Exhibit 99.1

KeyBanc Basic

Materials &

Packaging

Conference

September 10, 2013

Forward-Looking Statements

Some of the information included in this presentation constitutes “forward-looking statements” as defined in Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. All statements in this presentation that express opinions, expectations, beliefs, plans, objectives, assumptions or projections with respect to anticipated future performance of SunCoke Energy,

Inc. (“SunCoke”) or SunCoke Energy Partners, L.P. (“Partnership”), in contrast with statements of historical facts, are forward-looking statements. Such forward-looking statements are based on management’s beliefs and assumptions and on information currently available.

Forward-looking statements include information concerning possible or assumed future results of operations, business strategies, financing plans, competitive position, potential growth opportunities, potential operating performance improvements, the effects of competition and the effects of future legislation or regulations. Forward-looking statements include all statements that are not historical facts and may be identified by the use of forward-looking terminology such as the words “believe,” “expect,” “plan,” “intend,” “anticipate,” “estimate,” “predict,” “potential,” “continue,” “may,” “will,” “should” or the negative of these terms or similar expressions.

Although management believes that its plans, intentions and expectations reflected in or suggested by the forward-looking statements made in this presentation are reasonable, no assurance can be given that these plans, intentions or expectations will be achieved when anticipated or at all. Moreover, such statements are subject to a number of assumptions, risks and uncertainties. Many of these risks are beyond the control of SunCoke and the Partnership, and may cause actual results to differ materially from those implied or expressed by the forward-looking statements. Each of SunCoke and the Partnership has included in its filings with the Securities and Exchange Commission (including, in the case of the Partnership, its Form S-1) cautionary language identifying important factors (but not necessarily all the important factors) that could cause actual results to differ materially from those expressed in any forward-looking statement. For more information concerning these factors, see the Securities and Exchange Commission filings of SunCoke and the Partnership. All forward-looking statements included in this presentation are expressly qualified in their entirety by such cautionary statements. Although forward-looking statements are based on current beliefs and expectations, caution should be taken not to place undue reliance on any such forward-looking statements because such statements speak only as of the date hereof. Neither SunCoke nor the Partnership has any intention or obligation to update publicly any forward-looking statement (or its associated cautionary language) whether as a result of new information or future events or after the date of this presentation, except as required by applicable law.

This presentation includes certain non-GAAP financial measures intended to supplement, not substitute for, comparable GAAP measures. Reconciliations of non-GAAP financial measures to GAAP financial measures are provided in the Appendix at the end of the presentation. Investors are urged to consider carefully the comparable GAAP measures and the reconciliations to those measures provided in the Appendix.

KeyBanc Basic Materials & Packaging Conference 2

ABOUT SUNCOKE

SunCoke EnergyTM

KeyBanc Basic Materials & Packaging Conference 3

About SunCoke

Largest independent producer of coke in the Americas

Coke is an essential ingredient in the blast furnace production of steel

Cokemaking business

~6 million tons of capacity: 4.2m tons in U.S.; 1.7m in Brazil; ~0.2m tons via India JV

Secure, long-term take-or-pay contracts with leading steelmakers

General Partner and 58% owner of SunCoke Energy Partners LP (SXCP)

Coal mining operations

~114 million tons in Virginia and West Virginia

Primarily mid-vol. metallurgical coal

~1.4 million tons mined in 2013E

(1) | | For a definition and reconciliation of Adjusted EBITDA, please see appendix. |

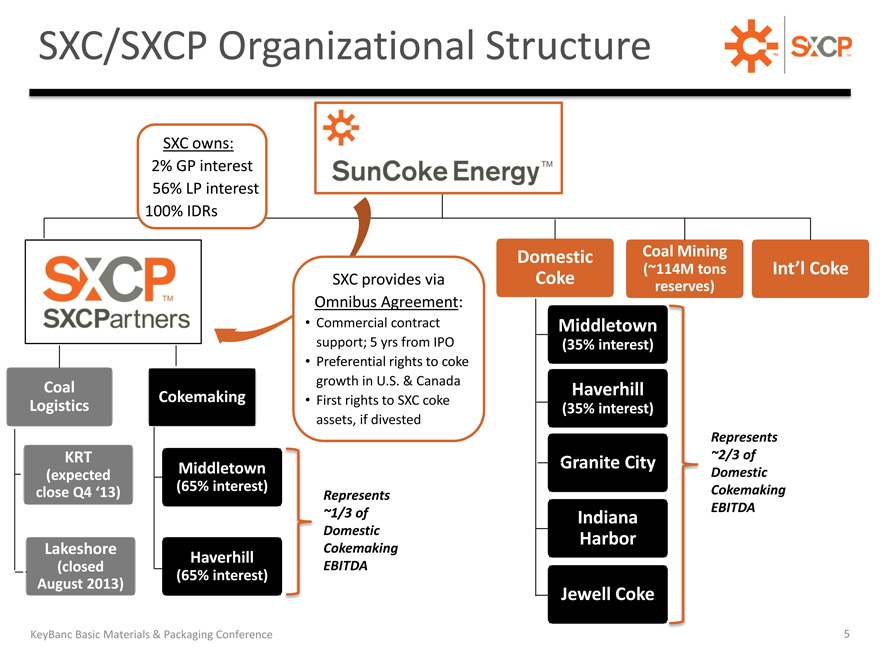

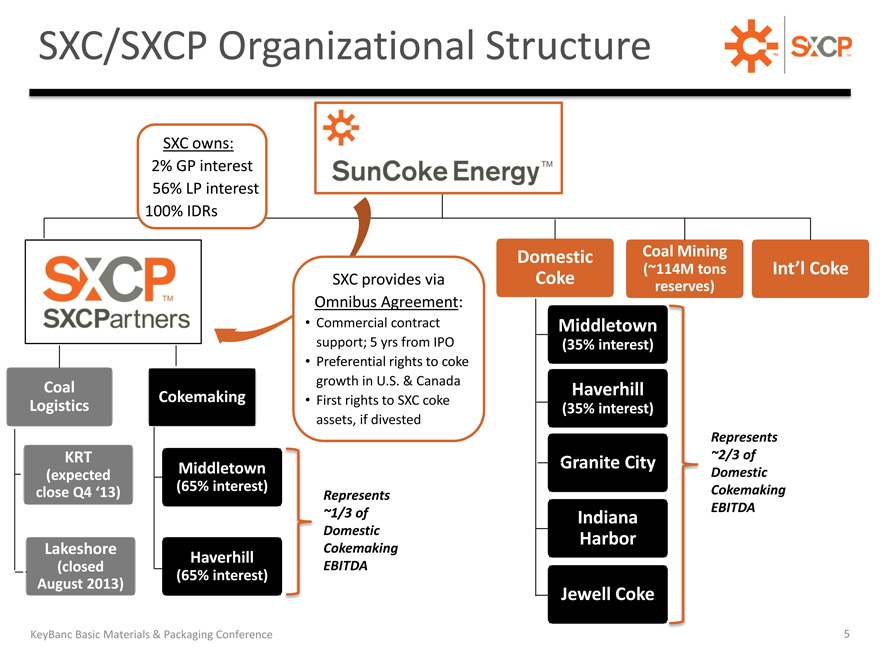

SXC/SXCP Organizational Structure

SXC owns:

2% GP interest 56% LP interest 100% IDRs

Coal Logistics

KRT

(expected close Q4 ‘13)

Lakeshore

(closed August 2013)

Cokemaking

Middletown

(65% interest)

Haverhill

(65% interest)

SXC provides via Omnibus Agreement:

Commercial contract support; 5 yrs from IPO

Preferential rights to coke growth in U.S. & Canada

First rights to SXC coke assets, if divested

Represents

~1/3 of

Domestic Cokemaking EBITDA

Domestic Coal Mining

(~114M tons Int’l Coke

Coke

reserves)

Middletown

(35% interest)

Haverhill

(35% interest)

Represents

Granite City ~2/3 of

Domestic

Cokemaking

EBITDA

Indiana

Harbor

Jewell Coke

KeyBanc Basic Materials & Packaging Conference 5

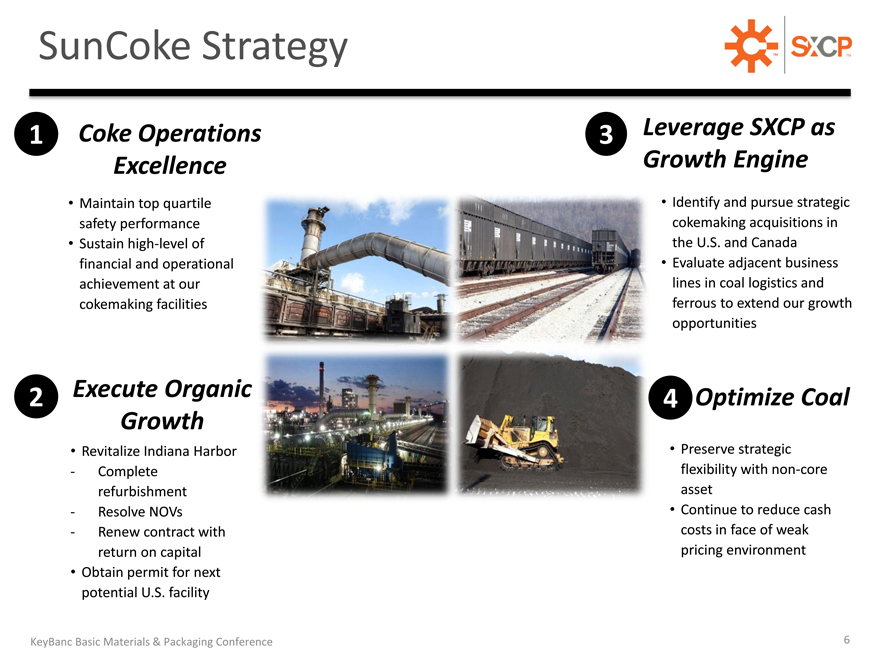

SunCoke Strategy

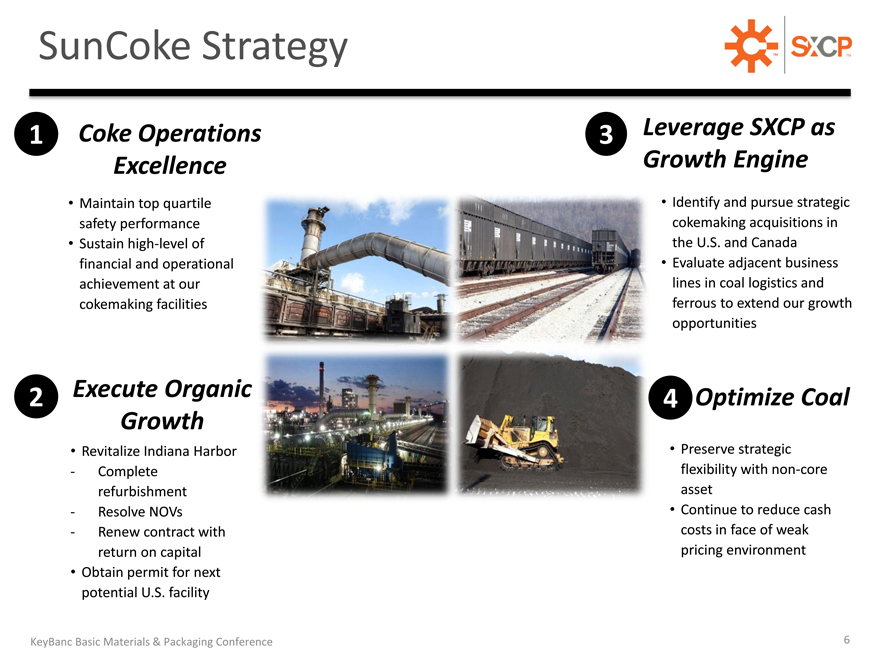

1 | | Coke Operations Excellence |

Maintain top quartile safety performance

Sustain high-level of financial and operational achievement at our cokemaking facilities

Revitalize Indiana Harbor

- Complete refurbishment

- Resolve NOVs

- Renew contract with return on capital

Obtain permit for next potential U.S. facility

3 | | Leverage SXCP as Growth Engine |

Identify and pursue strategic cokemaking acquisitions in the U.S. and Canada

Evaluate adjacent business lines in coal logistics and ferrous to extend our growth opportunities

Preserve strategic flexibility with non-core asset

Continue to reduce cash costs in face of weak pricing environment

KeyBanc Basic Materials & Packaging Conference 6

OUR MARKET OPPORTUNITY

SunCoke EnergyTM

KeyBanc Basic Materials & Packaging Conference 7

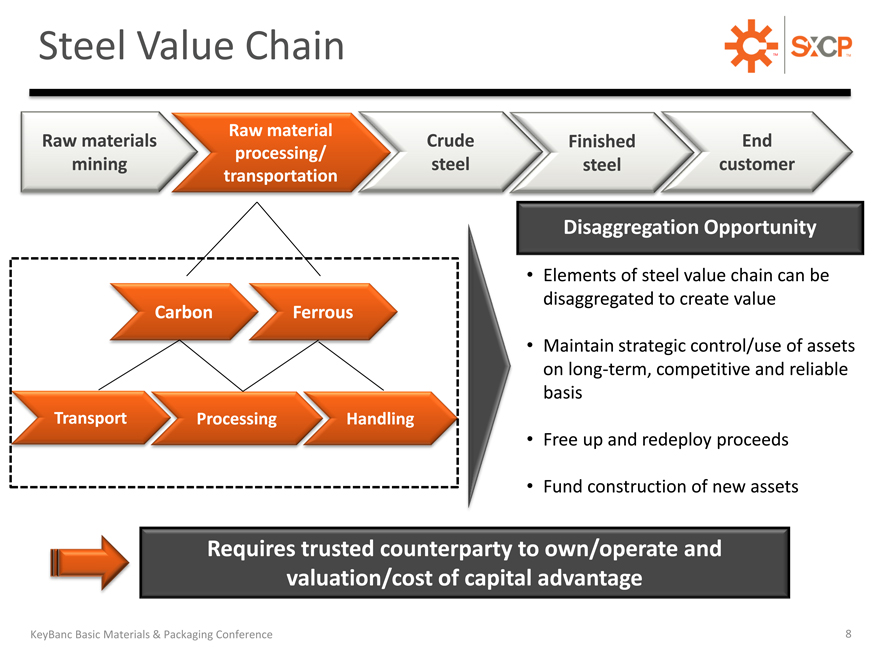

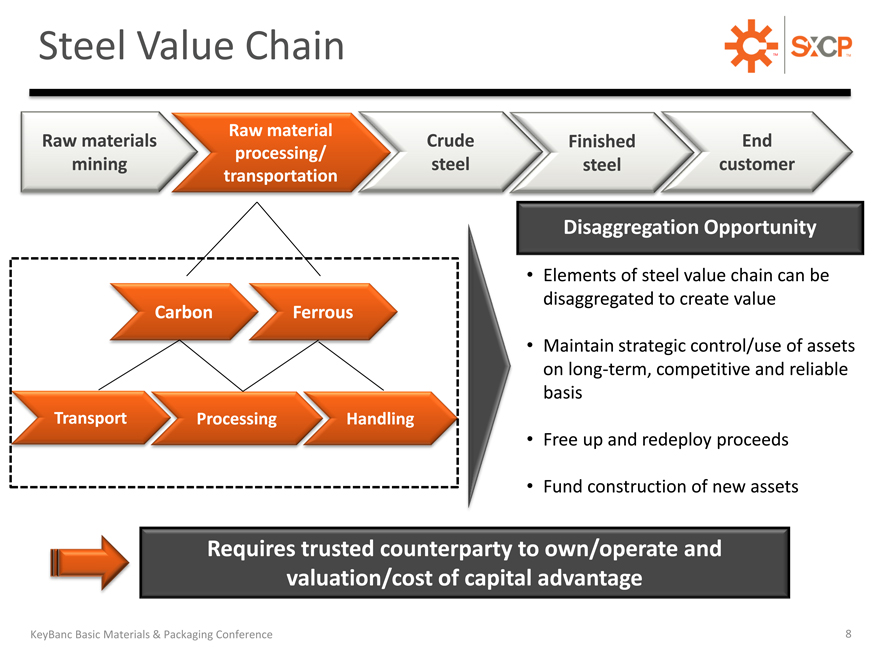

Steel Value Chain

Raw material

Raw materials Crude Finished End processing/ mining steel steel customer transportation

Carbon Ferrous

Transport Processing Handling

Disaggregation Opportunity

Elements of steel value chain can be disaggregated to create value

Maintain strategic control/use of assets on long-term, competitive and reliable basis

Free up and redeploy proceeds

Fund construction of new assets

Requires trusted counterparty to own/operate and valuation/cost of capital advantage

KeyBanc Basic Materials & Packaging Conference 8

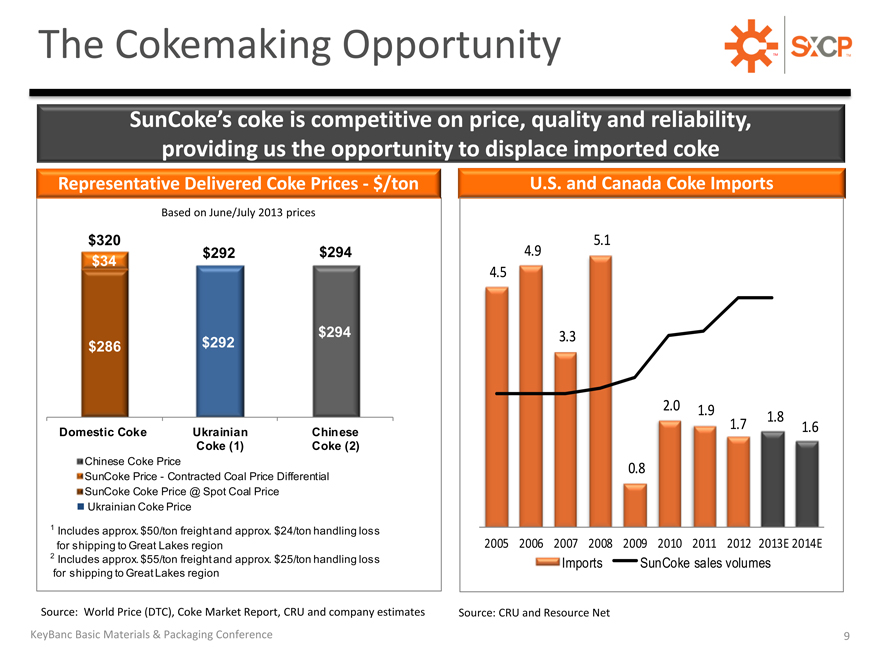

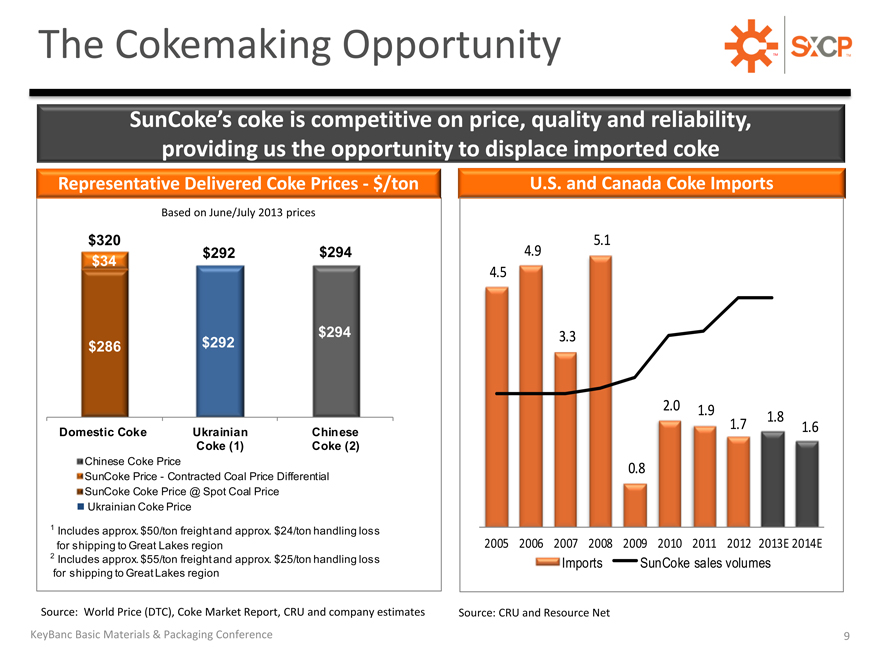

The Cokemaking Opportunity

SunCoke’s coke is competitive on price, quality and reliability, providing us the opportunity to displace imported coke

Representative Delivered Coke Prices—$/ton

Based on June/July 2013 prices

$320

$292 $294

$34

$294

$286 $292

U.S. and Canada Coke Imports

5.1

4.9

4.5

3.3

2.0 1.9

1.8

1.7 1.6

0.8

2005 2006 2007 2008 2009 2010 2011 2012 2013E 2014E

Imports SunCoke sales volumes

Source: World Price (DTC), Coke Market Report, CRU and company estimates Source: CRU and Resource Net

KeyBanc Basic Materials & Packaging Conference 9

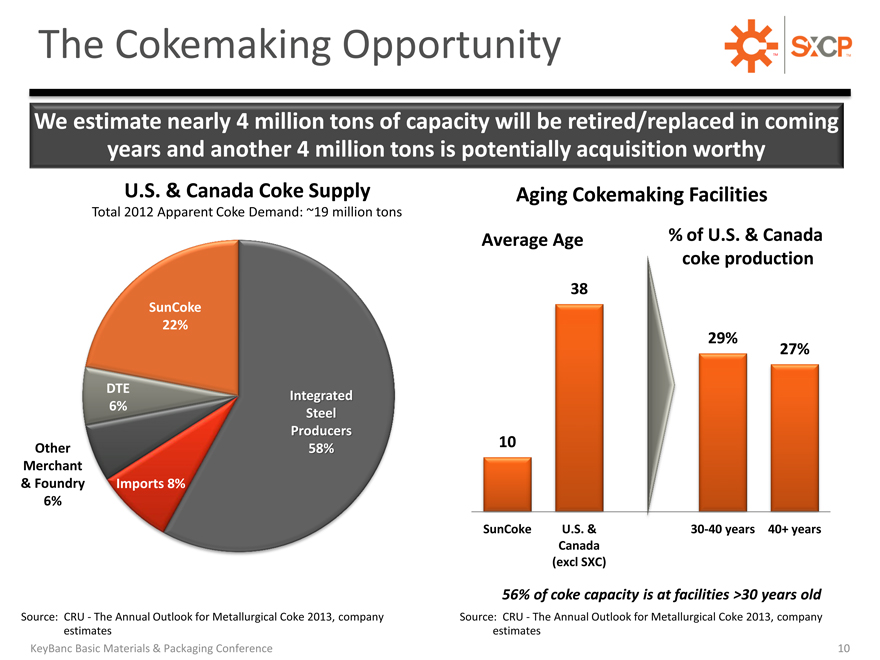

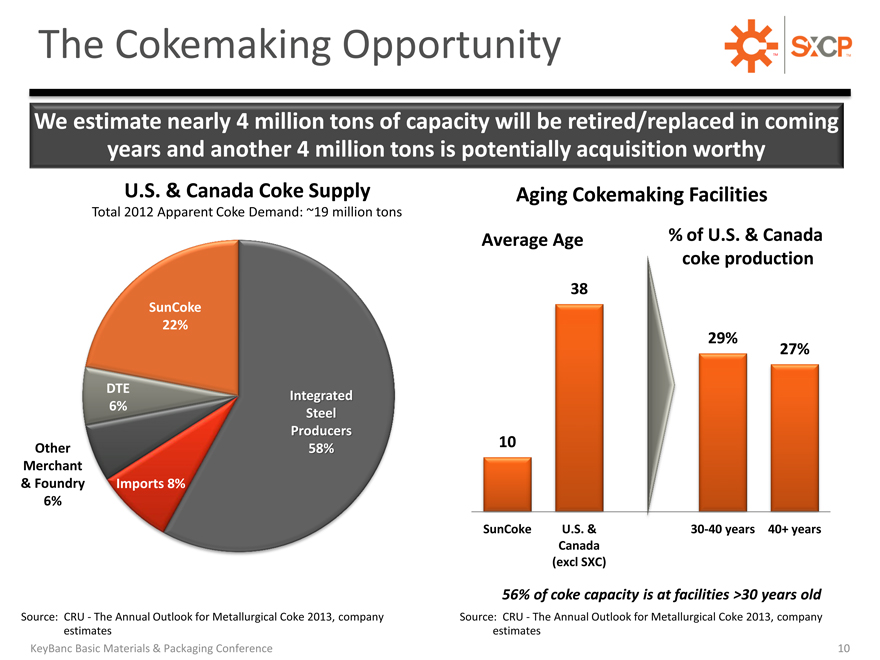

The Cokemaking Opportunity

We estimate nearly 4 million tons of capacity will be retired/replaced in coming years and another 4 million tons is potentially acquisition worthy

U.S. & Canada Coke Supply

Total 2012 Apparent Coke Demand: ~19 million tons

SunCoke

22%

DTE Integrated

6% Steel

Producers

58%

Imports 8%

Other Merchant

& Foundry 6%

Aging Cokemaking Facilities

Average Age

% of U.S. & Canada

coke production

38

29%

27%

10

SunCoke U.S. & 30-40 years 40+ years

Canada

(excl SXC)

56% of coke capacity is at facilities >30 years old

Source: CRU—The Annual Outlook for Metallurgical Coke 2013, company Source: CRU—The Annual Outlook for Metallurgical Coke 2013, company estimates estimates KeyBanc Basic Materials & Packaging Conference 10

The Coal Logistics Opportunity

Coal handling/blending operations are a natural backward integration play and provide opportunity to broaden our customer base

Adjacent Integration:

Into a business we understand, providing a service we are familiar with

Replicate Business Model:

Tolling, fee-based off-take agreements that limit commodity exposure akin to our coke contracts

Asset Rich:

Large market size combined with capital-constrained owners offers significant number of opportunities

Prep Plants

Potential asset types

Loadouts

Terminals

Barges

Private Railcars

KeyBanc Basic Materials & Packaging Conference

11

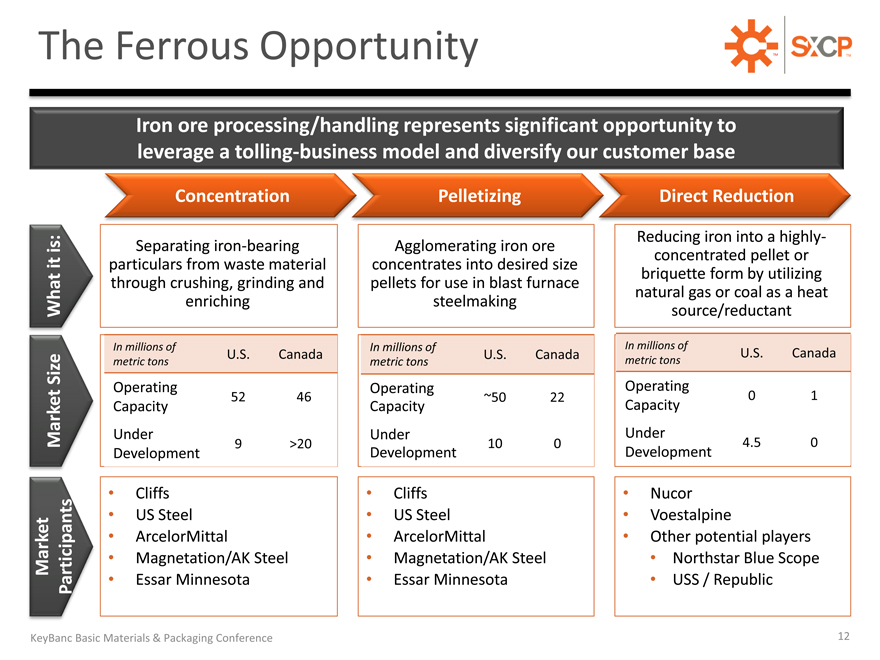

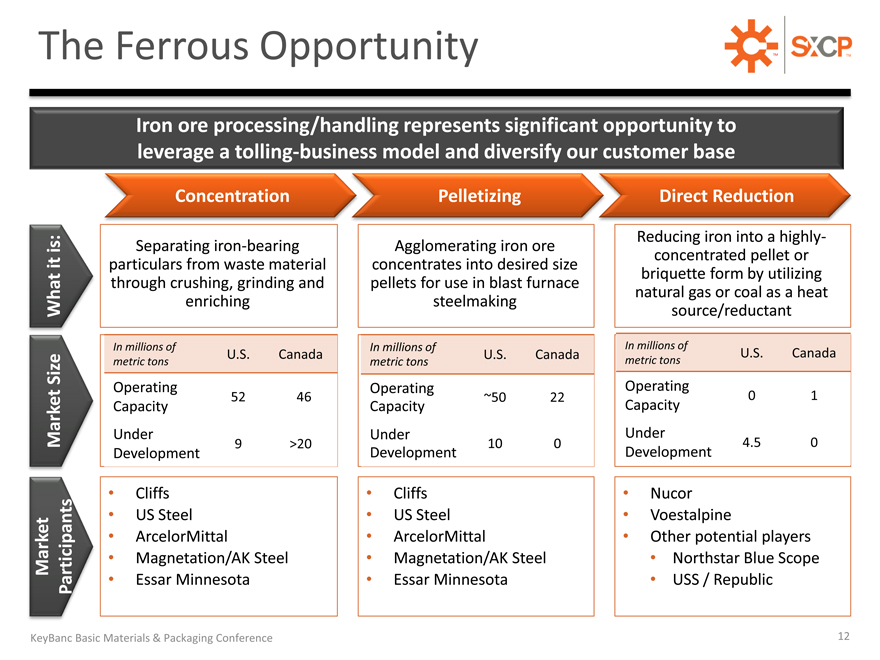

The Ferrous Opportunity

Iron ore processing/handling represents significant opportunity to leverage a tolling-business model and diversify our customer base

Concentration Pelletizing Direct Reduction

Market

Market Size What it is: Participants

Separating iron-bearing particulars from waste material through crushing, grinding and enriching

In millions of

U.S. Canada

metric tons

Operating

52 46

Capacity

Under

9 >20

Development

Cliffs

US Steel

ArcelorMittal

Magnetation/AK Steel

Essar Minnesota

Agglomerating iron ore concentrates into desired size pellets for use in blast furnace steelmaking

In millions of

U.S. Canada metric tons

Operating

~50 22

Capacity

Under

10 0

Development

Cliffs

US Steel

ArcelorMittal

Magnetation/AK Steel

Essar Minnesota

Reducing iron into a highly-concentrated pellet or briquette form by utilizing natural gas or coal as a heat source/reductant

In millions of

U.S. Canada

metric tons

Operating

0 1

Capacity

Under

4.5 0

Development

Nucor

Voestalpine

Other potential players

Northstar Blue Scope

USS / Republic

KeyBanc Basic Materials & Packaging Conference 12

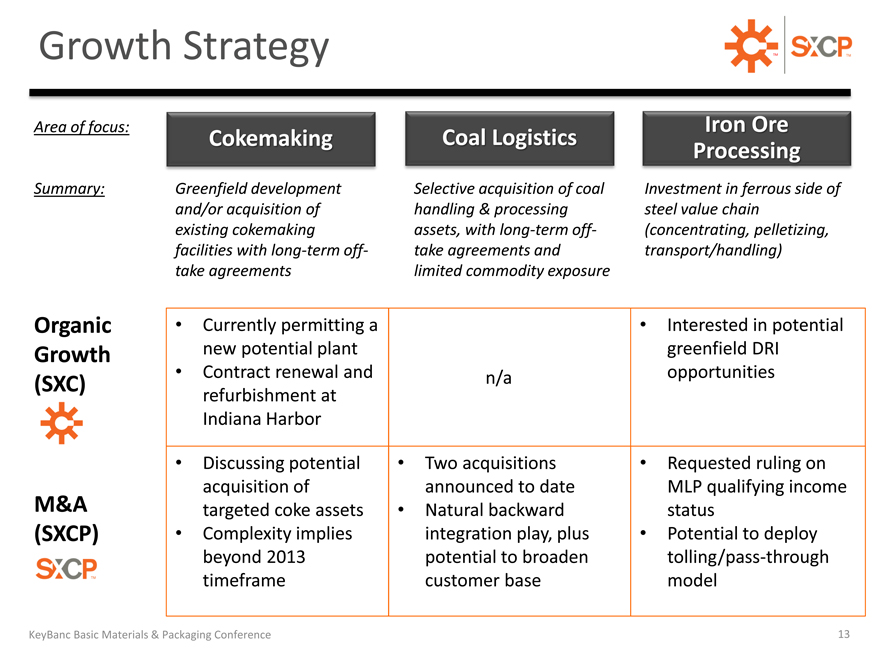

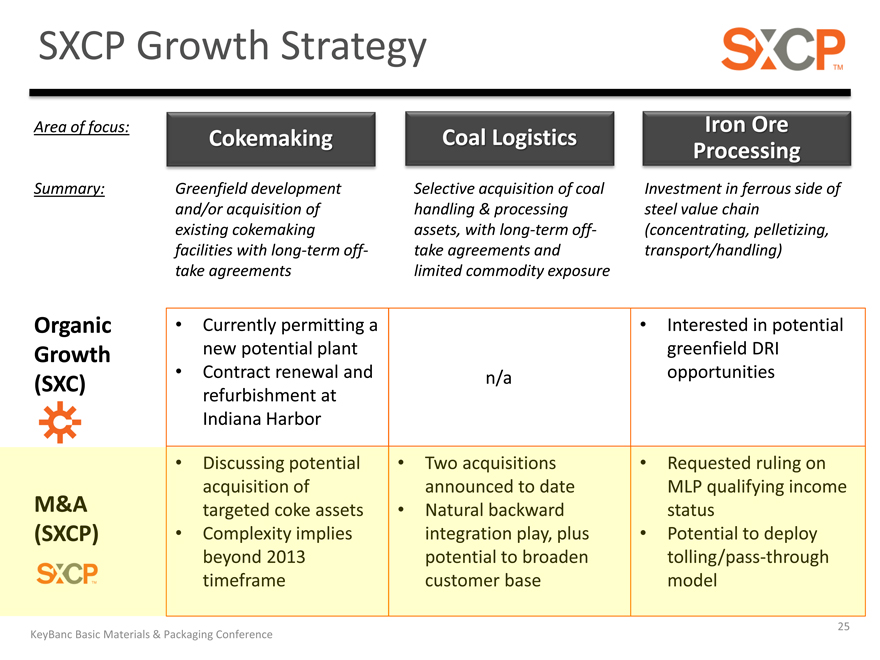

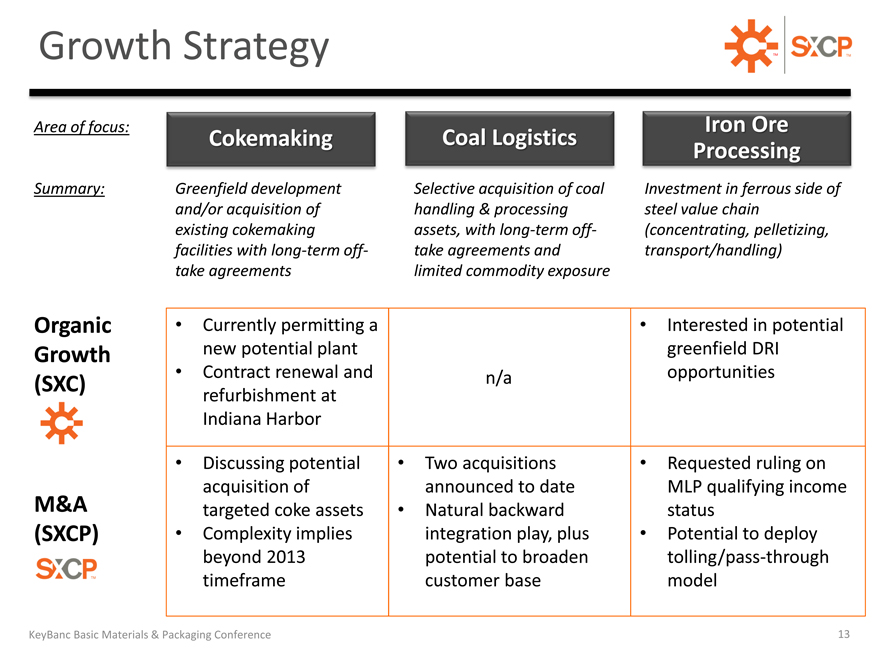

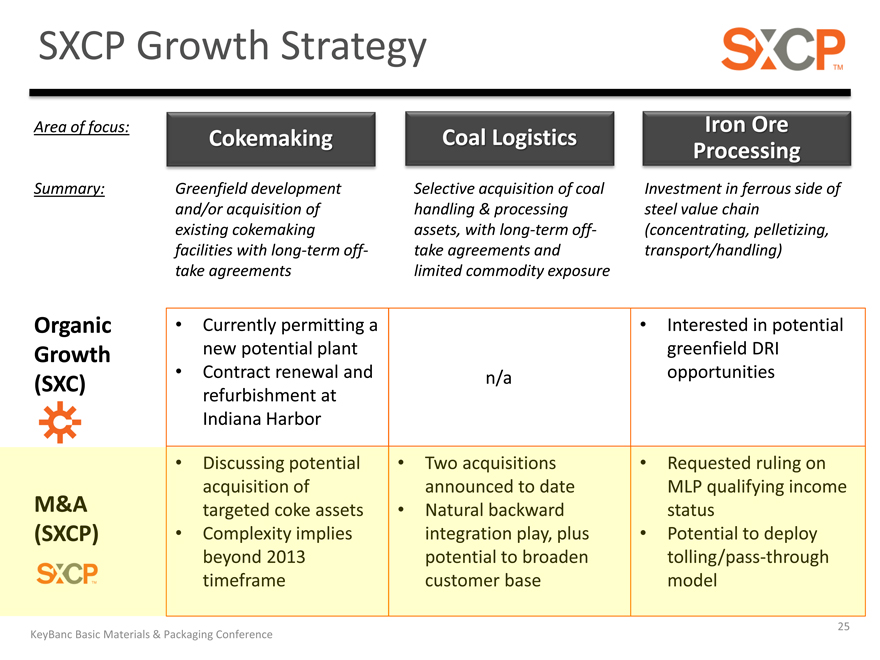

Growth Strategy

Area of focus:

Summary:

Cokemaking

Greenfield development and/or acquisition of existing cokemaking facilities with long-term off-take agreements

Coal Logistics

Selective acquisition of coal handling & processing assets, with long-term off-take agreements and limited commodity exposure

Iron Ore Processin

Investment in ferrous side of steel value chain (concentrating, pelletizing, transport/handling)

Organic Growth (SXC)

M&A (SXCP)

Currently permitting a Interested in potential

new potential plant greenfield DRI

Contract renewal and n/a opportunities

refurbishment at

Indiana Harbor

Discussing potential Two acquisitions Requested ruling on

acquisition of announced to date MLP qualifying income

targeted coke assets Natural backward status

Complexity implies integration play, plus Potential to deploy

beyond 2013 potential to broaden tolling/pass-through

timeframe customer base model

4 | | KeKeyBanc Basic Materials & Packaging Conference 13 |

SXC HIGHLIGHTS AND OUTLOOK

KeyBanc Basic Materials & Packaging Conference

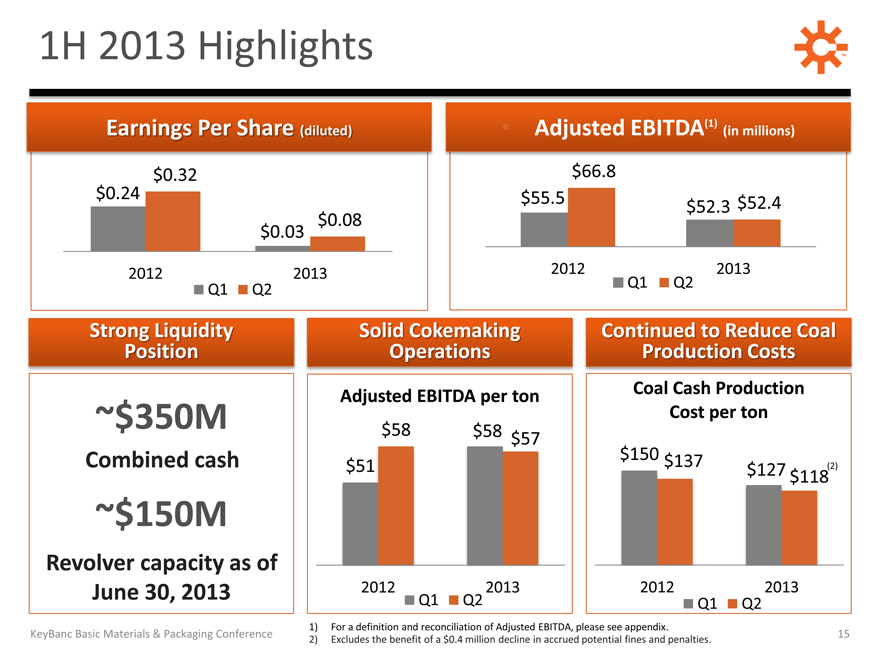

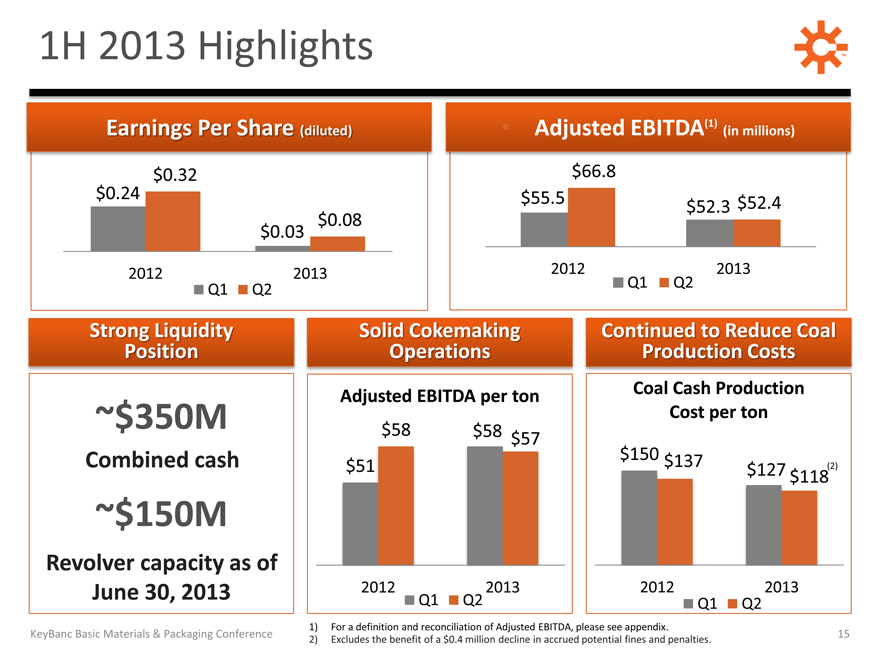

1H 2013 Highlights

Earnings Per Share (diluted)

$0.32 $0.24 $0.08 $0.03

2012 2013 Q1 Q2

Adjusted EBITDA(1)

(in millions)

$66.8 $55.5 $52.4 $52.3

2012 2013 Q1 Q2

Strong Liquidity Position

~$350M

Combined cash

~$150M

Revolver capacity as of June 30, 2013

Solid Cokemaking Operations

Adjusted EBITDA per ton

$58 $58 $57 $51

2012 Q1 Q2 2013

Continued to Reduce Coal Production Costs

Coal Cash Production Cost per ton

$150 $137 $127 (2) $118

2012 2013 Q1 Q2

1) For a definition and reconciliation of Adjusted EBITDA, please see appendix.

KeyBanc Basic Materials & Packaging Conference 15

2) Excludes the benefit of a $0.4 million decline in accrued potential fines and penalties.

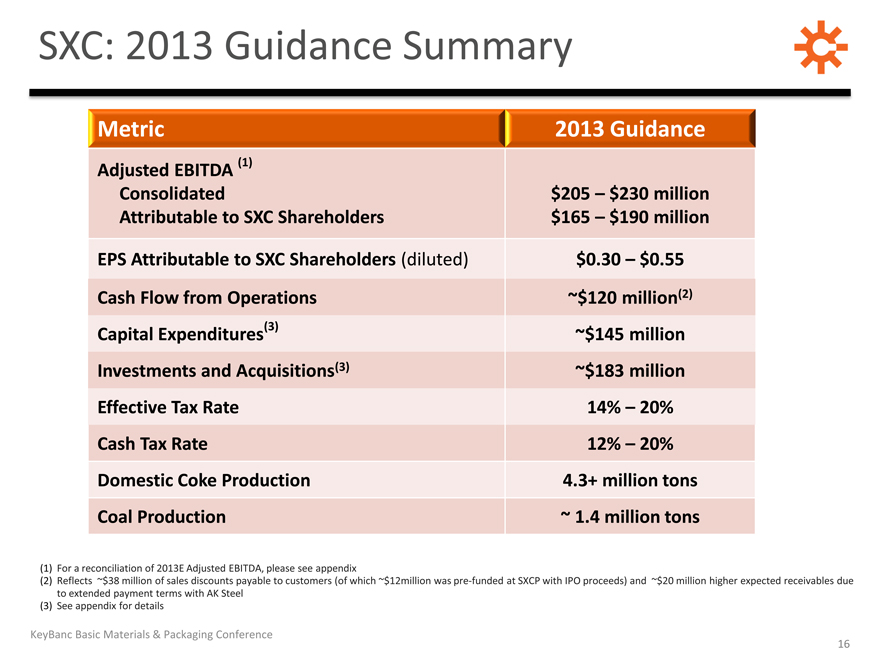

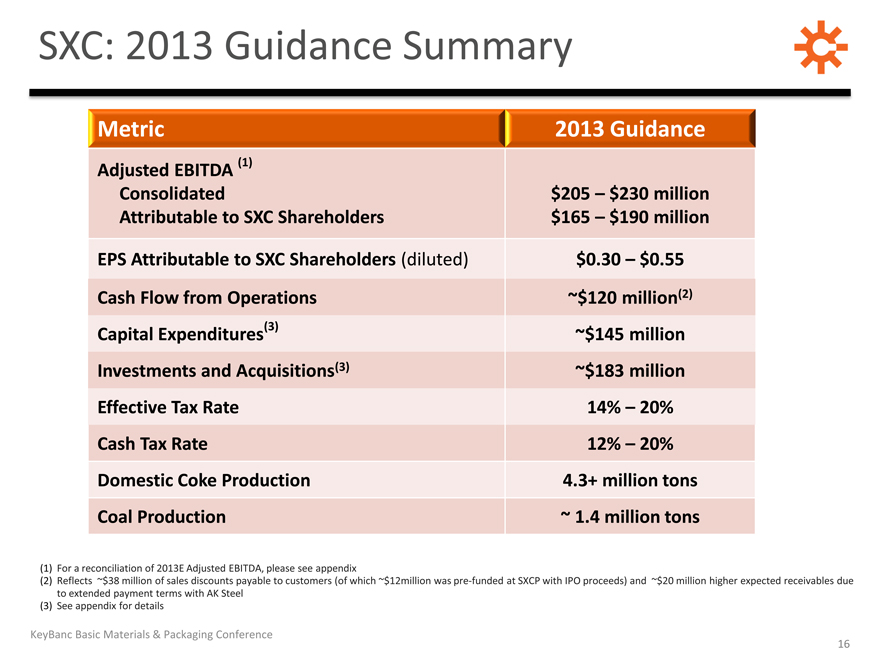

SXC: 2013 Guidance Summary

Metric 2013 Guidance

Adjusted EBITDA (1)

Consolidated $205 – $230 million

Attributable to SXC Shareholders $165 – $190 million

EPS Attributable to SXC Shareholders (diluted) $0.30 – $0.55

Cash Flow from Operations ~$120 million(2)

Capital Expenditures(3) ~$145 million

Investments and Acquisitions(3) ~$183 million

Effective Tax Rate 14% – 20%

Cash Tax Rate 12% – 20%

Domestic Coke Production 4.3+ million tons

Coal Production ~ 1.4 million tons

(1) | | For a reconciliation of 2013E Adjusted EBITDA, please see appendix |

(2) Reflects ~$38 million of sales discounts payable to customers (of which ~$12million was pre-funded at SXCP with IPO proceeds) and ~$20 million higher expected receivables due to extended payment terms with AK Steel (3) See appendix for details

KeyBanc Basic Materials & Packaging Conference 16

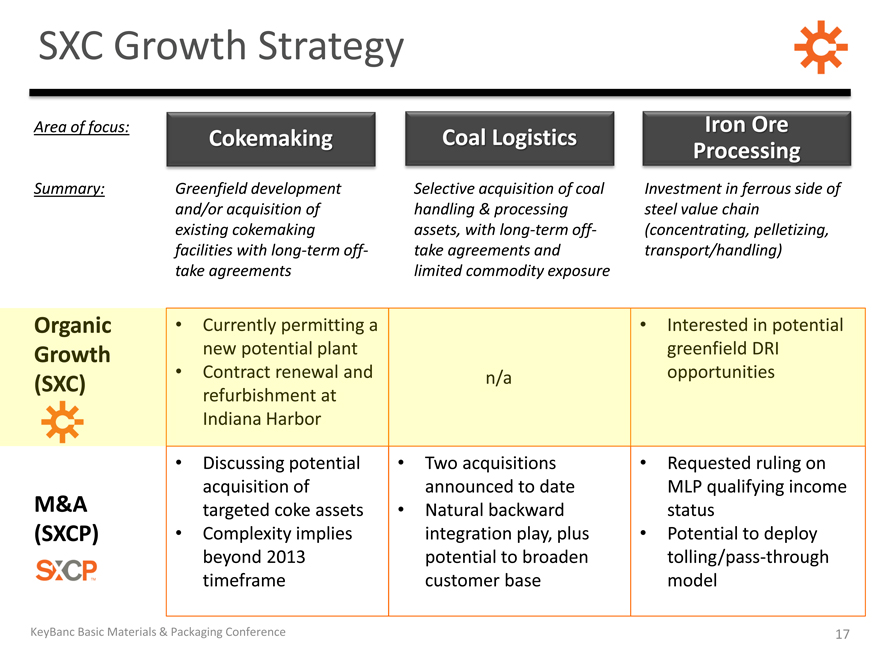

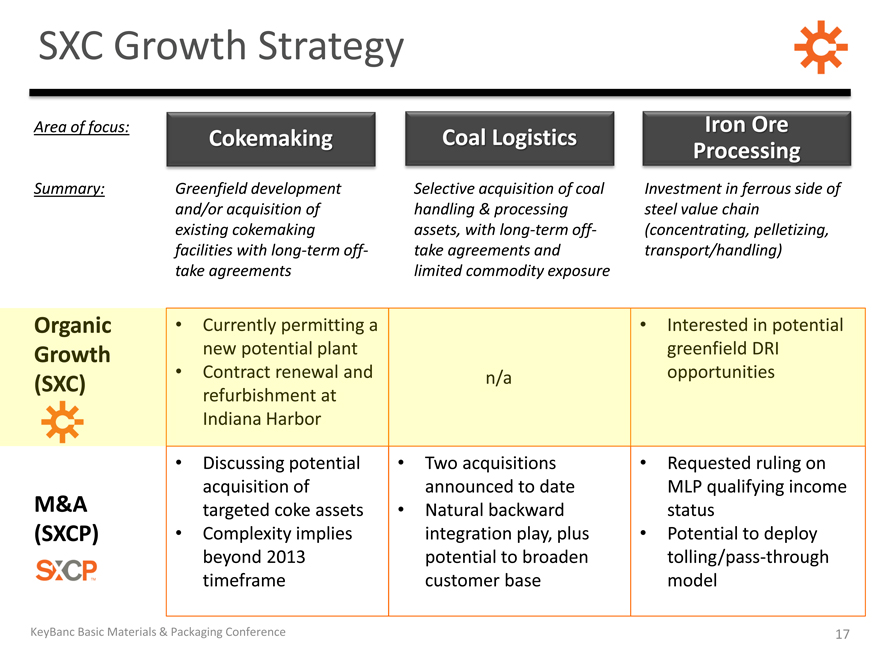

SXC Growth Strategy

Area of focus:

Summary:

Cokemaking

Greenfield development and/or acquisition of existing cokemaking facilities with long-term off-take agreements

Coal Logistics

Selective acquisition of coal handling & processing assets, with long-term off-take agreements and limited commodity exposure

Iron Ore Processin

Investment in ferrous side of steel value chain (concentrating, pelletizing, transport/handling)

Discussing potential Two acquisitions Requested ruling on

acquisition of announced to date MLP qualifying income

M&A targeted coke assets Natural backward status

(SXCP) Complexity implies integration play, plus Potential to deploy

beyond 2013 potential to broaden tolling/pass-through

timeframe customer base model

KeyBanc Basic Materials & Packaging Conference 17

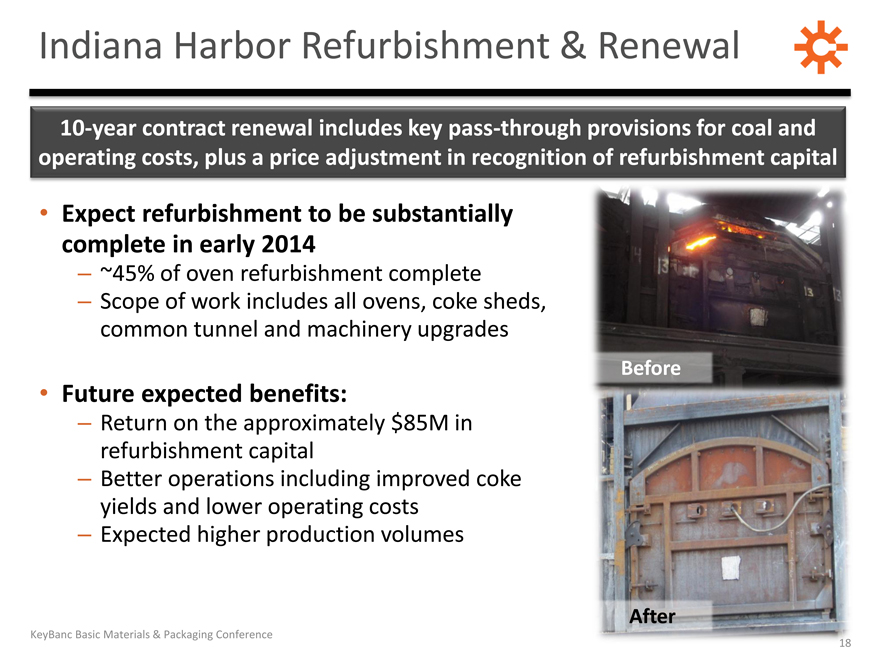

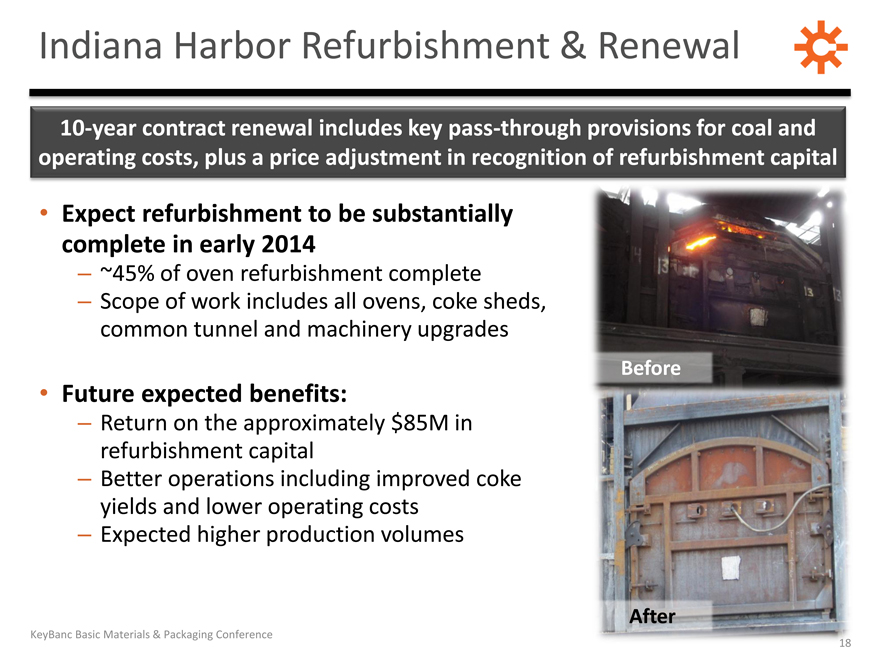

Indiana Harbor Refurbishment & Renewal

10-year contract renewal includes key pass-through provisions for coal and operating costs, plus a price adjustment in recognition of refurbishment capital

Expect refurbishment to be substantially complete in early 2014

– ~45% of oven refurbishment complete

– Scope of work includes all ovens, coke sheds, common tunnel and machinery upgrades

Before

Future expected benefits:

– Return on the approximately $85M in refurbishment capital

– Better operations including improved coke yields and lower operating costs

– Expected higher production volumes

After

KeyBanc Basic Materials & Packaging Conference

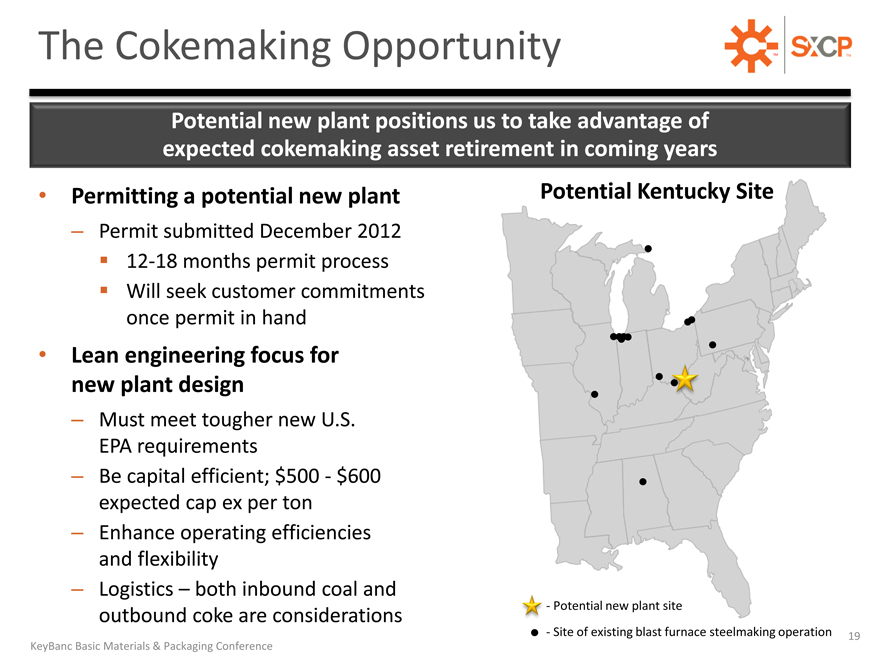

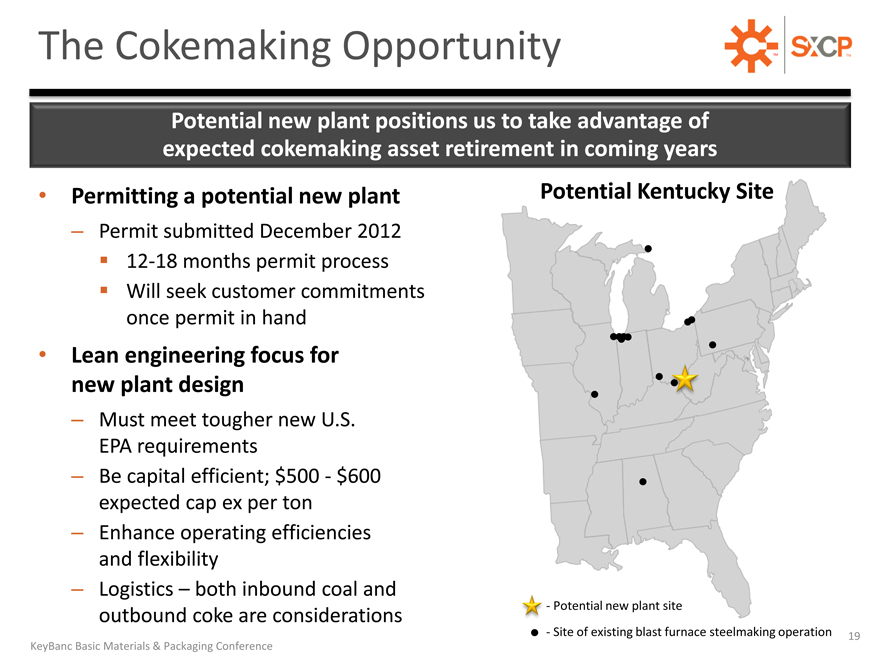

The Cokemaking Opportunity

Potential new plant positions us to take advantage of expected cokemaking asset retirement in coming years

Permitting a potential new plant

– Permit submitted December 2012 ??12-18 months permit process ??Will seek customer commitments once permit in hand

Lean engineering focus for new plant design

– Must meet tougher new U.S.

EPA requirements

– Be capital efficient; $500—$600 expected cap ex per ton

– Enhance operating efficiencies and flexibility

– Logistics – both inbound coal and outbound coke are considerations

Potential Kentucky Site

Potential new plant site

Site of existing blast furnace steelmaking operation

KeyBanc Basic Materials & Packaging Conference 19

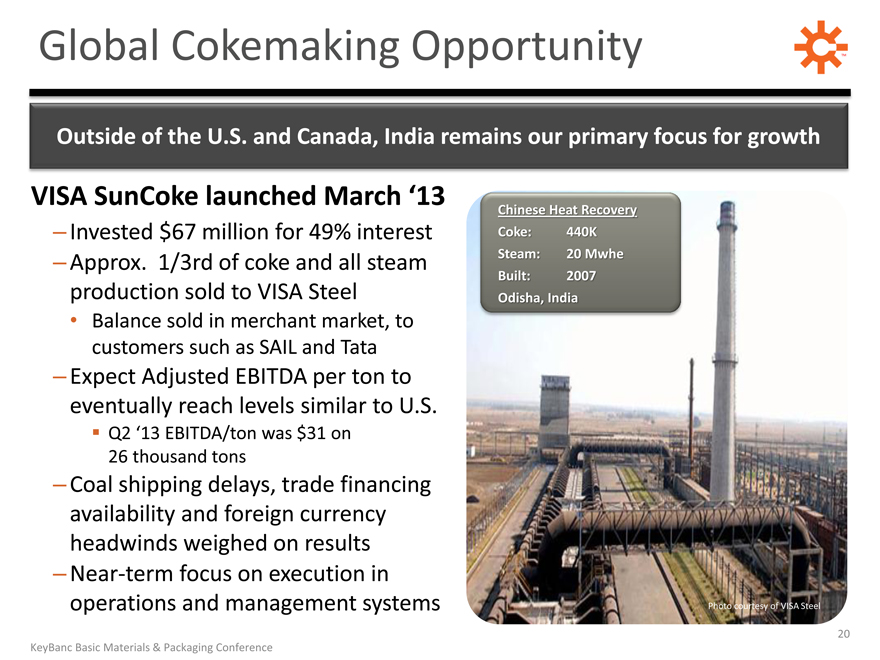

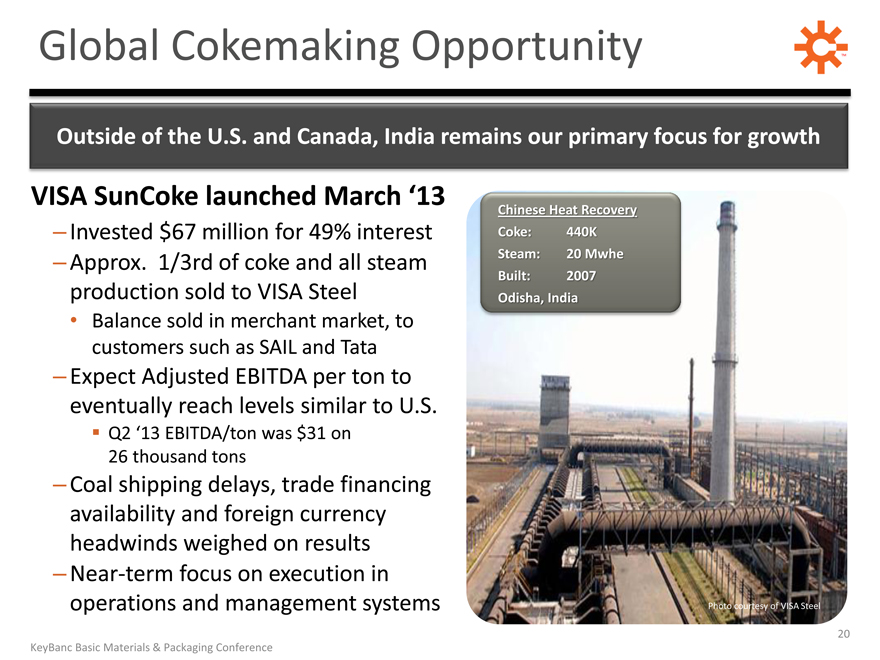

Global Cokemaking Opportunity

Outside of the U.S. and Canada, India remains our primary focus for growth

VISA SunCoke launched March ‘13

– Invested $67 million for 49% interest

– Approx. 1/3rd of coke and all steam production sold to VISA Steel

Balance sold in merchant market, to customers such as SAIL and Tata

– Expect Adjusted EBITDA per ton to eventually reach levels similar to U.S.

??Q2 ‘13 EBITDA/ton was $31 on

26 thousand tons

– Coal shipping delays, trade financing availability and foreign currency headwinds weighed on results

– Near-term focus on execution in operations and management systems

Chinese Heat Recover

Cok 440K

Steam 20 Mwh

Buil 2007

Odisha, Ind

20 KeyBanc Basic Materials & Packaging Conference

SXCP HIGHLIGHTS AND OUTLOOK

SunCoke EnergyTM

KeyBanc Basic Materials & Packaging Conference 21

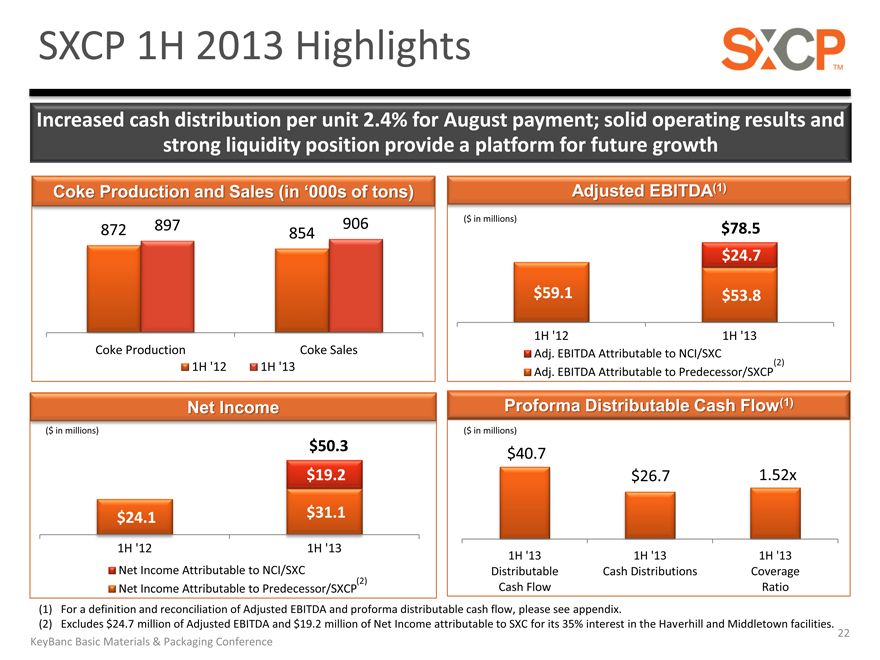

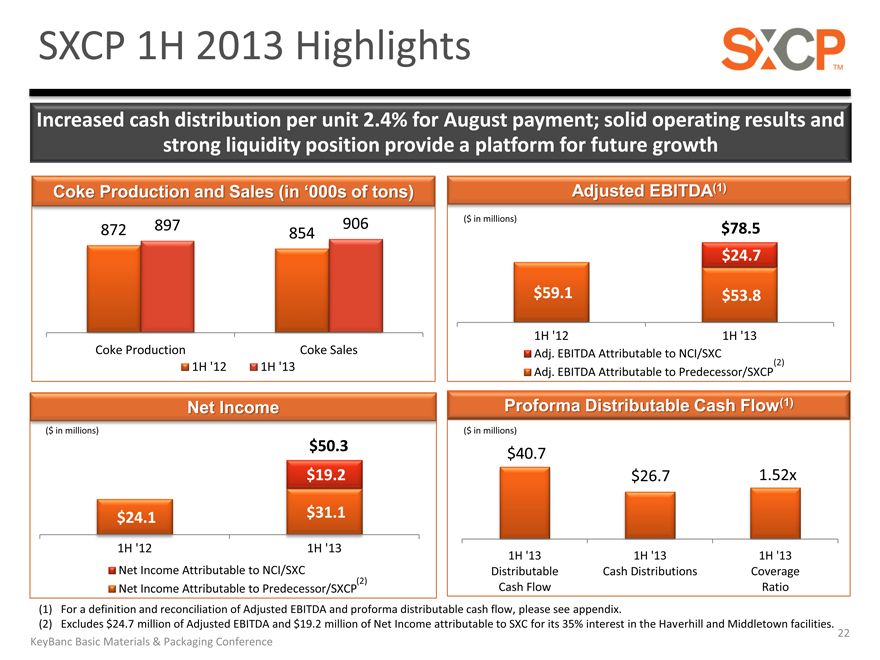

SXCP 1H 2013 Highlights

Increased cash distribution per unit 2.4% for August payment; solid operating results and strong liquidity position provide a platform for future growth

Coke Production and Sales (in ‘000s of ton

872 897 906 854

Coke Production Coke Sales

1H ‘12 1H ‘13

Adjusted EBITD

($ in millions)

$78.5 $24.7

$59.1 $53.8

1H ‘12 1H ‘13

Adj. EBITDA Attributable to NCI/SXC (2) Adj. EBITDA Attributable to Predecessor/SXCP

Net Income $50.3 $19.2

$24.1 $31.1

1H ‘12 1H ‘13

Net Income Attributable to NCI/SXC

Net Income Attributable to Predecessor/SXCP

Proforma Distributable Cash Flo

($ in millions)

$40.7 $26.7 1.52x

1H ‘13 1H ‘13 1H ‘13 Distributable Cash Distributions Coverage Cash Flow Ratio

(1) | | For a definition and reconciliation of Adjusted EBITDA and proforma distributable cash flow, please see appendix. |

(2) Excludes $24.7 million of Adjusted EBITDA and $19.2 million of Net Income attributable to SXC for its 35% interest in the Haverhill and Middletown facilities. 22 KeyBanc Basic Materials & Packaging Conference

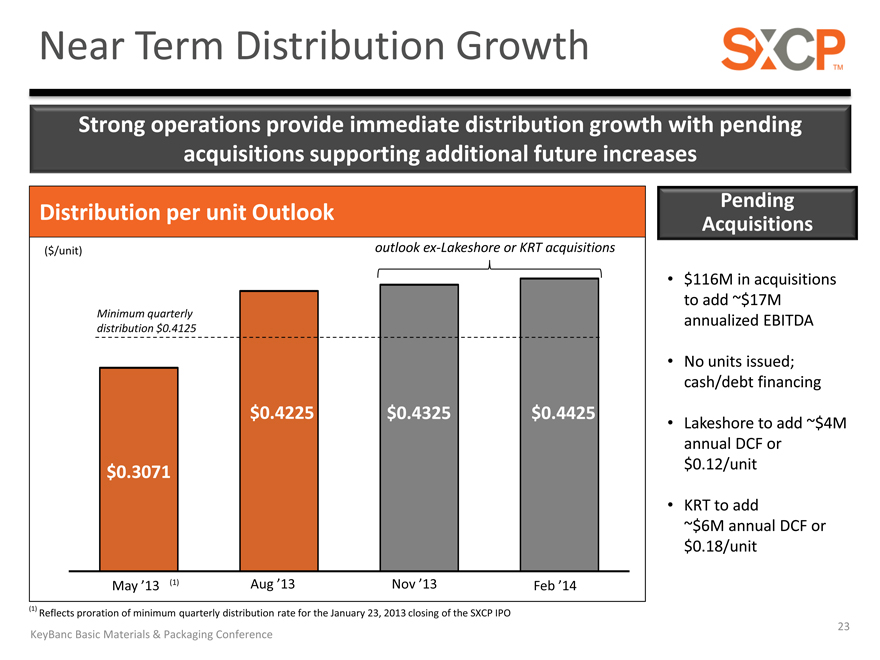

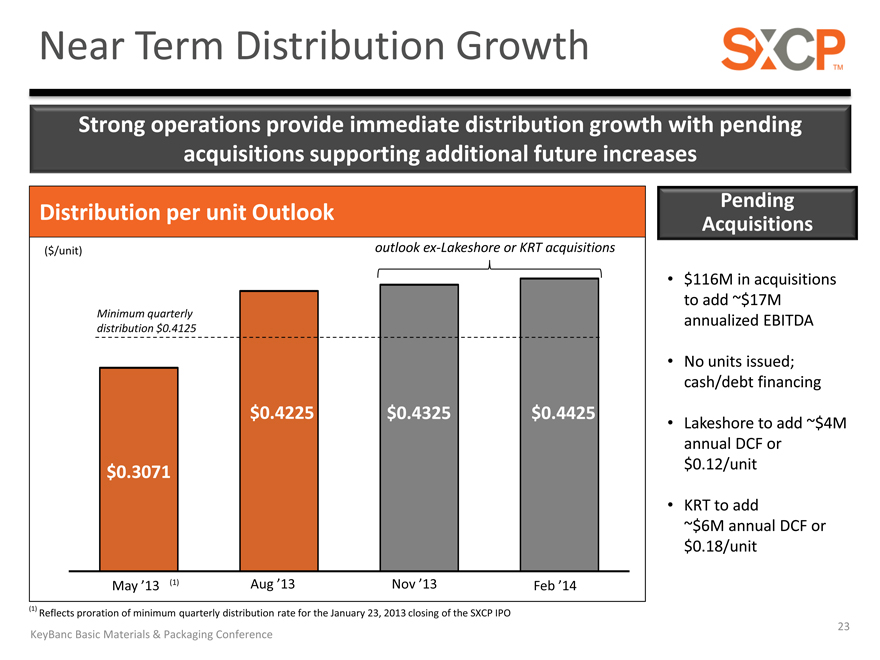

Near Term Distribution Growth

Strong operations provide immediate distribution growth with pending acquisitions supporting additional future increases

Distribution per unit Outlook

outlook ex-Lakeshore or KRT acquisitions

($/unit)

Minimum quarterly distribution $0.4125

$0.4225 $0.4325 $0.4425

$0.3071

Pending Acquisitions

$116M in acquisitions to add ~$17M annualized EBITDA

No units issued; cash/debt financing

Lakeshore to add ~$4M annual DCF or $0.12/unit

KRT to add

~$6M annual DCF or $0.18/unit

May ’13 (1) Aug ’13 Nov ’13 Feb ’14

Reflects proration of minimum quarterly distribution rate for the January 23, 2013 closing of the SXCP IPO

KeyBanc Basic Materials & Packaging Conference 23

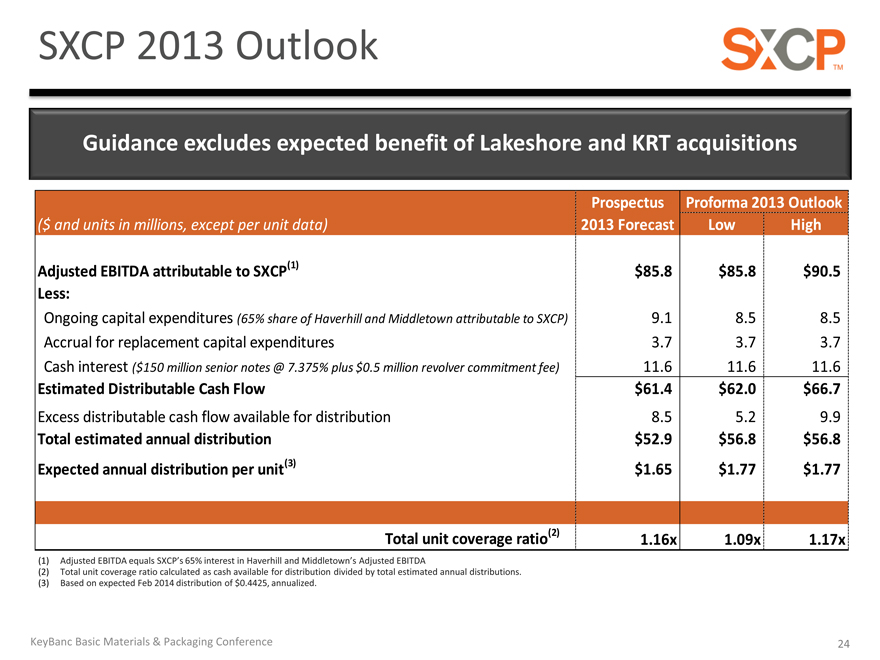

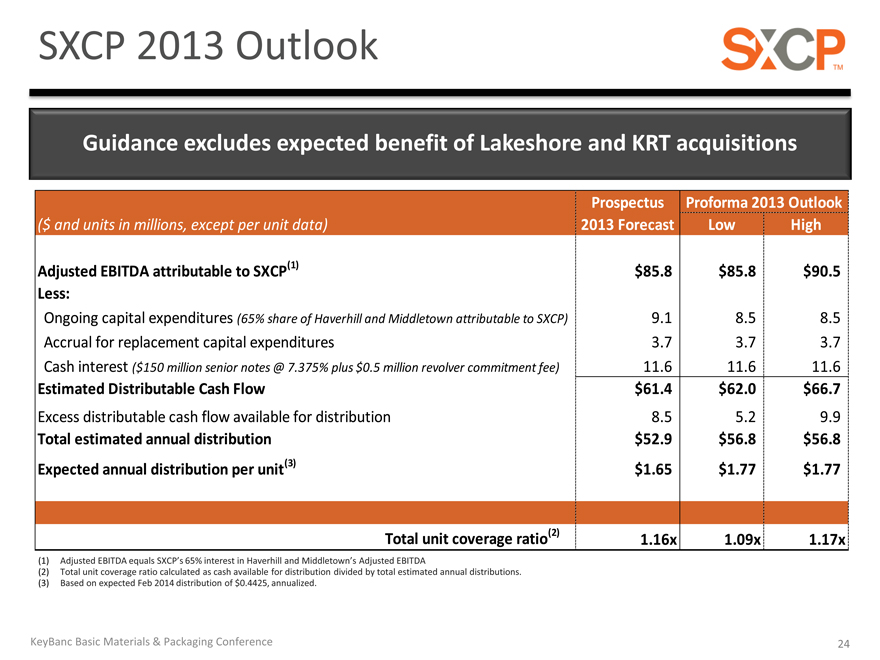

SXCP 2013 Outlook

Guidance excludes expected benefit of Lakeshore and KRT acquisitions

Prospectus Proforma 2013 Outlook

($ and units in millions, except per unit data) 2013 Forecast Low High

Adjusted EBITDA attributable to SXCP(1) $ 85.8 $ 85.8 $ 90.5

Less:

Ongoing capital expenditures (65% share of Haverhill and Middletown attributable to SXCP) 9.1 8.5 8.5

Accrual for replacement capital expenditures 3.7 3.7 3.7

Cash interest ($150 million senior notes @ 7.375% plus $0.5 million revolver commitment fee) 11.6 11.6 11.6

Estimated Distributable Cash Flow $ 61.4 $ 62.0 $ 66.7

Excess distributable cash flow available for distribution 8.5 5.2 9.9

Total estimated annual distribution $ 52.9 $ 56.8 $ 56.8

Expected annual distribution per unit(3) $ 1.65 $ 1.77 $ 1.77

Total unit coverage ratio(2) 1.16x 1.09x 1.17x

(1) | | Adjusted EBITDA equals SXCP’s 65% interest in Haverhill and Middletown’s Adjusted EBITDA |

(2) Total unit coverage ratio calculated as cash available for distribution divided by total estimated annual distributions. (3) Based on expected Feb 2014 distribution of $0.4425, annualized.

KeyBanc Basic Materials & Packaging Conference 24

SXCP Growth Strategy

Area of focus:

Summary:

Cokemaking

Greenfield development and/or acquisition of existing cokemaking facilities with long-term off-take agreements

Coal Logistics

Selective acquisition of coal handling & processing assets, with long-term off-take agreements and limited commodity exposure

Iron Ore Processin

Investment in ferrous side of steel value chain (concentrating, pelletizing, transport/handling)

Organic Growth (SXC)

Currently permitting a new potential plant Contract renewal and refurbishment at Indiana Harbor

n/a

Interested in potential greenfield DRI opportunities

M & A

(SXCP)

Discussion potential acquisition of targeted coke asset

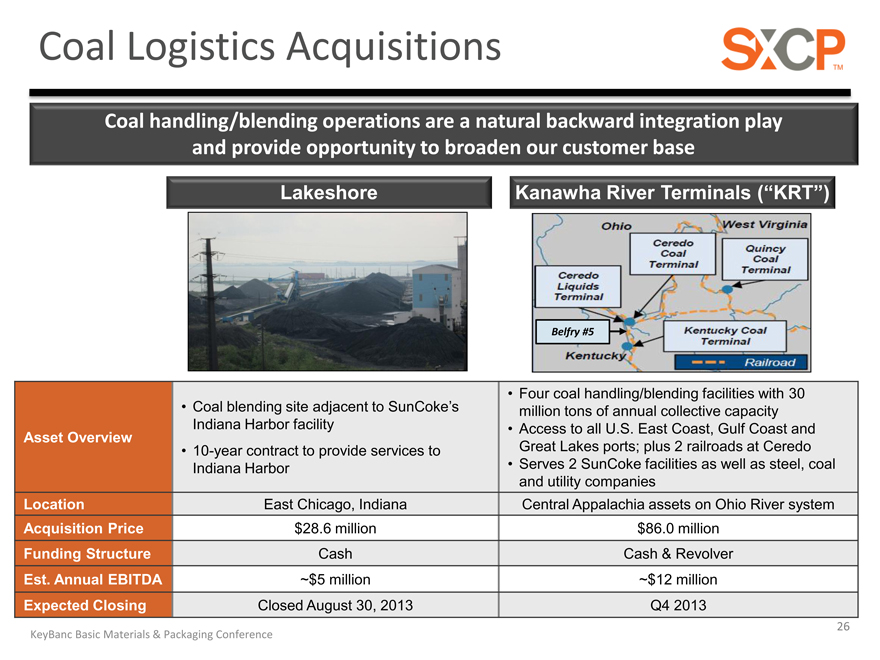

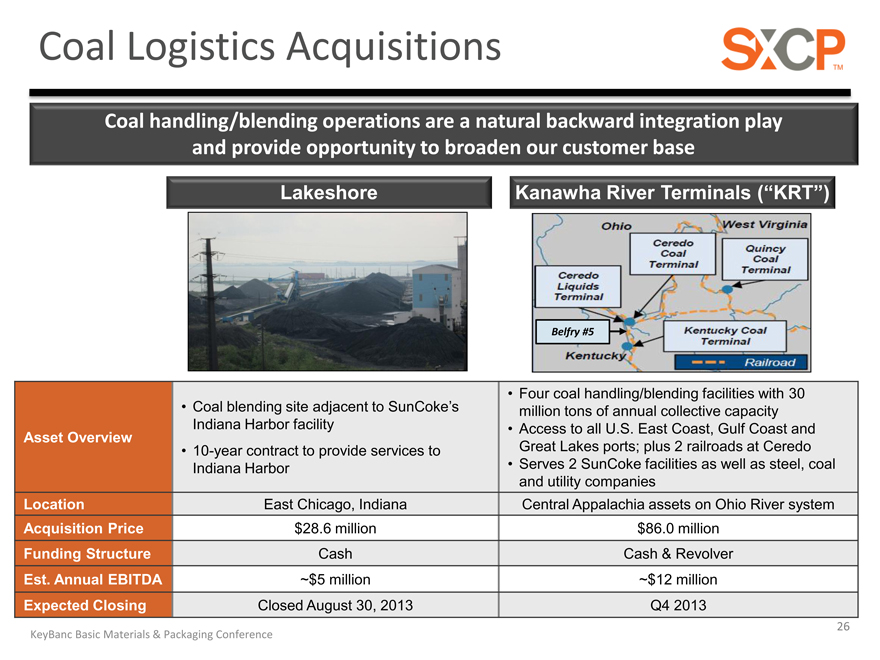

Coal Logistics Acquisitions

Coal handling/blending operations are a natural backward integration play and provide opportunity to broaden our customer base

Lakeshore

Kanawha River Terminals (“KRT”)

Four coal handling/blending facilities with 30

Coal blending site adjacent to SunCoke’s million tons of annual collective capacity

Asset Overview Indiana Harbor facility Access to all U.S. East Coast, Gulf Coast and

10-year contract to provide services to Great Lakes ports; plus 2 railroads at Ceredo

Indiana Harbor Serves 2 SunCoke facilities as well as steel, coal

and utility companies

Location East Chicago, Indiana Central Appalachia assets on Ohio River system

Acquisition Price $28.6 million $86.0 million

Funding Structure Cash Cash & Revolver

Est. Annual EBITDA ~$5 million ~$12 million

Expected Closing Closed August 30, 2013 Q4 2013

26

KeyBanc Basic Materials & Packaging Conference

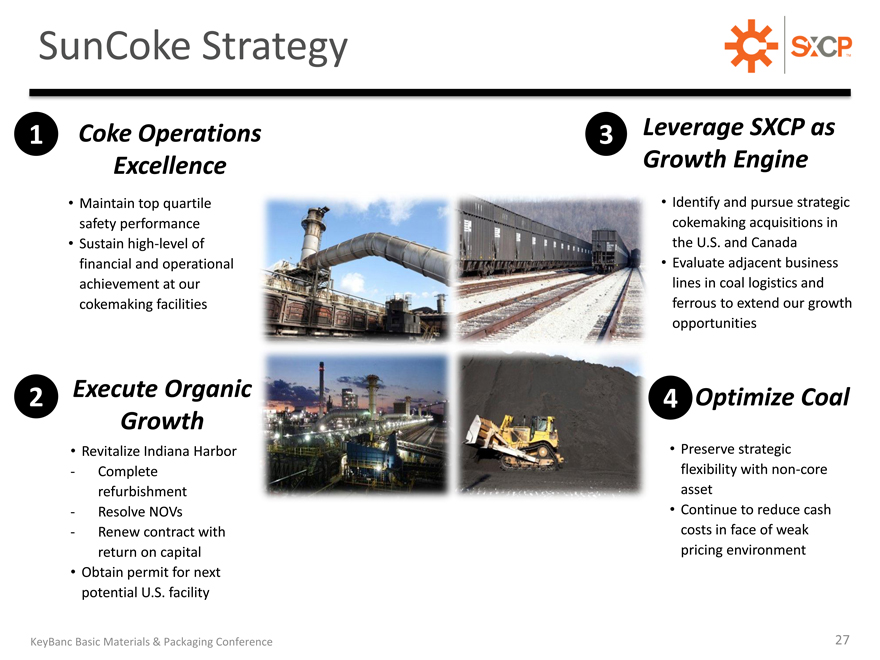

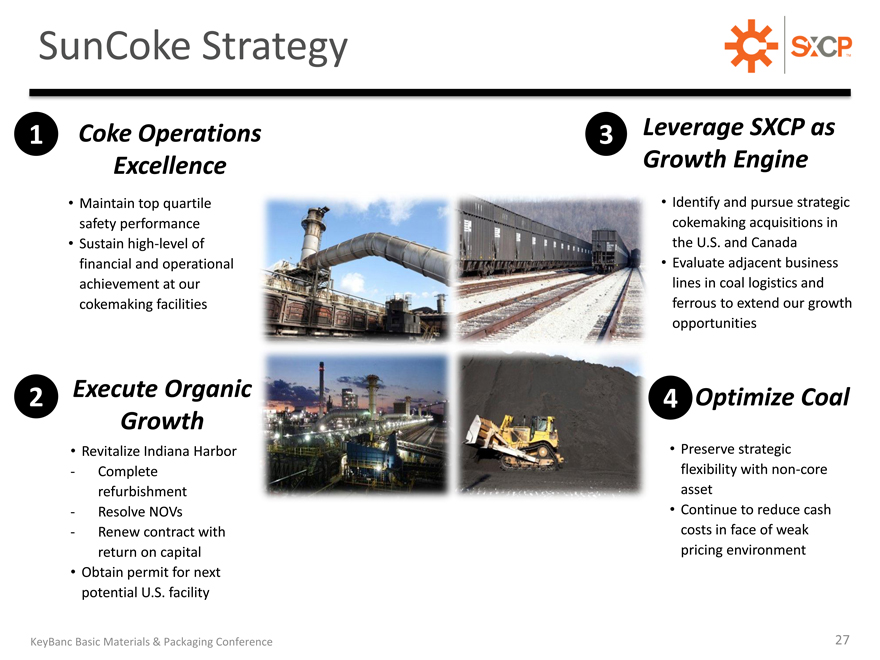

SunCoke Strategy

Coke Operations Excellence

Maintain top quartile safety performance Sustain high-level of financial and operational achievement at our cokemaking facilities

Execute Organic Growth

Revitalize Indiana Harbor

- Complete refurbishment

- Resolve NOVs

- Renew contract with return on capital

Obtain permit for next potential U.S. facility

Leverage SXCP as Growth Engine

Identify and pursue strategic cokemaking acquisitions in the U.S. and Canada

Evaluate adjacent business lines in coal logistics and ferrous to extend our growth opportunities

Preserve strategic flexibility with non-core asset

Continue to reduce cash costs in face of weak pricing environment

KeyBanc Basic Materials & Packaging Conference 27

APPENDIX

SunCoke Energy TM

28

KeyBanc Basic Materials & Packaging Conference 28

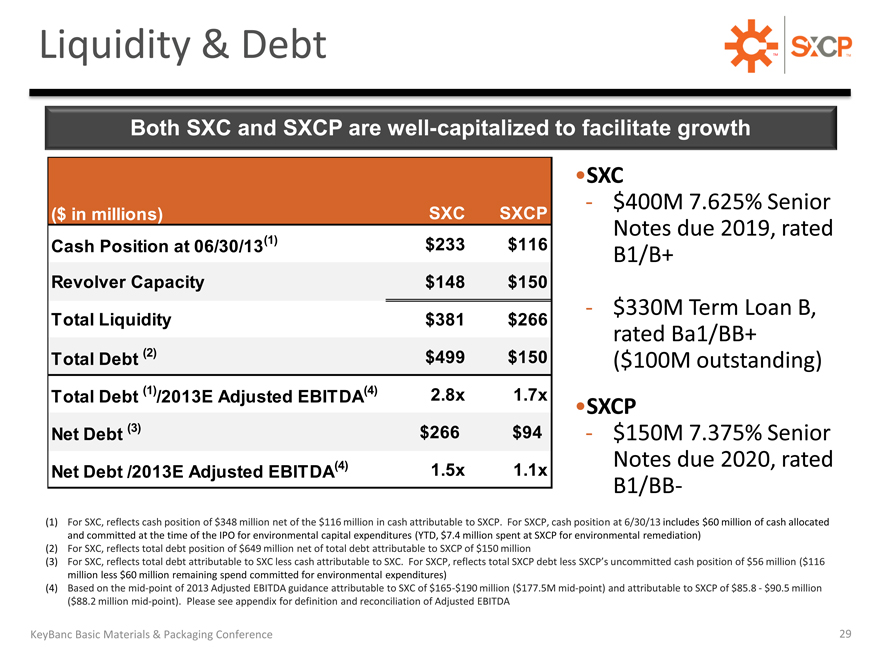

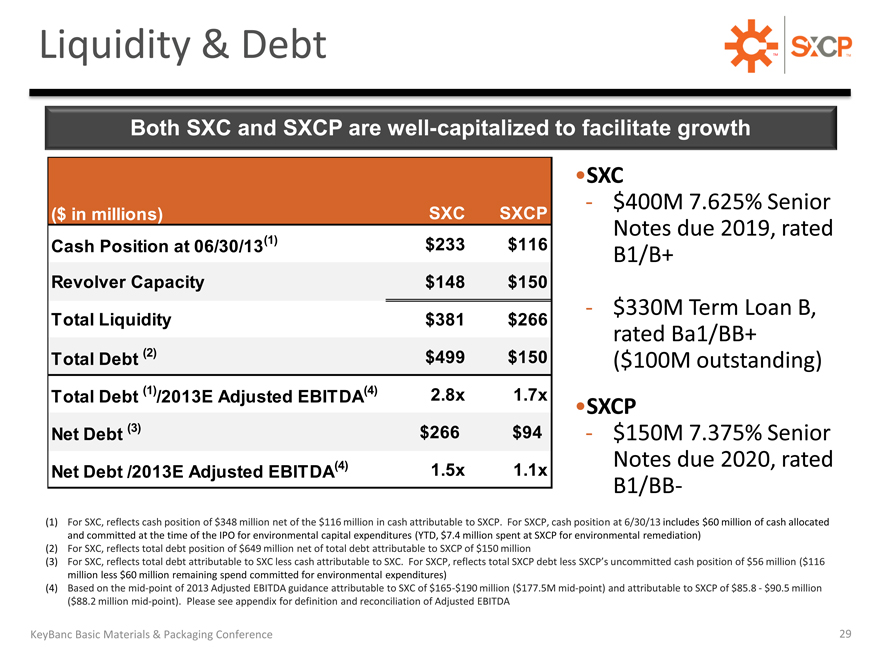

Liquidity & Debt

Both SXC and SXCP are well-capitalized to facilitate growth

($ in millions) SXC SXCP

Cash Position at 06/30/13(1) $233 $116

Revolver Capacity $148 $150

Total Liquidity $381 $266

Total Debt (2) $499 $150

Total Debt (1) /2013E Adjusted EBITDA(4) 2.8x 1.7x

Net Debt (3) $266 $94

Net Debt /2013E Adjusted EBITDA(4) 1.5x 1.1x

SXC

- $400M 7.625% Senior Notes due 2019, rated B1/B+

- $330M Term Loan B, rated Ba1/BB+

($100M outstanding)

SXCP

- $150M 7.375% Senior Notes due 2020, rated B1/BB-

(1) For SXC, reflects cash position of $348 million net of the $116 million in cash attributable to SXCP. For SXCP, cash position at 6/30/13 includes $60 million of cash allocated and committed at the time of the IPO for environmental capital expenditures (YTD, $7.4 million spent at SXCP for environmental remediation) (2) For SXC, reflects total debt position of $649 million net of total debt attributable to SXCP of $150 million

(3) For SXC, reflects total debt attributable to SXC less cash attributable to SXC. For SXCP, reflects total SXCP debt less SXCP’s uncommitted cash position of $56 million ($116 million less $60 million remaining spend committed for environmental expenditures) (4) Based on the mid-point of 2013 Adjusted EBITDA guidance attributable to SXC of $165-$190 million ($177.5M mid-point) and attributable to SXCP of $85.8—$90.5 million

($88.2 million mid-point). Please see appendix for definition and reconciliation of Adjusted EBITDA

KeyBanc Basic Materials & Packaging Conference 29

ABOUT SUNCOKE AND THE COKEMAKING PROCESS

SunCoke Energy TM

30

KeyBanc Basic Materials & Packaging Conference

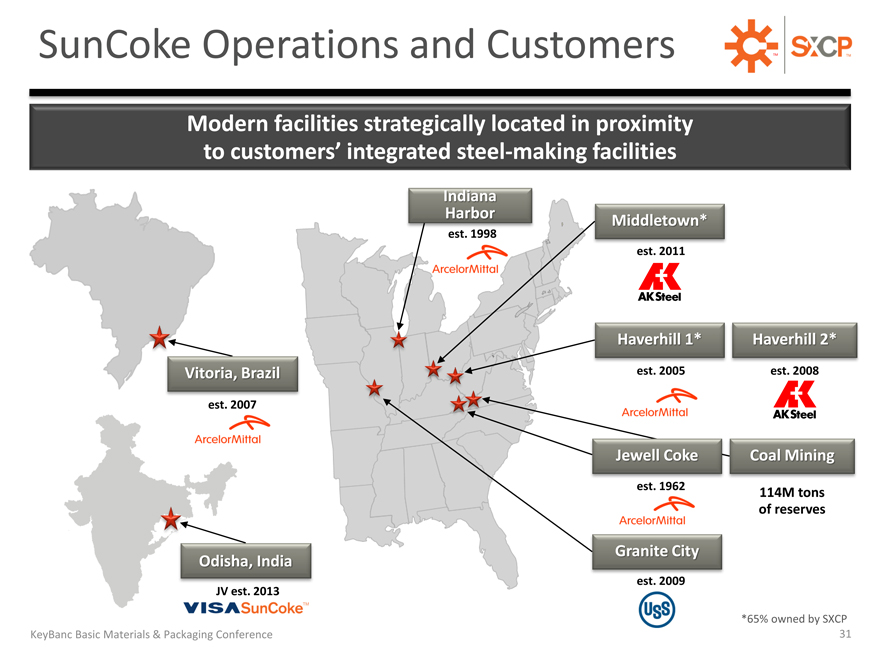

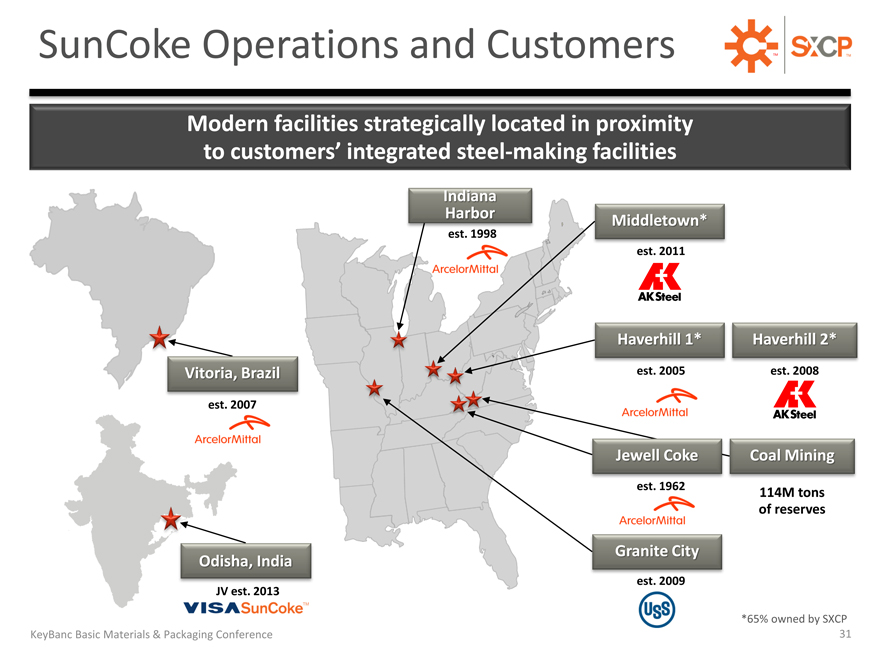

SunCoke Operations and Customers

Modern facilities strategically located in proximity to customers’ integrated steel-making facilities

Indiana Harbor

est. 1998

Middletown*

est. 2011

Vitoria, Brazil

est. 2007

Odisha, India

JV est. 2013

Haverhill

est. 2005

Haverhill

est. 2008

Coal Minin

114M tons of reserves

Granite Cit

est. 2009

*65% owned by SXCP

KeyBanc Basic Materials & Packaging Conference 31

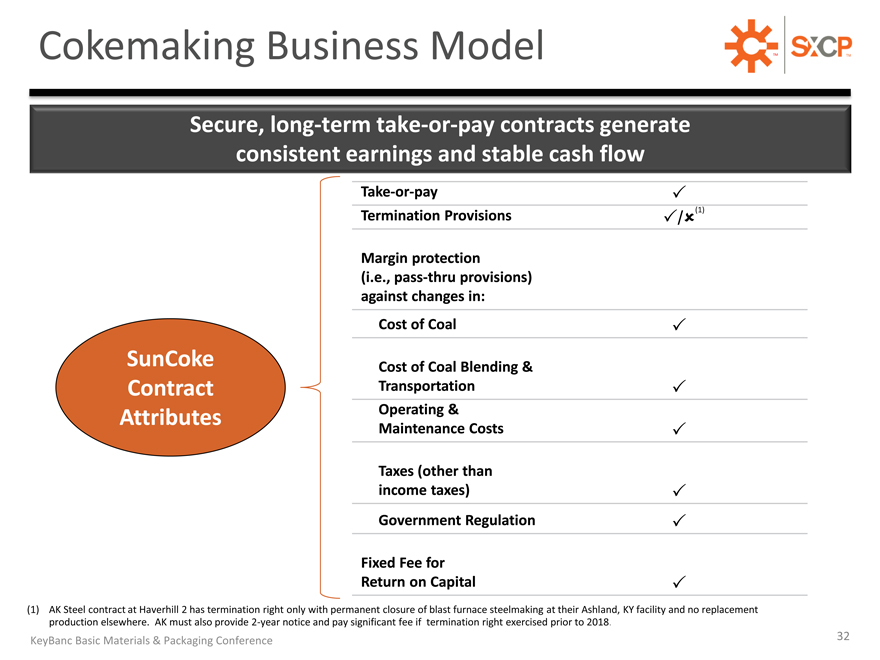

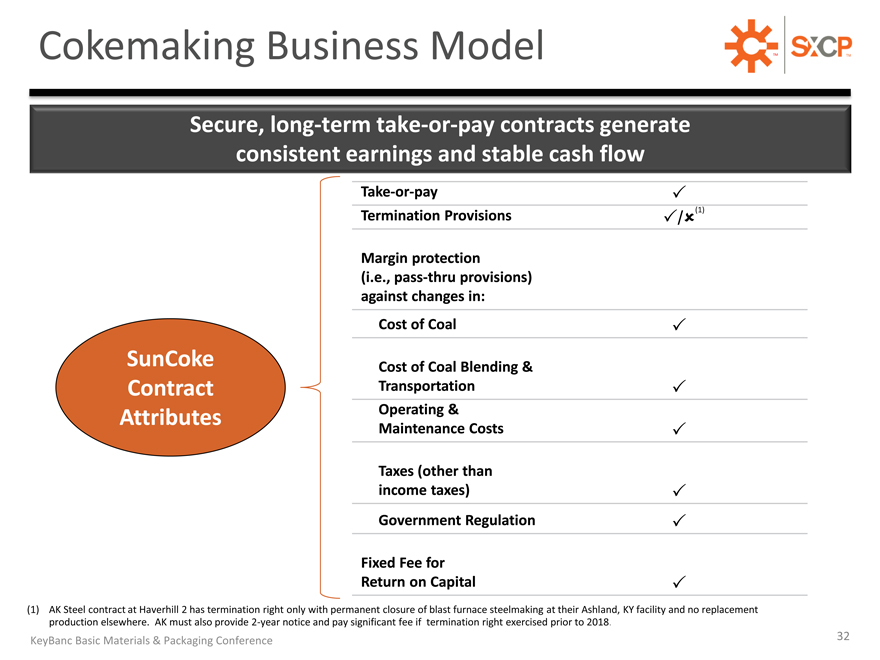

Cokemaking Business Model

Secure, long-term take-or-pay contracts generate consistent earnings and stable cash flow

Take-or-pay

Termination Provisions

Margin protection (i.e., pass-thru provisions) against changes in:

Cost of Coal

Cost of Coal Blending & Transportation Operating & Maintenance Costs

Taxes (other than income taxes)

Government Regulation

Fixed Fee for Return on Capital

(1) AK Steel contract at Haverhill 2 has termination right only with permanent closure of blast furnace steelmaking at their Ashland, KY facility and no replacement production elsewhere. AK must also provide 2-year notice and pay significant fee if termination right exercised prior to 2018.

KeyBanc Basic Materials & Packaging Conference 32

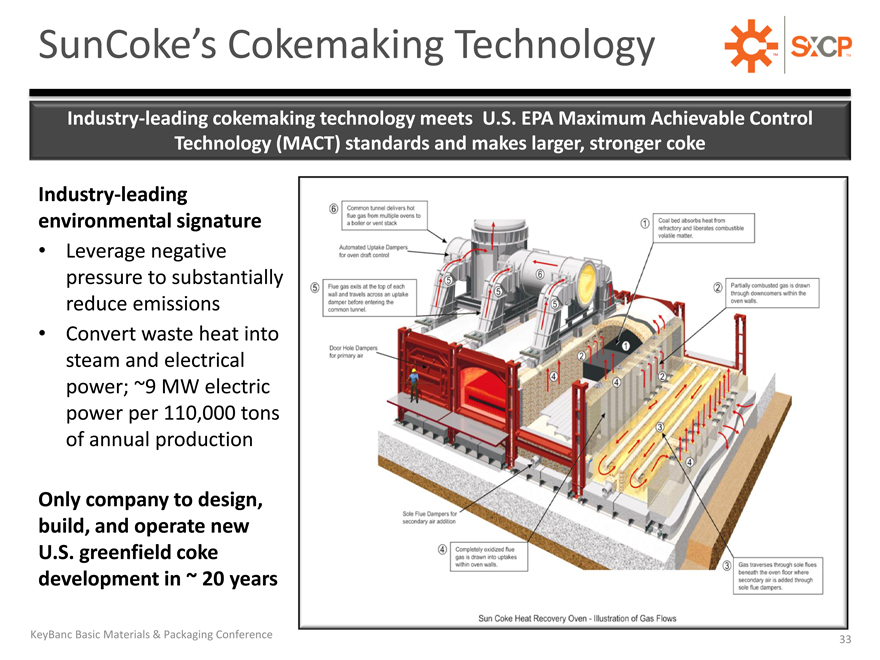

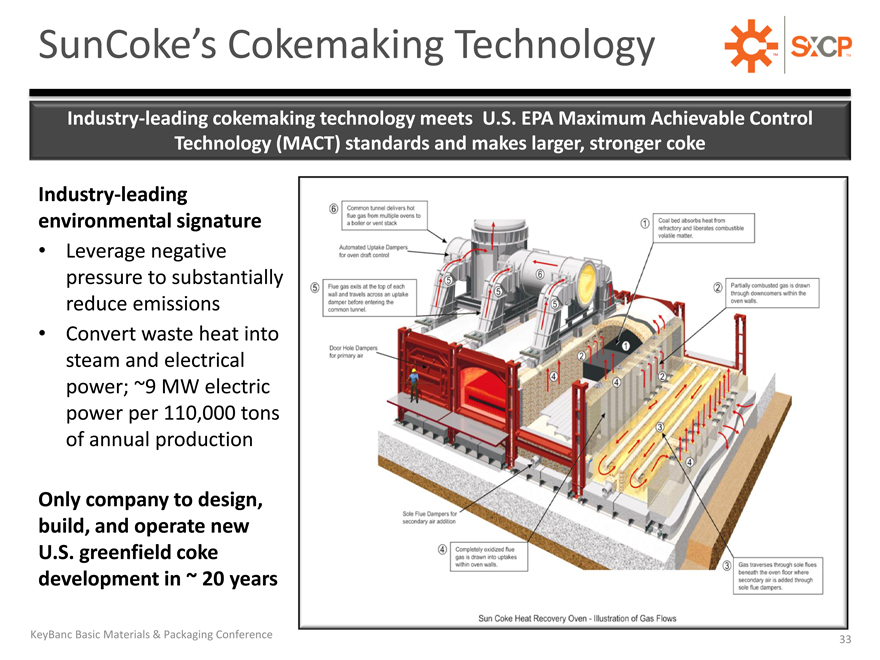

SunCoke’s Cokemaking Technology

Industry-leading cokemaking technology meets U.S. EPA Maximum Achievable Control Technology (MACT) standards and makes larger, stronger coke

Industry-leading environmental signature

Leverage negative pressure to substantially reduce emissions

Convert waste heat into steam and electrical power; ~9 MW electric power per 110,000 tons of annual production

Only company to design, build, and operate new U.S. greenfield coke development in ~ 20 years

KeyBanc Basic Materials & Packaging Conference

33

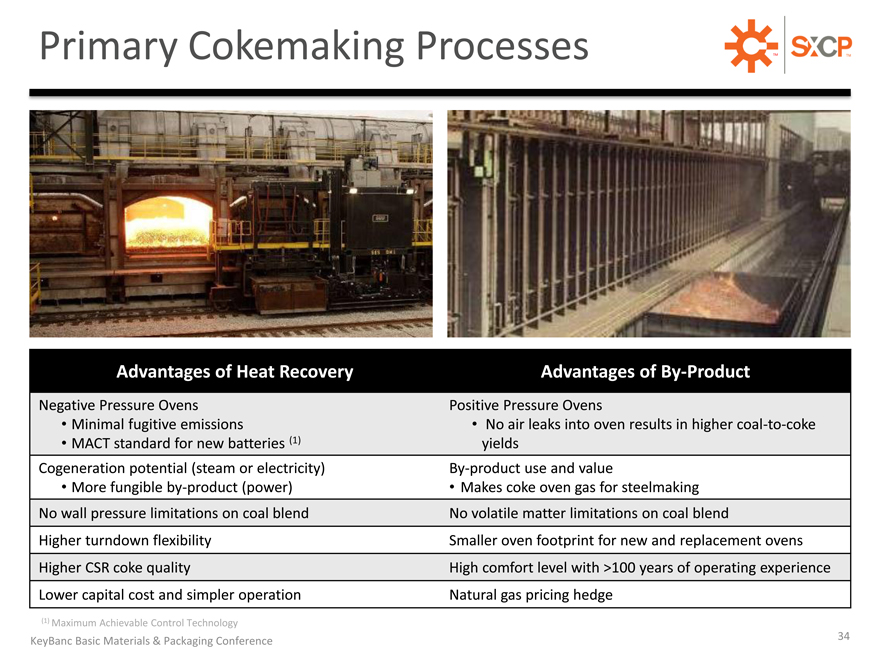

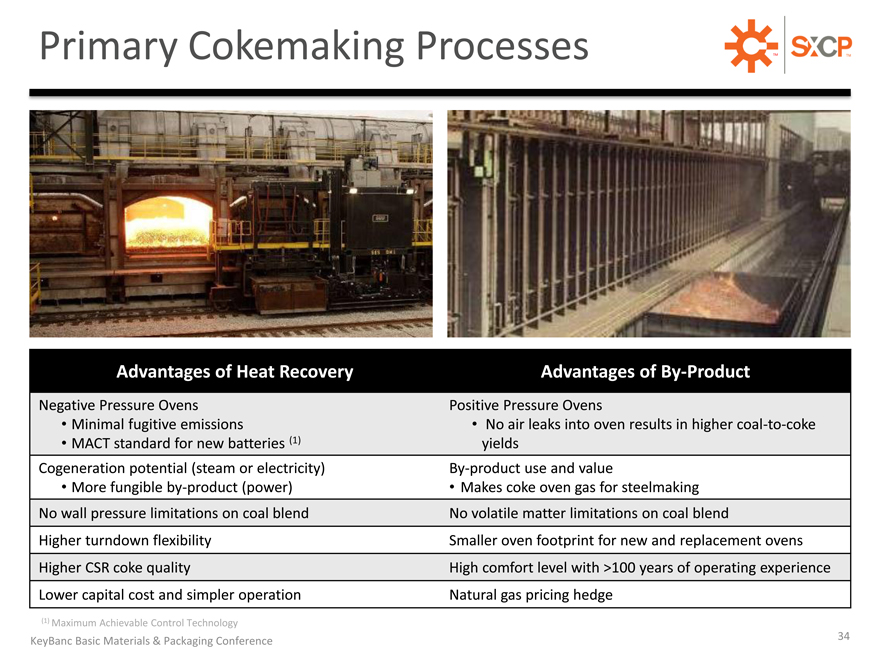

Primary Cokemaking Processes

Advantages of Heat Recovery

Negative Pressure Ovens

Minimal fugitive emissions

MACT standard for new batteries (1) Cogeneration potential (steam or electricity)

More fungible by-product (power) No wall pressure limitations on coal blend

Higher turndown flexibility

Higher CSR coke quality

Lower capital cost and simpler operation

Advantages of By-Product

Positive Pressure Ovens

No air leaks into oven results in higher coal-to-coke yields By-product use and value

Makes coke oven gas for steelmaking No volatile matter limitations on coal blend

Smaller oven footprint for new and replacement ovens High comfort level with >100 years of operating experience Natural gas pricing hedge

(1) | | Maximum Achievable Control Technology |

KeyBanc Basic Materials & Packaging Conference 34

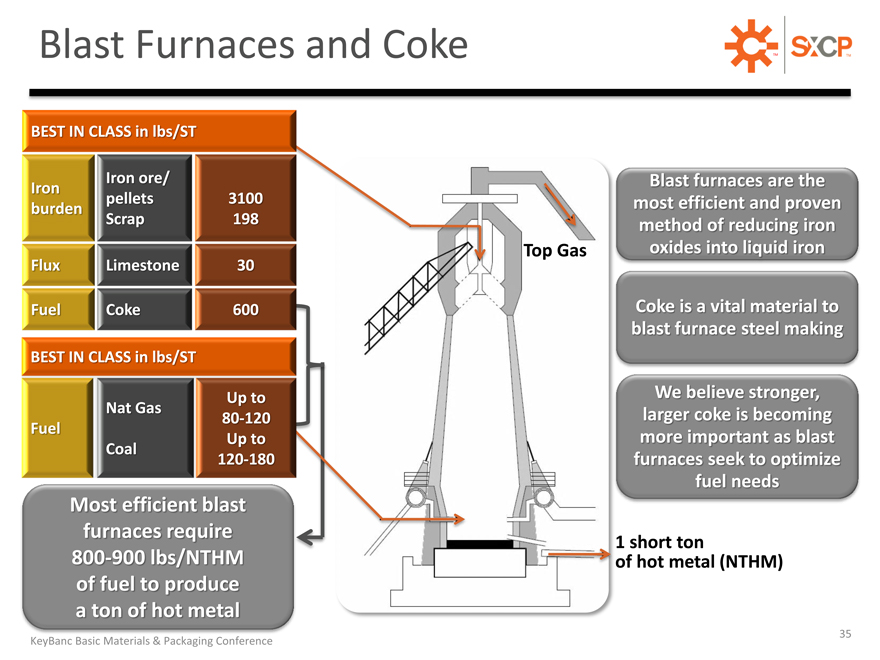

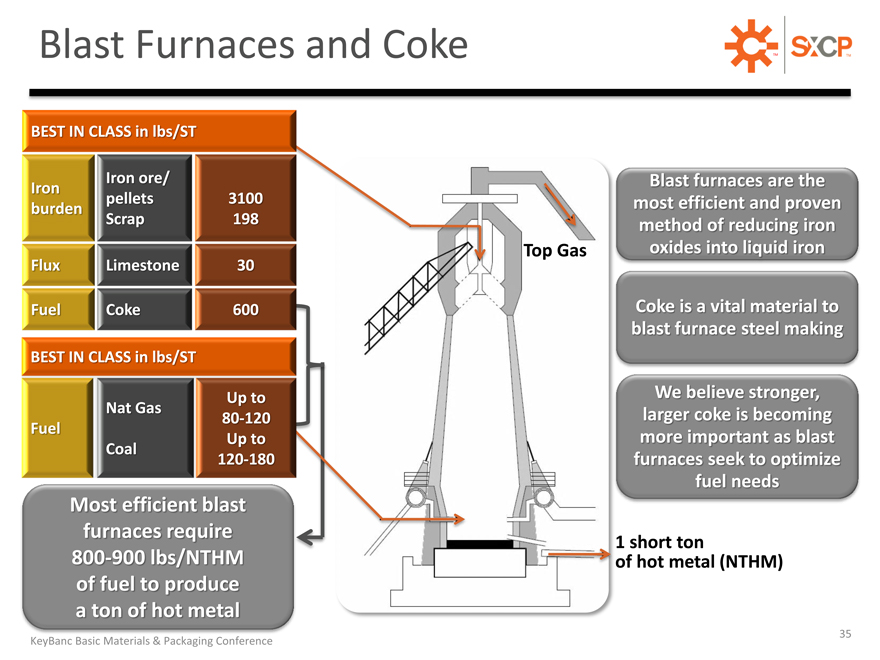

Blast Furnaces and Coke

BEST IN CLASS in lbs/ST

Iron ore/ Iron pellets 3100 burden Scrap 198

Flux Limestone 30 Fuel Coke 600 BEST IN CLASS in lbs/ST

Up to Nat Gas 80-120 Fuel Up to Coal 120-180

Most efficient blast furnaces require

800 900 lbs/NTHM of fuel to produce a ton of hot metal

Blast furnaces are the most efficient and proven method of reducing iron oxides into liquid iro

Coke is a vital material to blast furnace steel makin

We believe stronger, larger coke is becoming more important as blast furnaces seek to optimize fuel needs

1 | | short ton f hot metal (NTHM) |

KeyBanc Basic Materials & Packaging Conference 35

DEFINITIONS AND RECONCILIATIONS

KeyBanc Basic Materials & Packaging Conference

36

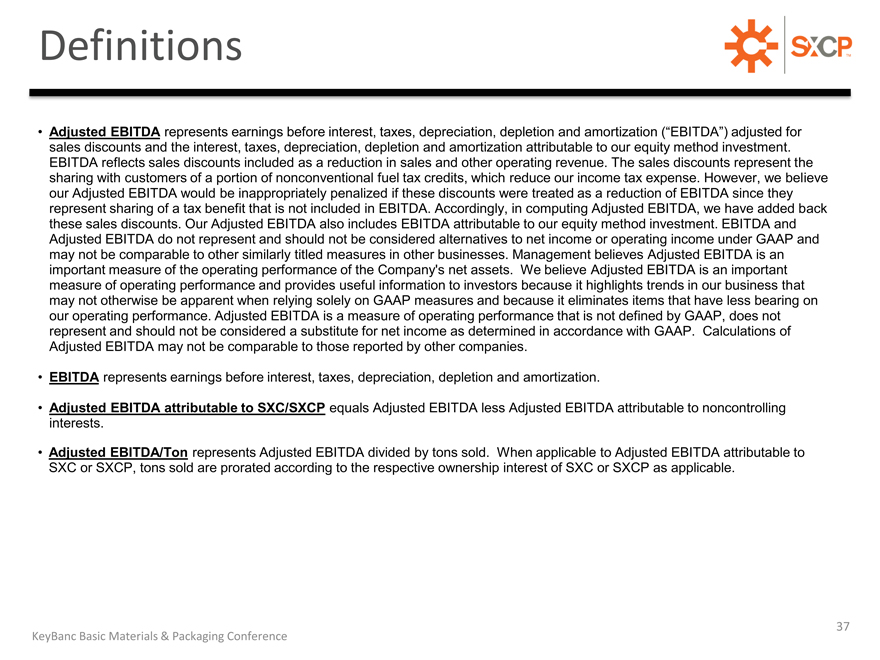

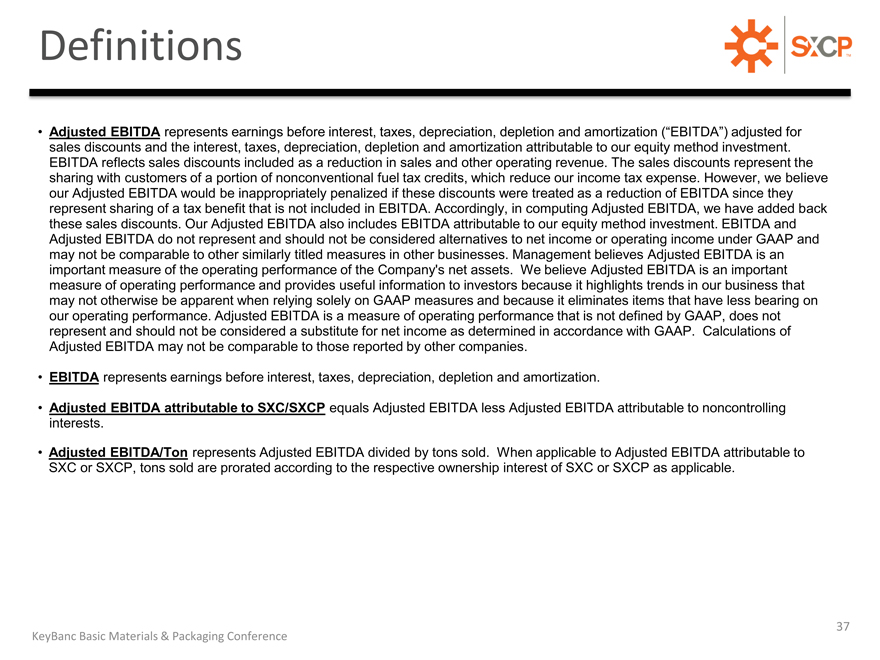

Definitions

Adjusted EBITDA represents earnings before interest, taxes, sales discounts and the interest, taxes, depreciation, depletion and amortization attributable to our equity method investment.

EBITDA reflects sales discounts included as a reduction in sales and other operating revenue. The sales discounts represent the sharing with customers of a portion of nonconventional fuel tax credits, which reduce our income tax expense. However, we believe our Adjusted EBITDA would be inappropriately penalized if these discounts were treated as a reduction of EBITDA since they represent sharing of a tax benefit that is not included in EBITDA. Accordingly, in computing Adjusted EBITDA, we have added back these sales discounts. Our Adjusted EBITDA also includes EBITDA attributable to our equity method investment. EBITDA and Adjusted EBITDA do not represent and should not be considered alternatives to net income or operating income under GAAP and may not be comparable to other similarly titled measures in other businesses. Management believes Adjusted EBITDA is an important measure of the operating performance of the Company’s net assets. We believe Adjusted EBITDA is an important measure of operating performance and provides useful information to investors because it highlights trends in our business that may not otherwise be apparent when relying solely on GAAP measures and because it eliminates items that have less bearing on our operating performance. Adjusted EBITDA is a measure of operating performance that is not defined by GAAP, does not represent and should not be considered a substitute for net income as determined in accordance with GAAP. Calculations of Adjusted EBITDA may not be comparable to those reported by other companies.

EBITDA represents earnings before interest, taxes, depreciation, depletion and amortization.

Adjusted EBITDA attributable to SXC/SXCP equals Adjusted EBITDA less Adjusted EBITDA attributable to noncontrolling interests.

Adjusted EBITDA/Ton represents Adjusted EBITDA divided by tons sold. When applicable to Adjusted EBITDA attributable to SXC or SXCP, tons sold are prorated according to the

respective ownership interest of SXC or SXCP as applicable.

KeyBanc Basic Materials & Packaging Conference

37

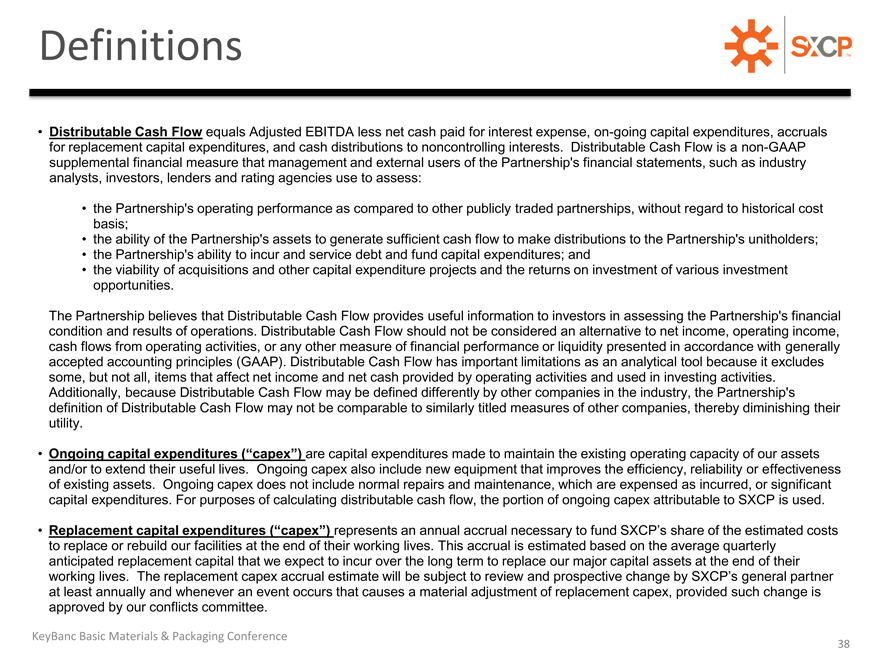

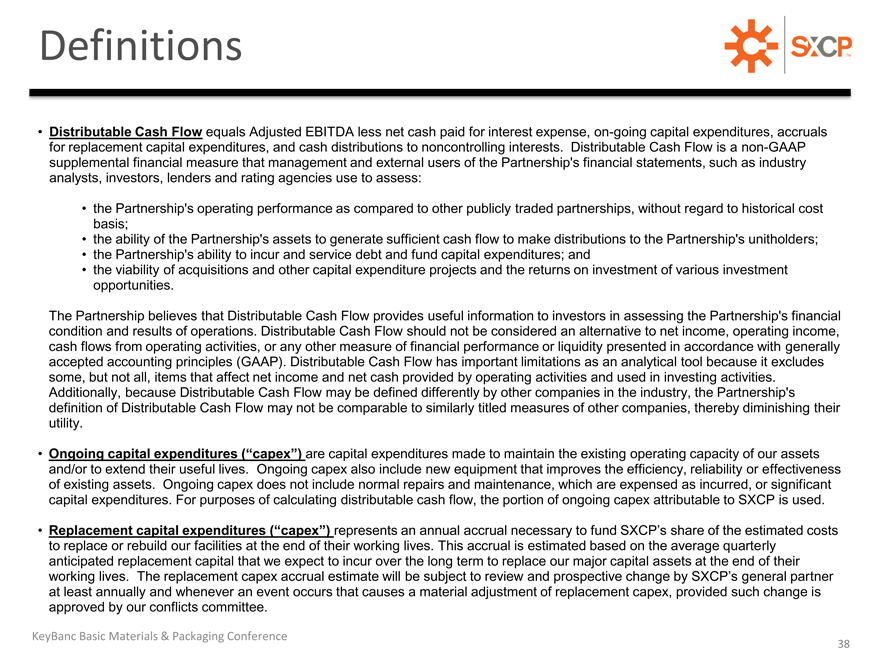

Definitions

Distributable Cash Flow equals Adjusted EBITDA less net cash paid for interest expense, on-going capital expenditures, accruals for replacement capital expenditures, and cash distributions to noncontrolling interests. Distributable Cash Flow is a non-GAAP supplemental financial measure that management and external users of the Partnership’s financial statements, such as industry analysts, investors, lenders and rating agencies use to assess:

the Partnership’s operating performance as compared to other publicly traded partnerships, without regard to historical cost basis; the ability of the Partnership’s assets to generate sufficient cash flow to make distributions to the Partnership’s unitholders; the Partnership’s ability to incur and service debt and fund capital expenditures; and the viability of acquisitions and other capital expenditure projects and the returns on investment of various investment opportunities.

The Partnership believes that Distributable Cash Flow provides useful information to investors in assessing the Partnership’s financial condition and results of operations. Distributable Cash Flow should not be considered an alternative to net income, operating income, cash flows from operating activities, or any other measure of financial performance or liquidity presented in accordance with generally accepted accounting principles (GAAP). Distributable Cash Flow has important limitations as an analytical tool because it excludes some, but not all, items that affect net income and net cash provided by operating activities and used in investing activities.

Additionally, because Distributable Cash Flow may be defined differently by other companies in the industry, the Partnership’s definition of Distributable Cash Flow may not be comparable to similarly titled measures of other companies, thereby diminishing their utility.

Ongoing capital are capital expenditures (“capex”) made to maintain the existing operating capacity of our assets and/or to extend their useful lives. Ongoing capex also include new equipment that improves the efficiency, reliability or effectiveness of existing assets. Ongoing capex does not include normal repairs and maintenance, which are expensed as incurred, or significant capital expenditures. For purposes of calculating distributable cash flow, the portion of ongoing capex attributable to SXCP is used.

Replacement capital expenditures represents an (“capex”) annual accrual necessary to replace or rebuild our facilities at the end of their working lives. This accrual is estimated based on the average quarterly anticipated replacement capital that we expect to incur over the long term to replace our major capital assets at the end of their working lives. The replacement capex accrual estimate will tner at least annually and whenever an event occurs that causes a material adjustment of replacement capex, provided such change is approved by our conflicts committee.

KeyBanc Basic Materials & Packaging Conference

38

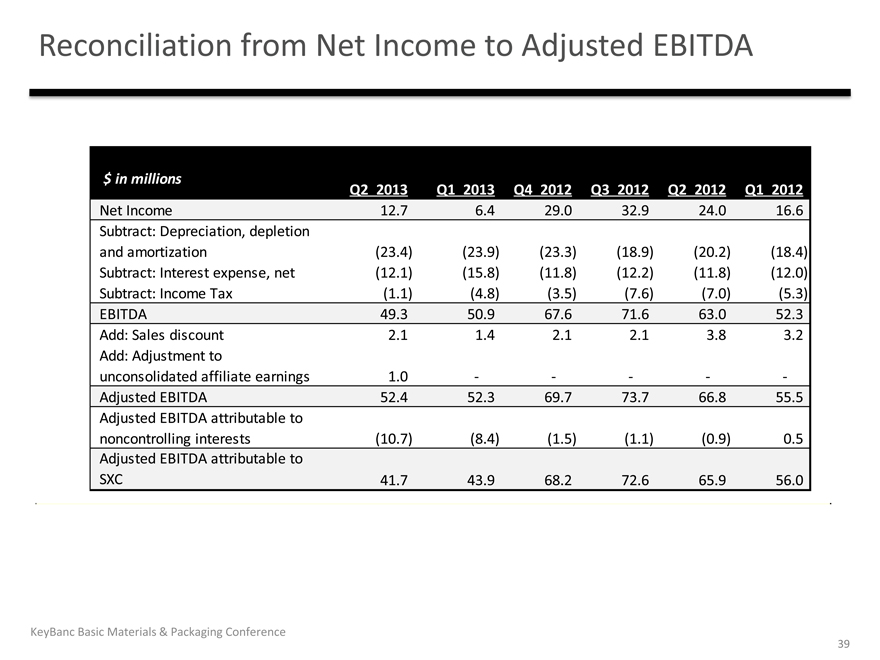

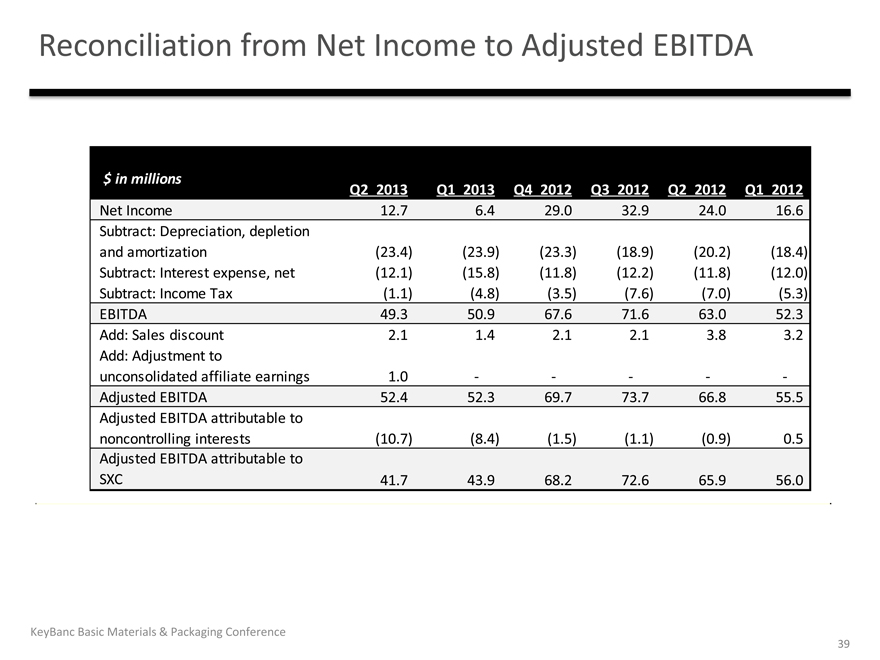

Reconciliation from Net Income to Adjusted EBITDA

$ in millions

Q2 2013 Q1 2013 Q4 2012 Q3 2012 Q2 2012 Q1 2012

Net Income 12.7 6.4 29.0 32.9 24.0 16.6

Subtract: Depreciation, depletion

and amortization (23.4) (23.9) (23.3) (18.9) (20.2) (18.4)

Subtract: Interest expense, net (12.1) (15.8) (11.8) (12.2) (11.8) (12.0)

Subtract: Income Tax (1.1) (4.8) (3.5) (7.6) (7.0) (5.3)

EBITDA 49.3 50.9 67.6 71.6 63.0 52.3

Add: Sales discount 2.1 1.4 2.1 2.1 3.8 3.2

Add: Adjustment to

unconsolidated affiliate earnings 1.0 —————

Adjusted EBITDA 52.4 52.3 69.7 73.7 66.8 55.5

Adjusted EBITDA attributable to

noncontrolling interests (10.7) (8.4) (1.5) (1.1) (0.9) 0.5

Adjusted EBITDA attributable to

SXC 41.7 43.9 68.2 72.6 65.9 56.0

KeyBanc Basic Materials & Packaging Conference

39

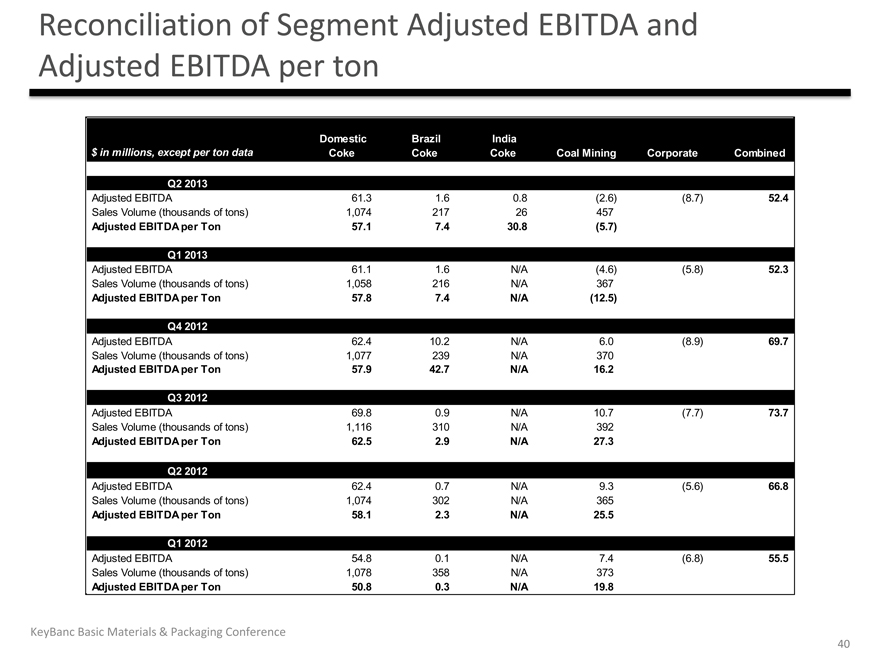

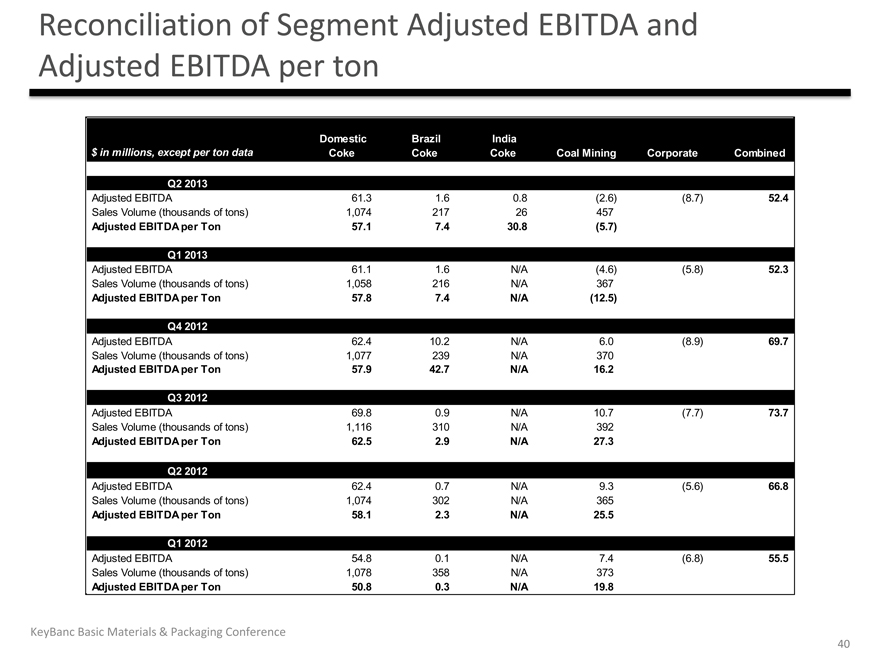

Reconciliation of Segment Adjusted EBITDA and

Adjusted EBITDA per ton

Domestic Brazil India

$ in millions, except per ton data Coke Coke Coke Coal Mining Corporate Combined

Q2 2013

Adjusted EBITDA 61.3 1.6 0.8 (2.6) (8.7) 52.4

Sales Volume (thousands of tons) 1,074 217 26 457

Adjusted EBITDA per Ton 57.1 7.4 30.8 (5.7)

Q1 2013

Adjusted EBITDA 61.1 1.6 N/A (4.6) (5.8) 52.3

Sales Volume (thousands of tons) 1,058 216 N/A 367

Adjusted EBITDA per Ton 57.8 7.4 N/A (12.5)

Q4 2012

Adjusted EBITDA 62.4 10.2 N/A 6.0 (8.9) 69.7

Sales Volume (thousands of tons) 1,077 239 N/A 370

Adjusted EBITDA per Ton 57.9 42.7 N/A 16.2

Q3 2012

Adjusted EBITDA 69.8 0.9 N/A 10.7 (7.7) 73.7

Sales Volume (thousands of tons) 1,116 310 N/A 392

Adjusted EBITDA per Ton 62.5 2.9 N/A 27.3

Q2 2012

Adjusted EBITDA 62.4 0.7 N/A 9.3 (5.6) 66.8

Sales Volume (thousands of tons) 1,074 302 N/A 365

Adjusted EBITDA per Ton 58.1 2.3 N/A 25.5

Q1 2012

Adjusted EBITDA 54.8 0.1 N/A 7.4 (6.8) 55.5

Sales Volume (thousands of tons) 1,078 358 N/A 373

Adjusted EBITDA per Ton 50.8 0.3 N/A 19.8

KeyBanc Basic Materials & Packaging Conference

40

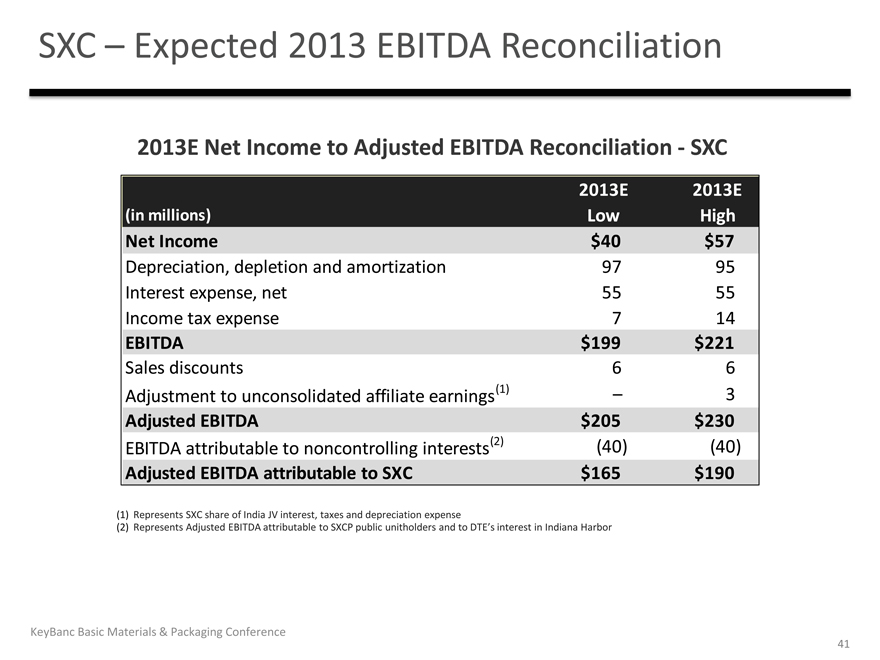

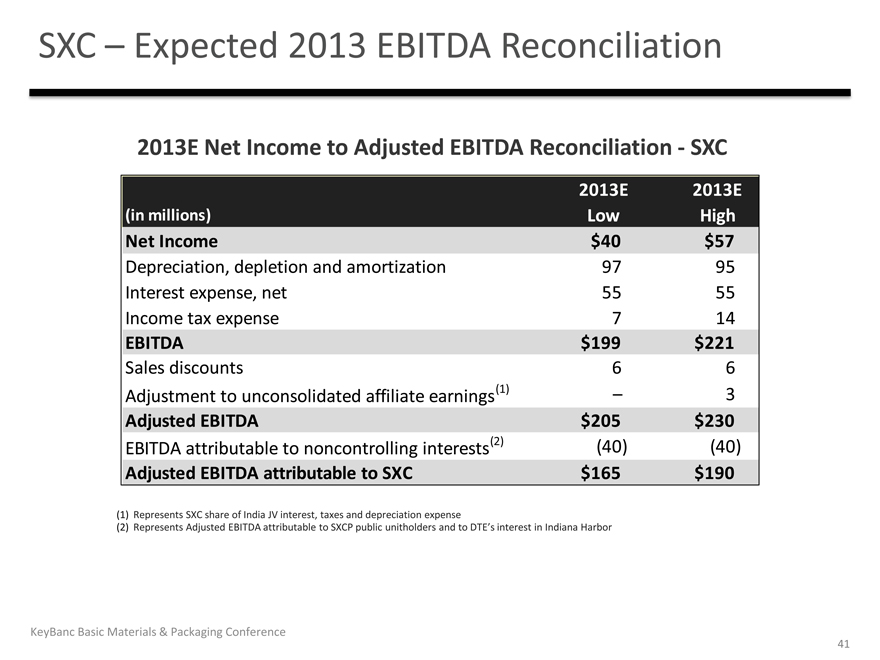

SXC –Expected 2013 EBITDA Reconciliation

2013E Net Income to Adjusted EBITDA Reconciliation—SXC

2013E 2013E

(in millions) Low High

Net Income $40 $57

Depreciation, depletion and amortization 97 95

Interest expense, net 55 55

Income tax expense 7 14

EBITDA $199 $221

Sales discounts 6 6

Adjustment to unconsolidated affiliate earnings(1) – 3

Adjusted EBITDA $205 $230

EBITDA attributable to noncontrolling interests(2) (40) (40)

Adjusted EBITDA attributable to SXC $165 $190

(1) | | Represents SXC share of India JV interest, taxes and depreciation expense |

(2) | | Represents Adjusted EBITDA attributable to SXCP public unitholders |

KeyBanc Basic Materials & Packaging Conference

41

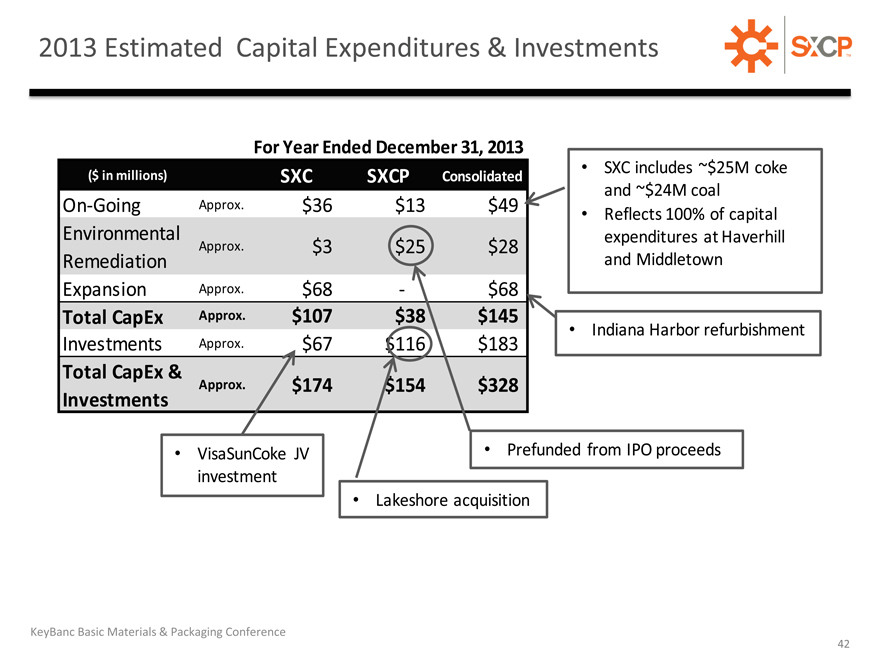

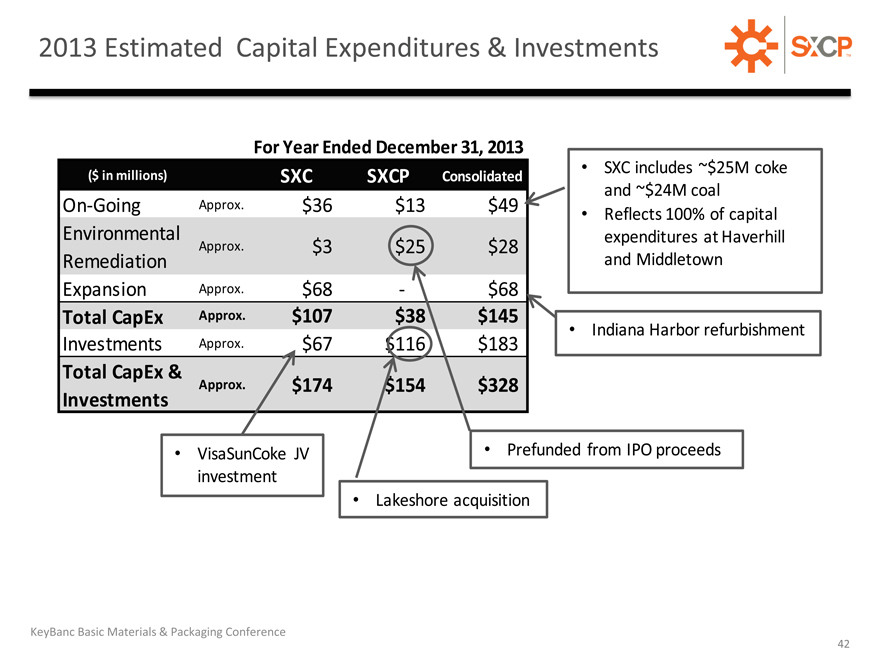

2013 Estimated Capital Expenditures & Investments

For Year Ended December 31, 2013

($ in millions) SXC SXCP Consolidated SXC includes ~$25M coke

and ~$24M coal

On-Going Approx. $36 $13 $49 Reflects 100% of capital

Environmental expenditures at Haverhill

Approx. $3 $25 $28

Remediation and Middletown

Expansion Approx. $68 — $68

Total CapEx Approx. $107 $38 $145 Indiana Harbor refurbishment

Investments Approx. $67 $116 $183

Total CapEx &

Approx. $174 $154 $328

Investments

VisaSunCoke JV Prefunded from IPO proceeds

investment

Lakeshore acquisition

KeyBanc Basic Materials & Packaging Conference

42

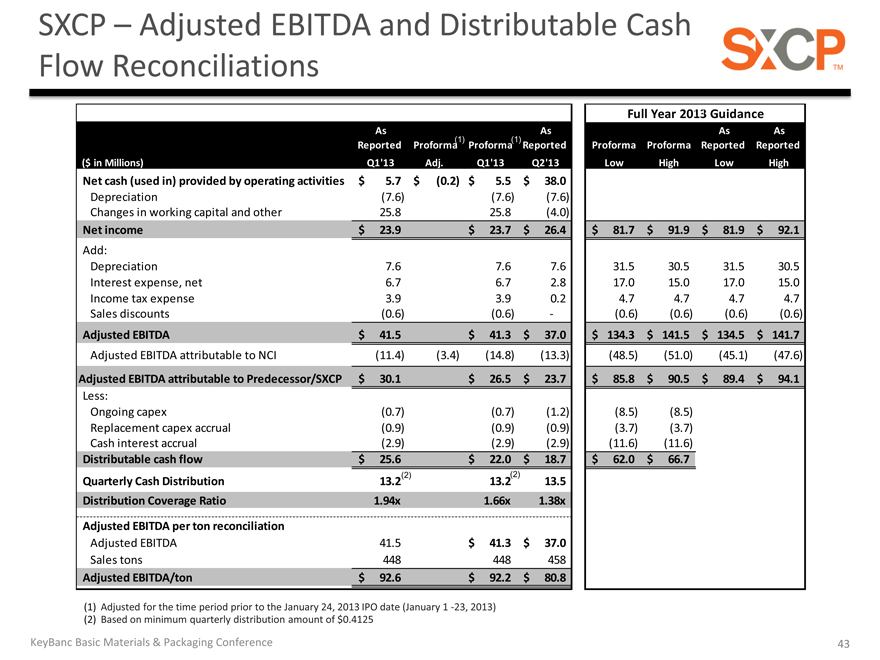

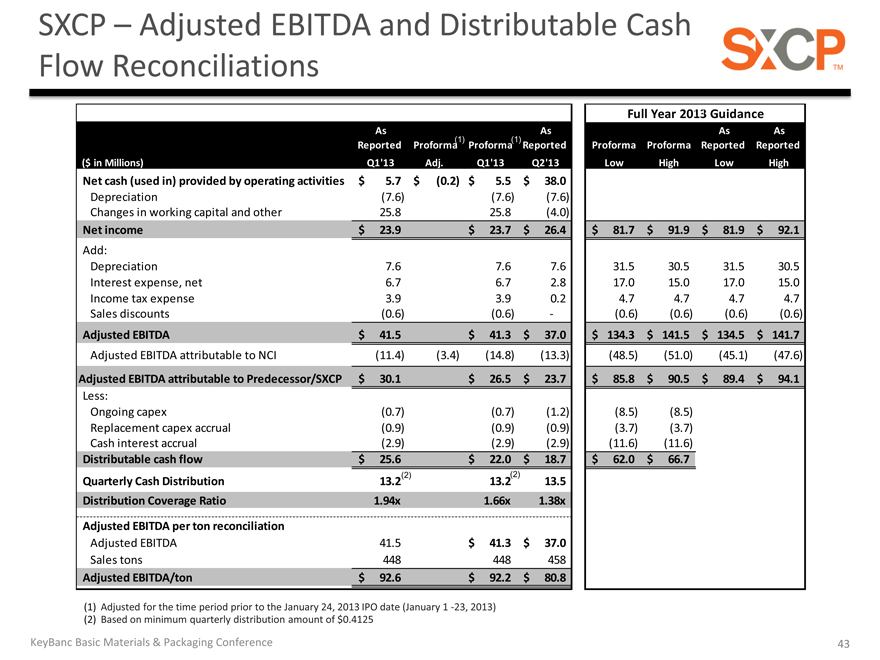

SXCP –Adjusted EBITDA and Distributable Cash

Flow Reconciliations

Full Year 2013(1) Guidance

As As As As

Reported Proforma(1)) Proforma(1)) Reported Proforma Proforma Reported Reported

($ in Millions) Q1’13 Adj. Q1’13 Q2’13 Low High Low High

Net cash (used in) provided by operating activities $ 5.7 $ (0.2) $ 5.5 $ 38.0

Depreciation (7.6) (7.6) (7.6)

Changes in working capital and other 25.8 25.8 (4.0)

Net income $ 23.9 $ 23.7 $ 26.4 $ 81.7 $ 91.9 $ 81.9 $ 92.1

Add:

Depreciation 7.6 7.6 7.6 31.5 30.5 31.5 30.5

Interest expense, net 6.7 6.7 2.8 17.0 15.0 17.0 15.0

Income tax expense 3.9 3.9 0.2 4.7 4.7 4.7 4.7

Sales discounts (0.6) (0.6) — (0.6) (0.6) (0.6) (0.6)

Adjusted EBITDA $ 41.5 $ 41.3 $ 37.0 $ 134.3 $ 141.5 $ 134.5 $ 141.7

Adjusted EBITDA attributable to NCI (11.4) (3.4) (14.8) (13.3) (48.5) (51.0) (45.1) (47.6)

Adjusted EBITDA attributable to Predecessor/SXCP $ 30.1 $ 26.5 $ 23.7 $ 85.8 $ 90.5 $ 89.4 $ 94.1

Less:

Ongoing capex (0.7) (0.7) (1.2) (8.5) (8.5)

Replacement capex accrual (0.9) (0.9) (0.9) (3.7) (3.7)

Cash interest accrual (2.9) (2.9) (2.9) (11.6) (11.6)

Distributable cash flow $ 25.6 $ 22.0 $ 18.7 $ 62.0 $ 66.7

Quarterly Cash Distribution 13.2(2) 13.2(2) 13.5

Distribution Coverage Ratio 1.94x 1.66x 1.38x

Adjusted EBITDA per ton reconciliation

Adjusted EBITDA 41.5 $ 41.3 $ 37.0

Sales tons 448 448 458

Adjusted EBITDA/ton $ 92.6 $ 92.2 $ 80.8

(1) | | Adjusted for the time period prior to the January 24, 2013 IPO date (January 1 -23, 2013) |

(2) | | Based on minimum quarterly distribution amount of $0.4125 |

KeyBanc Basic Materials & Packaging Conference 43

Investor Relations: 630-824-1987 www.suncoke.com