SunCoke Energy, Inc. Q3 2021 Earnings Conference Call Exhibit 99.2

This slide presentation should be reviewed in conjunction with the Second Quarter 2021 earnings release of SunCoke Energy, Inc. (SunCoke) and conference call held on November 1, 2021 at 10:00 a.m. ET. This presentation call contains “forward-looking statements” (as defined in Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended). Such forward-looking statements include statements that are not strictly historical facts, and include, among other things, statements regarding: our expectations of financial results, condition and outlook; anticipated effects of the COVID-19 pandemic and responses thereto, including the pandemic’s impact on general economic and market conditions, as well as on our business, our customers, our results of operations and financial condition; anticipated actions to be taken by management to sustain SunCoke during the economic uncertainty caused by the pandemic and related business actions; and anticipated actions by governments to contain the spread of COVID-19 or mitigate the severity thereof. Forward-looking statements often may be identified by the use of such words as "believe," "expect," "plan," "project," "intend," "anticipate," "estimate," "predict," "potential," "continue," "may," "will," "should," or the negative of these terms, or similar expressions. Forward-looking statements are inherently uncertain and involve significant known and unknown risks and uncertainties (many of which are beyond the control of SunCoke) that could cause actual results to differ materially. Such risks and uncertainties include, but are not limited to domestic and international economic, political, business, operational, competitive, regulatory and/or market factors affecting SunCoke, as well as uncertainties related to: pending or future litigation, legislation or regulatory actions; liability for remedial actions or assessments under existing or future environmental regulations; gains and losses related to acquisition, disposition or impairment of assets; recapitalizations; access to, and costs of, capital; the effects of changes in accounting rules applicable to SunCoke; and changes in tax, environmental and other laws and regulations applicable to SunCoke's businesses. Currently, such risks and uncertainties also include: SunCoke’s ability to manage its business during and after the COVID-19 pandemic; the impact of the COVID-19 pandemic on SunCoke’s results of operations, revenues, earnings and cash flows; SunCoke’s ability to reduce costs and capital spending in response to the COVID-19 pandemic; SunCoke’s balance sheet and liquidity throughout and following the COVID-19 pandemic; SunCoke’s prospects for financial performance and achievement of strategic objectives following the COVID-19 pandemic; capital allocation strategy following the COVID-19 pandemic; and the general impact on our industry and on the U.S. and global economy resulting from COVID-19, including actions by domestic and foreign governments and others to contain the spread, or mitigate the severity, thereof. Forward-looking statements are not guarantees of future performance, but are based upon the current knowledge, beliefs and expectations of SunCoke management, and upon assumptions by SunCoke concerning future conditions, any or all of which ultimately may prove to be inaccurate. The reader should not place undue reliance on these forward-looking statements, which speak only as of the date of the earnings release. SunCoke does not intend, and expressly disclaims any obligation, to update or alter its forward-looking statements (or associated cautionary language), whether as a result of new information, future events or otherwise after the date of the earnings release except as required by applicable law. In accordance with the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, SunCoke has included in its filings with the Securities and Exchange Commission cautionary language identifying important factors (but not necessarily all the important factors) that could cause actual results to differ materially from those expressed in any forward-looking statement made by SunCoke. For information concerning these factors and other important information regarding the matters discussed in this presentation, see SunCoke's Securities and Exchange Commission filings such as its annual and quarterly reports and current reports on Form 8-K, copies of which are available free of charge on SunCoke's website at www.suncoke.com. All forward-looking statements included in this presentation are expressly qualified in their entirety by such cautionary statements. Unpredictable or unknown factors not discussed in this presentation also could have material adverse effects on forward- looking statements. Forward-Looking Statements

Q3 2021 Highlights Continued strong performance across coke and logistics operations Delivered Q3 ‘21 Adjusted EBITDA of $73.9M; representing record Q3 performance CMT recovered quickly from Hurricane Ida with only minor damage and minimal business disruption Export and foundry coke initiatives continue to perform well with positive market dynamics Gross leverage at 2.5x on a trailing twelve month Adj. EBITDA basis Well positioned to modestly exceed FY 2021 Adjusted EBITDA guidance range of $255M - $265M See appendix for a definition and reconciliation of Adjusted EBITDA

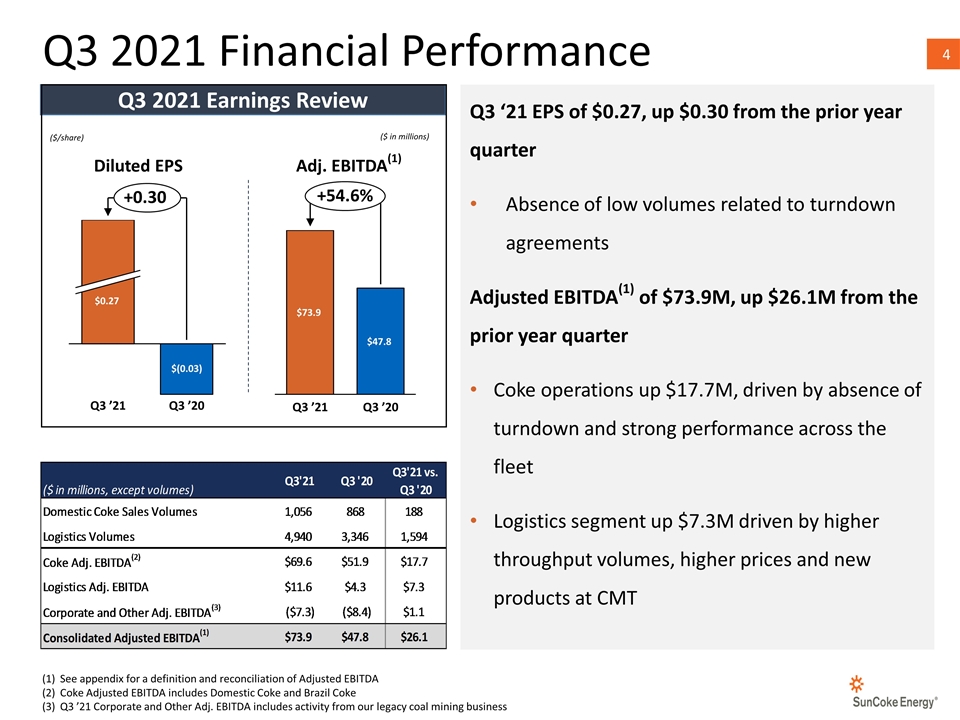

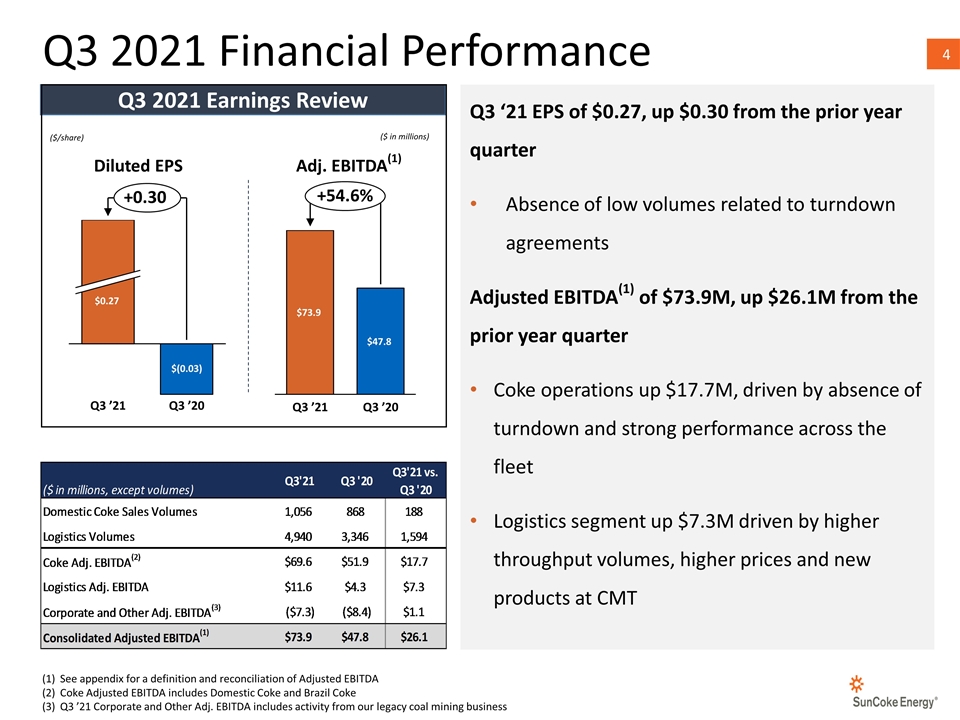

Q3 2021 Financial Performance See appendix for a definition and reconciliation of Adjusted EBITDA Coke Adjusted EBITDA includes Domestic Coke and Brazil Coke Q3 ’21 Corporate and Other Adj. EBITDA includes activity from our legacy coal mining business ($/share) ($ in millions) Diluted EPS Adj. EBITDA(1) Q3 2021 Earnings Review Q3 ‘21 EPS of $0.27, up $0.30 from the prior year quarter Absence of low volumes related to turndown agreements Adjusted EBITDA(1) of $73.9M, up $26.1M from the prior year quarter Coke operations up $17.7M, driven by absence of turndown and strong performance across the fleet Logistics segment up $7.3M driven by higher throughput volumes, higher prices and new products at CMT $ $

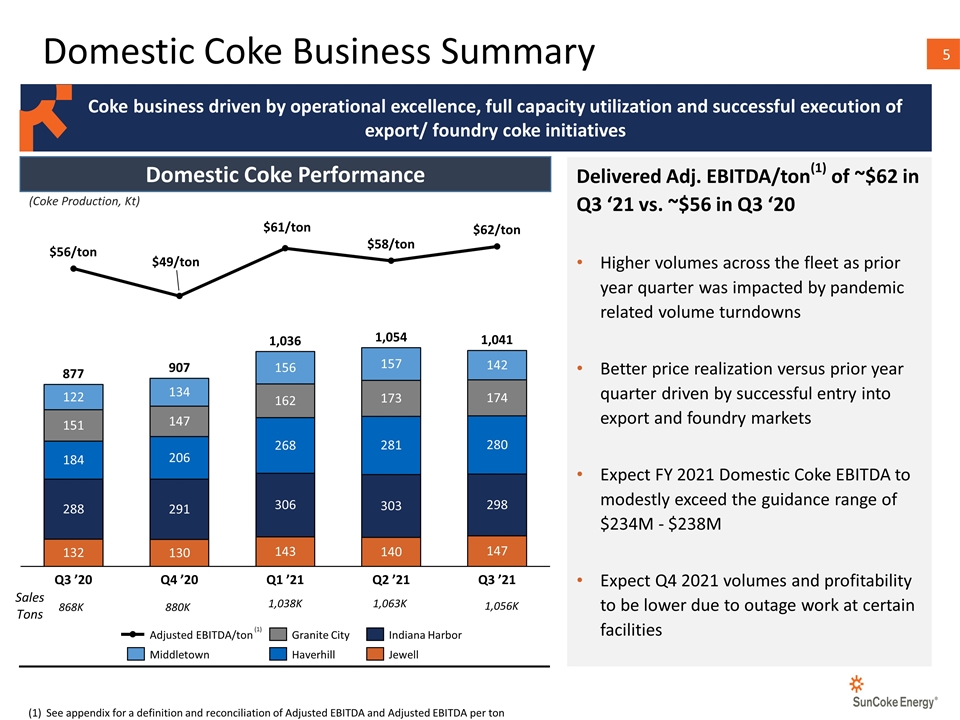

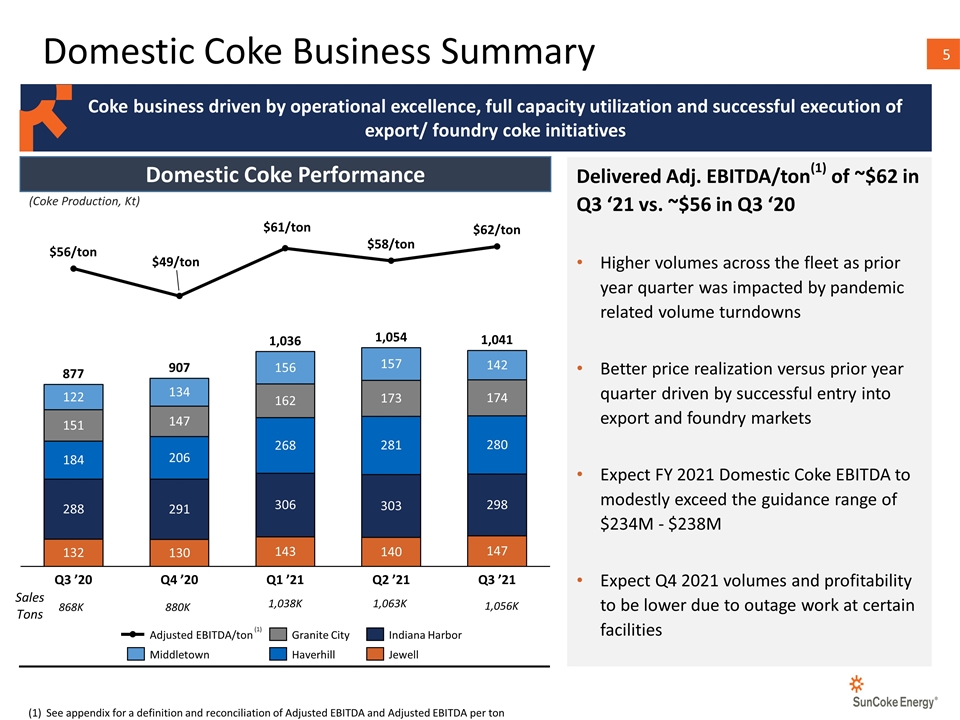

Domestic Coke Performance Domestic Coke Business Summary /ton $56/ton /ton /ton /ton Sales Tons (Coke Production, Kt) Delivered Adj. EBITDA/ton(1) of ~$62 in Q3 ‘21 vs. ~$56 in Q3 ‘20 Higher volumes across the fleet as prior year quarter was impacted by pandemic related volume turndowns Better price realization versus prior year quarter driven by successful entry into export and foundry markets Expect FY 2021 Domestic Coke EBITDA to modestly exceed the guidance range of $234M - $238M Expect Q4 2021 volumes and profitability to be lower due to outage work at certain facilities See appendix for a definition and reconciliation of Adjusted EBITDA and Adjusted EBITDA per ton (1) 880K 1,063K 1,038K 868K Coke business driven by operational excellence, full capacity utilization and successful execution of export/ foundry coke initiatives 1,056K

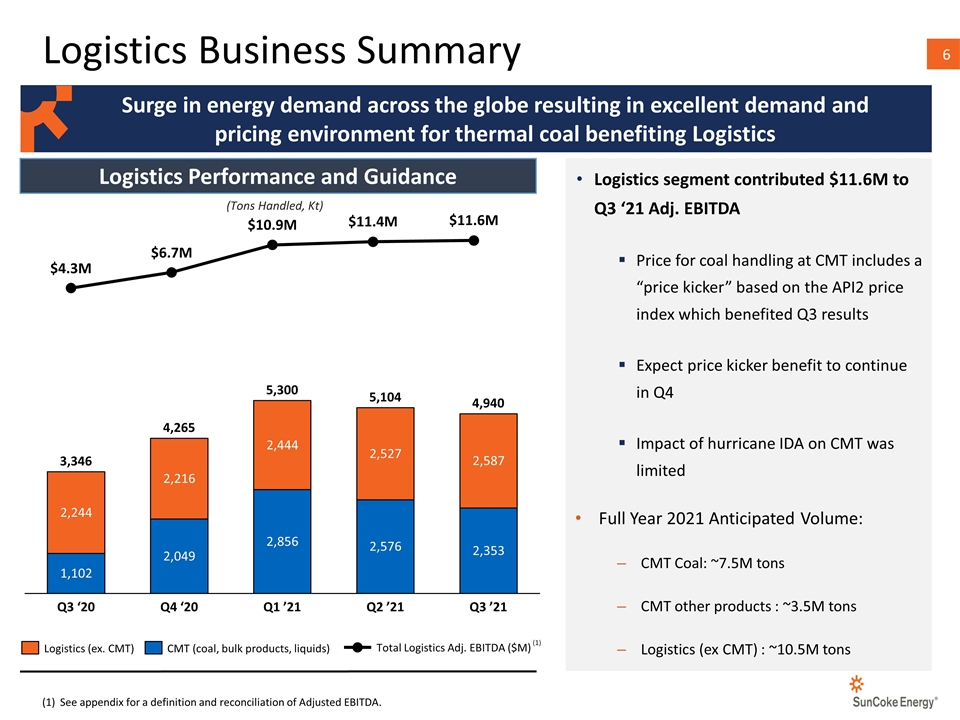

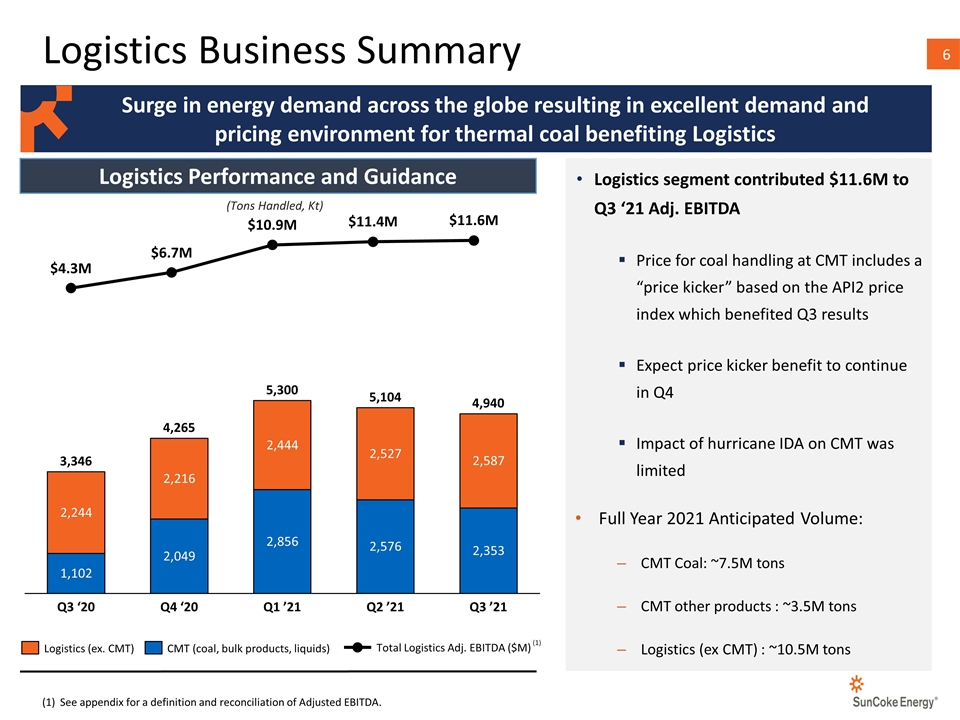

$10.9M $11.4M $11.6M Logistics Business Summary (Tons Handled, Kt) Logistics segment contributed $11.6M to Q3 ‘21 Adj. EBITDA Price for coal handling at CMT includes a “price kicker” based on the API2 price index which benefited Q3 results Expect price kicker benefit to continue in Q4 Impact of hurricane IDA on CMT was limited Full Year 2021 Anticipated Volume: CMT Coal: ~7.5M tons CMT other products : ~3.5M tons Logistics (ex CMT) : ~10.5M tons (1) See appendix for a definition and reconciliation of Adjusted EBITDA. Surge in energy demand across the globe resulting in excellent demand and pricing environment for thermal coal benefiting Logistics Logistics Performance and Guidance

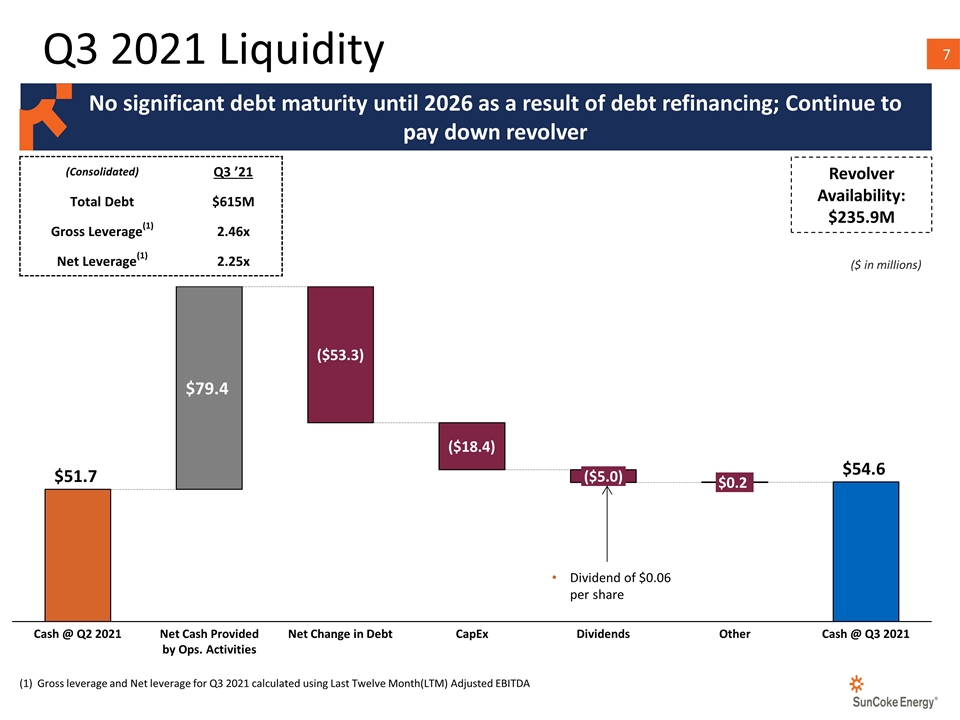

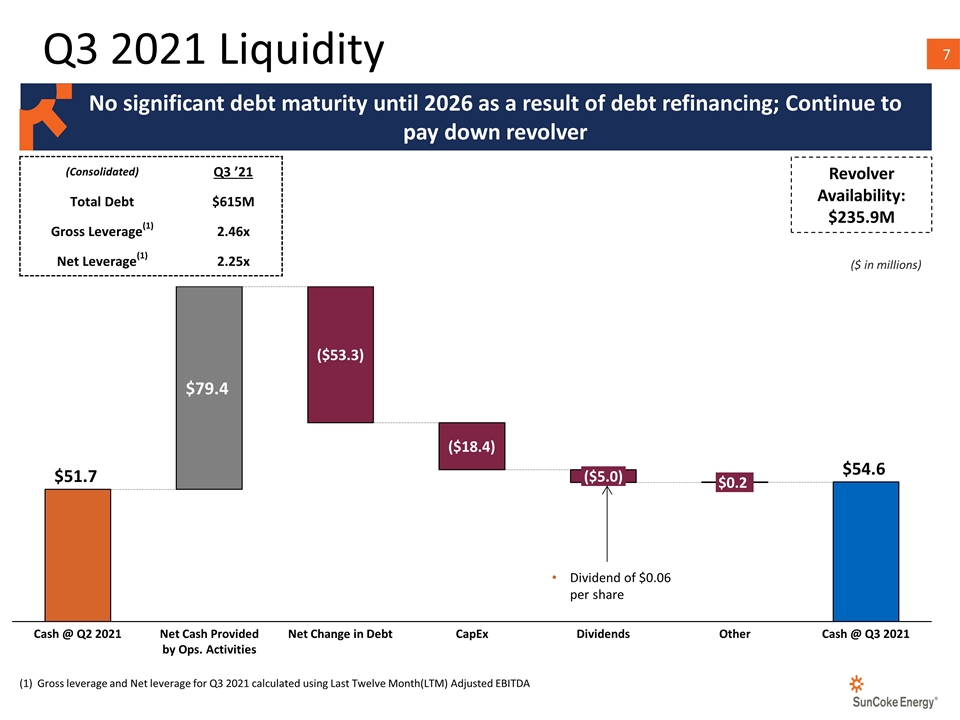

Revolver Availability: $235.9M (Consolidated) Q3 ’21 Total Debt $615M Gross Leverage(1) 2.46x Net Leverage(1) 2.25x Gross leverage and Net leverage for Q3 2021 calculated using Last Twelve Month(LTM) Adjusted EBITDA Q3 2021 Liquidity No significant debt maturity until 2026 as a result of debt refinancing; Continue to pay down revolver ($ in millions) Dividend of $0.06 per share

Provide stability in coke business by addressing uncontracted coke tons in the near future Continue to work towards revitalizing CMT with new product and customer mix Position Coke Business and CMT for Long-Term Success 2021 Initiatives $255M - $265M Adjusted EBITDA Achieve 2021 Financial Objectives Deliver Operational Excellence and Optimize Asset Base Continue strong safety and operational performance while optimizing asset utilization Successfully execute on capital plan Further develop foundry customer book and participate in coke export market enabling coke operations to run at full capacity Support Full Capacity Utilization via Export and Foundry Sales Continue to execute against our well-established capital allocation priorities of deleveraging and returning capital to shareholders Further Stabilize and Strengthen SunCoke Capital Structure

APPENDIX

Adjusted EBITDA represents earnings before interest, taxes, depreciation and amortization (“EBITDA”), adjusted for any impairments, restructuring costs and gains or losses on extinguishment of debt. EBITDA and Adjusted EBITDA do not represent and should not be considered alternatives to net income or operating income under GAAP and may not be comparable to other similarly titled measures in other businesses. Management believes Adjusted EBITDA is an important measure in assessing operating performance. Adjusted EBITDA provides useful information to investors because it highlights trends in our business that may not otherwise be apparent when relying solely on GAAP measures and because it eliminates items that have less bearing on our operating performance. EBITDA and Adjusted EBITDA are not measures calculated in accordance with GAAP, and they should not be considered a substitute for net income or any other measure of financial performance presented in accordance with GAAP. Additionally, other companies may calculate Adjusted EBITDA differently than we do, limiting its usefulness as a comparative measure. Adjusted EBITDA attributable to SXC represents Adjusted EBITDA less Adjusted EBITDA attributable to non-controlling interests. Adjusted EBITDA/Ton represents Adjusted EBITDA divided by tons sold/handled. Free Cash Flow (FCF) represents operating cash flow adjusted for capital expenditures, debt issuance costs and call premiums. Management believes FCF is an important measure of liquidity. FCF is not a measure calculated in accordance with GAAP, and it should not be considered a substitute for operating cash flow or any other measure of financial performance presented in accordance with GAAP. Definitions

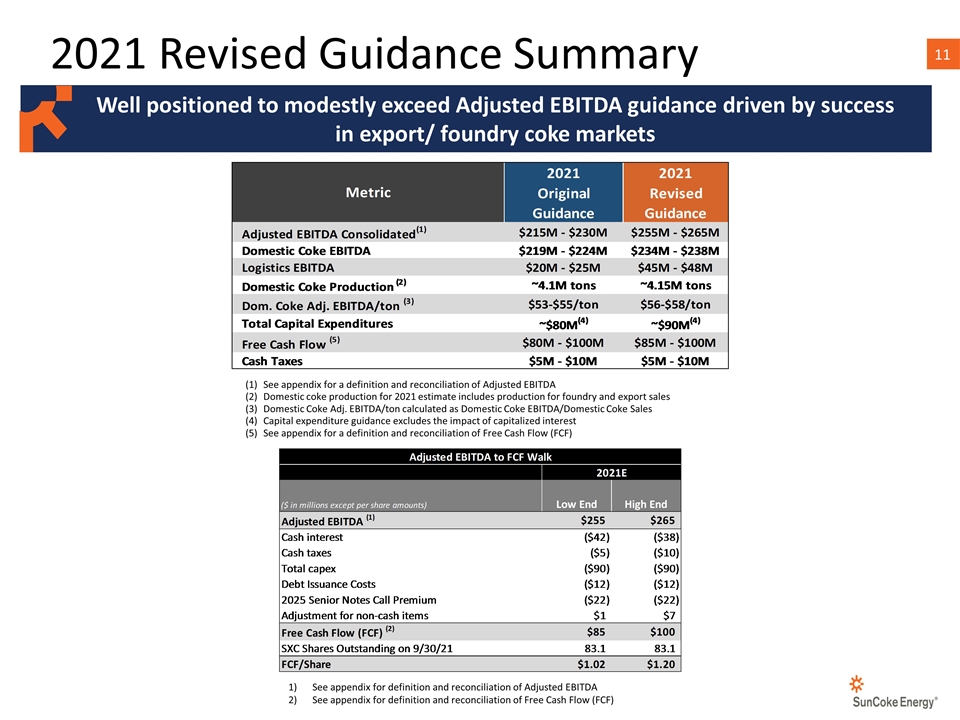

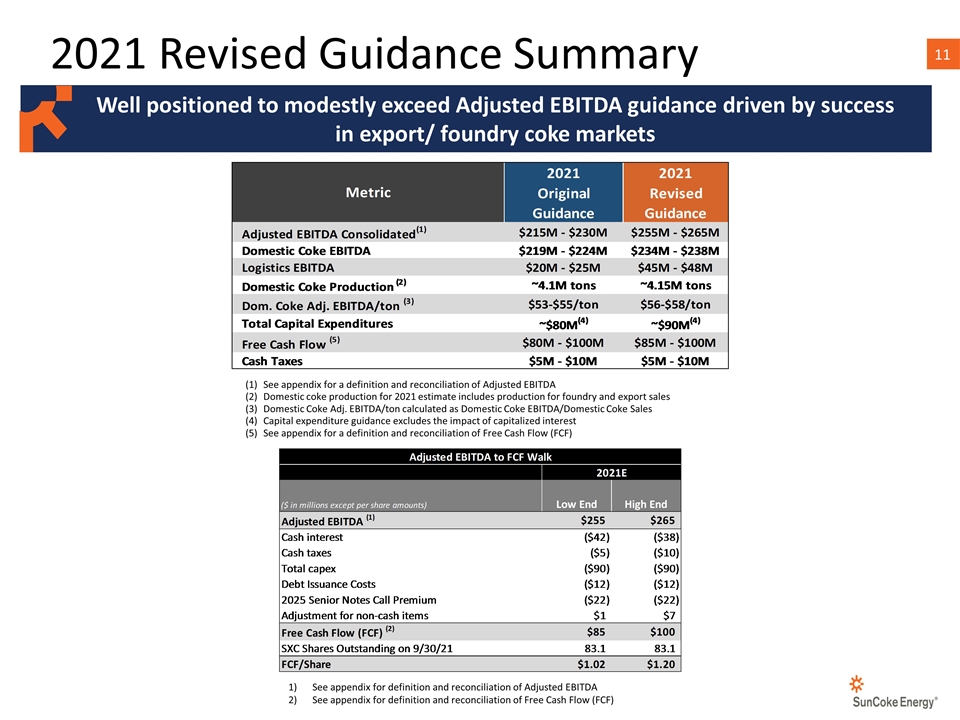

2021 Revised Guidance Summary Well positioned to modestly exceed Adjusted EBITDA guidance driven by success in export/ foundry coke markets See appendix for a definition and reconciliation of Adjusted EBITDA Domestic coke production for 2021 estimate includes production for foundry and export sales Domestic Coke Adj. EBITDA/ton calculated as Domestic Coke EBITDA/Domestic Coke Sales Capital expenditure guidance excludes the impact of capitalized interest See appendix for a definition and reconciliation of Free Cash Flow (FCF) See appendix for definition and reconciliation of Adjusted EBITDA See appendix for definition and reconciliation of Free Cash Flow (FCF)

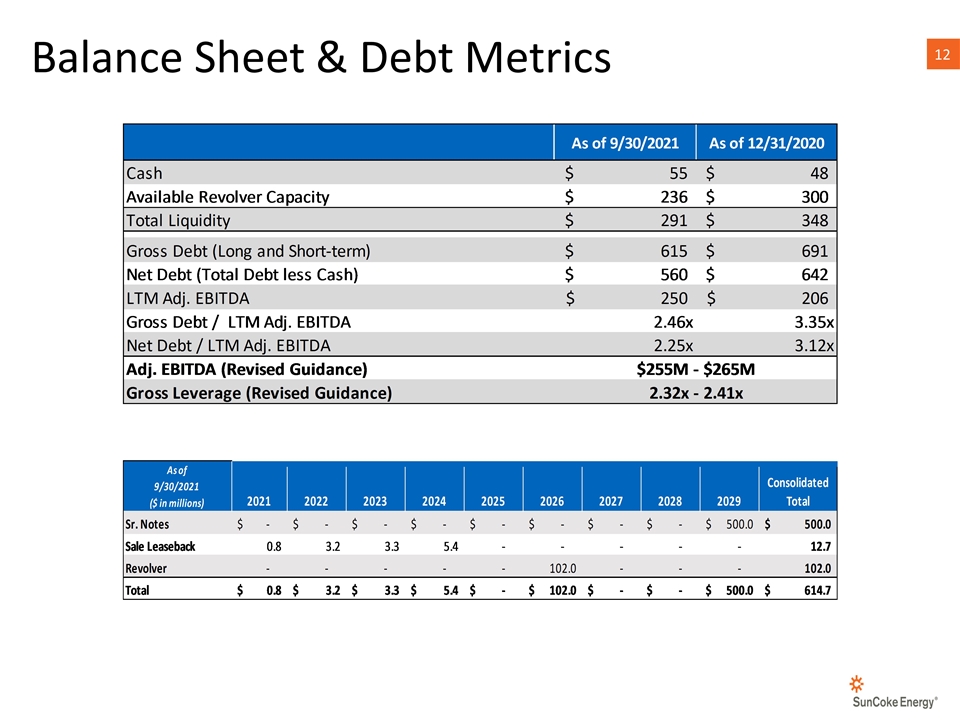

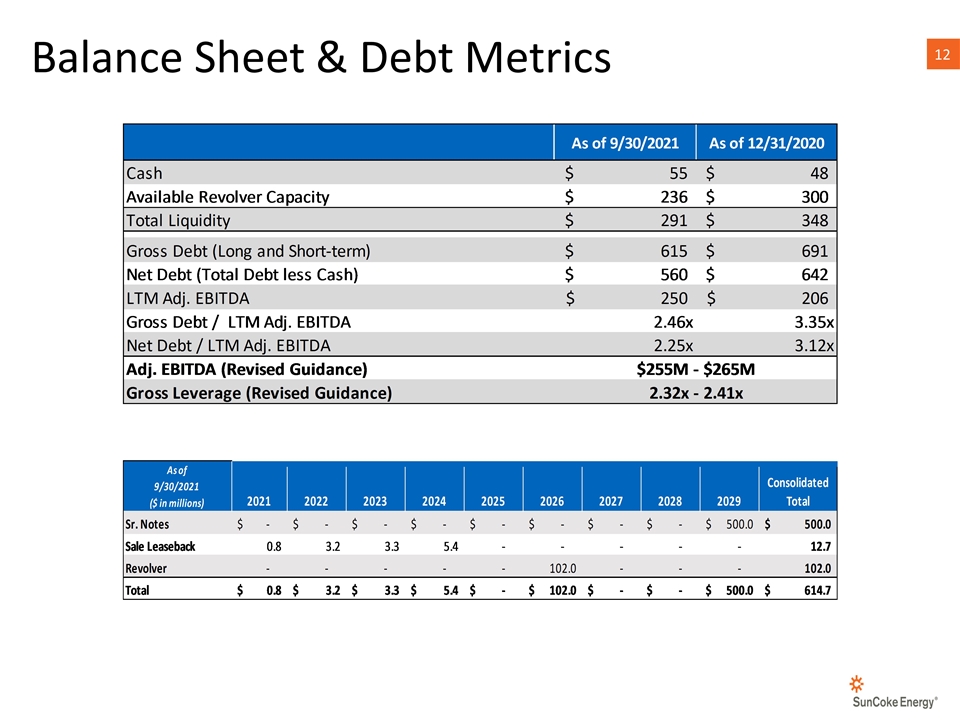

Balance Sheet & Debt Metrics

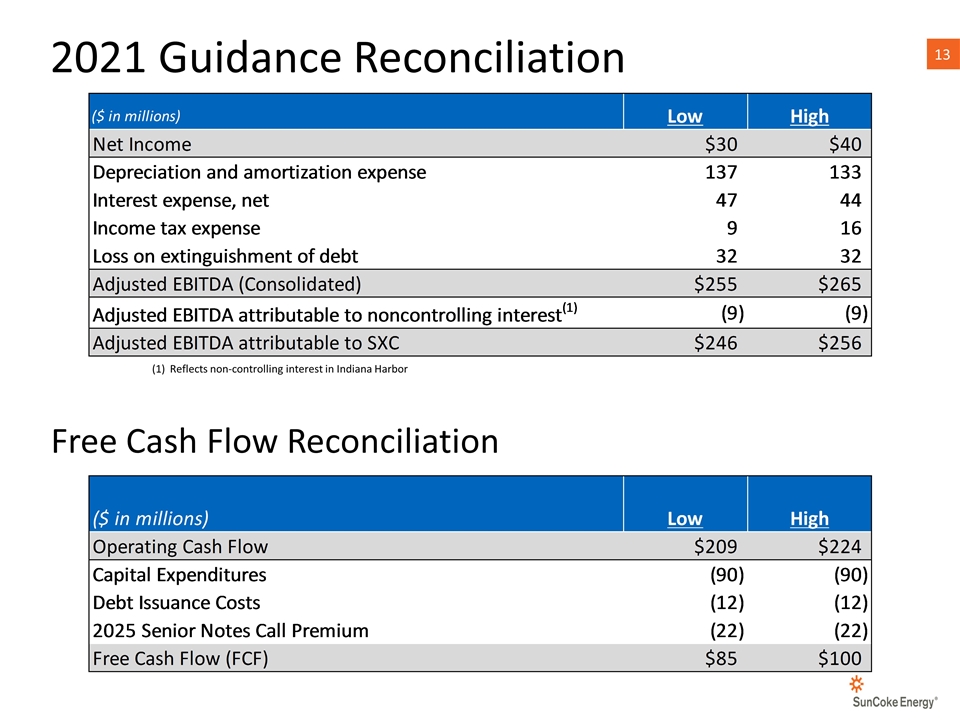

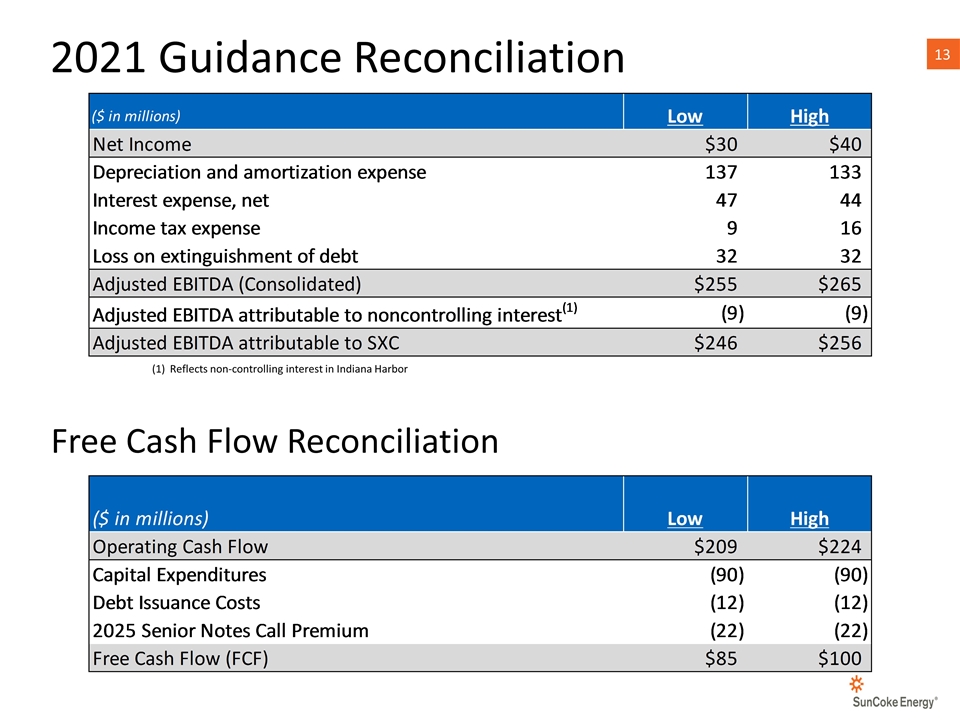

2021 Guidance Reconciliation Reflects non-controlling interest in Indiana Harbor Free Cash Flow Reconciliation

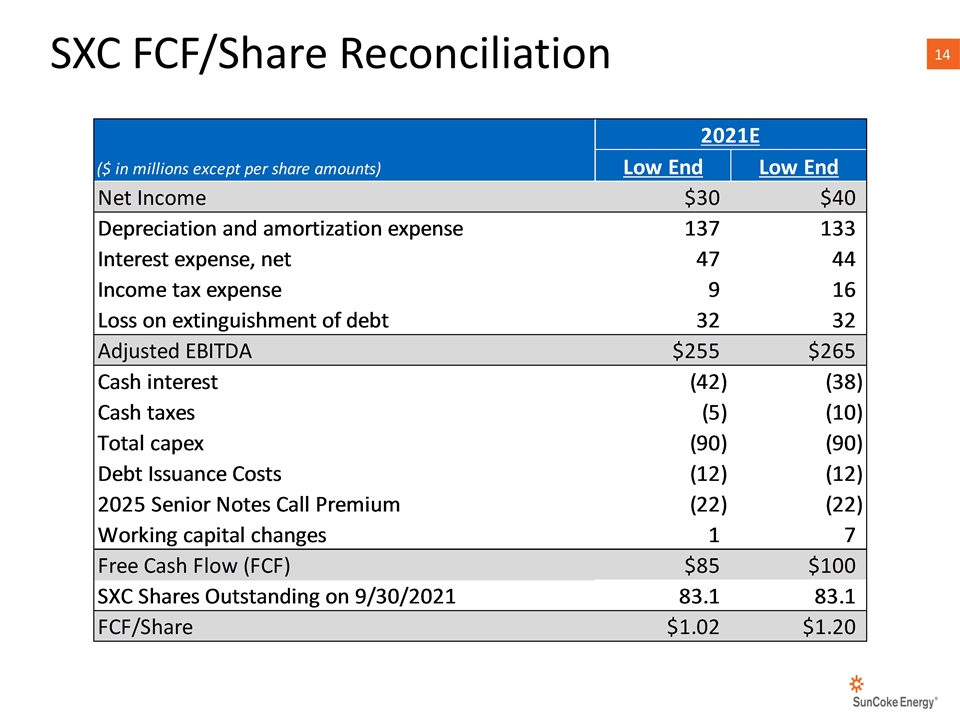

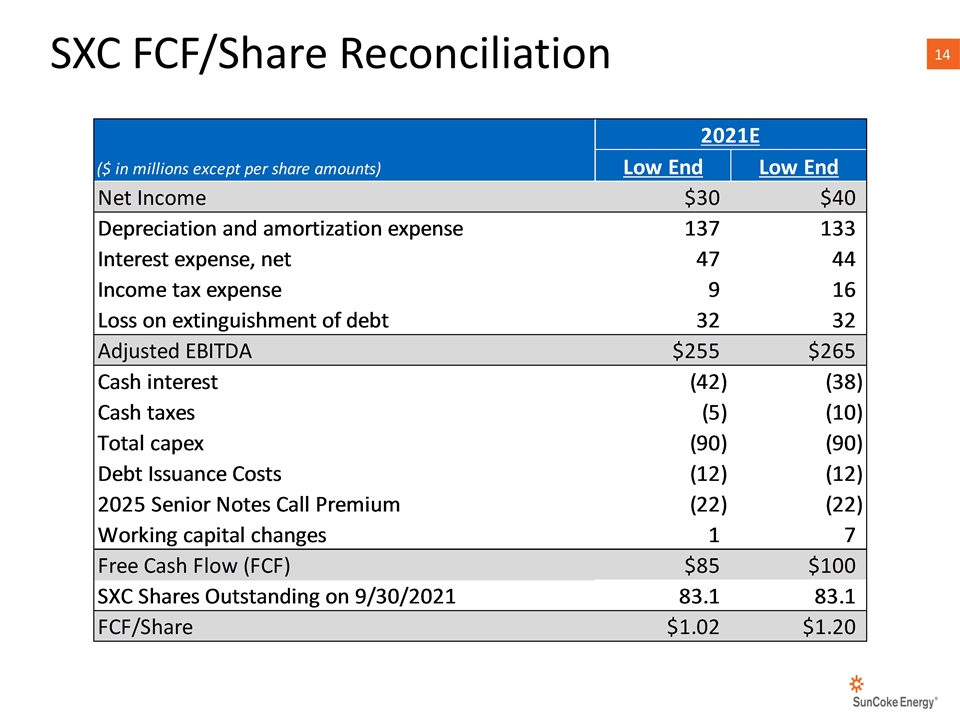

SXC FCF/Share Reconciliation

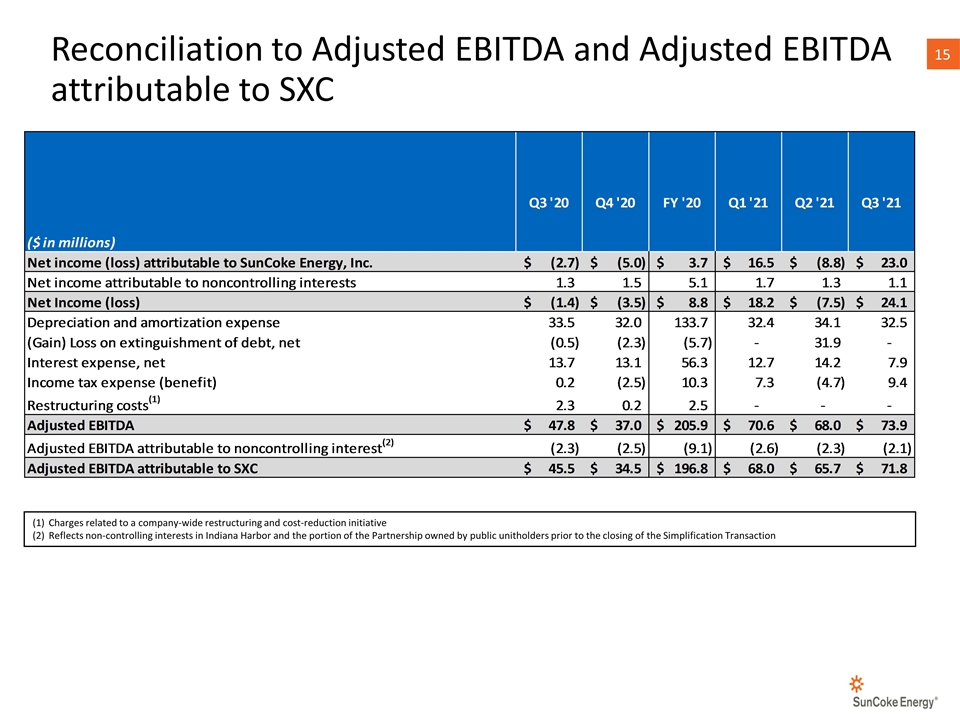

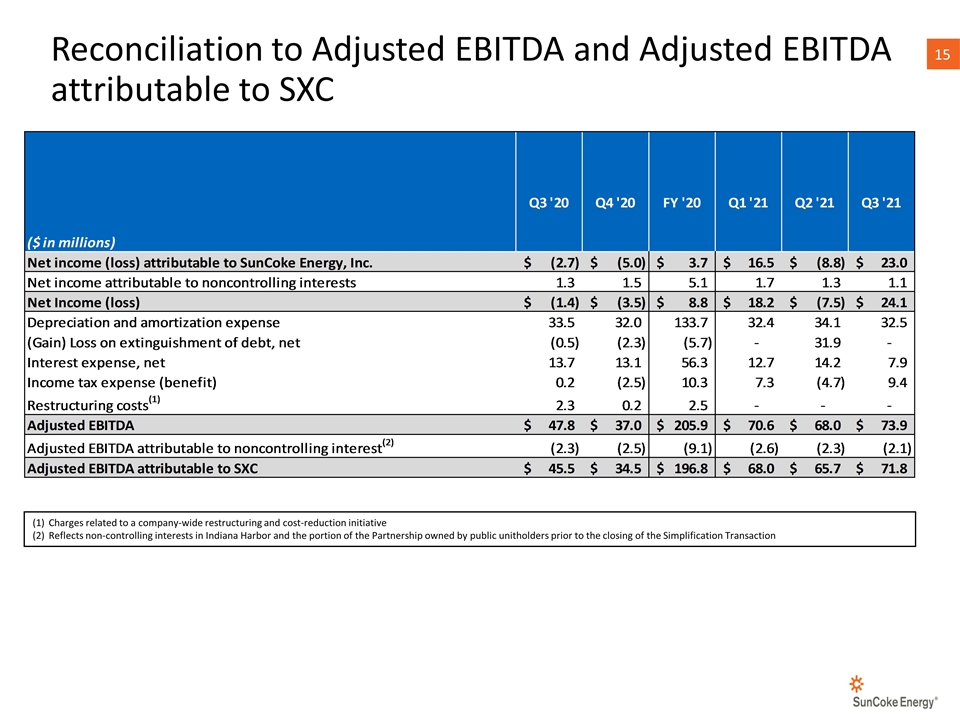

Reconciliation to Adjusted EBITDA and Adjusted EBITDA attributable to SXC Charges related to a company-wide restructuring and cost-reduction initiative Reflects non-controlling interests in Indiana Harbor and the portion of the Partnership owned by public unitholders prior to the closing of the Simplification Transaction

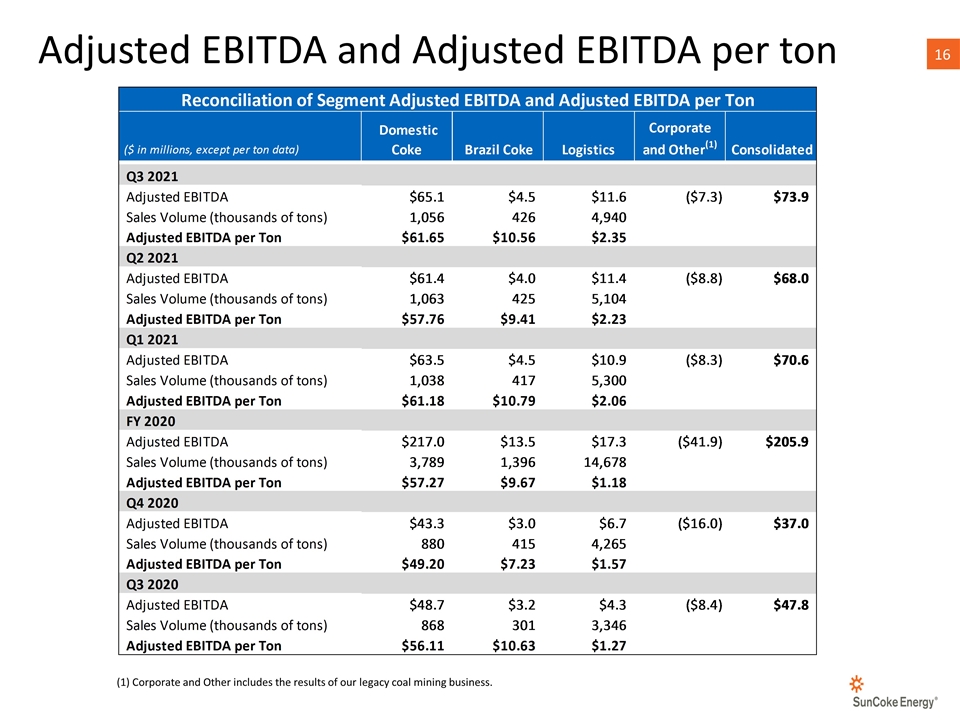

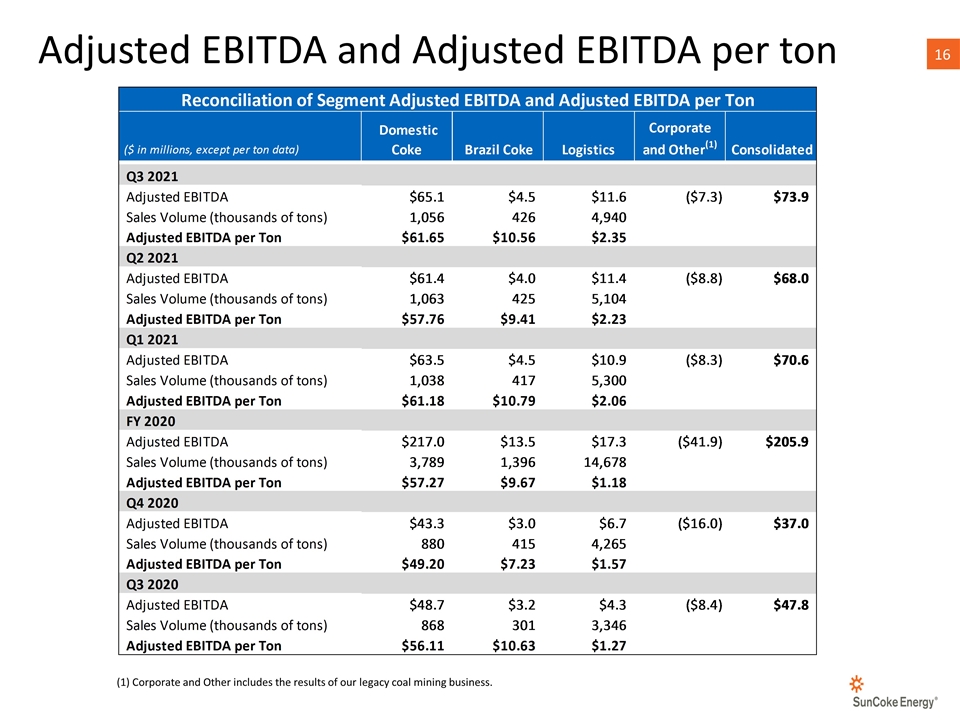

Adjusted EBITDA and Adjusted EBITDA per ton (1) Corporate and Other includes the results of our legacy coal mining business.