AGREEMENT ANDPLAN OFMERGER ANDREORGANIZATION

AMONG

CLEARSYSTEMRECYCLING, INC.,

CLEARSYSTEMMERGERSUB, INC.

AND

MASTERPIECEINVESTMENTSCORP.

AUGUST23, 2012

| |

| TABLE OF CONTENTS |

|

| ARTICLE 1 THE MERGER | 1 |

| ARTICLE 2 REPRESENTATIONS AND WARRANTIES OF THE COMPANY | 6 |

| ARTICLE 3 REPRESENTATIONS AND WARRANTIES OF PARENT AND | |

| MERGER SUB | 14 |

| ARTICLE 4 ADDITIONAL AGREEMENTS | 23 |

| ARTICLE 5 CLOSING; DELIVERIES | 24 |

| ARTICLE 6 DEFINITIONS | 29 |

| ARTICLE 7 MISCELLANEOUS | 33 |

LIST OF EXHIBITS AND DISCLOSURE SCHEDULES

Exhibits

| A | Articles of Incorporation of Merger Sub |

| B | By-laws of Merger Sub |

| C | Form of Opinion of Synergy Law Group, LLC |

| D | Form of Opinion of Pearlman & Schneider, LLP |

Company Disclosure Schedules

| 2.4 | Indebtedness |

| 2.5 | Company Stockholders and Shares; Allocation of Parent Common Stock |

| 2.7 | Compliance with Laws |

| 2.9 | Broker’s and Finder’s Fees |

| | |

| 2.13 | (a) | Schedule of Real and Personal Property |

| 2.13 | (b) | Material Agreements |

| 2.13 | (c) | Schedule of Insurance |

| 2.13 | (d) | Schedule of Patents and Other Intangible Assets |

| 2.14 | Employees and Employment Agreements |

| 2.16 | Ownership of Intellectual Property |

| 2.17 | Schedule of Employee Benefit Plans |

| 2.19 | Product Liability Claims |

| 2.20 | Litigation |

| 2.22 | Interested Party Transactions |

| 2.26 | Obligations to or by Stockholders |

Parent Disclosure Schedules

| | |

| 3.1 | (c) | Parent Board of Directors, Committees and Officers |

| 3.2 | (a) | Subsidiaries of Parent |

| 3.2 | (c) | Subsidiary Board of Directors, Committees and Officers |

| 3.10 | SEC Reporting |

| 3.16 | Compliance with Laws |

| 3.20 | Obligations to or by Stockholders |

| 3.23 | Interested Party Transactions |

| 3.25 | Bank Accounts and Safe Deposit Boxes |

| 3.26 | Intellectual Property |

ii

AGREEMENT ANDPLAN OFMERGER ANDREORGANIZATION

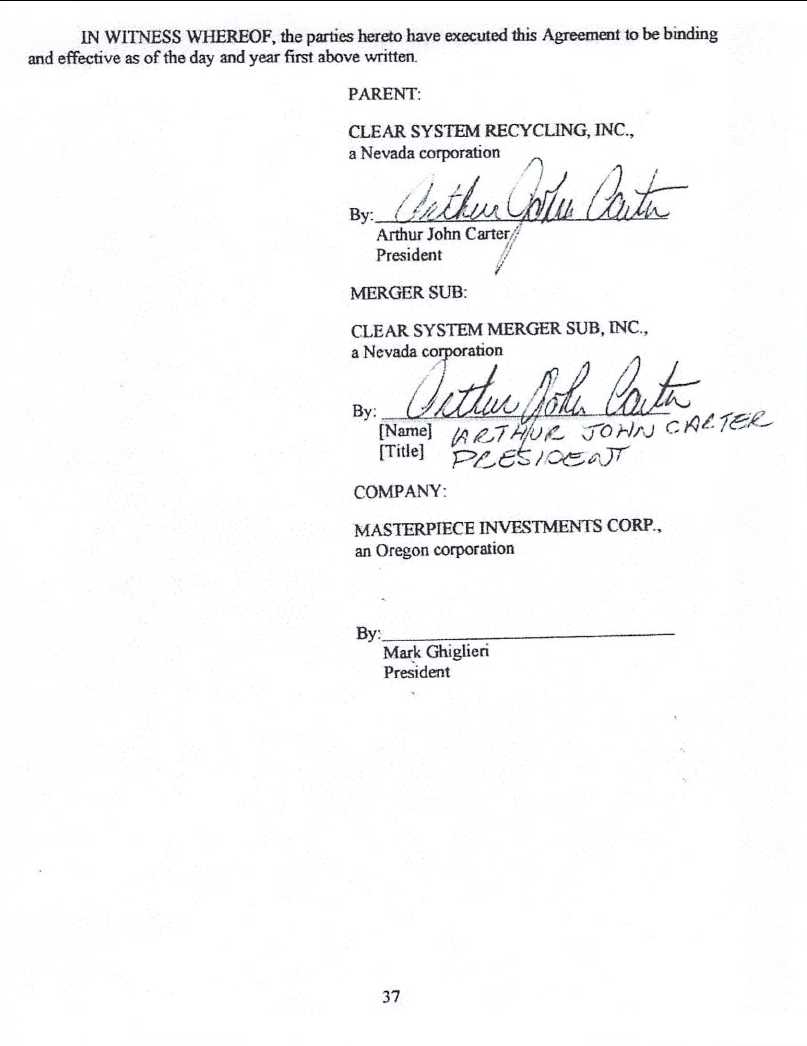

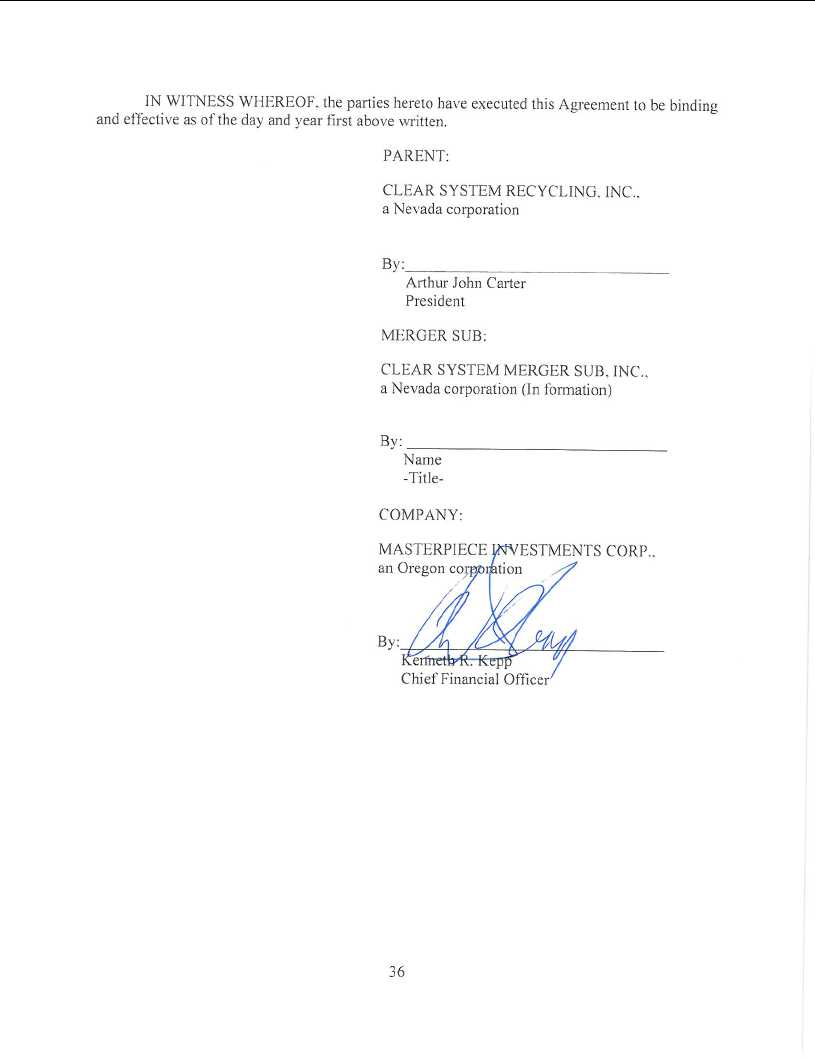

THIS AGREEMENT AND PLAN OF MERGER AND REORGANIZATION (the “Agreement”) is made and entered into on August __, 2012, by and among Clear System Recycling, Inc., a Nevada corporation (“Parent”), Clear System Merger Sub, Inc. (“Merger Sub”), an Oregon corporation and wholly-owned subsidiary of Parent, and Masterpiece Investments Corp., an Oregon corporation (“Company”).

W I T N E S S E T H:

WHEREAS, the Board of Directors of each of the Parent, the Merger Sub and the Company have each determined that it is in the best interests of their respective entities and the stockholders thereof to enter into a business combination transaction pursuant to which the Company will merge with and into the Merger Sub (the “Merger”), with the Merger Sub continuing after the Merger as the surviving corporation and wholly-owned subsidiary of the Parent; WHEREAS, pursuant to the Merger, outstanding shares of common stock, $0.001 par value per share, of the Company (“Company Common Stock”) will, in accordance with this Agreement, be converted into the right to receive shares of common stock, $0.001 par value per share, of the Parent (“Parent Common Stock”); WHEREAS, the Board of Directors of Parent, the Board of Directors of the Merger Sub and the Board of Directors of the Company have each approved this Agreement and transactions contemplated hereby; WHEREAS, the parties hereto intend, by executing this Agreement, to adopt a plan of reorganization within the meaning of Section 368 of the Internal Revenue Code of 1986, as amended (the “Code”) and the regulations promulgated thereunder and to cause the Merger to qualify as a tax-free reorganization under the provisions of Section 368 of the Code; and WHEREAS, the Parent Common Stock to be issued in connection with the Merger are expected to be exempt from registration pursuant to Section 4(2) of the Securities Act of 1933, as amended (the “Securities Act”) and Rule 506 promulgated thereunder; NOW, THEREFORE, in consideration of the mutual agreements and covenants hereinafter set forth, the parties hereto agree as follows:

ARTICLE 1

THE MERGER

1.1Merger of the Company with and into the Merger Sub. Upon the terms and subject to the conditions set forth in this Agreement and in accordance with the Nevada Revised Statutes (“NRS”) and the Oregon Revised Statutes (“ORS”), at the Effective Time, the Company shall be merged with and into the Merger Sub, and the separate existence of the Company shall cease. The Merger Sub will change its name to “Masterpiece Investments Corp.” and continue as the surviving corporation (“Masterpiece Nevada”) following the Merger. The Closing of the Merger shall be conditioned upon approval of the Stockholders of the Company.

1.2Effect of the Merger. The Merger shall have the effects set forth in this Agreement and the applicable provisions of the NRS and the ORS. As a result of the Merger, Masterpiece Nevada will become a wholly-owned subsidiary of the Parent. Without limiting the generality of the foregoing, and subject thereto, at the Effective Time, all the property, rights, privileges, powers and franchises of the Company and Merger Sub shall vest in Masterpiece Nevada, and all debts, liabilities and duties of the Company and Merger Sub shall become the debts, liabilities and duties of Masterpiece Nevada.

1.3Closing; Effective Time. Subject to the terms and conditions of this Agreement, simultaneous with the Closing hereof, the parties hereto shall cause the Merger to be consummated by executing and filing with the Secretary of State of the State of Nevada and the Secretary of State of the State of Oregon articles of merger (the “Articles of Merger”) with respect to the Merger, satisfying the applicable requirements of the NRS and the ORS and in a form reasonably acceptable to the Parent, the Merger Sub and the Company. The Merger shall become effective at the time of the filing of such Articles of Merger with the Secretary of State of the State of Nevada and the Secretary of State of the State of Oregon or at such later time as may be specified in such Articles of Merger (the time as of which the Merger becomes effective being referred to as the “Effective Time”).

| | | |

| | 1.4 | Articles of Incorporation and Bylaws; Directors and Officers. At the Effective |

| Time: | | | |

| |

| | | (a) | Merger Sub Articles of Incorporation. The Merger Sub Articles of |

| | Incorporation, as in effect immediately before the Effective Time, attached asExhibit A |

hereto, shall be the Articles of Incorporation of Masterpiece Nevada until thereafter amended as provided by the NRS and such Articles of Incorporation; (b)Merger Sub Bylaws. The Merger Sub Bylaws, as in effect immediately before the Effective Time, attached asExhibit Bhereto, shall be the Bylaws of Masterpiece Nevada, until thereafter amended as provided by the NRS and such Bylaws; (c)Merger Sub Directors. The directors of the Merger Sub immediately before the Effective Time shall be the directors of Masterpiece Nevada, each to hold office in accordance with the Articles of Incorporation and bylaws of the Masterpiece Nevada; and (d)Merger Sub Officers. The officers of the Merger Sub immediately before the Effective Time shall be the officers of Masterpiece Nevada, in each case until their respective successors are duly elected or appointed and qualified, or until their earlier death, resignation or removal.

1.5Shares to Be Issued; Effect on Capital Stock. Subject to the terms and conditions of this Agreement, at the Effective Time, by virtue of the Merger, the following shall occur:

(a)Conversion of Company Stock. Subject to the terms of Section 1.5(c), each share of Company Common Stock issued and outstanding immediately before the Effective Time will be converted automatically into the right to receive: (A) that number

2

of shares of Parent Common Stock equal to the Exchange Ratio and (B) any fractional share be rounded up to the nearest whole number.

(b)Capital Stock of Merger Sub. Each stock certificate of Merger Sub evidencing ownership of any such shares shall, as of the Effective Time, evidence ownership of such shares of common stock of Masterpiece Nevada.

(c)No Fractional Shares. No fractional shares of Parent Common Stock shall be issued in connection with the Merger, and no certificates or scrip representing such fractional shares shall be issued. Fractional shares shall be rounded up to the nearest whole number. The holder of shares of Company Common Stock who would otherwise be entitled to receive a fraction of a share of Parent Common Stock (after aggregating all fractional shares of Parent Common Stock to be received by such holder), in lieu of such fractional share and upon surrender of such holder’s certificate representing shares of Company Common Stock (the “Company Stock Certificate”), shall instead receive Parent Common Stock rounded up to the nearest whole number.

(d)Cancellation of Treasury Shares. Each share of stock held in the treasury of either the Parent, Merger Sub or the Company immediately prior to the Effective Time shall be cancelled and cease to exist.

1.6Calculation of Exchange Ratios. The “Exchange Ratio” shall be one share of Parent Common Stock in exchange for four shares of Company Common Stock outstanding immediately before the Effective Time.

1.7Dissenting Shares. Notwithstanding any other provision of this Agreement to the contrary, any shares of Company Common Stock that have not been voted in favor of adoption of this Agreement, and with respect to which a demand for payment and appraisal have been properly made in accordance with ORS 60.551 through 60.594 (such shares referred to as “Dissenting Shares”), shall not be converted into or represent a right to receive Parent Common Stock pursuant to Section 1.5(a), but shall be converted in to the right to receive such consideration as may be determined to be due with respect to such Dissenting Shares pursuant to the ORS, as applicable; provided, however, that if a holder of Dissenting Shares (a “Dissenting Stockholder”) withdraws such holder’s demand for such payment and appraisal or becomes ineligible for such payment and appraisal then, as of the later of the Effective Time or the date of which such Dissenting Stockholder withdraws such demand or otherwise becomes ineligible for such payment and appraisal, such holder’s Dissenting Shares will cease to be Dissenting Shares and will be converted into the right to receive Parent Common Stock as determined in accordance with Section 1.5(a).

1.8No Further Transfer of Company Common Stock. At the Effective Time all shares of Company Common Stock outstanding immediately before the Effective Time shall automatically be exchanged, and all holders of Company Common Stock that were outstanding immediately before the Effective Time shall cease to have any rights as stockholders of the Company, except the right to receive the consideration described in Section 1.5(a) or Section 1.7, as applicable. No further transfer of any such shares of Company Common Stock shall be made on such stock transfer books after the Effective Time. Subject to Section 1.9(f) if, after the

3

Effective Time, any shares of Company Common Stock are presented to the Exchange Agent or to the Company or the Parent, such shares shall be canceled and shall be exchanged as provided in Section 1.9.

| 1.9 | Exchange of Certificates. |

| | (a) | Exchange Agent. The Parent and the Company have jointly selected and |

| | designated | Island Stock Transfer Company (the “Exchange Agent”) to act as agent of the |

Parent for purposes of, among other things, mailing and receiving transmittal letters and distributing the Parent Common Stock to the holders of Company Common Stock.

(b)Parent to Provide Common Stock. Promptly after the Effective Time, the Parent shall supply or cause to be supplied or made available to the Exchange Agent for exchange in accordance with this Section 1.9 through such reasonable procedures as the Parent may adopt, instructions regarding issuance of certificates evidencing the shares of Parent Common Stock issuable pursuant to Section 1.5(a) in exchange for shares of Company Common Stock outstanding immediately before the Effective Time (the “Exchange Shares”).

(c)Exchange Procedures. As promptly as practicable after the Effective Time, the Exchange Agent will mail to each holder of record of Company Common Stock whose shares would be converted into the right to receive shares of Parent Common Stock pursuant to Section 1.5(a), (i) a letter of transmittal in customary form; (ii) such other customary documents as may be required pursuant to such instructions; and (iii) instructions for use in effecting the surrender of Company Common Stock in exchange for certificates representing shares of Parent Common Stock. Upon surrender of Company Common Stock for cancellation to the Exchange Agent, together with such letter of transmittal and other documents, duly completed and validly executed in accordance with the instructions thereto, the holder of such Company Common Stock shall be entitled to receive in exchange therefor (y) a certificate representing the number of whole Exchange Shares into which the Company Common Stock represented thereby shall have been converted into the right to receive as of the Effective Time and (z) cash in respect of any fractional shares as provided in Section 1.5(c), and the Company Common Stock so surrendered shall forthwith be canceled. Until so surrendered, each such outstanding share of Company Common Stock will be deemed from and after the Effective Time, for all corporate purposes other than the payment of dividends, to evidence the ownership of the number of full shares of Parent Common Stock into which such shares of Company Common Stock shall have been so converted and the right to receive cash in lieu of the issuance of any fractional shares. If any Company Stock Certificate shall have been lost, stolen or destroyed, Parent may, in its discretion and as a condition precedent to the issuance of any certificate representing Parent Common Stock, require the owner of such lost, stolen or destroyed Company Stock Certificate to provide a reasonable affidavit as indemnity against any claim that may be made against the Exchange Agent, Parent or the Company with respect to such Company Stock Certificate.

(d)Distributions With Respect to Unexchanged Shares. No dividends or other distributions with respect to Parent Common Stock with a record date after the

4

Effective Time will be paid to the holder of any unsurrendered Company Common Stock with respect to the shares of Parent Common Stock represented thereby until the holder of record of such Company Common Stock shall surrender such shares of Company Common Stock. Subject to applicable law, following surrender of any such Company Common Stock, there shall be delivered to the record holder of Company Common Stock a certificate representing whole shares of Parent Common Stock issued in exchange therefor (including any cash in respect of any fractional shares), without interest at the time of such surrender, and the amount of any such dividends or other distributions with a record date after the Effective Time theretofore payable (but for the provisions of this Section) with respect to such shares of Parent Common Stock.

(e)Transfers of Ownership. If any certificate for shares of Parent Common Stock is to be issued in a name other than that in which Company Stock Certificate surrendered in exchange therefor is registered, it will be a condition of the issuance thereof that the Company Common Stock so surrendered will be properly endorsed and otherwise in proper form for transfer and that the person requesting such exchange will have paid to Parent or the Exchange Agent any transfer or other taxes required by reason of the issuance of a certificate for shares of Parent Common Stock in any name other than that of the registered holder of the Company Common Stock surrendered, or established to the satisfaction of Parent or the Exchange Agent that such tax has been paid or is not payable, and shall provide such written assurances regarding federal and state securities law compliance as the Parent or the Exchange Agent may reasonably request.

(f)Termination of Exchange Shares.Any Exchange Shares which remain undistributed to the stockholders of the Company twelve (12) months after the Effective Time shall be delivered to Parent, upon demand, and any Company Stockholder who has not previously complied with this Section shall thereafter look only to Parent for payment of their claim for their portion of the Exchange Shares and any dividends or distributions with respect to the Exchange Shares.

(g)No Liability. Notwithstanding anything to the contrary in this Section, none of the Exchange Agent, Parent, the Company or any party hereto shall be liable to any person for any amount properly paid to a public official pursuant to any applicable abandoned property, escheat or similar law.

(h)Dissenting Shares. The provisions of this Section shall also apply to Dissenting Shares that lose their status as such, except that the obligations of Parent under this Section shall commence on the date of loss of such status and the holder of such shares shall be entitled to receive in exchange such shares to which such holder is entitled pursuant to Section 1.5.

1.10Further Action. If, at any time after the Effective Time, any further action that is commercially reasonable and lawful is determined by Parent to be necessary or appropriate to carry out the purposes of this Agreement or to vest Parent with full right, title and possession of all shares of Company Common Stock, the officers and directors of the Company and Parent shall be fully authorized (in the name of the Company and otherwise) to take such action.

5

ARTICLE 2

REPRESENTATIONS AND WARRANTIES OF THE COMPANY

The Company hereby represents and warrants to the Parent that, except as set forth in the Company’s Disclosure Schedules attached hereto, the statements contained in this Article 2 are true and correct as set forth below: 2.1Organization, Standing, Etc. The Company is a corporation duly organized and existing in good standing under the laws of the State of Oregon, and has all requisite power and authority to carry on its business, to own or lease its properties and assets, to enter into this Agreement and to carry out the terms hereof. Copies of the Articles of Incorporation and Bylaws of the Company that have been delivered to the Parent prior to the execution of this Agreement are true and complete and have not since been amended or repealed. The Company has no subsidiaries or direct or indirect interest (by way of stock ownership or otherwise) in any firm, corporation, limited liability company, partnership, association or business.

2.2Qualification. The Company is duly qualified to conduct business as a foreign corporation and is in good standing in each state or other jurisdiction wherein the nature of its activities or properties owned or leased makes such qualification necessary, except where the failure to be so qualified could not reasonably be expected to have a material adverse effect (“Material Adverse Effect”) on the properties, assets, liabilities or results of operations of the Company taken as a whole.

2.3Capitalization of the Company. There are 215,536,519 shares of common stock of the Company issued and outstanding, and such shares are duly authorized, validly issued, fully paid and, none of such shares have been issued in violation of preemptive rights, if any, of any person. The offer, issuance and sale of the shares were (a) exempt from the registration and prospectus delivery requirements of the Securities Act, (b) registered or qualified (or were exempt from registration or qualification) under the registration or qualification requirements of all applicable state securities laws and (c) accomplished in conformity with all other applicable securities laws. The Company has no outstanding options, rights or commitments to issue shares or other equity securities, and there are no outstanding securities convertible or exercisable into or exchangeable for shares or other equity securities of the Company.

2.4Indebtedness. The Company has no Indebtedness except as identified on the Company Financial Statements (as defined below) or inSchedule 2.4hereto.

2.5Stockholders of the Company.Schedule 2.5hereto contains a true and complete list of the names and addresses of the record owners of all of the outstanding shares and other equity securities of the Company, together with the number securities held. To the best knowledge of the Company, there is no voting trust, agreement or arrangement among any of the beneficial holders of the shares affecting the nomination or election of directors or the exercise of the voting rights of the shares.

2.6Acts and Proceedings. The execution, delivery and performance of this Agreement has been duly authorized by the Board of Directors of the Company, and all of the acts and other proceedings required for the due and valid authorization, execution, delivery and

6

performance of this Agreement have been or, at the Closing, shall be, validly and appropriately taken.

Except for the requisite approval of the Merger and the adoption of this Agreement by the Company’s stockholders and the Merger filings with the State of Oregon, no other corporate proceedings on the part of the Company are necessary to authorize this Agreement or to consummate the transactions contemplated hereby.

| | | | | | | | | |

| 2.7 | Compliance | with | Laws | and | Instruments. | The | execution, | delivery | and |

performance by the Company of this Agreement and the consummation by the Company of the transactions contemplated by this Agreement: (a) will not require any authorization, consent or approval of, or filing or registration with, any court or governmental agency or instrumentality, except such as shall have been obtained prior to the Closing or as set forth inSchedule 2.7, (b) will not cause the Company to violate or contravene (i) any provision of law, (ii) any rule or regulation of any agency or government, (iii) any order, judgment or decree of any court, or (iv) any provision of the Articles of Incorporation or By-laws of the Company, (c) will not violate or be in conflict with, result in a breach of or constitute (with or without notice or lapse of time, or both) a default under, any indenture, loan or credit agreement, deed of trust, mortgage, security agreement or other contract, agreement or instrument to which the Company is a party or by which the Company or any of its properties is bound or affected, except where any such violation, conflict, breach or default could not reasonably be expected to have a Material Adverse Effect, and (d) will not result in the creation or imposition of any Lien upon any property or asset of the Company. To the knowledge of the Company, the Company is not in violation of, or (with or without notice or lapse of time, or both) in default under, any material term or provision of its Articles of Incorporation or By-laws or any indenture, loan or credit agreement, deed of trust, mortgage, security agreement or any other material agreement or instrument to which the Company is a party or by which the Company or any of its respective properties is bound or affected, in each case except as could not reasonably be expected to have a Material Adverse Effect.

2.8Binding Obligations. This Agreement constitutes the legal, valid and binding obligation of the Company and is enforceable against the Company in accordance with its terms, except as such enforcement is limited by bankruptcy, insolvency and other similar laws affecting the enforcement of creditors’ rights generally and by general principles of equity.

2.9 Financial Statements. Prior to the Closing Date the Company shall furnish Parent with a true and complete copy of (i) the audited balance sheets of the Company as of December 31, 2011 and December 31, 2010, and the related audited statements of income and statements of cash flow of the Company for the fiscal years ended December 31, 2011 and December 31, 2010; and (ii) unaudited balance sheets and related unaudited income and unaudited statements of cash flow for the interim period ending June 30, 2012 (together items (i) and (ii) in this section are the “Company Financial Statements”). The Company Financial Statements will fairly present in all material respects the financial position, results of operations and other information purported to be shown thereon of the Company, at the dates and for the respective periods to which they apply. The Company Financial Statements through December 31, 2011 have been audited by LBB &Associates Ltd, LP and all Company Financial Statements (i) were prepared in conformity with United States generally accepted accounting

7

principles consistently applied throughout the periods involved (“GAAP”); and (ii) have been adjusted for all normal and recurring accruals (and, in the case of unaudited financial information, on a basis consistent with year-end audits).

2.10Liabilities. Except as otherwise disclosed in Company Financial Statements, Notes to the Financial Statements, or in Schedule 2.4, Company does not have any material liability or obligation whatsoever, either direct or indirect, matured or unmatured, accrued, absolute, contingent or otherwise. Furthermore, there is no pending proceeding that has been commenced against Company that challenges, or may have the effect of preventing, delaying, making illegal, or otherwise interfering with, any of the transactions contemplated by this Agreement. To the knowledge of Company, no such proceeding has been threatened.

| 2.11 | Adverse Officer and Director Information. |

Except as set forth on Schedule 2.11, during the past five year period neither the Company, nor, to its knowledge, any of its executive officers, members of executive management or directors, nor any Person intended upon consummation of the Merger to be nominated by the Company to become an officer, member of executive management or director of the Surviving Company or any successor entity or subsidiary, has been the subject of: (a) a petition under the federal bankruptcy laws or any other insolvency or moratorium law or has a receiver, fiscal agent or similar officer been appointed by a court for the business or property of the Company or such Person, or any partnership in which the Company or any such Person was a general partner at or within two years before the time of such filing, or any corporation or business association of which the Company or any such Person was an executive officer at or within two years before the time of such filing;

| (b) | a conviction in a criminal proceeding or a named subject of a pending criminal |

proceeding for violation of any federal or state securities statute or regulation;(c) any order, judgment or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining the Company or any such Person from, or otherwise limiting (i) acting as a futures commission merchant, introducing broker, commodity trading advisor, commodity pool operator, floor broker, leverage transaction merchant, any other Person regulated by the United States Commodity Futures Trading Commission or the SEC or an associated Person of any of the foregoing, or as an investment adviser, underwriter, broker or dealer in securities, or as an affiliated Person, director or employee of any investment company, bank, savings and loan association or insurance company, or engaging in or continuing any conduct or practice in connection with such activity; (ii) engaging in any type of business practice; or (iii) engaging in any activity in connection with the purchase or sale of any security or commodity or in connection with any violation of federal, state or other securities laws or commodities laws; (d) a finding by a court of competent jurisdiction in a civil action or by the SEC to have violated any securities law, regulation or decree and the judgment in such civil action or finding by the Commission has not been subsequently reversed, suspended or vacated; or

8

(e) a finding by a court of competent jurisdiction in a civil action or by the United States Commodity Futures Trading Commission to have violated any federal commodities law, and the judgment in such civil action or finding has not been subsequently reversed, suspended or vacated.

2.12Absence of Certain Changes. Since the date of the Company Financial Statements, and except as set forth onSchedule 2.12,the Financial Statements or the Notes to the Financial Statements, the Company has been operated only in the ordinary course, consistent with past practice, and there has not been any adverse change, or any event, fact or circumstance which might reasonably be expected to result in an adverse change, in either event that would have a Material Adverse Effect. Without limiting the generality of the foregoing, except as set forth on Schedule 2.12 and except in the ordinary course of business, since June 30, 2012, there has not been with respect to the Company:

(a) any sale, lease, transfer, license or assignment of any assets, tangible or intangible, of the Company; (b) any damage, destruction or property loss, whether or not covered by insurance, affecting adversely the properties or business of the Company; (c) any declaration or setting aside or payment of any dividend or distribution with respect to the shares of capital stock of the Company or any redemption, purchase or other acquisition of any such shares; (d) any subjection to any lien on any of the assets, tangible or intangible, of the Company; (e) any incurrence of indebtedness or liability or assumption of obligations by the Company;

| (f) | any waiver or release by the Company of any right of any material value; |

| (g) | any compensation or benefits paid to officers or directors of the Company; |

| (h) | any change made or authorized in the articles of incorporation or bylaws |

of the Company;

(i) any loan to or other transaction with any officer, director or stockholder of the Company giving rise to any claim or right of the Company against any such person or of such person against the Company; or (j) any material adverse change in the condition (financial or otherwise) of the respective properties, assets, liabilities or business of the Company.

2.13Schedule of Assets and Contracts. Attached hereto asSchedules 2.13(a) through 2.13(d)are various schedules listing assets and contracts of the Company, as described herein.

9

(a)Schedule 2.13(a)contains a true and complete list of all real property leased by the Company, including a brief description of each item thereof and of the nature of the Company’ interest therein, and of all tangible personal property owned or leased by the Company having a cost or fair market value of greater than $25,000, including a brief description of each item and of the nature of the interest of the Company therein. All the property listed inSchedule 2.13(a)as being leased by the Company is held by the Company under valid and enforceable leases having the rental terms, termination dates and renewal and purchase options described inSchedule 2.13(a); and there is not, under any such lease, any existing default or event of default or event which with notice or lapse of time, or both, would constitute a default by the Company, and the Company has not received any notice or claim of any such default. The Company does not own any real property.

(b) Except as expressly set forth in this Agreement, the Balance Sheet or the notes thereto, or as disclosed inSchedule 2.13(b)hereto, the Company is not a party to any written or oral agreement not made in the ordinary course of business that is material to the Company. Except as disclosed inSchedule 2.13(b)hereto, the Company is not a party to any written or oral (a) agreement with any labor union, (b) agreement for the purchase of fixed assets or for the purchase of materials, supplies or equipment in excess of normal operating requirements, (c) agreement for the employment of any officer, individual employee or other Person on a full-time basis or any agreement with any Person for consulting services, (d) bonus, pension, profit sharing, retirement, stock purchase, stock option, deferred compensation, medical, hospitalization or life insurance or similar plan, contract or understanding with respect to any or all of the employees of the Company or any other Person, (e) indenture, loan or credit agreement, note agreement, deed of trust, mortgage, security agreement, promissory note or other agreement or instrument relating to or evidencing Indebtedness or subjecting any asset or property of the Company to any Lien or evidencing any Indebtedness, (f) guaranty of any Indebtedness, (g) other than as set forth inSchedule 2.13(a)hereto, lease or agreement under which the Company is lessee of or holds or operates any property, real or personal, owned by any other Person under which payments to such Person exceed $25,000 per year or with an unexpired term (including any period covered by an option to renew exercisable by any other party) of more than 60 days, (h) lease or agreement under which the Company is lessor or permits any Person to hold or operate any property, real or personal, owned or controlled by the Company, (i) agreement granting any preemptive right, right of first refusal or similar right to any Person, (j) agreement or arrangement with any Affiliate or any “associate” (as such term is defined in Rule 405 under the Securities Act) of the Company or any present or former officer, director or stockholder of the Company, (k) agreement obligating the Company to pay any royalty or similar charge for the use or exploitation of any tangible or intangible property, (1) covenant not to compete or other restriction on its ability to conduct a business or engage in any other activity, (m) distributor, dealer, manufacturer’s representative, sales agency, franchise or advertising contract or commitment, (n) agreement to register securities under the Securities Act, (o) collective bargaining agreement, or (p) agreement or other commitment or arrangement with any Person continuing for a period of more than three months from the Closing Date which involves an expenditure or receipt by the Company in excess of $25,000. Except as disclosed inSchedule 2.13(b), none of the agreements,

10

contracts, leases, instruments or other documents or arrangements listed inSchedule 2.13(a)throughSchedule 2.13(d)requires the consent of any of the parties thereto other than the Company to permit the contract, agreement, lease, instrument or other document or arrangement to remain effective following consummation of the Merger and exchange and the transactions contemplated hereby.

(c)Schedule 2.13(c)contains a true and complete list of all insurance policies and insurance coverage with respect to the Company, and its business, premises, properties, assets, employees and agents.

(d)Schedule 2.13(d)contains a true and complete list of all patents, patent applications, trade names, trademarks, trademark registrations and applications, copyrights, copyright registrations and applications, and grants of licenses, both domestic and foreign, presently owned, possessed, used or held by the Company; and, except as set forth inSchedule 2.16, the Company owns the entire right, title and interest in and to the same, free and clear of all Liens and restrictions.Schedule 2.13(d)also contains a true and complete list of all licenses granted to or by the Company with respect to the foregoing. Except as disclosed inSchedule 2.13(d), none of the Company’s patents, patent applications, trade names, trademarks, trademark registrations and applications, copyrights, copyright registrations and applications and grants of licenses set forth inSchedule 2.13(d)are subject to any pending or, to the knowledge of the Company and the Stockholders, threatened challenge. Neither the execution nor delivery of this Agreement, nor the consummation of the transactions contemplated hereby, will give any licensor or licensee of the Company any right to change the terms or provisions of, terminate or cancel, any license to which the Company is a party.

(e) The Company has furnished to Parent true and complete copies of all agreements and other documents and a description of all applicable oral agreements disclosed or referred to inSchedule 2.13(a)throughSchedule 2.13(d), as well as any additional agreements or documents, requested by Parent. The Company has in all material respects performed all obligations required to be performed by it to date and is not in default in any respect under any of the contracts, agreements, leases, documents, commitments or other arrangements to which it is a party or by which it or any of its property is otherwise bound or affected. To the best knowledge of the Company, all parties having material contractual arrangements with the Company are in substantial compliance therewith and none are in material default thereunder. The Company has no outstanding power of attorney.

2.14Employees. The Company has complied in all material respects with all laws relating to the employment of labor, and the Company has encountered no material labor union difficulties. Except as set forth inSchedule 2.14, and other than pursuant to ordinary arrangements of employment compensation, the Company is not under any obligation or liability to any officer, director, employee or Affiliate of the Company.

2.15Tax Returns and Audits. All required federal, state and local Tax Returns of the Company have been accurately prepared in all material respects and duly and timely filed, and all federal, state and local Taxes required to be paid with respect to the periods covered by such

11

returns have been paid to the extent that the same are material and have become due, except where the failure so to file or pay could not reasonably be expected to have a Material Adverse Effect. To the knowledge of the Company, the Company is not and has not been delinquent in the payment of any Tax. To the knowledge of the Company, the Company has not had a Tax deficiency assessed against it. None of the Company’s federal income tax returns or any state or local income or franchise tax returns has been audited by governmental authorities. The reserves for Taxes reflected on the Balance Sheet are sufficient for the payment of all unpaid Taxes payable by the Company with respect to the period ended on the Balance Sheet Date. There are no federal, state, local or foreign audits, actions, suits, proceedings, investigations, claims or administrative proceedings relating to Taxes or any Tax Returns of the Company now pending, and the Company has not received any notice of any proposed audits, investigations, claims or administrative proceedings relating to Taxes or any Tax Returns.

| 2.16 | Patents and Other Intangible Assets. |

| | (a) Except as set forth inSchedule 2.16, the Company (i) owns or has the |

| right | to use, free and clear of all Liens, claims and restrictions, all patents, trademarks, |

service marks, trade names, copyrights, licenses and rights with respect to the foregoing used in or necessary for the conduct of its business as now conducted or proposed to be conducted without infringing upon a claimed right of any Person under or with respect to any of the foregoing and (ii) is not obligated to make any payments by way of royalties, fees or otherwise to any owner or licensor of, any patent, trademark, service mark, trade name, copyright or other intangible asset, with respect to the use thereof or in connection with the conduct of its business.

(b) To the knowledge of the Company, the Company owns or has the unrestricted right to use all trade secrets, if any, including know-how, negative knowhow, formulas, patterns, programs, devices, methods, techniques, inventions, designs, processes, computer programs and technical data (collectively, “intellectual property”) required for the development, operation and sale of its products, and all related technologies, products and services.

| 2.17 | Employee Benefit Plans; ERISA. |

| | (a) Except as disclosed inSchedule 2.17hereto, there are no “employee |

| benefit | plans” (within the meaning of Section 3(3) of the ERISA) or any other employee |

benefit or fringe benefit arrangements, practices, contracts, policies or programs other than programs merely involving the regular payment of wages, commissions, or bonuses established, maintained or contributed to by the Company. The plans listed inSchedule 2.17hereto are hereinafter referred to as the “Employee Benefit Plans.” (b) All current and prior material documents, including all amendments thereto, with respect to each Employee Benefit Plan have been given to Parent or its advisors.

(c) All Employee Benefit Plans are in material compliance with the applicable requirements of ERISA, the Code, and any other applicable state, federal or foreign law.

12

(d) There are no pending or, to the knowledge of the Company, threatened, claims or lawsuits which have been asserted or instituted against any Employee Benefit Plan, the assets of any of the trusts or funds under the Employee Benefit Plans, the plan sponsor or the plan administrator of any of the Employee Benefit Plans or against any fiduciary of an Employee Benefit Plan with respect to the operation of such plan.

(e) There is no pending or, to the knowledge of the Company, threatened, investigation or pending or possible enforcement action by the Pension Benefit Guaranty Corporation, the Department of Labor, the Internal Revenue Service or any other government agency with respect to any Employee Benefit Plan.

(f) No actual or, to the knowledge of the Company, contingent, liability exists with respect to the funding of any Employee Benefit Plan or for any other expense or obligation of any Employee Benefit Plan, except as disclosed on the financial statements of the Company or the Schedules to this Agreement, and to the knowledge of the Company, no contingent liability exists under ERISA with respect to any “multi-employer plan,” as defined in Section 3(37) or Section 4001(a)(3) of ERISA.

2.18 The Company has good, valid and marketable title to all properties and assets used in the conduct of its business free of all Liens and other encumbrances, except Permitted Liens and such ordinary and customary imperfections of title, restrictions and encumbrances as could not reasonably be expected to have a Material Adverse Effect.

2.19 Except as disclosed inSchedule 2.19hereto, no suit, proceeding or action or threat of suit, proceeding or action has been asserted or made against the Company within the last two years due to alleged bodily injury, death or property damage arising out of the function or malfunction of a product, procedure or service designed, manufactured, sold or distributed by the Company.

2.20 Except as disclosed inSchedule 2.20hereto, there is no legal action, suit, arbitration or other legal, administrative or other governmental proceeding pending or, to the knowledge of the Company, threatened against or affecting the Company or its properties, assets or business that could reasonably be expected to have a Material Adverse Effect. The Company is not in default with respect to any order, writ, judgment, injunction, decree, determination or award of any court or any governmental agency or instrumentality or arbitration authority.

2.21 The Company possesses from the appropriate governmental authorities all licenses, permits, authorizations, approvals, franchises and rights necessary for the Company to engage in the businesses currently conducted by it (except for those, the absence of which would not reasonably be expected to have a Material Adverse Effect), and all are in full force and effect.

2.22 Except as disclosed inSchedule 2.22hereto, no officer, director or stockholder of the Company or any Affiliate or “associate” (as such term is defined in Rule 405 under the Securities Act) of any such Person or the Company has or has had, either directly or indirectly, (a) an interest in any Person that (i) furnishes or sells services or products that are furnished or sold or are proposed to be furnished or sold by the Company or (ii) purchases from or sells or

13

furnishes to the Company any goods or services, or (b) a beneficial interest in any contract or agreement to which either of the Company is a party or by which either of them may be bound or affected.

2.23 There is no substance or material defined or designated as hazardous or toxic waste, material, substance or other similar term, by any environmental statute, regulation or ordinance currently in effect, on, about, or in any of the real property in which the Company now has or previously had any leasehold or ownership interest.

2.24 The Company has not been advised within the past thirty (30) days that any material customer, supplier or independent contractor of the Company intends to terminate or materially curtail its business relationship with the Company which could reasonably be expected to have a Material Adverse Effect.

2.25 Neither the Company nor, to their knowledge, any director, officer, stockholder, agent, employee or other Person associated with or acting on behalf of the Company, has used any corporate funds for unlawful contributions, gifts, entertainment or other unlawful expenses relating to political activity; made any direct or indirect unlawful payments to government officials or employees from corporate funds; established or maintained any unlawful or unrecorded fund of corporate monies or other assets; made any false or fictitious entries on the books of record of any such corporations; or made any bribe, rebate, payoff, influence payment, kickback or other unlawful payment.

2.26 Except as disclosed inSchedule 2.26, the Company has no liability or obligation or commitment to any Stockholder or any Affiliate or “associate” (as such term is defined in Rule 405 under the Securities Act) of any Stockholder, nor does any Stockholder or any such Affiliate or associate have any liability, obligation or commitment to the Company.

2.27 No representation or warranty by the Company herein and no information disclosed in the schedules or exhibits hereto by the Company, when considered as a whole together with all other information furnished to Parent, contains any untrue statement of a material fact or omits to state a material fact necessary to make the statements contained herein or therein not misleading.

2.28Broker’s and Finder’s Fees. No Person has, or as a result of the transactions contemplated herein will have, any right or valid claim against the Company for any commission, fee or other compensation as a finder or broker, or in any similar capacity, except as disclosed inSchedule 2.28hereto.

ARTICLE 3

REPRESENTATIONS AND WARRANTIES OF PARENT AND MERGER SUB

Parent and Merger Sub (with respect to the representations, warranties and covenants of Merger Sub) represent and warrant to the Company that, except as set forth in the Parent’s Disclosure Schedules attached hereto, the statements contained in this Article 3 are true and correct as set forth below:

3.1Organization and Good Standing.

14

(a) Parent is a corporation duly organized, validly existing and in good standing under the laws of the State of Nevada, with requisite corporate power and authority to conduct its business as now being conducted and to own or use its properties and assets. Parent has not conducted any business under or otherwise used, for any purpose or in any jurisdiction, any fictitious name, assumed name, trade name or other name, other than the name “Clear Systems Recycling, Inc.” (b) Parent is duly qualified to do business as a foreign corporation and is in good standing under the laws of each state or other jurisdiction in which either the ownership or use of the properties owned or used by it, or the nature of the activities conducted by it, requires such qualification except where the failure to be so qualified or in good standing would not have a Material Adverse Effect on Parent.

(c)Schedule 3.1(c)accurately sets forth (i) the names of the members of the board of directors of Parent, (ii) the names of the members of each committee of such board of directors, and (iii) the names and titles of the officers of Parent.

(d) Merger Sub was formed for the sole purpose of effecting the Merger and, except as contemplated by this Agreement, Merger Sub has not conducted any business activities and does not have any liabilities.

| 3.2 | Subsidiaries. |

| | (a)Schedule 3.2(a)sets forth all direct and indirect Subsidiaries of Parent. |

| Parent | owns all of the equity of each Subsidiary. Except as set forth onSchedule 3.2(a), |

Parent does not have any Subsidiaries or affiliated companies and does not otherwise own any shares in the capital of or any interest in, or control, directly or indirectly, any entity. Parent has not agreed and is not obligated to make any future investment in or capital contribution to any entity. Parent has not guaranteed and is not responsible or liable for any obligation of any of the entities in which it owns or has owned any equity interest.

(b) Each Subsidiary of Parent: (i) is a corporation duly organized and validly existing under the laws of its jurisdiction of incorporation, (ii) has all requisite corporate power and authority to own, operate or lease the properties and assets owned, operated or leased by such Subsidiary and to carry on its business as it has been and is currently conducted by such Subsidiary and (iii) is duly qualified to do business and is in good standing in each jurisdiction in which the properties owned or leased by it or the operation of its business makes such license and qualification necessary, expect, in each of clauses (i), (ii) and (iii), such failures which, when taken together with all other such failures, would not have a Material Adverse Effect on Parent or such Subsidiary.

(c) Schedule 3.2(c) accurately sets forth (i) the names of the members of the boards of directors of each Subsidiary of Parent, (ii) the names of the members of each committee of such boards of directors, and (iii) the names and titles of the officers of each Subsidiary of Parent.

15

3.3Authority. Each of Parent and Merger Sub has all requisite corporate power and authority to enter into this Agreement and the ancillary agreements to which it is a party, to perform its obligations hereunder and thereunder and to consummate the transactions contemplated hereby and thereby. The execution and delivery of this Agreement and the ancillary agreements and the consummation of the transactions contemplated hereby have been duly authorized by all necessary corporate action on the part of Parent and Merger Sub, subject only to the approval of this Agreement by the stockholders of Parent and Merger Sub. The Board of Directors of Parent and Merger Sub have unanimously approved this Agreement and authorized the Merger. This Agreement has been (and the ancillary agreements will be at the Closing) duly executed and delivered by Parent and Merger Sub, and this Agreement constitutes (and the ancillary agreements will constitute at the Closing) the valid and binding obligations of Parent and Merger Sub enforceable against each of Parent and Merger Sub in accordance with their terms, except as may be limited by bankruptcy, insolvency, reorganization, moratorium or other similar laws affecting or relating to creditors' rights generally, and subject to general principles of equity. Merger Sub has been formed solely for the purpose of executing and delivering this Agreement and consummating the transactions contemplated hereby. Since the date of its incorporation, Merger Sub has neither engaged in nor transacted any business or activity of any nature whatsoever other than activities related to its corporate organization and the execution and delivery of this Agreement and the related documents and instruments. Merger Sub has no assets or properties or debts, liabilities or obligations of any kind whatsoever, and with the exception of this Agreement and the related documents and instruments, is not a party to any contract, agreement or undertaking of any nature.

3.4No Conflict. The execution and delivery by Parent of this Agreement and the ancillary agreements to which Parent is a party, does not, and the consummation of the transactions contemplated hereby and thereby will not (a) conflict with, or result in any violation of, any provision of the Parent Articles of Incorporation or Parent Bylaws, (b) conflict with, or result in any violation of or default under (with or without notice or lapse of time, or both), or give rise to a right of termination, cancellation or acceleration of any obligation or loss of any benefit under any mortgage, indenture, lease, contract or other agreement or instrument, permit, concession, franchise or license of Parent, (c) conflict with, or result in any violation of any judgment, order, decree, statute, law, ordinance, rule or regulation applicable to Parent or any of its properties or assets, or (d) conflict with, or result in a violation of any resolution adopted by Parent’s stockholders, Parent’s board of directors or any committee of Parent’s board of directors.

3.5Consents. No consent, approval, order or authorization of or registration, declaration or filing with, any governmental entity or any party to any material contract is required by or with respect to Parent or any of its subsidiaries in connection with the execution and delivery of this Agreement by Parent and any ancillary agreement to which Parent is a party or the consummation by Parent of the transactions contemplated hereby, except (a) such consents, waivers, approvals, orders, authorizations, registrations, declarations and filings as may be required under applicable securities laws, (b) the filing of the Articles of Merger with the Secretary of State of the State of Nevada and (c) such consents, waivers, approvals, orders, authorizations, registrations, declarations and filings which, if not obtained or made, would not have a Material Adverse Effect on Parent.

16

3.6Governmental Authorizations.Parent has obtained each material federal, state, county, local or foreign governmental consent, license, permit, grant, or other authorization of a governmental entity (a) pursuant to which Parent currently operates or holds any interest in any of its properties, or (b) that is required for the operation of Parent’s business or the holding of any such interest, and all of such authorizations are in full force and effect.

3.7Broker’s and Finder’s Fees.No person, firm, corporation or other entity is entitled by reason of any act or omission of Parent to any broker’s or finder’s fees, commission or other similar compensation with respect to the execution and delivery of this Agreement, or with respect to the consummation of the transactions contemplated hereby, including the Merger and exchange.

| 3.8 | Capitalization of Parent. |

| | (a) The authorized capital stock of Parent consists of (i) 100,000,000 shares of |

| Parent | Common Stock, of which 36,750,000 shares are issued and outstanding on the |

date hereof, and (ii) 15,000,000 shares of undesignated preferred stock, none of which are issued or outstanding, prior to taking into consideration the issuance of Parent Common Stock in the exchange. Except with respect to the Parent Incentive Plan, the Parent has no other shares of capital stock reserved for issuance upon the exercise of any other options or any warrants and no shares of capital stock are reserved for issuance to any party, including upon the conversion of any outstanding convertible notes, debentures or securities. Parent has no outstanding options, rights, calls, preemptive rights, subscriptions or commitments to issue any equity Securities of Parent.

(b) There is no plan or arrangement to issue capital stock by Parent except as set forth in this Agreement, and there are no registration rights. There is no voting trust, proxy, rights plan, anti-takeover plan or other agreement or understanding to which the Parent is a party or by which it is bound with respect to any equity securities of Parent.

(c) There are no outstanding contractual obligations (contingent or otherwise) of Parent to retire, repurchase, redeem or otherwise acquire any outstanding shares of capital stock of, or other ownership interests in, Parent or to provide funds to or make any investment (in the form of a loan, capital contribution or otherwise) in any other entity or person.

| 3.9 | Validity of Shares. |

| | (a) All outstanding shares of the capital stock of Parent are (i) validly issued |

| and | outstanding, fully paid and non-assessable, (ii) were not issued in violation of the |

preemptive rights of any person, (iii) were issued in transactions that were (A) exempt from the registration and prospectus delivery requirements of the Securities Act, (B) registered or qualified (or were exempt from registration or qualification) under the registration or qualification requirements of all applicable state securities laws and (C) accomplished in conformity with all other applicable securities laws.

(b) The approximately 53,884,130 shares of Parent Common Stock to be issued at the Closing pursuant to Section 1.9(b) hereof, when issued and delivered in

17

accordance with the terms hereof, shall be duly and validly issued, fully paid and non-assessable and not in violation of any preemptive rights. Based, in part, on the representations and warranties of the Stockholders as contemplated by Section 4 hereof and assuming the accuracy thereof, the issuance of the Parent Common Stock upon the Merger and exchange pursuant to Article will be exempt from the registration and prospectus delivery requirements of the Securities Act and from the qualification or registration requirements of any applicable state blue sky or securities laws.

| 3.10 | SEC Reporting and Compliance. |

| | (a) Parent filed a registration statement on Form S-1 (No. 333-174175) under |

| the | Securities Act which became effective on July 12, 2011, and has not been withdrawn. |

All shares held by selling stockholders in such registration statement, other than those held by Affiliates of Parent, have been sold in accordance with the Plan of Distribution set forth in such registration statement.

(b) Since July 12, 2011, Parent has filed with the Commission all registration statements, proxy statements, information statements, reports, schedules, forms and other documents required to be filed pursuant to the Securities Act, the Exchange Act and the rules and regulations of the Commission on a timely basis (or has received a valid extension of such time of filing and has filed any such reports or other documents prior to the expiration of any such extension). Parent has not filed with the Commission a certificate on Form 15 pursuant to Rule 12h-3 of the Exchange Act.

(c) Parent has delivered or made available to the Company true and complete copies of its registration statement (including all amendments thereto and supplements to the prospectus contained therein) and reports (collectively, the “Parent SEC Documents”) filed by Parent with the Commission. The Parent SEC Documents, as of their respective dates (or, if amended, supplemented or superseded by a filing prior to the date hereof, then as of the date of such amendment, supplement or superseding filing) complied in all material respects with the requirements of the Securities Act or the Exchange Act, as the case may be, and the rules and regulations of the Commission promulgated thereunder applicable thereto, and did not contain any untrue statement of a material fact or omit to state a material fact necessary in order to make the statements contained therein not misleading.

(d) Except as set forth onSchedule 3.10, Parent has not filed, and nothing has occurred with respect to which Parent would be required to file, any report on Form 8-K since February 3, 2012. Prior to and until the Closing, Parent will provide to the Company copies of any and all amendments or supplements to the Parent SEC Documents filed with the Commission since July 12, 2011, and all subsequent registration statements and reports filed by Parent subsequent to the filing of the Parent SEC Documents with the Commission and any and all subsequent documents or notices filed by the Parent with the Commission or delivered to the stockholders of Parent.

(e) Parent is not an investment company within the meaning of Section 3 of the Investment Company Act.

18

(f) The shares of Parent Common Stock are quoted on the Over-the-Counter (OTC) Bulletin Board under the symbol “CLRS.OB,” and Parent is in compliance in all material respects with all rules and regulations of the OTC Bulletin Board applicable to it and the Parent Common Stock.

(g) The Parent SEC Documents include all certifications and statements required of it, if any, by (i) Rule 13a-14 or 15d-14 under the Exchange Act, and (ii) 18 U.S.C. Section 1350 (Section 906 of the Sarbanes-Oxley Act of 2002), and each of such certifications and statements contain no qualifications or exceptions to the matters certified therein other than a knowledge qualification, permitted under such provision, and have not been modified or withdrawn and neither Parent nor any of its officers has received any notice from the SEC or any other governmental entity questioning or challenging the accuracy, completeness, form or manner of filing or submission of such certifications or statements.

3.11Financial Statements. The balance sheets, and statements of income, changes in financial position and stockholders’ equity contained in the Parent SEC Documents (i) have been prepared in accordance with GAAP applied on a basis consistent with prior periods (and, in the case of unaudited financial information, on a basis consistent with year-end audits), (ii) are in accordance with the books and records of the Parent, and (iii) present fairly in all material respects the financial condition of the Parent at the dates therein specified and the results of its operations and changes in financial position for the periods therein specified. The financial statements included in the Annual Report on Form 10-K for the year ended December 31, 2011 (the “Parent Financial Statements”) were audited by, and include the related opinion of Sadler Gibb & Associates, Parent’s independent registered public accounting firm.

3.12Events Subsequent to Financial Statements. Since December 31, 2011, there has not been: (a) any sale, lease, transfer, license or assignment of any assets, tangible or intangible, of Parent; (b) any damage, destruction or property loss, whether or not covered by insurance, affecting adversely the properties or business of Parent;

(c) any declaration or setting aside or payment of any dividend or distribution with respect to the shares of capital stock of Parent or any redemption, purchase or other acquisition of any such shares;

| | |

| | (d) | any subjection to any lien on any of the assets, tangible or intangible, of |

| Parent; | | |

| | (e) | any incurrence of indebtedness or liability or assumption of obligations by |

| Parent; | | |

| | (f) | any waiver or release by Parent of any right of any material value; |

| | (g) | any compensation or benefits paid to officers or directors of Parent; |

19

(h) any change made or authorized in the articles of incorporation or bylaws of Parent; (i) any loan to or other transaction with any officer, director or stockholder of Parent giving rise to any claim or right of Parent against any such person or of such person against Parent; or (j) any material adverse change in the condition (financial or otherwise) of the respective properties, assets, liabilities or business of Parent.

3.13Liabilities. Except as otherwise disclosed in Parent Financial Statements, Parent does not have any liability or obligation whatsoever, either direct or indirect, matured or unmatured, accrued, absolute, contingent or otherwise. In addition, Parent represents that upon Closing, Parent will not have any liability or obligation whatsoever, either direct or indirect, matured or unmatured, accrued, absolute, contingent or otherwise. Furthermore, there is no pending proceeding that has been commenced against Parent that challenges, or may have the effect of preventing, delaying, making illegal, or otherwise interfering with, any of the transactions contemplated by this Agreement. To the knowledge of Parent, no such proceeding has been threatened.

3.14Tax Matters. Parent has duly filed all federal, state, local and foreign tax returns required to be filed by or with respect to it with the Internal Revenue Service or other applicable taxing authority, and no extensions with respect to such tax returns have been requested or granted. Parent has paid, or adequately reserved against in Parent Financial Statements, all material taxes due, or claimed by any taxing authority to be due, from or with respect to it. To the knowledge of Parent, there has been no material issue raised or material adjustment proposed (and none is pending) by the Internal Revenue Service or any other taxing authority in connection with any of Parent’s Tax Returns. No waiver or extension of any statute of limitations as to any material federal, state, local or foreign tax matter has been given by or requested from Parent. For the purposes of this Section, a Tax is due (and must therefore either be paid or adequately reserved against in Parent Financial Statements) only on the last date payment of such Tax can be made without interest or penalties, whether such payment is due in respect of estimated Taxes, withholding Taxes, required Tax credits or any other Tax.

3.15Governmental Consents. All consents, approvals, orders or authorizations of, or registrations, qualifications, designations, declarations, or filings with any federal or state governmental authority on the part of Parent required in connection with the consummation of the Merger and exchange have been or shall have been obtained prior to, and be effective as of, the Closing.

3.16Compliance with Laws and Other Instruments. The execution, delivery and performance by Parent of this Agreement and the consummation by it of the transactions contemplated by this Agreement, including the Merger and exchange: (a) will not require any authorization, consent or approval of, or filing or registration with, any court or governmental agency or instrumentality, except (i) such as shall have been obtained prior to the Closing, or (ii) as set forth inSchedule 3.16; (b) will not cause the Parent to violate or contravene (i) any provision of law, (ii) any rule or regulation of any agency or government, (iii) any order,

20

judgment or decree of any court, or (iv) any provision of its Articles of Incorporation or By-laws; (c) will not violate or be in conflict with in a material manner, result in a material breach of or constitute (with or without notice or lapse of time, or both) a material default under, any indenture, loan or credit agreement, deed of trust, mortgage, security agreement or other material contract, agreement or instrument to which the Parent is a party or by which the Parent or any of its properties are bound or affected, except where any such violation, conflict, breach or default could not reasonably be expected to have a Material Adverse Effect; and (d) will not result in the creation or imposition of any material Lien upon any property or asset of the Parent. Parent is not in violation of, or (with or without notice or lapse of time, or both) in default under, any term or provision of its Articles of Incorporation or By-laws, to its knowledge, or any indenture, loan or credit agreement, deed of trust, mortgage, security agreement, except as could not reasonably be expected to have a Material Adverse Effect on the Parent, or any other material agreement or instrument to which the Parent is a party or by which it or any of its properties are bound or affected.

3.17Binding Obligations. This Agreement constitutes the legal, valid and binding obligation of the Parent, and is enforceable against the Parent, in accordance with its terms, except as such enforcement is limited by bankruptcy, insolvency and other similar laws affecting the enforcement of creditors’ rights generally and by general principles of equity.

3.18No General Solicitation. In issuing the Parent Common Stock in the Merger and exchange hereunder, neither Parent nor, to its knowledge, anyone acting on its behalf has offered to sell the Parent Common Stock by any form of general solicitation or advertising.

3.19Litigation. There is no legal action, suit, arbitration or other legal, administrative or other governmental proceeding pending or, to the knowledge of Parent, threatened against or affecting Parent or its properties, assets or business. Parent is not in default with respect to any order, writ, judgment, injunction, decree, determination or award of any court or any governmental agency or instrumentality or arbitration authority.

3.20Obligations to or by Stockholders. Except as disclosed in the Parent SEC Documents or onSchedule 3.20, the Parent has no liability or obligation or commitment to any stockholder of Parent or any Affiliate or “associate” (as such term is defined in Rule 405 under the Securities Act) of any stockholder of Parent, nor does any stockholder of Parent or any such Affiliate or associate have any liability, obligation or commitment to Parent.

3.21Material Contracts. Parent has provided to the Company, prior to the date of this Agreement, true, correct and complete copies of each written material Parent contract, including each amendment, supplement and modification thereto.

3.22Employees. Except as disclosed in the Parent SEC Documents, Parent has no employees, independent contractors or other Persons providing services to it. Except as would not have a Material Adverse Effect, Parent is in full compliance with all relevant laws regarding employment, wages, hours, benefits, equal opportunity, collective bargaining, the payment of Social Security and other taxes, occupational safety and health and plant closing. Parent is not liable for the payment of any compensation, damages, taxes, fines, penalties or other amounts, however designated, for failure to comply with any of the foregoing laws. No director, officer or

21

employee of Parent is a party to, or is otherwise bound by, any contract (including any confidentiality, non-competition or proprietary rights agreement) with any other party that in any way adversely affects or will materially affect (a) the performance of his or her duties as a director, officer or employee of Parent or (b) the ability of Parent to conduct its business. Except as set forth in the Parent SEC Documents, each employee of Parent is employed on an at-will basis and Parent does not have any contract with any of its employees which would interfere with its ability to discharge its employees.

3.23Interested Party Transactions. Except as disclosed in Schedule 3.23, no officer, director or stockholder of Parent or any Affiliate or “associate” (as such term is defined in Rule 405 of the Commission under the Securities Act) of any such party, has or has had, either directly or indirectly, (a) an interest in any Person which (a) furnishes or sells services or products which are furnished or sold or are proposed to be furnished or sold by Parent, or (b) purchases from or sells or furnishes to, or proposes to purchase from, sell to or furnish Parent any goods or services; or (b) a beneficial interest in any contract or agreement to which Parent is a party or by which it may be bound or affected.

3.24Governmental Inquiries. Parent has provided to the Company a copy of each material written inspection report, questionnaire, inquiry, demand or request for information received by Parent from any governmental authority, and Parent’s response thereto, and each material written statement, report or other document filed by Parent with any governmental authority.

3.25Bank Accounts and Safe Deposit Boxes. Schedule 3.25 discloses the title and number of each bank or other deposit or financial account, and each lock box and safety deposit box used by Parent, the financial institution at which that account or box is maintained and the names of the persons authorized to draw against the account or otherwise have access to the account or box, as the case may be.

3.26Intellectual Property. Parent does not own, use or license any Intellectual Property in its business as presently conducted, except as set forth in Schedule 3.26.

3.27 Parent has no stock option plans except the Clear System Recycling, Inc. 2012 Incentive Compensation Plan (the “Parent Incentive Plan”), which will be adopted prior to the Closing. Parent has made no grants under the Parent Incentive Plan. Parent has no employee benefit plans or arrangements covering their present and former employees or providing benefits to such persons in respect of services provided to Parent. Neither the consummation of the transactions contemplated hereby alone, nor in combination with another event, with respect to each director, officer, employee and consultant of Parent, will result in (a) any payment (including, without limitation, severance, unemployment compensation or bonus payments) becoming due from Parent, (b) any increase in the amount of compensation or benefits payable to any such individual or (c) any acceleration of the vesting or timing of payment of compensation payable to any such individual. No agreement, arrangement or other contract of Parent provides benefits or payments contingent upon, triggered by, or increased as a result of a change in the ownership or effective control of Parent.

22

3.28 No representation or warranty by Parent herein and no information disclosed in the schedules or exhibits hereto by Parent when considered as a whole together with all other information furnished to the Company contains any untrue statement of a material fact or omits to state a material fact necessary to make the statements contained herein or therein misleading.

ARTICLE 4

ADDITIONAL AGREEMENTS

4.1 Within four (4) business days following the execution hereof, the Parent shall prepare file with the U.S. Securities and Exchange Commission a Current Report on Form 8-K disclosing the entry into this Agreement under Item 1.01 thereof.

4.2 The Company and Parent shall each afford to the other and to the other’s accountants, counsel and other representatives full access, during normal business hours throughout the period prior to the Closing, and subsequent to the Closing until all pre-Closing filing requirements are met, solely for the purposes of filing any documents required to be filed with the Commission, to all of its properties, books, contracts, commitments and records (including but not limited to tax returns) and during such period, each shall furnish promptly to the other all information concerning its business, properties and personnel as such other party may reasonably request, provided that no investigation pursuant to this Article shall affect any representations or warranties made herein. Each party shall hold, and shall cause its employees and agents to hold, in strict confidence, all such information (other than such information which: (i) is already in such party’s possession; (ii) becomes generally available to the public other than as a result of a disclosure by such party or its directors, officers, managers, employees, agents or advisors; or (iii) becomes available to such party on a non-confidential basis from a source other than a party hereto or its advisors provided that such source is not known by such party to be bound by a confidentiality agreement with or other obligation of secrecy to a party hereto or another party until such time as such information is otherwise publicly available; provided, however, that (A) any such information may be disclosed to such party’s directors, officers, employees and representatives of such party’s advisors who need to know such information for the purpose of evaluating the transactions contemplated hereby (it being understood that such directors, officers, employees and representatives shall be informed by such party of the confidential nature of such information), (B) any disclosure of such information may be made as to which the party hereto furnishing such information has consented in writing, and (C) any such information may be disclosed pursuant to a judicial, administrative or governmental order or request; provided, however, that the requested party will promptly so notify the other party so that the other party may seek a protective order or appropriate remedy and/or waive compliance with this Agreement and if such protective order or other remedy is not obtained or the other party waives compliance with this provision, the requested party will furnish only that portion of such information which is legally required and will exercise its best efforts to obtain a protective order or other reliable assurance that confidential treatment will be accorded the information furnished). If this Agreement is terminated, each party will deliver to the other all documents and other materials (including copies) obtained by such party or on its behalf from the other party as a result of this Agreement or in connection herewith, whether so obtained before or after the execution hereof.

23