SunCoke Energy, Inc. Q2 2017 Earnings Conference Call July 27, 2017 Exhibit 99.2

Forward-Looking Statements This slide presentation should be reviewed in conjunction with the Second Quarter 2017 earnings release of SunCoke Energy, Inc. (SXC) and conference call held on July 27, 2017 at 11:00 a.m. ET. Some of the information included in this presentation constitutes “forward-looking statements” as defined in Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. All statements in this presentation that express opinions, expectations, beliefs, plans, objectives, assumptions or projections with respect to anticipated future performance of SXC or SunCoke Energy Partners, L.P. (SXCP), in contrast with statements of historical facts, are forward-looking statements. Such forward-looking statements are based on management’s beliefs and assumptions and on information currently available. Forward-looking statements include information concerning possible or assumed future results of operations, business strategies, financing plans, competitive position, potential growth opportunities, potential operating performance improvements, the effects of competition and the effects of future legislation or regulations. Forward-looking statements include all statements that are not historical facts and may be identified by the use of forward-looking terminology such as the words “believe,” “expect,” “plan,” “intend,” “anticipate,” “estimate,” “predict,” “potential,” “continue,” “may,” “will,” “should” or the negative of these terms or similar expressions. Although management believes that its plans, intentions and expectations reflected in or suggested by the forward-looking statements made in this presentation are reasonable, no assurance can be given that these plans, intentions or expectations will be achieved when anticipated or at all. Moreover, such statements are subject to a number of assumptions, risks and uncertainties. Many of these risks are beyond the control of SXC and SXCP, and may cause actual results to differ materially from those implied or expressed by the forward-looking statements. Each of SXC and SXCP has included in its filings with the Securities and Exchange Commission cautionary language identifying important factors (but not necessarily all the important factors) that could cause actual results to differ materially from those expressed in any forward-looking statement. For more information concerning these factors, see the Securities and Exchange Commission filings of SXC and SXCP. All forward-looking statements included in this presentation are expressly qualified in their entirety by such cautionary statements. Although forward-looking statements are based on current beliefs and expectations, caution should be taken not to place undue reliance on any such forward-looking statements because such statements speak only as of the date hereof. SXC and SXCP do not have any intention or obligation to update publicly any forward-looking statement (or its associated cautionary language) whether as a result of new information or future events or after the date of this presentation, except as required by applicable law. This presentation includes certain non-GAAP financial measures intended to supplement, not substitute for, comparable GAAP measures. Reconciliations of non-GAAP financial measures to GAAP financial measures are provided in the Appendix at the end of the presentation. Investors are urged to consider carefully the comparable GAAP measures and the reconciliations to those measures provided in the Appendix. SXC Q2 2017 Earnings Call

Q2 2017 Highlights Achieved operating performance across coke and coal logistics fleet in line with expectations Began 2017 oven rebuild campaign at IHO; first set of completed ovens demonstrating strong performance Delivered significantly improved year-over-year performance at CMT Successfully completed refinancing of capital structure Purchased ~1.5M SXCP units for ~$25M in Q2; through July 26, 2017, total purchases of 1.6M units for ~$27M Remain well positioned to achieve FY 2017 Adj. EBITDA guidance of $220M to $235M SXC Q2 2017 Earnings Call

SunCoke Refinancing Successfully refinanced SunCoke capital structure, extending maturities while maintaining sufficient liquidity SXC Q2 2017 Earnings Call Completed 8-year, $630M unsecured SXCP note issuance w/ 7.50% coupon Offering proceeds enabled reduction in secured debt by ~0.6x Successfully restructured SXC and SXCP revolving credit facilities Finalized new 5-year, senior secured revolvers (SXCP: $285M, SXC: $100M) Retained significant flexibility going forward to continue to operate business Ample senior debt capacity available in future, if desired Ability to continue to distribute SXCP cash flow to unitholders Significant SXC flexibility to distribute cash & repurchase SXCP units and/or SXC shares Larger baskets for investments, asset sales and other indebtedness at SXCP Total debt outstanding increased slightly to $901M Expect SXCP to repay CMT seller-financing in Q3 primarily with revolver draw

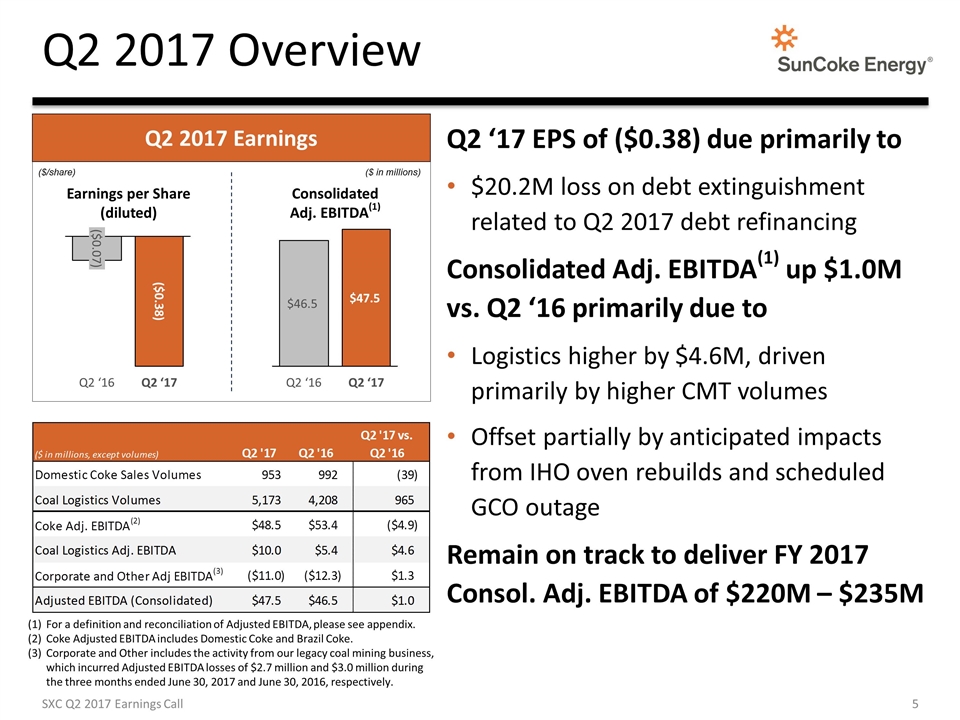

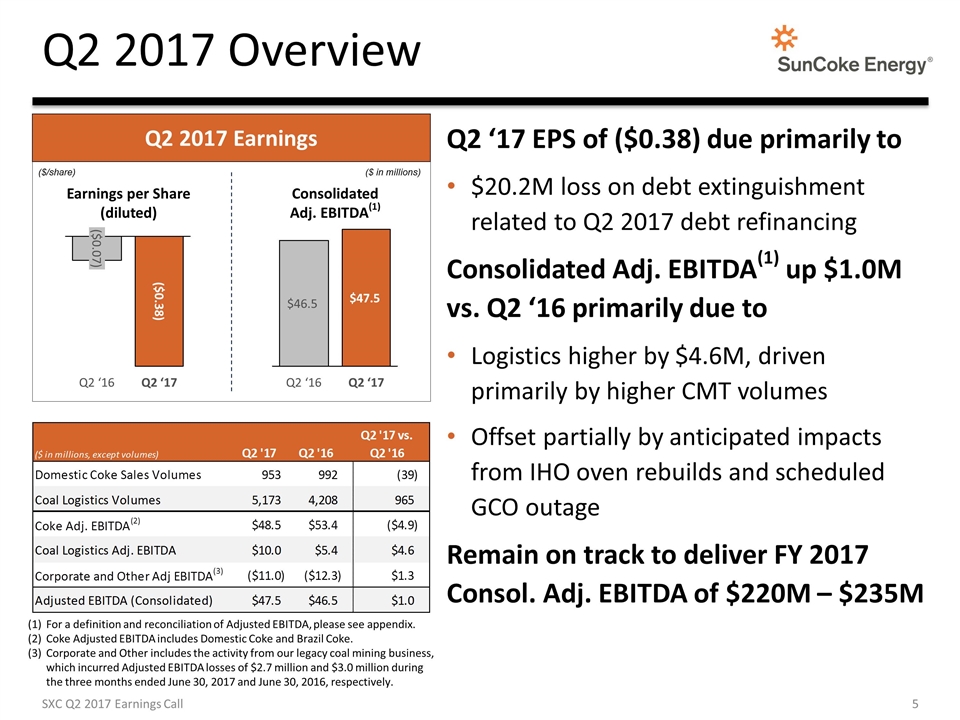

Q2 2017 Overview For a definition and reconciliation of Adjusted EBITDA, please see appendix. Coke Adjusted EBITDA includes Domestic Coke and Brazil Coke. Corporate and Other includes the activity from our legacy coal mining business, which incurred Adjusted EBITDA losses of $2.7 million and $3.0 million during the three months ended June 30, 2017 and June 30, 2016, respectively. Q2 ‘17 EPS of ($0.38) due primarily to $20.2M loss on debt extinguishment related to Q2 2017 debt refinancing Consolidated Adj. EBITDA(1) up $1.0M vs. Q2 ‘16 primarily due to Logistics higher by $4.6M, driven primarily by higher CMT volumes Offset partially by anticipated impacts from IHO oven rebuilds and scheduled GCO outage Remain on track to deliver FY 2017 Consol. Adj. EBITDA of $220M – $235M SXC Q2 2017 Earnings Call ($/share) ($ in millions) Earnings per Share (diluted) Consolidated Adj. EBITDA(1) Q2 2017 Earnings

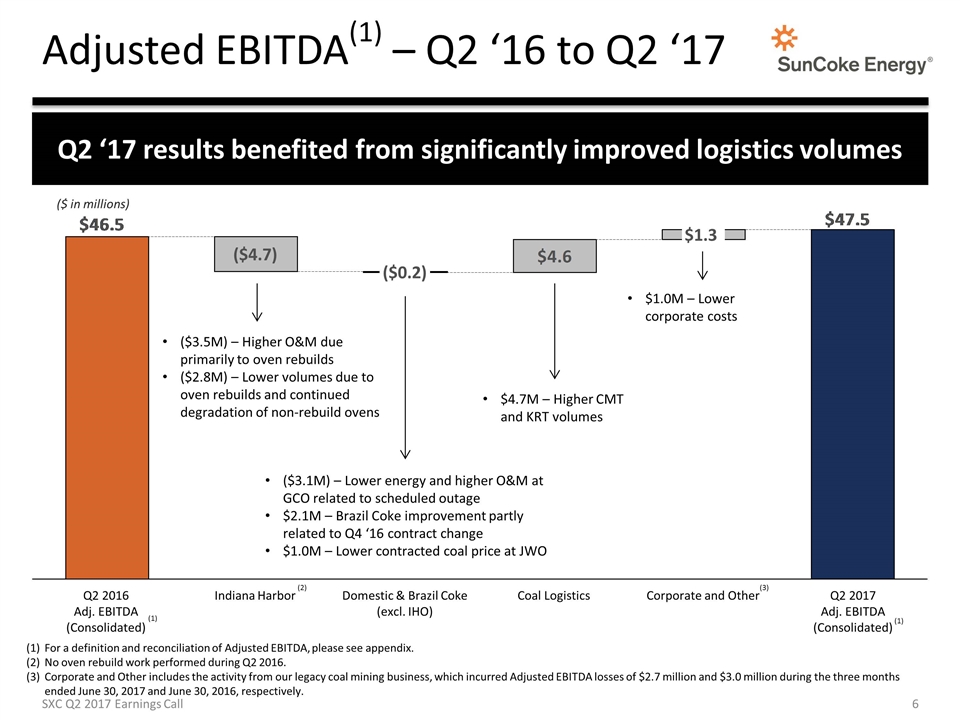

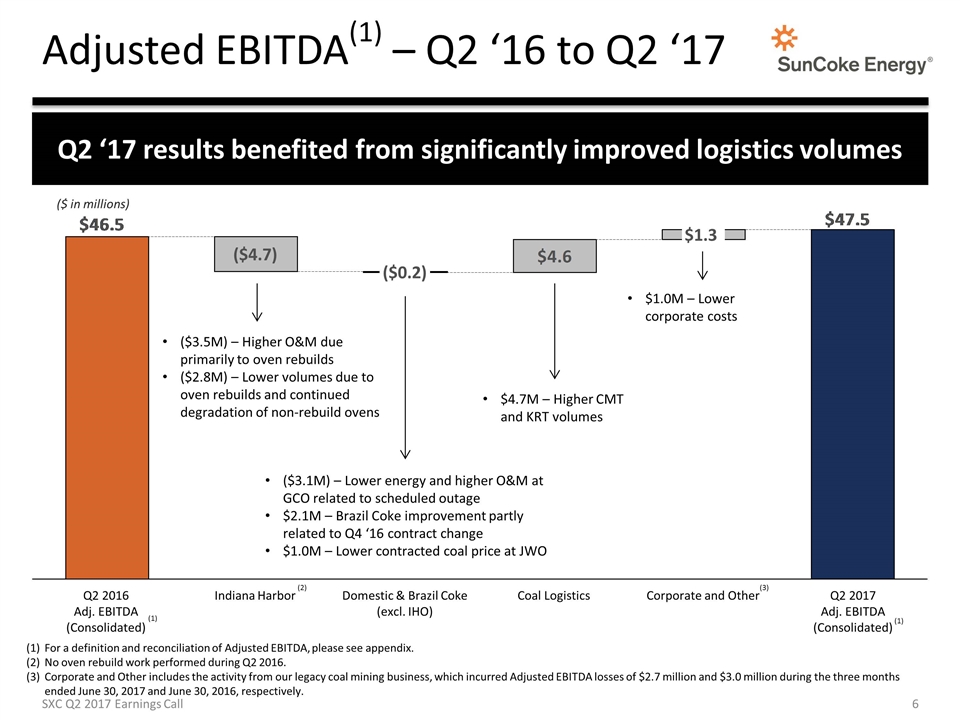

Adjusted EBITDA(1) – Q2 ‘16 to Q2 ‘17 Q2 ‘17 results benefited from significantly improved logistics volumes For a definition and reconciliation of Adjusted EBITDA, please see appendix. No oven rebuild work performed during Q2 2016. Corporate and Other includes the activity from our legacy coal mining business, which incurred Adjusted EBITDA losses of $2.7 million and $3.0 million during the three months ended June 30, 2017 and June 30, 2016, respectively. (1) (1) $1.0M – Lower corporate costs SXC Q2 2017 Earnings Call ($3.5M) – Higher O&M due primarily to oven rebuilds ($2.8M) – Lower volumes due to oven rebuilds and continued degradation of non-rebuild ovens $4.7M – Higher CMT and KRT volumes ($3.1M) – Lower energy and higher O&M at GCO related to scheduled outage $2.1M – Brazil Coke improvement partly related to Q4 ‘16 contract change $1.0M – Lower contracted coal price at JWO ($ in millions) (3) (2)

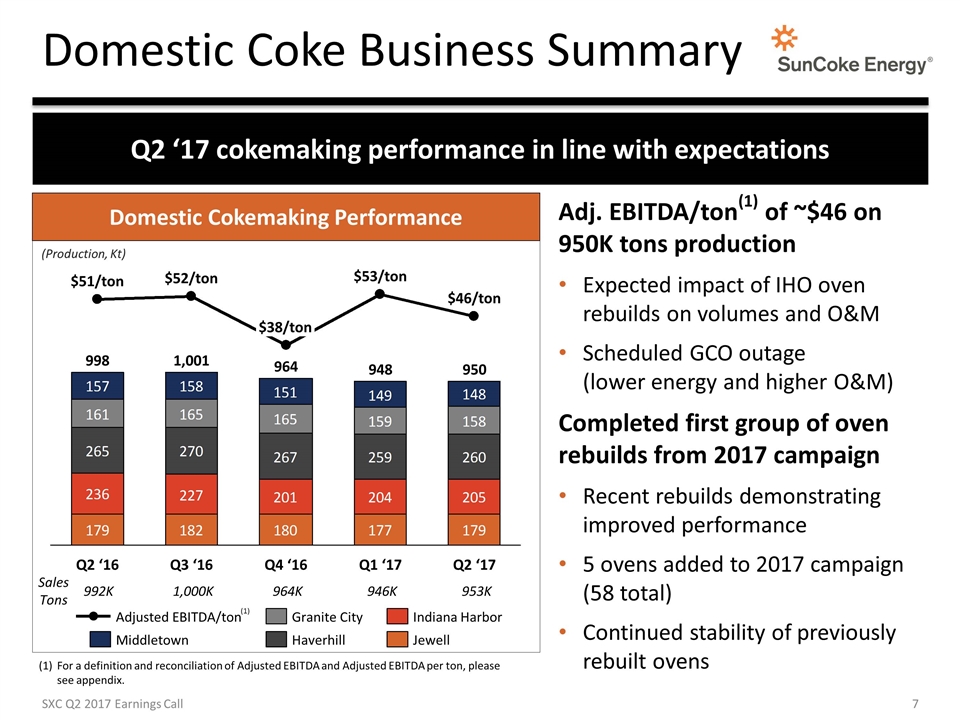

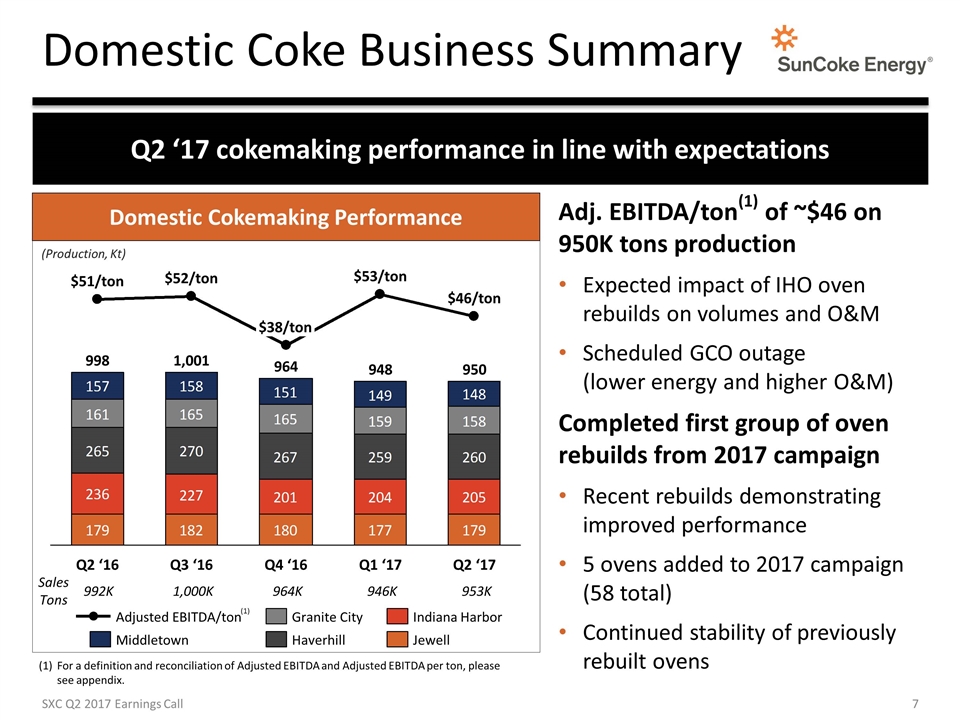

Domestic Coke Business Summary Q2 ‘17 cokemaking performance in line with expectations Domestic Cokemaking Performance /ton /ton /ton /ton /ton 992K 1,000K 964K 946K Sales Tons (Production, Kt) 953K Adj. EBITDA/ton(1) of ~$46 on 950K tons production Expected impact of IHO oven rebuilds on volumes and O&M Scheduled GCO outage (lower energy and higher O&M) Completed first group of oven rebuilds from 2017 campaign Recent rebuilds demonstrating improved performance 5 ovens added to 2017 campaign (58 total) Continued stability of previously rebuilt ovens For a definition and reconciliation of Adjusted EBITDA and Adjusted EBITDA per ton, please see appendix. SXC Q2 2017 Earnings Call (1)

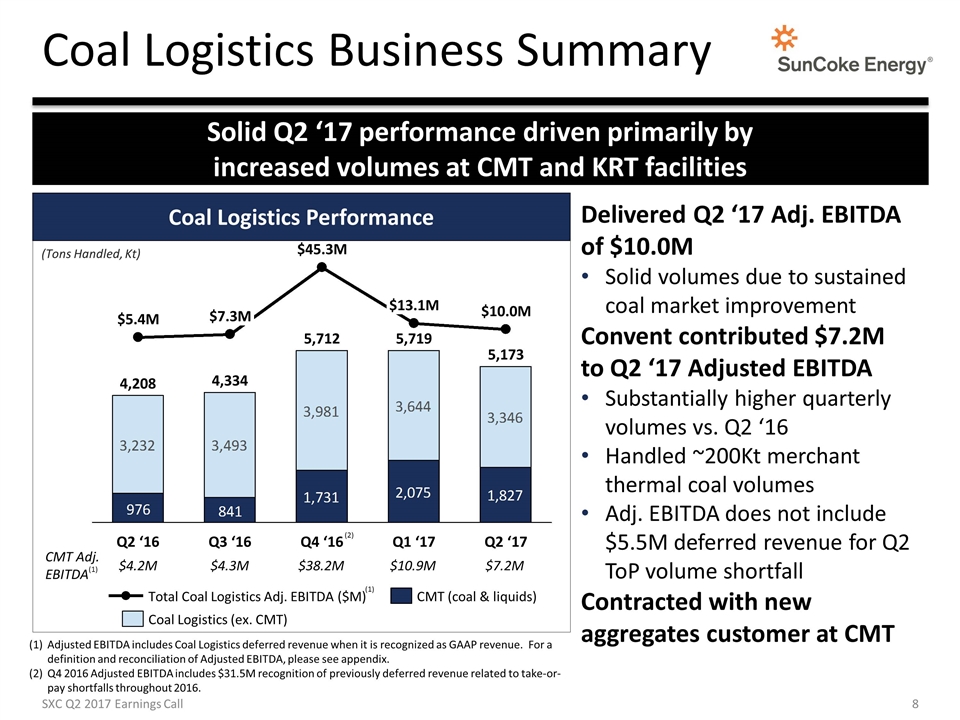

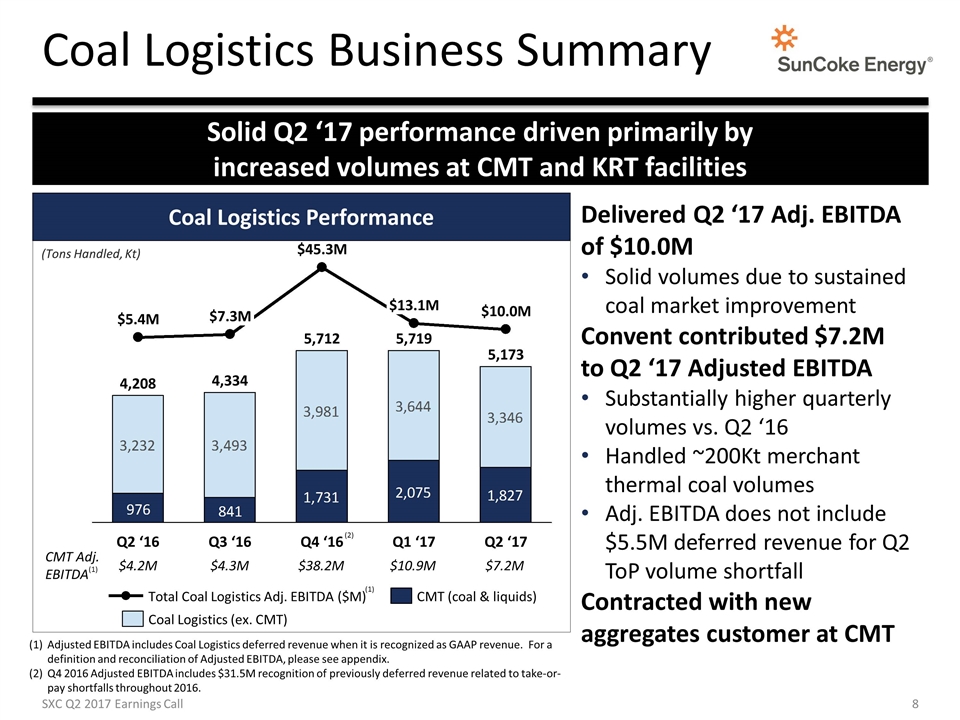

Coal Logistics Business Summary Solid Q2 ‘17 performance driven primarily by increased volumes at CMT and KRT facilities M M M M M (Tons Handled, Kt) Delivered Q2 ‘17 Adj. EBITDA of $10.0M Solid volumes due to sustained coal market improvement Convent contributed $7.2M to Q2 ‘17 Adjusted EBITDA Substantially higher quarterly volumes vs. Q2 ‘16 Handled ~200Kt merchant thermal coal volumes Adj. EBITDA does not include $5.5M deferred revenue for Q2 ToP volume shortfall Contracted with new aggregates customer at CMT Coal Logistics Performance $4.2M $4.3M $38.2M $10.9M CMT Adj. EBITDA $7.2M (1) (1) SXC Q2 2017 Earnings Call Adjusted EBITDA includes Coal Logistics deferred revenue when it is recognized as GAAP revenue. For a definition and reconciliation of Adjusted EBITDA, please see appendix. Q4 2016 Adjusted EBITDA includes $31.5M recognition of previously deferred revenue related to take-or-pay shortfalls throughout 2016. (2)

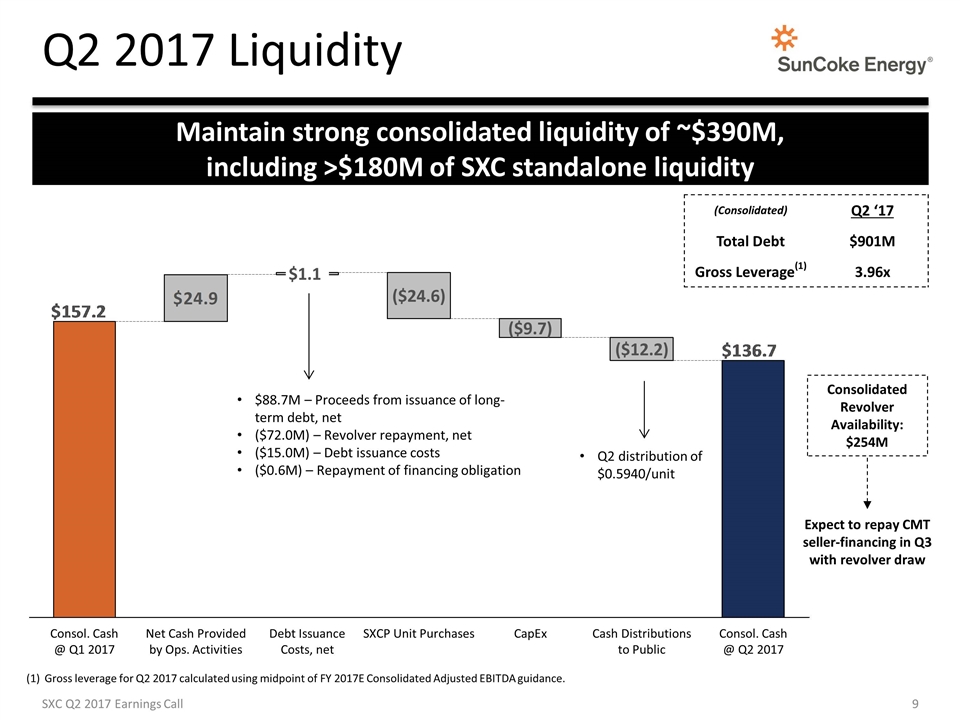

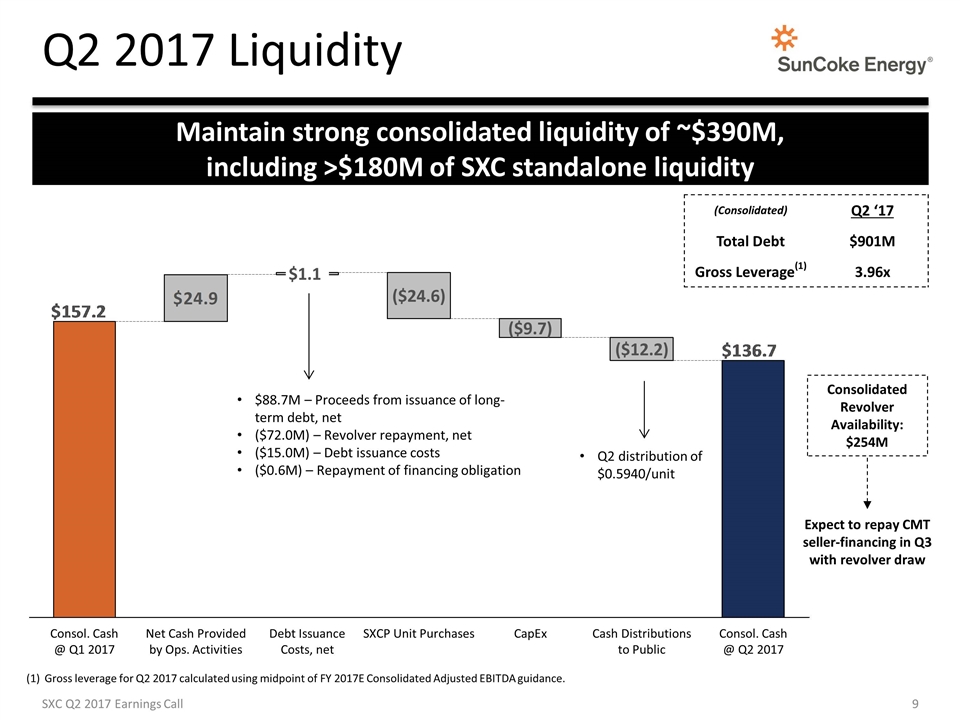

Q2 2017 Liquidity Maintain strong consolidated liquidity of ~$390M, including >$180M of SXC standalone liquidity SXC Q2 2017 Earnings Call Q2 distribution of $0.5940/unit $88.7M – Proceeds from issuance of long-term debt, net ($72.0M) – Revolver repayment, net ($15.0M) – Debt issuance costs ($0.6M) – Repayment of financing obligation Consolidated Revolver Availability: $254M (Consolidated) Q2 ‘17 Total Debt $901M Gross Leverage(1) 3.96x Gross leverage for Q2 2017 calculated using midpoint of FY 2017E Consolidated Adjusted EBITDA guidance. Expect to repay CMT seller-financing in Q3 with revolver draw

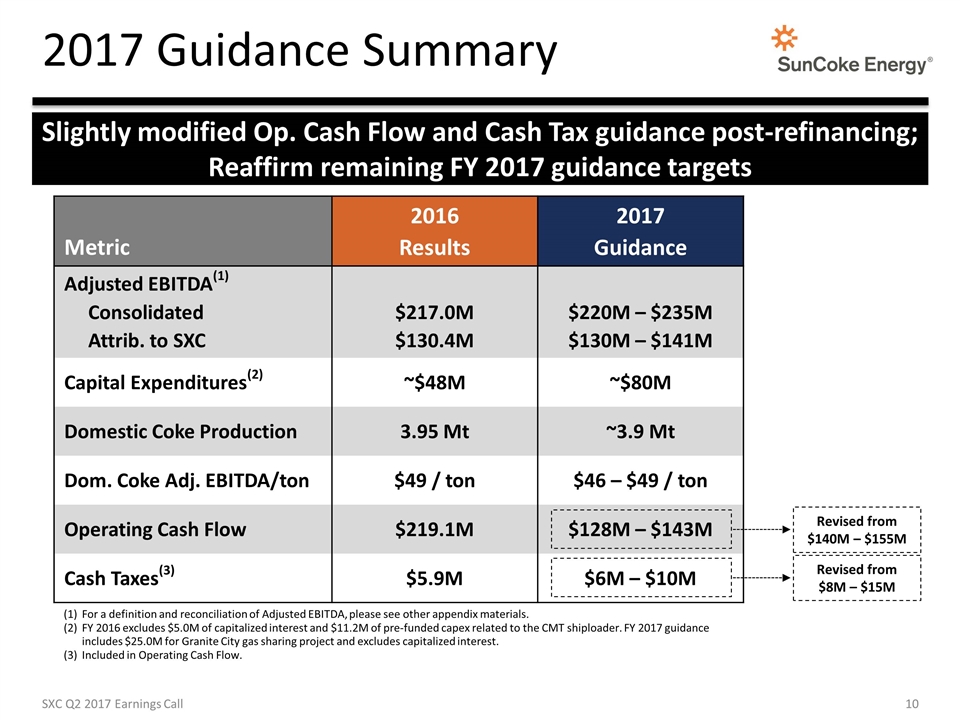

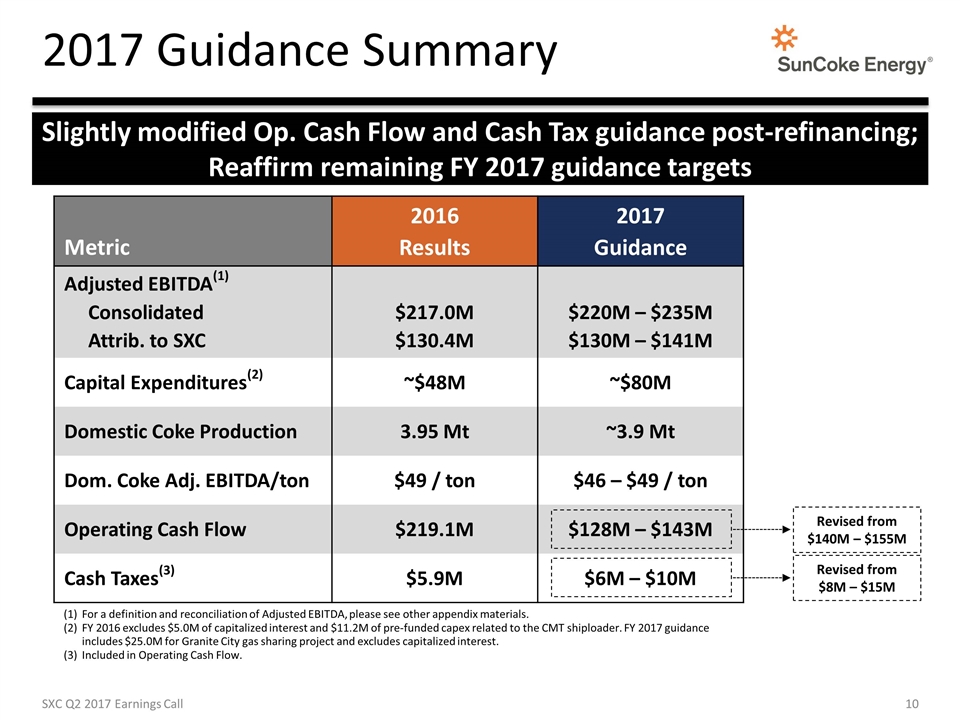

2017 Guidance Summary Metric 2016 Results 2017 Guidance Adjusted EBITDA(1) Consolidated Attrib. to SXC $217.0M $130.4M $220M – $235M $130M – $141M Capital Expenditures(2) ~$48M ~$80M Domestic Coke Production 3.95 Mt ~3.9 Mt Dom. Coke Adj. EBITDA/ton $49 / ton $46 – $49 / ton Operating Cash Flow $219.1M $128M – $143M Cash Taxes(3) $5.9M $6M – $10M For a definition and reconciliation of Adjusted EBITDA, please see other appendix materials. FY 2016 excludes $5.0M of capitalized interest and $11.2M of pre-funded capex related to the CMT shiploader. FY 2017 guidance includes $25.0M for Granite City gas sharing project and excludes capitalized interest. Included in Operating Cash Flow. Slightly modified Op. Cash Flow and Cash Tax guidance post-refinancing; Reaffirm remaining FY 2017 guidance targets SXC Q2 2017 Earnings Call Revised from $140M – $155M Revised from $8M – $15M

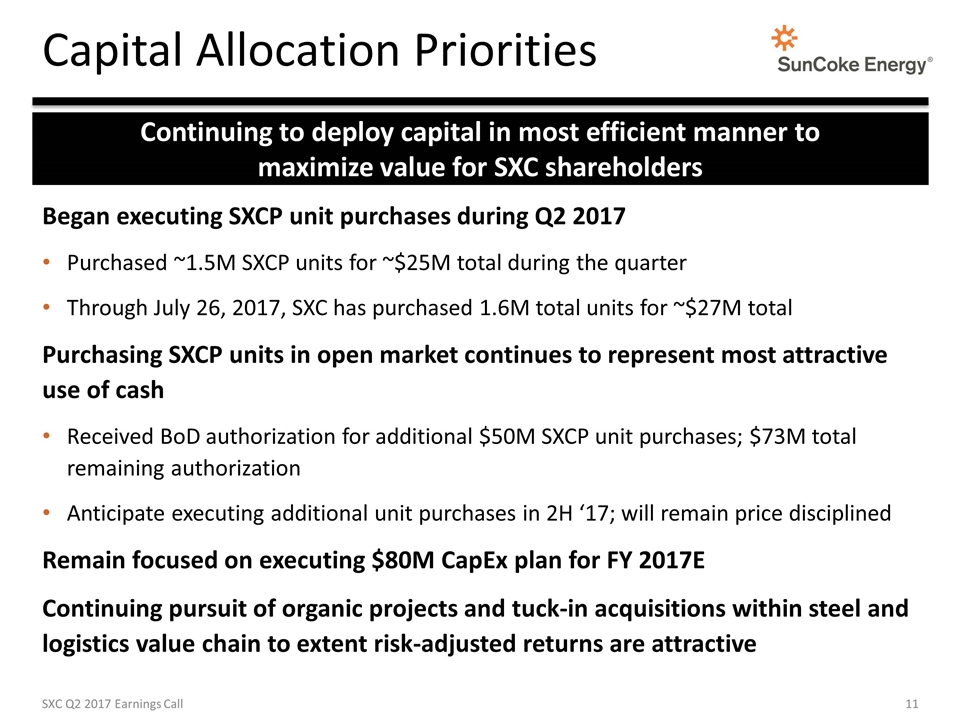

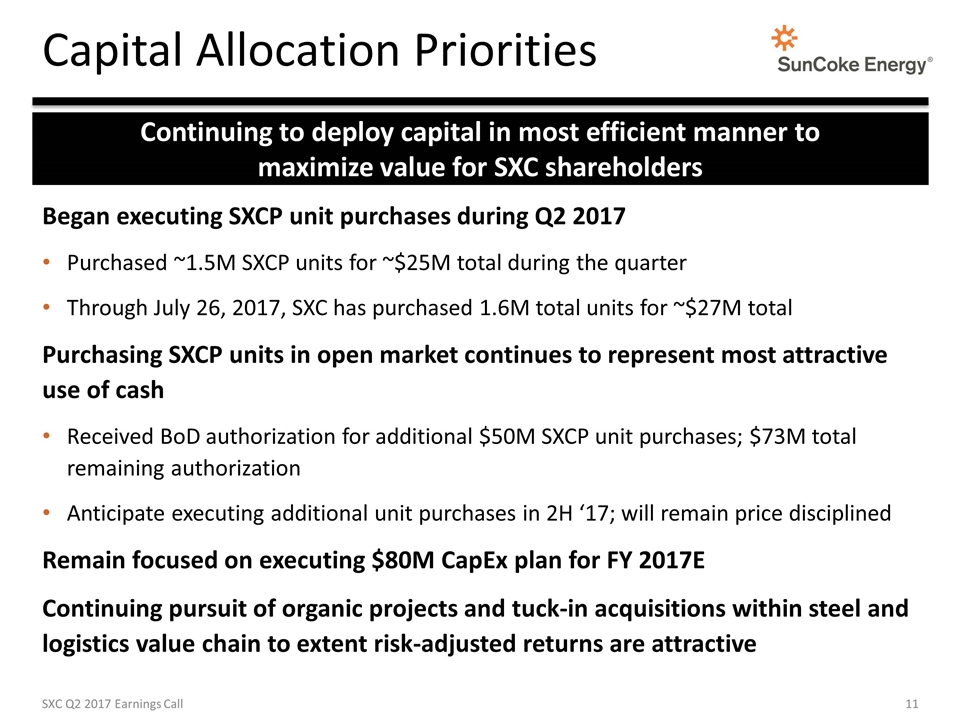

Capital Allocation Priorities Continuing to deploy capital in most efficient manner to maximize value for SXC shareholders Began executing SXCP unit purchases during Q2 2017 Purchased ~1.5M SXCP units for ~$25M total during the quarter Through July 26, 2017, SXC has purchased 1.6M total units for ~$27M total Purchasing SXCP units in open market continues to represent most attractive use of cash Received BoD authorization for additional $50M SXCP unit purchases; $73M total remaining authorization Anticipate executing additional unit purchases in 2H ‘17; will remain price disciplined Remain focused on executing $80M CapEx plan for FY 2017E Continuing pursuit of organic projects and tuck-in acquisitions within steel and logistics value chain to extent risk-adjusted returns are attractive SXC Q2 2017 Earnings Call

2017 Key Initiatives Drive strong operational & safety performance while optimizing asset utilization Deliver Operations Excellence and Optimize Asset Base Complete oven rebuilds to drive further performance improvements Execute Further Oven Rebuilds at IHO Cokemaking Operations Measure risk-adjusted alternatives to ensure most efficient allocation of capital Deploy Capital in Most Accretive Manner for SXC Shareholders Achieve $220M – $235M Consolidated Adjusted EBITDA guidance Accomplish 2017 Financial Objectives SXC Q2 2017 Earnings Call

Questions

Investor Relations 630-824-1907 www.suncoke.com

Appendix

Definitions Adjusted EBITDA represents earnings before interest, loss (gain) on extinguishment of debt, taxes, depreciation and amortization (“EBITDA”), adjusted for impairments, coal rationalization costs, changes to our contingent consideration liability related to our acquisition of CMT and the expiration of certain acquired contractual obligations. EBITDA and Adjusted EBITDA do not represent and should not be considered alternatives to net income or operating income under GAAP and may not be comparable to other similarly titled measures in other businesses. Management believes Adjusted EBITDA is an important measure of the operating performance and liquidity of the Company's net assets and its ability to incur and service debt, fund capital expenditures and make distributions. Adjusted EBITDA provides useful information to investors because it highlights trends in our business that may not otherwise be apparent when relying solely on GAAP measures and because it eliminates items that have less bearing on our operating performance and liquidity. EBITDA and Adjusted EBITDA are not measures calculated in accordance with GAAP, and they should not be considered a substitute for net income, operating cash flow or any other measure of financial performance presented in accordance with GAAP. EBITDA represents earnings before interest, taxes, depreciation and amortization. Adjusted EBITDA attributable to SXC/SXCP represents Adjusted EBITDA less Adjusted EBITDA attributable to noncontrolling interests. Adjusted EBITDA/Ton represents Adjusted EBITDA divided by tons sold/handled. Coal Rationalization expense / (income) includes employee severance, contract termination costs and other costs to idle mines incurred during the execution of our coal rationalization plan. Legacy Costs include costs associated with former mining employee-related liabilities net of certain royalty revenues. SXC Q2 2017 Earnings Call

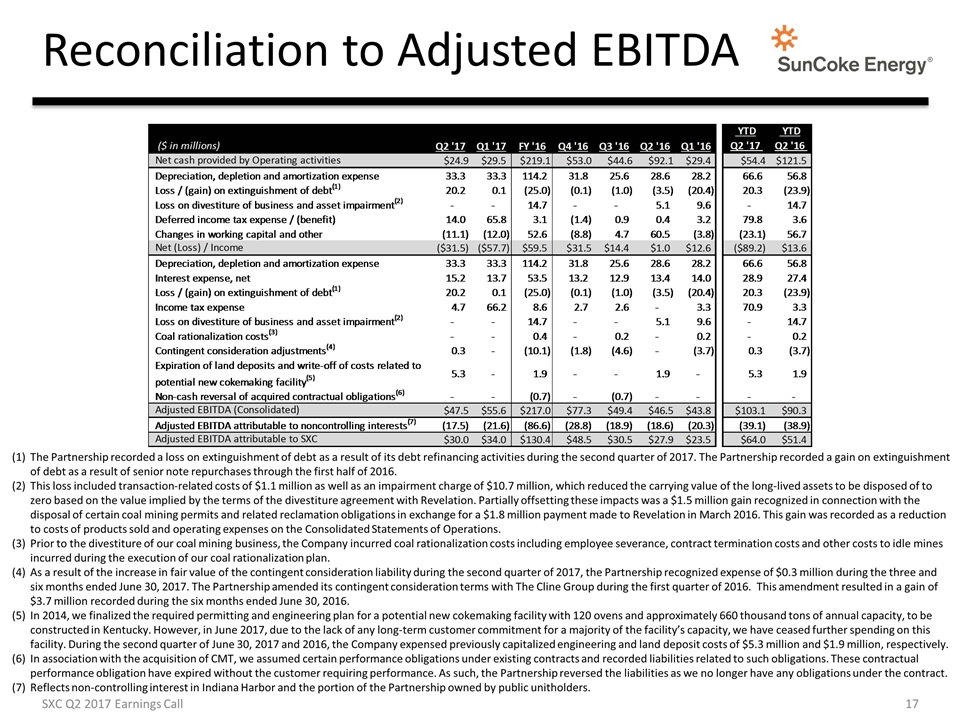

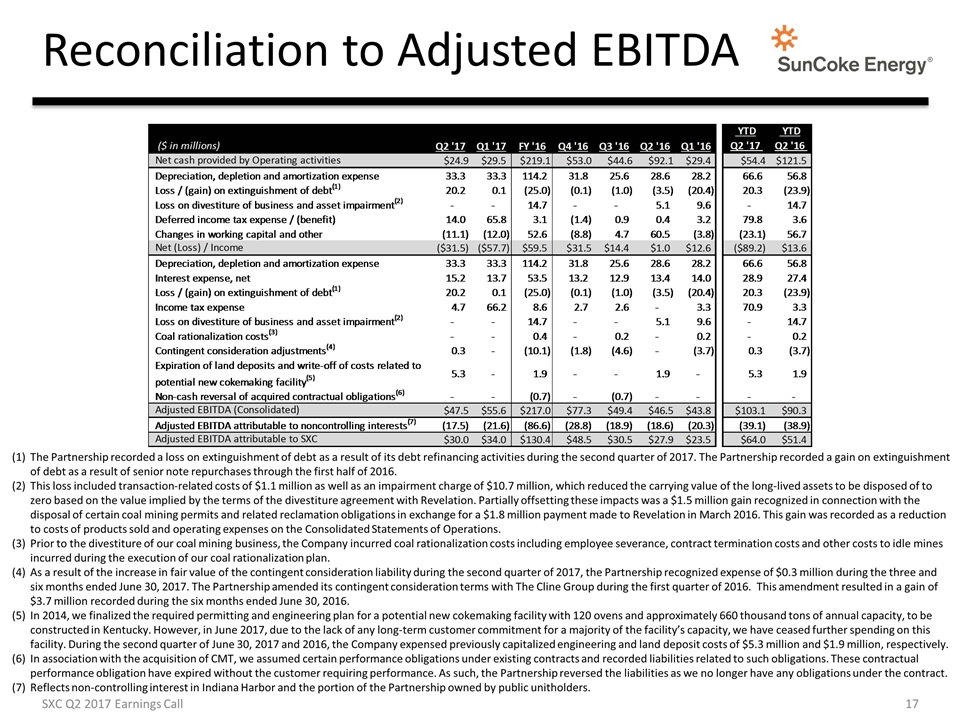

Reconciliation to Adjusted EBITDA The Partnership recorded a loss on extinguishment of debt as a result of its debt refinancing activities during the second quarter of 2017. The Partnership recorded a gain on extinguishment of debt as a result of senior note repurchases through the first half of 2016. This loss included transaction-related costs of $1.1 million as well as an impairment charge of $10.7 million, which reduced the carrying value of the long-lived assets to be disposed of to zero based on the value implied by the terms of the divestiture agreement with Revelation. Partially offsetting these impacts was a $1.5 million gain recognized in connection with the disposal of certain coal mining permits and related reclamation obligations in exchange for a $1.8 million payment made to Revelation in March 2016. This gain was recorded as a reduction to costs of products sold and operating expenses on the Consolidated Statements of Operations. Prior to the divestiture of our coal mining business, the Company incurred coal rationalization costs including employee severance, contract termination costs and other costs to idle mines incurred during the execution of our coal rationalization plan. As a result of the increase in fair value of the contingent consideration liability during the second quarter of 2017, the Partnership recognized expense of $0.3 million during the three and six months ended June 30, 2017. The Partnership amended its contingent consideration terms with The Cline Group during the first quarter of 2016. This amendment resulted in a gain of $3.7 million recorded during the six months ended June 30, 2016. In 2014, we finalized the required permitting and engineering plan for a potential new cokemaking facility with 120 ovens and approximately 660 thousand tons of annual capacity, to be constructed in Kentucky. However, in June 2017, due to the lack of any long-term customer commitment for a majority of the facility’s capacity, we have ceased further spending on this facility. During the second quarter of June 30, 2017 and 2016, the Company expensed previously capitalized engineering and land deposit costs of $5.3 million and $1.9 million, respectively. In association with the acquisition of CMT, we assumed certain performance obligations under existing contracts and recorded liabilities related to such obligations. These contractual performance obligation have expired without the customer requiring performance. As such, the Partnership reversed the liabilities as we no longer have any obligations under the contract. Reflects non-controlling interest in Indiana Harbor and the portion of the Partnership owned by public unitholders. SXC Q2 2017 Earnings Call

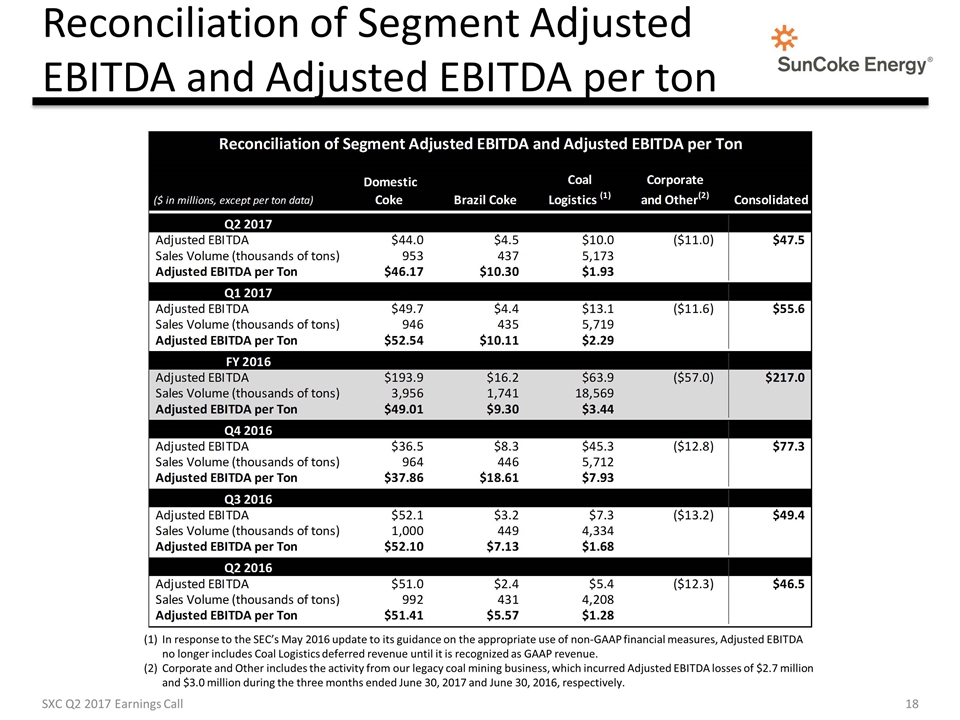

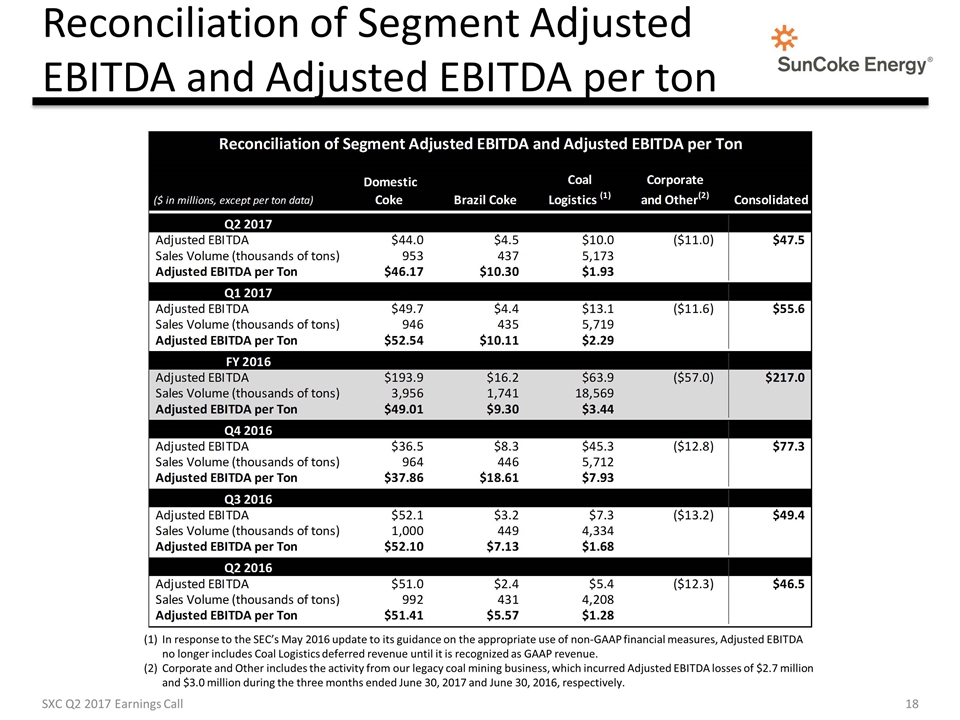

Reconciliation of Segment Adjusted EBITDA and Adjusted EBITDA per ton In response to the SEC’s May 2016 update to its guidance on the appropriate use of non-GAAP financial measures, Adjusted EBITDA no longer includes Coal Logistics deferred revenue until it is recognized as GAAP revenue. Corporate and Other includes the activity from our legacy coal mining business, which incurred Adjusted EBITDA losses of $2.7 million and $3.0 million during the three months ended June 30, 2017 and June 30, 2016, respectively. SXC Q2 2017 Earnings Call

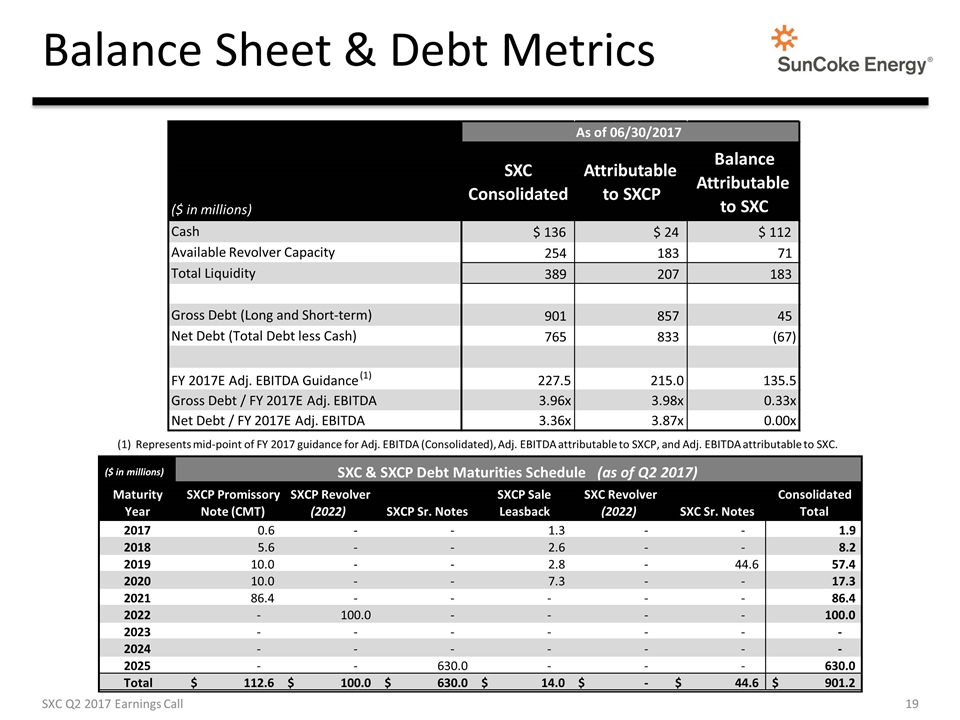

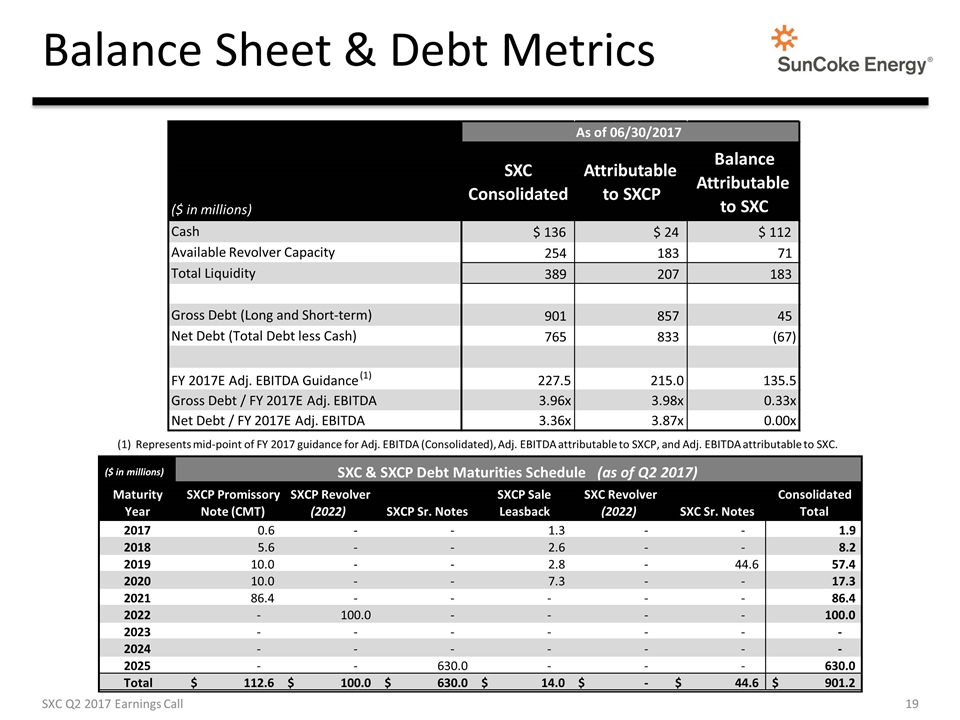

Balance Sheet & Debt Metrics Represents mid-point of FY 2017 guidance for Adj. EBITDA (Consolidated), Adj. EBITDA attributable to SXCP, and Adj. EBITDA attributable to SXC. SXC Q2 2017 Earnings Call ($ in millions) SXC Consolidated Attributable to SXCP Balance Attributable to SXC Cash $ 136 $ 24 $ 112 Available Revolver Capacity 254 183 71 Total Liquidity 389 207 183 Gross Debt (Long and Short-term) 901 857 45 Net Debt (Total Debt less Cash) 765 833 (67) FY 2017E Adj. EBITDA Guidance (1) 227.5 215.0 135.5 Gross Debt / FY 2017E Adj. EBITDA 3.96x 3.98x 0.33x Net Debt / FY 2017E Adj. EBITDA 3.36x 3.87x 0.00x As of 06/30/2017 ($ in millions) Maturity Year SXCP Promissory Note (CMT) SXCP Revolver (2022) SXCP Sr. Notes SXCP Sale Leasback SXC Revolver (2022) SXC Sr. Notes Consolidated Total 2017 0.6 - - 1.3 - - 1.9 2018 5.6 - - 2.6 - - 8.2 2019 10.0 - - 2.8 - 44.6 57.4 2020 10.0 - - 7.3 - - 17.3 2021 86.4 - - - - - 86.4 2022 - 100.0 - - - - 100.0 2023 - - - - - - - 2024 - - - - - - - 2025 - - 630.0 - - - 630.0 Total 112.6 $ 100.0 $ 630.0 $ 14.0 $ - $ 44.6 $ 901.2 $ SXC & SXCP Debt Maturities Schedule (as of Q2 2017)

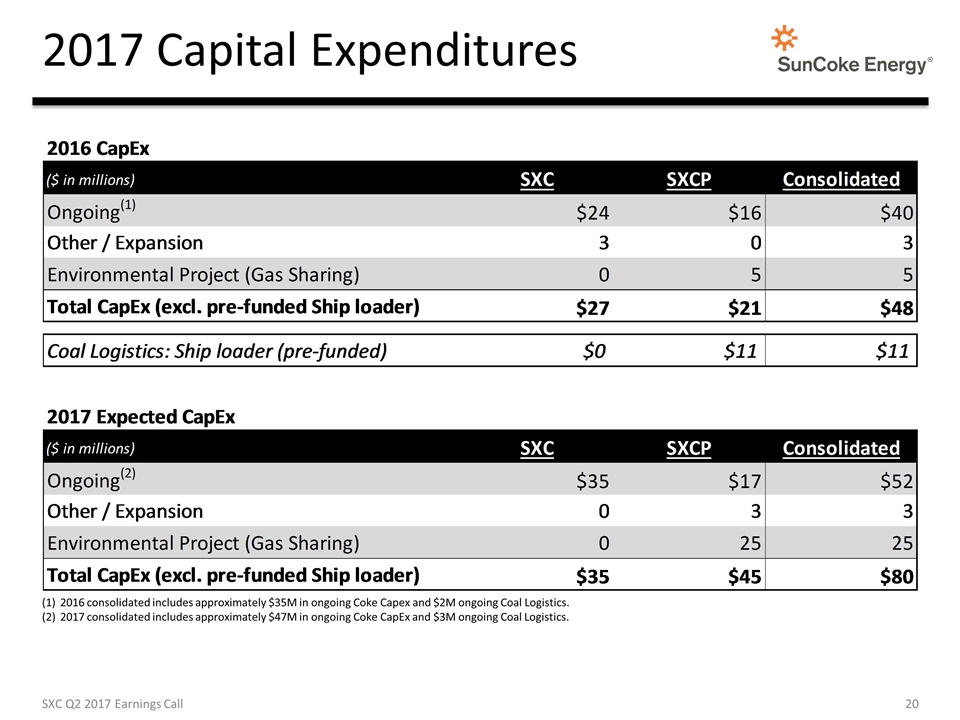

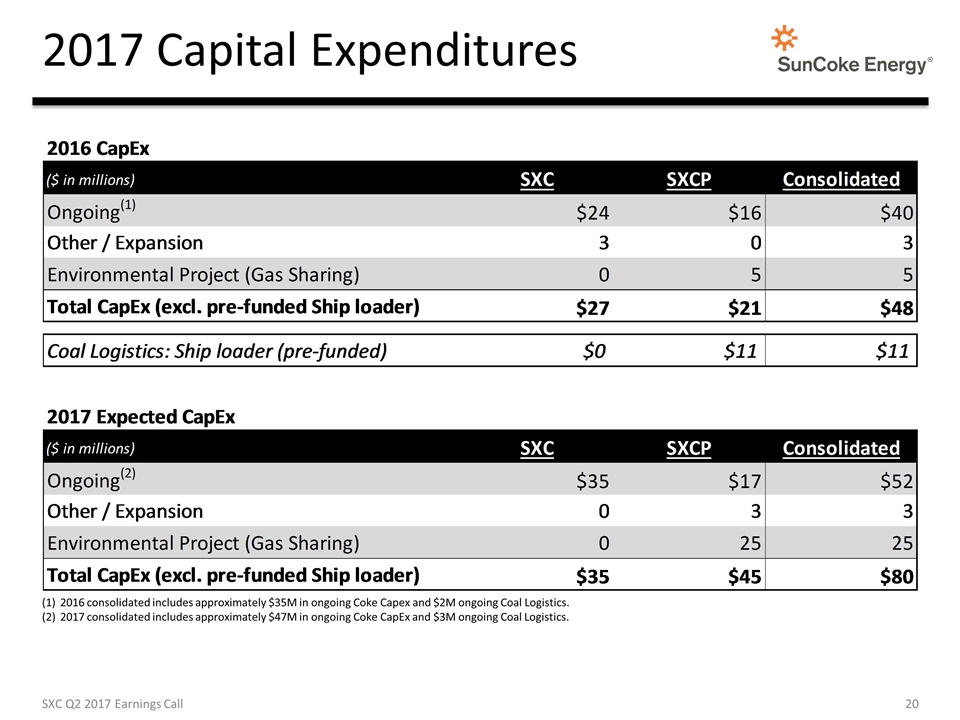

2017 Capital Expenditures SXC Q2 2017 Earnings Call 2016 consolidated includes approximately $35M in ongoing Coke Capex and $2M ongoing Coal Logistics. 2017 consolidated includes approximately $47M in ongoing Coke CapEx and $3M ongoing Coal Logistics.

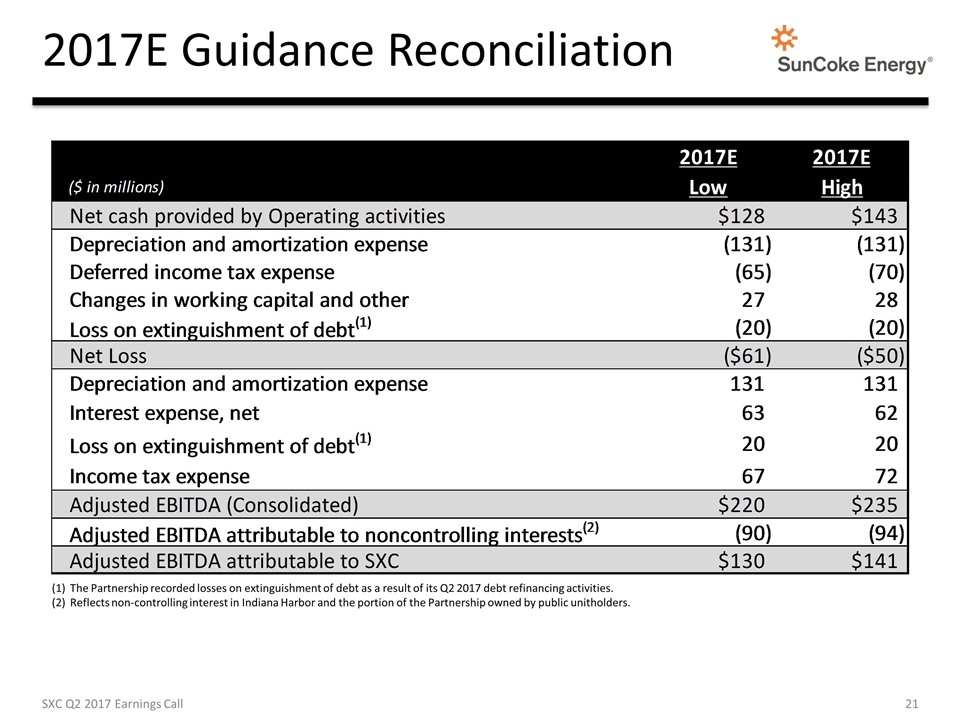

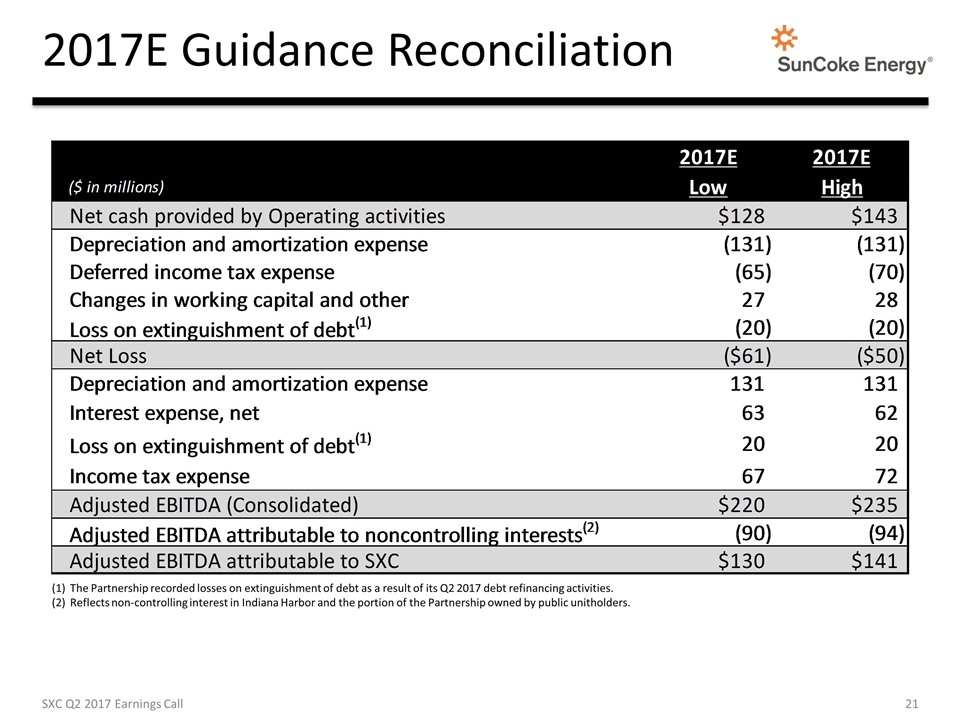

2017E Guidance Reconciliation The Partnership recorded losses on extinguishment of debt as a result of its Q2 2017 debt refinancing activities. Reflects non-controlling interest in Indiana Harbor and the portion of the Partnership owned by public unitholders. SXC Q2 2017 Earnings Call

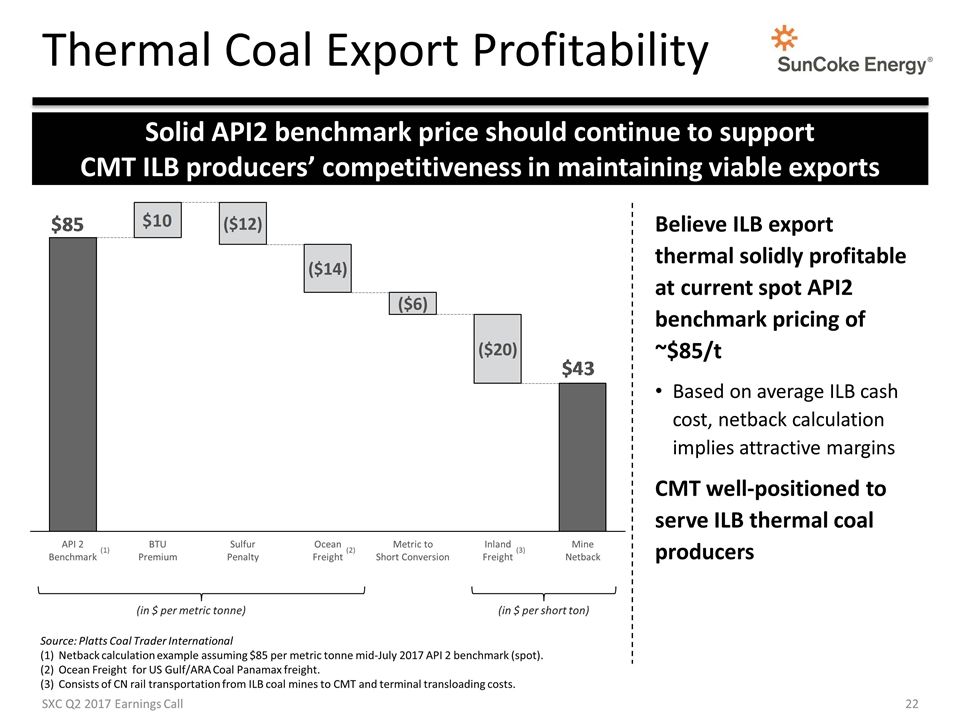

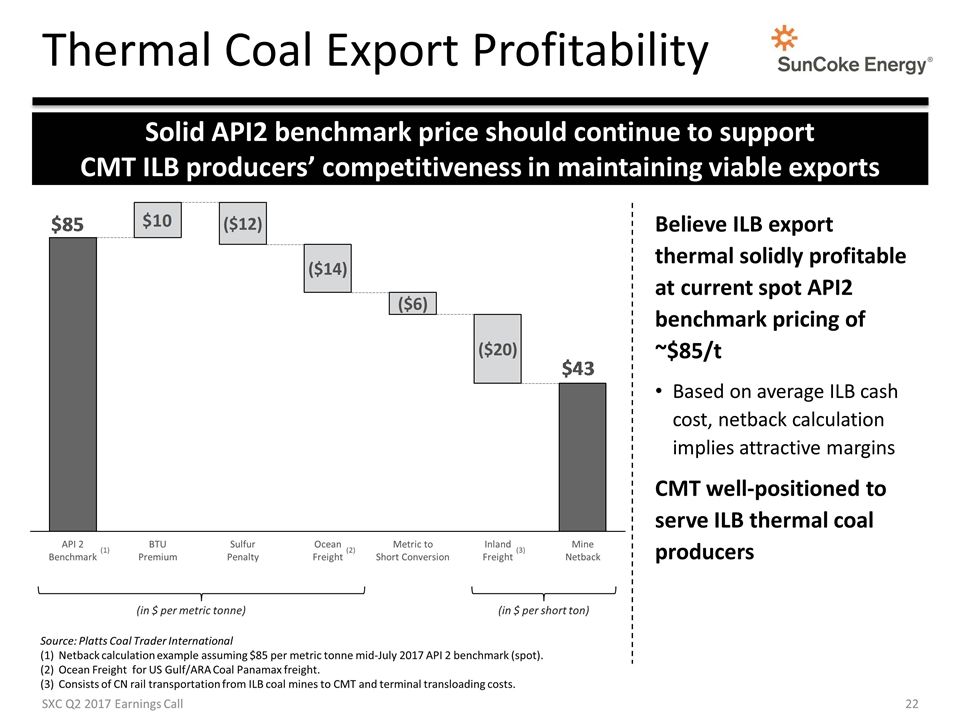

Thermal Coal Export Profitability (in $ per metric tonne) Solid API2 benchmark price should continue to support CMT ILB producers’ competitiveness in maintaining viable exports Source: Platts Coal Trader International Netback calculation example assuming $85 per metric tonne mid-July 2017 API 2 benchmark (spot). Ocean Freight for US Gulf/ARA Coal Panamax freight. Consists of CN rail transportation from ILB coal mines to CMT and terminal transloading costs. (1) (2) Believe ILB export thermal solidly profitable at current spot API2 benchmark pricing of ~$85/t Based on average ILB cash cost, netback calculation implies attractive margins CMT well-positioned to serve ILB thermal coal producers (in $ per short ton) (3) SXC Q2 2017 Earnings Call