(An exploration stage company)

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF AURYN RESOURCES INC.

FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2019

Dated: November 12, 2019

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the nine months ended September 30, 2019

(In thousands of Canadian dollars, unless otherwise noted)

TABLE OF CONTENTS

| PAGE |

HIGHLIGHTS FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2019 AND THE PERIOD UP TO NOVEMBER 12, 2019 | 3 |

| 1.1 | Date and forward-looking statements | 5 |

| 1.1.1 | Forward-looking statements and risk factors | 5 |

| 1.2.1 | Description of business | 6 |

| 1.2.2 | Peruvian projects | 7 |

| Sombrero | | 7 |

| Curibaya | | 13 |

| Huilacollo | | 15 |

| Baños del Indio | | 15 |

| 1.2.3 | Committee Bay and Gibson MacQuoid projects | 16 |

| Committee Bay |

| 16 |

| Gibson MacQuoid |

| 16 |

| 1.2.4 | Homestake Ridge project | 19 |

| 1.2.5 | Qualified persons and technical disclosures | 20 |

| 1.3 | Selected annual financial information | 22 |

| 1.4 | Discussion of operations | 23 |

| 1.5 | Summary of quarterly results | 25 |

1.6/1.7

| Financial position and liquidity and capital resources | 26 |

| 1.8 | Off-balance sheet arrangements | 31 |

| 1.9 | Transactions with related parties | 32 |

| 1.1 | Subsequent events | 32 |

| 1.11 | Proposed transactions | 32 |

| 1.12 | Critical accounting estimates | 32 |

| 1.13 | Changes in accounting policies including initial adoption | 34 |

| 1.14 | Financial instruments and other instruments | 34 |

| 1.15 | Other requirements | 35 |

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the nine months ended September 30, 2019

(In thousands of Canadian dollars, unless otherwise noted)

HIGHLIGHTS FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2019 AND THE PERIOD UP TO NOVEMBER 12, 2019

Corporate highlights

●

On September 12, 2019, Auryn Resources Inc. (the “Company” or “Auryn”) closed a secured bridge loan facility (the “Bridge Loan”) for up to $6,000, of which $3,000 was drawn. The funds will be used for general working capital.

●

On July 11, 2019, the Company closed a non-brokered flow-through private placement of 633,334 flow-through common shares (the “2019 FT Shares”) at a price of CAD$3.00 per 2019 FT Share for gross proceeds of $1,900 (the “July 2019 Offering”). The purpose of the July 2019 Offering was to fund the Company’s 2019 exploration program at its Committee Bay project.

●

On March 27, 2019, Auryn completed a non-brokered private placement for gross proceeds of $5,255. The placement consisted of 3,284,375 common shares (the “Shares”) priced at CAD$1.60 per Share (the “March 2019 Offering”).

●

On March 26, 2019, the Company announced the appointment of Stacy Rowa as Chief Financial Officer, effective April 1, 2019, upon the resignation of Peter Rees as Chief Financial Officer and Corporate Secretary to pursue a new opportunity.

●

On February 15, 2019 the Company announced that Jeffrey Mason, CPA, CA, was appointed to its Board of Directors. Mr. Mason is a corporate and financial professional with over 25 years of experience serving public companies in the mining and mineral exploration industry.

Operational highlights

●

On October 28, 2019 the Company announced results from its first rock sampling program at the Curibaya project in southern Peru since acquiring the Sambalay and Salvador concessions in August 2019 (see press release dated August 7, 2019). Highlights included more than 20 samples above 200 g/t silver, with multiple samples exceeding 1,500 g/t silver, and up to 7.67 g/t gold. The Company plans to advance the project further through additional sampling, geophysical surveys and mapping.

●

On October 25, 2019, the Company announced results from its 2019 Committee Bay drill program which consisted of 2,700 meters of diamond drilling. In addition to drilling a new gold-bearing hydrothermal system, the Company’s technical team advanced its understanding of geophysical responses associated with high-grade mineralization which will be a key proponent for the targeting process in future programs.

●

On October 17, 2019, Auryn announced that it has expanded its land position in southern Peru by staking 8,500 additional hectares adjacent to its Milpoc target in the Sombrero North project area. The newly acquired Macha Machay claims were part of the 7,000 square kilometer area screened by Auryn during a regional exploration program and contain the highest copper values in stream sediments sampled by Auryn to date.

●

On September 30, 2019, the Company announced results from a rock sampling program within the southern portion of the Sombrero district in southern Peru. Highlights from the rock sampling program include silver values of 981 g/t, 72.1 g/t, 64.4 g/t, 40.6 g/t, 26.6 g/t and 20.5 g/t. This was the Company’s first exploration program at the Ccello project, defined by a 2-kilometer-by-1.5-kilometer high sulphidation alteration system, and consisted of mapping and sampling to follow up on anomalous stream sediment samples.

●

On August 7, 2019, Auryn announced that it had acquired a 100% interest in the Sambalay and Salvador concessions which are adjacent to its wholly owned Curibaya property in southern Peru for US $250,000 and subject to certain NSR royalties as discussed further below.

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the nine months ended September 30, 2019

(In thousands of Canadian dollars, unless otherwise noted)

Operational highlights (continued)

●

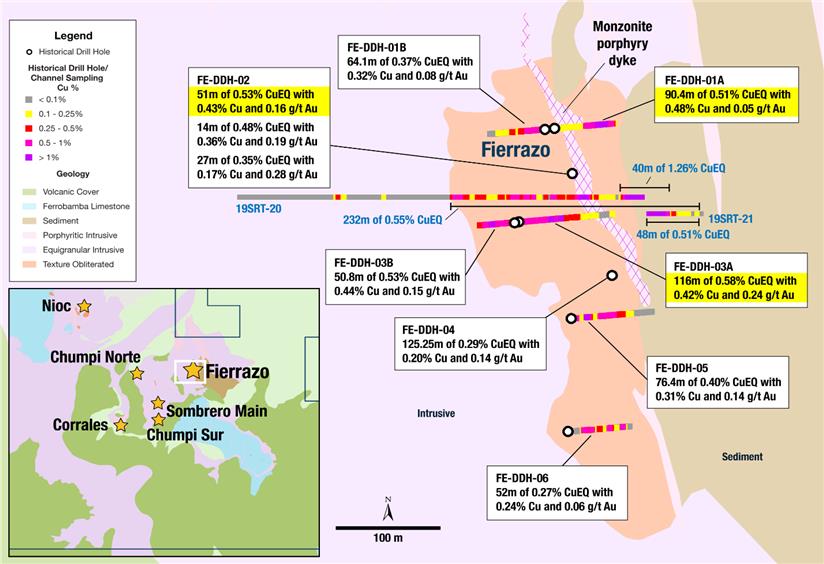

On June 13, 2019 the Company announced results from 8 historical drill holes, totalling 998 meters of drilling, from the Fierrazo target at its Sombrero project. Highlights included 116 meters of 0.58% CuEq1 (0.42% Cu and 0.24 g/t Au), 90.4 meters of 0.51% CuEq (0.48% Cu and 0.05 g/t Au) and 51 meters of 0.53% CuEq (0.43% Cu and 0.16 g/t Au). The historical drill holes had been drilled in 2013 by Corporacion Aceros Arequipa S.A. (“Aceros”) targeting iron skarn mineralization. The results confirmed the copper-gold sulphide mineralization extends to depth underneath the area where surface channel sampling was conducted earlier in 2019 (see below for summary of press releases dated March 12 and April 3, 2019).

●

On June 4, 2019, Auryn announced that two new regional targets had been identified at its Homestake Ridge gold project in the Golden Triangle in BC, Canada, following a full review of the historical datasets, geological mapping, stream sediment and rock chip sampling. The 2019 exploration program, which was completed during Q3 2019, included additional geological and geophysical work around these newly defined targets. The results from the 2019 surface program are still pending as of the date of this MD&A.

●

Effective May 20, 2019, the Company declared force majeure under its Mollecruz option agreement in one of the areas at its Sombrero project where it has not yet commenced work and thus does not affect the ongoing permitting process in other communities. The Company, to date, has been unable to obtain a community agreement allowing access to the concession to commence its work program. The Company continues to negotiate in good faith with the community to resolve this matter.

●

On April 3 and March 12, 2019 the Company released results from its initial surface program at the Fierrazo area within the Sombrero project. Highlights from the continuous channel sampling at the Fierrazo target include a combined width of mineralization of 232 meters of 0.55% copper equivalent (0.47% copper and 0.13 g/t gold) with a higher-grade internal interval of 40 meters of 1.26% copper equivalent (1.23% copper and 0.05 g/t gold). The sampling helped further validate the potential 7.5 kilometers of strike length of high-grade exoskarn targets at the Sombrero Main area, which will be the focus of Auryn’s first drill program at the project.

●

On February 19, 2019 the Company announced the results of applying machine learning to its geological datasets to aid in the targeting process at its Committee Bay project. Highlights included the generation of 12 new targets and the identification of an additional parallel shear zone located to the north of the Aiviq structure.

●

On January 7, 2019 the Company announced the identification of significant copper mineralization at Milpoc. Select grab sample results ranged from 0.1 – 8.45% copper and 0.06 – 101 g/t silver.

< Refer to the page 5 for cautionary wording concerning forward-looking information>

1 Metal price used for 2019 copper and gold equivalent (CuEq and AuEq) calculations: Au $1300/oz and Cu $3.00/lb, no adjustments for metallurgical recoveries have been made. AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the nine months ended September 30, 2019

(In thousands of Canadian dollars, unless otherwise noted)

1.1 Date and forward-looking statements

This Management Discussion and Analysis (“MD&A”) of Auryn has been prepared by management to assist the reader to assess material changes in the condensed consolidated interim financial condition and results of operations of the Company as at September 30, 2019 and for the nine months then ended. This MD&A should be read in conjunction with the condensed consolidated interim financial statements of the Company and related notes thereto as at and for the three and nine months ended September 30, 2019 and 2018. The condensed consolidated interim financial statements have been prepared in accordance with International Accounting Standard (“IAS”) 34, “Interim Financial Reporting” using accounting policies consistent with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”) and Interpretations issued by the International Financial Reporting Interpretations Committee (“IFRIC”). The accounting policies followed in these condensed consolidated interim financial statements are the same as those applied in the Company’s most recent audited annual consolidated financial statements for the year ended December 31, 2018, except as outlined in note 2 of the September 30, 2019 condensed consolidated interim financial statements. All financial information has been prepared in accordance with International Financial Reporting Standards (“IFRS” or “GAAP”) and all dollar amounts presented are Canadian dollars unless otherwise stated.

The effective date of this MD&A is November 12, 2019.

Forward-looking statements and risk factors

This MD&A may contain “forward-looking statements” which reflect the Company’s current expectations regarding the future results of operations, performance and achievements of the Company, including but not limited to statements with respect to the Company’s plans or future financial or operating performance, the estimation of mineral reserves and resources, conclusions of economic assessments of projects, the timing and amount of estimated future production, costs of future production, future capital expenditures, costs and timing of the development of deposits, success of exploration activities, permitting time lines, requirements for additional capital, sources and timing of additional financing, realization of unused tax benefits and future outcome of legal and tax matters.

The Company has tried, wherever possible, to identify these forward-looking statements by, among other things, using words such as “anticipate”, “believe”, “estimate”, “expect”, “budget”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved”.

The statements reflect the current beliefs of the management of the Company and are based on currently available information. Accordingly, these statements are subject to known and unknown risks, uncertainties and other factors, which could cause the actual results, performance, or achievements of the Company to differ materially from those expressed in, or implied by, these statements. These uncertainties are factors that include but are not limited to risks related to international operations; risks related to general economic conditions; actual results of current exploration activities and unanticipated reclamation expenses; fluctuations in prices of gold and other commodities; fluctuations in foreign currency exchange rates; increases in market prices of mining consumables; possible variations in mineral resources, grade or recovery rates; accidents, labour disputes, title disputes, claims and limitations on insurance coverage and other risks of the mining industry; delays in obtaining governmental approvals or financing or in the completion of development or construction activities; changes in national and local government regulation of mining operations, tax rules and regulations, and political and economic developments in countries in which the Company operates; as well as other factors. Additional information relating to the Company and its operations is available on SEDAR at www.sedar.com and on the Company’s web site at www.aurynresources.com.

The Company’s management periodically reviews information reflected in forward-looking statements. The Company has and continues to disclose in its MD&A and other publicly filed documents, changes to material factors or assumptions underlying the forward-looking statements and to the validity of the statements themselves, in the period the changes occur. Historical results of operations and trends that may be inferred from the following discussions and analysis may not necessarily indicate future results from operations.

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the nine months ended September 30, 2019

(In thousands of Canadian dollars, unless otherwise noted)

1.1.1

Forward-looking statements and risk factors (continued)

The operations of the Company are speculative due to the high-risk nature of its business which is the exploration of mining properties. For a comprehensive list of the risks and uncertainties facing the Company, please see “Risk Factors” in the Company’s most recent annual information form. These are not the only risks and uncertainties that Auryn faces. Additional risks and uncertainties not presently known to the Company or that the Company currently considers immaterial may also impair its business operations. These risk factors could materially affect the Company's future operating results and could cause actual events to differ materially from those described in forward-looking statements relating to the Company. Readers should refer to the risks discussed in the Company’s Annual Information Form and MD&A for the year ended December 31, 2018 and subsequent continuous disclosure filings with the Canadian Securities Administrators available at www.sedar.com and the Company’s registration statement on Form 40-F filed with the United States Securities and Exchange Commission and available at www.sec.gov. These documents are for information purposes only and not incorporated by reference in this MD&A.

Auryn Resources is a technically-driven, junior exploration company focused on finding and advancing globally significant precious and base metal deposits. The Company has a portfolio approach to asset acquisition and has seven projects, including two flagships: the Committee Bay high-grade gold project in Nunavut, Canada and the Sombrero copper-gold project in southern Peru.

Auryn’s technical and management teams have an impressive track record of successfully monetizing assets for all stakeholders and local communities in which it operates. Auryn conducts itself to the highest standards of corporate governance and social responsibility.

The Company was incorporated under the British Columbia Business Corporations Act on June 9, 2008 under the name Georgetown Capital Corp. Subsequently on October 15, 2013, the Company changed its name to Auryn Resources Inc. and is a reporting issuer in the provinces of British Columbia, Ontario and Alberta. The Company is listed on the Toronto Stock Exchange under the symbol AUG and effective July 17, 2017, the Company’s common shares commenced trading on the NYSE American under the US symbol AUG.

The Company’s principal business activities include the acquisition, exploration and development of resource properties. The head office and principal address of the Company are located at 1199 West Hastings Street, Suite 600, Vancouver, British Columbia, V6E 3T5.

Effective April 1, 2019, Mr. Rees resigned as Chief Financial Officer to pursue a new opportunity and the Company appointed Ms. Rowa. Ms. Rowa is a Canadian CPA, CA who has worked with Canadian and US publicly listed resource companies for the past 10 years, including the last 3 years with Auryn.

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the nine months ended September 30, 2019

(In thousands of Canadian dollars, unless otherwise noted)

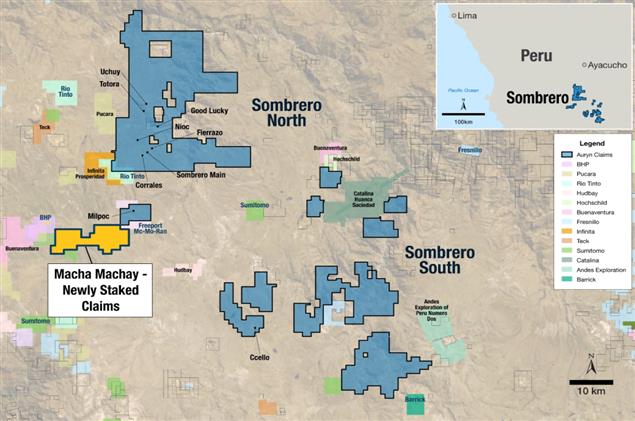

Figure 1 - Illustrates the Sombrero North and Sombrero South project areas within the north-western extension of the Andahuaylas-Yauri Belt of southern Peru

The Sombrero Project lies within the north-western extension of the Andahuaylas-Yauri Belt of southern Peru, an emerging and increasingly important porphyry copper and skarn belt. The belt strikes NW-SE and can be traced for more than 300 kilometers of strike length hosting important copper-gold-molybdenum deposits at Las Bambas, Haquira, Los Chancas, Cotambambas, Antapacay, Tintaya and Constancia, and is thought to be a northern extension of the copper-rich belt of the same Eocene-Oligocene age that strikes broadly N-S in Chile.

The current project consists of approximately 130,000 hectares of mineral claims covering a number of coincident gold and copper geochemical anomalies. Figure 1 above illustrates the Sombrero project area, which consists of the Sombrero North and Sombrero South areas. The main project area, where the Company has focused the majority of its exploration work, has been Sombrero North which is comprised of 75,036.7 net hectares; while the Sombrero South concession blocks lie within approximately 80km south and east of this main project area. The land package was assembled through three separate option agreements, detailed below, and a series of staking campaigns, with the Company most recently adding 8,500 hectares to the Sombrero North area in September 2019 (Figure 1) (see full press release dated October 17, 2019).

The Company currently has a surface rights agreement in place with the local community which covers the Sombrero Main target area and is actively working towards securing agreements with other local communities in order to expand its access over other parts of the project area.

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the nine months ended September 30, 2019

(In thousands of Canadian dollars, unless otherwise noted)

1.2.2

Peruvian projects (continued)

Sombrero (continued)

Alturas Option

On June 28, 2016, the Company entered into an option with Alturas Minerals Corp. whereby Auryn was granted the option to earn up to a 100% interest in the central area of the project referred to as Sombrero Main. Under the terms of this option, the Company may earn a 100% interest in the 6 mineral claims by making option payments of US$0.2 million, completing US$2.1 million in work expenditures within a five-year period and by making a final payment of US$5.0 million. As at September 30, 2019, the Company has satisfied the option payment requirements of the agreement and has incurred approximately US$1.7 million in exploration work on the project.

Mollecruz Option

On June 22, 2018, the Company acquired the rights to the Mollecruz concessions located just to the north of Sombrero Main, which is host to the Good Lucky prospect. Under the terms of the Mollecruz Option, the Company may acquire a 100% interest in the concessions by completing US$3.0 million in work expenditures and by making payments totaling US$1.6 million to the underlying owner over a five-year period. At signing, Auryn paid US$50,000 and upon exercise of the option, the underlying owner will retain 0.5% NSR royalty with an advance annual royalty payment of US$50,000.

Effective May 20, 2019, the Company formally declared the existence of a force majeure event under the Mollecruz Option as the Company has been unable to reach an access agreement with the local community in order to commence work in the region. The declaration of force majeure has deferred the Company’s obligation to make the June 22, 2019 property payment and any subsequent property payments and work expenditures for a maximum of 24 months from the declaration date. The Company has continued to have active and open communications with the community in an effort to better inform community members about work plans and address those concerns that may be hindering the Company from obtaining access in this particular area.

Aceros Option

On December 13, 2018, the Company entered into a series of agreements with Corporacion Aceros Arequipa S.A. (“Aceros”) to acquire the rights to three key inlier mineral concessions, which include Fierrazo and Nioc. If the Aceros Option is fully exercised, a joint venture would be formed in which the Company would hold an 80% interest (Aceros – 20%). The joint venture would combine the 530 hectare Aceros concessions plus 4,600 hectares of Auryn’s Sombrero land position. The Company is required to make a series of option payments totalling US$800,000, which includes the US$140,000 paid upon signing, as well as completing US$5.15 million in work expenditures over a five-year period, of which US$0.3 million has been spent to date.

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the nine months ended September 30, 2019

(In thousands of Canadian dollars, unless otherwise noted)

1.2.2

Peruvian projects (continued)

Sombrero (continued)

2019 Exploration

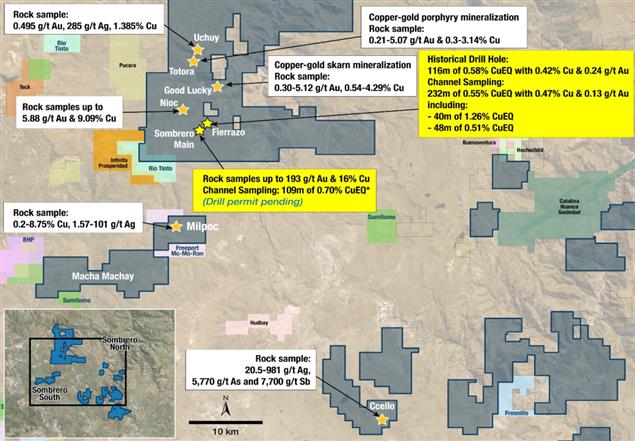

Figure 2 - Illustrates the primary Sombrero project area and the various Copper-Gold Skarn, Porphyry & Epithermal Targets

Since obtaining community access in early 2018, the Company has aggressively conducted surface geochemical and geophysical surveys across the southern portions of Sombrero Main in anticipation of an initial drill campaign. Work conducted to date in this area included 3,814 m of continuous channel samples, 913 rock samples, 261 soil samples and 13,156 XRF samples as well as 87 line-km of IP and 282 line-km of Mag. The results of this work have further indicated that Sombrero is host to a significant copper-gold system which contains porphyry, epithermal and skarn type mineralization. Auryn geologists completed grade control mapping throughout the Sombrero Main area with the goal of characterizing the controls on mineralization throughout the project area. The interpretation of this work is ongoing and constantly evolving.

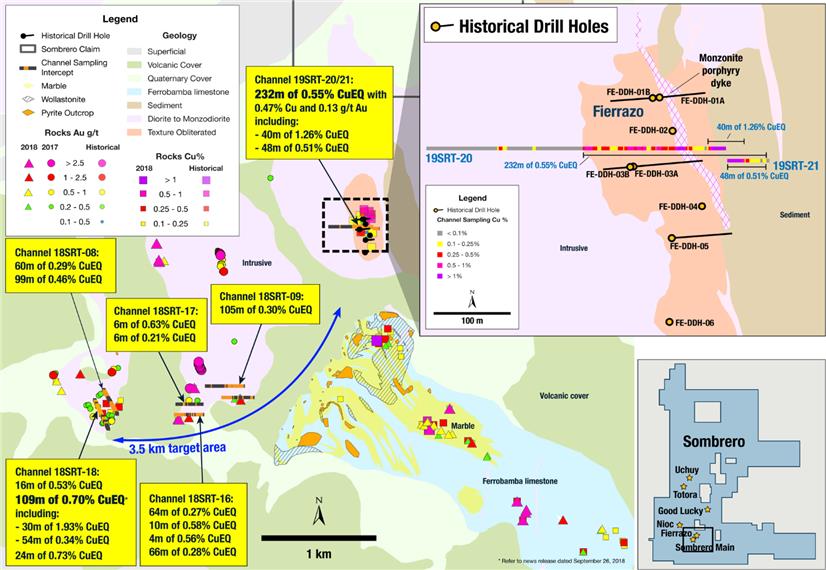

In Q1 2019, the surface work was expanded into the newly acquired Fierrazo area and included channel sampling which resulted in the extension of the mineralization to a potential 7.5 km target area over the Sombrero Main and Fierrazo areas. The identified contact zone between the Ferrobamba limestone and the Cascabamba intrusive body hosting high-grade copper and gold mineralization will continue to be the primary area of focus. Highlights from the continuous channel sampling at the Fierrazo target include a combined width of mineralization of 232 meters of 0.55% copper equivalent (0.47% copper and 0.13 g/t gold) with a higher-grade internal interval of 40 meters of 1.26% copper equivalent (1.23% copper and 0.05 g/t gold) (Figure 4) (full results can be found in the Company’s press releases dated March 12 and April 3, 2019).

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the nine months ended September 30, 2019

(In thousands of Canadian dollars, unless otherwise noted)

1.2.2

Peruvian projects (continued)

Sombrero (continued)

The Company has also had the opportunity to make use of past workings by Aceros including collecting 37 representative grab samples from the waste dumps and ore stockpiles left at the formerly producing Fierrazo iron mine. The results of the samples indicate copper and gold mineralization within the hematite-magnetite exoskarn mineralization. The average values of the samples were 0.91% Cu and 0.36 g/t Au. Complete results of this sampling can be found in the Company’s April 3, 2019 news release.

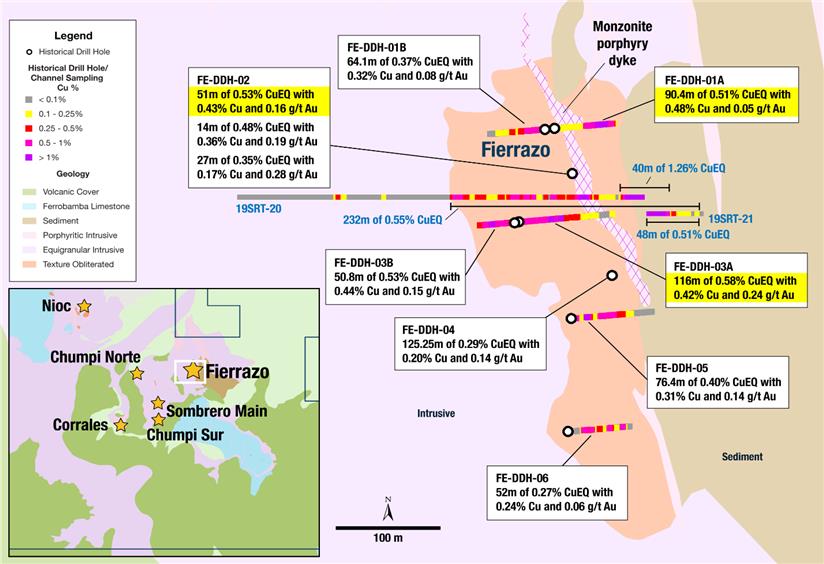

As announced April 29, 2019 the Company gained access to 988 meters of historical drill core from drilling conducted by Aceros (Figures 3 and 4). The previous sampling of the core by Aceros was considered incomplete as only partial sections were sampled targeting iron skarn mineralization. Additionally, historic analytical results did not include analysis for gold. On June 13, 2019 Auryn released the results of its sampling of the core. Highlights included 116 meters of 0.58% CuEq (0.42% Cu and 0.24 g/t Au), 90.4 meters of 0.51% CuEq (0.48% Cu and 0.05 g/t Au) and 51 meters of 0.53% CuEq (0.43% Cu and 0.16 g/t Au) (Figure 3). These results confirmed that the copper-gold sulfide mineralization extends to depth below where the Company had completed its channel sampling as discussed above (Figure 4). Collectively, the historical drill holes define a mineralized body totaling 300 meters of strike length with an average width of approximately 150 – 200 meters that is open both to the north and to the south.

Figure 3 - Illustrates the drill intercepts from the historical core at the Fierrazo exoskarn target.

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the nine months ended September 30, 2019

(In thousands of Canadian dollars, unless otherwise noted)

1.2.2

Peruvian projects (continued)

Sombrero (continued)

Figure 4 - illustrates the location of the 8 historical drill holes at the Fierrazo target in relation to the surface work Auryn has completed to date.

The Company’s initial permit application for drilling at Sombrero Main was submitted on June 5, 2019 and the Company is currently working through the various phases of the drill permit process, most recently having received approval of the archeological portion from the government in Ayacucho.

While the Company’s primary focus has been advancing the Sombrero Main target to a drill ready state, it has continued to conduct exploration work across its full land package to identify other areas of interest. The Good Lucky and Nioc target areas, which are situated adjacent to and show the similar geological and geophysical signatures as Sombrero Main, are additional prospects which have produced strong results and warrant significant geological follow-up. The Good Lucky prospect, contained within the Mollecruz concessions, represents an outcropping copper-gold skarn system exposed over 600 meters where sampling has returned up to 5.12 g/t Au and 4.29% Cu. Rock samples from Nioc, contained within the Aceros option, have returned assays of up to 5.88 g/t Au and 9.09% Cu. The Company plans to expand its surface program into the Good Lucky and Nioc target areas once community agreements are obtained and the Company thereby gains access to the land.

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the nine months ended September 30, 2019

(In thousands of Canadian dollars, unless otherwise noted)

1.2.2

Peruvian projects (continued)

Sombrero (continued)

In the meantime, surface work programs such as rock sampling, BLEG surveys and BLEG follow up continue to screen the overall land package in order to highlight additional mineralized centers. The Company recently conducted a first-pass reconnaissance at the Ccello project in Sombrero South, which consisted of mapping and rock sampling to follow up on anomalous stream sediment samples from previously completed screening efforts. The program, which yielded silver values of up to 981 g/t (see full press release dated September 30, 2019), identified a previously unrecognized 2 x 1.5 km high sulphidation alteration system.

As announced in a press release dated October 17, 2019, the Company has also staked the Macha Machay claims as a result of its previously completed regional exploration program. The new claims, which contained the highest copper values in stream sediments observed through the regional program, are located adjacent to the Company’s Milpoc target and are within the land area where the Company has an existing community agreement.

See the press releases dated June 19, September 5, September 26, October 15, November 26, 2018 and January 7, March 12, April 3, September 30, and October 17, 2019 for complete results from the Company’s geophysical and geochemical surface programs at Sombrero.

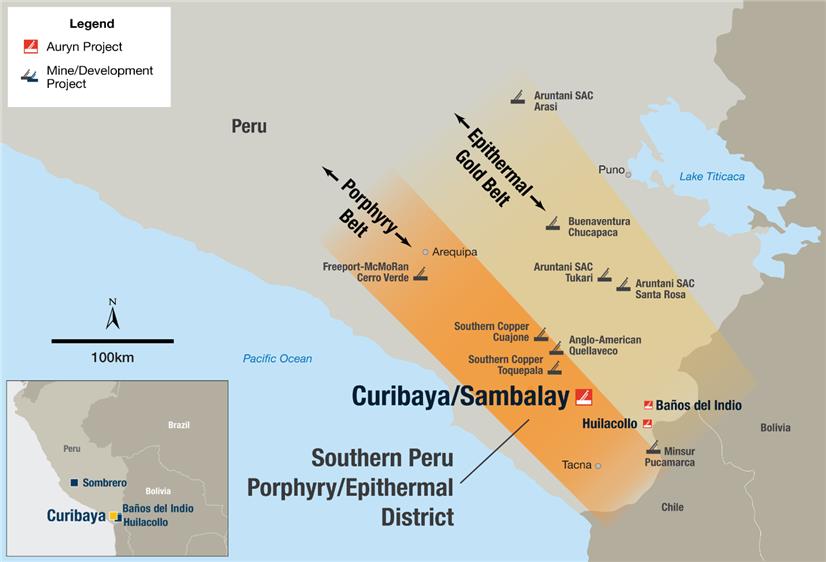

Figure 5: Illustrates the position of the Curibaya Project with respect to the large copper porphyry mines in Southern Peru.

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the nine months ended September 30, 2019

(In thousands of Canadian dollars, unless otherwise noted)

1.2.2

Peruvian projects (continued)

Curibaya (continued)

On August 2, 2019, the Company acquired the rights to the Sambalay and Salvador mineral concessions adjacent to the wholly owned Curibaya porphyry property in southern Peru, which was acquired by the Company in 2016. Under the terms of the mining concession transfer agreement with Wild Acre Metals (Peru) S.A.C., the Company paid US$250,000 on transfer of the concessions in favour of Corisur. The Sambalay concessions are subject to a combined 3% NSR royalty, 0.5% of which is buyable for US$1.0 million. The Salvador concessions are subject to a 2% NSR royalty and a US$2.0 million production payment, payable at the time a production decision is made, and to secure payment of such consideration a legal mortgage is recorded in the registry files of the Salvador concessions.

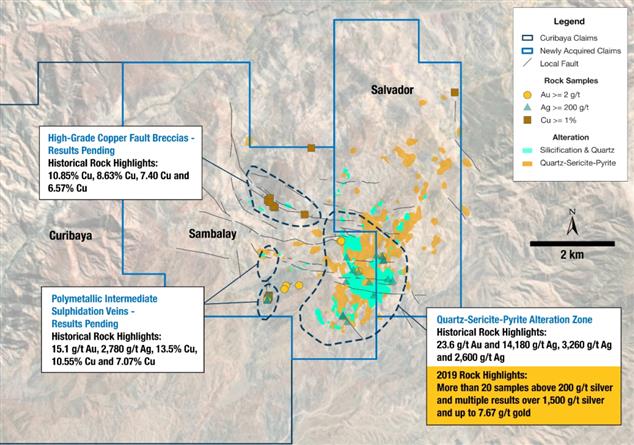

The Sambalay and Salvador concessions together represent a 2-kilometre by 3.3-km mineralized alteration system that shows affinities to both high-grade copper porphyry and precious metal intermediate sulphidation systems (Figure 5). Historical high-grade sampling includes up to 13.50% copper, 23.6 g/t gold and 14,180 g/t silver (Figure 6), however despite these results, Auryn is unaware of any historical systematic exploration or drilling on the properties.

Collectively, the Curibaya project now covers approximately 11,000 hectares and is located 53 km from the provincial capital, Tacna, and is accessible by road in 2.5 hours. It is also 11 km south of the Incapuquio regional fault, which is viewed as a major control on the emplacement of mineralized porphyries in the region. The concessions are not within the 50km border zone that would require the Peruvian government to approve the acquisition by Auryn, as a non-Peruvian company.

Figure 6: Illustrates the locations of the historical and 2019 surface rock samples taken from the Sambalay and Salvador concessions

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the nine months ended September 30, 2019

(In thousands of Canadian dollars, unless otherwise noted)

1.2.2

Peruvian projects (continued)

Curibaya (continued)

Curibaya Exploration

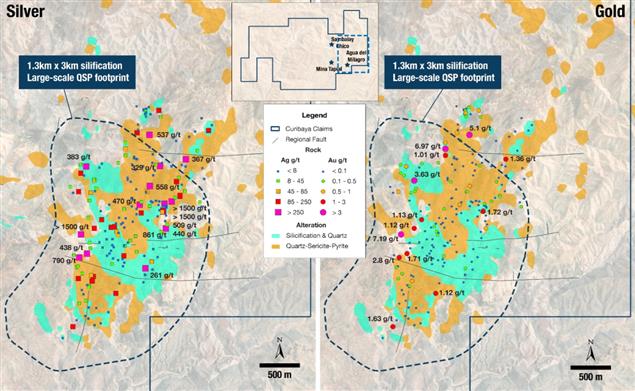

Since acquiring the Sambalay and Salvador concessions in August 2019, the Company has completed a first-pass reconnaissance rock sampling program which sampled high-grade mineralization throughout a 1.5 km by 3 km quartz – sericite – pyrite alteration system. In total, 378 rock samples and 9 stream sediment samples were taken during the program with the aim of better understanding the spatial distribution of high-grade mineralization throughout the alteration system as well as confirming results from historical rock samples. Highlights from the 2019 assay results included more than 20 samples above 200 g/t silver, of which multiple samples exceeded 1,500 g/t silver, and up to 7.67 g/t gold (Figure 7). Additional rock sampling results are still pending as at the date of this MD&A.

In the coming months, the Company plans to follow up this initial work with geological mapping, additional rock sampling and geophysical surveys in order to refine both the precious metal intermediate sulphidation and copper porphyry targets.

Figure 7: Illustrates the highlights from the 2019 rock sampling program.

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the nine months ended September 30, 2019

(In thousands of Canadian dollars, unless otherwise noted)

1.2.2

Peruvian projects (continued)

The Huilacollo property, located in the Tacna province of southern Peru, comprises 2,000 hectares of intense hydrothermal alteration over a 4 by 6 km area that is consistent with epithermal Au/Ag mineralization. Historic drilling has resulted in the identification of a continuously mineralized gold/silver zone open in all directions. Contained within this area, there appears to be higher grade mineralization focused along well-defined feeder structures as highlighted by trench intercepts up to 38m at 6.7 g/t Au and drill holes including 34m @ 2.14 g/t. The Company acquired the rights to Huilacollo through an option agreement with a local Peruvian company, Inversiones Sol S.A.C., under which the Company may acquire a 100% interest, subject to an NSR, through a combination of work expenditures and cash payments totaling US$7.0 million and US$8.75 million respectively. As of May 11, 2019, the Company had spent US$4.5 million at the Huilacollo project and did not satisfy the accumulated work expenditure requirement of US$5.0 million at that date. Under the terms of the Huilacollo option, the Company elected instead to make a cash payment of US$258,000 equal to 50% of the shortfall at the due date to keep the option in good standing.

Huilacollo Exploration

During 2017 and 2018 the Company completed its initial drill program, consisting of five holes, at its Huilacollo project. Drilling successfully expanded mineralization to the northwest by 100 meters with drill hole 17-HUI-002 intersecting 62 meters of 0.45 g/t Au (including 22 meters of 0.71g/t Au) oxide mineralization from surface and drill hole 17-HUI-004 intersecting 22 meters of 0.2 g/t Au 100 meters to the southwest from hole 17-HUI-002. Additional drilling would target further extensions of mineralization as well as surface mineralization discovered at the Tacora prospect. The Company is currently determining its future exploration programs for Huilacollo.

The Baños del Indio property is comprised of 5,000 hectares of well-developed high-level steam heated epithermal style alteration and is considered by Auryn to be one of the largest untested epithermal alteration centers in Peru. Baños del Indio is held through an option where the Company may acquire a 100% interest, subject to a 3.0% NSR, through a combination of work expenditures and cash payments.

Effective September 7, 2018, the Company declared the existence of a force majeure event under the Baños del Indio option thereby deferring the Company’s obligation to make the September 22, 2018 property payment and any subsequent property payments and work expenditures for a maximum of 24 months from the date of declaration. Despite the Company acting in good faith in its negotiations with the community, the Company, to date, has been unable to reach an access agreement in order to initiate its exploration program on the Baños properties.

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the nine months ended September 30, 2019

(In thousands of Canadian dollars, unless otherwise noted)

Committee Bay and Gibson MacQuoid projects

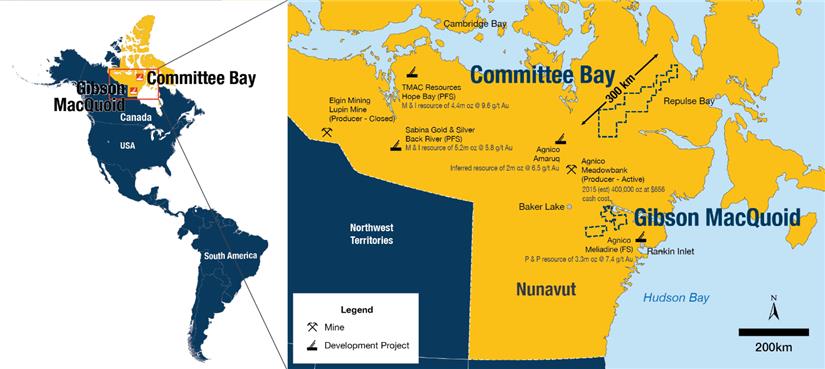

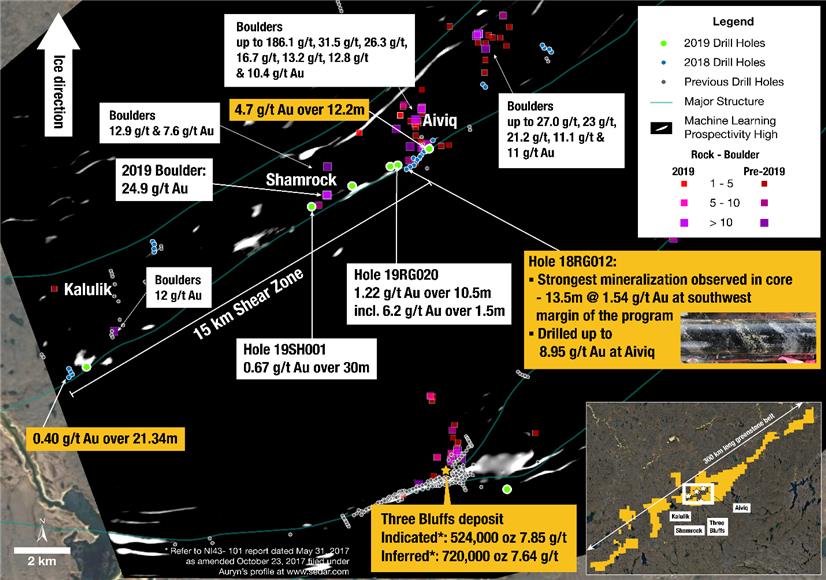

Figure 8 – regional map showing the locations of the Committee Bay and Gibson MacQuoid projects

The Committee Bay Project is comprised of approximately 300,000 hectares situated along the Committee Bay Greenstone Belt approximately 180 km northeast of the Meadowbank mine operated by Agnico Eagle Mines Limited.

The Committee Bay belt comprises one of a number of Archean aged greenstone belts occurring within the larger Western Churchill province of north-eastern Canada. The character and history of rock packages, and the timing and nature of mineralization occurring within the belt is considered to be equivalent to that of other significant gold bearing Archean greenstones within the Western Churchill Province, which hosts deposits such as Meadowbank, Meliadine and the newly discovered Amaruq.

Ownership

The Committee Bay project is held 100% by Auryn subject to a 1% Net Smelter Royalty (“NSR”) on the entire project, and an additional 1.5% NSR payable on only 7,596 hectares which is buyable within two years of the commencement of commercial production for $2,000 for each one-third (0.5%) of the NSR.

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the nine months ended September 30, 2019

(In thousands of Canadian dollars, unless otherwise noted)

1.2.3

Committee Bay and Gibson MacQuoid projects (continued)

Committee Bay Mineral resources

High-grade gold occurrences are found throughout the 300 km strike length of the Committee Bay project with the most advanced being the Three Bluffs deposit that contains the mineral resource as listed in the table below: *(refer to NI43-101 report dated May 31, 2017 as amended October 23, 2017 filed under Auryn’s profile at www.sedar.com).

| Class |

| | | | |

Indicated | Near SurfaceUnderground | 3.04.0 | 1,760,000310,000 | 7.728.57 | 437,00086,000 |

| | | | 2,070,000 | 7.85 | 524,000 |

Inferred | Near SurfaceUnderground | 3.04.0 | 590,0002,340,000 | 7.567.65 | 144,000576,000 |

| | | | 2,930,000 | 7.64 | 720,000 |

Table 1: Three Bluffs indicated and inferred resource. See section 1.2.6 for cautionary language concerning mineral resources.

The Three Bluffs deposit remains open along strike and at depth. Future programs will aim to significantly expand upon the current resource.

Committee Bay 2019 Exploration

Targeting and Machine Learning at Committee Bay

As a follow up to the results from the 2018 drill program, the Company engaged Computational Geosciences Inc to implement machine learning technologies to assist in the targeting of high-grade gold mineralization at the Committee Bay project. The machine learning targeting processed the vast amount of historic and modern surface geochemical, geological, geophysical and drill data across the project to derive non-biased correlations within the dataset. The machine learning results, as press released February 19, 2019, generated a total of twelve new targets which included two targets overlapping with Auryn’s geologist derived targets adjacent to the Aiviq and Kalulik discoveries.

2019 Exploration Program

During Q3 2019 the Company completed a 2,700 meter diamond drill program at Committee Bay which targeted a combination of both machine learning and traditional geologist generated targets. To aid in the 2019 targeting along the Aiviq-Shamrock corridor, a 27 line – kilometer induced polarization survey was conducted to identify both chargeability and conductivity targets.

In addition to drilling a new gold-bearing hydrothermal system along the regional fault zone that hosts the Aiviq and Kalulik systems, the program, through the use of geophysics, helped the Company advance its understanding of how to target high-grade mineralization. Going forward, conductivity and chargeability couplets, generated through the use of ground-based geophysical IP surveys and existing airborne geophysical data, will be used to produce future drill targets. These targets will be delineated in areas where high conductivity responses, high chargeability responses and gold-in-till anomalies coincide.

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the nine months ended September 30, 2019

(In thousands of Canadian dollars, unless otherwise noted)

1.2.3

Committee Bay and Gibson MacQuoid projects (continued)

The 2019 program also gave the Company the opportunity to test the machine learning platform. Three of the seven holes drilled were based on machine learning derived targets and the findings as well as additional data collected will be used as the Company continues to work with Computational Geosciences to refine the technology.

At the Shamrock target Auryn intersected 30 meters of 0.67 g/t gold, including 1.5 m of 5.03 g/t gold, which is characterized by quartz veining within gabbroic rocks (Figure 9). The Shamrock target is located 2.5 kilometers to the southwest of the Aiviq target where the Company drilled 10.5 meters of 1.22 g/t gold this summer (Figure 9).

Figure 9 - Illustrates the 15 kilometers of strike length where three gold bearing hydrothermal systems have been drilled at the Kalulik, Shamrock and Aiviq targets along the regional shear zone.

The Gibson MacQuoid project is an early stage gold exploration project situated between the Meliadine deposit and Meadowbank mine in Nunavut, Canada. The 19 prospecting permits and 57 mineral claims that make up the project encompass approximately 120 km of strike length of the prospective greenstone belt and total 375,000 hectares collectively.

The Gibson MacQuoid Greenstone belt is one of a number of Archean aged greenstone belts located in the Western Churchill province of north-eastern Canada. These gold bearing Archean greenstone belts host deposits such as the Meadowbank, Amaruq, and Meliadine deposits. In particular, the highly magnetic signature of the Gibson MacQuoid Belt is consistent with the other productive greenstone belts in the eastern Arctic that host large-scale gold deposits.

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the nine months ended September 30, 2019

(In thousands of Canadian dollars, unless otherwise noted)

1.2.3

Committee Bay and Gibson MacQuoid projects (continued)

Gibson MacQuoid 2019 Staking Program

In June 2019, the Company completed a small staking program in which 36 claims, totalling 42,640.7 hectares, were staked and have since been filed and approved. The staking of these claims, which overlap with the Company’s prospecting permits that expire in 2020, was completed in order to maintain a contiguous land package over the current areas of interest as identified in the previous years’ work programs.

The Homestake Ridge project is located in the Skeena mining division in north-western British Columbia and covers approximately 7,500 hectares. The project is host to a high-grade gold, silver, copper, lead resource which remains open at depth and along strike in several zones.

| | Tonnage | Gold | Gold | Silver | Silver | Copper | Copper |

| | (Mt) | (g/t) | (oz) | (g/t) | (Moz) | (%) | (Mlb) |

| Indicated | 0.624 | 6.25 | 125,000 | 47.9 | 1.0 | 0.18 | 2.4 |

| Inferred | 7.245 | 4.00 | 932,000 | 90.9 | 21.2 | 0.11 | 16.9 |

Table 2: Combined Main Homestake, Homestake Silver and South Reef Resources at a 2 g/t AuEq cut-offs. See section 1.2.6 for cautionary language concerning mineral resources and refer to technical report dated September 29, 2017 as amended October 23, 2017 filed under the Company’s SEDAR profile at www.sedar.com.

2019 Exploration

In July 2019, the Company completed a 558 ln-km Versatile Time Domain (VTEM) magnetic and electromagnetic survey flown by Geotech Airborne Geophysical Surveys. The survey was flown over two distinct blocks covering the newly identified Bria target area (see press release dated June 4, 2019) as well as the southern KN HSR 1 mineral claim. At this time the final survey data has not been received by Auryn.

The remainder of the 2019 exploration program at Homestake Ridge was focused on the newly identified mineralized zones outboard of the known resource area, namely Kombi and Bria. The work was guided by recently completed inversions of historical airborne geophysical data sets over the southern portion of the claims at Kombi as well as the VTEM data over the Bria target. Field work also comprised of detailed soil and rock chip sampling across Bria and Kombi. Results from the 2019 sampling program are still pending as of the date of this MD&A.

The 2019 exploration program fully utilized the BC flow-through funds that were remaining at the beginning of the year.

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the nine months ended September 30, 2019

(In thousands of Canadian dollars, unless otherwise noted)

Qualified persons and technical disclosures

Michael Henrichsen, P. Geo., Chief Operating Officer of Auryn, is the Qualified Person with respect to the technical disclosures in this MD&A.

Channel Sampling 2018/2019 (Sombrero, Peru)

Analytical samples were taken from each 1 meter (channels 18SRT-04 through 18SRT-09) or 2 meter (channels 18SRT-10 – 18SRT-20) interval of channel floor resulting in approximately 2-3kg of rock chips material per sample. Collected samples were sent to ALS Lab in Lima, Peru for preparation and analysis. All samples are assayed using 30g nominal weight fire assay with atomic absorption finish (Au-AA25) and multi-element four acid digest ICP-AES/ICP-MS method (ME-MS61). Where MS61 results were greater or near 10,000 ppm Cu, Zn or Pb the assays were repeated with ore grade four acid digest method (OG62). QA/QC programs for 2018/2019 channel grab samples using internal standard and blank samples; field and lab duplicates indicate good overall accuracy and precision.

Intervals were calculated using a minimum of a 0.1% Cu cut-off at beginning and end of the interval and allowing for no more than six consecutive meters of less than 0.1% Cu with a minimum length of the resulting composite of 5m. Copper and gold equivalent grades (CuEq and AuEq) were calculated for 2018 using gold price of US$1300/oz and copper price of US$3.28/lb and for 2019 using gold price of US$1300/oz and copper price of US$3.00/lb.

Historical Fierrazo Diamond Drill Hole (DDH) Re-Sampling 2019 (Sombrero)

Sample intervals averaged 2 meters where historical sample intervals taken and otherwise were 2 meters. Where at least half of HQ diameter core was present it was sawed into equal parts on site. Otherwise historical crush rejects were used in lieu of the core. In total 481 quarter core, 20 half core, and 10 crush rejects, approximately 3-5kg each, were sent to ALS Lab in Lima, Peru for preparation and analysis. All samples were assayed using 30g nominal weight fire assay with atomic absorption finish (Au-AA25) and multi-element four acid digest ICP-AES/ICP-MS method (ME-MS61). Where MS61 results were near or greater than 10,000 ppm Cu the assays were repeated with ore grade four acid digest method (OG62). QA/QC programs using internal standard samples, field and lab duplicates and blanks indicate good accuracy and precision in a large majority of standards assayed.

Intervals were calculated using a minimum of a 0.1% Cu cut-off at beginning and end of the interval and allowing for no more than six consecutive meters of less than 0.1% Cu with a minimum length of the resulting composite of 5 meters.

Rocks 2019 (Sombrero & Curibaya, Peru)

Approximately 2-3kg of material was collected for analysis and sent to ALS Lab in Lima, Peru for preparation and analysis. All samples are assayed using 30g nominal weight fire assay with ICP finish (Au-ICP21) and multi-element four acid digest ICP-AES/ICP-MS method (ME-MS61). Where ICP21 results were > 3 g/t Au the assay were repeated with 30g nominal weight fire assay with gravimetric finish (Au-GRA21). Where MS61 results were greater or near 10000 ppm Cu, 10000ppm Pb or 100ppm Ag the assay were repeated with ore grade four acid digest method (Cu-OG62). QA/QC programs for 2019 rock samples using company and lab duplicates, standards and blanks indicate good accuracy and precision in a large majority of standards assayed. These samples were collected in a non-representative manner. The mineralization may not be reflective of the underlying system.

For 3 samples at Curibaya where OG62 results were greater or near 1500ppm Ag the assay were requested to be repeated with 30g nominal weight fire assay with gravimetric finish (Ag-GRA21), results pending.

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the nine months ended September 30, 2019

(In thousands of Canadian dollars, unless otherwise noted)

1.2.5

Qualified persons and technical disclosures (continued)

Historical Grab Samples – Sambalay and Salvador

The historical grab samples on Sambalay and Salvador were collected by Teck (2010-2011), Compania de Exploraciones Orion SAC (2010-2011) and Wild Acre Metals (2012-2013). Auryn has not conducted any due diligence on whether appropriate QA/QC protocols were followed in the collection of these samples, nor can it confirm their accuracy or repeatability.

DDH 2019 (Committee Bay)

Intercepts were calculated using a minimum of a 0.25 g/t Au cut off at beginning and end of the intercept and allowing for no more than six consecutive meters of less than 0.25 g/t Au.

Analytical samples were taken by sawing NQ diameter core into equal halves on site and sending one of the halves to ALS Lab in Yellowknife, NWT for preparation and then to ALS Lab in Vancouver, BC for analysis. All samples are assayed using 50g nominal weight fire assay with atomic absorption finish (Au-AA26) and multi-element four acid digest ICP-AES/ICP-MS method (ME-MS61). QA/QC programs using internal standard samples, field and lab duplicates and blanks indicate good accuracy. Due to the nuggety nature of mineralization encountered, the Company will be running additional analysis on duplicate samples to better understand the analytical precision.

True widths of mineralization are unknown based on current geometric understanding of the mineralized intervals.

Grabs 2019 (Committee Bay)

Approximately 1-2kg of material was collected for analysis and sent to ALS Lab in Vancouver, BC for preparation and analysis. All samples are assayed using 50g nominal weight fire assay with atomic absorption finish (Au-AA26) and multi-element four acid digest ICP-AES/ICP-MS method (ME-MS61). QA/QC programs for rock grab samples using internal standard samples, lab duplicates, standards and blanks indicate good accuracy and precision in a large majority of standards assayed. Grab samples are selective in nature and cannot be considered as representative of the underlying mineralization.

Cautionary Note to United States Investors concerning Estimates of Measured, Indicated and Inferred Resource Estimates

This disclosure has been prepared in accordance with the requirements of Canadian provincial securities laws which differ from the requirements of U.S. securities laws. Unless otherwise indicated, all mineral resource estimates included in this disclosure have been prepared in accordance with Canadian National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum classification systems. NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. These standards differ significantly from the requirements of the United States Securities and Exchange Commission (the “SEC”), and resource estimates disclosed may not be comparable to similar information disclosed by U.S. companies.

In addition, this disclosure uses the terms “measured and indicated resources” and “inferred resources” to comply with the reporting standards in Canada. The Company advises United States investors that while those terms are recognized and required by Canadian regulations, the SEC does not recognize them. United States investors are cautioned not to assume that any part of the mineral deposits in these categories will ever be converted into mineral reserves. Further, “inferred resources” have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically. Therefore, United States investors are cautioned not to assume that all or any part of the “inferred resources” exist. In accordance with Canadian securities laws, estimates of “inferred resources” cannot form the basis of feasibility or other economic studies. It cannot be assumed that all or any part of “measured and indicated resources” or “inferred resources” will ever be upgraded to a higher category or are economically or legally mineable.

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the nine months ended September 30, 2019

(In thousands of Canadian dollars, unless otherwise noted)

1.2.5

Qualified persons and technical disclosures (continued)

Cautionary Note to United States Investors concerning Estimates of Measured, Indicated and Inferred Resource Estimates (continued)

Three Bluffs resource estimations were completed by Roscoe Postle Associates Inc. (“RPA”) (see the Technical Report on the Three Bluffs Project, Nunavut Territory, Canada filed on the SEDAR on May 31, 2017 as amended October 23, 2017). The Homestake Ridge resource estimate was prepared by RPA (see Technical Report on the Homestake Ridge Project, Skeena Mining Division, Northwestern British Columbia, September 29, 2017 as amended October 23, 2017 filed under the Company’s SEDAR profile at www.sedar.com).

Peruvian interests within a special economic zone - Auryn holds certain interests in Peru through Corisur Peru SAC, which controls (among other) certain licenses (including the Huilacollo and Baños del Indio projects) that are located within a special legal zone which runs 50km back from the Peruvian border. As a non-Peruvian company, Auryn’s right to ultimately acquire title over the shares issued by Corisur Peru SAC and to own and/or exploit these licenses requires approval from the Peruvian government. While Auryn is in the process of submitting its applications and does not foresee any legal reason why it would be denied the approval, some risk of denial or delay should be assumed to exist.

Selected annual financial information

| | | | |

| | | | |

| | | | |

| Comprehensive loss for the period | $17,389 | $36,578 | $20,539 |

| Net loss for the period | $17,674 | $36,500 | $20,376 |

| Basic and diluted loss per share | $0.21 | $0.48 | $0.35 |

| Total assets | $43,523 | $43,759 | $41,747 |

| Total long-term liabilities | $1,891 | $1,662 | $1,747 |

1 Restated for change in accounting policy as disclosed in note 4 of the Company’s audited annual consolidated financial statements for the year ended December 31, 2018.

The Company generated no revenues from operations during the above periods.

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the nine months ended September 30, 2019

(In thousands of Canadian dollars, unless otherwise noted)

1.4 Discussion of operations

Three months ended September 30, 2019 and 2018 (Q3 2019 vs. Q3 2018)

During the three months ended September 30, 2019, the Company reported a loss of $3,918 and loss per share of $0.04 compared to a loss of $7,488 and loss per share of $0.08 for the same period in 2018. The $3,570 decrease in loss in the current quarter is driven by a $4,486 decrease in exploration and evaluations costs, partially offset by a $243 increase in fees, salaries and other employee benefits, and an $888 decrease in the amortization of the flow-through liability. Significant variances within operating expenses and other expenses are discussed as follows:

Operating expenses

(1)

Exploration and evaluation costs in Q3 2019 were $3,335 compared to $7,821 in Q3 2018, a decrease of

$4,486, driven by the following:

a.

Committee Bay decrease of $3,388 – The decrease in costs at Committee Bay relates to the scale of the program completed which in Q3 2019 included 2,700 meters of drilling compared to 9,200 meters completed in Q3 2018.

b.

Homestake decrease of $728: The 2019 exploration program at Homestake was limited to surface sampling and geophysical surveys. In 2018, the exploration program included surface sampling and 2,500 meters of drilling which resulted in comparatively higher costs.

c.

Peru decrease of $370 – During Q3 2019 costs incurred in Peru related primarily to the Company’s drill permit process at Sombrero and ongoing community work. Higher costs in Q3 2018 related to a full surface program that included surface sampling, mapping and geophysical surveys.

(2)

Fees, salaries and other employee benefits in Q3 2019 were $839, including share-based compensation of $504, compared to $596 in Q3 2018, including share-based compensation of $249. The higher share-based compensation in the current quarter was driven by the timing and size of the grant, as well as the calculated fair value of the options.

Other expenses and income:

(3)

During the three months ended September 30, 2019, the Company recorded other income of $733 related to the amortization of the flow-through share premium liability compared to $1,621 for the three months ended September 30, 2018. The liability is amortized as flow-through eligible Canadian exploration and evaluation expenditures are incurred in the period, which, for the current quarter, totaled $2,492 compared to $6,769 for the same period in the previous year.

Nine months ended September 30, 2019 and 2018 (YTD 2019 vs. YTD 2018)

During the nine months ended September 30, 2019, the Company reported a loss of $10,889 and loss per share of $0.12 compared to a loss of $15,323 and loss per share of $0.18 for the same period in 2018. The $4,434 decrease in loss in the current period is driven by the same factors discussed above for the quarter being:

1)

lower exploration and evaluation costs in the current period due to smaller scale Canadian exploration programs and limited work in Peru while the Company works towards obtaining its drill permit at Sombrero;

2)

higher fees, salaries and other employee benefits driven by higher share-based compensation which is a result of a larger option grant in 2019; and

3)

a reduction in other income related to the amortization of the flow-through liability which is driven by the lower flow-through eligible expenditures incurred in the current year-to-date period.

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the nine months ended September 30, 2019

(In thousands of Canadian dollars, unless otherwise noted)

1.4

Discussion of operations (continued)

Summary of Project Costs

During the nine months ended September 30, 2019, the Company incurred $842 in mineral property acquisition costs and $6,535 in exploration and evaluation costs on its projects as outlined below:

| | Committee Bay & Gibson MacQuoid | | | |

| Acquisition costs | | | | |

| Balance as at December 31, 2018 | $18,871 | $16,060 | $4,141 | $39,072 |

| Additions | 11 | - | 831 | 842 |

Change in estimate of provision for site reclamation and closure | 234 | - | - | 234 |

| Currency translation adjustment | - | - | (107) | (107) |

| Balance as at September 30, 2019 | $19,116 | $16,060 | $4,865 | $40,041 |

| | Committee Bay & Gibson MacQuoid | | | |

| Exploration and evaluation costs | | | | |

| Assaying | $154 | $43 | $66 | $263 |

| Exploration drilling | 353 | - | - | 353 |

| Camp cost, equipment and field supplies | 273 | 136 | 223 | 632 |

| Geological consulting services | 144 | 79 | 479 | 702 |

| Geophysical analysis | 143 | 169 | - | 312 |

| Permitting, environmental and community costs | 52 | 9 | 1,069 | 1,130 |

| Expediting and mobilization | 102 | 26 | 24 | 152 |

| Salaries and wages | 576 | 146 | 299 | 1,021 |

| Fuel and consumables | 36 | 40 | 20 | 96 |

| Aircraft and travel | 701 | 186 | 91 | 978 |

| Share based compensation | 201 | 100 | 595 | 896 |

| Total for the nine months ended September 30, 2019 | $2,735 | $934 | $2,866 | $6,535 |

Future operations and 2019 expenditure forecast

The Company forecasts that total operating expenditures for the 2019 year will be approximately $11.8 million, which includes expenditures on mineral properties to execute the 2019 exploration programs, advance the drill permitting for Sombrero, acquire the Sambalay and Salvador concessions, and keep the mineral properties in good standing.

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the nine months ended September 30, 2019

(In thousands of Canadian dollars, unless otherwise noted)

1.4

Discussion of operations (continued)

Future operations and 2019 expenditure forecast (continued)

Having completed the 2019 summer programs at the Committee Bay and Homestake projects, the Company's focus for the remainder of 2019 will be its activities in Peru. The Company’s primary business objectives are to secure the initial drill permit at its Sombrero project and to continue to work with local communities to obtain access to all of the Sombrero land package. Although the Company could elect to draw on the second $3,000 tranche of the Bridge Loan, the work plan for the remainder of the year is aimed at conserving the treasury until the Sombrero drill permit is received. Proposed work plans through to the end of 2019, will be subject to raising funds through the issuance of shares or the sale of non-core assets. In the past, the Company has had success raising capital to fund its programs.

The Company is currently planning its 2020 exploration plans, with the priority being the initial drill program at Sombrero. Other work plans would include continued surface work at Curibaya and additional screening of the Sombrero land package. Programs for the Canadian projects will be determined in the first half of 2020 when the Company has had time to process the results from the 2019 programs.

1.5 Summary of quarterly results

| Three months ended | | | | |

In thousands of Canadian dollars except per share amounts |

| | $ | $ | $ | $ |

| September 30, 2019 | 14 | 3,918 | 3,871 | 0.04 |

| June 30, 2019 | 19 | 5,045 | 5,139 | 0.05 |

| March 31, 2019 | 1 | 1,926 | 2,000 | 0.02 |

| December 31, 2018 | 33 | 2,351 | 2,166 | 0.03 |

| September 30, 2018 | 31 | 7,488 | 7,545 | 0.08 |

| June 30, 2018 | 34 | 4,372 | 4,281 | 0.05 |

| March 31, 2018 | 12 | 3,463 | 3,397 | 0.04 |

December 31, 20171 | 38 | 4,706 | 4,715 | 0.06 |

| | | | | |

1 Restated for change in accounting policy as disclosed in note 4 of the Company’s audited annual consolidated financial statements for the year ended December 31, 2018.

During the last eight quarters, the Company’s net loss has ranged between $7,488 and $1,926. In the time period reflected, the largest losses are generally recorded in the second and third quarters each year due to the timing of option grants, which typically occur in the second quarter, and the Company’s summer exploration programs at its Canadian projects, which occur during the third quarter. Comparatively high losses were also reported for Q4 2017 and Q1 2018 as related to the Company’s initial drill program that was completed at its Huilacollo project in Peru.

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the nine months ended September 30, 2019

(In thousands of Canadian dollars, unless otherwise noted)

1.6/1.7 Financial position and liquidity and capital resources

| | | |

| Cash and restricted cash and cash equivalents | $3,109 | $1,768 |

| Mineral property interests | $40,041 | $39,072 |

| Current liabilities | $4,533 | $1,153 |

| Non-current liabilities | $2,157 | $1,891 |

As at September 30, 2019, the Company had unrestricted cash of $3,109 (December 31, 2018 - $1,653) and a working capital deficit of $188 (December 31, 2018 working capital - $1,460). Contractual obligations as at September 30, 2019 are reflected in the table below and include accounts payable and accrued liabilities of $1,695, which have primarily been incurred in connection with the Committee Bay and Homestake Ridge 2019 exploration programs as well as corporate costs related to keeping the Company’s public listings in good standing, and the Bridge Loan.

| Contractual Obligations as of September 30, 2019 | Payment terms | |

| Accounts payable and accrued liabilities | Immediately | $1,695 |

| Committee Bay flow-through expenditure requirements | By Dec 31, 2020 | 106 |

| Bridge loan and interest payable as at September 30, 2019 | By Sep 12, 2020 | 3,017 |

| Total | | $4,818 |

During the three and nine months ended September 30, 2019, the Company used net cash of $3,411 and $8,194, respectively, in operating activities compared to $7,289 and $14,384, respectively, in the prior year periods. As discussed in detail above, the primary driver for the decrease in the current periods is in relation to smaller scale exploration programs in 2019.

Cash used in investing activities during the three and nine months ended September 30, 2019 was $466 and $808, respectively, and $95 and $1,189 for the comparable periods in 2018. The outflow of cash for all periods was primarily related to the acquisition of mineral properties in Peru.

During the three and nine months ended September 30, 2019, the Company generated cash from financing activities of $4,858 and $10,463, respectively, through the issuance of common shares and from the advancement of the first $3,000 tranche of the Bridge Loan. Net proceeds of $6,931 and $18,277, during the three and nine months ended September 30, 2018, respectively, were generated from financing activities through the issuance of common shares.

As at September 30, 2019 the Company has a working capital deficit of $188 which is primarily related to the requirement to repay the first tranche of the Bridge Loan by September 12, 2020. While the Company may elect to draw on the second tranche of $3,000 to meet its short term liquidity needs (see contractual obligations above), with no source of operating cash flow the Company will be required to raise capital in order to repay the Bridge Loan in full. The Company’s ability to continue as a going concern remains dependent upon its ability to obtain the necessary financing and while the Company has been successful at raising capital in the past, there can be no assurance that the Company will have sufficient financing to meet its future capital requirements or that additional financing will be available on terms acceptable to the Company in the future.

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the nine months ended September 30, 2019

(In thousands of Canadian dollars, unless otherwise noted)

1.6/1.7 Financial position and liquidity and capital resources

Capital Resources

Bridge Loan

On September 12, 2019 the Company entered the Bridge Loan facility for up to $6,000 with a private lender (the “Lender”). The Bridge Loan consists of two tranches of $3,000, with the first having been received and the second being conditional upon the mutual agreement of the parties. The Bridge Loan bears interest at 10%, payable annually or on repayment of the principal, and has a term of one year from the date of advancement (the “Maturity Date”), however, can be repaid without penalty at any time after 90 days of advancement at the discretion of the Company. The Bridge Loan is secured by a first charge general security agreement over all of the Company’s present and future assets.

In connection with the Bridge Loan, the Company issued 500,000 bonus warrants to the Lender which have a term of three years from the date of issue. Each warrant is exercisable into one common share of the Company at a price of $2.00 per common share but cannot be exercised until after the Maturity Date.

The following table reflects the carrying values of the liability and equity components on initial recognition.

| | | | |

| | | | |

| Loan advance received | $2,801 | $199 | $3,000 |

| Transaction costs | (20) | (1) | (21) |

| Deferred tax impact | - | (54) | (54) |

| Impact on statement of financial position | $2,781 | $144 | $2,925 |

The first tranche of $3,000, net of transaction costs of $21, remains on hand at September 30, 2019.

July 2019 Private Placement

On July 11, 2019 the Company announced that it has completed a $1,900 non-brokered flow-through private placement. The placement consisted of 633,334 flow-through common shares priced at CAD$3.00 per flow-through share. The Shares issued under the July 2019 Offering are subject to a four-month hold period and were not registered in the United States.

The purpose of the financing was to fund the Company’s summer exploration program at its Committee Bay gold project in Nunavut, Canada. As of September 30, 2019, the Company has $106 remaining from the July 2019 Offering which is expected to be fully utilized by the end of 2020 in accordance with the underlying flow-through agreements. Share issue costs related to the July 2019 Offering totalled $44. A reconciliation of the impact of the July 2019 Offering on share capital is as follows:

| | | |

Common shares issued at $3.00 per share633,334 | | $1,902 |

| Cash share issue costs | - | (44) |

| Proceeds net of share issue costs | 633,334 | $1,856 |

| Flow-through share premium liability | - | (557) |

| | 633,334 | $1,299 |

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the nine months ended September 30, 2019

(In thousands of Canadian dollars, unless otherwise noted)

1.6/1.7

Financial position and liquidity and capital resources (continued)

March 2019 Private Placement

On March 27, 2019, the Company completed a non-brokered private placement for gross proceeds of $5,255 million. The placement consisted of 3,284,375 common shares priced at CAD$1.60 per Share. The Shares issued under the 2019 Offering are subject to a four-month hold period and were not registered in the United States.

The net proceeds from the March 2019 Offering have funded continued surface exploration at its Sombrero copper-gold project located in Ayacucho, Peru and general working capital and a nominal amount remains at September 30, 2019. Share issue costs related to the March 2019 Offering totalled $200, which included $110 in commissions, and $90 in other issuance costs. A reconciliation of the impact of the March 2019 Offering on share capital is as follows:

| | | |

Common shares issued at $1.60 per share3,284,375 | | $5,255 |

| Cash share issue costs | - | (200) |

| Proceeds net of share issue costs | 3,284,375 | $5,055 |

August 2018 Flow-Through Funding

On August 16, 2018 the Company closed its previously announced non-brokered flow-through private placement for gross proceeds of $7,331. The placement consisted of approximately 2.1 million flow-through common shares priced at CAD$1.60 per flow-through share and approximately 2.2 million charity flow-through shares priced at an average of CAD$ 1.80 per charity flow-through share. Goldcorp Inc. maintained its pro-rata interest in Auryn (approximately 12.4%) by acquiring 490,000 common shares from the purchasers of the charity flow-through shares.

Share issue costs related to the August 2018 Offering totalled $400, which included $350 in commissions, and $50 in other issuance costs. The gross proceeds from the August 2018 Offering were also offset by $1,742, an amount related to the flow-through share premium liability. A reconciliation of the impact of the August 2018 Offering on share capital is as follows:

| | | |

Flow-through shares issued at $1.60 per share2,084,375 | | $3,335 |

| Flow-through shares issued at $1.75 per share | 1,215,000 | 2,126 |

Flow-through shares issued at $1.87 per share Cash share issue costs | 1,000,000- | 1,870(400) |

| Proceeds net of share issue costs | 4,299,375 | 6,931 |

| Flow-through share premium liability | - | (1,742) |

| | 4,299,375 | $5,189 |

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the nine months ended September 30, 2019

(In thousands of Canadian dollars, unless otherwise noted)

1.6/1.7

Financial position and liquidity and capital resources (continued)

A summary of the intended use of the gross cash proceeds of $7,331 is presented in the table below. Due to the fact that only flow-through funds were raised in the August 2018 Offering, funds from the March 2018 Offering were used to cover the cash share issuance costs of $400.

| | Use of Proceeds: Proposed 12 Month Budget | Intended Use of Proceeds of the August 2018 Offering | Actual activities | Actual Use of Proceeds of the Offering to September 30, 2019 | |

| Committee Bay & Gibson MacQuoid | Flow-through eligible -2018 drill and exploration program | $5,461 | -2018 flow through E&E | $5,461 | $- |

| Homestake | Flow-through eligible -2018 drill and exploration program | 1,870 | -2018 flow through E&E | 1,870 | - |

| Total | $7,331 | | $7,331 | $- |

Explanation of variances and the impact of variances on the ability of the Company to achieve its business objectives and milestones. | As of September 30, 2019, the Company has fully utilized the flow-through funds from the August 2018 Offering on its exploration programs at the Committee Bay and Homestake projects as had been originally intended. |

March 2018 Offering

On March 23, 2018 the Company closed the March 2018 Offering by issuing a total of 6,015,385 common shares of the Company at a price of US$1.30 per share for gross proceeds of US$7.8 million. The 2018 Offering was completed pursuant to an underwriting agreement dated March 13, 2018 among the Company and Cantor Fitzgerald Canada Corporation and a syndicate of underwriters. The Company paid a 6% commission to the Underwriters.

In addition, the Company completed a concurrent private placement financing involving the sale of 1,091,826 flow-through common shares of the Company (the “March 2018 Flow-Through Shares”) at a price equal to the Canadian dollar equivalent of US$1.82 per share, for gross proceeds of US$2.0 million. The 2018 Flow-Through Shares formed part of a donation arrangement and were ultimately purchased by Goldcorp Inc. (“Goldcorp”) and enabled Goldcorp to maintain its 12.5% interest in the Company. The proceeds from the sale of the 2018 Flow-Through Shares were used exclusively for exploration on the Company’s Committee Bay project.

A reconciliation of the impact of the March 2018 Offering on share capital is as follows:

| | | |

Common shares issued at US$1.30 per share6,015,385 | | $10,054 |

| Flow-through shares issued at US$1.82 per share | 1,091,826 | 2,561 |

| Cash share issue costs | - | (1,340) |

| Proceeds net of share issue costs | 7,107,211 | 11,275 |

| Flow-through share premium liability | - | (737) |

| | 7,107,211 | $10,538 |

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the nine months ended September 30, 2019

(In thousands of Canadian dollars, unless otherwise noted)

1.6/1.7

Financial position and liquidity and capital resources (continued)

A summary of the intended use of the net cash proceeds of $11,280 is presented as follows:

| | Use of Proceeds: Proposed 12 Month Budget | Intended Use of Proceeds of the March 2018 Offering | Actual activities (March 23, 2018- September 30, 2019) | Actual Use of Proceeds of the Offering to September 30, 2019 | |

| Committee Bay & Gibson MacQuoid | Flow-through eligible funds -2018 drill and exploration programs Non-flow -through funds -Technical studies, permitting and other non-flow-through eligible exploration costs to be incurred in connection with its 2018 exploration program | $2,5611,928 | -flow through E&E

-other E&E | $2,561213 | $01,715 |

| Homestake | Non-flow -through funds -Technical studies, permitting and other non-flow-through eligible exploration costs to be incurred in connection with its 2018 exploration program | 1,286 | other E&E | 131 | 1,155 |