Exhibit 99.3

SAExploration INVESTOR UPDATE August 2018 A solid foundation of integrity, service and sustainability supports our global operations

Forward Looking Statements Corporate Profile Ticker Symbol: NASDAQ: SAEX Stock Price (as of 08/07/18): $0.671-Month Avg. Daily Volume (shares): ~1.4 million Total Shares Outstanding (as of 08/07/18): (1) ~20.5 million Market Cap. (as of 08/07/18): ~$13.7 million 1) On September 5, 2018, each outstanding share of Series A preferred stock will automatically convert into 3,271.4653 shares of common stock, or, if a warrant election is made, 3,271.4653 conversion warrants (with shares of common stock or warrants, as applicable, issued in whole integral multiples, rounded down in lieu of any fractional shares or warrants, as applicable). The number of shares of common stock and warrants issuable on conversion was determined as set forth in the Certificate of Designations. SAE anticipates that it will issue approximately 109 million new shares or warrants, or some combination thereof, upon conversion of the Series A preferred stock, subject to the rights of certain holders to receive warrants in lieu of shares of common stock. Forward Looking Statements This presentation, including any oral statements made regarding the contents of this presentation, contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act, as amended. All statements, other than statements of historical fact, included in this presentation that address activities, events or developments that SAExploration Holdings, Inc. (together with its subsidiaries, the “Company” or “SAE”) assumes, plans, expects, believes or anticipates will or may occur in the future are forward-looking statements. When used in this presentation, words such as “will,” “potential,” “believe,” “estimate,” “intend,” “expect,” “may,” “should,” “anticipate,” “could,” “plan,” “predict,” “forecast,” “budget,” “guidance,” “project,” “model,” “strategy,” “future” or their negatives or the statements that include these words or other words that convey the uncertainty of future events or outcomes, are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. Without limiting the generality of the foregoing, forward-looking statements contained in this presentation specifically include the expectations of plans, strategies, objectives, anticipated financial results of the Company and expected benefits from certain transactions and acquisitions, including the acquisition of Geokinetics, Inc. These statements are based on certain assumptions made by the Company based on management’s experience, perception of historical trends and technical analyses, current conditions, anticipated future developments and other factors believed to be appropriate and reasonable by management. Such statements are subject to a number of assumptions, risks and uncertainties, many of which are beyond the control of the Company, which may cause actual results to differ materially from those implied or expressed by the forward-looking statements. These include risks relating to the adequacy of the Company’s capital resources and liquidity including, but not limited to, access to additional borrowing capacity under the Company’s credit facilities; uncertainties about the Company’s ability to successfully execute the Company’s business and financial plans and strategies; financial performance and results; current economic conditions and other important factors that could cause actual results to differ materially from those projected as described in the Company’s Annual Report on Form10-K for the year ended December 31, 2017, and as updated in the Company’s Periodic Report to be filed on Form10-Q for the period ended June 30, 2018, and other reports filed with the Securities and Exchange Commission. Any forward-looking statement speaks only as of the date on which such statement is made and the Company undertakes no obligation to correct or update any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by applicable law. The consummation and actual terms of the new secured convertible notes are subject to a number of factors, including negotiation and execution of definitive documents and satisfaction of customary closing conditions. The terms of the new secured convertible notes could materially differ from those outlined herein and there can be no guarantee that the Company will issue the new secured convertible notes on favorable terms or at all or that it will use the proceeds as outlined herein. This presentation shall not constitute an offer to sell or a solicitation of an offer to purchase any loans or securities. 2

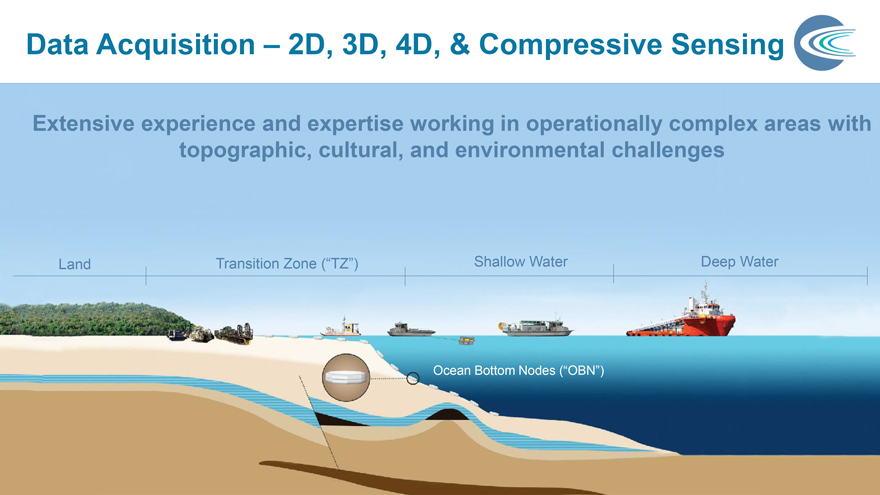

Business Overview Global Leader in Logistics, Land & Marine Data Acquisition, and Data Processing and Interpretation Global vertically integrated logistics and geophysical services company founded in 2006 Full service provider with the ability to facilitate projects from conception to data acquisition to data processing and interpretation Offers a broad range of specialized geophysical solutions to the petroleum and mining industries including: 2D, 3D, 4D, and compressive sensing seismic data acquisition services in land, transition zone (“TZ”), shallow water and deep water marine environments Extensive experience and expertise working in operationally complex areas with topographic, cultural, and environmental challenges Data processing and interpretation services emphasizing quality and deliverability through a specialized suite of advanced technologies including signal processing, depth imaging (“DI”), multi-component, amplitude variation with offset (“AVO”) processing, and quantitative interpretation (“QI”) 3

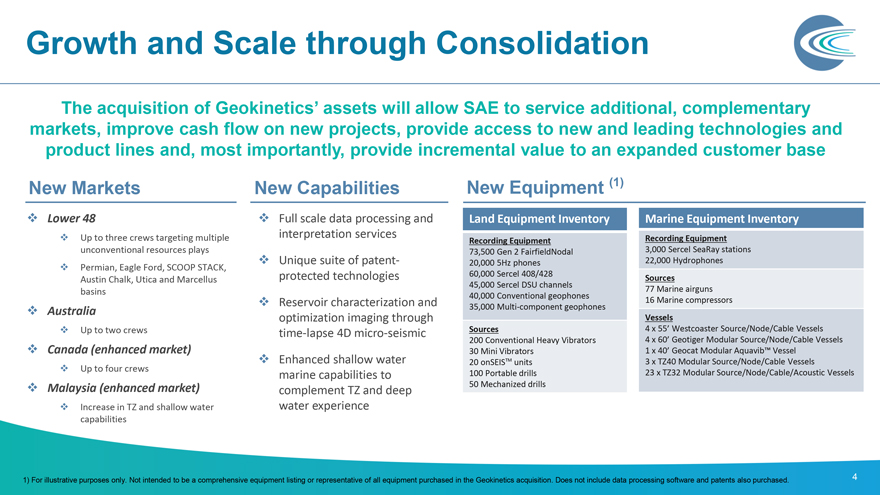

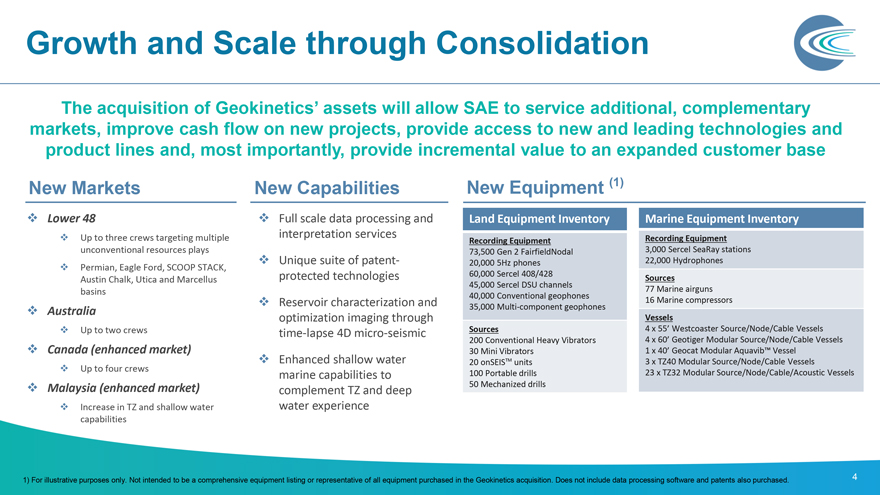

Growth and Scale through Consolidation The acquisition of Geokinetics’ assets will allow SAE to service additional, complementary markets, improve cash flow on new projects, provide access to new and leading technologies and product lines and, most importantly, provide incremental value to an expanded customer base New Markets Lower 48 Up to three crews targeting multiple unconventional resources plays Permian, Eagle Ford, SCOOP STACK, Austin Chalk, Utica and Marcellus basins Australia Up to two crews Canada (enhanced market) Up to four crews Malaysia (enhanced market) Increase in TZ and shallow water capabilities New Capabilities Full scale data processing and interpretation services Unique suite of patent-protected technologies Reservoir characterization and optimization imaging through time-lapse 4D micro-seismic Enhanced shallow water marine capabilities to complement TZ and deep water experience New Equipment (1) Land Equipment Inventory Recording Equipment 73,500 Gen 2 FairfieldNodal 20,000 5Hz phones 60,000 Sercel 408/428 45,000 Sercel DSU channels 40,000 Conventional geophones 35,000 Multi-component geophones Sources 200 Conventional Heavy Vibrators 30 Mini Vibrators 20 onSEISTM units 100 Portable drills 50 Mechanized drills Marine Equipment Inventory Recording Equipment 3,000 Sercel SeaRay stations 22,000 Hydrophones Sources 77 Marine airguns 16 Marine compressors Vessels 4 x 55’ Westcoaster Source/Node/Cable Vessels 4 x 60’ Geotiger Modular Source/Node/Cable Vessels 1 x 40’ Geocat Modular Aquavib™ Vessel 3 x TZ40 Modular Source/Node/Cable Vessels 23 x TZ32 Modular Source/Node/Cable/Acoustic Vessels 1) For illustrative purposes only. Not intended to be a comprehensive equipment listing or representative of all equipment purchased in the Geokinetics acquisition. Does not include data processing software and patents also purchased. 4

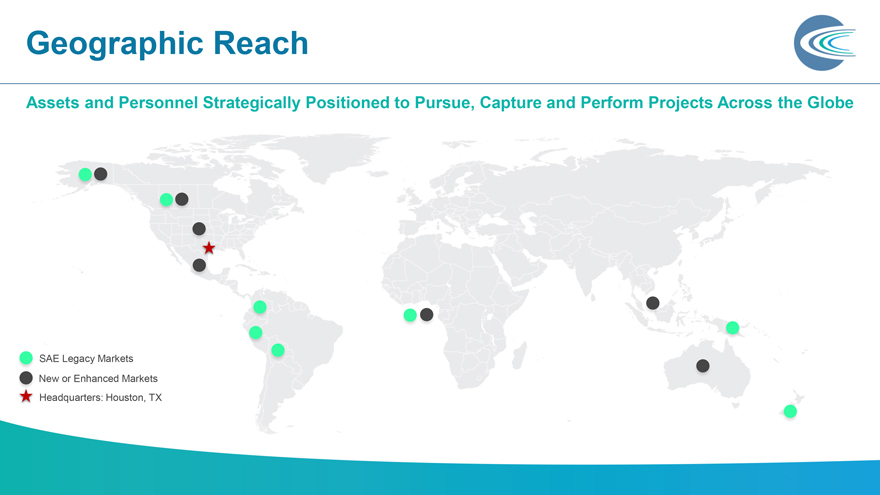

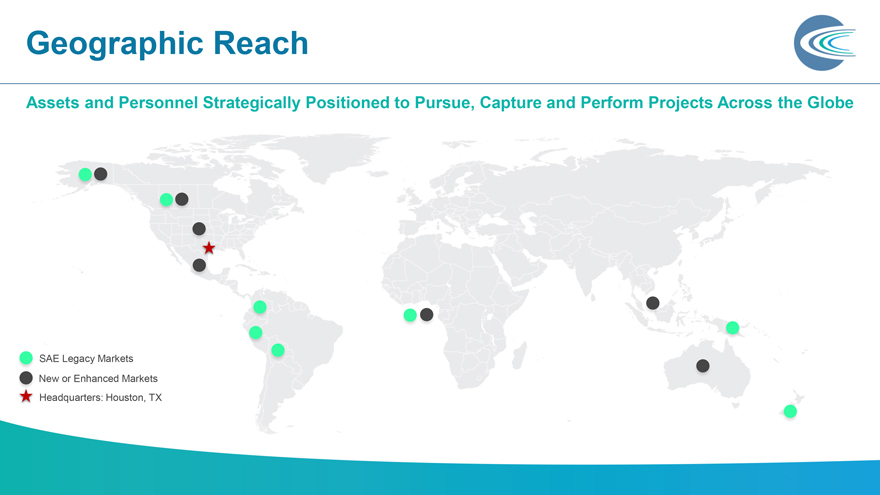

Geographic Reach Assets and Personnel Strategically Positioned to Pursue, Capture and Perform Projects Across the Globe SAE Legacy Markets New or Enhanced Markets Headquarters: Houston, TX

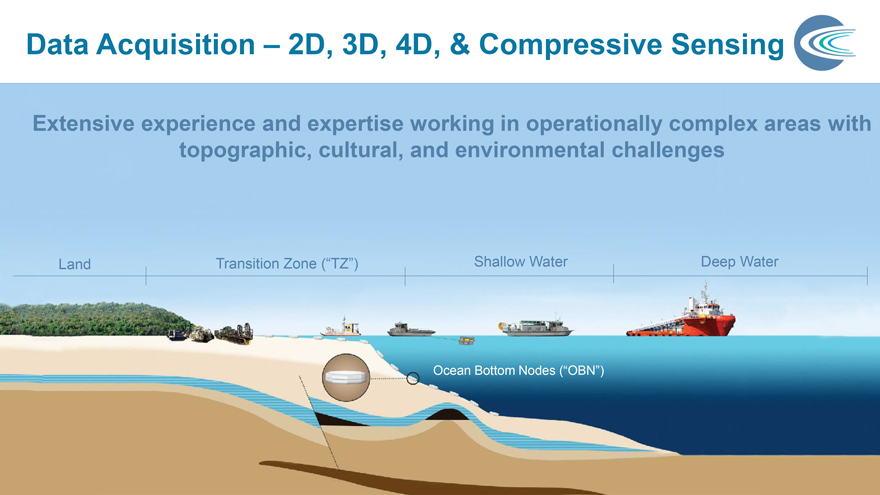

Data Acquisition – 2D, 3D, 4D, & Compressive Sensing Extensive experience and expertise working in operationally complex areas with topographic, cultural, and environmental challenges Land Transition Zone (“TZ”) Shallow Water Deep Water Ocean Bottom Nodes (“OBN”)

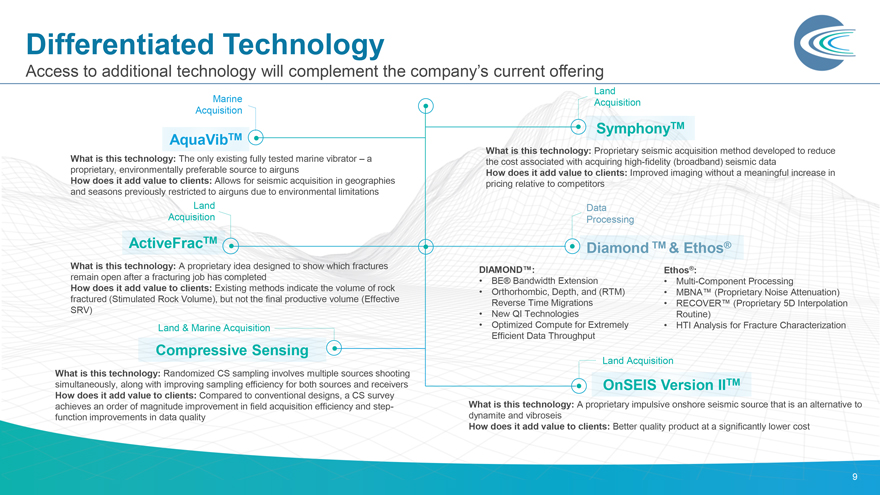

The Assets to Better Serve Our Customers Since 2006 SAE has operated an asset-light model, renting most of its equipment on aproject-by-project basis as contracts are awarded to the company Owned inventory as a result of this transaction will improve service to customers across the globe SAE will not be as reliant on availability in the rental market and customers will have the option to express their preference for equipment SAE can now service multiple high channel count, high source count projects Through the acquired technology, SAE will be able to offer additional source options Broad Band Vibrator Source with the use of “Symphony”Non-Invasive Source Options (OnSeis and Aquavib) New frac monitoring techniques with the use of “Active Frac” 7

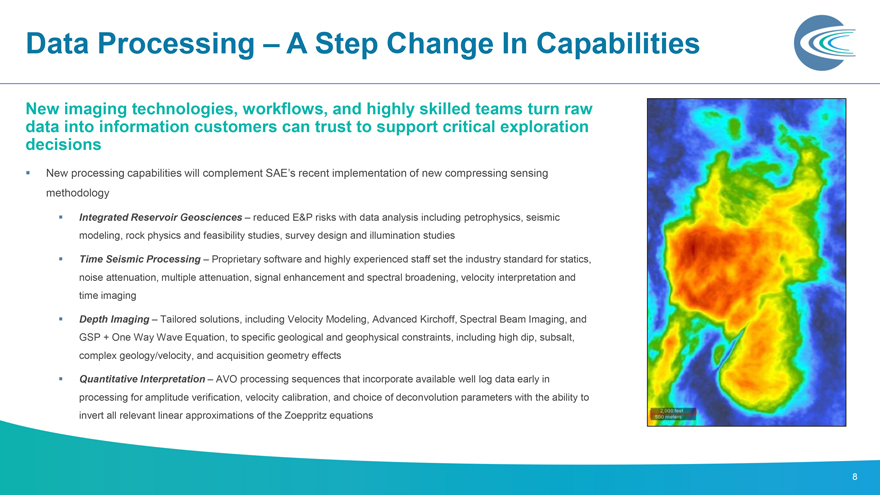

Data Processing – A Step Change In Capabilities New imaging technologies, workflows, and highly skilled teams turn raw data into information customers can trust to support critical exploration decisions New processing capabilities will complement SAE’s recent implementation of new compressing sensing methodology Integrated Reservoir Geosciences – reduced E&P risks with data analysis including petrophysics, seismic modeling, rock physics and feasibility studies, survey design and illumination studies Time Seismic Processing – Proprietary software and highly experienced staff set the industry standard for statics, noise attenuation, multiple attenuation, signal enhancement and spectral broadening, velocity interpretation and time imaging Depth Imaging – Tailored solutions, including Velocity Modeling, Advanced Kirchoff, Spectral Beam Imaging, and GSP + One Way Wave Equation, to specific geological and geophysical constraints, including high dip, subsalt, complex geology/velocity, and acquisition geometry effects Quantitative Interpretation – AVO processing sequences that incorporate available well log data early in processing for amplitude verification, velocity calibration, and choice of deconvolution parameters with the ability to invert all relevant linear approximations of the Zoeppritz equations 8

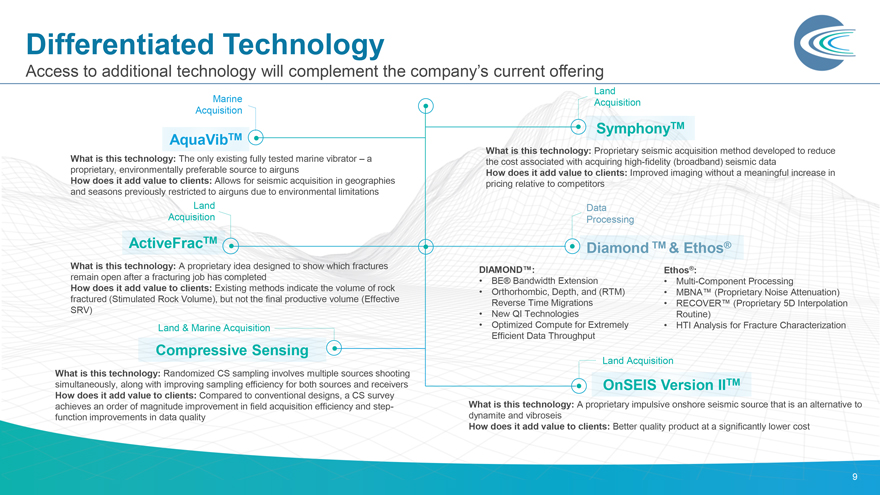

Differentiated Technology Access to additional technology will complement the company’s current offering Land Marine Acquisition Acquisition SymphonyTM AquaVibTM What is this technology: The only existing fully tested marine vibrator – a What is this technology: Proprietary seismic acquisition method developed to reduce proprietary, environmentally preferable source to airguns the cost associated with acquiring high-fidelity (broadband) seismic data How does it add value to clients: Allows for seismic acquisition in geographies How does it add value to clients: Improved imaging without a meaningful increase in and seasons previously restricted to airguns due to environmental limitations pricing relative to competitors Land Data Acquisition Processing ActiveFracTM Diamond TM & Ethos® What is this technology: A proprietary idea designed to show which fractures DIAMOND™: ® Ethos : remain open after a fracturing job has completed BE® Bandwidth Extension Multi-Component Processing How does it add value to clients: Existing methods indicate the volume of rock Orthorhombic, Depth, and (RTM) MBNA™ (Proprietary Noise Attenuation) fractured (Stimulated Rock Volume), but not the final productive volume (Effective Reverse Time Migrations RECOVER™ (Proprietary 5D Interpolation SRV) New QI Technologies Routine) Land & Marine Acquisition Optimized Compute for Extremely HTI Analysis for Fracture Characterization Efficient Data Throughput Compressive Sensing Land Acquisition What is this technology: Randomized CS sampling involves multiple sources shooting simultaneously, along with improving sampling efficiency for both sources and receivers OnSEIS Version IITM How does it add value to clients: Compared to conventional designs, a CS survey achieves an order of magnitude improvement in field acquisition efficiency and step- What is this technology: A proprietary impulsive onshore seismic source that is an alternative to function improvements in data quality dynamite and vibroseis How does it add value to clients: Better quality product at a significantly lower cost 9

Quality, Health, Safety and Environment Setting the standard for responsible stewardship through an industry-leading quality, health, safety and environmental program Alaska & Canada – Arctic SAE has never had an EPA recordable spill or caused damage to the tundra All vehicles are equipped with spill protection equipment and are maintained to reduce likelihood of a spill occurring Workforce is specially trained to identify and proactively avoid places where light snow or wind has caused tundra to become unprotected and when unavoidable, to build ice bridges to further protect the tundra SAE continues to research methods to reduce CO and CO2 emissions through vehicle maintenance and monitoring programs Latin America & Southeast Asia – Jungle & Rain Forests SAE prides itself on maintaining strong, positive relationships with the local communities where it operates Specialized line cutting methodologies, under-canopy-avoidance techniques, and reforestation activities all assist SAE in returning the environment to its natural standard SAE also employs strict recycling standards and specialized composting techniques to deal with onsite waste Global Health and Safety SAE always plans and prepares facilities to assist local populations with basic and emergency healthcare needs A robust health and safety program along with an effective injury management program continues to produce significantly lower injury frequencies than industry standard 10

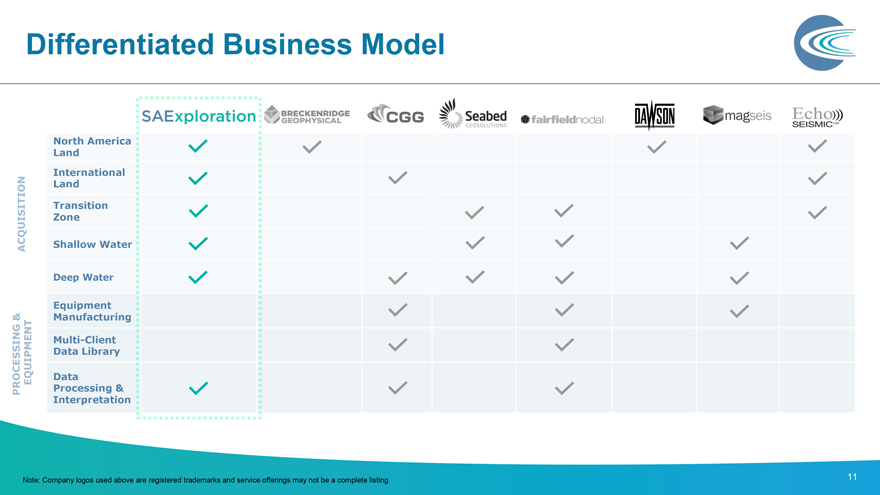

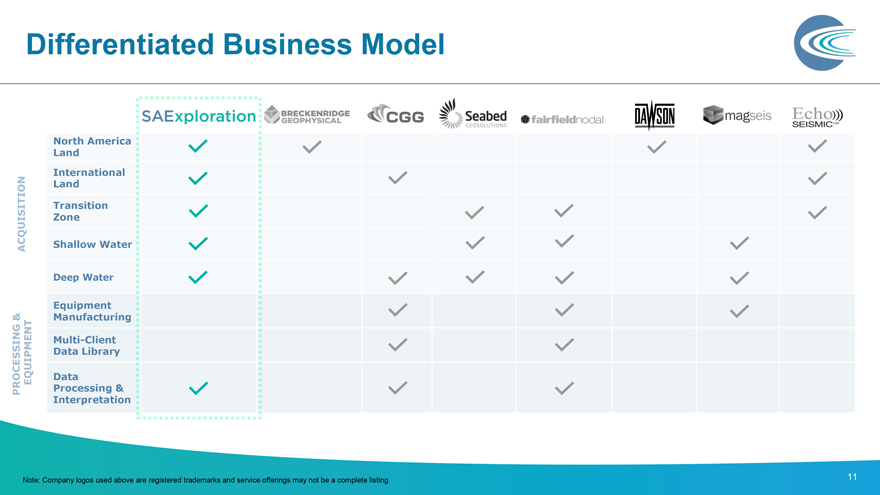

Differentiated Business Model North America Land International Land Transition Zone Shallow Water Deep Water Equipment Manufacturing Multi-Client Data Library Data Processing & Interpretation Note: Company logos used above are registered trademarks and service offerings may not be a complete listing 11

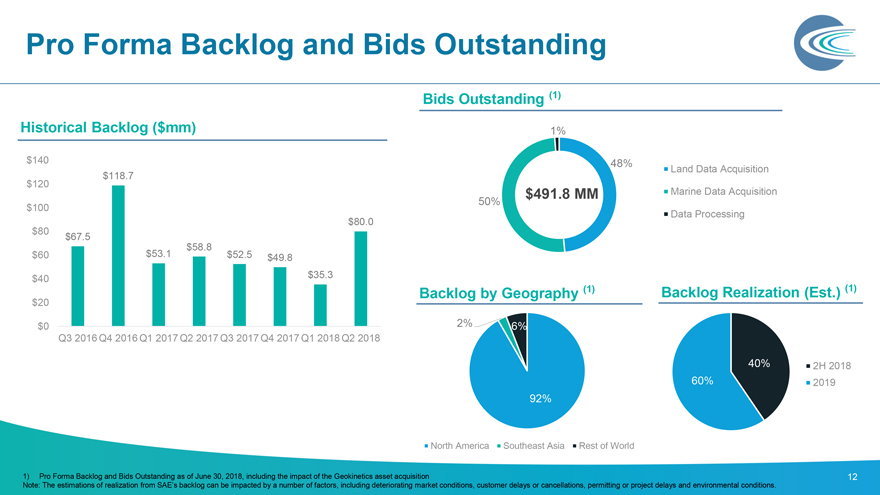

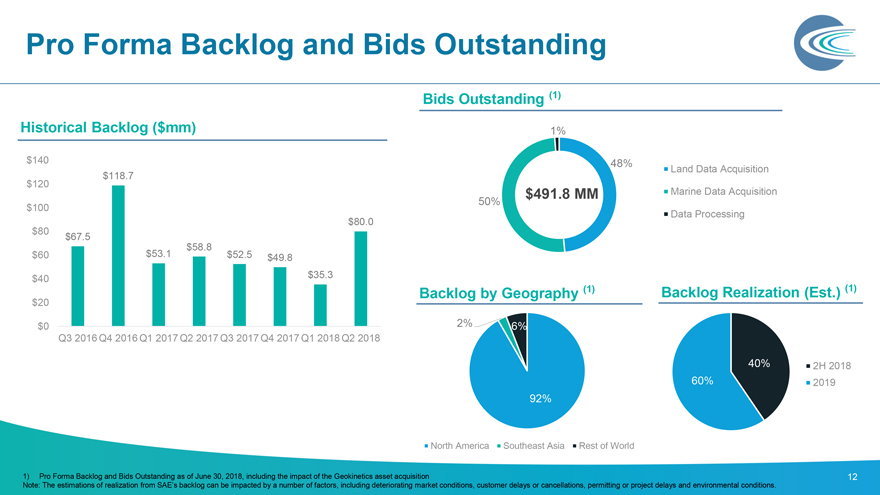

Pro Forma Backlog and Bids Outstanding Bids Outstanding (1) Historical Backlog ($mm) 1% $140 48% Land Data Acquisition $118.7 $120 $491.8 MM Marine Data Acquisition 50% $100 Data Processing $80.0 $80 $67.5 $58.8 $60 $53.1 $52.5 $49.8 $40 $35.3 Backlog by Geography (1) Backlog Realization (Est.) (1) $20 $0 2% 6% Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 40% 2H 2018 60% 2019 92% North America Southeast Asia Rest of World 1) Pro Forma Backlog and Bids Outstanding as of June 30, 2018, including the impact of the Geokinetics asset acquisition 12 Note: The estimations of realization from SAE’s backlog can be impacted by a number of factors, including deteriorating market conditions, customer delays or cancellations, permitting or project delays and environmental conditions.

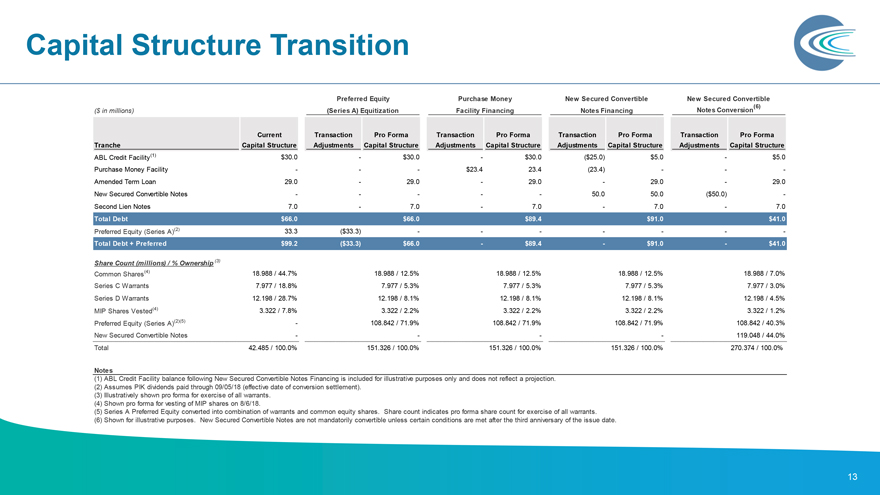

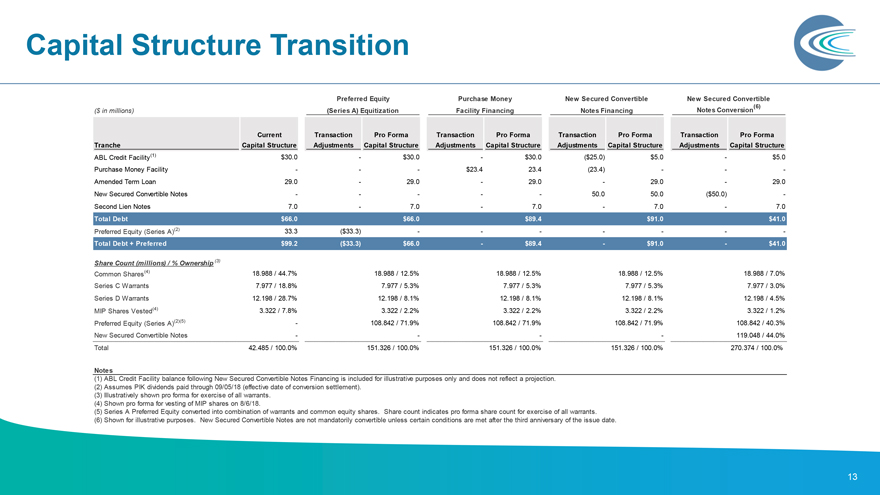

Capital Structure Transition Preferred Equity Purchase Money New Secured Convertible New Secured Convertible (6) ($ in millions) (Series A) Equitization Facility Financing Notes Financing Notes Conversion Current Transaction Pro Forma Transaction Pro Forma Transaction Pro Forma Transaction Pro Forma Tranche Capital Structure Adjustments Capital Structure Adjustments Capital Structure Adjustments Capital Structure Adjustments Capital Structure ABL Credit Facility(1) $30.0 - $30.0 - $30.0 ($25.0) $5.0 - $5.0 Purchase Money Facility - - - $23.4 23.4 (23.4) - - - Amended Term Loan 29.0 - 29.0 - 29.0 - 29.0 - 29.0 New Secured Convertible Notes - - - - - 50.0 50.0 ($50.0) - Second Lien Notes 7.0 - 7.0 - 7.0 - 7.0 - 7.0 Total Debt $66.0 $66.0 $89.4 $91.0 $41.0 Preferred Equity (Series A)(2) 33.3 ($33.3) - - - - - - - Total Debt + Preferred $99.2 ($33.3) $66.0 - $89.4 - $91.0 - $41.0 Share Count (millions) / % Ownership (3) Common Shares(4) 18.988 / 44.7% 18.988 / 12.5% 18.988 / 12.5% 18.988 / 12.5% 18.988 / 7.0% Series C Warrants 7.977 / 18.8% 7.977 / 5.3% 7.977 / 5.3% 7.977 / 5.3% 7.977 / 3.0% Series D Warrants 12.198 / 28.7% 12.198 / 8.1% 12.198 / 8.1% 12.198 / 8.1% 12.198 / 4.5% MIP Shares Vested(4) 3.322 / 7.8% 3.322 / 2.2% 3.322 / 2.2% 3.322 / 2.2% 3.322 / 1.2% Preferred Equity (Series A)(2)(5) - 108.842 / 71.9% 108.842 / 71.9% 108.842 / 71.9% 108.842 / 40.3% New Secured Convertible Notes - - - - 119.048 / 44.0% Total 42.485 / 100.0% 151.326 / 100.0% 151.326 / 100.0% 151.326 / 100.0% 270.374 / 100.0% Notes (1) ABL Credit Facility balance following New Secured Convertible Notes Financing is included for illustrative purposes only and does not reflect a projection. (2) Assumes PIK dividends paid through 09/05/18 (effective date of conversion settlement). (3) Illustratively shown pro forma for exercise of all warrants. (4) Shown pro forma for vesting of MIP shares on 8/6/18. (5) Series A Preferred Equity converted into combination of warrants and common equity shares. Share count indicates pro forma share count for exercise of all warrants. (6) Shown for illustrative purposes. New Secured Convertible Notes are not mandatorily convertible unless certain conditions are met after the third anniversary of the issue date. 13

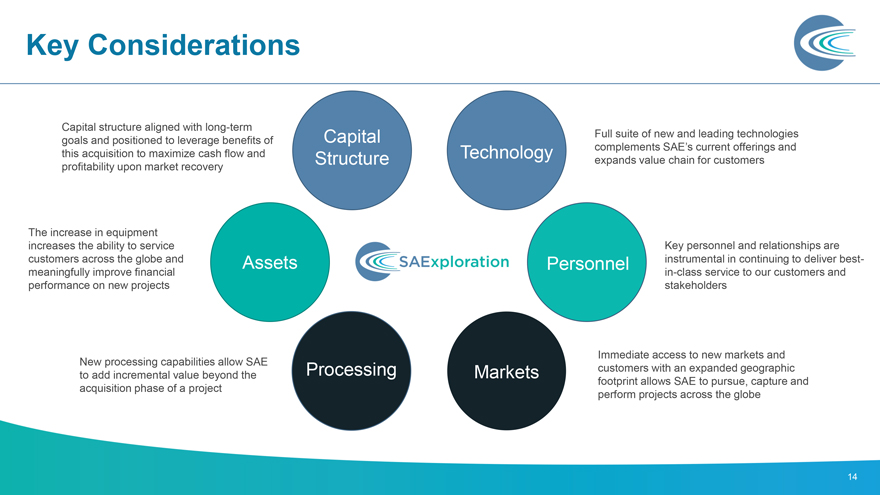

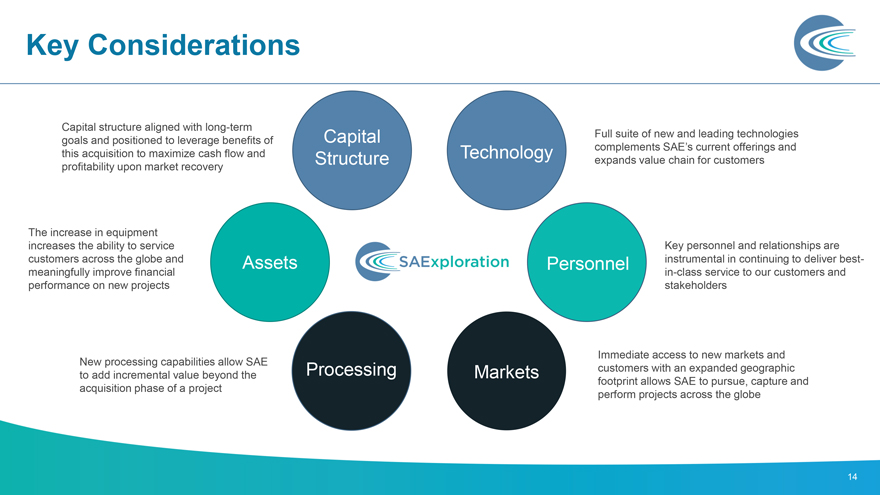

Key Considerations Capital structure aligned with long-term Capital Full suite of new and leading technologies goals and positioned to leverage benefits of complements SAE’s current offerings and this acquisition to maximize cash flow and Technology Structure expands value chain for customers profitability upon market recovery The increase in equipment increases the ability to service Key personnel and relationships are customers across the globe and Assets Personnel instrumental in continuing to deliver best-meaningfully improve financialin-class service to our customers and performance on new projects stakeholders Immediate access to new markets and New processing capabilities allow SAE Processing Markets customers with an expanded geographic to add incremental value beyond the footprint allows SAE to pursue, capture and acquisition phase of a project perform projects across the globe 14