SunCoke Energy, Inc. Q4 2016 Earnings and 2017 Guidance Conference Call January 26, 2017 Exhibit 99.2

Forward-Looking Statements This slide presentation should be reviewed in conjunction with the Fourth Quarter 2016 earnings and 2017 guidance release of SunCoke Energy, Inc. (SXC) and conference call held on January 26, 2017 at 11:00 a.m. ET. Some of the information included in this presentation constitutes “forward-looking statements” as defined in Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. All statements in this presentation that express opinions, expectations, beliefs, plans, objectives, assumptions or projections with respect to anticipated future performance of SXC or SunCoke Energy Partners, L.P. (SXCP), in contrast with statements of historical facts, are forward-looking statements. Such forward-looking statements are based on management’s beliefs and assumptions and on information currently available. Forward-looking statements include information concerning possible or assumed future results of operations, business strategies, financing plans, competitive position, potential growth opportunities, potential operating performance improvements, the effects of competition and the effects of future legislation or regulations. Forward-looking statements include all statements that are not historical facts and may be identified by the use of forward-looking terminology such as the words “believe,” “expect,” “plan,” “intend,” “anticipate,” “estimate,” “predict,” “potential,” “continue,” “may,” “will,” “should” or the negative of these terms or similar expressions. Although management believes that its plans, intentions and expectations reflected in or suggested by the forward-looking statements made in this presentation are reasonable, no assurance can be given that these plans, intentions or expectations will be achieved when anticipated or at all. Moreover, such statements are subject to a number of assumptions, risks and uncertainties. Many of these risks are beyond the control of SXC and SXCP, and may cause actual results to differ materially from those implied or expressed by the forward-looking statements. Each of SXC and SXCP has included in its filings with the Securities and Exchange Commission cautionary language identifying important factors (but not necessarily all the important factors) that could cause actual results to differ materially from those expressed in any forward-looking statement. For more information concerning these factors, see the Securities and Exchange Commission filings of SXC and SXCP. All forward-looking statements included in this presentation are expressly qualified in their entirety by such cautionary statements. Although forward-looking statements are based on current beliefs and expectations, caution should be taken not to place undue reliance on any such forward-looking statements because such statements speak only as of the date hereof. SXC and SXCP do not have any intention or obligation to update publicly any forward-looking statement (or its associated cautionary language) whether as a result of new information or future events or after the date of this presentation, except as required by applicable law. This presentation includes certain non-GAAP financial measures intended to supplement, not substitute for, comparable GAAP measures. Reconciliations of non-GAAP financial measures to GAAP financial measures are provided in the Appendix at the end of the presentation. Investors are urged to consider carefully the comparable GAAP measures and the reconciliations to those measures provided in the Appendix. SXC Q4 2016 Earnings and 2017 Guidance Call

Simplification Transaction Update Negotiations with SXCP Conflicts Committee ongoing; SXC is confident in merits of Simplification Transaction Progress towards proposed transaction remains on track to close by mid-2017 Continuing negotiations/dialogue with Conflicts Committee and their advisors Board and management actively gathering SXC shareholder feedback SXC is confident in strategic and financial merits of transaction; however, will remain price disciplined throughout negotiations Anticipate SXCP maintaining existing distribution policy during ongoing dialogue around proposed Simplification Transaction SXC capital allocation considerations on hold pending proposed transaction Qualifying Income regulations do not impact conviction in Simplification Transaction; continuing to pursue negotiations SXC Q4 2016 Earnings and 2017 Guidance Call

2016 Accomplishments Achieved Financial Objectives Delivered against key financial guidance targets De-levered consolidated SunCoke by >$145M in FY 2016 via open market debt repurchases and revolver pay-downs Managed Through Challenging Market Conditions Navigated through and remained responsive to industry backdrop; cyclicality did not materially impact SunCoke’s contracts nor earnings power Divested Coal Mining assets, improving long-term cash flow and allowing SXC to focus on core coke and coal logistics businesses Delivered Operating Excellence Achieved solid safety and operating performance across fleet Executed gas sharing project at Haverhill 1 Commissioned new shiploader and secured new domestic thermal coal business at CMT Remained Committed to Driving IHO Improvement Significantly reduced IHO operating expenses and continued to execute oven rebuild initiative in 2016; however, work remains SXC Q4 2016 Earnings and 2017 Guidance Call

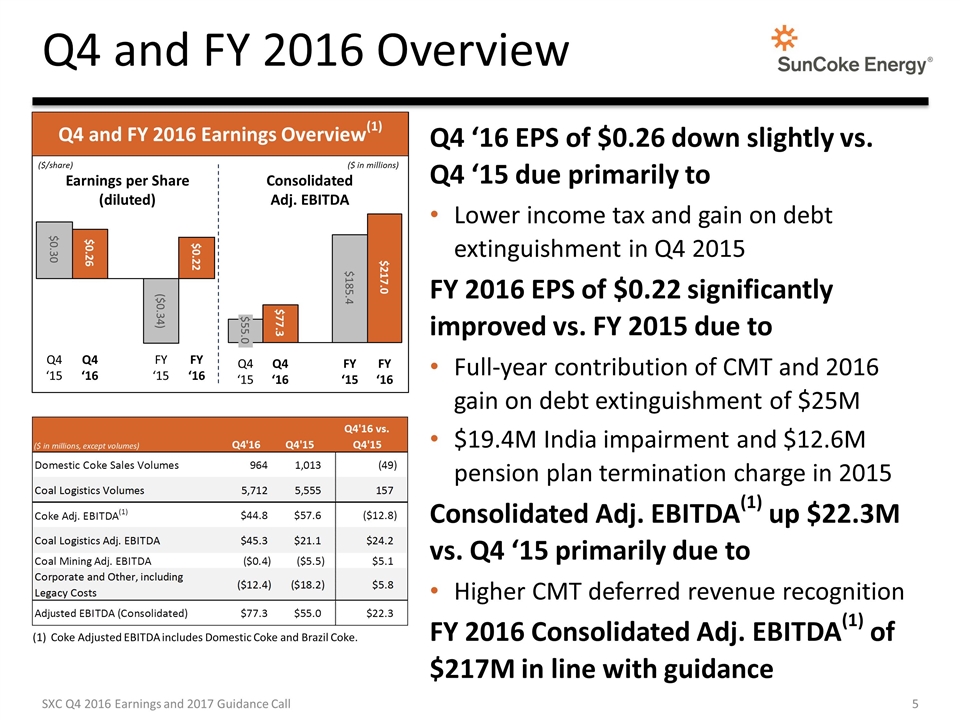

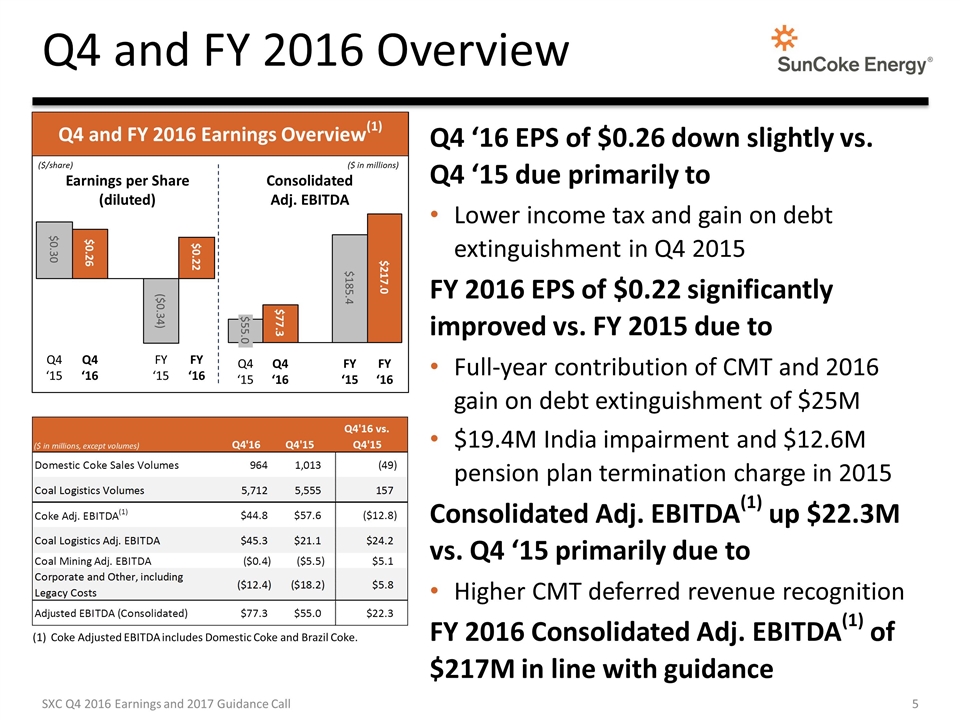

Q4 and FY 2016 Overview ($/share) Coke Adjusted EBITDA includes Domestic Coke and Brazil Coke. Q4 ‘16 EPS of $0.26 down slightly vs. Q4 ‘15 due primarily to Lower income tax and gain on debt extinguishment in Q4 2015 FY 2016 EPS of $0.22 significantly improved vs. FY 2015 due to Full-year contribution of CMT and 2016 gain on debt extinguishment of $25M $19.4M India impairment and $12.6M pension plan termination charge in 2015 Consolidated Adj. EBITDA(1) up $22.3M vs. Q4 ‘15 primarily due to Higher CMT deferred revenue recognition FY 2016 Consolidated Adj. EBITDA(1) of $217M in line with guidance ($ in millions) Consolidated Adj. EBITDA Earnings per Share (diluted) SXC Q4 2016 Earnings and 2017 Guidance Call

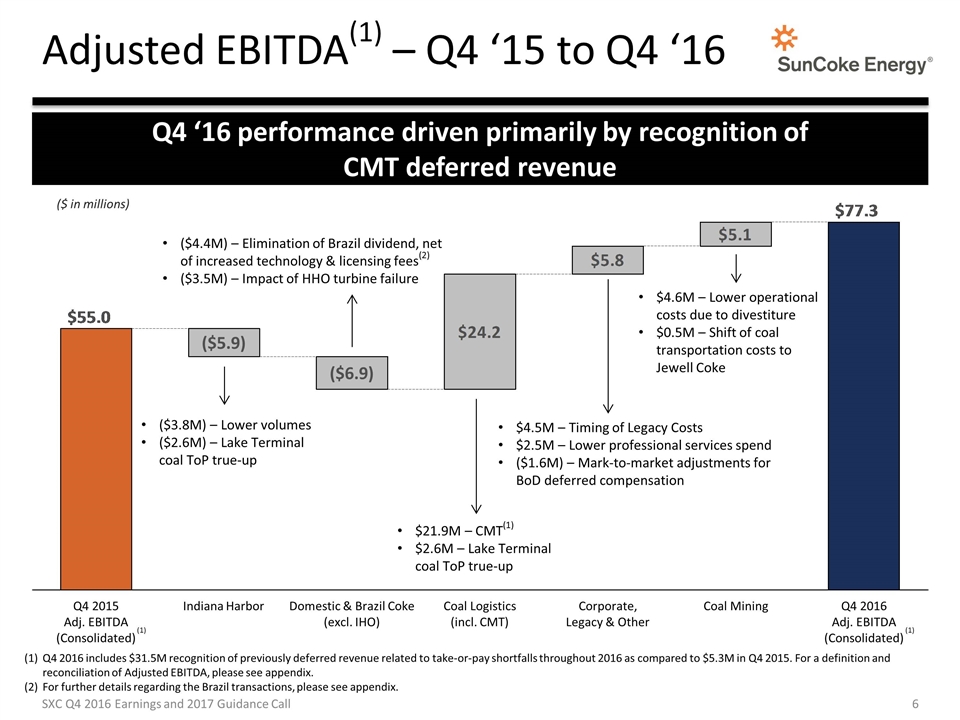

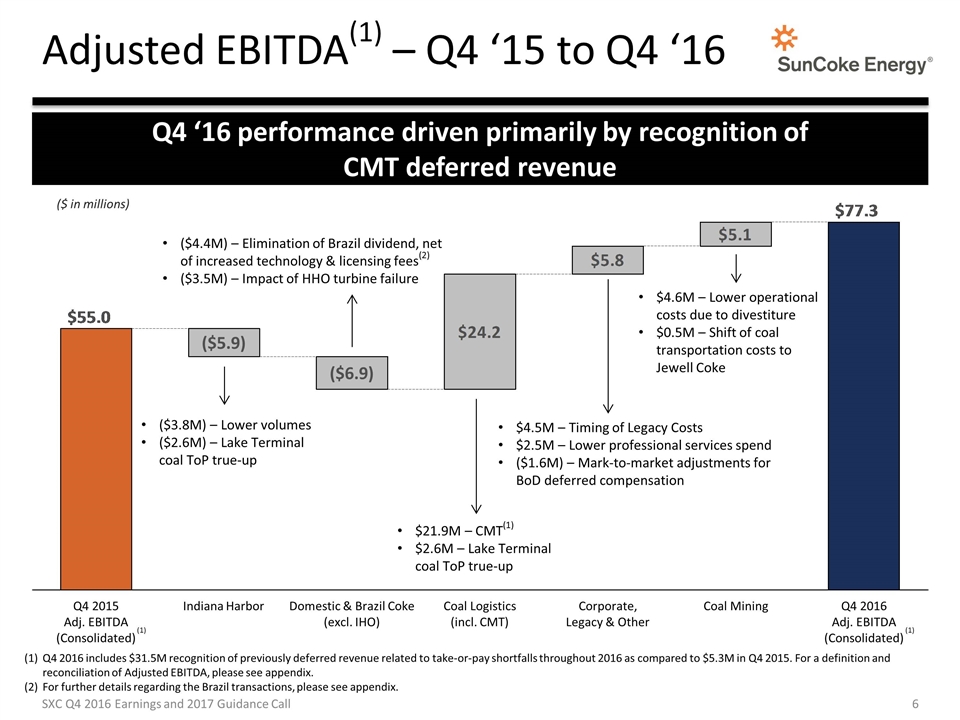

Adjusted EBITDA(1) – Q4 ‘15 to Q4 ‘16 Q4 ‘16 performance driven primarily by recognition of CMT deferred revenue Q4 2016 includes $31.5M recognition of previously deferred revenue related to take-or-pay shortfalls throughout 2016 as compared to $5.3M in Q4 2015. For a definition and reconciliation of Adjusted EBITDA, please see appendix. For further details regarding the Brazil transactions, please see appendix. (1) (1) ($4.4M) – Elimination of Brazil dividend, net of increased technology & licensing fees(2) ($3.5M) – Impact of HHO turbine failure $4.6M – Lower operational costs due to divestiture $0.5M – Shift of coal transportation costs to Jewell Coke SXC Q4 2016 Earnings and 2017 Guidance Call ($3.8M) – Lower volumes ($2.6M) – Lake Terminal coal ToP true-up $4.5M – Timing of Legacy Costs $2.5M – Lower professional services spend ($1.6M) – Mark-to-market adjustments for BoD deferred compensation $21.9M – CMT(1) $2.6M – Lake Terminal coal ToP true-up ($ in millions)

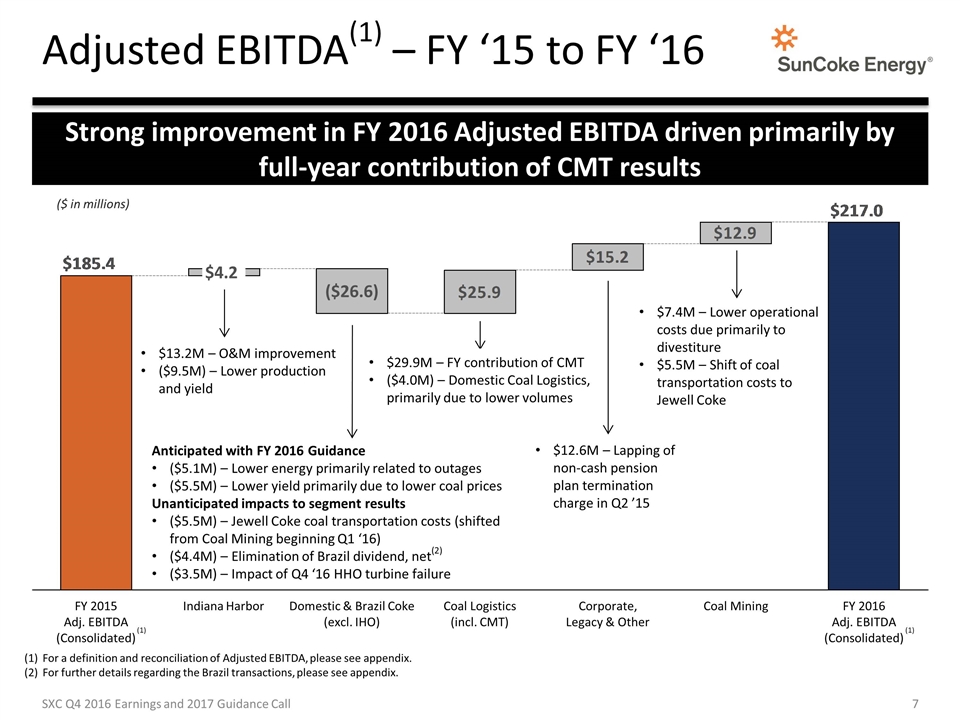

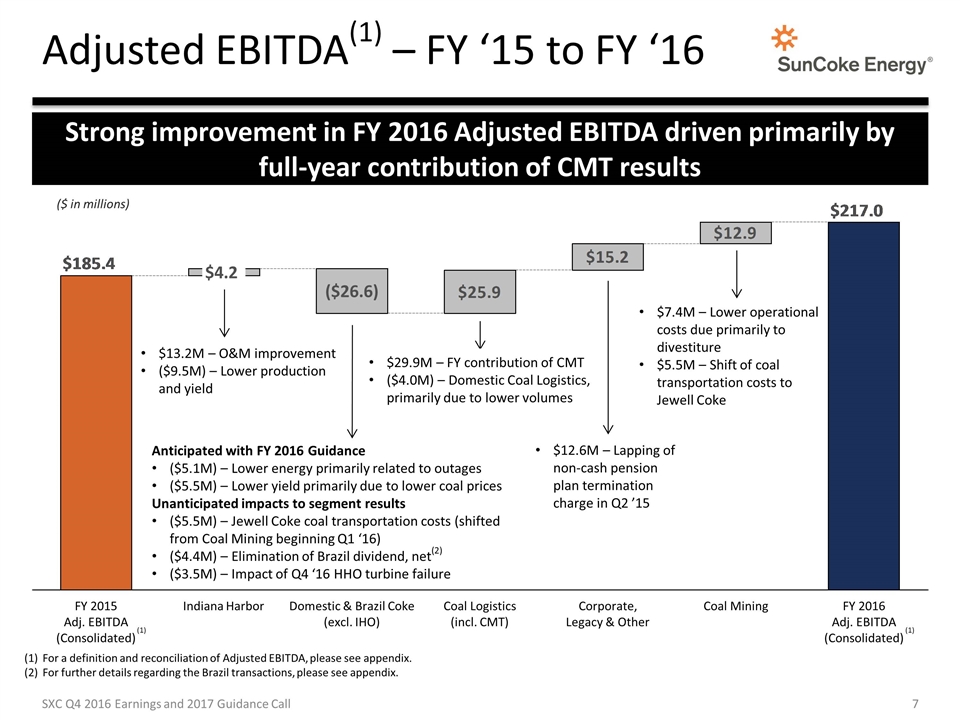

Adjusted EBITDA(1) – FY ‘15 to FY ‘16 ($ in millions) Strong improvement in FY 2016 Adjusted EBITDA driven primarily by full-year contribution of CMT results $13.2M – O&M improvement ($9.5M) – Lower production and yield Anticipated with FY 2016 Guidance ($5.1M) – Lower energy primarily related to outages ($5.5M) – Lower yield primarily due to lower coal prices Unanticipated impacts to segment results ($5.5M) – Jewell Coke coal transportation costs (shifted from Coal Mining beginning Q1 ‘16) ($4.4M) – Elimination of Brazil dividend, net(2) ($3.5M) – Impact of Q4 ‘16 HHO turbine failure $7.4M – Lower operational costs due primarily to divestiture $5.5M – Shift of coal transportation costs to Jewell Coke $12.6M – Lapping of non-cash pension plan termination charge in Q2 ’15 SXC Q4 2016 Earnings and 2017 Guidance Call (1) (1) For a definition and reconciliation of Adjusted EBITDA, please see appendix. For further details regarding the Brazil transactions, please see appendix. $29.9M – FY contribution of CMT ($4.0M) – Domestic Coal Logistics, primarily due to lower volumes

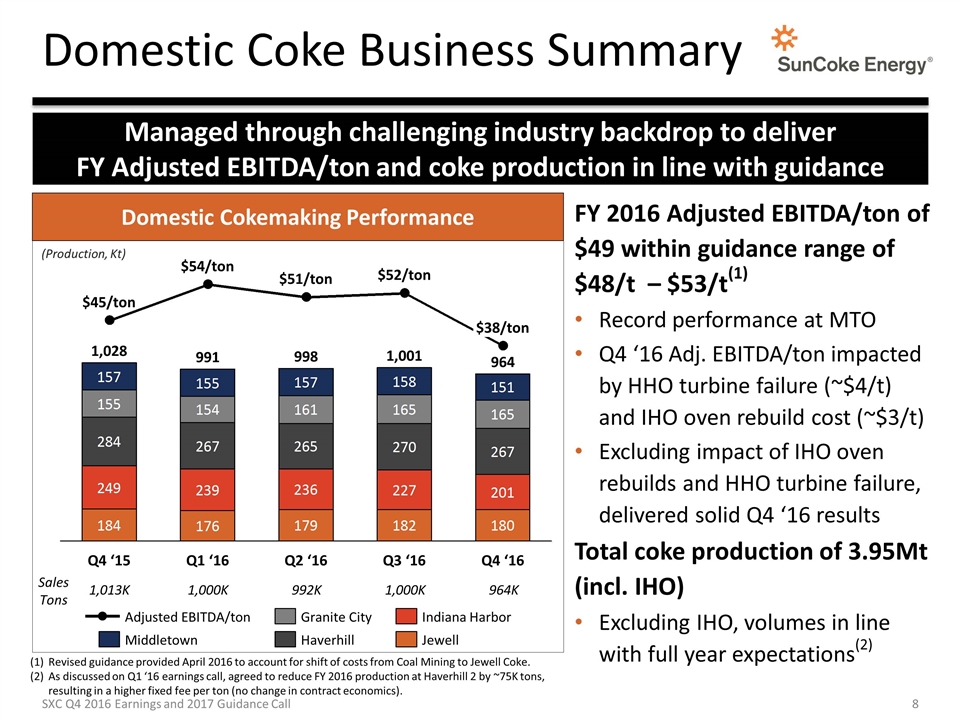

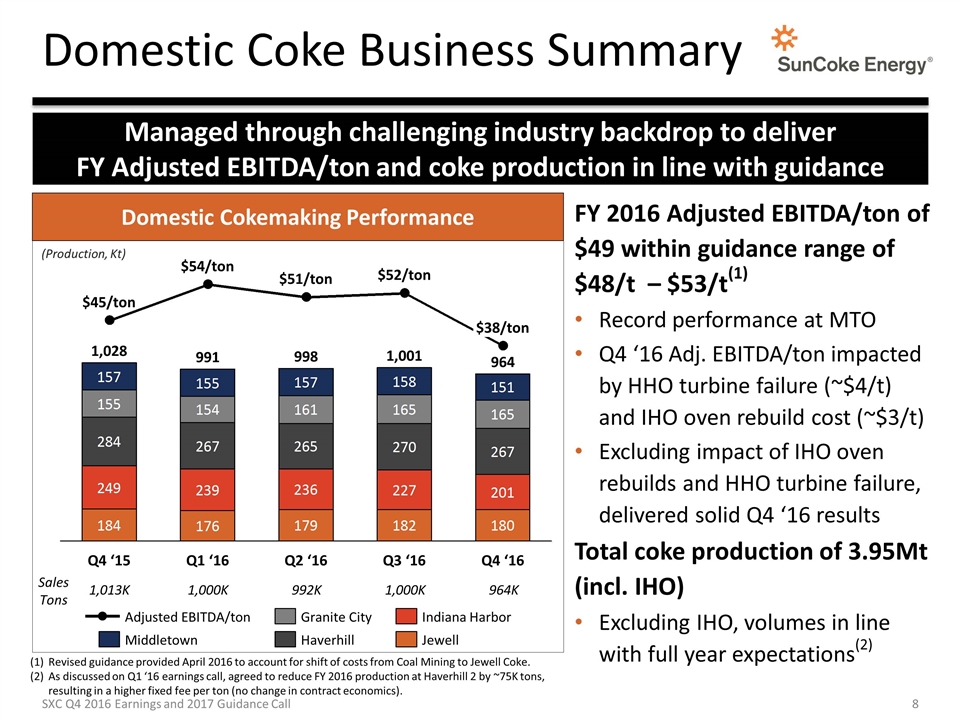

Domestic Coke Business Summary Managed through challenging industry backdrop to deliver FY Adjusted EBITDA/ton and coke production in line with guidance Domestic Cokemaking Performance /ton /ton /ton /ton /ton 1,013K 1,000K 992K 1,000K Sales Tons (Production, Kt) 964K FY 2016 Adjusted EBITDA/ton of $49 within guidance range of $48/t – $53/t(1) Record performance at MTO Q4 ‘16 Adj. EBITDA/ton impacted by HHO turbine failure (~$4/t) and IHO oven rebuild cost (~$3/t) Excluding impact of IHO oven rebuilds and HHO turbine failure, delivered solid Q4 ‘16 results Total coke production of 3.95Mt (incl. IHO) Excluding IHO, volumes in line with full year expectations(2) Revised guidance provided April 2016 to account for shift of costs from Coal Mining to Jewell Coke. As discussed on Q1 ‘16 earnings call, agreed to reduce FY 2016 production at Haverhill 2 by ~75K tons, resulting in a higher fixed fee per ton (no change in contract economics). SXC Q4 2016 Earnings and 2017 Guidance Call

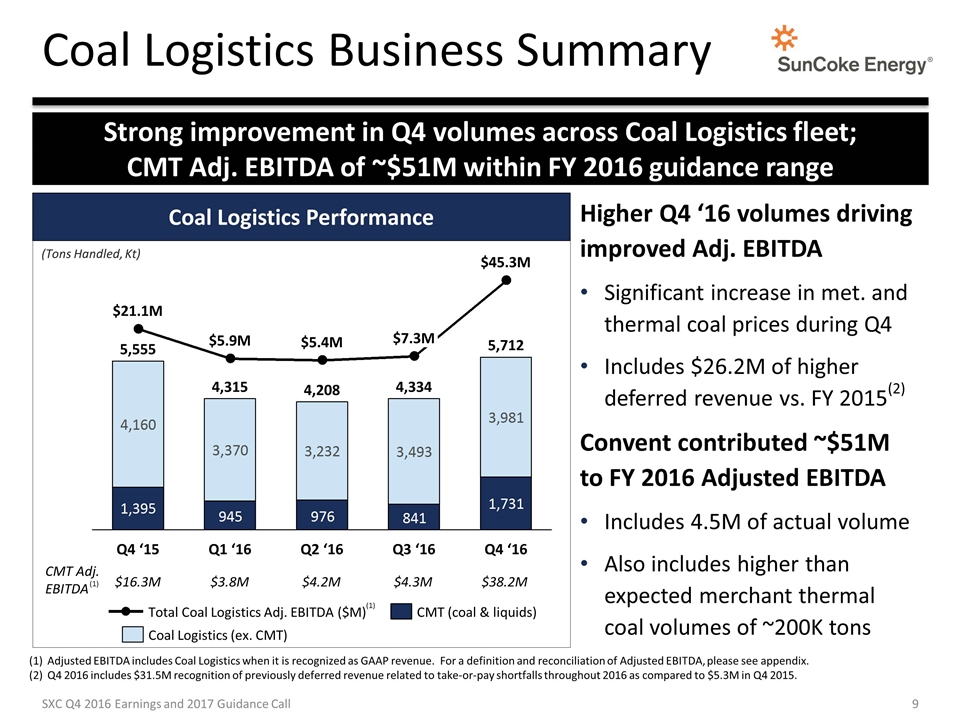

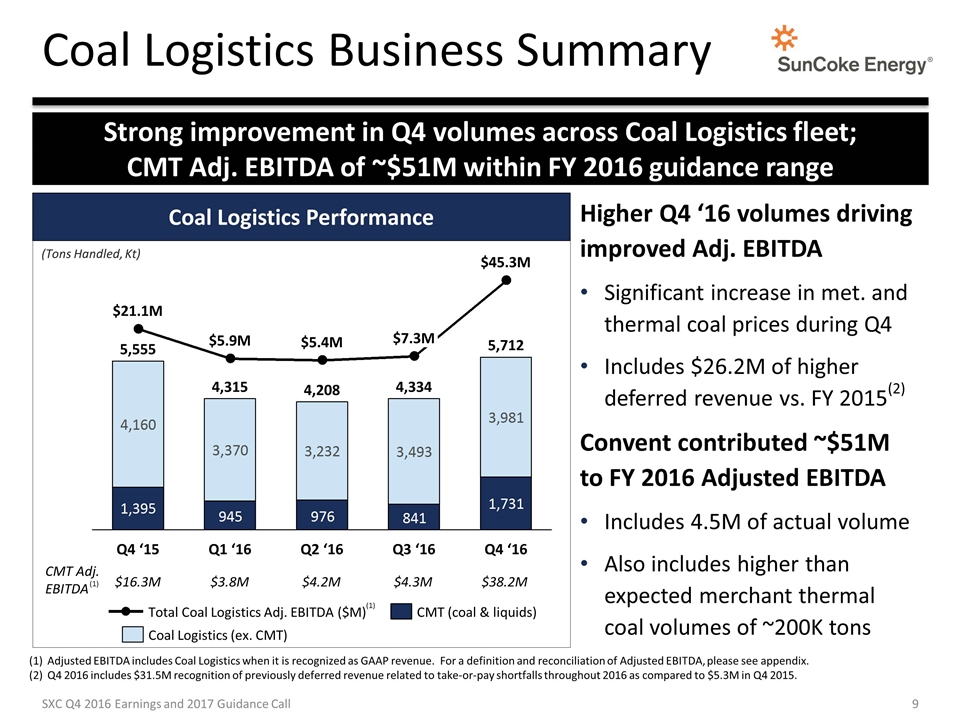

Coal Logistics Business Summary Strong improvement in Q4 volumes across Coal Logistics fleet; CMT Adj. EBITDA of ~$51M within FY 2016 guidance range M M M M M (Tons Handled, Kt) Higher Q4 ‘16 volumes driving improved Adj. EBITDA Significant increase in met. and thermal coal prices during Q4 Includes $26.2M of higher deferred revenue vs. FY 2015(2) Convent contributed ~$51M to FY 2016 Adjusted EBITDA Includes 4.5M of actual volume Also includes higher than expected merchant thermal coal volumes of ~200K tons Coal Logistics Performance $16.3M $3.8M $4.2M $4.3M CMT Adj. EBITDA $38.2M (1) (1) SXC Q4 2016 Earnings and 2017 Guidance Call Adjusted EBITDA includes Coal Logistics when it is recognized as GAAP revenue. For a definition and reconciliation of Adjusted EBITDA, please see appendix. Q4 2016 includes $31.5M recognition of previously deferred revenue related to take-or-pay shortfalls throughout 2016 as compared to $5.3M in Q4 2015.

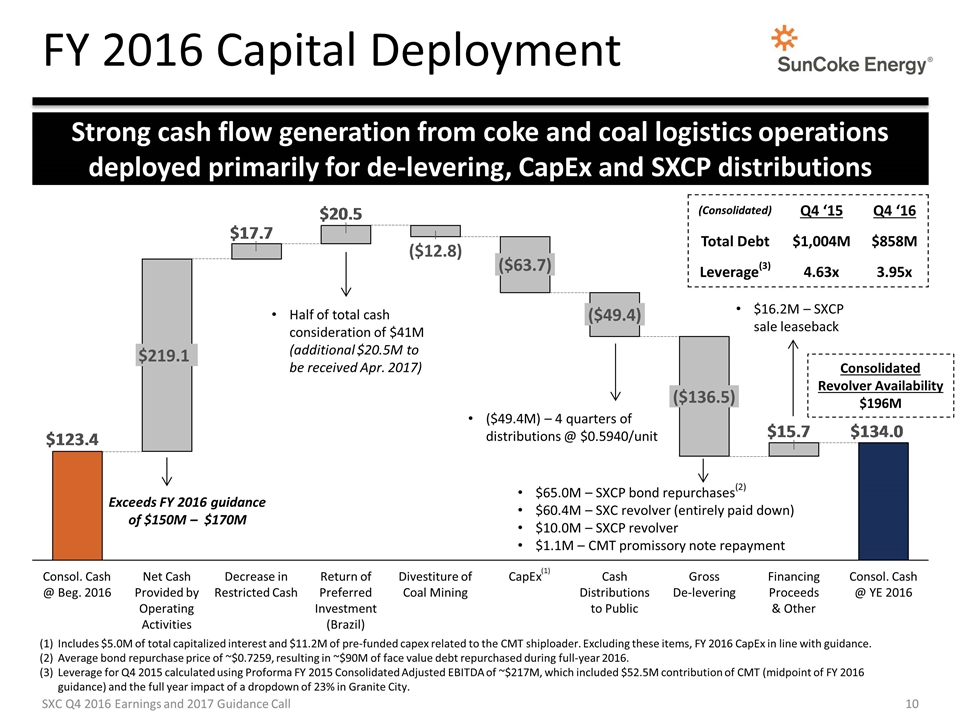

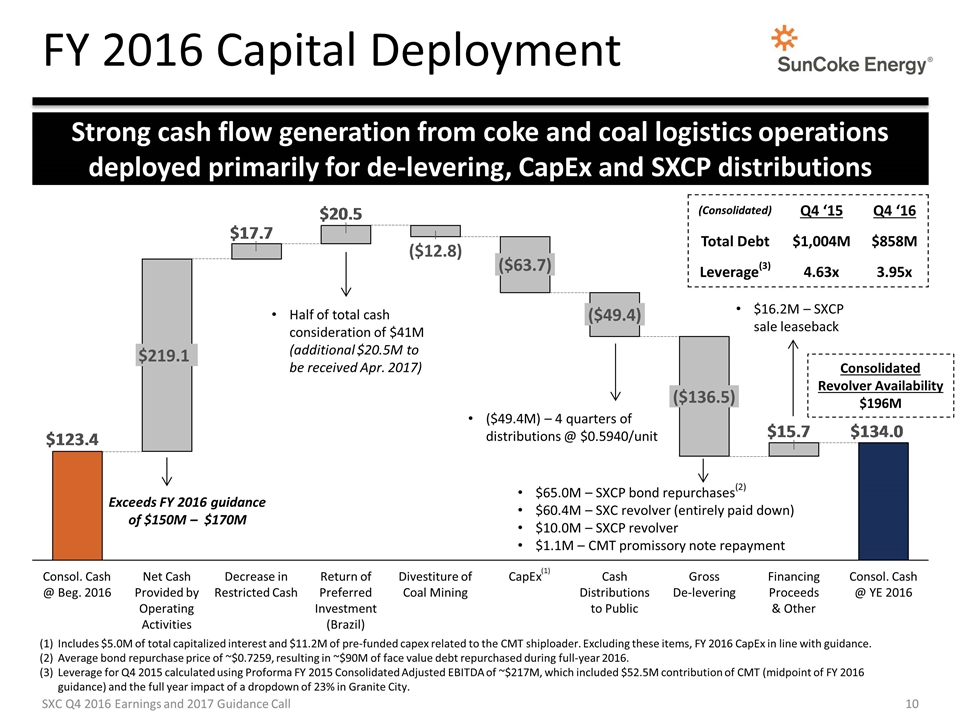

FY 2016 Capital Deployment Strong cash flow generation from coke and coal logistics operations deployed primarily for de-levering, CapEx and SXCP distributions Exceeds FY 2016 guidance of $150M – $170M SXC Q4 2016 Earnings and 2017 Guidance Call ($49.4M) – 4 quarters of distributions @ $0.5940/unit Half of total cash consideration of $41M (additional $20.5M to be received Apr. 2017) $65.0M – SXCP bond repurchases(2) $60.4M – SXC revolver (entirely paid down) $10.0M – SXCP revolver $1.1M – CMT promissory note repayment $16.2M – SXCP sale leaseback Includes $5.0M of total capitalized interest and $11.2M of pre-funded capex related to the CMT shiploader. Excluding these items, FY 2016 CapEx in line with guidance. Average bond repurchase price of ~$0.7259, resulting in ~$90M of face value debt repurchased during full-year 2016. Leverage for Q4 2015 calculated using Proforma FY 2015 Consolidated Adjusted EBITDA of ~$217M, which included $52.5M contribution of CMT (midpoint of FY 2016 guidance) and the full year impact of a dropdown of 23% in Granite City. (1) Consolidated Revolver Availability $196M (Consolidated) Q4 ‘15 Q4 ‘16 Total Debt $1,004M $858M Leverage(3) 4.63x 3.95x

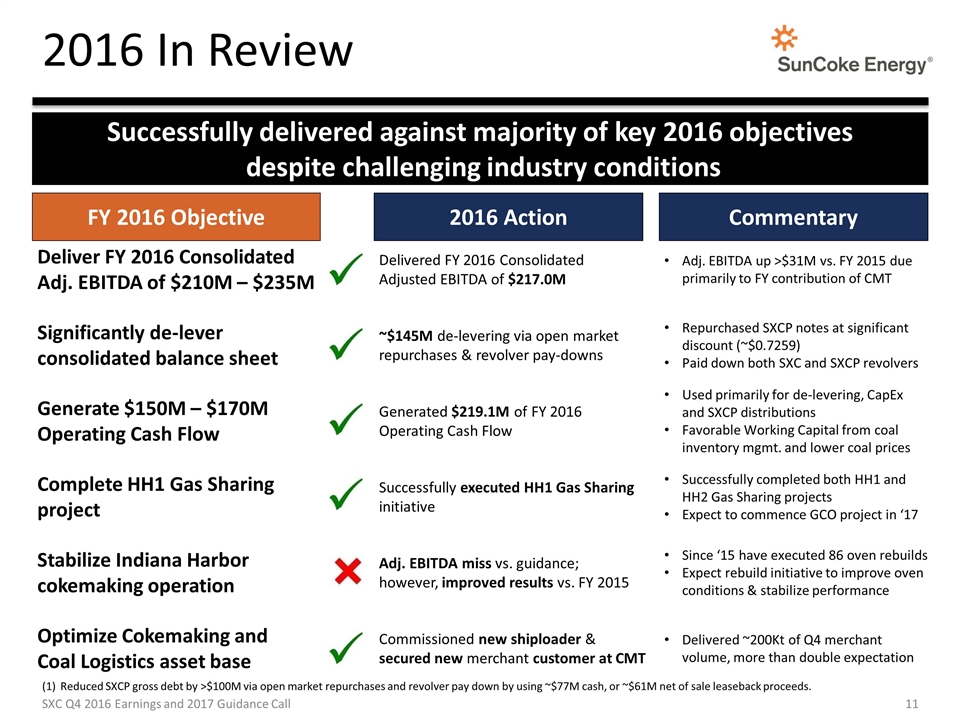

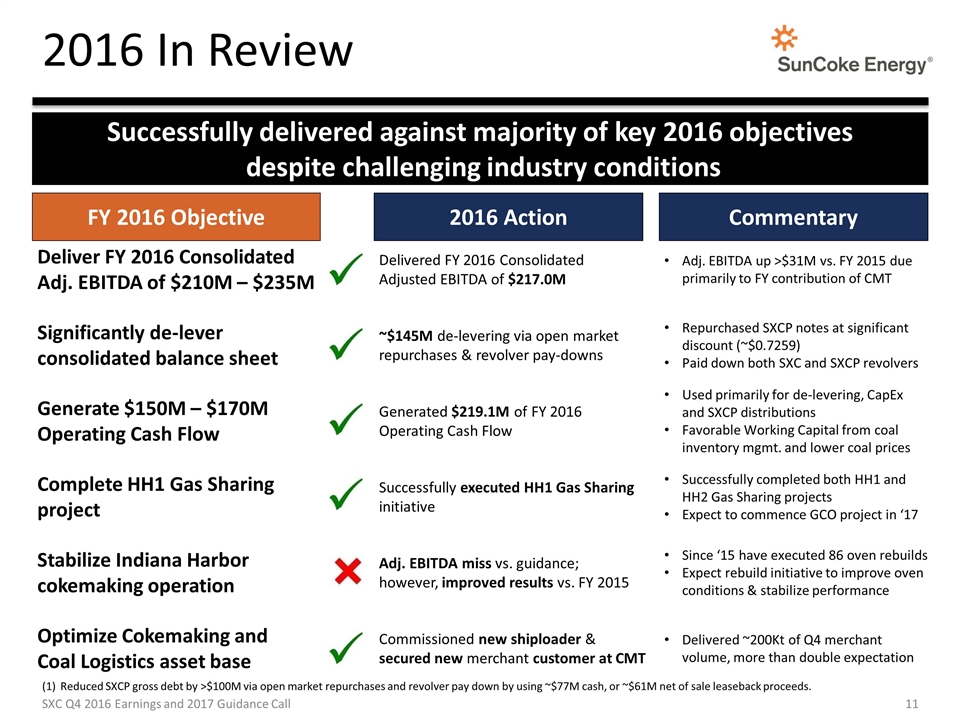

2016 In Review Successfully delivered against majority of key 2016 objectives despite challenging industry conditions SXC Q4 2016 Earnings and 2017 Guidance Call FY 2016 Objective 2016 Action Commentary Deliver FY 2016 Consolidated Adj. EBITDA of $210M – $235M Significantly de-lever consolidated balance sheet Generate $150M – $170M Operating Cash Flow Complete HH1 Gas Sharing project Optimize Cokemaking and Coal Logistics asset base Repurchased SXCP notes at significant discount (~$0.7259) Paid down both SXC and SXCP revolvers Delivered FY 2016 Consolidated Adjusted EBITDA of $217.0M ~$145M de-levering via open market repurchases & revolver pay-downs Stabilize Indiana Harbor cokemaking operation Adj. EBITDA miss vs. guidance; however, improved results vs. FY 2015 Adj. EBITDA up >$31M vs. FY 2015 due primarily to FY contribution of CMT Generated $219.1M of FY 2016 Operating Cash Flow Successfully executed HH1 Gas Sharing initiative Used primarily for de-levering, CapEx and SXCP distributions Favorable Working Capital from coal inventory mgmt. and lower coal prices Successfully completed both HH1 and HH2 Gas Sharing projects Expect to commence GCO project in ‘17 Since ‘15 have executed 86 oven rebuilds Expect rebuild initiative to improve oven conditions & stabilize performance Commissioned new shiploader & secured new merchant customer at CMT Delivered ~200Kt of Q4 merchant volume, more than double expectation Reduced SXCP gross debt by >$100M via open market repurchases and revolver pay down by using ~$77M cash, or ~$61M net of sale leaseback proceeds.

2017 Guidance

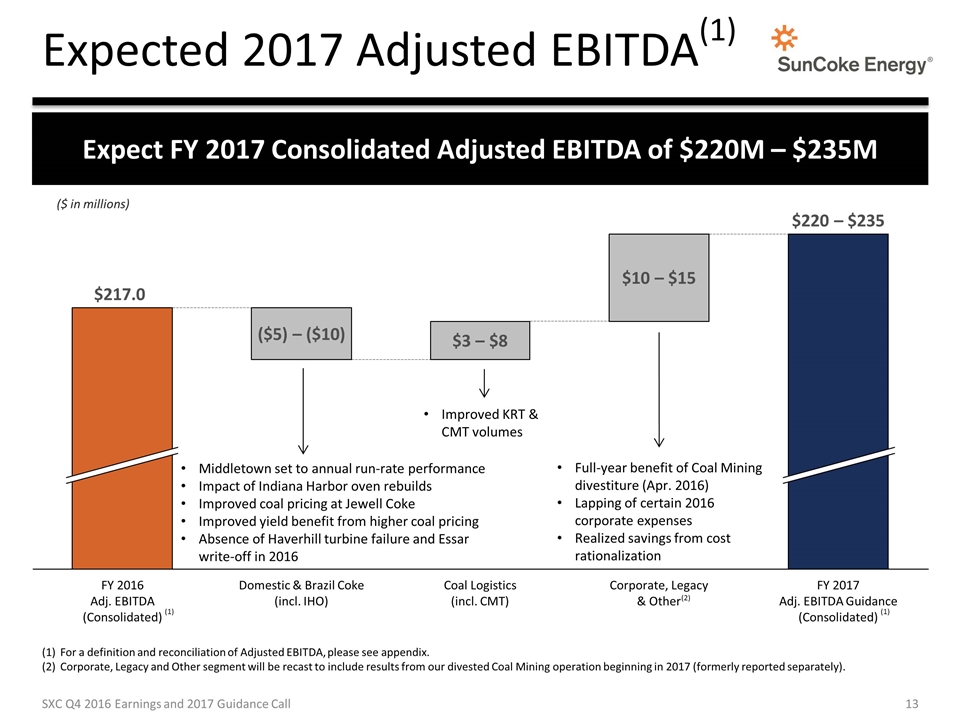

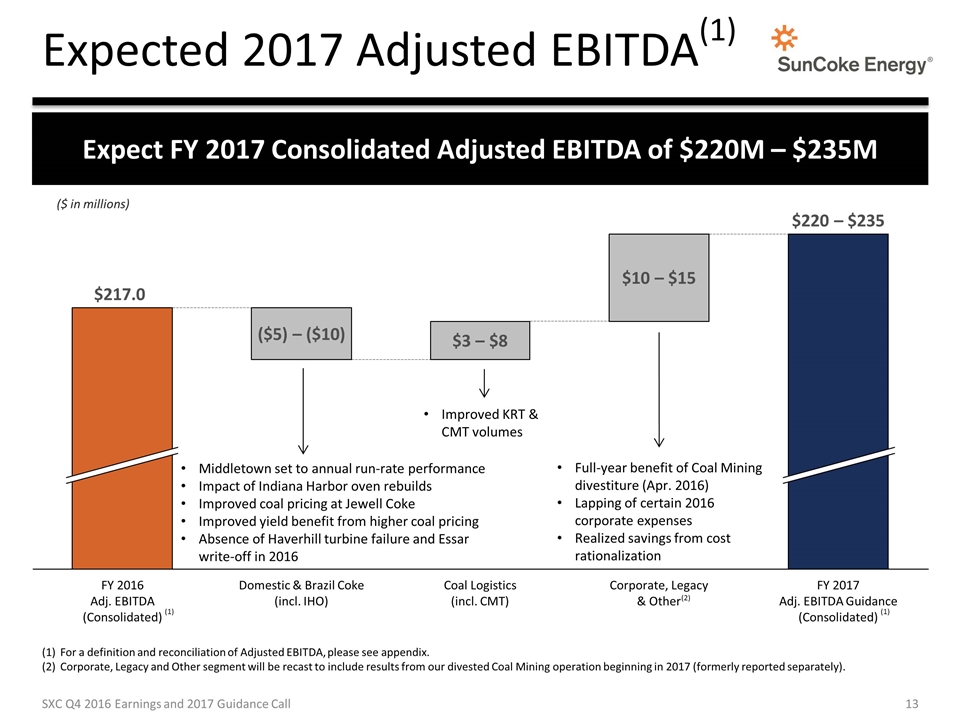

Expected 2017 Adjusted EBITDA(1) $220 – $235 $10 – $15 $3 – $8 ($5) – ($10) ($ in millions) Expect FY 2017 Consolidated Adjusted EBITDA of $220M – $235M For a definition and reconciliation of Adjusted EBITDA, please see appendix. Corporate, Legacy and Other segment will be recast to include results from our divested Coal Mining operation beginning in 2017 (formerly reported separately). (1) (1) Middletown set to annual run-rate performance Impact of Indiana Harbor oven rebuilds Improved coal pricing at Jewell Coke Improved yield benefit from higher coal pricing Absence of Haverhill turbine failure and Essar write-off in 2016 (2) Improved KRT & CMT volumes Full-year benefit of Coal Mining divestiture (Apr. 2016) Lapping of certain 2016 corporate expenses Realized savings from cost rationalization SXC Q4 2016 Earnings and 2017 Guidance Call

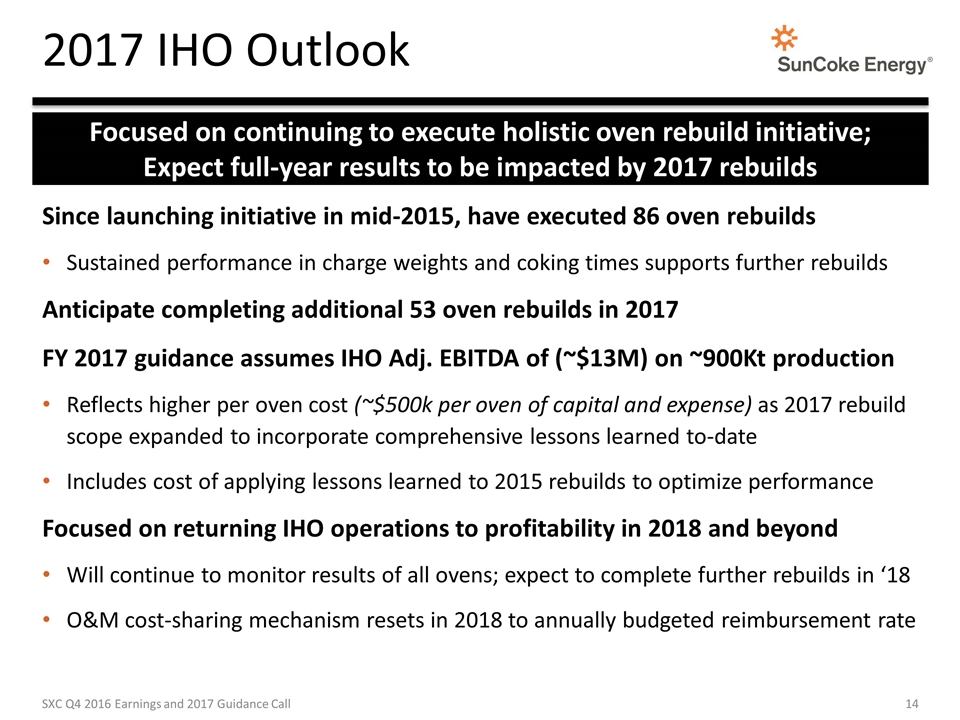

2017 IHO Outlook Focused on continuing to execute holistic oven rebuild initiative; Expect full-year results to be impacted by 2017 rebuilds Since launching initiative in mid-2015, have executed 86 oven rebuilds Sustained performance in charge weights and coking times supports further rebuilds Anticipate completing additional 53 oven rebuilds in 2017 FY 2017 guidance assumes IHO Adj. EBITDA of (~$13M) on ~900Kt production Reflects higher per oven cost (~$500k per oven of capital and expense) as 2017 rebuild scope expanded to incorporate comprehensive lessons learned to-date Includes cost of applying lessons learned to 2015 rebuilds to optimize performance Focused on returning IHO operations to profitability in 2018 and beyond Will continue to monitor results of all ovens; expect to complete further rebuilds in ‘18 O&M cost-sharing mechanism resets in 2018 to annually budgeted reimbursement rate SXC Q4 2016 Earnings and 2017 Guidance Call

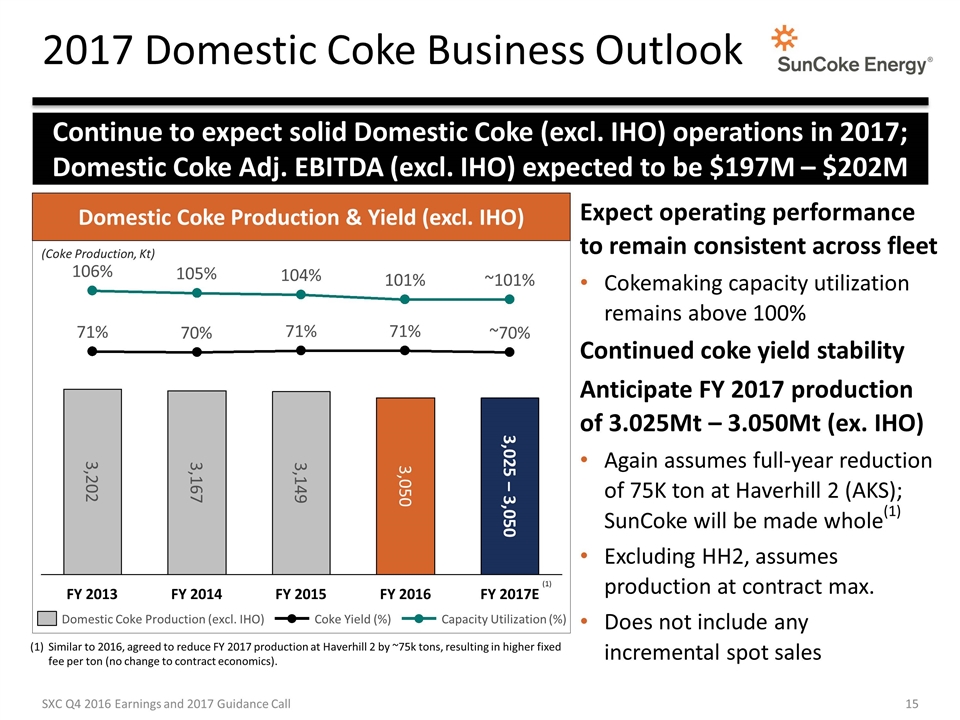

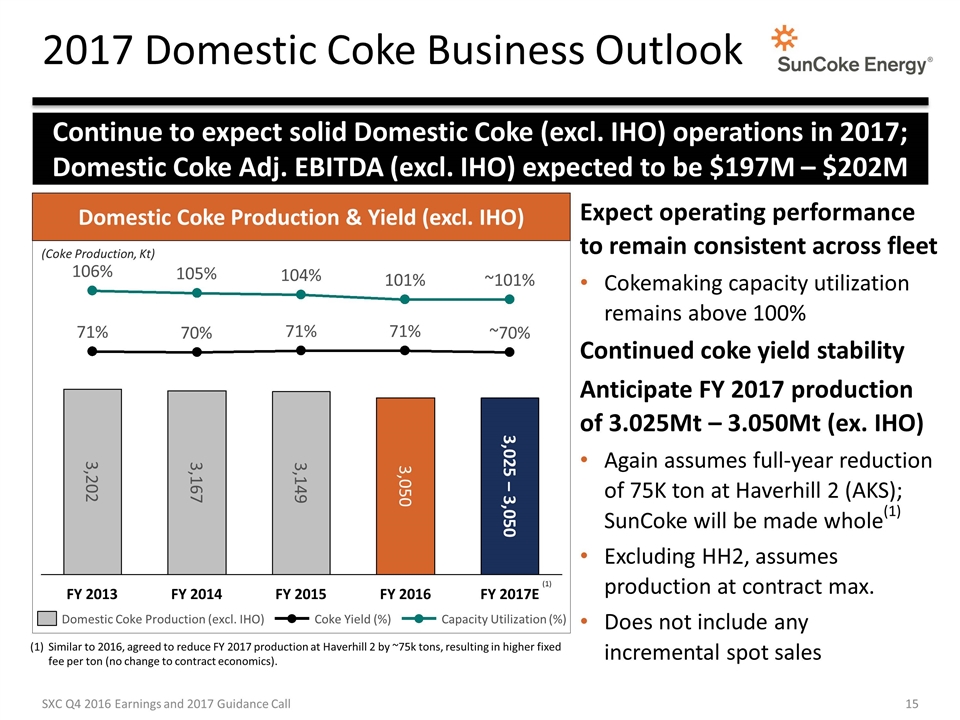

2017 Domestic Coke Business Outlook Continue to expect solid Domestic Coke (excl. IHO) operations in 2017; Domestic Coke Adj. EBITDA (excl. IHO) expected to be $197M – $202M Domestic Coke Production & Yield (excl. IHO) ~ ~ 3,025 – 3,050 Expect operating performance to remain consistent across fleet Cokemaking capacity utilization remains above 100% Continued coke yield stability Anticipate FY 2017 production of 3.025Mt – 3.050Mt (ex. IHO) Again assumes full-year reduction of 75K ton at Haverhill 2 (AKS); SunCoke will be made whole(1) Excluding HH2, assumes production at contract max. Does not include any incremental spot sales Similar to 2016, agreed to reduce FY 2017 production at Haverhill 2 by ~75k tons, resulting in higher fixed fee per ton (no change to contract economics). (Coke Production, Kt) SXC Q4 2016 Earnings and 2017 Guidance Call (1)

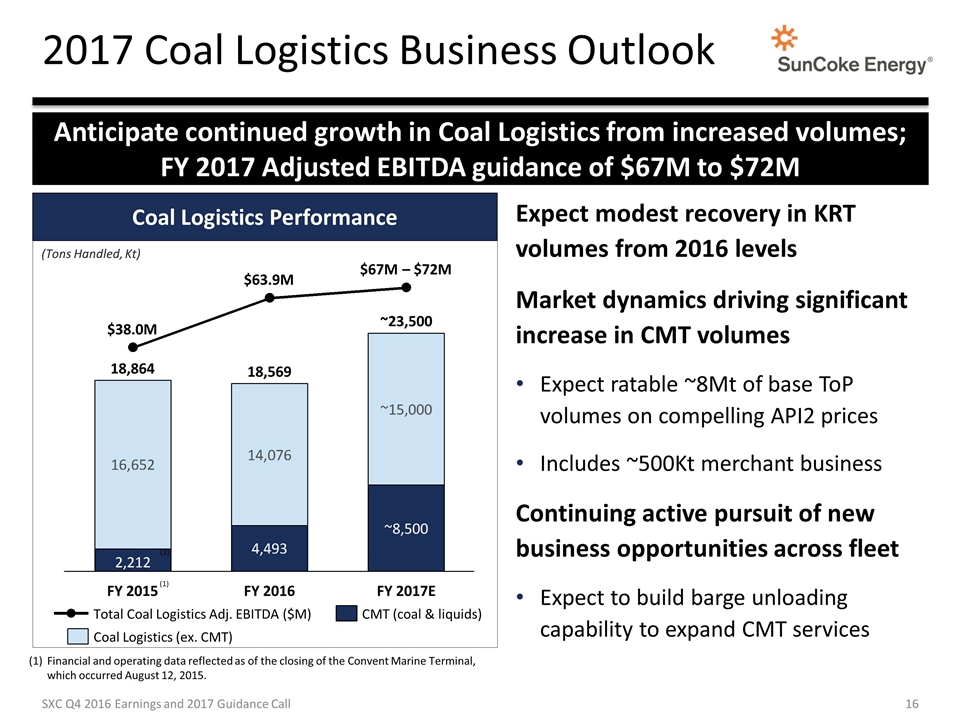

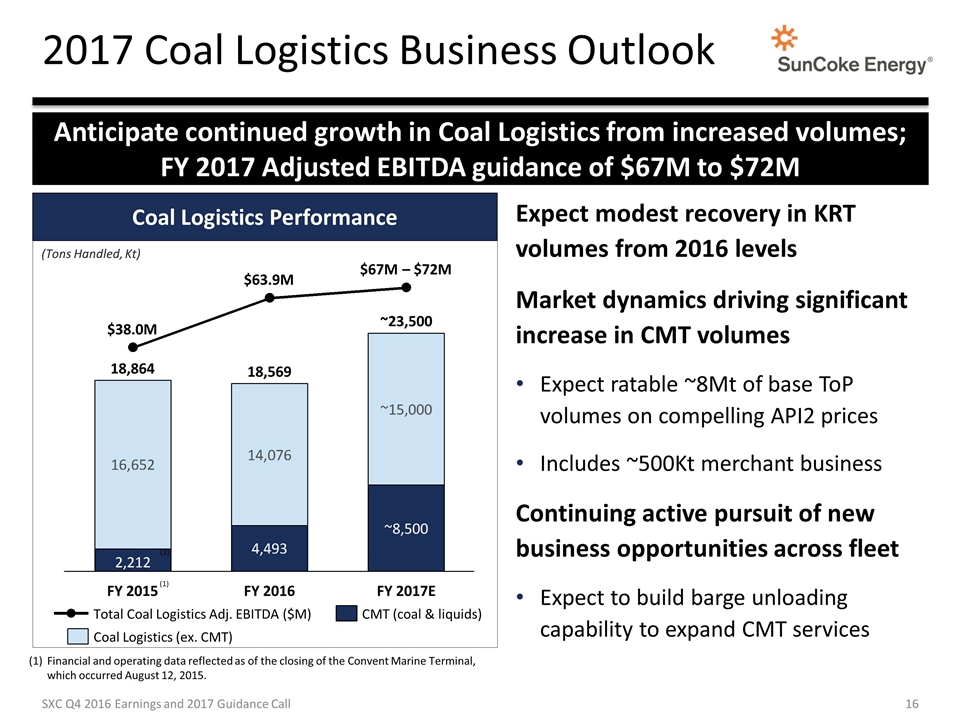

2017 Coal Logistics Business Outlook Anticipate continued growth in Coal Logistics from increased volumes; FY 2017 Adjusted EBITDA guidance of $67M to $72M ~23,500 ~8,500 ~ $67M – $72M M M (Tons Handled, Kt) Expect modest recovery in KRT volumes from 2016 levels Market dynamics driving significant increase in CMT volumes Expect ratable ~8Mt of base ToP volumes on compelling API2 prices Includes ~500Kt merchant business Continuing active pursuit of new business opportunities across fleet Expect to build barge unloading capability to expand CMT services Coal Logistics Performance Financial and operating data reflected as of the closing of the Convent Marine Terminal, which occurred August 12, 2015. (1) SXC Q4 2016 Earnings and 2017 Guidance Call (1)

SunCoke Cost Rationalization Engaged third party to assist management’s review of all SunCoke operations Partnered with A.T. Kearney in early-2016 to champion project alongside SunCoke management and local leadership Management and Board review encompassed all facets of SunCoke business Benchmarked and reviewed centralized and plant staffing levels Evaluated operational processes to identify savings Optimized procurement procedures, leveraging scale and ensuring proper pricing Anticipate annual cost savings of ~$10M, which are expected to drive annual Adjusted EBITDA benefit of ~$7M beginning in 2017 (included in guidance) Represents savings across corporate and operating facilities Includes savings passed through to steel customers as part of annual O&M budgeting process as well as cost avoidance (i.e., not recognized into SunCoke Adj. EBITDA) Project provided third-party validation of existing SunCoke practices SXC Q4 2016 Earnings and 2017 Guidance Call

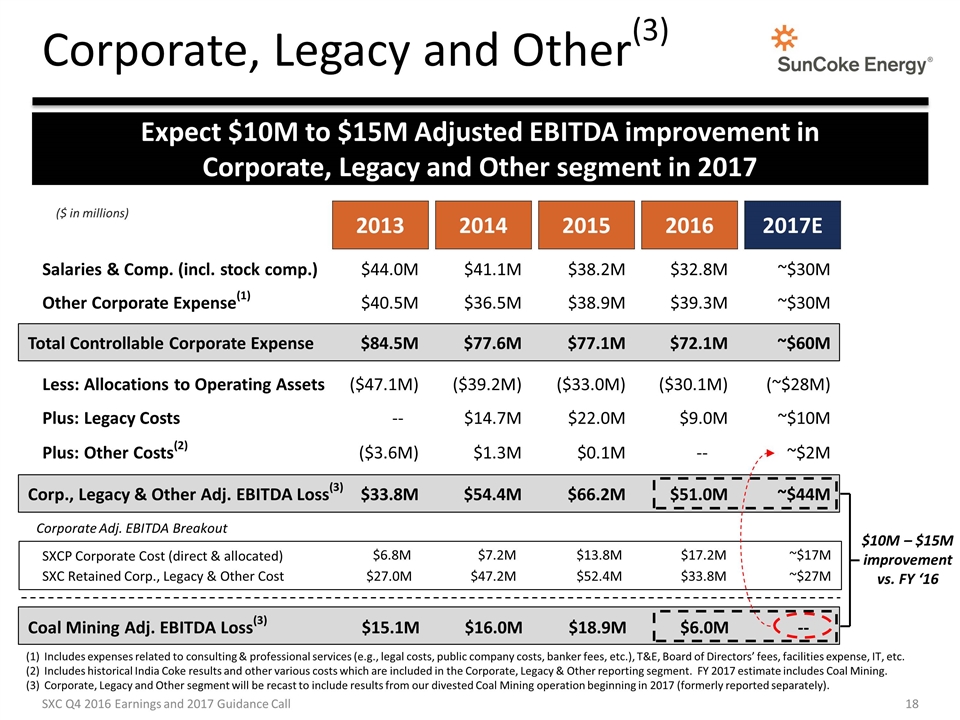

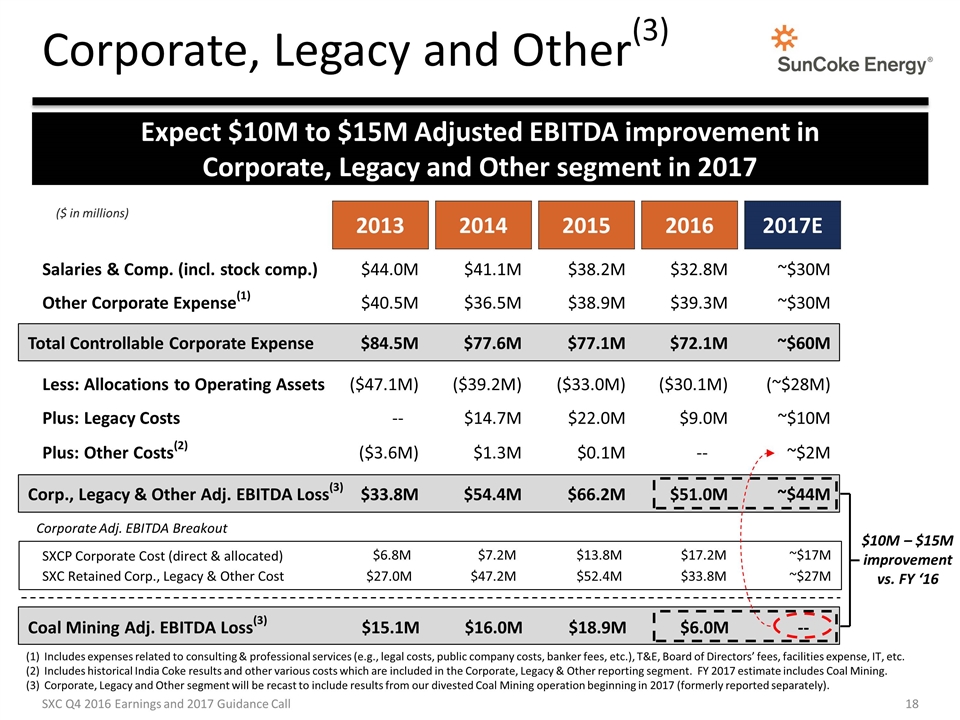

Corporate, Legacy and Other(3) SXC Q4 2016 Earnings and 2017 Guidance Call Expect $10M to $15M Adjusted EBITDA improvement in Corporate, Legacy and Other segment in 2017 Expect $10M to $15M Adjusted EBITDA improvement in Corporate, Legacy and Other segment in 2017 Includes expenses related to consulting & professional services (e.g., legal costs, public company costs, banker fees, etc.), T&E, Board of Directors’ fees, facilities expense, IT, etc. Includes historical India Coke results and other various costs which are included in the Corporate, Legacy & Other reporting segment. FY 2017 estimate includes Coal Mining. Corporate, Legacy and Other segment will be recast to include results from our divested Coal Mining operation beginning in 2017 (formerly reported separately). 2013 2014 2015 2016 2017E Total Controllable Corporate Expense Salaries & Comp. (incl. stock comp.) Other Corporate Expense(1) Corp., Legacy & Other Adj. EBITDA Loss(3) Less: Allocations to Operating Assets $44.0M $40.5M $84.5M ($47.1M) $33.8M $41.1M $36.5M $77.6M ($39.2M) $54.4M $38.2M $38.9M $77.1M ($33.0M) $66.2M $32.8M $39.3M $72.1M ($30.1M) $51.0M ~$30M ~$30M ~$60M (~$28M) ~$44M Plus: Legacy Costs -- $14.7M $22.0M $9.0M ~$10M Plus: Other Costs(2) ($3.6M) $1.3M $0.1M -- ~$2M ($ in millions) Coal Mining Adj. EBITDA Loss(3) $15.1M $16.0M $18.9M $6.0M -- SXCP Corporate Cost (direct & allocated) $6.8M $7.2M $13.8M $17.2M ~$17M SXC Retained Corp., Legacy & Other Cost $27.0M $47.2M $52.4M $33.8M ~$27M Corporate Adj. EBITDA Breakout $10M – $15M improvement vs. FY ‘16

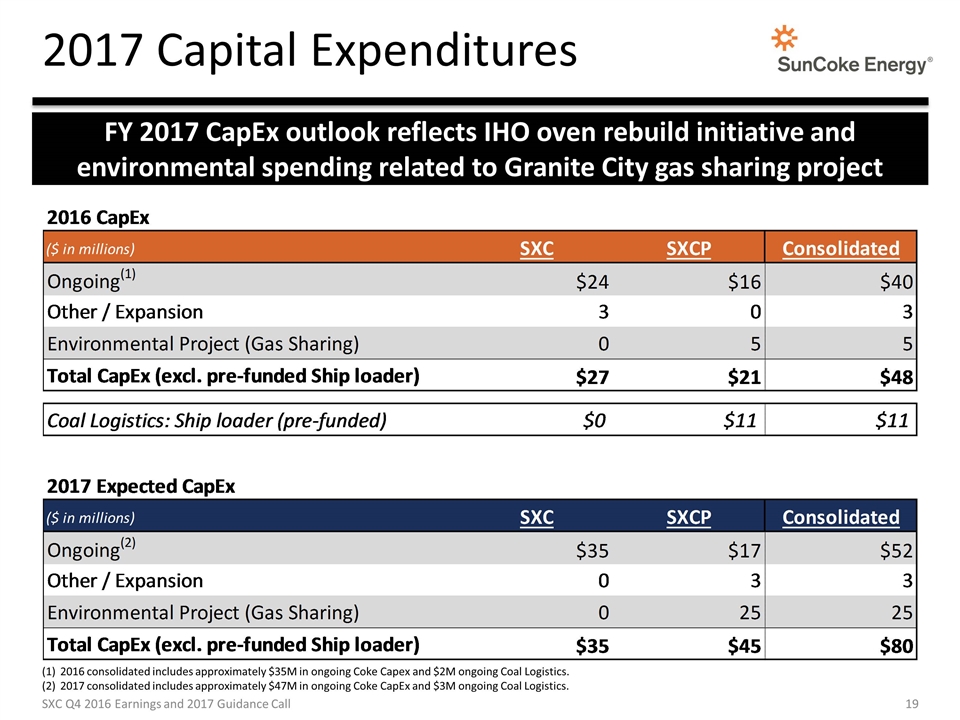

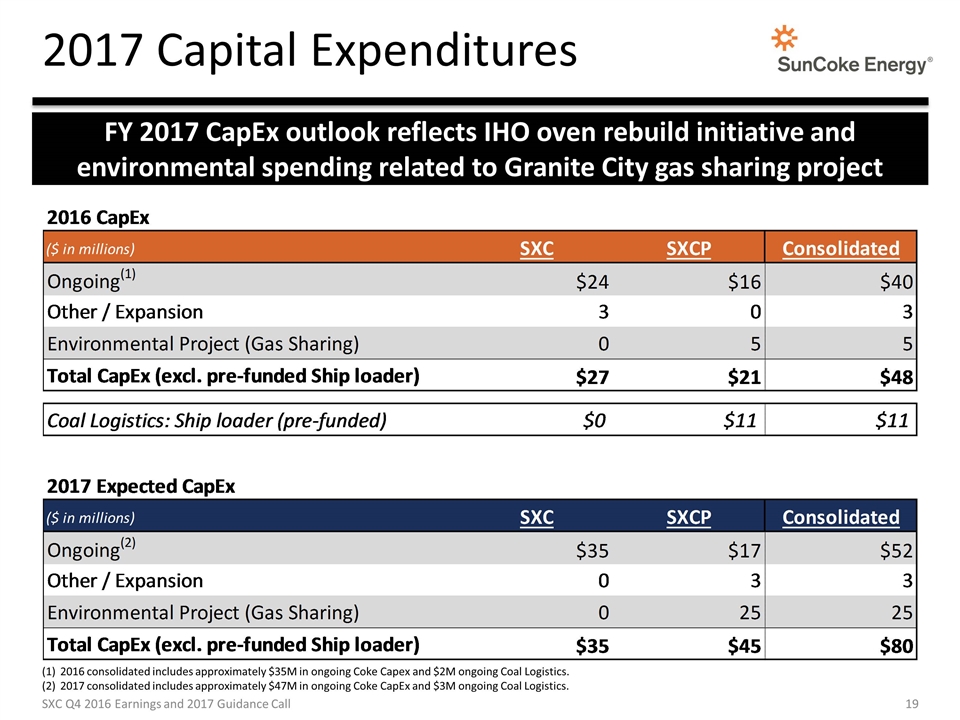

2017 Capital Expenditures SXC Q4 2016 Earnings and 2017 Guidance Call FY 2017 CapEx outlook reflects IHO oven rebuild initiative and environmental spending related to Granite City gas sharing project 2016 consolidated includes approximately $35M in ongoing Coke Capex and $2M ongoing Coal Logistics. 2017 consolidated includes approximately $47M in ongoing Coke CapEx and $3M ongoing Coal Logistics.

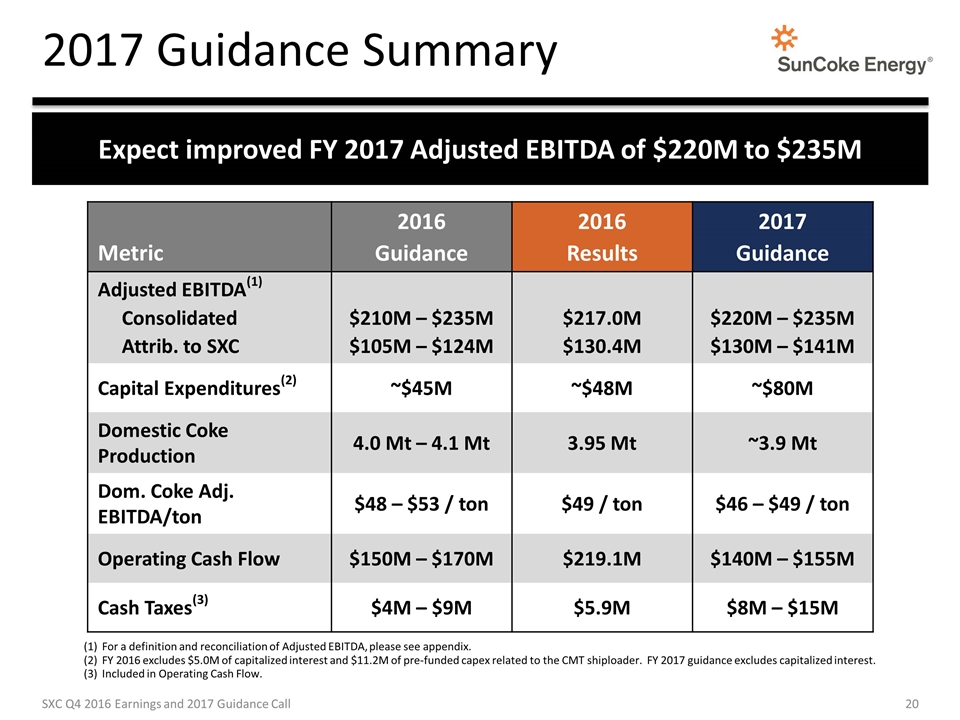

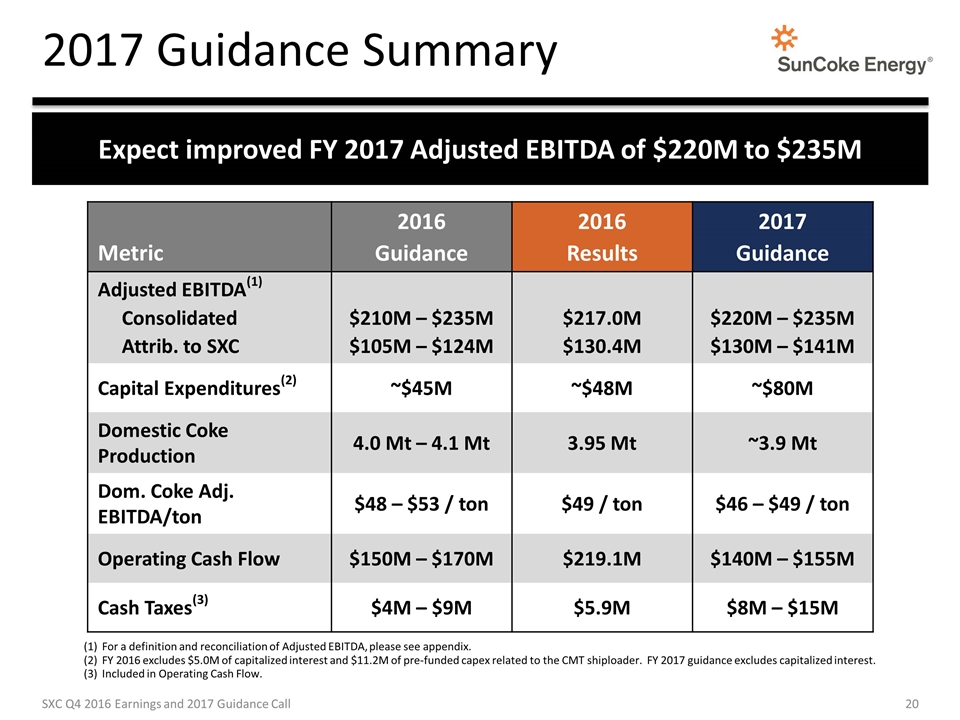

2017 Guidance Summary Metric 2016 Guidance 2016 Results 2017 Guidance Adjusted EBITDA(1) Consolidated Attrib. to SXC $210M – $235M $105M – $124M $217.0M $130.4M $220M – $235M $130M – $141M Capital Expenditures(2) ~$45M ~$48M ~$80M Domestic Coke Production 4.0 Mt – 4.1 Mt 3.95 Mt ~3.9 Mt Dom. Coke Adj. EBITDA/ton $48 – $53 / ton $49 / ton $46 – $49 / ton Operating Cash Flow $150M – $170M $219.1M $140M – $155M Cash Taxes(3) $4M – $9M $5.9M $8M – $15M For a definition and reconciliation of Adjusted EBITDA, please see appendix. FY 2016 excludes $5.0M of capitalized interest and $11.2M of pre-funded capex related to the CMT shiploader. FY 2017 guidance excludes capitalized interest. Included in Operating Cash Flow. Expect improved FY 2017 Adjusted EBITDA of $220M to $235M SXC Q4 2016 Earnings and 2017 Guidance Call

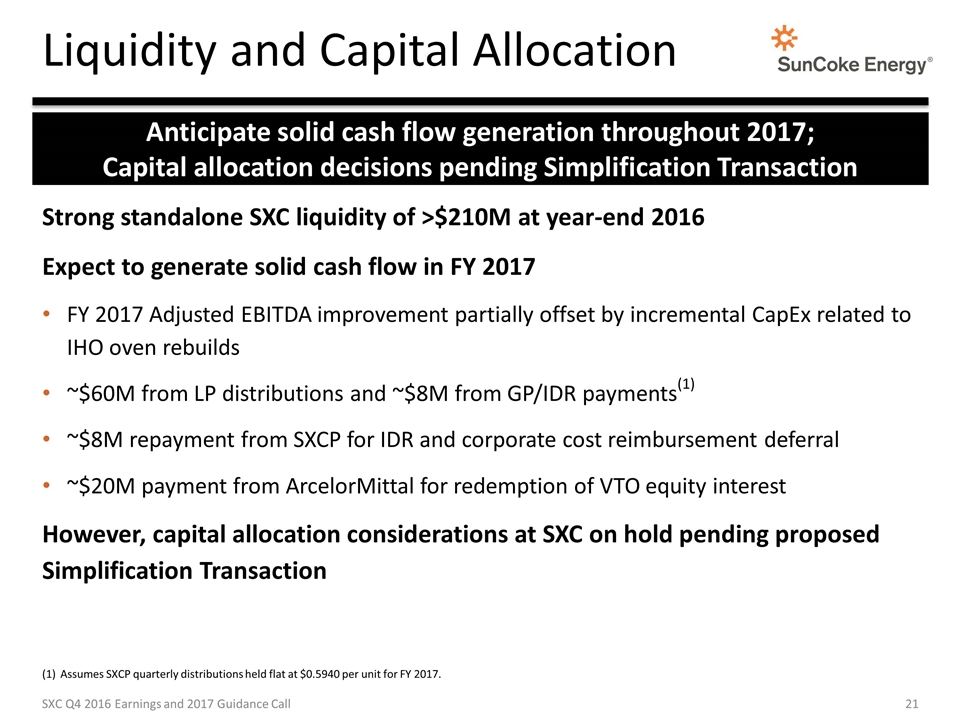

Liquidity and Capital Allocation Anticipate solid cash flow generation throughout 2017; Capital allocation decisions pending Simplification Transaction Strong standalone SXC liquidity of >$210M at year-end 2016 Expect to generate solid cash flow in FY 2017 FY 2017 Adjusted EBITDA improvement partially offset by incremental CapEx related to IHO oven rebuilds ~$60M from LP distributions and ~$8M from GP/IDR payments(1) ~$8M repayment from SXCP for IDR and corporate cost reimbursement deferral ~$20M payment from ArcelorMittal for redemption of VTO equity interest However, capital allocation considerations at SXC on hold pending proposed Simplification Transaction Assumes SXCP quarterly distributions held flat at $0.5940 per unit for FY 2017. SXC Q4 2016 Earnings and 2017 Guidance Call

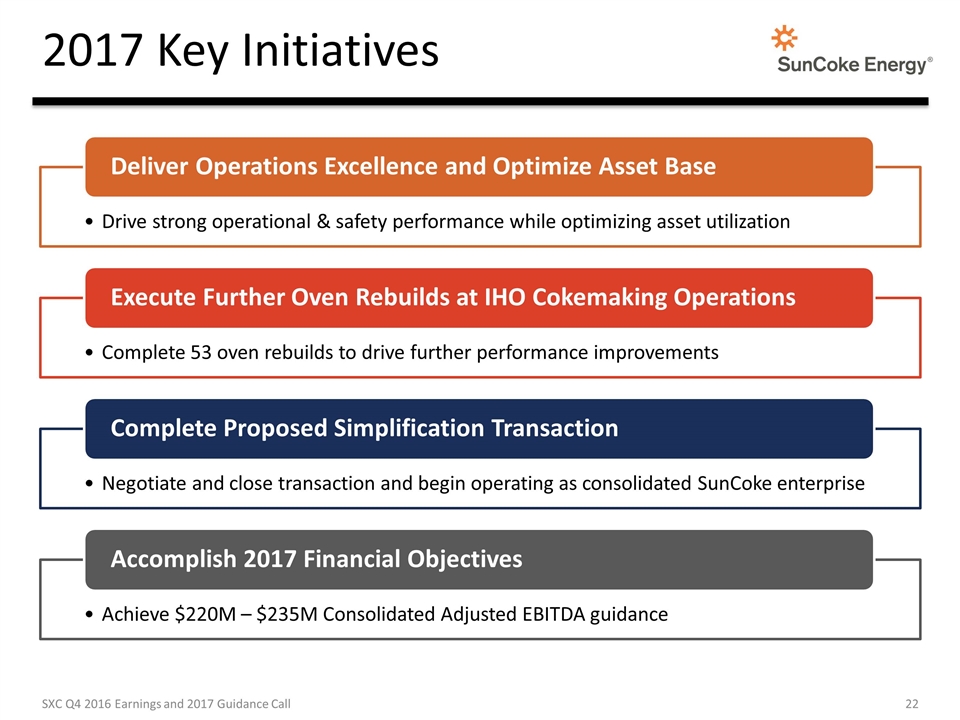

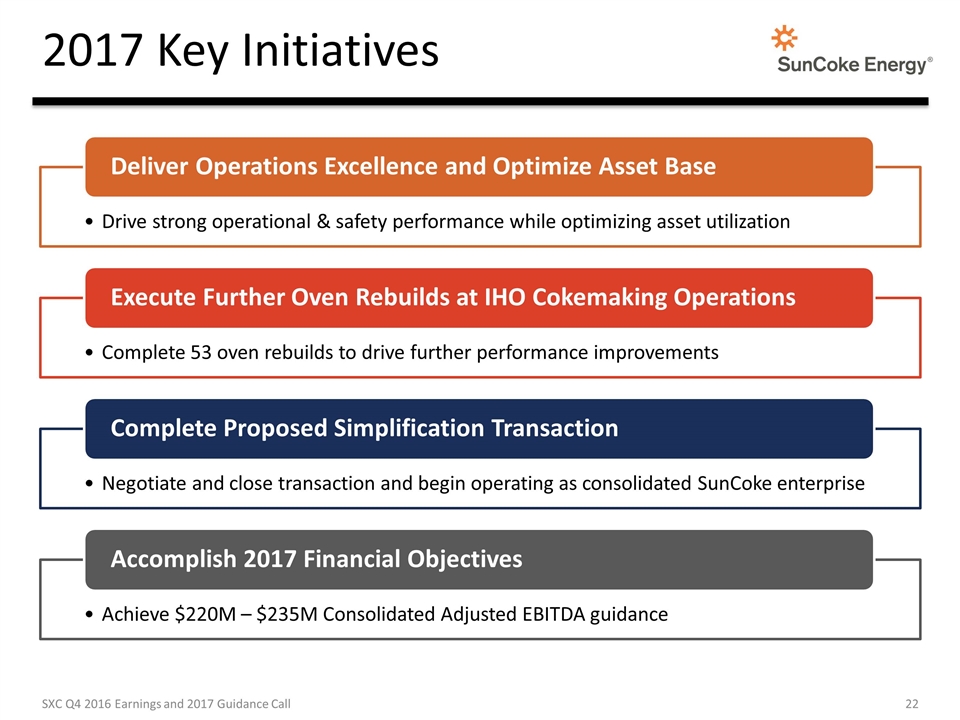

2017 Key Initiatives Drive strong operational & safety performance while optimizing asset utilization Deliver Operations Excellence and Optimize Asset Base Complete 53 oven rebuilds to drive further performance improvements Execute Further Oven Rebuilds at IHO Cokemaking Operations Negotiate and close transaction and begin operating as consolidated SunCoke enterprise Complete Proposed Simplification Transaction Achieve $220M – $235M Consolidated Adjusted EBITDA guidance Accomplish 2017 Financial Objectives SXC Q4 2016 Earnings and 2017 Guidance Call

Questions

Investor Relations 630-824-1907 www.suncoke.com

Appendix

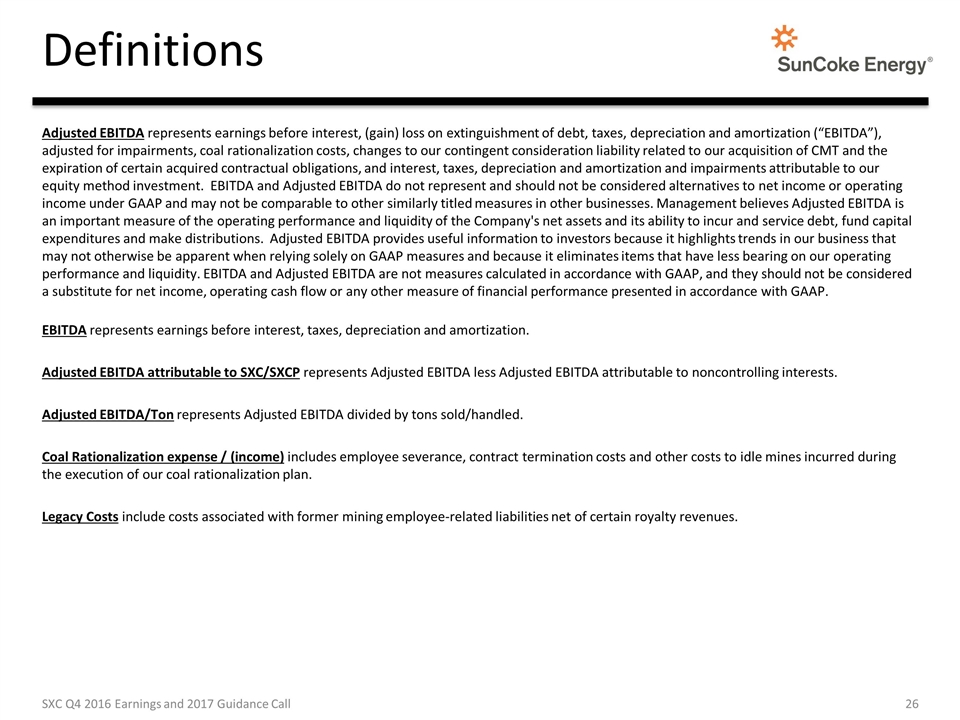

Definitions Adjusted EBITDA represents earnings before interest, (gain) loss on extinguishment of debt, taxes, depreciation and amortization (“EBITDA”), adjusted for impairments, coal rationalization costs, changes to our contingent consideration liability related to our acquisition of CMT and the expiration of certain acquired contractual obligations, and interest, taxes, depreciation and amortization and impairments attributable to our equity method investment. EBITDA and Adjusted EBITDA do not represent and should not be considered alternatives to net income or operating income under GAAP and may not be comparable to other similarly titled measures in other businesses. Management believes Adjusted EBITDA is an important measure of the operating performance and liquidity of the Company's net assets and its ability to incur and service debt, fund capital expenditures and make distributions. Adjusted EBITDA provides useful information to investors because it highlights trends in our business that may not otherwise be apparent when relying solely on GAAP measures and because it eliminates items that have less bearing on our operating performance and liquidity. EBITDA and Adjusted EBITDA are not measures calculated in accordance with GAAP, and they should not be considered a substitute for net income, operating cash flow or any other measure of financial performance presented in accordance with GAAP. EBITDA represents earnings before interest, taxes, depreciation and amortization. Adjusted EBITDA attributable to SXC/SXCP represents Adjusted EBITDA less Adjusted EBITDA attributable to noncontrolling interests. Adjusted EBITDA/Ton represents Adjusted EBITDA divided by tons sold/handled. Coal Rationalization expense / (income) includes employee severance, contract termination costs and other costs to idle mines incurred during the execution of our coal rationalization plan. Legacy Costs include costs associated with former mining employee-related liabilities net of certain royalty revenues. SXC Q4 2016 Earnings and 2017 Guidance Call

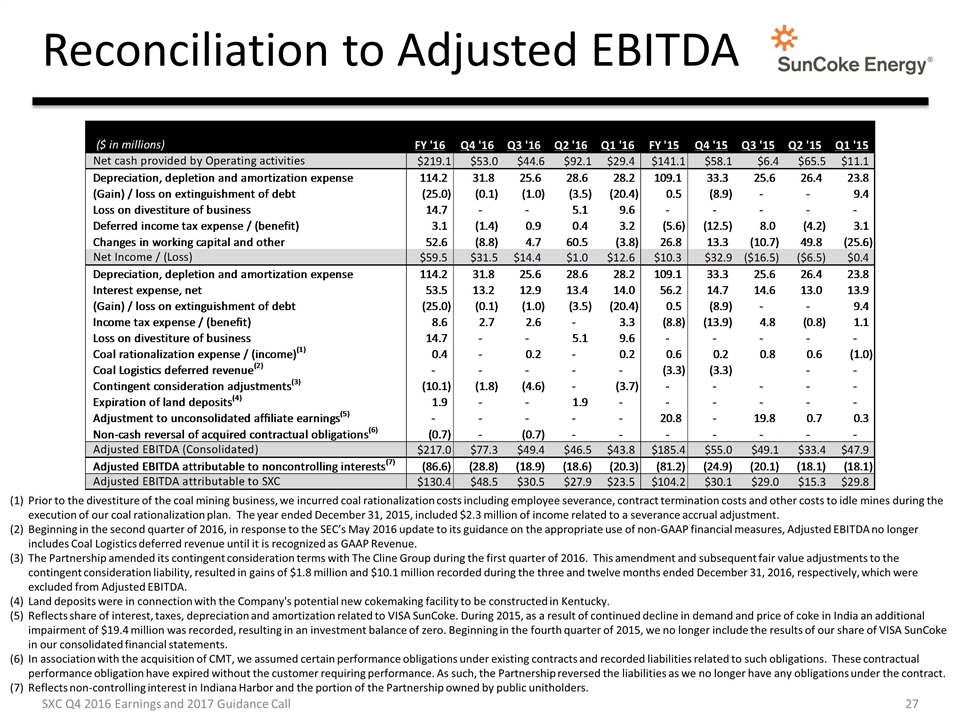

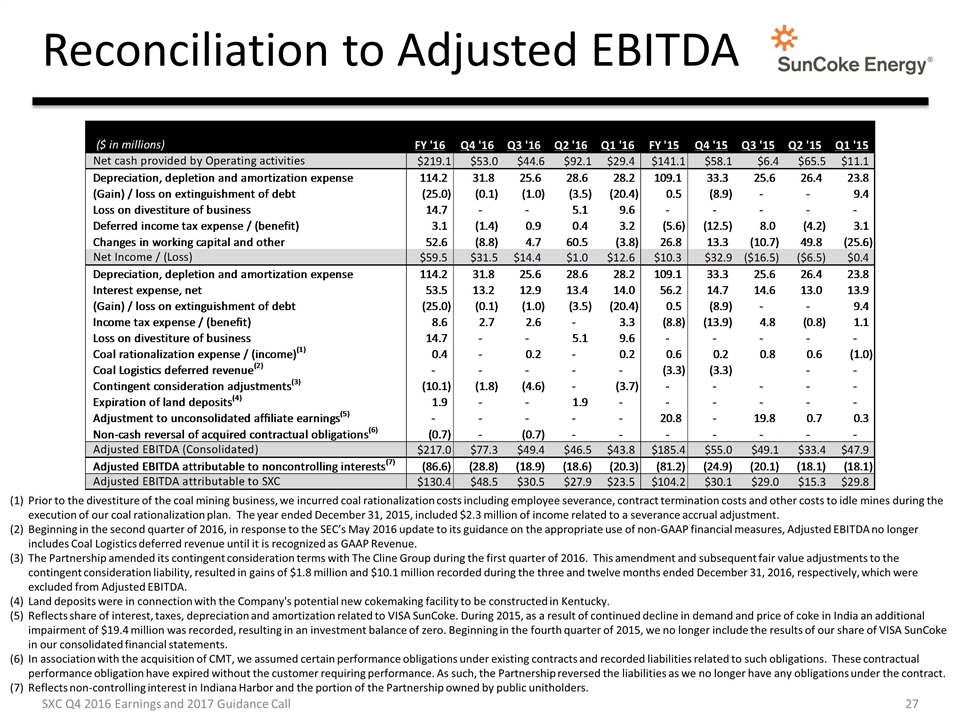

Reconciliation to Adjusted EBITDA Prior to the divestiture of the coal mining business, we incurred coal rationalization costs including employee severance, contract termination costs and other costs to idle mines during the execution of our coal rationalization plan. The year ended December 31, 2015, included $2.3 million of income related to a severance accrual adjustment. Beginning in the second quarter of 2016, in response to the SEC’s May 2016 update to its guidance on the appropriate use of non-GAAP financial measures, Adjusted EBITDA no longer includes Coal Logistics deferred revenue until it is recognized as GAAP Revenue. The Partnership amended its contingent consideration terms with The Cline Group during the first quarter of 2016. This amendment and subsequent fair value adjustments to the contingent consideration liability, resulted in gains of $1.8 million and $10.1 million recorded during the three and twelve months ended December 31, 2016, respectively, which were excluded from Adjusted EBITDA. Land deposits were in connection with the Company's potential new cokemaking facility to be constructed in Kentucky. Reflects share of interest, taxes, depreciation and amortization related to VISA SunCoke. During 2015, as a result of continued decline in demand and price of coke in India an additional impairment of $19.4 million was recorded, resulting in an investment balance of zero. Beginning in the fourth quarter of 2015, we no longer include the results of our share of VISA SunCoke in our consolidated financial statements. In association with the acquisition of CMT, we assumed certain performance obligations under existing contracts and recorded liabilities related to such obligations. These contractual performance obligation have expired without the customer requiring performance. As such, the Partnership reversed the liabilities as we no longer have any obligations under the contract. Reflects non-controlling interest in Indiana Harbor and the portion of the Partnership owned by public unitholders. SXC Q4 2016 Earnings and 2017 Guidance Call

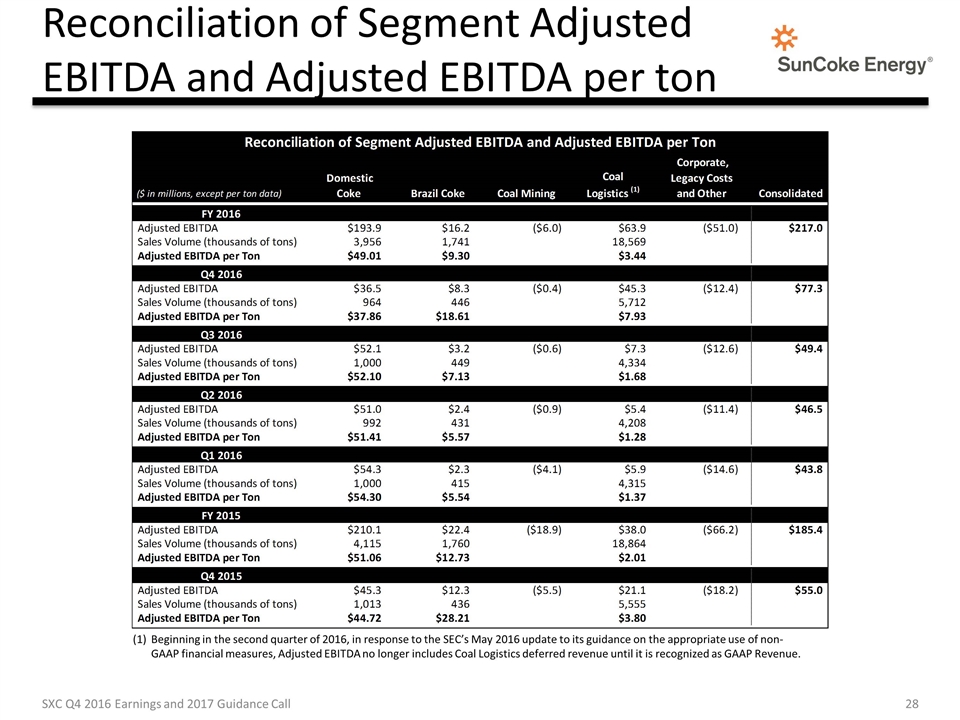

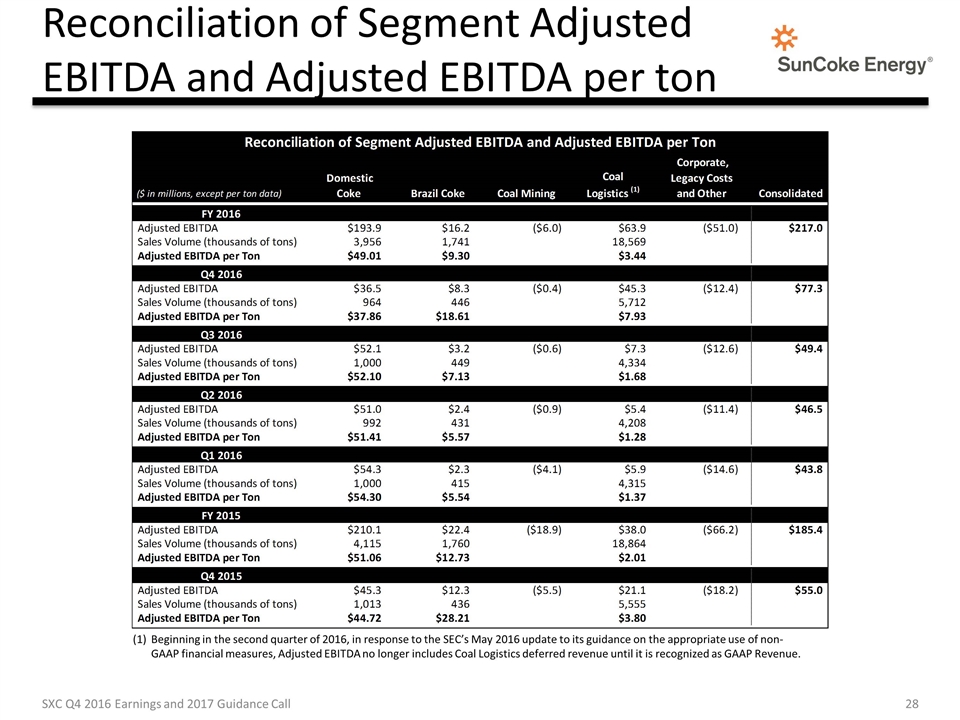

Reconciliation of Segment Adjusted EBITDA and Adjusted EBITDA per ton Beginning in the second quarter of 2016, in response to the SEC’s May 2016 update to its guidance on the appropriate use of non-GAAP financial measures, Adjusted EBITDA no longer includes Coal Logistics deferred revenue until it is recognized as GAAP Revenue. SXC Q4 2016 Earnings and 2017 Guidance Call

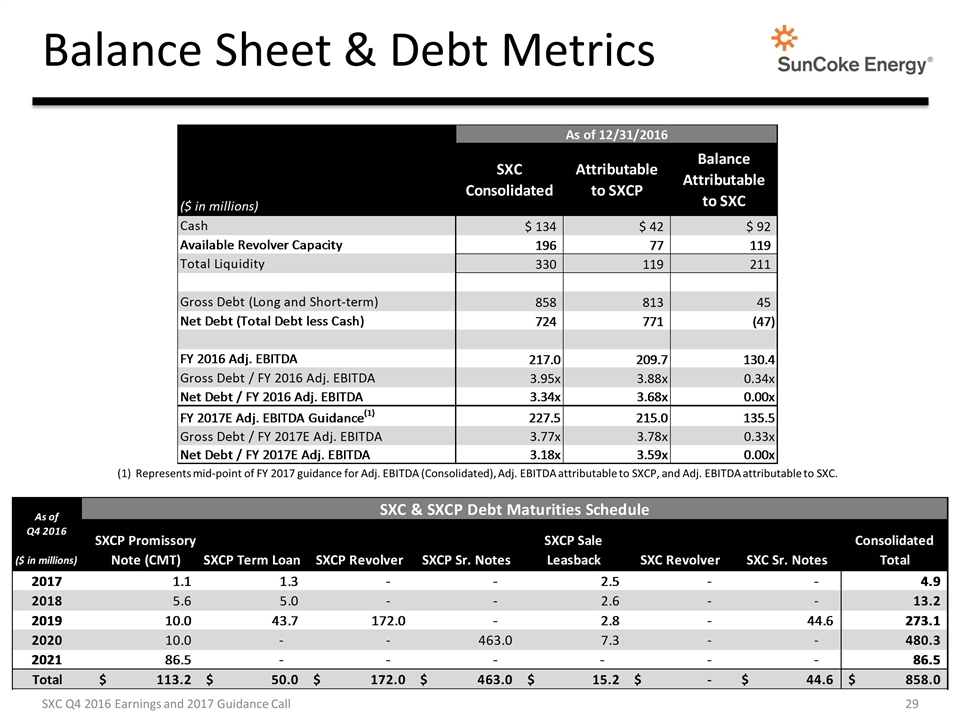

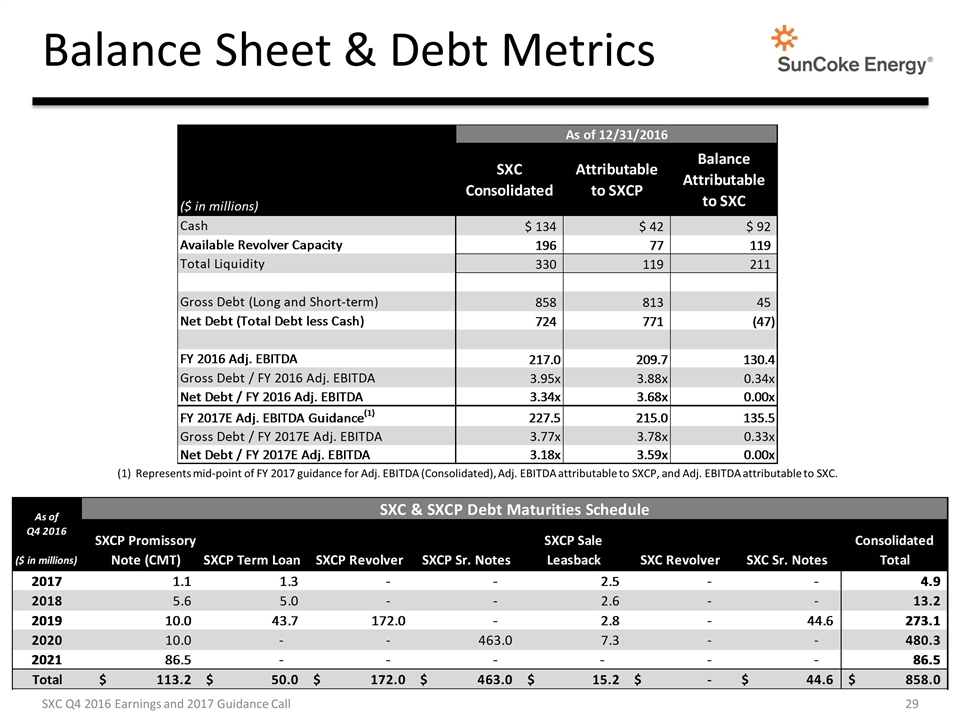

Balance Sheet & Debt Metrics Represents mid-point of FY 2017 guidance for Adj. EBITDA (Consolidated), Adj. EBITDA attributable to SXCP, and Adj. EBITDA attributable to SXC. SXC Q4 2016 Earnings and 2017 Guidance Call

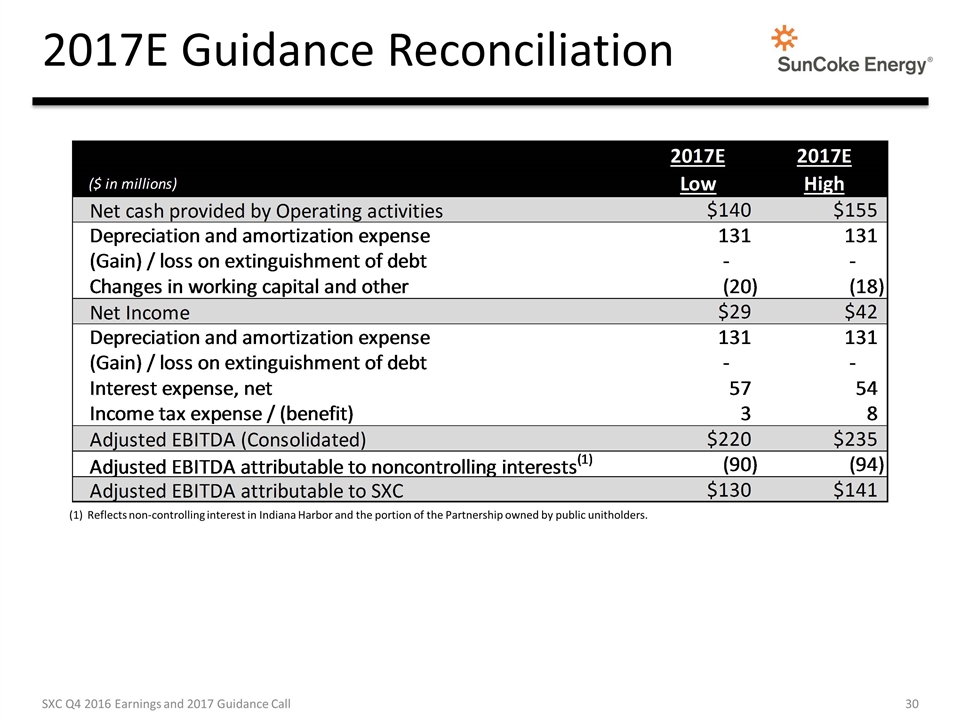

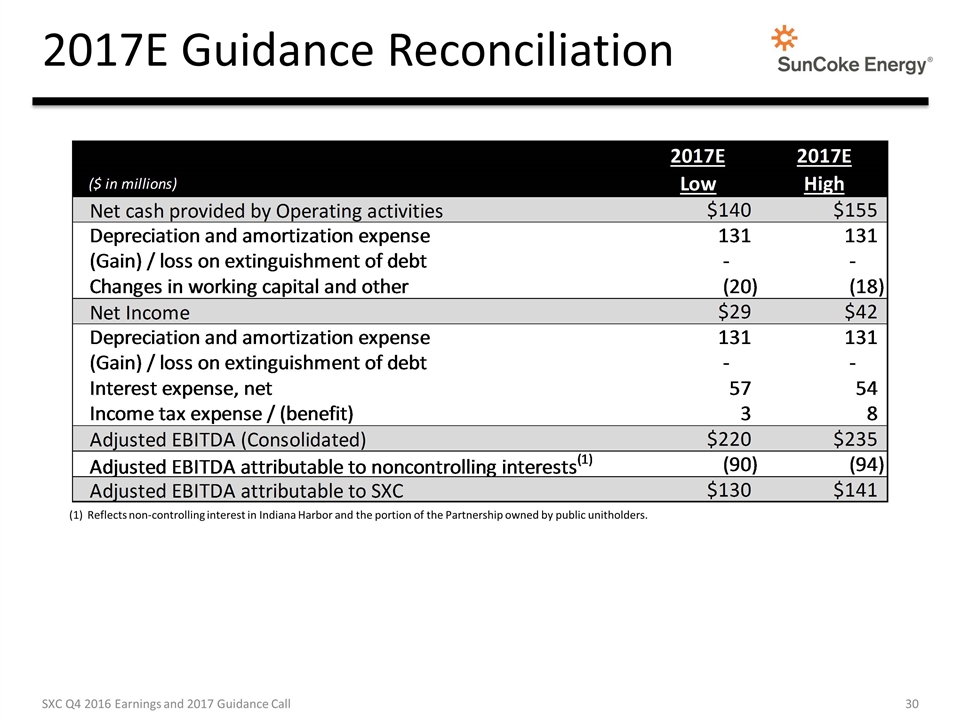

2017E Guidance Reconciliation Reflects non-controlling interest in Indiana Harbor and the portion of the Partnership owned by public unitholders. SXC Q4 2016 Earnings and 2017 Guidance Call

Brazil Coke Facility Transactions Announced Brazil Coke Facility Transactions on November 29, 2016 – For more information visit www.suncoke.com Announced ArcelorMittal Brasil S.A. redemption of SunCoke equity interest in Brazil facility on November 29, 2016 for cash consideration of $41M SXC received $20.5M in Q4 2016, with remaining $20.5M to be received in Apr. 2017 With redemption, SunCoke will no longer receive ~$9.5M annual dividend Additionally, beginning in 2016 SunCoke will receive incremental $5.1M in technology fees per year through 2023 Addition of certain patents to its IP licensing agreement in use by ArcelorMittal Results in net reduction of $4.4M to annual Adjusted EBITDA SunCoke will continue to earn existing operating & technology fees of ~$10M per year through 2023 Expect total Brazil Adj. EBITDA of $15M per annum through 2023 Patents extended through 2033 with Brazilian authorities, providing opportunity to extend existing operational & technology fees ($10M) beyond 2023 expiration SXC Q4 2016 Earnings and 2017 Guidance Call

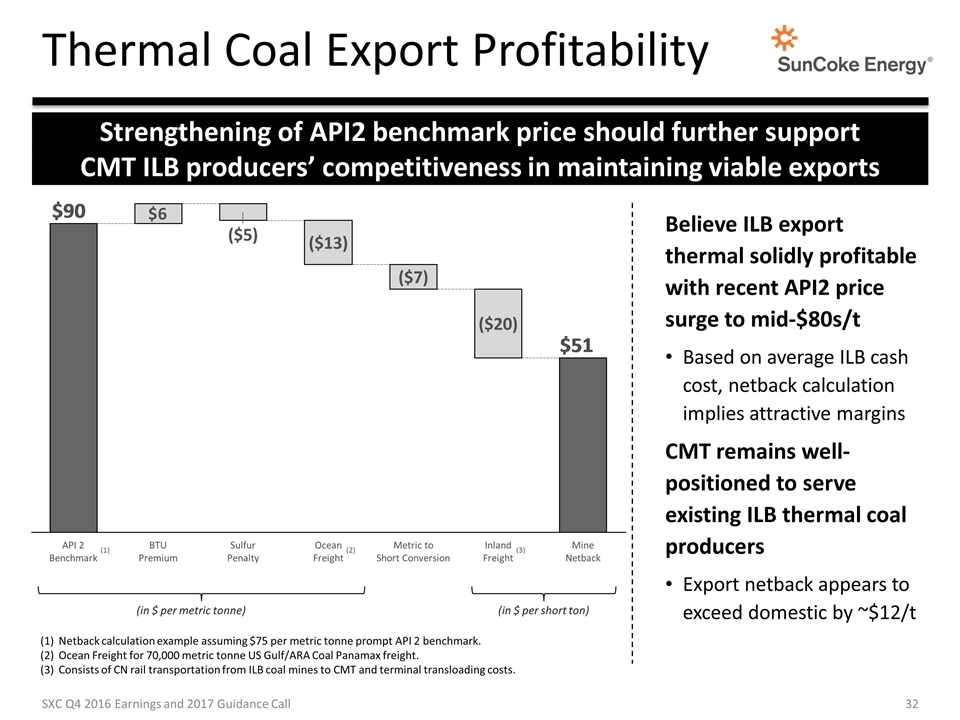

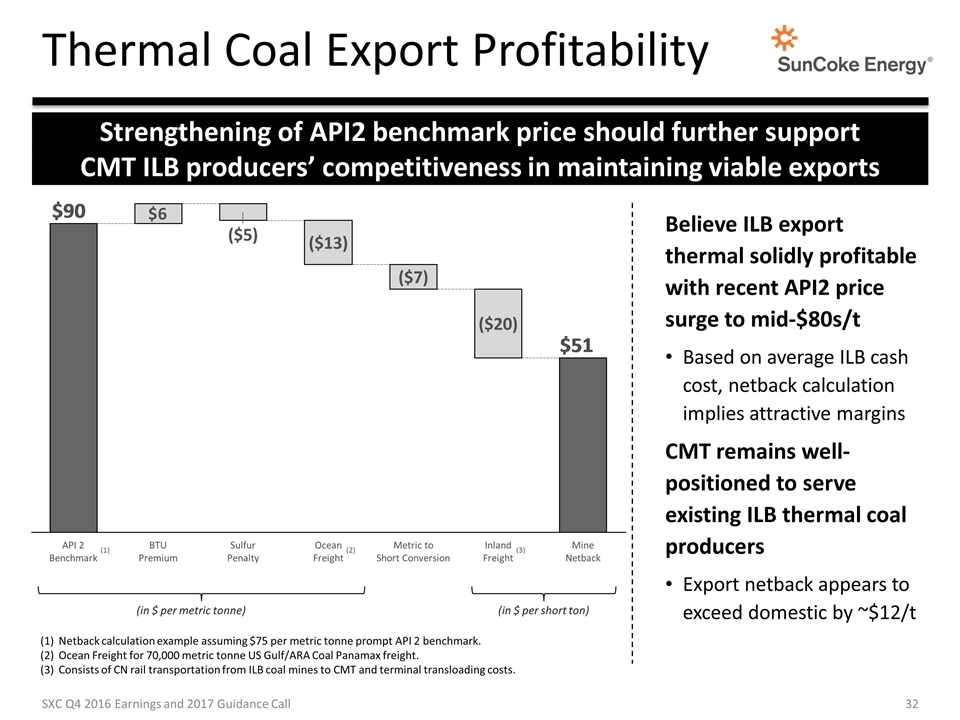

Thermal Coal Export Profitability (in $ per metric tonne) Strengthening of API2 benchmark price should further support CMT ILB producers’ competitiveness in maintaining viable exports Netback calculation example assuming $75 per metric tonne prompt API 2 benchmark. Ocean Freight for 70,000 metric tonne US Gulf/ARA Coal Panamax freight. Consists of CN rail transportation from ILB coal mines to CMT and terminal transloading costs. (1) (2) Believe ILB export thermal solidly profitable with recent API2 price surge to mid-$80s/t Based on average ILB cash cost, netback calculation implies attractive margins CMT remains well-positioned to serve existing ILB thermal coal producers Export netback appears to exceed domestic by ~$12/t (in $ per short ton) (3) SXC Q4 2016 Earnings and 2017 Guidance Call