Exhibit 99.1

Westernzagros Fueling Our Futures September 8, 2014 TSX.V: WZR A preliminary prospectus containing important information relating to the securities described in this document has been filed with the securities regulatory authorities in each of the provinces of Canada. A copy of the preliminary prospectus, and any amendment, is required to be delivered with this document. The preliminary prospectus is still subject to completion. There will not be any sale or any acceptance of an offer to buy the securities until a receipt for the final prospectus has been issued. This document does not provide full disclosure of all material facts relating to the securities offered. Investors should read the preliminary prospectus, the final prospectus and any amendment for disclosure of those facts, especially risk factors relating to the securities offered, before making an investment decision. A preliminary prospectus containing important information relating to the securities described in this document has been filed as part of a registration statement filed with the SEC.

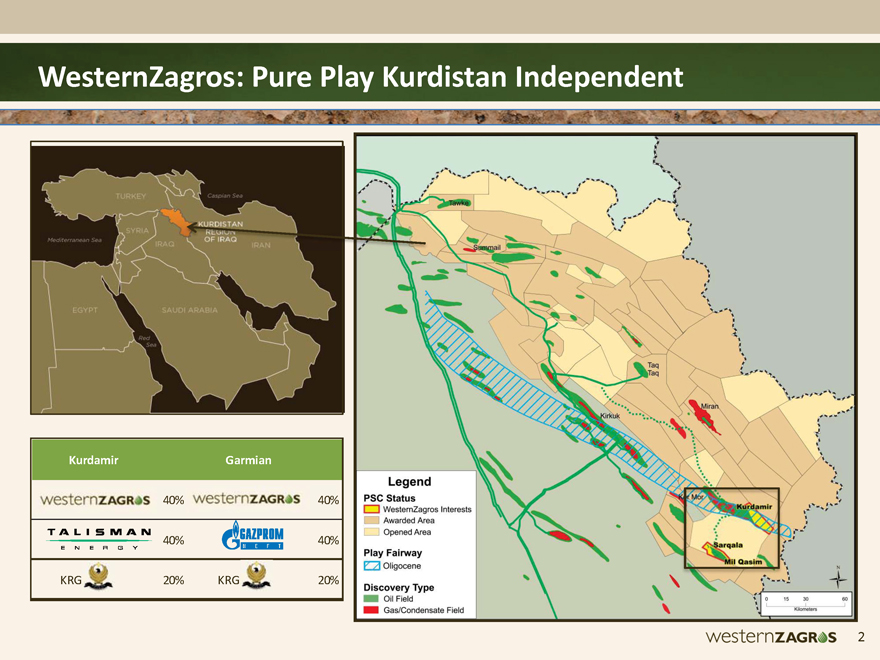

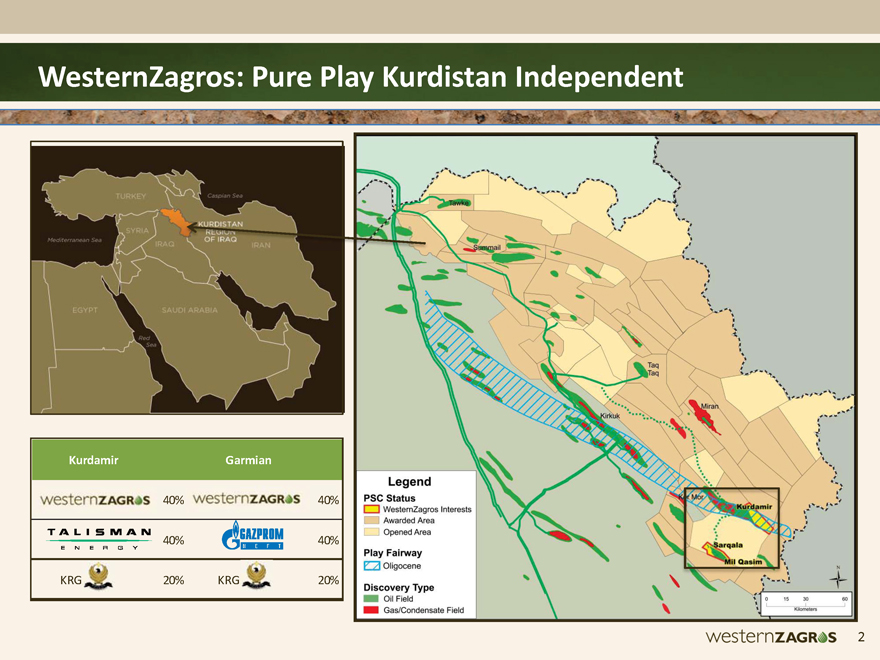

WesternZagros: Pure Play Kurdistan Independent 2 Kurdamir Garmian 40% 40% 40% 40% KRG 20% KRG 20% westernzagros talisman energy krg legend psc status westernzagros interests awarded area opened area play fairway Oligocene discovery type oil field gas/condensate field westernzagros 2

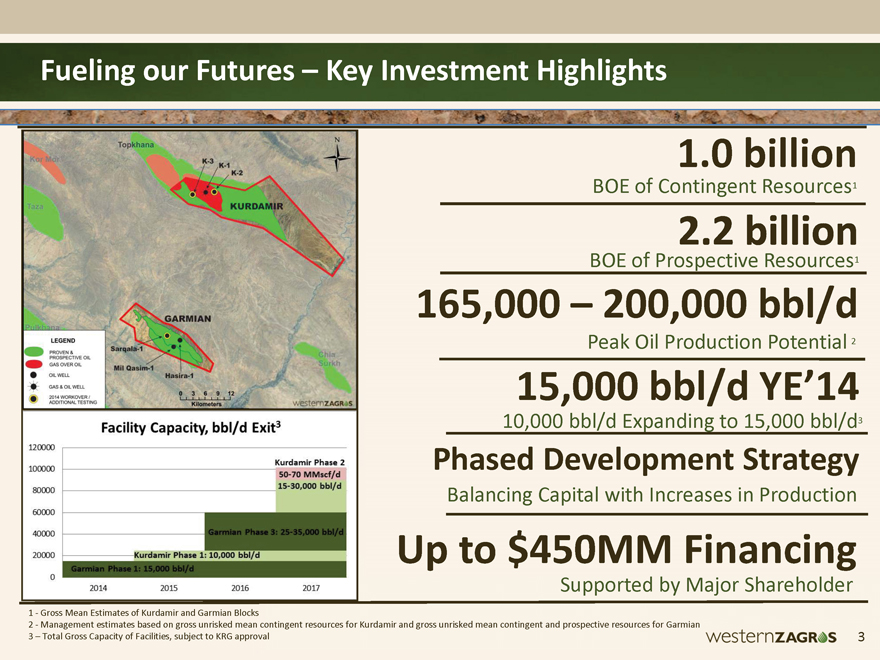

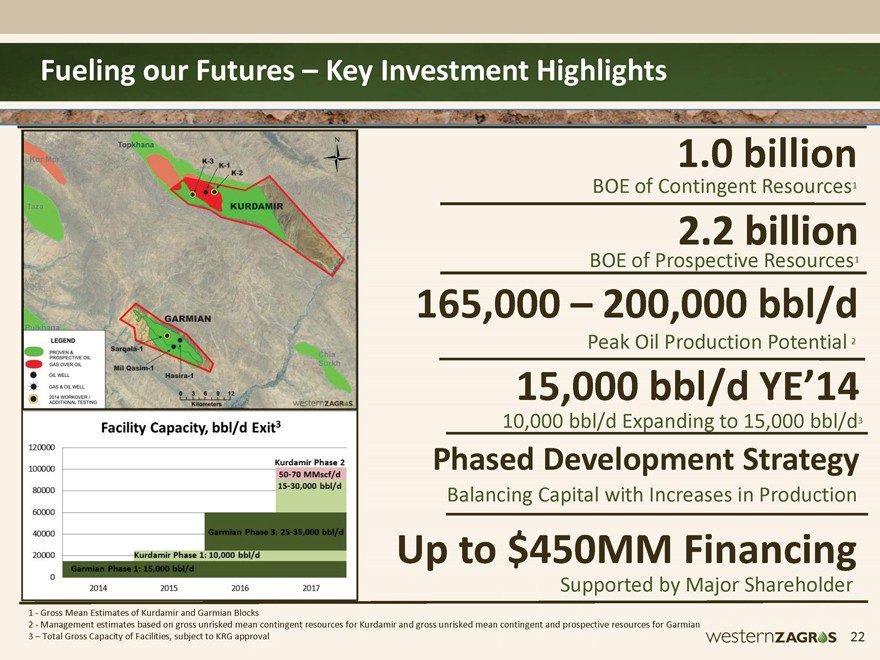

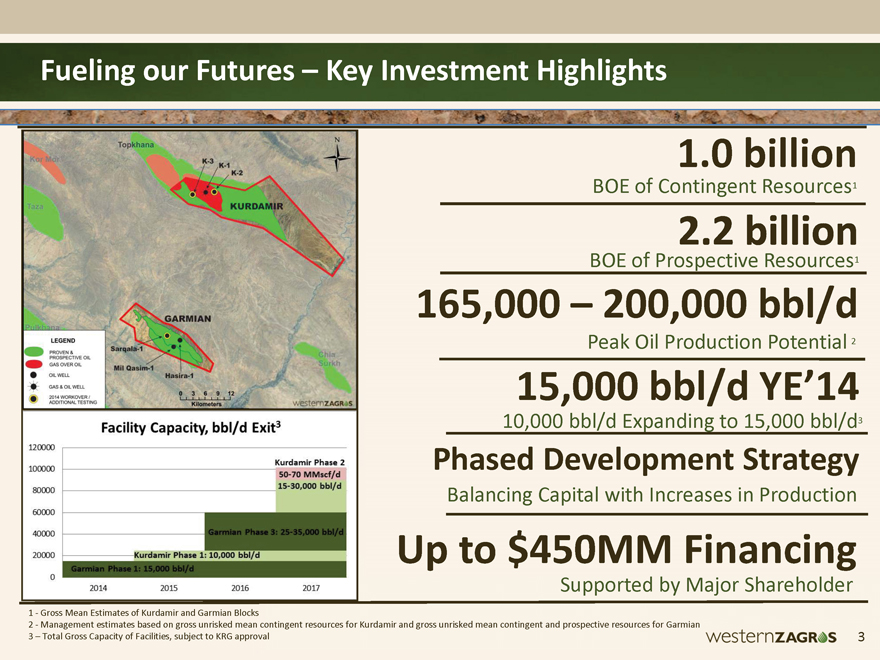

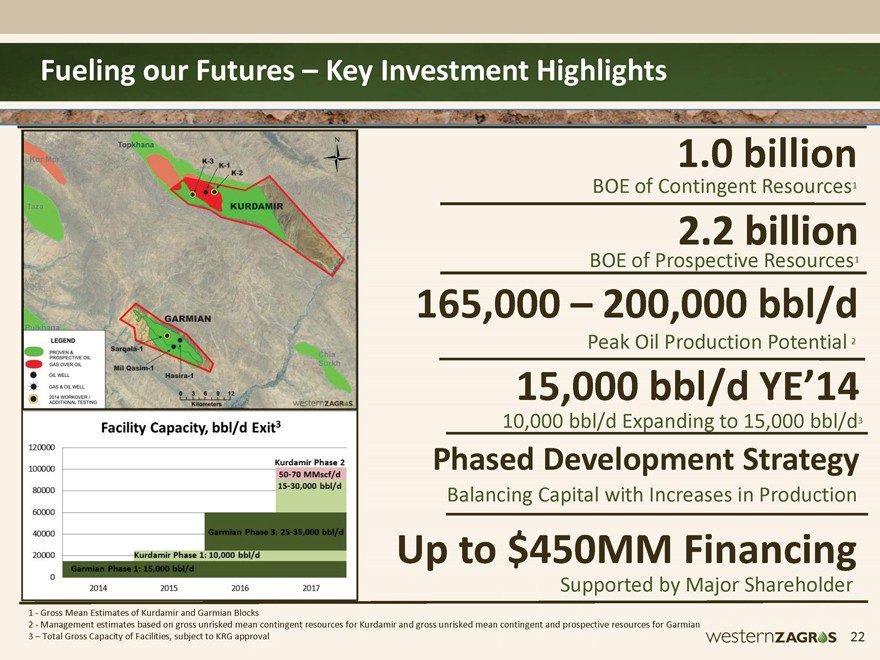

3 Fueling our Futures – Key Investment Highlights BOE of Resources1 2.2 billion BOE of Contingent Resources1 Prospective 1.0 billion 165,000 – 200,000 bbl/d Peak Oil Production Potential 2 1 - Gross Mean Estimates of Kurdamir and Garmian Blocks 2 - Management estimates based on gross unrisked mean contingent and gross unrisked mean contingent and prospective resources for Garmian 3 – Total Gross Capacity of Facilities, subject to approval 15,000 bbl/d YE’14 10,000 bbl/d Expanding to 15,000 bbl/d3 Phased Development Strategy Balancing Capital with Increases in Production ian Bloc ked mea KRG app cks an co rova ontingent resources for Kurdamir al Up to $450MM Financing Supported by Major Shareholder legend proven & prospective oil gas over oil oil well gas & oil well 2014 work over additional testing facility capacity, bbi/d exit3 120000 100000 800000 60000 40000 20000 0 2014 2015 2016 2017 kurdamir phase 2 50-70 mmscf/d 15-30,000 bbl/d westernzagros 3

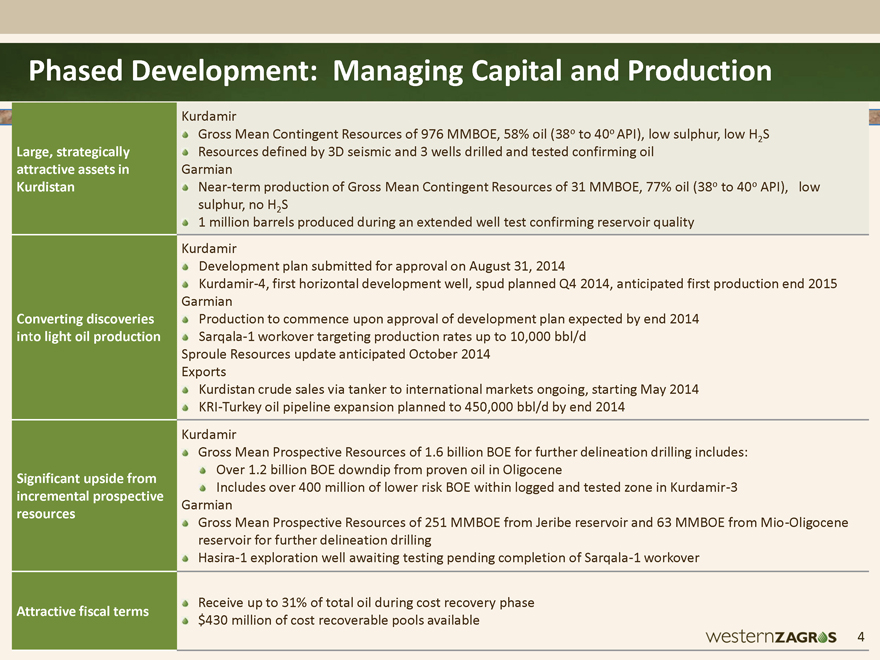

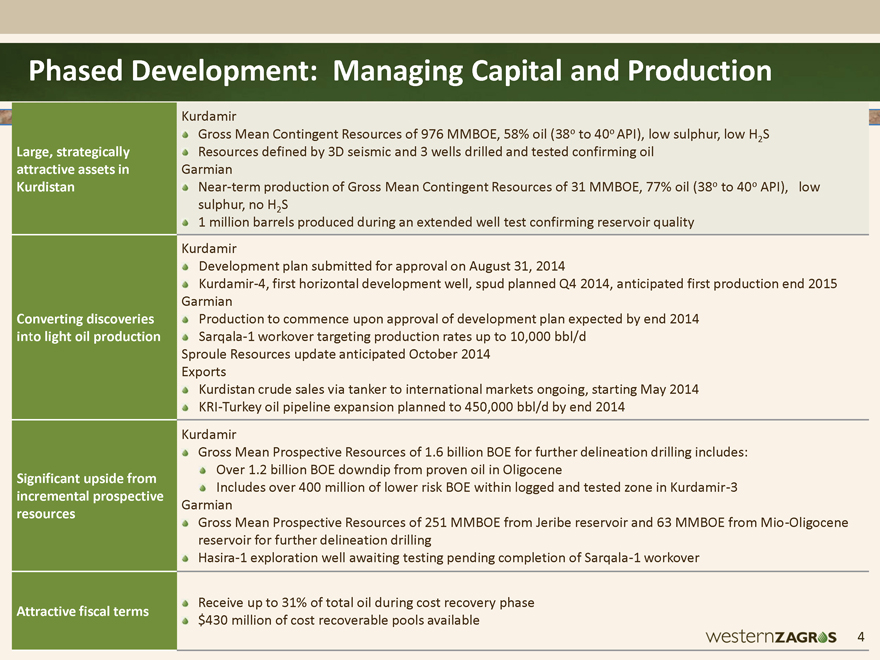

Phased Development: Managing Capital and Production Large, strategically attractive assets in Kurdistan Kurdamir Gross Mean Contingent Resources of 976 MMBOE, 58% oil (38o to 40o API), low sulphur, low H2S Resources defined by 3D seismic and 3 wells drilled and tested confirming oil Garmian Near-term production of Gross Mean Contingent Resources of 31 MMBOE, 77% oil (38o to 40o API), low sulphur, no H2S 1 million barrels produced during an extended well test confirming reservoir quality Converting discoveries into light oil production Kurdamir Development plan submitted for approval on August 31, 2014 Kurdamir-4, first horizontal development well, spud planned Q4 2014, anticipated first production end 2015 Garmian Production to commence upon approval of development plan expected by end 2014 Sarqala-1 workover targeting production rates up to 10,000 bbl/d Sproule Resources update anticipated October 2014 Exports Kurdistan crude sales via tanker to international markets ongoing, starting May 2014 KRI-Turkey oil pipeline expansion planned to 450,000 bbl/d by end 2014 Significant upside from incremental prospective resources Kurdamir Gross Mean Prospective Resources of 1.6 billion BOE for further delineation drilling includes: Over 1.2 billion BOE downdip from proven oil in Oligocene Includes over 400 million of lower risk BOE within logged and tested zone in Kurdamir-3 Garmian Gross Mean Prospective Resources of 251 MMBOE from Jeribe reservoir and 63 MMBOE from Mio-Oligocene reservoir for further delineation drilling Hasira-1 exploration well awaiting testing pending completion of Sarqala-1 workover Attractive fiscal terms Receive up to 31% of total oil during cost recovery phase $430 million of cost recoverable pools available 4

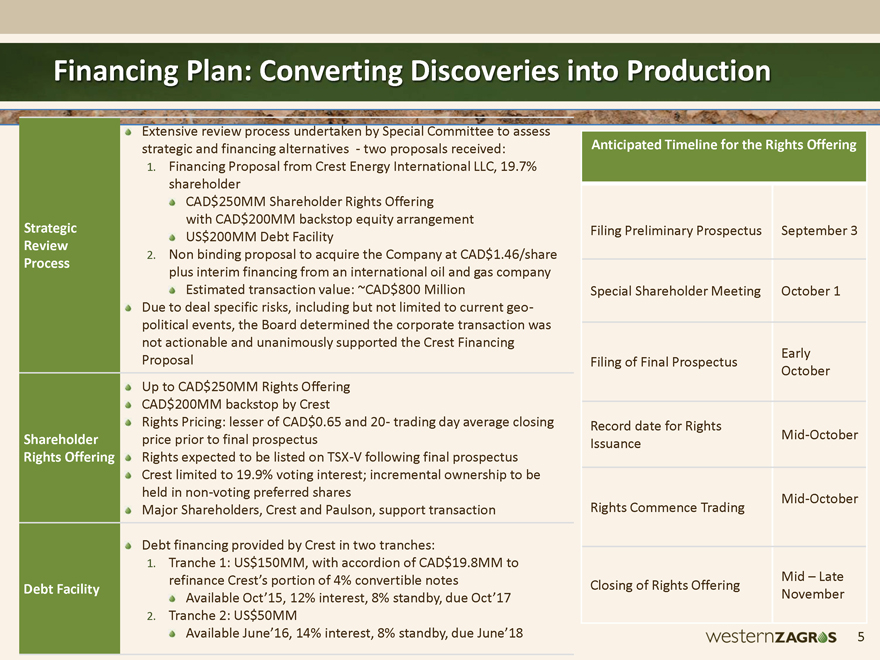

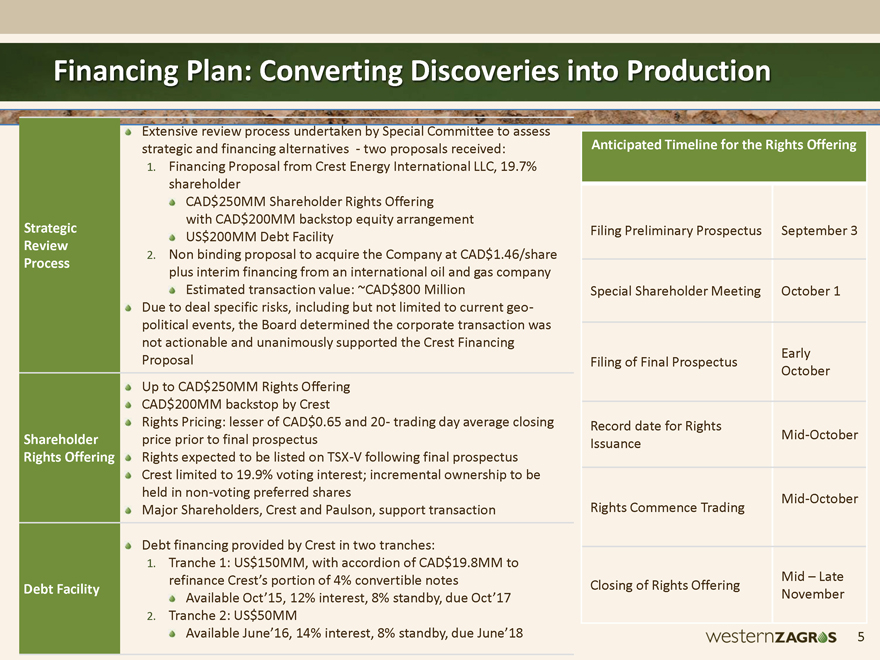

Financing Plan: Converting Discoveries into Production Strategic Review Process Extensive review process undertaken by Special Committee to assess strategic and financing alternatives - two proposals received: 1. Financing Proposal from Crest Energy International LLC, 19.7% shareholder CAD$250MM Shareholder Rights Offering with CAD$200MM backstop equity arrangement US$200MM Debt Facility 2. Non binding proposal to acquire the Company at CAD$1.46/share plus interim financing from an international oil and gas company Estimated transaction value: ~CAD$800 Million Due to deal specific risks, including but not limited to current geopolitical events, the Board determined the corporate transaction was not actionable and unanimously supported the Crest Financing Proposal Shareholder Rights Offering Up to CAD$250MM Rights Offering CAD$200MM backstop by Crest Rights Pricing: lesser of CAD$0.65 and 20- trading day average closing price prior to final prospectus Rights expected to be listed on TSX-V following final prospectus Crest limited to 19.9% voting interest; incremental ownership to be held in non-voting preferred shares Major Shareholders, Crest and Paulson, support transaction Debt Facility Debt financing provided by Crest in two tranches: 1. Tranche 1: US$150MM, with accordion of CAD$19.8MM to refinance Crest’s portion of 4% convertible notes Available Oct’15, 12% interest, 8% standby, due Oct’17 2. Tranche 2: US$50MM Available June’16, 14% interest, 8% standby, due June’18 5 Anticipated Timeline for the Rights Offering Filing Preliminary Prospectus September 3 Special Shareholder Meeting October 1 Filing of Final Prospectus Early October Record date for Rights Issuance Mid-October Rights Commence Trading Mid-October Closing of Rights Offering Mid – Late November 5

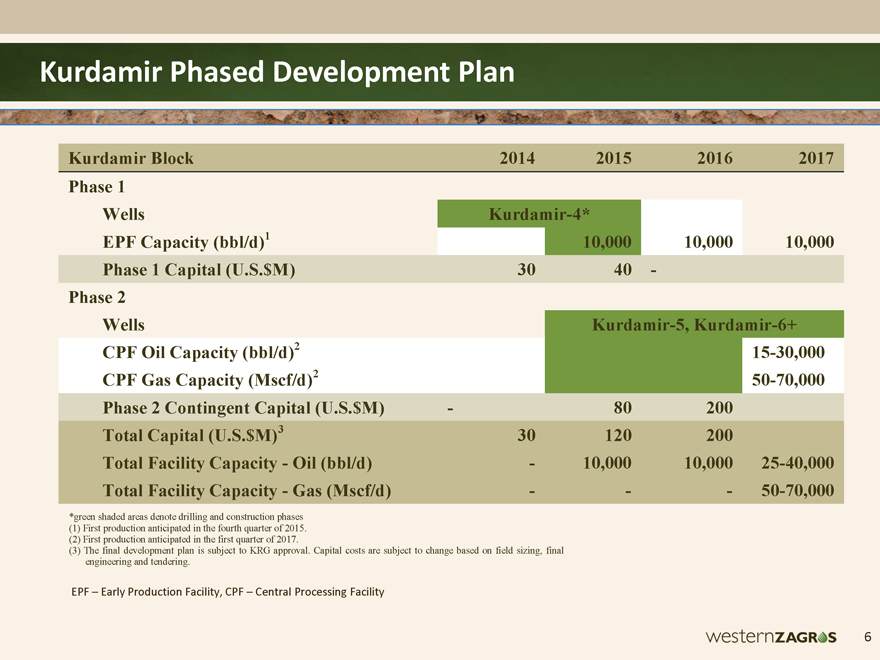

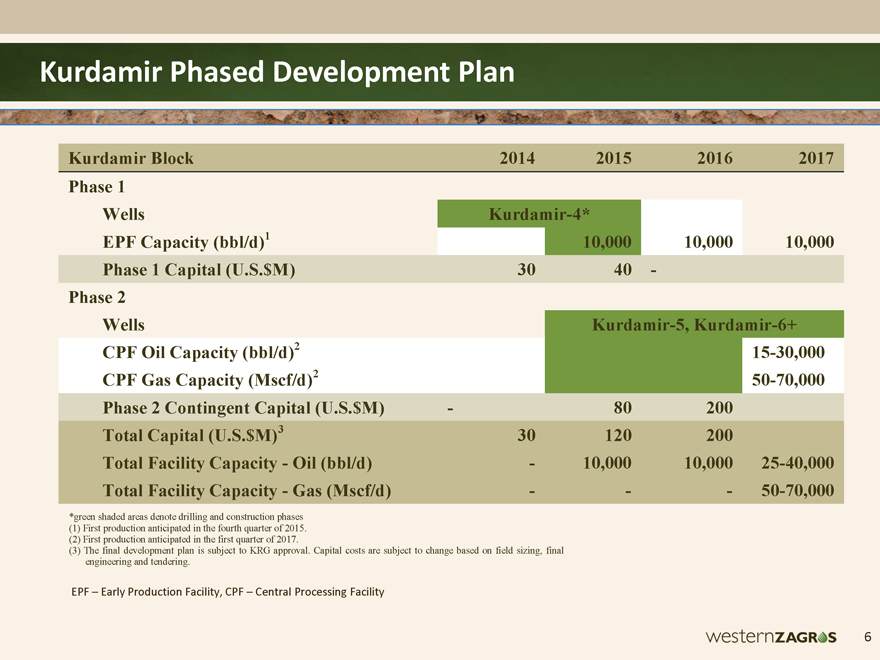

Kurdamir Phased Development Plan 6 EPF – Early Production Facility, CPF – Central Processing Facility Kurdamir Block 2014 2015 2016 2017 Phase 1 Wells Kurdamir-4* EPF Capacity (bbl/d)1 10,000 10,000 10,000 Phase 1 Capital (U.S.$M) 30 40 - Phase 2 Wells Kurdamir-5, Kurdamir-6+ CPF Oil Capacity (bbl/d)2 15-30,000 CPF Gas Capacity (Mscf/d)2 50-70,000 Phase 2 Contingent Capital (U.S.$M) - 80 200 Total Capital (U.S.$M)3 30 120 200 Total Facility Capacity - Oil (bbl/d) - 10,000 10,000 25-40,000 Total Facility Capacity - Gas (Mscf/d) - - - 50-70,000 *green shaded areas denote drilling and construction phases (1) First production anticipated in the fourth quarter of 2015. (2) First production anticipated in the first quarter of 2017. (3) The final development plan is subject to KRG approval. Capital costs are subject to change based on field sizing, final engineering and tendering. Epf – early production facility, cpf – central processing facility6

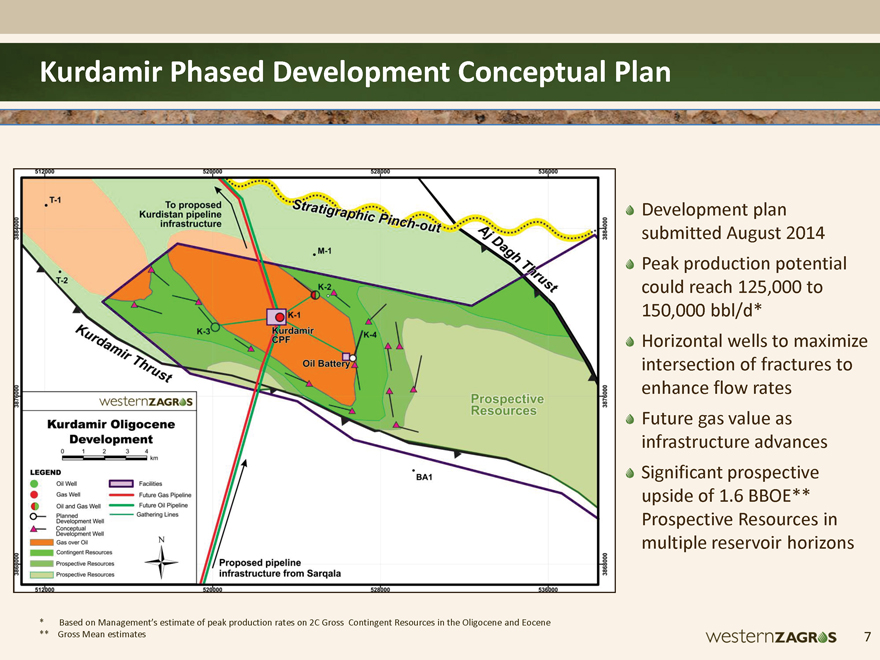

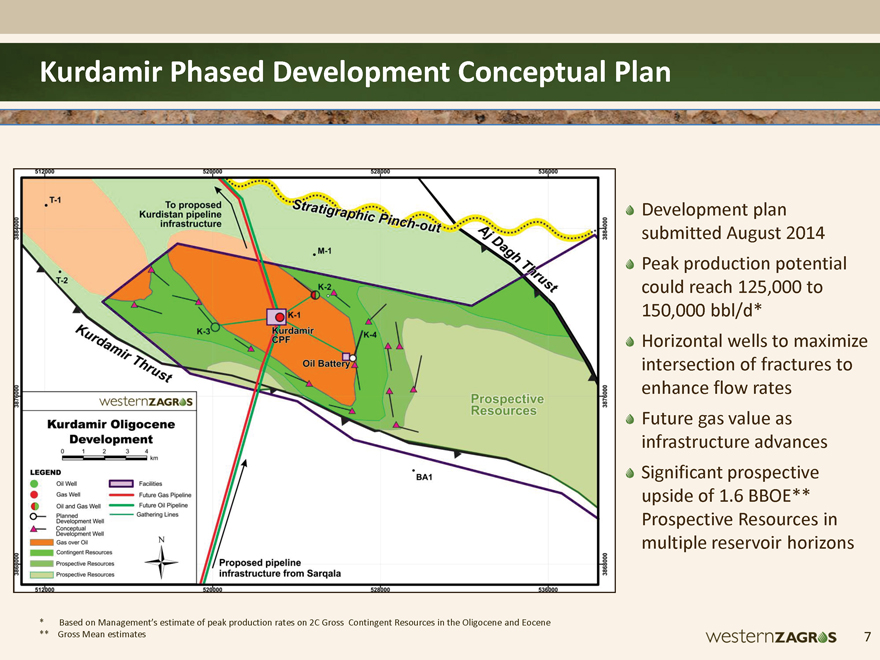

Kurdamir Phased Development Conceptual Plan 7 Development plan submitted August 2014 Peak production potential could reach 125,000 to 150,000 bbl/d* Horizontal wells to maximize intersection of fractures to enhance flow rates Future gas value as infrastructure advances Significant prospective upside of 1.6 BBOE** Prospective Resources in multiple reservoir horizons * Based on Management’s estimate of peak production rates on 2C Gross Contingent Resources in the Oligocene and Eocene ** Gross Mean estimates kurdamir Oligocene development legend oil well orioised pipeline infrastructure form sarqala ba1 7

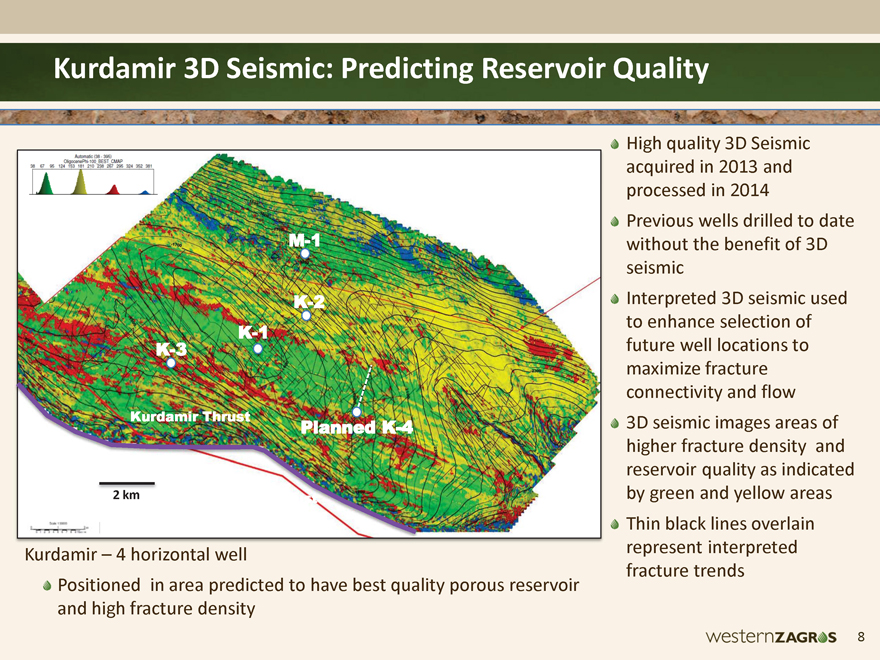

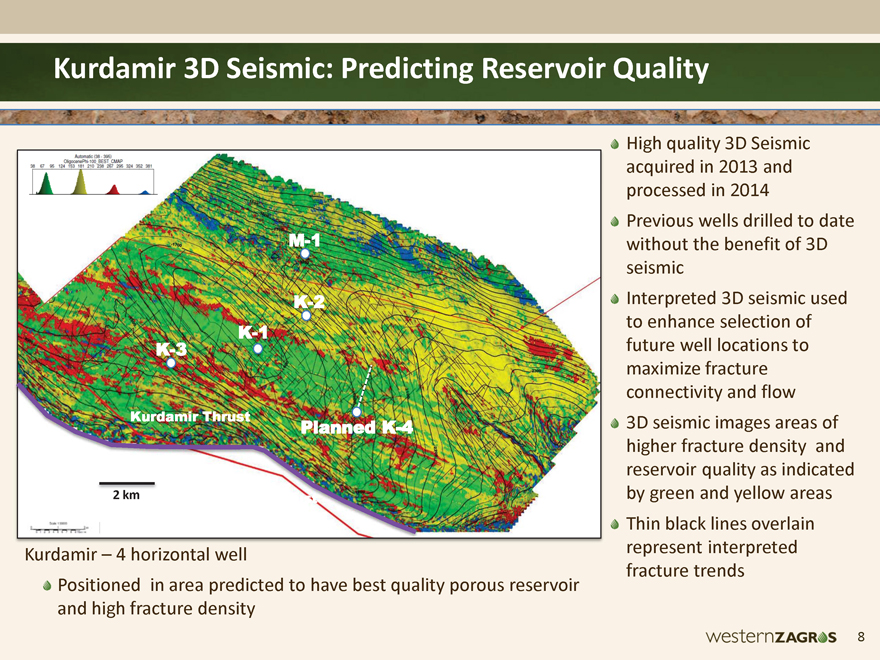

8 2 km K-1 K-2 K-3 M-1 Planned K-4 Kurdamir Thrust Kurdamir 3D Seismic: Predicting Reservoir Quality Kurdamir Thrust High quality 3D Seismic acquired in 2013 and processed in 2014 Previous wells drilled to date without the benefit of 3D seismic Interpreted 3D seismic used to enhance selection of future well locations to maximize fracture connectivity and flow 3D seismic images areas of higher fracture density and reservoir quality as indicated by green and yellow areas Thin black lines overlain represent interpreted fracture trends Kurdamir – 4 horizontal well Positioned in area predicted to have best quality porous reservoir and high fracture density

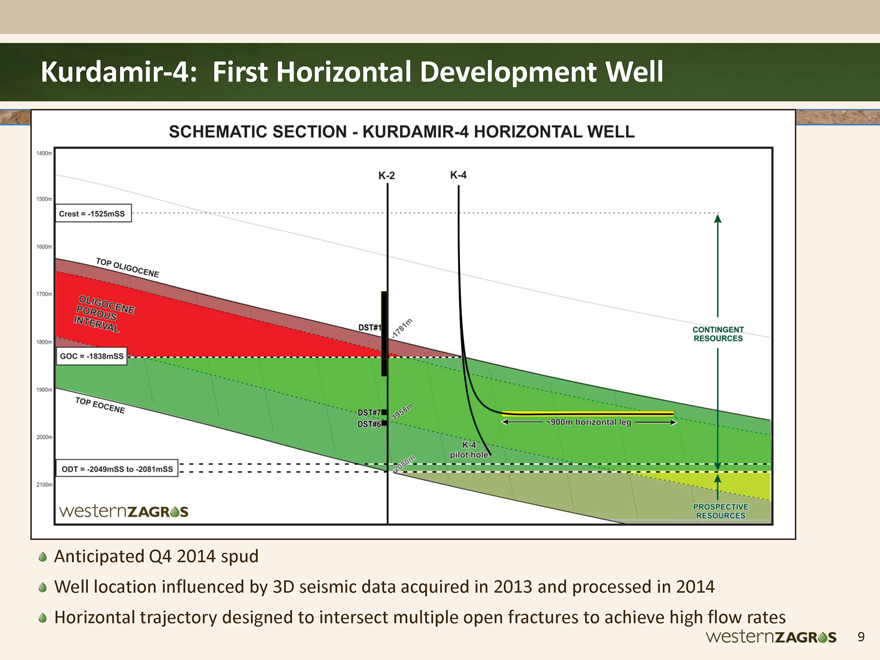

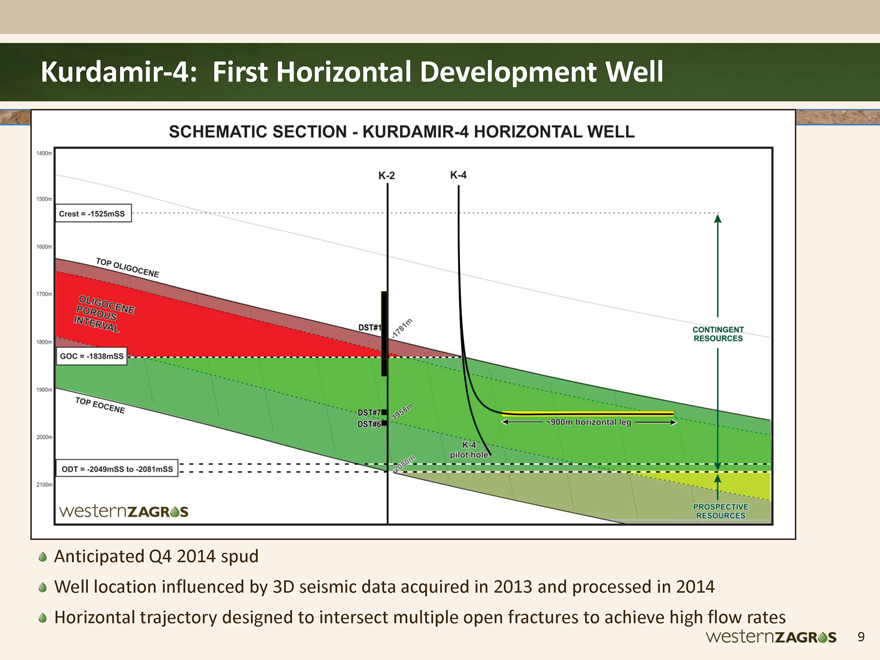

Kurdamir-4: First Horizontal Development Well Anticipated Q4 2014 spud Well location influenced by 3D seismic data acquired in 2013 and processed in 2014 Horizontal trajectory designed to intersect multiple open fractures to achieve high flow rates contingent resources prospective resources 9

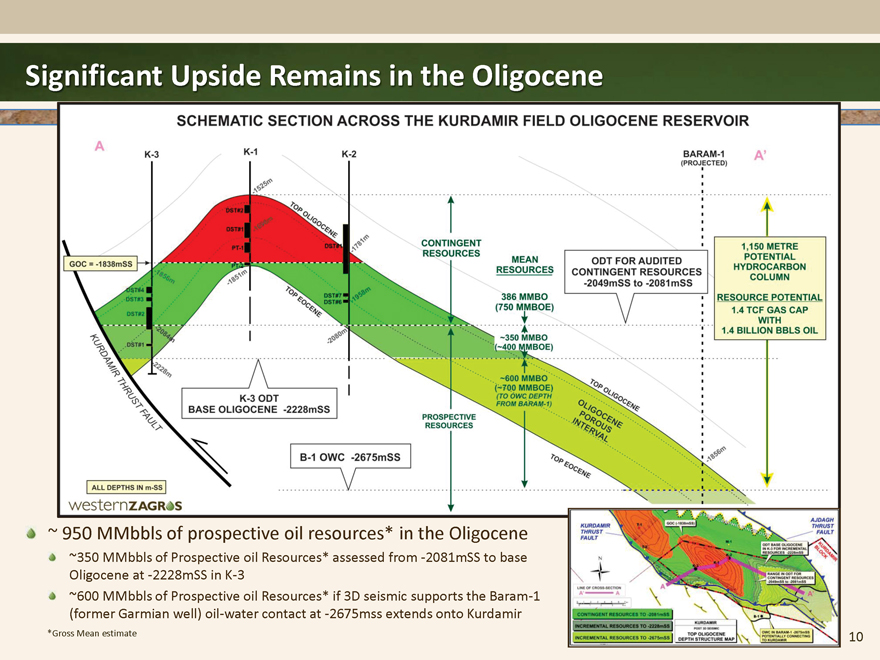

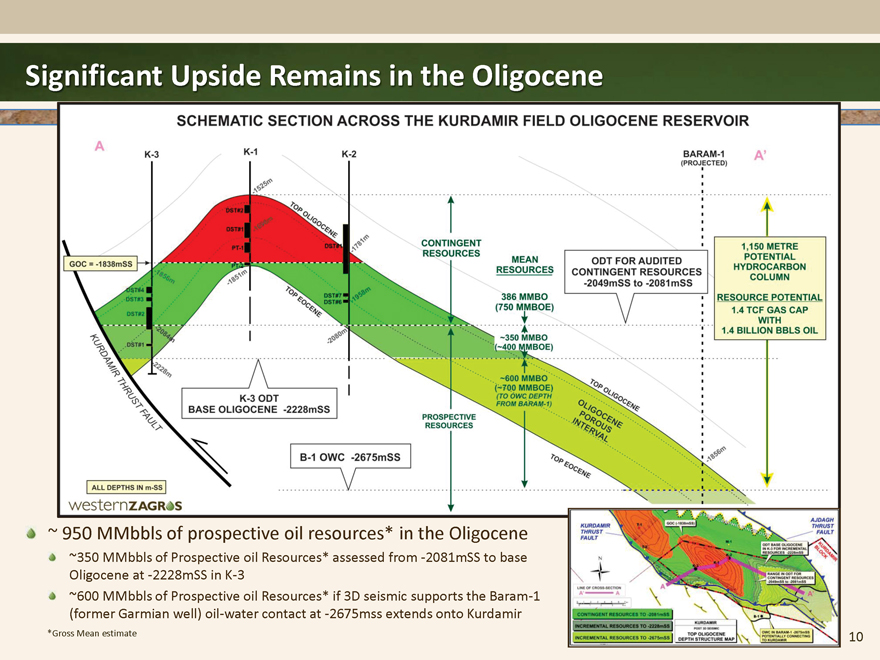

10 Significant Upside Remains in the Oligocene ~ 950 MMbbls of prospective oil resources* in the Oligocene ~350 MMbbls of Prospective oil Resources* assessed from -2081mSS to base Oligocene at -2228mSS in K-3 ~600 MMbbls of Prospective oil Resources* if 3D seismic supports the Baram-1 (former Garmian well) oil-water contact at -2675mss extends onto Kurdamir *Gross Mean estimate

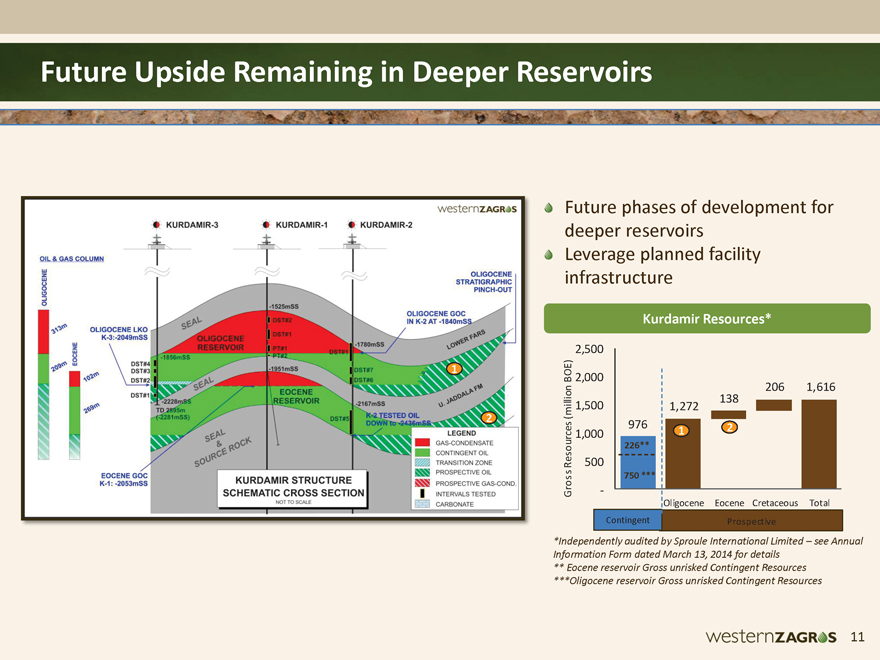

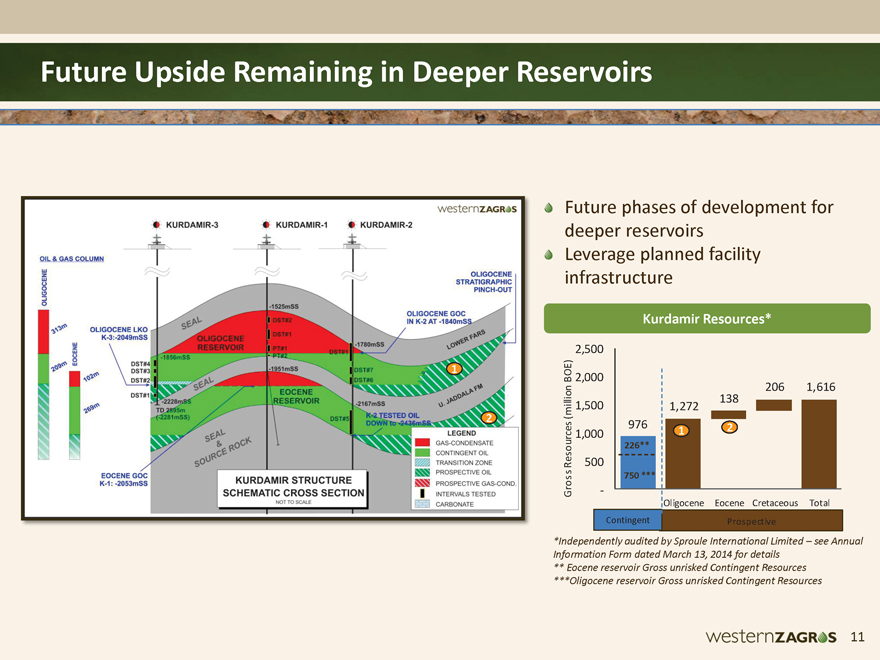

Future Upside Remaining in Deeper Reservoirs 11 Future phases of development for deeper reservoirs Leverage planned facility infrastructure 976 1,272 138 206 1,616 - 500 1,000 1,500 2,000 2,500 Oligocene Eocene Cretaceous Total Gross Resources (million BOE) Prospective 1 Kurdamir Resources* Contingent *Independently audited by Sproule International Limited – see Annual Information Form dated March 13, 2014 for details ** Eocene reservoir Gross unrisked Contingent Resources ***Oligocene reservoir Gross unrisked Contingent Resources 2 1 750 *** 226** 2

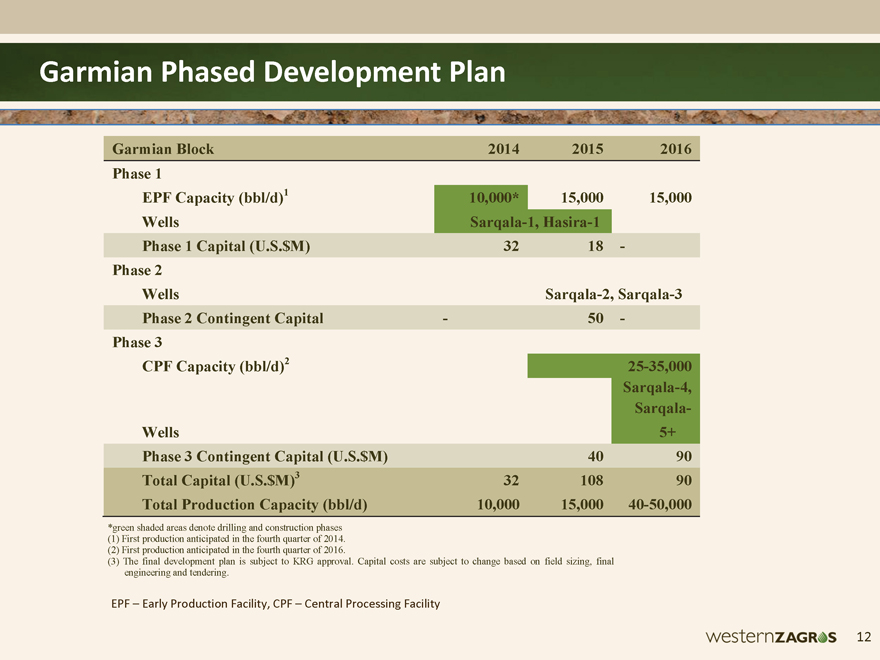

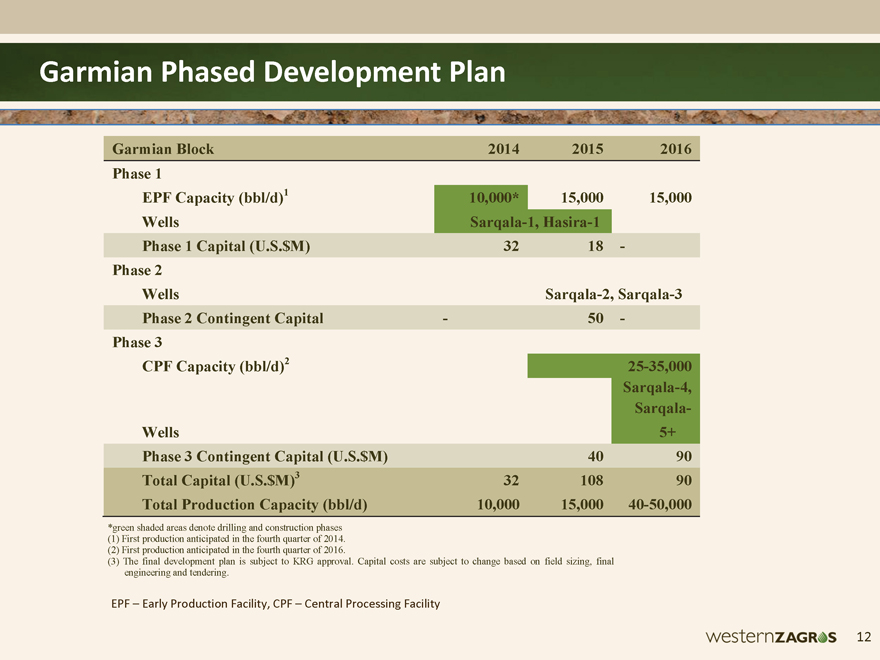

Garmian Phased Development Plan 12 EPF – Early Production Facility, CPF – Central Processing Facility Garmian Block 2014 2015 2016 Phase 1 EPF Capacity (bbl/d)1 10,000* 15,000 15,000 Wells Sarqala-1, Hasira-1 Phase 1 Capital (U.S.$M) 32 18 - Phase 2 Wells Sarqala-2, Sarqala-3 Phase 2 Contingent Capital - 50 - Phase 3 CPF Capacity (bbl/d)2 25-35,000 Sarqala-4, Sarqala- Wells 5+ Phase 3 Contingent Capital (U.S.$M) 40 90 Total Capital (U.S.$M)3 32 108 90 Total Production Capacity (bbl/d) 10,000 15,000 40-50,000 *green shaded areas denote drilling and construction phases (1) First production anticipated in the fourth quarter of 2014. (2) First production anticipated in the fourth quarter of 2016. (3) The final development plan is subject to KRG approval. Capital costs are subject to change based on field sizing, final engineering and tendering.

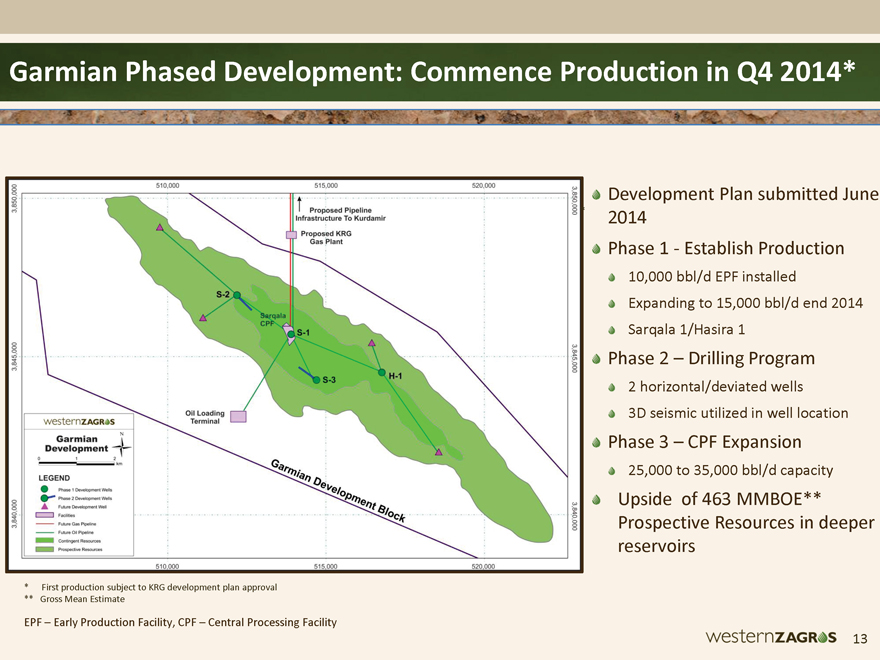

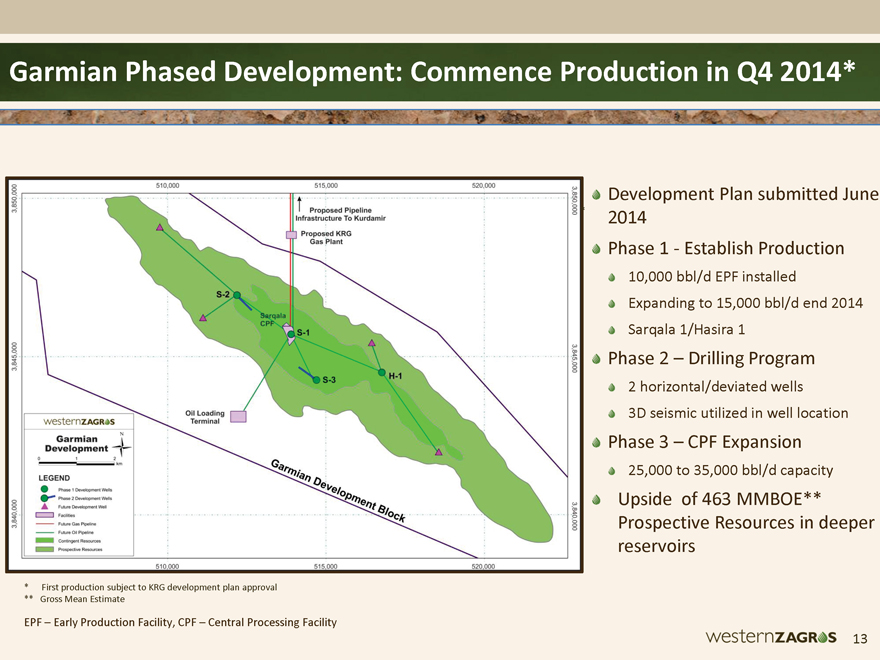

Garmian Phased Development: Commence Production in Q4 2014* 13 Development Plan submitted June 2014 Phase 1 - Establish Production 10,000 bbl/d EPF installed Expanding to 15,000 bbl/d end 2014 Sarqala 1/Hasira 1 Phase 2 – Drilling Program 2 horizontal/deviated wells 3D seismic utilized in well location Phase 3 – CPF Expansion 25,000 to 35,000 bbl/d capacity Upside of 463 MMBOE** Prospective Resources in deeper reservoirs Hasira-1 Well * EPF – Early Production Facility, CPF – Central Processing Facility * First production subject to KRG development plan approval ** Gross Mean Estimate EPF – Early Production Facility, CPF – Central Processing Facility

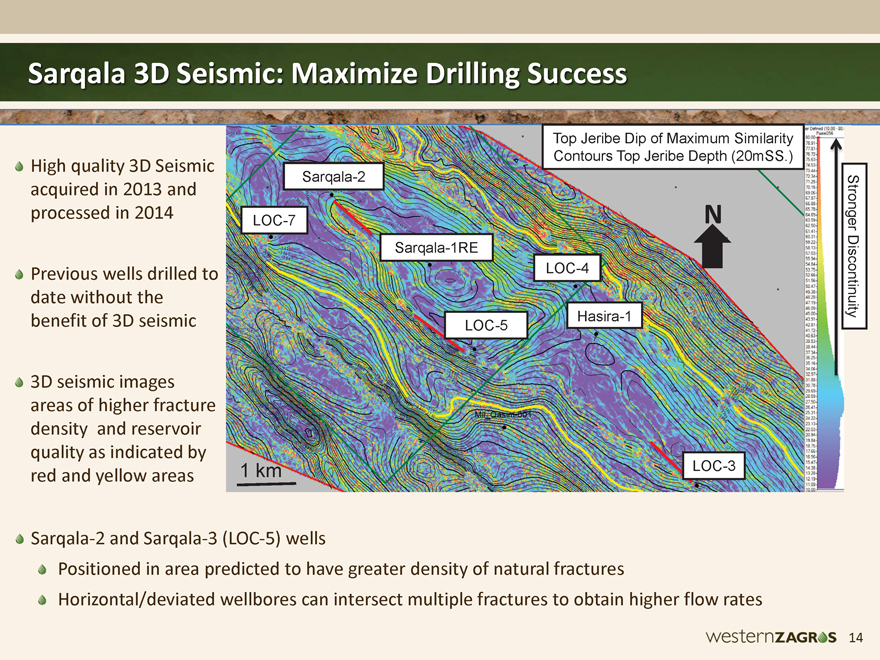

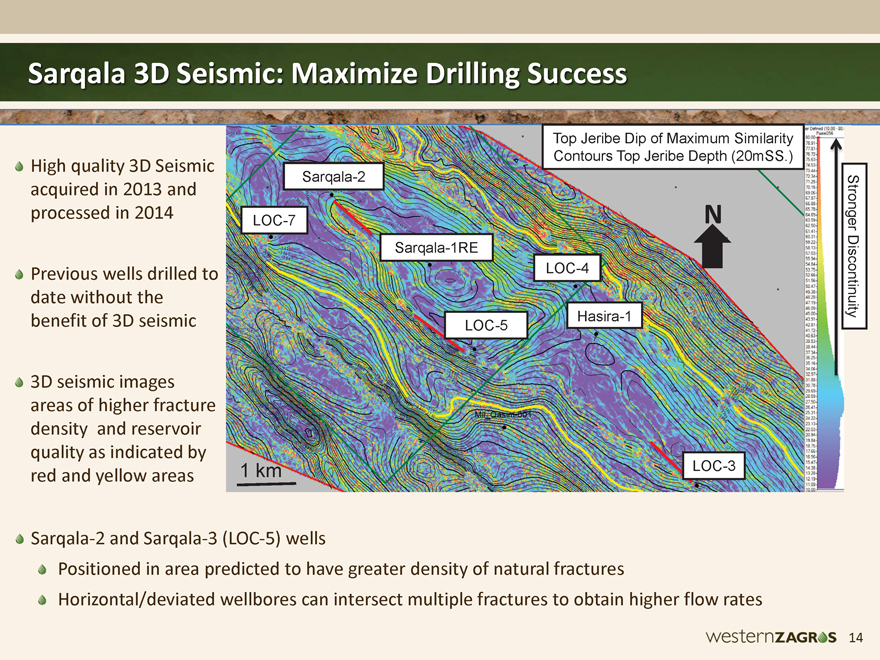

14 1 km N Sarqala 3D Seismic: Maximize Drilling Success Stronger Discontinuity Top Jeribe Dip of Maximum Similarity Contours Top Jeribe Depth (20mSS.) Hasira-1 LOC-3 LOC-5 Sarqala-2 Sarqala-1RE LOC-7 LOC-4 High quality 3D Seismic acquired in 2013 and processed in 2014 Previous wells drilled to date without the benefit of 3D seismic 3D seismic images areas of higher fracture density and reservoir quality as indicated by red and yellow areas Sarqala-2 and Sarqala-3 (LOC-5) wells Positioned in area predicted to have greater density of natural fractures Horizontal/deviated wellbores can intersect multiple fractures to obtain higher flow rates

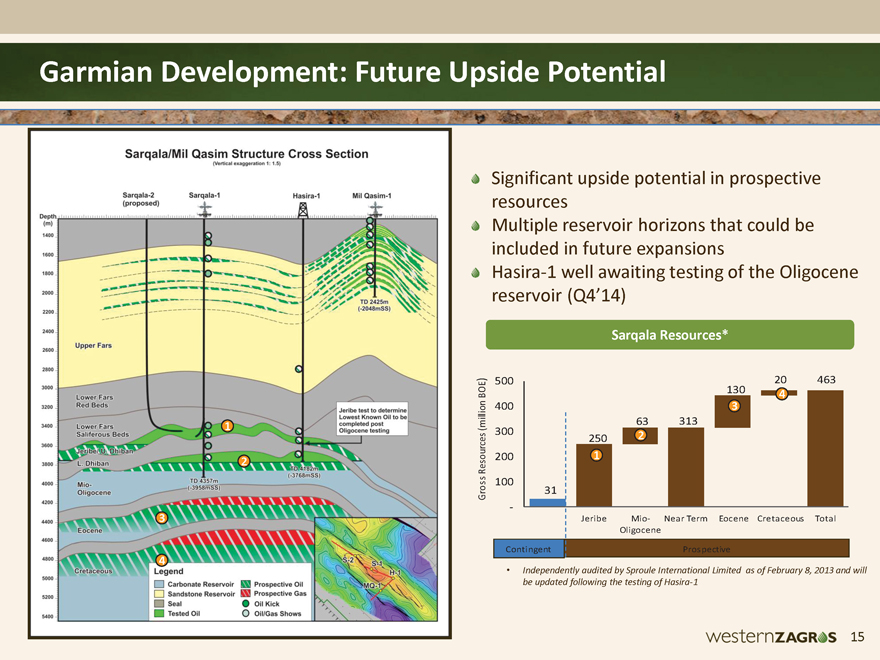

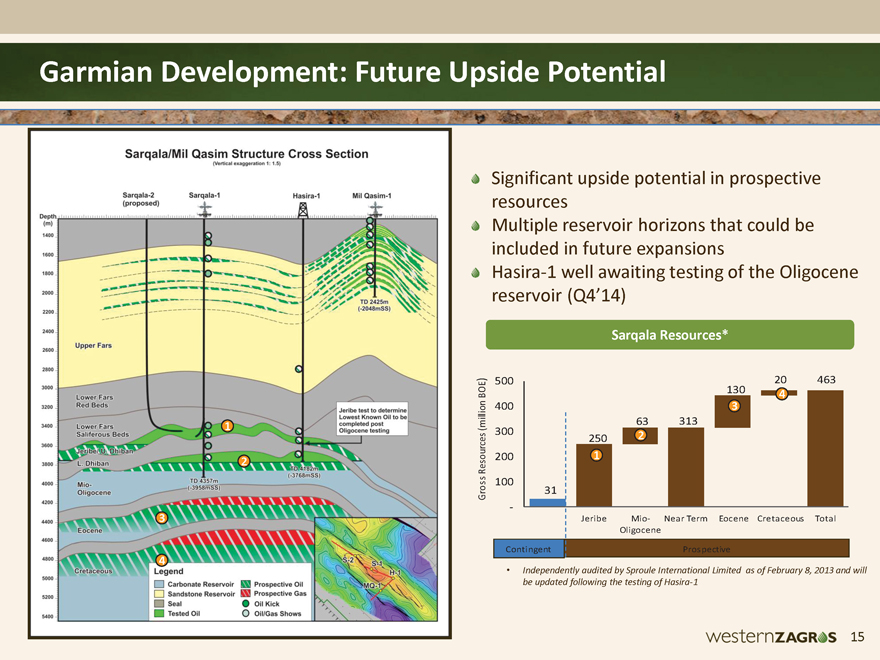

Sarqala Resources* Garmian Development: Future Upside Potential Significant upside potential in prospective resources Multiple reservoir horizons that could be included in future expansions Hasira-1 well awaiting testing of the Oligocene reservoir (Q4’14) 31 250 63 313 130 20 463 - 100 200 300 400 500 Jeribe Mio- Oligocene Near Term Eocene Cretaceous Total Gross Resources (million BOE) Contingent Prospective 1 2 3 4 * Independently audited by Sproule International Limited as of February 8, 2013 and will be updated following the testing of Hasira-1 WesternZagros 15

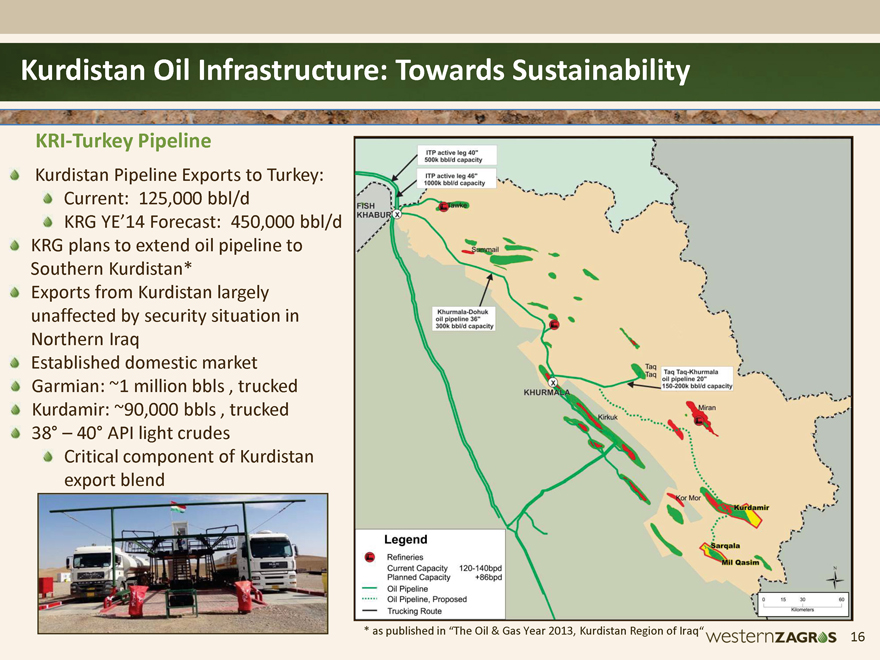

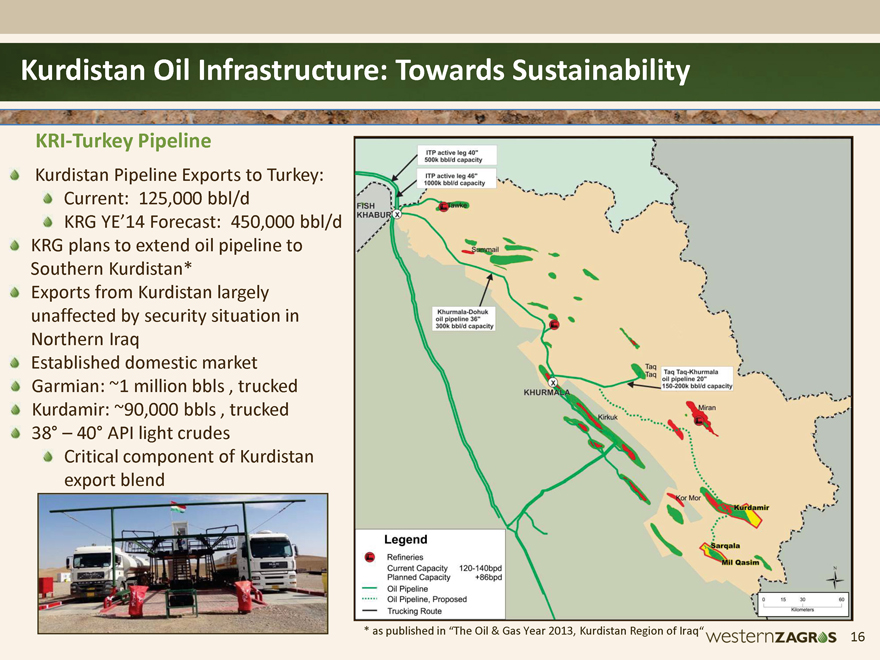

Kurdistan Oil Infrastructure: Towards Sustainability * as published in “The Oil & Gas Year 2013, Kurdistan Region of Iraq“ 16 Kurdistan Pipeline Exports to Turkey: Current: 125,000 bbl/d KRG YE’14 Forecast: 450,000 bbl/d KRG plans to extend oil pipeline to Southern Kurdistan* Exports from Kurdistan largely unaffected by security situation in Northern Iraq Established domestic market Garmian: ~1 million bbls , trucked Kurdamir: ~90,000 bbls , trucked 38° – 40° API light crudes Critical component of Kurdistan export blend KRI-Turkey Pipeline WesternZagros16

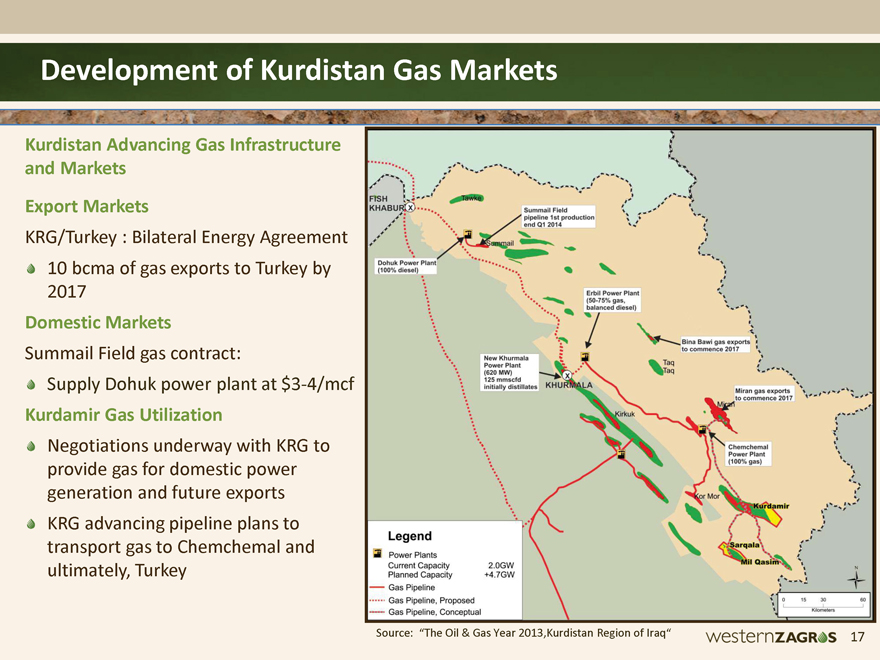

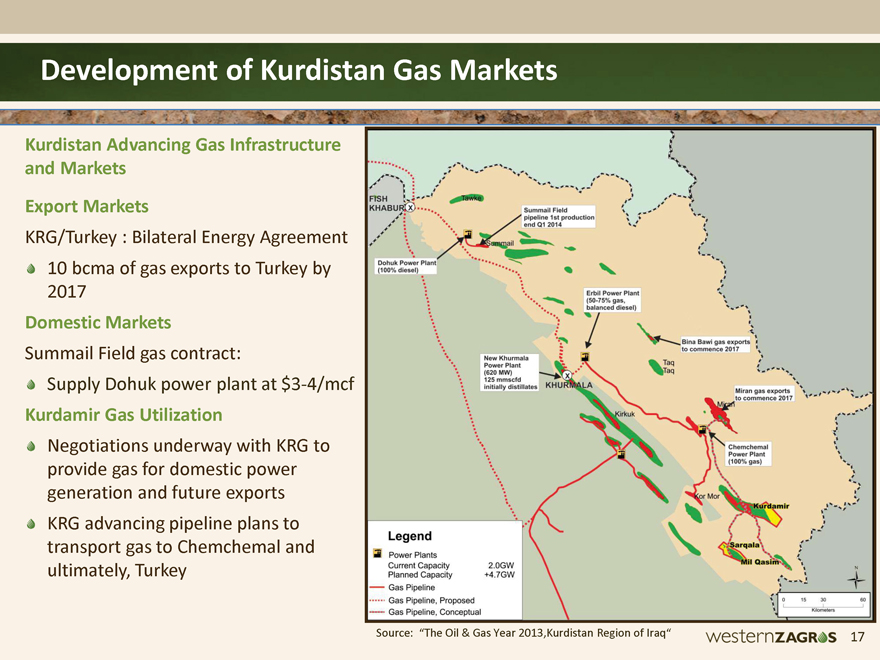

Development of Kurdistan Gas Markets Source: “The Oil & Gas Year 2013, Kurdistan Region of Iraq“ Kurdistan Advancing Gas Infrastructure and Markets Export Markets KRG/Turkey : Bilateral Energy Agreement 10 bcma of gas exports to Turkey by 2017 Domestic Markets Summail Field gas contract: Supply Dohuk power plant at $3-4/mcf Kurdamir Gas Utilization Negotiations underway with KRG to provide gas for domestic power generation and future exports KRG advancing pipeline plans to transport gas to Chemchemal and ultimately, Turkey Westernzagros 17

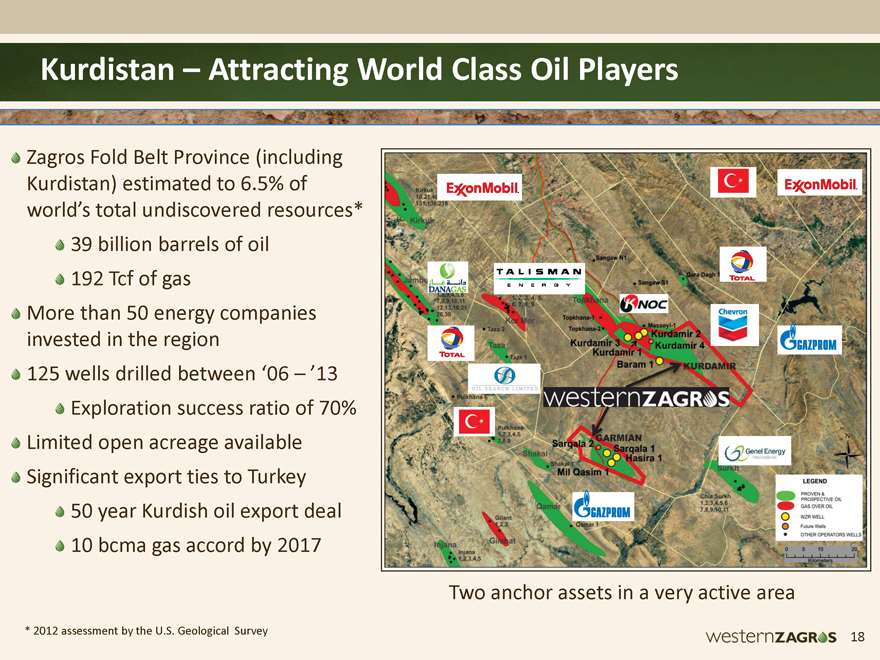

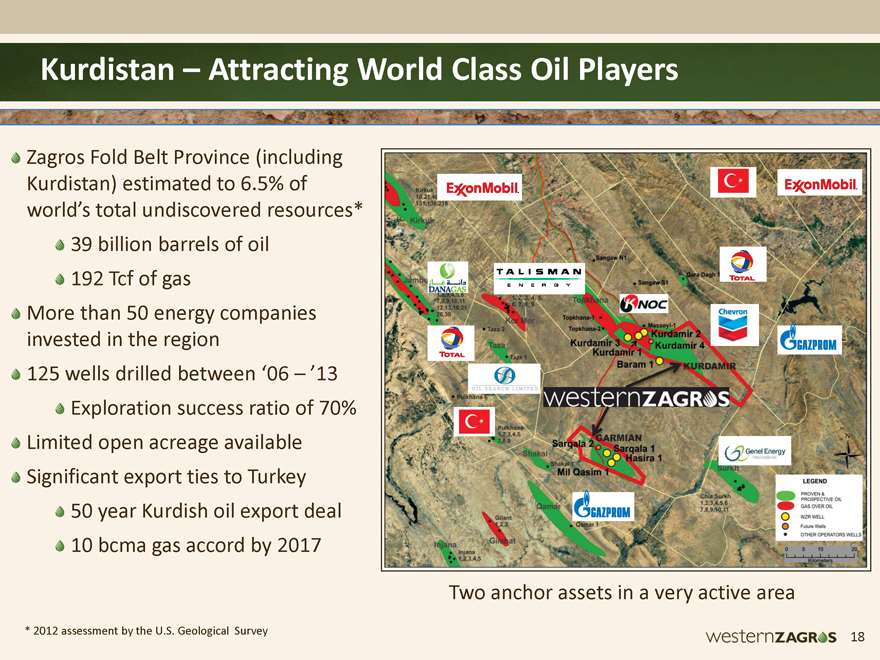

18 Kurdistan – Attracting World Class Oil Players Zagros Fold Belt Province (including Kurdistan) estimated to 6.5% of world’s total undiscovered resources* 39 billion barrels of oil 192 Tcf of gas More than 50 energy companies invested in the region 125 wells drilled between ‘06 – ‘13 Exploration success ratio of 70% Limited open acreage available Significant export ties to Turkey 50 year Kurdish oil export deal 10 bcma gas accord by 2017 Two anchor assets in a very active area * 2012 assessment by the U.S. Geological Survey

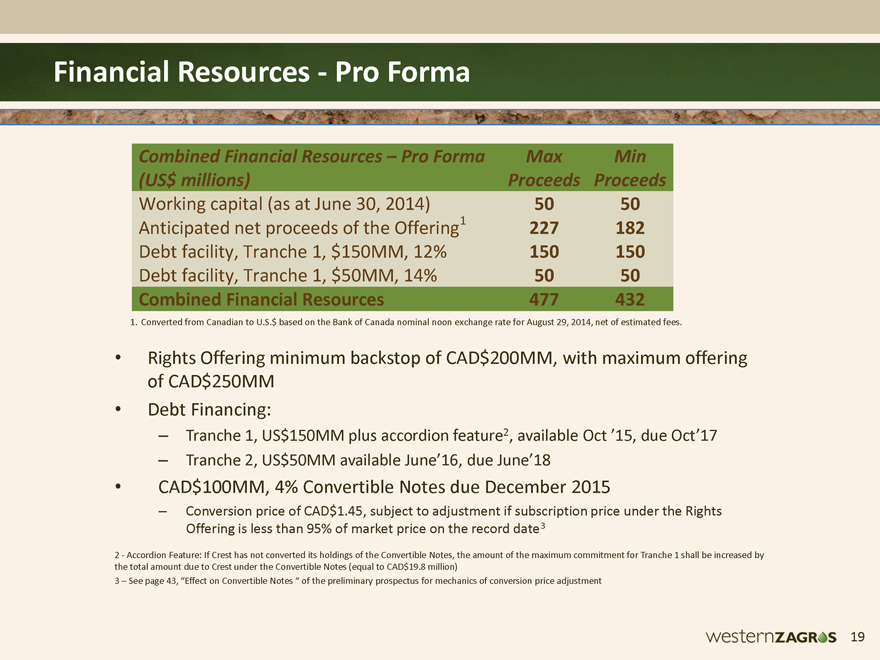

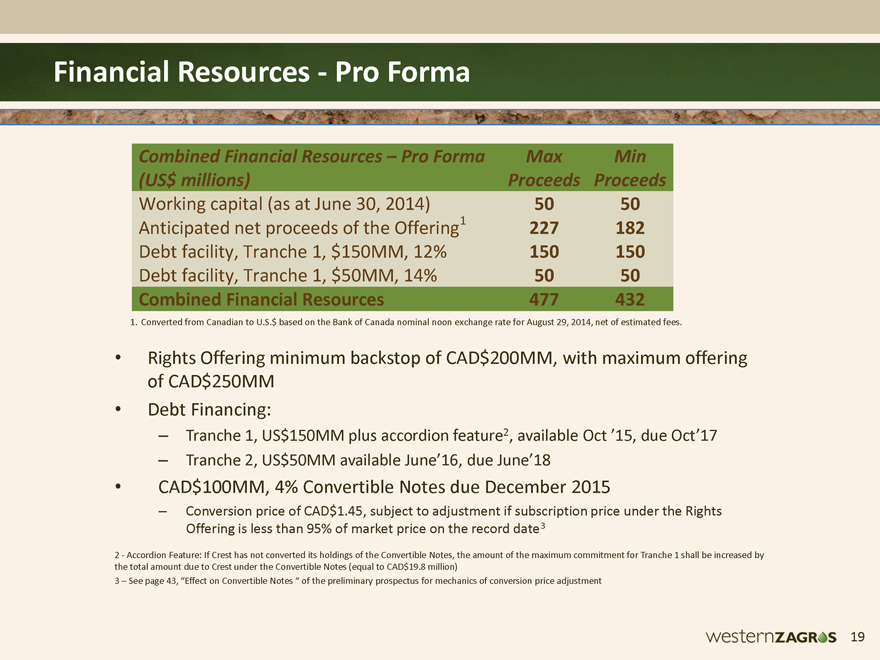

Financial Resources - Pro Forma 1. Converted from Canadian to U.S.$ based on the Bank of Canada nominal noon exchange rate for August 29, 2014, net of estimated fees. Combined Financial Resources – Pro Forma (US$ millions) Max Proceeds Min Proceeds Working capital (as at June 30, 2014) 50 50 Anticipated net proceeds of the Offering1 227 182 Debt facility, Tranche 1, $150MM, 12% 150 150 Debt facility, Tranche 1, $50MM, 14% 50 50 Combined Financial Resources 477 432 Rights Offering minimum backstop of CAD$200MM, with maximum offering of CAD$250MM Debt Financing: – Tranche 1, US$150MM plus accordion feature2, available Oct ‘15, due Oct’17 – Tranche 2, US$50MM available June’16, due June’18 CAD$100MM, 4% Convertible Notes due December 2015 – Conversion price of CAD$1.45, subject to adjustment if subscription price under the Rights Offering is less than 95% of market price on the record date3 2 - Accordion Feature: If Crest has not converted its holdings of the Convertible Notes, the amount of the maximum commitment for Tranche 1 shall be increased by the total amount due to Crest under the Convertible Notes (equal to CAD$19.8 million) 3 – See page 43, “Effect on Convertible Notes “ of the preliminary prospectus for mechanics of conversion price adjustment westernzagros 19

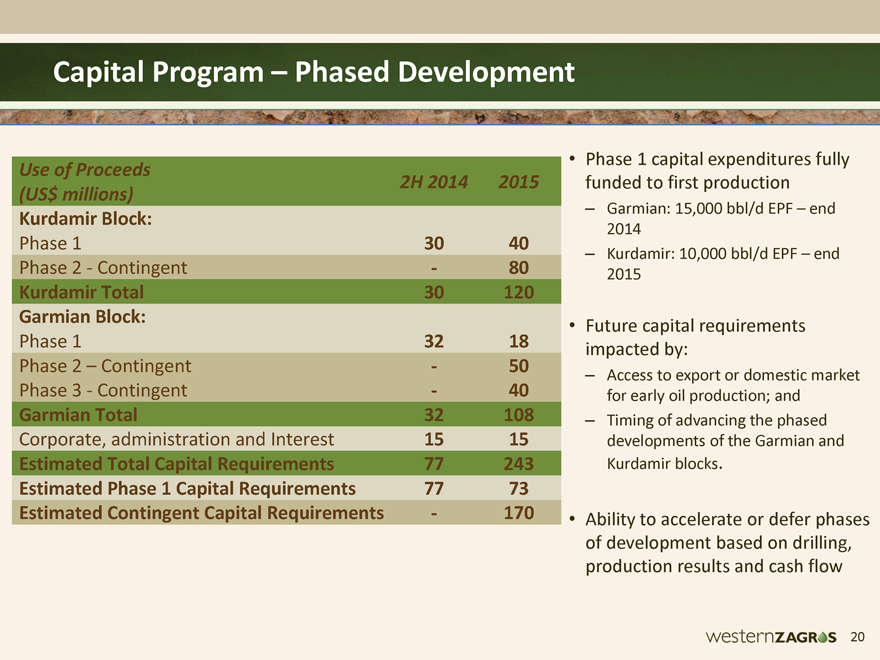

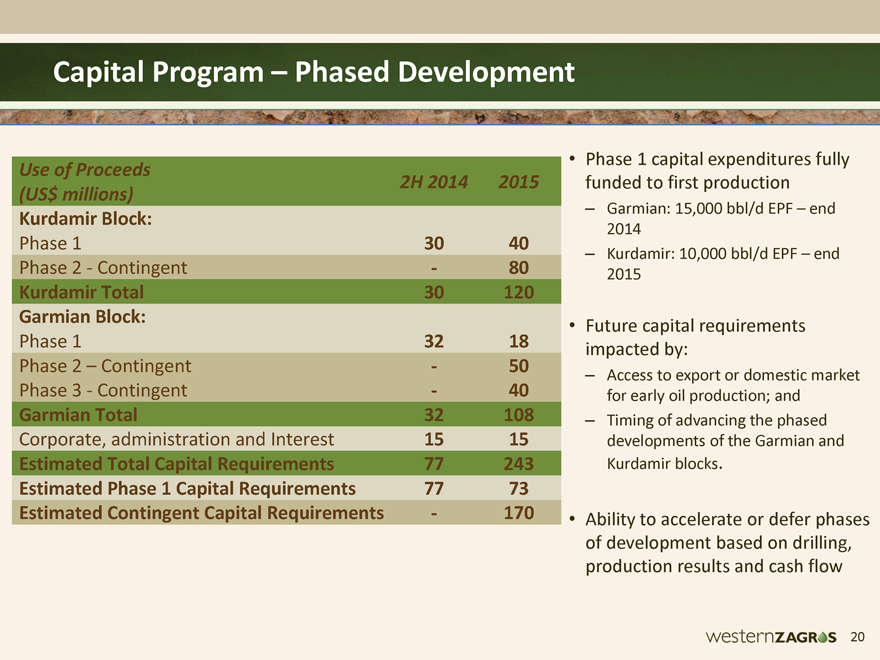

Capital Program – Phased Development Phase 1 capital expenditures fully funded to first production – Garmian: 15,000 bbl/d EPF – end 2014 – Kurdamir: 10,000 bbl/d EPF – end 2015 Future capital requirements impacted by: – Access to export or domestic market for early oil production; and – Timing of advancing the phased developments of the Garmian and Kurdamir blocks. Ability to accelerate or defer phases of development based on drilling, production results and cash flow Use of Proceeds (US$ millions) 2H 2014 2015 Kurdamir Block: Phase 1 30 40 Phase 2 - Contingent - 80 Kurdamir Total 30 120 Garmian Block: Phase 1 32 18 Phase 2 – Contingent - 50 Phase 3 - Contingent - 40 Garmian Total 32 108 Corporate, administration and Interest 15 15 Estimated Total Capital Requirements 77 243 Estimated Phase 1 Capital Requirements 77 73 Estimated Contingent Capital Requirements - 170 westernzagros 20

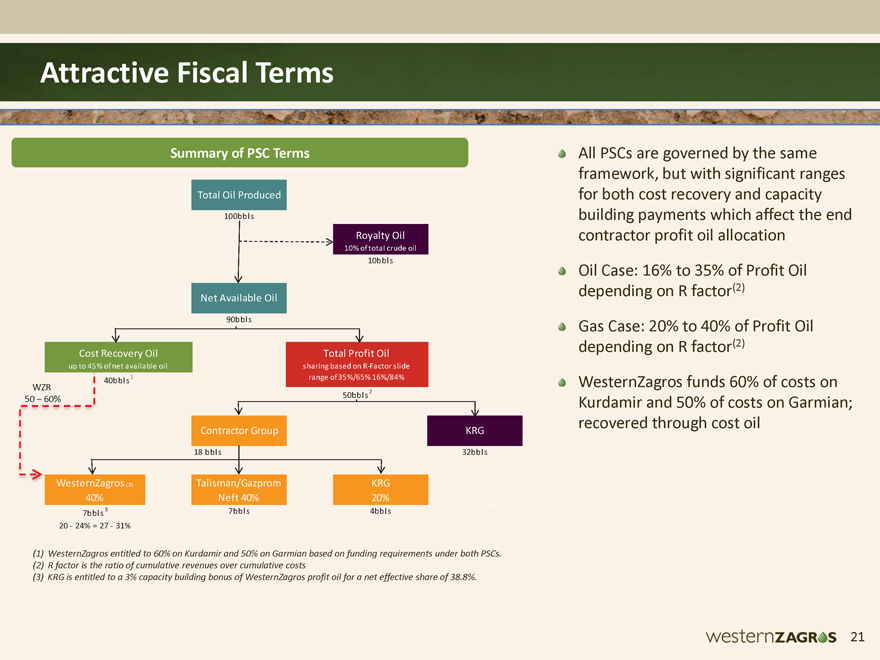

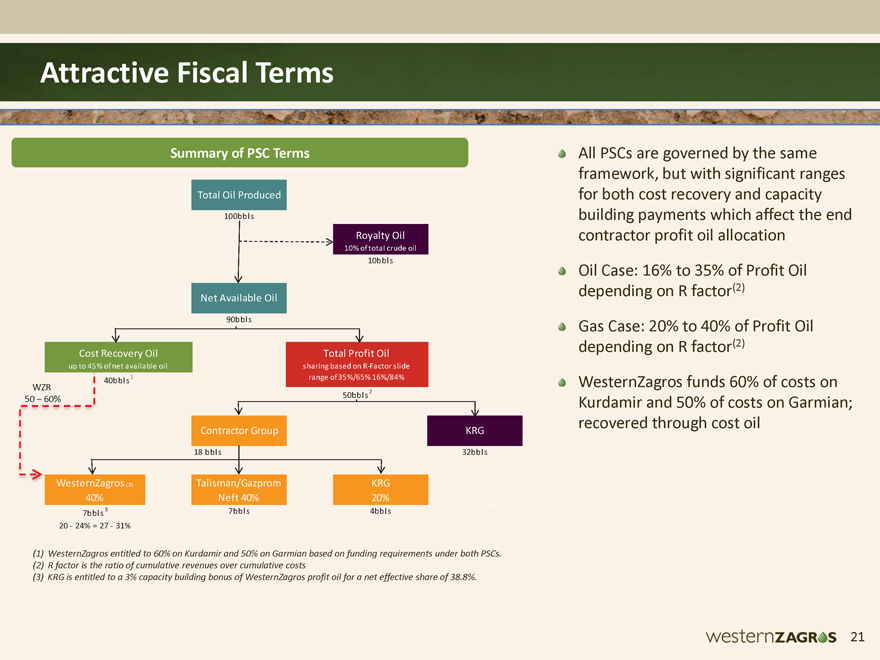

Attractive Fiscal Terms WesternZagros 21 (1) WesternZagros entitled to 60% on Kurdamir and 50% on Garmian based on funding requirements under both PSCs. (2) R factor is the ratio of cumulative revenues over cumulative costs (3) KRG is entitled to a 3% capacity building bonus of WesternZagros profit oil for a net effective share of 38.8%. * Summary of PSC Terms All PSCs are governed by the same framework, but with significant ranges for both cost recovery and capacity building payments which affect the end contractor profit oil allocation Oil Case: 16% to 35% of Profit Oil depending on R factor(2) Gas Case: 20% to 40% of Profit Oil depending on R factor(2) WesternZagros funds 60% of costs on Kurdamir and 50% of costs on Garmian; recovered through cost oil WZR (1) 50 – 60% 18 bbls 20 - 24% = 27 - 31% 90bbls 7bbls 3 7bbls 4bbls Royalty Oil 10% of total crude oil Total Oil Produced Net Available Oil 100bbls 10bbls 32bbls WesternZagros (2) 40% Talisman/Gazprom Neft 40% KRG 20% Cost Recovery Oil up to 45% of net available oil Total Profit Oil sharing based on R-Factor slide range of 35%/65% 16%/84% Contractor Group 40bbls 1 50bbls 2 KRG

WesternZagros 22 Fueling our Futures – Key Investment Highlights BOE of Resources1 2.2 billion BOE of Contingent Resources1 Prospective 1.0 billion 165,000 – 200,000 bbl/d Peak Oil Production Potential 2 1 - Gross Mean Estimates of Kurdamir and Garmian Blocks 2 - Management estimates based on gross unrisked mean contingent and gross unrisked mean contingent and prospective resources for Garmian 3 – Total Gross Capacity of Facilities, subject to approval 15,000 bbl/d YE’14 10,000 bbl/d Expanding to 15,000 bbl/d3 Phased Development Strategy Balancing Capital with Increases in Production ian Blocked mea KRG approval cks an contingent resources for Kurdamir Up to $450MM Financing Supported by Major Shareholder

Appendix 23 Sarqala-1 Workover Rig

Kurdamir and Garmian: Contingent and Prospective Resources 24 Note: Independently audited by Sproule International Limited – see Annual Information Form dated March 13, 2014 for details Mean – Oil Only (MMbbl, Gross) Mean – Oil and Gas (MMBOE, Gross) Contingent Resources Kurdamir Block – Kurdamir 541 976 Garmian Block - Sarqala 24 31 Total Unrisked Contingent Resources 565 1007 Prospective Resources: Kurdamir 1321 1616 Sarqala 305 463 Mil Qasim (Upper Fars) 106 121 Sub Total Kurdamir Block 1321 1616 Sub Total Garmian Block 411 584 Total Garmian and Kurdamir Blocks 1732 2200 westernZagros 24

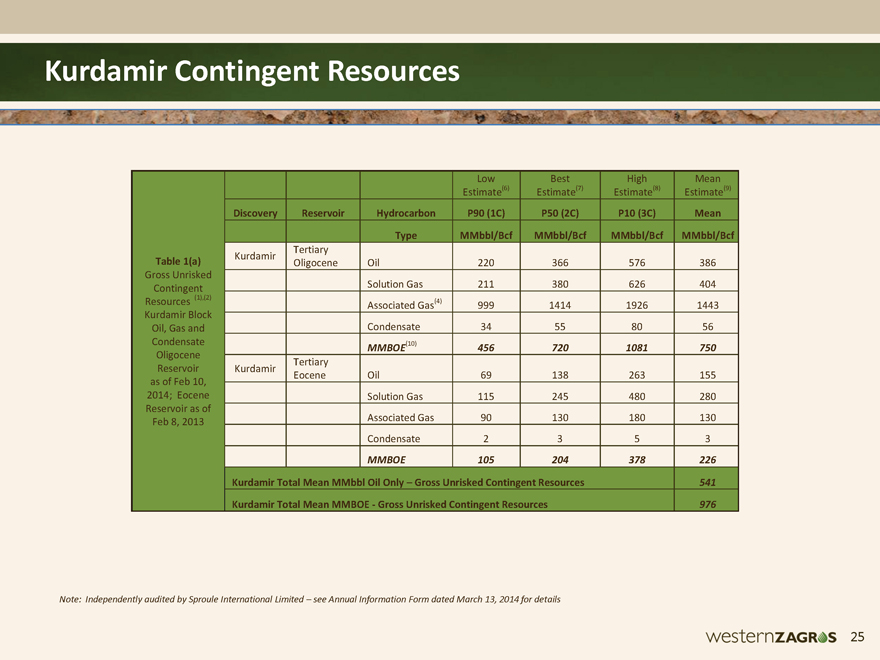

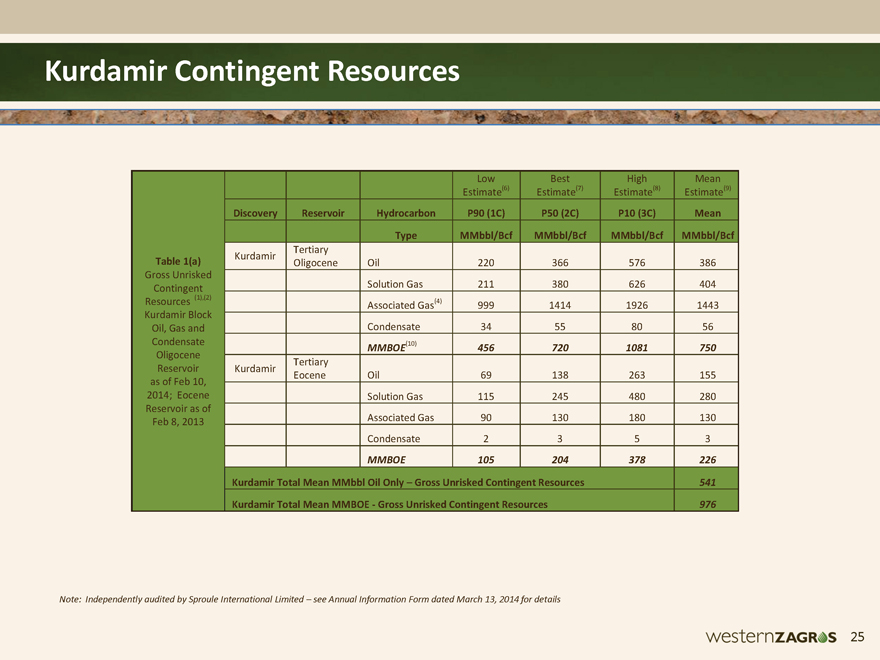

Kurdamir Contingent Resources 25 Note: Independently audited by Sproule International Limited – see Annual Information Form dated March 13, 2014 for details Table 1(a) Gross Unrisked Contingent Resources (1),(2) Kurdamir Block Oil, Gas and Condensate Oligocene Reservoir as of Feb 10, 2014; Eocene Reservoir as of Feb 8, 2013 Low Estimate(6) Best Estimate(7) High Estimate(8) Mean Estimate(9) Discovery Reservoir Hydrocarbon P90 (1C) P50 (2C) P10 (3C) Mean Type MMbbl/Bcf MMbbl/Bcf MMbbl/Bcf MMbbl/Bcf Kurdamir Tertiary Oligocene Oil 220 366 576 386 Solution Gas 211 380 626 404 Associated Gas(4) 999 1414 1926 1443 Condensate 34 55 80 56 MMBOE(10) 456 720 1081 750 Kurdamir Tertiary Eocene Oil 69 138 263 155 Solution Gas 115 245 480 280 Associated Gas 90 130 180 130 Condensate 2 3 5 3 MMBOE 105 204 378 226 Kurdamir Total Mean MMbbl Oil Only – Gross Unrisked Contingent Resources 541 Kurdamir Total Mean MMBOE - Gross Unrisked Contingent Resources 976 Westernzagros 25

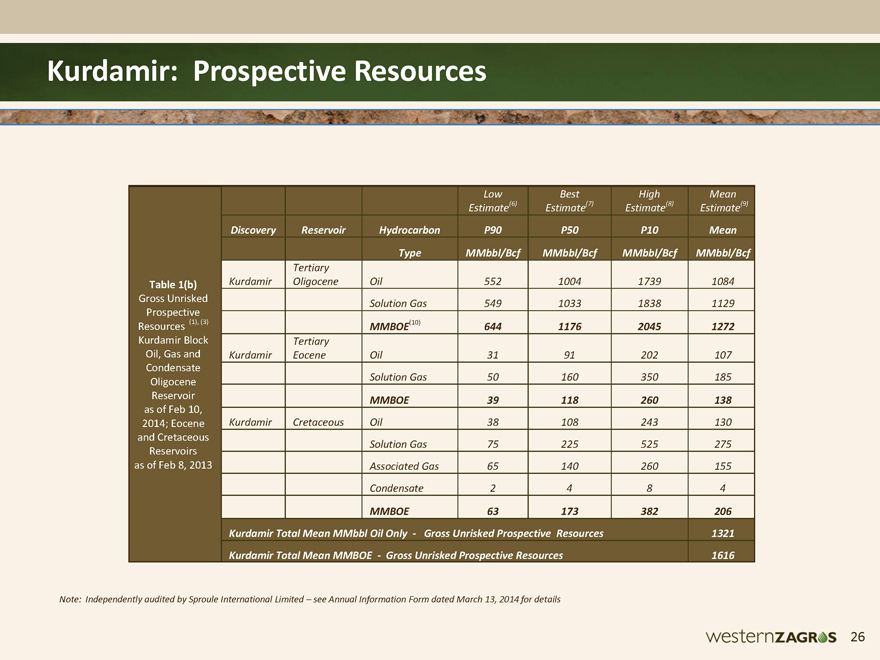

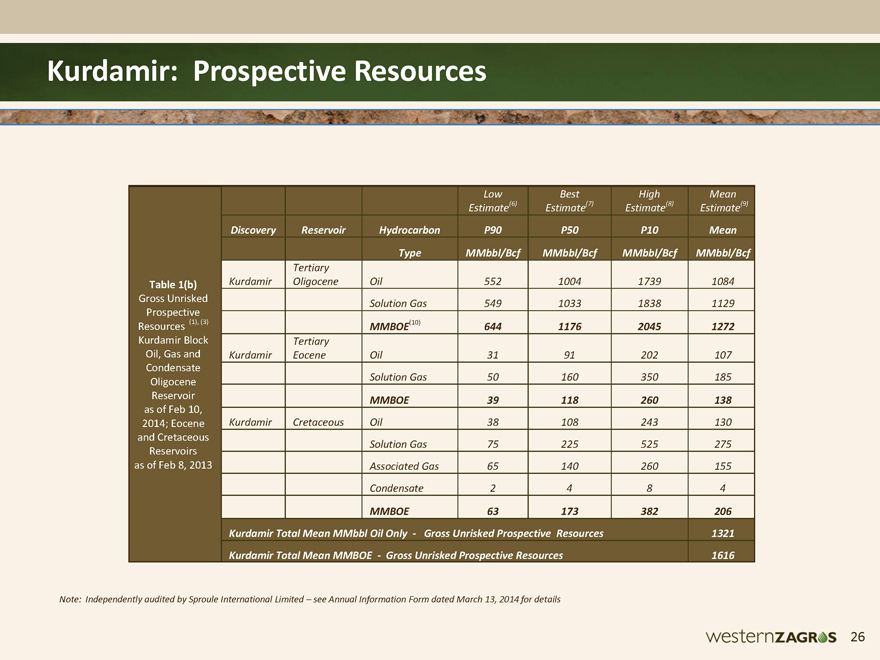

Kurdamir: Prospective Resources Westernzagros 26 Note: Independently audited by Sproule International Limited – see Annual Information Form dated March 13, 2014 for details Table 1(b) Gross Unrisked Prospective Resources (1), (3) Kurdamir Block Oil, Gas and Condensate Oligocene Reservoir as of Feb 10, 2014; Eocene and Cretaceous Reservoirs as of Feb 8, 2013 Low Estimate(6) Best Estimate(7) High Estimate(8) Mean Estimate(9) Discovery Reservoir Hydrocarbon P90 P50 P10 Mean Type MMbbl/Bcf MMbbl/Bcf MMbbl/Bcf MMbbl/Bcf Kurdamir Tertiary Oligocene Oil 552 1004 1739 1084 Solution Gas 549 1033 1838 1129 MMBOE(10) 644 1176 2045 1272 Kurdamir Tertiary Eocene Oil 31 91 202 107 Solution Gas 50 160 350 185 MMBOE 39 118 260 138 Kurdamir Cretaceous Oil 38 108 243 130 Solution Gas 75 225 525 275 Associated Gas 65 140 260 155 Condensate 2 4 8 4 MMBOE 63 173 382 206 Kurdamir Total Mean MMbbl Oil Only - Gross Unrisked Prospective Resources 1321 Kurdamir Total Mean MMBOE - Gross Unrisked Prospective Resources 1616

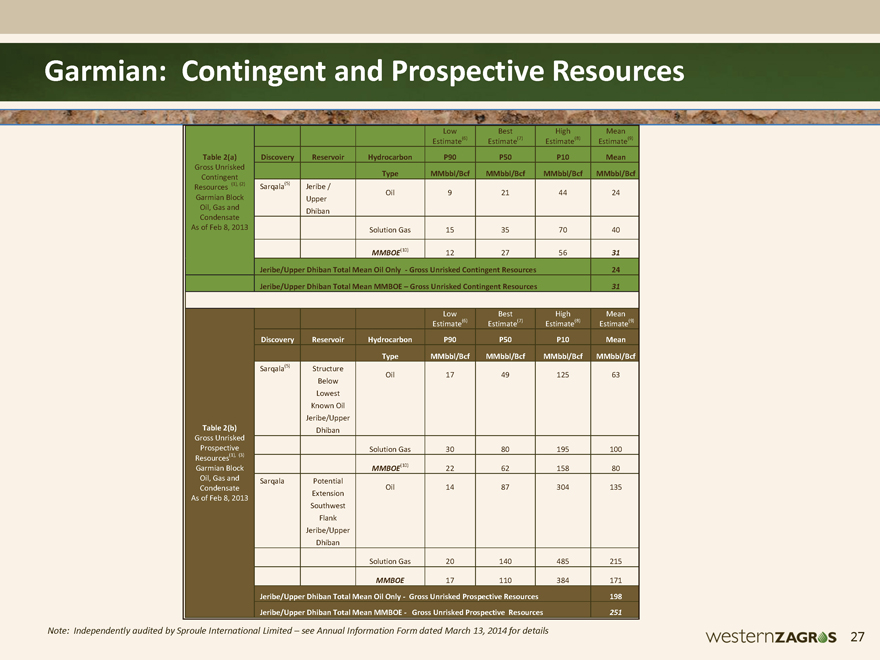

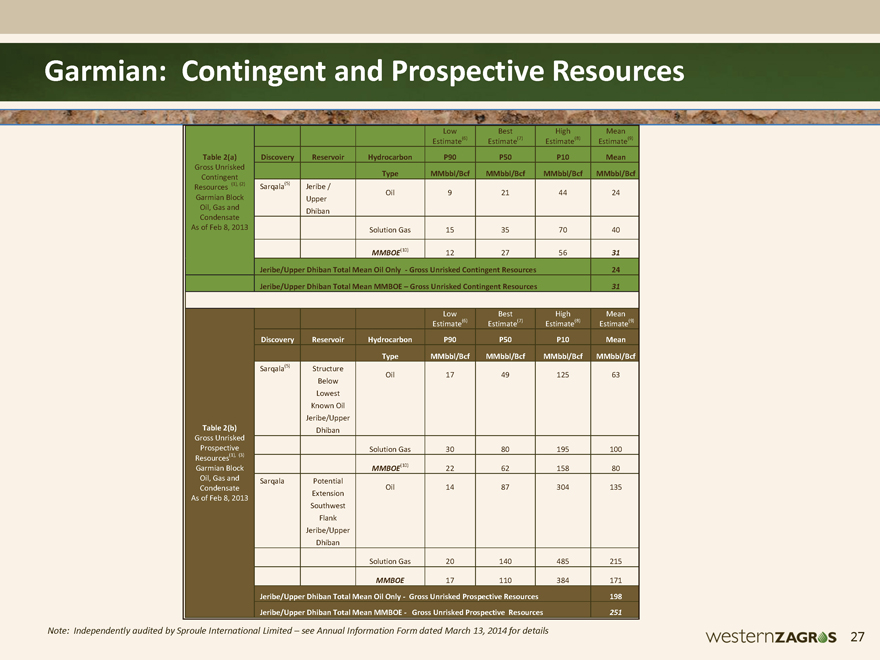

Garmian: Contingent and Prospective Resources Westernzagros 27 Note: Independently audited by Sproule International Limited – see Annual Information Form dated March 13, 2014 for details Table 2(a) Gross Unrisked Contingent Resources (1), (2) Garmian Block Oil, Gas and Condensate As of Feb 8, 2013 Low Estimate(6) Best Estimate(7) High Estimate(8) Mean Estimate(9) Discovery Reservoir Hydrocarbon P90 P50 P10 Mean Type MMbbl/Bcf MMbbl/Bcf MMbbl/Bcf MMbbl/Bcf Sarqala(5) Jeribe / Upper Dhiban Oil 9 21 44 24 Solution Gas 15 35 70 40 MMBOE(10) 12 27 56 31 Jeribe/Upper Dhiban Total Mean Oil Only - Gross Unrisked Contingent Resources 24 Jeribe/Upper Dhiban Total Mean MMBOE – Gross Unrisked Contingent Resources 31 Table 2(b) Gross Unrisked Prospective Resources(1), (3) Garmian Block Oil, Gas and Condensate As of Feb 8, 2013 Low Estimate(6) Best Estimate(7) High Estimate(8) Mean Estimate(9) Discovery Reservoir Hydrocarbon P90 P50 P10 Mean Type MMbbl/Bcf MMbbl/Bcf MMbbl/Bcf MMbbl/Bcf Sarqala(5) Structure Below Lowest Known Oil Jeribe/Upper Dhiban Oil 17 49 125 63 Solution Gas 30 80 195 100 MMBOE(10) 22 62 158 80 Sarqala Potential Extension Southwest Flank Jeribe/Upper Dhiban Oil 14 87 304 135 Solution Gas 20 140 485 215 MMBOE 17 110 384 171 Jeribe/Upper Dhiban Total Mean Oil Only - Gross Unrisked Prospective Resources 198 Jeribe/Upper Dhiban Total Mean MMBOE - Gross Unrisked Prospective Resources 251

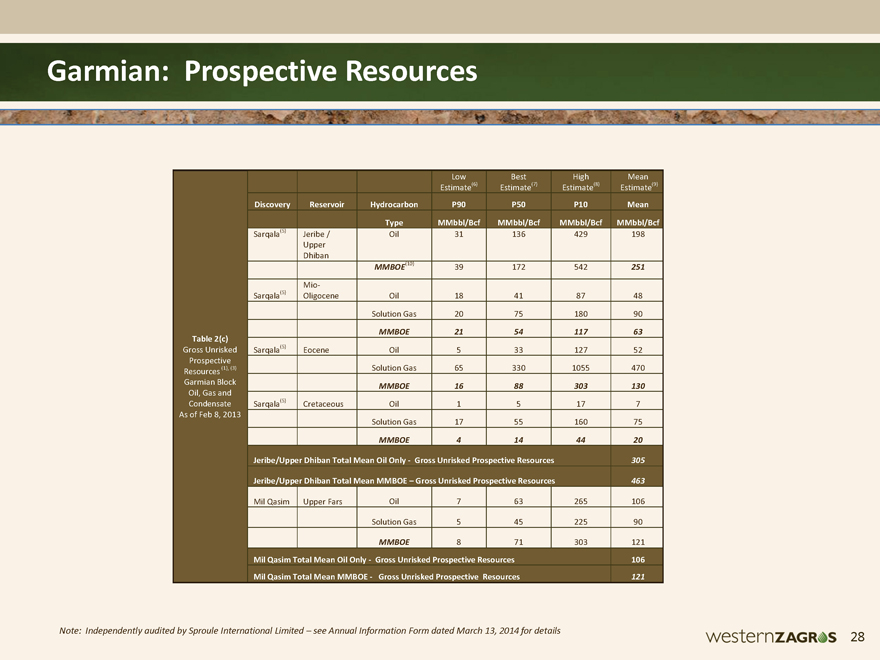

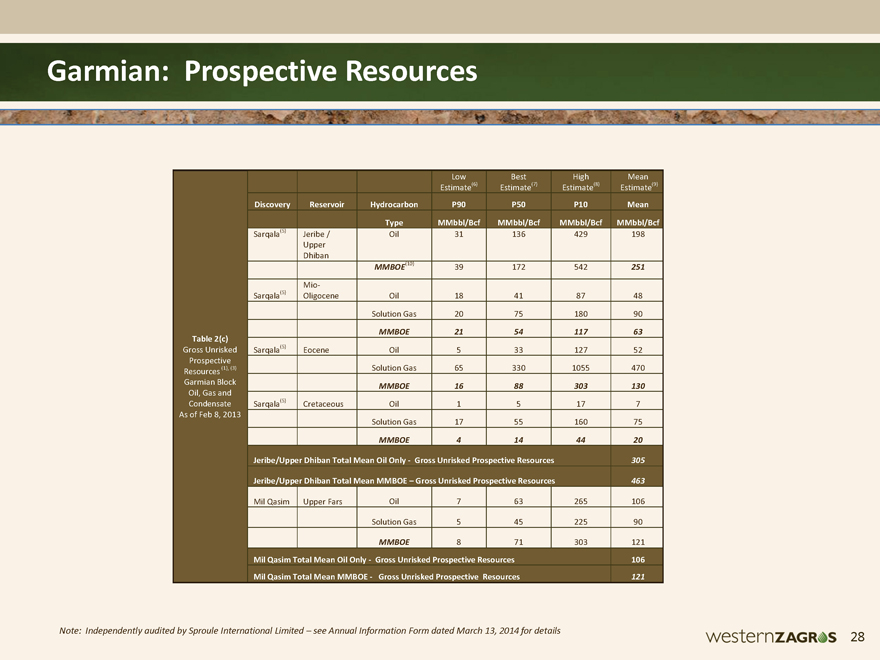

Garmian: Prospective Resources 28 Note: Independently audited by Sproule International Limited – see Annual Information Form dated March 13, 2014 for details Table 2(c) Gross Unrisked Prospective Resources (1), (3) Garmian Block Oil, Gas and Condensate As of Feb 8, 2013 Low Estimate(6) Best Estimate(7) High Estimate(8) Mean Estimate(9) Discovery Reservoir Hydrocarbon P90 P50 P10 Mean Type MMbbl/Bcf MMbbl/Bcf MMbbl/Bcf MMbbl/Bcf Sarqala(5) Jeribe / Upper Dhiban Oil 31 136 429 198 MMBOE(10) 39 172 542 251 Sarqala(5) Mio- Oligocene Oil 18 41 87 48 Solution Gas 20 75 180 90 MMBOE 21 54 117 63 Sarqala(5) Eocene Oil 5 33 127 52 Solution Gas 65 330 1055 470 MMBOE 16 88 303 130 Sarqala(5) Cretaceous Oil 1 5 17 7 Solution Gas 17 55 160 75 MMBOE 4 14 44 20 Jeribe/Upper Dhiban Total Mean Oil Only - Gross Unrisked Prospective Resources 305 Jeribe/Upper Dhiban Total Mean MMBOE – Gross Unrisked Prospective Resources 463 Mil Qasim Upper Fars Oil 7 63 265 106 Solution Gas 5 45 225 90 MMBOE 8 71 303 121 Mil Qasim Total Mean Oil Only - Gross Unrisked Prospective Resources 106 Mil Qasim Total Mean MMBOE - Gross Unrisked Prospective Resources 121

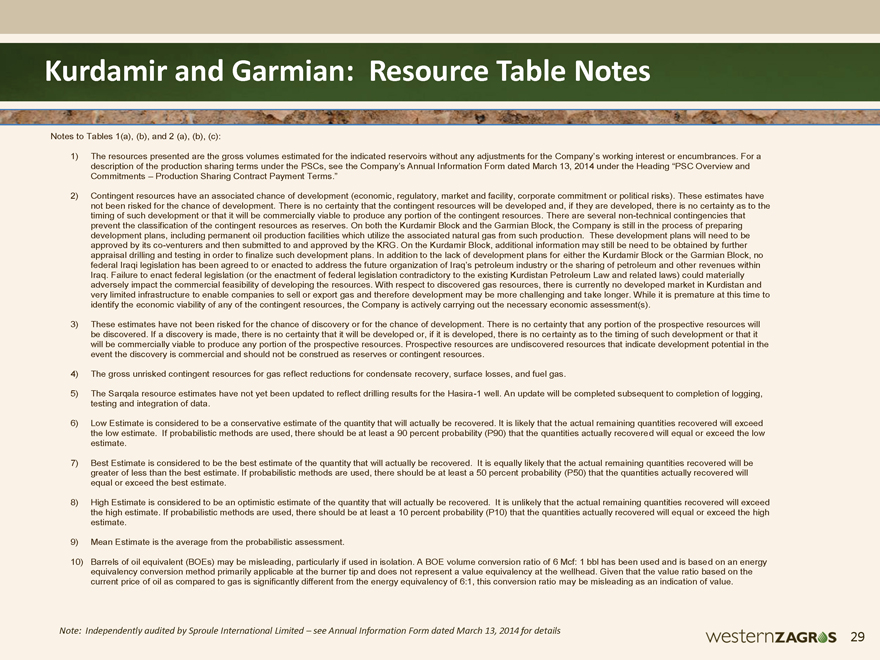

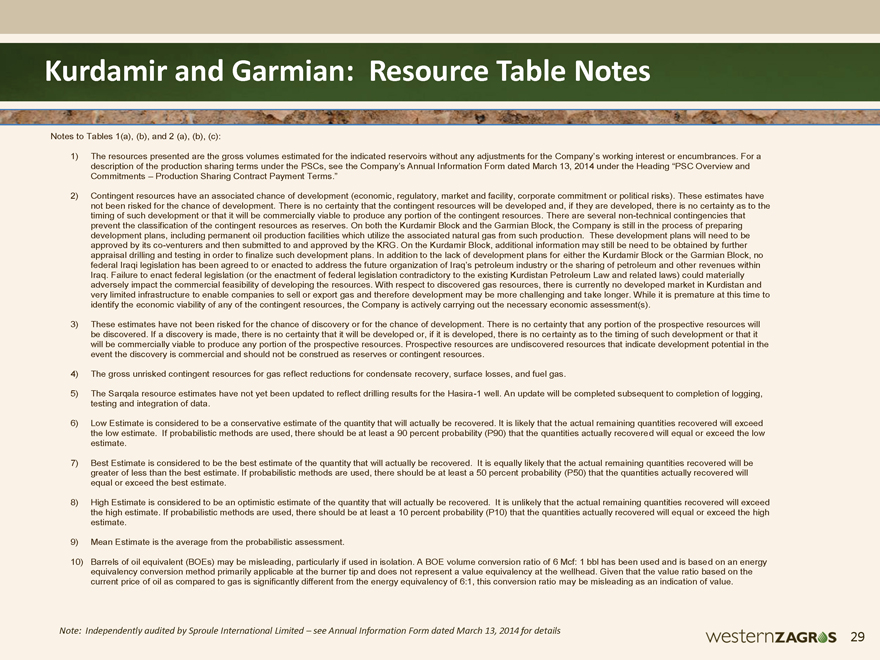

Kurdamir and Garmian: Resource Table Notes Westernzagros 29 Note: Independently audited by Sproule International Limited – see Annual Information Form dated March 13, 2014 for details Notes to Tables 1(a), (b), and 2 (a), (b), (c): 1) The resources presented are the gross volumes estimated for the indicated reservoirs without any adjustments for the Company’s working interest or encumbrances. For a description of the production sharing terms under the PSCs, see the Company’s Annual Information Form dated March 13, 2014 under the Heading “PSC Overview and Commitments – Production Sharing Contract Payment Terms.” 2) Contingent resources have an associated chance of development (economic, regulatory, market and facility, corporate commitment or political risks). These estimates have not been risked for the chance of development. There is no certainty that the contingent resources will be developed and, if they are developed, there is no certainty as to the timing of such development or that it will be commercially viable to produce any portion of the contingent resources. There are several non-technical contingencies that prevent the classification of the contingent resources as reserves. On both the Kurdamir Block and the Garmian Block, the Company is still in the process of preparing development plans, including permanent oil production facilities which utilize the associated natural gas from such production. These development plans will need to be approved by its co-venturers and then submitted to and approved by the KRG. On the Kurdamir Block, additional information may still be need to be obtained by further appraisal drilling and testing in order to finalize such development plans. In addition to the lack of development plans for either the Kurdamir Block or the Garmian Block, no federal Iraqi legislation has been agreed to or enacted to address the future organization of Iraq’s petroleum industry or the sharing of petroleum and other revenues within Iraq. Failure to enact federal legislation (or the enactment of federal legislation contradictory to the existing Kurdistan Petroleum Law and related laws) could materially adversely impact the commercial feasibility of developing the resources. With respect to discovered gas resources, there is currently no developed market in Kurdistan and very limited infrastructure to enable companies to sell or export gas and therefore development may be more challenging and take longer. While it is premature at this time to identify the economic viability of any of the contingent resources, the Company is actively carrying out the necessary economic assessment(s). 3) These estimates have not been risked for the chance of discovery or for the chance of development. There is no certainty that any portion of the prospective resources will be discovered. If a discovery is made, there is no certainty that it will be developed or, if it is developed, there is no certainty as to the timing of such development or that it will be commercially viable to produce any portion of the prospective resources. Prospective resources are undiscovered resources that indicate development potential in the event the discovery is commercial and should not be construed as reserves or contingent resources. 4) The gross unrisked contingent resources for gas reflect reductions for condensate recovery, surface losses, and fuel gas. 5) The Sarqala resource estimates have not yet been updated to reflect drilling results for the Hasira-1 well. An update will be completed subsequent to completion of logging, testing and integration of data. 6) Low Estimate is considered to be a conservative estimate of the quantity that will actually be recovered. It is likely that the actual remaining quantities recovered will exceed the low estimate. If probabilistic methods are used, there should be at least a 90 percent probability (P90) that the quantities actually recovered will equal or exceed the low estimate. 7) Best Estimate is considered to be the best estimate of the quantity that will actually be recovered. It is equally likely that the actual remaining quantities recovered will be greater of less than the best estimate. If probabilistic methods are used, there should be at least a 50 percent probability (P50) that the quantities actually recovered will equal or exceed the best estimate. 8) High Estimate is considered to be an optimistic estimate of the quantity that will actually be recovered. It is unlikely that the actual remaining quantities recovered will exceed the high estimate. If probabilistic methods are used, there should be at least a 10 percent probability (P10) that the quantities actually recovered will equal or exceed the high estimate. 9) Mean Estimate is the average from the probabilistic assessment. 10) Barrels of oil equivalent (BOEs) may be misleading, particularly if used in isolation. A BOE volume conversion ratio of 6 Mcf: 1 bbl has been used and is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. Given that the value ratio based on the current price of oil as compared to gas is significantly different from the energy equivalency of 6:1, this conversion ratio may be misleading as an indication of value.

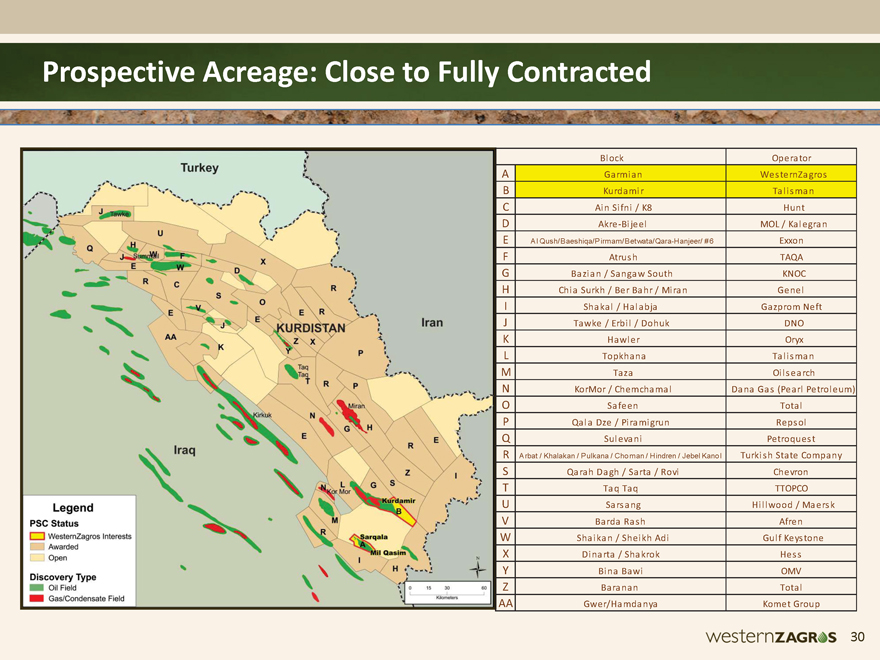

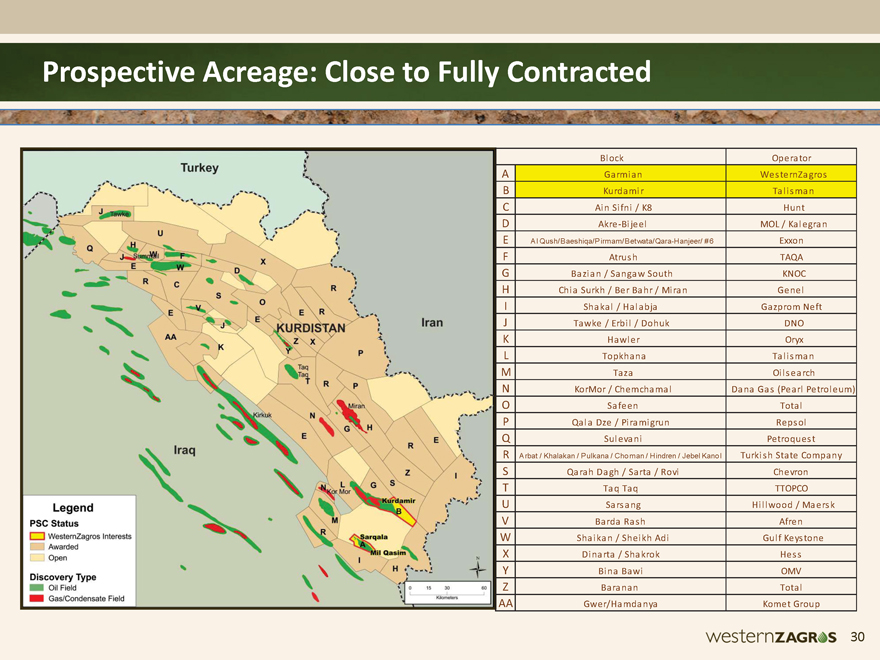

Prospective Acreage: Close to Fully Contracted westernzagros 30 Operator A Garmian WesternZagros B Kurdamir Talisman C Ain Sifni / K8 Hunt D Akre-Bijeel MOL / Kalegran E Al Qush/Baeshiqa/Pirmam/Betwata/Qara-Hanjeer/ #6 Exxon F Atrush TAQA G Bazian / Sangaw South KNOC H Chia Surkh / Ber Bahr / Miran Genel I Shakal / Halabja Gazprom Neft J Tawke / Erbil / Dohuk DNO K Hawler Oryx L Topkhana Talisman M Taza Oilsearch N KorMor / Chemchamal Dana Gas (Pearl Petroleum) O Safeen Total P Qala Dze / Piramigrun Repsol Q Sulevani Petroquest R Arbat / Khalakan / Pulkana / Choman / Hindren / Jebel Kanol Turkish State Company S Qarah Dagh / Sarta / Rovi Chevron T Taq Taq TTOPCO U Sarsang Hillwood / Maersk V Barda Rash Afren W Shaikan / Sheikh Adi Gulf Keys tone X Dinarta / Shakrok Hes s Y Bina Bawi OMV Z Baranan Total AA Gwer/Hamdanya Komet Group Block

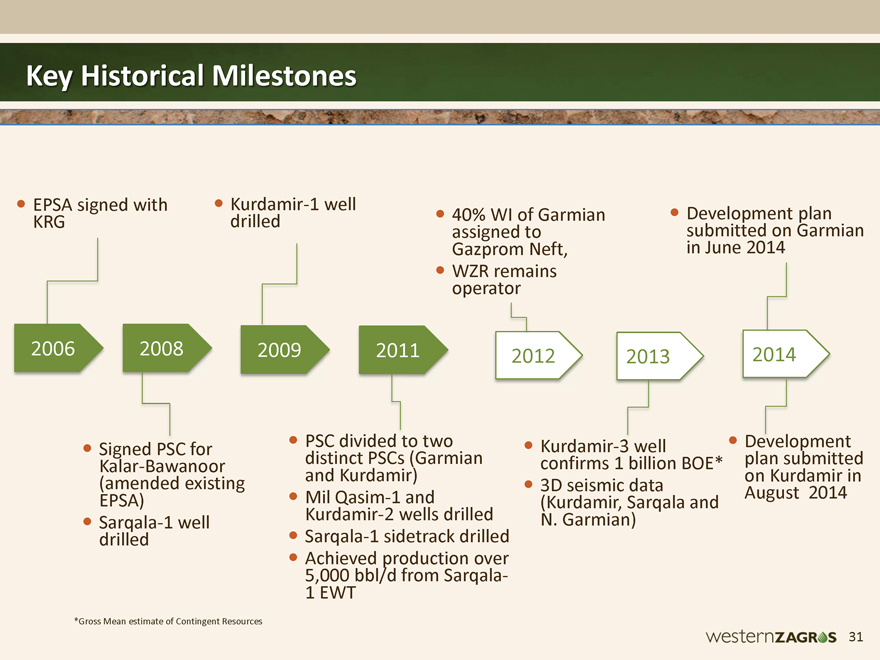

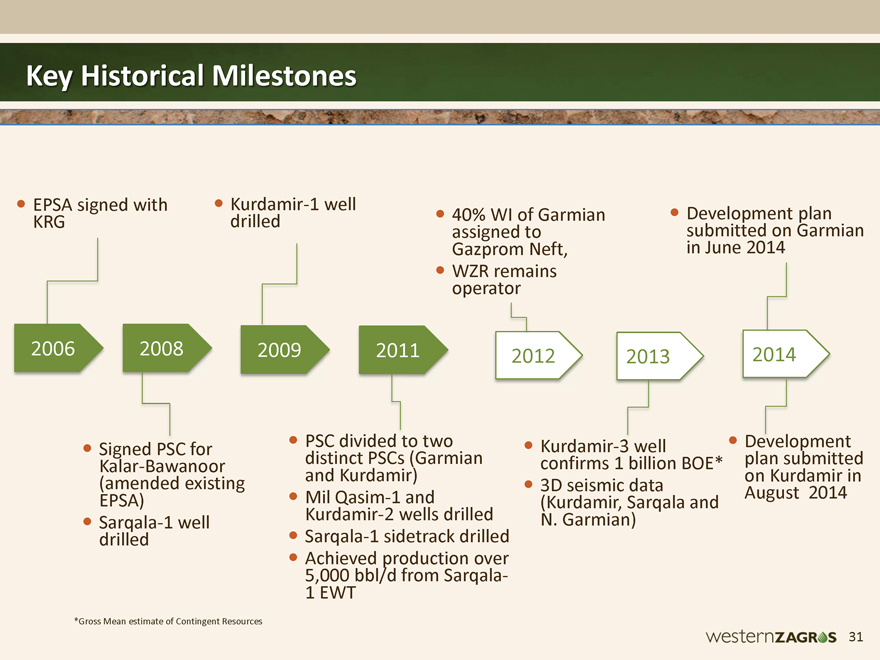

westernzagros 31 Key Historical Milestones 2006 2008 EPSA signed with KRG Kurdamir-1 well drilled Kurdamir-well confirms 1 billion BOE* 3D seismic data (Kurdamir, Sarqala and N. Garmian) 2009 2011 2012 2013 Signed PSC for Kalar-Bawanoor (amended existing EPSA) Sarqala-1 well drilled PSC divided to two distinct PSCs (Garmian and Kurdamir) Mil Qasim-1 and Kurdamir-2 wells drilled Sarqala-1 sidetrack drilled Achieved production over 5,000 bbl/d from Sarqala- 1 EWT 40% WI of Garmian assigned to Gazprom Neft, WZR remains operator d 3 2014 Development plan submitted on Garmian in June 2014 Development plan submitted on Kurdamir in August 2014 evelo *Gross Mean estimate of Contingent Resources

2007 Evolving Political Environment, Increasing Investment October 2005 Iraqi constitution adopted February 2007 Draft Federal Petroleum Law June 2007 Agreement on initial revenue sharing – 17% of net oil revenues from all regions in Iraq go to Kurdistan August 2007 KRG Petroleum Law approved February 2011 Iraq Prime Minister announces Kurdistan PSCs will be respected. Oil exports from Kurdistan resume April & August 2012 KRG cease oil exports April 1 due to a dispute with the Federal Government. KRG resumes oil exports to progress reconciliation with the Iraqi Central Government over the oil and gas law September 2012 Agreement signed with the KRG and Federal Government to increase Kurdistan’s oil exports and one arrears payment from Baghdad to KRG September 2012 Agreement signed with the KRG and Federal Government to increase Kurdistan’s oil exports and one arrears payment from Baghdad to KRG December 2012 KRG cease oil exports December 25 due to ongoing dispute with the Federal Government January 2013 KRG approves trucked oil exports from Taq Taq field directly to Turkey and in February the KRG Ministry of Natural Resources announces intentions to build its own export pipeline to Turkey November 2013 KRG/Turkey sign bilateral Energy Agreement April 2014 Construction of Kurdistan Region of Iraq (“KRI)-Turkish pipeline from Khurmala to Fish Khabur completed and first oil through KRI-Turkey pipeline May 2014 First cargo via the KRI-Turkey pipeline lifted from Ceyhan 7 8 9 10 11 5 4 3 2 1 32 6 2005 2006 2008 2009 2010 2011 2012 1 2 3 4 5 6 7 8 9 10 11 2007 2013 2014 12 12 13 13 Westernzagros 32

Caution to the Reader Rights Certificates will not be issued to Ineligible Holders (as defined in the preliminary prospectus) and shareholders will be presumed to be resident in the place of their registered address, unless the contrary is shown to the satisfaction of the Company. See “Details of the Offering — Ineligible Holders and Approved Eligible Holders” in the preliminary prospectus. The Rights may be transferred only in transactions outside of the United States in accordance with Regulation S (“Regulation S”) under the U.S. Securities Act of 1933, as amended (the “U.S. Securities Act”), which generally will permit the resale of the Rights through the facilities of the TSX Venture Exchange (“TSXV”). Listing will be subject to the Company fulfilling all of the listing requirements of the TSXV. There is currently no market through which the Rights may be sold and purchasers may not be able to resell the Rights issued under the final prospectus. This may affect the pricing of the Rights in the secondary market, the transparency and availability of trading prices, the liquidity of the Rights and the extent of issuer regulation. See “Risk Factors” in the preliminary prospectus. Prospective investors should be aware that the acquisition or disposition of the securities described in this presentation and the preliminary prospectus and the expiry of an unexercised Right may have tax consequences depending on each particular prospective investor’s specific circumstances. Prospective investors should consult their own tax advisors with respect to such tax considerations. An investment in the Rights offered under the final prospectus or Common Shares issuable upon exercise of the Rights should be considered speculative due to various factors, including the nature of the industry in which the Company operates, the present state of development of its business and the foreign jurisdiction in which it carries on business. The risk factors identified under the headings “Risk Factors” and “Forward Looking Statements” in the preliminary prospectus or incorporated by reference into the preliminary prospectus should be carefully reviewed and evaluated by prospective investors before purchasing any Rights or Common Shares being offered. See “Plan of Distribution” and “Risk Factors” in the preliminary prospectus. The Company’s board of directors makes no recommendation to you about whether you should exercise any Rights. You are urged to make an independent investment decision about whether to exercise your Rights based on your own assessment of the Company’s business and the rights offering. Rights not exercised before the Rights Expiry Time on the Rights Expiry Date will become void and be of no value. If a Shareholder elects not to exercise the Rights issued to it, or elects to sell or transfer those Rights, then such Shareholder’s current percentage ownership in the Company will be diluted as a result of the exercise of the Rights by others. See “Risk Factors - Dilution to Shareholders” in the preliminary prospectus. CDS Participants will have an earlier deadline for receipt of instructions and payment than the Rights Expiry Date. This rights offering is made by a Canadian issuer that is permitted, under a multijurisdictional disclosure system adopted by the United States and Canada, to prepare the preliminary and final prospectus in accordance with the disclosure requirements of Canada. Prospective purchasers of securities should be aware that such requirements are different from those of the United States. Financial statements included or incorporated herein, if any, have been prepared in accordance with International Financial Reporting Standards, and are subject to Canadian auditing and auditor independence standards, and thus may not be comparable to financial statements of United States companies. Prospective purchasers of securities should be aware that the acquisition or disposition of the securities described in this presentation and in the preliminary prospectus may have tax consequences in Canada, the United States, or elsewhere. Such consequences for purchasers who are resident in, or citizens of, the United States are not described fully herein. Prospective purchasers should consult their own tax advisors with respect to such tax considerations. The enforcement by purchasers of civil liabilities under United States federal securities laws may be affected adversely by the fact that the Company is incorporated under the laws of Alberta, that some or all of its officers and directors may be residents of a country other than the United States, that some or all of the experts named in the registration statement may be residents of Canada, and that all or a substantial portion of the assets of the Company and said persons may be located outside the United States.westernzagros 33

Caution to the Reader (Cont’d.) These securities have not been approved or disapproved by the United States Securities and Exchange Commission (the “SEC”) nor has the SEC passed upon the accuracy or adequacy of the presentation or the preliminary or final prospectus. Any representation to the contrary is a criminal offence. Crest Energy International LLC is not engaged as an underwriter in connection with the rights offering and has not been involved in the preparation of, or performed any review of, the preliminary prospectus in the capacity of an underwriter. All dollar amounts in the preliminary prospectus are in Canadian dollars unless otherwise stated. The reporting and functional currency of the Company is the United States dollar, and all dollar amounts in this presentation and the documents incorporated by reference in the preliminary prospectus are in U.S. dollars unless otherwise stated herein or therein. You may obtain copies of the preliminary prospectus and the documents incorporated by reference therein free of charge by visiting SEDAR at www.sedar.com or EDGAR at www.sec.gov. Alternatively, copies of these documents may be obtained by contacting the Company at (403) 693.7001. Forward-Looking Statements This presentation, the preliminary prospectus and the documents incorporated by reference therein contain certain forward-looking statements and forward-looking information (collectively “forward-looking statements”) within the meaning of applicable securities laws. All statements other than statements of historical fact may be forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as “anticipate”, “believe”, “could”, “estimate”, “expect”, “intend”, “may”, “plan”, “potential”, “predict”, “project”, “should”, “target”, “will”, “proposed”, “theory” or similar words suggesting future outcomes or language suggesting an outlook. This presentation, the preliminary prospectus and the documents incorporated by reference therein contain forward-looking statements including, but not limited to, the following: (i) use of proceeds from the rights offering; (ii) the completion of the rights offering and the timing of the distribution of the rights and common shares of the Company pursuant to the rights offering; (iii) operational information; (iv) future appraisal and development plans and the timing, funding and estimated costs associated therewith; (v) management’s beliefs as to phased development; (vi) the intersection of fractures at the Kurdamir-4 well; (vii) testing of the Hasira-1 well; (viii) the interpretation of 3D seismic data; (ix) future production capability and capacity of wells and facilities; (x) facility capacity for oil and gas processing, including estimated capital costs on the Kurdamir and Garmian Blocks; (xi) estimated commitments and operations under the PSCs; (xii) business plans and strategies; (xiii) future production, production rates, sales and export possibilities; (xiv) future pipeline development; (xv) plans for increasing or bringing on new production; (xvi) potential additions to contingent resources; (xvii) planned expenditures and anticipated financing transactions, including the expected timing thereof and proceeds therefrom; (xviii) expectations regarding the Iraqi political system and regulation of the oil and gas industry; and (xix) expectations regarding the outcome and impact of disputes. In addition, statements relating to “resources” are deemed to be forward-looking statements as they involve the implied assessment, based on certain estimates and assumptions, that the resources described exist in the quantities estimated or predicted and can be profitably produced in the future. Undue reliance should not be placed on forward-looking statements, which are inherently uncertain, are based on estimates and assumptions, and are subject to known and unknown risks and uncertainties (both general and specific) that contribute to the possibility that the future events or circumstances contemplated by the forward-looking statements will not occur. There can be no assurance that the plans, intentions or expectations upon which forward-looking statements are based will in fact be realized. Actual results will differ, and the difference may be material and adverse to WesternZagros and its shareholders. Forward-looking statements are provided for the purpose of providing information about management’s current expectations and plans relating to the future. Reliance on such information may not be appropriate for other purposes, such as making investment decisions. westernzagros 34

Caution to the Reader (Cont’d.) Forward-looking statements are not based on historical facts but rather on management’s current expectations as well as assumptions made by, and information currently available to, WesternZagros concerning, among other things, matters relating to the rights offering, outcomes of future well operations, completion of planned financing transactions and the ability to obtain all necessary regulatory and shareholder approvals in connection therewith, plans for and results of extended well tests and drilling activity, future capital and other expenditures (including the amount, nature and sources of funding thereof), future economic conditions, future currency and exchange rates, continued political stability, continued security in the Kurdistan Region, timely receipt of any necessary government or regulatory approvals, the successful resolution of disputes, the Company’s continued ability to employ qualified staff and to obtain equipment in a timely and cost efficient manner, the participation of the Company’s co-venturers in joint activities, and the ability to sell production and the prices to be received in connection therewith. In addition, budgets are based upon WesternZagros’s current appraisal and development plans and anticipated costs, both of which are subject to change based on, among other things, the actual outcomes of well operations and the installation and commissioning of facilities, unexpected delays, availability of future financing and changes in market conditions. Although the Company believes the expectations and assumptions reflected in such forward-looking information are reasonable, they may prove to be incorrect. Forward-looking information involves significant known and unknown risks and uncertainties. A number of factors could cause actual results to differ materially from those anticipated by WesternZagros including, but not limited to, failure to complete the rights offering in all material respects or at all, the risk that any of the conditions set forth in the equity backstop agreement between the Company and Crest Energy International LLC are not satisfied on a timely basis or other termination events under such agreement occur, risks associated with the oil and gas industry (e.g. operational risks in exploration and production; inherent uncertainties in interpreting geological data; changes in plans with respect to capital expenditures; interruptions in operations together with any associated insurance proceedings; the uncertainty of estimates and projections in relation to costs and expenses and health, safety and environmental risks), the risk of commodity price and foreign exchange rate fluctuations, the uncertainty associated with any dispute resolution proceedings, the uncertainty associated with negotiating with foreign governments, the risk of trade and economic sanctions or other restrictions being imposed by the Canadian or other governments which impact the Company’s operations, and risk associated with international activity, including the lack of federal petroleum legislation and ongoing political disputes in Iraq and recent terrorist activities in Iraq in particular. There is also the risk and uncertainty of access to or expansion of infrastructure, including appropriate pipelines, on acceptable terms or costs. See “Risk Factors” in the preliminary prospectus. Investors are cautioned that these factors and risks are difficult to predict and that the assumptions used in the preparation of such information, although considered reasonably accurate at the time of preparation, may prove to be incorrect. Accordingly, investors are cautioned that the actual results achieved will vary from the information provided herein and the variations may be material. Investors are also cautioned that the foregoing list of factors is not exhaustive. Consequently, there is no representation by WesternZagros that actual results achieved will be the same in whole or in part as those set out in the forward-looking statements. Furthermore, the forward-looking statements contained in this presentation, the preliminary prospectus and the documents incorporated by reference herein are made as of the date of such documents, and neither WesternZagros nor FirstEnergy Capital Corp. undertake any obligation, except as required by applicable securities legislation, to update publicly or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise. The forward-looking statements contained in this presentation and the preliminary prospectus and the documents incorporated by reference herein are expressly qualified by this cautionary statement. Presentation of Oil and Gas Resources Information All oil and natural gas resource information, including estimated production rates, contained in this presentation, the preliminary prospectus and in the documents incorporated by reference herein has been prepared and presented in accordance with National Instrument 51-101 - Standards of Disclosure for Oil and Gas Activities and the COGE Handbook. The recovery and resource estimates provided in this presentation, the preliminary prospectus and in the documents incorporated by reference herein are estimates only. Actual Contingent Resources and Prospective Resources (and any volumes that may be reclassified as reserves) and future production from such Contingent Resources and Prospective Recourses may be greater than or less than the estimates provided herein. westernzagros 35

Caution to the Reader (Cont’d.) Numbers in the resources tables and other oil and gas information contained in this presentation, the preliminary prospectus and in the documents incorporated herein by reference may not add due to rounding. With respect to the resources data contained herein, the following terms have the meanings indicated: “Best estimate”, “P50” or “2C” is considered to be the best estimate of the quantity of resources that will actually be recovered. It is equally likely that the actual remaining quantities recovered will be greater or less than the best estimate. If probabilistic methods are used, there should be at least a 50 percent probability (P50) that the quantities actually recovered will equal or exceed the best estimate. “Contingent Resources” means those quantities of petroleum estimated, as of a given date, to be potentially recoverable from known accumulations using established technology or technology under development, but which are not currently considered to be commercially recoverable due to one or more contingencies. Contingencies may include factors such as economic, legal, environmental, political, and regulatory matters or a lack of markets. It is also appropriate to classify as contingent resources the estimated discovered recoverable quantities associated with a project in the early evaluation stage. “Gross” is an estimate of resources which represents gross volumes for the indicated reservoirs, without any adjustments for the Company’s working interest or encumbrances. For a description of the production sharing terms under the Company’s PSCs, refer to the AIF under the heading “PSC Overview and Commitments - Production Sharing Contract Payment Terms”. “High estimate” is considered to be an optimistic estimate of the quantity of resources that will actually be recovered. It is unlikely that the actual remaining quantities recovered will exceed the high estimate. If probabilistic methods are used, there should be at least a 10 percent probability (P10) that the quantities actually recovered will equal or exceed the high estimate. “Low estimate” is considered to be a conservative estimate of the quantity of resources that will actually be recovered. It is likely that the actual remaining quantities recovered will exceed the low estimate. If probabilistic methods are used, there should be at least a 90 percent probability (P90) that the quantities actually recovered will equal or exceed the low estimate. “Mean estimate” is the average from a probabilistic assessment. “Prospective Resources” means those quantities of petroleum estimated, as of a given date, to be potentially recoverable from undiscovered accumulations by application of future development projects. Prospective resources have both an associated chance of discovery and a chance of development. The chance of commerciality is the product of these two risk components. A number of Mean estimates of resources which are presented in this presentation and the preliminary prospectus are combined Mean estimates which are an arithmetic sum of the Mean estimates for one or more individual reservoirs and each such Mean estimate is the average from the probabilistic assessment that was completed for the reservoir. Refer to “Statement of Oil and Gas Information - Resources Information” in the AIF for the detailed breakdown of the High (P10 or 3C), Low (P90 or 1C) and Best (P50 or 2C) estimates for each of the individual reservoir assessments. The Contingent Resources estimates referred to in this presentation and the preliminary prospectus have not been risked for the chance of development. There is no certainty that the Contingent Resources will be developed and, if developed, there is no certainty as to the timing of such development or that it will be commercially viable to produce any portion of the Contingent Resources. The estimates of Contingent Resources involve implied assessment, based on certain estimates and assumptions, that the resource described exists in the quantities predicted or estimated and that the resource can be profitably produced in the future. The Prospective Resources estimates referred to in this presentation and the preliminary prospectus have not been risked for either the chance of discovery or the chance of development. There is no certainty that any portion of the Prospective Resources will be discovered. If a discovery is made, there is no certainty that it will be developed or, if it is developed, there is no certainty as to the timing of such development or that it will be commercially viable to produce any portion of the Prospective Resources. A barrel of oil equivalent (“BOE”) is determined by converting a volume of natural gas to barrels using the ratio of 6 million cubic feet (“Mcf”) to one barrel. BOEs may be misleading, particularly if used in isolation. A BOE conversion ratio of 6 Mcf:1 BOE is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. Given that the value ratio based on the current price of oil as compared to natural gas is significantly different from the energy equivalency of 6:1, utilizing a conversion on a 6:1 basis may be misleading as an indication of value. westernzagros 36

Caution to the Reader, (Cont’d.) All resource estimates presented are gross volumes for the indicated reservoirs, without any adjustment for the Company’s working interest or encumbrances. The effective date of the resource estimate is February 8, 2013, except for the resources in the Oligocene reservoir of the Kurdamir prospect which were updated effective February 10, 2014 and all estimates presented have been independently audited by Sproule International Limited as of such dates. Refer to “Statement of Oil and Gas Information - Resources Information and - Significant Factors Relevant to the Resources Estimates” in the AIF and to “Risk Factors” in the AIF and the preliminary prospectus for further information on the Company’s audited resource estimates for the Kurdamir Block and Garmian Block, including the risks and level of uncertainty associated with the estimates and the recovery and development of the resources and in respect of Contingent Resources, the specific contingencies that prevent the classification of such resources as reserves. In addition, details of the Kurdamir Block and Garmian Block and the Company’s interests therein are contained in the AIF under the heading “Statement of Oil and Gas Information”. Cautionary Note Regarding Reserves and Resources for U.S. Investors Disclosure in this presentation, the preliminary prospectus and the documents incorporated by reference of reserves and resources is presented in accordance with Canadian securities laws. Specifically, the securities regulatory authorities in Canada have adopted NI 51-101, which imposes oil and gas disclosure standards for Canadian public issuers engaged in oil and gas activities. The SEC generally permits U.S. reporting oil and gas companies, in their filings with the SEC, to disclose only proved, probable and possible reserves and production that meet the SEC’s definitions of such terms, net of royalties and interests of others. The SEC generally does not permit U.S. companies to disclose net present value of future net revenue from reserves based on forecast prices and costs. Canadian securities laws permit, among other things, the presentation of certain categories of resources and the disclosure of production on a gross basis before deducting royalties. This presentation, the preliminary prospectus and the documents incorporated by reference contain estimates of quantities of oil and gas using Contingent Resources or Prospective Resources or other descriptions of volumes of resources potentially recoverable through additional exploratory drilling or recovery techniques, which terms include quantities of oil and gas that do not meet the SEC’s definitions of estimated proved, probable and possible reserves and in respect of which the SEC’s rules would prohibit a U.S. company from including in filings with the SEC. These estimates of resources should not be construed as comparable to disclosures of estimated reserves. These estimates are by their nature more speculative than estimated proved reserves and accordingly are subject to substantially greater risk of not being actually realized. Natural gas liquids referred to in this presentation and the preliminary prospectus and the documents incorporated herein by reference are reported on a combined basis with any condensate as required under NI 51-101. 37

www.westernzagros.com Head Office 600, 440 – 2nd Avenue S.W. Calgary, Alberta, Canada T2P 5E9 Tel: 1-403-693-7017 Fax: 1-403-233-0174 email : investorrelations@westernzagros.com Hasira-1 Well Aug 2013