SAEXPLORATION HOLDINGS, INC.

BACKSTOP COMMITMENT AGREEMENT

August 27, 2020

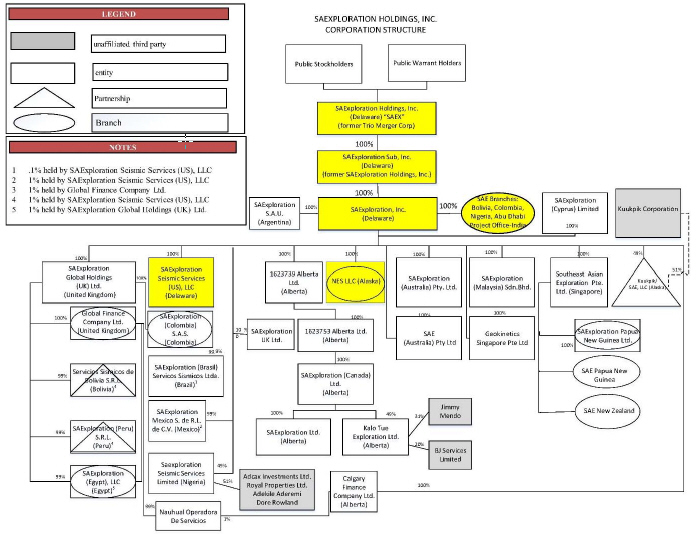

BACKSTOP COMMITMENT AGREEMENT, dated as of August 27, 2020 (this “Agreement”), among SAExploration Holdings, Inc. (the “Company”), a Delaware corporation, SAExploration Sub, Inc. (“SAE Sub”), SAExploration, Inc. (“SAE Inc.”), SAExploration Seismic Services (US), LLC (“Seismic”), and NES, LLC (“NES”) (collectively, the “Company Parties” or the “Debtors”) and the parties set forth on Schedule 1 hereto (each a “Backstop Party” and collectively, the “Backstop Parties”). Each Company Party and each Backstop Party is referred to herein, individually, as a “Party” and, collectively, as the “Parties.”

RECITALS

WHEREAS, SAE Inc. is the borrower under that certain Third Amended and Restated Credit and Security Agreement dated as of September 26, 2018 (as amended, the “Prepetition Credit Agreement”) among SAE Inc., as borrower, the Company, SAE Sub, Seismic, NES and SAExploration Acquisitions (U.S.), LLC, which was subsequently merged out of existence (“SAE Acquisitions”), as guarantors, Cantor Fitzgerald as the administrative agent and the collateral agent, and the lenders party thereto (the “Prepetition Credit Agreement Lenders”).

WHEREAS, on June 29, 2016, the Company entered into that certain Term Loan and Security Agreement (as amended or otherwise modified from time to time, the “Prepetition Term Loan Agreement”), among the Company, as borrower, SAE Sub, SAE Inc., Seismic and NES, as guarantors, the lenders party thereto (the “Prepetition Term Loan Lenders”) and Delaware Trust Company, as the collateral agent and as the administrative agent.

WHEREAS, on September 26, 2018, the Company issued $60 million in aggregate principal amount of 6.00% Senior Secured Convertible Notes due 2023 (the “Convertible Notes”, and the holders of such Convertible Notes, the “Convertible Noteholders”). The Convertible Notes were issued under that certain Indenture dated as of September 26, 2018 (as amended, supplemented or otherwise modified from time to time, collectively the “Prepetition Indenture”), among the Company, as issuer, SAE Sub, SAE Inc., Seismic, NES and SAE Acquisitions, as guarantors and Wilmington Savings Funds Society, FSB, as Trustee and Collateral Trustee thereunder.

WHEREAS, the Parties have engaged in arm’s-length, good faith discussions regarding a restructuring of certain of the Debtors’ indebtedness and other obligations, including the Debtors’ indebtedness and obligations under the Prepetition Credit Agreement, the Prepetition Term Loan Agreement and the Prepetition Indenture.

WHEREAS, the Company Parties, the Backstop Parties, and the other Consenting Creditors (as defined in the RSA) entered into that certain Restructuring Support Agreement, dated as of the date hereof (the “RSA”), pursuant to which the Parties agreed to, among other things, support a restructuring of the Debtors’ capital structure (the “Restructuring”).

WHEREAS, consistent with the RSA, the Restructuring is anticipated to be implemented through a prenegotiated plan of reorganization (as may be supplemented, amended, or modified from time to time, the “Plan”), a solicitation of votes thereon (the “Solicitation”), the Rights Offering (as defined below) and the commencement by the Debtors of voluntary cases (the “Chapter 11 Cases”) under chapter 11 of title 11 of the United States Code (the “Bankruptcy Code”) in the United States Bankruptcy Court for the Southern District of Texas (the “Bankruptcy Court”).

1