Technical Report,

Updated Mineral Resource Estimate and

Preliminary Economic Assessment

on the

HOMESTAKE RIDGE GOLD PROJECT

SKEENA MINING DIVISION

BRITISH COLUMBIA

Latitude 55° 45' 12.6" N and Longitude 129° 34' 39.8" W

Qualified Persons:

Paul Chamois, P.Geo.

Philip Geusebroek, P.Geo.

Mary Mioska, P.Eng.

David M.R. Stone, P.Eng.

Prepared by:

MINEFILL SERVICES, INC.

PO BOX 725

BOTHELL, WASHINGTON

Effective Date: May 29, 2020

Amended and Restated: June 24, 2020

IMPORTANT NOTICE

This report was prepared as a National Instrument 43-101 Technical Report for the exclusive use of Auryn Resources Ltd. (Auryn) by MineFill Services, Inc., (MineFill). The quality of information, conclusions, and estimates contained herein is consistent with industry standards based on i) information available at the time of preparation, ii) data supplied by outside sources, and iii) the assumptions, conditions, and qualifications as set forth in this report. This report is intended for use by Auryn subject to the terms and conditions of its contract with MineFill. Except for the purposes legislated under Canadian provincial and territorial securities law, any other use of this report by any third party is at that party’s sole risk.

Homestake Ridge Project

NI43-101F1 Technical Report

Table of Contents

| | | Page |

| 1 | SUMMARY | 1-1 |

| 1.1 | Overview | 1-1 |

| 1.2 | Geology | 1-1 |

| 1.3 | Mineralization | 1-2 |

| 1.4 | Exploration Highlights | 1-3 |

| 1.5 | Mineral Resources | 1-3 |

| 1.6 | Mineral Reserves | 1-4 |

| 1.7 | Mining Operations | 1-4 |

| 1.8 | Processing | 1-4 |

| 1.9 | Site Infrastructure | 1-5 |

| 1.1 | Capital Costs | 1-6 |

| 1.11 | Operating Costs | 1-6 |

| 1.12 | Financial Model | 1-6 |

| 1.13 | Qualified Persons Opinion | 1-7 |

| 2 | INTRODUCTION | 2-1 |

| 2.1 | The Issuer | 2-1 |

| 2.2 | Terms of Reference | 2-1 |

| 2.3 | Sources of Information | 2-1 |

| 2.4 | Qualified Persons | 2-3 |

| 2.5 | Personal Inspection

| 2-3 |

| 2.6 | Terms and Definitions | 2-4 |

| 3 | RELIANCE ON OTHER EXPERTS | 3-1 |

| 4 | PROPERTY DESCRIPTION AND LOCATION | 4-1 |

| 4.1 | Location | 4-1 |

| 4.2 | Project Ownership | 4-2 |

| 4.3 | Mineral Tenure | 4-2 |

| 4.4 | Royalties and Encumbrances | 4-2 |

| 4.5 | Property Agreements | 4-2 |

| 4.6 | Permitting Considerations | 4-2 |

| 4.7 | Environmental Considerations | 4-4 |

| 4.8 | Social License Considerations | 4-4 |

| 4.9 | Comments on Section 4 | 4-4 |

| 5 | ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE, AND PHYSIOGRAPHY | 5-1 |

| 5.1 | Site Access | 5-1 |

| 5.2 | Climate | 5-1 |

| 5.3 | Local Resources and Infrastructure | 5-3 |

| 5.4 | Physiography | 5-4 |

| 5.4.1 | Terrain | 5-4 |

| 5.4.2 | Vegetation | 5-4 |

Effective Date: May 29, 2020 Project No. TRQ-06 | |

|

Page i

Homestake Ridge Project

NI43-101F1 Technical Report

| 5.5 | Seismicity | 5-5 |

| 5.6 | Comments on Section 5 | 5-6 |

| 6 | HISTORY | 6-1 |

| 6.1 | Prior Ownership | 6-1 |

| 6.2 | Exploration History | 6-1 |

| 6.3 | Production | 6-3 |

| 7 | GEOLOGICAL SETTING AND MINERALIZATION | 7-1 |

| 7.1 | Regional Geology | 7-1 |

| 7.2 | Local Geology | 7-4 |

| 7.3 | Property Geology | 7-6 |

| 7.4 | Mineralization | 7-10 |

| 7.4.1 | Homestake Main Deposit | 7-12 |

| 7.4.2 | Homestake Silver Deposit | 7-12 |

| 7.4.3 | South Reef Zone | 7-13 |

| 7.5 | Prospects/Exploration Targets | 7-13 |

| 7.5.1 | Vanguard Cu and Au Zones | 7-15 |

| 7.5.2 | Sericite Zone (Gold Reef, Fox Reef) | 7-15 |

| 7.5.3 | Dilly and Dilly West Zones | 7-15 |

| 7.5.4 | North Homestake Zone (North Dome) | 7-16 |

| 7.5.5 | KNHSR1 | 7-16 |

| 7.5.6 | Kombi | 7-17 |

| 7.5.7 | Bria | 7-17 |

| 8 | DEPOSIT TYPES | 8-1 |

| 9 | EXPLORATION | 9-1 |

| 9.1 | Rock Sampling | 9-1 |

| 9.1.1 | Rock Sampling Methodology | 9-1 |

| 9.1.2 | Rock Sampling Results | 9-1 |

| 9.2 | Soil Sampling | 9-1 |

| 9.2.1 | 2017 Ah Horizon Soil Sampling Methodology | 9-1 |

| 9.2.2 | 2017 Talus Fines Sampling Methodology

| 9-1 |

| 9.2.3 | B-Horizon Soil Sampling Methodology

| 9-1 |

| 9.2.4 | Soil Sample Results

| 9-1 |

| 9.3 | Induced Polarization Survey | 9-2 |

| 9.4 | Re-log of Historic Drill Core | 9-2 |

| 9.5 | Geochronological Study | 9-2 |

| 9.6 | Airborne Geophysics | 9-3 |

| 10 | DRILLING | 10-1 |

| 10.1 | Historical Drilling | 10-1 |

| 10.2 | Auryn Resources Inc. Drilling | 10-1 |

| 11 | SAMPLE PREPARATION, ANALYSES, AND SECURITY | 11-5 |

| 11.1 | Historic Sampling | 11-5 |

| 11.2 | Homestake Resources Corporation Sampling | 11-5 |

| 11.3 | Assaying of Drill Core | 11-6 |

| 11.3.1 | 2003 to 2006 Procedure | 11-6 |

| 11.3.2 | 2007 to 2008 Procedure | 11-7 |

| 11.3.3 | 2009 to 2012 Procedure | 11-7 |

| 11.4 | Agnico Eagle Mines Limited Sampling | 11-8 |

Effective Date: May 29, 2020 Project No. TRQ-06 | |

|

Page ii

Homestake Ridge Project

NI43-101F1 Technical Report

| 11.5 | Auryn Sampling | 11-9 |

| 11.6 | Laboratory Methods | 11-11 |

| 11.7 | QC Sampling | 11-13 |

| 11.8 | 2017 to 2019 QC Programs | 11-13 |

| 12 | DATA VERIFICATION | 12-1 |

| 12.1 | Site Visit | 12-1 |

| 12.2 | Historical Verification | 12-1 |

| 12.3 | 2017 to 2019 Verification Work | 12-1 |

| 12.4 | Assay Verification | 12-2 |

| 13 | MINERAL PROCESSING AND METALLURGICAL TESTING | 13-1 |

| 13.1 | Overview | 13-1 |

| 13.2 | Base Metal Laboratories 2016 | 13-1 |

| 13.3 | Ore Sorting | 13-2 |

| 13.4 | Gravity Concentration | 13-3 |

| 13.5 | Main Composite Rougher Flotation Testing | 13-3 |

| 13.6 | Silver Composite Rougher Flotation Testing | 13-4 |

| 13.7 | Main Composite Cleaner Flotation Testing | 13-4 |

| 13.8 | Silver Composite Cleaner Flotation Testing | 13-5 |

| 13.9 | Cyanide Leaching of Flotation Products | 13-6 |

| 13.1 | Concentrate Quality Estimates | 13-6 |

| 13.11 | Comment on Metallurgical Sampling | 13-7 |

| 13.12 | Qualified Persons Opinion | 13-7 |

| 14 | MINERAL RESOURCE ESTIMATES | 14-1 |

| 14.1 | Resource Database | 14-1 |

| 14.2 | Geological Interpretation | 14-3 |

| 14.3 | True Thickness | 14-5 |

| 14.4 | Treatment of High-Grade Assays | 14-6 |

| 14.4.1 | Capping Levels | 14-6 |

| 14.5 | High-Grade Restriction | 14-8 |

| 14.6 | Compositing | 14-8 |

| 14.7 | Variography | 14-9 |

| 14.8 | Search Strategy and Grade Interpolation Parameters | 14-11 |

| 14.9 | Bulk Density | 14-12 |

| 14.1 | Block Models | 14-14 |

| 14.11 | Cut-off Grade | 14-18 |

| 14.12 | Classification | 14-19 |

| 14.13 | Block Model Validation | 14-20 |

| 14.14 | Mineral Resource Reporting | 14-24 |

| 14.15 | Comparison to Previous Estimates | 14-26 |

| 14.16 | Comments on Section 14 | 14-28 |

| 15 | MINERAL RESERVE ESTIMATES | 15-1 |

Effective Date: May 29, 2020 Project No. TRQ-06 | |

|

Page iii

Homestake Ridge Project

NI43-101F1 Technical Report

| 16 | MINING METHODS | 16-1 |

| 16.1 | Overview | 16-1 |

| 16.2 | Geotechnical Considerations | 16-1 |

| 16.3 | Cut-Off Grade | 16-1 |

| 16.4 | Mining Method | 16-2 |

| 16.5 | Production Schedule | 16-3 |

| 16.6 | Dilution | 16-5 |

| 16.7 | Mine Development | 16-6 |

| 16.7.1 | Equipment Utilization | 16-7 |

| 16.8 | Mine Backfill | 16-7 |

| 16.9 | Mine Services | 16-8 |

| 16.9.1 | Ventilation | 16-8 |

| 16.9.2 | Compressed Air | 16-8 |

| 16.9.3 | Water | 16-8 |

| 16.9.4 | Mine Dewatering | 16-8 |

| 16.9.5 | Electrical Power | 16-8 |

| 16.9.6 | Emergency Egress and Refuge | 16-8 |

| 17 | RECOVERY METHODS | 17-1 |

| 17.1 | Flowsheet Development | 17-1 |

| 17.2 | Deleterious Elements | 17-4 |

| 18 | PROJECT INFRASTRUCTURE | 18-1 |

| 18.1 | Site Access | 18-1 |

| 18.2 | Barge Landing | 18-3 |

| 18.3 | Power | 18-3 |

| 18.3.1 | Transmission Line Alternative | 18-3 |

| 18.3.2 | Hydropower Alternatives | 18-4 |

| 18.3.3 | Diesel Power Alternative | 18-4 |

| 18.4 | Water Supply | 18-4 |

| 18.5 | Waste Rock Storage | 18-5 |

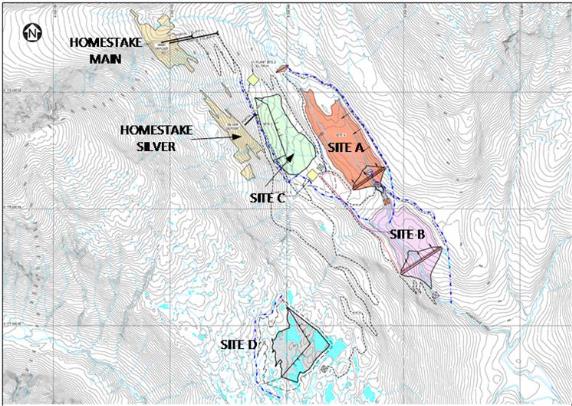

| 18.6 | Tailings Storage Facility | 18-5 |

| 18.6.1 | Slurried Tailings Options – Sites A and B | 18-6 |

| 18.6.2 | Filtered Tailings Options – Site C and Site D | 18-7 |

| 18.6.3 | Site Selection | 18-9 |

| 18.7 | Process Plant | 18-9 |

| 18.8 | Ancillary Facilities | 18-9 |

| 18.8.1 | Person-Camp | 18-9 |

| 18.8.2 | Core Shack | 18-9 |

| 18.8.3 | Assay Laboratory | 18-9 |

| 18.8.4 | Maintenance Shop and Warehouse | 18-10 |

| 18.8.5 | Mine Administration/Technical Offices | 18-10 |

| 18.8.6 | Underground Dry | 18-10 |

| 18.9 | Storage | 18-10 |

| 18.9.1 | Diesel Fuel | 18-10 |

| 18.9.2 | Potable Water | 18-10 |

| 18.9.3 | Fire Water | 18-10 |

| 18.9.4 | Explosives | 18-10 |

| 18.9.5 | Reagents | 18-11 |

Effective Date: May 29, 2020 Project No. TRQ-06 | |

|

Page iv

Homestake Ridge Project

NI43-101F1 Technical Report

| 19 | MARKET STUDIES AND CONTRACTS | 19-1 |

| 19.1 | Commodity Pricing | 19-1 |

| 19.2 | Material Contracts | 19-4 |

| 20 | ENVIRONMENTAL STUDIES, PERMITTING, AND SOCIAL OR COMMUNITY IMPACT | 20-1 |

| 20.1 | Environmental Studies Overview | 20-1 |

| 20.2 | Pre-Existing Conditions | 20-2 |

| 20.3 | Waste Rock Characterization | 20-2 |

| 20.4 | Tailings Geochemistry | 20-3 |

| 20.5 | Metals Leaching | 20-4 |

| 20.6 | Environmental Considerations/Monitoring Programs | 20-4 |

| 20.6.1 | Waste Rock Monitoring | 20-4 |

| 20.6.2 | Tailings Surface Water Management | 20-4 |

| 20.6.3 | Groundwater Monitoring | 20-4 |

| 20.6.4 | Surface Water Monitoring | 20-5 |

| 20.6.5 | Surface Runoff Water Management | 20-5 |

| 20.7 | Closure Plan | 20-6 |

| 20.8 | Permitting | 20-7 |

| 20.8.1 | Land Use Plans | 20-7 |

| 20.8.2 | Federal Permits, Approvals, Licences and Authorizations | 20-11 |

| 20.8.3 | Provincial Permits, Approvals and Licences | 20-12 |

| 20.8.4 | Access Road Permitting | 20-15 |

| 20.9 | Considerations of Social and Community Impacts | 20-15 |

| 20.1 | Comments on Section 20 | 20-18 |

| 21 | CAPITAL AND OPERATING COSTS | 21-1 |

| 21.1 | Capital Cost Estimates | 21-1 |

| 21.1.1 | Basis of Estimate | 21-1 |

| 21.1.2 | Direct Costs | 21-1 |

| 21.1.3 | Indirect Costs | 21-3 |

| 21.1.4 | Sustaining Capital | 21-4 |

| 21.2 | Operating Cost Estimates | 21-6 |

| 21.2.1 | Mining Operating Costs | 21-6 |

| 21.2.2 | Process Operating Costs | 21-6 |

| 21.2.3 | General and Administrative Operating Costs | 21-6 |

| 21.2.4 | Environmental Costs | 21-7 |

| 21.2.5 | Community and Social | 21-7 |

Effective Date: May 29, 2020 Project No. TRQ-06 | |

|

Page v

Homestake Ridge Project

NI43-101F1 Technical Report

| 22 | ECONOMIC ANALYSIS | 22-1 |

| 22.1 | Introduction | 22-1 |

| 22.2 | Mine Production Schedule | 22-1 |

| 22.3 | Metal Production | 22-2 |

| 22.4 | Concentrate Freight and Insurance | 22-2 |

| 22.5 | Smelting and Refining Terms | 22-2 |

| 22.6 | Concentrate Marketing Terms | 22-3 |

| 22.7 | Capital Costs | 22-3 |

| 22.7.1 | Sustaining Capital | 22-4 |

| 22.7.2 | Working Capital | 22-4 |

| 22.7.3 | Salvage Value | 22-4 |

| 22.8 | Net of Smelter Revenues | 22-4 |

| 22.9 | Royalties | 22-5 |

| 22.1 | Operating Costs | 22-5 |

| 22.11 | Other Cash Costs | 22-5 |

| 22.12 | Taxes | 22-6 |

| 22.13 | Financial Indicators | 22-6 |

| 22.14 | Sensitivity Analysis | 22-7 |

| 22.15 | Financial Model | 22-8 |

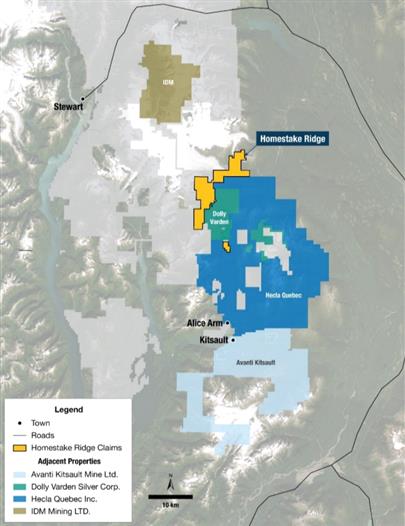

| 23 | ADJACENT PROPERTIES | 23-1 |

| 23.1 | Kinskuch (Extracted from the Hecla website) | 23-2 |

| 23.2 | Dolly Varden | 23-3 |

| 23.3 | Kitsault | 23-4 |

| 24 | OTHER RELEVANT DATA AND INFORMATION | 24-1 |

| 25 | INTERPRETATION AND CONCLUSIONS | 25-1 |

| 25.1 | Mineral Resource Conclusions | 25-2 |

| 25.2 | Risk | 25-3 |

| 25.3 | Opportunities | 25-4 |

| 26 | RECOMMENDATIONS | 26-1 |

| 26.1 | Future Studies | 26-1 |

| 26.1.1 | Geology and Mineral Resources | 26-1 |

| 26.1.2 | Resource Drilling | 26-2 |

| 26.1.3 | Geotechnical Studies | 26-2 |

| 26.1.4 | Environmental Testing | 26-2 |

| 26.1.5 | Environmental Monitoring | 26-2 |

| 26.1.6 | Surface Hydrology and Water Balance | 26-3 |

| 26.1.7 | Metallurgical Testing | 26-3 |

| 26.1.8 | Power Source | 26-3 |

| 26.2 | Proposed Budget | 26-4 |

| 27 | REFERENCES | 27-1 |

| 28 | QUALIFIED PERSONS CERTIFICATES | 28-1 |

Effective Date: May 29, 2020 Project No. TRQ-06 | |

|

Page vi

Homestake Ridge Project

NI43-101F1 Technical Report

List of Tables

| Table 1-1 Mineral Resources – Effective Date: December 31, 2019 Auryn Resources Inc. | |

| – Homestake Ridge Project | 1-3 |

| Table 1-2 Financial Indicators (US$ M) | 1-6 |

| Table 2-1 Qualified Persons | 2-3 |

| Table 4-1 Homestake Mineral Claims | 4-3 |

| Table 4-2 Crown Grants | 4-4 |

| Table 5-1 Climatic Data | 5-3 |

| Table 9-1 Summary of Geochronology Results | 9-3 |

| Table 9-2 VTEM Survey Summary | 9-3 |

| Table 10-1 Historical Drilling | 10-1 |

| Table 11-1 Certified Reference Material | 11-13 |

| Table 14-1 Mineral Resource Assay Statistics | 14-2 |

| Table 14-2 Capping: Au and Ag | 14-6 |

| Table 14-3 Capping: Cu, Pb, As, Sb | 14-7 |

| Table 14-4 Composite Statistics | 14-9 |

| Table 14-5 Variography Results | 14-10 |

| Table 14-6 Bulk Density by Zone | 14-14 |

| Table 14-7 Bulk Density by Domain | 14-14 |

| Table 14-8 Block Model Geometry: HM and HS | 14-15 |

| Table 14-9 Block Model Geometry: SR | 14-16 |

| Table 14-10 Key Block Model Variables | 14-16 |

| Table 14-11 Statistical Comparison of Block Model Grades | 14-21 |

| Table 14-12 Mineral Resources – December 31, 2019 Auryn Resources Inc. | |

| – Homestake Ridge Project | 14-24 |

| Table 14-13 Mineral Resources – Sensitivity by Cut-Off Grade Auryn Resources Inc. | |

| – Homestake Ridge Project | 14-25 |

| Table 14-14 Deleterious Element Content of Mineral Resources | 14-26 |

| Table 14-15 Comparison of 2017 and 2019 Mineral Resource Estimates | 14-27 |

| Table 16-1 Cutoff Grade Calculation | 16-2 |

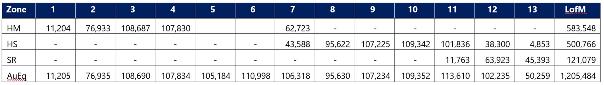

| Table 16-2 Life of Mine Production Schedule | 16-4 |

| Table 16-3 Stope Tonnage Dilution | 16-5 |

| Table 16-4 Life of Mine Development Lengths | 16-6 |

| Table 16-5 Lateral Development Summary | 16-6 |

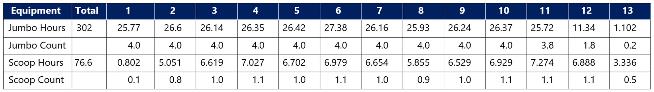

| Table 16-6 Major Equipment Utilization (hours x 1000) by Project Year | 16-7 |

| Table 16-7 Backfill Demand by Project Year (m3) | 16-7 |

| Table 17-1 Metals Distribution at Homestake Ridge | 17-1 |

| Table 17-2 Metallurgical Recoveries | 17-3 |

| Table 17-3 Concentrate Grades | 17-3 |

| Table 17-4 Concentrate Production – Life of Mine | 17-3 |

| Table 17-5 Deleterious Elements in the Concentrates | 17-4 |

| Table 19-1 Historical Metal Prices effective March 26, 2020 – US Dollars | 19-1 |

| Table 20-1 Federal Permits and Approvals Potentially Applicable to the Project | 20-11 |

| Table 20-2 Provincial Permits and Approvals Potentially Applicable to the Project | 20-13 |

| Table 21-1 Capital Cost Summary | 21-2 |

| Table 21-2 Environmental Monitoring Costs (C$) | 21-4 |

| Table 21-3 Sustaining Capital Costs – Life of Mine | 21-5 |

| Table 21-4 Operating Cost Summary (US$) | 21-6 |

| Table 21-5 Unit Mining Costs (US$) | 21-6 |

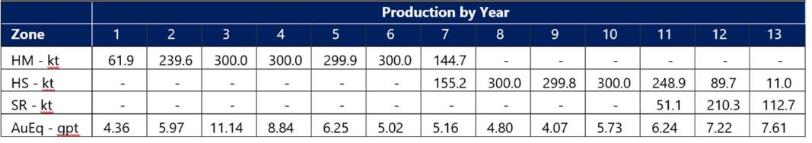

| Table 22-1 Production by Year (kt) | 22-1 |

| Table 22-2 Life of Mine Metal Production | 22-2 |

| Table 22-3 Concentrate Freight and Insurance (US$) | 22-2 |

| Table 22-4 Treatment and Refining Costs (US$) | 22-3 |

| Table 22-5 Concentrate Marketing Terms | 22-3 |

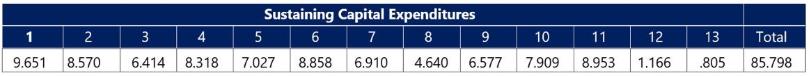

| Table 22-6 Sustaining Capital Expenditures over the Life of Mine(US$ Millions) | 22-4 |

| Table 22-7 Base Case Metal Prices (US$) | 22-4 |

| Table 22-8 Life of Mine Metal Revenues – (US$) | 22-5 |

| Table 22-9 Financial Indicators | 22-7 |

| Table 22-10 Metal Price Sensitivity – After-Tax | 22-7 |

| Table 22-11 Operating Cost Sensitivity – After-Tax | 22-8 |

| Table 22-12 Capital Cost Sensitivity – After-Tax | 22-8 |

| Table 22-13 Base Case Financial Model (US$ Millions) | 22-9 |

| Table 26-1 Future Work Tasks and Budget (US$) | 26-4 |

Effective Date: May 29, 2020 Project No. TRQ-06 | |

|

Page vii

Homestake Ridge Project

NI43-101F1 Technical Report

List of Figures

| Figure 4.2: Mineral Claims | 4-1 |

| Figure 4.3: Claims Subject to Royalty | 4-3 |

| Figure 5.1: Site Access | 5-2 |

| Figure 5.2: Earthquake Epicenter Map for Events in the Past 50 Years | 5-5 |

| Figure 7.1: Regional Geology | 7-3 |

| Figure 7.2: Local Geology | 7-5 |

| Figure 7.3: Property Geology | 7-7 |

| Figure 7.4: Deposit Locations | 7-11 |

| Figure 7.5: Longitudinal Section Through the Homestake Ridge Deposit Looking North-East | 7-11 |

| Figure 7.6: Prospects/Exploration Targets | 7-14 |

| Figure 9.1: Homestake Merged Magnetics | 9-4 |

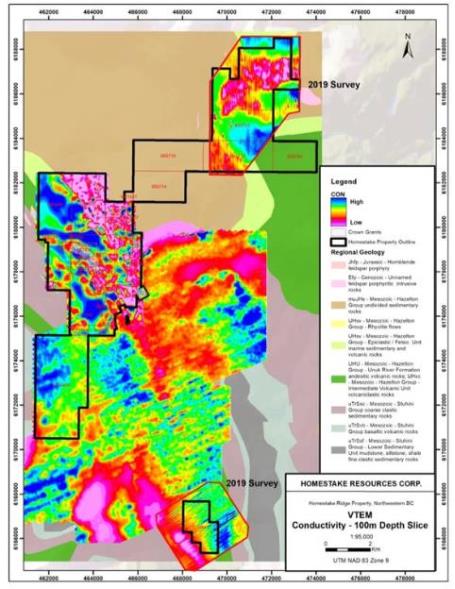

| Figure 9.2: Homestake Merged Conductivity | 9-5 |

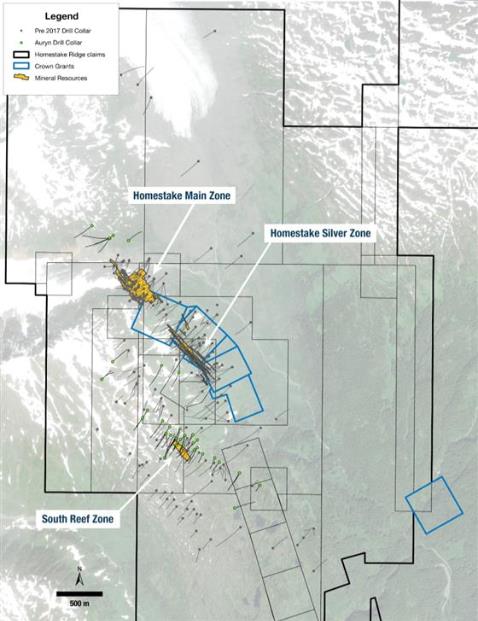

| Figure 10.1: Drilling Collar Locations | 10-3 |

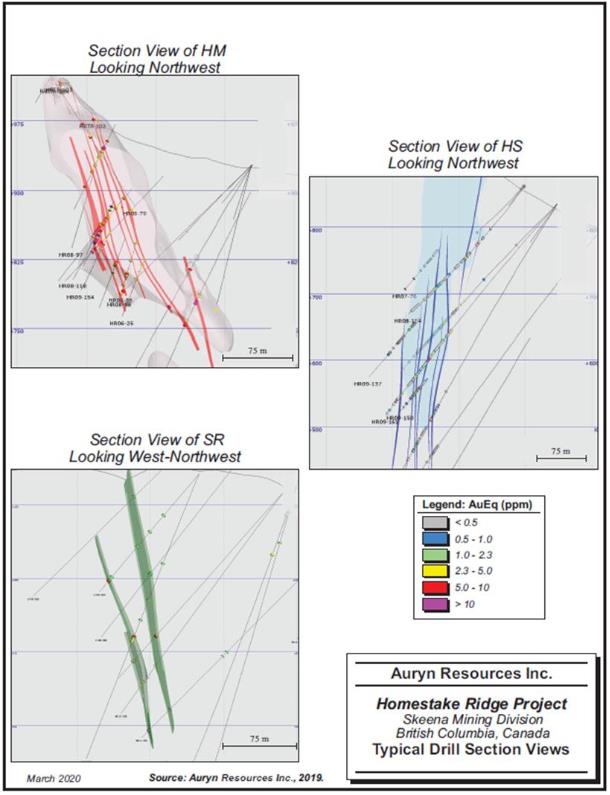

| Figure 10.2: Typical Drill Section Views | 10-4 |

| Figure 11.1: Core Handling Flow Chart | 11-10 |

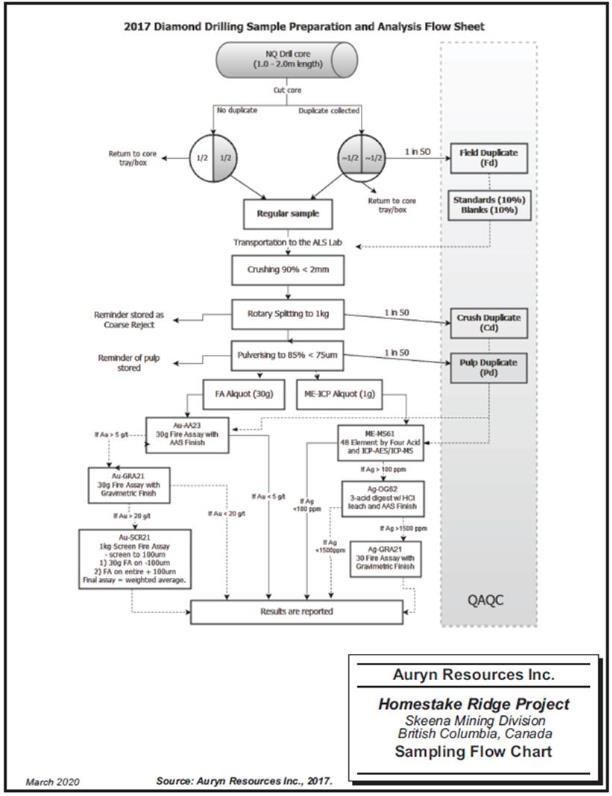

| Figure 11.2: Sampling Flow Chart | 11-12 |

| Figure 13.1: Metallurgical Sample Locations | 13-8 |

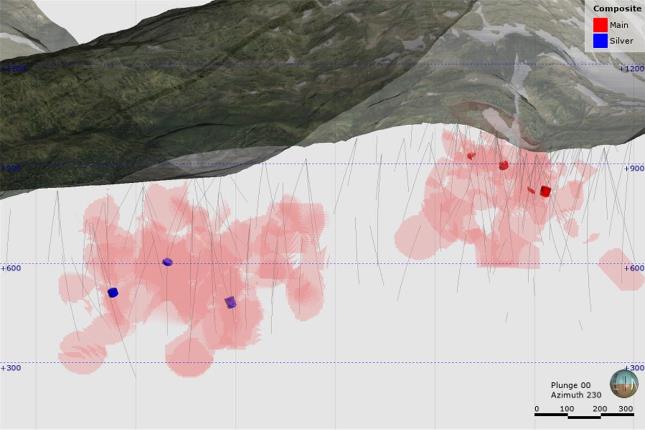

| Figure 14.1: Oblique View of HM (Left Side) And HS (Right Side) Veins | 14-4 |

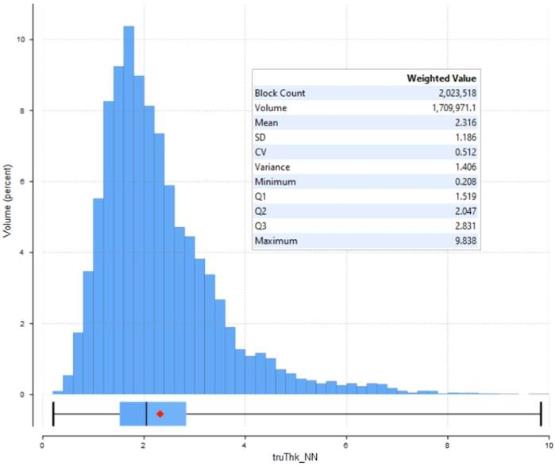

| Figure 14.2: Histogram of TT Where GTT > 4.0 | 14-5 |

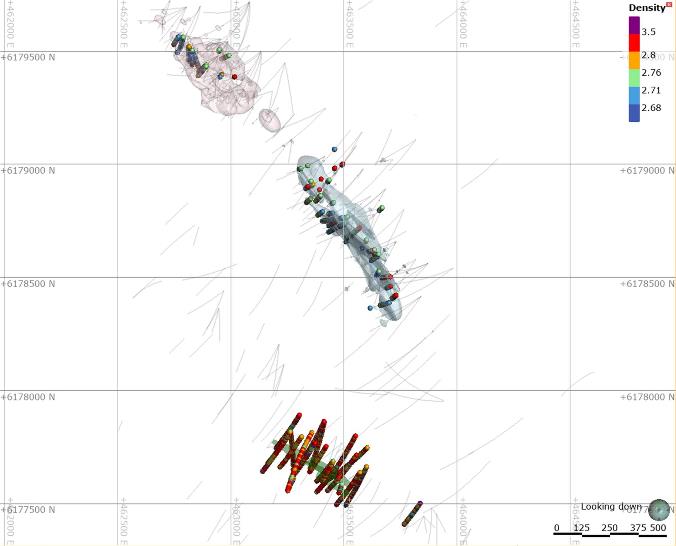

| Figure 14.3: Plan View of Bulk Density Sample Distribution | 14-13 |

| Figure 14.4: Plan View of Block Models | 14-17 |

| Figure 14.5: Visual Validation Example | 14-22 |

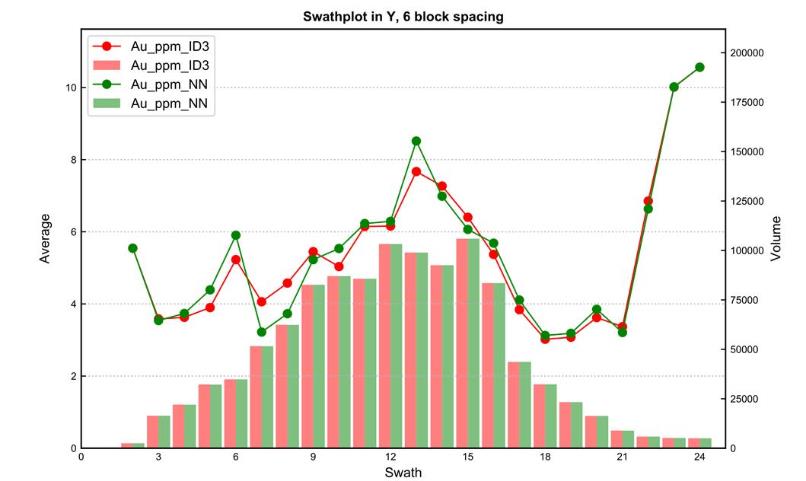

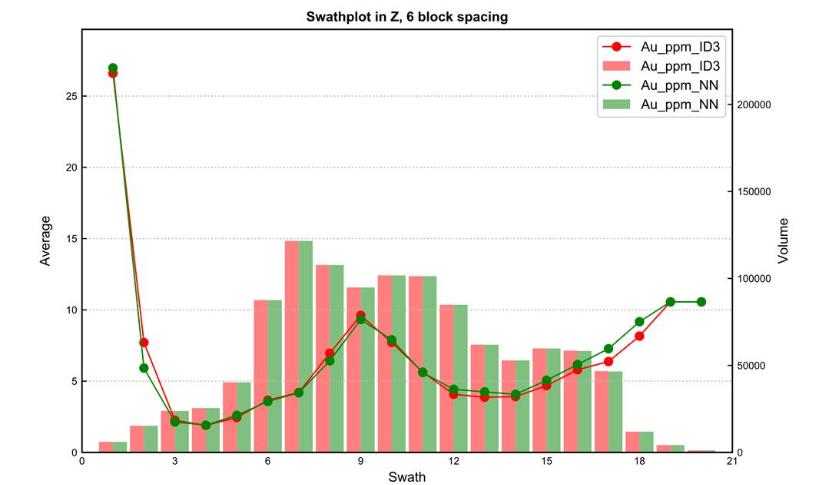

| Figure 14.6: Swath Plot Example (HM Y and Z, Width 30 m) | 14-23 |

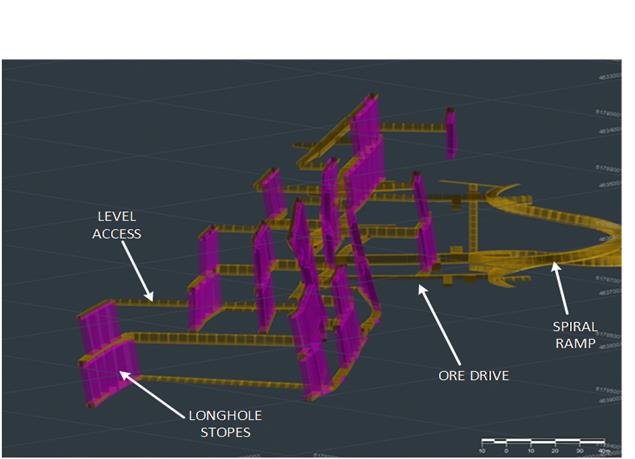

| Figure 16.1: Longhole Open Stoping at Homestake Ridge | 16-3 |

| Figure 16.2: Life of Mine Production Schedule | 16-5 |

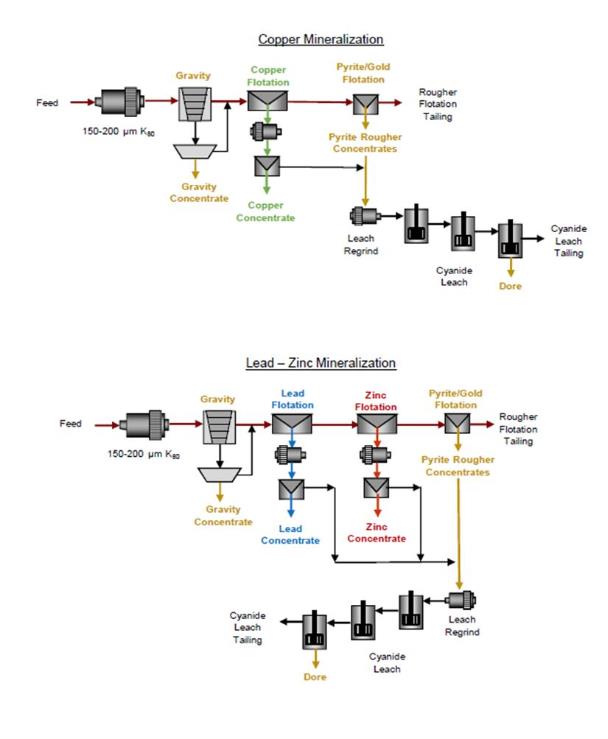

| Figure 17.1: Proposed Flowsheets for Homestake Main (Copper Circuit) and |

| Homestake Silver (Lead/Zinc Circuit) | 17-2 |

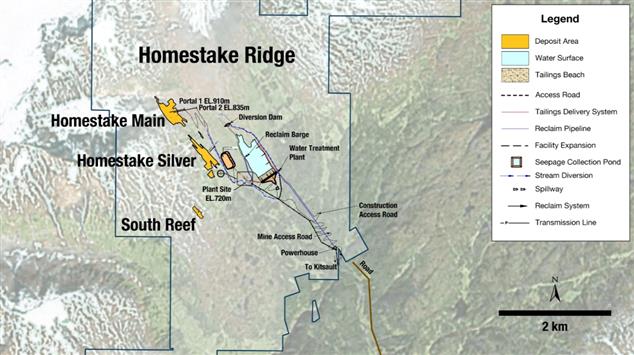

| Figure 18.1: Site Development Plan | 18-1 |

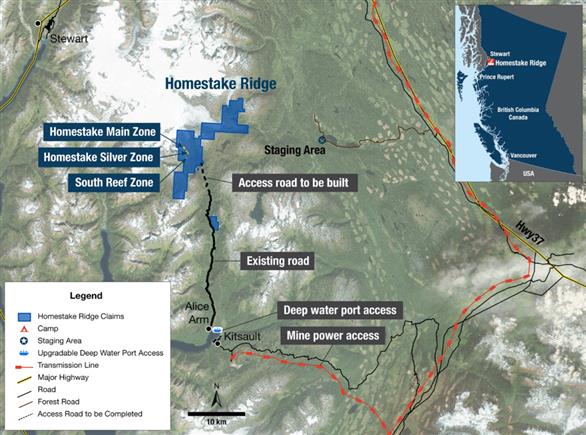

| Figure 18.2: Site Access | 18-2 |

| Figure 18.3: Potential Tailings Storage Options | 18-6 |

| Figure 19.1: 3-Year Historical Price Trends for Gold (top) and Silver (bottom) | 19-2 |

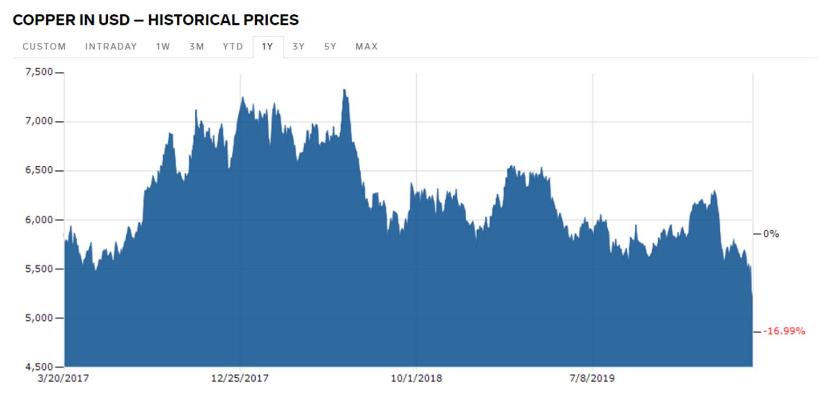

| Figure 19.2: 3-Year Historical Price Trends for Copper (top) and Lead (bottom) | 19-3 |

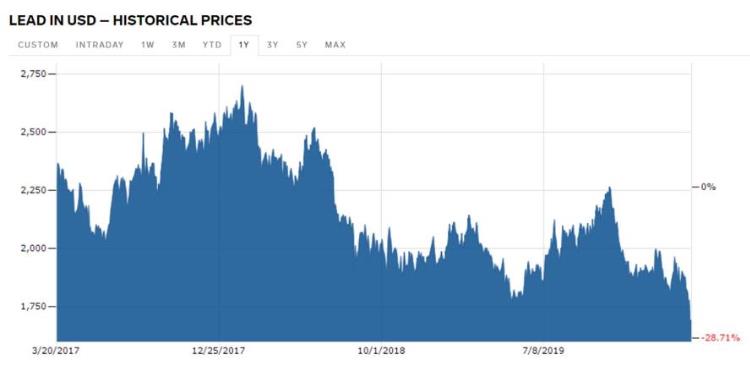

| Figure 20.1: Great Bear Rainforest Land Use Zones | 20-8 |

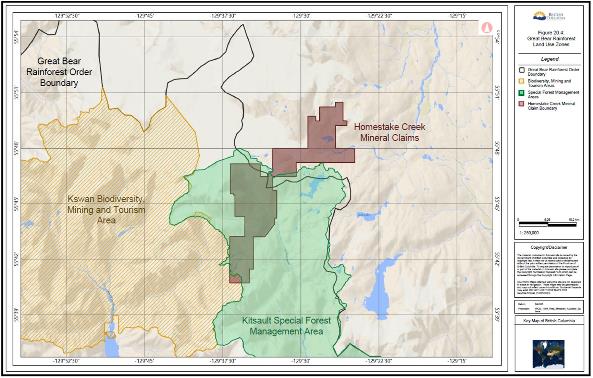

| Figure 20.2: Nass South Sustainable Resource Management Plan Areas | 20-10 |

| Figure 23.1: Mineral Properties in the Vicinity of Homestake Ridge | 23-1 |

Effective Date: May 29, 2020 Project No. TRQ-06 | |

|

Page viii

Homestake Ridge Project

NI43-101F1 Technical Report

The subject of this document is the Homestake Ridge gold project located in the so-called Golden Triangle of north-central British Columbia. The Project is owned and operated by Auryn Resources Inc. (the “Company” or “Auryn”) of Vancouver, B.C. Auryn is listed on the Toronto stock exchange and the New York Stock Exchange.

The Homestake Ridge Project comprises 7,484.37 hectares (ha) of mineral claims and crown grants and is located approximately 32 km north-northwest of the tidewater communities of Alice Arm and Kitsault, BC.

The Project is located within the prolific Iskut-Stewart-Kitsault Belt which hosts several precious and base metal mineral deposits. Diverse mineralization styles include stratabound sulphide and silica-rich zones, sulphide veins, and disseminated or stockwork sulphides. Mineralization is related to Early Jurassic feldspar-hornblende-phyric sub-volcanic intrusions and felsic volcanism, which commonly occurs with zones of pyrite-sericite alteration. Numerous genetic models can be proposed for the area and local deposits present a broad range of characteristics.

The Project lies within the metallogenic region known as the Stewart Complex. Described as the contact of the eastern Coast Plutonic Complex with the west-central margin of the successor Bowser Basin, the Stewart Complex ranges from Middle Triassic to Quaternary in age and is comprised of sedimentary, volcanic, and metamorphic rocks.

The Project covers the transition between the sedimentary and volcanic rocks of the Upper Triassic to Lower Jurassic Stuhini Group, a complex sequence of Lower to Middle Jurassic sedimentary, volcanic, and intrusive rocks of the Hazelton Group and sedimentary rocks of the Upper to Middle Jurassic Bowser Lake Group.

In the northern portion of the Project, at the headwaters of Homestake Creek, rhyolitic volcanic rocks occur at the base of the Salmon River sediments.

The eastern portion of the Project is dominated by the Middle to Upper Jurassic Bowser Basin Group which conformably overlies the thin bedded graphitic argillites of the Salmon River formation.

Effective Date: May 29, 2020 Project No. TRQ-06 | |

|

Page 1-1

Homestake Ridge Project

NI43-101F1 Technical Report

Structure on the Project largely reflects northeast-southwest compression that has continued from the Jurassic to present day. Recent drilling and mapping suggest that the local stratigraphy has undergone several deformation events including uplift and local extension of the Stuhini and lower Hazelton stratigraphy. Large northeast trending ankerite bearing faults have been mapped and related to Tertiary east-west extension.

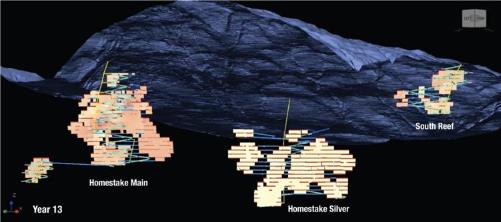

The main zones of the Homestake Ridge deposit are the Homestake Main (HM), Homestake Silver (HS), and South Reef (SR).

The Homestake Main zone is the more copper-rich of the zones, with both gold-rich and silver-rich variants and an apparent trend of increasing copper grade with depth. Grades for gold typically range from 0.1 g/t Au to 2 g/t Au with some intercepts measuring into the hundreds of grams per tonne and averaged at 7.75 g/t Au. Silver grades are generally in the 1.0 g/t Ag to 100 g/t Ag range but can be as high as hundreds and even thousands of grams per tonne. The average silver grade in the Homestake Main zone is 68.6 g/t Ag. Copper grades vary from parts per million to several percent, with mean grades observed to increase significantly with depth.

The Homestake Silver zone, located approximately 0.5 km southeast of Homestake Main, contains very little copper, and is relatively higher in silver content. Silver grades at Homestake Silver average 154 g/t Ag, approximately double that of the Homestake Main zone (68.6 g/t Ag) and 26 times that of South Reef (5.8 g/t Ag). Gold grades at Homestake Silver typically range up to several g/t Au and averaged 3.5 g/t Au in the samples contained within the interpreted zone boundaries. Copper content is comparatively low, however, geochemically significant, and generally measures between 10 ppm Cu and 500 ppm Cu.

The South Reef zone is comprised of two narrow sub-parallel tabular bodies which strike at approximately 120° to 130° and dip 70°NE to 80°NE. To date, only twelve holes have intersected significant mineralization, as such characterization of the structure and grades is preliminary. The zones measure one metre to three metres in thickness and have been traced for approximately 300 m vertically and 400 m along strike. Silver grades at SR average 5.8 g/t Ag in the vein samples. This is offset by high gold values, which average 5.9 g/t Au.

The Homestake deposits are commonly vertically zoned from a base metal poor Au-Ag-rich top to an Ag-rich base metal zone over a vertical range of 250 m to 350 m. The silver-galena-sphalerite veins of the Homestake Silver Zone exhibit many of these features.

Effective Date: May 29, 2020 Project No. TRQ-06 | |

|

Page 1-2

Homestake Ridge Project

NI43-101F1 Technical Report

1.4

Exploration Highlights

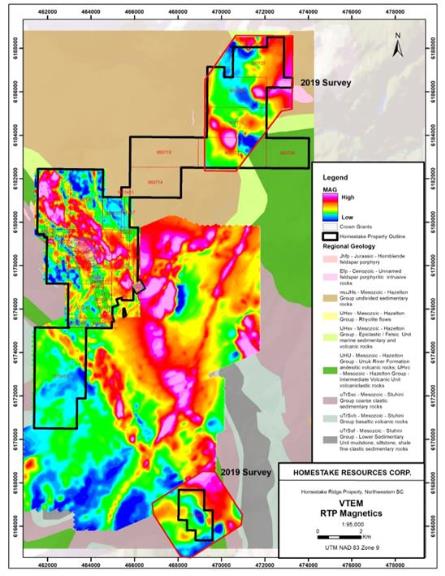

Since acquiring the Homestake Ridge Project in late 2016, Auryn has completed extensive exploration across the Property to advance additional targets to the drill ready stage. This work has included geological mapping, rock and soil geochemical sampling, portable X-ray fluorescence and shortwave infrared surveys, geophysical (IP) surveying, the re-logging of historical drill core, geochronological studies and airborne VTEM geophysical surveys along with reprocessing of historic geophysical survey data.

The Homestake Ridge property hosts a number of other mineral occurrences, however, none of these targets have NI43-101 complaint Mineral Resources.

Mineral Resources were estimated considering a potential underground mining scenario. At a cut-off grade of 2.0 g/t gold equivalent (AuEq), Indicated Mineral Resources were estimated to total 0.736 million tonnes (Mt) at average grades of 7.02 g/t Au, 74.8 g/t Ag, and 0.18 percent Cu. At the same cut-off grade, Inferred Mineral Resources were estimated to total 5.545 Mt at average grades of 4.58 g/t Au, 100.0 g/t Ag, and 0.13 percent Cu as shown in Table 1-1.

Mineral Resources – Effective Date: December 31, 2019

Auryn Resources Inc. – Homestake Ridge Project

Classification And Zone | Tonnes (Mt) | Average Grade | Contained Metal |

| Gold (g/t Au) | Silver (g/t Ag) | Copper (% Cu) | Lead(% Pb) | Gold (oz Au) | Silver (Moz Ag) | Copper (Mlb Cu) | Lead (Mlb Pb) |

| Indicated | | | | | | | | | |

| HM | 0.736 | 7.02 | 74.8 | 0.18 | 0.077 | 165,993 | 1.8 | 2.87 | 1.25 |

| Total Indicated | 0.736 | 7.02 | 74.8 | 0.18 | 0.077 | 165,993 | 1.8 | 2.87 | 1.25 |

| | | | | | | | | | |

| Inferred | | | | | | | | | |

| HM | 1.747 | 6.33 | 35.9 | 0.35 | 0.107 | 355,553 | 2.0 | 13.32 | 4.14 |

| HS | 3.354 | 3.13 | 146.0 | 0.03 | 0.178 | 337,013 | 15.7 | 2.19 | 13.20 |

| SR | 0.445 | 8.68 | 4.9 | 0.04 | 0.001 | 124,153 | 0.1 | 0.36 | 0.00 |

| Total Inferred | 5.545 | 4.58 | 100.0 | 0.13 | 0.142 | 816,719 | 17.8 | 15.87 | 17.34 |

Notes:

1.

Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definition Standards for Mineral Resources and Mineral Reserves dated May 10, 2014 (CIM (2014) definitions), as incorporated by reference in NI43-101, were followed for Mineral Resource estimation.

2.

Mineral Resources are estimated at a cut-off grade of 2.0 g/t AuEq.

Effective Date: May 29, 2020 Project No. TRQ-06 | |

|

Page 1-3

Homestake Ridge Project

NI43-101F1 Technical Report

3.

AuEq values were calculated using a long-term gold price of US$1,300 per ounce, silver price at US$20 per ounce, and copper price at US$2.50 per pound and a US$/C$ exchange rate of 1.2. The AuEq calculation included provisions for metallurgical recoveries, treatment charges, refining costs, and transportation.

4.

Bulk density ranges from 2.69 t/m3 to 3.03 t/m3 depending on the domain.

5.

Differences may occur in totals due to rounding.

6.

The Qualified Person responsible for this Mineral Resource Estimate is Philip A. Geusebroek of Roscoe Postle Associates Inc. (RPA), now part of SLR Consulting Ltd (SLR).

7.

The reader is cautioned that Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

8.

HM=Homestake Main Zone, HS= Homestake Silver Zone, and SR= South Reef Zone.

The Qualified Person is of the opinion that the practices and methods used by Auryn to estimate Mineral Resources at the Project are in accordance with the CIM (2014) definitions, and that the December 31, 2019 Mineral Resource estimate is reasonable and acceptable for use in the Preliminary Economic Assessment (PEA).

There are no Mineral Reserves on the Homestake Ridge Project.

The PEA mine plan and production schedule were generated with Deswik Stope Optimizer software on the basis of the undated block model and resource wireframes supplied by Auryn. The principal mining method was longhole open stoping in a longitudinal direction, with a minimum mining width of 2.5 m. A mining cutoff grade of 3.5 gpt gold-equivalent was used to define the stope outlines.

The resulting mine production schedule consists of 2.87 M stope tonnes and 0.55 M mineralized development tonnes for a total of 3.42 Mt grading 5.41 gpt Au, 84.31 gpt Ag, 0.13 percent Cu and 0.12 percent Pb. The nominal mining rate is 900 tpd for an overall mine life of 13 years.

Processing of Homestake Ridge mineralization will be complicated by the difference in metal contents across the 3 principal deposits. The Homestake Main mineralization is high in copper, low in lead, and moderate in zinc. The Homestake Silver and South Reef mineralization has low copper grades. Homestake Silver has relatively low gold grades but high lead, zinc, and silver grades. South Reef is essentially just gold with a minor amount of copper.

Effective Date: May 29, 2020 Project No. TRQ-06 | |

|

Page 1-4

Homestake Ridge Project

NI43-101F1 Technical Report

The PEA focuses on an optimal process strategy consisting of crushing and grinding, followed by gravity recovery of a gold concentrate, then selective flotation to produce base metal concentrates (one for copper and one for lead/zinc) and finally regrinding and flotation to produce a pyrite concentrate. Cyanide leaching of the pyrite concentrate would be used to produce doré bars.

The Homestake Ridge Project is a remote greenfields site with no existing roads, power, water or camp infrastructure. Development of the project will require:

■

Upgrading and extending the current access road to allow the movement of freight, consumable supplies and manpower

■

Installing local hydro or diesel power, or connecting to the nearby BC Hydro grid

■

Construction of a person-camp to allow drive-in, drive-out (DIDO) manpower rosters

■

Construction of a 900 tpd metallurgical plant

■

Construction of a tailings dam and tailings storage facilities.

The ancillary mine facilities include:

■

Core storage and exploration offices

■

Equipment maintenance shops

■

Mine administration and technical offices

■

Storage for diesel fuel and lubricants

■

Potable and fire water.

Effective Date: May 29, 2020 Project No. TRQ-06 | |

|

Page 1-5

Homestake Ridge Project

NI43-101F1 Technical Report

The pre-production capital cost has been estimated at US$88.4 million (C$126.3 million) including all direct and indirect costs. The PEA is based on contractor owned and operated equipment and manpower. A contingency of 15 percent has been applied to all direct facility costs.

Sustaining costs have been estimated at US$85.8 million after a US$3.5 million credit for the end-of-mine salvage.

Operating costs were developed from unit rate costs and benchmark costs for projects of a similar size and scope. The all-in operating costs have been estimated at US$89.40 per tonne milled.

The economic analysis was carried out using standard discounted cashflow modelling techniques. The production and capital estimates were estimated on an annual basis for the life of mine.

Applicable royalties were applied along with current Federal and Provincial taxes and incorporated into the cashflow model. The economic analysis was carried out on a 100 percent project basis. Given the location and relatively uncomplicated nature of the project, the Base Case uses a 5 percent discount factor in arriving at the project Net Present Value (NPV). Standard payback calculation methodology was also utilized.

The project generates a Before-Tax cashflow of US$277 million (US$184 million After-Tax) over 13 years or roughly US$21 million in free cashflow per year as shown in Table 1-2 below.

Financial Indicators

| Qualified Person | Pre-Tax | After Tax |

| NPV @ 0% (US$ M) | 277.82 | 183.99 |

| NPV @ 5% (US$ M) | 170.18 | 108.09 |

| NPV @ 7% (US$ M) | 140.04 | 86.73 |

| IRR % | 30.1% | 23.6% |

| Payback (mo) | 34 | 36 |

As required by NI43-101, the author cautions the reader that the PEA is preliminary in nature, that it includes Inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the preliminary economic assessment will be realized.

1.13

Qualified Persons Opinion

Based on the analyses herein, it is the opinion of the Qualified Person that the Homestake Ridge Project requires further study. MineFill recommends the project be advanced to a Feasibility level of evaluation.

Effective Date: May 29, 2020 Project No. TRQ-06 | |

|

Page 1-6

This Technical Report has been prepared for Auryn which is incorporated in British Columbia, Canada. The Company has offices in Vancouver, B.C., and is listed on the Toronto Stock Exchange and the NYSE-American, with its common shares trading under the symbols AUG.TO and AUG, respectively.

The subject of this document is the Homestake Ridge Gold Project located in the so-called Golden Triangle of north-central British Columbia. The Company is the 100 percent owner and operator of the Homestake Ridge Project which comprises 7,484.37 ha of mineral claims and crown grants.

This document presents the results of an updated Mineral Resource Estimate and Preliminary Economic Assessment (PEA) of the Homestake Ridge Project. The PEA was prepared in accordance with standard industry practices and in accordance with CIM Definition Standards on Mineral Resources and Reserves (dated May 10, 2014), and Canadian Securities Administrators National Instrument 43-101 (Standards of Disclosure for Mineral Projects) dated June 30, 2011. The effective date of this Technical Report is May 29, 2020.

2.3

Sources of Information

The Homestake Ridge Project has been the subject of several prior NI43-101 compliant Technical Reports. The most recent was completed by Roscoe Postle Associates Inc. (RPA) dated September 29, 2017 (later amended on October 23, 2017). This document included an updated mineral resource estimate.

Prior Technical Reports on Homestake Ridge include:

■

A 2013 Technical Report dated June 7, 2013 by Macdonald and Rennie for Homestake Resource Corporation.

■

A 2011 Technical Report dated May 20, 2011 by RPA for Bravo Gold Corp.

■

A 2010 Technical Report dated June 28, 2010 by Scott Wilson RPA for Bravo Gold Corp.

■

A 2007 Technical Report dated April 11, 2007 and amended on June 3, 2008 by Folk and Makepeace for Bravo Venture Group.

Effective Date: May 29, 2020 Project No. TRQ-06 | |

|

Page 2-1

Bravo Gold also completed a number of engineering studies on the site including:

■

A January 24, 2012 geotechnical assessment of the proposed new road extension for the Homestake Ridge Access Road by Golder Associates.

■

A February 27, 2012 preliminary geotechnical assessment of the proposed mine infrastructure sites for the Homestake Ridge Project by Golder Associates.

■

A Road Design Package for the Homestake Ridge access road by AllNorth Consultants dated March 20, 2009.

■

A Kitsault River Road Review Inspection report by AllNorth Consultants dated August 26, 2010.

■

A Homestake Ridge Mainline Access Road Feasibility Study by AllNorth Consultants dated March 3, 2012.

■

Conceptual mine site layouts and run of river hydropower assessments by Knight Piesold dated June 1, 2011.

■

A preliminary power study supply assessment by Knight Piesold dated April 23, 2011.

■

A report on integration of Hydroelectric power within the mine development concepts by Knight Piesold dated June 1, 2011.

■

A plant site and tailings storage facility alternatives assessment by Knight Piesold dated May 19, 2011.

■

A conceptual cost estimate for tailings disposal by Knight Piesold dated May 13, 2011.

■

An October 11, 2011 site inspection report by Knight Piesold.

■

A preliminary ore sorting investigation and benchtop amenability test by Commodas Ultrasort/Tomra Sorting Solutions dated June 14, 2012.

The project library includes a number of other supporting documents, drawings and historical data related to hydroelectric power in the Kitsault region, at the adjacent Kitsault Lake, and at Anyox.

Effective Date: May 29, 2020 Project No. TRQ-06 | |

|

Page 2-2

The Qualified Persons for this Technical Report are as listed in Table 2-1 below.

Qualified Persons

| Qualified Person | Company | Responsible Sections | Site Visit Dates |

| Dr. David Stone, P.E. | MineFill Services, Inc. | All report sections except: Sections 5-12, Section 14 Section 20 | None |

| Philip Geusebroek, P.Geo. | RPA | Sections 10-12 Section 14 | None |

| Paul Chamois, P.Geo. | RPA | Sections 5 – 9 | Aug. 26-28, 2017 |

| Mary Mioska, P.Eng. | OneEighty Consulting | Section 5.4 Section 20 | None |

Paul Chamois, M.Sc. (A), P.Geo., Principal Geologist with RPA and an independent QP, visited the Project from August 26 to 28, 2017. During the visit, Mr. Chamois examined core from the on-going drilling program, confirmed the local geological setting, reviewed the core handling and data collection methodologies, and investigated factors that may affect the Project. Due to the advanced nature of the Project, no independent samples were taken during the visit.

In the QP’s opinion, the limited work carried out during 2018 and 2019 is not material to the project. None of the post-2017 exploration work was utilized in the resource estimation outlined in Section 14, nor in the Preliminary Economic Assessment. The QP’s have reviewed Auryn’s regulatory filings, assessment reports, news releases and databases to verify that no material work was completed on the property post 2017.

None of the other Qualified Persons have visited the project site.

Effective Date: May 29, 2020 Project No. TRQ-06 | |

|

Page 2-3

2.6

Terms and Definitions

Units of measurement used in this report conform to the metric system.

| a | annum | L | litre |

| A | ampere | lb | pound |

| bbl | barrels | L/s | litres per second |

| btu | British thermal units | m | metre |

| °C | degree Celsius | M | mega (million); molar |

| C$ | Canadian dollars | m2 | square metre |

| cal | calorie | m3 | cubic metre |

| cfm | cubic feet per minute | | micron |

| cm | centimetre | MASL | metres above sea level |

cm2 | square centimetre | g | microgram |

| d | day | m3/h | cubic metres per hour |

| dia | diameter | mi | mile |

| dmt | dry metric tonne | min | minute |

| dwt | dead-weight ton | m | micrometre |

°F | degree Fahrenheit | mm | millimetre |

| ft | foot | mo | month |

ft2 | square foot | mph | miles per hour |

ft3 | cubic foot | Mtpa | Million tonnes per annum |

| ft/s | foot per second | Mtpd | Million tonnes per day |

| g | gram | MVA | megavolt-amperes |

| G | giga (billion) | MW | megawatt |

| Gal | Imperial gallon | MWh | megawatt-hour |

| g/L | gram per litre | oz | Troy ounce (31.1035g) |

| Gpm | Imperial gallons per minute | oz/st, opt | ounce per short ton |

| gpt | gram per tonne | ppb | part per billion |

gr/ft3 | grain per cubic foot | ppm | part per million |

gr/m3 | grain per cubic metre | psia | pound per square inch absolute |

| ha | hectare | psig | pound per square inch gauge |

| hp | horsepower | RL | relative elevation |

| hr | hour | s | second |

| Hz | hertz | t | tonne |

in2 | square inch | tpa | tonnes per year |

| J | joule | tpd | tonnes per day |

| k | kilo (thousand) | US$ | United States dollar |

| kcal | kilocalorie | USg | United States gallon |

| kg | kilogram | USgpm | US gallon per minute |

| km | kilometre | V | volt |

km2 | square kilometre | W | watt |

| km/h | kilometre per hour | wmt | wet metric tonne |

| kPa | kilopascal | wt% | weight percent |

| kVA | kilovolt-amperes | yd3 | cubic yard |

| kW | kilowatt | yr | year |

| kWh | kilowatt-hour | | |

Effective Date: May 29, 2020 Project No. TRQ-06 | |

|

Page 2-4

3.

RELIANCE ON OTHER EXPERTS

The authors are not qualified to provide an opinion or comment on issues related to legal agreements, royalties, permitting matters, and taxes.

The authors of this Technical Report have relied on non-QPs for Section 4.3, Mineral Tenure.

For the purpose of this report, the Qualified Person’s have relied on ownership information provided by Auryn and Broughton Law Corporation (Broughton Law), regarding title to the Homestake Ridge Project. Broughton Law provided a legal review and opinion dated September 7, 2016. This information was used in Sections 1 and 4 of this report. The Qualified Persons have not researched property title or mineral rights for the Homestake Ridge Project and expresses no opinion as to the ownership status of the property.

Effective Date: May 29, 2020 Project No. TRQ-06 | |

|

Page 3-1

4.

PROPERTY DESCRIPTION AND LOCATION

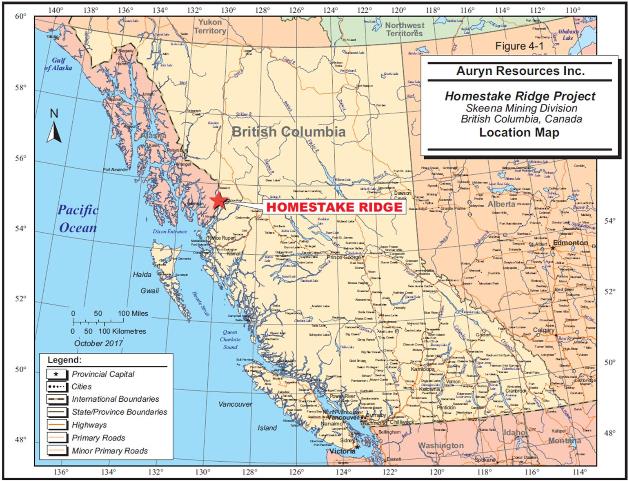

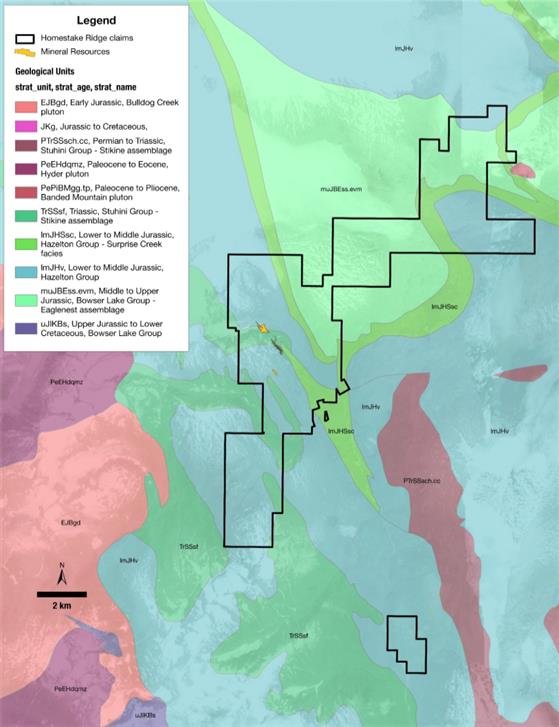

The Homestake Ridge Project covers 7,484.37 hectares and is located 32 km southeast of Stewart, BC, and approximately 32 km north-northwest of the tidewater communities of Alice Arm and Kitsault, BC (Figure 4.1). The property is located on 1:50,000 scale NTS map 102/P13.

The four claim blocks comprising the Project are located within a rectangular area extending for a distance of approximately 23 km in a north-south direction and approximately 13 km in an east-west direction. The claim block hosting the known Mineral Resources is centered on approximately 55° 45' 12.6" N latitude and 129° 34' 39.8" W longitude on Terrain Resource Integrated Management (TRIM) maps 103P072 and 103P073 and lies within Zone 9 of the UTM projection using the NAD’83 datum.

Figure 4.1: Homestake Ridge Project Location Map

Effective Date: May 29, 2020 Project No. TRQ-06 | |

|

Page 4-1

On June 14, 2016, Auryn announced that it had entered into a binding letter agreement with Homestake Resource Corporation (Homestake) whereby it would acquire Homestake under a plan of arrangement (the Arrangement). In consideration for 100 percent of Homestake’s issued and outstanding shares, Auryn would issue approximately 3.3 million shares to Homestake shareholders. During the Arrangement process, Auryn also agreed to provide Homestake with a demand loan of up to C$150,000 on an interest free, unsecured basis. On September 8, 2016, Auryn announced that it had completed the Arrangement and that Homestake had become a wholly owned subsidiary of Auryn.

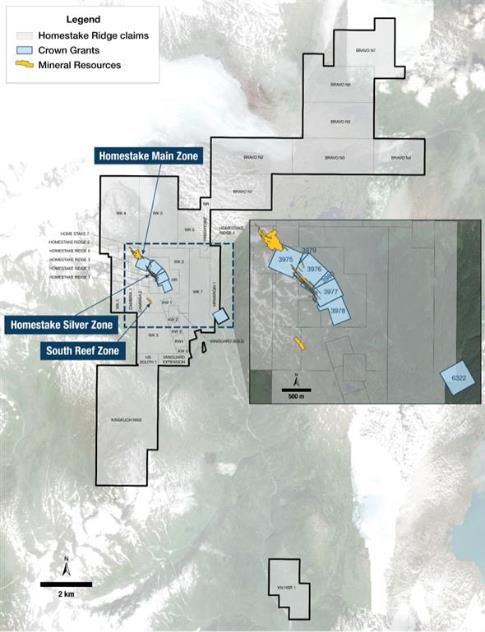

The Project comprises four non-contiguous blocks consisting of seven crown granted claims covering 96.712 ha and 37 mineral claims covering 7,484.37 ha (Figure 4.2). Table 4-1 lists the mineral claims along with the relevant individual tenure information including tenure number and name, issue and expiry dates, title type, and area. Table 4-2 lists the crown granted claims.

The crown grants include surface rights whereas the mineral claims do not.

There are no holding costs or work expenditure requirements for the crown grants other than roughly C$300 per year in property taxes.

The mineral claims are subject to minimum work requirements of:

■

C$5 per hectare for anniversary years 1 and 2;

■

C$10 per hectare for anniversary years 3 and 4;

■

C$15 per hectare for anniversary years 5 and 6; and

■

C$20 per hectare for subsequent anniversary years.

Expenditures in 2019, on the mineral claims shown in Table 4-1, amounted to C$860,000.

Effective Date: May 29, 2020 Project No. TRQ-06 | |

|

Page 4-2

NI43-101F1 Technical Report

Homestake Mineral Claims

| Title Number | Claim Name | Owner Name | Client # | Issue Date | Good to Date | Area (ha) | Protected | Tenure Sub Type Description | Title Type Description | Title Type Code | Tenure Type Code |

| 950714 | BRAVO N1 | HOMESTAKE RESOURCE CORPORATION | 202433 | February 19, 2012 | June 13, 2029 | 327.49 | N | CLAIM | Mineral Cell Title Submission | MCX | M |

| 950719 | BRAVO N2 | HOMESTAKE RESOURCE CORPORATION | 202433 | February 19, 2012 | June 13, 2029 | 436.51 | N | CLAIM | Mineral Cell Title Submission | MCX | M |

| 950722 | BRAVO N3 | HOMESTAKE RESOURCE CORPORATION | 202433 | February 19, 2012 | June 13, 2029 | 436.50 | N | CLAIM | Mineral Cell Title Submission | MCX | M |

| 950724 | BRAVO N4 | HOMESTAKE RESOURCE CORPORATION | 202433 | February 19, 2012 | June 13, 2029 | 272.81 | N | CLAIM | Mineral Cell Title Submission | MCX | M |

| 950725 | BRAVO N5 | HOMESTAKE RESOURCE CORPORATION | 202433 | February 19, 2012 | June 13, 2029 | 381.82 | N | CLAIM | Mineral Cell Title Submission | MCX | M |

| 950726 | BRAVO N6 | HOMESTAKE RESOURCE CORPORATION | 202433 | February 19, 2012 | June 13, 2029 | 418.04 | N | CLAIM | Mineral Cell Title Submission | MCX | M |

| 950727 | BRAVO N7 | HOMESTAKE RESOURCE CORPORATION | 202433 | February 19, 2012 | June 13, 2029 | 417.96 | N | CLAIM | Mineral Cell Title Submission | MCX | M |

| 1011645 | KN HSR 1 | HOMESTAKE RESOURCE CORPORATION | 202433 | August 1, 2012 | March 9, 2023 | 273.86 | N | CLAIM | Mineral Cell Title Submission | MCX | M |

| 1061421 | NR | HOMESTAKE RESOURCE CORPORATION | 202433 | August 25, 2006 | August 30, 2029 | 18.20 | N | CLAIM | Mineral Cell Title Submission | MCX | M |

| 251427 | CAMBRIA 1 | HOMESTAKE RESOURCE CORPORATION | 202433 | May 6, 1986 | December 17, 2029 | 100.00 | N | CLAIM | Four Post Claim | MC4 | M |

| 251428 | CAMBRIA 2 | HOMESTAKE RESOURCE CORPORATION | 202433 | May 6, 1986 | December 17, 2029 | 75.00 | N | CLAIM | Four Post Claim | MC4 | M |

| 377241 | WK 1 | HOMESTAKE RESOURCE CORPORATION | 202433 | May 23, 2000 | December 17, 2029 | 250.00 | N | CLAIM | Four Post Claim | MC4 | M |

| 377242 | WK 2 | HOMESTAKE RESOURCE CORPORATION | 202433 | May 23, 2000 | December 17, 2029 | 500.00 | N | CLAIM | Four Post Claim | MC4 | M |

| 377243 | WK 3 | HOMESTAKE RESOURCE CORPORATION | 202433 | May 23, 2000 | December 17, 2029 | 400.00 | N | CLAIM | Four Post Claim | MC4 | M |

| 380949 | WK 4 | HOMESTAKE RESOURCE CORPORATION | 202433 | September 20, 2000 | December 17, 2029 | 450.00 | N | CLAIM | Four Post Claim | MC4 | M |

| 380950 | WK 5 | HOMESTAKE RESOURCE CORPORATION | 202433 | September 20, 2000 | December 17, 2029 | 450.00 | N | CLAIM | Four Post Claim | MC4 | M |

| 380951 | KW 1 | HOMESTAKE RESOURCE CORPORATION | 202433 | September 20, 2000 | December 17, 2029 | 25.00 | N | CLAIM | Two Post Claim | MC2 | M |

| 380952 | KW 2 | HOMESTAKE RESOURCE CORPORATION | 202433 | September 20, 2000 | December 17, 2029 | 25.00 | N | CLAIM | Two Post Claim | MC2 | M |

| 380953 | KW 3 | HOMESTAKE RESOURCE CORPORATION | 202433 | September 20, 2000 | December 17, 2029 | 25.00 | N | CLAIM | Two Post Claim | MC2 | M |

| 383016 | KW 5 | HOMESTAKE RESOURCE CORPORATION | 202433 | November 28, 2000 | December 17, 2029 | 25.00 | N | CLAIM | Two Post Claim | MC2 | M |

| 383017 | KW4 | HOMESTAKE RESOURCE CORPORATION | 202433 | November 28, 2000 | December 17, 2029 | 25.00 | N | CLAIM | Two Post Claim | MC2 | M |

| 383037 | WK 6 | HOMESTAKE RESOURCE CORPORATION | 202433 | November 28, 2000 | December 17, 2029 | 150.00 | N | CLAIM | Four Post Claim | MC4 | M |

| 383038 | WK 7 | HOMESTAKE RESOURCE CORPORATION | 202433 | November 28, 2000 | December 17, 2029 | 400.00 | N | CLAIM | Four Post Claim | MC4 | M |

| 537435 | HR | HOMESTAKE RESOURCE CORPORATION | 202433 | July 20, 2006 | December 17, 2029 | 127.45 | N | CLAIM | Mineral Cell Title Submission | MCX | M |

| 537436 | HRMARGIN 1 | HOMESTAKE RESOURCE CORPORATION | 202433 | July 20, 2006 | December 17, 2029 | 109.25 | N | CLAIM | Mineral Cell Title Submission | MCX | M |

| 537437 | HRMARGIN2 | HOMESTAKE RESOURCE CORPORATION | 202433 | July 20, 2006 | December 17, 2029 | 54.60 | N | CLAIM | Mineral Cell Title Submission | MCX | M |

| 538791 | HOMESTAKE RIDGE 1 | HOMESTAKE RESOURCE CORPORATION | 202433 | August 5, 2006 | December 17, 2029 | 18.21 | N | CLAIM | Mineral Cell Title Submission | MCX | M |

| 540533 | HOMESTAKE RIDGE 2 | HOMESTAKE RESOURCE CORPORATION | 202433 | September 6, 2006 | December 17, 2029 | 18.20 | N | CLAIM | Mineral Cell Title Submission | MCX | M |

| 540540 | HOMESTAKE RIDGE 3 | HOMESTAKE RESOURCE CORPORATION | 202433 | September 6, 2006 | December 17, 2029 | 18.21 | N | CLAIM | Mineral Cell Title Submission | MCX | M |

| 545945 | HOMESTAKE RIDGE 4 | HOMESTAKE RESOURCE CORPORATION | 202433 | November 27, 2006 | December 17, 2029 | 18.20 | N | CLAIM | Mineral Cell Title Submission | MCX | M |

| 565708 | HOMESTAKE RIDGE 5 | HOMESTAKE RESOURCE CORPORATION | 202433 | September 7, 2007 | December 17, 2029 | 36.42 | N | CLAIM | Mineral Cell Title Submission | MCX | M |

| 565709 | HOMESTAKE RIDGE 6 | HOMESTAKE RESOURCE CORPORATION | 202433 | September 7, 2007 | December 17, 2029 | 18.21 | N | CLAIM | Mineral Cell Title Submission | MCX | M |

| 565710 | HOME STAKE 7 | HOMESTAKE RESOURCE CORPORATION | 202433 | September 7, 2007 | December 17, 2029 | 18.20 | N | CLAIM | Mineral Cell Title Submission | MCX | M |

| 598667 | VANGUARD GOLD | HOMESTAKE RESOURCE CORPORATION | 202433 | February 3, 2009 | December 17, 2029 | 18.21 | N | CLAIM | Mineral Cell Title Submission | MCX | M |

| 598668 | VANGUARD EXTENSION | HOMESTAKE RESOURCE CORPORATION | 202433 | February 3, 2009 | December 17, 2029 | 54.66 | N | CLAIM | Mineral Cell Title Submission | MCX | M |

| 1015450 | KINSKUCH NW2 | HOMESTAKE RESOURCE CORPORATION | 202433 | December 22, 2012 | December 17, 2029 | 1039.18 | N | CLAIM | Mineral Cell Title Submission | MCX | M |

| 1015588 | HS SOUTH 1 | HOMESTAKE RESOURCE CORPORATION | 202433 | December 31, 2012 | December 17, 2029 | 36.44 | N | CLAIM | Mineral Cell Title Submission | MCX | M |

| | | Number of Claims: | 37 | | Total Area (ha): | 7468.64 | | | | | |

Source: Auryn, 2019

Effective Date: May 29, 2020 Project No. TRQ-06 | |

|

Page 4-3

NI43-101F1 Technical Report

Crown Grants

| District Lot | Claim Name | CTGVRNNGPR | PRCLTP | SRVRGNRLPL | STTFPRCLSR | Area (ha) | CRWNGRNTNO | Mining Division | Lot Status |

| 3975 | HOMESTAKE | Mineral Tenure Act | Primary | 37TR7 CASSIAR | Active | 20.902 | 4004/511 | SKEENA | CROWN GRANTED |

| 3978 | HOMESTAKE NO. 3 | Mineral Tenure Act | Primary | 37TR7 CASSIAR | Active | 13.962 | 4007/311 | SKEENA | CROWN GRANTED |

| 3977 | HOMESTAKE NO. 2 | Mineral Tenure Act | Primary | 37TR7 CASSIAR | Active | 15.042 | 4006/511 | SKEENA | CROWN GRANTED |

| 3976 | HOMESTAKE NO. 1 | Mineral Tenure Act | Primary | 37TR7 CASSIAR | Active | 20.283 | 4005/511 | SKEENA | CROWN GRANTED |

| 3980 | HOMESTAKE NO. 1 FRACTION | Mineral Tenure Act | Primary | 37TR7 CASSIAR | Active | 4.702 | 5622/527 | SKEENA | CROWN GRANTED |

| 3979 | HOMESTAKE FRACTION | Mineral Tenure Act | Primary | 37TR7 CASSIAR | Active | 0.919 | 5621/527 | SKEENA | CROWN GRANTED |

| 6322 | MILLSITE | Land Act | Primary | 1TR8 CASSIAR | Active | 20.902 | 8826/859 | SKEENA | CROWN GRANTED |

| | | Total Crown Grant: | 7 | | Total Area (ha): | 96.712 | | | |

Source: Auryn, 2019

Effective Date: May 29, 2020 Project No. TRQ-06 | |

|

Page 4-4

Homestake Ridge Project

NI43-101F1 Technical Report

Source: Auryn

Figure 4.2: Mineral Claims

Effective Date: May 29, 2020 Project No. TRQ-06 | |

|

Page 4-5

Homestake Ridge Project

NI43-101F1 Technical Report

4.4

Royalties and Encumbrances

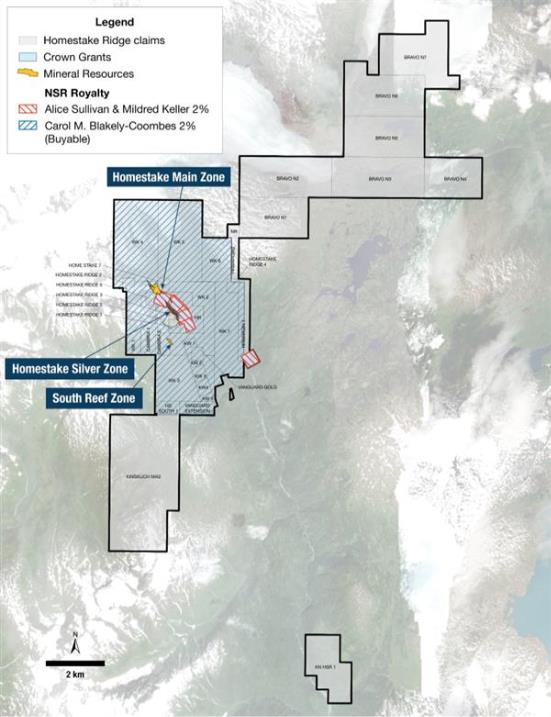

Homestake earned a 100 percent interest in 14 Homestake Ridge mineral claims through its option with Teck Cominco Limited, now Teck Resources (Teck). Teck failed to exercise its back-in rights in 2008 but retained a 2 percent net smelter return (NSR) royalty, 1 percent of which could be purchased at a future date for C$1.0 million. On May 16, 2016 Homestake announced that it had closed an agreement with Teck to purchase the 2 percent royalty and ancillary rights for C$100,000, effectively extinguishing this royalty.

The Coombes Claims (including Cambria 1, Cambria 2, KW1, KW2, KW3, KW4, KW5, WK1, WK3, WK4, WK6 and WK7) are subject to a 2 percent NSR royalty by virtue of an option agreement dated July 5, 2000. The royalty includes a purchase right in favour of Homestake for C$1,000,000.

The crown grants (including DL 3975, DL 3976, DL 3977, DL 3978, DL 3979, DL 3980, and DL 6322) are subject to a 2 percent NSR royalty which includes an annual advanced minimum royalty of C$50,000 in favour of Alice Sullivan and Mildred Keller.

A map of the claims subject to royalty is attached in Figure 4.3.

The authors are not aware of any other underlying agreements, obligations or back-in rights related to the Property other than those disclosed herein.

4.6

Permitting Considerations

Auryn Resources currently holds a Mineral and Coal Activities and Reclamation Permit (Permit No. MX-1-603) that includes the following approved work:

■

Camp with 1.0 ha of disturbance

■

Geophysical surveys of 50 line km

■

Surface drilling at 500 drill sites

■

2 km of exploration trails.

The above permit is secured with a C$68,000 reclamation bond and all work must be complete by March 23, 2023.

The Company has also been granted a Free Use Permit (No. MX-1-603:2018-2023) for the harvesting of Crown timber on the Crown granted lands.

Effective Date: May 29, 2020 Project No. TRQ-06 | |

|

Page 4-6

Homestake Ridge Project

NI43-101F1 Technical Report

Source: Auryn

Figure 4.3: Claims Subject to Royalty

Effective Date: May 29, 2020 Project No. TRQ-06 | |

|

Page 4-7

Homestake Ridge Project

NI43-101F1 Technical Report

4.7

Environmental Considerations

The Homestake Ridge Property is a greenfield site with no known pre-existing development or environmental liabilities.

4.8

Social License Considerations

Auryn does not have any Community or Social Agreements in place.

4.9

Comments on Section 4

The authors are not aware of any significant factors or risks that may affect access to the project site, or the right and ability to perform work on the property.

Effective Date: May 29, 2020 Project No. TRQ-06 | |

|

Page 4-8

Homestake Ridge Project

NI43-101F1 Technical Report

5.

ACCESSIBILITY, CLIMATE, LOCAL RESOURCES,INFRASTRUCTURE, AND PHYSIOGRAPHY

The Homestake Ridge Project is located 32 km southeast of Stewart, BC, at the southern extent of the Cambria ice field. Access to the Project from the town of Kitsault is by boat/barge to the community of Alice Arm. From there, an upgraded tractor trail follows an old railway bed for a distance of 32 km into the area of the past producing Dolly Varden silver mine, approximately four kilometres from the southern boundary of the Project. From there, overgrown mule trails lead to the historic workings of the Vanguard and Homestake areas of the Project (Figure 5.1).

In the absence of upgraded road access, the site is only accessible by helicopter as shown in Figure 5.1. Helicopters are available for charter from either Prince Rupert, Terrace, or Stewart.

Climate in the area is transitional, with moderately wet to dry, warm summers, and cool, wet winters (Ministry of Forests, 1993) driven by moist Pacific air that brings intense precipitation to the windward slopes and adjacent mountains, and by the cold Arctic air to pass down the Portland Canal through onto the Dixon Entrance (Demarchi, 2011). The area is classified as Oceanic or Marine West Coast and is characterized by moderately cool summers and mild winters with a narrower annual range of temperatures compared to sites of similar latitude. Climate data derived from historic monitoring stations at Alice Arm, and more recent long-ranging monitoring at Stewart and Nass Camp Table 5-1) indicates that temperatures range from an average low of - 6°C in January to an average high of 15°C in July. The mean temperature for the year is 5°C.

The area receives between 984 – 1,838 mm of precipitation each year (expressed in mm of water Table 5-1). Rainfall peaks in October with 150 mm. Snowfall is highest in December and January when accumulations are 287 cm and 86 cm, respectively, at Nass Camp (Government of Canada, 2019). Precipitation and heavy fog often impact on airborne access to the Project (RPA, 2017).

The property is reported to be covered in snow from late September to late June (Bryson, 2007). The ground is generally frozen throughout the winter and breakup occurs between early March and late May (Ministry of Forests, 1993). Rainfall / snowfall distribution ranges from 45 – 55 percent (Knight Piesold, 2011).

Effective Date: May 29, 2020 Project No. TRQ-06 | |

|

Page 5-1

Homestake Ridge Project

NI43-101F1 Technical Report

Source: MineFill Services, Inc.

Effective Date: May 29, 2020 Project No. TRQ-06 | |

|

Page 5-2

Homestake Ridge Project

NI43-101F1 Technical Report

Climatic Data

| | Alice Arm | Stewart | Nass Camp |

| Meteorological Location ID | 1060330 & 1060331 | 1067742 | 1075384 |

| Latitude | 55°28'00" N | 55°56'10" N | 55°14'15" N |

| Longitude | 129°28'00" W | 129°59'06" W | 129°01'47" W |

| Elevation | 1.50 m | 7.3 | 191 |

| Distance from Project | 31 km | 34 km | 65.5 |

| Period of Record | 1948-1964 & 1973-1978 | 1974-2016 | 1971-2017 |

| Mean January Temperature | -5.7 | -3.0 | -5.4 |

| Mean July Temperature | 14.5 | 15.1 | 15.8 |

| Extreme Maximum Temperature | 33.9 | 33.4 | 36.0 |

| Extreme Minimum Temperature | -25.0 | -25.6 | -32.5 |

| Average Annual Precipitation | 1792.0 | 1837.8 | 984.2 |

| Average Annual Rainfall | 1192.3 | 1317.3 | 725.1 |

| Average Annual Snowfall | 530.6 | 548.5 | 259.2 |

5.3

Local Resources and Infrastructure

The nearest communities to the Homestake project site include the towns of Kitsault and Alice Arm, roughly 35 km distant. Both of these towns are essentially ghost towns with few residents and no services.

Labour and supplies for the project can be brought in from the community of Terrace, which lies 185 km to the south, along Highway 113. Terrace has a population of 11,643 (2016 census) and hosts a wide range of supplies, services, and trained labour. Terrace is serviced by three air carriers with daily scheduled flights.

Stewart with a population of 400 (2016 census) is located 240 km, by road, from Kitsault. Stewart is well serviced, has trained labour with mining expertise, and hosts a deep-sea port that has been used for shipping ore and concentrate from other mines. Concentrates and bulk supplies, such fuel, could be barged between Alice Arm and Stewart, an ocean distance of some 225 km.

Kitwanga, 180 km by road from Kitsault, lies on the Canadian National Railway mainline and Trans-Canada Highway 16. Like Stewart, Kitwanga has served as a shipping centre for mineral ores and concentrates. Mining is supported in the local communities and, historically, companies have been able to form productive joint venture partnerships with local First Nations.

Effective Date: May 29, 2020 Project No. TRQ-06 | |

|

Page 5-3

Homestake Ridge Project

NI43-101F1 Technical Report

The project area is situated in steep terrain on the geologic boundary between the Coastal Belt and the Intermontane Belt, within an elevation range of 500 to 1100 masl (Knight Piesold, 2011). The project area lies at the transition from the Southern Boundary Ranges to the Meziadin Mountains ecosections (iMapBC, 2020). The Southern Boundary Ranges ecosection is an area of wet rugged mountains that are capped with glaciers, small icefields and exposed granitic and metamorphic bedrock. This area was heavily impacted by large sheets of ice that originated along the crest of the mountains and the area south of the Homestake Ridge Project is bisected by the Portland Canal (Demarchi, 2011). The Meziadin Mountains comprise the leeward side of the main Boundary Ranges and extend west of the low Nass Basin. Ice that formed in the Boundary Ranges moved east into the Nass Basin, coalescing with ice moving south from the adjacent Skeena Mountains, then the entire ice mass moved down out the Nass Valley to the Dixon Entrance or south through Cranberry Upland Ecosection to the Skeena River valley. The mountain summits still have small icefields or glaciers (Demarchi, 2011).

The area is characterized by steep headwater streams and gullies that drain the mountainsides, carrying water, sediment and organic materials to the fans and floodplains that line valley bottoms. Lakes head some valleys. Small wetlands are common on floodplains, but extensive wetlands are uncommon (Price and McLennan, 2001).

The Project overlays a south-southeast trending ridge at the headwaters of the Kitsault River and the lower portions of the Kitsault and Little Kitsault Glaciers. The eastern and southern portions of the property at lower elevations is subalpine forest, comprised of subalpine fir, western hemlock, Roche spruce, and mountain hemlock. East of this ridge, the subalpine forest is broken up by a large slide area that is covered by slide alder, grass, and lichen. Alpine areas are extensive at higher elevations, but are mainly barren rock or ice covered. Many large remnant icefields and glaciers remain on the summits north-west of the project area (Demarchi, 2011). The upper slopes are populated by alpine grass, moss, and lichen with intermittent patches of dwarf alpine spruce (Knight and Macdonald, 2010).

Regionally, the vegetation in the area is driven by the transitional nature of the climate on the leeward side of the Coast Mountains, and consequently combines elements of both coastal and interior flora (BC Ministry of Forests, 1993). In the valley bottoms, in the subalpine area, the understory vegetation includes a wide variety of shrub and herbaceous species, including salmonberry, bunchberry, various currants, five-leaf bramble, common snowberry, vine maple, sword fern, twinflower, deer fern, western trillium and others (Wright and Ebnet, nd). In the lower slopes of Portland Canal, the forests are either very wet, such as coastal western hemlock or, cold and wet, such as the subalpine mountain hemlock forests that occur on all the middle elevation slopes (Demarchi, 2011).

Effective Date: May 29, 2020 Project No. TRQ-06 | |

|

Page5-4

Homestake Ridge Project

NI43-101F1 Technical Report

There are no federally or provincially identified plant species at risk in the project area (BC Conservation Data Centre, 2020). The nearest observed plant species at risk is Polystichum setigerum (Alaska holly fern), observed in 1975 in lower Kitsault River approximately 2.5 km upstream from Alice Arm, classified as being of “special concern” (BC Conservation Data Centre, 2020).

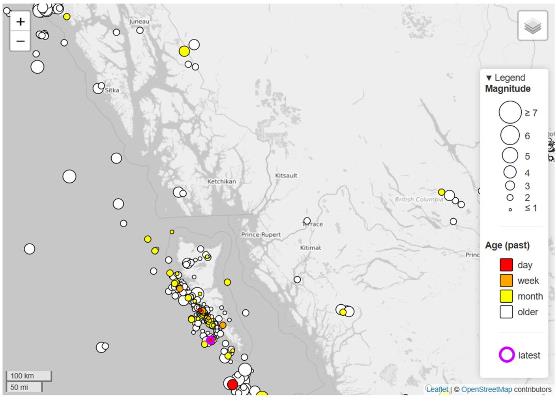

The town of Stewart is located in a zone of low to moderate seismicity with a peak ground acceleration of 0.031g for events with a 10 percent exceedance in 50 years (e.g. one in 1000-year event). As can be seen in Figure 5.2 earthquake frequency map, the main source of seismic risk is from the Cascadia subduction zone, located 200 km from the Project site, off the coast of British Columbia.

Source: Natural Resources Canada

Figure 5.2: Earthquake Epicenter Map for Events in the Past 50 Years

Effective Date: May 29, 2020 Project No. TRQ-06 | |

|

Page 5-5

Homestake Ridge Project

NI43-101F1 Technical Report

5.6

Comments on Section 5

The Homestake Ridge Project is a remote greenfields site with no existing roads, power, water or camp infrastructure. Development of the project will require:

■

Upgrading and extending the current access road to allow the movement of freight, consumable supplies and manpower

■

Installing local hydro or diesel power, or connecting to the nearby BC Hydro grid

■

Construction of a person-camp to allow drive-in, drive-out (DIDO) manpower rosters

■

Development of local water resources for potable and non-potable water consumption.

In the opinion of the Qualified Persons, the Homestake Ridge Project site offers adequate surface rights and land suitable for the construction of a processing plant, tailings facility, waste rock dumps, and a person-camp. The project site has several suitable sources of water pending the necessary approvals.

The required infrastructure for project development is discussed in Section 18 of this Technical Report, and the capital required is included in the Financial models.

Winter conditions are expected to prevail from October through to the following May, and this may impair year-round operations if the property were to be placed in production.

Effective Date: May 29, 2020 Project No. TRQ-06 | |

|

Page 5-6

The following Property History is taken from RPA (2017).

Claims were first staked at the Homestake group between 1914 and 1917 and, in 1918, the claims were bonded to the Mineral Claims Development Company (MCDC). MCDC was reorganized into the Homestake Mining and Development Company (Homestake Development) in 1921.

The following is taken from Macdonald and Rennie (2016).

The Homestake Ridge property comprises two areas of historic exploration. The Homestake and the Vanguard groups have been tested by past explorers starting in the early 1900s after the discoveries at Anyox and in the Stewart region. Claims were first staked at the Homestake group between 1914 and 1917 and, in 1918, the claims were bonded to the MCDC. MCDC was reorganized into Homestake Development in 1921. Limited surface and underground work was done on the property. In 1925, the claims were given “Crown Grant” status. In 1926,

Homestake Development and three other groups bonded to the interests of C. Spencer. The option was abandoned, with no further work being done on the property (Knight and Macdonald, 2010).Arm staked the area and conducted surface trenching, limited underground work and drilled seven holes to an aggregate depth of 58.2 m, on the Lucky Strike and Cascade claims which comprise part of the Homestake group (Knight and Macdonald, 2010).

In 1966, Canex Aerial Exploration Ltd. (Canex) undertook a program of prospecting, geochemical sampling, electromagnetic (EM) surveying, and chip sampling in the Vanguard area. In 1967, Amax Exploration conducted and extended examination of the Vanguard group but did not return (Folk and Makepeace, 2007). Dwight Collison died in 1979.

In 1979, Newmont Exploration of Canada Ltd. (Newmont) optioned part the property, known as the Wilberforce group, from Collison’s widow, Ruby Collison. The Wilberforce group excluded the original Homestake and Vanguard claims. Newmont explored for near surface, massive sulphides conducting magnetometer and Max-Min geophysical surveys, geological mapping, and trenching. A total of 595 soil samples and 82 rock samples were assayed.

Newmont terminated the option in late 1980 (Folk and Makepeace, 2007).

Effective Date: May 29, 2020 Project No. TRQ-06 | |

|

Page 6-1

Caulfield Resources Ltd. explored over the Vanguard group in 1981 taking 102 soil samples and conducting 5.25 line km of ground magnetic surveys, but no subsequent work was done (Folk and Makepeace, 2007).

Homeridge Resources Ltd. optioned the property from Ruby Collison in 1984, but no work was done (Bryson, 2007). The claims were allowed to lapse in 1986, were re-staked and optioned to Cambria Resources Ltd. (Cambria), which completed geological mapping, lithogeochemical sampling, trenching, and 4.3 line km of IP and resistivity surveying. Weather deferred drilling for that year and the ground was eventually optioned to Noranda Exploration Company Limited (Noranda) (Folk and Makepeace, 2007).

Between 1989 and 1991, Noranda consolidated ground by optioning more area including the Cambria (formerly Collison), Homestake, and Vanguard claims. A 44.3 km grid was cut along which magnetometer and IP surveys were performed in addition to geological mapping. A total of 1,930 rock samples and 1,943 silt and soil samples were taken. Twelve diamond drill holes were cored (diameter unknown) for an aggregate depth of 1,450.05 m (Folk and Makepeace, 2007).

Teck acquired the current Homestake Ridge property in 2000 via option agreements and staking. From 2000 to 2002, Teck conducted geochemical and geological surveys, trenching, and diamond drilling, exploring for volcanogenic massive sulphide (VMS) deposits. A total of 21 NQ (47.6 mm dia.) holes were drilled to an aggregate depth of 4,374.6 m yielding 618 core samples. In addition, 778 rock samples were analyzed by Inductively Coupled Plasma (ICP) multi-element geochemistry plus Au and another 31 samples were subjected to “whole rock” X-Ray Fluorescence (XRF) analysis (Folk and Makepeace, 2007).

From 2010 to 2012, Homestake completed additional surface exploration including further mapping, soil and rock sampling and 13.54 line km of IP geophysical surveys, and diamond drilling.

In 2011 a new discovery was made 800 m to the southwest of, and parallel to, the previously discovered Main Homestake and Homestake Silver deposits. This area, known as the South Reef target was tested by three holes with all three intersecting +30 g/t gold mineralization.

During 2012, Homestake completed two phases of drilling focussed on the delineation and extension of the South Reef target. The second phase of drilling was funded by Agnico Eagle Mines Limited (Agnico Eagle) as part of an option agreement (see below). The 2012 drilling was successful in identifying an approximate 250 m strike by 250 m down dip before ending in, or being offset by, a major fault structure. Mineralization is open along strike to the northwest. Other targets on the property remain to be explored.

Effective Date: May 29, 2020 Project No. TRQ-06 | |

|

Page 6-2

Agnico Eagle optioned the property from Homestake in 2012. In 2013, Agnico Eagle completed an exploration program consisting of geological mapping, soil sampling (785 samples), approximately 21 line km of ground geophysical surveying including IP/resistivity and magnetics and a 10-hole drilling program totalling 3,947.24 m. The drilling was meant to test various exploration targets outside of the Homestake Main and Homestake Silver deposits (Swanton et al., 2013). In 2014, Agnico Eagle completed a limited amount of prospecting, reconnaissance geological mapping and rock sampling (57 samples) as well as a 6-hole drilling program totalling 2,578 m designed to test the Slide Zone. The drilling suggested that the Slide Zone is concordant with the Homestake Main and Homestake Silver Zones and trends north northwesterly and dips steeply to the northeast.

There has been no historic production at the Homestake Ridge property.

Effective Date: May 29, 2020 Project No. TRQ-06 | |

|

Page 6-3

7.

GEOLOGICAL SETTING AND MINERALIZATION

Section 7 of this report is taken from Macdonald and Rennie (2016).

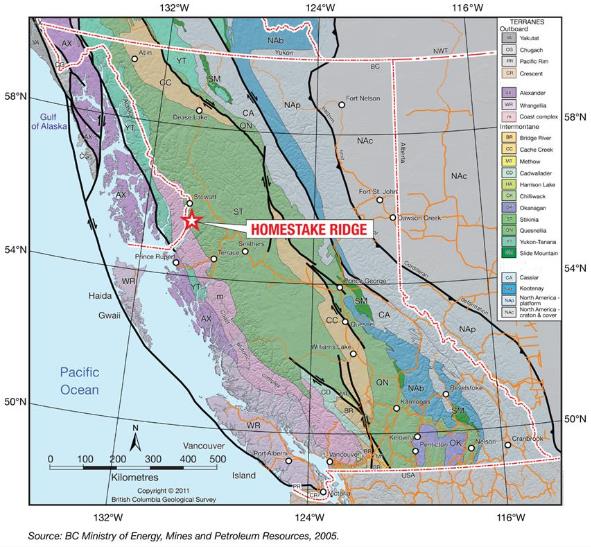

Four major building blocks constitute the terrane superstructure of northwestern British Columbia (Colpron and Nelson (2011): a western block of poly-deformed, metamorphosed Proterozoic to middle Paleozoic peri-continental rocks (Nisling Assemblage); an eastern block of exotic oceanic crustal and low-latitude marine strata (Cache Creek Terrane); central blocks including Paleozoic Stikine Assemblage and Triassic arcvolcanic and flanking sedimentary rocks of Stikine Terrane; and overlying Late Triassic to Middle Jurassic arc-derived strata of the Whitehorse Trough (including the Inklin overlap assemblage).

The following description of the Regional Geology is derived from Kasper and Metcalfe (2004), Knight and Macdonald (2010).

The Homestake Ridge property is located within a lobe of Upper Triassic to Middle Jurassic strata exposed along the western edge of the Bowser Basin within the Stikinia Terrane of the Intermontane Belt. Stikinia formed in the Pacific Ocean during Carboniferous to Early Jurassic (320 Ma to 190 Ma) and collided with North America during the Middle Jurassic (Folk and Makepeace, 2007).

The Project occurs within the metallogenic region known as the Stewart Complex (Grove 1986, Aldrick, 1993). Described as the contact of the eastern Coast Plutonic Complex with the west-central margin of the successor Bowser Basin, the Stewart Complex ranges from Middle Triassic to Quaternary in age and is comprised of sedimentary, volcanic, and metamorphic rocks (Grove, 1986). The Stewart Complex is one of the largest volcanic arc terranes in the Canadian Cordilleran. It forms a northwest-trending belt extending from the Iskut River in the north and Alice Arm in the south. The Coast Plutonic Complex forms the western boundary of the prospective stratigraphy; continental derived sediments of the Bowser Lake Group form the eastern border. The Stewart Complex is host to more than 200 mineral occurrences including the historic gold mines Eskay Creek, Silbak-Premier and SNIP, as well as the Granduc, Anyox, and Dolly Varden-Torbrit base-metal and silver mines. The dominant mineral occurrences are precious metal vein type, with related skarn, porphyry, and massive sulphide occurrences (Knight and Macdonald, 2010).

Effective Date: May 29, 2020 Project No. TRQ-06 | |

|

Page 7-1

Stikinia, which contains both the Stewart Complex and the Homestake Ridge property, is comprised of at least four Paleozoic to Cenozoic tectonostratigraphic packages (Kasper and Metcalfe, 2004) including: Paleozoic Stikine Assemblage consisting of quartz-rich rocks, carbonate slope deposits, and minor mafic to felsic volcanic rocks; Early Mesozoic volcanic and inter-arc and back-arc basin sedimentary rocks; Middle to Upper Jurassic Bowser Basin turbiditic sedimentary rocks; and Tertiary post-kinematic granitoid intrusions of the Coast Plutonic Complex.

Magmatic episodes of Stikinia alternated with the development of sedimentary basins. These basins formed during the Late Triassic to Early Jurassic, the Toarcian to Bajocian (183 to 168 Ma) and the Bathonian to Oxfordian (168 Ma to157 Ma) ages. The basin which formed during the Toarcian-Bajocian is of considerable importance because this west-facing, north-trending back arc basin contains the Eskay Creek “contact zone” rocks (Hazelton Group), which are overlain by Middle and Upper Jurassic marine basin sediments (Bowser Lake Group).

At least two periods of deformation occurred in the region, a contractional deformation during the post-Norian-pre-Hettangian (204 Ma to 197 Ma) and an Early Jurassic hiatus. These periods of deformation are represented by unconformities one of which also separates two metalliferous events that took place in the Early Jurassic (e.g., Silbak-Premier and SNIP) and Middle Jurassic (e.g., Eskay Creek). Regional geology is shown in Figure 7.1.

Effective Date: May 29, 2020 Project No. TRQ-06 | |

|

Page 7-2

Figure 7.1: Regional Geology

Effective Date: May 29, 2020 Project No. TRQ-06 | |

|

Page 7-3

This section is derived from Kasper and Metcalfe (2004) and Knight and Macdonald (2010).

The Stuhini Group rocks are found in the cores of anticlines and represent the oldest known rocks in the area. These rocks are composed of a thick sequence of volcanic and sedimentary rocks of Upper Triassic (Norian) age, interpreted as the products of a volcanic arc. The volcanic Stuhini Group rocks are generally pyroxene-bearing, a contrast to the well-defined early crystallized hornblende phenocrysts commonly found in the Lower Jurassic Hazelton Group volcanic rocks. Kasper and Metcalfe noted that the re-evaluation of bedrock mapping in the Homestake Ridge area in 2002 resulted in the assignation of some lithologies on the property to the Stuhini Group.

The Hazelton Group overlies the Stuhini Group. The Lower Jurassic Hazelton Group is represented by a lower unit comprising massive, hornblende+feldspar-phyric andesitic to latitic ignimbrites, flows, and associated volcanic sedimentary rocks. Overlying these intermediate volcanic rocks is the Lower-Middle Jurassic Eskay Creek stratigraphy composed of marine felsic volcanic rocks and associated epiclastic sedimentary rocks and fossiliferous clastic sedimentary rocks. Kasper and Metcalfe noted that rocks of similar lithology and stratigraphic relationship have been identified in the Homestake Ridge area.

The dominant local intrusive rocks are of Cretaceous to Eocene age associated with the Coast Plutonic Complex. However, intrusive rocks identified in the Homestake Ridge area are hornblende+feldspar phyric and resemble Early Jurassic Texas Creek Suite rocks, which are related to important mineralization elsewhere in the Stewart Complex.