Exhibit 99.2

(An exploration stage company)

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF AURYN RESOURCES INC.

FOR THE THREE MONTHS ENDED MARCH 31, 2020

Dated: May 12, 2020

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the three months ended March 31, 2020

(In thousands of Canadian dollars, unless otherwise noted)

TABLE OF CONTENTS

| PAGE |

HIGHLIGHTS FOR THE NINE MONTHS ENDED MARCH 31, 2020 AND THE PERIOD UP TOMAY 12, 2020

| 3 |

| 1.1 | Date and forward-looking statements | 5 |

| 1.1.1 | Forward-looking statements and risk factors | 5 |

| 1.2.1 | Description of business | 6 |

| 1.2.2 | Peruvian projects | 7 |

| Sombrero | | 7 |

| Curibaya | | 13 |

| Huilacollo | | 15 |

| Baños del Indio | | 15 |

| 1.2.3 | Committee Bay and Gibson MacQuoid projects | 16 |

| Committee Bay |

| 16 |

| Gibson MacQuoid |

| 16 |

| 1.2.4 | Homestake Ridge project | 19 |

| 1.2.5 | Qualified persons and technical disclosures | 20 |

| 1.3 | Selected annual financial information | 22 |

| 1.4 | Discussion of operations | 23 |

| 1.5 | Summary of quarterly results | 25 |

1.6/1.7

| Financial position and liquidity and capital resources | 26 |

| 1.8 | Off-balance sheet arrangements | 31 |

| 1.9 | Transactions with related parties | 32 |

| 1.10 | Subsequent events | 32 |

| 1.11 | Proposed transactions | 32 |

| 1.12 | Critical accounting estimates | 32 |

| 1.13 | Changes in accounting policies including initial adoption | 34 |

| 1.14 | Financial instruments and other instruments | 34 |

| 1.15 | Other requirements | 35 |

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the three months ended March 31, 2020

(In thousands of Canadian dollars, unless otherwise noted)

HIGHLIGHTS FOR THE THREE MONTHS ENDED MARCH 31, 2020 AND THE PERIOD UP TO MAY 12, 2020

Corporate highlights

●

On March 18, 2020, Auryn Resources Inc. (the “Company” or “Auryn”) provided a corporate update and discussed its response to concerns surrounding the COVID-19 pandemic, and the potential impact on the Company’s business. The Company advised that all of its office employees had been given the option to work from home, while personnel in Peru had been recalled from the field due to a 15 day government imposed lockdown in the country, which was subsequently extended. The Company also announced its plans to release an initial PEA on the Homestake Ridge project (see below) and revised targets for its Committee Bay project in the coming weeks.

●

On February 27, 2020, Auryn completed a non-brokered private placement, which closed in two tranches, for gross proceeds of $15,000, by issuing 9,375,000 common shares priced at $1.60 (the “2020 Offering”). A total of $59 was paid in commissions. Proceeds from the 2020 Offering will be used to fund continued surface exploration at its Sombrero and Curibaya projects located in southern Peru and for general working capital (see press release dated February 27, 2020).

●

On February 6, 2020, concurrent with the closing of the first tranche of the 2020 Offering, the Company completed an amendment to the September 2019 bridge loan (the “Bridge Loan Amendment”) to provide certain conversion rights to both the lender and the Company, as well as reducing the interest rate to 5% from the date of the Bridge Loan Amendment (see press release dated February 6, 2020).

Operational highlights

●

On April 15, 2020, the Company announced a positive preliminary economic assessment (“PEA”) for its Homestake Ridge gold project located in northwestern British Columbia. Under the base case scenario, which used a gold price of US$1,350 per ounce and a discount rate of 5%, the project is expected to generate an NPV of US$108 million and an IRR of 23.6%. The Company plans to file the NI43-101 PEA report within 45 days (see press release dated April 15, 2020).

●

On February 28, 2020, November 14 and October 28, 2019 the Company announced results from its initial surface programs at the Curibaya project in southern Peru. The work included a rock sampling program completed in Q4 2019 followed up by a geological mapping and sampling program completed in early 2020. Through geological mapping, a series of rhyolite to dacite flow dome complexes have been identified. Auryn’s technical team believes these domes are the source for the widespread, high-grade precious metal veins sampled to-date across a 4 x 4 kilometer alteration system. Highlights from the 2019 sampling include up to 7,990 g/t silver, 17.65 g/t gold and 6.97% copper.

●

On February 10, 2020 Auryn received its environmental permit, the Declaración de Impacto Ambiental (“DIA”), from the Peruvian Ministry of Energy and Mines for its Sombrero copper-gold project in Southern Peru. The DIA covers an area of 1,031 hectares and allows the Company to drill up to 33 holes from 23 platforms on the Ccascabamba Sombrero Main target area, where Auryn has completed the majority of its work to-date within the 130,000 hectare land package.

●

On January 17, 2020 the Company confirmed the age of the intrusives directly associated with mineralization at the Sombero copper – gold skarn project in Southern Peru. Based on results from five uranium – lead dates taken from zircon crystals obtained from diorite sills at the Ccascabamba and Nioc targets, ages range from 38.85 to 40.47 million years. This places the mineralization within the same Eocene-aged metallogenic event that produced several world-class deposits in the Andahuaylas-Yauri belt.

< Refer to the page 4 and 26 for cautionary wording concerning forward-looking information>

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the three months ended March 31, 2020

(In thousands of Canadian dollars, unless otherwise noted)

1.1 Date and forward-looking statements

This Management Discussion and Analysis (“MD&A”) of Auryn has been prepared by management to assist the reader to assess material changes in the condensed consolidated interim financial condition and results of operations of the Company as at March 31, 2020 and for the three months then ended. This MD&A should be read in conjunction with the condensed consolidated interim financial statements of the Company and related notes thereto as at and for the three months ended March 31, 2020 and 2019. The condensed consolidated interim financial statements have been prepared in accordance with International Accounting Standard (“IAS”) 34, “Interim Financial Reporting” using accounting policies consistent with International Financial Reporting Standards (“IFRS” or “GAAP”) as issued by the International Accounting Standards Board (“IASB”) and Interpretations issued by the International Financial Reporting Interpretations Committee (“IFRIC”). The accounting policies followed in these condensed consolidated interim financial statements are the same as those applied in the Company’s most recent audited annual consolidated financial statements for the year ended December 31, 2019, except as outlined in note 2 of the March 31, 2020 condensed consolidated interim financial statements. All financial information has been prepared in accordance with IFRS and all dollar amounts presented are Canadian dollars unless otherwise stated.

The effective date of this MD&A is May 12, 2020.

1.1.1 Forward-looking statements and risk factors

This MD&A may contain “forward-looking statements” which reflect the Company’s current expectations regarding the future results of operations, performance and achievements of the Company, including but not limited to statements with respect to the Company’s plans or future financial or operating performance, the estimation of mineral reserves and resources, conclusions of economic assessments of projects, the timing and amount of estimated future production, costs of future production, future capital expenditures, costs and timing of the development of deposits, success of exploration activities, permitting time lines, requirements for additional capital, sources and timing of additional financing, realization of unused tax benefits and future outcome of legal and tax matters.

The Company has tried, wherever possible, to identify these forward-looking statements by, among other things, using words such as “anticipate”, “believe”, “estimate”, “expect”, “budget”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved”.

The statements reflect the current beliefs of the management of the Company and are based on currently available information. Accordingly, these statements are subject to known and unknown risks, uncertainties and other factors, which could cause the actual results, performance, or achievements of the Company to differ materially from those expressed in, or implied by, these statements. These uncertainties are factors that include but are not limited to risks related to international operations; general economic conditions; public health crises such as the COVID-19 pandemic and other uninsurable risks; actual results of current exploration activities and unanticipated reclamation expenses; fluctuations in prices of gold and other commodities; fluctuations in foreign currency exchange rates; increases in market prices of mining consumables; possible variations in mineral resources, grade or recovery rates; accidents, labour disputes, title disputes, claims and limitations on insurance coverage and other risks of the mining industry; delays in obtaining governmental approvals or financing or in the completion of development or construction activities; changes in national and local government regulation of mining operations, tax rules and regulations, and political and economic developments in countries in which the Company operates; as well as other factors.

The Company’s management periodically reviews information reflected in forward-looking statements. The Company has and continues to disclose in its MD&A and other publicly filed documents, changes to material factors or assumptions underlying the forward-looking statements and to the validity of the statements themselves, in the period the changes occur. Historical results of operations and trends that may be inferred from the following discussions and analysis may not necessarily indicate future results from operations.

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the three months ended March 31, 2020

(In thousands of Canadian dollars, unless otherwise noted)

1.1.1 Forward-looking statements and risk factors (continued)

The operations of the Company are speculative due to the high-risk nature of its business which is the exploration of mining properties. For a comprehensive list of the risks and uncertainties facing the Company, please see “Risk Factors” in the Company’s most recent annual information form (“AIF”). These are not the only risks and uncertainties that Auryn faces. Additional risks and uncertainties not presently known to the Company or that the Company currently considers immaterial may also impair its business operations. These risk factors could materially affect the Company's future operating results and could cause actual events to differ materially from those described in forward-looking statements relating to the Company. Readers should refer to the risks discussed in the Company’s AIF and MD&A for the year ended December 31, 2019 and subsequent continuous disclosure filings with the Canadian Securities Administrators available at www.sedar.com and the Company’s registration statement on Form 40-F filed with the United States Securities and Exchange Commission and available at www.sec.gov. These documents are for information purposes only and not incorporated by reference in this MD&A. Additional information relating to the Company and its operations can also be found on the Company’s web site at www.aurynresources.com.

1.2.1 Description of business

Auryn Resources is a technically-driven, junior exploration company focused on finding and advancing globally significant precious and base metal deposits. The Company has a portfolio approach to asset acquisition and has six projects, including two flagships: the Committee Bay high-grade gold project in Nunavut, Canada and the Sombrero copper-gold project in southern Peru.

Auryn’s technical and management teams have an impressive track record of successfully monetizing assets for all stakeholders and local communities in which it operates. Auryn conducts itself to the highest standards of corporate governance and social responsibility.

The Company was incorporated under the British Columbia Business Corporations Act on June 9, 2008 under the name Georgetown Capital Corp. Subsequently on October 15, 2013, the Company changed its name to Auryn Resources Inc. and is a reporting issuer in the provinces of British Columbia, Ontario and Alberta. The Company is listed on the Toronto Stock Exchange under the symbol AUG and effective July 17, 2017, the Company’s common shares commenced trading on the NYSE American under the US symbol AUG.

The Company’s principal business activities include the acquisition, exploration and development of resource properties. The head office and principal address of the Company are located at 1199 West Hastings Street, Suite 600, Vancouver, British Columbia, V6E 3T5.

Temporary Suspension of Peru Operations and Other Impacts of COVID-19

On March 15, 2020, the Peruvian government mandated a 15 day lockdown of the country, including prohibiting movements within the country, in response to the COVID-19 pandemic. As a result, the Company recalled all personnel from the field. Since that time, the lockdown has been extended several times and most recently the government has stated its plans to start easing the restrictions and allowing certain operations to resume in phases. Most recent guidelines indicate that certain mining operations may recommence the week of May 11th while exploration activities are currently targeted to restart in June. The Company anticipates that certain movements within the communities may be possible prior to June but is aware that the situation is fluid and all timelines are subject to change. The Company will only restart its operations once permitted by the government and once it is confident that it is safe for its employees to do so.

In addition to the suspension of Peruvian operations, the Company has given all office employees the option to work from home consistent with current government recommendations. While the disruptions resulting from the pandemic have caused some delay in the Company’s business, mainly related to its inability to conduct field programs in Peru since the lockdown was mandated, the Company has still been able to continue with much of its planned activity for Q1 2020. During this period the Company has advanced targeting efforts at Committee Bay, completed the PEA for Homestake Ridge and continued its social programs in Peru. As the situation surrounding COVID-19 continues to develop daily, the Company will continue to monitor the situation closely.

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the three months ended March 31, 2020

(In thousands of Canadian dollars, unless otherwise noted)

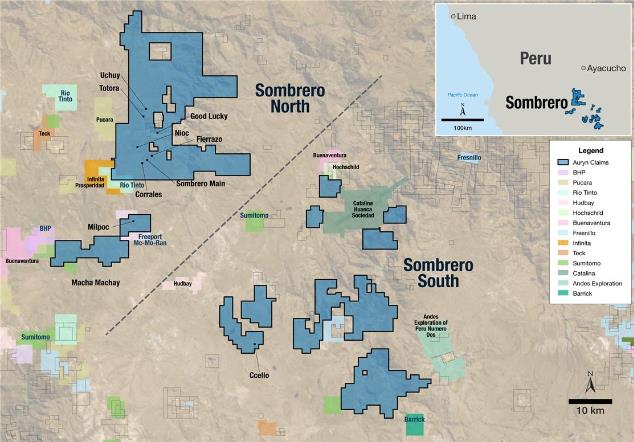

Figure 1 - Illustrates the Sombrero North and Sombrero South project areas within the western extension of the Andahuaylas-Yauri Belt of southern Peru

The Sombrero Project is located 340 kilometers SE of Lima in southern Peru and is hosted in the interpreted western extension of the Andahuaylas-Yauri belt. The project is located on the western margins of this Eocene-Oligocene aged copper-gold porphyry and skarn belt that hosts the Las Bambas, Haquira, Los Chancas, Cotambambas, Constancia, Antapaccay and Tintaya deposits. The project is characterized by a strong structural control and significant copper and gold values from surface sampling. The principal targets at Sombrero are copper-gold skarn and porphyry systems and precious metal epithermal deposits.

The current project consists of approximately 130,000 hectares of mineral claims covering a number of coincident gold and copper geochemical anomalies. Figure 1 above illustrates the Sombrero project area, which consists of the Sombrero North and Sombrero South areas. The main project area, where the Company has focused the majority of its exploration work, has been Sombrero North which is comprised of 75,036.7 hectares; while the Sombrero South concession blocks lie within approximately 80 km south and east of this main project area. The land package was assembled through three separate option agreements, detailed below, and a series of staking campaigns, with the Company most recently adding 8,500 hectares to the Sombrero North area in September 2019 (Figure 1) (see full press release dated October 17, 2019).

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the three months ended March 31, 2020

(In thousands of Canadian dollars, unless otherwise noted)

1.2.2

Peruvian projects (continued)

Sombrero (continued)

The Company is currently in the process of renewing the surface rights agreement it has in place with the local community which covers the Sombrero Main, Chumpi and Fierrazo target areas. In February 2020 the Company signed an agreement with the community authorities for another two year period which is now pending final approval at a public assembly to be convened once the government mandated COVID-19 lockdown is lifted in Peru.

During the shutdown, the Company has continued to have regular communications with the communities and is actively working towards securing additional agreements with other local communities and private land holders in order to expand its access to other parts of the project area. The Company was also able to provide much-needed support to the Huanca Sancos and Lucanamarca communities during the health crisis by providing essential food and other supplies to which they did not have access during the shutdown.

Alturas Option

On June 28, 2016, the Company entered into a letter agreement with Alturas Minerals Corp. which outlined the general terms of the option granted to Auryn to earn up to a 100% interest in the central area of the project referred to as Sombrero Main. Under the terms of the subsequent definitive agreement, which has an effective date of April 6, 2018, the Company may earn a 100% interest in the 6 mineral claims by making option payments of US$0.2 million, completing US$2.1 million in work expenditures within a five-year period and by making a final payment of US$5.0 million. As at March 31, 2020, the Company has satisfied the option payment requirements of the agreement and has incurred approximately US$1.8 million in exploration work on the project.

Mollecruz Option

On June 22, 2018, the Company acquired the rights to the Mollecruz concessions located north of Sombrero Main, which is host to the Good Lucky prospect. Under the terms of the Mollecruz Option, the Company may acquire a 100% interest in the concessions by completing US$3.0 million in work expenditures and by making payments totaling US$1.6 million to the underlying owner over a five-year period. At signing, Auryn paid US$50,000 and upon exercise of the option, the underlying owner will retain a 0.5% Net Smelter Return (“NSR”) royalty with an advance annual royalty payment of US$50,000.

Effective May 20, 2019, the Company formally declared the existence of a force majeure event under the Mollecruz Option as the Company has been unable to reach an access agreement with the local community in order to commence work in the region. The declaration of force majeure has deferred the Company’s obligation to make the June 22, 2019 property payment and any subsequent property payments and work expenditures for a maximum of 24 months from the declaration date. The Company has continued to have active and open communications with the community in an effort to better inform community members about work plans and address those concerns that may be hindering the Company from obtaining access in this particular area.

Aceros Option

On December 13, 2018, the Company entered into a series of agreements with Corporacion Aceros Arequipa S.A. (“Aceros”) to acquire the rights to three key inlier mineral concessions, which include Fierrazo and Nioc. If the Aceros Option is fully exercised, a joint venture would be formed in which the Company would hold an 80% interest (Aceros – 20%). The joint venture would combine the 530 hectare Aceros concessions plus 4,600 hectares of Auryn’s Sombrero land position. The Company is required to make a series of option payments totalling US$800,000, of which US$200,000 has been paid, as well as completing US$5.15 million in work expenditures over a five-year period, of which US$0.3 million has been spent to date.

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the three months ended March 31, 2020

(In thousands of Canadian dollars, unless otherwise noted)

1.2.2

Peruvian projects (continued)

Sombrero (continued)

Exploration

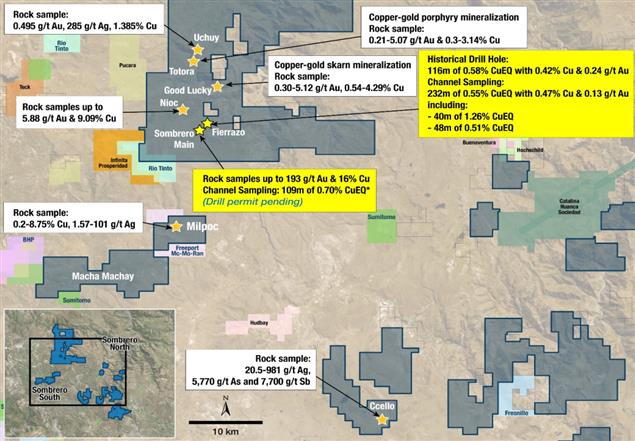

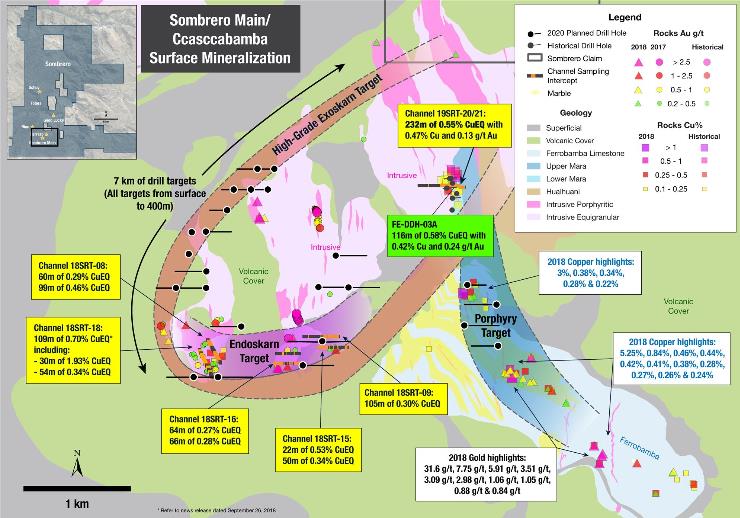

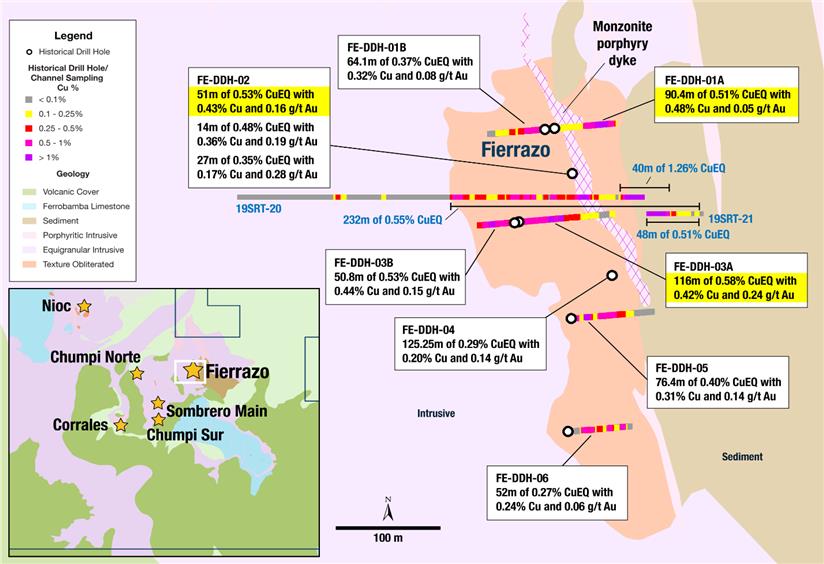

Figure 2 - Illustrates the primary Sombrero project area and the various Copper-Gold Skarn, Porphyry & Epithermal Targets

Since obtaining community access in early 2018, the Company has aggressively conducted surface geochemical and geophysical surveys across the southern portions of Sombrero Main in anticipation of an initial drill campaign. Work conducted to date in this area included 3,814 m of continuous channel samples, 913 rock samples, 261 soil samples and 13,156 XRF samples as well as 87 line-km of IP and 282 line-km of Mag. The results of this work have further indicated that Sombrero is host to a significant copper-gold system which contains porphyry, epithermal and skarn type mineralization. Auryn geologists completed grade control mapping throughout the Sombrero Main area with the goal of characterizing the controls on mineralization throughout the project area. The interpretation of this work is ongoing and continues to evolve.

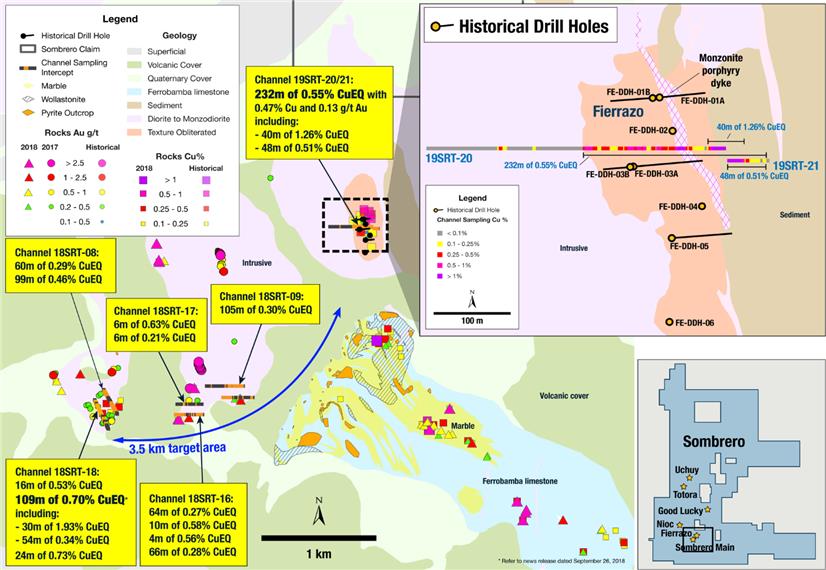

In Q1 2019, the surface work was expanded into the newly acquired Fierrazo area and included continuous channel sampling which resulted in the extension of the mineralization to a potential 7.5 km target area over the Sombrero Main and Fierrazo areas. The identified contact zone between the Ferrobamba limestone and the Cascabamba intrusive body hosting high-grade copper and gold mineralization will continue to be the primary area of focus. Highlights from the continuous channel sampling at the Fierrazo include a combined width of mineralization of 232 meters of 0.55% copper equivalent (0.47% copper and 0.13 g/t gold) with a higher-grade internal interval of 40 meters of 1.26% copper equivalent (1.23% copper and 0.05 g/t gold) (Figure 4) (full results can be found in the Company’s press releases dated March 12 and April 3, 2019).

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the three months ended March 31, 2020

(In thousands of Canadian dollars, unless otherwise noted)

1.2.2

Peruvian projects (continued)

Sombrero (continued)

The Company has also had the opportunity to make use of past workings by Aceros including collecting 37 representative grab samples from the waste dumps and ore stockpiles left at the formerly producing Fierrazo iron mine. The results of the samples indicate copper and gold mineralization within the hematite-magnetite exoskarn mineralization. The average values of the samples were 0.91% Cu and 0.36 g/t Au. Complete results of this sampling can be found in the Company’s April 3, 2019 news release.

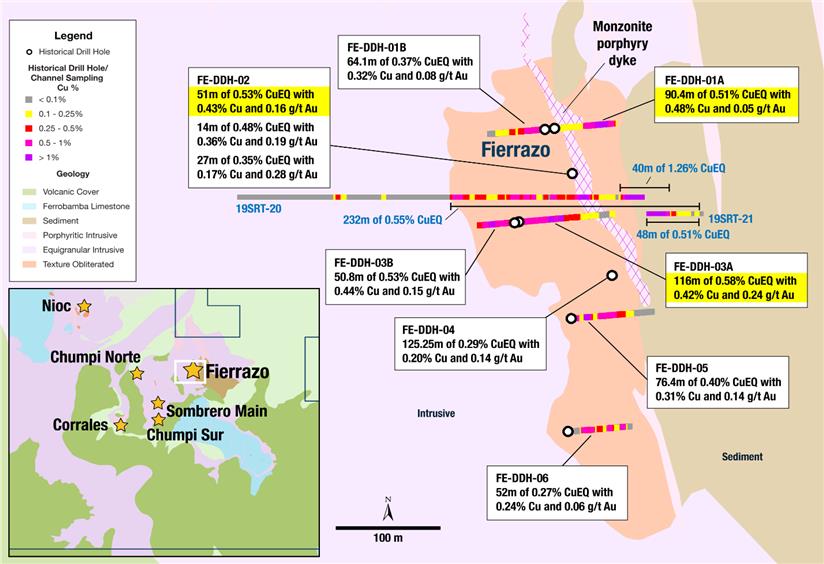

As announced April 29, 2019 the Company gained access to 988 meters of historical drill core from drilling conducted by Aceros (Figures 3 and 4). The previous sampling of the core by Aceros was considered incomplete as only partial sections were sampled targeting iron skarn mineralization. Additionally, historic analytical results did not include analysis for gold. On June 13, 2019 Auryn released the results of its sampling of the core. Highlights included 116 meters of 0.58% CuEq (0.42% Cu and 0.24 g/t Au), 90.4 meters of 0.51% CuEq (0.48% Cu and 0.05 g/t Au) and 51 meters of 0.53% CuEq (0.43% Cu and 0.16 g/t Au) (Figure 3). These results confirmed that the copper-gold sulfide mineralization extends to depth below where the Company had completed its channel sampling as discussed above (Figure 4). Collectively, the historical drill holes define a mineralized body totaling 300 meters of strike length with an average width of approximately 150 – 200 meters that is open both to the north and to the south.

Figure 3 - Illustrates the drill intercepts from the historical core at the Fierrazo exoskarn target.

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the three months ended March 31, 2020

(In thousands of Canadian dollars, unless otherwise noted)

1.2.2

Peruvian projects (continued)

Sombrero (continued)

Figure 4 - illustrates the location of the 8 historical drill holes at the Fierrazo target in relation to the surface work Auryn has completed to date.

The Company’s initial permit application for drilling at Sombrero Main was submitted in June 2019. The Company recently received its environmental permit, or DIA, as announced February 10, 2020, which covers an area of 1,031 hectares. The DIA allows the Company to drill up to 33 holes from 23 platforms on the Ccascabamba Sombrero Main target area, where the majority of work to-date has been completed (Figure 5). The next step required in the permitting process is to obtain the authorization for Inicio de Actividades (“Start of Activities”), which was filed with the Peruvian authorities in February 2020 and includes the Consulta Previa (“Social Consultation”), which will be the government authority’s confirmation that the community supports the upcoming drill program as well as future exploration activities. Auryn has prioritized efforts to achieve excellent relations within the Huanca Sancos community through a number of beneficial social programs and is concurrently working through the renewal of the community access agreement which will grant the Company access for another two-year period. The Company has also started to collect baseline data for a semi-detailed environmental assessment which would allow for up to 700 drill pads and would supplement the 33 holes allowed under the DIA so that drilling could be conducted over a larger portion of the Sombrero project.

Both the completion of the drill permit and the renewal and securing of key community access agreements have been put on hold temporarily during the COVID-19 lockdown in Peru. These will continue to be the Company’s main focus in the coming months once restrictions are lifted.

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the three months ended March 31, 2020

(In thousands of Canadian dollars, unless otherwise noted)

1.2.2

Peruvian projects (continued)

Sombrero (continued)

Figure 5: Illustrates the proposed drill plan on the Sombrero Main target area. The DIA allows Auryn to drill up to 33 holes from 23 platforms.

While the Company’s primary focus has been advancing the Sombrero Main target to a drill ready state, it has continued to conduct exploration work across its full land package to identify other areas of interest. The Good Lucky and Nioc target areas, which are situated adjacent to and show similar geological and geophysical signatures as Sombrero Main, are additional prospects which have produced highly anomalous results and warrant additional follow-up. The Good Lucky prospect, contained within the Mollecruz concessions, represents an outcropping copper-gold skarn system exposed over 600 meters where sampling has returned up to 5.12 g/t Au and 4.29% Cu. Rock samples from Nioc, contained within the Aceros option, have returned assays of up to 5.88 g/t Au and 9.09% Cu. The Company plans to expand its surface program into the Good Lucky and Nioc target areas once community agreements are obtained and the Company thereby gains access to the land.

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the three months ended March 31, 2020

(In thousands of Canadian dollars, unless otherwise noted)

1.2.2

Peruvian projects (continued)

Sombrero (continued)

In the meantime, surface work programs such as rock sampling, BLEG surveys and BLEG follow up continue to screen the overall land package in order to highlight additional mineralized centers. In 2019 the Company conducted first-pass reconnaissance at the Ccello project in Sombrero South, which consisted of mapping and rock sampling to follow up on anomalous stream sediment samples from previously completed screening efforts. The program, which yielded silver values of up to 981 g/t (see full press release dated September 30, 2019), identified a previously unrecognized 2 x 1.5 km high sulphidation alteration system.

As announced in a press release dated October 17, 2019, the Company has also staked the Macha Machay claims as a result of its previously completed regional exploration program. The new claims, which contained the highest copper values in stream sediments observed through the regional program, are located adjacent to the Company’s Milpoc target and are within the land area where the Company has an existing community agreement.

See the press releases dated June 19, September 5, September 26, October 15, November 26, 2018 and January 7, March 12, April 3, September 30, and October 17, 2019 for complete results from the Company’s geophysical and geochemical surface programs at Sombrero.

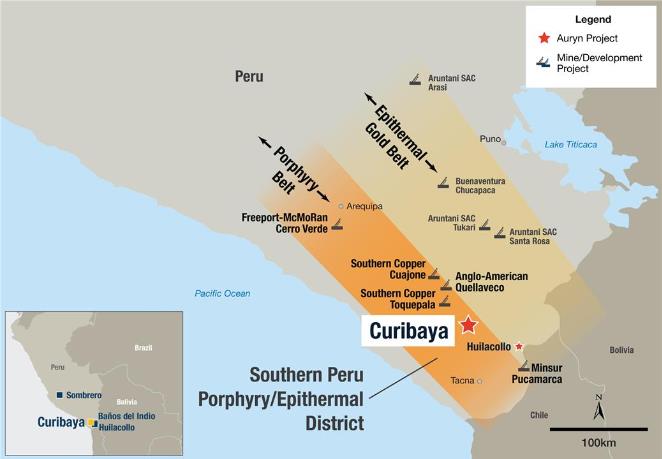

Figure 6: Illustrates the position of the Curibaya Project with respect to the large copper porphyry mines in southern Peru.

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the three months ended March 31, 2020

(In thousands of Canadian dollars, unless otherwise noted)

1.2.2

Peruvian projects (continued)

Curibaya (continued)

On August 2, 2019, the Company acquired the rights to the Sambalay and Salvador concessions adjacent to the wholly owned Curibaya porphyry property in southern Peru, which was staked by the Company in 2016. Under the terms of the mining concession transfer agreement with Wild Acre Metals (Peru) S.A.C., the Company paid US$250,000 on transfer of the concessions in favour of Corisur. The Sambalay concessions are subject to a combined 3% NSR royalty, 0.5% of which is buyable for US$1.0 million. The Salvador concessions are subject to a 2% NSR royalty and a US$2.0 million production payment, payable at the time a production decision is made, and to secure payment of such consideration a legal mortgage is recorded in the registry files of the Salvador concessions.

The Sambalay and Salvador concessions together encompass a 4 by 4 kilometer alteration system that shows affinities to precious metal low to intermediate sulphidation systems. Historical high-grade sampling includes up to 13.50% copper, 23.6 g/t gold and 14,180 g/t silver (Figure 6), however despite these results, Auryn is unaware of any historical systematic exploration or drilling on the properties.

Collectively, the Curibaya project now covers approximately 11,000 hectares and is located 53 km from the provincial capital of Tacna and is accessible by road. The project lies 11 km south of the Incapuquio regional fault, which is viewed as a major control on the emplacement of mineralized porphyries in the region. The concessions are outside the 50km border zone and therefore do not require the Peruvian government to approve the acquisition by Auryn.

Figure 7: Illustrates the locations of the Sambalay and Salvador concessions in relation to the Curibaya concessions and other projects in the region.

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the three months ended March 31, 2020

(In thousands of Canadian dollars, unless otherwise noted)

1.2.2

Peruvian projects (continued)

Curibaya (continued)

2019/2020 Curibaya Exploration

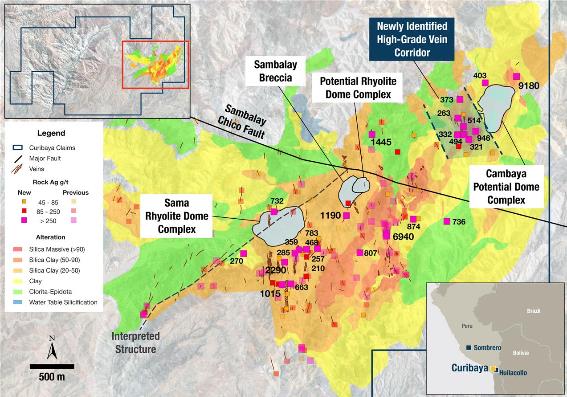

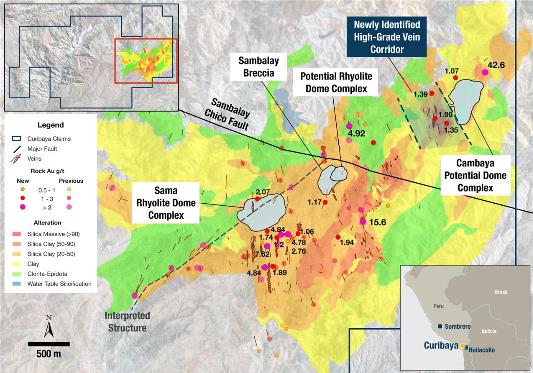

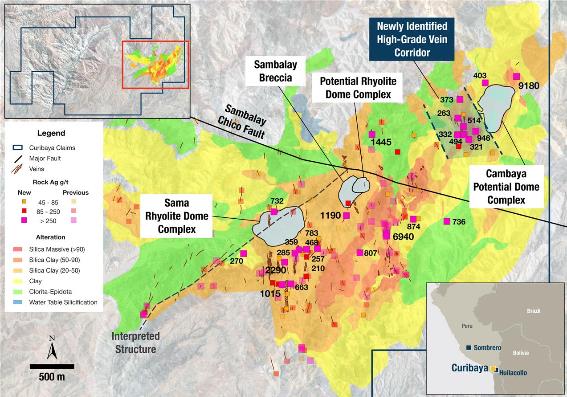

Since acquiring the Sambalay and Salvador concessions in August 2019, the Company completed a first-pass reconnaissance rock sampling program in Q4 2019 which sampled high-grade mineralization throughout a 1.5 km by 4.5 km quartz – sericite – pyrite alteration system. This was followed up with geological mapping and additional rock and channel sampling in early 2020. In total, 481 rock samples, 87 channel samples and 9 stream sediment samples have been taken. The goal of the exploration to date has been to gain a better understanding the spatial distribution of high-grade mineralization throughout the alteration system as well as confirming results from historical rock samples. Highlights from the 2019 and 2020 sampling include up to 7,990 g/t silver, 17.65 g/t gold and 6.97% copper.

The Company’s ongoing exploration program selectively sampled veins in previously unsampled areas and in doing so identified a new zone of mineralization approximately one kilometer to the northeast of previous sampling extending the alteration system to a 4 km by 4 km area. Through geological mapping a series of rhyolite to dacite flow dome complexes have been identified which the Company believes may be the sources of the widespread, high-grade precious metal veins sampled to date. In addition, a float sample 800 meters to the northeast returned grades of up to 9,180g/t silver and 42.6g/t gold (Figures 8 and 9) and will be followed up on in the next round of field work. See press releases dated February 28, 2020, November 14 and October 28, 2019 for full results from the Company’s surface programs at Curibaya.

Figure 8: Illustrates additional silver values from vein samples taken across the project area and the new north-south trending corridor of veins over approximately 400 meters that have been identified.

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the three months ended March 31, 2020

(In thousands of Canadian dollars, unless otherwise noted)

1.2.2

Peruvian projects (continued)

Curibaya (continued)

2019/2020 Curibaya Exploration

Figure 9: Illustrates additional gold values from vein samples taken across the project area and the new north-south trending corridor of veins over approximately 400 meters that have been identified.

The Company plans to continue geological and alteration mineral mapping, targeted rock sampling along the margins of the dome complexes and ground based and airborne geophysical surveys once COVID-19 restrictions have been lifted. The exploration work will be focused on defining drill targets to be incorporated in an FTA Drill Permit application which the Company estimates would take 4-6 months to be approved and would allow for up to 20 drill pads. Based on current government guidelines exploration work could restart as soon as June 1, 2020.

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the three months ended March 31, 2020

(In thousands of Canadian dollars, unless otherwise noted)

1.2.2

Peruvian projects (continued)

The Huilacollo property, located in the Tacna province of southern Peru, comprises 2,000 hectares of intense hydrothermal alteration over a 4 by 6 km area that is consistent with epithermal Au/Ag mineralization. Historic drilling has identified a continuously mineralized gold/silver zone open in all directions. Contained within this area, there appears to be higher grade mineralization focused along well-defined feeder structures as highlighted by trench intercepts up to 38m at 6.7 g/t Au and drill holes including 34m at 2.14 g/t. The Company acquired the rights to Huilacollo through an option agreement with a local Peruvian company, Inversiones Sol S.A.C., under which the Company may acquire a 100% interest, subject to an NSR, through a combination of work expenditures and cash payments totaling US$7.0 million and US$8.75 million respectively. As of May 11, 2019, the Company had spent US$4.5 million at the Huilacollo project and did not satisfy the accumulated work expenditure requirement of US$5.0 million at that date. Under the terms of the Huilacollo option, the Company elected instead to make a cash payment of US$258,000 equal to 50% of the shortfall at the due date to keep the option in good standing.

Effective April 3, 2020, the Company declared force majeure under its Huilacollo option as a result of the COVID-19 shutdown in Peru which allows the Company to defer the option payment that was otherwise due May 11, 2020. Once the government restrictions are lifted and exploration activities can resume, the Company will have a grace period, based on the length of the force majeure period, to make this payment.

Huilacollo Exploration

During 2017 and 2018 the Company completed its initial drill program, comprising five holes, at Huilacollo. Drilling successfully expanded mineralization to the northwest by 100 meters with drill hole 17-HUI-002 intersecting 62 meters of 0.45 g/t Au (including 22 meters of 0.71g/t Au) oxide mineralization from surface and drill hole 17-HUI-004 intersecting 22 meters of 0.2 g/t Au 100 meters to the southwest from hole 17-HUI-002. Additional drilling would target further extensions of mineralization as well as surface mineralization discovered at the Tacora prospect. The Company is currently determining its future exploration programs for Huilacollo.

Despite the Company acting in good faith in its negotiations with the community, the Company was unable to reach an access agreement in order to initiate its exploration program on the Baños del Indio property and as such the Company chose to terminate the Baños del Indio option in accordance with the agreement. On February 7, 2020, the Company formally gave notice to the option holder that it was terminating the agreement effective March 8, 2020. The Company had previously incurred a total of $337 (US$256,000) in option fees and other acquisition costs in relation to the Baños del Indio property, all of which were fully impaired as at December 31, 2019.

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the three months ended March 31, 2020

(In thousands of Canadian dollars, unless otherwise noted)

Committee Bay and Gibson MacQuoid projects

Figure 10 – regional map showing the locations of the Committee Bay and Gibson MacQuoid projects

The Committee Bay Project comprises approximately 280,000 hectares situated along the Committee Bay Greenstone Belt approximately 180 km northeast of the Meadowbank mine operated by Agnico Eagle Mines Limited.

The Committee Bay belt comprises one of a number of Archean aged greenstone belts occurring within the larger Western Churchill province of north-eastern Canada. The character and history of rock packages, and the timing and nature of mineralization occurring within the belt is considered to be equivalent to that of other significant gold bearing Archean greenstones within the Western Churchill Province, which hosts deposits such as Meadowbank, Meliadine and Amaruq.

Ownership

The Committee Bay project is held 100% by Auryn subject to a 1% NSR on the entire project, and an additional 1.5% NSR payable on only 7,596 hectares which is buyable within two years of the commencement of commercial production for $2,000 for each one-third (0.5%) of the NSR.

Committee Bay Mineral resources

High-grade gold occurrences are found throughout the 300 km strike length of the Committee Bay project with the most advanced being the Three Bluffs deposit that contains the mineral resource as listed in the table below: *(refer to NI43-101 report dated May 31, 2017 as amended October 23, 2017 filed under Auryn’s profile at www.sedar.com).

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the three months ended March 31, 2020

(In thousands of Canadian dollars, unless otherwise noted)

1.2.3

Committee Bay and Gibson MacQuoid projects (continued)

| Class | | | Tonnes (t) | | |

| Indicated | Near Surface | 3.0 | 1,760,000 | 7.72 | 437,000 |

| | Underground | 4.0 | 310,000 | 8.57 | 86,000 |

| | | | |

| | 2,070,000 | 7.85 | 524,000 |

| | | | |

| Inferred | Near Surface | 3.0 | 590,000 | 7.56 | 144,000 |

| | Underground | 4.0 | 2,340,000 | 7.65 | 576,000 |

| | | | |

| | 2,930,000 | 7.64 | 720,000 |

Table 1: Three Bluffs indicated and inferred resource. See section 1.2.5 for cautionary language concerning mineral resources.

The Three Bluffs deposit remains open along strike and at depth. Future programs will aim to significantly expand upon the current resource.

Committee Bay 2020 Plans

Analysis of 2019 Data and Targeting at Committee Bay

Through the continued use of geophysics in the Company’s 2019 exploration program, the Company’s technical team made significant advancements in their understanding of how to interpret certain geophysical responses to better aid in targeting high-grade gold mineralization on the property.

During Q1 2020, the Company continued to analyze previous exploration data focusing on conductivity and chargeability couplets. The reprocessing and reinterpretation of geophysical data on a prospect by prospect basis has been instrumental in developing new exploration concepts and will lead to the development of future targets. Sufficient fuel remains on site to complete a modest program and therefore a spring mobilization program was not necessary. The Company’s 2020 exploration plans will be decided based on the results of the targeting efforts that are still underway. Results and the details of 2020 program are expected to be released in Q2 2020.

The Nunavut Mining Recorders office has recently announced a relief program for reporting and expenditure requirements due to the COVID-19 pandemic. If Auryn’s application is successful this will extend the anniversary dates of all claims by one year.

The Gibson MacQuoid project is an early stage gold exploration project situated between the Meliadine deposit and Meadowbank mine in Nunavut, Canada. The 66 mineral claims that make up the project encompass approximately 120 km of strike length of the prospective greenstone belt and total 74,000 hectares collectively.

The Gibson MacQuoid Greenstone belt is one of a number of Archean aged greenstone belts located in the Western Churchill province of north-eastern Canada. These gold bearing Archean greenstone belts host deposits such as the Three Bluffs, Meadowbank, Amaruq, and Meliadine deposits. In particular, the highly magnetic signature of the Gibson MacQuoid Belt is consistent with the other productive greenstone belts in the eastern Arctic that host large-scale gold deposits.

The Nunavut Mining Recorders office has recently announced a relief program for reporting and expenditure requirements due to the COVID-19 pandemic. If Auryn’s application is successful this will extend the anniversary dates of all claims by one year.

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the three months ended March 31, 2020

(In thousands of Canadian dollars, unless otherwise noted)

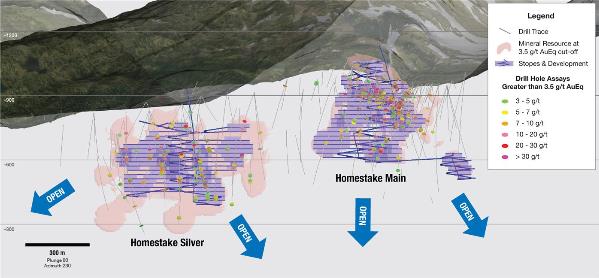

The Homestake Ridge project is located in the prolific Iskut-Stewart-Kisault gold belt in northwestern British Columbia, Canada and covers approximately 7,500 hectares (Figure 11). The project is host to a high-grade gold, silver, copper, lead resource which remains open at depth and along strike.

Figure 11: Illustrates the general location and access to infrastructure at the Homestake Ridge project.

2020 Updated Mineral Resource Estimate and Preliminary Economic Assessment

On April 15, 2020, the Company announced the results of its initial PEA prepared in accordance with National Instrument 43-101 (“NI 43-101”) by MineFill Services Inc. of Seattle, WA with other contributors including Roscoe Postle Associates Inc. (RPA), now part of SLR Consulting Ltd. (SLR), (QP for updated mineral resource estimate) and One-Eighty Consulting Group (environmental, permitting and social). The Company plans to file the PEA on SEDAR at www.sedar.com within 45 days in accordance with NI 43-101.

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the three months ended March 31, 2020

(In thousands of Canadian dollars, unless otherwise noted)

1.2.4

Homestake Ridge project (continued)

PEA Summary - Base Case

Net present value (NPV 5%) after tax and mining duties | US$108 million |

| Internal rate of return (IRR) after tax | 23.6% |

| Pre-production capital costs | US$88 million |

| After tax payback period | 36 months |

| All in sustaining costs (AISC) per ounce gold | US$670 |

| PEA life of mine (LOM) | 13 years |

| LOM metal production gold equivalent ounces | 590,040 AuEq ounces |

| LOM average diluted head grade | 6.42g/t AuEq |

| Peak year annual production (year three) | 88,660 AuEq ounces |

| Average LOM payable production | 45,400 AuEq ounces |

| LOM mineralized material mined | 3.4 Million tonnes |

| Mining scenario tonnes per day | 900 tonnes |

Table 2: Outlines the key results of the base case PEA which was based on $1,350/oz gold, $12/oz silver, $3.00/pound copper, $1.00/pound lead and an exchange rate of 0.70 (US$/C$). See section 1.2.5 regarding technical disclosures and cautionary language concerning mineral resources.

Updated Mineral Resource Estimate

The PEA is based on an updated mineral resource estimate that was prepared in-house by Auryn and audited by RPA using block models constrained to new geological wireframes. Grades for gold, silver, lead, arsenic and antimony were estimated using Inverse Distance (ID3) weighting. Two block models were constructed in Leapfrog Geo Edge software: one for the Homestake Main and Silver deposits and the other for South Reef.

The updated mineral resource estimate was developed using a revised geological model based on a complete re-log of the deposits that defined the geometry of breccia bodies and vein arrays that were successfully traced both laterally and vertically within the deposits. These resulting geometries provided additional confidence in tracing high-grade mineralization within the deposits. The resource remains open for expansion at depth and along strike (Figure 12). The updated mineral resource estimate, summarized in Table 2 below, demonstrates higher grades with a decrease in tonnes as compared to the previous resource estimate dated September 1, 2017 (detailed in a Canadian National Instrument 43-101 Technical Report dated September 29, 2017 as amended October 23, 2017 and filed on SEDAR) with overall metal content largely unchanged.

| | |

| Classification | | | | | | | | | |

| Total Indicated | 0.736 | 7.02 | 74.8 | 0.18 | 0.077 | 165,993 | 1.8 | 2.87 | 1.25 |

| Total Inferred | 5.545 | 4.58 | 100.0 | 0.13 | 0.142 | 816,719 | 17.8 | 15.87 | 17.34 |

Table 3: Combined Main Homestake, Homestake Silver and South Reef Resources at a 2 g/t AuEq cut-off as of December 31, 2019. See section 1.2.5 regarding technical disclosures and cautionary language concerning mineral resources

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the three months ended March 31, 2020

(In thousands of Canadian dollars, unless otherwise noted)

1.2.4

Homestake Ridge project (continued)

| | | |

| | | | | | | | | |

|

5.0 | 0.372 | 10.99 | 131.3 | 0.20 | 0.120 | 131,463 | 1.6 | 1.7 | 0.99 |

4.0 | 0.465 | 9.57 | 111.2 | 0.20 | 0.105 | 142,911 | 1.7 | 2.0 | 1.07 |

3.0 | 0.592 | 8.18 | 90.5 | 0.19 | 0.090 | 155,730 | 1.7 | 2.5 | 1.18 |

2.0 | 0.736 | 7.02 | 74.8 | 0.18 | 0.077 | 165,993 | 1.8 | 2.9 | 1.25 |

1.0 | 0.862 | 6.19 | 65.2 | 0.17 | 0.069 | 171,441 | 1.8 | 3.1 | 1.32 |

|

5.0 | 2.158 | 8.25 | 145.7 | 0.21 | 0.216 | 572,444 | 10.1 | 9.8 | 10.26 |

4.0 | 2.972 | 6.78 | 133.4 | 0.18 | 0.189 | 648,212 | 12.8 | 11.9 | 12.36 |

3.0 | 4.136 | 5.52 | 118.6 | 0.15 | 0.163 | 734,275 | 15.8 | 14.0 | 14.84 |

2.0 | 5.545 | 4.58 | 100.0 | 0.13 | 0.142 | 816,719 | 17.8 | 15.9 | 17.34 |

1.0 | 6.448 | 4.09 | 90.9 | 0.12 | 0.127 | 847,996 | 18.9 | 17.0 | 18.07 |

Table 4: Mineral Resource Sensitivity by Cut-Off Grade

Figure 12: Illustrates a long section of the Homestake Main and Homestake Silver deposits demonstrating the deposits are open at depth and along strike.

PEA Project Overview

To-date the project has been investigated with more than 275 drill holes, totaling more than 90,000 meters. In addition to the three known zones of mineralization, multiple exploration targets remain to be tested. The PEA envisions a 900 tonne per day underground mining operation spanning a 13-year mine life based on a mine plan using a gold price of US$1,300/oz. Mining would commence in the larger Homestake Main zone first, followed by the Homestake Silver zone around year six and finally the South Reef zone. The material would be treated in a conventional crushing, grinding and flotation plant to produce a copper concentrate, a lead/zinc concentrate and finally Au-Ag dore from cyanide leaching of regrind tailings.

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the three months ended March 31, 2020

(In thousands of Canadian dollars, unless otherwise noted)

1.2.4

Homestake Ridge project (continued)

Mining and Processing

The mine plan and production schedule were developed in Deswik mine stope optimizer software (MSO). The principal mining method in the MSO runs was overhand longhole retreat mining on 20-meter sublevel intervals. The minimum mining width was 2.5 meters and a mining cutoff grade of 3.5 g/t AuEq was used to develop the stope wireframes. An ELOS (equivalent linear overbreak) of 0.25 meters was added at the hanging-wall and footwall to account for dilution.

Processing of the Homestake Ridge mineralization is determined by the difference in metal contents across the three deposits included in the study. Given that 97% of the metal value is gold and silver, the realization of the value of the Homestake Ridge deposits will be dependent on the recovery of precious metals. Based on recent metallurgical test work, the optimal processing stream appears to be campaign processing of each deposit in sequence, rather than blending. The flowsheet thus consists of an initial rougher flotation to produce a base metal concentrate, followed by secondary flotation to produce a pyrite concentrate. The pyrite concentrate is then reground and subjected to cyanide leaching to recover the remaining gold and silver in rougher tailings.

The Homestake Main mineralization would be processed first to produce a copper concentrate rich in gold, then Homestake Silver to produce a lead/zinc concentrate rich in silver and finally South Reef to produce a gold concentrate. The metallurgical recoveries are estimated to be 86% for gold, 74% for silver, 70% for copper and 66% for lead.

Capital and Operating Costs

The pre-production capital is estimated at US$88 million (CAD$126 million) with US$86 million (CAD$123 million) in sustaining capital, primarily capitalized development underground. The PEA is based on owner-operated equipment and manpower. A contingency of 15% has been applied to all direct costs. Details of the pre-production and sustaining capital are shown on Table 5 below:

| Expenditure | | |

| Mining Equipment | $3.0 | $2.1 |

| Surface mobile equipment | $3.5 | $2.5 |

| Capitalized Underground Development | | $66.4 |

| Tailings | $8.4 | |

| Site Development – Roads, Airport | $6.3 | |

| Camp Facilities | $3.2 | |

| Site Infrastructure | $3.5 | |

| Power Supply | $8.4 | |

| Process Plant | $26.2 | |

| Access Upgrades – barge landing and roads | $2.1 | |

| EPCM costs – 15% of directs | $8.7 | |

| Owner Costs – 10% of directs | $5.8 | |

| Reclamation – tailings | | $3.5 |

| Closure | | $3.5 |

| Water Treatment | | $1.4 |

| Environmental Permits/Baseline Data | $0.6 | |

| End of Life Salvage | | $(3.5) |

Table 5: Capital cost summary.

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the three months ended March 31, 2020

(In thousands of Canadian dollars, unless otherwise noted)

1.2.4

Homestake Ridge project (continued)

| Area | | Life-of-Mine (US$) |

| Mining ($/t mined) | $63.50 | $182.9 million |

| Processing ($/t milled) | $21.00 | $71.9 million |

| General and Administration ($/t) | $14.00 | $48.0 million |

| Environmental/Water Treatment | $0.82 | $2.8 million |

| Community/Social | $0.17 | $0.6 million |

| Total Operating Costs ($/t milled) | $89.39 | $306.2 million |

Table 6: Operating Cost Summary. Operating costs were developed from unit costs for projects of a similar scale in Canada and translated to USD at an exchange rate of 0.70 (US$/C$).

Project Economics and Sensitivity Analyses

The following tables illustrate the PEA project economics and the sensitivity of the project to changes in the base case metal prices, operating costs and capital costs. As is typical with precious metal projects, the project is most sensitive to metal prices, followed by operating costs and initial capital costs.

| | | | | | |

| Before Tax | $278 | $170 | $140 | 30.1% | 26 |

| After Tax | $184 | $108 | $87 | 23.6% | 36 |

Table 4: Project Economics at $1,350 Gold

| | | | | | |

| $1,890 | $16.80 | $373 | $239 | 39.4% | 31 |

| $1,755 | $15.60 | $326 | $206 | 35.8% | 32 |

| $1,620 | $14.40 | $278 | $173 | 32.0% | 33 |

| $1,485 | $13.20 | $231 | $141 | 28.0% | 34 |

Base Case

| $1,350 | $12.00 | $184 | $108 | 23.6% | 36 |

| $1,215 | $10.80 | $137 | $75 | 18.8% | 40 |

| $1,080 | $9.60 | $90 | $42 | 13.2% | 46 |

| $945 | $8.40 | $39 | $6 | 6.4% | 75 |

Table 5: Metal Price Sensitivity – After-Tax

| | | | |

| $145 | $82 | 20.1% | 39 |

| $165 | $95 | 21.9% | 38 |

| $184 | $108 | 23.6% | 36 |

| $203 | $121 | 25.3% | 35 |

| $223 | $134 | 26.9% | 35 |

Table 6: Operating Cost Sensitivity – After-Tax

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the three months ended March 31, 2020

(In thousands of Canadian dollars, unless otherwise noted)

1.2.4

Homestake Ridge project (continued)

| | | | |

| $149 | $79 | 17.1% | 43 |

| $167 | $93 | 20.1% | 40 |

| $184 | $108 | 23.6% | 36 |

| $201 | $128 | 27.7% | 34 |

| $219 | $137 | 32.5% | 33 |

Table 7: Capital Cost Sensitivity – After-Tax

Indigenous and Community Relations

The pursuit of environmentally sound and socially responsible mineral development guides all of Auryn’s activities as the Company understands the broad societal benefits that responsible mining can bring, as well as the risks that must be managed through the implementation of sustainable development practices. Auryn strives to maintain the highest standards of environmental protection and community engagement at all of its projects.

Auryn considers sustainability to include the pursuit of three mutually reinforcing pillars: environmental and cultural heritage protection; social and community development; and, economic growth and opportunity. The Company assesses the environmental, social and financial benefits and risks of all our business decisions and believes this commitment to sustainability generates value and benefits for local communities and shareholders alike.

Auryn places a priority on creating mutually beneficial, long-term partnerships with the communities and countries in which it operates, and with its shareholders, respecting their interests as its own. At the community level, the Company works to establish constructive partnerships to address and contribute to local priorities and interests and ensure that local people benefit both socially and economically from its activities.

Auryn has undertaken early and ongoing engagement with respect to the Homestake Ridge gold project since January 2017. Engagement goals include providing Indigenous groups, residents of nearby communities and other regional interests with corporate and project-related information, details of work programs and other activities being undertaken in the field, project updates and opportunities for feedback and local involvement in the Homestake Ridge project.

Auryn’s approach to Indigenous and stakeholder engagement provides opportunities and benefits through:

●

the provision of jobs and training programs

●

contracting opportunities

●

capacity funding for Indigenous engagement

●

sponsorship of community events

Members of local Indigenous groups comprise approximately 40% of Auryn’s Homestake Ridge project team. Two of our primary contractors are local Indigenous-owned companies. Auryn and the Nisga’a Lisims Government entered into a Confidentiality Agreement in January 2020. The parties look forward to a collaborative relationship based on mutual respect and a desire for economic prosperity generated by responsible natural resource development in British Columbia.

The Company is currently working on preparing the NI43-101 PEA report to be filed on SEDAR no later than May 30, 2020. Plans for 2020 are still being developed for the Homestake Ridge project and will take into consideration the conclusions and recommendations of the preliminary economic assessment.

The BC Chief Gold Commissioner pursuant to section 66 of the Mineral Tenure Act, extended all reporting and expenditure requirements until December 31, 2020 for mineral titles.

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the three months ended March 31, 2020

(In thousands of Canadian dollars, unless otherwise noted)

Qualified persons and technical disclosures

Michael Henrichsen, P. Geo., Chief Operating Officer of Auryn, is the Qualified Person with respect to the technical disclosures in this MD&A.

Sombrero Age Dating, 2019

A total of seven samples of magmatic rocks were collected for U-Pb zircon geochronology analysis. From those, two samples (referred to above as A and B) were sent to Geolab SHRIMP IIe, Institute of Geochemistry – University of Sao Paulo, Brazil. They were analysed through the ‘Sensitive High Resolution Ion Microprobe IIe’ method, or SHRIMP. The other five samples (C, D, E, F, and G) were sent to CODES Analytical Laboratory, University of Tasmania, Australia, where it was found that only three contained zircon. Those three samples were then analysed with an ASI RESOLution S-155 ablation system with a Coherent Compex Pro 110 Ar-F excimer laser.

Channel Sampling 2018/2019 (Sombrero, Peru)

Analytical samples were taken from each 1 meter (channels 18SRT-04 through 18SRT-09) or 2 meter (channels 18SRT-10 – 18SRT-20) interval of channel floor resulting in approximately 2-3kg of rock chips material per sample. Collected samples were sent to ALS Lab in Lima, Peru for preparation and analysis. All samples are assayed using 30g nominal weight fire assay with atomic absorption finish (Au-AA25) and multi-element four acid digest ICP-AES/ICP-MS method (ME-MS61). Where MS61 results were greater or near 10,000 ppm Cu, Zn or Pb the assays were repeated with ore grade four acid digest method (OG62). QA/QC programs for 2018/2019 channel grab samples using internal standard and blank samples; field and lab duplicates indicate good overall accuracy and precision.

Intervals were calculated using a minimum of a 0.1% Cu cut-off at beginning and end of the interval and allowing for no more than six consecutive meters of less than 0.1% Cu with a minimum length of the resulting composite of 5m. Copper and gold equivalent grades (CuEq and AuEq) were calculated for 2018 using gold price of US$1300/oz and copper price of US$3.28/lb and for 2019 using gold price of US$1300/oz and copper price of US$3.00/lb.

Historical Fierrazo Diamond Drill Hole (DDH) Re-Sampling 2019 (Sombrero)

Sample intervals averaged 2 meters where historical sample intervals taken and otherwise were 2 meters. Where at least half of HQ diameter core was present it was sawed into equal parts on site. Otherwise historical crush rejects were used in lieu of the core. In total 481 quarter core, 20 half core, and 10 crush rejects, approximately 3-5kg each, were sent to ALS Lab in Lima, Peru for preparation and analysis. All samples were assayed using 30g nominal weight fire assay with atomic absorption finish (Au-AA25) and multi-element four acid digest ICP-AES/ICP-MS method (ME-MS61). Where MS61 results were near or greater than 10,000 ppm Cu the assays were repeated with ore grade four acid digest method (OG62). QA/QC programs using internal standard samples, field and lab duplicates and blanks indicate good accuracy and precision in a large majority of standards assayed.

Intervals were calculated using a minimum of a 0.1% Cu cut-off at beginning and end of the interval and allowing for no more than six consecutive meters of less than 0.1% Cu with a minimum length of the resulting composite of 5 meters.

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the three months ended March 31, 2020

(In thousands of Canadian dollars, unless otherwise noted)

1.2.5

Qualified persons and technical disclosures (continued)

Rocks 2019/2020 (Sombrero & Curibaya, Peru)

Approximately 2-3kg of material was collected for analysis and sent to ALS Lab in Lima, Peru for preparation and analysis. All samples are assayed using 30g nominal weight fire assay with ICP finish (Au-ICP21) and multi-element four acid digest ICP-AES/ICP-MS method (ME-MS61). Where ICP21 results were > 3 g/t Au the assay were repeated with 30g nominal weight fire assay with gravimetric finish (Au-GRA21). Where MS61 results were greater or near 10000 ppm Cu, 10000ppm Pb or 100ppm Ag the assay were repeated with ore grade four acid digest method (OG62). Where OG62 results were greater or near 1500ppm Ag the assays were repeated with 30g nominal weight fire assay with gravimetric finish (Ag-GRA21). QA/QC programs for 2019/2020 rock samples using company and lab duplicates, standards and blanks indicate good accuracy and precision in a large majority of standards assayed. These samples were collected in a non-representative manner. The mineralization may not be reflective of the underlying system.

Historical Grab Samples – Sambalay and Salvador

The historical grab samples on Sambalay and Salvador were collected by Teck (2010-2011), Compania de Exploraciones Orion SAC (2010-2011) and Wild Acre Metals (2012-2013). Auryn has not conducted any due diligence on whether appropriate QA/QC protocols were followed in the collection of these samples, nor can it confirm their accuracy or repeatability.

Channel Sampling 2020 – Curibaya

Analytical samples were taken from each 1-meter interval of trench floor resulting in approximately 2-3kg of rock chips material per sample. Collected samples were sent to ALS Lab in Arequipa, Peru for preparation and then to Lima, Peru for analysis. All samples are assayed using 30g nominal weight fire assay with atomic absorption finish (Au-AA25) and multi-element four acid digest ICP-AES/ICP-MS method (ME-MS61). Where MS61 results were greater or near 10000 ppm Cu, 10000ppm Pb or 100ppm Ag the assay were repeated with ore grade four acid digest method (Cu,Pb,Ag-OG62). Where OG62 results were greater or near 1500ppm Ag the assay were repeated with 30g nominal weight fire assay with gravimetric finish (Ag-GRA21). QA/QC programs for 2020 channel samples using internal standard and blank samples; field and lab duplicates indicate good overall accuracy and precision.

Committee Bay Resource Estimate and Technical Report

Three Bluffs resource estimations were completed by Roscoe Postle Associates Inc. (“RPA”) (see the Technical Report on the Three Bluffs Project, Nunavut Territory, Canada filed on the SEDAR on May 31, 2017 as amended October 23, 2017).

Homestake Ridge Updated Resource Estimate and Preliminary Economic Assessment

The Homestake Ridge updated mineral resource estimate was prepared internally and audited by RPA and is effective December 31, 2019. Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definition Standards for Mineral Resources and Mineral Reserves dated May 10, 2014 (CIM (2014) definitions), as incorporated by reference in National Instrument 43-101 (“NI 43-101”), were followed for Mineral Resource estimation. Mineral Resources are estimated at a cut-off grade of 2.0 g/t AuEq and AuEq values were calculated using a long-term gold price of US$1,300 per ounce, silver price at US$20 per ounce and copper price at US$2.5 per pound and an exchange rate of US$/C$1.20. The AuEq calculation included provisions for metallurgical recoveries, treatment charges, refining costs and transportation. Bulk density ranges from 2.69 t/m3 to 3.03 t/m3, depending on the domain. Differences may occur in totals due to rounding. The Qualified Person responsible for this mineral resource estimate is Philip A. Geusebroek, P. Geo., RPA.

The updated resource estimate will be included in the Company’s PEA which, in accordance with NI 43-101, the Company plans to file on SEDAR at www.sedar.com within 45 days of its press release dated April 15, 2020. The PEA was prepared in accordance with NI 43-101 by MineFill Services Inc. of Seattle, WA with other contributors including RPA (per above), and One-Eighty Consulting Group (environmental, permitting and social).

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the three months ended March 31, 2020

(In thousands of Canadian dollars, unless otherwise noted)

1.2.5

Qualified persons and technical disclosures (continued)

The Company cautions that the PEA is preliminary in nature in that it includes Inferred Mineral Resources which are considered too speculative geologically to have the economic considerations applied to them that would enable them to be characterized as mineral reserves, and there is no certainty that the PEA will be realized. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

Forward Looking Information and Additional Cautionary Language related to the PEA

Certain information contained in the above disclosure contains forward-looking statements and information about the economic analyses for the Homestake Ridge Gold Project and its potential for development and expansion, the anticipated IRR and NPV for the project, capital and operating costs, processing and recovery estimates and strategies, proposed mining method and development plans, mineral resource estimates and statements as to management's expectations with respect to, among other things, the matters and activities contemplated in this disclosure.

Such forward looking statements are necessarily based upon a number of factors and assumptions that, while considered reasonable by the Company as of the date of such statements, are inherently subject to significant business, economic and competitive uncertainties and contingencies. The assumptions made by the Company in preparing the forward looking statements contained in this disclosure, which may prove to be incorrect, include, but are not limited to: the specific assumptions set forth above and in the Technical Report; that the Company is able to develop the property in the manner set out in the Technical Report; that the Company is able to advance the property through to feasibility; that if viable, the Company is able to obtain all necessary permits to develop the mine on the property; that the Company is able to complete the consultation with the Indigenous people in the area of that Homestake Ridge Gold Project; that the exchange rate between the Canadian dollar, and the United States dollar remain consistent with current levels or as set out in this press release; that prices for gold and silver remain consistent with the Company's expectations; that prices for key mining supplies, including labour costs and consumables, remain consistent with the Company's current expectations; that Company’s current estimates of mineral resources, mineral grades and mineral recovery are accurate; and that there are no material variations in the current tax and regulatory environment. Many factors, known and unknown, could cause the actual results to be materially different from those expressed or implied.

By its nature, this information is subject to inherent risks and uncertainties that may be general or specific and which give rise to the possibility that expectations, forecasts, predictions, projections or conclusions will not prove to be accurate, that assumptions may not be correct and that objectives, strategic goals and priorities will not be achieved. Factors that could cause future results or events to differ materially from current expectations expressed or implied by the forward-looking statements include: availability of financing to fund the Company’s exploration and development activities, the ability of the Company’s exploration program to identify and expand mineral resources, operational risks in exploration and development for gold and silver, the Company’s ability to realize the PEA, delays or changes in plans with respect to exploration or development projects or capital expenditures, uncertainty as to calculation of mineral resources, changes in commodity and power prices, changes in interest and currency exchange rates, the ability to attract and retain qualified personnel, inaccurate geological and metallurgical assumptions (including with respect to the size, grade and recoverability of mineral resources), changes in development or mining plans due to changes in logistical, technical or other factors, title defects, government approvals and permits, cost escalation, changes in general economic conditions or conditions in the financial markets, environmental regulation, operating hazards and risks, delays, taxation rules, competition, public health crises such as the COVID-19 pandemic and other uninsurable risks, liquidity risk, share price volatility, dilution and future sales of common shares, aboriginal claims and consultation, cybersecurity threats, climate change, delays and other risks described in the Company’s documents filed with Canadian and U.S. securities regulatory authorities. Readers should refer to the risks discussed in the Company’s Annual Information Form and MD&A for the year ended December 31, 2019 and subsequent continuous disclosure filings with the Canadian Securities Administrators available at www.sedar.com and the Company’s registration statement on Form 40-F filed with the United States Securities and Exchange Commission and available at www.sec.gov. Readers should not place undue reliance on forward looking statements.

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the three months ended March 31, 2020

(In thousands of Canadian dollars, unless otherwise noted)

1.2.5

Qualified persons and technical disclosures (continued)

Cautionary Note to United States Investors concerning Estimates of Measured, Indicated and Inferred Resource Estimates

This disclosure uses the terms “indicated mineral resource” and “inferred mineral resource”, which are Canadian mining terms as defined in and required to be disclosed in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”), which references the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) – CIM Definition Standards on Mineral Resources and Mineral Reserves (“CIM Standards”), adopted by the CIM Council, as amended. However, these terms are not defined terms under Industry Guide 7 (“Industry Guide 7”) under the United States Securities Act of 1933, as amended, and, until recently, have not been permitted to be used in reports and registration statements filed with the U.S. Securities and Exchange Commission (the “SEC”). The SEC has adopted amendments to its disclosure rules to modernize the mineral property disclosure requirements for issuers whose securities are registered with the SEC under the Exchange Act. These amendments became effective February 25, 2019 (the “SEC Modernization Rules”) with compliance required for the first fiscal year beginning on or after January 1, 2021. The SEC Modernization Rules replace the historical disclosure requirements for mining registrants that were included in SEC Industry Guide 7.

United States investors are cautioned that there are differences in the definitions under the SEC Modernization Rules and the CIM Standards. Accordingly, there is no assurance any mineral reserves or mineral resources that the Company may report as “indicated mineral resources” and “inferred mineral resources” under NI 43- 101 would be the same had the Company prepared the reserve or resource estimates under the standards adopted under the SEC Modernization Rules. United States investors are also cautioned that while the SEC will now recognize “indicated mineral resources” and “inferred mineral resources”, investors should not assume that any part or all of the mineralization in these categories will ever be converted into a higher category of mineral resources or into mineral reserves. Mineralization described using these terms has a greater amount of uncertainty as to their existence and feasibility than mineralization that has been characterized as reserves. Accordingly, investors are cautioned not to assume that any “indicated mineral resources” or “inferred mineral resources” that the Company reports are or will be economically or legally mineable. Further, “inferred mineral resources” have a greater amount of uncertainty as to their existence and as to whether they can be mined legally or economically. Therefore, United States investors are also cautioned not to assume that all or any part of the “inferred mineral resources” exist. In accordance with Canadian securities laws, estimates of “inferred mineral resources” cannot form the basis of feasibility or other economic studies, except in limited circumstances where permitted under NI 43-101. In addition, United States investors are cautioned that a preliminary economic assessment cannot support an estimate of either “proven mineral reserves” or “probable mineral reserves” and that no feasibility studies have been completed on the Company’s mineral properties.

Accordingly, information contained in this disclosure describing the Company’s mineral deposits may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

Peruvian interests within a special economic zone - Auryn holds certain interests in Peru through Corisur Peru SAC, which controls (among other) certain licenses (including the Huilacollo project) that are located within a special legal zone which runs 50km back from the Peruvian border. As a non-Peruvian company, Auryn’s right to ultimately acquire title over the shares issued by Corisur Peru SAC and to own and/or exploit these licenses requires approval from the Peruvian government. While Auryn is in the process of submitting its applications and does not foresee any legal reason why it would be denied the approval, some risk of denial or delay should be assumed to exist.

Selected annual financial information

| | | | |

| | | | |

| | | | |

| Comprehensive loss for the period | $14,136 | $17,389 | $36,578 |

| Net loss for the period | $13,933 | $17,674 | $36,500 |

| Basic and diluted loss per share | $0.15 | $0.21 | $0.48 |

| Total assets | $42,962 | $43,523 | $43,759 |

| Total long-term liabilities | $2,134 | $1,891 | $1,662 |

1 Restated for change in accounting policy as disclosed in note 4 of the Company’s audited annual consolidated financial statements for the year ended December 31, 2018.

The Company generated no revenues from operations during the above periods.

AURYN RESOURCES INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations for the three months ended March 31, 2020

(In thousands of Canadian dollars, unless otherwise noted)

1.4 Discussion of operations

Three months ended March 31, 2020 and 2019 (Q1 2020 vs. Q1 2019)