Exhibit 2.10

Highlights

WesternZagros’s highlights and activities to May 21, 2014 include the following.

Health, Safety, Environment and Security (“HSE&S”)

| | • | | WesternZagros recognizes the importance of, and is committed to, safe, compliant and environmentally conscious operations for its employees, contractors, stakeholders and impacted communities. All levels of management are responsible for providing and maintaining a safe work place through proper procedures, training and equipment. WesternZagros has adopted Canadian and international health, safety, and environment standards for its Kurdistan Region operations. |

| | • | | Since January 1, 2014, the Company has not had any lost time incidents and has met or exceeded the other HSE&S targets that it monitors. In a continuous effort to improve safety conditions, the Company has initiated a program to investigate any high risk incidents, regardless of whether or not an injury was sustained. |

Operations

WesternZagros’s assets comprise two contract areas, the Garmian and Kurdamir blocks, with significant oil and gas discoveries on both. These blocks are on trend with the super-giant Kirkuk oil field and adjacent to a number of prolific oil and gas discoveries.

Operated Joint Venture: Garmian Block

| | • | | The Company declared the commerciality of the Sarqala Discovery on December 23, 2013, and design work is underway on future development plans for the oil resources in the Sarqala area. |

| | • | | As part of the Sarqala development plan, a workover commenced in March 2014 on the Sarqala-1 well to increase the production capability above the current capacity of 5,000 barrels of oil per day (“bbl/d”) up to 10,000 bbl/d. Upon approval of the development plan, the Company anticipates commencing oil sales into the domestic market or into the export market via the new Kurdistan Region-Turkey pipeline |

| | • | | The Hasira-1 well has reached a total depth of 4,181 metres, drilling through both the Jeribe and Oligocene reservoirs. Logging and initial open hole tests conducted in both reservoirs have confirmed light oil in both the Jeribe and Oligocene reservoirs. The open hole test completed in the Oligocene reservoir flowed oil to surface during an initial clean up flow, however the test was prematurely terminated after six hours due to formation debris plugging the tubing. Estimated rates from the cleanup flow period were 3,000 barrels per day of fluid, with up to 40 percent oil cut, the balance being drilling fluids. The oil flowed to surface was consistent with the oil produced from Sarqala-1, approximate 40 degree API and no indications of H2S. Currently the Company is casing the Oligocene reservoir section, and then will suspend the well for future testing of both the Oligocene and Jeribe reservoirs utilizing the more cost-effective workover rig which will be moved to Hasira-1 once it has completed the workover of Sarqala-1. |

Non-Operated Joint Venture: Kurdamir Block

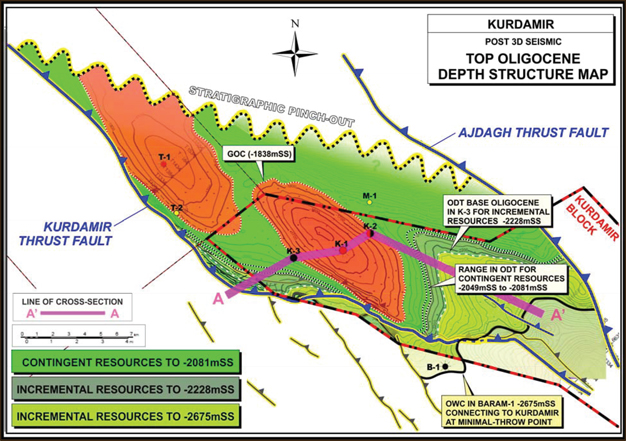

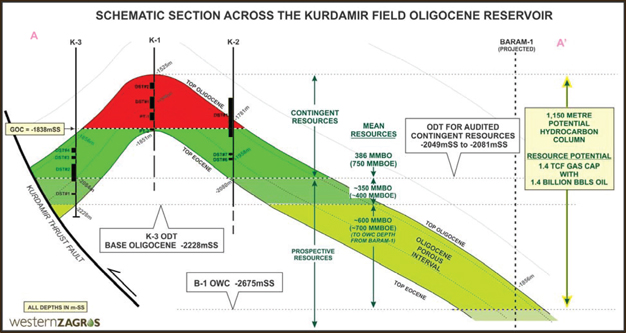

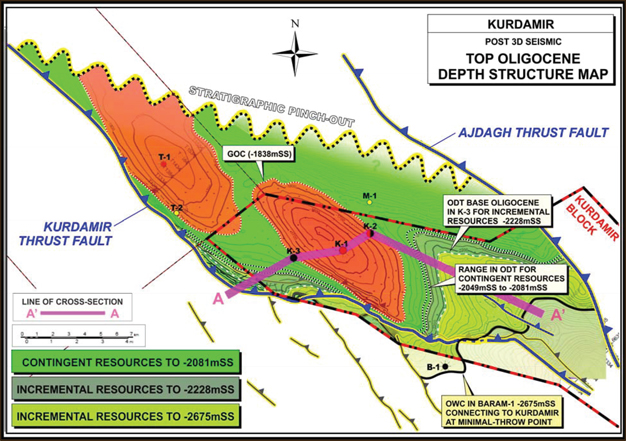

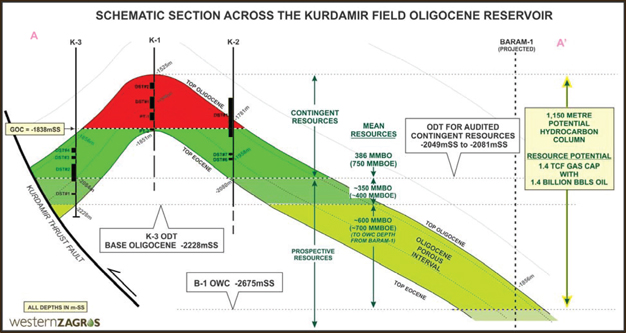

| | • | | WesternZagros updated its contingent and prospective resource estimates for the Oligocene reservoir in the Kurdamir structure based on new information obtained from the drilling of the Kurdamir-3 well and the interpretation of 3D seismic data. The revised resources assessment has been audited by the Company’s independent reserves evaluator, Sproule International Limited, as of February 10, 2014, resulting in a revised mean estimate of gross unrisked contingent resources (“Mean Contingent Resources”) of 750 MMBOE, an increase of five percent from those previously recognized. On an oil basis, the Mean Contingent Resources are now 386 million barrels of oil (“MMbbl”). The combined Mean Contingent Resources estimates for the Oligocene and Eocene reservoirs in the Kurdamir Block are now 976 MMBOE or 541 MMbbl on an oil basis. The revised mean estimate of gross unrisked prospective resources (“Mean Prospective Resources”) for the Oligocene reservoir at Kurdamir is now 1,084 MMbbl of oil, effectively unchanged from a previous estimate of 1,076 MMbbl of oil. |

1

| | • | | Subsequent to updating the contingent and prospective resources, the Company has conducted the following work to better understand the Kurdamir discovery and prepare for future development activities and for further delineation of the prospective resources: |

| | • | | A 44-day extended well test (“EWT”) from the drill stem test (“DST”) 6 interval at the Kurdamir-2 well (deepest test conducted in base of Oligocene at -1,966 to -1,986 metres sub-sea (“mSS”) was completed on May 2). Cumulative oil production was approximately 90,000 barrels and during this time no formation water was produced. The Company views this information as support that the current contingent resource estimates, which limit lowest known oil to a depth in the range between -2,049 and -2081 mSS, represents a conservative view. During testing, the oil flow rate was restricted to limit the volume of gas flared as per the requirements of the KRG. |

| | • | | Analyzed the Kurdamir-3 log and test data and concluded that the formation water encountered in Kurdamir-3 was most likely from a deeper interval. Based upon the oil tested at the DST 1 interval and oil pay calculated on wireline logs, the lowest known oil would extend significantly deeper, i.e. down to the deepest point drilled to date in the Oligocene reservoir at -2228 mSS. Extending the lowest known oil to that depth has the potential to convert approximately 350 million barrels of the current prospective oil resources to contingent oil resources. |

| | • | | In addition, the Company has continued to interpret the integrated 3D seismic data acquired over Baram and Kurdamir in 2013 and determine the implications to its understanding of the Kurdamir discovery. This work has recently identified that while the Kurdamir Thrust Fault exists between Baram and Kurdamir, the 3D seismic data clearly shows that the Oligocene reservoir interval remains juxtaposed and, as such, is unlikely to represent a pressure barrier between Kurdamir and Baram. In this case, the oil-water contact tested in Baram at -2,676 mSS is likely to represent a common oil-water contact for the whole Topkhana-Kurdamir structure. This is a very significant observation, as the implication is that it extends the known oil leg another 600 metres than that used in the current audited contingent resource estimate. If this common oil-water contact can be proven, this has the potential to convert an additional approximately 600 MMbbl of the current prospective oil resources to contingent oil resources. This is in addition to the additional 350 MMbbl of prospective oil resources discussed in the previous paragraph, i.e. on a combined basis this would allow the conversion of approximately 1 billion barrels of prospective oil resources to contingent resources. |

2

| | • | | Please refer to the following map and schematic diagram for further information based on the recent analysis and interpretation: |

3

| | • | | Work has continued during the first quarter to identify possible future drilling locations on the Kurdamir block, utilizing the 3D seismic to identify locations within the current contingent resources for a horizontal development well to target the Oligocene reservoir estimated to have the best fracture development for well deliverability and to identify locations that could also convert further prospective resources to contingent resources by confirming lowest known oil deeper than the currently recognized range of -2,049 to -2,081 mSS. |

| | • | | The Company continues to monitor the progress and results from wells that are drilling on neighboring blocks but still on the Kurdamir/Tophkana structure. The Tophkana-2 well currently being drilled by Talisman on its neighboring block is targeting the Oligocene reservoir, which reached total depth at the end of April, and is now commencing testing operations. The Massoyi-1 well currently being drilled by KNOC on its neighboring block to the north is targeting the Oligocene and Eocene reservoirs and is anticipated to be testing in the second half of 2014. |

Financial

| | • | | As at March 31, 2014, WesternZagros had $70.0 million in working capital, excluding the $5.3 million non-current portion of the deposit held in trust pertaining to the drilling contract. |

| | • | | WesternZagros’s share of exploration and evaluation (“E&E”) expenditures during the first quarter of 2014 included 50 percent of Garmian Block costs and 60 percent of Kurdamir Block costs. WesternZagros’s share for these activities and other capitalized costs was $26.0 million, comprised of $12.3 million of drilling-related costs on the Garmian Block and $13.7 million in other appraisal and development planning costs. The Company’s portion of drilling-related costs included $6.4 million for Hasira-1 and $5.9 million for Baram-1. Appraisal and development costs included $2.9 million for the Kurdamir-2 EWT, $1.4 million for the Sarqala workover, $4.5 million for initial long lead costs and other site preparation costs, $0.6 million for development planning and $4.3 million for local office and other PSC-related costs for both blocks. |

Infrastructure - Oil

| | • | | Construction of a pipeline in the Kurdistan Region from Khurmala to Fish Khabur has been completed with an initial capacity of 150,000 bbl/d. A separate pipeline from the Tawke field, in the Kurdistan Region, with a tie in at Fish Khabur, is capable of delivering 100,000 bbl/d for export to Turkey. |

| | • | | By the end of 2014, the Kurdistan Region is anticipated to have the capacity to export approximately 250,000 bbl/d through the Kurdistan Region-Turkey pipeline, with potential to increase to 400,000 bbl/d in early 2015 following installation of more pumping stations. Additional volumes are expected to be trucked, especially heavy crudes, which do not meet required pipeline oil specifications even with diluent. |

| | • | | Turkey has implemented upgrades on its portion of the 40 inch Iraq-Turkey pipeline (“ITP”) which receives Kurdistan Region crude from the tie in at Fish Khabur and transports it to the port city of Ceyhan. Turkey has allocated four oil storage tanks (capacity 2.5 MMbbl) at the port city of Ceyhan for Kurdish crude as part of the ITP system which are currently being filled by Kurdish oil from Fish Khabur. |

| | • | | The KRG has proposed an initiative to the Government of Iraq to use its new pipeline to export Iraqi produced crude oil. Under the prospective plan, the KRG and Government of Iraq would jointly commission a new 36 inch pipeline to connect federal oil infrastructure in Kirkuk with the newly completed Kurdistan Region-Turkey pipeline. |

Export and Payment for Crude Oil from the Kurdistan Region

| | • | | The Kurdistan Region re-started crude oil exports of approximately 100,000 bbl/d through the Kurdistan Region-Turkey pipeline on April 27, 2014. These exports into Turkey are independent of the Government of Iraq and are in anticipation of first oil sales in May. Prior to this, 1.5 million barrels of Kurdish crude had been pumped into storage tanks at Ceyhan awaiting sale. |

| | • | | The Turkish Government has authorized Tupras, a Turkish refining firm, to purchase the oil. It has not been confirmed from either the KRG or Turkey whether Tupras would be the end-buyer or whether the crude would be sold and loaded onto tankers. |

4

| | • | | The KRG and the Government of Iraq held a number of meetings between late December 2013 and February 2014, to advance discussions on the resumption of oil exports from the Kurdistan Region. The Government of Iraq’s latest proposal allows for a direct transfer to the Kurdistan Region of 17 percent of Kurdish export sales revenue from the Development Fund for Iraq account at the Federal Reserve Bank of New York. The KRG would also receive their share of Iraq’s budget. Marketing is proposed to be handled through a joint Kurdistan Oil Marketing Organization (“KOMO”) and the Government of Iraq’s State Oil Marketing Organization (“SOMO”). |

| | • | | In January 2014, the Iraqi Council of Ministers ratified the draft Government of Iraq 2014 budget. The draft budget requires the Kurdistan Region to export 400,000 bbl/d of crude oil and contains provisions to deduct any shortfall from the 17 percent share of government revenues allocated to the Kurdistan Region. The budget has yet to be voted on by the Iraqi Parliament and ongoing negotiations between the KRG and the Government of Iraq are anticipated to result in changes to the draft budget before it is presented for approval. |

| | • | | On April 30, 2014 a federal election was held in Iraq. Formal results are not expected until late May subsequent to the formal counting of the votes. It is anticipated that following the release of the official election results that a coalition government will need to be formed as no one party is expected to have a majority to form the next federal government. |

Corporate

| | • | | On January 1, 2014, William Jack was promoted to Vice President and General Manager Kurdistan. Mr. Jack joined WesternZagros as General Manager, Kurdistan, in February 2013 and is responsible for government liaison and in-country administration. |

| | • | | On February 18, 2014, Eric Stoerr, one of two representatives from Crest Energy International LLC (“Crest”), resigned from the Company’s Board of Directors for personal reasons. John Howland, the other nominee of Crest, remains a member of the board. Crest reserves its right to nominate a replacement board member pursuant to the terms of the investment agreement between WesternZagros and Crest. |

Corporate Social Responsibility (“CSR”)

| | • | | WesternZagros runs its business on the PSC Lands so that stakeholders benefit from the presence of the oil and natural gas industry. This is achieved on the ground through CSR aspects that create mutual benefits. In the first quarter of 2014, the Company continued to advance this goal by supporting local employment, water supply, education, health care, agriculture and recreation. |

| | • | | Specific CSR activities included a women’s health assessment project, distributing water bottle greenhouses as part of the STEP project, donating 5,000 trees and plants, as well as irrigation and agribusiness initiatives. In 2014, the Company is renewing its focus on improved waste and water management within the Garmian Region. |

5