5 million of MITT’s 9.500% senior unsecured notes due 2029.

13NYSE: MITT (a) Includes $95.5 million of MITT’s 9.500% senior unsecured notes due 2029 and, in periods prior to Q3 2024, included our 6.75% convertible senior unsecured notes due September 2024. (b) Includes financing on Commercial loans and CMBS included in the "Commercial Loans, at fair value" and “Real Estate Securities, at fair value” line items, respectively, on the Company’s consolidated balance sheets. (c) Includes financing on the retained tranches from securitizations issued by the Company and consolidated in the “Securitized residential mortgage loans, at fair value” line item on the Company’s consolidated balance sheets. Additionally, includes financing on Non-Agency RMBS included in the “Real Estate Securities, at fair value” and “Investments in debt and equity of affiliates” line items on the Company’s consolidated balance sheets. (d) Cost of Funds shown includes the cost or benefit from our interest rate hedges. Total Cost of Funds as of September 30, 2024 excluding the cost or benefit of our interest rate hedges was 5.4%. (e) The borrowing capacity under our Agency-Eligible Loan, Home Equity Loan, and Non-Agency Loan warehouse financing arrangements is uncommitted by the lenders. 1.2x 1.5x 1.4x 2.5x 1.5x Residential Agency Commercial Unsecured Notes Q3 ‘ 23 Q4 ‘ 23 Q1 ‘ 24 Q2 ‘ 24 Q3 ‘ 24 0.0x 1.0x 2.0x 3.0x Residential, 11.3% Commercial, 1.1% Unsecured Notes, 1.5% Securitized Debt, 86.1% As of 9/30/2024 Securitized Debt Residential Bond Financing(c) Residential Loan Financing Agency Financing Legacy WMC Commercial Financing(b) Unsecured Notes(a) Total Amount (in mm) $5,497.6 $497.5 $225.9 $2.1 $67.5 $95.5 $6,386.1 Cost of Funds10, (d) 5.1% 6.1% 6.2% 5.6% 7.8% 10.6% 5.3% Advance Rate 88% 58% 87% 70% 57% N/A N/A Available Capacity(e) (in mm) N/A N/A $1,574.1 N/A N/A N/A $1,574.1 Recourse/Non-Recourse Non-Recourse Recourse/Non- Recourse Recourse Recourse Recourse Recourse Recourse/Non- Recourse Financing Profile5 Successful in terming out warehouse financing through securitizations and paid off Legacy WMC Convertible Notes at maturity in September 2024 $6.4bn of Financing as of 9/30/2024 Economic Leverage Ratio3 (a) (b) (a) (b)

14NYSE: MITT Book Value Roll-Forward1 Three Months Ended September 30, 2024 Amount (000’s) Per Diluted Share6 6/30/24 Book Value(a) $305,511 $10.37 Common dividend (5,604) (0.19) Equity based compensation 133 — Earnings available for distribution (“EAD”) 4,876 0.17 Net realized and unrealized gain/(loss) included within equity in earnings/ (loss) from affiliates (1,155) (0.04) Net realized gain/(loss) (10,788) (0.37) Net unrealized gain/(loss) 19,700 0.66 Transaction related expenses and deal related performance fees (709) (0.02) Adjustment related to dividends on preferred stock(b) 130 — 9/30/24 Book Value(a) $312,094 $10.58 Change in Book Value ($) 6,583 0.21 Change in Book Value (%) 2.0 % (a) Book value is calculated using stockholders’ equity less the liquidation preference of our cumulative redeemable preferred stock of $228.0 million. (b) Represents the difference between the dividend accrual on our Series C Preferred Stock and the dividend declared during the quarter. On and after September 17, 2024, dividends on our Series C Preferred Stock accumulate at an annual floating rate of three-month CME Term SOFR (plus a tenor spread adjustment of 0.26161%) plus a spread of 6.476%.

15NYSE: MITT Reconciliation of Q3 2024 EAD7 (a) EAD excludes our portion of gains recorded by Arc Home in connection with the sale of residential mortgage loans to us. We eliminated such gains recognized by Arc Home and also decreased the cost basis of the underlying loans we purchased by the same amount. Upon reducing our cost basis, unrealized gains are recorded within net income based on the fair value of the underlying loans at quarter end. (b) EAD excludes $32.0 thousand or $0.00 per share of realized and unrealized changes in the fair value of Arc Home's net mortgage servicing rights, changes in the fair value of corresponding derivatives, and other transaction related expenses, net of deferred tax expense or benefit, for the three months ended September 30, 2024. Additionally, for the three months ended September 30, 2024, $0.8 million or $0.03 per share of unrealized changes in the fair value of our investment in Arc Home was excluded from EAD. Three Months Ended September 30, 2024 Components of Earnings Available for Distribution Amount (000’s) Per Diluted Share6 Net Interest Income $ 15,827 $ 0.54 Net Interest Component of Interest Rate Swaps 2,180 0.07 Arc Home EAD (154) (0.01) Less: Gains on loans sold to MITT(a) (359) (0.01) Arc Home EAD to MITT (513) (0.02) Management fee to affiliate (1,708) (0.06) Non-investment related expenses (2,750) (0.09) Investment related expenses (3,444) (0.11) Dividends on preferred stock (4,716) (0.16) Operating Expenses (12,618) (0.42) Earnings Available for Distribution $ 4,876 $ 0.17 Three Months Ended September 30, 2024 Reconciliation of GAAP Net Income to Earnings Available for Distribution Amount (000’s) Per Diluted Share6 Net Income/(loss) available to common stockholders $ 11,924 $ 0.40 Add (Deduct): Net realized (gain)/loss 10,788 0.37 Net unrealized (gain)/loss (19,700) (0.66) Transaction related expenses and deal related performance fees 709 0.02 Equity in (earnings)/loss from affiliates 849 0.03 EAD from equity method investments(a),(b) 306 0.01 Earnings Available for Distribution $ 4,876 $ 0.17

16 Appendix

17NYSE: MITT Responsible Investing • Industry Recognized Transactions with Community Development Financial Institutions (CDFIs) Partnerships • Established ESG Policy for Residential/Consumer Debt, integrating ESG factors into the investment process • Utilize SASB materiality map and other industry tools in due diligence to seek to mitigate climate and other geographic/environmental risk • Robust TPG AG Anti-Money Laundering Policy, with Know-Your-Customer (KYC) procedures as its cornerstone • TPG AG is a signatory to the UN-supported Principles of Responsible Investing (PRI) Diversity & Inclusion • Diverse MITT Board of Directors (3/8 Female) • TPG AG's D&I priorities are organized around three pillars: • Educate: Leadership and firm wide D&I training • Attract: Hiring managers formally encouraged to expand diversity in candidate pools; Active partnerships with organizations including Toigo Foundation, SEO, Girls Who Invest, FastTrack and iMentor • Retain & Develop: TPG AG Diversity Council and TPG AG Women's Network driving networking, awareness and engagement initiatives Operational Impact/Governance • Adopted Corporate Governance Guidelines & Code of Business Conduct and Ethics • Maintain Whistleblower/Ethics Hotline with anonymous reporting options • Commitment to Board Refreshment (3.9 year Avg Director Tenure) • Established Independent, Non-Executive Chair • Board Committees comprised solely of Independent Directors • Director shares subject to lock-up for duration of Board service, fostering strong alignment of interests • Robust cybersecurity monitoring and action plans • TPG AG Headquarters in building with LEED certification at the Gold level, in close proximity to major public transportation hub • MITT’s officers and directors, along with TPG AG and certain of its employees, collectively own ~5% of MITT’s outstanding common stock, fostering strong alignment of interests Community Engagement • TPG AG has a long history of supporting local communities, focused on long term charity partners, employee priorities and disaster relief efforts • Volunteering opportunities for TPG AG employees through partnership, such as NYC Cares, SuitUp and iMentor • Philanthropic platform, TPG AG Gives • Targeted employee matching activity MITT & Corporate Social Responsibility TPG Angelo Gordon's values of integrity, fairness, honesty, entrepreneurship and long-term value guides MITT's business and commitment to corporate responsibility

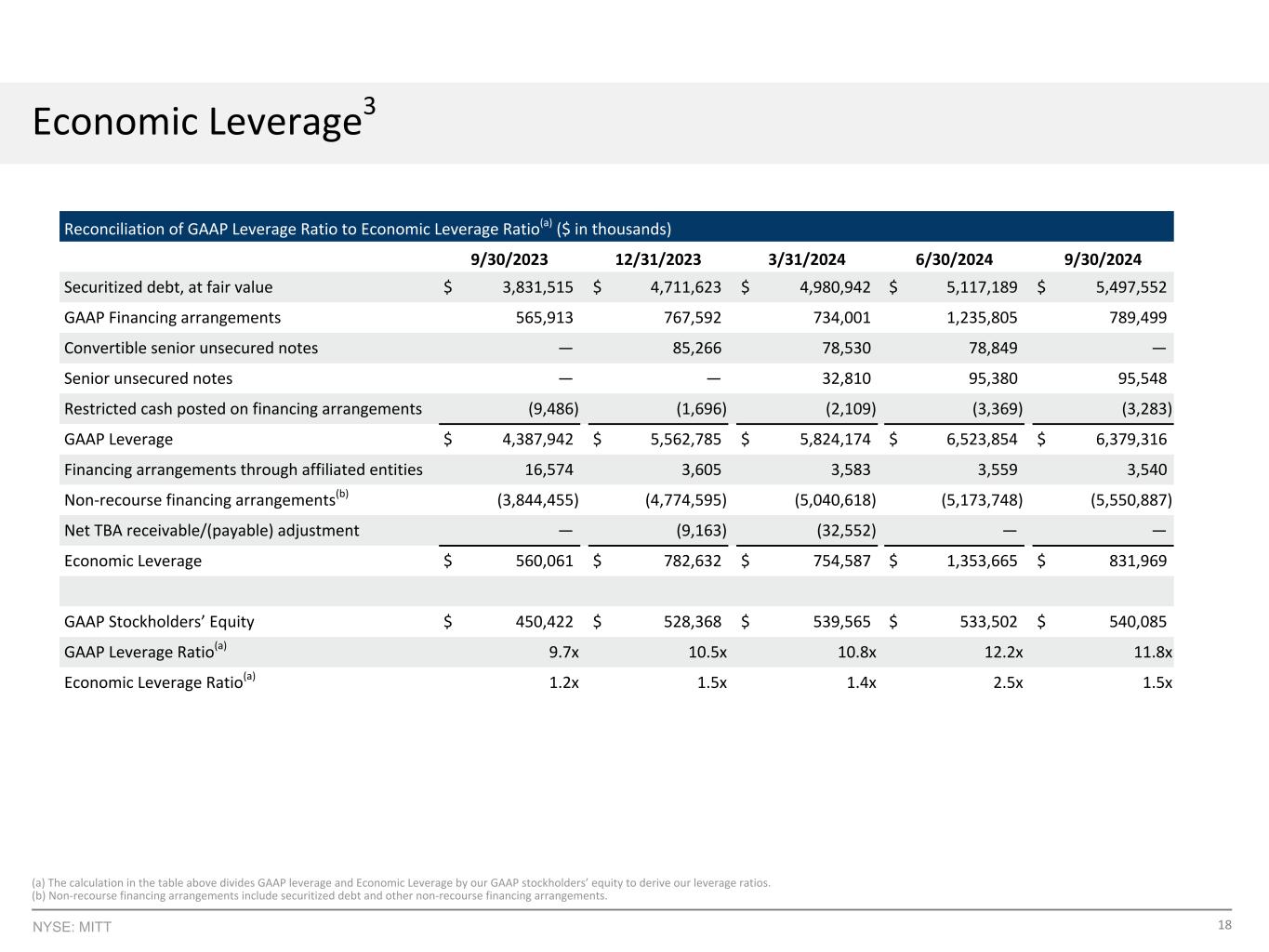

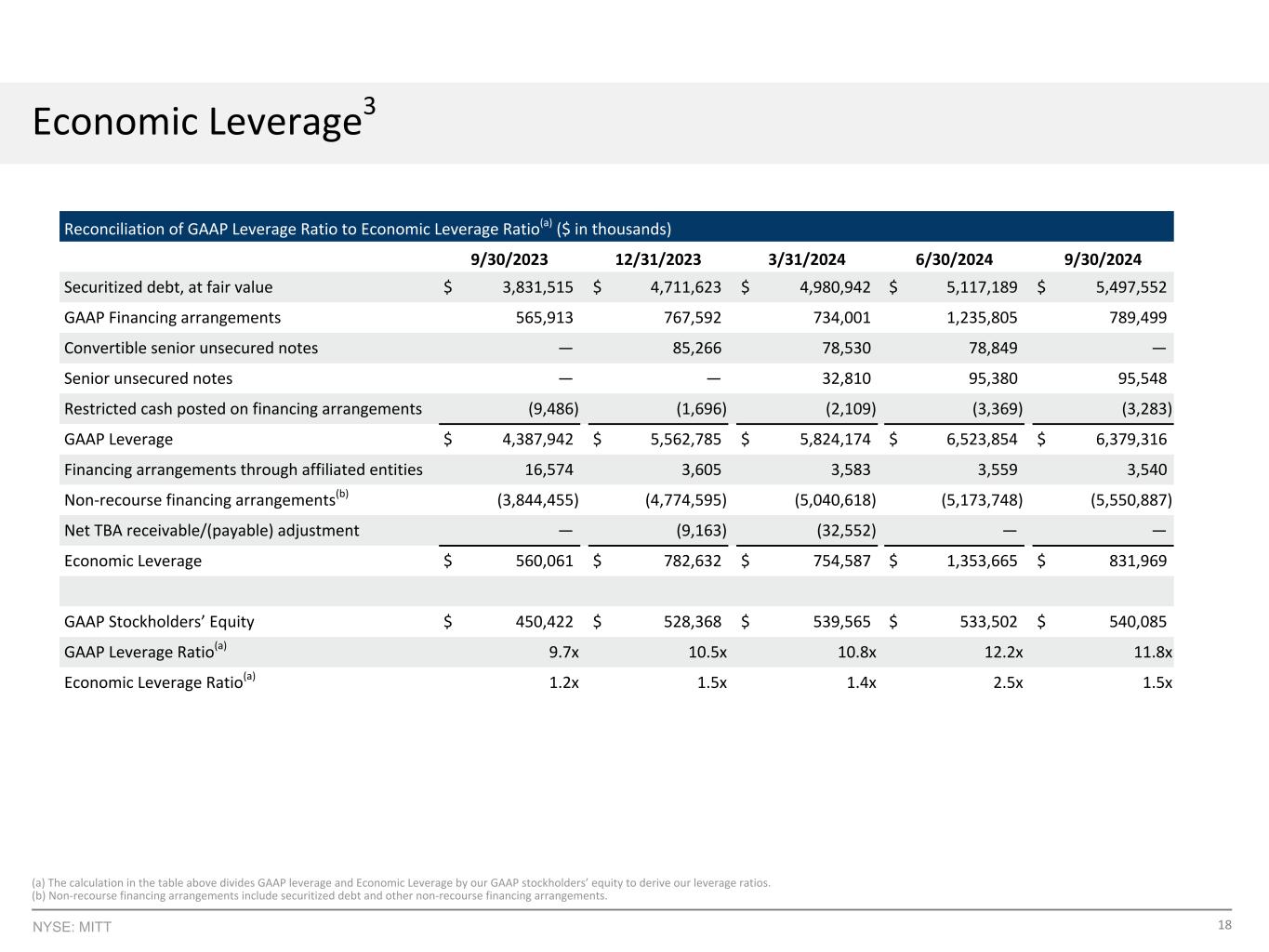

18NYSE: MITT Economic Leverage3 Reconciliation of GAAP Leverage Ratio to Economic Leverage Ratio - June 30, 2024 ($ in thousands) Leverage Stockholder’s Equity Leverage Ratio Securitized debt, at fair value $ 5,117,189 GAAP Financing arrangements 1,235,805 Convertible senior unsecured notes 78,849 Senior unsecured notes 95,380 Restricted cash posted on financing arrangements (3,369) GAAP Leverage $ 6,523,854 $ 533,502 12.2x Financing arrangements through affiliated entities 3,559 Non-recourse financing arrangements(a) (5,173,748) Economic Leverage $ 1,353,665 $ 533,502 2.5x(a) The calculation in the table above divides GAAP leverage and Economic Leverage by our GAAP stockholders’ equity to derive our leverage ratios. (b) Non-recourse financing arrangements include securitized debt and other non-recourse financing arrangements. Reconciliation of GAAP Leverage Ratio to Economic Leverage Ratio(a) ($ in thousands) 9/30/2023 12/31/2023 3/31/2024 6/30/2024 9/30/2024 Securitized debt, at fair value $ 3,831,515 $ 4,711,623 $ 4,980,942 $ 5,117,189 $ 5,497,552 GAAP Financing arrangements 565,913 767,592 734,001 1,235,805 789,499 Convertible senior unsecured notes — 85,266 78,530 78,849 — Senior unsecured notes — — 32,810 95,380 95,548 Restricted cash posted on financing arrangements (9,486) (1,696) (2,109) (3,369) (3,283) GAAP Leverage $ 4,387,942 $ 5,562,785 $ 5,824,174 $ 6,523,854 $ 6,379,316 Financing arrangements through affiliated entities 16,574 3,605 3,583 3,559 3,540 Non-recourse financing arrangements(b) (3,844,455) (4,774,595) (5,040,618) (5,173,748) (5,550,887) Net TBA receivable/(payable) adjustment — (9,163) (32,552) — — Economic Leverage $ 560,061 $ 782,632 $ 754,587 $ 1,353,665 $ 831,969 GAAP Stockholders’ Equity $ 450,422 $ 528,368 $ 539,565 $ 533,502 $ 540,085 GAAP Leverage Ratio(a) 9.7x 10.5x 10.8x 12.2x 11.8x Economic Leverage Ratio(a) 1.2x 1.5x 1.4x 2.5x 1.5x

19NYSE: MITT Condensed Consolidated Balance Sheets (unaudited) September 30, 2024 December 31, 2023 September 30, 2024 December 31, 2023 Assets (in thousands) Liabilities Securitized residential mortgage loans, at fair value $ 6,226,698 $ 5,358,281 Securitized debt, at fair value $ 5,497,552 $ 4,711,623 Residential mortgage loans, at fair value 265,047 317,631 Financing arrangements 789,499 767,592 Commercial loans, at fair value 66,875 66,303 Senior unsecured notes 95,548 — Real estate securities, at fair value 197,558 162,821 Convertible senior unsecured notes — 85,266 Investments in debt and equity of affiliates 48,596 55,103 Dividend payable 5,604 1,472 Cash and cash equivalents 102,532 111,534 Other liabilities 31,787 32,107 Restricted cash 11,686 14,039 Total Liabilities 6,419,990 5,598,060 Other assets 41,083 40,716 Total Assets $ 6,960,075 $ 6,126,428 Commitments and Contingencies Stockholders' Equity Preferred stock 220,472 220,472 Common stock 295 294 Additional paid-in capital 824,239 823,715 Retained earnings (deficit) (504,921) (516,113) Total Stockholders’ Equity 540,085 528,368 Total Liabilities & Stockholders’ Equity $ 6,960,075 $ 6,126,428

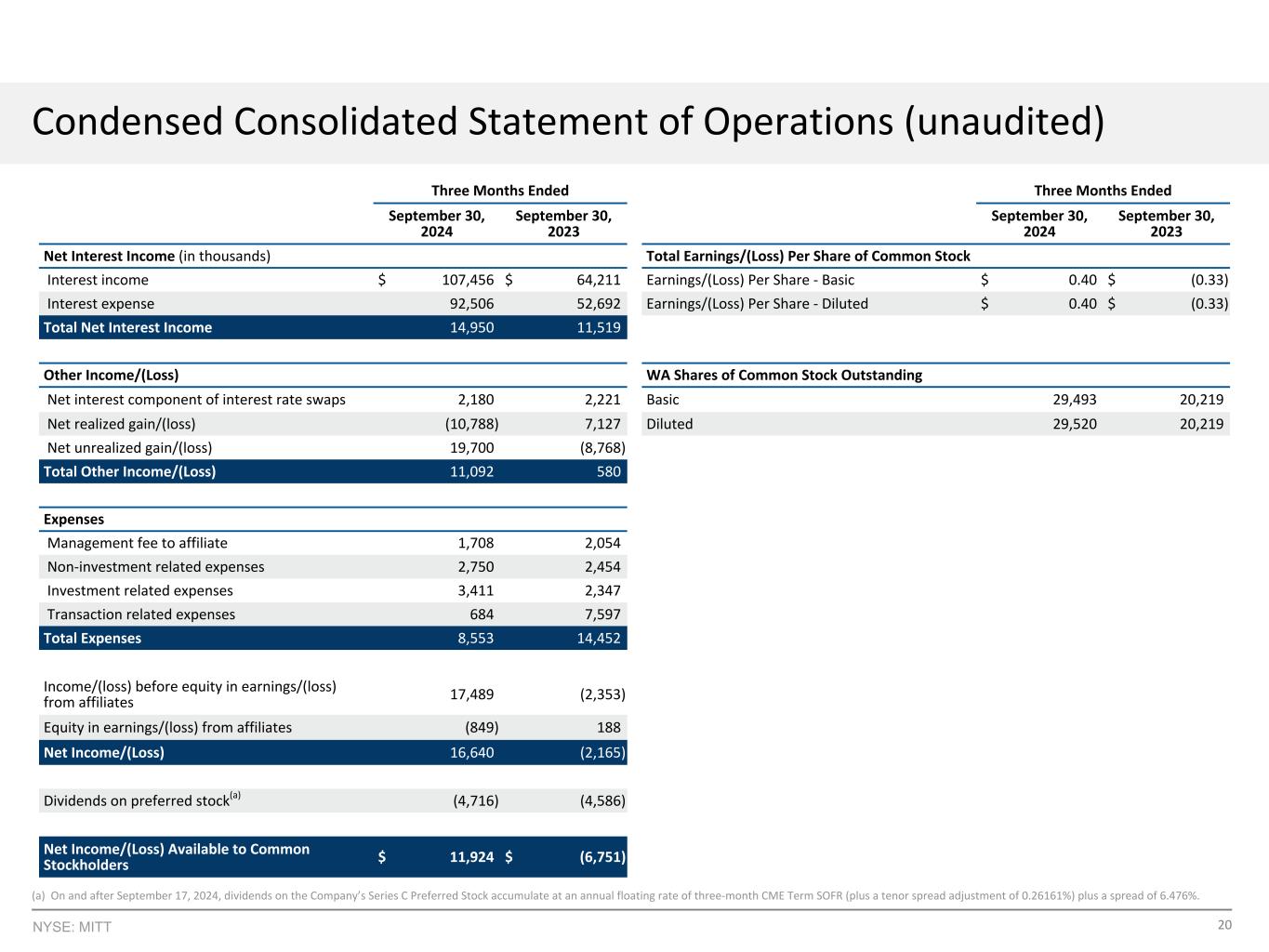

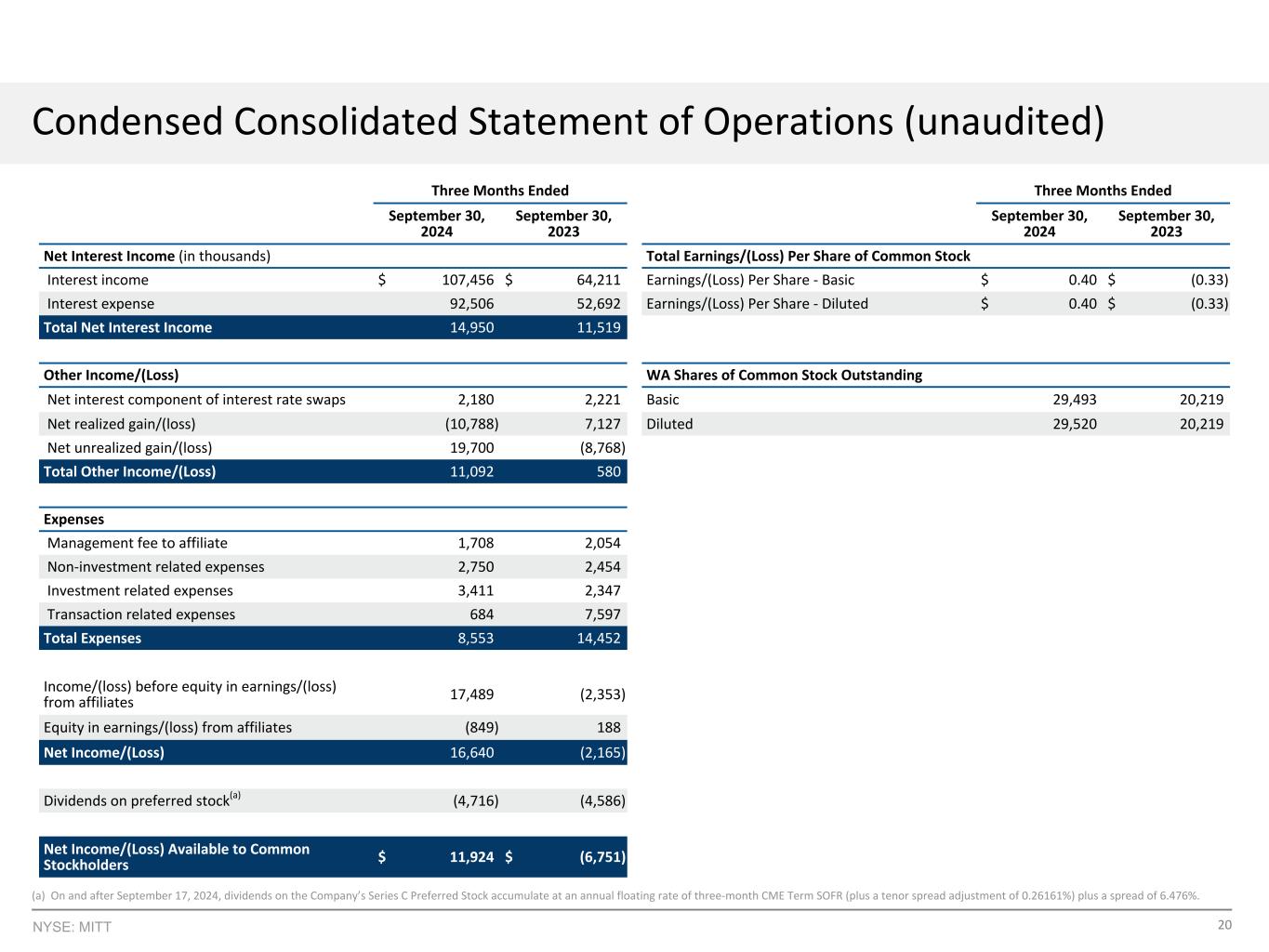

20NYSE: MITT (a) On and after September 17, 2024, dividends on the Company’s Series C Preferred Stock accumulate at an annual floating rate of three-month CME Term SOFR (plus a tenor spread adjustment of 0.26161%) plus a spread of 6.476%. Three Months Ended Three Months Ended September 30, 2024 September 30, 2023 September 30, 2024 September 30, 2023 Net Interest Income (in thousands) Total Earnings/(Loss) Per Share of Common Stock Interest income $ 107,456 $ 64,211 Earnings/(Loss) Per Share - Basic $ 0.40 $ (0.33) Interest expense 92,506 52,692 Earnings/(Loss) Per Share - Diluted $ 0.40 $ (0.33) Total Net Interest Income 14,950 11,519 Other Income/(Loss) WA Shares of Common Stock Outstanding Net interest component of interest rate swaps 2,180 2,221 Basic 29,493 20,219 Net realized gain/(loss) (10,788) 7,127 Diluted 29,520 20,219 Net unrealized gain/(loss) 19,700 (8,768) Total Other Income/(Loss) 11,092 580 Expenses Management fee to affiliate 1,708 2,054 Non-investment related expenses 2,750 2,454 Investment related expenses 3,411 2,347 Transaction related expenses 684 7,597 Total Expenses 8,553 14,452 Income/(loss) before equity in earnings/(loss) from affiliates 17,489 (2,353) Equity in earnings/(loss) from affiliates (849) 188 Net Income/(Loss) 16,640 (2,165) Dividends on preferred stock(a) (4,716) (4,586) Net Income/(Loss) Available to Common Stockholders $ 11,924 $ (6,751) Condensed Consolidated Statement of Operations (unaudited)

21NYSE: MITT Footnotes 1. Book value is calculated using stockholders’ equity less the liquidation preference of our cumulative redeemable preferred stock of $228.0 million. 2. Total liquidity includes $102.5 million of cash and cash equivalents and $17.2 million of unencumbered Agency RMBS. 3. The Economic Leverage Ratio is calculated by dividing total Economic Leverage, including any net TBA position, by our GAAP stockholders’ equity at quarter-end. Total Economic Leverage at quarter-end includes recourse financing arrangements recorded within "Investments in debt and equity of affiliates" exclusive of any financing utilized through AG Arc LLC, plus the payable on all unsettled buys less the financing on all unsettled sells and any net TBA position (at cost). Total Economic Leverage excludes any non-recourse financing arrangements. Non-recourse financing arrangements include securitized debt, as well as certain financing arrangements. Our obligation to repay our non-recourse financing arrangements is limited to the value of the pledged collateral thereunder and does not create a general claim against us as an entity. 4. The economic return on equity represents the change in book value per share during the period, plus the common dividends declared over the period, divided by book value per share from the prior period. 5. The Investment Portfolio consists of Residential Investments, Agency RMBS, and WMC Legacy Commercial Investments, all of which are held at fair value. Financing is inclusive of Securitized Debt, which is held at fair value, Financing Arrangements, Convertible Senior Unsecured Notes, and Senior Unsecured Notes. Throughout this presentation where we disclose the Investment Portfolio and the related financing, we have presented this information inclusive of (i) securities owned through investments in affiliates that are accounted for under GAAP using the equity method and, where applicable, (ii) long positions in TBAs, which are accounted for as derivatives under GAAP, but exclusive of our Convertible Senior Unsecured Notes and Senior Unsecured Notes. This presentation excludes investments through AG Arc LLC unless otherwise noted. 6. Diluted per share figures are calculated using diluted weighted average outstanding shares in accordance with GAAP. 7. We define EAD, a non-GAAP financial measure, as Net Income/(loss) available to common stockholders excluding (i) (a) unrealized gains/(losses) on loans, real estate securities, derivatives and other investments, inclusive of our investment in AG Arc, and (b) net realized gains/(losses) on the sale or termination of such instruments, (ii) any transaction related expenses incurred in connection with the acquisition, disposition, or securitization of our investments as well as transaction related expenses incurred in connection with the WMC acquisition, (iii) accrued deal-related performance fees payable to third party operators to the extent the primary component of the accrual relates to items that are excluded from EAD, such as unrealized and realized gains/(losses), (iv) realized and unrealized changes in the fair value of Arc Home's net mortgage servicing rights and the derivatives intended to offset changes in the fair value of those net mortgage servicing rights, (v) deferred taxes recognized at our taxable REIT subsidiaries, if any, (vi) any bargain purchase gains recognized, and (vii) certain other nonrecurring gains or losses. Items (i) through (vii) above include any amount related to those items held in affiliated entities. Transaction related expenses referenced in (ii) above are primarily comprised of costs incurred prior to or at the time of executing our securitizations and acquiring or disposing of residential mortgage loans. These costs are nonrecurring and may include underwriting fees, legal fees, diligence fees, and other similar transaction related expenses. Recurring expenses, such as servicing fees, custodial fees, trustee fees and other similar ongoing fees are not excluded from earnings available for distribution. Management considers the transaction related expenses to be similar to realized losses incurred at the acquisition, disposition, or securitization of an asset and does not view them as being part of its core operations. Management views the exclusion described in (iv) above to be consistent with how it calculates EAD on the remainder of its portfolio. Management excludes all deferred taxes because it believes deferred taxes are not representative of current operations. EAD includes the net interest income and other income earned on our investments on a yield adjusted basis, including TBA dollar roll income/(loss) or any other investment activity that may earn or pay net interest or its economic equivalent. 8. We invest in Arc Home LLC, a licensed mortgage originator, through AG Arc LLC, one of our equity method investees. Our investment in AG Arc LLC is $31.0 million as of September 30, 2024, representing a 44.6% ownership interest. 9. The yield on our investments represents an effective interest rate, which utilizes all estimates of future cash flows and adjusts for actual prepayment and cash flow activity as of quarter-end. Our calculation excludes cash held by the Company and excludes any net TBA position. The calculation of weighted average yield is presented based on cost. 10. The cost of funds at quarter-end is calculated as the sum of (i) the weighted average funding costs on recourse financing outstanding at quarter end, (ii) the weighted average funding costs on non-recourse financing outstanding at quarter end, and (iii) the weighted average of the net pay or receive rate on our interest rate swaps outstanding at quarter end. The cost of funds at quarter-end are presented based on the cost of our outstanding financing at quarter-end, including any non-recourse financing.

22 www.agmit.com