EASTMAIN RESOURCES INC. MANAGEMENT’S DISCUSSION AND ANALYSIS NINE MONTHS ENDED JULY 31, 2020 (EXPRESSED IN CANADIAN DOLLARS) |

Eastmain Resources Inc.

Management’s Discussion & Analysis

Nine Months Ended July 31, 2020

Discussion Dated September 8, 2020

General

The following management’s discussion and analysis (“MD&A”) of the financial condition and results of the operations of Eastmain Resources Inc. (“Eastmain”, the “Company”, “our” or “we”) constitutes management’s review of the factors that affected the Company’s consolidated financial and operating performance for the nine months ended July 31, 2020. This MD&A has been prepared in compliance with the requirements of National Instrument 51-102 – Continuous Disclosure Obligations. This discussion should be read in conjunction with the Company’s unaudited condensed interim consolidated financial statements for the three and nine months ended July 31, 2020, together with the notes thereto, which were prepared in accordance with International Financial Reporting Standards (“IFRS”). All amounts in the unaudited condensed interim consolidated financial statements and this discussion are expressed in Canadian dollars, unless otherwise stated. In the opinion of management, all adjustments (which consist only of normal recurring adjustments) considered necessary for a fair presentation have been included. The results for the periods presented are not necessarily indicative of the results that may be expected for any future period. Information contained herein is presented as at September 8, 2020, unless otherwise indicated.

For the purposes of preparing this MD&A, management, in conjunction with the Board of Directors, considers the materiality of information. Information is considered material if: (i) such information results in, or would reasonably be expected to result in, a significant change in the market price or value of Eastmain common shares; (ii) there is a substantial likelihood that a reasonable investor would consider it important in making an investment decision; (iii) it would significantly alter the total mix of information available to investors. Management, in conjunction with the Board of Directors, evaluates materiality with reference to all relevant circumstances, including potential market sensitivity.

Financial Statements are available at www.sedar.com and the Company’s website www.eastmain.com.

All statements, other than historical facts, included herein, including without limitation, statements regarding potential mineralization, resources, exploration results, potential financial return of the Eau Claire project on the Clearwater property, the ability of the Company to continue as a going concern, and future plans and objectives of the Company are forward-looking statements and involve various risks and uncertainties. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated. Factors which may cause actual results and events to differ materially from those anticipated include, but are not limited to: actual results of current mineral exploration and development; availability of financing; changes in applicable regulations; mineral value; equity market fluctuations; and, cost and supply of materials. Other risk factors may include: general business, economic, competitive, political and social uncertainties; reliability of resource estimates; actual results of reclamation activities; conclusions of economic evaluations; fluctuations in the value of Canadian and United States dollars relative to each other; changes in project parameters as plans continue to be refined; changes in labour costs or other costs of production; future prices of gold and other metal prices; possible variations of mineral grade or recovery rates; failure of plant, equipment or processes to operate as anticipated; accidents, labour disputes and other risks of the mining industry, including but not limited to environmental hazards, cave-ins, pit-wall failures, flooding, rock bursts and other acts of God or unfavourable operating conditions and losses; political instability, insurrection or war; delays in obtaining governmental approvals or financing or in the completion of development or construction activities; and, the factors discussed in the section entitled “Risk Factors” of the Annual Information Form filed under the Company’s profile on www.sedar.com, as well as “Risks and Uncertainties” below. See “Cautionary Note Regarding Forward-Looking Statements” below.

This MD&A is dated September 8, 2020.

Company Overview

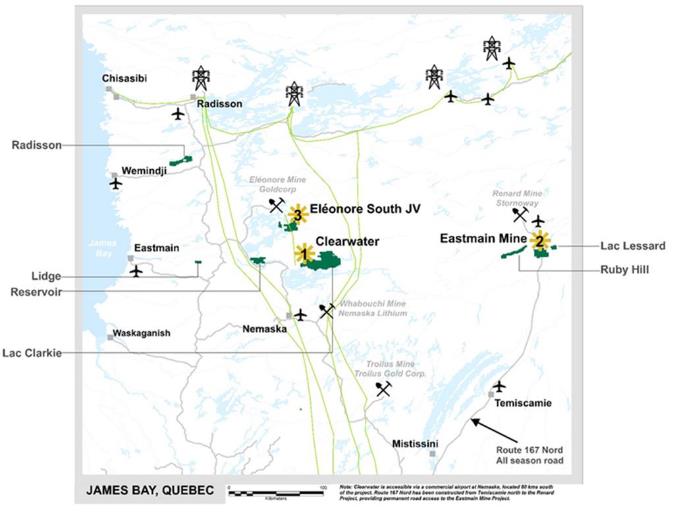

The Company, incorporated under the laws of Ontario, and its wholly-owned subsidiary, Eastmain Mines Inc. are engaged in the exploration of metallic mineral resource properties within Canada. The Company’s primary focus is exploration for precious metals in the Eastmain/Opinaca areas of Eeyou Istchee, James Bay, Québec, a relatively under-explored region that comprises several Archean greenstone belts which are rock assemblages responsible for most of the world’s historic gold production. The James Bay region is one of North America’s newest gold districts. Here, the Company holds a 100% interest in the high-grade Eau Claire deposit and holds approximately a 36.72%1 interest in Éléonore South, a mineral exploration joint venture, located immediately south of Les Mines Opinaca Ltée’s, a wholly-owned subsidiary of Newmont Goldcorp Inc’s. (“Newmont”), Éléonore gold mine. The Company also holds several prospective exploration properties covering approximately 1,300 km2 of this new and prospective mining district as well as the Eastmain Mine and Ruby Hill properties which are currently under option to Benz Mining (“Benz”).

1 ESJV ownership percentage as of March 31, 2019. Subsequent exploration conducted and funded by only two of the partners increased Eastmain’s proportionate share of the project and is subject to calculation and approval by the partners.

Eastmain Resources Inc.

Management’s Discussion & Analysis

Nine Months Ended July 31, 2020

Discussion Dated September 8, 2020

In conjunction with the recently announced transaction (see Arrangement Agreement), Eastmain and its acquirer Auryn Resources (“Auryn”) are conducting an in-depth review of Eastmain’s projects with intentions of conducting an intensive exploration program at the Company’s flagship Clearwater project. The program is expected to include several objectives, the first being testing of the lateral and vertical continuity of the Eau Claire deposit with an emphasis on further defining high-grade schist (HGS) veins. Other objectives include testing potential extensions and parallel structures of the Eau Claire deposit. At Éléonore South, discussions are underway with the Company’s joint venture partners to determine future strategy and key target areas for 2020 exploration.

With respect to the Company’s Eastmain Mine property, the Company announced on August 8, 2019 that it had reached an agreement with Benz Mining Corp. to option the Eastmain Mine Project. The option agreement includes contingent cash payments of up to $2.5 million, exploration spending commitments of up to $3.0 million, milestone payments of up to $2.5 million and a 2% Net Smelter Return (“NSR”) royalty on all production after the first 250,000 ounces produced.

On April 30, 2020, the Company announced that it optioned to Benz, the Ruby Hill Project. In conjunction with the option, the Company is amending the existing Eastmain Mine Project option agreement in relation to work commitments on the property. Pursuant to the Amending Agreement entered into with Benz, the terms of the original option to acquire up to a 100% interest in the Eastmain Mine Project were amended to remove the Company’s obligation to incur $500,000 in exploration expenditures by October 23, 2020 and add such expenditures to the work requirement for the period ending October 23, 2022.The Amending Agreement also adds the Ruby Hill Project to the Eastmain Mine Project. Benz can earn a 75% interest in the Ruby Hill Project.

The Amendment Agreement is further discussed in the Corporate Highlights and Exploration and Evaluation Expenditures section of the MD&A.

Corporate Highlights – Nine Months Ended July 31, 2020

General

On July 29, 2020, Eastmain announced it had entered into a definitive agreement with Auryn Resources Inc. ("Auryn") pursuant to which Auryn will acquire all of the issued and outstanding shares of Eastmain, immediately following a spin out of Auryn's Peruvian projects to Auryn shareholders and completion of a concurrent financing (collectively, the "Transaction"). The Transaction will create Fury Gold Mines Limited ("Fury Gold") and two independent spin-out entities ("SpinCos") which will hold Auryn's Peruvian projects.

Concurrent with the spin-out of the Peruvian projects, Fury Gold will consolidate its shares by approximately 10:7 such that approximately 110 million Fury Gold shares will be outstanding after the Eastmain acquisition (pre-financing), of which 69% will be owned by current Auryn shareholders and 31% will be owned by current Eastmain shareholders.

Eastmain shareholders as of the closing date of the Transaction will be entitled to receive approximately 0.117 of a Fury Gold share (approximately 0.165 of an Auryn share preconsolidation) for each Eastmain share (the “Eastmain Exchange Ratio”).

Fury Gold is expected to remain listed on the TSX and NYSE American exchanges, and will be led by new President and Chief Executive Officer, Mike Timmins.

Management and directors have unanimously agreed to vote in support of the transaction and advise shareholder, option holders and warrant holders to vote in favour of the transaction on October 5th, 2020.

Transaction Highlights

●

Auryn to spin out Peruvian assets into two new SpinCo companies – “SpinCo Sombrero” consisting of the Sombrero project and “SpinCo Curibaya” consisting of the Curibaya and Huilacollo projects. Auryn engaged Evans and Evans Inc. to provide a comprehensive valuation report on the value of the two SpinCos. The midpoint of Evans and Evans Inc.’s value range for the SpinCos was US$45.5M.

Eastmain Resources Inc

Management’s Discussion & Analysis

Nine Months Ended July 31, 2020

Discussion Dated September 8, 2020

●

Auryn shareholders to receive approximately 0.7 shares of Fury Gold together with one share in each SpinCo for each Auryn share held as of the closing date of the Transaction.

●

Auryn to combine its Canadian assets and operations (Committee Bay in Nunavut and Homestake Ridge in British Columbia) with Eastmain’s assets (Eau Claire and Eleonore South JV in Quebec) to create a Canadian developer platform with an aggressive growth strategy.

●

Mike Timmins, former Agnico Eagle VP of Corporate Development, to lead Fury Gold as President, Chief Executive Officer and Director.

●

Concurrent private placement of Fury Gold subscription receipts, raising a minimum of $15 million.

●

Fury Gold to commence a 50,000-meter drill program at Eau Claire shortly after closing of the Transaction.

●

Fury Gold will provide updated exploration plans for Homestake Ridge and Committee Bay after closing of the Transaction.

Corporate Affairs & Finance

●

During the nine months ended July 31, 2020, the Company granted 1,463,514 Restricted Stock Units (“RSU”) to an officer under its RSU Plan. These RSU vested immediately as they were taken in lieu of cash compensation.

●

On December 6, 2019, the Company appointed Blair Schultz, a director of the Company, as Interim President and Chief Executive Officer (“CEO”). This appointment followed the departure of Claude Lemasson as President and CEO and a director of the Company. The Board has formed an executive search committee to identify and hire a new CEO.

●

In January 2020, 3,428,000 share purchase options with an exercise price of $0.10 and expiry date of January 23, 2025 were issued to management, directors and certain employees of the Company. One-third of the options vested immediately, one-third vest on the first anniversary and one-third on the second anniversary.

●

On February 7, 2020, the Company granted 260,420 RSUs to directors as part of compensation under its RSU Plan. These RSUs vested immediately as the RSUs were taken in lieu of cash compensation.

●

On March 4, 2020, the Company announced that David Stein joined the Board of Directors. On March 6, 2020, 300,000 share purchase options with an exercise price of $0.09 and expiry date of March 6, 2025 were issued to David Stein, a director of the Company. One-third of the options vested immediately, one-third vest on the first anniversary and one-third on the second anniversary.

●

On March 6, 2020, the Company closed the first tranche of a private placement for gross proceeds of $2,650,000. Pursuant to the offering, the Company issued an aggregate of 4,700,000 units of the Company at a price of $0.10 per unit, 15,875,000 Quebec flow-through common shares of the Company at a price of $0.12 per Quebec flow-through common share and 2,391,304 federal flow-through common shares of the Company at a price of $0.115 per federal flow-through common share.

●

Each unit consisted of one common share of the Company and one-half of one common share purchase warrants. Each warrant entitles the holder to acquire one common share of the Company for 2 years from the closing of the offering at a price of $0.13.All securities issued and issuable pursuant to the offering are subject to a statutory hold period expiring July 7, 2020. Insiders of the Company purchased, directly or indirectly, an aggregate of 1,902,173 units in connection with the offering. On March 9, 2020, the Company closed the second and final tranche of the private placement of $350,000 and consisted entirely of units. Each unit consisted of one common share of the Company and one-half of one common share purchase warrants. Each warrant entitles the holder to acquire one common share of the Company for 2 years from the closing of the offering at a price of $0.13.

Eastmain Resources Inc.

Management’s Discussion & Analysis

Nine Months Ended July 31, 2020

Discussion Dated September 8, 2020

●

All securities issued and issuable pursuant to the offering are subject to a statutory hold period expiring July 10, 2020. The offering remains subject to the final approval of the TSX. In connection with the offering, the Company issued 315,000 units of the Company as finder's units, also subject to the statutory hold period.

●

In April 2020, 250,000 stock options with exercise price of $1.35 expired unexercised.

●

In April 2020, 500,000 share purchase options with an exercise price of $0.065 and expiry date of April 1, 2025 were issued to the Interim President and Chief Executive Officer of the Company. One-third of the options vested on the grant date; one-third of the options vest on the first anniversary; and one-third on the second anniversary.

●

In May 2020, according to the Amending Agreement with Benz, the Company received a cash payment of $75,000, 2,000,000 common shares and 500,000 warrants of Benz.

●

On July 4, 2020, 5,967,659 warrants with an exercise price of $0.35 expired unexercised.

Exploration and Evaluation Activities

Eastmain owns a 100% interest in nine mineral properties and a 36.7%2 interest in one mineral property as summarized below. Over the trailing 12-month period, the Company completed exploration activities on the Clearwater and Éléonore South Properties.

All claims on all properties have been renewed or are otherwise in good standing as of July 31, 2020.

2 ESJV ownership percentage as of March 31, 2019. Subsequent exploration conducted and funded by only two of the partners increased Eastmain’s proportionate share of the project and is subject to calculation and approval by the partners.

Eastmain Resources Inc.

Management’s Discussion & Analysis

Nine Months Ended July 31, 2020

Discussion Dated September 8, 2020

Eastmain Resources Properties in good standing as at July 2020

| Property | Claim units | Hectares |

| Clearwater (Eau Claire) | 446 | 23,285 |

| Eastmain Mine* | 152 | 8,014 |

Éléonore South JV (36.72%)2 | 282 | 14,760 |

| Lac Clarkie | 597 | 31,473 |

| Lac Hudson | 8 | 408 |

| Lac Lessard* | 47 | 2,476 |

| Lidge | 36 | 1,901 |

| Radisson | 175 | 9,043 |

| Reservoir | 136 | 7,043 |

| Ruby Hill (East and West)* | 268 | 14,125 |

| Total | 2,147 | 112,528 |

*currently under option to other Companies

Key Projects

Clearwater Property (including the Eau Claire Project, the Percival, Knight-Serendipity Discovery & the Snake Lake Target)

Eastmain owns a 100% interest in the Clearwater property, host to the Eau Claire project, one of five known gold deposits in the James Bay region of Québec. The largest of these deposits is the Éléonore Gold Mine held by Les Mines Opinaca Ltée, a wholly-owned subsidiary of Newmont-Goldcorp, which is located only 57 km due north of Clearwater and has a 2020 production forecast of 355,000 ounces of gold.

Eastmain Resources Inc.

Management’s Discussion & Analysis

Nine Months Ended July 31, 2020

Discussion Dated September 8, 2020

The Clearwater property covers about 220 km2 of Archean geology similar to that underlying many of the major mining camps within the Canadian Shield. The most prevalent Archean gold deposits are associated with deep-seated regional structural breaks and deformation zones, often localized by the interaction of these structures with large intrusive bodies. Most gold production in these camps is derived from structurally-controlled, vein-hosted deposits in deformed and altered volcanic sequences.

With ready access and nearby infrastructure in the form of permanent roads and power, Clearwater is superbly located for potential future development. The project is situated approximately 800 km north of Montréal, 80 km north of a commercial airport at Nemiscau and less than 20 km northeast of Hydro Québec's EM-1 hydro-electric complex. The Eau Claire gold deposit is situated at the western end of the Clearwater property, 2.5 km from a Hydro Québec service road. A road accessible exploration base camp is located 5 km from the permanent road network. Drill roads access all areas of the Eau Claire project.

The Company’s objective is to establish Eau Claire as a high-grade gold mineral resource that will support a profitable, stand-alone mining operation with a minimum ten-year mine life, based on prevailing metal prices. With the Eau Claire PEA announced in mid-2018, the Company has fulfilled this objective by clearly demonstrating the merits and robust economic potential of the Eau Claire project. In light of this achievement, the Company is now focused on two key initiatives (1) advancing engineering, environmental and permitting at Eau Claire and (2) regional exploration initiatives across the greater Clearwater property to test potential sources of supplemental process plant feed for the Eau Claire project.

In conjunction with the Transaction announced in July, the Company intends to further define its near term objectives under the new Fury gold management and exploration teams. With Eau Claire representing the most advanced project within Fury Gold’s portfolio, Fury Gold has communicated plans to conduct up to 50,000 metres of drilling within the Clearwater land package with an emphasis on several targets proximal to Eau Claire. Further details of upcoming exploration opportunities will be provided in conjunction with the closing of the Transaction which is anticipated for October 9, 2020.

Eau Claire Project

Located within the Clearwater property, the Eau Claire project is situated approximately one km north of a regional structural break which extends east-west for more than 100 km. Gold mineralization at the Eau Claire project is generally located within approximately EW-trending structurally-controlled, high-grade en-echelon quartz-tourmaline (QT) veins and adjacent altered wall rocks, as well as variable width ESE trending gold-bearing schist zones, or High Grade Schist (“HGS”) veins, of altered gold-bearing rock. HGS zones are aligned parallel to the host rock foliation and interpreted to parallel the southern or hanging-wall side of the deposit. Host rocks have been folded and deformed (sheared) through several deformation events. Both gold bearing vein sets may occur as narrow intervals with tourmaline and develop into thick quartz-tourmaline veins with zoned tourmaline+/-actinolite+/-biotite+/-carbonate alteration halos which can measure up to several metres in thickness.

The deposit’s QT veins occur as two distinctly oriented vein sets known as the 450W and 850W zones which form a crescent-shaped body covering a footprint approximately 100 m wide, extending for about 1.8 km in lateral extent and to a vertical depth in excess of 900 m. The 450W and 850W zones outcrop on topographic highs and surface stripping has exposed several veins within the deposit. The 450W Zone vein set is interpreted to be oriented at N 85oE / 45o to 60oS, plunging steeply to the southeast, sub-parallel to an F2 fold axis. The 850 West Zone vein set is oriented N 60o E, dipping sub-vertically and plunging gently to the southwest.

2018 Mineral Resource & PEA: On May 23, 2018, Eastmain announced an updated Mineral Resource Estimate and the first-ever Preliminary Economic Assessment (PEA) on the Eau Claire project. The new resource reflected an additional 19 drill holes totaling 14,884 metres. These holes were completed between September and November 2017 and increased Eau Claire’s Mineral Resource Estimate by 62,000 oz at a grade of 6.9 g/t Au. Taking into account this addition, the updated Eau Claire Mineral Resource effective as of February 4, 2018 was as follows:

Eastmain Resources Inc.

Management’s Discussion & Analysis

Nine Months Ended July 31, 2020

Discussion Dated September 8, 2020

| | Open Pit (surface to 150 m) | Underground (150 m – 860 m) |

| Category | | | | | | |

| Measured | 574,000 | 6.66 | 123,000 | 332,000 | 6.56 | 70,000 |

| Indicated | 636,000 | 5.13 | 105,000 | 2,752,000 | 6.27 | 555,000 |

| Measured & Indicated | 1,210,000 | 5.86 | 228,000 | 3,084,000 | 6.30 | 625,000 |

| Inferred | 43,000 | 5.06 | 7,000 | 2,339,000 | 6.56 | 493,000 |

The announcement of the Eau Claire PEA represented a key milestone in that it provided the first-ever technical study assessing the project economics of developing a commercial mining operation at the Eau Claire gold deposit. The full Eau Claire PEA press release “Eastmain Announces Robust Preliminary Economic Assessment and Updated Mineral Resource Estimate at the Eau Claire Project” can be found at www.sedar.com (or at the following link);

Key highlights from May 2018 Preliminary Economic Assessment (PEA) included:

Metal Price & FX Assumptions

| | | Mining Assumptions

| |

Gold Price Assumption

| US$1,250 | | Mine Life

| 12 years

|

$US/$C

| 0.77:1 | | Daily Throughput (life of mine)

| 1,500 tpd

|

Project Economics

| | | LOM Au Produced

| 951,000 oz

|

NPV5% (pre-tax)

| C$381M

| | LOM Average Annual Production

| 79,200 oz/y

|

IRR (pre-tax)

| 32% | | Average Annual Production (Yrs 1-10)

| 86,100 oz/y

|

NPV5% (after-tax)

| C$260M | | | |

IRR (after-tax)

| 27% | | Total Open Pit Tonnes Processed

| OP: 1.64 Mt

|

Payback

| 3.1 years

| | Total Underground Tonnes Processed

| UG: 4.76 Mt

|

Capital & Operating Cost Estimates

| | | Total Tonnes Processed

| Total: 6.40 Mt

|

Pre-Production Capex

| C$175M | | | |

Sustaining Capex (life of mine)

| C$108M | | Avg. Open-Pit Head Grade (diluted)

| OP: 3.78 g/t Au

|

Avg. LOM Total Cash Costs ($C)

| C$632/oz | | Avg. Underground Head Grade (diluted)

| UG: 5.24 g/t Au

|

Avg. LOM Total Cash Costs ($US)

| US$486/oz | | Avg. Consolidated Head Grade (diluted)

| 4.86 g/t Au

|

AISC ($C)

| C$746/oz | | | |

AISC ($US)

| US$574/oz | | Process Plant Recovery

| 95% |

Production is forecast to come from two open pits in the initial three years of the mine life with a transition to underground mining commencing in year two. While the PEA reflected robust results, Eastmain has identified additional opportunities to further improve project economics. Beyond infill drilling to convert Inferred resources into M&I, the most significant opportunity is believed to be growth-focused exploration activities. Growth-focused activities include extending high-grade structures laterally and at depth while also scouting for new targets across the Clearwater property. With various prospective targets identified within a 20 km radius of the Eau Claire project, the Company believes that additional discoveries from surface and underground targets, could provide supplemental feed to support a larger production profile, enhance project economics and/or extend the current 12-year mine life.

Eastmain notes that the US$1,250/oz gold price assumption is conservative as the gold price has ranged up to US$1,950/oz in recent months. The Company is encouraged by recent strength in the price of gold which serves to further improve project economics. Were the Company to use a US$1,500/oz gold price assumption in the PEA, Eau Claire’s after-tax NPV5% and after-tax IRR would rise to C$397MM and 36%, respectively.

Eastmain filed the NI 43-101 Technical Reports for both the updated Mineral Resource Estimate and Preliminary Economic Assessment for the Eau Claire Project on the Company’s SEDAR profile page and on the Company’s website. Please refer to “Scientific & Technical Disclosure” and “Cautionary Note Regarding Forward-Looking Statements” for further details.

Eastmain Resources Inc.

Management’s Discussion & Analysis

Nine Months Ended July 31, 2020

Discussion Dated September 8, 2020

Percival Discovery & Knight-Serendipity Volcano-Sedimentary Horizon

With PEA-related drilling completed in early 2018, Eastmain shifted its focus towards reviewing and investigating new and existing exploration targets on the greater Clearwater land package. After completing prospecting and surface sampling programs in the summer of 2018, numerous targets were identified including very encouraging results obtained from the Knight-Serendipity Volcano Sedimentary Horizon (KS Horizon). The KS Horizon represents a volcano-sedimentary horizon which can be traced along a large regional fold and spans approximately 14km from the Knight target to Serendipity.

On the back of the summer program, diamond drilling commenced in the fall. In conjunction with this drill program, Eastmain announced the discovery of a new gold mineralized zone at Percival on November 13, 2018. The Percival discovery is located 14 km ESE of the Company’s million-ounce Eau Claire gold deposit and represents a new and distinct style of mineralization on the property. Highlight intervals include ER18-822: 1.46 g/t Au over 78.5 m (beginning at 16.5 m downhole), including 4.46 g/t Au over 8.2 m and ER18-823: 2.35 g/t Au over 87.0 m (beginning 28.0 m downhole), including 5.76 g/t Au over 6.0 m.

With the benefit of the new geophysical work, the Company mobilized in early February to commence a follow-up 5,500 metre drill program on Percival and surrounding targets. The Initial assay results from this program were released in late February and included ER19-832: 1.86 g/t Au over 52.7 m (beginning 25 m downhole), including 4.89 g/t Au over 11.0 m zone and ER19-833: 1.84 g/t Au over 22.2 m (beginning 86 m downhole), including 13.4 g/t Au over 1.0 m.

Follow-up drill results released on March 21st, 2019 included ER19-836: 0.97 g/t Au over 74.5 m (beginning 45m downhole). including 1.38 g/t Au over 24.0 m, and 1.38 g/t Au over 25.0 m. With the completion of this drilling, the Company noted that Percival had been extended to over 400m along a SW-NE strike length.

On May 15th, 2019, the Company announced an additional 1,767 m of new drilling at Percival which included highlight results ER19-839: 2.57 g/t gold over 14.5 m (vertical depth of 60 m), including 4.66 g/t Au over 7.0 m, and 9.40 g/t Au over 2.0 m. This intercept was prominent in that it demonstrated robust mineralization while also extending Percival 200 m east of the November 2018 discovery holes. With these results, the mineralized strike had been expanded to ~650m with an indication of convergence along the eastern extent.

Final assays from the winter 2019 drill program returned holes ER19-845 and ER19-846 collared 100 m and 150 m east of the Percival discovery holes, respectively. Both undercut mineralization intersected at higher intervals, establishing downward continuity of mineralization on these sections. Hole ER19-845 intersected two silicified breccia intervals (4.1 m of 1.63 g/t Au and 7.0 m of 3.15 g/t Au each at approximately 100 m vertically below similar breccias identified in hole ER18-837 (1.55 g/t Au over 11.0 m, vertical depth of 125 m, see press release March 21, 2019).

With the winter season subsiding, Eastmain completed surface geophysics, geological mapping, trenching and sampling over 5 km strike of the KS Horizon in the spring of 2019. Testing focused on the KS Horizon beginning at Knight and continued eastwards towards known and untested new targets. Highlight results from channel sampling at Percival included Channel F (2.07 g/t Au over 11 m), Channel G & G_a (3.33 g/t Au over 18 m, 3.69 g/t Au over 14 m) and P (1.96 g/t Au over 28 m). In early August, Eastmain resumed drilling on targets along the KS Horizon with a focus on testing Percival and recently identified new targets such as Caradoc target, located 1.7km to the east of Percival (see January 24, 2020 Press Release).

Net of the impairments recognized at year-end, the Company’s net investment in the Clearwater property to July 31, 2020, is $58.4 million.

Éléonore South Joint Venture Property

Éléonore South is an exploration drilling-stage project which lies in the Opinaca geologic Sub-province of James Bay, Québec. The project is immediately south of and contiguous with the Éléonore property held by Les Mines Opinaca Ltée, a wholly-owned subsidiary of Goldcorp, which hosts the multi-million-ounce Roberto gold deposit. The Éléonore South property is also located immediately west of and is contiguous with the Sirios Resources Inc. Cheechoo property.

Eastmain Resources Inc.

Management’s Discussion & Analysis

Nine Months Ended July 31, 2020

Discussion Dated September 8, 2020

Jointly held by Eastmain Resources Inc. (36.72%)3, Azimut Exploration Inc. (“Azimut”) (26.57%), and Les Mines Opinaca Ltée. (36.71%), the property consists of 282 mining claims covering 147 km2 of prospective land, contiguous with and underlain by the same rock formations as those found on Goldcorp’s Éléonore mine property. Éléonore mine geology is interpreted to extend on to the Éléonore South property.

In H2/2016-H1/2017, the JV partners agreed to undertake a $2 million work program, including 5,000 m of diamond drilling at the Éléonore South property. The 2016 program began in July 2016 with a mandate to test high-priority gold targets with detailed surface prospecting to increase the sampling density in seven target areas. The second phase of the program took place in early 2017 and included 14 (2,733 m) new drill holes. Assays from this drilling ranged from sub-1 g/t to over 38 g/t and included the highlight intercept of 4.88 g/t Au over 45.0 m (see press release dated March 2, 2017).

For the H2/2017-H1/2018 field season, the joint venture (JV) partners approved a $4 million work program. Eastmain’s share of the program was approximately $1.47 million. This program was double the previous year’s program and reflected the JV partners’ strong interest in further exploring the Éléonore South JV claims. During 2017, a variety of exploration initiatives including geophysics, surface sampling, prospecting, mapping and drilling were completed by the end of the period and the JV partners announced a discovery of a high-grade gold-bearing vein system in the fall of 2017 at the Moni Prospect. This discovery was confirmed at surface by extensive channel sampling which results include 79.6 g/t Au over 4.25 m and 79.5 g/t Au over 5.87 m and boulder samples which returned assays from less than 1 g/t up to 1,500 g/t Au.

Diamond drilling continued in 2018 with a continued focus on the area extending from the Moni, Trench and 101 Prospect located approximately 400 m southwest of Moni. Drilling and other surface sampling activities commenced in early February and continued into Q2/2018.

In July 2018, Eastmain assumed operatorship of the Éléonore South property on behalf of its JV partners. The new program focused in the eastern section of the Contact Trend at Éléonore South, and successfully identified and extended the known gold mineralization. Drilling also intersected mineralization northwards from the Contact Trend into a more central portion of the Cheechoo tonalite, within the large gold bearing system which extends at least 2 km long, and 600-700 m wide. Results from this program were released in late 2019 and included highlight intercepts of 1.02 g/t Au over 92.0 m (Contact trend), including 7.36 g/t Au over 8.2 m, at 152 m vertical depth (ES19-157) and 7.44 g/t Au over 9.7 m (Contact trend), including 63.2 g/t Au over 0.8 m, at 111 m vertical depth (ES19-156).

Due to earlier impairment charges in fiscal 2014, the Company’s net remaining investment in the project to July 31, 2020, is $4.2 million.

Exploration Project Pipeline

Lac Clarkie

The Lac Clarkie (“Clarkie”) property is located immediately to the east of the Clearwater property, host of the Eau Claire project. The Clarkie claims represent 31,473 ha and together with Clearwater, the two properties cover 51,614 ha (516 km2) of prospective greenstone belt in the Eastmain/Opinaca district of James Bay, Quebec. Eastmain staked the Clarkie claims in July 2016.

In 2017, Eastmain conducted a grassroots exploration program including a 3,552 line-km helicopter-borne magnetometer survey, till sampling program and prospecting. The preliminary survey delineates three distinct geological domains on the property which may host analogues to the Éléonore Gold Mine (Northern Sedimentary Basin), the Éléonore South JV (Central Intrusive Complex) and the continuation of the Cannard Deformation Zone (greenstone belt) from Clearwater onto Clarkie.

3 ESJV ownership percentage as of March 31, 2019. Subsequent exploration conducted and funded by only two of the partners increased Eastmain’s proportionate share of the project and is subject to calculation and approval by the partners.

Eastmain Resources Inc.

Management’s Discussion & Analysis

Nine Months Ended July 31, 2020

Discussion Dated September 8, 2020

The Company’s net investment in the Clarkie Project to July 31, 2020, is $nil. In accordance with IFRS analysis of impairment, expenditures for Clarkie Project has been written-off until such time as economic conditions permit a reversal of the impairment.

Reservoir

The Company holds a 100% interest in the Reservoir property which comprises 136 claims. The property covers approximately 7,043 ha, located in the Eastmain-Opinaca district of James Bay, Québec, approximately 60 km southwest of the Éléonore property held by Les Mines Opinaca Ltée, a wholly-owned subsidiary of Newmont, and approximately 45 km west of the Eau Claire gold deposit. This project hosts a large copper-gold occurrence in albite-altered volcanic-sedimentary rocks, similar to those hosting multi-million-ounce past producing gold mines in Timmins, Ontario.

Reservoir straddles the regional structural/stratigraphic break dividing volcanic and sedimentary domains. This break represents an important ore localizing event throughout the region. Previous trenching and drilling confirmed there is a significant kilometric-scale mineralizing system at Reservoir. After completion of an internal review of Eastmain’s properties by the internal exploration team, the Company identified certain high-priority targets at Reservoir and recently completed an exploration program for this project. The Company is currently awaiting assays for surface sampling results.

The Reservoir property will be evaluated for further exploration in 2020. Due to previous impairment analysis under IFRS, the Company’s investment in Reservoir as at July 31, 2020 is recorded as $nil. Expenditures for Reservoir have been written-off until such time as economic conditions permit a reversal of the impairment.

Lac Hudson

The Company holds a 100% interest in Lac Hudson which is represented by eight claims totaling 408 ha. The claims are located immediately south of the Reservoir Project and 35 km west of Clearwater. Several gold and base metal occurrences have been detected in an iron formation on the property. The Lac Hudson property will continue to be evaluated in 2020.

The Company’s net investment in the Lac Hudson project as at July 31, 2020, is $nil. In accordance with IFRS analysis of impairment, expenditures for Lac Hudson have been written-off until such time as economic conditions permit a reversal of the impairment.

Radisson

The Company owns a 100% interest in Radisson which comprises 196 mineral claims covering approximately 10,129 ha located within the La Grande Greenstone Belt district of James Bay, Québec. The property straddles a structural and stratigraphic setting of similar age to the Éléonore property, held by Les Mines Opinaca Ltée, including a significant structural break which separates complex volcanic and sedimentary rocks. The Radisson property will be evaluated for further exploration in 2020. After completion of an internal review of Eastmain’s properties by the internal exploration team, the Company identified certain high-priority targets at Radisson and were subject to exploration activities in the Summer of 2020.

Due to earlier impairment analysis under IFRS, the Company’s net investment in the project as at July 31, 2020 is $nil. Expenditures for Radisson have been written-off until such time as economic conditions permit a reversal of the impairment.

Lidge

The Company holds a 100% interest in Lidge, an early-stage exploration property located in a prospective geological regime within the James Bay District of Québec. High-density airborne magnetic surveys flown over Lidge in 2014 delineated several geophysical anomalies. No work is planned at the Lidge project in 2020.

The Company’s net investment in the project to July 31, 2020, is $nil. Under earlier IFRS impairment analysis expenditures for Lidge were written-down.

Eastmain Resources Inc.

Management’s Discussion & Analysis

Nine Months Ended July 31, 2020

Discussion Dated September 8, 2020

Projects under Option to Other Companies

Eastmain Mine Project

The Eastmain Mine Project hosts a high-grade, gold-copper deposit within an extensive volcanic formation (Mine Trend) which extends across the property for over 10 km on a northwest to southeast strike. The Mine Trend follows a very distinctive geological horizon (“Mine Package”), which is comprised of a strongly deformed and altered sequence of rhyolitic tuffs and mafic to ultramafic flows.

The Eastmain Mine gold deposit, a copper-gold-silver, sulphide-rich deposit, consists of three high-grade, gold-rich zones known as the, “A”, “B” and “C” Zones. The mine was developed and operated by MSV Resources in 1994. MSV mined approximately 100,000 tonnes of ore in 1995, producing 40,000 ounces at an average grade of 10.6 g/t Au.

The Company engaged P&E Mining Consultants Inc. (“P&E”) in calendar Q3 2017 to review and assess the historical Eastmain Mine resource and prepare a Mineral Resource Estimate using the NI 43-101 standard. Through review of historical drill data from previous operators who conducted exploration and mining activities, and the completion of a twin hole program of historical bore holes during Q4 2017-Q1 2018, the Company issued a new Mineral Resource Estimate for the Eastmain Mine Gold Deposit in January 2018. The 2018 Mineral Resource Estimate describes (i) Indicated Mineral Resources of 0.9 Mt at an average grade of 8.2 g/t Au containing 236,500 ounces of gold and (ii) Inferred Mineral Resources of 0.57 Mt at an average grade of 7.5 g/t Au containing 139,300 ounces of gold. The Mineral Resource Estimate technical report has been posted on the Company’s webpage and on Eastmain’s SEDAR profile page.

While the Company continues to view the past-producing Eastmain Mine as an attractive high-grade deposit with significant exploration potential, the Company elected to option the property on August 8, 2019 to Benz with key terms summarized as follows:

●

Eastmain granted an exclusive option to Benz to acquire an initial 75% interest in the Eastmain Mine Project (the "Option") following:

o

Payments to Eastmain of $2,500,000, of which up to $875,000 may be paid in common shares of Benz ("Payment Shares"), during a 4-year earn-in period (3,000,000 Benz shares received on October 23, 2019 value at $270,000 and cash payment of $75,000); and

o

Benz incurring expenditures of $3,500,000 on the Project over 4 years;

●

A milestone payment of $1,000,000 related to Benz obtaining project financing following the exercise of the Option, to complete the 100% earn-in;

●

A milestone payment of $1,500,000 related to commercial production following the exercise of the Option; and

●

NSR Royalty of 2% after the first 250,000 oz of production, with a buyback of 1% for $1,500,000, to be granted to Eastmain following exercise of the Option.

The Company’s net investment (inclusive of acquisition cost) in the Eastmain Mine project to July 31, 2020, is $5.9 million.

Ruby Hill East and West

The Company holds a 100% interest in the Ruby Hill project, located within the Upper Eastmain River Greenstone Belt of Northern Québec. The project is currently under option to Benz Mining as press released on April 30, 2020 with the option agreement allowing Benz to earn into a 100%-ownership position after satisfying certain obligations including upfront cash, share and warrant payments as well as minimum exploration expenditure commitments and milestone cash and/or share payments.

Ruby Hill West straddles the western limb of the Upper Eastmain River Greenstone Belt approximately 30 km northwest of the Eastmain Mine Project. Previous exploration successfully identified several mineralized targets on both Ruby Hill properties, having a similar gold-silver-copper signature to the Eastmain Mine gold deposit as well as finding mineralization near an interpreted structural break at Ruby Hill West. The project, which consists of two separate claim blocks, referred to as the Ruby Hill East and Ruby Hill West blocks, covers approximately 10,600 ha of prospective geology similar to the key Mine Trend horizon at the Eastmain Mine gold-copper Project.

Eastmain Resources Inc.

Management’s Discussion & Analysis

Nine Months Ended July 31, 2020

Discussion Dated September 8, 2020

On April 30, 2020, the Company announced that it optioned to Benz, the Ruby Hill Project. In conjunction with the option, the Company is amending the existing Eastmain Mine Project option agreement in relation to work commitments on the property. Pursuant to the Amending Agreement entered into with Benz, the terms of the original option to acquire up to a 100% interest in the Eastmain Mine Project were amended to remove the Company’s obligation to incur $500,000 in exploration expenditures by October 23, 2020 and add such expenditures to the work requirement for the period ending October 23, 2022.The Amending Agreement also adds the Ruby Hill Project to the Eastmain Mine Project. Benz can earn a 75% interest in the Ruby Hill Project.

The Company’s net investment in the Ruby Hill project as at July 31, 2020, is $nil.

Lac Lessard

The Company holds a 100% interest in the Lac Lessard project. Located 15 km northeast of the Eastmain Mine project, The project is currently under option to a private company as press released on June 10, 2020. Lac Lessard consists of 47 claims in one claim block covering 2,476 ha. Airborne VTEM and magnetic surveys previously completed by the Company indicate that a large portion of the property is underlain by the Crete-du-Coq ultramafic intrusion, a prospective host to nickel, copper, platinum group metals and gold (Ni-Cu-PGM-Au). Nine drill holes intersected the Crete-du-Coq ultramafic intrusion returning values ranging from below detection to as high as 1.08% Ni and 0.31% Cu over 2.5 m. At this time, there has been insufficient exploration to define a mineral resource at this target.

In June, Eastmain optioned Lac Lessard to a private company for:

●

An initial option payment for the project of $85,000 has been received.

●

In order to earn 100-per-cent interest in the project, the company exercising the option must:

o

Incur at least $100,000 of project expenditures within 12 months of the agreement date;

o

Pay to the seller $100,000 within 12 months of the agreement date.

●

Eastmain will retain a 2-per-cent net smelter return (NSR) from any ore extracted and sold from the permits; half the royalty may be purchased for $500,000, thereby reducing the royalty to a 1-per-cent NSR.

The Company’s net investment in the Lac Lessard project to July 31, 2020, is $nil. In accordance with IFRS analysis of impairment, expenditures for Lessard project has been written-off until such time as economic conditions permit a reversal of the impairment.

Going Concern

The Company is in the exploration stage and has not yet determined whether its exploration and evaluation assets contain reserves that are economically recoverable. The continued operations of the Company and the recoverability of amounts shown for its exploration and evaluation assets are dependent upon the ability of the Company to obtain financing to complete exploration of its exploration and evaluation assets, the existence of economically recoverable reserves and future profitable production, or alternatively, upon the Company’s ability to recover its costs through a disposition of its exploration and evaluation assets. The amount shown for exploration and evaluation assets does not necessarily represent present or future value. Changes in future conditions could require a material change in the amount recorded for the exploration and evaluation assets.

The unaudited condensed interim consolidated financial statements are prepared on the basis that the Company will continue as a going concern, which assumes that the Company will be able to continue operating for the foreseeable future and will be able to realize its assets and discharge its liabilities and commitments in the normal course of operations. As an exploration-stage company, the Company does not have any sources of revenue and historically has incurred recurring operating losses. At July 31, 2020, the Company had working capital of $1,743,591 (October 31, 2019 - $1,098,392) and shareholders’ equity of $69,531,108 (October 31, 2019 - $67,374,058). Management has assessed that this working capital and the proceeds of the recent financing are sufficient for the Company to continue as a going concern beyond one year. If the going concern assumption was not appropriate for the unaudited condensed interim consolidated financial statements it would be necessary to restate the Company’s assets and liabilities on a liquidation basis.

Eastmain Resources Inc.

Management’s Discussion & Analysis

Nine Months Ended July 31, 2020

Discussion Dated September 8, 2020

Results of Operations

The Company does not earn any significant revenue from consolidated operations. Interest income is derived from the investment of funds for the period between the receipt of funds from equity placements and the disbursement of exploration expenditures. From time to time, other income is derived from management fees and charges for the use of Company facilities by third parties.

Three months ended July 31, 2020, compared to the three months ended July 31, 2019:

●

Net income for the quarter was $381,625 (2019 – loss of $681,391) a variance of $1,063,016.

●

Operating expenses, including non-cash impairments, were $560,685 (2019 - $753,292) a variance of $192,607. The variance is primarily due to a decrease in salaries compared to the comparative period, which was offset by an increase of impairment of exploration and evaluation assets.

●

Interest and other income was $9,484 (2019 - $12,912) a variance of $3,428. The income was recorded during the period for interest earned on cash balances.

●

The unrealized gain on marketable securities for the quarter was $520,547 (2019 – loss of $13,622) a variance of $534,169. The gain is attributable to an increase in market values of the common shares in resource companies held by the Company detailed in Note 4 to the unaudited condensed interim consolidated financial statements.

●

Premium income from flow-through common shares was $210,769 (2019 – $543,349) a variance of $332,580. The premium on flow-through common shares is calculated as being the difference between the price paid by investors for flow-through common shares and the fair-market price of the common shares. The premium is recorded as a liability and income is derived from premium amortization pro-rata to eligible expenditures incurred.

●

Deferred income tax recovery of $217,695 (2019 – expense of $470,738) a variance of $688,433. Deferred income tax recovery/expense is largely affected by the amount of exploration expenditures, flow-through renunciation, and flow-through premium income and impairment charges recorded.

Nine months ended July 31, 2020, compared to the nine months ended July 31, 2019:

●

Net loss for the period was $586,810 (2019 – loss of $1,228,191) a variance of $641,381.

●

Operating expenses, including non-cash impairments, were $1,885,321 (2019 - $2,602,585) a variance of $717,264. The variance is primarily due to a decrease in salaries, general and office, marketing and investor relations and share-based compensation which were offset by an increase in professional fees and impairment of exploration and evaluation assets compared to the comparative period.

●

Interest and other income was $20,124 (2019 - $54,747) a variance of $34,623. The income was recorded during the period for interest earned on cash balances.

●

The realized gain on marketable securities for the quarter was $9,490 (2019 –$nil) a variance of $9,490. The loss is attributable to the sale of Benz common shares during the current period compared to none in the comparative period.

●

The unrealized gain on marketable securities for the quarter was $486,738 (2019 – gain of $31,187) a variance of $455,551. The gain is attributable to an increase in market values of the common shares in resource companies held by the Company detailed in Note 4 to the unaudited condensed interim consolidated financial statements.

Eastmain Resources Inc.

Management’s Discussion & Analysis

Nine Months Ended July 31, 2020

Discussion Dated September 8, 2020

●

Premium income from flow-through common shares was $308,385 (2019 – $987,348) a variance of $678,963. The premium on flow-through common shares is calculated as being the difference between the price paid by investors for flow-through common shares and the fair-market price of the common shares. The premium is recorded as a liability and income is derived from premium amortization pro-rata to eligible expenditures incurred.

●

Deferred income tax recovery of $526,627 (2019 – recovery of $301,112) a variance of $225,515. Deferred income tax recovery/expense is largely affected by the amount of exploration expenditures, flow-through renunciation, and flow-through premium income and impairment charges recorded.

Summary of Quarterly Results

| | | | | |

| | | | | |

| Interest / other income | $9,484 | $7,012 | $3,628 | $13,666 |

| Comprehensive income (loss) | $381,625 | $(494,619) | $(473,816) | $(15,364,565) |

| Per share basic | $0.0013 | $(0.0018) | $(0.0018) | $(0.0629) |

| Per share diluted | $0.0013 | $(0.0018) | $(0.0018) | $(0.0629) |

| Trading range of shares | | | | |

| High | $0.27 | $0.12 | $0.12 | $0.20 |

| Low | $0.11 | $0.06 | $0.10 | $0.11 |

| | | | | |

| | | | | |

| Interest / other income | $12,912 | $18,622 | $23,213 | $24,724 |

| Comprehensive loss | $(681,391) | $(338,975) | $(207,825) | $(71,303) |

| Per share basic | $(0.0028) | $(0.0015) | $(0.0009) | $(0.0003) |

| Per share diluted | $(0.0028) | $(0.0015) | $(0.0009) | $(0.0003) |

| Trading range of shares | | | | |

| High | $0.22 | $0.16 | $0.27 | $0.22 |

| Low | $0.10 | $0.12 | $0.13 | $0.16 |

Significant charges included in the amounts above are as follows:

7/31/2020

Comprehensive net income includes: impairment of exploration and evaluation assets of $140,612; share-based compensation of $19,581; an unrealized gain on marketable securities of $520,547; a premium on flow-through shares of $210,769; and a deferred income tax expense of $217,695.

4/30/2020

Comprehensive net loss includes: impairment of exploration and evaluation assets of $42,391; share-based compensation of $47,514; a realized loss on marketable securities of $36,900, an unrealized loss on marketable securities of $4,978; a premium on flow-through shares of $55,571; and a deferred income tax expense of $163,892.

1/31/2020

Comprehensive net loss includes: impairment of exploration and evaluation assets of $7,205; share-based compensation of $215,808; a realized gain on marketable securities of $46,390, an unrealized loss on marketable securities of $28,831; a premium on flow-through shares of $42,045; and a deferred income tax expense of $145,040.

Eastmain Resources Inc.

Management’s Discussion & Analysis

Nine Months Ended July 31, 2020

Discussion Dated September 8, 2020

10/31/2019

Comprehensive net loss includes: impairment of exploration and evaluation assets of $20,395,851; share-based compensation of $41,564; an unrealized loss on marketable securities of $46,370; a premium on flow-through shares of $271,747; and a deferred income tax expense of $5,008,353.

7/31/2019

Comprehensive net loss includes: $63,014 for share-based compensation; impairment of exploration and evaluation assets of $31,965; an unrealized loss on marketable securities of $13,622; and a deferred income tax expense of $470,738.

4/30/2019

Comprehensive net loss includes: $65,229 for share-based compensation; impairment of exploration and evaluation assets of $9,595; an unrealized gain on marketable securities of $57,813; and a deferred income tax recovery of $312,633.

1/31/2019

Comprehensive net loss includes: $206,464 for share-based compensation; impairment of exploration and evaluation assets of $61,218; an unrealized loss on marketable securities of $13,004; a premium on flow-through shares of $443,999; and a deferred income tax recovery of $459,217.

10/31/2018

Comprehensive net loss includes: $164,037 for share-based compensation; impairment of exploration and evaluation assets of $21,907; an unrealized loss on marketable securities of $17,237; a premium on flow-through shares of $355,350; and a deferred income tax expense of $78,616.

Trends and Economic Conditions

Management regularly monitors economic conditions and estimates their impact on the Company’s operations and incorporates these estimates in both short-term operating and longer-term strategic decisions.

Due to the worldwide COVID-19 pandemic, material uncertainties may arise that could influence management’s going concern assumption. Management cannot accurately predict the future impact COVID-19 may have on:

●

Global gold and precious metal prices;

●

Demand for gold and precious metal and the ability to explore for gold and precious metal;

●

The severity and the length of potential measures taken by governments to manage the spread of the virus, and their effect on labour availability and supply lines;

●

Availability of government supplies, such as water and electricity;

●

Purchasing power of the Canadian dollar; and

●

Ability to obtain funding.

At the date of this MD&A, the Canadian federal government and the provincial governments of Ontario and Quebec have not introduced measures that have directly impeded the operational activities of the Company other than the implementation of new working procedures on the resumption of exploration. Although cash in the Company has declined, management believes the business will continue and, accordingly, the current situation has not impacted management’s going concern assumption. However, it is not possible to reliably estimate the length and severity of these developments and the impact on the financial results and condition of the Company in future periods.

Apart from these and the risk factors noted under the heading “Risks and Uncertainties”, management is not aware of any other trends, commitments, events or uncertainties that would have a material effect on the Company’s business, financial condition or results of operations. See “Cautionary Note Regarding Forward-Looking Statements” below.

Eastmain Resources Inc.

Management’s Discussion & Analysis

Nine Months Ended July 31, 2020

Discussion Dated September 8, 2020

Risks and Uncertainties

The exploration, development and mining of mineral resources are highly speculative in nature and are subject to significant risks. Such investment should be undertaken only by investors whose financial resources are sufficient to enable them to assume these risks and who have no need for immediate liquidity in their investment. Prospective investors should carefully consider the risk factors that have affected, and which in the future are reasonably expected to affect, the Company and its financial position. Please do refer to the section entitled “Risks and Uncertainties” in the Company’s Annual MD&A for the fiscal year ended October 31, 2019, available on SEDAR at www.sedar.com.

COVID-19 Risks

The worldwide emergency measures taken to combat the COVID-19 pandemic may continue, could be expanded, and could also be reintroduced in the future following relaxation. As governments implement monetary and fiscal policy changes aimed to help stabilize economies and capital markets, the Company cannot predict legal and regulatory responses to concerns about the COVID-19 pandemic and related public health issues and how these responses may impact its business. The COVID-19 pandemic, actions taken globally in response to it, and the ensuing economic downturn has caused significant disruption to business activities and economies. The depth, breadth and duration of these disruptions remain highly uncertain at this time. Furthermore, governments are developing frameworks for the staged resumption of business activities. As a result, it is difficult to predict how significant the impact of the COVID-19 pandemic, including any responses to it, will be on the global economy and Eastmain’s business. The Company has outlined these risks in more detail below.

Strategic & Operational Risks

The ongoing COVID-19 pandemic could adversely impact Eastmain’s financial condition in future periods as a result of reduced business opportunities via acquisitions and dispositions of exploration and development properties. The uncertainty around the expected duration of the pandemic and the measures put in place by governments to respond to it could further depress business activity and financial markets. The Company’s strategic initiatives to advance our business may be delayed or cancelled as a result.

To date, Eastmain’s operations have remained stable under the pandemic but there can be no assurance that our ability to continue to operate our business will not be adversely impacted, in particular to the extent that aspects of Company operations which rely on services provided by third parties fail to operate as expected. The successful execution of business continuity strategies by third parties is outside the Company’s control. If one or more of the third parties to whom Eastmain outsources critical business activities fails to perform as a result of the impacts from the spread of COVID-19, it could have a material adverse effect on business and operations.

Liquidity risk and capital management

Extreme market volatility and stressed conditions resulting from COVID-19 and the measures implemented to control its spread could limit the Company’s access to capital markets and ability to generate funds to meet future capital requirements. Sustained global economic uncertainty could result in higher-cost or limited access to funding sources. In addition, while Eastmain currently maintains sources of liquidity, such as cash balances, there can be no assurance that these sources will provide us with sufficient liquidity on commercially reasonable terms in the future. Extreme market volatility may leave us unable to react in a manner consistent with historical business practices.

Market Risk

The pandemic and resulting economic downturn have created significant volatility and declines in financial and commodity markets. Central banks have announced emergency interest rate cuts, while governments are implementing unprecedented fiscal stimulus packages to support economic stability. The pandemic could result in a global recessionary environment with continued market volatility, which may continue to impact Eastmain’s financial condition.

Eastmain Resources Inc.

Management’s Discussion & Analysis

Nine Months Ended July 31, 2020

Discussion Dated September 8, 2020

Transaction Risk

The Company’s recently announced transaction comes with risks, most notably that the transaction may not be completed due to insufficient securityholder approvals or termination by either party in certain circumstances. Other risks include the existence of a termination fee which may discourage other parties from attempting to acquire Eastmain and restrictions on the actions of Eastmain while arrangement is pending. Post-closing of the arrangement, Eastmain shareholders, through their holdings in Fury Gold, will be subject to risks pertaining to the businesses of Eastmain and Auryn; also, the integration of Auryn and Eastmain may not occur as planned resulting in additional costs or time required to complete.

Exploration and Evaluation Assets

The cost of exploration and evaluation is recorded on a property-by-property basis and deferred in the Company’s accounts, pending recovery, based on the discovery and/or extraction of economically recoverable reserves. When it is determined that there is little prospect of minerals being economically extracted from a property, the deferred costs associated with that property are charged to operations. The Company has an impairment policy, described in Note 3 to the annual audited consolidated financial statements for the year ended October 31, 2019, whereby the carrying amounts of exploration properties are reviewed for events or changes in circumstances that suggest that the carrying amount may not be recoverable. As at July 31, 2020, the Company’s carrying value of exploration and evaluation assets, net of recoveries and impairment charges was $68,526,772 (October 31, 2019 - $68,120,719).

Project expenditures for the nine months ended July 31, 2020

| Project | Drilling & assay $ | Technical surveys $ | Project acquisition & maintenance $ | Cash callJV $ | 2020 net expenditures $ |

| Clearwater | 256,694 | 653,718 | 1,771 | nil | 912,183 |

| Eastmain Mine | nil | 8,171 | nil | nil | 8,171 |

| Eléonore South JV | 61,577 | 163,773 | 4,484 | (404,135) | (174,301) |

| Ruby Hill | nil | 231 | 16,762 | nil | 16,993 |

| Reservoir | nil | 6,893 | 10,394 | nil | 17,287 |

| Radisson | nil | 254,770 | 24,708 | nil | 279,478 |

| Lac Lessard | nil | nil | 15,007 | nil | 15,007 |

| Lac Clarkie | nil | nil | 5,171 | nil | 5,171 |

| Other | nil | 6,751 | 9,521 | nil | 16,272 |

| Total | 318,271 | 1,094,307 | 87,818 | (404,135) | 1,096,261 |

Eastmain Resources Inc.

Management’s Discussion & Analysis

Nine Months Ended July 31, 2020

Discussion Dated September 8, 2020

Cumulative acquisition, exploration and evaluation expenditures as at July 31, 2020

| Project | Balance October 31, 2019 $ | 2020 net expenditures $ | 2020 Write-down $ | 2020 Recoveries $ | Balance July 31, 2020 $ |

| Clearwater | 57,501,473 | 912,183 | nil | nil | 58,413,656 |

| Eastmain Mine | 6,245,000 | 8,171 | nil | (340,000) | 5,913,171 |

| Eléonore South JV | 4,374,246 | (174,301) | nil | nil | 4,199,945 |

| Ruby Hill | nil | 16,993 | 58,007 | (75,000) | nil |

| Reservoir | nil | 17,287 | (17,287) | nil | nil |

| Radisson | nil | 279,478 | (279,478) | nil | nil |

| Lac Lessard | nil | 15,007 | 69,993 | (85,000) | nil |

| Lac Clarkie | nil | 5,171 | (5,171) | nil | nil |

| Other | nil | 16,272 | (16,272) | nil | nil |

| Total | 68,120,719 | 1,096,261 | (190,208) | (500,000) | 68,526,772 |

Liquidity

Working capital is a measure of both a company’s efficiency and its short-term financial health, which is calculated as current assets less current liabilities. The working capital ratio of current assets to current liabilities indicates whether a company has enough short-term assets to cover its short-term debt.

At July 31, 2020, the Company had current assets of $3,680,339, and current liabilities of $1,936,748 yielding a working capital of $1,743,591. The Company notes that the flow-through share premium liability which represents $731,143 of current liabilities balance is not settled through cash payment. Instead, this balance is amortized against qualifying flow-through expenditures which are required to be incurred before December 31, 2020 and December 31, 2021. The Company maintains a high liquidity by holding cash balances in interest-bearing Canadian bank accounts. The high working capital ratio is a reflection of the Company’s operating cycle, which consists of obtaining funds through the issuance of shares, before engaging in exploration activities. The Company believes there may be changes to the Canada Revenue Agency flow-through deadline due to COVID-19 and as a result, the December 31, 2020 deadline may change. If exploration deadlines are indeed extended, the Company expects it may choose to defer certain expenditures to better align with optimal exploration conditions on certain targets. However, there is no certainty when, or if, deadline extensions will be implemented and thus, the Company continues to operate with the intention of fulfilling its exploration spending requirements assuming no changes are implemented.

The Company has no short or long-term debt.

At July 31, 2020, the Company held equity investments of $999,381 valued at fair market with initial maturities extending beyond one year. Funds-on-hand for future exploration costs are invested from time-to-time in money market funds, term deposits, and bonds or certificates of deposit with maturities matching the Company’s cash-flow requirements, which in management’s opinion, yield the greatest return with the least risk. Apart from certain securities received as a result of past company dealings, the Company’s policy is to maintain its investment portfolio in very low-risk liquid securities, which are selected and managed under advice from independent professional advisors.

Prepaid and sundry receivables at July 31, 2020, were $183,164 which included recoverable sales taxes paid of $61,049 which are subject to verification and normally refunded within 60 to 90 days of the claim. Refunds of taxes are not considered a financial instrument since governments are not obligated to make these payments. Other accounts receivable and advances were $121,035.

Eastmain Resources Inc.

Management’s Discussion & Analysis

Nine Months Ended July 31, 2020

Discussion Dated September 8, 2020

At July 31, 2020, amounts payable and accrued liabilities were $798,667. Trade accounts are normally settled within 30 days. The balance includes a $280,000 accrual for flow-through financings reassessment from CRA. The Company and its tax advisors are currently filing objections to the CRA to vigorously contest the reassessment.

During the nine months ended July 31, 2020, the Company spent $87,818 on claim acquisition, claim maintenance, and exploration and evaluation of mineral resource properties. Exploration expenditures are discretionary except for the flow-through commitments described below. As such, management believes the Company will have sufficient funds available to meet all of its flow-through obligations and cover its ongoing administrative and overhead costs for the foreseeable future.

The Company is reliant on equity markets over the long term to raise capital to fund its exploration activities. In the past, the Company has been successful in raising funds through equity offerings, and while there is no guarantee that this will continue, there is no reason either to believe that this capacity will diminish.

Commitments

The Company issued common flow-through shares during May 2019, October 2019 and March 2020, which require the Company to incur flow-through eligible expenditures of $4.03 million before December 31, 2020 and $2.18 million before December 31, 2021. As disclosed to investors, the funds raised are being used to fund exploration and development of the Company’s properties in Quebec. As at July 31, 2020, the Company had a remaining flow-through spending obligation of $0.78 million which was previously due for December 31, 2020. Recently, the Canadian Federal government has stated that flow-through spending deadlines have been deferred in light of COVID-19, the Company fully intends to satisfy its $0.78 million obligations by December 31, 2020 and $2.18 million by December 31, 2021, respectively.

Capital Resources

The Company, as is typical of junior exploration companies, has only a small investment in capital resources, which is comprised of $81,968 in computer equipment and field equipment of $403,396. The net book value at July 31, 2020, was $21,868.

Income Taxes

For tax year-ends after December 31, 2006, non-capital losses can be carried forward and used to offset future gains for a period of twenty years, after which they expire (ten years for losses in tax years ending prior to December 31, 2006). To the extent that loss carry-forwards could be used to reduce future tax liabilities, they are a financial resource that can be managed. The Company, by its nature as a mineral exploration business, generates non-capital tax losses, which are not recognized on the income statement because, at this point in time, it is not certain that they will be used to offset tax liabilities within their carry-forward life.

As at October 31, 2019, the Company has non-capital losses available for deduction of $23,514,618 which begin to expire in 2026, and unused capital losses of $379,582 which have no expiry date. In addition, the Company has Canadian exploration and development expenditures available to reduce future years’ taxable income of approximately $33,400,000. The tax benefit of these amounts may be carried forward indefinitely.

Income taxes on interim results have been estimated and apportioned at a reasonable approximation of the deferred income tax liability that will be applicable to the operating results for the full fiscal year.

Off-Balance-Sheet Arrangements

The Company has no off-balance-sheet arrangements.

Eastmain Resources Inc.

Management’s Discussion & Analysis

Nine Months Ended July 31, 2020

Discussion Dated September 8, 2020

Transactions with Related Parties

The Vice President Exploration of Eastmain is the President of OTD Exploration Services Inc. (“OTD”). During the three and nine months ended July 31, 2020, $23,100 and $71,148, respectively was paid to OTD as related to professional geological exploration and management services (three and nine months ended July 31, 2019 - $39,963 and $153,824, respectively). At July 31, 2020, the amount due to OTD was $nil (October 31, 2019 - $50,693) related to a) his function as the Vice President, Exploration of Eastmain and to b) reimburse operating and exploration expenses incurred by OTD on behalf of the Company.

On December 6, 2019, the Company appointed Blair Schultz, a director of the Company, as Interim President and Chief Executive Officer. This appointment followed the departure of Claude Lemasson as President and Chief Executive Officer and a director of the Company. The interim Chief Executive Officer, is the president of Schultz Capital Inc. Fees paid to Schultz Capital Inc. are related to the Chief Executive Officer function. During the three and nine months ended July 31, 2020, $18,750 and $45,242, respectively was paid to Schultz Capital Inc. as management services (2019 - $nil). At July 31, 2020, the amount due to Schultz Capital Inc. was $6,250 (October 31, 2019 - $nil).

Remuneration of directors and key management personnel, other than consulting fees, of the Company was as follows:

| | Three months ended July 31, 2020 ($) | Three months ended July 31, 2019 ($) | Nine months ended July 31, 2020 ($) | Nine months ended July 31, 2019 ($) |

| Salaries and benefits | 113,448 | 234,397 | 461,704 | 725,082 |

| Share-based compensation | 56,309 | 53,340 | 296,574 | 273,331 |

| Total | 169,757 | 287,737 | 758,278 | 998,413 |

The Company considers its key management personnel to be the CEO and Chief Financial Officer (“CFO”).

Independent directors do not have any employment or service contracts but received remuneration for their work. Officers and directors are entitled to share-based compensation and cash remuneration for their services.

At July 31, 2020, the amount due to officers was $19,903 (October 31, 2019 - $5,020) and the amount due to directors was $nil (October 31, 2019 - $3,143).

The Company has a diversified base of investors. To the Company’s knowledge, no shareholder holds more than 10% of the Company’s common shares as at July 31, 2020.

Share Capital

The authorized capital of the Company consists of an unlimited number of common shares of which, as of September 8, 2020, there are 290,623,095 common shares outstanding; 14,395,233 options outstanding with a weighted average exercise price of $0.39, which would generate proceeds of $5,614,140, if exercised; 12,545,456 warrants outstanding with a weighted average exercise price of $0.15, which if exercised would have generated proceeds of $1,881,818; and 116,666 unvested RSU.

Critical Accounting Estimates

The preparation of these unaudited condensed interim consolidated financial statements under IFRS requires management to make certain estimates, judgements and assumptions about future events that affect the amounts reported in the unaudited condensed interim consolidated financial statements and related notes.

Eastmain Resources Inc.

Management’s Discussion & Analysis

Nine Months Ended July 31, 2020

Discussion Dated September 8, 2020

Although these estimates are based on management’s best knowledge of the amounts, events or actions, actual results may differ from those estimates and these differences could be material.

a)

Significant judgements in applying accounting policies

The areas which require management to make significant judgements in determining carrying values include, but are not limited to:

Exploration and evaluation assets

In estimating the recoverability of capitalized exploration and evaluation assets, management is required to apply judgement in determining whether technical feasibility and commercial viability can be demonstrated for its mineral properties. Once technical feasibility and commercial viability of a property can be demonstrated, it is reclassified from exploration and evaluation assets to property and equipment, and subject to different accounting treatment. As at July 31, 2020, management deemed that no reclassification of exploration and evaluation assets was required.

Income taxes and recoverability of potential deferred tax assets

In assessing the probability of realizing income tax assets recognized, management makes estimates related to expectations of future taxable income, applicable tax planning opportunities, expected timing of reversals of existing temporary differences, and the likelihood that tax positions taken will be sustained upon examination by applicable tax authorities. In making its assessments, management gives additional weight to both positive and negative evidence that can be objectively verified. Estimates of future taxable income are based on forecasted cash flows from operations and the application of existing tax laws in each jurisdiction. The Company considers whether relevant tax planning opportunities are within the Company's control, are feasible, and are within management's ability to implement.