Exhibit 99.2

SunCoke Energy, Inc.

Q3 2015 Earnings

Conference Call

October 12, 2015

Forward-Looking Statements TM

This slide presentation should be reviewed in conjunction with the Third Quarter 2015 earnings release of SunCoke Energy, Inc. (SXC) and conference call held on October 12, 2015 at 9:00 a.m. ET.

Some of the information included in this presentation constitutes “forward-looking statements” as defined in Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. All statements in this presentation that express opinions, expectations, beliefs, plans, objectives, assumptions or projections with respect to anticipated future performance of SXC or SunCoke Energy Partners, L.P. (SXCP), in contrast with statements of historical facts, are forward-looking statements. Such forward-looking statements are based on management’s beliefs and assumptions and on information currently available. Forward-looking statements include information concerning possible or assumed future results of operations, business strategies, financing plans, competitive position, potential growth opportunities, potential operating performance improvements, the effects of competition and the effects of future legislation or regulations. Forward-looking statements include all statements that are not historical facts and may be identified by the use of forward-looking terminology such as the words

“believe,” “expect,” “plan,” “intend,” “anticipate,” “estimate,” “predict,” “potential,” “continue,” “may,” “will,” “should” or the negative of these terms or similar expressions.

Although management believes that its plans, intentions and expectations reflected in or suggested by the forward-looking statements made in this presentation are reasonable, no assurance can be given that these plans, intentions or expectations will be achieved when anticipated or at all. Moreover, such statements are subject to a number of assumptions, risks and uncertainties. Many of these risks are beyond the control of SXC and SXCP, and may cause actual results to differ materially from those implied or expressed by the forward-looking statements. Each of SXC and SXCP has included in its filings with the Securities and Exchange Commission cautionary language identifying important factors (but not necessarily all the important factors) that could cause actual results to differ materially from those expressed in any forward-looking statement. For more information concerning these factors, see the Securities and Exchange Commission filings of SXC and SXCP. All forward-looking statements included in this presentation are expressly qualified in their entirety by such cautionary statements. Although forward-looking statements are based on current beliefs and expectations, caution should be taken not to place undue reliance on any such forward-looking statements because such statements speak only as of the date hereof. SXC and SXCP do not have any intention or obligation to update publicly any forward-looking statement (or its associated cautionary language) whether as a result of new information or future events or after the date of this presentation, except as required by applicable law.

This presentation includes certain non-GAAP financial measures intended to supplement, not substitute for, comparable GAAP measures.

Reconciliations of non-GAAP financial measures to GAAP financial measures are provided in the Appendix at the end of the presentation. Investors are urged to consider carefully the comparable GAAP measures and the reconciliations to those measures provided in the Appendix.

SXC Q3 2015 Earnings Call

1

Management Perspective TM

Completed successful Convent Marine Terminal integration

Executed ~$16M of share repurchases and declared quarterly dividend of $0.15 per share

Initiated additional measures to strengthen improvement efforts at Indiana Harbor due to continued challenges

Flattened organization in Q3

Revised FY 2015E Consolidated Adj. EBITDA(1) guidance of $180M $190M reflects Convent benefit, offset by significant Indiana Harbor underperformance

Cokemaking value proposition positions SXC as preferred supplier of coke from cost, quality and logistics perspective

(1) For a definition and reconciliation of Adjusted EBITDA (Consolidated), please see appendix.

SXC Q3 2015 Earnings Call 2

Q3 ‘15 Overview TM

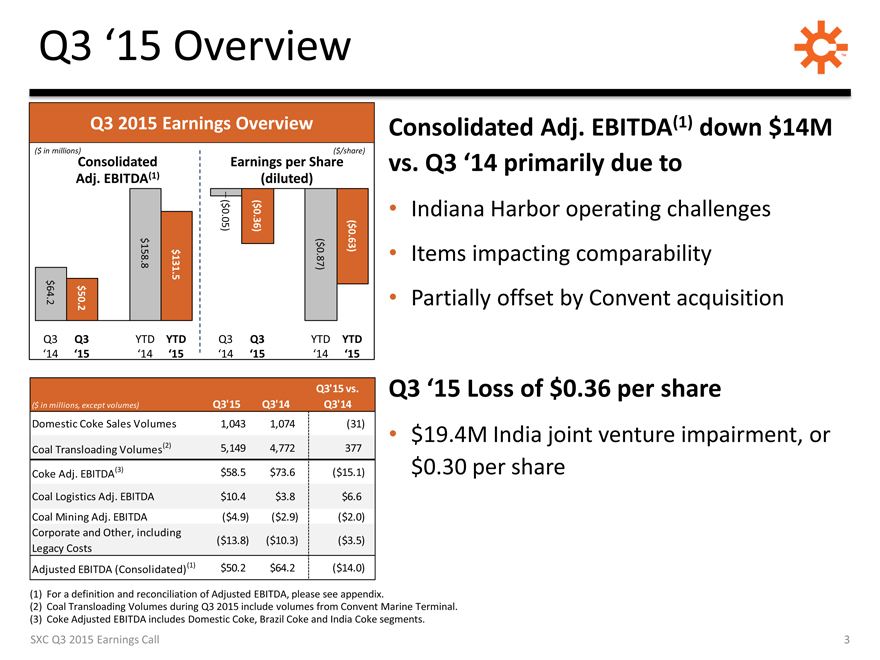

Q3 2015 Earnings Overview

($ in millions)($/share)

Consolidated Earnings per Share

Adj. EBITDA(1)(diluted)

05) . 0$ ( 36) . 0$ (

8.158$ 5.131$ 87) . 0$ ( 63) . 0$ (

2.64$ 2.50$

Q3 Q3 YTD YTD Q3 Q3 YTD YTD

‘14 ‘15 ‘14 ‘15 ‘14 ‘15 ‘14 ‘15

Consolidated Adj. EBITDA(1) down $14M vs. Q3 ‘14 primarily due to

Indiana Harbor operating challenges Items impacting comparability Partially offset by Convent acquisition

Q3’15 vs. Q3 ‘15 Loss of $0.36 per share

($ in millions, except volumes) Q3’15 Q3’14 Q3’14

Domestic Coke Sales Volumes 1,043 1,074(31)

$19.4M India joint venture impairment, or

Coal Transloading Volumes(2) 5,149 4,772 377

Coke Adj. EBITDA(3) $58.5 $73.6($15.1) $0.30 per share

Coal Logistics Adj. EBITDA $10.4 $3.8 $6.6

Coal Mining Adj. EBITDA($4.9)($2.9)($2.0)

Corporate and Other, including

($13.8)($10.3)($3.5)

Legacy Costs

Adjusted EBITDA (Consolidated)(1) $50.2 $64.2($14.0)

(1) For a definition and reconciliation of Adjusted EBITDA, please see appendix.

(2) Coal Transloading Volumes during Q3 2015 include volumes from Convent Marine Terminal. (3) Coke Adjusted EBITDA includes Domestic Coke, Brazil Coke and India Coke segments.

SXC Q3 2015 Earnings Call

3

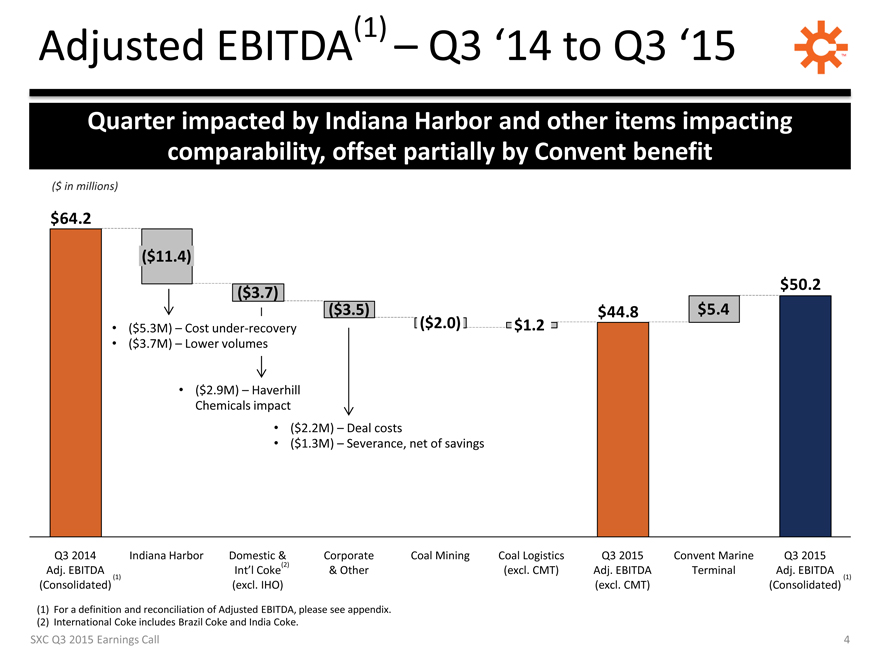

Adjusted EBITDA(1) Q3 ‘14 to Q3 ‘15 TM

Quarter impacted by Indiana Harbor and other items impacting

comparability, offset partially by Convent benefit

($ in millions)

$64.2

(2)

($11.4)

($3.7)

$50.2

($5.3M) Cost under-recovery

($3.7M) Lower volumes

($2.9M) Haverhill

Chemicals impact

($3.5) $44.8 $5.4

($2.0) $1.2

($2.2M) Deal costs

($1.3M) Severance, net of savings

Q3 2014 Indiana Harbor Domestic & Corporate Coal Mining Coal Logistics Q3 2015 Convent Marine Q3 2015

Adj. EBITDA Int’l Coke(2) & Other(excl. CMT) Adj. EBITDA Terminal Adj. EBITDA

(1)(1)

(Consolidated)(excl. IHO)(excl. CMT)(Consolidated)

(1) For a definition and reconciliation of Adjusted EBITDA, please see appendix. (2) International Coke includes Brazil Coke and India Coke.

SXC Q3 2015 Earnings Call

4

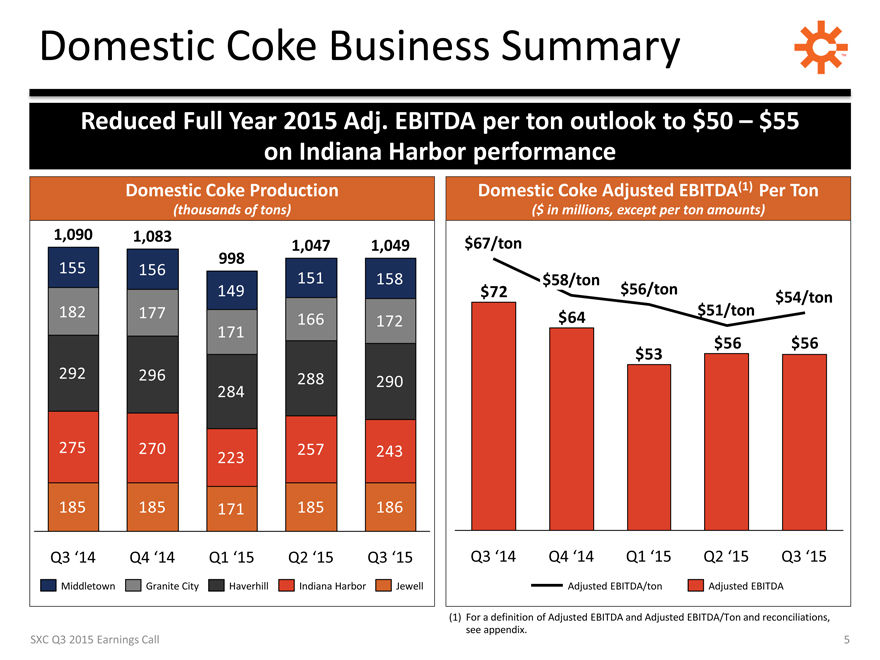

Domestic Coke Business Summary TM

Reduced Full Year 2015 Adj. EBITDA per ton outlook to $50 $55 on Indiana Harbor performance

Domestic Coke Production Domestic Coke Adjusted EBITDA(1) Per Ton

(thousands of tons) ($ in millions, except per ton amounts)

1,090 1,083

1,047 1,049 $67/ton 998

155 156

151 158 $58/ton

149 $72 $56/ton $51/ton $54/ton

182 177 $64 171 166 172 $56 $56 $53

292 296 288

290 284

275 270 257 243 223

185 185 171 185 186

Q3 ‘14 Q4 ‘14 Q1 ‘15 Q2 ‘15 Q3 ‘15 Q3 ‘14 Q4 ‘14 Q1 ‘15 Q2 ‘15 Q3 ‘15

Middletown Granite City Haverhill Indiana Harbor Jewell Adjusted EBITDA/ton Adjusted EBITDA

(1) For a definition of Adjusted EBITDA and Adjusted EBITDA/Ton and reconciliations, see appendix.

SXC Q3 2015 Earnings Call

5

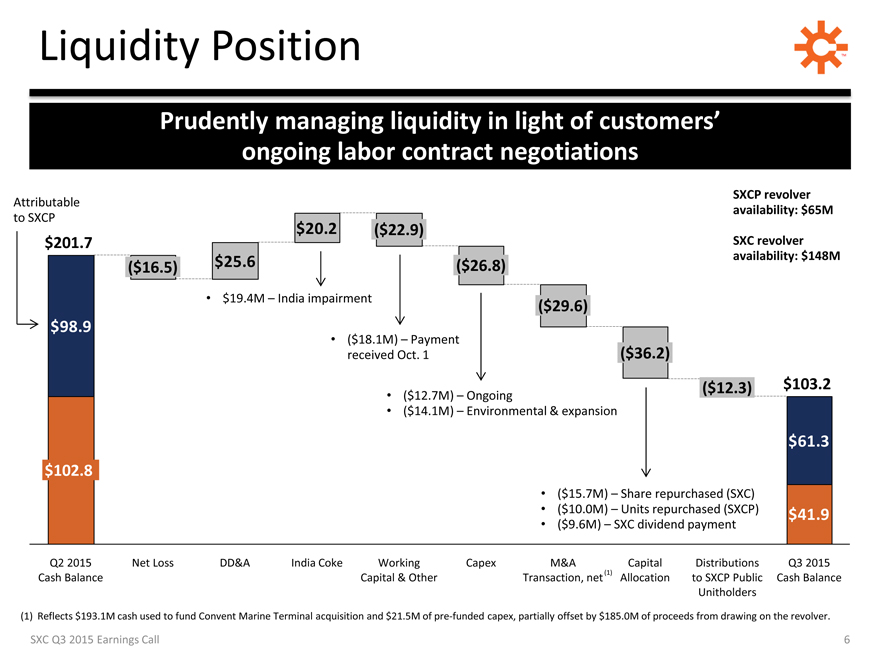

Liquidity Position TM

Prudently managing liquidity in light of customers’

ongoing labor contract negotiations

SXCP revolver

Attributable

availability: $65M

to SXCP

$20.2($22.9)

$201.7 SXC revolver

($16.5) $25.6($26.8) availability: $148M

$19.4M India impairment($29.6)

$98.9

($18.1M) Payment

received Oct. 1($36.2)

($12.7M) Ongoing($12.3) $103.2

($14.1M) Environmental & expansion

$ 61.3

$ 102.8

($ 15.7M) Share repurchased (SXC)

($ 10.0M) Units repurchased (SXCP) $ 41.9

($ 9.6M) SXC dividend payment

Q2 2015 Net Loss DD&A India Coke Working Capex M&A Capital Distributions Q3 2015

Cash Balance Capital & Other Transaction, net (1) Allocation to SXCP Public Cash Balance

Unitholders

(1) Reflects $193.1M cash used to fund Convent Marine Terminal acquisition and $21.5M of pre-funded capex, partially offset by $185.0M of proceeds from drawing on the revolver.

SXC Q3 2015 Earnings Call 6

Executing Capital Allocation Strategy TM

Continued commitment to meaningfully create shareholder value

Executed ~$16M of share repurchases, representing highly attractive opportunity to repurchase undervalued SXC shares

Intend to opportunistically execute against remaining ~$39M authorization, subject to near-term liquidity management

Declared quarterly dividend of $0.15 per share

Redeeming remaining SXC bonds (~$60M)

Expect SXCP to redeem assumed SXC bonds (~$45M) in Q4

After bond redemption, will have more flexibility to pursue capital allocation strategy

SXC Q3 2015 Earnings Call

7

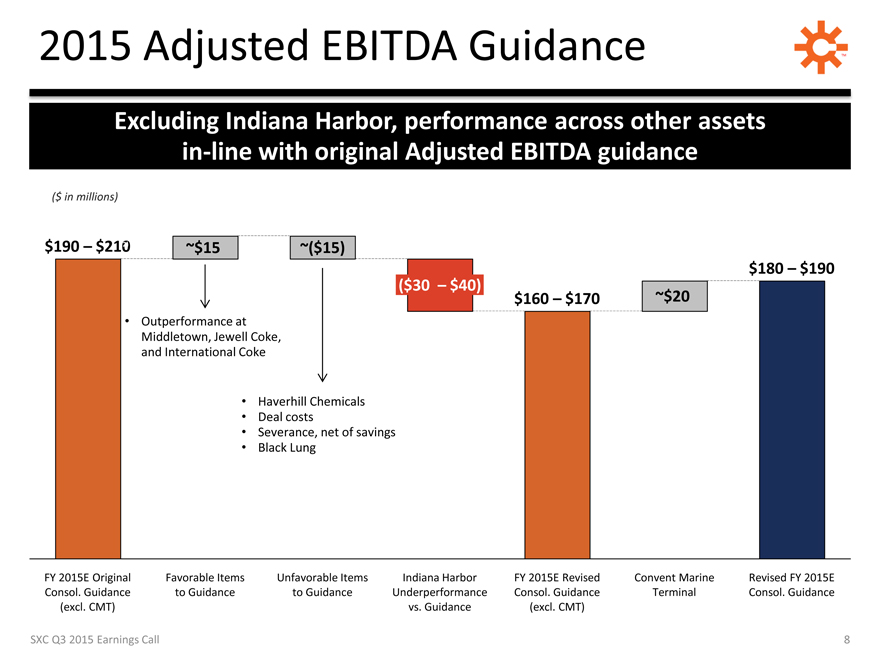

2015 Adjusted EBITDA Guidance TM

Excluding Indiana Harbor, performance across other assets

in-line with original Adjusted EBITDA guidance

($ in millions)

$190 $210 (2)

~$15

~($15)

$180 $190

($30 $40) $160 $170 ~$20

Outperformance at Middletown, Jewell Coke, and International Coke

Haverhill Chemicals Deal costs Severance, net of savings Black Lung

FY 2015E Original Favorable Items Unfavorable Items Indiana Harbor FY 2015E Revised Convent Marine Revised FY 2015E

Consol. Guidance to Guidance to Guidance Underperformance Consol. Guidance Terminal Consol. Guidance

(excl. CMT) vs. Guidance(excl. CMT)

SXC Q3 2015 Earnings Call 8

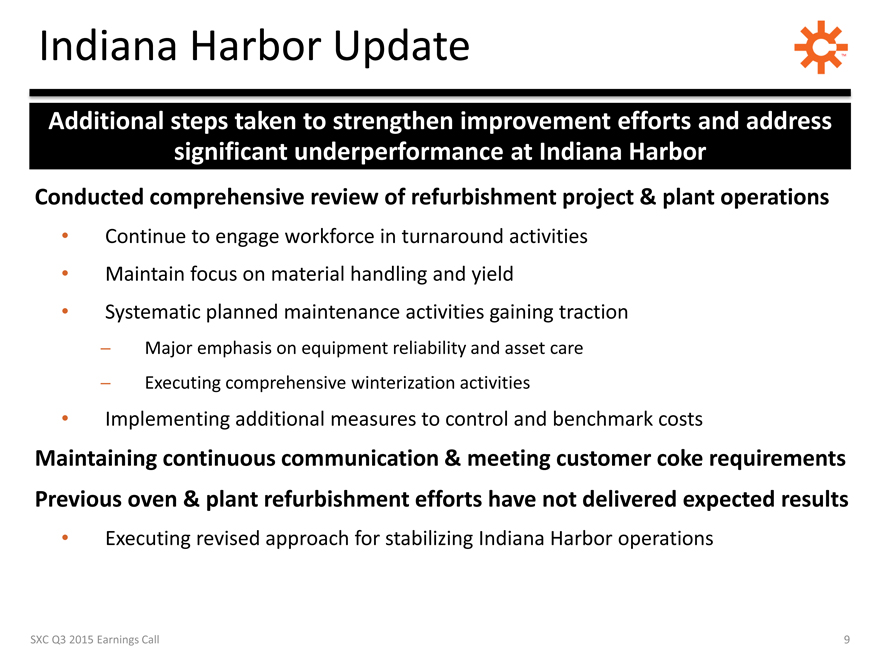

Indiana Harbor Update TM

Additional steps taken to strengthen improvement efforts and address

significant underperformance at Indiana Harbor

Conducted comprehensive review of refurbishment project & plant operations

Continue to engage workforce in turnaround activities

Maintain focus on material handling and yield

Systematic planned maintenance activities gaining traction

Major emphasis on equipment reliability and asset care

Executing comprehensive winterization activities

Implementing additional measures to control and benchmark costs

Maintaining continuous communication & meeting customer coke requirements Previous oven & plant refurbishment efforts have not delivered expected results

Executing revised approach for stabilizing Indiana Harbor operations

SXC Q3 2015 Earnings Call

9

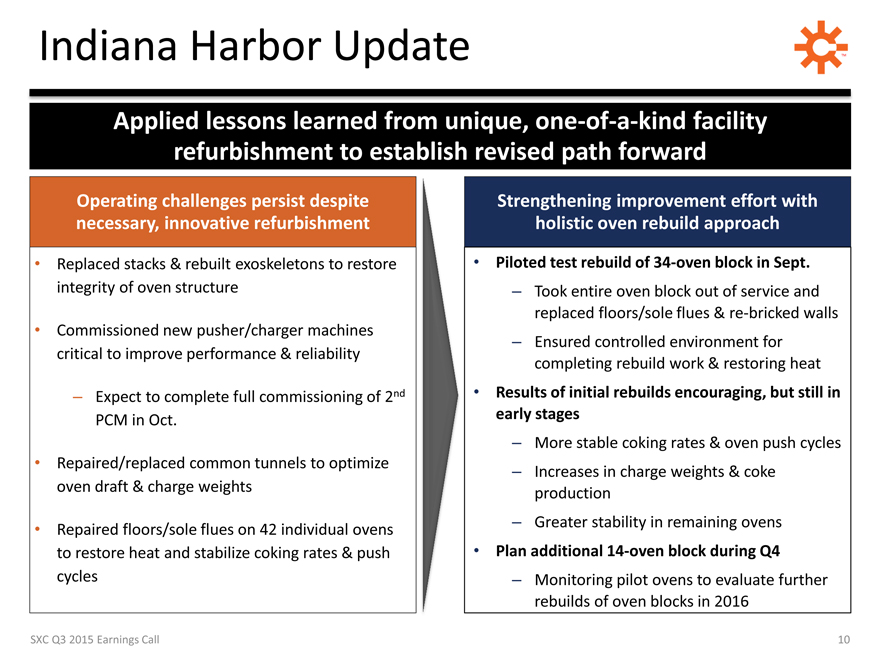

Indiana Harbor Update TM

Applied lessons learned from unique, one-of-a-kind facility

refurbishment to establish revised path forward

Operating challenges persist despite necessary, innovative refurbishment

Replaced stacks & rebuilt exoskeletons to restore integrity of oven structure

Commissioned new pusher/charger machines critical to improve performance & reliability

Expect to complete full commissioning of 2nd PCM in Oct.

Repaired/replaced common tunnels to optimize oven draft & charge weights

Repaired floors/sole flues on 42 individual ovens to restore heat and stabilize coking rates & push cycles

Strengthening improvement effort with holistic oven rebuild approach

Piloted test rebuild of 34-oven block in Sept.

Took entire oven block out of service and replaced floors/sole flues & re-bricked walls Ensured controlled environment for completing rebuild work & restoring heat

Results of initial rebuilds encouraging, but still in early stages

More stable coking rates & oven push cycles Increases in charge weights & coke production Greater stability in remaining ovens

Plan additional 14-oven block during Q4

Monitoring pilot ovens to evaluate further rebuilds of oven blocks in 2016

SXC Q3 2015 Earnings Call

10

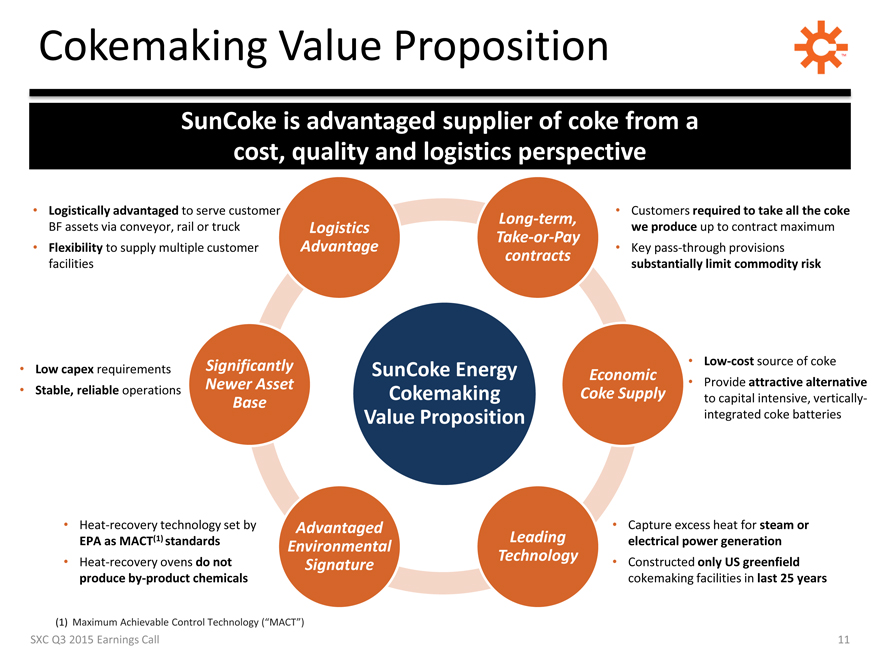

Cokemaking Value Proposition TM

SunCoke is advantaged supplier of coke from a

cost, quality and logistics perspective

Logistically advantaged to serve customer Customers required to take all the coke

Long-term,

BF assets via conveyor, rail or truck Logistics we produce up to contract maximum

Take-or-Pay

Flexibility to supply multiple customer Advantage Key pass-through provisions

contracts

facilities substantially limit commodity risk

Low-cost source of coke

Low capex requirements Significantly SunCoke Energy Economic

Newer Asset Provide attractive alternative

Stable, reliable operations Cokemaking Coke Supply to capital intensive, vertically-

Base

Value Proposition integrated coke batteries

Heat-recovery technology set by Advantaged Capture excess heat for steam or

EPA as MACT(1) standards Leading electrical power generation

Environmental Technology

Heat-recovery ovens do not Signature Constructed only US greenfield

produce by-product chemicals cokemaking facilities in last 25 years

(1) Maximum Achievable Control Technology (“MACT”)

SXC Q3 2015 Earnings Call 11

Concluding Remarks TM

Deliver Operations Excellence

Focused on driving strong operational performance across our fleet

Positioned with Unique Cokemaking Value Proposition

Strong cokemaking value proposition positions SunCoke as preferred supplier of coke

Executing Disciplined Capital Allocation Strategy

Balanced approach to returning cash to shareholders

SXC Q3 2015 Earnings Call

12

QUESTIONS

SXC Q3 2015 Earnings Call

13

Investor Relations

630-824-1907 www.suncoke.com

APPENDIX

SXC Q3 2015 Earnings Call

15

Definitions TM

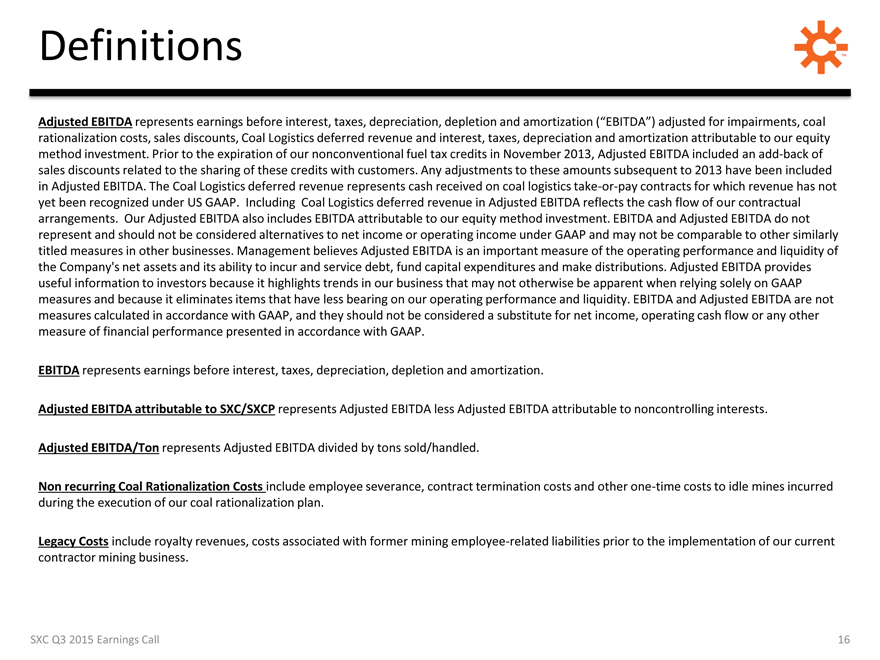

Adjusted EBITDA represents earnings before interest, taxes, depreciation, depletion and amortization (“EBITDA”) adjusted for impairments, coal rationalization costs, sales discounts, Coal Logistics deferred revenue and interest, taxes, depreciation and amortization attributable to our equity method investment. Prior to the expiration of our nonconventional fuel tax credits in November 2013, Adjusted EBITDA included an add-back of sales discounts related to the sharing of these credits with customers. Any adjustments to these amounts subsequent to 2013 have been included in Adjusted EBITDA. The Coal Logistics deferred revenue represents cash received on coal logistics take-or-pay contracts for which revenue has not yet been recognized under US GAAP. Including Coal Logistics deferred revenue in Adjusted EBITDA reflects the cash flow of our contractual arrangements. Our Adjusted EBITDA also includes EBITDA attributable to our equity method investment. EBITDA and Adjusted EBITDA do not represent and should not be considered alternatives to net income or operating income under GAAP and may not be comparable to other similarly titled measures in other businesses. Management believes Adjusted EBITDA is an important measure of the operating performance and liquidity of the Company’s net assets and its ability to incur and service debt, fund capital expenditures and make distributions. Adjusted EBITDA provides useful information to investors because it highlights trends in our business that may not otherwise be apparent when relying solely on GAAP measures and because it eliminates items that have less bearing on our operating performance and liquidity. EBITDA and Adjusted EBITDA are not measures calculated in accordance with GAAP, and they should not be considered a substitute for net income, operating cash flow or any other measure of financial performance presented in accordance with GAAP.

EBITDA represents earnings before interest, taxes, depreciation, depletion and amortization.

Adjusted EBITDA attributable to SXC/SXCP represents Adjusted EBITDA less Adjusted EBITDA attributable to noncontrolling interests.

Adjusted EBITDA/Ton represents Adjusted EBITDA divided by tons sold/handled.

Non recurring Coal Rationalization Costs include employee severance, contract termination costs and other one-time costs to idle mines incurred during the execution of our coal rationalization plan.

Legacy Costs include royalty revenues, costs associated with former mining employee-related liabilities prior to the implementation of our current contractor mining business.

SXC Q3 2015 Earnings Call

16

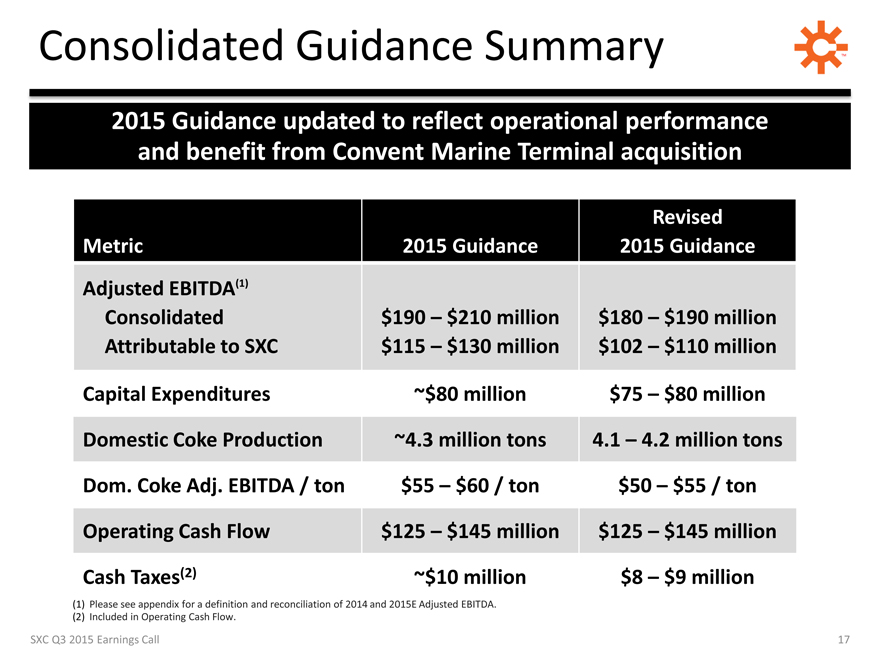

Consolidated Guidance Summary TM

2015 Guidance updated to reflect operational performance and benefit from Convent Marine Terminal acquisition

Revised

Metric 2015 Guidance 2015 Guidance

Adjusted EBITDA(1)

Consolidated $190 $210 million $180 $190 million

Attributable to SXC $115 $130 million $102 $110 million

Capital Expenditures ~$80 million $75 $80 million

Domestic Coke Production ~4.3 million tons 4.1 4.2 million tons

Dom. Coke Adj. EBITDA / ton $55 $60 / ton $50 $55 / ton

Operating Cash Flow $125 $145 million $125 $145 million

Cash Taxes(2) ~$10 million $8 $9 million

(1) Please see appendix for a definition and reconciliation of 2014 and 2015E Adjusted EBITDA. (2) Included in Operating Cash Flow.

SXC Q3 2015 Earnings Call 17

Reconciliation to Adjusted EBITDA TM

[Graphic Appears Here]

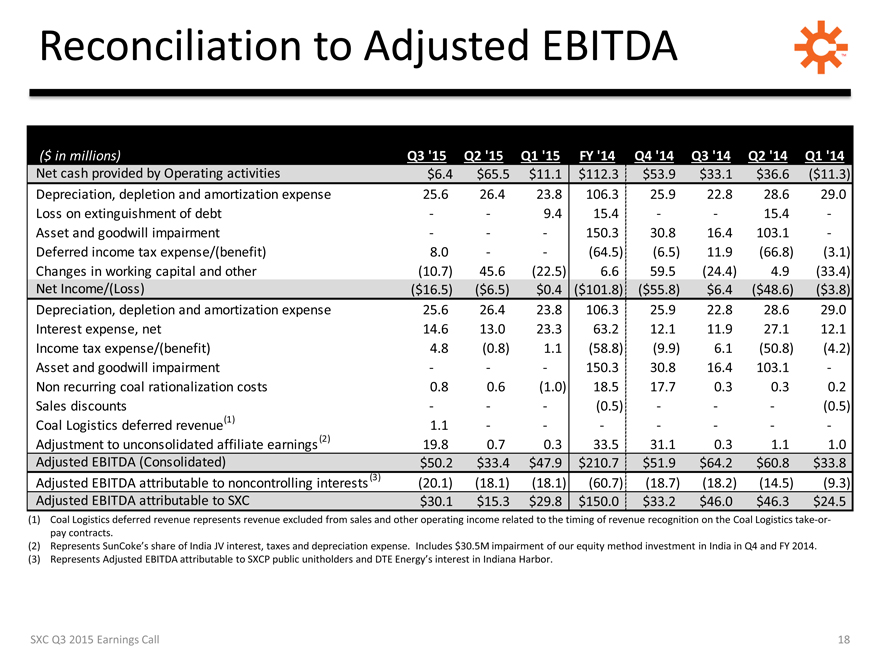

($ in millions) Q3 ‘15 Q2 ‘15 Q1 ‘15 FY ‘14 Q4 ‘14 Q3 ‘14 Q2 ‘14 Q1 ‘14

Net cash provided by Operating activities $6.4 $65.5 $11.1 $112.3 $53.9 $33.1 $36.6($11.3)

Depreciation, depletion and amortization expense 25.6 26.4 23.8 106.3 25.9 22.8 28.6 29.0

Loss on extinguishment of debt — 9.4 15.4 — 15.4 -

Asset and goodwill impairment ——150.3 30.8 16.4 103.1 -

Deferred income tax expense/(benefit) 8.0 —(64.5)(6.5) 11.9(66.8)(3.1)

Changes in working capital and other(10.7) 45.6(22.5) 6.6 59.5(24.4) 4.9(33.4)

Net Income/(Loss)($16.5)($6.5) $0.4($101.8)($55.8) $6.4($48.6)($3.8)

Depreciation, depletion and amortization expense 25.6 26.4 23.8 106.3 25.9 22.8 28.6 29.0

Interest expense, net 14.6 13.0 23.3 63.2 12.1 11.9 27.1 12.1

Income tax expense/(benefit) 4.8(0.8) 1.1(58.8)(9.9) 6.1(50.8)(4.2)

Asset and goodwill impairment ——150.3 30.8 16.4 103.1 -

Non recurring coal rationalization costs 0.8 0.6(1.0) 18.5 17.7 0.3 0.3 0.2

Sales discounts — -(0.5) — -(0.5)

Coal Logistics deferred revenue(1) 1.1 — — — -

Adjustment to unconsolidated affiliate earnings (2) 19.8 0.7 0.3 33.5 31.1 0.3 1.1 1.0

Adjusted EBITDA (Consolidated) $50.2 $33.4 $47.9 $210.7 $51.9 $64.2 $60.8 $33.8

Adjusted EBITDA attributable to noncontrolling interests (3)(20.1)(18.1)(18.1)(60.7)(18.7)(18.2)(14.5)(9.3)

Adjusted EBITDA attributable to SXC $30.1 $15.3 $29.8 $150.0 $33.2 $46.0 $46.3 $24.5

Coal Logistics deferred revenue represents revenue excluded from sales and other operating income related to the timing of revenue recognition on the Coal Logistics take-or-pay contracts.

Represents SunCoke’s share of India JV interest, taxes and depreciation expense. Includes $30.5M impairment of our equity method investment in India in Q4 and FY 2014. Represents Adjusted EBITDA attributable to SXCP public unitholders and DTE Energy’s interest in Indiana Harbor.

SXC Q3 2015 Earnings Call

18

Reconciliation of Segment Adjusted EBITDA and

Adjusted EBITDA per ton TM

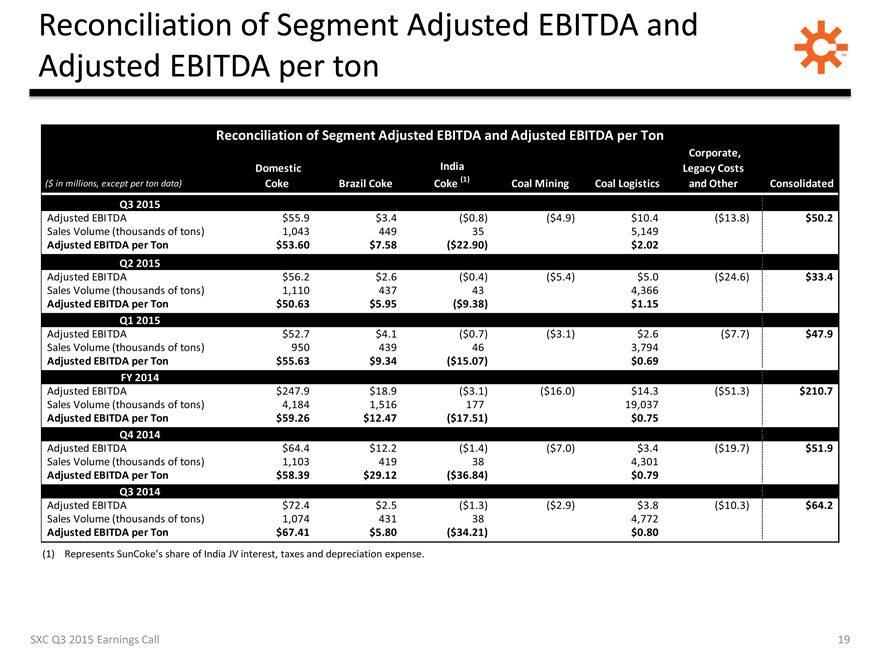

Reconciliation of Segment Adjusted EBITDA and Adjusted EBITDA per Ton

Corporate,

Domestic India Legacy Costs

($ in millions, except per ton data) Coke Brazil Coke Coke (1) Coal Mining Coal Logistics and Other Consolidated

Q3 2015

Adjusted EBITDA $55.9 $3.4($0.8)($4.9) $10.4($13.8) $50.2

Sales Volume (thousands of tons) 1,043 449 35 5,149

Adjusted EBITDA per Ton $53.60 $7.58($22.90) $2.02

Q2 2015

Adjusted EBITDA $56.2 $2.6($0.4)($5.4) $5.0($24.6) $33.4

Sales Volume (thousands of tons) 1,110 437 43 4,366

Adjusted EBITDA per Ton $50.63 $5.95($9.38) $1.15

Q1 2015

Adjusted EBITDA $52.7 $4.1($0.7)($3.1) $2.6($7.7) $47.9

Sales Volume (thousands of tons) 950 439 46 3,794

Adjusted EBITDA per Ton $55.63 $9.34($15.07) $0.69

FY 2014

Adjusted EBITDA $247.9 $18.9($3.1)($16.0) $14.3($51.3) $210.7

Sales Volume (thousands of tons) 4,184 1,516 177 19,037

Adjusted EBITDA per Ton $59.26 $12.47($17.51) $0.75

Q4 2014

Adjusted EBITDA $64.4 $12.2($1.4)($7.0) $3.4($19.7) $51.9

Sales Volume (thousands of tons) 1,103 419 38 4,301

Adjusted EBITDA per Ton $58.39 $29.12($36.84) $0.79

Q3 2014

Adjusted EBITDA $72.4 $2.5($1.3)($2.9) $3.8($10.3) $64.2

Sales Volume (thousands of tons) 1,074 431 38 4,772

Adjusted EBITDA per Ton $67.41 $5.80($34.21) $0.80

(1) Represents SunCoke’s share of India JV interest, taxes and depreciation expense.

SXC Q3 2015 Earnings Call

19

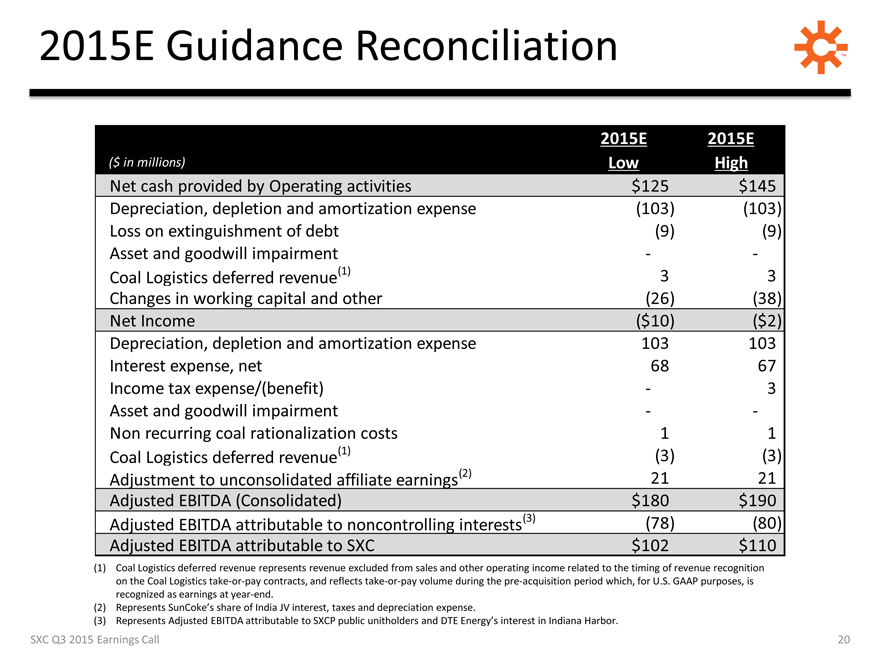

2015E Guidance Reconciliation TM

2015E 2015E

($ in millions) Low High

Net cash provided by Operating activities $125 $145

Depreciation, depletion and amortization expense(103)(103)

Loss on extinguishment of debt(9)(9)

Asset and goodwill impairment —

Coal Logistics deferred revenue(1) 3 3

Changes in working capital and other(26)(38)

Net Income($10)($2)

Depreciation, depletion and amortization expense 103 103

Interest expense, net 68 67

Income tax expense/(benefit)—3

Asset and goodwill impairment —

Non recurring coal rationalization costs 1 1

Coal Logistics deferred revenue(1)(3)(3)

Adjustment to unconsolidated affiliate earnings(2) 21 21

Adjusted EBITDA (Consolidated) $180 $190

Adjusted EBITDA attributable to noncontrolling interests(3)(78)(80)

Adjusted EBITDA attributable to SXC $102 $110

(1) Coal Logistics deferred revenue represents revenue excluded from sales and other operating income related to the timing of revenue recognition on the Coal Logistics take-or-pay contracts, and reflects take-or-pay volume during the pre-acquisition period which, for U.S. GAAP purposes, is recognized as earnings at year-end.

(2) Represents SunCoke’s share of India JV interest, taxes and depreciation expense.

(3) Represents Adjusted EBITDA attributable to SXCP public unitholders and DTE Energy’s interest in Indiana Harbor.

SXC Q3 2015 Earnings Call

20

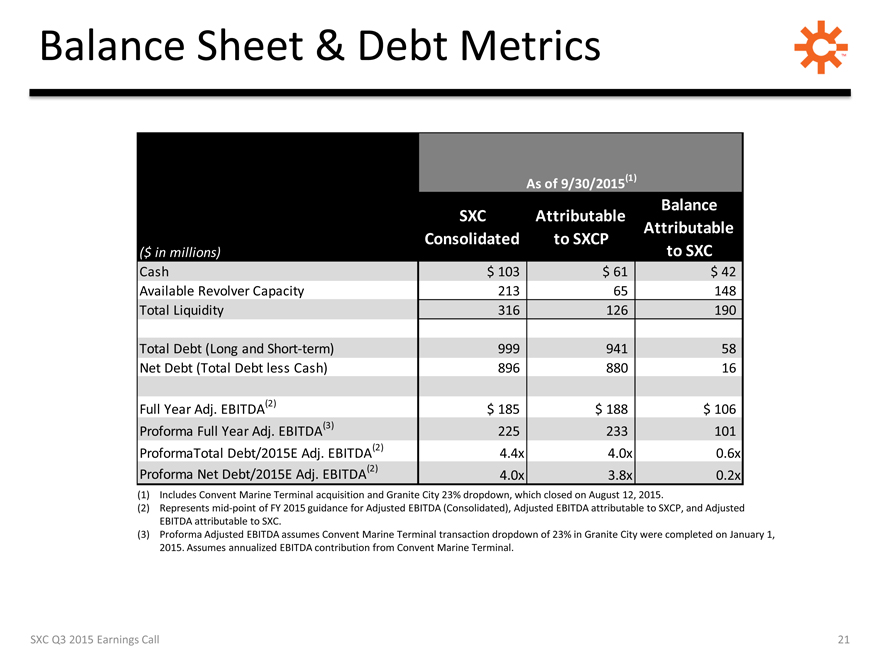

Balance Sheet & Debt Metrics TM

As of 9/30/2015(1)

Balance

SXC Attributable

Attributable

Consolidated to SXCP

($ in millions) to SXC

Cash $ 103 $ 61 $ 42

Available Revolver Capacity 213 65 148

Total Liquidity 316 126 190

Total Debt (Long and Short-term) 999 941 58

Net Debt (Total Debt less Cash) 896 880 16

Full Year Adj. EBITDA(2) $ 185 $ 188 $ 106

Proforma Full Year Adj. EBITDA(3) 225 233 101

ProformaTotal Debt/2015E Adj. EBITDA(2) 4.4x 4.0x 0.6x

Proforma Net Debt/2015E Adj. EBITDA(2) 4.0x 3.8x 0.2x

(1) Includes Convent Marine Terminal acquisition and Granite City 23% dropdown, which closed on August 12, 2015.

(2) Represents mid-point of FY 2015 guidance for Adjusted EBITDA (Consolidated), Adjusted EBITDA attributable to SXCP, and Adjusted EBITDA attributable to SXC.

(3) Proforma Adjusted EBITDA assumes Convent Marine Terminal transaction dropdown of 23% in Granite City were completed on January 1, 2015. Assumes annualized EBITDA contribution from Convent Marine Terminal.

SXC Q3 2015 Earnings Call

21

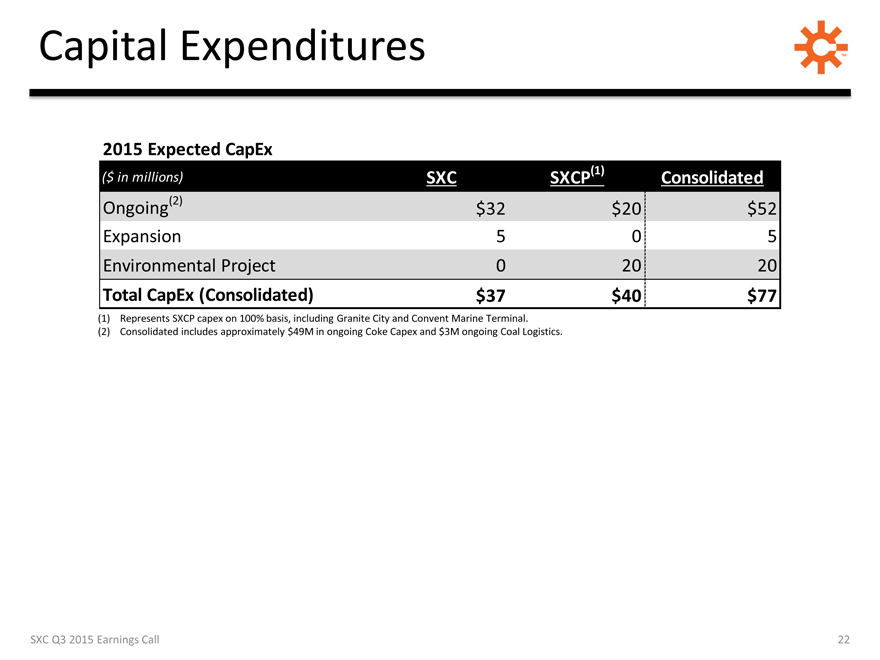

Capital Expenditures TM

2015 Expected CapEx

($ in millions) SXC SXCP(1) Consolidated

Ongoing(2) $ 32 $ 20 $ 52

Expansion 5 0 5

Environmental Project 0 20 20

Total CapEx (Consolidated) $ 37 $ 40 $ 77

(1) Represents SXCP capex on 100% basis, including Granite City and Convent Marine Terminal. (2) Consolidated includes approximately $49M in ongoing Coke Capex and $3M ongoing Coal Logistics.

SXC Q3 2015 Earnings Call

22