(An exploration stage company)

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF AURYN RESOURCES INC.

FOR THE SIX MONTHS ENDED JUNE 30, 2019

Dated: August 13, 2019

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the six months ended June 30, 2019

(In thousands of Canadian dollars, unless otherwise noted)

TABLE OF CONTENTS

| HIGHLIGHTS FOR THE SIX MONTHS ENDED JUNE 30, 2019 AND THE PERIOD UP TO AUGUST 13, 2019 | 3 |

| 1.1. Date and forward-looking statements | 5 |

| 1.1.1 Forward-looking statements and risk factors | 5 |

| 1.2.1 Description of business | 6 |

| 1.2.2 Committee Bay and Gibson MacQuoid projects | 7 |

| Committee Bay | 7 |

| Gibson MacQuoid | 9 |

| 1.2.3 Peruvian projects | 10 |

Sombrero | 10 |

Huilacollo | 14 |

| Baños del Indio | 14 |

Curibaya | 15 |

| 1.2.4 Homestake Ridge project | 16 |

| 1.2.5 Qualified persons and technical disclosures | 17 |

| 1.3 Selected annual financial information | 19 |

| 1.4 Discussion of operations | 19 |

| 1.5 Summary of quarterly results | 22 |

| 1.6/1.7 Financial position and liquidity and capital resources | 23 |

| 1.8 Off-balance sheet arrangements | 27 |

| 1.9 Transactions with related parties | 28 |

| 1.1 Subsequent events | 28 |

| 1.11 Proposed transactions | 28 |

| 1.12 Critical accounting estimates | 28 |

| 1.13 Changes in accounting policies including initial adoption | 30 |

| 1.14 Financial instruments and other instruments | 30 |

| 1.15 Other requirements | 31 |

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the six months ended June 30, 2019

(In thousands of Canadian dollars, unless otherwise noted)

HIGHLIGHTS FOR THE SIX MONTHS ENDED JUNE 30, 2019 AND THE PERIOD UP TO AUGUST 13, 2019

Corporate highlights

●

On August 7, 2019, Auryn Resources Inc. (the “Company” or “Auryn”) announced that it had acquired a 100% interest in the Sambalay and Salvador concessions which are adjacent to its wholly owned Curibaya property in southern Peru for US $250,000 and subject to certain NSR royalties as discussed further below.

●

On July 11, 2019, the Company closed a non-brokered flow-through private placement of 633,334 flow-through common shares (the “FT Shares”) at a price of CAD$3.00 per FT Share for gross proceeds of $1,900 (the “2019 FT Offering”).

●

On March 27, 2019, Auryn completed a non-brokered private placement for gross proceeds of $5,255. The placement consisted of 3,284,375 common shares (the “Shares”) priced at CAD$1.60 per Share (the “2019 Offering”).

●

On March 26, 2019, the Company announced the appointment of Stacy Rowa as Chief Financial Officer, effective April 1, 2019, upon the resignation of Peter Rees as Chief Financial Officer and Corporate Secretary to pursue a new opportunity.

●

On February 15, 2019 the Company announced that Jeffrey Mason, CPA, CA, was appointed to its Board of Directors. Mr. Mason is a corporate and financial professional with over 25 years of experience serving public companies in the mining and mineral exploration industry.

Operational highlights

●

On July 8, 2019, the Company commenced its drilling program at its Committee Bay gold project in Nunavut, Canada. The program, which by the date of this MD&A has been completed and consisted of 2,700 meters of diamond drilling, tested two targets identified through the use of machine learning targeting (see below for summary of press release dated February 19, 2019) and also followed up on drilled fluid pathways along the Aiviq structural corridor from the 2017 and 2018 programs.

●

On June 13, 2019 the Company announced results from 8 historical drill holes, totalling 998 meters of drilling, from the Fierrazo target at its Sombrero project. Highlights included 116 meters of 0.58% CuEq1 (0.42% Cu and 0.24 g/t Au), 90.4 meters of 0.51% CuEq (0.48% Cu and 0.05 g/t Au) and 51 meters of 0.53% CuEq (0.43% Cu and 0.16 g/t Au). The historical drill holes had been drilled in 2013 by Corporacion Aceros Arequipa S.A. (“Aceros”) targeting iron skarn mineralization. The results confirmed the copper-gold sulphide mineralization extends to depth underneath the area where surface channel sampling was conducted earlier in 2019 (see below for summary of press releases dated March 12 and April 3, 2019).

●

On June 4, 2019, Auryn announced that two new targets have been identified at its Homestake Ridge gold project in the Golden Triangle in BC, Canada, following a full review of the historical datasets, geological mapping, stream sediment and rock chip sampling. The 2019 exploration program will include additional geological and geophysical work around these newly defined targets, one of which, Bria, returned rock sample assays of up to 11 g/t gold and 448 g/t silver.

●

Effective May 20, 2019, the Company declared force majeure under its Mollecruz option agreement at its Sombrero project. The Company, to date, has been unable to obtain a community agreement allowing access to the concession, which covers the Good Lucky prospect, to commence its work program. The Company continues to negotiate in good faith with the community to resolve this matter.

____________

1 Metal price used for 2019 copper and gold equivalent (CuEq and AuEq) calculations: Au $1300/oz and Cu $3.00/lb, no adjustments for metallurgical recoveries have been made. AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the six months ended June 30, 2019

(In thousands of Canadian dollars, unless otherwise noted)

Operational highlights (continued)

●

On April 3 and March 12, 2019 the Company released results from its initial surface program at the Fierrazo area within the Sombrero project. Highlights from the continuous channel sampling at the Fierrazo target include a combined width of mineralization of 232 meters of 0.55% copper equivalent (0.47% copper and 0.13 g/t gold) with a higher-grade internal interval of 40 meters of 1.26% copper equivalent (1.23% copper and 0.05 g/t gold). The sampling helped further validate the potential 7.5 kilometers of strike length of high-grade exoskarn targets at the Sombrero Main area, which will be the focus of Auryn’s first drill program at the project.

●

On February 19, 2019 the Company announced the results of applying machine learning to its geological datasets to aid in the targeting process at its Committee Bay project. Highlights included the generation of 12 new targets and the identification of an additional parallel shear zone located to the north of the Aiviq structure.

●

On January 7, 2019 the Company announced the identification of significant copper mineralization at Milpoc. Select grab sample results ranged from 0.1 – 8.45% copper and 0.06 – 101 g/t silver.

< Refer to the page 5 for cautionary wording concerning forward-looking information>

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the six months ended June 30, 2019

(In thousands of Canadian dollars, unless otherwise noted)

1.1.

Date and forward-looking statements

This Management Discussion and Analysis (“MD&A”) of Auryn has been prepared by management to assist the reader to assess material changes in the condensed consolidated interim financial condition and results of operations of the Company as at June 30, 2019 and for the six months then ended. This MD&A should be read in conjunction with the condensed consolidated interim financial statements of the Company and related notes thereto as at and for the three and six months ended June 30, 2019 and 2018. The condensed consolidated interim financial statements have been prepared in accordance with International Accounting Standard (“IAS”) 34, “Interim Financial Reporting” using accounting policies consistent with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”) and Interpretations issued by the International Financial Reporting Interpretations Committee (“IFRIC”). The accounting policies followed in these condensed consolidated interim financial statements are the same as those applied in the Company’s most recent audited annual consolidated financial statements for the year ended December 31, 2018, except as outlined in note 2 of the June 30, 2019 condensed consolidated interim financial statements. All financial information has been prepared in accordance with International Financial Reporting Standards (“IFRS” or “GAAP”) and all dollar amounts presented are Canadian dollars unless otherwise stated.

The effective date of this MD&A is August 13, 2019.

1.1.1 Forward-looking statements and risk factors

This MD&A may contain “forward-looking statements” which reflect the Company’s current expectations regarding the future results of operations, performance and achievements of the Company, including but not limited to statements with respect to the Company’s plans or future financial or operating performance, the estimation of mineral reserves and resources, conclusions of economic assessments of projects, the timing and amount of estimated future production, costs of future production, future capital expenditures, costs and timing of the development of deposits, success of exploration activities, permitting time lines, requirements for additional capital, sources and timing of additional financing, realization of unused tax benefits and future outcome of legal and tax matters.

The Company has tried, wherever possible, to identify these forward-looking statements by, among other things, using words such as “anticipate”, “believe”, “estimate”, “expect”, “budget”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved”.

The statements reflect the current beliefs of the management of the Company and are based on currently available information. Accordingly, these statements are subject to known and unknown risks, uncertainties and other factors, which could cause the actual results, performance, or achievements of the Company to differ materially from those expressed in, or implied by, these statements. These uncertainties are factors that include but are not limited to risks related to international operations; risks related to general economic conditions; actual results of current exploration activities and unanticipated reclamation expenses; fluctuations in prices of gold and other commodities; fluctuations in foreign currency exchange rates; increases in market prices of mining consumables; possible variations in mineral resources, grade or recovery rates; accidents, labour disputes, title disputes, claims and limitations on insurance coverage and other risks of the mining industry; delays in obtaining governmental approvals or financing or in the completion of development or construction activities; changes in national and local government regulation of mining operations, tax rules and regulations, and political and economic developments in countries in which the Company operates; as well as other factors. Additional information relating to the Company and its operations is available on SEDAR at www.sedar.com and on the Company’s web site at www.aurynresources.com.

The Company’s management periodically reviews information reflected in forward-looking statements. The Company has and continues to disclose in its MD&A and other publicly filed documents, changes to material factors or assumptions underlying the forward-looking statements and to the validity of the statements themselves, in the period the changes occur. Historical results of operations and trends that may be inferred from the following discussions and analysis may not necessarily indicate future results from operations

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the six months ended June 30, 2019

(In thousands of Canadian dollars, unless otherwise noted)

1.1.1

Forward-looking statements and risk factors (continued)

The operations of the Company are speculative due to the high-risk nature of its business which is the exploration of mining properties. For a comprehensive list of the risks and uncertainties facing the Company, please see “Risk Factors” in the Company’s most recent annual information form. These are not the only risks and uncertainties that Auryn faces. Additional risks and uncertainties not presently known to the Company or that the Company currently considers immaterial may also impair its business operations. These risk factors could materially affect the Company's future operating results and could cause actual events to differ materially from those described in forward-looking statements relating to the Company. Readers should refer to the risks discussed in the Company’s Annual Information Form and MD&A for the year ended December 31, 2018 and subsequent continuous disclosure filings with the Canadian Securities Administrators available at www.sedar.com and the Company’s registration statement on Form 40-F filed with the United States Securities and Exchange Commission and available at www.sec.gov. These documents are for information purposes only and not incorporated by reference in this MD&A.

1.2.1

Description of business

Auryn Resources is a technically-driven, well-financed junior exploration company focused on finding and advancing globally significant precious and base metal deposits. The Company has a portfolio approach to asset acquisition and has seven projects, including two flagships: the Committee Bay high-grade gold project in Nunavut, Canada and the Sombrero copper-gold project in southern Peru.

Auryn’s technical and management teams have an impressive track record of successfully monetizing assets for all stakeholders and local communities in which it operates. Auryn conducts itself to the highest standards of corporate governance and sustainability.

The Company was incorporated under the British Columbia Business Corporations Act on June 9, 2008 under the name Georgetown Capital Corp. Subsequently on October 15, 2013, the Company changed its name to Auryn Resources Inc. and is a reporting issuer in the provinces of British Columbia, Ontario and Alberta. The Company is listed on the Toronto Stock Exchange under the symbol AUG and effective July 17, 2017, the Company’s common shares commenced trading on the NYSE American under the US symbol AUG.

The Company’s principal business activities include the acquisition, exploration and development of resource properties. The head office and principal address of the Company are located at 1199 West Hastings Street, Suite 600, Vancouver, British Columbia, V6E 3T5.

Effective April 1, 2019, Mr. Rees resigned as Chief Financial Officer to pursue a new opportunity and the Company appointed Ms. Rowa. Ms. Rowa is a Canadian CPA, CA who has worked with Canadian and US publicly listed resource companies for the past 10 years, including the last 3 years with Auryn.

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the six months ended June 30, 2019

(In thousands of Canadian dollars, unless otherwise noted)

1.2.2

Committee Bay and Gibson MacQuoid projects

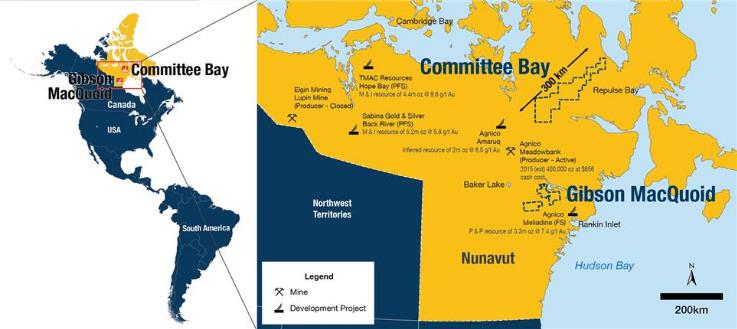

Figure 1 – regional map showing the locations of the Committee Bay and Gibson MacQuoid projects

Committee Bay

The Committee Bay Project is comprised of approximately 300,000 hectares situated along the Committee Bay Greenstone Belt approximately 180 km northeast of the Meadowbank mine operated by Agnico Eagle Mines Limited and extends more than 300 km northeast.

The Committee Bay belt comprises one of a number of Archean aged greenstone belts occurring within the larger Western Churchill province of north-eastern Canada. The character and history of rock packages, and the timing and nature of mineralization occurring within the belt is considered to be equivalent to that of other significant gold bearing Archean greenstones within the Western Churchill Province, which hosts deposits such as Meadowbank, Meliadine and the newly discovered Amaruq.

Ownership

The Committee Bay project is held 100% by Auryn subject to a 1% Net Smelter Royalty (“NSR”) on the entire project and an additional 1.5% NSR on a small portion of the project. The 1.5% NSR is payable on only 7,596 hectares and is buyable within two years of the commencement of commercial production for $2,000 for each one-third (0.5%) of the NSR.

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the six months ended June 30, 2019

(In thousands of Canadian dollars, unless otherwise noted)

1.2.2

Committee Bay and Gibson MacQuoid projects (continued)

Mineral resources

High-grade gold occurrences are found throughout the 300 km strike length of the Committee Bay project with the most advanced being the Three Bluffs deposit that contains the mineral resource as listed in the table below: *(refer to NI43-101 report dated May 31, 2017 as amended October 23, 2017 filed under Auryn’s profile at www.sedar.com).

| Class |

| Cut off grade (g/t Au) | Tonnes (t)

| Gold grade (g/t Au) | Contained Au (oz) |

Indicated | Near Surface Underground | 3.0 4.0 | 1,760,000 310,000 | 7.72 8.57 | 437,000 86,000 |

| | | | 2,070,000 | 7.85 | 524,000 |

Inferred | Near Surface Underground | 3.0 4.0 | 590,000 2,340,000 | 7.56 7.65 | 144,000 576,000 |

| | | | 2,930,000 | 7.64 | 720,000 |

Table 1: Three Bluffs indicated and inferred resource. See section 1.2.6 for cautionary language concerning mineral resources.

The Three Bluffs deposit remains open along strike and at depth. Future programs will aim to significantly expand upon the current resource.

2019 Exploration Plans

Targeting and Machine Learning at Committee Bay

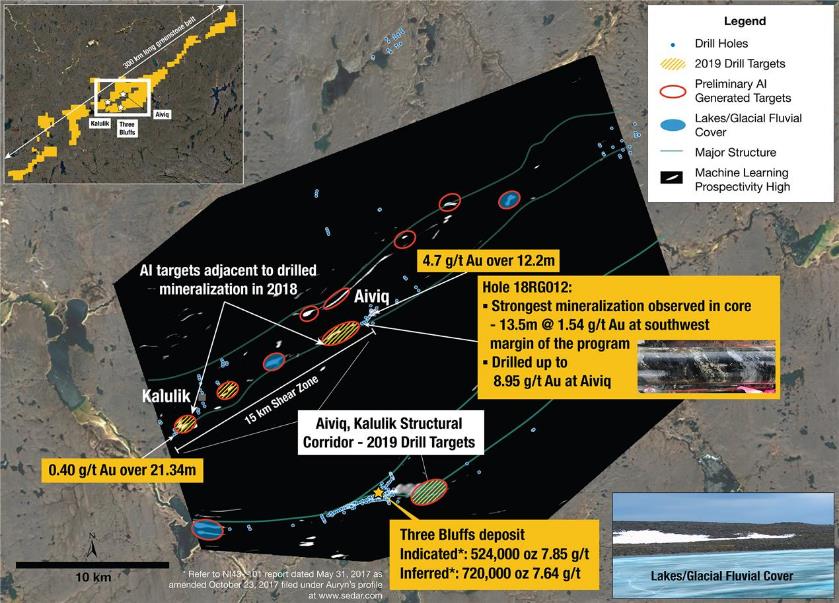

As a follow up to the results from the 2018 drill program, the Company engaged Computational Geosciences Inc to implement machine learning technologies to assist in the targeting of high-grade gold mineralization at the Committee Bay project. The machine learning targeting processed the vast amount of historic and modern surface geochemical, geological, geophysical and drill data across the project to derive non-biased correlations within the dataset. The machine learning results, as press released February 19, 2019, include the following highlights:

● A total of twelve new targets were generated, including:

➢

Two targets overlapping with Auryn’s geologist derived targets, adjacent to the Aiviq and Kalulik discoveries (Figure 2);

➢

Two targets creating east and west extensions of the Three Bluffs deposit; and,

➢

Multiple targets hidden beneath shallow lakes and glacial-fluvial cover.

●

A third structure has been identified (in addition to the Three Bluffs structure and Aiviq and Kalulik structure) with 15 kilometers of strike length.

2019 Exploration Program

On July 8, 2019, the Company commenced its drill program at Committee Bay and by the date of this MD&A the program has been completed and consisted of 2,700 meters of diamond drilling. The drilling tested two targets identified through the use of machine learning targeting as well as following up on drilled fluid pathways along the Aiviq structural corridor from the 2017 and 2018 programs. To aid in the 2019 targeting along the Aiviq-Shamrock corridor, a 27 line – kilometer induced polarization survey was conducted to identify both chargeability and conductivity targets. The camp is currently in the process of being shutdown for the season, and full results from the program are expected later in 2019.

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the six months ended June 30, 2019

(In thousands of Canadian dollars, unless otherwise noted)

1.2.2

Committee Bay and Gibson MacQuoid projects (continued)

Figure 2 - Illustrates the targets generated with the assistance of machine learning along the Kalulik – Aiviq structural corridor, which will form the basis of the 2019 summer drill program.

Gibson MacQuoid

The Gibson MacQuoid project is an early stage gold exploration project situated between the Meliadine deposit and Meadowbank mine in Nunavut, Canada. The 19 prospecting permits and 57 mineral claims that make up the project encompass approximately 120 km of strike length of the prospective greenstone belt and total 375,000 hectares collectively.

The Gibson MacQuoid Greenstone belt is one of a number of Archean aged greenstone belts located in the Western Churchill province of north-eastern Canada. These gold bearing Archean greenstone belts host deposits such as the Meadowbank, Amaruq, and Meliadine deposits. In particular, the highly magnetic signature of the Gibson MacQuoid Belt is consistent with the other productive greenstone belts in the eastern Arctic that host large-scale gold deposits.

2019 Staking Program

In June 2019, the Company completed a small staking program in which 36 claims, totalling 42,640.7 hectares, were staked and are currently in the process of being filed. The staking of these claims, which overlap with the Company’s prospecting permits that expire in 2020, was completed in order to maintain a contiguous land package over the current areas of interest as identified in the previous years’ work programs.

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the six months ended June 30, 2019

(In thousands of Canadian dollars, unless otherwise noted)

Sombrero

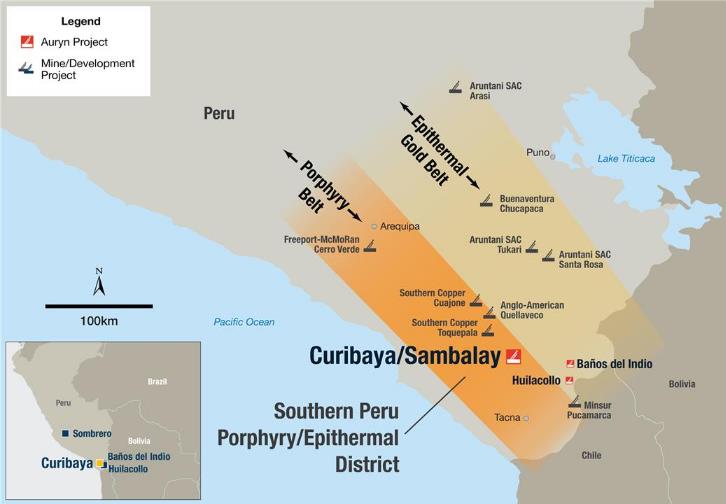

The Sombrero Project lies within the north-western most projections of the Andahuaylas-Yauri Belt of southern Peru, an emerging and increasingly important porphyry copper and skarn belt. The belt strikes NW-SE and can be traced for more than 300 kilometers of strike length hosting important copper-gold-molybdenum deposits at Las Bambas, Haquira, Los Chancas, Cotambambas, Antapacay, Tintaya and Constancia, and is thought to be a northern extension of the copper-rich belt of the same Eocene-Oligocene age that strikes broadly N-S in Chile.

The current project consists of over 120,000 hectares of mineral claims covering a number of coincident gold and copper geochemical anomalies. Figure 3 below illustrates the main Sombrero project area comprising of 65,494.7 net hectares where the Company is currently focusing its exploration work; the remainder of the concession blocks held by the Company in the region lie within approximately 80km south and east of this main project area. The land package was assembled through a series of staking campaigns and three separate option agreements detailed below.

Alturas Option

On June 28, 2016, the Company entered into an option with Alturas Minerals Corp. whereby Auryn was granted the option to earn up to a 100% interest in the central area of the project referred to as Sombrero Main. Under the terms of this option, the Company may earn a 100% interest in the 6 mineral claims by completing US$2.1 million in work expenditures within a five-year period and by making a final payment of US$5.0 million. As at June 30, 2019, the Company has satisfied the cash payment requirements of the option and has incurred approximately US$1.6 million in exploration work on the project.

Mollecruz Option

On June 22, 2018, the Company acquired the rights to the Mollecruz concessions located just to the north of Sombrero Main. Under the terms of the Mollecruz Option, the Company may acquire a 100% interest in the concessions by completing US$3.0 million in work expenditures and by making payments totaling US$1.6 million to the underlying owner over a five-year period. At signing, Auryn paid US$50,000 and upon exercise of the option, the underlying owner will retain 0.5% NSR royalty with an advance annual royalty payment of US$50,000.

Effective May 20, 2019, the Company formally declared the existence of a force majeure event under the Mollecruz Option thereby deferring the Company’s obligation to make the June 22, 2019 property payment and any subsequent property payments and work expenditures for a maximum of 24 months from the declaration date. To date, the Company has not been able to reach an access agreement with the local community in order to commence work in the region but has continued to have open communications with the community and continues to negotiate in good faith to obtain access to the property.

Aceros Option

On December 13, 2018, the Company entered into a series of agreements with Corporacion Aceros Arequipa S.A. (“Aceros”) to acquire the rights to three key inlier mineral concessions. If the Aceros Option is exercised, a joint venture would be formed in which the Company would hold an 80% interest (Aceros – 20%). The joint venture would combine the 530 hectare Aceros concessions plus 4,600 hectares of Auryn’s Sombrero land position. The Company is required to make a series of option payments totalling US$800,000, which includes the US$140,000 paid upon signing, as well as completing US$5.15 million in work expenditures over a five-year period.

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the six months ended June 30, 2019

(In thousands of Canadian dollars, unless otherwise noted)

1.2.3

Peruvian projects (continued)

Figure 3 - Illustrates the main Sombrero project area and the various Copper-Gold Skarn, Porphyry & Epithermal Targets

2019 Exploration

Throughout 2018 and up until the date of this MD&A, the Company has been aggressively conducting surface geochemical and geophysical surveys across the southern portions of Sombrero Main and in Q1 2019 expanded its surface work into the newly acquired Fierrazo area. Work conducted to date in this area included 3,814 m of continuous channel samples, 913 rock samples, 261 soil samples and 13,156 XRF samples as well as 87 line-km of IP and 282 line-km of Mag. This work has further indicated that Sombrero is host to a significant copper-gold system which contains porphyry, epithermal and skarn type mineralization. Auryn geologists completed grade control mapping throughout the Sombrero Main area with the goal of characterizing the controls on mineralization throughout the project area. The interpretation of this work is ongoing and constantly evolving.

The channel sampling completed at Fierrazo in early 2019 resulted in the extension of the mineralization to a potential 7.5 km target area over the Sombrero Main and Fierrazo areas. This identified contact zone between the Ferrobamba limestone and the Cascabamba intrusive body hosting high-grade copper and gold mineralization will continue to be the primary area of focus. The Company is in the process of permitting an initial drill program to further test the observed mineralization at depth. Highlights from the continuous channel sampling at the Fierrazo target include a combined width of mineralization of 232 meters of 0.55% copper equivalent (0.47% copper and 0.13 g/t gold) with a higher-grade internal interval of 40 meters of 1.26% copper equivalent (1.23% copper and 0.05 g/t gold) (full results can be found in the Company’s press releases dated March 12 and April 3, 2019).

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the six months ended June 30, 2019

(In thousands of Canadian dollars, unless otherwise noted)

1.2.3

Peruvian projects (continued)

The Company has also had the opportunity to make use of past workings by Aceros including collecting 37 representative grab samples from the waste dumps and ore stockpiles left at the formerly producing Fierrazo iron mine (Figure 4). The results of the samples indicate copper and gold mineralization within the hematite-magnetite exoskarn mineralization. The average values of the samples were 0.91% Cu and 0.36 g/t Au. Complete results of this sampling can be found in the Company’s April 3, 2019 news release.

As announced April 29, 2019 the Company gained access to 988 meters of historical drill core from drilling conducted by Aceros (Figure 5). The sampling of the core by Aceros was considered incomplete as only partial sections of the holes were sampled and were targeting iron skarn mineralization. Additionally, historic analytical results did not include analysis for gold. On June 13, 2019 Auryn released the results of its resampling of the core and the highlights included 116 meters of 0.58% CuEq (0.42% Cu and 0.24 g/t Au), 90.4 meters of 0.51% CuEq (0.48% Cu and 0.05 g/t Au) and 51 meters of 0.53% CuEq (0.43% Cu and 0.16 g/t Au) (figure 4). These results confirmed that the copper-gold sulfide mineralization extends to depth below the surface where the Company had completed its channel sampling as discussed above (figure 5). Collectively, the historical drill holes define a mineralized body totaling 300 meters of strike length with an average width of approximately 150 – 200 meters that is open both to the north and to the south. The Company’s initial permit application was submitted on June 5, 2019 and the Company is currently working through the various phases of the drill permit process.

Figure 4 - Illustrates the drill intercepts from the historical core at the Fierrazo exoskarn target.

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the six months ended June 30, 2019

(In thousands of Canadian dollars, unless otherwise noted)

1.2.3

Peruvian projects (continued)

Figure 5 - illustrates the location of the 8 historical drill holes at the Fierrazo target in relation to the surface work Auryn has completed to date.

The Good Lucky and Nioc target areas, which are situated adjacent to and show the similar geological and geophysical signatures as Sombrero Main, are additional prospects which warrant significant geological follow-up. The Good Lucky prospect, contained within the Mollecruz concessions, represents an outcropping copper-gold skarn system exposed over 600 meters where sampling has returned up to 5.12 g/t Au and 4.29% Cu. Rock samples from Nioc, contained within the Aceros option, have returned assays of up to 5.88 g/t Au and 9.09% Cu. The Company plans to expand its surface program into the Good Lucky and Nioc target areas once community agreements are obtained and the Company thereby gains access to the land.

Surface work programs such as rock sampling, BLEG surveys and BLEG follow up continue to screen the overall land package in order to highlight additional mineralized centers.

See the press releases dated June 19, September 5, September 26, October 15, November 26, 2018 and January 7, March 12, and April 3, 2019 for complete results from the Company’s geophysical and geochemical surface programs at Sombrero.

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the six months ended June 30, 2019

(In thousands of Canadian dollars, unless otherwise noted)

1.2.3

Peruvian projects (continued)

Huilacollo

The Huilacollo property, located in the Tacna province of southern Peru, comprises 2,000 hectares of intense hydrothermal alteration over a 4 by 6 km area that is consistent with epithermal Au/Ag mineralization. Historic drilling has resulted in the identification of a continuously mineralized gold/silver zone open in all directions. Contained within this area, there appears to be higher grade mineralization focused along well-defined feeder structures as highlighted by trench intercepts up to 38m at 6.7 g/t Au and drill holes including 34m @ 2.14 g/t. The Company acquired the rights to Huilacollo through an option agreement with a local Peruvian company, Inversiones Sol S.A.C., under which the Company may acquire a 100% interest, subject to an NSR, through a combination of work expenditures and cash payments totaling US$7.0 million and US$8.75 million respectively. As of May 11, 2019, the Company had spent US$4.5 million at the Huilacollo project and did not satisfy the accumulated work expenditure requirement of US$5.0 million at that date. Under the terms of the Huilacollo option, the Company elected instead to make a cash payment of US$258,000 equal to 50% of the shortfall at the due date to keep the option in good standing.

Huilacollo Exploration

During 2017 and 2018 the Company completed its initial drill program, consisting of five holes, at its Huilacollo project. Drilling successfully expanded mineralization to the northwest by 100 meters with drill hole 17-HUI-002 intersecting 62 meters of 0.45 g/t Au (including 22 meters of 0.71g/t Au) oxide mineralization from surface and drill hole 17-HUI-004 intersecting 22 meters of 0.2 g/t Au 100 meters to the southwest from hole 17-HUI-002. Additional drilling would target further extensions of mineralization as well as surface mineralization discovered at the Tacora prospect. The Company is currently determining its future exploration programs for Huilacollo.

Baños del Indio

The Baños del Indio epithermal property is comprised of 5,000 hectares of well-developed high-level steam heated epithermal style alteration and is considered by Auryn to be one of the largest untested epithermal alteration centers in Peru. Baños del Indio is held through an option where the Company may acquire a 100% interest, subject to a 3.0% NSR, through a combination of work expenditures and cash payments.

Effective September 7, 2018, the Company declared the existence of a force majeure event under the Baños del Indio option thereby deferring the Company’s obligation to make the September 22, 2018 property payment and any subsequent property payments and work expenditures for a maximum of 24 months from the date of declaration. Despite the Company acting in good faith in its negotiations with the community, the Company, to date, has been unable to reach an access agreement in order to initiate its exploration program on the Baños properties. A local community worker has been hired to advocate for the Company and work towards the resolution of this matter.

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the six months ended June 30, 2019

(In thousands of Canadian dollars, unless otherwise noted)

1.2.3

Peruvian projects (continued)

Curibaya

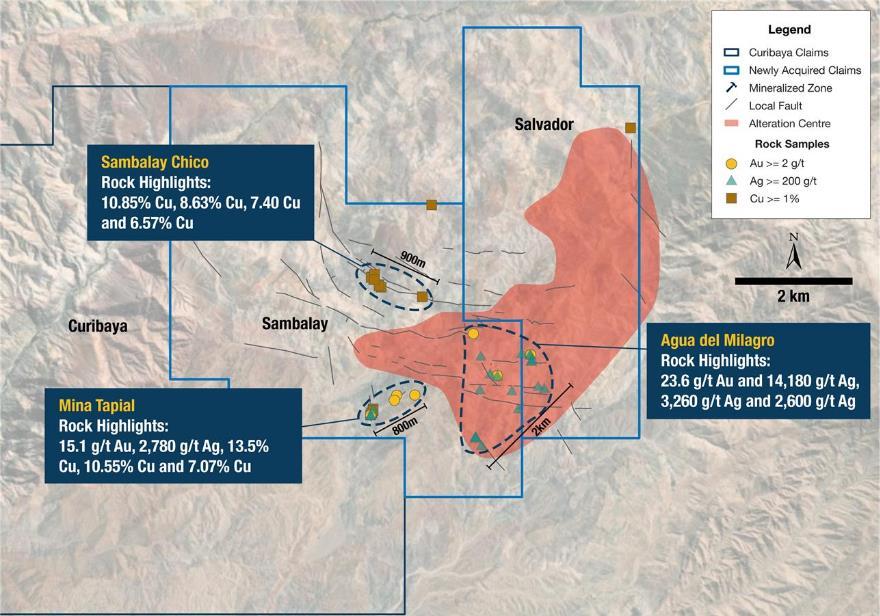

On August 2, 2019, the Company acquired the rights to the Sambalay and Salvador mineral concessions adjacent to the wholly owned Curibaya porphyry property in southern Peru, which was acquired by the Company in 2016. Under the terms of the mining concession transfer agreement with Wild Acre Metals (Peru) S.A.C., the Company will pay US$250,000 on transfer of the concessions in favour of Corisur. The Sambalay concessions are subject to a combined 3% NSR royalty, 0.5% of which is buyable for US$1.0 million. The Salvador concessions are subject to a 2% NSR royalty and a US$2.0 million production payment, payable at the time a production decision is made, and to secure payment of such consideration a legal mortgage is recorded in the registry files of the Salvador concessions.

The Sambalay and Salvador concessions together represent a 2-kilometre by 3.3-km mineralized alteration system that shows affinities to both high-grade copper porphyry and precious metal intermediate sulphidation systems (figure 6). Historical high-grade sampling includes up to 13.50% copper, 23.6 g/t gold and 14,180 g/t silver (figure 7), however despite these results, Auryn is unaware of any historical systematic exploration or drilling on the properties.

Collectively, the Curibaya project now covers approximately 11,000 hectares and is located 53 km from the provincial capital, Tacna, and is accessible by road in 2.5 hours. It is also 11 km south of the Incapuquio regional fault, which is viewed as a major control on the emplacement of mineralized porphyries in the region. The concessions are not within the 50km border zone that would require the Peruvian government to approve the acquisition by Auryn, as a non-Peruvian company.

Figure 6: Illustrates the position of the Curibaya Project with respect to the large copper porphyry mines in Southern Peru.

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the six months ended June 30, 2019

(In thousands of Canadian dollars, unless otherwise noted)

1.2.3

Peruvian projects (continued)

Figure 7: Illustrates the surface rock samples taken from the Sambalay and Salvador concessions

1.2.4

Homestake Ridge project

The Homestake Ridge project is located in the Skeena mining division in in north-western British Columbia and covers approximately 7,500 hectares. The project is host to a high-grade gold, silver, copper, lead resource which remains open at depth and along strike in several zones.

| | Tonnage | Gold | Gold | Silver | Silver | Copper | Copper |

| | (Mt) | (g/t) | (oz) | (g/t) | (Moz) | (%) | (Mlb) |

| Indicated | 0.624 | 6.25 | 125,000 | 47.9 | 1.0 | 0.18 | 2.4 |

| Inferred | 7.245 | 4.00 | 932,000 | 90.9 | 21.2 | 0.11 | 16.9 |

Table 2: Combined Main Homestake, Homestake Silver and South Reef Resources at a 2 g/t AuEq cut-offs. See section 1.2.6 for cautionary language concerning mineral resources and refer to technical report dated September 29, 2017 as amended October 23, 2017 filed under the Company’s SEDAR profile at www.sedar.com.

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the six months ended June 30, 2019

(In thousands of Canadian dollars, unless otherwise noted)

1.2.4

Homestake Ridge project (continued)

2019 Exploration Plans

In July 2019, the Company completed a 558 ln-km Versatile Time Domain (VTEM) magnetic and electromagnetic survey flown by Geotech Airborne Geophysical Surveys. The survey was flown over two distinct blocks covering the newly identified Bria target area (see press release dated June 4, 2019) as well as the southern KN HSR 1 mineral claim. At this time the final survey data has not been received by Auryn.

The remainder of the 2019 exploration program at Homestake Ridge will be focused on the newly identified mineralized zones outboard of the known resource area, namely Kombi and Bria. This work will be guided by recently completed inversions of historical airborne geophysical data sets over the southern portion of the claims at Kombi as well as the VTEM data over the Bria target.

Additionally, field work will comprise detailed soil sampling across Bria and Kombi as well as targeted geologic mapping commencing in mid-August.

The 2019 exploration program is planned to fully utilize the $637 of BC flow-through funds remaining as at June 30, 2019.

1.2.5

Qualified persons and technical disclosures

Michael Henrichsen, P. Geo., Chief Operating Officer of Auryn, is the Qualified Person with respect to the technical disclosures in this MD&A.

Channel Sampling 2018/2019 (Sombrero, Peru) - Analytical samples were taken from each 1 meter (channels 18SRT-04 through 18SRT-09) or 2 meter (channels 18SRT-10 – 18SRT-20) interval of channel floor resulting in approximately 2-3kg of rock chips material per sample. Collected samples were sent to ALS Lab in Lima, Peru for preparation and analysis. All samples are assayed using 30g nominal weight fire assay with atomic absorption finish (Au-AA25) and multi-element four acid digest ICP-AES/ICP-MS method (ME-MS61). Where MS61 results were greater or near 10,000 ppm Cu, Zn or Pb the assays were repeated with ore grade four acid digest method (OG62). QA/QC programs for 2018/2019 channel grab samples using internal standard and blank samples; field and lab duplicates indicate good overall accuracy and precision.

Intervals were calculated using a minimum of a 0.1% Cu cut-off at beginning and end of the interval and allowing for no more than six consecutive meters of less than 0.1% Cu with a minimum length of the resulting composite of 5m. Copper and gold equivalent grades (CuEq and AuEq) were calculated for 2018 using gold price of US$1300/oz and copper price of US$3.28/lb and for 2019 using gold price of US$1300/oz and copper price of US$3.00/lb.

Rocks 2019 (Sombrero, Peru) - Approximately 2-3kg of material was collected for analysis and sent to ALS Lab in Lima, Peru for preparation and analysis. All samples are assayed using 30g nominal weight fire assay with ICP finish (Au-ICP21) and multi-element four acid digest ICP-AES/ICP-MS method (ME-MS61). Where ICP21 results were > 3 g/t Au the assay was repeated with 30g nominal weight fire assay with gravimetric finish (Au-GRA21). Where MS61 results were greater or near 10000 ppm Cu, 10000ppm Pb or 100ppm Ag the assay was repeated with ore grade four acid digest method (Cu-OG62). QA/QC programs for 2019 rock samples using lab duplicates, standards and blanks indicate good accuracy and precision in a large majority of standards assayed.

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the six months ended June 30, 2019

(In thousands of Canadian dollars, unless otherwise noted)

1.2.5

Qualified persons and technical disclosures (continued)

Historical Fierrazo Diamond Drill Hole (DDH) Re-Sampling 2019 (Sombrero)

Sample intervals averaged 2 meters where historical sample intervals taken and otherwise were 2 meters. Where at least half of HQ diameter core was present it was sawed into equal parts on site. Otherwise historical crush rejects were used in lieu of the core. In total 481 quarter core, 20 half core, and 10 crush rejects, approximately 3-5kg each, were sent to ALS Lab in Lima, Peru for preparation and analysis. All samples were assayed using 30g nominal weight fire assay with atomic absorption finish (Au-AA25) and multi-element four acid digest ICP-AES/ICP-MS method (ME-MS61). Where MS61 results were near or greater than 10,000 ppm Cu the assays were repeated with ore grade four acid digest method (OG62). QA/QC programs using internal standard samples, field and lab duplicates and blanks indicate good accuracy and precision in a large majority of standards assayed.

Intervals were calculated using a minimum of a 0.1% Cu cut-off at beginning and end of the interval and allowing for no more than six consecutive meters of less than 0.1% Cu with a minimum length of the resulting composite of 5 meters.

Historical Grab Samples – Sambalay and Salvador

The historical grab samples on Sambalay and Salvador were collected by Teck (2010-2011), Compania de Exploraciones Orion SAC (2010-2011) and Wild Acre Metals (2012-2013). Auryn has not conducted any due diligence on whether appropriate QA/QC protocols were followed in the collection of these samples, nor can it confirm their accuracy or repeatability.

Cautionary Note to United States Investors concerning Estimates of Measured, Indicated and Inferred Resource Estimates

This disclosure has been prepared in accordance with the requirements of Canadian provincial securities laws which differ from the requirements of U.S. securities laws. Unless otherwise indicated, all mineral resource estimates included in this disclosure have been prepared in accordance with Canadian National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum classification systems. NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. These standards differ significantly from the requirements of the United States Securities and Exchange Commission (the “SEC”), and resource estimates disclosed may not be comparable to similar information disclosed by U.S. companies.

In addition, this disclosure uses the terms “measured and indicated resources” and “inferred resources” to comply with the reporting standards in Canada. The Company advises United States investors that while those terms are recognized and required by Canadian regulations, the SEC does not recognize them. United States investors are cautioned not to assume that any part of the mineral deposits in these categories will ever be converted into mineral reserves. Further, “inferred resources” have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically. Therefore, United States investors are cautioned not to assume that all or any part of the “inferred resources” exist. In accordance with Canadian securities laws, estimates of “inferred resources” cannot form the basis of feasibility or other economic studies. It cannot be assumed that all or any part of “measured and indicated resources” or “inferred resources” will ever be upgraded to a higher category or are economically or legally mineable.

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the six months ended June 30, 2019

(In thousands of Canadian dollars, unless otherwise noted)

1.2.5

Qualified persons and technical disclosures (continued)

Cautionary Note to United States Investors concerning Estimates of Measured, Indicated and Inferred Resource Estimates (continued)

Three Bluffs resource estimations were completed by Roscoe Postle Associates Inc. (“RPA”) (see the Technical Report on the Three Bluffs Project, Nunavut Territory, Canada filed on the SEDAR on May 31, 2017 as amended October 23, 2017). The Homestake Ridge resource estimate was prepared by RPA (see Technical Report on the Homestake Ridge Project, Skeena Mining Division, Northwestern British Columbia, September 29, 2017 as amended October 23, 2017 filed under the Company’s SEDAR profile at www.sedar.com).

Peruvian interests within a special economic zone - Auryn holds certain interests in Peru through Corisur Peru SAC, which controls (among other) certain licenses (including the Huilacollo and Baños del Indio projects) that are located within a special legal zone which runs 50km back from the Peruvian border. As a non-Peruvian company, Auryn’s right to ultimately acquire title over the shares issued by Corisur Peru SAC and to own and/or exploit these licenses requires approval from the Peruvian government. While Auryn is in the process of submitting its applications and does not foresee any legal reason why it would be denied the approval, some risk of denial or delay should be assumed to exist.

1.3

Selected annual financial information

| | Year ended | Year ended | Yearn ended |

| | December 31, 2018 | December 31, 2017 | December 31, 2016 |

| | | (Restated1) | (Restated1) |

| Comprehensive loss for the period | $ 17,389 | $ 36,578 | $ 20,539 |

| Net loss for the period | $ 17,674 | $ 36,500 | $ 20,376 |

| Basic and diluted loss per share | $ 0.21 | $ 0.48 | $ 0.35 |

| Total assets | $ 43,523 | $ 43,759 | $ 41,747 |

| Total long-term liabilities | $1,891 | $ 1,662 | $ 1,747 |

1 Restated for change in accounting policy as disclosed in note 4 of the Company’s audited annual consolidated financial statements for the year ended December 31, 2018.

The Company generated no revenues from operations during the above periods.

1.4

Discussion of operations

Three months ended June 30, 2019 and 2018 (Q2 2019 vs. Q2 2018)

During the three months ended June 30, 2019, the Company reported a net loss of $5,045 and loss per share of $0.05 compared to a net loss of $4,372 and loss per share of $0.05 for the same period in 2018. The $673 increase in net loss in the current quarter is driven by a $1,054 increase in fees, salaries and other employee benefits, and a $381 decrease in the amortization of the flow-through liability, partially offset by a $847 decrease in the exploration and evaluation costs. Significant variances within operating expenses and other expenses are discussed as follows:

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the six months ended June 30, 2019

(In thousands of Canadian dollars, unless otherwise noted)

1.4

Discussion of operations (continued)

Operating expenses

(1)

Exploration and evaluation costs in Q2 2019 were $2,425 compared to $3,272 in Q2 2018, a decrease of

$847, driven by the following:

a.

Committee Bay decrease of $1,067 – During Q2 2019 the Company had minimal expenditures which primarily related to salaries and wages and share based compensation for employees and consultants preparing for the summer program which commenced in early July 2019. In Q2 2018 the Company incurred substantial costs to complete its spring mobilization program. Such a program was unnecessary in 2019 as the Company already had sufficient fuel on site to complete all of its exploration plans for the current year.

b.

Peru increase of $355 – Both the Q2 2019 and Q2 2018 work in Peru consisted of surface work at the Sombrero project however higher costs were incurred in Q2 2019 as the Company worked to complete its drill permit application for Sombrero. Additionally, in Q2 2019 share-based compensation of $459 was recorded compared to only $83 for Q2 2018.

(2)

Fees, salaries and other employee benefits in Q2 2019 were $1,868, including share-based compensation of $1,239, compared to $814 in Q2 2018, including share-based compensation of $225. The higher share-based compensation in the current quarter was driven by the timing and size of the grant, as well as the calculated fair value of the options.

Other expenses and income:

(3)

During the three months ended June 30, 2019, the Company recorded other income of $78 related to the amortization of the flow-through share premium liability compared to $459 for the three months ended June 30, 2018. The amortization of the liability is driven by the amount of flow-through eligible Canadian exploration and evaluation expenditures incurred in the period which for the current quarter was $339 compared to $1,608 for the same period in the previous year.

Six months ended June 30, 2019 and 2018 (YTD 2019 vs. YTD 2018)

During the six months ended June 30, 2019, the Company reported a net loss of $6,971 and loss per share of $0.08 compared to a net loss of $7,835 and loss per share of $0.09 for the same period in 2018. The $864 decrease in net loss in the current quarter is driven by a $2,363 decrease in the exploration and evaluation costs, offset partially by a $1,100 increase in fees, salaries and other employee benefits and a $505 reduction in the amortization of the flow-through liability. The significant variances related to the fees, salaries and employee benefits and the amortization of the flow-through liability for the six month period is consistent with that described above for the three-month period. The reduction in the exploration and evaluations costs is discussed below:

Operating expenses

(1)

Exploration and evaluation costs for the six months ended June 30, 2019 were $3,200 compared to $5,563 in the prior year period, a decrease of $2,363, driven by the following:

a.

Committee Bay decrease of $1,802 – During the six month period ended June 30, 2018 the Company completed it’s spring mobilization program whereas in the same period for 2019 a spring mobilization program was not necessary and the only work that was completed was in relation to the machine learning targeting exercise.

b.

Peru decrease of $270 – Costs in Peru for the six months ended June 30, 2018 were higher due to the Q1 2018 drill program that was completed at the Huilacollo project. This was partially offset in 2019 by the Sombrero permitting costs and the higher share-based compensation discussed above for the three months ended June 30, 2019.

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the six months ended June 30, 2019

(In thousands of Canadian dollars, unless otherwise noted)

1.4

Discussion of operations (continued)

Summary of Project Costs

During the six months ended June 30, 2019, the Company incurred $373 in mineral property acquisition costs and $3,200 in exploration and evaluation costs on its projects as outlined below:

| | Committee Bay & Gibson MacQuoid | Homestake Ridge | Peru | Total |

| Acquisition costs | | | | |

| Balance as at December 31, 2018 | $ 18,871 | $ 16,060 | $ 4,141 | $ 39,072 |

| Additions | 11 | - | 362 | 373 |

| Change in estimate of provision for site reclamation and closure | 148 | | | |

| Currency translation adjustment | - | - | (150) | (150) |

| Balance as at June 30, 2019 | $ 19,030 | $ 16,060 | $ 4,353 | $ 39,443 |

| | Committee Bay & Gibson MacQuoid | Homestake Ridge | Peru | Total |

| Exploration and evaluation costs | | | | |

| Assaying | $ 20 | $ 11 | $ 49 | $ 80 |

| Exploration drilling | 121 | - | - | 121 |

| Camp cost, equipment and field supplies | 132 | 10 | 164 | 306 |

| Geological consulting services | 31 | 12 | 420 | 463 |

| Permitting, environmental and community costs | 9 | 4 | 873 | 886 |

| Expediting and mobilization | 12 | 2 | 19 | 33 |

| Salaries and wages | 189 | 62 | 232 | 483 |

| Fuel and consumables | 7 | - | 15 | 22 |

| Aircraft and travel | 63 | 4 | 73 | 140 |

| Share based compensation | 121 | 63 | 482 | 666 |

| Total for the six months ended June 30, 2019 | $ 705 | $ 168 | $ 2,327 | $ 3,200 |

Future operations and 2019 expenditure forecast

The Company's business objectives for the remainder of 2019 are to secure the initial drill permit and additional community access agreements at its Sombrero project in order to continue the advancement of the project through a combination of surface work and drilling. The Company will also complete its planned exploration programs at the Committee Bay and Homestake Ridge projects. Currently the Company has no official work programs planned for 2020 as they will be subject to receiving the results from the 2019 programs.

The Company forecasts that total expenditures for the 2019 year will be approximately $10.7 million, of which, $6.5 million is budgeted to be spent on mineral properties to complete the 2019 exploration programs and keep the mineral properties in good standing. Completing the forecasted expenditures for the year is subject to raising additional funds through the issuance of shares, a debt offering or the sale of non-core assets. In the past, the Company has had success raising capital to fund its programs.

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the six months ended June 30, 2019

(In thousands of Canadian dollars, unless otherwise noted)

1.4

Discussion of operations (continued)

Future operations and 2019 expenditure forecast (continued)

●

At the Sombrero Project in Peru, the Company has continued to advance its copper-gold skarn project/porphyry target through surface exploration programs, which have included soil sampling, rock sampling, channel sampling and geophysical surveys. The Company has been working in the Sombrero Main and Fierrazo areas and has submitted its permit application so that an initial drill program can be conducted to target the Ferrobamba limestone to intrusive contact zone that has been identified. The Company is currently working with other surrounding communities in order to gain access to and expand its surface programs to the Nioc, Good Lucky and Totora targets.

●

At the Committee Bay Project, the Company has just completed its summer program which consisted of 2,700 meters of diamond drilling. The drilling tested two targets identified through the use of machine learning targeting as well as following up on drilled fluid pathways along the Aiviq structural corridor from the 2017 and 2018 programs. To aid in the 2019 targeting along the Aiviq-Shamrock corridor, a 27 line – kilometer induced polarization survey was conducted to identify both chargeability and conductivity targets. Results from the 2019 drill program are still pending. The program is expected to be fully funded by the $1.9 million of flow-through funds raised in the July 2019 Private Placement.

●

At the Homestake Ridge Project the Company anticipates completing additional surface work developing prospects outboard of the structural trend hosting the Homestake Main deposit. The 2019 work program will focus on following up on 2018 stream sediment anomalies and historic MinFile occurrences.

1.5

Summary of quarterly results

Three months ended | Interest income | Net loss | Comprehensive loss | Loss per share |

| In thousands of Canadian dollars except per share amounts |

| | $ | $ | $ | $ |

| June 30, 2019 | 19 | 5,045 | 5,139 | 0.05 |

| March 31, 2019 | 1 | 1,926 | 2,000 | 0.02 |

| December 31, 2018 | 33 | 2,351 | 2,166 | 0.03 |

| September 30, 2018 | 31 | 7,488 | 7,545 | 0.08 |

| June 30, 2018 | 34 | 4,372 | 4,281 | 0.05 |

| March 31, 2018 | 12 | 3,463 | 3,397 | 0.04 |

December 31, 20171 | 38 | 4,706 | 4,715 | 0.06 |

September 30, 20171 | 67 | 18,374 | 18,422 | 0.24 |

| | | | | |

1 Restated for change in accounting policy as disclosed in note 4 of the Company’s audited annual consolidated financial statements for the year ended December 31, 2018.

During the last eight quarters, the Company’s net loss has ranged between $18,374 and $1,926. In the time period reflected, the largest losses have been recorded for the third quarter which is when the Company’s summer drill programs occur at each of its Canadian projects while the losses recorded in the first quarter of each year tend to be relatively low as the Company’s exploration efforts are limited to Peru during these months, however the comparatively high losses for Q4 2017 and Q1 2018 related to the Company’s initial drill program that was completed at its Huilacollo project in Peru.

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the six months ended June 30, 2019

(In thousands of Canadian dollars, unless otherwise noted)

1.6/1.7 Financial position and liquidity and capital resources

| | June 30, 2019 | December 31, 2018 |

| Cash and restricted cash and cash equivalents | $ 2,241 | $ 1,768 |

| Mineral property interests | $ 39,443 | $ 39,072 |

| Current liabilities | $ 1,252 | $ 1,153 |

| Non-current liabilities | $ 2,061 | $ 1,891 |

As at June 30, 2019, the Company had unrestricted cash of $2,126 (December 31, 2018 - $1,653) and working capital (excluding the flow-through premium liability) of $2,188 (December 31, 2018 - $1,777). Current liabilities that are to be settled in cash as at June 30, 2019 include accounts payable and accrued liabilities of $1,045, which have primarily been incurred in connection with preparing for the Committee Bay and Homestake Ridge 2019 exploration programs as well as corporate costs related to keeping the Company’s public listings in good standing.

During the three and six months ended June 30, 2019, the Company used net cash of $3,086 and $4,783, respectively, in operating activities compared to $4,549 and $7,094, respectively, in the prior year periods.

Cash used in investing activities during the three and six months ended June 30, 2019 was $331 and $342, respectively, and $1,084 and $1,094, respectively, for the comparable periods in 2018. The outflow of cash for all periods was primarily related to the acquisition of mineral properties in Peru.

During the three months ended June 30, 2019, and 2018 cash provided by financing activities was negligible. The Company, however, generated net proceeds of $5,605 from financing activities through the issuance of common shares during the six months ended June 30, 2019 compared to $11,346 in the comparable period in 2018.

The Company’s working capital as at June 30, 2019 provides sufficient capital for the Company to meet its immediate liquidity requirements, including its contractual obligations which consist primarily of accounts payable and accrued liabilities and the requirement to spend remaining flow through funds at the Company’s Canadian projects. In addition to the flow-through private placement completed in July 2019 (discussed below) to fund the 2019 Committee Bay Exploration program, the Company may raise additional capital to further fund its other exploration programs.

July 2019 Private Placement

On July 11, 2019 the Company announced that it has completed a $1,900 non-brokered flow-through private placement. The placement consisted of 633,334 flow-through common shares priced at CAD$3.00 per flow-through share. The funds will be used to fund its summer exploration program at its Committee Bay gold project in Nunavut, Canada.

March 2019 Private Placement

On March 27, 2019, the Company completed a non-brokered private placement for gross proceeds of $5,255 million. The placement consisted of approximately 3,284,375 common shares priced at CAD$1.60 per Share. The Shares issued under the 2019 Offering are subject to a four-month hold period and were not registered in the United States.

The net proceeds from the 2019 Offering will fund continued surface exploration at its Sombrero copper-gold project located in Ayacucho, Peru and general working capital. Share issue costs related to the 2019 Offering totalled $135, which included $110 in commissions, and $25 in other issuance costs. A reconciliation of the impact of the 2019 Offering on share capital is as follows:

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the six months ended June 30, 2019

(In thousands of Canadian dollars, unless otherwise noted)

1.6/1.7

Financial position and liquidity and capital resources (continued)

| | Number of common shares | Impact on share capital |

| Common shares issued at $1.60 per share | 3,284,375 | $ 5,255 |

| Cash share issue costs | - | (135) |

| Proceeds net of share issue costs | 3,284,375 | $ 5,120 |

August 2018 Flow-Through Funding

On August 16, 2018 the Company closed its previously announced non-brokered flow-through private placement for gross proceeds of $7,331. The placement consisted of approximately 2.1 million flow-through common shares priced at CAD$1.60 per flow-through share and approximately 2.2 million charity flow-through shares priced at an average of CAD$ 1.80 per charity flow-through share. Goldcorp Inc. maintained its pro-rata interest in Auryn (approximately 12.4%) by acquiring 490,000 common shares from the purchasers of the charity flow-through shares.

Share issue costs related to the August 2018 Offering totalled $400, which included $350 in commissions, and $50 in other issuance costs. The gross proceeds from the August 2018 Offering were also offset by $1,742, an amount related to the flow-through share premium liability. A reconciliation of the impact of the August 2018 Offering on share capital is as follows:

| | Number of common shares | Impact on share capital |

| Flow-through shares issued at $1.60 per share | 2,084,375 | $ 3,335 |

| Flow-through shares issued at $1.75 per share | 1,215,000 | 2,126 |

Flow-through shares issued at $1.87 per share Cash share issue costs | 1,000,000 - | 1,870 (400) |

| Proceeds net of share issue costs | 4,299,375 | 6,931 |

| Flow-through share premium liability | - | (1,742) |

| | 4,299,375 | $ 5,189 |

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the six months ended June 30, 2019

(In thousands of Canadian dollars, unless otherwise noted)

1.6/1.7

Financial position and liquidity and capital resources (continued)

A summary of the intended use of the gross cash proceeds of $7,331 is presented in the table below. Due to the fact that only flow-through funds were raised in the August 2018 Offering, funds from the March 2018 Offering were used to cover the cash share issuance costs of $400.

| | Use of Proceeds: Proposed 12 Month Budget | Intended Use of Proceeds of the August 2018 Offering | Actual activities | Actual Use of Proceeds of the Offering to June 30, 2019 | (Over)/under expenditure |

| Committee Bay & Gibson MacQuoid | Flow-through eligible 2018 drill and exploration program | $5,461 | - 2018 flow through E&E | $5,401 | $60 |

| Homestake | Flow-through eligible 2018 drill and exploration program | 1,870 | - 2018 flow through E&E | 1,233 | 637 |

| | Total | $7,331 | | $6,634 | $697 |

Explanation of variances and the impact of variances on the ability of the Company to achieve its business objectives and milestones. | The Company completed 9,200 meters of drilling at its Committee Bay project, (budgeted 10,000 meters), 3,000 till samples surface program at Gibson MacQuoid (budgeted 3,600) and 2,500 meters of drilling at Homestake Ridge (budgeted 3,000). Minimal funds were expended in Q1 2019 as the Company analyzed its 2018 program data and planned for 2019 programs. Remaining flow-through funds will be used in 2019 programs. |

March 2018 Offering

On March 23, 2018 the Company closed the March 2018 Offering by issuing a total of 6,015,385 common shares of the Company at a price of US$1.30 per share for gross proceeds of US$7.8 million. The 2018 Offering was completed pursuant to an underwriting agreement dated March 13, 2018 among the Company and Cantor Fitzgerald Canada Corporation and a syndicate of underwriters. The Company paid a 6% commission to the Underwriters.

In addition, the Company completed a concurrent private placement financing involving the sale of 1,091,826 flow-through common shares of the Company (the “March 2018 Flow-Through Shares”) at a price equal to the Canadian dollar equivalent of US$1.82 per share, for gross proceeds of US$2.0 million. The 2018 Flow-Through Shares formed part of a donation arrangement and were ultimately purchased by Goldcorp Inc. (“Goldcorp”) and enabled Goldcorp to maintain its 12.5% interest in the Company. The proceeds from the sale of the 2018 Flow-Through Shares will be used exclusively for exploration on the Company’s Committee Bay project.

A reconciliation of the impact of the March 2018 Offering on share capital is as follows:

| | Number of common shares | Impact on share capital |

| Common shares issued at US$1.30 per share | 6,015,385 | $ 10,054 |

| Flow-through shares issued at US$1.82 per share | 1,091,826 | 2,561 |

| Cash share issue costs | - | (1,340) |

| Proceeds net of share issue costs | 7,107,211 | 11,275 |

| Flow-through share premium liability | - | (737) |

| | 7,107,211 | $ 10,538 |

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the six months ended June 30, 2019

(In thousands of Canadian dollars, unless otherwise noted)

1.6/1.7

Financial position and liquidity and capital resources (continued)

A summary of the intended use of the net cash proceeds of $11,280 is presented as follows:

| | Use of Proceeds: Proposed 12 Month Budget | Intended Use of Proceeds of the March 2018 Offering | Actual activities (March 23, 2018- June 30, 2019) | Actual Use of Proceeds of the Offering to June 30, 2019 | (Over)/under expenditure |

| Committee Bay & Gibson MacQuoid | Flow-through eligible funds 2018 drill and exploration programs Non-flow -through funds Technical studies, permitting and other non-flow-through eligible exploration costs to be incurred in connection with its 2018 exploration program | $ 2,561 1,928 | - flow through E&E - other E&E | $ 2,561 213 | $ 0 1,715 |

| Homestake | Non-flow -through funds Technical studies, permitting and other non-flow-through eligible exploration costs to be incurred in connection with its 2018 exploration program | 1,286 | - other E&E | 131 | 1,155 |

| Peru | Non-flow -through funds Exploration expenditures in Peru including the continuation of the Company’s drill program at the Huilacollo project and initial surface work at it Sombrero project | 2,571 | - Acquisition costs - E&E | 1,382 3,167 | (1,978) |

Other | General working capital | 2,934 | | 3,826 | (892) |

| | Total | $ 11,280 | | $ 11,280 | $ - |

Explanation of variances and the impact of variances on the ability of the Company to achieve its business objectives and milestones. | The financing was completed on March 23, 2018 and the funds have been fully expended and included both flow-through funds expended on the 2018 Committee Bay mobilization as well as non-flow through funds spent on mineral property acquisitions and exploration in Peru. |

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the six months ended June 30, 2019

(In thousands of Canadian dollars, unless otherwise noted)

1.6/1.7

Financial position and liquidity and capital resources (continued)

Exercise of Share Options

During the six months ended June 30, 2019, 864,375 shares were issued as a result of share options being exercised with a weighted average exercise price of approximately $0.56 for gross proceeds of $485. Attributed to these share options, fair value of $449 was transferred from the equity reserves and recorded against share capital.

Other sources of funds

As at June 30, 2019, the other sources of funds potentially available to the Company are through the exercise of outstanding stock options with terms as follows:

Stock options

| | Outstanding | Exercisable |

| Expiry date | Number of options | Exercise price | Remaining contractual life (years) | Number of options | Exercise price | Remaining contractual life (years) |

| Aug 17, 2020 | 915,000 | $1.30 | 1.13 | 915,000 | $1.30 | 1.13 |

| June 21, 2021 | 2,095,000 | 2.63 | 1.98 | 2,095,000 | 2.63 | 1.98 |

| Jan 10, 2022 | 440,000 | 3.22 | 2.53 | 440,000 | 3.22 | 2.53 |

| May 5, 2022 | 65,000 | 3.04 | 2.85 | 65,000 | 3.04 | 2.85 |

| June 20, 2023 | 795,000 | 1.42 | 3.98 | 596,250 | 1.42 | 3.98 |

| June 26, 2023 | 900,000 | 1.42 | 3.99 | 675,000 | 1.42 | 3.99 |

| Feb 7, 2024 | 200,625 | 1.36 | 4.61 | 69,375 | 1.36 | 4.61 |

| April 9, 2024 | 2,785,000 | 1.96 | 4.78 | 696,250 | 1.96 | 4.78 |

| | 8,195,625 | $ 2.01 | 3.35 | 5,551,875 | $ 2.09 | 2.74 |

In the future, the Company may have capital requirements in excess of its currently available resources and may be required to seek additional financing. There can be no assurance that the Company will have sufficient financing to meet its future capital requirements or that additional financing will be available on terms acceptable to the Company in the future.

1.8

Off-balance sheet arrangements

The Company does not utilize off-balance sheet arrangements.

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the six months ended June 30, 2019

(In thousands of Canadian dollars, unless otherwise noted)

1.9

Transactions with related parties

All transactions with related parties have occurred in the normal course of operations. All amounts are unsecured, non-interest bearing and have no specific terms of settlement, unless otherwise noted.

| | Three months ended June 30, | Six months ended June 30, |

| | 2019 | 2018 | 2019 | 2018 |

Universal Mineral Services Ltd. 1 | | | | |

| Exploration and evaluation costs: | | | | |

| Committee Bay and Gibson MacQuoid | $ 86 | $ 107 | $ 167 | $ 283 |

| Homestake | 30 | 18 | 53 | 44 |

| Peru | 103 | 71 | 129 | 98 |

| Fees, salaries and other employee benefits | 99 | 139 | 191 | 303 |

| Insurance | - | - | - | 1 |

| Legal and professional fees | - | 6 | - | 6 |

| Marketing and investor relations | 22 | 18 | 40 | 18 |

| Office and administration | 105 | 96 | 199 | 171 |

| Project investigation costs | 11 | - | 15 | 6 |

| Total transactions for the periods | 456 | 455 | $ 794 | $ 930 |

1.

Universal Mineral Services Ltd., (“UMS”) is a private company with certain directors and officers in common. Pursuant to an agreement dated March 30, 2012 and as amended on December 30, 2015, UMS provides geological, financial and transactional advisory services as well as administrative services to the Company on an ongoing, cost recovery basis. Having these services available through UMS, on an as needed basis, allows the Company to maintain a more efficient and cost-effective corporate overhead structure by hiring fewer full time employees and engaging outside professional advisory firms less frequently.

The outstanding balance owing at June 30, 2019 was $258 (December 31, 2018 – $262). In addition, the Company had $150 on deposit with UMS as at June 30, 2019 (December 31, 2018 - $150).

See sections 1.2.3 and 1.6/1.7

1.11

Proposed transactions

None

1.12

Critical accounting estimates

The preparation of the financial statements in conformity with IFRS requires management to select accounting policies and make estimates and judgments that may have a significant impact on the consolidated financial statements. Estimates are continuously evaluated and are based on management’s experience and expectations of future events that are believed to be reasonable under the circumstances.

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the six months ended June 30, 2019

(In thousands of Canadian dollars, unless otherwise noted)

1.12

Critical accounting estimates (continued)

Key sources of estimation uncertainty that have a significant risk of causing a material adjustment to the carrying amounts of assets and liabilities are:

Provisions recognized in the financial statements involve judgments on the occurrence of future events, which could result in a material outlay for the Company. In determining whether an outlay will be material, the Company considers the expected future cash flows based on facts, historical experience and probabilities associated with such future events. Uncertainties exist with respect to estimates made by management and as a result, the actual expenditure may differ from amounts currently reported.

The Company does not have any provisions recorded as at June 30, 2019 and December 31, 2018, other than that related to the reclamation obligations which are discussed below.

ii.

Reclamation obligations

Management assesses its reclamation obligations annually and when circumstances suggest that a material change to the obligations have occurred. Significant estimates and assumptions are made in determining the provision for rehabilitation and site restoration, as there are numerous factors that will affect the ultimate liability payable. These factors include estimates of the extent, the timing and the cost of reclamation activities, regulatory change, cost increases, and changes in discount rates. Those uncertainties may result in actual expenditure differing from the amounts currently provided. The provision at the reporting date represents management’s best estimate of the present value of the future reclamation costs required. Changes to estimated future costs are recognized in the statement of financial position by adjusting the reclamation asset and liability.

iii.

Share-based compensation

The Company determines the fair value of stock options granted using the Black‐Scholes option pricing model. This option pricing model requires the development of market-based subjective inputs, including the risk-free interest rate, expected price volatility and expected life of the option. Changes in these inputs and the underlying assumption used to develop them can materially affect the fair value estimate.

The fair value of the share-based options granted during the three and six months ended June 30, 2019 were estimated using the Black-Scholes option valuation model with the following weighted average assumptions:

| | Three months ended June 30, | Six months ended June 30, |

| | 2019 | 2018 | 2019 | 2018 |

| Risk-free interest rate | 1.59% | 1.97% | 1.61% | 1.97% |

| Expected dividend yield | Nil | Nil | Nil | Nil |

| Share price volatility | 62% | 67% | 63% | 67% |

| Expected forfeiture rate | 0% | 0% | 0% | 0% |

| Expected life in years | 4.33 | 4.36 | 4.34 | 4.36 |

iv.

Deferred tax assets and liabilities