|

Exhibit 99.2

|

Exhibit 99.2

SunCoke Energy, Inc.

Q2 2016 Earnings

Conference Call

July 28, 2016

Forward-Looking Statements TM

This slide presentation should be reviewed in conjunction with the Second Quarter 2016 earnings release of SunCoke Energy, Inc. (SXC) and conference call held on July 28, 2016 at 11:00 a.m. ET.

Some of the information included in this presentation constitutes “forward-looking statements” as defined in Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. All statements in this presentation that express opinions, expectations, beliefs, plans, objectives, assumptions or projections with respect to anticipated future performance of SXC or SunCoke Energy Partners, L.P. (SXCP), in contrast with statements of historical facts, are forward-looking statements. Such forward-looking statements are based on management’s beliefs and assumptions and on information currently available. Forward-looking statements include information concerning possible or assumed future results of operations, business strategies, financing plans, competitive position, potential growth opportunities, potential operating performance improvements, the effects of competition and the effects of future legislation or regulations. Forward-looking statements include all statements that are not historical facts and may be identified by the use of forward-looking terminology such as the words

“believe,” “expect,” “plan,” “intend,” “anticipate,” “estimate,” “predict,” “potential,” “continue,” “may,” “will,” “should” or the negative of these terms or similar expressions.

Although management believes that its plans, intentions and expectations reflected in or suggested by the forward-looking statements made in this presentation are reasonable, no assurance can be given that these plans, intentions or expectations will be achieved when anticipated or at all. Moreover, such statements are subject to a number of assumptions, risks and uncertainties. Many of these risks are beyond the control of SXC and SXCP, and may cause actual results to differ materially from those implied or expressed by the forward-looking statements. Each of SXC and SXCP has included in its filings with the Securities and Exchange Commission cautionary language identifying important factors (but not necessarily all the important factors) that could cause actual results to differ materially from those expressed in any forward-looking statement. For more information concerning these factors, see the Securities and Exchange Commission filings of SXC and SXCP. All forward-looking statements included in this presentation are expressly qualified in their entirety by such cautionary statements. Although forward-looking statements are based on current beliefs and expectations, caution should be taken not to place undue reliance on any such forward-looking statements because such statements speak only as of the date hereof. SXC and SXCP do not have any intention or obligation to update publicly any forward-looking statement (or its associated cautionary language) whether as a result of new information or future events or after the date of this presentation, except as required by applicable law.

This presentation includes certain non-GAAP financial measures intended to supplement, not substitute for, comparable GAAP measures.

Reconciliations of non-GAAP financial measures to GAAP financial measures are provided in the Appendix at the end of the presentation. Investors are urged to consider carefully the comparable GAAP measures and the reconciliations to those measures provided in the Appendix.

SXC Q2 2016 Earnings Call 1

Management Perspective TM

Achieved solid safety, environmental and operating

performance across cokemaking fleet

Realized strong cost improvement at Indiana Harbor;

expanding scope of oven rebuild initiative in Q4 ‘16

Handled below-target logistics volumes due to coal

market challenges; fundamentals improving as of late

Completed Coal Mining divestiture, contributing to year-

over-year Adj. EBITDA improvement

Reduced consolidated debt outstanding by >$57M,

including >$17M bond repurchases at SXCP

Reaffirmed FY 2016 Consolidated Adjusted EBITDA(1)

guidance of $210M – $235M

(1) | | For a definition and reconciliation of Adjusted EBITDA, please see appendix. |

SXC Q2 2016 Earnings Call 2

Navigating Current Market Conditions TM

Encouraged by recent improvement in steel and coal market conditions, and will remain flexible and responsive to industry landscape

Reached resolution on several previously uncertain items in 1H 2016 Continued improvement in steel industry outlook

Improving customer balance sheets

Favorable AD and CVD rulings against unfairly traded steel imports

Strong recovery in HRC prices & utilization rates

Stabilizing coal industry fundamentals

API2 prices have rebounded sharply; exports near economic breakeven

Higher natural gas prices, warmer summer weather, restocking

Continue to closely follow CMT customer developments

Progress on FELP bondholder negotiations

Monitoring Murray’s progress with its creditors and labor union

Will remain flexible & responsive to industry backdrop

SXC Q2 2016 Earnings Call 3

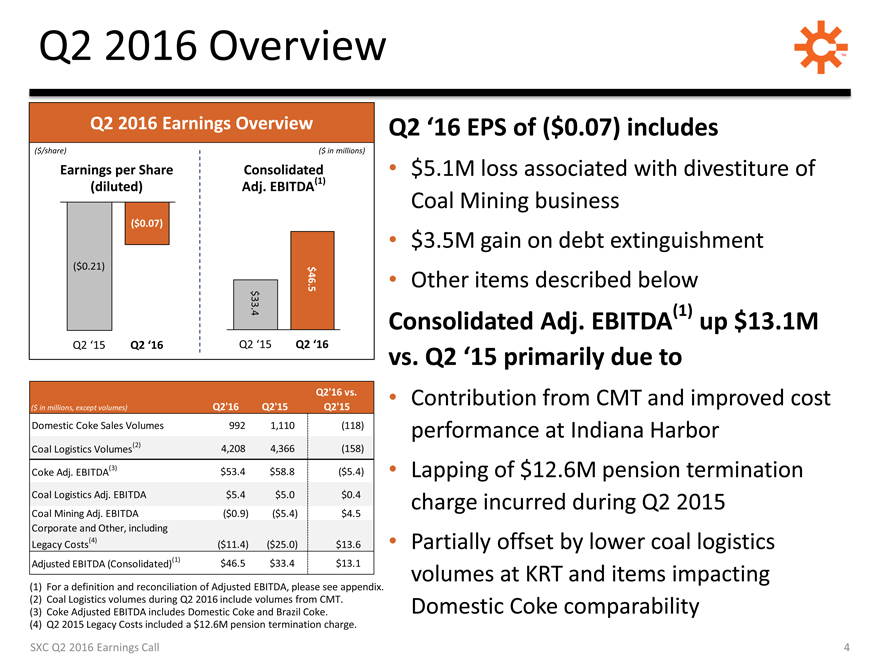

Q2 2016 Overview

Q2 2016 Earnings Overview

($/share)($ in millions)

Earnings per Share Consolidated

(diluted) Adj. EBITDA(1)

($0.07)

($0.21)

5.46$

4.33$

Q2 ‘15 Q2 ‘16 Q2 ‘15 Q2 ‘16

Q2’16 vs.

($ in millions, except volumes) Q2’16 Q2’15 Q2’15

Domestic Coke Sales Volumes 992 1,110(118)

Coal Logistics Volumes(2) 4,208 4,366(158)

Coke Adj. EBITDA(3) $53.4 $58.8($5.4)

Coal Logistics Adj. EBITDA $5.4 $5.0 $0.4

Coal Mining Adj. EBITDA($0.9)($5.4) $4.5

Corporate and Other, including

Legacy Costs(4)($11.4)($25.0) $13.6

Adjusted EBITDA (Consolidated)(1) $46.5 $33.4 $13.1

Q2 ‘16 EPS of ($0.07) includes

$5.1M loss associated with divestiture of Coal Mining business

$3.5M gain on debt extinguishment

Other items described below

Consolidated Adj. EBITDA up $13.1M vs. Q2 ‘15 primarily due to

Contribution from CMT and improved cost performance at Indiana Harbor

Lapping of $12.6M pension termination charge incurred during Q2 2015

Partially offset by lower coal logistics volumes at KRT and items impacting Domestic Coke comparability

(1) For a definition and reconciliation of Adjusted EBITDA, please see appendix. (2) Coal Logistics volumes during Q2 2016 include volumes from CMT. (3) Coke Adjusted EBITDA includes Domestic Coke and Brazil Coke.

(4) | | Q2 2015 Legacy Costs included a $12.6M pension termination charge. |

SXC Q2 2016 Earnings Call

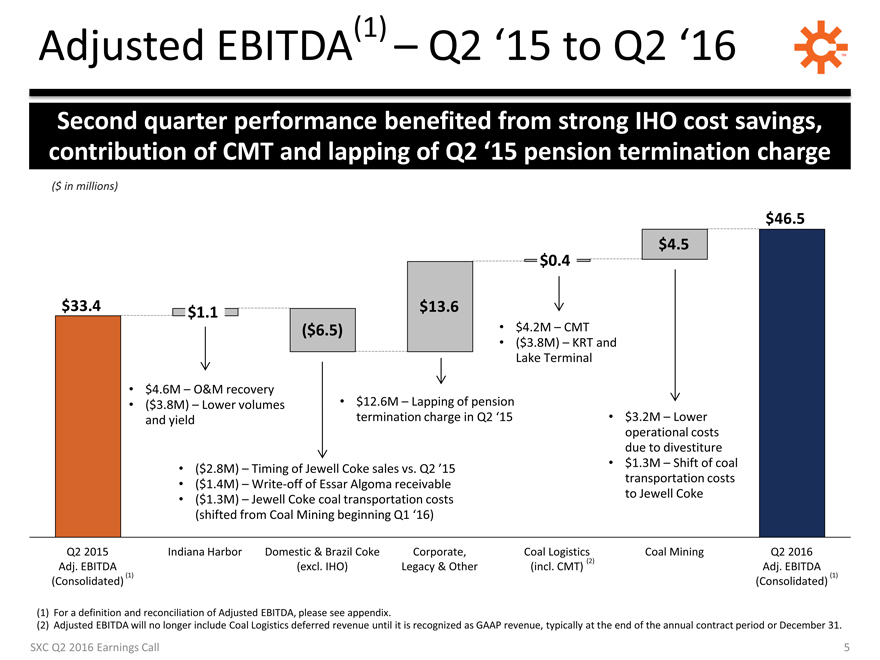

Adjusted EBITDA – Q2 ‘15 to Q2 ‘16 TM

Second quarter performance benefited from strong IHO cost savings,

contribution of CMT and lapping of Q2 ‘15 pension termination charge

($ in millions)

$46.5

$4.5

$0.4

Lake Terminal

($3.8M) | | – Lower volumes $12.6M – Lapping of pension |

and yield termination charge in Q2 ‘15 • $3.2M – Lower

operational costs

due to divestiture

($2.8M) | | – Timing of Jewell Coke sales vs. Q2 ’15 $1.3M – Shift of coal |

($1.4M) | | – Write-off of Essar Algoma receivable transportation costs |

($1.3M) | | – Jewell Coke coal transportation costs to Jewell Coke |

(shifted from Coal Mining beginning Q1 ‘16)

Q2 2015 Indiana Harbor Domestic & Brazil Coke Corporate, Coal Logistics Coal Mining Q2 2016

Adj. EBITDA(excl. IHO) Legacy & Other(incl. CMT) (2) Adj. EBITDA

(Consolidated) (1)(Consolidated) (1)

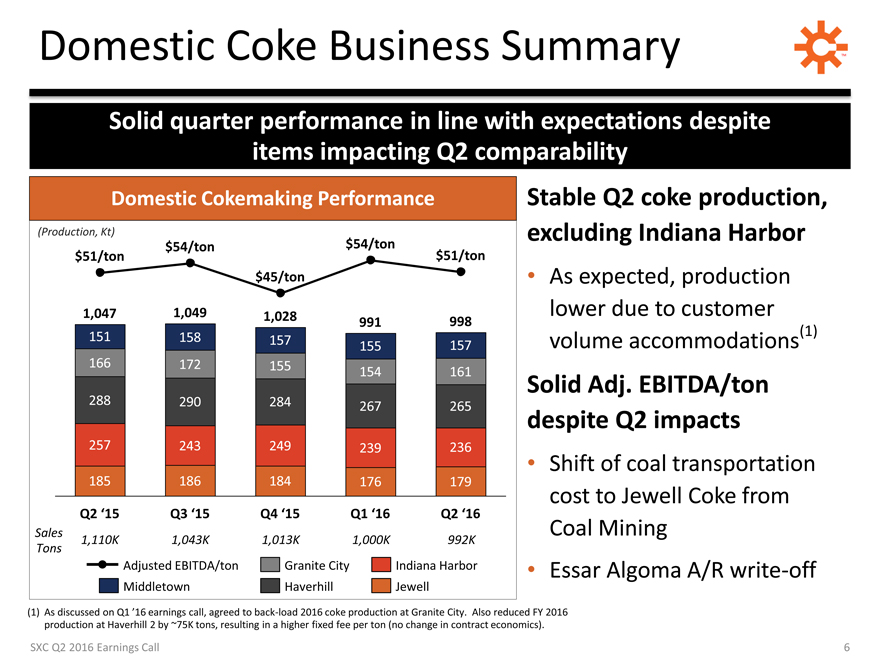

Domestic Coke Business Summary TM

Solid quarter performance in line with expectations despite items impacting Q2 comparability

Domestic Cokemaking Performance

(Production, Kt)

$54/ton $54/ton

$51/ton $51/ton

$45/ton

1,047 1,049 1,028 991 998

151 158 157 155 157

166 172 155 154 161

288 290 284 267 265

257 243 249 239 236

185 186 184 176 179

Q2 ‘15 Q3 ‘15 Q4 ‘15 Q1 ‘16 Q2 ‘16

Sales 1,110K 1,043K 1,013K 1,000K 992K

Tons

Adjusted EBITDA/ton Granite City Indiana Harbor

Middletown Haverhill Jewell

Stable Q2 coke production, excluding Indiana Harbor

As expected, production lower due to customer volume accommodations(1)

Solid Adj. EBITDA/ton despite Q2 impacts

Shift of coal transportation cost to Jewell Coke from Coal Mining

Essar Algoma A/R write-off

(1) As discussed on Q1 ’16 earnings call, agreed to back-load 2016 coke production at Granite City. Also reduced FY 2016 production at Haverhill 2 by ~75K tons, resulting in a higher fixed fee per ton (no change in contract economics).

SXC Q2 2016 Earnings Call

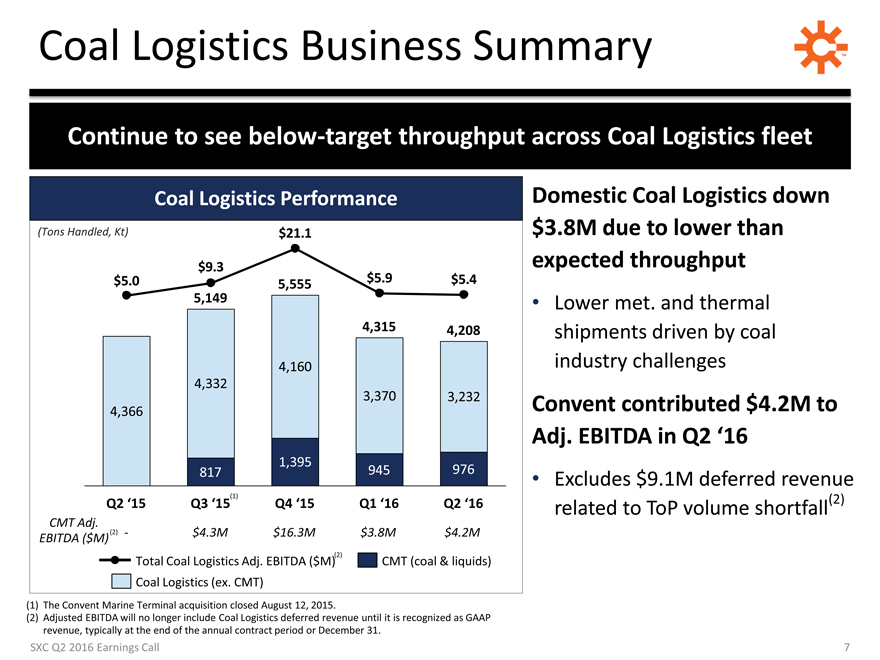

Coal Logistics Business Summary TM

Continue to see below-target throughput across Coal Logistics fleet

Coal Logistics Performance

(Tons Handled, Kt) $21.1

$9.3 $5.9

$5.0 5,555 $5.4 5,149

4,315 4,208

4,160 4,332

3,370 3,232 4,366

1,395

817 945 976

Q2 ‘15 Q3 ‘15 Q4 ‘15 Q1 ‘16 Q2 ‘16

CMT Adj.

(2) | | - $4.3M $16.3M $3.8M $4.2M EBITDA ($M) |

Total Coal Logistics Adj. EBITDA ($M) CMT (coal & liquids) Coal Logistics (ex. CMT)

(1) | | The Convent Marine Terminal acquisition closed August 12, 2015. |

(2) Adjusted EBITDA will no longer include Coal Logistics deferred revenue until it is recognized as GAAP revenue, typically at the end of the annual contract period or December 31.

SXC Q2 2016 Earnings Call

Domestic Coal Logistics down $3.8M due to lower than expected throughput

Lower met. and thermal shipments driven by coal industry challenges

Convent contributed $4.2M to

Adj. EBITDA in Q2 ‘16

Excludes $9.1M deferred revenue

related to ToP volume shortfall

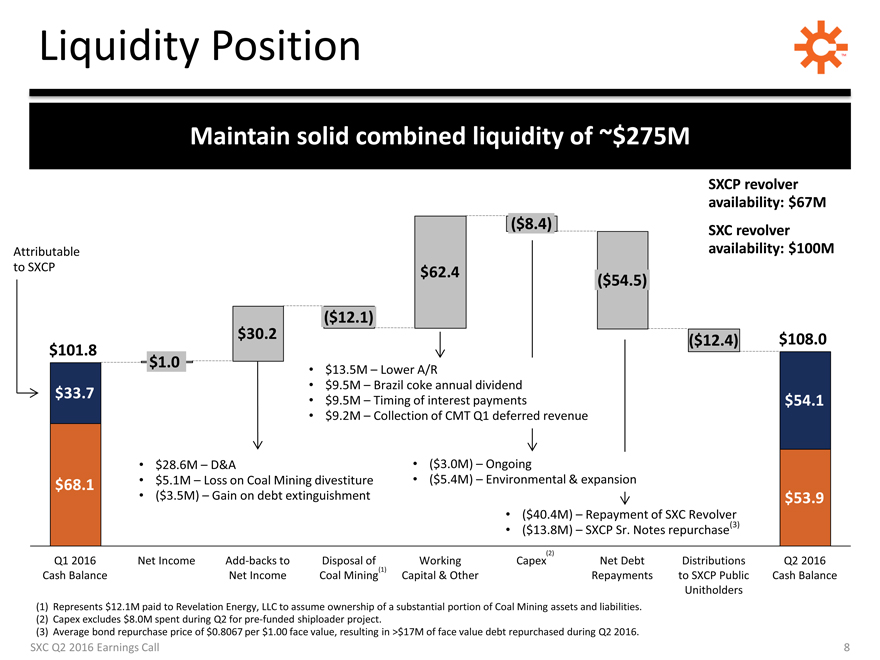

Liquidity Position TM

Maintain solid combined liquidity of ~$275M

SXCP revolver

availability: $67M

Attributable availability: $100M

to SXCP $ 62.4($54.5)

($12.1)

$30.2($12.4) $108.0

$101.8

$9.5M | | – Brazil coke annual dividend |

$33.7 | | $9.5M – Timing of interest payments $54.1 |

$9.2M | | – Collection of CMT Q1 deferred revenue |

$28.6M | | – D&A($ 3.0M) – Ongoing |

$68.1 | | $5.1M – Loss on Coal Mining divestiture($ 5.4M) – Environmental & expansion |

($3.5M) | | – Gain on debt extinguishment $53.9 |

($40.4M) | | – Repayment of SXC Revolver |

($13.8M) | | – SXCP Sr. Notes repurchase(3) |

Q1 2016 Net Income Add-backs to Disposal of Working Capex(2) Net Debt Distributions Q2 2016

Cash Balance Net Income Coal Mining(1) Capital & Other Repayments to SXCP Public Cash Balance

Unitholders

(1) Represents $12.1M paid to Revelation Energy, LLC to assume ownership of a substantial portion of Coal Mining assets and liabilities.

(2) | | Capex excludes $8.0M spent during Q2 for pre-funded shiploader project. |

(3) Average bond repurchase price of $0.8067 per $1.00 face value, resulting in >$17M of face value debt repurchased during Q2 2016.

SXC Q2 2016 Earnings Call 8

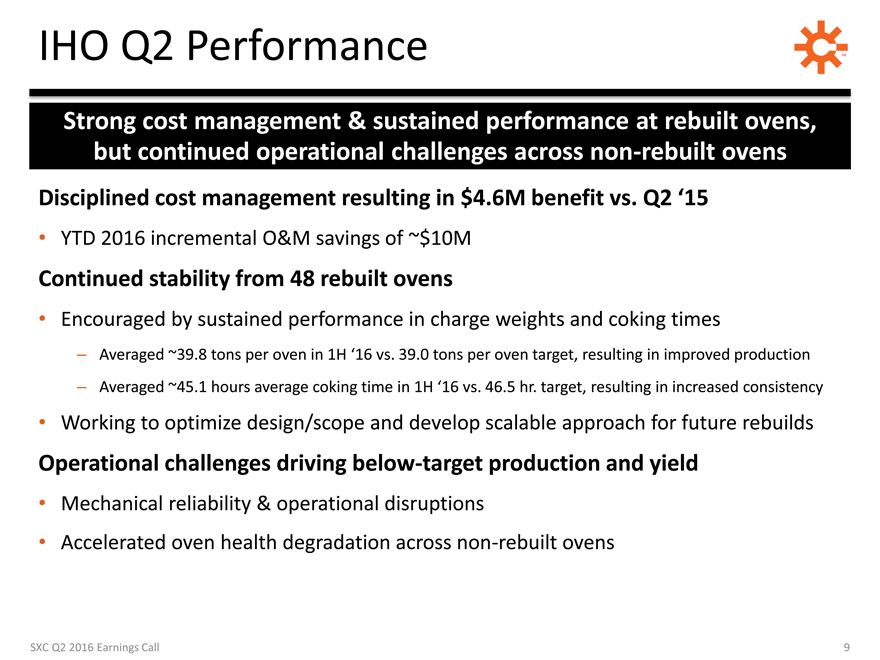

IHO Q2 Performance TM

Strong cost management & sustained performance at rebuilt ovens,

but continued operational challenges across non-rebuilt ovens

Disciplined cost management resulting in $4.6M benefit vs. Q2 ‘15

YTD 2016 incremental O&M savings of ~$10M

Continued stability from 48 rebuilt ovens

Encouraged by sustained performance in charge weights and coking times

– Averaged ~39.8 tons per oven in 1H ‘16 vs. 39.0 tons per oven target, resulting in improved production

– Averaged ~45.1 hours average coking time in 1H ‘16 vs. 46.5 hr. target, resulting in increased consistency

Working to optimize design/scope and develop scalable approach for future rebuilds

Operational challenges driving below-target production and yield

Mechanical reliability & operational disruptions

Accelerated oven health degradation across non-rebuilt ovens

SXC Q2 2016 Earnings Call 9

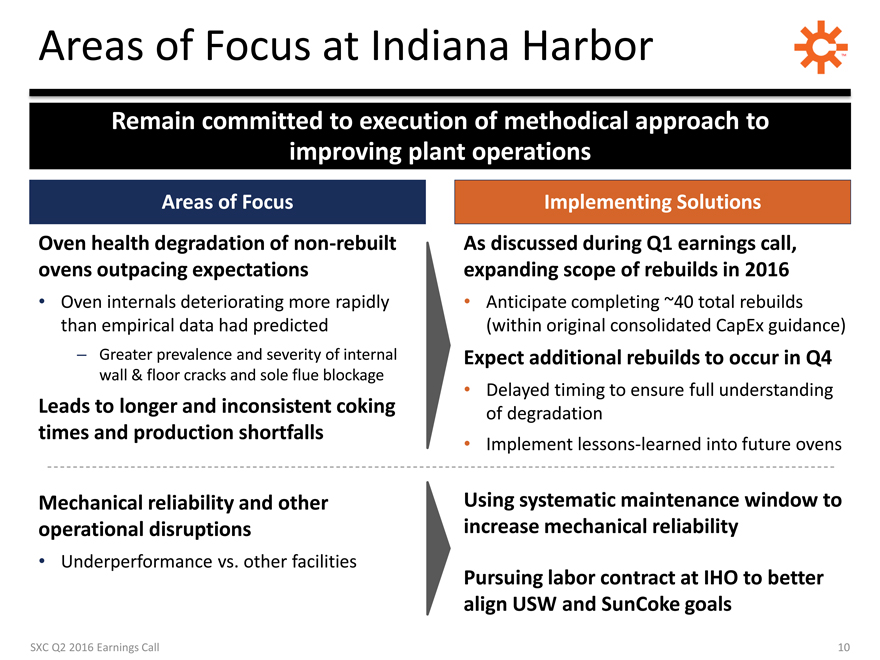

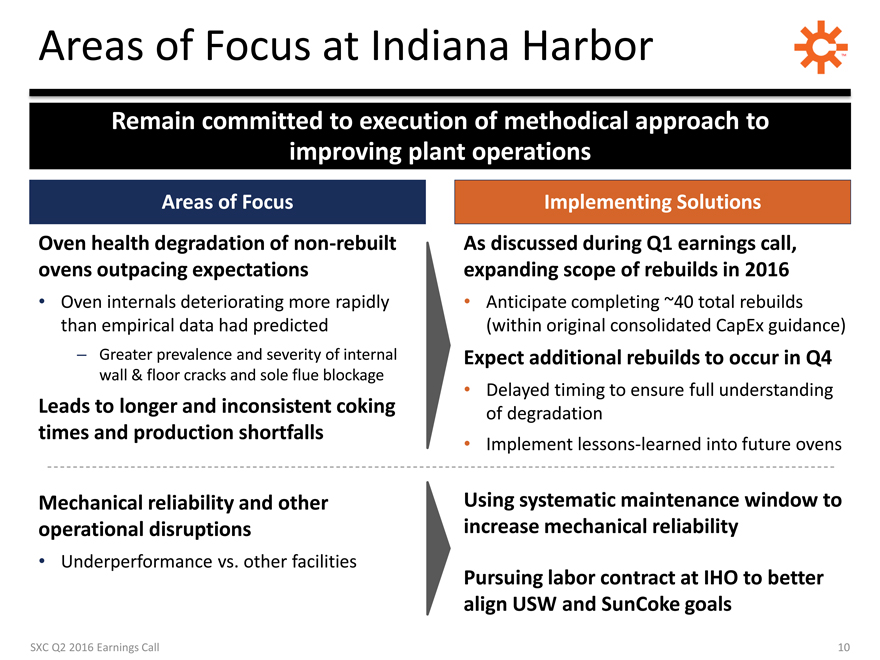

Areas of Focus at Indiana Harbor TM

Remain committed to execution of methodical approach to

improving plant operations

Areas of Focus Implementing Solutions

Oven health degradation of non-rebuilt As discussed during Q1 earnings call,

ovens outpacing expectations expanding scope of rebuilds in 2016

Oven internals deteriorating more rapidly Anticipate completing ~40 total rebuilds

than empirical data had predicted(within original consolidated CapEx guidance)

– Greater prevalence and severity of internal Expect additional rebuilds to occur in Q4

wall & floor cracks and sole flue blockage

Delayed timing to ensure full understanding

Leads to longer and inconsistent coking of degradation

times and production shortfalls Implement lessons-learned into future ovens

Mechanical reliability and other Using systematic maintenance window to

operational disruptions

increase mechanical reliability

Underperformance vs. other facilities

Pursuing labor contract at IHO to better

align USW and SunCoke goals

SXC Q2 2016 Earnings Call

10

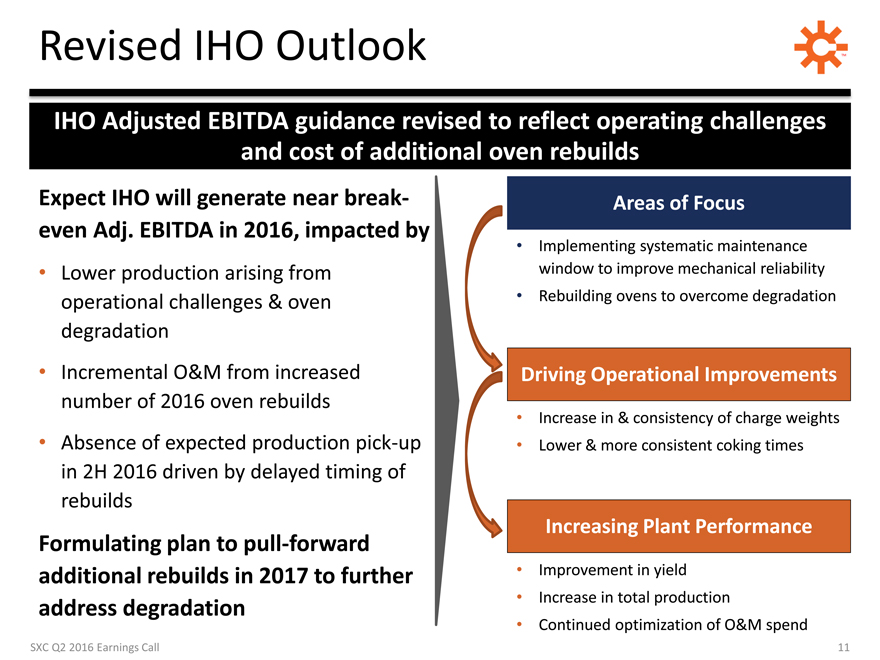

Revised IHO Outlook TM

IHO Adjusted EBITDA guidance revised to reflect operating challenges and cost of additional oven rebuilds

Expect IHO will generate near break- Areas of Focus even Adj. EBITDA in 2016, impacted by

Implementing systematic maintenance

Lower production arising from window to improve mechanical reliability operational challenges & oven Rebuilding ovens to overcome degradation

degradation

Incremental O&M from increased Driving Operational Improvements number of 2016 oven rebuilds

Increase in & consistency of charge weights

Absence of expected production pick-up • Lower & more consistent coking times in 2H 2016 driven by delayed timing of rebuilds

Formulating plan to pull-forward Increasing Plant Performance additional rebuilds in 2017 to further • Improvement in yield

Increase in total production

address degradation

Continued optimization of O&M spend

2016 Priorities TM

Manage Through Challenging Market Conditions

Remain flexible & responsive to industry backdrop while leveraging unique value proposition

Stabilize Indiana Harbor Cokemaking Operations

Improve profitability by executing oven rebuilds and reducing O&M costs

Deliver Operations Excellence

Drive strong operational & safety performance across our fleet

Achieve Financial Objectives & Strengthen Balance Sheet

Deliver $210M – $235M Consol. Adj. EBITDA guidance & execute de-levering strategy

SXC Q2 2016 Earnings Call 12

QUESTIONS

SXC Q2 2016 Earnings Call 13

Investor Relations 630-824-1907 www.suncoke.com

APPENDIX

Definitions TM

Adjusted EBITDA represents earnings before interest, (gain) loss on extinguishment of debt, taxes, depreciation and amortization (“EBITDA”), adjusted for impairments, coal rationalization costs, changes to our contingent consideration liability related to our acquisition of CMT, and interest, taxes, depreciation and amortization and impairments attributable to our equity method investment. EBITDA and Adjusted EBITDA do not represent and should not be considered alternatives to net income or operating income under GAAP and may not be comparable to other similarly titled measures in other businesses. Management believes Adjusted EBITDA is an important measure of the operating performance and liquidity of the Company’s net assets and its ability to incur and service debt, fund capital expenditures and make distributions. Adjusted EBITDA provides useful information to investors because it highlights trends in our business that may not otherwise be apparent when relying solely on GAAP measures and because it eliminates items that have less bearing on our operating performance and liquidity. EBITDA and Adjusted EBITDA are not measures calculated in accordance with GAAP, and they should not be considered a substitute for net income, operating cash flow or any other measure of financial performance presented in accordance with GAAP.

EBITDA represents earnings before interest, taxes, depreciation and amortization.

Adjusted EBITDA attributable to SXC/SXCP represents Adjusted EBITDA less Adjusted EBITDA attributable to noncontrolling interests.

Adjusted EBITDA/Ton represents Adjusted EBITDA divided by tons sold/handled.

Coal Rationalization expense / (income) includes employee severance, contract termination costs and other costs to idle mines incurred during the execution of our coal rationalization plan. The six months ended June 30, 2015, included $2.2 million of income related to a severance accrual adjustment.

Legacy Costs include costs associated with former mining employee-related liabilities net of certain royalty revenues.

Reconciliation to Adjusted EBITDA

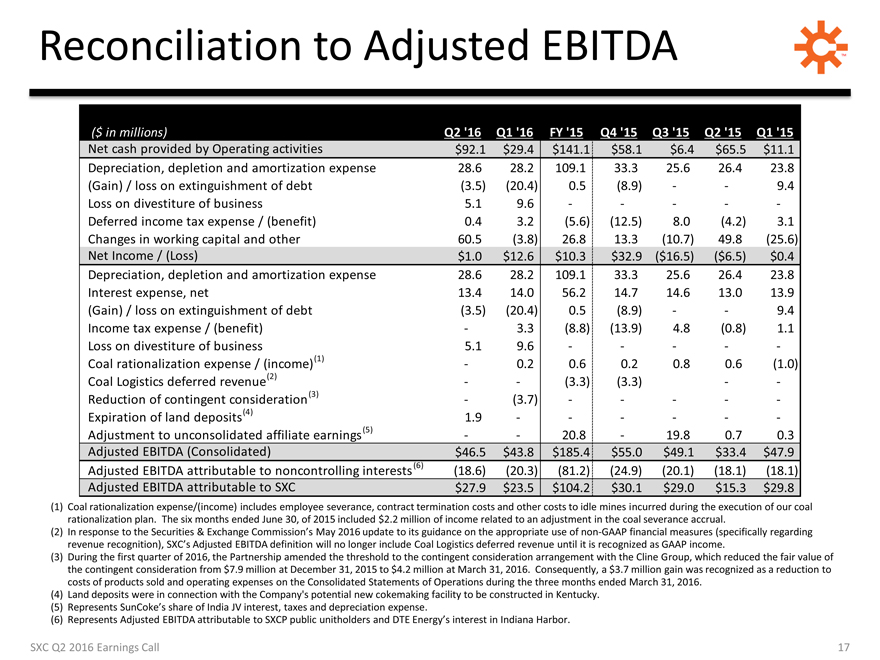

($ in millions) Q2 ‘16 Q1 ‘16 FY ‘15 Q4 ‘15 Q3 ‘15 Q2 ‘15 Q1 ‘15

Net cash provided by Operating activities $92.1 $29.4 $141.1 $58.1 $6.4 $65.5 $11.1

Depreciation, depletion and amortization expense 28.6 28.2 109.1 33.3 25.6 26.4 23.8

(Gain) / loss on extinguishment of debt(3.5)(20.4) 0.5(8.9) - - 9.4

Loss on divestiture of business 5.1 9.6 - - - - -

Deferred income tax expense / (benefit) 0.4 3.2(5.6)(12.5) 8.0(4.2) 3.1

Changes in working capital and other 60.5(3.8) 26.8 13.3(10.7) 49.8(25.6)

Net Income / (Loss) $1.0 $12.6 $10.3 $32.9($16.5)($6.5) $0.4

Depreciation, depletion and amortization expense 28.6 28.2 109.1 33.3 25.6 26.4 23.8

Interest expense, net 13.4 14.0 56.2 14.7 14.6 13.0 13.9

(Gain) / loss on extinguishment of debt(3.5)(20.4) 0.5(8.9) - - 9.4

Income tax expense / (benefit) - 3.3(8.8)(13.9) 4.8(0.8) 1.1

Loss on divestiture of business 5.1 9.6 - - - - -

Coal rationalization expense / (income)(1) - 0.2 0.6 0.2 0.8 0.6(1.0)

Coal Logistics deferred revenue(2) - -(3.3)(3.3) - -

Reduction of contingent consideration (3) -(3.7) - - - - -

Expiration of land deposits(4) 1.9 - - - - - -

Adjustment to unconsolidated affiliate earnings (5) - - 20.8 - 19.8 0.7 0.3

Adjusted EBITDA (Consolidated) $46.5 $43.8 $185.4 $55.0 $49.1 $33.4 $47.9

Adjusted EBITDA attributable to noncontrolling interests (6)(18.6)(20.3)(81.2)(24.9)(20.1)(18.1)(18.1)

Adjusted EBITDA attributable to SXC $27.9 $23.5 $104.2 $30.1 $29.0 $15.3 $29.8

(1)

Coal rationalization expense/(income) includes employee severance, contract termination costs and other costs to idle mines incurred during the execution of our coal

rationalization plan. The six months ended June 30, of 2015 included $2.2 million of income related to an adjustment in the coal severance accrual.

(2) In response to the Securities & Exchange Commission’s May 2016 update to its guidance on the appropriate use of non-GAAP financial measures (specifically regarding revenue recognition), SXC’s Adjusted EBITDA definition will no longer include Coal Logistics deferred revenue until it is recognized as GAAP income.

(3) During the first quarter of 2016, the Partnership amended the threshold to the contingent consideration arrangement with the Cline Group, which reduced the fair value of

the contingent consideration from $7.9 million at December 31, 2015 to $4.2 million at March 31, 2016. Consequently, a $3.7 million gain was recognized as a reduction to

costs of products sold and operating expenses on the Consolidated Statements of Operations during the three months ended March 31, 2016.

(4) Land deposits were in connection with the Company’s potential new cokemaking facility to be constructed in Kentucky.

(5) Represents SunCoke’s share of India JV interest, taxes and depreciation expense.

(6) Represents Adjusted EBITDA attributable to SXCP public unitholders and DTE Energy’s interest in Indiana Harbor.

SXC Q2 2016 Earnings Call

17

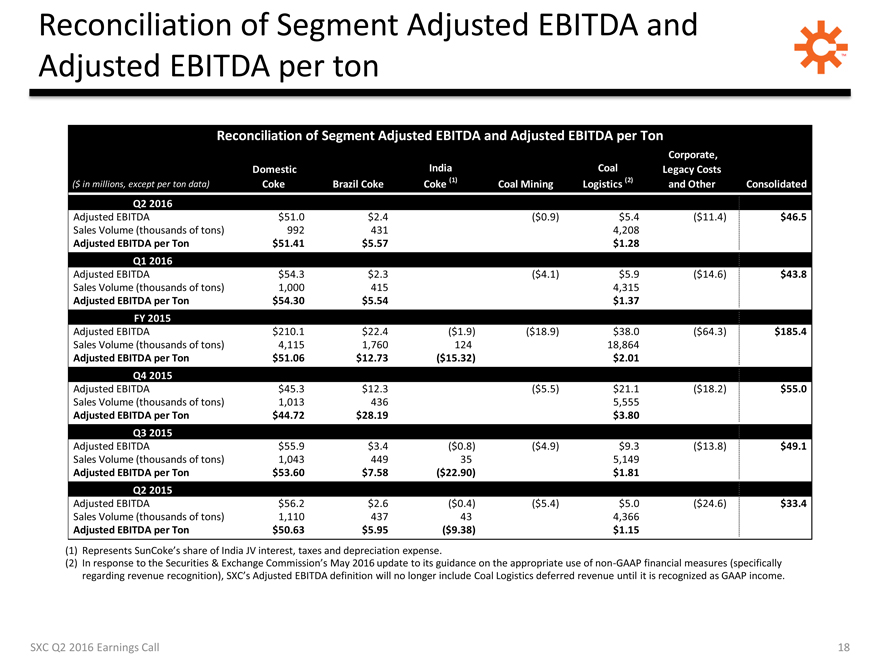

Reconciliation of Segment Adjusted EBITDA and

Adjusted EBITDA per ton TM

Reconciliation of Segment Adjusted EBITDA and Adjusted EBITDA per Ton

Corporate, Domestic India Coal Legacy Costs

($ in millions, except per ton data) Coke Brazil Coke Coke Coal Mining Logistics and Other Consolidated

Q2 2016

Adjusted EBITDA $51.0 $2.4 ($0.9) $5.4 ($11.4) $46.5

Sales Volume (thousands of tons) 992 431 4,208

Adjusted EBITDA per Ton $51.41 $5.57 $1.28 Q1 2016

Adjusted EBITDA $54.3 $2.3 ($4.1) $5.9 ($14.6) $43.8

Sales Volume (thousands of tons) 1,000 415 4,315

Adjusted EBITDA per Ton $54.30 $5.54 $1.37 FY 2015

Adjusted EBITDA $210.1 $22.4 ($1.9) ($18.9) $38.0 ($64.3) $185.4

Sales Volume (thousands of tons) 4,115 1,760 124 18,864

Adjusted EBITDA per Ton $51.06 $12.73 ($15.32) $2.01 Q4 2015

Adjusted EBITDA $45.3 $12.3 ($5.5) $21.1 ($18.2) $55.0

Sales Volume (thousands of tons) 1,013 436 5,555

Adjusted EBITDA per Ton $44.72 $28.19 $3.80 Q3 2015

Adjusted EBITDA $55.9 $3.4 ($0.8) ($4.9) $9.3 ($13.8) $49.1

Sales Volume (thousands of tons) 1,043 449 35 5,149

Adjusted EBITDA per Ton $53.60 $7.58 ($22.90) $1.81 Q2 2015

Adjusted EBITDA $56.2 $2.6 ($0.4) ($5.4) $5.0 ($24.6) $33.4

Sales Volume (thousands of tons) 1,110 437 43 4,366

Adjusted EBITDA per Ton $50.63 $5.95 ($9.38) $1.15

(1) | | Represents SunCoke’s share of India JV interest, taxes and depreciation expense. |

(2) In response to the Securities & Exchange Commission’s May 2016 update to its guidance on the appropriate use of non-GAAP financial measures (specifically regarding revenue recognition), SXC’s Adjusted EBITDA definition will no longer include Coal Logistics deferred revenue until it is recognized as GAAP income.

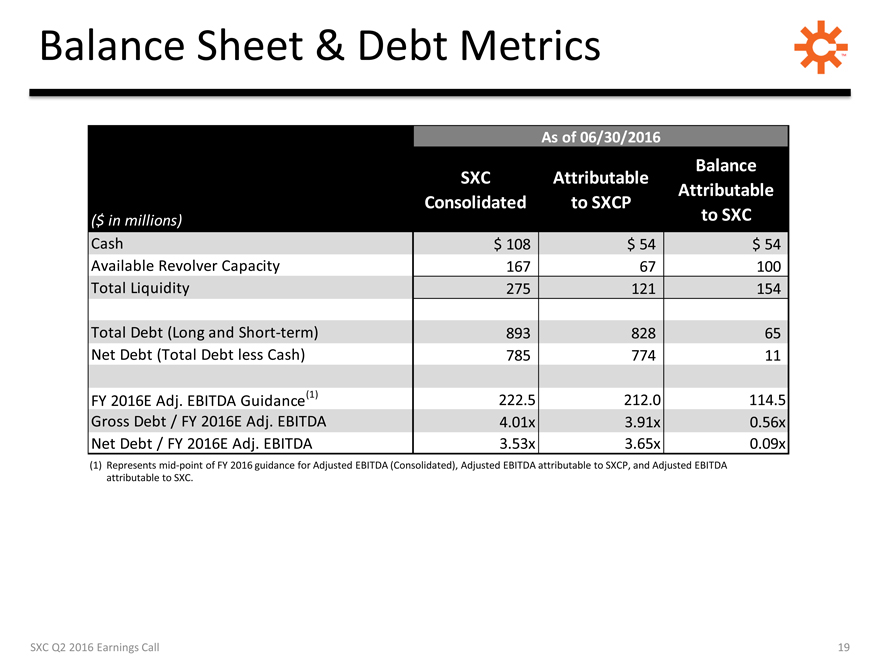

Balance Sheet & Debt Metrics TM

As of 06/30/2016

Balance

SXC Attributable

Attributable

Consolidated to SXCP

($ in millions) to SXC

Cash $ 108 $ 54 $ 54

Available Revolver Capacity 167 67 100

Total Liquidity 275 121 154

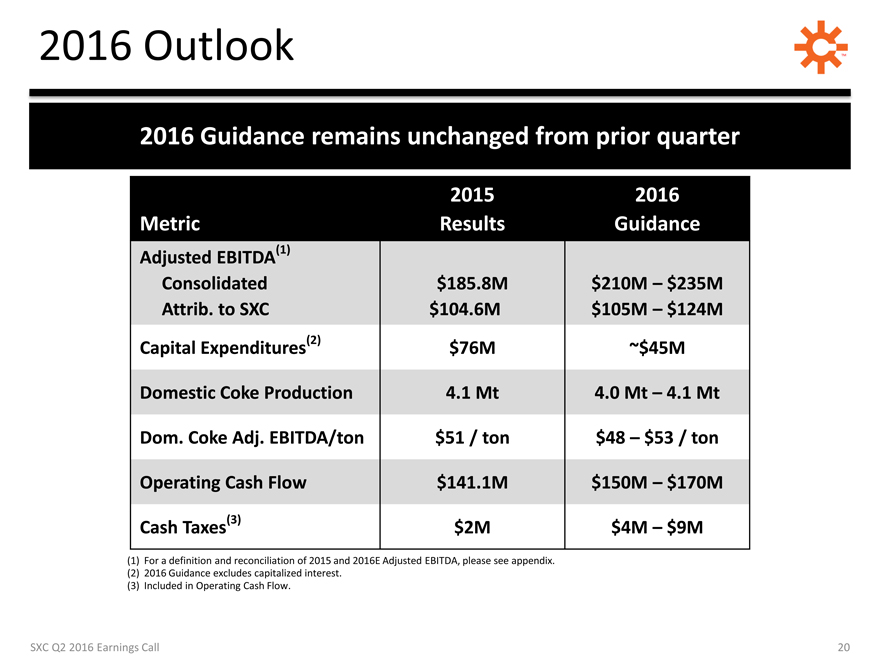

Total Debt (Long and Short-term) 893 828 2016 Outlook TM

2016 Guidance remains unchanged from prior quarter

2016 Outlook TM

2016 Guidance remains unchanged from prior quarter

2015 2016

Metric Results Guidance

Adjusted EBITDA(1)

Consolidated $185.8M $210M – $235M

Attrib. to SXC $104.6M(1) $105M – $124M

Capital Expenditures(2) $76M ~$45M

Domestic Coke Production 4.1 Mt 4.0 Mt – 4.1 Mt

Dom. Coke Adj. EBITDA/ton $51 / ton $48 – $53 / ton

Operating Cash Flow $141.1M $150M – $170M

Cash Taxes(3) $2M $4M – $9M

(1) | | For a definition and reconciliation of 2015 and 2016E Adjusted EBITDA, please see appendix. |

(2) | | 2016 Guidance excludes capitalized interest. |

(3) | | Included in Operating Cash Flow. |

SXC Q2 2016 Earnings Call 20

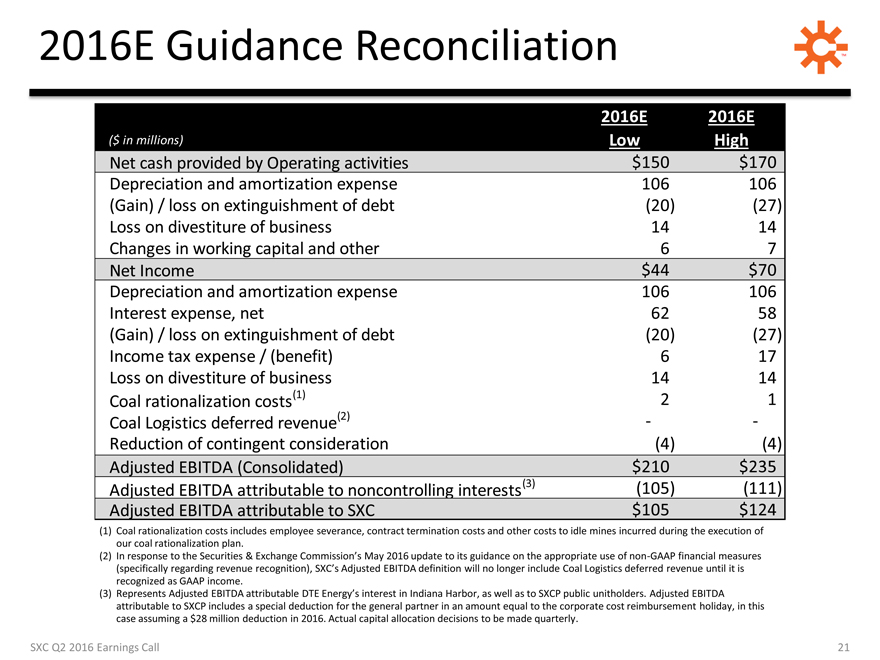

2016E Guidance Reconciliation

2016E 2016E

($ in millions) Low High

Net cash provided by Operating activities $150 $170

Depreciation and amortization expense 106 106

(Gain) / loss on extinguishment of debt (20) (27)

Loss on divestiture of business 14 14

Changes in working capital and other 6 7

Net Income $44 $70

Depreciation and amortization expense 106 106

Interest expense, net 62 58

(Gain) / loss on extinguishment of debt (20) (27)

Income tax expense / (benefit) 6 17

Loss on divestiture of business 14 14

Coal rationalization costs(1) 2 1

Coal Logistics deferred revenue(2) - -

Reduction of contingent consideration (4) (4)

Adjusted EBITDA (Consolidated) $210 $235

Adjusted EBITDA attributable to noncontrolling interests(3) (105) (111)

Adjusted EBITDA attributable to SXC $105 $124

Coal rationalization costs includes employee severance, contract termination costs and other costs to idle mines incurred during the execution of our coal rationalization plan.

In response to the Securities & Exchange Commission’s May 2016 update to its guidance on the appropriate use of non-GAAP financial measures (specifically regarding revenue recognition), SXC’s Adjusted EBITDA definition will no longer include Coal Logistics deferred revenue until it is recognized as GAAP income.

Represents Adjusted EBITDA attributable DTE Energy’s interest in Indiana Harbor, as well as to SXCP public unitholders. Adjusted EBITDA attributable to SXCP includes a special deduction for the general partner in an amount equal to the corporate cost reimbursement holiday, in this case assuming a $28 million deduction in 2016. Actual capital allocation decisions to be made quarterly.

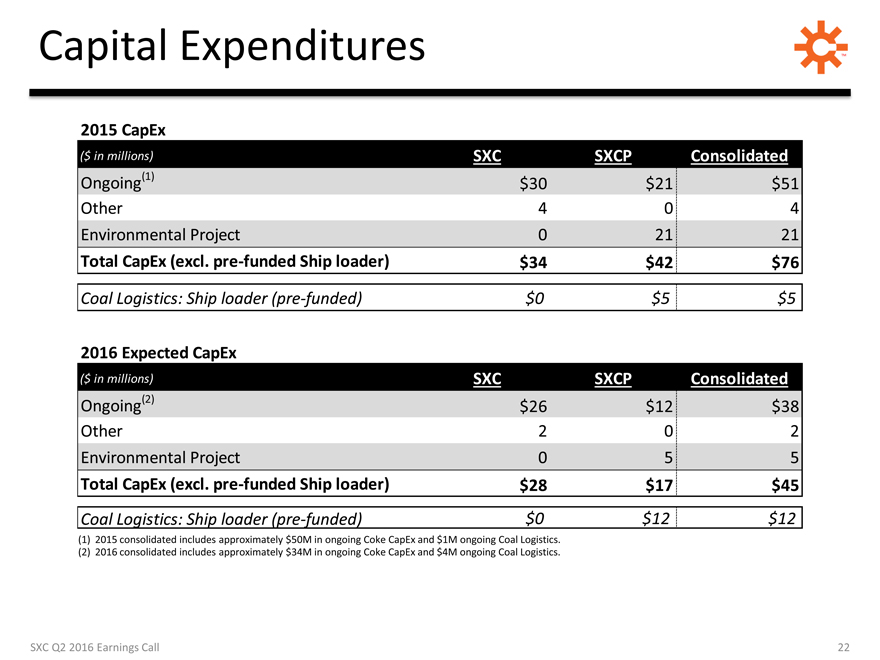

Capital Expenditures TM

2015 CapEx

($ in millions) SXC SXCP Consolidated

Ongoing(1) $30 $21 $51

Other 4 0 4

Environmental Project 0 21 21

Total CapEx (excl. pre-funded Ship loader) $34 $42 $76

Coal Logistics: Ship loader (pre-funded) $0 $5 $5

2016 Expected CapEx

($ in millions) SXC SXCP Consolidated

Ongoing(2) $26 $12 $38

Other 2 0 2

Environmental Project 0 5 5

Total CapEx (excl. pre-funded Ship loader) $28 $17 $45

Coal Logistics: Ship loader (pre-funded) $0 $12 $12

(1) 2015 consolidated includes approximately $ 50M in ongoing Coke CapEx and $1M ongoing Coal Logistics.

(2) 2016 consolidated includes approximately $ 34M in ongoing Coke CapEx and $4M ongoing Coal Logistics.

SXC Q2 2016 Earnings Call 22