- SXC Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

SunCoke Energy (SXC) DEF 14ADefinitive proxy

Filed: 27 Mar 24, 4:31pm

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under §240.14a-12 | |

| ☒ | No fee required. | |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | |||

LETTER TO OUR STOCKHOLDERS

March 27, 2024

Dear Stockholder:

You are cordially invited to attend the 2024 Annual Meeting of Stockholders of SunCoke Energy, Inc., on May 16, 2024 at 8:30 a.m., Central Time. We have adopted a virtual meeting format for our 2024 Annual Meeting. We will provide a live webcast of the meeting at https://meetnow.global/MCHDMWX, where you will be able to vote your shares and submit questions online by logging in with the control number included on your proxy card or any additional voting instructions accompanying these proxy materials. We recommend that you log into the website a few minutes before the meeting to ensure that you are logged in when the meeting begins.

The following pages contain our notice of annual meeting and proxy statement. Please review this material for information concerning the business to be conducted at the 2024 Annual Meeting, including the nominees for election as directors.

As we have in the past, we are furnishing our proxy statement and other proxy materials to our stockholders over the Internet and mailing paper copies to stockholders who have requested them. For further details, please refer to the section entitled “Questions and Answers About the 2024 Annual Meeting” beginning on page 58 of the proxy statement.

Whether or not you plan to attend the 2024 Annual Meeting, it is important that your shares be represented. Please vote via telephone, the Internet, proxy card, or voter instruction form.

Thank you for your continued support of SunCoke Energy.

Sincerely, | ||||||

Michael G. Rippey Chief Executive Officer |

Katherine T. Gates President and CEO Elect | |||||

SunCoke Energy, Inc.

1011 Warrenville Road | Suite 600 | Lisle, Illinois 60532 | tel (630) 824-1000 | www.suncoke.com

NOTICE OF 2024 ANNUAL MEETING

| To Be Held on May 16, 2024 8:30 a.m. CDT Online at https://meetnow.global/MCHDMWX |

To the Stockholders of SunCoke Energy, Inc.:

The 2024 Annual Meeting of Stockholders of SunCoke Energy, Inc. (the “2024 Annual Meeting”) is scheduled to be held on May 16, 2024 at 8:30 a.m., Central Time, at https://meetnow.global/MCHDMWX, for the following purposes:

| 1. | To elect two directors: Ralph M. Della Ratta, Jr. and Susan R. Landahl, to the class of directors whose term expires at the 2027 annual meeting of stockholders; |

| 2. | To hold a non-binding advisory vote on the compensation of the Company’s named executive officers; |

| 3. | To hold an advisory vote to approve the frequency of future advisory votes on executive compensation; and |

| 4. | To ratify the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024. |

Stockholders also will transact such other business as may properly come before the 2024 Annual Meeting or any adjournment or postponement thereof.

All of our stockholders are cordially invited to attend, although only holders of record of SunCoke Energy Common Stock, par value $0.01 per share, at the close of business on March 19, 2024, (the “Record Date”) are entitled to vote at the 2024 Annual Meeting. You may vote at the 2024 Annual Meeting if you were a stockholder of record at the close of business on the Record Date. To ensure that your vote is properly recorded, please vote as soon as possible, even if you plan to attend the 2024 Annual Meeting. Most stockholders have four options for submitting their vote: (1) via telephone, (2) over the Internet, (3) through the mail, or (4) live at the 2024 Annual Meeting. For further details about voting, please refer to the section entitled “Questions and Answers About the 2024 Annual Meeting” on page 58 of the proxy statement.

If your shares are held in “street name” in a stock brokerage account, or by a bank or other nominee, you must provide your broker with instructions on how to vote your shares in order for your shares to be voted on important matters presented at the 2024 Annual Meeting. If you do not instruct your broker on how to vote with regard to the election of directors and the advisory vote on executive compensation, your shares will not be voted on these matters.

The approximate date of mailing of the Notice of Internet Availability of Proxy Materials to our stockholders will be on or about March 27, 2024, and the attached proxy statement, together with our 2023 Annual Report on Form 10-K, will be made available to our stockholders on that same date. We also will begin mailing paper copies of our proxy statement and other proxy materials to stockholders who have requested them on or about that date.

By order of the Board of Directors,

John J. DiRocco, Jr. Vice President, Assistant General Counsel and Corporate Secretary |

TABLE OF CONTENTS

| PROPOSAL 1 — ELECTION OF DIRECTORS | 1 | |||

| 1 | ||||

| 1 | ||||

| 2 | ||||

| 4 | ||||

| 4 | ||||

| 5 | ||||

| THE BOARD OF DIRECTORS AND ITS COMMITTEES | 12 | |||

| 12 | ||||

| 12 | ||||

| 13 | ||||

| 13 | ||||

| 13 | ||||

| CORPORATE GOVERNANCE | 14 | |||

| 14 | ||||

| 14 | ||||

| 15 | ||||

| 15 | ||||

| 16 | ||||

| 16 | ||||

| 16 | ||||

| 16 | ||||

| 17 | ||||

| 17 | ||||

| 17 | ||||

| 18 | ||||

| 18 | ||||

| 18 | ||||

| 18 | ||||

| DIRECTOR COMPENSATION | 19 | |||

| 19 | ||||

| 20 | ||||

| 20 | ||||

| EXECUTIVE COMPENSATION | 21 | |||

| 21 | ||||

| 21 | ||||

| 21 | ||||

| 22 | ||||

| 24 | ||||

Section 3 – Role of Management, Compensation Consultants and Market Data | 25 | |||

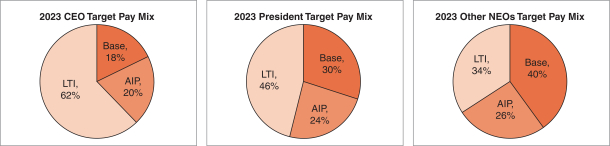

Section 4 – Elements of Compensation, Pay Mix, Opportunity and Leverage | 28 | |||

| 34 | ||||

SUNCOKE ENERGY, INC. 2024 PROXY STATEMENT i

| Proposal One | The Board & Committees | Corporate Governance | Director Compensation | Executive Compensation | Proposal Two | Proposal Three | Beneficial Stock Ownership | Audit Committee Matters | Proposal Four | Q&A | Other Information | |||||||||||

PROPOSAL 1

ELECTION OF DIRECTORS

Board of Directors

Our Board annually recommends the slate of director-nominees for election by stockholders at the annual meeting and is responsible for filling vacancies on the Board at any time during the year. The Governance Committee has a process to identify and review qualified candidates to stand for election, and the full Board reviews and has final approval of all potential director nominees being recommended to the stockholders for election. Our Board currently consists of eight members: Arthur F. Anton, Martha Z. Carnes, Ralph M. Della Ratta, Jr., Katherine T. Gates, Susan R. Landahl, Michael W. Lewis, Andrei A. Mikhalevsky and Michael G. Rippey.

Our Board currently is divided into three classes, each serving staggered three-year terms. Directors for each class are elected at the annual meeting of stockholders held in the year in which the term for their class expires. There are two nominees for election this year. These nominees are: Ralph M. Della Ratta, Jr. and Susan R. Landahl, and the Board has nominated each of them for a new three-year term that will expire at the annual meeting in 2027, or until their respective successors are elected and qualified.

Detailed information on these nominees is provided on pages 5 through 6, including a discussion of each nominee’s specific experience, qualifications and attributes or skills that led our Board to conclude that such person should serve as a director of SunCoke Energy. Each of these nominees is a current director, and each has consented to be named in this Proxy Statement and to serve if elected. If any nominee is unable to serve as a director at the time of the 2024 Annual Meeting, your proxy may be voted for the election of another nominee proposed by the Board, or the Board may reduce the number of directors to be elected at the 2024 Annual Meeting. At this time, the Board knows no reason why any of these nominees would not be able to serve as a director if elected.

RECOMMENDATION

The Board of Directors unanimously recommends that you vote “FOR” the election of the Company’s two nominees for director: Ralph M. Della Ratta, Jr. and Susan R. Landahl.

| ||||||

SUNCOKE ENERGY, INC. 2024 PROXY STATEMENT 1

| Proposal One | The Board & Committees | Corporate Governance | Director Compensation | Executive Compensation | Proposal Two | Proposal Three | Beneficial Stock Ownership | Audit Committee Matters | Proposal Four | Q&A | Other Information | |||||||||||

Director Nominee Skills, Experience, and Background

Our directors come from a variety of backgrounds and bring a diverse set of skills and experiences to the boardroom. In conjunction with our Board’s refreshment process, the Board regularly reviews the skills, experience, and background of our directors to better align with the Company’s strategic vision, business, and operations. The Board has taken a thoughtful and deliberate approach to board composition to ensure that our directors have backgrounds that collectively add significant value to the strategic decisions made by the Company and enable them to provide oversight of management to ensure accountability to our stockholders. The following is a summary of some of the skills, experience, and background of our directors whose terms of office are expected to continue after our 2024 Annual Meeting:

Nominee Skills | Anton | Carnes | Della Ratta, Jr. | Gates | Landahl | Lewis | Mikhalevsky | |||||||||||

Strategic Planning/Business Development CEO or COO for a manufacturing entity. Development and implementation of proactive, innovative and pragmatic solutions for optimizing of manufacturing processes. |  | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ||||||||||

Financial Expertise/ Accounting Knowledge Corporate finance and/or accounting experience at an executive level. Use of financial information to shape, drive, and monitor effectiveness of organizational strategies. |  | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ||||||||||

Human Resources Management Knowledge and expertise in labor and employment matters (e.g., EEO, diversity, equity and inclusion issues), compensation and benefit, and health and welfare plans. |  | ✔ | ✔ | ✔ | ✔ | ✔ | ||||||||||||

Government Relations/ Agency Experience Significant experience dealing with government at the local, state and federal levels on issues such as economic development, energy, environmental, health and safety issues. |  | ✔ | ✔ | ✔ | ✔ | ✔ | ||||||||||||

Information Technology/Data Security Experience General information systems experience. Understanding of information security risk management and oversight of data integrity. |  | ✔ | ✔ | ✔ | ||||||||||||||

International Experience Experience with international business/markets managing the affairs of a global, publicly traded company, particularly in countries where SunCoke does business, or would like to do business. |  | ✔ | ✔ | ✔ | ✔ | |||||||||||||

Health, Environment and Safety Background Experience in hazardous materials management and environmental compliance; process safety management and “gap” analysis; emergency management and disaster recovery; and occupational health and safety law, regulation, and practice |  | ✔ | ✔ | ✔ | ✔ | |||||||||||||

Enterprise Risk Management Experience planning, organizing and leading activities of an organization in order to minimize the effects of financial, strategic, operational, and other risks on capital and earnings |  | ✔ | ✔ | ✔ | ✔ | ✔ | ||||||||||||

Nominee Diversity | ||||||||||||||||||

Gender Diversity of Directors | ✔ | ✔ | ✔ | |||||||||||||||

Ethnic Diversity of Directors | ||||||||||||||||||

Hispanic or Latinx | ||||||||||||||||||

White | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ||||||||||||

Black or African American | ✔ | |||||||||||||||||

Asian | ||||||||||||||||||

Native Hawiian or Other Pacific Islander | ||||||||||||||||||

American Indian or Alaska Native | ||||||||||||||||||

In addition, half of our current directors have general manufacturing experience (including development and integration of large-scale production processes), as well as investment banking expertise and a background in the areas of health, environment and safety.

2 SUNCOKE ENERGY, INC. 2024 PROXY STATEMENT

| Proposal One | The Board & Committees | Corporate Governance | Director Compensation | Executive Compensation | Proposal Two | Proposal Three | Beneficial Stock Ownership | Audit Committee Matters | Proposal Four | Q&A | Other Information | |||||||||||

SUNCOKE ENERGY, INC. 2024 PROXY STATEMENT 3

| Proposal One | The Board & Committees | Corporate Governance | Director Compensation | Executive Compensation | Proposal Two | Proposal Three | Beneficial Stock Ownership | Audit Committee Matters | Proposal Four | Q&A | Other Information | |||||||||||

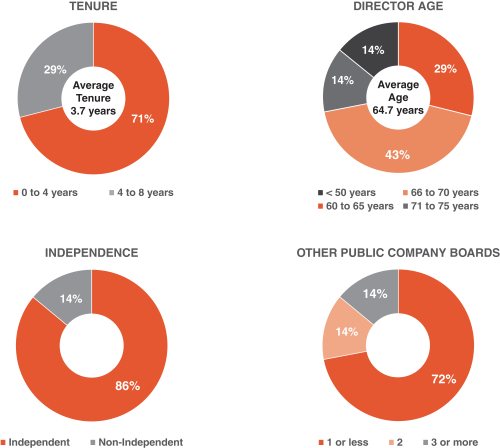

Director Succession and Board Refreshment

The Governance Committee oversees and plans for director succession and refreshment of the Board to ensure a mix of skills, experience, tenure, and diversity that promote and support SunCoke Energy’s long-term strategy. In doing so, the Governance Committee takes into consideration the overall needs, composition and size of the Board, as well as the criteria adopted by the Board regarding director candidate qualifications. The Governance Committee considers director-nominees from various sources and chooses nominees with the primary goal of ensuring that the Board collectively serves the interests of our stockholders.

The Governance Committee annually reviews the qualifications and experience of current directors and identifies specific competencies required in director-nominees. Director nominees should have a proven record of professional success and leadership and demonstrate the highest personal and professional ethics, integrity and values. The Board also considers diversity of age, ethnicity and gender. Directors also are expected to devote sufficient time and effort to their duties as members of the Board.

| (1) | On February 22, 2024, the Company announced Mr.Rippey’s retirement as Chief Executive Officer, and his resignation from the Board, effective May 15, 2024. The Company also announced that Ms. Gates would succeed Mr. Rippey as Chief Executive Officer, effective upon his retirement. |

Governance Committee Process for Director Nominations

The Governance Committee evaluates potential director candidates and makes recommendations to the Board. Candidates may be identified by current directors, by a search firm or by stockholders. The Governance Committee may engage the services of a third-party consultant to assist in identifying and screening potential candidates. The Governance Committee’s evaluation of a candidate generally includes inquiries as to the candidate’s reputation and background, examination of the candidate’s experience and skills in relation to the Board’s requirements at the time, consideration of the candidate’s independence as measured by the Board’s independence standards and any other considerations that the Governance Committee deems appropriate. The Governance Committee periodically reviews the criteria for the nomination of director candidates and approves changes to the criteria, as appropriate. Following its evaluation process, the Governance Committee recommends candidates to the full Board. The Board makes the final determination regarding a candidate based on its consideration of the Governance Committee’s recommendation. Candidates recommended by our stockholders will be evaluated on the same basis as candidates recommended by current directors, search firms, or third-party consultants.

4 SUNCOKE ENERGY, INC. 2024 PROXY STATEMENT

| Proposal One | The Board & Committees | Corporate Governance | Director Compensation | Executive Compensation | Proposal Two | Proposal Three | Beneficial Stock Ownership | Audit Committee Matters | Proposal Four | Q&A | Other Information | |||||||||||

Certain Information Regarding Directors

On the following pages is information regarding the principal occupation and business experience of each director, and the reasons the Board believes each of the two nominees, Ralph M. Della Ratta, Jr. and Susan R. Landahl, should be elected to serve on the Board, are described below:

Class III: Nominees Up for Election at the 2024 Annual Meeting

Ralph M. Della Ratta, Jr.

|

AGE: 70

DIRECTOR SINCE 2020

BOARD COMMITTEES

• Audit

• Compensation (Chair) | |||

BUSINESS EXPERIENCE

Mr. Della Ratta was appointed as a director of SunCoke Energy, Inc., effective December 3, 2020. From 2004 to 2017, he was Founder, Senior Managing Director and Chief Executive Officer of Western Reserve Partners LLC, a Cleveland, Ohio based investment banking merger and acquisition advisory firm. The firm was acquired in 2017 by Citizens Financial Group [NYSE: CFG], a large commercial banking institution. Since the acquisition, Mr. Della Ratta served as Co-Head of Merger and Acquisition Advisory Services for Citizens Financial Group, Inc., leading a team focused on delivering M&A services and related financial analysis to middle-market customers. Mr. Della Ratta retired from Citizens on June 30, 2022. He joined Kirtland Capital Partners, a middle market private equity firm, as a partner on July 1, 2022. From 2004 to 2020, Mr. Della Ratta served on the Board of Olympic Steel, Inc. [NASDAQ: ZEUS] (a leading U.S. metals service center), where he was Lead Independent Director, a member of the Audit and Compliance Committee and, at different times, served as Chair of the Compensation Committee and Chair of the Nominating Committee. Mr. Della Ratta is involved in numerous non-profit and civic organizations, including: The Duke University Alumni Association and Annual Fund, Kent State University Board of Trustees (past Chair), The Ohio Venture Capital Authority, The Rock and Roll Hall of Fame, and United Cerebral Palsy Telethon (Chair).

QUALIFICATIONS

Mr. Della Ratta brings valuable business and extensive financial experience to the Board, particularly with regard to capital raising, commercial banking, mergers and acquisitions, strategic financial analysis and capital markets transactions. In addition, Mr. Della Ratta also has knowledge of manufacturing and distribution in the steel and metals services industry. |

SUNCOKE ENERGY, INC. 2024 PROXY STATEMENT 5

| Proposal One | The Board & Committees | Corporate Governance | Director Compensation | Executive Compensation | Proposal Two | Proposal Three | Beneficial Stock Ownership | Audit Committee Matters | Proposal Four | Q&A | Other Information | |||||||||||

Susan R. Landahl

|

AGE: 63

DIRECTOR SINCE 2017

BOARD COMMITTEES

• Compensation

• Governance (Chair)

| |||

BUSINESS EXPERIENCE

Ms. Landahl was appointed as a director of SunCoke Energy, Inc., effective September 1, 2017. From June 2015 until her retirement in January 2021, Ms. Landahl served as Senior Vice President, Organizational Effectiveness and Integrated Performance Assessment of Exelon Generation Company, LLC, a major generator and marketer of electricity and a subsidiary of Exelon Corporation, one of the nation’s largest power generators, with operations in 48 states. Since joining Exelon in 1999, Ms. Landahl has held a number of senior leadership positions, including Senior Vice President, Operations Integration & Business Development from August 2012 to January 2014, and Chief Operating Officer & Senior Vice President, Exelon Nuclear from June 2010 to August 2012. In this latter position, she oversaw 10 nuclear facilities with 17 nuclear reactors in Illinois, New Jersey and Pennsylvania, and was responsible for 5,000 employees and annual budgets in excess of $1.5 billion. Exelon’s nuclear fleet has since grown to 14 nuclear facilities, including 23 reactors in five states. As Vice President, Industry Leadership at the Institute for Nuclear Power Operations from January 2014 to June 2015, Ms. Landahl led development of INPO 15-005, now the industry standard for leadership development and organizational effectiveness for the entire U.S. nuclear fleet and much of the world.

QUALIFICATIONS

Ms. Landahl is a knowledgeable and experienced industry leader with strong operational skills and a proven track record for successfully managing large, complex projects. She has a keen and strategic understanding of the energy industry, and possesses senior-level planning and managerial experience. |

6 SUNCOKE ENERGY, INC. 2024 PROXY STATEMENT

| Proposal One | The Board & Committees | Corporate Governance | Director Compensation | Executive Compensation | Proposal Two | Proposal Three | Beneficial Stock Ownership | Audit Committee Matters | Proposal Four | Q&A | Other Information | |||||||||||

Class I: Nominees Up for Election at the 2025 Annual Meeting

Arthur F. Anton (Chairman)

|

AGE: 66

DIRECTOR SINCE 2020

BOARD COMMITTEES

• Compensation

• Governance

OTHER PUBLIC BOARDS

• Diebold Nixdorf Incorporated

• Olympic Steel

• Sherwin-Williams Company | |||

BUSINESS EXPERIENCE

Mr. Anton was appointed as a director of SunCoke Energy, Inc., effective March 16, 2020, and was appointed as non-executive Chairman of the Board effective January 1, 2021. During the course of his career, Mr. Anton has served in various senior roles at The Swagelok Company (a large fluid systems technology company) most recently as Chairman of the board from September 2017 to December 2019, and as Chief Executive Officer from 2004 to 2017. Prior to that, he served as Swagelok’s President and Chief Executive Officer from 2004 to 2017, as its President and Chief Operating Officer from 2001 to 2004, as its Executive Vice President from 2000 to 2001, and as its Chief Financial Officer from 1998 to 2000. Prior to joining Swagelok in 1998, Mr. Anton was a Partner of Ernst & Young LLP (a professional accounting and consulting services firm), where he consulted with companies in manufacturing, energy, service, and other industries. Mr. Anton currently serves as a director on the boards of the following companies: Olympic Steel [NASDAQ: ZEUS] (a leading U.S. metals service center), where he is the Lead Independent Director and a member of both the Audit and Compliance Committee, and the Compensation Committee; The Sherwin-Williams Company [NYSE: SHW] (a major paint coatings manufacturer), where he serves on the Audit Committee; and Diebold Nixdorf, Incorporated [NYSE: DBD] (a leading manufacturer of automated teller, calculating, and accounting machinery), where he serves as Chair of the Audit Committee and as a member of the Nominating and Governance Committee. Mr. Anton also serves as Chairman of University Hospitals Health System in the Cleveland, Ohio area.

QUALIFICATIONS

Mr. Anton is an experienced corporate executive with strong operational, financial and leadership expertise, along with significant experience in the steel industry. He brings substantial domestic and international manufacturing and distribution experience and strategic planning expertise to our Board. In addition, as a former partner of Ernst & Young LLP and the former Chief Financial Officer of Swagelok, Mr. Anton has financial expertise and extensive financial experience. |

SUNCOKE ENERGY, INC. 2024 PROXY STATEMENT 7

| Proposal One | The Board & Committees | Corporate Governance | Director Compensation | Executive Compensation | Proposal Two | Proposal Three | Beneficial Stock Ownership | Audit Committee Matters | Proposal Four | Q&A | Other Information | |||||||||||

Michael W. Lewis

|

AGE: 74

DIRECTOR SINCE 2020

BOARD COMMITTEES

• Audit

• Governance | |||

BUSINESS EXPERIENCE

Mr. Lewis was appointed as a director of SunCoke Energy, Inc., effective December 3, 2020. During the course of his career, Mr. Lewis has risen through progressively responsible senior leadership positions at BMO Harris Bank, N.A. (a large U.S. banking institution and subsidiary of Bank of Montreal, the Canadian multinational investment bank and financial services company) and, from 1998 until his retirement in 2013, Mr. Lewis was Executive Vice President, and Chicago metro regional president. His responsibilities have included strategic integration and management of business segments across the regional network of BMO Harris branches, as well as growing the bank’s commercial and retail business, community development and consumer loans and services. Mr. Lewis is an active member of Chicago’s business and civic communities and has served on several boards, including the Chicago Regional Transportation Authority, the Urban Partnership Bank (a full-service community development bank), and Chicago United (a corporate membership and advocacy organization promoting economic opportunities by advancing multiracial leadership in corporate governance, executive level management, and business diversity). Mr. Lewis also serves on the Foundation Board of Western Michigan University and has served as past Chairman of the Western Michigan University Business School Advisory Council.

QUALIFICATIONS

Mr. Lewis is an experienced banking executive who has spent over 40 years in the financial services industry with business line responsibility. He provides significant senior management-level strategic planning, business development and managerial expertise to the Board. |

8 SUNCOKE ENERGY, INC. 2024 PROXY STATEMENT

| Proposal One | The Board & Committees | Corporate Governance | Director Compensation | Executive Compensation | Proposal Two | Proposal Three | Beneficial Stock Ownership | Audit Committee Matters | Proposal Four | Q&A | Other Information | |||||||||||

Class II: Nominees Up for Election at the 2026 Annual Meeting

Martha Z. Carnes

|

AGE: 63

DIRECTOR SINCE 2019

BOARD COMMITTEES

• Audit (Chair)

OTHER PUBLIC BOARDS

• Core Laboratories Inc.

• Matrix Service Company | |||

BUSINESS EXPERIENCE

Ms. Carnes was appointed as a director of SunCoke Energy, Inc., effective December 5, 2019. From 1982 until her retirement from the firm in June 2016, Ms. Carnes served in various senior roles at PricewaterhouseCoopers, or PwC (an international accounting firm), including as: (i) Assurance Partner serving large, publicly traded companies in the energy industry; (ii) Managing Partner of PwC’s Houston, Texas office; and (iii) PwC’s Energy and Mining leader for the United States, where she led the firm’s energy and mining assurance, tax and advisory practices. Ms. Carnes currently serves as a director on the Board of Core Laboratories Inc. [NYSE: CLB], (one of the world’s largest providers of reservoir description and production enhancement services to the oil and gas industry), where she is the Lead Independent Director and Chairman of the Audit Committee. She is also a director of Matrix Service Company [NASDAQ: MTRX] (a provider of design, engineering, construction, repair and maintenance services to industrial and energy clients in North America), where she Chairs the Audit Committee and serves on the Compensation, and Nominating and Corporate Governance committees. She also is a Member Representative for Ohio Valley Midstream, LLC, a member-managed limited liability company engaged in natural gas and natural gas liquids gathering and processing. From September 1, 2017 through June 2019, Ms. Carnes served as a director of SunCoke Energy Partners GP LLC, the general partner of SunCoke Energy, L.P., our former master limited partnership.

QUALIFICATIONS

Ms. Carnes is an experienced finance and public accounting executive, having spent her entire 34-year career with PwC. By virtue of her experience, Ms. Carnes possesses strategic planning, managerial and leadership expertise, having led the design and execution of market and sector strategies, business development, compensation, professional development, succession planning, and client satisfaction initiatives for clients in the mining, utilities and energy industries. In addition, Ms. Carnes brings vast experience with capital markets and financing activities, having served as lead audit partner on some of the largest merger and acquisition transactions completed in the energy sector. |

SUNCOKE ENERGY, INC. 2024 PROXY STATEMENT 9

| Proposal One | The Board & Committees | Corporate Governance | Director Compensation | Executive Compensation | Proposal Two | Proposal Three | Beneficial Stock Ownership | Audit Committee Matters | Proposal Four | Q&A | Other Information | |||||||||||

Andrei A. Mikhalevsky

|

AGE: 69

DIRECTOR SINCE 2023

BOARD COMMITTEES

• Compensation

• Governance | |||

BUSINESS EXPERIENCE

Mr. Mikhalevsky was appointed as a director of SunCoke Energy, Inc., effective February 23, 2023. He is the former President and Chief Executive Officer of California Dairies, Inc., a leading milk marketing and processing cooperative co-owned by 390 dairy producers supplying 17 billion pounds of milk products annually. Mikhalevsky has more than 40 years of leadership experience. Prior to California Dairies, Inc., he served as managing director of global ingredients and foodservices at Fonterra Cooperative Group Ltd., the world’s largest dairy exporter. In this role, Mr. Mikhalevsky was responsible for developing and building many of Fonterra’s global customer partnerships. In addition, he oversaw Fonterra’s research and innovation division and its branded business in Latin America. Previously, Mr. Mikhalevsky held senior executive positions at Campbell Soup Company, Georgia Pacific Corp. and Symrise Inc. He has been affiliated with numerous food & dairy industry-related boards, trade associations, and charitable boards, including SmithFoods, where he has served as a Director since 2017. He was an Executive Board Member of the International Dairy Foods Association, from 2014 to 2021. Previous industry-related board experience includes: Dairy America, Board Member from 2012 to 2020 and Chairman from 2018 to 2020; The National Milk Producers Federation, Board Member and Delegate (2019 to 2020); Challenge Food Products, Board Chairman (2012 to 2019); the U.S. Dairy Export Council, Board Member (2012 to 2019); and the Dairy Innovation Center, Board Member (2012 to 2019).

QUALIFICATIONS

Mr. Mikhalevsky is a highly experienced senior-level executive, with global manufacturing and marketing expertise, as well as senior-level strategic planning and business development experience. He has been significantly engaged in trade advocacy efforts and legislative efforts in Washington D.C. and has testified before congressional committees and subcommittees. In addition, he has extensive board-level oversight experience as a director of several large private companies and industry associations. |

10 SUNCOKE ENERGY, INC. 2024 PROXY STATEMENT

| Proposal One | The Board & Committees | Corporate Governance | Director Compensation | Executive Compensation | Proposal Two | Proposal Three | Beneficial Stock Ownership | Audit Committee Matters | Proposal Four | Q&A | Other Information | |||||||||||

Katherine T. Gates

|

AGE: 48

DIRECTOR SINCE 2023

BOARD COMMITTEES

• None | |||

BUSINESS EXPERIENCE

Ms. Gates was elected President of SunCoke Energy, Inc., and was appointed as a director on SunCoke’s Board of Directors, effective January 1, 2023. Prior to that, she was Senior Vice President, Chief Legal Officer and Chief Human Resource Officer since November 2019. Ms. Gates served as Senior Vice President, General Counsel and Chief Compliance Officer from October 2015 to November 2019. From July 2014 to October 2015, she was Vice President and Assistant General Counsel, where she focused on litigation, regulatory and commercial matters. In addition, from October 2015 through June 2019, Ms. Gates served as a director of SunCoke Energy Partners GP LLC, the general partner of SunCoke Energy Partners, L.P., our former master limited partnership subsidiary. Ms. Gates joined SunCoke in February 2013 as Senior Health, Environment and Safety Counsel. Ms. Gates practiced law for two decades. As a Partner at Beveridge & Diamond, P.C., she served on the firm’s Management Committee and also co-chaired the civil litigation section of the firm’s Litigation Practice Group.

QUALIFICATIONS

Ms. Gates’ legal and regulatory knowledge and skills, along with extensive executive experience at SunCoke, provides the Board of Directors with valuable expertise regarding operations, commercial, legal, environmental, health, safety and senior level strategic planning matters. |

SUNCOKE ENERGY, INC. 2024 PROXY STATEMENT 11

| Proposal One | The Board & Committees | Corporate Governance | Director Compensation | Executive Compensation | Proposal Two | Proposal Three | Beneficial Stock Ownership | Audit Committee Matters | Proposal Four | Q&A | Other Information | |||||||||||

THE BOARD OF DIRECTORS AND ITS COMMITTEES

Our Board is composed of a majority of independent directors and our Audit, Compensation and Governance Committees are each composed entirely of independent directors. The following table shows the membership of our Committees as of March 27, 2024:

Name | Audit | Compensation | Governance | ||||||||||||

Katherine T. Gates | |||||||||||||||

Arthur F. Anton | ✔ | ✔ | |||||||||||||

Martha Z. Carnes | ✔ | * | |||||||||||||

Ralph M. Della Ratta, Jr. | ✔ | ✔ | * | ||||||||||||

Susan R. Landahl | ✔ | ✔ | * | ||||||||||||

Michael W. Lewis | ✔ | ✔ | |||||||||||||

Andrei A. Mikhalevsky | ✔ | ✔ | |||||||||||||

| * | Denotes Committee Chair |

Meeting Attendance

The Board held seven meetings in fiscal year 2023. Each director who served in fiscal year 2023 attended over 75% of the aggregate of: (i) the total number of meetings of the Board during the periods that he or she served in fiscal year 2023 and (ii) the total number of meetings of the Committees on which he or she served during the periods that he or she served in fiscal year 2023. The Company does not have a specific policy regarding director attendance at the Annual Meeting. However, all directors attended the 2023 Annual Meeting which was held on May 11, 2023.

Audit Committee

CHAIRMAN: Ms. Carnes*

MEMBERS: Mr. Della Ratta* Mr. Lewis*

*Financial Expert

All members of the Audit Committee are “independent” as defined in the listing standards of the New York Stock Exchange, or NYSE, and the rules and regulations of the Securities and Exchange Commission, or SEC. | COMMITTEE KEY RESPONSIBILITIES: The Board has determined that members of the Audit Committee are independent directors for purposes of serving on an audit committee under applicable SEC and NYSE requirements, and each is financially literate and has accounting or related financial management expertise as required by the applicable rules of the NYSE.

The Audit Committee assists the Board in: (1) the appointment, evaluation and compensation of the Company’s independent auditor, (2) the review and monitoring of the Company’s financial statements and disclosures, (3) pre-approval of audit services, internal control-related services and permitted non-audit services, (4) oversight and monitoring of the Company’s internal audit function and independent auditors, (5) monitoring compliance by the Company with legal and regulatory requirements, including the Company’s Code of Business Conduct and Ethics; and (6) oversight of the Company’s information technology use and protection including, but not limited to enterprise cybersecurity and privacy.

The Audit Committee does not itself prepare financial statements or perform audits and its members are not auditors or certifiers of SunCoke Energy’s financial statements. In fulfilling its oversight responsibility of appointing and reviewing the services performed by our independent registered public accounting firm, the Audit Committee carefully reviews the policies and procedures for the engagement of our independent registered public accounting firm, including the scope of the audit, audit fees, critical audit matters, auditor independence matters and the extent to which the independent registered public accounting firm may be retained to perform non-audit related services.

| |

The Board has adopted a written charter for the Audit Committee, which is available on our corporate website at www.SunCoke.com. The Audit Committee met eight times in fiscal year 2023.

12 SUNCOKE ENERGY, INC. 2024 PROXY STATEMENT

| Proposal One | The Board & Committees | Corporate Governance | Director Compensation | Executive Compensation | Proposal Two | Proposal Three | Beneficial Stock Ownership | Audit Committee Matters | Proposal Four | Q&A | Other Information | |||||||||||

Compensation Committee

CHAIRMAN: Mr. Della Ratta

MEMBERS: Mr. Anton Ms. Landahl Mr. Mikhalevsky

| COMMITTEE KEY RESPONSIBILITIES: The Compensation Committee is responsible for the approval, evaluation and oversight of compensation plans, policies and programs for the executive officers and certain other employees of SunCoke Energy and its subsidiaries. The Compensation Committee also has sole authority over the appointment, evaluation and compensation of any independent compensation consultant it uses in the evaluation of executive officer compensation.

| |

The Board has adopted a written charter for the Compensation Committee, which is available on our corporate website at www.SunCoke.com. The Compensation Committee met four times in fiscal year 2023.

Governance Committee

CHAIRMAN: Ms. Landahl

MEMBERS: Mr. Anton Mr. Lewis Mr. Mikhalevsky

| COMMITTEE KEY RESPONSIBILITIES: The Governance Committee: (1) assists the Board in identifying individuals qualified to become Board members, (2) recommends to the Board director nominees to be considered by stockholders, (3) recommends Corporate Governance Guidelines to the Board, (4) leads the Board in its annual review of Board performance, (5) recommends to the Board nominees for each Board committee, (6) reviews the form and amount of director compensation and makes recommendations to the Board regarding the Company’s director compensation program, and (7) provides oversight of the Company’s on-going environmental, health, sustainability and corporate social responsibility policies, initiatives, objectives and practices.

| |

The Board has adopted a written charter for the Governance Committee, which is available on our corporate website at www.SunCoke.com. The Governance Committee met three times in fiscal year 2023.

Compensation Committee Interlocks and Insider Participation

None of the members of the Compensation Committee is or ever was an officer or employee of SunCoke Energy or any of our subsidiaries. In addition, none of our executive officers served on the compensation committee or board of directors of any other company of which any of our directors also was an executive officer.

SUNCOKE ENERGY, INC. 2024 PROXY STATEMENT 13

| Proposal One | The Board & Committees | Corporate Governance | Director Compensation | Executive Compensation | Proposal Two | Proposal Three | Beneficial Stock Ownership | Audit Committee Matters | Proposal Four | Q&A | Other Information | |||||||||||

CORPORATE GOVERNANCE

Corporate governance at SunCoke Energy is designed to promote the long-term interests of our stockholders, strengthen Board and management accountability, foster responsible decision-making and engender public trust. We have adopted leading governance practices that establish strong independent leadership in our boardroom, ensure Board and management accountability, and provide our stockholders with meaningful rights.

We believe that such corporate governance practices are essential to our long-term success. The following are key governance provisions that highlight SunCoke Energy’s commitment to transparency and accountability:

✔ Strong Board independence (6 out of 7 continuing directors are independent)

✔ Independent Chairman with robust responsibilities

✔ Separate independent Chairman and CEO roles

✔ Majority vote standard for uncontested election of directors

✔ Limitations on outside board and audit committee service

✔ Non-executive directors meet in executive session without management present

✔ Board oversight of sustainability matters and comprehensive annual report addressing environmental and social impact and responsible business practices

|

✔ Fully independent Audit, Compensation and Governance Committees

✔ Annual Board and Committee self-evaluations

✔ Robust stock ownership requirements for executive officers and directors

✔ Strong stockholder engagement practices

✔ Greater than 75% attendance at Board and Committee meetings

✔ Code of Business Conduct & Ethics applicable to directors and executive officers

✔ Demonstrated focus on, and commitment to, ongoing Board refreshment

|

Director Independence

The Board, upon the recommendation of the Governance Committee, has determined that each of our non-executive directors who serves as a director is “independent” under the applicable rules of the NYSE and the SEC and is free of any direct or indirect material relationship with SunCoke Energy or its management.

Board Leadership Structure

Our Board currently separates the roles of Chairman and Chief Executive Officer. The current leadership structure of the Board includes our independent non-executive Chairman (Mr. Anton), and our Chief Executive Officer (Mr. Rippey). Our Governance Committee and Board believes that the current Board leadership structure, with separate roles for the Chairman and the Chief Executive Officer is in the best interests of SunCoke Energy and its stockholders at the present time. In our view, a number of factors support the current leadership structure chosen by the Board, including, among others:

| • | Separating these two roles increases the Board’s independence from management and leads to better monitoring and oversight, thus reducing the potential for actual or perceived conflicts of interest related to executive compensation, performance and succession. |

| • | The Chairman provides independent oversight, presiding over the meetings of our Board of Directors (including sessions with only independent directors present) and coordinating the work of the standing Committees of our Board. |

| • | The Chairman serves as a liaison between our Board and senior management, but having an independent Chairman enables non-executive directors to raise issues and concerns for Board consideration without immediately involving management. |

14 SUNCOKE ENERGY, INC. 2024 PROXY STATEMENT

| Proposal One | The Board & Committees | Corporate Governance | Director Compensation | Executive Compensation | Proposal Two | Proposal Three | Beneficial Stock Ownership | Audit Committee Matters | Proposal Four | Q&A | Other Information | |||||||||||

| • | This governance structure promotes a balance between the Board’s independent authority to oversee our business and the Chief Executive Officer and his management team who manage the business on a day-to-day basis. |

| • | Separating the roles of Chairman and Chief Executive Officer promotes overall board independence, allowing the Chief Executive Officer to focus his time and energy on the everyday demands of managing our business successfully (including strategy and operations), while at the same time leveraging the experience and perspectives of the Chairman. |

Our Governance Committee annually assesses these roles and the board leadership structure to ensure that the interests of SunCoke Energy and its stockholders are best served. Our By-laws allow the Chief Executive Officer to be designated as Chairman of the Board. If the individual elected as Chairman of the Board is also the Chief Executive Officer, or if the Chairman of the Board is otherwise not independent, then the Chair of our Governance Committee will act in the role of Lead Director. The duties of such a Lead Director are described in our Corporate Governance Guidelines and include: (1) the authority to chair those meetings of the Board of Directors at which the Chairman is not present; and (2) the authority to preside at executive sessions of the independent directors. A Lead Director also may provide advice and counsel, as needed, to the Chairman, and/or the Chief Executive Officer, on strategic issues and on Board of Directors and Committee matters generally. If appointed, a Lead Director also would lead the Board and Committee self-evaluation process, as well as the annual evaluation of the Chief Executive Officer by the independent directors. Except for our current Chief Executive Officer, Mr. Rippey, and our current President, Ms. Gates, our Board of Directors is composed entirely of independent directors. The Audit, Compensation and Governance Committees are composed solely of independent directors.

Risk Oversight

Our Board has an active role, both as a whole, and also at the committee level, in overseeing management of the Company’s risks, including financial risks, cybersecurity risks, credit and liquidity risks, legal and regulatory risks, and operational risks. The Board is responsible for general oversight of risks and regularly reviews information from management who is responsible for the day-to-day processes and operations to manage risks.

In accordance with NYSE requirements, the Audit Committee charter provides that the Audit Committee is responsible for reviewing and discussing SunCoke Energy’s major financial risk exposures and the steps management has taken to monitor and control such exposures, including our risk assessment and risk management policies. On a regular basis, our officers who are responsible for monitoring and managing SunCoke Energy’s risks, including our Chief Executive Officer, our President, our Senior Vice President and Chief Financial Officer and our Vice President, Assistant General Counsel and Chief Compliance Officer, make reports to the Audit Committee. The Audit Committee, in turn, reports to the full Board of Directors. While the Audit Committee has primary responsibility for overseeing risk management, our entire Board is actively involved in overseeing risk management by engaging in periodic discussions with our officers as it may deem appropriate. In addition, each of our Committees considers the risks within its areas of responsibility. For example, the Audit Committee focuses on risks inherent in our accounting, financial reporting and internal controls, and the Compensation Committee considers the risks that may be implicated by our executive compensation program. The Compensation Committee’s assessment of risk related to compensation practices is discussed in more detail in the Compensation Discussion and Analysis section of this Proxy Statement. We believe that the leadership structure of our Board supports its effective oversight of our risk management.

Cybersecurity

Our Board recognizes the importance of maintaining the trust and confidence of our customers, suppliers, vendors, contractors and employees, and devotes significant time and attention to oversight of cybersecurity and information security risk. In 2021, we updated our Audit Committee charter to memorialize the Committee’s role in reviewing cybersecurity matters. The Audit Committee oversees the initial assessment of cybersecurity threats as well as the Company’s approach to management and mitigation of such risks, compliance with industry standards related to cybersecurity, and the Company’s public disclosures related to cybersecurity matters. In addition, our

SUNCOKE ENERGY, INC. 2024 PROXY STATEMENT 15

| Proposal One | The Board & Committees | Corporate Governance | Director Compensation | Executive Compensation | Proposal Two | Proposal Three | Beneficial Stock Ownership | Audit Committee Matters | Proposal Four | Q&A | Other Information | |||||||||||

Board of Directors devotes regular attention to oversight of cybersecurity risks. At least annually the entire Board of Directors receives an update from our Chief Information Officer detailing our cybersecurity threat risk management and strategy processes. This update covers topics such as data security posture, results from assessments conducted by third parties, progress toward security goals, and any material cybersecurity developments, as well as steps taken in response to such developments. Management has continued to take significant steps to enhance our data security infrastructure and defenses. We utilize third-party experts, independent cybersecurity advisors, and auditors to conduct regular risk assessments, penetration testing, and vulnerability analyses. We also conduct a periodic review of the Company’s cyber insurance policies to ensure appropriate coverage.

Sustainability

Our Board recognizes the importance of sustainability and is actively engaged in overseeing the Company’s sustainability practices and works alongside management to ensure focus on these matters. As part of this ongoing focus our Governance Committee provides broad oversight of the Company’s policies, initiatives, objectives and practices regarding safety and environmental matters, climate change, health and corporate social responsibility. The Governance Committee receives updates from management and considers stakeholder concerns regarding current and emerging sustainability matters that may affect the business, operations, performance, or public image of the Company, and reviews such matters with the Board and management, as appropriate. We continue to incorporate sustainability into our businesses’ core strategy, reflecting our belief that sustainability is essential to long-term growth. We also believe in transparency, and report on our sustainability efforts in an annual Sustainability Report which discusses our programs and policies designed to promote ethical business practices, good corporate governance, and the well-being and health of our environment, employees, and the communities in which we live and work.

Executive Sessions of the Board

Our Board holds regular executive sessions in which the independent directors meet without any members of management present. The purpose of these executive sessions is to promote open and candid discussion among the independent directors. In accordance with applicable NYSE rules, our non-executive Chairman presides over the executive sessions of the independent directors. The independent directors met in executive sessions separate from management seven times during fiscal 2023.

Corporate Governance Guidelines

Our Board has adopted Corporate Governance Guidelines that address the following matters, among others: (1) composition of the Board and director qualifications; (2) operations of the Board; (3) responsibilities of the Board; and (4) Committee structure and responsibilities. These Corporate Governance Guidelines are posted on our corporate website at www.SunCoke.com.

Insider Trading Policy Restrictions on Hedging & Pledging

SunCoke Energy’s Insider Trading Policy applies to our employees, executives, including our named executive officers (“NEOs”), and the members of our Board. The Insider Trading Policy prohibits trading in SunCoke Energy securities except during specifically designated windows, and also prohibits certain types of trading activities whether or not they technically involve insider trading. SunCoke Energy considers it inappropriate for any director, officer or other employee to enter into speculative hedging or monetization transactions involving SunCoke Energy securities. In general, such transactions are designed to offset or reduce the risk of price fluctuations in the underlying security and, as such, sever the ultimate alignment with our stockholders’ interests. Under our Insider Trading Policy, no employee, officer, or director of SunCoke Energy may, either directly or indirectly through a third party, enter into short sales or purchase, sell or exercise any puts, calls or similar instruments pertaining to securities of SunCoke Energy (other than options exercised in accordance with the terms of an option plan sponsored by SunCoke Energy) or engage in hedging activities of any kind (e.g., covered calls, collars, equity swaps, prepaid variable forwards, and exchange funds) pertaining to any SunCoke Energy securities, in each case because of the potential conflict of interest or the perceptions created, and the resulting

16 SUNCOKE ENERGY, INC. 2024 PROXY STATEMENT

| Proposal One | The Board & Committees | Corporate Governance | Director Compensation | Executive Compensation | Proposal Two | Proposal Three | Beneficial Stock Ownership | Audit Committee Matters | Proposal Four | Q&A | Other Information | |||||||||||

possible impact on the market. Additionally, no employee (including any officer) or director of SunCoke Energy may pledge any SunCoke Energy securities as collateral for any loan or deposit, or hold any such securities in a margin account, since a foreclosure sale or margin sale could occur at a time when the pledgor is aware of material non-public information, or otherwise not permitted to trade in SunCoke Energy securities.

Review of Related Person Transactions

The Board has adopted a written policy that applies to interested transactions with related parties. For purposes of the policy, interested transactions include transactions, arrangements or relationships involving amounts greater than $100,000 in the aggregate in which the Company is a participant and a related person has a direct or indirect interest. Related persons are deemed to include executive officers, directors, director-nominees, owners of more than five percent of our Common Stock or an immediate family member of the preceding group. The policy provides that the Governance Committee is responsible for the review and approval of all such related person transactions.

The Governance Committee reviews the material facts of all interested transactions that require its approval and either approves or disapproves of the entry into the interested transaction, subject to certain exceptions described below. The policy prohibits any director from participating in any discussion or approval of an interested transaction for which such director is a related person, except that such director is required to provide all material information concerning the interested transaction to the Governance Committee. As part of its review and approval of a related person transaction, the Governance Committee considers, among other things, whether the transaction is made on terms no less favorable than terms that would be generally available to an unaffiliated third party under the same or similar circumstances and the extent of the related person’s interest in the transaction.

Our related person transactions policy also provides that certain interested transactions will have standing pre-approval from the Governance Committee. These include: (1) employment of executive officers if the compensation is disclosed in the proxy statement or approved by the Board or the Compensation Committee; (2) employment of an immediate family member of a director, director nominee or executive officer with compensation that does not exceed $120,000; (3) director compensation that is disclosed in the proxy statement; (4) transactions with companies where the business is less than the larger of $1 million or two percent of the other company’s total revenues; (5) certain charitable contributions; (6) transactions where all stockholders receive proportional benefits; (7) transactions involving competitive bids; (8) regulated transactions; (9) certain banking services; and (10) certain transactions available to all employees or third parties generally.

In 2023, we did not engage in any related person transaction(s) requiring disclosure under Item 404 of Regulation S-K.

Director Attendance Policy

Directors are expected to attend the Board meetings and meetings of Committees on which they serve, as well as our annual meeting of stockholders.

Indemnification Agreements

Our directors are asked to enter into individual Indemnification Agreements with SunCoke Energy when joining the Board. The Indemnification Agreement is the same for each director and provides contractual indemnification in addition to the indemnification provided in our Certificate of Incorporation and the By-laws. The Indemnification Agreement provides each director with indemnification to the fullest extent permitted by law. Subject to certain limitations and exceptions, the Indemnification Agreement provides, among other things, that we will indemnify each director against expenses, liabilities, losses, judgments, fines and amounts paid in settlement incurred in connection with any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative, by reason of the fact that the director is or was our director or by reason of the fact that the director is or was serving at our request as a director, officer, manager, trustee, fiduciary, employee or agent of another entity, with certain stated exceptions. In addition, under the Indemnification Agreement, we are obligated to advance payment to each director for all expenses reasonably incurred by such director with respect to the events or occurrences specified above, provided that the director must repay the advanced expenses to the extent that it is ultimately determined that the director is not entitled to indemnification under the terms of the Indemnification Agreement.

SUNCOKE ENERGY, INC. 2024 PROXY STATEMENT 17

| Proposal One | The Board & Committees | Corporate Governance | Director Compensation | Executive Compensation | Proposal Two | Proposal Three | Beneficial Stock Ownership | Audit Committee Matters | Proposal Four | Q&A | Other Information | |||||||||||

Code of Business Conduct and Ethics

We have adopted a Code of Business Conduct and Ethics that applies to all of our officers, directors and employees, including our Chairman, Chief Executive Officer, President, Senior Vice President and Chief Financial Officer, Vice President and Controller and other senior financial officers. The Code of Business Conduct and Ethics is posted on our corporate website at www.SunCoke.com.

Oversight of Management Succession

The Company has adopted a management succession policy pursuant to which the Board of Directors regularly reviews the Company’s succession plan for the CEO and other senior executives. This process is designed to prepare the Company for both planned succession events as well as unplanned succession events, such as those arising from unexpected illness or death or other sudden departure, to ensure the stability and accountability of the Company during periods of transition. The Board of Directors’ periodic review of the Company’s succession plan includes an evaluation of potential candidates for the CEO position and other senior executive positions, including an assessment of whether each candidate possesses the skills, experience, education, and other attributes that the Board of Directors believes to be required for such positions in light of the Company’s business, operations, strategy and culture. The Company’s management succession policy also provides process guidelines in the event of an emergency management succession event.

Board of Directors and Committee Evaluations

Our Board recognizes that a robust and constructive Board and committee evaluation process is an essential component of board effectiveness. As such, our Board and each of our committees conduct an annual evaluation, which includes a qualitative assessment by each director of the performance of the Board and the committee or committees on which the director sits. The Governance Committee oversees the evaluation process.

The results of these annual self-evaluations have led to changes aimed at improving the Board’s effectiveness, including the appropriate distribution of oversight responsibilities across the various committees of the Board, the conduct of executive sessions, and considerations of the type and content of information included in meeting materials.

Communications with the Board

Stockholders and other interested persons may communicate any concerns they may have regarding SunCoke Energy to the attention of the Board or to any specific member of the Board, including the Chairman, by writing to the following address:

SunCoke Energy, Inc.

c/o Corporate Secretary

1011 Warrenville Road – Suite 600

Lisle, Illinois 60532

Communications directed to the independent directors as a group should be sent to the attention of the Chairman, c/o the Corporate Secretary, at the address indicated above. Any stockholder or other interested person who has a particular concern regarding accounting, internal accounting controls or other audit matters that he or she wishes to bring to the attention of the Audit Committee of the Board may communicate those concerns to the Audit Committee or its Chair, c/o the Corporate Secretary, using the address indicated above.

18 SUNCOKE ENERGY, INC. 2024 PROXY STATEMENT

| Proposal One | The Board & Committees | Corporate Governance | Director Compensation | Executive Compensation | Proposal Two | Proposal Three | Beneficial Stock Ownership | Audit Committee Matters | Proposal Four | Q&A | Other Information | |||||||||||

DIRECTOR COMPENSATION

The compensation program for our independent directors is designed to attract experienced and highly qualified directors, provide appropriate compensation for their time, efforts, commitment and contributions to SunCoke Energy and our stockholders and align the interests of the independent directors and our stockholders. The Governance Committee reviews director compensation regularly. On a biennial basis, Meridian Compensation Partners LLC, or Meridian, an independent compensation consulting firm, presents a benchmarking report on director compensation for the same peer group of companies that the Compensation Committee uses to benchmark compensation for our executive. After reviewing the information presented by Meridian and other public information on the topic, the Compensation Committee evaluates the compensation program for our independent directors to ensure that it is consistent with market practice and makes recommendations of appropriate changes to the Board.

Annual Retainer

SunCoke Energy does not pay meeting fees. The table below summarizes the current structure of the independent director compensation program for SunCoke Energy’s independent directors:

BOARD SERVICE | ||||

Annual Retainer (Cash Portion) | $ | 90,000 | ||

Annual Retainer (Stock Portion) | $ | 120,000 | ||

COMMITTEE SERVICE | ||||

Annual non-executive Chairman Retainer | $ | 80,000 | ||

Annual Lead Director Retainer (if applicable) | $ | 30,000 | ||

Annual Committee Chair Retainers: | ||||

• Audit Committee Chair | $ | 25,000 | ||

• Compensation Committee Chair | $ | 15,000 | ||

• Governance Committee Chair | $ | 12,000 | ||

Annual Audit Committee Member Retainer | $ | 10,000 | ||

Retainer Paid in Shares

A portion of the independent directors’ annual retainer is paid in the form of our Common Stock. Each independent director also may elect to receive payment of all or a portion of his or her annual cash retainer in the form of our Common Stock.

Each independent director may designate his or her compensation to be delivered in the form of share units. Each share unit is treated as if it were invested in shares of our Common Stock, but it does not have voting rights. Share units are credited with dividend equivalents that entitle the holder to receive payment in an amount equal to the cash dividends payable on a number of shares of Common Stock equal to the number of outstanding share units. The dividend equivalents are credited to a bookkeeping account for each director who has share units. The dividend equivalent account does not bear interest. Payment of dividend equivalents coincides with the settlement of the related share units. Independent directors may choose to receive their aggregate share units paid out in a lump sum, or as a series of up to three approximately equal annual installments, commencing on January 15 of the calendar year following the calendar year in which they leave the Board. Successive annual installment payments are made no earlier than January 15 of each such year. Share units are settled in an equivalent number of shares of Common Stock on the payment date.

SUNCOKE ENERGY, INC. 2024 PROXY STATEMENT 19

| Proposal One | The Board & Committees | Corporate Governance | Director Compensation | Executive Compensation | Proposal Two | Proposal Three | Beneficial Stock Ownership | Audit Committee Matters | Proposal Four | Q&A | Other Information | |||||||||||

Director Stock Ownership Guidelines

Each independent director is expected to own a number of shares of our Common Stock having an aggregate market value equal to at least five times the independent director’s annual cash retainer. Share units credited to an independent director will be counted for purposes of determining compliance with these guidelines. Once the applicable guideline ownership level has been attained, compliance will not otherwise be affected by a subsequent decline in the trading price of our Common Stock. Our directors are allowed a five-year phase-in period to reach their respective stock ownership goals in order to comply with the applicable guidelines. As of December 31, 2023, each of our independent directors with five or more years of services were in compliance with the guidelines. Each of our independent directors with less than five years of service (Mr. Anton, Mr. Della Ratta, Mr. Lewis and Mr. Mikhalevsky) will have five years from their respective appointments to the Board in which to meet their respective stock ownership goals.

Director Compensation Table

The table below sets forth the compensation paid by SunCoke Energy, Inc. to its independent directors in fiscal 2023. Mr. Rippey and Ms. Gates are employee directors and do not receive separate compensation for their Board service.

Name | Fees Earned or Paid in Cash ($) (1) | Stock Awards ($) (2) | Option Awards ($) | Non-Equity Incentive Plan Compensation ($) | Nonqualified Deferred Compensation Earnings ($) | All Other Compensation ($) | Total ($) | |||||||||||||||||||||

Arthur F. Anton | 170,000 | 120,000 | 290,000 | |||||||||||||||||||||||||

Martha Z. Carnes | 115,000 | 120,000 | 235,000 | |||||||||||||||||||||||||

Ralph M. Della Ratta, Jr. | 115,000 | 120,000 | 235,000 | |||||||||||||||||||||||||

Susan R. Landahl | 102,000 | 120,000 | 222,000 | |||||||||||||||||||||||||

Michael W. Lewis | 100,000 | 120,000 | 220,000 | |||||||||||||||||||||||||

Andrei A. Mikhalevsky (3) | 75,000 | 100,000 | 175,000 | |||||||||||||||||||||||||

| (1) | The amounts in this column reflect all cash retainers paid to independent directors during fiscal year 2023. Mr. Della Ratta elected to have half ($57,500) of his annual cash retainer delivered in shares of Common Stock. |

| (2) | The amounts in this column represent the grant date fair value of the stock retainer payments paid to each director in fiscal 2023, calculated pursuant to FASB ASC Topic 718. Ms. Carnes, Ms. Landahl, Mr. Lewis, and Mr. Mikhalevsky each received their respective stock retainers in the form of share units. Messrs. Anton and Della Ratta each received their respective stock retainers in the form of shares of our Common Stock. |

| (3) | The compensation for Mr. Mikhalevsky was prorated for the number of full calendar months that he served as a director. |

20 SUNCOKE ENERGY, INC. 2024 PROXY STATEMENT

| Proposal One | The Board & Committees | Corporate Governance | Director Compensation | Executive Compensation | Proposal Two | Proposal Three | Beneficial Stock Ownership | Audit Committee Matters | Proposal Four | Q&A | Other Information | |||||||||||

EXECUTIVE COMPENSATION

Compensation Committee Report

The Compensation Committee has reviewed and discussed the Compensation Discussion and Analysis section of this proxy statement with management. Based on our review and discussion with management, we have recommended to the Board of Directors that the Compensation Discussion and Analysis be included in this proxy statement and incorporated in the Annual Report on Form 10-K for the year ended December 31, 2023.

Members of the Compensation Committee:

|  |  |  | |||

| Ralph M. Della Ratta, Jr. (Chair) | Arthur F. Anton | Susan R. Landahl | Andrei A. Mikhalevsky | |||

Compensation Discussion and Analysis (“CD&A”)

This CD&A describes the material elements of the 2023 compensation and benefit programs for our NEOs. For 2023, our NEOs were:

|  |

|

|

| ||||

Michael G. Rippey, Chief Executive Officer(1) | Katherine T. Gates, President(1) | Mark W. Marinko, Senior Vice President and Chief Financial Officer | P. Michael Hardesty, Senior Vice President Commercial Operations, Business Development, Terminals and International Coke | John F. Quanci, Vice President, Chief Technology Officer | ||||

The CD&A is organized into five sections:

| 1 | SunCoke Energy’s Board of Directors appointed Ms. Gates as President of the Company effective January 1, 2023, and as a member of the Board effective the same date. Mr. Rippey has continued to serve as Chief Executive Officer from the date of Ms. Gates’ promotion to President. On February 22, 2024, the Company announced Mr. Rippey’s retirement and Ms. Gates’ promotion to President and Chief Executive Officer, to be effective May 15, 2024, as part of the Company’s long-term succession planning process. |

SUNCOKE ENERGY, INC. 2024 PROXY STATEMENT 21

| Proposal One | The Board & Committees | Corporate Governance | Director Compensation | Executive Compensation | Proposal Two | Proposal Three | Beneficial Stock Ownership | Audit Committee Matters | Proposal Four | Q&A | Other Information | |||||||||||

SECTION 1 — EXECUTIVE SUMMARY

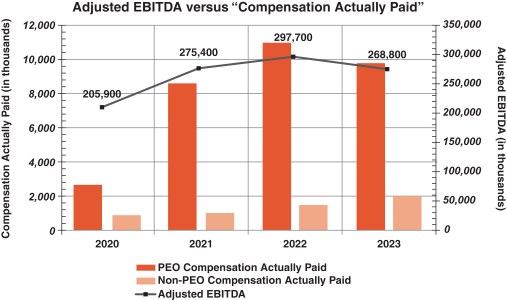

Following record-setting Adjusted EBITDA (1) performance in 2022, the Company delivered solid financial performance in 2023 with strong domestic coke operational performance, coupled with headwinds in our Logistics segment. We further built upon our success in foundry coke by completing the foundry coke expansion project and expanding our market participation. The project improves handling efficiency of foundry coke while maintaining flexibility for the Jewell plant to shift between blast and foundry coke production. Our strategy to diversify our product and customer bases by producing and selling foundry coke and non-contracted blast furnace coke in the spot market has further established SunCoke as a supplier of high-quality products. We have developed strong customer relationships due to our reliable production, excellent quality, and operational and technical expertise. SunCoke’s reputation in the marketplace was additionally affirmed by the extension of our largest cokemaking contract with Cleveland-Cliffs, Inc. through September 2035, which positions our Indiana Harbor plant well for the future. Participation in the foundry and spot coke markets, and successful execution on our contracted coke sales, supported our Domestic Coke facilities in running at full capacity and selling out.

Our long-term, take-or-pay coke contracts continue to provide stability to our coke operations, with strong operational performance driving our results in 2023. We were able to successfully sell all non-contracted coke tons into the foundry and spot coke markets during the year. These factors resulted in consolidated Adjusted EBITDA of $268.8 million, exceeding the high end of our guidance range of $250million to $265 million. Additionally, we generated $249.0 million in operating cash flow, exceeding our guidance range of $200 million to $215 million.

Following strong performance from our Logistics segment in 2022 and 2021, we experienced weaker market conditions at the Company’s Convent Marine Terminal (“CMT”) in Louisiana during the second half of 2023. Tepid thermal coal demand in Europe due to milder weather and low-cost gas imports impacted the volume and price of thermal coal handled at CMT.

We made great progress on our capital allocation priorities in 2023, focusing on further strengthening the balance sheet by lowering our gross debt by $43.8 million. We returned approximately $31 million of capital to shareholders, having increased our quarterly dividend from $0.08 per share to $0.10 per share during the year, representing a 25 percent increase. Additionally, we continued to work on developing the granulated pig iron (GPI) project at our Granite City plant.

Safety is our first priority, and our 2023 performance, when measured against steel and coke industry-wide rates, continued to be better than those benchmarks. Moreover, we set our safety target, for the purposes of our annual incentive plan, significantly better than industry benchmarks. To that end, our safety record is best understood in comparison to industry-wide safety performance. Our Total Recordable Incident Rate (“TRIR”) was 0.99 for 2023. For comparison, the Bureau of Labor Statistics reported the overall TRIR for Petroleum and Coal (Coke) Products Manufacturing as 3.1, and the TRIR for the Iron and Steel Mills Sector as 2.2. (2)

Environmental performance has always been central to our operations, and the Company continues to utilize actual, measurable environmental performance for our compensation program — as it has done since the Company’s inception. Our 2023 performance was excellent, achieving the maximum metrics and continuing our consistent, strong results from prior years.

| (1) | For a reconciliation of Adjusted EBITDA, a non-GAAP measure, to net income, its most directly comparable financial measure calculated and presented in accordance with GAAP, please refer to Item 7 of our Annual Report on Form 10-K for the year ended December 31, 2023. |

| (2) | TRIR is described in greater detail in the Rationale and Definition for our Safety Performance metric under Annual Cash Incentive Awards on page 30 of this proxy statement. |

22 SUNCOKE ENERGY, INC. 2024 PROXY STATEMENT

| Proposal One | The Board & Committees | Corporate Governance | Director Compensation | Executive Compensation | Proposal Two | Proposal Three | Beneficial Stock Ownership | Audit Committee Matters | Proposal Four | Q&A | Other Information | |||||||||||

2023 PERFORMANCE HIGHLIGHTS

Our executive team and employees continued to focus on the Company’s long-term success by pursuing the diversification of our customer and product bases while preserving contracted capacity. We made progress on these objectives by completing the foundry coke expansion project to help further broaden our participation in the foundry coke market, continuing to work on the GPI project at Granite City, and extending our Indiana Harbor cokemaking contract with our customer through September 2035. We further strengthened our capital structure by lowering gross debt by $43.8 million and returned capital to shareholders with a quarterly dividend that increased from $0.08/share to $0.10/share. The foundation for these accomplishments is first-rate, consistent operational execution, including strong safety and environmental performance.

Here is a summary of our major accomplishments during 2023:

Delivered solid financial performance | • Achieved consolidated Adjusted EBITDA of $268.8 million

• Exceeded high end of guidance ($265 million) due to strong Domestic Coke operational performance while navigating challenging market conditions in the Logistics segment

• Generated $249.0 million of operating cash flow | |

Supported full cokemaking capacity utilization via spot/foundry sales and long-term, take-or-pay contract extension | • Our domestic coke fleet operated at full capacity

• Continued to build on success in foundry by completing the foundry coke expansion project and broadening market participation

• Successfully executed on our contracted coke sales

• Extended our Indiana Harbor contract with Cleveland-Cliffs for an additional 12 years, with key provisions similar to the previous agreement | |

Executed on well-established capital allocation priorities | • Lowered gross debt by $43.8 million, with a gross leverage ratio of 1.86x at year-end, on a last twelve months Adjusted EBITDA basis

• Returned $30.7 million of capital to shareholders via our quarterly dividend, which increased by 25% during 2023; we anticipate the dividend to continue in 2024

• Continued working with U.S. Steel on the Granite City GPI project | |

Demonstrated strong commitment to safety and environmental | • Continued to deliver strong safety and operational excellence, with safety performance that is consistently better than industry-wide rates

• Demonstrated rigorous environmental compliance and contributed to lower carbon steelmaking by providing high-quality, high strength coke that lowers need for carbon-intensive fuels in the blast furnace | |

SUNCOKE ENERGY, INC. 2024 PROXY STATEMENT 23