SunCoke Energy, Inc. Q4 & FY 2024 Earnings and 2025 Guidance Conference Call

2 This presentation should be reviewed in conjunction with the Fourth Quarter and Full-Year 2024 earnings release of SunCoke Energy, Inc. (SunCoke) and conference call held on January 30, 2025 at 11:00 a.m. ET. This presentation contains “forward-looking statements” (as defined in Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended). Forward-looking statements often may be identified by the use of such words as "believe," "expect," "plan," "project," "intend," "anticipate," "estimate," "predict," "potential," "continue," "may," "will," "should," or the negative of these terms, or similar expressions. However, the absence of these words or similar expressions does not mean that a statement is not forward-looking. Any statements made in this presentation or during the related conference call that are not statements of historical fact, including statements about our full-year consolidated and segment 2025 guidance, our 2025 key initiatives, anticipated lower margins on coke sales and challenging market conditions, future dividends and the timing of such dividend payments, the anticipated timing, completion, and increased volume capabilities as a result of the capital investment project at the Kanawha River Terminal (KRT) logistics facility, the extension of our Granite City cokemaking agreement for an additional six months, and future sale commitments, are forward-looking statements and should be evaluated as such. Forward-looking statements represent only our present beliefs regarding future events, many of which are inherently uncertain and involve significant known and unknown risks and uncertainties (many of which are beyond the control of SunCoke) that could cause our actual results and financial condition to differ materially from the anticipated results and financial condition indicated in such forward-looking statements. These risks and uncertainties include, but are not limited to, the risks and uncertainties described in Item 1A (“Risk Factors”) of our Annual Report on Form 10-K for the most recently completed fiscal year, as well as those described from time to time in our other reports and filings with the Securities and Exchange Commission (SEC). In accordance with the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, SunCoke has included in its filings with the SEC cautionary language identifying important factors (but not necessarily all the important factors) that could cause actual results to differ materially from those expressed in any forward- looking statement made by SunCoke. For information concerning these factors and other important information regarding the matters discussed in this presentation, see SunCoke’s SEC filings, copies of which are available free of charge on SunCoke's website at www.suncoke.com or on the SEC’s website at www.sec.gov. All forward- looking statements included in this presentation or made during the related conference call are expressly qualified in their entirety by such cautionary statements. Unpredictable or unknown factors not discussed in this presentation also could have material adverse effects on forward-looking statements. Forward-looking statements are not guarantees of future performance, but are based upon the current knowledge, beliefs and expectations of SunCoke management, and upon assumptions by SunCoke concerning future conditions, any or all of which ultimately may prove to be inaccurate. You should not place undue reliance on these forward-looking statements, which speak only as of the date of the earnings release. SunCoke does not intend, and expressly disclaims any obligation, to update or alter its forward-looking statements (or associated cautionary language), whether as a result of new information, future events, or otherwise, after the date of the earnings release except as required by applicable law. Forward-Looking Statements

32024 Year In Review Delivered FY 2024 Adjusted EBITDA(1) above increased guidance; added new Logistics business; increased quarterly dividend; eliminated majority of black lung liabilities FY 2024 Objective 2024 Achievements Commentary Deliver FY 2024 Consolidated Adj. EBITDA(1) within increased guidance range of $260M - $270M Generate $75M – $90M Free Cash Flow(2) Pursue Balanced Capital Allocation • Increased quarterly dividend from $0.10/share to $0.12/share • Gross leverage ratio at 1.83x (LTM basis) • Delivered FY 2024 consolidated Adj. EBITDA(1) of $272.8M • Generated $96M of Free Cash Flow(2) • Reached an agreement with the U.S. Department of Labor (DOL), eliminating the majority of black lung liabilities • Exceeded original and revised guidance due to excellent Logistics segment performance and the agreement with the DOL • Anticipate continuation of quarterly dividend • Continue to develop the GPI project (1) See appendix for a definition and reconciliation of Adjusted EBITDA (2) See appendix for a definition and reconciliation of Free Cash Flow Support Full Cokemaking Capacity Utilization Continue Adding New Customers at Logistics Terminals • Successfully sold all non-contracted tons into foundry coke and spot blast coke markets • Extended Granite City cokemaking contract through June 30, 2025 • Signed a new 3-year, take-or-pay coal handling agreement at Kanawha River Terminal beginning in Q2 2025 • Coke fleet ran at full capacity and delivered Adjusted EBITDA within the revised guidance range despite lower coal-to-coke yields • New contract will grow our barge business at KRT Continue to deliver strong safety performance • Achieved Total Recordable Incident Rate (TRIR) of 0.50 for the full-year 2024 • Represents record safety performance in Company history

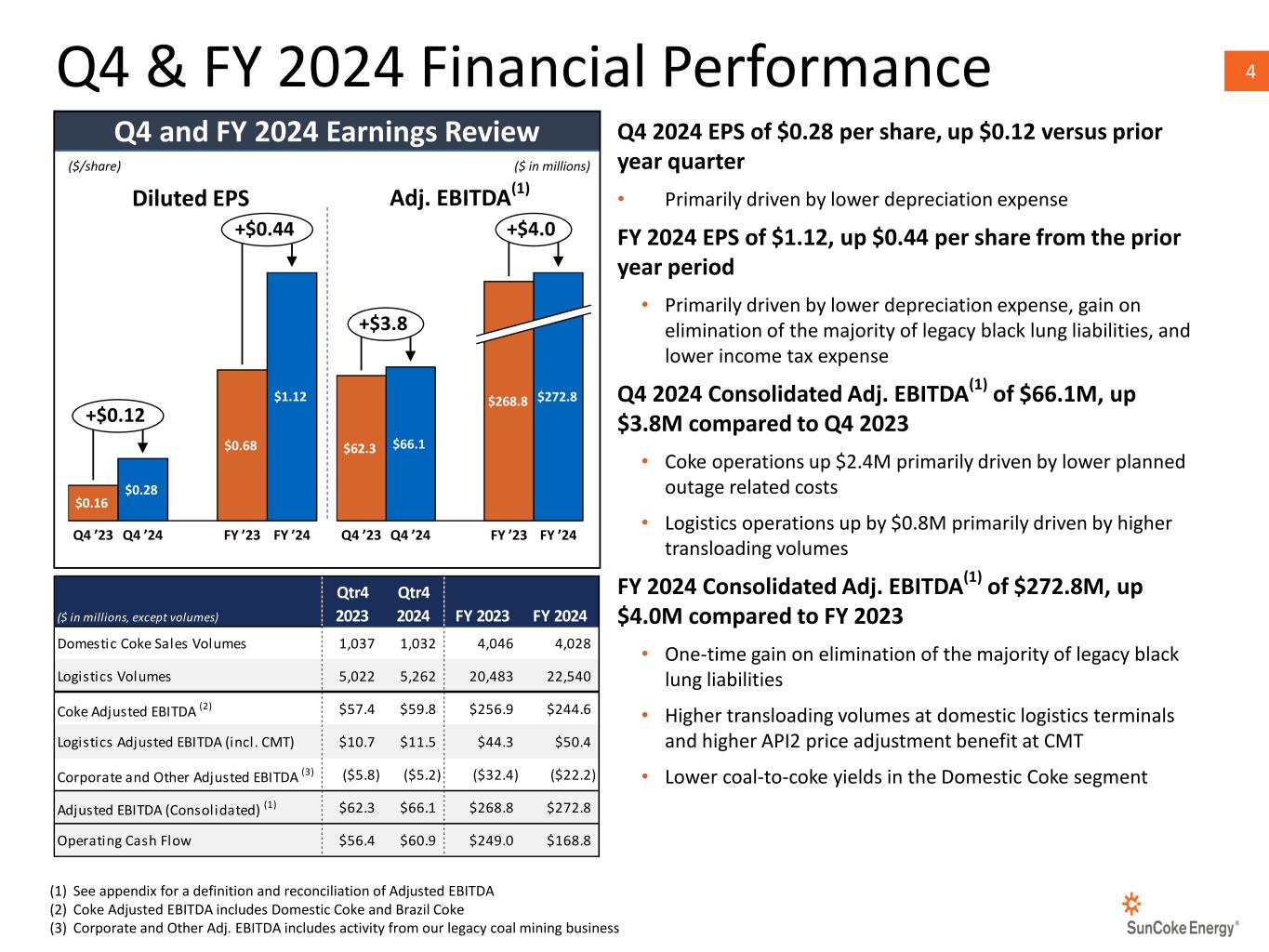

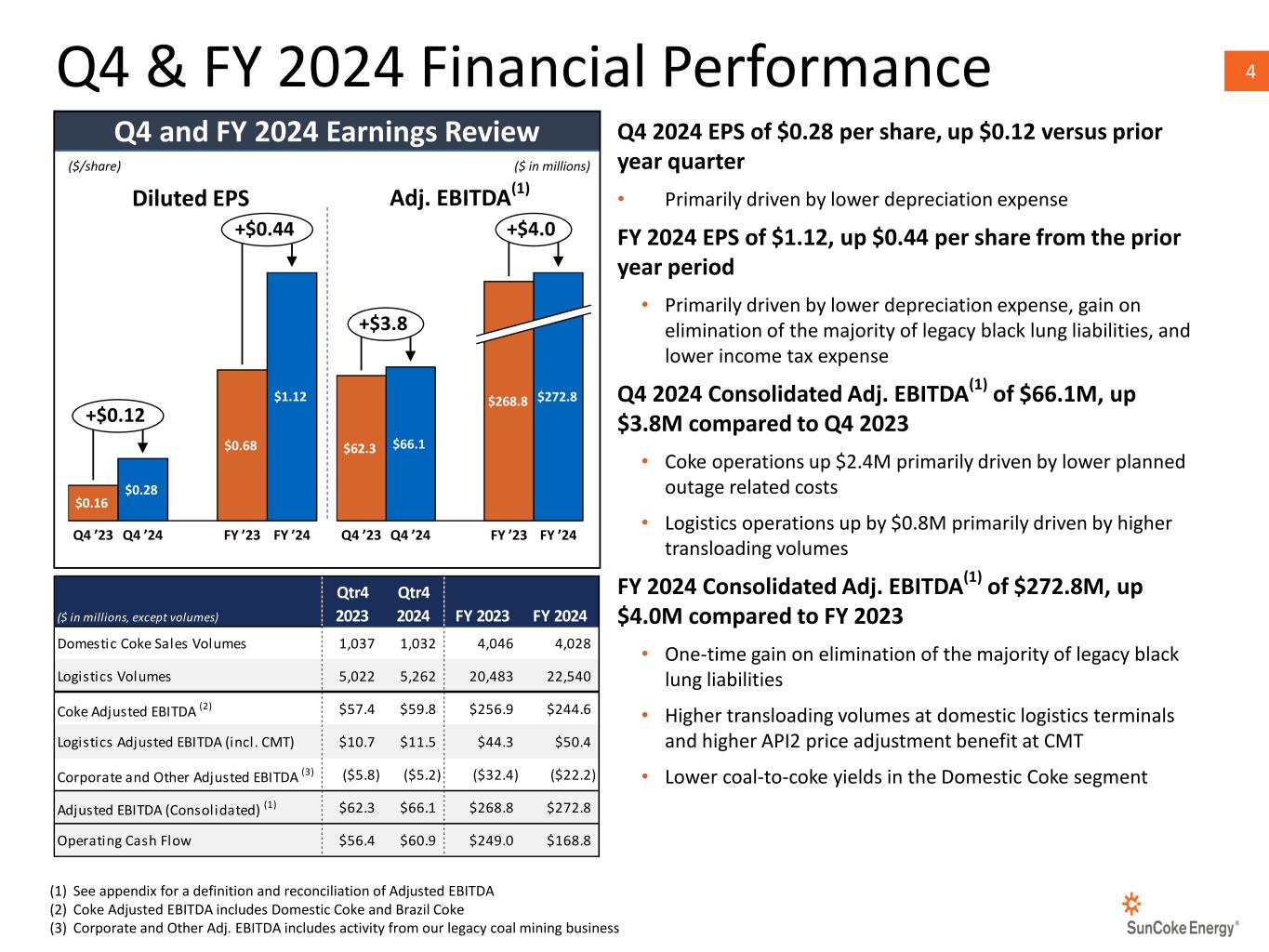

4Q4 & FY 2024 Financial Performance (1) See appendix for a definition and reconciliation of Adjusted EBITDA (2) Coke Adjusted EBITDA includes Domestic Coke and Brazil Coke (3) Corporate and Other Adj. EBITDA includes activity from our legacy coal mining business ($/share) ($ in millions) Diluted EPS Adj. EBITDA(1) $62.3 $66.1 Q4 ’23 Q4 ’24 $268.8 FY ’23 $272.8 FY ’24 +$3.8 +$4.0 Q4 and FY 2024 Earnings Review $0.16 $0.28 $0.68 $1.12 Q4 ’23 Q4 ’24 FY ’23 FY ’24 +$0.12 +$0.44 Q4 2024 EPS of $0.28 per share, up $0.12 versus prior year quarter • Primarily driven by lower depreciation expense FY 2024 EPS of $1.12, up $0.44 per share from the prior year period • Primarily driven by lower depreciation expense, gain on elimination of the majority of legacy black lung liabilities, and lower income tax expense Q4 2024 Consolidated Adj. EBITDA(1) of $66.1M, up $3.8M compared to Q4 2023 • Coke operations up $2.4M primarily driven by lower planned outage related costs • Logistics operations up by $0.8M primarily driven by higher transloading volumes FY 2024 Consolidated Adj. EBITDA(1) of $272.8M, up $4.0M compared to FY 2023 • One-time gain on elimination of the majority of legacy black lung liabilities • Higher transloading volumes at domestic logistics terminals and higher API2 price adjustment benefit at CMT • Lower coal-to-coke yields in the Domestic Coke segment ($ in millions, except volumes) Qtr4 2023 Qtr4 2024 FY 2023 FY 2024 Domestic Coke Sales Volumes 1,037 1,032 4,046 4,028 Logistics Volumes 5,022 5,262 20,483 22,540 Coke Adjusted EBITDA (2) $57.4 $59.8 $256.9 $244.6 Logistics Adjusted EBITDA (incl. CMT) $10.7 $11.5 $44.3 $50.4 Corporate and Other Adjusted EBITDA (3) ($5.8) ($5.2) ($32.4) ($22.2) Adjusted EBITDA (Consolidated) (1) $62.3 $66.1 $268.8 $272.8 Operating Cash Flow $56.4 $60.9 $249.0 $168.8

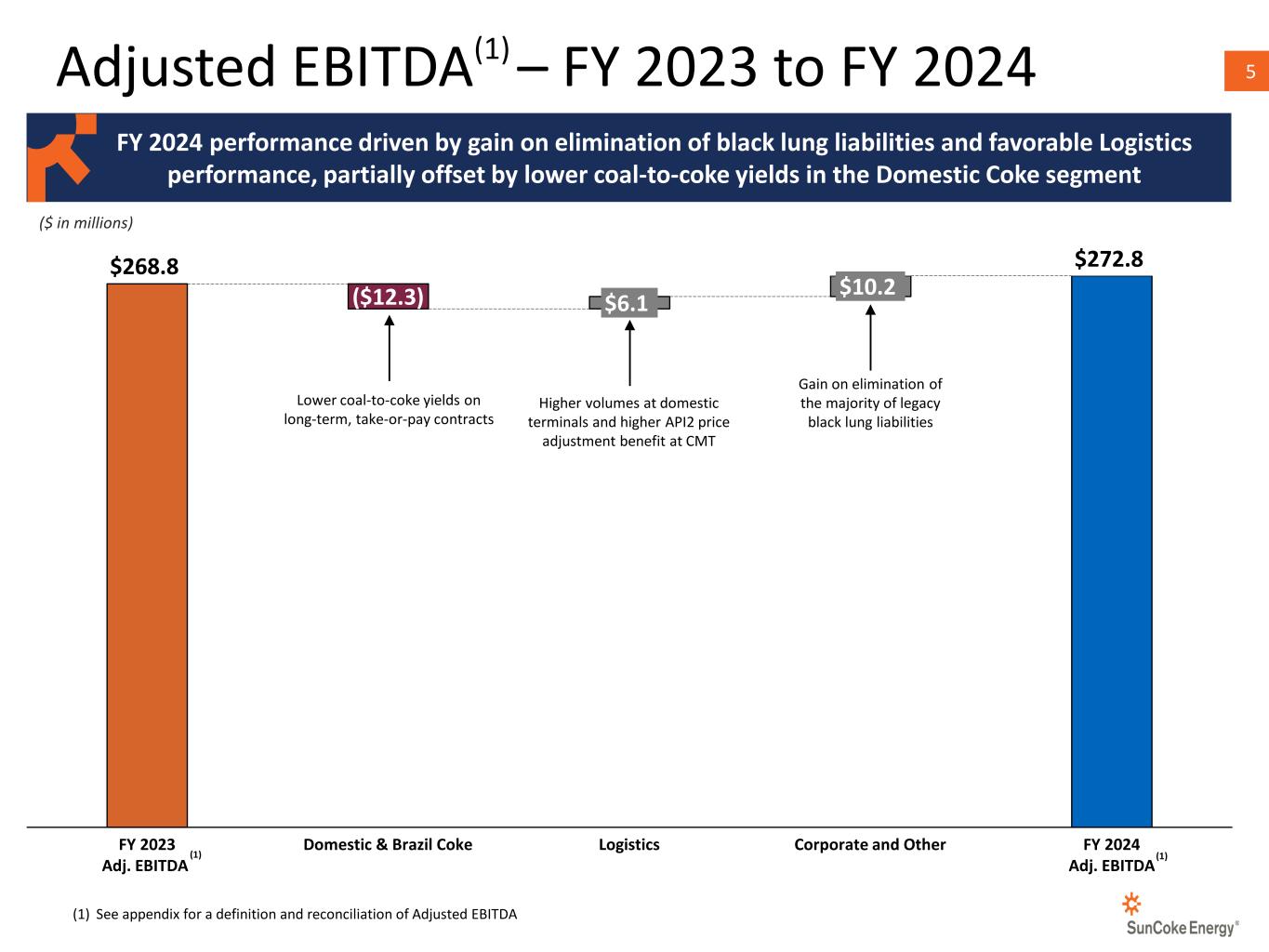

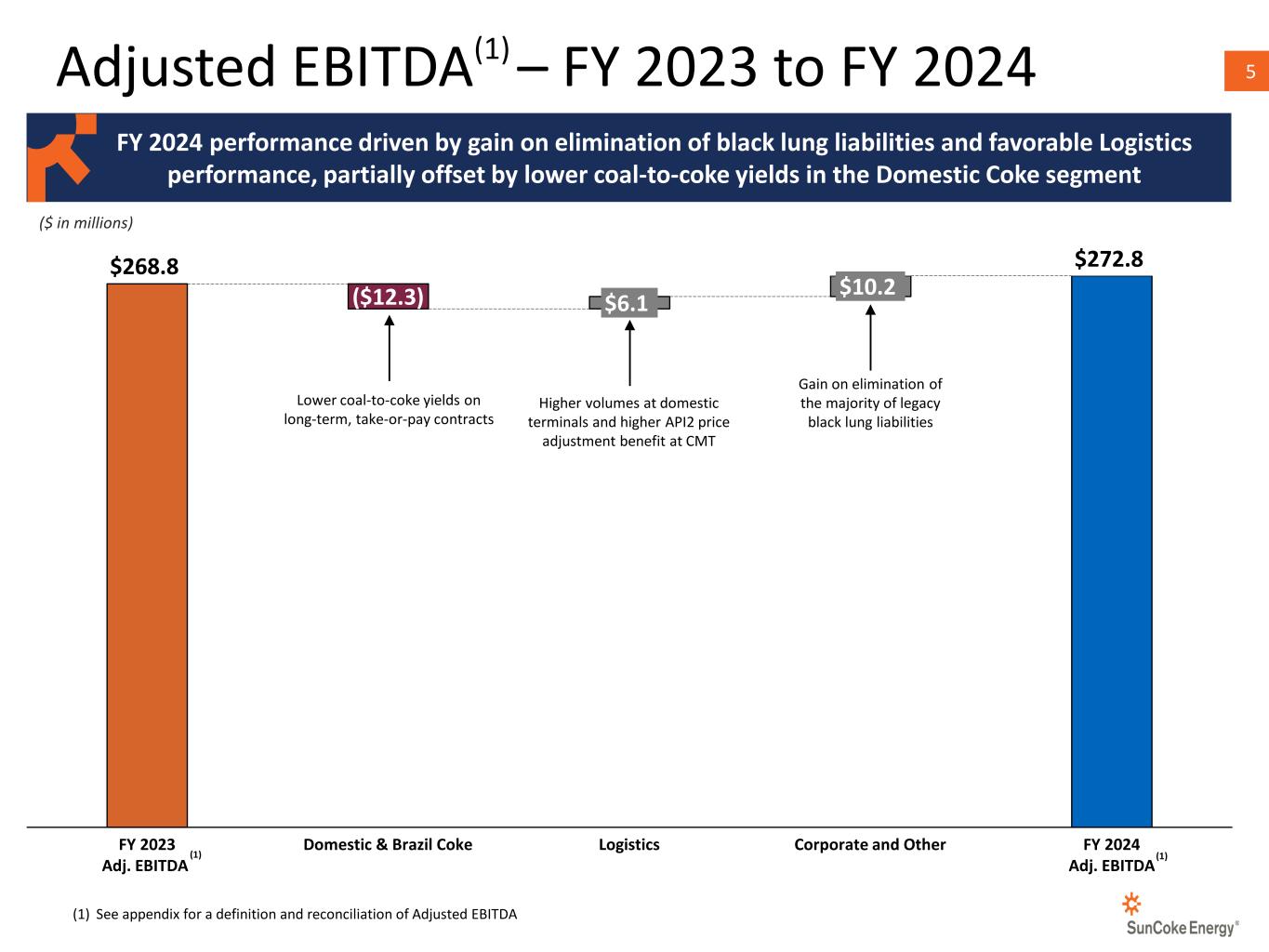

5Adjusted EBITDA(1) – FY 2023 to FY 2024 $268.8 $272.8 FY 2023 Adj. EBITDA ($12.3) Domestic & Brazil Coke $6.1 Logistics $10.2 Corporate and Other FY 2024 Adj. EBITDA (1) See appendix for a definition and reconciliation of Adjusted EBITDA (1) ($ in millions) (1) FY 2024 performance driven by gain on elimination of black lung liabilities and favorable Logistics performance, partially offset by lower coal-to-coke yields in the Domestic Coke segment Lower coal-to-coke yields on long-term, take-or-pay contracts Higher volumes at domestic terminals and higher API2 price adjustment benefit at CMT Gain on elimination of the majority of legacy black lung liabilities

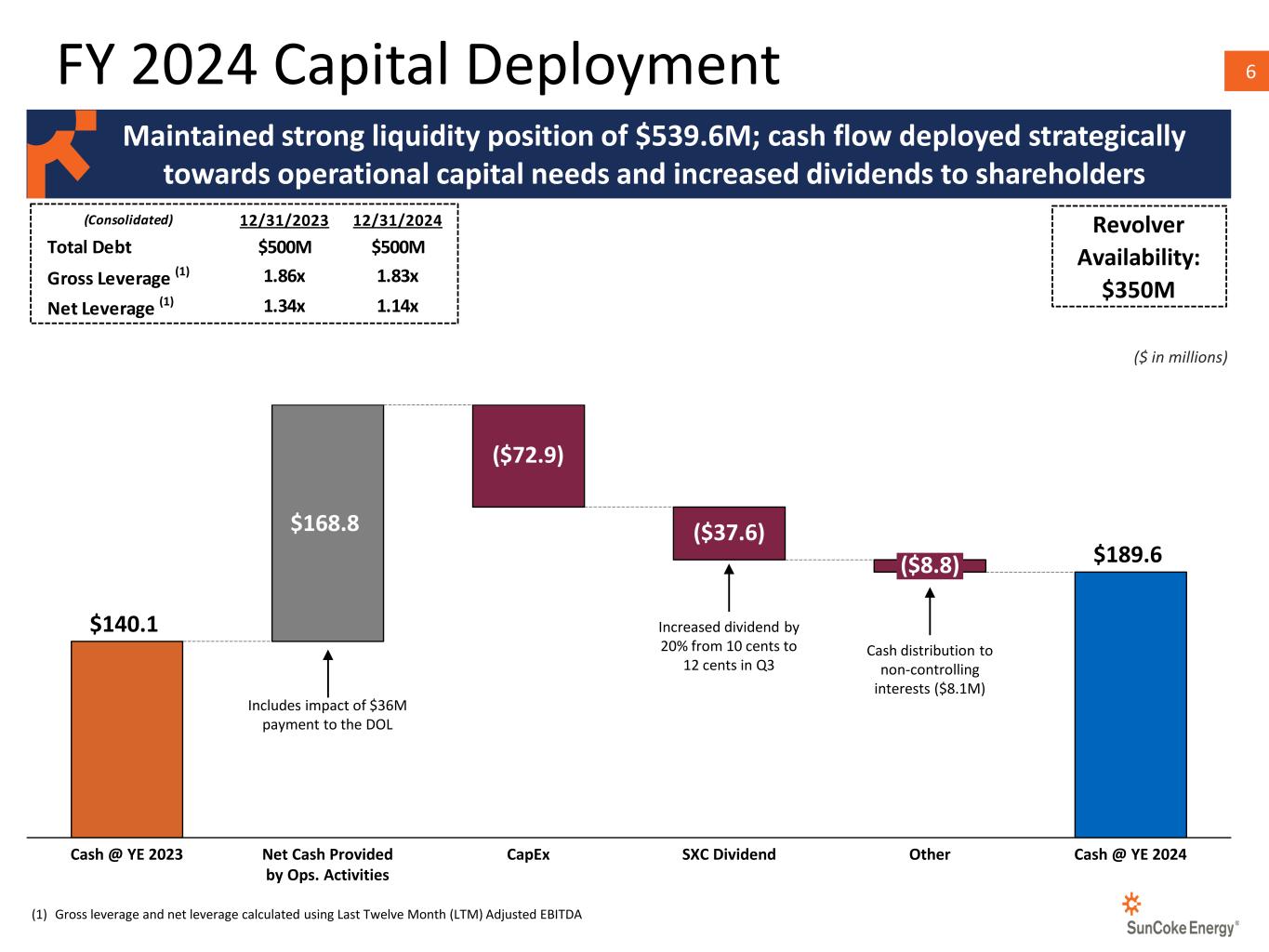

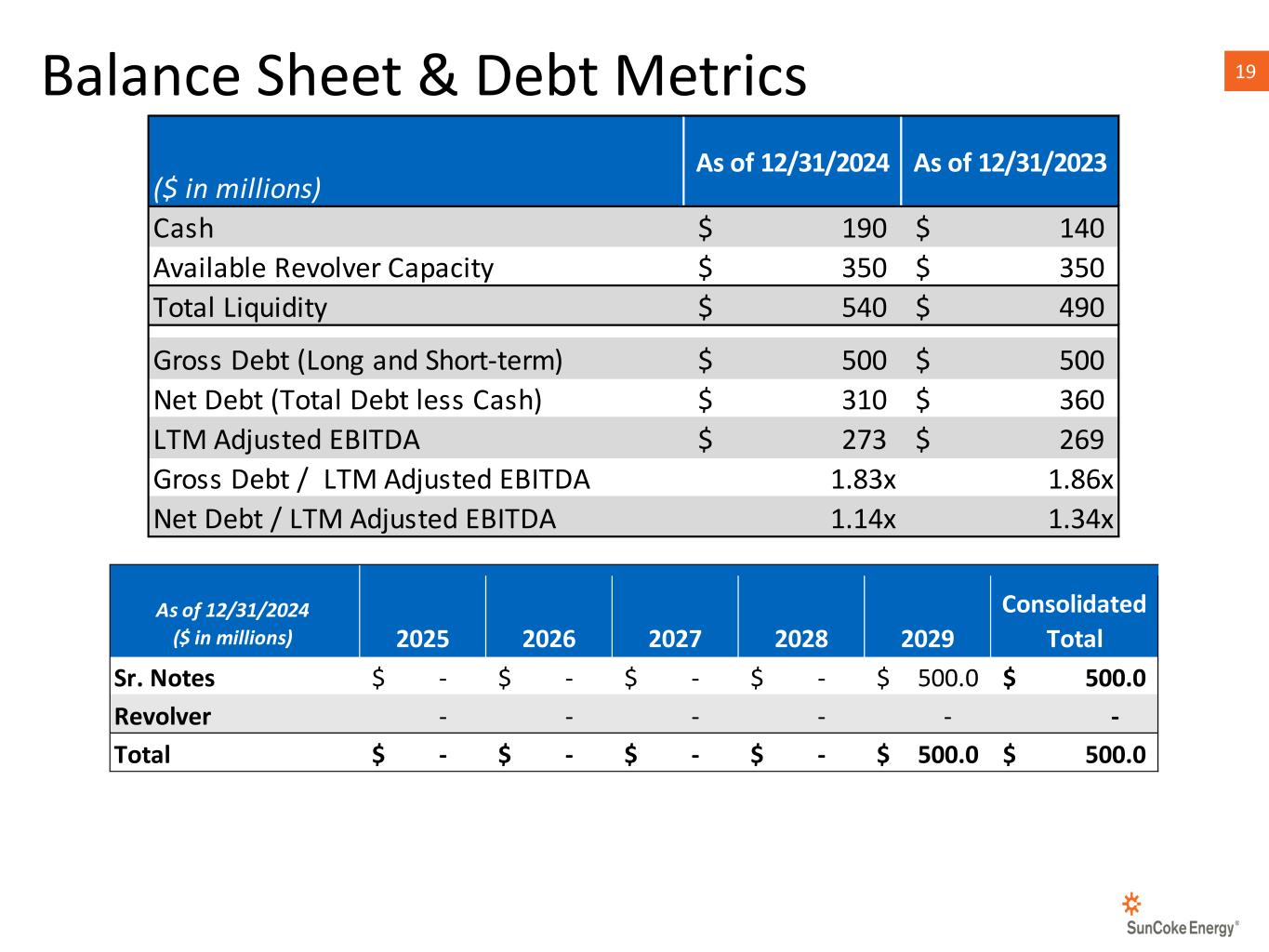

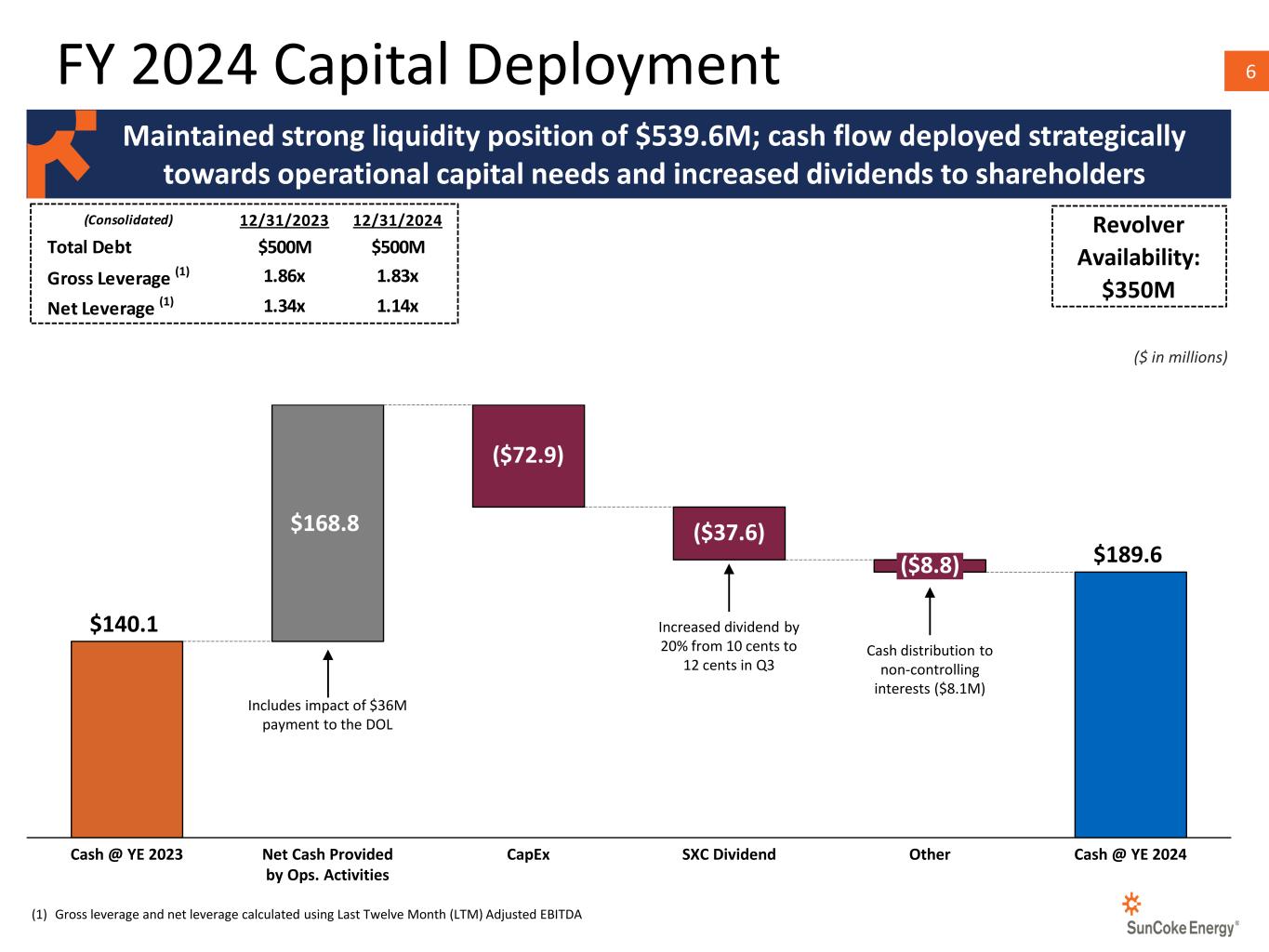

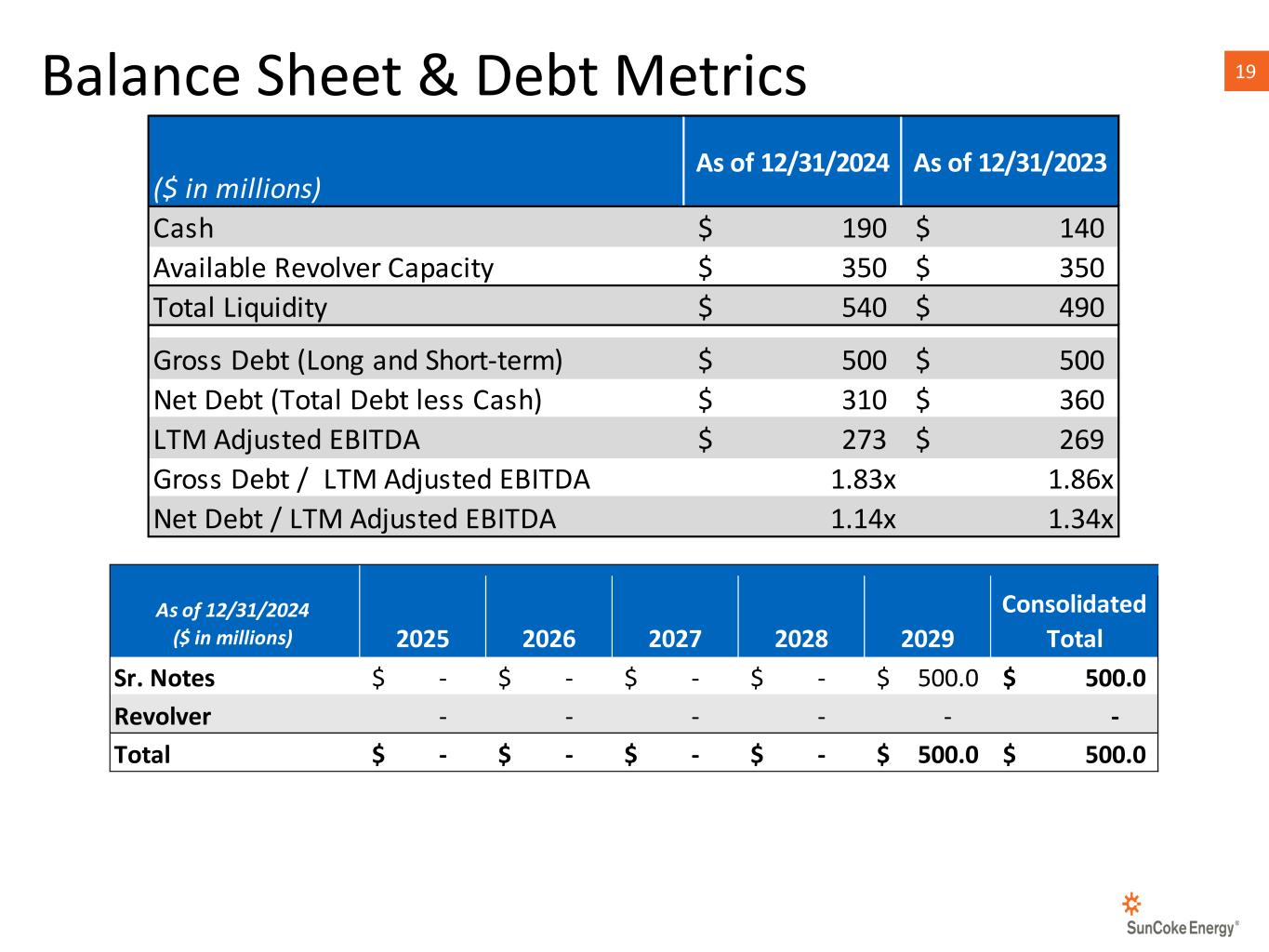

6 $140.1 $189.6 $168.8 Cash @ YE 2023 Net Cash Provided by Ops. Activities ($72.9) CapEx ($37.6) SXC Dividend ($8.8) Other Cash @ YE 2024 FY 2024 Capital Deployment Maintained strong liquidity position of $539.6M; cash flow deployed strategically towards operational capital needs and increased dividends to shareholders ($ in millions) Increased dividend by 20% from 10 cents to 12 cents in Q3 (1) Gross leverage and net leverage calculated using Last Twelve Month (LTM) Adjusted EBITDA Cash distribution to non-controlling interests ($8.1M) Revolver Availability: $350M (Consolidated) 12/31/2023 12/31/2024 Total Debt $500M $500M Gross Leverage (1) 1.86x 1.83x Net Leverage (1) 1.34x 1.14x Includes impact of $36M payment to the DOL

2025 GUIDANCE

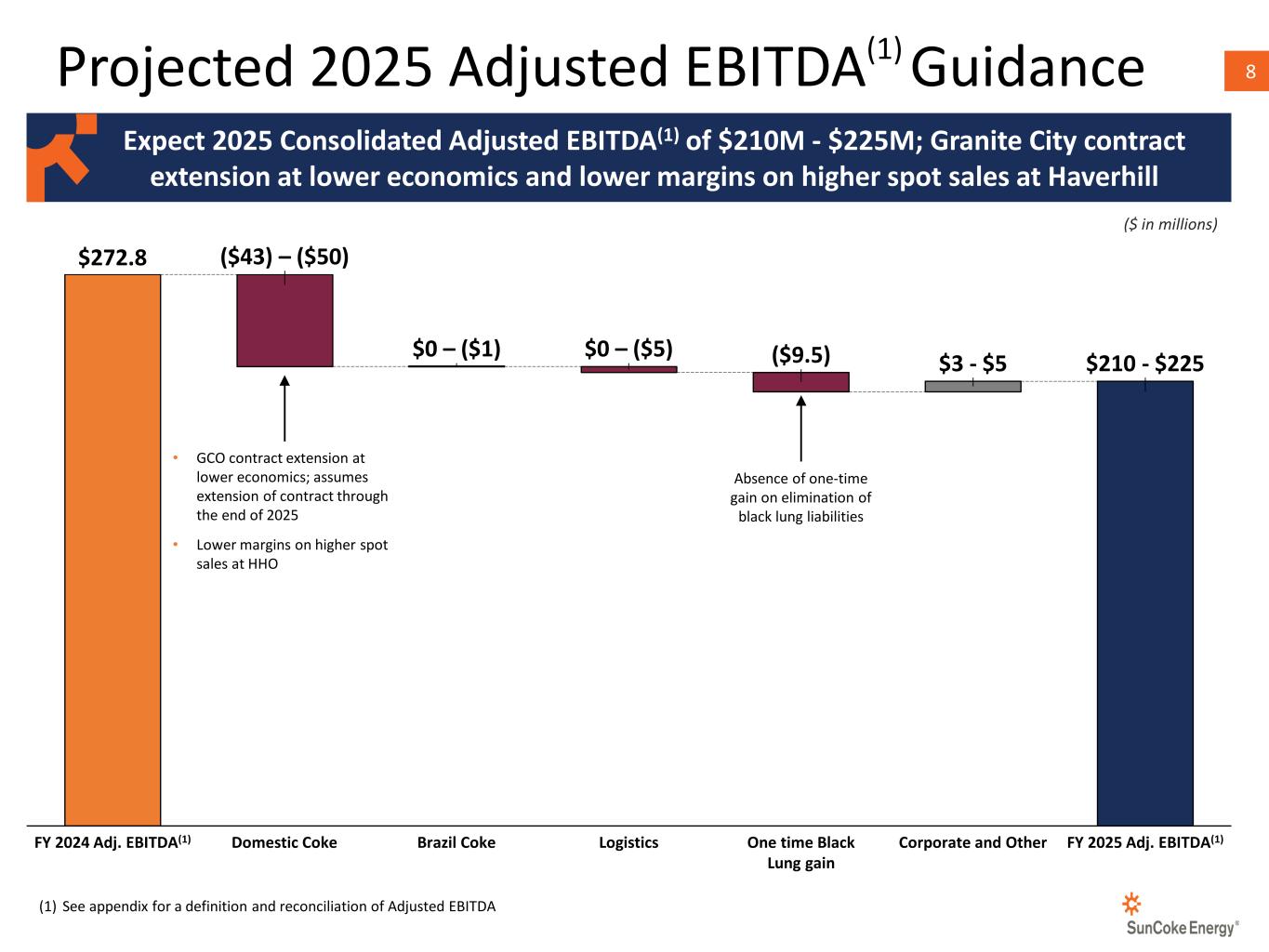

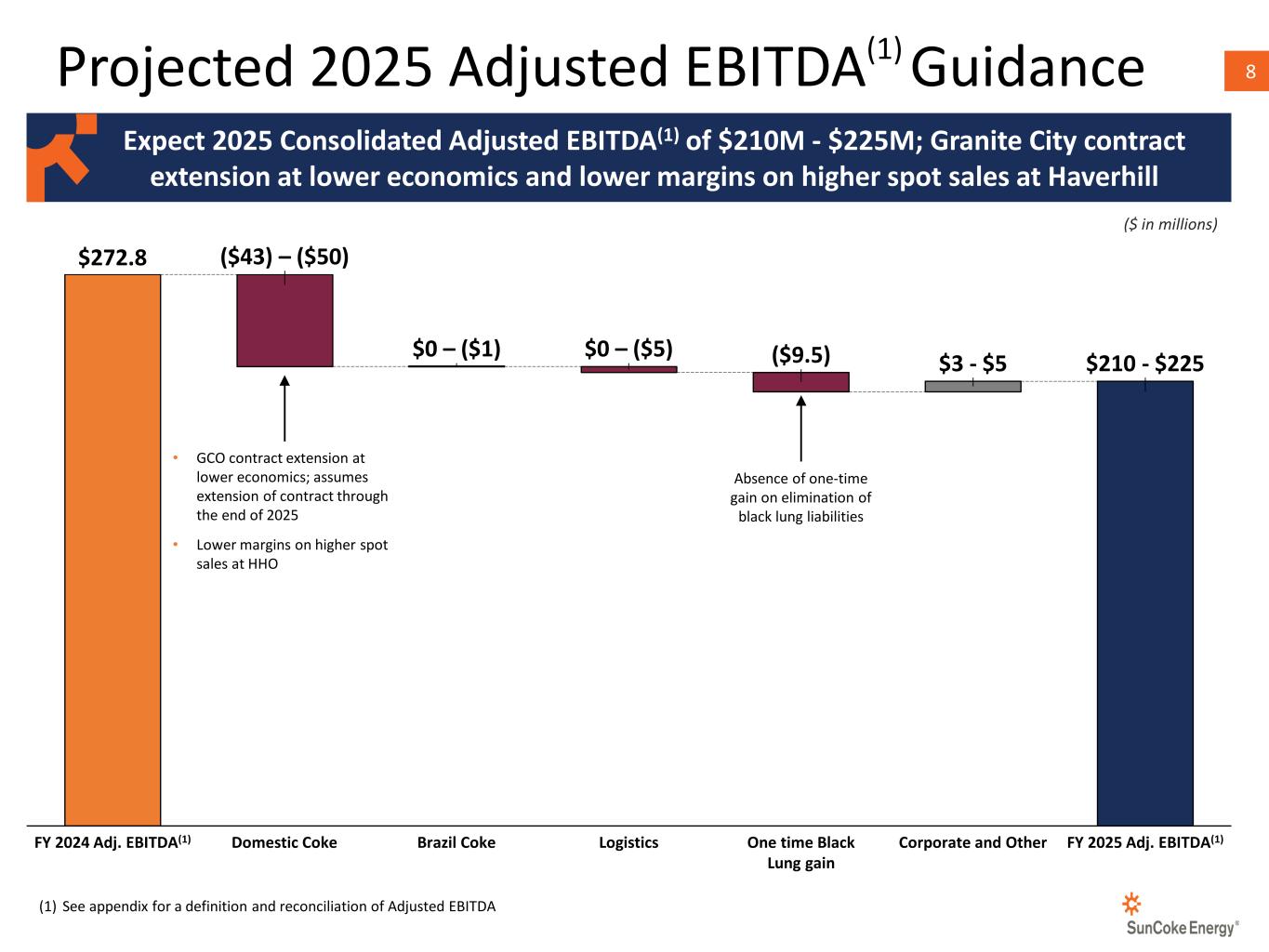

8Projected 2025 Adjusted EBITDA(1) Guidance $272.8 FY 2024 Adj. EBITDA(1) ($43) – ($50) Domestic Coke $0 – ($1) Brazil Coke $0 – ($5) Logistics ($9.5) One time Black Lung gain $3 - $5 Corporate and Other $210 - $225 FY 2025 Adj. EBITDA(1) (1) See appendix for a definition and reconciliation of Adjusted EBITDA ($ in millions) Expect 2025 Consolidated Adjusted EBITDA(1) of $210M - $225M; Granite City contract extension at lower economics and lower margins on higher spot sales at Haverhill Absence of one-time gain on elimination of black lung liabilities • GCO contract extension at lower economics; assumes extension of contract through the end of 2025 • Lower margins on higher spot sales at HHO

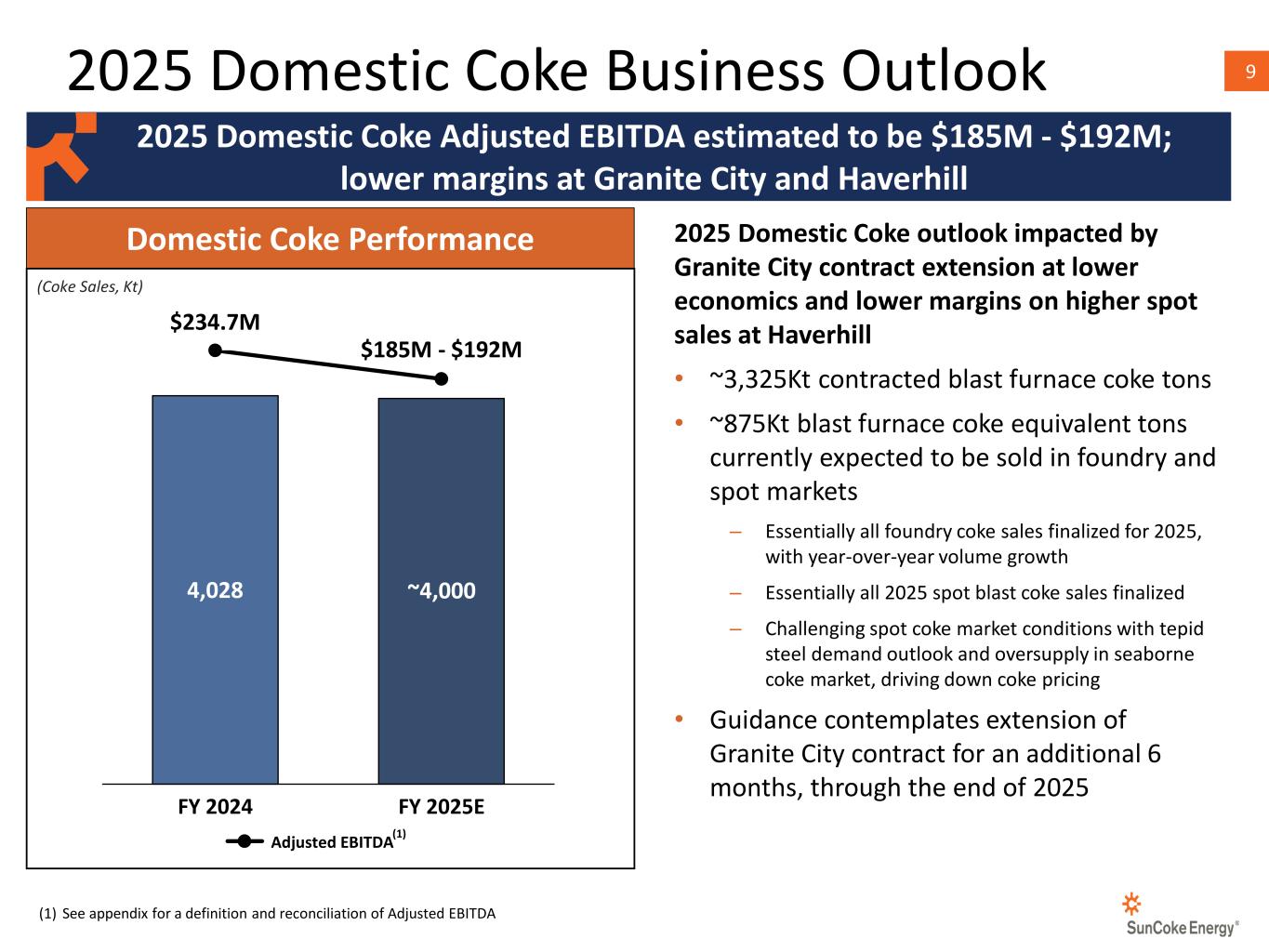

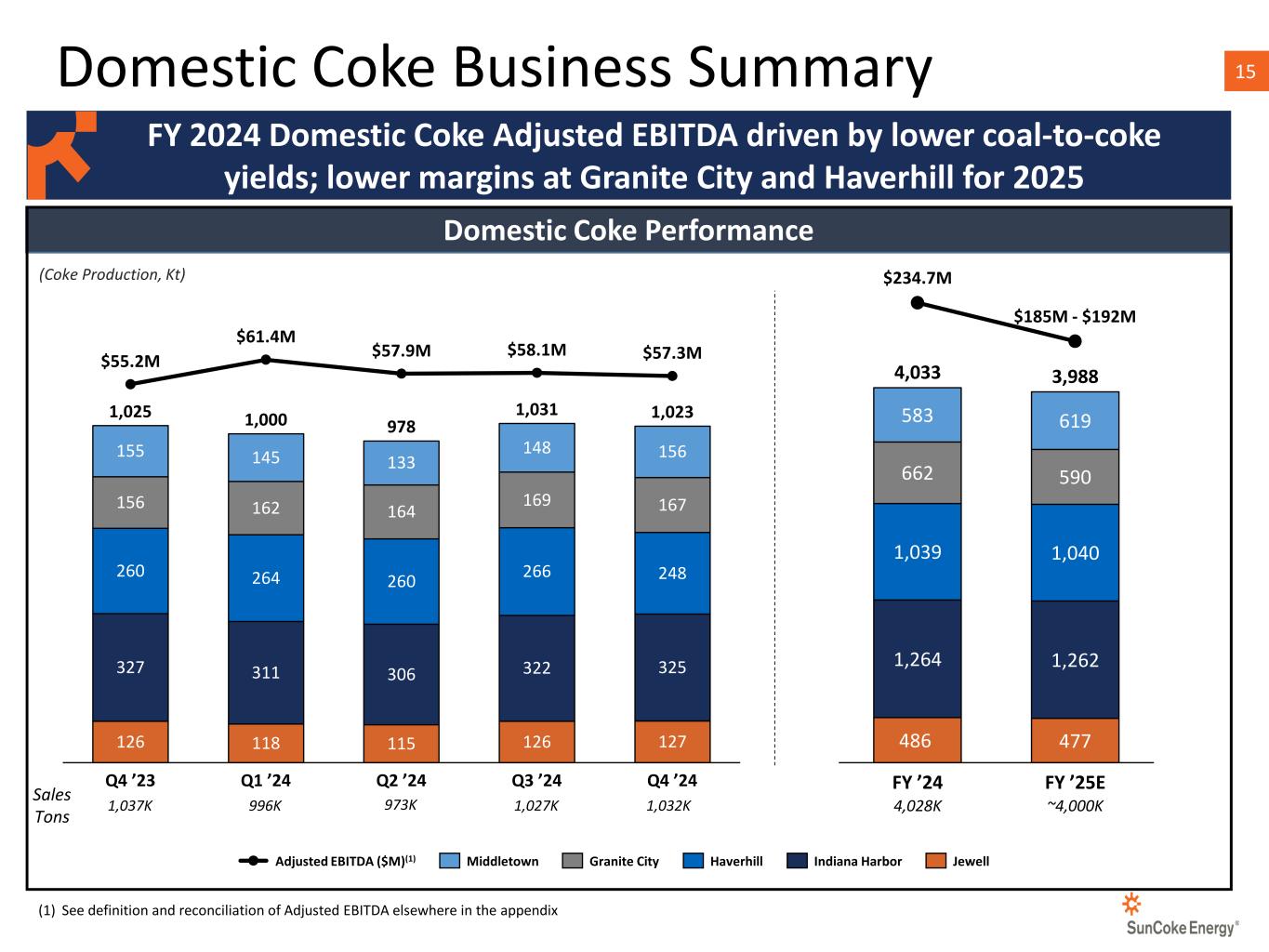

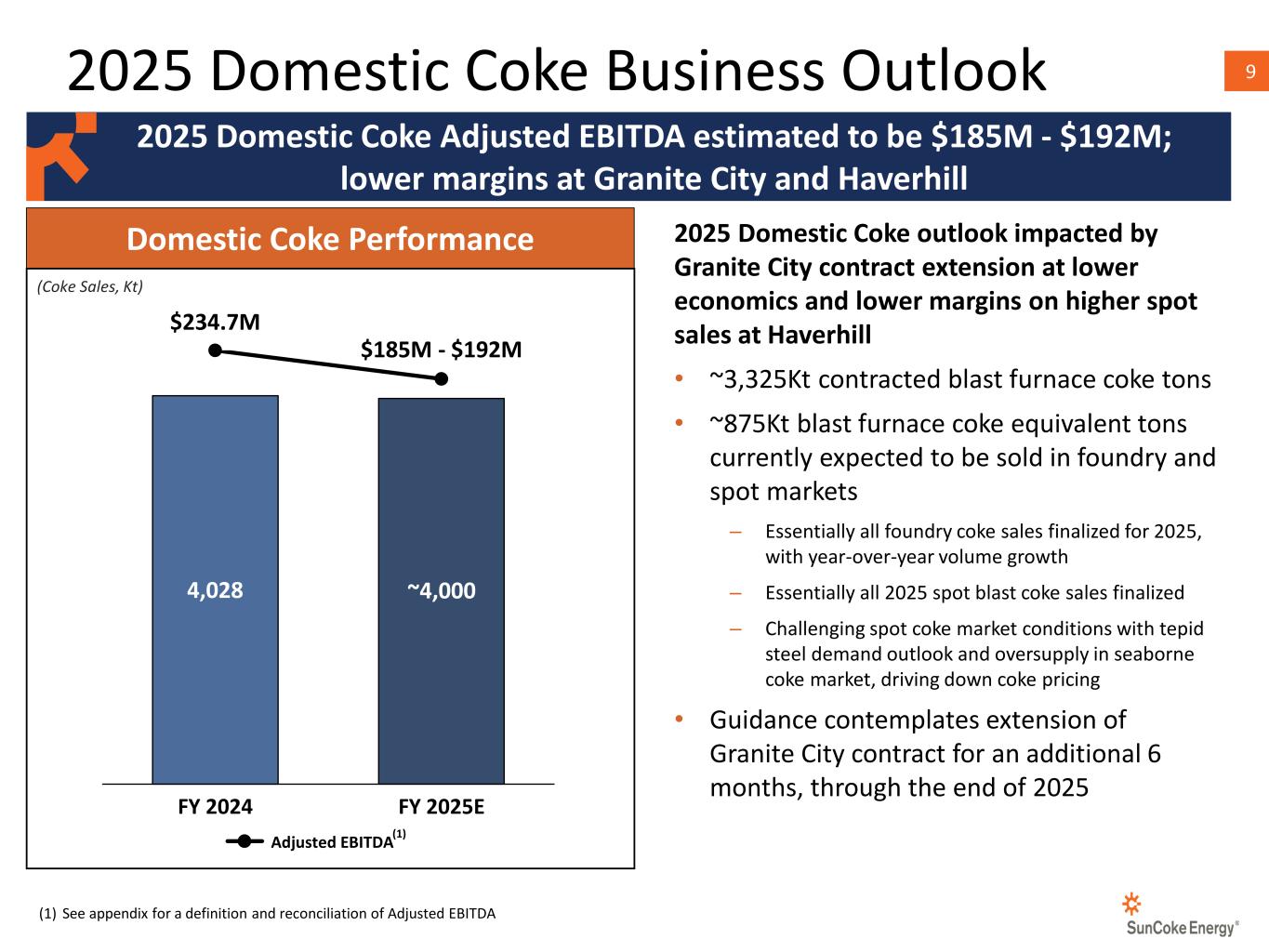

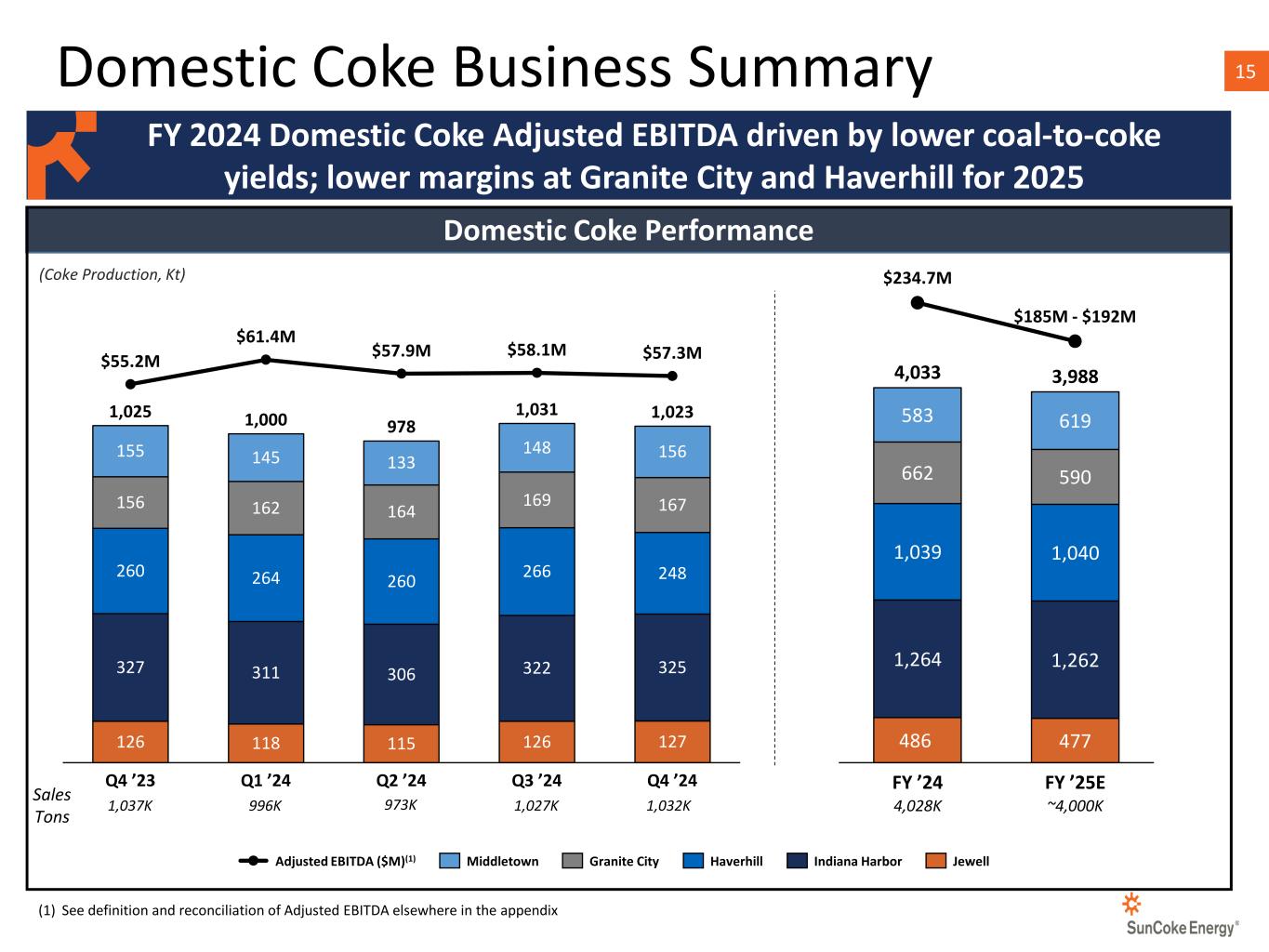

92025 Domestic Coke Business Outlook 2025 Domestic Coke Adjusted EBITDA estimated to be $185M - $192M; lower margins at Granite City and Haverhill Domestic Coke Performance 4,028 $234.7M FY 2024 ~4,000 $185M - $192M FY 2025E Adjusted EBITDA 2025 Domestic Coke outlook impacted by Granite City contract extension at lower economics and lower margins on higher spot sales at Haverhill • ~3,325Kt contracted blast furnace coke tons • ~875Kt blast furnace coke equivalent tons currently expected to be sold in foundry and spot markets – Essentially all foundry coke sales finalized for 2025, with year-over-year volume growth – Essentially all 2025 spot blast coke sales finalized – Challenging spot coke market conditions with tepid steel demand outlook and oversupply in seaborne coke market, driving down coke pricing • Guidance contemplates extension of Granite City contract for an additional 6 months, through the end of 2025 (1) See appendix for a definition and reconciliation of Adjusted EBITDA (1) (Coke Sales, Kt)

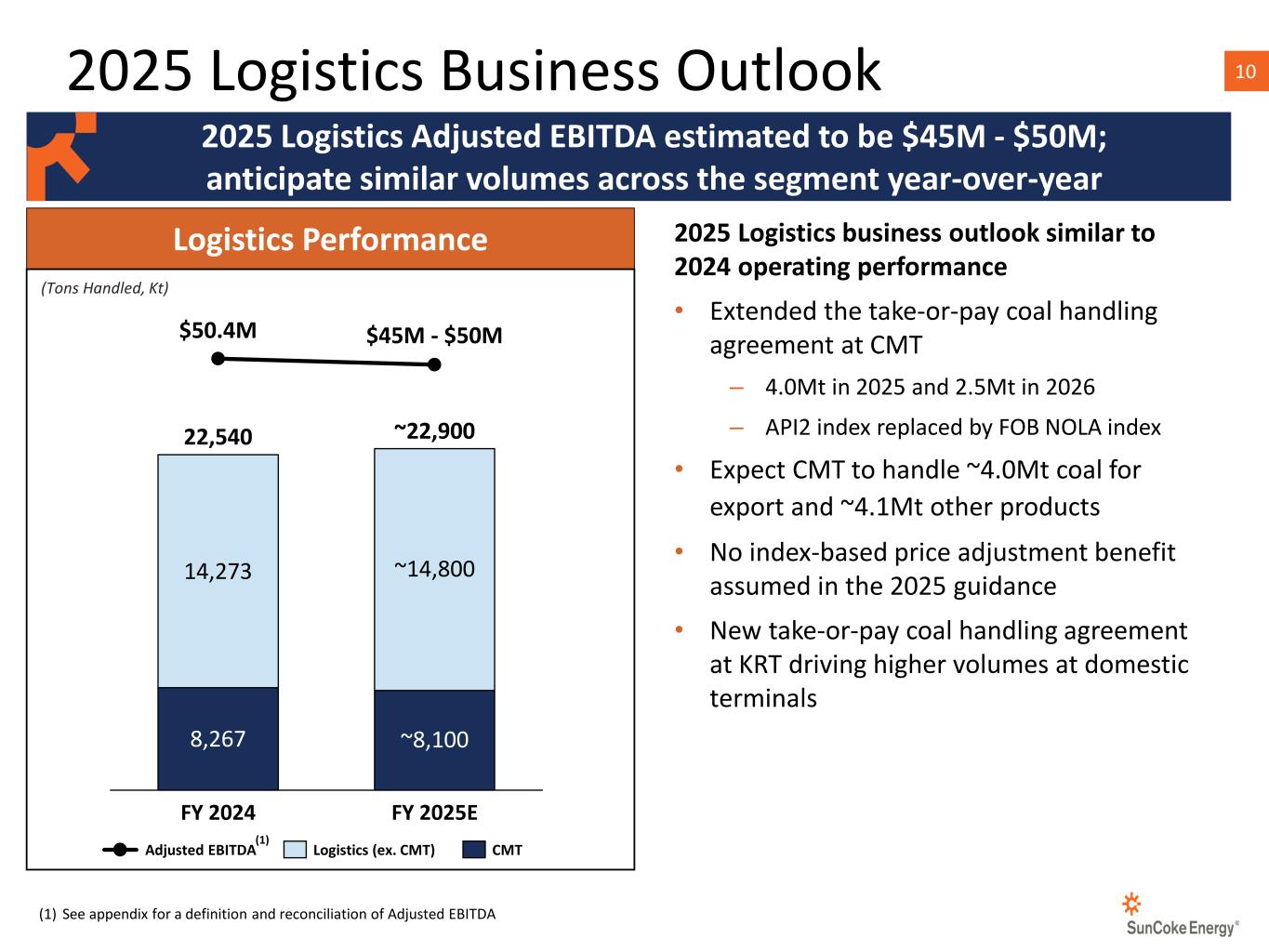

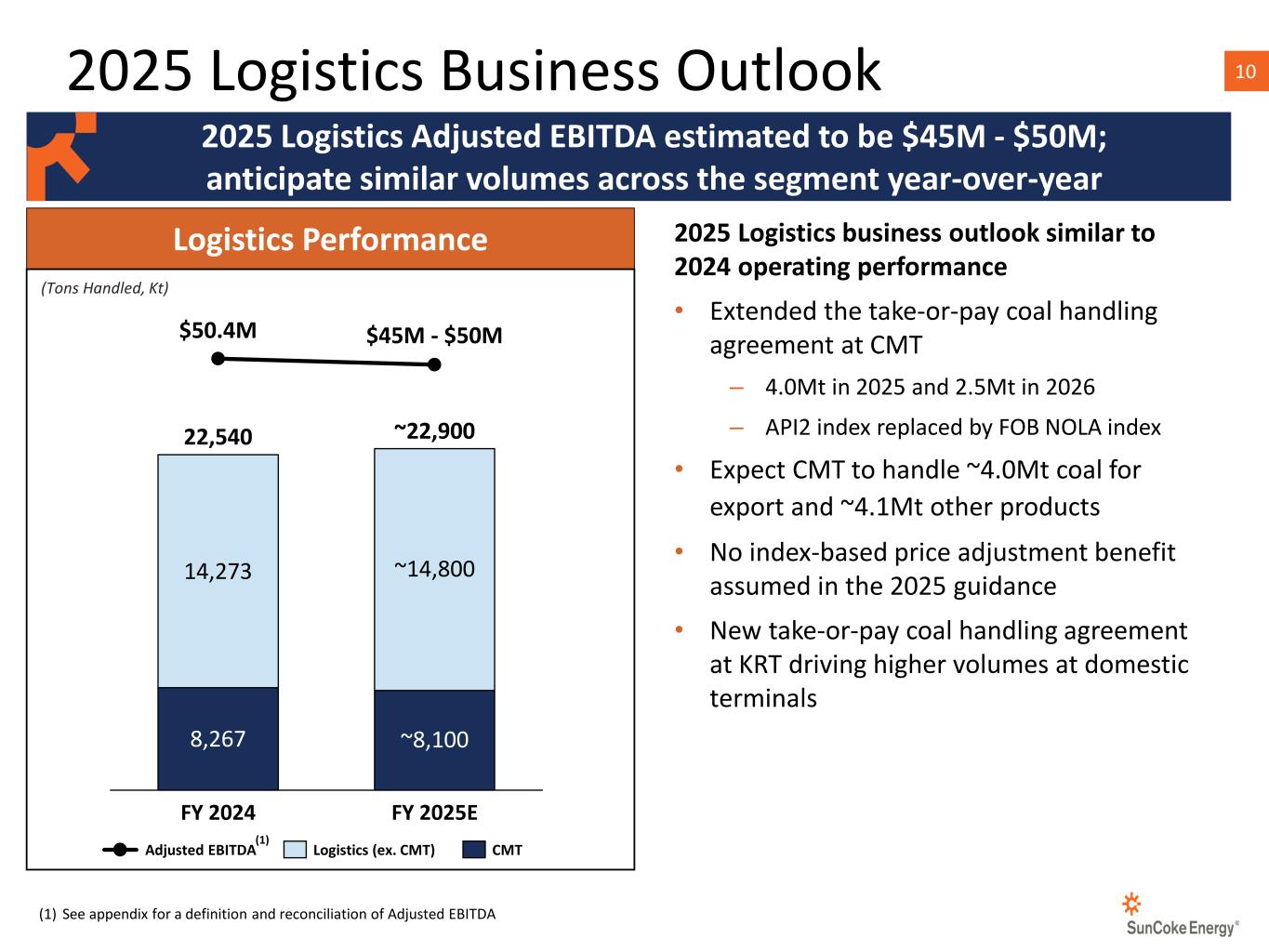

102025 Logistics Business Outlook 2025 Logistics Adjusted EBITDA estimated to be $45M - $50M; anticipate similar volumes across the segment year-over-year Logistics Performance 8,267 14,273 $50.4M FY 2024 $45M - $50M ~14,800 ~8,100 FY 2025E 22,540 ~22,900 2025 Logistics business outlook similar to 2024 operating performance • Extended the take-or-pay coal handling agreement at CMT – 4.0Mt in 2025 and 2.5Mt in 2026 – API2 index replaced by FOB NOLA index • Expect CMT to handle ~4.0Mt coal for export and ~4.1Mt other products • No index-based price adjustment benefit assumed in the 2025 guidance • New take-or-pay coal handling agreement at KRT driving higher volumes at domestic terminals (1) (1) See appendix for a definition and reconciliation of Adjusted EBITDA (Tons Handled, Kt) Adjusted EBITDA Logistics (ex. CMT) CMT

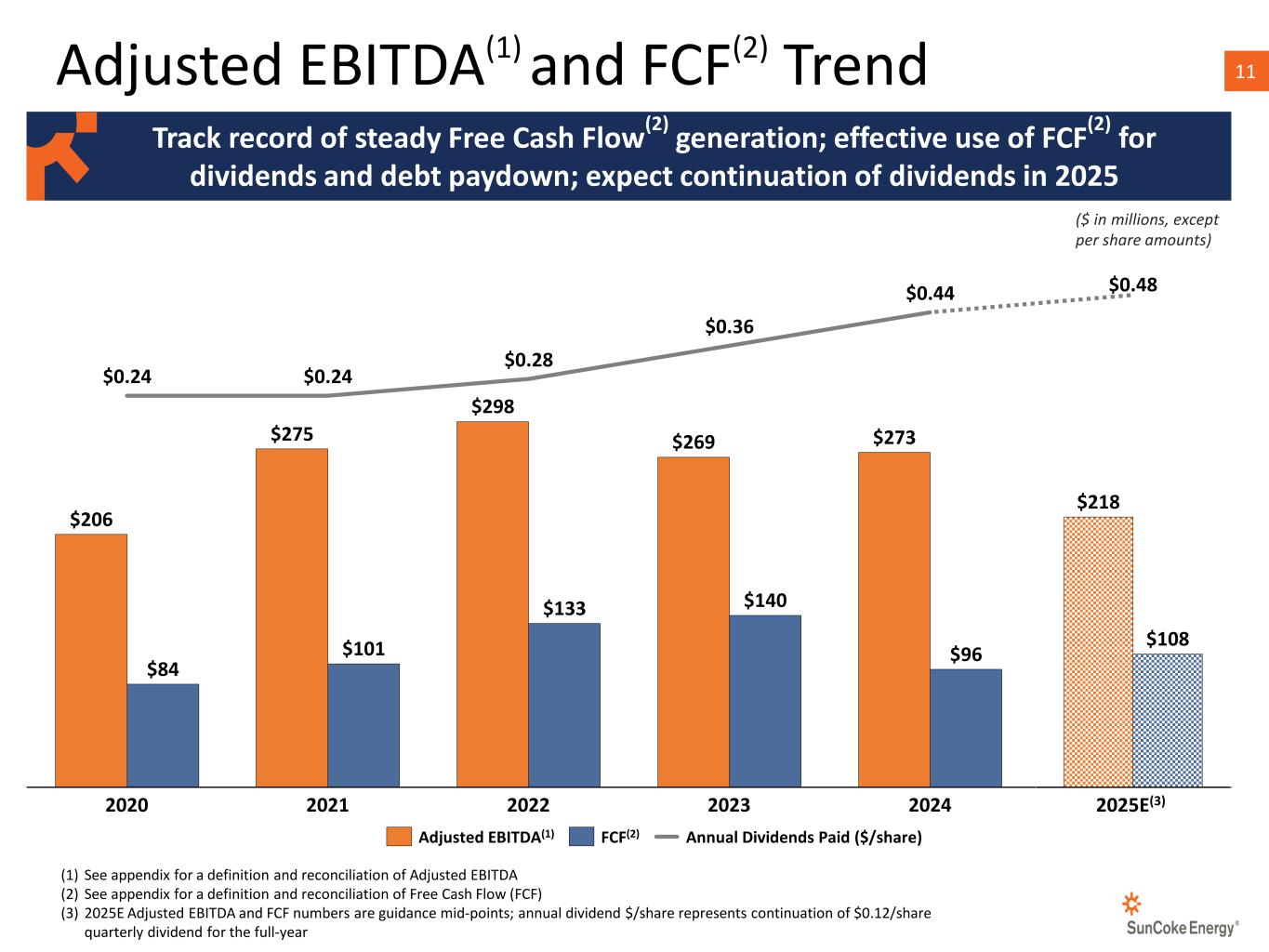

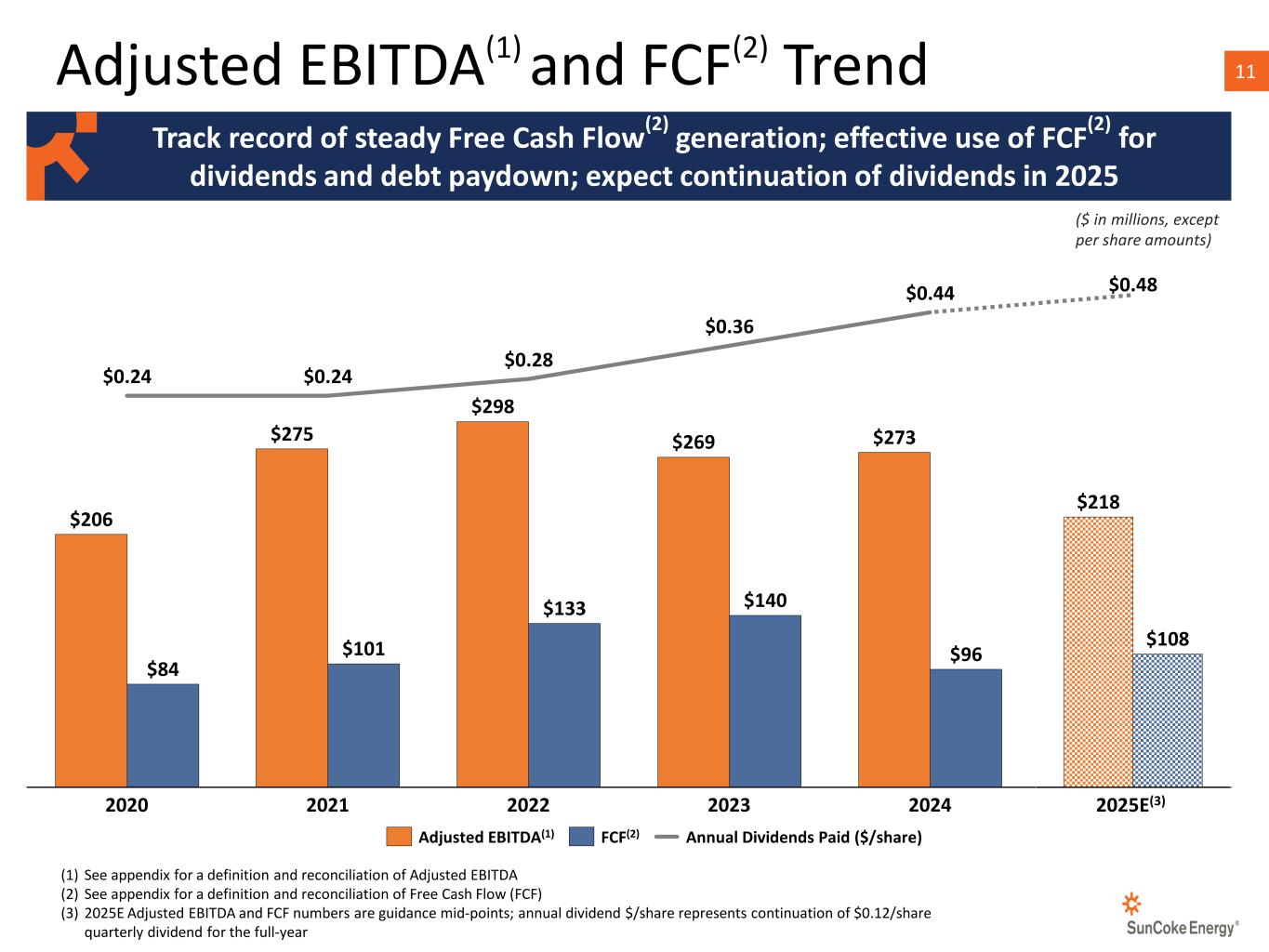

11Adjusted EBITDA(1) and FCF(2) Trend (1) See appendix for a definition and reconciliation of Adjusted EBITDA (2) See appendix for a definition and reconciliation of Free Cash Flow (FCF) (3) 2025E Adjusted EBITDA and FCF numbers are guidance mid-points; annual dividend $/share represents continuation of $0.12/share quarterly dividend for the full-year ($ in millions, except per share amounts) Track record of steady Free Cash Flow(2) generation; effective use of FCF(2) for dividends and debt paydown; expect continuation of dividends in 2025 $206 $275 $298 $269 $273 $84 $101 $133 $140 $96 $0.24 $0.24 $0.28 $0.36 $0.44 2020 2021 2022 2023 2024 2025E(3) Adjusted EBITDA(1) FCF(2) Annual Dividends Paid ($/share) $218 $108 $0.48

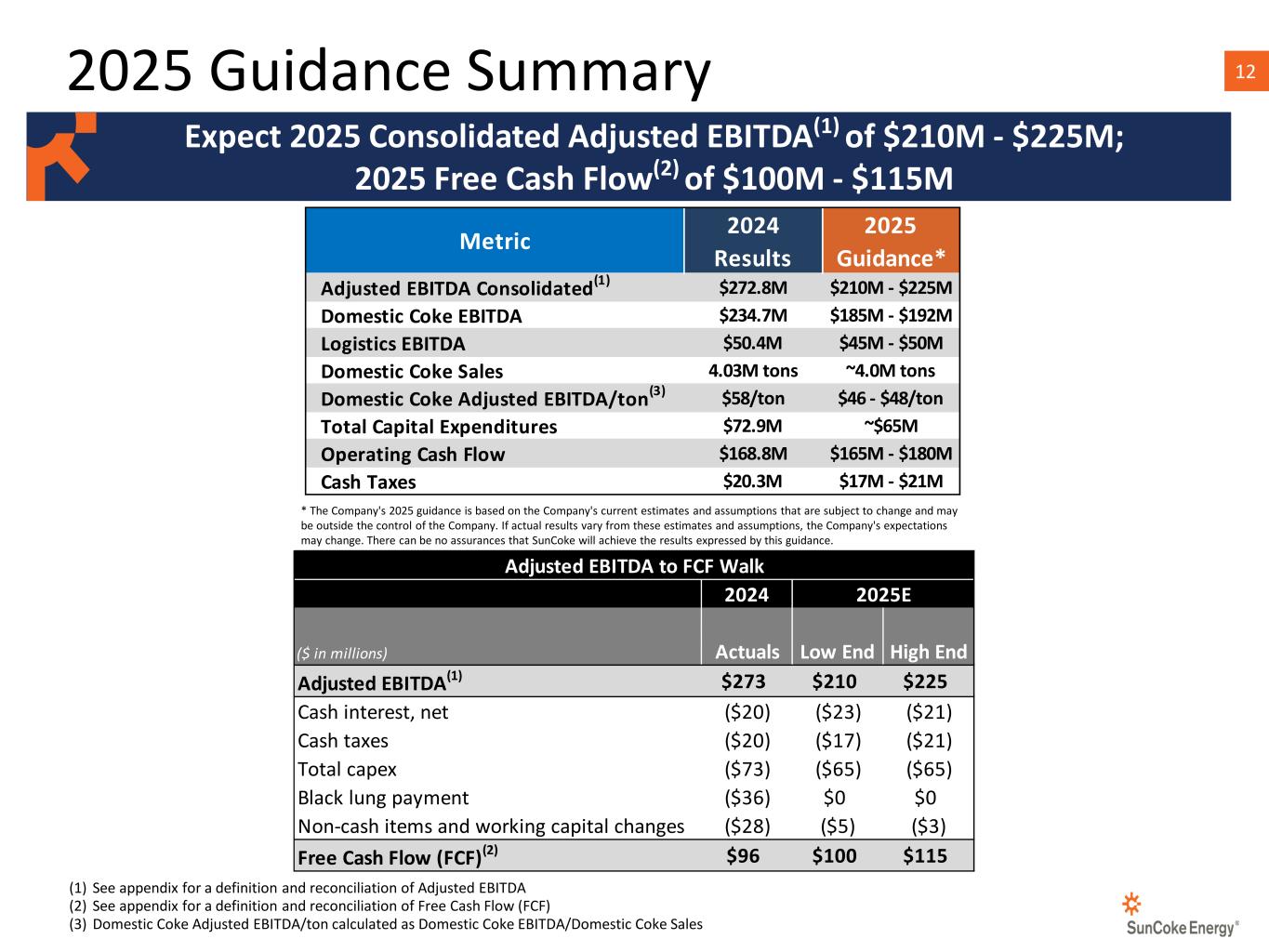

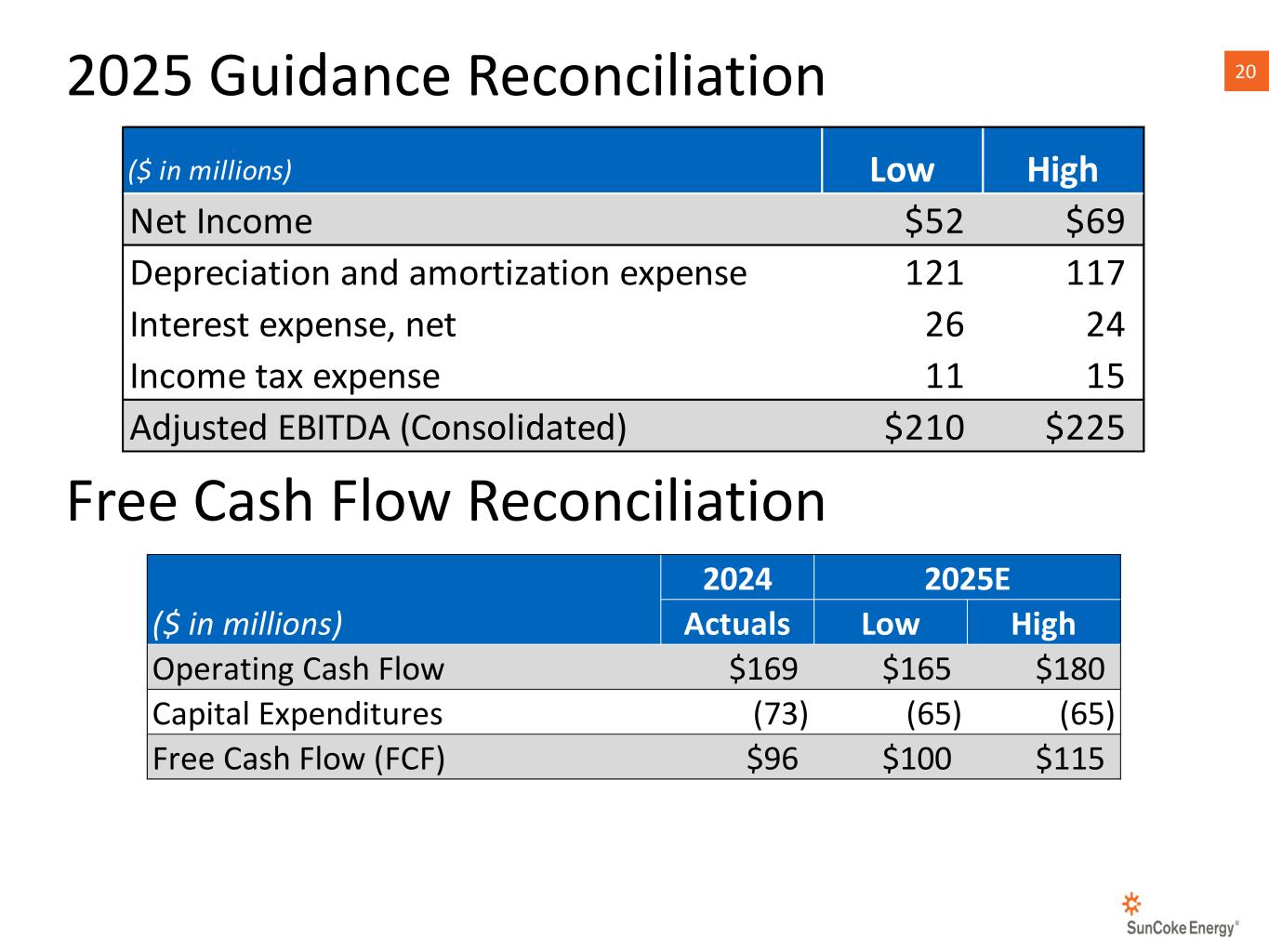

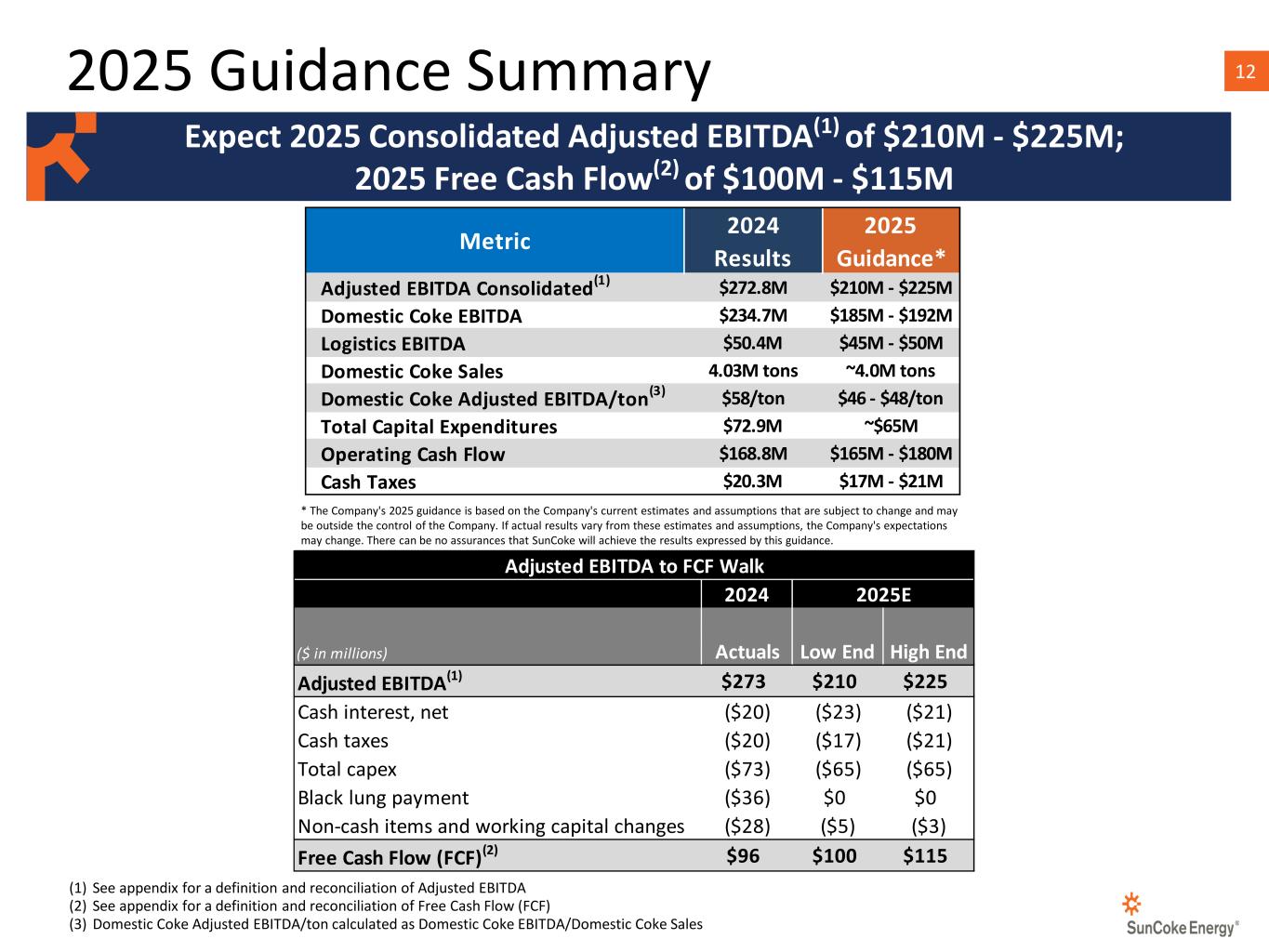

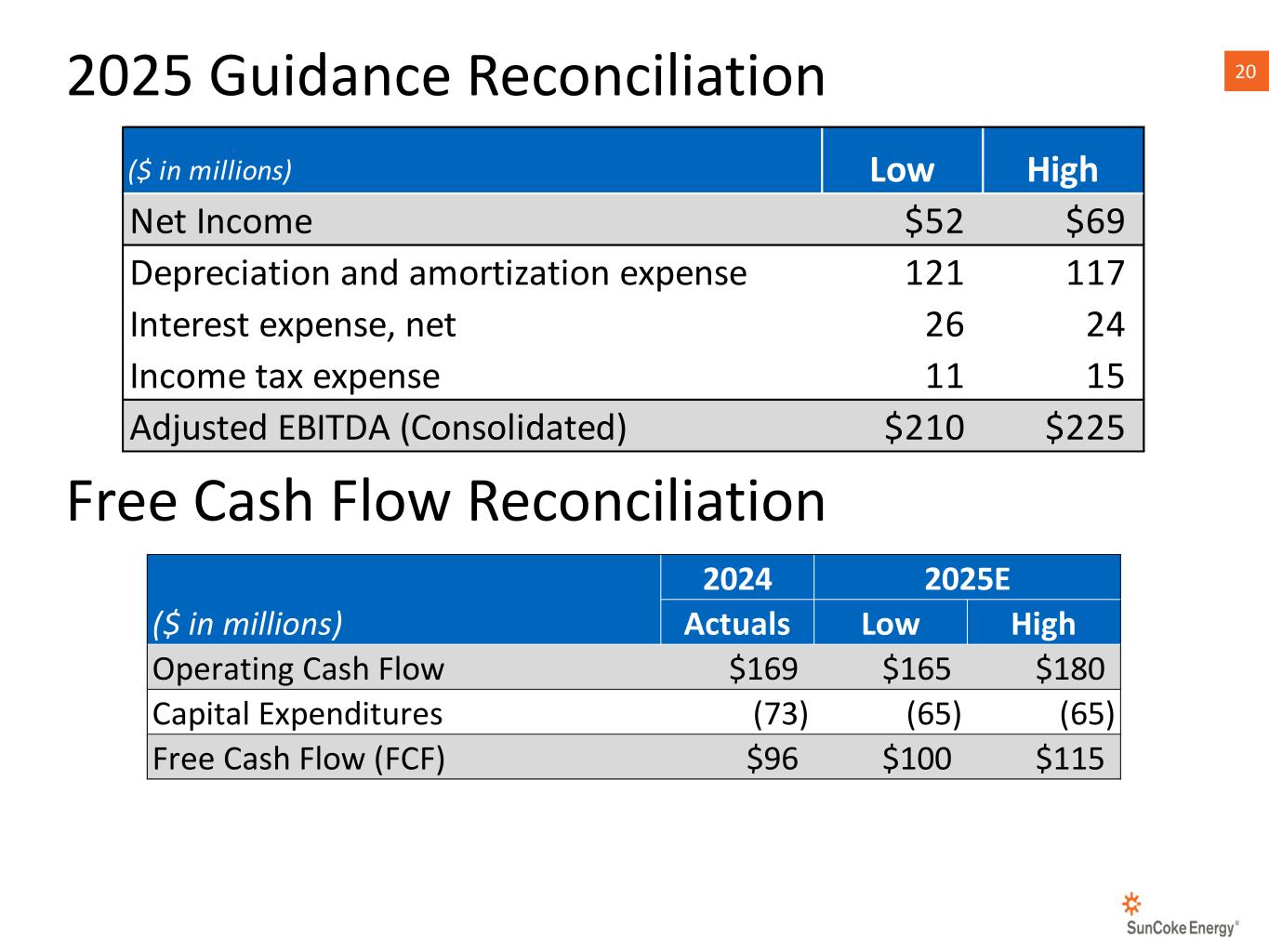

122025 Guidance Summary Expect 2025 Consolidated Adjusted EBITDA(1) of $210M - $225M; 2025 Free Cash Flow(2) of $100M - $115M (1) See appendix for a definition and reconciliation of Adjusted EBITDA (2) See appendix for a definition and reconciliation of Free Cash Flow (FCF) (3) Domestic Coke Adjusted EBITDA/ton calculated as Domestic Coke EBITDA/Domestic Coke Sales * The Company's 2025 guidance is based on the Company's current estimates and assumptions that are subject to change and may be outside the control of the Company. If actual results vary from these estimates and assumptions, the Company's expectations may change. There can be no assurances that SunCoke will achieve the results expressed by this guidance. 2024 ($ in millions) Actuals Low End High End Adjusted EBITDA(1) $273 $210 $225 Cash interest, net ($20) ($23) ($21) Cash taxes ($20) ($17) ($21) Total capex ($73) ($65) ($65) Black lung payment ($36) $0 $0 Non-cash items and working capital changes ($28) ($5) ($3) Free Cash Flow (FCF)(2) $96 $100 $115 Adjusted EBITDA to FCF Walk 2025E 2024 2025 Results Guidance* Adjusted EBITDA Consolidated(1) $272.8M $210M - $225M Domestic Coke EBITDA $234.7M $185M - $192M Logistics EBITDA $50.4M $45M - $50M Domestic Coke Sales 4.03M tons ~4.0M tons Domestic Coke Adjusted EBITDA/ton(3) $58/ton $46 - $48/ton Total Capital Expenditures $72.9M ~$65M Operating Cash Flow $168.8M $165M - $180M Cash Taxes $20.3M $17M - $21M Metric

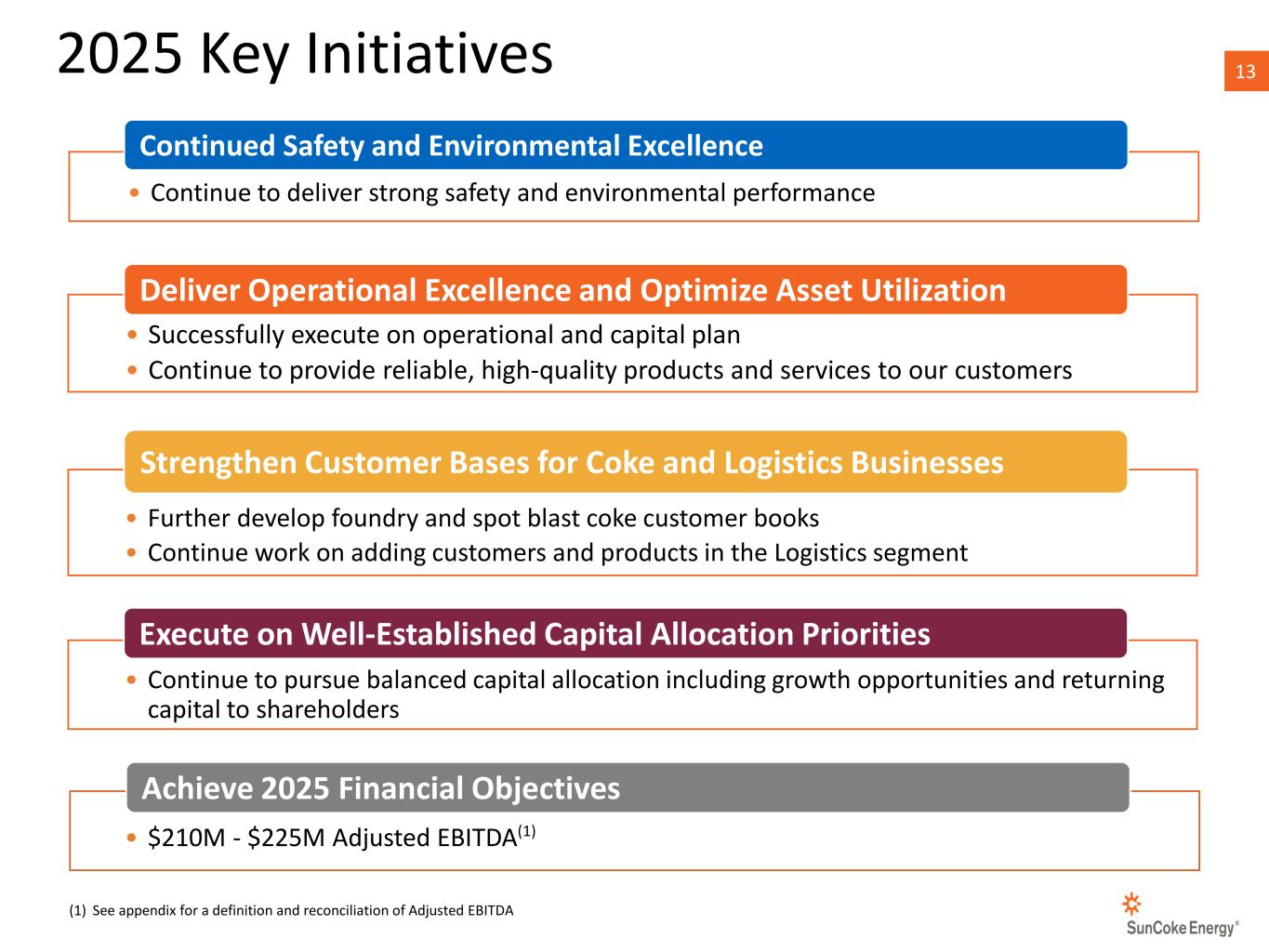

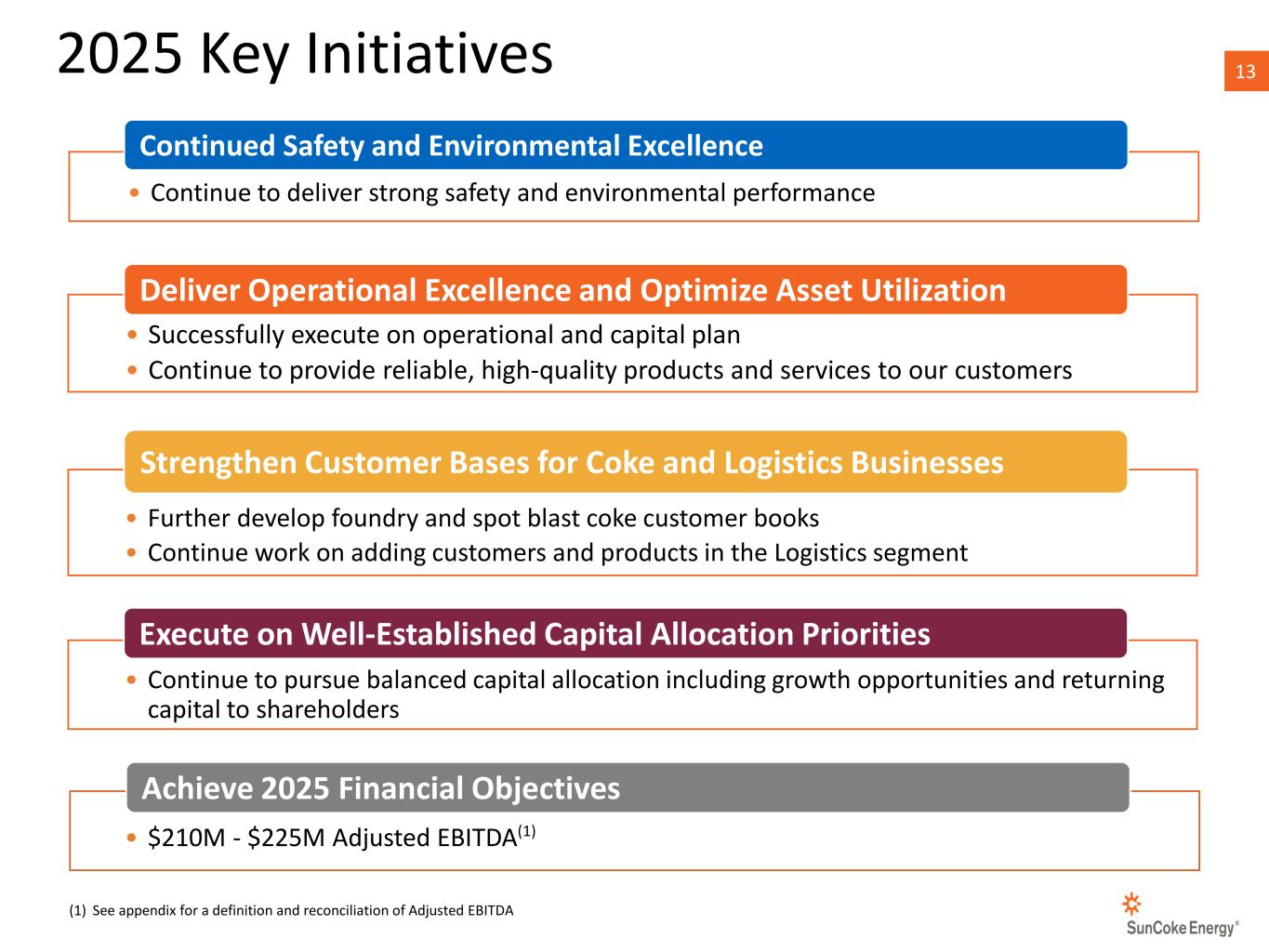

13 • Further develop foundry and spot blast coke customer books • Continue work on adding customers and products in the Logistics segment Strengthen Customer Bases for Coke and Logistics Businesses 2025 Key Initiatives • $210M - $225M Adjusted EBITDA(1) Achieve 2025 Financial Objectives Continued Safety and Environmental Excellence • Continue to deliver strong safety and environmental performance • Successfully execute on operational and capital plan • Continue to provide reliable, high-quality products and services to our customers Deliver Operational Excellence and Optimize Asset Utilization • Continue to pursue balanced capital allocation including growth opportunities and returning capital to shareholders Execute on Well-Established Capital Allocation Priorities (1) See appendix for a definition and reconciliation of Adjusted EBITDA

APPENDIX

15 Domestic Coke Performance Domestic Coke Business Summary Sales Tons (Coke Production, Kt) (1) See definition and reconciliation of Adjusted EBITDA elsewhere in the appendix 973K1,037K FY 2024 Domestic Coke Adjusted EBITDA driven by lower coal-to-coke yields; lower margins at Granite City and Haverhill for 2025 996K 1,027K 486 477 1,264 1,262 1,039 1,040 662 590 583 619 $234.7M FY ’24 $185M - $192M FY ’25E 4,033 3,988 1,032K 4,028K ~4,000K 126 118 115 126 127 327 311 306 322 325 260 264 260 266 248 156 162 164 169 167 155 145 133 148 156 $55.2M Q4 ’23 $61.4M Q1 ’24 $57.9M Q2 ’24 $58.1M Q3 ’24 $57.3M Q4 ’24 1,025 1,000 978 1,031 1,023 Adjusted EBITDA ($M)(1) Middletown Granite City Haverhill Indiana Harbor Jewell

16 $10.7M $13.0M $12.2M $13.7M $11.5M Logistics Business Summary 1,891 1,841 2,498 2,013 1,915 3,131 3,612 3,484 3,830 3,347 Q4 ’23 Q1 ’24 Q2 ’24 Q3 ’24 Q4 ’24 5,022 5,453 5,982 5,843 5,262 Logistics (ex. CMT) CMT (coal, bulk products, liquids) (Tons Handled, Kt) (1) See definition and reconciliation of Adjusted EBITDA elsewhere in the appendix FY 2024 Logistics Adjusted EBITDA results driven by higher transloading volumes at domestic terminals and higher API2 price adjustment benefit at CMT; similar year-over-year coal export volumes at CMT and higher volumes at domestic terminals driving 2025 outlook Logistics Performance Adjusted EBITDA ($M) 8,267 14,273 $50.4M FY ’24 $45M - $50M ~14,800 ~8,100 FY ’25E 22,540 ~22,900 (1)

17 NON-GAAP FINANCIAL MEASURES In order to assist readers in understanding the core operating results that our management uses to evaluate the business, we describe our non-GAAP measures referenced in this presentation below. In addition to U.S. GAAP measures, this presentation contains certain non-GAAP financial measures. These non-GAAP financial measures should not be considered as alternatives to the measures derived in accordance with U.S. GAAP. Non-GAAP financial measures have important limitations as analytical tools, and you should not consider them in isolation or as substitutes for results as reported under U.S. GAAP. Additionally, other companies may calculate non-GAAP metrics differently than we do, thereby limiting their usefulness as a comparative measure. Because of these and other limitations, you should consider our non-GAAP measures only as supplemental to other U.S. GAAP-based financial performance measures, including revenues and net income. Reconciliations to the most comparable GAAP financial measures are included at the end of this Appendix. DEFINITIONS Adjusted EBITDA represents earnings before interest, taxes, depreciation and amortization (“EBITDA”), adjusted for any impairments, restructuring costs, gains or losses on extinguishment of debt, and/or transaction costs ("Adjusted EBITDA"). EBITDA and Adjusted EBITDA do not represent and should not be considered alternatives to net income or operating income under GAAP and may not be comparable to other similarly titled measures in other businesses. Management believes Adjusted EBITDA is an important measure in assessing operating performance. Adjusted EBITDA provides useful information to investors because it highlights trends in our business that may not otherwise be apparent when relying solely on GAAP measures and because it eliminates items that have less bearing on our operating performance. EBITDA and Adjusted EBITDA are not measures calculated in accordance with GAAP, and they should not be considered a substitute for net income, or any other measure of financial performance presented in accordance with GAAP. EBITDA represents earnings before interest, taxes, depreciation and amortization. Adjusted EBITDA/Ton represents Adjusted EBITDA divided by tons sold/handled. Free Cash Flow (FCF) represents operating cash flow adjusted for capital expenditures. Management believes FCF is an important measure of liquidity. FCF is not a measure calculated in accordance with GAAP, and it should not be considered a substitute for operating cash flow or any other measure of financial performance presented in accordance with GAAP. Domestic logistics terminals represents Lake Terminal and Kanawha River Terminals.

18Coke Facility Capacity and Contract Duration/Volume (1) Capacity represents blast furnace equivalent production capacity (2) Represents production capacity for blast-furnace sized coke, however, customer takes all on a “run of oven” basis, which represents >600k tons per year (3) Will operate in a turn-down mode in 2025 as part of the contract extension Facility Capacity (1) Customer Contract Expiry Contract Volume Indiana Harbor 1,220 Kt Cliffs Steel Sep. 2035 Capacity Middletown 550 Kt (2) Cliffs Steel Dec. 2032 Capacity Haverhill II 550 Kt Cliffs Steel Jun. 2025 Capacity Granite City 650 Kt US Steel Jun. 2025 Capacity (3) Haverhill I/JWO 1,270Kt Cliffs Steel Algoma Steel Dec. 2025 Dec. 2026 400 Kt 150 Kt

19Balance Sheet & Debt Metrics ($ in millions) As of 12/31/2024 As of 12/31/2023 Cash 190$ 140$ Available Revolver Capacity 350$ 350$ Total Liquidity 540$ 490$ Gross Debt (Long and Short-term) 500$ 500$ Net Debt (Total Debt less Cash) 310$ 360$ LTM Adjusted EBITDA 273$ 269$ Gross Debt / LTM Adjusted EBITDA 1.83x 1.86x Net Debt / LTM Adjusted EBITDA 1.14x 1.34x 2025 2026 2027 2028 2029 Consolidated Total Sr. Notes -$ -$ -$ -$ 500.0$ 500.0$ Revolver - - - - - - Total -$ -$ -$ -$ 500.0$ 500.0$ As of 12/31/2024 ($ in millions)

202025 Guidance Reconciliation Free Cash Flow Reconciliation 2024 ($ in millions) Actuals Low High Operating Cash Flow $169 $165 $180 Capital Expenditures (73) (65) (65) Free Cash Flow (FCF) $96 $100 $115 2025E Low High Net Income $52 $69 Depreciation and amortization expense 121 117 Interest expense, net 26 24 Income tax expense 11 15 Adjusted EBITDA (Consolidated) $210 $225 ($ in millions)

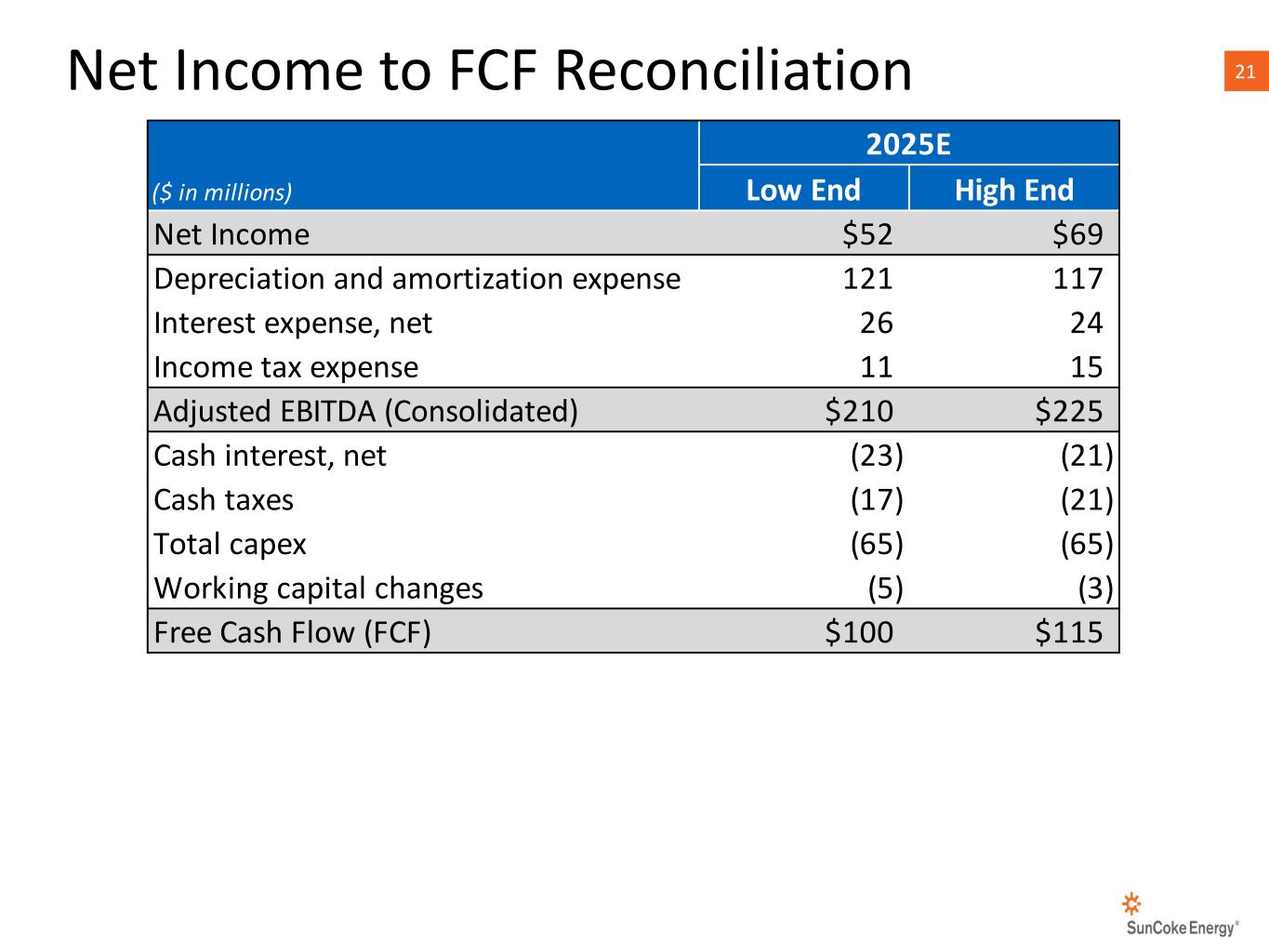

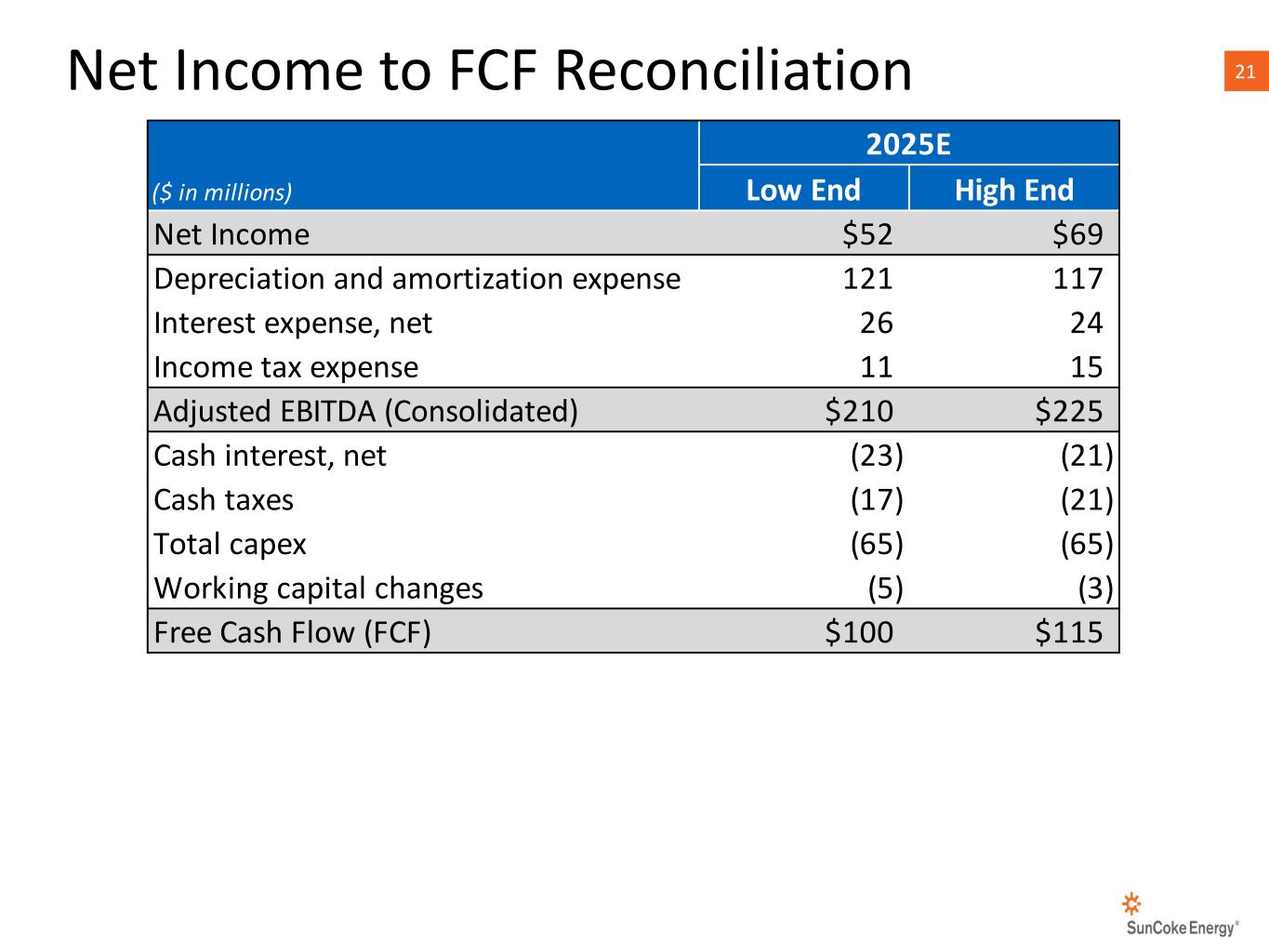

21Net Income to FCF Reconciliation Low End High End Net Income $52 $69 Depreciation and amortization expense 121 117 Interest expense, net 26 24 Income tax expense 11 15 Adjusted EBITDA (Consolidated) $210 $225 Cash interest, net (23) (21) Cash taxes (17) (21) Total capex (65) (65) Working capital changes (5) (3) Free Cash Flow (FCF) $100 $115 ($ in millions) 2025E

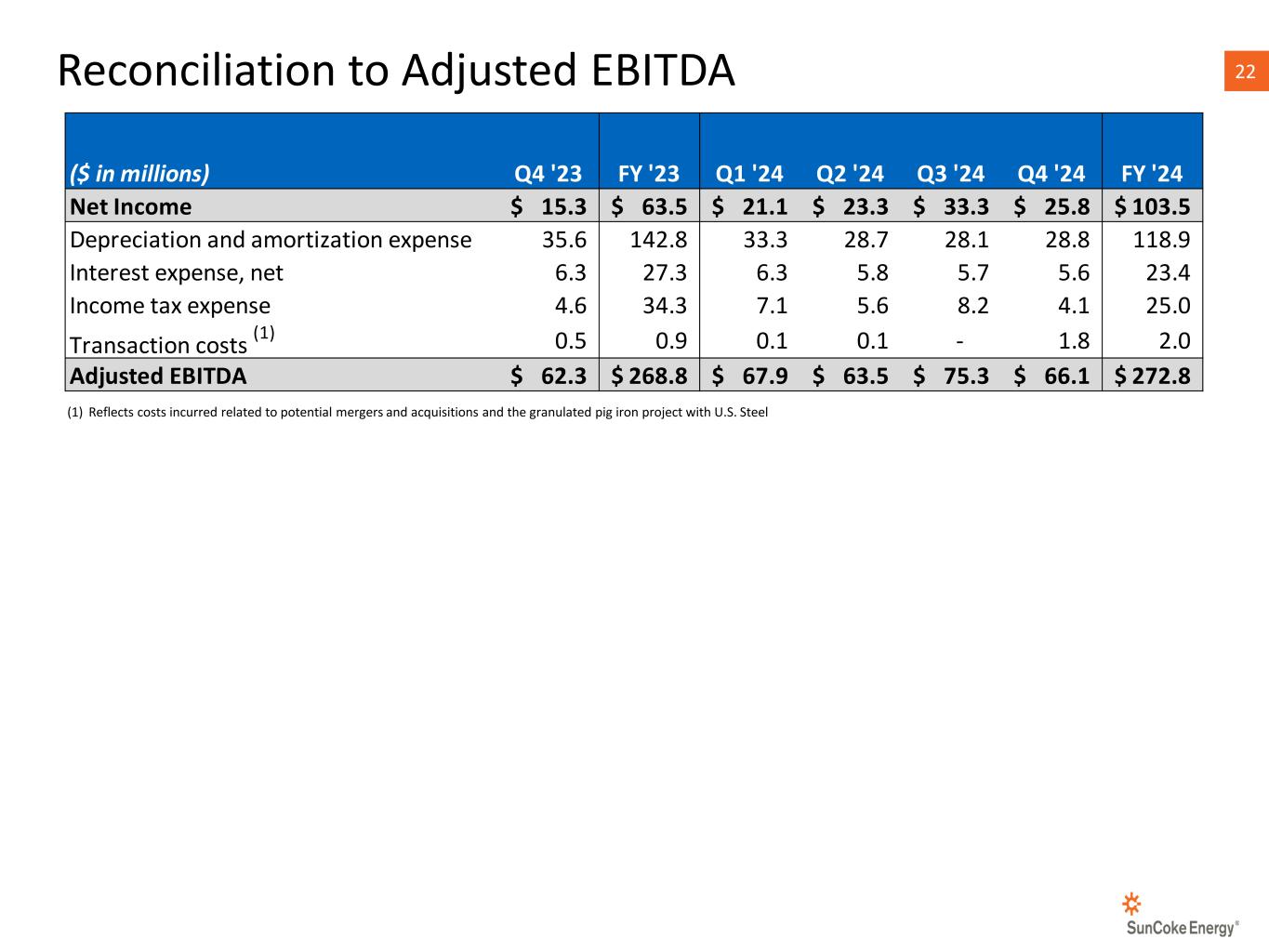

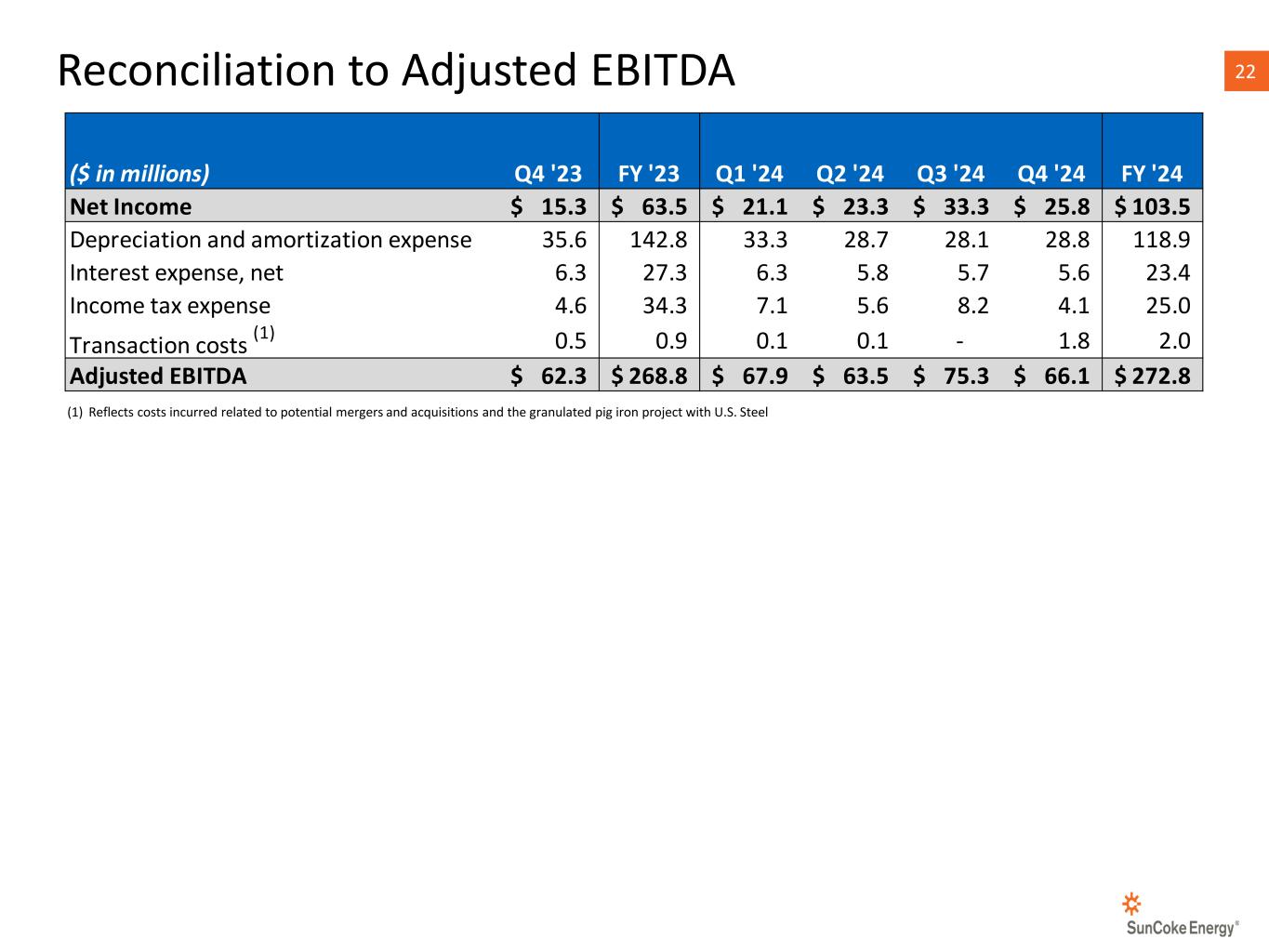

22Reconciliation to Adjusted EBITDA (1) Reflects costs incurred related to potential mergers and acquisitions and the granulated pig iron project with U.S. Steel ($ in millions) Q4 '23 FY '23 Q1 '24 Q2 '24 Q3 '24 Q4 '24 FY '24 Net Income 15.3$ 63.5$ 21.1$ 23.3$ 33.3$ 25.8$ 103.5$ Depreciation and amortization expense 35.6 142.8 33.3 28.7 28.1 28.8 118.9 Interest expense, net 6.3 27.3 6.3 5.8 5.7 5.6 23.4 Income tax expense 4.6 34.3 7.1 5.6 8.2 4.1 25.0 Transaction costs (1) 0.5 0.9 0.1 0.1 - 1.8 2.0 Adjusted EBITDA 62.3$ 268.8$ 67.9$ 63.5$ 75.3$ 66.1$ 272.8$

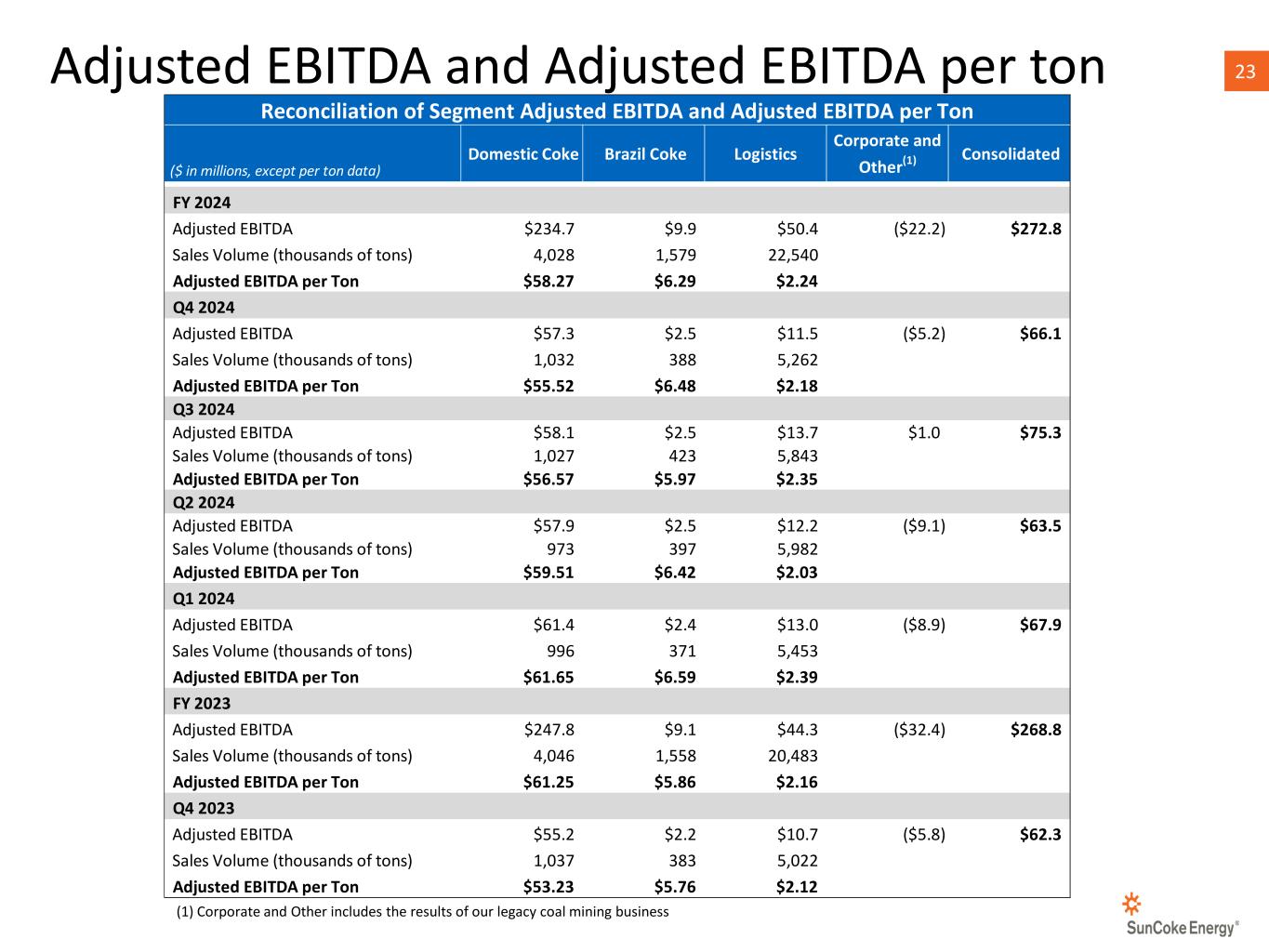

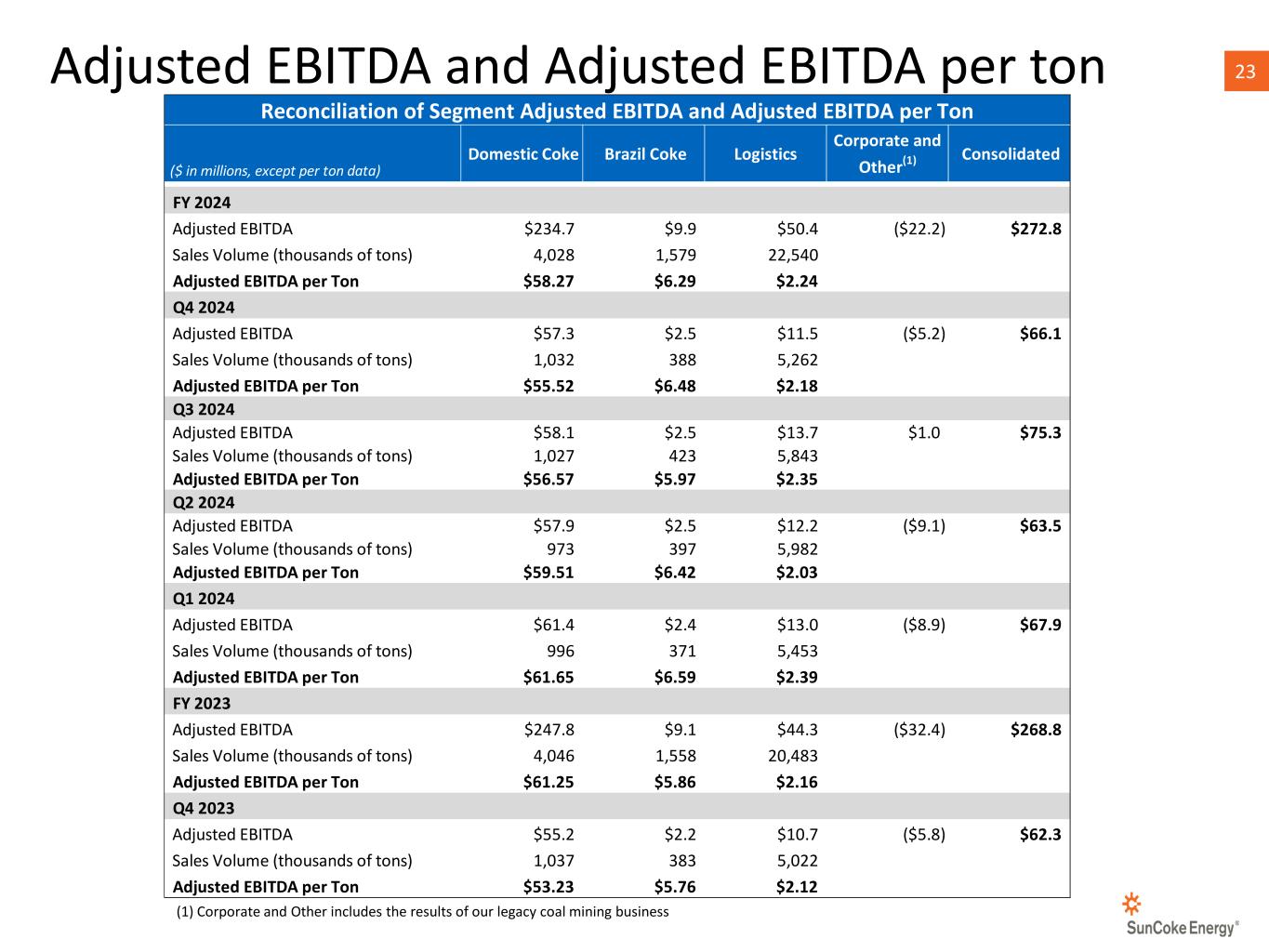

23Adjusted EBITDA and Adjusted EBITDA per ton (1) Corporate and Other includes the results of our legacy coal mining business Reconciliation of Segment Adjusted EBITDA and Adjusted EBITDA per Ton ($ in millions, except per ton data) Domestic Coke Brazil Coke Logistics Corporate and Other(1) Consolidated FY 2024 Adjusted EBITDA $234.7 $9.9 $50.4 ($22.2) $272.8 Sales Volume (thousands of tons) 4,028 1,579 22,540 Adjusted EBITDA per Ton $58.27 $6.29 $2.24 Q4 2024 Adjusted EBITDA $57.3 $2.5 $11.5 ($5.2) $66.1 Sales Volume (thousands of tons) 1,032 388 5,262 Adjusted EBITDA per Ton $55.52 $6.48 $2.18 Q3 2024 Adjusted EBITDA $58.1 $2.5 $13.7 $1.0 $75.3 Sales Volume (thousands of tons) 1,027 423 5,843 Adjusted EBITDA per Ton $56.57 $5.97 $2.35 Q2 2024 Adjusted EBITDA $57.9 $2.5 $12.2 ($9.1) $63.5 Sales Volume (thousands of tons) 973 397 5,982 Adjusted EBITDA per Ton $59.51 $6.42 $2.03 Q1 2024 Adjusted EBITDA $61.4 $2.4 $13.0 ($8.9) $67.9 Sales Volume (thousands of tons) 996 371 5,453 Adjusted EBITDA per Ton $61.65 $6.59 $2.39 FY 2023 Adjusted EBITDA $247.8 $9.1 $44.3 ($32.4) $268.8 Sales Volume (thousands of tons) 4,046 1,558 20,483 Adjusted EBITDA per Ton $61.25 $5.86 $2.16 Q4 2023 Adjusted EBITDA $55.2 $2.2 $10.7 ($5.8) $62.3 Sales Volume (thousands of tons) 1,037 383 5,022 Adjusted EBITDA per Ton $53.23 $5.76 $2.12

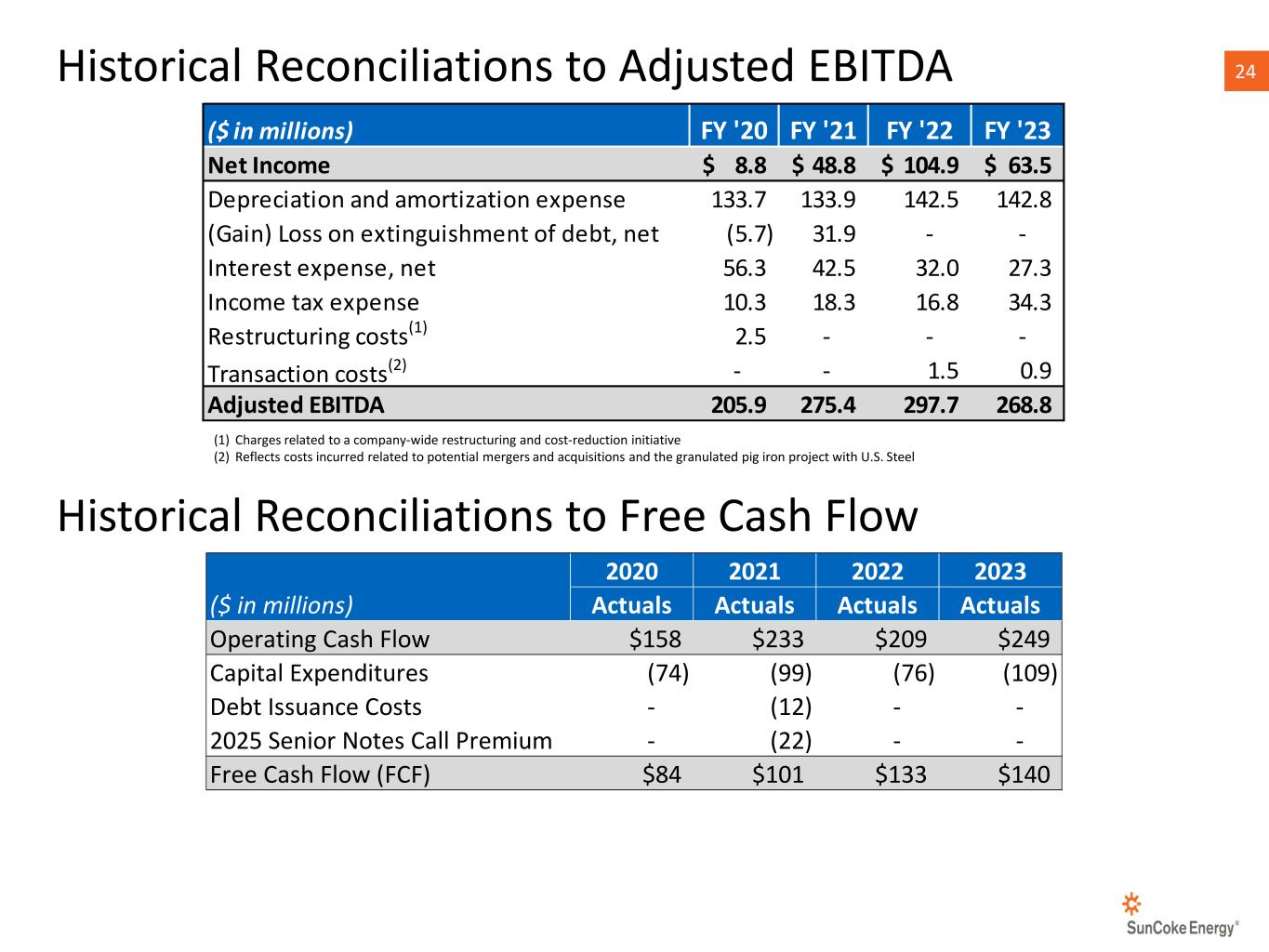

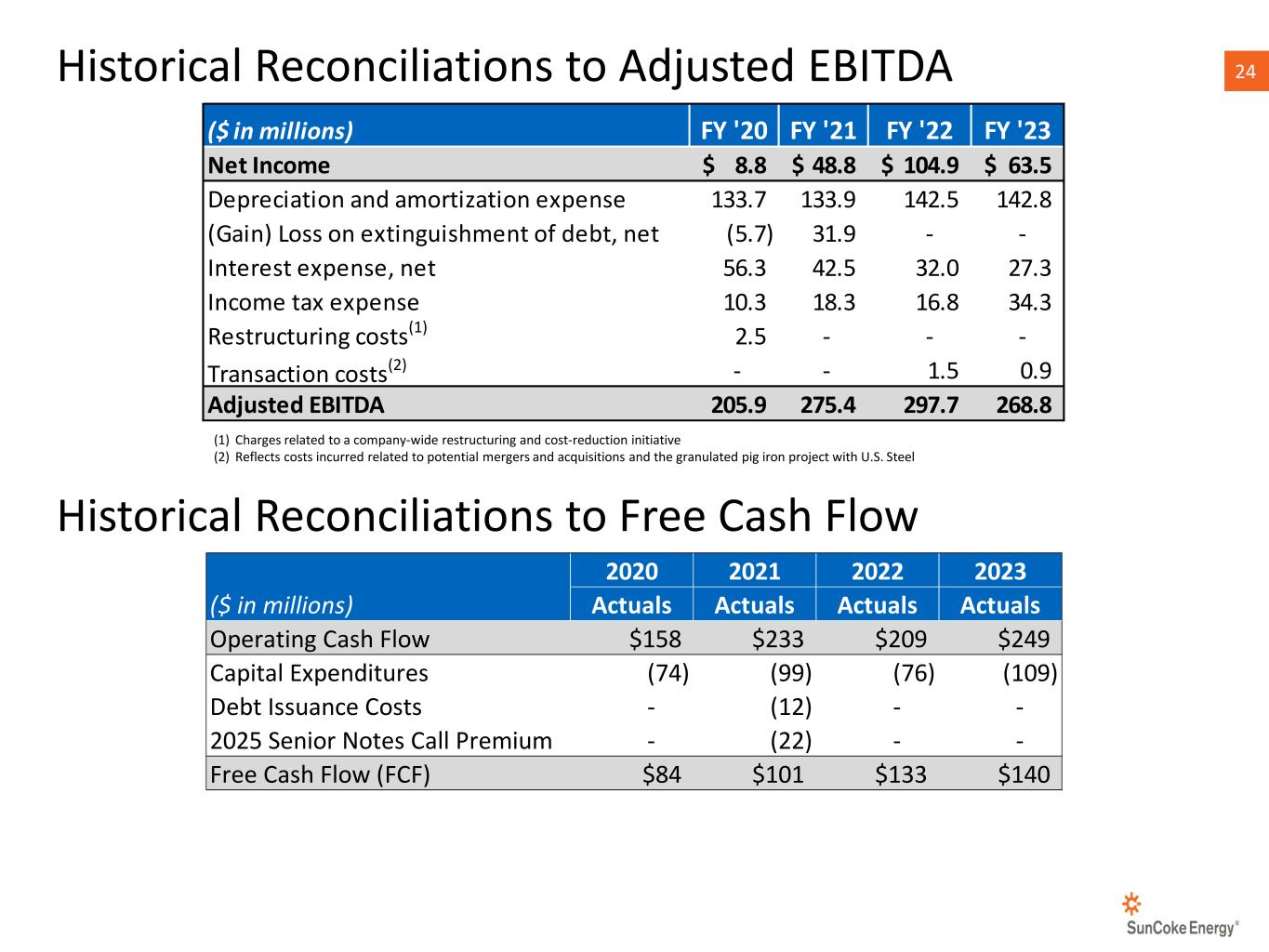

24 ($ in millions) FY '20 FY '21 FY '22 FY '23 Net Income 8.8$ 48.8$ 104.9$ 63.5$ Depreciation and amortization expense 133.7 133.9 142.5 142.8 (Gain) Loss on extinguishment of debt, net (5.7) 31.9 - - Interest expense, net 56.3 42.5 32.0 27.3 Income tax expense 10.3 18.3 16.8 34.3 Restructuring costs(1) 2.5 - - - Transaction costs(2) - - 1.5 0.9 Adjusted EBITDA 205.9 275.4 297.7 268.8 Historical Reconciliations to Adjusted EBITDA (1) Charges related to a company-wide restructuring and cost-reduction initiative (2) Reflects costs incurred related to potential mergers and acquisitions and the granulated pig iron project with U.S. Steel 2020 2021 2022 2023 ($ in millions) Actuals Actuals Actuals Actuals Operating Cash Flow $158 $233 $209 $249 Capital Expenditures (74) (99) (76) (109) Debt Issuance Costs - (12) - - 2025 Senior Notes Call Premium - (22) - - Free Cash Flow (FCF) $84 $101 $133 $140 Historical Reconciliations to Free Cash Flow