SunCoke Energy, Inc. Q3 2019 Earnings Conference Call Exhibit 99.2

This slide presentation should be reviewed in conjunction with the Third Quarter 2019 earnings release of SunCoke Energy, Inc. (SunCoke) and conference call held on November 5, 2019 at 10:30 a.m. ET. Except for statements of historical fact, information contained in this presentation constitutes “forward-looking statements” as defined in Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements are based upon information currently available, and express management’s opinions, expectations, beliefs, plans, objectives, assumptions or projections with respect to SunCoke’s anticipated future performance. These statements are not guarantees of future performance and undue reliance should not be placed on them. Although management believes that its plans, intentions and expectations reflected in, or suggested by, the forward-looking statements made in this presentation are reasonable, no assurance can be given that these plans, intentions or expectations will be achieved when anticipated or at all. Forward-looking statements often may be identified by the use of forward-looking terminology such as the words “believe,” “expect,” “plan,” “intend,” “anticipate,” “contemplate,” “estimate,” “predict,” “guidance,” “forecast,” “potential,” “continue,” “may,” “will,” “could,” “should,” or the negative of these terms or similar expressions, and include, but are not limited to, statements regarding: possible or assumed future results of operations, expected benefits and anticipated timing of proposed transactions; expected levels of distributions to shareholders; future credit ratings; financial condition; plans and objectives of management for future operations and growth; effects of competition; and the effects of future legislation or regulations. Such statements are subject to a number of known and unknown risks, and uncertainties, many of which are beyond control, or are difficult to predict, and may cause actual results to differ materially from those implied or expressed by the forward-looking statements. SunCoke has included in its filings with the Securities and Exchange Commission (SEC) cautionary language identifying important factors (but not necessarily all the important factors) that could cause actual results to differ materially from those expressed in any forward-looking statement. Such factors include, but are not limited to: changes in industry conditions; the ability to renew current customer, supplier and other material agreements; future liquidity, working capital and capital requirements; the ability to successfully implement business strategies and potential growth opportunities; the impact of indebtedness and financing plans, including sources and availability of third-party financing; possible or assumed future results of operations; the outcome of pending and future litigation; potential operating performance improvements and the ability to achieve anticipated cost savings from strategic revenue and efficiency initiatives. For more information concerning these factors, see SunCoke’s SEC filings. All forward-looking statements included in this presentation are expressly qualified in their entirety by the cautionary statements contained in such SEC filings. The forward-looking statements in this presentation speak only as of the date hereof. Except as required by applicable law, SunCoke does not have any intention or obligation to revise or update publicly any forward-looking statement (or associated cautionary language) made herein, whether as a result of new information, future events, or otherwise, after the date of this presentation. This presentation includes certain non-GAAP financial measures intended to supplement, not substitute for, comparable GAAP measures. Furthermore, the non-GAAP financial measures presented herein may not be consistent with similar measures provided by other companies. Reconciliations of non-GAAP financial measures to GAAP financial measures are provided in the Appendix at the end of the presentation. Investors are urged to consider carefully the comparable GAAP measures and the reconciliations to those measures provided in the Appendix. These data should be read in conjunction with SunCoke’s periodic reports previously filed with the SEC. Due to rounding, numbers presented throughout this presentation may not add up precisely to the totals indicated and percentages may not precisely reflect the absolute figures for the same reason. Industry and market data used in this presentation have been obtained from industry publications and sources as well as from research reports prepared for other purposes. SunCoke has not independently verified the data obtained from these sources and cannot assure investors of either the accuracy or completeness of such data. Forward-Looking Statements

Q3 2019 Highlights Operations: Delivered Q3 ‘19 Adjusted EBITDA of $66.7M and YTD 2019 Adjusted EBITDA of $197.1; ended quarter with ample liquidity position of ~$338M Continued solid operating performance across the coke fleet Remain on track with 2019 IHO oven rebuild campaign; well positioned to deliver 1.2M tons production in 2020 Logistics segment volume down ~2.2M tons versus the prior year quarter Guidance: Adjusting the guidance range down reflecting financial impact at Logistics due to coal export customer bankruptcy; new Adj. EBITDA guidance range of $240M to $250M as compared to previous guidance of $266M to $276M Capital Allocation: Extinguished $50M face value of 2025 Senior Notes; gross leverage at 3.0x (based on LTM EBITDA) Declared a $0.06/share dividend Beginning in early August, repurchased ~2.1 million during the third quarter Refinanced the revolving credit facilities at lower interest rate, increased capacity to $400M and extended maturity date to August 2024 Board of Directors authorized new $100M share repurchase program

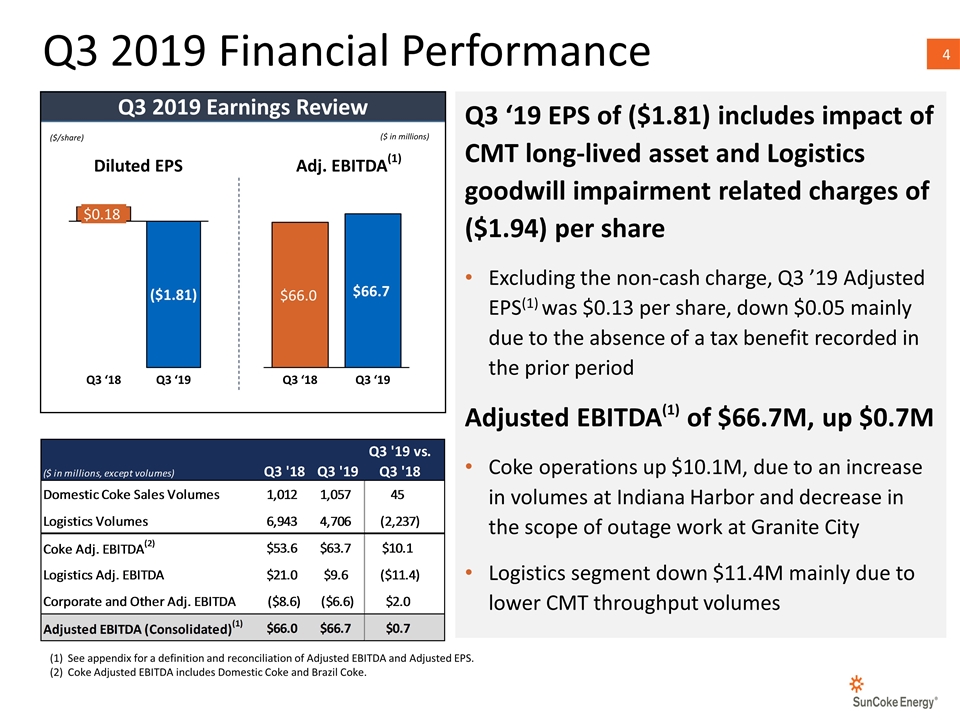

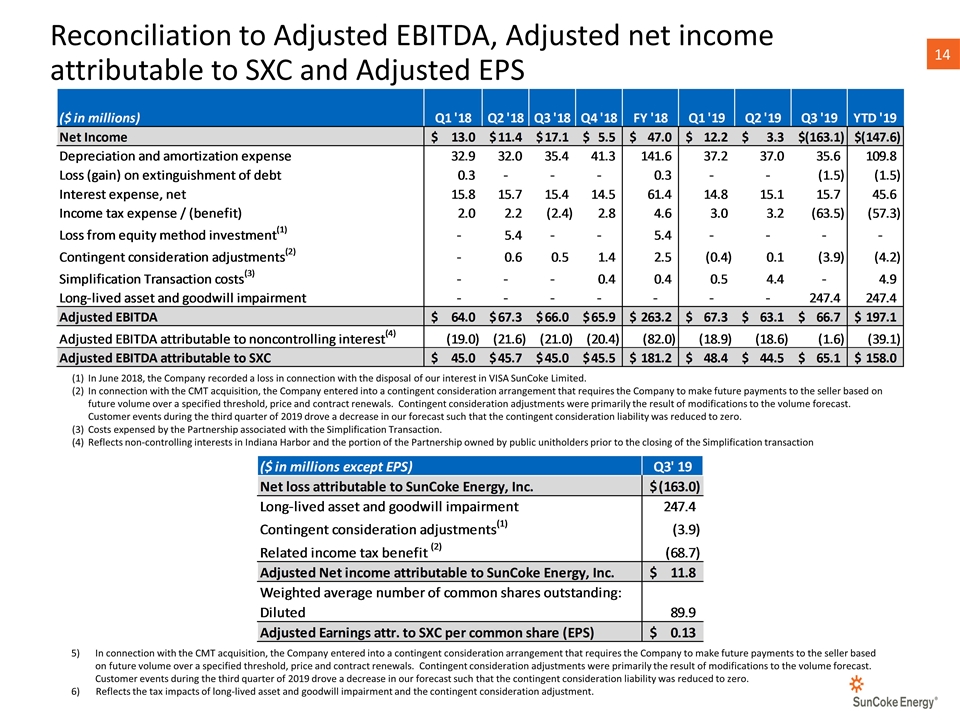

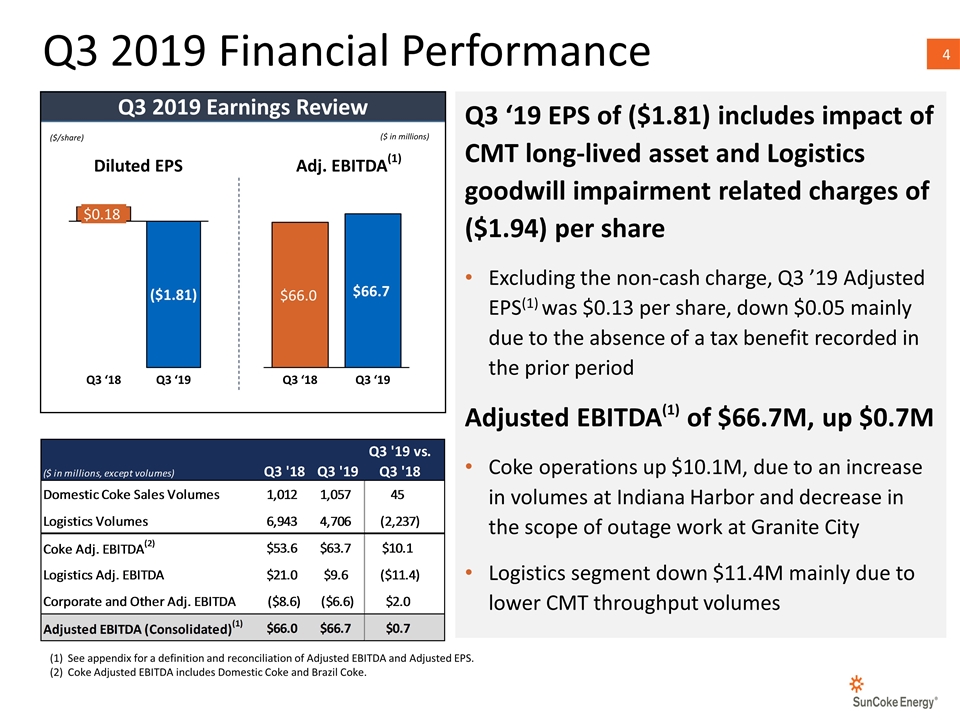

Q3 2019 Financial Performance See appendix for a definition and reconciliation of Adjusted EBITDA and Adjusted EPS. Coke Adjusted EBITDA includes Domestic Coke and Brazil Coke. Q3 ‘19 EPS of ($1.81) includes impact of CMT long-lived asset and Logistics goodwill impairment related charges of ($1.94) per share Excluding the non-cash charge, Q3 ’19 Adjusted EPS(1) was $0.13 per share, down $0.05 mainly due to the absence of a tax benefit recorded in the prior period Adjusted EBITDA(1) of $66.7M, up $0.7M Coke operations up $10.1M, due to an increase in volumes at Indiana Harbor and decrease in the scope of outage work at Granite City Logistics segment down $11.4M mainly due to lower CMT throughput volumes ($/share) ($ in millions) Diluted EPS Adj. EBITDA(1) Q3 2019 Earnings Review

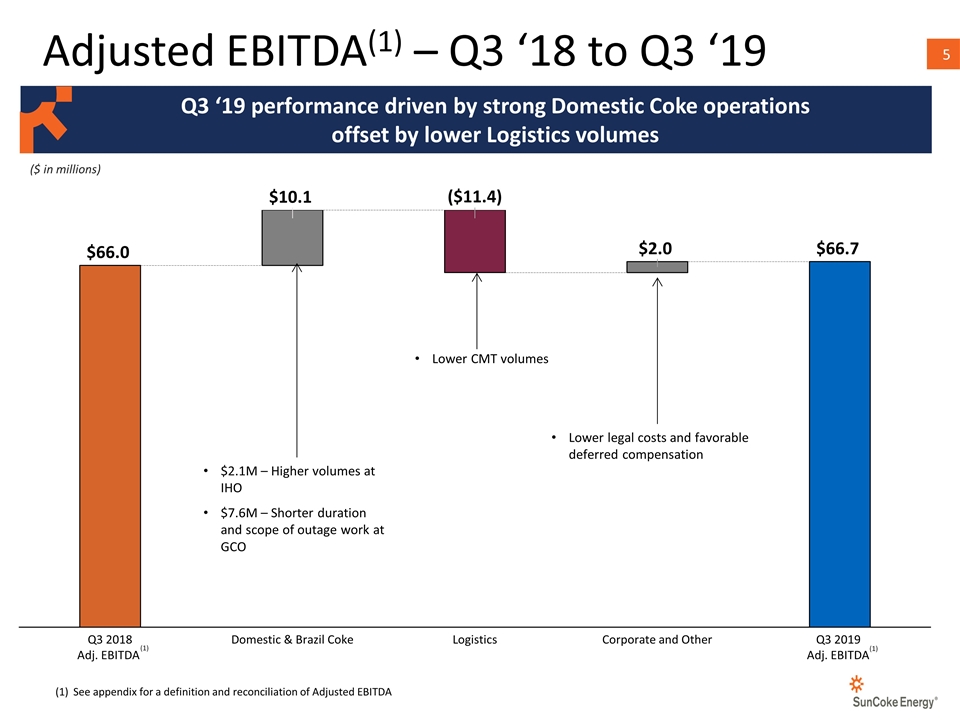

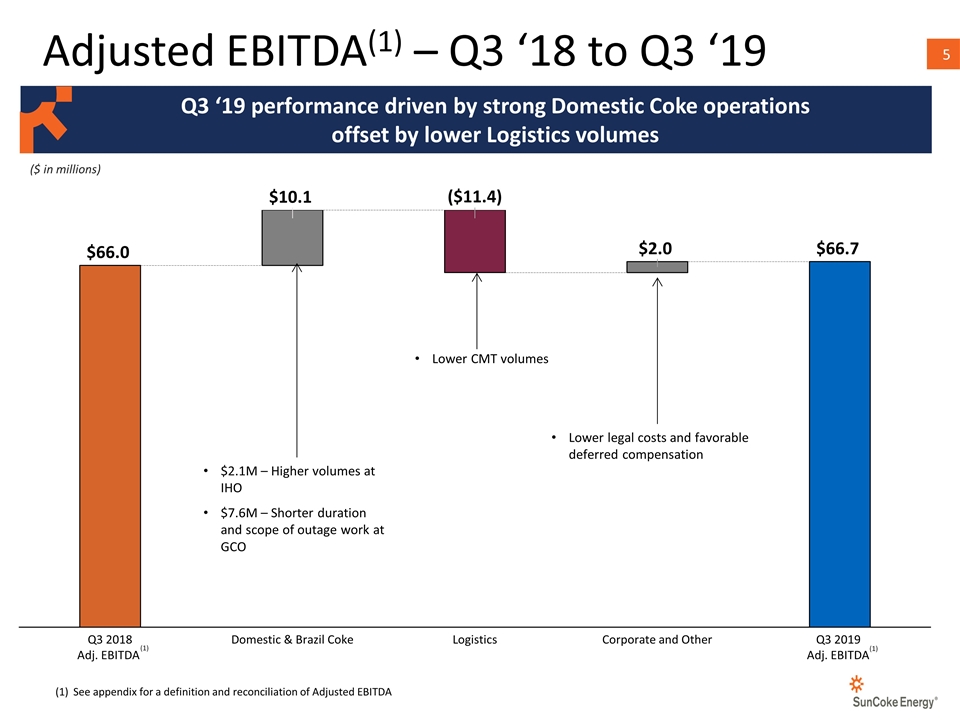

Adjusted EBITDA(1) – Q3 ‘18 to Q3 ‘19 See appendix for a definition and reconciliation of Adjusted EBITDA (1) $2.1M – Higher volumes at IHO $7.6M – Shorter duration and scope of outage work at GCO Lower CMT volumes ($ in millions) (1) Q3 ‘19 performance driven by strong Domestic Coke operations offset by lower Logistics volumes Lower legal costs and favorable deferred compensation

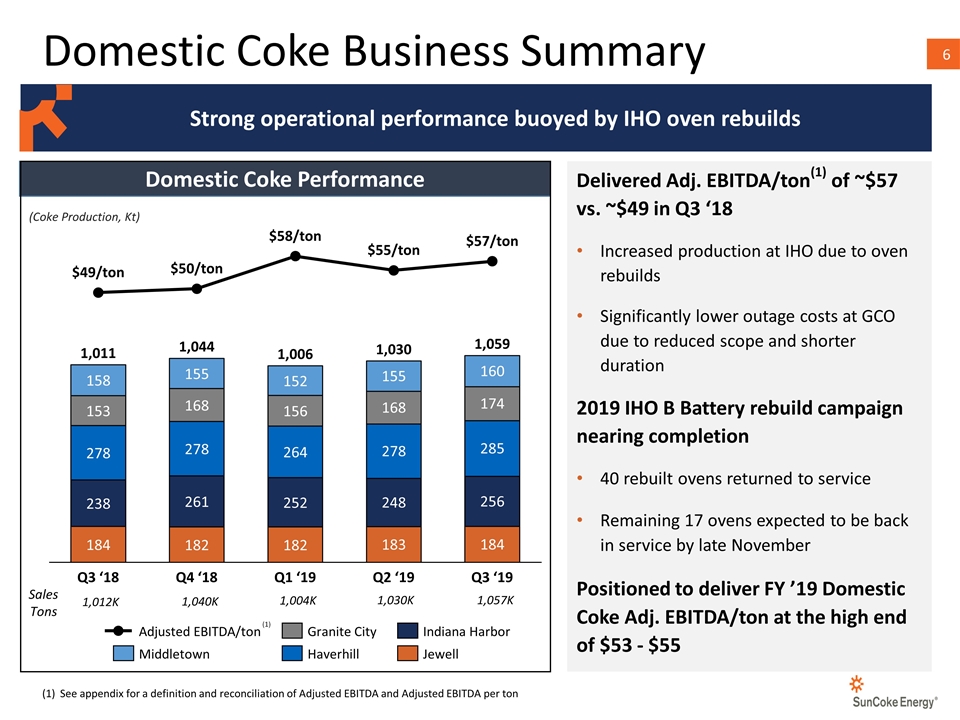

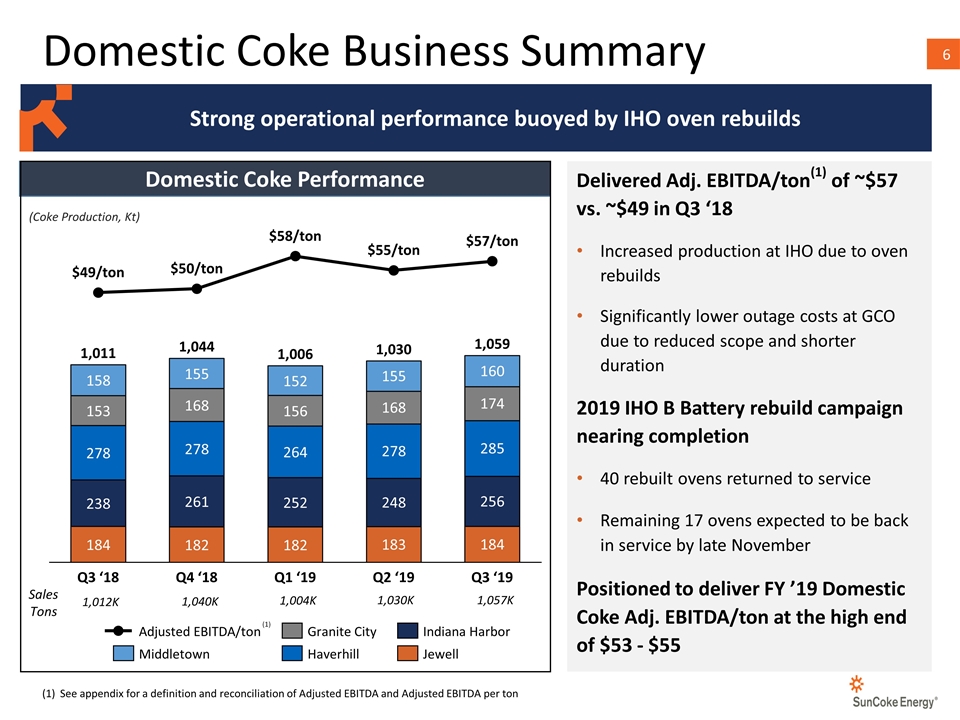

Domestic Coke Performance Domestic Coke Business Summary /ton /ton /ton $55/ton /ton Sales Tons (Coke Production, Kt) Delivered Adj. EBITDA/ton(1) of ~$57 vs. ~$49 in Q3 ‘18 Increased production at IHO due to oven rebuilds Significantly lower outage costs at GCO due to reduced scope and shorter duration 2019 IHO B Battery rebuild campaign nearing completion 40 rebuilt ovens returned to service Remaining 17 ovens expected to be back in service by late November Positioned to deliver FY ’19 Domestic Coke Adj. EBITDA/ton at the high end of $53 - $55 See appendix for a definition and reconciliation of Adjusted EBITDA and Adjusted EBITDA per ton (1) 1,012K 1,040K 1,004K 1,030K Strong operational performance buoyed by IHO oven rebuilds 1,057K

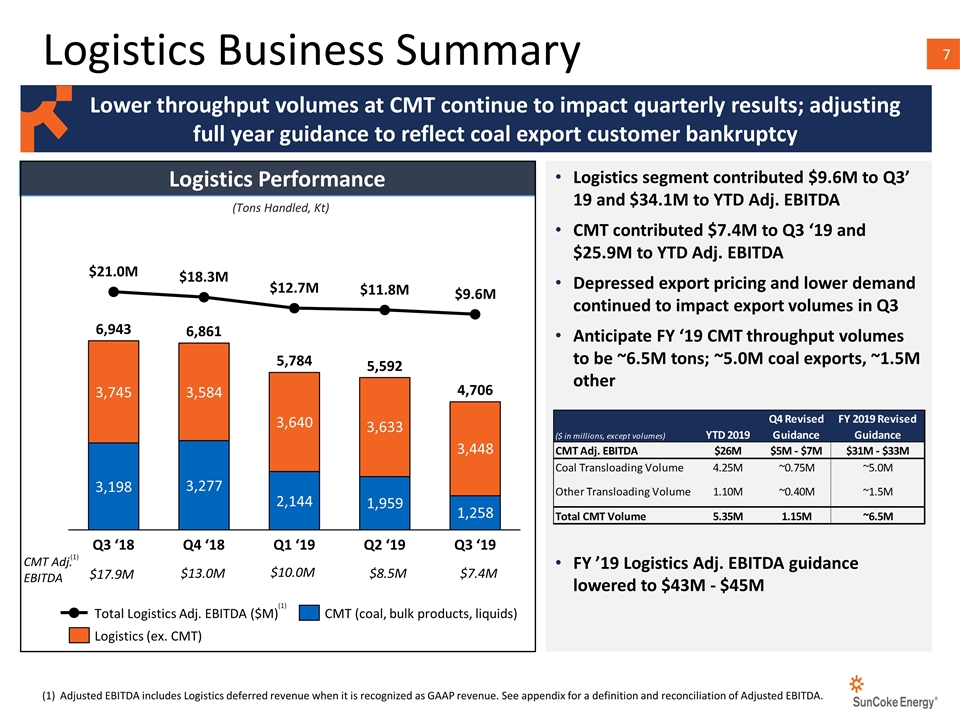

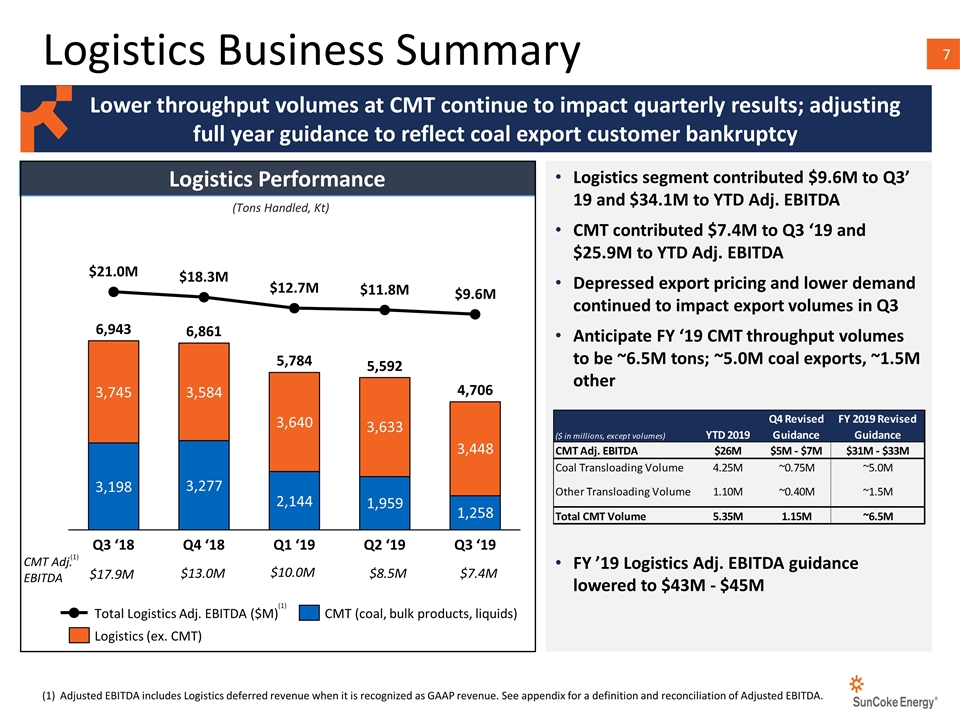

Logistics Business Summary M M M M M (Tons Handled, Kt) Logistics segment contributed $9.6M to Q3’ 19 and $34.1M to YTD Adj. EBITDA CMT contributed $7.4M to Q3 ‘19 and $25.9M to YTD Adj. EBITDA Depressed export pricing and lower demand continued to impact export volumes in Q3 Anticipate FY ‘19 CMT throughput volumes to be ~6.5M tons; ~5.0M coal exports, ~1.5M other FY ’19 Logistics Adj. EBITDA guidance lowered to $43M - $45M $17.9M $13.0M $10.0M CMT Adj. EBITDA $7.4M (1) Adjusted EBITDA includes Logistics deferred revenue when it is recognized as GAAP revenue. See appendix for a definition and reconciliation of Adjusted EBITDA. Lower throughput volumes at CMT continue to impact quarterly results; adjusting full year guidance to reflect coal export customer bankruptcy (1) $8.5M Logistics Performance

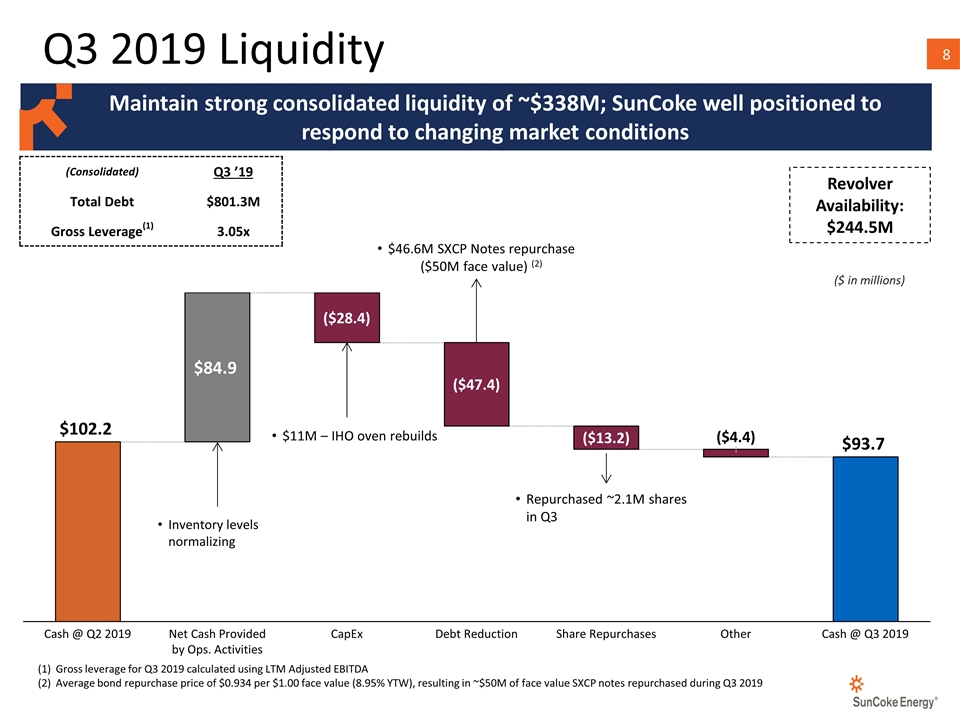

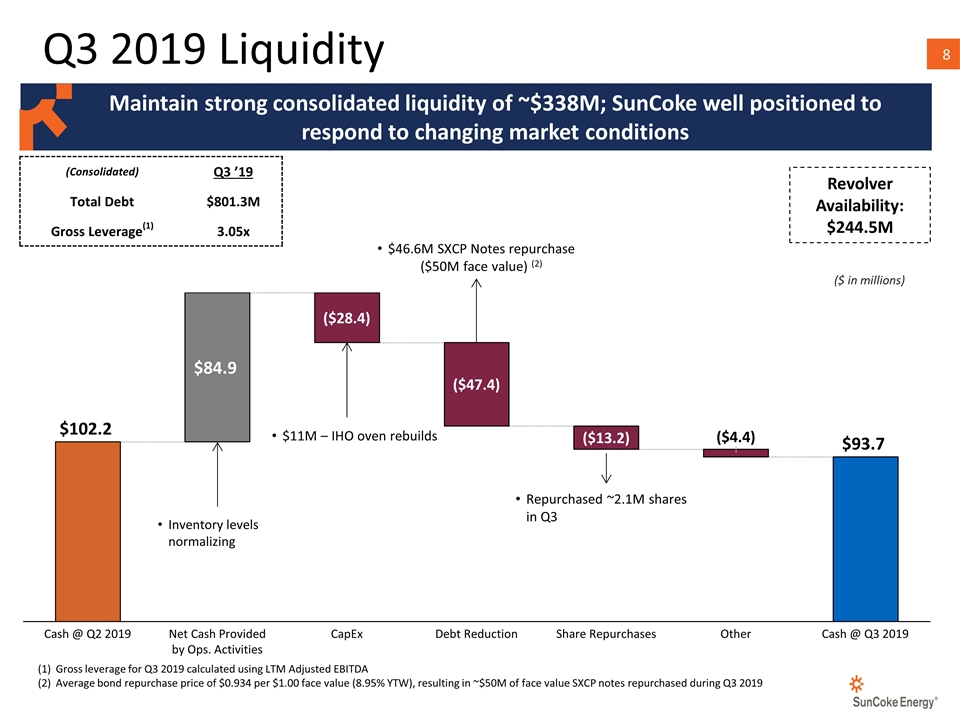

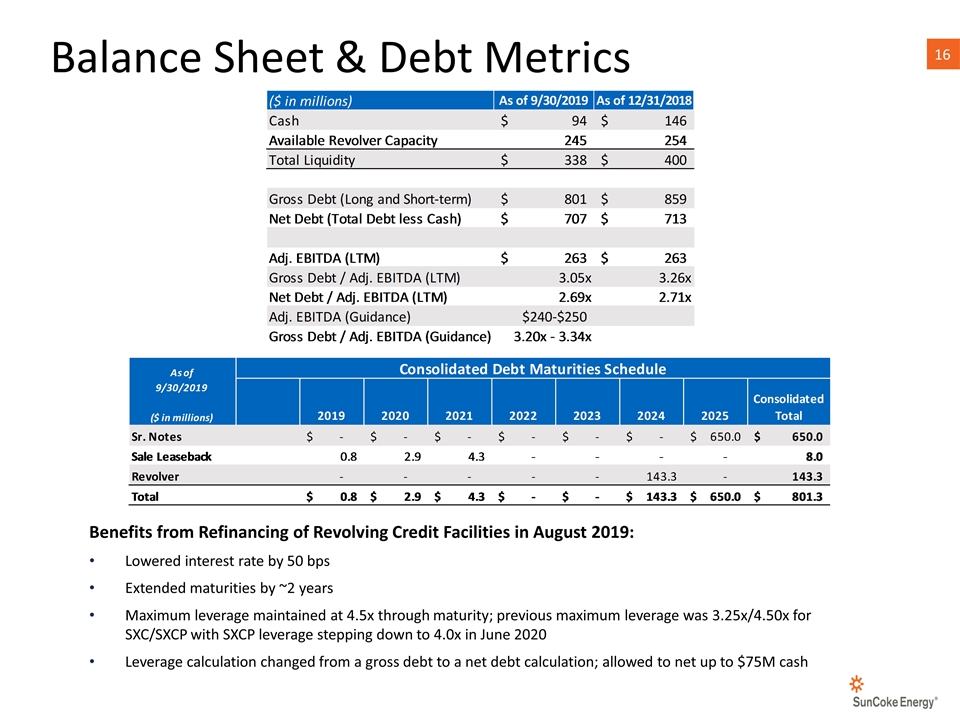

Revolver Availability: $244.5M (Consolidated) Q3 ’19 Total Debt $801.3M Gross Leverage(1) 3.05x Gross leverage for Q3 2019 calculated using LTM Adjusted EBITDA Average bond repurchase price of $0.934 per $1.00 face value (8.95% YTW), resulting in ~$50M of face value SXCP notes repurchased during Q3 2019 Repurchased ~2.1M shares in Q3 Q3 2019 Liquidity Maintain strong consolidated liquidity of ~$338M; SunCoke well positioned to respond to changing market conditions ($ in millions) $46.6M SXCP Notes repurchase ($50M face value) (2) $11M – IHO oven rebuilds Inventory levels normalizing

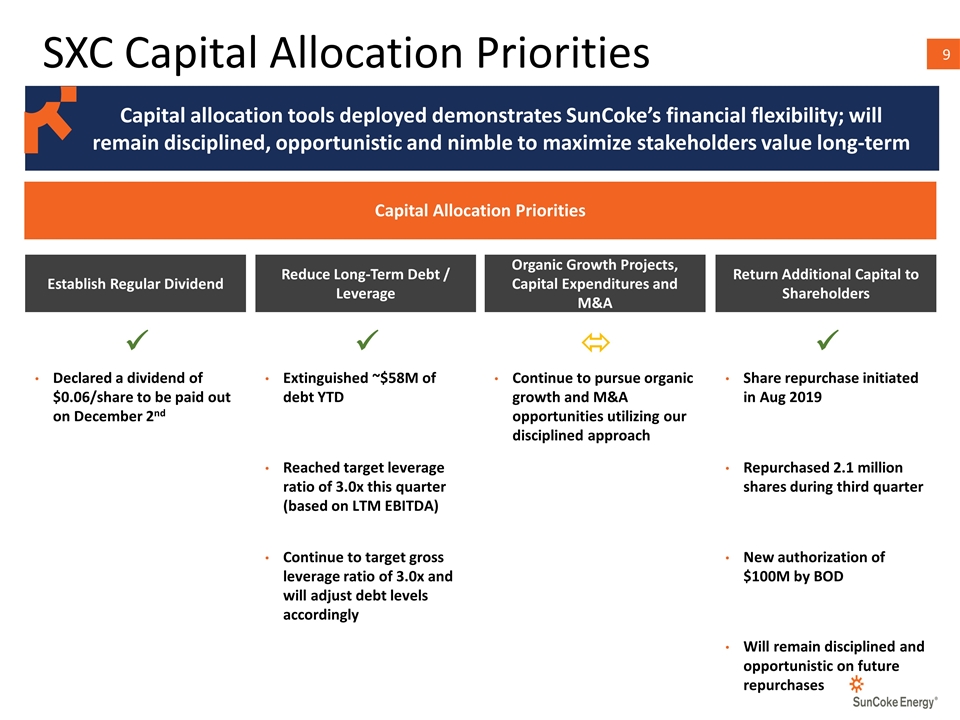

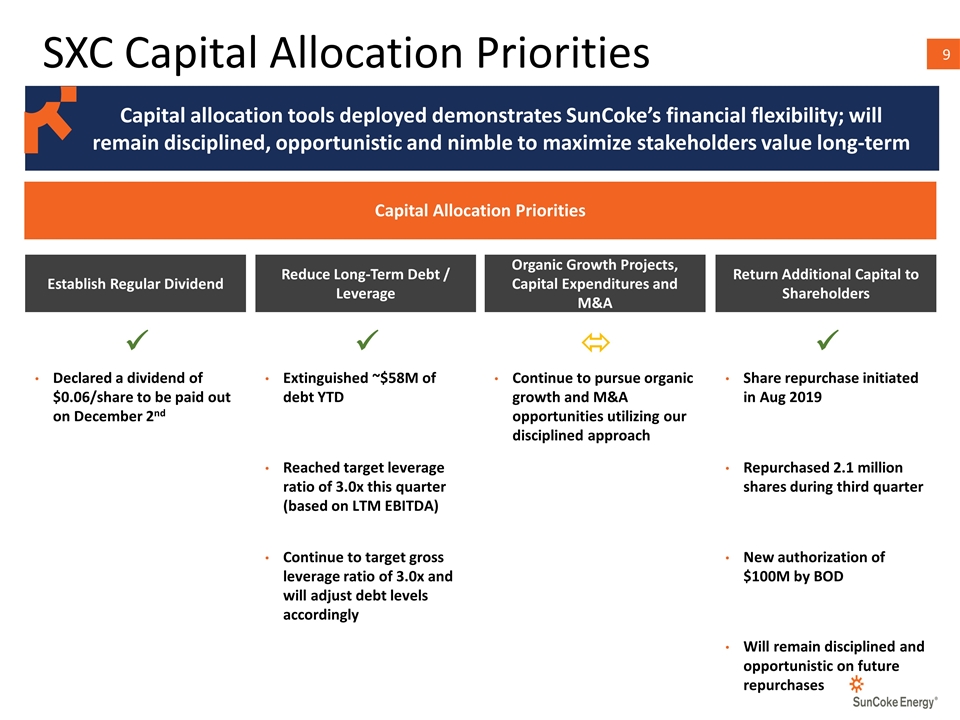

SXC Capital Allocation Priorities Capital allocation tools deployed demonstrates SunCoke’s financial flexibility; will remain disciplined, opportunistic and nimble to maximize stakeholders value long-term Capital Allocation Priorities Organic Growth Projects, Capital Expenditures and M&A Return Additional Capital to Shareholders Establish Regular Dividend Reduce Long-Term Debt / Leverage Declared a dividend of $0.06/share to be paid out on December 2nd Extinguished ~$58M of debt YTD Reached target leverage ratio of 3.0x this quarter (based on LTM EBITDA) Continue to target gross leverage ratio of 3.0x and will adjust debt levels accordingly Share repurchase initiated in Aug 2019 Repurchased 2.1 million shares during third quarter New authorization of $100M by BOD Will remain disciplined and opportunistic on future repurchases Continue to pursue organic growth and M&A opportunities utilizing our disciplined approach ü ü ü ó

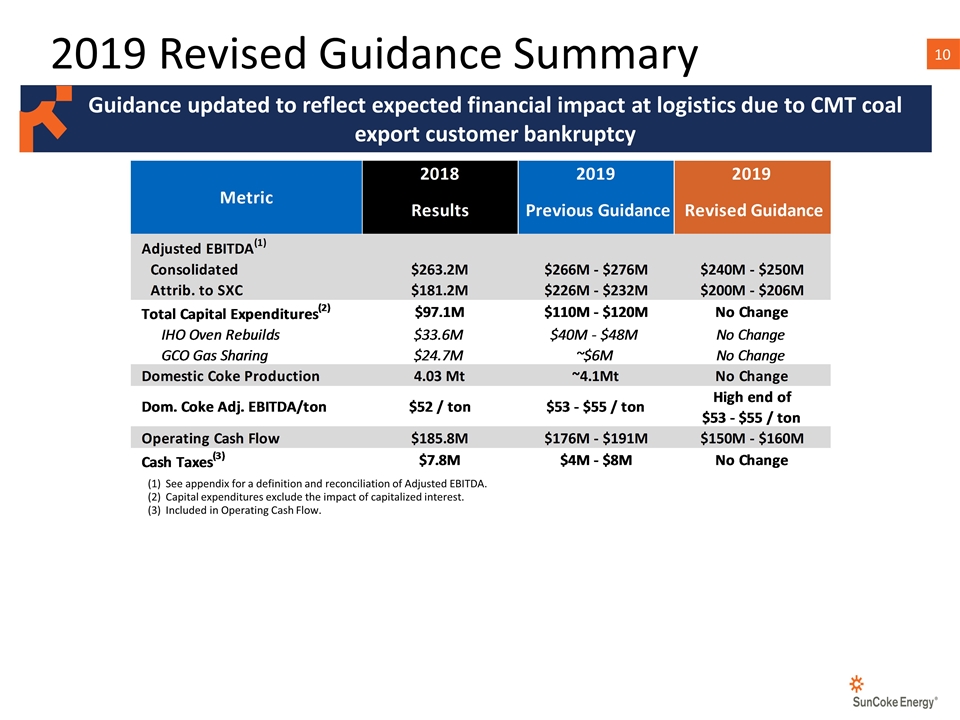

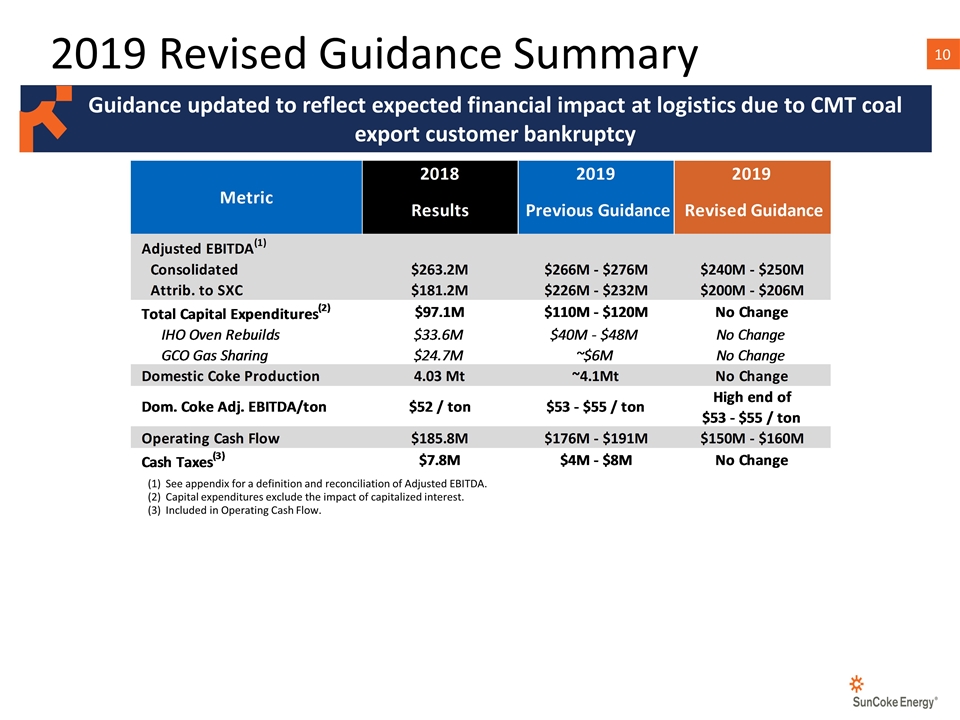

2019 Revised Guidance Summary See appendix for a definition and reconciliation of Adjusted EBITDA. Capital expenditures exclude the impact of capitalized interest. Included in Operating Cash Flow. Guidance updated to reflect expected financial impact at logistics due to CMT coal export customer bankruptcy

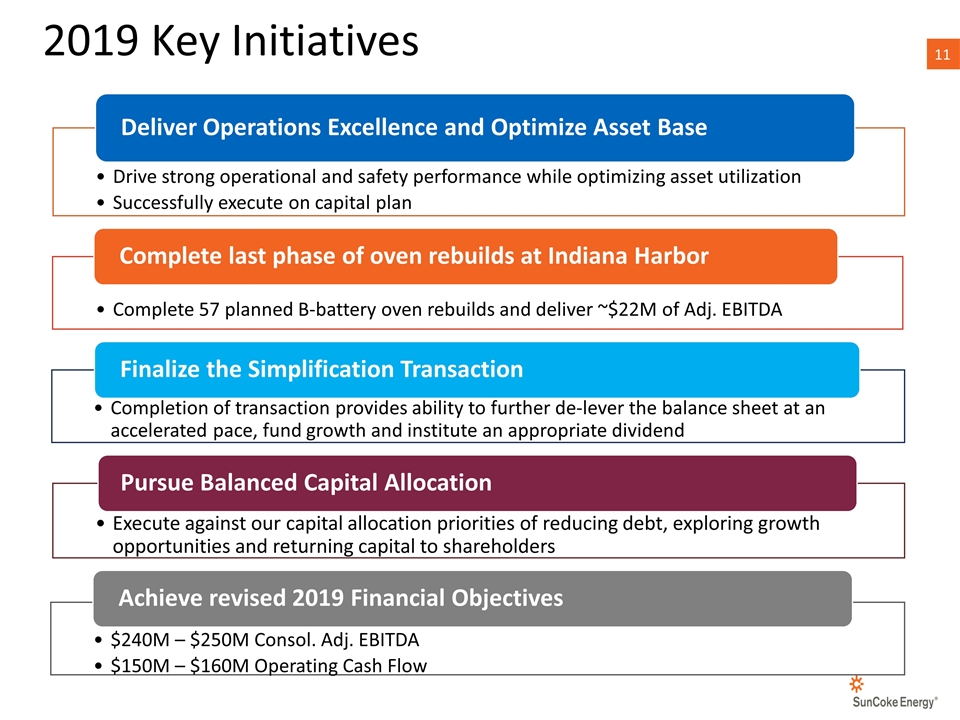

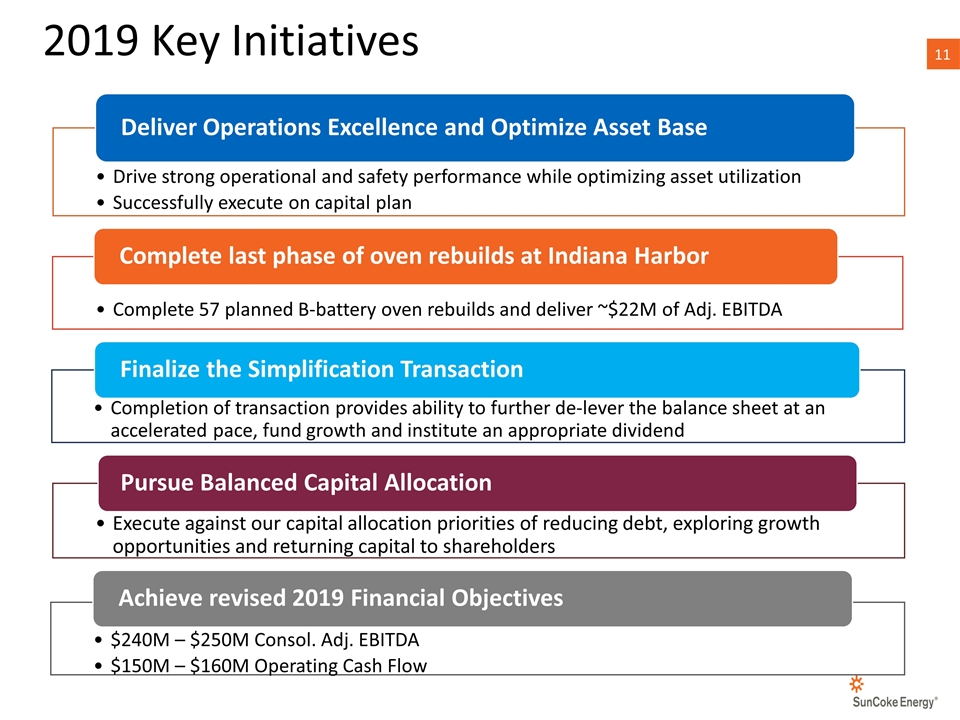

Drive strong operational and safety performance while optimizing asset utilization Successfully execute on capital plan Deliver Operations Excellence and Optimize Asset Base Complete 57 planned B-battery oven rebuilds and deliver ~$22M of Adj. EBITDA Complete last phase of oven rebuilds at Indiana Harbor Completion of transaction provides ability to further de-lever the balance sheet at an accelerated pace, fund growth and institute an appropriate dividend Finalize the Simplification Transaction $240M – $250M Consol. Adj. EBITDA $150M – $160M Operating Cash Flow Achieve revised 2019 Financial Objectives Execute against our capital allocation priorities of reducing debt, exploring growth opportunities and returning capital to shareholders Pursue Balanced Capital Allocation 2019 Key Initiatives

APPENDIX

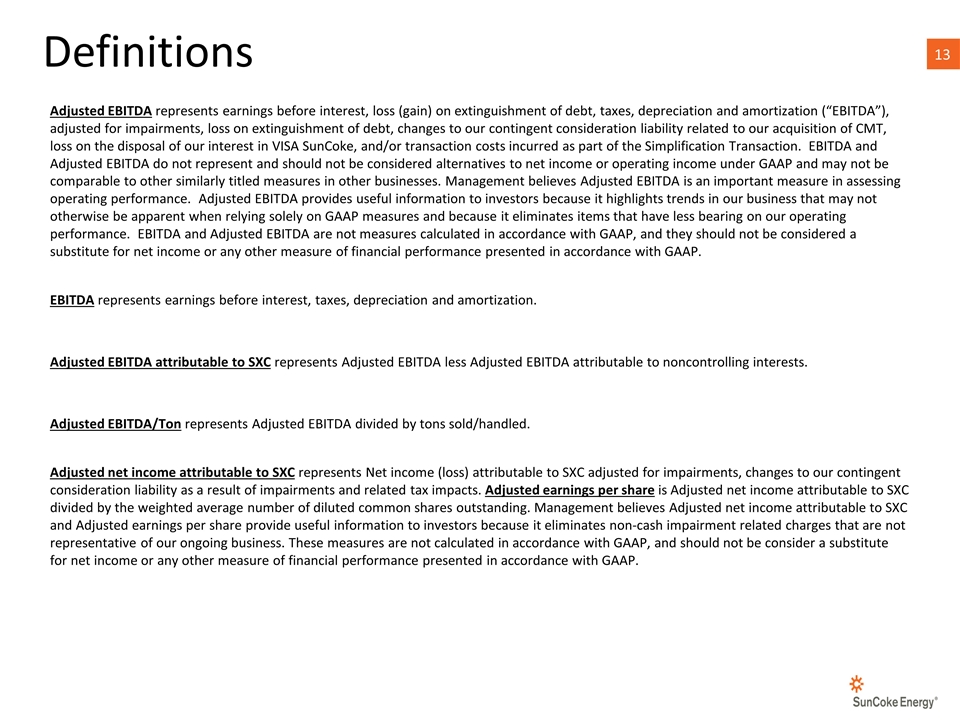

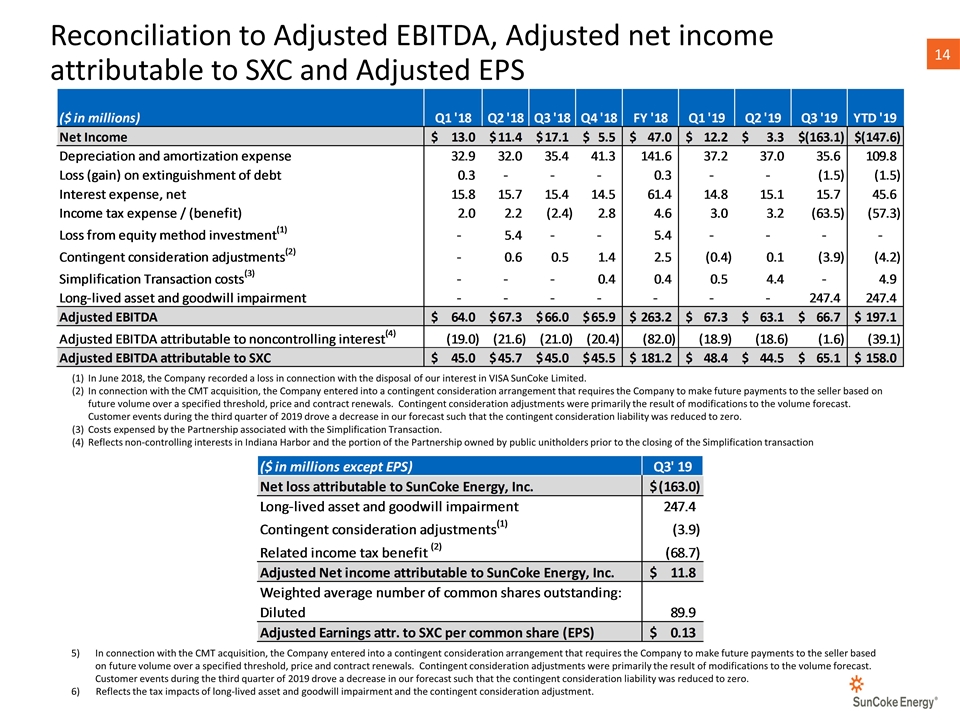

Adjusted EBITDA represents earnings before interest, loss (gain) on extinguishment of debt, taxes, depreciation and amortization (“EBITDA”), adjusted for impairments, loss on extinguishment of debt, changes to our contingent consideration liability related to our acquisition of CMT, loss on the disposal of our interest in VISA SunCoke, and/or transaction costs incurred as part of the Simplification Transaction. EBITDA and Adjusted EBITDA do not represent and should not be considered alternatives to net income or operating income under GAAP and may not be comparable to other similarly titled measures in other businesses. Management believes Adjusted EBITDA is an important measure in assessing operating performance. Adjusted EBITDA provides useful information to investors because it highlights trends in our business that may not otherwise be apparent when relying solely on GAAP measures and because it eliminates items that have less bearing on our operating performance. EBITDA and Adjusted EBITDA are not measures calculated in accordance with GAAP, and they should not be considered a substitute for net income or any other measure of financial performance presented in accordance with GAAP. EBITDA represents earnings before interest, taxes, depreciation and amortization. Adjusted EBITDA attributable to SXC represents Adjusted EBITDA less Adjusted EBITDA attributable to noncontrolling interests. Adjusted EBITDA/Ton represents Adjusted EBITDA divided by tons sold/handled. Adjusted net income attributable to SXC represents Net income (loss) attributable to SXC adjusted for impairments, changes to our contingent consideration liability as a result of impairments and related tax impacts. Adjusted earnings per share is Adjusted net income attributable to SXC divided by the weighted average number of diluted common shares outstanding. Management believes Adjusted net income attributable to SXC and Adjusted earnings per share provide useful information to investors because it eliminates non-cash impairment related charges that are not representative of our ongoing business. These measures are not calculated in accordance with GAAP, and should not be consider a substitute for net income or any other measure of financial performance presented in accordance with GAAP. Definitions

Reconciliation to Adjusted EBITDA, Adjusted net income attributable to SXC and Adjusted EPS In June 2018, the Company recorded a loss in connection with the disposal of our interest in VISA SunCoke Limited. In connection with the CMT acquisition, the Company entered into a contingent consideration arrangement that requires the Company to make future payments to the seller based on future volume over a specified threshold, price and contract renewals. Contingent consideration adjustments were primarily the result of modifications to the volume forecast. Customer events during the third quarter of 2019 drove a decrease in our forecast such that the contingent consideration liability was reduced to zero. Costs expensed by the Partnership associated with the Simplification Transaction. Reflects non-controlling interests in Indiana Harbor and the portion of the Partnership owned by public unitholders prior to the closing of the Simplification transaction In connection with the CMT acquisition, the Company entered into a contingent consideration arrangement that requires the Company to make future payments to the seller based on future volume over a specified threshold, price and contract renewals. Contingent consideration adjustments were primarily the result of modifications to the volume forecast. Customer events during the third quarter of 2019 drove a decrease in our forecast such that the contingent consideration liability was reduced to zero. Reflects the tax impacts of long-lived asset and goodwill impairment and the contingent consideration adjustment.

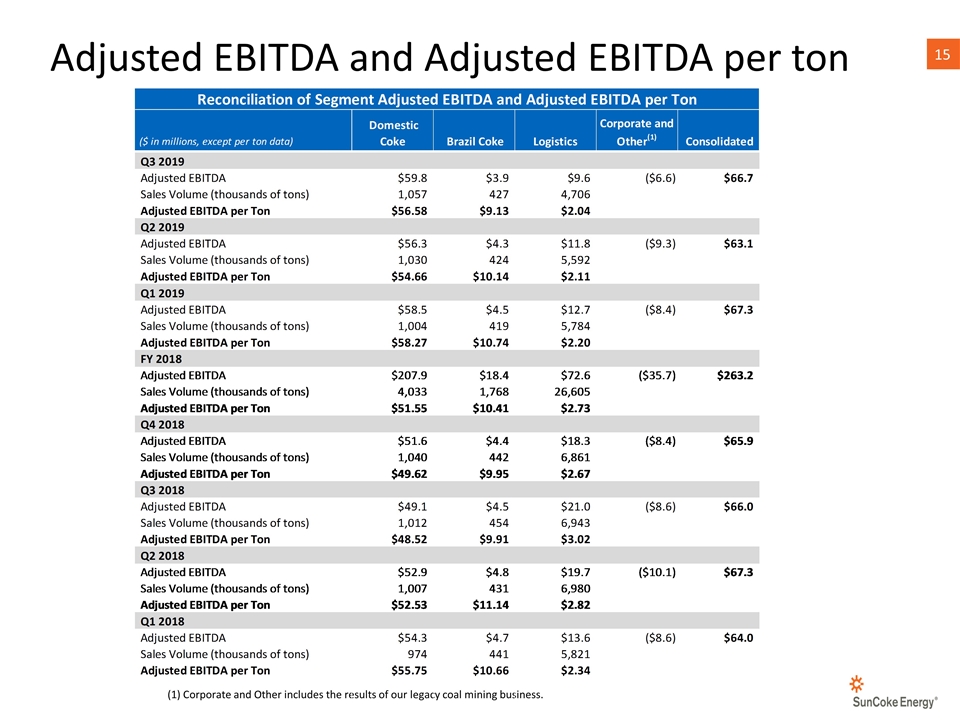

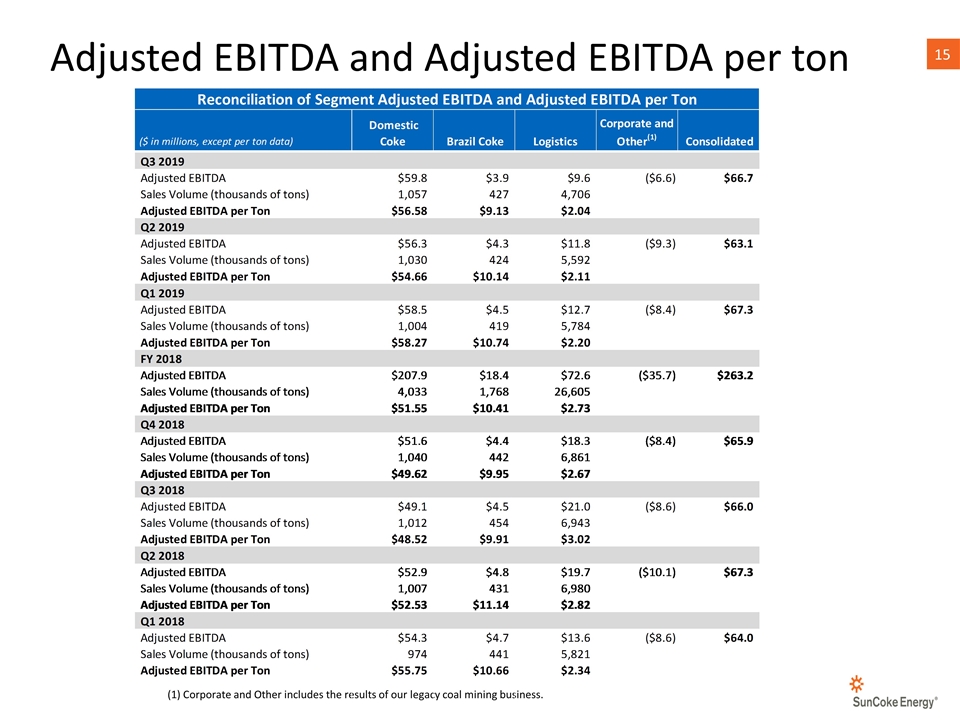

Adjusted EBITDA and Adjusted EBITDA per ton (1) Corporate and Other includes the results of our legacy coal mining business.

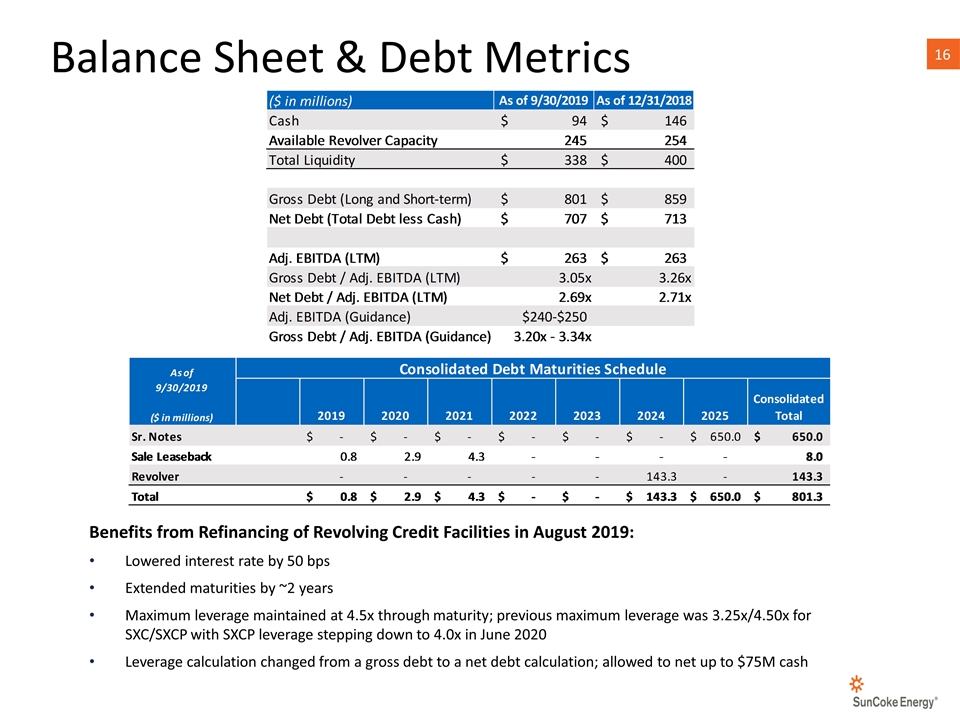

Balance Sheet & Debt Metrics Benefits from Refinancing of Revolving Credit Facilities in August 2019: Lowered interest rate by 50 bps Extended maturities by ~2 years Maximum leverage maintained at 4.5x through maturity; previous maximum leverage was 3.25x/4.50x for SXC/SXCP with SXCP leverage stepping down to 4.0x in June 2020 Leverage calculation changed from a gross debt to a net debt calculation; allowed to net up to $75M cash

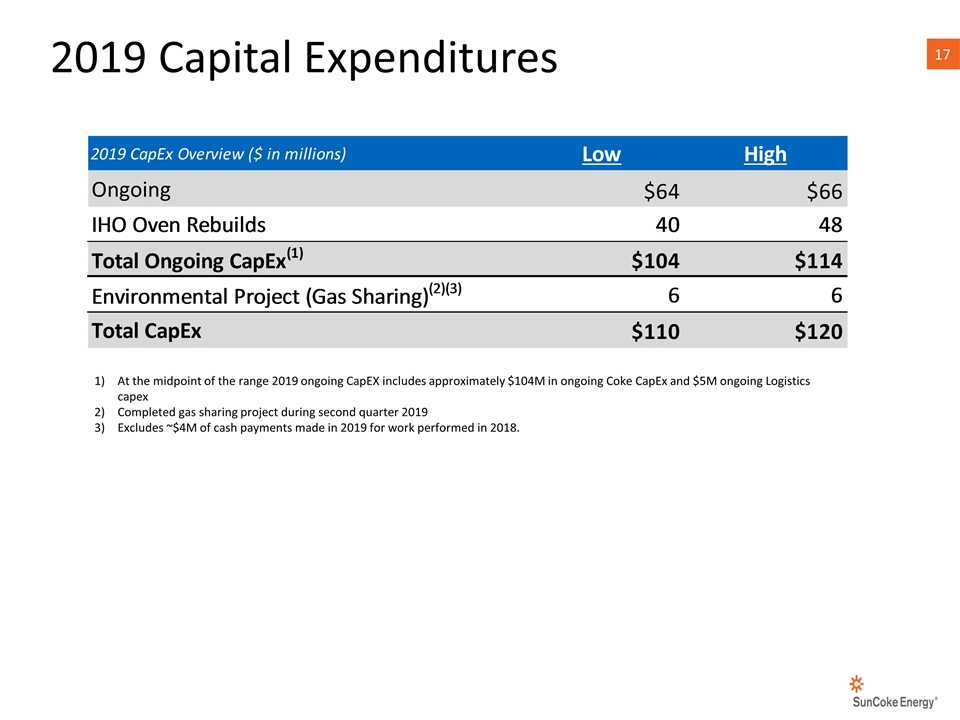

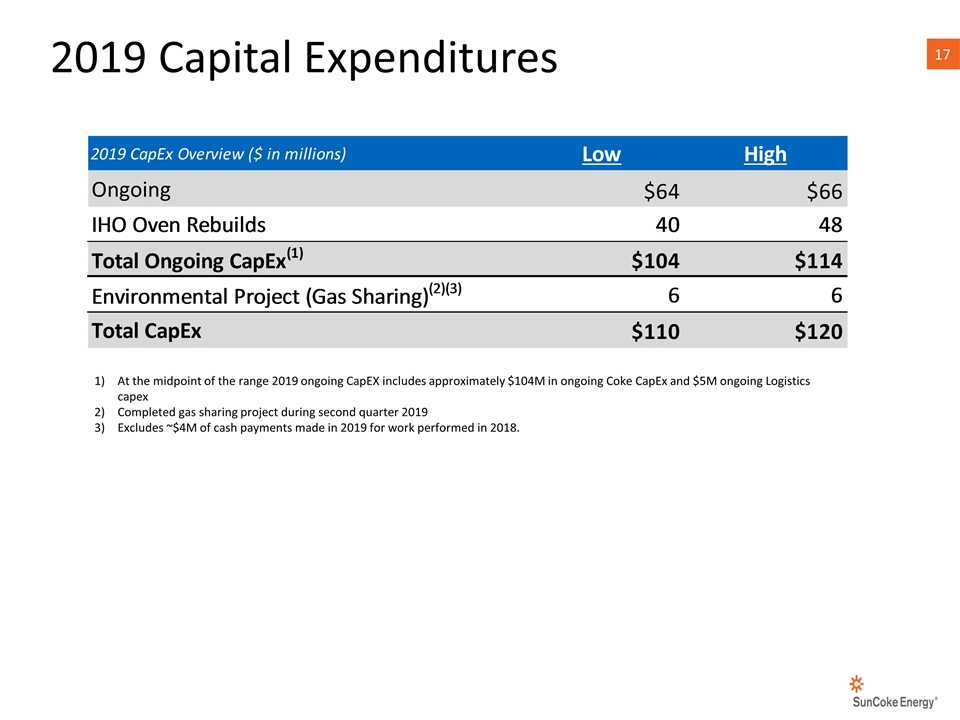

2019 Capital Expenditures At the midpoint of the range 2019 ongoing CapEX includes approximately $104M in ongoing Coke CapEx and $5M ongoing Logistics capex Completed gas sharing project during second quarter 2019 Excludes ~$4M of cash payments made in 2019 for work performed in 2018.

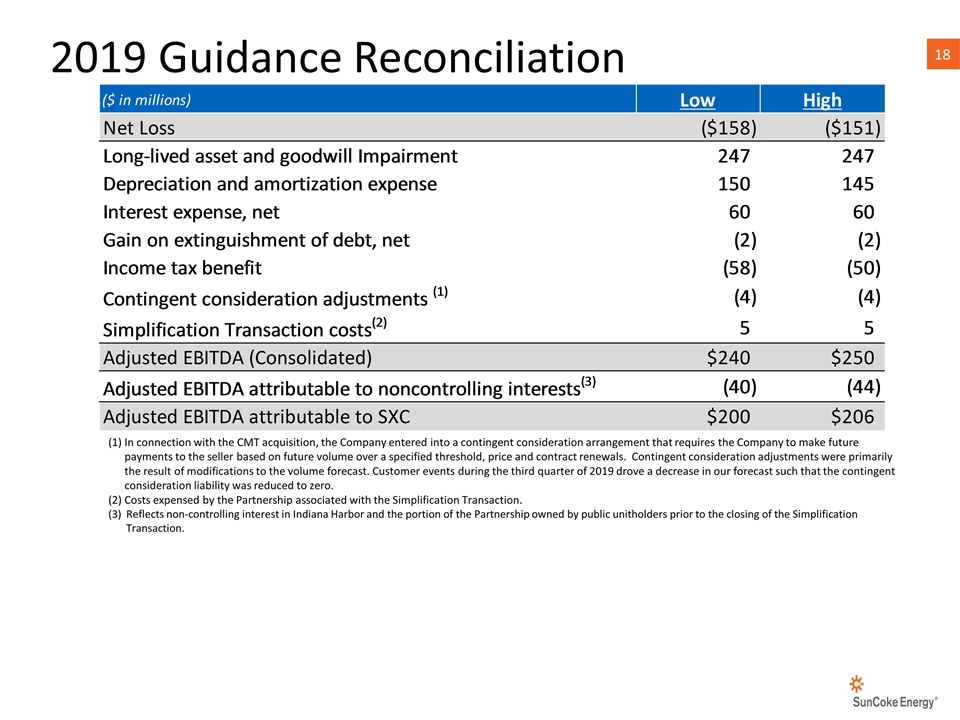

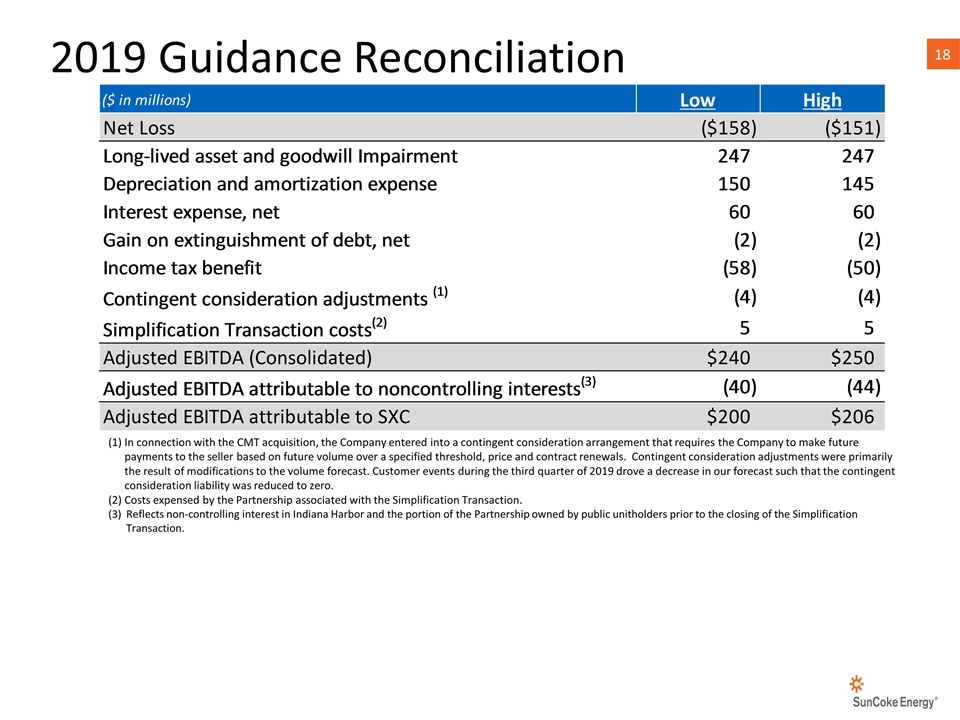

2019 Guidance Reconciliation In connection with the CMT acquisition, the Company entered into a contingent consideration arrangement that requires the Company to make future payments to the seller based on future volume over a specified threshold, price and contract renewals. Contingent consideration adjustments were primarily the result of modifications to the volume forecast. Customer events during the third quarter of 2019 drove a decrease in our forecast such that the contingent consideration liability was reduced to zero. Costs expensed by the Partnership associated with the Simplification Transaction. Reflects non-controlling interest in Indiana Harbor and the portion of the Partnership owned by public unitholders prior to the closing of the Simplification Transaction.

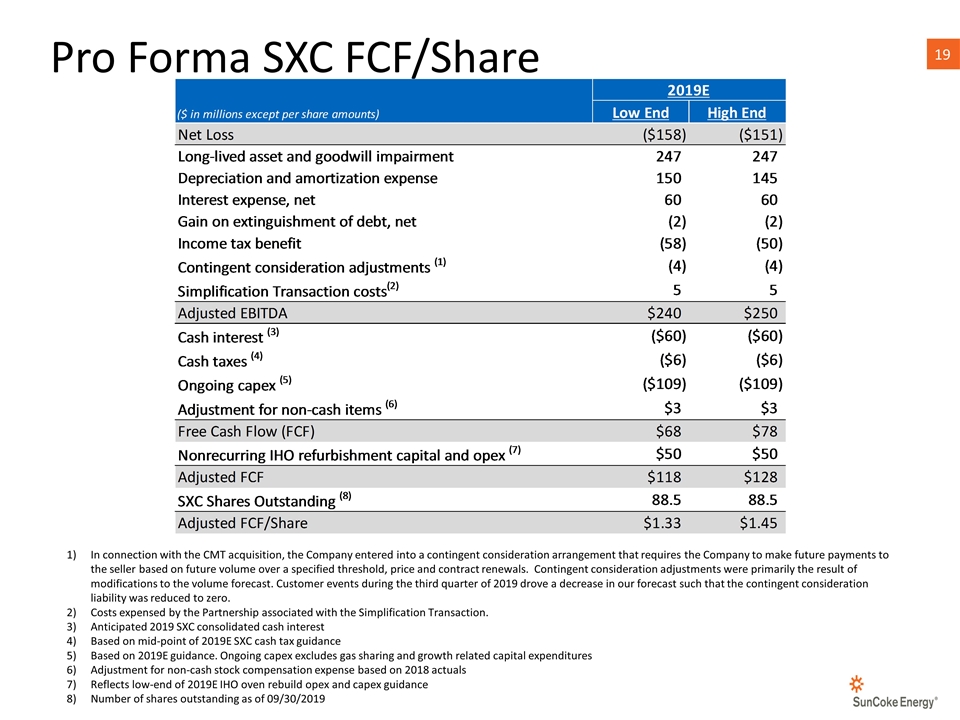

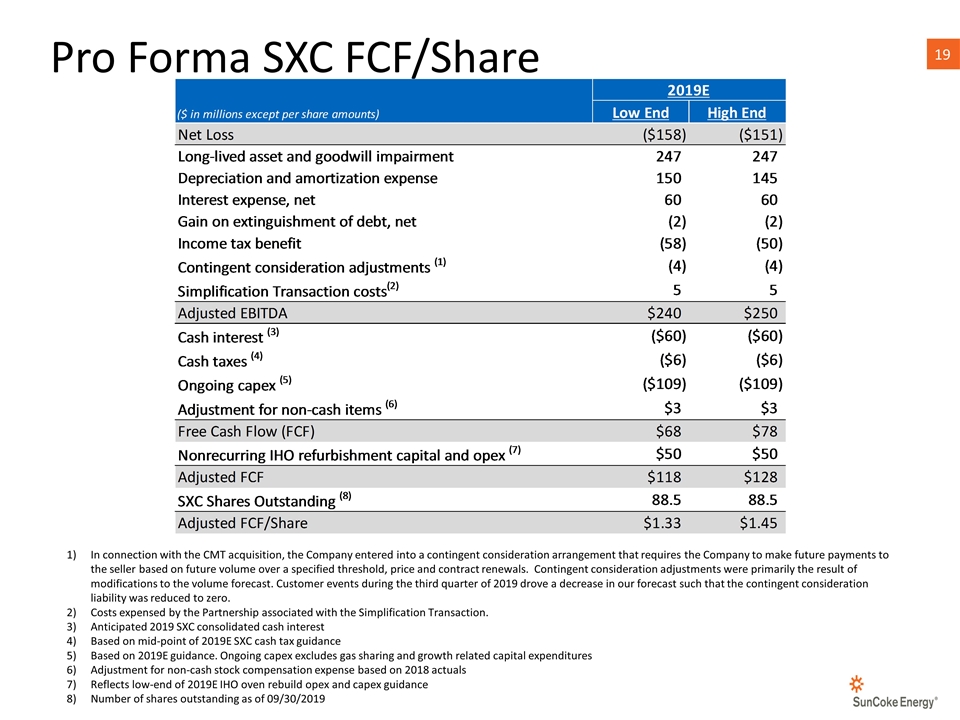

Pro Forma SXC FCF/Share In connection with the CMT acquisition, the Company entered into a contingent consideration arrangement that requires the Company to make future payments to the seller based on future volume over a specified threshold, price and contract renewals. Contingent consideration adjustments were primarily the result of modifications to the volume forecast. Customer events during the third quarter of 2019 drove a decrease in our forecast such that the contingent consideration liability was reduced to zero. Costs expensed by the Partnership associated with the Simplification Transaction. Anticipated 2019 SXC consolidated cash interest Based on mid-point of 2019E SXC cash tax guidance Based on 2019E guidance. Ongoing capex excludes gas sharing and growth related capital expenditures Adjustment for non-cash stock compensation expense based on 2018 actuals Reflects low-end of 2019E IHO oven rebuild opex and capex guidance Number of shares outstanding as of 09/30/2019