UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________________

FORM 10-K

______________________________________

(Mark One)

|

| |

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended December 31, 2012 |

| OR |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

Commission file number: 333-172772

______________________________________

DIAMOND RESORTS CORPORATION

(Exact name of registrant as specified in its charter)

______________________________________

|

| | |

| Maryland | | 95-4582157 |

| (State or other jurisdiction of | | (I.R.S. Employer |

| incorporation or organization) | | Identification No.) |

| | | |

10600 West Charleston Boulevard Las Vegas, Nevada | | 89135 |

| (Address of principal executive offices) | | (Zip code) |

| | | |

| (702) 684-8000 |

| (Registrant's telephone number including area code) |

| |

| Securities registered pursuant to Section 12(b) of the Act: None |

| Securities registered pursuant to Section 12(g) of the Act: None |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES o NO x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES x NO o

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES x NO o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES x NO o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. (See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act). (Check one): |

| | |

Large accelerated filer o | | Accelerated filer o |

| | | |

Non-accelerated filer x | | Smaller Reporting Company o |

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). o YES x NO

The aggregate market value of the voting stock held by non-affiliates of the registrant as of June 30, 2012: Not applicable.

There is no public trading market for the common stock of Diamond Resorts Corporation. As of March 31, 2013, there were 100 outstanding shares of the common stock, par value $0.01 per share, of Diamond Resorts Corporation.

TABLE OF CONTENTS

|

| |

| |

| | |

| |

| | |

| ITEM 1A. RISK FACTORS | |

| | |

| ITEM 1B. UNRESOLVED STAFF COMMENTS | |

| | |

| ITEM 2. PROPERTIES | |

| | |

| ITEM 3. LEGAL PROCEEDINGS | |

| | |

| ITEM 4. MINE SAFETY DISCLOSURES | |

| | |

| |

| | |

| ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES | |

| | |

| ITEM 6. SELECTED FINANCIAL DATA | |

| | |

| |

| | |

| |

| | |

| ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | |

| | |

| ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | |

| | |

| |

| | |

| ITEM 9B. OTHER INFORMATION | |

| | |

| |

| | |

| ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE | |

| | |

| ITEM 11. EXECUTIVE COMPENSATION | |

| | |

| ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | |

| | |

| ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE | |

| | |

| ITEM 14. PRINCIPAL ACCOUNTING FEES AND SERVICES | |

| | |

| |

| | |

| ITEM 15. EXHIBITS, FINANCIAL STATEMENT SCHEDULES | |

| | |

| SIGNATURES | |

PART I

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements. These statements can be identified by the fact that they do not relate strictly to historical or current facts. We have tried to identify forward-looking statements in this report by using words such as “anticipates,” “estimates,” “expects,” “intends,” “plans” and “believes,” and similar expressions or future or conditional verbs such as “will,” “should,” “would,” “may” and “could.” These forward-looking statements include, among others, statements relating to our future financial performance, our business prospects and strategy, anticipated financial position, liquidity and capital needs and other similar matters. These forward-looking statements are based on management's current expectations and assumptions about future events, which are inherently subject to uncertainties, risks and changes in circumstances that are difficult to predict.

Although we believe that our expectations are based on reasonable assumptions, our actual results may differ materially from those expressed in, or implied by, the forward-looking statements included in this report as a result of various factors, including, among others:

| |

| • | adverse trends or disruptions in economic conditions generally or in the vacation ownership, vacation rental and travel industries; |

| |

| • | adverse changes to, or interruptions in, relationships with our affiliates and other third parties may occur, including the expiration, termination or renegotiation of our hospitality management contracts or the failure of the managers of our affiliated resorts to ensure that those properties meet our customers' expectations, which could adversely affect our business and results of operations; |

| |

| • | our ability to maintain an optimal inventory of VOIs for sale; |

| |

| • | our ability to sell, securitize or borrow against our consumer loans; |

| |

| • | decreased demand from prospective purchasers of VOIs; |

| |

| • | adverse events or trends in vacation destinations and regions where the resorts in our network are located; |

| |

| • | changes in our senior management; |

| |

| • | our ability to comply with regulations applicable to the vacation ownership industry; |

| |

| • | the effects of our indebtedness and our compliance with the terms thereof; |

| |

| • | our ability to successfully implement our growth strategy; |

| |

| • | our ability to compete effectively; and |

| |

| • | other risks and uncertainties discussed in Item 1A, “Risk Factors” and elsewhere in this report. |

Accordingly, you should read this report completely and with the understanding that our actual future results may be materially different from what we expect.

Forward-looking statements speak only as of the date of this report. Except as expressly required under federal securities laws and the rules and regulations of the Securities and Exchange Commission (the "SEC"), we do not have any obligation, and do not undertake, to update any forward-looking statements to reflect events or circumstances arising after the date of this report, whether as a result of new information or future events or otherwise. You should not place undue reliance on the forward-looking statements included in this report or that may be made elsewhere from time to time by us, or on our behalf. All forward-looking statements attributable to us are expressly qualified by these cautionary statements.

INDUSTRY AND MARKET DATA

Certain market, industry and similar data included in this report have been obtained from third-party sources that we believe to be reliable, including the ARDA International Foundation, (the "AIF"). Our market estimates are calculated by using independent industry publications and other publicly available information in conjunction with our assumptions about our markets. We have not independently verified any market, industry or similar data presented in this report. Such data involves risks and uncertainties and are subject to change based on various factors, including those discussed under the headings

“Cautionary Statement Regarding Forward-Looking Statements” and Item 1A, “Risk Factors” in this report.

TRADEMARKS

Diamond Resorts International®, Diamond Resorts®, THE Club®, The Meaning of Yes® and our other registered or common law trademarks, service marks or trade names appearing in this report are property of the Company. This report also refers to brand names, trademarks or service marks of other companies. All brand trademarks, service marks or trade names cited in this report are the property of their respective holders.

WHERE YOU CAN FIND MORE INFORMATION

We maintain our principal executive offices at 10600 West Charleston Boulevard, Las Vegas, Nevada 89135, and our telephone number is (702) 684-8000.

We are required to file annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and other information with the SEC. You can obtain copies of these materials by visiting the SEC's Public Reference Room at 100 F Street, NE, Washington, D.C. 20549, by calling the SEC at 1-800-SEC-0330, or by accessing the SEC's website at www.sec.gov.

ITEM 1. BUSINESS

Except as otherwise stated or required from the context, references in this report to the "Company," "we," "us" and "our" refer to Diamond Resorts Parent, LLC ("DRP") and its subsidiaries, including Diamond Resorts Corporation ("DRC"). All financial information contained in this report is that of DRP.

Company Overview

We are a global leader in the hospitality and vacation ownership industry, with an ownership base of more than 490,000 owner-families, or members, and a worldwide network of 263 vacation destinations located in 28 countries throughout the continental United States ("U.S."), Hawaii, Canada, Mexico, the Caribbean, Central America, South America, Europe, Asia, Australia and Africa. Our resort network includes 79 Diamond Resorts-branded properties with a total of 9,274 units, which we manage, and 180 affiliated resorts and hotels and four cruise itineraries, which we do not manage and do not carry our brand, but are a part of our network and are available for our members to use as vacation destinations.

We offer a vacation ownership program whereby members acquire vacation ownership interests ("VOIs" or "Vacation Interests"), in the form of points. Members receive an annual allotment of points depending on the number of points purchased, and they can use these points to stay at any of the destinations within our network of resort properties, including both Diamond Resorts-branded properties as well as affiliated resorts, hotels and cruises. Unlike a traditional weeks-based vacation ownership product that is linked to a specific resort and week during the year, our points-based system permits our members to maintain flexibility relating to the location, season and duration of their vacation.

A core tenet of our management philosophy is delivering consistent quality and personalized services to each of our members, and we strive to infuse hospitality and service excellence into every aspect of our business and each member's vacation experience. To that end, we are committed to The Meaning of Yes®, a set of Diamond values designed to ensure that each of our members and guests receives a consistent, “high touch” hospitality experience through our efforts to respond to the desires of our members and guests. Our service-oriented culture is highly effective in building a strong brand name and fostering long-term relationships with our members, resulting in additional sales to our existing member base.

Our business consists of (i) hospitality and management services and (ii) sales and financing of VOIs.

| |

| • | Hospitality and Management Services. We are fundamentally a hospitality company that manages a worldwide network of resort properties and provides services to a broad member base. We manage our branded resort properties, as well as seven multi-resort trusts (the "Collections"), each of which holds ownership interests in a group of resort properties within a geographic region. For example, the U.S. Collection includes interests in 36 resorts located throughout the continental U.S. Our management contracts automatically renew, and the management fees we receive are based on a cost-plus structure. As the manager of our branded resorts, we operate the front desks, furnish housekeeping, maintenance and human resources services and operate amenities such as golf courses, food and beverage venues and retail shops. We also provide an online reservation system, a customer service contact center, rental services, billing services, account collections, accounting and treasury functions and communications and information technology services. In addition, a key component of our business is THE Club, through which we operate a proprietary reservation system that enables our members to use their points to stay at any of the resorts in our network. THE Club also offers our members a wide range of other benefits, such as the opportunity to purchase various products and services (such as consumer electronics, home appliances and insurance products) from third parties at discounted prices, for which we earn commissions. Annual fees paid by our members cover the operating costs of our managed resorts (including an allocation of a substantial portion of our overhead related to the provision of our management services), our management fees and, in the case of THE Club members, dues for membership in THE Club. |

| |

| • | Sales and Financing of VOIs. As part of our hospitality and management services, we typically enter into agreements with our managed resorts and the Collections under which we reacquire VOIs from members who fail to pay their annual maintenance fees or other assessments, serving as the principal source of our VOI inventory that we sell. We sell VOIs principally through presentations, which we refer to as “tours,” at our 50 sales centers, substantially all of which are located at our managed resorts. We generate sales prospects by utilizing a variety of marketing programs, including presentations at our managed resorts targeted at existing members and current guests who stay on a per-night or per-week basis, overnight mini-vacation packages, targeted mailings, telemarketing, gift certificates and various destination-specific marketing efforts. As part of our sales efforts, and to generate interest income and other fees, we also provide loans to qualified VOI purchasers. |

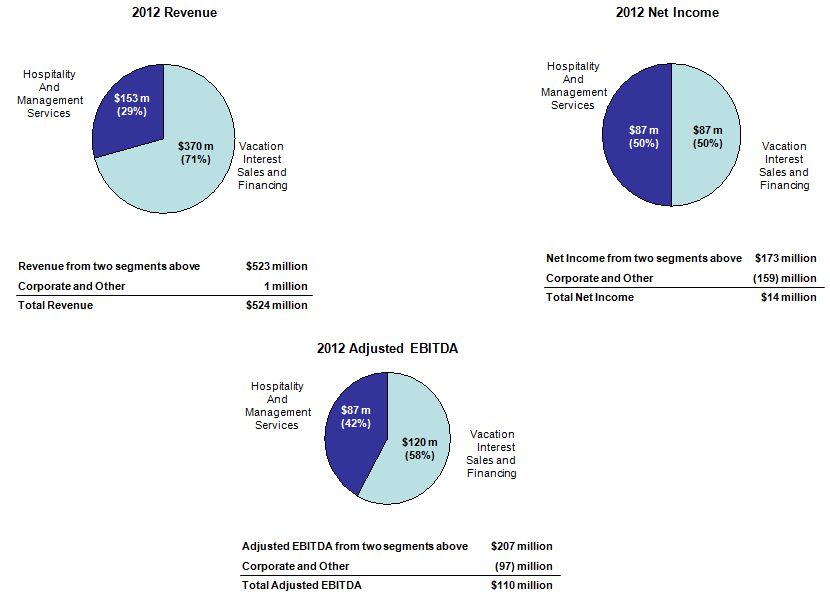

The following charts show the contribution that each segment of our business made to our total revenue, net income and Adjusted EBITDA for the year ended December 31, 2012 (with the percentages representing the relative contributions of these two segments):

Adjusted EBITDA is a non-U.S. generally accepted accounting principles ("U.S. GAAP") financial measure and should not be considered in isolation of, or as an alternative to, net income (loss), operating income (loss) or any other measure of financial performance calculated and presented in accordance with U.S. GAAP. See "Management's Discussion and Analysis of Financial Condition and Results of Operations—Presentation of Certain Financial Metrics" for a description of how we define Adjusted EBITDA and a reconciliation of net income (loss) to Adjusted EBITDA for each segment of our business and for the reasons we believe presenting Adjusted EBITDA is useful to readers.

The Vacation Ownership Industry

The vacation ownership industry enables individuals and families to purchase VOIs, which facilitate shared ownership and use of fully-furnished vacation accommodations at a particular resort or network of resorts. VOI ownership distinguishes itself from other vacation options by integrating aspects of traditional property ownership and the flexibility afforded by pay-per-day resorts or hotels. As compared to pay-per-day resorts or hotels, VOI ownership typically offers consumers more space and home-like features such as a full kitchen and one or more bedrooms. Further, room rates and availability at pay-per-day resorts and hotels are subject to periodic change, while much of the cost of a VOI is generally fixed at the time of purchase. Relative to traditional property ownership, VOI ownership affords consumers greater convenience and variety of vacation experiences and requires significantly less up-front capital, while still offering common area amenities such as swimming pools, playgrounds, restaurants and gift shops. Consequently, for many vacationers, VOI ownership is an attractive alternative to traditional property ownership and pay-per-day resorts and hotels.

Typically, a vacation ownership resort is operated through an organization sometimes referred to as a homeowners association ("HOA"), which is administered by a board of directors elected by the owners of VOIs at the resort. The HOA is responsible for ensuring that the resort is adequately maintained and operated. To fund the ongoing operating costs of the resort, each VOI holder is required to pay its pro rata share of the expenses to operate and maintain the resort, including any management fees payable to a company to manage and oversee the day-to-day operation of the resort. These management fees are often payable to the management companies annually in advance. If a VOI owner fails to pay its maintenance fee, that owner will be in default, which may ultimately result in a forfeiture of that owner's VOI to the HOA and a consequent ratable increase in the expense-sharing obligations of the non-defaulted VOI owners.

The management and maintenance of a resort in which VOIs are sold is generally provided either by the developer of the resort or outsourced to a management company but, in either case, many developers often regard the management services provided as ancillary to the primary activities of property development and VOI sales. Historically, certain real estate developers have created and offered VOI products in connection with their investments in purpose-built vacation ownership properties or converted hotel or condominium buildings. These developers have frequently used substantial project-specific debt financing to construct or convert vacation ownership properties. The sales and marketing efforts of these developers have typically focused on selling out the intervals in the development, so that the developer can repay its indebtedness, realize a profit from the interval sales and proceed to a new development project.

As the vacation ownership industry evolved, some in the industry recognized the potential benefits of a more integrated approach, where the developer's resort management operations complement its sales and marketing efforts. In addition, the types of product offerings have also expanded over time, moving from fixed-or floating-week intervals which provide the right to use the same property each year or in alternate years, to points-based memberships in multi-resort vacation networks, which offer a more flexible vacation experience. In addition to these resort systems, developers of all sizes typically may also affiliate with vacation ownership exchange companies in order to give customers the ability to exchange their rights to use the developer's resorts for the right to access a broader network of resorts. According to the AIF, a trade association representing the vacation ownership and resort development industries, the percentage of resort networks offering points-based products has been rising in recent years and, due to the flexibility of these types of products, the AIF believes that this trend will continue in the near future as companies that have traditionally offered only weekly intervals expand their product offerings.

Growth in the vacation ownership industry has been achieved through expansion of existing resort companies as well as the entry of well-known lodging and entertainment companies, including Disney, Four Seasons, Hilton, Hyatt, Marriott, Starwood and Wyndham, which have developed larger purpose-built resorts and added vacation ownership developments to their existing pay-per-day resorts and hotels. The industry's growth can also be attributed to increased market acceptance of vacation ownership resorts, enhanced consumer protection laws and the evolution from a product offering a specific week-long stay at a single resort to multi-resort, often points-based, vacation networks, which offer a more flexible vacation experience.

According to AIF, as of December 31, 2011, the U.S. vacation ownership community was comprised of approximately 1,548 resorts, representing approximately 194,200 units and an estimated 8.4 million vacation ownership week equivalents. As reported by the AIF and reflected in the graph below, VOI sales during 2009 through 2011 were down significantly from levels prior to the economic downturn that started in 2008, which the AIF attributes largely to the fact that several of the larger VOI developers intentionally slowed their sales efforts through increased credit score requirements and larger down payment requirements in the face of an overall tighter credit environment. However, according to the AIF, VOI sales in the U.S. increased by 1.6% from 2009 to 2010, and by 2.4% from 2010 to 2011, and this trend of increasing VOI sales continued to accelerate in the final three months of 2012, which showed a 10.6% increase as compared to the same period in 2011.

Source: Historical timeshare industry research conducted by Ragatz Associates, American Economic Group and Ernst & Young on behalf of the AIF, as of December 31, 2011.

We expect the U.S. vacation ownership industry to continue to grow over the long term due to favorable demographics, more positive consumer attitudes and the low penetration of vacation ownership in North America. According to the AIF's bi-annual 2012 Shared Vacation Ownership Owners Report (the “Owners Report”), based upon a survey of the U.S. VOI owners, the median household income of VOI owners was $74,000 in 2012, 89% of VOI owners own their primary residence and 58% have a college degree. The Owners Report indicated that 83% of VOI owners rate their overall ownership experience as good to excellent and that the top four reasons for purchasing a VOI are resort location, saving money on future vacations, overall flexibility and quality of the accommodations. According to the Owners Report, less than 8% of U.S. households own a VOI. We believe this relatively low penetration rate of vacation ownership suggests the presence of a large base of potential customers.

The European vacation ownership industry is also significant. According to the AIF, in 2010, the European vacation ownership community was comprised of approximately 1,345 resorts, representing approximately 87,832 units. In addition, we believe that rapidly-growing international markets, such as Asia and Central and South America, present significant opportunities for expansion of the vacation ownership industry due to the substantial increases in spending on travel and leisure activities forecasted for consumers in those markets.

As the vacation ownership industry continues to mature, we believe that keys to success for a company in this industry include:

| |

| • | Hospitality Focus. Integrating hospitality into every aspect of a guest's vacation experience, including VOI sales, should result in higher levels of customer satisfaction and generate increased VOI sales, as compared to companies that do not view hospitality as an integral component of the services they provide. |

| |

| • | Broad, Flexible Product Offering. Offering a flexible VOI product that allows customers to choose the location, season, duration and size of accommodation for their vacation, based upon the size of the product purchased, coupled with a broad resort network, will likely attract a broader spectrum of customers. |

| |

| • | Consistent, High-Quality Resort Management. Ensuring a consistent, high-quality guest experience across a company's managed resorts and a brand the customer can trust should not only enhance VOI sales and marketing efforts targeted at new customers but also increase the potential for additional VOI sales to existing customers. |

| |

| • | Financing. Providing quick and easy access to consumer financing will often expedite a potential purchaser's decision-making process and result in a larger VOI purchase. |

We believe that competition in the vacation ownership industry is based primarily on the quality of the hospitality services and overall experience provided to customers, the number and location of vacation ownership resorts in the network, trust in the brand and the availability of program benefits, such as VOI exchange programs.

Competitive Strengths

Our competitive strengths include:

A substantial portion of the revenue from our hospitality and management services business converts directly to Adjusted EBITDA.

Our management contracts with our managed resorts and the Collections automatically renew, and under these contracts we receive management fees generally ranging from 10% to 15% of the other costs of operating the applicable resort or Collection (with an average based upon the total management fee revenue of 14.6%). The covered costs paid by our managed resorts and the Collections include both the direct resort operating costs and an allocation of a substantial portion of our overhead related to this part of our business. Accordingly, our management fee revenue results in a comparable amount of Adjusted EBITDA. See Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations— Presentation of Certain Financial Metrics." Generally, our revenue from management contracts increases to the extent that (i) operating costs at our managed resorts and the Collections rise and, consequently, our management fees increase proportionately under our cost-plus management contracts, (ii) we add services under our management contracts or (iii) we acquire or enter into contracts to manage resorts not previously managed by us.

The principal elements of our business typically provide us with significant financial visibility.

| |

| • | Management fees from our cost-plus management contracts. All anticipated operating costs of each of our managed resorts and Collections, including our management fees and costs pertaining to the specific managed resort or Collection, such as costs associated with the maintenance and operations of the resort, are included in the annual budgets of these resorts and Collections. These annual budgets are determined by the board of directors of the HOA or Collection, as applicable, and are typically finalized before the end of the prior year. As a result, a substantial majority of our management fees are collected by January of the applicable year as part of the annual maintenance fees billed to VOI owners. Unlike typical management agreements for traditional hotel properties, our management fees are not affected by Average Daily Rates ("ADR") or occupancy rates at our managed resorts. In addition, while our management contracts may be subject to non--renewal or termination, no resort or Collection has terminated or elected not to renew any of our management contracts during the past five years. |

| |

| • | Recurring fees earned by operating THE Club. Dues payments for THE Club are billed and collected together with the annual maintenance fees billed to our members who are also members of THE Club. Members of THE Club are not permitted to make reservations or access THE Club's services and benefits if they are not current in payment of these dues. |

| |

| • | VOI sales. Our VOI sales revenue is primarily a function of three factors: the number of tours we conduct, our closing percentage (which represents the percentage of VOI sales closed relative to the total number of sales presentations at our sales centers) and the sales price per transaction. We generally have a high degree of near-term visibility as to each of these factors. Before the beginning of a year, we can predict with a high degree of confidence the number of tours we will conduct that year, and we believe that we can tailor our sales and marketing efforts to effectively influence our closing percentage and average transaction size in order to calibrate our VOI sales levels over the course of the year. |

| |

| • | Financing of VOI sales. We target the level of our consumer financing activity in response to capital market conditions. We accomplish this by offering sales programs that either encourage or discourage our customers to finance their VOI purchases with us, without compromising our underwriting standards. As of December 31, 2012, the weighted average Fair Isaac Corporation ("FICO ") score (based upon loan balance) for our borrowers across our existing loan portfolio was 707, and the weighted average FICO score for our borrowers on loans originated since October 2008 was 758. The |

default rate on our consumer loan portfolio was 6.6% for 2012, and ranged from 6.6% to 9.9% on an annual basis from 2009 through 2012.

Our capital-efficient business model requires limited investment in working capital and capital expenditures.

| |

| • | Limited working capital required. Our hospitality and management services business consumes limited working capital because a substantial portion of the funds we receive under our management contracts is collected by January of each year and released to us as services are provided. Moreover, all resort-level maintenance and improvements are paid for by the owners of VOIs, with our financial obligation generally limited to our pro rata share of the VOIs we hold as inventory. |

| |

| • | Limited investment capital required. We do not believe that we will need to build resort properties or acquire real estate in the foreseeable future to support our anticipated VOI sales levels; however, in certain geographic areas, we may from time to time need to acquire additional VOI inventory through open market purchases or other means. Although the volume of points or intervals that we recover could fluctuate in the future for various reasons, we have consistently reacquired approximately 3.0% to 4.0% of our total outstanding VOIs from defaulted owners on an annual basis. This provides us with a relatively low-cost, consistent stream of VOI inventory that we can resell. Furthermore, other than the planned completion of a portion of a resort we now manage following our recently completed transaction with Pacific Monarch Resorts, Inc., we have not undertaken any major development projects in the last several years, nor are any such projects planned. In each of our recent strategic transactions, we have acquired an on-going business, consisting of management contracts, unsold VOI inventory and an existing owner base, which has generated immediate cash flow for us. |

| |

| • | Access to financing. The liquidity to support our provision of financing to our customers for VOI purchases is provided through conduit, loan sale and securitization financing and, as a result, also consumes limited working capital. |

Our scalable VOI sales and marketing platform has considerable operating leverage and drives increases in Adjusted EBITDA.

We have built a robust and versatile sales and marketing platform. This platform enables us to take actions that directly impact the three factors that primarily determine our VOI sales revenue: the number of tours we conduct, our closing percentage and the sales price per transaction. Our objective is to consistently monitor and adjust these three factors to reach an optimum level of VOI sales based on our available VOI inventory. With our scalable sales platform in place, we do not foresee the need to build new sales centers or significantly increase the size of our sales team. Accordingly, we believe our VOI sales business has considerable operating leverage and the ability to drive increases in Adjusted EBITDA.

Our high level of customer satisfaction results in significant sales of additional VOIs to our members.

We believe our efforts to introduce hospitality, service excellence and quality into each member's vacation experience have resulted in a high degree of customer satisfaction, driving significant sales of additional VOIs to our members. The percentage of VOI sales made to our existing members purchasing additional points for the years ended December 31, 2012, 2011 and 2010 was 72%, 66% and 59%, respectively.

Our accomplished management team positions us for continued growth.

We are led by an experienced management team that has delivered strong operating results through disciplined execution. Our founder and Chairman, Stephen J. Cloobeck, who provides strategic oversight and direction for our hospitality services, including the services provided to our managed resorts, has over 25 years of experience in the hospitality and vacation ownership industry and in the development, management, operation, marketing and sales of real estate properties. Our President and Chief Executive Officer, David F. Palmer, has over 20 years of management and finance experience, and our Executive Vice President and Chief Financial Officer, C. Alan Bentley, has over 30 years focused on business management, strategic planning and complex financing transactions. Messrs. Cloobeck and Palmer, as well as other members of our management team, have substantial equity interests in the Company that will closely align their economic interests with those of our other investors. Our management team has taken a number of significant steps to refine our strategic focus, build our brand recognition and streamline our operations, including (i) maximizing revenue from our hospitality and management services business, which rose from $99.4 million for the year ended December 31, 2008 to $153.3 million for the year ended December 31, 2012, (ii) strengthening our vacation interest sales and financing segment by integrating it more closely into our hospitality and management services business, (iii) implementing a focus throughout our business on service and hospitality and (iv) adding resorts to our network and owners to our owner base through complementary strategic acquisitions.

Growth Strategies

Our growth strategies are as follows:

Continue to grow our hospitality and management services business.

We expect our hospitality and management services revenue will continue to grow as rising operating expenses at our managed resorts result in higher revenues under our cost-plus management contracts. We intend to generate additional growth in our hospitality and management services business by (i) increasing membership in THE Club, (ii) adding service and activity offerings for members of THE Club and (iii) expanding opportunities for our members to purchase third-party products and services.

| |

| • | Increase membership in THE Club. Purchasers of our points are, in almost all cases, automatically enrolled in THE Club. In addition, we regularly reacquire previously sold VOIs from defaulted owners, including legacy owners of non-points-based VOIs (intervals). Because all intervals that we reacquire are then sold by us in the form of points, we expect that membership in THE Club will grow organically as intervals are reacquired and resold in the form of points to new members. We also encourage interval owners at our managed resorts to join THE Club, and we have instituted special offers and promotional programs to target for membership in THE Club the ownership bases at resorts that we now manage as a result of our recent strategic acquisitions. |

| |

| • | Broaden hospitality service and activity offerings. We intend to continue to make membership in THE Club more attractive to our members by expanding the number and variety of offered services and activities, such as airfare, cruises, excursions, golf outings, entertainment, theme park tickets and luggage and travel protection. These hospitality-focused enhancements may allow us to increase the annual dues paid by members of THE Club and should also generate commission revenue for us. |

| |

| • | Expand offers of third-party products and services to our members. We intend to expand the opportunities we offer our members to purchase products and services (such as consumer electronics, home appliances and insurance products) from third parties at discounted prices. We receive a commission based on the sales revenue from those transactions, without incurring costs associated with these products and services. |

Continue to leverage our scalable sales and marketing platform to increase VOI sales revenue.

We intend to continue to take advantage of the operating leverage in our sales and marketing platform. We will focus not only on potential new customers but also on our existing membership base, and expect that through these efforts and our continuing commitment to ensuring high member satisfaction, a significant percentage of our VOI sales will continue to be made to our existing members. We also intend to target the ownership bases at resorts that we now manage as a result of our recent strategic acquisitions to encourage these prospective customers to purchase our VOIs. While we anticipate that the bulk of our future VOI sales will be made through our traditional selling methods, we are seeking to more fully integrate the VOI sales experience into our hospitality and management services. For example, we have begun to offer an enhanced mini-vacation package at some of our managed resorts at which a group of members or prospective customers who have purchased such a package are invited to dine together, along with our sales team members, and to attend a show or other local attraction as a group over a two-day period. At the end of the stay, our sales team provides an in-depth explanation of our points-based VOI system and the value proposition it offers. We have found that, by creatively engaging with potential purchasers and infusing hospitality into the sales process, we improve potential purchasers' overall experience and level of satisfaction and, as a result, are able to increase the likelihood that they will buy our VOIs and increase the average transaction size.

Pursue additional revenue opportunities consistent with our capital-efficient business model.

We believe that we can achieve growth without pursuing revenue opportunities beyond those already inherent in our core business model. However, to the extent consistent with our capital-efficient business model, we intend to:

| |

| • | Selectively pursue strategic transactions. We intend to pursue acquisitions of ongoing businesses, including management contracts and VOI inventory, on an opportunistic basis where the economic terms are favorable and we can achieve substantial synergies and cost savings. Future acquisitions may be similar in structure to the four transactions we have completed since August 2010, including that with Pacific Monarch Resorts, Inc., in which we added nine locations to our network of available resorts, four management contracts, new members to our owner base and additional VOI inventory that we may sell to existing members and potential customers. Additionally, we may purchase or otherwise obtain additional management contracts, including from hospitality companies facing financial distress, and acquire VOI inventory at resorts that we do not currently manage. |

| |

| • | Prudently expand our geographic footprint. We believe that there are significant opportunities to expand our business into new geographic markets in which we currently may have affiliations, but do not manage resorts or market or sell our VOIs. We believe that certain countries in Asia and Central and South America are particularly attractive potential new |

markets for us because of the substantial increases in spending on travel and leisure activities forecasted for their consumers. To the extent that we can maintain our high quality standards and strong brand reputation, we are selectively exploring acquisitions of ongoing resort businesses in these markets and may also pursue co-branding opportunities, joint ventures or other strategic alliances with existing local or regional hospitality companies. We believe that expansion of our geographic footprint will produce revenue from consumers in the markets into which we enter and also make our resort network more attractive to existing and prospective members worldwide.

| |

| • | Broaden our business-to-business services. We have developed a broad set of business systems, skills and practices that we believe we can profitably offer on a fee-for-service basis to other companies in the hospitality and vacation ownership industry. For example, we have entered into fee-for-service agreements with resort operators and hospitality companies pursuant to which we provide them with resort management services, VOI sales and marketing services and inventory rental services. These types of arrangements are highly profitable for us because we are not required to invest any significant capital. In the future, in situations where we can leverage our unique expertise, skills and infrastructure, we intend to expand our provision of business-to-business services on an a-la-carte basis or as a suite of services, to third-party resort developers and operators and other hospitality companies. |

Our Customers

Our customers are typically families seeking a flexible vacation experience. A majority of our new customers stay at one of the resorts in our network, either by reserving a unit on a per-night or per-week basis, exchanging points through an external exchange service, or purchasing a mini-vacation package, prior to purchasing a VOI. We have also generated significant additional sales to our existing members who wish to purchase additional points and thereby increase their vacation options within our network.

A majority of our customers are baby boomers, between 45 and 65 years old. The baby boomer generation is the single largest population segment in the U.S. and Europe and is our target market. With the premium resorts in our network, we believe we are well-positioned to target an affluent subsection of the baby boomer population.

Our Recent and Proposed Strategic Acquisitions

On August 31, 2010, we acquired from ILX Resorts Incorporated and its affiliates certain resort management agreements, unsold VOIs and the rights to recover and resell such interests, portfolio of consumer loans and certain real property and other assets (the “ILX Acquisition”), which added ten additional resorts to our resort network. On July 1, 2011, we acquired from Tempus Resorts International, Ltd., and its subsidiaries certain management agreements, unsold VOIs and the rights to recover and resell such interests, the seller's consumer loan portfolio and certain real property and other assets (the “Tempus Resorts Acquisition”), which added two resorts to our resort network. On May 21, 2012, in connection with the PMR Acquisition, we acquired from Pacific Monarch Resorts, Inc., and its affiliates four management contracts, unsold VOIs and the rights to recover and resell such interests, portfolio of consumer loans and certain real property and other assets, which added nine locations to our resort network. On October 5, 2012, we acquired all of the issued and outstanding shares of Aegean Blue Holdings Plc, thereby acquiring management contracts, unsold VOIs and the rights to recover and resell such interests and certain other assets (the “Aegean Blue Acquisition”), which added five resorts located on the Greek Islands of Rhodes and Crete to our resort network. These transactions were effected through special-purpose subsidiaries, and funded by financial partners on a non-recourse basis. We believe that this transaction structure enables us to obtain substantial benefits from these acquisitions, without subjecting our historical business or our capital structure to the full risks associated with acquisitions and related leverage.

On January 29, 2013, DRC and Diamond Resorts Holdings, LLC entered into a memorandum of understanding with Island One, Inc. (“Island One”), Crescent One, LLC (“Crescent”) and the holder of their respective equity interests. Island One and Crescent operate a vacation ownership, hospitality and resort management business that emerged from Chapter 11 bankruptcy in July 2011. Since their emergence, we have provided sales and marketing services and HOA management oversight services to Island One. Pursuant to the memorandum of understanding, we have agreed to enter into definitive documents to (i) operate the business of Island One and Crescent prior to the closing of the potential acquisition transaction, and (ii) upon a change of control of the Company or other specified transaction, and subject to other terms and conditions in the definitive documents, purchase all of the equity interests in Island One and Crescent, thereby acquiring management contracts, unsold VOIs, a portfolio of consumer loans and other assets owned by Island One and Crescent, which would add nine additional resorts to our resort network.

Our Services

Hospitality and Management Services. We manage 79 Diamond Resorts-branded resort properties, which are located in the continental U.S., Hawaii, Mexico, the Caribbean and Europe, as well as the Collections. As the manager of these branded resorts and the Collections, we provide rental services, billing services, account collections, accounting and treasury functions

and communications and information technology services. In addition, for branded resorts we also provide an online reservation system and customer service contact center, operate the front desks, furnish housekeeping, maintenance and human resources services and operate amenities such as golf courses, food and beverage venues and retail shops.

As an integral part of our hospitality and management services, we have entered into inventory recovery agreements with substantially all of the HOAs for our managed resorts in North America, together with similar arrangements with all of the Collections and a majority of our European managed resorts, whereby we recover VOIs from members who fail to pay their annual maintenance fee or assessments due to, among other things, death or divorce or other life-cycle events or lifestyle changes. Because the cost of operating the resorts that we manage is spread across our member base, by recovering VOIs from members who have failed to pay their annual maintenance fee or assessments, we reduce bad debt expense at the HOA and Collection level (which is a component of the management fees billed to members by each resort's HOA or Collection association), supporting the financial well-being of those HOAs and Collections.

HOAs. Each of the Diamond Resorts-branded resorts, other than certain resorts in our European Collection (as defined below), is typically operated through an HOA, which is administered by a board of directors. Directors are elected by the owners of intervals at the resort (which may include one or more of the Collections) and may also include representatives appointed by us as the developer of the resort. As a result, we are entitled to voting rights with respect to directors of a given HOA by virtue of (i) our ownership of intervals at the related resort, (ii) our control of the Collections that hold intervals at the resort and/or (iii) our status as the developer of the resort. The board of directors of each HOA hires a management company to provide the services described above, which in the case of all Diamond Resorts-branded resorts, is us. We serve as the HOA for two resorts in St. Maarten and earn maintenance fees and incur operating expenses at these two resorts.

Our management fees with respect to a resort are based on a cost-plus structure and are calculated based on the direct and indirect costs (including an allocation of a substantial portion of our overhead related to the provision of management services) incurred by the HOA of the applicable resort. Under our current resort management agreements, we receive management fees generally ranging from 10% to 15% of the other costs of operating the applicable resort (with an average based upon the total management fee revenue of approximately 14.6%). Unlike typical commercial lodging management contracts, our management fees are not impacted by changes in a resort's ADR or occupancy level. Instead, the HOA for each resort engages in an annual budgeting process in which the board of directors of the HOA estimates the costs the HOA will incur for the coming year. In evaluating the anticipated costs of the HOA, the board of directors of the HOA considers the operational needs of the resort, the services and amenities that will be provided at or to the applicable resort and other costs of the HOA, some of which are impacted significantly by the location of the resort, size and type of the resort. Included in the anticipated operating costs of each HOA are our management fees. The board of directors of the HOA discusses the various considerations and approves the annual budget, which determines the annual maintenance fees charged to each owner. One of the management services we provide to the HOA is the billing and collection of annual maintenance fees on the HOA's behalf. Annual maintenance fees for a given year are generally billed during the previous November, due by January and deposited in a segregated or restricted account we manage on behalf of the HOA. As a result, a substantial majority of our fees for February through December of each year are collected from owners in advance. Funds are released to us from these accounts on a monthly basis for the payment of management fees as we provide our management services.

Our HOA management contracts typically have initial terms of three to five years, with automatic one-year renewals. These contracts can generally only be terminated by the HOA upon a vote of the owners (which may include one or more of the Collections) prior to each renewal period, other than in some limited circumstances involving cause. No HOA has terminated any of our management contracts during the past five years. We generally have the right to terminate our HOA management contracts at any time upon notice to the HOA but have terminated only one immaterial HOA management contract during the past five years.

Collections. The Collections currently consist of the following:

| |

| • | the Diamond Resorts U.S. Collection (the “U.S. Collection”), which includes interests in resorts located in Arizona, California, Florida, Missouri, New Mexico, Nevada, South Carolina, Tennessee, Virginia and St. Maarten; |

| |

| • | the Diamond Resorts Hawaii Collection (the “Hawaii Collection”), which includes interests in resorts located in Arizona, Hawaii and Nevada; |

| |

| • | the Diamond Resorts California Collection (the “California Collection”), which includes interests in resorts located in Arizona, California and Nevada; |

| |

| • | the Diamond Resorts European Collection (the “European Collection”), which includes interests in resorts located in Austria, England, France, Italy, Norway, Portugal, Scotland, Spain Balearics, Spain Costa and Spain Canaries; |

| |

| • | the Premiere Vacation Collection (“PVC”), which includes interests in resorts added to our network in connection with the |

ILX Acquisition (see "Our Recent Strategic and Proposed Acquisitions" for the definition of the ILX Acquisition) located in Arizona, Colorado, Indiana, Nevada and Mexico;

| |

| • | the Monarch Grand Vacations Collection (“MGVC”), which includes interests in resorts added to our network in connection with the PMR Acquisition (see "Our Recent Strategic and Proposed Acquisitions" for the definition of the PMR Acquisition) located in California, Nevada, Utah and Mexico; and |

| |

| • | the Diamond Resorts Mediterranean Collection (the “Mediterranean Collection”), which includes interests in resorts added to our network in connection with the Aegean Blue Acquisition (see “Our Recent Strategic and Proposed Acquisitions” for the definition of the Aegean Blue Acquisition) located in the Greek Islands of Crete and Rhodes. |

Each of the Collections is operated through a Collection association, which is administered by a board of directors. With the exception of PVC, which allows the developer to appoint the board of directors until 90% of all membership interests are sold, directors are elected by the points holders within the applicable Collection. We own a significant number of points in each of the Collections, which we hold as inventory. The board of directors of each Collection hires a company to provide management services to the Collection, which in each case is us.

As with our HOA management contracts, management fees charged to the Collections in the U.S. are based on a cost-plus structure and are calculated based on the direct and indirect costs (including an allocation of a substantial portion of our overhead related to the provision of our management services) incurred by the Collection. Under our current Collection management agreements, we receive management fees of 15% of the other costs of the applicable Collection (except with respect to our management agreement with MGVC, under which we receive a management fee of 10% of the cost of MGVC). Our management fees are included in the budgets prepared by each Collection association, which determines the annual maintenance fee charged to each owner. One of the management services we provide to the Collections is the billing and collection of annual maintenance fees on the Collection's behalf. Annual maintenance fees for a given year are generally billed during the previous November, due by January and deposited in a segregated or restricted account we maintain on behalf of each Collection. As a result, a substantial majority of our fees for February through December of each year are collected from owners in advance. Funds are released to us from these accounts on a monthly basis for the payment of management fees as we provide our management services.

Apart from the management contract for the European Collection, our Collection management contracts generally have initial terms of three to five years, with automatic three to five year renewals and can generally only be terminated by the Collection upon a vote of the Collection's members prior to each renewal period, other than in some limited circumstances involving cause. In the case of the resorts we manage that are part of the European Collection, generally the management agreements have either indefinite terms or long remaining terms (i.e., over 40 years) and can only be terminated for an uncured breach by the manager or a winding up of the European Collection. No Collection has terminated or elected not to renew any of our management contracts during the past five years. Apart from the management contract for the European Collection, we generally have the right to terminate our Collection management contracts at any time upon notice to the Collection. The management contract for the European Collection has an indefinite term, can only be terminated by the European Collection for an uncured breach by the manager or a winding up of the European Collection, and may not be terminated by the manager.

THE Club. Another key component of our hospitality and management services business is THE Club, through which we operate a proprietary reservation system that enables our members to use their points to stay at any of our branded or affiliated resorts. THE Club also offers our members a wide range of other benefits, such as the opportunity to purchase various products and services (such as consumer electronics, home appliances and insurance products) from third parties at discounted prices, for which we earn commissions. Dues payments for THE Club are billed and collected together with the annual maintenance fees billed to our members who are also members of THE Club. See "Our Flexible Points-Based Vacation Ownership System and THE Club— THE Club" for additional information regarding THE Club.

Sales and Financing of VOIs. We market and sell VOIs that provide access to our network of 79 Diamond Resorts-branded and 180 affiliated resorts and hotels and four cruise itineraries. Since late 2007, we have marketed and sold VOIs primarily in the form of points.

The VOI inventory that we reacquire pursuant to our inventory recovery agreements provides us with a low-cost, recurring supply of VOIs that we can sell to our current and prospective members. Our VOI inventory is also supplemented by VOIs recovered from members who default on their consumer loans. We capitalized amounts in unsold Vacation Interests, net, in the case of North America, and reclassified amounts from due from related parties, net to unsold Vacation Interest, net, in the case of Europe, related to our inventory recovery agreements and arrangements as well as consumer loan defaults of approximately $48.1 million, $25.7 million and $16.8 million during the years ended 2012, 2011 and 2010, respectively. These amounts are inclusive of capitalized legal costs of $2.2 million, $2.2 million and $3.2 million, respectively. See Note 2—Summary of Significant

Accounting Policies of our consolidated financial statements included elsewhere in this report for discussions on unsold Vacation Interests.

We acquired VOI inventory in connection with our recent strategic acquisitions. Specifically, we acquired $10.1 million and $23.1 million of additional VOI inventory in the ILX Acquisition in 2010 and the Tempus Resorts Acquisition in 2011, respectively. In 2012, we acquired $30.4 million of inventory in the PMR Acquisition and $3.5 million in the Aegean Blue Acquisition. As of December 31, 2012, 2011, and 2010, we had VOI inventory with a value of approximately $315.9 million, $256.8 million and $190.6 million, respectively.

We have 50 sales centers across the globe, 44 of which are located at branded and managed resorts, two of which are located at affiliated resorts and four of which are located off-site. We currently employ an in-house sales and marketing team at 38 of these locations and also maintain agency agreements with independent sales organizations at 12 locations. A relatively small portion of our sales, principally sales of additional points to existing members, are effected through our call centers. Our sales representatives utilize a variety of marketing programs to generate prospects for our sales efforts, including presentations at resorts targeted to current members, guests, overnight mini-vacation packages, targeted mailing, telemarketing, gift certificates and various destination-specific local marketing efforts. Additionally, we offer incentive premiums in the form of tickets to local attractions and activities, hotel stays, gift certificates or free meals to guests and other potential customers to encourage attendance at sales presentations. We also offer volume discounts for purchasers of a large number of points.

We close our VOI sales primarily through tours. These tours occur at sales centers and include a tour of the resort properties, as well as an in-depth explanation of our points-based VOI system and the value proposition it offers our members. Our tours are designed to provide guests with an in-depth overview of our company and our resort network, as well as a customized presentation to explain how our products and services can meet their vacationing needs.

Our sales force is highly trained in a consultative sales approach designed to ensure that we meet customers' needs on an individual basis. We manage our sales representatives' consistency of presentation and professionalism using a variety of sales tools and technology. The sales representatives are principally compensated on a variable basis determined by performance, subject to a base compensation amount.

Our marketing efforts are principally directed at the following channels:

| |

| • | our existing member base; |

| |

| • | participants in third-party vacation ownership exchange programs, such as Interval International, Inc. (“Interval International”), and Resorts Condominiums International, LLC (“RCI”), who stay at our managed resorts; |

| |

| • | guests who stay at our managed resorts; |

| |

| • | off-property contacts who are solicited from the premises of hospitality, entertainment, gaming and retail locations; and |

| |

| • | other potential customers who we target through various marketing programs. |

We employ innovative programs and techniques designed to infuse hospitality into our sales and marketing efforts. For example, we have begun to offer an enhanced mini-vacation package at some of our managed resorts at which our members or prospective customers who have purchased such a package are invited to dine together, along with our sales team members, and to attend a show or other local attraction as a group over a two-day period. At the end of the stay, our sales team provides an in-depth explanation of our points-based VOI system and the value proposition it offers our members. We have found that, by creatively engaging with potential purchasers and infusing hospitality into the sales process, we improve potential purchasers' overall experience and level of satisfaction and, as a result, are able to increase the likelihood that they will buy our VOIs and increase the average transaction size.

We also seek to provide one-on-one in-unit presentations of the benefits of our points-based VOI system to interested customers at resorts who otherwise may not desire to enter one of our sales centers. In limited trials, we have found that customers who participate in these in-unit presentations sign up for tours and subsequently purchase VOIs at a greater rate than customers who are not provided with an in-unit presentation. By focusing on sales and marketing methods that do not rely exclusively on increased tour flow, we believe that we can improve our closing percentage and increase the average VOI sales price per transaction, without significant increases in fixed sales and marketing costs associated with our sales centers.

In addition, we have an initiative in which select members and guests receive “high-touch” services such as a special welcome package, resort orientation and concierge services, as part of a pre-scheduled in-person sales presentation. Results from these enhanced programs and initiatives have been positive.

Although the principal goal of our marketing activities is the sale of points, in order to generate additional revenue and offset the carrying cost of our VOI inventory, we use a portion of the points and intervals which we own to offer accommodations to consumers on a per-night or per-week basis, similar to hotels. We generate these stays through direct consumer marketing, travel agents, websites and vacation package wholesalers. We believe that these operations, in addition to generating supplemental revenue, provide us with a good source of potential customers for the purchase of points.

We provide loans to eligible customers who purchase VOIs through our U.S and Mexican sales centers and choose to finance their purchase. These loans are collateralized by the underlying VOI, generally bear interest at a fixed rate, have a typical term of 10 years and are generally made available to consumers who make a down payment within established credit guidelines. Our minimum required down payment is 10%. Since late 2008, our average cash down payment has been 18.3% and the average initial equity contribution for new VOI purchases by existing owners (which take into account the value of VOIs already held by purchasers and pledged to secure a new consumer loan) has been 30.7%, which has resulted in an average combined cash and equity contribution of 49.0% for these new VOI purchases. As of December 31, 2012, our loan portfolio (including loans we have transferred to special-purpose subsidiaries in connection with conduit, loan sale and securitization transactions) was comprised of approximately 56,000 loans (which includes loans that have been written off for financial reporting purposes due to payment defaults and delinquencies but which we continue to administer), with an outstanding aggregate loan balance of approximately $513.0 million. Approximately 41,000 of these consumer loans are loans under which the consumer was not in default, and the average balance of such loans was approximately $9,200. Customers were in default (which we define as having occurred upon the earlier of (i) the initiation of cancellation or foreclosure proceedings or (ii) the customer’s account becoming over 180 days delinquent) under approximately 15,000 of these loans, and the average balance of such loans was approximately $9,100. The weighted-average interest rate for all of such loans is approximately 15.90%, which includes a weighted average interest rate for loans in default of approximately 16.6%. As of December 31, 2012, approximately 8.35% of our approximately 490,000 owner-families had a loan outstanding with us.

We underwrite each loan application to assess the prospective buyer's ability to pay through the credit evaluation score methodology developed by FICO based on credit files compiled and maintained by Experian (for U.S. residents) and Equifax (for Canadian residents). In underwriting each loan, we review the completed credit application and the credit bureau report and/or the applicant’s performance history with us, including any delinquency on existing loans with us, and consider in specified circumstances, among other factors, whether the applicant has been involved in bankruptcy proceedings within the previous 12 months and any judgments or liens, including civil judgments and tax liens, against the applicant. As of December 31, 2012, the weighted average FICO score (based upon loan balance) for our borrowers across our existing loan portfolio was 707, and the weighted average FICO score for our borrowers on loans we originated since late 2008 was 758.

Our consumer finance servicing division includes underwriting, collection and servicing of our consumer loan portfolio. Loan collections and delinquencies are managed by utilizing current technology to minimize account delinquencies and maximize cash flow. We generally sell or securitize a substantial portion of the consumer loans we generate from our customers through conduit and securitization financings. We also act as servicer for consumer loan portfolios, including those sold or securitized through conduit or securitization financings, for which we receive a fee.

Through arrangements with three financial institutions in the United Kingdom, we broker financing for qualified customers who purchase points through our European sales centers.

We take measures to adjust the percentage of the sales of our VOIs that we finance based on prevailing economic conditions. For example, during the 12 month period prior to October 2008, we financed approximately 67.0% of the total amount of our VOI sales. In response to the dramatic contraction of conduit and securitization financing during the economic downturn that began in late 2008, we implemented a strategy to increase the cash sales of VOIs, which included offering discounts for purchases paid in cash and raising the interest rates applicable to financed purchases. As a result of these changes, the percentage of the total amount of our VOI sales we financed from October 2008 through September 2011 was approximately 34.6%. In October 2011, in response to some stabilization in the consumer markets and improved securitization and conduit markets, we eliminated incentives for cash VOI purchases and took other actions to generate more financed sales of VOIs. From October 1, 2011 through December 31, 2012, we financed approximately 69.3% of the total amount of our VOI sales.

Our Resort Network

Our resort network currently consists of 263 vacation destinations, which includes 79 Diamond Resorts-branded properties with a total of 9,274 units, which we manage, and 180 affiliated resorts and hotels and four cruise itineraries, which we do not manage and which do not carry our brand name but are a part of our network and, consequently, are available for our members to use as vacation destinations. Through our management of Diamond Resorts-branded resorts, we provide guests with a consistent and high quality suite of services and amenities and, pursuant to our management agreements, we have oversight and management responsibility over the staff at each location. Of these Diamond Resorts-branded resorts, 38 have food and beverage

operations, 41 have a gift shop, pro shop or convenience store, and 20 have a golf course, leisure center or spa. Most of these amenities are operated by third parties pursuant to leases, licenses or similar agreements. Revenue from these operations is included in Consolidated Resort Operations Revenue in our consolidated statements of operations, together with revenues from services that we provide for our properties located in St. Maarten which are traditionally administered by an HOA (which have historically constituted a majority of such revenue). For a further discussion of our Consolidated Resort Operations Revenue, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Revenue and Expense Items—Consolidated Resort Operations Revenue."

Affiliated resorts are resorts with which we have contractual arrangements to use a certain number of vacation intervals or units either in exchange for our providing similar usage of intervals or units at our managed resorts or for a maintenance or rental fee. These resorts are made available to members of THE Club through affiliation agreements. In the vast majority of cases, our affiliated resorts provide us with access to their vacation intervals or units in exchange for our providing similar usage of intervals or units at our managed resorts, and no fees are paid by us in connection with these exchanges. However, in a very limited number of circumstances, we receive access to vacation intervals or units at our affiliated resorts through two other types of arrangements. In the first of these types of arrangements, we pay an upfront fee to an affiliated resort for access to a specified number of vacation intervals or units, and we incorporate this upfront fee into our calculation for annual dues to be paid by members of THE Club. In the second of these types of arrangements, a holder of our points or intervals who desires to stay at an affiliated resort for a particular time period deposits points with us and, in exchange, we pay our affiliated resort the funds required in order to allow such holder access to the desired unit for the desired time period.

We identify and select affiliated resorts based on a variety of factors, including location, amenities and preferences of our members. We have established standards of quality that we require each of our affiliates to meet, including with respect to the maintenance of their properties and level of guest services. In general, our affiliate agreements allow for termination by us upon 30 days’ notice to the affiliate, although some of our affiliate agreements cannot be terminated until a specified future date. Further, our affiliate agreements permit us to terminate our relationship with an affiliate if it fails to meet our standards. In any event, none of our affiliate agreements requires us to make any payments in connection with terminating the agreement. In addition to our affiliate agreements, we own, through one or more of the Collections, intervals at a few of our affiliated resorts.

Our network of resorts includes a wide variety of locations and geographic diversity, including beach, mountain, ski and major city locations, as well as locations near major theme parks and historical sites. The accommodations at these resorts are fully furnished and typically include kitchen and dining facilities, a living room and a combination of bedroom types including studios and one-, two- and three-bedroom units with multiple bathrooms. Resort amenities are appropriate for the type of resort and may include an indoor and/or outdoor swimming pool, hot tub, children's pool, fitness center, golf course, children's play area and/or tennis courts. Further, substantially all of our Diamond Resorts-branded resorts in Europe and some of our Diamond Resorts-branded resorts in North America include onsite food and beverage operations, the majority of which are operated by third-party vendors.

Purchasers of points acquire memberships in one of the seven Collections. Legal title to the real estate underlying the points is held by the trustees or the associations for the Collections and, accordingly, such purchasers do not have direct ownership interests in the underlying real estate. Other than unsold intervals which we maintain in inventory, various common areas and amenities at certain resorts and a small number of units in European resorts, we do not hold any legal title to the resort properties in our resort network.

The following is a list, by geographic location, of our branded and managed resorts, with a brief description and the number of units at each such branded and managed resort, together with a list of our affiliated resorts:

Branded and Managed Resorts

| NORTH AMERICA AND THE CARIBBEAN |

| | | | |

| Resort | | Location | Units |

| | | | |

| Rancho Manana Resort | | Cave Creek, Arizona | 38 |

|

| | | | |

| Set in the high desert of Arizona, Rancho Manana Resort provides guests with breathtaking mountain views. The secluded retreat features spacious two bedroom accommodations, each with a gourmet kitchen, two full master suites and an elegant western decor. Guests can relax poolside or play golf at the adjacent championship Rancho Manana Golf Club. Nearby amenities include shops, restaurants, galleries, sporting activities and cultural events in Phoenix. | |

| | | | |

| | | | |

| | | | |

| NORTH AMERICA AND THE CARIBBEAN |

| | | | |

| | | | |

| Resort | | Location | Units |

|

| Kohl's Ranch Lodge | | Payson, Arizona | 66 |

|

| | | | |

| Located on the banks of Tonto Creek in the largest Ponderosa Pine Forest in the world, Kohl's Ranch Lodge is historically famous for its western hospitality. Situated at the base of the Mogollon Rim in the area that author Zane Grey made famous with his popular adventures of the Old West, the friendly and casual atmosphere of Kohl's Ranch Lodge makes each stay an inviting experience where guests can enjoy a classic stay in Arizona's back country. | |

| | | | |

| PVC at The Roundhouse | | Pinetop, Arizona | 20 |

|

| | | | |

| Nestled in eastern Arizona’s White Mountains where Pinetop-Lakeside’s motto is “Celebrate the Seasons” and where guests can enjoy year-round adventures. The log-sided mountain homes at this resort feature fireplaces, jetted spas, large fully equipped kitchens, covered porches and private yards and are a perfect getaway for family cabin fun. After a day of outdoor play, guests can look forward to a relaxing master suite spa retreat. | |

| | | | |

| Scottsdale Links Resort | | Scottsdale, Arizona | 218 |

|

| | | | |

| This resort with one-, two- and three-bedroom accommodations is located between the TPC Desert Golf Course and the McDowell Mountains in Scottsdale, within easy reach of Phoenix. With a spa, fitness center, outdoor heated pool and spacious units, this resort is ideal for families making it a base for exploring the area. | |

| | | | |

| Scottsdale Villa Mirage | | Scottsdale, Arizona | 154 |

|

| | | | |

|

| Located 25 minutes from the Phoenix airport, this resort has a heated outdoor pool, children’s pool, whirlpools, tennis courts, playground, fitness center and games room to provide for guests and families of all ages. | |

| | | | |

|

| Bell Rock Inn and Suites | | Sedona, Arizona | 85 |

|

| | | | |

|

| Framed by extraordinary views along the Red Rock Scenic Byway with its sandstone formations and rich red landscape of Arizona’s backcountry, this resort is set amid the natural beauty of Sedona and provides easy access to the sights, sounds and wonder of the Coconino National Forest. In addition to a laid-back and friendly ambience, the resort offers a poolside barbeque and in-suite fireplaces. | |

| | | | |

|

| Los Abrigados Resort and Spa | | Sedona, Arizona | 193 |

|

| | | | |