Exhibit 99.4

Suite 600 – 1199 West Hastings Street

Vancouver, British Columbia, V6E 3T5

Telephone No.: 778-729-0600 Fax No.: 778-729-0650

INFORMATION CIRCULAR

as at April 22, 2019 (unless otherwise indicated)

This Information Circular is furnished in connection with the solicitation of proxies by the management of Auryn Resources Inc. (the “Company”) for use at the annual general and special meeting (the “Meeting”) of its shareholders to be held on June 5, 2019 at the time and place and for the purposes set forth in the accompanying notice of the Meeting.

In this Information Circular, references to the “Company”, “we” and “our” refer to Auryn Resources Inc. “Common Shares” means common shares without par value in the capital of the Company. “Beneficial Shareholders” means shareholders who do not hold Common Shares in their own name and “intermediaries” refers to brokers, investment firms, clearing houses and similar entities that own securities on behalf of Beneficial Shareholders. All dollar amounts in this Circular are expressed in Canadian dollars unless otherwise indicated.

GENERAL PROXY INFORMATION

Solicitation of Proxies

The solicitation of proxies will be primarily by mail, subject to the use of Notice-and-Access Provisions in relation to delivery of the Information Circular, but proxies may be solicited personally or by telephone by directors, officers and regular employees of the Company. The Company will bear all costs of this solicitation. We have arranged for intermediaries to forward the meeting materials to beneficial owners of the Common Shares held of record by those intermediaries and we may reimburse the intermediaries for their reasonable fees and disbursements in that regard.

Notice-and-Access

Notice-and-Access means provisions concerning the delivery of proxy-related materials to Shareholders found in section 9.1.1. of National Instrument 51-102 – Continuous Disclosure Obligations (“NI 51-102”), in the case of registered Shareholders, and section 2.7.1 of National Instrument 54-101 – Communication with Beneficial Owners of Securities of a Reporting Issuer (“NI 54-101”), in the case of beneficial Shareholders (“Notice-and- Access Provisions”), which allow an issuer to deliver an information circular forming part of proxy-related materials to Shareholders via certain specified electronic means provided that the conditions of NI 51-102 and NI 54-101 are met.

Notice-and-Access Provisions allow reporting issuers, other than investment funds, to choose to deliver proxy-related materials to registered holders and beneficial owners of securities by posting such materials on a non-SEDAR website (usually the reporting issuer’s website and sometimes the transfer agent’s website) rather than by delivering such materials by mail. Notice-and-Access Provisions can be used to deliver materials for both general and special meetings. Reporting issuers may still choose to continue to deliver such materials by mail, and beneficial owners will be entitled to request delivery of a paper copy of the information circular at the reporting issuer’s expense.

Use of Notice-and-Access Provisions reduces paper waste and printing and mailing costs incurred by the issuer. In order for the Company to utilize Notice-and-Access Provisions the Company must send a notice to Shareholders, including Non-Registered Holders, indicating that the proxy-related materials have been posted and explaining how a Shareholder can access them or obtain from the Company, a paper copy of those materials. This Information Circular has been posted in full on the Company’s website at http://www.aurynresources.com/investors/investor-package/ and under the Company’s SEDAR profile at www.sedar.com.

In order to use Notice-and-Access Provisions, a reporting issuer must set the record date for notice of the meeting to be on a date that is at least 40 days prior to the meeting in order to ensure there is sufficient time for the materials to be posted on the applicable website and other materials to be delivered to Shareholders. The requirements of that notice, which requires the Company to provide basic information about the Meeting and the matters to be voted on, explain how a Shareholder can obtain a paper copy of the Information Circular and any related financial statements and related management discussion and analysis, and explain the Notice-and-Access Provisions process, have been built into the Notice of Meeting. The Notice of Meeting has been delivered to Shareholders by the Company, along with the applicable voting document (a form of Proxy in the case of registered Shareholders or a Voting Instruction Form in the case of Non-Registered Holders).

The Company will not rely upon the use of ‘stratification’. Stratification occurs when a reporting issuer using Notice-and-Access Provisions provides a paper copy of the information circular with the notice to be provided to Shareholders as described above. In relation to the Meeting, all Shareholders will have received the required documentation under the Notice-and-Access Provisions and all documents required to vote in respect of all matters to be voted on at the Meeting. No Shareholder will receive a paper copy of the information circular from the Company or any intermediary unless such Shareholder specifically requests same.

The Company will pay intermediaries, including Broadridge Financial Solutions (“Broadridge”), to deliver proxy-related materials to NOBOs (as defined below under Beneficial Shareholders) and the Company will not pay for delivery of proxy-related materials to OBOs (as defined below under Beneficial Shareholders).

Any Shareholder who wishes to receive a paper copy of this Information Circular must make contact with the Company at Suite 600 – 1199 West Hastings Street, Vancouver, British Columbia, Tel: (778) 729-0600 or Fax: (778) 729-0650. In order to ensure that a paper copy of the Information Circular can be delivered to a requesting Shareholder in time for such Shareholder to review the Information Circular and return a proxy or voting instruction form prior to the deadline for receipt of Proxies at 10 a.m. on June 3, 2019 (the “Proxy Deadline”), it is strongly suggested that a Shareholder ensure their request is received by the Company no later than May 20, 2019.

All Shareholders may call 1-800-863-8655 (toll-free) in order to obtain additional information relating to the Notice-and-Access Provisions or to obtain a paper copy of the Information Circular, up to and including the date of the Meeting, including any adjournment of the Meeting.

Appointment of Proxyholders

The individuals named in the accompanying form of proxy (the “Proxy”) are officers and/or directors of the Company. If you are a Shareholder entitled to vote at the Meeting, you have the right to appoint a person or company other than either of the persons designated in the Proxy, who need not be a Shareholder, to attend and act for you and on your behalf at the Meeting. You may do so either by inserting the name of that other person in the blank space provided in the Proxy or by completing and delivering another suitable form of proxy.

Voting by Proxyholder

The persons named in the Proxy will vote or withhold from voting the Common Shares represented thereby in accordance with your instructions on any ballot that may be called for. If you specify a choice with respect to any matter to be acted upon, your Common Shares will be voted accordingly. The Proxy confers discretionary authority on the persons named therein with respect to:

(a)

each matter or group of matters identified therein for which a choice is not specified, other than the appointment of an auditor and the election of directors;

(b)

any amendment to or variation of any matter identified therein; and

(c)

any other matter that properly comes before the Meeting.

In respect of a matter for which a choice is not specified in the Proxy, the management appointee acting as a proxyholder will vote in favour of each matter identified on the Proxy and, if applicable, for the nominees of management for directors and auditors as identified in the Proxy.

Registered Shareholders

Registered shareholders may wish to vote by proxy whether or not they are able to attend the Meeting in person. A registered shareholder may submit a proxy using one of the following methods:

(a)

complete, date and sign the Proxy and return it to the Company’s transfer agent, Computershare Trust Company of Canada (“Computershare”), by fax within North America at 1-866-249-7775, outside North America at (416) 263-9524, or by mail to 8th Floor, 100 University Avenue, Toronto, Ontario, M5J 2Y1 or by hand delivery at 2nd Floor, 510 Burrard Street, Vancouver, British Columbia, V6C 3B9; or

(b)

use a touch-tone phone to transmit voting choices to the toll free number given in the proxy. Registered shareholders who choose this option must follow the instructions of the voice response system and refer to the enclosed proxy form for the toll free number, the holder’s account number and the proxy access number; or

(c)

log on to Computershare’s website at, www.investorvote.com. Registered shareholders must follow the instructions provided on the website and refer to the enclosed proxy form for the holder’s account number and the proxy access number.

In either case you must ensure the proxy is received at least 48 hours (excluding Saturdays, Sundays and statutory holidays) before the Meeting or the adjournment thereof. Failure to complete or deposit a proxy properly may result in its invalidation. The time limit for the deposit of proxies may be waived by the Company’s board of directors (the “Board”) at its discretion without notice.

Beneficial Shareholders

The following information is of significant importance to many Shareholders who do not hold Common Shares in their own name. Beneficial Shareholders should note that the only proxies that can be recognized and acted upon at the Meeting are those deposited by Registered Shareholders (those whose names appear on the records of the Company as the registered holders of Common Shares) or as set out in the following disclosure.

If Common Shares are listed in an account statement provided to a Shareholder by a broker, then in almost all cases those Common Shares will not be registered in the Shareholder’s name on the records of the Company. Such Common Shares will more likely be registered under the names of the Shareholder’s broker or an agent of that broker (an “intermediary”). In Canada the vast majority of such Common Shares are registered under the name of CDS & Co. (the registration name for The Canadian Depository for Securities Limited, which acts as nominee for many Canadian brokerage firms), and in the United States, under the name of Cede & Co. as nominee for The Depository Trust Company (which acts as depositary for many U.S. brokerage firms and custodian banks).

Intermediaries are required to seek voting instructions from Beneficial Shareholders in advance of shareholder meetings. Every intermediary has its own mailing procedures and provides its own return instructions to clients. Beneficial Shareholders should ensure that instructions respecting the voting of their Common Shares are communicated in a timely manner and in accordance with the instructions provided by their intermediary. Your intermediary will not vote your Common Shares without receiving instructions from you.

There are two kinds of Beneficial Shareholders: Non-Objecting Beneficial Owners (“NOBOs”) who do not object to allow the issuers of the securities they own to know who they are; and Objecting Beneficial Owners (“OBOs”) who object to their name being disclosed to the issuer of any securities they own.

These securityholder materials are being sent to both registered and non-registered owners of the securities of the Company utilizing Notice-and-Access Provisions. The Company has asked Broadridge to send the Meeting Notice and Access proxy materials to NOBO holders. Please return your VIF (defined below) as specified in the request for voting instructions that was sent to you.

The Company will not pay to send Meeting Notice and Access materials to OBOs or beneficial holders declining to receive annual meeting documents. Beneficial Shareholders who are OBOs should follow the instructions received from their intermediary carefully to ensure their Common Shares are voted at the Meeting.

The Voting Instruction Form (the “VIF”) supplied to you by your broker will be similar to the Proxy provided to Registered Shareholders by the Company. However, its purpose is limited to instructing the intermediaries on how to vote your Common Shares on your behalf. Most brokers delegate responsibility for obtaining instructions from clients to Broadridge in Canada and the United States. Broadridge mails a VIF, in lieu of the Proxy provided by the Company. The VIF will name the same persons as are set out in the Company’s Proxy to represent your Common Shares at the Meeting.

Although a Beneficial Shareholder may not be recognized directly at the Meeting for the purpose of voting Common Shares registered in the name of its intermediary, a Beneficial Shareholder may attend the Meeting as a proxyholder for the intermediary and vote the Common Shares in that capacity. You have the right to appoint a person (who need not be a Beneficial Shareholder of the Company), other than any of the persons designated in the VIF, to represent your Common Shares at the Meeting and that person may be you. To exercise this right, insert the name of the desired representative (which may be you) in the blank space provided in the VIF. The completed VIF must then be returned to Broadridge by mail or facsimile or given to Broadridge by phone or over the internet, in accordance with Broadridge’s instructions. Broadridge will then tabulate the results of all instructions received and provide appropriate instructions respecting the voting of Common Shares to be represented at the Meeting and the appointment of any Shareholder’s representative. If you receive a VIF from Broadridge, the VIF must be completed and returned to Broadridge, in accordance with its instructions, well in advance of the Meeting in order to have your Common Shares voted, or to have an alternate representative duly appointed by you attend the Meeting and vote your Common Shares at the Meeting.

Notice to Shareholders in the United States

The solicitation of proxies involves securities of an issuer located in Canada and is being effected in accordance with the corporate laws of the Province of British Columbia, Canada and securities laws of the provinces of Canada. The proxy solicitation rules under the United States Securities Exchange Act of 1934, as amended, are not applicable to the Company or this solicitation, and this solicitation has been prepared in accordance with the disclosure requirements of the securities laws of the provinces of Canada. Shareholders should be aware that disclosure requirements under the securities laws of the provinces of Canada differ from the disclosure requirements under United States securities laws.

The enforcement by Shareholders of civil liabilities under United States federal securities laws may be affected adversely by the fact that the Company is incorporated under the Business Corporations Act (British Columbia), as amended (the “BCA”), and by the fact that six of its seven directors and all of its executive officers are residents of Canada or elsewhere outside the United States; and all of its assets and the assets of such persons are located outside the United States. Shareholders may not be able to sue a foreign company or its officers or directors in a foreign court for violations of United States federal securities laws. It may be difficult to compel a foreign company and its officers and directors to subject themselves to a judgment by a United States court.

Revocation of Proxies

In addition to revocation in any other manner permitted by law, a Registered Shareholder who has given a proxy may revoke it by:

(a)

executing a proxy bearing a later date or by executing a valid notice of revocation, either of the foregoing to be executed by the Registered Shareholder or the Registered Shareholder’s authorized attorney in writing, or, if the Shareholder is a corporation, under its corporate seal by an officer or attorney duly authorized, and by delivering the proxy bearing a later date to Computershare Trust Company of Canada, or at the address of the registered office of the Company at 1500 Royal Centre, 1055 West Georgia Street, P. O. Box 11117, Vancouver, British Columbia, V6E 4N7, at any time up to and including the last business day that precedes the day of the Meeting or, if the Meeting is adjourned, the last business day that precedes any reconvening thereof, or to the chairman of the Meeting on the day of the Meeting or any reconvening thereof, or in any other manner provided by law; or

(b)

personally attending the Meeting and voting the Registered Shareholder’s Common Shares.

Beneficial Shareholders should follow the instructions to revoke found on the Proxy or VIF provided to them from their intermediary.

A revocation of a proxy will not affect a matter on which a vote is taken before the revocation.

INTEREST OF CERTAIN PERSONS OR COMPANIES IN MATTERS TO BE ACTED UPON

No director or executive officer of the Company, or any person who has held such a position since the beginning of the last completed financial year end of the Company, nor any nominee for election as a director of the Company, nor any associate or affiliate of the foregoing persons, has any substantial or material interest, direct or indirect, by way of beneficial ownership of securities or otherwise, in any matter to be acted on at the Meeting other than the election of directors and as may be set out herein.

VOTING SECURITIES AND PRINCIPAL HOLDERS OF VOTING SECURITIES

The Board has fixed April 22, 2019 as the record date (the “Record Date”) for determination of persons entitled to receive notice of the Meeting. Only shareholders of record at the close of business on the Record Date who either attend the Meeting personally or complete, sign and deliver a form of proxy in the manner and subject to the provisions described above will be entitled to vote or to have their Common Shares voted at the Meeting.

Until October 31, 2016 the Common Shares of the Company were listed for trading on the TSX Venture Exchange (the “TSXV”). On November 1, 2016 the Common Shares of the Company became listed for trading on the Toronto Stock Exchange (the “TSX”); and on July 17, 2017 the Common Shares began trading on the NYSE American Stock Exchange under the symbol “AUG”. As a result, the Company ceased to be a “venture issuer” as defined under Canadian securities regulations effective November 1, 2016.

The Company is authorized to issue an unlimited number of Common Shares. As of the Record Date, there were 94,507,191 Common Shares issued and outstanding, each carrying the right to one vote. There are no Common Shares held in escrow. No group of shareholders has the right to elect a specified number of directors, nor are there cumulative or similar voting rights attached to the Common Shares. The Company is also authorized to issue an unlimited number of preferred shares. There were no preferred shares issued and outstanding as at the Record Date.

To the knowledge of the directors and executive officers of the Company, the following corporation beneficially owned, directly or indirectly, or exercised control or direction over, Common Shares carrying more than 10% of the voting rights attached to all outstanding Common Shares of the Corporation as at the Record Date:

Shareholder Name(1) | Number of Common Shares Held | Percentage of Issued Common Shares |

| Newmont Goldcorp Corporation (formerly Goldcorp Inc.) | 11,124,228(1) | 11.77% |

Note:

(1)

The above information was obtained from SEDI.

VOTES NECESSARY TO PASS RESOLUTIONS

A simple majority of affirmative votes cast at the Meeting is required to pass the ordinary resolutions described herein. If there are more nominees for election as director than there are vacancies to fill, or another auditor is nominated, those nominees receiving the greatest number of votes will be elected or appointed, as the case may be, until all such vacancies have been filled. If the number of nominees for election or appointment is equal to the number of vacancies to be filled, all such nominees will be declared elected or appointed by acclamation.

ELECTION OF DIRECTORS

The size of the Board was set at seven (7) directors by ordinary resolution of the shareholders at the last annual general meeting of the Company held on June 7, 2018. On February 7, 2019 Mr. Jeffrey Mason was appointed as a director of the Company to hold office until the next annual meeting or until his revocation or resignation, bringing the number of directors to eight (8). Pursuant to the Articles of the Company and the BCA, the Board has determined that the number of directors on the Board for the ensuing year should remain at seven (7). Accordingly, the Board proposes that seven (7) directors be elected at the Meeting. Shareholders will therefore be asked to approve a resolution to set the number of persons to be elected to a Board position at the Meeting at seven (7).

The term of office of each of the current directors will end at the conclusion of the Meeting. Unless the director’s office is vacated earlier in accordance with the provisions of the BCA, each director elected will hold office until the conclusion of the next annual general meeting of the Company, or if no director is then elected, until a successor is elected.

The following disclosure sets out the names of management’s nominees for election as directors, all major offices and positions held by each nominee with the Company and any of its significant affiliates, each nominee’s principal occupation, business or employment (for the five preceding years for new director nominees), the period of time during which each has been a director of the Company and the number of Common Shares of the Company beneficially owned by each, directly or indirectly, or over which each exercised control or direction, as at the Record Date:

| Name of Nominee; Current Position with the Company and Province or State and Country of Residence | Period as a Director of the Company | Common Shares Beneficially Owned or Controlled(1) |

Ivan James Bebek Executive Chairman, DirectorBritish Columbia, Canada | Since November 2, 2009 | 4,933,000(6) |

| Shawn Wallace President, Chief Executive Officer, DirectorBritish Columbia, Canada | Since May 7, 2013 | 3,558,333(6) |

Steve Cook(2) (3) (4) (5)DirectorBritish Columbia, Canada | Since October 28, 2013 | 1,032,199(6) (7) |

Gordon J. Fretwell(2) (3) (4) (5)DirectorBritish Columbia, Canada | Since October 28, 2013 | 85,784(6) |

Jeffrey R. Mason(2) (3) (4)Director | Since February 7, 2019 | 550,000(6) |

| Antonio ArribasDirectorAkita, Japan | Since August 17, 2015 | |

Michael Kosowan(5)DirectorBritish Columbia Canada | Since November 30, 2016 | 2,950,000(6) |

Notes:

(1)

The information as to Common Shares beneficially owned or controlled is not within the knowledge of the management of the Company and has been furnished by the respective nominees.

(2)

Member of Audit Committee.

(3)

Member of Compensation Committee.

(4)

Member of Governance and Nominating Committee.

(5)

Member of Mergers and Acquisitions Committee.

(6)

Options to purchase Common Shares are held by: Mr. Bebek as to 655,000; Mr. Wallace as to 655,000; Mr. Cook as to 260,000; Mr. Fretwell as to 260,000; Mr. Mason as to 260,000; Mr. Arribas as to 330,000; and Mr. Kosowan as to 330,000.

(7)

942,199 of these Common Shares are held by SMCook Legal Services Law Corporation, a company over which Mr. Cook has control and direction.

Occupation, Business or Employment of Nominees

Ivan James Bebek – Mr. Bebek is Executive Chairman and Director to the Company. Mr. Bebek has over 18 years’ experience in financing, foreign negotiations, and acquisitions in the mineral exploration industry. His understanding of the capital markets and ability to position, structure and finance companies that he has been associated with has been instrumental in their successes. Mr. Bebek was formerly the President, CEO and co-founder of Cayden Resources Inc., which was sold to Agnico Eagle Mines Limited for $205 million in November 2014, and a co-founder of Keegan Resources Inc. (now Asanko Gold Inc.). Mr. Bebek is a co-founder, Co-Chairman and Director of Torq Resources Inc. (formerly, Stratton Resources Inc.) and serves on the advisory board of Gold Standard Ventures Corp.

Shawn Wallace – Mr. Wallace is President, Chief Executive Officer and Director to the Company. Mr Wallace has been involved in all aspects of the mining industry, from mineral exploration and project management, to financing, mergers & acquisitions, and corporate development. Over the past 25 years, Mr. Wallace has been instrumental in building numerous high-quality mineral exploration, development, and production stage companies including co-founding Cayden Resources Inc., which was acquired by Agnico Eagle Mines Limited for $205 million in November 2014. Mr. Wallace is also a co-founder and Director of Asanko Gold Inc. and a co-founder, Co-Chairman and Director of Torq Resources Inc.

Steve Cook - Mr. Cook is a practicing tax partner at the law firm of Thorsteinssons LLP, Vancouver, British Columbia. Mr. Cook received his B.Comm. and LL.B. degrees from the University of British Columbia and was called to the British Columbia Bar in 1982 and the Ontario Bar in 1992. Mr. Cook is a specialist in corporate and international tax planning, offshore structures, representation, and civil and criminal tax litigation. Mr. Cook has served on the board of Brett Resources Ltd. prior to it being acquired by Osisko Mining Corp. and Cayden Resources Inc. prior to it being acquired by Agnico Eagle Mines Limited. Mr. Cook currently serves as a Director of Torq Resources Inc.

Gordon J. Fretwell - Mr. Fretwell holds a B.Comm. degree and graduated from the University of British Columbia in 1979 with his Bachelor of Law degree. Formerly a partner in a large Vancouver law firm, Mr. Fretwell has, since 1991, been a self-employed solicitor (Gordon J. Fretwell Law Corporation) in Vancouver, practicing primarily in the areas of corporate and securities law. He currently serves on the board of several public companies engaged in mineral exploration including: Asanko Gold Inc. and Canada Rare Earth Corp.

Jeffrey R. Mason – Mr. Mason is a Chartered Professional Accountant and holds an Institute of Corporate Directors designation. He has extensive experience in the exploration, development, construction and operation of precious and base metals projects in the Americas, Asia and Africa, including 15 years (1994 - 2008) as a Principal, Director and Chief Financial Officer for Hunter Dickinson Inc. group of companies. Overall, Mr. Mason has served as Chief Financial Officer, Corporate Secretary and Director for 20 public companies listed on the TSX, TSXV, NYSE Mkt and NASDAQ. Mr. Mason currently serves as independent Director of Great Panther Mining Limited and Torq Resources Inc.

Antonio Arribas – Mr. Arribas holds a BA and MSc in Geology from the Universidad de Salamanca and a PhD from the University of Michigan. He is a world-renowned expert in his field with over 20 years’ experience in the resources industry across multiple companies, commodities and geographic regions. Mr. Arribas has held a variety of positions including Vice President Geoscience at BHP Billiton Minerals Exploration in Singapore (2013), Senior Manager Geosciences at Newmont Mining Corp. (2012) in Denver, Colorado, and Exploration Manager South America at Placer Dome Exploration in Reno, Nevada (2006). Mr. Arribas is currently a Professor at the Graduate School of Mineral Resource Sciences of Akita University, Japan. He is an experienced lecturer and has contributed to over 40 publications. In 2013, Mr. Arribas was elected President of the Society of Economic Geologists, Inc., where he continues to be a member.

Michael Kosowan – Mr. Kosowan holds a Masters of Applied Science degree, is a Mining Engineer (P.Eng.) and a former Investment Advisor of Sprott Private Wealth (Canada) and Sprott Global Resources Inc. (USA). Mr. Kosowan is also an industry expert with over 20 years’ experience in the junior mining sector. For the past 17 years, he has been leading mining investment and financings in the USA and Canada through his work with Sprott and other premier brokerage houses. Previously, Mr. Kosowan worked for a number of top-tier Canadian mining companies such as Placer Dome Inc., Falconbridge Ltd. and Inco Limited, as a project Engineer, and for Atapa Minerals Ltd. in Indonesia and Peru, as an Exploration Manager. Mr. Kosowan also serves as President, Chief Executive Officer and as a Director of Torq Resources Inc.

None of the proposed nominees for election as a director of the Company are proposed for election pursuant to any arrangement or understanding between the nominee and any other person, except the directors and senior officers of the Company acting solely in such capacity.

Cease Trade Orders and Bankruptcy

Except as set out below, within the last 10 years before the date of this Information Circular, no proposed nominee for election as a director of the Company was a director or executive officer of any company (including the Company in respect of which this Information Circular is prepared) or acted in that capacity for a company that was:

(a)

subject to a cease trade or similar order or an order denying the relevant company access to any exemptions under securities legislation, for more than 30 consecutive days;

(b)

subject to an event that resulted, after the director or executive officer ceased to be a director or executive officer, in the company being the subject of a cease trade or similar order or an order that denied the relevant company access to any exemption under the securities legislation, for a period of more than 30 consecutive days;

(c)

within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets; or has become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of the proposed director;

(d)

subject to any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority; or

(e)

subject to any other penalties or sanctions imposed by a court or a regulatory body that would likely be considered important to a reasonable securityholder in deciding whether to vote for a proposed director.

Gordon Fretwell was a director of TSXV listed Lignol Energy Corporation (“Lignol”) from January 2007 to May 2015. Lignol went into receivership on August 22, 2014.

Jeffery Mason was a director since March 2015 of the online shoe retailer Shoes.com Technologies Inc., a private BC company, and was a director since September 2016 of certain of its wholly-owned private subsidiary companies, including Shoes.com, Inc., a Delaware company, and Onlineshoes.com, Inc., a Washington company, but was never a director of Shoeme Technologies Limited, a Canadian Federal private company (together, Shoeme Technologies Limited, Shoes.com Technologies Inc., Shoes.com, Inc. and Onlineshoes.com, Inc., the “Shoes Private Companies”). In September 2016, following the resignation of the prior chief financial officer, Mr. Mason assumed the role of interim chief financial officer of the Shoes Private Companies. Due in part to an increasing competitive landscape, the Shoes Private Companies became insolvent, and were not believed to be financeable. The boards of directors of the Shoes Private Companies determined that the interests of stakeholders would be best protected by placing the Shoes Private Companies into receivership in February 2017. Mr. Mason resigned as interim chief financial officer and director of the Shoes Private Companies in February 2017.

Mr. Mason was a director of Red Eagle Mining Corporation, a TSX listed company, commencing on Jan 1, 2010 continuing to his resignation on June 22, 2018. On November 9, 2018, the secured lenders gave default notice and a demand letter under the secured credit facility advised of their intention to appoint FTI Consulting as receiver over Red Eagle Mining’s assets. Red Eagle Mining had negotiated a restructuring, announced August 24, 2018 under which the secured lenders would write off a significant part of their debt to enable Red Eagle Mining to recommence operations, but the restructuring was contingent upon a US$38 million equity financing from Annibale SAC, personally guaranteed by its principal Fernando Palazuelo. Annibale defaulted on that commitment and as a result, the restructuring could not proceed.

Conflicts of Interest

Directors and officers of Auryn are also directors, officers and/or promoters of other reporting and non-reporting issuers which raises the possibility of future conflicts in connection with property opportunities which they may become aware of and have a duty to disclose to more than the issuer on whose board they serve. This type of conflict is common in the junior resource exploration industry and is not considered an unusual risk. Conflicts, if any, will be subject to the procedures and remedies provided under the BCA.

Majority Voting Policy

The Board believes that each of its members should carry the confidence and support of its shareholders. To this end, on April 12, 2017 the Board adopted a majority voting policy for the election of directors. The policy provides that if a nominee for election as director receives a greater number of “withheld” votes than “for” votes, that nominee will tender a resignation to the Chair of the Board following the meeting of shareholders at which the director is elected. The Board will consider the offer of resignation and announce its decision on whether to accept it in a press release within 90 days following the shareholder meeting.

In its deliberations, the Board will consider all factors it deems relevant including any stated reasons why shareholders “withheld” votes from the election of that director, the length of service and the qualifications of the director, the director’s contributions to the Company, the effect such resignation may have on the Company’s ability to comply with any applicable governance rules and policies and the dynamics of the Board, and whether the resignation would be in the best interests of the Company. The Board will be expected to accept the resignation except in situations where extenuating circumstances would warrant the director to continue to serve.

This policy only applies in circumstances involving an uncontested election of directors, being those where the number of director nominees is the same as the number of directors to be elected to the Board. This policy is now part of the governance policies on the Company’s website.

Corporate Disclosure Policy

Auryn adheres to a comprehensive Disclosure Policy that governs communication and information management by Company personnel. To this end, on June 11, 2018 the Board adopted a Disclosure, Confidentiality and Insider Trading policy (the “Disclosure Policy”) which sets out specific procedures for reviewing and approving the dissemination of company information to the public. The Company has a Disclosure Committee that is responsible for the administration of this policy and its compliance with legal statutes, policies and procedures regarding disclosure of Company information.

The Disclosure Policy includes, but is not limited to, the following basic elements:

●

Confidentiality. In carrying out the Company’s business activities, employees, officers and directors often learn confidential or proprietary information about the Company, its shareholders, suppliers, or joint venture parties. Confidentiality of such information must be respected, except when disclosure is authorized or legally mandated. Confidential or proprietary information includes any non-public information that would be harmful to the Company, useful or helpful to competitors if disclosed or would provide unfair advantage within the capital markets.

●

Securities Law & Insider Trading. Auryn complies with all applicable securities laws and regulations to ensure that material, non-public information (“inside information”), is disclosed using proper authority and in accordance with the law. Only those personnel who have a need to know receive inside information before it is released to the public. Company insiders must not use inside information for personal profit and must not take advantage of inside information by trading, or providing inside information to others to trade in the securities of the Company.

APPOINTMENT OF AUDITOR

Deloitte, Chartered Professional Accountants, 2800 – 1055 Dunsmuir Street, 4 Bentall Centre, P.O. Box 49279, Vancouver, British Columbia V7X 1P4, will be nominated at the Meeting for appointment as auditor of the Company. Deloitte, Chartered Professional Accountants, are the current auditor of the Company and were first appointed effective October 28, 2015 in place of Hay & Watson, Chartered Accountants, who were auditor of the Company since 2008.

AUDIT COMMITTEE AND RELATIONSHIP WITH AUDITOR

Under National Instrument 52-110 (“NI 52-110”) the Company is required to disclose its audit committee information annually in its Annual Information Form. The Company refers to its Annual Information Form as SEDAR filed at www.sedar.com on March 26, 2019 for current information concerning the Audit Committee of the Company. The Charter of the Company’s Audit Committee can be viewed at https://www.aurynresources.com/site/assets/files/1895/charterauditcommitteeaug2017.pdf.

CORPORATE GOVERNANCE

General

Corporate governance refers to the policies and structure of the board of directors of a company, whose members are elected by and are accountable to the shareholders of the company. Corporate governance encourages establishing a reasonable degree of independence of the board of directors from executive management and the adoption of policies to ensure the board of directors recognizes the principles of good management. The Board is committed to sound corporate governance practices; as such practices are both in the interests of shareholders and help to contribute to effective and efficient decision-making.

Mandate of the Board of Directors

The Board has a formal mandate as outlined in the Governance Policies which can be accessed on the Company’s website http://www.aurynresources.com/corporate/corporate-governance/. The Board Guidelines mandate the Board to: (i) assume responsibility for the overall stewardship and development of the Company and the monitoring of its business decisions, (ii) identify the principal risks and opportunities of the Company’s business and ensure the implementation of appropriate systems to manage these risks, (iii) oversee ethical management and succession planning, including appointing, training and monitoring of senior management and directors, and (iv) oversee the integrity of the Company’s internal financial controls and management information systems. The Governance Policies include written charters for each of the Board committees and it contains a Code of Business Conduct and Ethics (the “code of ethics”), policies dealing with issuance of news releases and also disclosure documents. The Company’s code of ethics provides a framework for undertaking ethical conduct in employment, and pursuant to the code of ethics the Company will not tolerate any form of discrimination or harassment in the workplace.

Board of Directors and Board Committees

The Board is responsible for corporate governance and establishes the overall policies and standards of the Company. The Board meets on a regularly scheduled basis. In addition to these meetings, the directors are kept informed of our operations through reports and analyses by, and discussions with, management.

Composition of the Board

Regulatory policies require that a listed issuer’s board of directors determine the status of each director as independent or not, based on each director’s interest in or other relationship with, the Company. Such policies recommend that a board of directors be constituted with a majority of directors who qualify as independent directors (as defined below). A board of directors should also examine its size with a view to determining the impact of the number of directors upon the effectiveness of the board of directors, and should implement a system enabling an individual director to engage an outside advisor at the expense of the corporation in appropriate circumstances. The Company has policies that allow for retention of independent advisors by members of the Board when they consider it advisable.

Under regulatory policies, an “independent” director does not have, “directly or indirectly, a financial, legal or other relationship with the Company.” Generally speaking, a director is independent if he or she is free from any employment, business or other relationship which could, or could reasonably be expected to; materially interfere with the exercise of the director’s independent judgement. A material relationship includes having been (or having a family member who has been) within the last three years an employee or executive of the Company or having been employed by the Company’s external auditor. An individual who (or whose family member) is or has been within the last three years, an executive officer of an entity where any of the Company’s current executive officers served at the same time on that entity’s compensation committee is deemed to have a material relationship as is any individual who (or whose family members or partners) received directly or indirectly, any consulting, advisory, accounting or legal fee or investment banking compensation from the Company (other than compensation for acting as a director or as a part time chairman or vice-chairman).

The Board is proposing seven (7) nominees for election to the office of director, all of whom are currently Board members and of whom a majority are considered independent directors. The independent nominees are: Gordon J. Fretwell, Steve Cook, Antonio Arribas and Jeffrey Mason. The non-independent members of the Board are Shawn Wallace, who is the President and Chief Executive Officer of the Company; Ivan Bebek, who is the Executive Chairman of the Company and Michael Kosowan, who is the President and Chief Executive Officer of Torq Resources Inc., a public company listed on the TSXV, which has the same management, administration and shares office space with the Company, and of which Shawn Wallace is also a Director and a member of the Compensation Committee.

The Board monitors the activities of the senior management through regular meetings and discussions amongst the Board members and between the Board and senior management. The Board is of the view that its communication policy between senior management, members of the Board and shareholders is good. Meetings of independent directors are not held on a regularly scheduled basis but communication among this group occurs on an ongoing basis and as needs arise from regularly scheduled meetings of the Board or otherwise. The number of these meetings has not been recorded but it would be less than five in the financial year that commenced on January 1, 2017. The Board also encourages independent directors to bring up and discuss any issues or concerns and the Board is advised of and addresses any such issues or concerns raised thereby. The Board believes that adequate structures and processes are in place to facilitate the functioning of the Board with a sufficient level of independence from the Company’s management. The Board is satisfied with the integrity of the Company’s internal control and financial management information systems.

Other Directorships

The directors currently serving on boards of other reporting corporations (or equivalent) are set out below:

| Name of Director | Name of Reporting Issuer | Exchange |

| Ivan James Bebek | Torq Resources Inc. | TSXV, OTCQX |

| Shawn Wallace | Torq Resources Inc.Asanko Gold Inc. | TSXV, OTCQXTSX, NYSE.AM |

| Steve Cook | Torq Resources Inc. | TSXV, OTCQX |

| Gordon J. Fretwell | Asanko Gold Inc.Coro Mining Corp.Canada Rare Earth Corporation RE Royalties Ltd. | TSX, NYSE.AM TSXTSXV TSXV |

| Michael Kosowan | Torq Resources Inc. | TSXV, OTCQX |

| Jeffrey R. Mason | Torq Resources Inc. Great Panther Mining Limited | TSXV, OTCQX TSX, NYSE.AM |

Committees of the Board

The Board has established an audit committee, a compensation committee, a governance and nominating committee, a mergers and acquisitions committee and a technical committee. All committee members are Board members except for the technical committee which has been comprised of two directors, Keith Minty and Daniel McCoy, together with Michael Henrichsen, COO. Keith Minty resigned from the Board on June 7, 2018.

Audit Committee

Composition of the Audit Committee

The Audit Committee has the following members:

Steve Cook (Chairperson)

Gordon J. Fretwell

Jeffrey R. Mason

The function of the Audit Committee is to: (a) meet with the financial officers of Auryn and its independent auditors to review matters affecting financial reporting, the system of internal accounting and financial controls and procedures and the audit procedures and audit plans; (b) appoint the auditors, subject to shareholder approval; and (c) review and recommend to the Board for approval of Auryn’s financial statements and certain other documents required by regulatory authorities.

All members of the Audit Committee are independent (as assessed in accordance with our independence standards) and financially literate. None of the members of the Audit Committee were, during the most recently completed financial year of the Company, an officer or employee of the Company or any of its subsidiaries. Upon appointment to the Board, Jeffrey Mason was elected to the Audit Committee thereby replacing Daniel McCoy effective February 7, 2019.

The Company refers to its Annual Information Form as at March 26, 2019 as SEDAR filed at www.sedar.com on March 26, 2019 for current information concerning the Audit Committee.

Compensation Committee

Composition of the Compensation Committee

The Compensation Committee has the following members:

Gordon J. Fretwell (Chairperson)

Steve Cook

Jeffrey Mason

The function of the Compensation Committee is to consider the terms of employment of the Chief Executive Officer, Chief Financial Officer, Chief Operating Officer and other executive officers, and general compensation policy, as well as the policy for granting awards under Auryn’s share option plan.

All members of the Compensation Committee are independent in accordance with applicable securities laws. None of the members of the Compensation Committee were, during the most recently completed financial year of the Company, an officer or employee of the Company or any of its subsidiaries. Upon appointment to the Board, Jeffrey Mason was elected to the Compensation Committee thereby replacing Daniel McCoy effective February 7, 2019.

The Compensation Committee recommends compensation for the directors and executive officers of the Company. See further disclosure under Statement of Executive Compensation below. The Compensation Committee Charter is included in the Company’s corporate governance material, which is posted on the Company’s website at http://www.aurynresources.com/corporate/corporate-governance/.

Compensation Committee functions include: the annual review of compensation paid to the Company’s executive officers and directors, the review of the performance of the Company’s executive officers and the task of making recommendations on compensation to the Board.

The Compensation Committee also periodically considers the grant of stock options. Options have been granted to the executive officers and directors and certain other service providers taking into account competitive compensation factors and the belief that options help align the interests of executive officers, directors and service providers with the interests of shareholders.

Governance and Nominating Committee

Composition of the Governance and Nominating Committee

The Governance and Nominating Committee has the following members:

Gordon J. Fretwell (Chairperson)

Steve Cook

Jeffrey Mason

The function of the Governance and Nominating Committee is to provide a focus on governance that will enhance the Company’s performance, to assess and make recommendations regarding the effectiveness of the Board and to establish and lead the process for identifying, recruiting, appointing, re-appointing and providing ongoing development for directors.

The Company has formal procedures for assessing the effectiveness of Board committees as well as the Board as a whole. This function is carried out annually under the direction of the Governance and Nominating Committee and those assessments are then provided to the Board.

All members of the Governance and Nominating Committee are independent in accordance with applicable securities laws. None of the members of the Governance and Nominating Committee were, during the most recently completed financial year of the Company, an officer or employee of the Company or any of its subsidiaries. Upon appointment to the Board, Jeffrey Mason was elected to the Governance and Nominating Committee thereby replacing Daniel McCoy effective February 7, 2019.

The Charter of the Governance and Nominating Committee is posted on the Company’s website at https://www.aurynresources.com/corporate/corporate-governance/.

The Governance and Nominating Committee is responsible for developing and recommending to the Board the Company’s approach to corporate governance and assists members of the Board in carrying out their duties. The Governance and Nominating Committee also reviews all new and modified rules and policies applicable to governance of listed corporations to assure that the Company remains in full compliance with such requirements as are applicable to the Company.

In exercising its nominating function, the Governance and Nominating Committee evaluates and recommends to the Board the size of the Board and certain persons as nominees for the position of director of the Company. The Company has formal procedures for assessing the effectiveness of Board committees as well as the Board as a whole. This function is carried out annually under the direction of the Governance and Nominating Committee and those assessments are then provided to the Board.

Director Evaluation

To supplement Board succession planning and its efforts to ensure Board renewal, the Governance and Nominating Committee carries out an annual assessment of the Board members and the various committees in order to assess the overall effectiveness of the Board.

The evaluation process assists the Board in:

●

Assessing its overall performance and measuring the contributions made by the Board as a whole and by each committee;

●

Evaluating the mechanisms in place for the Board and each committee to operate effectively and make decisions in the best interests of the Company;

●

Improving the overall performance of the Board by assisting individual directors to build on their strengths;

●

Identifying gaps in skills and educational opportunities for the Board and individual directors in the coming year; and

●

Developing the Board’s succession plan and recruitment efforts.

The Governance and Nominating Committee annually reviews the adequacy of the evaluation process and recommends any changes to the Board for approval. Each director completes certain surveys regarding the effectiveness of the Board and each committee of the Board of which each director is a member, including their processes and their relationship with management, and provides suggestions for improvement. This self-assessment also assists the Governance and Nominating Committee in determining the financial literacy of each director and topics for continuing education.

Mergers and Acquisitions Committee

Composition of the Mergers and Acquisitions Committee

The Mergers and Acquisitions Committee has the following members:

Steve Cook

Gordon J. Fretwell

Michael Kosowan

The function of the Mergers and Acquisitions Committee is to analyze, consider and develop recommendations to the Board regarding the mission and future direction of the Company over the next five years, and to develop an ongoing process for the review and revision of these recommendations. The Mergers and Acquisitions Committee may also act on behalf of the Board with respect to analyzing any specific transactions and make recommendations to the Board.

Two of the three members of the Mergers and Acquisitions Committee are independent, the non-independent member being Michael Kosowan. None of the members of the Mergers and Acquisitions Committee were, during the most recently completed financial year of the Company, an officer or employee of the Company or any of its subsidiaries.

Technical Committee

Composition of the Technical Committee

The Technical Committee has the following members:

Daniel McCoy

Michael Henrichsen (non-director – COO)

The function of the Technical Committee is to analyze, consider and develop recommendations to the Board regarding the technical mission and future direction of the Company over the next five years, and to develop an ongoing process for the review and revision of these recommendations. The Technical Committee may also act on behalf of the Board with respect to analyzing any specific technical decisions and make recommendations to the Board.

All members of the Technical Committee are independent in accordance with applicable securities laws, except Michael Henrichsen who is the Chief Operating Officer, but not a director of the Company. Mr. Henrichsen is the only member of the Technical Committee who was, during the most recently completed financial year of the Company, an officer or employee of the Company or any of its subsidiaries. Mr. Daniel McCoy will not stand for re-election at the Meeting. The new Technical Committee members will be appointed following the Meeting.

Director Term Limits

The Company has not adopted term limits or other mechanisms to force Board renewal. Given the normal process of annual elections of individual directors by the shareholders of the Company and the fact that individual directors also undertake annual director assessments, the Board has determined that term limits or a mandatory retirement is not essential. Directors who have served on the Board for an extended period of time are in a unique position to provide valuable insight into the operations and future of the Company based on their experience with a perspective on the Company’s history, performance and objectives. From time to time, Board renewal is facilitated by introducing new director appointments to the Board with fresh perspectives to facilitate a balance between Board refreshment and continuity.

Representation of Women on the Board and Senior Management

Auryn adopted a Gender Diversity Policy on November 14, 2018 which outlines the Company’s commitment to be diverse for which diversity includes, but is not limited to, business experience, geography, age, gender and ethnicity and aboriginal status (the “Diversity Policy). In particular, the Board should include an appropriate number of women directors. Diversity promotes the inclusion of different perspectives and ideas, mitigates against group think and ensures that the Company has the opportunity to benefit from all available talent. The promotion of a diverse board of directors makes prudent business sense and makes for better corporate governance.

Annually, the Company’s Governance and Nominating Committee will conduct a review of this Diversity Policy and will report to the Board on its effectiveness in promoting a diverse board of directors, which includes an appropriate number of women directors. In connection with such review, the Governance and Nominating Committee will recommend to the Board any changes that it thinks appropriate. The Governance and Nominating Committee will also be responsible for reviewing the Company’s public disclosure with respect to diversity

In furtherance of Board diversity, the Company aspires to attain by its annual meeting in 2020, and thereafter maintain, a Board composition in which at least 1 (one) member is a woman.

On March 26, 2019 the Board appointed Ms. Stacy Rowa to be CFO of the Company effective April 1, 2019.

Board of Directors Decisions

Good governance policies require the board of an exchange listed corporation, together with its chief executive officer, to develop position descriptions for the board and for the chief executive officer, including the definition of limits to management’s responsibilities. In management of the Company, any responsibility which is not delegated to senior management or to a Board committee remains with the full Board. The Board has approved written position descriptions for the Chairman of the Board, the Chair of each Board committee and the Chief Executive Officer of the Company.

The following table sets forth the record of attendance of each Board member to each of the Board and Committee meetings for the year ended December 31, 2018:

| Director | Board of Directors | Audit | Compensation | Governance and Nominating | Mergers and Acquisitions | Technical |

| Ivan Bebek | 3 of 3 | N/A | N/A | N/A | N/A | N/A |

| Shawn Wallace | 3 of 3 | N/A | N/A | N/A | N/A | N/A |

| Steve Cook | 3 of 3 | 4 of 4 | 2 of 2 | 3 of 3 | Nil (1) | N/A |

| Gordon J. Fretwell | 3 of 3 | 4 of 4 | 2 of 2 | 3 of 3 | Nil (1) | N/A |

| Daniel T. McCoy | 2 of 3 | 3 of 4 | 2 of 2 | 2 of 3 | N/A | Nil(2) |

| Antonio Arribas | 3 of 3 | N/A | N/A | N/A | N/A | N/A |

| Michael Kosowan | 3 of 3 | N/A | N/A | N/A | Nil (1) | N/A |

Jeffrey R. Mason(3) | N/A | N/A | N/A | N/A | N/A | N/A |

Notes:

(1)

There were no Mergers and Acquisitions Committee meetings held in 2018.

(2)

There were no Technical Committee meetings held in 2018.

(3)

Mr. Mason became a Director of the Company on February 7, 2019

Orientation and Continuing Education

The Board and the Company’s senior management will conduct orientation programs for new directors as soon as possible after their appointment as directors. The orientation programs will include presentations by management to familiarize new directors with the Company’s projects and strategic plans, its significant financial, accounting and risk management issues, its compliance programs, its code of business conduct and ethics, its principal officers, its internal and independent auditors and its outside legal advisors. In addition, the orientation program will include a review of the Company’s expectations of its directors in terms of time and effort, a review of the directors’ fiduciary duties and visits to Company headquarters and, to the extent practical, the Company’s significant facilities.

To enable each director to better perform his or her duties and to recognize and deal appropriately with issues that arise, the Company will provide the directors with appropriate education programs and/or suggestions to undertake continuing director education, the cost of which will be borne by the Company.

Ethical Business Conduct

The Board has adopted a Code of Business Conduct and Ethics (the “Code”), which is contained in the Company’s corporate governance material, a copy of which is available for viewing on the Company’s website at https://www.aurynresources.com/corporate/corporate-governance/. The Board and its committees have established the standards of business ethics and conduct contained in the Code, and it is their responsibility to oversee compliance with the Code. The Board has implemented an annual procedure whereby directors, officers and employees of the Company sign off on, and certify that they have read and understand the Company’s Code and that they are unaware of any violation thereof. Any change in or waiver of any provision of the Code shall require approval of the applicable Board Committee, and shall be publicly disclosed in the time period and manner as required by law or regulation.

The Board also believes that the fiduciary duties placed on individual directors by the Company’s governing corporate policies and the common law, and the restrictions placed by applicable corporate legislation on an individual directors’ participation in decisions of the Board in which the director has an interest have been sufficient to ensure the Board operates independently of management and in the best interests of the Company.

Nomination of Directors

The Board considers its size each year when it considers the number of directors to recommend to the shareholders for election at the annual meeting of shareholders, taking into account the number required to carry out the Board’s duties effectively and to maintain a diversity of views and experience. The Governance and Nominating Committee recommended to the Board seven (7) directors as nominees for election this year. See Governance and Nominating Committee above.

Other Board Committees

All committees of the Board are described above.

Assessments

The Board monitors the adequacy of information given to directors, communication between the Board and management and the strategic direction and processes of the Board and its committees. The Governance and Nominating Committee oversees an annual formal assessment of the Board and its three main committees namely the Audit Committee, Compensation Committee and the Governance and Nominating Committee. The Board and the various sub-committees completed self-assessments of their performance during the year and are satisfied with the overall project and corporate achievements of the Company and believe this reflects well on the Board and its practices.

STATEMENT OF EXECUTIVE COMPENSATION

Named Executive Officer

In this section “Named Executive Officer” (”NEO”) means the Chief Executive Officer (“CEO”), the Chief Financial Officer (“CFO”) and each of the three most highly compensated executive officers, other than the CEO and CFO, who were serving as executive officers at the end of the most recently completed fiscal year and whose total salary and bonus exceeds $150,000 as well as any additional individuals for whom disclosure would have been provided except that the individual was not serving as an officer of the Company at the end of the most recently completed financial year.

Ivan Bebek, Executive Chairman; Shawn Wallace, CEO; Peter Rees, former CFO; Michael Henrichsen, COO; Russell Starr, Senior VP Corporate Finance; and David Smithson, VP Exploration are each an NEO of the Company for purposes of the following disclosure.

Compensation Discussion and Analysis

The function of the Compensation Committee generally is to assist the Board in carrying out its responsibilities relating to executive and director compensation, including reviewing and recommending director compensation, overseeing the Company’s base compensation structure and equity-based compensation programs, recommending compensation of the Company’s officers and employees, and evaluating the performance of officers generally and in light of annual goals and objectives.

The Board assumes responsibility for reviewing and monitoring the long-range compensation strategy for the senior management of the Company although the Compensation Committee guides it into this role. The Company’s Compensation Committee receives independent competitive market information on compensation levels for executives.

Prior to appointing members to the Compensation Committee, the Board assesses the Company’s compensation plans and programs for its executive officers to ensure alignment with the Company’s business plan and to evaluate the potential risks associated with those plans and programs. The Board has concluded that the compensation policies and practices do not create any risks that are reasonably likely to have a material adverse effect on the Company. The Board considers the risks associated with executive compensation and corporate incentive plans when designing and reviewing such plans and programs.

Philosophy and Objectives

The Company’s senior management compensation program is designed to ensure that the level and form of compensation achieves certain objectives, including:

(a)

attracting and retaining talented, qualified and effective executives;

(b)

motivating the short and long-term performance of these executives; and

(c)

better aligning their interests with those of the Company’s shareholders.

In compensating its senior management, the Company employs a combination of base salary, bonus compensation and equity participation through its stock option plan.

Base Salary

In the Board’s view, paying base salaries or fees competitive in the markets in which the Company operates will be a first step to attracting and retaining talented, qualified and effective executives. Competitive salary information on comparable companies within the industry is compiled from a variety of sources, including surveys conducted by independent consultants and national and international publications. Comparable companies included but were not limited to: Almaden Minerals Ltd., Sabina Gold & Silver Corp., Gold Standard Ventures Corp., Northern Dynasty Minerals Ltd. and Pershing Gold Corporation. The Company’s peer group was determined by identifying other mining issuers listed on both the NYSE American and Toronto Stock Exchange with comparable market capitalizations.

Bonus Incentive Compensation

The Company’s objective is to achieve certain strategic objectives and milestones. The Board will consider executive bonus compensation dependent upon the Company meeting those strategic objectives and milestones and sufficient cash resources being available for the granting of bonuses. The Board approves executive bonus compensation dependent upon compensation levels based on recommendations of the Compensation Committee. Amounts recommended by the Compensation Committee are entirely discretionary. Such recommendations are generally based on information provided by issuers that are similar in size and scope to the Company’s operations.

Bonus Incentive Compensation paid during fiscal 2018 is related to the Company’s and the executive performance during the preceding year being that of 2017. A summary of this has been included in the Summary Compensation Table below.

Equity Participation

The Company believes that encouraging its executives and employees to become shareholders is the best way of aligning their interests with those of its shareholders. Equity participation is accomplished through the Company’s share option plan. Options to purchase Common Shares in the Company are granted to executives and employees taking into account a number of factors, including the amount and term of options previously granted, base salary and bonuses and competitive factors. The amounts and terms of options granted are determined by the Board.

Given the evolving nature of the Company’s business as a mineral exploration and development company, the Board continues to review and redesign the overall compensation plan for senior management so as to continue to address the objectives identified above.

The Compensation Committee has assessed the Company’s compensation plans and programs for its executive officers to ensure alignment with the Company’s business plan and to evaluate the potential risks associated with those plans and programs. The Compensation Committee has concluded that the compensation policies and practices do not create any risks that are reasonably likely to have a material adverse effect on the Company incentive plans when designing and reviewing such plans and programs.

Actions, Policies and Decisions made following December 31, 2018:

On March 26, 2019, the Company appointed Stacy Rowa to the position of CFO, effective April 1, 2019.

Option-Based Awards

The Company’s current share option plan was adopted by the Board on April 12, 2017 (the “Option Plan”) and provides incentive to directors, members of management, employees and certain consultants of the Company (“service providers”) to acquire an equity interest in the Company. Thus it encourages the alignment of interests of management with shareholders of the Company, and fosters their continued association with the Company. At the Company’s annual general and special meeting held June 1, 2017 the shareholders approved adoption of the Option Plan.

The only long-term or equity incentives which the Company uses are share options pursuant to the Option Plan. The Board, or the Compensation Committee, authorize the grant of share options to service providers and options are generally granted annually, as well as at other times of the year to individuals who are commencing employment with the Company. Option exercise prices are set in accordance with TSX rules and are based on the five-day volume weighted average closing price prior to the date of grant. Options are granted taking into account a number of factors, including the amount and term of options previously granted, base salary and bonuses, and competitive factors. Share options vest on terms established by the Compensation Committee. See disclosure under “Securities Authorized for Issuance under Equity Compensation Plans” for material terms of the shareholder approved Option Plan.

General

The Compensation Committee considered the implications of the risks associated with the Company’s compensation policies and practices and concluded that, given the nature of the Company’s business and the role of the Compensation Committee in overseeing the Company’s executive compensation practices, the compensation policies and practices do not serve to encourage any NEO or individual at a principal business unit or division to take inappropriate or excessive risks, and no risks were identified arising from the Company’s compensation policies and practices that are reasonably likely to have a material adverse effect on the Company.

There is a restriction on NEOs or directors regarding the purchase of financial instruments including prepaid variable forward contracts, equity swaps, collars, or units of exchange funds that are designed to hedge or offset a decrease in market value of equity securities granted as compensation or held, directly or indirectly, by the NEO or director. For the year ended December 31, 2018, no NEO or director, directly or indirectly, employed a strategy to hedge or offset a decrease in market value of equity securities granted as compensation or held.

Pursuant to TSX Policies the Company expects it will present an ordinary resolution to its shareholders at the annual general meeting, likely to be held in June 2020, asking them to approve the Option Plan for continuation for a further three years.

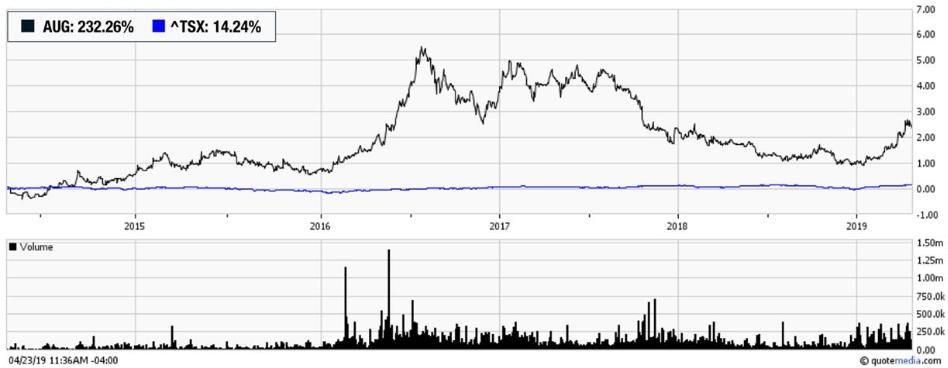

Performance Graph

The following graph compares the cumulative shareholder return on an investment of $100 in the Common Shares of the Company for the past five years of the Company on the TSX and the TSXV with a cumulative total shareholder return on the S&P/TSX Composite Index.

Note:

(1)

The Company commenced trading on the TSX on November 1, 2016 and does not pay a dividend on its Common Shares. Prior to listing on the TSX, from September 15, 2008 to October 31, 2016, the Company was listed for trading on the TSXV. The Company commenced trading on NYSE on July 17, 2017.

The NEO compensation for the fiscal year 2018 is expected to be in line with that of 2017. NEO salaries have increased in line with overall increases in the Company’s operating activities for the year as well as the corporate complexity including its listing on the NYSE American stock exchange. Bonus Incentive Compensation in 2018 is comparable to that of 2017. At its meeting on April 4, 2019, the Compensation Committee made its recommendations to the Board for Bonus Incentive Compensation for fiscal 2019. There were 650,000 options granted to the NEOs during fiscal year ended December 31, 2018, while no options were granted during fiscal year ended December 31, 2017.

Summary Compensation Table

The compensation earned by the NEOs during the Company’s most recently completed fiscal years ended December 31, 2018, December 31, 2017 and December 31, 2016, is set out below and expressed in Canadian dollars unless otherwise noted. There were no share-based awards, long-term incentive plans or pension value payments paid to NEOs during these periods.

It should be noted that the annual incentive plan amounts are paid in the year subsequent to the year of evaluation by the Compensation Committee. In the past, the Company has reported annual incentive plan payments in the year it was paid to the NEO, whereas this year the Company is reporting annual incentive plan payments in the year it was earned by the NEO. The 2018 annual incentive plan payments, reflected in the table below, are based on milestones met in 2018, share price performance and market conditions, and will be paid in 2019.

| Name and principal position | Year | Salary($) | Option-based awards($) | Non-equity incentive plan compensation(7) ($) | Total compensation($) |

Ivan Bebek,(1) Executive Chairman | Dec 2018 Dec 2017 Dec 2016 | 270,000 262,500 215,000 | 105,663 Nil 350,266 | 67,500 67,500 120,000 | 443,163 330,000 685,266 |

Shawn Wallace,(2) CEO | Dec 2018 Dec 2017 Dec 2016 | 225,000 262,500 240,000 | 105,663 Nil 350,266 | 45,000 47,500 120,000 | 375,663 262,500 710,266 |

Peter Rees,(3) Former CFO | Dec 2018 Dec 2017 Dec 2016 | 180,000 193,750 175,000 | 84,530 Nil 262,699 | 40,000 50,000 87,500 | 304,530 243,750 525,199 |

Michael Henrichsen,(4) COO | Dec 2018 Dec 2017 Dec 2016 | 230,000 223,500 204,000 | 84,530 Nil 271,456 | 57,500 57,500 102,000 | 372,030 281,000 577,456 |

Russell Starr(5) Senior VP Corporate Finance | Dec 2018 Dec 2017 Dec 2016 | 180,000 175,000 160,000 | 84,530 Nil 525,399 | 45,000 45,000 80,000 | 309,530 220,000 765,399 |

David Smithson(6) VP Exploration | Dec 2018 Dec 2017 Dec 2016 | 200,000 195,000 180,000 | 84,530 Nil 182,075 | 50,000 50,000 90,000 | 334,530 245,000 452,075 |

Notes:

(1)

Ivan Bebek was appointed to the position of Executive Chairman of the Company on June 16, 2016.

(2)

Shawn Wallace was re-appointed as a director on May 7, 2013 and was appointed as President and CEO on May 23, 2013.

(3)

Peter Rees was appointed as CFO and Corporate Secretary on September 7, 2012 and resigned on March 31, 2019 when Ms. Stacy Rowa was appointed to replace him as CFO effective April 1, 2019.

(4)

Michael Henrichsen was appointed as COO on November 1, 2013.

(5)

Russell Starr was appointed Senior VP Corporate Communications on January 1, 2016 and was appointed Senior VP Corporate Finance on June 7, 2018.

(6)

David Smithson was appointed as VP Exploration on June 7, 2018

(7)

Annual incentive payments listed pertain to the Company’s and the Executives’ performance during the year the payment was earned, whereas the amount is paid to the NEO in the subsequent year.

Incentive Plan Awards

Outstanding Share-based Awards and Option-based Awards

No share-based awards have been granted to any of the NEOs of the Company. The following table sets out all option-based awards outstanding as at December 31, 2018, for each NEO:

| | Option-based Awards |

| Name | Number of securities underlying unexercised options(#) | Optionexercise price($) | Option expiration date(M/D/Y) | Value of unexercised in-the-money options(1)($) |

| Ivan Bebek | 125,000(2) 200,000(3) 130,000(4) 170,000(5)(6) | 1.42 2.63 1.30 0.51 | June 26, 2023 June 20, 2021 August 17, 2020 February 17, 2019 | Nil Nil Nil 125,800 |

| Shawn Wallace | 125,000(2) 200,000(3) 130,000(4) 170,000(5)(6) | 1.42 2.63 1.30 0.51 | June 26, 2023 June 20, 2021 August 17, 2020 February 17, 2019 | Nil Nil Nil 125,800 |

| Peter Rees | 100,000(2) 150,000(3) 100,000(4) 100,000(5)(6) | 1.42 2.63 1.30 0.51 | June 26, 2023 June 20, 2021 August 17, 2020 February 17, 2019 | Nil Nil Nil 74,000 |

| Michael Henrichsen | 100,000(2) 155,000(3) 75,000(4) 170,000(5)(6) | 1.42 2.63 1.30 0.51 | June 26, 2023 June 20, 2021 August 17, 2020 February 17, 2019 | Nil Nil Nil 125,800 |

| Russell Starr | 100,000(2) 300,000(3)

60,000(5)(6) | 1.42 2.63 0.51 | June 26, 2023 June 20, 2021 February 17, 2019 | Nil Nil 44,400 |

| David Smithson | 100,000(2) 200,000(3) 100,000(4) | 1.42 2.63 1.30 | June 26, 2023 June 20, 2021 August 17, 2020 | Nil Nil Nil |

Notes:

(1)

The last day of trading of the fiscal year was December 31, 2018 and the closing price of the Common Shares was $1.25 each.

(2)

These options were granted on June 26, 2018.

(3)

These options were granted on June 20, 2016.

(4)

These options were granted on August 17, 2015.

(5)

These options were granted on February 17, 2014.

(6)