SunCoke Energy, Inc. Q1 2022 Earnings Conference Call Exhibit 99.2

This slide presentation should be reviewed in conjunction with the First Quarter 2022 earnings release of SunCoke Energy, Inc. (SunCoke) and conference call held on May 2, 2022 at 11:30 a.m. ET. This presentation call contains “forward-looking statements” (as defined in Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended). Such forward-looking statements include statements that are not strictly historical facts, and include, among other things, statements regarding: our expectations of financial results, condition and outlook; anticipated effects of the COVID-19 pandemic and responses thereto. Forward-looking statements often may be identified by the use of such words as "believe," "expect," "plan," "project," "intend," "anticipate," "estimate," "predict," "potential," "continue," "may," "will," "should," or the negative of these terms, or similar expressions. Forward-looking statements are inherently uncertain and involve significant known and unknown risks and uncertainties (many of which are beyond the control of SunCoke) that could cause actual results to differ materially. Such risks and uncertainties include, but are not limited to domestic and international economic, political, business, operational, competitive, regulatory and/or market factors affecting SunCoke, as well as uncertainties related to: pending or future litigation, legislation or regulatory actions; liability for remedial actions or assessments under existing or future environmental regulations; gains and losses related to acquisition, disposition or impairment of assets; recapitalizations; access to, and costs of, capital; the effects of changes in accounting rules applicable to SunCoke; and changes in tax, environmental and other laws and regulations applicable to SunCoke's businesses. Currently, such risks and uncertainties also include the impacts on our industry and on the U.S. and global economy resulting from COVID-19, including actions by domestic and foreign governments and others to contain the spread, or mitigate the severity, thereof. Forward-looking statements are not guarantees of future performance, but are based upon the current knowledge, beliefs and expectations of SunCoke management, and upon assumptions by SunCoke concerning future conditions, any or all of which ultimately may prove to be inaccurate. The reader should not place undue reliance on these forward-looking statements, which speak only as of the date of the earnings release. SunCoke does not intend, and expressly disclaims any obligation, to update or alter its forward-looking statements (or associated cautionary language), whether as a result of new information, future events or otherwise after the date of the earnings release except as required by applicable law. In accordance with the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, SunCoke has included in its filings with the Securities and Exchange Commission cautionary language identifying important factors (but not necessarily all the important factors) that could cause actual results to differ materially from those expressed in any forward-looking statement made by SunCoke. For information concerning these factors and other important information regarding the matters discussed in this presentation, see SunCoke's Securities and Exchange Commission filings such as its annual and quarterly reports and current reports on Form 8-K, copies of which are available free of charge on SunCoke's website at www.suncoke.com. All forward-looking statements included in this presentation are expressly qualified in their entirety by such cautionary statements. Unpredictable or unknown factors not discussed in this presentation also could have material adverse effects on forward- looking statements. Forward-Looking Statements

Q1 2022 Highlights Strong start to the year across our coke and logistics operations Delivered Q1 ‘22 Adjusted EBITDA of $83.8M, representing best ever quarterly results Export and foundry coke initiatives continue to excel Extended coal handling contract at CMT through 2024; 4.0M tons annual take-or-pay volume commitment with higher base rate and upside potential with price adjustment based on API2 index pricing Gross leverage at 2.2x on a trailing twelve month Adj. EBITDA basis Well positioned to modestly exceed FY 2022 Adjusted EBITDA guidance range of $240M - $255M See appendix for a definition and reconciliation of Adjusted EBITDA

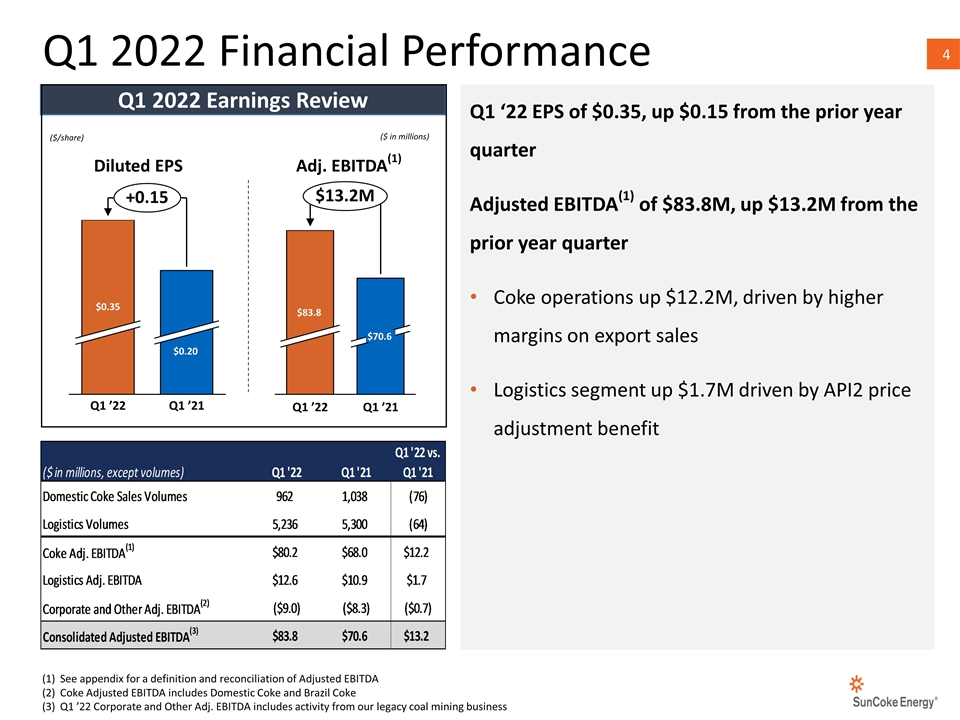

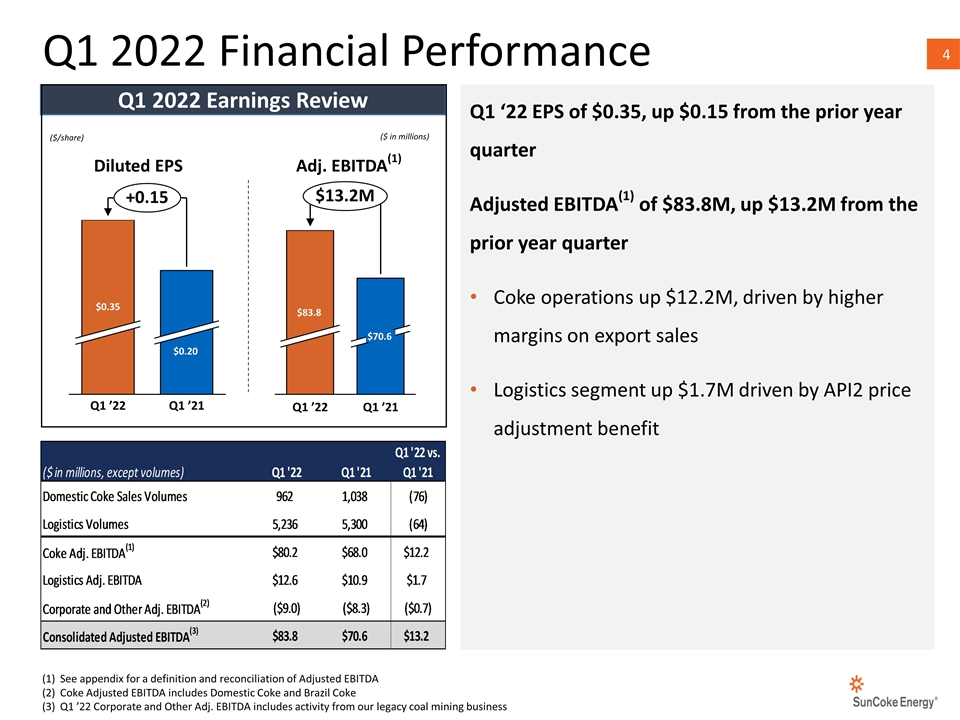

Q1 2022 Financial Performance See appendix for a definition and reconciliation of Adjusted EBITDA Coke Adjusted EBITDA includes Domestic Coke and Brazil Coke Q1 ’22 Corporate and Other Adj. EBITDA includes activity from our legacy coal mining business ($/share) ($ in millions) Diluted EPS Adj. EBITDA(1) $13.2M Q1 2022 Earnings Review Q1 ‘22 EPS of $0.35, up $0.15 from the prior year quarter Adjusted EBITDA(1) of $83.8M, up $13.2M from the prior year quarter Coke operations up $12.2M, driven by higher margins on export sales Logistics segment up $1.7M driven by API2 price adjustment benefit $0.35 $ +0.15

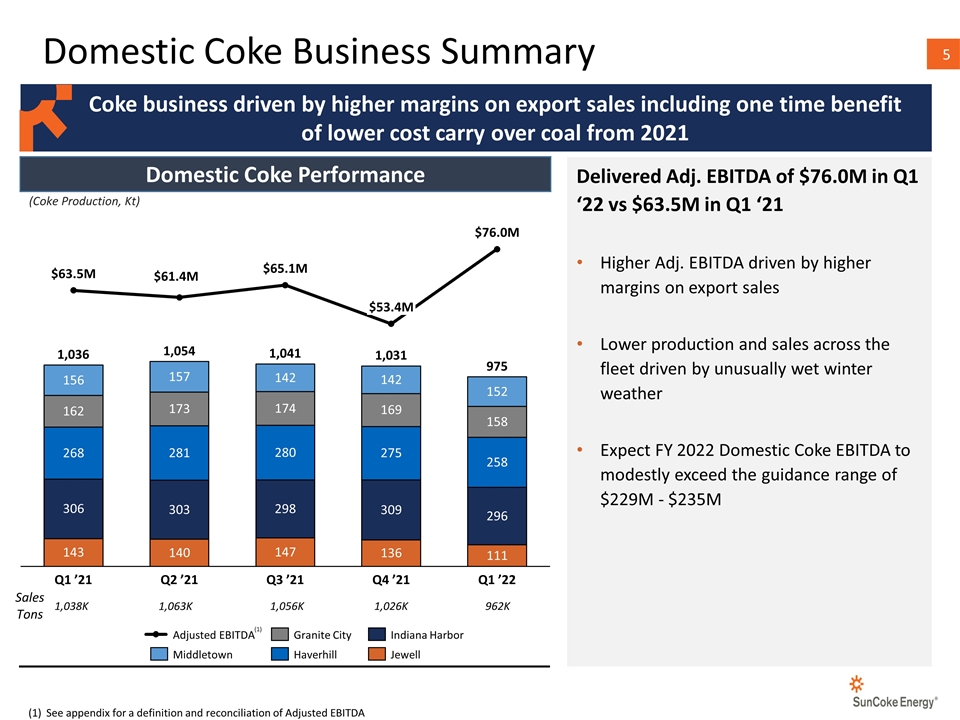

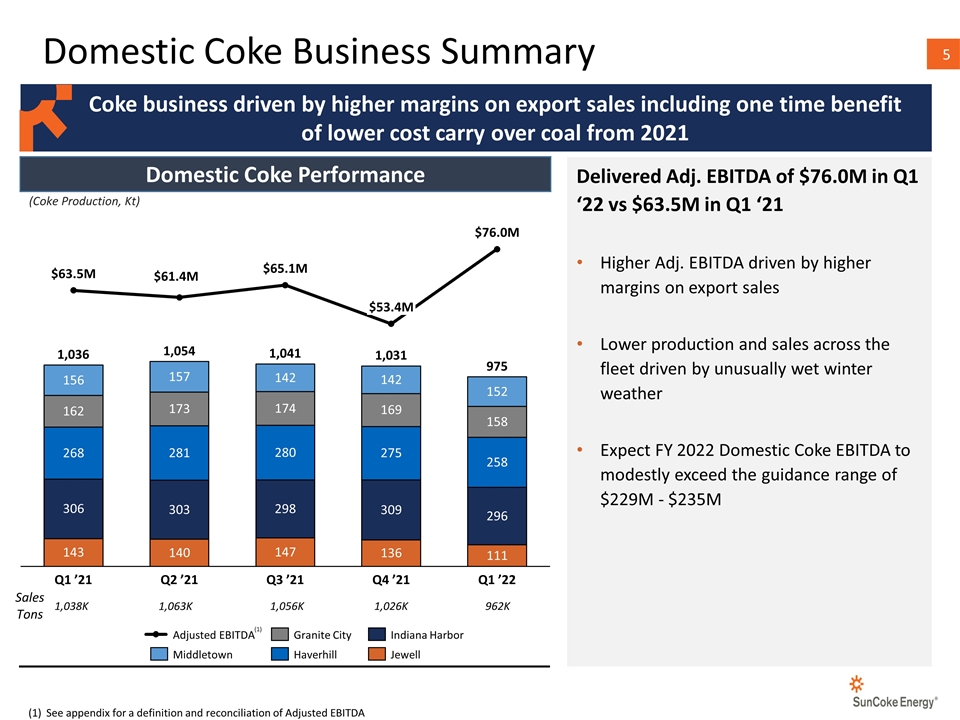

Domestic Coke Performance Domestic Coke Business Summary M M M M M Sales Tons (Coke Production, Kt) Delivered Adj. EBITDA of $76.0M in Q1 ‘22 vs $63.5M in Q1 ‘21 Higher Adj. EBITDA driven by higher margins on export sales Lower production and sales across the fleet driven by unusually wet winter weather Expect FY 2022 Domestic Coke EBITDA to modestly exceed the guidance range of $229M - $235M See appendix for a definition and reconciliation of Adjusted EBITDA (1) 962K 1,063K 1,038K 1,026K Coke business driven by higher margins on export sales including one time benefit of lower cost carry over coal from 2021 1,056K

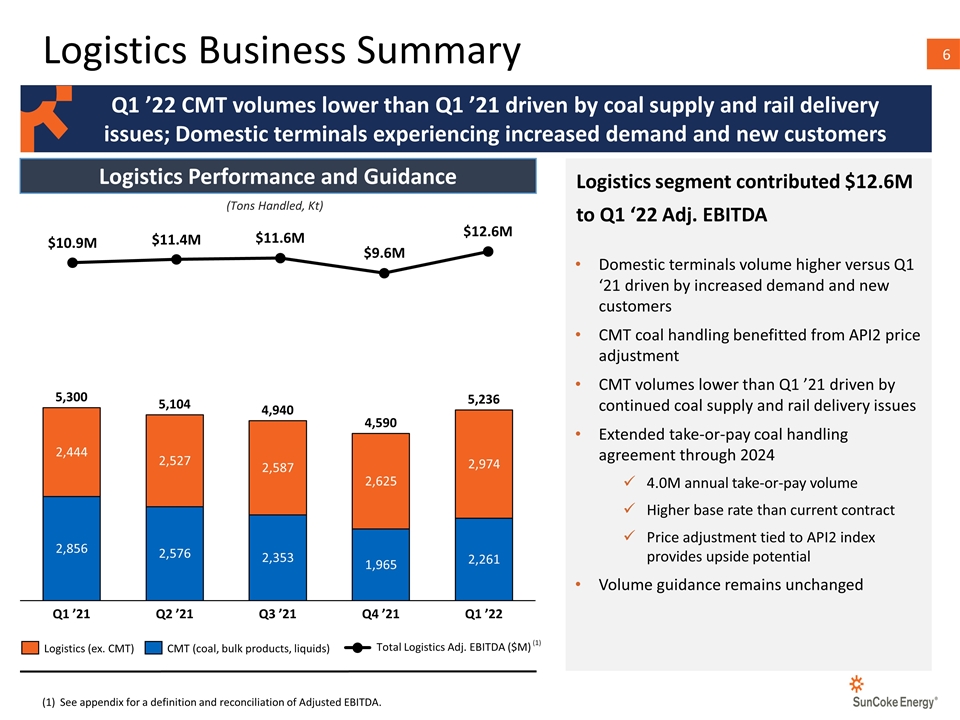

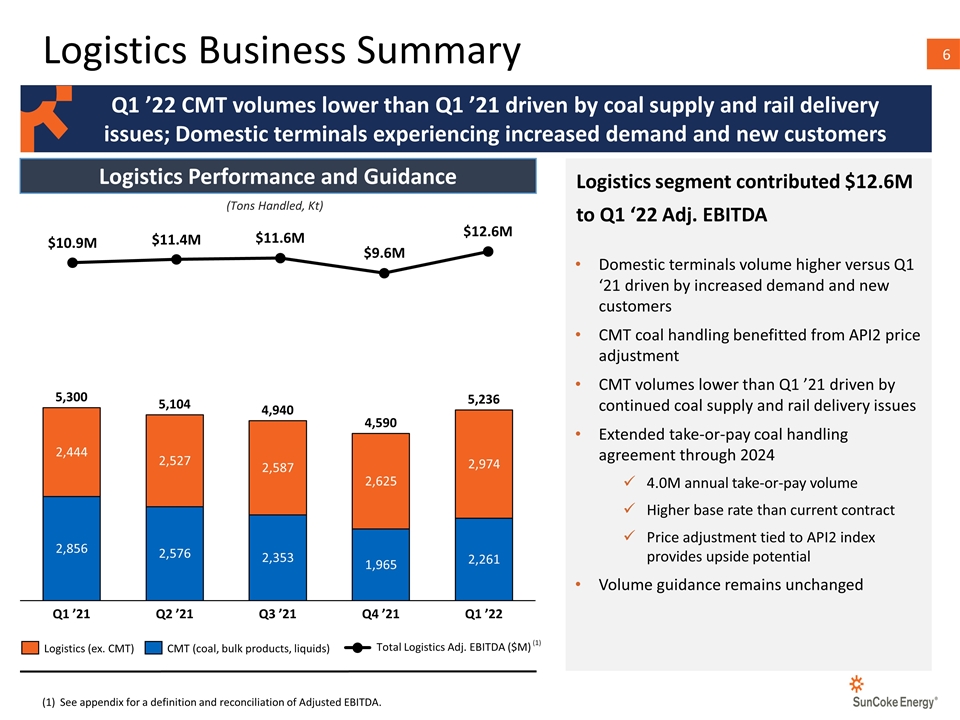

$11.6M $9.6M $12.6M Logistics Business Summary (Tons Handled, Kt) Logistics segment contributed $12.6M to Q1 ‘22 Adj. EBITDA Domestic terminals volume higher versus Q1 ‘21 driven by increased demand and new customers CMT coal handling benefitted from API2 price adjustment CMT volumes lower than Q1 ’21 driven by continued coal supply and rail delivery issues Extended take-or-pay coal handling agreement through 2024 4.0M annual take-or-pay volume Higher base rate than current contract Price adjustment tied to API2 index provides upside potential Volume guidance remains unchanged (1) See appendix for a definition and reconciliation of Adjusted EBITDA. Q1 ’22 CMT volumes lower than Q1 ’21 driven by coal supply and rail delivery issues; Domestic terminals experiencing increased demand and new customers Logistics Performance and Guidance

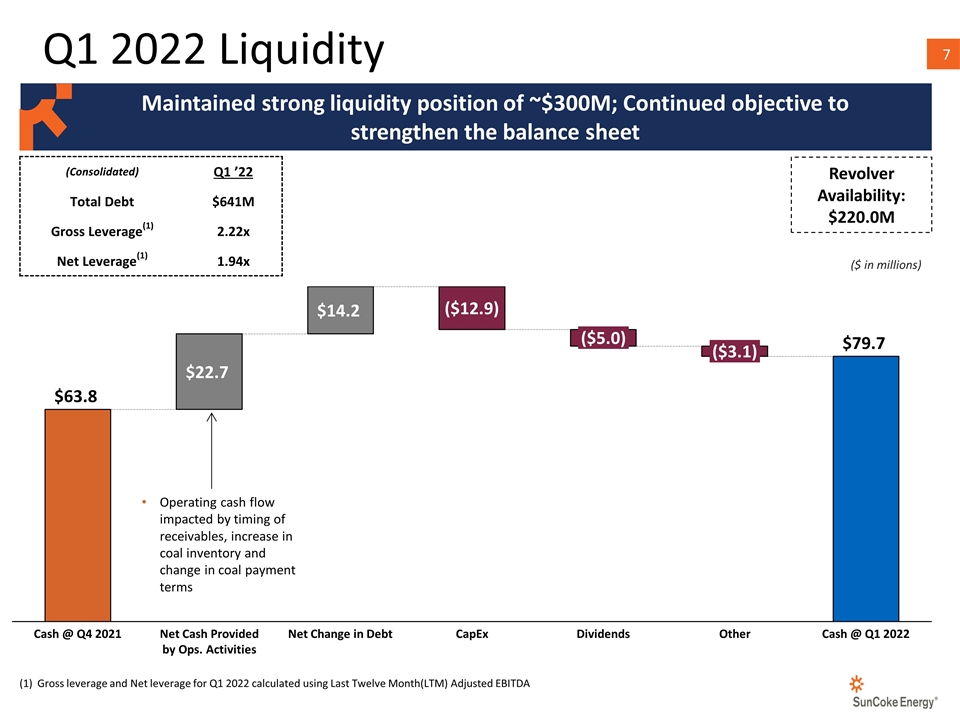

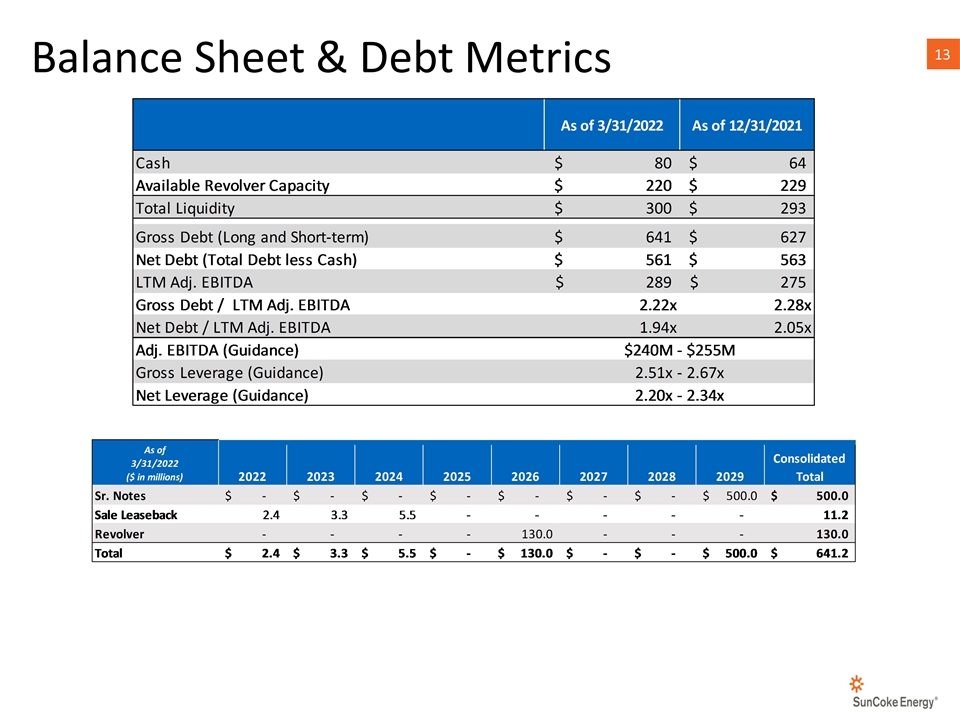

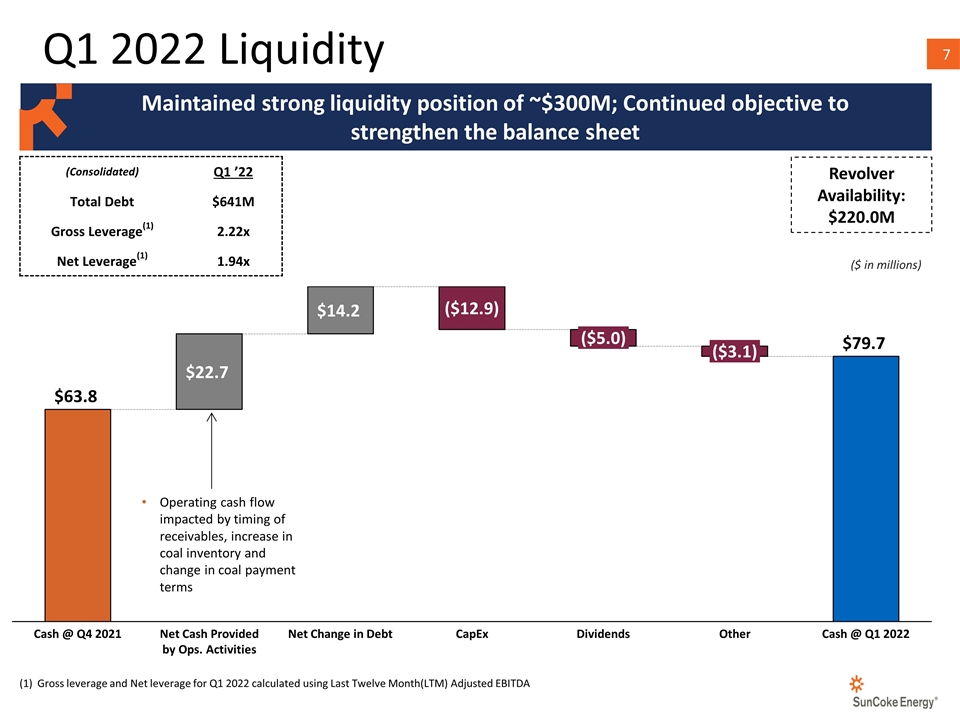

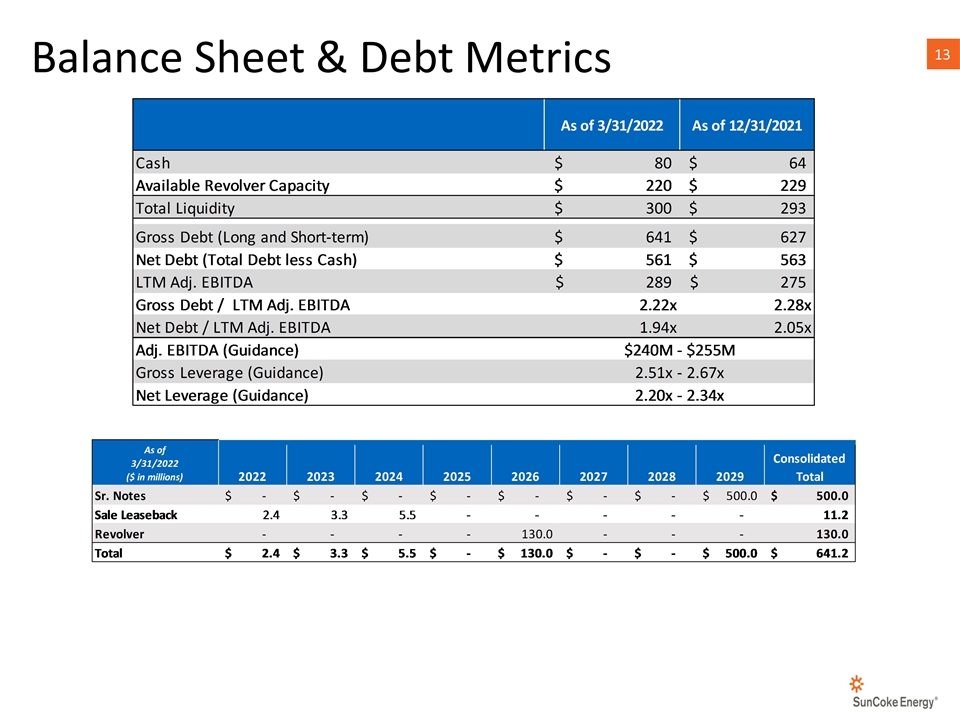

Revolver Availability: $220.0M (Consolidated) Q1 ’22 Total Debt $641M Gross Leverage(1) 2.22x Net Leverage(1) 1.94x Gross leverage and Net leverage for Q1 2022 calculated using Last Twelve Month(LTM) Adjusted EBITDA Q1 2022 Liquidity Maintained strong liquidity position of ~$300M; Continued objective to strengthen the balance sheet ($ in millions) Operating cash flow impacted by timing of receivables, increase in coal inventory and change in coal payment terms

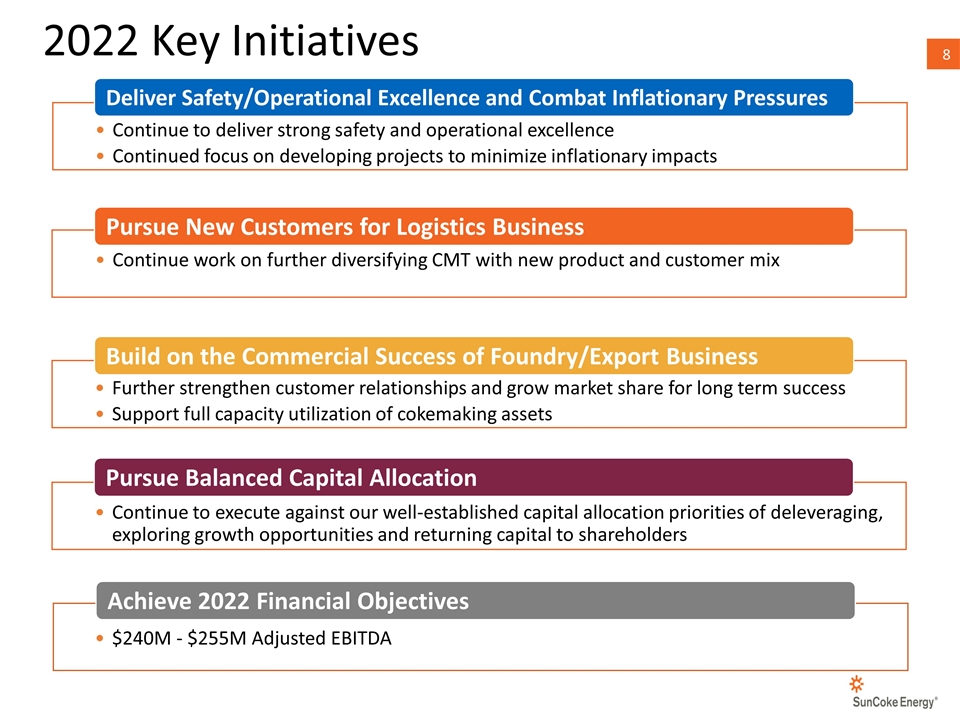

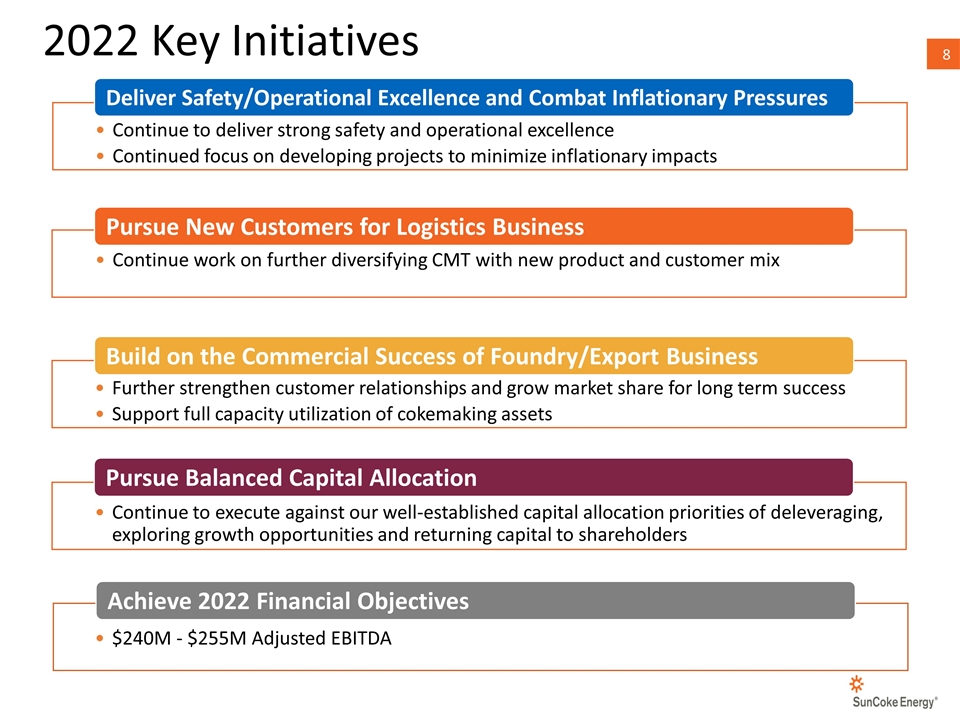

Further strengthen customer relationships and grow market share for long term success Support full capacity utilization of cokemaking assets Build on the Commercial Success of Foundry/Export Business 2022 Key Initiatives $240M - $255M Adjusted EBITDA Achieve 2022 Financial Objectives Deliver Safety/Operational Excellence and Combat Inflationary Pressures Continue to deliver strong safety and operational excellence Continued focus on developing projects to minimize inflationary impacts Continue work on further diversifying CMT with new product and customer mix Pursue New Customers for Logistics Business Continue to execute against our well-established capital allocation priorities of deleveraging, exploring growth opportunities and returning capital to shareholders Pursue Balanced Capital Allocation

APPENDIX

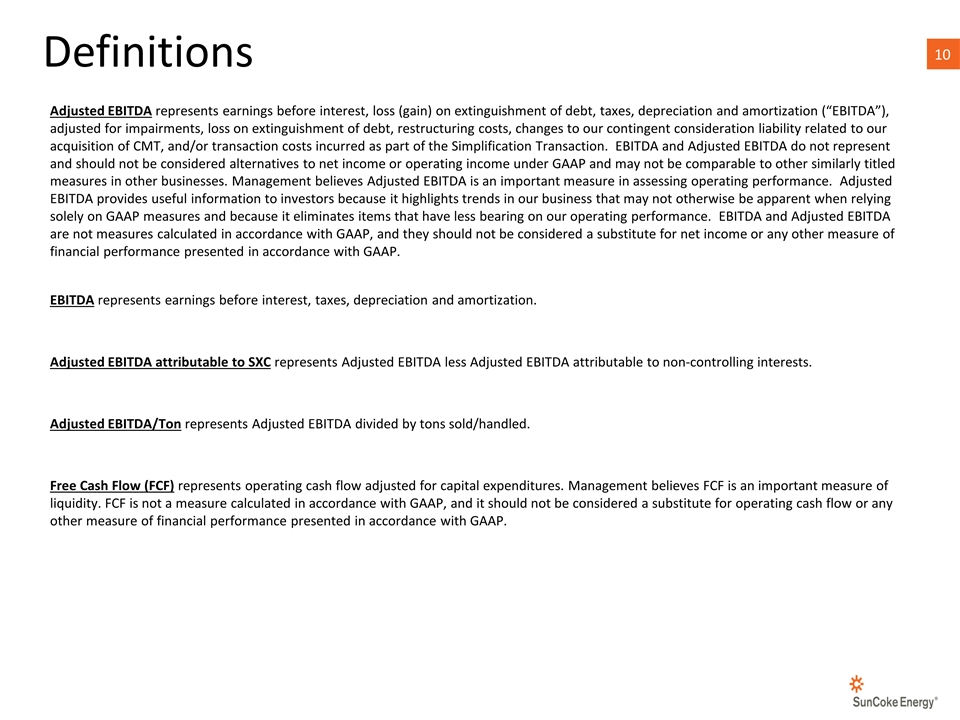

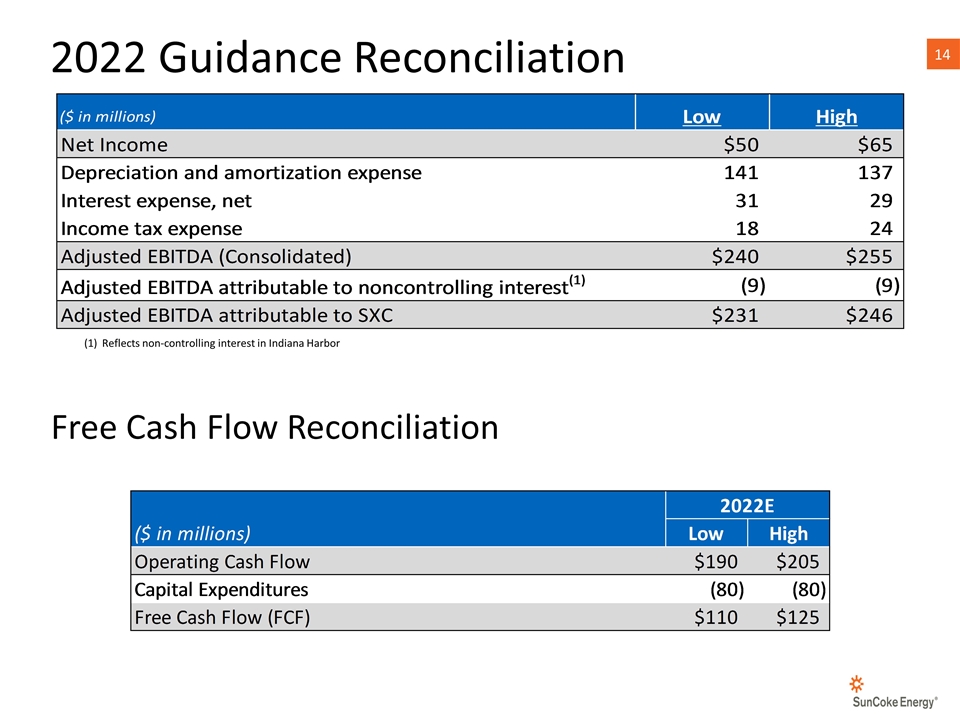

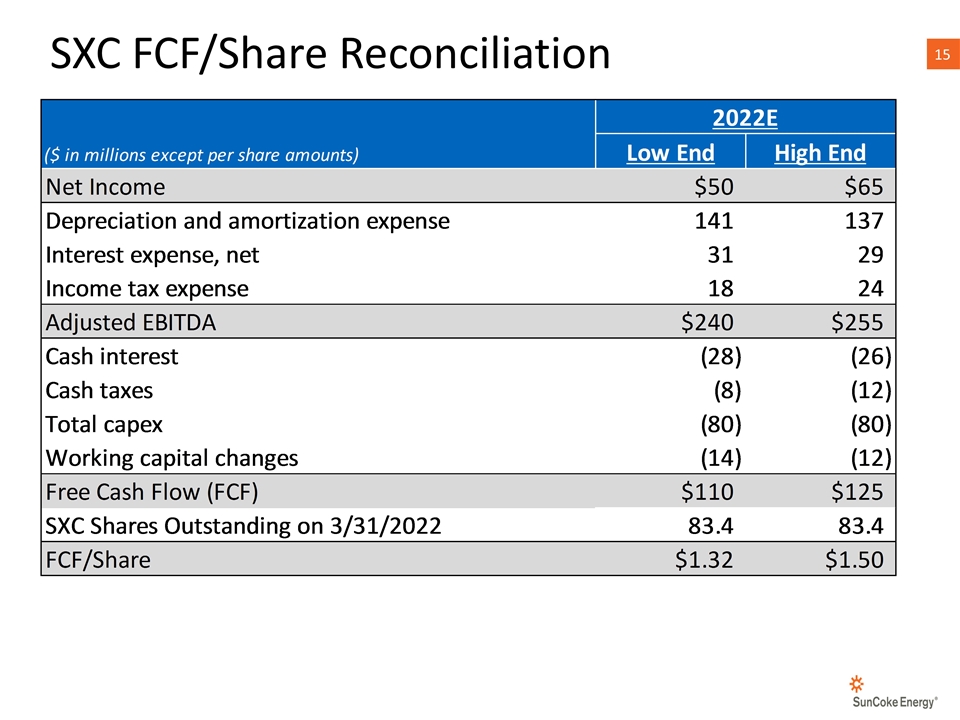

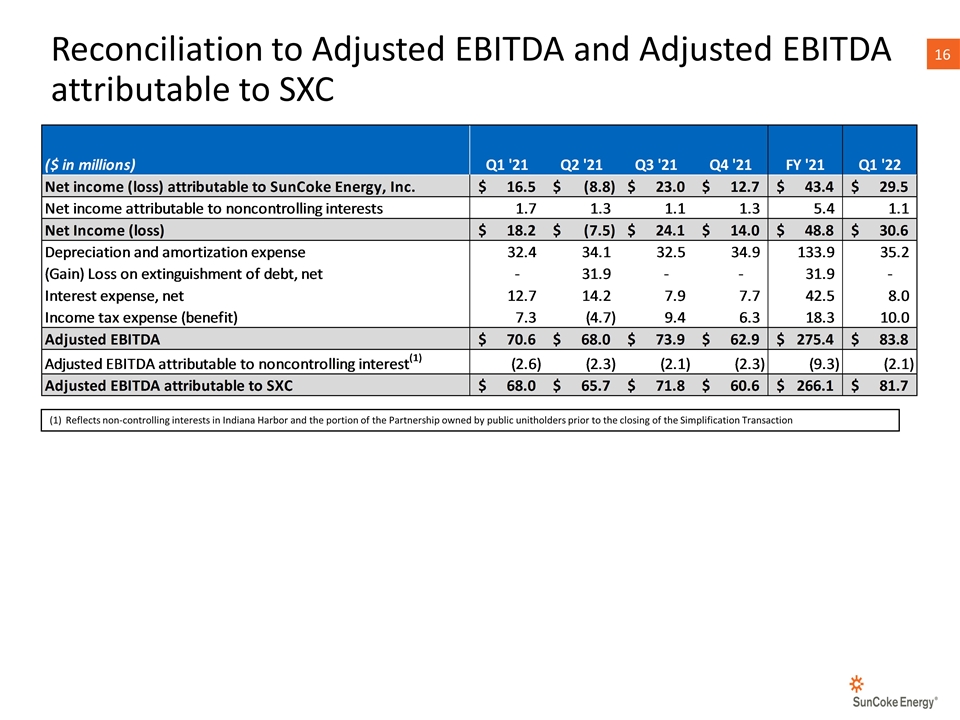

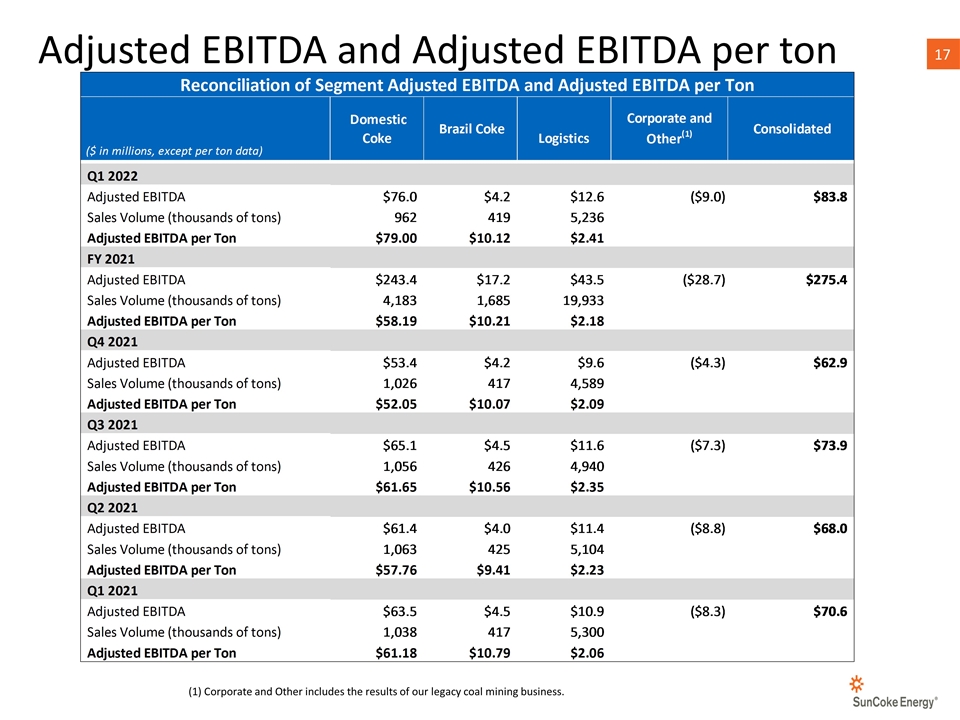

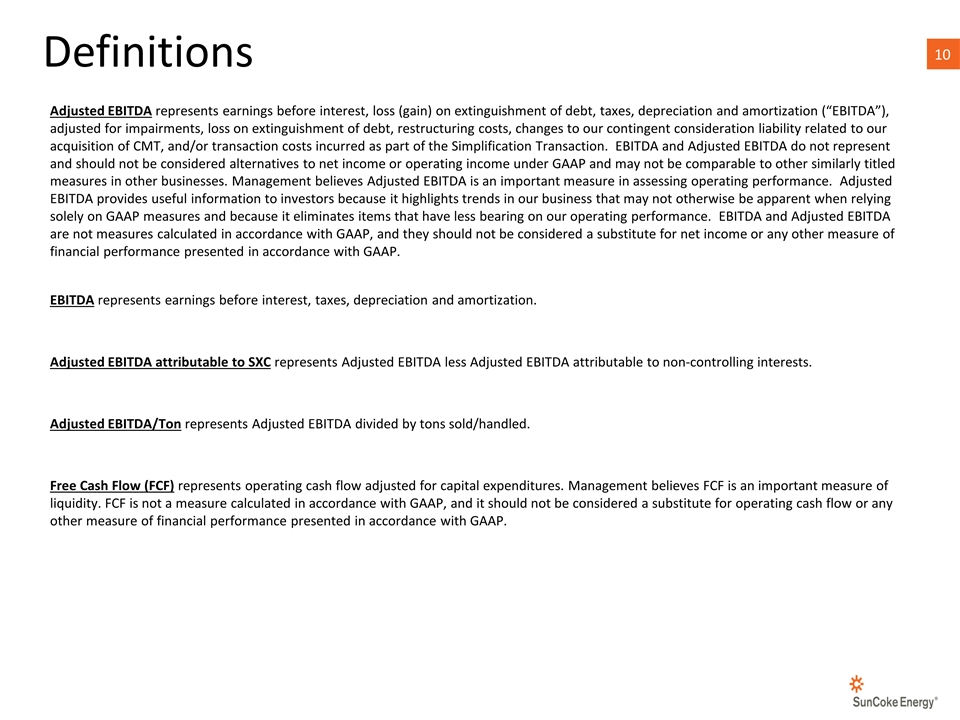

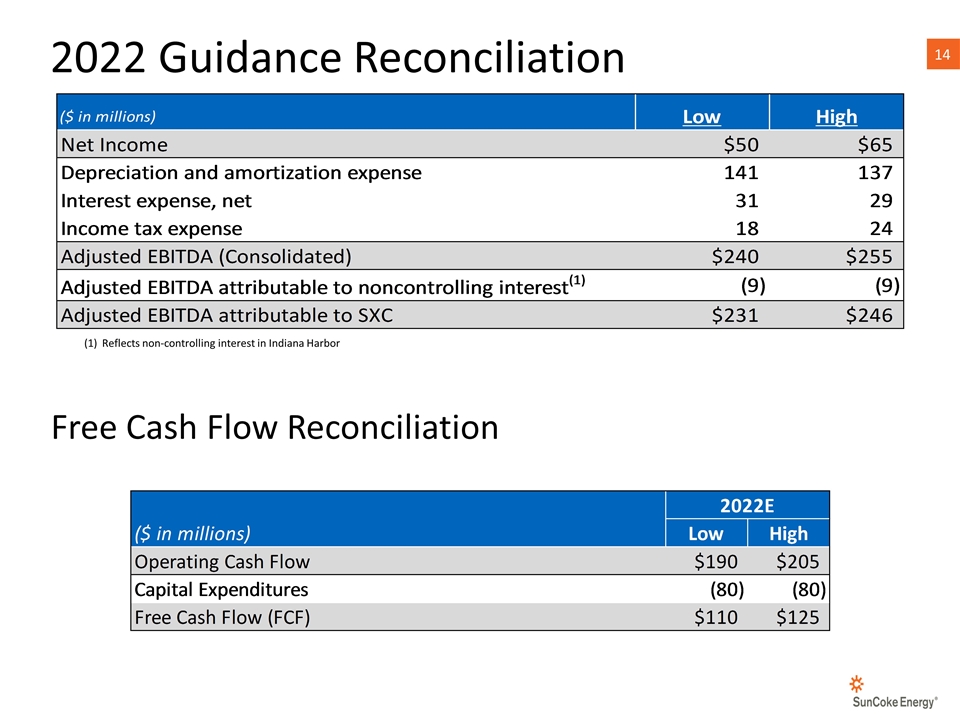

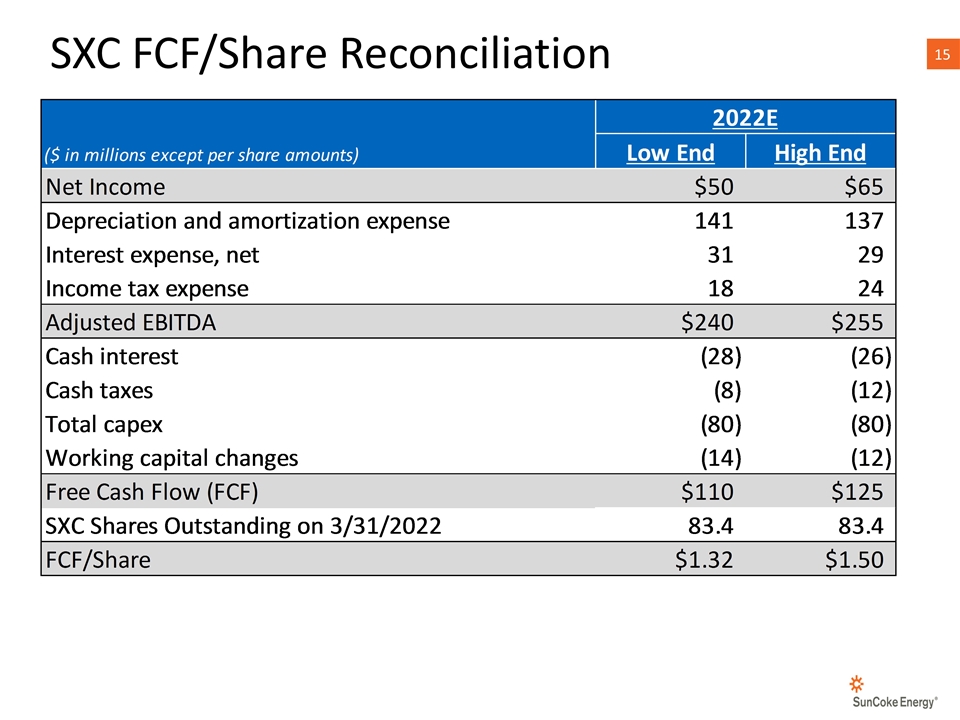

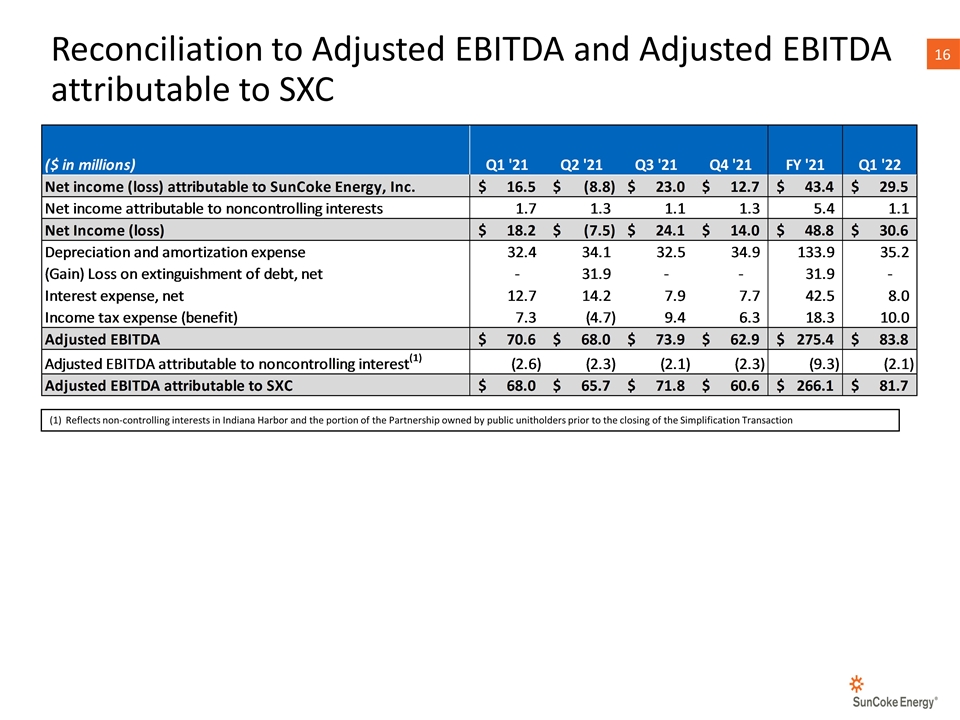

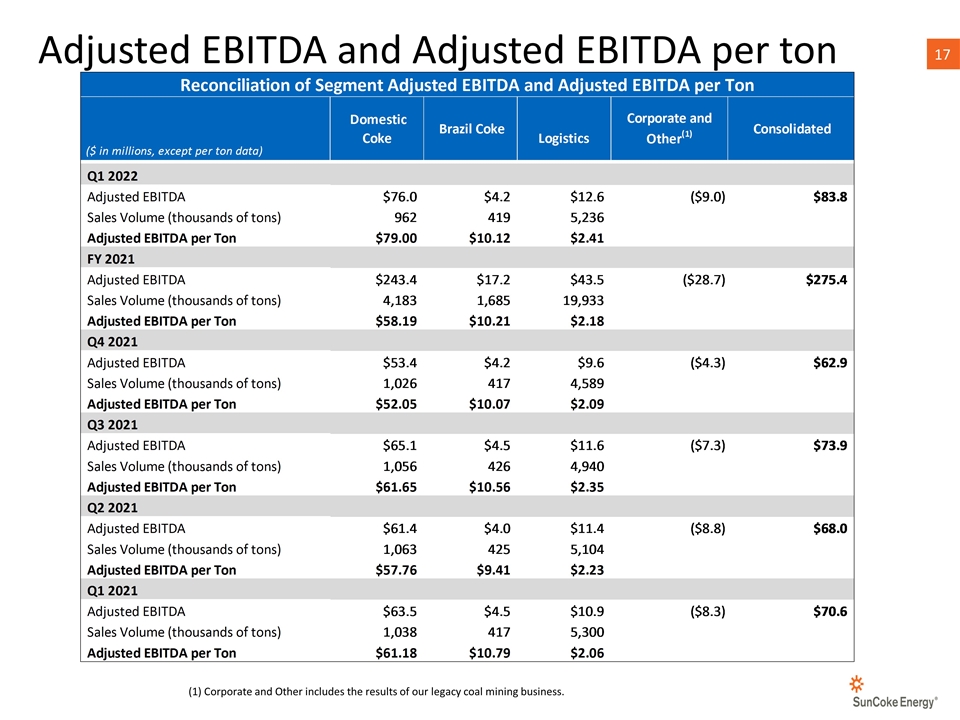

Adjusted EBITDA represents earnings before interest, loss (gain) on extinguishment of debt, taxes, depreciation and amortization (“EBITDA”), adjusted for impairments, loss on extinguishment of debt, restructuring costs, changes to our contingent consideration liability related to our acquisition of CMT, and/or transaction costs incurred as part of the Simplification Transaction. EBITDA and Adjusted EBITDA do not represent and should not be considered alternatives to net income or operating income under GAAP and may not be comparable to other similarly titled measures in other businesses. Management believes Adjusted EBITDA is an important measure in assessing operating performance. Adjusted EBITDA provides useful information to investors because it highlights trends in our business that may not otherwise be apparent when relying solely on GAAP measures and because it eliminates items that have less bearing on our operating performance. EBITDA and Adjusted EBITDA are not measures calculated in accordance with GAAP, and they should not be considered a substitute for net income or any other measure of financial performance presented in accordance with GAAP. EBITDA represents earnings before interest, taxes, depreciation and amortization. Adjusted EBITDA attributable to SXC represents Adjusted EBITDA less Adjusted EBITDA attributable to non-controlling interests. Adjusted EBITDA/Ton represents Adjusted EBITDA divided by tons sold/handled. Free Cash Flow (FCF) represents operating cash flow adjusted for capital expenditures. Management believes FCF is an important measure of liquidity. FCF is not a measure calculated in accordance with GAAP, and it should not be considered a substitute for operating cash flow or any other measure of financial performance presented in accordance with GAAP. Definitions

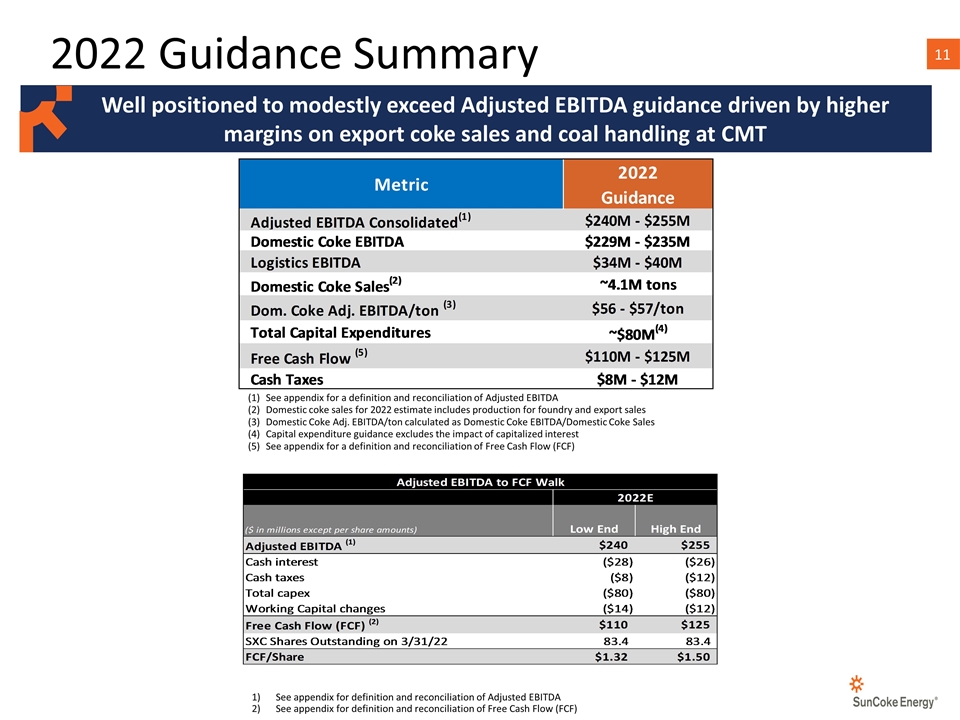

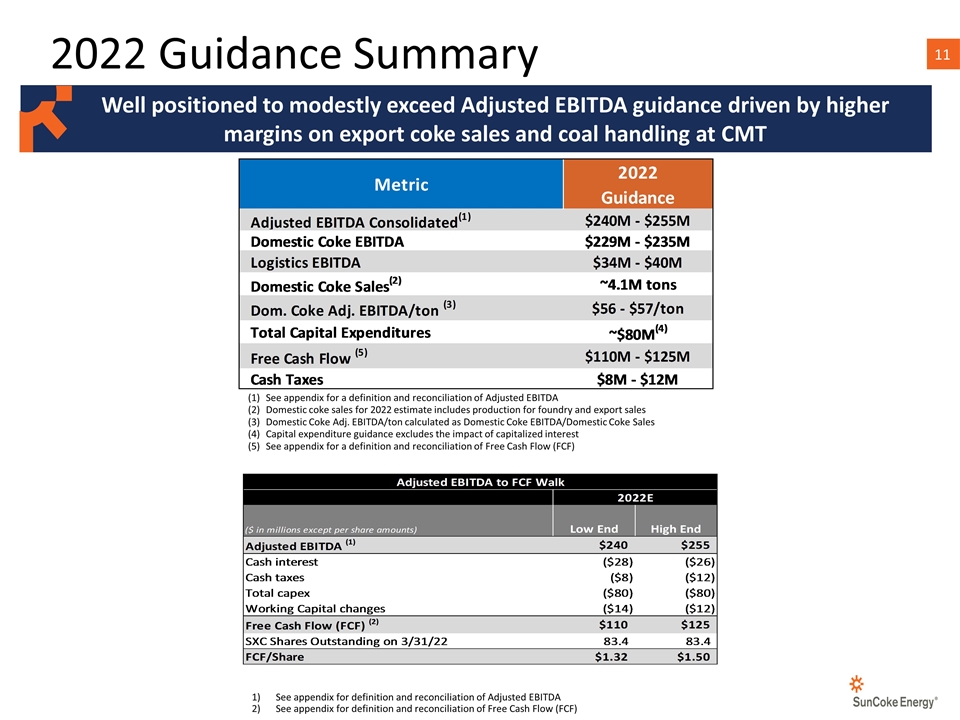

2022 Guidance Summary Well positioned to modestly exceed Adjusted EBITDA guidance driven by higher margins on export coke sales and coal handling at CMT See appendix for a definition and reconciliation of Adjusted EBITDA Domestic coke sales for 2022 estimate includes production for foundry and export sales Domestic Coke Adj. EBITDA/ton calculated as Domestic Coke EBITDA/Domestic Coke Sales Capital expenditure guidance excludes the impact of capitalized interest See appendix for a definition and reconciliation of Free Cash Flow (FCF) See appendix for definition and reconciliation of Adjusted EBITDA See appendix for definition and reconciliation of Free Cash Flow (FCF)

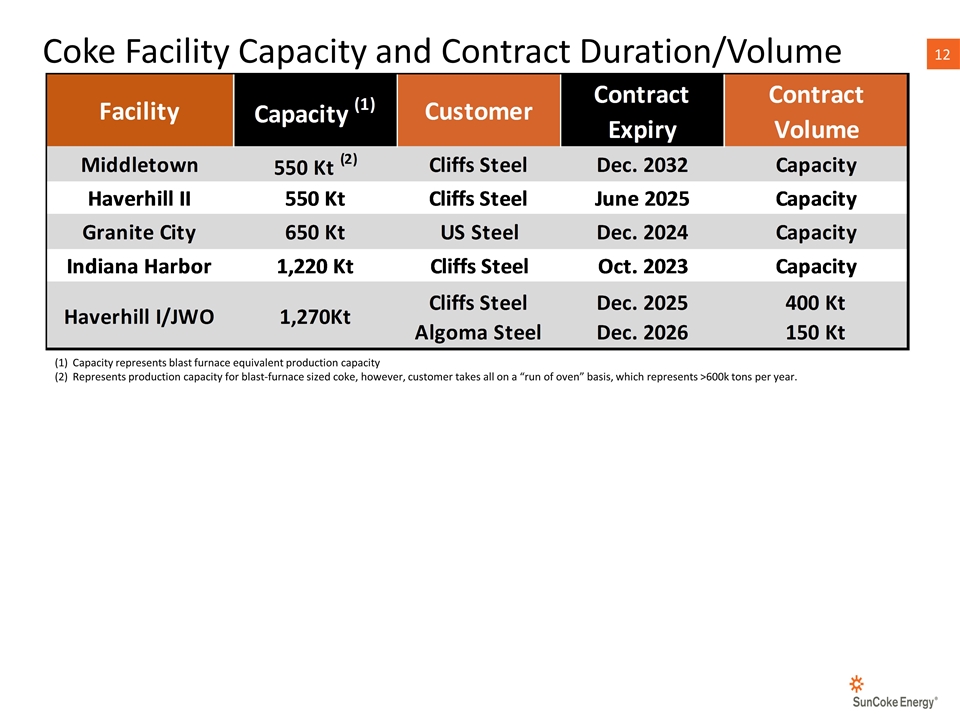

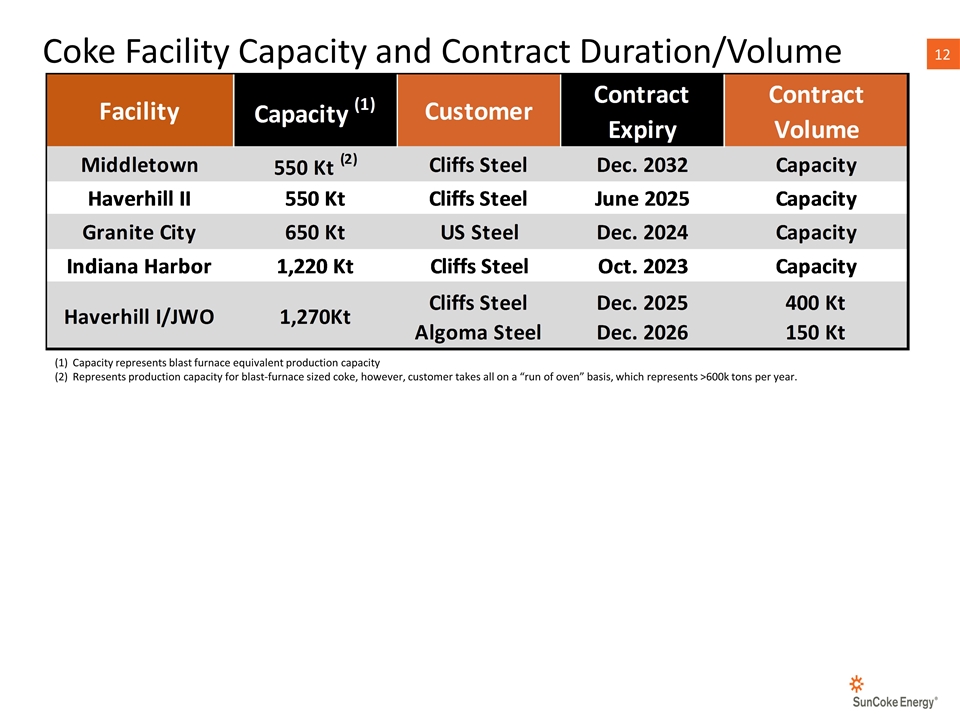

Coke Facility Capacity and Contract Duration/Volume Capacity represents blast furnace equivalent production capacity Represents production capacity for blast-furnace sized coke, however, customer takes all on a “run of oven” basis, which represents >600k tons per year.

Balance Sheet & Debt Metrics

2022 Guidance Reconciliation Reflects non-controlling interest in Indiana Harbor Free Cash Flow Reconciliation

SXC FCF/Share Reconciliation

Reconciliation to Adjusted EBITDA and Adjusted EBITDA attributable to SXC Reflects non-controlling interests in Indiana Harbor and the portion of the Partnership owned by public unitholders prior to the closing of the Simplification Transaction

Adjusted EBITDA and Adjusted EBITDA per ton (1) Corporate and Other includes the results of our legacy coal mining business.